UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

☐ Registration statement pursuant to section 12 of the Securities Exchange Act of 1934

☒ Annual report pursuant to section 13(a) or 15(d) of the securities exchange act of 1934

For the fiscal year ended February 28, 2023

Commission File Number 001-40416

American Lithium Corp.

(Exact name of Registrant as specified in its charter)

| British Columbia | 1000 | Not Applicable |

| (Province or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

1030 West Georgia St., Suite 710

Vancouver, B.C., Canada V6E 2Y3

(604) 428-6128

(Address and telephone number of Registrant's principal executive offices)

C T Corporation System

1015 15th Street N.W., Suite 1000

Washington, DC 20005

(202) 572-3133

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered | ||

| Common Shares, no par value | AMLI | Nasdaq Capital Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this form:

| ☒Annual Information Form | ☒Audited Annual Financial Statements |

Number of outstanding shares of each of the issuer’s classes of capital or common stock as of February 28, 2023: 214,088,980 Common Shares, no par value.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

| Yes ☒ | No ☐ |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

| Yes ☐ | No ☒ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging Growth Company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.1 ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-(b).2 ☐

____________________________

1 Check boxes are blank, pending adoption of the underlying rules.

2 Check boxes are blank, pending adoption of the underlying rules.

EXPLANATORY NOTE

American Lithium Corp. (the “Company” or “Registrant”) is a Canadian public company whose common shares are listed on the TSX Venture Exchange (the “TSXV”) under the symbol “LI” and the Nasdaq Capital Market (the “Nasdaq”) under the symbol “AMLI”. The Company is eligible to file its annual report pursuant to Section 13 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), on Form 40-F pursuant to the multijurisdictional disclosure system of the Exchange Act (“MJDS”). The Company is a “foreign private issuer” as defined in Rule 3b- 4 under the Exchange Act. Equity securities of the Company are accordingly exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3.

FORWARD-LOOKING STATEMENTS

This annual report on Form 40-F (the “Annual Report”) and the documents incorporate by reference herein contain "forward-looking information" and “forward-looking statements” within the meaning of applicable securities legislation (collectively, "forward-looking statements"). All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements relate to future events or future performance and reflect management’s expectations or beliefs regarding future events and include, but are not limited to, statements regarding the business, operations, outlook and financial performance and condition of the Company; potential benefits from the acquisition of Plateau Energy Metals Inc. (“Plateau”) and its subsidiaries; plans, objectives and advancement of the TLC Lithium Property, the Falchani Lithium Project and Macusani Uranium Project (each as defined below, and collectively, the “Projects”); exploration drilling plans, in-fill and expansion drilling plans and other work plans, exploration programs and development plans to be conducted; results of exploration, development and operations; expansion of resources and testing of new deposits; environmental and social community and other permitting; timing, type and amount of capital and operating and exploration expenditures, as well as future production costs; estimation of mineral resources and mineral reserves; realization of mineral reserves; preliminary economic assessments (each, a “PEA”), including the timing for completion, and the assumptions and parameters upon which they are based, and the timing and amount of future estimated production; development and advancement of the Projects; success of mining operations; treatment under regulatory regimes; ability to realize value from the Company’s assets; adequacy of the Company’s financial resources; environmental matters, including reclamation expenses; insurance coverage; title disputes or claims, including the status of the “Precautionary Measures” filed by the Company’s subsidiary Macusani Yellowcake S.A.C. (“Macusani”), the outcome of the judicial appeal process, and any and all future remedies pursued by the Company and its subsidiary Macusani to resolve the title for 32 of its concessions; the anticipated New Uranium Regulations affecting Peru; and limitations on insurance coverage any other statements regarding the business plans, expectations and objectives of the Company; and any other information contained herein that is not a statement of historical fact. In certain cases, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative of these terms or comparable terminology. In this document, certain forward-looking statements are identified by words including “may”, “future”, “expected”, “intends” and “estimates”.

Forward-looking statements are based on management’s reasonable estimates, expectations, analyses and opinions at the date the information is provided and is based on a number of assumptions and subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. Assumptions upon which such forward-looking statements are based include, without limitation: that no significant event will occur outside the ordinary course of business of the Company; the Company’s ability to achieve its stated goals and objectives, including the anticipated benefits of the acquisition of Plateau and its subsidiaries; legislative and regulatory environment; impact of increasing competition; current technological trends; price of lithium, uranium and other metals; costs of development and advancement; anticipated results of exploration and development activities; the ability to operate in a safe and effective manner; and the ability to obtain financing on reasonable terms. Readers are cautioned that the foregoing list is not exhaustive. Further, the aforementioned assumptions may be affected by the long lasting negative disruptive effects of the coronavirus (“COVID-19”) pandemic, which resulted in a widespread health crisis that continues to affect the economies and financial markets of many countries around the world, as well as the ongoing Russo-Ukrainian War, which has resulted increased volatility in commodity markets. The consequences of the COVID-19 pandemic, as well as the ongoing Russo-Ukrainian War, include global stock market and financial market volatility; operating, supply chain and project development delays and disruptions; and increased interest rates, all of which have and could further affect commodity prices, credit ratings and credit risk. The ongoing effects of the COVID-19, and any escalation of the Russo-Ukrainian War, could have a material adverse impact on the Company’s plans, operations, financial condition, and the market for its securities; however, as at the date of this Annual Report, such impact cannot be reasonably estimated. Although the Company believes that the current opinions and expectations reflected in such forward-looking statements are reasonable based on information available at the time, undue reliance should not be placed on forward-looking statements since the Company can provide no assurance that such opinions and expectations will prove to be correct.

All forward-looking statements are inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including risks, uncertainties and assumptions related to: the Company’s ability to achieve its stated goals, including the benefits of the acquisition of Plateau and its subsidiaries; the estimated valuation of the Company being accurate; the estimated costs associated with the advancement of the Projects; legislative changes that impact operations of the Company; risks and uncertainties relating to the COVID-19 or similar such pandemics; the anticipated New Uranium Regulations affecting Peru; risks related to the certainty of title to the properties of the Company, including the status of the “Precautionary Measures” filed by the Company’s subsidiary Macusani, the outcome of the administrative process, the judicial appeal process, and any and all future remedies pursued by the Company and its subsidiary Macusani to resolve the title for 32 of its concessions; the ongoing ability to work cooperatively with stakeholders, including, but not limited to, local communities and all levels of government; the potential for delays in exploration or development activities and other effects due to global pandemics, such as the COVID-19 pandemic; the interpretation of drill results, the geology, grade and continuity of mineral deposits; variations in mineralization reserves, grade and recover rates; changes in project parameters as plans continue to be refined; the possibility that any future exploration, development or mining results will not be consistent with expectations; risks that permits or approvals will not be obtained as planned or delays in obtaining permits or approvals; mining and development risks, including risks related to accidents, equipment breakdowns, labour disputes (including work stoppages, strikes and loss of personnel) or other unanticipated difficulties with or interruptions in exploration and development; other risks of the mining industry; risks related to commodity price and foreign exchange rate fluctuations; risks related to foreign operations; the cyclical nature of the industry in which the Company operate; risks related to failure to obtain adequate financing on a timely basis and on acceptable terms or delays in obtaining governmental approvals; risks related to environmental regulation and liability; political and regulatory risks associated with mining and exploration; risks related to the uncertain global economic environment and the effects upon the global market generally, and due to the pandemic measures taken to reduce the spread of COVID-19 or any such future pandemics; any of which could continue to negatively affect global financial markets, including the trading price of the Company’s shares and could negatively affect the Company’s ability to raise capital and may also result in additional and unknown risks or liabilities to the Company. Other risks and uncertainties related to prospects, properties and business strategy of the Company are identified in the “Risk Factors” section of the Company’s Annual Information Form for the fiscal year ended February 28, 2023 (the “AIF”), filed as exhibit 99.1 hereto, as well as those factors detailed from time to time in the Company’s condensed interim and annual consolidated financial statements, management discussion and analysis and other recent filings that can be found at www.sec.gov.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements that are contained herein, except in accordance with applicable securities laws.

Capitalized terms under the heading “Forward-Looking Statements” and not otherwise defined herein have the meanings given to them in the AIF.

DIFFERENCES IN UNITED STATES AND CANADIAN REPORTING PRACTICES

The Company is permitted, under the MJDS, to prepare this Annual Report in accordance with Canadian disclosure requirements, which are different from those of the United States. The Company prepares its financial statements, which are filed with this Annual Report, in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board, and the audit is subject to the Public Company Accounting Oversight Board Standards. In addition, the Company is not required to prepare a reconciliation of its financial statements between IFRS and U.S. generally accepted accounting principles, and has not quantified such differences, which may be significant.

CAUTIONARY NOTE TO U.S. INVESTORS

Disclosure regarding Mineral Reserve and Mineral Resource estimates included in the documents incorporated by reference herein were prepared in accordance with Regulation 43-101 respecting Standards of Disclosure for Mineral Projects (“NI 43-101”) and applicable mining terms are as defined in accordance with the CIM Definition Standards on Mineral Resources and Reserves adopted by the Canadian Institute of Mining, Metallurgy and Petroleum Council (the “CIM Definition Standards”), as required by NI 43-101. Unless otherwise indicated, all reserve and resource information included in the documents incorporated by reference herein have been prepared in accordance with the CIM Definition Standards, as required by NI 43-101.

NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes the Canadian standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ from the requirements of the United Securities and Exchange Commission (the “SEC”) applicable to United States companies. Accordingly, mineral resource and reserve information contained in the documents incorporated by reference herein may not be comparable to similar information made public by United States companies reporting pursuant to SEC reporting and disclosure requirements.

CURRENCY

Unless otherwise indicated, all dollar amounts in this Annual Report on Form 40-F are in Canadian dollars. The exchange rate of Canadian dollars into United States dollars, based upon the daily exchange rate as quoted by the Bank of Canada, was US$1.00 = CDN$1.3609 on February 28, 2023 and US$1.00 = CDN$1.3628 on May 26, 2023.

ANNUAL INFORMATION FORM

The AIF is filed as Exhibit 99.1 to this Annual Report and is incorporated by reference herein.

AUDITED FINANCIAL STATEMENTS

The audited consolidated financial statements of the Company for the years ended February 28, 2023 and 2022, including the report of the independent auditor thereon (the “Financial Statements”), are filed as Exhibit 99.2 to this Annual Report and are incorporated by reference herein.

MANAGEMENT’S DISCUSSION AND ANALYSIS

The Company’s Management’s Discussion and Analysis (the “MD&A”) dated May 29, 2023 for the year ended February 28, 2023, is filed as Exhibit 99.3 to this Annual Report and is incorporated by reference herein.

CERTIFICATIONS AND DISCLOSURE REGARDING CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

As of the end of the period covered by this Annual Report, the Company carried out an evaluation, under the supervision of the Company’s Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), of the effectiveness of the Company’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act). Based upon that evaluation, the Company’s CEO and CFO have concluded that, as of the end of the period covered by this Annual Report, the Company’s disclosure controls and procedures are effective to ensure that information required to be disclosed by the Company in reports that it files or submits under the Exchange Act is (i) recorded, processed, summarized and reported within the time periods specified in SEC rules and forms, and (ii) accumulated and communicated to the Company’s management, including its principal executive officer and principal financial officer, to allow timely decisions regarding required disclosure.

While the Company’s principal executive officer and principal financial officer believe that the Company’s disclosure controls and procedures provide a reasonable level of assurance that they are effective, they do not expect that the Company’s disclosure controls and procedures or internal control over financial reporting will prevent all errors or fraud. A control system, no matter how well conceived or operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met.

Management’s Annual Report On Internal Control Over Financial Reporting

This Annual Report does not include a report of management’s assessment regarding internal control over financial reporting due to a transition period established by rules of the SEC for newly public companies.

Attestation Report of the Registered Public Accounting Firm

This Annual Report does not include an attestation report of the Company’s registered public accounting firm due to a transition period established by rules of the SEC for newly public companies.

Changes Internal Control Over Financial Reporting

During the period covered by this Annual Report, no change occurred in the Company’s internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting.

AUDIT COMMITTEE

The Board of Directors has a separately designated standing Audit Committee established for the purpose of overseeing the accounting and financial reporting processes of the Company and audits of the financial statements of the Company in accordance with Section 3(a)(58)(A) of the Exchange Act and Nasdaq Stock Market Rule 5602(c). As of the date of this Annual Report, the Company’s Audit Committee is comprised of G.A. (Ben) Binninger, Claudia Tornquist, and Carsten Korch, each of whom are independent based on the criteria for independence prescribed by Rule 10A-3 of the Exchange Act and Nasdaq Stock Market Rule 5605(a)(2). The Audit Committee meets the composition requirements set forth by Section 5605(c)(2) of the Nasdaq Stock Market Rules.

