| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

American Depositary Shares of 20 340 ⁄399 pence each |

IHG IHG |

New York Stock Exchange New York Stock Exchange* |

Ordinary Shares of 20 340 ⁄399 pence each |

164,711,854 |

| Large accelerated filer | ☑ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ | Emerging growth company | ☐ | |||

Section 13(a) of the Exchange Act. ☐

| US GAAP ☐ |

International Financial Reporting Standards as issued by the International Accounting Standards Board ☑ |

Other ☐ |

| Auditor Firm Id: 876 | Auditor Name: PricewaterhouseCoopers LLP | Auditor Location: Birmingham, United Kingdom |

Table of Contents

Annual Report and Form 20-F 2024

Table of Contents

| 2 | IHG | Annual Report and Form 20-F 2024 | ||||||

Introduction

Welcome to IHG®

Hotels & Resorts

| In this year’s report ... |

Table of Contents

| Strategic | Group Financial | Parent Company | Additional | |||||||||||||||

| Report | Governance | Statements | Financial Statements | Information | Annual Report and Form 20-F 2024 | IHG | 3 | |||||||||||

IHG® Hotels & Resorts is a global

hospitality company with 19 hotel brands,

one of the industry’s largest loyalty

programmes, over 6,600 open hotels

in more than 100 countries,

and a further 2,200 hotels in our

development pipeline.

| Additional Information |

|

|||||

| Other financial information | 266 | |||||

| Directors’ Report | 276 | |||||

| Group information | 280 | |||||

| Shareholder information | 296 | |||||

| Schedule 1: Condensed Parent Company financial information | 304 | |||||

| Exhibits | 308 | |||||

| Forward-looking statements | 309 | |||||

| Form 20-F cross-reference guide | 310 | |||||

| Glossary | 313 | |||||

| Useful information | 315 | |||||

| The Strategic Report on pages 4 to 110 was approved by the Board on 17 February 2025.

Nicolette Henfrey Company Secretary |

||||||

Table of Contents

| 4 | IHG | Annual Report and Form 20-F 2024 | ||||||

Chair’s statement

“The business is united behind an evolved strategy designed to deliver at pace strategic objectives that drive performance and growth of our brands, while creating value for all IHG stakeholders.” 114.4¢ 167.6¢ Final dividend proposed for 2024 Total dividend proposed for 2024 (2023: 104.0¢) (2023: 152.3¢) >$1bn $900m returned to shareholders through share buyback programme share buyback programme approved for 2025 (completed in December 2024) and ordinary dividends

Our commitment to evolve, adapt and drive continuous improvement is central to the organisation’s long-term success, and in 2024 important progress was made to further strengthen IHG Hotels & Resorts for guests, hotel owners, colleagues and shareholders.

Spanning more than 100 countries, IHG is part of a vibrant travel and tourism industry sitting at the heart of economic growth plans globally, with our brands embedded in high-value markets and segments and supported by a talented workforce getting the most out of IHG’s global and local approach. A truly international footprint offers great potential, which has again been capitalised on during 2024 with the further expansion of our brands, continued RevPAR growth and the delivery of a strong financial performance amid a competitive and complex global landscape.

In what was his first full year as Group CEO, Elie Maalouf has brought great clarity to ensuring the organisation is focused on realising IHG’s full potential. The business is united behind an evolved strategy designed to deliver at pace strategic objectives that drive performance and growth of our brands, while creating value for all IHG stakeholders. On behalf of the Board, I would like to congratulate Elie and his leadership team for delivering success across so many fronts this year.

A key element of our progress has been strong colleague engagement with our strategic priorities, which was reflected in various forms of feedback, including IHG’s Colleague HeartBeat survey and the work of our designated Voice of the Employee Non-Executive Director.

IHG’s strategy is being applied to an asset-light, fee-based, predominantly franchised business model that enables us to remain agile to adapt by market, while at the same time building global scale, attracting millions of guests and fostering long-standing relationships with thousands of owners.

Table of Contents

| Strategic | Group Financial | Parent Company | Additional | |||||||||||||||

| Report | Governance | Statements | Financial Statements | Information | Annual Report and Form 20-F 2024 | IHG | 5 | |||||||||||

Crucially, it is a model that is highly cash generative, which enables reinvestment in key areas of IHG’s enterprise to drive demand for our brands and returns for owners, create a rewarding culture for colleagues, and deliver on our commitment to shareholder returns.

The benefits of this approach can be seen through the transformation of the business in recent years and in 2024, we continued to take important steps towards creating an even stronger IHG. This included growing our brands, creating even more rewarding and personalised guest experiences, delivering a compelling loyalty offer, and growing ancillary fee revenues, such as our US co-brand IHG® One Rewards credit cards. As ever, our focus has also remained steadfast on helping our hotel owners run an efficient business with strong returns, and we put great importance on regular dialogue and close collaboration with them, including through the IHG Owners Association.

Our scale also provides a valuable platform to grow responsibly so that we can give back to the communities in which we operate and look after the world around us. Guided by our purpose of delivering True Hospitality for Good, our commitment to care is woven into the fabric of the business and is of increasing importance to all our stakeholders, so I was proud to see us make further progress against our Journey to Tomorrow responsible business plan during the year.

The role of the Board

Against an ever-changing global backdrop, strong governance is fundamental to the success of any business, as is the ability to stay agile and move at pace while retaining focus on longer-term ambitions.

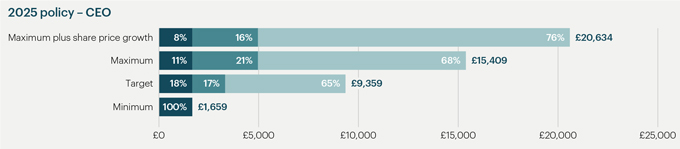

The role of the Board has been to support and constructively challenge the Executive Committee around how we prioritise, manage risk, grow and generate future value. Focus areas in 2024 included growth within a shifting trading environment, the development of our brands and technology platforms, the use of artificial intelligence, and the evolving environmental and societal agenda. Particular focus was also paid to executive remuneration to support IHG’s succession planning and talent development strategy, which is reflected in the 2025 Directors’ Remuneration Policy.

Following Sir Ron Kalifa joining the Board on 1 January 2024, details of which were included in our Annual Report and Form 20-F 2023, there was one other change to the Board during 2024, with Daniela Barone Soares stepping down as Non-Executive Director at end of the year. I would like to thank Daniela for her valuable contribution, particularly in support of our Journey to Tomorrow commitments. Part of my role as Chair is to ensure our Board continues to contain a rich blend of experience, expertise and backgrounds that reflect the evolving nature of our business and stakeholder expectations, and taking into account several Board changes in recent years I am confident we have that in place.

Succession planning and talent development has been a hallmark of IHG for many years. There were two Executive leadership changes and a role expansion in 2024, with Daniel Aylmer replacing Jolyon Bulley as Greater China CEO, following Jolyon’s appointment as Americas CEO, Jolie Fleming appointed as Chief Product & Technology Officer, following George Turner’s decision to leave the business, and the remit of Heather Balsley expanded to include IHG’s commercial function. Each individual has and continues to bring substantial and relevant industry experience, a strong track record of producing excellent results and a thorough understanding of IHG and its business, and I have great confidence in the leadership team delivering further success in what promises to be an exciting next chapter.

Shareholder returns

Following a strong financial performance this year, I am pleased to announce the Board is recommending a final dividend of 114.4 cents per ordinary share, an increase of 10% on the final dividend for 2023. An interim dividend of 53.2 cents was paid in October 2024, taking the total dividend for the year to 167.6 cents, representing an increase of 10% on 2023. An additional $800m was also returned to shareholders through a share buyback programme completed in December 2024, taking the total returns for the year to over $1bn, and the Board has approved a further share buyback of $900m for 2025. The Board expects IHG’s business model to continue its strong long-term track record of generating substantial capacity to enable investment plans that drive growth, fund a sustainably growing ordinary dividend, and return surplus capital to our shareholders.

As we look to the future, we must remain alive to the potential challenges created by geopolitical and macroeconomic uncertainty and conflict in parts of the world, but the industry’s long-term prospects remain attractive. Having proven its resilience over many decades, demand will continue to be driven by several fundamental factors, including people’s inherent desires and needs to travel, and the growing population and rising wealth in emerging markets that further support this.

As ever, our achievements are the result of the hard work of everyone in our hotels and offices, and I look forward with confidence to further strategic progress and success in 2025. I have enjoyed meeting and spending time with colleagues, owners and guests in different markets and would like to thank our teams for their dedication and commitment to bringing our brands to life, and our owners for their long-term confidence in IHG and our brands.

Deanna Oppenheimer

Non-Executive Chair

Table of Contents

| 6 | IHG | Annual Report and Form 20-F 2024 | ||||||

Our brands

A brand

for every

occasion

Our focus on having a diverse selection of brands has transformed our portfolio, enabling us to meet the needs of a broader range of guests and owners, and grow our estate to more than 6,600 hotels globally.

Demand for branded hotels is creating fresh opportunities for expansion in high-growth markets, as guests seek new experiences and owners look to use the advantages of our scale and systems.

To meet this demand, we are investing in and strengthening the enterprise that supports our brands, from our digital channels and IHG One Rewards loyalty programme, to our hotel technology and IHG Hotels & Resorts masterbrand.

