UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2025

Commission File Number: 001-41356

Electra Battery Materials Corporation

(Translation of registrant's name into English)

133 Richmond St W, Suite 602

Toronto, Ontario, Canada

M5H 2L3

(416) 900-3891

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

DOCUMENTS INCLUDED AS PART OF THIS REPORT

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Electra Battery Materials Corporation | ||

| (Registrant) | ||

| Date: March 28, 2025 | /s/ Trent Mell | |

| Trent Mell | ||

| Chief Executive Officer and Director | ||

Exhibit 99.1

ELECTRA BATTERY MATERIALS CORPORATION

CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(EXPRESSED IN THOUSANDS OF CANADIAN DOLLARS)

Report of Management’s Accountability

The accompanying audited consolidated financial statements of Electra Battery Materials Corporation were prepared by management in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board. Management acknowledges responsibility for significant accounting judgements and estimates and for the choice of accounting principles and methods that are appropriate to the Company’s circumstances.

Management has implemented appropriate processes to support management representations that it has exercised reasonable diligence that the consolidated financial statements fairly present, in all material respects, the financial condition, financial performance and cash flows of the Company, as of the date of and for the periods presented in the consolidated financial statements.

The Board of Directors is responsible for reviewing and approving the audited consolidated financial statements to ensure the Company fulfills its financial reporting responsibilities. The Board of Directors carries out this responsibility principally through its Audit Committee.

The Audit Committee is appointed by the Board of Directors and all of its members are non-management Directors. The Audit Committee reviews the consolidated financial statements, management’s discussion and analysis and the external auditors’ report; examines the fees and expenses for audit services; and considers the engagement or reappointment of the external auditors. The Audit Committee reports its findings to the Board of Directors for its consideration when approving the consolidated financial statements for issuance. MNP LLP, the external auditors, have full and free access to the Audit Committee.

| “Trent Mell” | “Marty Rendall” | |

| President and Chief Executive Officer | Chief Financial Officer |

March 28, 2025

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors of Electra Battery Materials Corporation

Opinion on the Consolidated Financial Statements

We have audited the accompanying consolidated statements of financial position of Electra Battery Materials Corporation (the “Company") as at December 31, 2024 and 2023 and the related consolidated statements of loss and other comprehensive loss, shareholders’ equity, and cash flows for each of the years in the two-year period ended December 31, 2024, and the related notes (collectively referred to as the “consolidated financial statements”).

In our opinion, the consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Company as at December 31, 2024 and 2023, and the results of its consolidated operations and its consolidated cash flows for each of the years in the two-year period ended December 31, 2024, in conformity with IFRS® Accounting Standards as issued by the International Accounting Standards Board.

Material Uncertainty Related to Going Concern

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 of the consolidated financial statements, the Company has suffered recurring losses and negative cash flows from operations which raises substantial doubt about its ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 1. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Change in Accounting Principle

As discussed in Note 4 to the consolidated financial statements, the Company has changed its method of accounting for the classification of convertible notes as current or non-current as of January 1, 2023 due to the adoption of amendments to IAS 1 – Non- current liabilities with covenants.

Basis for Opinion

These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s consolidated financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

MNP LLP

| 1 Adelaide Street East, Suite 1900, Toronto ON, M5C 2V9 | 1.877.251.2922 T: 416.596.1711 F: 416.596.7894 |

Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provide a reasonable basis for our opinion.

Chartered Professional Accountants

Licensed Public Accountants

March 28, 2025

Toronto, Ontario

We have served as the Company’s auditor since 2023.

1 Adelaide Street East, Suite 1900, Toronto, Ontario, M5C 2V9

| 1.877.251.2922 T: 416.596.1711 F: 416.596.7894 MNP.ca |  |

ELECTRA BATTERY MATERIALS CORPORATION

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

AS AT DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

| December 31, 2024 |

December 31, 2023 (Restated Note 4) |

|||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 3,717 | $ | 7,560 | ||||

| Restricted cash | - | 888 | ||||||

| Marketable securities (Note 8) | 12 | 595 | ||||||

| Prepaid expenses and deposits | 672 | 468 | ||||||

| Receivables (Note 5) | 1,310 | 1,081 | ||||||

| 5,711 | 10,592 | |||||||

| Non-Current Assets | ||||||||

| Exploration and evaluation assets (Note 7) | 93,200 | 85,634 | ||||||

| Property, plant and equipment (Note 6) | 51,189 | 51,258 | ||||||

| Capital long-term prepayments (Note 6) | 139 | - | ||||||

| Long-term restricted cash | 1,208 | 1,208 | ||||||

| Total Assets | $ | 151,447 | $ | 148,692 | ||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Current Liabilities | ||||||||

| Accounts payable and accrued liabilities | $ | 3,579 | $ | 8,828 | ||||

| Accrued interest | 2,799 | 5,730 | ||||||

| Convertible notes payable (Note 11) | 63,963 | 40,101 | ||||||

| Warrants (Note 11) | 1,582 | 1,421 | ||||||

| US warrants (Note 14 (c)) | - | 7 | ||||||

| Lease liability (Note 12) | 50 | 43 | ||||||

| 71,973 | 56,130 | |||||||

| Non-Current Liabilities | ||||||||

| Government loan payable (Note 10) | 7,824 | 4,299 | ||||||

| Government grants (Note 10) | 3,124 | 849 | ||||||

| Royalty (Note 11) | 1,283 | 858 | ||||||

| Lease liability (Note 12) | 83 | 132 | ||||||

| Asset retirement obligations (Note 9) | 2,842 | 3,126 | ||||||

| Total Liabilities | $ | 87,129 | $ | 65,394 | ||||

| Shareholders’ Equity | ||||||||

| Common shares (Note 13) | 307,723 | 304,721 | ||||||

| Reserve (Note 14) | 26,848 | 25,579 | ||||||

| Accumulated other comprehensive loss | 4,639 | (1,557 | ) | |||||

| Deficit | (274,892 | ) | (245,445 | ) | ||||

| Total Shareholders’ Equity | $ | 64,318 | $ | 83,298 | ||||

| Total Liabilities and Shareholders’ Equity | $ | 151,447 | $ | 148,692 | ||||

Going Concern (Note 1)

Commitments and Contingencies (Note 21)

Subsequent events (Note 24)

Approved on behalf of the Board of Directors and authorized for issue on March 28, 2025

| Susan Uthayakumar, Director | Trent Mell, Director |

See accompanying notes to consolidated financial statements.

| Page |

ELECTRA BATTERY MATERIALS CORPORATION

CONSOLIDATED STATEMENTS OF LOSS AND OTHER COMPREHENSIVE LOSS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

| For the years ended December 31, | ||||||||

| 2024 | 2023 | |||||||

| Operating expenses | ||||||||

| General and administrative | $ | 2,902 | $ | 2,395 | ||||

| Consulting and professional fees | 3,782 | 4,659 | ||||||

| Exploration and evaluation expenditures | 442 | 700 | ||||||

| Investor relations and marketing | 811 | 633 | ||||||

| Salaries and benefits | 4,318 | 3,775 | ||||||

| Share-based payments (Note 14) | 1,739 | 1,821 | ||||||

| Operating loss before noted items below: | 13,994 | 13,983 | ||||||

| Other | ||||||||

| Unrealized gain (loss) on marketable securities (Note 8) | 41 | (253 | ) | |||||

| (Loss) gain on financial derivative liability – Convertible Notes (Note 11) | (4,493 | ) | 6,683 | |||||

| Changes in fair value of US Warrant (Note 14 (c)) | 7 | 1,243 | ||||||

| Other non-operating loss (Note 16) | (11,008 | ) | (6,472 | ) | ||||

| Impairment (Note 6) | - | (51,884 | ) | |||||

| Net loss | $ | (29,447 | ) | $ | (64,666 | ) | ||

| Other comprehensive income (loss): | ||||||||

| Fair value adjustment of 2028 Notes due to credit risk | (1,342 | ) | - | |||||

| Foreign currency translation gain (loss) | 7,538 | (2,082 | ) | |||||

| Net loss and other comprehensive loss | $ | (23,251 | ) | $ | (66,748 | ) | ||

| Basic and diluted loss per share (Note 17) | $ | (2.07 | ) | $ | (5.96 | ) | ||

| Weighted average number of common shares outstanding - Basic and diluted (Note 17) | 14,256,263 | 10,857,737 | ||||||

See accompanying notes to consolidated financial statements.

