UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2025

Commission File Number: 001-41737

Lifezone Metals Limited

2nd Floor, St George’s Court,

Upper Church Street,

Douglas, Isle of Man, IM1 1EE

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40- F ☐

Lifezone Metals Limited (the “Company”) is furnishing this current report on Form 6-K to report a June 2025 Kabanga Nickel Project - Technical Report Summary - Initial Assessment.

The Company intends to incorporate this Form 6-K and the accompanying exhibits by reference into its registration statements on Form F-3 (File Nos. 333-272865 and 333-281189) and Form S-8 (File No. 333-274449) and the related prospectuses, respectively as such registration statements and prospectuses may be amended from time to time, and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

Exhibit Index

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| LIFEZONE METALS LIMITED | ||

| Date: June 2, 2025 | By: | /s/ Chris Showalter |

| Name: | Chris Showalter | |

| Title: | Chief Executive Officer | |

Exhibit 23.1

CONSENT OF EXPERT

I hereby consent to the use of and reference to my name, Sharron Sylvester, B.Sc. (Geol), RPGeo AIG, and the information listed below that I reviewed and approved, as described or incorporated by reference in Lifezone Metals Limited’s Form F-3 (File Nos. 333-272865 and 333-281189) and Form S-8 (File No. 333-274449) and the related prospectuses, filed with the United States Securities and Exchange Commission and any amendments and/or exhibits thereto (collectively, the “Registration Statements”). I am a “Qualified Person” as defined in Regulation S-K 1300.

I have reviewed and approved the following:

| ● | the Kabanga Nickel Project Initial Assessment Technical Report Summary titled “Initial Assessment - Technical Report Summary” effective June 2, 2025 (the ” IA Technical Report Summary”); and |

| ● | the information derived, summarized, quoted or referenced from the IA Technical Report Summary, or portions thereof, that was prepared by me, that I supervised the preparation of and/or that was reviewed and approved by me, that is included or incorporated by reference in the Registration Statements. |

I consent to the public filing and use of the IA Technical Report Summary as exhibits to the Registration Statements and the Form 6-K of Lifezone Metals Limited to which this consent is an exhibit.

| Dated this 2nd day of June, 2025. | |

| Yours sincerely, | |

| /s/ Sharron Sylvester | |

| Sharron Sylvester, B.Sc. (Geol), RPGeo AIG | |

| Technical Director – Geology | |

| OreWin Pty Ltd |

Exhibit 23.2

CONSENT OF EXPERT

DRA Projects (Pty) Ltd hereby consents to the use of and reference to it and its name, DRA Projects (Pty) Ltd, and the information listed below that it has reviewed and approved, as described or incorporated by reference in Lifezone Metals Limited’s Form F-3 (File Nos. 333-272865 and 333-281189) and Form S-8 (File No. 333-274449) and the related prospectuses, filed with the United States Securities and Exchange Commission and any amendments and/or exhibits thereto (collectively, the “Registration Statements”). DRA Projects (Pty) Ltd is a “Qualified Person” as defined in Regulation S-K 1300.

DRA Projects (Pty) Ltd has reviewed and approved the following:

| ● | the Kabanga Nickel Project Initial Assessment Technical Report Summary titled “Initial Assessment - Technical Report Summary” effective June 2, 2025 (the ” IA Technical Report Summary”); and |

| ● | the information derived, summarized, quoted or referenced from the IA Technical Report Summary, or portions thereof, that were prepared by DRA Projects (Pty) Ltd, that DRA Projects (Pty) Ltd supervised the preparation of and/or that was reviewed and approved by DRA Projects (Pty) Ltd, that is included or incorporated by reference in the Registration Statements. |

DRA Projects (Pty) Ltd consents to the public filing and use of the IA Technical Report Summary as exhibits to the Registration Statements and the Form 6-K of Lifezone Metals Limited to which this consent is an exhibit.

| Dated this 2nd day of June, 2025. | |

| Yours sincerely, | |

| /s/ DRA Projects (Pty) Ltd | |

| For and on behalf of | |

| DRA Projects (Pty) Ltd | |

Exhibit 96.1

|

/ / Initial Assessment - Technical Report Summary |

|

TABLE OF CONTENTS

| ABBREVIATIONS | 17 | |||

| UNITS OF MEASURE | 22 | |||

| 1 | EXECUTIVE SUMMARY | 23 | ||

| 1.1 | Introduction | 23 | ||

| 1.2 | Property Description, Mineral Tenure, Ownership, Surface Rights, Royalties, Agreements and Permits | 23 | ||

| 1.3 | Geology | 27 | ||

| 1.3.1 | Geological Setting | 27 | ||

| 1.3.2 | Style of Mineralization | 27 | ||

| 1.3.3 | Exploration History | 27 | ||

| 1.3.4 | Sample Preparation, Analyses, Security and Data Verification | 28 | ||

| 1.4 | Mineral Processing and Metallurgical Testing | 29 | ||

| 1.4.1 | Kabanga Concentrator | 29 | ||

| 1.4.2 | Kahama Refinery | 30 | ||

| 1.5 | Mineral Resource Estimate | 30 | ||

| 1.6 | Mineral Reserve Estimate | 34 | ||

| 1.7 | Mining Methods | 34 | ||

| 1.8 | Processing and Recovery Methods | 36 | ||

| 1.8.1 | Kabanga Concentrator | 36 | ||

| 1.8.2 | Kahama Refinery | 36 | ||

| 1.9 | Project Infrastructure | 37 | ||

| 1.9.1 | Kabanga Site | 37 | ||

| 1.9.2 | Kahama Site | 37 | ||

| 1.9.3 | Logistics | 38 | ||

| 1.10 | Market Studies | 38 | ||

| 1.11 | Environmental, Permitting and Social License | 40 | ||

| 1.12 | Capital and Operating Costs | 41 | ||

| 1.12.1 | Capital Costs | 41 | ||

| 1.12.2 | Operating Costs | 42 | ||

| 1.13 | Economic Analysis | 42 | ||

| 1.14 | Conclusions and Recommendations | 44 | ||

| 1.14.1 | Geology and Mineral Resources | 44 | ||

| 1.14.2 | Project Development | 44 | ||

| 2 | INTRODUCTION | 46 | ||

| 2.1 | Background | 46 | ||

| 2.2 | Registrant for Whom the Technical Report Summary was Prepared | 46 | ||

| 2.3 | Terms of Reference and Purpose of the Report | 46 | ||

| 2.4 | Source of Information and Data | 46 | ||

| 2.5 | Qualified Persons | 47 | ||

| 2.5.1 | QP – Sharron Sylvester | 47 | ||

| 2.5.2 | QP – DRA | 47 | ||

| 2.6 | Details of Personal Inspection | 49 | ||

| 2.6.1 | Site Inspections – Sharron Sylvester | 49 | ||

| 2.6.2 | Site Inspections – DRA | 49 | ||

| 2.7 | Units and Currency | 50 | ||

| 2.8 | Effective Dates | 50 | ||

| 3 | PROPERTY DESCRIPTION | 50 | ||

| 3.1 | Project Location | 50 | ||

| 3.1.1 | Co-ordinates System | 50 | ||

Page

|

/ / Initial Assessment - Technical Report Summary |

|

| 3.2 | Ownership | 51 | ||

| 3.3 | Framework Agreement Summary and Economic Benefits Sharing Principal | 52 | ||

| 3.4 | Special Mining Licence | 52 | ||

| 3.5 | The Refinery and the Refining Licence | 53 | ||

| 3.6 | Special Economic Zone – Kahama | 53 | ||

| 3.7 | BHP Investment in Kabanga Nickel Limited | 54 | ||

| 3.8 | Lifezone Limited-KNL Development, Licensing and Services Agreement | 54 | ||

| 3.9 | Mineral Rights, Surface Rights and Environmental Rights | 54 | ||

| 4 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE, AND PHYSIOGRAPHY | 56 | ||

| 4.1 | Overview | 56 | ||

| 4.2 | Kabanga Site | 56 | ||

| 4.2.1 | Location | 56 | ||

| 4.2.2 | Accessibility | 56 | ||

| 4.2.3 | Existing Infrastructure | 56 | ||

| 4.2.4 | Physiography and Vegetation (and Habitats/Species of Conservation Importance) | 57 | ||

| 4.2.5 | Climate | 57 | ||

| 4.2.6 | Seismicity | 57 | ||

| 4.2.7 | Catchments and Water Resources | 57 | ||

| 4.3 | Kahama Site | 58 | ||

| 4.3.1 | Location | 58 | ||

| 4.3.2 | Accessibility | 58 | ||

| 4.3.3 | Existing Infrastructure and Local Resources | 59 | ||

| 4.3.4 | Physiography and Vegetation | 59 | ||

| 4.3.5 | Climate | 60 | ||

| 4.3.6 | Catchments and Water Resources | 60 | ||

| 4.4 | Availability of Infrastructure | 60 | ||

| 4.5 | Country and Regional Setting | 60 | ||

| 5 | HISTORY | 61 | ||

| 5.1 | UNDP Era (1976–79) | 61 | ||

| 5.2 | Sutton Era (1990–99) | 61 | ||

| 5.2.1 | Sutton – BHP JV Era (1990–95) | 61 | ||

| 5.2.2 | Sutton (1995–97) | 61 | ||

| 5.2.3 | Sutton – Anglo JV Era (1997–99) | 61 | ||

| 5.3 | Barrick Era (1999–2004) | 62 | ||

| 5.4 | Barrick – Glencore JV Era (2005–18) | 62 | ||

| 5.5 | Tanzanian Mining Law Reform (2018–21) | 63 | ||

| 5.6 | Previous Technical Report Summaries | 63 | ||

| 5.6.1 | March 2023 Technical Report Summary | 63 | ||

| 5.6.2 | November 2023 Technical Report Summary | 63 | ||

| 5.6.3 | December 2024 Technical Report Summary | 63 | ||

| 6 | GEOLOGICAL SETTING, MINERALIZATION, AND DEPOSIT | 64 | ||

| 6.1 | Regional Geological Setting | 64 | ||

| 6.2 | Property Geology | 65 | ||

| 6.3 | Lithologies and Stratigraphy | 66 | ||

| 6.4 | Structural Setting | 67 | ||

| 6.5 | Deposit Description | 67 | ||

| 6.6 | Mineralization Style | 67 | ||

| 6.7 | Alteration and Weathering | 68 | ||

Page

|

/ / Initial Assessment - Technical Report Summary |

|

| 7 | EXPLORATION | 73 | ||

| 7.1 | Exploration Timeline | 73 | ||

| 7.1.1 | Early Regional Exploration 1976–79 | 73 | ||

| 7.1.2 | Sutton Era Exploration | 74 | ||

| 7.1.3 | Barrick Era Exploration | 75 | ||

| 7.1.4 | TNCL Exploration: 2021–Present | 77 | ||

| 7.2 | Exploration and Drillhole Database | 77 | ||

| 7.3 | Drilling, Core Logging, Downhole Survey, and Sampling | 78 | ||

| 7.3.1 | Drilling | 78 | ||

| 7.3.2 | Core Recovery | 78 | ||

| 7.3.3 | Core Logging | 78 | ||

| 7.3.4 | Core Sampling | 78 | ||

| 7.3.5 | Collar Survey | 79 | ||

| 7.3.6 | Downhole Survey | 79 | ||

| 7.3.7 | BHEM Data | 80 | ||

| 7.3.8 | Drillhole Database | 81 | ||

| 7.4 | Density Measurements | 82 | ||

| 7.5 | Planned Drilling Campaigns | 83 | ||

| 7.6 | Exploration Targets | 84 | ||

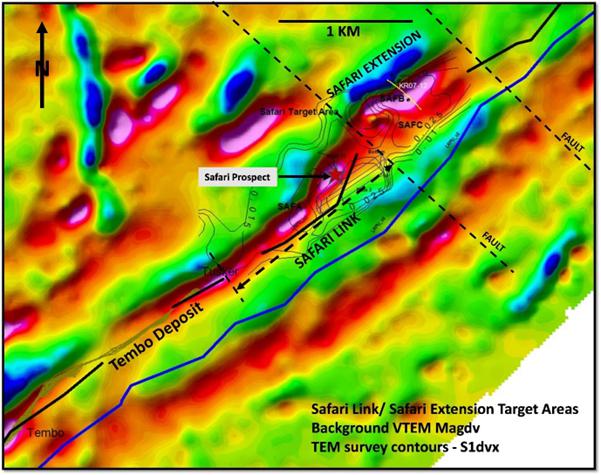

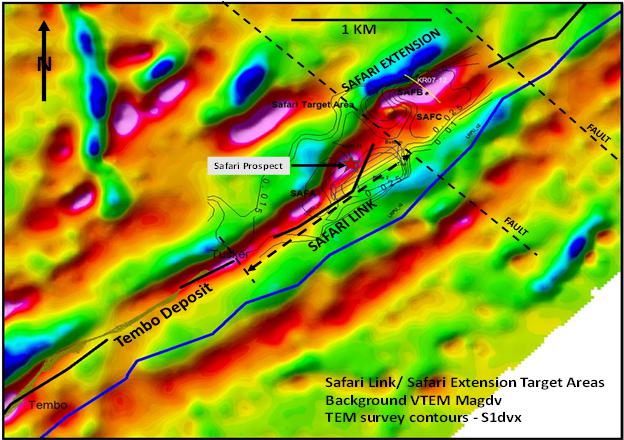

| 7.6.1 | Safari Link Exploration Target | 84 | ||

| 7.6.2 | Safari Extension Exploration Target | 86 | ||

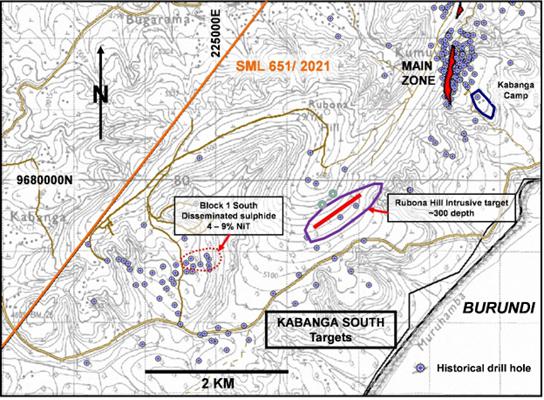

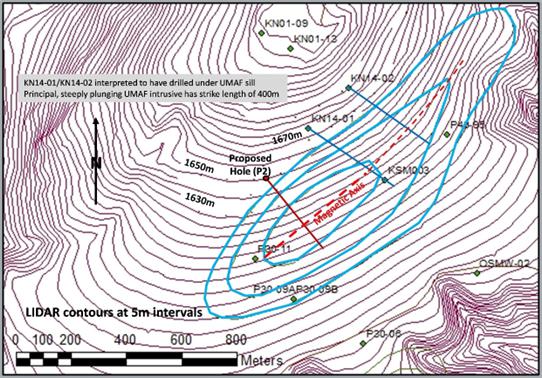

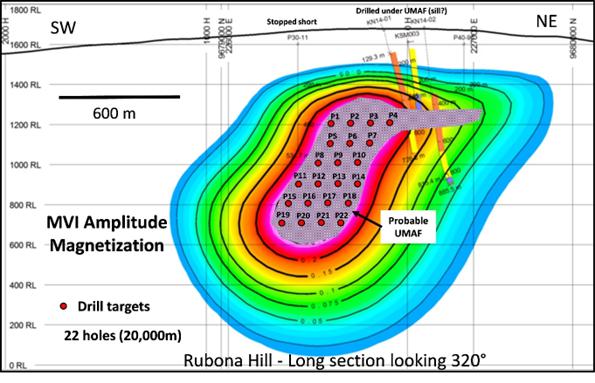

| 7.6.3 | Rubona Hill Exploration Target | 87 | ||

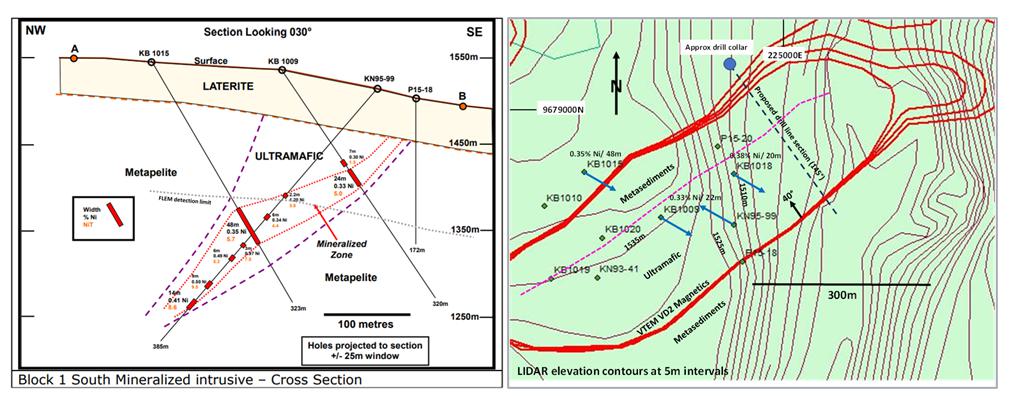

| 7.6.4 | Block 1 South Exploration Target | 89 | ||

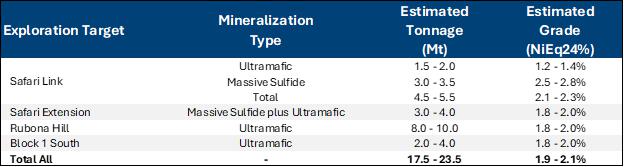

| 7.6.5 | Exploration Target Summary | 90 | ||

| 8.1 | Introduction | 91 | ||

| 8.2 | Sample Preparation | 91 | ||

| 8.3 | Assaying | 91 | ||

| 8.4 | Quality Assurance and Quality Control | 94 | ||

| 8.4.1 | QA/QC Sample Frequency | 94 | ||

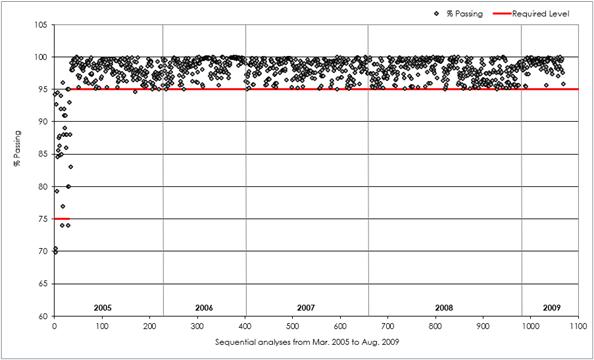

| 8.4.2 | Sample Preparation QA/QC – Screen Test | 94 | ||

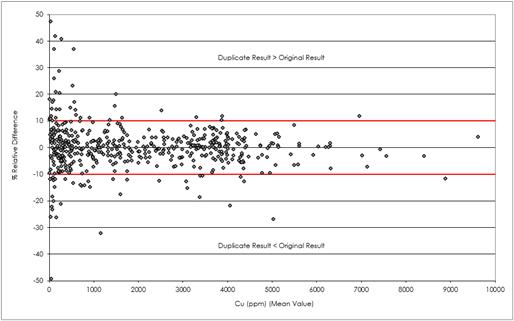

| 8.4.3 | Duplicates and Check Assays – ALS-Chemex Coarse Reject Duplicates | 95 | ||

| 8.4.4 | Genalysis Pulp Check Assays | 96 | ||

| 8.4.5 | SGS Lakefield Pulp Check Assays | 99 | ||

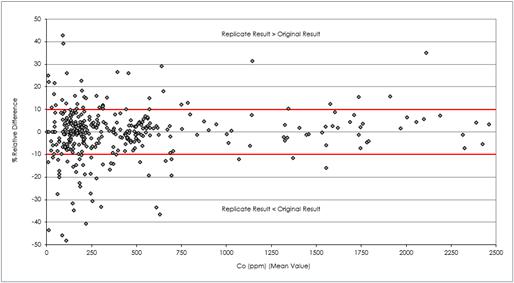

| 8.4.6 | Quarter Core Replicates | 100 | ||

| 8.4.7 | Certified Reference Material Standards | 101 | ||

| 8.4.8 | Blanks | 107 | ||

| 8.5 | Security | 108 | ||

| 8.6 | QP Opinion | 108 | ||

| 9.1 | Independent Verifications | 109 | ||

| 9.1.1 | Site Visit | 109 | ||

| 9.1.2 | Verifications of Analytical Quality Control Data | 109 | ||

| 9.2 | QP Opinion | 109 | ||

| 10.1 | Background | 110 | ||

| 10.2 | Concentrator | 110 | ||

| 10.2.1 | Concentrator Historical Testwork | 110 | ||

| 10.2.2 | Concentrator Current Testwork (2022-25) | 113 | ||

| 10.2.3 | Concentrator Metallurgical Performance Projection | 122 | ||

| 10.2.4 | QP Opinion – Concentrator | 130 | ||

| 10.3 | Refinery | 130 | ||

| 10.3.1 | Historical Flowsheet Assessments and Metallurgical Testwork | 130 | ||

