| Exhibit No. | Description | |||||||

| Appendix 3Y - R PETERSON | ||||||||

| Appendix 3Y Correction - R PETERSON | ||||||||

| Appendix 3Y - PJ DAVIS | ||||||||

| Appendix 3Y - P LISBOA | ||||||||

| Appendix 3Y - A LLOYD | ||||||||

| Appendix 3Y - J PFEIFER | ||||||||

| Appendix 3Y - R RODRIGUEZ | ||||||||

| Appendix 3Y - S ROWLAND | ||||||||

| Appendix 3Y - N STEIN | ||||||||

| Appendix 3Y - H WIENS | ||||||||

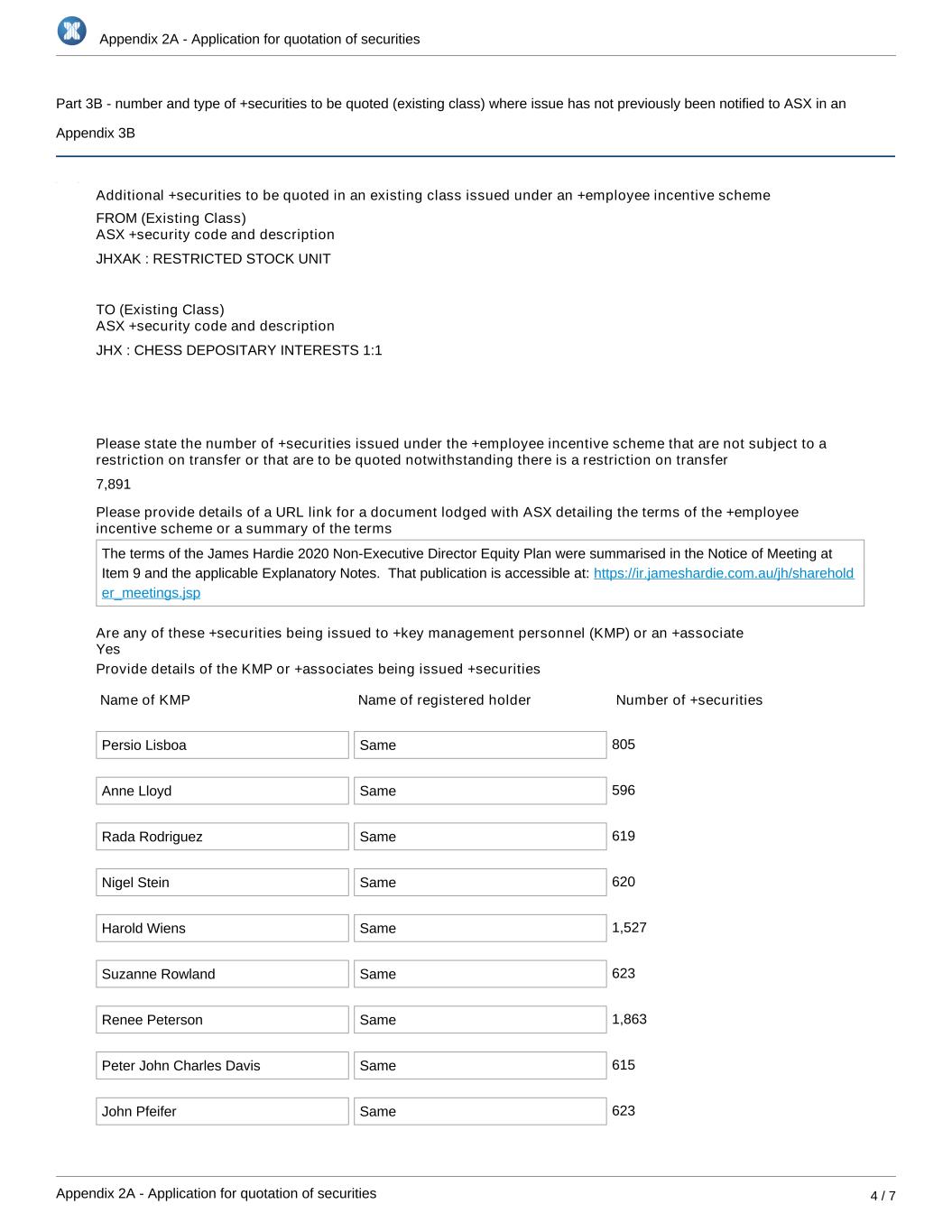

| Application for quotation of securities - JHX | ||||||||

| James Hardie Industries plc | ||||||||

| Date: 27 June 2025 | By: /s/ Aoife Rockett |

|||||||

Aoife Rockett |

||||||||

Company Secretary |

||||||||

| Exhibit No. | Description | |||||||

| Appendix 3Y - R PETERSON | ||||||||

| Appendix 3Y Correction - R PETERSON | ||||||||

| Appendix 3Y - PJ DAVIS | ||||||||

| Appendix 3Y - P LISBOA | ||||||||

| Appendix 3Y - A LLOYD | ||||||||

| Appendix 3Y - J PFEIFER | ||||||||

| Appendix 3Y - R RODRIGUEZ | ||||||||

| Appendix 3Y - S ROWLAND | ||||||||

| Appendix 3Y - N STEIN | ||||||||

| Appendix 3Y - H WIENS | ||||||||

| Application for quotation of securities - JHX | ||||||||

|

Exhibit 99.1

Appendix 3Y

Change of Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc |

||||

ARBN |

097 829 895 |

||||

| Name of Director | Renee Peterson | ||||

| Date of last notice | 21 March 2025 | ||||

| Direct or indirect interest | Direct |

||||

|

Nature of indirect interest

(including registered holder)

Note: Provide details of the circumstances giving rise to the relevant interest.

|

Interest in ordinary shares/CUFS of James Hardie Industries plc held in the form of American Depository Receipts (ADRs). The ADRs are issued by Deutsche Bank Trust Company Americas. |

||||

| Date of change | 13 June 2025 |

||||

| No. of securities held prior to change | Direct interest in 8,338 ADRs, equivalent to a holding of 8,338 ordinary shares/CUFS. |

||||

| Class | ADRs. ADRs trade on the NYSE in the United States and one ADR is equivalent to one ordinary share/CUFS. |

