UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 4, 2025

SUNPOWER INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-40117 | 93-2279786 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

| 45700 Northport Loop East, Fremont, CA | 94538 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (510) 270-2507

Complete Solaria, Inc.

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.0001 per share | SPWR | The Nasdaq Global Market | ||

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share | SPWRW | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

Item 7.01. Regulation FD Disclosure.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒ On December 4, 2025, SunPower Inc. (the “Company”) made available on its website, sunpower.com, an investor presentation (the “Presentation”). A copy of the Presentation can be viewed at the Company’s website by first selecting “About SunPower,” then selecting “Investors,” then selecting “News & Events,” then selecting “Presentations.” A copy of the presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein.

All statements in the Presentation, other than historical financial information, may be deemed to be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, and actual results or developments may differ materially from those in the forward-looking statements. See the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on April 30, 2025, the Company’s Quarterly Reports on Form 10-Q filed with the SEC on May 19, 2025 and August 13, 2025, and the Company’s other filings with the SEC for a discussion of other risks and uncertainties. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

The information contained in this Item 7.01, the Presentation, Exhibit 99.1 and the contents of the sunpower.com website shall not be incorporated by reference into any filing of the Company with the SEC, whether made before or after the date hereof, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference to such filing. The information in this Item 7.01, the Presentation, Exhibit 99.1 and the contents of the sunpower.com website shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act.

Item 9.01. Financial Statement and Exhibits.

(d) Exhibits.

| Exhibit No. | Description | |

| 99.1 | Presentation, dated December 4, 2025. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| SUNPOWER INC. | ||

| Dated: December 4, 2025 | By: | /s/ Thurman J. Rodgers |

| Thurman J. Rodgers | ||

| Chief Executive Officer | ||

2

Exhibit 99.1

1 Jefferies Renewables & Clean Energy Conference T.J. Rodgers, December 4, 2025 Record 92,863 Ft. August 13, 2001

2

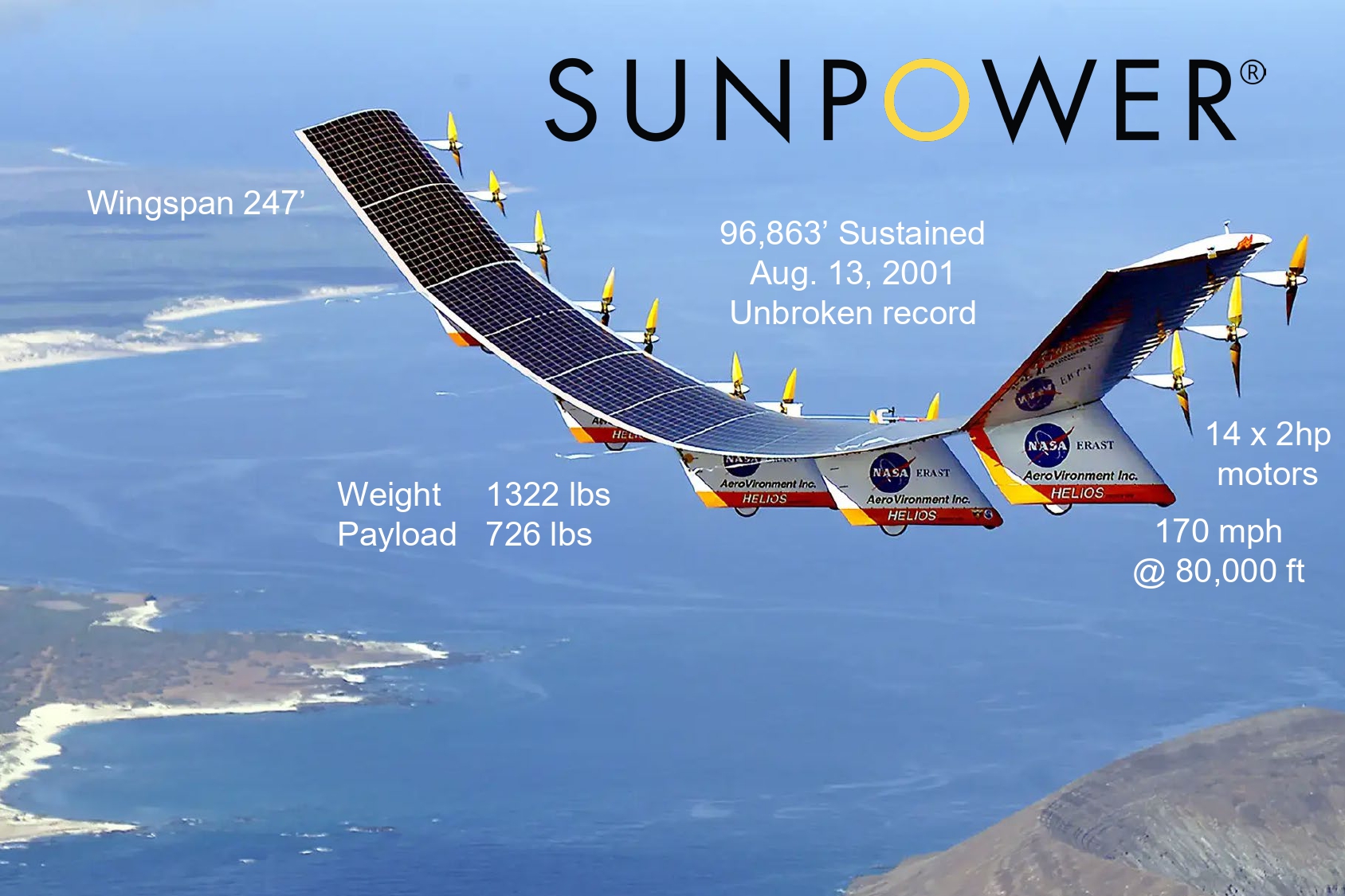

3 Wingspan 247’ Weight Payload 1322 lbs 726 lbs 96,863’ Sustained Aug. 13, 2001 Unbroken record 14 x 2hp motors 170 mph @ 80,000 ft

©2024 Complete Solaria Owner: T.J. Rodgers 4 A Public Solar Company With Venture Return Potential Convertible Debenture Offering T.J. Rodgers, CEO August 19, 2024

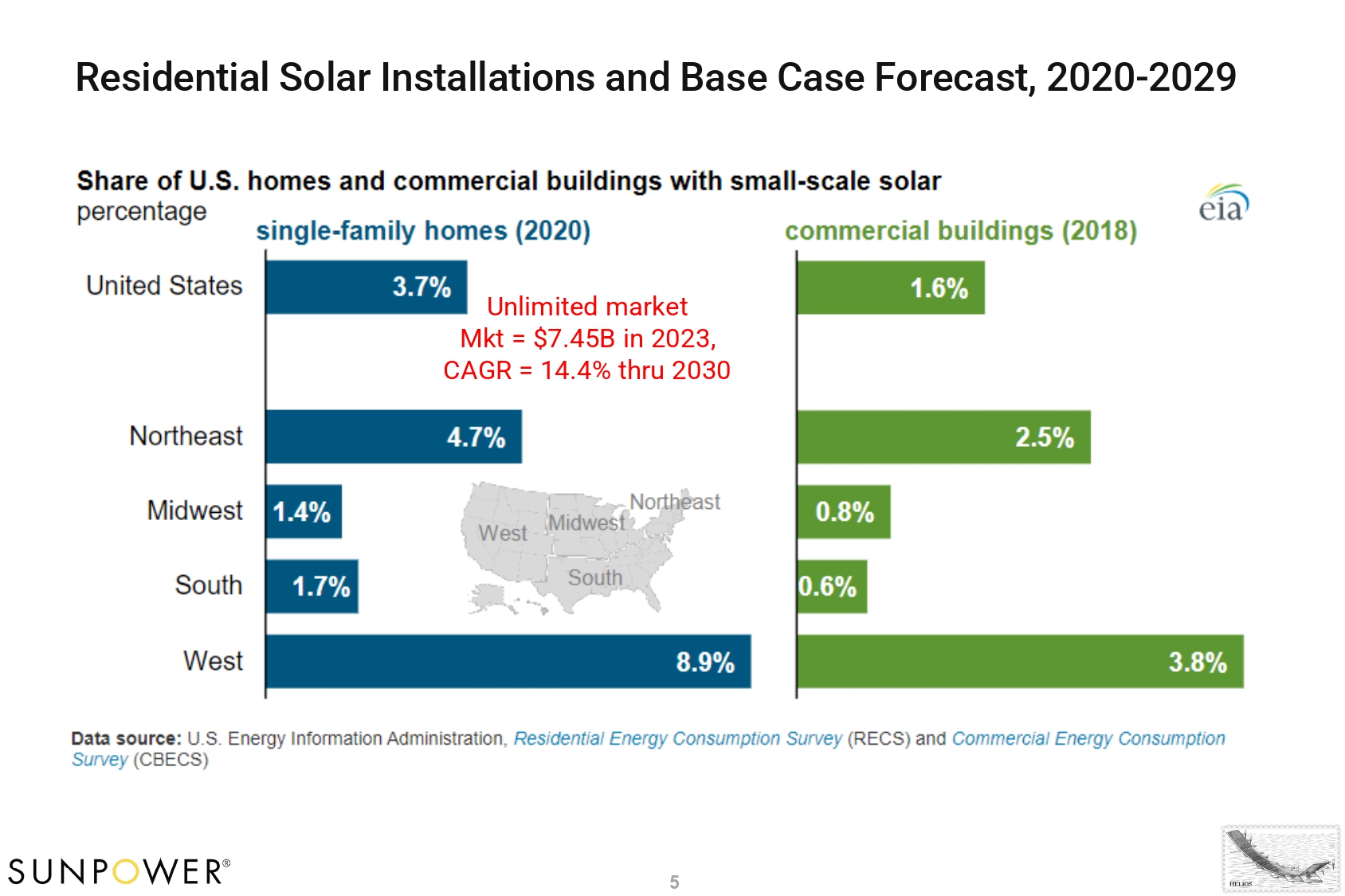

5 Residential Solar Installations and Base Case Forecast, 2020 - 2029 Unlimited market Mkt = $7.45B in 2023, CAGR = 14.4% thru 2030

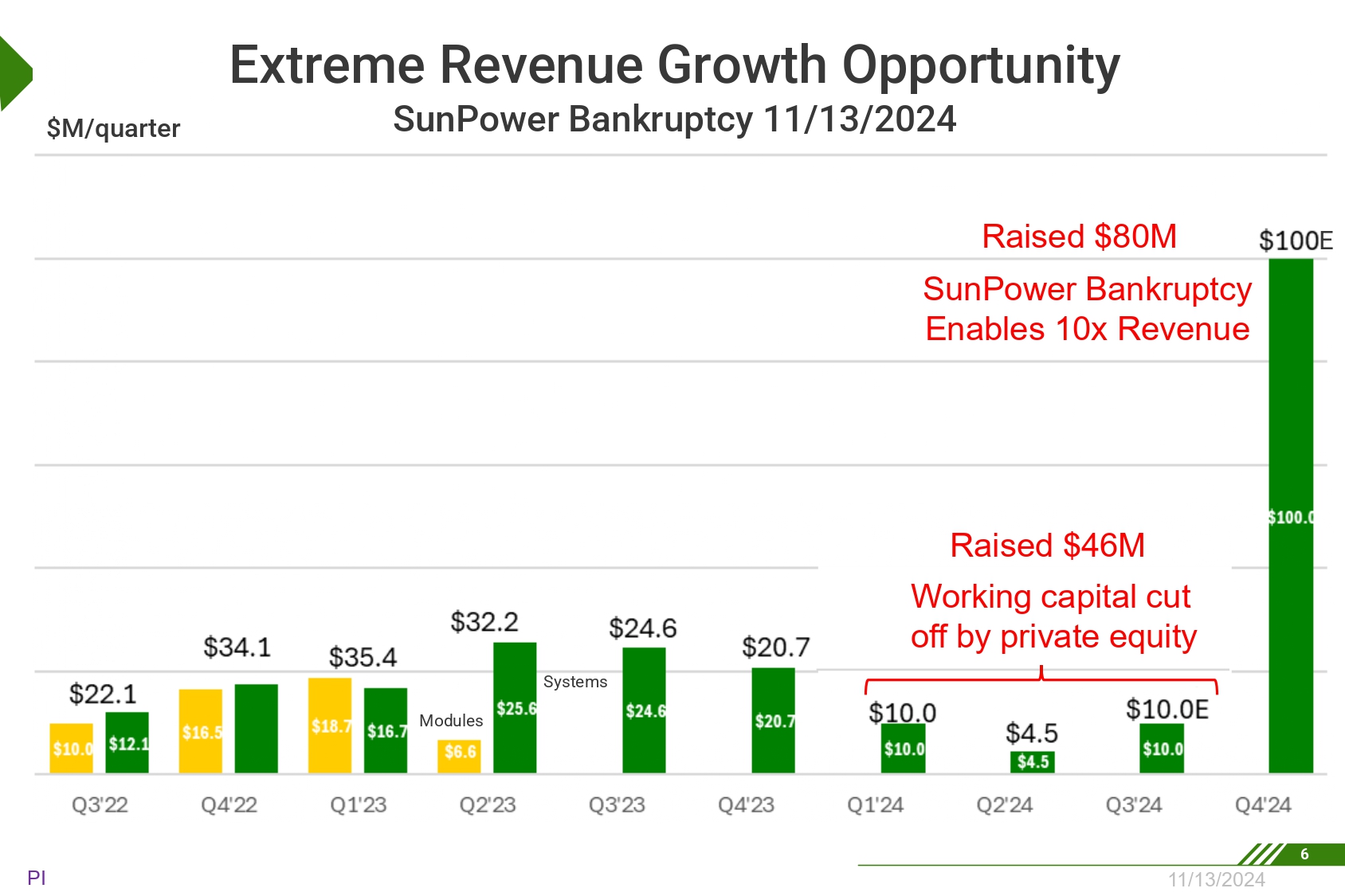

6 $M/quarter Systems Modules Extreme Revenue Growth Opportunity SunPower Bankruptcy 11/13/2024 11/13/2024 PI E Raised $80M SunPower Bankruptcy Enables 10x Revenue Raised $46M Working capital cut off by private equity

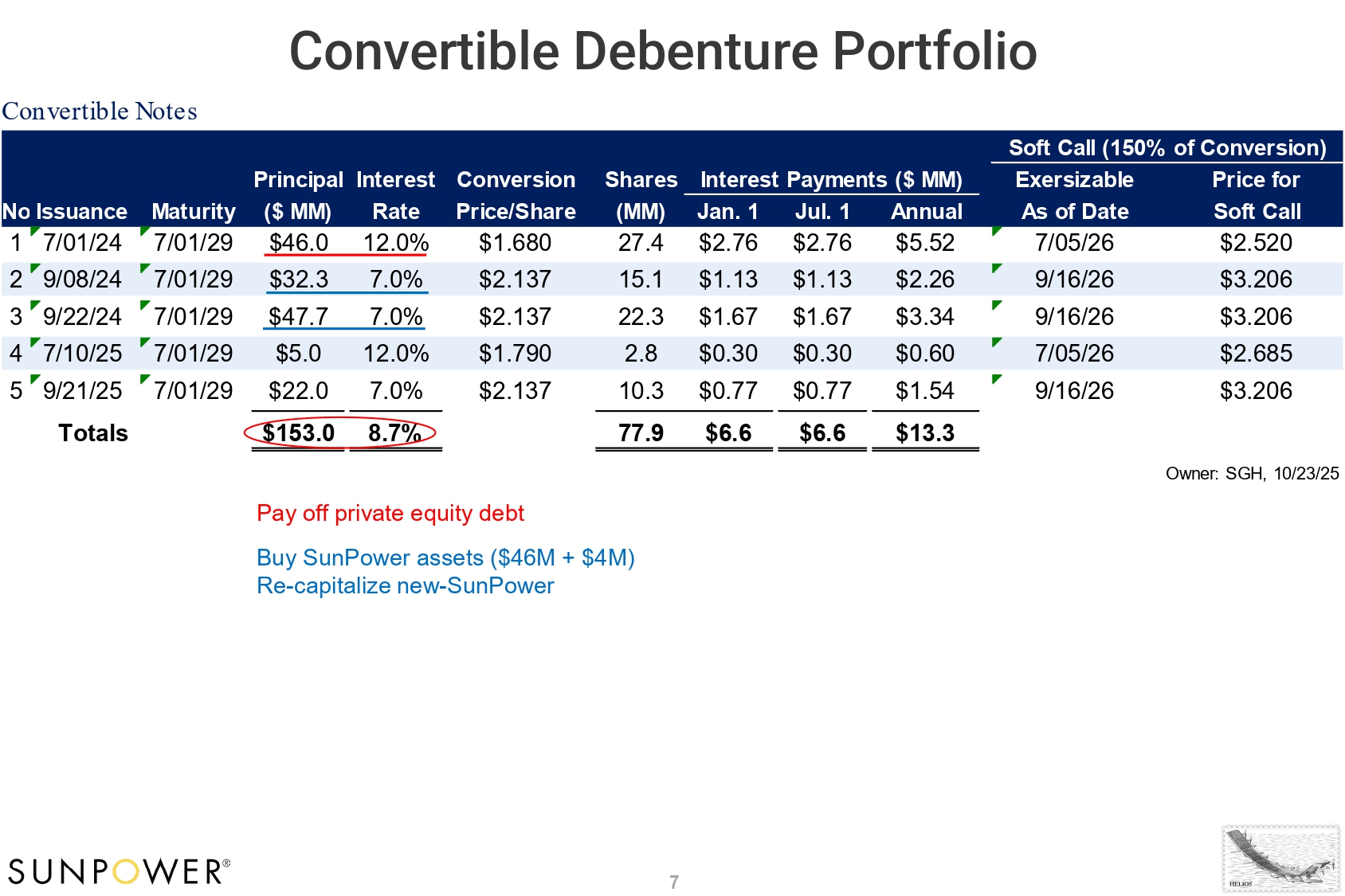

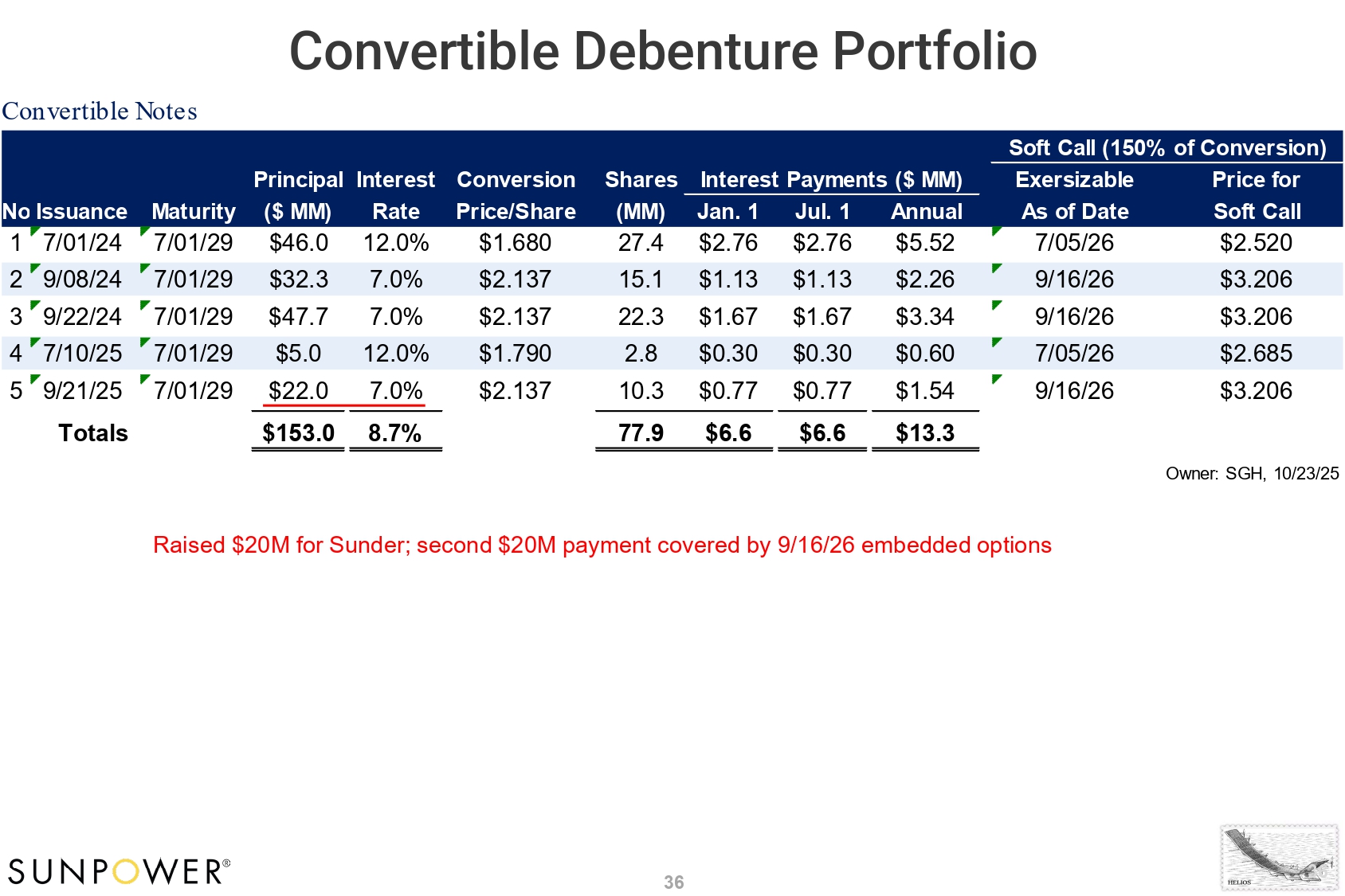

7 7 Convertible Debenture Portfolio Soft Call (150% of Conversion) Price for Exersizable Interest Payments ($ MM) Shares Conversion Principal Interest Soft Call As of Date Jan. 1 Jul. 1 Annual (MM) Price/Share ($ MM) Rate Maturity No Issuance $2.520 7/05/26 $5.52 $2.76 $2.76 27.4 $1.680 $46.0 12.0% 7/01/29 7/01/24 1 $3.206 9/16/26 $2.26 $1.13 $1.13 15.1 $2.137 $32.3 7.0% 7/01/29 9/08/24 2 $3.206 9/16/26 $3.34 $1.67 $1.67 22.3 $2.137 $47.7 7.0% 7/01/29 3 9/22/24 $2.685 7/05/26 $0.60 $0.30 $0.30 2.8 $1.790 12.0% $5.0 7/01/29 4 7/10/25 $3.206 9/16/26 $1.54 $0.77 $0.77 10.3 $2.137 7.0% $22.0 7/01/29 5 9/21/25 $13.3 $6.6 $6.6 77.9 8.7% $153.0 Totals Owner: SGH, 10/23/25 Convertible Notes Pay off private equity debt Buy SunPower assets ($46M + $4M) Re - capitalize new - SunPower

