FINANCIAL RESULTS Jason Kim CEO Darren Ma CFO November 12, 2025 PRESENTED BY Q3 2025

DISCLAIMER Cautionary Note Regarding Forward-Looking Statements This presentation contains forward-looking statements (including within the meaning of Section 21E of the United States Securities Exchange Act of 1934, as amended, and Section 27A of the United States Securities Act of 1933, as amended) concerning Firefly. Statements included in this press release that are not statements of historical fact, including statements about our expectations, beliefs, plans, strategies, objectives, prospects, assumptions or future events or performance, are forward-looking statements. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “objective,” “ongoing,” “plan,” “predict,” “project,” “potential,” “should,” “will,” “would,” or the negative of these terms or other comparable terminology. In particular, our guidance, outlook and forecasts for full-year 2025, statements about the markets in which we operate, including growth of our various markets, statements about potential new products and product innovation, statements regarding the expected benefits of the acquisition of SciTec, Inc. ("SciTec") our ability or expectations to establish new partnerships, our expectations regarding new vehicle launches and launch timelines, and our ability to retain existing customers and maintain their bookings are forward-looking statements. Accordingly, undue reliance should not be placed on such statements. Various risks that could cause actual results to differ from those expressed by the forward-looking statements included in this press release include, but are not limited to: our failure to manage our growth effectively and our ability to achieve and maintain profitability; the potential for delayed or failed launches, and any failure of our launch vehicles and spacecraft to operate as intended; our inability to manufacture our launch vehicles, landers, or orbital vehicles at a quantity and quality that our customers demand; the hazards and operational risks that our products and service offerings are exposed to, including the wide and unique range of risks due to the unpredictability of space; the market for commercial launch services for small- and medium-sized payloads not achieving the growth potential we expect; adverse impacts from current or future disruptions in U.S. government operations, including as a result of delays or reduction in appropriations or regulatory approvals from our programs, or changes in U.S. government funding and budgetary priorities and spending levels; our dependence on contracts entered into in the ordinary course of business and our dependence on major customers and vendors; a loss of, or default by, one or more of our major customers, or a material adverse change in any such customer’s business or financial condition, could materially reduce our revenues and backlog; uncertain global macro-economic and political conditions, including the implementation of tariffs; the failure of our information technology systems, physical or electronic security protections; the inability to operate Alpha at our anticipated launch rate (including due to potential regulatory delays) or finalize the development and delivery of Eclipse; our failure to establish and maintain important relationships with government agencies and prime contractors; the inability to realize our backlog; evolving government laws and regulations; our ability to remediate the material weakness with respect to our internal control over financial reporting and disclosure controls and procedures; our ability to implement and maintain effective internal control over financial reporting in the future; and other factors set forth in our filings with the Securities and Exchange Commission. You should not place undue reliance on these forward-looking statements, which speak only as of the date stated, or if no date is stated, as of the date of this press release. Actual results may vary from the estimates provided. We undertake no intent or obligation to publicly update or revise any of the estimates and other forward-looking statements made in this announcement, whether as a result of new information, future events or otherwise, except as required by law. Use of Non-GAAP Financial Measures Adjusted EBITDA, Free Cash Flow, Non-GAAP Operating Expenses, Non-GAAP Research and Development, Non-GAAP Selling, General, and Administrative, Non-GAAP Other Expense, and Non-GAAP Net Loss, as well as Pro Forma Non-GAAP Net Loss and Pro Forma Non-GAAP Net Loss Per Share are non-GAAP financial measures. These non-GAAP measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with U.S. GAAP. A reconciliation of each non-GAAP financial measure to the most directly comparable financial measure prepared in accordance with U.S. GAAP is included in the supplemental financial data attached to this press release. Non-GAAP financial measures have important limitations as analytical tools and should not be considered in isolation or as a substitute for analyses of Firefly’s performance or cash flows as reported under U.S. GAAP. Non-GAAP financial measures may be defined differently by other companies in our industry and may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. Firefly believes non-GAAP financial information provides additional insight into the Company’s ongoing performance. Therefore, Firefly provides this information to investors for a more consistent basis of comparison and to help them evaluate the Company’s ongoing performance and liquidity and to enable more meaningful period to period comparisons. Adjusted EBITDA We define Adjusted EBITDA as net loss adjusted for interest (income) expense, net, provision for income taxes, depreciation and amortization, stock-based compensation expense, change in fair value of warrant liability, loss on disposal of fixed assets, loss on extinguishment of debt, certain one-time costs related to the IPO, transaction-related expenses, and certain other items that are not expected to recur in the future or that management does not view as reflective of the performance of the business. In addition to net loss, we use Adjusted EBITDA to evaluate our business, measure its performance, and make strategic decisions. We believe that Adjusted EBITDA provides useful information to management, investors, and analysts in assessing our financial performance and results of operations across reporting periods by excluding items we do not believe are indicative of our core operating performance. Net loss is the U.S. GAAP measure most directly comparable to Adjusted EBITDA. Adjusted EBITDA should not be considered as an alternative to net loss. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Free Cash Flow We define Free Cash Flow as net cash used in operating activities, less purchases of property and equipment. We believe that Free Cash Flow is a meaningful indicator of liquidity that provides information to management and investors about the amount of cash generated from or used in operations that, after purchases of property and equipment, can be used for strategic initiatives, including continuous investment in our business and strengthening our balance sheet. Free Cash Flow has limitations as a liquidity measure, and you should not consider it in isolation or as a substitute for analysis of our cash flows as reported under U.S. GAAP. Free Cash Flow may be affected in the near to medium term by the timing of capital investments, fluctuations in our growth and the effect of such fluctuations on working capital, and our changes in our cash conversion cycle. Non-GAAP Research and Development We define Non-GAAP Research and Development as research and development less stock-based compensation expense. Management believes this non-GAAP measure provides investors with meaningful insight into results from ongoing operations by excluding items of income or loss to present it in accordance with how management manages the business. Non-GAAP Selling, General, and Administrative We define Non-GAAP Selling, General and Administrative as selling, general and administrative less stock-based compensation expense, certain one-time costs related to the IPO, transaction-related expenses, and certain other items that are not expected to recur in the future or that management does not view as reflective of the performance of the business. Management believes this non-GAAP measure provides investors with meaningful insight into results from ongoing operations by excluding items of income or loss to present it in accordance with how management manages the business. Non-GAAP Operating Expenses We define Non-GAAP Operating Expenses as operating expenses, less stock-based compensation expense, certain one-time costs related to the IPO, transaction-related expenses, loss on disposal of fixed assets, and certain other items that are not expected to recur in the future or that management does not view as reflective of the performance of the business. Management believes this non-GAAP measure provides investors with meaningful insight into results from ongoing operations by excluding items of income or loss to present it in accordance with how management manages the business. Non-GAAP Other Income (Expense) We define Non-GAAP Other Income (Expense) as other expense less change in fair value of warrant liability and loss on extinguishment of debt. Management believes this non-GAAP measure provides investors with meaningful insight into results from ongoing operations by excluding items of income or loss to present it in accordance with how management manages the business. Non-GAAP Net Loss We define Non-GAAP Net Loss as net loss less stock-based compensation, change in fair value of warrant liability, loss on disposal of fixed assets, loss on extinguishment of debt, certain one-time costs related to the IPO, transaction-related expenses, and certain other items that are not expected to recur in the future or that management does not view as reflective of the performance of the business. Management believes this non-GAAP measure provides investors with meaningful insight into results from ongoing operations by excluding items of income or loss to present it in accordance with how management manages the business.

THIRD QUARTER OVERVIEW Update on Alpha Flight 7 SciTec Acquisition Closed Firefly Business Updates Financial Performance Firefly is honored to support America’s boldest National Security missions, ensuring we remain the Land of the Free and Home of the Brave.

ALPHA FLIGHT 7 Second Stage and Fairing Delivered Corrective Measures Implemented Upgrading Test Stand First Stage Getting Ready to Ship Preparing to Return to Flight ALPHA STAGE TEST STAND 2 AT FIREFLY'S BRIGGS FACILITY, PHOTO TAKEN LATE OCTOBER 2025 Targeting Launch Between Late Q4 & Early Q1 ALPHA STAGE 1 PREPARING TO SHIP TO THE PAD FOR FLIGHT 7 ALPHA’S FLIGHT 7, STAGE 2 AT THE LAUNCH SITE

SCITEC ACQUISITION Delivering rockets and spacecraft to support national security, exploration, and commercial missions Delivering ground and onboard data processing with AI-enabled systems in support of advanced threat tracking and responses in multiple domains + Together, Firefly and SciTec keep America at the Forefront of Space

FIREFLY + SCITEC THE FULL-SERVICE HARDWARE AND SOFTWARE SPACE AND DEFENSE COMPANY Expands and further diversifies Firefly’s responsive mission services for space and defense customers. Adds mission-proven defense software, state-of-the-art facilities and servers, and multi-phenomenology data expertise. Fast tracks and enhances Firefly’s ability to support national security and defense missions. Bolsters Firefly’s offerings for the Golden Dome program as well as other national security and Moon to Mars missions. Brings well developed data processing infrastructure and software talent to Firefly. Expands Firefly’s robust contracts supporting commercial, intelligence community, and defense customers. 1 2 3 4 5 6 May 2025: SciTec awarded $259M contract to enhance the Future Operational Resilient Ground Evolution framework. SciTec strengthens the Space Force missile warning and tracking and accelerate threat-responsive solutions for warfighters.