||||

| Number acquired | 1,863 ADRs, equivalent to a holding of 1,863 ordinary shares/CUFS. |

||||

| Number disposed | Nil |

||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and estimated valuation

|

US$42,886.26 |

||||

| No. of securities held after change |

Current relevant interest is:

•Direct interest in 10,201 ADRs, equivalent to a holding of 10,201 ordinary shares/CUFS.

|

||||

|

Nature of change

Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back.

|

Issuance of ADRs pursuant to the terms of the James Hardie 2020 Non-Executive Director Equity Plan. | ||||

| +See chapter 19 for defined terms. | ||

|

Appendix 3Y

Change of Director’s Interest Notice

| ||

| Detail of contract | Not applicable |

||||

| Nature of interest | Not applicable |

||||

|

Name of registered holder

(if issued securities)

|

Not applicable |

||||

| Date of change | Not applicable |

||||

|

No. and class of securities to which interest related prior to change

Note: Details are only required for a contract in relation to which the interest has changed

|

Not applicable |

||||

| Interest acquired | Not applicable |

||||

| Interest disposed | Not applicable |

||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and an estimated valuation

|

Not applicable |

||||

| Interest after change | Not applicable |

||||

Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? |

No |

||||

| If so, was prior-written clearance provided to allow the trade to proceed during this period? | Not applicable |

||||

| If prior written clearance was provided, on what date was this provided? | Not applicable |

||||

| +See chapter 19 for defined terms. | ||

|

James Hardie Industries plc

1st Floor, Block A,

One Park Place,

Upper Hatch Street, Dublin 2,

D02 FD79, Ireland

T: +353 (0) 1 411 6924

F: +353 (0) 1 479 1128

|

|||||

James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at

James Hardie Industries plc is a limited liability company incorporated in Ireland with its registered office at |

