UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2024

Airbnb, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-39778 | 26-3051428 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 888 Brannan Street |

| San Francisco, California 94103 |

| (Address of principal executive offices) (Zip Code) |

Registrant’s telephone number, including area code: (415) 510-4027

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Class A common stock, $0.0001 par value per share | ABNB | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02. | Results of Operations and Financial Condition. |

On November 7, 2024, Airbnb, Inc. (the “Company”) issued a Shareholder Letter (the “Letter”) announcing its financial results for the third quarter ended September 30, 2024. In the Letter, the Company also announced that it would be holding a conference call on November 7, 2024 at 1:30 p.m. PT / 4:30 p.m. ET to discuss its financial results for the third quarter ended September 30, 2024. A copy of the Letter is furnished as Exhibit 99.1 to this Current Report on Form 8-K (“Form 8-K”) and is incorporated herein by reference.

The Company is making reference to non-GAAP financial information in both the Letter and the conference call. A reconciliation of these non-GAAP financial measures to their nearest GAAP equivalents is provided in the Letter.

The information furnished pursuant to Item 2.02 of this Form 8-K, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, except as expressly set forth by specific reference in such filing.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. | Description |

|

| 99.1 | Shareholder Letter, dated November 7, 2024 | |

| 104.1 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| AIRBNB, INC. | ||||||||

| Date: November 7, 2024 | By: | /s/ Elinor Mertz Elinor Mertz |

||||||

| Chief Financial Officer | ||||||||

Exhibit 99.1

Q3 2024 Shareholder Letter

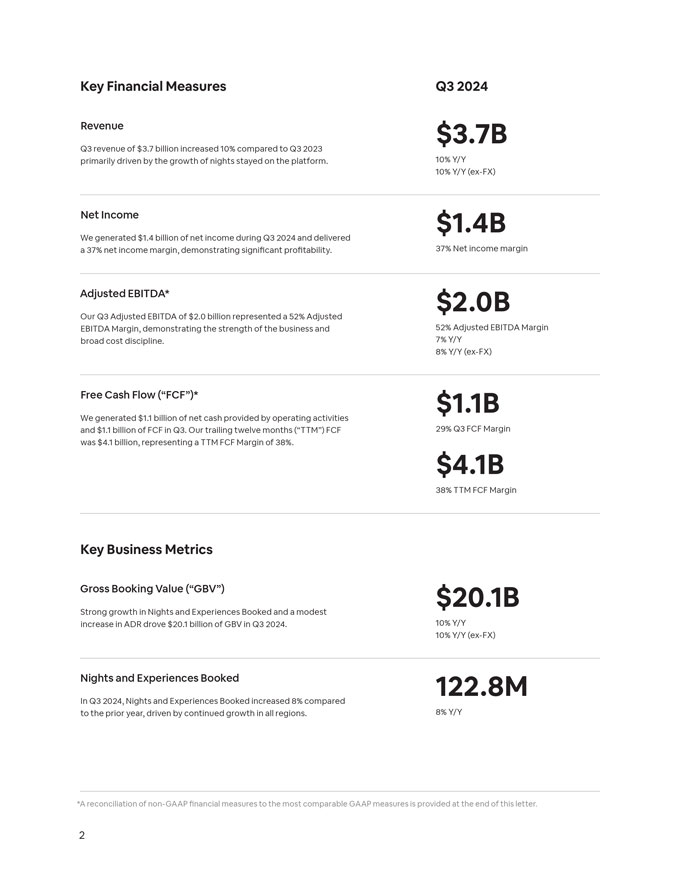

Key Financial Measures Q3 2024 Revenue $3.7B Q3 revenue of $3.7 billion increased 10% compared to Q3 2023 primarily driven by the growth of nights stayed on the platform. 10% Y/Y 10% Y/Y (ex-FX) Net Income $1.4B We generated $1.4 billion of net income during Q3 2024 and delivered a 37% net income margin, demonstrating significant profitability. 37% Net income margin Adjusted EBITDA* $2.0B Our Q3 Adjusted EBITDA of $2.0 billion represented a 52% Adjusted EBITDA Margin, demonstrating the strength of the business and 52% Adjusted EBITDA Margin broad cost discipline. 7% Y/Y 8% Y/Y (ex-FX) Free Cash Flow (“FCF”)* $1.1B We generated $1.1 billion of net cash provided by operating activities and $1.1 billion of FCF in Q3. Our trailing twelve months (“TTM”) FCF 29% Q3 FCF Margin was $4.1 billion, representing a TTM FCF Margin of 38%. $4.1B 38% TTM FCF Margin Key Business Metrics Gross Booking Value (“GBV”) $20.1B Strong growth in Nights and Experiences Booked and a modest increase in ADR drove $20.1 billion of GBV in Q3 2024. 10% Y/Y 10% Y/Y (ex-FX) Nights and Experiences Booked 122.8M In Q3 2024, Nights and Experiences Booked increased 8% compared to the prior year, driven by continued growth in all regions. 8% Y/Y *A reconciliation of non-GAAP financial measures to the most comparable GAAP measures is provided at the end of this letter.

Q3 2024 Shareholder Letter Airbnb had a strong Q3. Nights and Experiences Booked accelerated throughout the quarter and into Q4, despite a softer start due to shorter booking lead times compared to 2023. Revenue grew 10% year-over-year to $3.7 billion. Net income was $1.4 billion, representing a net income margin of 37%. Adjusted EBITDA of $2.0 billion increased 7% year-over-year and represented an Adjusted EBITDA Margin of 52%. We generated $1.1 billion of FCF during Q3 and $4.1 billion of FCF over the trailing twelve months, highlighting the strength of our cash-generating business model. During the quarter, we made significant progress across our three strategic priorities: • Making hosting mainstream: We’re focused on making hosting just as popular as traveling on Airbnb. Today, we have over 8 million active listings, with growth seen across all regions and market types during Q3 2024. To retain and attract new hosts, we’ve prioritized making hosting easier. Last month, we introduced Co-Host Network, an easy way to find the best local hosts to manage your Airbnb. Co-hosts are experienced hosts who provide personalized support based on the hosts’ needs, from listing setup to managing bookings and communicating with guests. • Perfecting the core service: Over the past three years, we’ve launched more than 535 new features and upgrades to make Airbnb an overall better service for hosts and guests. Our 2024 Winter Release included over 50 upgrades for guests that make the app more personalized, including recommended destinations, suggested search filters, and personalized listing highlights. We’re also addressing one of the top issues for guests: listing quality. Since last year, we’ve removed over 300,000 listings that failed to meet guest expectations. • Expanding beyond the core: Outside of our core markets, there are many countries and regions that remain under-penetrated. We’re focused on these expansion markets as part of our global markets strategy, and we believe our approach is working. In Q3, the average growth rate of nights booked on an origin basis in our expansion markets was more than double that of our core markets. We’ll remain focused on accelerating growth while preparing for Airbnb’s next chapter, which will take us beyond accommodations. You’ll see more on this next year. Q3 2024 Financial Results Here’s a snapshot of our Q3 2024 results: • Q3 revenue was $3.7 billion, up 10% year-over-year. Revenue increased to $3.7 billion in Q3 2024 from $3.4 billion in Q3 2023, primarily driven by solid growth in nights stayed and a modest increase in Average Daily Rate (“ADR”). • Q3 net income was $1.4 billion, representing a 37% net income margin. Net income decreased to $1.4 billion in Q3 2024 from $4.4 billion in Q3 2023, primarily due to the prior year’s valuation allowance release of our U.S. deferred tax assets of $2.8 billion, and the recognition of non-cash tax expense related to the utilization of some of those assets in the current year.

• Q3 Adjusted EBITDA was $2.0 billion, up 7% year-over-year. Adjusted EBITDA increased to $2.0 billion in Q3 2024 from $1.8 billion in Q3 2023, which demonstrates the continued strength of our business and discipline in managing our cost structure. Adjusted EBITDA Margin was 52% in Q3 2024, down from 54% in Q3 2023.1 • Q3 Free Cash Flow was $1.1 billion, representing a FCF Margin of 29%. In Q3 2024, net cash provided by operating activities was $1.1 billion compared to $1.3 billion in Q3 2023. The year-over-year decline in cash flow was driven primarily by a $163 million payment to the IRS related to an outstanding matter. Our TTM FCF was $4.1 billion, representing a FCF Margin of 38%.2 • Q3 share repurchases of $1.1 billion. Our strong cash flow enabled us to repurchase $1.1 billion of our Class A common stock in Q3 2024. Share repurchases for the trailing twelve months totaled $3.3 billion and helped us to reduce our fully diluted share count from 681 million at the end of Q3 2023 to 665 million at the end of Q3 2024. As of September 30, 2024, we had the ability to purchase up to $4.2 billion of our Class A common stock under our current share repurchase authorization. Business Highlights Our strong quarter was driven by a number of positive business highlights: • Guest demand accelerated during the quarter. In Q3, Nights and Experiences Booked increased 8% year-over-year. After a slower start to the quarter, bookings accelerated steadily each month, returning to double-digit growth by the end of Q3. Global lead times also normalized throughout the quarter. Growth has been partly driven by our app strategy with nights booked on our app increasing 18% year-over-year in Q3. App bookings now account for 58% of total nights booked—up from 53% in the same period last year. We also saw continued growth of first-time bookers, particularly with our youngest travelers. • Our global markets strategy is working. In Q3, the average growth rate of gross nights booked on an origin basis in our expansion markets was more than twice the rate of our core markets. While our timing and investment level vary by market, our strategy is consistent: make Airbnb local and relevant. In each market, we focus on finding product-market fit, increasing awareness, and driving traffic. Japan is one example. Airbnb is still relatively new to Japanese travelers. In order to raise awareness, we launched a brand campaign last month centered on domestic travel. Beyond Japan, we’re also introducing more local payment options in countries like Vietnam, Denmark, and Poland. By Spring 2025, we expect to offer nearly 40 local payment methods across five continents. • Supply quality is improving on Airbnb. We’re focused on removing low-quality supply and making it easier for guests to find the best places to stay. Since last year, we’ve removed over 300,000 listings. As a result, customer service issue rates have decreased, and guest net promoter scores have improved. We’ve also made it easier for guests to find the best 1, 2 A reconciliation of non-GAAP financial measures to the most comparable GAAP measures is provided at the end of this letter.

