UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDERTHE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

Commission file number: 001-41972

BitFuFu Inc.

(Exact Name of Registrant as Specified in Its Charter)

111 North Bridge Road,

#15-01, Peninsula Plaza

Singapore 179098

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Attached as Exhibit 99.1 hereto is a presentation that representatives of BitFuFu Inc. plan to use with investors.

EXHIBIT INDEX

| Exhibit No. | Description | |

| 99.1 | BitFuFu Inc. Investor Presentation – July 2024 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| BitFuFu Inc. | ||

| Date: July 24, 2024 | By: | /s/ Leo Lu |

| Name: | Leo Lu | |

| Title: | Director, Chief Executive Officer | |

2

Exhibit 99.1

July 2024 PAGE 1 BitFuFu NASDAQ: FUFU Disclaimer PAGE 2 This presentation does not constitute an offer to sell or issue or solicitation of an offer to buy or acquire securities of BitFuFu Inc. (the “Company”) in any jurisdiction or an inducement to enter into investment activity, nor may it or any part of it form the basis of or be relied on in connection with any contract or commitment whatsoever. This presentation does not contain all relevant information relating to the Company or its securities, particularly with respect to the risks and special considerations involved with an investment in the securities of the Company. This presentation does not constitute legal, regulatory, accounting or tax advice to you. We recommend that you seek independent third party legal, regulatory, accounting and tax advice regarding the contents of this presentation. This presentation does not constitute and should not be considered as any form of financial opinion or recommendation by the Company or any other party. This presentation includes “forward - looking statements” within the meaning of the “safe harbor ” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward - looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends. Statements that are not historical facts, including statements about the Company's beliefs and expectations, are forward - looking statements. These statements are based on various assumptions, whether or not identified in this presentation, and on the current expectations of BitFuFu's management and are not predictions of actual performance. These statements involve risks, uncertainties and other factors that may cause BitFuFu's actual results, levels of activity, performance, or achievements to be materially different from those expressed or implied by these forward - looking statements. Although the Company believes that it has a reasonable basis for each forward - looking statement contained in this presentation, the Company cautions you that these statements are based on a combination of facts and factors currently known and projections of the future, which are inherently uncertain. All information provided in this presentation is as of the date of this presentation and the Company does not undertake any duty to update such information, except as required under applicable law. The Company uses certain financial measures that are not recognized under generally accepted accounting principles in the United States (“GAAP”) in evaluating its business. These non - GAAP financial measures have limitations as analytical tools. One of the key limitations of using non - GAAP financial measures is that they do not reflect all items of income and expense that affect the Company’s operations. Further, the non - GAAP measures may differ from the non - GAAP measures used by other companies, including peer companies, and therefore their comparability may be limited. The use of such non - GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. Bit F uFu Investment Highlights Bit F uFu PAGE 3