| Page |

ELECTRA BATTERY MATERIALS CORPORATION

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

| Common Shares | ||||||||||||||||||||||||

| Number of shares (1) | Amount | Reserves | Accumulated Other Comprehensive Income (Loss) |

Deficit | Total | |||||||||||||||||||

| Balance – January 1, 2024 | 13,962,832 | $ | 304,721 | $ | 25,579 | $ | (1,557 | ) | $ | (245,445 | ) | $ | 83,298 | |||||||||||

| Other comprehensive earnings for the period, net of taxes | - | - | - | 6,196 | - | 6,196 | ||||||||||||||||||

| Net loss for the period | - | - | - | - | (29,447 | ) | (29,447 | ) | ||||||||||||||||

| Share-based payment expense | - | - | 1,739 | - | - | 1,739 | ||||||||||||||||||

| Directors’ fees paid in deferred share units | - | - | 29 | - | - | 29 | ||||||||||||||||||

| Proceeds from issuance of shares, net of transaction costs (Note 11) | 443,225 | 1,221 | - | - | - | 1,221 | ||||||||||||||||||

| Warrants issued in connection with 2027 Notes, net of transaction costs (Note 11) | - | - | 605 | - | - | 605 | ||||||||||||||||||

| Performance based incentive payment (Note 13) | 41,314 | 134 | - | - | - | 134 | ||||||||||||||||||

| Exercise of restricted and performance share units (Note 13) | 151,066 | 1,104 | (1,104 | ) | - | - | - | |||||||||||||||||

| Settlement of interest on 2028 Notes (Notes 11 and 13) | 210,760 | 543 | - | - | - | 543 | ||||||||||||||||||

| Balance – December 31, 2024 | 14,809,197 | $ | 307,723 | $ | 26,848 | $ | 4,639 | $ | (274,892 | ) | $ | 64,318 | ||||||||||||

| Balance – January 1, 2023 | 8,796,494 | $ | 288,871 | $ | 17,892 | $ | 525 | $ | (180,779 | ) | $ | 126,509 | ||||||||||||

| Other comprehensive loss for the period, net of taxes | - | - | - | (2,082 | ) | - | (2,082 | ) | ||||||||||||||||

| Net loss for the period | - | - | - | - | (64,666 | ) | (64,666 | ) | ||||||||||||||||

| Share-based payment expense | - | - | 1,226 | - | - | 1,226 | ||||||||||||||||||

| Directors’ fees paid in deferred share units | - | - | 595 | - | - | 595 | ||||||||||||||||||

| Exercise of warrants, options, deferred share units, performance share units and restricted share units | 763 | 17 | (17 | ) | - | - | - | |||||||||||||||||

| Proceeds from issuance of shares, net of transaction costs | 4,886,364 | 14,077 | 5,883 | - | - | 19,960 | ||||||||||||||||||

| Settlement transaction costs on 2028 Notes | 19,375 | 240 | - | - | - | 240 | ||||||||||||||||||

| Convertible notes conversion | 92,136 | 998 | - | - | - | 998 | ||||||||||||||||||

| Settlement of interest on 2028 Notes (Note 11) | 165,200 | 795 | - | - | - | 795 | ||||||||||||||||||

| 2022 Private Placement transaction costs | - | (284 | ) | - | - | - | (284 | ) | ||||||||||||||||

| Settlement of easement | 2,500 | 7 | - | - | - | 7 | ||||||||||||||||||

| Balance – December 31, 2023 | 13,962,832 | $ | 304,721 | $ | 25,579 | $ | (1,557 | ) | $ | (245,445 | ) | $ | 83,298 | |||||||||||

| (1) | Reflects the Company’s consolidation of common shares, see Note 13(a) for details. |

See accompanying notes to consolidated financial statements.

| Page |

ELECTRA BATTERY MATERIALS CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

| Year ended December 31, 2024 |

Year ended December 31, 2023 |

|||||||

| Operating activities | ||||||||

| Net loss | $ | (29,447 | ) | $ | (64,666 | ) | ||

| Adjustments for items not affecting cash: | ||||||||

| Share-based payments | 1,768 | 1,226 | ||||||

| Change in fair value of marketable securities | (41 | ) | 253 | |||||

| Realized gain on marketable securities | (306 | ) | (90 | ) | ||||

| Depreciation (Note 6) | 65 | 56 | ||||||

| Accretion (Notes 9, 10 and 11) | 1,008 | - | ||||||

| Changes in fair value of convertible 2028 Notes and 2027 Notes (Note 11) | 4,356 | - | ||||||

| Interest expense on convertible 2028 Notes and 2027 Notes (Note 11) | 6,731 | 4,805 | ||||||

| Changes in fair value of convertible 2026 Notes | - | 5,076 | ||||||

| Loss on extinguishment of 2026 Notes and recognition of 2028 Notes (Note 11) | - | 18,727 | ||||||

| Change in fair value of warrants related to 2028 Notes (Note 11) | 137 | (30,758 | ) | |||||

| Settlement of transaction costs on 2028 Notes (Note 11) | - | (240 | ) | |||||

| Impairment charge | - | 51,884 | ||||||

| Directors’ fees paid in DSUs | - | 595 | ||||||

| Fair value gain on warrants (US Warrants) | (7 | ) | (1,243 | ) | ||||

| Performance based incentive payment | 134 | - | ||||||

| Unrealized loss on foreign exchange | 4,272 | 696 | ||||||

| Other | - | 15 | ||||||

| $ | (11,330 | ) | $ | (13,664 | ) | |||

| Changes in working capital: | ||||||||

| Decrease in receivables | (229 | ) | 1,848 | |||||

| Increase in prepaid expenses and other assets | (204 | ) | 247 | |||||

| (Decrease) increase in accounts payable and accrued liabilities | (5,249 | ) | (11,477 | ) | ||||

| Cash used in operation activities | $ | (17,012 | ) | $ | (23,046 | ) | ||

| Investing activities | ||||||||

| Payment (transfer) to / from restricted cash | 888 | (1,158 | ) | |||||

| Proceeds from sale of marketable securities (Note 8) | 930 | 816 | ||||||

| Incurring of exploration and evaluation expenditures | (36 | ) | - | |||||

| Additions to property, plant and equipment (Note 6) | (519 | ) | (13,705 | ) | ||||

| Cash provided in investing activities | $ | 1,263 | $ | (14,047 | ) | |||

| Financing activities | ||||||||

| Proceeds from issuance of shares, net transaction cost of $180 (2023 - $1,582) | 1,221 | 19,960 | ||||||

| Transaction costs private placement 2022 | - | (284 | ) | |||||

| Proceeds from government loans, net of repayments of $45 (2023 - $Nil) (Note 10) | 5,222 | 250 | ||||||

| Payment of lease liability, net of interest | (42 | ) | (43 | ) | ||||

| Proceeds from 2028 Notes (Note 11) | - | 68,049 | ||||||

| Proceeds from 2027 Notes, net of transaction costs of $722 (Note 11) | 5,498 | - | ||||||

| Repayment of 2026 Notes (Note 11) | - | (48,036 | ) | |||||

| Settlement of transaction costs on 2028 Notes (Note 11) | - | (2,100 | ) | |||||

| Exercise of Convertible Notes | - | 397 | ||||||

| Interest settlement of 2026 Notes (Note 11) | - | (1,656 | ) | |||||

| Cash provided by financing activities | $ | 11,899 | $ | 36,537 | ||||

| Change in cash during the period | (3,850 | ) | (556 | ) | ||||

| Effect of exchange rates | 7 | 164 | ||||||

| Cash, beginning of the period | 7,560 | 7,952 | ||||||

| Cash, end of period | $ | 3,717 | $ | 7,560 | ||||

See accompanying notes to consolidated financial statements.

