UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 1, 2024

GRYPHON DIGITAL MINING, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

| 001-39096 | 83-2242651 | |

| (Commission File Number) | (IRS Employer Identification No.) |

|

| 1180 N. Town Center Drive, Suite 100 | ||

| Las Vegas, NV | 89144 | |

| (Address of Principal Executive Offices) | (Zip Code) |

(702) 945-2700

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||

| Common Stock, par value $0.0001 per share | GRYP | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-1 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

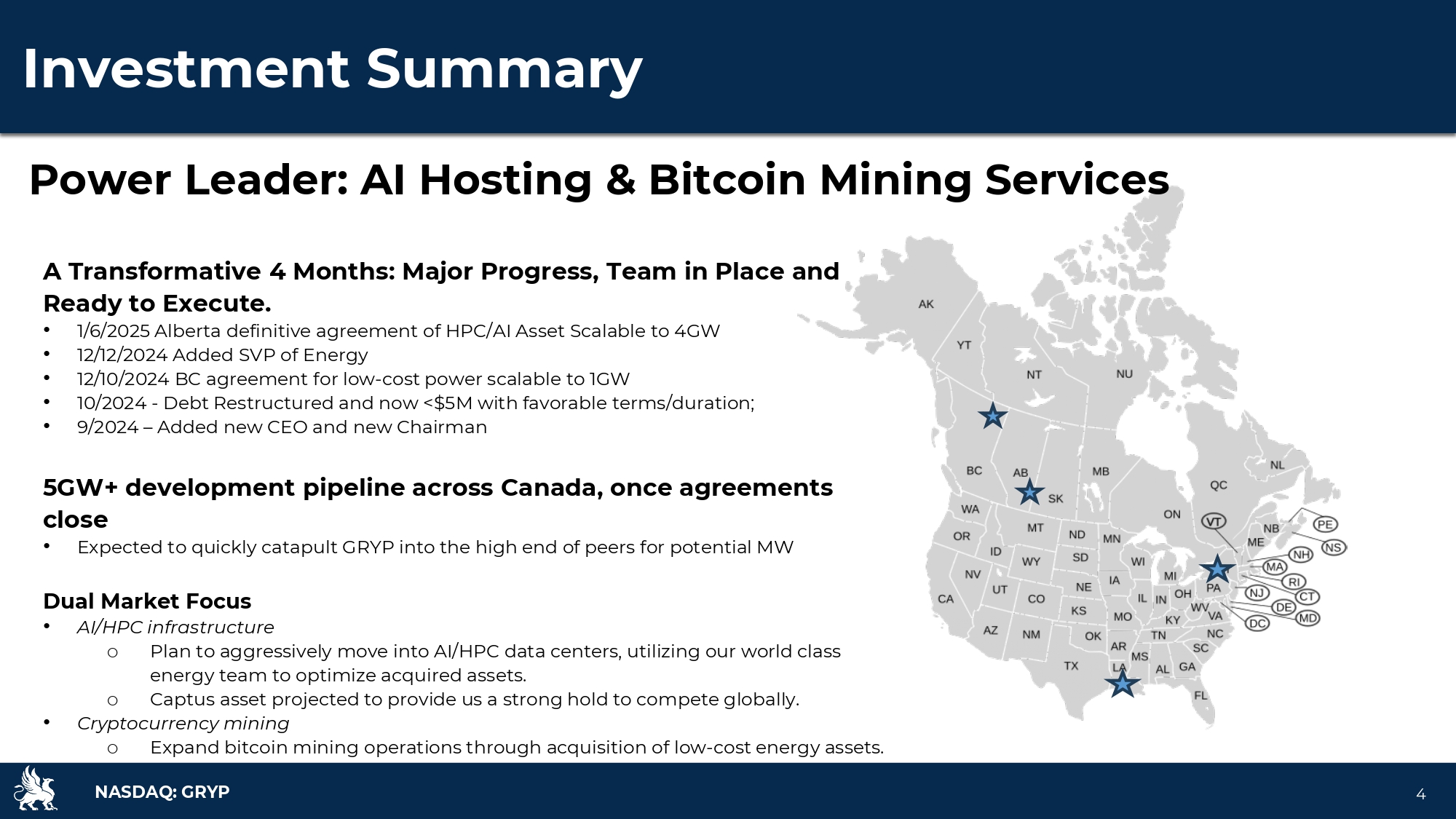

Captus Acquisition

Gryphon Digital Mining, Inc. (the “Company”) and 2670786 Alberta Ltd., a Canadian corporation and a wholly-owned subsidiary of the Company (the “Purchaser”), entered into a Share and Unit Purchase Agreement (the “Captus Agreement”), dated as of January 8, 2024, with BTG Energy Corp., a Canadian corporation (“BTG Energy”), BTG Power Corp., a Canadian corporation (“BTG Power”) and West Lake Energy Corp., a Canadian corporation (“West Lake,” and together with BTG Energy and BTG Power, the “Vendors”). Pursuant to the Captus Agreement, the Purchaser will acquire from the Vendors all of the issued and outstanding shares or units, as applicable, of (i) Captus Generation Ltd. (“Captus GP”) and BowArk Energy Ltd., each a Canadian corporation, and (ii) Captus General Limited Partnership, a Canadian limited partnership.

The aggregate consideration payable by the Purchaser to the Vendors is CAD $24.0 million (the “Cash Consideration”), subject to adjustment in accordance with the terms of the Captus Agreement. In November 2024, the Company paid a cash deposit of CAD $200,000 to Captus GP for the benefit of the Vendors (the “LOI Cash Deposit”). Within two business days of the date of the Captus Agreement, the Purchaser will pay a cash deposit of CAD $1.0 million to Captus GP for the benefit of the Vendors (the “Signing Cash Deposit,” and together with the LOI Cash Deposit, the “Cash Deposits”). The Cash Deposits may be applied towards the payment of the Cash Consideration in accordance with the terms of the Captus Agreement, and the remainder of the Cash Consideration will be paid by the Purchaser upon closing.

The transaction remains subject to certain conditions, including the transfer and assignment of certain agreements from the Vendors to the Purchaser. Pending approval by the Alberta Energy Regulator, BTG Energy and West Lake will hold certain well, pipeline and facility licenses in trust for an agreed fee.

In connection with the Captus Agreement, on January 8, 2025, as a material inducement to their agreeing to become employees of the Company, the Company granted a restricted stock award to each of Harry Andersen, Paul Connolly, Mark Taylor and Steve Giacomin (collectively, the “Restricted Stock Awards”). The Restricted Stock Awards are intended to constitute “employment inducement awards” under the Nasdaq Stock Market Rules.

The number of restricted shares granted to each individual is specified in the table below:

| Name | Number of Restricted Shares |

|||

| Harry Andersen | 1,972,907 | |||

| Paul Connolly | 851,206 | |||

| Mark Taylor | 851,206 | |||

| Steve Giacomin | 407,981 | |||

Each of the Restricted Stock Awards vests in three equal installments on the first three anniversaries of the grant date subject to the grantee’s continued engagement with the Company through each applicable vesting date, provided however, that the Restricted Stock Awards will accelerate and vest immediately upon the grantee’s death, disability, termination by the Company without “cause” (as defined in each Restricted Stock Award agreement), or the consummation of a change in control of the Company.

The Restricted Stock Awards are entitled to receive all cash dividends and other distributions paid on the underlying shares during the period of restriction, but the Company may retain custody of all such distributions until such time, if ever, that the underlying shares on which such distributions are paid become vested.

As a condition of the Restricted Stock Awards, each grantee agrees to vote shares subject to each award that are subject to a vesting restriction in favor of all proposals recommended by the Board at any annual or special meeting of the Company’s stockholders. The Restricted Stock Awards were issued pursuant to the exemption from registration contained in Section 4(a)(2) of the Securities Act of 1933, as amended.

The foregoing description of the Captus Agreement and the Restricted Stock Awards does not purport to be complete and is qualified in its entirety by reference to the full text of the Captus Agreement and the form of Restricted Stock Award, which are filed as Exhibits 10.1 and 10.2 to this Current Report on Form 8-K, respectively, and are incorporated herein by reference. The foregoing summary has been included to provide investors and security holders with information regarding the terms of the Captus Agreement and the Restricted Stock Awards and is qualified in its entirety by the terms and conditions of the Captus Agreement and Restricted Stock Awards. It is not intended to provide any other factual information about the Company, the parties to the Captus Agreement or their respective subsidiaries and affiliates. The Captus Agreement contains representations, warranties and covenants by each of the parties to the Captus Agreement, which were made only for purposes of the Captus Agreement and as of specified dates. The representations, warranties and covenants in the Captus Agreement were made solely for the benefit of the parties to the Captus Agreement, may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Captus Agreement instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the Company or any of its subsidiaries or the parties to the Captus Agreement. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the Captus Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures.