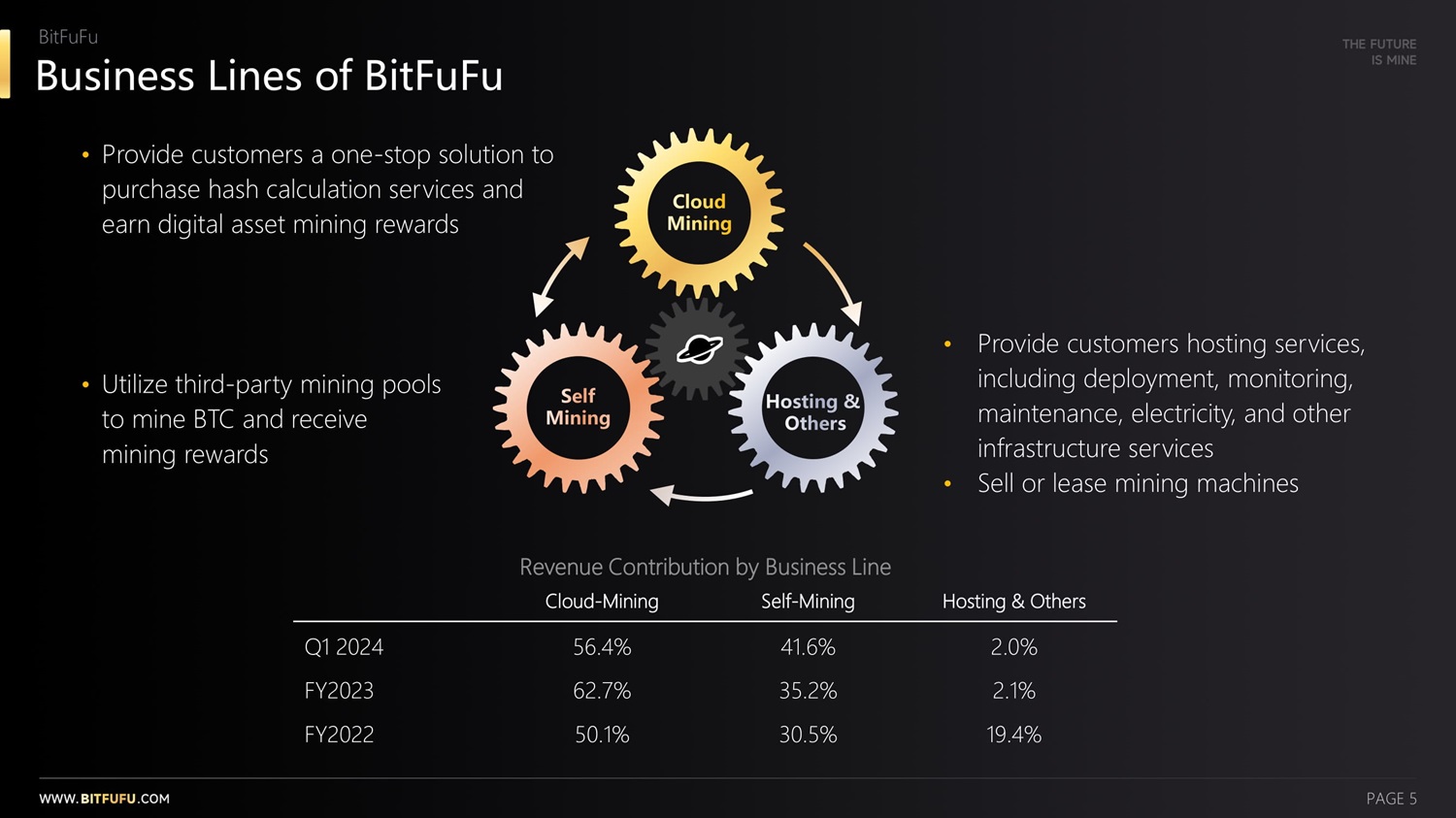

BitFuFu: Introduction and milestones Bit F uFu Adj. EBITDA: ~$50 Listed on Nasdaq Registered BITMAIN and BITMAIN Antpool & BitFuFu Hashrate selling Hosting Capacity: 644 MW users surpass Antpool commit to invested in begin strategic platform went live Registered Users: 320,000+ 300,000 invest a further BitFuFu cooperation $70+ million Dec 2020 Mar 2021 J u l 202 1 J a n 202 2 Dec 2023 Mar 2024 May 2024 Customer R e c o gnit io n PAGE 4 PIPE I n v e s tm ent 1Q2024 E a r n ings A fast - growing digital asset mining service and world - leading cloud - mining service provider headquartered in Singapore Business Lines of BitFuFu Bit F uFu Hosting & Others Cloud M ining Self M i n i ng • Provide customers a one - stop solution to purchase hash calculation services and earn digital asset mining rewards • Provide customers hosting services, including deployment, monitoring, maintenance, electricity, and other infrastructure services • Sell or lease mining machines PAGE 5 Revenue Contribution by Business Line Hosting & Others Self - Mining Cloud - Mining 2.0% 41.6% 56.4% Q1 2024 2.1% 35.2% 62.7% FY2023 19.4% 30.5% 50.1% FY2022 • Utilize third - party mining pools to mine BTC and receive mining rewards

