UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 13, 2025

Faraday Future Intelligent Electric Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-39395 | 84-4720320 | ||

| (State or other jurisdiction | (Commission File Number) | (I.R.S. Employer | ||

| of incorporation) | Identification No.) |

| 18455 S. Figueroa Street | ||

| Gardena, CA | 90248 | |

| (Address of principal executive offices) | (Zip Code) |

(424) 276-7616

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Class A common stock, par value $0.0001 per share | FFAI | The Nasdaq Stock Market LLC | ||

| Redeemable warrants, exercisable for shares of Class A common stock at an exercise price of $11.50 per share | FFAIW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 13, 2025, Faraday Future Intelligent Electric Inc. (the “Company”) issued a press release in which the Company provided certain third quarter 2025 financial results, as well as its 2025 outlook. The full text of the press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 8.01 Other Events.

In connection with a conference call held by the Company on November 13, 2025, to discuss certain third quarter 2025 financial results, as well as its 2025 outlook, the Company referenced the presentation furnished as Exhibit 99.2 to this Current Report on Form 8-K and incorporated herein by reference.

The information contained in Items 2.02 and 8.01 in this Current Report on Form 8-K and the information in Exhibits 99.1 and 99.2 hereto is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed with this Current Report on Form 8-K:

| No. | Description of Exhibits | |

| 99.1 | Press Release dated November 13, 2025 | |

| 99.2 | Investor Presentation (Third Quarter 2025 Earnings Release) dated November 13, 2025 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| FARADAY FUTURE INTELLIGENT ELECTRIC INC. | ||

| Date: November 14, 2025 | By: | /s/ Koti Meka |

| Name: | Koti Meka | |

| Title: | Chief Financial Officer | |

Exhibit 99.1

FARADAY FUTURE REPORTS FINANCIAL RESULTS FOR Q3 2025

| ● | FX Super One has entered the pre-production phase at its Hanford manufacturing factory with the target of the first FX Super One pre-production vehicle rolling off the line in the U.S. in the near future. |

| ● | Future FF and FX BEV vehicles equipped with NACS charge ports in North America, Japan and South Korea will gain access to 28,000+ Tesla Superchargers, providing more infrastructure convenience for future drivers. |

| ● | FX has now established FX Pars, for FX pre-order holders, in California, New York, Massachusetts, Texas, and Nevada. The next phase of expansion will target New Jersey, Florida, and Washington, where there are strong signs of demand. |

| ● | FF expects to complete a series of safety assessment tests at MGA to ensure full compliance. |

| ● | Secured $136 million in financing commitments. |

| ● | Cash on the balance sheet at quarter-end was at the highest level in more than two years. |

| ● | FX launched the FX Super One in the UAE on October 28, 2025, with first vehicle delivery planned in the UAE for later this month. |

| ● | Founder and Global Co-CEO YT Jia completed approximately $560,000 in purchases of FFAI common stock under a previously announced plan as of September 8, 2025. |

Los Angeles, CA (November 13, 2025) -- Faraday Future Intelligent Electric Inc. (Nasdaq: FFAI) (“FF”, “Faraday Future”, or the “Company”), a California-based global shared intelligent electric mobility ecosystem company, today announced its financial results for its third quarter 2025. The Company highlighted several key metrics across its business that underscore the operations execution, financial position, and its outlook for the fourth quarter of 2025 and into 2026.

THIRD QUARTER SUMMARY

The Company held the Global Launch of the FX Super One MPV at an in Los Angeles on July 17, where the FX brand unveiled three groundbreaking innovations: the FX Super One EAI-MPV, the FF Super EAI F.A.C.E. System, and the FF EAI Embodied AI Agent 6x4 Architecture. The event, drew major attention across the U.S. and China, further elevating the FX brand. Since that launch event, FX has secured non-binding paid FX Super One pre-orders for more than 11,000 units.

Faraday Future also finalized the U.S. production assembly plan for FX Super One. The Company’s bridge partners and supply chain collaborators will commence component supply for the production assembly phase. The FX Super One will be assembled at the Company’s manufacturing facility in Hanford, CA. The FX Super One officially entered the trial production phase in the third quarter at Hanford. FX Super One is progressing with process planning and validation, defining manufacturing processes, refining work procedures, establishing quality standards, and ramping up training for engineers and production teams.

On FX Super One, more than half of the Federal Motor Vehicle Safety Standards (FMVSS) 201U test points have been completed. Full-vehicle safety testing has also delivered interim results. The series of assessment tests continues at MGA Research, keeping the vehicle on track for development and validation. The FX team is continuing the push toward the milestone of rolling the first U.S.-pre-production version of the FX Super One off the line in the near future.

FX has also rolled out national co-creation and sales events across eight major U.S. states, receiving enthusiastic feedback in New York, Boston, and Los Angeles. The FX Super One continues to build strong momentum, reflecting the growing success of the Company’s Co-Creation Ecosystem Online Direct Sales model. With increasing pre-orders and rising brand visibility, FX Super One is strengthening its position as a leading AI-driven ultra-luxury mobility brand, while driving both user and brand equity through our co-creation ecosystem.

Another key milestone this quarter was FF’s strategic investment in Qualigen Therapeutics. This investment underpins FF’s Dual-Flywheel and Dual-Bridge ecosystem, and the Company’s AI technology capabilities and ecosystem reach in both Web2 and Web3. The transaction strengthens the synergy between our EAI EV platform and fast-moving AI, crypto and digital asset initiatives.

The Middle East Final Launch of the FX Super One took place on October 28 at the Armani Hotel, Burj Khalifa, Dubai, and was a tremendous success. The launch featured the debut of the first-class EAI-MPV in the region, the release of the FX Super One price point at approximately $85,000, and the announcement of Andrés Iniesta as the first global FX Super One owner. This event reflects the strong traction of our Co-Creation Ecosystem in the region and demonstrates FX Super One’s appeal among high-net-worth and influential customers. From the event we received three B2C non-binding non-refundable paid preorders for more than 200 FX Super Ones within 48 hours after this event.

