2025 Third Quarter Review Nov. 6, 2025

Forward-looking Statements COMPANY INFORMATION Black Hills Corporation P.O. Box 1400Rapid City, SD 57709-1400 NYSE Ticker: BKH www.blackhillscorp.com Company Contacts Kimberly Nooney Senior Vice President and CFO 605-721-2370 kim.nooney@blackhillscorp.com Sal DiazDirector of Investor Relations 605-399-5079sal.diaz@blackhillscorp.com This presentation includes “forward-looking statements” as defined by the Securities and Exchange Commission. We make these forward-looking statements in reliance on the safe harbor protections provided under the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this presentation that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements. This includes, without limitations, our 2025 earnings guidance, long-term growth target and our expectations for regulatory filings for and the closing of the merger with NorthWestern Energy. These forward-looking statements are based on assumptions which we believe are reasonable based on current expectations and projections about future events and industry conditions and trends affecting our business. However, whether actual results and developments will conform to our expectations and predictions is subject to a number of risks and uncertainties that, among other things, could cause actual results to differ materially from those contained in the forward-looking statements, including without limitation, the risk factors described in Item 1A of Part I of our 2024 Annual Report on Form 10-K, Exhibit 99.4 to our Current Report on Form 8-K filed on Sept. 15, 2025, Item 1A of our forthcoming Quarterly Report on Form 10-Q for the quarter ended Sept. 30, 2025, and other reports that we file with the SEC from time to time, and the following: The accuracy of our assumptions on which our earnings guidance and growth target are based; Our ability to obtain adequate cost recovery for our utility operations through regulatory proceedings and favorable rulings on periodic applications to recover costs for capital additions, plant retirements and decommissioning, fuel, transmission, purchased power and other operating costs, and the timing in which new rates would go into effect; Our ability to complete our capital program in a cost-effective and timely manner; Our ability to execute on our strategy; Our ability to successfully execute our financing plans; The effects of changing interest rates; Our ability to achieve our greenhouse gas emissions intensity reduction goals; The impact of future governmental regulation; Our ability to overcome the impacts of supply chain disruptions on availability and cost of materials; Our ability to obtain sufficient insurance coverage at acceptable costs and whether such coverage will protect us against significant losses; The effects of inflation, tariffs and volatile energy prices; The expected timing and likelihood of completion and our ability to realize the anticipated benefits of the proposed merger with NorthWestern Energy Group, Inc., including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the proposed acquisition that could reduce anticipated benefits or give rise to the termination of the merger; and Other factors discussed from time to time in our filings with the SEC. New factors that could cause actual results to differ materially from those described in forward-looking statements emerge from time to time, and it is not possible for us to predict all such factors, or the extent to which any such factor or combination of factors may cause actual results to differ from those contained in any forward-looking statement. We assume no obligation to update publicly any such forward-looking statements, whether as a result of new information, future events or otherwise. MERGER-RELATED INFORMATION No Offer or Solicitation This document is for informational purposes only and is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. Important Information and Where to Find It Black Hills intends to file a registration statement on Form S-4 with the SEC to register the shares of Black Hills’ common stock that will be issued to NorthWestern stockholders in connection with the pending merger transaction. The registration statement will include a joint proxy statement of Black Hills and NorthWestern that will also constitute a prospectus of Black Hills. The definitive joint proxy statement/prospectus will be sent to the stockholders of each of Black Hills and NorthWestern in connection with the pending merger transaction. Additionally, Black Hills and NorthWestern will file other relevant materials in connection with the pending merger transaction with the SEC. Investors and security holders are urged to read the registration statement and joint proxy statement/prospectus when they become available (and any other documents filed with the SEC in connection with the transaction or incorporated by reference into the joint proxy statement/prospectus) because such documents will contain important information regarding the pending merger transaction and related matters. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC by Black Hills or NorthWestern through the website maintained by the SEC at http://www.sec.gov or by contacting the investor relations department of Black Hills or NorthWestern at investorrelations@blackhillscorp.com or travis.meyer@northwestern.com, respectively. Before making any voting or investment decision, investors and security holders of Black Hills and NorthWestern are urged to read carefully the entire registration statement and joint proxy statement/prospectus when they become available, including any amendments thereto (and any other documents filed with the SEC in connection with the pending merger transaction) because they will contain important information about the pending merger transaction. Free copies of these documents may be obtained as described above. Participants in Solicitation Black Hills, NorthWestern and certain of their directors and executive officers may be deemed participants in the solicitation of proxies from the stockholders of each of Black Hills and NorthWestern in connection with the pending merger transaction. Information regarding the directors and executive officers of Black Hills and NorthWestern and other persons who may be deemed participants in the solicitation of the stockholders of Black Hills or of NorthWestern in connection with the pending merger transaction will be included in the joint proxy statement/prospectus related to the pending merger transaction, which will be filed by Black Hills with the SEC. Information about the directors and executive officers of Black Hills and their ownership of Black Hills common stock can also be found in Black Hills’ filings with the SEC, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2024, which was filed on February 12, 2025, under the header “Information About Our Executive Officers,” and its Proxy Statement on Schedule 14A, which was filed on March 14, 2025, under the headers “Election of Directors” and “Security Ownership of Management and Principal Shareholders,” and other documents subsequently filed by Black Hills with the SEC. Information about the directors and executive officers of NorthWestern and their ownership of NorthWestern common stock can also be found in NorthWestern’s filings with the SEC, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2024, which was filed on February 13, 2025, under the header “Information About Our Executive Officers” and its Proxy Statement on Schedule 14A, which was filed on March 12, 2025, under the headers “Election of Directors” and “Who Owns our Stock”. To the extent any such person's ownership of Black Hills’ or NorthWestern’s securities, respectively, has changed since the filing of such proxy statement, such changes have been or will be reflected on Forms 3, 4 or 5 filed with the SEC. Additional information regarding the interests of such participants will be included in the joint proxy statement/prospectus and other relevant documents regarding the pending merger transaction filed with the SEC when they become available.

BKH | 2025 Third Quarter Review | Nov. 6, 2025 | Reaffirmed full-year adjusted earnings guidance Completed 2025 equity issuance of $220 million* and debt refinancing Maintained strong balance sheet to enable growth Delivering on Our Commitments to Stakeholders Reached settlement for Nebraska Gas rate review Constructing Ready Wyoming transmission expansion project on track to be placed in service by year-end Commenced construction on 99 MW Lange II generation project in Rapid City; expect to be in service in 2H 2026 Engaged with high-quality partners representing 3 GW+ of data center load requests Delivering industry-leading reliability Recognized by Escalent as 2025 Most Trusted Utility Brand and 2025 Easiest Utilities to do Business With BKH | 2025 Third Quarter Review | Nov. 6, 2025 | Advancing Regulatory and Growth Initiatives Providing Excellent Operational Performance Delivering on Financial Commitments * 2025 equity issuance net of fees

