|

☐

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______

|

|

☐

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Israel

|

65 Yigal Alon St.

Tel Aviv 6744316, Israel Tel: +972 3 7177050 |

|

|

(Jurisdiction of incorporation or organization)

|

(Address of principal executive offices)

|

|

Title of each class to be registered

|

|

Trading Symbol(s)

|

|

Name of each exchange on which each

class is to be registered |

|

Ordinary shares, no par value NIS per share

|

|

PRFX

|

|

The Nasdaq Stock Market LLC

|

|

|

Large accelerated filer ☐

|

|

Accelerated filer ☐

|

|

Non-accelerated filer ☒

|

|

|

|

|

|

|

|

Emerging Growth Company ☒

|

|

|

|

|

Page |

| 1 | ||

| 1 | ||

| 2 | ||

| 4 | ||

|

|

| |

|

|

5 | |

|

|

|

|

| 5 | ||

| 5 | ||

| 5 | ||

|

A. |

[RESERVED] |

5 |

|

B. |

Capitalization and Indebtedness |

5 |

|

C. |

Reasons for the Offer and Use of Proceeds |

5 |

|

D. |

Risk Factors |

5 |

| 48 | ||

|

A. |

History and Development of the Company |

48 |

|

B. |

Business Overview |

49 |

|

C. |

Organizational Structure |

75 |

|

D. |

Property, Plants and Equipment |

75 |

| 75 | ||

| 75 | ||

|

A. |

Operating Results |

80 |

|

B. |

Liquidity and Capital Resources |

87 |

|

C. |

Research and Development, Patents and Licenses |

87 |

|

D. |

Trend Information |

87 |

|

E. |

Critical Accounting Estimates |

88 |

| 89 | ||

|

A. |

Directors and Senior Management |

89 |

|

B. |

Compensation |

91 |

|

C. |

Board Practices |

94 |

|

D. |

Employees |

111 |

|

E. |

Share Ownership |

111 |

|

F |

Disclosure of a Registrant’s Action to Recover Erroneously Awarded Compensation |

112 |

| 113 | ||

|

A. |

Major Shareholders |

113 |

|

B. |

Related Party Transactions |

115 |

|

C. |

Interests of Experts and Counsel |

115 |

| 116 | ||

|

A. |

Consolidated Statements and Other Financial Information |

116 |

|

B. |

Significant Changes |

116 |

| 116 | ||

|

A. |

Offer and Listing Details |

116 |

|

B. |

Plan of Distribution |

116 |

|

C. |

Markets |

116 |

|

D. |

Selling Shareholders |

116 |

|

E. |

Dilution |

116 |

|

F. |

Expenses of the Issue |

116 |

| 117 | ||

|

A. |

Share Capital |

117 |

|

B. |

Articles of Association |

117 |

|

C. |

Material Contracts |

117 |

|

D. |

Exchange Controls |

117 |

|

E. |

Taxation |

117 |

|

F. |

Dividends and Paying Agents |

129 |

|

G. |

Statement by Experts |

129 |

|

H. |

Documents on Display |

129 |

|

I. |

Subsidiary Information |

129 |

|

J. |

Annual Report to Security Holders. |

129 |

| 130 | ||

| 130 | ||

|

A. |

Debt Securities |

130 |

|

B. |

Warrants and rights |

130 |

|

C. |

Other Securities |

130 |

|

D. |

American Depositary Shares |

130 |

|

|

|

|

|

|

130 | |

|

|

|

|

| 130 | ||

| 130 | ||

| 131 | ||

| 132 | ||

| 132 |

| 132 | ||

| 132 | ||

| 133 | ||

| 133 | ||

| 133 | ||

| 134 | ||

| 134 | ||

| 135 | ||

| 135 | ||

|

|

|

|

|

|

136 | |

|

|

|

|

| 136 | ||

| 136 | ||

| 136 | ||

| 139 | ||

|

|

● |

our ability to continue as a going concern;

|

|

|

● |

our history of losses and need for additional capital to fund our operations, and

our ability to obtain additional capital on acceptable terms, or at all; |

|

|

● |

our dependence on the success of our initial product candidate, PRF-110; |

|

|

● |

the outcomes of preclinical studies, clinical trials and other research regarding

PRF-110 and future product candidates; |

|

|

● |

our limited experience managing clinical trials; |

|

|

● |

our ability to retain key personnel and recruit additional employees; |

|

|

● |

our reliance on third parties for the conduct of clinical trials, product manufacturing

and development; |

|

|

● |

the impact of competition and new technologies; |

|

|

● |

our ability to comply with regulatory requirements relating to the development and

marketing of our product candidates; |

|

|

● |

our ability to establish and maintain strategic partnerships and other corporate collaborations;

|

|

|

● |

the implementation of our business model and strategic plans for our business and

product candidates; |

|

|

● |

the scope of protection we are able to establish and maintain for intellectual

property rights covering our product candidates and our ability to operate our business without infringing the intellectual property rights

of others; |

|

|

● |

the overall global economic environment; |

|

|

● |

our ability to develop an active trading market for our ordinary shares and whether

the market price of our ordinary shares is volatile; |

|

|

● |

statements as to the impact of the political and security situation

in Israel on our business, including due to the current security situation in Israel; and |

|

|

● |

those factors referred to in “Item 3.D. Risk Factors,” “Item 4.

Information on the Company,” and “Item 5. Operating and Financial Review and Prospects”, as well as in this Annual Report

on Form 20-F generally. |

|

|

Not applicable. |

|

|

Not applicable. |

|

A. |

[RESERVED] |

|

B. |

Capitalization and Indebtedness

Not applicable. |

|

C. |

Reasons for the Offer and Use of Proceeds

Not applicable. |

|

D. |

Risk Factors |

| |

● |

Our limited operating history may make it difficult for you to assess our future viability. We have never

generated revenues and may never be profitable; |

|

|

● |

The report of our independent registered public accounting firm contains an explanatory

paragraph regarding substantial doubt about our ability to continue as a going concern; |

|

|

● |

We have incurred significant losses and negative cash flows from operations since

our inception and expect to incur losses for the foreseeable future. We may never achieve or maintain profitability; |

|

|

● |

We will need substantial additional funding, which may not be available to us on acceptable

terms or at all. If we are unable to raise capital when needed, we may be forced to delay, reduce and/or eliminate our research and drug

development programs or future commercialization efforts; and |

|

|

● |

Raising additional capital may cause dilution to our shareholders, restrict our operations

or require us to relinquish rights to our product candidates. |

|

|

● |

We are dependent on the success of our initial product candidate, PRF-110. If we are unable to obtain

approval for and ultimately commercialize PRF-110 or experience significant delays in doing so, our business will be materially harmed.