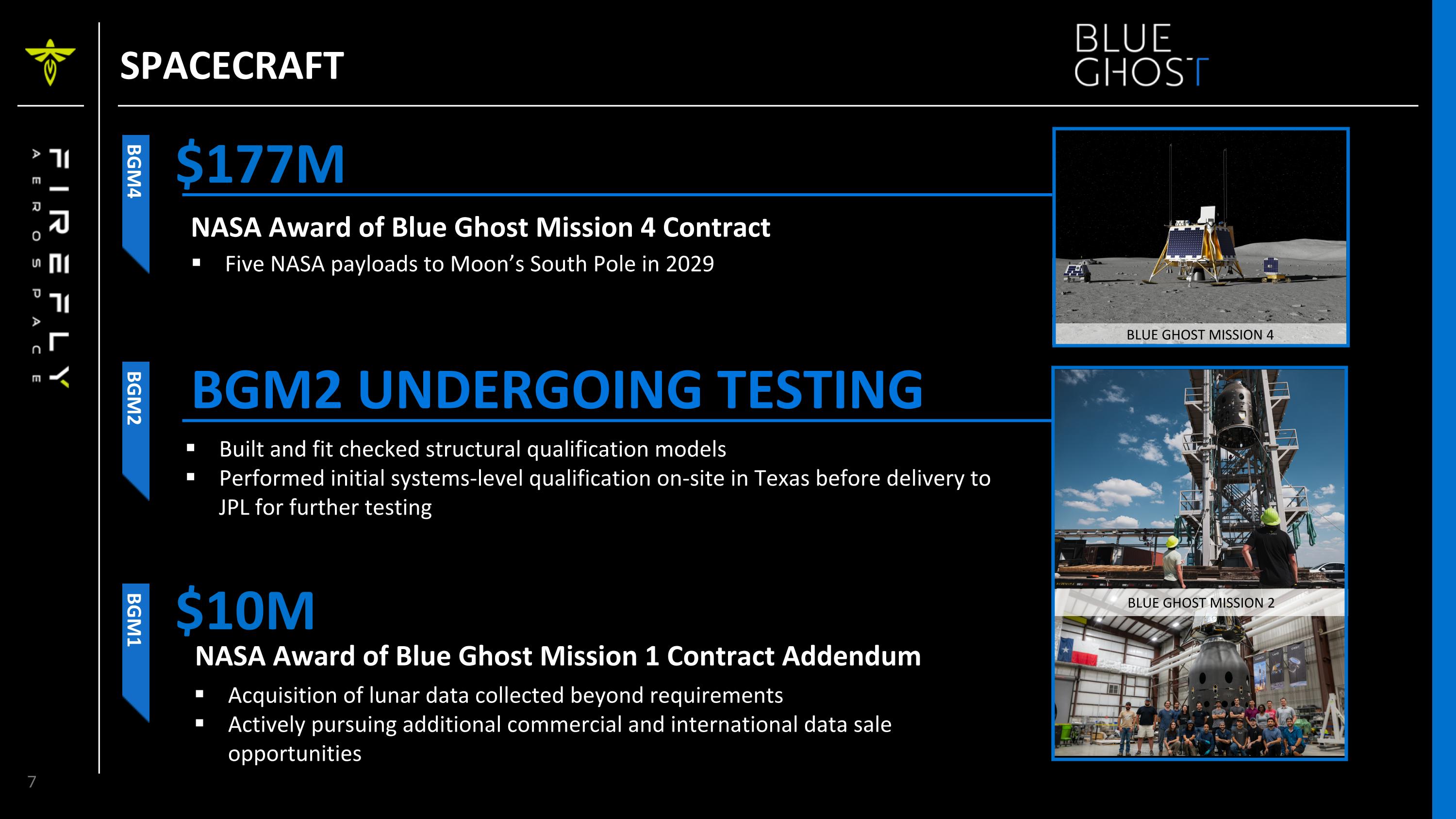

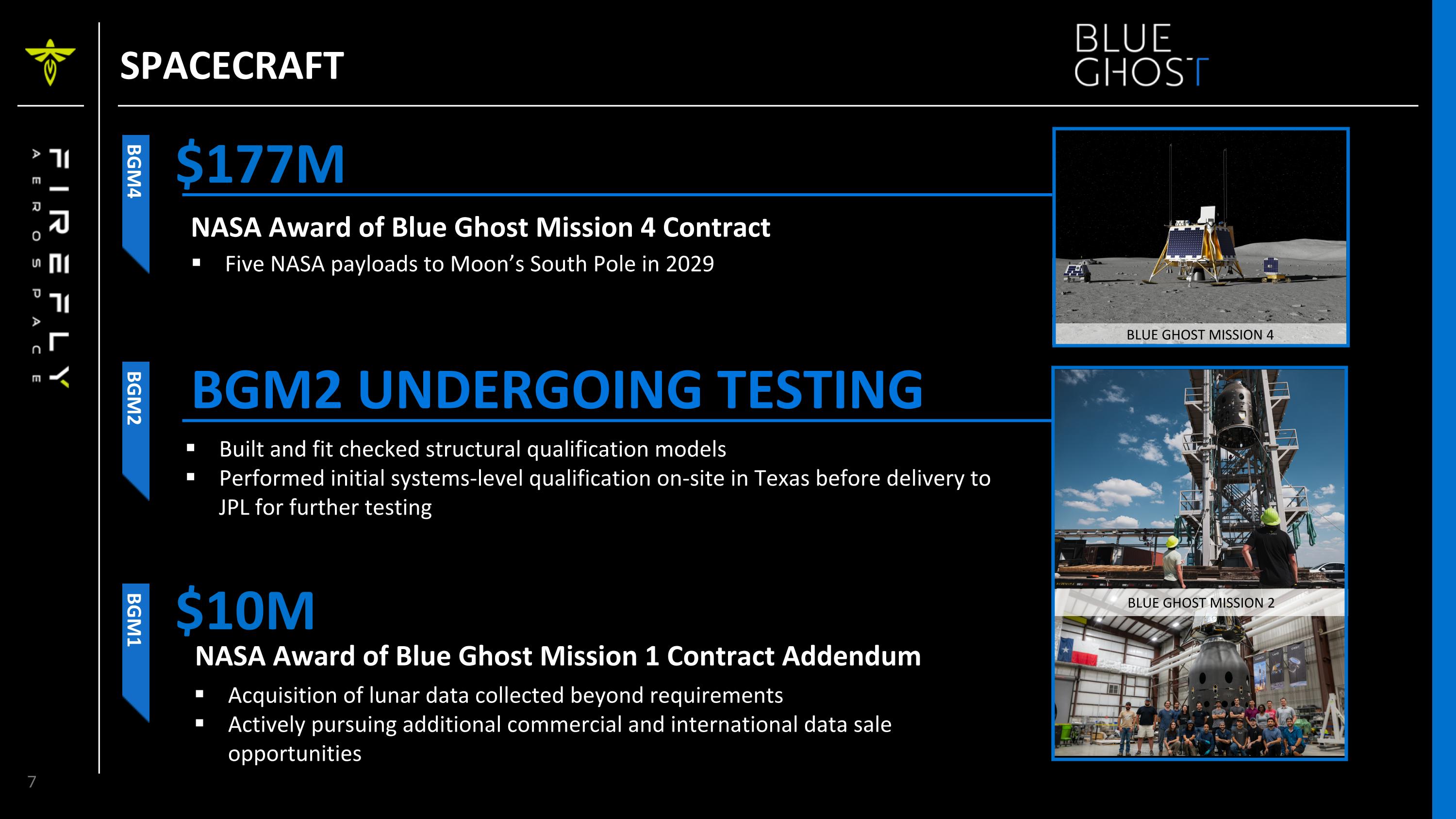

SPACECRAFT $10M NASA Award of Blue Ghost Mission 1 Contract Addendum Acquisition of lunar data collected beyond requirements Actively pursuing additional commercial and international data sale opportunities $177M NASA Award of Blue Ghost Mission 4 Contract Five NASA payloads to Moon’s South Pole in 2029 BGM2 UNDERGOING TESTING Built and fit checked structural qualification models Performed initial systems-level qualification on-site in Texas before delivery to JPL for further testing BLUE GHOST MISSION 4 BLUE GHOST MISSION 2 BGM4 BGM2 BGM1

