Mid-Fourth Quarter 2025Update 11/10/2025 HANCOCK WHITNEY

This presentation contains forward-looking statements within the meaning of section 27A of the Securities Act of 1933, as amended, and section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements that we may make include statements regarding our expectations of our performance and financial condition, balance sheet and revenue growth, the provision for credit losses, capital levels, deposits (including growth, pricing, and betas), investment portfolio, other sources of liquidity, loan growth expectations, management’s predictions about charge-offs for loans, the impact of current and future economic conditions, including the effects of a prolonged government shutdown, declines in the real estate market, tariffs or trade wars (including reduced consumer spending, lower economic growth or recession, reduced demand for U.S. exports, disruptions to supply chains, and decreased demand for other banking products and services), high unemployment, inflationary pressures, increasing insurance costs, fluctuations in interest rates, including the impact of changes in interest rates on our financial projections, models and guidance and slowdowns in economic growth, as well as the financial stress on borrowers as a result of the foregoing, general economic business conditions in our local markets, Federal Reserve action with respect to interest rates, the effects of war or other conflicts, acts of terrorism, climate change, the impact of natural or man-made disasters, the adequacy of our enterprise risk management framework, potential claims, damages, penalties, fines and reputational damage resulting from pending or future litigation, regulatory proceedings, assessments, and enforcement actions, as well as the impact of negative developments affecting the banking industry and the resulting media coverage; the potential impact of current (including Sabal Trust Company) or future business combinations on our performance and financial condition, including our ability to successfully integrate the businesses, success of revenue-generating and cost reduction initiatives, the potential impact of third-party business combinations in our footprint on our performance and financial condition, the effectiveness of derivative financial instruments and hedging activities to manage risks, projected tax rates, increased cybersecurity risks, including potential business disruptions or financial losses, the adequacy of our internal controls over financial and non-financial reporting, the financial impact of regulatory requirements and tax reform legislation, deposit trends, credit quality trends, net interest margin trends, future expense levels, future profitability, improvements in expense to revenue (efficiency) ratio, purchase accounting impacts and expected returns. Also, any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “forecast,” “goals,” “targets,” “initiatives,” “focus,” “potentially,” “probably,” “projects,” “outlook," or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Forward-looking statements are based upon the current beliefs and expectations of management and on information currently available to management. Our statements speak as of the date hereof, and we do not assume any obligation to update these statements or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. Forward-looking statements are subject to significant risks and uncertainties. Any forward-looking statement made in this presentation is subject to the safe harbor protections set forth in the Private Securities Litigation Reform Act of 1995. Investors are cautioned against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Additional factors that could cause actual results to differ materially from those described in the forward-looking statements can be found in Part I, “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024, and in other periodic reports that we file with the SEC. Important cautionary statement about forward-looking statements

