UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2025

Silence Therapeutics plc

(Exact name of registrant as specified in its charter)

| England and Wales | 001-39487 | Not Applicable | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

72 Hammersmith Road London United Kingdom |

W14 8TH | |

| (Address of principal executive offices) | (Zip Code) |

+44 20 3457 6900

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading |

Name of each exchange |

||

| American Depositary Shares, each representing 3 ordinary shares, nominal value £0.05 per share | SLN | The Nasdaq Stock Market LLC | ||

| Ordinary share, nominal value £0.05 per share* | * | The Nasdaq Stock Market LLC |

* Not for trading, but only in connection with the listing of the American Depositary Shares on The Nasdaq Stock Market LLC.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02. | Results of Operations and Financial Condition. |

On February 27, 2025, Silence Therapeutics plc (the “Company”) issued a press release announcing its financial results for the fourth quarter and full year ended December 31, 2024, as well as other recent corporate updates. A copy of the press release is furnished as Exhibit 99.1 to this report and incorporated by reference.

The information in this Item 2.02 of this Current Report on 8-K, including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific references in such filing.

| Item 7.01. | Regulation FD Disclosure. |

In connection with its earnings call on February 27, 2025 to discuss its results for the fourth quarter and full year ended December 31, 2024, the Company utilized a corporate presentation, a copy of which is furnished as Exhibit 99.2 to this report and incorporated by reference.

The information contained in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.2 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference into any of the Company’s filings under the Securities Act or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01. | Financial Statements and Exhibits |

(d) Exhibits.

Exhibit No. |

Description |

|

| 99.1 | Press Release dated February 27, 2025. | |

| 99.2 | Silence Therapeutics plc Presentation dated February 2025. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| SILENCE THERAPEUTICS PLC | ||||||

| Dated: February 27, 2025 | By: | /s/ Craig Tooman |

||||

| Name: Craig Tooman | ||||||

| Title: Chief Executive Officer | ||||||

Exhibit 99.1

Silence Therapeutics Reports Full Year 2024 Financial Results and Provides Business Update

The Company’s cash guidance is now extended into 2027

Company to host conference call and webcast today at 8 a.m. EST / 1 p.m. GMT

27 February 2025

LONDON, Silence Therapeutics plc, Nasdaq: SLN (“Silence” or “the Company”), a global clinical-stage company developing novel siRNA (short interfering RNA) therapies, today reported its financial results for the full year ended December 31, 2024, and provided a business update.

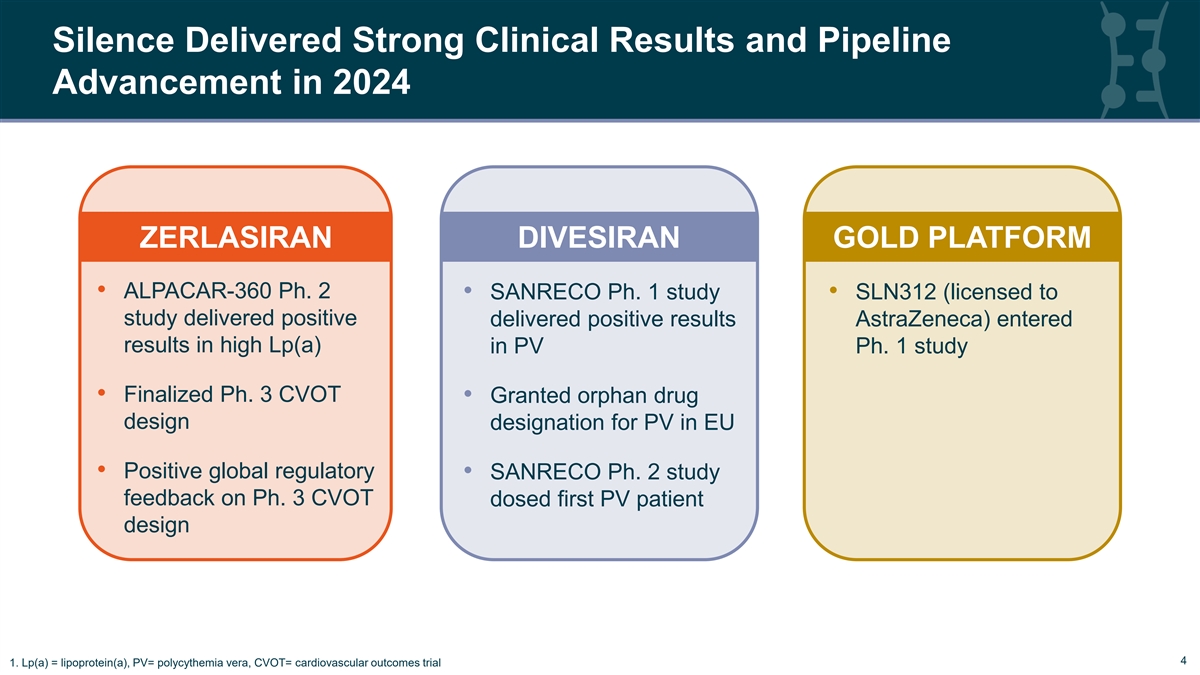

“2024 was marked by strong clinical execution and pipeline advancement, highlighting the broad potential of our mRNAi GOLD™ platform to silence disease causing genes,” said Craig Tooman, President and CEO of Silence. “In 2025, we are prioritizing investment in programs targeting rare conditions where we believe we can deliver on clear unmet needs with first-in-class and/or best-in-class siRNAs. We believe divesiran is a great example of this strategy and clinical commitment. We are pleased to announce today that we anticipate full enrollment in the SANRECO Phase 2 study of divesiran in PV by year-end. While we remain confident in our zerlasiran program for high Lp(a), we will only initiate the Phase 3 cardiovascular outcomes study once a partner is secured.”