| 10.3.2 | Refinery Testwork Concentrate Samples | 131 | ||

| 10.3.3 | Refinery Phase 1 Testwork | 132 | ||

Page

|

/ / Initial Assessment - Technical Report Summary |

|

| 10.3.4 | Refinery Phase 2 Testwork | 132 | ||

| 10.3.5 | Refinery Piloting Testwork (2024) | 133 | ||

| 10.3.6 | Refinery Ongoing Testwork | 134 | ||

| 10.3.7 | Refinery Testwork Conclusions | 134 | ||

| 10.3.8 | Refinery Metallurgical Performance | 135 | ||

| 10.3.9 | QP Opinion – Refinery | 135 | ||

| 11 | MINERAL RESOURCE ESTIMATE | 136 | ||

| 11.1 | Mineral Resource Modeling | 136 | ||

| 11.2 | 2024 Mineral Resource Drillhole Database | 136 | ||

| 11.3 | Mineral Resource Domain Interpretations | 136 | ||

| 11.3.1 | Grade and Lithology | 138 | ||

| 11.3.2 | Drillhole Compositing | 144 | ||

| 11.3.3 | Top Cutting | 145 | ||

| 11.3.4 | Boundary Treatment | 145 | ||

| 11.3.5 | Variography | 147 | ||

| 11.3.6 | Search Parameters | 147 | ||

| 11.3.7 | Grade Estimation | 150 | ||

| 11.3.8 | Model Validation | 150 | ||

| 11.3.9 | Classification | 155 | ||

| 11.4 | Mineral Resource Cut-off Grade | 157 | ||

| 11.4.1 | NiEq24 Cut-off Grade | 158 | ||

| 11.4.2 | Cut-off Grade Sensitivity | 162 | ||

| 11.5 | Reasonable Prospects of Economic Extraction | 164 | ||

| 11.6 | Mineral Resource Statement – Kabanga 2024 | 164 | ||

| 11.6.1 | Comparison to Previous Mineral Resource Estimates – All Mineralization Types | 169 | ||

| 11.7 | Mineral Resource Risks and Opportunities | 171 | ||

| 11.7.1 | Specific Identified Risks | 171 | ||

| 11.7.2 | Mineral Resource Opportunities | 172 | ||

| 11.8 | QP Opinion | 172 | ||

| 11.8.1 | Opinion – Geology and Mineral Resources | 172 | ||

| 11.8.2 | QP Opinion – Other | 172 | ||

| 12 | MINERAL RESERVE ESTIMATES | 172 | ||

| 13 | MINING METHODS | 173 | ||

| 13.1 | Summary | 173 | ||

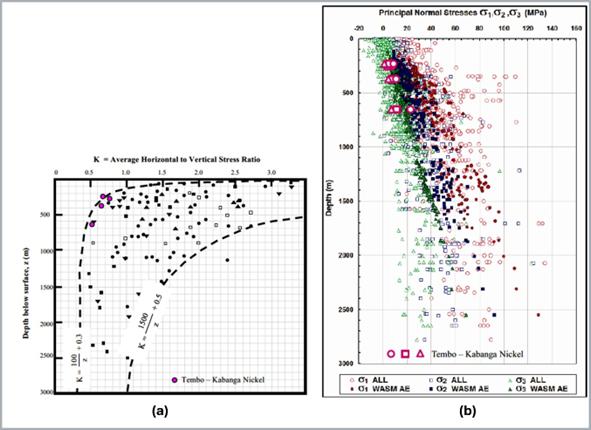

| 13.2 | Mine Geotechnical | 174 | ||

| 13.2.1 | Ground Support | 174 | ||

| 13.2.2 | Stress Environment | 174 | ||

| 13.2.3 | Material Strength Testwork | 175 | ||

| 13.2.4 | Structural Setting | 177 | ||

| 13.2.5 | Stope Spans | 177 | ||

| 13.2.6 | Vertical Development | 178 | ||

| 13.2.7 | Numerical Modeling | 178 | ||

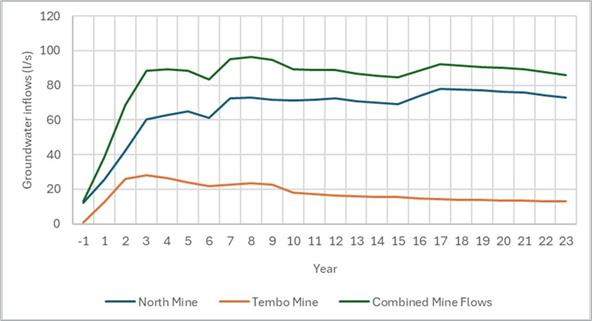

| 13.3 | Hydrogeology | 179 | ||

| 13.4 | Mining Design | 179 | ||

| 13.4.1 | Stope Optimization | 179 | ||

| 13.4.2 | Mining Method | 181 | ||

| 13.4.3 | Development | 182 | ||

| 13.4.4 | Dilution and Recovery | 184 | ||

| 13.4.5 | Scheduling | 184 | ||

| 13.4.6 | Mining Sequence | 185 | ||

| 13.4.7 | Equipment | 186 | ||

Page

|

/ / Initial Assessment - Technical Report Summary |

|

| 13.5 | Backfill | 187 | ||

| 13.5.1 | Backfill Demand | 187 | ||

| 13.5.2 | Testwork and Paste Recipe | 187 | ||

| 13.5.3 | Reticulation | 188 | ||

| 13.5.4 | Fill Strategy | 188 | ||

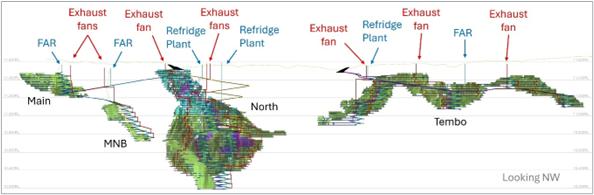

| 13.6 | Ventilation | 189 | ||

| 13.6.1 | Airflow Requirements | 189 | ||

| 13.6.2 | Ventilation Infrastructure | 190 | ||

| 13.6.3 | Secondary Ventilation | 191 | ||

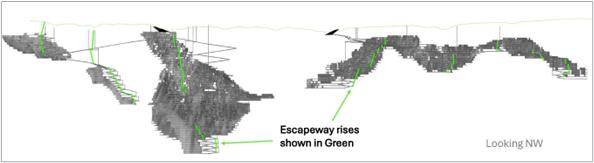

| 13.7 | Secondary Egress | 191 | ||

| 13.8 | Mining Underground Infrastructure | 192 | ||

| 13.9 | Mining Labor | 192 | ||

| 13.10 | Mine Schedule | 192 | ||

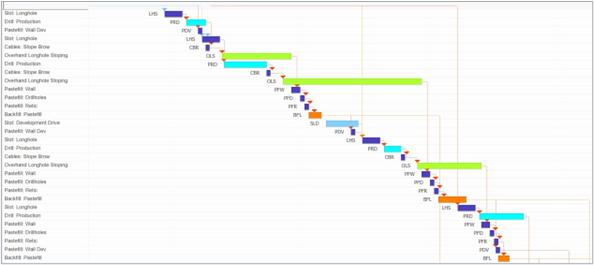

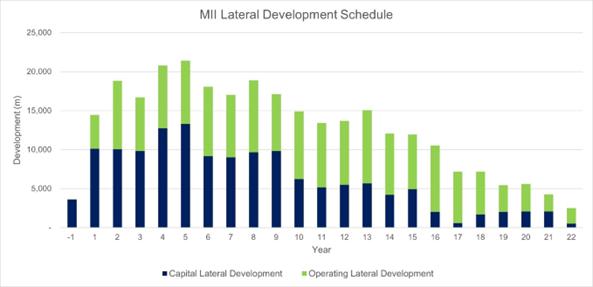

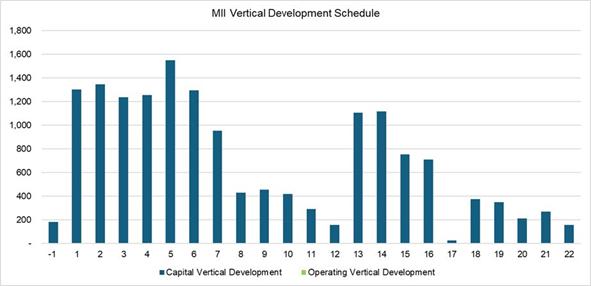

| 13.10.1 | Development Schedule | 193 | ||

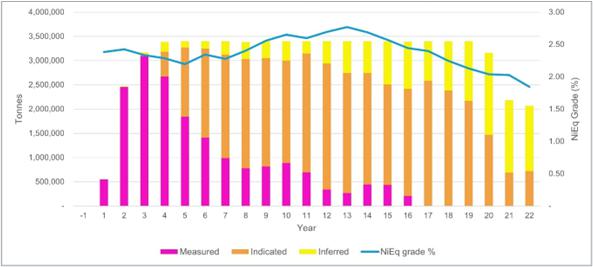

| 13.10.2 | Production Schedule (Measured, Indicated, and Inferred Case) | 194 | ||

| 13.10.3 | Production Schedule without Inferred Mineral Resource | 196 | ||

| 13.11 | QP Opinion | 197 | ||

| 14 | PROCESSING AND RECOVERY METHODS | 197 | ||

| 14.1 | Concentrator Processing and Recovery Methods | 197 | ||

| 14.1.1 | Process Overview and Description | 197 | ||

| 14.1.2 | Process Flowsheet and Design Basis | 198 | ||

| 14.1.3 | Process Description | 200 | ||

| 14.2 | Refinery Processing and Recovery Methods | 204 | ||

| 14.2.1 | Process Overview and Description | 204 | ||

| 14.2.2 | Process Description | 206 | ||

| 14.2.3 | Reagents, Utilities and Consumables | 209 | ||

| 14.2.4 | Refinery Demonstration Plant | 210 | ||

| 14.3 | QP Opinion | 210 | ||

| 14.3.1 | Concentrator | 210 | ||

| 14.3.2 | Refinery | 210 | ||

| 15 | INFRASTRUCTURE | 211 | ||

| 15.1 | Kabanga | 211 | ||

| 15.1.1 | Power Supply | 211 | ||

| 15.1.2 | Water Supply | 211 | ||

| 15.1.3 | External and Internal Site Access Roads | 212 | ||

| 15.1.4 | Kabanga Site Infrastructure | 213 | ||

| 15.1.5 | Waste Handling | 215 | ||

| 15.1.6 | Hydrology and Water Balance | 215 | ||

| 15.1.7 | TSF | 215 | ||

| 15.2 | Kahama | 216 | ||

| 15.2.1 | Existing External Power | 216 | ||

| 15.2.2 | Water Supply and Treatment | 217 | ||

| 15.2.3 | External and Internal Site Access Roads | 217 | ||

| 15.2.4 | Kahama Site Infrastructure | 217 | ||

| 15.2.5 | Refinery Waste Management | 218 | ||

| 15.2.6 | Refinery Residue Storage | 218 | ||

| 15.2.7 | Other | 218 | ||

| 15.3 | Logistics | 219 | ||

| 15.3.1 | Construction Logistics | 219 | ||

| 15.3.2 | Operational Logistics | 220 | ||

| 15.4 | QP Opinion | 222 | ||

Page

|

/ / Initial Assessment - Technical Report Summary |

|

| 16 | MARKET STUDIES | 223 | ||

| 16.1 | Market Outlook | 223 | ||

| 16.1.1 | Nickel | 223 | ||

| 16.1.2 | Cobalt | 223 | ||

| 16.1.3 | Copper | 224 | ||

| 16.2 | Market Prices | 225 | ||

| 16.2.1 | Metal Prices – IA | 225 | ||

| 16.2.2 | Metal Prices – Mineral Resource Estimate | 225 | ||

| 16.2.3 | Price Sensitivities | 225 | ||

| 16.3 | Concentrate and Refined Products Marketing | 226 | ||

| 16.3.1 | Concentrate Marketing | 226 | ||

| 16.3.2 | Refinery Marketing | 228 | ||

| 16.3.3 | Refinery Product Specifications | 228 | ||

| 16.4 | QP Opinion | 228 | ||

| 17 | ENVIRONMENTAL STUDIES, PERMITTING, AND PLANS, NEGOTIATIONS, OR AGREEMENTS WITH LOCAL INDIVIDUALS OR GROUPS | 229 | ||

| 17.1 | Summary | 229 | ||

| 17.2 | Licensing Conditions | 229 | ||

| 17.2.1 | Permitting Requirements | 230 | ||

| 17.2.2 | Required Bonds | 230 | ||

| 17.3 | Environmental, Social and Cultural Impact Assessments | 231 | ||

| 17.3.1 | Environmental, Social and Cultural Impact Assessment Background | 231 | ||

| 17.3.2 | Project ESIAs and Baseline Studies | 231 | ||

| 17.3.3 | Environmental, Social and Cultural Baseline Assessment Summary | 232 | ||

| 17.4 | Stakeholder Engagement Considerations | 239 | ||

| 17.5 | Land Access and Resettlement | 239 | ||

| 17.5.1 | Overview | 239 | ||

| 17.5.2 | Resettlement Action Plan | 239 | ||

| 17.5.3 | Stakeholder Engagement | 239 | ||

| 17.5.4 | Compensation Agreements and Process | 239 | ||

| 17.5.5 | Livelihood Restoration | 240 | ||

| 17.5.6 | Land Acquisition and Management Strategy | 240 | ||

| 17.5.7 | Relocation and Land Access Risk Assessment | 241 | ||

| 17.6 | Mine and Facility Closure, Remediation and Reclamation | 241 | ||

| 17.6.1 | Mine and Facility Closure | 241 | ||

| 17.6.2 | Tailings Management and Closure | 242 | ||

| 17.7 | QP Opinion | 242 | ||

| 18 | CAPITAL AND OPERATING COSTS | 243 | ||

| 18.1 | Capital Cost Estimates | 243 | ||

| 18.1.1 | Pre-Production Capex | 244 | ||

| 18.1.2 | Growth Capital | 245 | ||

| 18.1.3 | Sustaining Capital | 245 | ||

| 18.1.4 | Contingency | 246 | ||

| 18.1.5 | Capital Estimate Exclusions | 246 | ||

| 18.2 | Operating Costs | 247 | ||

| 18.2.1 | 2000 - Mining | 247 | ||

| 18.2.2 | A3000/A6000 – Concentrator and Infrastructure | 247 | ||

| 18.2.3 | A5000 – Kahama Refinery | 247 | ||

| 18.2.4 | A8000 – Owner’s Cost, Admin and Overheads | 248 | ||

| 18.2.5 | Product Logistics | 248 | ||

Page

|

/ / Initial Assessment - Technical Report Summary |

|

| 19 | ECONOMIC ANALYSIS | 249 | ||

| 19.1 | General Description | 249 | ||

| 19.2 | Forward-looking Statements | 250 | ||

| 19.3 | Assumptions and Inputs | 251 | ||

| 19.3.1 | Metal Pricing | 251 | ||

| 19.3.2 | Discounting | 251 | ||

| 19.3.3 | General | 251 | ||

| 19.3.4 | Taxes, Duties, Levies, and Depreciation | 251 | ||

| 19.3.5 | Royalties | 253 | ||

| 19.3.6 | Working Capital | 253 | ||

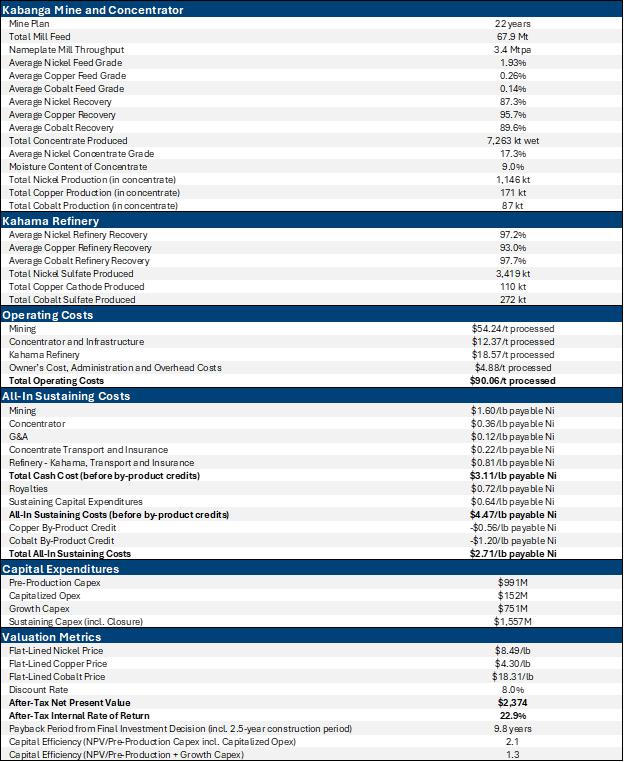

| 19.4 | Economic Analysis Results | 253 | ||

| 19.4.1 | Overview | 253 | ||

| 19.4.2 | Project Economics | 253 | ||

| 19.4.3 | Production Summary | 255 | ||

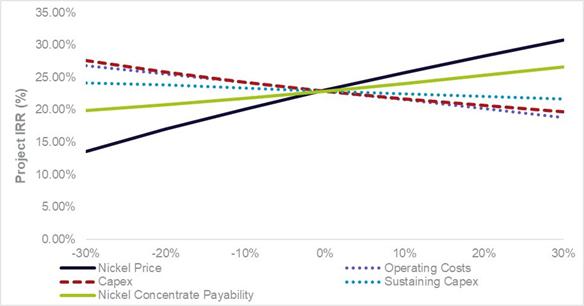

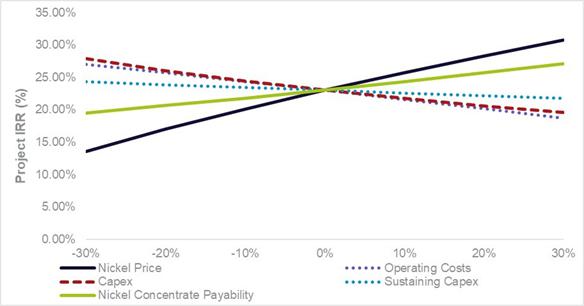

| 19.4.4 | Sensitivity Analysis | 261 | ||

| 20 | ADJACENT PROPERTIES | 263 | ||

| 21 | OTHER RELEVANT DATA AND INFORMATION | 263 | ||

| 22 | INTERPRETATION AND CONCLUSIONS | 264 | ||

| 22.1 | Geology and Mineral Resources | 264 | ||

| 22.2 | Mining Methods | 264 | ||

| 22.3 | Hydrogeology and Groundwater Modeling | 264 | ||

| 22.4 | Geochemistry | 264 | ||

| 22.5 | Metallurgy and Process | 264 | ||

| 22.5.1 | Kabanga Concentrator | 264 | ||

| 22.5.2 | Kahama Refinery | 265 | ||

| 22.6 | Infrastructure | 265 | ||

| 22.6.1 | Water | 266 | ||

| 22.6.2 | TSF | 266 | ||

| 22.7 | Environmental | 266 | ||

| 22.8 | Market Studies | 266 | ||

| 22.9 | Economic Analysis | 267 | ||

| 22.10 | Risks and Uncertainties | 267 | ||

| 23 | RECOMMENDATIONS | 268 | ||

| 23.1 | Geology and Mineral Resources | 268 | ||

| 23.2 | Mining Methods | 268 | ||

| 23.3 | Hydrogeology and Surface Water | 268 | ||

| 23.4 | Metallurgy and Processing | 268 | ||

| 23.4.1 | Kabanga Concentrator | 268 | ||

| 23.4.2 | Kahama Refinery | 268 | ||

| 23.5 | Infrastructure | 269 | ||

| 23.5.1 | Kabanga Site | 269 | ||

| 23.5.2 | Kahama Site | 269 | ||

| 23.5.3 | Logistics | 269 | ||

| 23.6 | Environmental and Social Studies, Permitting and Plans | 269 | ||

| 23.7 | Economic Analysis | 269 | ||

| 23.8 | The Project Work Plan and Costs for Recommended Work | 269 | ||

| 23.8.1 | QP Opinion – Geology and Mineral Resources | 270 | ||

| 23.8.2 | QP Opinion – Other | 270 | ||

| 24 | REFERENCES | 271 | ||

| 25 | RELIANCE ON INFORMATION PROVIDED BY THE REGISTRANT | 278 | ||

| EFFECTIVE DATE AND QP SIGNATURE PAGE | 279 | |||

| GLOSSARY | 280 | |||

Page

|

/ / Initial Assessment - Technical Report Summary |

|

LIST OF TABLES

| Table 1-1: Kabanga Mineral Resource Estimates as at December 4, 2024 – Tonnes and Grade | 32 |

| Table 1-2: Kabanga Mineral Resource Estimates as at December 4, 2024 –Contained Metals | 33 |

| Table 1-3: Kabanga Long-Term Metal Price Assumptions | 39 |

| Table 1-4: Kabanga Concentrate Typical Specification | 39 |

| Table 1-5: Project Capital Cost Estimate Summary | 42 |

| Table 1-6: Operating Cost Estimate Summary | 42 |

| Table 1-7: Key Project Metrics | 43 |

| Table 2-1: Qualified Persons’ Responsibility Breakdown per Section | 47 |

| Table 2-2: QP Site Inspection Details – Sharron Sylvester | 49 |

| Table 2-3: QP Site Inspection Details – DRA | 49 |

| Table 7-1: Exploration Drilling Summary | 73 |

| Table 7-2: Downhole Survey Statistics for North and Tembo – Survey Method | 79 |