Classification: James Hardie Collaborate

Appendix 3Y

Change of Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc |

||||

ARBN |

097 829 895 | ||||

| Name of Director | Renee PETERSON | ||||

| Date of last notice | 2 December 2022 | ||||

| Direct or indirect interest | Direct |

||||

|

Nature of indirect interest

(including registered holder)

Note: Provide details of the circumstances giving rise to the relevant interest.

|

Interest in ordinary shares/CUFS of James Hardie Industries plc held in the form of American Depository Receipts (ADRs). The ADRs are issued by Deutsche Bank Trust Company Americas. |

||||

| Date of change | 18 September 2023 | ||||

| No. of securities held prior to change | Nil | ||||

| Class | ADRs. ADRs trade on the NYSE in the United States and one ADR is equivalent to one ordinary share/CUFS. | ||||

| Number acquired | 1,817 ADRs, equivalent to a holding of 1,817 ordinary shares/CUFS. | ||||

Number disposed |

Nil | ||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and estimated valuation

|

US$47,116 | ||||

| No. of securities held after change |

Current relevant interest is:

•Direct interest in 1,817 ADRs, equivalent to a holding of 1,817 ordinary shares/CUFS.

|

||||

|

Nature of change

Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back

|

Issuance of ADRs pursuant to the terms of the James Hardie 2020 Non-Executive Director Equity Plan. |

||||

+ See chapter 19 for defined terms. | ||

|

Classification: James Hardie Collaborate

Appendix 3Y

Change of Director’s Interest Notice

| ||

| Detail of contract | Not applicable |

||||

| Nature of interest | Not applicable |

||||

|

Name of registered holder

(if issued securities)

|

Not applicable |

||||

| Date of change | Not applicable |

||||

|

No. and class of securities to which interest related prior to change

Note: Details are only required for a contract in relation to which the interest has changed

|

Not applicable |

||||

| Interest acquired | Not applicable |

||||

| Interest disposed | Not applicable |

||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and an estimated valuation

|

Not applicable |

||||

| Interest after change | Not applicable |

||||

Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? |

No |

||||

| If so, was prior-written clearance provided to allow the trade to proceed during this period? | Not applicable |

||||

| If prior written clearance was provided, on what date was this provided? | Not applicable |

||||

+ See chapter 19 for defined terms. | ||

|

Exhibit 99.3

Appendix 3Y

Change of Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc |

||||

ARBN |

097 829 895 |

||||

| Name of Director | Peter John Charles Davis | ||||

| Date of last notice | 21 March 2025 | ||||

| Direct or indirect interest | Direct |

||||

|

Nature of indirect interest

(including registered holder)

Note: Provide details of the circumstances giving rise to the relevant interest.

|

Direct interest in ordinary shares/CUFS registered in the name of Peter John Charles Davis. |

||||

| Date of change | 13 June 2025 |

||||

| No. of securities held prior to change | 3,744 ordinary shares/CUFS registered in the name of Peter John Charles Davis. |

||||

| Class | Ordinary shares/CUFS |

||||

| Number acquired | 615 ADRs, equivalent to a holding of 615 ordinary shares/CUFS. |

||||

Number disposed |

Nil |

||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and estimated valuation

|

A$22,053.90 |

||||

| No. of securities held after change |

Current relevant interest is:

•4,359 ordinary shares/CUFS registered in the name of Peter John Charles Davis

|

||||

|

Nature of change

Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back

|

Issuance of CUFs pursuant to the terms of the James Hardie 2020 Non-Executive Director Equity Plan. | ||||

| + See chapter 19 for defined terms. | ||

|

Appendix 3Y

Change of Director’s Interest Notice

| ||

| Detail of contract | Not applicable |

||||

| Nature of interest | Not applicable |

||||

|

Name of registered holder

(if issued securities)

|

Not applicable |

||||

| Date of change | Not applicable |

||||

|

No. and class of securities to which interest related prior to change

Note: Details are only required for a contract in relation to which the interest has changed

