UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) July 17, 2025

SIMMONS FIRST NATIONAL CORPORATION

(Exact name of registrant as specified in its charter)

| Arkansas | 0-6253 | 71-0407808 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (I.R.S. Employer Identification No.) | ||

| 501 Main Street, Pine Bluff, Arkansas | 71601 | |||

| (Address of principal executive offices) | (Zip Code) | |||

(870) 541-1000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common stock, par value $0.01 per share | SFNC | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

| Item 2.02 | Results of Operations and Financial Condition. |

On July 17, 2025, the Registrant issued a press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information provided pursuant to this Item 2.02, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (“Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Registrant under the Securities Act of 1933 (“Securities Act”) or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 7.01 | Regulation FD Disclosure. |

On July 17, 2025, the Registrant issued an investor presentation, a copy of which is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

The information provided pursuant to this Item 7.01, including Exhibit 99.2, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Registrant under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

| Exhibit 99.1 | Press Release dated July 17, 2025 | |||

| Exhibit 99.2 | Investor Presentation issued on July 17, 2025 | |||

| Exhibit 104 | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| SIMMONS FIRST NATIONAL CORPORATION | ||||||

| /s/ C. Daniel Hobbs | ||||||

| Date: July 17, 2025 | C. Daniel Hobbs, Executive Vice President and Chief Financial Officer |

|||||

Exhibit 99.1

July 17, 2025

Simmons First National Corporation Reports Second Quarter 2025 Results

George Makris, Jr., Simmons’ Chairman and CEO, commented on second quarter 2025 results:

We were pleased with our second quarter results which reflected strong revenue growth, disciplined expense management and positive underlying balance sheet growth that led to further improvement in profitability measures.

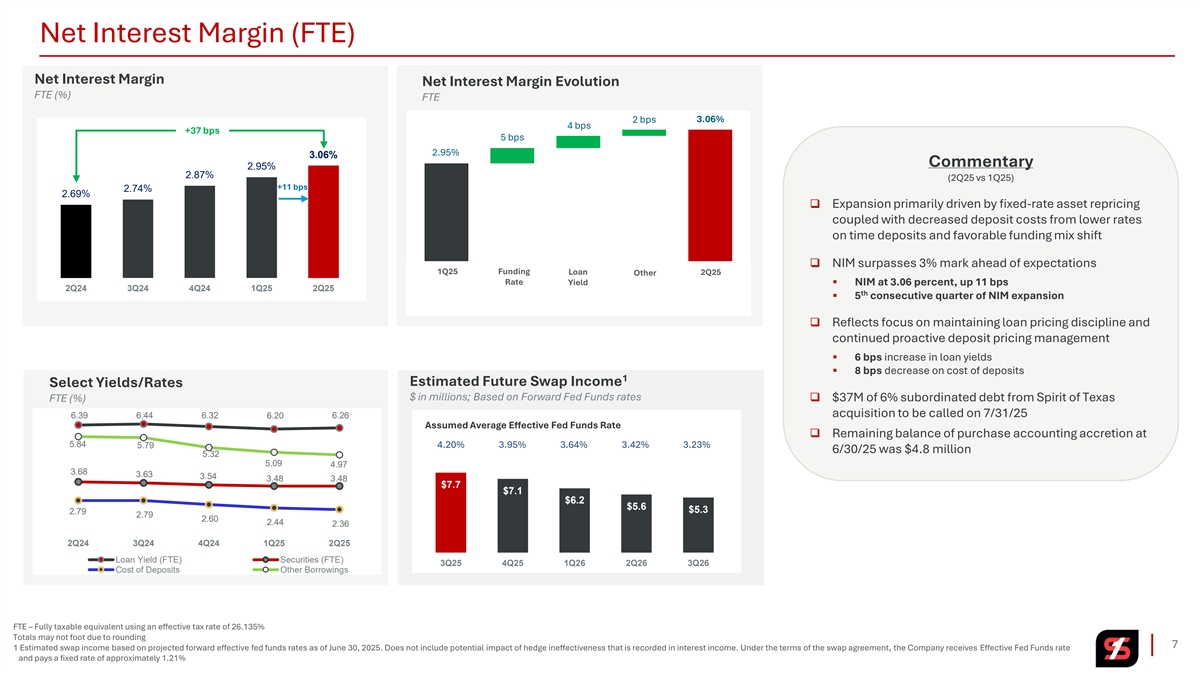

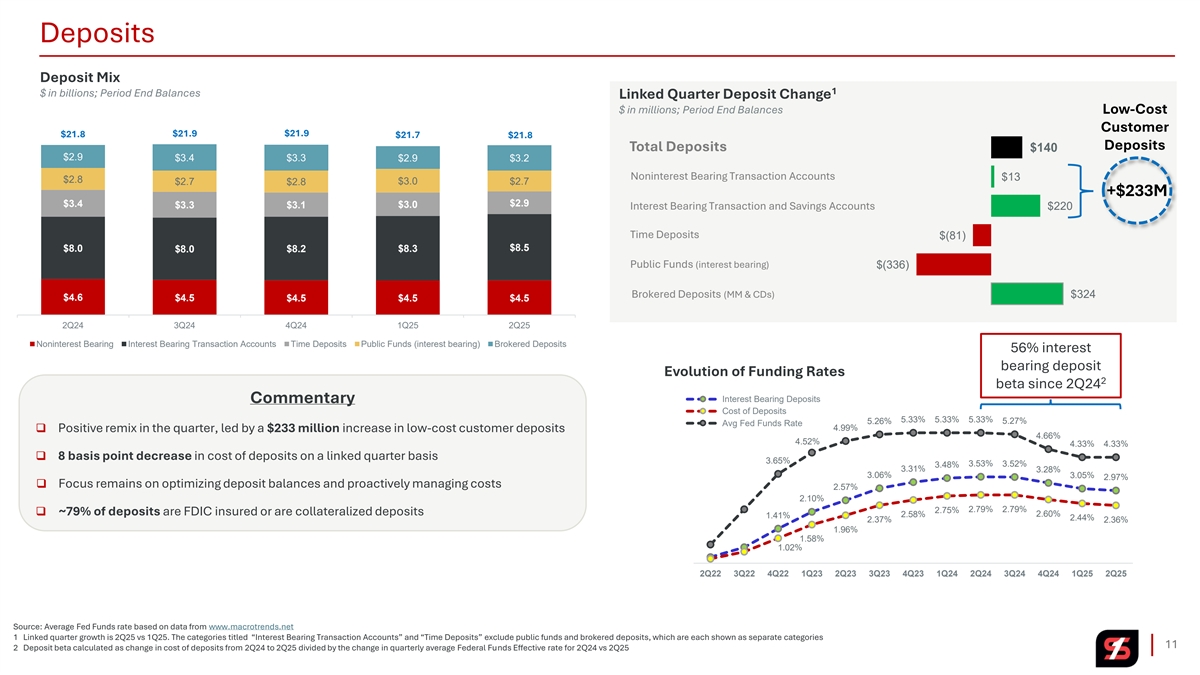

Our net interest margin increased for the fifth consecutive quarter and surpassed the 3 percent mark ahead of expectations. Loan yields were up and deposit costs declined for the third consecutive quarter. While overall balance sheet growth was muted, our loan pipeline remains strong and our focus on profitability as well as loan and deposit remixing resulted in C&I growth coupled with a $233.1 million increase in low-cost customer deposits. At the same time, asset quality metrics were stable.

While certain administration policies have become clearer, tariff volatility looms large and is a key to future interest rate moves and economic conditions. Against this backdrop, we continue our focus on organic growth in our very attractive footprint and are encouraged by our positive momentum heading into the last half of 2025.

| FINANCIAL HIGHLIGHTS |

2Q25 | 1Q25 | 2Q24 | 2Q25 Highlights |

||||||||||

| BALANCE SHEET (in millions) |

Comparisons reflect 2Q25 vs 1Q25 unless otherwise noted

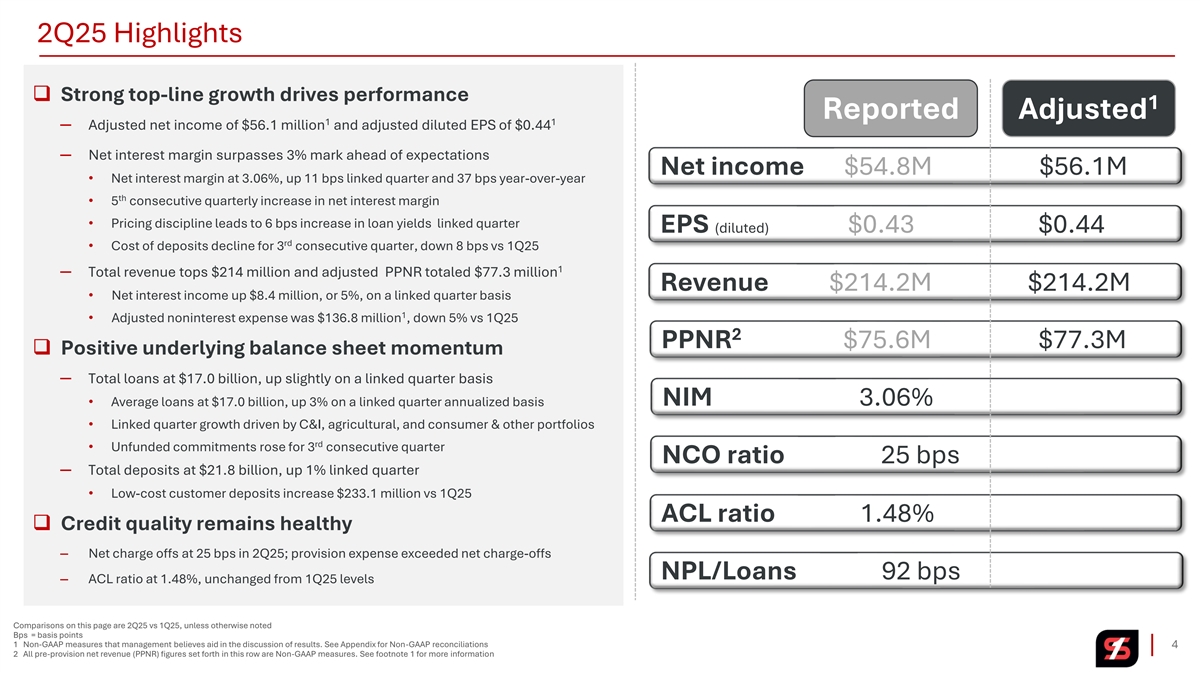

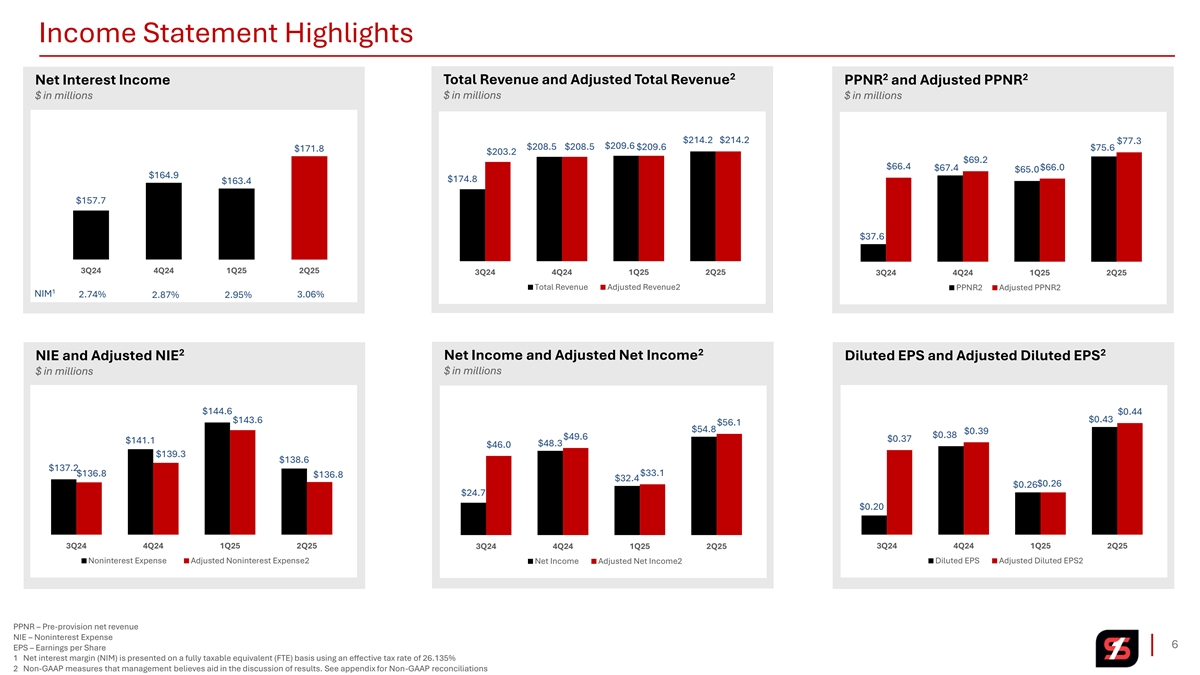

• Net income of $54.8 million and diluted EPS of 0.43

• Adjusted net income1 of $56.1 million and adjusted diluted EPS1 of $0.44

• Total revenue of $214.2 million and PPNR1 of $75.6 million

• Adjusted total revenue1 of $214.2 million and adjusted PPNR1 of $77.3 million

• Net interest income up $8.4 million, or 5 percent

• Net interest margin up 11 basis points to 3.06 percent; the 5th consecutive quarterly increase in net interest margin

• Pricing discipline led to 6 basis point increase in loan yields

• Cost of deposits down 8 bps; low-cost customer deposits up $233.1 million

• Noninterest expense of $138.6 million; adjusted noninterest expense1 of $136.8 million, down 5 percent

• NCO ratio of 25 bps in 2Q24; provision expense exceeds net charge-offs |

|||||||||||||

| Total loans |

$ | 17,111 | $ | 17,094 | $ | 17,192 | ||||||||

| Total investment securities |

5,997 | 6,107 | 6,571 | |||||||||||

| Total deposits |

21,825 | 21,685 | 21,841 | |||||||||||

| Total assets |

26,694 | 26,793 | 27,369 | |||||||||||

| Total shareholders’ equity |

3,549 | 3,531 | 3,459 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| PERFORMANCE MEASURES (in millions) |

||||||||||||||

| Total revenue |

$ | 214.2 | $ | 209.6 | $ | 197.2 | ||||||||

| Adjusted total revenue1 |

214.2 | 209.6 | 197.2 | |||||||||||

| Pre-provision net revenue1 (PPNR) |

75.6 | 65.0 | 57.9 | |||||||||||

| Adjusted pre-provision net revenue1 |

77.3 | 66.0 | 59.4 | |||||||||||

| Provision for credit losses on loans |

11.9 | 26.8 | 11.1 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| PER SHARE DATA |

||||||||||||||

| Diluted earnings |

$ | 0.43 | $ | 0.26 | $ | 0.32 | ||||||||

| Adjusted diluted earnings1 |

0.44 | 0.26 | 0.33 | |||||||||||

| Book value |

28.17 | 28.04 | 27.56 | |||||||||||

| Tangible book value1 |

16.97 | 16.81 | 16.20 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| ASSET QUALITY |

||||||||||||||

| Net charge-off ratio (NCO ratio) |

0.25 | % | 0.23 | % | 0.19 | % | ||||||||

| Nonperforming loan ratio |

0.92 | 0.89 | 0.60 | |||||||||||

| Nonperforming assets to total assets |

0.62 | 0.61 | 0.39 | |||||||||||

| Allowance for credit losses to loans (ACL) |

1.48 | 1.48 | 1.34 | |||||||||||

| Nonperforming loan coverage ratio |

161 | 165 | 223 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| CAPITAL RATIOS |

||||||||||||||

| Equity to assets (EA ratio) |

13.30 | % | 13.18 | % | 12.64 | % | ||||||||

| Tangible common equity (TCE) ratio1 |

8.46 | 8.34 | 7.84 | |||||||||||

| Common equity tier 1 (CET1) ratio |

12.36 | 12.21 | 12.00 | |||||||||||

| Total risk-based capital ratio |

14.42 | 14.59 | 14.17 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| OTHER DATA |

