EX-99.1

MINDWALK HOLDINGS CORP.

(the “Company”)

REVISED STATEMENT OF EXECUTIVE COMPENSATION

for the fiscal year ended April 30, 2025

Dated as of October 8, 2025

All monetary amounts herein are expressed in Canadian Dollars (“$”) unless otherwise stated.

For the purpose of this section:

“NEO” or “named executive officer” means each of the following individuals:

(a) each individual who, in respect of the Company, during any part of the most recently completed financial year, served as chief executive officer (“CEO”), including an individual performing functions similar to a CEO;

(b) each individual who, in respect of the Company, during any part of the most recently completed financial year, served as chief financial officer (“CFO”), including an individual performing functions similar to a CFO;

(c) in respect of the Company and its subsidiaries, each of the three most highly compensated executive officers, other than the CEO and CFO, at the end of the most recently completed financial year whose total compensation was more than $150,000;

(d) each individual who would be a named executive officer under paragraph (c) but for the fact that the individual was not an executive officer of the Company, and was not acting in a similar capacity, at the end of that financial year.

General

Based on the foregoing definition, during the financial year ended April 30, 2025, the Company had six named officers (“NEOs”), namely:

1.

Dr. Jennifer Bath, who has been CEO and President since February 22, 2018;

2.

Joseph Scheffler, who has been the interim CFO since February 24, 2025;

3.

Kristin Taylor, who was the former CFO from June 16, 2024 to January 16, 2025, having previously served as interim CFO since September 29, 2023;

4.

Dr. Ilse Roodink, who was the Chief Scientific Officer since July 1, 2021 to August 6, 2025;

5.

Kari Graber, who has been VP of Commercial Services since November 1, 2021, and has worked for the Company since May 1, 2018; and

6.

Shuji Sato, who has been VP of Innovative Solutions since November 2024, and has worked for the company since January 3, 2023.

Compensation Discussion and Analysis

Compensation Philosophy and Objectives

The Company’s executive compensation program is administered by the Board through the Compensation, Nomination and Governance Committee of the Company (the “Compensation, Nomination and Governance Committee”). The primary objectives of the executive compensation program include:

•

attracting and retaining high-quality senior executives, aligning executive compensation with long-term success of the Company, and

•

providing compensation that is competitive with that of comparable companies.

Compensation Elements

The Company’s executive compensation program consists of three elements, detailed below:

|

|

Compensation Element |

Purpose |

Base salary |

The Company provides a base salary to each NEO to attract and retain key employees and provide a cash payment to executives not tied to performance objectives or Common Share return. Base salary is determined and reviewed annually by the Compensation, Nomination and Governance Committee. |

Short-term cash incentives |

The Company provides cash incentive payments based on the overall performance of the Company according to corporate goals, as well as the individual performance of executives. The target incentive for the CEO is 70% of base salary, while other NEOs have a target incentive of from 30% to 50% of base salary. |

Stock incentive plan |

The Company provides stock option awards and restricted stock units to align executive compensation with the long-term success of the Company. |

Base salary is reviewed annually by the Compensation, Nomination and Governance Committee.

During the fiscal year ended April 30, 2025, the Compensation, Nomination and Governance Committee engaged Arnosti Consulting to complete a benchmarking analysis of the Company’s executive compensation program. The services of Arnosti Consulting were initially retained in 2021. The goal was to benchmark and provide recommendations for executive and director cash and equity compensation components. A total of 30 publicly traded peer companies of similar focus and market capitalization were included to complete the study. The benchmark group contained the following companies:

|

|

|

Compensation Benchmark Companies |

Aadi Bioscience, Inc. |

CorMedix, Inc. |

Kezar Life Sciences, Inc. |

Absci Corp. |

Cue Biopharma, Inc. |

Lantern Pharma, Inc. |

Aclaris Therapeutics, Inc. |

CytomX Therapeutics, Inc. |

MediciNova, Inc. |

AnaptysBio, Inc. |

DURECT Corporation |

MEI Pharma, Inc. |

Assembly Biosciences, Inc. |

GlycoMimetics, Inc. |

Pieris Pharmaceuticals, Inc. |

BioAtla, Inc. |

Harpoon Therapeutics, Inc. |

Rallybio Corp. |

BioVie, Inc. |

IGC Pharma, Inc. |

Scholar Rock Holding Corp. |

BriaCell Therapeutics, Inc |

Ikena Oncology, Inc. |

Solid Biosciences, Inc. |

Cara Therapeutics |

Immuneering Corp. |

Sutro Biopharma, Inc. |

Clene, Inc. |

Jounce Therapeutics, Inc. |

XBiotech, Inc. |

As a result of the study, the compensation of each NEO was adjusted effective July 1, 2024, to ensure competitive compensation as compared to the benchmark group.

The following table sets forth the fees billed to the Company by Arnosti Consulting for the financial years ended April 30, 2025 and 2024:

|

|

|

|

|

|

|

Fee Category |

Year Ended April 30, 2025

($) |

|

Year Ended April 30, 2024

($)

|

|

Executive Compensation-Related Fees (1) |

|

49,960 |

|

|

13,603 |

|

All Other Fees |

|

— |

|

|

— |

|

Total |

|

49,960 |

|

|

13,603 |

|

(1)

Fees disclosed under this heading are for the consultant’s services related to determining compensation for the Company’s directors and executive officers.

Short-term cash incentives are based on the financial performance of the Company and the achievement of individual performance objectives by each NEO. The Board reviews the Company’s performance against these targets annually and determines the NEO’s short-term incentive payment. The performance objectives and achievement criteria for the financial year ending April 30, 2025, have been reviewed and approved by the Compensation, Nomination and Governance Committee. These objectives consist of a weighted combination of corporate metrics and individual performance goals.