|

Not applicable |

||||

| Interest acquired | Not applicable |

||||

| Interest disposed | Not applicable |

||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and an estimated valuation

|

Not applicable |

||||

| Interest after change | Not applicable |

||||

Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? |

No |

||||

| If so, was prior-written clearance provided to allow the trade to proceed during this period? | Not applicable |

||||

| If prior written clearance was provided, on what date was this provided? | Not applicable |

||||

| + See chapter 19 for defined terms. | ||

|

Exhibit 99.4

Appendix 3Y

Change of Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc |

||||

ARBN |

097 829 895 |

||||

| Name of Director | Persio Lisboa | ||||

| Date of last notice | 21 March 2025 | ||||

| +See chapter 19 for defined terms. | ||

|

Appendix 3Y

Change of Director’s Interest Notice

| ||

| Direct or indirect interest | Direct |

||||

|

Nature of indirect interest

(including registered holder)

Note: Provide details of the circumstances giving rise to the relevant interest.

|

Interest in ordinary shares/CUFS of James Hardie Industries plc held in the form of American Depository Receipts (ADRs). The ADRs are issued by Deutsche Bank Trust Company Americas. |

||||

| Date of change | 13 June 2025 |

||||

| No. of securities held prior to change |

•Indirect interest in 12,174 ADRs, equivalent to a holding of 12,174 ordinary shares/CUFS. The registered holder is Merrill Lynch Pierce Fenner, & Smith and they are held on account for the beneficial owner, Persio Lisboa.

•Direct interest in 9,502 ADRs, equivalent to a holding of 9,502 ordinary shares/CUFS.

|

||||

| Class | ADRs. ADRs trade on the NYSE in the United States and one ADR is equivalent to one ordinary share/CUFS. |

||||

| Number acquired | 805 ADRs, equivalent to a holding of 805 ordinary shares/CUFS. |

||||

Number disposed |

Nil |

||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and estimated valuation

|

US$18,531.10 |

||||

| No. of securities held after change |

Current relevant interest is:

•Indirect interest in 12,174 ADRs, equivalent to a holding of 12,174 ordinary shares/CUFS. The registered holder is Merrill Lynch Pierce Fenner, & Smith and they are held on account for the beneficial owner, Persio Lisboa.

•Direct interest in 10,307 ADRs, equivalent to a holding of 10,307 ordinary shares/CUFS.

|

||||

|

Nature of change

Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back

|

Issuance of ADRs pursuant to the terms of the James Hardie 2020 Non-Executive Director Equity Plan. | ||||

| +See chapter 19 for defined terms. | ||

|

Appendix 3Y

Change of Director’s Interest Notice

| ||

| Detail of contract | Not applicable |

||||

| Nature of interest | Not applicable |

||||

|

Name of registered holder

(if issued securities)

|

Not applicable |

||||

| Date of change | Not applicable |

||||

|

No. and class of securities to which interest related prior to change

Note: Details are only required for a contract in relation to which the interest has changed

|

Not applicable |

||||

| Interest acquired | Not applicable |

||||

| Interest disposed | Not applicable |

||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and an estimated valuation

|

Not applicable |

||||

| Interest after change | Not applicable |

||||

Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? |

No |

||||

| If so, was prior-written clearance provided to allow the trade to proceed during this period? | Not applicable |

||||

| If prior written clearance was provided, on what date was this provided? | Not applicable |

||||

| +See chapter 19 for defined terms. | ||

|

Exhibit 99.5

Appendix 3Y

Change of Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc |

||||

ARBN |

097 829 895 |

||||

| Name of Director | Anne Lloyd | ||||

| Date of last notice | 21 March 2025 | ||||

| + See chapter 19 for defined terms. | ||

|

Appendix 3Y

Change of Director’s Interest Notice

| ||

| Direct or indirect interest | Direct |

||||

|

Nature of indirect interest

(including registered holder)

Note: Provide details of the circumstances giving rise to the relevant interest.

|

Interest in ordinary shares/CUFS of James Hardie Industries plc held in the form of American Depository Receipts (ADRs). The ADRs are issued by Deutsche Bank Trust Company Americas. |

||||

| Date of change | 13 June 2025 |

||||

| No. of securities held prior to change |

•Indirect interest in 18,000 ADRs, equivalent to a holding of 18,000 ordinary shares/ CUFS. The ADRs are issued by Deutsche Bank Trust Company Americas. The registered holder is Pershing LLC and they are held on account for the beneficial owners, Anne Lloyd and Steven Lloyd.