||||||||||||||

| Net interest margin (FTE) |

3.06 | % | 2.95 | % | 2.69 | % | ||||||||

| Loan yield (FTE) |

6.26 | 6.20 | 6.39 | |||||||||||

| Cost of deposits |

2.36 | 2.44 | 2.79 | |||||||||||

| Loan to deposit ratio |

78.40 | 78.83 | 78.72 | |||||||||||

| Borrowed funds to total liabilities |

4.46 | 5.59 | 7.38 | |||||||||||

|

|

|

|

|

|

|

|||||||||

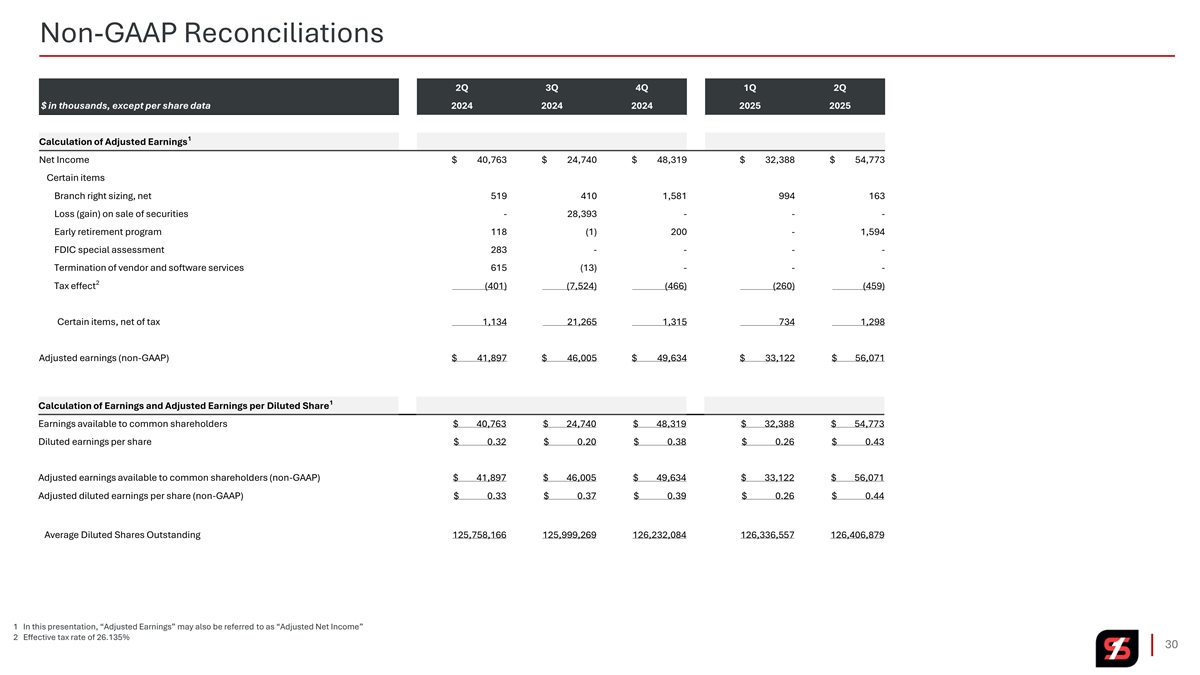

Simmons First National Corporation (NASDAQ: SFNC) (Simmons or Company) today reported net income of $54.8 million for the second quarter of 2025, compared to $32.4 million in the first quarter of 2025 and $40.8 million in the second quarter of 2024. Diluted earnings per share were $0.43 for the second quarter of 2025, compared to $0.26 in the first quarter of 2025 and $0.32 for the second quarter of 2024. Adjusted earnings1 for the second quarter of 2025 were $56.1 million, compared to $33.1 million in the first quarter of 2025 and $41.9 million in the second quarter of 2024. Adjusted diluted earnings per share1 for the second quarter of 2025 were $0.44, compared to $0.26 in the first quarter of 2025 and $0.33 in the second quarter of 2024.

The table below summarizes the impact of certain items, consisting primarily of branch right sizing, early retirement program, FDIC special assessments and termination of vendor and software services. They are also described in further detail in the “Reconciliation of Non-GAAP Financial Measures” tables contained in this press release.

Impact of Certain Items on Earnings and Diluted Earnings Per Share (EPS)

| $ in millions, except per share data |

2Q25 | 1Q25 | 2Q24 | |||||||||

| Net income |

$ | 54.8 | $ | 32.4 | $ | 40.8 | ||||||

| Branch right sizing, net |

0.2 | 1.0 | 0.5 | |||||||||

| Early retirement program |

1.6 | — | 0.1 | |||||||||

| FDIC special assessment |

— | — | 0.3 | |||||||||

| Termination of vendor and software services |

— | — | 0.6 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total pre-tax impact |

1.8 | 1.0 | 1.5 | |||||||||

| Tax effect2 |

(0.5 | ) | (0.3 | ) | (0.4 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total impact on earnings |

1.3 | 0.7 | 1.1 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted earnings1,3 |

$ | 56.1 | $ | 33.1 | $ | 41.9 | ||||||

|

|

|

|

|

|

|

|||||||

| Diluted EPS |

$ | 0.43 | $ | 0.26 | $ | 0.32 | ||||||

| Branch right sizing, net |

— | — | — | |||||||||

| Early retirement program |

0.01 | — | — | |||||||||

| FDIC special assessment |

— | — | — | |||||||||

| Termination of vendor and software services |

— | — | 0.01 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total pre-tax impact |

0.01 | — | 0.01 | |||||||||

| Tax effect2 |

— | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total impact on earnings |

0.01 | — | 0.01 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted Diluted EPS1 |

$ | 0.44 | $ | 0.26 | $ | 0.33 | ||||||

|

|

|

|

|

|

|

|||||||

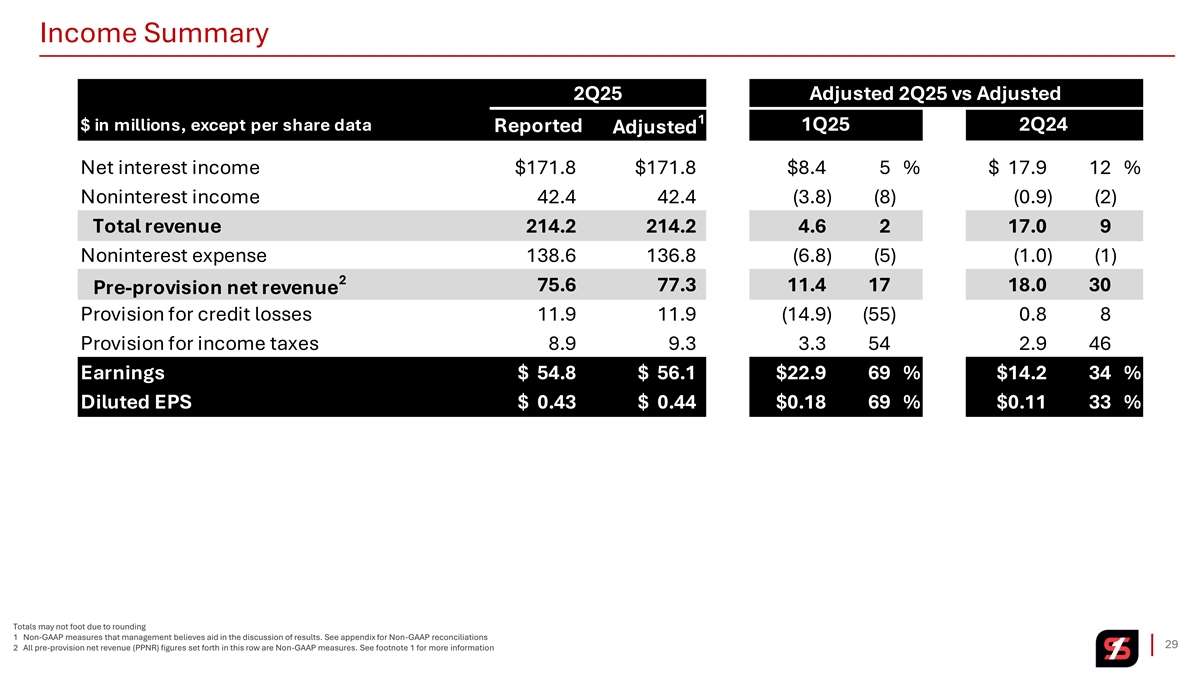

Net Interest Income

Net interest income for the second quarter of 2025 totaled $171.8 million, up $8.4 million, or 5 percent, compared to $163.4 million in the first quarter of 2025 and up $17.9 million, or 12 percent, from $153.9 million in the second quarter of 2024. Interest income totaled $315.0 million for the second quarter of 2025, compared to $307.8 million in the first quarter of 2025 and $329.1 million in the second quarter of 2024. The increase in interest income on a linked quarter basis was primarily due to an increase in earning asset yields, principally loan yields, driven by disciplined pricing of new originations as well as positive fixed-rate loan repricing. Interest expense totaled $143.2 million for the second quarter of 2025, compared to $144.4 million in the first quarter of 2025 and $175.2 million in the second quarter of 2024. The decrease in interest expense on a linked quarter basis reflected management’s efforts to proactively manage deposit costs given maturing deposit repricing and remixing opportunities. Included in net interest income is accretion recognized on acquisition related loans, which totaled $1.3 million in the second quarter of 2025, $1.1 million in the first quarter of 2025 and $1.6 million in the second quarter of 2024.

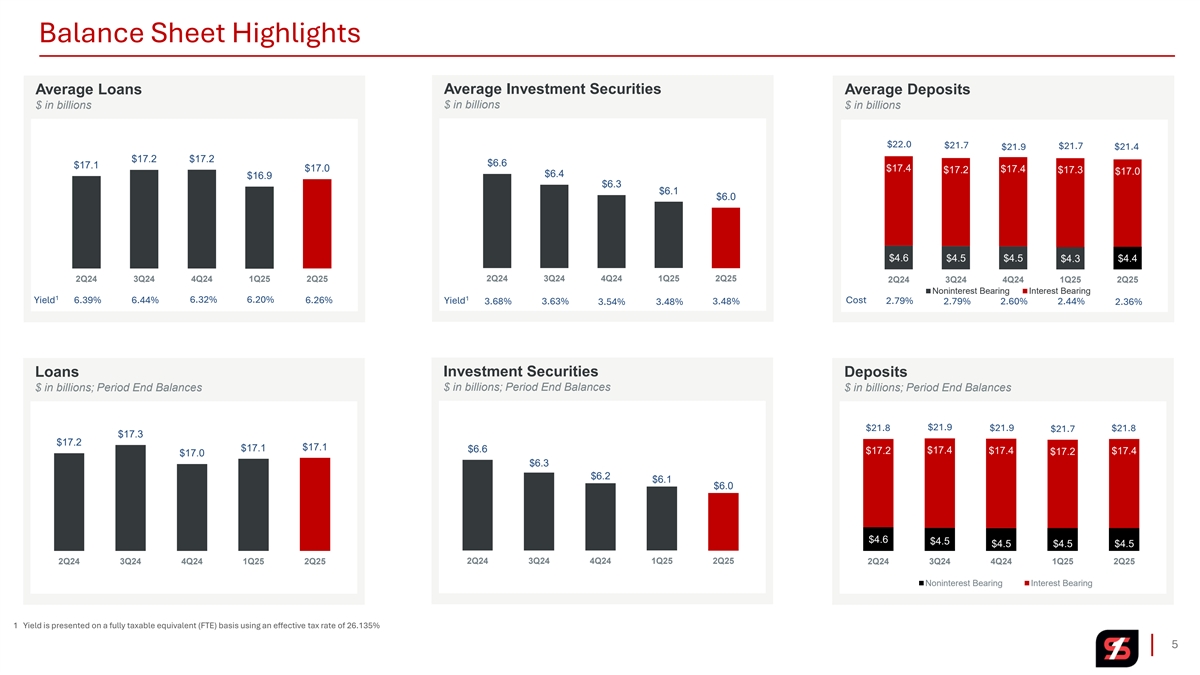

The yield on loans on a fully taxable equivalent (FTE) basis for the second quarter of 2025 was 6.26 percent, up 6 basis points from the 6.20 percent for the first quarter of 2025 and down 13 basis points from 6.39 percent in the second quarter of 2024. Cost of deposits for the second quarter of 2025 was 2.36 percent, down 8 basis points from 2.44 percent in the first quarter of 2025 and down 43 basis points from 2.79 percent in the second quarter of 2024. The net interest margin on an FTE basis for the second quarter of 2025 was 3.06 percent, up 11 basis points from 2.95 percent in the first quarter of 2025, and up 37 basis points from 2.69 percent in the second quarter of 2024. This marked the fifth consecutive quarter of net interest margin expansion. The increase in net interest margin on a linked quarter basis was primarily due to fixed-rate asset repricing coupled with decreased deposit costs from lower rates on time deposits and favorable funding mix shift.