Corporate goals for year ending April 30, 2025:

•

Broaden and Strengthen Market Engagement for BioStrand Adoption

•

Enhance Organizational Effectiveness, Efficiency and Agility while Achieving Required Return on Investment

•

Strengthen Assets through Enhanced Data Generation and Strategic Technological Integration

The Board periodically awards stock options and restricted stock units to NEOs under the Company’s stock incentive plan to align executive compensation with the long-term success of the Company. The amount and terms of outstanding options and restricted stock units held by an executive are considered when determining whether and how new option and restricted stock unit grants should be made to the executive. The exercise periods of options are set at the date of grant.

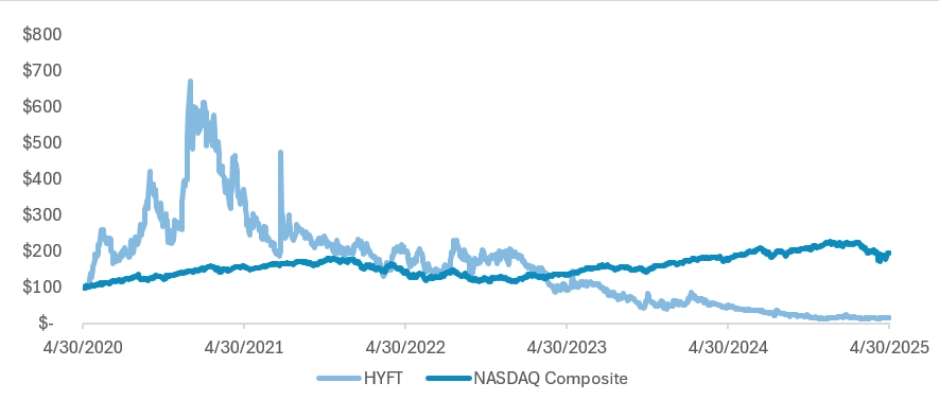

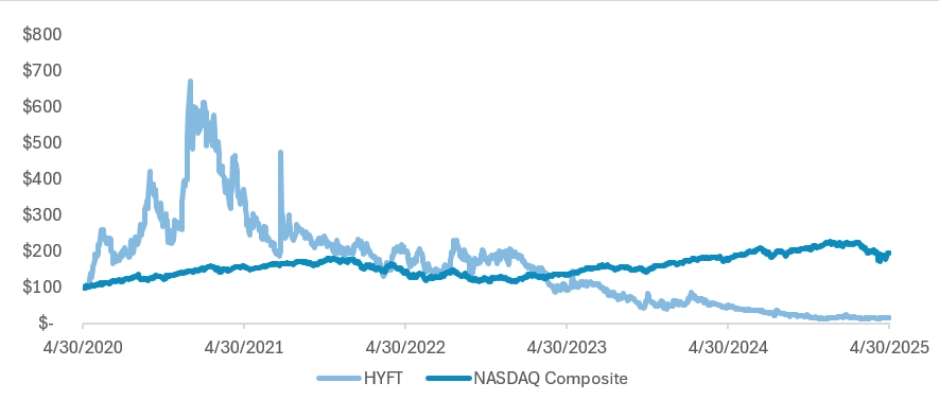

Performance Graph

On April 30, 2025, the closing price of the Company’s common shares (the “Common Shares”) on the Nasdaq Global Market exchange was U.S.$0.43. The following graph shows the cumulative return of U.S.$100 invested in the Common Shares on May 1, 2021, to the total return of the Nasdaq Composite Index.

Compensation paid to executives does not directly correlate with the above performance graph. The Company’s compensation philosophy is detailed under the heading entitled “Compensation Philosophy and Objectives” above and is not based on short-term performance of the Common Shares.

Compensation Governance

The Compensation, Nomination and Governance Committee comprises three independent directors: Kamil Isaev, Jon Lieber, and Dirk Witters.

Direct Experience Relevant to Executive Compensation

Kamil Isaev brings over 30 years of experience in artificial intelligence, semiconductor technologies, and global R&D operations. He has held senior leadership roles at Intel, Align Technology, Dell EMC, and others, leading R&D commercialization and AI-driven innovation strategy, which positions him well to evaluate and advise on performance objectives and incentive alignment grounded in technological and operational performance metrics.

Jon Lieber is an industry veteran with over 30 years of financial leadership in biotechnology and life sciences. He currently serves as Chief Financial Officer at Rallybio and has served as CFO at Applied Genetic Technologies Corporation (AGTC). His extensive background includes capital-raising, strategic planning, investor relations, and experience with Nasdaq governance, both as an executive and board member. He also serves on the board of Salarius Pharmaceuticals, contributing expertise in audit and governance functions.

Dirk Witters offers extensive finance, capital markets, and corporate advisory experience, accumulated through more than 20 years in KBC Group’s Corporate and Investment Banking, including executive leadership roles. Since 2019, he has served as an independent advisor and executive partner in a family office, guiding capital raising of EUR 250 million and making direct investments in healthcare and other sectors. He also served as President of Biostrand BV until its acquisition by the Company and maintains a track record in private equity and healthcare finance advisory.

Collectively, their backgrounds equip the Compensation, Nomination and Governance Committee with robust expertise in financial oversight, technology-driven business strategy, capital allocation, and incentive design, enabling informed oversight of executive compensation frameworks aligned with both corporate performance and technological or strategic milestones.

Compensation, Nomination and Governance Committee Responsibilities, Powers, and Operation

The Compensation, Nomination and Governance Committee’s mandate, as detailed in its charter, includes:

•

Reviewing and recommending to the Board the Company’s agreements with executive officers, compensation policies and plans, as well as key human resources policies.

•

The Compensation, Nomination and Governance Committee operates in accordance with governance best practices.

•

It is chaired by Dirk Witters (Committee Chair), with Kamil Isaev and Jon Lieber serving as members.

•

Dirk Witters, as Chairman of the Board, acts as principal liaison between independent directors and executive officers, reviews Board agendas, presides over Board and independent director meetings, and ensures that independent perspectives inform corporate governance.