Illustrating the confidence owners have in IHG, we celebrated the opening of 371 hotels in 2024 and the signing of another 714 into our pipeline, equivalent to almost two properties a day.

Table of Contents

| Strategic | Group Financial | Parent Company | Additional | |||||||||||||||

| Report | Governance | Statements | Financial Statements | Information | Annual Report and Form 20-F 2024 | IHG | 7 | |||||||||||

Luxury Lifestyle & 27 11 227 20 77 169 open open open open open open 38 9 101 35 61 130 pipeline pipeline pipeline pipeline pipeline pipeline Premium 87 22 415 33 open open open open 90 24 140 32 pipeline pipeline pipeline pipeline Essentials 1,249 3,237 23 76 open open open open 266 637 94 137 pipeline pipeline pipeline pipeline Suites 6 335 30 392 open open open open 54 157 - 183 pipeline pipeline pipeline pipeline Exclusive Partners 55 open 7 pipeline

Table of Contents

| 8 | IHG | Annual Report and Form 20-F 2024 | ||||||

2024 in review

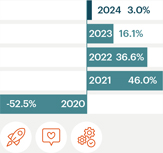

| Financial performance | ||||||||

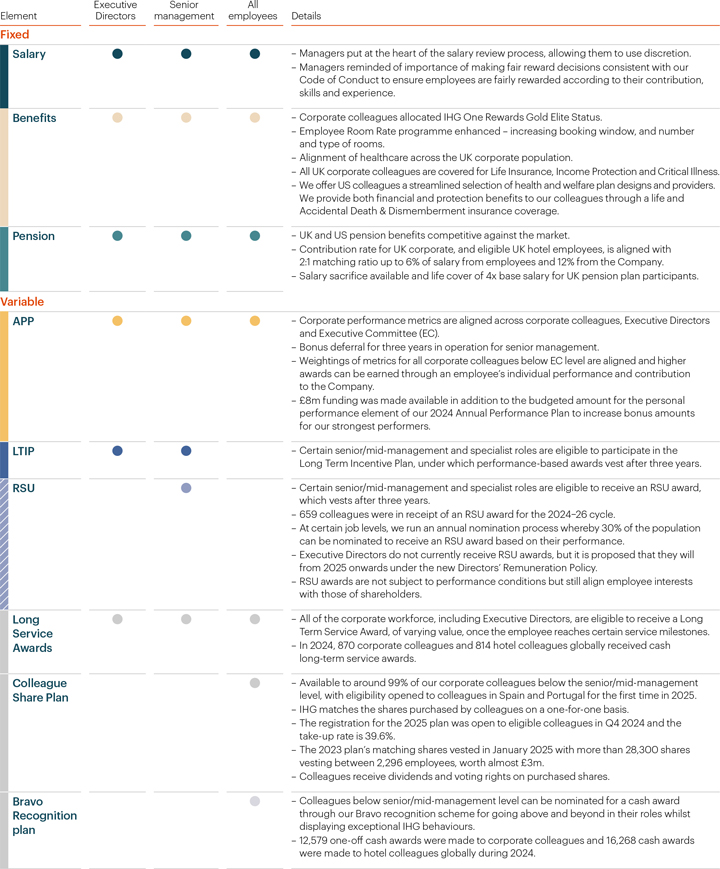

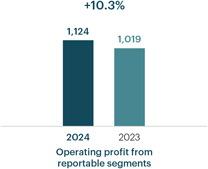

| In 2024, we delivered an excellent financial performance, with improvements across RevPAR and profit from reportable segments, alongside the return of more than $1 billion to shareholders. |

||||||||

|

|

||||||||

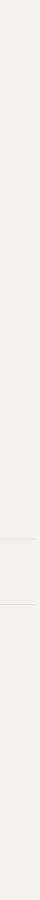

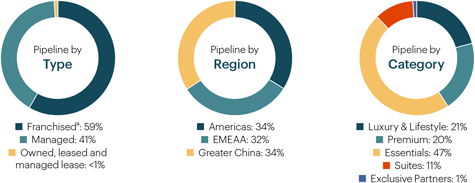

| Global RevPAR | Net system size growth | Signings (rooms) | ||||||

| +3.0% | 4.3% | 106,242 | ||||||

| 2023: +16.1% | 2023: 3.8% | 2023: 79,220 | ||||||

|

|

||||||||

| Total gross revenue in IHG’s systema | Total revenue | Revenue from reportable segmentsa | ||||||

| $33.4bn | $4,923m | $2,312m | ||||||

| 2023: $31.6bn | 2023: $4,624m | 2023: $2,164m | ||||||

|

|

||||||||

| Operating | Operating profit from | Basic | ||||||

| profit | reportable segmentsa | EPS | ||||||

| $1,041m | $1,124m | 389.6¢ | ||||||

| 2023: $1,066m | 2023: $1,019m | 2023: 443.8¢ | ||||||

|

|

||||||||

| Adjusted EPSa | Dividend | Share buyback completed | ||||||

| 432.4¢ | 167.6¢ | $800m | ||||||

| 2023: 375.7¢ | 2023: 152.3¢ | 2023: $750m | ||||||

| a. Use of Non-GAAP measures: In addition to performance measures directly observable in the Group Financial Statements (IFRS measures), additional financial measures (described as Non-GAAP) are presented that are used internally by management as key measures to assess performance. Non-GAAP measures are either not defined under IFRS or are adjusted IFRS figures. Further explanation in relation to these measures can be found on pages 103 to 108, and reconciliations to IFRS figures, where they have been adjusted, are on pages 266 to 272. |

||||||||

| Regional growth | ||||||||||||

| Strong demand globally from hotel owners for our brands was reflected in the opening of 371 hotels and 714 properties signed into our pipeline, equivalent to almost two a day. |

||||||||||||

| Americas | EMEAA | Greater China | ||||||||||

| Room openings | Room openings | Room openings | ||||||||||

| 16,832 | 23,620 | 18,665 | ||||||||||

| 2023: 10,405 | 2023: 21,174 | 2023: 16,340 | ||||||||||

| Room signings | Room signings | Room signings | ||||||||||

| 26,552 | 50,275 | 29,415 | ||||||||||

| 2023: 28,297 | 2023: 24,787 | 2023: 26,136 | ||||||||||

More on page 90.

More on page 90. |

More on page 94.

More on page 94. |

More on page 98.

More on page 98. |

||||||||||

Table of Contents

| Strategic | Group Financial | Parent Company | Additional | |||||||||||||||

| Report | Governance | Statements | Financial Statements | Information | Annual Report and Form 20-F 2024 | IHG | 9 | |||||||||||

| Stakeholders | ||||||||||

| By investing in our iconic brands, leading loyalty programme, and prioritising digital innovation and sustainability, we have continued to enhance guest experiences, expand our portfolio, and deliver strong returns for our hotel owners and shareholders.

|

||||||||||

| Our shareholders and investors

Our focus on strengthening the

|

– Total dividend payments of $259m and $800m share buyback completed that together returned over $1bn to shareholders for the 2024 financial year.

– New $900m share buyback programme approved for 2025.

– Americas RevPAR growth +2.5%; EMEAA +6.6%; Greater China -4.8%.

– Surpassed 6,600 open hotels; +4.3% net system size growth.

– Signings +34% year-on-year (YOY); conversions +88% YOY to reach record level.

– Operating profit of $1,041m and basic EPS of 389.6¢ achieved in the year.

– $1,124m operating profit from reportable segmentsa, up +10% vs 2023.

– Adjusted EPSa grew +15% to 432.4¢.

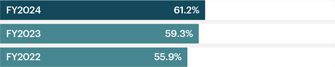

– Fee margina 61.2%, up +1.9%pts, driven by strong trading together with new and growing ancillary fee streams. |

|||||||||

|

|

||||||||||

| Our hotel owners

Owners choose to work with

|

– Enterprise contribution of 81% of total room revenue (vs 72% four years ago), illustrating success of our loyalty programme, technology platforms, sales and distribution channels.

– Guest How You Guest campaign increased awareness of IHG Hotels & Resorts brand.

– New brand prototypes and procurement programmes launched to reduce costs.

– New US co-brand credit card agreements further drive revenue and customer loyalty.

– Agreement with NOVUM Hospitality will double presence in priority market Germany. |

|||||||||

|

|

||||||||||

| Our guests

We focus on ensuring the services,

|

– Outperformed key competitors on Guest Satisfaction Index in all three regions.

– Grew loyalty members to over 145m, up from over 130m at the end of 2023.

– New and continued partnerships providing loyalty members access to music and sporting events.

– Enhanced websites and award-winning mobile app; downloads of mobile app increased more than 20% YOY.

– Updated guest room and public space designs, and food and beverage offering. |

|||||||||

|

|

||||||||||

| Our people

We champion a high-performance

|

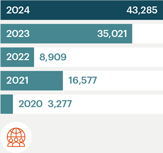

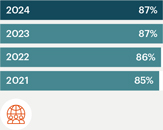

– Employee engagement maintained at 87%. A Mercer Global Best Employer.

– Strengthened our leadership pipeline through our accelerated talent programmes, including Journey to GM (general manager) and RISE.

– Strengthened learning and development offer through IHG® University.