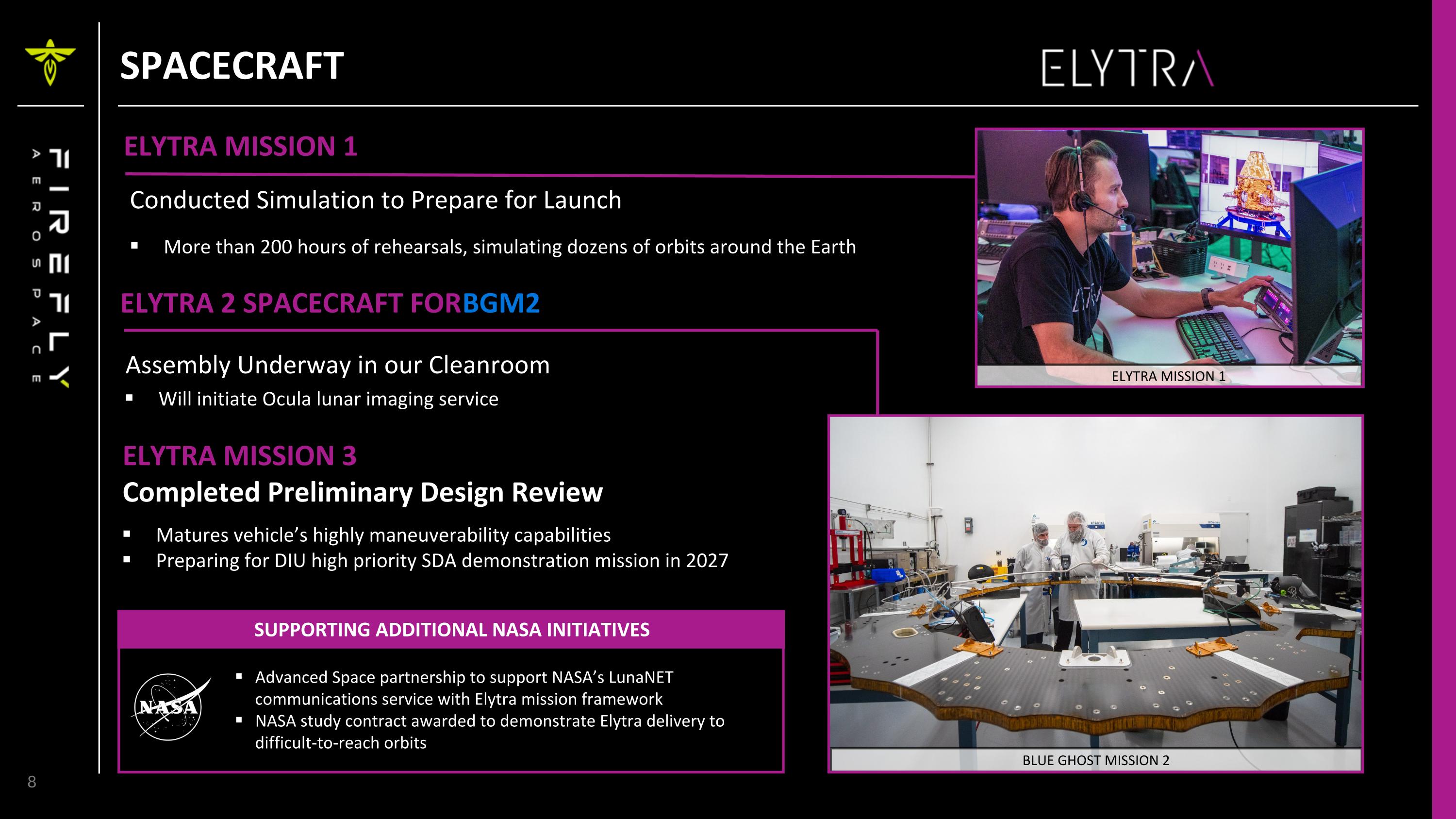

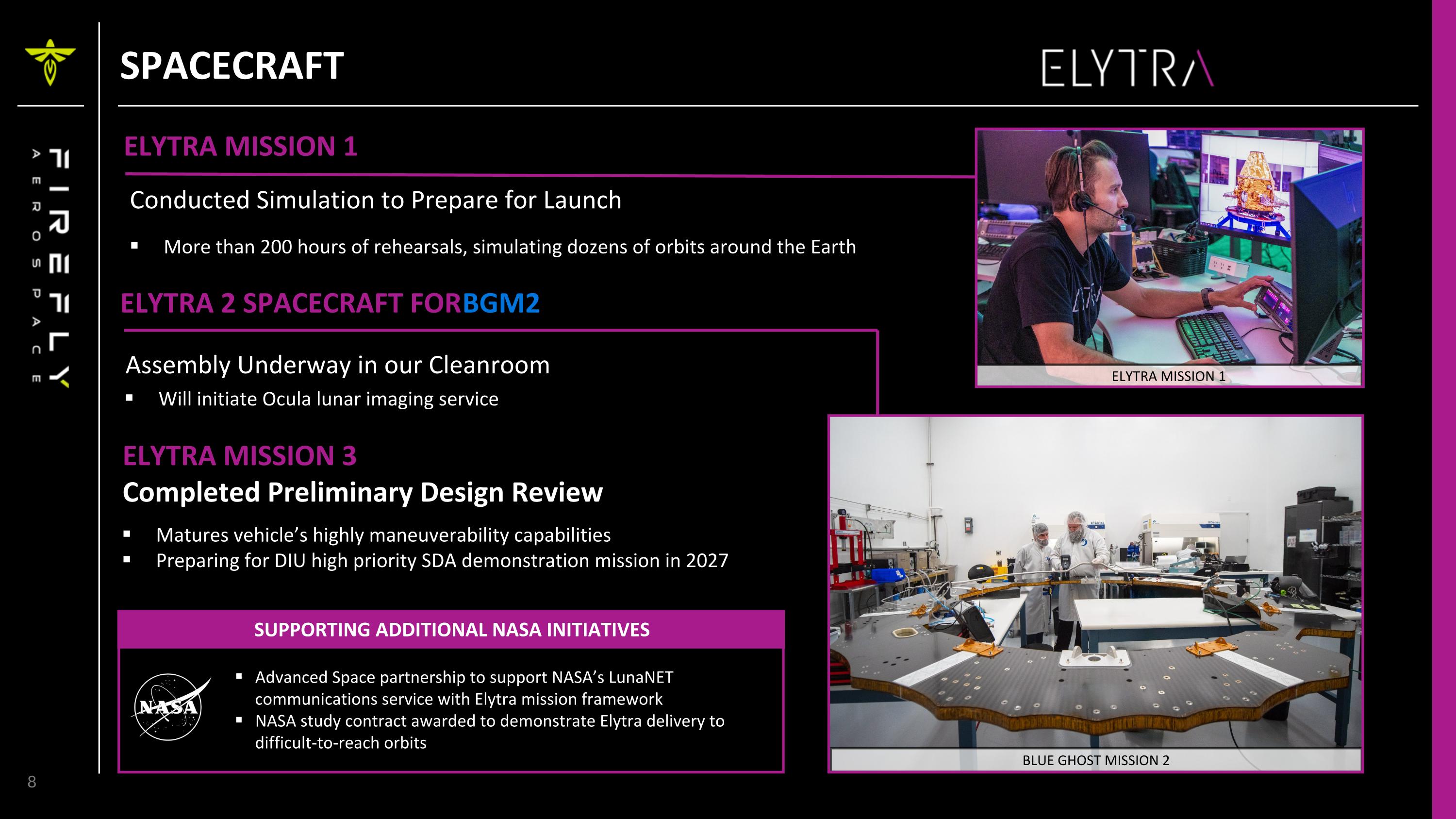

SPACECRAFT More than 200 hours of rehearsals, simulating dozens of orbits around the Earth ELYTRA MISSION 1 Will initiate Ocula lunar imaging service ELYTRA 2 SPACECRAFT FOR BGM2 Matures vehicle’s highly maneuverability capabilities Preparing for DIU high priority SDA demonstration mission in 2027 ELYTRA MISSION 3 Completed Preliminary Design Review Advanced Space partnership to support NASA’s LunaNET communications service with Elytra mission framework NASA study contract awarded to demonstrate Elytra delivery to difficult-to-reach orbits SUPPORTING ADDITIONAL NASA INITIATIVES Conducted Simulation to Prepare for Launch Assembly Underway in our Cleanroom ELYTRA MISSION 1 BLUE GHOST MISSION 2

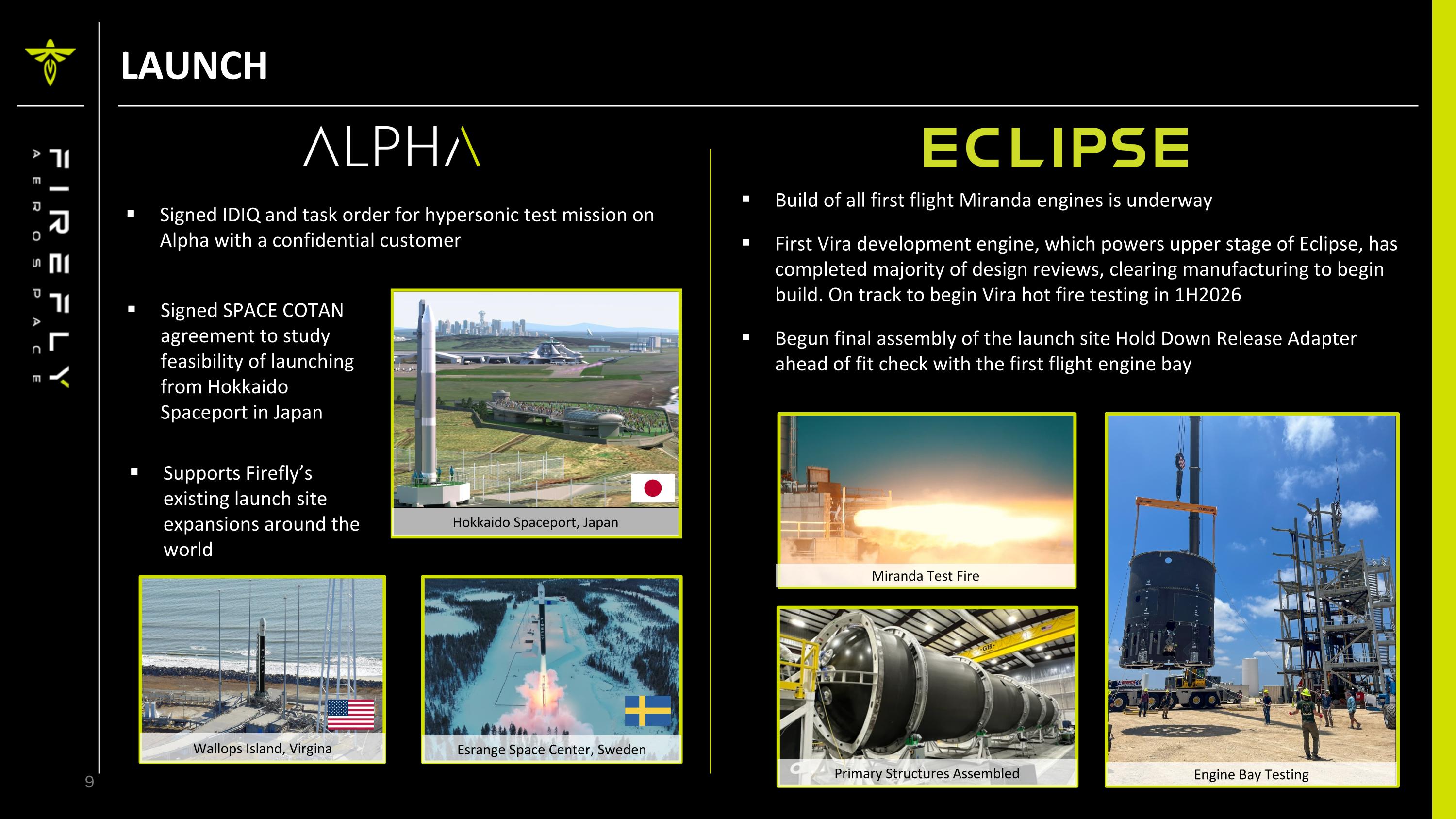

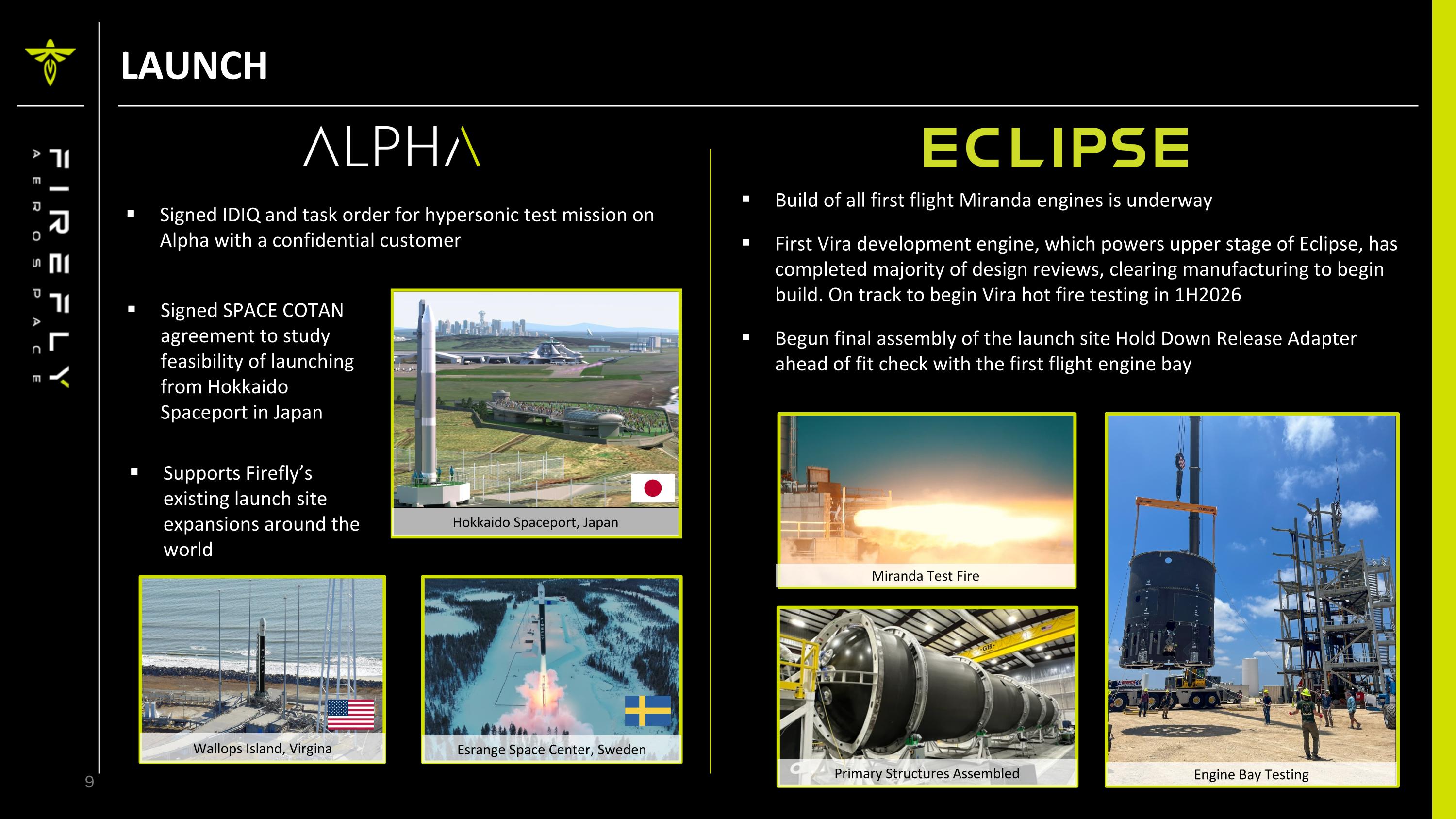

LAUNCH Signed IDIQ and task order for hypersonic test mission on Alpha with a confidential customer Build of all first flight Miranda engines is underway First Vira development engine, which powers upper stage of Eclipse, has completed majority of design reviews, clearing manufacturing to begin build. On track to begin Vira hot fire testing in 1H2026 Begun final assembly of the launch site Hold Down Release Adapter ahead of fit check with the first flight engine bay Signed SPACE COTAN agreement to study feasibility of launching from Hokkaido Spaceport in Japan Esrange Space Center, Sweden Wallops Island, Virgina Miranda Test Fire Engine Bay Testing Hokkaido Spaceport, Japan Supports Firefly’s existing launch site expansions around the world Primary Structures Assembled