•Direct interest in 4,484 ADRs, equivalent to a holding of 4,484 ordinary shares/CUFS.

|

||||

| Class | ADRs. ADRs trade on the NYSE in the United States and one ADR is equivalent to one ordinary share/CUFS. |

||||

| Number acquired | 596 ADRs, equivalent to a holding of 596 ordinary shares/CUFS. |

||||

Number disposed |

Nil |

||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and estimated valuation

|

US$13,719.92 |

||||

| No. of securities held after change |

Current relevant interest is:

•Indirect interest in 18,000 ADRs, equivalent to a holding of 18,000 ordinary shares/ CUFS. The ADRs are issued by Deutsche Bank Trust Company Americas. The registered holder is Pershing LLC and they are held on account for the beneficial owners, Anne Lloyd and Steven Lloyd.

•Direct interest in 5,080 ADRs, equivalent to a holding of 5,080 ordinary shares/CUFS.

|

||||

|

Nature of change

Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back

|

Issuance of ADRs pursuant to the terms of the James Hardie 2020 Non-Executive Director Equity Plan. | ||||

| + See chapter 19 for defined terms. | ||

|

Appendix 3Y

Change of Director’s Interest Notice

| ||

| Detail of contract | Not applicable |

||||

| Nature of interest | Not applicable |

||||

|

Name of registered holder

(if issued securities)

|

Not applicable |

||||

| Date of change | Not applicable |

||||

|

No. and class of securities to which interest related prior to change

Note: Details are only required for a contract in relation to which the interest has changed

|

Not applicable |

||||

| Interest acquired | Not applicable |

||||

| Interest disposed | Not applicable |

||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and an estimated valuation

|

Not applicable |

||||

| Interest after change | Not applicable |

||||

Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? |

No |

||||

| If so, was prior-written clearance provided to allow the trade to proceed during this period? | Not applicable |

||||

| If prior written clearance was provided, on what date was this provided? | Not applicable |

||||

| + See chapter 19 for defined terms. | ||

|

Exhibit 99.6

Appendix 3Y

Change of Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc |

||||

ARBN |

097 829 895 | ||||

| Name of Director | John C Pfeifer | ||||

| Date of last notice | 21 March 2025 | ||||

| Direct or indirect interest | Direct |

||||

|

Nature of indirect interest

(including registered holder)

Note: Provide details of the circumstances giving rise to the relevant interest.

|

Interest in ordinary shares/CUFS of James Hardie Industries plc held in the form of American Depository Receipts (ADRs). The ADRs are issued by Deutsche Bank Trust Company Americas. |

||||

| Date of change | 13 June 2025 |

||||

| No. of securities held prior to change | •Direct interest in 1,564 ADRs, equivalent to a holding of 1,564 ordinary shares/CUFS. |

||||

| Class | ADRs. ADRs trade on the NYSE in the United States and one ADR is equivalent to one ordinary share/CUFS. |

||||

| Number acquired | 623 ADRs, equivalent to a holding of 623 ordinary shares/CUFS. |

||||

Number disposed |

Nil |

||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and estimated valuation

|

US$14,341.46 |

||||

| No. of securities held after change |

Current relevant interest is:

•Direct interest in 2,187 ADRs, equivalent to a holding of 2,187 ordinary shares/CUFS.