“In July we unveiled the groundbreaking FX Super One in Los Angeles to a global audience, and then just last month, we successfully launched the FX Super One in the UAE with strong interest from customers, investors, and government officials. We remain committed on the delivery of the FX Super One vehicles for the UAE. I would like to thank our team, partners and investors in the UAE,” said Matthias Aydt, Global Co-CEO of Faraday Future.

RESULTS FOR THIRD QUARTER 2025

| ● | Loss from Operations: $206.8 million for the three months ending September 30, 2025, due to our investment in engineering, talent expansion, strategic initiatives and alignment of the value of our assets related to manufacturing. |

| · | Operating Cash Outflow: $79.2 million for the nine months ended September 30, 2025, primarily driven by changes in working capital and the operational ramp-up of the FX platform. |

| ● | Financing Cash Inflow: $135.8 million for the nine months ended September 30, 2025, a 144% increase from $55.7 million in the same period of the prior year. Marks the sixth consecutive quarter where financing inflows exceeded operating outflows, a consistent trend that reinforces operational strength. |

In summary, the Company’s Q3 performance reflects meaningful progress, and FF remains focused on executing strategic investments aligned with its roadmap, while optimizing capital deployment and driving toward long-term, sustainable growth.

THIRD QUARTER CAPITAL FINANCING

Turning to liquidity and financing, FF previously announced approximately $136 million in financing commitments to support its growth strategy, FX Super One launch readiness, and FF’s position in the AIEV market. As of the end of the third quarter, FF had received approximately $82 million, with the remaining amounts subject to closing conditions and timing. The Company continues to manage deployment carefully and evaluate additional financing opportunities as needed to prudently support commercialization and ecosystem execution.

Turning to corporate compliance and governance, in September FF successfully completed the Nasdaq one-year compliance monitoring period, returning to fully normal listed-company status. In addition, management continued to demonstrate alignment with stockholders through Rule 10b5-1 stock purchase plans. Founder and Global Co-CEO YT Jia completed approximately $560,000 in purchases of FFAI common stock under a previously announced plan as of September 8, 2025. These purchases underscore management’s long-term confidence and commitment to creating stockholder value.

We have taken a conservative one-time realignment of asset values in Q3 2025 based on the updated operational plans, as the Company shifts from FF 91 program activities toward reorganization and retooling in preparation for the upgrade to FF 92 and the commercial production of the FX Super One. The Company intends to take several actions, including continuing to improve operating efficiency, reducing certain liabilities, and exploring better financing options, to strengthen our balance sheet.

FF announced and subsequently closed an approximately $41 million strategic investment in Qualigen, a Nasdaq listed company, with $30 million invested directly by Faraday Future and $4 million personal investment from Mr. Jia. This investment is intended to accelerate development of the Company’s Crypto Flywheel business and further advance its Dual-Flywheel and Dual-Bridge strategy.

FOURTH QUARTER 2025 OUTLOOK

The Company continues to drive FF 91 2.0 Futurist Alliance deliveries and FX Super One pre-orders. FF is on track to deliver an additional FF 91 2.0 Futurist Alliance unit in December.

FX has now established FX Pars, for FX pre-order holders, in California, New York, Massachusetts, Texas, and Nevada. The next phase of expansion will target New Jersey, Florida, and Washington, where there are strong signs of demand. This expansion will support incremental pre-order volume and broaden the FX Par network. In parallel, steady progress on tasks required to support vehicle deliveries is being made — including sales operations, after-sales and service capability, auto finance, and compliance.

The

Company will continue to focus on building a robust internal R&D capability in software and AI, while accelerating the transfer of

core technologies from the flagship FF 91 into the FX product line to deliver a deeply interactive user ecosystem across all vehicles.

On the regulatory front, FF expects to complete a series of Federal Motor Vehicle Safety Standards assessment tests at MGA in the near

future.

The Company is making progress on the supply chain, industrialization

and delivery fronts, including a plan to release the first version of the Manufacturing Management System to ensure the first U.S. pre-production

version FX Super One off the line by year-end, alongside the inaugural Super One offline event in December 2025.

FX’s second planned model, FX 4, will show a rear design rendering during the time period of Los Angeles Auto Show later this month, subject to securing the necessary agreements. With continued FF 91 deliveries as well as the start of delivery of FX Super One in the UAE market, FX also reaffirms its plan to introduce a series of models over the next five years, covering four blue-ocean segments in the U.S. market.

And lastly, the Company’s other key markets beyond the U.S. update - Following a successful Super One Product Final Launch event in Dubai, the preparatory work related to the delivery for the Middle East has officially been completed. The first Super One is scheduled to be delivered in November and then continue to ramp up the sale and enhance the high-end user co-creation gradually in the UAE market. The Company believes the high-net-worth users and investors in this region will strongly support our expansion.

Meanwhile, the FF China team will strengthen the global supply chain management capabilities and is seeking to establish a strategic business and capital partnership with another leading intelligent driving company, aiming to complete the signing of all agreements for at least one vehicle model. The Company is solidifying compliance to fully support the rollout of the first pre-production FX vehicle by the end of 2025 and will also continue improving operational efficiency and cost control across all entities, reinforcing the Company’s corporate goal of putting “Stockholders First.”

EARNINGS WEBCAST

Faraday Future management will host a webcast today, November 13, 2025, at 7:30 p.m. Eastern time (4:30 p.m. Pacific time). Interested investors and other parties can listen to a webcast of the conference call by logging onto the Investor Relations section of the Company’s website at https://investors.ff.com/. A replay of the webcast will be available on the Company’s website shortly thereafter. More detail on FF’s 2025 Q3, when filed, can be found in our SEC filings and online at https://investors.ff.com/financial-information/sec-filings.