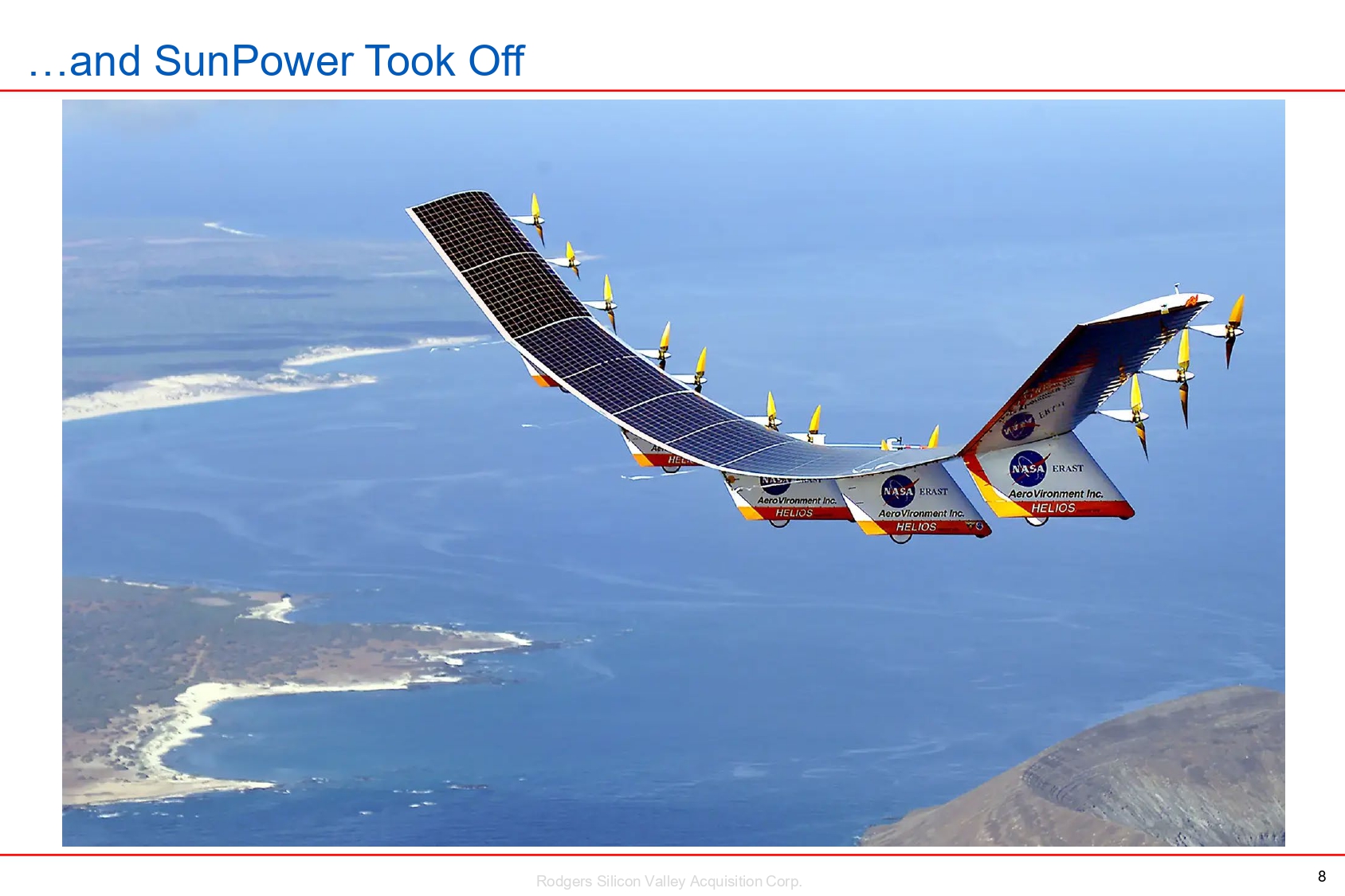

…and SunPower Took Off 8 Rodgers Silicon Valley Acquisition Corp.

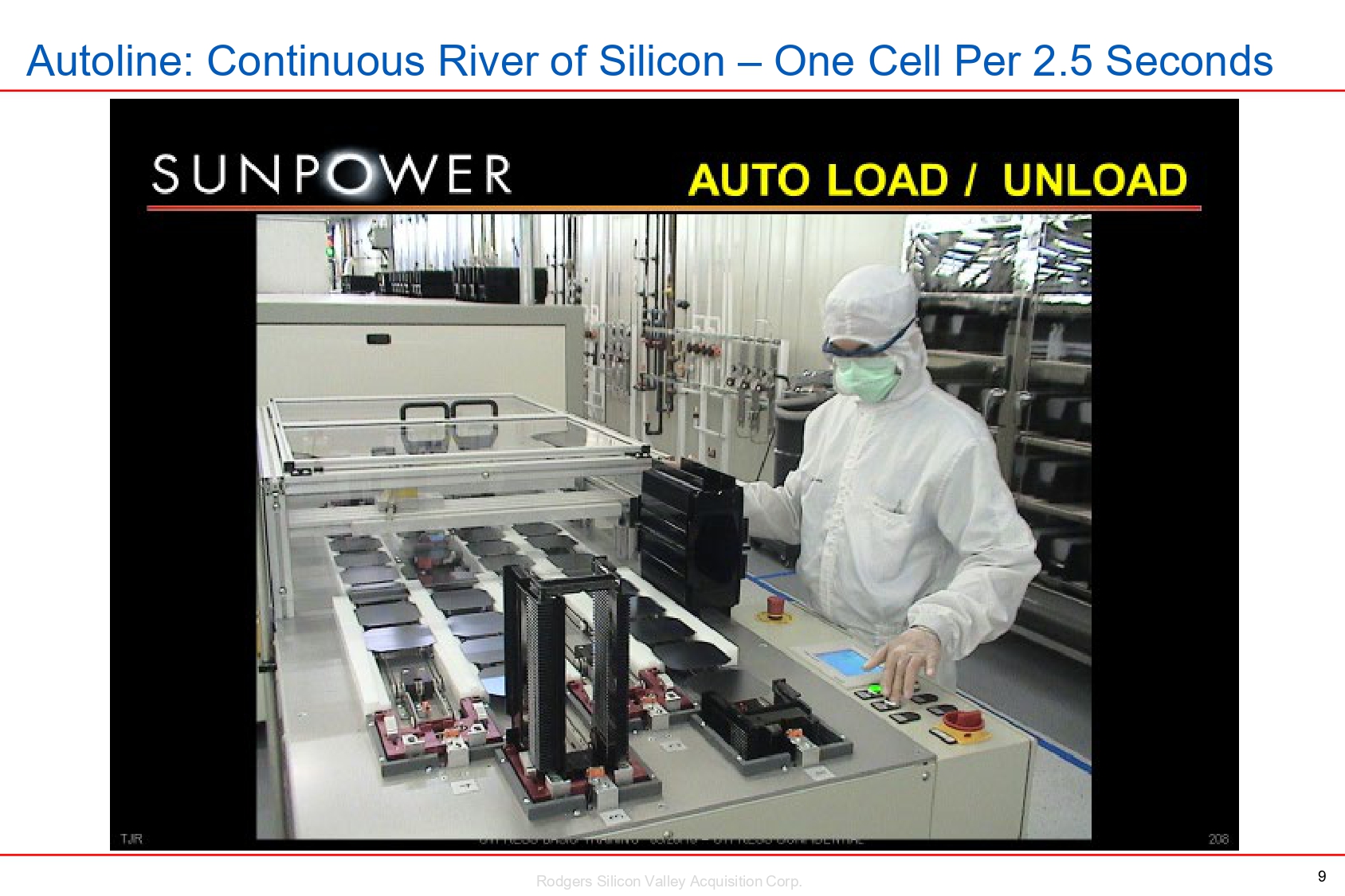

Autoline: Continuous River of Silicon – One Cell Per 2.5 Seconds 9 Rodgers Silicon Valley Acquisition Corp.

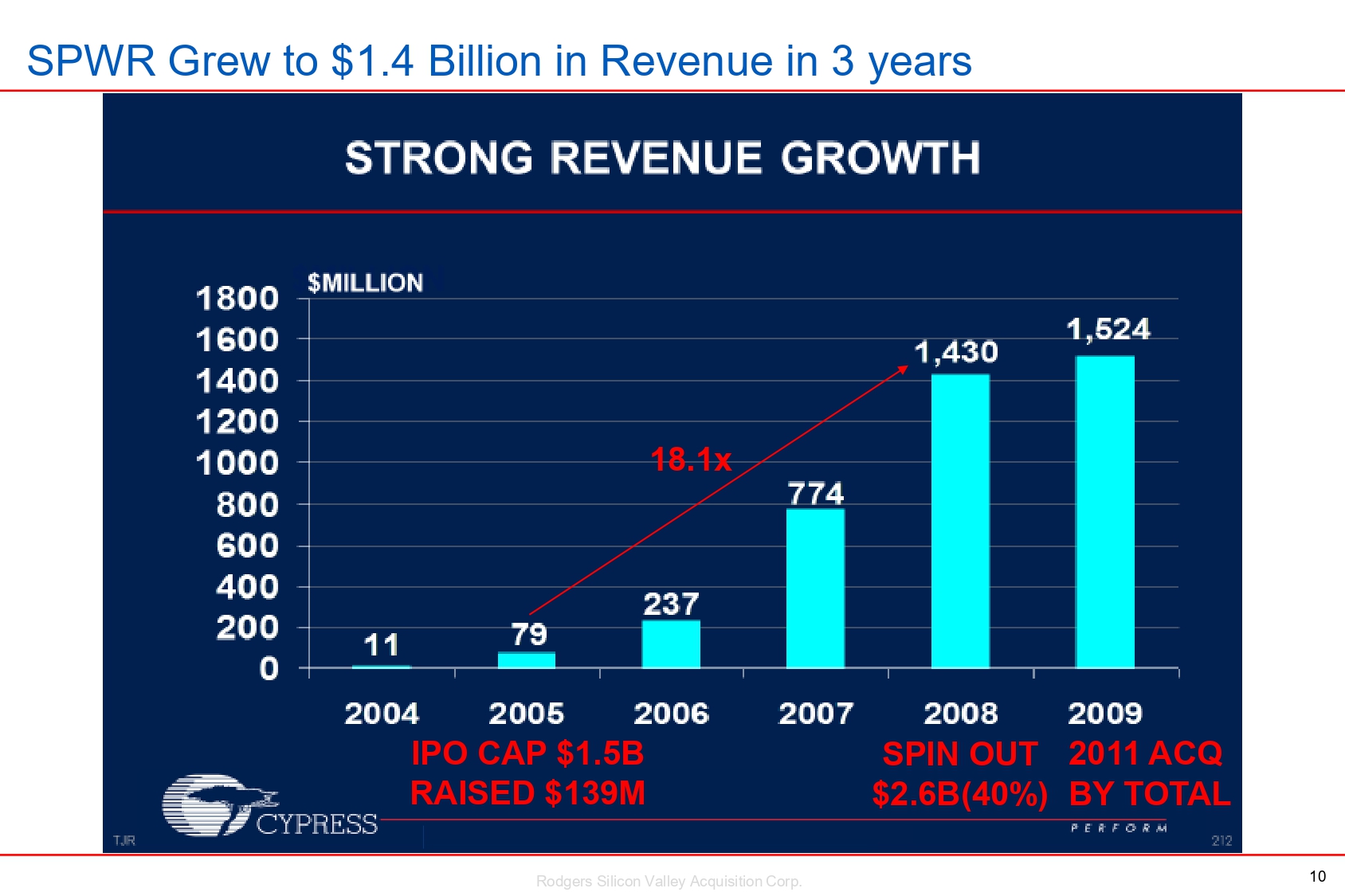

IPO CAP $1.5B RAISED $139M SPWR Grew to $1.4 Billion in Revenue in 3 years 18.1x 10 Rodgers Silicon Valley Acquisition Corp. SPIN OUT 2011 ACQ $2.6B(40%) BY TOTAL

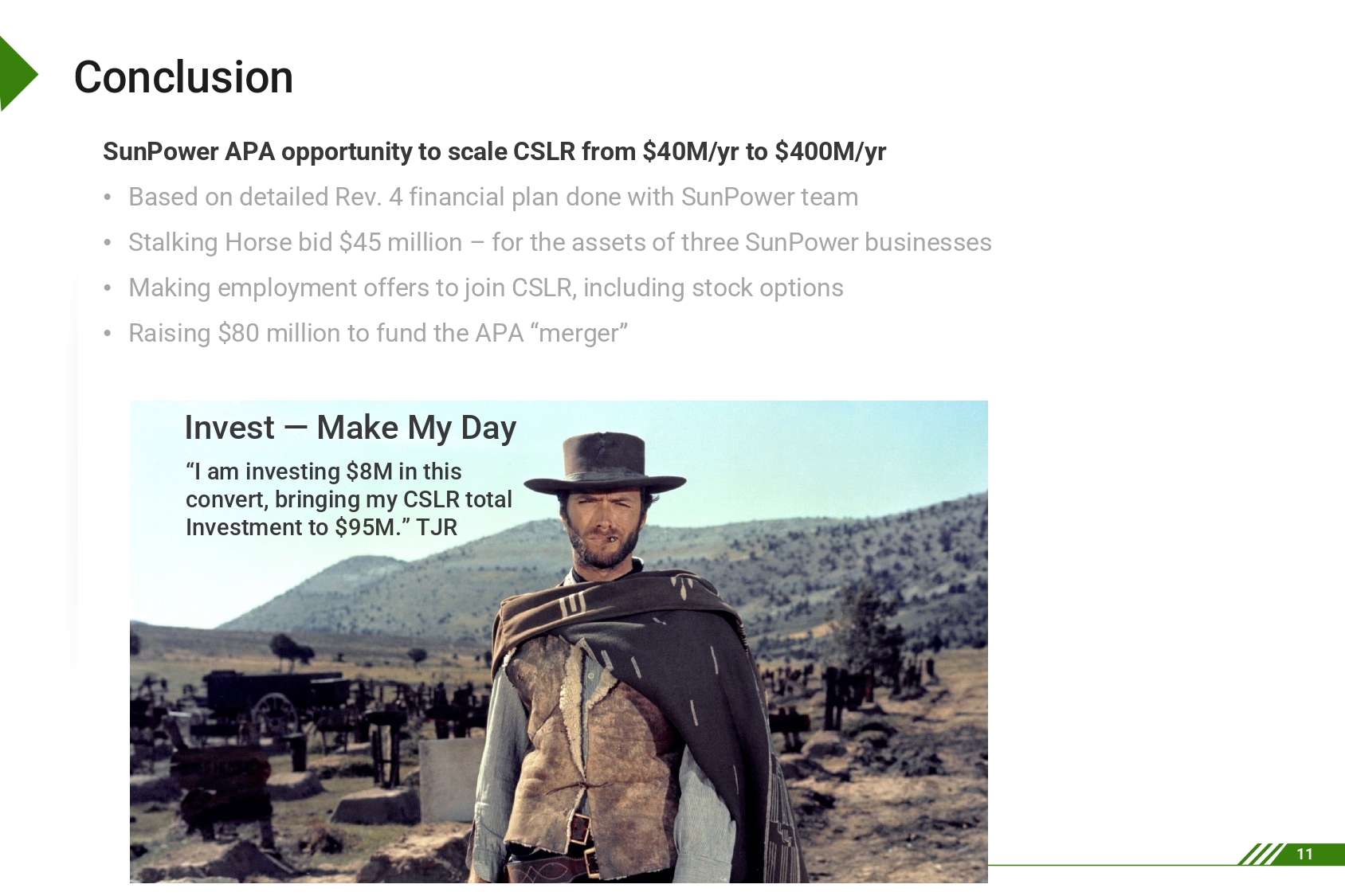

Conclusion 11 SunPower APA opportunity to scale CSLR from $40M/yr to $400M/yr • Based on detailed Rev. 4 financial plan done with SunPower team • Stalking Horse bid $45 million – for the assets of three SunPower businesses • Making employment offers to join CSLR, including stock options • Raising $80 million to fund the APA “merger” Invest — Make My Day “I am investing $8M in this convert, bringing my CSLR total Investment to $95M.” TJR

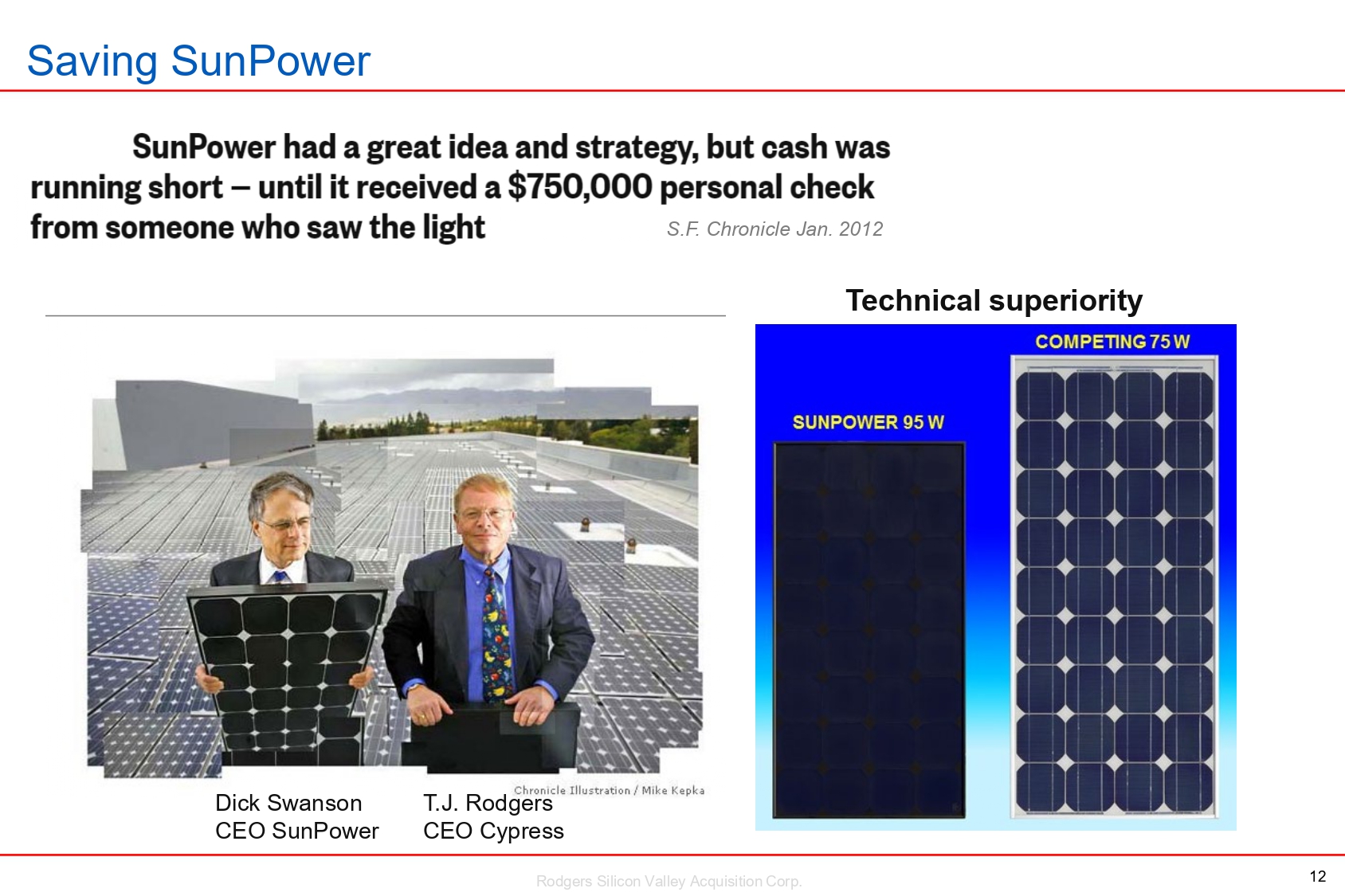

Saving SunPower Dick Swanson CEO SunPower T.J. Rodgers CEO Cypress S.F. Chronicle Jan. 2012 12 Rodgers Silicon Valley Acquisition Corp. Technical superiority