The Board of Directors has also determined that each member of the Audit Committee is financially literate, meaning each such member has the ability to read and understand a set of financial statements that present a breadth and level of complexity of the issues that can reasonably be expected to be raised by the Company’s financial statements.

Audit Committee Financial Expert

The Board of Directors has determined that G.A. (Ben) Binninger and Claudia Tornquist qualify as financial experts (as defined in Item 407(d)(5)(ii) of Regulation S-K under the Exchange Act) and Nasdsaq Stock Market Rule 5605(c)(2)(A); and are independent (as determined under Exchange Act Rule 10A-3 and Nasdaq Stock Market Rule 5605(a)(2)).

The SEC has indicated that the designation or identification of a person as an audit committee financial expert does not make such person an “expert” for any purpose, impose any duties, obligations or liability on such person that are greater than those imposed on members of the audit committee and the board of directors who do not carry this designation or identification, or affect the duties, obligations or liability of any other member of the audit committee or board of directors.

CODE OF ETHICS

The Company’s Code of Conduct (the “Code”) applies to all employees, officers and members of the Board of Directors of the Company, including the CEO and CFO. Since the adoption of the Code, there have not been any waivers, including implied waivers, from any provision of the Code. A copy of the Code can be found on the Company’s internet website at the following address: www.americanlithiumcorp.com/about-us/#governance.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The following table sets forth the fees billed to the Registrant by Ernst & Young LLP, Chartered Professional Accountants, located in Toronto, Ontario, Canada PCAOB ID# 1263) for professional services rendered in each of the years ended February 28, 2023 and February 28, 2022. During these years, Ernest & Young LLP was the Registrant’s only external auditor.

| Fiscal Year Ended February 28, 2023 | Fiscal Year Ended February 28, 2022 | |

| Audit Fees | $254,120 | $150,000 |

| Audit-Related fees | - | - |

| Tax fees | $19,795 | $44,512 |

| All Other Fees | - | - |

The Registrant’s Audit Committee has not adopted specific policies or procedures for the engagement of non-audit services. However, the Registrant’s Audit Committee may approve, from time to time, expenses made for non-audit-related services contracts. All audit and non-audit fees paid to Ernst & Young LLP for the financial year ended February 28, 2022, were pre-approved by the Audit Committee and none were approved on the basis of the de minimis exemption set forth in Rule 2-01(c)(7)(i)(C) of Regulation S-X.

OFF-BALANCE SHEET ARRANGEMENTS

The information provided under the heading “Off-Balance Sheet Arrangements” contained in the MD&A, filed as Exhibit 99.3 hereto, is incorporated by reference herein.

CONTRACTUAL OBLIGATIONS

The following table lists, as of February 28, 2023, information with respect to the Registrant’s known contractual obligations.

| Payments due by period | ||||||||||||||||||||

| Contractual Obligations | Total | Less than 1 year |

1-3 years | 3-5 years | More than 5 years |

|||||||||||||||

| Long-Term Debt Obligations | - | - | - | - | - | |||||||||||||||

| Capital (Finance) Lease Obligations | $ | 226,361 | $ | 74,981 | $ | 151,308 | - | - | ||||||||||||

| Operating Lease Obligations | - | - | - | - | - | |||||||||||||||

| Purchase Obligations | - | - | - | - | - | |||||||||||||||

| Other Long-Term Liabilities Reflected on the Company’s Balance Sheet under the GAAP of the primary financial statements | - | - | - | - | - | |||||||||||||||

| Total | $ | 226,361 | $ | 74,981 | $ | 151,308 | - | - | ||||||||||||

NASDAQ CORPORATE GOVERNANCE

The Registrant is a “foreign private issuer” as defined in Rule 3b-4 under Exchange Act and its common shares are listed on Nasdaq and the TSXV. Rule 5615(a)(3) of Nasdaq Stock Market Rules permits foreign private issuers to follow home country practices in lieu of certain provisions of Nasdaq Stock Market Rules. A foreign private issuer that follows home country practices in lieu of certain provisions of Nasdaq Stock Market Rules must disclose ways in which its corporate governance practices differ from those followed by domestic companies either on its website or in the annual report that it distributes to shareholders in the United States. A description of the ways in which the Registrant’s governance practices differ from those followed by domestic companies pursuant to Nasdaq Stock Market Rules are as follows:

Majority Independent Directors: The Registrant does not follow Nasdaq Stock Market Rule 5605(b)(1), which requires listed companies to have a majority of the board of directors comprised of “Independent Directors” as defined in Nasdaq Stock Market Rule 5605(a)(2). In lieu of following Nasdaq Stock Market Rule 5605(b)(1), the Registrant follows the rules of the TSXV.

Executive Sessions: The Registrant does not follow Nasdaq Stock Market Rule 5605(b)(2), which requires listed companies to have their Independent Directors regularly schedule meetings at which only Independent Directors are present. In lieu of following Nasdaq Stock Market Rule 5605(b)(2), the Registrant follows the rules of the TSXV.

Audit Committee Charter: The Registrant does not follow Nasdaq Stock Market Rule 5605(c)(1), which requires listed companies to adopt a formal written audit committee charter that specifies the scope of its responsibilities and the means by which it carries out those responsibilities; the outside auditor's accountability to the audit committee; and the audit committee's responsibility to ensure the independence of the outside auditor. In lieu of following Nasdaq Stock Market Rule 5605(c)(1), the Registrant follows the rules of the TSXV.

Compensation Committee Charter: The Registrant does not follow Nasdaq Stock Market Rule 5605(d)(1), which requires listed companies to adopt a formal written compensation committee charter and have a compensation committee review and reassess the adequacy of the charter on an annual basis. In lieu of following Nasdaq Stock Market Rule 5605(d)(1), the Registrant follows the rules of the TSXV.

Composition of Compensation Committee: The Registrant does not follow Rule Nasdaq Stock Market 5605(d)(2), which requires listed companies to have a compensation committee comprised of at least two members, with each member being an Independent Director as defined under Nasdaq Stock Market Rule 5605(a)(2). In lieu of following Nasdaq Stock Market Rule 5605(d)(2), the Registrant follows the rules of the TSXV.

Independent Director Oversight of Director Nominations: The Registrant does not follow Nasdaq Stock Market Rule 5605(e)(1), which requires Independent Director involvement in the selection of director nominees, by having a nominations committee comprised solely of Independent Directors. In lieu of following Nasdaq Stock Market Rule 5605(e)(1), the Registrant follows the rules of the TSXV.

Nominations Committee Charter: The Registrant does not follow Nasdaq Stock Market Rule 5605(e)(2), which requires listed companies to adopt a formal written nominations committee charter or board resolution, as applicable, addressing the director nomination process and such related matters as may be required under the federal securities laws. In lieu of following Nasdaq Stock Market Rule 5605(e)(2), the Registrant follows the rules of the TSXV.

Shareholder Meeting Quorum Requirements: The Registrant does not follow Nasdaq Stock Market Rule 5620(c) which requires that the minimum quorum requirement for a meeting of shareholders be 33 1/3 % of the outstanding common shares. In addition, Nasdaq Stock Market Rule 5620(c) requires that an issuer listed on Nasdaq state its quorum requirement in its by-laws. In lieu of following Nasdaq Stock Market Rule 5620(c), the Registrant follows the rules of the TSXV.

The foregoing is consistent with applicable laws, customs and practices in Canada.

NOTICES PURSUANT TO REGULATION BTR

There were no notices required by Rule 104 of Regulation BTR that the Company sent during the year ended February 28, 2023 concerning any equity security subject to a blackout period under Rule 101 of Regulation BTR.

MINE SAFETY DISCLOSURE

Not applicable.

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS

Not applicable.

RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION

Not applicable.

EXHIBIT INDEX

*To be filed by amendment.

UNDERTAKING

The Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the SEC staff, and to furnish promptly, when requested to do so by the SEC staff, information relating to the securities in relation to which the obligation to file an annual report on Form 40-F arises or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Registrant has previously filed a Form F-X in connection with the class of securities in relation to which the obligation to file this report arises.

Any change to the name or address of the agent for service of the Registrant shall be communicated promptly to the Commission by amendment to Form F-X referencing the file number of the Registrant.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

| American Lithium Corp. | |

| By: /s/ Simon Clarke | |

| Name: Simon Clarke | |

| Title: Chief Executive Officer | |

| Date: May 30, 2023 |

Exhibit 99.1

AMERICAN LITHIUM CORP.