– Ranked 28th on Fortune’s 100 Best Companies to Work For, recognised as a top company for women in the US by Forbes, certified as one of Singapore’s and Greater China’s Best Workplaces 2024, and in the top 10 on Financial Times Europe’s Diversity Leaders 2024 list. |

|||||||||

|

|

||||||||||

| Our communities and suppliers

We aim to improve millions of lives by

|

– Launched global partnership with Action Against Hunger to help tackle food insecurity and deliver lasting change in thousands of communities.

– Supported charities providing aid following 27 natural disasters.

– Refreshed IHG® Academy, giving over 43,000 people free access to skills and training.

– Over two million lives improved through community partnerships and programmes, Giving for Good month and partnership with Action Against Hunger. |

|||||||||

|

|

||||||||||

| Our planet

We are committed to reducing carbon,

|

– 11.5% reduction in carbon emissions per available room and a 9.4% reduction in energy per available room compared with 2019 baseline. Total carbon emissions increased 7.2% over the same period.

– Launched Low Carbon Pioneers programme to help encourage wider adoption of carbon reduction practices across IHG’s estate.

– Introduced brand standards removing single-use plastic bottles from guest rooms and meetings in Europe.

– Updated IHG Green Engage® environmental platform to strengthen hotel measurement of energy, water and waste.

|

|||||||||

Table of Contents

| 10 | IHG | Annual Report and Form 20-F 2024 | ||||||

2024 in review continued

From growing our brands and elevating the guest and owner

experience, to strengthening our enterprise and caring for

the world around us, here are some of the highlights of 2024.

From special moments Going the extra mile for our guests. In 2024, we maintained our outperformance versus key competitors on the Guest Satisfaction Index in all three regions, with our success down to those all-important personal touches. Take the Holiday Inn Express® in Richmond, Virginia, whose staff not only found a four-year-old’s lost beloved soft toy but took it on a tour of the hotel before returning it to its happy owner complete with pictures of its fun adventure in an accompanying email. Now that’s True Hospitality for Good. A warm welcome at more fantastic hotels. From the mountains of Japan and foodie hotspots, to the white-sand beaches of the Maldives and vibrant city centres, we celebrated opening 371 hotels in 2024, as well as signing 714 more – equivalent to almost two a day.

Table of Contents

| Strategic | Group Financial | Parent Company | Additional | |||||||||||||||

| Report | Governance | Statements | Financial Statements | Information | Annual Report and Form 20-F 2024 | IHG | 11 | |||||||||||

A Mercer Global . Best Employer We are proud to say IHG is a business all about people, with a rich culture and a place where colleagues get behind our strategy to be the hotel company of choice for guests and owners. In 2024, this was reflected by maintaining our high overall employee engagement score of 87% and being named a Mercer Global Best Employer. Fighting food insecurity with Action Against Hunger . We announced a multi-year partnership with Action Against Hunger, one of the world’s largest NGOs combating hunger. Helping to support and fund its nutrition programmes, this work complements existing partnerships IHG and its hotels have in many local markets that together aim to strengthen the food system in a community – from providing tools and training to reduce food waste, to diverting surplus food to those in need.

Table of Contents

| 12 | IHG | Annual Report and Form 20-F 2024 | ||||||

2024 in review continued

From …rewards Loyalty that keeps on growing… Fuelled by new partnerships, more points and fresh stay experiences, our IHG One Rewards loyalty programme grew to more than 145 million members in 2024. A powerful commercial engine. The success of our commercial engine across our loyalty programme, technology platforms, sales and distribution channels was illustrated by the percentage of room revenue booked through IHG-managed channels and sources reaching 81% for 2024 – up 9% in four years.

Table of Contents

| Strategic | Group Financial | Parent Company | Additional | |||||||||||||||

| Report | Governance | Statements | Financial Statements | Information | Annual Report and Form 20-F 2024 | IHG | 13 | |||||||||||

Getting noticed in all the right places. Our masterbrand strategy continued to drive awareness of the IHG Hotels & Resorts brand as we launched a new chapter for our Guest How You Guest global marketing campaign, secured new partnerships with sporting events and music festivals, and began rolling out a simplified ‘By IHG’ brand endorsement. Leading the way in luxury. We have built one of the world’s largest Luxury & Lifestyle portfolios in recent years to meet growing demand for one-of-a-kind travel experiences. Momentum continued to build in this higher-fee segment in 2024, with 46 properties awarded prestigious Condé Nast Traveler’s Readers’ Choice Awards and 14 earning Michelin Keys. …to awardsg

Table of Contents

| 14 | IHG | Annual Report and Form 20-F 2024 | ||||||

2024 in review continued

Milestone momentsin Greater China. We strengthened our position as one of the leading international hotel companies in Greater China by reaching 789 open hotels by the end of 2024. At the start of 2025, we reached a landmark 800th hotel opening, along with celebrating IHG’s 50th anniversary in the region. Reducing waste in our hotels. Building on the important work we have been doing to reduce waste in our operations for many years, we made further progress against our commitments by introducing two new brand standards to remove single-use plastic bottles in guest rooms and across meetings and events in Europe.

Table of Contents

| Strategic | Group Financial | Parent Company | Additional | |||||||||||||||

| Report | Governance | Statements | Financial Statements | Information | Annual Report and Form 20-F 2024 | IHG | 15 | |||||||||||

Growing demand for co-brand credit cards. Our US co-brand credit card holders stay more and spend more in our hotels, and 2024 was a record-breaking year for new applications, with double-digit percentage growth in total card customers. We also signed new card agreements during the year that will significantly increase revenues for IHG in the years ahead. Taking our brands to new markets. Demand for our brands stretched far and wide in 2024, with 29 debut openings for individual IHG brands across the globe. This included Staybridge Suites opening its doors for the first time in Spain and our first opening for Vignette™ Collection in the Maldives. We also saw the return of Regent® Hotels to the Americas – the Regent Santa Monica Beach. West

Table of Contents

| 16 | IHG | Annual Report and Form 20-F 2024 | ||||||

Chief Executive Officer’s review

of “I am the incredibly work being proud done to accelerate grow our outstanding performance, brands and take around IHG Hotels the world, & Resorts to its full potential.” Elie Maalouf Chief Executive Officer 371 714 hotels opened hotels signed (2023: 275) (2023: 556) 44% 21% of total openings and signings were of our pipeline now represented for our Holiday Inn® Brand Family by Luxury & Lifestyle brands +3.0% 119 global RevPAR growth hotels signed through initial agreement with NOVUM Hospitality that doubles our presence in Germany

| a. | Use of Non-GAAP measures: In addition to performance measures directly observable in the Group Financial Statements (IFRS measures), additional financial measures (described as Non-GAAP) are presented that are used internally by management as key measures to assess performance. Non-GAAP measures are either not defined under IFRS or are adjusted IFRS figures. Further explanation in relation to these measures can be found on pages 103 to 108, and reconciliations to IFRS figures, where they have been adjusted, are on pages 266 to 272. |

In my first full year as Group CEO, I am incredibly proud of the work being done to accelerate performance, grow our outstanding brands around the world, and take IHG Hotels & Resorts to its full potential as the hotel company of choice for guests and hotel owners.

We began 2024 by evolving our strategy to best capitalise on the investments we have made in our brands and enterprise platform in recent years, and I have been hugely impressed with how colleagues have got behind our plans. We have built real momentum over the past 12 months characterised by growth of not just our brands but also our technological capabilities, loyalty programme and ability to be a force for good in our communities.

Collectively, our work is resonating with stakeholders, driving awareness of our portfolio and consumer preference for our brands, strengthening our reputation as a valued partner with owners, and building further trust in IHG. I have seen this first-hand during visits to many markets around the globe to speak with colleagues, owners, shareholders and investors.

Strategic progress

In 2024, we expanded into new markets, with many of our brands making their debuts in new countries. We also strengthened our presence in high-growth markets such as Greater China, India, Japan and Saudi Arabia, as well as Germany, where we signed a long-term agreement with NOVUM Hospitality that doubles our presence there and secures European debuts for Garner™ and Candlewood Suites®.

Quality remains key to maintaining the trusted reputation of our brands, and fresh design and service concepts supported our Holiday Inn Brand Family in generating 44% of openings and signings. Momentum also continued to build behind our newer brands, including Garner, which in its first full year since launch reached 117 open and pipeline hotels. Its excellent progress illustrates appetite for quicker-to-market conversions, which represented around half of total room openings and signings in 2024.

We have transformed our position in Luxury & Lifestyle in recent years, with our brands now representing 14% of our system size and 21% of our pipeline. Flagship openings included Regent Santa Monica Beach in the US and Six Senses Kyoto in Japan, while Vignette Collection is tracking ahead of schedule, having surpassed 50 open and pipeline hotels just three years since launch.

Table of Contents

| Strategic | Group Financial | Parent Company | Additional | |||||||||||||||

| Report | Governance | Statements | Financial Statements | Information | Annual Report and Form 20-F 2024 | IHG | 17 | |||||||||||

Along with attractive brands, our success depends on having powerful loyalty and technology platforms that drive performance and unlock value for our owners. IHG One Rewards grew to more than 145 million members, who are now booking more than 60% of room nights globally. We entered into new long-term US co-brand credit card agreements and more strategic partnerships to further drive membership, deliver more business to our hotels, and provide guests with fresh experiences.