Select Yield/Rates

| 2Q25 | 1Q25 | 4Q24 | 3Q24 | 2Q24 | ||||||||||||||||

| Loan yield (FTE)2 |

6.26 | % | 6.20 | % | 6.32 | % | 6.44 | % | 6.39 | % | ||||||||||

| Investment securities yield (FTE)2 |

3.48 | 3.48 | 3.54 | 3.63 | 3.68 | |||||||||||||||

| Cost of interest bearing deposits |

2.97 | 3.05 | 3.28 | 3.52 | 3.53 | |||||||||||||||

| Cost of deposits |

2.36 | 2.44 | 2.60 | 2.79 | 2.79 | |||||||||||||||

| Cost of borrowed funds |

4.97 | 5.09 | 5.32 | 5.79 | 5.84 | |||||||||||||||

| Net interest spread (FTE)2 |

2.41 | 2.30 | 2.15 | 1.95 | 1.92 | |||||||||||||||

| Net interest margin (FTE)2 |

3.06 | 2.95 | 2.87 | 2.74 | 2.69 | |||||||||||||||

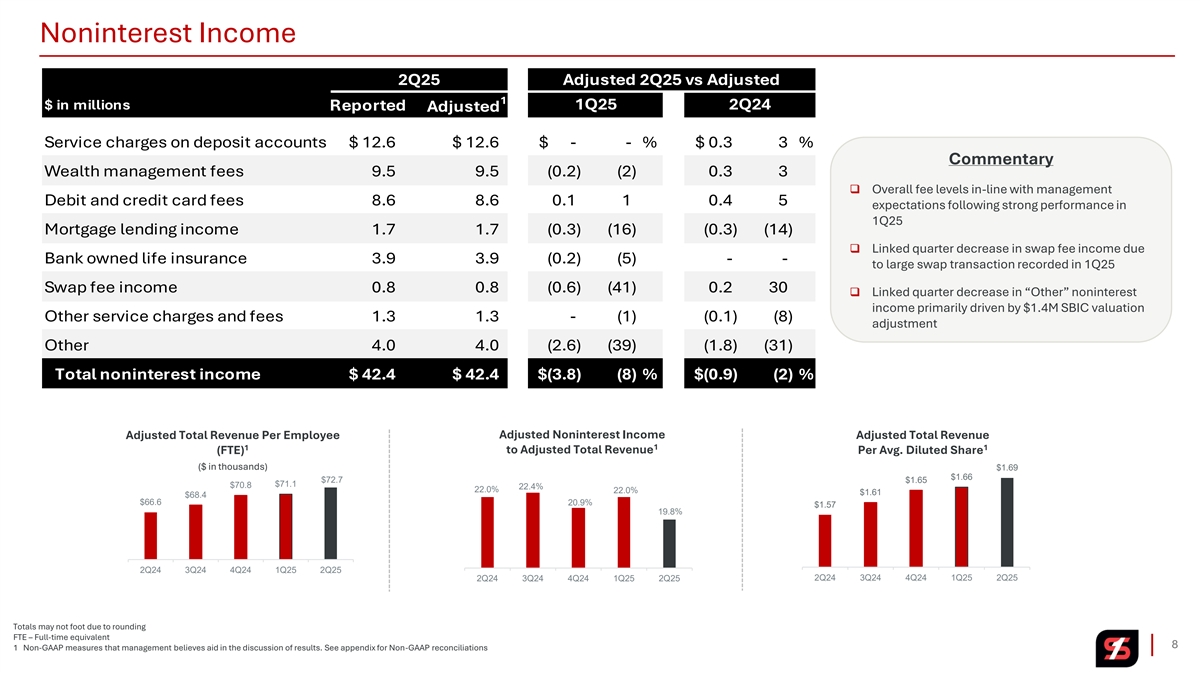

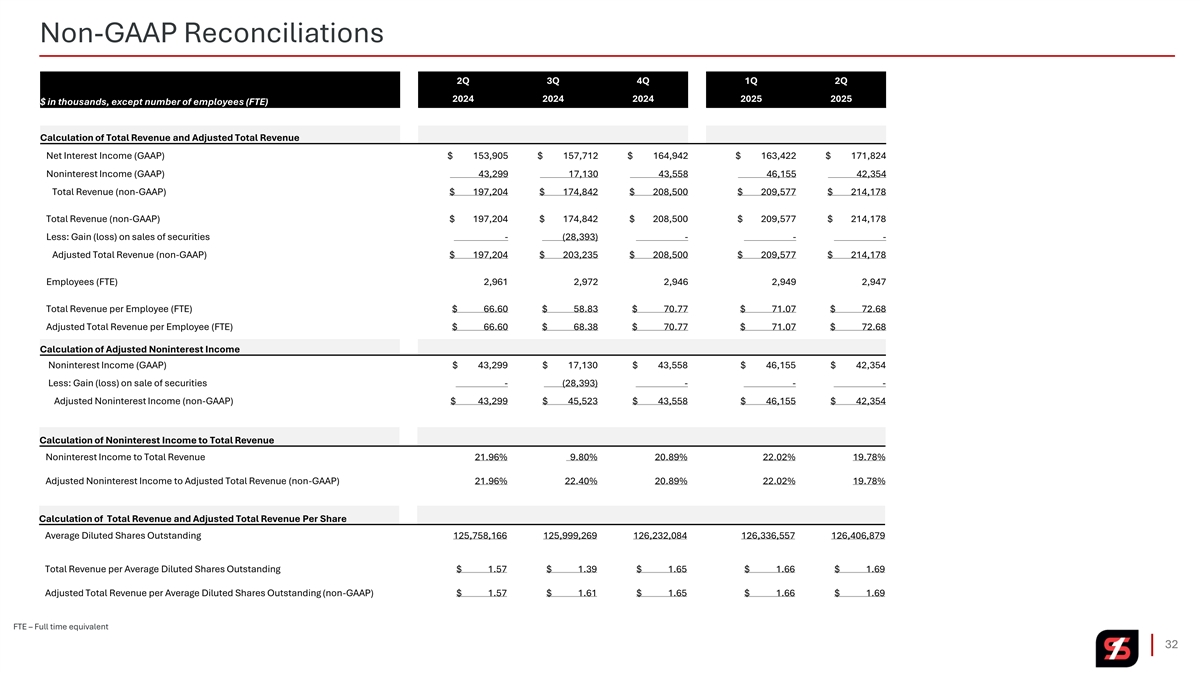

Noninterest Income

Noninterest income for the second quarter of 2025 was $42.4 million, compared to $46.2 million in the first quarter of 2025 and $43.3 million in the second quarter of 2024. The decrease in noninterest income on a linked quarter basis reflected strong performance during the first quarter of 2025, coupled with lower swap fee income due to a large swap transaction and associated fees recorded in the first quarter of 2025, and a Small Business Investment Company (SBIC) valuation adjustment, which are included in other income in the table below.

Noninterest Income

| $ in millions |

2Q25 | 1Q25 | 4Q24 | 3Q24 | 2Q24 | |||||||||||||||

| Service charges on deposit accounts |

$ | 12.6 | $ | 12.6 | $ | 13.0 | $ | 12.7 | $ | 12.3 | ||||||||||

| Wealth management fees |

9.5 | 9.6 | 9.7 | 9.1 | 9.2 | |||||||||||||||

| Debit and credit card fees |

8.6 | 8.4 | 8.3 | 8.1 | 8.2 | |||||||||||||||

| Mortgage lending income |

1.7 | 2.0 | 1.8 | 2.0 | 2.0 | |||||||||||||||

| Other service charges and fees |

1.3 | 1.3 | 1.4 | 1.5 | 1.4 | |||||||||||||||

| Bank owned life insurance |

3.9 | 4.1 | 3.8 | 3.8 | 3.9 | |||||||||||||||

| Gain (loss) on sale of securities |

— | — | — | (28.4 | ) | — | ||||||||||||||

| Other income |

4.8 | 8.0 | 5.6 | 8.3 | 6.4 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total noninterest income |

$ | 42.4 | $ | 46.2 | $ | 43.6 | $ | 17.1 | $ | 43.3 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted noninterest income1 |

$ | 42.4 | $ | 46.2 | $ | 43.6 | $ | 45.5 | $ | 43.3 | ||||||||||

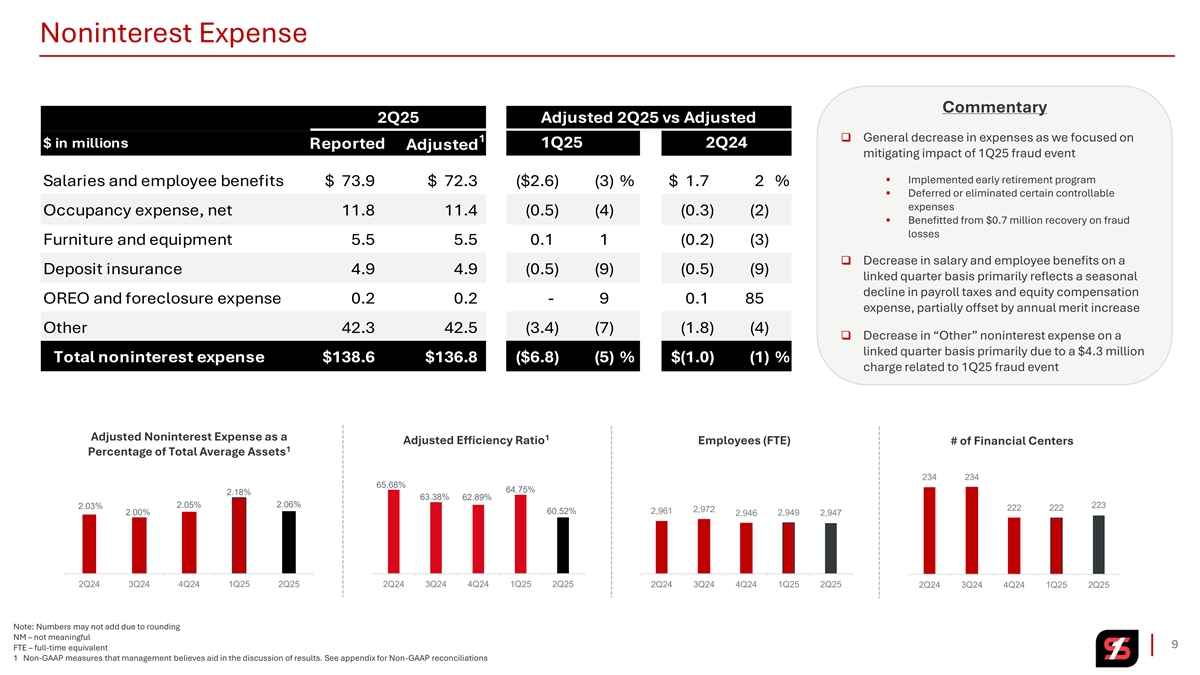

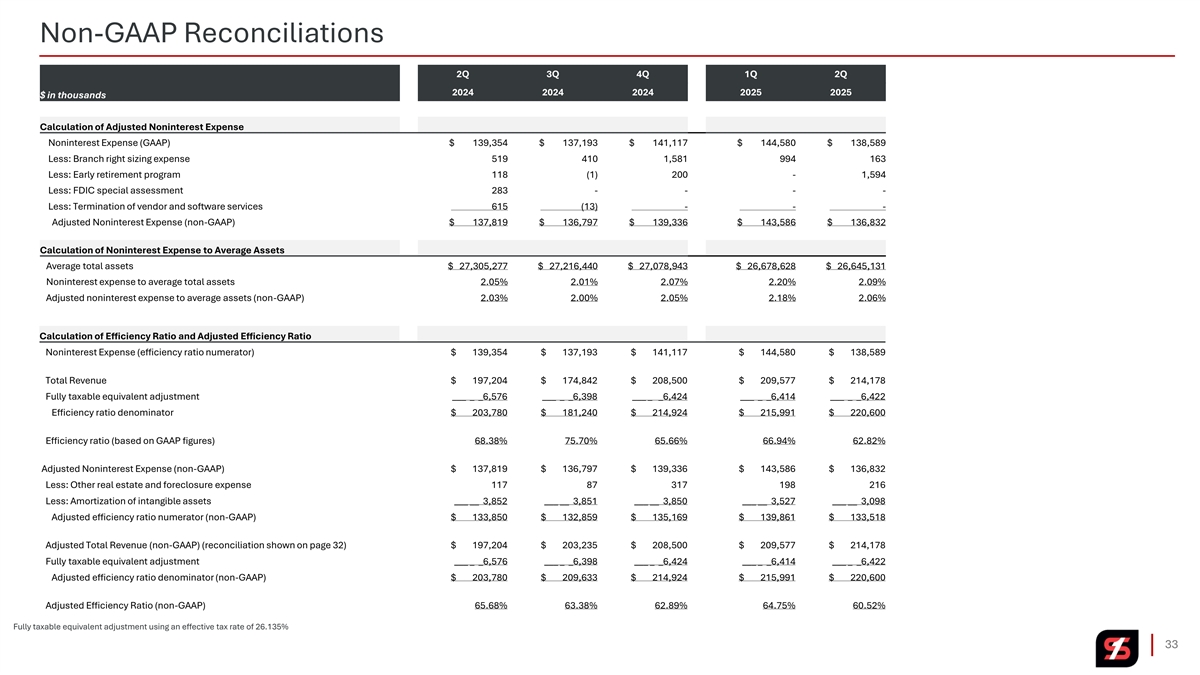

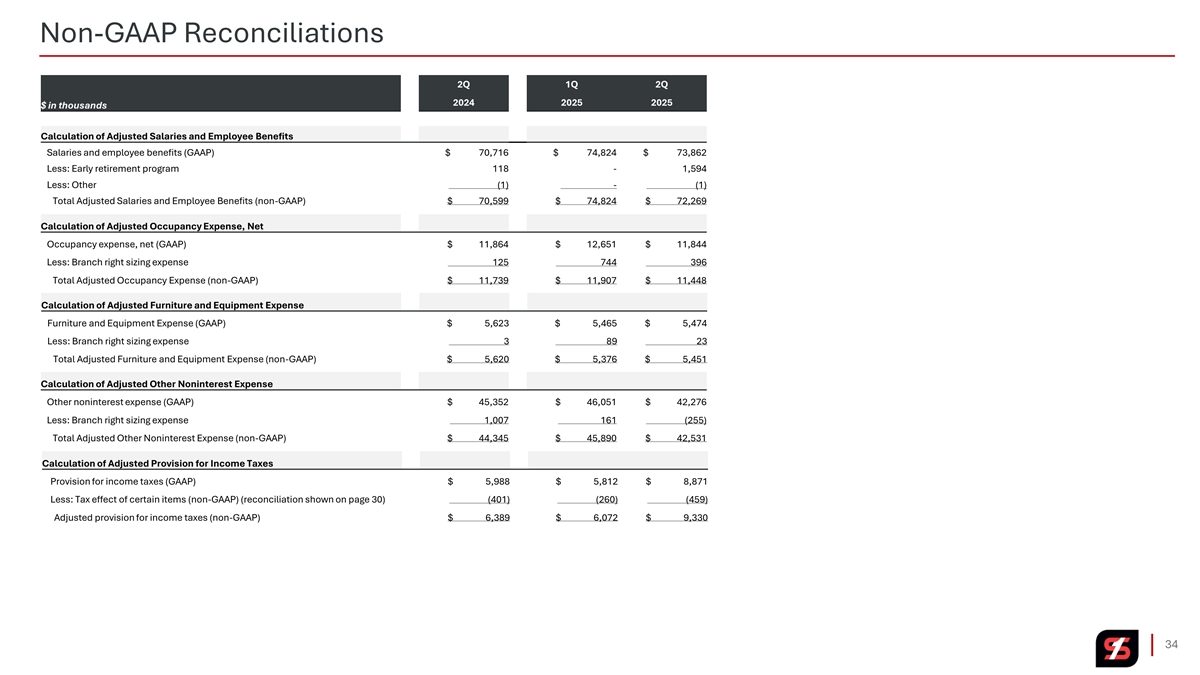

Noninterest Expense

Noninterest expense for the second quarter of 2025 was $138.6 million, compared to $144.6 million in the first quarter of 2025 and $139.4 million in the second quarter of 2024. Included in noninterest expense are certain items consisting of branch right sizing, early retirement program, termination of vendor and software services and an FDIC special assessment. Collectively, these items totaled $1.8 million in the second quarter of 2025, $1.0 million in the first quarter of 2025 and $1.5 million in the second quarter of 2024. Excluding these items (which are described in the “Reconciliation of Non-GAAP Financial Measures” tables below), adjusted noninterest expense1 was $136.8 million for the second quarter of 2025, $143.6 million in the first quarter of 2025 and $137.8 million in the second quarter of 2024. The decrease in adjusted noninterest expense1 on a linked quarter basis reflected lower salaries and benefit expenses primarily due to a seasonal decline in payroll taxes and equity compensation expense, and a decline in other operating expenses resulting from a $4.3 million charge related to a customer deposit fraud event in the first quarter of 2025.

Noninterest Expense

| $ in millions |

2Q25 | 1Q25 | 4Q24 | 3Q24 | 2Q24 | |||||||||||||||

| Salaries and employee benefits |

$ | 73.9 | $ | 74.8 | $ | 71.6 | $ | 69.2 | $ | 70.7 | ||||||||||

| Occupancy expense, net |

11.8 | 12.7 | 11.9 | 12.2 | 11.9 | |||||||||||||||

| Furniture and equipment |

5.5 | 5.5 | 5.7 | 5.6 | 5.6 | |||||||||||||||

| Deposit insurance |

4.9 | 5.4 | 5.6 | 5.6 | 5.4 | |||||||||||||||

| Other real estate and foreclosure expense |

0.2 | 0.2 | 0.3 | 0.1 | 0.1 | |||||||||||||||

| FDIC special assessment |

— | — | — | — | 0.3 | |||||||||||||||

| Other operating expenses |

42.3 | 46.1 | 46.1 | 44.5 | 45.4 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total noninterest expense |

$ | 138.6 | $ | 144.6 | $ | 141.1 | $ | 137.2 | $ | 139.4 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted salaries and employee benefits1 |