•

The Compensation, Nomination and Governance Committee holds regular meetings (and as needed), with members participating in in-camera executive sessions without management present to promote candid oversight and independent judgment.

•

It reports its deliberations and recommendations to the full Board to facilitate sound decision-making regarding executive pay, performance goals, and governance policies.

Summary Compensation Table

The following table provides a summary of the compensation paid by the Company to each NEO of the Company for the financial years ended April 30, 2025, 2024, and 2023. All cash payments in the table below were made in U.S.

dollars, except for Dr. Roodink’s and Dr. Duplantis’, which were made in Euros and Canadian dollars, respectively. All amounts listed are in Canadian dollars, translated using the average daily exchange rate on the last day of the period provided by the Bank of Canada. The average daily exchange rates on the relevant date as reported by the Bank of Canada are:

|

|

|

Bank of Canada USD/CAD Average Daily Exchange Rate |

April 30, 2025 |

|

1.3812 |

April 30, 2024 |

|

1.3746 |

April 30, 2023 |

|

1.3578 |

|

|

|

Bank of Canada EUR/CAD Average Daily Exchange Rate |

April 30, 2025 |

|

1.5687 |

April 30, 2024 |

|

1.4695 |

April 30, 2023 |

|

1.3578 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-equity incentive plan compensation(1)

($) |

|

|

|

|

|

|

|

Name and principal position |

Year |

Salary

($) |

|

Share-based

awards

($) |

|

Option-based

awards

($) |

|

Annual

incentive

plans |

|

Long-term

incentive

plans |

|

Pension

value

($) |

|

All other

compensation

($) |

|

Total

compensation

($) |

|

Dr. Jennifer Bath(2) |

2025 |

|

877,062 |

|

|

— |

|

|

280,800 |

|

|

— |

|

|

— |

|

|

— |

|

|

(5) |

|

|

1,157,862 |

|

CEO, |

2024 |

|

731,989 |

|

|

— |

|

|

— |

|

|

273,353 |

|

|

— |

|

|

— |

|

|

(5) |

|

|

1,005,342 |

|

President, and

Director |

2023 |

|

713,558 |

|

|

— |

|

|

1,069,310 |

|

|

678,031 |

|

|

— |

|

|

— |

|

|

(5) |

|

|

2,460,899 |

|

Joseph Scheffler(3)

Interim CFO |

2025 |

|

146,929 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(5) |

|

|

146,929 |

|

Kristin Taylor (3) |

2025 |

|

259,103 |

|

|

— |

|

|

176,100 |

|

|

— |

|

|

— |

|

|

— |

|

|

(5) |

|

|

435,203 |

|

Former CFO |

2024 |

|

533,477 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(5) |

|

|

533,477 |

|

Dr. Ilse

Roodink |

2025 |

|

319,601 |

|

|

— |

|

|

90,300 |

|

|

— |

|

|

— |

|

|

— |

|

|

(5) |

|

|

409,901 |

|

CSO |

2024 |

|

276,930 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(5) |

|

|

276,930 |

|

|

2023 |

|

298,419 |

|

|

— |

|

|

142,360 |

|

|

78,297 |

|

|

— |

|

|

— |

|

|

(5) |

|

|

519,076 |

|

|

Shuji Sato

VP of Innovative Solutions

|

2025 |

|

290,052 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(5) |

|

|

290,052 |

|

|

2024 |

|

288,666 |

|

|

— |

|

|

— |

|

|

102,765 |

|

|

— |

|

|

— |

|

|

(5) |

|

|

391,431 |

|

|

2023 |

|

271,560 |

|

|

— |

|

|

42,708 |

|

|

— |

|

|

— |

|

|

— |

|

|

(5) |

|

|

314,268 |

|

Kari Graber |

2025 |

|

331,488 |

|

|

— |

|

|

62,400 |

|

|

— |

|

|

— |

|

|

— |

|

|

(5) |

|

|

393,888 |

|

VP of Commercial |

2024 |

|

273,599 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(5) |

|

|

273,599 |

|

Services |

2023 |

|

262,395 |

|

|

— |

|

|

177,950 |

|

|

76,312 |

|

|

— |

|

|

— |

|

|

(5) |

|

|

516,657 |

|

Notes:

(1)

Non-equity incentive plan compensation includes bonuses earned during the financial year and payable as of the year-end date. Cash payments are made upon approval by the Board following year-end.

(2)

Dr. Bath received no compensation in her capacity as director of the Company.

(3)

Ms. Taylor was appointed as interim CFO on September 19, 2023, and was employed though a consulting firm up to her June 16, 2024 hire date as permanent CFO until her departure on January 16, 2025. Her salary for the 2024 financial year represents compensation paid to the consulting firm. Ms. Taylor’s salary for the 2025 financial year represents compensation for the 8.5 months that she served as CFO. Mr. Scheffler was appointed as interim CFO on February 24, 2025 and therefore served as interim CFO for two months of the 2025 financial year.

(4)

No options have been adjusted, amended, cancelled, replaced or exercise price modified.

(5)

Perquisites, including property or other personal benefits provided to a NEO that are not generally available to all employees, did not exceed $50,000 or 10% of the NEO’s total salary for the financial year.