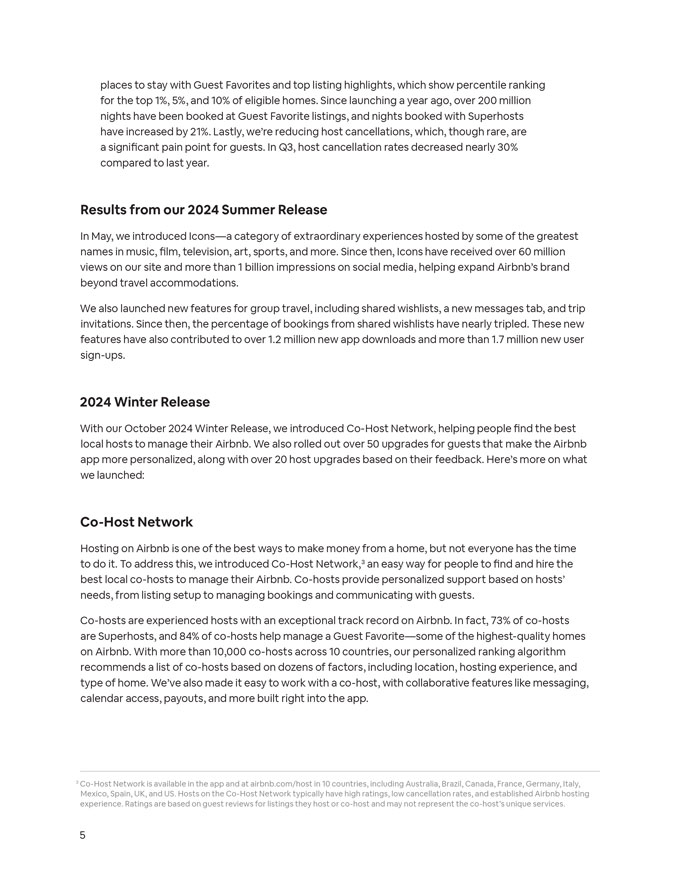

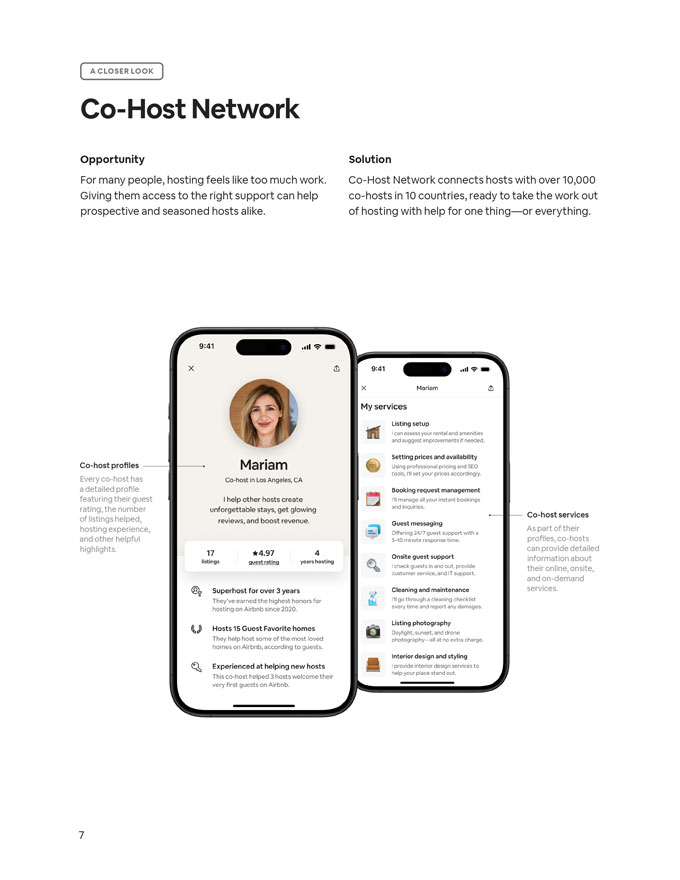

places to stay with Guest Favorites and top listing highlights, which show percentile ranking for the top 1%, 5%, and 10% of eligible homes. Since launching a year ago, over 200 million nights have been booked at Guest Favorite listings, and nights booked with Superhosts have increased by 21%. Lastly, we’re reducing host cancellations, which, though rare, are a significant pain point for guests. In Q3, host cancellation rates decreased nearly 30% compared to last year. Results from our 2024 Summer Release In May, we introduced Icons—a category of extraordinary experiences hosted by some of the greatest names in music, film, television, art, sports, and more. Since then, Icons have received over 60 million views on our site and more than 1 billion impressions on social media, helping expand Airbnb’s brand beyond travel accommodations. We also launched new features for group travel, including shared wishlists, a new messages tab, and trip invitations. Since then, the percentage of bookings from shared wishlists have nearly tripled. These new features have also contributed to over 1.2 million new app downloads and more than 1.7 million new user sign-ups. 2024 Winter Release With our October 2024 Winter Release, we introduced Co-Host Network, helping people find the best local hosts to manage their Airbnb. We also rolled out over 50 upgrades for guests that make the Airbnb app more personalized, along with over 20 host upgrades based on their feedback. Here’s more on what we launched: Co-Host Network Hosting on Airbnb is one of the best ways to make money from a home, but not everyone has the time to do it. To address this, we introduced Co-Host Network,3 an easy way for people to find and hire the best local co-hosts to manage their Airbnb. Co-hosts provide personalized support based on hosts’ needs, from listing setup to managing bookings and communicating with guests. Co-hosts are experienced hosts with an exceptional track record on Airbnb. In fact, 73% of co-hosts are Superhosts, and 84% of co-hosts help manage a Guest Favorite—some of the highest-quality homes on Airbnb. With more than 10,000 co-hosts across 10 countries, our personalized ranking algorithm recommends a list of co-hosts based on dozens of factors, including location, hosting experience, and type of home. We’ve also made it easy to work with a co-host, with collaborative features like messaging, calendar access, payouts, and more built right into the app. 3 Co-Host Network is available in the app and at airbnb.com/host in 10 countries, including Australia, Brazil, Canada, France, Germany, Italy, Mexico, Spain, UK, and US. Hosts on the Co-Host Network typically have high ratings, low cancellation rates, and established Airbnb hosting experience. Ratings are based on guest reviews for listings they host or co-host and may not represent the co-host’s unique services.