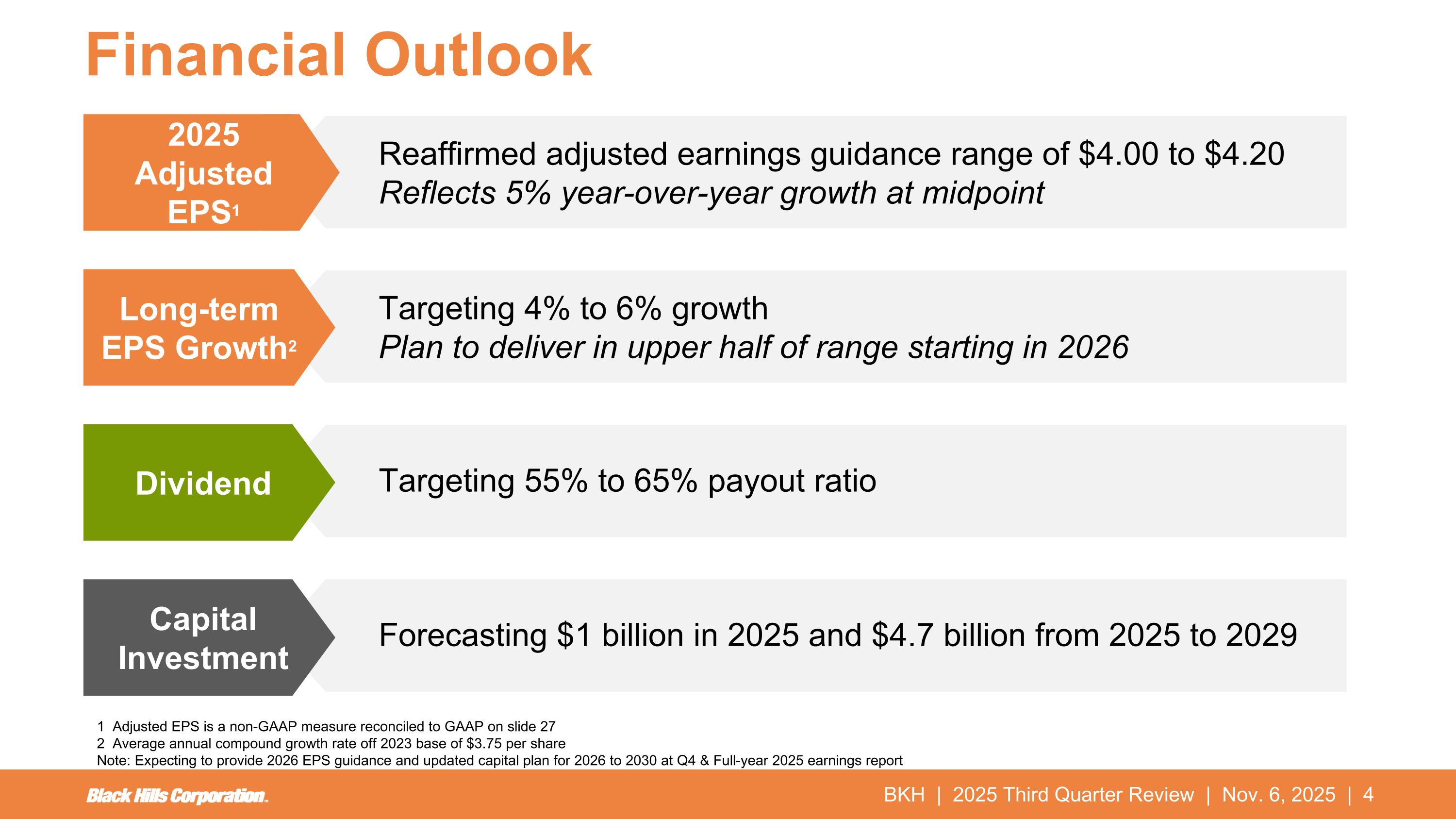

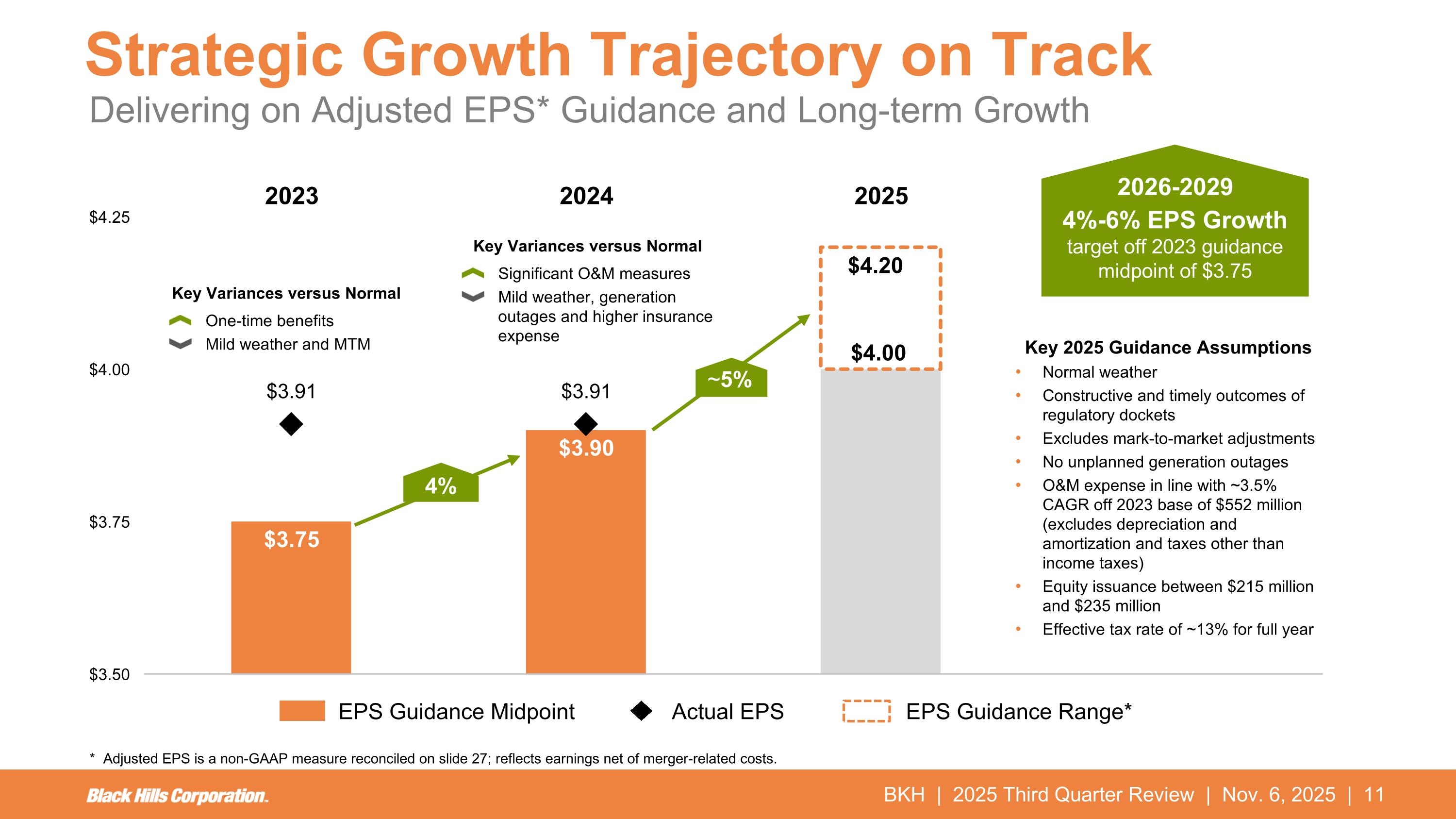

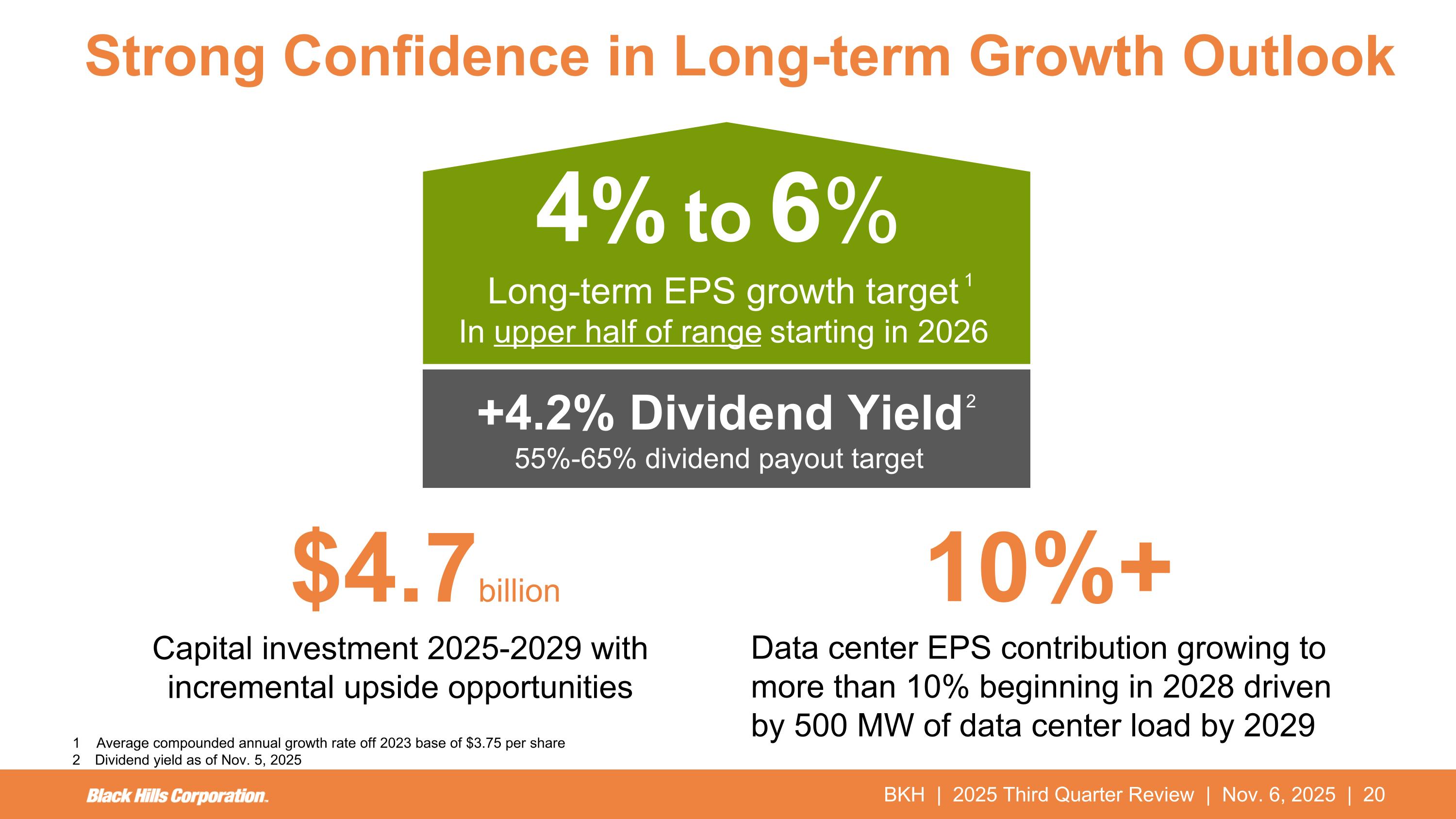

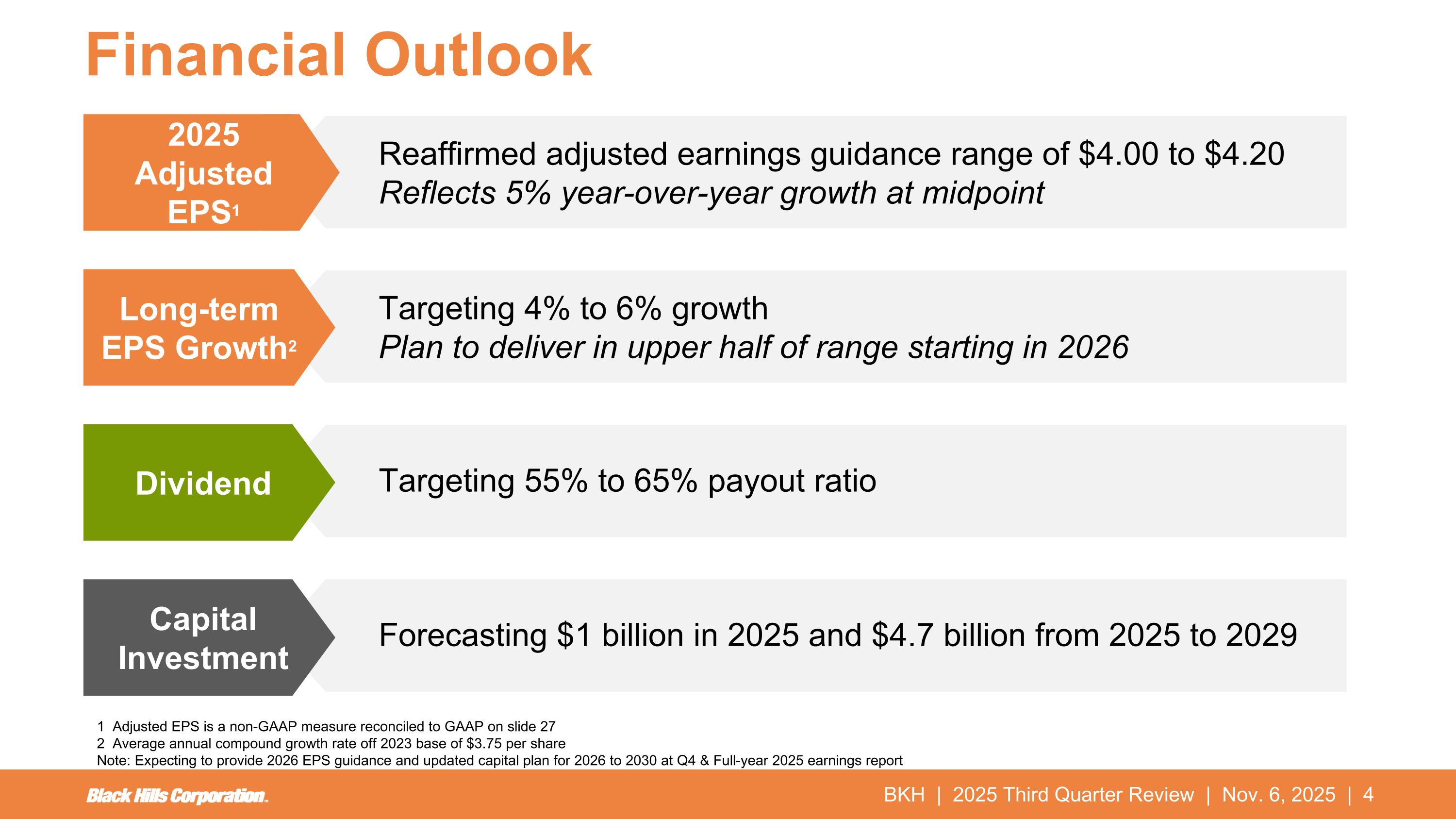

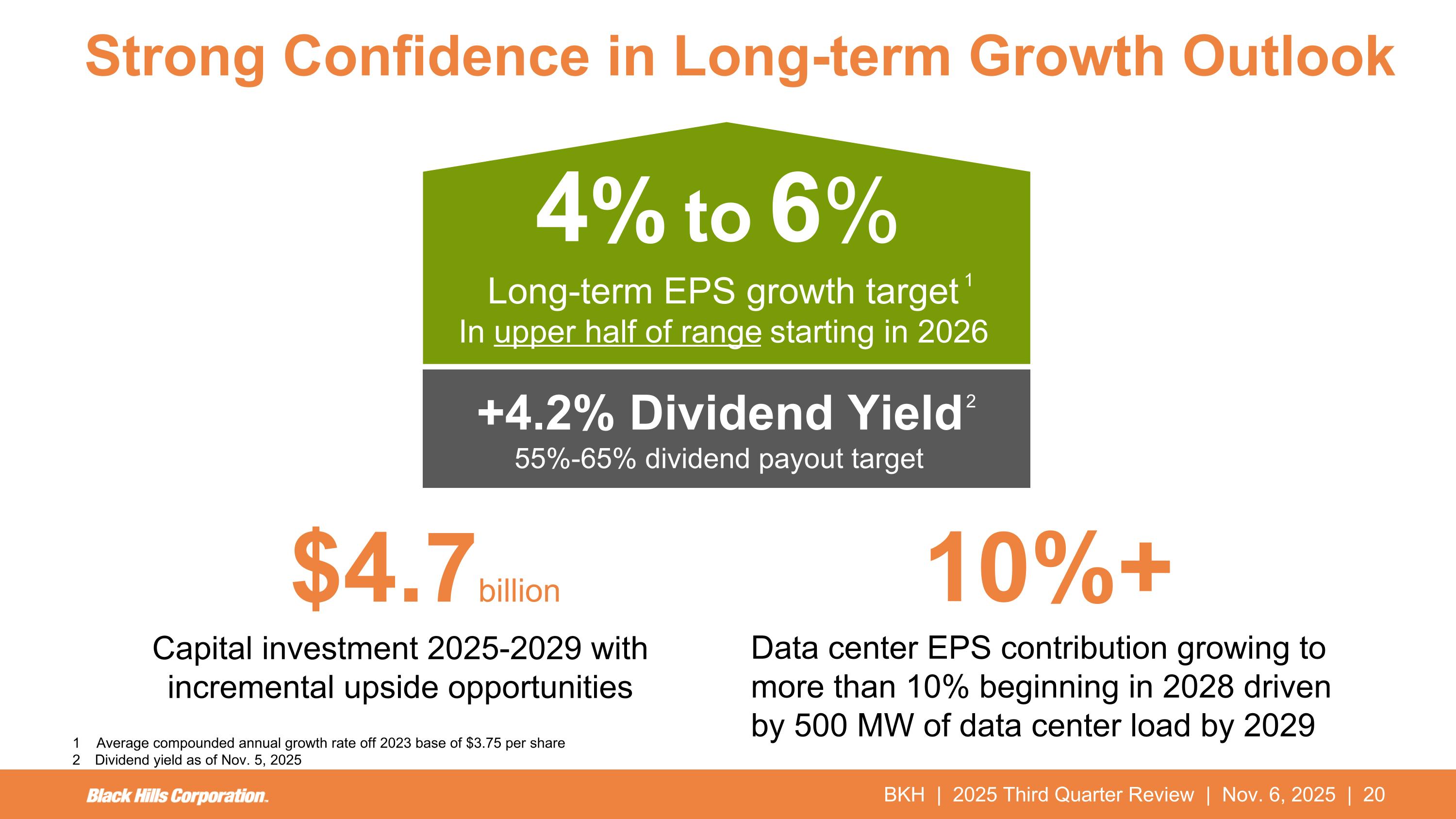

BKH | 2025 Third Quarter Review | Nov. 6, 2025 | 1 Adjusted EPS is a non-GAAP measure reconciled to GAAP on slide 27 2 Average annual compound growth rate off 2023 base of $3.75 per share Note: Expecting to provide 2026 EPS guidance and updated capital plan for 2026 to 2030 at Q4 & Full-year 2025 earnings report Financial Outlook Targeting 55% to 65% payout ratio Dividend Targeting 4% to 6% growth Plan to deliver in upper half of range starting in 2026 Long-term EPS Growth2 Forecasting $1 billion in 2025 and $4.7 billion from 2025 to 2029 Capital Investment Reaffirmed adjusted earnings guidance range of $4.00 to $4.20Reflects 5% year-over-year growth at midpoint 2025 Adjusted EPS1

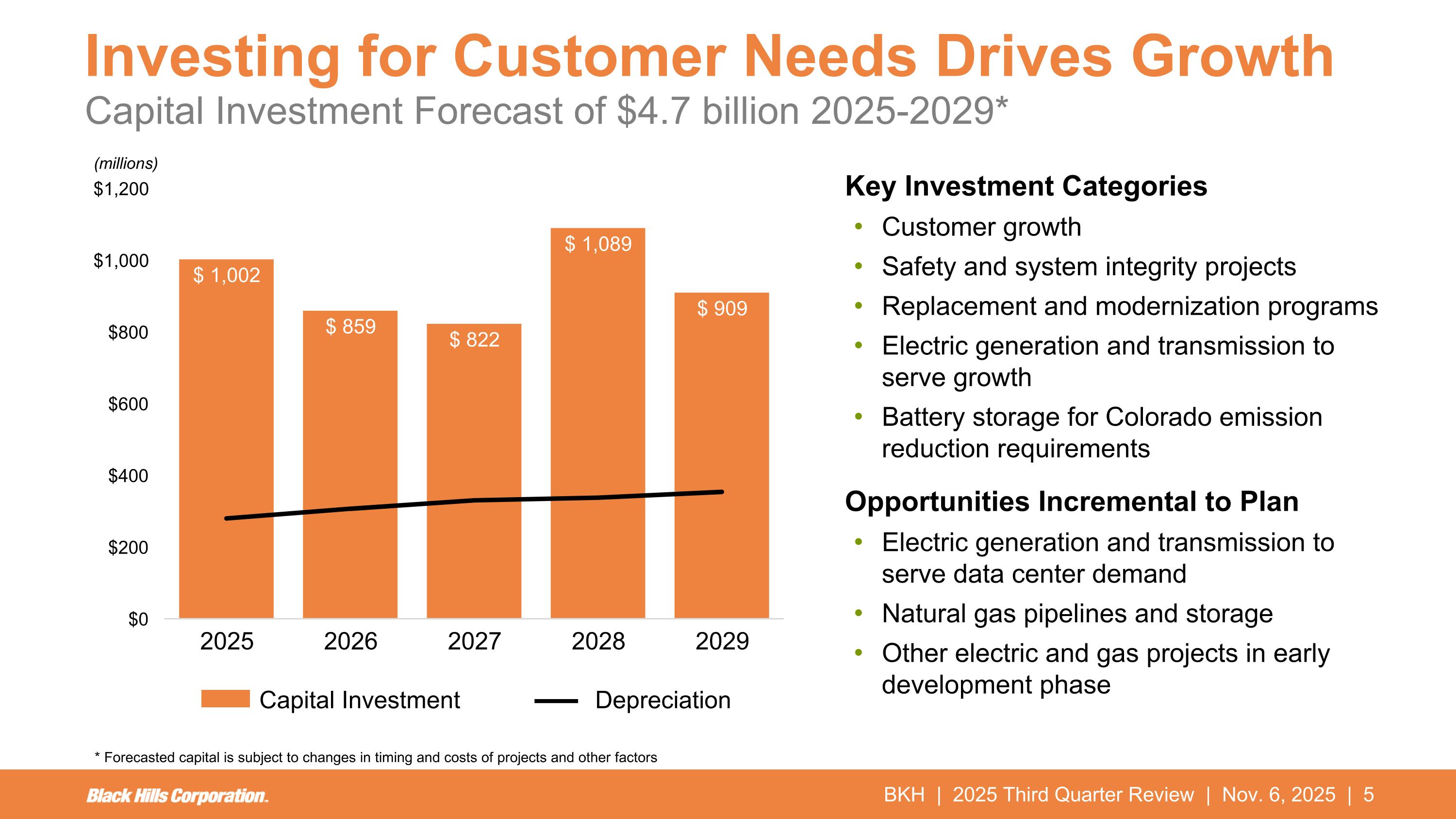

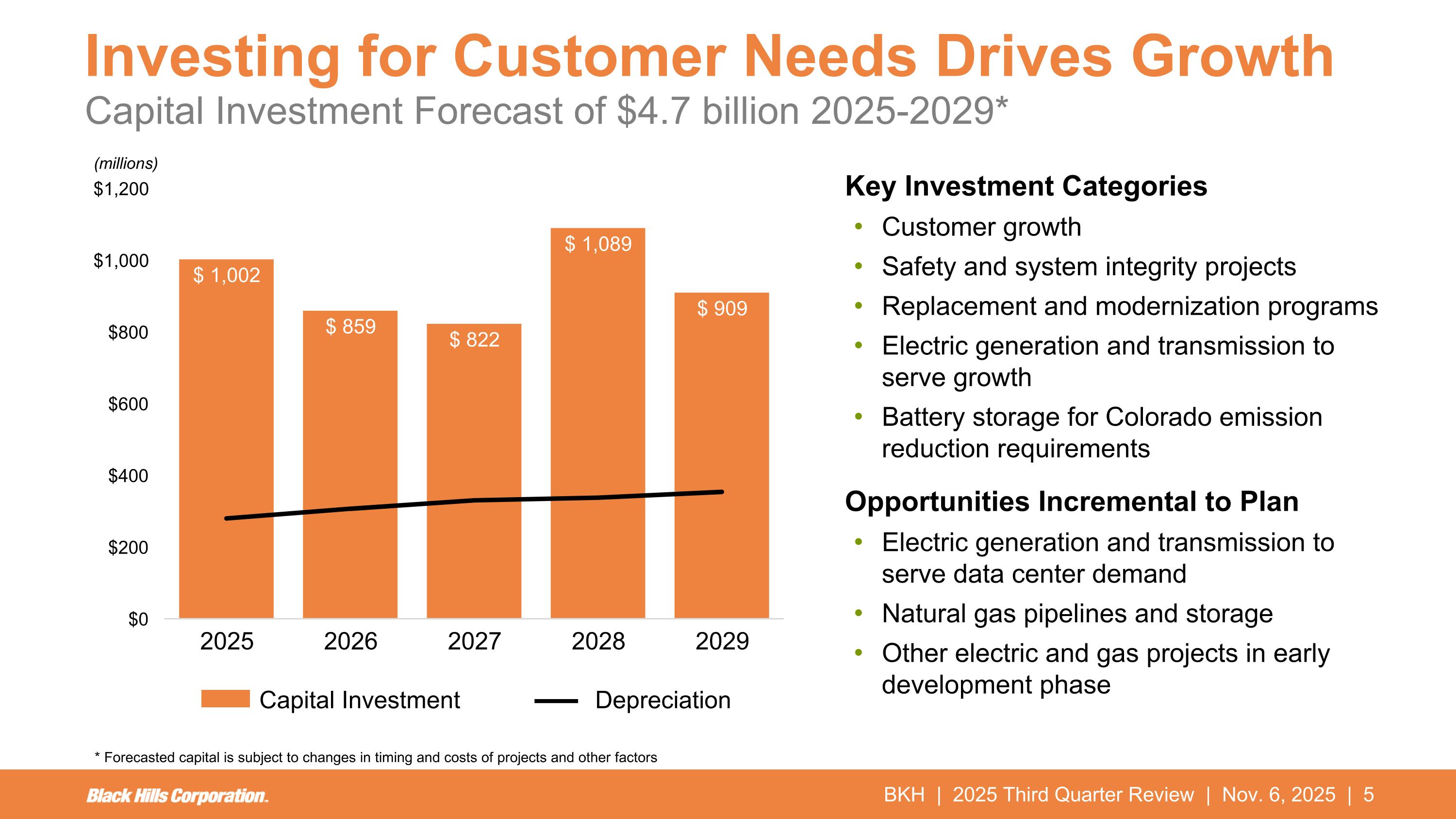

Key Investment Categories Customer growth Safety and system integrity projects Replacement and modernization programs Electric generation and transmission to serve growth Battery storage for Colorado emission reduction requirements Opportunities Incremental to Plan Electric generation and transmission to serve data center demand Natural gas pipelines and storage Other electric and gas projects in early development phase Capital Investment Depreciation BKH | 2025 Third Quarter Review | Nov. 6, 2025 | Investing for Customer Needs Drives Growth Capital Investment Forecast of $4.7 billion 2025-2029* (millions) * Forecasted capital is subject to changes in timing and costs of projects and other factors