The Company uses the Black-Scholes option pricing model to calculate the fair value of stock options on their grant date. The Company applies this methodology to value the stock options as accurately as possible using observable market inputs. The assumptions used in the model and the resulting fair value for each issuance is shown below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Black-Scholes model inputs |

Optionee |

Year |

Fair value of

option

($) |

|

Number of

options

awarded |

|

Fair value of

award

($) |

|

Common

share price

on grant date

($) |

|

|

Exercise price

($) |

|

|

Expected life

(years) |

|

Risk-free

rate |

Dr. Jennifer Bath |

2025 |

|

1.040 |

|

|

270,000 |

|

|

280,800 |

|

|

0.860 |

|

(1) |

|

0.860 |

|

(1) |

|

10.0 |

|

|

2.88% |

|

2024 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

— |

|

2023 |

|

3.559 |

|

|

300,452 |

|

|

1,069,310 |

|

|

4.100 |

|

(1) |

|

4.100 |

|

(1) |

|

5.00 |

|

|

3.57% |

Shuji Sato |

2025 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

— |

|

2024 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

— |

|

2023 |

|

3.559 |

|

|

12,000 |

|

|

42,708 |

|

|

4.100 |

|

(1) |

|

4.100 |

|

(1) |

|

5.0 |

|

|

3.57% |

Kristin Taylor |

2025 |

|

1.040 |

|

|

204,767 |

|

|

176,100 |

|

|

0.860 |

|

(1) |

|

0.860 |

|

(1) |

|

— |

|

|

— |

|

2024 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

— |

Dr. Ilse Roodink |

2025 |

|

1.040 |

|

|

105,000 |

|

|

90,300 |

|

|

0.860 |

|

(1) |

|

0.860 |

|

(1) |

|

10.0 |

|

|

2.88% |

|

2024 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

— |

|

2023 |

|

3.559 |

|

|

40,000 |

|

|

142,360 |

|

|

4.100 |

|

(1) |

|

4.100 |

|

(1) |

|

5.00 |

|

|

3.57% |

Kari Graber |

2025 |

|

1.040 |

|

|

60,000 |

|

|

62,400 |

|

|

0.860 |

|

(1) |

|

0.860 |

|

(1) |

|

10.0 |

|

|

2.88% |

|

2024 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

— |

|

2023 |

|

3.559 |

|

|

50,000 |

|

|

177,950 |

|

|

4.100 |

|

(1) |

|

4.100 |

|

(1) |

|

5.00 |

|

|

3.57% |

Notes:

Outstanding Share-based Awards and Option-based Awards

The following table of compensation securities provides a summary of all compensation securities outstanding to each NEO as of April 30, 2025.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Option-based awards |

|

|

Share-based awards |

|

Name |

Issuance

date |

|

Number of

securities

underlying

unexercised

options

(#) |

|

Option

exercise

price

($) |

|

|

Option

expiration

date |

|

Value of

unexercised

in-the-money

options

($) |

Number of

shares or

units of

shares that

have not

vested

(#) |

Market or

payout

value of

share-based

awards that

have not

vested

($) |

|

Market or

payout

value of

vested share-

based

awards not

paid out or

distributed

($) |

|

Dr. Jennifer |

09/01/2020 |

|

|

210,000 |

|

|

8.500 |

|

|

09/01/2025 |

|

|

1,254,750 |

|

— |

|

— |

|

|

— |

Bath |

01/07/2022 |

|

|

120,000 |

|

|

7.940 |

|

|

01/07/2027 |

|

|

594,720 |

|

— |

|

— |

|

|

— |

|

02/19/2023 |

|

|

300,452 |

|

|

4.100 |

|

(1) |

02/19/2028 |

|

|

1,069,309 |

|

— |

|

— |

|

|

— |

|

08/03/2025 |

|

|

270,000 |

|

|

0.860 |

|

(1) |

08/03/2034 |

|

|

232,200

|

|

— |

— |

|

|

— |

|

Joseph Scheffler |

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

Kristin Taylor |

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

Dr. Ilse |

01/06/2021 |

|

|

15,000 |

|

|

20.300 |

|

|

01/06/2026 |

|

|

175,545

|

|

— |

|

— |

|

|

— |

Roodink |

01/07/2022 |

|

|

50,000 |

|

|

7.940 |

|

|

01/07/2027 |

|

|

247,800

|

|

— |

|

— |

|

|

— |

|

|

02/19/2023 |

|

|

40,000 |

|

|

4.100 |

|

(1) |

02/19/2028 |

|

|

142,360

|

|

— |

|

— |

|

|

— |

|

|

08/03/2025 |

|

|

105,000 |

|

|

0.860 |

|

(1) |

08/03/2034 |

|

|

90,300

|

|

— |

|

— |

|

|

— |

|

Shuji Sato |

|

02/19/2023 |

|

|

12,000 |

|

|

4.100 |

|

(1) |

|

02/19/2028 |

|

|

42,708

|

|

— |

|

— |

|

|

— |

|

Kari Graber |

09/01/2020 |

|

|

10,000 |

|

|

8.500 |

|

|

09/01/2025 |

|

|

59,750

|

|

— |

|

— |

|

|

— |

|

02/19/2023 |

|

|

50,000 |

|

|

4.100 |

|

(1) |

02/19/2028 |

|

|

177,950

|

|

— |

|

— |

|

|

— |

|

|

08/03/2025 |

|

|

60,000 |

|

|

0.860 |

|

(1) |

08//2034 |

|

|

51,600

|

|

— |

|

— |

|

|

— |

Incentive Plan Awards – Value Vested or Earned During the Year

The following table shows the incentive plan awards value vested or earned for each NEO for the fiscal year ended April 30, 2025:

|

|

|

|

|

|

|

|

|

Name |

Option-based awards –

Value vested during the year

($) |

|

Share-based awards –

Value vested during the year

($) |

|

Non-equity incentive plan

compensation – Value

earned during the year

($) |

Dr. Jennifer Bath |

|

237,623 |

|

|

— |

|

|

— |

Joseph Scheffler |

|

— |

|

|

— |

|

|

— |

Kristin Taylor |

|

18,344 |

|

|

— |

|

|

— |

Dr. Ilse Roodink |

|

31,365 |

|

|

— |

|

|

— |

Shuji Sato |

|

14,236 |

|

|

— |

|

|

— |

Kari Graber |

|

39,543 |

|

|

— |

|

|

— |

Director Compensation Table

The following table provides a summary of compensation paid by the Company to each director of the Company for the financial year ended April 30, 2025. Cash payments are made in U.S. dollars, translated using the USD/CAD average daily exchange rate on April 30, 2025.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name(1) |

|

Fees earned

($) |

|

Share-

based awards

($) |

|

Option-

based awards

($) |

|

Non-equity

incentive plan

compensation

($) |

|

Pension

value

($) |

|

All other

compensation

($) |

|

Total

($)

|

|

Mitch Levine (2) |

|

|

77,798 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

77,798 |

|

Kamil Isaev (3) |

|

|

— |

|

|

13,800 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

13,800 |

|

Chris Buyse (4) |

|

|

83,126 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

83,126 |

|

Dirk Witters |

|

|

94,619 |

|

|

4,600 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

99,219 |

|

Barry Springer(5) |

|

|

62,239 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

62,239 |

|

Notes:

(1)

The compensation of Dr. Jennifer Bath, a director and the Chief Executive Officer and President of the Company, is set out in the summary compensation table above in respect of NEOs. Dr. Bath did not receive any compensation for her role as a director of the Company.