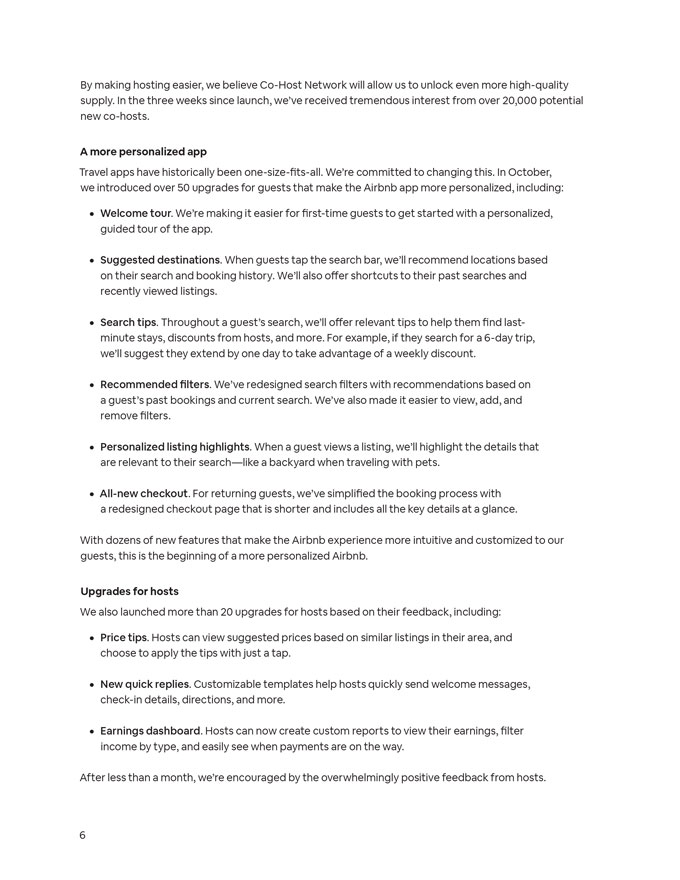

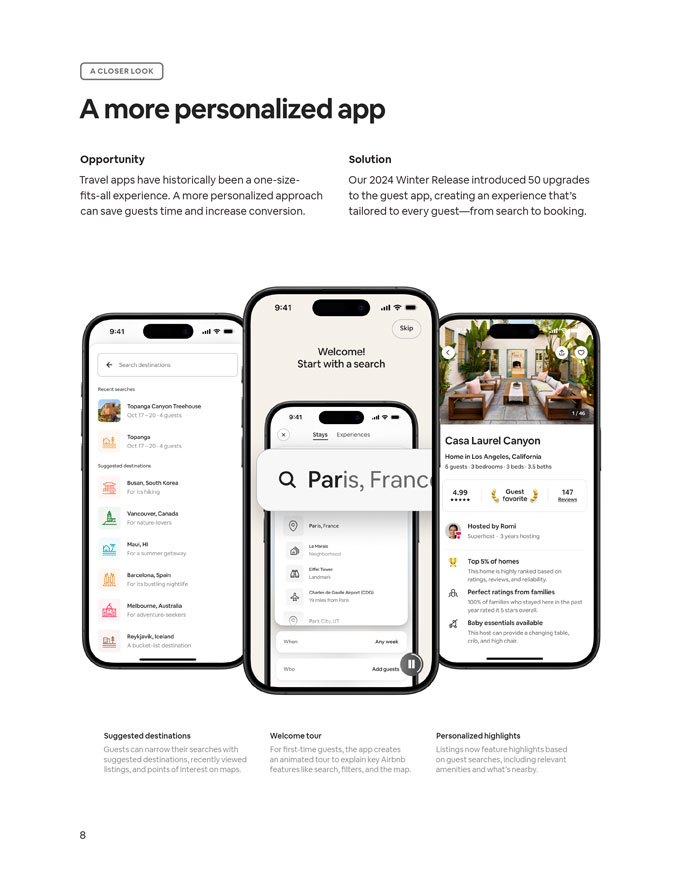

By making hosting easier, we believe Co-Host Network will allow us to unlock even more high-quality supply. In the three weeks since launch, we’ve received tremendous interest from over 20,000 potential new co-hosts. A more personalized app Travel apps have historically been one-size-fits-all. We’re committed to changing this. In October, we introduced over 50 upgrades for guests that make the Airbnb app more personalized, including: • Welcome tour. We’re making it easier for first-time guests to get started with a personalized, guided tour of the app. • Suggested destinations. When guests tap the search bar, we’ll recommend locations based on their search and booking history. We’ll also offer shortcuts to their past searches and recently viewed listings. • Search tips. Throughout a guest’s search, we’ll offer relevant tips to help them find last-minute stays, discounts from hosts, and more. For example, if they search for a 6-day trip, we’ll suggest they extend by one day to take advantage of a weekly discount. • Recommended filters. We’ve redesigned search filters with recommendations based on a guest’s past bookings and current search. We’ve also made it easier to view, add, and remove filters. • Personalized listing highlights. When a guest views a listing, we’ll highlight the details that are relevant to their search—like a backyard when traveling with pets. • All-new checkout. For returning guests, we’ve simplified the booking process with a redesigned checkout page that is shorter and includes all the key details at a glance. With dozens of new features that make the Airbnb experience more intuitive and customized to our guests, this is the beginning of a more personalized Airbnb. Upgrades for hosts We also launched more than 20 upgrades for hosts based on their feedback, including: • Price tips. Hosts can view suggested prices based on similar listings in their area, and choose to apply the tips with just a tap. • New quick replies. Customizable templates help hosts quickly send welcome messages, check-in details, directions, and more. • Earnings dashboard. Hosts can now create custom reports to view their earnings, filter income by type, and easily see when payments are on the way. After less than a month, we’re encouraged by the overwhelmingly positive feedback from hosts.

A CLOSER LOOK Co-Host Network Opportunity Solution For many people, hosting feels like too much work. Co-Host Network connects hosts with over 10,000 Giving them access to the right support can help co-hosts in 10 countries, ready to take the work out prospective and seasoned hosts alike. of hosting with help for one thing—or everything. Co-host profiles Every co-host has a detailed profile featuring their guest rating, the number Co-host services of listings helped, hosting experience, As part of their and other helpful profiles, co-hosts highlights. can provide detailed information about their online, onsite, and on-demand services.

A CLOSER LOOK A more personalized app Opportunity Solution Travel apps have historically been a one-size- Our 2024 Winter Release introduced 50 upgrades fits-all experience. A more personalized approach to the guest app, creating an experience that’s can save guests time and increase conversion. tailored to every guest—from search to booking. Suggested destinations Welcome tour Personalized highlights Guests can narrow their searches with For first-time guests, the app creates Listings now feature highlights based suggested destinations, recently viewed an animated tour to explain key Airbnb on guest searches, including relevant listings, and points of interest on maps. features like search, filters, and the map. amenities and what’s nearby.

Airbnb.org: supporting hurricane victims Airbnb.org is a nonprofit founded by Airbnb that helps provide access to free, emergency housing for people displaced by disaster and conflict around the world. In recent months, hurricanes have devastated millions of lives across the southeastern U.S. Airbnb.org is providing free, emergency housing to people who have been displaced by the storms, as well as volunteers and first responders. Because Airbnb.org uses the Airbnb platform and its hosts, as well as a global network of local nonprofit partners, it’s able to quickly connect people who need a place to stay. Since the start of Hurricanes Helene and Milton, approximately 800 hosts in Florida, North Carolina, South Carolina and Georgia have generously offered their homes for free or at a discount. Based on the power of our community, Airbnb.org has already been able to provide access to free, temporary housing for more than 6,000 people who either lost their homes in the hurricanes or have been forced to evacuate for their safety.

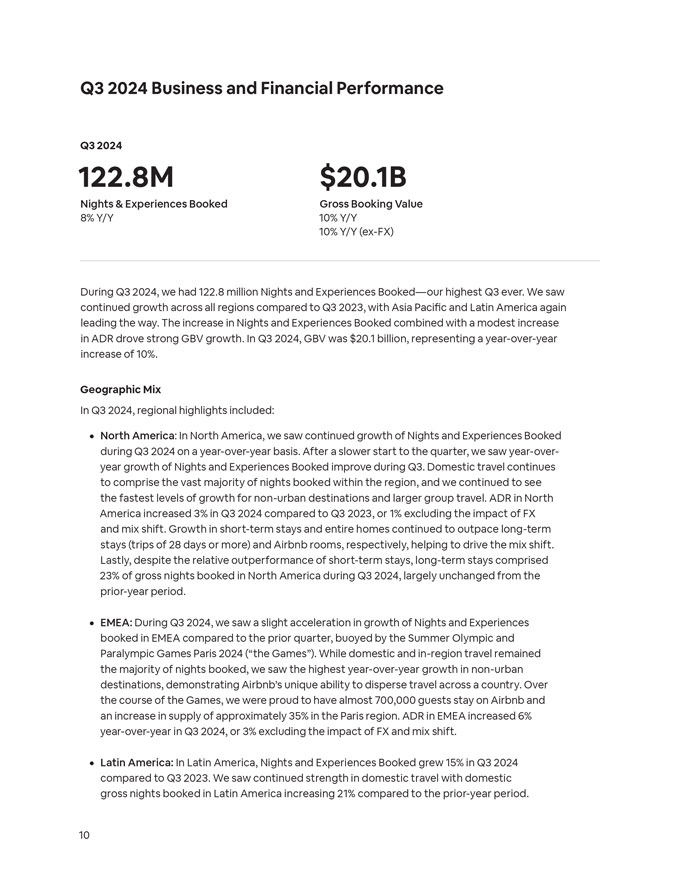

Q3 2024 Business and Financial Performance Q3 2024 122.8M $20.1B Nights & Experiences Booked Gross Booking Value 8% Y/Y 10% Y/Y 10% Y/Y (ex-FX) During Q3 2024, we had 122.8 million Nights and Experiences Booked—our highest Q3 ever. We saw continued growth across all regions compared to Q3 2023, with Asia Pacific and Latin America again leading the way. The increase in Nights and Experiences Booked combined with a modest increase in ADR drove strong GBV growth. In Q3 2024, GBV was $20.1 billion, representing a year-over-year increase of 10%. Geographic Mix In Q3 2024, regional highlights included: • North America: In North America, we saw continued growth of Nights and Experiences Booked during Q3 2024 on a year-over-year basis. After a slower start to the quarter, we saw year-over-year growth of Nights and Experiences Booked improve during Q3. Domestic travel continues to comprise the vast majority of nights booked within the region, and we continued to see the fastest levels of growth for non-urban destinations and larger group travel. ADR in North America increased 3% in Q3 2024 compared to Q3 2023, or 1% excluding the impact of FX and mix shift. Growth in short-term stays and entire homes continued to outpace long-term stays (trips of 28 days or more) and Airbnb rooms, respectively, helping to drive the mix shift. Lastly, despite the relative outperformance of short-term stays, long-term stays comprised 23% of gross nights booked in North America during Q3 2024, largely unchanged from the prior-year period. • EMEA: During Q3 2024, we saw a slight acceleration in growth of Nights and Experiences booked in EMEA compared to the prior quarter, buoyed by the Summer Olympic and Paralympic Games Paris 2024 (“the Games”). While domestic and in-region travel remained the majority of nights booked, we saw the highest year-over-year growth in non-urban destinations, demonstrating Airbnb’s unique ability to disperse travel across a country. Over the course of the Games, we were proud to have almost 700,000 guests stay on Airbnb and an increase in supply of approximately 35% in the Paris region. ADR in EMEA increased 6% year-over-year in Q3 2024, or 3% excluding the impact of FX and mix shift. • Latin America: In Latin America, Nights and Experiences Booked grew 15% in Q3 2024 compared to Q3 2023. We saw continued strength in domestic travel with domestic gross nights booked in Latin America increasing 21% compared to the prior-year period.

Consistent with recent quarters, we saw the highest year-over-year growth of active listings in Latin America and Asia Pacific—the two regions that also had the highest level of year-over-year growth of Nights and Experiences Booked. • Asia Pacific: In Asia Pacific, Nights and Experiences Booked increased 19% on a year-over-year basis—stable with the prior quarter. This region is generally reliant on cross-border travel and in Q3 2024, we saw overall cross-border travel to Asia Pacific grow 23% year-over-year. In addition, although the recovery has been and continues to be gradual, we are encouraged by the recovery of the outbound China business. Average Daily Rates ADR was $164 in Q3 2024, increasing 1% compared to Q3 2023. Excluding the impact of FX, ADR in Q3 2024 increased 2% and was flat to up across all regions, largely due to price appreciation and mix shift.