ANNUAL INFORMATION FORM

FOR THE FINANCIAL YEAR ENDED FEBRUARY 28, 2023

Dated May 29, 2023

Corporate Office

Suite 710, 1030 West Georgia Street

Vancouver, British Columbia, V6E

2Y3

Registered Office

Suite 2200, 885 West Georgia Street

Vancouver, British Columbia, V6C

3E8

TABLE OF CONTENTS

| Date of Information | 4 |

| Cautionary Notes to U.S. Investors Concerning Resource Estimates | 4 |

| Currency | 5 |

| Forward-Looking Information | 5 |

| Cautionary Note Regarding Peru Concessions | 7 |

| Certain Other Information | 7 |

| Qualified Person and Technical Reports | 7 |

| Name, Address and Incorporation | 8 |

| Intercorporate Relationships | 9 |

| Three Year History | 10 |

| 2022 – 2023 Developments | 13 |

| Selected Financings | 16 |

| Subsequent Events to February 28, 2023 | 16 |

| Background | 16 |

| Specialized Skills and Knowledge | 17 |

| Competitive Conditions | 17 |

| Business Cycles | 17 |

| Environmental Protection | 17 |

| Employees | 18 |

| Foreign Operations | 18 |

| Reorganizations | 18 |

| Social and Environmental Policies | 18 |

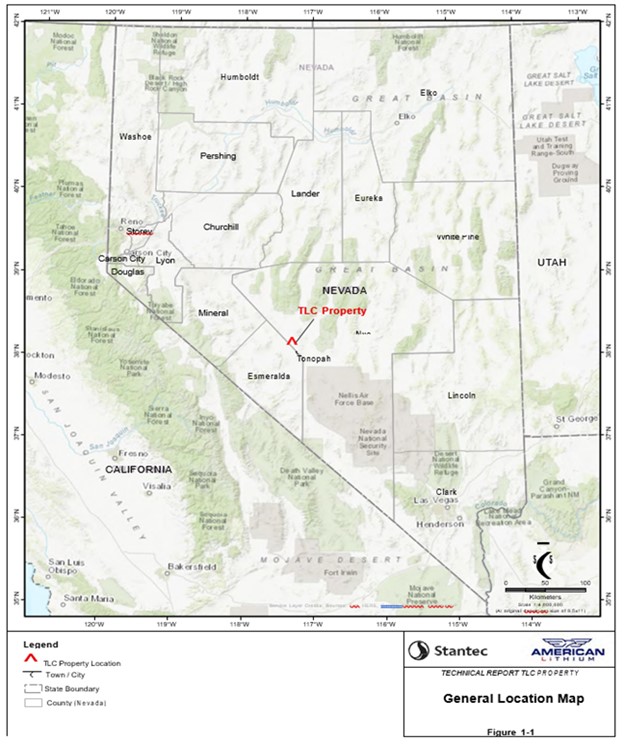

| TLC Lithium Project | 28 |

| Introduction | 29 |

| Reliance on other Experts | 29 |

| Property Description and Location | 29 |

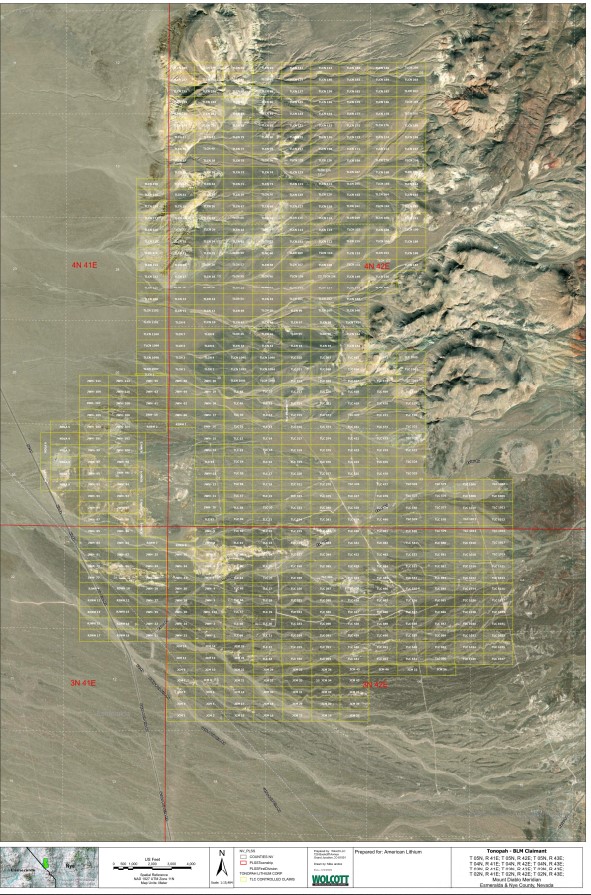

| Property Concessions | 31 |

| Accessibility, Climate, Local Resources, Infrastructure | 33 |

| History | 33 |

| Geological Setting and Mineralization | 33 |

| Exploration | 34 |

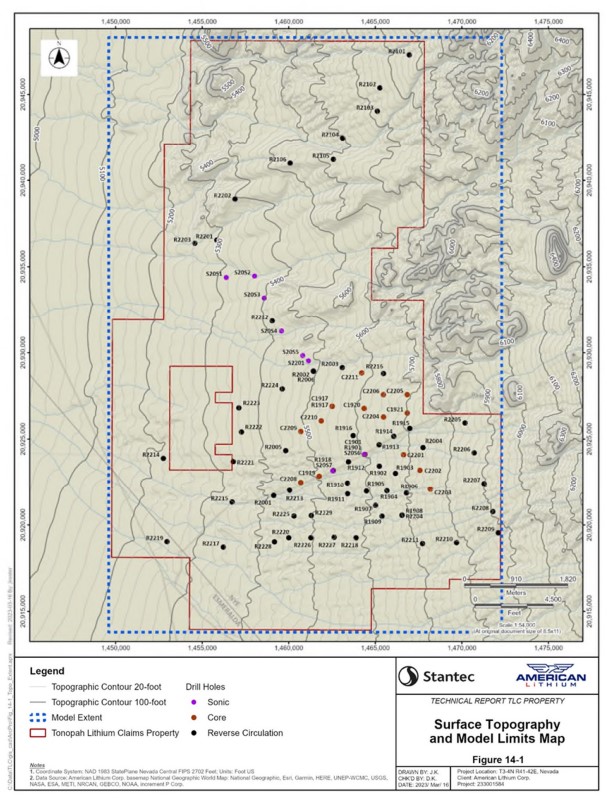

| Drilling | 35 |

| Sample Preparation, Analyses and Analyses | 35 |

| Quality Control | 36 |

| Data Verification | 36 |

| Limitation to Data Validation by QP | 36 |

| Opinion of the Independent QP | 36 |

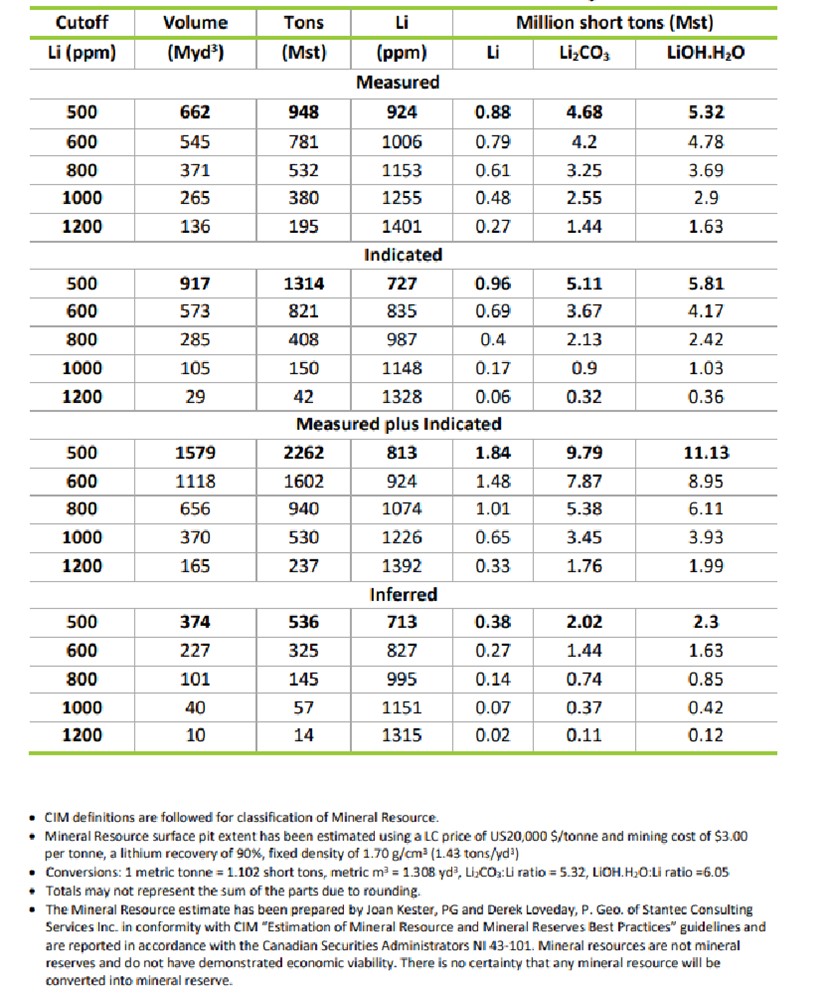

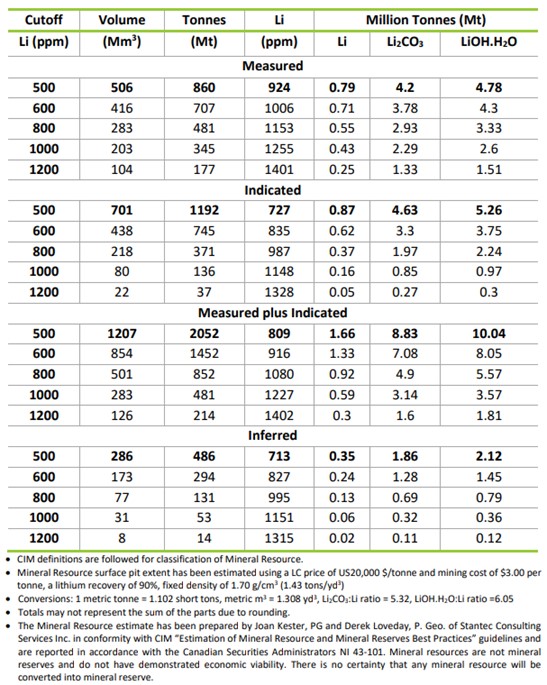

| Mineral Resource Estimation | 37 |

| Potential Risks | 41 |

| Mineral Reserve Estimates | 41 |

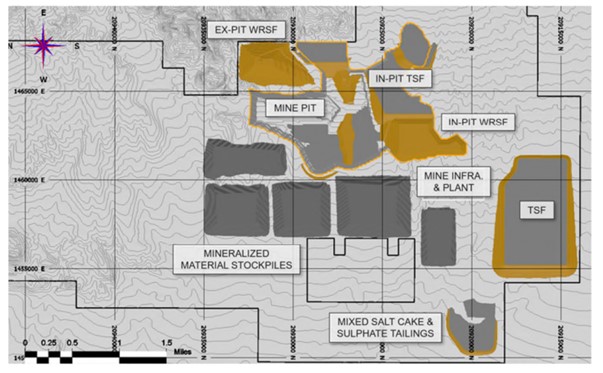

| Mining Operations/Methods | 41 |

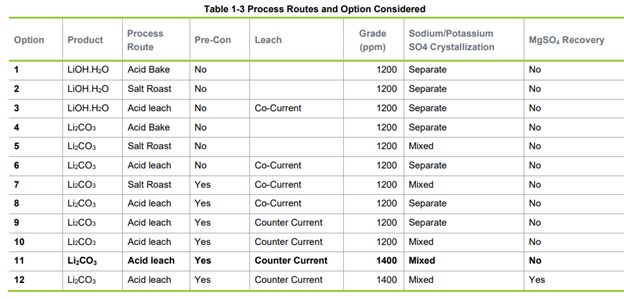

| Mineral Processing and Recovery | 42 |

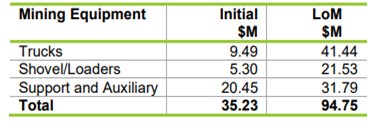

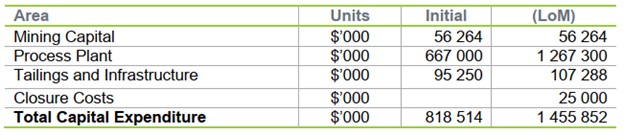

| Capital Cost Estimates | 45 |

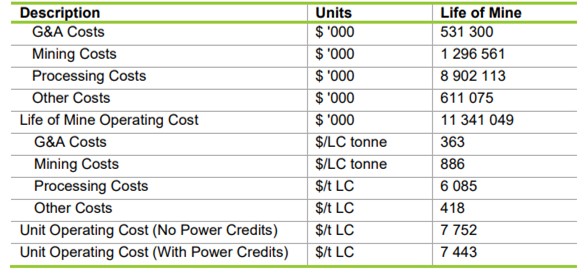

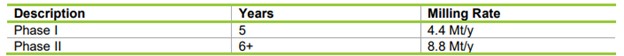

| Operating Cost Estimates | 47 |

| Alternative Case: By-Product Recovery | 50 |

| Adjacent Properties | 50 |

| Interpretations and Conclusions | 51 |

| Recommendations | 51 |

| Exploration, Development and Production | 52 |

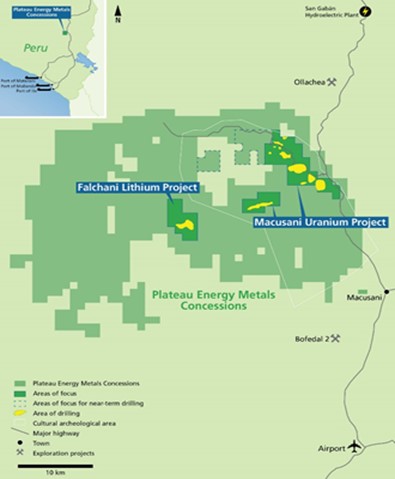

| Falchani Lithium Project (“Falchani Project”) and Macusani Uranium Project (“Macusani Project”) – Puno, Peru | 54 |