ABOUT FARADAY FUTURE

Faraday Future is a California-based global shared intelligent electric mobility ecosystem company. Founded in 2014, the Company’s mission is to disrupt the automotive industry by creating a user-centric, technology-first, and smart driving experience. Faraday Future’s flagship model, the FF91, exemplifies its vision for luxury, innovation, and performance. The new FX strategy aims to introduce mass production models equipped with state-of-the-art luxury technology similar to the FF 91, targeting a broader market with middle-to-low price range offerings. For more information, please visit https://www.ff.com/us/.

FORWARD LOOKING STATEMENTS

This press release includes “forward looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. When used in this press release, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements, which include statements regarding the Super One MPV and related future production and deliveries, the FX brand, other potential FX models including but not limited to the FX 4, crypto and digital asset initiatives , and production and sales goals, are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the Company’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements.

Important factors, among others, that may affect actual results or outcomes include, among others: the ability of OEMs and suppliers to timely delivery products and parts to the U.S.; the ability to timely clear customs; the Company’s ability to homologate FX vehicles for sale; the Company’s ability to execute on a Web 3 strategy; the Company’s ability to secure an occupancy certificate for its Hanford facility; the Company’s and QLGN’s ability to complete its public reporting requirements in a timely manner; the Company’s ability to secure the necessary funding to execute on its AI, EREV and Faraday X (FX) strategies, each of which will be substantial; the Company’s ability to design and develop EREV technology; the Company’s ability to design and develop AI-based solutions; competition in the AI and EREV areas, where actual or potential competitors have or are likely to have substantial advantages relative to the Company, including but not limited to experience, expertise, funding, infrastructure and personnel; the ability of the Company to execute across multiple concurrent strategies, including the UAE, bridge strategy, or FX, EREV, AI, and US geographic expansion; the Company’s ability to secure necessary agreements to license third-party range extender technology and/or license or produce FX vehicles in the U.S., the Middle East, or elsewhere, none of which have been secured; the Company’s ability to homologate FX vehicles for sale in the U.S., the Middle East, or elsewhere; and the Company’s ability to secure necessary permits at its Hanford, CA production facility; the potential impact of tariff policy; the ability of Company executives to purchase FFAI common stock; the Company’s ability to continue as a going concern and improve its liquidity and financial position; the Company’s ability to pay its outstanding obligations; the Company’s ability to remediate its material weaknesses in internal control over financial reporting and the risks related to the restatement of previously issued consolidated financial statements; the Company’s limited operating history and the significant barriers to growth it faces; the Company’s history of losses and expectation of continued losses; the success of the Company’s payroll expense reduction plan; the Company’s ability to execute on its plans to develop and market its vehicles and the timing of these development programs; the Company’s estimates of the size of the markets for its vehicles and cost to bring those vehicles to market; the rate and degree of market acceptance of the Company’s vehicles; the Company’s ability to cover future warranty claims; the success of other competing manufacturers; the performance and security of the Company’s vehicles; current and potential litigation involving the Company; the Company’s ability to receive funds from, satisfy the conditions precedent of and close on the various financings described elsewhere by the Company; the result of future financing efforts, the failure of any of which could result in the Company seeking protection under the Bankruptcy Code; the Company’s indebtedness; the Company’s ability to cover future warranty claims; the Company’s ability to use its “at-the-market” program; insurance coverage; general economic and market conditions impacting demand for the Company’s products; potential negative impacts of a reverse stock split; potential cost, headcount and salary reduction actions may not be sufficient or may not achieve their expected results; circumstances outside of the Company’s control, such as natural disasters, climate change, health epidemics and pandemics, terrorist attacks, and civil unrest; risks related to the Company’s operations in China; the success of the Company’s remedial measures taken in response to the Special Committee findings; the Company’s dependence on its suppliers and contract manufacturer; the Company’s ability to develop and protect its technologies; the Company’s ability to protect against cybersecurity risks; and the ability of the Company to attract and retain employees, any adverse developments in existing legal proceedings or the initiation of new legal proceedings, and volatility of the Company’s stock price. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the Company’s Form 10-K filed with the SEC on March 31, 2025, and other documents filed by the Company from time to time with the SEC.

CONTACTS

Investors (English): steven.park@ff.com

Investors (Chinese): cn-ir@faradayfuture.com

Media: john.schilling@ff.com

Exhibit 99.2

© 2025 FARADAY FUTURE Faraday Future Intelligent Electric Inc. (Nasdaq: FFAI) Fiscal Third Quarter 2025 Earnings Presentation November 13, 2025 = © 2025 FARADAY FUTURE © 2025 FARADAY FUTURE LEGAL DISCLAIMERS 2 Forward Looking Statements This presentation includes “forward looking statements” within the meaning of the safe harbor provisions of the United States Pr ivate Securities Litigation Reform Act of 1995.