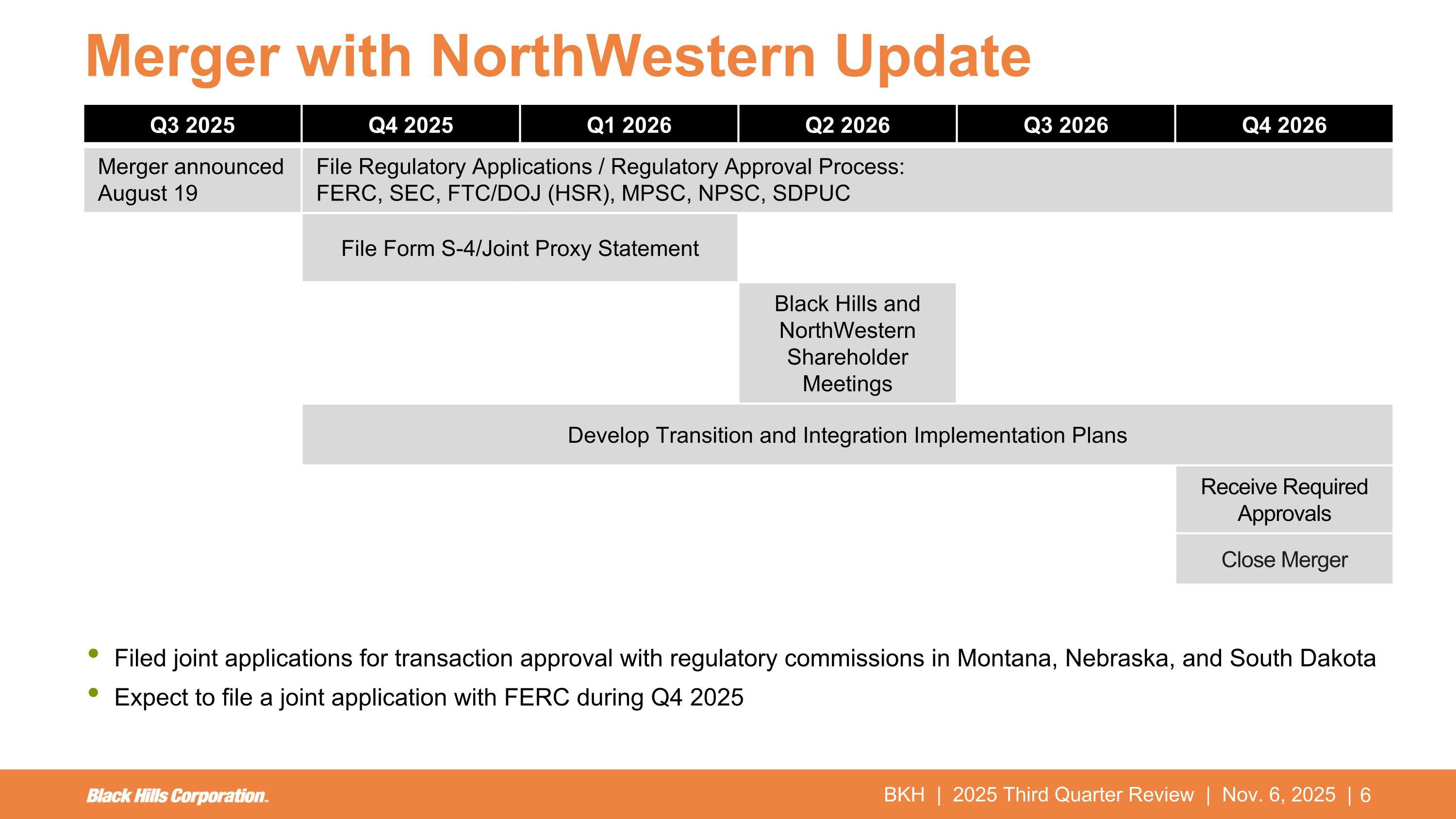

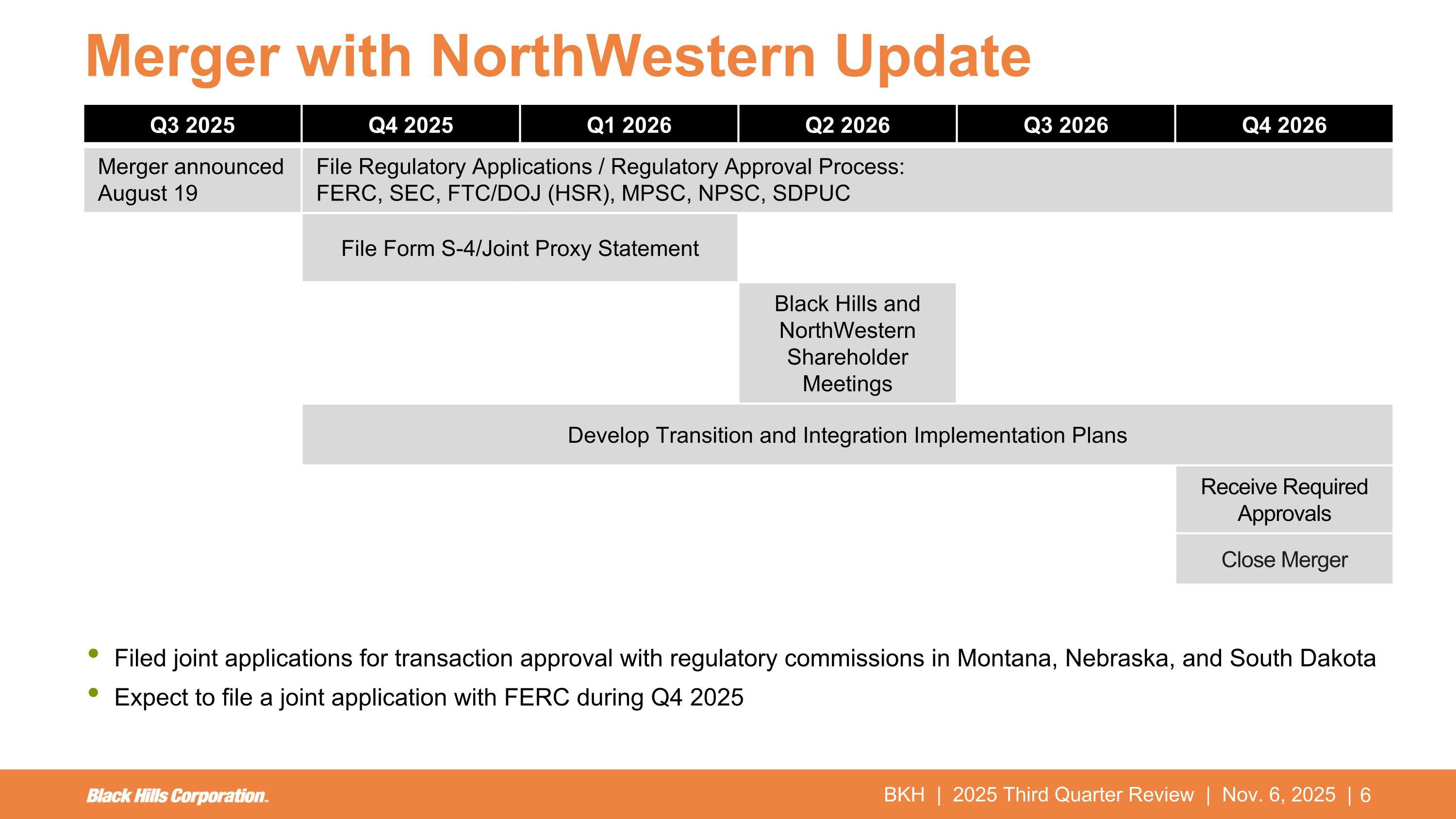

BKH | 2025 Third Quarter Review | Nov. 6, 2025 | Merger with NorthWestern Update Q3 2025 Q4 2025 Q1 2026 Q2 2026 Q3 2026 Q4 2026 Merger announced August 19 File Regulatory Applications / Regulatory Approval Process: FERC, SEC, FTC/DOJ (HSR), MPSC, NPSC, SDPUC File Form S-4/Joint Proxy Statement Black Hills and NorthWestern Shareholder Meetings Develop Transition and Integration Implementation Plans Receive Required Approvals Close Merger Filed joint applications for transaction approval with regulatory commissions in Montana, Nebraska, and South Dakota Expect to file a joint application with FERC during Q4 2025

Q3 2025 Financial Review BKH | 2025 Third Quarter Review | Nov. 6, 2025 |

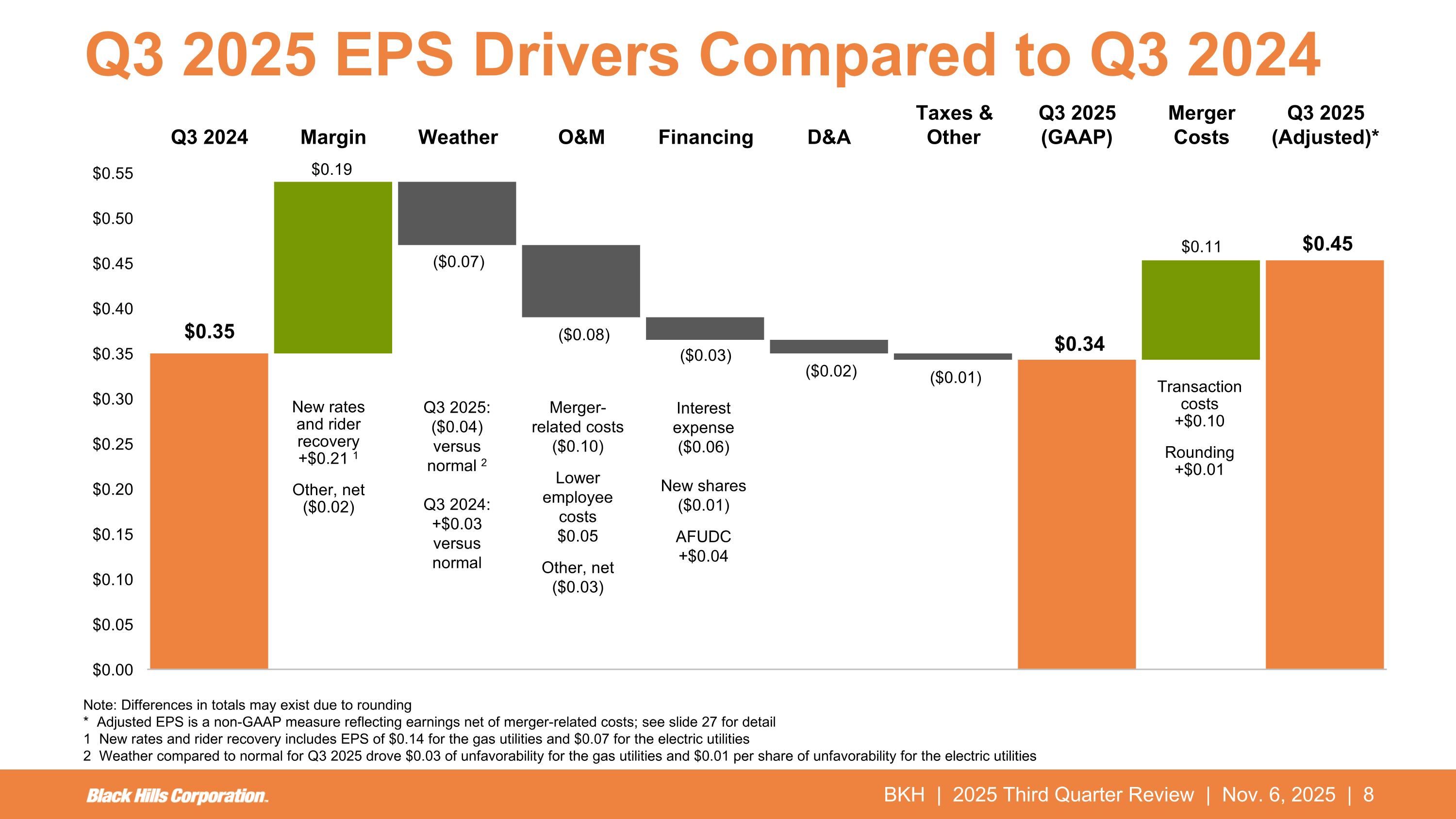

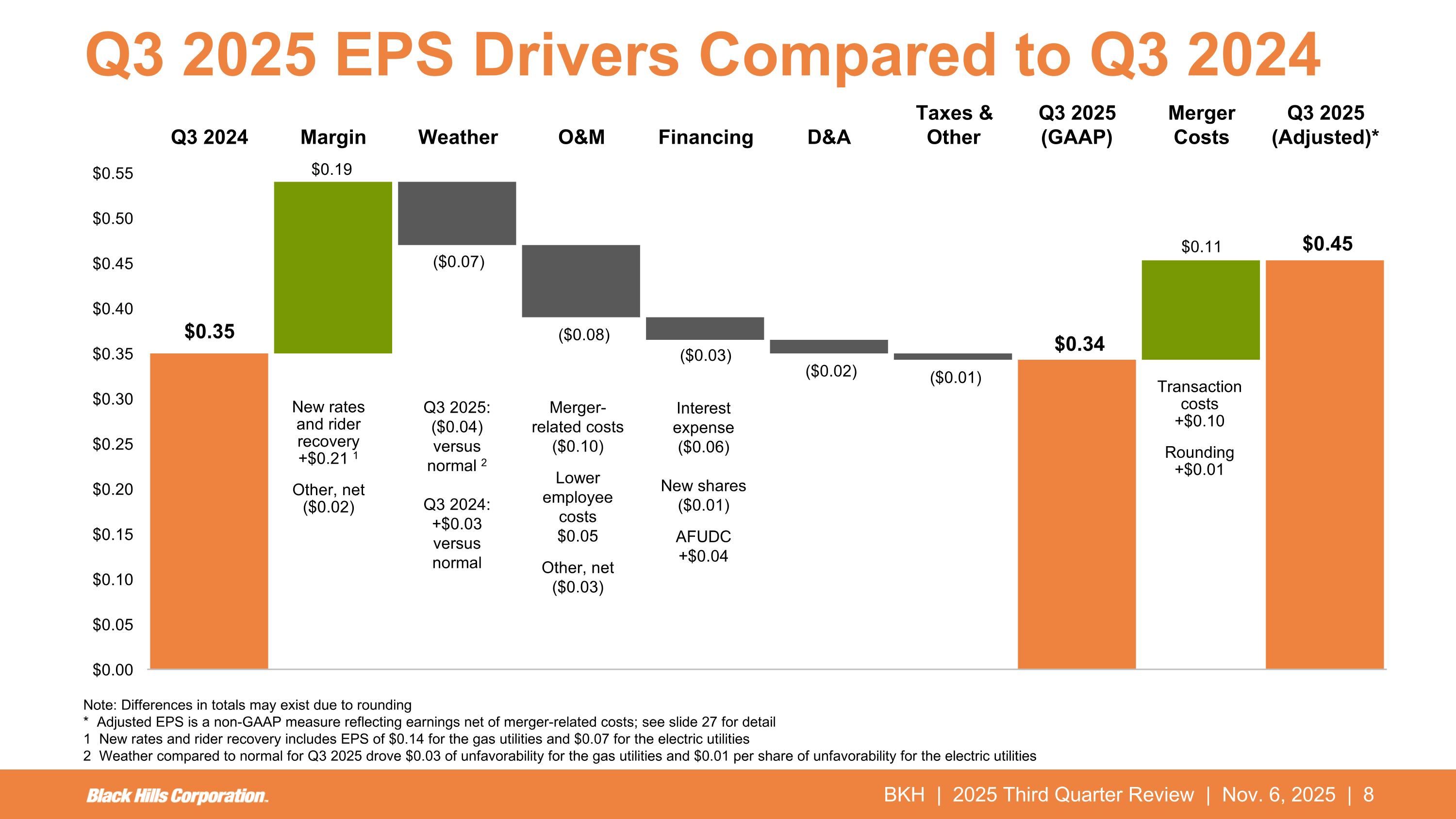

BKH | 2025 Third Quarter Review | Nov. 6, 2025 | Q3 2025 EPS Drivers Compared to Q3 2024 Interest expense ($0.06) New shares ($0.01) AFUDC +$0.04 Merger-related costs ($0.10) Lower employee costs $0.05 Other, net ($0.03) New rates and rider recovery +$0.21 1 Other, net ($0.02) Note: Differences in totals may exist due to rounding * Adjusted EPS is a non-GAAP measure reflecting earnings net of merger-related costs; see slide 27 for detail 1 New rates and rider recovery includes EPS of $0.14 for the gas utilities and $0.07 for the electric utilities 2 Weather compared to normal for Q3 2025 drove $0.03 of unfavorability for the gas utilities and $0.01 per share of unfavorability for the electric utilities Q3 2025: ($0.04) versus normal 2 Q3 2024: +$0.03 versus normal Transaction costs +$0.10 Rounding +$0.01

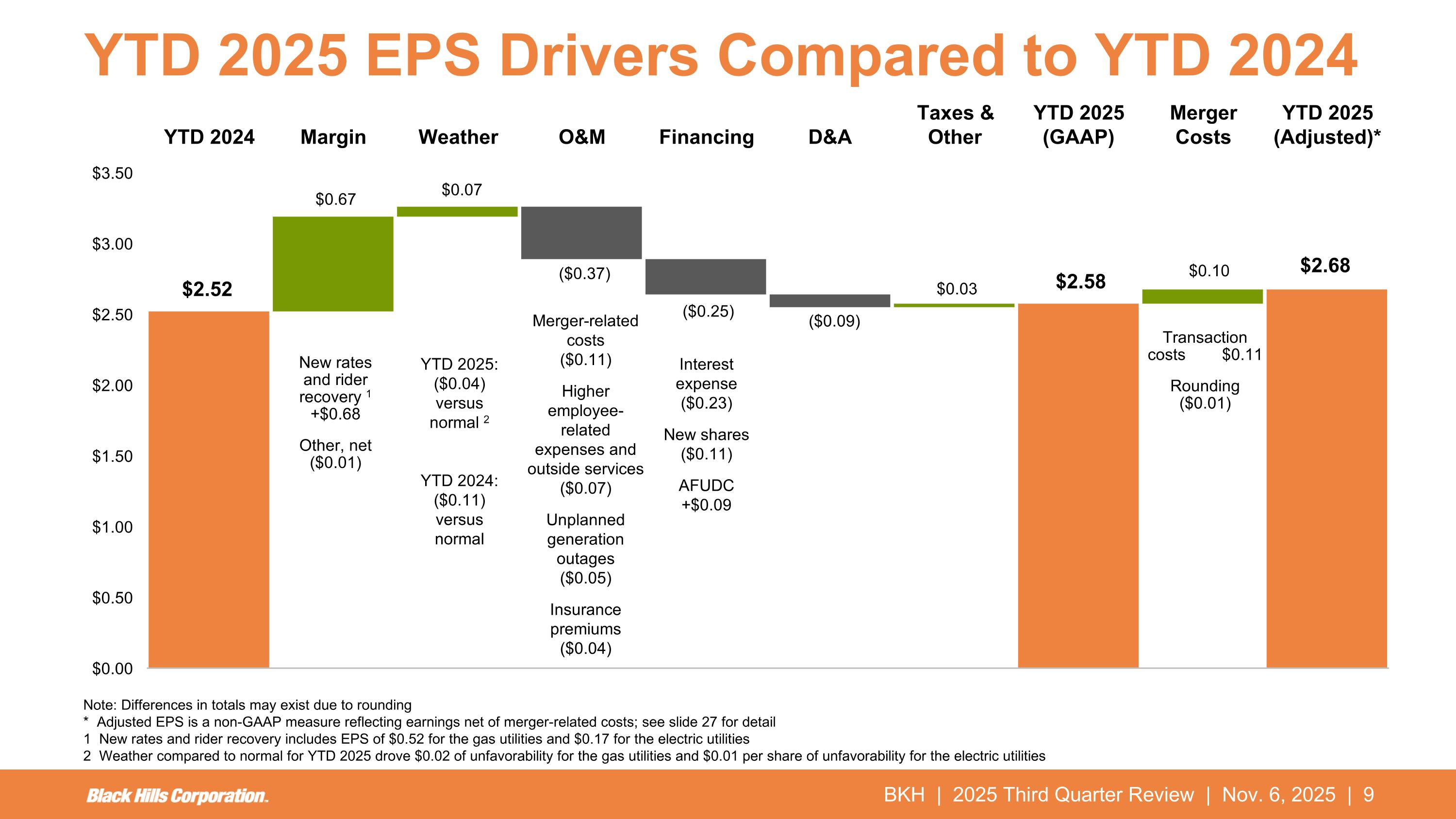

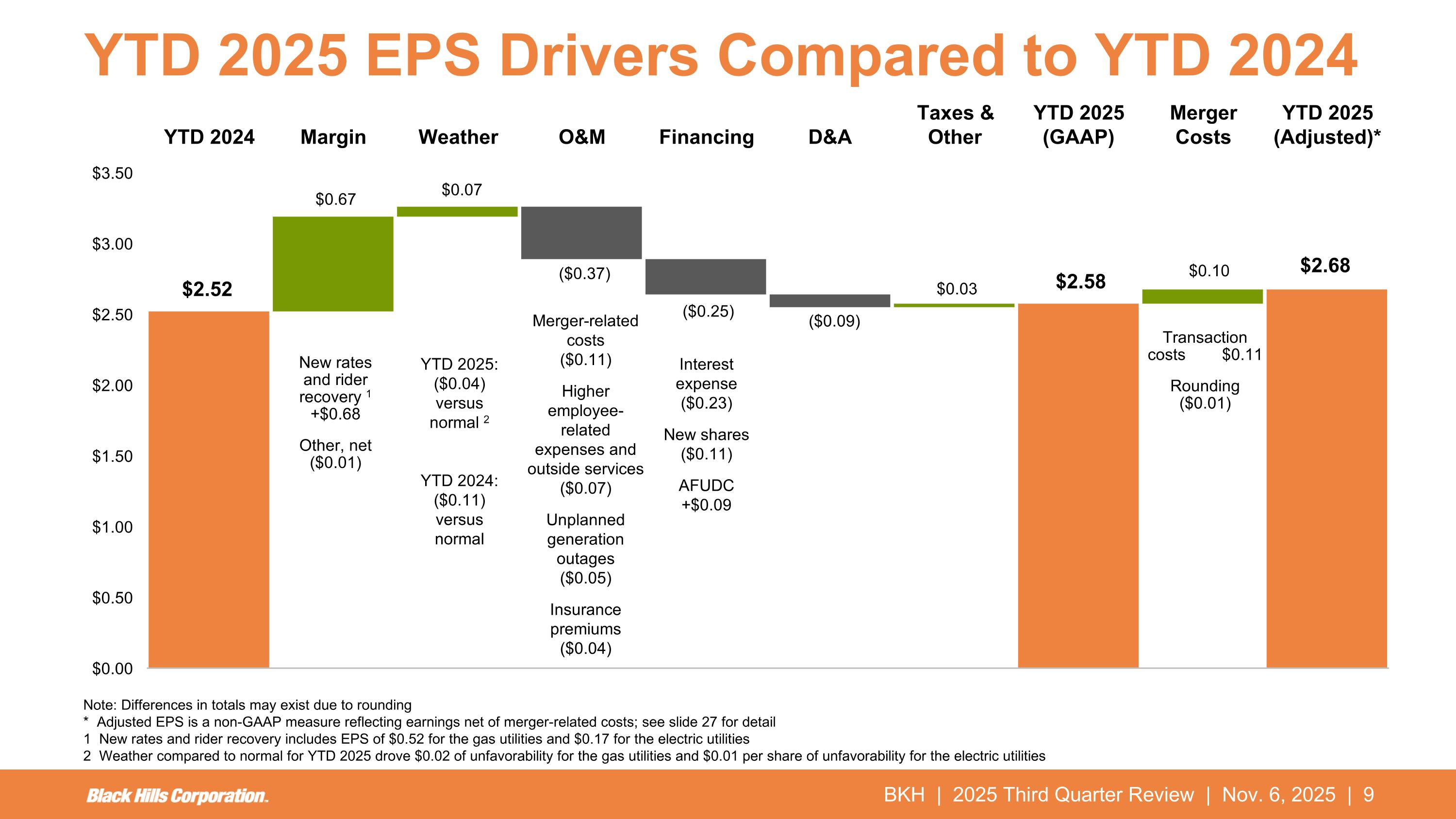

BKH | 2025 Third Quarter Review | Nov. 6, 2025 | YTD 2025 EPS Drivers Compared to YTD 2024 Interest expense ($0.23) New shares ($0.11) AFUDC +$0.09 Merger-related costs ($0.11) Higher employee- related expenses and outside services ($0.07) Unplanned generation outages ($0.05) Insurance premiums ($0.04) New rates and rider recovery 1 +$0.68 Other, net ($0.01) YTD 2025: ($0.04) versus normal 2 YTD 2024: ($0.11) versus normal Note: Differences in totals may exist due to rounding * Adjusted EPS is a non-GAAP measure reflecting earnings net of merger-related costs; see slide 27 for detail 1 New rates and rider recovery includes EPS of $0.52 for the gas utilities and $0.17 for the electric utilities 2 Weather compared to normal for YTD 2025 drove $0.02 of unfavorability for the gas utilities and $0.01 per share of unfavorability for the electric utilities Transaction costs $0.11 Rounding ($0.01)