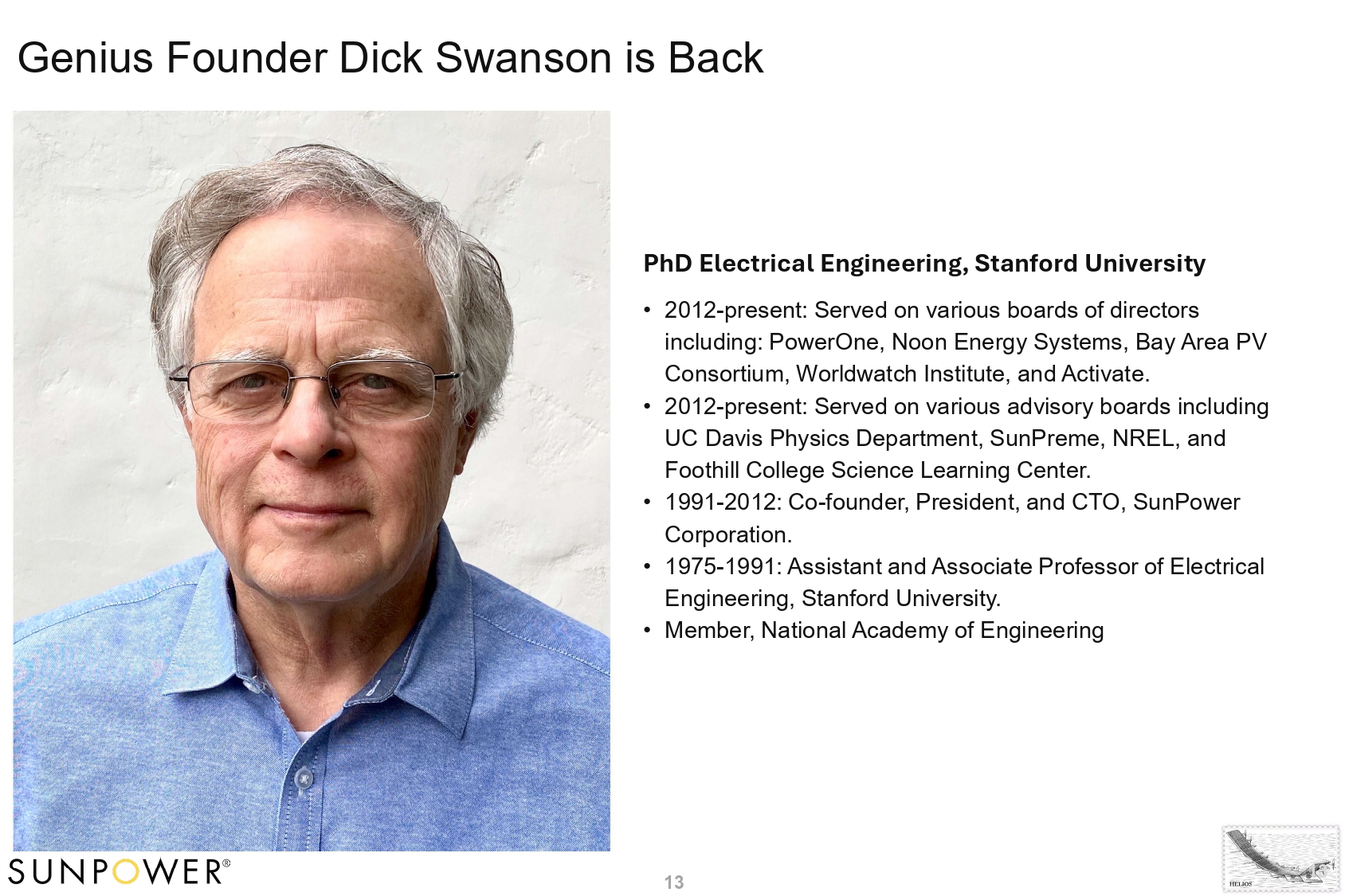

Genius Founder Dick Swanson is Back PhD Electrical Engineering, Stanford University • 2012 - present: Served on various boards of directors including: PowerOne, Noon Energy Systems, Bay Area PV Consortium, Worldwatch Institute, and Activate. • 2012 - present: Served on various advisory boards including UC Davis Physics Department, SunPreme, NREL, and Foothill College Science Learning Center. • 1991 - 2012: Co - founder, President, and CTO, SunPower Corporation. • 1975 - 1991: Assistant and Associate Professor of Electrical Engineering, Stanford University. • Member, National Academy of Engineering 13 13

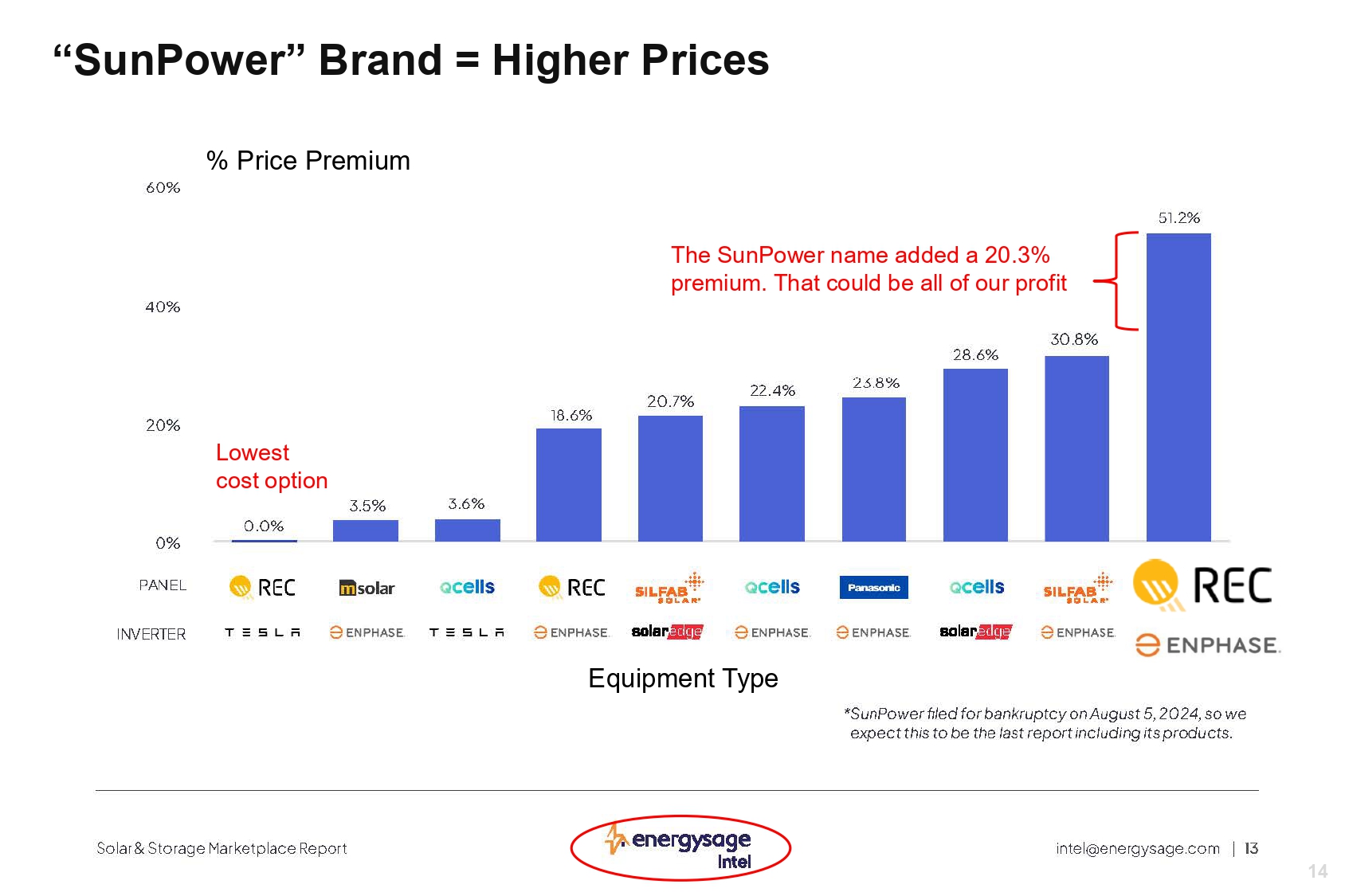

The SunPower name added a 20.3% premium. That could be all of our profit “SunPower” Brand = Higher Prices 14 Lowest cost option % Price Premium Equipment Type

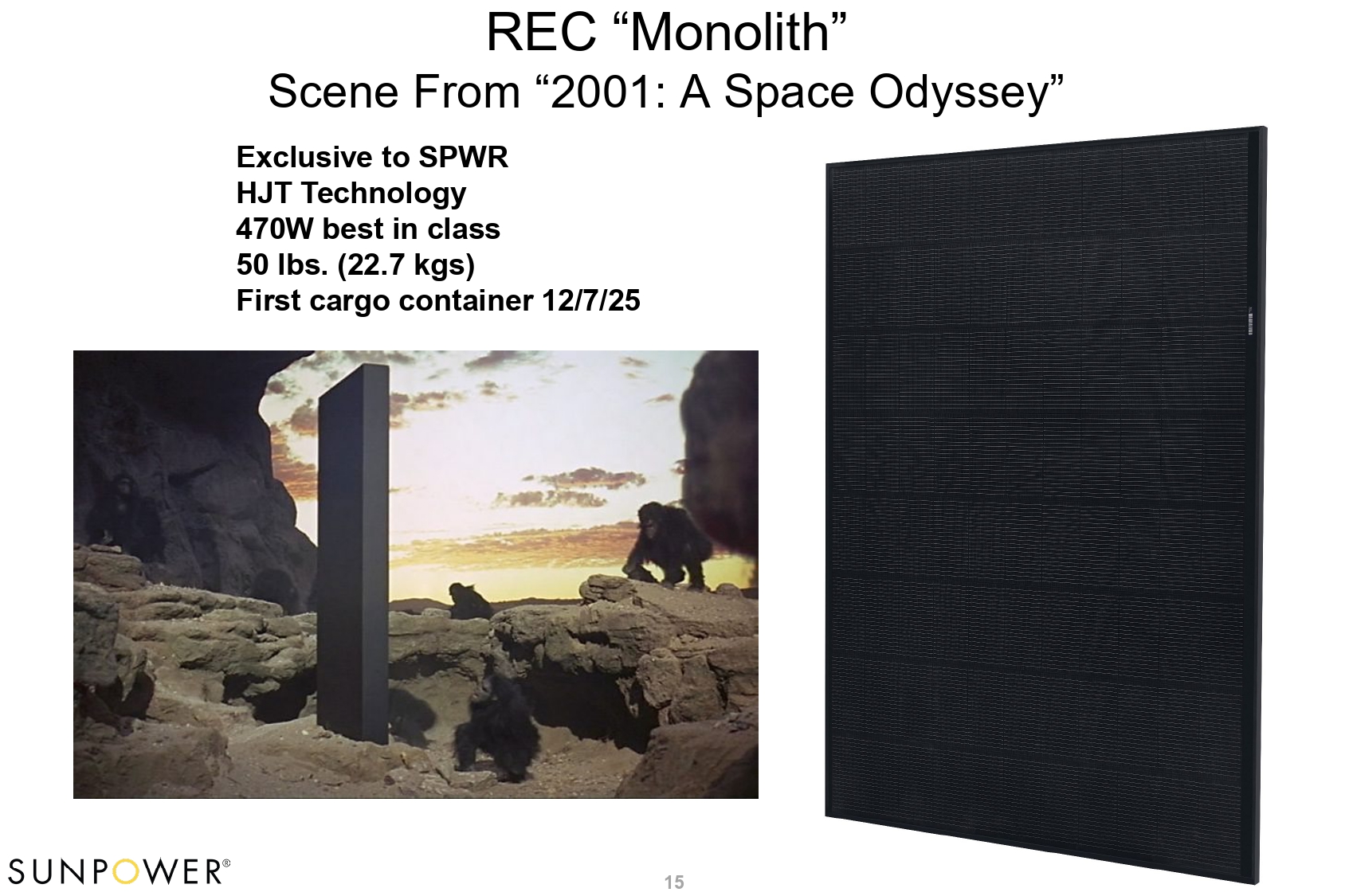

15 REC “Monolith” Scene From “2001: A Space Odyssey” Exclusive to SPWR HJT Technology 470W best in class 50 lbs. (22.7 kgs) First cargo container 12/7/25

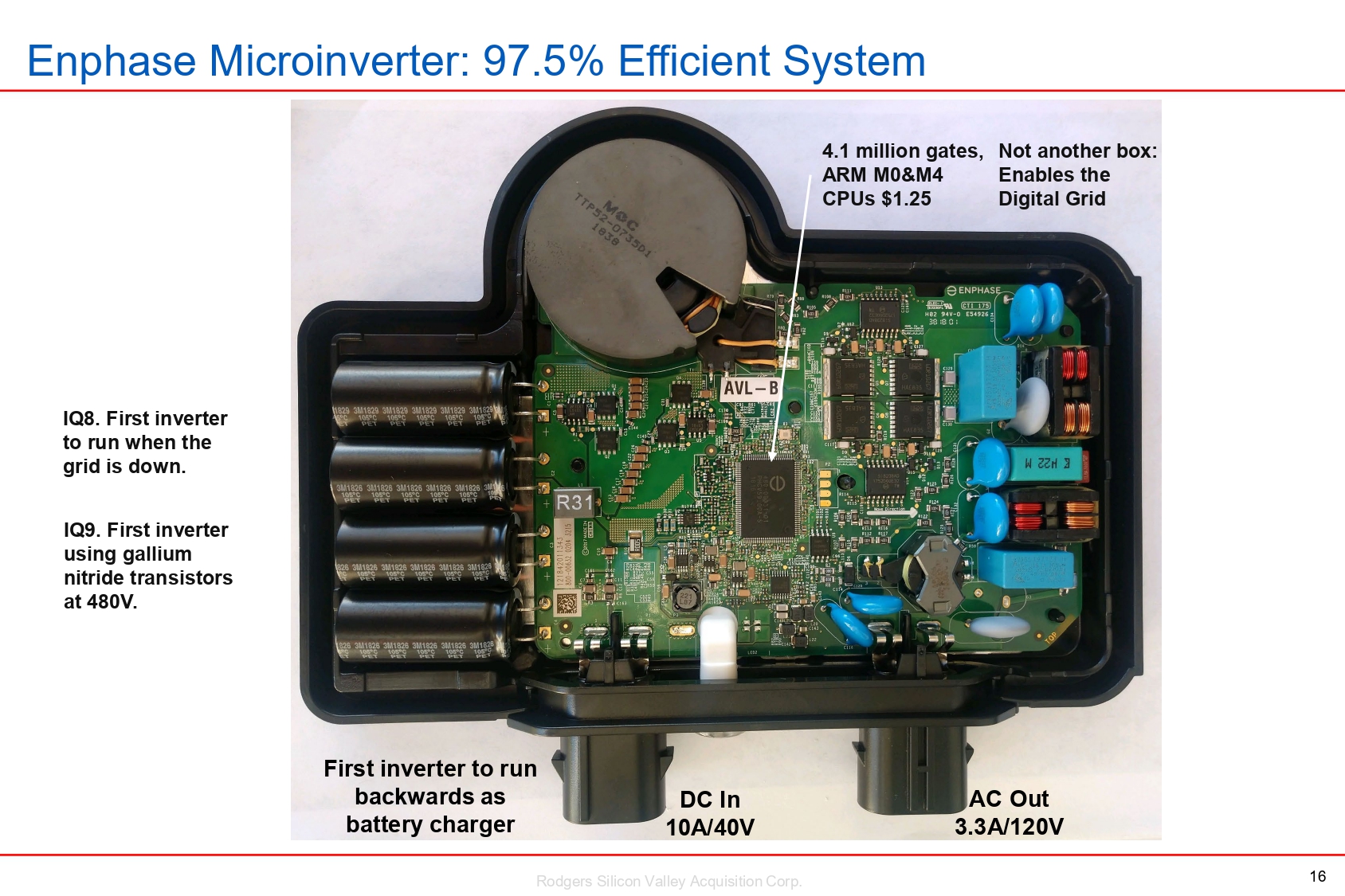

16 Rodgers Silicon Valley Acquisition Corp. Enphase Microinverter: 97.5% Efficient System Not another box: Enables the Digital Grid 4.1 million gates, ARM M0&M4 CPUs $1.25 AC Out 3.3A/120V DC In 10A/40V IQ8. First inverter to run when the grid is down. IQ9. First inverter using gallium nitride transistors at 480V. First inverter to run backwards as battery charger

17 Quality & Customer Success Surinder Bedi, 7 - 25 - 2025

Surinder Bedi EVP, Quality, Operational Excellence & Customer Success 18 18 MS Industrial Engineering, Ohio University o Award Product Innovation Excellence for Bifacial Solar Panels, Frost & Sullivan, US. 2018 o Award: Intel Quality Leadership, Intel Corporation o Award: Applied Materials President Gold Leadership o Award: Applied Materials President Annual Quality Leadership o Award The Philippine State Quality for Exemplary Performance. SunPower Corp. o 12 US Patents , Semiconductor Tech .

19

Don’t worry Mr. Jones, I have 85% first pass yield. 20

21

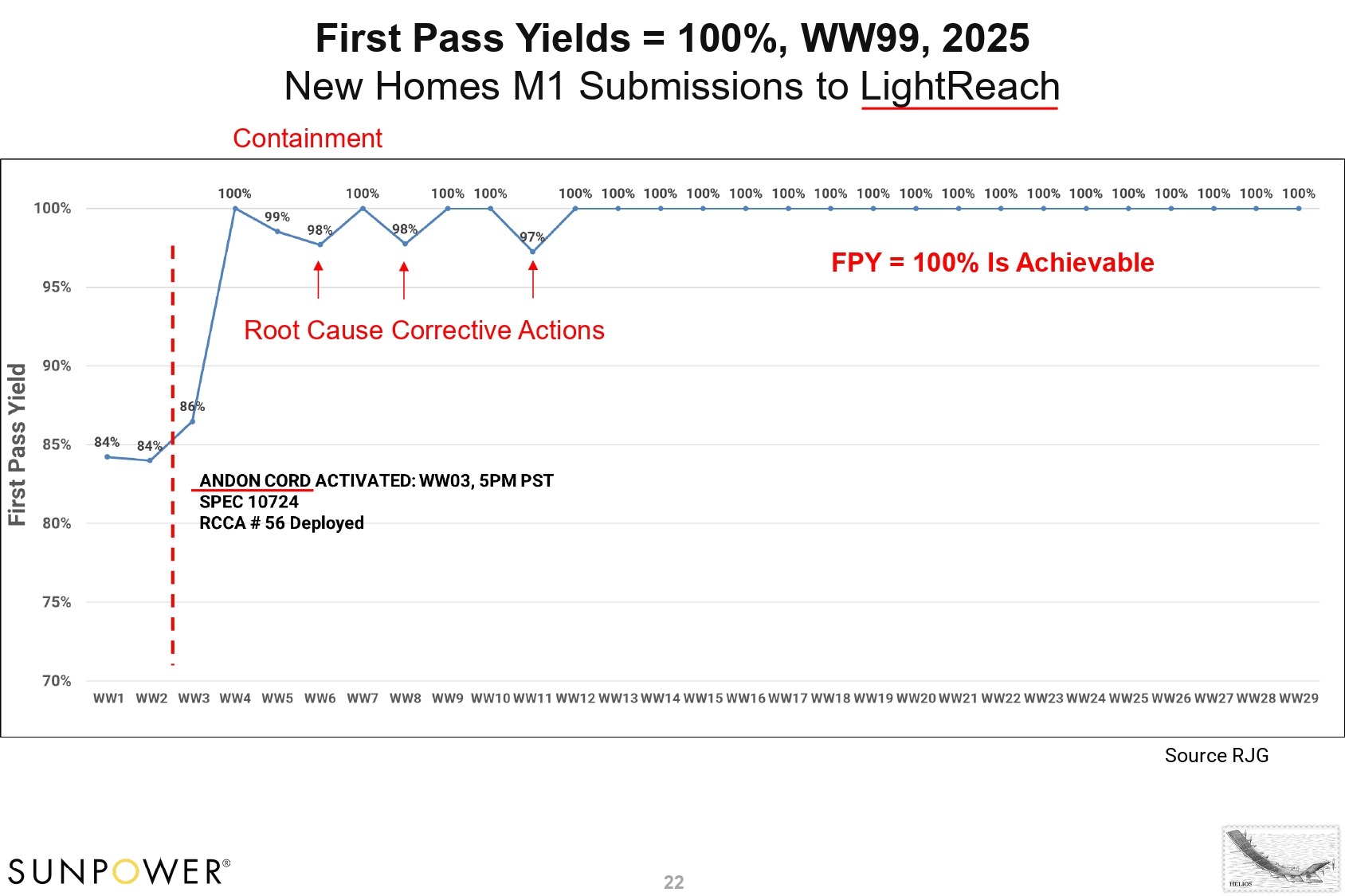

First Pass Yields = 100%, WW99, 2025 New Homes M1 Submissions to LightReach Source RJG FPY = 100% Is Achievable Containment 22 Root Cause Corrective Actions