|

|

|

● |

We have not yet commercialized any products or technologies, and we may never become

profitable; |

|

|

● |

If we are unable to successfully complete our clinical trial programs for PRF-110,

or if such clinical trials take longer to complete than we project, our ability to execute our current business strategy will be adversely

affected; |

|

|

● |

We have limited experience in conducting and managing clinical trials necessary to

obtain regulatory approvals. If our drug candidates and technologies do not receive the necessary regulatory approvals, we will be unable

to commercialize our products; |

|

|

● |

If third parties on which we will have to rely for clinical trials do not perform

as contractually required or as we expect, we may not be able to obtain regulatory approval for or commercialize our products; and

|

|

|

● |

If our competitors develop and market products that are less expensive or more effective

than our product, our revenues and results may be harmed and our commercial opportunities may be reduced or eliminated; |

|

|

● |

We recently entered into a new line of business that offers an AI software solution, which subjects us to additional risks.

|

|

|

● |

The market for our DeepSolar solution is new and unproven, may experience limited growth. |

|

|

● |

The market for AI-based software applications is relatively new and unproven and may decline or experience limited growth. Concerns

over the use of AI, including from regulators, the public and our customers, may hinder the adoption of AI technologies, which would adversely

affect our ability to fully realize the potential of the DeepSolar solution. |

|

|

● |

If we are not able to enhance our existing solution or introduce new solutions that achieve market acceptance and keep pace with

technological developments, our business, results of operations and financial condition could be harmed. |

|

|

● |

Our sales efforts involve considerable time and expense and the sales cycle is often long and unpredictable. |

|

|

● |

If we fail to scale our business operations or otherwise manage future growth of the DeepSolar business effectively as we attempt

to grow our company, we may not be able to market and sell the DeepSolar solution successfully. |

|

|

● |

We may face intense competition and expect competition to increase in the future, which could prohibit us from developing a customer

base and generating revenue. |

|

|

● |

Our DeepSolar business could be significantly disrupted if we lose key members of the DeepSolar team. |

|

|

●

|

If we are unable to maintain patent protection for our products, our competitors could

develop and commercialize products and technology similar or identical to our product candidates, and our ability to successfully commercialize

any product candidates we may develop, and our science may be adversely affected. |

|

|

● |

Conditions in the Middle East and in Israel may harm our operations. |

|

|

● |

Our business and operations would suffer in the event of IT system failures, cybersecurity attacks, data

breaches, or vulnerabilities in our or our third-party vendors’ information security program or defenses. |

|

|

● |

We may not be able to successfully identify and execute strategic alliances or other relationships with

third parties or to successfully manage the impacts of acquisitions, dispositions or relationships on our operations. |

|

|

●

|

If we fail to regain compliance with the Nasdaq minimum listing requirements, our

ordinary shares will be subject to delisting. Our ability to publicly or privately sell equity securities and the liquidity of our ordinary

shares could be adversely affected if our ordinary shares are delisted; |

|

|

● |

We are currently operating in a period of economic uncertainty and capital markets disruption,

which has been significantly impacted by geopolitical instability due to the ongoing military conflict between Israel and Hamas and Russia

and Ukraine; |

|

|

● |

Because we are not subject to compliance with rules requiring the adoption of certain

corporate governance measures, our shareholders have limited protections against interested director transactions, conflicts of interest

and similar matters; and |

|

|

● |

If we are unable to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act as they apply to

a foreign private issuer that is listed on a U.S. exchange, or our internal control over financial reporting is not effective, the reliability

of our financial statements may be questioned and our share price may suffer. |

|

|

● |

We have identified a material weakness in

our internal control over financial reporting. If our remediation of the material weakness is not effective, or we fail to develop and

maintain effective internal controls over financial reporting, our ability to produce timely and accurate financial statements or comply

with applicable laws and regulations could be impaired. |

|

|

● |

initiate and manage clinical trials for PRF-110; |

|

|

● |

integrate and expand our DeepSolar business; |

|

|

● |

seek regulatory approvals; |

|

|

● |

implement internal systems and infrastructures; |

|

|

● |

hire management and other personnel; and |

|

|

● |

progress PRF-110 towards commercialization. |

|

|

● |

the costs, timing and outcome of manufacturing clinical trial and commercial quantities

of PRF-110 |

|

|

● |

the scope, progress, results and costs of our current and future clinical trials of

PRF-110 for our current targeted uses; |

|

|

● |

the costs, timing and outcome of regulatory review of PRF-110; |

|

|

● |

the extent to which we acquire or invest in businesses, products and technologies,

including entering into or maintaining licensing or collaboration arrangements for PRF-110 on favorable terms, although we currently have

no commitments or agreements to complete any such transactions; |

|

|

● |

the costs and timing of future commercialization activities, including sales, marketing,

manufacturing and distribution, for any of our product candidates for which we receive marketing approval, to the extent that such sales,

marketing, manufacturing and distribution are not the responsibility of any collaborator that we may have at such time; |

|

● |

the cost to continue the development of the DeepSolar technology to develop a wider

portfolio of solutions; | |

|

● |

the cost of establishing a sales, marketing, and technical support infrastructure

to support the ramp up of the DeepSolar solution; | |

|

|

● |

the amount of revenue, if any, received from commercial sales of PRF-110, should it

receive marketing approval, or from the DeepSolar solution; |

|

|

● |

the costs of preparing, filing and prosecuting patent applications, maintaining, defending

and enforcing our intellectual property rights and defending intellectual property-related claims; |

|

|

● |

our ability to establish strategic collaborations, licensing or other arrangements

and the financial terms of any such agreements, including the timing and amount of any future milestone, royalty or other payments due

under any such agreement; |

|

|

● |

our headcount growth and associated costs as we expand our business operations and

our research and development activities; |

|

|

● |

the costs of operating as a public company; |

|

|

● |

maintaining minimum shareholders’ equity requirements under the Nasdaq rules;

and |

|

|

● |

the impact of the current war between Israel and Hamas which may exacerbate the magnitude

of the factors discussed above. |

|

● |

the outcome of further research and development of PRF-110 following the announcement

in December 2024 that the Phase 3 clinical trial did not satisfy the study’s primary endpoint; |

|

|

●

|

establishing supply arrangements with third-party raw materials and components suppliers,

and drug product manufacturers who can manufacture clinical trial and commercial quantities of PRF-110, and developing, validating and

maintaining a commercially-viable manufacturing process that is compliant with current Good Manufacturing Practices, or cGMP, at a scale

sufficient to meet anticipated demand, which will ultimately enable us to reduce our cost of manufacturing; |

|

|

● |

successfully initiating patient enrollment and completion of additional clinical trials

on a timely basis; |

|

|

● |

our ability to demonstrate PRF-110’s safety, tolerability and efficacy to the

FDA and any comparable foreign regulatory authority for marketing approval; |

|

|

● |

timely receipt of marketing approvals for PRF-110; |

|

|

● |

maintaining patent protection, trade secret protection and regulatory exclusivity,

both in the U.S. and internationally; |

|

|

● |

successfully defending and enforcing our proprietary rights in our intellectual property

portfolio; |

|

|

● |

avoiding and successfully defending against any claims that we have infringed, misappropriated

or otherwise violated any intellectual property of any third party; |

|

|

● |

the performance of any future collaborations; |

|

|

● |

our ability to timely complete any post-marketing approval commitments required by