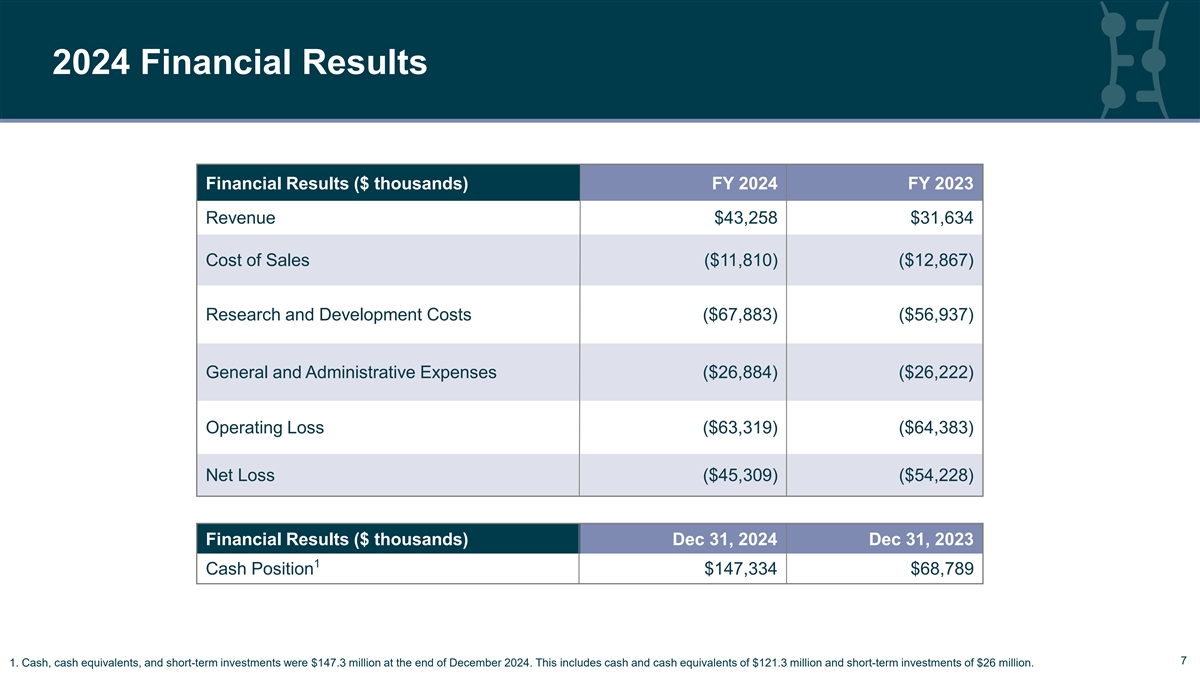

“We ended the year with over $147 million in cash, cash equivalents and short-term investments.” said Rhonda Hellums, Chief Financial Officer at Silence. “The decision not to initiate the zerlasiran Phase 3 outcomes study without a partner extends our projected cash runway into 2027 and gives us flexibility to invest in our innovative pipeline while we continue partnering discussions for this program.”

Recent Business Highlights

Zerlasiran for Cardiovascular Disease

| • | Received positive regulatory feedback from the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA) and the Pharmaceuticals and Medical Devices Agency (PMDA) in Japan on the Phase 3 cardiovascular (CV) outcomes study design for zerlasiran in patients with elevated lipoprotein(a) (Lp(a)) and at high risk of a CV event. |

| • | Progressed core activities to ensure the zerlasiran program is Phase 3 ready in the first half of 2025. |

| • | Partnering discussions for this program are ongoing; timing for Phase 3 initiation is dependent on partnership. |

Divesiran for Polycythemia Vera (PV)

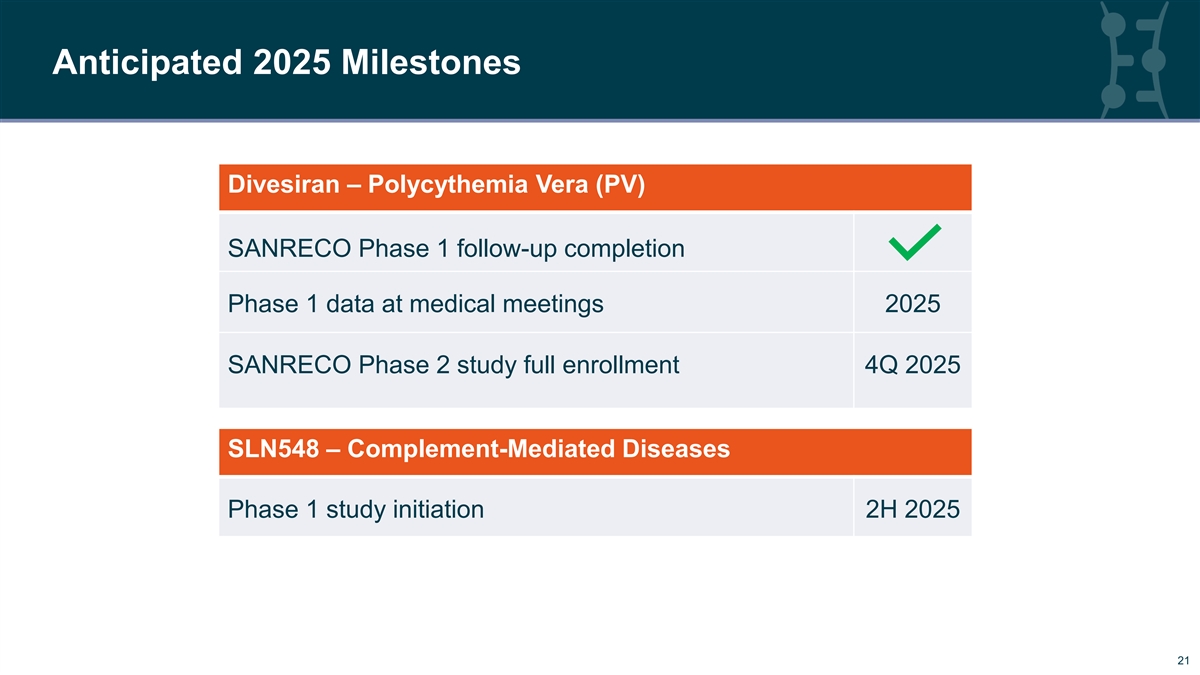

| • | Follow-up has concluded in the SANRECO Phase 1 study of divesiran in PV patients. Data presentations at medical congresses are anticipated in 2025. |

| • | Enrollment is underway in the SANRECO Phase 2 study of divesiran in PV patients. Full enrollment is anticipated by the end of 2025. |

Other mRNAi GOLD™ Pipeline Updates

| • | A Phase 1 study of SLN548, Silence’s wholly owned siRNA product candidate for complement-mediated diseases, is planned for the second half of 2025. |

| • | A Phase 1 study of SLN312 (licensed to AstraZeneca) is ongoing. |

| • | Hansoh Pharma opted not to pursue further development under the collaboration agreement to develop siRNAs for three undisclosed preclinical targets using Silence’s mRNAi GOLD platform. Silence retains global rights to all three programs and is evaluating plans for further development. |

Financial Highlights for Year End 2024

| • | Cash Position: Cash, cash equivalents, and short-term investments were $147.3 million at the end of December 2024. This includes cash and cash equivalents of $121.3 million and short-term investments of $26 million. |

| • | Collaboration Revenue: Collaboration revenue was $43.1 million for the year ended December 31, 2024, compared to $30.9 million for the year ended December 31, 2023. The increase of $12.2 million is largely due to the cumulative catch-up following completion of required obligations under collaboration arrangements entered for development of candidates utilizing the siRNA platform. |

| • | R&D Expenses: Research and development (R&D) expenses were $67.9 million for the year ended December 31, 2024, compared to $56.9 million for the year ended December 31, 2023. The increase is a result of additional clinical studies and an increase in contract manufacturing activities for Silence’s proprietary programs. |

| • | G&A Expenses: General and administrative (G&A) expenses were $26.9 million for the year ended December 31, 2024, compared to $26.2 million for the year ended December 31, 2023. The increase was primarily as result of additional expenses required to comply with the U.S. domestic reporting requirements under the Exchange Act. |

| • | Net Loss: Net loss was $45.3 million, or $0.33 basic and diluted net loss per share for the year ended December 31, 2024, compared to a net loss of $54.2 million, or $0.49 basic and diluted net loss per share for the year ended December 31, 2023. |

| • | Total outstanding shares were 141,674,074 ordinary shares (including shares in the form of American Depositary Shares) as of December 31, 2024. |

2025 Financial Guidance

| • | Silence announced today that it will only initiate the zerlasiran Phase 3 CVOT study once a partner is secured. Following this announcement, Silence is extending its projected cash runway into 2027. The Company plans to prioritize development of divesiran in PV and programs in rare conditions with high unmet needs. |

Conference Call & Webcast Details

Company management will host a conference call and webcast today, Thursday, February 27, 2025, at 8 a.m. EST / 1:00 p.m. GMT.