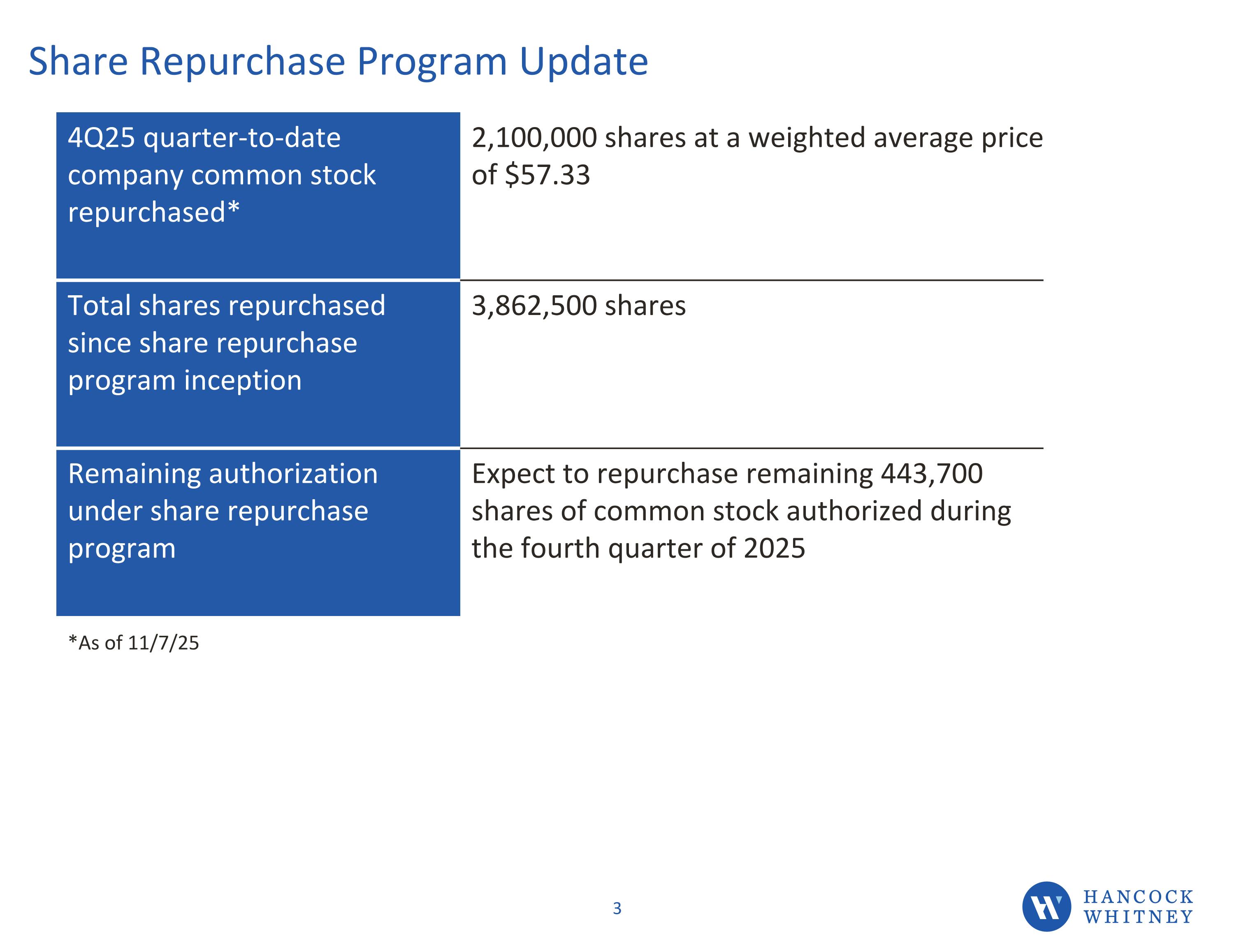

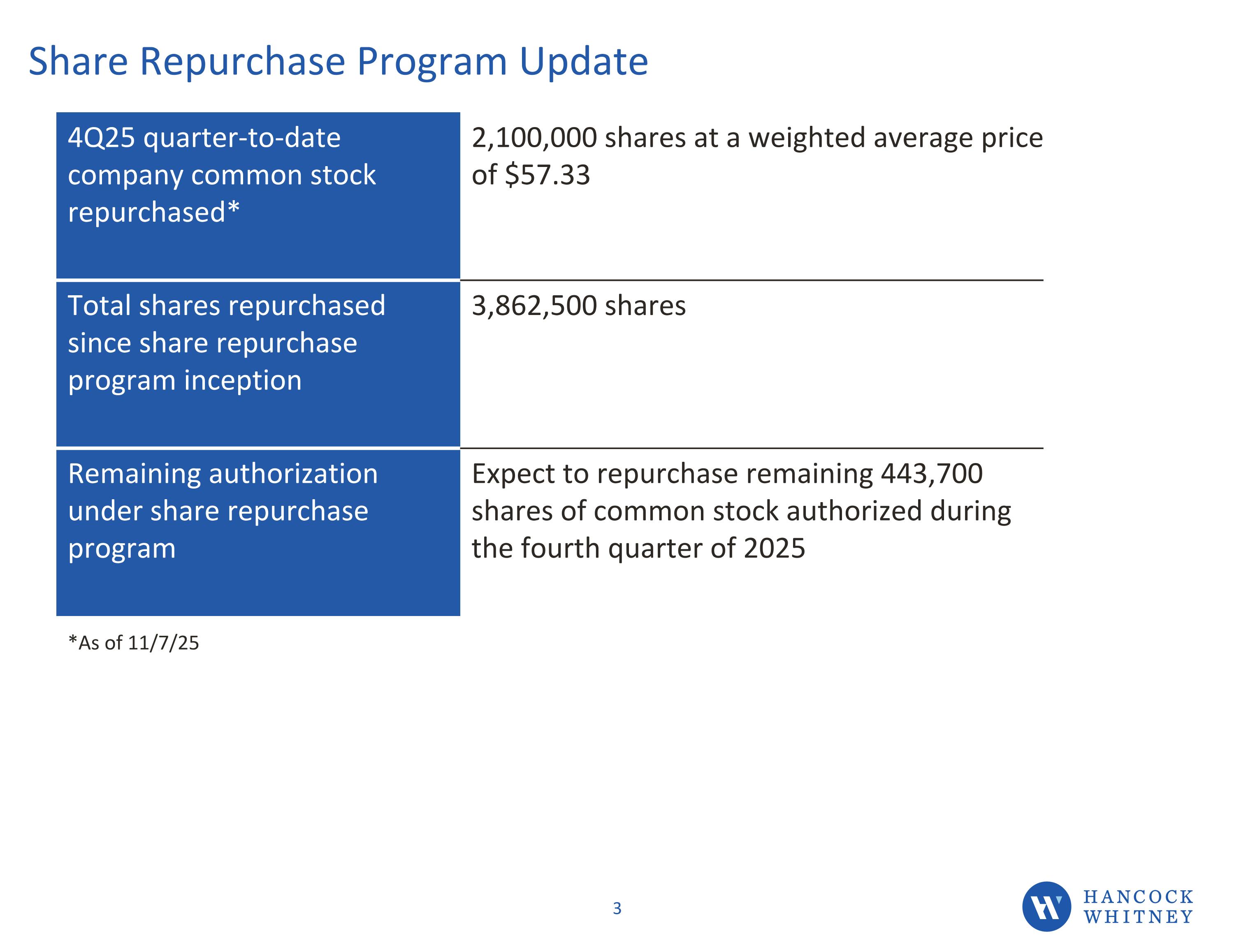

Share Repurchase Program Update 4Q25 quarter-to-date company common stock repurchased* 2,100,000 shares at a weighted average price of $57.33 Total shares repurchased since share repurchase program inception 3,862,500 shares Remaining authorization under share repurchase program Expect to repurchase remaining 443,700 shares of common stock authorized during the fourth quarter of 2025 *As of 11/7/25