| Page |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

| 1. | Significant Nature of Operations |

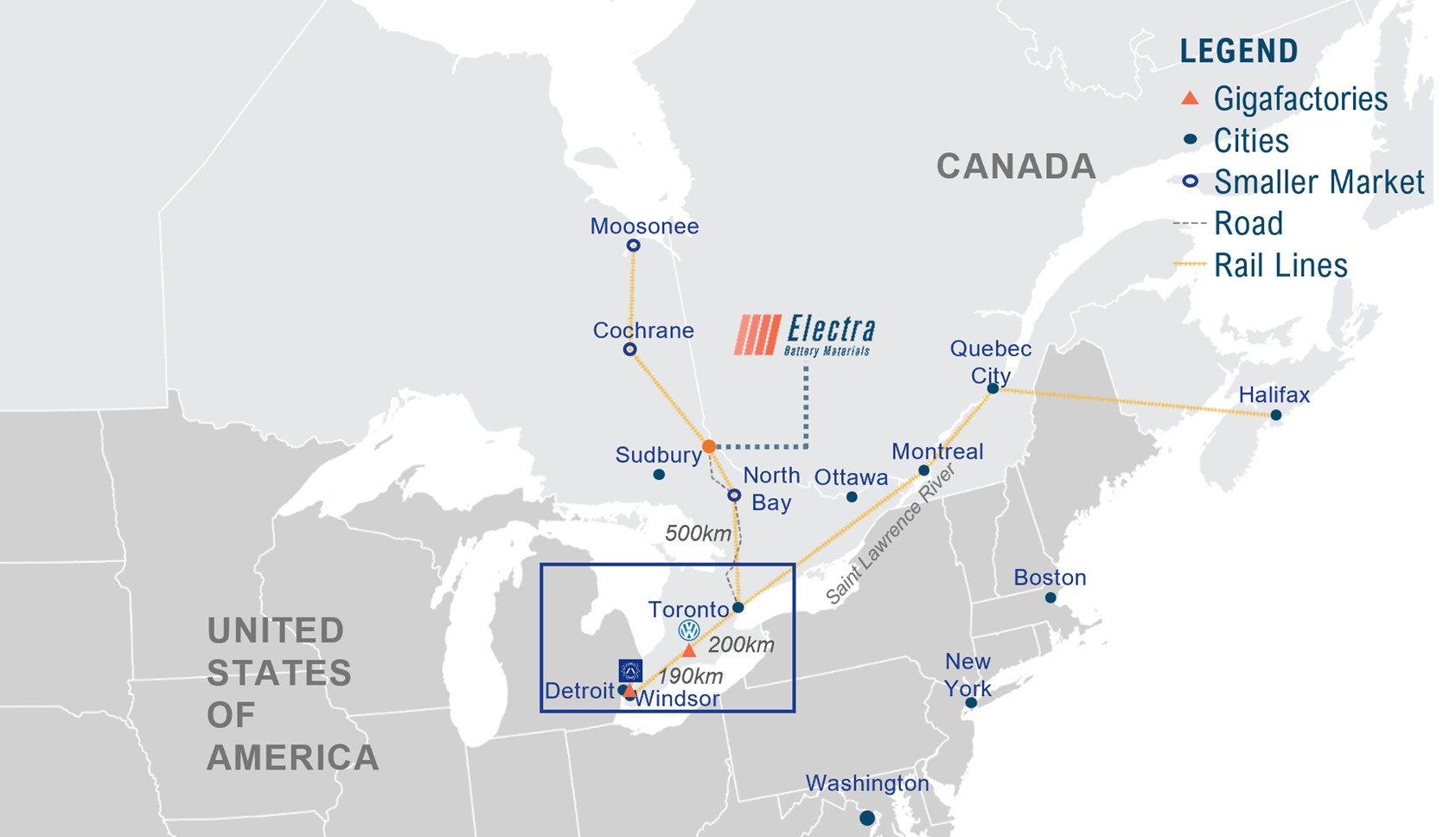

Electra Battery Materials Corporation (the “Company”, “Electra”) was incorporated on July 13, 2011 under the Business Corporations Act of British Columbia (the “Act”). On September 4, 2018, the Company filed a Certificate of Continuance into Canada and adopted Articles of Continuance as a Federal Company under the Canada Business Corporations Act (the “CBCA”). On December 6, 2021, the Company changed its corporate name from First Cobalt Corp. to Electra Battery Materials Corporation. The Company is in the business of producing battery materials for the electric vehicle supply chain. The Company is focused on building a supply of cobalt, nickel and recycled battery materials.

Electra is a public company which is listed on the Toronto Venture Stock Exchange (“TSXV”) (under the symbol ELBM). On April 27, 2022, the Company began trading on the NASDAQ (under the symbol ELBM). The Company’s registered office is Suite 2400, Bay-Adelaide Centre, 333 Bay Street, Toronto, Ontario, M5H 2T6 and the corporate head office is located at 133 Richmond Street W, Suite 602, Toronto, Ontario, M5H 2L3.

On December 31, 2024, the Company completed a share consolidation on the basis of one new post-consolidation common share for every four (4) pre-consolidation common shares. All prior share capital information has been presented based on this ratio.

The Company is focused on building a North American integrated battery materials facility for the electric vehicle supply chain. The Company is in the process of constructing its expanded hydrometallurgical cobalt refinery (the “Refinery”), assessing the various optimizations and modular growth scenarios for a recycled battery material (known as black mass) program, and exploring and developing its mineral properties.

Going Concern Basis of Accounting

The accompanying audited consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business for the foreseeable future, and, as such, the consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue in existence.

The Company has recurring net operating losses and negative cash flows from operations. As of December 31, 2024 and December 31, 2023, the Company had an accumulated deficit of $274,892 and $245,445, respectively. The Company’s recurring losses from operations and negative cash flows raise substantial doubt about the Company’s ability to continue as a going concern. The global economy, including the financial and credit markets, have experienced extreme volatility and disruptions, including fluctuating inflation rates and interest rates, foreign currency impacts, declines in consumer confidence, and declines in economic growth. Additionally, the Company suspended construction of the Refinery in 2023 due to lack of sufficient funding in the wake of supply chain disruptions. All these factors point to uncertainty about economic stability, and the severity and duration of these conditions on our business cannot be predicted, and the Company cannot assure that it will remain in compliance with the financial covenants contained within its credit facilities. Management monitors recent developments in relation to global tariffs and does not anticipate any material impacts on the financial position of the Company.

| Page |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

In order to continue its operations, the Company must achieve profitable operations and/or obtain additional equity or debt financing. Until the Company achieves profitability, management plans to fund its operations and capital expenditures with cash on hand, borrowings, and issuance of capital stock. Until the Company generates revenue at a level to support its cost structure, the Company expects to continue to incur significant operating losses and net cash outflows from operating activities.

The Company is actively pursuing various alternatives including government grants and loans, strategic partnerships, equity and debt financing to increase its liquidity and capital resources. During 2024, a government loan from Federal Economic Development Agency for Northern Ontario (“FedNor’) was received in the amount of $5,267.

On August 19, 2024, the Company was awarded US$20,000 in funding by the U.S. Department of Defense (“DoD”) for the construction of the Refinery funded on a reimbursement basis. The award was made pursuant to Title III of the Defense Production Act (DPA) to expand domestic production capability. On November 25, 2024, the Company completed a private placement of US$1,000 as detailed in Note 13. On November 27, 2024, the Company issued secured convertible notes in the principal amount of US$4,000 as detailed in Note 11. Although the Company has historically been successful in obtaining financing in the past, there can be no assurances that the Company will be able to obtain adequate financing in the future. These audited consolidated financial statements do not include the adjustments to the amounts and classifications of assets and liabilities that would be necessary should the Company be unable to continue as a going concern. These adjustments may be material.

| 2. | Material Accounting Policies and Basis of Preparation |

Basis of Presentation and Statement of Compliance

These consolidated financial statements, including comparatives, have been prepared in accordance with IFRS® Accounting Standards as issued by the International Accounting Standard Board.

These financial statements have been prepared on a historical cost basis, except for certain financial instruments, which are classified as fair value through profit or loss (“FVTPL”). All amounts on the consolidated financial statements are presented in thousands of Canadian dollars, except share and per share amounts, and otherwise noted.

Certain comparative amounts have been restated to conform with current accounting presentation.

Functional Currency

The functional currency of the Company and its controlled entities are measured using the principal currency of the primary economic environment in which each entity operates. The functional currency of the Company and its subsidiaries is Canadian dollars, except for Australia entities which have a functional currency of Australian Dollars and United States entities which have a functional currency of US Dollars.