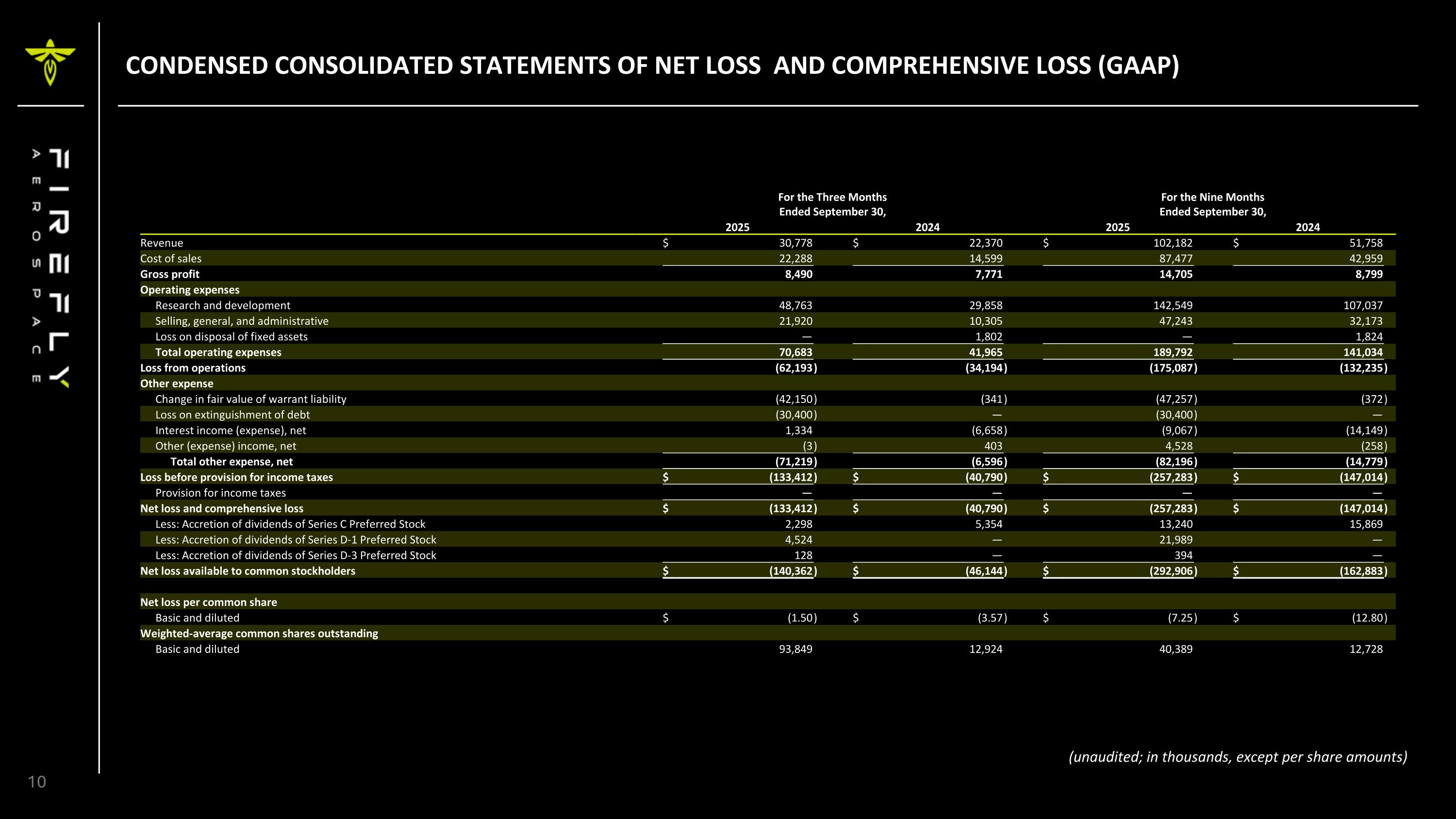

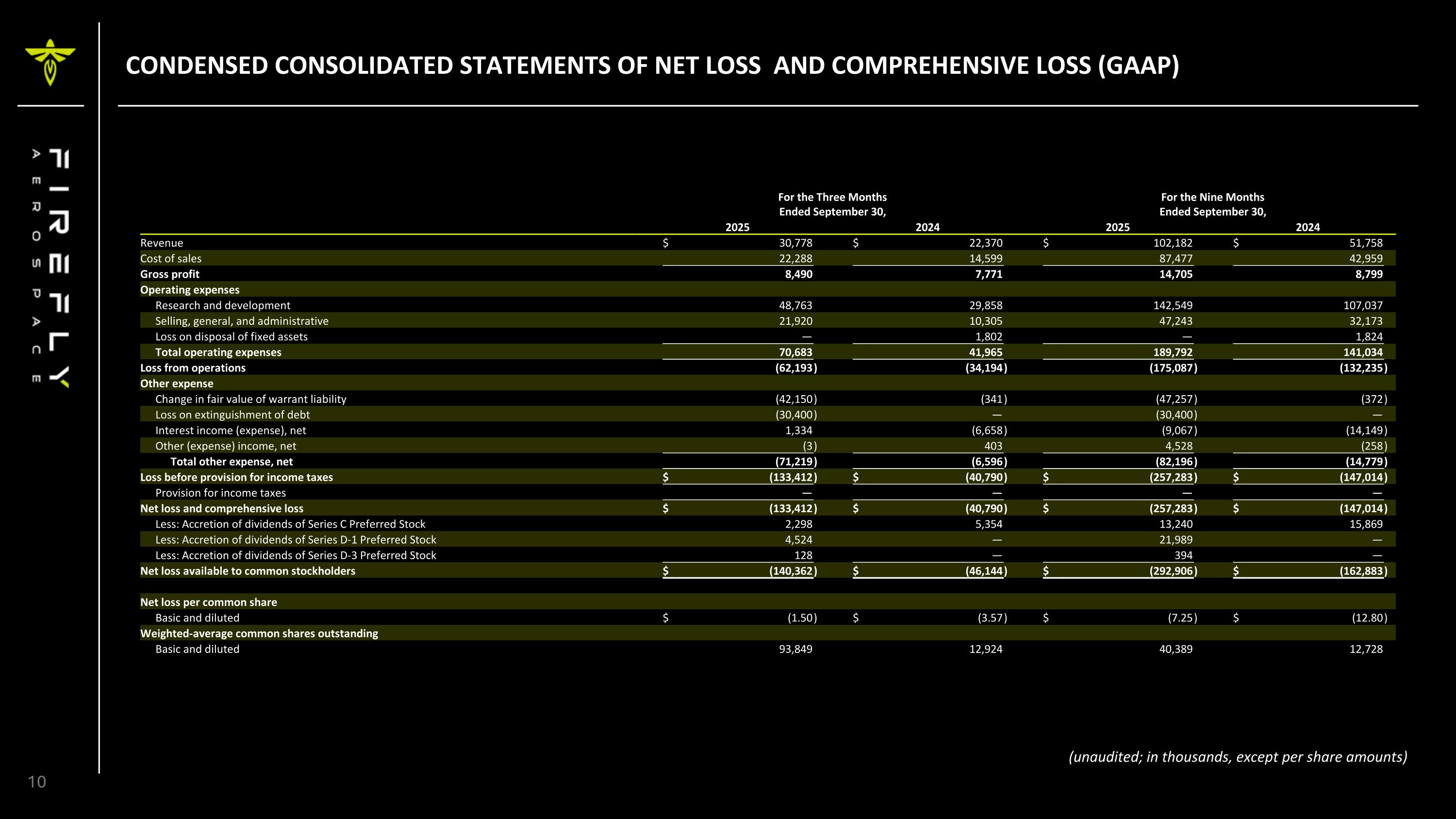

CONDENSED CONSOLIDATED STATEMENTS OF NET LOSS AND COMPREHENSIVE LOSS (GAAP) For the Three MonthsEnded September 30, For the Nine MonthsEnded September 30, 2025 2024 2025 2024 Revenue $ 30,778 $ 22,370 $ 102,182 $ 51,758 Cost of sales 22,288 14,599 87,477 42,959 Gross profit 8,490 7,771 14,705 8,799 Operating expenses Research and development 48,763 29,858 142,549 107,037 Selling, general, and administrative 21,920 10,305 47,243 32,173 Loss on disposal of fixed assets — 1,802 — 1,824 Total operating expenses 70,683 41,965 189,792 141,034 Loss from operations (62,193 ) (34,194 ) (175,087 ) (132,235 ) Other expense Change in fair value of warrant liability (42,150 ) (341 ) (47,257 ) (372 ) Loss on extinguishment of debt (30,400 ) — (30,400 ) — Interest income (expense), net 1,334 (6,658 ) (9,067 ) (14,149 ) Other (expense) income, net (3 ) 403 4,528 (258 ) Total other expense, net (71,219 ) (6,596 ) (82,196 ) (14,779 ) Loss before provision for income taxes $ (133,412 ) $ (40,790 ) $ (257,283 ) $ (147,014 ) Provision for income taxes — — — — Net loss and comprehensive loss $ (133,412 ) $ (40,790 ) $ (257,283 ) $ (147,014 ) Less: Accretion of dividends of Series C Preferred Stock 2,298 5,354 13,240 15,869 Less: Accretion of dividends of Series D-1 Preferred Stock 4,524 — 21,989 — Less: Accretion of dividends of Series D-3 Preferred Stock 128 — 394 — Net loss available to common stockholders $ (140,362 ) $ (46,144 ) $ (292,906 ) $ (162,883 ) Net loss per common share Basic and diluted $ (1.50 ) $ (3.57 ) $ (7.25 ) $ (12.80 ) Weighted-average common shares outstanding Basic and diluted 93,849 12,924 40,389 12,728 (unaudited; in thousands, except per share amounts)

