UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of October, 2025

Commission File Number 001-15216

HDFC BANK LIMITED

(Translation of registrant’s name into English)

HDFC Bank House, Senapati Bapat Marg,

Lower Parel, Mumbai. 400 013, India

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| HDFC BANK LIMITED |

||||||

| (Registrant) | ||||||

| Date: October 13, 2025 | By: | /s/ Ajay Agarwal |

||||

| Name: Ajay Agarwal |

||||||

| Title: Company Secretary Group Head – Secretarial & Group Oversight |

||||||

EXHIBIT INDEX

The following documents (bearing the exhibit number listed below) are furnished herewith and are made a part of this report pursuant to the General Instructions for Form 6-K.

Description

Intimation of ESG rating

October 13, 2025

New York Stock Exchange

11, Wall Street,

New York,

NY 10005

USA

Dear Sir,

Sub: Intimation of ESG rating

We wish to inform that NSE Sustainability Ratings & Analytics Ltd. vide its email dated October 10, 2025 has assigned a ESG rating of “70” to the Bank for FY 2024.

The rating report received from NSE Sustainability Ratings & Analytics Ltd. has been enclosed herewith.

We would like to clarify that the Bank has not engaged NSE Sustainability Ratings & Analytics Ltd. and the ESG report is independently prepared by them based on information available in the public domain.

This is for your information and appropriate dissemination.

Yours faithfully,

For HDFC Bank Limited

Sd/-

Ajay Agarwal

Company Secretary

Group Head – Secretarial & Group Oversight

Exhibit 99 ESG RATINGS FY2024 HDFC Bank Limited NSE Sustainability Ratings & Analytics

