| ☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

23-2424711

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

1195 River Road, Marietta, Pennsylvania

|

17547

|

|

|

(Address of principal executive offices)

|

(Zip code)

|

|

Title of Each Class

|

Trading Symbols

|

Name of Each Exchange on Which Registered

|

||

|

Class A Common Stock, $.01 par value

|

DGICA

|

The NASDAQ Global Select Market

|

||

|

Class B Common Stock, $.01 par value

|

DGICB

|

The NASDAQ Global Select Market

|

|

Large accelerated filer ☐

|

Accelerated filer ☑

|

Non-accelerated filer ☐

|

Smaller reporting company ☐

|

|

Emerging growth company ☐

|

|

Page

|

||

|

PART I

|

||

|

Item 1.

|

1

|

|

|

Item 1A.

|

26

|

|

|

Item 1B.

|

40

|

|

|

Item 1C.

|

40

|

|

|

Item 2.

|

41 | |

|

Item 3.

|

41 |

|

|

Item 4.

|

41

|

|

|

PART II

|

||

|

Item 5.

|

41

|

|

|

Item 6.

|

43

|

|

|

Item 7.

|

44

|

|

|

Item 7A.

|

60 | |

|

Item 8.

|

62

|

|

|

Item 9.

|

107

|

|

|

Item 9A.

|

107 | |

|

Item 9B.

|

107

|

|

| Item 9C. | Disclosure Regarding Foreign Jurisdiction that Prevent Inspections. | 107 |

|

PART III

|

||

|

Item 10.

|

109

|

|

|

Item 11.

|

109 | |

|

Item 12.

|

109 | |

|

Item 13.

|

109 | |

|

Item 14.

|

109 | |

|

PART IV

|

||

|

Item 15.

|

110

|

|

|

Item 16.

|

112

|

| Item 1. |

Business.

|

|

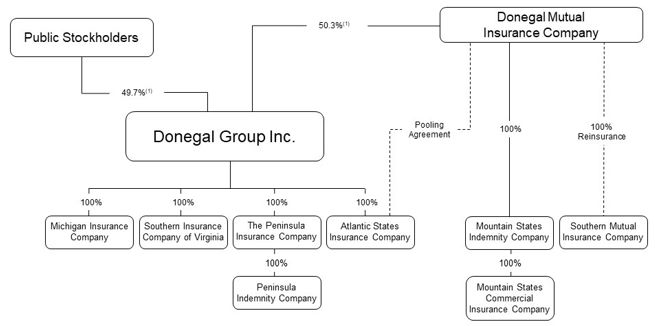

(1)

|

Because of the different relative voting power of our Class A common stock and our Class B common stock, our public stockholders hold approximately 30% of the combined voting power of our Class A common stock and our Class B common

stock and Donegal Mutual holds approximately 70% of the combined voting power of our Class A common stock and our Class B common stock.

|

|

|

• |

both of our members on the coordinating committee must determine that the new agreement or the change in an existing agreement is fair and equitable to us and in the best interests of our stockholders;

|

|

|

• |

both of Donegal Mutual’s members on the coordinating committee must determine that the new agreement or the change in an existing agreement is fair and equitable to Donegal Mutual and in the best interests of its policyholders;

|

|

|

• |

our board of directors must approve the new agreement or the change in an existing agreement; and

|

|

|

• |

Donegal Mutual’s board of directors must approve the new agreement or the change in an existing agreement.

|

|

|

• |

enabling our stable management, the consistent underwriting discipline of our insurance subsidiaries, external growth, long-term profitability and financial strength;

|

|

|

• |

creating operational and expense synergies from the combination of resources and integrated operations of the Donegal Insurance Group;

|

|

|

• |

producing more stable and uniform underwriting results for our insurance subsidiaries over extended periods of time than we could achieve without our relationship with Donegal Mutual;

|

|

|

• |

providing opportunities for growth because of the ability of Donegal Mutual to affiliate and enter into reinsurance agreements with, or otherwise acquire control of, mutual insurance companies and place the business it assumes into

the underwriting pool; and

|

|

|

• |

providing Atlantic States with a significantly larger underwriting capacity because of the underwriting pool Donegal Mutual and Atlantic States have maintained since 1986.

|

|

|

2024

|

2023

|

2022

|

2021

|

2020

|

|||||||||||||||

|

Our GAAP combined ratio

|

98.6

|

%

|

104.4

|

%

|

103.3

|

%

|

101.0

|

%

|

96.0

|

%

|

||||||||||

|

Our SAP combined ratio

|

98.3

|

104.2

|

103.3

|

100.8

|

95.4

|

|||||||||||||||

|

Industry SAP combined ratio (1)

|

98.9

|

101.9

|

103.1

|

100.0

|

98.8

|

|||||||||||||||

| (1) |

As reported (projected for 2024) by A.M. Best Company.

|

|

|

• |

Achieving sustained excellent financial performance.

|

|

|

• |

carefully selecting the product lines, classes of business and individual risks they underwrite;

|

|

|

• |

executing localized strategies to achieve a mix of business they expect will generate targeted margins of profitability;

|

|

|

• |

monitoring premium rate adequacy and adjusting premium rates to achieve targeted growth, returns and retention levels;

|

|

|

• |

utilizing enhanced underwriting and technology tools to inform underwriting decisions and determine coverage availability;

|

|

|

• |

utilizing data analytics and predictive modeling tools to inform risk selection and pricing decisions;

|

|

|

• |

utilizing economic capital modeling tools to carefully manage the geographic concentration of risks they underwrite; and

|

|

|

• |

evaluating their claims history on a regular basis to ensure the adequacy of their underwriting guidelines and product pricing.

|

|

|

• |

Strategically modernizing our operations and processes to transform our business.

|

|

|

• |

Capitalizing on opportunities to grow profitably.

|

|

|

• |

Delivering a superior experience to our agents and policyholders.

|

|

|

• |

training programs;

|

|

|

• |

marketing support;

|

|

|

• |

availability of a personal lines service center that provides comprehensive service for our personal lines policyholders;

|

|

|

• |

availability of a commercial lines small business unit to monitor straight-through processing results and enhance turnaround time for responses to agents for less complicated commercial risks;

|

|

|

• |

availability of a commercial lines service center, which is an optional service enhancement for agencies who prefer that we interact directly with their customers for mid-term policy coverage changes and other service requests; and

|

|

|

• |

accessibility to and regular interactions with marketing and underwriting personnel and senior management of our insurance subsidiaries.

|

|

|

• |

availability of a customer call center, secure website and mobile application for claims reporting;

|

|

|

• |

availability of a secure website and mobile application for access to policy information and documents, payment processing and other features;

|

|

|

• |

timely replies to information requests and policy submissions; and

|

|

|

• |

prompt responses to, and processing of, claims.

|

|

|

• |

Acquiring property and casualty insurance companies to augment the organic growth of our insurance subsidiaries.

|

|

Company Name

|

State of Domicile

|

Year Control Acquired

|

Method of Acquisition/Affiliation

|

|||

|

Southern Heritage Insurance

Company (1)

|

Georgia

|

1998

|

Purchase of stock by us in 1998.

|

|||

|

Le Mars Mutual Insurance

Company of Iowa and then Le Mars Insurance Company (1)

|

Iowa

|

2002

|

Surplus note investment by Donegal Mutual in 2002; conversion to stock company in 2004; acquisition of stock by us in 2004.

|

|||

|

Peninsula Insurance Group

|

Maryland

|

2004

|

Purchase of stock by us in 2004.

|

|||

|

Sheboygan Falls Mutual Insurance Company and then Sheboygan Falls Insurance Company (1)

|

Wisconsin

|

2007

|

Contribution note investment by Donegal Mutual in 2007; conversion to stock company in 2008; acquisition of stock by us in 2008.