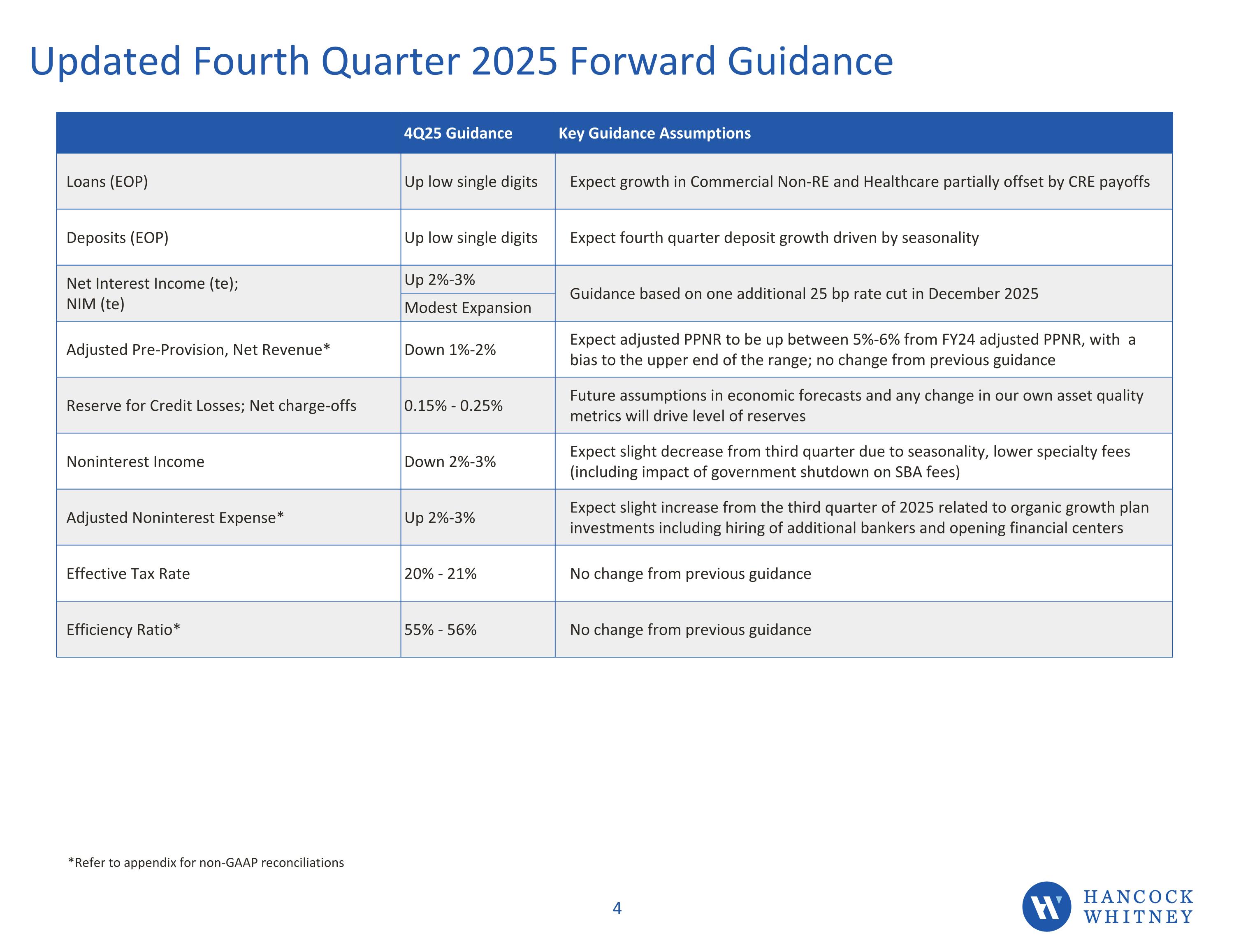

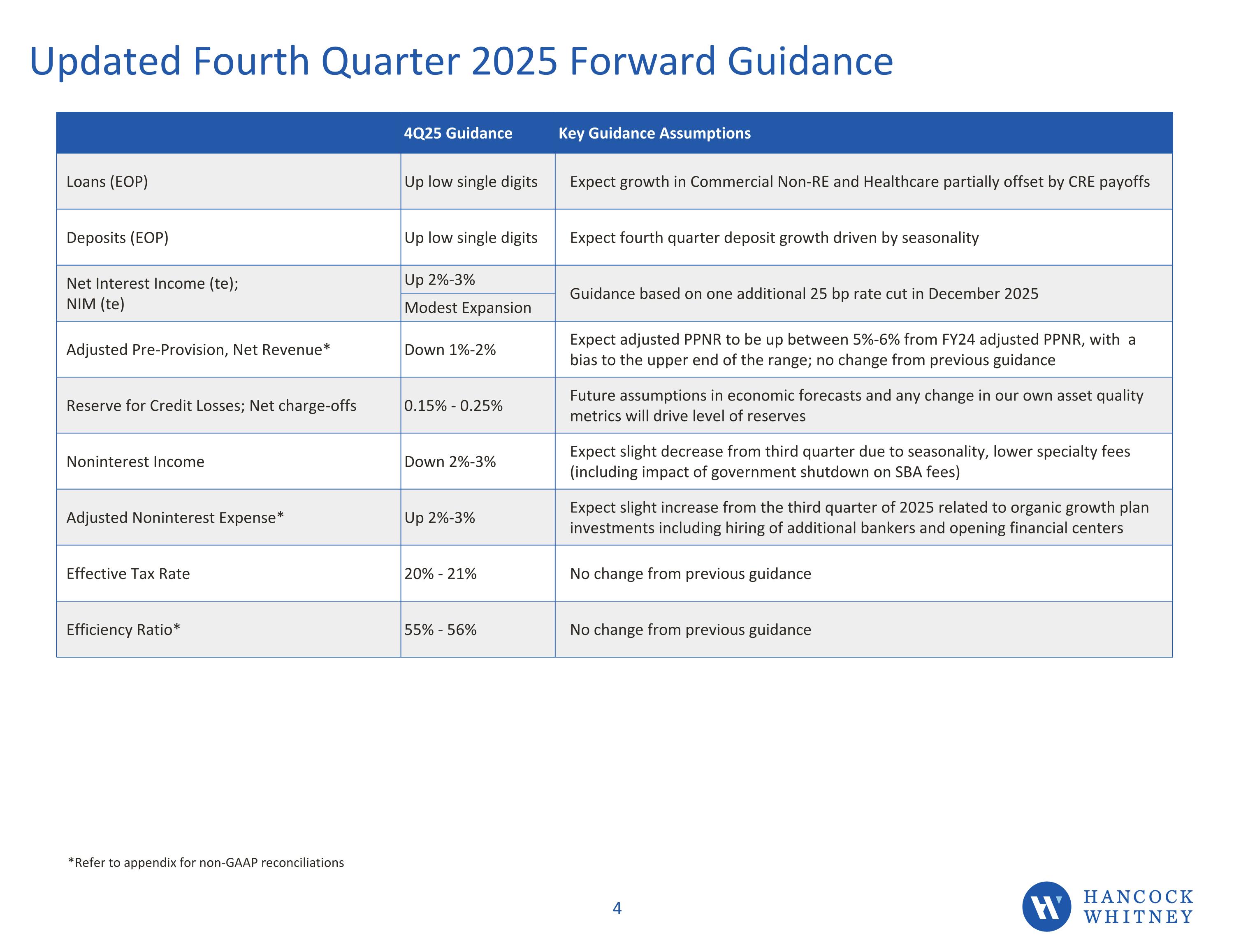

Updated Fourth Quarter 2025 Forward Guidance 4Q25 Guidance Key Guidance Assumptions Loans (EOP) Up low single digits Expect growth in Commercial Non-RE and Healthcare partially offset by CRE payoffs Deposits (EOP) Up low single digits Expect fourth quarter deposit growth driven by seasonality Net Interest Income (te); NIM (te) Up 2%-3% Guidance based on one additional 25 bp rate cut in December 2025 Modest Expansion Adjusted Pre-Provision, Net Revenue* Down 1%-2% Expect adjusted PPNR to be up between 5%-6% from FY24 adjusted PPNR, with a bias to the upper end of the range; no change from previous guidance Reserve for Credit Losses; Net charge-offs 0.15% - 0.25% Future assumptions in economic forecasts and any change in our own asset quality metrics will drive level of reserves Noninterest Income Down 2%-3% Expect slight decrease from third quarter due to seasonality, lower specialty fees (including impact of government shutdown on SBA fees) Adjusted Noninterest Expense* Up 2%-3% Expect slight increase from the third quarter of 2025 related to organic growth plan investments including hiring of additional bankers and opening financial centers Effective Tax Rate 20% - 21% No change from previous guidance Efficiency Ratio* 55% - 56% No change from previous guidance *Refer to appendix for non-GAAP reconciliations