Webcast link: https://edge.media-server.com/mmc/p/73gzxc8m

Conference call registration link: https://register.vevent.com/register/BIbb8ec3d3557e47e3a4db7b8c03339124

The conference call and webcast will also be archived on the Company’s website at www.silence-therapeutics.com.

About Silence Therapeutics

Silence Therapeutics is a global clinical-stage biotechnology company committed to transforming people’s lives by silencing diseases through precision engineered medicines created with proprietary siRNA (short interfering RNA) technology.

Silence leverages its mRNAi GOLD™ platform to create innovative siRNAs designed to precisely target and silence disease-associated genes in the liver, which represents a substantial opportunity. Silence focuses on areas of high unmet medical need with programs advancing in cardiovascular disease, hematology and rare diseases. For more information, please visit https://www.silence-therapeutics.com/.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements may be identified by words such as “aims,” “anticipates,” “believes,” “could,” “estimates,” “expects,” “forecasts,” “goal,” “intends,” “may,” “plans,” “possible,” “potential,” “seeks,” “will” and variations of these words or similar expressions that are intended to identify forward-looking statements, although not all forward-looking statements contain these words. All statements in this press release, other than statements of historical facts, are forward-looking statements. These statements include, but are not limited to, statements regarding: the Company’s business strategy and plans, including its decision to prioritize the development of divesiran as the first-in-class siRNA product candidate for treatment of PV and programs in rare conditions with high unmet needs; the Company’s clinical development activities and timelines for divesiran, including patient enrollment in the SANRECO Phase 2 trial; expected clinical benefits, efficacy and safety of divesiran and the potential to produce clinically meaningful outcomes in PV patients; the Company’s plans to secure a partner to fund further clinical development of zerlasiran, including possible initiation of a Phase 3 clinical study; the design, timing, initiation, progress and results of current and future clinical development for the Company’s other product candidates; and the Company’s anticipated extended cash runway due to portfolio re-prioritization. Any forward-looking statements are based on management’s current expectations and beliefs of future events and are subject to a number of risks and uncertainties that could cause actual events or results to differ materially and adversely from those set forth in or implied by such forward-looking statements, many of which are beyond the Company’s control. These risks and uncertainties include, but are not limited to: the impact of worsening macroeconomic conditions, including the conflict in Ukraine and the conflict between Israel and Hamas, heightened inflation and uncertain credit and financial markets, on the Company’s business, clinical trials and financial position; the risk that success in preclinical testing and earlier clinical trials is not replicated in later clinical trials; the delay of any current or planned clinical trials, whether due to patient enrollment delays or otherwise; the Company’s ability to successfully demonstrate the safety and efficacy of its product candidates and gain approval of its product candidates on a timely basis, if at all; competition with respect to market opportunities; unexpected safety or efficacy data observed during preclinical studies or clinical trials; actions of regulatory agencies, which may affect the initiation, timing and progress of clinical trials or future regulatory approval; clinical trial site activation or enrollment rates that are lower than expected; the Company’s ability to realize the benefits of its collaborations and license agreements; changes in expected or existing competition; changes in the regulatory environment; the uncertainties and timing of the regulatory approval process; and unexpected litigation or other disputes. These and other risks and uncertainties are identified in the section titled “Risk Factors” in the Company’s most recent Annual Report on Form 20-F for the year ended December 31, 2023 filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 13, 2024 as updated by the section titled “Risk Factors” in the Company’s Report on Form 6-K filed with the SEC on November 14, 2024, as well as its other documents subsequently filed with or furnished to the SEC. The Company expressly disclaims any obligation to update any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise, except as otherwise required by law.

Inquiries:

| Silence Therapeutics plc Gem Hopkins, VP, Head of IR and Corporate Communications ir@silence-therapeutics.com |

Tel: +1 (646) 637-3208 |

SILENCE THERAPEUTICS PLC

CONSOLIDATED STATEMENTS OF INCOME (LOSS)

(in thousands, except for loss per share)

| Year ended December 31, | ||||||||||||

| 2024 | 2023 | 2022 | ||||||||||

| Revenue |

$ | 43,258 | $ | 31,643 | $ | 21,655 | ||||||

| Cost of sales |

(11,810 | ) | (12,867 | ) | (13,463 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Gross profit |

31,448 | 18,776 | 8,192 | |||||||||

| Research and development costs |

(67,883 | ) | (56,937 | ) | (43,550 | ) | ||||||

| General and administrative expenses |

(26,884 | ) | (26,222 | ) | (25,682 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Operating loss |

(63,319 | ) | (64,383 | ) | (61,040 | ) | ||||||

| Foreign currency gain/(loss), net |

646 | (2,641 | ) | 1,294 | ||||||||

| Other income, net |

4,472 | 1,803 | 280 | |||||||||

| Benefit from R&D credit |

13,737 | 11,949 | 9,820 | |||||||||

|

|

|

|

|

|

|

|||||||

| Loss before income tax expense |

(44,464 | ) | (53,272 | ) | (49,646 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Income tax expense |

(845 | ) | (956 | ) | (688 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net Loss |

$ | (45,309 | ) | $ | (54,228 | ) | $ | (50,334 | ) | |||

|

|

|

|

|

|

|

|||||||

| Loss per share (basic and diluted) |

$ | (0.33 | ) | $ | (0.49 | ) | $ | (0.52 | ) | |||

|

|

|

|

|

|

|

|||||||

| Weighted average shares outstanding (basic and diluted) |

138,752,224 | 111,277,250 | 96,584,512 | |||||||||

|

|

|

|

|

|

|

|||||||

SILENCE THERAPEUTICS PLC

CONSOLIDATED BALANCE SHEETS

(in thousands)

| Year ended December 31, | ||||||||

| 2024 | 2023 | |||||||

| Current assets |

||||||||

| Cash and cash equivalents |

$ | 121,330 | $ | 68,789 | ||||

| Short-term investments |

26,004 | — | ||||||

| R&D benefit receivable |

24,396 | 22,442 | ||||||

| Other current assets |

14,664 | 11,630 | ||||||

| Trade receivables |

972 | 290 | ||||||

|

|

|

|

|

|||||

| Total current assets |

187,366 | 103,151 | ||||||

|

|

|

|

|

|||||

| Property, plant and equipment |

1,818 | 1,938 | ||||||

| Operating lease right-of-use assets |

157 | 370 | ||||||

| Goodwill |

9,392 | 9,981 | ||||||

| Other intangible assets |

312 | 362 | ||||||

| Other long-term assets |

3,590 | 3,646 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 202,635 | $ | 119,448 | ||||

|

|

|

|

|

|||||

| Current liabilities |

||||||||

| Contract liabilities |

$ | (306 | ) | $ | (6,571 | ) | ||

| Trade and other payables |

(16,399 | ) | (15,537 | ) | ||||

| Operating lease liabilities, current |

(117 | ) | (228 | ) | ||||

| Total current liabilities |

(16,822 | ) | (22,336 | ) | ||||

|

|

|

|

|

|||||

| Contract liabilities |

(51,790 | ) | (75,001 | ) | ||||

| Operating lease liabilities, long-term |

— | (118 | ) | |||||

|

|

|

|

|

|||||

| Total liabilities |

$ | (68,612 | ) | $ | (97,455 | ) | ||

|

|

|

|

|

|||||

| Commitments and contingencies (Note 20) |

||||||||

| Shareholders’ equity |

||||||||

| Ordinary shares - par value £0.05 per share; 141,674,074 shares issued at December 31, 2024 (2023: 118,846,966) |