(2)

Mitch Levine did not stand for re-election at the 2024 Annual General Meeting held on November 14, 2024 and therefore only served as director of the Company for 6.5 months during the financial year ended April 30, 2025.

(3)

Kamil Isaev was appointed to the Board effective February 24, 2025 and therefore only served as director of the Company for 2 months during the financial year ended April 30, 2025.

(4)

Chris Buyse ceased to be a Board member on February 24, 2025 and therefore only served as a director of the Company for 10 months during the financial year ended April 30, 2025.

(5)

Dr. Barry A. Springer ceased to be a Board member on November 14, 2024 and therefore only served as a director of the Company for 6.5 months during the financial year ended April 30, 2025.

The Company uses the Black-Scholes pricing model to calculate the fair value of stock options and restricted stock units on their grant date. The Company applies this methodology to value the stock options and restricted stock units as accurately as possible using observable market inputs. The assumptions used in the model and the resulting fair value for each issuance is shown below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Black-Scholes model inputs |

Awardee |

Year |

Fair value of

RSU

($) |

|

Number of

RSUs

awarded |

|

Fair value of

award

($) |

|

Common

share price

on grant date

($) |

|

|

Exercise price

($) |

|

|

Expected life

(years) |

|

Risk-free

rate |

Dirk Witters |

2025 |

|

0.40 |

|

|

11,500 |

(1)

|

|

4,600 |

|

|

0.40 |

|

(1) |

|

- |

|

|

|

3.00 |

|

|

2.59% |

Kamil Isaev |

2025 |

|

0.40 |

|

|

34,500 |

(1)

|

|

13,800 |

|

|

0.40 |

|

|

|

- |

|

|

|

3.00 |

|

|

2.59% |

Notes:

With respect to their service for the year following the Company’s annual general meeting in November 2024, Directors of the Company are paid a base annual retainer for various positions, detailed below:

|

|

|

|

|

Position |

|

Additional Annual Compensation

(U.S. $) |

|

Chair/Lead Independent Director |

|

|

65,000 |

|

Independent Director, on at least one Committee |

|

|

45,000 |

|

Independent Director, if not on at least one Committee |

|

|

40,000 |

|

Annual compensation is provided for the year beginning at the annual general meeting of Shareholders, and payments are made quarterly in arrears. Fees earned in the Director Compensation Table reflect cash compensation during the fiscal year ended April 30, 2025.

Option-based director awards adopted as of the 2024 AGM are 23,000 options to each director on appointment to the Board, and an award of 11,500 options to each director annually.

Director Outstanding Share-based Awards and Option-based Awards

The following table of compensation securities provides a summary of all compensation securities outstanding to each director as of April 30, 2025.

|

|

|

|

|

|

|

Option-based awards |

|

|

Share-based awards |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (2) |

Issuance

date |

Number of

securities

underlying

unexercised

options

(#) |

|

Option

exercise

price

($) |

|

|

Option

expiration

date |

Value of

unexercised

in-the-

money

options

($) |

|

|

Number of

shares or

units of

shares that

have not

vested

(#) |

|

Market or

payout value

of share-

based

awards

that have

not vested

($) |

|

Market or

payout value

of vested

share-based

awards not

paid out or

distrib |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

uted

($) |

|

Dirk Witters |

1/19/2024 |

|

60,000 |

|

|

1.480 |

|

(1) |

1/19/2029 |

|

86,175 |

|

|

|

11,500 |

|

|

4,600 |

|

|

— |

|

Kamil Isaev |

—

|

|

—

|

|

|

—

|

|

|

—

|

|

—

|

|

|

|

28,271 |

|

|

11,308 |

|

|

2,492 |

|

(2)

The Option-based awards and Share-based awards of Dr. Jennifer Bath, a director and the Chief Executive Officer and President of the Company, is set out under the “Outstanding Share-based Awards and Option-based Awards” table in respect of NEOs above.

Incentive Plan Awards – Value Vested or Earned During the Year

The following table shows the incentive plan awards value vested or earned for each Director for the fiscal year ended April 30, 2025:

|

|

|

|

|

|

|

|

|

|

Name(1) |

Option-based awards –

Value vested during the year

($) |

|

Share-based awards –

Value vested during the year

($) |

|

Non-equity incentive plan

compensation – Value

earned during the year

($) |

|

Dirk Witters |

46,242 |

|

|

|

— |

|

|

— |

|

Kamil Isaev |

— |

|

|

|

2,492 |

|

|

— |

|

(1)

The Incentive-plan awards of Dr. Jennifer Bath, a director and the Chief Executive Officer and President of the Company, is set out under the “Incentive Plan Awards” table in respect of NEOs above.

Stock Incentive Plan

On April 7, 2025, the Board of Directors adopted a new Stock Incentive Plan (the “Stock Incentive Plan”) to replace the Company’s prior Stock Option Plan adopted by the Board of Directors on May 4, 2021 (the “Prior Plan”). The Stock Incentive Plan is administered by the Compensation, Nomination and Governance Committee and is intended to align employees, officers, non-employee directors, consultants, independent contractors and advisors (“Eligible Persons”) with the interests of the Company. Pursuant to the Stock Incentive Plan, the Compensation, Nomination and Governance Committee is authorized to grant stock options, stock appreciation rights, restricted stock and restricted stock units, dividend equivalents and other stock-based awards to Eligible Persons. The number of Common Shares that may be issued under all awards granted under the Stock Incentive Plan shall equal 5,620,254 Shares.