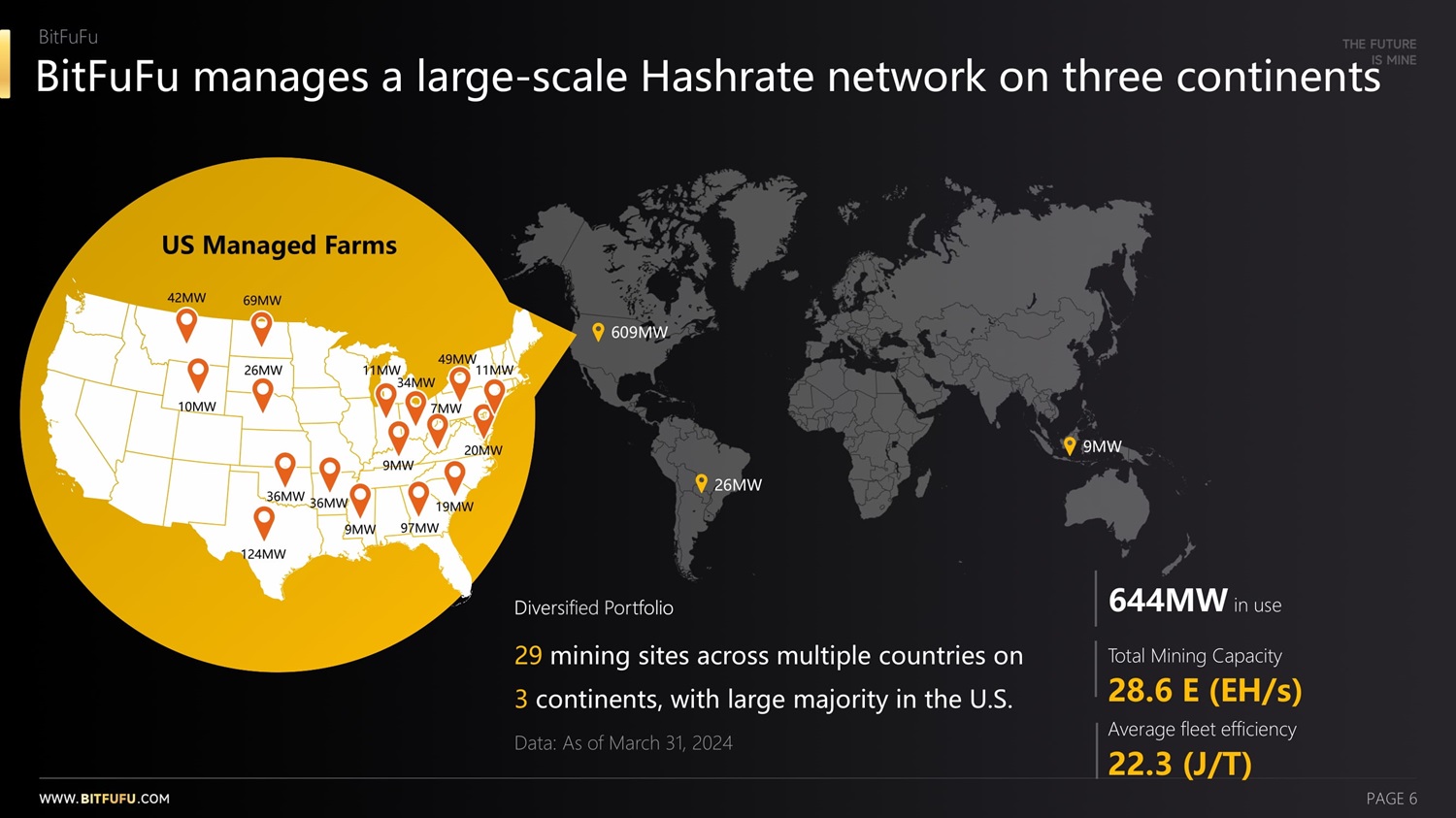

BitFuFu manages a large - scale Hashrate network on three continents Bit F uFu US Managed Farms 20 M W 11MW 19 M W 97MW 9 M W 36MW 36MW 9MW 124MW 10 M W 69 M W 42 M W 49 M W 11MW 34 M W 26 M W 7 M W 26 MW 9 MW 609 MW Diversified Portfolio 29 mining sites across multiple countries on 3 continents, with large majority in the U.S.