|

||||

|

Nature of change

Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back

|

Issuance of ADRs pursuant to the terms of the James Hardie 2020 Non-Executive Director Equity Plan. |

||||

'+ See chapter 19 for defined terms. | ||

|

Appendix 3Y

Change of Director’s Interest Notice

| ||

| Detail of contract | Not applicable |

||||

| Nature of interest | Not applicable |

||||

|

Name of registered holder

(if issued securities)

|

Not applicable |

||||

| Date of change | Not applicable |

||||

|

No. and class of securities to which interest related prior to change

Note: Details are only required for a contract in relation to which the interest has changed

|

Not applicable |

||||

| Interest acquired | Not applicable |

||||

| Interest disposed | Not applicable |

||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and an estimated valuation

|

Not applicable |

||||

| Interest after change | Not applicable |

||||

Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? |

No |

||||

| If so, was prior-written clearance provided to allow the trade to proceed during this period? | Not applicable |

||||

| If prior written clearance was provided, on what date was this provided? | Not applicable |

||||

| + See chapter 19 for defined terms. | ||

|

Exhibit 99.7

Appendix 3Y

Change of Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc |

||||

ARBN |

097 829 895 |

||||

| Name of Director | Rada Rodriguez | ||||

| Date of last notice | 21 March 2025 | ||||

| Direct or indirect interest | Direct |

||||

|

Nature of indirect interest

(including registered holder)

Note: Provide details of the circumstances giving rise to the relevant interest.

|

Interest in ordinary shares/CUFS of James Hardie Industries plc held in the form of American Depository Receipts (ADRs). The ADRs are issued by Deutsche Bank Trust Company Americas. |

||||

| Date of change | 13 June 2025 |

||||

| No. of securities held prior to change | Direct interest in 6,062 ADR’s, equivalent to a holding of 6,062 ordinary shares/CUFS. |

||||

| Class | ADRs. ADRs trade on the NYSE in the United States and one ADR is equivalent to one ordinary share/CUFS. |

||||

| Number acquired | 619 ADRs, equivalent to a holding of 619 ordinary shares/CUFS. |

||||

Number disposed |

Nil |

||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and estimated valuation

|

US$14,249.38 |

||||

| No. of securities held after change |

Current relevant interest is:

•Direct interest in 6,681 ADR’s, equivalent to a holding of 6,681 ordinary shares/CUFS.

|

||||

|

Nature of change

Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back

|

Issuance of ADRs pursuant to the terms of the James Hardie 2020 Non-Executive Director Equity Plan. | ||||

'+ See chapter 19 for defined terms. | ||

|

Appendix 3Y

Change of Director’s Interest Notice

| ||

| Detail of contract | Not applicable |

||||

| Nature of interest | Not applicable |

||||

|

Name of registered holder

(if issued securities)

|

Not applicable |

||||

| Date of change | Not applicable |

||||

|

No. and class of securities to which interest related prior to change

Note: Details are only required for a contract in relation to which the interest has changed

|

Not applicable |

||||

| Interest acquired | Not applicable |

||||

| Interest disposed | Not applicable |

||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and an estimated valuation

|

Not applicable |

||||

| Interest after change | Not applicable |

||||

Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? |

No |

||||

| If so, was prior-written clearance provided to allow the trade to proceed during this period? | Not applicable |

||||

| If prior written clearance was provided, on what date was this provided? | Not applicable |

||||

'+ See chapter 19 for defined terms. | ||

|

Exhibit 99.8

Appendix 3Y

Change of Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc |

||||

ARBN |

097 829 895 |

||||

| Name of Director | Suzanne Rowland | ||||

| Date of last notice | 21 March 2025 | ||||

| + See chapter 19 for defined terms. | ||

|

Appendix 3Y

Change of Director’s Interest Notice

| ||

| Direct or indirect interest | Direct |

||||

|

Nature of indirect interest

(including registered holder)

Note: Provide details of the circumstances giving rise to the relevant interest.

|

Interest in ordinary shares/CUFS of James Hardie Industries plc held in the form of American Depository Receipts (ADRs). The ADRs are issued by Deutsche Bank Trust Company Americas. |

||||

| Date of change | 13 June 2025 |

||||

| No. of securities held prior to change |

•Indirect interest in 5,000 ADRs, equivalent to a holding of 5,000 ordinary shares/CUFS. The registered holder is Charles Schwab & Co. Inc. and they are held on account for the beneficial owner, Suzanne B. Rowland.