| Falchani Lithium Project Description, Location and Access | 54 |

| History | 56 |

| Geological Setting, Mineralization and Deposit Types | 57 |

| Exploration | 58 |

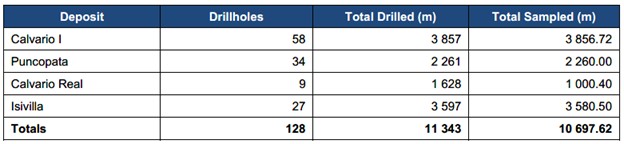

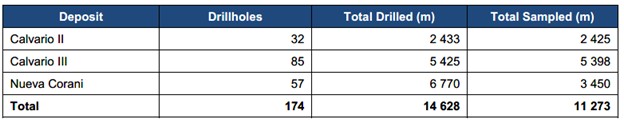

| Drilling | 59 |

| Sampling, Analysis and Data Verification | 59 |

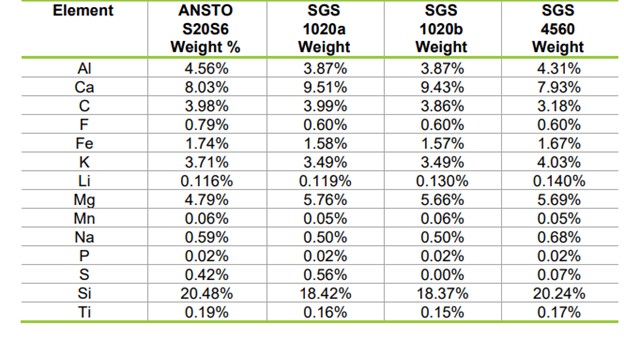

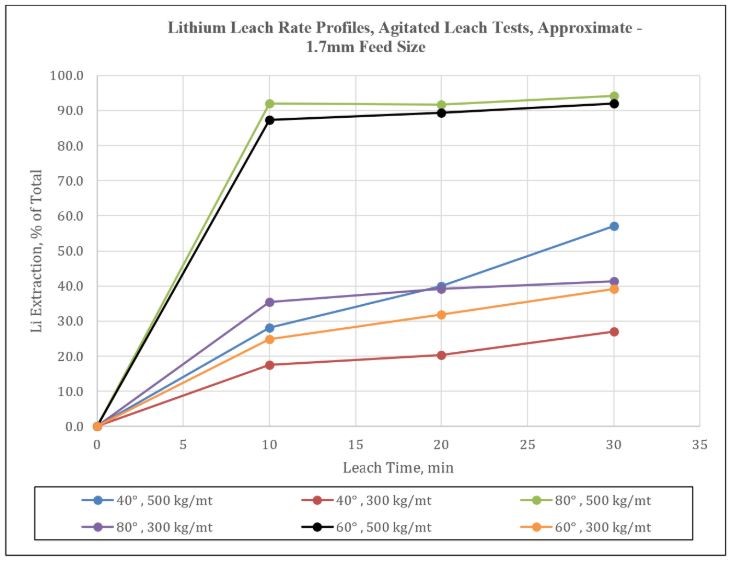

| Mineral Processing and Metallurgical Testing | 61 |

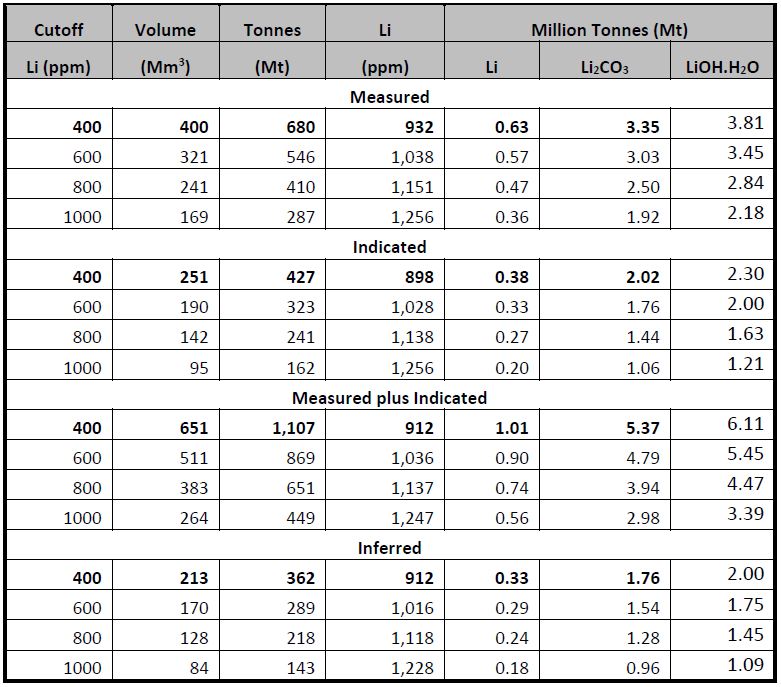

| Mineral Resource Estimates | 62 |

| Mineral Reserve Estimates | 66 |

| Mining Operations | 66 |

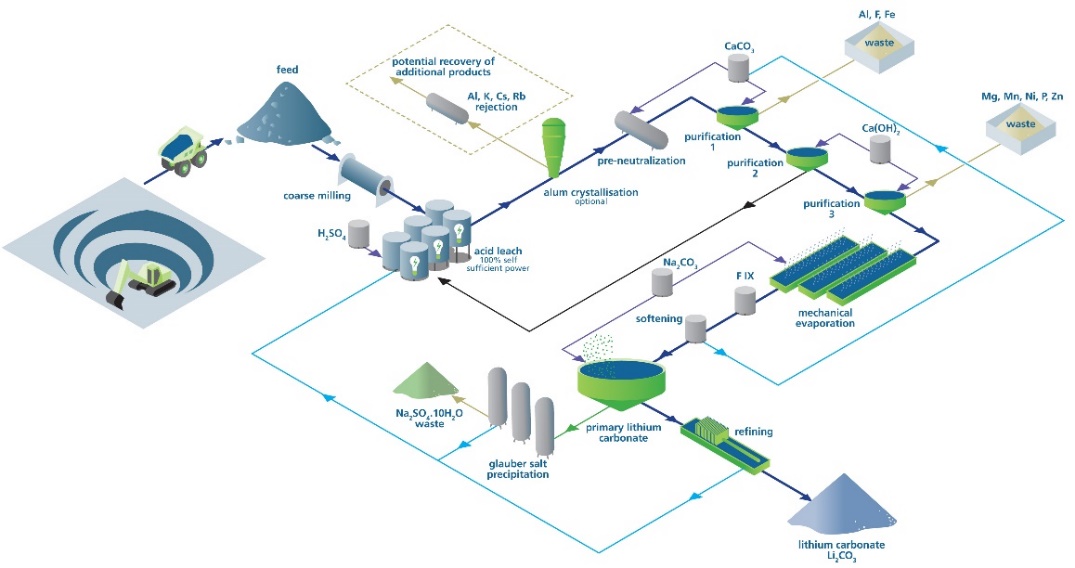

| Processing and Recovery Operations | 68 |

| Infrastructure, Permitting and Compliance Activities | 69 |

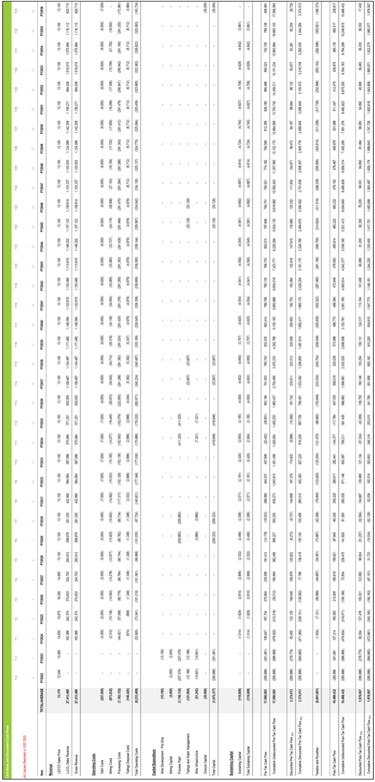

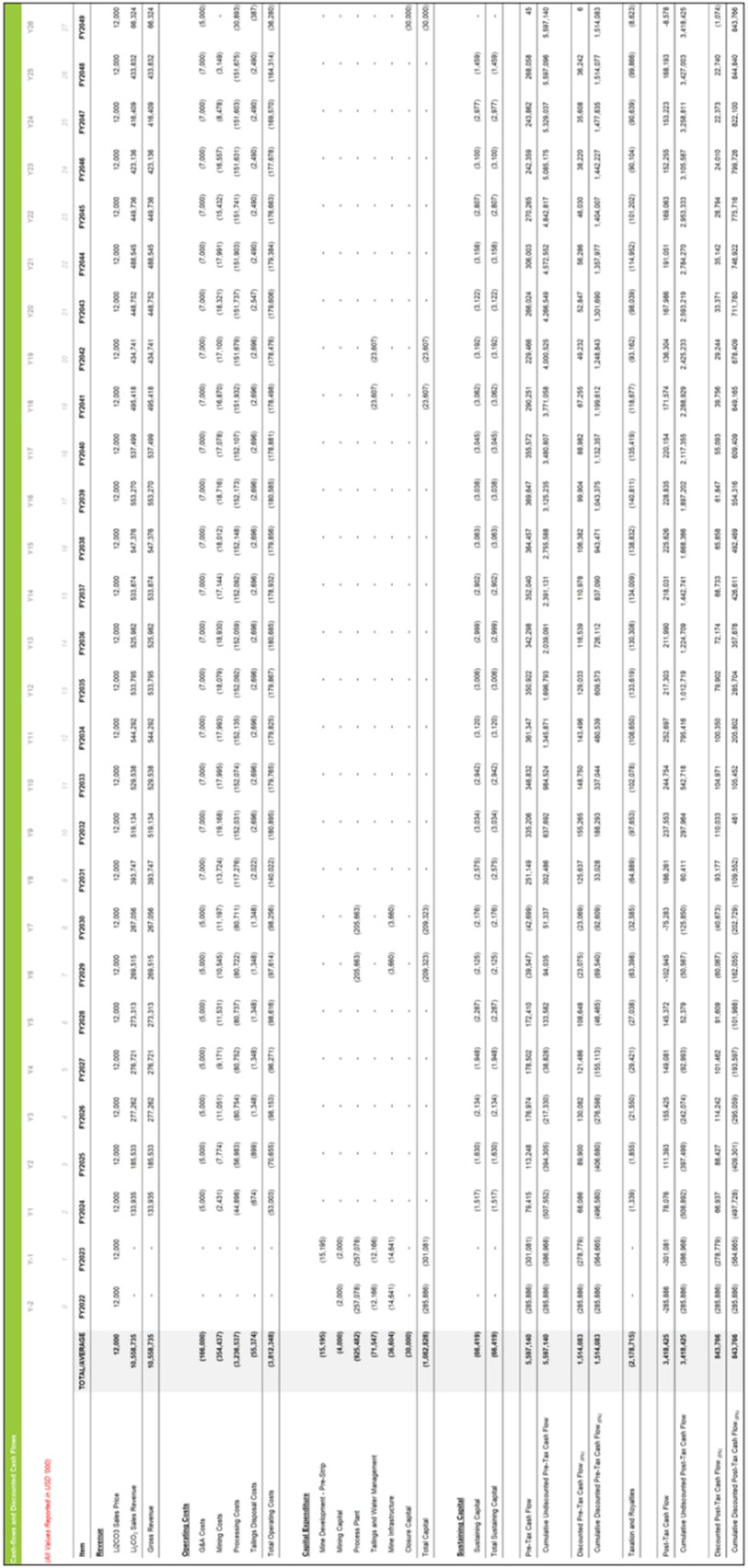

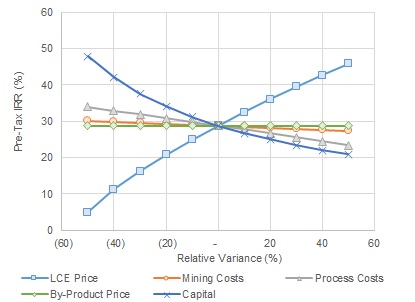

| Capital and Operating Costs | 71 |

| Macusani Uranium Project – Peru | 79 |

| Macusani Uranium Project Description, Location and Access | 80 |

| History | 82 |

| Geological Setting, Mineralization and Deposit Types | 84 |

| Exploration | 85 |

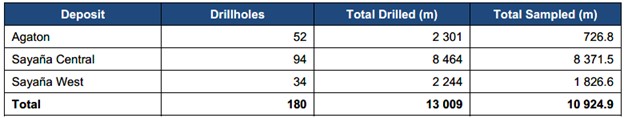

| Drilling | 86 |

| Sampling, Analysis and Data Verification | 89 |

| Mineral Processing and Metallurgical Testing | 93 |

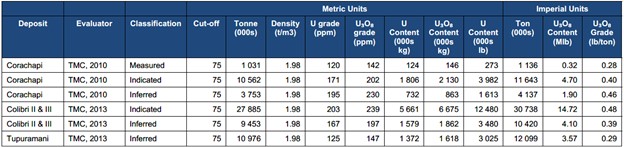

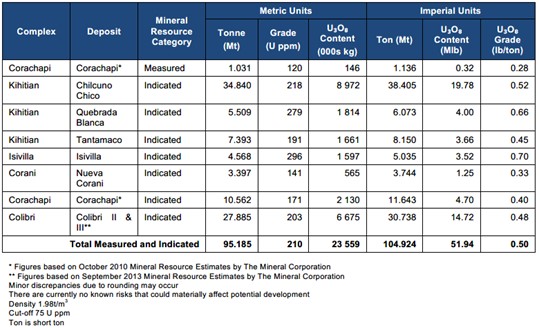

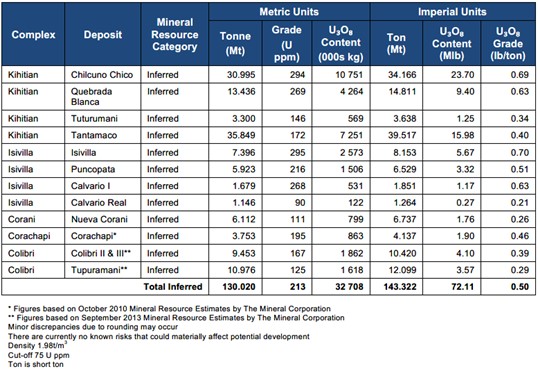

| Mineral Resource Estimates | 98 |

| Mining Operations | 101 |

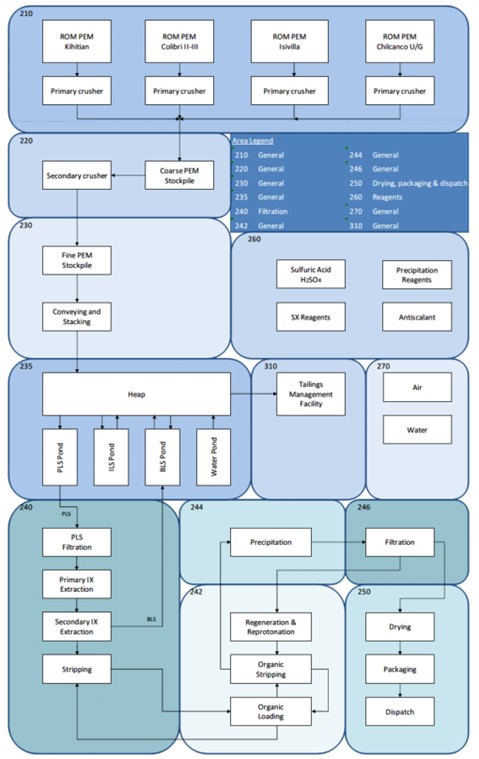

| Processing and Recovery Methods | 103 |

| Infrastructure, Permitting and Compliance Activities | 105 |

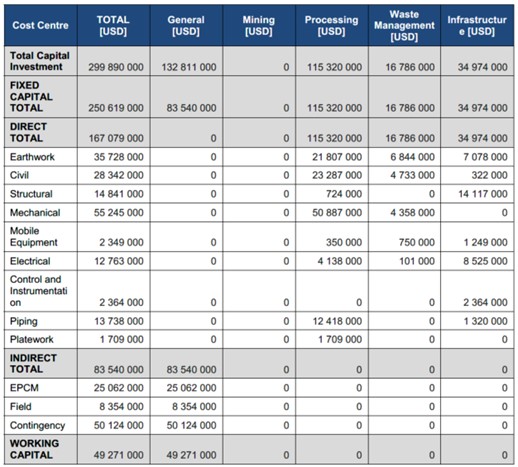

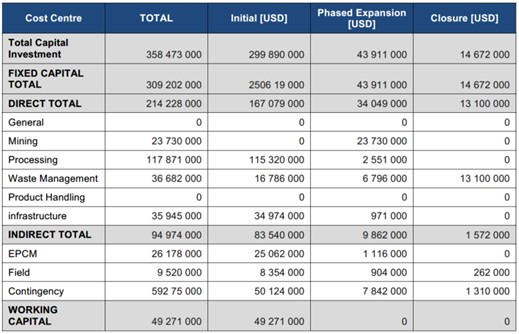

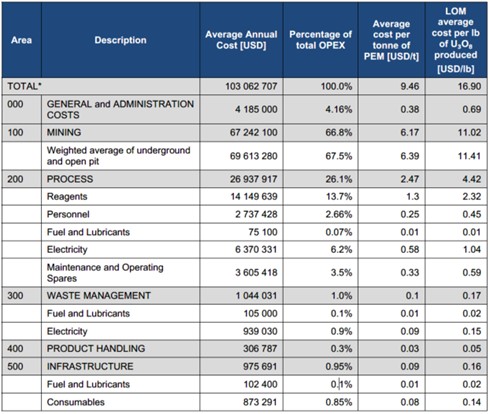

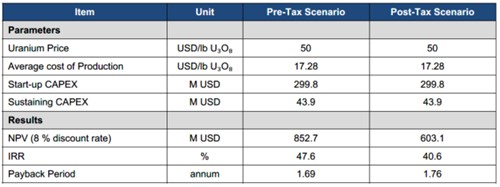

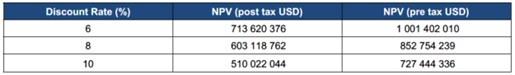

| Capital and Operating Costs | 110 |

| Shares | 116 |

| Trading Price and Volume | 117 |

| Prior Sales | 117 |

| Name, Occupation and Security Holding | 118 |

| Shareholdings of Directors and Officers | 119 |

| Cease Trade Orders, Bankruptcies, Penalties or Sanctions | 119 |

| Conflicts of Interest | 120 |

| Auditors | 121 |

| Transfer Agents, Registrars or Other Agents | 121 |

PRELIMINARY NOTES

Date of Information

Unless otherwise stated, the information herein is presented as at February 28, 2023, being the date of American Lithium Corp.’s (“American Lithium” or the “Company”) most recently completed financial year.

Cautionary Notes to U.S. Investors Concerning Resource Estimates

This Annual Information Form (“AIF”) was prepared in accordance with Canadian securities laws and standards for reporting of mineral resource estimates, which differ in some respects from United States standards. In particular, and without limiting the generality of the foregoing, the terms “measured mineral resources,” “indicated mineral resources,” “inferred mineral resources,” and “mineral resources” used or referenced in this AIF are Canadian mineral disclosure terms as defined in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) under the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum Standards for Mineral Resources and Mineral Reserves, Definitions and Guidelines, May 2014 (the “CIM Standards”). Until recently, the CIM Standards definition differed significantly from standards in the United States. The United States Securities and Exchange Commission (the “SEC”) has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the United States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”). These amendments became effective February 25, 2019 (the “SEC Modernization Rules”) with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replaced the property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be “substantially similar” to the corresponding definitions under the CIM Standards definition that are required under NI 43-101. Investors are cautioned that while the above terms are “substantially similar” to the corresponding CIM Standards definition, there are differences in the definitions under the SEC Modernization Rules and the CIM Standards definition. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the mineral reserve or mineral resource estimates under the standards adopted under the SEC Modernization Rules. Investors are cautioned that “inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies, except in limited circumstances. The term “resource” does not equate to the term “reserves”. Investors should not assume that all or any part of measured or indicated mineral resources will ever be converted into mineral reserves. Investors are also cautioned not to assume that all or any part of an inferred mineral resource exists or is economically mineable.

Currency

Except where otherwise indicated, all references to currency in this AIF are to Canadian Dollars (“$”).

Forward-Looking Information

This AIF may contain “forward-looking information” and “forward-looking statements” within the meaning of applicable securities legislation (“forward-looking statements”). All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements relate to future events or future performance and reflect management’s expectations or beliefs regarding future events and include, but are not limited to, statements regarding the business, operations, outlook and financial performance and condition of the Company; potential benefits from the acquisition of Plateau Energy Metals Inc. (“Plateau”) and its subsidiaries; plans, objectives and advancement of the TLC Lithium Property, the Falchani Lithium Project and Macusani Uranium Project (each as defined below, and collectively, the “Projects”); exploration drilling plans, in-fill and expansion drilling plans and other work plans, exploration programs and development plans to be conducted; results of exploration, development and operations; expansion of resources and testing of new deposits; environmental and social community and other permitting; timing, type and amount of capital and operating and exploration expenditures, as well as future production costs; estimation of mineral resources and mineral reserves; realization of mineral reserves; preliminary economic assessments (each, a “PEA”), including the timing for completion, and the assumptions and parameters upon which they are based, and the timing and amount of future estimated production; development and advancement of the Projects; success of mining operations; treatment under regulatory regimes; ability to realize value from the Company’s assets; adequacy of the Company’s financial resources; environmental matters, including reclamation expenses; insurance coverage; title disputes or claims, including the status of the “Precautionary Measures” filed by the Company’s subsidiary Macusani Yellowcake S.A.C. (“Macusani”), the outcome of the judicial appeal process, and any and all future remedies pursued by the Company and its subsidiary Macusani to resolve the title for 32 of its concessions; the anticipated New Uranium Regulations affecting Peru; and limitations on insurance coverage any other statements regarding the business plans, expectations and objectives of the Company; and any other information contained herein that is not a statement of historical fact. In certain cases, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative of these terms or comparable terminology. In this document, certain forward-looking statements are identified by words including “may”, “future”, “expected”, “intends” and “estimates”.