$ | 72.3 | $ | 74.8 | $ | 71.4 | $ | 69.2 | $ | 70.6 | ||||||||||

| Adjusted other operating expenses1 |

42.5 | 45.9 | 44.7 | 44.4 | 44.3 | |||||||||||||||

| Adjusted noninterest expense1 |

136.8 | 143.6 | 139.3 | 136.8 | 137.8 | |||||||||||||||

| Efficiency ratio |

62.82 | % | 66.94 | % | 65.66 | % | 75.70 | % | 68.38 | % | ||||||||||

| Adjusted efficiency ratio1 |

60.52 | 64.75 | 62.89 | 63.38 | 65.68 | |||||||||||||||

| Full-time equivalent employees |

2,947 | 2,949 | 2,946 | 2,972 | 2,961 | |||||||||||||||

| Number of financial centers |

223 | 222 | 222 | 234 | 234 |

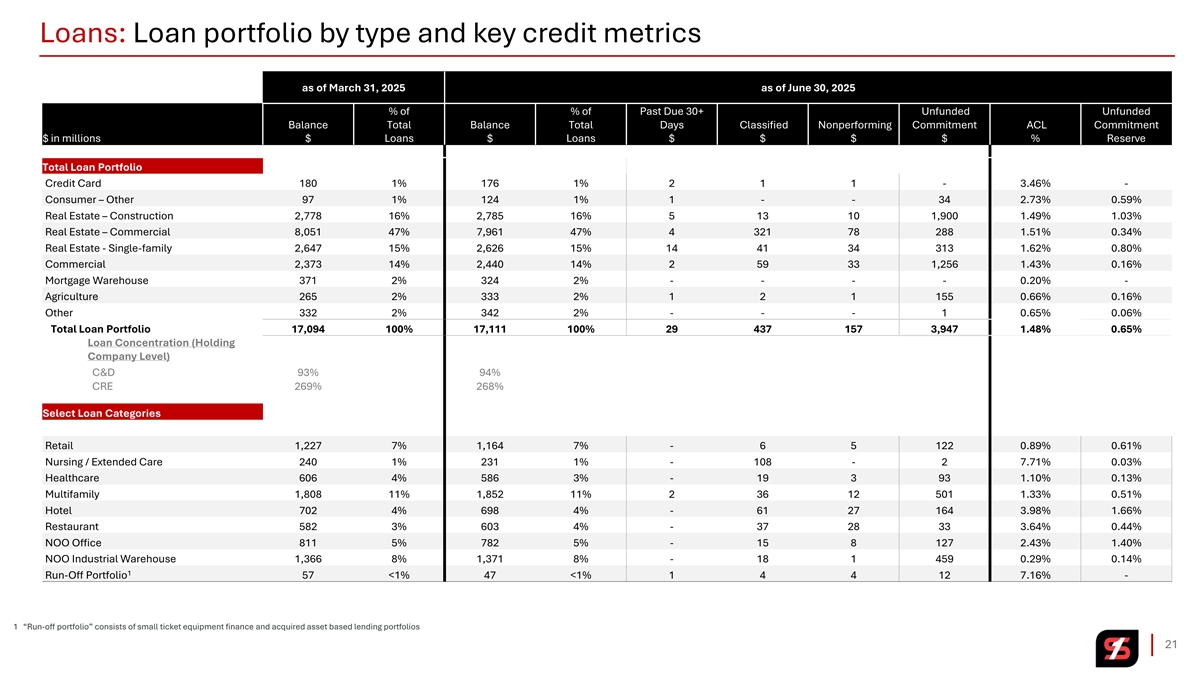

Loans and Unfunded Loan Commitments

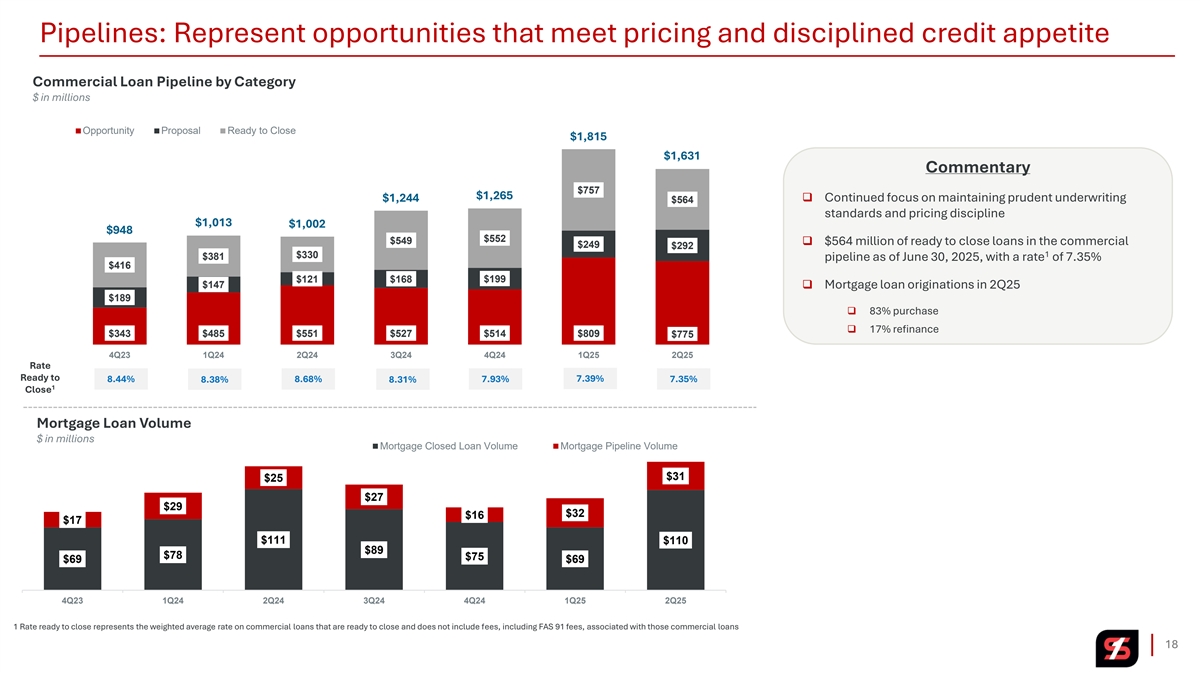

Total loans at the end of the second quarter of 2025 were $17.1 billion, up slightly from first quarter 2025 levels. The increase in total loans on a linked quarter basis was broadly-based, driven primarily by growth in the commercial, agricultural, consumer & other portfolios, offset in part by declines in the real estate – commercial and mortgage warehouse portfolios. Unfunded loan commitments at the end of the second quarter of 2025 were $3.9 billion, up $59 million, or 2 percent, from first quarter 2025 levels. The commercial loan pipeline totaled $1.6 billion at the end of the second quarter of 2025, and ready to close commercial loans totaled $564 million with a weighted average rate of 7.35 percent.

Loans and Unfunded Loan Commitments

| $ in millions |

2Q25 | 1Q25 | 4Q24 | 3Q24 | 2Q24 | |||||||||||||||

| Total loans |

$ | 17,111 | $ | 17,094 | $ | 17,006 | $ | 17,336 | $ | 17,192 | ||||||||||

| Unfunded loan commitments |

3,947 | 3,888 | 3,739 | 3,681 | 3,746 | |||||||||||||||

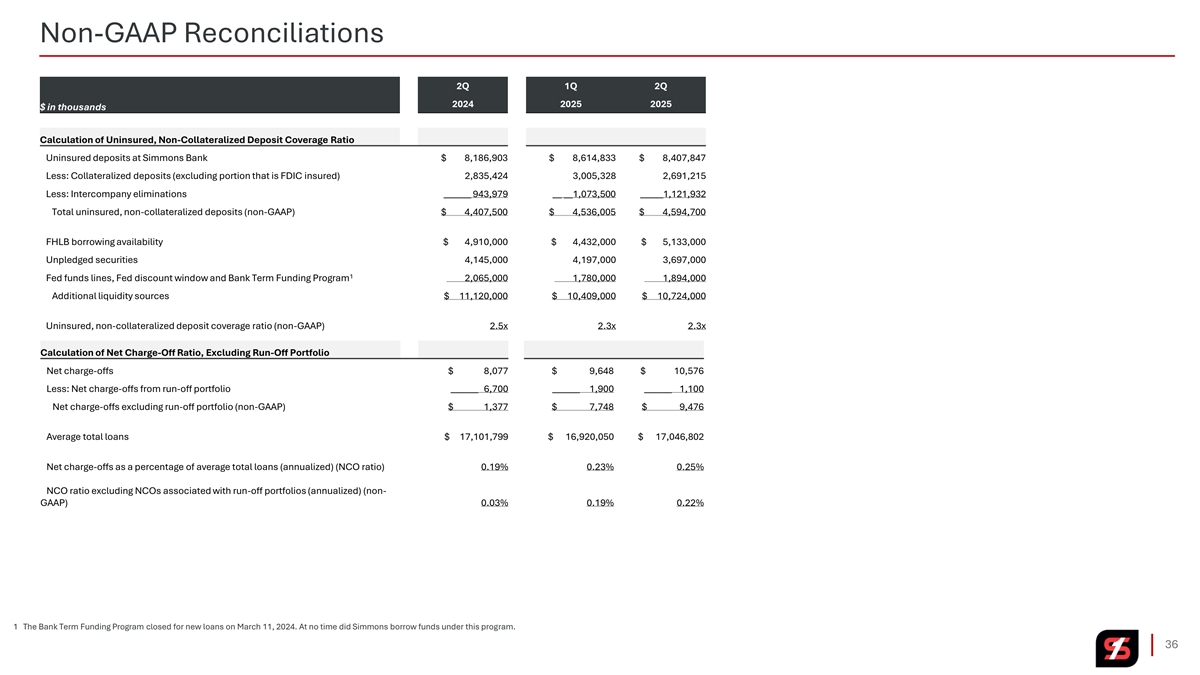

Deposits and Other Borrowings

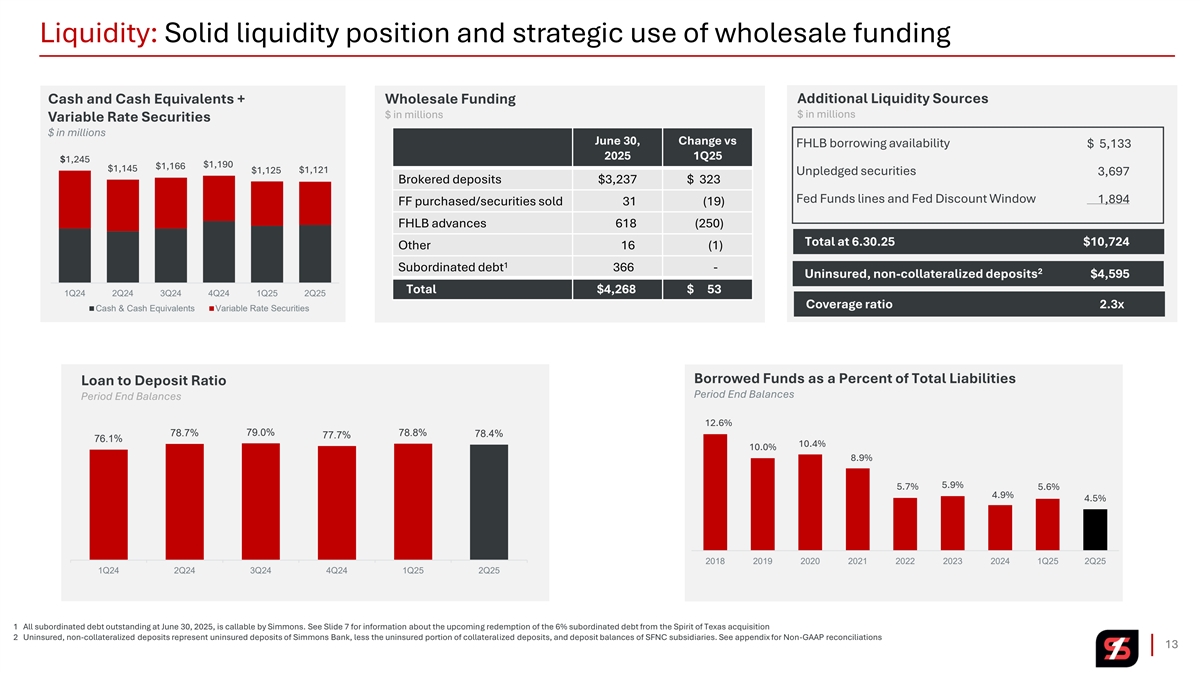

Total deposits at the end of the second quarter of 2025 were $21.8 billion, compared to $21.7 billion at the end of the first quarter of 2025 and $21.8 billion at the end of the second quarter of 2024. The increase in total deposits on a linked quarter basis reflected a $233 million increase in low-cost customer deposits (noninterest bearing and interest bearing transaction accounts) and a $324 million increase in brokered deposits, offset in part by a decrease in public fund deposits due to seasonal factors. Other borrowings totaled $1.0 billion at the end of the second quarter of 2025, compared to $1.3 billion at the end of the first quarter of 2025 and $1.8 billion at the end of the second quarter of 2024. The decrease in other borrowings on a linked quarter basis and year-over-year basis was primarily due to a decrease in FHLB advances.

Deposits

| $ in millions |

2Q25 | 1Q25 | 4Q24 | 3Q24 | 2Q24 | |||||||||||||||

| Noninterest bearing deposits |

$ | 4,468 | $ | 4,455 | $ | 4,461 | $ | 4,522 | $ | 4,624 | ||||||||||

| Interest bearing transaction accounts |

10,532 | 10,621 | 10,331 | 10,038 | 10,092 | |||||||||||||||

| Time deposits |

3,588 | 3,695 | 3,796 | 4,014 | 4,185 | |||||||||||||||

| Brokered deposits |

3,237 | 2,914 | 3,298 | 3,361 | 2,940 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total deposits |

$ | 21,825 | $ | 21,684 | $ | 21,886 | $ | 21,935 | $ | 21,841 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Noninterest bearing deposits to total deposits |