the FDA or other applicable regulatory authorities; |

|

|

● |

establishing scaled production arrangements with third-party manufacturers to obtain

finished products that are compliant with cGMP and appropriately packaged for commercialization; |

|

|

● |

successful launch of commercial sales following any marketing approval; |

|

|

● |

maintaining an acceptable safety profile following any marketing approval; |

|

|

● |

commercial acceptance by patients, the medical community and third-party payors;

|

|

|

● |

the availability of coverage and adequate reimbursement and pricing by third-party

payors and government authorities; |

|

|

● |

the availability, perceived advantages, relative cost, relative safety and relative

efficacy of alternative and competing treatments; and |

|

|

● |

our ability to compete with other post-operative pain, or POP, treatments. |

|

|

● |

the timing of regulatory approvals in the requested countries, for the applications we seek; |

|

|

● |

competitive market environment; |

|

|

● |

the establishment and demonstration in the medical community of the safety and clinical

efficacy of our products and their potential advantages over existing therapeutic products; |

|

|

● |

our ability to enter into strategic agreements with pharmaceutical and biotechnology

companies with strong marketing and sales capabilities; |

|

|

● |

the adequacy and success of distribution and marketing efforts; and |

|

|

● |

the pricing and reimbursement policies of government and third-party payors, such

as insurance companies, health maintenance organizations and other plan administrators. |

|

|

● |

obtaining regulatory approvals (e.g., an Investigational New Drug, or IND, application)

to commence a clinical trial; |

|

|

● |

reaching agreement on acceptable terms with prospective contract research organizations,

or CROs, and trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and

trial sites; |

|

|

● |

slower than expected rates of patient recruitment due to narrow screening requirements

and competing clinical studies; |

|

|

● |

the inability of patients to meet protocol requirements imposed by the FDA or other

regulatory authorities; |

|

|

● |

the need or desire to modify our manufacturing process; |

|

|

● |

delays, suspension, or termination of the clinical trials due to the institutional

review board responsible for overseeing the study at a particular study site; and |

|

|

● |

governmental or regulatory delays or “clinical holds” requiring suspension

or termination of the trials. |

|

|

● |

assist us in developing, testing and obtaining regulatory approval; |

|

|

● |

manufacture our drug candidates; and |

|

|

● |

market and distribute our products. |

|

|

● |

perceptions by members of the health care community, including physicians, of the

safety and efficacy of our product; |

|

|

● |

the potential advantages that our product offers over existing treatment methods or

other products that may be developed; |

|

|

● |

the cost-effectiveness of our product relative to competing products; |

|

|

● |

the availability of government or third-party pay or reimbursement for our products;

and |

|

|

● |

the effectiveness of our or our partners’ sales, marketing and distribution

efforts. |

|

|

● |

litigation involving patients taking our drug; |

|

|

● |

restrictions on such drugs, manufacturers or manufacturing processes; |

|

|

● |

restrictions on the labeling or marketing of a drug; |

|

|

● |

restrictions on drug distribution or use; |

|

|

● |

requirements to conduct post-marketing studies or clinical trials; |

|

|

● |

warning letters or untitled letters; |

|

|

● |

withdrawal of the drugs from the market; |

|

|

● |

refusal to approve pending applications or supplements to approved applications that

we submit; |

|

|

● |

recall of drugs; |

|

|

● |

fines, restitution or disgorgement of profits or revenues; |

|

|

● |

suspension or withdrawal of marketing approvals; |

|

|

● |

damage to relationships with any potential collaborators; |

|

|

● |

exclusion from or restrictions on coverage by third-party payors; |

|

|

● |

unfavorable press coverage and damage to our reputation; |

|

|

● |

refusal to permit the import or export of drugs; |

|

|

● |

drug seizure; or |

|

|

● |

injunctions or the imposition of civil or criminal penalties. |

|

|

● |

decreased demand for a product; |

|

|

● |

damage to our reputation; |

|

|

● |

withdrawal of clinical trial volunteers; and |

|

|

● |

loss of revenues. |

|

|

● |

diversion of management’s attention, available cash, and other resources from

our existing business; |

|

|

● |

unanticipated liabilities or contingencies; |

|

|

● |

compliance with additional regulatory burdens; |

|

|

● |

potential damage to existing customer relationships, lack of customer acceptance or

inability to attract new customers; and |

|

|

● |

the inability to compete effectively in the new line of business. |

|

|

● |

we have not recruited adequate numbers

of effective sales and marketing personnel; |

|

|

|

|

|

|

● |

the challenge of sales personnel to obtain

access to potential customers; |

|

|

|

|

|

|

● |

unforeseen costs and expenses associated

with creating an independent sales and marketing organization. |

|

|

● |

result in costly litigation; |

|

|

● |

divert management’s attention and resources; |

|

|

● |

cause product shipment delays; and |

|

|

● |

require us to enter into royalty or licensing agreements. Such royalty or licensing

agreements, if required, may not be available on terms acceptable to us, if at all. |

|

|

● |

others may be able to make products that are similar to our product candidates or

utilize similar science or technology but that are not covered by the claims of the patents that we may own or license from our licensors

or that incorporate certain research in our product candidates that is in the public domain; |

|

|

● |

we might not have been the first to file patent applications covering our inventions;

|

|

|

● |

others may independently develop similar or alternative technologies or duplicate

any of our technologies without infringing our intellectual property rights; |

|

|

● |

issued patents that we hold rights to may be held invalid or unenforceable,

including as a result of legal challenges by our competitors or other third parties; |

|

|

●

|

our competitors or other third parties might conduct research and development activities

in countries where do not have patent rights and then use the information learned from such activities to develop competitive products

for sale in our major commercial markets; |

|

|

● |

the patents of others may harm our business if, for example, we are found to have

infringed those patents or if those patents serve as prior art to our patents which could potentially invalidate our patents; and

|

|

|

● |

we may choose not to file a patent in order to maintain certain trade secrets or know-how,

and a third party may subsequently file a patent covering such intellectual property, which could ultimately result in public disclosure

of the intellectual property if the third party’s patent application is published or issues to a patent. |

|

|

● |

the potential disruption of our ongoing business; |

|

|

● |

the distraction of management away from the ongoing oversight of our existing business

activities; |

|

|

● |

incurring additional indebtedness; |

|

|

● |

the anticipated benefits and cost savings of those transactions not being realized

fully, or at all, or taking longer to realize than anticipated; |

|

|

● |

an increase in the scope and complexity of our operations; and |

|

|

● |

the loss or reduction of control over certain of our assets. |

|

|

● |

less liquid trading market for our securities; |

|

|

● |

more limited market quotations for our securities; |

|

|

● |

determination that our ordinary shares and/or warrants are a “penny stock”

that requires brokers to adhere to more stringent rules and possibly resulting in a reduced level of trading activity in the secondary

trading market for our securities; |

|

|

● |

more limited research coverage by stock analysts; |

|

|

● |

loss of reputation; and |

|

|

● |

more difficult and more expensive equity financings in the future. |

|

|

● |

changes or developments in laws or regulations governing our business; |

|

|

● |

announcements of regulatory approvals or the failure to obtain them, or specific label

indications or patient populations for their use, or changes or delays in the regulatory review process; |

|

|

● |

unsatisfactory results of preclinical studies or clinical trials; |

|

|

● |

adverse actions taken by regulatory agencies with respect to our manufacturing supply

chain or sales and marketing activities; |

|

|

● |

announcements of innovations or new products by us or our competitors; |

|

|

● |

any intellectual property infringement, misappropriation or other actions in which

we may become involved; |

|

|

● |

any adverse changes to our relationships with manufacturers or suppliers; |

|

|

● |

announcements concerning our competitors; |

|

|

● |

achievement of expected product sales and profitability or our failure to meet expectations;

|

|

|

● |

our commencement of, or involvement in, litigation; and |

|

|

● |

any changes in our board of directors or management. |

|

ITEM 4.