While no additional options can be granted by the Company under the Prior Plan following the adoption of the Stock Incentive Plan, all outstanding options previously granted under the Prior Plan remain outstanding and subject to the terms of the Prior Plan.

Shareholder Rights Plan

On October 17, 2019, the Board of Directors approved the Company’s shareholder rights plan (the “Shareholder Rights Plan”) which was ratified and confirmed by the shareholders at the annual general meeting of shareholders of the Company held on November 22, 2019 and last approved by the shareholders of the Company on December 13, 2022. The Shareholder Rights Plan was implemented to create mechanisms to assist in maximizing shareholder value and to ensure, to the extent possible, that all shareholders of the Company are treated fairly in connection with any take-over bid or other acquisition of control of the Company.

Purusant to the terms of the Shareholder Rights Plan, shareholder approval of the Shareholder Rights Plan is required every three years failing which the Shareholder Rights Plan and all outstanding Rights (as defined therein) are terminated immediately. As the Company is not seeking shareholder approval of the Shareholder Rights Plan at the annual general meeting to be held on October 9, 2025, the Shareholder Rights Plan and all outstanding Rights will be terminated immediately following the meeting.

Employment, Consulting and Management Agreements

Except as outlined below, the Company has not entered into a written management contract with any of its directors or officers.

Dr. Jennifer Bath

Dr. Jennifer Bath entered into an executive employment agreement with the Company on January 1, 2020, as amended pursuant to an amending agreement dated March 12, 2025, pursuant to which Dr. Bath is paid U.S.$635,000 per annum for providing services as President and CEO of the Company. The Company has also agreed to pay Dr. Bath a discretionary bonus equal to 70% of the base salary payable upon achievement of performance targets mutually agreed to with the Board. In the event of termination without cause, Dr. Bath would be entitled to the equivalent of 12 months’ salary plus a lump sum payment equal to Dr. Bath’s target discretionary bonus for the fiscal year in which the termination occurs, pro-rated for any partial fiscal year based on the number of full months worked in the fiscal year. If Dr. Bath had been terminated on April 30, 2025, she would have been entitled to U.S.$1,079,500.

Joseph Scheffler

Mr. Scheffler was appointed Interim CFO on February 1, 2025, as the Company engaged a professional services consulting firm. Under the terms of the engagement, the consulting firm supplied an experienced finance executive who fulfilled the responsibilities of the CFO on an interim basis. As a result of this arrangement, the Company incurred consulting expenses of approximately U.S.$108,738 in fiscal year 2025, which are included in general and administrative expenses.

Kari Graber

Ms. Graber entered into an executive employment agreement with the Company on July 1, 2019, as amended on March 12, 2025 (the “Graber Employment Agreement”) pursuant to which Ms. Graber was paid U.S.$135,200 per annum, subject to periodic review and adjustment as part of the Company’s annual executive compensation review, for providing services as VP of Commercial Services of the Company. Pursuant to the terms of the Graber Employment Agreement, the Company will pay Ms. Graber an annual bonus payable upon achievement of targets mutually agreed to with the Chief Business Officer of the Company. During 2022, the Board approved an adjustment to Ms. Graber’s base salary to U.S.$200,000 per annum and an annual bonus of 30% of base salary. In July 2024, the Board approved a further adjustment to the base salary payable to Ms. Graber pursuant to the Graber Employment Agreement to U.S.$240,000, with no change in the bonus percentage of base salary.

Dr. Ilse Roodink

Dr. Ilse Roodink entered into an executive employment agreement with ImmunoPrecise Antibodies (Europe) B.V. (“IPA Europe”), an indirect, wholly-owned subsidiary of the Company, commencing on January 1, 2025 (the “Roodink Employment Agreement”), pursuant to which Dr. Roodink was paid € 20,165.73 per month, subject to periodic review and adjustment as part of the Company’s annual executive compensation review, for providing services as Chief Scientific Officer of IPA Europe. The Company will pay Dr. Roodink an annual bonus payable upon achievement of targets mutually agreed to with the President and Chief Executive Officer of IPA Europe. Pursuant to the terms of the Roodink Employment Agreement, each of IPA Europe and Dr. Roodink may terminate the Roodink Employment Agreement upon the provision of notice of termination to the other pursuant to the statutory notice period required under applicable Dutch employment law. Dr. Roodink shall not be entitled to any severance or termination benefits upon termination of his employment other than as required pursuant to applicable Dutch employment law.

Kristin Taylor

Ms. Taylor entered into an executive employment agreement with the Company on June 16, 2024 (the "Taylor Employment Agreement”) pursuant to which Ms. Taylor was paid U.S.$400,000 per annum, subject to periodic review and adjustment as part of the Company’s annual executive compensation review, for providing services as CFO of the Company. Under the terms of the Taylor Employment Agreement, on August 3, 2024 the Board of Directors of the Company approved an initial grant of stock options to purchase 204,767 Common Shares, including: (i) 4-year vesting commencing retroactive to September 18, 2023, with 25% vesting on September 18, 2024, and the balance vesting in equal 1/36 increments from September 18, 2024, onwards; and (ii) a ten-year exercise period from the grant date.

Shuji Sato

Dr. Sato entered into an executive employment agreement with the Company on December 1, 2024, pursuant to which Dr. Sato was paid U.S.$210,000 per annum, subject to periodic review and adjustment as part of the Company’s annual executive compensation review, for providing services as VP of Innovative Solutions of the Company. The Company will pay Dr. Sato an annual bonus payable upon achievement of targets mutually agreed to with the CEO.