Erikson National Energy Agreement

On December 9, 2024, Gryphon Digital Mining, Inc. (the “Company” or “Gryphon”) entered into an asset purchase and sale agreement (the “Purchase Agreement”) with Erikson National Energy Inc. (“Erikson”), a Canadian corporation under the laws of the Province of Alberta. Erikson commenced proposal proceedings under the Bankruptcy and Insolvency Act (Canada) (“BIA”) on October 1, 2024 by filing a Notice of Intention to Make a Proposal, pursuant to section 50.4 of the BIA, and KSV Restructuring Inc. was named as proposal trustee. Pursuant to an order of the Court of King’s Bench of Alberta (the “Court”) granted on October 21, 2024, the Court approved a sale and investment solicitation process (“SISP”) in respect of the sale of the assets and properties of Erikson. As part of the SISP, Gryphon and Erikson entered into the Court-approved Purchase Agreement pursuant to which Gryphon agreed to purchase substantially all of Erikson’s assets for a purchase price of CAD $2,000,000, subject to certain adjustments as provided for in the Purchase Agreement. Pursuant to the Purchase Agreement, the Company will acquire all of Erikson’s natural gas and oil wells, facilities and pipelines, which are currently shut in. The assets are located in northeast British Columbia and span the Fort St. John, Stoddart, Roseland, Fireweed, Buick Creek, Laprise and Wildboy areas. The representations and warranties provided by the parties are standard for a transaction of this nature.

The transaction remains subject to certain conditions, which conditions include obtaining the mineral rights formerly held by Erikson, obtaining approval for the well, facility and pipeline license transfers from the British Columbia Energy Regulator, completion of Gryphon’s due diligence, and the granting of a sale approval and vesting order by the Court, all of which must be satisfied or waived by the Company by January 31, 2025, which date may be extended at the Company’s option to March 8, 2025 (in either case, the “Outside Date”). No assurance can be given that the transactions contemplated by the Purchase Agreement will close.

The Court also granted an amended interim financing order approving Gryphon as a debtor in possession (“DIP”) lender to Erikson. As part of the transaction, Gryphon is providing DIP interim financing to Erikson to cover its operating expenses and legal and professional fees during the period between December 9, 2024 and the applicable Outside Date. Upon closing, Gryphon may offset some or all of the interim financing provided against the

purchase price.

The foregoing description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Purchase Agreement, which is filed as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference. The foregoing summary has been included to provide investors and security holders with information regarding the terms of the Purchase Agreement and is qualified in its entirety by the terms and conditions of the Purchase Agreement. It is not intended to provide any other factual information about the Company, Erikson or their respective subsidiaries and affiliates. The Purchase Agreement contains representations, warranties and covenants by each of the parties to the Purchase Agreement, which were made only for purposes of the Purchase Agreement and as of specified dates. The representations, warranties and covenants in the Purchase Agreement were made solely for the benefit of the parties to the Purchase Agreement, may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Purchase Agreement instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the Company, Erikson or any of their subsidiaries or assets. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the Purchase Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures.

New Colocation Agreements

As previously disclosed, the Company determined not to renew its agreement with Coinmint, LLC (“Coinmint”) for colocation services at Cointmint’s facility in Massena, New York, and the agreement expired on January 1, 2025.

The Company entered into a Co-Location Mining Services Agreement (the “Blockfusion Agreement”), dated as of December 1, 2024, with Blockfusion USA, Inc. (“Blockfusion”) for hosting 4,969 of its bitcoin miners at Blockfusion’s facility in Niagara Falls, New York. Pursuant to the Blockfusion Agreement, the Company is entitled to 12 MW of power at a cost of $156,000 per month, as well as certain other fees set forth in the agreement. At signing, the Company paid an initial $156,000 facility fee. In addition, the Company will be required to (i) by January 31, 2025, maintain a cash deposit or (ii) by January 27, 2025, an irrevocable standby letter of credit with Blockfusion’s energy provider, in each case in the amount of $1,200,000. The Blockfusion Agreement has a term of twelve months and automatically renews for subsequent one-month terms, until terminated on thirty days’ notice.

On January 3, 2025, the Company entered into a Master Co-Location Agreement (the “Mawson Agreement”) with Mawson Hosting LLC (“Mawson”) for hosting the remaining 635 of our bitcoin miners at Mawson’s facility in Midland Pennsylvania, with the right to host up to 5,880 miners. Pursuant to the Mawson Agreement, the Company is entitled to 20 MW of power at a cost of approximately $23.50 per MW/hour paid monthly with a minimum fee of approximately $165,521 per month, as well as certain other fees set forth in the agreement. The Mawson Agreement has an initial term of one year and may be terminated on sixty days’ notice.

The foregoing descriptions of the Blockfusion Agreement and the Mawson Agreement do not purport to be complete and are qualified in their entirety by reference to the full text of the Blockfusion Agreement and the Mawson Agreement, which are filed as Exhibit 10.3 and Exhibit 10.4, respectively to this Current Report on Form 8-K and are incorporated herein by reference.

Item 3.02 Unregistered Sale of Equity Securities

The information in Item 1.01 above under the caption “Captus Acquisition” is incorporated by reference as if set forth in this Item 3.02.

Item 7.01 Regulation FD Disclosure

On January 10, 2025, the Company issued a press release announcing the Captus Agreement (the “Press Release”).

On January 10, 2025, the Company published an updated investor presentation to its website (the “Investor Presentation”). The Company may use the Investor Presentation, possibly with modifications, in presentations from time to time thereafter to current and potential investors, analysts, lenders, business partners, acquisition candidates, customers, employees and others with an interest in the Company and its business.

A copy of the Press Release and Investor Presentation are furnished as Exhibit 99.1 and Exhibit 99.2, respectively, and are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

Set forth below is a list of Exhibits included as part of this Current Report.

| * | Certain schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The registrant agrees to furnish supplementally a copy of any omitted schedule or exhibit to the Commission upon request. |

| ^ | Certain confidential portions of this exhibit have been redacted from the publicly filed document because such portions are (i) not material and (ii) would be competitively harmful if publicly disclosed. |

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| GRYPHON DIGITAL MINING, INC. | |||

| Date: January 10, 2025 | By: | /s/ Steve Gutterman | |

| Name: | Steve Gutterman | ||

| Title: | Chief Executive Officer | ||

Exhibit 2.1

Execution Version

ERIKSON NATIONAL ENERGY INC.

- and -

GRYPHON DIGITAL MINING, INC.