The next chapter of our Guest How You Guest global marketing campaign also went live across TV and streaming platforms in the US ahead of an international rollout to further grow awareness of our brand portfolio. We have also begun simplifying our brand endorsement from ‘an IHG Hotel’ to ‘By IHG’ across brands in the Americas and EMEAA to improve its visibility.

We strengthened what is a leading suite of technology for guests and owners. New features went live on our mobile app, which generated over 20% more revenue year-on-year, grew downloads by more than 20% and won three Webby Awards, including Best Travel App. Our Guest Reservation System is offering guests more choice while helping hotels maximise revenue from their property’s unique attributes. New revenue management capabilities went live in around 3,500 hotels globally to help drive top-line revenue, and we rolled out new property management systems to provide above-property, cloud-based solutions that can deploy efficient enhancements at scale.

Collectively, our investments are creating greater value for owners, with the percentage of room revenue booked through IHG-managed channels and sources rising from 72% to 81% in the past four years, while our Guest Satisfaction Index showed we had maintained our outperformance versus key competitors in all three regions. In parallel, we are focused on reducing the cost to build, open and operate our hotels. Working closely with our owners, we increased procurement options and introduced efficient prototypes for many of our brands, and we worked with governments and trade bodies on important issues to support the industry on a broader scale.

As we strengthen the business, it’s important we do so responsibly and sustainably for our people, communities and planet.

Our people are at the heart of our success as a global business and we took further steps to develop and retain talent across the organisation, including adding more tailored learning tools on IHG University. We were there for our communities, announcing a global partnership with Action Against Hunger to help tackle food insecurity, alongside responding to natural disasters, and making a positive difference to thousands of people during our annual Giving for Good month.

We continue to focus on reducing the environmental impact of our hotels, including launching our Low Carbon Pioneers programme – the first community of its kind in our industry designed to help us test, learn and share findings on sustainability measures. Our work to improve the efficiency of our hotel estate has reduced both emissions and energy per available room compared with a 2019 baseline. However, the lack of a clean energy infrastructure in our markets, alongside the opening of more hotels during that period, means that total carbon emissions have increased overall since 2019. We remain committed to reducing emissions and will continue our many initiatives, working closely with our hotel owners while at the same time continuing to evaluate our approach and performance in the rapidly changing sustainability landscape.

Strong performance

In parallel to our strategic progress, we delivered an excellent financial performance for the year. Increases in both daily rate and occupancy, combined with the breadth of our diverse international footprint, pushed global RevPAR 3.0% ahead of 2023, with growth in each of leisure, business and groups travel. Trading momentum continued in the Americas, with RevPAR up 2.5%, while EMEAA was up 6.6% following strong demand across Continental Europe and East Asia & Pacific. RevPAR in Greater China was -4.8% due to unusually strong comparatives a year ago, when there was a strong rebound in demand following the lifting of pandemic restrictions, and some short-term impacts on consumer confidence. However, we remain encouraged by long-term demand drivers in the region, and in 2024 saw record levels of development activity.

This overall performance, coupled with fee margin growth and disciplined cost management, helped deliver operating profit of $1,041m.

Operating profit from reportable segmentsa rose 10% to $1,124m. Basic EPS was 389.6¢, while adjusted EPSª grew 15% to 432.4¢ and we returned over $1bn to shareholders through ordinary dividend payments and a $800m share buyback programme. A new $900m share buyback programme for 2025 has been approved.

The long-term confidence owners have in IHG and our brands drove the opening of 371 hotels in 2024, which contributed to net system size growth of 4.3%. Another 714 hotels were signed – an increase of 34% year-on-year – taking our development pipeline to 2,210 hotels, representing future system size growth of 33%. As we look ahead, industry forecasts expect strong guest demand to continue, underpinned by long-term drivers, such as people’s desire to travel and a growing global middle class.

In February 2025, we acquired RubyTM as our 20th brand, which complements our existing portfolio with an exciting, distinct and high-quality offer for both guests and owners in popular city destinations. The urban micro space is a franchise-friendly model with attractive owner economics, and we see excellent opportunities to not only expand the Ruby brand’s strong European base but also rapidly take this exciting brand to the Americas and across Asia, as we have successfully done with previous brand acquisitions.

The many awards we received this year are a testament to the progress we are making towards being a brand of choice for guests, the best long-term partner for owners and a great place to work for colleagues. These include again being named a Mercer Global Best Employer, Holiday Inn® voted the most trusted travel and hospitality brand in the US, recognition from Forbes, Fortune Best Companies and the Financial Times for our inclusive culture, and dozens of our Luxury & Lifestyle hotels being awarded Condé Nast Traveler Readers’ Choice Awards and Michelin Keys.

I would like to thank the Board for its support throughout 2024 and our talented and passionate colleagues for their commitment to delivering True Hospitality for Good and hard work to grow IHG to its full potential. I would also like to thank our owners for their partnership and the continued trust they place in our business and brands.

Elie Maalouf

Chief Executive Officer

Table of Contents

| 18 | IHG | Annual Report and Form 20-F 2024 | ||||||

Industry overview

A strong

and resilient

sector full of

opportunity

We operate in an industry with high growth potential, underpinned by strong long-term fundamentals.

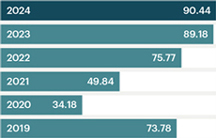

The global hotel industry strengthened to record RevPAR levels in 2024 as stable employment markets, resilient consumer spending and robust levels of business activity created supportive conditions for growth.

The $730 billion hotel industry has compelling structural growth drivers, underpinned by factors including the inherent needs and desires to travel for business and leisure purposes, and an expanding middle class in emerging markets with increasing disposable incomes. Spend on travel continues to be an area of resilient discretionary spending by consumers, while demand for business travel remains robust. Easing inflationary pressures and the turn in the interest rate cycle over the last 12 months has supported stable employment markets and robust levels of business activity and economic growth. Whilst in some countries geopolitical risk and economic outlook present challenges and uncertainties, overall conditions for the global industry remain supportive for continued growth.

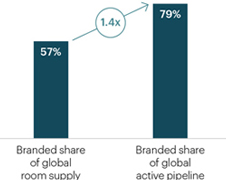

In what is a relatively fragmented sector, with 57% of rooms affiliated with a global or regional chain, competitor pressures in the branded space remain intense as all major players pursue growth strategies through a combination of organic growth, partnership arrangements and acquisitions.

Branded hotel penetration has steadily increased as a long-term trend, with this expected to continue to grow as consumers look to trusted brands to meet their evolving expectations, particularly when it comes to state-of-the-art technology and the skills, scale and resources required to provide enjoyable, effective and sustainable stays. Hotels affiliated with a major global brand and enterprise system also tend to generate higher owner returns.

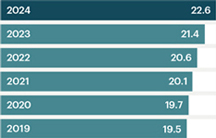

While there have been short-term challenges impacting the completion and opening of new-build hotels, primarily driven by the cost and availability of financing, there remains a long-term need for new hotel supply to satisfy the demand drivers previously mentioned. Global hotel room net new supply increased at a CAGR of 2.3% over the 10 years from 2014 to 2024, with industry forecasts showing a similar rate in the years beyond.

Cost remains a significant barrier to building a scale position in the global hotel industry, whether that’s due to investment to build and maintain the properties, establishing strong loyalty programmes and technology platforms, or developing and marketing leading brands.

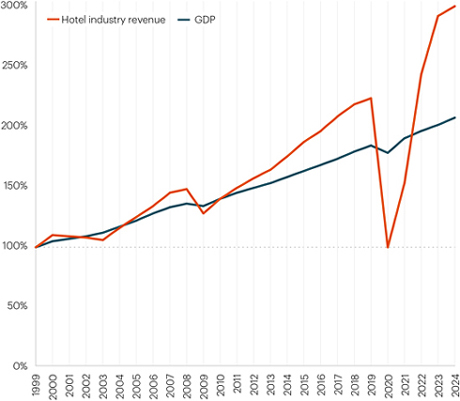

The hotel industry is cyclical: long-term fluctuations in RevPAR tend to reflect the interplay between industry demand, supply and the macro-economic environment. At a local level, political and economic factors, as well as those such as terrorism, oil market conditions and significant weather events, can also impact demand and supply. While the potential for macro-economic challenges from factors such as lingering inflation, higher borrowing costs and geopolitical flashpoints create some ongoing uncertainty in 2025, the attractive industry fundamentals that led to the sector outpacing global economic growth in 17 out of 25 years between 2000 and 2024 remain firmly in place for the long term.

As a global business, with a footprint in more than 100 countries, operating in the midst of change and uncertainty is something IHG is very used to and this experience continues to be one of our greatest strengths. Our strategy of developing a strong brand portfolio and an industry-leading loyalty programme, together with our fee-based income streams and prevalent midscale positioning, means IHG is well positioned to remain resilient through varying economic cycles.