•Direct interest in 3,744 ADRs, equivalent to a holding of 3,744 ordinary shares/CUFS.

|

||||

| Class | ADRs. ADRs trade on the NYSE in the United States and one ADR is equivalent to one ordinary share/CUFS. |

||||

| Number acquired | 623 ADRs, equivalent to a holding of 623 ordinary shares/CUFS. |

||||

Number disposed |

Nil |

||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and estimated valuation

|

US$14,341.46 |

||||

| No. of securities held after change |

Current relevant interest is:

•Indirect interest in 5,000 ADRs, equivalent to a holding of 5,000 ordinary shares/CUFS. The registered holder is Charles Schwab & Co. Inc. and they are held on account for the beneficial owner, Suzanne B. Rowland.

•Direct interest in 4,367 ADRs, equivalent to a holding of 4,367 ordinary shares/CUFS.

|

||||

|

Nature of change

Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back

|

Issuance of ADRs pursuant to the terms of the James Hardie 2020 Non-Executive Director Equity Plan. | ||||

'+ See chapter 19 for defined terms. | ||

|

Appendix 3Y

Change of Director’s Interest Notice

| ||

| Detail of contract | Not applicable |

||||

| Nature of interest | Not applicable |

||||

|

Name of registered holder

(if issued securities)

|

Not applicable |

||||

| Date of change | Not applicable |

||||

|

No. and class of securities to which interest related prior to change

Note: Details are only required for a contract in relation to which the interest has changed

|

Not applicable |

||||

| Interest acquired | Not applicable |

||||

| Interest disposed | Not applicable |

||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and an estimated valuation

|

Not applicable |

||||

| Interest after change | Not applicable |

||||

Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? |

No |

||||

| If so, was prior-written clearance provided to allow the trade to proceed during this period? | Not applicable |

||||

| If prior written clearance was provided, on what date was this provided? | Not applicable |

||||

| + See chapter 19 for defined terms. | ||

|

Exhibit 99.9

Appendix 3Y

Change of Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc |

||||

ARBN |

097 829 895 |

||||

| Name of Director | Nigel Stein | ||||

| Date of last notice | 21 March 2025 | ||||

' + See chapter 19 for defined terms. | ||

|

Appendix 3Y

Change of Director’s Interest Notice

| ||

| Direct or indirect interest | Direct |

||||

|

Nature of indirect interest

(including registered holder)

Note: Provide details of the circumstances giving rise to the relevant interest.

|

Interest in ordinary shares/CUFS of James Hardie Industries plc held in the form of American Depository Receipts (ADRs). The ADRs are issued by Deutsche Bank Trust Company Americas. |

||||

| Date of change | 13 June 2025 |

||||

| No. of securities held prior to change |

•Indirect interest in 3,400 ordinary shares/CUFS. The registered holder is Evelyn Partners Investment Services Limited (Formerly Pershing Securities Limited) and they are held on account for beneficial owner, Nigel Stein.

•Direct interest in 5,927 ADRs, equivalent to a holding of 5,927 ordinary shares/CUFS.

|

||||

| Class | ADRs. ADRs trade on the NYSE in the United States and one ADR is equivalent to one ordinary share/CUFS. |

||||

| Number acquired | 620 ADRs, equivalent to a holding of 620 ordinary shares/CUFS. |

||||

Number disposed |

Nil |

||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and estimated valuation

|

US$14,272.40 |

||||

| No. of securities held after change |

Current relevant interest is:

•Indirect interest in 3,400 ordinary shares/CUFS. The registered holder is Evelyn Partners Investment Services Limited (Formerly Pershing Securities Limited) and they are held on account for beneficial owner, Nigel Stein.