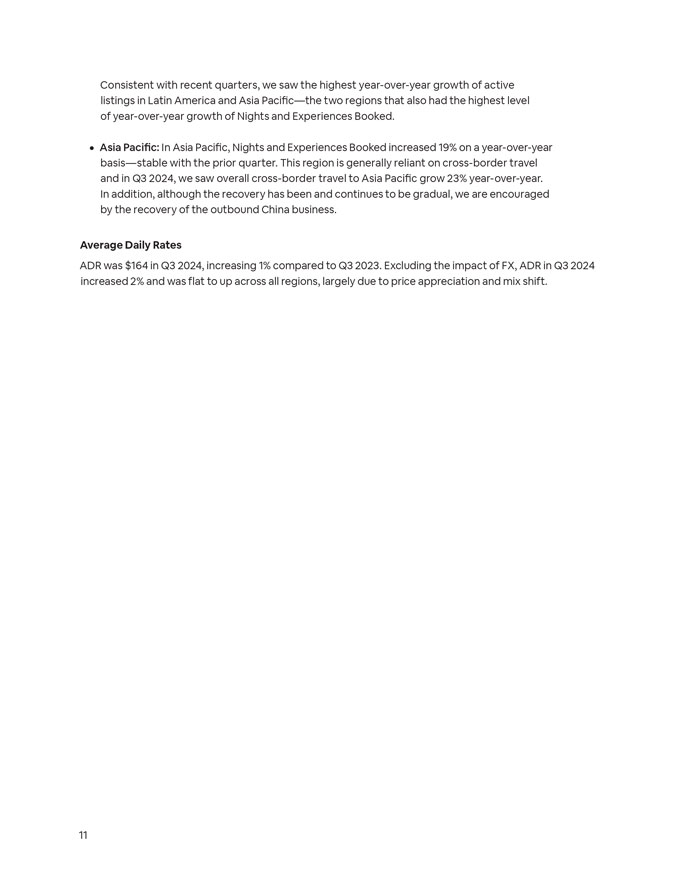

Q3 2024 $3.7B $1.4B $2.0B Revenue Net Income Adjusted EBITDA 10% Y/Y 37% Margin 52% Margin 10% Y/Y (ex-FX) $1.1B $1.1B $4.1B Net Cash Provided by Free Cash Flow TTM Free Cash Flow Operating Activities 29% Margin 38% Margin 29% Margin In Q3 2024, revenue was $3.7 billion, representing a year-over-year increase of 10%. The increase in revenue was driven by the strong growth in nights stayed and a modest increase in ADR. Net income in Q3 2024 was $1.4 billion, which was down compared to net income of $4.4 billion in Q3 2023, primarily due to the prior year’s valuation allowance release of our U.S. deferred tax assets of $2.8 billion, and the recognition of non-cash tax expense related to the utilization of some of those assets in the current year. For the full-year 2024, we anticipate our effective tax rate to be approximately 20%, subject to variables including profitability, stock-based compensation deductions, and changes in tax laws. Net income margin during Q3 2024 was 37%. Adjusted EBITDA of $2.0 billion was our highest quarter ever, up compared to $1.8 billion in Q3 2023.4 The growth in our Q3 2024 Adjusted EBITDA reflects the continued strength of our business and cost discipline. Adjusted EBITDA Margin during Q3 2024 was 52%, down compared to 54% in Q3 2023. Take Rate During Q3 2024, the implied take rate (defined as revenue divided by GBV) was flat year-over-year at 18.6%, as the revenue generated by the additional service fee amount for cross-currency bookings was offset by investments in customer service aimed to enhance the guest and host experience, which impact contra-revenue. Sales and Marketing Earlier this year, we shared our intent to invest in growth in 2024. Accordingly, in Q3, sales and marketing expense grew faster than revenue on a year-over-year basis, partially due to investments in global markets as well as highly efficient performance marketing. Based on our investments, we saw great results from 4 A reconciliation of non-GAAP financial measures to the most comparable GAAP measures is provided at the end of this letter.

our brand and performance marketing across all key markets as we optimize channel and audience mix, including in those areas where we are less penetrated. For instance, we continued to see faster growth in bookings on an origin basis in low penetration states in middle-America through our marketing efforts. Stock-Based Compensation For full-year 2024, we expect our stock-based compensation (“SBC”) expense to be approximately 25% higher than in full-year 2023. The increase in SBC expense is expected to exceed headcount growth over the same time period due to the accounting for our restricted stock unit (“RSU”) awards, which has changed over time. Beyond 2024, after the last of the double-trigger RSUs (which we stopped issuing after our IPO in December 2020) have vested, we anticipate that SBC expense will grow largely in-line with headcount growth.

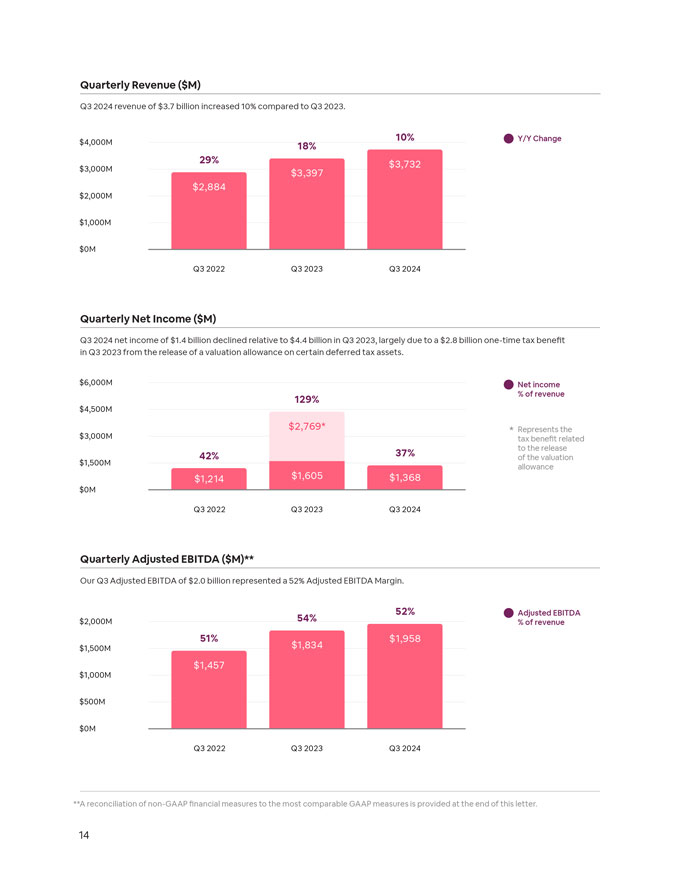

Quarterly Revenue ($M) Q3 2024 revenue of $3.7 billion increased 10% compared to Q3 2023. 10% Y/Y Change $ $4,000M 4,000M 18% 10% Y/Y Change 18% 10% $4,000M 29% $3,732 Y/Y Change $3,000M 29% 18% $3,732 $3,000M $3,397 29% $3,397 $3,732 $3,000M $2,884 $2,000M $2,884 $3,397 $2,000M $2,884 $2,000M $ $1,000M 1,000M $1,000M $ $0M 0M $0M Q3 Q3 2022 2022 Q3 Q3 2023 2023 Q3 Q3 2024 2024 Q3 2022 Q3 2023 Q3 2024 Quarterly Net Income ($M) Q3 2024 net income of $1.4 billion declined relative to $4.4 billion in Q3 2023, largely due to a $2.8 billion one-time tax benefit in Q3 2023 from the release of a valuation allowance on certain deferred tax assets. $ $6,000M 6,000M Net income Net % of income revenue 129% % of revenue $4,500M 129% $4,500M $2,769* * Represents the $3,000M $2,769* * Represents the tax benefit related $3,000M tax benefit related 37% to to the the release release 42% 37% of valuation $1,500M 42% of the valuation $1,500M allowance allowance $1,214 $1,368 $1,214 $1,605 $1,368 $ $0M 0M Q3 Q3 2022 2022 Q3 Q3 2023 2023 Q3 Q3 2024 2024 Quarterly Adjusted EBITDA ($M)** Our Q3 Adjusted EBITDA of $2.0 billion represented a 52% Adjusted EBITDA Margin. 52% Adjusted EBITDA $2,000M 54% % of revenue 51% $1,958 $1,500M $1,834 $1,457 $1,000M $500M $0M Q3 2022 Q3 2023 Q3 2024 Q3 2022 Q3 2023 Q3 2024 **A reconciliation of non-GAAP financial measures to the most comparable GAAP measures is provided at the end of this letter.

Quarterly Net Cash Provided by Operating Activities ($M) $1,500M 39% 39% Net cash provided by $ In 1,500M Q3 2024, net cash provided by operating activities was $1.1 billion. Net cash provided by operating activities 29% operating activities 29% % of revenue 33% % of revenue $1,125M 33% $1,325 $1,125M $39% 1,325 $1,500M Net cash provided by $ $1,078 1,078 operating activities $750M $964 29% % of revenue $750M $ 33% 964 $1,125M $1,325 $375M $1,078 $375M $750M $964 $0M $0M $375M Q3 2022 Q3 2023 Q3 2024 Q3 2022 Q3 2023 Q3 2024 $0M Q3 2022 Q3 2023 Q3 2024 Quarterly Free Cash Flow ($M)* We generated $1.1 billion of FCF in Q3 2024, representing a FCF Margin of 29%. $1,500M 39% 39% Free Cash Flow $1,500M Free Cash Flow % of revenue 29% % of revenue 29% 33% $1,125M 33% $1,310 $1,125M $39% 1,310 $1,500M Free Cash Flow $ $1,074 1,074 % of revenue $750M $958 29% $750M $ 33% 958 $1,125M $1,310 $375M $1,074 $375M $750M $958 $0M $0M $375M Q3 2022 Q3 2023 Q3 2024 Q3 2022 Q3 2023 Q3 2024 $0M Q3 2022 Q3 2023 Q3 2024 TTM Free Cash Flow ($M)* As of Q3 2024, we generated $4.1 billion of TTM FCF, representing a TTM FCF Margin of 38%. $6,000M TTM Free Cash Flow $6,000M 44% 44% % TTM of TTM Free revenue Cash Flow 38% 38% % of TTM revenue $4,500M 41% $4,500M 41% $6,000M $4,246 TTM Free Cash Flow $4,246 44% $ $4,072 4,072 38% % of TTM revenue $3,000M $3,328 $3,000M $3,328 $4,500M 41% $4,246 $4,072 $1,500M $1,500M $3,000M $3,328 $0M $0M $1,500M Q3 2022 Q3 2023 Q3 2024 Q3 2022 Q3 2023 Q3 2024 $0M Q3 2022 Q3 2023 Q3 2024 *A reconciliation of non-GAAP financial measures to the most comparable GAAP measures is provided at the end of this letter.