| Table 7-3: Downhole Survey Statistics for North and Tembo – Location | 79 |

| Table 7-4: Safari Link Exploration Target Range Estimates | 86 |

| Table 7-5: Summary of Kabanga Nickel Project Exploration Target Estimates | 90 |

| Table 8-1: Summary of Analytical Techniques for Mineral Resource Drilling | 93 |

| Table 8-2: Frequency of QA/QC Samples 2005–09 | 94 |

| Table 8-3: Kabanga CRMs – Accepted Grades | 101 |

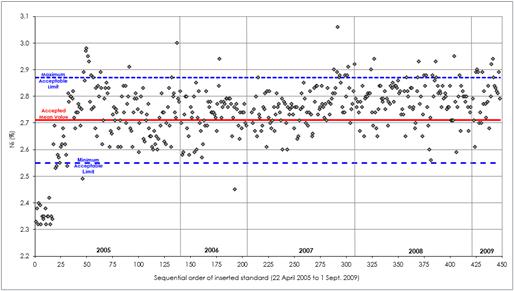

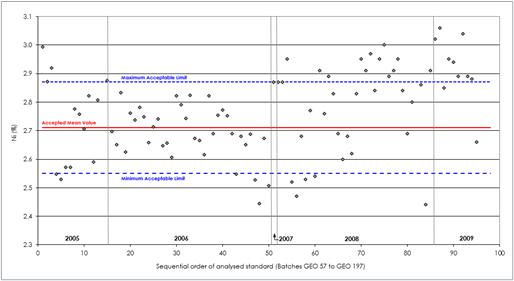

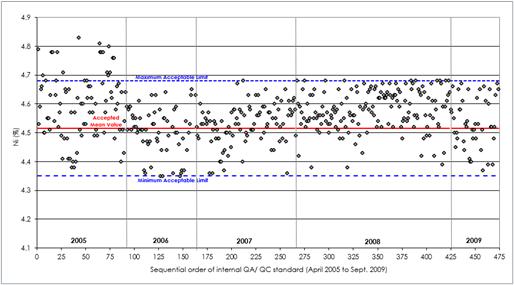

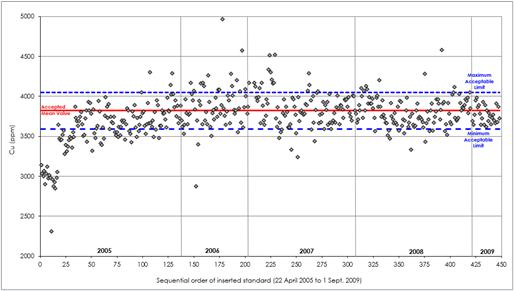

| Table 8-4: Kabanga CRMs – Tracking of Ni% Results 2005–09 | 102 |

| Table 8-5: Kabanga Massive Sulfide CRM – Tracking of Ni% Results by Phase | 103 |

| Table 8-6: Kabanga CRMs – Summary Statistics 2005–09 | 104 |

| Table 8-7: ALS-Chemex Internal Reference Material Standards – Tracking of Ni% Results 2005–09 | 104 |

| Table 8-8: ALS-Chemex Internal Forrest B Standard – Summary Statistics 2005–09 | 105 |

| Table 10-1: Summary of Historical Mini Pilot Plant Mass Balance Results | 111 |

| Table 10-2: Concentrator Tembo Testwork Sample Intervals | 114 |

| Table 10-3: Concentrator North Testwork Sample Intervals | 116 |

| Table 10-4: Summary of Test Data Used for Concentrator Recovery Modeling | 122 |

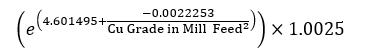

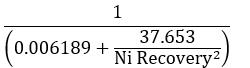

| Table 10-5: MSSX Recovery Algorithms Based on Mill Feed | 127 |

| Table 10-6: UMAF_1a Recovery Algorithms Based on Mill Feed | 128 |

| Table 10-7: MII Plan Concentrator Summary Mass Balance | 128 |

Page

|

/ / Initial Assessment - Technical Report Summary |

|

| Table 10-8: Concentrate Samples – Feed Blends | 132 |

| Table 10-9: Summary of POX Extractions – Pilot Plant versus Bench-Scale Testwork | 134 |

| Table 10-10: Projected Refinery Recoveries | 135 |

| Table 11-1: Grade Estimation Search Parameters | 148 |

| Table 11-2: Kabanga Metal Prices | 157 |

| Table 11-3: NiEq24 MSSX Input Parameters | 157 |

| Table 11-4: NiEq24 UMAF Input Parameters | 158 |

| Table 11-5: Concentrator Recoveries and Mass Pull Assumptions | 159 |

| Table 11-6: 2024 Cut-off Grade Assumptions | 162 |

| Table 11-7: 2025 IA Sensitivity Assumptions | 163 |

| Table 11-8: Kabanga Mineral Resource Estimates as at December 4, 2024 | 165 |

| Table 11-9: Kabanga Mineral Resource Estimates – Massive Sulfide (subset of Table 11-8) as at December 4, 2024 | 166 |

| Table 11-10: Kabanga Mineral Resource Estimates – Ultramafic1 (subset of Table 11-8) as at December 4, 2024 | 167 |

| Table 11-11: Kabanga Mineral Resource Estimates – Showing Contained Metals as at December 4, 2024 | 168 |

| Table 11-12: Kabanga Mineral Resource Estimates Comparison – Tonnes and Grades | 170 |

| Table 11-13: Kabanga Mineral Resource Estimates Comparison – Contained Metals | 171 |

| Table 13-1: Potential Mill Feed | 173 |

| Table 13-2: Potential Mill Feed Proportion by Zone | 173 |

| Table 13-3: Details of Ground Support Scheme Elements Used | 174 |

| Table 13-4: Material Strength Results from Laboratory Testing | 176 |

| Table 13-5: North Mine Unsupported Stope Span Configuration | 177 |

| Table 13-6: Tembo Mine Unsupported Stope Span Configuration | 178 |

| Table 13-7: Main Mine Unsupported Stope Span Recommendations | 178 |

| Table 13-8: NSR and Stope Optimization Assumptions | 180 |

| Table 13-9: Stope Parameters | 181 |

| Table 13-10: Typical Development Profiles | 182 |

| Table 13-11: Unplanned Dilution Values Applied to North and Main Stopes | 184 |

| Table 13-12: Lateral Development Productivity Rates | 184 |

| Table 13-13: Stope Tonnage and Associated Productivity Rate | 185 |

| Table 13-14: Mobile Equipment List | 186 |

| Table 13-15: Kabanga Backfill Requirements | 187 |

| Table 13-16: Primary Fesh Air Estimates | 190 |

| Table 13-17: Primary Return Air Estimates | 190 |

Page

|

/ / Initial Assessment - Technical Report Summary |

|

| Table 13-18: Ventilation Infrastructure | 191 |

| Table 13-19: Maximum Mining Labor Requirements | 192 |

| Table 13-20: Proposed Mill Feed by Mineral Resource Category | 194 |

| Table 13-21: Potential Mill Feed without Inferred Mineral Resource | 196 |

| Table 14-1: Key Concentrator Process Design Criteria | 199 |

| Table 16-1: Kabanga Metal Prices – IA Economic Assessment | 225 |

| Table 16-2: Kabanga Metal Prices – 2024MRU | 225 |

| Table 16-3: Kabanga Concentrate Typical Specification | 227 |

| Table 16-4: Projected Kahama Nickel Sulfate Specification | 228 |

| Table 16-5: Projected Kahama Cobalt Sulfate Specification | 228 |

| Table 17-1: Summary of the Project EIAs, ESIAs, ESMPs | 231 |

| Table 18-1: Project Capital Cost Estimate Summary | 243 |

| Table 18-2: Foreign Exchange Rates | 244 |

| Table 18-3: Average Project Operating Cost Estimate Summary | 247 |

| Table 19-1: Metal Prices | 251 |

| Table 19-2: The Project’s Cash Flow Summary | 254 |

| Table 19-3: Key Project Metrics | 254 |

| Table 19-4: Preliminary Production Summary | 255 |

| Table 19-5: Project All-in Sustaining Costs | 256 |

| Table 19-6: Mining, Concentrator and G&A Operating Costs | 257 |

| Table 19-7: Project Net Present Value and Discount Rate | 258 |

| Table 19-8: Summary of Project LoM Annual Cash Flow (with Inferred Mineral Resources) | 259 |

| Table 19-9: Summary of Project LoM Annual Cash Flow (without Inferred Mineral Resources) | 260 |

| Table 23-1: Summary of Costs for Recommended Work | 270 |

Page

|

/ / Initial Assessment - Technical Report Summary |

|

LIST OF FIGURES

| Figure 1-1: Kabanga Nickel Project Location in Tanzania | 23 |

| Figure 1-2: Kabanga Special Mining Licence (SML), Site Project Footprint, Resettlement Sites and Southern Access Road | 24 |

| Figure 1-3: Kahama Site at the Buzwagi SEZ | 25 |

| Figure 1-4: Current Ownership Structure of the Kabanga Nickel Project | 26 |

| Figure 1-5: Mine Design and Sequence (in years) | 34 |

| Figure 1-6: Typical Mine Design – North Mine (Isometric 3D) | 35 |

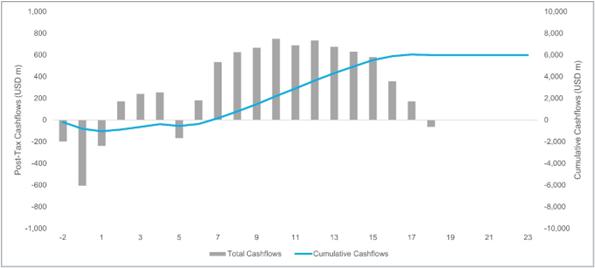

| Figure 1-7: Project Cash Flows (with Inferred Mineral Resources) | 43 |

| Figure 1-8: Project Cash Flows (without Inferred Mineral Resources) | 44 |

| Figure 3-1: Kabanga Nickel Project Location in Tanzania | 50 |

| Figure 3-2: Current Ownership Structure of the Kabanga Nickel Project | 51 |

| Figure 3-3: Location of the Proposed Mine Site showing SML 651/2021 | 53 |

| Figure 4-1: Kamaha Location relative to Mwanza, Kabanga Site and Isaka Dry Port | 58 |

| Figure 6-1: Stratigraphic Column for the Kagera Supergroup | 65 |

| Figure 6-2: Plan View Schematic of Geology of the Kabanga Area (UTM) | 66 |

| Figure 6-3: Typical Stratigraphy Cross-Section Schematics for North and Tembo (local grid) | 67 |

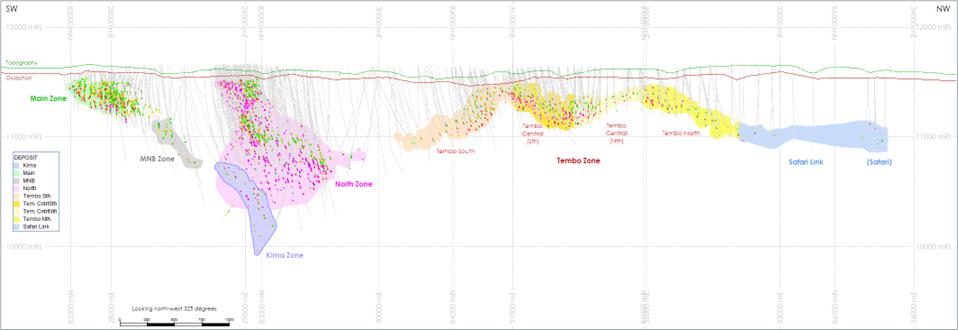

| Figure 6-4: Schematic Projected Long-Section of the Kabanga Mineralized Zones (truncated UTM, looking northwest) | 68 |

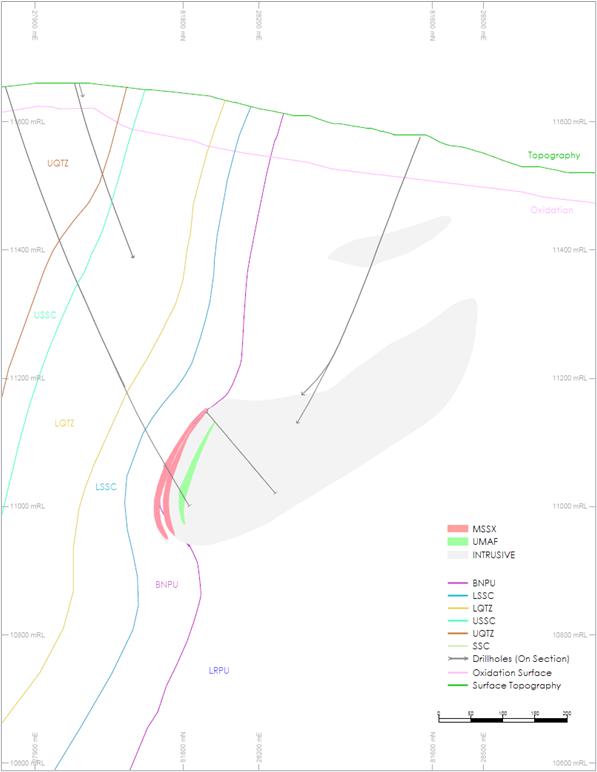

| Figure 6-5: Example Schematic Cross-Section* of Mineralization Geometry at Main Zone (truncated UTM) | 69 |

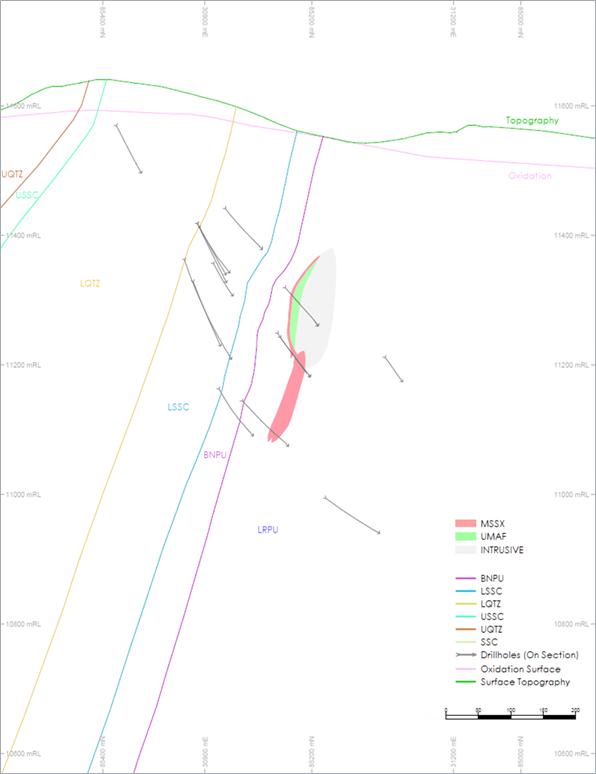

| Figure 6-6: Example Schematic Cross-section* of Mineralization Geometry at MNB Zone (truncated UTM) | 70 |

| Figure 6-7: Example Schematic Cross-section* of Mineralization Geometry at North Zone (with Kima) (truncated UTM) | 71 |

Page

|

/ / Initial Assessment - Technical Report Summary |

|

| Figure 6-8: Example Schematic Cross-section* of Mineralization Geometry at Tembo Zone (truncated UTM) | 72 |

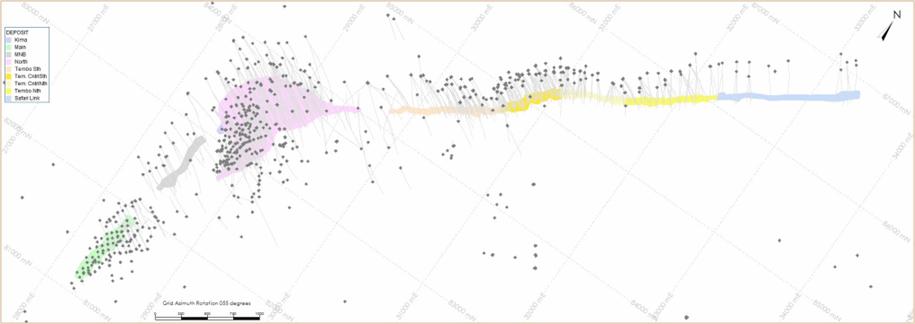

| Figure 7-1: Kabanga Drillhole Locations Proximal to Mineral Resources (truncated UTM) | 81 |

| Figure 7-2: Comparison of Water Immersion Density vs. Pycnometry Specific Gravity for Massive Sulfide | 83 |

| Figure 7-3: Pycnometer Specific Gravity Measurements for Massive Sulfide in North and Tembo | 84 |

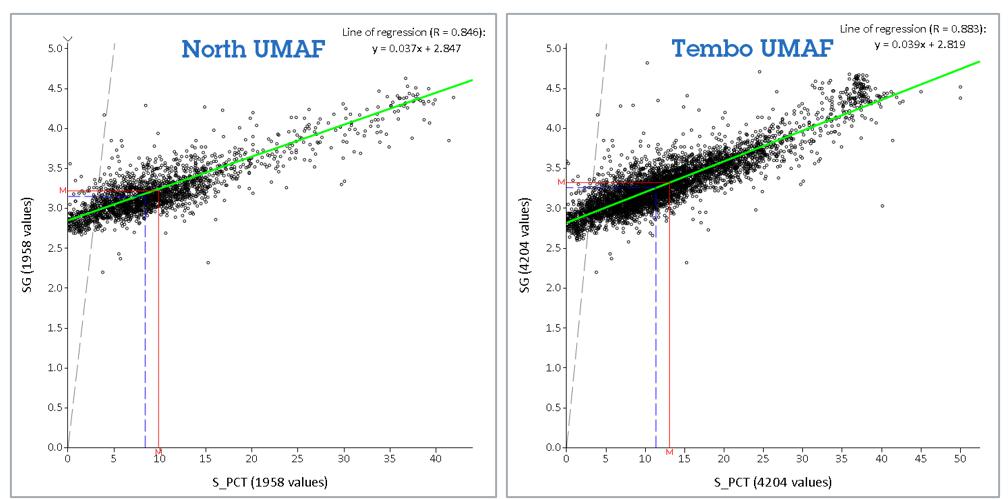

| Figure 7-4: Pycnometer Specific Gravity Measurements for UMAF_1a in North and Tembo | 84 |

| Figure 7-5: Location of Safari Link and Safari Extension Exploration Targets with Airborne VTEM Background and Interpreted Major Faults | 87 |

| Figure 7-6: Location of Rubona Hill and Block 1 South Target Areas | 88 |

| Figure 7-7: Rubona Hill MVI Magnetic Contours at 1,200 m Elevation with Historical Holes and Proposed Priority Hole | 88 |

| Figure 7-8: Magnetic Vector Inversion (MVI) Model of Rubona Hill Target with Proposed Drillhole Intercepts | 89 |

| Figure 7-9: Block 1 South Target Potential | 90 |

| Figure 8-1: Percent Reject Passing –2 mm Screen – 2005–09 | 95 |

| Figure 8-2: ALS-Chemex – Percent Relative Difference for Ni Duplicates – 2005–09 | 95 |

| Figure 8-3: ALS-Chemex – Percent Relative Difference for Cu Duplicates – 2005–09 | 96 |

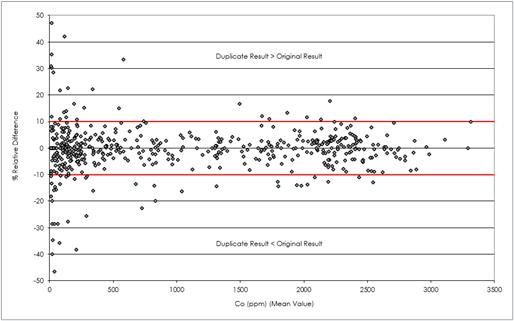

| Figure 8-4: ALS-Chemex – Percent Relative Difference for Co Duplicates – 2005–09 | 96 |

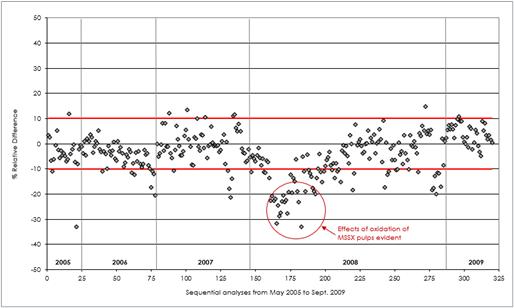

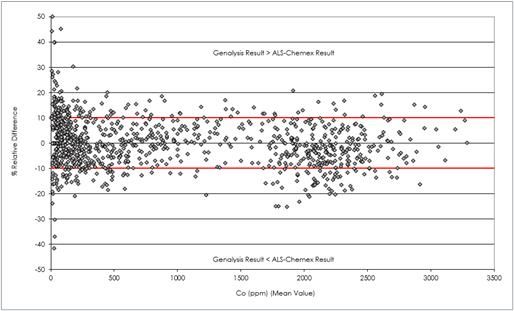

| Figure 8-5: Genalysis vs. ALS-Chemex Pulp Check Assays Percent Relative Difference for Ni Grades 2005–09 – Sequential Analysis for Massive Sulfide Ni > 2% | 97 |