When used in this presentation, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “see ks, ” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward(looking statemen ts. These forward(looking statements, which include statements regarding Faraday Future Intelligent Electric Inc.’s (the “Company’s”) “Bridge Strategy,” the Company’s growth strategy, fund rai sing activities and prospects, the development of markets in which the Company operates or seeks to operate, the production and delivery of the FF 91, the Faraday X(FX) brand, and future complianc e w ith Nasdaq listing requirements, are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other imp ort ant factors, many of which are outside the Company’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward(looking statements. Thes e f orward - looking statements speak only as of the date of this call, and the Company expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward(looking sta tement contained herein to reflect any change in the Company’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Important factors, among others, that may affect actual results or outcomes include, among others: the Company’s ability to c ont inue as a going concern and improve its liquidity and financial position; the Company’s ability to regain compliance with, and thereafter continue to comply with, the Nasdaq listing require men ts; the Company’s ability to pay its outstanding obligations; the Company’s ability to raise necessary capital, including but not limited to the capital required to fund production of the FF 91 and the Bridge Strategy; the Company’s ability to remediate its material weaknesses in internal control over financial reporting and the risks related to the restatement of previously issued consoli dat ed financial statements; the Company’s limited operating history and the significant barriers to growth it faces; the Company’s history of losses and expectation of continued losses; the success of the Company’s payroll expense reduction plan; the Company’s ability to execute on its plans to develop and market its vehicles and the timing of these development programs; the Company’s estima tes of the size of the markets for its vehicles and cost to bring those vehicles to market; the rate and degree of market acceptance of the Company’s vehicles; the Company’s ability to cover future wa rrant claims; the success of other competing manufacturers; the performance and security of the Company’s vehicles; current and potential litigation involving the Company; the Company’s abi lit y to receive funds from, satisfy the conditions precedent of and close on the various financings described elsewhere by the Company; the result of future financing efforts, the failure of an y o f which could result in the Company seeking protection under the Bankruptcy Code; the Company’s indebtedness; the Company’s ability to cover future warranty claims; insurance coverage; gener al economic and market conditions impacting demand for the Company’s products; potential negative impacts of a reverse stock split; potential cost, headcount and salary reduction actio ns may not be sufficient or may not achieve their expected results; circumstances outside of the Company’s control, such as natural disasters, climate change, health epidemics and pandemics, te rro rist attacks, and civil unrest; risks related to the Company’s operations in China; the success of the Company’s remedial measures taken in response to the Special Committee findings; the Company’s dependence on its suppliers and contract manufacturer; the Company’s ability to develop and protect its technologies; the Company’s ability to protect against cybersecurity risks; the ability of the Company to attract and retain employees; any adverse developments in existing legal proceedings or the initiation of new legal proceedings; and volatility of the Company’s stock pri ce. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the Company’s Form 10 - K filed with the Securities and Exchang e Commission (“SEC”) on March 31, 2025 , and other documents filed by the Company from time to time with the SEC. No Offer or Solicitation This presentation shall neither constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall the re be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. SG1 © 2025 FARADAY FUTURE TABLE OF CONTENTS 3 1.

2025 Q3 Overview 2. Q3 Financial Highlights 3. Subsequent Events 4. 2025 Q4 Outlook 5. Q&A 6.

Appendix © 2025 FARADAY FUTURE © 2025 FARADAY FUTURE 2025 Q3 OVERVIEW 4 © 2025 FARADAY FUTURE ▪ FX Super One Launch in the U.S. in July and subsequent launch in the UAE in October ▪ Successfully completed the first round of safety testing for upper interior occupant impact protection in vehicles ▪ FX Super One received non - binding preorders for more than 11,000 FX Super Ones in the U.S., and three non - binding preorders for more than 200 FX Super Ones in the UAE ▪ FFAI announced the closing of its $30 million investment in Qualigen Therapeutics, Inc. (NASDAQ: QLGN) ▪ Launched “EAI + Crypto” Dual - Flywheel & Dual - Bridge Ecosystem strategy ▪ Strengthened leadership team across key regions to support global operations © 2025 FARADAY FUTURE 5 © 2025 FARADAY FUTURE Q3 2025 HIGHLIGHTS 11,000+ FX Super One Units Reserved Through Non - Binding Preorders Closed $ 30M Investment in Qualigen Therapeutics Inc. Trial FX assembly phase at Hanford factory $136M capital from financing Global launch of the FX Super One in U.S. and UAE SG1

© 2025 FARADAY FUTURE 6 © 2025 FARADAY FUTURE OPERATIONS UPDATE Global Strategy • UAE Launch as part of "Third Pole" strategy • Andres Iniesta as first FX Co - Creation Officer • International market expansion Operation Systems • FX procurement agreement signed • "Dual flywheel" strategy • Leadership expansion Product, Technology, AI • FX Super One Launch in the UAE • AI Platform Innovation • U.S. FX assembly plan finalized • Increasing pre - orders in the U.S.