Table of Contents

| Strategic | Group Financial | Parent Company | Additional | |||||||||||||||

| Report | Governance | Statements | Financial Statements | Information | Annual Report and Form 20-F 2024 | IHG | 19 | |||||||||||

|

The hotel industry has long-term growth drivers…

|

||||||

| 1.6% | $44tn | 2.3% | ||||

| US disposable personal income

Source: Federal Reserve Economic Data (FRED) |

Globally, middle income

Source: The Brookings Institution

|

Global hotel room net new supply

Source: STR |

||||

|

with significant barriers to entry…

|

||||||

| The top five hotel groupsa have

Share of top five branded hotel groups

a. Includes IHG, Marriott International, Inc., Hilton Worldwide Holdings Inc., Wyndham Hotels & Resorts Inc., Accor S.A.

Source: STR |

Share expected to further expand

Branded share of global industry

|

Consumers value loyalty

79%

of consumers are more likely to recommend brands with good

Source: Bond, in partnership with Visa

85%

of consumers are more likely to

Source: Bond, in partnership with Visa |

||||

|

Source: STR

|

||||||

|

and a track record of growth

|

||||||

| Global hotel revenues have outpaced GDP growth,

Global industry revenue vs global GDP, indexed to 1999

|

Global industry RevPAR ($)

RevPAR movements are illustrative

Source: STR

Global rooms supply (m rooms)

Supply growth further reflects the attractiveness of the hotel industry

Source: STR |

|||||

Table of Contents

| 20 | IHG | Annual Report and Form 20-F 2024 | ||||||

Trends shaping our industry

Continuing to

evolve and adapt

| The tourism industry continues to demonstrate strong fundamentals. Travel remains a top priority for many, maintaining its status as a leading category for discretionary spending. There are several impactful trends with the potential to reshape the hospitality landscape. |

Loyalty programmes are becoming increasingly competitive, hotel formats are continuing to evolve driven by demand for types of blended travel, and personalised experiences enabled by technology and data are becoming essential. We see these trends leading to the prioritisation of customer-centric strategies, and investment in products that align with evolving traveller expectations. | |||

| Flexibility of loyalty programmes

|

||||

| The lodging loyalty landscape is becoming increasingly competitive as guest expectations continue to evolve, becoming more immediate, personalised, and experience-based. To fulfil guest expectations, loyalty programmes are having to become increasingly flexible, utilising data-driven insights on customer preferences.

A McKinsey study found that hotel guests utilise more than two competing loyalty programmes a year, which is more than airline and cruise travellers. |

With younger generations more likely to transact with multiple programmes, and competition strengthening amongst global peers, it will be necessary to further expand reward personalisation. Increasing the breadth of offerings for members to select from, whilst utilising advanced analytics to tailor messaging, will give members control over their desired benefits, helping support a diverse portfolio of brands.

The strength of loyalty programmes is supported by customer experiences during their stay. |

Frontline teams are vital in delivering the core product that loyalty programmes are built around. Initiatives to develop the ability of teams to deliver exceptional experiences, such as the IHG Climb gamification platform, which led to 1.5–2.5x increase in loyalty delivery for highly engaged hotels and will continue to be a priority of industry leaders looking to develop robust brand and programme preferences. | ||

|

Our responses include:

|

||||

|

– Offering members the ability to personalise benefits via Milestone Rewards by selecting what they value most (including Food & Beverage Rewards and bonus points).

– Expanding Reward Night flexibility, including discounts for new hotels, ability to use points on both non-standard room types and Confirmable Suite Upgrades, plus exclusive Reward Night discount access for Platinum and Diamond members.

– Introducing free points transfer for our Diamond Elite and Business Rewards members, allowing our most active members to share their rewards with friends, family or colleagues.

– Forming exclusive partnerships providing our members culturally relevant, personalised experiences, including events such as the US Open Tennis Championships and Six Nations rugby.

|

|||

Table of Contents

| Strategic | Group Financial | Parent Company | Additional | |||||||||||||||

| Report | Governance | Statements | Financial Statements | Information | Annual Report and Form 20-F 2024 | IHG | 21 | |||||||||||

| Space for everyone

|

||||

| The lodging industry is rapidly transforming, with evolving formats that cater to diverse traveller needs and preferences. Industry leaders are complementing traditional hotel models with innovative alternatives that emphasise flexibility, authenticity, and unique experiences.

|

As Gen Z starts to enter the middle class, the requirement for variation will become even more essential.

Demand continues to grow for shared spaces, and increasingly lifestyle offerings that provide guests the opportunity to connect with the location and fellow travellers. By meeting these needs through carefully designed bars, lounge areas and restaurants, hotels of all chain scales will be able to facilitate guest desires to work flexibly, immerse themselves in experiences and connect locally.

The industry is embracing the desire for spaces dedicated to wellness and fitness. From rooftop yoga studios and immersive spa retreats to interactive gaming lounges and AI-enhanced gyms, properties are incorporating elements that encourage guests to relax, recharge and play.

At the top-end, luxury brands are investing heavily in branded residential offerings, with projects increasing by more than 180% over the last decade. |

The segment is becoming increasingly competitive due to the presence of major lodging companies alongside uber-luxury retail brands. | ||

|

Our responses include:

– Expanding our portfolio of branded residences across our Luxury & Lifestyle brands, with signings in 2024 including the Regent Residences Dubai at Marasi Marina and Six Senses Telluride in Colorado.

– Introducing Holiday Inn Express Generation 5 and Holiday Inn H5 public spaces to match the desire for local connections with the requirements of the modern traveller, facilitating social connection and co-working.

– Continuing growth of new brands designed to accommodate developing guest needs. Brands launched since 2019 have grown 62% in 2024. |

||||

| Rapidly evolving technology

|

||||

| The technology landscape is rapidly changing, driven by advancements in automation and artificial intelligence (AI). Today’s consumers have heightened expectations, seeking control, convenience, and speed across every industry they interact with.

To adapt to these expectations, hotels are embracing modern, cloud-based systems that simplify operations and alleviate pressure on front-desk staff. Hotel owners seek technology to automate tasks and streamline their operations, while guests increasingly seek technology that gives them more control.

Hotel companies are modernising their core platforms, with a shift towards cloud-based systems to optimise operations, pricing, reservations, and customer relationship management. |

The digital stay experience is an increasingly important guest expectation, with mobile check-ins, digital room keys, kiosks, and automated check-outs growing in popularity and becoming mainstream. This renewed focus on self-service not only leads to guest control but also hotel operational efficiencies.

Additionally, the integration of AI offers more personalised guest experiences, with chatbots that provide instant support and tailored recommendations, while predictive analytics enhance pricing, staffing, and inventory management for hotel operators. However, these innovations also introduce significant data protection challenges, requiring robust infrastructure to safeguard sensitive information and systems. |

Our responses include:

– We are undergoing a multi-year modernisation of our core systems, introducing new property management solutions that transform hotel operations and payment processes to address global and regional needs.

– Creating a dedicated task force focused on digital stay experience, with the goal of empowering guests with greater flexibility and control.

– We are developing new capabilities, including a cutting-edge customer relationship management system, and investing in self-service options to elevate guest satisfaction.

– Our commitment to cybersecurity remains steadfast, focusing on the protection of our systems against existing and potential threats.

– Utilising AI to upgrade system intelligence and enable our hotel and corporate colleagues to work more efficiently. |

||

|

||||

Table of Contents

| 22 | IHG | Annual Report and Form 20-F 2024 | ||||||

Our business model

| What we do |

|

|||||||||||||

| We provide an enterprise platform for hotel owners to join the IHG system through a family |

This in turn attracts further new-build hotel investment and existing hotels to convert to IHG’s brands, which grows our system size. We predominantly franchise our brands and manage hotels on behalf of third-party hotel owners, with the decision largely driven by market maturity, owner preference and, in certain cases, the particular brand. |

|||||||||||||

|

|

||||||||||||||

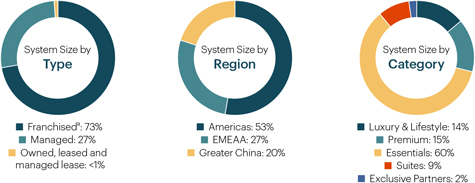

| The growth of our

RevPAR indicates the value guests ascribe to a given hotel brand or market, and grows when they stay more often or pay higher prices. Room supply and the size of our system also reflect capturing structural growth drivers of increasing demand to travel and experience, |

as well as how attractive the hotel industry and IHG is as an investment from a hotel owner’s perspective.

IHG is an asset-light business, with a focus on growing fee revenues and fee margins, which we can do with limited capital requirements. This enables us to grow and invest in our business while generating high returns on invested capital and strong cash flow.

Hotels in the Essentials category tend to be franchised, while Luxury & Lifestyle hotels are predominantly managed. Our broad geographic spread and weighting towards essential business and domestic leisure drives comparative resilience during times of economic downturn. |

We have made excellent progress in expanding our presence in the Luxury & Lifestyle segment, which generally generates higher fees per room. This category is currently 14% of IHG’s system size, and comprises 21% of the future growth pipeline.