Foreign currency transactions are translated into the functional currency using the exchange rates prevailing at the date of the transaction. Foreign currency monetary items are retranslated at the period-end exchange rate. Non-monetary items measured at historical cost continue to be carried at the exchange rate at the date of the transaction. Non-monetary items measured at fair value are reported at the exchange rate at the date when fair values were determined.

| Page |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

Foreign exchange differences on monetary items are recognized in profit or loss in the period in which they arise except for:

| · | Exchange differences on foreign currency borrowings relating to assets under construction for future productive use, which are included in the costs of assets as they are regarded as an adjustment to interest costs on those currency borrowings. |

| · | Foreign exchange gains or losses arising from a monetary item receivable from or payable to a foreign operation, the settlement of which is neither planned nor likely to occur in the foreseeable future and which in substance is considered to form part of the net investment in the foreign operation are recognized in other comprehensive income or loss. |

The assets and liabilities of entities with a functional currency that differs from the presentation currency are translated to the presentation currency as follows:

| · | Assets and liabilities are translated at the closing rate at the end of the financial reporting period; |

| · | Income, expenses, and cash flows are translated at average exchange rates (unless the average is not a reasonable approximation of the cumulative effect of the rates prevailing on the transaction dates, in which case, income and expenses are translated at the rate on the dates of the transactions); |

| · | Equity transactions are translated using the exchange rate at the date of the transaction; and |

| · | All resulting exchange differences are recognized as a separate component of equity as accumulated other comprehensive income or loss. |

During 2023, the Company considered primary and secondary indicators in determining functional currency including the currency in which funds from financing activities were generated, the Company re-evaluated the functional currency of its US subsidiaries and determined that a change in their functional currency from Canadian dollars to US Dollars was appropriate. Accordingly, the Company recorded a translation adjustment in 2023, to reflect the impact of translating the Company’s US Dollar assets and liabilities into Canadian Dollars (the presentation currency) at the opening spot rate for the year. The change in functional currency for these subsidiaries has been applied prospectively.

Basis of Consolidation

These consolidated financial statements include the accounts of the Company and its controlled entities. Control is achieved when the Company has the power to govern the financial operating policies of an entity to obtain benefits from its activities. Subsidiaries are fully consolidated from the date on which control is transferred to the Company until the date on which control ceases.

| Page |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

The following subsidiaries have been consolidated for all dates presented within these financial statements:

| Subsidiary | Ownership | Location | Status |

| Cobalt Projects International Corp. | 100% | Canada | Inactive |

| Cobalt Industries of Canada Corp. | 100% | Canada | Inactive |

| Cobalt One Limited | 100% | Australia | Active |

| Cobalt Camp Refinery Ltd. | 100% | Canada | Active |

| Cobalt Camp Ontario Holdings Corp. | 100% | Canada | Inactive |

| Ophiolite Consultants Pty Ltd. | 100% | Australia | Inactive |

| Acacia Minerals Pty Ltd. | 100% | Australia | Inactive |

| CobalTech Mining Inc. | 100% | Canada | Inactive |

| US Cobalt Inc. (“USCO”) | 100% | Canada | Active |

| 1086360 BC Ltd. | 100% | Canada | Active |

| Idaho Cobalt Company | 100% | United States | Active |

| Scientific Metals (Delaware) Corp. | 100% | United States | Inactive |

| Orion Resources NV | 80% | United States | Inactive |

| Grafito La Barranca de Mexico S.A. de C.V. | 100% | Mexico | Inactive |

| Grafito La Colorada de Mexico S.A. de C.V. | 50% | Mexico | Inactive |

All inter-company transactions, balances, income and expenses are eliminated in full upon consolidation.

Cash and Cash equivalents

Cash and cash equivalents consist of cash on hand, deposits in banks and highly liquid investments with an original maturity of three months or less.

Restricted cash

Restricted cash consists of escrow funds for settlement with vendors held by the Company’s legal counsel with term of less than one year. Long-term restricted cash relates to amounts on deposit as financial assurance for the refinery closure plan.

Marketable Securities

Marketable securities represent shares held in a publicly traded company. Marketable securities held by the Company are held for trading purposes and are classified as financial asset measured at FVTPL. At each reporting date, the Company marks-to-market the value of the marketable securities based on quoted market prices; therefore, these financial assets are classified as Level 1 on the fair value hierarchy.

Any profit or loss arising from the sale of these securities, or the revaluation at reporting dates, is recorded to the consolidated statement of income (loss) and other comprehensive income (loss). As the marketable securities are held for trading purposes and not as part of a strategic investment, they are expected to be liquidated within a twelve-month period and are classified as a current asset on the statement of financial position.

Financial instruments

Cash and cash equivalents, restricted cash, receivables, accounts payable and accrued liabilities, and debt securities issued are initially recognized when they are originated. All other financial assets and financial liabilities are initially recognized when the Company becomes a party to the contractual provisions of the instrument.

| Page |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

The Company recognizes all financial assets initially at fair value and classifies them into one of the following measurement categories: FVTPL, fair value through other comprehensive income or amortized cost, as appropriate.

Financial liabilities are initially recognized at fair value and classified as either FVTPL or amortized cost, as appropriate.

Financial assets are derecognized when the rights to receive cash flows from the investments have expired or have been transferred and the Company has transferred substantially all risks and rewards of ownership.

At each reporting date, the Company assesses whether there is objective evidence that a financial asset has been impaired.

The Company had made the following classification of its financial instruments:

| Financial assets or liabilities, accrued interest and lease liability | Measurement Category |

| Cash and cash equivalents | Amortized Cost |

| Restricted cash | Amortized Cost |

| Receivables | Amortized Cost |

| Marketable securities | FVTPL |

| Account payable and accrued liabilities | Amortized Cost |

| Convertible notes payable | FVTPL |

| Government loan payable | Amortized Cost |

| Warrants | FVTPL |

| Royalty | Amortized Cost |

Financial instruments measured at fair value are classified into one of the three levels in the fair value hierarchy according to the relative reliability of the inputs used to estimate the fair values. The three levels of the fair value hierarchy are:

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities;

Level 2 – Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly;

Level 3 – Inputs that are not based on observable market data.

Exploration and Evaluation Assets

The acquisition costs of mineral property interests have been capitalized as exploration and evaluation assets within the Company’s financial statements. Subsequent exploration and evaluation costs are expensed until the property to which they relate has demonstrated technical feasibility and commercial viability, after which costs are capitalized.

The acquisition costs include the cash consideration paid and the fair market value of any shares issued for mineral property interests being acquired or optioned pursuant to the terms of relevant agreements. When a partial sale of a mineral property occurs, if control is lost the asset is derecognized and there is a resultant gain or loss recorded to profit and loss in the period the transaction takes place. When all of the interest in a property is sold, subject only to any retained royalty interests which may exist, the accumulated property costs are derecognized, with any gain or loss included in profit or loss in the period the transaction takes place.

| Page |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

Management reviews its mineral property interests at each reporting period for indicators of impairment taking into consideration whether there has been a significant adverse change in the legal, regulatory, accessibility, title, environmental or political factors that could affect the property’s value; whether exploration activities produced results that are not promising such that no more work is being planned in the foreseeable future and management’s assessment of likely proceeds from the disposition of the property. If a property’s carrying value exceeds its recoverable amount through either not being recoverable, being abandoned, or considered to have no future economic potential, the acquisition and deferred exploration and evaluation costs are written down to their recoverable amount.

Should a project be put into production, the costs of acquisition will be amortized using the units-of-production method over the life of the project based on estimated economic reserves.

Property, Plant and Equipment

Plant and equipment are recorded at cost less accumulated depreciation and accumulated impairment losses. The cost of an asset includes the purchase price or construction cost, any costs directly attributable to bringing the asset to the location and condition necessary for its intended use, an initial estimate of the costs of dismantling and removing the item and restoring the site on which it is located, and borrowing costs related to the acquisition or construction of the qualifying assets.

Depreciation of plant and equipment commences when the asset is in the condition and location necessary for it to operate in the manner intended by management. Plant and equipment assets are depreciated using the straight-line method over the estimated useful life of the asset. Where an item of plant and equipment comprises of major components with different useful lives, the components are accounted for as separate items of plant and equipment. Depreciation is recognized in the consolidated statement of loss and comprehensive loss upon commercial production having been achieved.

At the date of this consolidated financial statements no plant and equipment assets are in use. The Company will assess the useful lives of the assets once they are put into use.

Development costs associated with bringing the Company’s Refinery to the location and condition necessary for it to be capable of operating in its intended manner are capitalized as property, plant and equipment costs.

Capital Long-Term Prepayments

For major equipment items where milestone payments are made during the manufacturing process, these costs are initially recorded as capital long-term prepayments. Once the piece of equipment is delivered to the Refinery site, the associated cost is then reclassified to property, plant and equipment costs.