Appendix and Non-GAAP Reconciliations Appendix and Non-GAAP Reconciliations CHANCOCK WHITNEY

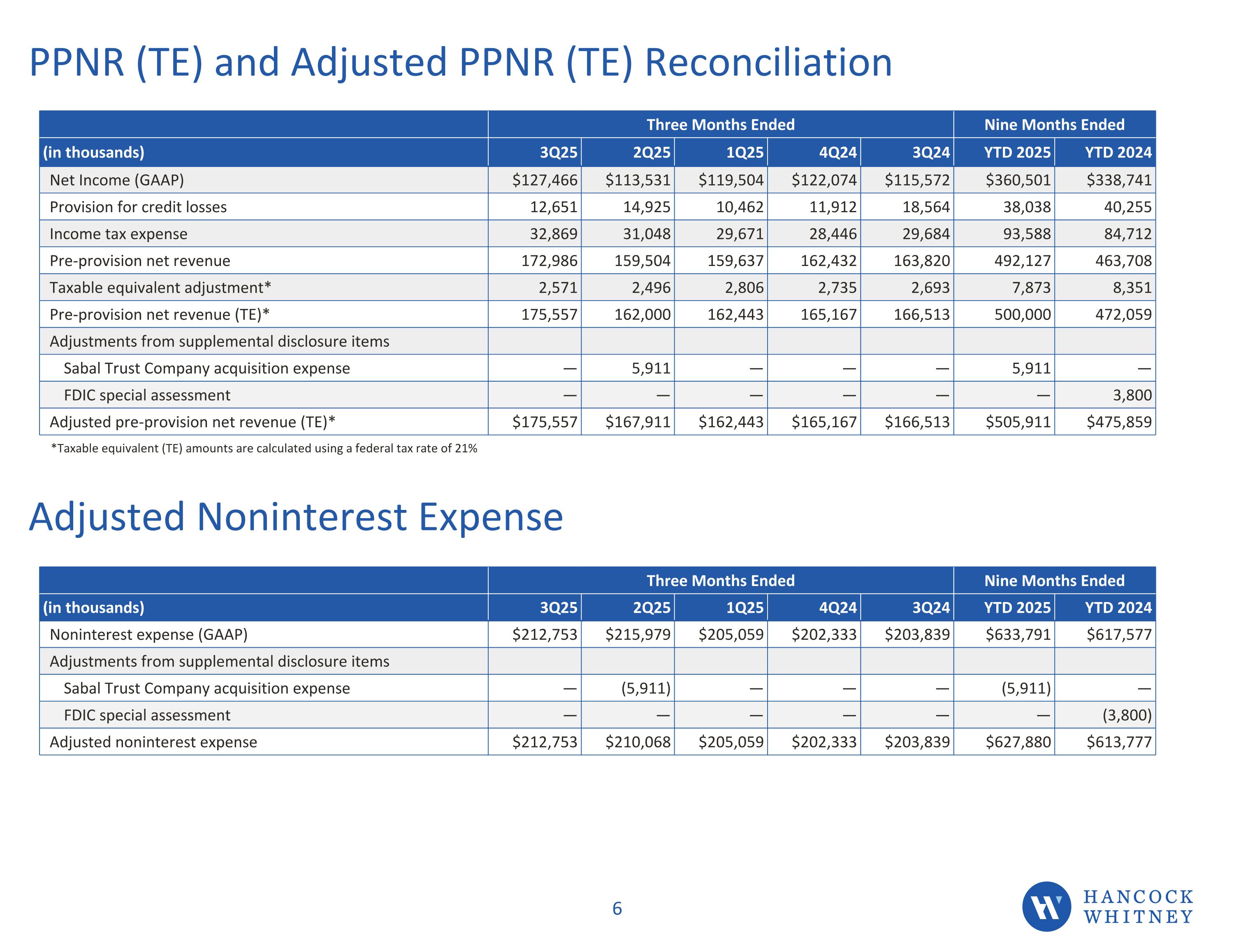

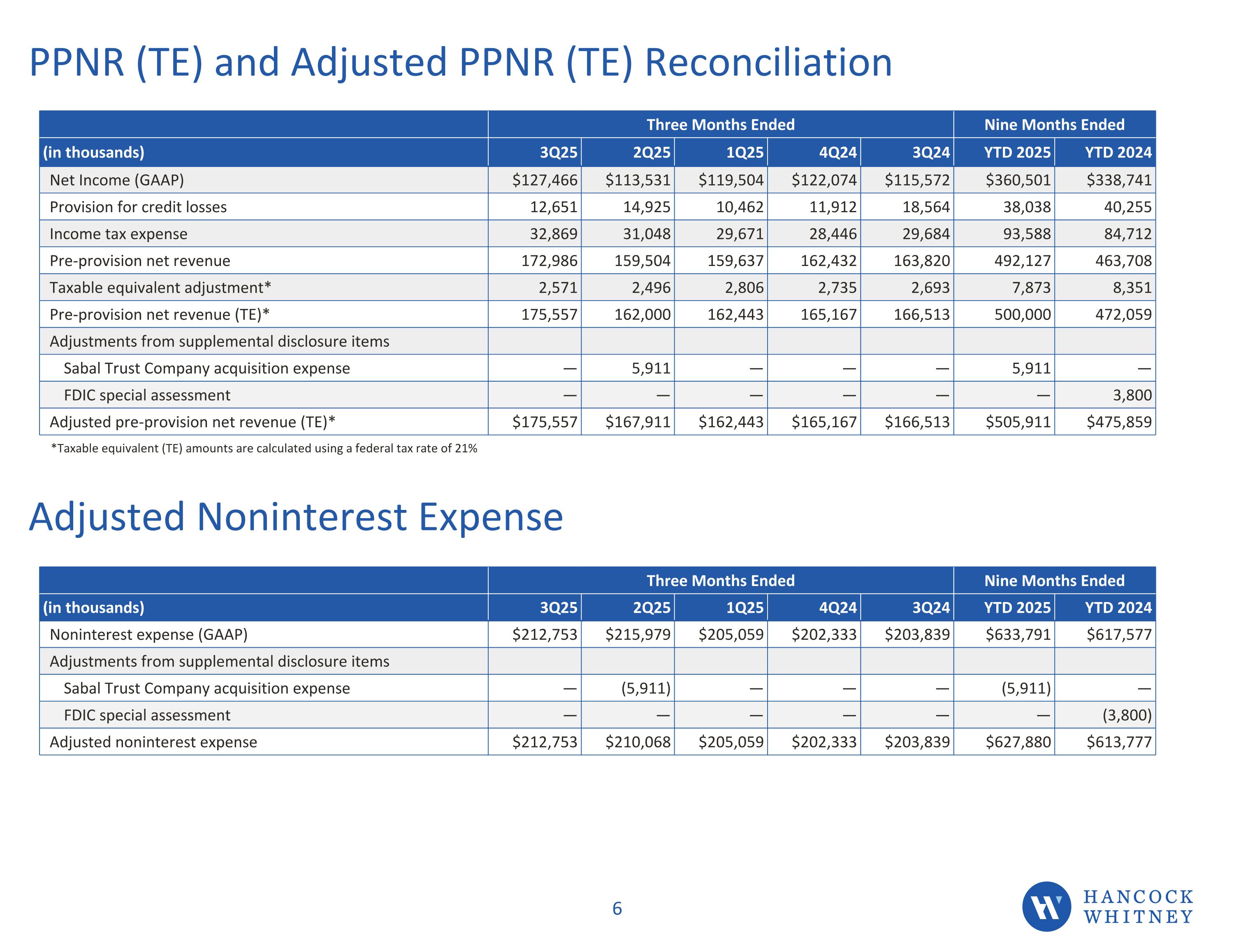

PPNR (TE) and Adjusted PPNR (TE) Reconciliation Three Months Ended Nine Months Ended (in thousands) 3Q25 2Q25 1Q25 4Q24 3Q24 YTD 2025 YTD 2024 Net Income (GAAP) $127,466 $113,531 $119,504 $122,074 $115,572 $360,501 $338,741 Provision for credit losses 12,651 14,925 10,462 11,912 18,564 38,038 40,255 Income tax expense 32,869 31,048 29,671 28,446 29,684 93,588 84,712 Pre-provision net revenue 172,986 159,504 159,637 162,432 163,820 492,127 463,708 Taxable equivalent adjustment* 2,571 2,496 2,806 2,735 2,693 7,873 8,351 Pre-provision net revenue (TE)* 175,557 162,000 162,443 165,167 166,513 500,000 472,059 Adjustments from supplemental disclosure items Sabal Trust Company acquisition expense — 5,911 — — — 5,911 — FDIC special assessment — — — — — — 3,800 Adjusted pre-provision net revenue (TE)* $175,557 $167,911 $162,443 $165,167 $166,513 $505,911 $475,859 Total Revenue (TE), Operating PPNR (TE) Reconciliations Taxable equivalent (TE) amounts are calculated using a federal