Shares (M) We repurchased $1.1 billion of Class A common stock during Q3 2024 to help manage the impact of share dilution. 800M Fully Diluted 698 681 665 Share Count 65 42 38 Stock Based Awards & 600M Warrants Outstanding 633 639 627 Common Shares Outstanding 400M 200M 0M Sept 2022 Sept 2023 Sept 2024

Balance Sheet and Cash Flows For the three months ended September 30, 2024, we reported $1.1 billion of net cash provided by operating activities and $1.1 billion of FCF, compared to $1.3 billion and $1.3 billion, respectively, for the three months ended September 30, 2023.5 As of September 30, 2024, we had $11.3 billion of cash and cash equivalents, short-term investments, and restricted cash, as well as $6.6 billion of funds held on behalf of guests. Capital Allocation During Q3 2024, we repurchased $1.1 billion of our Class A common stock. As of September 30, 2024, we had $4.2 billion remaining under our $6 billion repurchase authorization. The repurchase program continues to be executed as part of our broader capital allocation strategy which prioritizes investments in organic growth, strategic acquisitions where relevant, and return of capital to shareholders, in that order. Our strong balance sheet and significant cash flow generation provides us the opportunity to pursue all three capital allocation priorities. In addition to our share repurchase plan, we often use corporate cash to make required tax payments associated with the vesting of employee RSUs, and withhold a corresponding number of shares from employees, rather than selling employee shares on their behalf to cover related taxes. Since the inception of our share repurchases in Q3 2022, our fully diluted share count has decreased approximately 6%, driven in part by our share repurchases and cash used for employee tax obligations totaling $8.3 billion. Outlook Building on robust momentum in September, we are off to a great start in Q4 2024. We are seeing strong demand trends in Q4 2024 across core and expansion markets for both long and short lead times. As a result, we expect year-over-year growth of Nights and Experienced Booked in Q4 2024 to be higher than Q3 2024. In Q4 2024, we expect ADR to increase modestly on a year-over-year basis, driven by continued demand for larger and higher priced listings, as well as a small benefit from foreign exchange. For Q4 2024, we expect to deliver revenue of $2.39 billion to $2.44 billion, representing year-over-year growth of 8% to 10%, inclusive of a modest foreign exchange tailwind. We anticipate that our implied take rate in Q4 2024 will be slightly lower on a year-over-year basis, primarily due to one-time benefits recognized from unused gift cards in Q4 2023. Excluding these one-time benefits related to gift cards in Q4 2023, revenue growth in Q4 2024 would be approximately two percentage points higher. For the full-year 2024, we now expect to deliver an Adjusted EBITDA Margin of approximately 35.5%. In addition, we expect to deliver a full-year 2024 Free Cash Flow Margin several points above our Adjusted EBITDA Margin. Q4 2024 Adjusted EBITDA Margin is expected to decline relative to the same time period last year due to higher marketing and product development expenses. 5 A reconciliation of non-GAAP financial measures to the most comparable GAAP measures is provided at the end of this letter.

In Q1 2025, the year-over-year growth rate of revenue will be negatively impacted by the comparison to Q1 2024, which benefited from both the timing of Easter and inclusion of Leap Day. For the full-year 2025, we’ll continue to pursue our growth initiatives, including offering new products and services, as well as expanding in global markets. We’re excited to share more about our 2025 growth and investment plans early next year. Earnings Webcast Airbnb will host an audio webcast to discuss its third quarter results at 1:30 p.m. PT / 4:30 p.m. ET on November 7, 2024. The link to the webcast will be made available on the Investor Relations website at https://investors.airbnb.com. Interested parties can register for the call in advance by visiting https://registrations.events/direct/ Q4I663650. After registering, instructions will be shared on how to join the call. Investor Relations Contact: ir@airbnb.com Press Contact: contact.press@airbnb.com About Airbnb Airbnb was born in 2007 when two hosts welcomed three guests to their San Francisco home, and has since grown to over 5 million hosts who have welcomed over 2 billion guest arrivals in almost every country across the globe. Every day, hosts offer unique stays and experiences that make it possible for guests to connect with communities in a more authentic way. Forward-Looking Statements This letter contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, statements regarding the future performance of Airbnb, Inc. and its consolidated subsidiaries (the “Company”), including its financial outlook for the fourth quarter of 2024 and the fiscal year 2024; the other expectations described under “Outlook” above; the Company’s expectations regarding travel trends and the travel industry generally; the Company’s strategic priorities and investments, including those in certain markets; the Company’s expectations with respect to the demand for bookings, and expectations with respect to increases in and the quality of active listings; the Company’s expectations regarding cross-border travel; the Company’s expectation of attracting and retaining more hosts; the growth of active listings; the Company’s expectations regarding international expansion; the Company’s expectations regarding long-term stays through its platform; the Company’s expectations regarding its investments in sales and marketing; the Company’s expectations regarding bookings around major holidays or events; the Company’s plans regarding guest service fees and cross-currency bookings and the impact on take rate; the Company’s expectations regarding its financial performance, including its revenue, implied take rate, Adjusted EBITDA, and Adjusted EBITDA Margin;

the Company’s expectations regarding future operating performance, including Nights and Experiences Booked and GBV; the Company’s expectations regarding ADR; the anticipated tax rate; the Company’s expectations regarding marketing spend; the Company’s expectations with respect to stock-based compensation expense; the Company’s share repurchase program; the Company’s expectations for product and services growth and enhancements, including the ongoing impact and results from platform enhancements or new features, including the Company’s 2024 Summer Release and 2024 Winter Release; the Company’s expectations regarding its Co-Host Network; the Company’s expectations regarding the success of offerings beyond accommodations, including Icons; and the Company’s business strategy, plans, and objectives for future operations. In some cases, forward-looking statements can be identified by terms such as “may,” “will,” “appears,” “should,” “expects,” “plans,” “anticipates,” “could,” “outlook,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans, or intentions. Such statements are subject to a number of known and unknown risks, uncertainties, assumptions, and other factors that may cause the Company’s actual results, performance, or achievements to differ materially from results expressed or implied in this letter. Investors are cautioned not to place undue reliance on these statements, and reported results should not be considered as an indication of future performance. Risks that contribute to the uncertain nature of the forward-looking statements include, among others, the travel industry, travel trends, and the global economy generally; the Company’s ability to retain existing hosts and guests and add new hosts and guests; any decline or disruption in the travel and hospitality industries or economic downturn; the Company’s ability to compete successfully; changes to the laws and regulations that may limit the Company’s hosts’ ability and willingness to provide their listings, and/or result in significant fines, liabilities, and penalties to the Company; the effect of extensive regulation and oversight, litigation, and other proceedings related to the Company’s business in a variety of areas; the Company’s ability to maintain its brand and reputation, and effectively drive traffic to its platform; the effectiveness of the Company’s strategy and business initiatives; the Company’s operations in international markets; the Company’s level of indebtedness; the Company’s final accounting closing procedures, final adjustments, and other developments that may arise in the course of audit and review procedures; and changes in political, business, and economic conditions; as well as other risks listed or described from time to time in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, the Company’s Quarterly Report on Form 10-Q for the quarters ended March 31, 2024, June 30, 2024 and September 30, 2024 and any subsequent filings, which are or will be on file with the SEC and available on the investor relations page of the Company’s website. All forward-looking statements are based on information and estimates available to the Company at the time of this letter and are not guarantees of future performance. Except as required by law, the Company assumes no obligation to update any of the statements in this letter. The information that can be accessed through hyperlinks or website addresses included herein is deemed not to be incorporated in or part of this letter. Non-GAAP Financial Measures In addition to our results determined in accordance with generally accepted accounting principles in the United States (“GAAP”), we review financial measures that are not calculated and presented in accordance

with GAAP (“non-GAAP financial measures”). We believe our non-GAAP financial measures are useful in evaluating our operating performance. We use various non-GAAP financial information, collectively, to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that non-GAAP financial information, when taken collectively, may be helpful to investors because it provides consistency and comparability with past financial performance, and assists in comparisons with other companies, some of which use similar non-GAAP financial information to supplement their GAAP results. The non-GAAP financial information is presented for supplemental informational purposes only, should not be considered a substitute for financial information presented in accordance with GAAP, and may be different from similarly titled non-GAAP measures used by other companies. A reconciliation of each non-GAAP financial measure to the most directly comparable financial measure stated in accordance with GAAP is provided below. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures. Our non-GAAP financial measures include Adjusted EBITDA, Adjusted EBITDA Margin, Free Cash Flow, Free Cash Flow Margin, trailing twelve months (“TTM”) Free Cash Flow, TTM Free Cash Flow Margin, revenue change excluding the effect of changes in foreign exchange rates (“ex-FX”), net income ex-FX, and Adjusted EBITDA ex-FX. Adjusted EBITDA is defined as net income or loss adjusted for (i) provision for (benefit from) income taxes; (ii) other income (expense), net, and interest income; (iii) depreciation and amortization; (iv) stock-based compensation expense; (v) acquisition-related impacts consisting of gains (losses) recognized on changes in the fair value of contingent consideration arrangements; (vi) lodging taxes for which we may have joint and several liability with hosts for collecting and remitting such taxes, withholding taxes on payments made to such hosts, and any related settlements and transactional taxes where there is significant ambiguity as to how the taxes apply to our platform; and (vii) restructuring charges. The above items are excluded from our Adjusted EBITDA measure because these items are non-cash in nature, or because the amount and timing of these items is unpredictable, not driven by core results of operations and renders comparisons with prior periods and competitors less meaningful. Reconciliations of expected Adjusted EBITDA and Adjusted EBITDA Margins to corresponding net income (loss) and net income (loss) margins have not been provided because of the unpredictability of certain of the items excluded from Adjusted EBITDA and because we cannot determine their probable significance. We believe Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our results of operations, as well as provides a useful measure for period-to-period comparisons of our business performance. Moreover, we have included Adjusted EBITDA in this letter because it is a key measurement used by our management internally to make operating decisions, including those related to operating expenses, evaluating performance, and performing strategic planning and annual budgeting. Adjusted EBITDA has limitations as a financial measure, should be considered as supplemental in nature, and is not meant as a substitute for the related financial information prepared in accordance with GAAP. These limitations include the following: • Adjusted EBITDA does not reflect interest income and other income (expense), net, which include unrealized and realized gains and losses on foreign currency exchange, investments, and financial instruments;