We do not employ colleagues in franchise hotels, nor do we control their day-to-day operations, policies or procedures. That being said, IHG and our franchise hotels are committed to delivering a consistent brand experience and conducting business responsibly and sustainably. |

||||||||||||

|

Total system size

|

||||||||||||||

| 987,125 rooms |

|

|||||||||||||

|

|

||||||||||||||

| Total development pipeline

|

||||||||||||||

| 325,252

rooms

a. Includes Iberostar Beachfront Resorts, which joined IHG’s system and pipeline as part of a long-term commercial agreement.

|

|

|||||||||||||

Table of Contents

| Strategic | Group Financial | Parent Company | Additional | |||||||||||||||

| Report | Governance | Statements | Financial Statements | Information | Annual Report and Form 20-F 2024 | IHG | 23 | |||||||||||

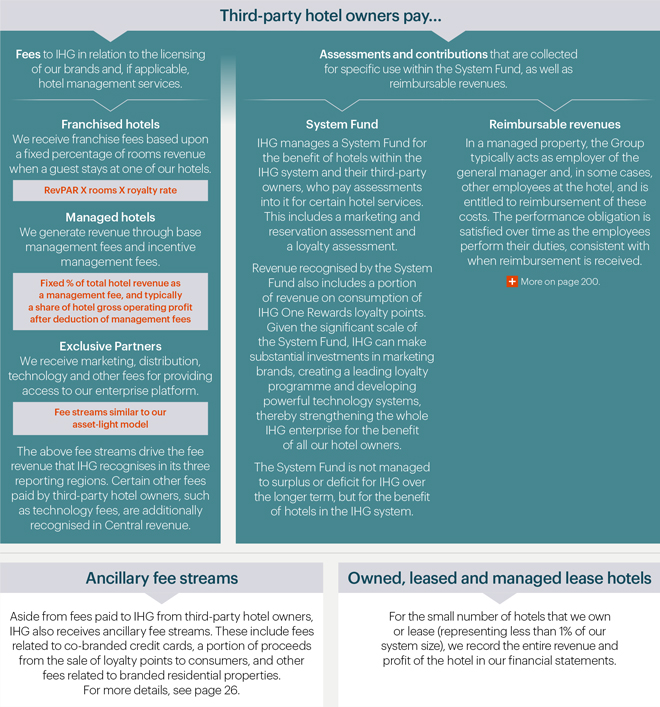

| How we generate revenue |

|

|||||||

| As an asset-light business, revenue attributable to IHG is the fees charged to third-party hotel owners, rather than the entire revenue base of the hotels themselves. IHG also receives various ancillary fee streams. |

In 2024, IHG’s revenue from fee business was $1,774m (which generated an operating profit of $1,085m). For the small number of owned, leased and managed lease hotels, the entire revenue of these hotels is attributable to IHG, which in 2024 was $515m (generating an operating profit of $45m). Total revenue reported for IHG in 2024 was $4,923m, which additionally includes $1,611m of System Fund revenue, $1,000m of reimbursable revenue, and $23m of insurance activities revenue. |

|||||||

|

||||||||

Table of Contents

| 24 | IHG | Annual Report and Form 20-F 2024 | ||||||

Our business model continued

| How we drive operating profit |

|

|||||||||

| Our asset-light business model requires a limited increase in IHG’s own operating expenditure to support our revenue growth, which delivers operating profit and fee margin growth. |

||||||||||

|

|

||||||||||

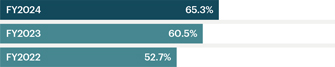

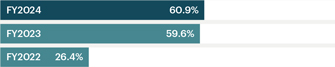

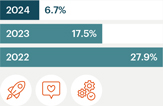

| The benefit of operational efficiencies, along with brands and markets becoming more mature, supported fee margin expansion that averaged around 130bps a year between 2009 and 2019 in total for IHG.

In 2024, our fee margin increased by 190bps, which was ahead of the 100–150bps annual improvement on average over the medium to long-term that is expected to be driven by positive operating leverage.

|

For franchised hotels, the flow through of revenue to operating profit is higher than it is at managed hotels, given the fee model and our well-invested scale platform, where limited resources are required to support the addition of an incremental hotel.

This is most evident in our Americas region, where fee margins are the highest, reflecting our scale and more than 90% of our hotels operating under our franchised model. |

Across our managed hotels, the flow through of revenue to profit can be lower, given higher operating expenditure on operations teams supporting the hotel network.

Our owned, leased and managed lease hotels tend to have significantly lower margins than our fee business This is because we not only record the entire revenue of the hotel, but also the entire cost base, which includes staff and maintenance of the hotel. |

||||||||

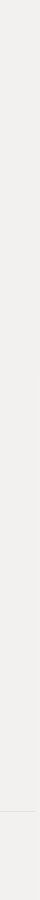

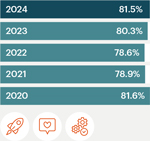

| Fee margin by region | ||||||||||

| Americas | EMEAA | |||||||||

|

|

|||||||||

| Greater China | Total IHG | |||||||||

|

|

|||||||||

| Capital allocation |

|

|||||||||

| Our priorities for the uses of the cash flow that IHG generates are consistent with previous years and comprise three pillars: |

||||||||||

|

|

||||||||||

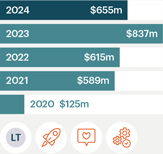

| Shareholder returns 2022–24 ($bn) | ||||||||||

|

|

1 Invest in the business We look to strategically drive growth, while maintaining strict control on investments and our day-to-day capital expenditures. |

2 Target sustainable IHG has a dividend policy where we would look to grow the ordinary dividend each year, while balancing all our stakeholder interests and ensuring our long-term success. |

3 Return surplus The Board expects our asset-light model to provide the opportunity to routinely return additional capital to shareholders such as through share buybacks. |

|||||||

Table of Contents

| Strategic | Group Financial | Parent Company | Additional | |||||||||||||||

| Report | Governance | Statements | Financial Statements | Information | Annual Report and Form 20-F 2024 | IHG | 25 | |||||||||||

| Capital expenditure |

|

|||||||

| Spend incurred by IHG can be summarised as follows: | ||||||||

| Type | What is it? | Recent examples | ||||||

| Key money and maintenance capital expenditure | Key money is expenditure used to access strategic opportunities, particularly in high-quality and

Maintenance capital expenditure is devoted to the maintenance of our systems and corporate offices, along with our owned, leased and managed lease hotels. |

Examples of key money include investments to secure representation for our brands in prime locations.

Examples of maintenance spend include investment in corporate technology and software, as well as office refurbishment and maintenance. Across our owned, leased and managed lease hotels we invest in refurbishment of public spaces and guest rooms. |

||||||

| Recyclable investments to drive the growth of our brands and our expansion in priority markets |

Recyclable investments are capital used to acquire real estate or investment through joint ventures, equity capital, or loans to facilitate third-party ownership of hotel assets. This expenditure is strategic to help build brand presence.

We would look to divest these investments at an appropriate time and reinvest the proceeds across the business. |

Examples of recyclable investments in prior years include our EVEN Hotels brand, where we used our capital to develop three hotel properties in the US to showcase the concept. These hotels were subsequently sold and now operate under franchise agreements.

More recently, recyclable investments have included the initial purchasing of sites for the Six Senses brand to be developed in key markets in the US. |

||||||

| System Fund capital investments for strategic investment to drive growth at hotel level |

The development of tools and systems that hotels use to drive performance. This is charged back to the System Fund over the life of the asset. | We continue to invest in a range of upgraded technology solutions, including the ongoing development of IHG’s mobile app and IHG One Rewards loyalty evolution. | ||||||

| Dividend policy and shareholder returns |

|

|||||||

| The Board consistently reviews the Group’s approach to capital allocation and seeks to maintain an efficient balance sheet and investment grade credit rating. |

||||||||

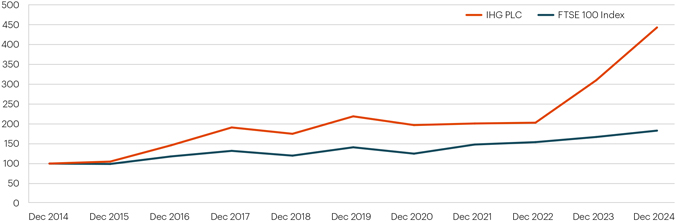

| IHG has an excellent track record of returning funds to shareholders through ordinary and special dividends, and share buybacks. The ordinary dividend paid to shareholders increased at an 11% CAGR between 2004 and 2019, and at a 10% CAGR after resuming dividend payments at the end of 2021.

Our asset-light business model is highly cash generative through the cycle and enables us to invest in our brands and strengthen our enterprise. When reviewing dividend recommendations, the Board looks to ensure that any recommendation does not harm the sustainable success of the Company and that there are sufficient distributable reserves to pay any recommended dividend. The Board assesses the Group’s ability to pay a dividend bearing in mind its responsibilities to its stakeholders and its objective of maintaining an investment grade credit rating. |

One of the measures we use to monitor this is net debt:adjusted EBITDA where we aim for a ratio of 2.5–3.0x.

$500m of surplus capital was returned via a buyback programme announced in August 2022, $750m via a programme announced in February 2023, and then a further $800m via a subsequent programme in 2024. The highly cash-generative nature of our business model means we expect to have substantial ongoing capacity to return further surplus capital to shareholders, such as through share buybacks, as we look to move leverage into our target range over time.

The Board intends to continue sustainably growing the ordinary dividend and to typically pay dividends weighted approximately one-third to the interim and two-thirds to the final payment. |

In February 2024, IHG’s Board proposed a final dividend of 104.0¢ in respect of 2023, representing growth of 10% on that for 2022. The proposal was subsequently approved at the AGM and paid to shareholders on 14 May 2024.