|

|||

|

Southern Mutual Insurance

Company (2)

|

Georgia

|

2009

|

Surplus note investment by Donegal Mutual and quota-share reinsurance in 2009.

|

|||

|

Michigan Insurance Company

|

Michigan

|

2010

|

Purchase of stock by us in 2010.

|

|||

|

Mountain States Mutual Casualty Company(3)

|

New Mexico

|

2017

|

Merger with and into Donegal Mutual in 2017.

|

|

|

(1) |

To reduce administrative and compliance costs and expenses, these subsidiaries subsequently merged into one of our existing insurance subsidiaries.

|

|

|

(2) |

Control acquired by Donegal Mutual.

|

|

|

(3) |

Donegal Mutual completed the merger of Mountain States Mutual Casualty Company with and into Donegal Mutual effective May 25, 2017. Donegal Mutual was the surviving company in the merger, and Mountain States insurance subsidiaries

became insurance subsidiaries of Donegal Mutual upon completion of the merger. Donegal Mutual also entered into a 100% quota-share reinsurance agreement with the Mountain States insurance subsidiaries on the merger date. Beginning with

policies effective in 2021, Donegal Mutual places the business of the Mountain States insurance subsidiaries into the underwriting pool.

|

|

|

• |

Commercial automobile — policies that provide protection against liability for bodily injury and property damage arising from automobile accidents and protection against loss from damage to automobiles owned by the insured.

|

|

|

• |

Commercial multi-peril — policies that provide protection to businesses against many perils, usually combining liability and physical damage coverages.

|

|

|

• |

Workers’ compensation — policies employers purchase to provide benefits to employees for injuries sustained during employment. The workers’ compensation laws of each state determine the extent of the coverage we provide.

|

|

|

• |

Private passenger automobile — policies that provide protection against liability for bodily injury and property damage arising from automobile accidents and protection against loss from damage to automobiles owned by the insured.

|

|

|

• |

Homeowners — policies that provide coverage for damage to residences and their contents from a broad range of perils, including fire, lightning, windstorm and theft. These policies also cover liability of the insured arising from

injury to other persons or their property while on the insured’s property and under other specified conditions.

|

|

Year Ended December 31,

|

||||||||||||||||||||||||

|

2024

|

2023

|

2022

|

||||||||||||||||||||||

|

(dollars in thousands)

|

Amount

|

%

|

Amount

|

%

|

Amount

|

%

|

||||||||||||||||||

|

Commercial lines:

|

||||||||||||||||||||||||

|

Automobile

|

$

|

184,989

|

19.6

|

%

|

$

|

174,741

|

19.5

|

%

|

$

|

167,774

|

19.9

|

%

|

||||||||||||

|

Workers’ compensation

|

103,533

|

11.0

|

107,598

|

12.0

|

111,892

|

13.3

|

||||||||||||||||||

|

Commercial multi-peril

|

213,959

|

22.7

|

195,632

|

21.8

|

200,045

|

23.7

|

||||||||||||||||||

|

Other

|

45,439

|

4.9

|

50,458

|

5.7

|

51,135

|

6.0

|

||||||||||||||||||

|

Total commercial lines

|

547,920

|

58.2

|

528,429

|

59.0

|

530,846

|

62.9

|

||||||||||||||||||

|

Personal lines:

|

||||||||||||||||||||||||

|

Automobile

|

243,036

|

25.8

|

215,957

|

24.1

|

181,129

|

21.5

|

||||||||||||||||||

|

Homeowners

|

140,613

|

14.9

|

139,688

|

15.6

|

120,087

|

14.2

|

||||||||||||||||||

|

Other

|

10,712

|

1.1

|

11,623

|

1.3

|

11,468

|

1.4

|

||||||||||||||||||

|

Total personal lines

|

394,361

|

41.8

|

367,268

|

41.0

|

312,684

|

37.1

|

||||||||||||||||||

|

Total business

|

$

|

942,281

|

100.0

|

%

|

$

|

895,697

|

100.0

|

%

|

$

|

843,530

|

100.0

|

%

|

||||||||||||

|

|

• |

assess and select primarily standard and preferred risks;

|

|

|

• |

adhere to disciplined underwriting guidelines;

|

|

|

• |

seek to price risks appropriately based on exposure, risk characteristics, utilization of predictive models and application of underwriting judgment; and

|

|

|

• |

utilize various types of risk management and loss control services.

|

|

Pennsylvania

|

37.6

|

%

|

|

|

Michigan

|

15.9

|

||

|

Maryland

|

8.2

|

||

|

Delaware

|

6.6

|

||

|

Virginia

|

6.1

|

||

|

Ohio

|

4.0

|

||

|

Wisconsin

|

2.9

|

||

|

Indiana

|

2.7

|

||

|

Georgia

|

2.6

|

||

|

North Carolina

|

2.3

|

||

|

Texas

|

2.2

|

||

|

Other

|

8.9

|

||

|

Total

|

100.0

|

%

|

|

Year Ended December 31,

|

||||||||||||

|

(in thousands)

|

2024

|

2023

|

2022

|

|||||||||

|

Gross liability for unpaid losses and loss expenses at beginning of year

|

$

|

1,126,157

|

$

|

1,121,046

|

$

|

1,077,620

|

||||||

|

Less reinsurance recoverable

|

437,014

|

451,184

|

451,261

|

|||||||||

|

Cumulative effect of adoption of updated accounting guidance for credit losses at January 1

|

—

|

1,132

|

—

|

|||||||||

|

Net liability for unpaid losses and loss expenses at beginning of year

|

689,143

|

670,994

|

626,359

|

|||||||||

|

Provision for net losses and loss expenses for claims incurred in the current year

|

619,090

|

625,831

|

608,900

|

|||||||||

|

Change in provision for estimated net losses and loss expenses for claims incurred in prior years

|

(14,972

|

)

|

(16,653

|

)

|

(44,821

|

)

|

||||||

|

Total incurred

|

604,118

|

609,178

|

564,079

|

|||||||||

|

Net losses and loss expense payments for claims incurred during:

|

||||||||||||

|

The current year

|

319,196

|

330,290

|

302,272

|

|||||||||

|

Prior years

|

269,701

|

260,739

|

218,304

|

|||||||||

|

Total paid

|

588,897

|

591,029

|

520,576

|

|||||||||

|

Net liability for unpaid losses and loss expenses at end of year

|

704,364

|

689,143

|

669,862

|

|||||||||

|

Plus reinsurance recoverable

|

416,621

|

437,014

|

451,184

|

|||||||||

|

Gross liability for unpaid losses and loss expenses at end of year

|

$

|

1,120,985

|

$

|

1,126,157

|

$

|

1,121,046

|

||||||

|

Year Ended December 31,

|

||||||||||||||||||||||||||||||||||||||||||||

|

(in thousands)

|

2014

|

2015

|

2016

|

2017

|

2018

|

2019

|

2020

|

2021

|

2022

|

2023

|

2024

|

|||||||||||||||||||||||||||||||||

|

Net liability at end of

year for unpaid

losses and loss

expenses

|

$

|

292,301

|

$

|

322,054

|

$

|

347,518

|

$

|

383,401

|

$

|

475,398

|

$

|

506,906

|

$

|

557,189

|

$

|

626,359

|

$

|

669,862

|

$

|

689,143

|

$

|

704,364

|

||||||||||||||||||||||

|

Net liability re-estimated as of:

|

||||||||||||||||||||||||||||||||||||||||||||

|

One year later

|

299,501

|

325,043

|

354,139

|

419,032

|

462,466

|

493,961

|

525,981

|

581,538

|

653,209

|

674,171

|

||||||||||||||||||||||||||||||||||

|

Two years later

|

299,919

|

329,115

|

375,741

|

413,535

|

450,862

|

479,927

|

498,724

|

564,326

|

638,428

|

|||||||||||||||||||||||||||||||||||

|

Three years later

|

304,855

|

338,118

|

376,060

|

404,902

|

440,168

|

463,441

|

490,177

|

550,972

|

||||||||||||||||||||||||||||||||||||

|

Four years later

|

307,840

|

339,228

|

372,230

|

398,560

|

432,027

|

459,835

|

480,865

|

|||||||||||||||||||||||||||||||||||||

|

Five years later

|

310,354

|

338,020

|

370,960

|

396,695

|

431,115

|

455,494

|

||||||||||||||||||||||||||||||||||||||

|

Six years later

|

310,380

|

338,200

|

372,346

|

396,748

|

429,865

|

|||||||||||||||||||||||||||||||||||||||

|

Seven years later

|

311,594

|

339,625

|

371,859

|

396,167

|

||||||||||||||||||||||||||||||||||||||||

|

Eight years later

|

313,354

|

340,191

|

372,477

|

|||||||||||||||||||||||||||||||||||||||||

|

Nine years later

|

313,539

|

340,800

|

||||||||||||||||||||||||||||||||||||||||||

|

Ten years later

|

314,490

|

|||||||||||||||||||||||||||||||||||||||||||

|

Cumulative

deficiency

(excess)

|

22,189

|

18,746

|

24,959

|

12,766

|

(45,533

|

)

|

(51,412

|

)

|

(76,324

|

)

|

(75,387

|

)

|

(31,434

|

)

|

(14,972

|

)

|

||||||||||||||||||||||||||||

|

Cumulative amount of liability paid through:

|

||||||||||||||||||||||||||||||||||||||||||||

|

One year later

|

$

|

131,779

|

$

|

149,746

|

$

|

163,005

|

$

|

175,883

|

$

|

195,956

|

$

|

172,497

|

$

|

182,223

|

$

|

218,304

|

$

|

260,739

|

$

|

269,701

|

||||||||||||||||||||||||

|

Two years later

|

206,637

|

228,506

|

250,678

|

276,331

|

275,993

|

276,069

|

297,860

|

346,107

|

405,216

|

|||||||||||||||||||||||||||||||||||

|

Three years later

|

251,654

|

274,235

|

306,338

|

317,447

|

335,310

|

343,912

|

374,043

|

426,648

|

||||||||||||||||||||||||||||||||||||

|

Four years later

|

274,248

|

300,715

|

324,628

|

342,583

|

371,231

|

393,068

|

418,283

|

|||||||||||||||||||||||||||||||||||||

|

Five years later

|

287,178

|

309,630

|

337,946

|

362,061

|

394,251

|

414,690

|

||||||||||||||||||||||||||||||||||||||

|

Six years later

|

292,327

|

315,105

|

349,496

|

372,584

|

404,251

|

|||||||||||||||||||||||||||||||||||||||

|

Seven years later

|

295,106

|

321,777

|

355,809

|

378,937

|

||||||||||||||||||||||||||||||||||||||||

|

Eight years later

|

300,306

|

326,617

|

359,527

|

|||||||||||||||||||||||||||||||||||||||||

|

Nine years later

|

303,708

|

329,651

|

||||||||||||||||||||||||||||||||||||||||||

|

Ten years later

|

306,019

|

|||||||||||||||||||||||||||||||||||||||||||

|

Year Ended December 31,

|

||||||||||||||||||||||||||||||||||||

|

(in thousands)

|

2016

|

2017

|

2018

|

2019

|

2020

|

2021

|

2022

|

2023

|

2024

|

|||||||||||||||||||||||||||

|

Gross liability at end of year

|

$

|

606,665

|

$

|

676,672

|

$

|

814,665

|

$

|

869,674

|

$

|

962,007

|

$

|

1,077,620

|

$

|

1,121,046

|

$

|

1,126,157

|

$

|

1,120,985

|

||||||||||||||||||

|

Reinsurance recoverable

|

259,147

|

293,271

|

339,266

|

362,768

|

404,818

|

451,261

|

451,184

|

437,014

|

416,621

|

|||||||||||||||||||||||||||

|

Net liability at end of

year

|

347,518

|

383,401

|

475,398

|

506,906

|

557,189

|

626,359

|

669,862

|

689,143

|

704,364

|

|||||||||||||||||||||||||||

|

Gross re-estimated liability

|

621,200

|

674,826

|

751,479

|

787,575

|

869,571

|

938,746

|

1,011,779

|

1,072,359

|

||||||||||||||||||||||||||||

|

Re-estimated recoverable

|

248,723

|

278,659

|

321,614

|

332,081

|

388,706

|

387,774

|

373,351

|

398,188

|

||||||||||||||||||||||||||||

|

Net re-estimated liability

|

372,477

|

396,167

|

429,865

|

455,494

|

480,865

|

550,972

|

638,428

|

674,171

|

||||||||||||||||||||||||||||

|

Gross cumulative deficiency (excess)

|

14,535

|

(1,846

|

)

|

(63,186

|

)

|

(82,099

|

)

|

(92,436

|

)

|

(138,874

|

)

|

(109,267

|

)

|

(53,798

|

)

|

|||||||||||||||||||||

|

|

• |

excess of loss reinsurance, under which Donegal Mutual and our insurance subsidiaries recovered losses over a set retention of $4.0 million for all property losses and $3.0 million for all liability and workers’ compensation losses

for 2024 (set retention of $4.0 million for all property losses, $6.0 million for all liability losses except workers’ compensation losses and $3.0 million for all workers’ compensation losses for 2025); and

|

|

|

• |

catastrophe reinsurance, under which Donegal Mutual and our insurance subsidiaries recovered 100% of an accumulation of many losses resulting from a single event, including natural disasters, over a set retention of $25.0 million up

to aggregate losses of $175.0 million ($200.0 million for 2025) per occurrence.

|

|

(dollars in thousands)

|

December 31, 2024

|

|||||||

|

Rating(1)

|

Amount

|

Percent

|

||||||

|

U.S. Treasury and U.S. agency securities(2)

|

$

|

474,882

|

35.9

|

%

|

||||

|

Aaa or AAA

|

25,112

|

1.9

|

||||||

|

Aa or AA

|

345,547

|

26.1

|

||||||

|

A

|

222,934

|

16.8

|

||||||

|

BBB

|

198,041

|

15.0

|

||||||

|

BB

|

58,478

|

4.4

|

||||||

|

Allowance for expected credit losses

|

(1,388

|

)

|

(0.1

|

)

|

||||

|

Total

|

$

|

1,323,606

|

100.0

|

%

|

||||

|

|

(1) |

Ratings assigned by Moody’s Investors Services, Inc. or Standard & Poor’s Corporation.

|

|

|

(2) |

Includes mortgage-backed securities of $304.5 million.