• Adjusted EBITDA excludes certain recurring, non-cash charges, such as depreciation of property and equipment and amortization of intangible assets, and although these are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect all cash requirements for such replacements or for new capital expenditure requirements; • Adjusted EBITDA excludes stock-based compensation expense, which has been, and will continue to be for the foreseeable future, a significant recurring expense in our business and an important part of our compensation strategy; • Adjusted EBITDA excludes acquisition-related impacts consisting of gains (losses) recognized on changes in the fair value of contingent consideration arrangements. The contingent consideration, which was in the form of equity, was valued as of the acquisition date and is marked-to-market at each reporting period based on factors including our stock price; • Adjusted EBITDA does not reflect lodging taxes for which we may have joint and several liability with hosts for collecting and remitting such taxes, withholding taxes on payments made to such hosts, and any related settlements and transactional taxes where there is significant ambiguity as to how the taxes apply to our platform; and • Adjusted EBITDA does not reflect restructuring charges, which include impairment of operating lease right-of-use assets and leasehold improvements. Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by revenue. Because of these limitations, you should consider Adjusted EBITDA and Adjusted EBITDA Margin alongside other financial performance measures, including net income (loss) and our other GAAP results. Free Cash Flow represents net cash provided by operating activities less purchases of property and equipment. We believe Free Cash Flow is a meaningful indicator of liquidity that provides information to management and investors about the amount of cash generated from operations that, after purchases of property and equipment, can be used for strategic initiatives, including continuous investment in our business, growth through acquisitions, and strengthening our balance sheet. Our Free Cash Flow is impacted by the timing of GBV because we collect our service fees at the time of booking, which is generally before a stay or experience occurs. Funds held on behalf of our hosts and guests and amounts payable to our hosts and guests do not impact Free Cash Flow, except interest earned on these funds. Free Cash Flow Margin is defined as Free Cash Flow divided by revenue. We track our TTM Free Cash Flow to account for the timing difference in when we receive cash from service fees, which is at the time of booking. Free Cash Flow has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of other GAAP financial measures, such as net cash provided by operating activities. Free Cash Flow does not reflect our ability to meet future contractual commitments and may be calculated differently by other companies in our industry, limiting its usefulness as a comparative measure. TTM Free Cash Flow Margin is defined as TTM Free Cash Flow divided by TTM revenue. In addition to the actual amount or percentage change, we disclose the amount or percentage change in our current period results for revenue, GBV, net income (loss), Adjusted EBITDA, and ADR from the corresponding prior period results by comparing results using constant currencies. We present constant

currency amounts and change rate information to provide a framework for assessing how our revenue, GBV, net income (loss), Adjusted EBITDA, and ADR performed excluding the effect of changes in foreign exchange rates. We use the amounts and percentage change in constant currency revenues, GBV, net income (loss), Adjusted EBITDA, and ADR for financial and operational decision-making and as a means to evaluate period-to-period comparisons. We believe the presentation of results on a constant currency basis in addition to the U.S. GAAP presentation helps improve the ability to understand our performance because it excludes the effects of foreign currency volatility that are not indicative of our core operating results. We calculate the percentage change in constant currency by determining the change in the current period over the prior comparable period where current period foreign currency amounts are translated using the exchange rates of the comparative period. Share Repurchases Share repurchases under our share repurchase programs may be made through a variety of methods, which may include open market purchases, privately negotiated transactions, block trades or accelerated share repurchase transactions, or by any combination of such methods. Any such repurchases will be made from time to time subject to market and economic conditions, applicable legal requirements and other relevant factors. Our share repurchase program does not obligate us to repurchase any specific number of shares and may be modified, suspended, or terminated at any time at our discretion.

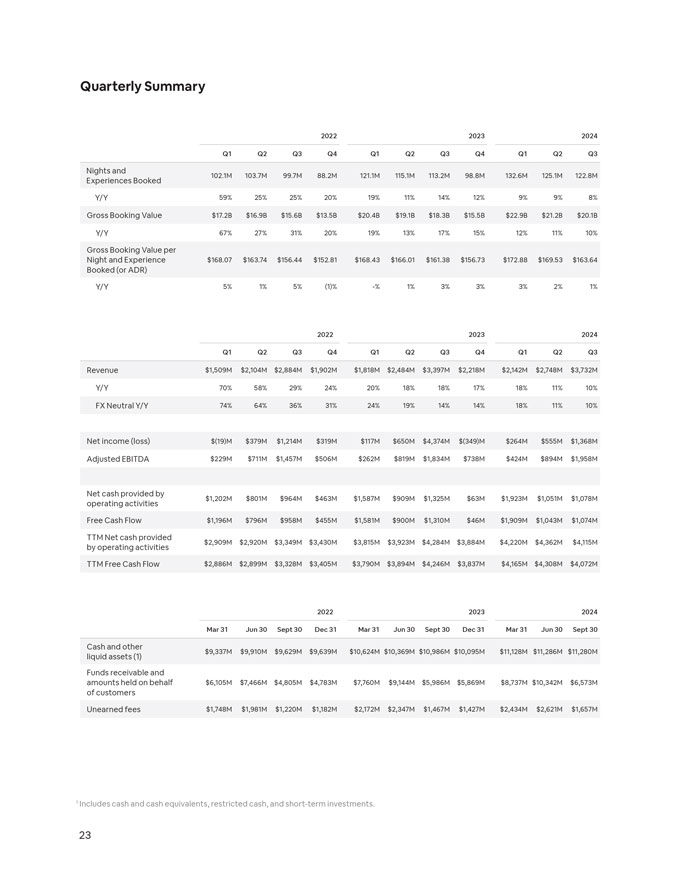

Quarterly Summary 2022 2023 2024 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Nights and 102.1M 103.7M 99.7M 88.2M 121.1M 115.1M 113.2M 98.8M 132.6M 125.1M 122.8M Experiences Booked Y/Y 59% 25% 25% 20% 19% 11% 14% 12% 9% 9% 8% Gross Booking Value $17.2B $16.9B $15.6B $13.5B $20.4B $19.1B $18.3B $15.5B $22.9B $21.2B $20.1B Y/Y 67% 27% 31% 20% 19% 13% 17% 15% 12% 11% 10% Gross Booking Value per Night and Experience $168.07 $163.74 $156.44 $152.81 $168.43 $166.01 $161.38 $156.73 $172.88 $169.53 $163.64 Booked (or ADR) Y/Y 5% 1% 5% (1)% -% 1% 3% 3% 3% 2% 1% 2022 2023 2024 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Revenue $1,509M $2,104M $2,884M $1,902M $1,818M $2,484M $3,397M $2,218M $2,142M $2,748M $3,732M Y/Y 70% 58% 29% 24% 20% 18% 18% 17% 18% 11% 10% FX Neutral Y/Y 74% 64% 36% 31% 24% 19% 14% 14% 18% 11% 10% Net income (loss) $(19)M $379M $1,214M $319M $117M $650M $4,374M $(349)M $264M $555M $1,368M Adjusted EBITDA $229M $711M $1,457M $506M $262M $819M $1,834M $738M $424M $894M $1,958M Net cash provided by $1,202M $801M $964M $463M $1,587M $909M $1,325M $63M $1,923M $1,051M $1,078M operating activities Free Cash Flow $1,196M $796M $958M $455M $1,581M $900M $1,310M $46M $1,909M $1,043M $1,074M TTM Net cash provided $2,909M $2,920M $3,349M $3,430M $3,815M $3,923M $4,284M $3,884M $4,220M $4,362M $4,115M by operating activities TTM Free Cash Flow $2,886M $2,899M $3,328M $3,405M $3,790M $3,894M $4,246M $3,837M $4,165M $4,308M $4,072M 2022 2023 2024 Mar 31 Jun 30 Sept 30 Dec 31 Mar 31 Jun 30 Sept 30 Dec 31 Mar 31 Jun 30 Sept 30 Cash and other $9,337M $9,910M $9,629M $9,639M $10,624M $10,369M $10,986M $10,095M $11,128M $11,286M $11,280M liquid assets (1) Funds receivable and amounts held on behalf $6,105M $7,466M $4,805M $4,783M $7,760M $9,144M $5,986M $5,869M $8,737M $10,342M $6,573M of customers Unearned fees $1,748M $1,981M $1,220M $1,182M $2,172M $2,347M $1,467M $1,427M $2,434M $2,621M $1,657M 1 Includes cash and cash equivalents, restricted cash, and short-term investments.