23 Third Quarter Report October 21, 2025, Live @ 1:00PM ET

Helios at 80,000 Feet, Pressure 14.7psi 0.4 psi 24

Solar - Powered Spaceman 25

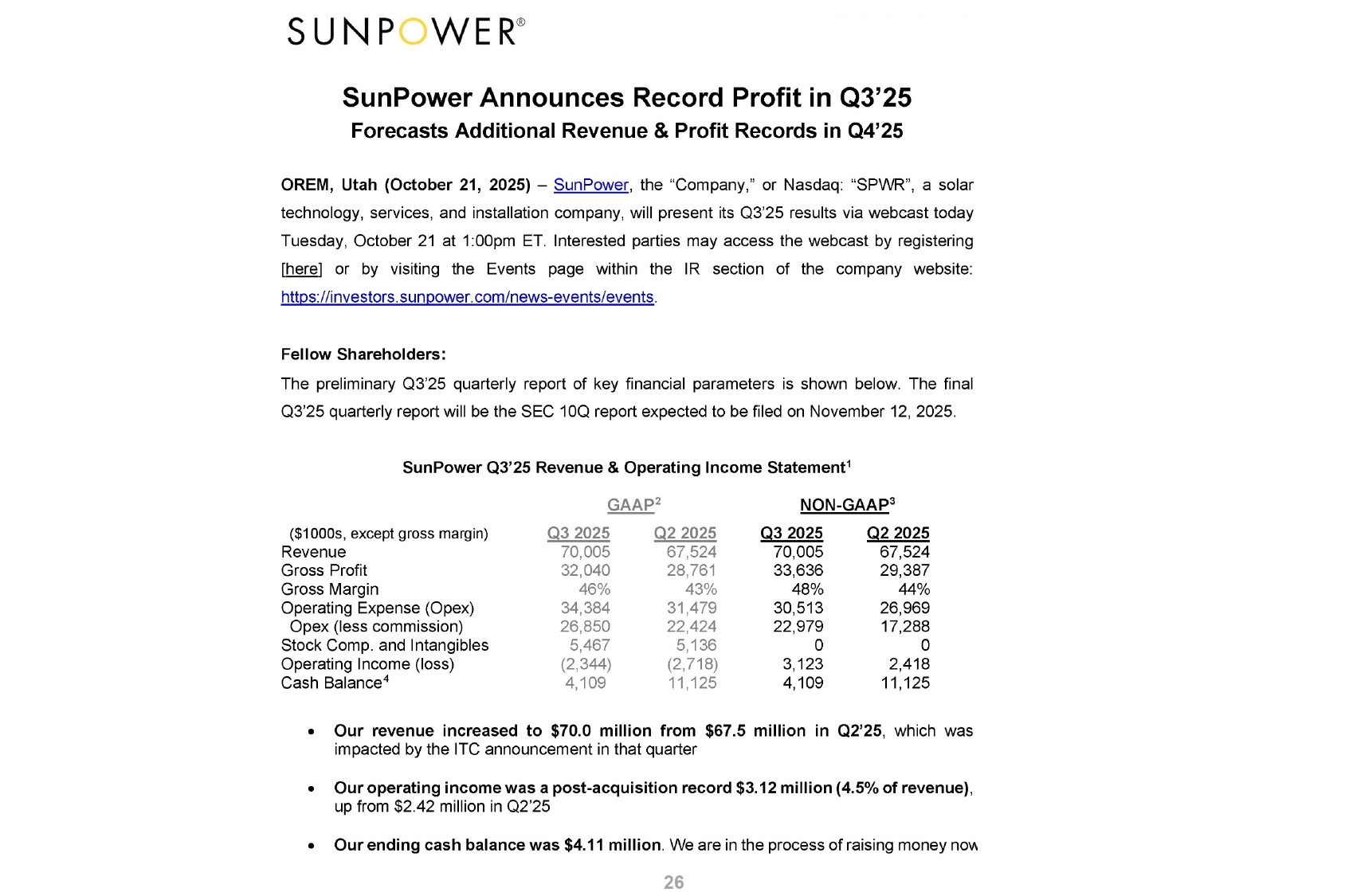

26

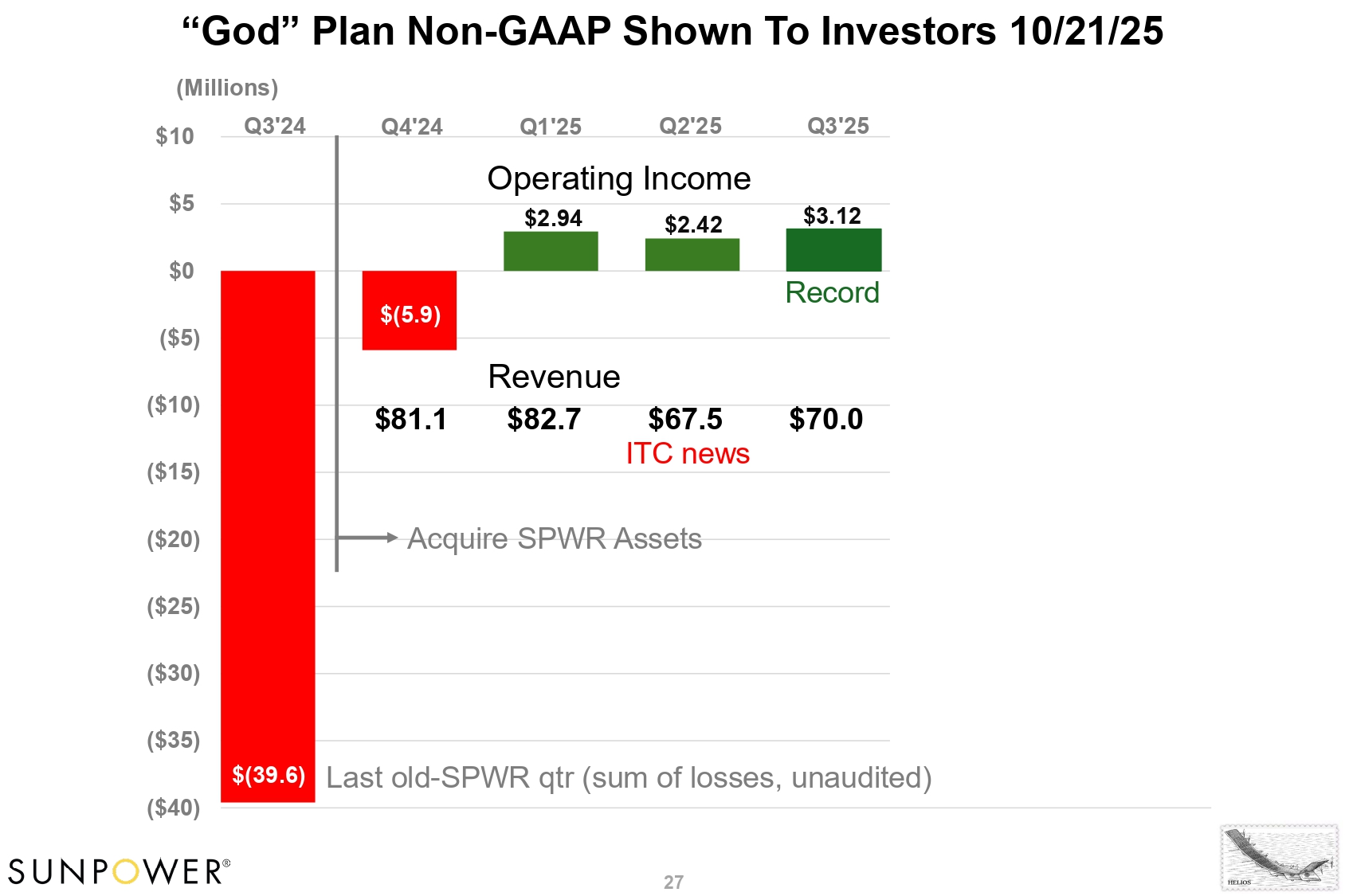

$(39.6) $(5.9) $2.94 $2.42 $3.12 ($40) ($25) ($30) ($35) ($20) ($15) ($10) ($5) $0 $5 $10 Q3'24 Q4'24 Q3'25 (Millions) $81.1 $70.0 $67.5 ITC news Record Revenue $82.7 Acquire SPWR Assets Last old - SPWR qtr (sum of losses, unaudited) “God” Plan Non - GAAP Shown To Investors 10/21/25 Q1'25 Q2'25 Operating Income Q4'25E Q1'26E $3.56 $2.00 Record Minimum $88.0 $83.3 Record Acquire Sunder Acquire Ambia ? 27

28

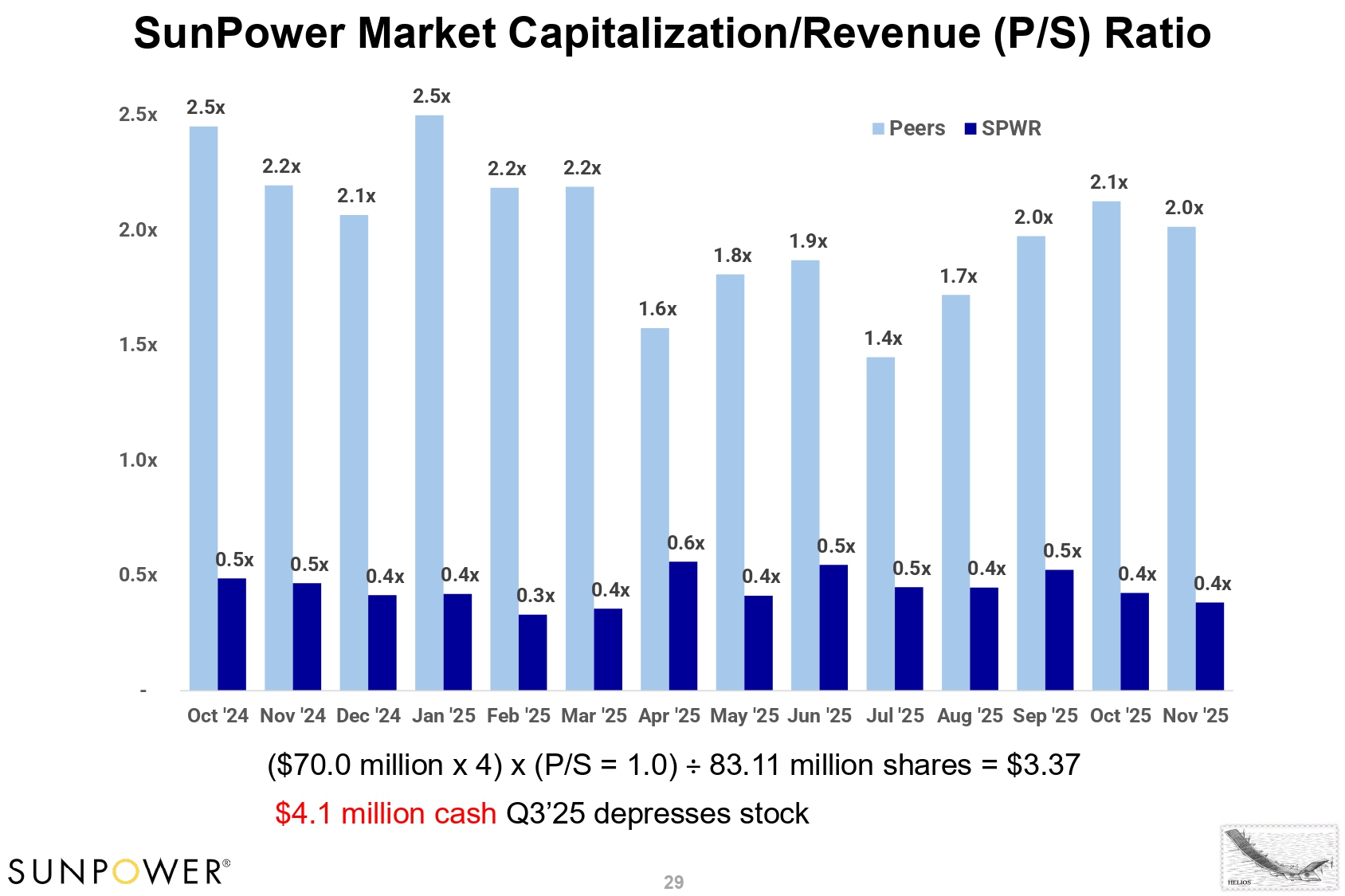

SunPower Market Capitalization/Revenue (P/S) Ratio 2.5x 2.2x 2.1x 2.5x 2.2x 2.2x 1.6x 1.8x 1.9x 1.4x 1.7x 2.0x 2.1x 2.0x 0.5x 0.5x 0.4x 0.4x 0.3x 0.4x 0.6x 0.4x 0.5x 0.5x 0.4x 0.5x 0.4x 0.4x - 0.5x 1.0x 1.5x 2.0x 2.5x Peers SPWR 29 Oct '24 Nov '24 Dec '24 Jan '25 Feb '25 Mar '25 Apr '25 May '25 Jun '25 Jul '25 Aug '25 Sep '25 Oct '25 Nov '25 ($70.0 million x 4) x (P/S = 1.0) р 83.11 million shares = $3.37 $4.1 million cash Q3’25 depresses stock

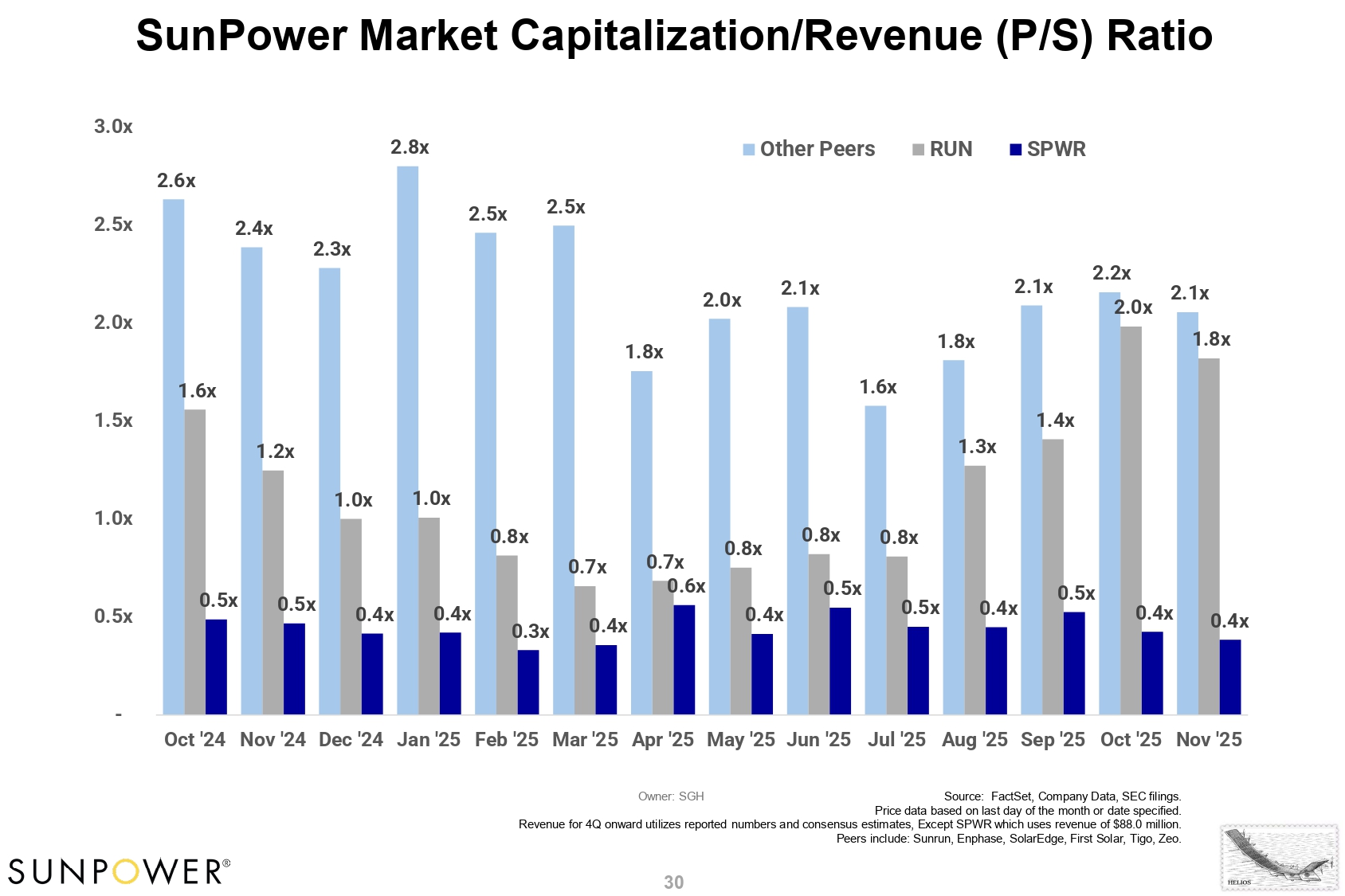

2.6x 2.4x 2.3x 2.8x 2.5x 2.5x 1.8x 2.0x 2.1x 1.6x 1.8x 2.1x 2.2x 2.1x 1.6x 1.2x 1.0x 1.0x 0.8x 0.7x 0.7x 0.8x 0.8x 0.8x 1.3x 1.4x 2.0x 1.8x 0.5x 0.5x 0.4x 0.4x 0.3x 0.4x 0.6x 0.4x 0.5x 0.5x 0.4x 0.5x 0.4x 0.4x - Oct '24 Nov '24 Dec '24 Jan '25 Feb '25 Mar '25 Apr '25 May '25 Jun '25 Jul '25 Aug '25 Sep '25 Oct '25 Nov '25 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x Other Peers RUN SPWR 30 Owner: SGH Source: FactSet, Company Data, SEC filings. Price data based on last day of the month or date specified. Revenue for 4Q onward utilizes reported numbers and consensus estimates, Except SPWR which uses revenue of $88.0 million. Peers include: Sunrun, Enphase, SolarEdge, First Solar, Tigo, Zeo. SunPower Market Capitalization/Revenue (P/S) Ratio

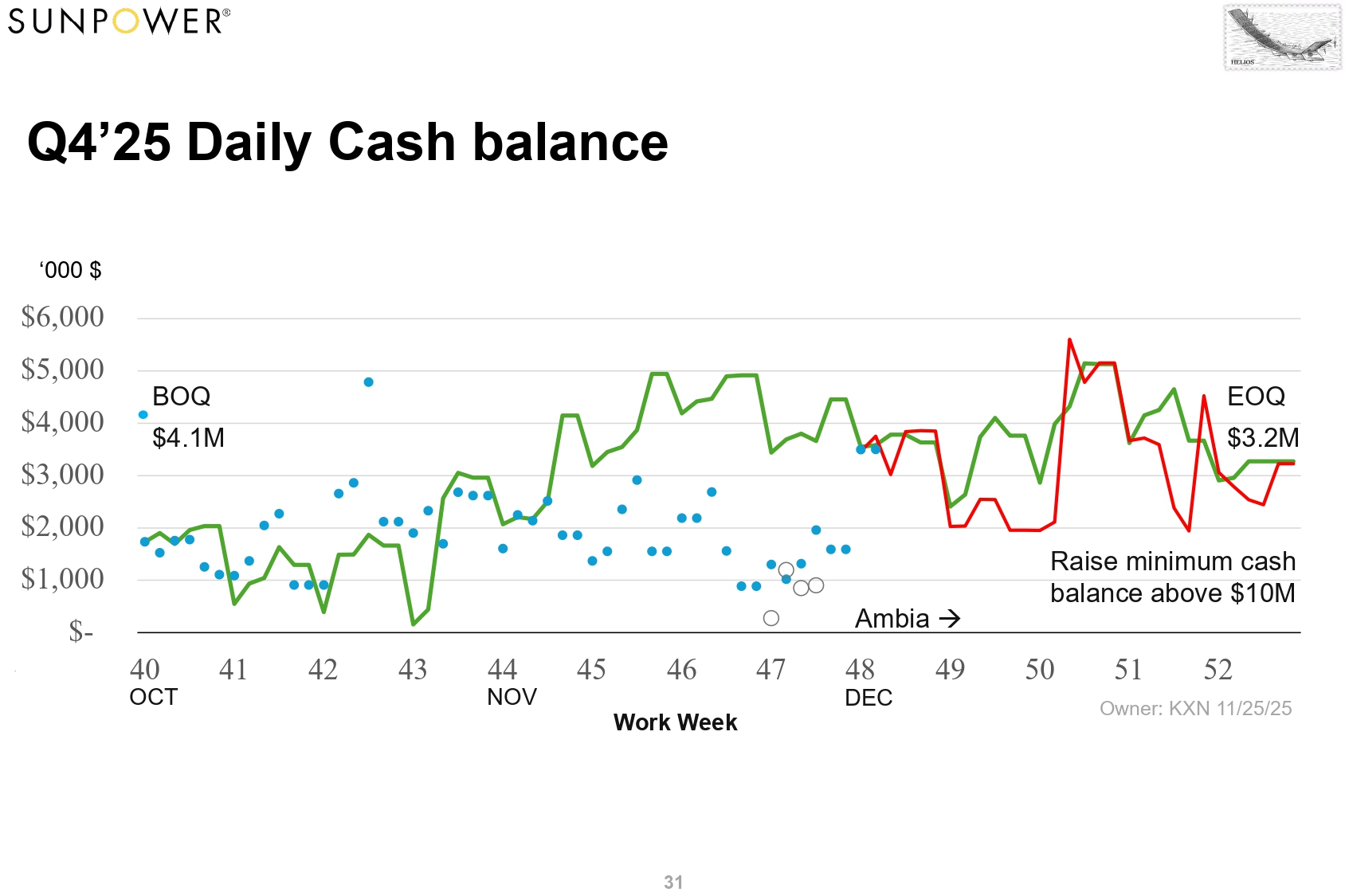

$(1,000) $(2,000) $(3,000) ‘000 $ $6,000 $5,000 $4,000 $3,000 $2,000 $1,000 $ - Q4’25 Daily Cash balance BOQ $4.1M EOQ $3.2M Ambia Work Week NOV DEC Raise minimum cash balance above $10M 40 41 42 43 44 45 46 47 48 49 50 51 52 OCT Owner: KXN 11/25/25 31