•Direct interest in 6,547 ADRs, equivalent to a holding of 6,547 ordinary shares/CUFS.

|

||||

|

Nature of change

Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back

|

Issuance of ADRs pursuant to the terms of the James Hardie 2020 Non-Executive Director Equity Plan. | ||||

' + See chapter 19 for defined terms. | ||

|

Appendix 3Y

Change of Director’s Interest Notice

| ||

| Detail of contract | Not applicable |

||||

| Nature of interest | Not applicable |

||||

|

Name of registered holder

(if issued securities)

|

Not applicable |

||||

| Date of change | Not applicable |

||||

|

No. and class of securities to which interest related prior to change

Note: Details are only required for a contract in relation to which the interest has changed

|

Not applicable |

||||

| Interest acquired | Not applicable |

||||

| Interest disposed | Not applicable |

||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and an estimated valuation

|

Not applicable |

||||

| Interest after change | Not applicable |

||||

Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? |

No |

||||

| If so, was prior-written clearance provided to allow the trade to proceed during this period? | Not applicable |

||||

| If prior written clearance was provided, on what date was this provided? | Not applicable |

||||

' + See chapter 19 for defined terms. | ||

|

Exhibit 99.10

Appendix 3Y

Change of Director’s Interest Notice

| ||

Name of entity |

James Hardie Industries plc |

||||

ARBN |

097 829 895 |

||||

| Name of Director | Harold Wiens | ||||

| Date of last notice | 21 March 2025 | ||||

' + See chapter 19 for defined terms. | ||

|

Appendix 3Y

Change of Director’s Interest Notice

| ||

| Direct or indirect interest | Direct |

||||

|

Nature of indirect interest

(including registered holder)

Note: Provide details of the circumstances giving rise to the relevant interest.

|

Interest in ordinary shares/CUFS of James Hardie Industries plc held in the form of American Depository Receipts (ADRs). The ADRs are issued by Deutsche Bank Trust Company Americas. |

||||

| Date of change | 13 June 2025 |

||||

| No. of securities held prior to change |

•Indirect interest in 7,370 ADRs, equivalent to a holding of 7,370 ordinary shares/CUFS. The registered holder is UBS Financial Services Inc. and they are held on account for the joint beneficial owners, Harold and Claudia Wiens.

•Direct interest in 10,147 ADRs, equivalent to a holding of 10,147 ordinary shares/CUFS.

|

||||

| Class | ADRs. ADRs trade on the NYSE in the United States and one ADR is equivalent to one ordinary share/CUFS. |

||||

| Number acquired | 1,527 ADRs, equivalent to a holding of 1,527 ordinary shares/CUFS. |

||||

Number disposed |

Nil |

||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and estimated valuation

|

US$35,151.54 |

||||

| No. of securities held after change |

Current relevant interest is:

•Indirect interest in 7,370 ADRs, equivalent to a holding of 7,370 ordinary shares/CUFS. The registered holder is UBS Financial Services Inc. and they are held on account for the joint beneficial owners, Harold and Claudia Wiens.

•Direct interest in 11,674 ADRs, equivalent to a holding of 11,674 ordinary shares/CUFS.

|

||||

|

Nature of change

Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back

|

Issuance of ADRs pursuant to the terms of the James Hardie 2020 Non-Executive Director Equity Plan. | ||||

' + See chapter 19 for defined terms. | ||

|

Appendix 3Y

Change of Director’s Interest Notice

| ||

| Detail of contract | Not applicable |

||||

| Nature of interest | Not applicable |

||||

|

Name of registered holder

(if issued securities)

|

Not applicable |

||||

| Date of change | Not applicable |

||||

|

No. and class of securities to which interest related prior to change

Note: Details are only required for a contract in relation to which the interest has changed

|

Not applicable |

||||

| Interest acquired | Not applicable |

||||

| Interest disposed | Not applicable |

||||

|

Value/Consideration

Note: If consideration is non-cash, provide details and an estimated valuation

|

Not applicable |

||||

| Interest after change | Not applicable |

||||

Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? |

No |

||||

| If so, was prior-written clearance provided to allow the trade to proceed during this period? | Not applicable |

||||

| If prior written clearance was provided, on what date was this provided? | Not applicable |

||||

' + See chapter 19 for defined terms. | ||