|

|

December 31,

|

||||||||||||||||||||||||

|

2024

|

2023

|

2022

|

||||||||||||||||||||||

|

Percent of

|

Percent of

|

Percent of

|

||||||||||||||||||||||

|

(dollars in thousands)

|

Amount

|

Total

|

Amount

|

Total

|

Amount

|

Total

|

||||||||||||||||||

|

Fixed maturities(1):

|

||||||||||||||||||||||||

|

Held to maturity:

|

||||||||||||||||||||||||

|

U.S. Treasury securities and obligations of U.S. government corporations and agencies

|

$

|

86,579

|

6.3

|

%

|

$

|

91,517

|

6.9

|

%

|

$

|

103,362

|

7.9

|

%

|

||||||||||||

|

Obligations of states and political subdivisions

|

371,896

|

26.9

|

376,898

|

28.4

|

382,097

|

29.3

|

||||||||||||||||||

|

Corporate securities

|

236,550

|

17.0

|

201,847

|

15.2

|

190,949

|

14.6

|

||||||||||||||||||

|

Mortgage-backed securities

|

10,689

|

0.8

|

9,235

|

0.7

|

12,031

|

1.0

|

||||||||||||||||||

|

Total held to maturity

|

705,714

|

51.0

|

679,497

|

51.2

|

688,439

|

52.8

|

||||||||||||||||||

|

Available for sale:

|

||||||||||||||||||||||||

|

U.S. Treasury securities and obligations of U.S. government corporations and agencies

|

83,793

|

6.0

|

85,419

|

6.4

|

63,521

|

4.9

|

||||||||||||||||||

|

Obligations of states and political subdivisions

|

37,404

|

2.7

|

38,116

|

2.9

|

40,156

|

3.1

|

||||||||||||||||||

|

Corporate securities

|

202,932

|

14.7

|

196,793

|

14.8

|

202,838

|

15.5

|

||||||||||||||||||

|

Mortgage-backed securities

|

293,763

|

21.2

|

269,020

|

20.3

|

217,277

|

16.6

|

||||||||||||||||||

|

Total available for sale

|

617,892

|

44.6

|

589,348

|

44.4

|

523,792

|

40.1

|

||||||||||||||||||

|

Total fixed maturities

|

1,323,606

|

95.6

|

1,268,845

|

95.6

|

1,212,231

|

92.9

|

||||||||||||||||||

|

Equity securities(2)

|

36,808

|

2.6

|

25,903

|

2.0

|

35,105

|

2.7

|

||||||||||||||||||

|

Short-term investments(3)

|

24,558

|

1.8

|

32,306

|

2.4

|

57,321

|

4.4

|

||||||||||||||||||

|

Total investments

|

$

|

1,384,972

|

100.0

|

%

|

$

|

1,327,054

|

100.0

|

%

|

$

|

1,304,657

|

100.0

|

%

|

||||||||||||

|

|

(1) |

We refer to Notes 1 and 4 to our Consolidated Financial Statements. We value those fixed maturities we classify as held to maturity at amortized cost; we value those fixed maturities we classify as available for sale at fair value.

The total fair value of fixed maturities we classified as held to maturity was $631.6 million at December 31, 2024, $611.5 million at December 31, 2023 and $598.0 million at December 31, 2022. The amortized cost of fixed maturities we

classified as available for sale was $652.6 million at December 31, 2024, $629.7 million at December 31, 2023 and $571.9 million at December 31, 2022.

|

|

|

(2) |

We value equity securities at fair value. The total cost of equity securities was $24.7 million at December 31, 2024, $18.8 million at December 31, 2023 and $30.8 million at December 31, 2022.

|

|

|

(3) |

We value short-term investments at cost, which approximates fair value.

|

|

December 31,

|

||||||||||||||||||||||||

|

2024

|

2023

|

2022

|

||||||||||||||||||||||

|

Percent

of

|

Percent

of

|

Percent

of

|

||||||||||||||||||||||

|

(dollars in thousands)

|

Amount

|

Total

|

Amount

|

Total

|

Amount

|

Total

|

||||||||||||||||||

|

Due in(1):

|

||||||||||||||||||||||||

|

One year or less

|

$

|

56,914

|

4.3

|

%

|

$

|

54,392

|

4.3

|

%

|

$

|

39,094

|

3.2

|

%

|

||||||||||||

|

Over one year through three years

|

210,184

|

15.9

|

130,158

|

10.3

|

107,689

|

8.9

|

||||||||||||||||||

|

Over three years through five years

|

175,577

|

13.3

|

141,994

|

11.2

|

133,068

|

11.0

|

||||||||||||||||||

|

Over five years through ten years

|

318,912

|

24.1

|

347,035

|

27.3

|

357,114

|

29.5

|

||||||||||||||||||

|

Over ten years through fifteen years

|

208,445

|

15.7

|

201,585

|

15.9

|

191,118

|

15.8

|

||||||||||||||||||

|

Over fifteen years

|

50,503

|

3.8

|

116,747

|

9.2

|

154,840

|

12.7

|

||||||||||||||||||

|

Mortgage-backed securities

|

304,459

|

23.0

|

278,260

|

21.9

|

229,308

|

18.9

|

||||||||||||||||||

|

Allowance for expected credit losses

|

(1,388

|

)

|

(0.1

|

)

|

(1,326

|

)

|

(0.1

|

)

|

—

|

—

|

||||||||||||||

|

$

|

1,323,606

|

100.0

|

%

|

$

|

1,268,845

|

100.0

|

%

|

$

|

1,212,231

|

100.0

|

%

|

|||||||||||||

|

|

(1) |

Based on stated maturity dates with no prepayment assumptions. Actual maturities will differ because borrowers may have the right to call or prepay obligations with or without call or prepayment penalties.

|

|

Year Ended December 31,

|

||||||||||||

|

(dollars in thousands)

|

2024

|

2023

|

2022

|

|||||||||

|

Invested assets(1)

|

$

|

1,356,013

|

$

|

1,315,855

|

$

|

1,290,752

|

||||||

|

Investment income(2)

|

44,918

|

40,853

|

34,016

|

|||||||||

|

Average yield

|

3.3

|

%

|

3.1

|

%

|

2.6

|

%

|

||||||

|

Average tax-equivalent yield

|

3.4

|

3.2

|

2.7

|

|||||||||

|

|

(1) |

Average of the aggregate invested amounts at the beginning and end of the period.

|

|

|

(2) |

Investment income is net of investment expenses and does not include investment gains or losses or provision for income taxes.

|

|

Name of Insurance Subsidiary

|

Ordinary Dividend Amount

|

|||

|

Atlantic States

|

$

|

40,741,454

|

||

|

MICO

|

7,822,780

|

|||

|

Peninsula

|

4,734,260

|

|||

|

Southern

|

—

|

|||

|

Total

|

$

|

53,298,494

|

||

|

Name

|

Age

|

Position

|

||

|

Kevin G. Burke

|

59

|

President and Chief Executive Officer of us since 2015; President and Chief Executive Officer of Donegal Mutual since 2018; Executive Vice President and Chief Operating Officer of Donegal Mutual from 2014

to 2018; Senior Vice President of Human Resources of Donegal Mutual and us from 2005 to 2014; other positions from 2000 to 2005.

|

||

|

W. Daniel DeLamater

|

52

|

Executive Vice President and Chief Operating Officer of Donegal Mutual and us since 2024; Senior Vice President of us from 2022 to 2024; Senior Vice President and Head of Field Operations & National Accounts of Donegal Mutual

from 2022 to 2024; Senior Vice President of National Accounts for Donegal Mutual from 2020 to 2022; President of Southern Mutual Insurance Company since 2016; other positions at Southern Mutual Insurance Company from 2000 to 2016.

|

||

|

Jeffery T. Hay

|

50

|

Executive Vice President and Chief Underwriting Officer of Donegal Mutual and us since 2025; Senior Vice President and Chief Underwriting Officer of Donegal Mutual and Senior Vice President of us from

2021 to 2025; Senior Director of Willis Towers Watson from 2018 to 2021; Head of Personal Lines Product Management of The Hartford from 2015 to 2018; other positions at The Hartford from 2005 to 2015.

|

||

|

Jeffrey D. Miller

|

60

|

Executive Vice President and Chief Financial Officer of Donegal Mutual and us since 2014; Senior Vice President and Chief Financial Officer of Donegal Mutual and us from 2005 to 2014; other positions from