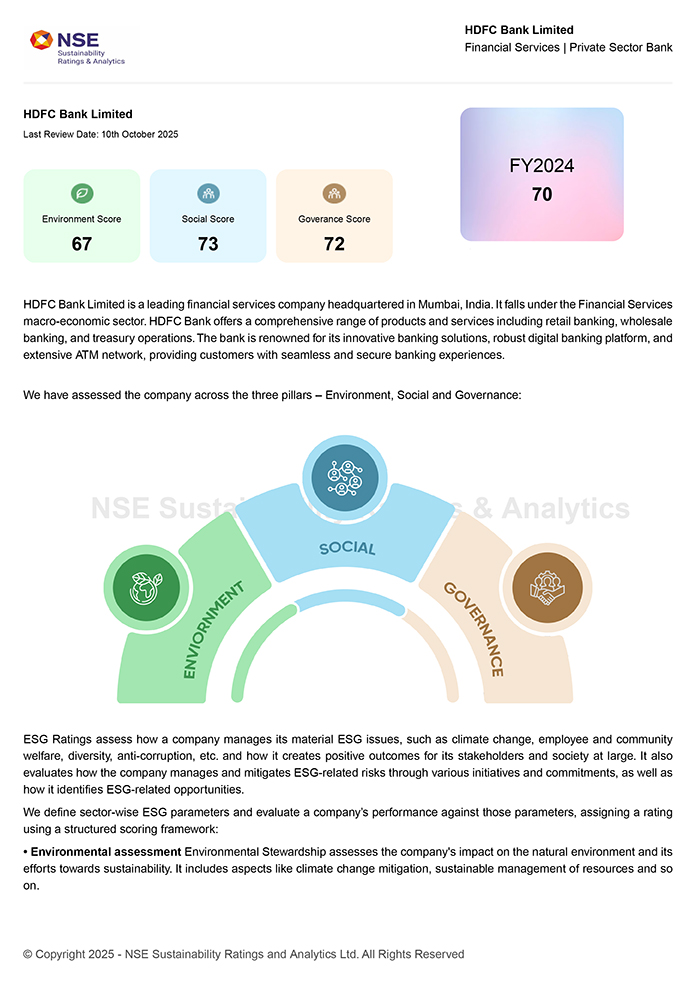

NSE Sustainability Ratings & Analytics HDFC Bank Limited Financial Services | Private Sector Bank HDFC Bank Limited Last Review Date: 10th October 2025 FY2024 70 Environment Score Social Score Goverance Score 67 73 72 Rating Category : Leaders HDFC Bank Limited is a leading financial services company headquartered in Mumbai, India. It falls under the Financial Services macro-economic sector. HDFC Bank offers a comprehensive range of products and services including retail banking, wholesale banking, and treasury operations. The bank is renowned for its innovative banking solutions, robust digital banking platform, and extensive ATM network, providing customers with seamless and secure banking experiences. We have assessed the company across the three pillars – Environment, Social and Governance: NSE Sustainability Ratings & Analytics ESG Ratings assess how a company manages its material ESG issues, such as climate change, employee and community welfare, diversity, anti-corruption, etc. and how it creates positive outcomes for its stakeholders and society at large. It also evaluates how the company manages and mitigates ESG-related risks through various initiatives and commitments, as well as how it identifies ESG-related opportunities. We define sector-wise ESG parameters and evaluate a company’s performance against those parameters, assigning a rating using a structured scoring framework: • Environmental assessment Environmental Stewardship assesses the company’s impact on the natural environment and its efforts towards sustainability. It includes aspects like climate change mitigation, sustainable management of resources and so on. © Copyright 2025 - NSE Sustainability Ratings and Analytics Ltd. All Rights Reserved

• Social impact helps assess how well leadership manages relationships with stakeholders, ensures employee welfare, positively impacts communities, and holds supply chain partners accountable. Businesses are evaluated based on their policies and initiatives around diversity, inclusion, social equity, and ethical conduct. • Effective governance including transparency and disclosures is crucial for ensuring business continuity and minimizing risk. We assess factors such as the independence and diversity of the board, segregation of the roles of CEO and Chairperson, and the composition of auditors, including the balance between audit and non-audit/advisory services.