INFORMATION ON THE COMPANY |

|

A. |

History and Development of the Company |

|

B. |

Business Overview |

|

|

● |

addressing unmet medical needs; |

|

|

● |

de-risked drug development by using long-established APIs and our patented, proprietary

extended release drug-delivery system; |

|

|

● |

reduced development costs; |

|

|

● |

rapid preclinical and clinical testing; |

|

|

● |

well understood paths to approval: and |

|

|

● |

the potential to disrupt current practices. |

|

|

● |

PRF-110 is highly viscous and thus stays in place when placed into a surgical wound

bed. |

|

|

● |

PRF-110 remains within the surgical site when the skin is closed, without being toxic

or proinflammatory. |

|

|

● |

PRF-110 is easy to administer and its use is consistent with current surgical practice.

|

|

|

● |

PRF-110 is highly uniform and resistant to degradation in the wound, resulting is

sustained,/extended release of the analgesic. |

|

|

● |

Ropivacaine, the active drug used in PRF-110, is a safe and well-characterized local

anesthetic. |

|

|

● |

The components that make up the remainder of the PRF-110 formulation are classified

as GRAS (Generally Regarded As Safe) by the FDA. |

|

|

● |

We have amassed a human toxicology portfolio for PRF-110, demonstrating that there

are no PRF-110-associated serious adverse events in either healthy controls or in surgical patients. |

|

|

● |

Based on extensive toxicology and pharmacokinetic studies, as well as positive Phase

2 results, the FDA has granted our company an IND for PRF-110 and approved the initiation of Phase 3 trials for the treatment of post-operative

pain. |

|

|

● |

Unlike many drug trials that take months to years to complete and which are complex

and whose endpoints are difficult to interpret, the planned trials are expected to last for 72 hours with a seven day and a one-month

follow-up, with primary endpoint of pain measurement on the familiar scale of 0 (no pain) to 10 (worst imaginable pain). |

|

|

● |

If and when approved for commercial sale, we intend to capitalize on the opportunity

and carry out post-approval trials in a number of additional surgical indications, including breast augmentation/reduction, bariatric

procedures, hysterectomy, cholecystectomy as well as orthopedic procedures including joint replacements and open fracture repair. We intend

to capitalize on these opportunities to become the leader in opiate-free, long-acting local and regional analgesia. |

|

|

● |

Hospitals; |

|

|

● |

Free-standing surgical centers; and |

|

|

● |

Surgical offices. |

|

|

● |

Posimir by Durect (DRRX). A bupivacaine collagen matrix was recently approved by the

FDA for only arthroscopic subacromial decompression (niche market ~600,000 annual procedures in the U.S.). |

|

|

● |

Xaracoll by Innocoll, a surgically implantable and bioresorbable bupivacaine-collagen

matrix, FDA approved the product for only open inguinal hernia repair. |

|

|

● |

Allay Therapeutics ATX-101, a product based on bupivacaine is in development stage.

|

|

|

●

|

TLC590, from the Taiwan Liposome Company, is a liposomal formulation of ropivacaine

that completed Phase II trials in patients following hernia surgery.

|

|

|

●

|

Cali Biosciences developing an injectable ropivacaine formulation CPL-01 which is currently in

phase III for bunion and hernia; and |

|

|

|

|

|

|

● |

Vertex pharmaceuticals, which completed phase III clinical studies in abdominoplasty

and bunionectomy with VX-548, a selective NaV1.8 inhibitor. |

|

|

● |

completion of preclinical laboratory tests, animal studies and formulation studies

in compliance with the FDA’s good laboratory practice, or GLP, regulations; |

|

|

● |

submission to the FDA of an IND, which must take effect before human clinical trials

begin; |

|

|

● |

approval by an independent institutional review board, or IRB, representing each clinical

site before each clinical trial may be initiated; |

|

|

● |

performance of adequate and well-controlled human clinical trials in accordance with

good clinical practices, or GCP, to establish the safety and efficacy of the proposed drug product for each proposed indication;

|

|

|

● |

preparation and submission to the FDA of an NDA requesting marketing for one or more

proposed indications; |

|

|

● |

review by an FDA advisory committee, where appropriate or if applicable; |

|

|

● |

satisfactory completion of one or more FDA inspections of the manufacturing facility

or facilities at which the product, or components thereof, are produced to assess compliance with current Good Manufacturing Practices,

or cGMP, requirements and to assure that the facilities, methods and controls are adequate to preserve the product’s identity, strength,

quality and purity; |

|

|

● |

satisfactory completion of FDA audits of clinical trial sites to assure compliance

with GCPs and the integrity of the clinical data; |

|

|

● |

payment of user fees and securing FDA approval of the NDA; and |

|

|

● |

compliance with any post-approval requirements, including the potential requirement

to implement a Risk Evaluation and Mitigation Strategy, or REMS, and the potential requirement to conduct post-approval studies.

|

|

Phase 1:

|

The drug is initially introduced into healthy human subjects or, in certain indications

such as cancer, patients with the target disease or condition and tested for safety, dosage tolerance, absorption, metabolism, distribution,

excretion and, if possible, to gain an early indication of its effectiveness and to determine optimal dosage.

|

|

Phase 2: |

The drug is administered to a limited patient population to identify possible adverse

effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted diseases and to determine dosage

tolerance and optimal dosage.

|

|

Phase 3: |

The drug is administered to an expanded patient population, generally at geographically

dispersed clinical trial sites, in well-controlled clinical trials to generate enough data to statistically evaluate the efficacy and

safety of the product for approval, to establish the overall risk-benefit profile of the product, and to provide adequate information

for the labeling of the product.