ASSET PURCHASE AND SALE AGREEMENT

December 9, 2024

TABLE OF CONTENTS

| ARTICLE 1 INTERPRETATION | 2 | |

| 1.1 | Definitions | 2 |

| 1.2 | Interpretation | 12 |

| 1.3 | Schedules | 13 |

| 1.4 | Interpretation if Closing Does Not Occur | 13 |

| ARTICLE 2 PURCHASE AND SALE | 14 | |

| 2.1 | Agreement of Purchase and Sale | 14 |

| 2.2 | Transfer of Property and Assumption of Liabilities | 14 |

| 2.3 | Licence Transfers | 14 |

| 2.4 | Whitemap Area | 15 |

| 2.5 | Specific Conveyances | 16 |

| 2.6 | Post-Closing Maintenance of Assets | 16 |

| 2.7 | Assumed Liabilities | 17 |

| 2.8 | Outside Date Extension | 17 |

| ARTICLE 3 PURCHASE PRICE | 18 | |

| 3.1 | Purchase Price | 18 |

| 3.2 | Allocation of Purchase Price | 18 |

| 3.3 | Satisfaction of Purchase Price | 18 |

| ARTICLE 4 TRANSFER TAXES | 18 | |

| 4.1 | Transfer Taxes | 18 |

| ARTICLE 5 REPRESENTATIONS AND WARRANTIES | 19 | |

| 5.1 | Vendor’s Representations | 19 |

| 5.2 | Purchaser’s Representations | 19 |

| 5.3 | Enforcement of Representations and Warranties | 21 |

| ARTICLE 6 “AS IS, WHERE IS” AND NO ADDITIONAL REPRESENTATIONS AND WARRANTIES | 21 | |

| 6.1 | Due Diligence Acknowledgement | 21 |

| 6.2 | “As Is, Where Is”, No Additional Representations | 22 |

| ARTICLE 7 RISK AND COSTS AND INSURANCE | 24 | |

| 7.1 | Risk and Costs | 24 |

| 7.2 | Insurance | 24 |

| ARTICLE 8 INDEMNIFICATION | 24 | |

| 8.1 | Indemnification Given by Purchaser | 24 |

| 8.2 | Third Party Claims | 25 |

| 8.3 | Failure to Give Timely Notice | 26 |

| 8.4 | No Merger | 26 |

| 8.5 | Third Party Beneficiary | 26 |

| ARTICLE 9 ENVIRONMENTAL MATTERS | 26 | |

| 9.1 | Acknowledgements Regarding Environmental Condition | 26 |

| 9.2 | Assumption of Environmental Liabilities | 26 |

| ARTICLE 10 COVENANTS | 27 | |

| 10.1 | Conduct of Business Until Closing | 27 |

| 10.2 | ROFRs | 27 |

| 10.3 | Document Review | 29 |

| 10.4 | Due Diligence | 29 |

| ARTICLE 11 CONDITIONS | 29 | |

| 11.1 | Mutual Conditions | 29 |

| 11.2 | Conditions for the Benefit of the Purchaser | 29 |

| 11.3 | Conditions for the Benefit of the Vendor | 30 |

| 11.4 | Satisfaction of Conditions | 30 |

| 11.5 | Proposal Trustee’s Certificate | 31 |

| ARTICLE 12 CLOSING | 31 | |

| 12.1 | Closing Date and Place of Closing | 31 |

| 12.2 | Deliveries on Closing by the Vendor | 31 |

| 12.3 | Deliveries on Closing by the Purchaser | 31 |

| ARTICLE 13 TERMINATION | 32 | |

| 13.1 | Grounds for Termination | 32 |

| 13.2 | Effect of Termination | 32 |

| ARTICLE 14 GENERAL | 33 | |

| 14.1 | Public Announcements | 33 |

| 14.2 | Liability of the Proposal Trustee | 33 |

| 14.3 | Dissolution of Vendor | 33 |

| 14.4 | Survival | 33 |

| 14.5 | Governing Law | 34 |

| 14.6 | Consequential Damages | 34 |

| 14.7 | Right to Contact Governmental Authorities and Stakeholders | 34 |

| 14.8 | Further Assurances | 34 |

| 14.9 | Assignment | 34 |

| 14.10 | Waiver | 35 |

| 14.11 | Amendment | 35 |

| 14.12 | Time of the Essence | 35 |

| 14.13 | Costs and Expenses | 35 |

| 14.14 | Entire Agreement | 35 |

| 14.15 | Notices | 35 |

| 14.16 | Enurement | 36 |

| 14.17 | Third Party Beneficiaries | 36 |

| 14.18 | Severability | 36 |

| 14.19 | Counterparts | 36 |

SCHEDULES

| Schedule A | Assets Listing | |

| A-1 - Lands | ||

| A-2 - Wells | ||

| A-3 - Facilities | ||

| A-4 - Pipelines | ||

| Schedule B | Whitemap Area | |

| Schedule C | Form of General Conveyance, Assignment and Assumption Agreement | |

| Schedule D | Forms of Conditions Certificates | |

| Schedule E | Assumed Contracts | |

| Schedule F | Thirteen Week Cash Flow Schedule |

PURCHASE AND SALE AGREEMENT

THIS PURCHASE AND SALE AGREEMENT is dated as of December 9, 2024,

BETWEEN:

ERIKSON NATIONAL ENERGY INC., a corporation existing under the laws of the Province of Alberta (herein referred to as the “Vendor”)

- and -

GRYPHON DIGITAL MINING, INC., a corporation existing under the laws of the State of Delaware (herein referred to as the “Purchaser”)

WHEREAS:

| A. | on October 1, 2024, the Vendor filed a Notice of Intention to Make a Proposal (the “NOI”), pursuant to section 50.4 of the Bankruptcy and Insolvency Act, with KSV Restructuring Inc. (“KSV”) named as proposal trustee (the “NOI Proceedings”); |

| B. | on October 21, 2024, the Vendor received an order of the Court (the “Initial Order”) approving a sale and investment solicitation process in respect of the sale of its assets and properties (the “SISP”); |

| C. | on October 21, 2024, the Vendor received an order of the Court (the “Interim Financing Order”) approving certain debtor in possession financing by Third Eye Capital Corporation, as agent for one or more investment vehicles managed, advised, or operated by Third Eye Asset Management Inc. or its Affiliates (“Third Eye Capital”); |

| D. | on November 21, 2024, the Vendor received an order of the Court (the “Second Interim Financing Order”) approving certain amendments to the debtor in possession financing by Third Eye Capital; |

| E. | the Vendor has retained the services of Sayer Energy Advisors (the “Sales Advisor”) to act as the sale advisor for the purposes of its sale and investment solicitation process; |

| F. | certain of the Vendor’s mineral leases have been cancelled or suspended and the Vendor is in discussions with the Governmental Authorities regarding the reinstatement of such mineral leases; |

| G. | subject to receipt of Court Approval, the Purchaser has agreed to purchase and acquire and the Vendor has agreed to sell, transfer and assign to the Purchaser, all of the Vendor’s Interest in and to the Assets, on the terms and conditions set forth herein. |

NOW THEREFORE, this Agreement witnesses that in consideration of the mutual covenants and agreements contained herein, and for other good and valuable consideration, the receipt and adequacy of which are acknowledged by each Party to the other, the Parties covenant and agree as follows:

ARTICLE 1 INTERPRETATION

| 1.1 | Definitions |

In this Agreement:

| (a) | “Abandonment and Reclamation Obligations” means all past, present and future obligations to: |

| (i) | abandon, shut-down, close, decommission, dismantle or remove any and all Wells and Tangibles, including all structures, foundations, buildings, pipelines, equipment and other facilities forming part of the Wells and Tangibles or otherwise located on the Lands or used or previously used in respect of Petroleum Substances produced or previously produced from the Lands; and |

| (ii) | restore, remediate and reclaim the surface and subsurface locations of the Wells and the Tangibles and any lands used to gain access thereto, including such obligations relating to wells, pipelines and facilities which were abandoned or decommissioned prior to the Closing Date that were located on the Lands or that were located on other lands and used in respect of Petroleum Substances produced or previously produced from the Lands, and including the remediation, restoration and reclamation of any other surface and sub-surface lands affected by any environmental damage, contamination or other environmental issues emanating from or relating to the sites for the Wells or the Tangibles; |

all in accordance with generally accepted oil and gas industry practices and in compliance with all Applicable Laws;

| (b) | “Affiliate” means, with respect to any specified Person, any other Person directly or indirectly controlling or controlled by or under direct or indirect common control with that specified Person. For the purposes of this definition, “control” (including with correlative meanings, controlling, controlled by and under common control with) means the power to direct or cause the direction of the management and policies of that Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise and, it being understood and agreed that with respect to a corporation or partnership, control shall mean direct or indirect ownership of more than 50% of the voting shares in any such corporation or of the general partnership interest or voting interest in any such partnership; |

| (c) | “Agency Agreement” means the agency agreement to be dated as of December 9, 2024, between the Purchaser and Third Eye Capital; |

| (d) | “Agreement” means this agreement of purchase and sale and any schedules attached hereto which are referred to in this agreement, together with any amendment or supplement thereto; |

| (e) | “Applicable Law” means, in respect of any Person, asset, transaction, event or circumstance: (i) statutes (including regulations enacted thereunder); (ii) judgments, decrees and orders of courts of competent jurisdiction (including the common law); (iii) regulations, orders, ordinances and directives issued by Governmental Authorities; and (iv) the terms and conditions of all permits, licenses, approvals and authorizations, in each case which are applicable to such Person, asset, transaction, event or circumstance; |