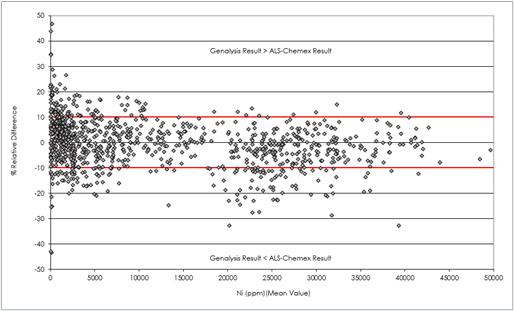

| Figure 8-6: Genalysis vs. ALS-Chemex Pulp Check Assays Percent Relative Difference for Ni Grades 2005–09 | 98 |

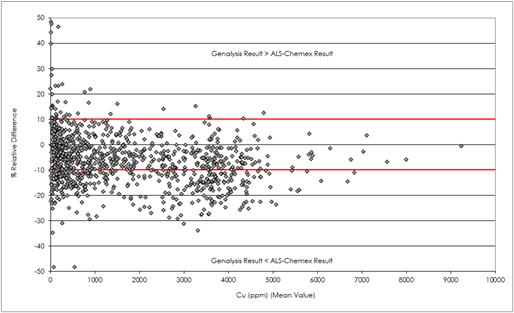

| Figure 8-7: Genalysis vs. ALS-Chemex Pulp Check Assays Percent Relative Difference for Cu Grades 2005–09 | 98 |

| Figure 8-8: Genalysis vs. ALS-Chemex Pulp Check Assays Percent Relative Difference for Co Grades 2005–09 | 99 |

| Figure 8-9: SGS Lakefield vs. ALS-Chemex Pulp Check Assays Percent Relative Difference for Ni Grades | 99 |

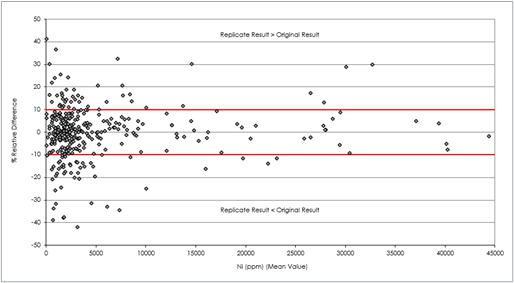

| Figure 8-10: ALS-Chemex – Percent Relative Difference for Ni Grades for Quarter Core Replicates – 2005–07 | 100 |

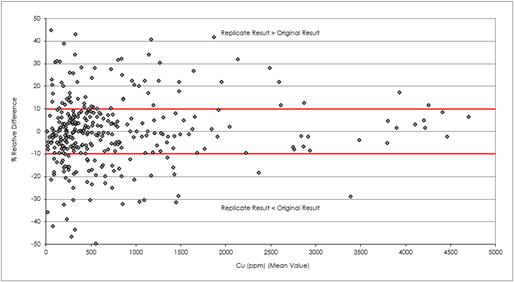

| Figure 8-11: ALS-Chemex – Percent Relative Difference for Cu Grades for Quarter Core Replicates – 2005–07 | 100 |

| Figure 8-12: ALS-Chemex – Percent Relative Difference for Co Grades for Quarter Core Replicates – 2005–07 | 101 |

| Figure 8-13: Kabanga Massive Sulfide CRM Ni Values 2005–09 | 102 |

| Figure 8-14: Kabanga Ultramafic CRM Ni Values 2005–09 | 102 |

| Figure 8-15: Kabanga Massive Sulfide CRM Ni% Values by Genalysis 2005–09 | 103 |

| Figure 8-16: ALS-Chemex Internal Forrest B Standard – Results from 2005–09 | 104 |

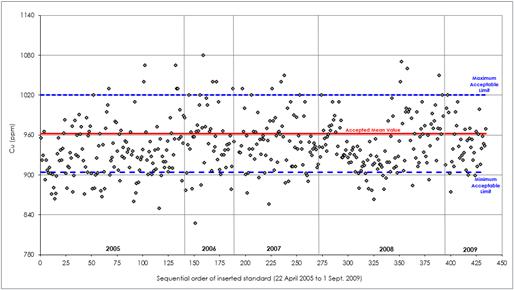

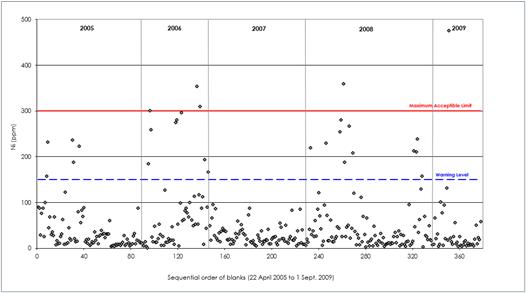

| Figure 8-17: Kabanga MSSX CRM Cu Values 2005–09 | 105 |

| Figure 8-18: Kabanga UMAF CRM Cu Values 2005–09 | 106 |

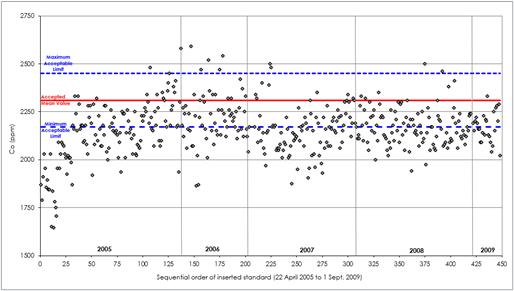

| Figure 8-19: Kabanga MSSX CRM Co Values 2005–09 | 106 |

| Figure 8-20: Kabanga UMAF CRM Co Values 2005–09 | 107 |

Page

|

/ / Initial Assessment - Technical Report Summary |

|

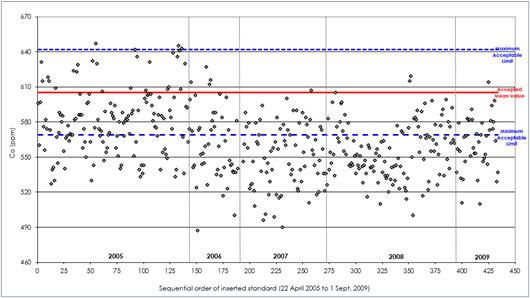

| Figure 8-21: Blanks – Ni Results 2005–09 | 107 |

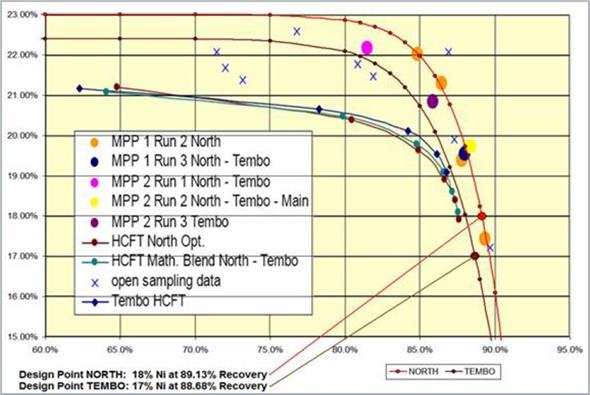

| Figure 10-1: Summary of Historical MPP Testwork Grade Recovery Curves | 112 |

| Figure 10-2: Example of Concentrator Metallurgical Testwork Drill Core Intervals | 113 |

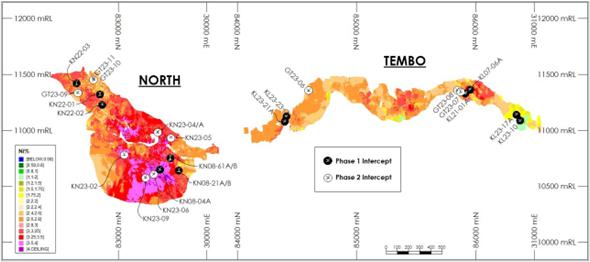

| Figure 10-3: MSSX Metallurgical Testwork Sample Locations | 118 |

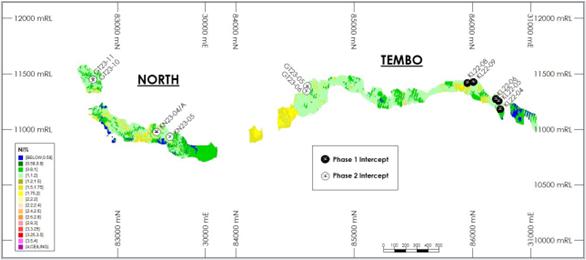

| Figure 10-4: UMAF_1a Metallurgical Testwork Sample Locations | 118 |

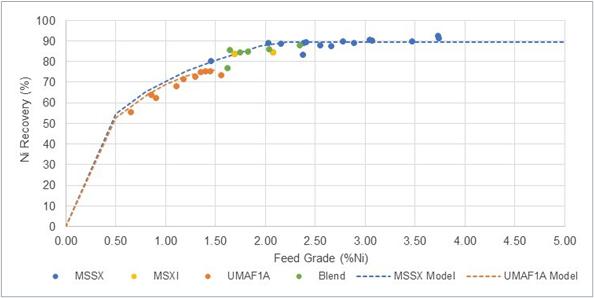

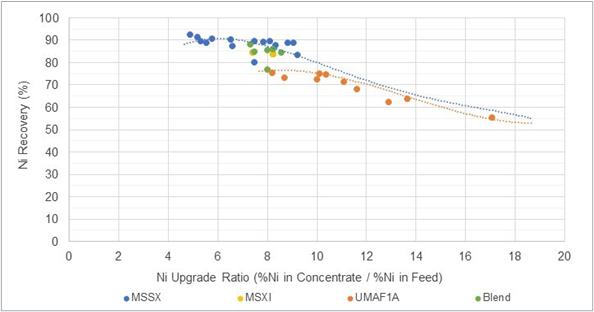

| Figure 10-5: Nickel Recovery as a Function of Feed Grade: Modeling Output versus Testwork Performance | 124 |

| Figure 10-6: Nickel Recovery as a Function of Concentrate Upgrade Ratio: Modeling Output versus Testwork Performance | 124 |

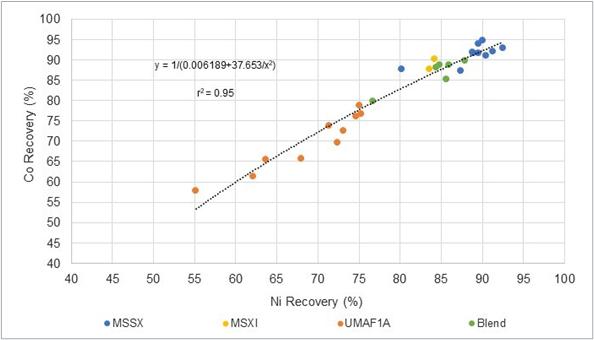

| Figure 10-7: Cobalt Flotation Recovery as a Function of Nickel Recovery | 125 |

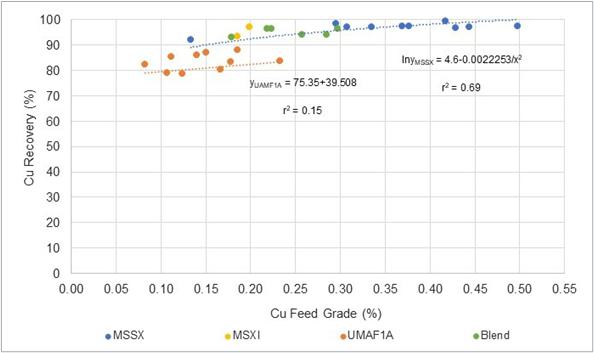

| Figure 10-8: Copper Flotation Recovery as a Function of Copper Feed Grade | 125 |

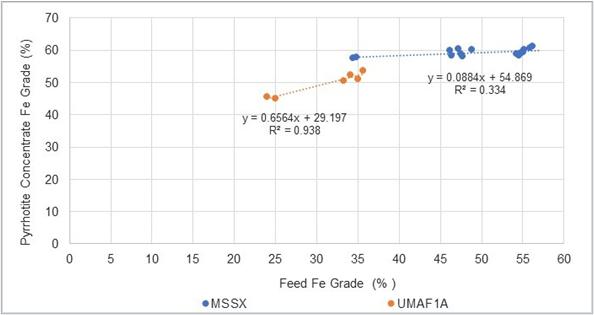

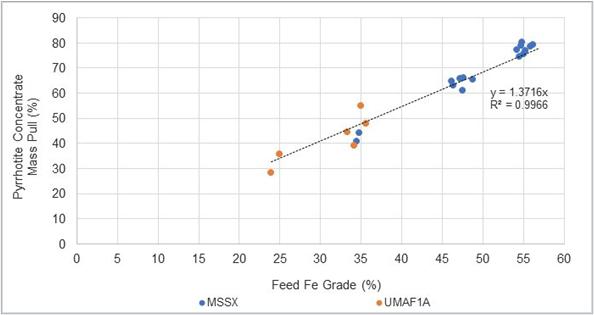

| Figure 10-9: Pyrrhotite Concentrate Iron Grade as a Function of Iron in Feed | 126 |

| Figure 10-10: Pyrrhotite Concentrate Mass Pull as a Function of Iron in Feed | 127 |

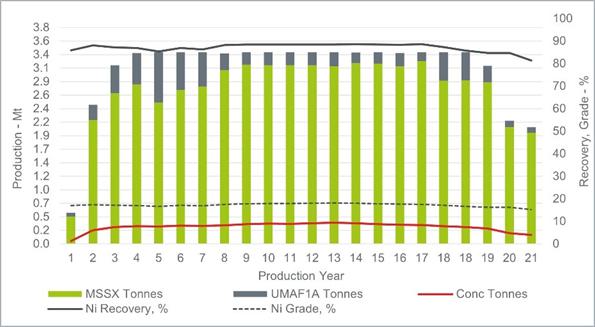

| Figure 10-11: Concentrator Production Profile (MII Plan) | 129 |

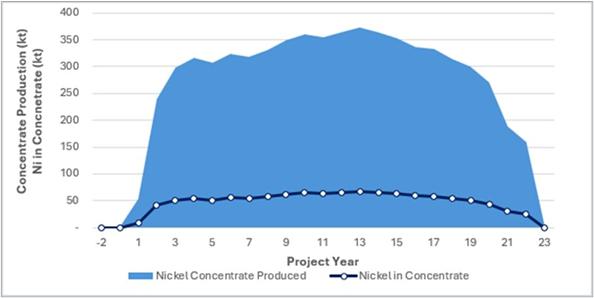

| Figure 10-12: Concentrate Tonnage and Contained Nickel Profile (MII Plan) | 130 |

| Figure 10-13: POX Kinetics (Test No. KABA-0145) | 133 |

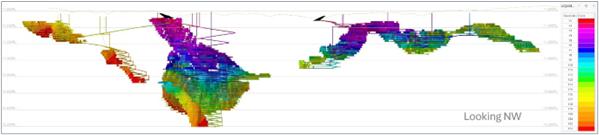

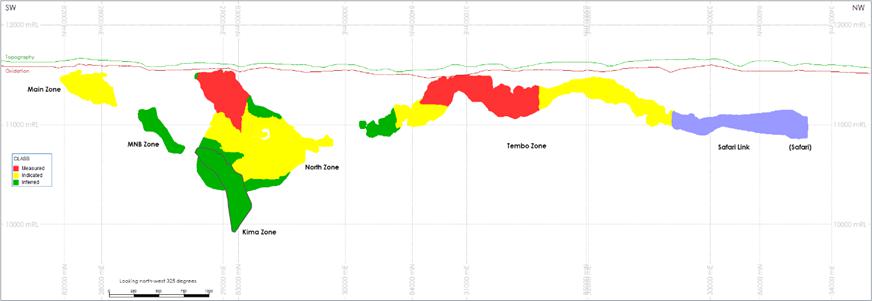

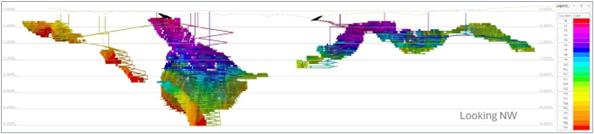

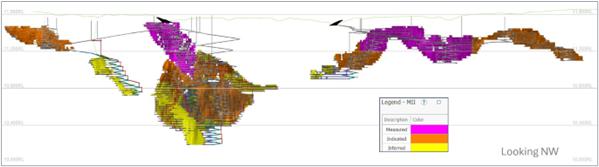

| Figure 11-1: Schematic Projected Long-Section of the Kabanga Mineralized Zones (looking northwest) | 137 |

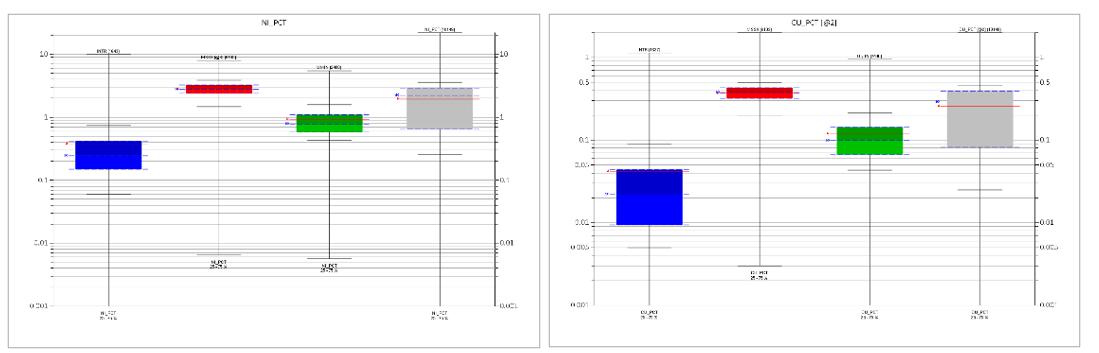

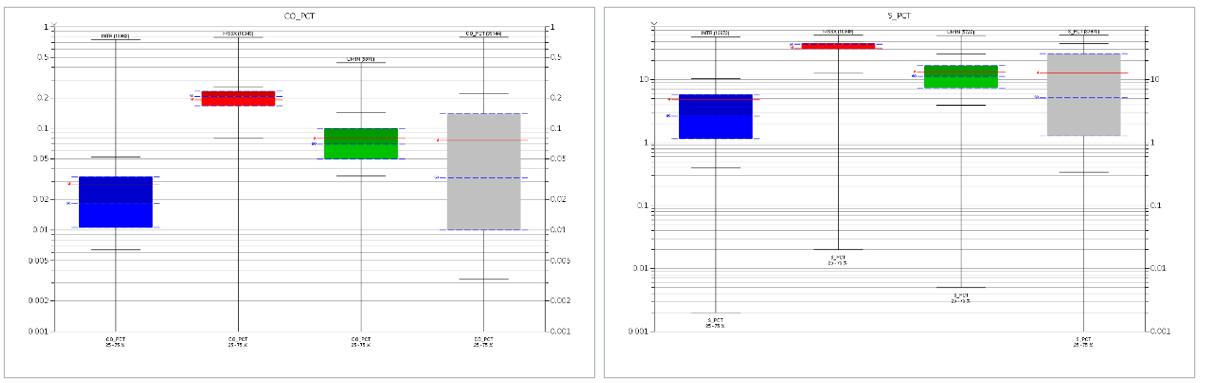

| Figure 11-2: Ni Box Plot for all Assayed Lithologies – All Zones | 138 |

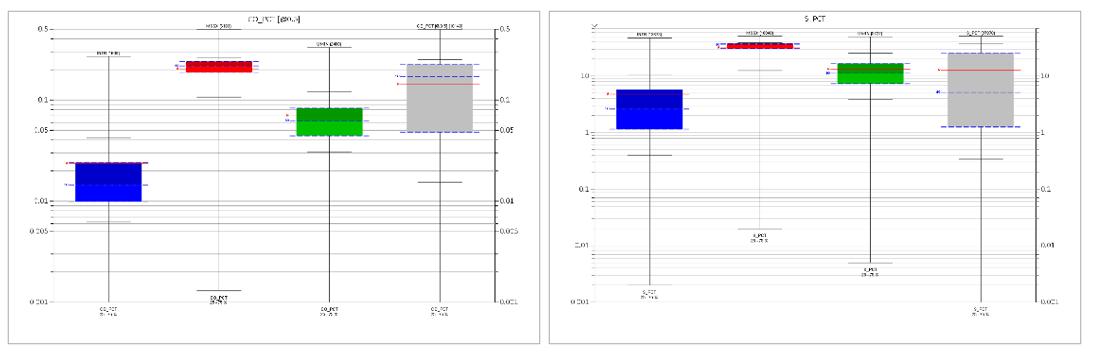

| Figure 11-3: Pie Chart of Assayed Lithologies – North Zone | 139 |

| Figure 11-4: Box Plots for a Suite of Elements for the Three Predominant Mineralization Types – North Zone | 140 |

| Figure 11-5: Pie Chart of Assayed Lithologies – Tembo Zone | 141 |

| Figure 11-6: Box Plots for a Suite of Elements for the Three Predominant Mineralization Types – Tembo Zone | 142 |