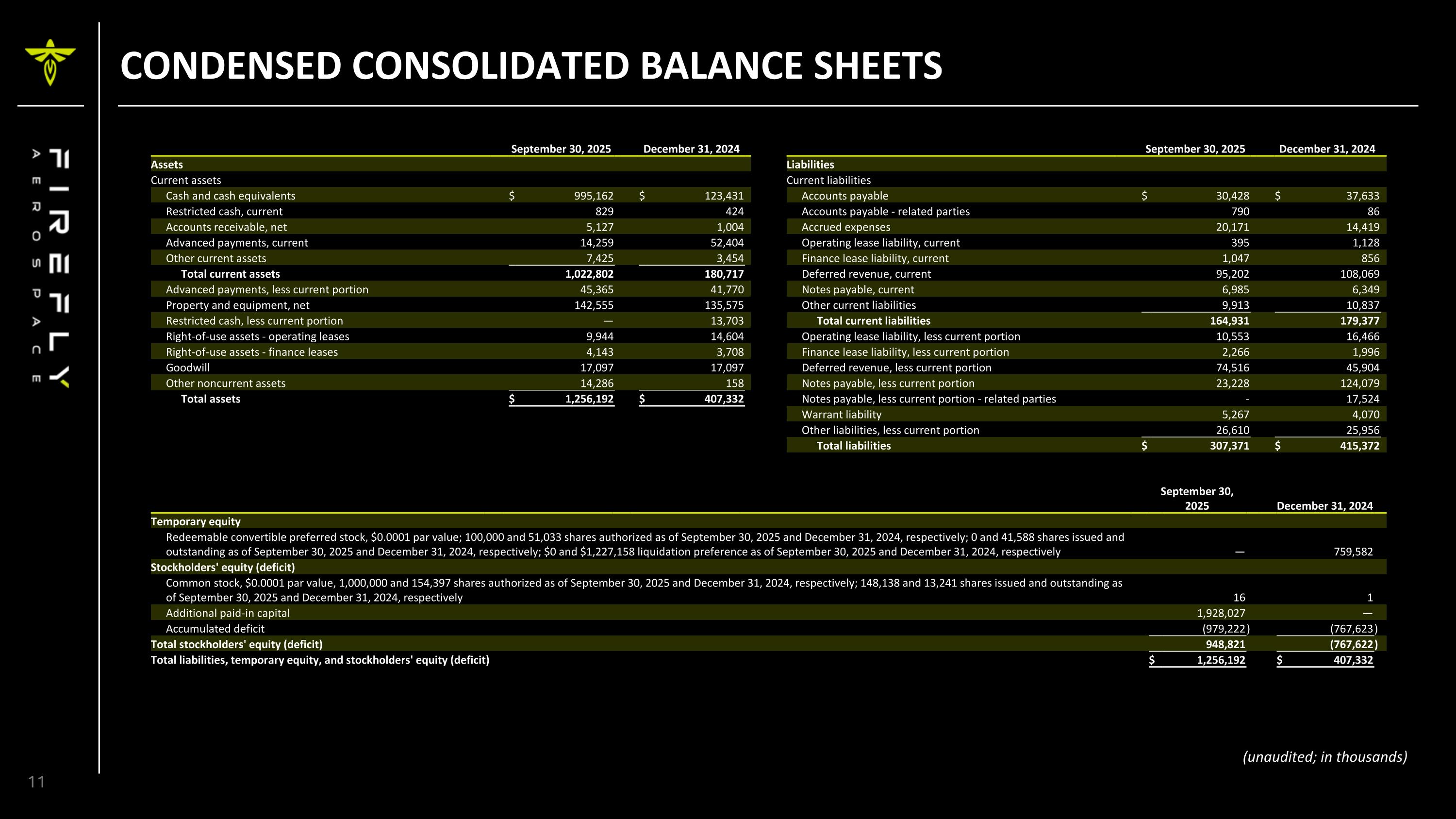

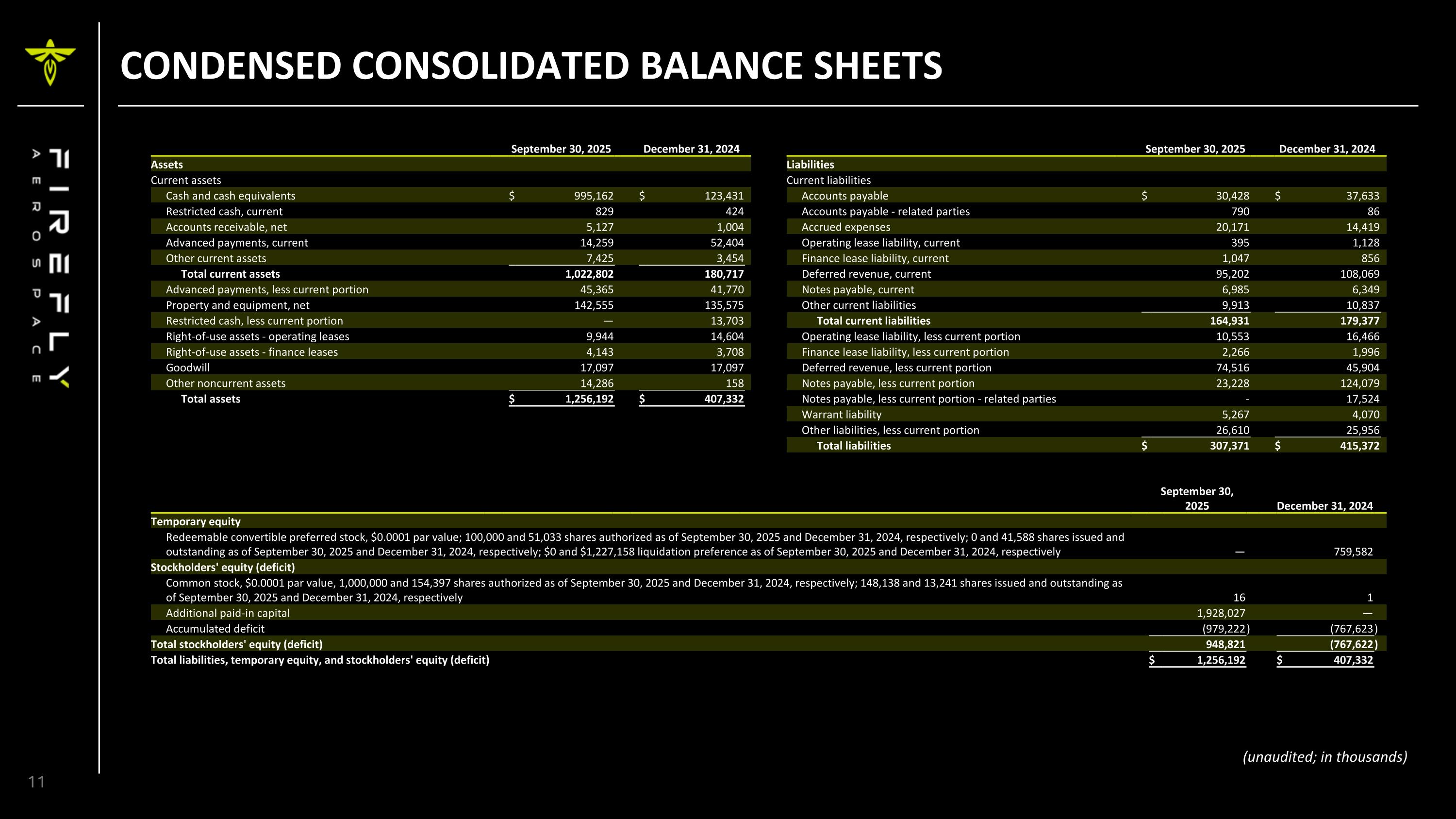

CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited; in thousands) September 30, 2025 December 31, 2024 Assets Current assets Cash and cash equivalents $ 995,162 $ 123,431 Restricted cash, current 829 424 Accounts receivable, net 5,127 1,004 Advanced payments, current 14,259 52,404 Other current assets 7,425 3,454 Total current assets 1,022,802 180,717 Advanced payments, less current portion 45,365 41,770 Property and equipment, net 142,555 135,575 Restricted cash, less current portion — 13,703 Right-of-use assets - operating leases 9,944 14,604 Right-of-use assets - finance leases 4,143 3,708 Goodwill 17,097 17,097 Other noncurrent assets 14,286 158 Total assets $ 1,256,192 $ 407,332 September 30, 2025 December 31, 2024 Liabilities Current liabilities Accounts payable $ 30,428 $ 37,633 Accounts payable - related parties 790 86 Accrued expenses 20,171 14,419 Operating lease liability, current 395 1,128 Finance lease liability, current 1,047 856 Deferred revenue, current 95,202 108,069 Notes payable, current 6,985 6,349 Other current liabilities 9,913 10,837 Total current liabilities 164,931 179,377 Operating lease liability, less current portion 10,553 16,466 Finance lease liability, less current portion 2,266 1,996 Deferred revenue, less current portion 74,516 45,904 Notes payable, less current portion 23,228 124,079 Notes payable, less current portion - related parties - 17,524 Warrant liability 5,267 4,070 Other liabilities, less current portion 26,610 25,956 Total liabilities $ 307,371 $ 415,372 September 30, 2025 December 31, 2024 Temporary equity Redeemable convertible preferred stock, $0.0001 par value; 100,000 and 51,033 shares authorized as of September 30, 2025 and December 31, 2024, respectively; 0 and 41,588 shares issued and outstanding as of September 30, 2025 and December 31, 2024, respectively; $0 and $1,227,158 liquidation preference as of September 30, 2025 and December 31, 2024, respectively — 759,582 Stockholders' equity (deficit) Common stock, $0.0001 par value, 1,000,000 and 154,397 shares authorized as of September 30, 2025 and December 31, 2024, respectively; 148,138 and 13,241 shares issued and outstanding as of September 30, 2025 and December 31, 2024, respectively 16 1 Additional paid-in capital 1,928,027 — Accumulated deficit (979,222 ) (767,623 ) Total stockholders' equity (deficit) 948,821 (767,622 ) Total liabilities, temporary equity, and stockholders' equity (deficit) $ 1,256,192 $ 407,332