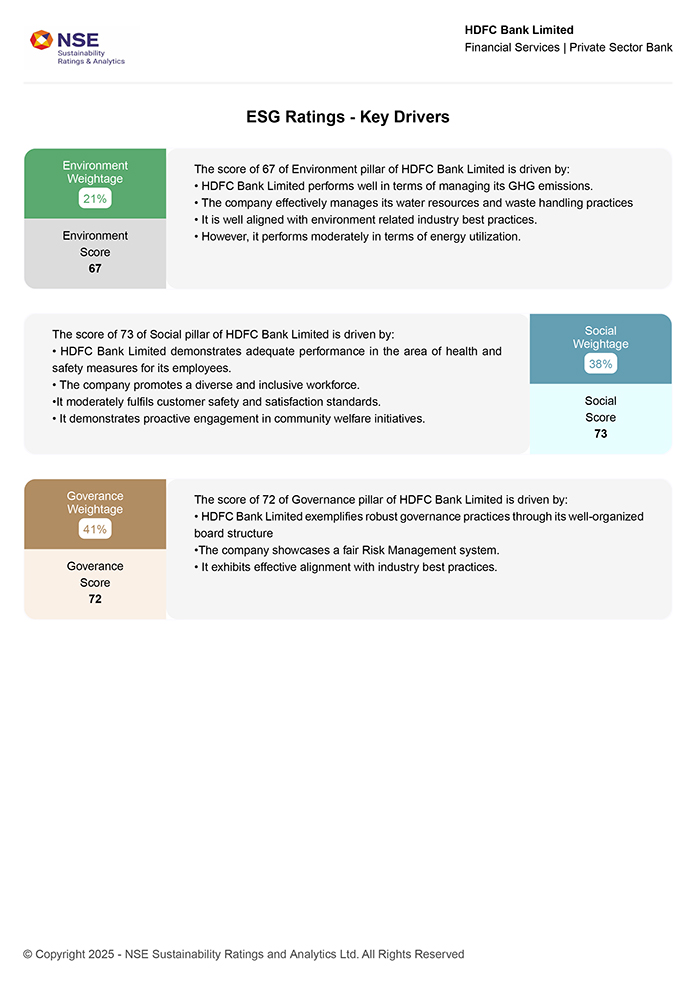

NSE Sustainability Ratings & Analytics HDFC Bank Limited Financial Services | Private Sector Bank ESG Ratings - Key Drivers Environment The score of 67 of Environment pillar of HDFC Bank Limited is driven by: Weightage • HDFC Bank Limited performs well in terms of managing its GHG emissions. 21% • The company effectively manages its water resources and waste handling practices • It is well aligned with environment related industry best practices. Environment • However, it performs moderately in terms of energy utilization. Score 67 The score of 73 of Social pillar of HDFC Bank Limited is driven by: Social Weightage • HDFC Bank Limited demonstrates adequate performance in the area of health and safety measures for its employees. 38% • The company promotes a diverse and inclusive workforce. •It moderately fulfils customer safety and satisfaction standards. Social • It demonstrates proactive engagement in community welfare initiatives. Score 73 Goverance The score of 72 of Governance pillar of HDFC Bank Limited is driven by: Weightage NSE Sustainability Ratings & Analytics • HDFC Bank Limited exemplifies robust governance practices through its well-organized 41% board structure •The company showcases a fair Risk Management system. Goverance • It exhibits effective alignment with industry best practices. Score 72 © Copyright 2025 - NSE Sustainability Ratings and Analytics Ltd. All Rights Reserved

NSE Sustainability Ratings & Analytics HDFC Bank Limited Financial Services | Private Sector Bank Material Events In September 2025, the Dubai Financial Services Authority (DFSA) imposed restrictions on HDFC Bank’s DIFC branch, preventing it from offering financial services to new customers. The action was taken due to concerns over client onboarding practices and the mis-selling of high-risk Credit Suisse AT1 bonds, which were rendered worthless during the 2023 Credit Suisse–UBS merger. While the branch is allowed to continue servicing its existing 1,489 clients, it is prohibited from advising, arranging deals, or promoting financial products to new clients. HDFC Bank stated that the DIFC branch is not material to its overall business and confirmed its cooperation with the DFSA to resolve the issues. In September 2025, HDFC Bank issued a public clarification denying that a woman heard abusing a CRPF jawan in a viral audio clip was one of its employees. The clip, which circulated widely on social media, featured a woman allegedly insulting the jawan during a loan-related conversation, prompting outrage and calls for action. Multiple posts had incorrectly identified her as an HDFC Bank telecaller. The bank stated that the individual in question is not affiliated with HDFC Bank and that her conduct is unacceptable and does not reflect the organization’s values. HDFC Bank confirmed its commitment to maintaining professional standards and reiterated that the incident does not materially impact its business operations. In July 2025, a high-net-worth individual filed a complaint with the Economic Offences Wing (EOW) in Nagpur against four HDFC Bank officials, alleging mis-selling of high-risk Credit Suisse AT1 bonds. The bonds, sold in May 2021, were written down to zero during the Credit Suisse–UBS merger in March 2023, resulting in a complete loss for investors. The complainants, including professionals based in South Africa, Dubai, and India, reportedly invested ¿20–25 crore and were promised returns of 10–13%. HDFC Bank clarified that it has not received any summons and stated that it will cooperate with authorities if approached. The bank emphasized that the matter does not materially impact its overall business operations. In July 2025, NSE the Reserve Sustainability Bank of India (RBI) imposed a monetary Ratings penalty of ¿4.88 lakh & on Analytics HDFC Bank for contraventions related to foreign investment regulations. The action was taken under Section 11(3) of the Foreign Exchange Management Act, 1999, in connection with a loan disbursed by the bank in November 2021. The RBI cited non-compliance with Paragraph 9.3.6 of its Master Direction on Foreign Investment in India. While the penalty is modest in financial terms, HDFC Bank confirmed that it has undertaken corrective measures to address the issue. The bank stated that the matter does not materially impact its financial or operational performance and disclosed the development in accordance with SEBI’s Listing Regulations. In May 2025, the Mumbai Magistrate Court directed the police to file an FIR against HDFC Bank’s Managing Director and CEO, Sashidhar Jagdishan, following allegations made by the Lilavati Kirtilal Mehta Medical Trust. The complaint alleged that Jagdishan received ¿2.05 crore from a former trustee to harass the father of a current trustee, with the transaction reportedly recorded in a handwritten diary. HDFC Bank strongly denied the allegations, calling them baseless, malicious, and a misuse of the legal process aimed at obstructing loan recovery efforts from Splendour Gems, a firm promoted by the Mehta family. The bank stated that the trust’s actions are part of a long-standing pattern of legal harassment to delay repayment of dues amounting to ¿65.22 crore. HDFC Bank confirmed its intent to pursue legal remedies and reiterated that the matter does not materially impact its business operations. Source: As per Exchange Filing/News © Copyright 2025 - NSE Sustainability Ratings and Analytics Ltd. All Rights Reserved