Leases

At inception of a contract, the Company assesses whether a contract is, or contains, a lease. A contract is, or contains, a lease if the contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration. For such contracts, the Company recognizes a right-of-use (“ROU”) asset and a lease liability at the lease commencement date.

| Page |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

The ROU asset is initially measured at cost, which comprises of initial amount of the lease liability adjusted for any lease payments made at or before the commencement date, plus any initial direct costs incurred and any estimated costs to dismantle or restore the underlying asset, less any lease incentives received. ROU asset is subsequently depreciated using straight-line method over the lease term, or useful life of the underlying asset if a purchase option is expected to be exercised. ROU asset is presented as part of property, plant and equipment.

Lease liabilities are initially measured at the present value of the lease payments that are not paid at the commencement date and subsequently measured at amortized cost using the effective interest rate method.

Lease payments for short-term leases with a term of 12 months or less, leases of low-value assets, as well as leases with variable lease payments are recognized as an expense over the term of such leases.

Borrowing Costs

Borrowing costs are expensed as incurred except where they relate to the financing of construction or development of qualifying assets in which case they are capitalized as property, plant and equipment up to the date when the qualifying asset is ready for its intended use.

Majority of the proceeds from the convertible notes and the government grant are being utilized for the construction and expansion of the Refinery, which given its construction timeline of over a year, is a qualifying asset under IAS 23 Borrowing Costs. Construction of the Refinery has not resumed during 2024 and no borrowing have been capitalized during the year ended December 31, 2024.

Impairment

(i) Financial assets

For financial assets measured at amortized cost, the impairment model under IFRS 9, Financial Instruments (“IFRS 9”), reflects expected credit losses. The Company recognizes loss allowances for expected credit losses and changes in those expected credit losses. At each reporting date, financial assets carried at amortized cost are assessed to determine whether they are credit impaired. A financial asset is credit-impaired when one or more events that have a detrimental impact on the estimated future cash flows of the financial asset have occurred. Loss allowances for financial assets measured at amortized cost are deducted from the gross carrying amount of the assets. The gross carrying amount of a financial asset is written off to the extent that there is no realistic prospect of recovery.

(ii) Non-financial assets

Non-financial assets are evaluated at each reporting period by management for indicators that carrying value is impaired and may not be recoverable. When indicators of impairment are present the recoverable amount of an asset is evaluated at the CGU level, the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets, where the recoverable amount of a CGU is the greater of the CGU’s fair value less costs to sell and its value in use. An impairment loss is recognized in profit or loss to the extent that the carrying amount exceeds the recoverable amount.

Previously recognized impairment losses are evaluated at each reporting period for indication that an impairment loss recognized in prior periods for an asset may no longer exist or may have decreased. If such indication exists, the Company estimates the recoverable amount of that asset, and an impairment loss is reversed only to the extent that the asset’s carrying amount does not exceed the carrying amount that would have been determined, net of depreciation or amortization, if no impairment loss had been recognized.

| Page |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

Share capital

Common shares are classified as equity. Transaction costs directly attributable to the issue of common shares and share options are recognized as a deduction from equity, net of any tax effects. Common shares issued for consideration other than cash, are valued based on the fair value of goods or services received.

Warrants classified as equity

Warrants classified as equity are recorded at fair value as of the date of issuance on the Company’s consolidated balance sheets and no further adjustments to their valuation are made.

Warrants classified as liabilities

Warrants classified as derivative liabilities and other derivative financial instruments require separate accounting as liabilities are recorded on the Company’s consolidated balance sheets at their fair value on the date of issuance and will be revalued on each subsequent balance sheet date until such instruments are exercised or expire, with any changes in the fair value between reporting periods recorded as other income or expense. Management estimates the fair value of these liabilities using option pricing models and assumptions that are based on the individual characteristics of the warrants or instruments on the valuation date, as well as assumptions for expected volatility, expected life, yield, and risk-free interest rate.

Share-based payment transactions

The Company has a long-term incentive plan that provides for the granting of options, deferred share units (“DSUs”), restricted share units (“RSUs”) and performance share units (“PSUs”) to officers, directors, consultants and related company employees to acquire shares of the Company.

(i) Stock options

The fair value of the options is measured on grant date and is recognized as an expense with a corresponding increase in reserves as the options vest. Options granted to employees and others providing similar services are measured on grant date at the fair value of the instruments issued. Fair value is determined using the Black-Scholes option pricing model considering the terms and conditions upon which the options were granted. The amount recognized as an expense is adjusted to reflect the actual number of stock options that are expected to vest. Each tranche in an award with graded vesting is considered a separate grant with a different vesting date. Each grant is accounted for on that basis.

Options granted to non-employees are measured at the fair value of the goods or services received, unless that fair value cannot be estimated reliably, in which case the fair value of the equity instruments issued is used. The value of the goods or services is recorded at the earlier of the vesting date, or the date the goods or services are received. On vesting, share-based payments are recorded as an operating expense and as reserves. When options are exercised, the consideration received is recorded as share capital. The related share-based payments originally recorded as reserves remain in reserves on either exercise or expiry of the underlying options.

(ii) Deferred, restricted and performance share units

DSUs, RSUs and PSUs are classified as equity settled share-based payments and are measured at fair value on the grant date. The expense for DSUs, RSUs and PSUs, to be redeemed in shares, is recognized over the vesting period, or using management’s best estimate when contractual provisions restrict vesting until completion of certain performance conditions, with a charge as an expense and a corresponding increase in reserves as the instrument vests. Upon exercise of any DSUs, RSUs, and PSUs, the grant date fair value of the instrument is transferred to share capital.

| Page |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

Environmental rehabilitation

An obligation to incur restoration, rehabilitation and environmental costs arises when environmental disturbance is caused by the exploration, development or ongoing production of a mineral property interest. The estimated costs arising from the future decommissioning of plant and other site preparation work, discounted to their net present value where material, are determined, and capitalized at the start of each project to the carrying amount of the asset, as soon as the obligation to incur such costs arises. Discount rates, using a pretax rate that reflect the time value of money and risks specific to the liability, are used to calculate the net present value. Costs are charged against profit or loss over the economic life of the related asset, through amortization of the asset retirement obligation using either the unit-of-production or the straight-line method. The related liability is adjusted at each period end with changes related to the unwinding of the discount rate accounted for in profit or loss and changes related to the current market-based discount rate or the amount or timing of the underlying cash flows needed to settle the obligation accounted for as an adjustment to the related rehabilitation asset.

Income taxes

Income tax expense is comprised of current and deferred taxes. Current tax and deferred tax are recognized in profit or loss, except to the extent that they relate to items recognized directly in equity or equity investments.

Current tax is the expected tax payable or receivable on the taxable income or loss for the year, using tax rates enacted or substantively enacted at the reporting date, and any adjustment to tax payable in respect of previous years.

Deferred tax is recognized in respect of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for taxation purposes. Deferred tax is measured at the tax rates that are expected to be applied to temporary differences when they reverse, based on the laws that have been enacted or substantively enacted by the reporting date. Deferred tax assets and liabilities are offset if there is a legally enforceable right to offset current tax liabilities and assets, and they relate to income taxes levied by the same tax authority for the same taxable entity. A deferred tax asset is recognized for unused tax losses, tax credits and deductible temporary differences, to the extent that it is probable that future taxable profits will be available against which they can be utilized. Deferred tax assets are reviewed at each reporting date and are reduced to the extent that it is no longer probable that the related income tax benefit will be realized.

Income / Loss per share

The Company presents basic and diluted income/loss per share (“LPS”) data for its common shares. Basic LPS is calculated by dividing the income/loss attributable to common shareholders of the Company by the weighted average number of common shares outstanding during the period, adjusted for own shares held. Diluted LPS is determined by adjusting the loss attributable to common shareholders and the weighted average number of common shares outstanding, adjusted for own shares held and for the effects of all dilutive potential common shares related to outstanding stock options and warrants issued by the Company. In a period of losses, the warrants, options and non-vested RSUs, PSUs and DSUs are excluded for the determination of dilutive net loss per share because their effect is anti-dilutive.

| Page |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

Operating Segments

The Company’s Chief Operating Decision Maker reviews operating results and assesses performance for the Refinery and Exploration and Evaluation activities on a separate basis, and therefore, the Refinery and Exploration and Evaluation assets both meet the definition of a segment. Upon the decision to move into the full development stage of the Refinery, this business unit is likely to earn revenue and incur expenses that are separate and discrete from the rest of the Company. The Company’s operating segments are as follows:

| · | Refinery |

| · | Exploration and Evaluation |

| · | Corporate and Other |

Related Party Transactions

Parties are related if one party has the ability, directly or indirectly, to control the other party or exercise significant influence over the other party in making financial and operating decisions. Parties are also considered to be related if they are subject to common control. Related parties may be individuals or corporate entities and include directors and key management of the Company and its parent. A transaction is a related party transaction when there is a transfer of resources, services or obligations between related parties.