|

|

Phase 4: |

Post-approval studies, which are conducted following initial approval, are typically

conducted to gain additional experience and data from treatment of patients in the intended therapeutic indication. |

|

|

● |

restrictions on the marketing or manufacturing of the product, including total or

partial suspension of production, complete withdrawal of the product from the market or product recalls; |

|

|

● |

fines, warning letters or holds on post-approval clinical trials; |

|

|

● |

refusal of the FDA to approve pending NDAs or supplements to approved NDAs, or suspension

or revocation of product license approvals; |

|

|

● |

product seizure or detention, or refusal to permit the import or export of products;

or |

|

|

● |

injunctions or the imposition of civil or criminal penalties. |

|

|

● |

Compliance with the EU’s stringent pharmacovigilance and safety reporting rules,

pursuant to which inter alia post-authorization studies and additional monitoring obligations

can be imposed, has to be ensured. |

|

|

● |

The manufacturing of authorized drugs, for which a separate manufacturer’s license

is mandatory, must also be conducted in strict compliance with the EMA’s GMP requirements and comparable requirements of other regulatory

bodies in the EU, which mandate the methods, facilities and controls used in manufacturing, processing and packing of drugs to assure

their safety and identity. |

|

|

● |

The marketing and promotion of authorized drugs, including industry-sponsored continuing

medical education and advertising directed toward the prescribers of drugs, cooperation with healthcare professionals and advertising

of drugs directed to the general public, are strictly regulated in the EU notably under Directive 2001/83EC, as amended, and EU member

state laws. |

|

|

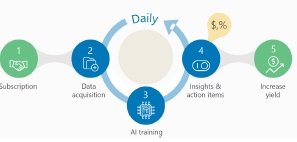

• |

PV Production Analytics: MyDeepSolar goes beyond conventional energy monitoring by factoring

in true irradiance levels. This enables precise performance assessments, ensuring that energy production is optimized under all conditions.

|

|

|

• |

Hardware Malfunction Alerts: The application continuously monitors inverters, panels, and

other critical components, automatically generating real-time alerts for any malfunctions. These notifications are delivered promptly,

reducing downtime and preventing further losses. |

|

|

• |

Losses Breakdown Analysis: MyDeepSolar quantifies energy losses caused by underperforming

devices, soiling levels, and other inefficiencies. This granular analysis empowers homeowners to identify and prioritize corrective actions

effectively. |

|

|

• |

Daily Prioritized Task Lists: The software provides actionable recommendations in real time,

tailored to specific needs such as cleaning schedules, hardware repairs, or system adjustments. Each task is quantified in terms of its

ROI impact, helping users make informed, data-driven decisions. |

|

|

• |

Comprehensive System Visibility: MyDeepSolar offers high-resolution diagnostics at the string

and panel levels, enabling users to understand exactly what is happening across their solar field and address issues with pinpoint accuracy.

|

|

|

• |

Seamless Integration: The application is fully compatible with existing monitoring solutions

and hardware, requiring no additional site visits or hardware installations. This frictionless process ensures easy adoption for homeowners.

|

|

|

• |

Cost Optimization: By automating diagnostics and reducing reliance on manual monitoring or

expensive analyst services, MyDeepSolar delivers savings on operational and maintenance costs. |

|

|

• |

the smart live monitoring feature which offers alerts, availability dashboards, and plots for raw data analysis, ensuring real-time

visibility into system performance; |

|

|

• |

performance analytics which delivers a full breakdown of losses, highlighting gaps between planned and actual outputs; |

|

|

• |

event management which prioritizes fault checks to address issues promptly and efficiently; |

|

|

• |

automatic verification which ensures full gain recovery by continuously validating system performance; |

|

|

• |

the report generator feature which provides detailed reports for any specified time range, enabling thorough analysis and informed

decision-making; and |

|

|

• |

management dashboards with customer-specific performance ratios and tailored insights to support strategic planning and operational

excellence. |

|

C. |

Organizational Structure |

|

D. |

Property, Plant and Equipment |

|

ITEM 4A.

UNRESOLVED STAFF COMMENTS |

|

ITEM

5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

| ● |

Implement our acquisition of the DeepSolar business; |

|

|

● |

continue the ongoing and planned preclinical and clinical development of our drug

candidates; |

|

|

● |

build a portfolio of drug candidates through the acquisition or in-license of drugs,

drug candidates or technologies; |

|

|

● |

initiate preclinical studies and clinical trials for any additional drug candidates

that we may pursue in the future; |

|

|

● |

seek marketing approvals for our current and future drug candidates that successfully

complete clinical trials; |

|

|

● |

establish a sales, marketing and distribution infrastructure to commercialize any

drug candidate for which we may obtain marketing approval; |

|

|

● |

develop, maintain, expand and protect our intellectual property portfolio; |

|

|

● |

implement operational, financial and management systems; and |

|

|

● |

attract, hire and retain additional administrative, clinical, regulatory and scientific

personnel. |

|

|

● |

employee-related expenses, including salaries, benefits and stock-based compensation

expense; |

|

|

● |

fees paid to consultants for services directly related to our drug development and

regulatory effort; |

|

|

● |

expenses incurred under agreements with contract research organizations, as well as CMOs and consultants

that conduct preclinical studies and clinical trials; |

|

|

● |

costs associated with preclinical activities and development activities; and

|

|

|

● |

costs associated with technology and intellectual property licenses. |

|

|

● |

number of clinical trials required for approval and any requirement for extension

trials; |

|

|

● |

per patient trial costs; |

|

|

● |

number of patients that participate in the clinical trials; |

|

|

● |

number of sites included in the clinical trials; |

|

|

● |

countries in which the clinical trial is conducted; |

|

|

● |

length of time required to enroll eligible patients; |

|

|

● |

potential additional safety monitoring or other studies requested by regulatory agencies;

and |

|

|

● |

efficacy and safety profile of the drug candidate. |

|

A. |

Operating Results |

|

|

Year ended December 31, |

|

||||||||||

|

|

|

2024 |

|

|

2023 |

|

|

2022 |

|

|||

|

Statements of comprehensive loss data: |

|

(US$ thousands) |

|

|||||||||

|

Research and development |

11,705 |

6,035 |

4,422 |

|||||||||

|

General and administrative |

2,968 |

3,549 |

4,447 |

|||||||||

|

Total operating loss |

14,673 |

9,584 |

8,869 |

|||||||||

|

financial (income) expenses, net |

(93 |

) |

(248 |

) |

86 |

|||||||

|

Loss before taxes |

14,580 |

9,336 |

8,783 |

|||||||||

|

Income tax expense |

8 |

8 |

9 |

|||||||||

|

Net loss |

14,588 |

9,344 |

8,792 |

|||||||||

|

JOBS Act Exemptions and Foreign Private Issuer Status |

|

|

● |

the sections of the Exchange Act regulating the solicitation of proxies, consents

or authorizations in respect of a security registered under the Exchange Act; |

|

|

● |

the sections of the Exchange Act requiring insiders to file public reports of their

stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; |

|

|

● |

the rules under the Exchange Act requiring the filing with the SEC of quarterly reports

on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K, upon the occurrence of specified

significant events; and |

|

|

● |

Regulation FD, which regulates selective disclosures of material information by issuers.

|

|

B. |

Liquidity and Capital Resources. |

|

|

● |

the costs, timing and outcome of manufacturing clinical trial and commercial quantities

of PRF-110 |

|

|

● |

the scope, progress, results and costs of our current and future clinical trials of