NSE Sustainability Ratings & Analytics HDFC Bank Limited Financial Services | Private Sector Bank ESG Rating Framework employed by NSE Sustainability Ratings and Analytics Ltd Data Source and Extraction Data has been gathered from a variety of reliable sources, ensuring a well-rounded perspective on a company’s practices. A multifaceted approach has been deployed, incorporating both quantitative and qualitative information to generate a comprehensive assessment of the company’s ESG performance. NSE Sustainability derives data from trusted public sources including but not limited to Annual Reports, ESG Reports, BRSR (Business Responsibility & Sustainability Reports) report, Company Website, News, Stock Exchange Filings. Assigning Weights to Theme Based on Materiality The materiality assessment identifies the most significant ESG themes for the company within its specific industry context. By assigning higher weights to these material themes, we ensure that the aspects with the greatest impact on the company’s sustainability and long-term value receive the most emphasis in the final ESG rating. Weighting Methodology: The findings from the materiality assessment are often presented in a Materiality Matrix. This matrix visually lepicts the relative importance of ESG themes based on their environmental, social, and economic impact on the company and its stakeholders. Themes identified NSE as having Sustainability high financial impact and high stakeholder Ratings importance receive & the Analytics highest weightings. Weights are assigned by thoroughly evaluating industry-specific ESG challenges and opportunities. This process ensures that the weighting is accurately refined based on the particular sector’s context. The availability and quality of data for each theme is also considered during the weighting process. Themes with robust and reliable data points receive a higher weighting to ensure the final ESG rating reflects a more accurate picture of the company’s performance Categorization of assessment parameters The assessment parameters are categorised into five criteria designed to understand a company’s ESG performance. These criteria are; 1. Performance :This assesses the company’s actual resuls on a specific ESG metric based on the data points provided. 2. Compliance :This evaluates the company’s adherence to relevant regulations and industry had practices related to the specific ESG theme. 3. Policy :This assesses the strength and comprehensiveness of the company’s policies addressing the specific ESG theme 4. Initiatives :This assesses address the ESG theme and achieve its stated goals. specific initiatives the company is undertaking to address the ESG theme and achieve its stated goals. 5. Best Practise :By incorporating these categories, a comprehensive and detailed evaluation of a company’s ESG performance is provided. Each criterion offers a unique perspective, collectively ensuring a balanced and thorough assessment © Copyright 2025 - NSE Sustainability Ratings and Analytics Ltd. All Rights Reserved