Data: As of March 31, 2024 644MW in u se Total Mining Capacity 28.6 E (EH/s) Average fleet efficiency 22.3 (J/T) PAGE 6 Continuous Growth in scale and efficiency Bit F uFu 100 188 2 14 336 513 374 339 515 6 44 3 . 0 5 . 4 6 . 5 11. 1 1 8 . 8 1 5 . 2 1 3 . 9 22 . 9 2 0 .0 15.0 10.0 5.0 0.0 28.6 25.0 3 5 .0 3 0 .0 700 6 0 0 5 0 0 4 00 3 0 0 2 0 0 100 0 1Q22 4Q 22 Mining Capacity Under Management (EH/S) Hosting Capacity (MW) 2Q22 3Q22 Hosting Capacity (MW) 1Q23 2Q23 3Q23 4Q23 1Q24 End of Period mining capacity under management (EH/S) 33 .3 3 4.9 33 .0 30 .3 27.3 2 4.6 2 4.4 22 .5 22 .3 4 0.0 3 5 .0 3 0 .0 2 5 .0 2 0 .0 15.0 10.0 5.0 0.0 1Q22 2Q22 3Q22 3Q23 4Q23 1Q24 Average Fleet Efficiency (J/T) 4Q2 2 1Q23 2Q 23 Average Fleet Efficiency (J/T) PAGE 7 Notes: As of 3/31/2024, all of the mining machine under BitFuFu's management were from Antminer S19 series, more than 88% of which were from the Antminer S19 XP series, one of the most advanced miner series on the market.