-

| (f) | “Approval and Vesting Order” means an order of the Court approving the Transaction in accordance with the provisions of this Agreement, and, subject to Closing, vesting all of the Vendor’s Interest in and to the Assets in the Purchaser free and clear of all Claims (other than Permitted Encumbrances) and interests, such order to be based on the template sale approval and vesting order of the Court together with such modifications and amendments to such form as may be approved by both the Vendor and the Purchaser, acting reasonably; |

| (g) | “Assets” means the Tangibles, and the Miscellaneous Interests and specifically excludes: (i) any employees or contractors and their respective contracts; and (ii) any obligation, whether existing or cancelled, in relation to the purchase from Tidewater Midstream and Infrastructure Ltd. of any interest in any interprovincial pipelines; |

| (h) | “Assumed Contracts” means the contracts referenced in subsection (i) of the definition of Miscellaneous Interests, which contracts shall be assigned by the Vendor and assumed by the Purchaser in accordance with the terms of this Agreement, the relevant contracts and/or the Approval and Vesting Order, and/or other order of the Court in form and substance satisfactory to the Parties; |

| (i) | “Assumed Liabilities” means, collectively, all liabilities and obligations arising from the possession, ownership and/or use of the Assets following Closing (including for greater certainty any municipal or property taxes that accrue commencing on the Closing Date), along with Environmental Liabilities, Abandonment and Reclamation Obligations and Cure Costs; |

| (j) | “BCER” means the British Columbia Energy Regulator, or any successor thereto having jurisdiction over the Assets or certain of them or the operation thereof; |

| (k) | “BC Minister of Finance” means the British Columbia Minister of Finance, or any successor thereto having jurisdiction over the Assets or certain of them or the operation thereof; |

| (l) | “BC Ministry” means the British Columbia Ministry of Energy, Mines and Low Carbon Innovation, or any successor thereto having jurisdiction over the Assets or certain of them or the operation thereof; |

| (m) | “Business Day” means any day other than a Saturday, Sunday or a statutory holiday in the City of Calgary in the Province of Alberta or City of New York in the State of New York; |

| (n) | “Claim” means any caveats, security interests, hypothecs, pledges, mortgages, liens, trusts or deemed trusts, reservations of ownership, royalties, options, rights of pre-emption, privileges, interests, assignments, actions, judgments, executions, levies, taxes, writs of enforcement, charges, or other claims, whether contractual, statutory, financial, monetary or otherwise, whether or not they have attached or been perfected, registered or filed and whether secured, unsecured or otherwise, including, without limiting the generality of the foregoing: |

| (i) | any encumbrances or charges created by the Initial Order or any other order of the Court in the NOI Proceedings; |

-

| (ii) | any charges, security interests or claims evidenced by registrations pursuant to the Personal Property Security Act (British Columbia) or any other personal property registry system; |

| (iii) | any liens or claims of lien under the Builders’ Lien Act (British Columbia); |

| (iv) | any linear or non-linear municipal property tax claims under the Local Government Act (British Columbia), the Community Charter (British Columbia), or otherwise; |

| (v) | any outstanding amounts owing to the BCER; and |

| (vi) | those claims which may be specifically identified in Schedule “C” to the Approval and Vesting Order, as applicable; |

| (o) | “Closing” means the completion of the purchase by the Purchaser, and sale by the Vendor, of the Vendor’s Interest in and to the Assets and the completion of all other transactions contemplated by this Agreement that are to occur contemporaneously with such purchase and sale, all subject to and in accordance with the terms and conditions of this Agreement; |

| (p) | “Closing Date” means the date on which Closing occurs, being the date which is five Business Days following the date upon which all conditions in Sections 11.1, 11.2 and 11.3 have been satisfied or waived (other than such conditions which are to be satisfied on the Closing Date), or such other date as the Parties may agree in writing; provided, however, that the Closing Date shall not be later than the Outside Date; |

| (q) | “Closing Payment” has the meaning ascribed to that term in Section 3.3; |

| (r) | “Conditions Certificates” has the meaning ascribed to that term in Section 11.5; |

| (s) | “Confidentiality Agreement” means the confidentiality agreement between the Vendor and the Purchaser and executed prior to the date hereof in respect of the evaluation by the Purchaser of potential transactions involving the assets of the Vendor; |

| (t) | “Consequential Damages” has the meaning ascribed to that term in Section 14.6; |

| (u) | “Court” means the Court of King’s Bench of Alberta, Judicial Centre of Calgary; |

| (v) | “Court Approval” means both the issuance of the Approval and Vesting Order by the Court approving the sale of the Assets, and such Approval and Vesting Order having become a Final Order; |

| (w) | “Cure Costs” means, in respect of any Assumed Contract, all amounts, required to be paid to remedy all of the Vendor’s monetary defaults under such Assumed Contract or required to secure a counterparty’s or any other necessary Person’s consent to the assignment of such Assumed Contract pursuant to its terms (including any deposits or other forms of security required by any Governmental Authority) or as may be required pursuant to the Approval and Vesting Order, and includes any other fees and expenses required to be paid to a counterparty or any other Person in connection with the assignment of an Assumed Contract pursuant to its terms or Applicable Laws; |

-

| (x) | “Due Diligence Information” means all information made available (by the Vendor, the Sales Advisor or otherwise) for the Purchaser’s review in paper or electronic form in relation to the Vendor, its Affiliates and/or the Assets; |

| (y) | “Environment” means the components of the earth and includes the air, the surface and subsurface of the earth, bodies of water (including rivers, streams, lakes and aquifers) and plant and animal life (including humans); |

| (z) | “Environmental Laws” means all Applicable Laws relating to pollution or protection of human health or the Environment (including ambient air, water, surface water, groundwater, land surface, soil, or subsurface) or natural resources, including Applicable Laws relating to the storage, transfer, transportation, investigation, cleanup, treatment, or use of, or release or threatened release into the Environment of, any Hazardous Substances; |

| (aa) | “Environmental Liabilities” means all past, present and future Losses and Liabilities, Legal Proceedings and other duties and obligations, whether arising under contract, Applicable Laws or otherwise, arising from, relating to or associated with: |

| (i) | any damage, pollution, contamination or other adverse situations pertaining to the Environment howsoever and by whomsoever caused and regardless of whether such damage, pollution, contamination or other adverse situations occur or arise in whole or in part prior to, at or subsequent to the date of this Agreement; |

| (ii) | the presence, storage, use, holding, collection, accumulation, assessment, generation, manufacture, processing, treatment, stabilization, disposition, handling, transportation, release, emission or discharge of Petroleum Substances, oilfield wastes, water, Hazardous Substances, environmental contaminants and all other substances and materials regulated under any Applicable Law, including any forms of energy, or any corrosion to or deterioration of any structures or other property; |

| (iii) | compliance with or the consequences of any non-compliance with, or violation or breach of, any Environmental Law; |

| (iv) | sampling, monitoring or assessing the Environment or any potential impacts thereon from any past, present or future activities or operations; or |

| (v) | the protection, reclamation, remediation or restoration of the Environment; |

that relate to or arise by virtue of the Assets or the ownership thereof or any past, present or future operations and activities conducted in connection with the Assets or on or in respect of the Lands or any lands pooled or unitized therewith;

| (bb) | “Facilities” means the Vendor’s Interest in and to all field facilities whether or not solely located on or under the surface of the Lands (or lands with which the Lands are pooled) and that are, or have been, used for production, gathering, treatment, compression, transportation, injection, water disposal, measurement, processing, storage or other operations respecting the Leased Substances, including any applicable battery, separator, compressor station, gathering system, pipeline, production storage facility or warehouse, in the Whitemap Area, including those facilities and pipelines identified in Schedule A-3 and Schedule A-4 under the headings entitled “Facilities” and “Pipelines”, respectively, and as applicable; |

-

| (cc) | “Final Order” means an order of the Court that has not been vacated, stayed, set aside, amended, reversed, annulled or modified, as to which no appeal or application for leave to appeal therefrom has been filed and the applicable appeal period with respect thereto shall have expired without the filing of any appeal or application for leave to appeal, or if any appeal(s) or application(s) for leave to appeal therefrom have been filed, any (and all) such appeal(s) or application(s) have been dismissed, quashed, determined, withdrawn or disposed of with no further right of appeal and all opportunities for rehearing, reargument, petition for certiorari and appeal being exhausted or having expired without any appeal, motion or petition having been filed and remaining pending, any requests for rehearing have been denied, and no order having been entered and remaining pending staying, enjoining, setting aside, annulling, reversing, remanding, or superseding the same, and all conditions to effectiveness prescribed therein or otherwise by Applicable Law or order having been satisfied; |

| (dd) | “General Conveyance, Assignment and Assumption Agreement” means an agreement providing for the assignment by the Vendor of the Vendor’s Interest in and to the Assets, free and clear of all Claims (other than Permitted Encumbrances), substantially in the form attached hereto as Schedule B, and the assumption by the Purchaser of the Assumed Liabilities, substantially in the form attached hereto as Schedule B; |

| (ee) | “Governmental Authority” means any domestic or foreign government, whether federal, provincial, state, territorial or municipal; and any governmental agency, ministry, department, tribunal, commission, bureau, board, court (including the Court) or other instrumentality exercising or purporting to exercise legislative, judicial, regulatory or administrative functions of, or pertaining to, government, having jurisdiction over a Party, the Assets or this Transaction, including for greater certainty the BCER, the BC Ministry, and the BC Minister of Finance; |

| (ff) | “GST” means taxes, interest, penalties and other additions thereto imposed under Part IX of the Excise Tax Act (Canada) and the regulations made thereunder; and “GST Legislation” means such act and regulations collectively; |

| (gg) | “Hazardous Substances” means any substance, material or waste defined, regulated, listed or prohibited by Environmental Laws, including pollutants, contaminants, chemicals, deleterious substances, dangerous goods, hazardous or industrial toxic wastes or substances, radioactive materials, flammable substances, explosives, Petroleum Substances and products of Petroleum Substances, polychlorinated biphenyls, chlorinated solvents and asbestos; |

| (hh) | “Initial Order” has the meaning ascribed to that term in the recitals hereto; |

| (ii) | “Interim Advances” means, the Vendor’s operating expenses and legal and professional fees as set out and described in the Thirteen Week Cash Flow Schedule; |

| (jj) | “Interim Financing Order” has the meaning ascribed to that term in the recitals hereto; |