Forward-looking statements are based on management’s reasonable estimates, expectations, analyses and opinions at the date the information is provided and is based on a number of assumptions and subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. Assumptions upon which such forward-looking statements are based include, without limitation: that no significant event will occur outside the ordinary course of business of the Company; the Company’s ability to achieve its stated goals and objectives, including the anticipated benefits of the acquisition of Plateau and its subsidiaries; legislative and regulatory environment; impact of increasing competition; current technological trends; price of lithium, uranium and other metals; costs of development and advancement; anticipated results of exploration and development activities; the ability to operate in a safe and effective manner; and the ability to obtain financing on reasonable terms. Readers are cautioned that the foregoing list is not exhaustive. Further, the aforementioned assumptions may be affected by the long lasting negative disruptive effects of the coronavirus (“COVID-19”) pandemic, which resulted in a widespread health crisis that continues to affect the economies and financial markets of many countries around the world, as well as the ongoing Russo-Ukrainian War, which has resulted increased volatility in commodity markets. The consequences of the COVID-19 pandemic, as well as the ongoing Russo-Ukrainian War, include global stock market and financial market volatility; operating, supply chain and project development delays and disruptions; and increased interest rates, all of which have and could further affect commodity prices, credit ratings and credit risk. The ongoing effects of the COVID-19, and any escalation of the Russo-Ukrainian War, could have a material adverse impact on the Company’s plans, operations, financial condition, and the market for its securities; however, as at the date of this AIF, such impact cannot be reasonably estimated. Although the Company believes that the current opinions and expectations reflected in such forward-looking statements are reasonable based on information available at the time, undue reliance should not be placed on forward-looking statements since the Company can provide no assurance that such opinions and expectations will prove to be correct.

All forward-looking statements are inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including risks, uncertainties and assumptions related to: the Company’s ability to achieve its stated goals, including the benefits of the acquisition of Plateau and its subsidiaries; the estimated valuation of the Company being accurate; the estimated costs associated with the advancement of the Projects; legislative changes that impact operations of the Company; risks and uncertainties relating to the COVID-19 or similar such pandemics; the anticipated New Uranium Regulations affecting Peru; risks related to the certainty of title to the properties of the Company, including the status of the “Precautionary Measures” filed by the Company’s subsidiary Macusani, the outcome of the administrative process, the judicial appeal process, and any and all future remedies pursued by the Company and its subsidiary Macusani to resolve the title for 32 of its concessions; the ongoing ability to work cooperatively with stakeholders, including, but not limited to, local communities and all levels of government; the potential for delays in exploration or development activities and other effects due to global pandemics, such as the COVID-19 pandemic; the interpretation of drill results, the geology, grade and continuity of mineral deposits; variations in mineralization reserves, grade and recover rates; changes in project parameters as plans continue to be refined; the possibility that any future exploration, development or mining results will not be consistent with expectations; risks that permits or approvals will not be obtained as planned or delays in obtaining permits or approvals; mining and development risks, including risks related to accidents, equipment breakdowns, labour disputes (including work stoppages, strikes and loss of personnel) or other unanticipated difficulties with or interruptions in exploration and development; other risks of the mining industry; risks related to commodity price and foreign exchange rate fluctuations; risks related to foreign operations; the cyclical nature of the industry in which the Company operate; risks related to failure to obtain adequate financing on a timely basis and on acceptable terms or delays in obtaining governmental approvals; risks related to environmental regulation and liability; political and regulatory risks associated with mining and exploration; risks related to the uncertain global economic environment and the effects upon the global market generally, and due to the pandemic measures taken to reduce the spread of COVID-19 or any such future pandemics; any of which could continue to negatively affect global financial markets, including the trading price of the Company’s shares and could negatively affect the Company’s ability to raise capital and may also result in additional and unknown risks or liabilities to the Company. Other risks and uncertainties related to prospects, properties and business strategy of the Company are identified in the “Risk Factors” section of this AIF, as well as those factors detailed from time to time in the Company’s condensed interim and annual consolidated financial statements, management discussion and analysis and other recent securities filings available at www.sedar.com.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements that are contained herein, except in accordance with applicable securities laws.

Cautionary Note Regarding Peru Concessions

Thirty-two (32) of the 174 Falchani Lithium Project and the Macusani Uranium Project concessions originally held by American Lithium’s subsidiary Macusani, are currently subject to Administrative and Judicial processes (together, the “Processes”) in Peru to overturn resolutions issued by the Geological, Mining, and Metallurgical Institute of Peru (“INGEMMET”) and the Mining Council of the Ministry of Energy and Mines of Peru (“MINEM”) in February 2019 and July 2019, respectively, which declared Macusani’s title to the 32 concessions invalid due to late receipt of the annual validity payment. Macusani successfully applied for injunctive relief on these 32 concessions in a Court in Lima, Peru, and the grant of the Precautionary Measures (Medida Cautelar) has restored the title, rights, and validity of those 32 concessions to Macusani. On November 2, 2021, the Company was made aware that the judicial ruling in relation to those 32 concessions had been issued in favour of the Company. The ruling restored full title to these concessions. On November 26, 2021, the Company confirmed that appeals of the judicial ruling were lodged by INGEMMET and MINEM, and subsequently other parties. The appeal will be considered by a higher court tribunal currently scheduled for September 7, 2023. If American Lithium’s subsidiary Macusani does not obtain a successful resolution to the Processes, Macusani’s title to the 32 concessions could be revoked. However, the Company would then have further recourse through an appeal to the Supreme Court.

Certain Other Information

Certain information in this AIF is obtained from third party sources, including public sources, and there can be no assurance as to the accuracy or completeness of such information. Although believed to be reliable, management of the Company has not independently verified any of the data from third party sources unless otherwise stated.