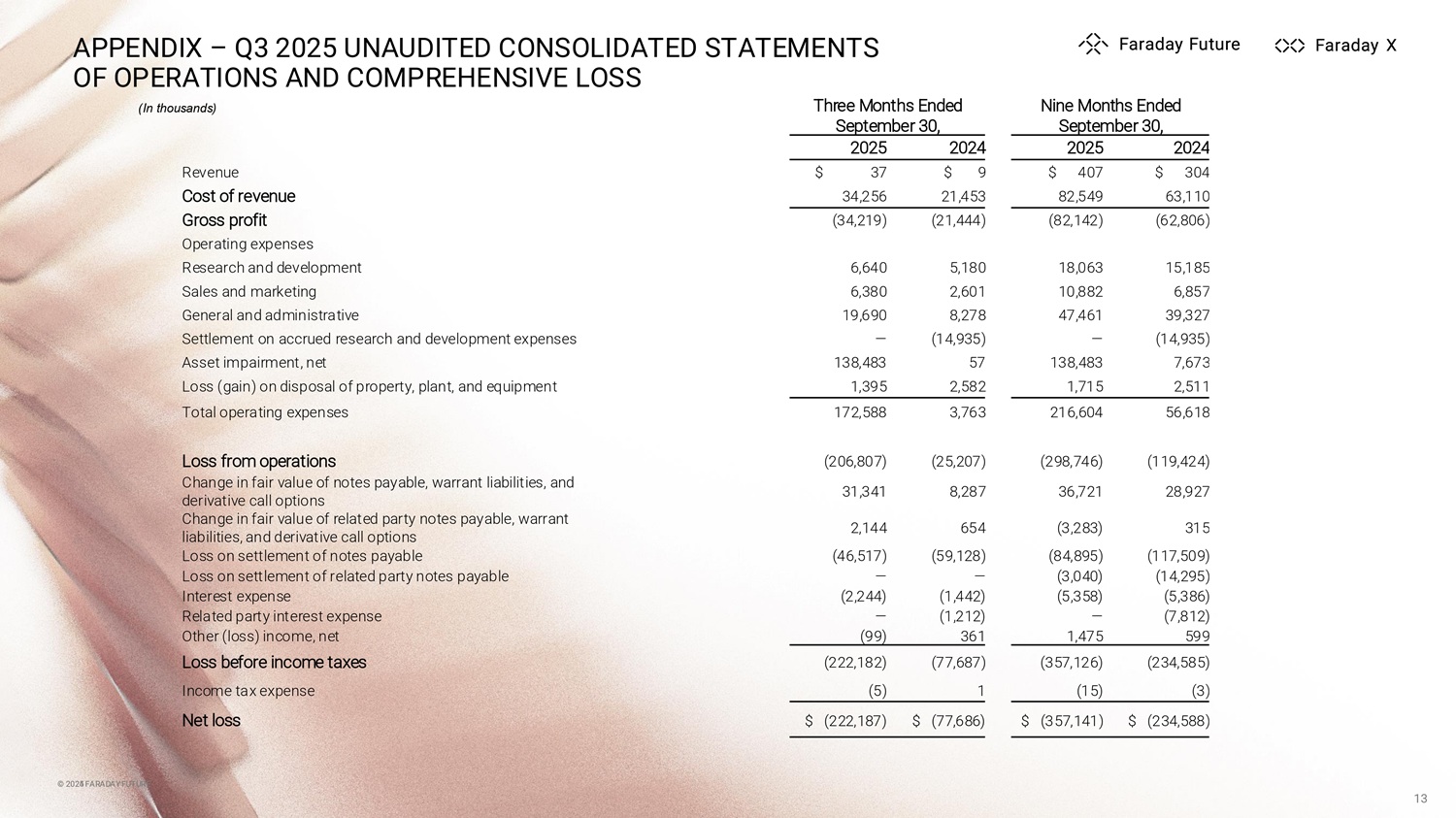

and UAE Capital • $136 million from financing • $30 million investment in Qualigen • Stockperks program Increasing collaboration with partners, customers, and co - creators © 2025 FARADAY FUTURE SUBSEQUENT EVENTS © 2025 FARADAY FUTURE 7 ▪ The Middle East Launch of the FX Super One took place on October 28, 2025 in the UAE ▪ Non - binding B2B pre - orders for more than 200 FX Super Ones from the UAE ▪ 11,000+ non - binding B2B pre - orders for FX Super One in the U.S. ▪ Finalized U.S. assembly plan at Hanford factory ▪ Ongoing safety assessment tests at the MGA facility for vehicle development ▪ Closed a strategic investment of $30 million in Qualigen Therapeutics Inc. ▪ New leaders added to strengthen investor relations, legal, and treasury © 2025 FARADAY FUTURE 2025 Q3 FINANCIAL HIGHLIGHTS © 2025 FARADAY FUTURE 8 • Loss from Operations: Net Loss from Operations was $206.8 million , compared to $25.2 million in the same period in 2024.

These changes reflect our investment in engineering, talent expansion, and strategic initiatives and alignment of the value of our assets rela ted to manufacturing. • Financing Cash Inflow: Financing activities generated $135.8 million in cash during the nine months ended September 30, 2025, a 144% increase from $55.7 million in the same period of the prior year. This marks the sixth consecutive quarter i n which financing inflows outpaced operating outflows that supports our operating runway and FX platform execution. • Financial Summary: Ongoing capital inflows continues to support the ramp - up of FX and FF vehicle production.

© 2025 FARADAY FUTURE 9 Q4 2025 OUTLOOK – STRATEGIC FOCUS 1 User Ecosystem Expansion Accelerate channel development for the FX Super One and increase pre - order volume 2 Product & AI Development Deploy AI including advanced voice and gesture interactions 3 Manufacturing Readiness Complete safety assessments and prepare vehicles 4 Global Market Execution Accelerate international market penetration 5 Operational Infrastructure Strengthen strategic and financial partnerships to enhance customer engagement Focus on FX Super One in the UAE and U.S.

© 2025 FARADAY FUTURE Faraday Future Intelligent Electric Inc.