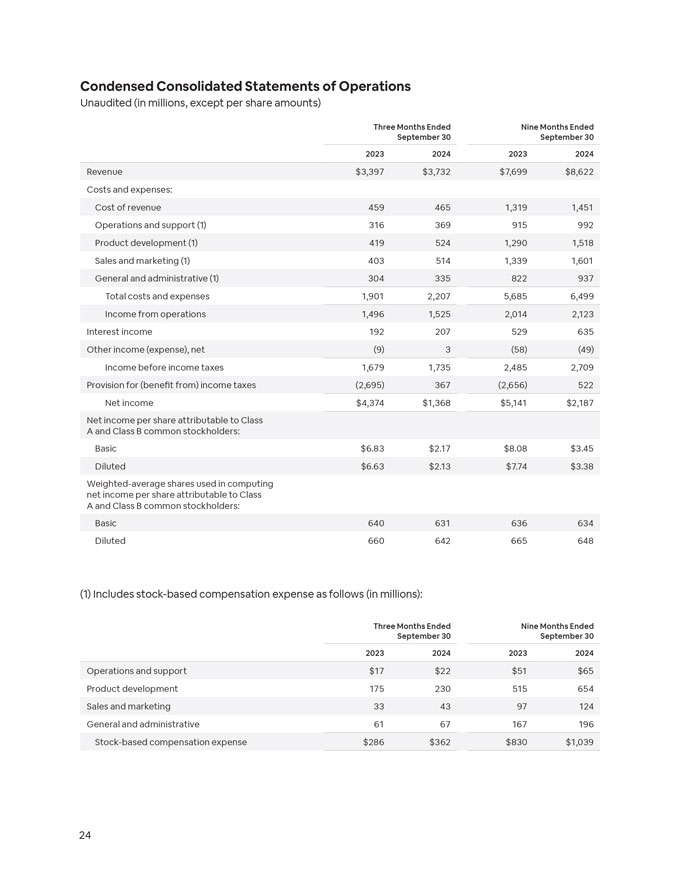

Condensed Consolidated Statements of Operations Unaudited (in millions, except per share amounts) Three Months Ended Nine Months Ended September 30 September 30 2023 2024 2023 2024 Revenue $3,397 $3,732 $7,699 $8,622 Costs and expenses: Cost of revenue 459 465 1,319 1,451 Operations and support (1) 316 369 915 992 Product development (1) 419 524 1,290 1,518 Sales and marketing (1) 403 514 1,339 1,601 General and administrative (1) 304 335 822 937 Total costs and expenses 1,901 2,207 5,685 6,499 Income from operations 1,496 1,525 2,014 2,123 Interest income 192 207 529 635 Other income (expense), net (9) 3 (58) (49) Income before income taxes 1,679 1,735 2,485 2,709 Provision for (benefit from) income taxes (2,695) 367 (2,656) 522 Net income $4,374 $1,368 $5,141 $2,187 Net income per share attributable to Class A and Class B common stockholders: Basic $6.83 $2.17 $8.08 $3.45 Diluted $6.63 $2.13 $7.74 $3.38 Weighted-average shares used in computing net income per share attributable to Class A and Class B common stockholders: Basic 640 631 636 634 Diluted 660 642 665 648 (1) Includes stock-based compensation expense as follows (in millions): Three Months Ended Nine Months Ended September 30 September 30 2023 2024 2023 2024 Operations and support $17 $22 $51 $65 Product development 175 230 515 654 Sales and marketing 33 43 97 124 General and administrative 61 67 167 196 Stock-based compensation expense $286 $362 $830 $1,039

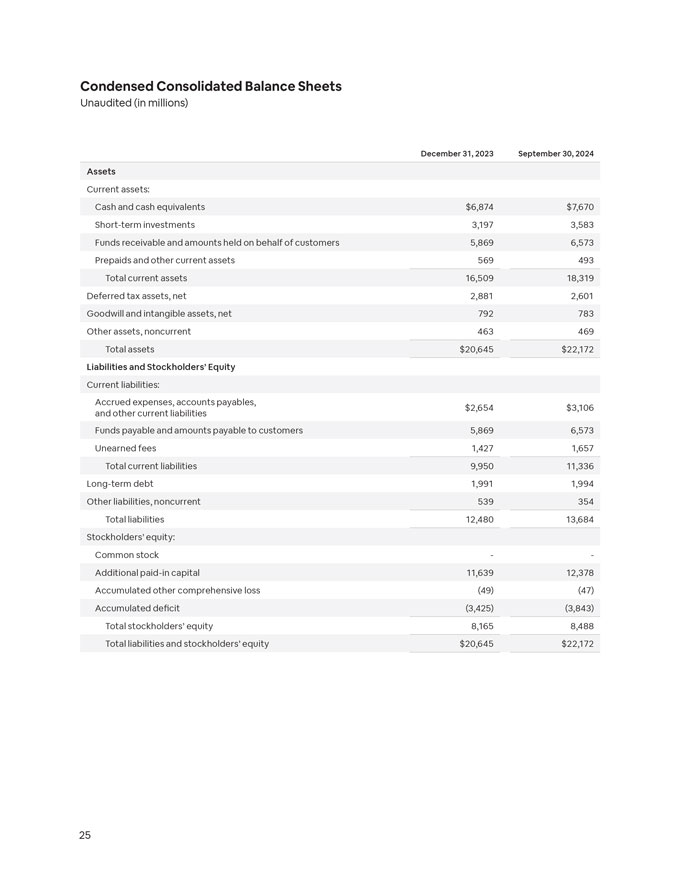

Condensed Consolidated Balance Sheets Unaudited (in millions) December 31, 2023 September 30, 2024 Assets Current assets: Cash and cash equivalents $6,874 $7,670 Short-term investments 3,197 3,583 Funds receivable and amounts held on behalf of customers 5,869 6,573 Prepaids and other current assets 569 493 Total current assets 16,509 18,319 Deferred tax assets, net 2,881 2,601 Goodwill and intangible assets, net 792 783 Other assets, noncurrent 463 469 Total assets $20,645 $22,172 Liabilities and Stockholders’ Equity Current liabilities: Accrued expenses, accounts payables, $2,654 $3,106 and other current liabilities Funds payable and amounts payable to customers 5,869 6,573 Unearned fees 1,427 1,657 Total current liabilities 9,950 11,336 Long-term debt 1,991 1,994 Other liabilities, noncurrent 539 354 Total liabilities 12,480 13,684 Stockholders’ equity: Common stock——Additional paid-in capital 11,639 12,378 Accumulated other comprehensive loss (49) (47) Accumulated deficit (3,425) (3,843) Total stockholders’ equity 8,165 8,488 Total liabilities and stockholders’ equity $20,645 $22,172

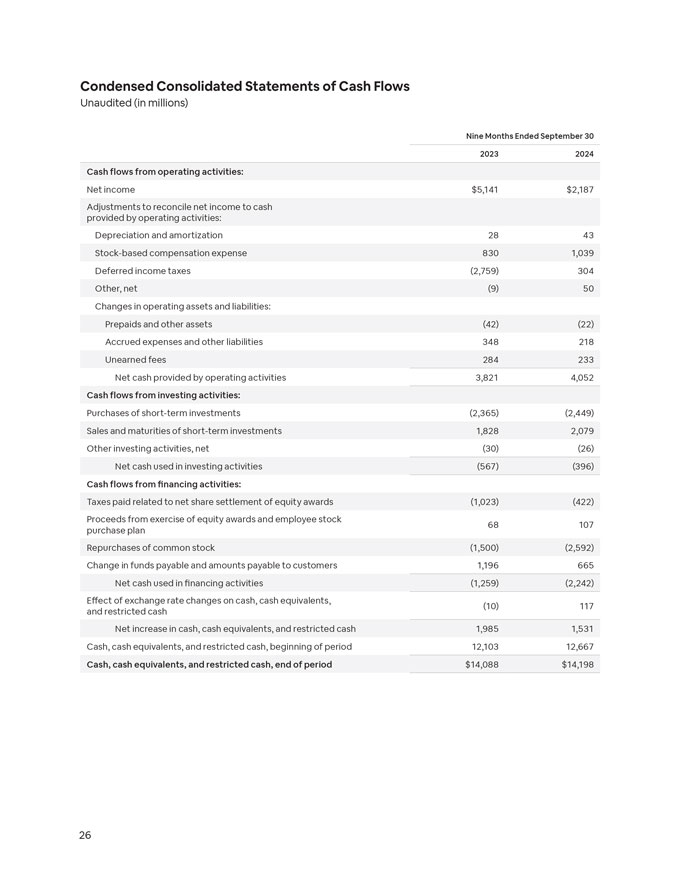

Condensed Consolidated Statements of Cash Flows Unaudited (in millions) Nine Months Ended September 30 2023 2024 Cash flows from operating activities: Net income $5,141 $2,187 Adjustments to reconcile net income to cash provided by operating activities: Depreciation and amortization 28 43 Stock-based compensation expense 830 1,039 Deferred income taxes (2,759) 304 Other, net (9) 50 Changes in operating assets and liabilities: Prepaids and other assets (42) (22) Accrued expenses and other liabilities 348 218 Unearned fees 284 233 Net cash provided by operating activities 3,821 4,052 Cash flows from investing activities: Purchases of short-term investments (2,365) (2,449) Sales and maturities of short-term investments 1,828 2,079 Other investing activities, net (30) (26) Net cash used in investing activities (567) (396) Cash flows from financing activities: Taxes paid related to net share settlement of equity awards (1,023) (422) Proceeds from exercise of equity awards and employee stock 68 107 purchase plan Repurchases of common stock (1,500) (2,592) Change in funds payable and amounts payable to customers 1,196 665 Net cash used in financing activities (1,259) (2,242) Effect of exchange rate changes on cash, cash equivalents, (10) 117 and restricted cash Net increase in cash, cash equivalents, and restricted cash 1,985 1,531 Cash, cash equivalents, and restricted cash, beginning of period 12,103 12,667 Cash, cash equivalents, and restricted cash, end of period $14,088 $14,198