Qualified Person and Technical Reports

The scientific and technical information contained in this AIF relating to the TLC Lithium Property, the Falchani Lithium Project and the Macusani Uranium Project has been reviewed and approved by Ted O’Connor, Executive Vice-President and Technical Advisor of the Company, who is a Qualified Person as defined in NI 43-101. Certain scientific and technical information with respect to the TLC Lithium Property contained in this AIF has been taken from the technical report entitled “Tonopah Lithium Claims Project NI 43-101 Technical Report – Preliminary Economic Assessment” with an effective date of January 31, 2023 and prepared by John Joseph Riordan, Valentine Eugene Coetzee of DRA Pacific, and Derek J. Loveday, Satjeet Pandher, Joan C. Kester and Sean Ennis of Stantec Consulting Inc., a copy of which is available on American Lithium’s SEDAR profile at www.sedar.com. Certain scientific and technical information with respect to: (a) the Falchani Lithium Project contained in this AIF has been taken from the technical report entitled “Falchani Lithium Project NI 43-101 Technical Report – Preliminary Economic Assessment” with an effective date of February 4, 2020 and prepared by John Joseph Riordan, David Alan Thompson, Valentine Eugene Coetzee and Stewart Nupen of DRA Pacific.; and (b) the Macusani Uranium Project contained in this AIF has been taken from the technical report entitled “Macusani Project, Macusani, Peru, NI 43-101 Report – Preliminary Economic Assessment” with an effective date of January 12, 2016 and prepared by Michael Short and Thomas Apelt of GBM Minerals Engineering Consultants Limited, David Young of The Mineral Corporation and Mark Mounde of Wardell Armstrong International Limited, copies of both of which are available on Plateau’s SEDAR profile at www.sedar.com. The PEAs included herein are preliminary in nature and include inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEAs will be realized. Additional work is required to upgrade the mineral resources to mineral reserves. In addition, the mineral resource estimates could be materially affected by environmental, geotechnical, permitting, legal, title, taxation, socio-political, marketing, or other relevant factors.

Certain information in this AIF updates information from the TLC Technical Report, the Falchani Technical Report and the Macusani Technical Report, as applicable, which such updates have been reviewed and approved by Ted O’Connor, Executive Vice-President and Technical Advisor of the Company and a Qualified Person as defined in NI 43-101.

CORPORATE STRUCTURE

Name, Address and Incorporation

American Lithium Corp. was incorporated under the Business Corporations Act (British Columbia) (the “BCBCA”) on February 25, 1974 as Menika Mining Ltd. On April 11, 2016, the Company announced that it had changed its name from Menika Mining Ltd. to “American Lithium Corp.” and that trading would commence under the new name effective at the open of markets on April 18, 2016 under the symbol “LI”.

The Company has been actively involved in lithium exploration since April 2016 and has been focused on the acquisition, exploration and development of properties in North- and South- America prospective for lithium deposits and, in particular, its Tonopah Lithium Project in Nevada (the “TLC Lithium Project” or the “TLC Lithium Property”) with drilling in 2019 and 2020 leading to the publication of a maiden NI 43-101 resource in April 2020 and a PEA in January 2023. With the acquisition of Plateau in May 2021, the Company also added additional lithium and uranium properties in Peru. Currently, American Lithium focuses its operations on the TLC Lithium Project, the Falchani Lithium Project, and the Macusani Uranium Project, and as they have NI 43-101 mineral resource estimates and published PEAs, the Company recognizes them to have potential for continued development.

American Lithium is listed on the TSX Venture Exchange (“TSXV”) and trades under the symbol “LI”, on the Frankfurt Stock Exchange (“FRA”) under the symbol “5LA1” and on the Nasdaq Capital Market (“Nasdaq”) under the symbol “AMLI”. The Company is a reporting issuer in British Columbia and Alberta and files its continuous disclosure documents with the Canadian Securities Authorities in such provinces. Such documents are available on SEDAR at www.sedar.com. Except as otherwise expressly indicated, American Lithium’s filings through SEDAR are not incorporated by reference in this AIF.

The Company’s corporate office is located at Suite 710, 1030 West Georgia Street, Vancouver, British Columbia, V6E 2Y3 and its registered and records office is located at Suite 2200, 885 West Georgia Street, Vancouver, British Columbia, V6C 3E8.

Intercorporate Relationships

As of the date of this AIF, American Lithium has seven subsidiaries: (i) one of which is incorporated under the laws of the Province of British Columbia, being American Lithium Holdings Corp. (“Holdings”); (ii) three of which are incorporated under the laws of the State of Nevada (the “Nevada Subsidiaries”), being, Big Smoky Holdings, Inc., Tonopah Lithium Corp. (“TLC”) and Maran Ventures Ltd.; (iii) one of which is incorporated under the laws of the Province of Ontario, being Plateau Energy Metals Inc.; and (iv) two of which are incorporated under the laws of Peru, being Macusani Yellowcake S.A.C. and Macusani Uranium S.A.C. (“Macusani Uranium”, and together with Macusani, the “Peru Subsidiaries”). Holdings is the registered and beneficial owner of all the outstanding share capital of the Nevada Subsidiaries. Plateau is the registered owner of 99.5% of the outstanding share capital of Macusani, which owns 99.5% of the outstanding share capital of Macusani Uranium, with the remaining 0.5% held by a Peruvian individual as recommended by the Ministry of Energy and Mines (“MEM”).

The following diagram shows the Company’s intercorporate relationships. Each of the below noted subsidiaries are wholly-owned, with the exception of the Peru Subsidiaries.

| I. | American Lithium Holdings Corp. (British Columbia) |

| (a) | Tonopah Lithium Corp. (Nevada) |

| (b) | Big Smoky Holdings, Inc. (Nevada) |

| (c) | Maran Ventures Ltd. (Nevada) |

| II. | Plateau Energy Metals Inc. (Ontario) |

| (a) | Macusani Yellowcake S.A.C. (Peru)(1) |

| (A) | Macusani Uranium S.A.C. (Peru) |

Note:

| (1) | Plateau Energy Metals Inc. controls 100% of and owns 99.5% of the outstanding share capital of Macusani Yellowcake S.A.C., with the remaining 0.5% held by a Peruvian individual as recommended by the MEM. |

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

2020 – 2021 Developments

On May 4, 2020, the Company completed a technical report on the TLC Lithium Project titled “Technical Report TLC Property, Nye County, Nevada, USA”, which is available under the Company’s profile on www.sedar.com.

On June 25, 2020, the Company announced that Simon Clarke was appointed to the Board of Directors.

On July 10, 2020, the Company announced it had reached an agreement with Nevada Alaska Mining Company, Inc. (“Nevada Alaska”), under which the Company would buyback (the “Buyback”) 1.5% of the existing gross overriding royalty pertaining to a number of the original concessions comprising the Company’s wholly owned TLC Lithium Property (the “Buyback Agreement”). Prior to the exercise of the Buyback, Nevada Alaska held a 2.5% gross overriding royalty on commercial production from certain of the concessions comprising the TLC Lithium Property, and following completion of the Buyback, continues to hold a 1.0% royalty. In consideration for the Buyback, the Company paid US$150,000 and issued 843,750 Shares to Nevada Alaska.

Also on July 10, 2020, the Company announced it had reached an agreement to acquire all of the outstanding share capital of an arm’s length Nevada company, 4286128 Nevada Corp., which holds the rights to a series of lode mining claims totaling approximately 2,000 acres contiguous to and north and northwest of the TLC Lithium Property (the “4286128 Agreement”). In accordance with the 4286128 Agreement, the Company issued 4,000,000 Shares to the existing shareholders of 4286128 Nevada Corp.

On July 27, 2020, the Company signed a letter of intent to acquire a 100% interest in certain privately held lands and the accompanying 1,176 acre-feet of water rights (the “Water Rights LOI”).

In August 2020, the Company announced the results from its draft Baseline Biological Survey which examined the TLC Lithium Property area in detail to document all species present. The report had positive results as it showed that “no species or habitat protected under the Endangered Species Act are present within the project area.” These results facilitated the continuation of study and the completion and filing of the plan of operations (the “PO”) as set out below.

On August 20, 2020, the Company announced that Andrew Squires had resigned from, and G.A. (Ben) Binninger was appointed to, the Board of Directors.

On September 17, 2020, pursuant to the Water Rights LOI, the Company entered into a real property purchase agreement (the “Water Right Purchase Agreement”). Pursuant to the terms of the Water Rights Purchase Agreement, the Company paid USD$300,000 to the vendor with an additional USD$1 million will be paid in equal annual installments over the next four years. On August 31, 2022 the Company made accelerated payments of $1,300,000 and now has full title to this property and associated water rights.

The Company submitted its PO for the next phase of advancement at the TLC Lithium Project to the Bureau of Land Management (“BLM”) in January 2021 which also included the Baseline Biological Survey as well as a Baseline Cultural Survey.

During the financial year ended February 28, 2021 the Company also received an aggregate of $14,514,896 from the exercise of various outstanding Warrants and Options (as defined below).

2021 – 2022 Developments

On February 9, 2021, the Company announced that it had reached agreement to acquire Plateau and to consolidate both companies’ development-stage lithium assets and acquire the Macusani Uranium Project. Such agreement was, amongst other things, subject to a court approved plan of arrangement (the “Arrangement”), the approval of Plateau equity holders as well as regulatory approvals.

On March 4, 2021, the Company announced that it had been selected by the US Department of Energy Advanced Manufacturing Office, with co-recipient American Battery Technology Company and another industry partner, to receive grant funding totaling 50% of the capital cost for a US$4.5M lithium processing pilot plant. However, the Company subsequently decided during 2022, to focus on traditional processing methods as it was able to successfully extract lithium through acid leaching and roasting options and it wanted to focus its resources on these approaches. The Company also found the structure being proposed difficult to support and it notified the other parties accordingly.

On April 29, 2021, the Company announced that Simon Clarke was appointed Chief Executive Officer.

On April 29, 2021, the Company also completed a private placement of 7,518,750 units (each, a “Unit”) at a price of $2.00 per Unit, for gross proceeds of $15,037,500.

On May 3, 2021, the Company closed a share purchase agreement with the shareholder of 1301420 BC Ltd. (“1301420 BC”) whereby the Company purchased 100% of the outstanding shares of 1301420 BC. 1301420 BC’s only asset is comprised of its ownership of 100% of the issued and outstanding shares of 1301420 Nevada Ltd., which holds the title to a series of mining claims totaling 2,260 acres located in Esmeralda County, Nevada, contiguous and to the west of the Company’s TLC Lithium Property. The claims are not subject to any royalties or encumbrances. Pursuant to the agreement (the “1301420 Agreement”), the Company issued 4,000,000 Shares to the existing shareholder of 1301420 BC Ltd. and this has been accounted for as an asset acquisition.

On May 11, 2021 the Company completed the acquisition of Plateau by way of the Arrangement, resulting in Plateau becoming a wholly-owned subsidiary of the Company. Under the terms of the Arrangement, each holder of Plateau common shares received 0.29 of a common share of the Company (a “Share”) and 0.145 of a Share purchase warrant of the Company (a “Warrant”, each whole Warrant an “Exchange Warrant”) for each Plateau common share held immediately prior to effective time (the “Exchange Ratio”). Each whole Exchange Warrant entitles the holder to acquire one Share at a price of $3.00 until May 11, 2024.

Each Plateau common share purchase warrant existing at the time, upon the exercise thereof on or after the effective time in accordance with its terms, entitled the holder to acquire 0.29 of a Share and 0.145 of an Exchange Warrant for each Plateau common share the warrant holder would have been entitled to acquire prior to the closing of the Arrangement. Existing Plateau stock options were exchanged for an Option to acquire from American Lithium the number of Shares equal to the product of: (A) the number of Plateau common shares subject to such Plateau stock option immediately prior to the effective date of the Arrangement, multiplied by (B) 0.29 of a Share for each Plateau common share. Each restricted share unit and deferred share unit of Plateau vested immediately prior to the effective time and was exchanged for one Plateau common share, and the holders thereof participated in the Arrangement as Plateau shareholders. Pursuant to the Arrangement, American Lithium acquired 127,213,511 Plateau common shares, representing 100% of the outstanding share capital of Plateau. The Company filed a Form 51-102F4 Business Acquisition Report in respect of the Arrangement.

Also on May 11, 2021, in connection with the acquisition of Plateau, Andrew Bowering stepped down as Chief Financial Officer and was appointed Chairman of the Board, Laurence Stefan was appointed President and Chief Operating Officer and was appointed to the Board of Directors, Philip N. Gibbs was appointed Chief Financial Officer and Ted O’Connor was appointed to the Board of Directors.