(10,288 | ) | (8,847 | ) | ||||

| Additional paid-in capital |

(609,560 | ) | (455,765 | ) | ||||

| Accumulated deficit |

474,044 | 431,894 | ||||||

| Accumulated other comprehensive loss |

11,781 | 10,725 | ||||||

|

|

|

|

|

|||||

| Total shareholders’ equity |

(134,023 | ) | (21,993 | ) | ||||

|

|

|

|

|

|||||

| Total liabilities and shareholders’ equity |

$ | (202,635 | ) | $ | (119,448 | ) | ||

|

|

|

|

|

|||||

Exhibit 99.2 Full Year 2024 Results February 27, 2025

Forward-Looking Statements The information contained in this presentation is being supplied and communicated to you solely for your information and may not be reproduced, further distributed to any other person or published, in whole or in part, for any purpose. The distribution of this presentation in certain jurisdictions may be restricted by law, and persons into whose possession this presentation comes should inform themselves about, and observe, any such restrictions. Although reasonable care has been taken to ensure that the facts stated in this presentation are accurate and that the opinions expressed are fair and reasonable, the contents of this presentation have not been verified by Silence Therapeutics plc (the “Company”) or any other person. Accordingly no representation or warranty, express or implied, is made as to the fairness, accuracy, completeness or correctness of the information and opinions contained in this presentation and no reliance should be placed on such information or opinions. None of the Company, or any of its respective members, directors, officers or employees nor any other person accepts any liability whatsoever for any loss howsoever arising from any use of such information or opinions or otherwise arising in connection with this presentation. No part of this presentation, or the fact of its distribution, should form the basis of or be relied upon in connection with any contract or commitment or investment decision whatsoever. This presentation does not form part of any offer of securities, or constitute a solicitation of any offer to purchase or subscribe for securities or an inducement to enter into any investment activity. Recipients of this presentation are not to construe its contents, or any prior or subsequent communications from or with the Company or its representatives as investment, legal or tax advice. In addition, this presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of any transaction. Further, the information in this presentation is not complete and may be changed. Recipients of this presentation should each make their own independent evaluation of the information and of the relevance and adequacy of the information in this document and should make such other investigations as they deem necessary. This presentation may contain forward-looking statements that reflect the Company’s current views and expectations regarding future events. In particular certain statements with regard to management’s strategic vision, aims and objectives, the conduct of clinical trials, the filing dates for product license applications and the anticipated launch of specified products in various markets, the Company’s ability to find partners for the development and commercialization of its products as well as the terms for such partnerships, anticipated levels of demand for the Company’s products (including in development), the effect of competition, anticipated efficiencies, trends in results of operations, margins, the market and exchange rates, are all forward-looking in nature. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied by the forward looking statements. Although not exhaustive, the following factors could cause actual results to differ materially from those the Company expects: difficulties inherent in the discovery and development of new products and the design and implementation of pre-clinical and clinical studies, trials and investigations, delays in and results from such studies, trials and investigations that are inconsistent with previous results and the Company’s expectations, the failure to obtain and maintain required regulatory approvals, product and pricing initiatives by the Company’s competitors, inability of the Company to market existing products effectively and the failure of the Company to agree beneficial terms with potential partners for any of its products or the failure of the Company’s existing partners to perform their obligations, the ability of the Company to obtain additional financing for its operations and the market conditions affecting the availability and terms of such financing, the successful integration of completed mergers and acquisitions and achievement of expected synergies from such transactions, and the ability of the Company to identify and consummate suitable strategic and business combination transactions and the risks described in our most recent Admission Document. By participating in this presentation and/or accepting any copies hereof you agree to be bound by the foregoing restrictions and the other terms of this disclaimer. 2 2

Company Overview CRAIG TOOMAN Chief Executive Officer 3

Silence Delivered Strong Clinical Results and Pipeline Advancement in 2024 ZERLASIRAN DIVESIRAN GOLD PLATFORM • ALPACAR-360 Ph. 2 • SANRECO Ph. 1 study • SLN312 (licensed to study delivered positive delivered positive results AstraZeneca) entered results in high Lp(a) in PV Ph. 1 study • Finalized Ph. 3 CVOT • Granted orphan drug design designation for PV in EU • Positive global regulatory • SANRECO Ph. 2 study feedback on Ph. 3 CVOT dosed first PV patient design 4 4 1. Lp(a) = lipoprotein(a), PV= polycythemia vera, CVOT= cardiovascular outcomes trial

2025: Advancing Clinical Pipeline in Rare Conditions with High Unmet Needs DIVESIRAN GOLD PLATFORM EXTRA HEPATIC • First-in-class siRNA for PV • SLN548 (complement factor • Advancing programs targeting B) Ph. 1 study start multiple cell types • SANRECO Ph. 1 data anticipated in 2H 2025 presentations planned in 2025 • Prioritizing programs in rare diseases with high unmet • SANRECO Ph. 2 full needs enrollment anticipated by year-end 2025 5 5

Financial Review and 2025 Guidance RHONDA HELLUMS Chief Financial Officer 6

2024 Financial Results Financial Results ($ thousands) FY 2024 FY 2023 Revenue $43,258 $31,634 Cost of Sales ($11,810) ($12,867) Research and Development Costs ($67,883) ($56,937) General and Administrative Expenses ($26,884) ($26,222) Operating Loss ($63,319) ($64,383) Net Loss ($45,309) ($54,228) Financial Results ($ thousands) Dec 31, 2024 Dec 31, 2023 1 Cash Position $147,334 $68,789 7 7 1. Cash, cash equivalents, and short-term investments were $147.3 million at the end of December 2024. This includes cash and cash equivalents of $121.3 million and short-term investments of $26 million.

2025 Financial Guidance FINANCIAL PRIORITIES CASH GUIDANCE • Divesiran for PV Projected Runway • Advancing pipeline in rare conditions Extended into 2027 • Extra-hepatic 8 8