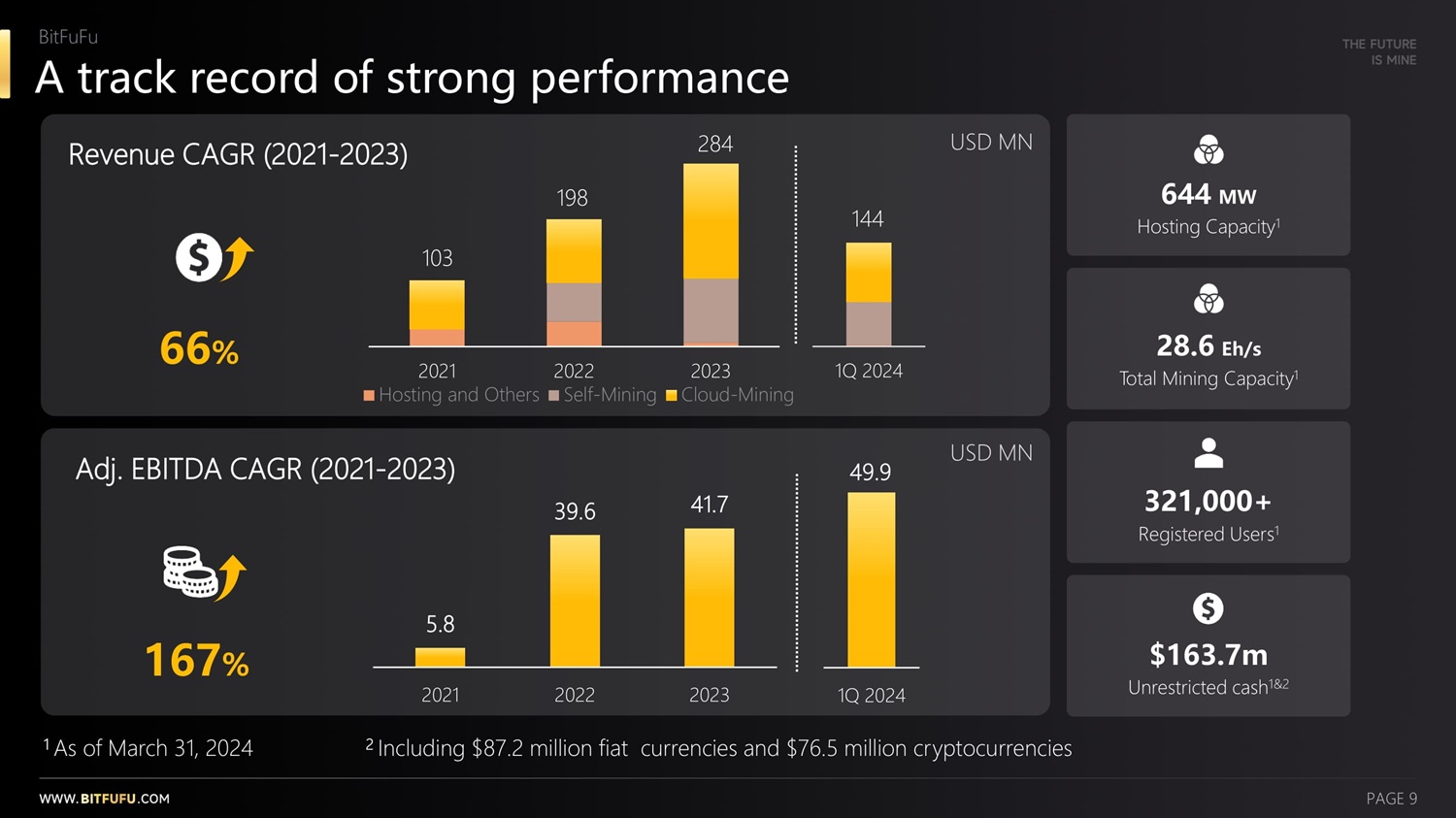

BitFuFu: A leading player in the industry Bit F uFu Notes: 1. Source: Hashrate and Hosting Capacity are obtained from IR presentations, official press releases, and financial reports of the related companies as of 31/03/2024, except for Marathon as of 28/02/2024. 28.6 28.7 25.5 22.5 1 6.4 1 2.4 B itF u F u M a r a t h o n Hut 8 B it d e e r Cl e a n S par k R i o t Hashrate Under Management (EH/s ͤ 6 4 4 PAGE 8 7 30 884 895 4 20 7 00 B itF u F u M a r a t h o n Hut 8 B it d e e r CleanSpark Ri o t Hosting Capacity (MW ͤ A track record of strong performance Bit F uFu 321,000+ Registered Users 1 66 % 28.6 Eh/s Total Mining Capacity 1 644 MW Hosting Capacity 1 167 % 1 As of March 31, 2024 $163.7m Unrestricted cash 1&2 Revenue CAGR (2021 - 2023) Adj.

EBITDA CAGR (2021 - 2023) 5.8 39.6 41.7 2021 Hosting and Others 2022 Self - Mining 2023 Cloud - Mining 103 198 284 1Q 2024 PAGE 9 144 49.9 2021 2022 2023 1Q 2024 2 Including $87.2 million fiat currencies and $76.5 million cryptocurrencies USD MN USD MN Bit F uFu Cloud - Mining: how it works and its value proposition Onlin e For Customers Offline Cloud - mining offers a unique value proposition for both customers and service providers Customers can mine BTC independently which potentially offers a lower cost of acquisition compared to directly purchasing BTC from exchanges For BitFuFu • Generates upfront working capital to expand and scale operations while at the same time hedging against Bitcoin price volatility. • Pre - selling hash rate at a fixed price allows secure future revenue regardless of Bitcoin prices. Customer 1. Purchase a suitable product to start mining 2. Select mining pool and provide wallet address to receive mined Bitcoins 1. Purchase or lease mining machines 2. Host and manage the miners 3. Connect miners to the mining pool 4. Cluster all miners’ Hashrate 5.