Government Loans

The Company received funding from the Federal Government of Canada in the form of non-interest-bearing loans. The Company records the present value of these loans, assuming a market rate of interest, as a liability in accordance with IFRS 9 Financial Instruments. The difference between the funding received and the present value of the loan is the benefit provided by the below market interest rate and is recorded as government grant liability. This is amortized to income over the life of the Refinery asset to which the funding related to.

The funding from the Federal Government of Canada is received as a proportion of construction costs incurred.

Government Grant / Award

Governmental grants are accounted for in accordance with IAS 20, Accounting for Governmental Grants. Governmental Grants are recognised when they are received or receivable and when there is reasonable assurance that the Company will comply with any conditions attached to the grant.

The Company received funding from the Ontario Government and US Department of Defense in the form of a non-repayable grant. Government grants will be recognized in profit or loss on a systematic basis over the periods in which the entity recognizes as expenses the related costs for which the grants are intended to compensate. Government grants related to assets shall be presented in the statement of financial position either by setting up the grant as deferred income or by deducting the grant in arriving at the carrying amount of the asset. The Company records government grants by reducing the carrying amount of the asset.

Convertible notes payable

Convertible notes payable are financial instruments which contain a separate financial liability and equity instrument. These financial instruments are accounted for separately dependent on the nature of their components. The identification of such components embedded within a convertible notes payable requires significant judgement given that it is based on the interpretation of the substance of the contractual arrangement. The convertible notes are considered to contain embedded derivatives. The embedded derivatives were measured at fair value upon initial recognition and separated from the debt component of the notes. The debt component of the notes is measured at residual value upon initial recognition. Subsequent to initial recognition, the embedded derivative components are re-measured at fair value at each reporting date while the debt components are accreted to the face value of the note using the effective interest rate through periodic charges to finance expense over the term of the note. The Company elected to measure the convertible notes payable at fair value as a whole instrument (“FVO”), therefore the convertible notes payable are measured at FVTPL at their entirety.

| Page |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

| 3. | Significant Accounting Judgments and Estimates |

The preparation of the Company’s financial statements in conformity with IFRS® Accounting Standards as issued by the International Accounting Standard Board requires management to make judgments, estimates and assumptions that affect the reported amounts of assets, liabilities and contingent liabilities at the date of the financial statements and reported amounts of income and expenses during the reporting period. Estimates and assumptions are continuously evaluated and are based on management’s experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances. However, actual outcomes may differ significantly from these estimates.

Judgments and estimates that have the most significant effect on the amounts recognized in the Company’s consolidated financial statements are as follows:

| · | Refinery Asset |

The net carrying value of the Refinery asset is reviewed regularly for conditions that suggest potential indications of impairment. The review requires significant judgment. Factors considered in the assessment of asset impairment include, but are not limited to, whether there has been a significant adverse change in the technological, market, economic or legal environment in which the entity operates; and internal indicators that the economic performance of the asset will be worse than expected.

| · | Exploration and Evaluation Assets |

The net carrying value of each mineral property is reviewed regularly for conditions that suggest potential indications of impairment. This review requires significant judgment. Factors considered in the assessment of asset impairment include, but are not limited to, whether there has been a significant adverse change in the legal, regulatory, accessibility, title, environmental or political factors that could affect the property’s value; whether exploration activities produced results that are not promising such that no more work is being planned in the foreseeable future and management’s assessment of likely proceeds from the disposition of the property.

| · | Financial Derivative Liability |

The Financial Derivative Liability values relating to convertible note and US dollar denominated warrants involve significant estimation. The fair value of the financial derivative liability was determined at inception and is reviewed and adjusted on a quarterly basis or when conversions take place. Factors considered in the fair value of the financial derivative liability are risk free rate, the Company’s share price, equity volatility, and credit spread.

| Page |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

| · | Environmental Rehabilitation |

Management’s determination of the Company’s decommissioning and rehabilitation provision is based on the reclamation and closure activities it anticipates as being required, the additional contingent mitigation measures it identifies as potentially being required and its assessment of the likelihood of such contingent measures being required, and its estimate of the probable costs and timing of such activities and measures. Significant estimations must be made when determining such reclamation and closure activities and measures required or potentially required.

| 4. | New Accounting Standards Issued |

Certain new accounting standards and interpretations have been published that are either applicable in the current year or not mandatory for the current period. The Company adopted amendments to IAS 1 – Non-current liabilities with covenants, and determined a reclassification of the convertible notes from long-term to current liabilities during the current period. The amendments clarify certain requirements for determining whether a liability should be classified as current or non-current and require new disclosures for non-current liabilities that are subject to covenants within 12 months after the reporting period. This resulted in a change in the accounting policy for classification of liabilities that can be settled in the Company’s own shares (e.g. convertible notes issued by the Company). Previously, the Company excluded all counterparty conversion options when classifying the related liabilities as current or non-current. Under the revised policy, when a liability includes a counterparty conversion option that may be settled by a transfer of a Company’s own shares, the Company takes into account the conversion option in classifying the host liability as current or non-current except when it is classified as a equity component of a compound instrument. The Company’s other liabilities were not impacted by the amendments.

The Company has presented convertible notes payable as current liabilities in these consolidated financial statements in accordance with the amendments. Since the amendments are applicable retrospectively for annual reporting periods beginning on or after January 1, 2024, the Company has restated the comparative figures. The amendments to IAS 1 did not have any impact on the consolidated statement of financial position as at January 1, 2023. The following table outlines the impact of the restatements as at December 31, 2023:

| December 31, 2023 | ||||||||||||

| As reported | Restatement | Restated | ||||||||||

| Current liabilities | $ | 15,986 | $ | 40,144 | $ | 56,130 | ||||||

| Non-current liabilities | 49,408 | (40,144 | ) | 9,264 | ||||||||

IFRS 18 Presentation and Disclosure in Financial Statements was issued by the IASB in April 2024, with mandatory application of the standard in annual reporting periods beginning on or after January 1, 2027. The Company is currently assessing the impact of IFRS 18 on its consolidated financial statements. No standards have been early adopted in the current period.

| Page |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

| 5. | Receivables |

| December 31, 2024 |

December 31, 2023 |

|||||||

| GST receivables | $ | 494 | $ | 1,071 | ||||

| Grant receivables | 570 | - | ||||||

| Other | 246 | 10 | ||||||

| $ | 1,310 | $ | 1,081 | |||||

Grant receivables consist of $432 submitted to the Natural Resources Canada (“NRCan”) of which $101 have been reimbursed as at December 31, 2024. In addition, $362 have been submitted to the U.S. Department of Defense (“DoD”) of which $123 have been reimbursed. These reimbursements have been offset to property, plant and equipment and profit of loss for the year ended December 31, 2024.

| 6. | Property, Plant and Equipment and Capital Long-Term Prepayments |

| Cost | Property, Plant and Equipment | Construction in Progress | Right-of-use Assets | Total | ||||||||||||

| January 1, 2023 | $ | 5,989 | $ | 76,048 | $ | 301 | $ | 82,338 | ||||||||

| Additions during the year | - | 16,942 | - | 16,942 | ||||||||||||

| Transfers from capital long-term prepayments | - | 3,968 | - | 3,968 | ||||||||||||

| Impairment | - | (51,884 | ) | - | (51,884 | ) | ||||||||||

| Balance December 31, 2023 | $ | 5,989 | $ | 45,074 | $ | 301 | $ | 51,364 | ||||||||

| Reclassification | 1,334 | (1,334 | ) | - | - | |||||||||||

| Additions during the period | 133 | 386 | - | 519 | ||||||||||||

| Transfers to capital long-term prepayments | - | (139 | ) | - | (139 | ) | ||||||||||

| Asset retirement obligation - Change in estimate | (384 | ) | - | - | (384 | ) | ||||||||||

| Balance December 31, 2024 | $ | 7,072 | $ | 43,987 | $ | 301 | $ | 51,360 | ||||||||

| Accumulated Depreciation | ||||||||||||||||

| January 1, 2023 | $ | 10 | $ | - | $ | 40 | $ | 50 | ||||||||

| Change for the year | - | - | 56 | 56 | ||||||||||||

| Balance December 31, 2023 | $ | 10 | $ | - | $ | 96 | $ | 106 | ||||||||

| Change for the period | - | - | 65 | 65 | ||||||||||||

| Balance December 31, 2024 | $ | 10 | $ | - | $ | 161 | $ | 171 | ||||||||

| Net Book Value | ||||||||||||||||

| Balance December 31, 2023 | $ | 5,979 | $ | 45,074 | $ | 205 | $ | 51,258 | ||||||||

| Balance December 31, 2024 | $ | 7,062 | $ | 43,987 | $ | 140 | $ | 51,189 | ||||||||