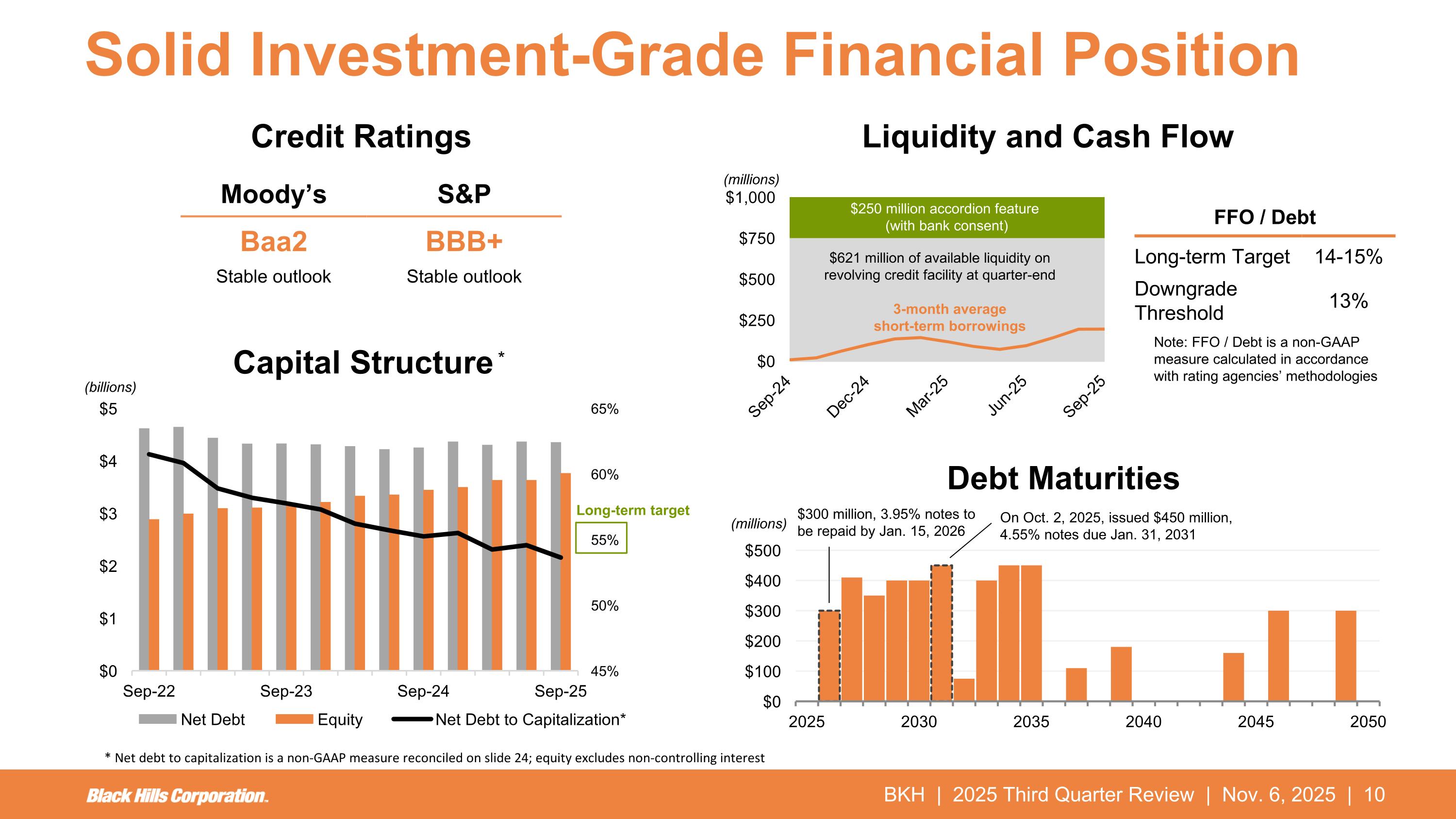

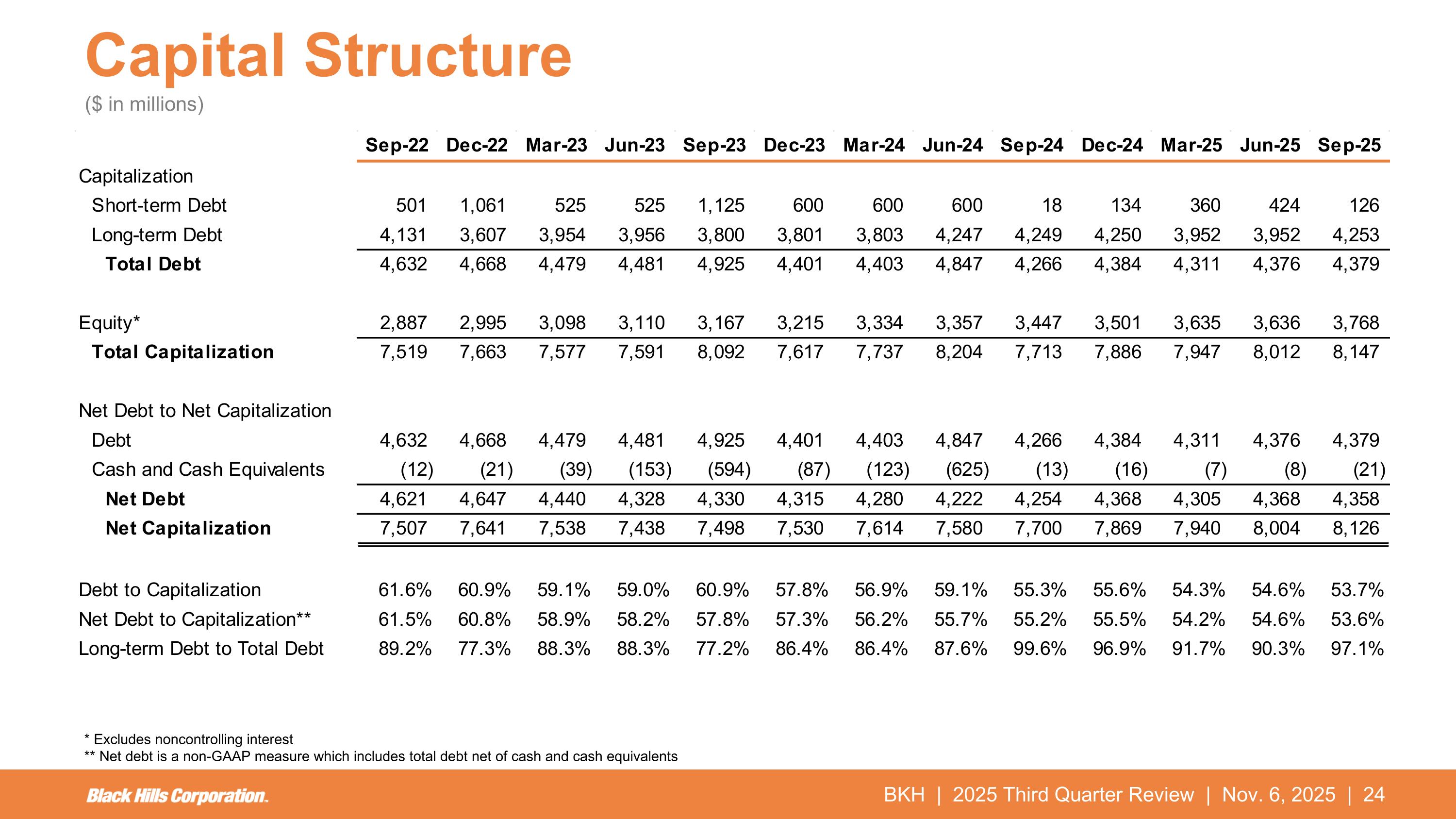

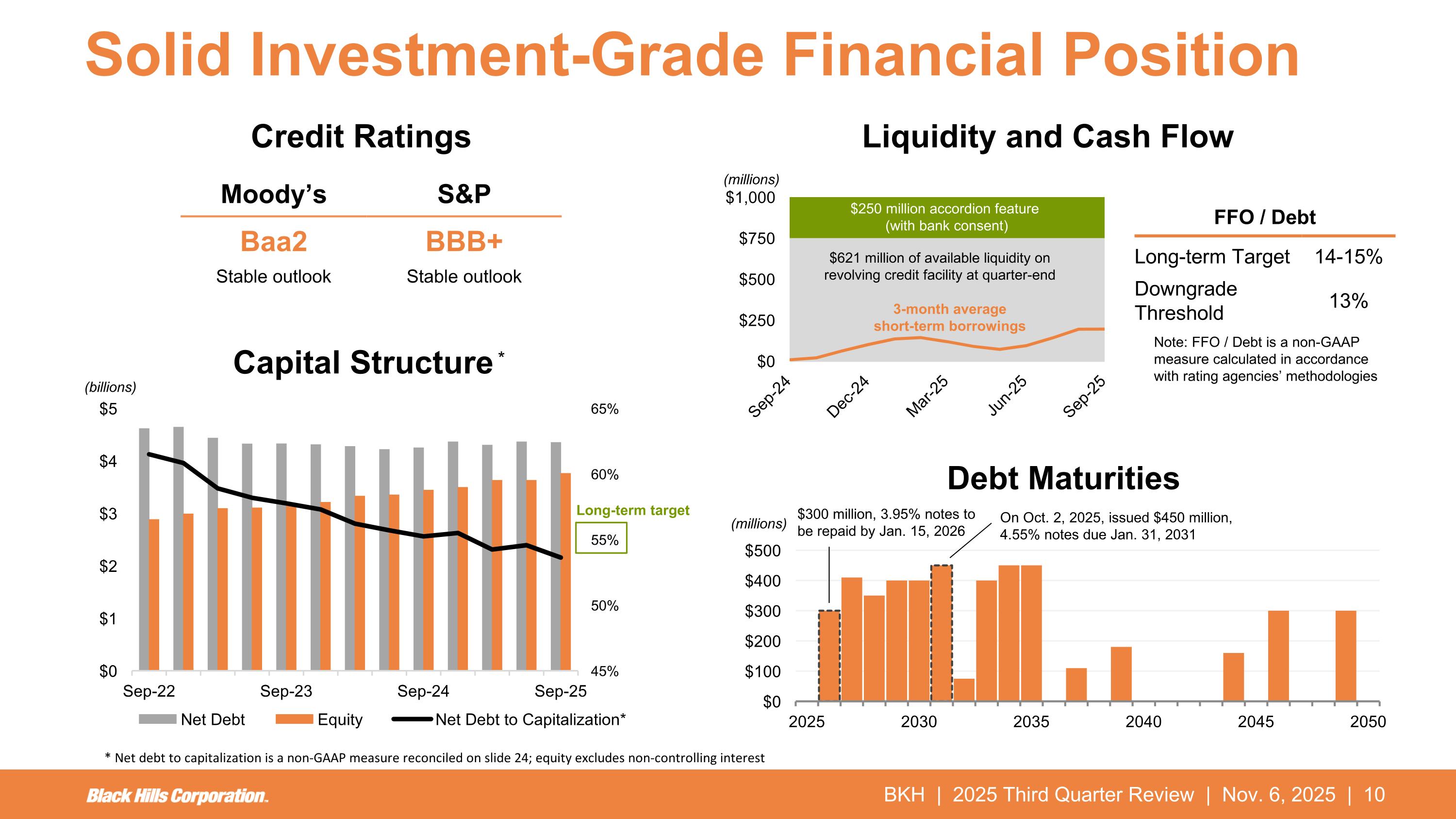

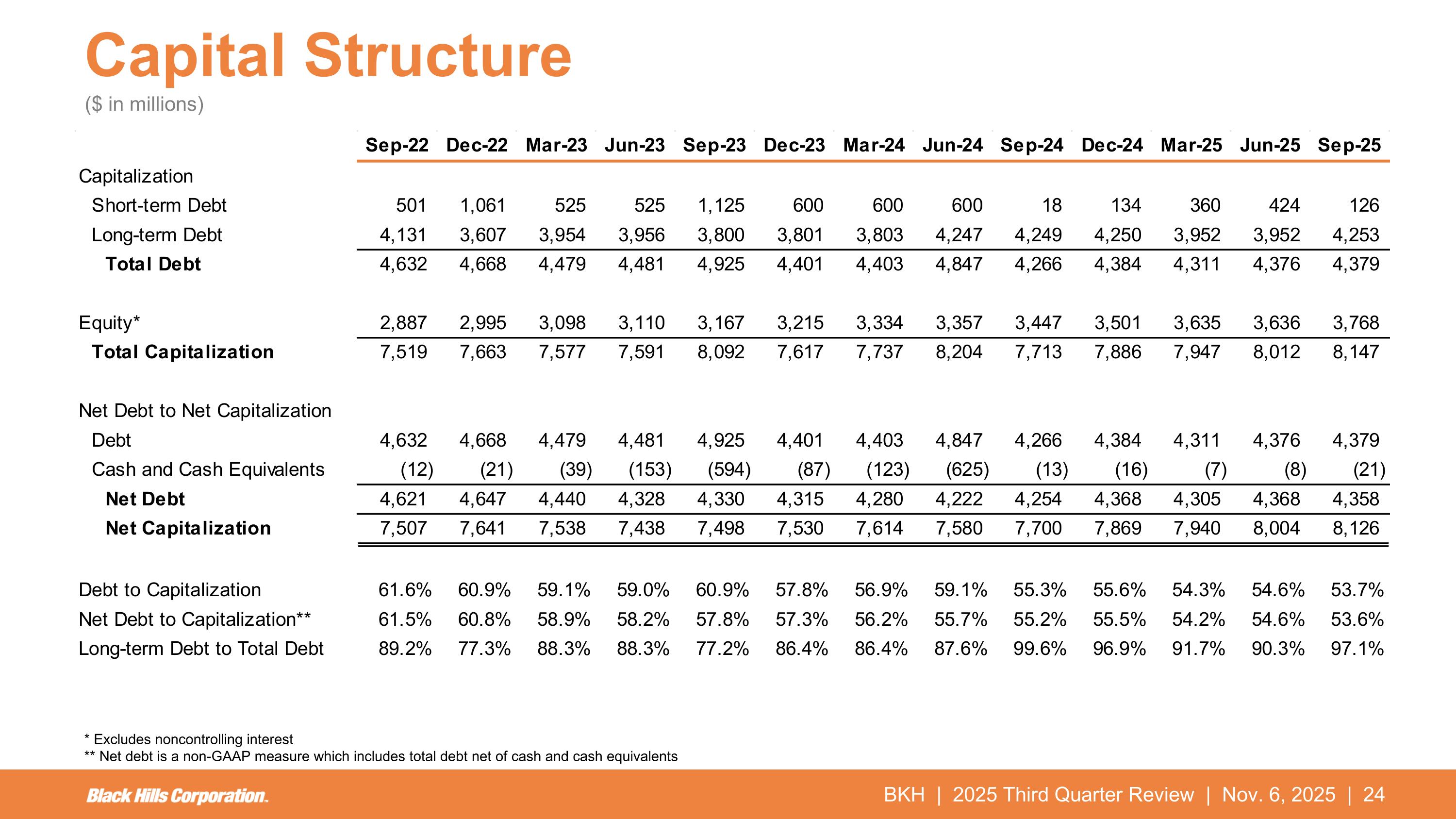

(millions) $250 million accordion feature (with bank consent) BKH | 2025 Third Quarter Review | Nov. 6, 2025 | Solid Investment-Grade Financial Position Capital Structure * Liquidity and Cash Flow Debt Maturities (millions) Long-term target $621 million of available liquidity on revolving credit facility at quarter-end (billions) Credit Ratings FFO / Debt Long-term Target 14-15% Downgrade Threshold 13% Note: FFO / Debt is a non-GAAP measure calculated in accordance with rating agencies’ methodologies 3-month average short-term borrowings Moody’s S&P Baa2 BBB+ Stable outlook Stable outlook $300 million, 3.95% notes to be repaid by Jan. 15, 2026 On Oct. 2, 2025, issued $450 million, 4.55% notes due Jan. 31, 2031 * Net debt to capitalization is a non-GAAP measure reconciled on slide 24; equity excludes non-controlling interest

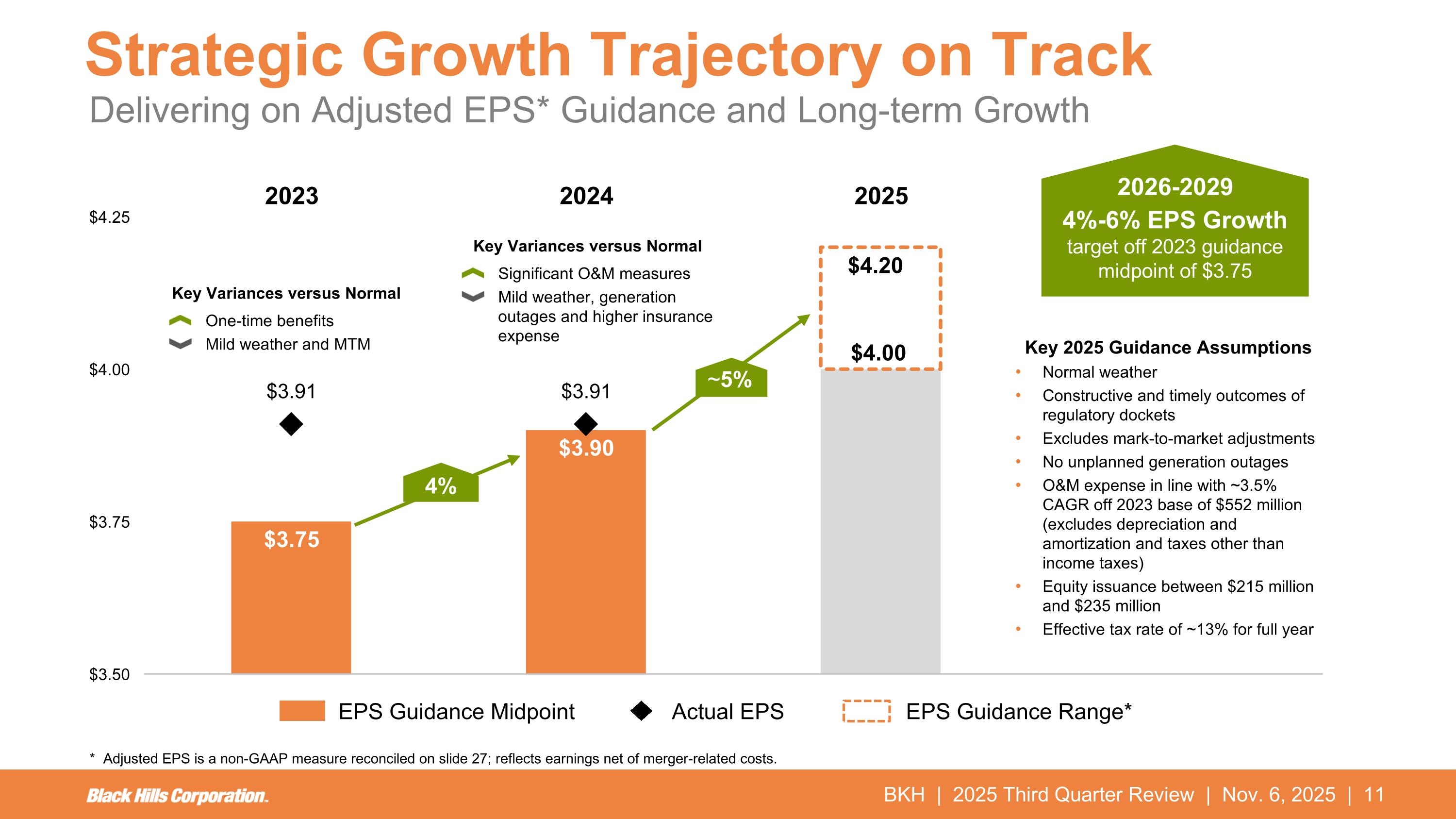

BKH | 2025 Third Quarter Review | Nov. 6, 2025 | $4.20 $4.00 Strategic Growth Trajectory on Track 4% EPS Guidance Midpoint Actual EPS EPS Guidance Range* 2026-2029 4%-6% EPS Growth target off 2023 guidance midpoint of $3.75 ~5% Delivering on Adjusted EPS* Guidance and Long-term Growth Key Variances versus Normal One-time benefits Mild weather and MTM Key Variances versus Normal Significant O&M measures Mild weather, generation outages and higher insurance expense Key 2025 Guidance Assumptions Normal weather Constructive and timely outcomes of regulatory dockets Excludes mark-to-market adjustments No unplanned generation outages O&M expense in line with ~3.5% CAGR off 2023 base of $552 million (excludes depreciation and amortization and taxes other than income taxes) Equity issuance between $215 million and $235 million Effective tax rate of ~13% for full year * Adjusted EPS is a non-GAAP measure reconciled on slide 27; reflects earnings net of merger-related costs.