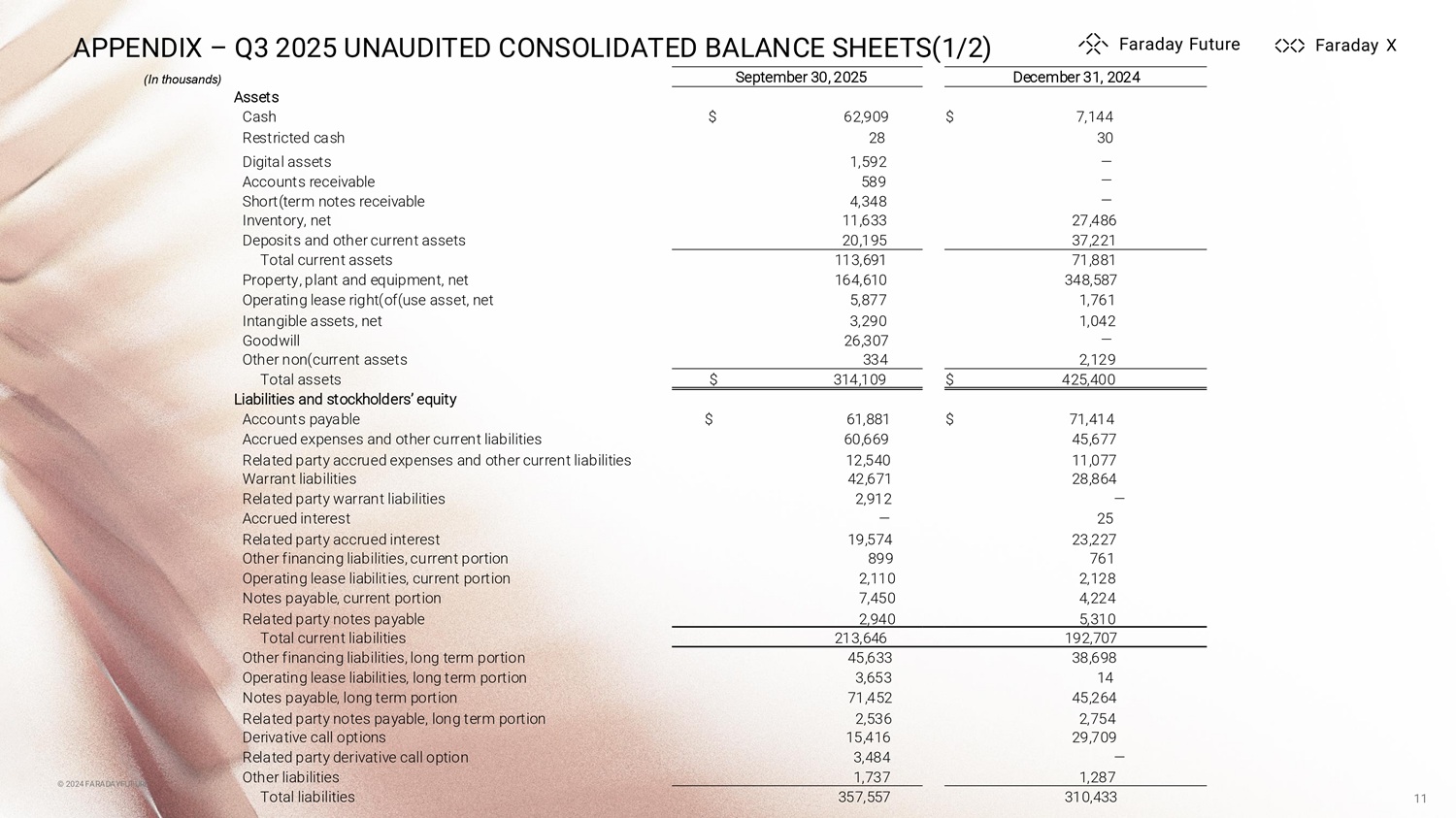

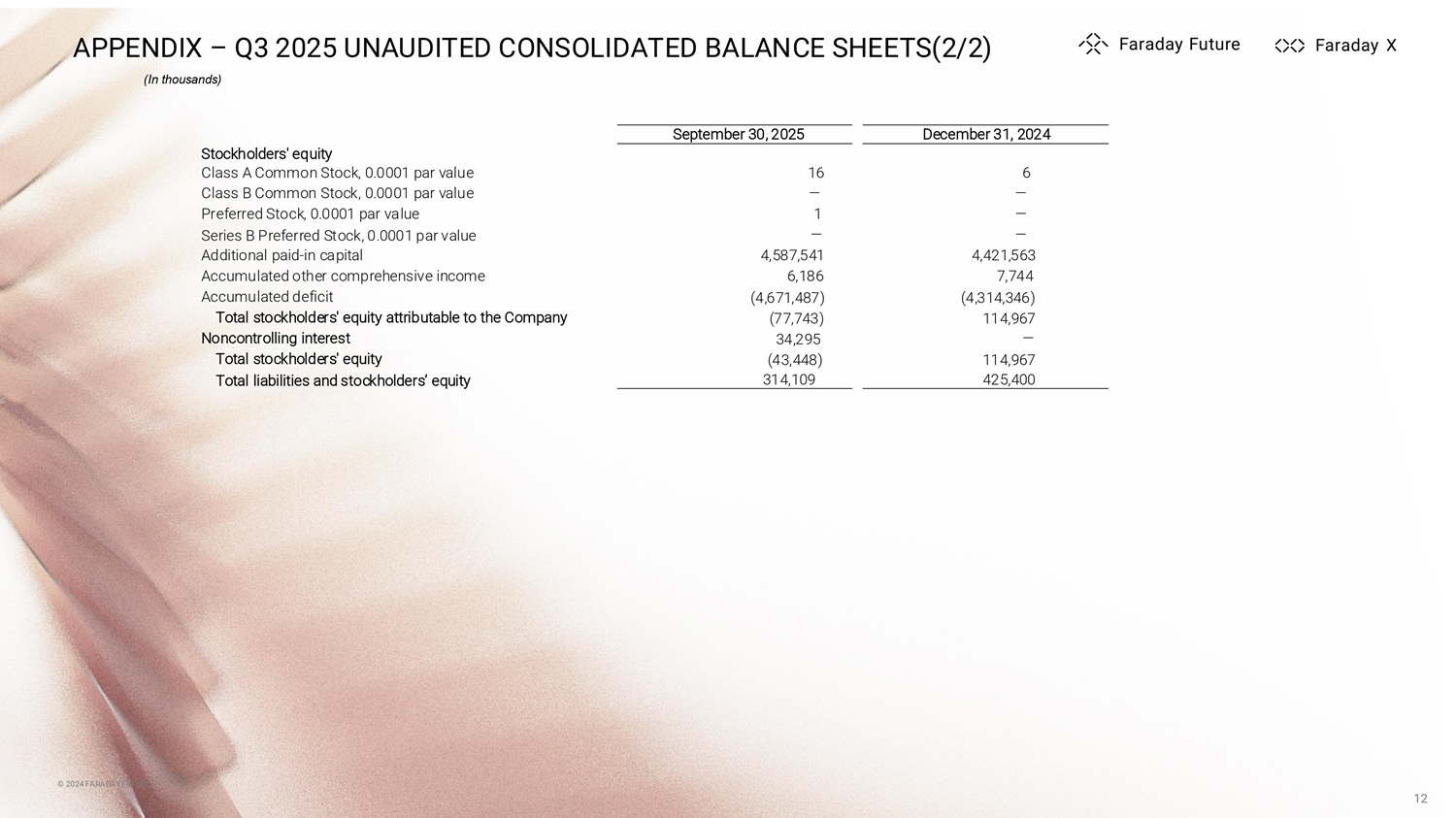

(Nasdaq: FFAI) Appendix November 13, 2025 = © 2025 FARADAY FUTURE © 2025 FARADAY FUTURE APPENDIX – Q3 2025 UNAUDITED CONSOLIDATED BALANCE SHEETS(1/2) (In thousands) © 2024 FARADAYFUTURE 11 December 31, 2024 September 30, 2025 Assets $ 7,144 $ 62,909 Cash 30 28 Restricted cash — 1,592 Digital assets — 589 Accounts receivable — 4,348 Short(term notes receivable 27,486 11,633 Inventory, net 37,221 20,195 Deposits and other current assets 71,881 113,691 Total current assets 348,587 164,610 Property, plant and equipment, net 1,761 5,877 Operating lease right(of(use asset, net 1,042 3,290 Intangible assets, net — 26,307 Goodwill 2,129 334 Other non(current assets $ 425,400 $ 314,109 Total assets Liabilities and stockholders’ equity $ 71,414 $ 61,881 Accounts payable 45,677 60,669 Accrued expenses and other current liabilities 11,077 12,540 Related party accrued expenses and other current liabilities 28,864 42,671 Warrant liabilities — 2,912 Related party warrant liabilities 25 — Accrued interest 23,227 19,574 Related party accrued interest 761 899 Other financing liabilities, current portion 2,128 2,110 Operating lease