Majority of the Company’s property, plant, and equipment assets relate to the Refinery located near Temiskaming Shores, Ontario, Canada. The carrying value of property, plant, and equipment and construction in progress is $51,059 (December 31, 2023 - $51,063), all of which is pledged as security for the 2028 Notes and 2027 Notes (Note 11).

| Page |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

During the year ended December 31, 2023, an impairment charge was recognized on the Refinery in Ontario. The impairment loss of $49,743 was determined based on the recoverable amount of the Refinery cash generating unit (“CGU”) that was based on value in use, assuming that commercial production will commence in 2026, applying a discount rate of 20% and a terminal multiple of 4.75. The recoverable amount of the Refinery CGU was determined as $44,899. In addition, costs of $2,141 related to the black mass program were included in the impairment charge.

During the year ended December 31, 2024, the Company performed their annual impairment assessment and determined based on third party appraisal, the fair value less costs of disposal was determined to be higher than the carrying value of the Refinery CGU, resulting in no impairment charge.

Capitalized development costs for the year ended December 31, 2024 totaled $Nil (for the year ended December 31, 2023 - $16,942) of which capitalized borrowing costs were $Nil (December 31, 2023 - $2,781). Capital long-term prepayments of $139 (December 31, 3023 - $Nil) relate to payments for long-term capital contracts made for Refinery equipment that have not yet been received by the Company as at December 31, 2024. No depreciation has been recorded for the Refinery in the current year (December 31, 2023 - $Nil) as the asset is not yet in service.

| 7. | Exploration and Evaluation Assets |

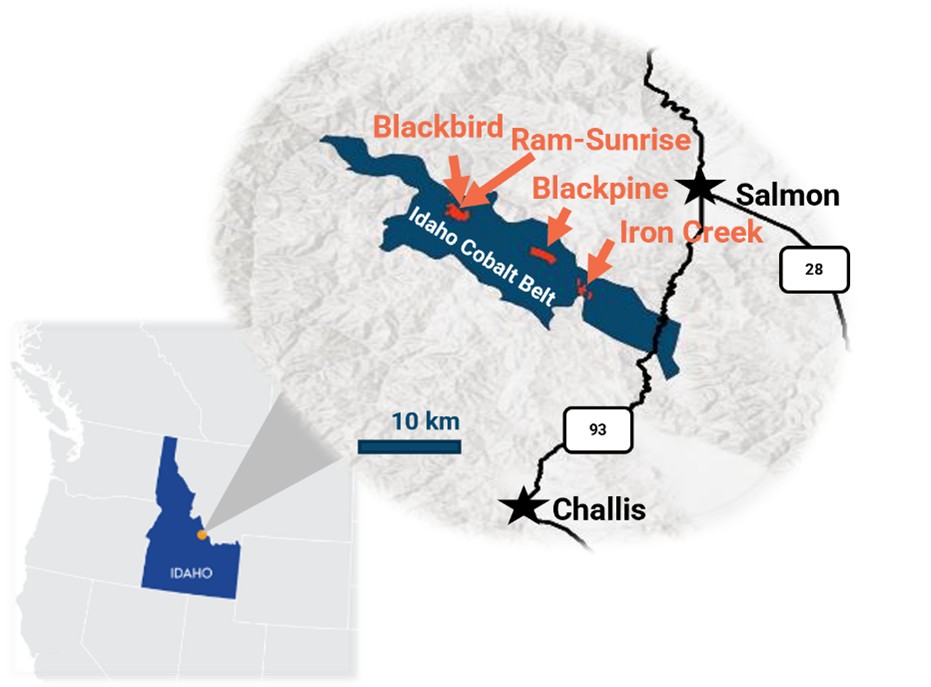

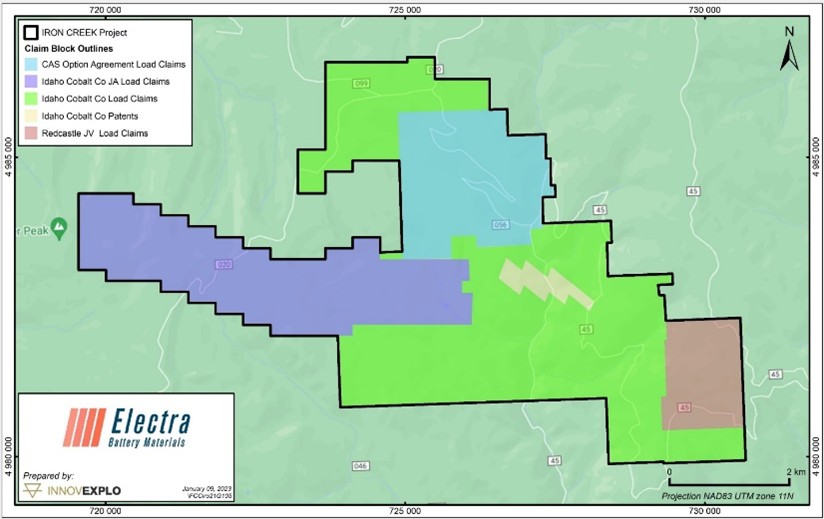

| Balance January 1, 2023 | Foreign Exchange | Balance December 31, 2023 | Foreign Exchange | Acquisition cost | Balance December 31, 2024 | |||||||||||||||||||

| Idaho, USA | $ | 87,693 | $ | (2,059 | ) | $ | 85,634 | $ | 7,530 | $ | 36 | $ | 93,200 | |||||||||||

All of the Iron Creek mineral properties are pledged as security for the Convertible Notes issued on February 13, 2023 and November 27, 2024 (Note 11). Upon successful commissioning of the Refinery, the Iron Creek mineral properties will be released from the Convertible Notes security package.

Certain claims relating to the Iron Creek properties were acquired by the Company against earn-in and option agreements entered with the original owners of such claims. These agreements provide a working interest in the property to the Company, upon making certain milestone payments and/or incurring certain expenditures on the property. The claims are also subject to future net smelter royalty (“NSR”) payments.

| 8. | Marketable Securities |

Marketable securities represent Kuya Silver Corp (“Kuya”) shares held by the Company. The Kuya shares were acquired via the Kerr Assets sale on February 26, 2021 and January 31, 2023. The total value of marketable securities at December 31, 2024 was $12 (December 31, 2023 - $595). These shares were marked-to-market at December 31, 2024 resulting in a unrealized gain of $41 being recorded during the year ended December 31, 2024 (the year ended December 31, 2023 – unrealized losses $253). During the year ended December 31, 2024, the Company sold marketable securities for proceeds of $930 from sale of 2,332,000 shares (the year ended December 31, 2023 –$816 from sale of 1,719,500 shares) and realized gain of $306 (the year ended December 31, 2023 – gain of $90).

| Page |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

| 9. | Asset Retirement Obligations |

As at December 31, 2024, the estimated cost of closure is $3,323. The Company maintains a surety bond for $3,450 as financial assurance based on the October 2021 closure plan.

The full estimated closure cost in the latest closure plan incorporated a number of new disturbances that have yet to take place, such as new roadways, new chemicals on site, and a new tailings area. The latest closure plan also included cost updates relating to remediating disturbances that existed at December 31, 2024. The following assumptions were used to calculate the asset retirement obligation:

| · | Discounted cash flows of $2,842 (December 31, 2023 - $3,126) |

| · | Closure activities date of 2073 (December 31, 2023 – 2037) |

| · | Risk-free discount rate of 3.33% (December 31, 2023 – 3.98%) |

| · | Long-term inflation rate of 3.0% (December 31, 2023 – 3.0%) |

The continuity of the asset retirement obligation at December 31, 2024 and December 31, 2023 is as follows:

| December 31, 2024 |

December 31, 2023 |

|||||||

| Balance at January 1, | $ | 3,126 | $ | 1,790 | ||||

| Change in estimate from discounting | (562 | ) | 126 | |||||

| Accretion | 100 | |||||||

| Change in estimate of costs | 178 | 1,210 | ||||||

| Balance | $ | 2,842 | $ | 3,126 | ||||

| 10. | Long-Term Government Loan Payable, Grants and Awards |

On November 24, 2020, the Company had entered into a contribution agreement with the Ministry of Economic Development and Official Languages as represented by the Federal Economic Development Agency for Northern Ontario (“FedNor”) for up to a maximum of $5,000 financing related to the recommissioning and expansion of the Refinery in Ontario. The contribution is in the form of debt bearing a 0% interest rate and funded in proportion to certain Refinery construction activities. The Company received approval for an additional $5,000 funding under the agreement on December 27, 2023, which was fully received during the year ended December 31, 2024.