PRF-110 for our current targeted uses; |

|

|

● |

the costs, timing and outcome of regulatory review of PRF-110; |

|

|

● |

the extent to which we acquire or invest in businesses, products and technologies,

including entering into or maintaining licensing or collaboration arrangements for PRF-110 on favorable terms, although we currently have

no commitments or agreements to complete any such transactions; |

|

|

●

|

the costs and timing of future commercialization activities, including sales, marketing,

manufacturing and distribution, for any of our product candidates for which we receive marketing approval, to the extent that such sales,

marketing, manufacturing and distribution are not the responsibility of any collaborator that we may have at such time; |

|

|

● |

the cost to continue the development of the DeepSolar technology to develop a wider

portfolio of solutions; |

|

|

|

|

● |

the cost of establishing a sales, marketing, and technical support infrastructure to support the ramp up

of the DeepSolar solution; |

|

|

● |

the amount of revenue, if any, received from commercial sales of PRF-110, should it receive marketing approval,

or from DeepSolar solution; |

|

|

● |

the costs of preparing, filing and prosecuting patent applications, maintaining, defending

and enforcing our intellectual property rights and defending intellectual property-related claims; |

|

|

● |

our ability to establish strategic collaborations, licensing or other arrangements

and the financial terms of any such agreements, including the timing and amount of any future milestone, royalty or other payments due

under any such agreement; |

|

|

● |

our headcount growth and associated costs as we expand our business operations and

our research and development activities; |

|

|

● |

the costs of operating as a public company; |

|

|

● |

maintaining minimum shareholders’ equity requirements under the Nasdaq rules;

and |

|

|

|

|

● |

the impact of the current war between Israel and Hamas which may exacerbate the magnitude of the factors

discussed above. |

|

|

|

Payments due by period

|

||||||||||||||||||

|

|

|

(US$ thousands)

|

||||||||||||||||||

|

|

Less than

1 year |

1-3 Years

|

3-5 Years

|

More than 5 years

|

Total

|

|||||||||||||||

|

Obligations under master clinical research agreements(1) |

1,730 |

-

|

-

|

-

|

1,730

|

|||||||||||||||

|

Years ended December 31, |

||||||||||||

|

(US$ thousands) |

||||||||||||

|

|

2024 |

2023 |

2022 |

|||||||||

|

Net cash used in operating activities |

(12,621 |

) |

(6,679 |

) |

(6,459 |

) | ||||||

|

Net cash provided by (used in) investing activities |

(13 |

) |

5,991 |

(6,006 |

) | |||||||

|

Net cash provided by financing activities |

8,863 |

4,616 |

- |

|||||||||

|

Effect of Exchange rate changes on cash, cash equivalents and restricted cash |

6 |

2 |

- |

|||||||||

|

(Decrease) Increase in cash and cash equivalents and restricted cash |

(3,765 |

) |

3,930 |

(12,465 |

) | |||||||

|

Cash and cash equivalents and restricted cash, at the beginning of the year |

8,036 |

4,106 |

16,571 |

|||||||||

|

Cash and cash equivalents and restricted cash, at the end of the year |

4,271 |

8,036 |

4,106 |

|||||||||

|

C. |

Research and Development, Patents and Licenses |

|

D. |

Trend Information |

|

E. |

Critical Accounting Estimates |

|

ITEM 6.

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

|

A. |

Directors and Senior Management |

|

Name |

|

Age |

|

Position |

|

Senior Management |

|

|

|

|

|

Dr. Ehud Geller |

|

78 |

|

Interim Chief Executive Officer, Executive Chairman of the Board, and Director |

| Eyal Broder | 54 | Interim Chief Financial Officer | ||

|

Prof. Eli Hazum |

|

77 |

|

Chief Technology Officer and Director |

|

Dr. Sigal Aviel |

|

61 |

|

Chief Operating Officer |

|

Rita Keynan |

|

56 |

|

Vice President of Pharmaceutical Operations |

|

|

|

|

|

|

|

Non-Employee Director |

|

|

|

|

|

|

|

|

||

|

Efi Cohen-Arazi(1) (2) (3) (4) |

|

70 |

|

Director |

|

Dr. Ellen S. Baron(1) (2) (3)(4) |

|

72 |

|

External Director |

|

Augustine Lawlor(1) (2) (3)(4) |

|

69 |

|

External Director |

|

(1) |

Member of the Compensation Committee |

|

(2) |

Member of the Audit Committee |

|

(3) |

Independent Director under Israeli Law |

|

(4) |

Independent Director under the Nasdaq Listing Rules |

|

B. |

Compensation |

|

|

Salaries, fees, commissions, and bonuses |

Pension, retirement and similar benefits |

Value of Options Granted(1) |

|||||||||

|

|

(in thousands of U.S. dollars) |

(in thousands of U.S. dollars) |

(in thousands of U.S. dollars)

|

|||||||||

|

All senior management and directors as a group, consisting of 8 persons |

1,348

|

198 |

304 |

|||||||||

|

(1) |

Consists of amounts recognized as share-based compensation expense for the year ended

December 31, 2024. Assumptions and key variables used in the calculation of such amounts are discussed in Note 10 of our financial statements.

|

|

Name and Position(1)

|

Salary |

Social

Benefits

(2) |

Bonuses |

Value of Options

Granted

(3) |

All Other

Compensation(4)

|

Total |

||||||||||||||||||

|

|

(in thousands of U.S. dollars) |

|||||||||||||||||||||||

|

Ehud Geller,

Interim Chief Executive Officer and Chairman |

- |

- |

- |

31 |

150 |

181 | ||||||||||||||||||

|

Sigal Aviel

Chief Operating Officer |

281 |

49 |

- |

17 |

- |

347 | ||||||||||||||||||

|

Rita Keynan

Vice President of Pharmaceutical Operations |

230 | 57 |

- |

68 |

- |

355 | ||||||||||||||||||

|

Eyal Broder,

Interim Chief Financial Officer |

153 | 50 | 32 | - |

- |

235 | ||||||||||||||||||

|

Eli Hazum

Chief Technology Officer |

- |

- |

- |

23 |

144 |

167 | ||||||||||||||||||

|

(1) |

All executive officers listed in the table were employed on a full-time basis during 2024. |

|

(2) |

“Social Benefits” include payments to the National Insurance Institute,

advanced education funds, managers’ insurance and pension funds, vacation pay and recuperation pay as mandated by Israeli law.

|

|

(3) |

Consists of amounts recognized as share-based compensation expense for the year ended

December 31, 2024. Assumptions and key variables used in the calculation of such amounts are discussed in Note 10 of our financial statements.

|

|

(4) |

“All Other Compensation” includes chairman of the board of directors’ annual fee and

directors’ consulting related fees. |

|

C. |

Board Practices |

|

|

● |

at least a majority of the shares of non-controlling shareholders or shareholders

that do not have a personal interest in the approval voted at the meeting are voted in favor (disregarding abstentions); or |

|

|

● |

the total number of shares of non-controlling shareholders or shareholders that do

not have a personal interest in the approval voted against the proposal does not exceed 2% of the aggregate voting rights in the company.