The Company made strong progress in metallurgy and process engineering in mid-2021. On June 29, 2021, the Company announced the ability to extract lithium from TLC Lithium Project claystones through roasting and water leaching. On August 5, 2021, the Company announced 95.1% lithium extraction using hydrochloric acid leaching process, and on August 25, 2021, the Company announced the highest lithium extraction results achieved by the Company to date, at 97.4% extraction, utilizing the warm sulfuric acid leaching process.

Continued metallurgical work since these developments has focused on optimizing the Company’s processing through to the lithium carbonate (“LC”) and/or lithium hydroxide precipitation stage before selecting the optimal process, based on economic and environmental criteria, to enable the completion of an in-depth PEA on the TLC Lithium Property. In parallel, and as also previously reported, pre-concentration test work, designed to increase the lithium head grade prior to leaching, continues using different gravimetric routes and commercially available equipment. This work is also relevant to the PEA as it has the potential to materially impact the economics of the TLC Lithium Project.

In August 2021, the Company reorganized its wholly-owned British Columbia subsidiaries, pursuant to a horizontal short-form amalgamation, such that American Lithium Holdings Corp. (formerly 1032701 B.C. Ltd.) (“Holdings”), 1065604 B.C. Ltd., 1067323 B.C. Ltd., 1074654 B.C. Ltd., 1134989 B.C. Ltd., 1301420 B.C. Ltd., and Esoteric Consulting Ltd. were combined into one entity, being Holdings.

On September 8, 2021, the Company announced that it had entered into a share purchase agreement dated September 7, 2021 with Big Smoky Holdings Corp. (“Big Smoky”), which has since been amalgamated with Holdings, to buy the Company and therefore its assets which comprised the rights to a series of mining claims totaling approximately 3,886 acres of highly prospective land immediately north and northwest of the TLC Lithium Property, and each of the shareholders thereof (the “Big Smoky Agreement”). Pursuant to the Big Smoky Agreement, on September 23, 2021, the Company acquired all of the issued and outstanding share capital of Big Smoky, which controls (through its subsidiary) the Crescent Dunes project consisting of 3,886 acres of exploration land immediately north of, and contiguous with, the TLC Lithium Property in exchange for the issuance of 2,500,000 Shares to the existing shareholders of Big Smoky.

On September 9, 2021, the Company announced positive pre-concentration upgrading results from the TLC Lithium Project mineralization using Falcon continuous gravity concentrators with 88% of lithium concentrated in 60% of the original mass.

In addition, on September 15, 2021, the Company announced details of additional progress optimizing recent salt roasting and water leaching on lithium mineralization from the TLC Lithium Project, including yielding 89.4% lithium extraction using a combination of gypsum, sodium chloride and sodium sulfate roasting, 87.3% lithium extraction using a combination of gypsum and sodium chloride and 79.3% lithium extraction using gypsum-only.

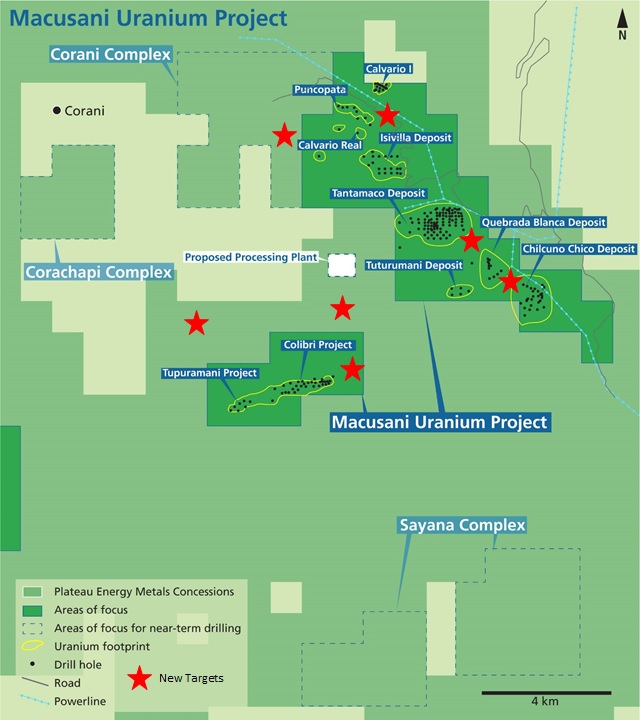

On September 28, 2021, the Company announced results of its prospecting, mapping and sampling on the Macusani Uranium Project; in particular, radiometric prospecting and sampling work identified possible extensions to five existing uranium deposits and three new anomalies for drill testing.

On November 2, 2021, the judicial ruling in relation to title to the 32 disputed concessions on the Falchani and Macusani projects in Peru was issued in favour of Macusani. The ruling confirmed that Macusani has full title to these concessions.

On November 25, 2021, the judicial ruling issued in favour of Macusani, in relation to title to 32 disputed concessions was appealed by INGEMMET and MINEM.

On December 1, 2021, the Company announced that initial exploration drilling has been launched at TLC North (Big Smoky acquisition land) near Tonopah Nevada. Initial drilling has successfully drilled thick intersections (up to 96.9 m / 318 ft) of lithium-bearing claystone.

On January 11, 2022, the BLM approved the PO and reclamation plan for the Company’s TLC Lithium Project, including construction of 110 drill sites and the excavation of five test pits to acquire samples for metallurgical testing. In addition, with the EA combining all previously planned phases of project exploration and pre-feasibility work into one phase of development, the PO was updated accordingly. While this will result in all required environmental bonding being paid upfront on approval, it is expected to stream-line the process, maximize efficiencies and potentially fast-track resulting work programs.

On February 16, 2022, the Company announced that it had achieved highest uranium extraction rates to date combined with lowest acid consumption from leach testing of Macusani uranium mineralization at Australian Nuclear Science and Technology Organization (“ANSTO”) and TECMMINE Mineral Processing Consultants Limited (“TECMMINE”) in Lima, Peru.

On February 24, 2022, the Company announced that it had been named to the TSX Venture 50, an annual ranking of top performing listed companies on the TSXV.

2022 – 2023 Developments

On March 1, 2022, the Company announced it was launching the final phase towards completion of its maiden PEA on the Company’s TLC Lithium Project with the appointment of DRA Global (“DRA”) as lead engineer. The first draft of the maiden TLC PEA as well as preliminary economic modeling was completed in March 2023.

On April 29, 2022, at the request of the Company, Manning Elliott LLP, Chartered Professional Accountants resigned as auditor to the Company. Subsequently, the Board appointed Ernst & Young LLP to act as the Company’s auditor.

Throughout May 2022 to August 2022, the Company reorganized its Nevada subsidiaries, pursuant to a series of horizontal short-form amalgamations, such that 1032701 Nevada Ltd., 1065604 Nevada Ltd., 1067323 Nevada Ltd., 1134989 Nevada Ltd., 1301420 Nevada Ltd. and 4286128 Nevada Corp. continued as one entity, being TLC.

In May 2022, the Company entered into an agreement to acquire 431 acres of privately held agricultural lands near TLC, along with the accompanying 1,468 acre-feet of water rights for consideration of US$3.125 million. This brings the total water rights owned by the Company to approximately 2,500 acre-feet, which is expected to provide a material portion of the water required for the initial phases of future production at TLC.

In June 2022, the Company entered into a mining rights transfer agreement whereby it acquired 18 additional concessions in Southern Peru, covering an area of approximately 14,243 hectares. The concessions are highly prospective and will further broaden the Company’s existing asset base and operations in Peru (the “Concessions”). The Company paid US$400,000 and issued 2,250,000 common shares of the Company to the vendor with the transaction receiving TSXV approval on June 8, 2022.

On June 27, 2022, the Company announced that successful precipitation of high purity, fertilizer-quality potassium sulfate (“SOP”) by-product was produced at the Falchani Lithium Project. The SOP produced from Falchani mineralization is 45% potassium and 20% sulfur and falls within the specification parameters of SOP marketed by producers and traders of fertilizers.

On July 5, 2022, the Company announced the appointment of Claudia Tornquist to the Board of Directors and Audit Chair and Ted O’Connor as Executive Vice-President of the Company.

On July 11, 2022, the Company announced that it commenced the work required for a pre-feasibility study (“PFS”) on the Falchani Lithium Project with the initiation of an Environmental Impact Assessment (“EIA”) with SRK Peru. The Company commenced the EIA hydrology drilling program at the Falchani Lithium Project on August 24, 2022.

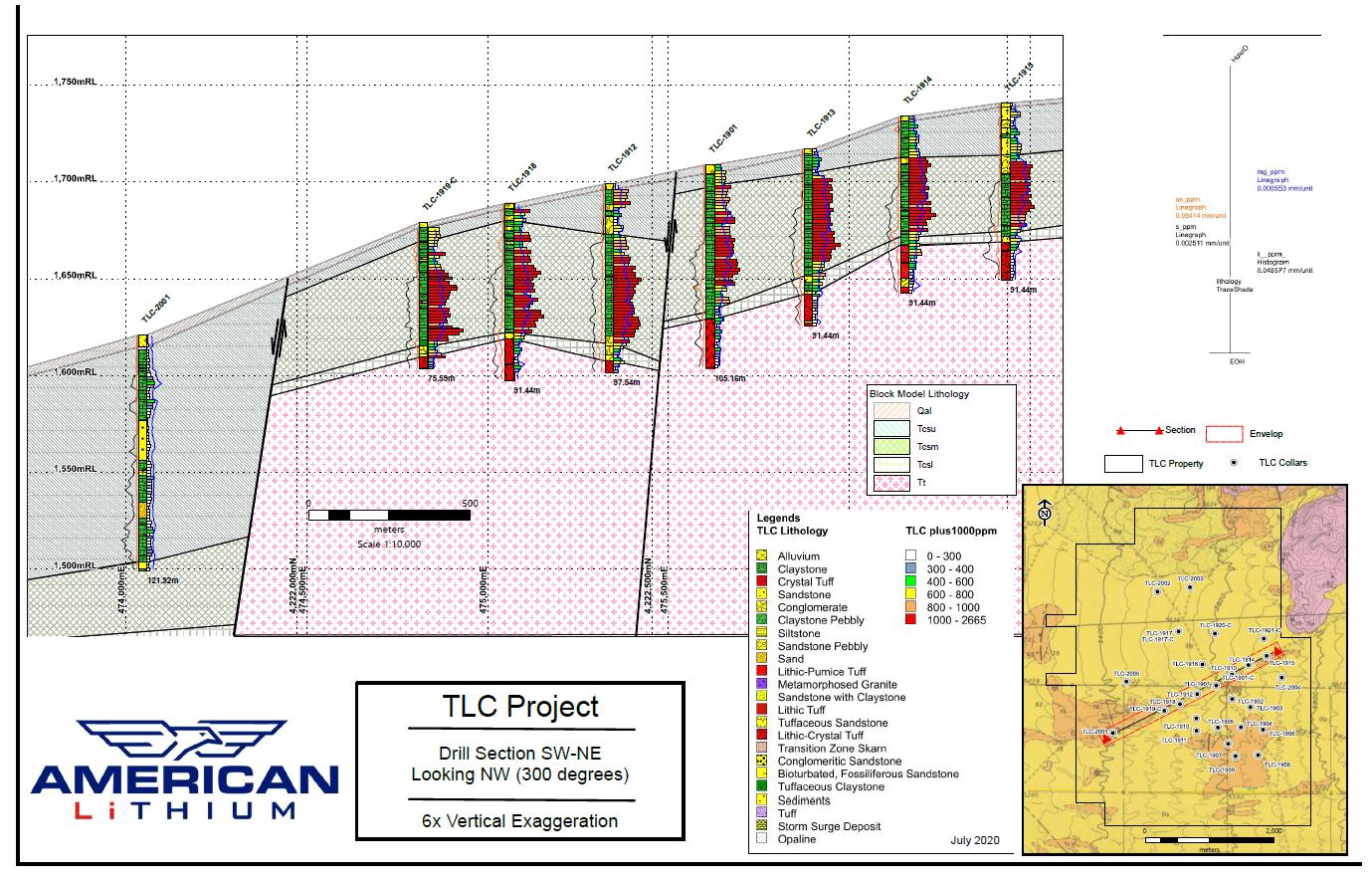

On July 14, 2022, drill results from the initial 5 holes of the TLC diamond core drilling program were released, with some of the highest-grade thicknesses discovered on the TLC Lithium Property to date. The best results were from diamond drill hole TLC-2206C which had 50.3 m (165’ feet) averaging 1,550 ppm Li from 145’ to 310’ downhole; including 11.0 m averaging 2,104 ppm Li from 225’ to 261.2’. The entire hole from 30’ to 351’ (End of Hole; “EOH” – 97.8 m true thickness) is mineralized averaging 1012 ppm Li with a 4.4’ maximum interval sample of 2,900 ppm sample from 234.5’.

On September 30, 2022, pursuant to a horizontal short-form amalgamation, American Lithium Holdings Corp. and Big Smoky were combined into one entity, being Holdings.