income tax rate of 21%. Three Months Ended (in thousands) 12/31/2020 9/30/2020 6/30/2020 3/31/2020 12/31/2019 Net interest income $238,286 $235,183 $237,866 $231,188 $233,156 Noninterest income 82,350 83,748 73,943 84,387 82,924 Total revenue $320,636 $318,931 $311,809 $315,575 $316,080 Taxable equivalent adjustment 3,115 3,189 3,248 3,448 3,580 Total revenue (TE) $323,751 $322,120 $315,057 $319,023 $319,660 Noninterest expense (193,144) (195,774) (196,539) (203,335) (197,856) Nonoperating expense — — — — 3,856 Operating pre-provision net revenue $130,607 $126,346 $118,518 $115,688 $125,660CHANCOCK WHITNEY 31 *Taxable equivalent (TE) amounts are calculated using a federal tax rate of 21% Adjusted Noninterest Expense Three Months Ended Nine Months Ended (in thousands) 3Q25 2Q25 1Q25 4Q24 3Q24 YTD 2025 YTD 2024 Noninterest expense (GAAP) $212,753 $215,979 $205,059 $202,333 $203,839 $633,791 $617,577 Adjustments from supplemental disclosure items Sabal Trust Company acquisition expense — (5,911) — — — (5,911) — FDIC special assessment — — — — — — (3,800) Adjusted noninterest expense $212,753 $210,068 $205,059 $202,333 $203,839 $627,880 $613,777