|

|

|

● |

an employment relationship; |

|

|

● |

a business or professional relationship maintained on a regular basis; |

|

|

● |

control; and |

|

|

● |

service as an office holder, excluding service as a director in a private company

prior to the first offering of its shares to the public if such director was appointed as a director of the private company in order to

serve as an external director following the initial public offering. |

|

|

●

|

such majority includes at least a majority of the shares held by shareholders who

are non-controlling shareholders and do not have a personal interest in the election of the external director (other than a personal interest

not deriving from a relationship with a controlling shareholder) that are voted at the meeting, excluding abstentions, to which we refer

as a disinterested majority; or |

|

|

● |

the total number of shares voted by non-controlling shareholders and by shareholders

who do not have a personal interest in the election of the external director, against the election of the external director, does not

exceed 2% of the aggregate voting rights in the company. |

|

|

●

|

his or her service for each such additional term is recommended by one or more shareholders

holding at least 1% of the company’s voting rights and is approved at a shareholders meeting by a disinterested majority, where

the total number of shares held by non-controlling, disinterested shareholders voting for such reelection exceeds 2% of the aggregate

voting rights in the company. In such event, the external director so reappointed may not be a Related or Competing Shareholder, as defined

below, or a relative of such shareholder, at the time of the appointment, and is not and has not had any affiliation with a Related or

Competing Shareholder, at such time or during the two years preceding such person’s reappointment to serve an additional term as

external director. The term “Related or Competing Shareholder” means a shareholder proposing the reappointment or a shareholder

holding 5% or more of the outstanding shares or voting rights of the company, provided, that at the time of the reappointment, such shareholder,

the controlling shareholder of such shareholder, or a company controlled by such shareholder, have a business relationship with the company

or are competitors of the company; |

|

|

● |

the external director proposed his or her own nomination, and such nomination was

approved in accordance with the requirements described above; |

|

|

● |

his or her service for each such additional term is recommended by the board of directors

and is approved at a shareholders meeting by the same majority required for the initial election of an external director (as described

above). |

|

|

●

|

he or she meets the qualifications for being appointed as an external director, except

for the requirement that the director be an Israeli resident (which does not apply to companies whose securities have been offered outside

of Israel or are listed outside of Israel); and |

|

|

● |

he or she has not served as a director of the company for a period exceeding nine

consecutive years, provided that, for this purpose, a break of less than two years in service shall not be deemed to interrupt the continuation

of the service. |

|

|

● |

retaining and terminating our independent auditors, subject to the ratification of

the board of directors, and in the case of retention, to that of the shareholders; |

|

|

● |

pre-approving of audit and non-audit services and related fees and terms, to be provided

by the independent auditors; |

|

|

● |

overseeing the accounting and financial reporting processes of the Company and audits

of our financial statements, the effectiveness of our internal control over financial reporting and making such reports as may be required

of an audit committee under the rules and regulations promulgated under the Exchange Act; |

|

|

● |

reviewing with management and our independent auditor our annual and quarterly financial

statements prior to publication or filing (or submission, as the case may be) to the SEC; |

|

|

●

|

recommending to the board of directors the retention and termination of the internal

auditor, and the internal auditor’s engagement fees and terms, in accordance with the Companies Law as well as approving the yearly

or periodic work plan proposed by the internal auditor; |

|

|

● |

reviewing with our general counsel and/or external counsel, as deem necessary, legal

and regulatory matters that could have a material impact on the financial statements; |

|

|

● |

identifying irregularities in our business administration, inter alia, by consulting

with the internal auditor or with the independent auditor, and suggesting corrective measures to the board of directors; and |

|

|

●

|

reviewing policies and procedures with respect to transactions (other than transactions

related to the compensation or terms of services) between the company and officers and directors, or affiliates of officers or directors,

or transactions that are not in the ordinary course of the Company’s business and deciding whether to approve such acts and transactions

if so required under the Companies Law. |

|

|

●

|

determining whether there are deficiencies or irregularities in the business management

practices of our company, including in consultation with our internal auditor or the independent auditor, and making recommendations to

the board of directors to improve such practices; |

|

|

● |

determining the approval process for transactions with a controlling shareholder or

in which a controlling shareholder has a personal interest; |

|

|

● |

determining whether to approve certain related party transactions (including transactions

in which an office holder has a personal interest and whether such transaction is extraordinary or material under Companies Law) (see

“- Approval of Related Party Transactions under Israeli Law”); |

|

|

● |

where the board of directors approves the working plan of the internal auditor, to

examine such working plan before its submission to the board of directors and proposing amendments thereto; |

|

|

● |

examining our internal controls and internal auditor’s performance, including

whether the internal auditor has sufficient resources and tools to dispose of its responsibilities; |

|

|

● |

examining the scope of our auditor’s work and compensation and submitting a

recommendation with respect thereto to our board of directors or shareholders, depending on which of them is considering the appointment

of our auditor; and |

|

|

● |

establishing procedures for the handling of employees’ complaints as to the

management of our business and the protection to be provided to such employees. |

|

|

● |

Officers’ interests are as closely as possible aligned with our interests;

|

|

|

● |

The correlation between pay and performance will be enhanced; |

|

|

● |

We will be able to recruit and retain top level executives capable of leading us to further business success,

facing the challenges ahead; |

|

|

● |

Our officers will be motivated to achieve a high level of business performance without taking unreasonable

risks. Therefore, the variable compensation component may not be based on extreme business performance goals which might potentially impose

unreasonable risks on our officers; and |

|

|

● |

An appropriate balance between different compensation elements (e.g., fixed vs. variable, short-term vs.

long-term and cash payments vs. equity-based compensation). |

|

|

●

|

recommending whether a compensation policy should continue in effect, if the then-current

policy has a term of greater than five years from the company’s initial public offering, or otherwise three years (approval of either

a new compensation policy or the continuation of an existing compensation policy must in any case occur five years from the company’s

initial public offering, or otherwise every three years); |

|

|

● |

recommending to the board of directors periodic updates to the compensation policy;

|

|

|

● |

assessing implementation of the compensation policy; |

|

|

● |

determining whether to approve the terms of compensation of certain office holders

which, according to the Companies Law, require the committee’s approval; and |

|

|

● |

determining whether the compensation terms of a candidate for the position of the

chief executive officer of the company needs to be brought to approval of the shareholders according to the Companies Law. |

|

|

● |

the responsibilities set forth in the compensation policy; |

|

|

● |

reviewing and approving the granting of options and other incentive awards to the

extent such authority is delegated by our board of directors; and |

|

|

● |

reviewing, evaluating and making recommendations regarding the compensation and benefits

for our non-employee directors. |

|

|

● |

overseeing our corporate governance functions on behalf of the board; |

|

|

● |

making recommendations to the board regarding corporate governance issues; |

|

|

● |

identifying and evaluating candidates to serve as our directors consistent with the

criteria approved by the board; |

|

|

● |

reviewing and evaluating the performance of the board; |

|

|

● |

serving as a focal point for communication between director candidates, non-committee

directors and our management; selecting or recommending to the board for selection candidates to the board; and |

|

|

● |

making other recommendations to the board regarding affairs relating to our directors.