Change of Control Benefits

Dr. Jennifer Bath

The Company has entered into a change of control agreement (the “Change of Control Agreement”) with Dr. Jennifer Bath, which provides for payments in the event of a change of control of the Company. The term “Change of Control” is defined as meaning that a person or group of persons acting jointly or in concert acquires, beneficially or otherwise (whether by purchase, exchange, amalgamation, merger, consolidation, or otherwise), directly or indirectly, in one transaction or in a series of related transactions, (a) Control (as defined below) of the Company, or (b) all or substantially all of the assets of the Company. The term “Control” is defined as meaning the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of the Company through the ownership of more than 50% of the voting securities.

If certain circumstances occur within 18 months following a Change of Control, the Change of Control Agreement provides for payments to be made to Dr. Bath. These circumstances include: (a) the assignment to Dr. Bath of any duties which are materially inconsistent, in an adverse respect, with her position, authority, status, duties, or responsibilities prior to the Change of Control, other than the assignment of duties related to the transition to a person who gains control of the Company or who acquires all or substantially all of the assets of the Company pursuant to the Change of Control (a “Successor”) that are reasonably commensurate with Dr. Bath’s position; (b) the removal or elimination of one or more of Dr. Bath’s duties, responsibilities, or functions that were material to her position, authority, status, duties or responsibilities prior to the Change of Control; (c) a reduction in Dr. Bath’s base salary or annual bonus compensation opportunity; (d) a requirement that Dr.

Bath relocate to or be based at a location which is 50 miles or more from the location where she was based immediately prior to the Change of Control; (e) the failure to continue Dr. Bath’s participation in substantially all of the insured group benefit plans (or substantially equivalent successor plans, programs, or policies) as were in effect for Dr. Bath immediately prior to the Change of Control, including medical, dental, life, and other benefits plans, but excluding short and long term disability coverage and out of country medical coverage (“Benefit Plans”); and (f) any other change in the terms and conditions of Dr. Bath’s employment that would constitute a constructive dismissal at common law (each such circumstance, a “Triggering Event”).

In the event that Dr. Bath’s employment with the Company is terminated: (a) by Dr. Bath within three months after a Triggering Event where just cause for the Company to terminate Dr. Bath’s employment does not exist; or (b) by the Company within 3 months precedeing or the 12 months subsequent to a Change of Control where just cause does not exist and other than (i) in response to a resignation by Dr. Bath that is not a resignation set out in (a) above; and (ii) where a Successor offers to employ or engage Dr. Bath immediately following a Change of Control on terms and conditions that, on the whole, are at least as favourable to Dr. Bath as she enjoyed immediately prior to the earlier of the termination date and the Change of Control, excluding the terms of the Change of Control Agreement (either such termination, an “Involuntary Termination”), then the Change of Control Agreement entitles Dr. Bath to receive: (c) an amount equal to 24 months of her salary; (d) an amount equal to double the full target bonus entitlement for the fiscal year in which the Involuntary Termination occurred as well as any earned but unpaid bonus entitlement for the fiscal year preceding the Involuntary Termiatnion.

In addition, if an Involuntary Termination occurs, Dr. Bath’s rights and entitlements under any incentive plans will vest on an accelerated basis and the exercise of all right will be determined by the terms and conditions of such incentive plans, and the Company will continue to provide Dr. Bath with coverage under Benefit Plans for a period of 18 months following such Involuntary Termination, subject to Dr. Bath’s timely election of continued coverage.

The following table sets forth an estimated aggregate amount that Dr. Bath would have been entitled to receive pursuant to the Change of Control Agreement (assuming the continuation of coverage under all applicable Benefits Plans) if an Involuntary Termination had occurred on April 30, 2025:

|

|

|

|

|

Change of control compensation based on

salary and discretionary bonus

(U.S.$) |

Entitlements under

incentive plans |

|

Total

(U.S.$) |

2,603,556 |

|

|

|

2,603,556 |

Kari Graber

Pursuant to the terms of the Graber Employment Agreement: (a) the Company may terminate the employment of Ms. Graber without cause, upon which Ms. Graber shall be entitled to: (i) any earned but unpaid base salary and vacation pay up to and including the effective date of termination; (ii) the equivalent of six (6) months of the annual base salary in effect at the time of termination; (iii) one-half of Ms. Graber’s target annual bonus entitlement in the year in which the termination occurs; and (iv) continuation of health insurance coverage (COBRA) for six (6) months after the date of termination in the event Ms. Graber has elected to receive insurance continuation coverage; and (b) in the event that Ms. Graber’s employment is terminated for Just Cause, Ms. Graber shall not be entitled to the payment of any benefits or severance other than any earned but unpaid base salary and vacation pay up to and including the effective date of termination and the payment of any other entitlements pursuant to applicable employment legislation. If within twelve (12) months following the occurrence of a Change of Control, Ms. Graber’s employment is terminated by the Company without cause, or within three (3) months following the occurrence of a Change of Control, Ms. Graber terminates her employment with the Company for Good Reason, she shall be entitled to receive all entitlements payable in the event of a termination by the Company without cause as described above, in addition to accelerate vesting of all stock options, restricted stock units and other equity incentive compensation held by Ms. Graber at the applicable time, such that all such securities of the Company held by Ms. Graber on the effective date of termination shall be fully vested.