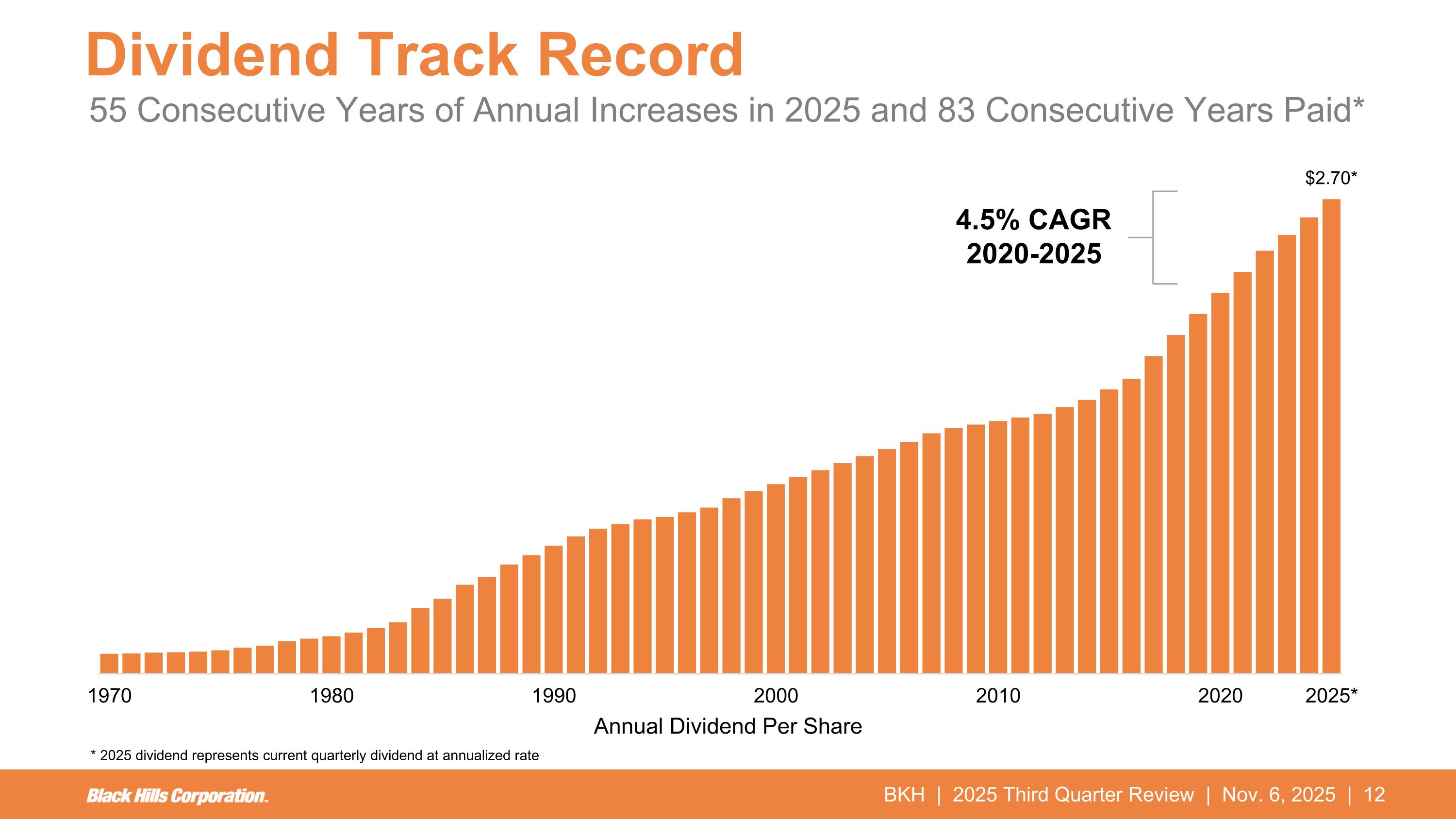

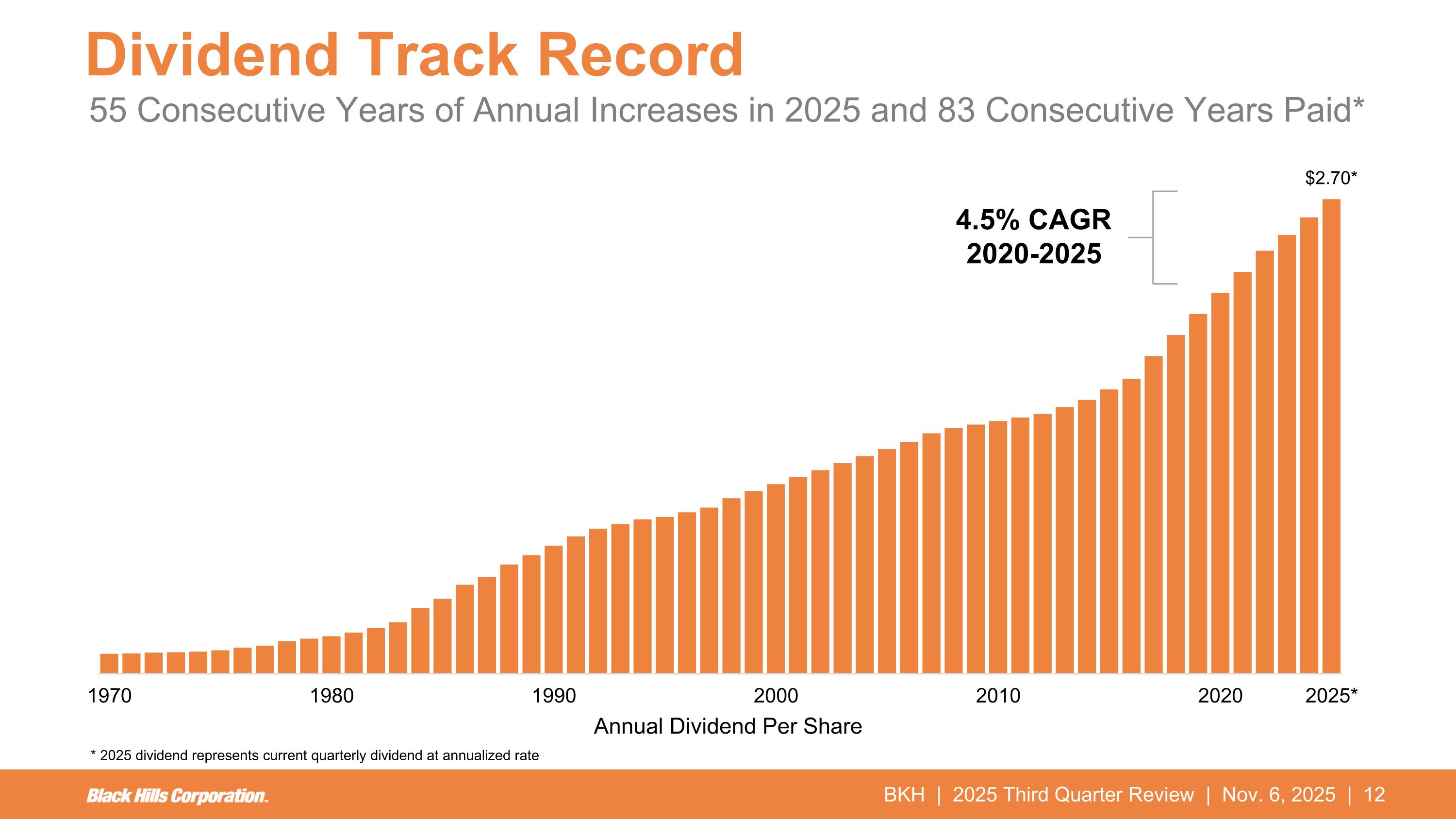

BKH | 2025 Third Quarter Review | Nov. 6, 2025 | Dividend Track Record 55 Consecutive Years of Annual Increases in 2025 and 83 Consecutive Years Paid* Annual Dividend Per Share * 2025 dividend represents current quarterly dividend at annualized rate 4.5% CAGR 2020-2025

BKH | 2025 Third Quarter Review | Nov. 6, 2025 | Business Update Data Center Growth Regulatory Progress Ready Wyoming Transmission Expansion Colorado Clean Energy Plan South Dakota Integrated Resource Plan (99 MW Lange II) Wildfire Management and Risk Mitigation Legislation PSPS Mitigation Plan

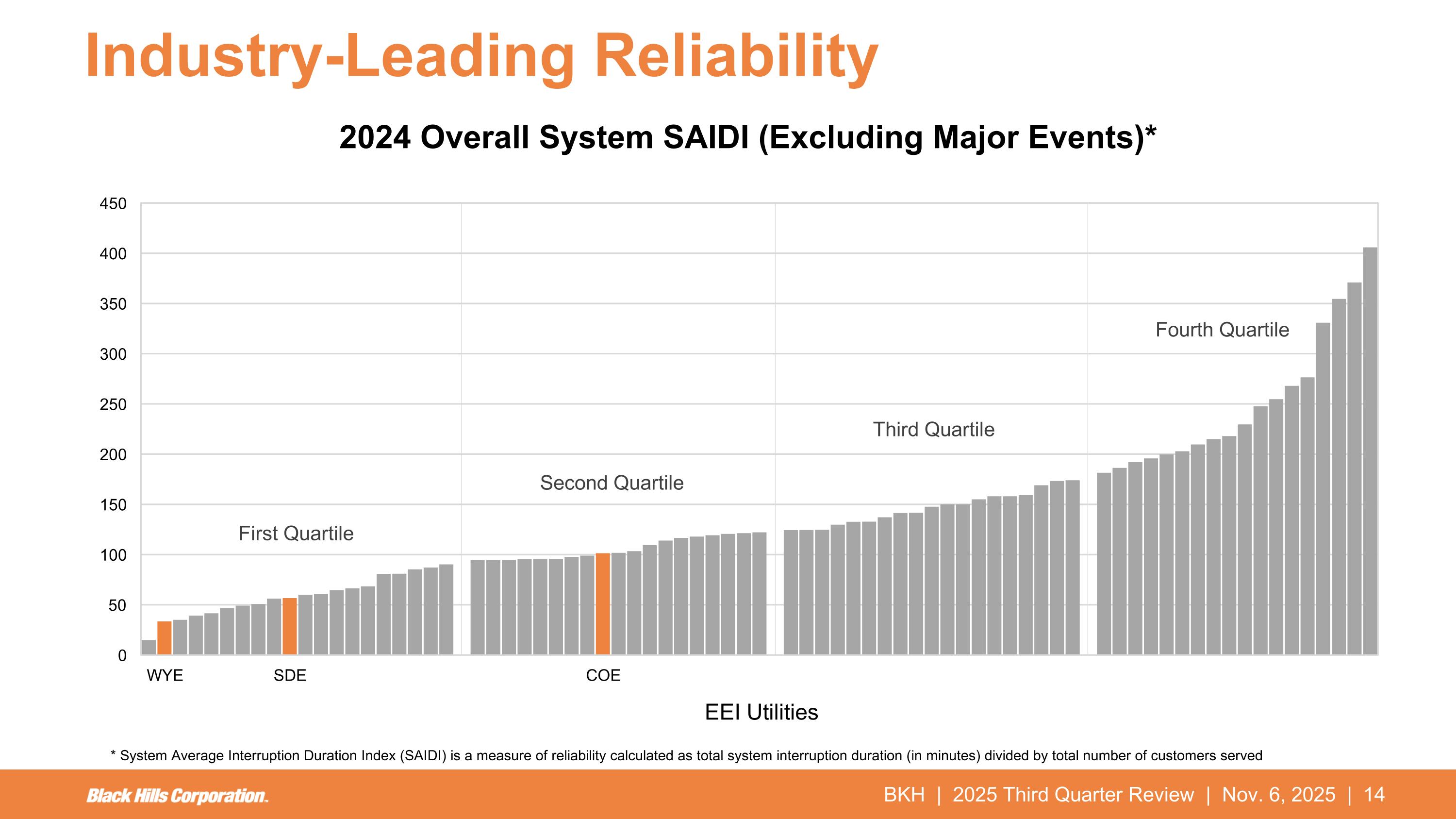

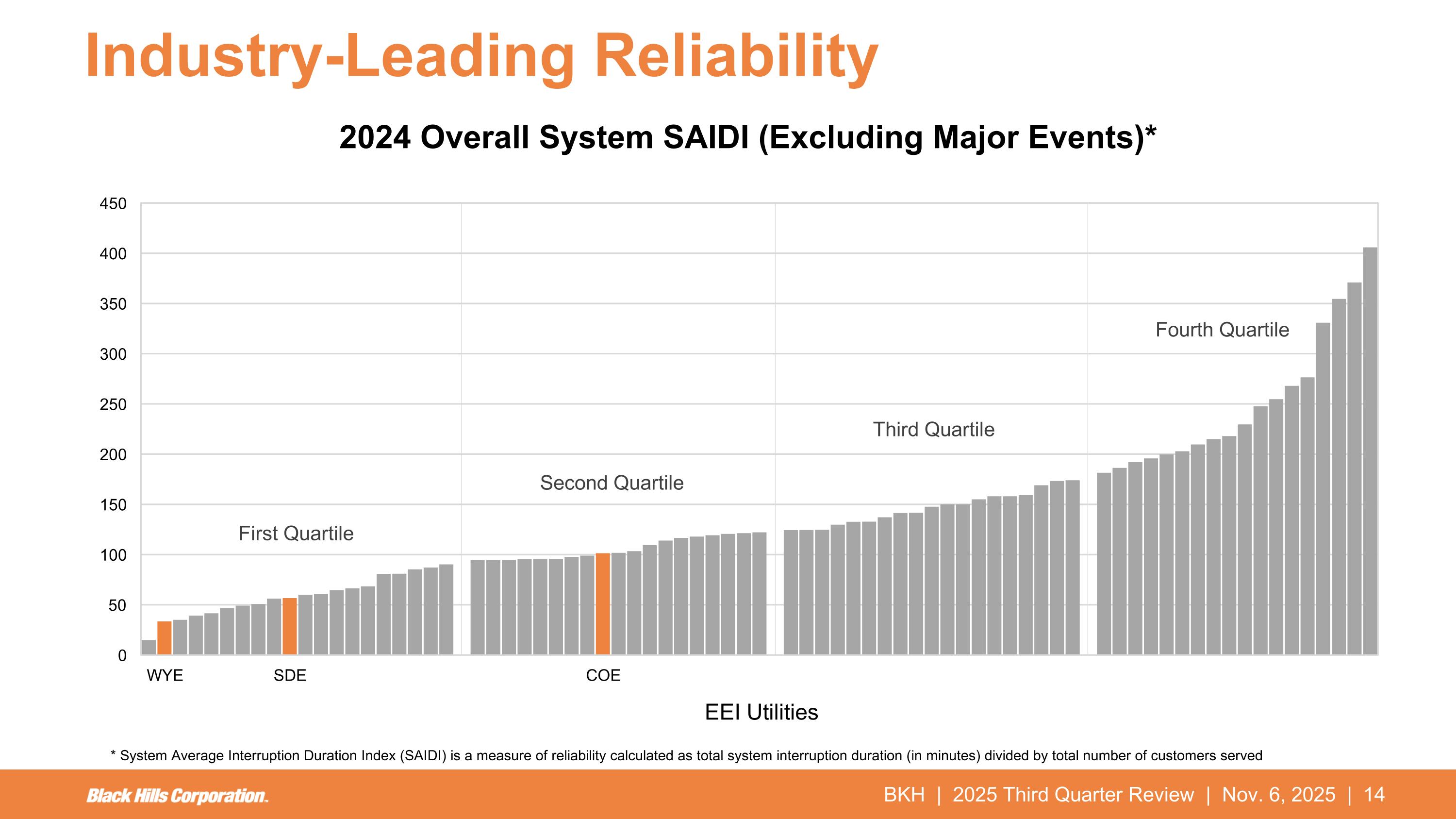

BKH | 2025 Third Quarter Review | Nov. 6, 2025 | Industry-Leading Reliability * System Average Interruption Duration Index (SAIDI) is a measure of reliability calculated as total system interruption duration (in minutes) divided by total number of customers served 2024 Overall System SAIDI (Excluding Major Events)* EEI Utilities First Quartile Second Quartile Third Quartile Fourth Quartile

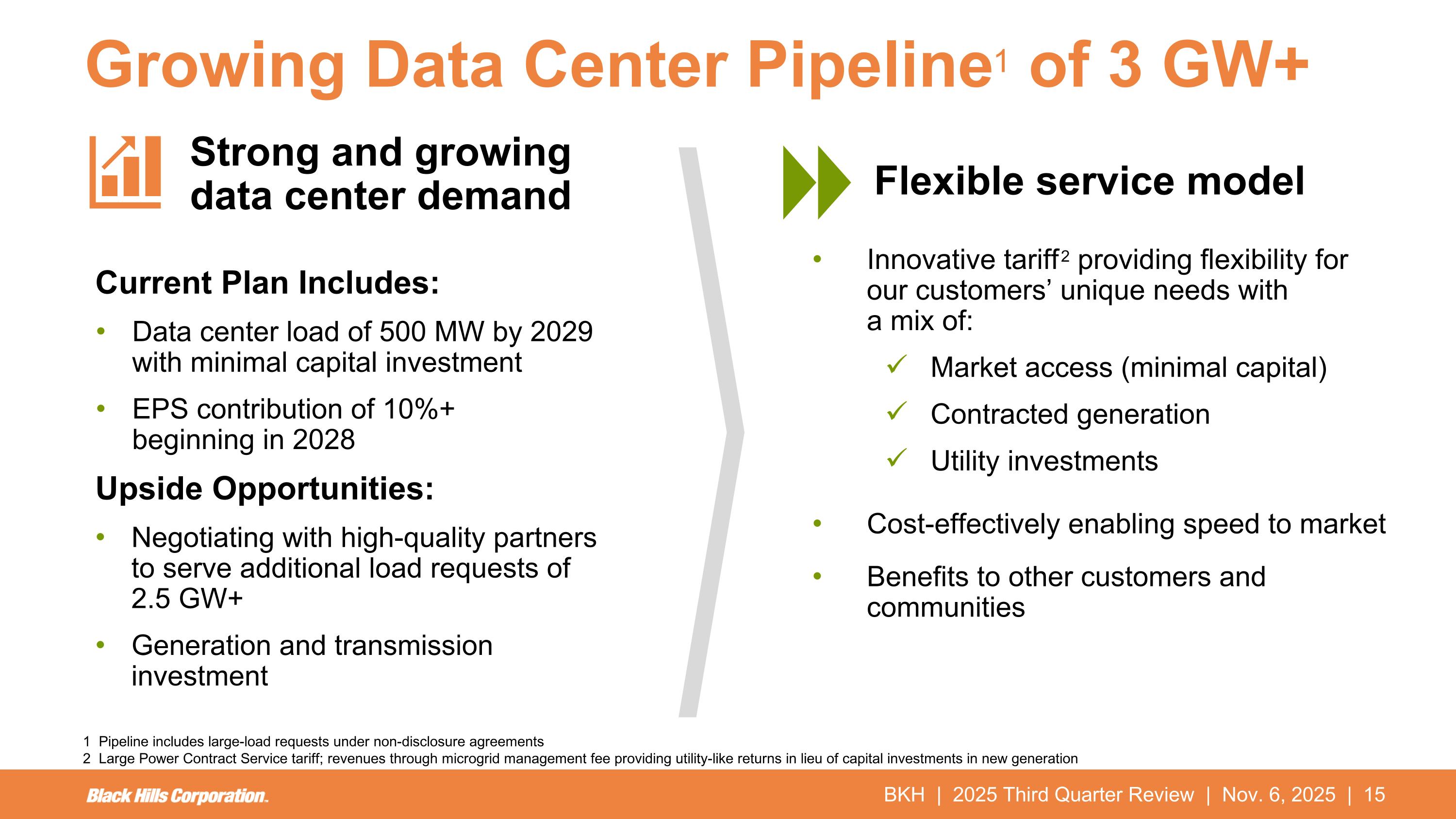

BKH | 2025 Third Quarter Review | Nov. 6, 2025 | Current Plan Includes: Data center load of 500 MW by 2029 with minimal capital investment EPS contribution of 10%+ beginning in 2028 Upside Opportunities: Negotiating with high-quality partners to serve additional load requests of 2.5 GW+ Generation and transmission investment Strong and growing data center demand Innovative tariff 2 providing flexibility for our customers’ unique needs with a mix of: Market access (minimal capital) Contracted generation Utility investments Cost-effectively enabling speed to market Benefits to other customers and communities Growing Data Center Pipeline1 of 3 GW+ Flexible service model 1 Pipeline includes large-load requests under non-disclosure agreements 2 Large Power Contract Service tariff; revenues through microgrid management fee providing utility-like returns in lieu of capital investments in new generation