-

| (kk) | “Interim Financing Participation” means the Purchaser’s obligation to participate in the funding of the NOI Proceedings pursuant to the Agency Agreement and the Second A&R Financing Term Sheet; |

| (ll) | “Interim Financing Participation Period” means the period from December 9, 2024 to January 31, 2025, subject to an option exercisable by the Purchaser in writing at any time prior to January 31, 2025, to extend such period to March 31, 2025; |

| (mm) | “KSV” has the meaning ascribed to that term in the recitals hereto; |

| (nn) | “Lands” means the Vendor’s Interest in the lands located in the Whitemap Area including the lands set out and described in Schedule A-1 under the heading entitled “Lands Schedule/Mineral Property Report”, and the Petroleum Substances within, upon or under such lands (subject to the restrictions and exclusions identified in the Title Documents as to Petroleum Substances and geological formations); |

| (oo) | “Leased Substances” means all Petroleum Substances, rights to or in respect of which are granted, reserved or otherwise conferred by or under the Title Documents (but only to the extent that the Title Documents pertain to the Lands); |

| (pp) | “Legal Proceeding” means any litigation, action, suit, investigation, hearing, claim, complaint, grievance, arbitration proceeding or other proceeding and includes any appeal or review or retrial of any of the foregoing and any application for same; |

| (qq) | “Licence Transfers” means the transfer from the Vendor to the Purchaser of any permits, approvals, licences and authorizations granted by the BCER or any other Governmental Authority in relation to the construction, installation, ownership, use or operation of the Wells or the Facilities, as applicable; |

| (rr) | “Losses and Liabilities” means any and all assessments, charges, costs, damages, debts, expenses, fines, liabilities, losses, obligations and penalties, whether accrued or fixed, absolute or contingent, matured or unmatured or determined or determinable, including those arising under any Applicable Law, claim, Legal Proceeding by any Governmental Authority or any order, writ, judgment, injunction, decree, stipulation, determination or award entered by or with any Governmental Authority, and those arising under any contract, agreement, arrangement, commitment or undertaking and costs and expenses of any Legal Proceeding, assessment, judgment, settlement or compromise relating thereto, and all interest, fines and penalties and reasonable legal fees and expenses incurred in connection therewith (on a full indemnity basis); |

| (ss) | “LTAs” has the meaning set forth in Section 2.3(a); |

| (tt) | “Miscellaneous Interests” means, subject to any and all limitations and exclusions provided for in this definition, the Vendor’s Interest in and to all property, assets, interests and rights pertaining to the Petroleum and Natural Gas Rights and the Tangibles (other than the Petroleum and Natural Gas Rights and the Tangibles), or either of them, but only to the extent that such property, assets, interests and rights pertain to the Petroleum and Natural Gas Rights and the Tangibles, or either of them, including any and all of the following: |

| (i) | all contracts relating to the Petroleum and Natural Gas Rights and the Tangibles, or either of them (including the Title Documents); |

-

| (ii) | all warranties, guarantees and similar rights relating to the Petroleum and Natural Gas Rights and the Tangibles, or either of them, including warranties and guarantees made by suppliers, manufacturers and contractors under the Assets, and claims against other Third Parties in connection with the contracts relating to the Petroleum and Natural Gas Rights and the Tangibles; |

| (iii) | all subsisting rights to carry out operations relating to the Lands, the Tangibles or the Wells, and without limitation, all easements and other permits, licenses and authorizations pertaining to the Tangibles or the Wells; |

| (iv) | rights to enter upon, use, occupy and enjoy the surface of any lands which are used or may be used to gain access to or otherwise use the Petroleum and Natural Gas Rights and the Tangibles, or either of them; |

| (v) | all records, books, documents, licences, reports and data which relate to the Petroleum and Natural Gas Rights and the Tangibles, or either of them including any of the foregoing that pertain to geological or geophysical matters and, including plats, surveys, maps, cross-sections, production records, electric logs, cuttings, cores, core data, pressure data, decline and production curves, well files, and related matters, division of interest records, lease files, title opinions, abstracts of title, title curative documents, lease operating statements and all other accounting information, marketing reports, statements, gas balancing information, and all other documents relating to customers, sales information, supplier lists, records, literature and correspondence, physical maps, geologic or geophysical interpretation, electronic and physical project files; and |

| (vi) | the Wells, including the wellbores and any and all casing and down-hole monitoring and pumping equipment; |

provided that unless otherwise agreed in writing by the Parties, the Miscellaneous Interests shall not include any documents or data to the extent that they are owned or licensed by Third Parties with restrictions on their deliverability or disclosure by the Vendor to an assignee;

| (uu) | “NOI” has the meaning ascribed to that term in the recitals hereto; |

| (vv) | “NOI Proceedings” has the meaning ascribed to that term in the recitals hereto; |

| (ww) | “Notice Period” has the meaning ascribed to that term in Section 8.2(b); |

| (xx) | “Order” means any order, writ, judgment, injunction, decree, stipulation, determination, decision, verdict, ruling, subpoena, or award entered by or with any Governmental Authority (whether temporary, preliminary, or permanent); |

| (yy) | “Outside Date” means, subject to Section 2.8, January 31, 2025, or such other date as the Parties may agree; |

| (zz) | “Outstanding ROFR Assets” has the meaning set forth in Section 10.2(e)(ii); |

-

| (aaa) | “Outstanding ROFRs” has the meaning set forth in Section 10.2(e); |

| (bbb) | “Parties” means, collectively, the Purchaser and the Vendor, and “Party” means any one of them; |

| (ccc) | “Permitted Encumbrances” means: |

| (i) | any overriding royalties, net profits interests and other burdens, which are provided for under the Title Documents; |

| (ii) | the terms and conditions of the Assumed Contracts and the Title Documents, including ROFRs, the requirement to pay any rentals or royalties to the grantor thereof to maintain the Title Documents in good standing and any royalty or other burden reserved to the grantor thereof or any gross royalty trusts applicable to the grantor’s interest in any of the Title Documents; |

| (iii) | the right reserved to or vested in any grantor, Governmental Authority or other public authority by the terms of any Title Document or by Applicable Laws to terminate any Title Document; |

| (iv) | easements, rights of way, servitudes or other similar rights in land, including rights of way and servitudes for highways, railways, sewers, drains, gas and oil pipelines, gas and water mains, electric light, power, telephone or cable television conduits, poles, wires or cables; |

| (v) | taxes on Petroleum Substances or the income or revenue therefrom, unless specifically excluded and governmental restrictions on production rates from the Wells or on operations being conducted on the Lands or otherwise affecting the value of any of the Assets; |

| (vi) | agreements for the sale, processing, transmission or transportation of Petroleum Substances entered into by the Vendor subsequent to the date of this Agreement; |

| (vii) | any obligation of the Vendor to hold any portion of their interest in and to any of the Assets in trust for Third Parties; |

| (viii) | any rights reserved to or vested in any Governmental Authority to control or regulate the ownership, use or operation of any of the Assets in any manner, including governmental requirements imposed by statute or Governmental Authorities as to rates of production from operations or otherwise affecting recoverability of Petroleum Substances; |

| (ix) | undetermined or inchoate liens incurred or created as security in favour of any Person with respect to the development or operation of any of the Assets, as regards the Vendor’s share of the costs and expenses thereof which are not due or delinquent as of the date hereof; |

| (x) | the reservations, limitations, provisos and conditions in any grants or transfers from the Crown of any of the Lands or interests therein, and statutory exceptions to title; |