Once construction is completed, the cumulative balance borrowed will be repaid in 19 equal quarterly instalments. The funding is provided pro rata with incurred Refinery construction costs, with all other conditions required for the funding having been met. The loan is discounted using a market rate between 7.0% and 17.1% with the resulting difference between the amortized cost and cash proceeds recognized as Government Grant. The FedNor loan requires completion of the construction on or before June 30, 2025. The Company is currently in negotiations to extend the commencement of payments based on the Company's latest estimated construction completion date.

On June 10, 2024, the Company received $5,000 in commitment funding on a reimbursement basis from Natural Resources Canada (“NRCan”) to support the development of its proprietary battery materials recycling technology.

| Page |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

On August 19, 2024, the Company was awarded US$20,000 by the U.S. Department of Defense (“DoD”). The award was made pursuant to Title III of the Defense Production Act (“DPA”) to expand domestic production capability and is funded through the Additional Ukraine Supplemental Appropriations Act. Partial proceeds have been received in the fourth quarter of 2024 on a reimbursement basis for approved expenditures.

The following table sets out the balances of Government Loan and Government Grant received at December 31, 2024 and December 31, 2023:

| Government Loan | Government Grant | Total | ||||||||||

| Balance at January 1, 2023 | $ | 3,777 | $ | 1,121 | $ | 4,898 | ||||||

| FedNor loan (Nickel Study) – February 2023 | 250 | - | 250 | |||||||||

| Accretion | 272 | (272 | ) | - | ||||||||

| Balance at December 31, 2023 | $ | 4,299 | $ | 849 | $ | 5,148 | ||||||

| FedNor loan – February 2024 | 2,267 | - | 2,267 | |||||||||

| FedNor Loan – April 2024 | 2,000 | - | 2,000 | |||||||||

| FedNor Loan (Nickel Study) - Payment | (45 | ) | - | (45 | ) | |||||||

| FedNor Loan – August 2024 | 1,000 | - | 1,000 | |||||||||

| Allocation to government grant | (2,275 | ) | 2,275 | - | ||||||||

| Accretion | 578 | - | 578 | |||||||||

| Balance at December 31, 2024 | $ | 7,824 | $ | 3,124 | $ | 10,948 | ||||||

| 11. | Convertible Note Arrangement |

On February 13, 2023, the Company completed subscription agreements with certain institutional investors in the United States with respect to $68,049 (US$51,000) principal amount of 8.99% senior secured notes due February 2028 (“2028 Notes”). The initial conversion rate of the Notes is 100,804 common shares per US$1,000 principal amount of Notes (equivalent to an initial conversion price of approximately US$9.92 per common share) subject to certain adjustments set forth in the 2028 Notes. The 2028 Notes are convertible at the discretion of the lenders. The 2028 Notes bear interest at 8.99% per annum, payable in cash or common shares semi-annually in arrears in February and August of each year and mature in February 2028. In the event the Company achieves a third-party green bond designation during the term of the note indenture, the interest rate on future cash interest payments shall be reduced to 8.75% per year.

The investors in the offering also received an aggregate of 2,699,014 warrants to purchase common shares (“2028 Warrants”) in the Company. The 2028 Warrants are exercisable for five years at an exercisable price US$9.92, subject to certain adjustments. Certain terms of the 2028 Warrants were amended in 2024 as discussed below.

Upon early conversion of the 2028 Notes, the Company will make an interest make whole payment equal to the lesser of the two years of interest payments or interest payable to maturity, which may be made in cash or shares at the Company’s discretion. The investors also received a royalty of: (i) 0.6% on “Operating Revenue” from the sale of all cobalt produced from the Refinery payable in the first twelve months following a defined threshold of commercial production, where Operating Revenue consists of revenue from the Refinery less certain permitted deductions; and (ii) 0.6% on all revenue from sales of cobalt generated from the Refinery in the second to fifth years following the commencement of commercial production. Royalty payments under the royalty agreements are subject to a cumulative cap of US$6,000.

| Page |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

The Company used a portion of the proceeds of the 2028 Notes offering to purchase all of the outstanding convertible notes consisting of $48,035(US$36,000) of existing 6.95% senior secured notes due December 2026 (“2026 Notes”) for cancellation at par, as well as to pay accrued and unpaid interest on the 2026 Notes through the closing date of the 2028 Notes offering for US$51,000 ($68,049). The net proceeds were $20,013, before interest payment of $1,656 and transaction costs of $2,340. As the terms of the 2028 Notes are substantially different from the 2026 Notes, the Company accounted for the 2026 Notes as an extinguishment of the original financial liability and recognized a new financial liability for the 2028 Notes. The extinguishment of 2026 Notes and recognition of 2028 Notes resulted in a loss of $18,727 as determined below.

| Convertible Notes Payable | Financial Derivative Liability | Total | ||||||||||

| Balance at January 1, 2023 | $ | 25,662 | $ | 6,674 | $ | 32,336 | ||||||

| Effective interest | 914 | - | 914 | |||||||||

| Foreign exchange loss | (22 | ) | - | (22 | ) | |||||||

| Loss on fair value derivative re-valuation | - | 5,076 | 5,076 | |||||||||

| Less: Accrued interest | (356 | ) | - | (356 | ) | |||||||

| Balance at February 13, 2023 | $ | 26,198 | $ | 11,750 | $ | 37,948 | ||||||

| Proceeds from 2028 Notes | 20,013 | |||||||||||

| Fair value used to settle 2026 Notes | 57,961 | |||||||||||

| Fair value of 2028 Notes | 74,348 | |||||||||||

| Loss before transaction costs | (16,387 | ) | ||||||||||

| Transaction costs | (2,340 | ) | ||||||||||

| Loss on extinguishment of 2026 Notes and recognition of 2028 Notes | $ | (18,727 | ) | |||||||||

The 2028 Notes contain components of Convertible Notes, 2028 Warrants, and a Royalty. Based on the 2028 Notes agreements, these components are separately exercisable hence the Company has accounted for each as a freestanding financial instrument and initially recorded these components at fair value. They have been recorded as derivative liabilities until they are elected to conversion to common shares.

As at initial recognition on February 13, 2023, the convertible notes were fair valued using the finite difference valuation method with the following key assumptions:

| · | Risk free rate at February of 13, 2023 of 3.96% based on the US dollar zero curve; |

| · | Equity volatility at February 13, 2023 of 56% based on an assessment of the Company’s historical volatility and the estimated maximum a third-party investor would be willing to pay for; |

| · | An Electra share price at February 13, 2023 of $8.92 reflecting the quoted market prices; and |

| · | A credit spread at February 13, 2023 of 28.9%. |

In addition, subject to certain conditions, the noteholders have agreed to waive the requirement set out in the 2028 Notes for the Company to file a registration statement to provide for the resale of the common shares underlying the 2028 Notes and the common share purchase warrants issued on February 13, 2023.

In January 2024, the terms of the 2028 Warrants were amended and the exercise price of US$9.92 was re-priced to $4.00. On November 27, 2024, in conjunction with the issuance of the 2027 Notes discussed below, the exercise price was amended from $4.00 to $3.40.

| Page |

ELECTRA BATTERY MATERIALS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2024 AND 2023

(expressed in thousands of Canadian dollars)

In addition, the 2028 Warrants now include a revised acceleration clause such that their term will be reduced to thirty-day in the event the closing price of the common shares on the TSXV exceeds $3.40 by twenty percent or more for ten consecutive trading dates, with the reduced term beginning seven calendar days after such 10 consecutive trading-day period. Upon the occurrence of an acceleration event, noteholders of the 2028 Warrants may exercise the 2028 Warrants on a cashless basis, based on the value of the 2028 Warrants at the time of exercise.