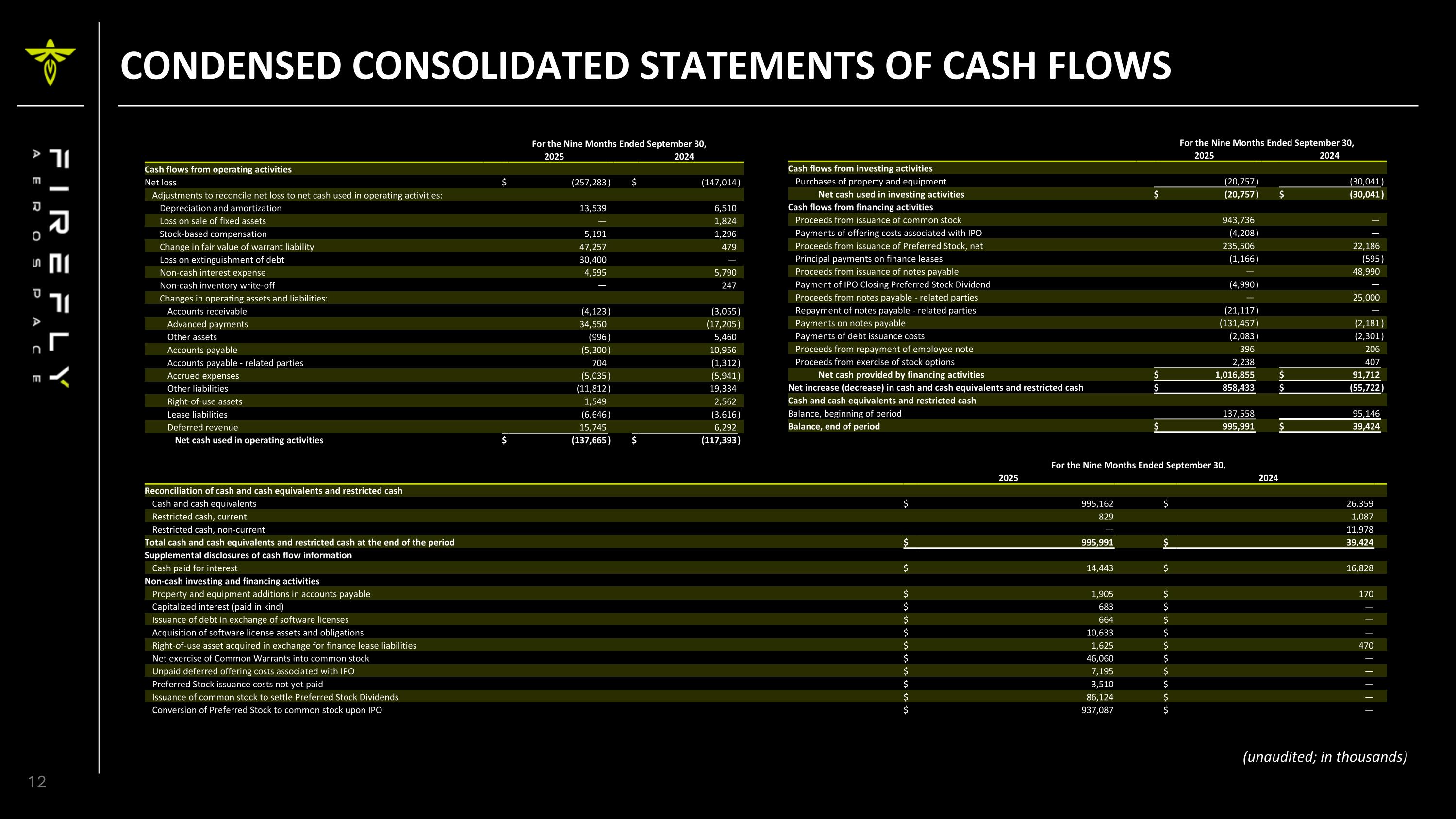

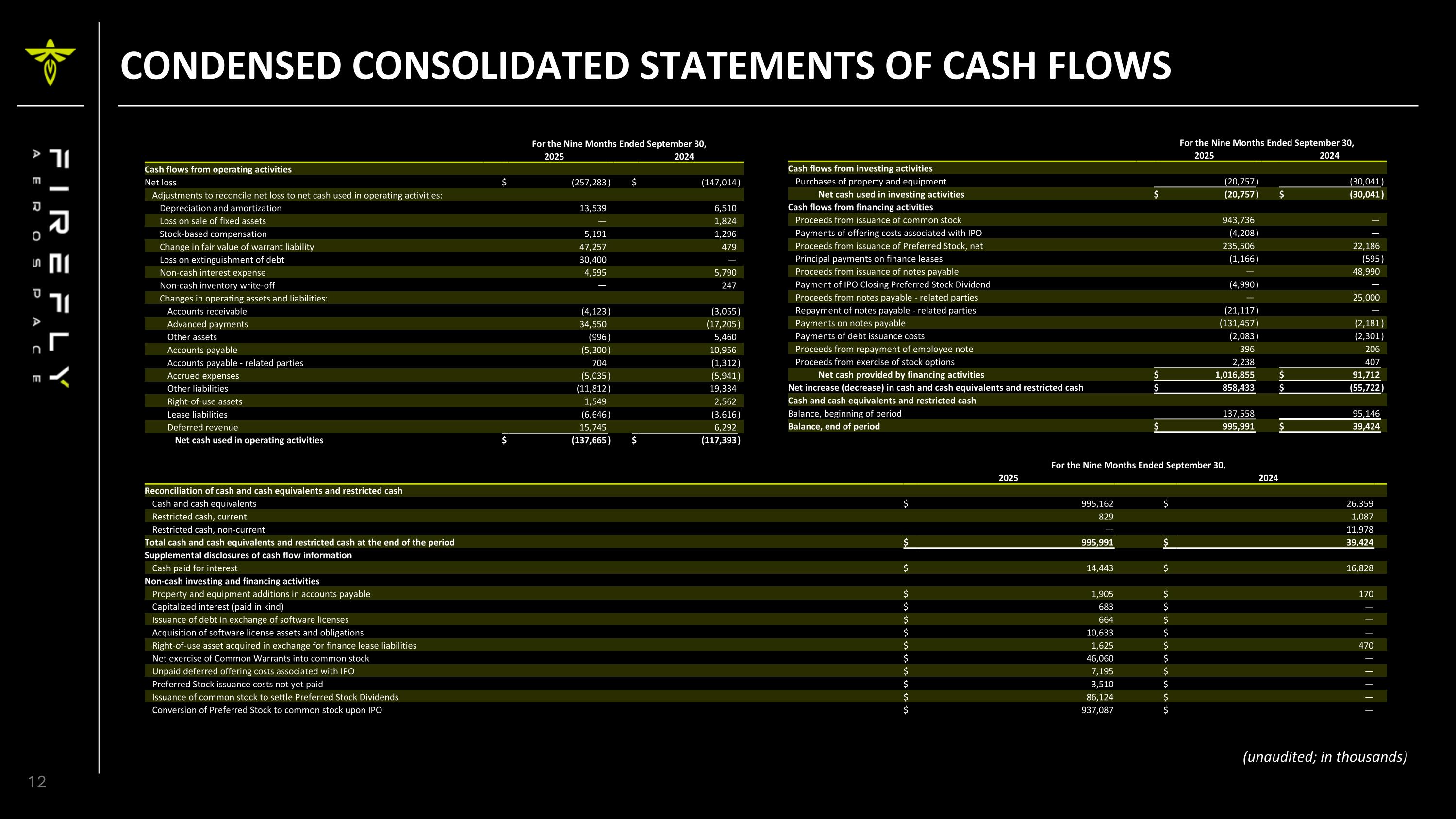

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS For the Nine Months Ended September 30, 2025 2024 Cash flows from operating activities Net loss $ (257,283 ) $ (147,014 ) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 13,539 6,510 Loss on sale of fixed assets — 1,824 Stock-based compensation 5,191 1,296 Change in fair value of warrant liability 47,257 479 Loss on extinguishment of debt 30,400 — Non-cash interest expense 4,595 5,790 Non-cash inventory write-off — 247 Changes in operating assets and liabilities: Accounts receivable (4,123 ) (3,055 ) Advanced payments 34,550 (17,205 ) Other assets (996 ) 5,460 Accounts payable (5,300 ) 10,956 Accounts payable - related parties 704 (1,312 ) Accrued expenses (5,035 ) (5,941 ) Other liabilities (11,812 ) 19,334 Right-of-use assets 1,549 2,562 Lease liabilities (6,646 ) (3,616 ) Deferred revenue 15,745 6,292 Net cash used in operating activities $ (137,665 ) $ (117,393 ) For the Nine Months Ended September 30, 2025 2024 Cash flows from investing activities Purchases of property and equipment (20,757 ) (30,041 ) Net cash used in investing activities $ (20,757 ) $ (30,041 ) Cash flows from financing activities Proceeds from issuance of common stock 943,736 — Payments of offering costs associated with IPO (4,208 ) — Proceeds from issuance of Preferred Stock, net 235,506 22,186 Principal payments on finance leases (1,166 ) (595 ) Proceeds from issuance of notes payable — 48,990 Payment of IPO Closing Preferred Stock Dividend (4,990 ) — Proceeds from notes payable - related parties — 25,000 Repayment of notes payable - related parties (21,117 ) — Payments on notes payable (131,457 ) (2,181 ) Payments of debt issuance costs (2,083 ) (2,301 ) Proceeds from repayment of employee note 396 206 Proceeds from exercise of stock options 2,238 407 Net cash provided by financing activities $ 1,016,855 $ 91,712 Net increase (decrease) in cash and cash equivalents and restricted cash $ 858,433 $ (55,722 ) Cash and cash equivalents and restricted cash Balance, beginning of period 137,558 95,146 Balance, end of period $ 995,991 $ 39,424 For the Nine Months Ended September 30, 2025 2024 Reconciliation of cash and cash equivalents and restricted cash Cash and cash equivalents $ 995,162 $ 26,359 Restricted cash, current 829 1,087 Restricted cash, non-current — 11,978 Total cash and cash equivalents and restricted cash at the end of the period $ 995,991 $ 39,424 Supplemental disclosures of cash flow information Cash paid for interest $ 14,443 $ 16,828 Non-cash investing and financing activities Property and equipment additions in accounts payable $ 1,905 $ 170 Capitalized interest (paid in kind) $ 683 $ — Issuance of debt in exchange of software licenses $ 664 $ — Acquisition of software license assets and obligations $ 10,633 $ — Right-of-use asset acquired in exchange for finance lease liabilities $ 1,625 $ 470 Net exercise of Common Warrants into common stock $ 46,060 $ — Unpaid deferred offering costs associated with IPO $ 7,195 $ — Preferred Stock issuance costs not yet paid $ 3,510 $ — Issuance of common stock to settle Preferred Stock Dividends $ 86,124 $ — Conversion of Preferred Stock to common stock upon IPO $ 937,087 $ — (unaudited; in thousands)