20 | % | 21 | % | 20 | % | 21 | % | 21 | % | ||||||||||

| Total loans to total deposits |

78 | 79 | 78 | 79 | 79 | |||||||||||||||

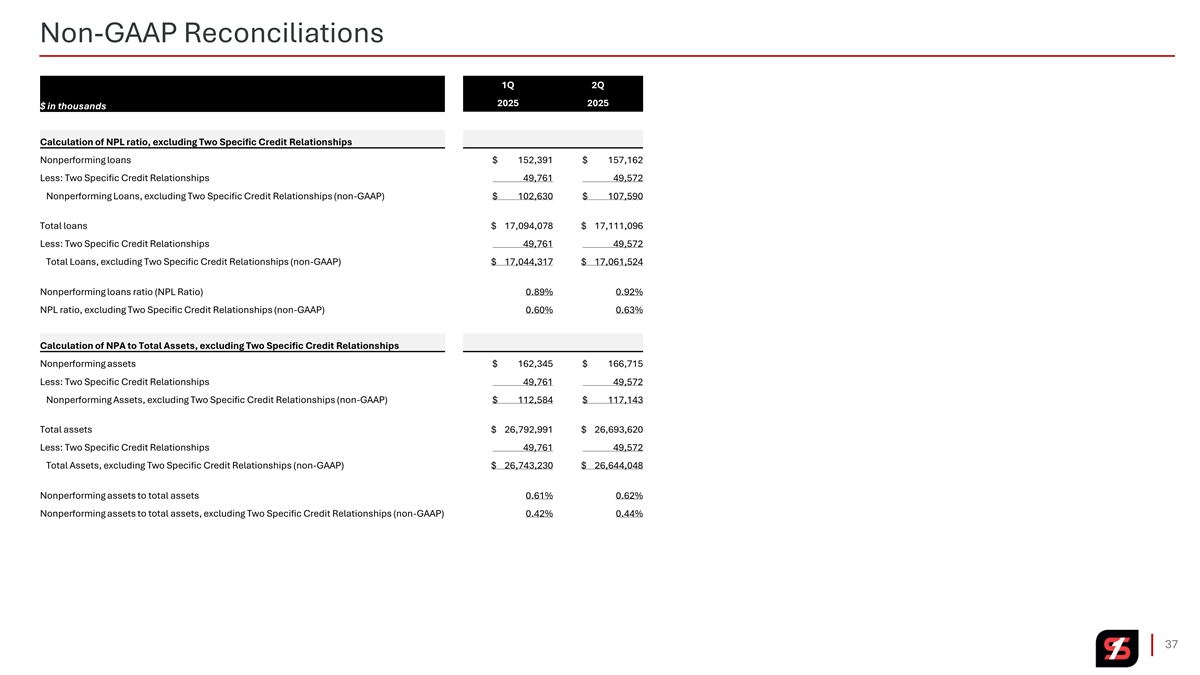

Asset Quality

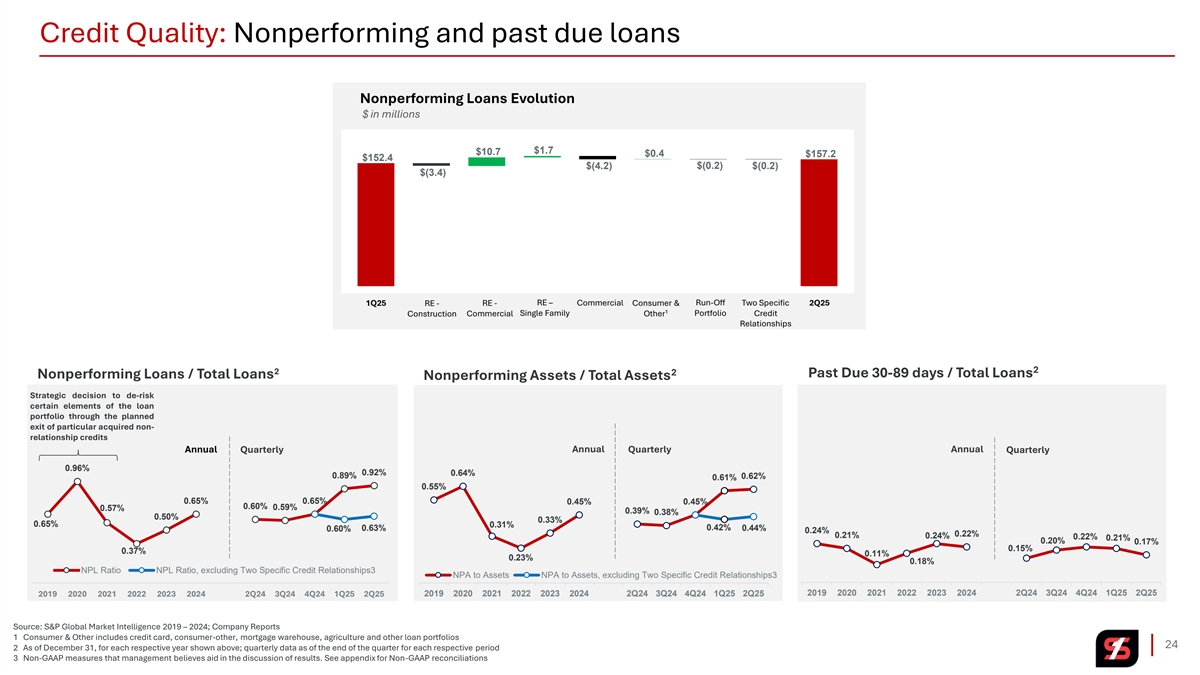

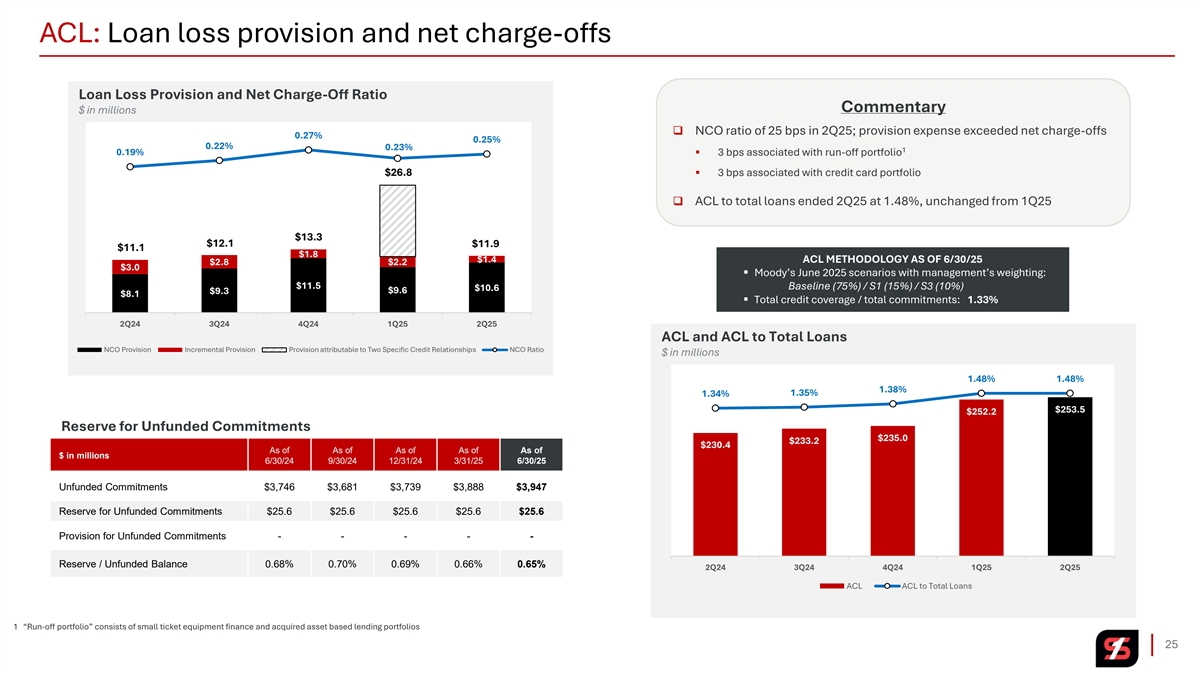

Net charge-offs as a percentage of average loans for the second quarter of 2025 were 25 basis points, compared to 23 basis points in the first quarter of 2025 and 19 basis points in the second quarter of 2024. Net charge-offs in the second quarter of 2025 included $1.1 million of charge-offs associated with the run-off portfolio consisting of small ticket equipment finance and acquired asset-based lending portfolios (run-off portfolio). Net charge-offs from the run-off portfolio accounted for 3 basis points of total net charge-offs in the second quarter of 2025, 4 basis points of total net charge-offs in the first quarter of 2025 and 16 basis points of total net charge-offs in the second quarter of 2024.

Total nonperforming loans at the end of the second quarter of 2025 totaled $157.2 million, compared to $152.4 million at the end of the first quarter of 2025 and $103.4 million at the end of the second quarter of 2024. The increase in nonperforming loans on a year-over-year basis was primarily due to two specific credit relationships that were placed on nonaccrual at the end of first quarter of 2025. The nonperforming loan coverage ratio ended the second quarter of 2025 at 161 percent, compared to 165 percent at the end of the first quarter of 2025 and 223 percent at the end of the second quarter of 2024. Total nonperforming assets as a percentage of total assets were 62 basis points at the end of the second quarter of 2025, compared to 61 basis points at the end of the first quarter of 2025 and 39 basis points at the end of the second quarter of 2024.

Provision for credit losses on loans totaled $11.9 million for the second quarter of 2025, compared to $26.8 million in the first quarter of 2025 and $11.1 million in the second quarter of 2024. The decrease in provision for credit losses on loans on a linked quarter basis was primarily due to $15.6 million of incremental provision related to the aforementioned two specific credit relationships that was recorded in the first quarter of 2025. The allowance for credit losses on loans at the end of the second quarter of 2025 was $253.5 million, compared to $252.2 million at the end of the first quarter of 2025 and $230.4 million at the end of the second quarter of 2024. The allowance for credit losses on loans as a percentage of total loans was 1.48 percent at the end of the second quarter of 2025, unchanged from the first quarter of 2025 and up from 1.34 percent at the end of the second quarter of 2024.

Asset Quality

| $ in millions |

2Q25 | 1Q25 | 4Q24 | 3Q24 | 2Q24 | |||||||||||||||

| Allowance for credit losses on loans to total loans |

1.48 | % | 1.48 | % | 1.38 | % | 1.35 | % | 1.34 | % | ||||||||||

| Allowance for credit losses on loans to nonperforming loans |

161 | 165 | 212 | 229 | 223 | |||||||||||||||

| Nonperforming loans to total loans |

0.92 | 0.89 | 0.65 | 0.59 | 0.60 | |||||||||||||||

| Net charge-off ratio (annualized) |

0.25 | 0.23 | 0.27 | 0.22 | 0.19 | |||||||||||||||

| Net charge-off ratio YTD (annualized) |

0.24 | 0.23 | 0.22 | 0.20 | 0.19 | |||||||||||||||

| Total nonperforming loans |

$ | 157.2 | $ | 152.3 | $ | 110.7 | $ | 101.7 | $ | 103.4 | ||||||||||

| Total other nonperforming assets |

9.5 | 10.0 | 10.5 | 2.6 | 3.4 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total nonperforming assets |

$ | 166.7 | $ | 162.3 | $ | 121.2 | $ | 104.3 | $ | 106.8 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Reserve for unfunded commitments |