The following table sets forth the estimated amounts payable to Ms. Graber under certain circumstances in the event that a termination of her employment has occurred on April 30, 2025:

|

|

|

|

Compensation Element |

Termination Without Cause |

Termination for Just Cause |

Termination following a Change of Control |

Base Salary |

U.S.$120,000 |

None |

U.S.$120,000 |

Annual Bonus |

U.S.$36,000 |

None |

U.S.$36,000 |

Pursuant to the Graber Employment Agreement:

(a)

“Just Cause” means any wrongful or inappropriate conduct of Kari Graber in the performance of her roles and responsibilities as VP of Commercial Services of the Company;

(b)

“Change of Control” means that an individual, partnership, body corporate, limited liability company, association, trust or a personal representative or group of any of the foregoing acquires, beneficially or otherwise (whether by purchase, exchange, amalgamation, merger, consolidation or otherwise), directly or indirectly, in one transaction or in a series of related transactions:

(i)

the direct or indirect ownership of, or control or direction over, more than 50% of the voting securities of the Company and as a result of which are in a position to exercise effective control over the Company for the first time; or

(ii)

all or substantially all of the Company’s assets; and

(c)

“Good Reason” means the occurrence of any of the following events without Kari Graber’s prior written consent:

(i)

a material change in Kari Graber’s overall authority and responsibilities with the Company including a material and fundamental change in the nature or scope of the duties of Kari Graber as VP of Commercial Services of the Company;

(ii)

a material decrease in Kari Graber’s base salary, benefits, or annual bonus compensation opportunity;

(iii)

a requirement that Kari Graber relocate to or be based at a location which is fifty (50) miles or more from the location where she was based immediately prior to the Change of Control; or

(iv)

any other change in the terms and conditions of Kari Graber’s employment that would constitute a constructive discharge.

Oversight and Description of Director and NEO Compensation

The Company’s executive compensation program is administered by the Compensation, Nomination and Governance Committee. The Compensation, Nomination and Governance Committee’s responsibilities include reviewing and making recommendations to the Board with respect to the adequacy and form of compensation to all executive officers and directors of the Company, making recommendations to the Board in respect of granting of stock options and restricted stock units to management, directors, officers and other employees and consultants of the Company, and monitoring the performance of the Company’s executive officers. On October 14, 2024, the Remuneration and Nomination Committee and the Governance Committee were merged to form the Remuneration, Nomination and Governance Committee. In April 2025, the Remuneration, Nomination and Governance Committee’s name was changed to the Compensation, Nomination and Governance Committee. The Compensation, Nomination and Governance Committee performs the functions and has the mandate of the former Remuneration and Nomination Committee and the former Governance Committee. The members of the Compensation, Nomination and Governance Committee are Kamil Isaev, Dirk Witters and Jon Lieber, each of whom are independent within the meaning of Section 1.4 of National Instrument 52-110 – Audit Committees (“NI 52-110”) and individually and collectively possess the requisite knowledge, skill and experience in governance and compensation matters, including human resource management, executive compensation matters and general business leadership, to fulfill the committee’s mandate.

Executive compensation awarded to the NEOs consists of a combination of base salary, short-term cash incentives, and options and restricted stock units granted under the stock incentive plan. The Company does not presently have a long-term incentive plan for its NEOs.

There is no policy or target regarding allocation between cash and non-cash elements of the Company’s compensation program.

In setting compensation rates for NEOs, the Company compares the amounts paid to them with the amounts paid to executives in comparable positions at other comparable companies. The Company’s compensation payable to the NEOs is based upon, among other things, the responsibility, skills, and experience required to carry out the functions of each position held by each NEO and varies with the amount of time spent by each NEO in carrying out his or her functions on behalf of the Company. The grant of stock options and restricted stock units, as a key component of the executive compensation package, enables the Company to attract and retain qualified executives. Stock option and restricted stock unit grants are based on the total of awards available under the Company's Stock Incentive Plan. In granting awards, the Board reviews the total of awards available under the Company's Stock Incentive Plan, recommends grants to newly retained executive officers at the time of their appointment, and considers recommending further grants to executive officers from time to time thereafter. The amount and terms of outstanding awards held by an executive are taken into account when determining whether and how new awards should be granted to the executive. The exercise periods, if applicable, are to be set at the date of grant. The awards grants may contain vesting provisions in accordance with the Company’s Stock Incentive Plan.

Except as otherwise disclosed herein, the Company did not make any changes to its compensation policies during or after the fiscal year ended April 30, 2025.

Directors, officers, and employees of the Company are not prohibited from the practice of selling “short” securities of the Company and the practice of buying or selling a “call” or “put” or any other derivative security or financial instrument in respect of any securities of the Company.

The Compensation, Nomination and Governance Committee reviews, from time to time and at least once annually, the risks, if any, associated with the Company’s compensation program at such time. As at the date hereof, the Compensation, Nomination and Governance Committee has not identified any risks associated with the Company’s compensation program that would be reasonably likely to have a material adverse effect on the Company. Under the compensation program, the Compensation, Nomination and Governance Committee and the Board consider risks associated with executive compensation and does not believe that the Company’s executive compensation policies and practices encourage its executive officers to take inappropriate or excessive risks. Aside from a fixed base salary and fixed or discretionary bonus, NEOs are compensated through the granting of options and restricted stock units which is compensation that is both “at risk” and associated with long-term value creation. The value of such compensation is dependent upon shareholder return over the applicable vesting period, which reduces the incentive for executives to take inappropriate or excessive risks as their long-term compensation is at risk.

Pension

The Company does not provide any pension benefits for directors or executive officers.

**************

EQUITY COMPENSATION PLAN INFORMATION

The following table sets out those securities of the Company which have been authorized for issuance under the equity compensation plans of the Company, as of the end of the Company’s most recently completed financial year ended April 30, 2025:

|

|

|

|

Plan Category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights

(a)

|

Weighted-average exercise price of outstanding options, warrants and rights

(b)

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

(c)

|

|

Equity compensation plans approved by the security holders

(prior Stock Option Plan)

|

2,160,686 |

$7.52 |

Nil(1) |

|

Equity compensation plans not approved by the security holders

(new Stock Incentive Plan)

|

46,000 |

- |

5,574,254(2) |

Total |

2,206,686 |

- |

5,574,254 |

(1)

Upon the adoption of the Stock Incentive Plan, no additional options may be granted under the Stock Option Plan.

(2)

Based on 5,620,254, being the total number of Common Shares reserved and authorized for issuance pursuant to the Stock Incentive Plan.