Clinical Update STEVEN ROMANO, MD Chief R&D Officer 9

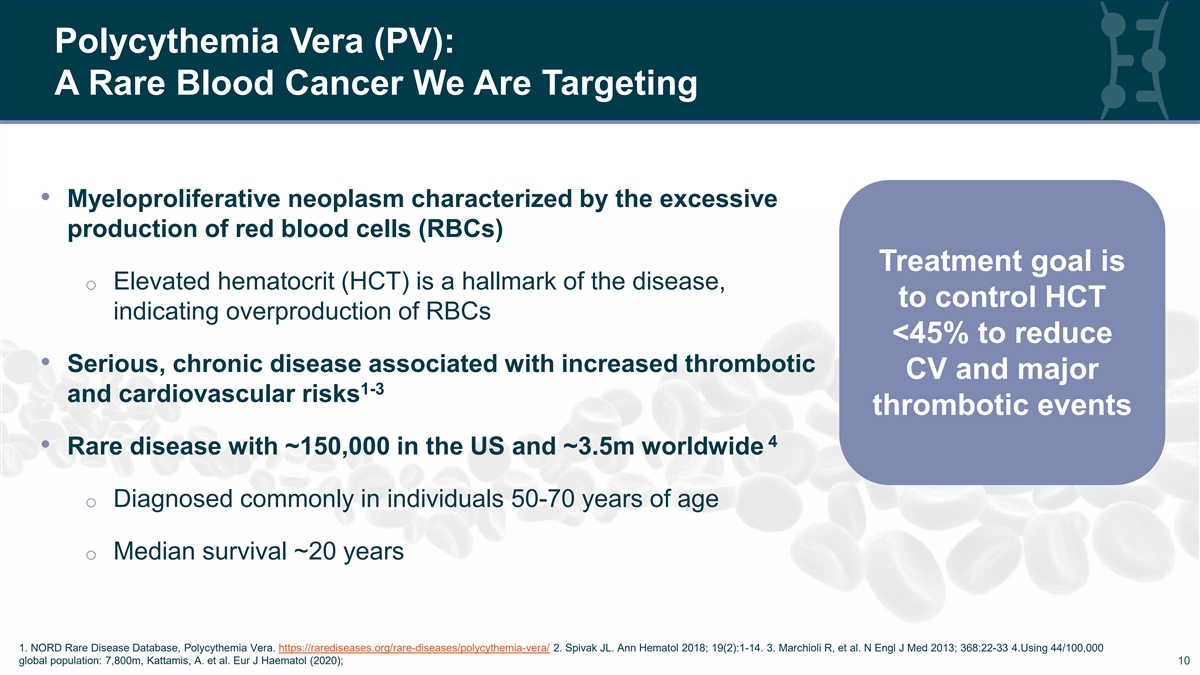

Polycythemia Vera (PV): A Rare Blood Cancer We Are Targeting • Myeloproliferative neoplasm characterized by the excessive production of red blood cells (RBCs) Treatment goal is o Elevated hematocrit (HCT) is a hallmark of the disease, to control HCT indicating overproduction of RBCs <45% to reduce • Serious, chronic disease associated with increased thrombotic CV and major 1-3 and cardiovascular risks thrombotic events 4 • Rare disease with ~150,000 in the US and ~3.5m worldwide o Diagnosed commonly in individuals 50-70 years of age o Median survival ~20 years 1. NORD Rare Disease Database, Polycythemia Vera. https://rarediseases.org/rare-diseases/polycythemia-vera/ 2. Spivak JL. Ann Hematol 2018; 19(2):1-14. 3. Marchioli R, et al. N Engl J Med 2013; 368:22-33 4.Using 44/100,000 10 global population: 7,800m, Kattamis, A. et al. Eur J Haematol (2020); 10

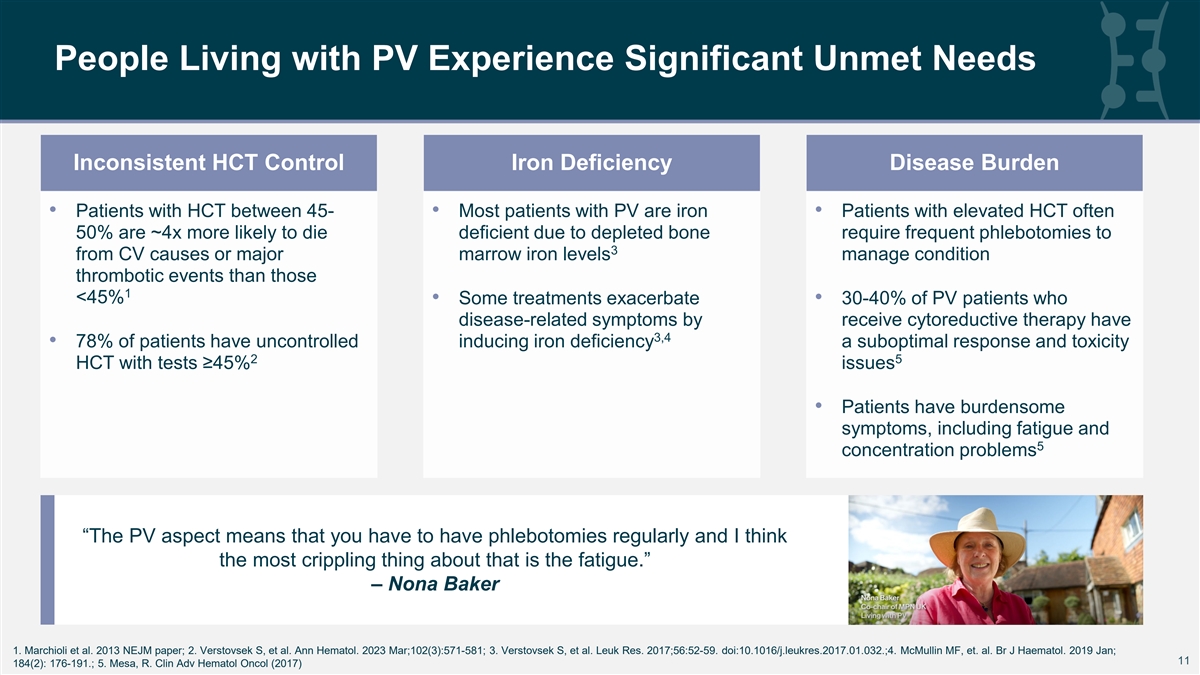

People Living with PV Experience Significant Unmet Needs Inconsistent HCT Control Iron Deficiency Disease Burden • Patients with HCT between 45- • Most patients with PV are iron • Patients with elevated HCT often 50% are ~4x more likely to die deficient due to depleted bone require frequent phlebotomies to 3 from CV causes or major marrow iron levels manage condition thrombotic events than those 1 <45% • Some treatments exacerbate • 30-40% of PV patients who disease-related symptoms by receive cytoreductive therapy have 3,4 • 78% of patients have uncontrolled inducing iron deficiency a suboptimal response and toxicity 2 5 HCT with tests ≥45% issues • Patients have burdensome symptoms, including fatigue and 5 concentration problems “The PV aspect means that you have to have phlebotomies regularly and I think the most crippling thing about that is the fatigue.” – Nona Baker 1. Marchioli et al. 2013 NEJM paper; 2. Verstovsek S, et al. Ann Hematol. 2023 Mar;102(3):571-581; 3. Verstovsek S, et al. Leuk Res. 2017;56:52-59. doi:10.1016/j.leukres.2017.01.032.;4. McMullin MF, et. al. Br J Haematol. 2019 Jan; 11 11 184(2): 176-191.; 5. Mesa, R. Clin Adv Hematol Oncol (2017)