32 Convertible Debenture Offering To Acquire Sunder Energy T.J. Rodgers, CEO September 15, 2025

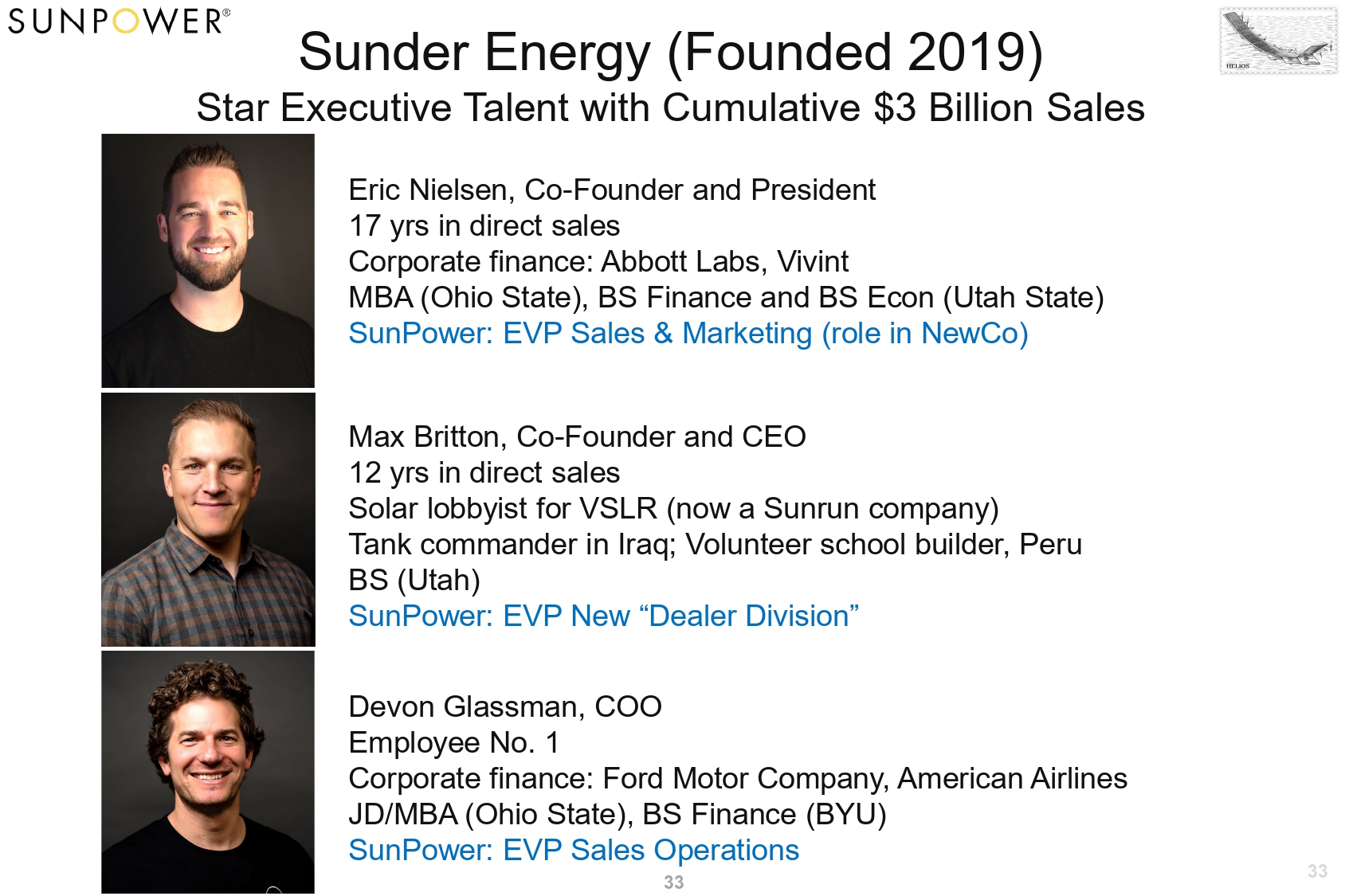

Sunder Energy (Founded 2019) Star Executive Talent with Cumulative $3 Billion Sales Eric Nielsen, Co - Founder and President 17 yrs in direct sales Corporate finance: Abbott Labs, Vivint MBA (Ohio State), BS Finance and BS Econ (Utah State) SunPower: EVP Sales & Marketing (role in NewCo) Max Britton, Co - Founder and CEO 12 yrs in direct sales Solar lobbyist for VSLR (now a Sunrun company) Tank commander in Iraq; Volunteer school builder, Peru BS (Utah) SunPower: EVP New “Dealer Division” Devon Glassman, COO Employee No. 1 Corporate finance: Ford Motor Company, American Airlines JD/MBA (Ohio State), BS Finance (BYU) SunPower: EVP Sales Operations 33 33

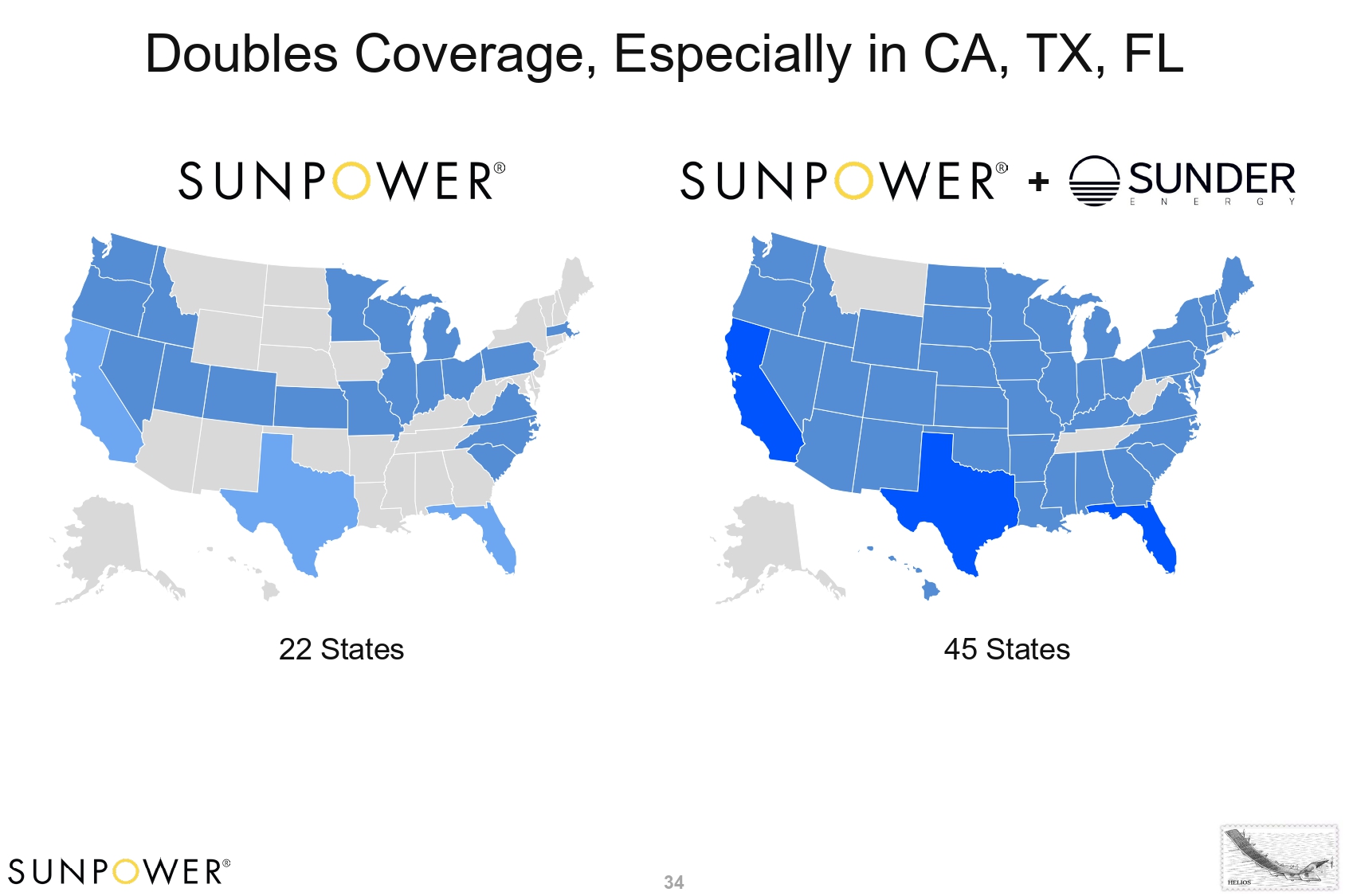

+ 34 34 22 States 45 States Doubles Coverage, Especially in CA, TX, FL

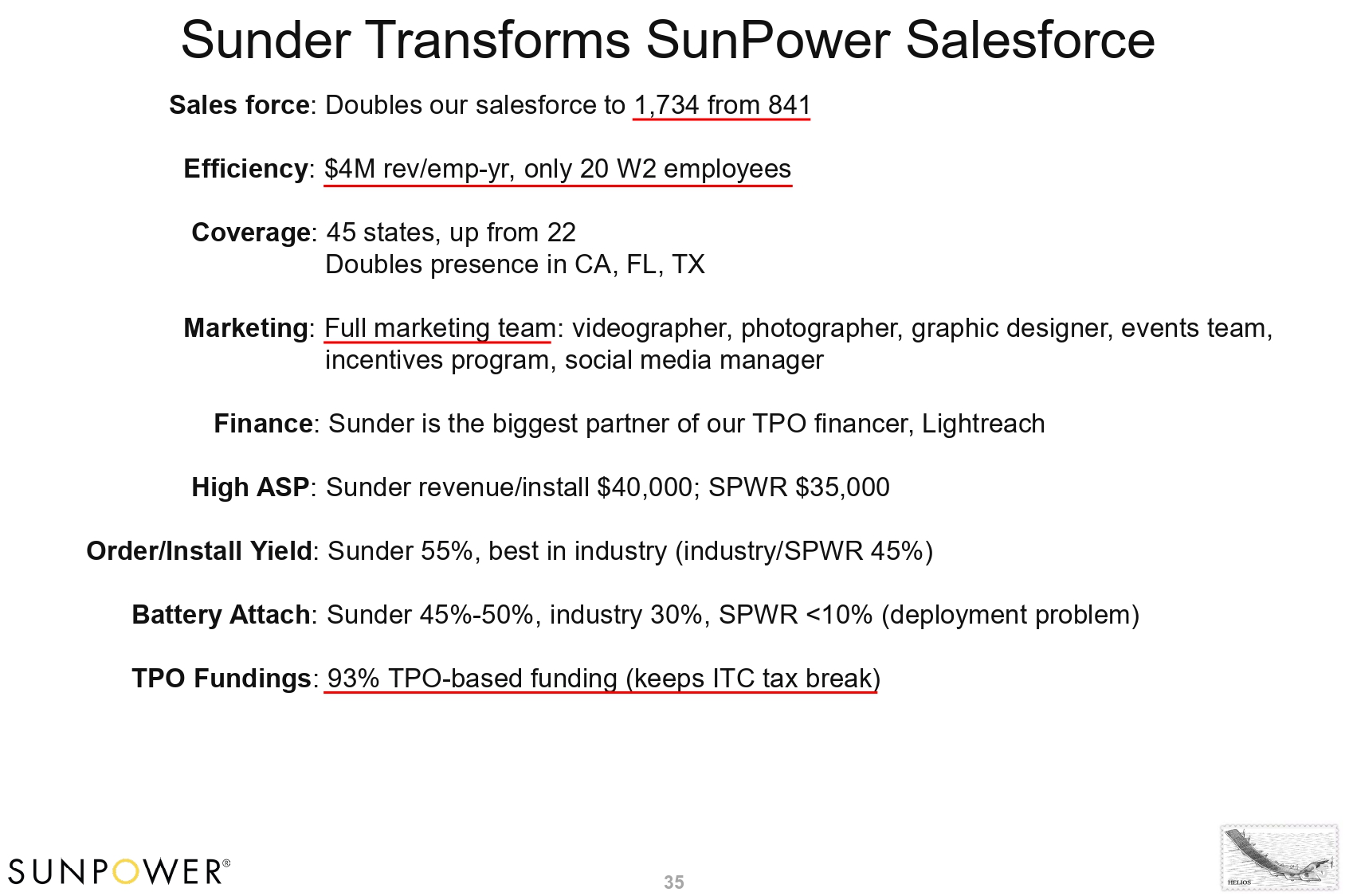

Sunder Transforms SunPower Salesforce Sales force : Doubles our salesforce to 1,734 from 841 Efficiency : $4M rev/emp - yr, only 20 W2 employees Coverage : 45 states, up from 22 Doubles presence in CA, FL, TX Marketing : Full marketing team : videographer, photographer, graphic designer, events team, incentives program, social media manager Finance : Sunder is the biggest partner of our TPO financer, Lightreach High ASP : Sunder revenue/install $40,000; SPWR $35,000 Order/Install Yield : Sunder 55%, best in industry (industry/SPWR 45%) Battery Attach : Sunder 45% - 50%, industry 30%, SPWR <10% (deployment problem) TPO Fundings : 93% TPO - based funding (keeps ITC tax break) 35 35

Convertible Debenture Portfolio Convertible Notes Maturity Conversion Price/Share Shares (MM) Exersizable As of Date Price for Soft Call 7/01/29 $1.680 7/05/26 $2.520 7/01/29 $2.137 9/16/26 $3.206 No Issuance 1 7/01/24 2 9/08/24 3 9/22/24 7/01/29 $2.137 9/16/26 $3.206 4 7/10/25 7/01/29 $1.790 7/05/26 $2.685 7/01/29 $2.137 9/16/26 $3.206 5 9/21/25 Totals Principal Interest ($ MM) Rate $46.0 12.0% $32.3 7.0% $47.7 7.0% $5.0 12.0% $22.0 7.0% $153.0 8.7% Owner: SGH, 10/23/25 Soft Call (150% of Conversion) Interest Payments ($ MM) Jan. 1 Jul. 1 Annual 27.4 $2.76 $2.76 $5.52 15.1 $1.13 $1.13 $2.26 22.3 $1.67 $1.67 $3.34 2.8 $0.30 $0.30 $0.60 10.3 $0.77 $0.77 $1.54 77.9 $6.6 $6.6 $13.3 Raised $20M for Sunder; second $20M payment covered by 9/16/26 embedded options 36 36