1993 to 2005.

|

||

|

Sanjay Pandey

|

58

|

Executive Vice President and Chief Information Officer of Donegal Mutual and us since 2025; Senior Vice President and Chief Information Officer of Donegal Mutual and us from 2013 to 2025; other positions

from 2000 to 2013.

|

||

|

Kristi S. Altshuler

|

44

|

Senior Vice President and Chief Analytics Officer of us since 2020; Senior Vice President and Chief Analytics Officer of Donegal Mutual since 2019; Director of Willis Towers Watson from 2018 to 2019;

Director of Pricing Innovation of USAA from 2014 to 2018; other positions at USAA from 2001 to 2014.

|

||

|

David B. Bawel

|

38

|

Senior Vice President and Chief Accounting Officer of Donegal Mutual and us since 2024; Vice President of Financial Reporting and Analysis of Donegal Mutual and Vice President of us from 2018 to 2024;

Assistant Vice President of Internal Audit of Donegal Mutual from 2012 to 2018.

|

||

|

Noland R. Deas, Jr.

|

57

|

Senior Vice President of Field Operations & National Accounts of Donegal Mutual and Senior Vice President of us since 2024; Senior Regional Vice President of Donegal Mutual from 2022 to 2024 and

Regional Vice President of Donegal Mutual from 2020 to 2022; other positions with Donegal Mutual from 2006 to 2020.

|

||

|

William A. Folmar

|

66

|

Senior Vice President of Claims of Donegal Mutual and Senior Vice President of us since 2019; Vice President of Claims of Donegal Mutual from 2010 to 2019; other positions from 1998 to 2010.

|

||

|

Rick J. Hecker

|

37

|

Senior Vice President and General Counsel of Donegal Mutual and us since 2025; Senior Vice President and General Counsel of Conestoga Title Insurance Company from 2022 to 2024; Vice President and General

Counsel of Conestoga Title Insurance Company from 2021 to 2022.

|

||

|

Christina M. Hoffman

|

50

|

Senior Vice President and Chief Risk Officer of Donegal Mutual and us since 2019; Senior Vice President of Internal Audit of Donegal Mutual and Senior Vice President of us from 2013 to 2019; Vice

President of Internal Audit of Donegal Mutual and Vice President of us from 2009 to 2013.

|

||

|

David W. Sponic

|

60

|

Senior Vice President of Personal Lines of Donegal Mutual and Senior Vice President of us since 2022; Vice President of Personal Lines of Donegal Mutual from 2008 to 2022; other positions from 1990 to

2008.

|

||

|

V. Anthony Viozzi

|

51

|

Senior Vice President and Chief Investment Officer of Donegal Mutual and us since 2012; Vice President of Investments of Donegal Mutual and us from 2007 to 2012.

|

||

|

Daniel J. Wagner

|

64

|

Senior Vice President and Treasurer of Donegal Mutual and us since 2005; other positions from 1987 to 2005.

|

| Item 1A. |

Risk Factors.

|

|

|

• |

trends in claim frequency and severity;

|

|

|

• |

changes in operations;

|

|

|

• |

emerging economic and social trends;

|

|

|

• |

economic and social inflation; and

|

|

|

• |

changes in the regulatory and litigation environments.

|

|

|

• |

the availability of sufficient, reliable data;

|

|

|

• |

the ability to conduct a complete and accurate analysis of available data;

|

|

|

• |

the ability to recognize in a timely manner changes in trends and to project both the severity and frequency of losses with reasonable accuracy;

|

|

|

• |

uncertainties generally inherent in estimates and assumptions;

|

|

|

• |

the ability to project changes in certain operating expense levels with reasonable certainty;

|

|

|

• |

the development, selection and application of appropriate rating formulae or other pricing methodologies;

|

|

|

• |

the effective development, governance and appropriate use of modeling tools to assist with correctly and consistently achieving the intended results in underwriting and pricing;

|

|

|

• |

the ability to innovate with new pricing strategies and the success of those innovations upon implementation;

|

|

|

• |

the ability to secure regulatory approval of premium rates on an adequate and timely basis;

|

|

|

• |

the ability to predict policyholder retention accurately;

|

|

|

• |

unanticipated court decisions, legislation or regulatory action;

|

|

|

• |

unanticipated changes in our claim settlement practices;

|

|

|

• |

changes in driving patterns for auto exposures;

|

|

|

• |

changes in weather patterns for property exposures;

|

|

|

• |

changes in the medical sector of the economy that impact bodily injury loss costs;

|

|

|

• |

changes in new and used car prices, auto repair costs and auto parts prices, including the increasing integration of sophisticated technology-related components;

|

|

|

• |

the impact of emerging technologies, including driver assistance technologies and autonomous vehicles, on pricing, insurance coverages and loss costs;

|

|

|

• |

the impact of inflation and other factors on the cost and availability of construction materials and labor;

|

|

|

• |

the impact of medical advances on the cost and duration of bodily injury claims;

|

|

|

• |

the ability to monitor property concentration in catastrophe-prone areas, such as hurricane, earthquake, wildfire and wind/hail regions; and

|

|

|

• |

the general state of the economy in the states in which our insurance subsidiaries operate.

|

|

|

• |

licensing and examination;

|

|

|

• |

approval of premium rates;

|

|

|

• |

market conduct;

|

|

|

• |

policy forms;

|

|

|

• |

limitations on the nature and amount of certain investments;

|

|

|

• |

claims practices;

|

|

|

• |

mandated participation in involuntary markets and guaranty funds;

|

|

|

• |

reserve adequacy;

|

|

|

• |

insurer solvency;

|

|

|

• |

transactions between affiliates;

|

|

|

• |

the amount of dividends that insurers may pay; and

|

|

|

• |

restrictions on underwriting standards.

|

|

|

• |

insurance company investments;

|

|

|

• |

issues relating to the solvency of insurance companies;

|

|

|

• |

risk-based capital guidelines;

|

|

|

• |

restrictions on the terms and conditions included in insurance policies;

|

|

|

• |

certain methods of accounting;

|

|

|

• |

reserves for unearned premiums, losses and other purposes;

|

|

|

• |

the values at which insurance companies may carry investment securities and the definition of other-than-temporary impairment of investment securities; and

|

|

|

• |

interpretations of existing laws and the development of new laws.

|

|

|

• |

the business operations or a specific operational function of our insurance subsidiaries and Donegal Mutual could be disrupted by the illness of significant numbers of their employees and remedial efforts that would be required upon

discovery of exposure to a communicable illness within their facilities;

|

|

|

• |

the business operations of our insurance subsidiaries and Donegal Mutual are dependent upon technology systems for which regular physical access is required to maintain critical operational capabilities, and the business operations

of our insurance subsidiaries and Donegal Mutual would be adversely impacted by government mandates requiring closure of facilities where those technology systems are located or restricting physical access to such facilities;

|

|

|

• |

the revenues of our insurance subsidiaries and Donegal Mutual may decrease as a result of reduced demand for their insurance products as economic disruption adversely impacts current and potential insurance customers;

|

|

|

• |

our insurance subsidiaries and Donegal Mutual may incur an increase in their losses and loss expenses in certain lines of business as a result of a pandemic and related economic disruption, and such losses and loss expenses may

exceed the reserves our insurance subsidiaries and Donegal Mutual have established or may establish in the future;

|

|

|

• |

our insurance subsidiaries and Donegal Mutual may incur increased costs related to legal disputes over policy coverages or exclusions and their defense against litigation related to a pandemic;

|

|

|

• |

legislative, judicial and regulatory actions may expand coverage definitions, retroactively mandate coverage or otherwise require our insurance subsidiaries and Donegal Mutual to pay losses for damages that their policies explicitly

excluded or did not intend to cover;

|

|

|

• |

legislative, judicial and regulatory actions may require our insurance subsidiaries and Donegal Mutual to reduce or refund premiums, suspend cancellation of policies for non-payment of premiums or otherwise grant extended grace

periods and time allowances for the payment of premium balances due to them;

|

|

|

• |

our insurance subsidiaries and Donegal Mutual may not be able to collect premium balances due to them, resulting in reduced operating cash flows and an increase in premium write-offs that would increase their operating expenses;

|

|

|

• |

our insurance subsidiaries may suffer declines in the market values of their investments as a result of financial market volatility related to pandemic concerns and related economic disruption; and

|

|

|

• |

economic disruption related to a pandemic could result in significant declines in the credit quality of issuers, ratings downgrades or changes in financial market conditions and regulatory changes that might adversely impact the

value of the fixed-maturity investments that our insurance subsidiaries own.