Slice and dispatch the Hashrate as per service contracts purchased by customers PAGE 10 Cloud - Mining: Competitive advantages over traditional mining Bit F uFu 1 It was based on historical data and not indicative of future results 2 As of July 2024 Obtain more BTC with lower price • O n a n an n ua l b asis , g et 3% ~ 20% 1 m o r e B T C w i th cloud - mining than buy at market price 0 Use installment payment to leverage ROI Pay down payment as low as 30% 2 with installment plan 02 • Start Bitcoin mining with a few clicks, no need to buy any expensive mining machine, nor to wait for shipment or installation • Stop Bitcoin mining whenever you want, without worrying about selling mining machine Start mining BTC wherever and whenever you want 03 Stable BTC Output for cloud - mining 95%+ extremely high guaranteed uptime rate for mining machines, which is crucial to generate stable BTC output 04 Cloud - Mining Registered Users 1Q 2023 1Q 2024 196,00 0 + 321,000+ + 63% PAGE 11 Cloud - Mining obtains more Bitcoin than traditional ways Bit F uFu $8,199 Investment after 30 days 468.5T V s . vs. 0.11881214 BTC 5,000T Buy Mining Machine v s. Buy Hashrate Buy Bitcoin Hashra t e Bi t c oin 0.01134525 BTC 0.12107686 BTC 1.91% More BTC in 30 days A real example of a BitFuFu customer paid $8,199 for 5,000T hashrate at 08:41:49 on June 8, 2024, when the price of Bitcoin was $69,008, and Mining machine selling price was $17.5 /T. Future return or output is not guaranteed R eal Examp l e: PAGE 12

BitFuFu Self - Mining: How it works at BitFuFu BitFuFu purchases Hashrate from various suppliers, and connects them to mining pools BitFuFu purchases mining machines from suppliers and hosts them in mining Facilities • Consolidate Hashrate and utilize it to mine Bitcoin for BitFuFu΄s own account • Allocate more Hashrate to Self - mining during Bear market for Bitcoin, and to allocate more to Cloud - mining during Bull market Hashrate Mining machines PAGE 13 Strong strategic alliances with industry leaders Bit F uFu Miner Supply • Bitmain΄s S - level client, the highest - level client ensuring access to various VIP privileges • Competitive miner supply & computing power cooperation Marketing • Global marketing collaboration with Bitmain, resulting in lower customer acquisition and marketing spend Operations • Maintenance center to improve operational efficiencies • Competitive mining pool fee rate Mining Farms • 10 - year 300MW miner hosting capacity cooperation • Competitive electricity and hosting fees Strategic Alliances with PAGE 14

Supply - chain advantage for machine purchases and large - scale distributed Hashrate network Bit F uFu Competitive Terms Procure mining machine at preferential payment terms or delivery schedule from strategic alliance with Bitmain Large - Scale Distributed Hashrate Network Reduce concerns over geopolitical factors affecting mining operations Mitigated Risk of Devaluation Mitigate devaluation risk from rapid advancements in mining machines High - Quality Mining Facilities Select mining facilities with superior location and uptime Mining Machine Hash ra t e PAGE 15 Advanced proprietary technology to deliver operational excellency Bit F uFu Mining Platform BitFuFu Dispatcher Engine BitFuFu Proxy System BitFuFu Sentry • Aladdin is BitFuFu΄s proprietary ultra - large scale hashrate management and dispatching system • Aladdin consists of three core systems: Dispatcher Engine, Proxy System and BitFuFu Sentry, the miner monitoring system.

• Capable of hosting millions of mining machine, offering efficiency, authenticity and security to hash power for users around the world. Reliable Stability BitFuFu Dispatcher Engine sets power fluctuation within 1% Capable of managing millions of mining machine simultaneously High Uptime Provides stable cloud - mining service to users 99%+ Scalable Capability 100,000,000+ 95%+ A la d d in PAGE 16 4,455.80 32,071.49 6,891.74 28, 7 96.