In August 2024, IHG’s Board declared an interim dividend of 53.2¢ per share, representing growth of 10% on 2023’s interim dividend. This was paid to shareholders on 3 October 2024.

The Board is proposing a final dividend of 114.4¢ in respect of 2024, representing growth of 10% on that for 2023. The proposed total dividend for the year is therefore 167.6¢. Further, the Board have approved a share buyback programme to return an additional $900m of surplus capital in 2025. Given expectations for growth and EBITDA in 2025, leverage is expected to be around the lower end of our target range of 2.5–3.0x. |

||||||

Table of Contents

| 26 | IHG | Annual Report and Form 20-F 2024 | ||||||

Our business model continued

| Driving ancillary fee streams |

|

|||||||

| Ancillary fee streams further leverage the strength of IHG’s brands and our powerful enterprise platform. As well as additional fee revenue, they typically flow through to operating profit at a high incremental margin, therefore contributing to overall fee margin accretion.

|

||||||||

|

|

||||||||

| Loyalty points sales to consumers |

Our loyalty programme, IHG One Rewards, allows members to earn points through qualifying stays and through third-party partnerships and programmes. Points revenue is generated through hotel assessments from qualifying stays, third-party points purchases to support partnership arrangements, and points purchased by members. Points revenue was previously included in the System Fund, but from the start of 2024 a portion of revenue from the sale of certain loyalty points is attributed to fee business revenue, delivering approximately $25m incrementally to revenue and operating profit from reportable segments in 2024. The change applied to 50% of proceeds from points sold in 2024 and will increase to 100% in 2025, approximately doubling the benefit to IHG’s reportable segments. Further points revenue growth is expected in future years as the number of points sold continues to increase, driven by the growth in the attraction and scale of the IHG One Rewards Programme. In 2024, the programme grew to over 145 million members who are responsible for over 60% of room nights consumed globally. |

|

||||||

|

|

||||||||

| Co-brand credit cards |

Co-brand credit cards drive further membership and loyalty to our IHG One Rewards programme, deepening guest relationships and delivering more business to our hotels. Co-brand credit card partners pay fees to IHG for:

– access to our loyalty programme and customer base and the rights to use IHG brands;

– arranging for the provision of future benefits to members who have earned points or free night certificates;

– performing marketing services.

IHG One Rewards co-brand credit card holders stay even more frequently and spend more in IHG hotels. 2024 was a record-breaking year for new account applications, there was double-digit percentage growth year-on-year in total card customers, and total card spend was around 25% higher than before the relaunch of card products two years’ earlier. In November 2024, IHG entered into new agreements with our card issuing and financial services partners that were effective immediately from that date and have an initial term running through to 2036. Under prior arrangements, fees recognised within IHG’s operating profit from reportable segments were $39m in 2023, with these expected to be double that level in 2025. |

|

||||||

|

|

||||||||

| Branded residential properties |

A further example of driving ancillary fees through the strength of IHG’s brands is their use to generate increased sales of residential property, typically alongside a hotel development with shared services and facilities. This industry segment has increased by 180% over the last decade. IHG already has more than 30 branded residential projects that are open or selling properties across five brands in 15 countries, and more in the pipeline including further projects where sales will launch in 2025. Signings in 2024 involving branded residences included Kimpton Monterrey in Mexico, the Regent Residences Dubai at Marasi Marina, and several for Six Senses, such as in the US at Telluride in the Colorado Rockies and Riverstone Estate in Foxburg, Pennsylvania, and at Dubai Marina. Fees earned by IHG from branded residences are recognised within IHG’s operating profit from reportable segments. |

|

||||||

Table of Contents

| Strategic | Group Financial | Parent Company | Additional | |||||||||||||||

| Report | Governance | Statements | Financial Statements | Information | Annual Report and Form 20-F 2024 | IHG | 27 | |||||||||||

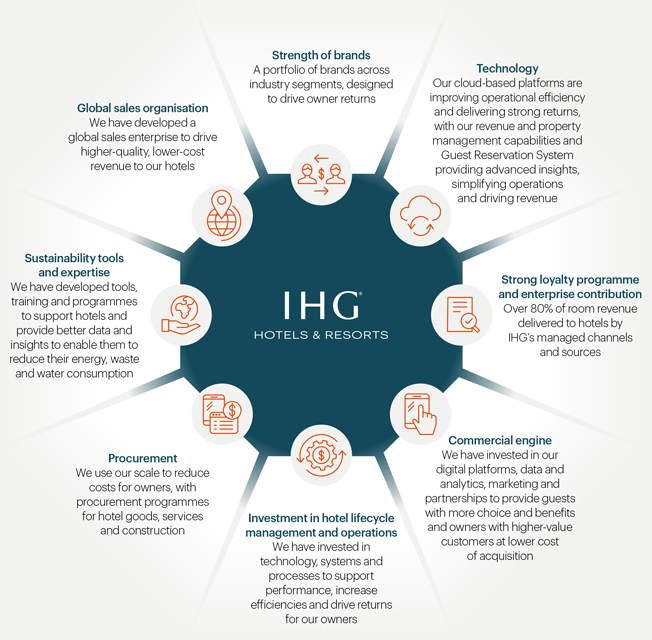

| Why hotel owners choose to work with IHG |

|

|||||||

| Hotel owners choose to work with IHG because of the trust they have in our brands and our track record in delivering strong returns.

|

||||||||

|

|

||||||||

|

||||||||

Global sales organisation We have developed a global sales enterprise to drive higher-quality, lower-cost revenue to our hotels Sustainability tools and expertise We have developed tools, training and programmes to support hotels and provide better data and insights to enable them to reduce their energy, waste and water consumption Procurement We use our scale to reduce costs for owners, with procurement programmes for hotel goods, services and construction Strength of brands A portfolio of brands across industry segments, designed to drive owner returns Investment in hotel lifecycle management and operations We have invested in technology, systems and processes to support performance, increase efficiencies and drive returns for our owners Technology Our cloud-based platforms are improving operational efficiency and delivering strong returns, with our revenue and property management capabilities and Guest Reservation System providing advanced insights, simplifying operations and driving revenue Strong loyalty programme and enterprise contribution Over 80% of room revenue delivered to hotels by IHG’s managed channels and sources Commercial engine We have invested in our digital platforms, data and analytics, marketing and partnerships to provide guests with more choice and benefits and owners with higher-value customers at lower cost of acquisition

Table of Contents

| 28 | IHG | Annual Report and Form 20-F 2024 | ||||||

Our strategy

Making it happen Our ambition to be the hotel company of choice for guests and owners is underpinned by strategic investments in our brands, people, technology and scale. Over the long term, with disciplined execution, our strategy drives the growth of our brands in high-value markets. It creates value for all our stakeholders and delivers sustained growth in profits and cash flows, which can be reinvested in our business and returned to shareholders. Our strategic priorities and the behaviours that drive them have been designed to put the expanded brand portfolio we have built in recent years at the heart of our business, and our owners and guests at the heart of our thinking. They recognise the crucial role of a well-invested loyalty programme and technology systems, and ensure we meet our growing responsibility to care for and invest in our people, and to make a positive difference to our communities and planet. Our strategy is inspired and informed by our purpose of providing True Hospitality for Good, which is underpinned by our commitment to a culture of operating and growing in a responsible, ethical and inclusive manner. This sets the tone for how we do business, enabling us to focus on creating value for all stakeholders as we build an even stronger IHG. What we do Provide True Hospitality for Good Why we do it To be the hotel company of choice for guests and owners How we make it happen Relentless Brands Leading Care for focus guests and commercial our people, on growth owners love engine communities and planet Our growth behaviours Ambitious Dedicated Courageous Caring

Table of Contents

| Strategic | Group Financial | Parent Company | Additional | |||||||||||||||

| Report | Governance | Statements | Financial Statements | Information | Annual Report and Form 20-F 2024 | IHG | 29 | |||||||||||