|

|

|

• |

the significant competition among insurance companies to attract independent agents;

|

|

|

• |

the labor-intensive and time-consuming process of selecting new independent agents;

|

|

|

• |

the insistence of our insurance subsidiaries and Donegal Mutual that independent agents adhere to certain standards;

|

|

|

• |

the ability of our insurance subsidiaries and Donegal Mutual to pay competitive and attractive commissions, bonuses and other incentives to independent agents; and

|

|

|

• |

the ongoing consolidation of independent agencies, which may result in the acquisition of independent agencies from which our insurance subsidiaries and Donegal Mutual currently receive business by larger entities with which our

insurance subsidiaries and Donegal Mutual do not have business relationships.

|

|

|

• |

the potential inadequacy of reserves for losses and loss expenses of the other insurer;

|

|

|

• |

the need to supplement management of the other insurer with additional experienced personnel;

|

|

|

• |

conditions imposed by regulatory agencies that make the realization of cost-savings through integration of the operations of the other insurer with our operations more difficult;

|

|

|

• |

our management’s lack of familiarity with the geography, demographics and distribution systems in the markets the other insurer serves that cause the other insurer to fail to meet the growth and profitability objectives we

anticipated at the time of the acquisition or affiliation;

|

|

|

• |

potential difficulties with integration of information technology systems and other operations;

|

|

|

• |

the need of the other insurer for additional capital that we did not anticipate at the time of the acquisition or affiliation; and

|

|

|

• |

the use of more of our management’s time in improving the operations of the other insurer than we originally anticipated.

|

|

|

• |

the perceived financial strength of the insurer;

|

|

|

• |

premium rates;

|

|

|

• |

policy terms and conditions;

|

|

|

• |

policyholder service;

|

|

|

• |

reputation; and

|

|

|

• |

experience.

|

|

|

• |

we and Donegal Mutual periodically review the percentage participation of Atlantic States and Donegal Mutual in the underwriting pool that Donegal Mutual and Atlantic States have maintained since 1986;

|

|

|

• |

our insurance subsidiaries and Donegal Mutual annually review and then establish the terms of certain reinsurance agreements between our insurance subsidiaries and Donegal Mutual;

|

|

|

• |

we and Donegal Mutual allocate certain shared expenses among ourselves and our insurance subsidiaries in accordance with various inter-company expense-sharing agreements; and

|

|

|

• |

we and our insurance subsidiaries may enter into other transactions or contractual relationships with Donegal Mutual.

|

|

|

• |

elect all of the members of our board of directors, who determine our management and policies; and

|

|

|

• |

control the outcome of any corporate transaction or other matter submitted to a vote of our stockholders for approval, including mergers or other acquisition proposals and the sale of all or substantially all of our assets, in each

case regardless of how all of our stockholders other than Donegal Mutual vote their shares.

|

|

|

• |

our board of directors is classified into three classes, so that our stockholders elect only one-third of the members of our board of directors each year;

|

|

|

• |

our stockholders may remove our directors only for cause;

|

|

|

• |

our stockholders may not take stockholder action except at an annual or special meeting of our stockholders;

|

|

|

• |

the request of stockholders holding at least 20% of the combined voting power of our Class A common stock and our Class B common stock is required for a stockholder to call a special meeting of our stockholders;

|

|

|

• |

our by-laws require that stockholders provide advance notice to us to nominate candidates for election to our board of directors or to propose any other item of stockholder business at a stockholders’ meeting;

|

|

|

• |

we do not permit cumulative voting rights in the election of our directors;

|

|

|

• |

our certificate of incorporation does not provide for preemptive rights in connection with any issuance of securities by us; and

|

|

|

• |

our board of directors may issue, without stockholder approval unless otherwise required by law, preferred stock with such terms as our board of directors may determine.

|

| Item 1B. |

Unresolved Staff Comments.

|

| Item 1C. |

Cybersecurity.

|

| Item 2. |

Properties.

|

| Item 3. |

Legal Proceedings.

|

| Item 4. |

Mine Safety Disclosures.

|

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

|

Period

|

(a) Total Number of Shares

(or Units) Purchased

|

(b) Average Price Paid per

Share (or Unit)

|

(c) Total Number of Shares

(or Units) Purchased as

Part of Publicly

Announced Plans or

Programs

|

(d) Maximum Number (or

Approximate Dollar Value)

of Shares (or Units) that

May Yet Be Purchased

Under the Plans or

Programs

|

||||

|

Month #1

October 1-31, 2024

|

Class A – 150,432

Class B – None

|

Class A – $15.49

Class B – None

|

Class A – 150,432

Class B – None

|

(1)

|

||||

|

Month #2

November 1-30, 2024

|

Class A – 235,884

Class B – None

|

Class A – $15.88

Class B – None

|

Class A – 235,884

Class B – None

|

(1)

|

||||

|

Month #3

December 1-31, 2024

|

Class A – 414,122

Class B – None

|

Class A – $16.63

Class B – None

|

Class A – 414,122

Class B – None

|

(1)

|

||||

|

Total

|

Class A – 800,438

Class B – None

|

Class A – $16.20

Class B – None

|

Class A – 800,438

Class B – None

|

|

|

(1) |

Donegal Mutual purchased these shares pursuant to its disclosure on April 29, 2022 that it will, at its discretion, purchase shares of our Class A common stock and Class B common stock at market prices prevailing from time

to time in the open market subject to the provisions of SEC Rule 10b-18 and in privately negotiated transactions. Such disclosure did not stipulate a maximum number of shares that may be purchased under this program.