-

| (xi) | provisions for penalties and forfeitures under Title Documents as a consequence of non-participation in operations; |

| (xii) | any requirement to post or maintain any deposits or other form of security required by any Governmental Authority; and |

| (xiii) | liens granted in the ordinary course of business to a public utility, municipality or Governmental Authority with respect to operations pertaining to any of the Assets as regards the Vendor’s share of amounts owing to such public utility, municipality or Governmental Authority which are not due or delinquent as of the date hereof; |

| (ddd) | “Person” means any individual, corporation, limited or unlimited liability company, joint venture, partnership (limited or general), trust, trustee, executory, Governmental Authority, or other entity however designated or instituted; |

| (eee) | “Petroleum and Natural Gas Rights” means the Vendor’s former interest, immediately prior to such rights being cancelled or suspended by the BC Ministry on or about July 24, 2024, in and to all rights to and in respect of the Leased Substances and the Title Documents (but only to the extent that the Title Documents pertain to the Lands, including the interests set out and described in Schedule A-1 under the heading entitled “Lands Schedule/Mineral Property Report”; |

| (fff) | “Petroleum Substances” means any of crude oil, petroleum, natural gas, natural gas liquids, coal bed methane and any and all other substances related to any of the foregoing, whether liquid, solid or gaseous, and whether hydrocarbons or not, including sulphur; |

| (ggg) | “Proposal Trustee” means KSV, in its capacity as the proposal trustee of the Vendor and not in its personal or corporate capacity; |

| (hhh) | “Proposal Trustee’s Certificate” means the certificate, substantially in the form attached as Schedule “A” to the Approval and Vesting Order, to be delivered by the Proposal Trustee to the Vendor and the Purchaser on Closing and thereafter filed by the Proposal Trustee with the Court certifying that it has received the Conditions Certificates; |

| (iii) | “Proposal Trustee’s Solicitors” means the law firm of Fasken, Martineau Dumoulin LLP, or such other firm or firms of solicitors as are retained or engaged by the Proposal Trustee from time to time and notice of which is provided to the Purchaser; |

| (jjj) | “Purchase Price” has the meaning ascribed to that term in Section 3.1; |

| (kkk) | “Purchaser” has the meaning ascribed to that term in the preamble hereto; |

| (lll) | “Purchaser’s Solicitors” means Cassels Brock & Blackwell LLP, or such other firm or firms of solicitors as are retained or engaged by the Purchaser from time to time and notice of which is provided to the Vendor; |

| (mmm) | “Representative” means, in respect of a Person, each director, officer, employee, agent, legal counsel, accountant, consultant, contractor, professional advisor and other representative of such Person and its Affiliates and, with respect to the Vendor, includes the Sales Advisor and the Proposal Trustee; |

-

| (nnn) | “ROFR” means a right of first refusal, right of first offer or other pre-emptive or preferential right of purchase or similar right to acquire the Assets or certain of them that may become operative by virtue of this Agreement or the completion of the Transaction; |

| (ooo) | “Sales Advisor” has the meaning ascribed to that term in the recitals hereto; |

| (ppp) | “Second A&R Financing Term Sheet” means the second amended and restated interim financing term sheet to be dated as of December 9, 2024, between the Corporation and Third Eye Capital; |

| (qqq) | “Second Interim Financing Order” has the meaning ascribed to that term in the recitals hereto; |

| (rrr) | “Second Amended Interim Financing Order” means, an amendment to the Second Interim Financing Order, whereby the Purchaser will fund the Vendor’s Interim Advances during the Interim Financing Participation Period, in accordance with the terms and conditions of the Agency Agreement and the Second A&R Financing Term Sheet; |

| (sss) | “SISP” has the meaning ascribed to that term in the recitals hereto; |

| (ttt) | “Specific Conveyances” means all conveyances, assignments, transfers, novations and other documents or instruments that are reasonably required or desirable to convey, assign and transfer the Vendor’s Interest in and to the Assets to the Purchaser and to novate the Purchaser in the place and stead of the Vendor, as applicable, with respect to the Assets (excluding the Licence Transfers); |

| (uuu) | “Tangibles” means the Vendor’s Interest in and to the Facilities and any and all other tangible depreciable property and assets, if any, which are located within, upon or in the vicinity of the Lands and which are used or are intended to be used to produce, process, gather, treat, measure, store, transport, make marketable or inject the Leased Substances or any of them; |

| (vvv) | “Third Eye Capital” has the meaning ascribed to that term in the recitals hereto; |

| (www) | “Third Party” means any Person who is not a Party or an Affiliate of a Party; |

| (xxx) | “Third Party Claim” means any Legal Proceeding by a Third Party asserted against the Vendor for which the Purchaser has indemnified the Vendor or is otherwise responsible pursuant to this Agreement; |

| (yyy) | “Thirteen Week Cash Flow Schedule” means, the thirteen week cash flow schedule prepared by Third Eye Capital detailing the Vendor’s operating expenses as set out and described in Schedule F; |

| (zzz) | “Title Documents” means, collectively, any and all certificates of title, leases, reservations, permits, licences, assignments, trust declarations, operating agreements, royalty agreements, gross overriding royalty agreements, participation agreements, farm-in agreements, sale and purchase agreements, pooling agreements, acreage contribution agreements, joint venture agreements and any other documents and agreements granting, reserving or otherwise conferring rights to (i) explore for, drill for, produce, take, use or market Petroleum Substances, (ii) share in the production of Petroleum Substances, (iii) share in the proceeds from, or measured or calculated by reference to the value or quantity of, Petroleum Substances which are produced, and (iv) rights to acquire any of the rights described in items (i) to (iii) of this definition; but only if the foregoing pertain in whole or in part to Petroleum Substances within, upon or under the Lands; |

-

| (aaaa) | “Transaction” means the transaction for the purchase and sale of the Vendor’s Interest in and to the Assets, together with all other transactions contemplated in this Agreement, all as contemplated in this Agreement; |

| (bbbb) | “Transfer Taxes” means all transfer taxes, sales taxes, use taxes, production taxes, value-added taxes, goods and services taxes, land transfer taxes, registration and recording fees, and any other similar or like taxes and charges imposed by a Governmental Authority in connection with the sale, transfer or registration of the transfer of the Assets, including GST and any applicable provincial sales tax; and which, for certainty, shall not include freehold mineral taxes; |

| (cccc) | “Unscheduled Assets” has the meaning ascribed to that term in Section 2.4(a); |

| (dddd) | “Vendor” has the meaning ascribed to that term in the preamble hereto; |

| (eeee) | “Vendor’s Interest” means, when used in relation to any asset, undertaking or property, the entire right, title and interest, if any, of the Vendor, as applicable, in, to and/or under such asset, undertaking or property; |

| (ffff) | “Vendor’s Solicitors” means the law firm of Bennett Jones LLP, or such other firm or firms of solicitors as are retained or engaged by the Vendor from time to time and notice of which is provided to the Purchaser; |

| (gggg) | “Wells” means the Vendor’s Interest in and to the wells included in the Whitemap Area, including the wells listed in Schedule A-2 under the heading entitled “Wells”; |

| (hhhh) | “Whitemap Area” means the entire area on the map attached as Schedule B; and |

| (iiii) | “Wildboy Area” means the area shown on Schedule B under the heading “Wildboy Area”. |

| 1.2 | Interpretation |

The following rules of construction shall apply to this Agreement unless the context otherwise requires:

| (a) | All references to monetary amounts are to the lawful currency of Canada. |

| (b) | Words importing the singular include the plural and vice versa, and words importing gender include the masculine, feminine and neuter genders. |

| (c) | The word “include” and “including” and derivatives thereof shall be read as if followed by the phrase “without limitation”. |

| (d) | The words “hereto”, “herein”, “hereof”, “hereby”, “hereunder” and similar expressions refer to this Agreement and not to any particular provision of this Agreement. |

-

| (e) | The headings contained in this Agreement are for convenience of reference only, and shall not affect the meaning or interpretation hereof. |

| (f) | Reference to any Article, Section or Schedule means an Article, Section or Schedule of this Agreement unless otherwise specified. |

| (g) | If any provision of a Schedule hereto conflicts with or is at variance with any provision in the body of this Agreement, the provisions in the body of this Agreement shall prevail to the extent of the conflict. |

| (h) | All documents executed and delivered pursuant to the provisions of this Agreement are subordinate to the provisions hereof and the provisions hereof shall govern and prevail in the event of a conflict. |

| (i) | This Agreement has been negotiated by each Party with the benefit of legal representation, and any rule of construction to the effect that any ambiguities are to be resolved against the drafting Party does not apply to the construction or interpretation of this Agreement. |

| (j) | Reference to an agreement, instrument or other document means such agreement, instrument or other document as amended, supplemented and modified from time to time to the extent permitted by the provisions thereof. |

| (k) | References to an Applicable Law means such Applicable Law as amended from time to time and includes any successor Applicable Law thereto any regulations promulgated thereunder. |

| 1.3 | Schedules |

The following are the Schedules attached to and incorporated in this Agreement by reference and deemed to be a part hereof:

| Schedule A | Assets Listing | |

| A-1 - Lands | ||

| A-2 - Wells | ||

| A-3 - Facilities | ||

| A-4 - Pipelines | ||

| Schedule B | Whitemap Area | |

| Schedule C | Form of General Conveyance, Assignment and Assumption Agreement | |

| Schedule D | Forms of Conditions Certificates | |

| Schedule E | Assumed Contracts | |

| Schedule F | Thirteen Week Cash Flow Schedule |

| 1.4 | Interpretation if Closing Does Not Occur |

If Closing does not occur, each provision of this Agreement which presumes that the Purchaser has acquired the Assets shall be construed as having been contingent upon Closing having occurred.