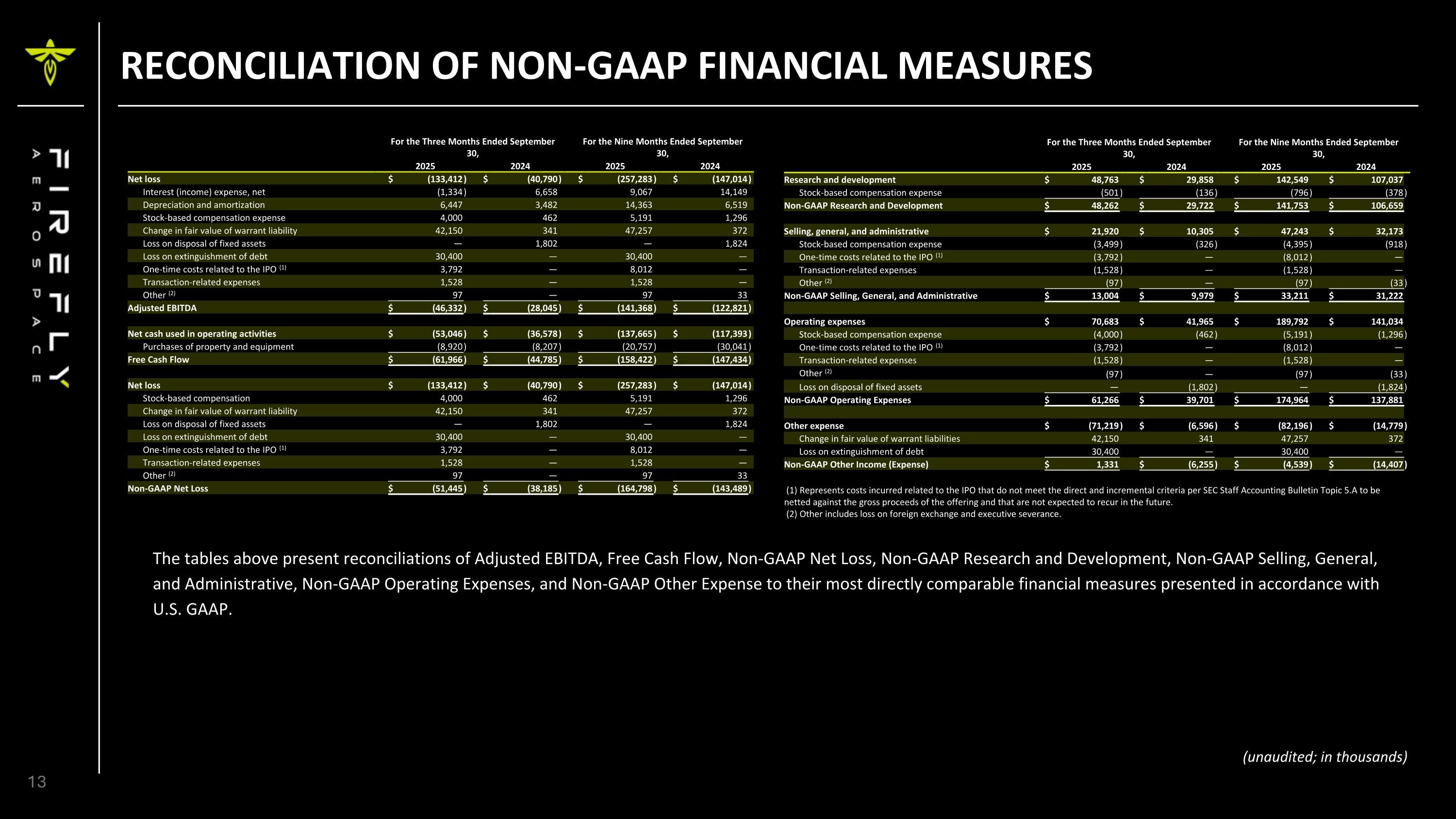

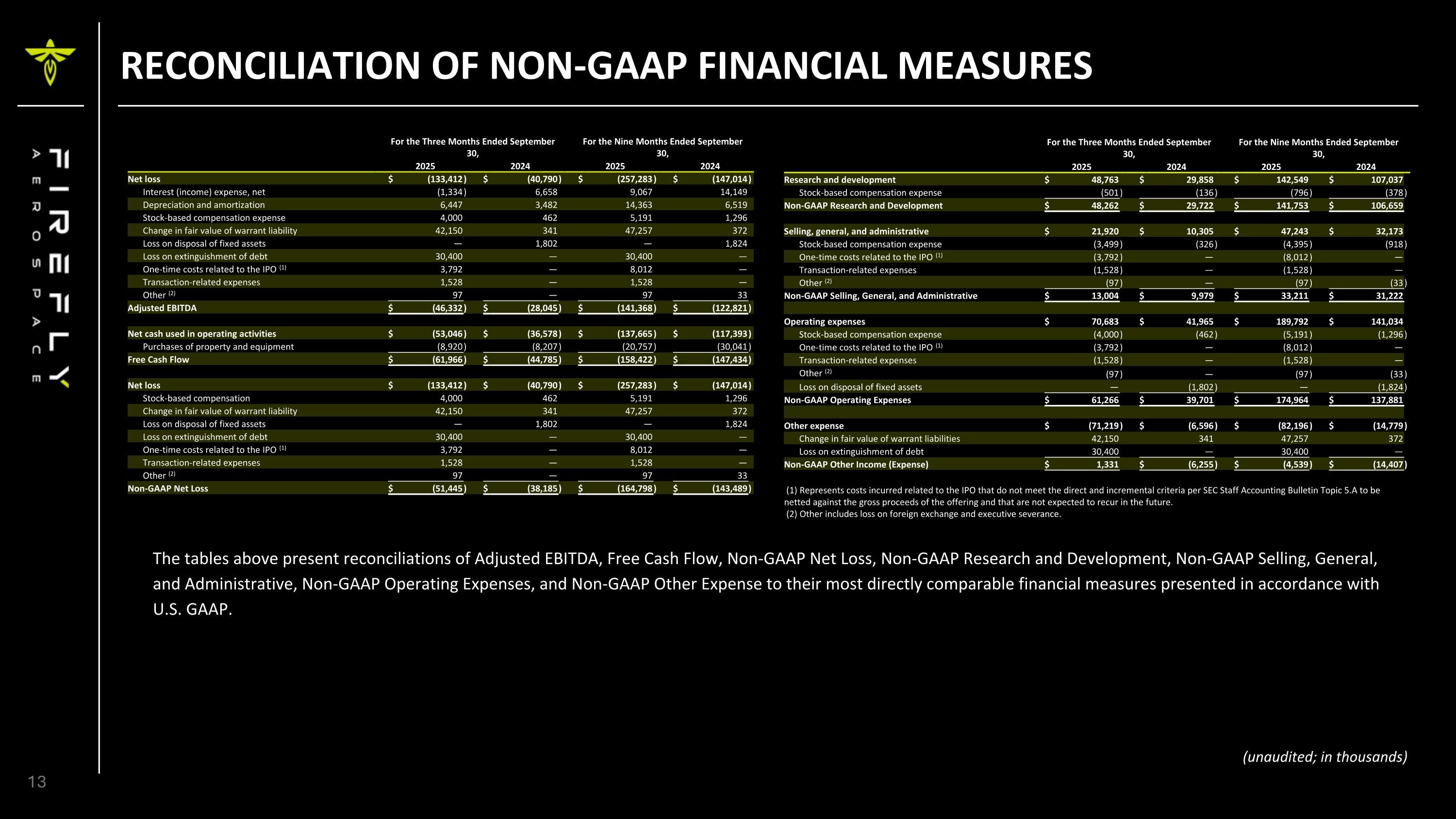

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES For the Three Months Ended September 30, For the Nine Months Ended September 30, 2025 2024 2025 2024 Net loss $ (133,412 ) $ (40,790 ) $ (257,283 ) $ (147,014 ) Interest (income) expense, net (1,334 ) 6,658 9,067 14,149 Depreciation and amortization 6,447 3,482 14,363 6,519 Stock-based compensation expense 4,000 462 5,191 1,296 Change in fair value of warrant liability 42,150 341 47,257 372 Loss on disposal of fixed assets — 1,802 — 1,824 Loss on extinguishment of debt 30,400 — 30,400 — One-time costs related to the IPO (1) 3,792 — 8,012 — Transaction-related expenses 1,528 — 1,528 — Other (2) 97 — 97 33 Adjusted EBITDA $ (46,332 ) $ (28,045 ) $ (141,368 ) $ (122,821 ) Net cash used in operating activities $ (53,046 ) $ (36,578 ) $ (137,665 ) $ (117,393 ) Purchases of property and equipment (8,920 ) (8,207 ) (20,757 ) (30,041 ) Free Cash Flow $ (61,966 ) $ (44,785 ) $ (158,422 ) $ (147,434 ) Net loss $ (133,412 ) $ (40,790 ) $ (257,283 ) $ (147,014 ) Stock-based compensation 4,000 462 5,191 1,296 Change in fair value of warrant liability 42,150 341 47,257 372 Loss on disposal of fixed assets — 1,802 — 1,824 Loss on extinguishment of debt 30,400 — 30,400 — One-time costs related to the IPO (1) 3,792 — 8,012 — Transaction-related expenses 1,528 — 1,528 — Other (2) 97 — 97 33 Non-GAAP Net Loss $ (51,445 ) $ (38,185 ) $ (164,798 ) $ (143,489 ) For the Three Months Ended September 30, For the Nine Months Ended September 30, 2025 2024 2025 2024 Research and development $ 48,763 $ 29,858 $ 142,549 $ 107,037 Stock-based compensation expense (501 ) (136 ) (796 ) (378 ) Non-GAAP Research and Development $ 48,262 $ 29,722 $ 141,753 $ 106,659 Selling, general, and administrative $ 21,920 $ 10,305 $ 47,243 $ 32,173 Stock-based compensation expense (3,499 ) (326 ) (4,395 ) (918 ) One-time costs related to the IPO (1) (3,792 ) — (8,012 ) — Transaction-related expenses (1,528 ) — (1,528 ) — Other (2) (97 ) — (97 ) (33 ) Non-GAAP Selling, General, and Administrative $ 13,004 $ 9,979 $ 33,211 $ 31,222 Operating expenses $ 70,683 $ 41,965 $ 189,792 $ 141,034 Stock-based compensation expense (4,000 ) (462 ) (5,191 ) (1,296 ) One-time costs related to the IPO (1) (3,792 ) — (8,012 ) — Transaction-related expenses (1,528 ) — (1,528 ) — Other (2) (97 ) — (97 ) (33 ) Loss on disposal of fixed assets — (1,802 ) — (1,824 ) Non-GAAP Operating Expenses $ 61,266 $ 39,701 $ 174,964 $ 137,881 Other expense $ (71,219 ) $ (6,596 ) $ (82,196 ) $ (14,779 ) Change in fair value of warrant liabilities 42,150 341 47,257 372 Loss on extinguishment of debt 30,400 — 30,400 — Non-GAAP Other Income (Expense) $ 1,331 $ (6,255 ) $ (4,539 ) $ (14,407 ) (1) Represents costs incurred related to the IPO that do not meet the direct and incremental criteria per SEC Staff Accounting Bulletin Topic 5.A to be netted against the gross proceeds of the offering and that are not expected to recur in the future. (2) Other includes loss on foreign exchange and executive severance. The tables above present reconciliations of Adjusted EBITDA, Free Cash Flow, Non-GAAP Net Loss, Non-GAAP Research and Development, Non-GAAP Selling, General, and Administrative, Non-GAAP Operating Expenses, and Non-GAAP Other Expense to their most directly comparable financial measures presented in accordance with U.S. GAAP. (unaudited; in thousands)