|

|

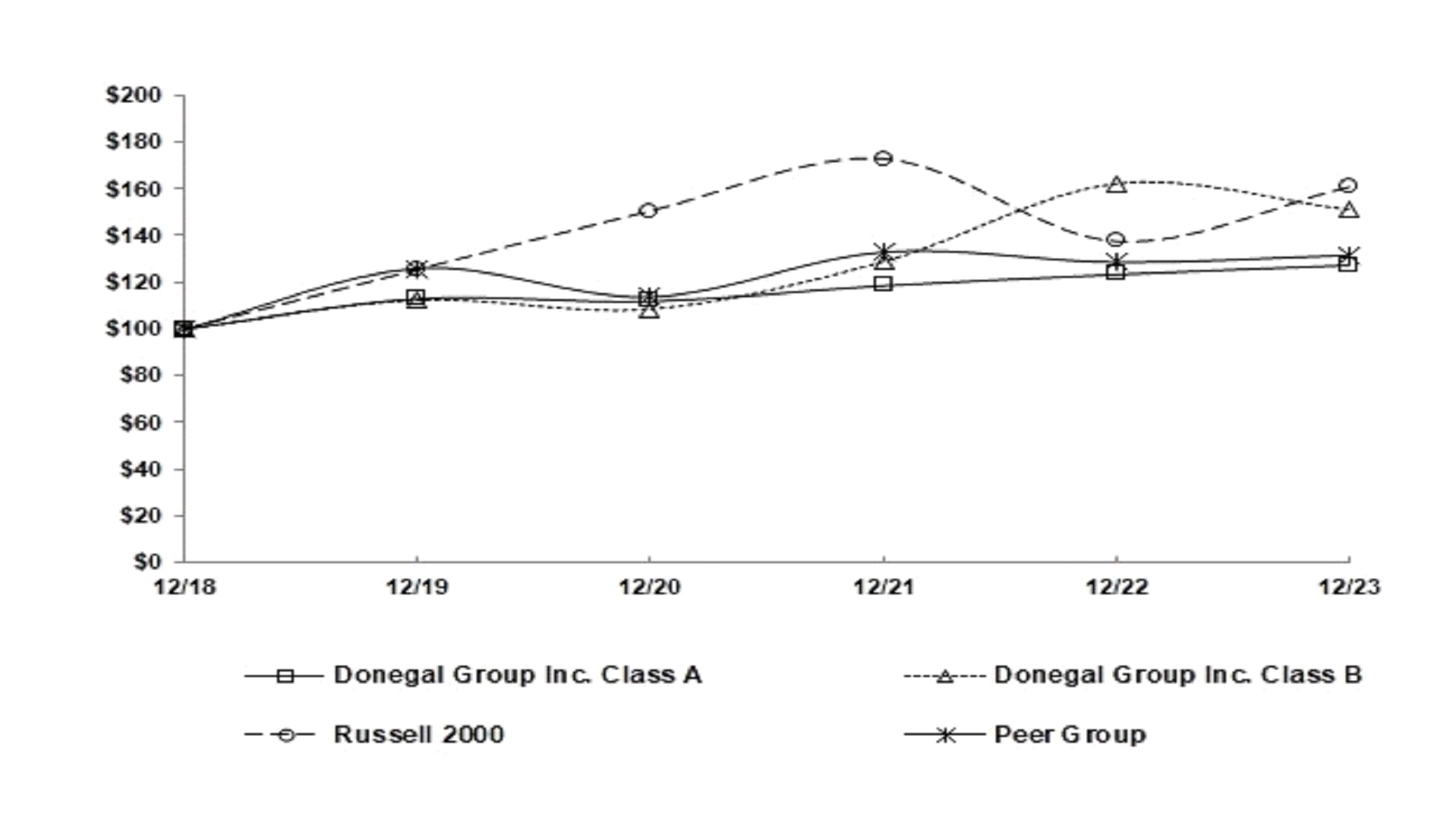

2019

|

2020

|

2021

|

2022

|

2023

|

2024

|

||

|

Donegal Group Inc. Class A

|

$100.00

|

$98.98

|

$104.91

|

$109.16

|

$112.65

|

$130.65

|

|

|

Donegal Group Inc. Class B

|

100.00

|

96.57

|

114.54

|

144.15

|

134.32

|

136.44

|

|

|

Russell 2000

|

100.00

|

119.96

|

137.74

|

109.59

|

128.14

|

142.93

|

|

|

Peer Group

|

100.00

|

90.33

|

105.60

|

102.08

|

104.50

|

136.71

|

| Item 6. |

[Reserved]

|

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

2024

|

2023

|

|||||||

|

(in thousands)

|

||||||||

|

Commercial lines:

|

||||||||

|

Automobile

|

$

|

180,757

|

$

|

168,749

|

||||

|

Workers’ compensation

|

129,406

|

122,473

|

||||||

|

Commercial multi-peril

|

208,676

|

217,292

|

||||||

|

Other

|

39,336

|

27,167

|

||||||

|

Total commercial lines

|

558,175

|

535,681

|

||||||

|

Personal lines:

|

||||||||

|

Automobile

|

116,693

|

112,509

|

||||||

|

Homeowners

|

26,591

|

28,001

|

||||||

|

Other

|

2,905

|

12,952

|

||||||

|

Total personal lines

|

146,189

|

153,462

|

||||||

|

Total commercial and personal lines

|

704,364

|

689,143

|

||||||

|

Plus reinsurance recoverable

|

416,621

|

437,014

|

||||||

|

Total liability for losses and loss expenses

|

$

|

1,120,985

|

$

|

1,126,157

|

||||

|

Change in Loss and Loss

Expense Reserves Net of

Reinsurance

|

Adjusted Loss and Loss

Expense Reserves Net of

Reinsurance at

December 31, 2024

|

Percentage Change in

Equity at

December 31, 2024(1)

|

Adjusted Loss and Loss

Expense Reserves Net of

Reinsurance at

December 31, 2023

|

Percentage Change in

Equity at

December 31, 2023(1)

|

||||

|

(dollars in thousands)

|

||||||||

|

-10.0%

|

$633,928

|

10.2%

|

$620,229

|

11.3%

|

||||

|

-7.5

|

651,537

|

7.6

|

637,457

|

8.5

|

||||

|

-5.0

|

669,146

|

5.1

|

654,686

|

5.7

|

||||

|

-2.5

|

686,755

|

2.5

|

671,914

|

2.8

|

||||

|

Base

|

704,364

|

—

|

689,143

|

—

|

||||

|

2.5

|

721,973

|

-2.5

|

706,372

|

-2.8

|

||||

|

5.0

|

739,582

|

-5.1

|

723,600

|

-5.7

|

||||

|

7.5

|

757,191

|

-7.6

|

740,829

|

-8.5

|

||||

|

10.0

|

774,800

|

-10.2

|

758,057

|

-11.3

|

||||

|

(1)

|

Net of income tax effect.

|

|

For the Year Ended December 31,

|

||||||||

|

(dollars in thousands)

|

2024

|

2023

|

||||||

|

Number of claims pending, beginning of period

|

3,144

|

3,366

|

||||||

|

Number of claims reported

|

5,066

|

5,928

|

||||||

|

Number of claims settled or dismissed

|

5,378

|

6,150

|

||||||

|

Number of claims pending, end of period

|

2,832

|

3,144

|

||||||

|

Losses paid

|

$

|

54,597

|

$

|

54,336

|

||||

|

Loss expenses paid

|

$

|

10,953

|

$

|

12,292

|

||||

|

Year Ended December 31,

|

||||||||||||

|

(in thousands)

|

2024

|

2023

|

2022

|

|||||||||

|

Net premiums written:

|

||||||||||||

|

Commercial lines:

|

||||||||||||

|

Automobile

|

$

|

184,989

|

$

|

174,741

|

$

|

167,774

|

||||||

|

Workers’ compensation

|

103,533

|

107,598

|

111,892

|

|||||||||

|

Commercial multi-peril

|

213,959

|

195,632

|

200,045

|

|||||||||

|

Other

|

45,439

|

50,458

|

51,135

|

|||||||||

|

Total commercial lines

|

547,920

|

528,429

|

530,846

|

|||||||||

|

Personal lines:

|

||||||||||||

|

Automobile

|

243,036

|

215,957

|

181,129

|

|||||||||

|

Homeowners

|

140,613

|

139,688

|

120,087

|

|||||||||

|

Other

|

10,712

|

11,623

|

11,468

|

|||||||||

|

Total personal lines

|

394,361

|

367,268

|

312,684

|

|||||||||

|

Total net premiums written

|

$

|

942,281

|

$

|

895,697

|

$

|

843,530

|

||||||

|

Components of combined ratio:

|

||||||||||||

|

Loss ratio

|

64.5

|

%

|

69.1

|

%

|

68.6

|

%

|

||||||

|

Expense ratio

|

33.7

|

34.7

|

34.1

|

|||||||||

|

Dividend ratio

|

0.4

|

0.6

|

0.6

|

|||||||||

|

Combined ratio

|

98.6

|

%

|

104.4

|

%

|

103.3

|

%

|

||||||

|

Revenues:

|

||||||||||||

|

Net premiums earned:

|

||||||||||||

|

Commercial lines

|

$

|

539,683

|

$

|

533,029

|

$

|

521,227

|

||||||

|

Personal lines

|

396,968

|

349,042

|

301,263

|

|||||||||

|

Total net premiums earned

|

936,651

|

882,071

|

822,490

|

|||||||||

|

Net investment income

|

44,918

|

40,853

|

34,016

|

|||||||||

|

Investment gains (losses)

|

4,981

|

3,173

|

(10,185

|

)

|

||||||||

|

Other

|

3,055

|

1,241

|

1,900

|

|||||||||

|

Total revenues

|

$

|

989,605

|

$

|

927,338

|

$

|

848,221

|

||||||

|

Year Ended December 31,

|

||||||||||||

|

(in thousands)

|

2024

|

2023

|

2022

|

|||||||||

|

Components of net income (loss):

|

||||||||||||

|

Underwriting income (loss):

|

||||||||||||

|

Commercial lines

|

$

|

5,826

|

$

|

(6,998

|

)

|

$

|

(22,665

|

)

|

||||

|

Personal lines

|

5,739

|

(35,118

|

)

|

(13,506

|

)

|

|||||||

|

SAP underwriting income (loss)

|

11,565

|

(42,116

|

)

|

(36,171

|

)

|

|||||||

|

GAAP adjustments

|

1,331

|

3,735

|

8,667

|

|||||||||

|

GAAP underwriting income (loss)

|

12,896

|

(38,381

|

)

|

(27,504

|

)

|

|||||||

|

Net investment income

|

44,918

|

40,853

|

34,016

|

|||||||||

|

Investment gains (losses)

|

4,981

|

3,173

|

(10,185

|

)

|

||||||||

|

Other

|

(456

|

)

|

(582

|

)

|

35

|

|||||||

|

Income (loss) before income tax expense (benefit)

|

62,339

|

5,063

|

(3,638

|

)

|

||||||||

|

Income tax expense (benefit)

|

11,477

|

637

|

(1,679

|

)

|

||||||||

|

Net income (loss)

|

$

|

50,862

|

$

|

4,426

|

$

|

(1,959

|

)

|

|||||

|

(in thousands)

|

Commercial Lines

|

Personal

Lines

|

Total

|

|||||||||

|

Net premiums earned

|

$

|

539,683

|

$

|

396,968

|

$

|

936,651

|

||||||

|

Change in net unearned premiums

|

8,237

|

(2,607

|

)

|

5,630

|

||||||||

|

Net premiums written

|

$

|

547,920

|

$

|

394,361

|

$

|

942,281

|

||||||

|

(in thousands)

|

Commercial Lines

|

Personal

Lines

|

Total

|

|||||||||

|

Net premiums earned

|

$

|

533,029

|

$

|

349,042

|

$

|

882,071

|

||||||

|

Change in net unearned premiums

|

(4,600

|

)

|

18,226

|

13,626

|

||||||||

|

Net premiums written

|

$

|

528,429

|

$

|

367,268

|

$

|

895,697

|

||||||

|

(in thousands)

|

Commercial Lines

|

Personal

Lines

|

Total

|

|||||||||

|

Net premiums earned

|

$

|

521,227

|

$

|

301,263

|

$

|

822,490

|

||||||

|

Change in net unearned premiums

|

9,619

|

11,421

|

21,040

|

|||||||||

|

Net premiums written

|

$

|

530,846

|

$

|

312,684

|

$

|

843,530

|

||||||

|

|

• |

the statutory loss ratio, which is the ratio of calendar-year net incurred losses and loss expenses to net premiums earned;

|

|

|

• |

the statutory expense ratio, which is the ratio of expenses incurred for net commissions, premium taxes and underwriting expenses to net premiums written; and

|

|

|

• |

the statutory dividend ratio, which is the ratio of dividends to holders of workers’ compensation policies to net premiums earned.

|

|

Year Ended December 31,

|

||||||||||||

|

2024

|

2023

|

2022

|

||||||||||

|

GAAP Combined Ratios (Total Lines)

|

||||||||||||

|

Loss ratio - core losses

|

54.0

|

%

|

57.5

|

%

|

59.8

|

%

|

||||||

|

Loss ratio - weather-related losses

|

7.2

|

8.3

|

7.7

|

|||||||||

|

Loss ratio - large fire losses

|

4.9

|

5.2

|

6.5

|

|||||||||

|

Loss ratio - net prior-year reserve development

|

-1.6

|

-1.9

|

-5.4

|

|||||||||

|

Loss ratio

|

64.5

|

69.1

|

68.6

|

|||||||||

|

Expense ratio

|

33.7

|

34.7

|

34.1

|

|||||||||

|

Dividend ratio

|

0.4

|

0.6

|

0.6

|

|||||||||

|

Combined ratio

|

98.6

|

%

|

104.4

|

%

|

103.3

|

%

|

||||||

|

Statutory Combined Ratios

|

||||||||||||

|

Commercial lines:

|

||||||||||||

|

Automobile

|

102.6

|

%

|

97.3

|

%

|

98.0

|

%

|

||||||

|

Workers’ compensation

|

104.4

|

96.6

|

97.3

|

|||||||||

|

Commercial multi-peril

|

95.0

|

112.3

|

116.9

|

|||||||||

|

Other

|

80.0

|

85.5

|

80.8

|

|||||||||

|

Total commercial lines

|

98.2

|

101.6

|

103.7

|

|||||||||

|

Personal lines:

|

||||||||||||

|

Automobile

|

97.4

|

109.7

|

103.8

|

|||||||||

|

Homeowners

|

99.6

|

108.6

|

111.0

|

|||||||||

|

Other

|

99.5

|

75.8

|

52.1

|

|||||||||

|

Total personal lines

|

98.3

|

108.2

|

102.8

|

|||||||||

|

Total commercial and personal lines

|

98.3

|

104.2

|

103.3

|

|||||||||

|

December 31,

|

||||||||||||||||

|

2024

|

2023

|

|||||||||||||||

|

Percent of

|

Percent of

|

|||||||||||||||

|

(dollars in thousands)

|

Amount

|

Total

|

Amount

|

Total

|

||||||||||||

|

Fixed maturities:

|

||||||||||||||||

|

Total held to maturity

|

$

|

705,714

|

51.0

|

%

|

$

|

679,497

|

51.2

|

%

|

||||||||

|

Total available for sale

|

617,892

|

44.6

|

589,348

|

44.4

|

||||||||||||

|

Total fixed maturities

|

1,323,606

|

95.6

|

1,268,845

|

95.6

|

||||||||||||

|

Equity securities

|

36,808

|

2.6

|

25,903

|

2.0

|

||||||||||||

|

Short-term investments

|

24,558

|

1.8

|

32,306

|

2.4

|

||||||||||||

|

Total investments

|

$

|

1,384,972

|

100.0

|

%

|

$

|

1,327,054

|

100.0

|

%

|

||||||||

|

(in thousands)

|

Principal

Cash Flows

|

Weighted-

Average

Interest Rate

|

||||||

|

Fixed-maturity and short-term investments:

|

||||||||

|

2025

|

$

|

82,064

|

4.18

|

%

|

||||

|

2026

|

65,538

|

3.93

|

||||||

|

2027

|