-

ARTICLE 2 PURCHASE AND SALE

| 2.1 | Agreement of Purchase and Sale |

Subject to the terms and conditions of this Agreement, and in consideration of the Purchase Price, the Vendor hereby agrees to sell, assign and transfer to the Purchaser, and the Purchaser agrees to purchase, accept and receive from the Vendor, the Vendor’s Interest in and to the Assets.

| 2.2 | Transfer of Property and Assumption of Liabilities |

Provided that Closing occurs and subject to the terms and conditions of this Agreement, possession, risk, and legal and beneficial ownership of the Assets shall transfer from the Vendor to the Purchaser on the Closing Date, and the Purchaser agrees to assume, discharge, perform and fulfil all Assumed Liabilities. Without limiting the provisions of this Agreement relating to the General Conveyance, Assignment and Assumption Agreement (and such agreement itself), or any other provisions of this Agreement relating to sale, transfer, assignment, conveyance or delivery, the Assets shall be sold, assigned, transferred, conveyed, and delivered by the Vendor to the Purchaser by way of the Licence Transfers, the Specific Conveyances and other appropriate instruments of transfer, bills of sale, endorsements, assignments, and deeds, in recordable form, or by way of an Order of the Court, as appropriate, and free and clear of any and all Claims other than Permitted Encumbrances, as applicable.

| 2.3 | Licence Transfers |

| (a) | Within forty (40) days of the date hereof, the Vendor shall electronically submit applications to the BCER for the Licence Transfers, in a form and content acceptable to Purchaser, acting reasonably, with instructions that such Licence Transfers shall not take effect until the BCER is in receipt of written confirmation from the Parties that Closing has occurred (“LTAs”), and confirm that such submission has been made to the Purchaser, and in addition the Vendor shall cause to be provided any information and documentation along with such LTAs to the BCER which are required to be provided by the transferor in connection with the foregoing. The Purchaser shall accept or ratify such LTAs without delay, provided that, if the Purchaser in good faith determines or believes that any of the LTAs are not complete and accurate, or the BCER refuses to process any such LTAs because of some defect therein, the Parties shall cooperate to duly complete or to correct such incomplete or inaccurate LTAs as soon as practicable and, thereafter, the Vendor shall promptly re-submit such LTAs and the Purchaser shall accept or ratify such re-submitted LTAs without delay. Each Party shall be responsible for its own costs relating to LTAs hereunder. The Purchaser shall provide any information and documentation in respect of such LTAs to the BCER which are required to be provided by the transferee in connection with the foregoing. Following submission of the LTAs, the Purchaser shall use reasonable commercial efforts to obtain the approval from the BCER of the LTAs and registration of the Licence Transfers, subject to the specific requirements of this Section 2.3. |

| (b) | If the BCER denies any of the LTAs because of misdescription or other minor deficiencies contained therein, the Vendor shall, within two Business Days of such denial, correct the LTA(s) and amend and re-submit the LTA(s), and the Purchaser shall accept or ratify such re-submitted LTAs without delay. |

-

| (c) | In the event that the Purchaser has applied, or prior to the Closing Date applies, to the BCER for a discretionary waiver from the BCER’s security requirements in respect of the Transaction, then Vendor shall provide such information and documentation to the BCER regarding the Assets as may reasonably be required in connection with the BCER’s review of such discretionary waiver application made by the Purchaser (but only to the extent such information and documentation has not already been made available by the Vendor or its Representatives to the Purchaser or its Representatives); provided that the Purchaser agrees it shall have primary carriage of, and be solely responsible at is own cost for submitting and liaising with the BCER in respect of, such application. |

| (d) | Each Party shall on a timely and continuing basis keep the other Party fully apprised and informed regarding all communications the Purchaser may have with the BCER in connection with the Transaction, including all communications respecting LTAs, and without limiting the generality of the foregoing the Purchaser shall provide copies to the Vendor of all related correspondence from the Purchaser to the BCER, and the Purchaser shall request that the BCER provide copies to the Vendor of all related correspondence from the BCER to the Purchaser. |

| (e) | If Closing does not occur by the Outside Date, Vendor shall forthwith terminate any pending LTAs. |

| (f) | Within three (3) Business Days of Closing, the Parties shall provide a joint written notification to the BCER that Closing has occurred and direct the BCER to complete the LTAs. |

| 2.4 | Whitemap Area |

| (a) | The Parties acknowledge that although Vendor has prepared, and Purchaser has reviewed, the Schedules attached hereto, they recognize that there may be unintended omissions or misdescriptions. As such, the Parties acknowledge and agree that it is their intention that, in addition to those Assets included and specified in the Schedules hereto, the Assets shall include Vendor’s entire interest in and to all Tangibles and Miscellaneous Interests (as those terms are defined herein) which fall within the Whitemap Area, any of such additional unscheduled Assets, being the “Unscheduled Assets”, and that the Purchase Price includes consideration for such Unscheduled Assets. The Parties acknowledge that the Schedules are incomplete. During the due diligence investigation period provided for in Section 11.2(d)(iv), the Purchaser and the Vendor shall use commercially reasonable efforts to finalize a complete listing of the Vendor’s Wells, Facilities and Pipelines and revise Schedule A and attach a completed listing of the Assumed Contracts in Schedule E. |

| (b) | To the extent that any Unscheduled Assets are identified by either Party after the Closing Date or to the extent that any Assets are undeliverable by the Vendor or were erroneously included on the Schedules, the Parties shall use all reasonable efforts to replace the affected Schedules attached hereto with corrected Schedules, which corrected Schedules shall be deemed to be the applicable Schedule as of the date hereof, and to take such additional steps as are necessary to specifically convey Vendor’s interest in such Unscheduled Assets to Purchaser. |

| (c) | The Parties further acknowledge that all liabilities and obligations associated with the Unscheduled Assets shall likewise be assumed by Purchaser in accordance with the terms hereof applicable to the Assets. |

-

| 2.5 | Specific Conveyances |

| (a) | Within a reasonable time following its receipt of the Title Documents from Vendor, Purchaser shall prepare and provide for the Vendor’s review all Specific Conveyances. None of the Specific Conveyances shall confer or impose upon either Party any greater right or obligation than as contemplated in this Agreement. Promptly after Closing, the Purchaser shall register and/or distribute (as applicable), all such Specific Conveyances and shall bear all costs incurred therewith and in preparing and registering any further assurances required to convey the Assets to the Purchaser. |

| (b) | As soon as practicable, and in any event within ten (10) days following Closing, the Vendor shall deliver or cause to be delivered to the Purchaser such original copies of the Title Documents and any other agreements and documents to which the Assets are subject and such original copies of contracts, agreements, records, books, documents, licenses, reports and data comprising Miscellaneous Interests which are now in the possession or control of the Vendor or of which the Vendor gains possession or control prior to Closing. |

| (c) | Notwithstanding Sections 2.5(a) and 2.5(b), requests for the transfers from the Vendor to the Purchaser of registered Crown leases or licences, related surface rights and any other Title Documents which are administered by a Governmental Authority shall be submitted by the Vendor and accepted by the Purchaser as soon as is practicable after receipt of acceptable LTA terms and conditions from the BCER. with instructions that such transfers shall take effect upon receipt of written confirmation from the Parties that Closing has occurred. |

| 2.6 | Post-Closing Maintenance of Assets |

| (a) | Following Closing, if and to the extent that Purchaser must be novated into, recognized as a party to, or otherwise accepted as assignee or transferee of Vendor’s interest in the Assets or certain of them, including any Title Documents and Assumed Contracts, the following provisions shall apply with respect to the applicable Assets until such novation, recognition or acceptance has occurred: |

| (i) | the Purchaser shall use reasonable commercial efforts to obtain, as may be required by the terms of any Assumed Contracts, consents or approvals to the assignment of such Assumed Contracts; provided that to the extent that any Cure Costs are payable with respect to any Assumed Contract, the Purchaser shall be responsible for and shall pay all such Cure Costs, which shall be paid directly to the counterparty as and when required in conjunction with the assignment of the Assumed Contracts, and which Cure Costs shall form part of the Purchase Price for the Assets; |

| (ii) | to the extent permitted by any applicable Assumed Contract: |

| (A) | the Purchaser will pay, perform and discharge the duties and obligations accruing after Closing under such Assumed Contract, on behalf of the Vendor, until such time as the effective transfer or assignment of the relevant Assumed Contract to the Purchaser; and |

| (B) | the Vendor shall use reasonable commercial efforts to exercise the rights, entitlements, benefits and remedies under such Assumed Contract, on behalf of the Purchaser until such time as the effective transfer or assignment of the relevant Assumed Contract to the Purchaser, or such Assumed Contract expires or otherwise terminates; and |