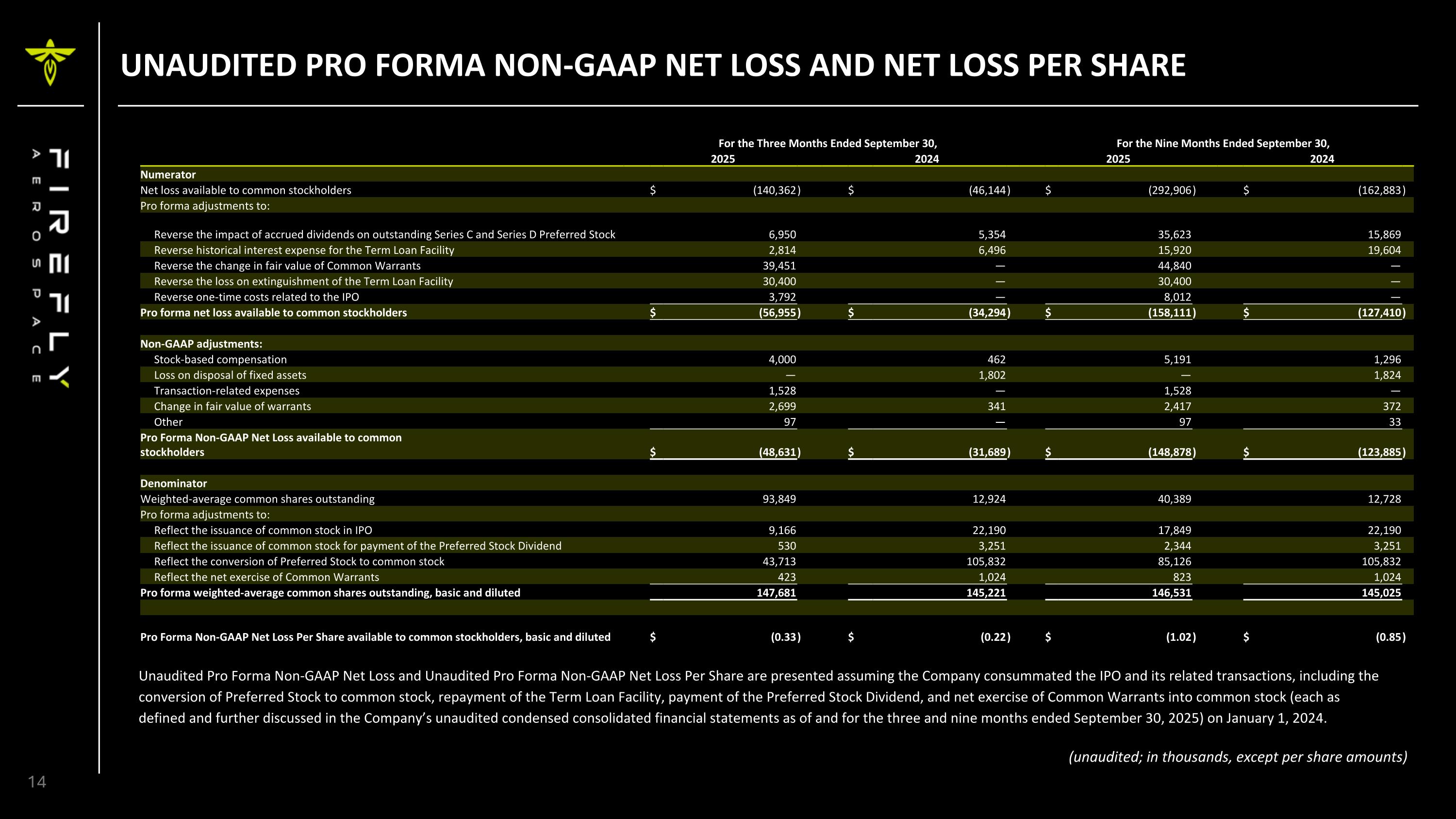

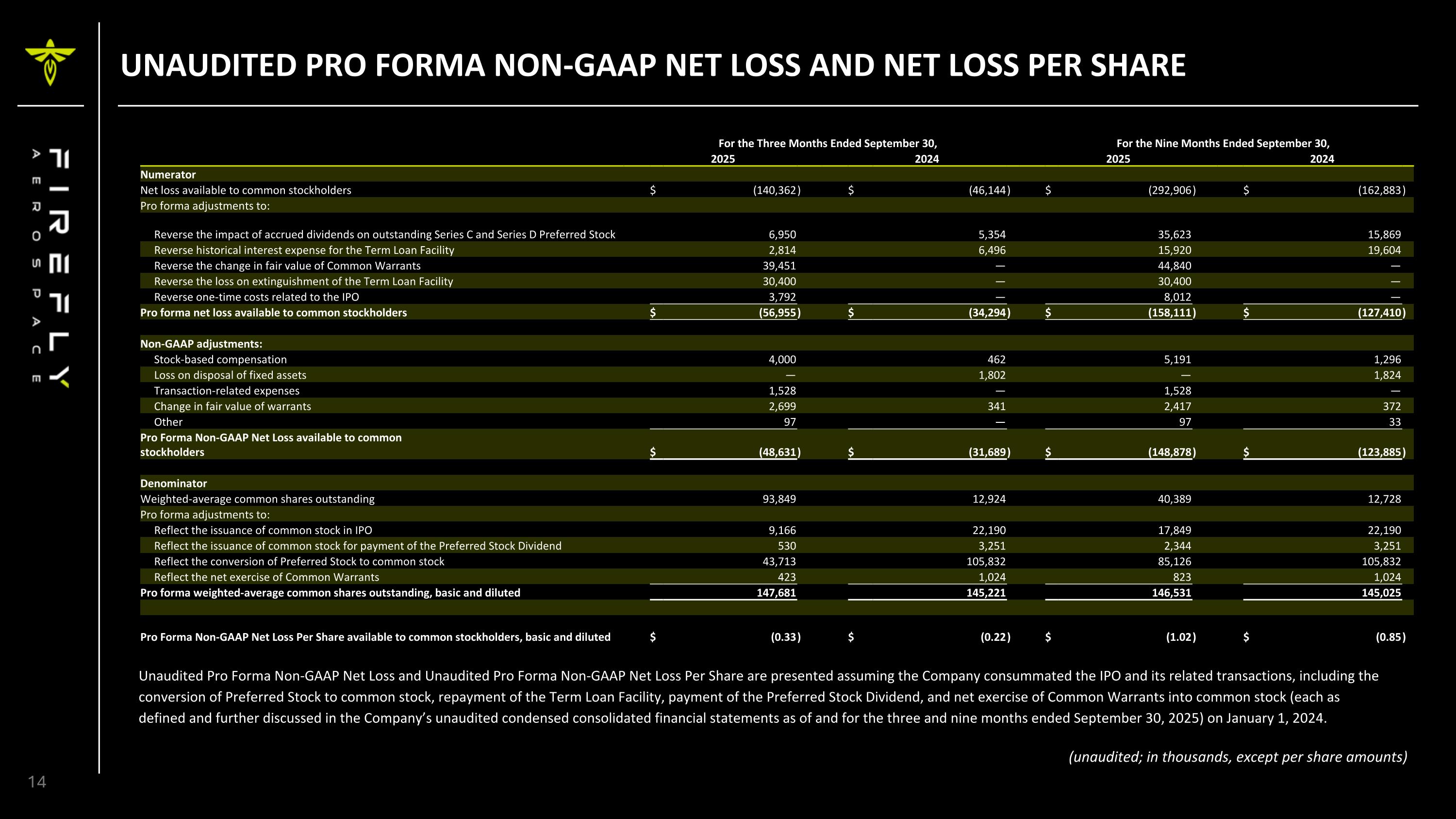

UNAUDITED PRO FORMA NON-GAAP NET LOSS AND NET LOSS PER SHARE (unaudited; in thousands, except per share amounts) For the Three Months Ended September 30, For the Nine Months Ended September 30, 2025 2024 2025 2024 Numerator Net loss available to common stockholders $ (140,362 ) $ (46,144 ) $ (292,906 ) $ (162,883 ) Pro forma adjustments to: Reverse the impact of accrued dividends on outstanding Series C and Series D Preferred Stock 6,950 5,354 35,623 15,869 Reverse historical interest expense for the Term Loan Facility 2,814 6,496 15,920 19,604 Reverse the change in fair value of Common Warrants 39,451 — 44,840 — Reverse the loss on extinguishment of the Term Loan Facility 30,400 — 30,400 — Reverse one-time costs related to the IPO 3,792 — 8,012 — Pro forma net loss available to common stockholders $ (56,955 ) $ (34,294 ) $ (158,111 ) $ (127,410 ) Non-GAAP adjustments: Stock-based compensation 4,000 462 5,191 1,296 Loss on disposal of fixed assets — 1,802 — 1,824 Transaction-related expenses 1,528 — 1,528 — Change in fair value of warrants 2,699 341 2,417 372 Other 97 — 97 33 Pro Forma Non-GAAP Net Loss available to commonstockholders $ (48,631 ) $ (31,689 ) $ (148,878 ) $ (123,885 ) Denominator Weighted-average common shares outstanding 93,849 12,924 40,389 12,728 Pro forma adjustments to: Reflect the issuance of common stock in IPO 9,166 22,190 17,849 22,190 Reflect the issuance of common stock for payment of the Preferred Stock Dividend 530 3,251 2,344 3,251 Reflect the conversion of Preferred Stock to common stock 43,713 105,832 85,126 105,832 Reflect the net exercise of Common Warrants 423 1,024 823 1,024 Pro forma weighted-average common shares outstanding, basic and diluted 147,681 145,221 146,531 145,025 Pro Forma Non-GAAP Net Loss Per Share available to common stockholders, basic and diluted $ (0.33 ) $ (0.22 ) $ (1.02 ) $ (0.85 ) Unaudited Pro Forma Non-GAAP Net Loss and Unaudited Pro Forma Non-GAAP Net Loss Per Share are presented assuming the Company consummated the IPO and its related transactions, including the conversion of Preferred Stock to common stock, repayment of the Term Loan Facility, payment of the Preferred Stock Dividend, and net exercise of Common Warrants into common stock (each as defined and further discussed in the Company’s unaudited condensed consolidated financial statements as of and for the three and nine months ended September 30, 2025) on January 1, 2024.

ADDITIONAL PROGRESS Firefly took delivery of the Rashid 2 Rover at our Spacecraft Facilities in Texas. The rover was built by the United Arab Emirates’ Mohammed Bin Rashid Space Centre, and one of our commercial payload flying on this missions. TIME named BGM1 to “Best Inventions of 2025” BGM3 completed Preliminary Design Review BLUE GHOST MISSION 3 BLUE GHOST MISSION 2 BLUE GHOST MISSION 1

Q&A