Evan Dwyer, SVP Direct Sales SPWR Sales Force Now Works For Ex - Sunder CEO 37

38

39

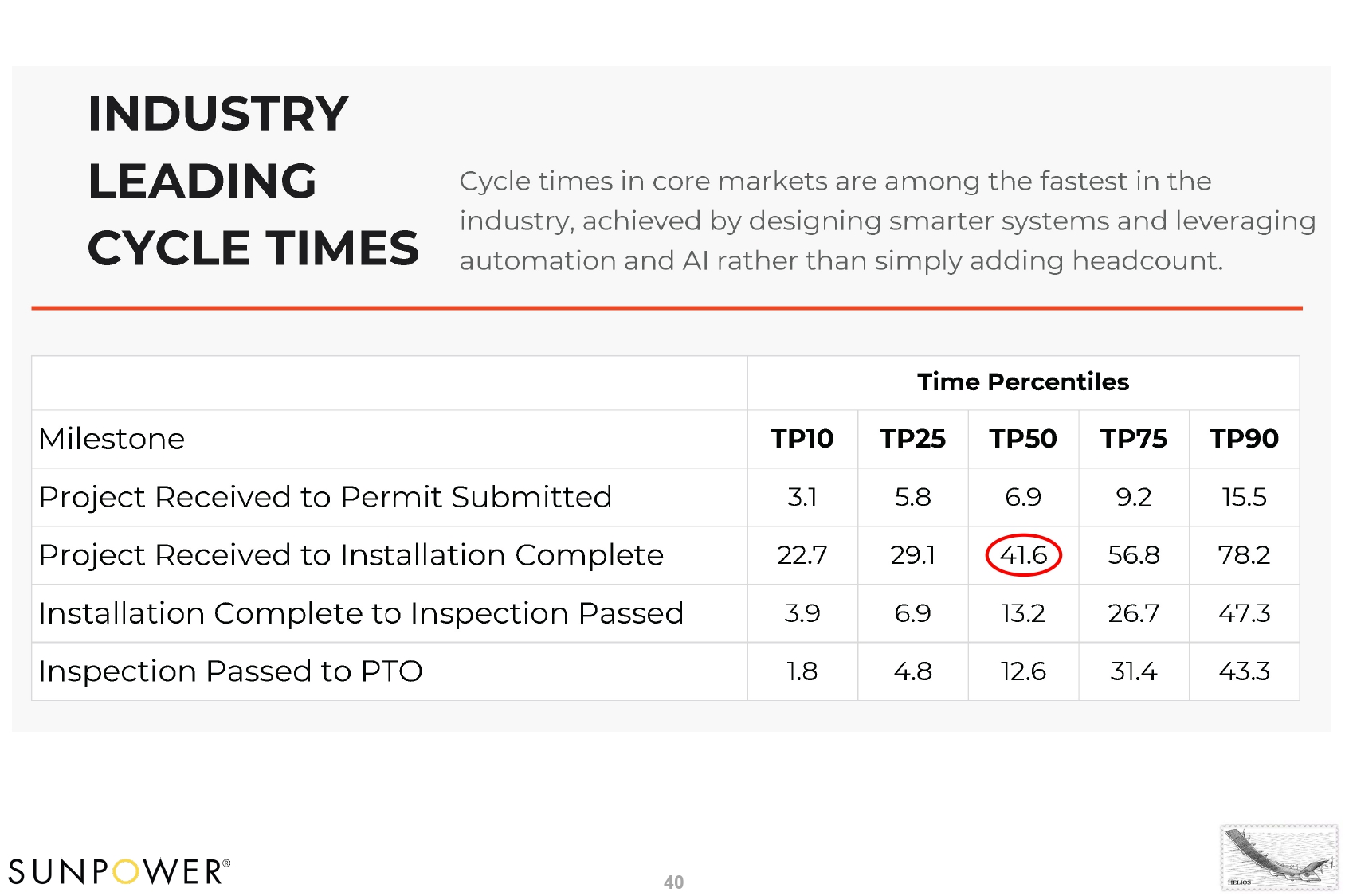

40

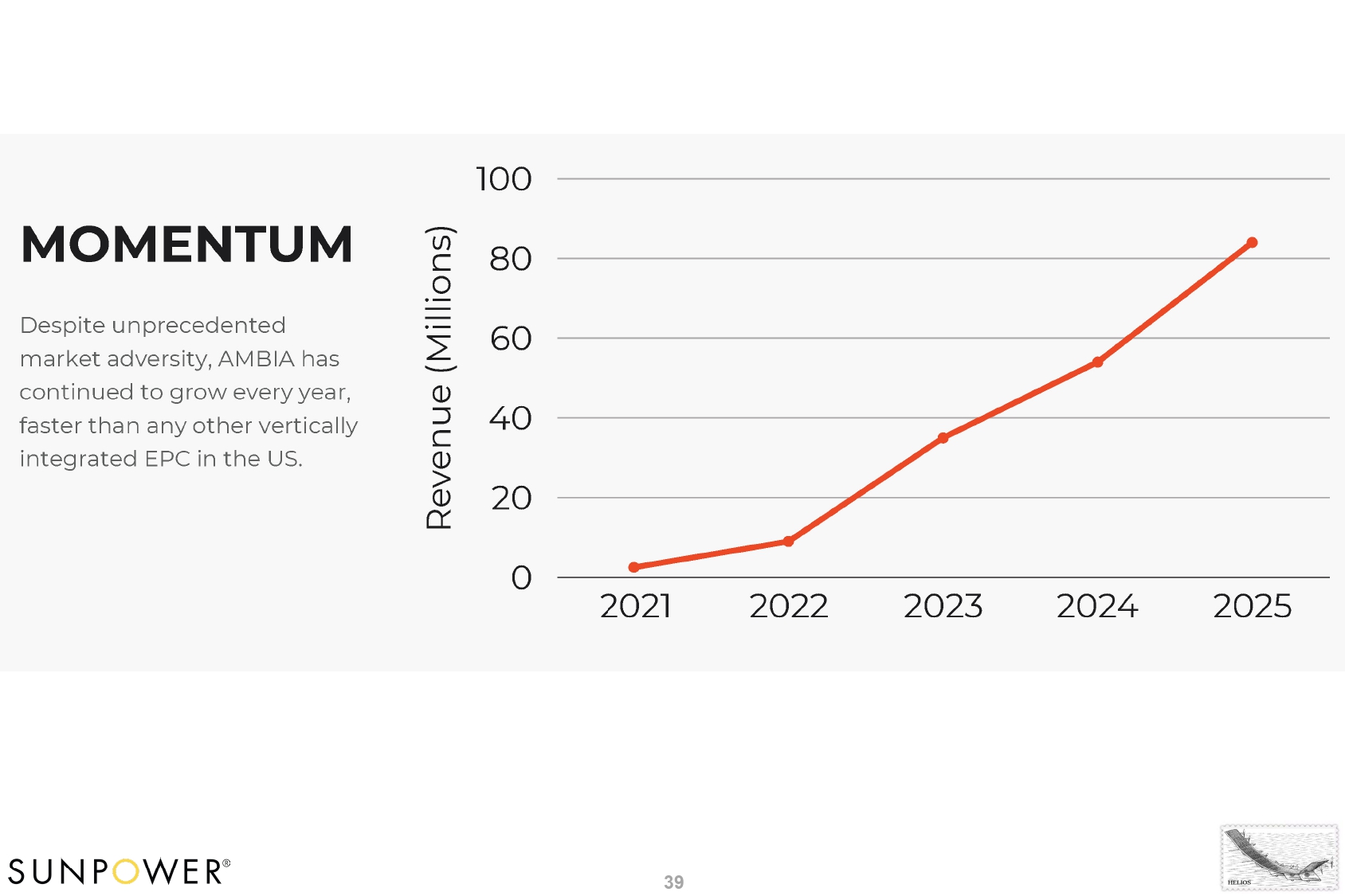

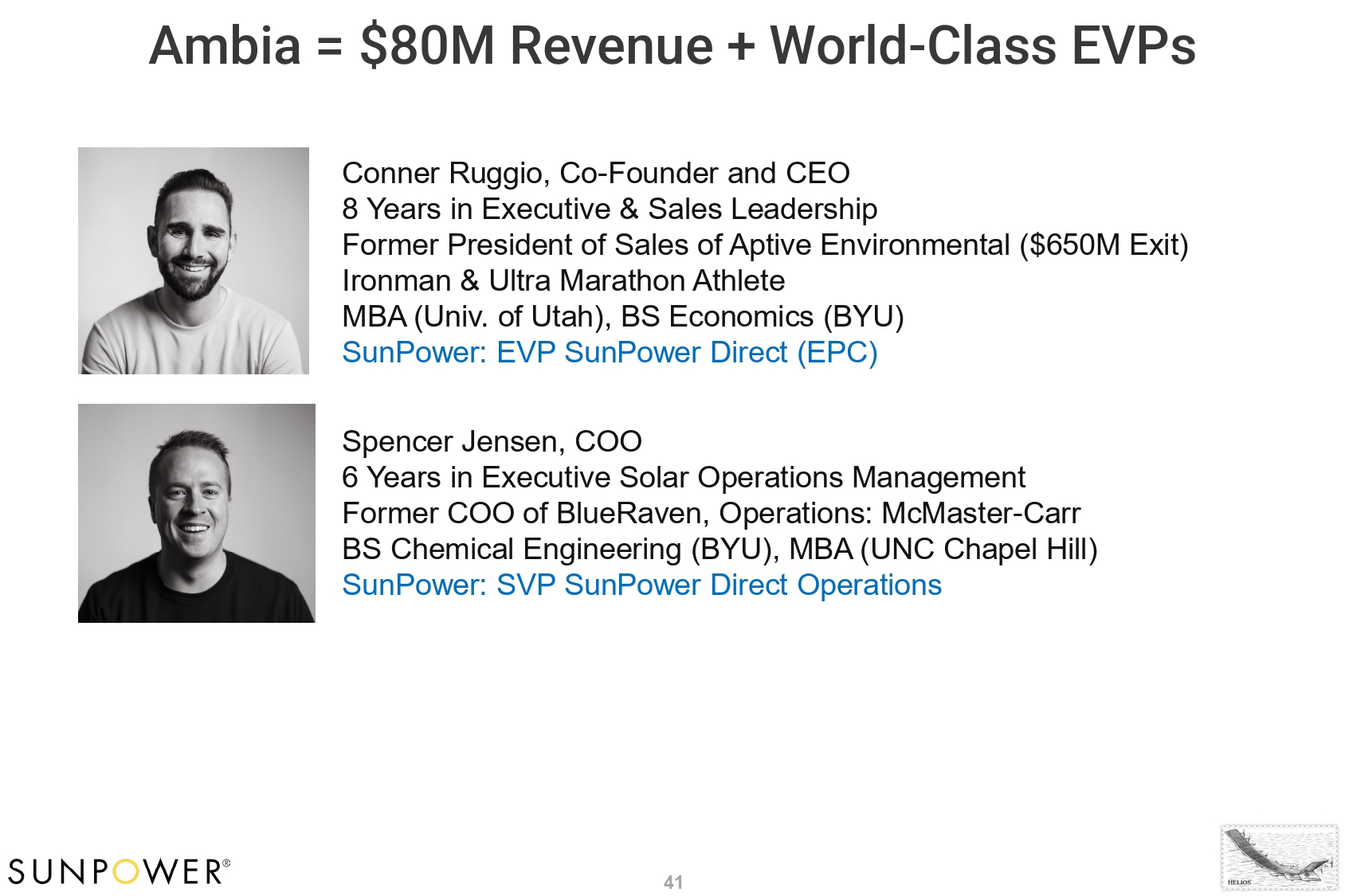

Ambia = $80M Revenue + World - Class EVPs Conner Ruggio, Co - Founder and CEO 8 Years in Executive & Sales Leadership Former President of Sales of Aptive Environmental ($650M Exit) Ironman & Ultra Marathon Athlete MBA (Univ. of Utah), BS Economics (BYU) SunPower: EVP SunPower Direct (EPC) Spencer Jensen, COO 6 Years in Executive Solar Operations Management Former COO of BlueRaven, Operations: McMaster - Carr BS Chemical Engineering (BYU), MBA (UNC Chapel Hill) SunPower: SVP SunPower Direct Operations 41

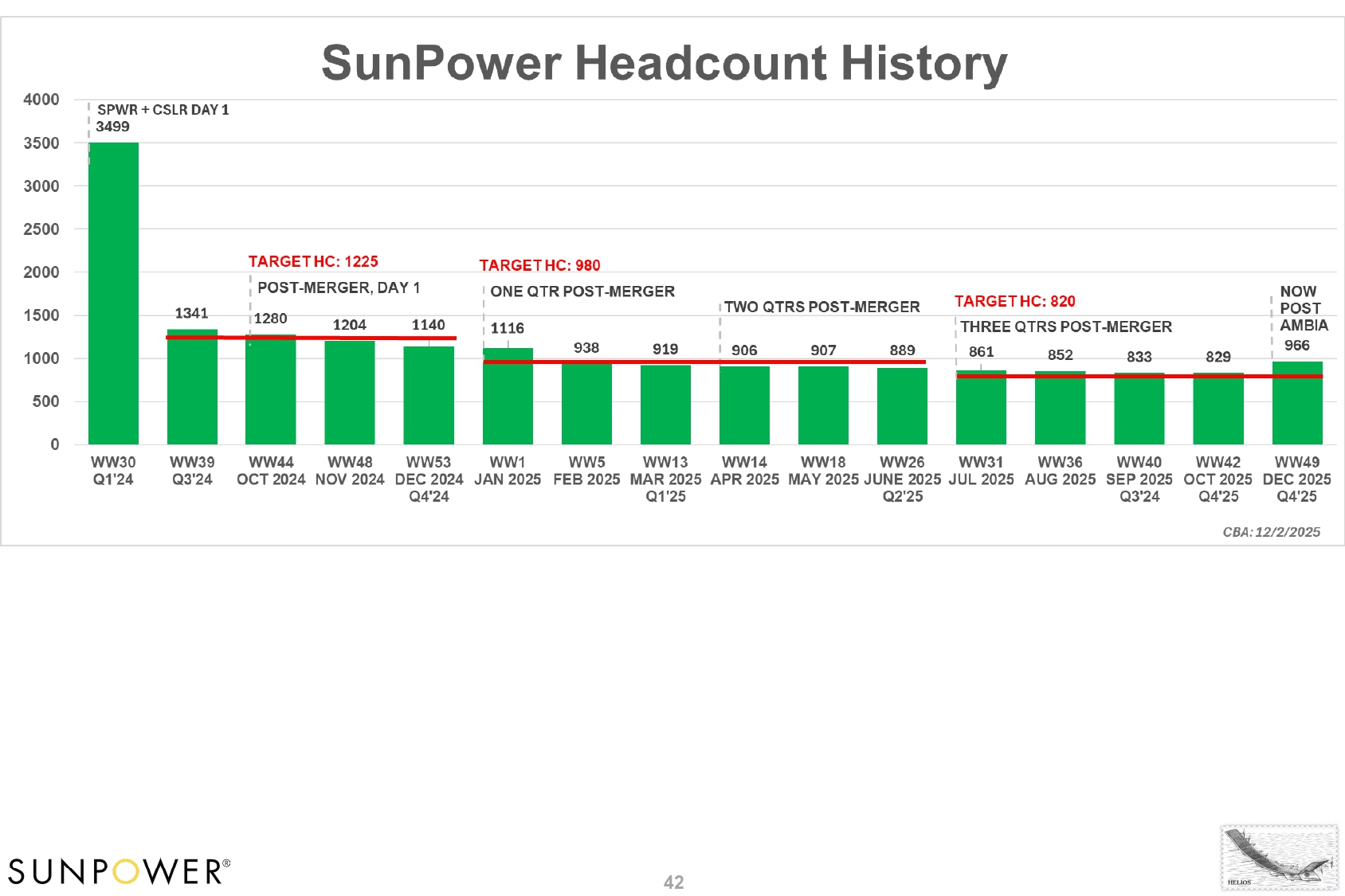

42

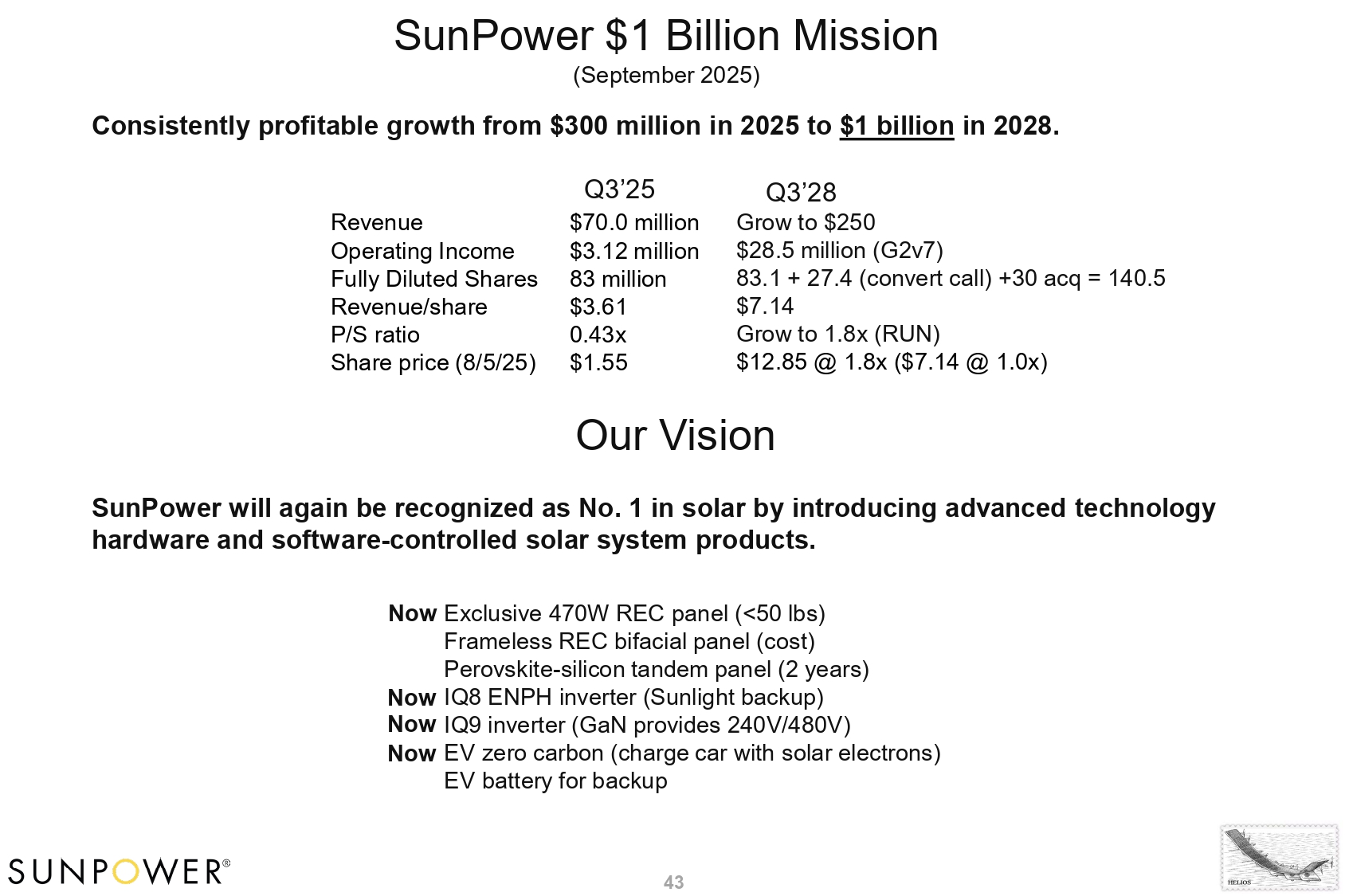

Q3’28 Q3’25 Grow to $250 $70.0 million Revenue $28.5 million (G2v7) $3.12 million Operating Income 83.1 + 27.4 (convert call) +30 acq = 140.5 83 million Fully Diluted Shares $7.14 $3.61 Revenue/share Grow to 1.8x (RUN) 0.43x P/S ratio $12.85 @ 1.8x ($7.14 @ 1.0x) $1.55 Share price (8/5/25) 43 Our Vision SunPower will again be recognized as No. 1 in solar by introducing advanced technology hardware and software - controlled solar system products. Now Exclusive 470W REC panel (<50 lbs) Frameless REC bifacial panel (cost) Perovskite - silicon tandem panel (2 years) Now IQ8 ENPH inverter (Sunlight backup) Now IQ9 inverter (GaN provides 240V/480V) Now EV zero carbon (charge car with solar electrons) EV battery for backup SunPower $1 Billion Mission (September 2025) Consistently profitable growth from $300 million in 2025 to $1 billion in 2028.

44 Integration Status: 12/1/25, Rev 3.0 1. SunPower: Sunder 2. SunPower Ambia

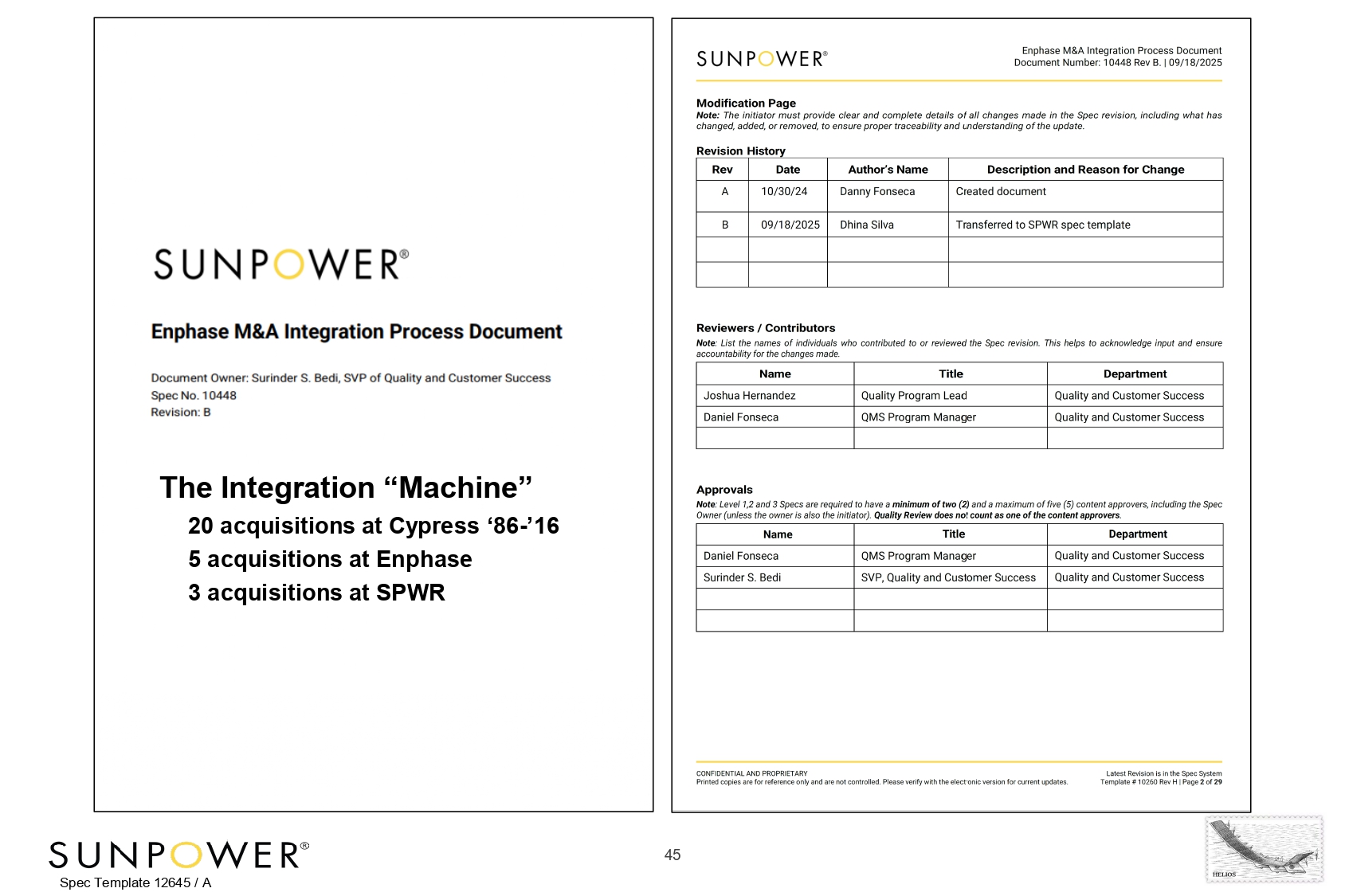

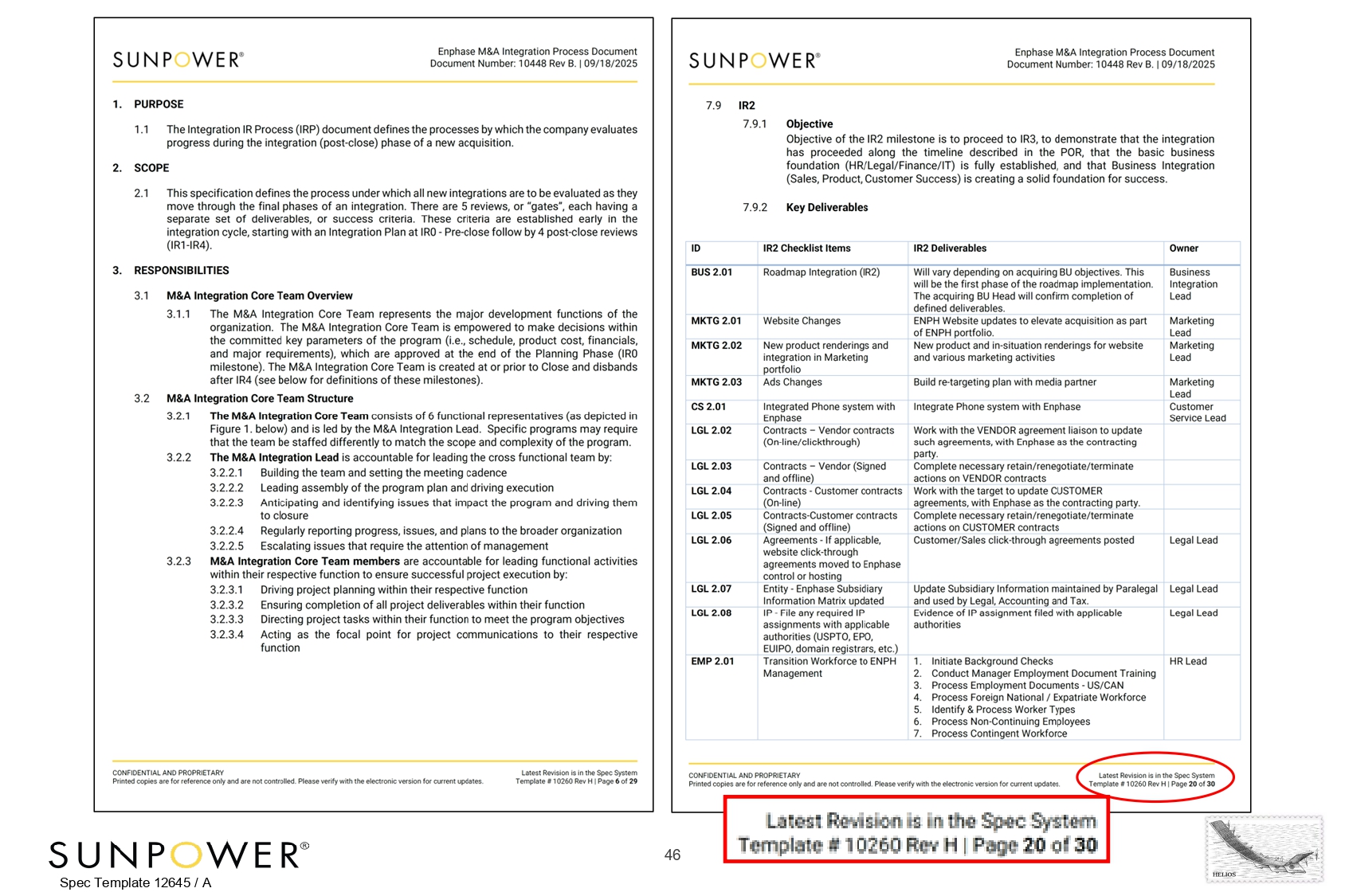

The Integration “Machine” 20 acquisitions at Cypress ‘86 - ’16 5 acquisitions at Enphase 3 acquisitions at SPWR 45 Spec Template 12645 / A