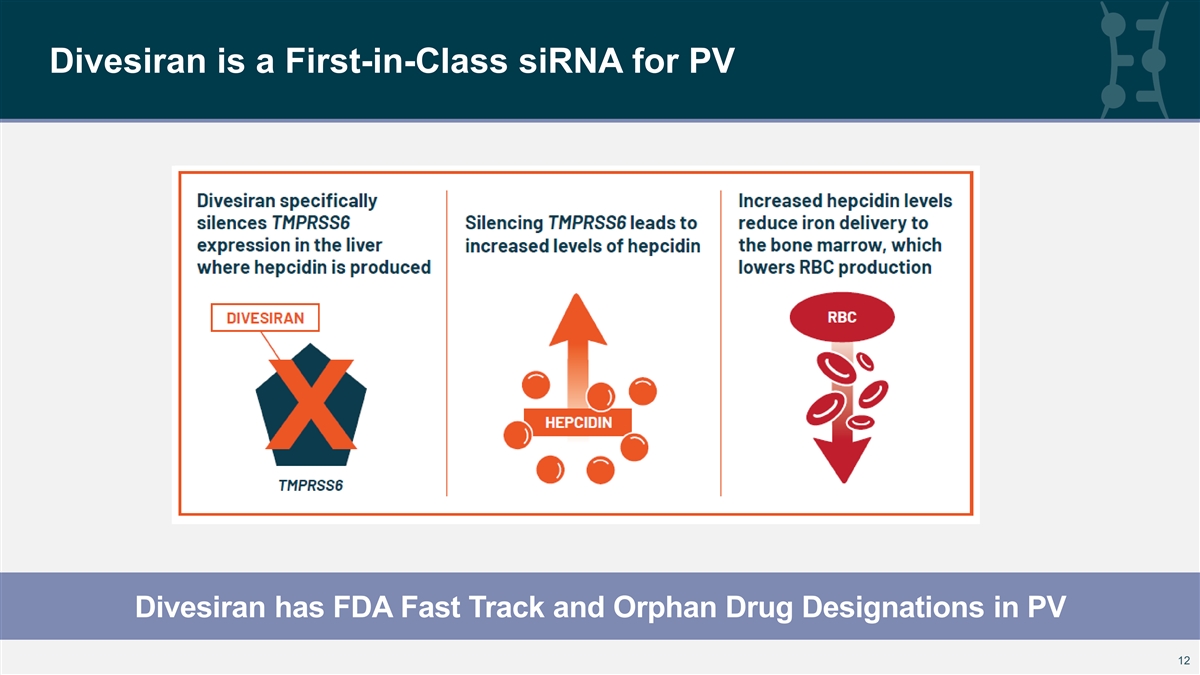

Divesiran is a First-in-Class siRNA for PV Divesiran has FDA Fast Track and Orphan Drug Designations in PV 12 12

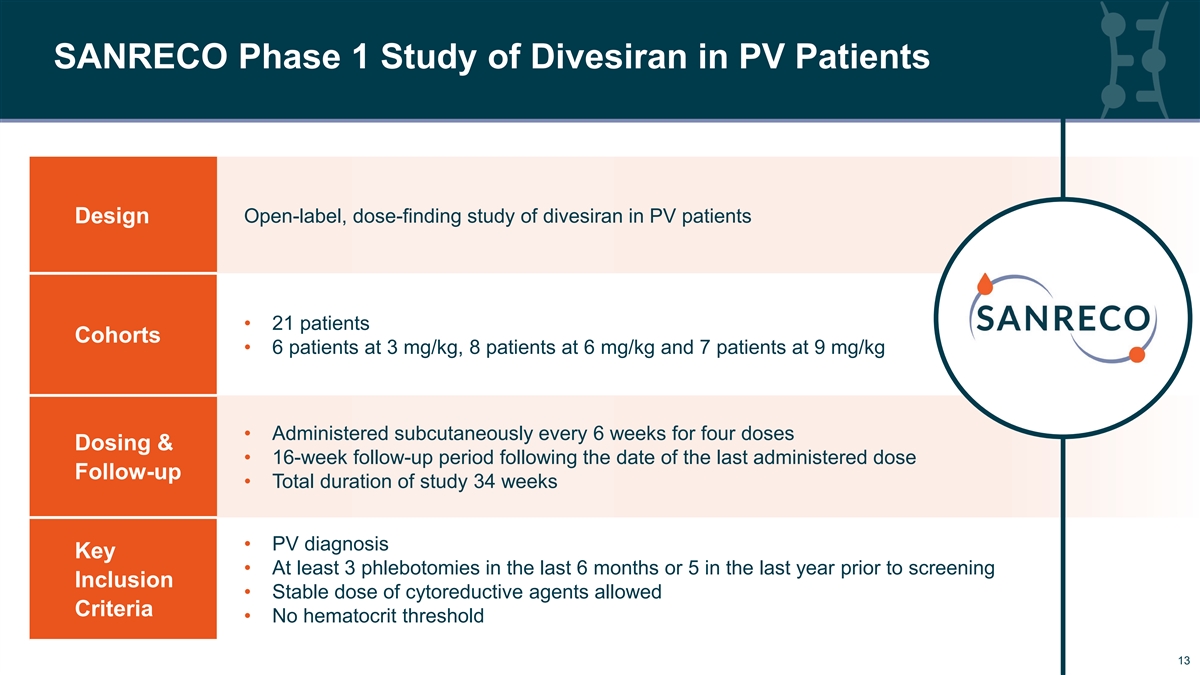

SANRECO Phase 1 Study of Divesiran in PV Patients Open-label, dose-finding study of divesiran in PV patients Design • 21 patients Cohorts • 6 patients at 3 mg/kg, 8 patients at 6 mg/kg and 7 patients at 9 mg/kg • Administered subcutaneously every 6 weeks for four doses Dosing & • 16-week follow-up period following the date of the last administered dose Follow-up • Total duration of study 34 weeks • PV diagnosis Key • At least 3 phlebotomies in the last 6 months or 5 in the last year prior to screening Inclusion • Stable dose of cytoreductive agents allowed Criteria • No hematocrit threshold 13 13

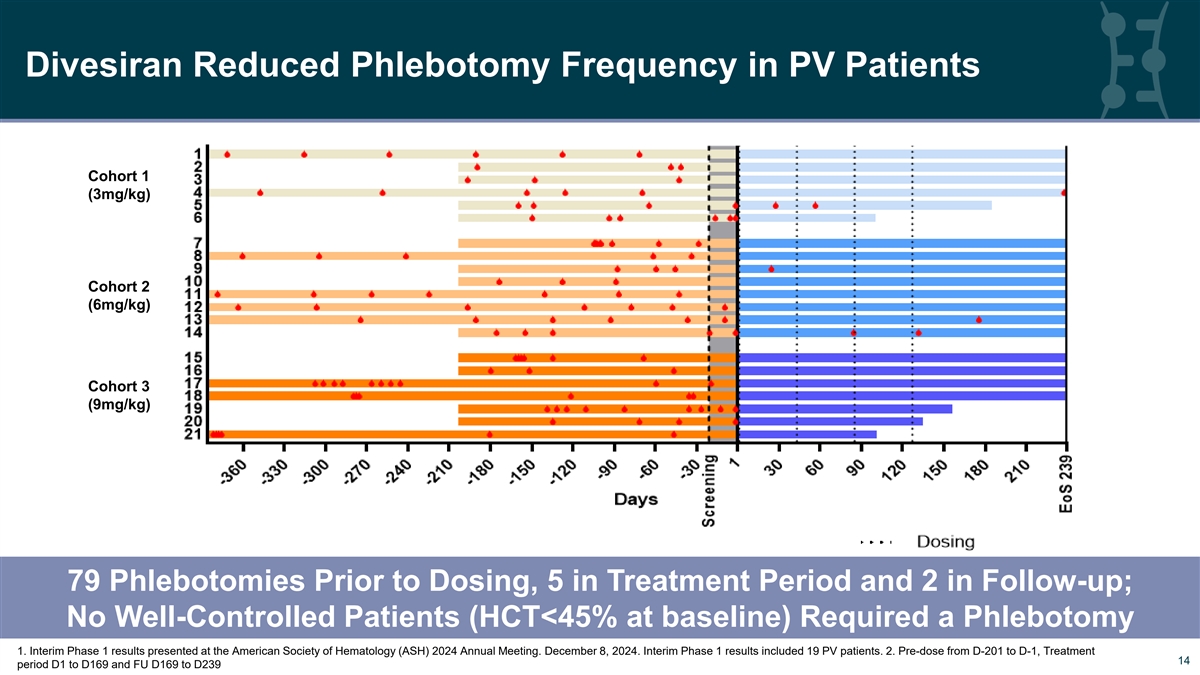

Divesiran Reduced Phlebotomy Frequency in PV Patients Cohort 1 (3mg/kg) Cohort 2 (6mg/kg) Cohort 3 (9mg/kg) 79 Phlebotomies Prior to Dosing, 5 in Treatment Period and 2 in Follow-up; No Well-Controlled Patients (HCT<45% at baseline) Required a Phlebotomy 1. Interim Phase 1 results presented at the American Society of Hematology (ASH) 2024 Annual Meeting. December 8, 2024. Interim Phase 1 results included 19 PV patients. 2. Pre-dose from D-201 to D-1, Treatment 14 14 period D1 to D169 and FU D169 to D239