$ | 25.6 | $ | 25.6 | $ | 25.6 | $ | 25.6 | $ | 25.6 | ||||||||||

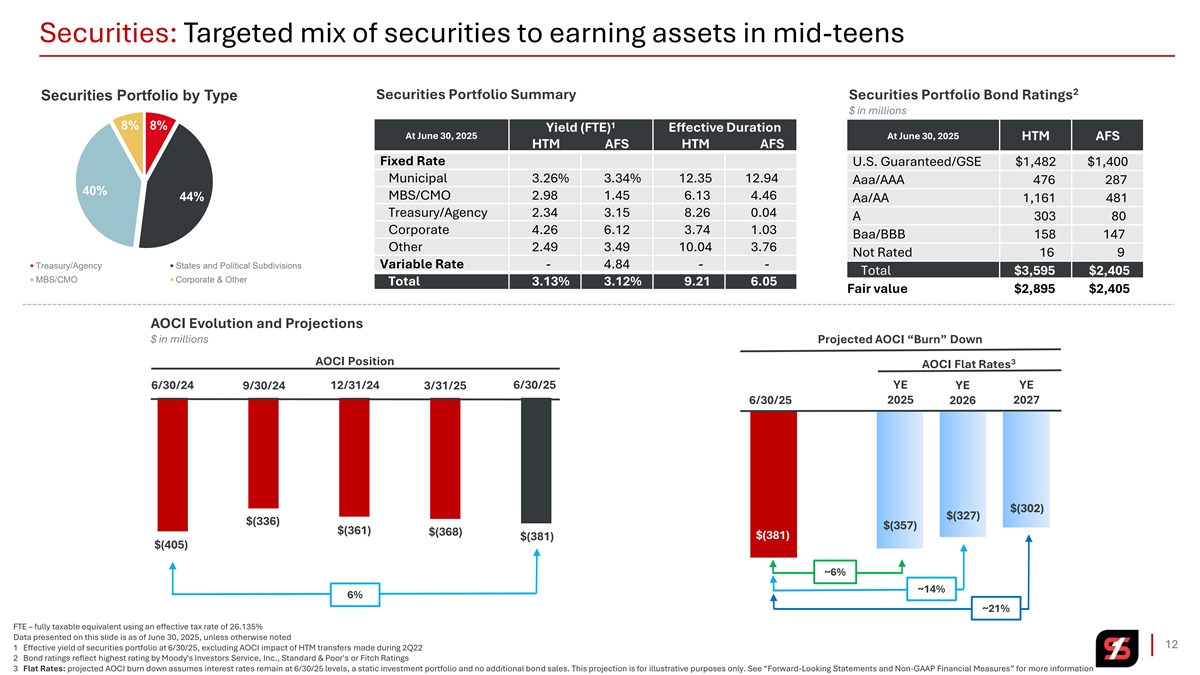

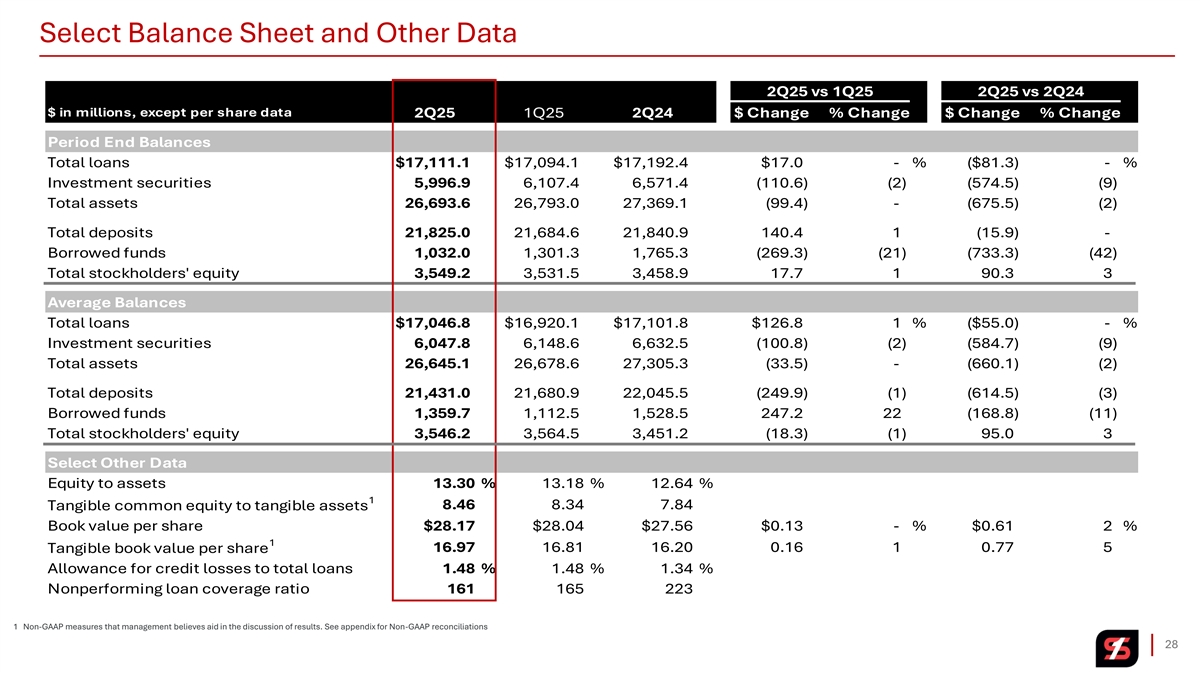

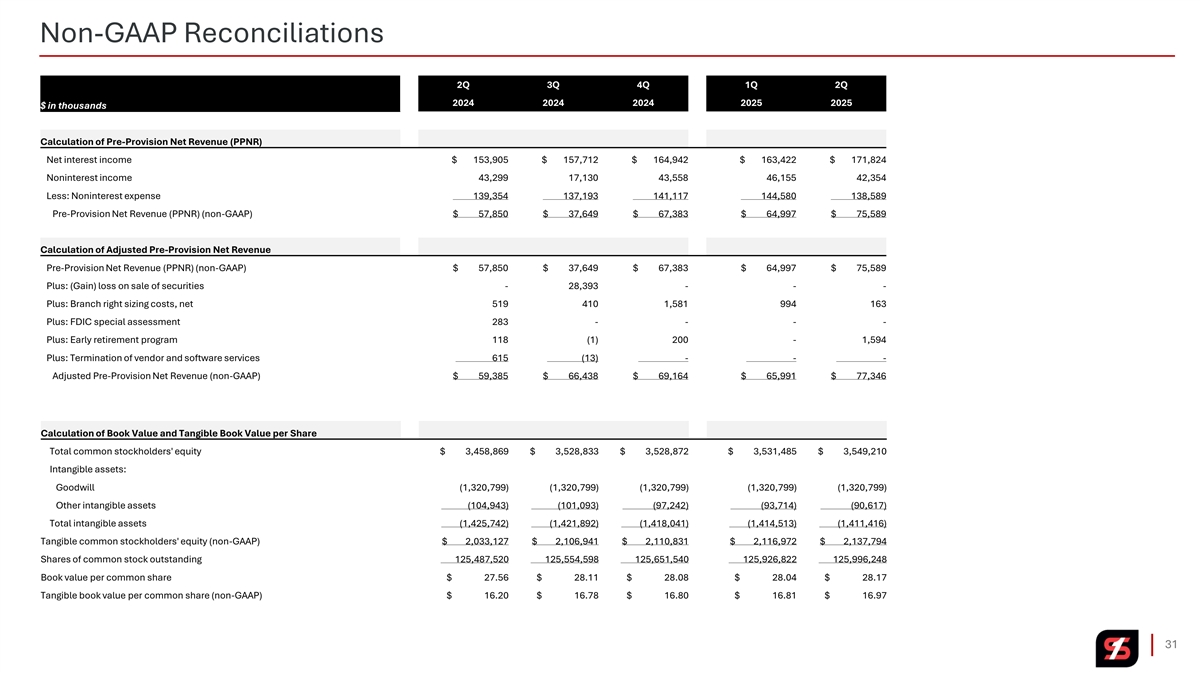

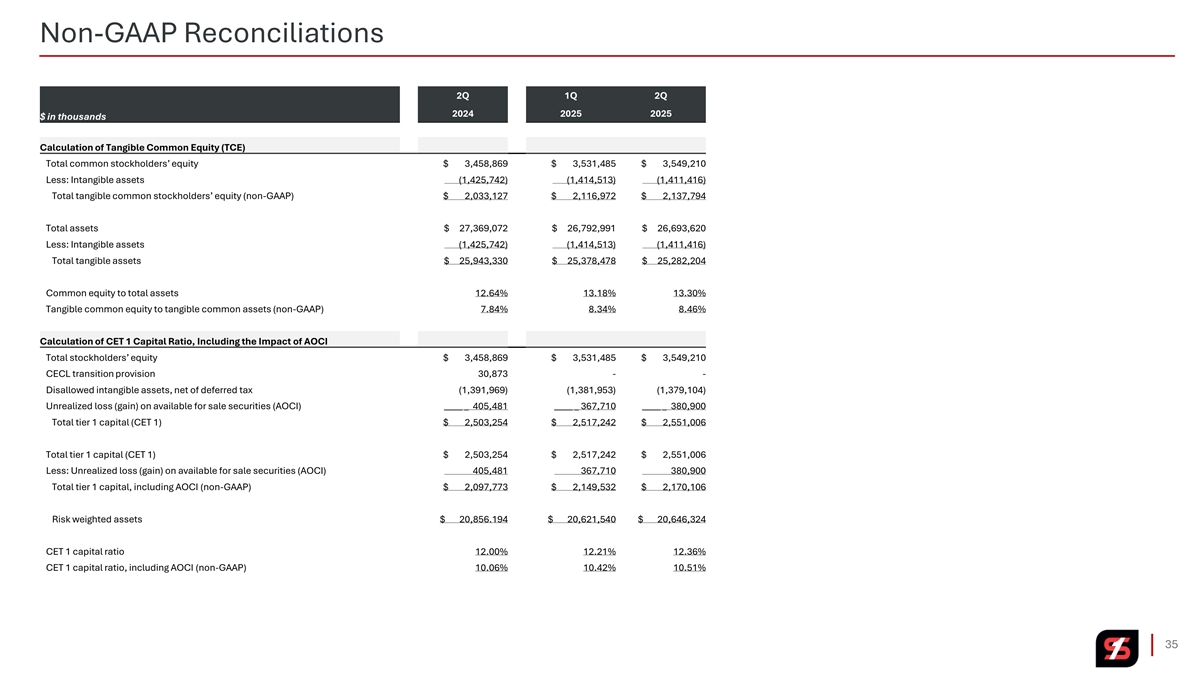

Capital

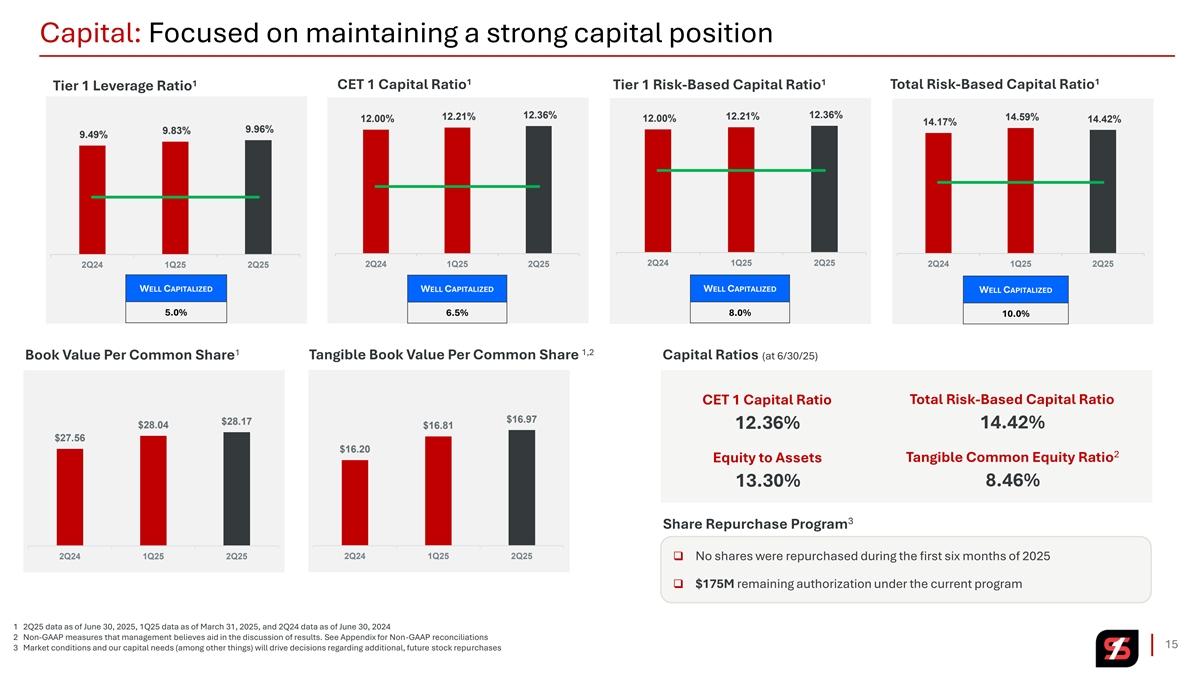

Total stockholders’ equity at the end of the second quarter of 2025 was $3.5 billion, up $17.7 million from the end of the first quarter of 2025 and up $90.3 million from the end of the second quarter of 2024. The increase on a year-over-year basis was primarily due to an increase of $53.9 million in retained earnings, coupled with a $24.6 million recapture of accumulated other comprehensive income principally associated with the mark-to-market adjustment on available for sale investment securities. Book value per share at the end of the second quarter of 2025 was $28.17 compared to $28.04 at the end of the first quarter of 2025 and $27.56 at the end of the second quarter of 2024. Tangible book value per share1 at the end of the second quarter of 2025 was $16.97, compared to $16.81 at the end of the first quarter of 2025 and $16.20 at the end of the second quarter of 2024.

Total stockholders’ equity as a percentage of total assets at the end of the second quarter of 2025 was 13.3 percent, compared to 13.2 percent at the end of the first quarter of 2025 and 12.6 percent at the end of the second quarter of 2024. Tangible common equity as a percentage of tangible assets1 at the end of the second quarter of 2025 was 8.5 percent, compared to 8.3 percent at the end of the first quarter of 2025 and 7.8 percent at the end of the second quarter of 2024. Each of the applicable regulatory capital ratios for Simmons and its principal subsidiary, Simmons Bank, continue to significantly exceed “well-capitalized” regulatory guidelines.

Select Capital Ratios

| 2Q25 | 1Q25 | 4Q24 | 3Q24 | 2Q24 | ||||||||||||||||

| Stockholders’ equity to total assets |

13.3 | % | 13.2 | % | 13.1 | % | 12.9 | % | 12.6 | % | ||||||||||

| Tangible common equity to tangible assets1 |

8.5 | 8.3 | 8.3 | 8.2 | 7.8 | |||||||||||||||

| Common equity tier 1 (CET1) ratio |

12.4 | 12.2 | 12.4 | 12.1 | 12.0 | |||||||||||||||

| Tier 1 leverage ratio |

10.0 | 9.8 | 9.7 | 9.6 | 9.5 | |||||||||||||||

| Tier 1 risk-based capital ratio |

12.4 | 12.2 | 12.4 | 12.1 | 12.0 | |||||||||||||||

| Total risk-based capital ratio |

14.4 | 14.6 | 14.6 | 14.3 | 14.2 | |||||||||||||||

Share Repurchase Program

During the second quarter of 2025, Simmons did not repurchase shares under its stock repurchase program that was authorized in January 2024 (2024 Program), which replaced its former repurchase program that was authorized in January 2022. Remaining authorization under the 2024 Program as of June 30, 2025, was approximately $175 million. The timing, pricing and amount of any repurchases under the 2024 Program will be determined by Simmons’ management at its discretion based on a variety of factors including, but not limited to, market conditions, trading volume and market price of Simmons’ common stock, Simmons’ capital needs, Simmons’ working capital and investment requirements, other corporate considerations, economic conditions, and legal requirements. The 2024 Program does not obligate Simmons to repurchase any common stock and may be modified, discontinued or suspended at any time without prior notice.

| (1) | Non-GAAP measurement. See “Non-GAAP Financial Measures” and “Reconciliation of Non-GAAP Financial Measures” below |

| (2) | FTE – fully taxable equivalent basis using an effective tax rate of 26.135% |

| (3) | In this press release, “Adjusted Earnings” may also be referred to as “Adjusted Net Income” |

Conference Call

Management will conduct a live conference call to review this information beginning at 7:30 a.m. Central Time on Friday, July 18, 2025. Interested persons can listen to this call by dialing toll-free 1-844-481-2779 (North America only) and asking for the Simmons First National Corporation conference call, conference ID 10200827. In addition, the call will be available live or in recorded version on Simmons’ website at simmonsbank.com for at least 60 days following the date of the call.

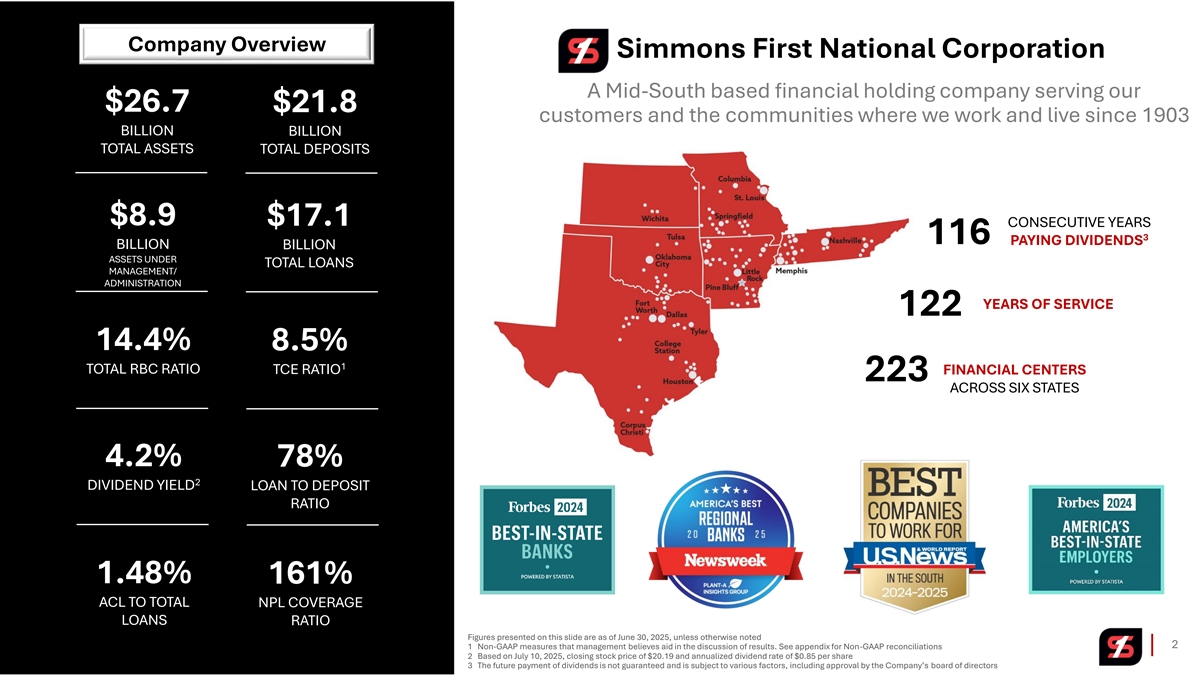

Simmons First National Corporation

Simmons First National Corporation (NASDAQ: SFNC) is a Mid-South based financial holding company that has paid cash dividends to its shareholders for 116 consecutive years. Its principal subsidiary, Simmons Bank, operates more than 220 branches in Arkansas, Kansas, Missouri, Oklahoma, Tennessee and Texas. Founded in 1903, Simmons Bank offers comprehensive financial solutions delivered with a client-centric approach. In 2024, Simmons Bank was recognized by Newsweek as one of America’s Best Regional Banks 2025, by U.S. News & World Report as one of the 2024-2025 Best Companies to Work For in the South and by Forbes as one of America’s Best-In-State Banks 2024 in Tennessee and America’s Best-In-State Employers 2024 in Missouri. Additional information about Simmons Bank can be found on our website at simmonsbank.com, by following @Simmons_Bank on X (formerly Twitter) or by visiting our newsroom.

Non-GAAP Financial Measures

This press release contains financial information determined by methods other than in accordance with U.S. generally accepted accounting principles (GAAP). The Company’s management uses these non-GAAP financial measures in their analysis of the Company’s performance. These measures adjust GAAP performance measures to, among other things, include the tax benefit associated with revenue items that are tax-exempt, as well as exclude from net income (including on a per share diluted basis), pre-tax, pre-provision earnings, net charge-offs, income available to common shareholders, noninterest income, and noninterest expense certain income and expense items attributable to, for example, merger activity (primarily including merger-related expenses), gains and/or losses on sale of branches, net branch right-sizing initiatives, early retirement program, termination of vendor and software services, FDIC special assessment charges and expenses related to the fraud event reported in the first quarter of 2025.

In addition, the Company also presents certain figures based on tangible common stockholders’ equity, tangible assets and tangible book value, which exclude goodwill and other intangible assets. The Company further presents certain figures that are exclusive of the impact of deposits and/or loans acquired through acquisitions, mortgage warehouse loans, and/or energy loans, or gains and/or losses on the sale of securities, or the aforementioned two specific credit relationships. The Company’s management believes that these non-GAAP financial measures are useful to investors because they, among other things, present the results of the Company’s ongoing operations without the effect of mergers or other items not central to the Company’s ongoing business, as well as normalize for tax effects and certain other effects. Management, therefore, believes presentations of these non-GAAP financial measures provide useful supplemental information that is essential to a proper understanding of the operating results of the Company’s ongoing businesses, and management uses these non-GAAP financial measures to assess the performance of the Company’s ongoing businesses as related to prior financial periods. These non-GAAP disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in the tables of this release.

Forward-Looking Statements

Certain statements in this press release may not be based on historical facts and should be considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements, including, without limitation, statements made in Mr. Makris’s quote, may be identified by reference to future periods or by the use of forward-looking terminology, such as “believe,” “budget,” “expect,” “foresee,” “anticipate,” “intend,” “indicate,” “target,” “estimate,” “plan,” “project,” “continue,” “contemplate,” “positions,” “prospects,” “predict,” or “potential,” by future conditional verbs such as “will,” “would,” “should,”

“could,” “might” or “may,” or by variations of such words or by similar expressions. These forward-looking statements include, without limitation, statements relating to Simmons’ future growth, business strategies, lending capacity and lending activity, loan demand, revenue, assets, asset quality, profitability, dividends, net interest margin, non-interest revenue, share repurchase program, acquisition strategy, digital banking initiatives, the Company’s ability to recruit and retain key employees, the adequacy of the allowance for credit losses, future economic conditions and interest rates, and the adequacy of reserve levels for loans. Any forward-looking statement speaks only as of the date of this press release, and Simmons undertakes no obligation to update these forward-looking statements to reflect events or circumstances that occur after the date of this press release. By nature, forward-looking statements are based on various assumptions and involve inherent risk and uncertainties. Various factors, including, but not limited to, changes in economic conditions, changes in credit quality, changes in interest rates and related governmental policies, changes in loan demand, changes in deposit flows, changes in real estate values, changes in the assumptions used in making the forward-looking statements, changes in the securities markets generally or the price of Simmons’ common stock specifically, changes in information technology affecting the financial industry, and changes in customer behaviors, including consumer spending, borrowing, and saving habits; changes in tariff policies; general economic and market conditions; changes in governmental administrations; market disruptions including pandemics or significant health hazards, severe weather conditions, natural disasters, terrorist activities, financial crises, political crises, war and other military conflicts (including the ongoing military conflicts between Russia and Ukraine and between Israel and Iran) or other major events, or the prospect of these events; the soundness of other financial institutions and any indirect exposure related to the closings of other financial institutions and their impact on the broader market through other customers, suppliers and partners, or that the conditions which resulted in the liquidity concerns experienced by closed financial institutions may also adversely impact, directly or indirectly, other financial institutions and market participants with which the Company has commercial or deposit relationships; increased inflation; the loss of key employees; increased competition in the markets in which the Company operates and from non-bank financial institutions; increased unemployment; labor shortages; claims, damages, and fines related to litigation or government actions; changes in accounting principles relating to loan loss recognition (current expected credit losses); fraud that results in material losses or that we have not discovered yet that may result in material losses; the Company’s ability to manage and successfully integrate its mergers and acquisitions and to fully realize cost savings and other benefits associated with acquisitions; increased delinquency and foreclosure rates on commercial real estate loans; significant increases in nonaccrual loan balances; cyber or other information technology threats, attacks or events; reliance on third parties for key services; government legislation; and other factors, many of which are beyond the control of the Company, could cause actual results to differ materially from those projected in or contemplated by the forward-looking statements. In addition, there can be no guarantee that the board of directors (Board) of Simmons will approve a quarterly dividend in future quarters, and the timing, payment, and amount of future dividends (if any) is subject to, among other things, the discretion of the Board and may differ significantly from past dividends. Additional information on factors that might affect the Company’s financial results is included in the Company’s Form 10-K for the year ended December 31, 2024, and other reports that the Company has filed with or furnished to the U.S. Securities and Exchange Commission (the SEC), all of which are available from the SEC on its website, www.sec.gov.