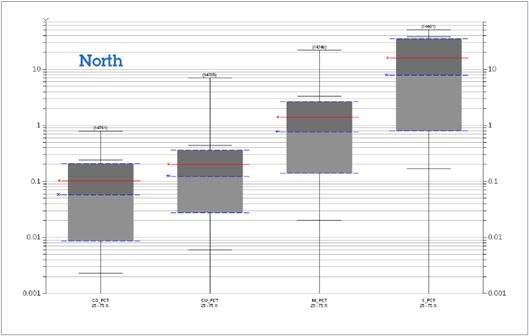

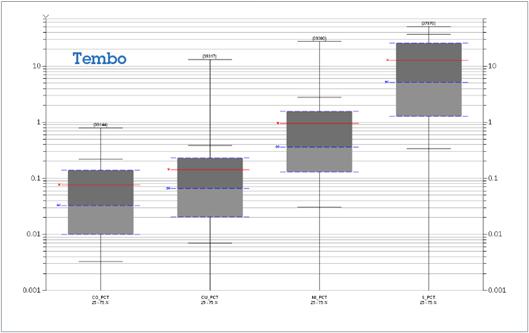

| Figure 11-7: Box Plot of Grades (Co, Cu, Ni, and S) for North Zone | 143 |

| Figure 11-8: Box Plot of Grades (Co, Cu, Ni, and S) for Tembo Zone | 143 |

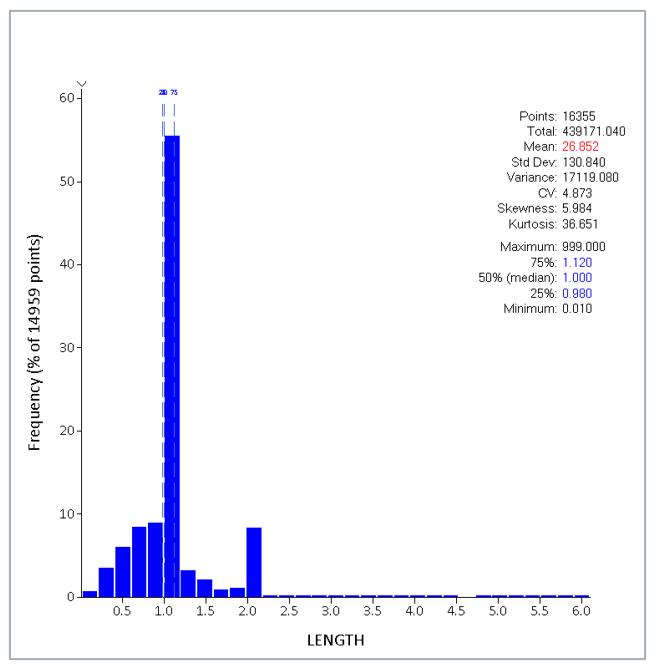

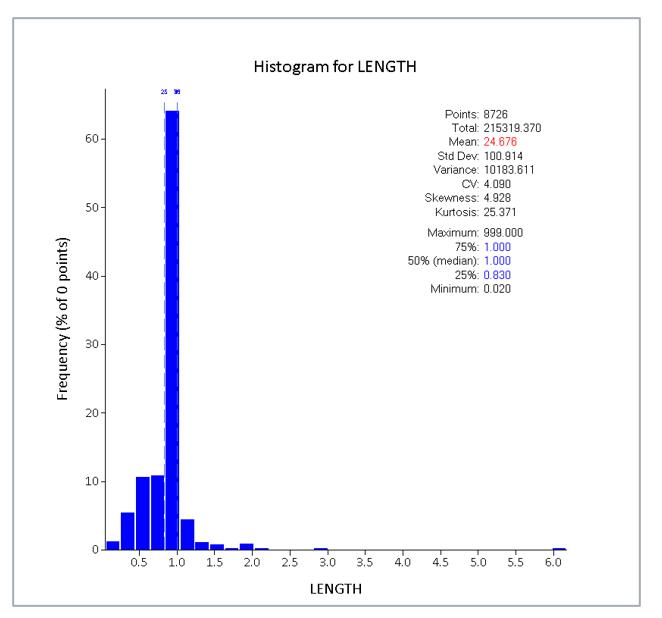

| Figure 11-9: Histograms of Sample Lengths –North Zone (where assayed) | 144 |

| Figure 11-10: Histograms of Sample Lengths – Tembo Zone (where assayed) | 145 |

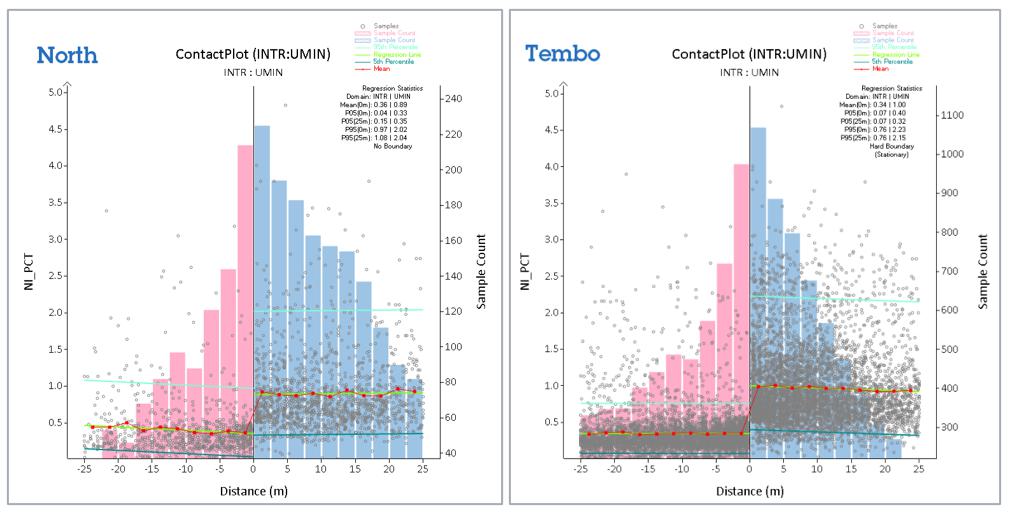

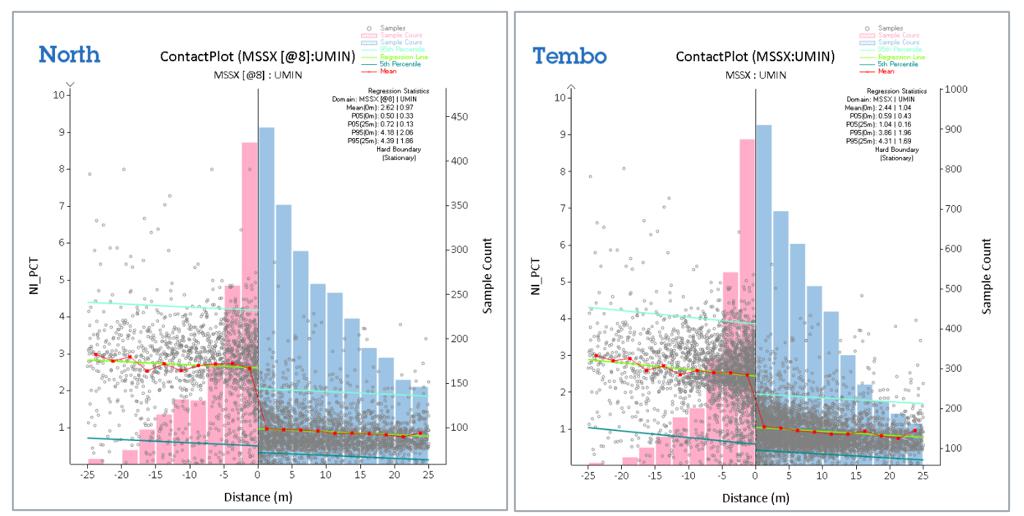

| Figure 11-11: Contact Plots for Ni% Across INTRUSIV:UMAF Boundary | 146 |

| Figure 11-12: Contact Plots for Ni% Across UMAF:MSSX Boundary | 146 |

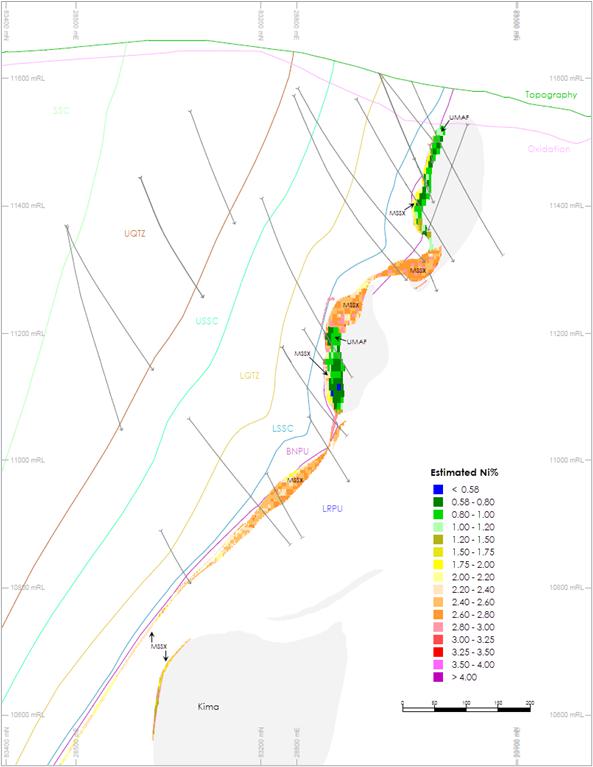

| Figure 11-13: Example Cross-section* of Ni% Grade Estimates at North Zone (shows Kima) | 151 |

| Figure 11-14: Example Cross-section* of Ni% Grade Estimates at Tembo Zone | 152 |

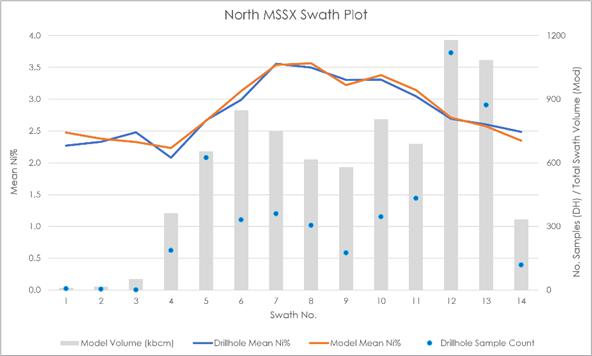

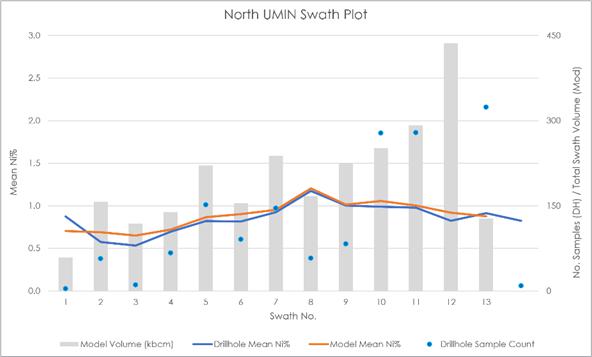

| Figure 11-15: Example Swath Plots – Ni% Along Strike for North Zone MSSX and UMAF | 153 |

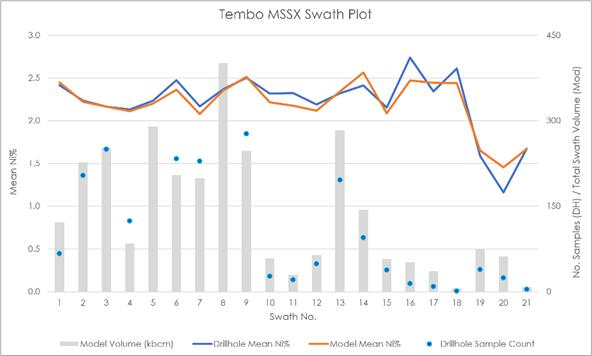

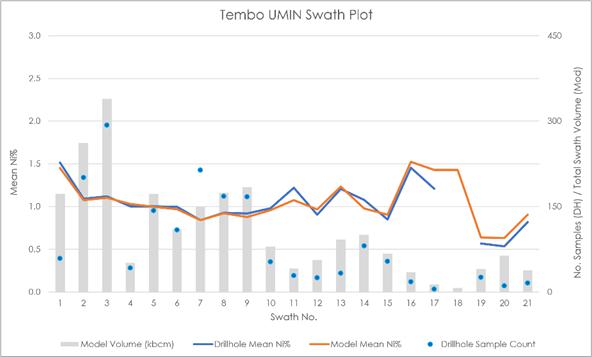

| Figure 11-16: Example Swath Plots – Ni% Along Strike for Tembo Zone MSSX and UMAF | 154 |

Page

|

/ / Initial Assessment - Technical Report Summary |

|

| Figure 11-17: Schematic Projected Long-section of the Kabanga Classification (truncated UTM, looking northwest) | 156 |

| Figure 11-18: MSSX and UMAF Concentrator Nickel Recoveries | 159 |

| Figure 11-19: MSSX and UMAF Concentrator Copper Recoveries | 160 |

| Figure 11-20: MSSX and UMAF Concentrator Cobalt Recoveries | 160 |

| Figure 11-21: MSSX and UMAF Concentrate Nickel Grade | 161 |

| Figure 11-22: MSSX and UMAF Mass PulTl | 161 |

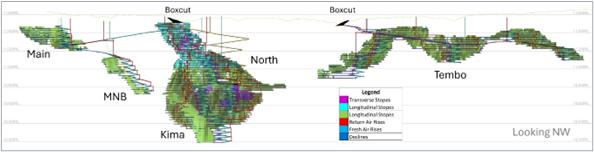

| Figure 13-1: Long-section of the Resource Case Mine Design | 173 |

| Figure 13-2: Kabanga AE Measurement Results Compared to WASM Dataset (a) Ratio of average horizontal to vertical stress (b) Principal stress magnitude chart comparison | 175 |

| Figure 13-3: North Mine and Tembo Mine Groundwater Ingress | 179 |

| Figure 13-4: Stope Optimizer NSR Cut-off Grade by Zone | 180 |

| Figure 13-5: Typical Mine Design at North Mine | 181 |

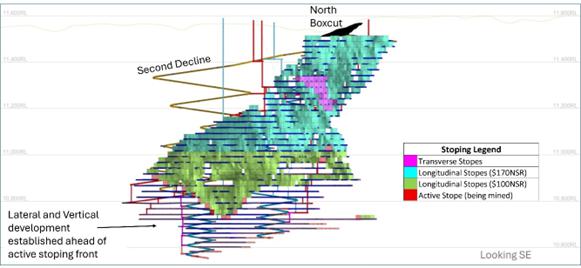

| Figure 13-6: Longitudinal and Transverse Stoping at North (Oblique 3D) | 182 |

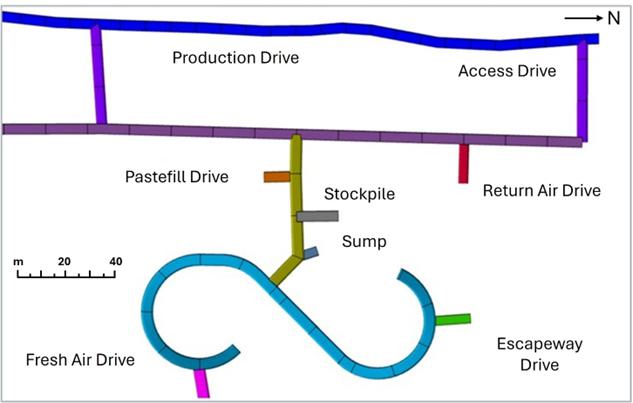

| Figure 13-7: Typical Level Plan – North Mine | 183 |

| Figure 13-8: Typical Level Plan – Tembo Mine | 183 |

| Figure 13-9: Schematic of North Mining Sequence | 185 |

| Figure 13-10: Schematic of Tembo Mining Sequence | 186 |

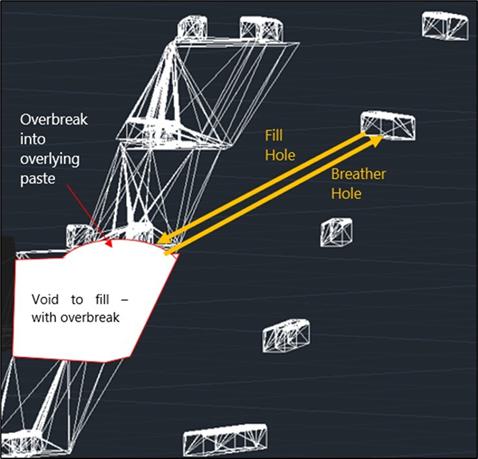

| Figure 13-11: In-level Filling Arrangement | 188 |

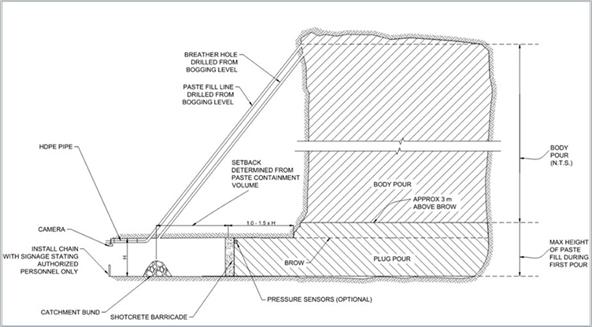

| Figure 13-12: Typical Cross Section Showing the Proposed Tight Filling Strategy | 189 |

| Figure 13-13: Ventilation Rise Locations | 190 |

| Figure 13-14: Example of Safescape Ladder System | 191 |

| Figure 13-15: Escapeway Raise Locations | 192 |

| Figure 13-16: Production Cycle Example | 193 |

| Figure 13-17: Lateral Development by Year | 193 |

| Figure 13-18: Vertical Development by Year | 194 |

| Figure 13-19: Mining Sequence by Year | 194 |

| Figure 13-20: Kabanga Long-Section by Mineral Resource Category | 195 |

| Figure 13-21: MII Production Schedule by Mineral Resource Category | 195 |

Page

|

/ / Initial Assessment - Technical Report Summary |

|

| Figure 13-22: MII Production Schedule by Mining Type | 195 |

| Figure 13-23: MII Production Schedule by Source | 196 |

| Figure 13-24: MI Production Schedule by Source | 196 |

| Figure 14-1: Simplified Concentrator Process Flowsheet | 199 |

| Figure 14-2: Concentrator 3D Model Layout | 203 |

| Figure 14-3: Kahama Refinery Simplified Process Flowsheet | 205 |

| Figure 15-1: Kabanga Site Layout (including TSF) | 213 |

| Figure 15-2: Kabanga Proposed Logistics Route | 221 |

| Figure 15-3: SGR Rail Locomotives | 222 |

| Figure 17-1: Kabanga Project Area and Affected Communities | 233 |

| Figure 17-2: Kahama Site Local Setting | 235 |

| Figure 17-3: Proposed Kahama Site adjacent existing Buzwagi Mine | 236 |

| Figure 17-4: Kabanga Site Project Area and Resettlement Sites | 238 |

| Figure 19-1: Production Schedule with Inferred Mineral Resources | 249 |

| Figure 19-2: Production Schedule without Inferred Mineral Resources | 250 |

| Figure 19-3: Project Cash Flows (with Inferred Mineral Resources) | 257 |

| Figure 19-4: Project Cash Flows (without Inferred Mineral Resources) | 257 |

| Figure 19-5: Sensitivity Analysis of Post-Tax NPV (with Inferred Mineral Resources) | 261 |

| Figure 19-6: Sensitivity Analysis of Post-Tax NPV (without Inferred Mineral Resources) | 261 |

| Figure 19-7: Sensitivity Analysis of Post-Tax IRR (with Inferred Mineral Resources) | 262 |

| Figure 19-8: Sensitivity Analysis of Post-Tax IRR (without Inferred Mineral Resources) | 262 |