46 Spec Template 12645 / A

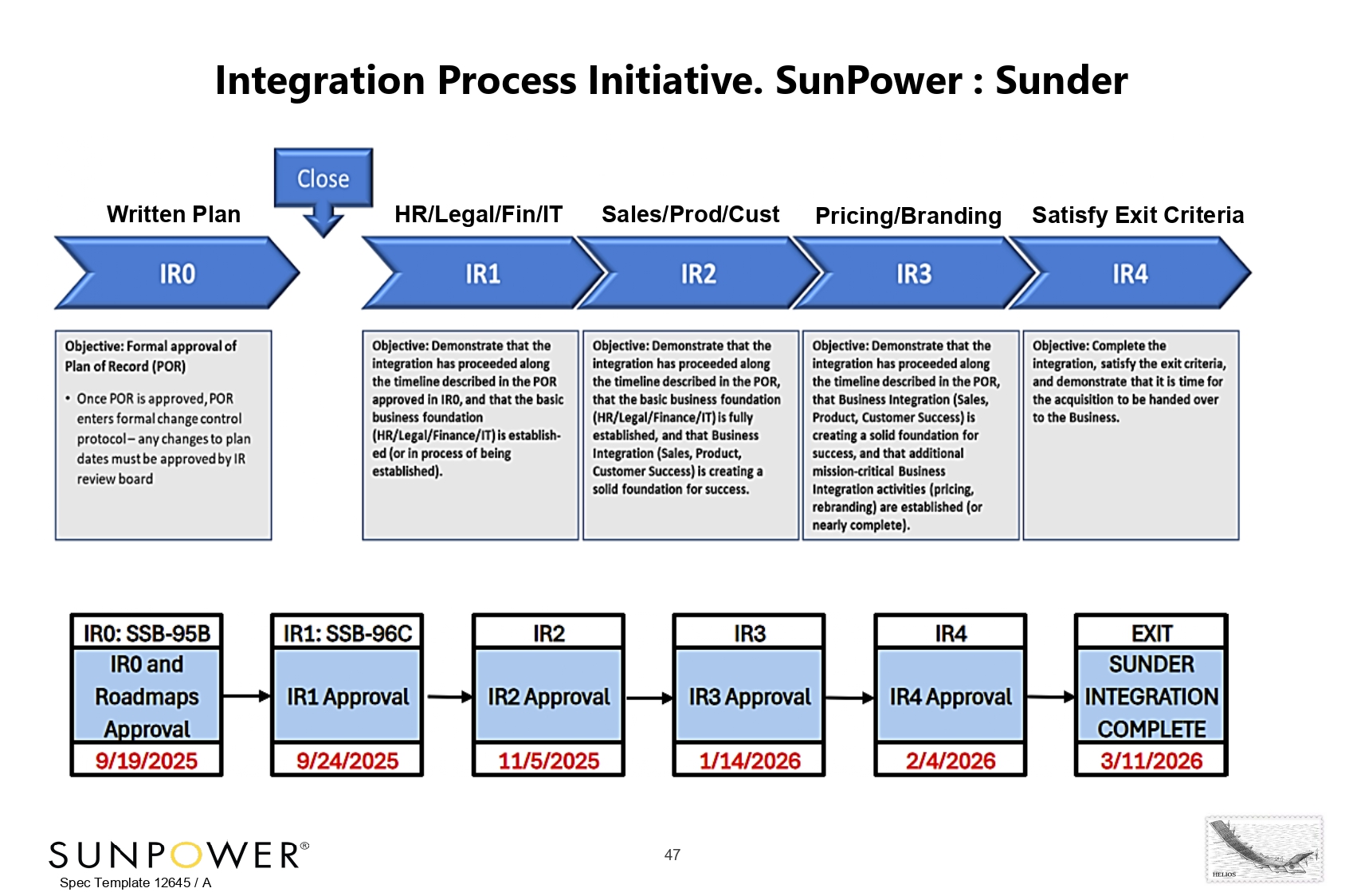

Integration Process Initiative. SunPower : Sunder HR/Legal/Fin/IT 47 Spec Template 12645 / A Sales/Prod/Cust Pricing/Branding Satisfy Exit Criteria Written Plan

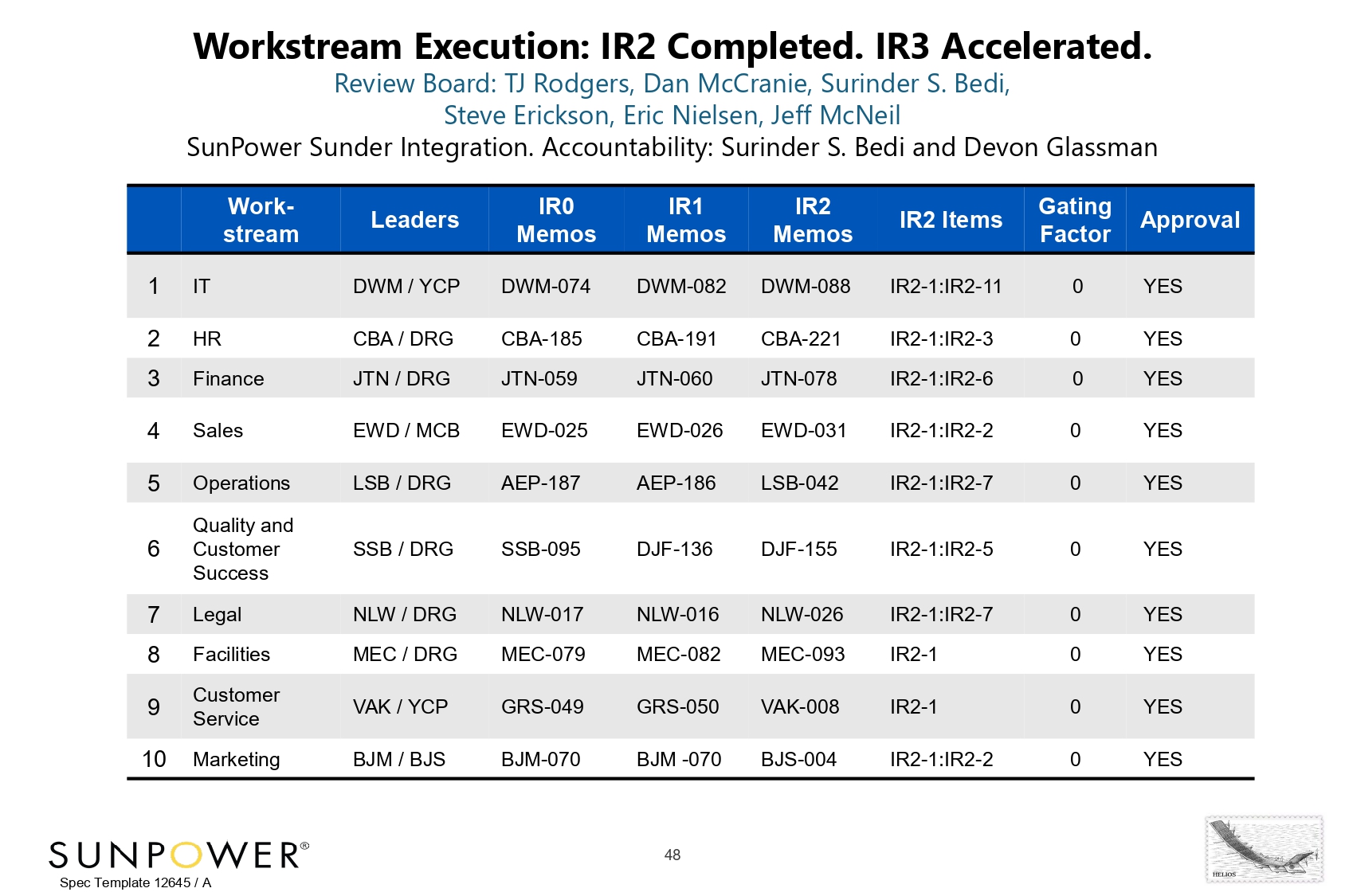

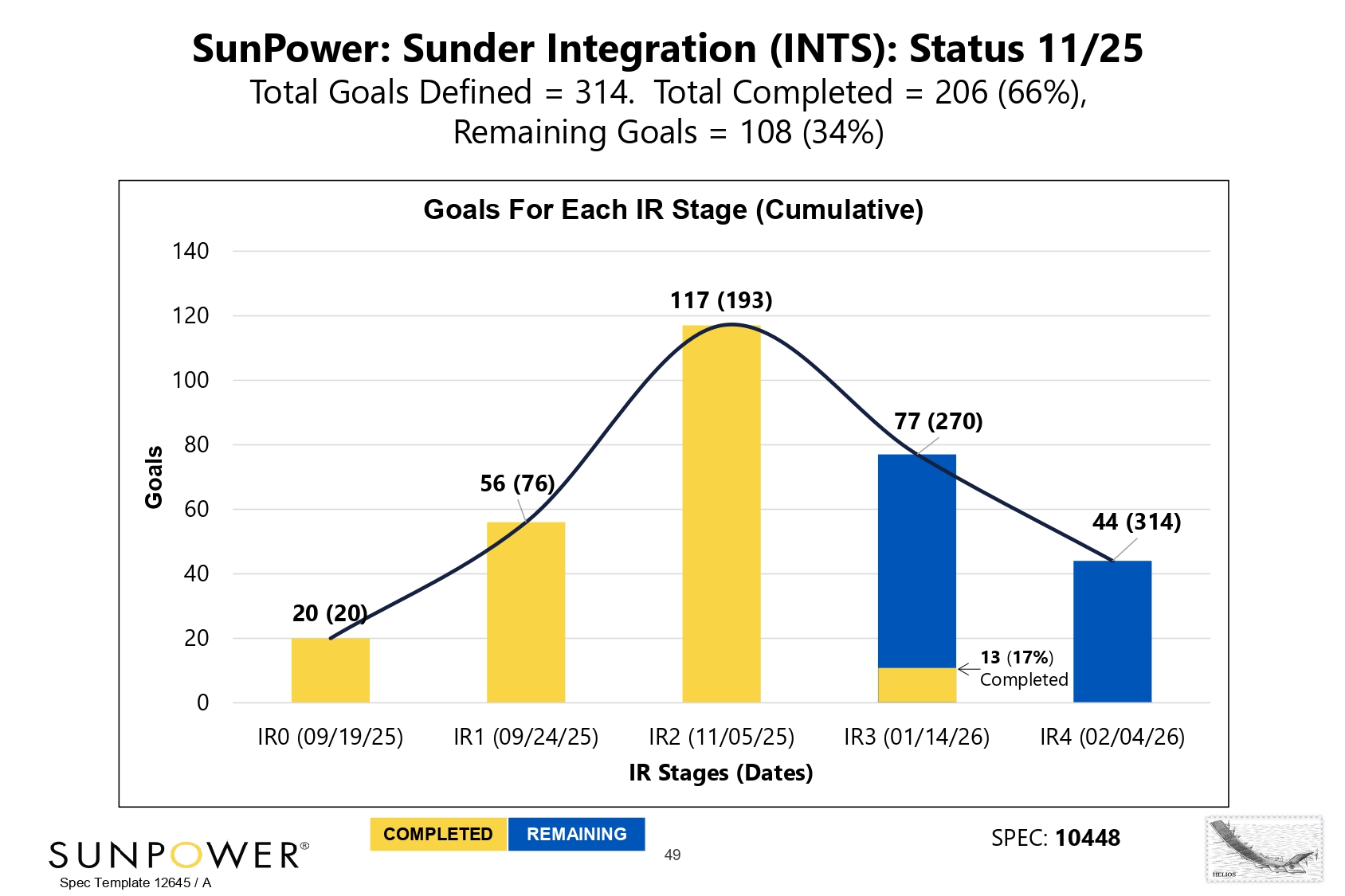

Workstream Execution: IR2 Completed. IR3 Accelerated. 48 Spec Template 12645 / A Review Board: TJ Rodgers, Dan McCranie, Surinder S. Bedi, Steve Erickson, Eric Nielsen, Jeff McNeil SunPower Sunder Integration. Accountability: Surinder S. Bedi and Devon Glassman Approval Gating Factor IR2 Items IR2 Memos IR1 Memos IR0 Memos Leaders Work - stream YES 0 IR2 - 1:IR2 - 11 DWM - 088 DWM - 082 DWM - 074 DWM / YCP IT 1 YES 0 IR2 - 1:IR2 - 3 CBA - 221 CBA - 191 CBA - 185 CBA / DRG HR 2 YES 0 IR2 - 1:IR2 - 6 JTN - 078 JTN - 060 JTN - 059 JTN / DRG Finance 3 YES 0 IR2 - 1:IR2 - 2 EWD - 031 EWD - 026 EWD - 025 EWD / MCB Sales 4 YES 0 IR2 - 1:IR2 - 7 LSB - 042 AEP - 186 AEP - 187 LSB / DRG Operations 5 YES 0 IR2 - 1:IR2 - 5 DJF - 155 DJF - 136 SSB - 095 SSB / DRG Quality and Customer Success 6 YES 0 IR2 - 1:IR2 - 7 NLW - 026 NLW - 016 NLW - 017 NLW / DRG Legal 7 YES 0 IR2 - 1 MEC - 093 MEC - 082 MEC - 079 MEC / DRG Facilities 8 YES 0 IR2 - 1 VAK - 008 GRS - 050 GRS - 049 VAK / YCP Customer Service 9 YES 0 IR2 - 1:IR2 - 2 BJS - 004 BJM - 070 BJM - 070 BJM / BJS Marketing 10

SunPower: Sunder Integration (INTS): Status 11/25 Total Goals Defined = 314. Total Completed = 206 (66%), Remaining Goals = 108 (34%) 56 (76) 117 (193) 77 (270) 44 (314) 0 40 20 (20) 20 60 80 100 120 140 IR0 (09/19/25) IR1 (09/24/25) Goals IR2 (11/05/25) IR Stages (Dates) Goals For Each IR Stage (Cumulative) 13 ( 17% ) Completed IR3 (01/14/26) IR4 (02/04/26) SPEC: 10448 COMPLETED REMAINING 49 Spec Template 12645 / A

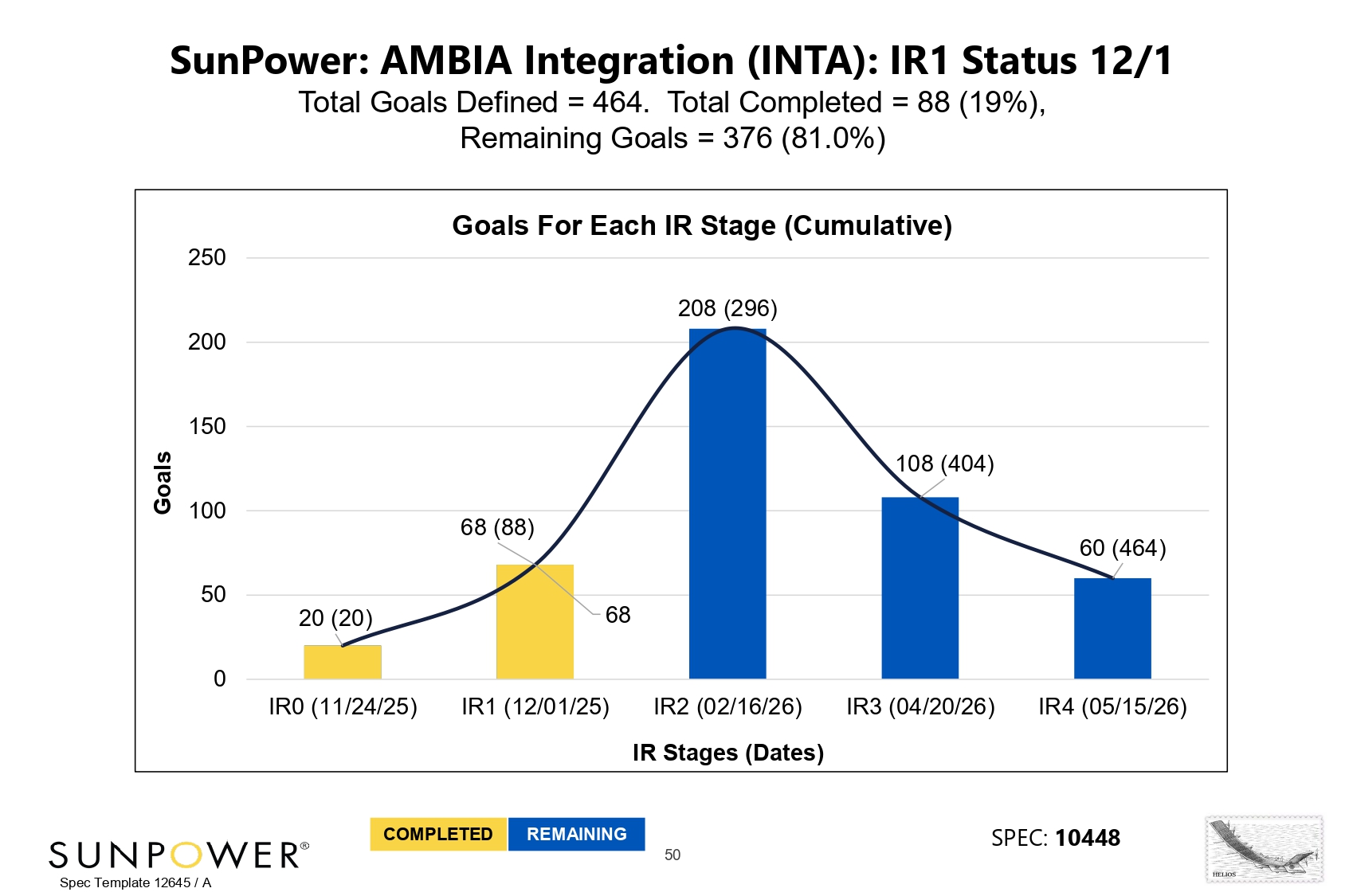

50 SunPower: AMBIA Integration (INTA): IR1 Status 12/1 Total Goals Defined = 464. Total Completed = 88 (19%), Remaining Goals = 376 (81.0%) SPEC: 10448 COMPLETED REMAINING 20 (20) 68 (88) 208 (296) 108 (404) 60 (464) 68 0 50 100 200 150 250 IR0 (11/24/25) IR1 (12/01/25) IR3 (04/20/26) IR4 (05/15/26) Goals IR2 (02/16/26) IR Stages (Dates) Goals For Each IR Stage (Cumulative) Spec Template 12645 / A

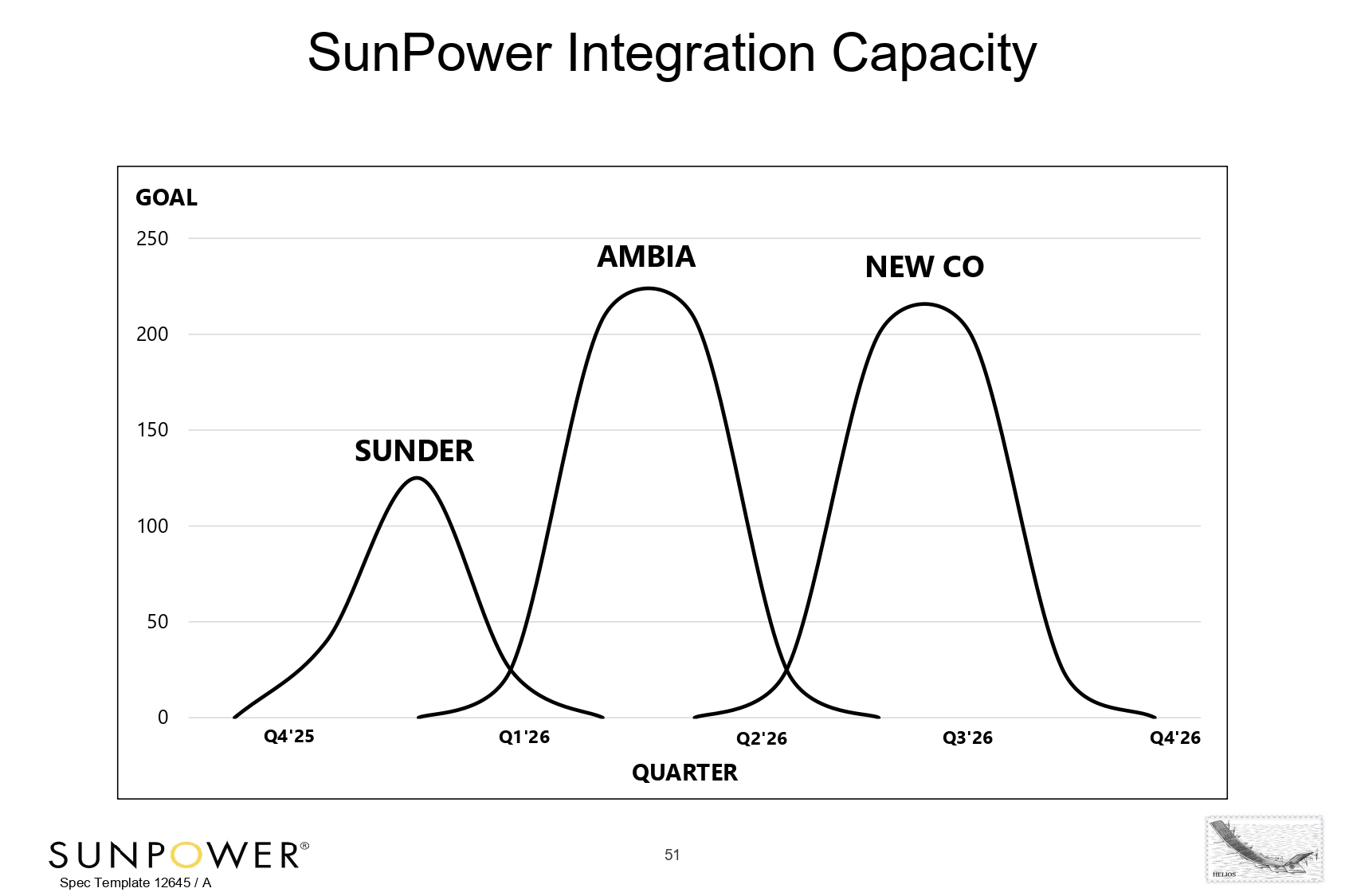

51 SunPower Integration Capacity 0 50 100 150 200 250 GOAL Q4'25 Spec Template 12645 / A SUNDER AMBIA NEW CO Q1'26 Q2'26 QUARTER Q3'26 Q4'26