NSE Sustainability Ratings & Analytics HDFC Bank Limited Financial Services | Private Sector Bank Rating Scale The ESG rating methodology utilizes a clear and transparent rating scale to communicate a company’s performance across the Environment, Social, and Governance (ESG) pillars. The ESG rating scale ranges such as to represent the degree of performance on a particular ESG theme. This scale is applied to each assessment parameter within the Environment, Social, and Governance pillars. However, crucially, the benchmarks for achieving a specific score vary depending on the industry a company operates in. This industry-specific approach acknowledges that different industries have inherent differences in their environmental and social impact. For example, the expectations for greenhouse gas emission reduction will be significantly higher for an energy company compared to a software development company. Further, companies are also scored on Environment and Social assessment parameters based on threshold / benchmark which are sector-agnostic making the scores comparable across industries. Quantitative Data and Peer Benchmarks: When dealing with quantitative data points, such as energy consumption or waste generation, we benchmark a company’s performance partly against peers within the basicindustry and partly across sectors. If a company performs significantly better than its peers on a specific metric, it will achieve a higher score on the scale for that assessment parameter. Conversely, a company lagging behind the industry peers will receive a lower score Qualitative Data and Transparency of Disclosures: For qualitative data points, the richness and detail of the company’s disclosures play a crucial role in determining the score. It factors initiatives and goals undertaken by the company and their impact. A company that provides a comprehensive and transparent explanation of its policies, initiatives, and their resultant impact will be rewarded with a higher score. On the other hand, companies with vague or limited disclosures will receive a lower score. The process NSE initiates with the Sustainability identification of relevance of each question Ratings . This precise approach & Analytics ensures that each question’s significance is accurately captured and contributes to the overall theme score. By meticulously mapping them and their corresponding weightages, a coherent system is created where the aggregation of theme scores reflects the true importance of each aspect assessed. Rather than assigning weightages at the pillar level, we allow the weightages determined during the materiality mapping phase to flow seamlessly into the broader themes. This method ensures that the granular details of each theme’s impact are preserved in the overall scoring process at the industry level. The theme scores are consolidated into a comprehensive ESG rating. This is achieved by combining the scores of individual themes, which have been carefully assessed and scored based on the company’s disclosures and performance against industry benchmarks. Each theme score is integrated to form a holistic view of the company’s ESG performance ESG landscape is evolving in terms of regulation, measurement standards, boundaries, disclosure levo1 quantity/quality and standardization of parameters disclosed etc. Creating benchmarks or ideal scores using today’s data may not be the best option. As these factors change in the next few years, the scores will undergo change across the board, most likely upwards, without necessarily improvement in the underlying core issues (but due to improvement in awareness/disclosures etc). To provide for that the current ESG rating is deflated by a factor that helps ESG ratings to be a fair representation of the systemic change in the ESG space and comparable over the years. The ESG rating is normalized on a scale of 0 to 100. The ESG rating allows for cross-company and cross- industry comparisons of ESG performance. © Copyright 2025 - NSE Sustainability Ratings and Analytics Ltd. All Rights Reserved

NSE Sustainability Ratings & Analytics HDFC Bank Limited Financial Services | Private Sector Bank NSE Sustainability ESG Rating Category Classification Table: The ESG rating is adjusted based on the number, severity and frequency of negative events or allegations related to its ESG practices. The controversy score is used to discount the ESG rating of the company, according to a predefined framework. The higher the controversy score, the greater the discount applied to the raw ESG rating. Methodology Limitations Despite the robust and adaptive methodology, it is important to acknowledge certain limitations inherent in the methodology. Two primary areas of concern identified are disclosure bias and coverage bias. Disclosure Bias Disclosure bias occurs due to reliance on self-reported data from the companies we assess. Unlike financial data, which is typically subject to rigorous external audits, ESG data often lacks such stringent verificatior processes. This means that the data provided is not always audited or assured, raising questions about its accuracy and reliability. Given that our ratings are heavily reliant on the data provided by the companies themselves, the veracity of our evaluations can be compromised if the disclosed information is not comprehensive or transparent. Coverage Bias Another significant limitation is coverage bias, which arises because our ratings predominantly cover listed companies. This focus means that many privately held companies, small and medium enterprises (SMEs), and companies in emerging markets may not be included in our assessments. As a result, stakeholders may not have a complete picture of the ESG performance across the entire market landscape. This limitation can impact the overall comparability and comprehensiveness of our ratings. We are continuously exploring ways to expand our coverage to include a broader range of companies and provide a more holistic view of the market’s ESG performance. © Copyright 2025 - NSE Sustainability Ratings and Analytics Ltd. All Rights Reserved

NSE Sustainability Ratings & Analytics HDFC Bank Limited Financial Services | Private Sector Bank Rating Analyst Senior Rating Analyst Chief Rating Officer Ms. Anushka Arukar Mr. Piyush Palan Ms. Snehal Suryawanshi Mr. Mohit Singh Mr. Suhas Shetty Ms. Divyani Chaudhari NSE Sustainability Ratings & Analytics Registered Office Contact Us NSE Sustainability Ratings and Analytics Limited Email: esgratings@nse.co.in Exchange Plaza C-1, Block G, Bandra Kurla Complex, Phone:022-66418156 Bandra(E),Mumbai-400051 For additional details on NSE Sustainability and its ESG ratings, please visit https://www.nse-esgrating.com or you may reach out on esgratings@nse.co.in © Copyright 2025 - NSE Sustainability Ratings and Analytics Ltd. All Rights Reserved