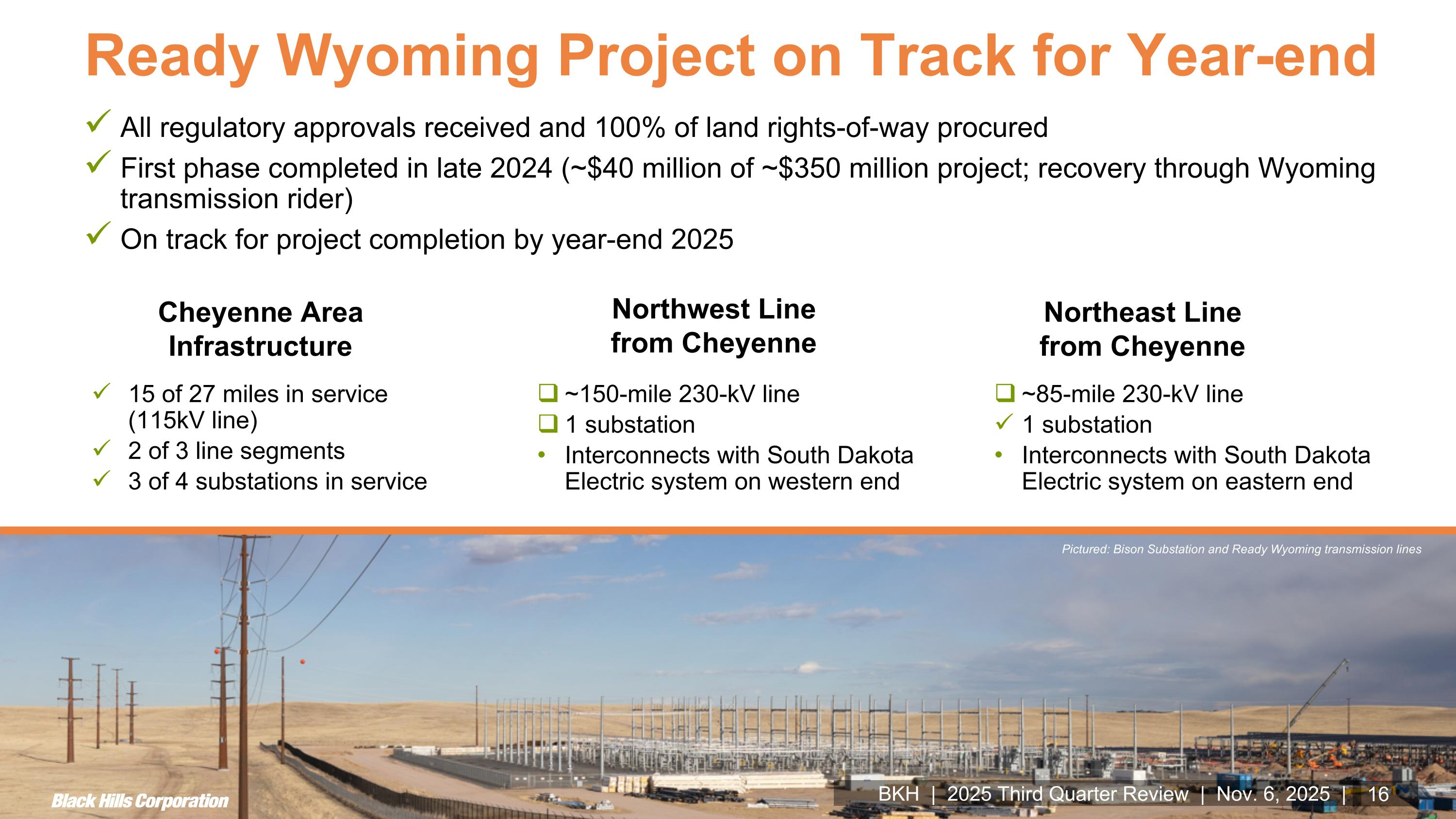

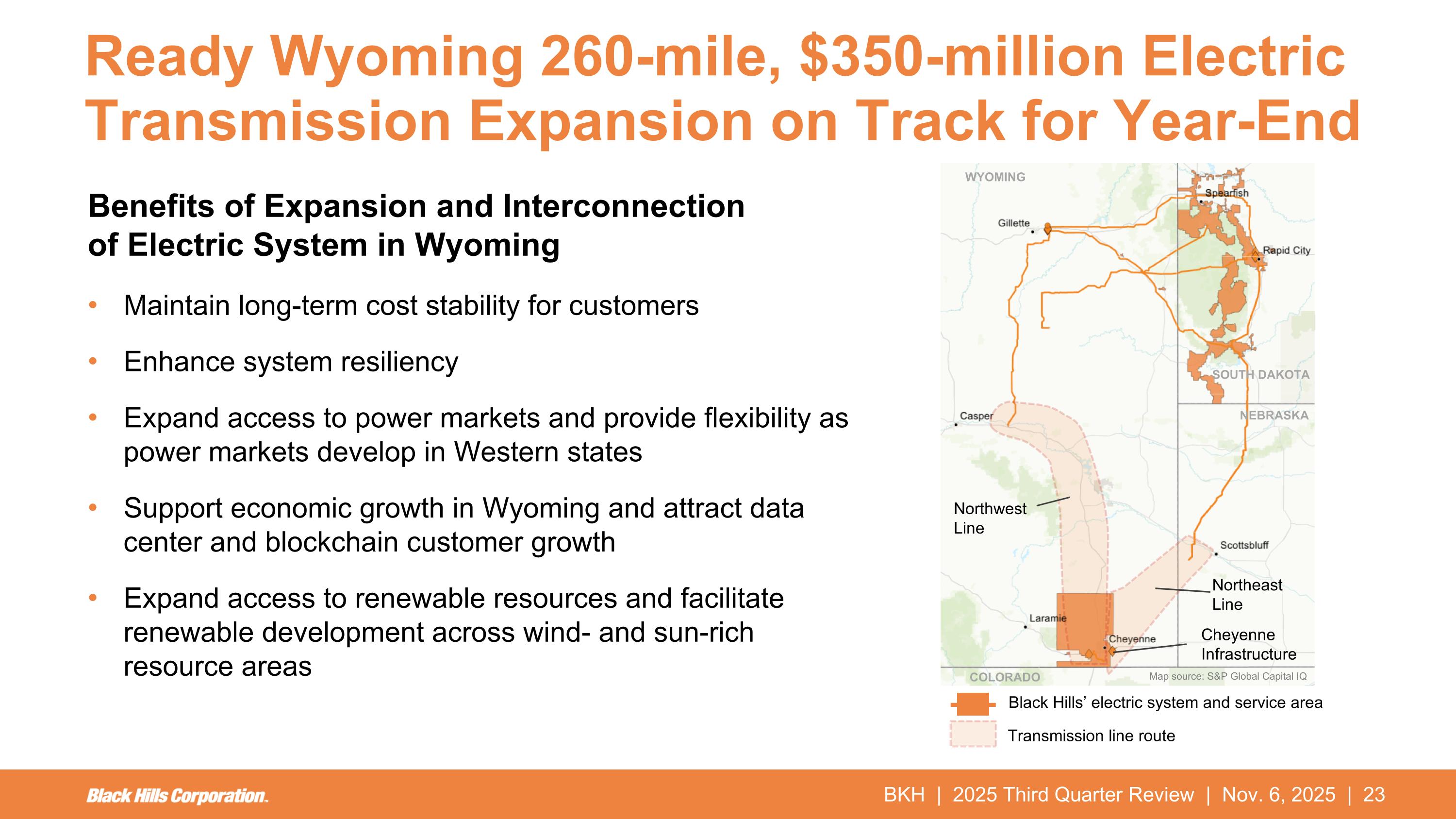

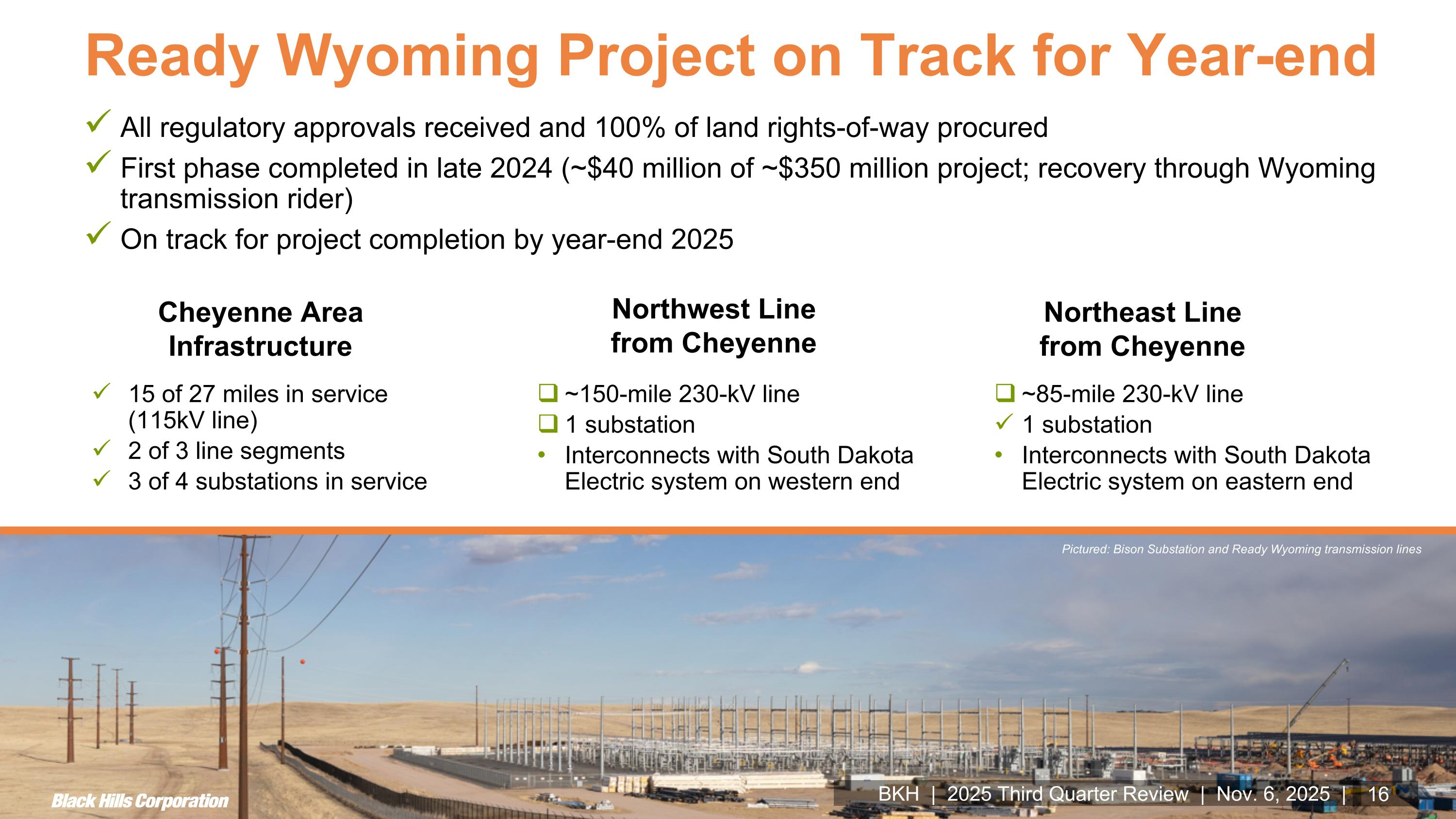

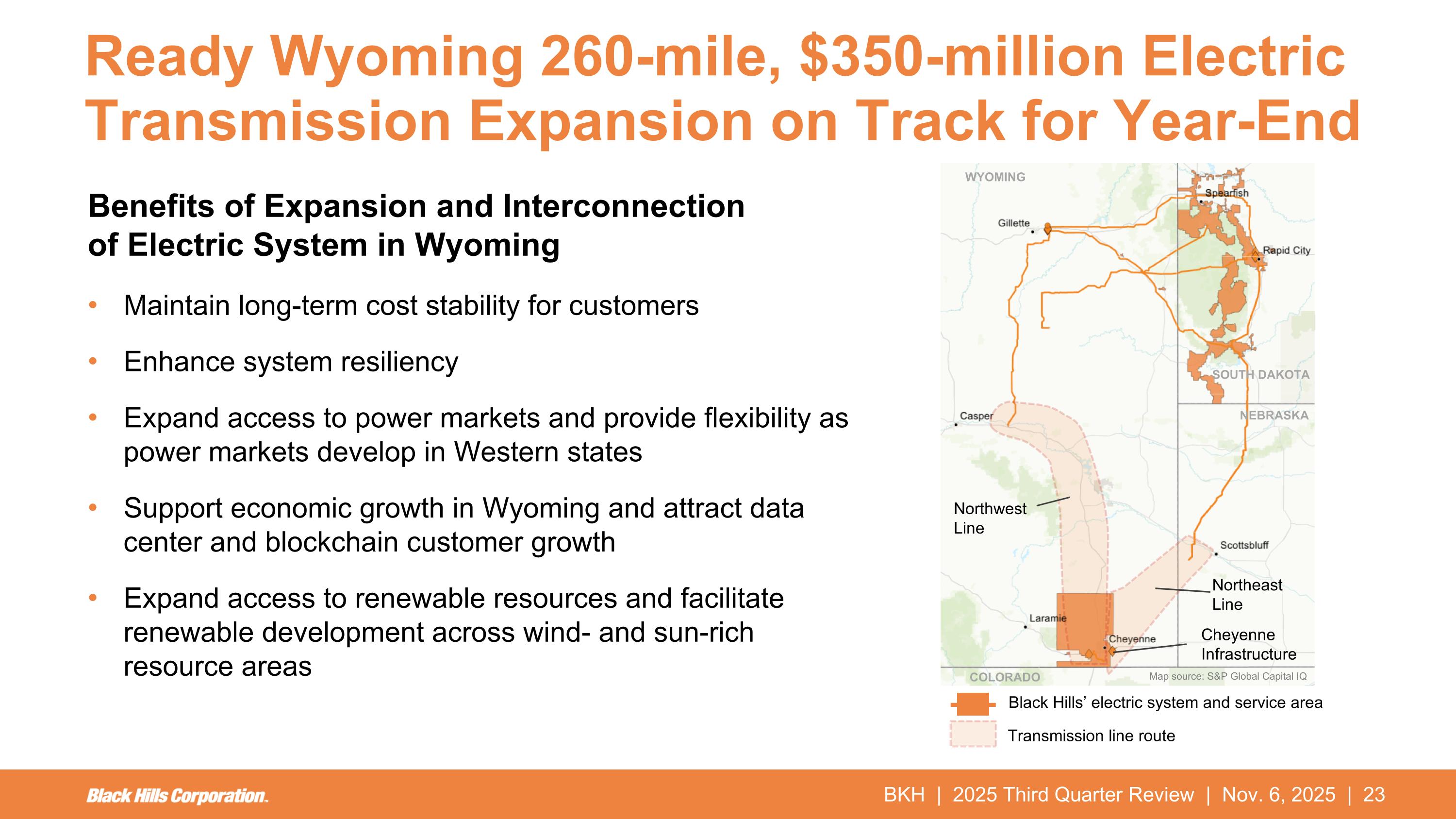

Ready Wyoming Project on Track for Year-end All regulatory approvals received and 100% of land rights-of-way procured First phase completed in late 2024 (~$40 million of ~$350 million project; recovery through Wyoming transmission rider) On track for project completion by year-end 2025 ~150-mile 230-kV line 1 substation Interconnects with South Dakota Electric system on western end ~85-mile 230-kV line 1 substation Interconnects with South Dakota Electric system on eastern end Northeast Line from Cheyenne Northwest Line from Cheyenne Cheyenne Area Infrastructure 15 of 27 miles in service (115kV line) 2 of 3 line segments 3 of 4 substations in service Pictured: Bison Substation and Ready Wyoming transmission lines BKH | 2025 Third Quarter Review | Nov. 6, 2025 |