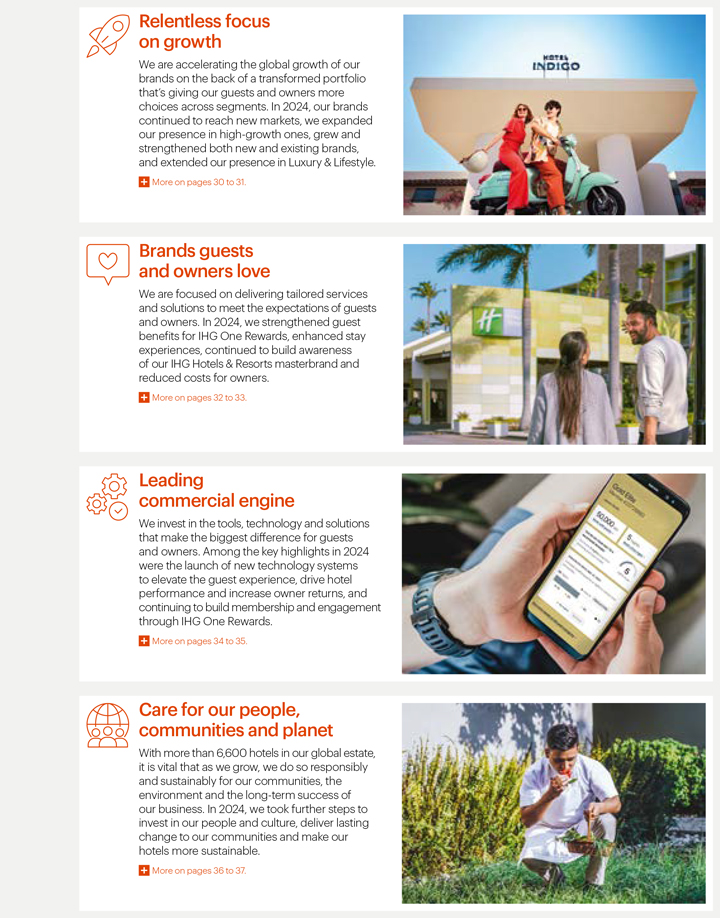

Relentless focus on growth We are accelerating the global growth of our brands on the back of a transformed portfolio that’s giving our guests and owners more choices across segments. In 2024, our brands continued to reach new markets, we expanded our presence in high-growth ones, grew and strengthened both new and existing brands, and extended our presence in Luxury & Lifestyle. More on pages 30 to 31. Brands guests and owners love We are focused on delivering tailored services and solutions to meet the expectations of guests and owners. In 2024, we strengthened guest benefits for IHG One Rewards, enhanced stay experiences, continued to build awareness of our IHG Hotels & Resorts masterbrand and reduced costs for owners. More on pages 32 to 33. Leading commercial engine We invest in the tools, technology and solutions that make the biggest difference for guests and owners. Among the key highlights in 2024 were the launch of new technology systems to elevate the guest experience, drive hotel performance and increase owner returns, and continuing to build membership and engagement through IHG One Rewards. More on pages 34 to 35. Care for our people, communities and planet With more than 6,600 hotels in our global estate, it’s vital that as we grow, we do so responsibly and sustainably for our communities, the environment and the long-term success of our business. In 2024, we took further steps to invest in our people and culture, deliver lasting change to our communities and make our hotels more sustainable. More on pages 36 to 37.

Table of Contents

| 30 | IHG | Annual Report and Form 20-F 2024 | ||||||

Our strategy continued

Relentless focus on growth The transformation of our portfolio is fuelling our growth for today and tomorrow. We have grown from 10 to 19 brands since 2015 to diversify across segments and meet guest and owner demand, while at the same time investing in the continued success of our established brands. Global expansion is supported by investment in our enterprise, including a leading loyalty programme, masterbrand and a powerful suite of technology products. >6,600 >2,200 >40% hotels open globally pipeline hotels, representing of global pipeline future system size growth of 33% under construction Signed long-term agreement with NOVUM Hospitality, which will double our presence in Germany – a priority growth market. Holiday Inn Brand Family generated 44% of hotel openings and signings globally in 2024.

Table of Contents

| Strategic | Group Financial | Parent Company | Additional | |||||||||||||||

| Report | Governance | Statements | Financial Statements | Information | Annual Report and Form 20-F 2024 | IHG | 31 | |||||||||||

What we achieved in 2024

We opened 371 hotels in 2024 to surpass 6,600 globally and signed 714 properties into our pipeline – the equivalent of almost two a day – to take it to more than 2,200 hotels.

We are focused on capitalising on strong travel demand in markets with big growth opportunities. During the year, 29 openings represented a country debut for a particular IHG brand. We expanded our presence in high-growth markets, including India, Japan, Saudi Arabia, and Greater China, where record levels of development activity took our pipeline in the region to 549 hotels at the end of 2024 – its largest ever size, representing almost 60% of the region’s current system size. In Germany, one of our largest markets in Europe, we signed a long-term deal with NOVUM Hospitality that will double IHG’s presence. The agreement includes properties joining IHG through the new Holiday Inn – the niu brand collaboration, and has brought Candlewood Suites and Garner to Europe for the first time.

The enduring appeal of our established brands once again shone through, with our Holiday Inn Brand Family generating 44% of hotel openings and signings globally. Momentum behind our new brands also continued, with Garner having already reached 23 open hotels and a pipeline of 94 properties since becoming franchise-ready in the US in 2023, while avid® hotels grew its pipeline to 137 properties – almost double today’s existing system size. Atwell Suites® surpassed a pipeline of 50 hotels for the first time and launched in Greater China to capitalise on the appetite for our brands in this high-growth market. Premium brand voco™ hotels achieved debut openings in India, Sweden and Malaysia on its way to reaching 177 open and pipeline hotels. Underlining the huge growth potential of our newest brands, our seven most recently launched or acquired brands – not including Garner or our commercial agreement with Iberostar – now represent 17% of our pipeline.

Following acquisitions and new brand launches in recent years, we have established one of the industry’s biggest Luxury & Lifestyle portfolios and our six brands continued to drive our growth and performance. We achieved 133 openings and signings in this higher-fee segment in 2024, with Six Senses® Hotels, Resorts & Spas reaching 65 open and pipeline hotels, with debut openings in Japan and the Caribbean. Regent reached 20 open and pipeline properties, including the opening of another flagship property – Regent Santa Monica Beach, which marked the return of the brand to the Americas. Vignette Collection celebrated debut signings in key markets such as the Maldives, Spain and Turkey to surpass 50 open and pipeline hotels in just three years since launch, tracking ahead of our long-term target to attract more than 100 properties by 2031. A debut opening on the Greek islands was one of 25 openings and signings for InterContinental® Hotels & Resorts on the back of an exciting brand evolution in 2024, taking its system size to 227 and its pipeline to 101, which reflects its strong future growth opportunities. Kimpton® Hotels & Restaurants continued its global expansion, with a debut signing in the Turks and Caicos Islands and a first opening in the Dominican Republic adding to the brand’s growing presence in prime leisure destinations. A first opening in the Caribbean was among 42 openings and signings for Hotel Indigo®, further reflecting IHG’s success in internationalising its brands.

The strong future growth prospects of Luxury & Lifestyle are reflected by our portfolio now representing 14% of our current system size and 21% of our pipeline. Illustrating our growing reputation, 46 hotels were awarded Condé Nast Traveler Readers’ Choice Awards – more than double the number of two years ago – while 14 earned Michelin Keys.

In our Exclusive Partners category, we continued to integrate the Iberostar Beachfront Resorts brand into our systems, with 55 out of up to 70 properties from the original agreement in 2022 added to IHG’s system, as we capitalise on the growing demand for resort and all-inclusive stays.

Conversion deals were again central to our growth, representing around 50% of both room openings and signings. This strong performance reflects the appeal of our brands and wider enterprise to owners, alongside a sharpened strategic focus on driving these quicker-to-market opportunities. In Greater China, for example, we have a dedicated Conversions and Contract Renewals team and we collaborate closely with owners to deliver a quick return on investment. There were also 340 new-build signings globally during the year – another key indication of growing developer confidence.

What’s to come

We have grown our development pipeline to more than 2,200 hotels, the equivalent of 33% of today’s system size. This, together with investments in our enterprise, lays the foundation for continued system size growth in the years ahead.

Supporting this, we will further expand our presence in high-growth markets, such as Greater China, Germany, Japan, Saudi Arabia and India.

We will continue to assert the competitive advantage of our Essentials brands so we can extend their leadership in major markets by optimising their cost to build, open and operate, while at the same time accelerating conversion deals. We will also drive expansion of our newer brands by strengthening their performance and taking them into more new markets globally.

We will embed our Luxury & Lifestyle capabilities to further strengthen our reputation with guests and owners, and accelerate the growth of our brands. Linked to this, we will continue to develop a world-class branded residences offer following strong progress in 2024, which included signing the first Regent Residences in Dubai and Six Senses Residences Dubai Marina, which will be the world’s tallest residential tower once complete.

Table of Contents

| 32 | IHG | Annual Report and Form 20-F 2024 | ||||||

Our strategy continued

Brands guests and owners love Staying successful means putting ourselves in the shoes of our guests, corporate customers and owners in everything we do. This is how we are creating unrivalled service and tailored experiences in our hotels, and attractive investment opportunities with strong returns for our owners. Maintained outperformance versus key competitors on Guest Satisfaction Index in all three regions. Launched new chapter of Guest How You Guest marketing campaign to increase awareness of IHG Hotels & Resorts masterbrand for guests and owners. >145m ~10% IHG One Rewards loyalty reduction in cost per occupied programme grown to room for Essentials and Suites brands over 145 million members through procurement programmes and enhanced Food & Beverage offer

Table of Contents

| Strategic | Group Financial | Parent Company | Additional | |||||||||||||||

| Report | Governance | Statements | Financial Statements | Information | Annual Report and Form 20-F 2024 | IHG | 33 | |||||||||||

What we achieved in 2024

Strong leisure, business and group demand pushed Global RevPAR up 3.0% in 2024, as we continued to position IHG as first choice for guests and owners. The work we are doing in collaboration with our owners and hotel teams to elevate the guest experience has helped IHG maintain its outperformance versus key competitors on the externally measured Guest Satisfaction Index in all three regions. This included strengthening our IHG One Rewards loyalty programme with fresh experiences, rewards and stay enhancements that helped it grow to more than 145m members. Reward Night redemption is also around 30% higher than prior to the programme refresh two years ago, demonstrating strong member engagement and driving increased owner returns.