Page

|

/ / Initial Assessment - Technical Report Summary |

|

ABBREVIATIONS

Abbreviation |

Definition |

| AACE | Association for the Advancement of Cost Engineering |

| AAS | Atomic Absorption Spectroscopy |

| AE | Acoustic Emission |

| Ai | Bond Abrasion Index |

| AISC | all-in sustaining cost |

| ALS | ALS Metallurgy Pty Ltd |

| ANCOLD | Australian National Committee on Large Dams |

| AARL | Anglo American Research Laboratories |

| BAC | bulk air cooler |

| BECO | Break-even Cut-off |

| BHEM | Borehole Electromagnetic |

| BHP | BHP Billiton (UK) DDS Limited (also refers to BHP Group, subsidiaries & ancestors) |

| BNPU | Banded Pelite stratigraphic unit |

| BV | Bureau Veritas Minerals Pty Ltd |

| BWi | Bond Ball Mill Work Index |

| CET | Common External Tariff |

| CIF | Cost, Insurance and Freight (Incoterms® 2020) |

| CIT | corporate income tax |

| Co | cobalt |

| CoSX | Cobalt Solvent Extraction |

| CRM | Certified Reference Material |

| CSR | Corporate Social Responsibility |

| CRU | CRU International Ltd |

| Cu | copper |

| CuSO4 | copper sulfate |

| CuSX | copper solvent extraction |

| CWi | Bond crusher work index |

| DFS | Definitive Feasibility Study |

| DRA | DRA Projects (Pty) Ltd |

| DRC | Democratic Republic of the Congo |

| DSX | Direct Solvent Extraction |

| DWT | deadweight tonnage |

| EBSP | Economic Benefit Sharing Principle |

| EDH | economically displaced households |

| EIA | Environmental Impact Assessment |

| EIS | Environmental Impact Statement |

| EM | electromagnetic |

| EPCM | Engineering, Procurement and Construction Management |

| ESG | Environmental, Social and Governance |

| ESIA | Environmental and Social Impact Assessment |

Page

|

/ / Initial Assessment - Technical Report Summary |

|

Abbreviation |

Definition |

| ESMP | Environmental and Social Management Plan |

| ESS | Energy Storage Systems |

| EU | European Union |

| EV | electric vehicle |

| EW | electrowinning |

| FAR | fresh air raise |

| FBC | Flexible Bulk Container |

| FID | Final Investment Decision |

| FW | footwall |

| FS | Feasibility Study |

| G&A | General and Administrative |

| GAB | gabbro lithology |

| GAB_KAB | generally unmineralized gabbro/gabbronorite in the Karagwe-Ankole Belt |

| GISTM | Global Industry Standard on Tailings Management |

| Golder | Golder Associates Inc. |

| GoT | Government of Tanzania |

| H2SO4 | sulfuric acid |

| HCFT | High Confidence Flotation Test |

| HCl | hydrochloric acid |

| HDPE | high-density polyethylene |

| HIV | Human Immunodeficiency Virus |

| HW | hanging wall |

| IBIS | IBIS Consulting |

| ICMM | International Council on Mining and Metals |

| ICP | Inductively Coupled Plasma Spectroscopy Analytical Technique |

| ICP-MS | Inductively Coupled Plasma Mass Spectroscopy |

| ICP-OES | Inductively Coupled Plasma Optical Emission Spectroscopy |

| IFC | International Finance Corporation |

| IFC PS | International Finance Corporation Performance Standards |

| IRR | internal rate of return |

| ISO | International Organization for Standardization |

| JFM | Joint Financial Model |

| JV | Joint Venture |

| KAB | Karagwe-Ankole Belt |

| KNCL | Kabanga Nickel Company Limited (pre-Lifezone ownership) |

| KNL | Kabanga Nickel Limited |

| KUWASA | Kahama Urban Water Supply and Sanitation Authority |

| LCT | locked-cycle test |

| LFP | lithium iron phosphate |

| LME | London Metal Exchange |

| LoM | life of mine |

| LRP | Livelihood Restoration Plan |

Page

|

/ / Initial Assessment - Technical Report Summary |

|

Abbreviation |

Definition |

| LRPU | Lower Pelite stratigraphic unit |

| LSSC | Lower Spotted Schist stratigraphic unit |

| LZM | Lifezone Metals Limited |

| M&E | monitoring and evaluation |

| MAF | generic mafic lithology |

| MCC | motor control center |

| MHP | mixed hydroxide precipitate |

| MIA | mine infrastructure area |

| MI | Measured and Indicated Mineral Resource Classifications |

| MII | Measured, Indicated and Inferred Mineral Resource Classifications |

| MineFill | MineFill Services Pty Ltd |

| MP-AES | Microwave Plasma Atomic Emission Spectroscopy |

| MPP | mini pilot plant |

| MRE | Mineral Resource Estimate |

| MRU | Mineral Resource Update |

| MSP | mixed sulfide precipitate |

| MSSX | massive sulfide mineralization |

| MSXI | massive sulfide mineralization with xenolith intrusions |

| MVR | mechanical vapor recompression |

| NATA | National Association of Testing Authorities |

| NEMC | National Environment Management Council |

| Ni | nickel |

| NiEq | nickel equivalent |

| NiSO4.6H2O | nickel sulfate hexahydrate |

| NMC | nickel manganese cobalt |

| No. | number |

| NPV | net present value |

| NSR | net sales return |

| OHL | overhead line (power) |

| OOG | out of gauge |

| OreWin | OreWin Pty Ltd |

| PAF | Paste Aggregate Fill |

| PAH | project-affected household |

| PAP | project-affected person |

| pCAM | precursor cathode active material |

| PCD | pollution control dam |

| PDC | process design criteria |

| PDH | physically displaced household |

| PEX | potassium ethyl xanthate |

| PFS | Pre-feasibility Study |

| PLS | pregnant leach solution |

| POX | pressure oxidation |

Page

|

/ / Initial Assessment - Technical Report Summary |

|

Abbreviation |

Definition |

| PSA | Particle Size Analyzer |

| PSD | particle size distribution |

| PSWP | plant site water pond |

| QA/QC | Quality Assurance/Quality Control |

| QP | Qualified Person |

| RAP | Resettlement Action Plan |

| RAR | Return Air Raise |

| RFL | Refining Licence |

| RO | reverse osmosis |

| RoM | run-of-mine |

| RWG | Resettlement Working Group |

| SADC | Southern African Development Community |

| SEC | U.S. Securities and Exchange Commission |

| SEZ | Special Economic Zone |

| SGR | Standard Gauge Rail |

| SI | International System of Units |

| SML | Special Mining Licence |

| SMM | Shanghai Metals Market |

| SO4 | sulfate |

| SQUID | Superconducting Quantum Interference Device |

| SX | Solvent Extraction |

| TAA | Tanzania Airports Authority |

| TANESCO | Tanzania Electric Supply Company Limited |

| TANROADS | Tanzania National Roads Agency |

Page

|

/ / Initial Assessment - Technical Report Summary |

|

Abbreviation |

Definition |

| TAZARA | Tanzania-Zambia Railway Authority |

| TEM | Transient Electromagnetic |

| TML | Transportable Moisture Limit |

| TNCL | Tembo Nickel Corporation Limited |

| TRC | Tanzania Railways Corporation |

| TRS | Technical Report Summary (as defined in S-K 1300) |

| TSF | tailings storage facility |

| UCS | uniaxial compressive strength |

| UMAF | generic ultramafic lithological unit |

| UMAF_1a | ultramafic-hosted mineralization |

| UMAF_KAB | unmineralized ultramafic |

| UMIN | mineralized UMAF (i.e., UMAF_1a (used as a coding field in Resource modeling work) |

| UNDP | United Nations Development Programme |

| URT | United Republic of Tanzania |

| USD | United States dollars |

| VSD | variable speed drive |

| VTEM | Versatile Time Domain Electromagnetic |

| WASM | Western Australia School of Mines |

| WRD | waste rock dump |

| WSP (AUS) | WSP Australia Ltd |

| WSP (NZ) | WSP New Zealand Ltd |

| WSP (SA) | WSP South Africa (Pty) Ltd |

| WTP | water treatment plant |

| XPS | Xstrata Process Solutions |

| XRF | X-ray Fluorescence |

Page

|

/ / Initial Assessment - Technical Report Summary |

|

UNITS OF MEASURE

Abbreviation |

Definition |

| µm | micrometer/micron |

| Ø | diameter |

| DWT | deadweight tonnage |

| h | hour |

| ha | hectare |

| kg | kilogram |

| kg/m2h | kilogram per square meter per hour |

| km | kilometer |

| kPa(g) | kilo pascal (gauge) |

| ktpa | kilotonnes (metric) per annum |

| kV | kilovolt |

| kVA | kilovolt ampere |

| kWh/t | kilowatt hour per metric tonne |

| L/s | liters per second |

| L | liter |

| m | meter |

| m2 | square meter |

| m3 | cubic meter |

| M | million (mega) |

| Ma | one million years |

| mAMSL | meter above mean sea level |

| mBS | meters below surface |

| min | minute |

| Mm3 | million cubic meters |

| Mtpa | million tonnes (metric) per annum |

| MVA | Megavolt-Amperes |

| MW | Megawatts |

| MWc | Megawatt cooling |

| pH | Quantitative measure of the acidity or basicity of aqueous or other liquid solutions. |

| °C | degrees Celsius |

| t | tonne (metric) |

| tpa | tonnes (metric) per annum |

| tph | tonnes (metric) per hour |

| V | Volts |

| w/w | weight by weight |

SYSTEM OF UNITS

The International System of Units (SI), the metric system, will be used throughout the design in all documentation, specifications, drawings, reports and all other documents associated with the study.

Page

|

/ / Initial Assessment - Technical Report Summary |

|

| 1 | EXECUTIVE SUMMARY |

| 1.1 | Introduction |

DRA Projects (Pty) Ltd (DRA) and OreWin Pty Ltd (OreWin) were engaged by Lifezone Metals Limited (NYSE LZM) (hereafter referred to as “LZM”) to prepare an independent Initial Assessment (IA) Technical Report Summary (TRS) for the Kabanga Nickel Project (hereafter referred to as “the Project”), located in northwest Tanzania. This TRS provides supplemental technical and economic information to support the Mineral Resource Update (MRU) disclosed in LZM’s prior TRS dated December 4, 2024. The TRS was prepared in accordance with the United States Securities and Exchange Commission’s (SEC) Modernized Property Disclosure Requirements under Subpart 229.1300 of Regulation S-K (S-K 1300) and Item 601(b)(96). The purpose of this IA is to provide a preliminary indication that the Project may have potential for technically viable and economically favorable development based on the current Mineral Resources estimate. The IA is intended to serve as a foundation for demonstrating the overall staged development strategy, including advancing the Project to a Feasibility Study (FS), and subsequently, to detailed design, execution, and operation.

The Project, in which LZM holds a 69.713% ownership interest, is a fully integrated, greenfield development that will produce nickel, copper, and cobalt products for the global market. Designed to deliver strong financial returns, the Project is also expected to generate social and economic benefits for local communities. As one of the world’s largest undeveloped high-grade nickel sulfide deposits, the Project offers a strategically important, unencumbered source of nickel ideally suited for the evolving electric vehicle (EV) battery supply chain.

The Project represents a globally significant opportunity aligned with the accelerating transition to a low-carbon economy, driven by the rising demand for responsible and ethically sourced battery minerals essential to EVs and energy storage systems. The Project is positioned to deliver both strategic value to the global supply chain and meaningful economic and social benefits to Tanzania and its citizens.

| 1.2. | Property Description, Mineral Tenure, Ownership, Surface Rights, Royalties, Agreements and Permits |

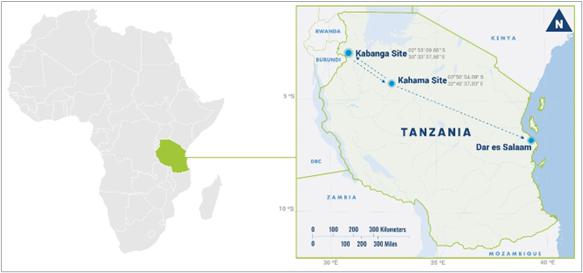

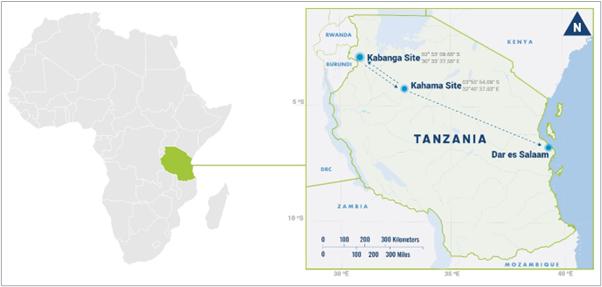

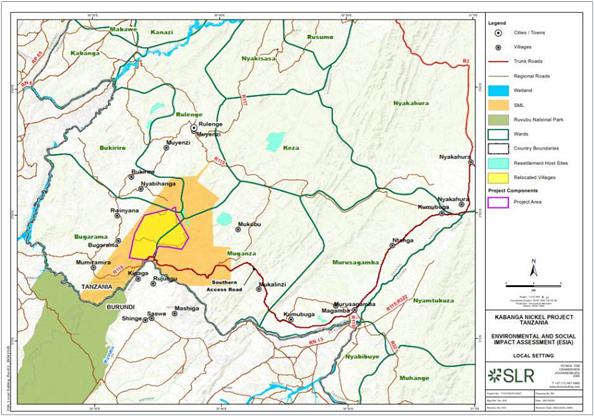

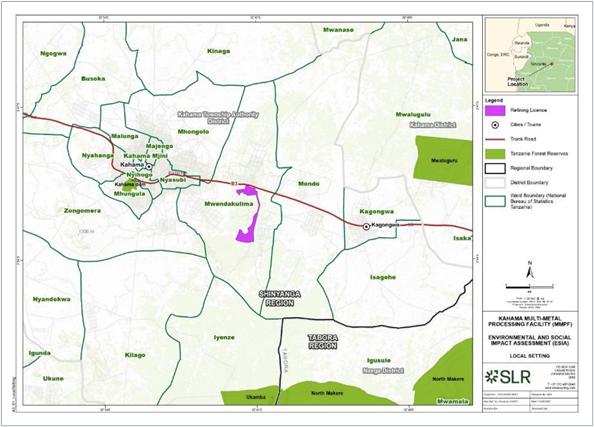

The Project is located in the northwest of Tanzania, approximately 1,300 km northwest of Dar es Salaam, adjacent to the Burundi border (see Figure 1-1). The Project comprises two sites, the Kabanga Mine and Concentrator and associated infrastructure (hereafter known as “Kabanga Site”) and the Kahama Hydrometallurgical Refinery (hereafter known as the “Refinery”) and associated infrastructure (collectively known as “Kahama Site”), which will be operational five years after first concentrate production.

Figure 1-1: Kabanga Nickel Project Location in Tanzania The Kabanga Site will see the development of an underground mine and the construction of a concentrator, tailings storage facility (TSF), and the associated infrastructure.

Page

|

/ / Initial Assessment - Technical Report Summary |

|

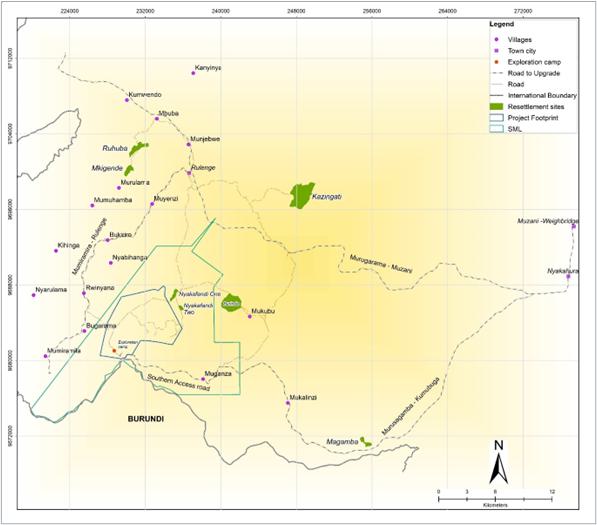

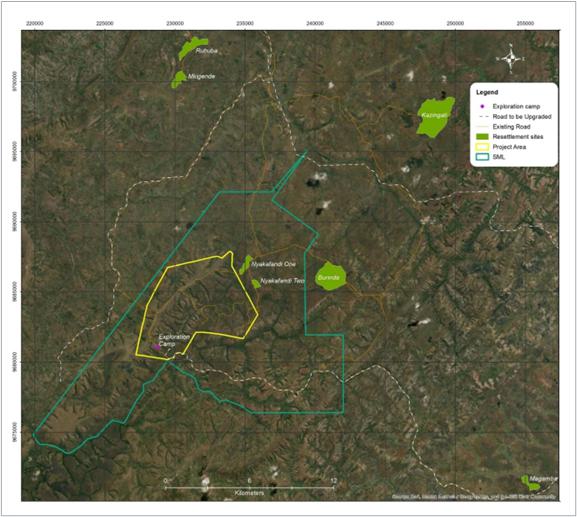

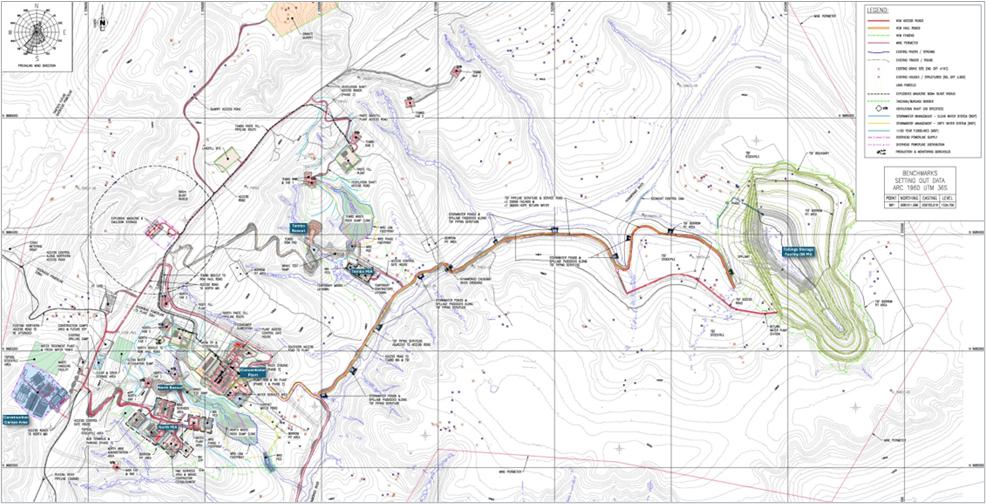

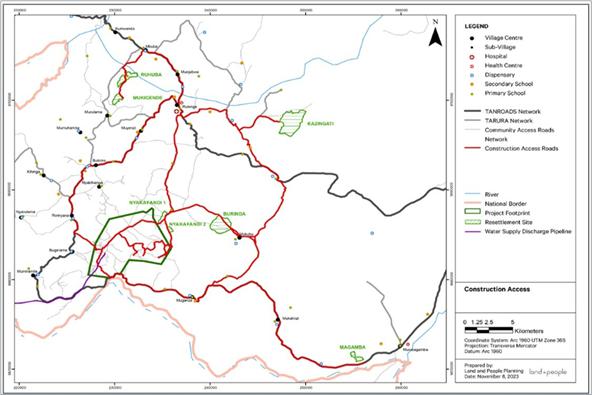

The site is reached by 77 km of unpaved public road (Southern Access Road) from the paved National Route B3 (see Figure 1-2). Grid electricity (33 kV, 9 MVA) is currently supplied to the site by the Tanzania Electric Supply Company Limited (TANESCO) and is sufficient for construction and initial mine development. The development of the site includes the resettlement of economically displaced households (EDHs) and physically displaced households (PDHs) onto seven identified relocation host sites (hereafter known as the “Kabanga Resettlement Sites”).

Figure 1-2: Kabanga Special Mining Licence (SML), Site Project Footprint, Resettlement Sites and Southern Access Road

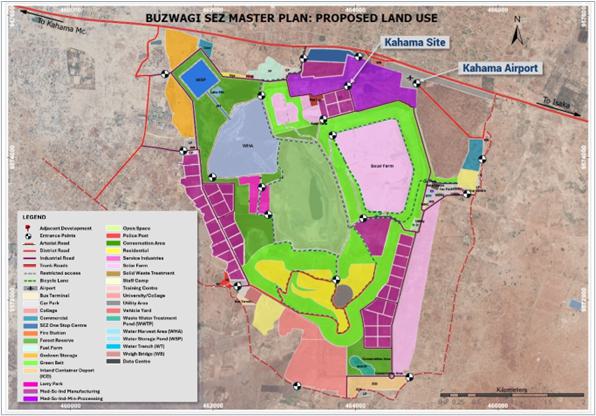

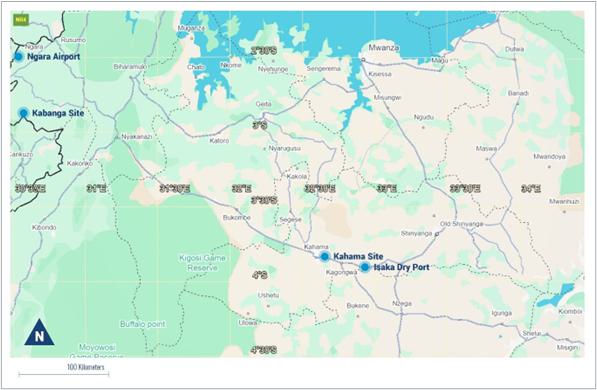

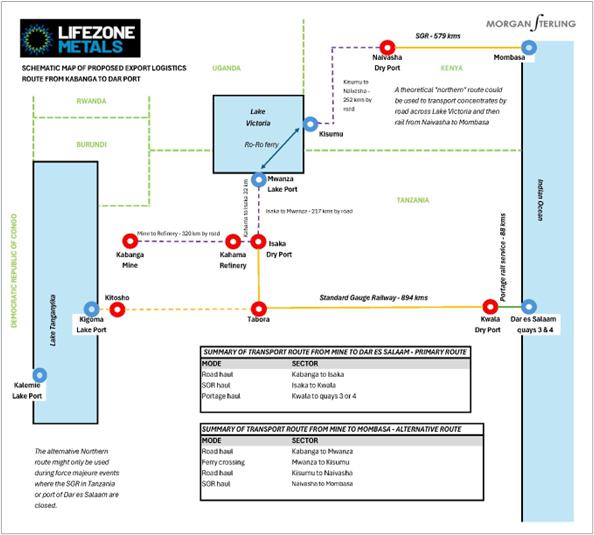

The Kahama Site will be located within the Buzwagi Special Economic Zone (SEZ), located in Kahama, a town with a population of approximately 453,000 (2022 census). The Kahama Site comprises the Refinery, associated infrastructure, and utilities. The Kahama Site is approximately 320 km from the Kabanga Site on the paved B3 highway. The Kahama Site is 32 km from the Isaka Dry Port, which will provide a 982 km Standard Gauge Rail (SGR) link to Dar es Salaam Port via Tabora and Kwala. The site has existing infrastructure consisting of workshops, warehouses, offices, security, and water storage dams. An existing bulk water supply is available from the local Kahama Urban Water Supply and Sanitation Authority (KUWASA). The Kahama Airport (KBH) has commercial domestic flights to and from Dar es Salaam (See Figure 1-3). Bulk (220 kV) power supply from TANESCO is available to the site.