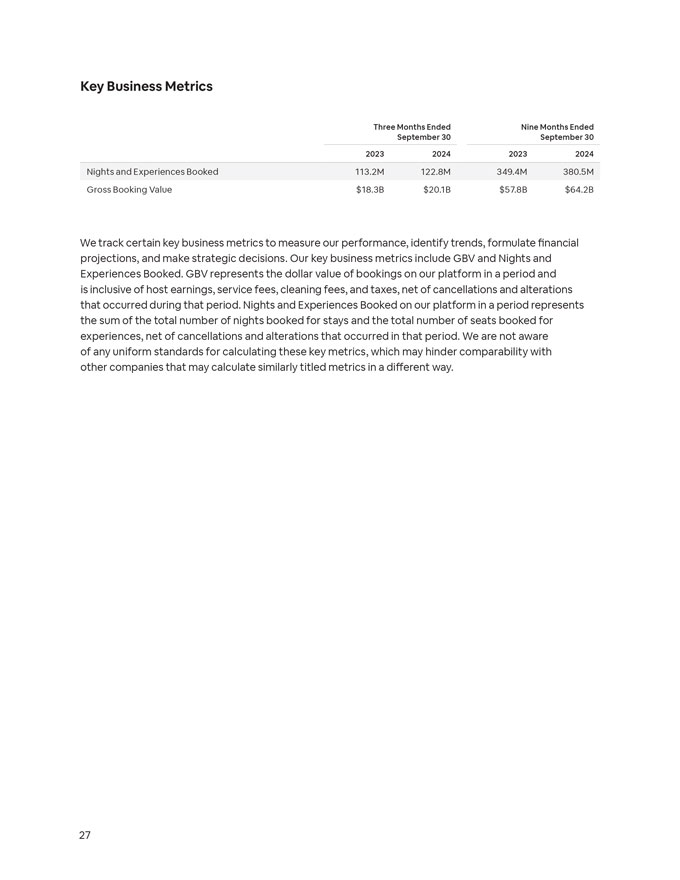

Key Business Metrics Three Months Ended Nine Months Ended September 30 September 30 2023 2024 2023 2024 Nights and Experiences Booked 113.2M 122.8M 349.4M 380.5M Gross Booking Value $18.3B $20.1B $57.8B $64.2B We track certain key business metrics to measure our performance, identify trends, formulate financial projections, and make strategic decisions. Our key business metrics include GBV and Nights and Experiences Booked. GBV represents the dollar value of bookings on our platform in a period and is inclusive of host earnings, service fees, cleaning fees, and taxes, net of cancellations and alterations that occurred during that period. Nights and Experiences Booked on our platform in a period represents the sum of the total number of nights booked for stays and the total number of seats booked for experiences, net of cancellations and alterations that occurred in that period. We are not aware of any uniform standards for calculating these key metrics, which may hinder comparability with other companies that may calculate similarly titled metrics in a different way.

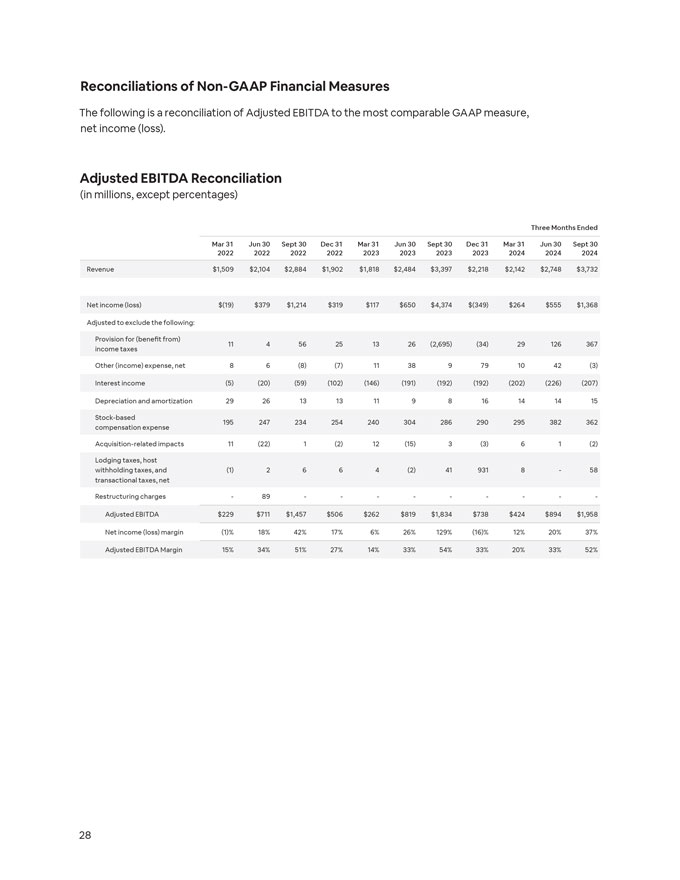

Reconciliations of Non-GAAP Financial Measures The following is a reconciliation of Adjusted EBITDA to the most comparable GAAP measure, net income (loss). Adjusted EBITDA Reconciliation (in millions, except percentages) Three Months Ended Mar 31 Jun 30 Sept 30 Dec 31 Mar 31 Jun 30 Sept 30 Dec 31 Mar 31 Jun 30 Sept 30 2022 2022 2022 2022 2023 2023 2023 2023 2024 2024 2024 Revenue $1,509 $2,104 $2,884 $1,902 $1,818 $2,484 $3,397 $2,218 $2,142 $2,748 $3,732 Net income (loss) $(19) $379 $1,214 $319 $117 $650 $4,374 $(349) $264 $555 $1,368 Adjusted to exclude the following: Provision for (benefit from) 11 4 56 25 13 26 (2,695) (34) 29 126 367 income taxes Other (income) expense, net 8 6 (8) (7) 11 38 9 79 10 42 (3) Interest income (5) (20) (59) (102) (146) (191) (192) (192) (202) (226) (207) Depreciation and amortization 29 26 13 13 11 9 8 16 14 14 15 Stock-based 195 247 234 254 240 304 286 290 295 382 362 compensation expense Acquisition-related impacts 11 (22) 1 (2) 12 (15) 3 (3) 6 1 (2) Lodging taxes, host withholding taxes, and (1) 2 6 6 4 (2) 41 931 8 — 58 transactional taxes, net Restructuring charges— 89 —————————Adjusted EBITDA $229 $711 $1,457 $506 $262 $819 $1,834 $738 $424 $894 $1,958 Net income (loss) margin (1)% 18% 42% 17% 6% 26% 129% (16)% 12% 20% 37% Adjusted EBITDA Margin 15% 34% 51% 27% 14% 33% 54% 33% 20% 33% 52%

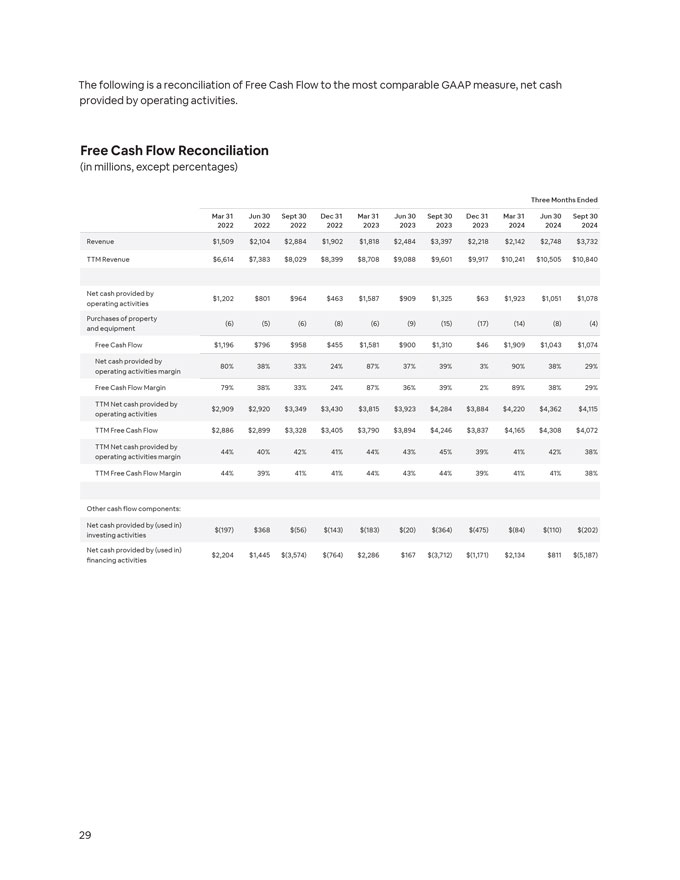

The following is a reconciliation of Free Cash Flow to the most comparable GAAP measure, net cash provided by operating activities. Free Cash Flow Reconciliation (in millions, except percentages) Three Months Ended Mar 31 Jun 30 Sept 30 Dec 31 Mar 31 Jun 30 Sept 30 Dec 31 Mar 31 Jun 30 Sept 30 2022 2022 2022 2022 2023 2023 2023 2023 2024 2024 2024 Revenue $1,509 $2,104 $2,884 $1,902 $1,818 $2,484 $3,397 $2,218 $2,142 $2,748 $3,732 TTM Revenue $6,614 $7,383 $8,029 $8,399 $8,708 $9,088 $9,601 $9,917 $10,241 $10,505 $10,840 Net cash provided by $1,202 $801 $964 $463 $1,587 $909 $1,325 $63 $1,923 $1,051 $1,078 operating activities Purchases of property (6) (5) (6) (8) (6) (9) (15) (17) (14) (8) (4) and equipment Free Cash Flow $1,196 $796 $958 $455 $1,581 $900 $1,310 $46 $1,909 $1,043 $1,074 Net cash provided by 80% 38% 33% 24% 87% 37% 39% 3% 90% 38% 29% operating activities margin Free Cash Flow Margin 79% 38% 33% 24% 87% 36% 39% 2% 89% 38% 29% TTM Net cash provided by $2,909 $2,920 $3,349 $3,430 $3,815 $3,923 $4,284 $3,884 $4,220 $4,362 $4,115 operating activities TTM Free Cash Flow $2,886 $2,899 $3,328 $3,405 $3,790 $3,894 $4,246 $3,837 $4,165 $4,308 $4,072 TTM Net cash provided by 44% 40% 42% 41% 44% 43% 45% 39% 41% 42% 38% operating activities margin TTM Free Cash Flow Margin 44% 39% 41% 41% 44% 43% 44% 39% 41% 41% 38% Other cash flow components: Net cash provided by (used in) $(197) $368 $(56) $(143) $(183) $(20) $(364) $(475) $(84) $(110) $(202) investing activities Net cash provided by (used in) $2,204 $1,445 $(3,574) $(764) $2,286 $167 $(3,712) $(1,171) $2,134 $811 $(5,187) financing activities

One idea can We believe that daring thinking and fearless creativity can change everything. Just as Prince redefined music, start a revolution we endeavor to transform how people explore and experience the world. This bold spirit is what pushes us to defy conventions and create unforgettable moments— like the Purple Rain house, an Icon on Airbnb. Learn more about the Purple Rain Icon experience at airbnb.com/prince

Cover image: The Purple Rain house, an Icon on Airbnb