FOR MORE INFORMATION CONTACT:

Ed Bilek, EVP, Director of Investor and Media Relations

ed.bilek@simmonsbank.com or 205.612.3378 (cell)

| Simmons First National Corporation | SFNC | |

| Consolidated End of Period Balance Sheets | ||

| For the Quarters Ended | ||

| (Unaudited) |

| Jun 30 | Mar 31 | Dec 31 | Sep 30 | Jun 30 | ||||||||||||||||

| 2025 | 2025 | 2024 | 2024 | 2024 | ||||||||||||||||

| ($ in thousands) | ||||||||||||||||||||

| ASSETS |

||||||||||||||||||||

| Cash and noninterest bearing balances due from banks |

$ | 398,081 | $ | 423,171 | $ | 429,705 | $ | 398,321 | $ | 320,021 | ||||||||||

| Interest bearing balances due from banks and federal funds sold |

246,381 | 211,115 | 257,672 | 205,081 | 254,312 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash and cash equivalents |

644,462 | 634,286 | 687,377 | 603,402 | 574,333 | |||||||||||||||

| Interest bearing balances due from banks - time |

100 | 100 | 100 | 100 | 100 | |||||||||||||||

| Investment securities - held-to-maturity |

3,591,531 | 3,615,556 | 3,636,636 | 3,658,700 | 3,685,450 | |||||||||||||||

| Investment securities - available-for-sale |

2,405,320 | 2,491,849 | 2,529,426 | 2,691,094 | 2,885,904 | |||||||||||||||

| Mortgage loans held for sale |

16,972 | 8,351 | 11,417 | 8,270 | 13,053 | |||||||||||||||

| Loans: |

||||||||||||||||||||

| Loans |

17,111,096 | 17,094,078 | 17,005,937 | 17,336,040 | 17,192,437 | |||||||||||||||

| Allowance for credit losses on loans |

(253,537 | ) | (252,168 | ) | (235,019 | ) | (233,223 | ) | (230,389 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loans |

16,857,559 | 16,841,910 | 16,770,918 | 17,102,817 | 16,962,048 | |||||||||||||||

| Premises and equipment |

573,160 | 573,616 | 585,431 | 584,366 | 581,893 | |||||||||||||||

| Foreclosed assets and other real estate owned |

8,794 | 8,976 | 9,270 | 1,299 | 2,209 | |||||||||||||||

| Interest receivable |

120,443 | 117,398 | 123,243 | 125,700 | 126,625 | |||||||||||||||

| Bank owned life insurance |

535,481 | 535,324 | 531,805 | 508,781 | 505,023 | |||||||||||||||

| Goodwill |

1,320,799 | 1,320,799 | 1,320,799 | 1,320,799 | 1,320,799 | |||||||||||||||

| Other intangible assets |

90,617 | 93,714 | 97,242 | 101,093 | 104,943 | |||||||||||||||

| Other assets |

528,382 | 551,112 | 572,385 | 562,983 | 606,692 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 26,693,620 | $ | 26,792,991 | $ | 26,876,049 | $ | 27,269,404 | $ | 27,369,072 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||||||||||||||||

| Deposits: |

||||||||||||||||||||

| Noninterest bearing transaction accounts |

$ | 4,468,237 | $ | 4,455,255 | $ | 4,460,517 | $ | 4,521,715 | $ | 4,624,186 | ||||||||||

| Interest bearing transaction accounts and savings deposits |

11,176,791 | 11,265,554 | 10,982,022 | 10,863,945 | 10,925,179 | |||||||||||||||

| Time deposits |

6,179,962 | 5,963,811 | 6,443,211 | 6,549,774 | 6,291,518 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total deposits |

21,824,990 | 21,684,620 | 21,885,750 | 21,935,434 | 21,840,883 | |||||||||||||||

| Federal funds purchased and securities sold under agreements to repurchase |

31,306 | 50,133 | 37,109 | 51,071 | 52,705 | |||||||||||||||

| Other borrowings |

634,349 | 884,863 | 745,372 | 1,045,878 | 1,346,378 | |||||||||||||||

| Subordinated notes and debentures |

366,369 | 366,331 | 366,293 | 366,255 | 366,217 | |||||||||||||||

| Accrued interest and other liabilities |

287,396 | 275,559 | 312,653 | 341,933 | 304,020 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities |

23,144,410 | 23,261,506 | 23,347,177 | 23,740,571 | 23,910,203 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Stockholders’ equity: |

||||||||||||||||||||

| Common stock |

1,260 | 1,259 | 1,257 | 1,256 | 1,255 | |||||||||||||||

| Surplus |

2,518,286 | 2,515,372 | 2,511,590 | 2,508,438 | 2,506,469 | |||||||||||||||

| Undivided profits |

1,410,564 | 1,382,564 | 1,376,935 | 1,355,000 | 1,356,626 | |||||||||||||||

| Accumulated other comprehensive (loss) income |

(380,900 | ) | (367,710 | ) | (360,910 | ) | (335,861 | ) | (405,481 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total stockholders’ equity |

3,549,210 | 3,531,485 | 3,528,872 | 3,528,833 | 3,458,869 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities and stockholders’ equity |

$ | 26,693,620 | $ | 26,792,991 | $ | 26,876,049 | $ | 27,269,404 | $ | 27,369,072 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Page 1

| Simmons First National Corporation | SFNC | |

| Consolidated Statements of Income - Quarter-to-Date |

||

| For the Quarters Ended |

||

| (Unaudited) |

| Jun 30 | Mar 31 | Dec 31 | Sep 30 | Jun 30 | ||||||||||||||||

| 2025 | 2025 | 2024 | 2024 | 2024 | ||||||||||||||||

| ($ in thousands, except per share data) | ||||||||||||||||||||

| INTEREST INCOME |

||||||||||||||||||||

| Loans (including fees) |

$ | 265,373 | $ | 257,755 | $ | 272,727 | $ | 277,939 | $ | 270,937 | ||||||||||

| Interest bearing balances due from banks and federal funds sold |

2,531 | 2,703 | 2,913 | 2,921 | 2,964 | |||||||||||||||

| Investment securities |

46,898 | 47,257 | 50,162 | 53,220 | 55,050 | |||||||||||||||

| Mortgage loans held for sale |

221 | 122 | 180 | 209 | 194 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| TOTAL INTEREST INCOME |

315,023 | 307,837 | 325,982 | 334,289 | 329,145 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| INTEREST EXPENSE |

||||||||||||||||||||

| Time deposits |

57,231 | 62,559 | 70,661 | 73,937 | 73,946 | |||||||||||||||

| Other deposits |

69,108 | 67,895 | 72,369 | 78,307 | 79,087 | |||||||||||||||

| Federal funds purchased and securities sold under agreements to repurchase |

59 | 113 | 119 | 138 | 156 | |||||||||||||||

| Other borrowings |

10,613 | 7,714 | 11,386 | 17,067 | 15,025 | |||||||||||||||

| Subordinated notes and debentures |

6,188 | 6,134 | 6,505 | 7,128 | 7,026 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| TOTAL INTEREST EXPENSE |

143,199 | 144,415 | 161,040 | 176,577 | 175,240 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET INTEREST INCOME |

171,824 | 163,422 | 164,942 | 157,712 | 153,905 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| PROVISION FOR CREDIT LOSSES |

||||||||||||||||||||

| Provision for credit losses on loans |

11,945 | 26,797 | 13,332 | 12,148 | 11,099 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| TOTAL PROVISION FOR CREDIT LOSSES |

11,945 | 26,797 | 13,332 | 12,148 | 11,099 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET INTEREST INCOME AFTER PROVISION FOR CREDIT LOSSES |

159,879 | 136,625 | 151,610 | 145,564 | 142,806 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NONINTEREST INCOME |

||||||||||||||||||||

| Service charges on deposit accounts |

12,588 | 12,635 | 12,978 | 12,713 | 12,252 | |||||||||||||||

| Debit and credit card fees |

8,567 | 8,446 | 8,323 | 8,144 | 8,162 | |||||||||||||||

| Wealth management fees |

9,464 | 9,629 | 9,658 | 9,098 | 9,187 | |||||||||||||||

| Mortgage lending income |

1,687 | 2,013 | 1,828 | 1,956 | 1,973 | |||||||||||||||

| Bank owned life insurance income |

3,890 | 4,092 | 3,780 | 3,757 | 3,876 | |||||||||||||||

| Other service charges and fees (includes insurance income) |

1,321 | 1,333 | 1,426 | 1,509 | 1,439 | |||||||||||||||

| Gain (loss) on sale of securities |

— | — | — | (28,393 | ) | — | ||||||||||||||

| Other income |

4,837 | 8,007 | 5,565 | 8,346 | 6,410 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| TOTAL NONINTEREST INCOME |

42,354 | 46,155 | 43,558 | 17,130 | 43,299 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NONINTEREST EXPENSE |

||||||||||||||||||||

| Salaries and employee benefits |

73,862 | 74,824 | 71,588 | 69,167 | 70,716 | |||||||||||||||

| Occupancy expense, net |

11,844 | 12,651 | 11,876 | 12,216 | 11,864 | |||||||||||||||

| Furniture and equipment expense |

5,474 | 5,465 | 5,671 | 5,612 | 5,623 | |||||||||||||||

| Other real estate and foreclosure expense |

216 | 198 | 317 | 87 | 117 | |||||||||||||||

| Deposit insurance |

4,917 | 5,391 | 5,550 | 5,571 | 5,682 | |||||||||||||||

| Other operating expenses |

42,276 | 46,051 | 46,115 | 44,540 | 45,352 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| TOTAL NONINTEREST EXPENSE |

138,589 | 144,580 | 141,117 | 137,193 | 139,354 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET INCOME BEFORE INCOME TAXES |

63,644 | 38,200 | 54,051 | 25,501 | 46,751 | |||||||||||||||

| Provision for income taxes |

8,871 | 5,812 | 5,732 | 761 | 5,988 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET INCOME |

$ | 54,773 | $ | 32,388 | $ | 48,319 | $ | 24,740 | $ | 40,763 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| BASIC EARNINGS PER SHARE |

$ | 0.43 | $ | 0.26 | $ | 0.38 | $ | 0.20 | $ | 0.32 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| DILUTED EARNINGS PER SHARE |

$ | 0.43 | $ | 0.26 | $ | 0.38 | $ | 0.20 | $ | 0.32 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Page 2

| Simmons First National Corporation | SFNC | |

| Consolidated Risk-Based Capital |

||

| For the Quarters Ended | ||

| (Unaudited) |

| Jun 30 | Mar 31 | Dec 31 | Sep 30 | Jun 30 | ||||||||||||||||

| 2025 | 2025 | 2024 | 2024 | 2024 | ||||||||||||||||

| ($ in thousands) | ||||||||||||||||||||

| Tier 1 capital |

||||||||||||||||||||

| Stockholders’ equity |

$ | 3,549,210 | $ | 3,531,485 | $ | 3,528,872 | $ | 3,528,833 | $ | 3,458,869 | ||||||||||

| CECL transition provision (1) |

— | — | 30,873 | 30,873 | 30,873 | |||||||||||||||

| Disallowed intangible assets, net of deferred tax |

(1,379,104 | ) | (1,381,953 | ) | (1,385,128 | ) | (1,388,549 | ) | (1,391,969 | ) | ||||||||||

| Unrealized loss (gain) on AFS securities |

380,900 | 367,710 | 360,910 | 335,861 | 405,481 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Tier 1 capital |

2,551,006 | 2,517,242 | 2,535,527 | 2,507,018 | 2,503,254 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Tier 2 capital |

||||||||||||||||||||

| Subordinated notes and debentures |

366,369 | 366,331 | 366,293 | 366,255 | 366,217 | |||||||||||||||

| Subordinated debt phase out |

(198,000 | ) | (132,000 | ) | (132,000 | ) | (132,000 | ) | (132,000 | ) | ||||||||||

| Qualifying allowance for loan losses and reserve for unfunded commitments |

258,079 | 257,769 | 222,313 | 220,517 | 217,684 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Tier 2 capital |

426,448 | 492,100 | 456,606 | 454,772 | 451,901 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total risk-based capital |

$ | 2,977,454 | $ | 3,009,342 | $ | 2,992,133 | $ | 2,961,790 | $ | 2,955,155 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Risk weighted assets |

$ | 20,646,324 | $ | 20,621,540 | $ | 20,473,960 | $ | 20,790,941 | $ | 20,856,194 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted average assets for leverage ratio |

$ | 25,606,135 | $ | 25,619,424 | $ | 26,037,459 | $ | 26,198,178 | $ | 26,371,545 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ratios at end of quarter |

||||||||||||||||||||

| Equity to assets |

13.30 | % | 13.18 | % | 13.13 | % | 12.94 | % | 12.64 | % | ||||||||||

| Tangible common equity to tangible assets (2) |

8.46 | % | 8.34 | % | 8.29 | % | 8.15 | % | 7.84 | % | ||||||||||

| Common equity Tier 1 ratio (CET1) |

12.36 | % | 12.21 | % | 12.38 | % | 12.06 | % | 12.00 | % | ||||||||||

| Tier 1 leverage ratio |

9.96 | % | 9.83 | % | 9.74 | % | 9.57 | % | 9.49 | % | ||||||||||

| Tier 1 risk-based capital ratio |

12.36 | % | 12.21 | % | 12.38 | % | 12.06 | % | 12.00 | % | ||||||||||

| Total risk-based capital ratio |

14.42 | % | 14.59 | % | 14.61 | % | 14.25 | % | 14.17 | % | ||||||||||

| (1) | The Company has elected to use the CECL transition provision allowed for in the year of adopting ASC 326. |

| (2) | Calculations of tangible common equity to tangible assets and the reconciliations to GAAP are included in the schedules accompanying this release. |

Page 3

| Simmons First National Corporation | SFNC | |

| Consolidated Investment Securities | ||

| For the Quarters Ended | ||

| (Unaudited) |

| Jun 30 2025 |

Mar 31 2025 |

Dec 31 2024 |

Sep 30 2024 |

Jun 30 2024 |

||||||||||||||||

| ($ in thousands) | ||||||||||||||||||||

| Investment Securities - End of Period |

||||||||||||||||||||

|

Held-to-Maturity |

||||||||||||||||||||

| U.S. Government agencies |

$ | 457,228 | $ | 456,545 | $ | 455,869 | $ | 455,179 | $ | 454,488 | ||||||||||

| Mortgage-backed securities |

1,024,313 | 1,048,170 | 1,070,032 | 1,093,070 | 1,119,741 | |||||||||||||||

| State and political subdivisions |

1,855,614 | 1,856,905 | 1,857,177 | 1,857,283 | 1,857,409 | |||||||||||||||

| Other securities |

254,376 | 253,936 | 253,558 | 253,168 | 253,812 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total held-to-maturity (net of credit losses) |

3,591,531 | 3,615,556 | 3,636,636 | 3,658,700 | 3,685,450 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Available-for-Sale |

||||||||||||||||||||

| U.S. Treasury |

$ | 400 | $ | 699 | $ | 996 | $ | 1,290 | $ | 1,275 | ||||||||||

| U.S. Government agencies |

49,498 | 52,318 | 54,547 | 58,397 | 66,563 | |||||||||||||||

| Mortgage-backed securities |

1,349,991 | 1,380,913 | 1,392,759 | 1,510,402 | 1,730,842 | |||||||||||||||

| State and political subdivisions |

807,842 | 832,898 | 858,182 | 898,178 | 864,190 | |||||||||||||||

| Other securities |

197,589 | 225,021 | 222,942 | 222,827 | 223,034 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total available-for-sale (net of credit losses) |

2,405,320 | 2,491,849 | 2,529,426 | 2,691,094 | 2,885,904 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total investment securities (net of credit losses) |

$ | 5,996,851 | $ | 6,107,405 | $ | 6,166,062 | $ | 6,349,794 | $ | 6,571,354 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Fair value - HTM investment securities |

$ | 2,891,974 | $ | 2,929,625 | $ | 2,949,951 | $ | 3,109,610 | $ | 3,005,524 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Page 4

| Simmons First National Corporation | SFNC | |

| Consolidated Loans | ||

| For the Quarters Ended | ||

| (Unaudited) |

| Jun 30 2025 |

Mar 31 2025 |

Dec 31 2024 |

Sep 30 2024 |

Jun 30 2024 |

||||||||||||||||

| ($ in thousands) | ||||||||||||||||||||

| Loan Portfolio - End of Period |

||||||||||||||||||||

| Consumer: |

||||||||||||||||||||

| Credit cards |

$ | 176,166 | $ | 179,680 | $ | 181,675 | $ | 177,696 | $ | 178,354 | ||||||||||

| Other consumer |

123,831 | 97,198 | 127,319 | 113,896 | 130,278 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total consumer |

299,997 | 276,878 | 308,994 | 291,592 | 308,632 | |||||||||||||||

| Real Estate: |

||||||||||||||||||||

| Construction |

2,784,578 | 2,778,245 | 2,789,249 | 2,796,378 | 3,056,703 | |||||||||||||||

| Single-family residential |

2,625,717 | 2,647,451 | 2,689,946 | 2,724,648 | 2,666,201 | |||||||||||||||

| Other commercial real estate |

7,961,412 | 8,051,304 | 7,912,336 | 7,992,437 | 7,760,266 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total real estate |

13,371,707 | 13,477,000 | 13,391,531 | 13,513,463 | 13,483,170 | |||||||||||||||

| Commercial: |

||||||||||||||||||||

| Commercial |

2,440,507 | 2,372,681 | 2,434,175 | 2,467,384 | 2,484,474 | |||||||||||||||

| Agricultural |

333,078 | 264,469 | 261,154 | 314,340 | 285,181 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total commercial |

2,773,585 | 2,637,150 | 2,695,329 | 2,781,724 | 2,769,655 | |||||||||||||||

| Other |

665,807 | 703,050 | 610,083 | 749,261 | 630,980 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total loans |