Page

|

/ / Initial Assessment - Technical Report Summary |

|

Figure 1-3: Kahama Site at the Buzwagi SEZ

Both sites are situated within a temperate moist sub-humid climatic zone, experiencing bi-modal rainfall patterns with an average annual precipitation of approximately 1,000 mm, and mean annual temperatures around 20°C, allowing for year-round site access.

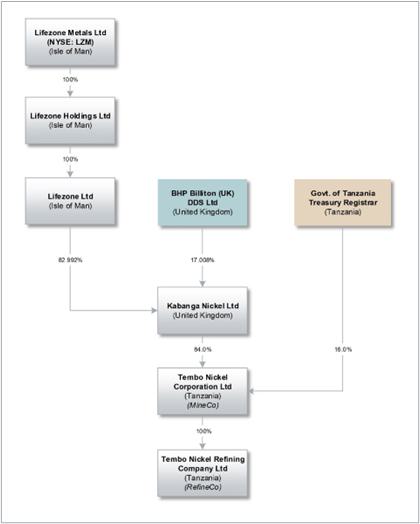

The Project is owned by Tembo Nickel Corporation Limited (TNCL). TNCL is 84% owned by Kabanga Nickel Limited (KNL) and 16% by the Government of Tanzania (GoT) Treasury Registrar. KNL is jointly owned by LZM (82.992%), through its 100% owned subsidiaries, and by BHP Billiton (UK) DDS Limited (BHP) (17.008%). The LZM attributable ownership is thus 69.713%, after accounting for the GoT and BHP shareholding. The current Project ownership structure is presented in Figure 1-4.

Page

|

/ / Initial Assessment - Technical Report Summary |

|

Figure 1-4: Current Ownership Structure of the Kabanga Nickel Project

A Framework Agreement exists with the GoT for the development and operation of the Project, which describes the equitable Economic Benefit Sharing Principle (EBSP) between KNL and the GoT. The overarching principle is that KNL and the GoT equally share income derived from the Project over the Project life, where GoT’s income is derived from dividends, taxes, royalties, duties, and levies.

TNCL holds a 201.85 km2 Special Mining Licence (SML) granted on October 29, 2021, which is valid up to 33 years (2054) and includes all mineralized areas relating to the resource. TNCL also holds a Refining Licence (RFL), granted on March 19, 2024, which confers the right to refine copper, cobalt, and nickel products in the Kahama District, Shinyanga Region. In addition, TNCL holds six prospecting licenses covering a combined area of 101.44 km2, which are not part of the Project.

BHP holds a 17% direct interest in KNL, acquired via a convertible loan in July 2022 and an equity subscription in February 2023. In addition, KNL and LZM’s wholly-owned subsidiary Lifezone Limited entered into an option agreement with BHP in October 2022, pursuant to which KNL would receive an investment from BHP by way of an equity subscription, such that in aggregate, BHP would indirectly own 51% of the total voting and economic equity rights in TNCL and RefineCo (60.71% of the total voting and economic equity rights in KNL on a fully diluted basis). The price is to be determined through an independent expert valuation and the option process commences on the later date on which the Definitive Feasibility Study (DFS) is agreed between BHP and KNL, or the date on which the Joint Financial Model (JFM) in respect of the Project is agreed between BHP, GoT, and Lifezone Limited.

Page

|

/ / Initial Assessment - Technical Report Summary |

|

Lifezone Limited and KNL entered into a Development, Licensing and Services Agreement on October 14, 2022, pursuant to which Lifezone Limited agreed to study the proposed Refinery that will utilize Lifezone Limited’s hydrometallurgical technology.

| 1.3 | Geology |

| 1.3.1 | Geological Setting |

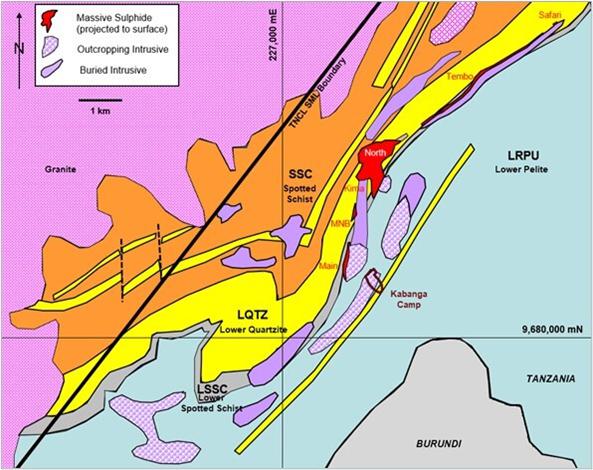

The Kabanga nickel deposit is located within the East African Nickel Belt, which extends approximately 1,500 km along a northeast trend that extends from Zambia in the southwest to Uganda in the northeast. In the northern and central sections of the East African Nickel Belt, a thick package of Paleoproterozoic to Mesoproterozoic metasedimentary rocks, known as the Karagwe-Ankole Belt (KAB), overlies this boundary, within which occurs a suite of broadly coeval, bimodal intrusions that correspond to the Mesoproterozoic Kibaran tectonothermal event between 1,350 Ma and 1,400 Ma.

The Kibaran igneous rocks comprise mafic-ultramafic intrusions, including well-differentiated lopolithic layered intrusions and small, narrow, tube-like sills, often concentrically zoned, called chonoliths. The nickel mineralization zones discovered to date have exclusively been found associated with the mafic-ultramafic intrusions, in particular, along the Kabanga-Musongati Alignment.

The intrusions that host the potentially economic nickel-bearing massive sulfide zones in the Project area, namely, from southwest to northeast, Main, MNB, Kima, North, Tembo, and Safari, are hosted within steeply dipping overturned metasediments (dipping 70° to 80° to the west), with a north–northeast strike orientation (025°) from the Main zone to North zone, changing to a northeast strike orientation (055°) (dipping northwest) from North to Tembo. These zones are located within and at the bottom margin of the mafic ultramafic chonoliths. The chonoliths are concentrically zoned with a gabbronorite margin and an ultramafic cumulate core.

Three lithological groups are present at Kabanga:

| ● | Metasediments comprising a series of pelitic units, schists, and quartzites, forming the hanging wall and footwall of the massive sulfide mineralization. |

| ● | Mafic ultramafic intrusive complex rocks, which display a wide range of metamorphism/metasomatism and can carry significant sulfide mineralization (i.e., UMAF_1a (≥ 30% sulfides)). |

| ● | Remobilized massive sulfide (MSSX) mineralization (i.e., MSSX (> 80% sulfides), which carries 90% of the sulfide occurrence, and massive sulfide mineralization with xenoliths of metasedimentary or gabbro/ultramafic (i.e., MSXI (≥ 50% < 80% sulfides). |

| 1.3.2 | Style of Mineralization |

The principal sulfide in the massive sulfide is pyrrhotite, with up to 15% pentlandite. The pentlandite shows distinct globular recrystallization textures, with crystals reaching up to 5 cm in size. Sulfide mineralization occurs both as:

| ● | Disseminated to net-textured interstitial sulfides within and external to the cumulate core of the chonoliths. |

| ● | Massive and semi-massive bodies along the lower or side margins of the chonolith. |

| 1.3.3 | Exploration History |

Exploration at the Project has been undertaken in several different phases for approximately 50 years, with more than 637 km of drilling completed up to the effective date of the current Mineral Resource estimate (MRE) reported in December 2024.

The first drilling on the deposit was undertaken between 1976 and 1979 by the United Nations Development Programme (UNDP). This program resulted in over 20 km of drilling and the estimation of a Mineral Resource for Main zone.

Page

|

/ / Initial Assessment - Technical Report Summary |

|

In 1990, Sutton Resources Ltd (Sutton) negotiated the mineral rights to the Project. Between 1990 and 1999, Sutton, in two separate joint ventures (JVs), completed over 100 km of drilling that resulted in Mineral Resource estimates for the Main zone and North zone.

In 1999, Barrick Gold Corporation (Barrick) purchased Sutton and commenced a 14-year exploration program. During the first four years of this program, Barrick explored the Main zone and North zone areas further, resulting in the discovery of the MNB zone and the Kima zone, updates to the resource models, and the completion of a scoping study. In 2005, Barrick entered into a JV with Falconbridge Ltd (which became Xstrata plc, then ultimately Glencore plc) that lasted for nine years and resulted in two additional scoping studies, a Pre-Feasibility Study (PFS), an FS and a draft FS update. During this period, over 450 km of drilling was completed, the Tembo zone mineralization was discovered, and Mineral Resource updates were generated for all the zones.

Other historical exploration work completed included the following:

| ● | Geophysical surveys: |

| ‒ | Crone borehole electromagnetic (BHEM) geophysical surveys with physical properties, ground geophysical surveys, and airborne versatile time domain electromagnetic (VTEM) surveys (which were used, in conjunction with historical soil surveys and a BHP GEOTEM® airborne magnetic survey, to target the ground surveys). |

| ‒ | Superconducting quantum interference device (SQUID) and fixed-loop transient electromagnetic (TEM) surface electromagnetic surveys (Crone and UTEM), as well as a helicopter-borne versatile time domain electromagnetic VTEM survey. |

| ● | Collection and testing of metallurgical samples. |

| ● | Geotechnical drilling at proposed infrastructure sites. |

In December 2021, the Project commenced activities at the Kabanga Site, after SML 651/2021 was granted. Since that time, over 52 km of additional drilling has been completed.

In December 2024, a revised Mineral Resource estimate (2024MRU) was generated based on all the Project drilling completed up to June 4, 2024, and this IA is based on that Mineral Resource estimate.

The Project drillhole database is currently maintained using Fusion software. Data collection activities have been performed using industry-standard practices.

| 1.3.4 | Sample Preparation, Analyses, Security and Data Verification |

The Kabanga sample preparation, assaying, quality assurance and quality control (QA/QC) activities and protocols can be summarized as follows:

| ● | Sample preparation was completed in Tanzania at the ALS Metallurgy Pty Ltd (ALS)-Chemex laboratory in Mwanza (ALS-Chemex Mwanza). |

| ● | All the material was crushed to –2 mm, and 2 × 250 g pulp bags were sent to the ALS-Chemex laboratory in Perth, Western Australia (ALS-Chemex Perth) for analysis. |

| ● | The Perth samples were pulverized to –75 µm and analyzed as follows: |

| ‒ | 4-acid digestion/inductively coupled plasma mass spectroscopy (ICP-MS) for Ni, Cu, Co, Ag, Fe, Cr, Mg, Mn, As, Pb, Bi, Cd, and Sb. |

| ‒ | Fire assay/ICP-MS for Au, Pd, and Pt. |

| ‒ | Ni and Cu samples exceeding 10,000 ppm, and Au, Pd, and Pt samples exceeding 1.0 g/t were re-analyzed with a more accurate technique. |

| ‒ | LECO (Laboratory Equipment Corporation) technique for the determination of sulfur. |

| ‒ | Gravimetric method for density determination (pycnometry) on all samples. |

| ● | Not all the samples were assayed for the complete elemental suite: only 66% for North (10,053 of 15,200 samples), and 95% for Tembo (6,422 of 6,717 samples). |

Page

|

/ / Initial Assessment - Technical Report Summary |

|

| ● | An industry-standard QA/QC protocol was used at Kabanga, using certified reference material (CRM) standards, blanks, check assays, and duplicates. |

| ● | ALS is an independent laboratory accredited by the National Association of Testing Authorities (NATA) and complies with international standards such as ISO/IEC 17025 for testing and calibration in laboratories |

All the aspects of the data that could materially impact the integrity of the Mineral Resource estimates (core logging, sampling, analytical results, and database management) were reviewed by OreWin with TNCL staff. OreWin personnel met with the TNCL staff to ascertain exploration and production procedures and protocols. Drill rigs were visited, and core was observed being obtained from the diamond drillholes and being logged at the exploration camp to confirm that the logging information accurately reflects the actual core. The lithology contacts that were checked matched the information reported in the core logs.

| 1.4 | Mineral Processing and Metallurgical Testing |

| 1.4.1 | Kabanga Concentrator |

Extensive historical metallurgical testwork was previously undertaken for the Kabanga Concentrator (hereinafter referred to as the “Concentrator”) over the period 2005 to 2010, including mineralogical, comminution, flotation (bench and pilot scale) and dewatering testwork, which provided a basis for the additional metallurgical testwork undertaken as part of the 2023-25 concentrator testwork program.

As part of this program, comminution and flotation flowsheet development and variability testwork was conducted on 4,616 kg of quarter, half, and full NQ sized (approximately 47.6 mm) drill core. The testwork was conducted to feasibility level, on a range of composite and variability samples which were selected to represent the major feed types and feed blends expected to be processed over the potential life of mine (LoM). Sample selection and composite preparation also considered:

| ● | Grade ranges and expected LoM grades. |

| ● | Spatial coverage, including depth and along strike. |

| ● | Appropriate levels of planned and unplanned mining dilution advised by the relevant mining disciplines. |

| ● | The proportion of MSSX and UMAF_1a tonnage in the overall mine life. |

Testing included comprehensive head grade analysis, mineralogy, comminution (physical crushing and grinding) tests, open circuit and locked-cycle bench-scale flotation tests, open circuit bulk flotation tests, feed oxidation assessments, concentrate regrind, thickening, filtration and rheology testing. The aim of the testwork was to further characterize the flotation response, optimize the flowsheet, generate bulk concentrate samples for the refinery testwork, and to evaluate the degree of variability that could be expected across the deposit.

The comminution testwork confirmed the previous historical testwork findings, demonstrating that the MSSX and MSXI material is characterized as soft to medium with respect to hardness, while the UMAF_1a and waste dilution are characterized as medium-hard to hard. All the samples had a low abrasion tendency.

The flotation testwork demonstrated that a conventional flotation flowsheet, using a typical flotation reagent regime, could be used for the effective separation of pentlandite and chalcopyrite from the pyrrhotite and non-sulfide gangue. It also confirmed the historical optimal flotation circuit feed size of 80% passing 100 µm and a feed solids concentration of 35% (w/w). The regrind testwork highlighted the relatively soft nature of the sulfide rougher concentrate.

The dewatering testwork was aligned with historical testing by equipment vendors, showing the concentrate and tailings could readily thicken to a density > 65% solids (w/w) and is amenable to pressure filtration, achieving a final concentrate moisture level of 9% (w/w). Tailings testwork showed that rheology is not expected to cause pumping issues at design densities.

Page

|

/ / Initial Assessment - Technical Report Summary |

|

The concentrator metallurgical performance projections indicate that the Concentrator will potentially produce over 300 ktpa of nickel-copper-cobalt sulfide flotation concentrate, containing 17.3% nickel over the proposed LoM. The nickel recovery is expected to average 87.3% over the proposed LoM, while the copper and cobalt recoveries are expected to average 95.7% and 89.6%, respectively.

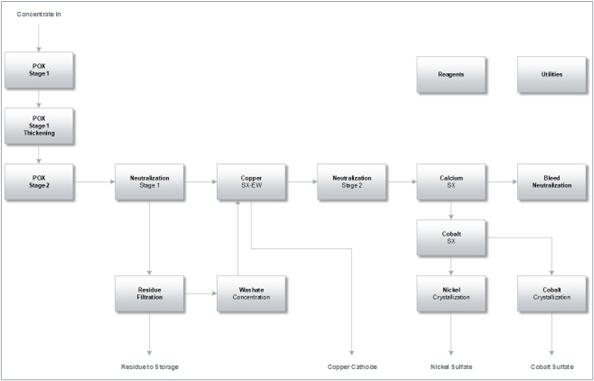

| 1.4.2 | Kahama Refinery |

Refinery testwork was conducted using samples of concentrate generated from the concentrator testwork program, derived from feed containing varying amounts of MSSX, UMAF_1a and waste dilution lithologies, with the dominant minerals in the MSSX being pentlandite, chalcopyrite, and pyrrhotite.

The testwork program included pressure oxidation (POX), primary neutralization, locked-cycle POX and primary and secondary neutralization, copper, cobalt, calcium and impurity solvent extraction (SX), anolyte neutralization, bleed crystallization characterization, and local limestone characterization.

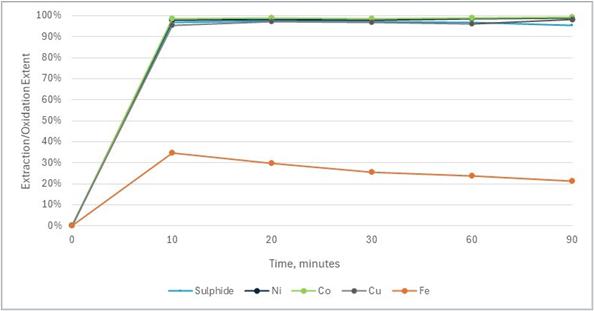

Over 50 POX batch tests demonstrated high leach extractions of nickel (98%), cobalt (99%), and copper (98%) across a range of operating conditions. The pregnant leach solution (PLS) produced was low in impurities, making it well suited to direct electrowinning and battery-grade nickel sulfate production. A high recovery of copper (> 98%) in SX was demonstrated, in line with the vendor’s performance projections.

Key impurities like iron and aluminum were effectively removed during the precipitation process, with minimal loss of valuable metals (< 1% for nickel, cobalt, and copper). Additional tests on CoSX showed that other impurities, including impurities such as calcium and sodium introduced during processing, can be managed. These were successfully rejected while still maintaining high recoveries of nickel and cobalt (> 99%) in the impurity removal circuits.

Limestone samples sourced from the nearby Shinyanga Region in Tanzania were tested and confirmed to have acid neutralization properties consistent with their calcium content, making them suitable for use in the Refinery.

The test results for the pilot plant samples agree with prior tests on the pilot plant concentrate sample and as well as the broader dataset generated from the POX bench-scale testwork on the Kabanga concentrate samples. The hydrometallurgical testwork supports the overall Refinery flowsheet design and demonstrates the potential that London Metal Exchange (LME) grade A copper and battery grade nickel sulfate can be produced. Overall Refinery recoveries of 97.2%, 93.0%, and 97.7% for nickel, copper, and cobalt, respectively, are expected.

| 1.5 | Mineral Resource Estimate |

The 2024MRU was based on industry best practice, is similar in approach to the resource modeling of previous estimates, conforms to the requirements of S-K 1300, and is suitable for reporting as current estimates of Mineral Resources.

The 2024MRU was completed using Datamine software, with macros developed to estimate the full suite of component elements and density for each zone (Main, MNB, North, Kima, and Tembo). All zones were estimated using the ordinary kriging method, with domain-specific search and estimation parameters determined by statistical and geostatistical analyses.

Three distinct mineralization units were interpreted for the Main, MNB, Kima, North, Tembo, and Safari zones:

| ● | Massive sulfide (MSSX), |

| ● | Ultramafic (UMAF), and |

| ● | Intrusive (INTRUSIV/INTR) unit, which is generally poorly mineralized but occurs in close association with the mineralized units. |

Within these three units, additional sub-domains were created based on spatial continuity, intersecting geological structures, and geochemical variability.

Page

|

/ / Initial Assessment - Technical Report Summary |

|

Solid wireframes were constructed for the intrusive bodies at each zone, which predominantly represented the logged generally unmineralized ultramafic (peridotite) (UMAF_KAB) lithology but also served as an ‘umbrella’ unit for any intervals logged as generic mafic (MAF), generally unmineralized gabbro-gabbronorite (GAB_KAB), UMAF_1a, MSSX, and MSXI. The stratigraphic contacts between the Banded Pelite unit (BNPU) and the Lower Pelite unit (LRPU) were also used to interpret folding structures and unconformities to help orient the sulfide mineralization interpretations.

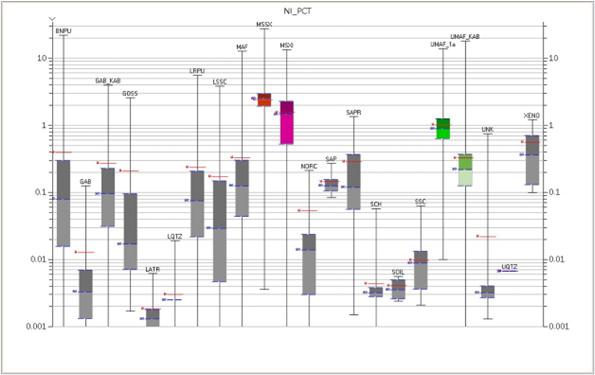

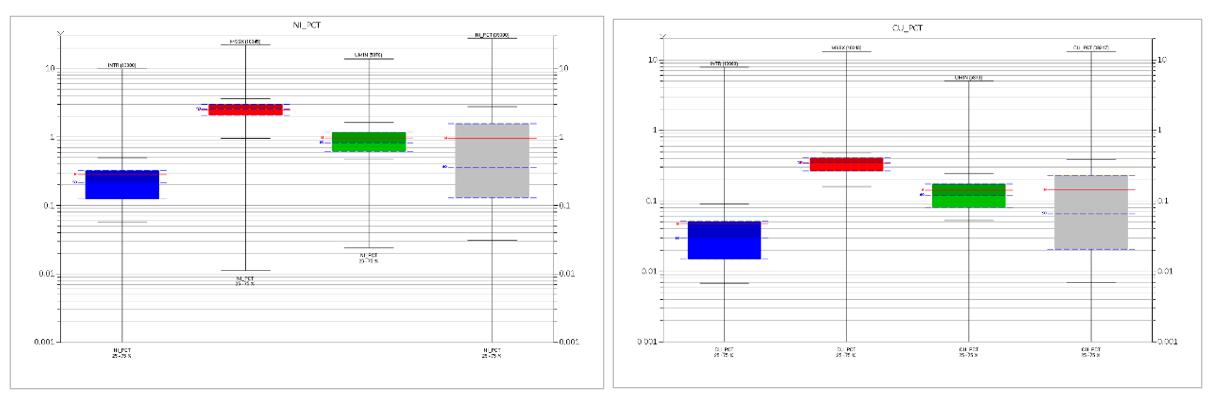

A multivariate statistical analysis was completed for all domains within each zone. It was based on the assay data limited to the samples that have the complete suite of elements assayed.