-

| (iii) | the Vendor shall not have any liability as a consequence of the Vendor taking any action or causing anything to be done under this Section 2.6(a), and the Purchaser shall be responsible and liable for, and, as a separate covenant, shall hereby indemnify and save harmless the Vendor and its Representatives against, all costs and expenses reasonably incurred by the Vendor, its Affiliates or their respective Representatives as a consequence of or in connection with this Section 2.6(a); and |

| (iv) | nothing in this Agreement shall constitute an agreement to assign, and shall not be construed as an assignment of, or an attempt to assign to the Purchaser, any Assumed Contract until such time as the necessary consents or approvals with respect to the assignment are obtained. |

| (b) | Both before and after Closing, the Purchaser shall use all commercially reasonable efforts to obtain any and all approvals required under Applicable Law and any and all material consents of Third Parties required to permit this Transaction to be completed. The Parties acknowledge that the acquisition of such consents shall not be a condition precedent to Closing. It shall be the sole obligation of the Purchaser, at the Purchaser’s sole cost and expense, to provide any and all financial assurances, deposits or security that may be required by Governmental Authorities or any Third Parties under the Assumed Contracts or Applicable Laws to permit the transfer of the Assets, including the Assumed Contracts, to the Purchaser. |

| (c) | Where Vendor is the operator, the Vendor shall transfer operatorship of the Assets to the Purchaser pursuant to the terms and conditions of such transfer under the Title Documents. Nothing in this Agreement shall transfer or be deemed to transfer operatorship, or shall be interpreted as any assurance by the Vendor that the Purchaser will be able to serve as operator with respect to any of the Assets in which interests are held by Third Parties. |

| 2.7 | Assumed Liabilities |

Following Closing, the Purchaser shall assume, perform, discharge and pay when due all of the Assumed Liabilities. For greater certainty, the Purchaser acknowledges and agrees that the Environmental Liabilities and Abandonment and Reclamation Obligations in respect of the Assets are future costs and obligations associated with the ownership of the Assets that are tied and connected to the ownership of the Assets such that they are inextricably linked and embedded with the Assets.

| 2.8 | Outside Date Extension |

The Parties agree that if the period during which the Purchaser has agreed to provide financing under the Agency Agreement or the Second A&R Term Sheet, each as amended from time to time, is extended, then the Parties shall agree to extend the Outside Date to align with such extended financing period.

-

ARTICLE 3 PURCHASE PRICE

| 3.1 | Purchase Price |

The consideration payable by the Purchaser for the Assets shall be the sum of $2,000,000 (the “Purchase Price”). The Purchase Price shall be satisfied in accordance with Section 3.3 and shall not be subject to any adjustment (and for greater certainty, Cure Costs shall be satisfied in accordance with Section 2.6(a)(i)). The Purchaser and the Vendor acknowledge and agree that the Purchase Price reflects the fair market value of the Assets as of the Closing Date, having due regard to the Environmental Liabilities connected to and embedded in the Assets that depress the value of the Assets. The Vendor shall be responsible for paying any applicable provincial sales taxes in respect of the assets from sale proceeds received from the Purchaser under this Agreement. The effective date of the Transaction shall be the Closing Date and subject to Section 10.2, there shall be no adjustments to the Purchase Price.

| 3.2 | Allocation of Purchase Price |

The Purchase Price shall be allocated among the Assets as follows:

| (a) | to the Tangibles located in the Wildboy Area, 90%; |

| (b) | to the Tangibles located outside of the Wildboy Area, 10%, less $10.00; and |

| (c) | to the Miscellaneous Interests, $10.00. |

| 3.3 | Satisfaction of Purchase Price |

At Closing, the Purchaser shall pay the Purchase Price (other than Cure Costs, which are payable in accordance with Section 2.6(a)(i)) along with any additional amounts owing in respect of applicable GST (the “Closing Payment”) to the Vendor by electronic wire transfer. During the due diligence investigation period provided for in Section 11.2(d)(iv),, the Parties shall work collaboratively to determine whether a joint election under section 167 of the Excise Tax Act (Canada) is available with respect to the purchase and sale of the Assets and, if such election is available, the Parties shall make such election and the Purchaser shall file such election in the manner and within the time prescribed by the Excise Tax Act (Canada).

ARTICLE 4 TRANSFER TAXES

| 4.1 | Transfer Taxes |

The Parties agree that:

| (a) | the Purchase Price does not include Transfer Taxes and the Purchaser shall be liable for and shall pay, and be solely responsible for, any and all Transfer Taxes (excluding any provincial sales taxes) pertaining to the Purchaser’s acquisition of the Assets; and |

| (b) | the Purchaser shall indemnify the Vendor and its Affiliates for, from and against any Transfer Taxes (including any interest or penalties imposed by a Governmental Authority, but excluding any provincial sales taxes) that any of them are required to pay or for which any of them may become liable as a result of any failure by the Purchaser to self-assess, pay or remit such Transfer Taxes, other than as a result of a failure by the Vendor or its Affiliates to timely remit any amounts on account of Transfer Taxes paid by the Purchaser hereunder. |

-

ARTICLE 5 REPRESENTATIONS AND WARRANTIES

| 5.1 | Vendor’s Representations |

The Vendor hereby represents and warrants to the Purchaser that:

| (a) | it is a corporation duly continued and validly subsisting under the laws of the Province of Alberta and has the requisite power and authority to enter into this Agreement and to complete the Transaction; |

| (b) | except for: (i) Court Approval; and (ii) the Licence Transfers and any consents, approvals or waivers that are required in connection with the assignment of an Assumed Contract; the execution, delivery and performance of this Agreement by it does not and will not require any consent, approval, authorization or other order of, action by, filing with or notification to, any Governmental Authority, except where failure to obtain such consent, approval, authorization or action, or to make such filing or notification, would not prevent or materially delay the consummation by the Vendor of the Transaction; |

| (c) | it is not a non-resident of Canada within the meaning of such term under the Income Tax Act (Canada) and is not an agent or trustee for anyone with an interest in the Assets who is a non-resident of Canada within the meaning of such term under the Income Tax Act (Canada) (or a partnership that is not a “Canadian partnership” within the meaning of such term under the Income Tax Act (Canada)); |

| (d) | subject to Court Approval being obtained, this Agreement has been duly executed and delivered by the Vendor and constitutes a legal, valid and binding obligation of it and is enforceable against it in accordance with its terms, except as enforceability may be limited by applicable bankruptcy, insolvency, reorganization or similar Applicable Laws relating to creditors’ rights generally and subject to general principles of equity; |

| (e) | the Purchaser will not be liable for any brokerage commission, finder’s fee or other similar payment in connection with the Transaction because of any action taken by, or agreement or understanding reached by the Vendor; and |

| (f) | with respect to the GST imposed under the GST Legislation, the Vendor is registered under the GST Legislation and will continue to be registered at the Closing Date in accordance with the provisions of the GST Legislation and its GST registration number is 726368681RT0001. |

| 5.2 | Purchaser’s Representations |

The Purchaser hereby represents and warrants to the Vendor that:

| (a) | it is a corporation duly formed and validly subsisting under the laws of the jurisdiction of its incorporation or formation and has the requisite power and authority to enter into this Agreement and to complete the Transaction; |

-

| (b) | it has taken all necessary corporate or other acts to authorize the execution, delivery and performance by it of this Agreement; |

| (c) | neither the execution of this Agreement nor its performance by the Purchaser will result in a breach of any term or provision or constitute a default under any indenture, mortgage, deed of trust or any other agreement to which the Purchaser is a party or by which it is bound which breach could materially affect the ability of the Purchaser to perform its obligations hereunder; |