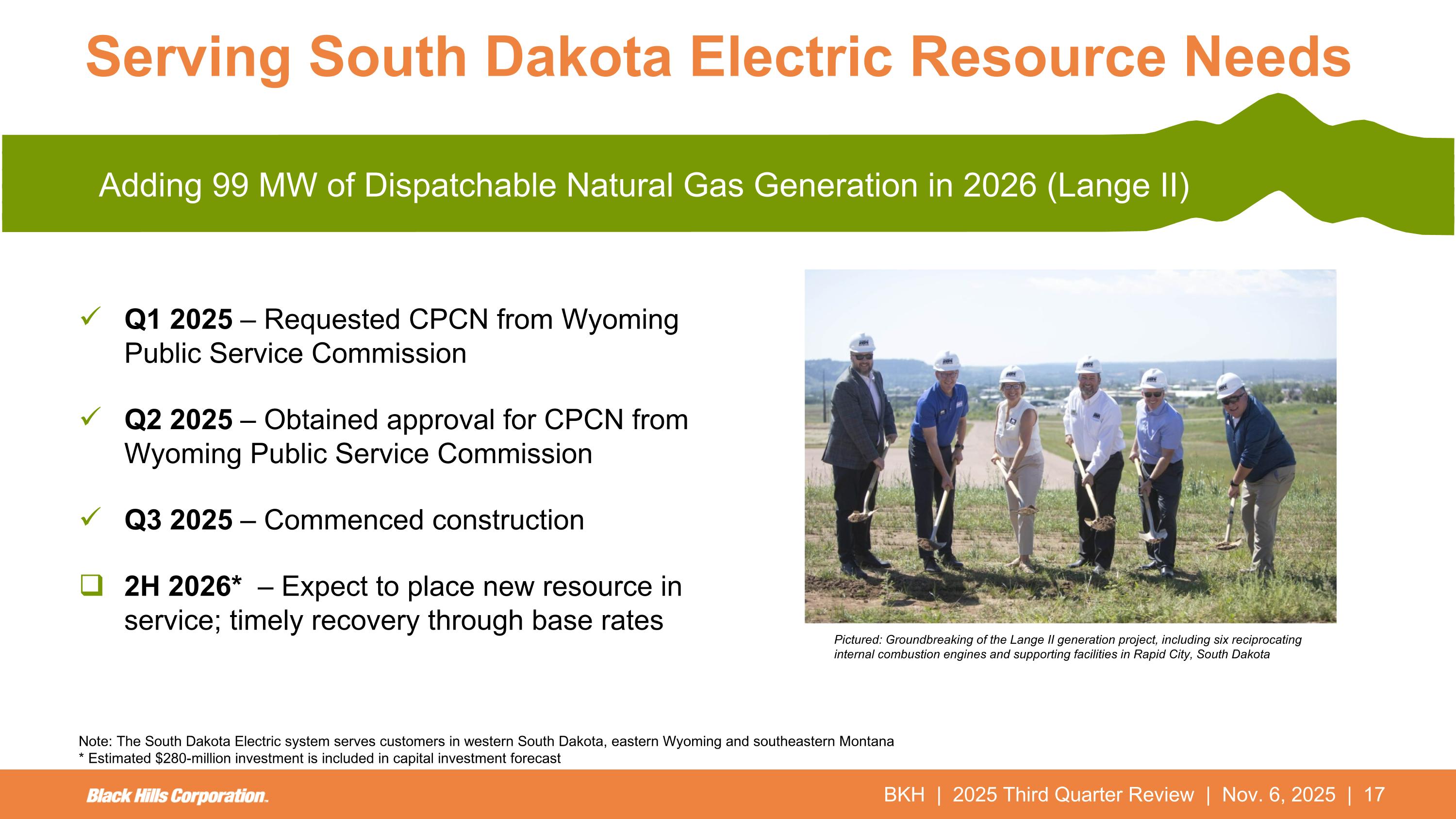

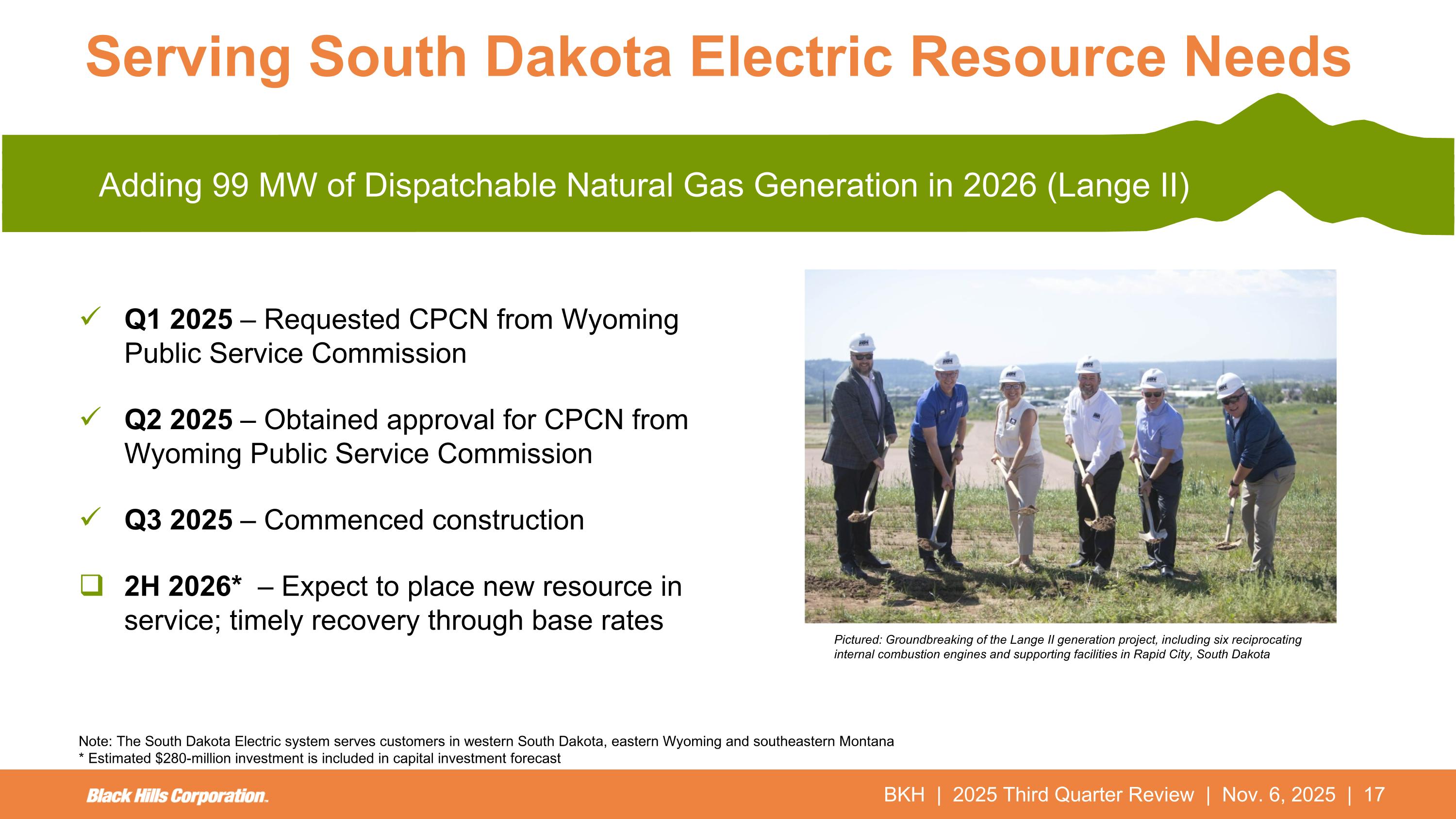

BKH | 2025 Third Quarter Review | Nov. 6, 2025 | Serving South Dakota Electric Resource Needs Note: The South Dakota Electric system serves customers in western South Dakota, eastern Wyoming and southeastern Montana * Estimated $280-million investment is included in capital investment forecast Adding 99 MW of Dispatchable Natural Gas Generation in 2026 (Lange II) Q1 2025 – Requested CPCN from Wyoming Public Service Commission Q2 2025 – Obtained approval for CPCN from Wyoming Public Service Commission Q3 2025 – Commenced construction 2H 2026* – Expect to place new resource in service; timely recovery through base rates Pictured: Groundbreaking of the Lange II generation project, including six reciprocating internal combustion engines and supporting facilities in Rapid City, South Dakota

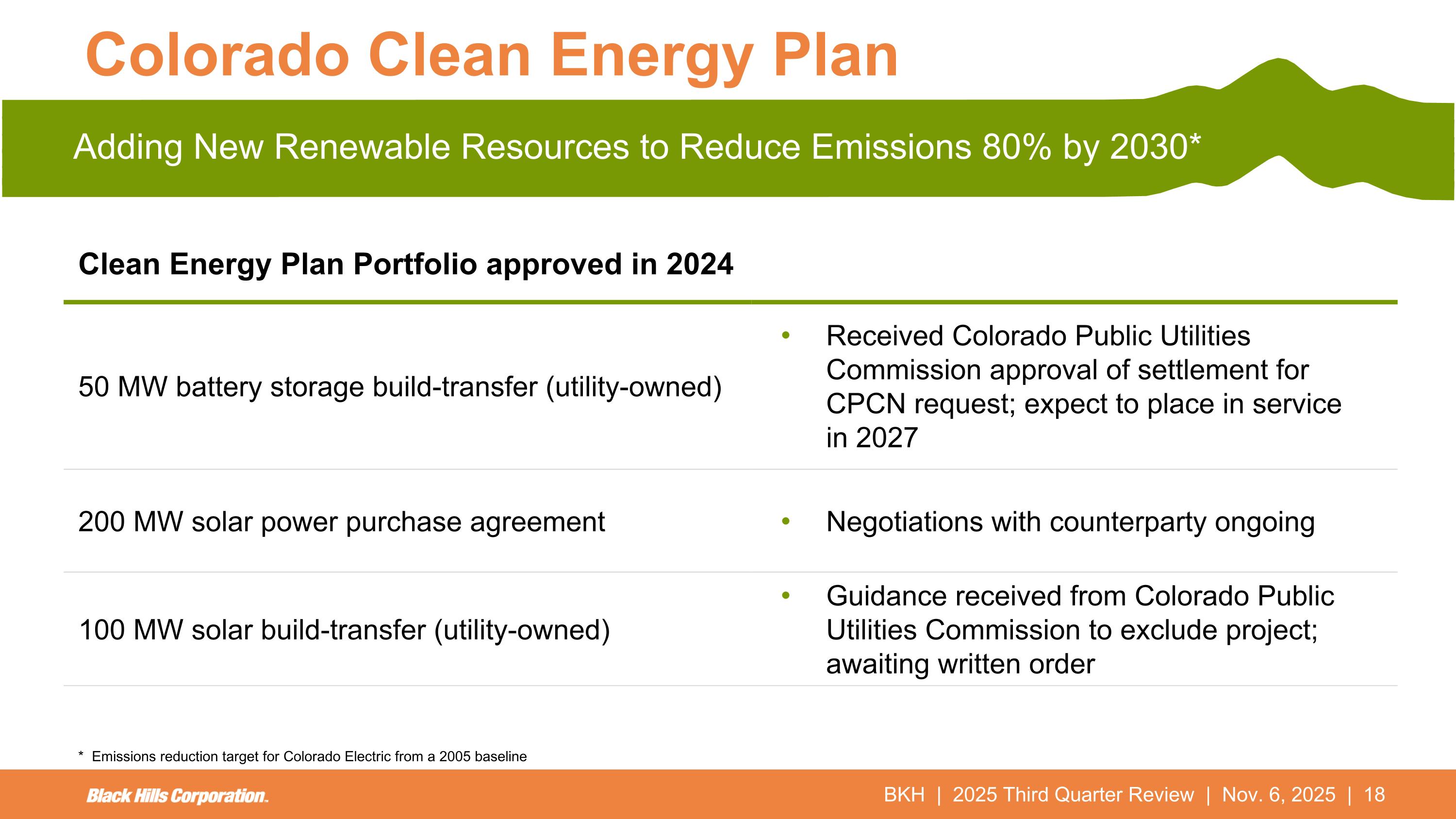

BKH | 2025 Third Quarter Review | Nov. 6, 2025 | Colorado Clean Energy Plan Clean Energy Plan Portfolio (Approved in Q4 2024) 50 MW battery storage build-transfer (utility owned) 200 MW solar power purchase agreement 100 MW solar build-transfer (utility owned) * Emissions reduction target for Colorado Electric from a 2005 baseline Adding New Renewable Resources to Reduce Emissions 80% by 2030* Received CPUC approval of settlement for CPCN approval of 50 MW battery storage project Negotiations for 200 MW solar PPA ongoing Guidance from CPUC to exclude 100 MW solar project Clean Energy Plan Portfolio approved in 2024 50 MW battery storage build-transfer (utility-owned) Received Colorado Public Utilities Commission approval of settlement for CPCN request; expect to place in service in 2027 200 MW solar power purchase agreement Negotiations with counterparty ongoing 100 MW solar build-transfer (utility-owned) Guidance received from Colorado Public Utilities Commission to exclude project; awaiting written order

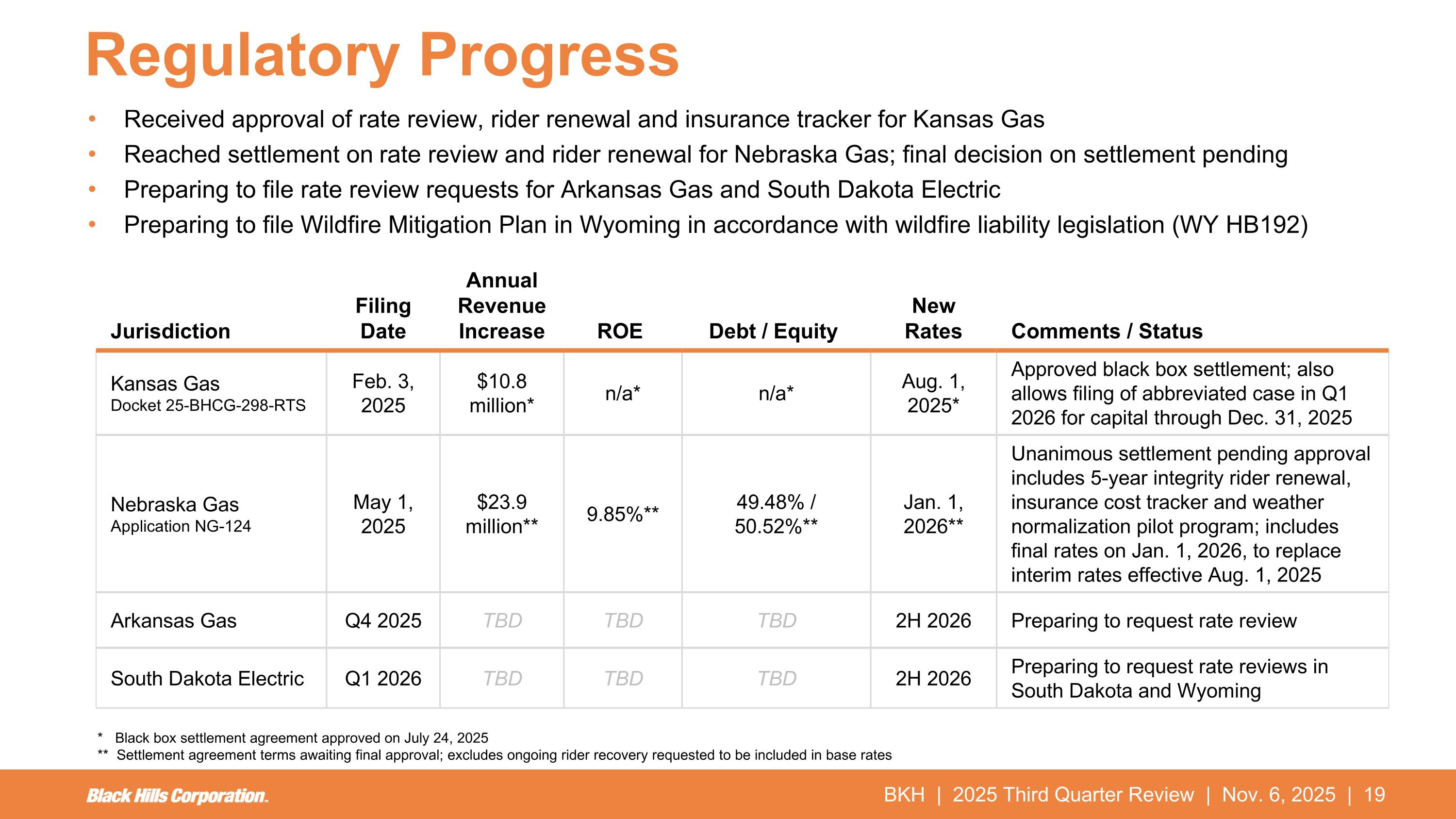

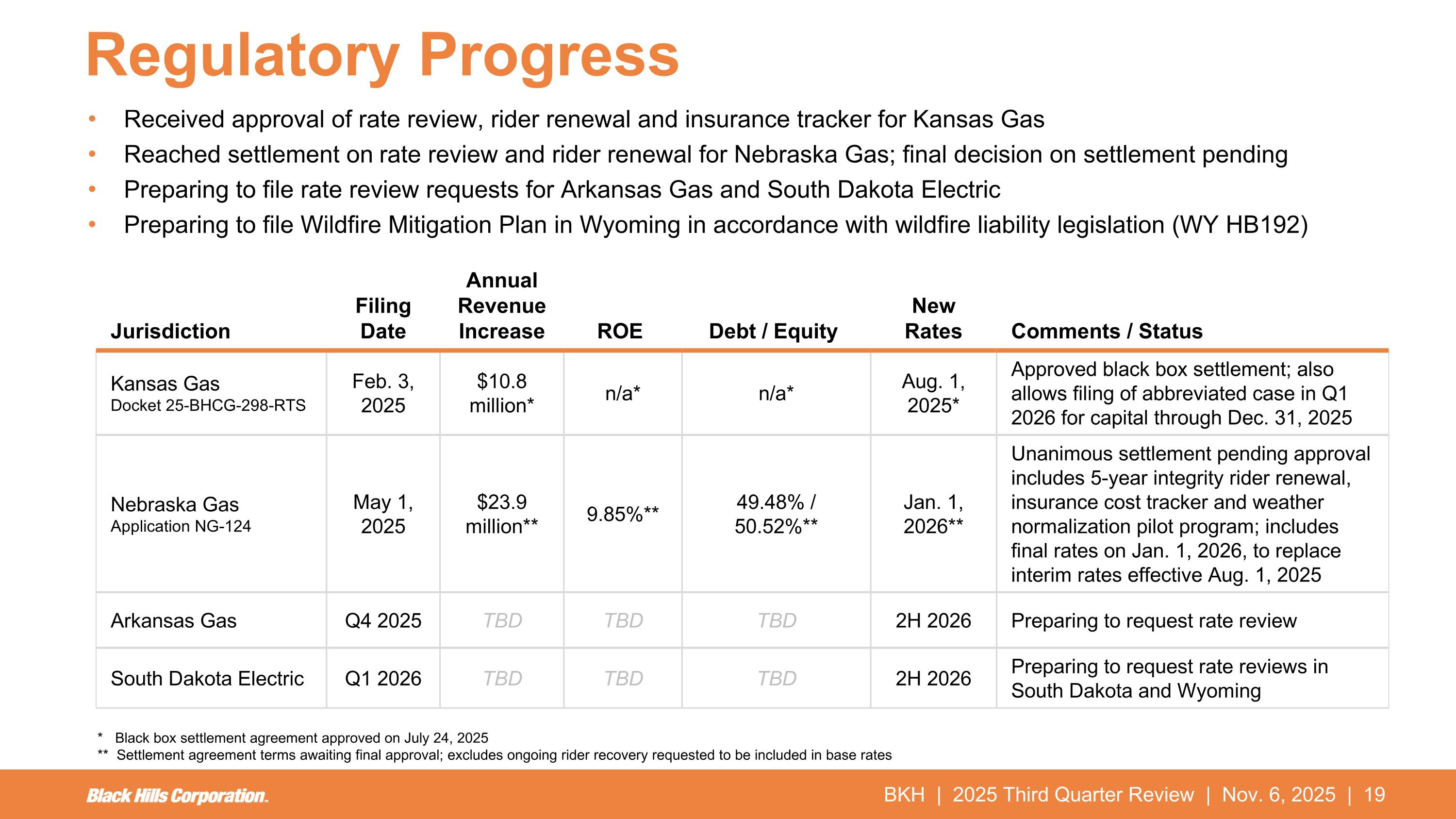

BKH | 2025 Third Quarter Review | Nov. 6, 2025 | Regulatory Progress * Black box settlement agreement approved on July 24, 2025 ** Settlement agreement terms awaiting final approval; excludes ongoing rider recovery requested to be included in base rates Jurisdiction Filing Date Annual Revenue Increase ROE Debt / Equity New Rates Comments / Status Kansas Gas Docket 25-BHCG-298-RTS Feb. 3, 2025 $10.8 million* n/a* n/a* Aug. 1, 2025* Approved black box settlement; also allows filing of abbreviated case in Q1 2026 for capital through Dec. 31, 2025 Nebraska Gas Application NG-124 May 1, 2025 $23.9 million** 9.85%** 49.48% / 50.52%** Jan. 1, 2026** Unanimous settlement pending approval includes 5-year integrity rider renewal, insurance cost tracker and weather normalization pilot program; includes final rates on Jan. 1, 2026, to replace interim rates effective Aug. 1, 2025 Arkansas Gas Q4 2025 TBD TBD TBD 2H 2026 Preparing to request rate review South Dakota Electric Q1 2026 TBD TBD TBD 2H 2026 Preparing to request rate reviews in South Dakota and Wyoming Received approval of rate review, rider renewal and insurance tracker for Kansas Gas Reached settlement on rate review and rider renewal for Nebraska Gas; final decision on settlement pending Preparing to file rate review requests for Arkansas Gas and South Dakota Electric Preparing to file Wildfire Mitigation Plan in Wyoming in accordance with wildfire liability legislation (WY HB192)