$ | 17,111,096 | $ | 17,094,078 | $ | 17,005,937 | $ | 17,336,040 | $ | 17,192,437 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Page 5

| Simmons First National Corporation | SFNC | |

| Consolidated Allowance and Asset Quality | ||

| For the Quarters Ended | ||

| (Unaudited) |

| Jun 30 2025 |

Mar 31 2025 |

Dec 31 2024 |

Sep 30 2024 |

Jun 30 2024 |

||||||||||||||||

| ($ in thousands) | ||||||||||||||||||||

| Allowance for Credit Losses on Loans |

||||||||||||||||||||

| Beginning balance |

$ | 252,168 | $ | 235,019 | $ | 233,223 | $ | 230,389 | $ | 227,367 | ||||||||||

| Loans charged off: |

||||||||||||||||||||

| Credit cards |

1,702 | 1,460 | 1,629 | 1,744 | 1,418 | |||||||||||||||

| Other consumer |

351 | 1,133 | 505 | 524 | 550 | |||||||||||||||

| Real estate |

1,450 | 4,425 | 3,810 | 159 | 123 | |||||||||||||||

| Commercial |

8,257 | 4,243 | 6,796 | 8,235 | 7,243 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total loans charged off |

11,760 | 11,261 | 12,740 | 10,662 | 9,334 | |||||||||||||||

| Recoveries of loans previously charged off: |

||||||||||||||||||||

| Credit cards |

334 | 211 | 391 | 231 | 221 | |||||||||||||||

| Other consumer |

294 | 306 | 279 | 275 | 509 | |||||||||||||||

| Real estate |

87 | 99 | 275 | 403 | 72 | |||||||||||||||

| Commercial |

469 | 997 | 259 | 439 | 455 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total recoveries |

1,184 | 1,613 | 1,204 | 1,348 | 1,257 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loans charged off |

10,576 | 9,648 | 11,536 | 9,314 | 8,077 | |||||||||||||||

| Provision for credit losses on loans |

11,945 | 26,797 | 13,332 | 12,148 | 11,099 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance, end of quarter |

$ | 253,537 | $ | 252,168 | $ | 235,019 | $ | 233,223 | $ | 230,389 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Nonperforming assets |

||||||||||||||||||||

| Nonperforming loans: |

||||||||||||||||||||

| Nonaccrual loans |

$ | 156,453 | $ | 151,897 | $ | 110,154 | $ | 100,865 | $ | 102,891 | ||||||||||

| Loans past due 90 days or more |

709 | 494 | 603 | 830 | 558 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total nonperforming loans |

157,162 | 152,391 | 110,757 | 101,695 | 103,449 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Other nonperforming assets: |

||||||||||||||||||||

| Foreclosed assets and other real estate owned |

8,794 | 8,976 | 9,270 | 1,299 | 2,209 | |||||||||||||||

| Other nonperforming assets |

759 | 978 | 1,202 | 1,311 | 1,167 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total other nonperforming assets |

9,553 | 9,954 | 10,472 | 2,610 | 3,376 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total nonperforming assets |

$ | 166,715 | $ | 162,345 | $ | 121,229 | $ | 104,305 | $ | 106,825 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ratios |

||||||||||||||||||||

| Allowance for credit losses on loans to total loans |

1.48 | % | 1.48 | % | 1.38 | % | 1.35 | % | 1.34 | % | ||||||||||

| Allowance for credit losses to nonperforming loans |

161 | % | 165 | % | 212 | % | 229 | % | 223 | % | ||||||||||

| Nonperforming loans to total loans |

0.92 | % | 0.89 | % | 0.65 | % | 0.59 | % | 0.60 | % | ||||||||||

| Nonperforming assets to total assets |

0.62 | % | 0.61 | % | 0.45 | % | 0.38 | % | 0.39 | % | ||||||||||

| Annualized net charge offs to average loans (QTD) |

0.25 | % | 0.23 | % | 0.27 | % | 0.22 | % | 0.19 | % | ||||||||||

| Annualized net charge offs to average loans (YTD) |

0.24 | % | 0.23 | % | 0.22 | % | 0.20 | % | 0.19 | % | ||||||||||

| Annualized net credit card charge offs to average credit card loans (QTD) |

2.99 | % | 2.72 | % | 2.63 | % | 3.23 | % | 2.50 | % | ||||||||||

Page 6

| Simmons First National Corporation | SFNC | |

| Consolidated - Average Balance Sheet and Net Interest Income Analysis | ||

| For the Quarters Ended | ||

| (Unaudited) |

| Three Months Ended Jun 2025 |

Three Months Ended Mar 2025 |

Three Months Ended Jun 2024 |

||||||||||||||||||||||||||||||||||

| ($ in thousands) | Average Balance |

Income/ Expense |

Yield/ Rate |

Average Balance |

Income/ Expense |

Yield/ Rate |

Average Balance |

Income/ Expense |

Yield/ Rate |

|||||||||||||||||||||||||||

| ASSETS |

||||||||||||||||||||||||||||||||||||

| Earning assets: |

||||||||||||||||||||||||||||||||||||

| Interest bearing balances due from banks and federal funds sold |

$ | 219,928 | $ | 2,531 | 4.62 | % | $ | 241,021 | $ | 2,703 | 4.55 | % | $ | 214,777 | $ | 2,964 | 5.55 | % | ||||||||||||||||||

| Investment securities - taxable |

3,483,805 | 31,233 | 3.60 | % | 3,540,559 | 31,584 | 3.62 | % | 4,035,508 | 39,283 | 3.92 | % | ||||||||||||||||||||||||

| Investment securities - non - taxable (FTE) |

2,564,037 | 21,210 | 3.32 | % | 2,608,070 | 21,217 | 3.30 | % | 2,597,005 | 21,429 | 3.32 | % | ||||||||||||||||||||||||

| Mortgage loans held for sale |

13,063 | 221 | 6.79 | % | 8,142 | 122 | 6.08 | % | 10,328 | 194 | 7.55 | % | ||||||||||||||||||||||||

| Loans - including fees (FTE) |

17,046,802 | 266,250 | 6.26 | % | 16,920,050 | 258,625 | 6.20 | % | 17,101,799 | 271,851 | 6.39 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total interest earning assets (FTE) |

23,327,635 | 321,445 | 5.53 | % | 23,317,842 | 314,251 | 5.47 | % | 23,959,417 | 335,721 | 5.64 | % | ||||||||||||||||||||||||

| Non-earning assets |

3,317,496 | 3,360,786 | 3,345,860 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total assets |

$ | 26,645,131 | $ | 26,678,628 | $ | 27,305,277 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||||||||||||||||||||||||||||||||

| Interest bearing liabilities: |

||||||||||||||||||||||||||||||||||||

| Interest bearing transaction and savings accounts |

$ | 11,220,060 | $ | 69,108 | 2.47 | % | $ | 11,177,550 | $ | 67,895 | 2.46 | % | $ | 10,973,462 | $ | 79,087 | 2.90 | % | ||||||||||||||||||

| Time deposits |

5,820,499 | 57,231 | 3.94 | % | 6,160,429 | 62,559 | 4.12 | % | 6,447,259 | 73,946 | 4.61 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total interest bearing deposits |

17,040,559 | 126,339 | 2.97 | % | 17,337,979 | 130,454 | 3.05 | % | 17,420,721 | 153,033 | 3.53 | % | ||||||||||||||||||||||||

| Federal funds purchased and securities sold under agreement to repurchase |

32,565 | 59 | 0.73 | % | 39,797 | 113 | 1.15 | % | 50,558 | 156 | 1.24 | % | ||||||||||||||||||||||||

| Other borrowings |

960,817 | 10,613 | 4.43 | % | 706,402 | 7,714 | 4.43 | % | 1,111,734 | 15,025 | 5.44 | % | ||||||||||||||||||||||||

| Subordinated notes and debentures |

366,350 | 6,188 | 6.77 | % | 366,312 | 6,134 | 6.79 | % | 366,198 | 7,026 | 7.72 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total interest bearing liabilities |

18,400,291 | 143,199 | 3.12 | % | 18,450,490 | 144,415 | 3.17 | % | 18,949,211 | 175,240 | 3.72 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Noninterest bearing liabilities: |

||||||||||||||||||||||||||||||||||||

| Noninterest bearing deposits |

4,390,454 | 4,342,948 | 4,624,819 | |||||||||||||||||||||||||||||||||

| Other liabilities |

308,223 | 320,721 | 280,092 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total liabilities |

23,098,968 | 23,114,159 | 23,854,122 | |||||||||||||||||||||||||||||||||

| Stockholders’ equity |

3,546,163 | 3,564,469 | 3,451,155 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total liabilities and stockholders’ equity |

$ | 26,645,131 | $ | 26,678,628 | $ | 27,305,277 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Net interest income (FTE) |

$ | 178,246 | $ | 169,836 | $ | 160,481 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Net interest spread (FTE) |

2.41 | % | 2.30 | % | 1.92 | % | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Net interest margin (FTE) |

3.06 | % | 2.95 | % | 2.69 | % | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

Page 7

| Simmons First National Corporation | SFNC | |

| Consolidated - Selected Financial Data | ||

| For the Quarters Ended | ||

| (Unaudited) |

| Jun 30 2025 |

Mar 31 2025 |

Dec 31 2024 |

Sep 30 2024 |

Jun 30 2024 |

||||||||||||||||

| ($ in thousands, except share data) | ||||||||||||||||||||

|

QUARTER-TO-DATE |

||||||||||||||||||||

| Financial Highlights - As Reported |

||||||||||||||||||||

| Net Income |

$ | 54,773 | $ | 32,388 | $ | 48,319 | $ | 24,740 | $ | 40,763 | ||||||||||

| Diluted earnings per share |

0.43 | 0.26 | 0.38 | 0.20 | 0.32 | |||||||||||||||

| Return on average assets |

0.82 | % | 0.49 | % | 0.71 | % | 0.36 | % | 0.60 | % | ||||||||||

| Return on average common equity |

6.20 | % | 3.69 | % | 5.43 | % | 2.81 | % | 4.75 | % | ||||||||||

| Return on tangible common equity (non-GAAP) (1) |

10.73 | % | 6.61 | % | 9.59 | % | 5.27 | % | 8.67 | % | ||||||||||

| Net interest margin (FTE) |

3.06 | % | 2.95 | % | 2.87 | % | 2.74 | % | 2.69 | % | ||||||||||

| Efficiency ratio (2) |

62.82 | % | 66.94 | % | 65.66 | % | 75.70 | % | 68.38 | % | ||||||||||

| FTE adjustment |

6,422 | 6,414 | 6,424 | 6,398 | 6,576 | |||||||||||||||

| Average diluted shares outstanding |

126,406,879 | 126,336,557 | 126,232,084 | 125,999,269 | 125,758,166 | |||||||||||||||

| Cash dividends declared per common share |

0.213 | 0.213 | 0.210 | 0.210 | 0.210 | |||||||||||||||

| Accretable yield on acquired loans |

1,263 | 1,084 | 1,863 | 1,496 | 1,569 | |||||||||||||||

| Financial Highlights - Adjusted (non-GAAP) (1) |

||||||||||||||||||||

| Adjusted earnings |

$ | 56,071 | $ | 33,122 | $ | 49,634 | $ | 46,005 | $ | 41,897 | ||||||||||

| Adjusted diluted earnings per share |

0.44 | 0.26 | 0.39 | 0.37 | 0.33 | |||||||||||||||

| Adjusted return on average assets |

0.84 | % | 0.50 | % | 0.73 | % | 0.67 | % | 0.62 | % | ||||||||||

| Adjusted return on average common equity |

6.34 | % | 3.77 | % | 5.57 | % | 5.22 | % | 4.88 | % | ||||||||||

| Adjusted return on tangible common equity |

10.97 | % | 6.75 | % | 9.83 | % | 9.34 | % | 8.89 | % | ||||||||||

| Adjusted efficiency ratio (2) |

60.52 | % | 64.75 | % | 62.89 | % | 63.38 | % | 65.68 | % | ||||||||||

|

YEAR-TO-DATE |

||||||||||||||||||||

| Financial Highlights - GAAP |

||||||||||||||||||||

| Net Income |

$ | 87,161 | $ | 32,388 | $ | 152,693 | $ | 104,374 | $ | 79,634 | ||||||||||

| Diluted earnings per share |

0.69 | 0.26 | 1.21 | 0.83 | 0.63 | |||||||||||||||

| Return on average assets |

0.66 | % | 0.49 | % | 0.56 | % | 0.51 | % | 0.59 | % | ||||||||||

| Return on average common equity |

4.94 | % | 3.69 | % | 4.38 | % | 4.02 | % | 4.64 | % | ||||||||||

| Return on tangible common equity (non-GAAP) (1) |

8.67 | % | 6.61 | % | 7.96 | % | 7.39 | % | 8.50 | % | ||||||||||

| Net interest margin (FTE) |

3.01 | % | 2.95 | % | 2.74 | % | 2.70 | % | 2.68 | % | ||||||||||

| Efficiency ratio (2) |

64.86 | % | 66.94 | % | 69.57 | % | 71.00 | % | 68.90 | % | ||||||||||

| FTE adjustment |

12,836 | 6,414 | 25,820 | 19,396 | 12,998 | |||||||||||||||

| Average diluted shares outstanding |

126,325,650 | 126,336,557 | 126,115,606 | 125,910,260 | 125,693,536 | |||||||||||||||

| Cash dividends declared per common share |

0.425 | 0.213 | 0.840 | 0.630 | 0.420 | |||||||||||||||

| Financial Highlights - Adjusted (non-GAAP) (1) |

||||||||||||||||||||

| Adjusted earnings |

$ | 89,193 | $ | 33,122 | $ | 177,887 | $ | 128,253 | $ | 82,248 | ||||||||||

| Adjusted diluted earnings per share |

0.71 | 0.26 | 1.41 | 1.02 | 0.65 | |||||||||||||||

| Adjusted return on average assets |

0.67 | % | 0.50 | % | 0.65 | % | 0.63 | % | 0.61 | % | ||||||||||

| Adjusted return on average common equity |

5.06 | % | 3.77 | % | 5.10 | % | 4.94 | % | 4.80 | % | ||||||||||

| Adjusted return on tangible common equity |

8.86 | % | 6.75 | % | 9.18 | % | 8.96 | % | 8.76 | % | ||||||||||

| Adjusted efficiency ratio (2) |

62.62 | % | 64.75 | % | 64.56 | % | 65.14 | % | 66.05 | % | ||||||||||

| END OF PERIOD |

||||||||||||||||||||

| Book value per share |

$ | 28.17 | $ | 28.04 | $ | 28.08 | $ | 28.11 | $ | 27.56 | ||||||||||

| Tangible book value per share |

16.97 | 16.81 | 16.80 | 16.78 | 16.20 | |||||||||||||||

| Shares outstanding |

125,996,248 | 125,926,822 | 125,651,540 | 125,554,598 | 125,487,520 | |||||||||||||||

| Full-time equivalent employees |

2,947 | 2,949 | 2,946 | 2,972 | 2,961 | |||||||||||||||

| Total number of financial centers |

223 | 222 | 222 | 234 | 234 | |||||||||||||||

| (1) | Non-GAAP measurement that management believes aids in the understanding and discussion of results. Reconciliations to GAAP are included in the schedules accompanying this release. |

| (2) | Efficiency ratio is noninterest expense as a percent of net interest income (fully taxable equivalent) and noninterest revenues. Adjusted efficiency ratio is noninterest expense before foreclosed property expense, amortization of intangibles and certain adjusting items as a percent of net interest income (fully taxable equivalent) and noninterest revenues, excluding gains and losses from securities transactions and certain adjusting items, and is a non-GAAP measurement. |

Page 8

| Simmons First National Corporation | SFNC | |

| Reconciliation Of Non-GAAP Financial Measures - Adjusted Earnings - Quarter-to-Date | ||

| For the Quarters Ended | ||

| (Unaudited) |

| Jun 30 2025 |

Mar 31 2025 |

Dec 31 2024 |

Sep 30 2024 |

Jun 30 2024 |

||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

|

QUARTER-TO-DATE |

||||||||||||||||||||

| Net income |

$ | 54,773 | $ | 32,388 | $ | 48,319 | $ | 24,740 | $ | 40,763 | ||||||||||

| Certain items (non-GAAP) |

||||||||||||||||||||

| FDIC Deposit Insurance special assessment |

— | — | — | — | 283 | |||||||||||||||

| Early retirement program |

1,594 | — | 200 | (1 | ) | 118 | ||||||||||||||

| Termination of vendor and software services |

— | — | — | (13 | ) | 615 | ||||||||||||||

| Loss (gain) on sale of securities |

— | — | — | 28,393 | — | |||||||||||||||

| Branch right sizing (net) |

163 | 994 | 1,581 | 410 | 519 | |||||||||||||||

| Tax effect of certain items (1) |

(459 | ) | (260 | ) | (466 | ) | (7,524 | ) | (401 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Certain items, net of tax |

1,298 | 734 | 1,315 | 21,265 | 1,134 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted earnings (non-GAAP) (2) |

$ | 56,071 | $ | 33,122 | $ | 49,634 | $ | 46,005 | $ | 41,897 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted earnings per share |