liabilities, current portion 4,224 7,450 Notes payable, current portion 5,310 2,940 Related party notes payable 192,707 213,646 Total current liabilities 38,698 45,633 Other financing liabilities, long term portion 14 3,653 Operating lease liabilities, long term portion 45,264 71,452 Notes payable, long term portion 2,754 2,536 Related party notes payable, long term portion 29,709 15,416 Derivative call options — 3,484 Related party derivative call option 1,287 1,737 Other liabilities 310,433 357,557 Total liabilitiesSG1 © 2025 FARADAY FUTURE APPENDIX – Q3 2025 UNAUDITED CONSOLIDATED BALANCE SHEETS(2/2) (In thousands) © 2024 FARADAY FUTURE 12 December 31, 2024 September 30, 2025 Stockholders' equity 6 16 Class A Common Stock, 0.0001 par value — — Class B Common Stock, 0.0001 par value — 1 Preferred Stock, 0.0001 par value — — Series B Preferred Stock, 0.0001 par value 4,421,563 4,587,541 Additional paid - in capital 7,744 6,186 Accumulated other comprehensive income (4,314,346) (4,671,487) Accumulated deficit 114,967 (77,743) Total stockholders' equity attributable to the Company — 34,295 Noncontrolling interest 114,967 (43,448) Total stockholders' equity 425,400 314,109 Total liabilities and stockholders’ equity