BKH | 2025 Third Quarter Review | Nov. 6, 2025 | 2 Strong Confidence in Long-term Growth Outlook 4% to 6% Long-term EPS growth target In upper half of range starting in 2026 $4.7billion Capital investment 2025-2029 with incremental upside opportunities 1 Average compounded annual growth rate off 2023 base of $3.75 per share 2 Dividend yield as of Nov. 5, 2025 +4.2% Dividend Yield 55%-65% dividend payout target 10%+ Data center EPS contribution growing to more than 10% beginning in 2028 driven by 500 MW of data center load by 2029 2 1

Questions BKH | 2025 Third Quarter Review | Nov. 6, 2025 |

Appendix BKH | 2025 Third Quarter Review | Nov. 6, 2025 |

BKH | 2025 Third Quarter Review | Nov. 6, 2025 | Ready Wyoming 260-mile, $350-million Electric Transmission Expansion on Track for Year-End Black Hills’ electric system and service area Transmission line route WYOMING SOUTH DAKOTA NEBRASKA COLORADO Map source: S&P Global Capital IQ Northeast Line Northwest Line Cheyenne Infrastructure Benefits of Expansion and Interconnection of Electric System in Wyoming Maintain long-term cost stability for customers Enhance system resiliency Expand access to power markets and provide flexibility as power markets develop in Western states Support economic growth in Wyoming and attract data center and blockchain customer growth Expand access to renewable resources and facilitate renewable development across wind- and sun-rich resource areas

BKH | 2025 Third Quarter Review | Nov. 6, 2025 | Capital Structure * Excludes noncontrolling interest ** Net debt is a non-GAAP measure which includes total debt net of cash and cash equivalents ($ in millions) **

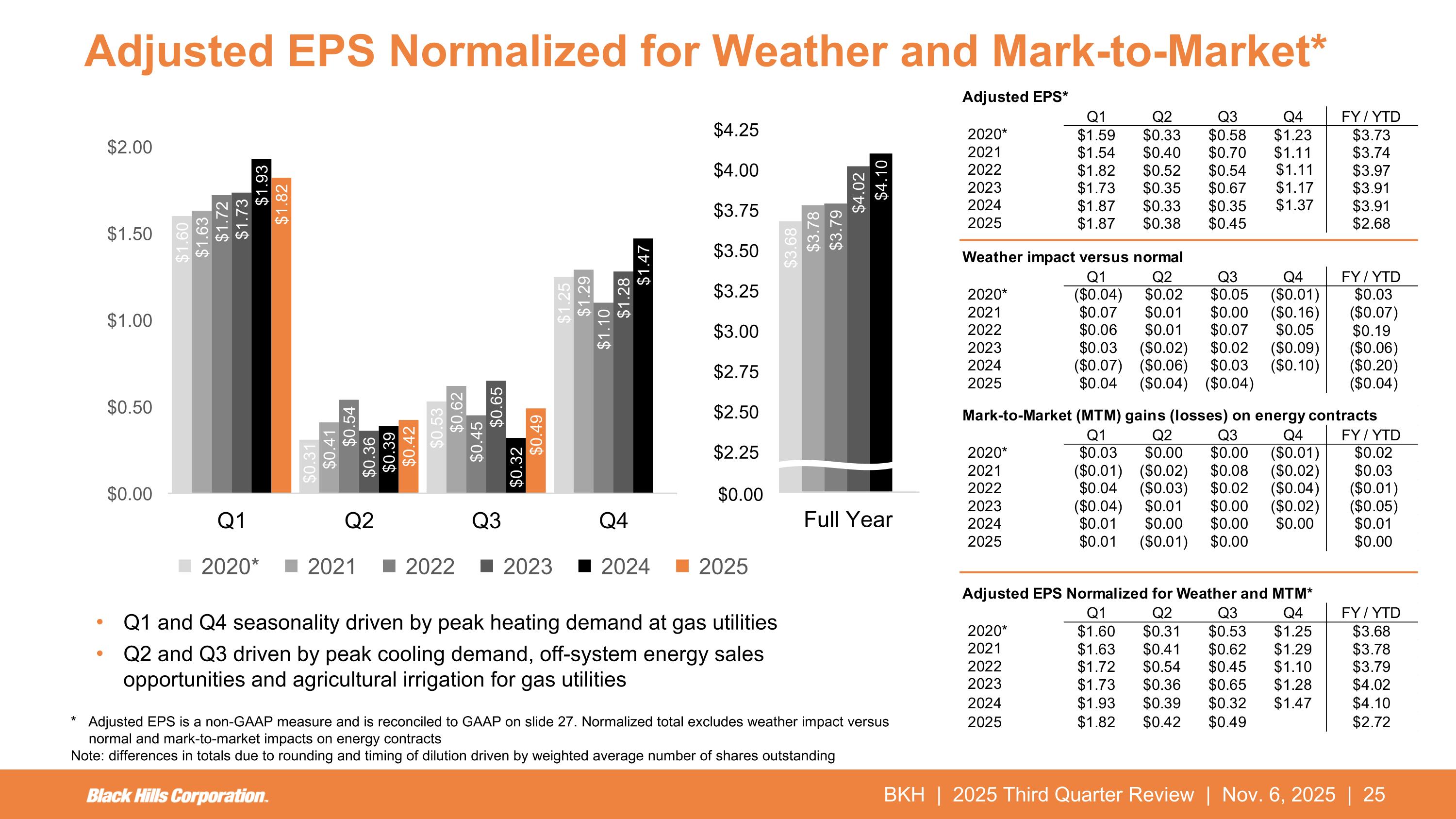

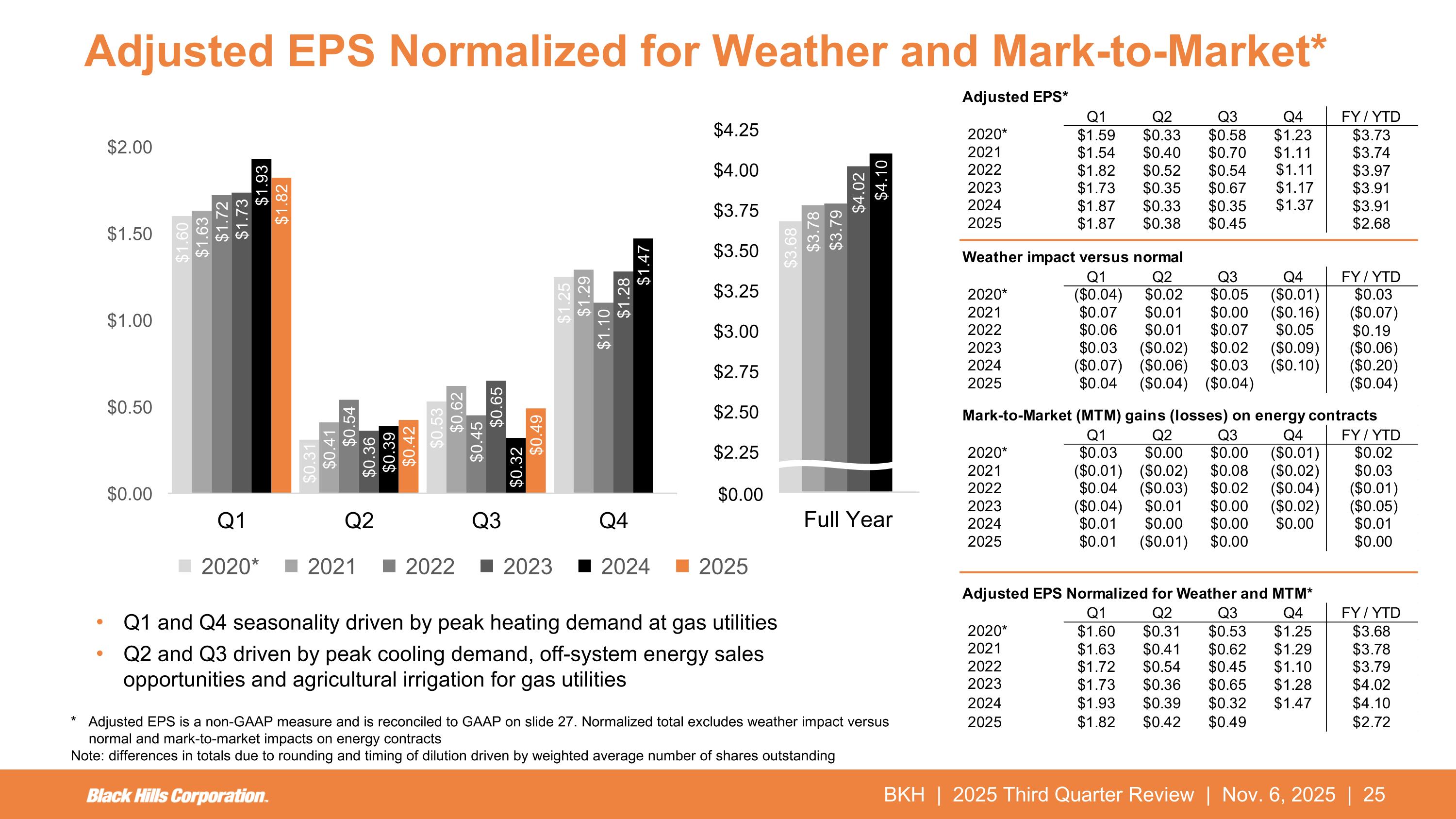

BKH | 2025 Third Quarter Review | Nov. 6, 2025 | * Adjusted EPS is a non-GAAP measure and is reconciled to GAAP on slide 27. Normalized total excludes weather impact versus normal and mark-to-market impacts on energy contracts Note: differences in totals due to rounding and timing of dilution driven by weighted average number of shares outstanding Adjusted EPS Normalized for Weather and Mark-to-Market* Q1 and Q4 seasonality driven by peak heating demand at gas utilities Q2 and Q3 driven by peak cooling demand, off-system energy sales opportunities and agricultural irrigation for gas utilities $0.00

BKH | 2025 Third Quarter Review | Nov. 6, 2025 | Adjusted earnings and Adjusted EPS As noted in this presentation, in addition to presenting its earnings information in conformity with Generally Accepted Accounting Principles (GAAP), the company has provided non-GAAP Adjusted earnings and Adjusted EPS, which reflect adjustments for expenses, gains and losses that the company believes do not reflect ongoing core operating performance. The company’s management uses these non-GAAP financial measures as indicators for evaluating current periods and planning and forecasting future periods. The company also uses these non-GAAP measures when communicating with analysts and investors regarding our earnings results and outlook, as the company believes that these non-GAAP measures allow the company to more accurately compare its ongoing performance across periods. In providing adjusted earnings guidance, there could be differences between adjusted earnings and earnings prepared in accordance with GAAP as a result of our treatment of certain items, such as those described in the reconciliation on the following page. Limitations on the Use of Non-GAAP Measures Non-GAAP measures have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. Our presentation of these non-GAAP financial measures should not be construed as an inference that our future results will not be affected by unusual, non-routine, or non-recurring items. The company is not able to provide a forward-looking quantitative GAAP to Non-GAAP reconciliation for non-GAAP measures due to items that are not considered representative of the company's underlying operating performance that cannot be reasonably quantified, including merger-related costs and any other unplanned items that may affect GAAP results during the remainder of 2025. Our non-GAAP measures may not be comparable to those of other companies. Non-GAAP measures should be used in addition to and in conjunction with results presented in accordance with GAAP. Non-GAAP measures should not be considered as an alternative to net income, operating income or any other operating performance measure prescribed by GAAP, nor should these measures be relied upon to the exclusion of GAAP financial measures. Our non-GAAP measures reflect an additional way of viewing our operations that we believe, when viewed with our GAAP results and the reconciliation to the corresponding GAAP financial measures, provide a more complete understanding of factors and trends affecting our business than could be obtained absent this disclosure. Management strongly encourages investors to review our financial information in its entirety and not rely on a single financial measure. Non-GAAP Financial Measures

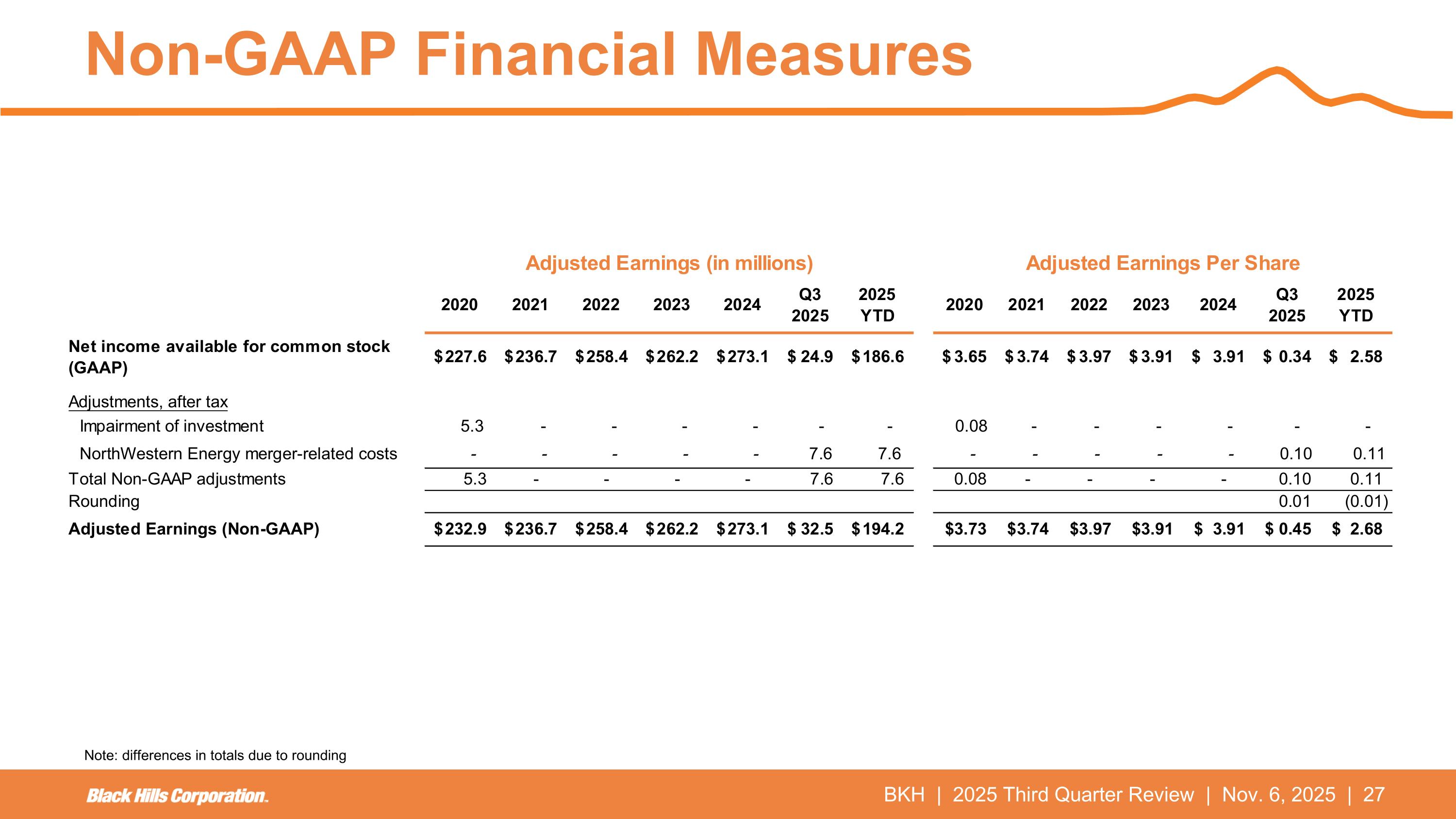

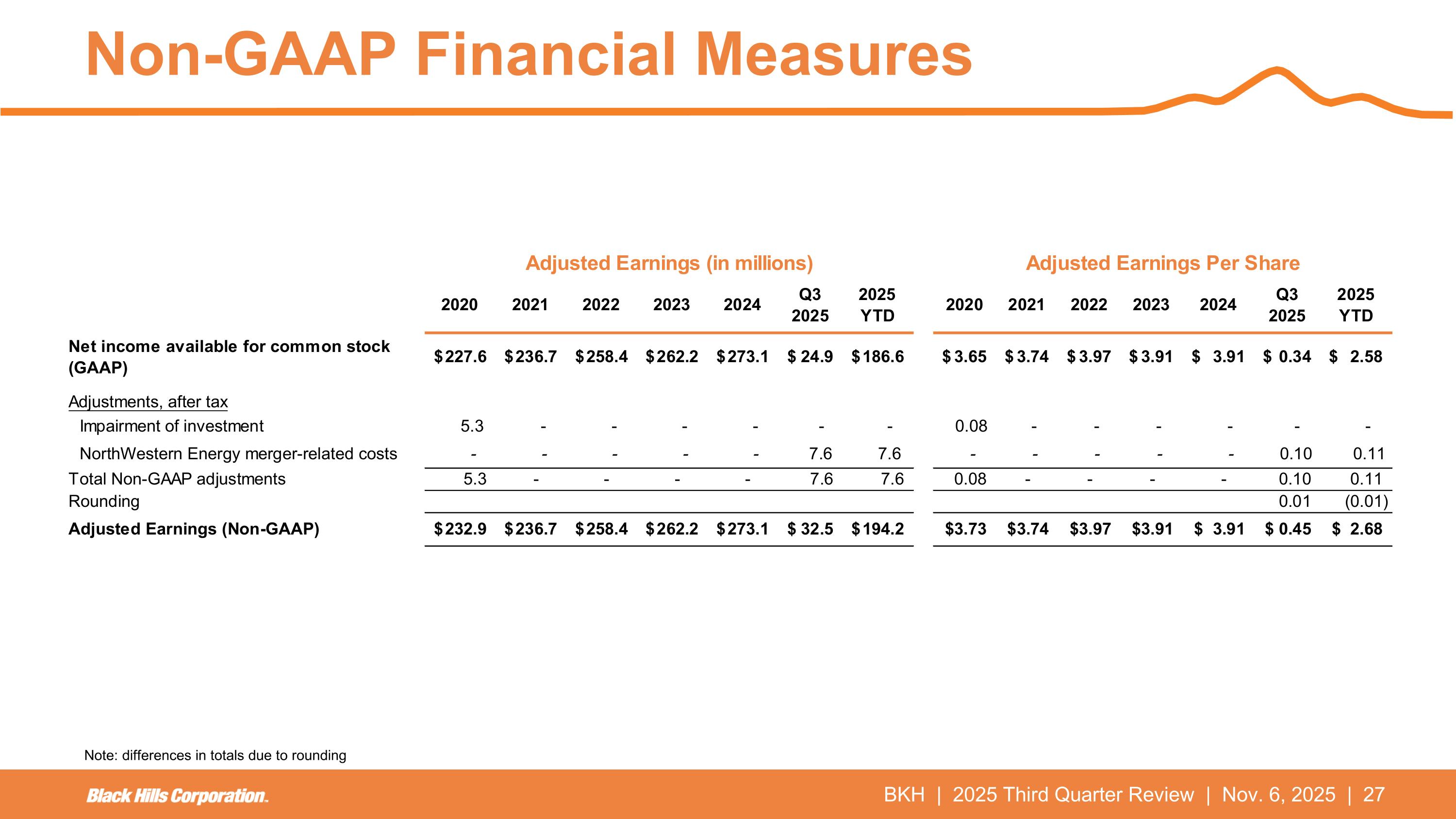

BKH | 2025 Third Quarter Review | Nov. 6, 2025 | Non-GAAP Financial Measures Note: differences in totals due to rounding

BKH | 2025 Third Quarter Review | Nov. 6, 2025 |