Some individual domains were combined where they were found to be statistically similar and could be plausibly related in a geological and spatial sense. The classification criteria and zoning used for the 2024MRU were based on a two-stage approach that considered objective criteria and visual observation.

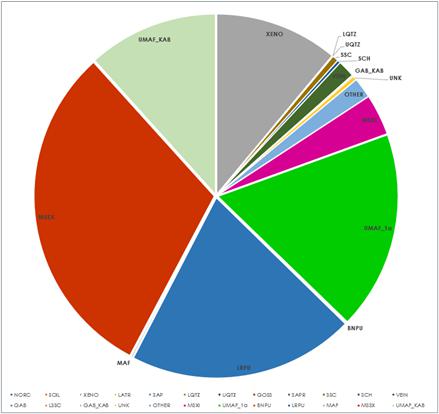

The criteria referenced for the assignment of Inferred and Indicated mineralization globally included the distance from the cell centroid to the drillhole samples and the search pass in which the estimate was achieved. This global classification was then reviewed visually with specific focus on geological factors, including the geometry of the mineralized zones, spatial and geochemical continuity of the mineralization, and the success rate when intersecting the mineralization at predicted locations and thicknesses with the new drilling. Manually defined wireframe solids were then developed to enclose those areas that warrant upgrading to Indicated or Measured. As the Kabanga North and Tembo zones contain multi-element mineralization, a nickel equivalent (NiEq) formula, updated for current metal prices, costs, and other modifying factors, has been used for reporting from the Mineral Resource.

The 2024 nickel-equivalent (NiEq24) formula is as follows:

| ● | MSSX NiEq24% = Ni% + (Cu% x 0.454) + (Co% x 2.497) |

| ● | UMAF NiEq24% = Ni% + (Cu% x 0.547) + (Co% x 2.480) |

The 2024 NiEq cut-off grades are:

| ● | MSSX NiEq24% is 0.73% |

| ● | UMAF NiEq24% is 0.77% |

Metal price assumptions used for cut-off grade determination were USD 9.50/lb for nickel, USD 4.50/lb for copper, and USD 23.00/lb for cobalt. Other input parameters and assumptions used for the NiEq24% formula and determining the cut-off grade are discussed in Section 11.4.

Reasonable prospects for economic extraction for the Mineral Resource determination were assessed by way of an IA, as defined in S-K 1300.

The overall MRE (LZM-attributable) is shown in Table 1-1. Reporting of contained nickel-equivalent metal is shown in Table 1-2. Only the portion of the total mineralization that is attributable to LZM’s interest in the property (69.713%) is shown in Table 1-1 and Table 1-2.

The MREs have an effective date of December 4, 2024 MREs have been reported in accordance with S-K 1300.

Page

|

/ / Initial Assessment - Technical Report Summary |

|

Table 1-1: Kabanga Mineral Resource Estimates as at December 4, 2024 – Tonnes and Grade

Mineral

Resource |

LZM Tonnage2 (Mt) | Grades (%) | Recovery (%) | |||||

| NiEq24 | Ni | Cu | Co | Ni | Cu | Co | ||

| MINERAL RESOURCE ALL ZONES – Massive Sulfide Only | ||||||||

| Measured | 10.3 | 3.14 | 2.49 | 0.33 | 0.20 | 86.2 | 95.1 | 89.2 |

| Indicated | 20.5 | 3.44 | 2.77 | 0.38 | 0.20 | 85.8 | 95.4 | 88.8 |

| Measured + Indicated | 30.9 | 3.34 | 2.68 | 0.36 | 0.20 | 85.9 | 95.3 | 88.9 |

| Inferred | 9.4 | 2.89 | 2.32 | 0.32 | 0.17 | 85.2 | 94.9 | 88.1 |

| MINERAL RESOURCE ALL ZONES – Ultramafic Only | ||||||||

| Measured | 5.5 | 1.24 | 0.96 | 0.13 | 0.08 | 65.7 | 77.8 | 68.0 |

| Indicated | 10.4 | 1.23 | 0.95 | 0.15 | 0.08 | 65.6 | 78.3 | 67.8 |

| Measured + Indicated | 16.0 | 1.23 | 0.95 | 0.14 | 0.08 | 65.6 | 78.2 | 67.9 |

| Inferred | 1.9 | 1.05 | 0.83 | 0.12 | 0.06 | 62.7 | 77.2 | 64.3 |

| MINERAL RESOURCE ALL ZONES – Massive Sulfide plus Ultramafic | ||||||||

| Measured | 15.9 | 2.48 | 1.95 | 0.26 | 0.16 | 82.7 | 92.0 | 85.4 |

| Indicated | 31.0 | 2.69 | 2.16 | 0.30 | 0.16 | 82.9 | 92.6 | 85.3 |

| Measured + Indicated | 46.8 | 2.62 | 2.09 | 0.29 | 0.16 | 82.8 | 92.4 | 85.3 |

| Inferred | 11.3 | 2.59 | 2.08 | 0.28 | 0.15 | 83.7 | 93.7 | 86.5 |

| ● | Mineral Resources in Table 1-1 are reported exclusive of Mineral Reserves. |

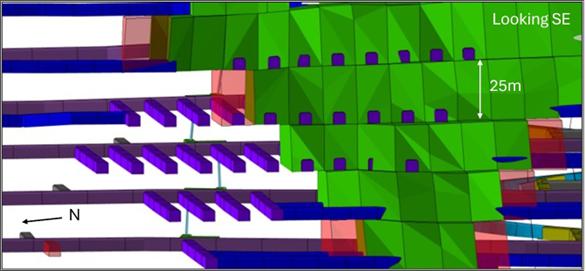

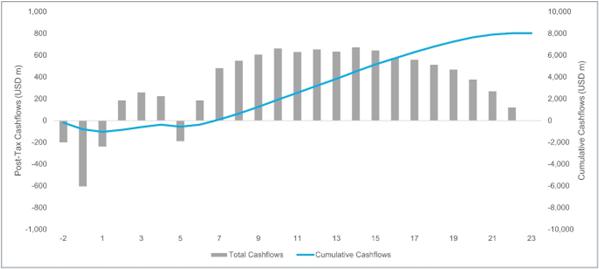

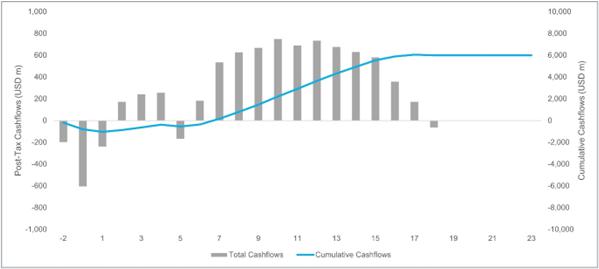

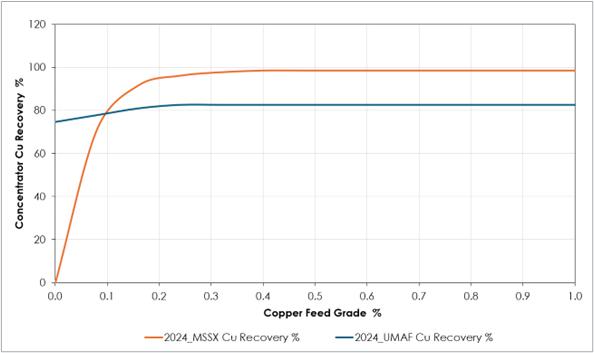

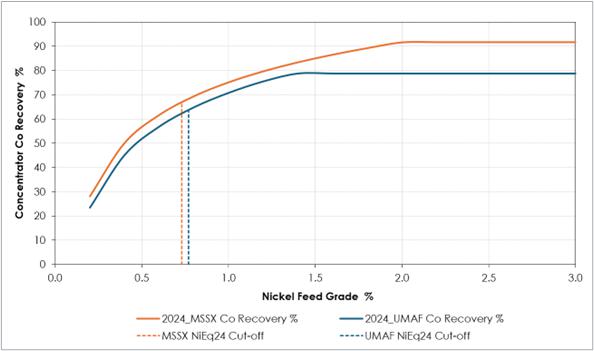

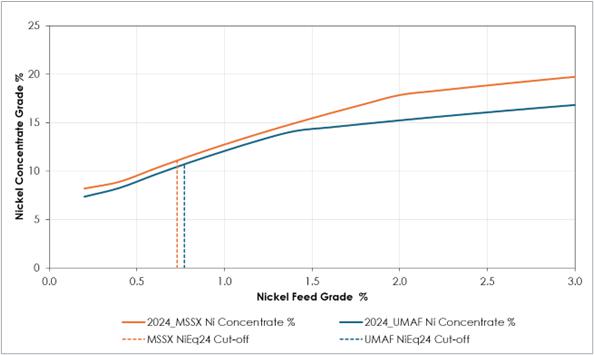

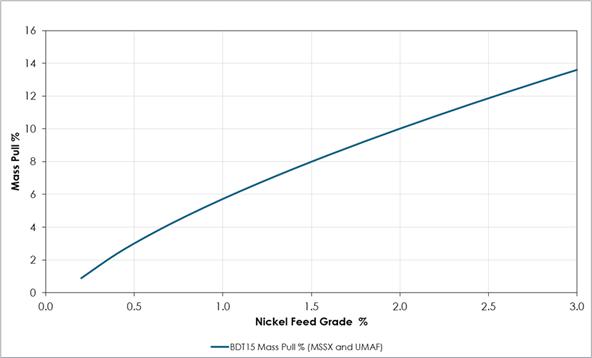

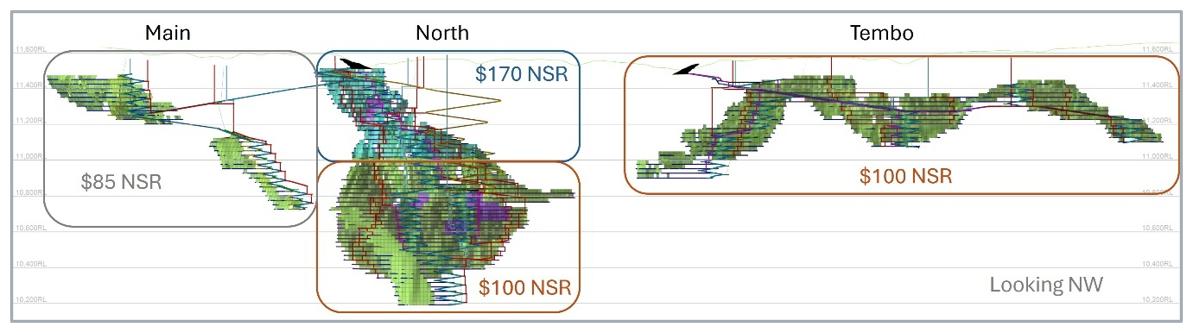

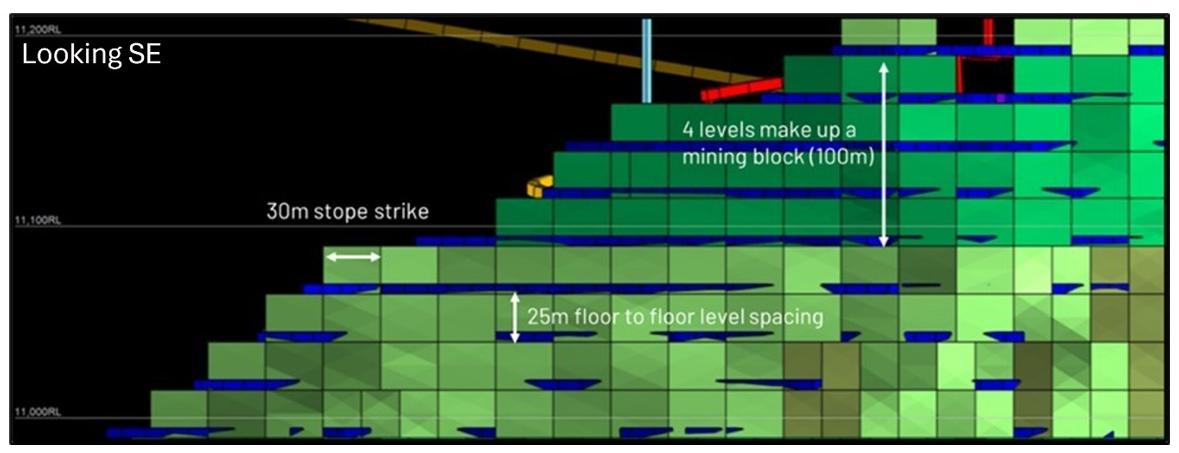

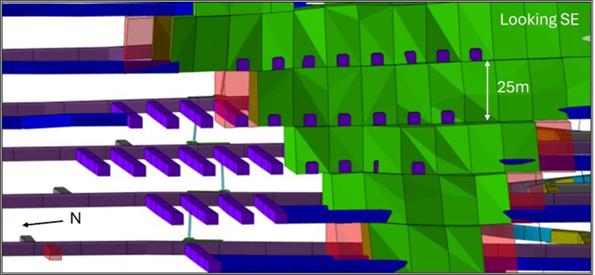

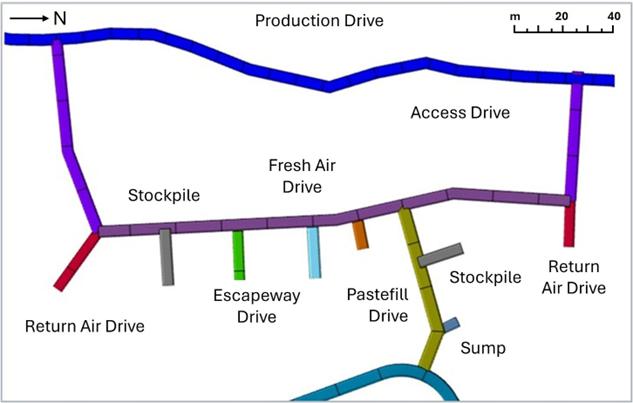

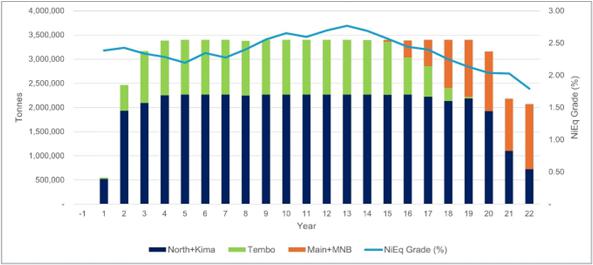

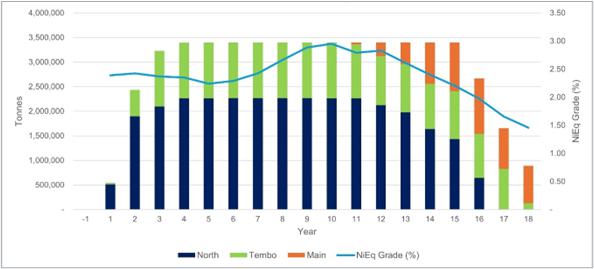

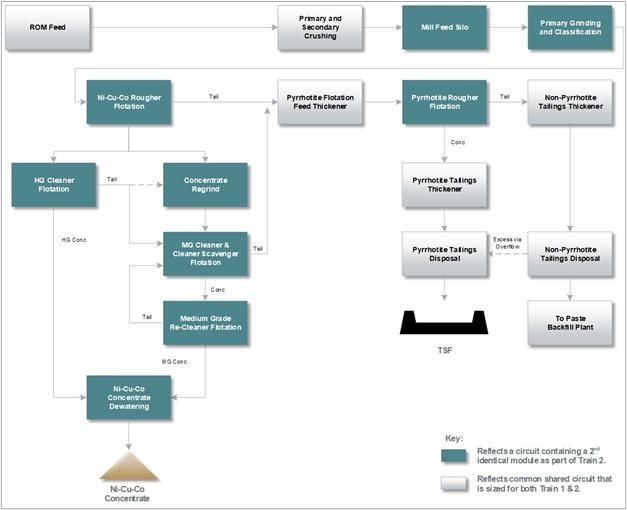

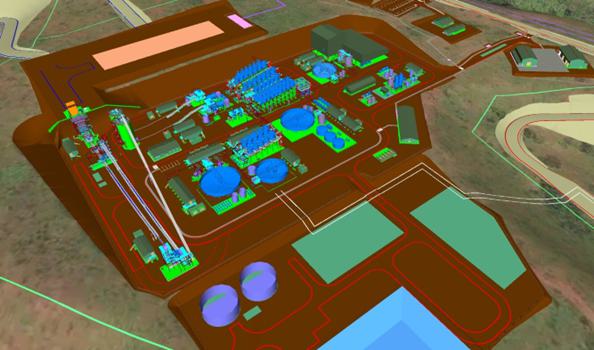

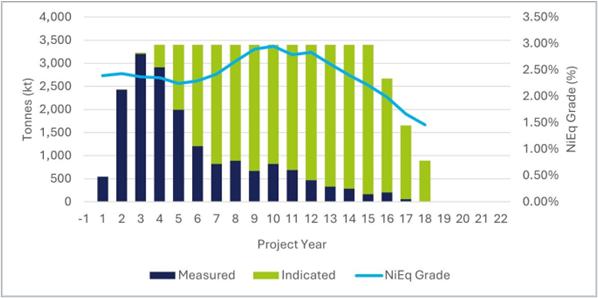

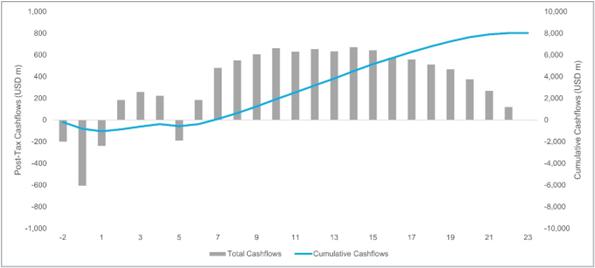

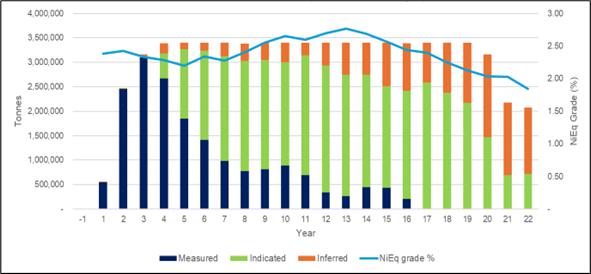

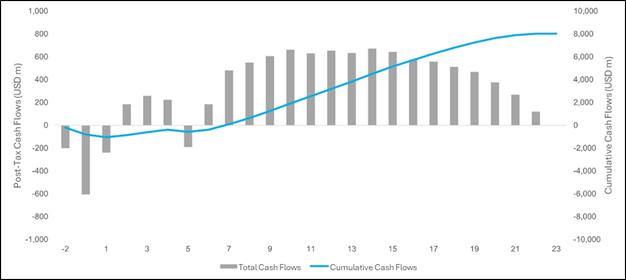

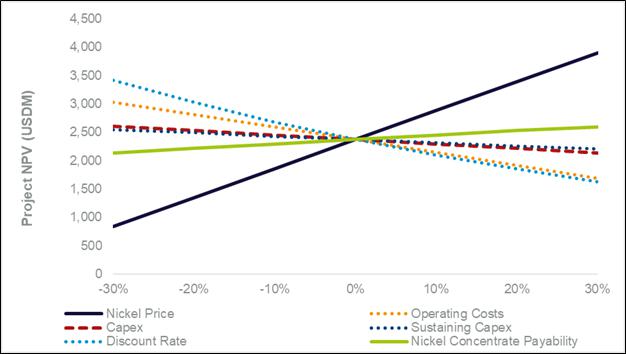

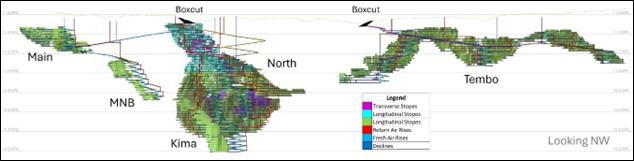

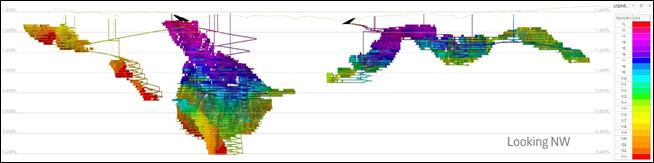

| ● | Mineral Resources are reported showing only the LZM-attributable tonnage portion, which is 69.713% of the total. |