52 Financial Model

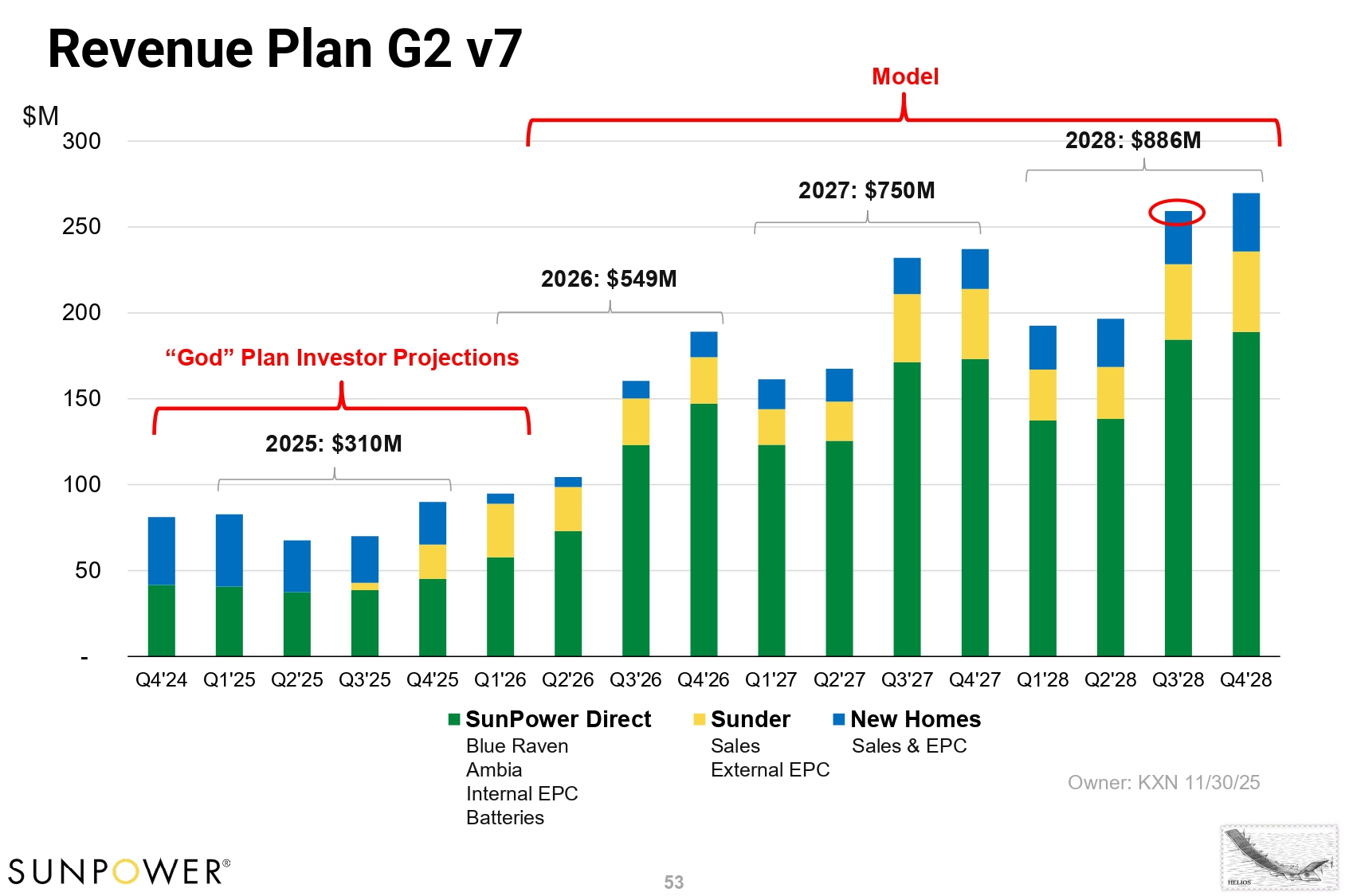

- 50 100 150 200 250 $M 300 Q4'26 Q1'27 Q2'27 Q3'27 Q4'27 Q1'28 Q2'28 Q3'28 Q4'28 Sunder Sales External EPC New Homes Sales & EPC Revenue Plan G2 v7 Owner: KXN 11/30/25 Q4'24 Q1'25 Q2'25 Q3'25 Q4'25 Q1'26 Q2'26 Q3'26 SunPower Direct Blue Raven Ambia Internal EPC Batteries 2025: $310M 2026: $549M 2027: $750M 2028: $886M “God” Plan Investor Projections Model 53

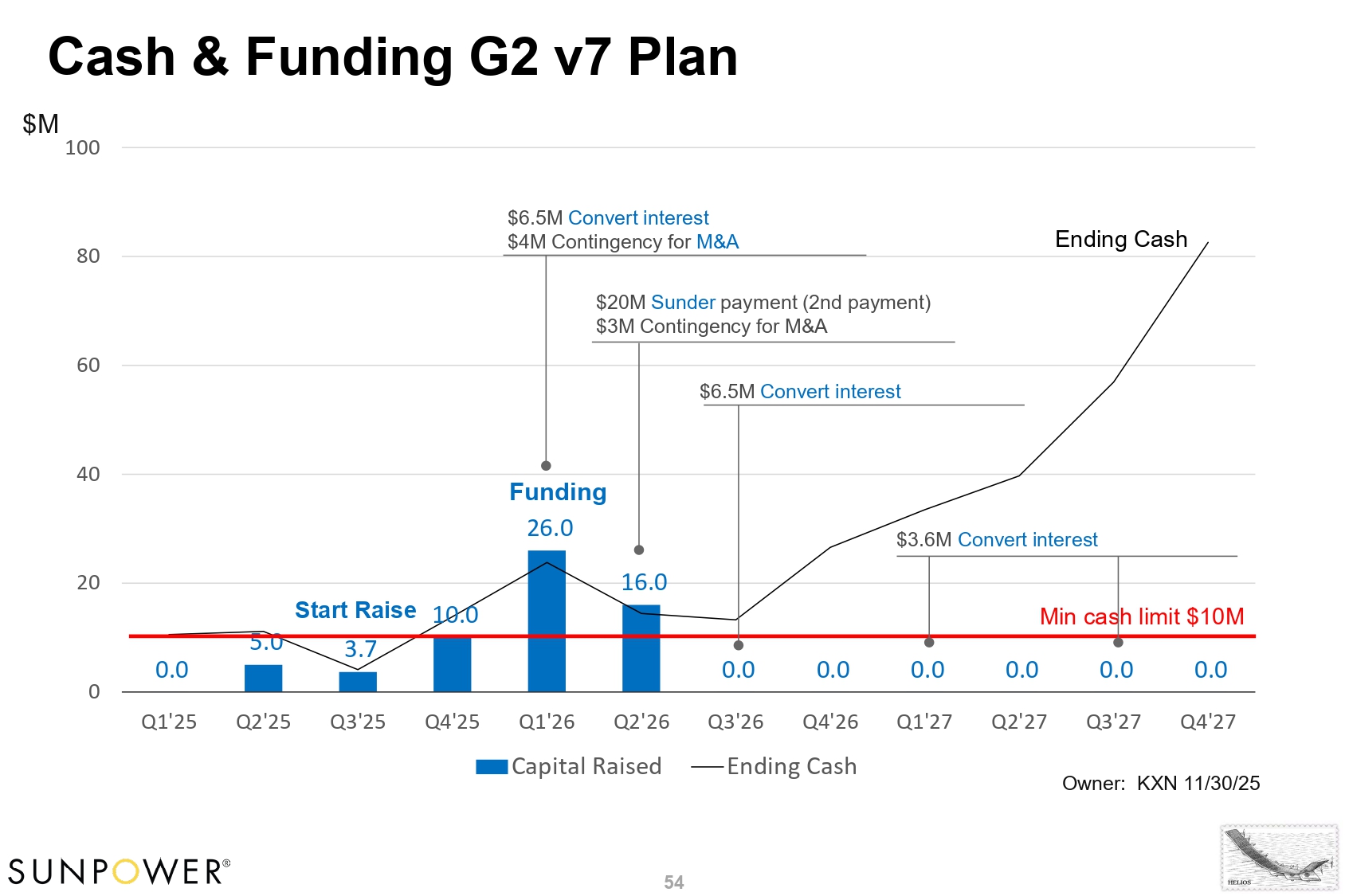

Cash & Funding G2 v7 Plan Q1'27 Q2'27 Q3'27 Q4'27 Owner: KXN 11/30/25 $M 100 0.0 5.0 3.7 10.0 16.0 0.0 0.0 0.0 0.0 0 20 40 60 80 Q1'25 Q2'25 Q3'25 Q4'25 Q1'26 Q2'26 Q3'26 Q4'26 Capital Raised Ending Cash Min cash limit $10M 0.0 0.0 Ending Cash Funding 26.0 Start Raise $6.5M Convert interest $4M Contingency for M&A $20M Sunder payment (2nd payment) $3M Contingency for M&A $6.5M Convert interest $3.6M Convert interest 54

55 Q4’25 Outlook

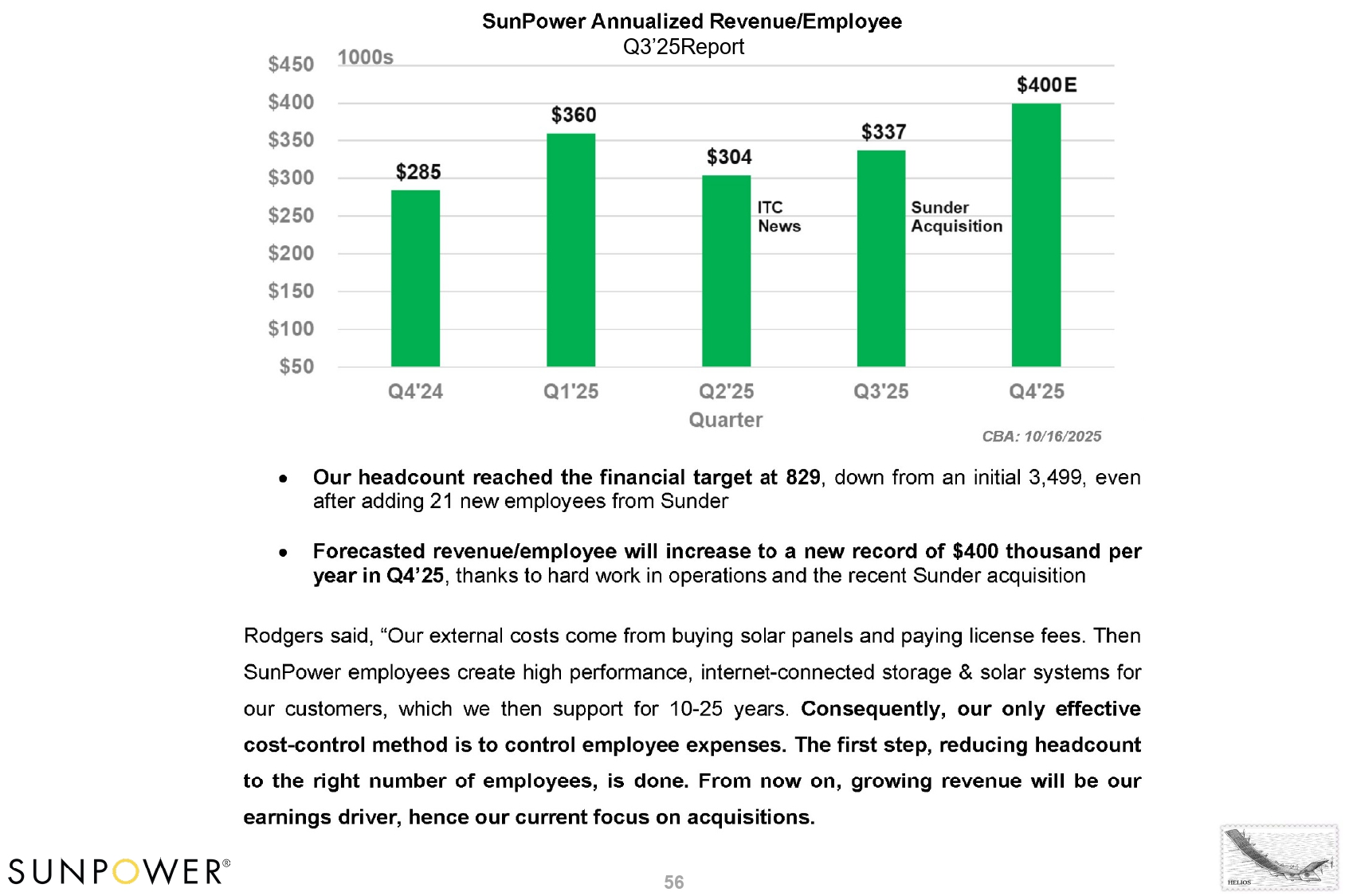

Q3’25Report 56

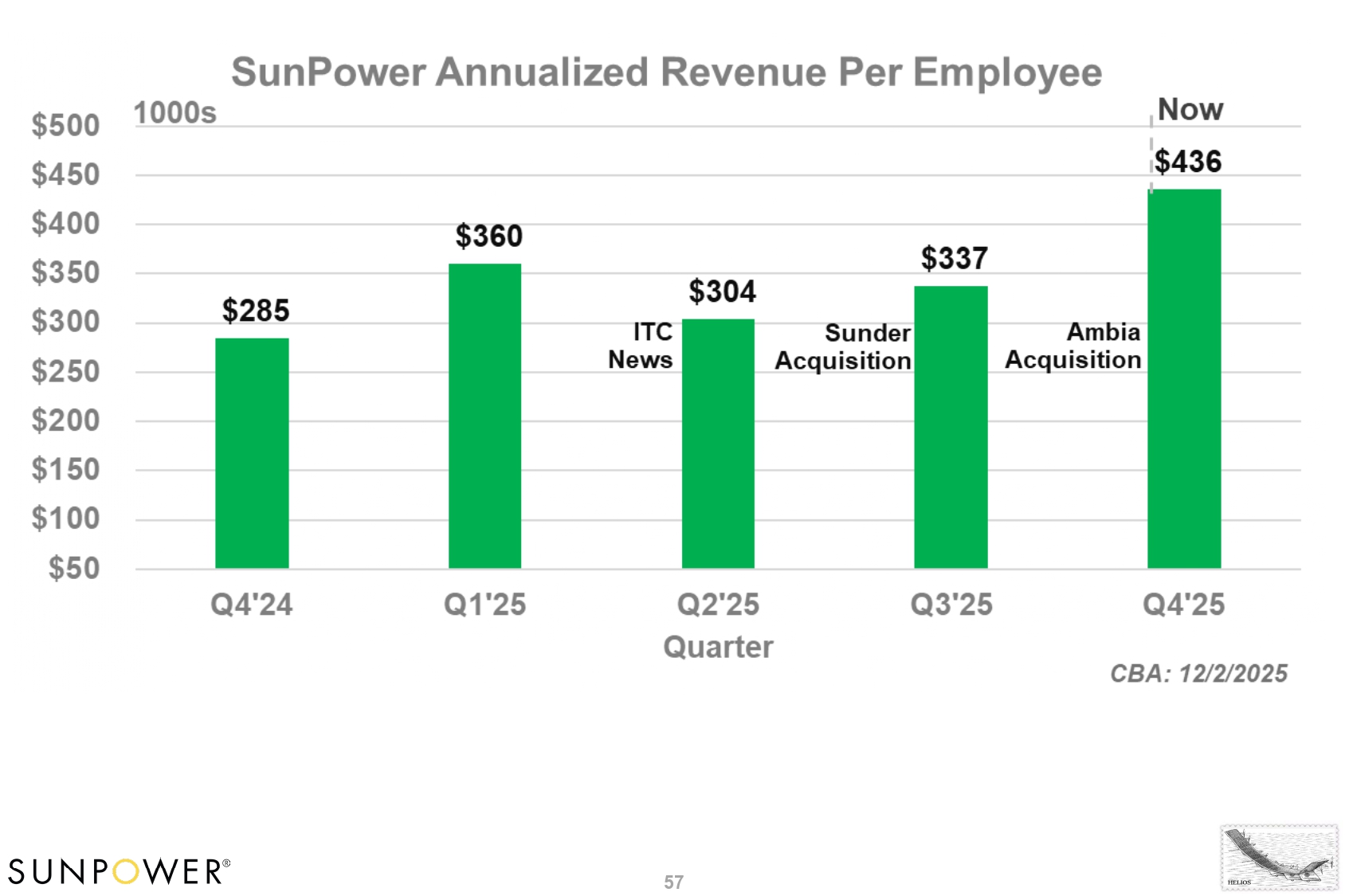

57

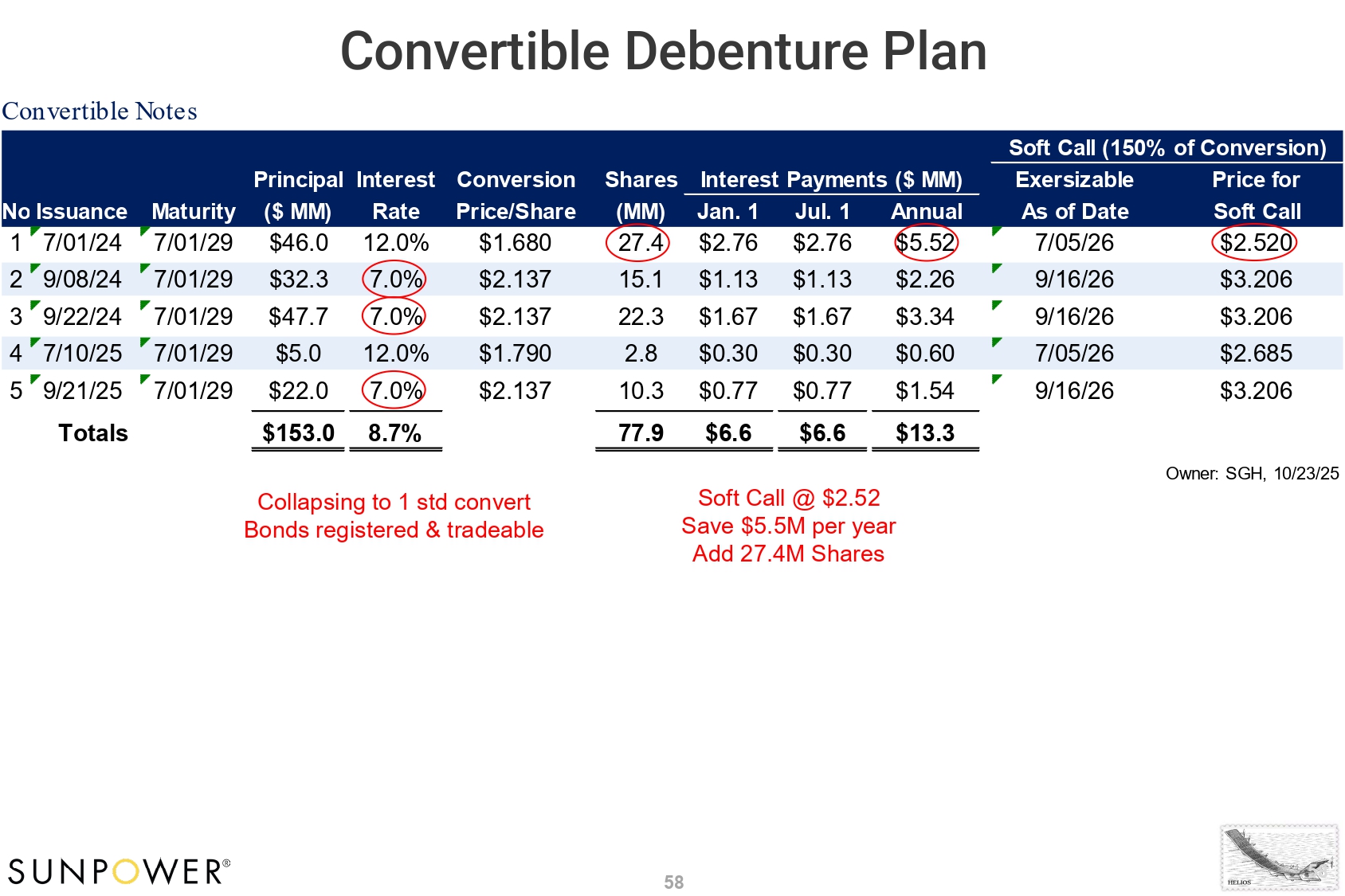

Convertible Debenture Plan Convertible Notes Maturity Conversion Price/Share Shares (MM) Exersizable As of Date Price for Soft Call 7/01/29 $1.680 7/05/26 $2.520 7/01/29 $2.137 9/16/26 $3.206 No Issuance 1 7/01/24 2 9/08/24 3 9/22/24 7/01/29 $2.137 9/16/26 $3.206 4 7/10/25 7/01/29 $1.790 7/05/26 $2.685 7/01/29 $2.137 9/16/26 $3.206 5 9/21/25 Totals Principal Interest ($ MM) Rate $46.0 12.0% $32.3 7.0% $47.7 7.0% $5.0 12.0% $22.0 7.0% $153.0 8.7% Owner: SGH, 10/23/25 Soft Call (150% of Conversion) Interest Payments ($ MM) Jan. 1 Jul. 1 Annual 27.4 $2.76 $2.76 $5.52 15.1 $1.13 $1.13 $2.26 22.3 $1.67 $1.67 $3.34 2.8 $0.30 $0.30 $0.60 10.3 $0.77 $0.77 $1.54 77.9 $6.6 $6.6 $13.3 Soft Call @ $2.52 Save $5.5M per year Add 27.4M Shares Collapsing to 1 std convert Bonds registered & tradeable 58 58

60 Questions