Resource expansion and exploration drilling continued at the TLC Lithium Property under the PO, including ongoing water monitoring and piezometer well installation. Processing work continued on all potential process options following successful upgrading work on the TLC Lithium Property claystone mineralization ahead of the finalization of a maiden PEA at the TLC Lithium Property.

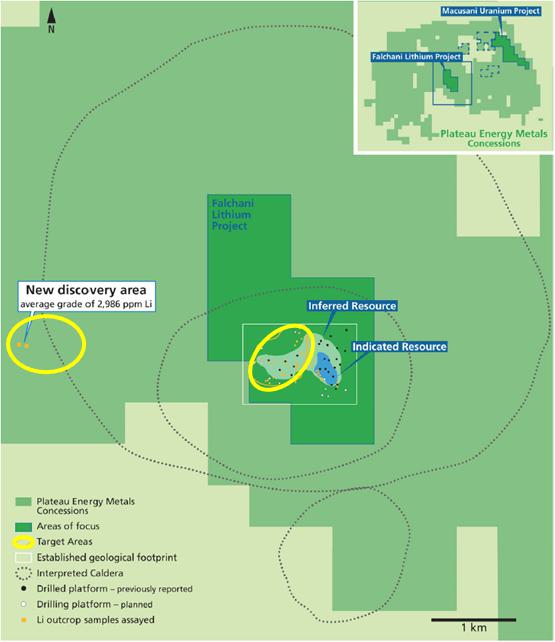

In-fill and resource expansion drilling was, and remains, planned for the Falchani Lithium Project to focus on the Tres Hermanas area southwest of the Falchani Lithium Project resource area and untested areas immediately northwest. Metallurgical work, aimed at optimizing existing processing options, commenced on the Falchani Lithium Project lithium mineralization, and includes ongoing work to incorporate sulfate of potash, cesium and other potential by-products into the Falchani Flow-Sheet. As reported above a 10-hole hydrology diamond drill program commenced on the Falchani Lithium Project as part of the initiation of an EIA with SRK Peru and the launch of the Project into pre-feasibility.

Resource expansion drilling was also planned at the Macusani Uranium Project to follow up encouraging prospecting and sampling results adjacent to several existing uranium deposits. Permitting work has been completed for both the Falchani and Macusani projects to support the drill programs, including community acceptance approvals, archeological clearances and environmental sampling and monitoring. The Company now anticipates this drilling to occur later in 2023. Metallurgical work at the Macusani Uranium Project continued throughout the period and focused on leaching upgraded uranium mineralization to produce a saleable product (‘yellowcake’) for specification testing and purity.

On October 4, 2022, the Company announced the appointment of Carsten Korch to the Board of Directors and as an audit committee member.

On November 2, 2022, the Company announced the resolution of regulatory proceeds brought by the Ontario Securities Commission (the “OSC”) against Plateau, and Alexander Holmes and Philip Gibbs, the former chief executive officer and chief financial officer of Plateau respectively.

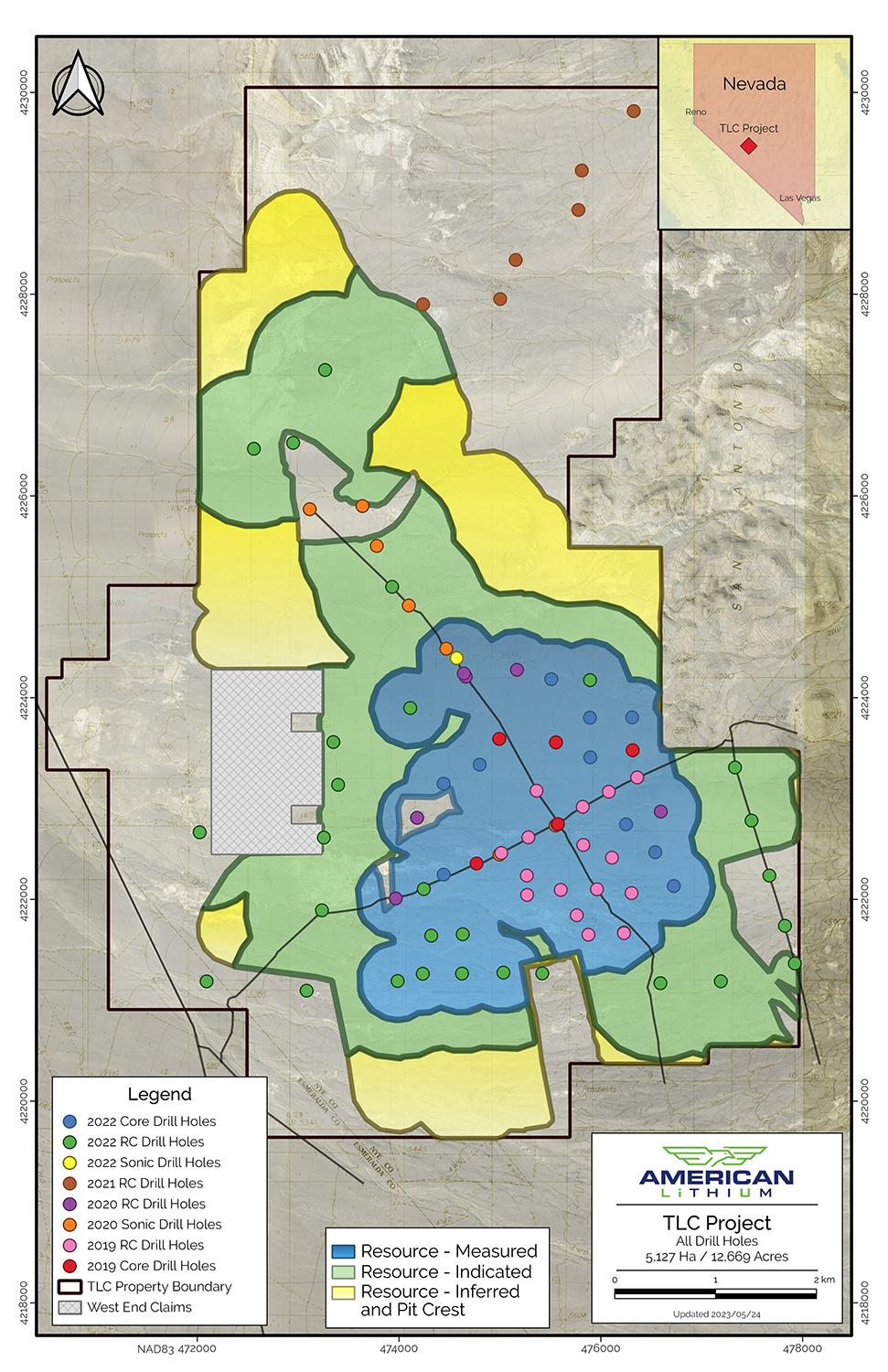

On December 2, 2022, the Company announced an updated mineral reserve estimate (“MRE”) that significantly increases the contained lithium resources for the TLC Lithium Project, including measured and indicated resource increases 64% from the original April 2020 MRE.

On December 7, 2022, the Company announced its intention to “spin-out” its Macusani Uranium Project in Peru into an independent public company for the benefit of shareholders (the “2023 Spin-Out”). The Company has not, as at the date of this AIF, conducted the 2023 Spin-Out but will continue to update the public in respect of the progress.

On January 5, 2023, the Company announced it received approval to list its Shares on the Nasdaq under the symbol “AMLI”. Concurrently with the listing, the Shares will cease to be quoted on the OTCQB Venture Market but continue to trade on the TSXV and FRA.

On January 17, 2023, the Company filed an independent NI 43-101 technical report on the updated MRE for the TLC Lithium Project. The MRE established a much larger lithium resource base to support the maiden PEA on TLC.

On January 24, 2023, the Company entered into an agreement with Nevada Alaska (“Second Buyback Agreement”) to buy back the remaining 1% gross overriding royalty on the Company’s wholly owned TLC Lithium Project. Pursuant to the Second Buyback Agreement, American Lithium issued 950,000 Shares to Nevada Alaska.

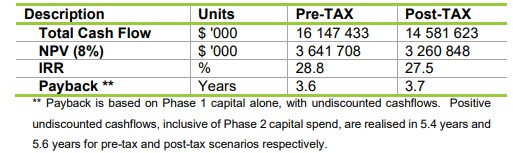

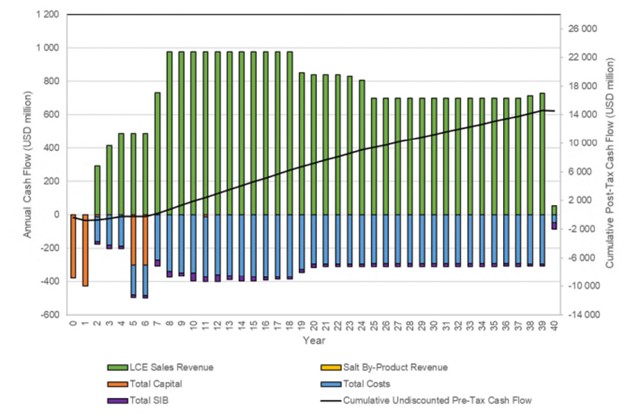

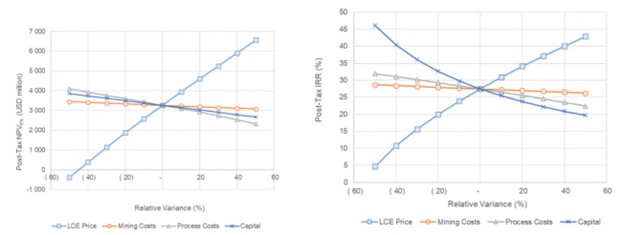

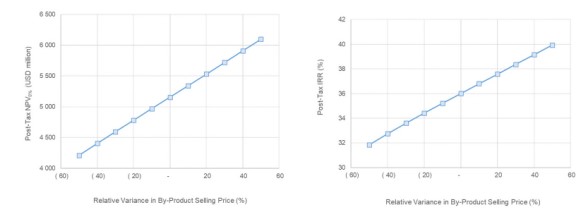

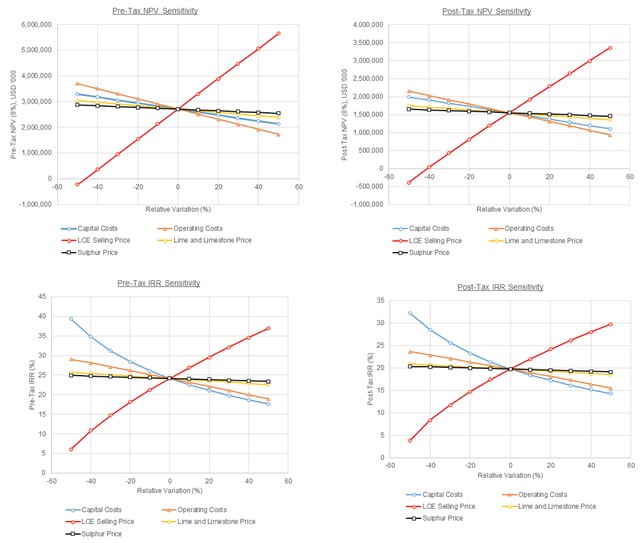

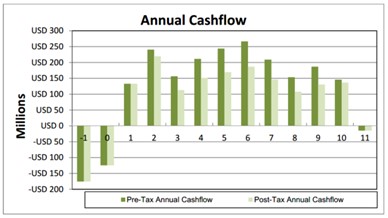

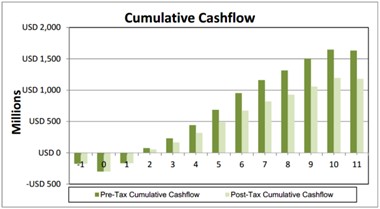

On February 1, 2023, the Company announced the results of its maiden Preliminary Economic Assessment (“PEA”) for the TLC Lithium Project, completed jointly by DRA Global and Stantec Consulting Ltd. (“Stantec”), and demonstrating that the TLC Lithium Project has the potential to become a substantial, long-life producer of low-cost lithium carbonate (“LCE” or “Li2CO3”) with the potential to produce either battery grade LCE or lithium hydroxide (“LiOH”). Highlights for the Base Case (lithium only with no by products), include after-tax NPV8% of US$3.26 Billion & After-tax IRR of 27.5%.

Selected Financings

The Company has completed the following financings over the last three completed financial years:

| • | On April 29, 2021, the Company completed a private placement of 7,518,750 units at a price of $2.00 per unit for gross proceeds of $15,037,500. Each unit consisted of one Share and one-half of a Share purchase warrant. Each whole warrant is exercisable to acquire one additional Share at an exercise price of $3.00 per Warrant Share for a period of two years. |