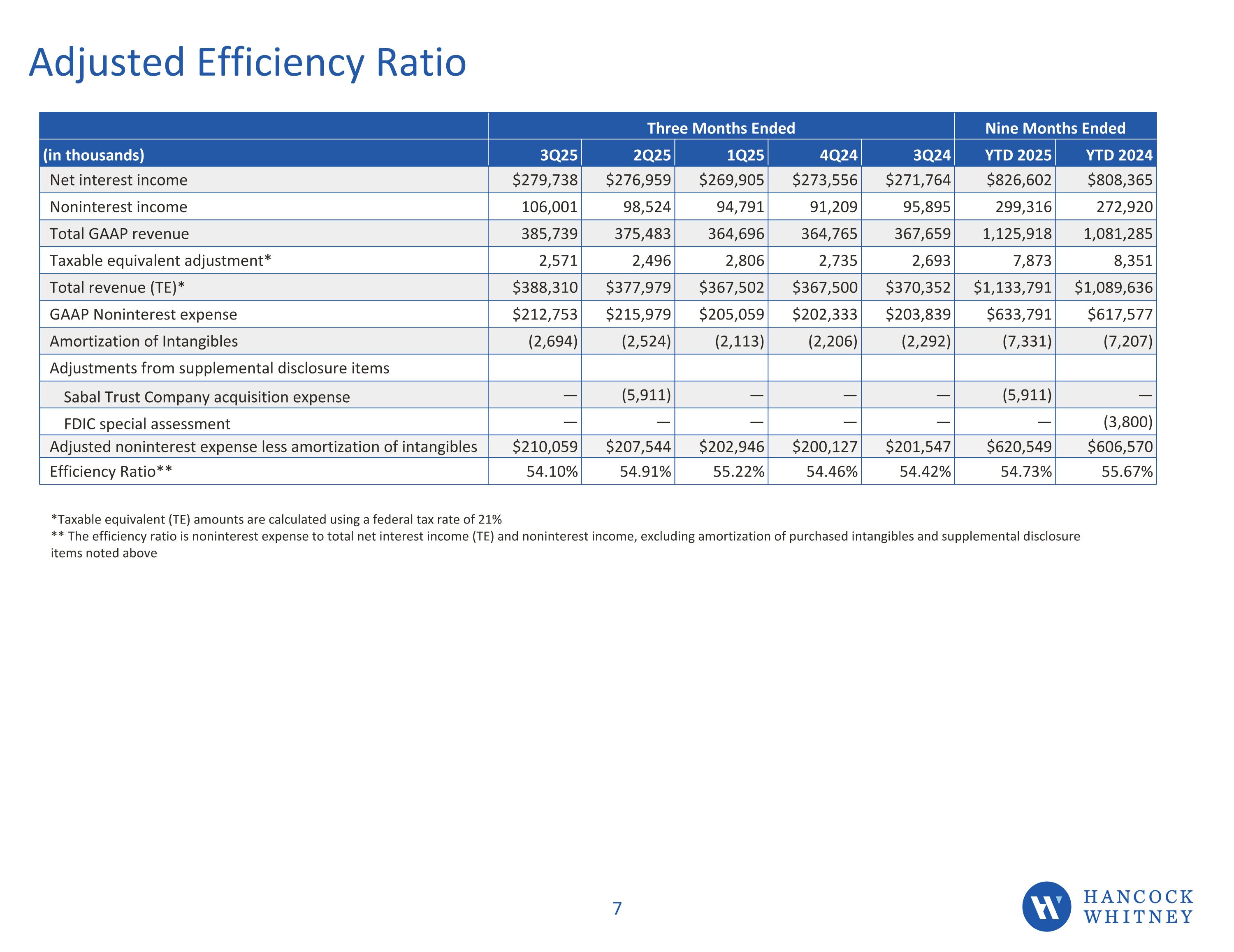

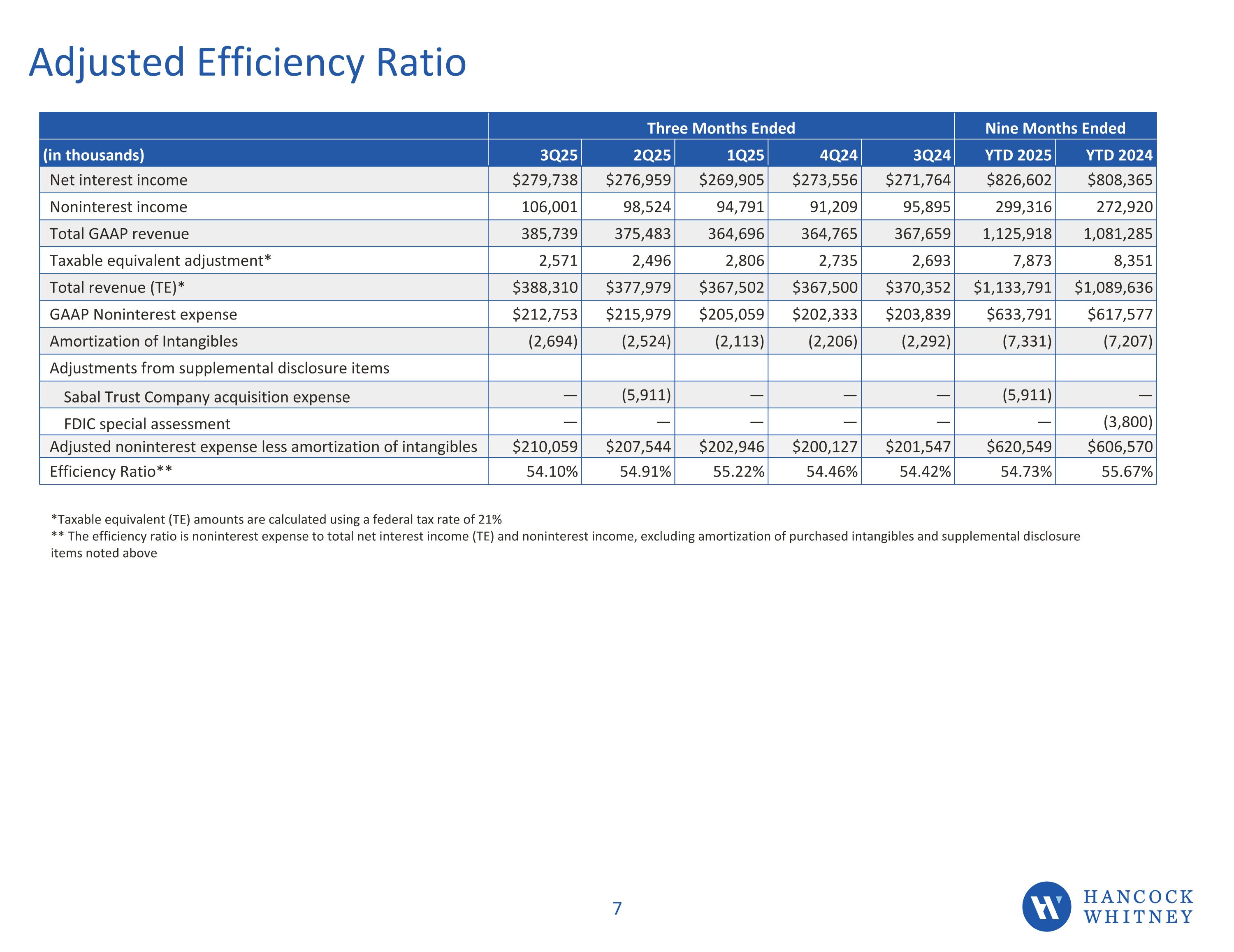

Adjusted Efficiency Ratio Three Months Ended Nine Months Ended (in thousands) 3Q25 2Q25 1Q25 4Q24 3Q24 YTD 2025 YTD 2024 Net interest income $279,738 $276,959 $269,905 $273,556 $271,764 $826,602 $808,365 Noninterest income 106,001 98,524 94,791 91,209 95,895 299,316 272,920 Total GAAP revenue 385,739 375,483 364,696 364,765 367,659 1,125,918 1,081,285 Taxable equivalent adjustment* 2,571 2,496 2,806 2,735 2,693 7,873 8,351 Total revenue (TE)* $388,310 $377,979 $367,502 $367,500 $370,352 $1,133,791 $1,089,636 GAAP Noninterest expense $212,753 $215,979 $205,059 $202,333 $203,839 $633,791 $617,577 Amortization of Intangibles (2,694) (2,524) (2,113) (2,206) (2,292) (7,331) (7,207) Adjustments from supplemental disclosure items Sabal Trust Company acquisition expense — (5,911) — — — (5,911) — FDIC special assessment — — — — — — (3,800) Adjusted noninterest expense less amortization of intangibles $210,059 $207,544 $202,946 $200,127 $201,547 $620,549 $606,570 Efficiency Ratio** 54.10% 54.91% 55.22% 54.46% 54.42% 54.73% 55.67% *Taxable equivalent (TE) amounts are calculated using a federal tax rate of 21% ** The efficiency ratio is noninterest expense to total net interest income (TE) and noninterest income, excluding amortization of purchased intangibles and supplemental disclosure items noted above

Mid-Fourth Quarter 2025Update 11/10/2025 HANCOCK WHITNEY