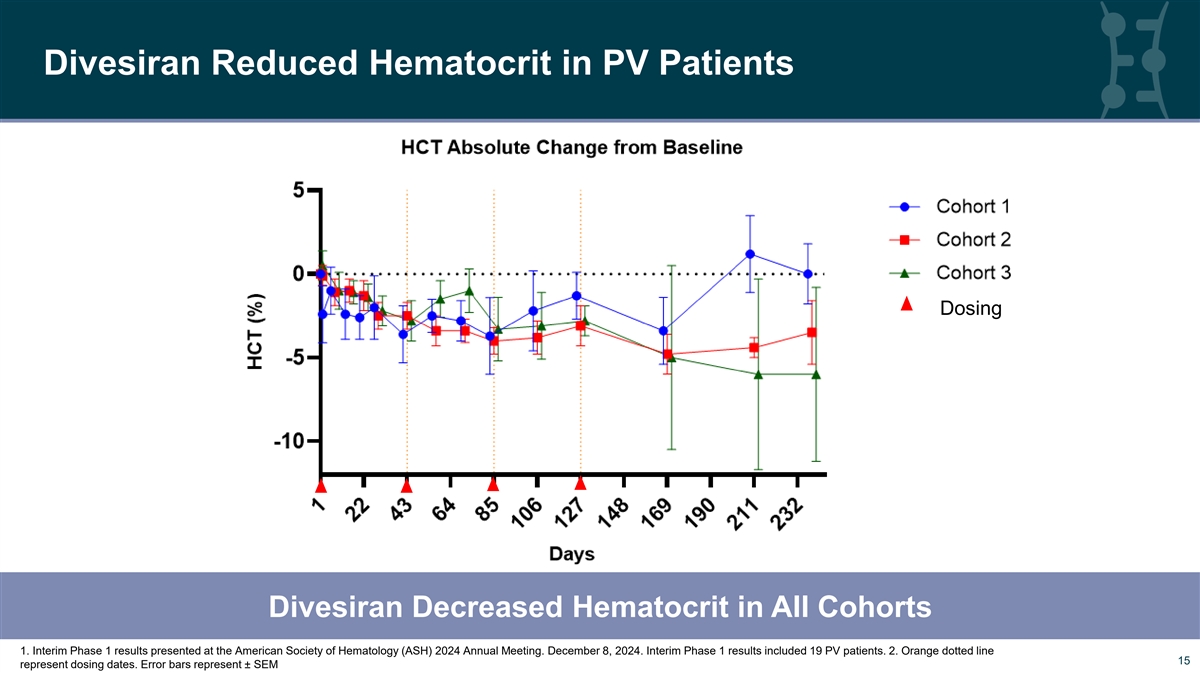

Divesiran Reduced Hematocrit in PV Patients Dosing Divesiran Decreased Hematocrit in All Cohorts 1. Interim Phase 1 results presented at the American Society of Hematology (ASH) 2024 Annual Meeting. December 8, 2024. Interim Phase 1 results included 19 PV patients. 2. Orange dotted line 15 15 represent dosing dates. Error bars represent ± SEM

Divesiran Treatment Produced Sustained Increases in Hepcidin Dosing Divesiran Treatment Induced Hepcidin 1. Interim Phase 1 results presented at the American Society of Hematology (ASH) 2024 Annual Meeting. December 8, 2024. Interim Phase 1 results included 19 PV patients. 2. Orange dotted line represent 16 16 dosing dates. Error bars represent ± SEM

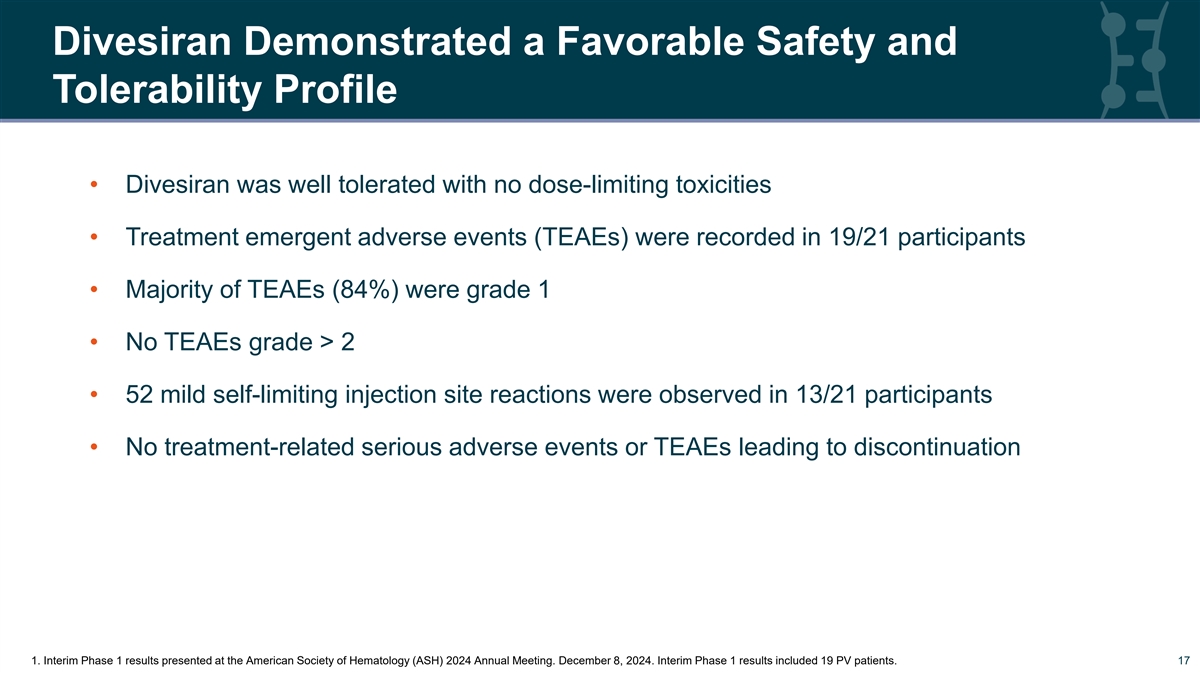

Divesiran Demonstrated a Favorable Safety and Tolerability Profile • Divesiran was well tolerated with no dose-limiting toxicities • Treatment emergent adverse events (TEAEs) were recorded in 19/21 participants • Majority of TEAEs (84%) were grade 1 • No TEAEs grade > 2 • 52 mild self-limiting injection site reactions were observed in 13/21 participants • No treatment-related serious adverse events or TEAEs leading to discontinuation 17 1. Interim Phase 1 results presented at the American Society of Hematology (ASH) 2024 Annual Meeting. December 8, 2024. Interim Phase 1 results included 19 PV patients. 17