NSE Sustainability Ratings & Analytics HDFC Bank Limited Financial Services | Private Sector Bank About NSE Sustainability Ratings and Analytics Limited: Environmental, Social and Governance performance of companies to provide ESG ratings and related products to stakeholders for making informed decisions. The comprehensive assessment involves conducting thorough evaluation of corporate sustainability practices, policies and disclosures across relevan sectors and industries. It offers a detailed ESG rating scorecard highlighting the strengths and areas for improvement for all the evaluated entities by NSE Sustainability. NSE Sustainability’s model delivers a thorough and unbiased evaluation of a company’s ESG performance. In addition to ESG ratings services, NSE Sustainability will be actively involved in a range of associated ESG-related activities including but not limited to scoring products, and research activities incidental to ESG ratings, for domestic and international dissemination. For more information, please visit: https://www.nse-esgrating.com About NSE Indices Limited. NSE Indices Limited,a subsidiary of NSE,provides a variety of indices and index related services for the capital markets. The company focuses on the index as a core product. The company owns and manages a portfolio of indices under the Nifty brand of NSE, including the flagship index, the Nifty 50. Nifty equity indices comprise broad-based benchmark indices, sectoral indices, strategy indices, thematic indices, and customised indices. NSE Indices Limited also maintains fixed income indices based on Government of India securities, corporate bonds, money market instruments and hybrid indices. Many investment products based on Nifty indices have been developed within India and abroad. These include index-based derivatives traded on NSE and NSE International Exchange IFSC Limited (NSE IX) and a number of index funds and exchange traded funds. The flagship ‘Nifty 50’ index is widely tracked and traded as the benchmark for Indian Capital Markets. For more information, please visit: www.niftyindices.com NSE Sustainability Ratings & Analytics © Copyright 2025 - NSE Sustainability Ratings and Analytics Ltd. All Rights Reserved

NSE Sustainability Ratings & Analytics HDFC Bank Limited Financial Services | Private Sector Bank Disclaimer NSE Sustainability Ratings & Analytics Limited ensures accuracy and reliability of the information in this document to the best of its endeavours. However, NSE Sustainability Ratings & Analytics Limited makes no warranty or representation as to the accuracy, completeness or reliability of any of the information contained in the attached document and disclaims any and all liability whatsoever to any person for any damage or loss of any nature arising from or as a result of reliance on any of the information provided in the attached document. This report has been prepared based on information that is publicly disclosed by the company. The availability, scope, and quality of such disclosures vary considerably across entities and has an impact on the company’s rating. Accordingly, the analyses, conclusions, and any comparative assessments contained herein may inherently reflect a bias in favour of entities with more robust disclosure practices. No independent verification of the disclosed data has been undertaken. Therefore, readers are advised to undertake their own diligence and are advised not to solely rely on the information provided in this document. All intellectual property rights in this document and its content and presentation, including but not limited to text, graphics, logos, images and designs are owned by or licensed to NSE Sustainability Ratings & Analytics Limited. NSE Sustainability Ratings & Analytics Limited further clarifies that any intellectual property rights applicable to excerpt of information borrowed from third party /entity vests with such third party/entity and NSE Sustainability Ratings & Analytics Limited disclaims any intellectual property rights in such excerpt of information. The information contained in the attached document is not intended to provide any professional advice., ih no event shall NSE Sustainability Ratings & Analytics Limited be liable to any reader(s) for any loss or damage, ifcluding without limitation any direct or indirect, special, incidental or consequential damages or any other loss or expenses whatsoever arising out of the use of the Information or its excerpts covered in this document. NSE Sustainability Ratings & Analytics © Copyright 2025 - NSE Sustainability Ratings and Analytics Ltd. All Rights Reserved