|

|

|

● |

a person (or a relative of a person) who holds more than 5% of the company’s

outstanding shares or voting rights; |

|

|

● |

a person (or a relative of a person) who has the power to appoint a director or the

general manager of the company; |

|

|

● |

an office holder or director (or a relative of an officer or director) of the company;

or |

|

|

● |

a member of the company’s independent accounting firm, or anyone on its behalf.

|

|

|

● |

information on the advisability of a given action brought for his or her approval

or performed by virtue of his or her position; and |

|

|

● |

all other important information pertaining to these actions. |

|

|

● |

refrain from any act involving a conflict of interest between the performance of his

or her duties to the company and his or her other duties or personal affairs; |

|

|

● |

refrain from any activity that is competitive with the company; |

|

|

● |

refrain from exploiting any business opportunity of the company to receive a personal

gain for himself or herself or others; and |

|

|

● |

disclose to the company any information or documents relating to the company’s

affairs which the office holder received as a result of his or her position as an office holder. |

|

|

● |

a transaction other than in the ordinary course of business; |

|

|

● |

a transaction that is not on market terms; or |

|

|

● |

a transaction that may have a material impact on the company’s profitability,

assets, or liabilities. |

|

|

● |

an amendment of the articles of association of the company; |

|

|

● |

an increase in the company’s authorized share capital; |

|

|

● |

a merger; or |

|

|

● |

the approval of related party transactions and acts of office holders that require shareholder approval.

|

|

|

●

|

financial liability imposed on him or her in favor of another person pursuant to a

judgment, including a settlement or arbitrator’s award approved by a court. However, if an undertaking to indemnify an office holder

with respect to such liability is provided in advance, then such an undertaking must be limited to events which, in the opinion of the

board of directors, can be foreseen based on the company’s activities when the undertaking to indemnify is given, and to an amount

or according to criteria determined by the board of directors as reasonable under the circumstances, and such undertaking must detail

the abovementioned foreseen events and amount or criteria; |

|

|

●

|

reasonable litigation expenses, including attorneys’ fees, incurred by the office holder: (i) as

a result of an investigation or proceeding instituted against him or her by an authority authorized to conduct such investigation or proceeding,

provided that (a) no indictment was filed against such office holder as a result of such investigation or proceeding and (b) no financial

liability was imposed upon him or her as a substitute for the criminal proceeding as a result of such investigation or proceeding or,

if such financial liability was imposed, it was imposed with respect to an offense that does not require proof of criminal intent; and

(ii) in connection with a monetary sanction; |

|

|

● |

expenses associated with an administrative procedure, as defined in the Israeli Securities

Law, conducted regarding an office holder, including reasonable litigation expenses and reasonable attorneys’ fees; and |

|

|

● |

reasonable litigation expenses, including attorneys’ fees, incurred by the office

holder or imposed by a court in proceedings instituted against him or her by the company, on its behalf, or by a third party or in connection

with criminal proceedings in which the office holder was acquitted or as a result of a conviction for an offense that does not require

proof of criminal intent. |

|

|

● |

a breach of duty of care to the company or to a third party, including a breach arising out of the negligent

conduct of the office holder; |

|

|

● |

a breach of fiduciary duty to the company, to the extent that the office holder acted in good faith and

had a reasonable basis to believe that the act would not prejudice the company; |

|

|

● |

a monetary liability imposed on the office holder in favor of a third party; and |

|

|

● |

expenses incurred by an office holder in connection with an administrative procedure, including reasonable

litigation expenses and reasonable attorneys’ fees. |

|

|

● |

a breach of fiduciary duty, except for indemnification and insurance for a breach of the fiduciary duty

to the company and to the extent that the office holder acted in good faith and had a reasonable basis to believe that the act would not

prejudice the company; |

|

|

● |

a breach of duty of care committed intentionally or recklessly, excluding a breach arising out of the negligent

conduct of the office holder; |

|

|

● |

an act or omission committed with intent to derive illegal personal benefit; or |

|

|

● |

a fine or forfeit levied against the office holder. |

|

D. |

Employees. |

|

E. |

Share Ownership. |

|

F. |

Disclosure of a Registrant’s Action to Recover Erroneously

Awarded Compensation |

|

ITEM 7.

MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS |

|

A. |

Major Shareholders |

|

|

● |

each of our directors and senior management; |

|

|

● |

all of our directors and senior management as a group; and |

|

|

● |

each person (or group of affiliated persons) known by us to be the beneficial owner of 5% or more of the

outstanding ordinary shares. |

|

|

Ordinary Shares Beneficially Owned |

Percentage Owned** |

||||||

|

Senior Management and Directors |

||||||||

|

Dr. Ehud Geller(1) |

21,546 |

1.2 |

% | |||||

|

Eyal Broder (2) |

1,733 |

* | ||||||

|

Dr. Sigal Aviel(3) |

5,045 |

* |

||||||

|

Rita Keynan(4) |

3,952 |

* |

||||||

|

Prof. Eli Hazum(5) |

2,368 |

* |

||||||

|

Ellen S. Baron(6) |

765 |

* |

||||||

|

Augustine Lawlor(7) |

765 |

* |

||||||

|

Efi Cohen-Arazi(8) |

1,327 |

* |

||||||

|

All senior management and directors as a group (8 persons) |

37,501 |

2.0 |

% | |||||

|

More than 5% Shareholders |

||||||||

|

Bladeranger Ltd (9) |

402,561 |

19.1 |

% | |||||

|

* |

Less than 1% |

|

|

|

|

** |

Based on 1,885,001 ordinary shares outstanding. |

|

(1)

|

Consists of 13,720 beneficially owned by the Zori Medica III Ltd., or Zori Medica

III, which includes Zori Medica III Ltd FBO Medica III Investments (International) L.P. which holds 4,637 ordinary shares, Zori Medica

III Ltd. FBO Medica III Investments (Israel) (B) L.P. which holds 2,381 ordinary shares, Zori Medica III Ltd. FBO Poalim Medica III Investments

L.P. which holds 2,198 ordinary shares, Zori Medica III Ltd. FBO Medica III Investments (S.F.) L.P. which holds 1,832 ordinary shares,

Zori Medica III Ltd. FBO Medica III Investments (Israel) L.P. which holds 1,686 ordinary shares, and Zori Medica III Ltd. FBO Medica III

Investments (P.F.) L.P. which holds 986 ordinary shares and Dr. Ehud Geller who holds options to purchase 7,826 ordinary shares that are

currently exercisable average exercise price of $50.0 per share and expiring on October 10, 2034 or will be exercisable within 60 days

from April 1, 2025. Zori Medica III Management L.P., an entity held 50% by Dr. Ehud Geller and 50% by Batsheva Elran, is the managing

entity of Zori Medica III. The principal business address of Zori Medica III is 60C Medinat Hayehudim, Herzliya, 4676670, Israel. Does

not include options to purchase 188 ordinary shares approved for issuance to Mr. Geller. Such options are exercisable at $141.4 per share

and expiring on June 8, 2033, that vest in more than 60 days from April 1, 2025. |

|

(2) |

Consists of options to purchase 900 ordinary shares exercisable at $6.0 per share