SANRECO Phase 2 Study of Divesiran in PV Patients Design Randomized, double-blind study of divesiran in up to 40 PV patients • PV diagnosis Key • At least 3 phlebotomies in the last 6 months or 5 in the last year prior to screening Inclusion • Stable dose of cytoreductive agents allowed Criteria • HCT level <45% prior to dosing Dosing & • Evaluating two different divesiran dose levels and regimens vs. placebo • Primary endpoint at 36-weeks Follow-up Primary • % of patients with HCT at or below 45% without the need for phlebotomies • Effect of divesiran in improving PV related symptoms Objectives Full Enrollment Expected by Year-end 2025 18 18

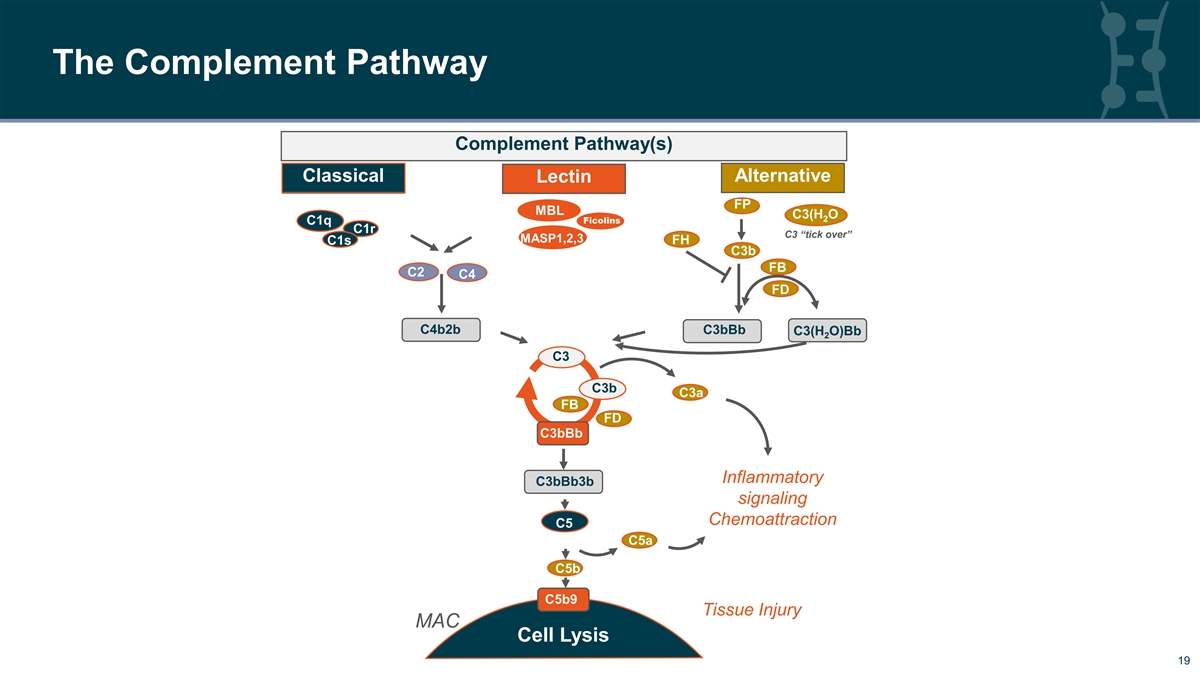

The Complement Pathway Complement Pathway(s) CC lassi lassi cal cal Lectin Alternative FP MBL C3(H O 2 Ficolins C1q C1r C3 “tick over” MASP1,2,3 C1s FH C3b FB C2 C4 FD C4b2b C3bBb C3(H O)Bb 2 C3 C3b C3a FB FD C3bBb Inflammatory C3bBb3b signaling Chemoattraction C5 C5a C5b C5b9 Tissue Injury MAC Cell Lysis 19 19

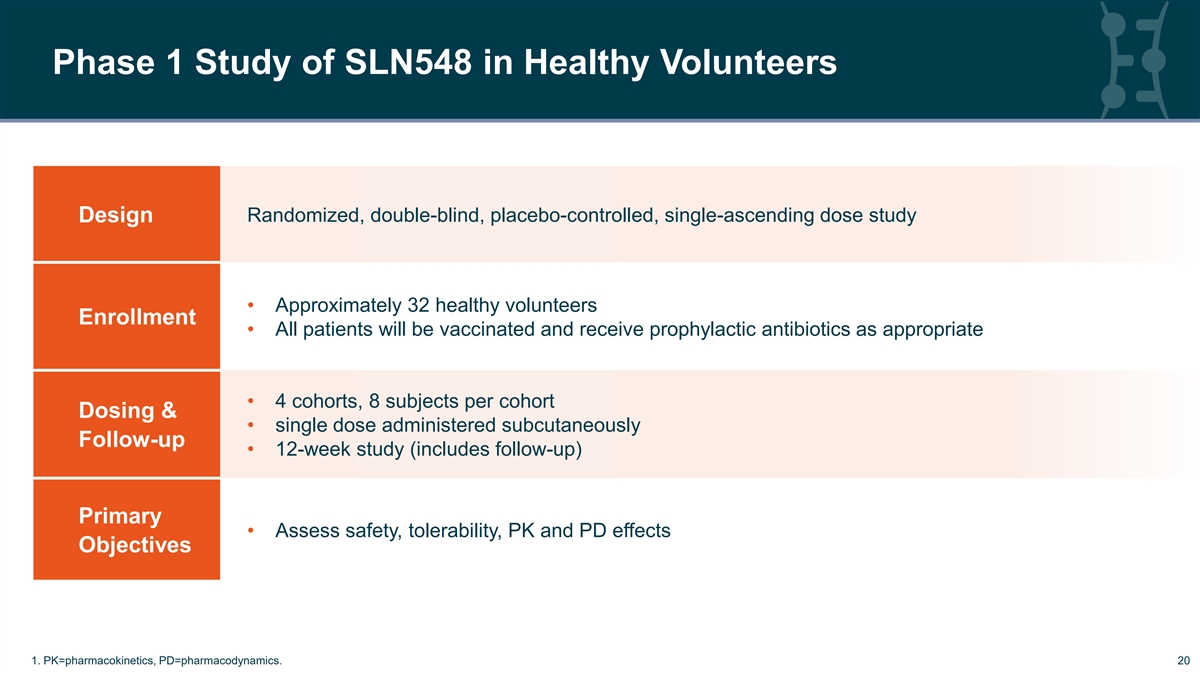

Phase 1 Study of SLN548 in Healthy Volunteers Design Randomized, double-blind, placebo-controlled, single-ascending dose study • Approximately 32 healthy volunteers Enrollment • All patients will be vaccinated and receive prophylactic antibiotics as appropriate • 4 cohorts, 8 subjects per cohort Dosing & • single dose administered subcutaneously Follow-up • 12-week study (includes follow-up) Primary • Assess safety, tolerability, PK and PD effects Objectives 20 1. PK=pharmacokinetics, PD=pharmacodynamics. 20

Anticipated 2025 Milestones Divesiran – Polycythemia Vera (PV) SANRECO Phase 1 follow-up completion Phase 1 data at medical meetings 2025 SANRECO Phase 2 study full enrollment 4Q 2025 SLN548 – Complement-Mediated Diseases Phase 1 study initiation 2H 2025 21 21

Q&A 22

THANK YOU! 23