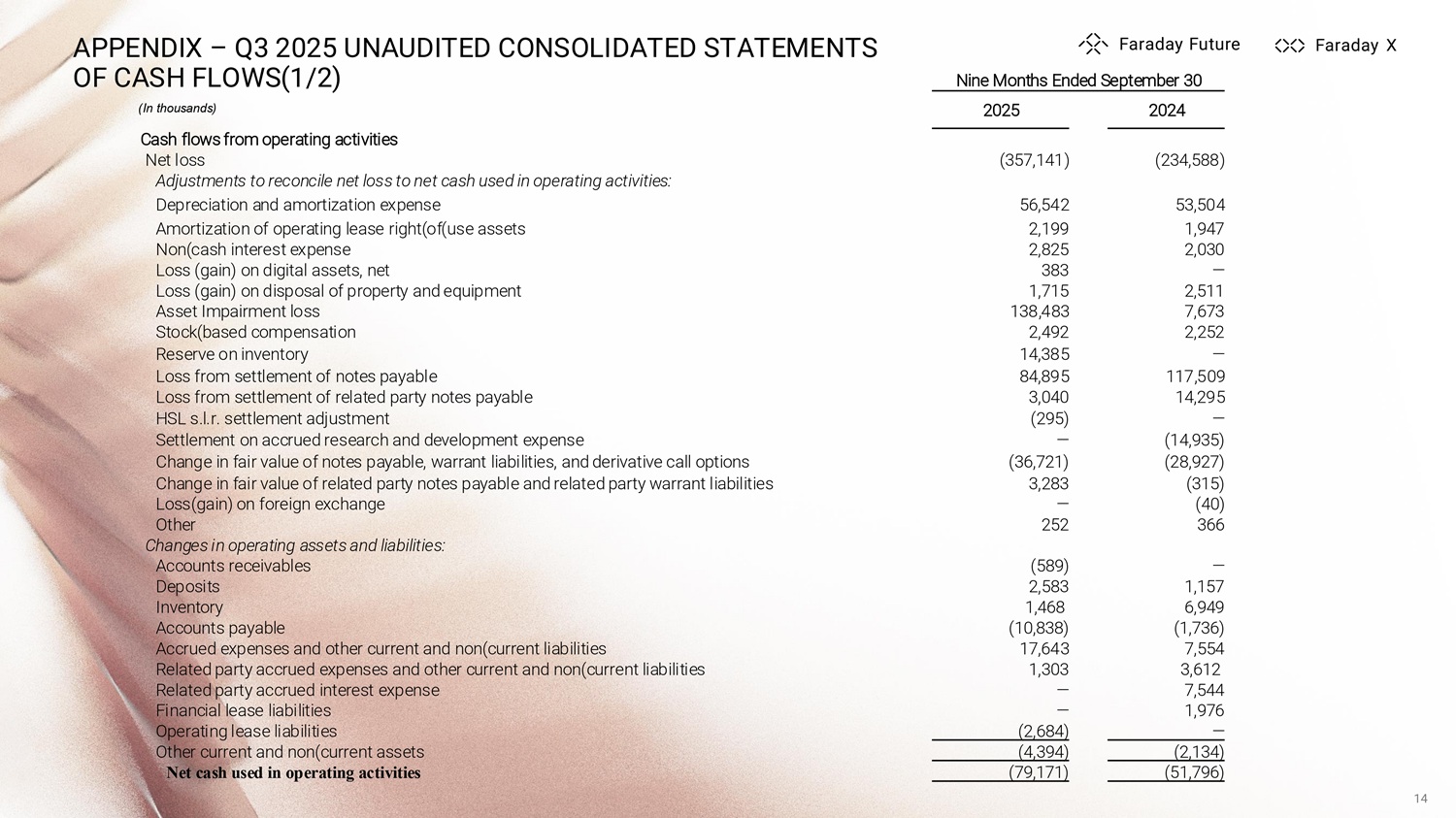

© 2025 FARADAY FUTURE © 2024 FARADAY FUTURE 13 APPENDIX – Q3 2025 UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (In thousands) Nine Months Ended September 30, Three Months Ended September 30, 2024 2025 2024 2025 $ 304 $ 407 $ 9 $ 37 Revenue 63,110 82,549 21,453 34,256 Cost of revenue (62,806) (82,142) (21,444) (34,219) Gross profit Operating expenses 15,185 18,063 5,180 6,640 Research and development 6,857 10,882 2,601 6,380 Sales and marketing 39,327 47,461 8,278 19,690 General and administrative (14,935) — (14,935) — Settlement on accrued research and development expenses 7,673 138,483 57 138,483 Asset impairment, net 2,511 1,715 2,582 1,395 Loss (gain) on disposal of property, plant, and equipment 56,618 216,604 3,763 172,588 Total operating expenses (119,424) (298,746) (25,207) (206,807) Loss from operations 28,927 36,721 8,287 31,341 Change in fair value of notes payable, warrant liabilities, and derivative call options 315 (3,283) 654 2,144 Change in fair value of related party notes payable, warrant liabilities, and derivative call options (117,509) (84,895) (59,128) (46,517) Loss on settlement of notes payable (14,295) (3,040) — — Loss on settlement of related party notes payable (5,386) (5,358) (1,442) (2,244) Interest expense (7,812) — (1,212) — Related party interest expense 599 1,475 361 (99) Other (loss) income, net (234,585) (357,126) (77,687) (222,182) Loss before income taxes (3) (15) 1 (5) Income tax expense $ (234,588) $ (357,141) $ (77,686) $ (222,187) Net loss © 2025 FARADAY FUTURE APPENDIX – Q3 2025 UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS(1/2) 14 (In thousands) Nine Months Ended September 30 2024 2025 Cash flows from operating activities (234,588) (357,141) Net loss Adjustments to reconcile net loss to net cash used in operating activities: 53,504 56,542 Depreciation and amortization expense 1,947 2,199 Amortization of operating lease right(of(use assets 2,030 2,825 Non(cash interest expense — 383 Loss (gain) on digital assets, net 2,511 1,715 Loss (gain) on disposal of property and equipment 7,673 138,483 Asset Impairment loss 2,252 2,492 Stock(based compensation — 14,385 Reserve on inventory 117,509 84,895 Loss from settlement of notes payable 14,295 3,040 Loss from settlement of related party notes payable — (295) HSL s.l.r . settlement adjustment (14,935) — Settlement on accrued research and development expense (28,927) (36,721) Change in fair value of notes payable, warrant liabilities, and derivative call options (315) 3,283 Change in fair value of related party notes payable and related party warrant liabilities (40) — Loss(gain) on foreign exchange 366 252 Other Changes in operating assets and liabilities: — (589) Accounts receivables 1,157 2,583 Deposits 6,949 1,468 Inventory (1,736) (10,838) Accounts payable 7,554 17,643 Accrued expenses and other current and non(current liabilities 3,612 1,303 Related party accrued expenses and other current and non(current liabilities 7,544 — Related party accrued interest expense 1,976 — Financial lease liabilities — (2,684) Operating lease liabilities (2,134) (4,394) Other current and non(current assets (51,796) (79,171) Net cash used in operating activities

© 2025 FARADAY FUTURE APPENDIX – Q3 2025 UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS(2/2) © 2024 FARADAY FUTURE 15 (In thousands) Nine Months Ended September 30 2024 2025 Cash flows from investing activities — 8,777 Investment in Qualigen Therapeutics, Inc., net of cash 87 — Proceeds from the sale of equipment — (10,500) Purchase of digital assets — 8,525 Sale of digital assets (659) (6,525) Payments for property and equipment (572) 277 Net cash used in investing activities Cash flows from financing activities 54,021 132,391 Proceeds from notes payable, net of original issuance discount — 4,802 Proceeds from other financial obligations 3,075 4,731 Proceeds from related party notes payable, net of original issuance discount — 1,441 Proceeds from exercise of warrants (101) (4,482) Payments of notes payable and other financing obligations (1,310) (2,540) Payments of notes payable issuance costs — (560) Payments of related party notes payable 55,685 135,783 Net cash provided by financing activities 7 (1,126) Effect of exchange rate changes on cash and restricted cash 3,324 55,763 Net (decrease) increase in cash and restricted cash 4,025 7,174 Cash and restricted cash, beginning of period 7,349 62,937 Cash and restricted cash, end of period © 2025 FARADAY FUTURE Faraday Future Intelligent Electric Inc. (Nasdaq: FFAI) Q & A November 13, 2025 = © 2025 FARADAY FUTURE