7 9 28,685.05 32,689.18 Marathon Hut 8 B it d e er CleanSpark Ri o t 32.49 231. 7 5 68.54 69.22 262.36 29 7 . 7 5 B it F u F u Marathon Hut 8 Bitdeer CleanSpark Ri o t 2 4. 36x 166.30x 7 8.00x 5 9.83x 69.26x 316.94x B it F u F u Marathon Hut 8 Bitdeer CleanSpark Ri o t 6.44x 33. 7 8x 13.03x 38.49x 46.56x B it F u F u Marathon Hut 8 Bitdeer CleanSpark Ri o t Traded at a major discount to the peer group average Bit F uFu Notes: Source: the IR presentations, the official press releases, and the financial reports by 3/31/2024, except for EV on 6/28/2024. Enterprise Value (EV) is calculated as (Market Capitalization + Long Term Debt – Cash and Cash Equivalents) 1. Comparable companies’ number of miners are obtained from the latest IR presentations and official press releases of the comparable companies as of 31/03/2024, except for Marathon as of 29/02/2024. 2. Including self - owned and third - party owned miners. 3. Comparable companies' 1Q2024 Adjusted EBITDA is calculated as (31/03/2024 Adjusted EBITDA in the financial statements ” Unrealized fair value gains/losses on digital assets held during 1Q 024) to exclude the impact of the adoption of ASC 2023 - 08 and to improve comparability. EV / 1Q 2024 Miner ($/Miner) 1 Comps. Average: 25,826.85 EV / 1Q 2 024 A d ju st ed E B IT D A 3 Comps. Average: 138.06x EV / 1Q 2024 Revenue Comps. Average: 34.42x 40.26x 2 EV / 1Q 2024 Hash Rate ($/EH/s) Comps.

Appendix PAGE 18

Average: 185.92 PAGE 17 B it F u F u 2 1Q 2024 operational highlights Bit F uFu Year - Over - Year Change Amount Bitcoin Production - 136 1,103 Self - Mined Bitcoin (# BTC) +726 2,096 Cloud - Mined Bitcoin by Customers (# BTC) +590 3,199 Q1 2024 Total Bitcoin Mined (#BTC ͤ +7.9 23.3 Average BTC produced per day by Customers (#BTC) - 1.7 12.2 Average BTC produced per day by BitFuFu (#BTC) +6.2 35.5 Average BTC produced per day by Customers and BitFuFu Combined +$17,274 $39,182 Average cost to mine BTC from self - mining operations Mining Capacity +9.8 28.6 End of Period mining capacity under management (EH/s) +131 644 Hosting Capacity (MW) - 4.8 22.5 Average Fleet Efficiency (J/T) +124,716 321,184 Cloud - Mining Registered Users Revene and profit 181.0% $81.5 Cloud - Mining revenue ͧ mn ͨ 117.0% $60.1 Self - Mining revenue ͧ mn ͨ 115.4% $2.8 Other revenue ͧ mn ͨ 149.0% $144.4 Total Revenue ͣ mn ͤ 430.9% $49.9 Adjusted EBITDA ͣ mn ͤ 1207.4% $35.3 Net income ͧ mn ͨ +$0.21 $0.23 EPS ͧ $/Share ͨ PAGE 19 Unaudited Reconciliation of GAAP and non - GAAP Results Bit F uFu FY2021 FY2022 FY2023 1Q 2024 in $US '000 $4,926 $2,443 $10,494 $35,308 Net profit (135) 2,174 4,481 1,185 Add: Interest expenses/(income), net 1,044 (666) 2,183 7,314 Add: Income tax expense/(benefit) 3 18,156 24,501 6,097 Add: Depreciation - 11,850 - - Add: Impairment loss on mining equipment - 9,827 - - Add: Impairment loss on assets held by FTX - (4,206) - - Minus: Realized fair value gain on digital asset borrowings $5,838 $39,578 $41,659 $49,904 Adjusted EBITDA PAGE 20

FuFu Thank You! Charley Brady Vice President, Investor Relations Email: charley.b@bitfufu.com Website: ir.bitfufu.com I n v e st or C o n t a ct: Calla Zhao CFO Email: calla.zhao@bitfufu.com PAGE 21