UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 23, 2025 (May 22, 2025)

HERITAGE COMMERCE CORP

(Exact name of registrant as specified in its charter)

| California | 000-23877 | 77-0469558 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

| 224 Airport Parkway, San Jose, California | 95110 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (408) 947-6900

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, No Par Value | HTBK | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| ITEM 5.02 | Departure of Directors or Certain Officers |

On May 22, 2025, Heritage Commerce Corp (the “Company”), the holding company for Heritage Bank of Commerce (the “Bank”) issued a press release announcing it had received notice from Director and former Chair of the Board Jack W. Conner, of his intention to retire as a Director in October 2025. Following Mr. Conner’s retirement, he will be entitled to receive certain benefits pursuant to a First Amended and Restated Director Compensation Benefits Agreement dated December 29, 2008 (“Benefits Agreement”). A copy of the Benefits Agreement is filed as Exhibit 10.23 to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024. A summary of the Benefits Agreement is set forth on page 16 of the Company’s Definitive Proxy Statement on Schedule 14A, filed in connection with the Company’s 2025 Annual Meeting of Shareholders. Both the Benefits Agreement and the summary thereof are incorporated by reference herein.

| ITEM 5.07 | Submission of Matters to a Vote of Security Holders |

On May 22, 2025, the Company held its virtual Annual Meeting of Shareholders (the “Shareholders Meeting”). There were 61,611,121 shares of common stock entitled to vote at the meeting and a total of 51,110,249 shares (83.0%) were represented at the meeting. At the Shareholders Meeting, the shareholders voted on the following proposals as described in detail in the Company’s Proxy Statement filed with the Securities and Exchange Commission (“SEC”) on April 7, 2025. The proposals voted on and approved by the shareholders at the Shareholders Meeting were as follows:

Proposal 1: Election of Directors

The election of eight directors, named in the Proxy Statement, to serve as members of the Company’s Board of Directors until the next annual meeting of shareholders. The results are set forth below:

| Name | For | Withheld | Broker Non-Votes |

| Julianne M. Biagini-Komas | 44,974,914 | 716,888 | 5,418,447 |

| Bruce H. Cabral | 44,400,672 | 1,291,130 | 5,418,447 |

| Jack W. Conner | 44,160,178 | 1,531,624 | 5,418,447 |

| Jason DiNapoli | 43,992,434 | 1,699,368 | 5,418,447 |

| Steven G. Heitel | 44,943,567 | 748,235 | 5,418,447 |

| Kamran F. Husain | 44,920,849 | 770,953 | 5,418,447 |

| Robertson Clay Jones | 44,992,176 | 699,626 | 5,418,447 |

| Marina H. Park Sutton | 44,285,569 | 1,406,233 | 5,418,447 |

Proposal 2: Amendment to the Company’s Bylaws to Increase the Range of the Permitted Number of Directors

The consideration of an amendment of the Company’s Bylaws that would adjust the range of the permitted number of directors to eight (8) to fifteen (15) directors. The results are set forth below:

| For | Against | Abstentions | Broker Non-Votes |

| 50,199,233 | 779,914 | 131,102 | 0 |

Proposal 3: Advisory Vote on Executive Compensation

The consideration of an advisory proposal on the compensation of the Company’s named executive officers, as described in the Compensation Discussion and Analysis, the compensation tables, and the related disclosures required by Item 402 of Regulation S-K contained in the Company’s Proxy Statement. The results are set forth below:

| For | Against | Abstentions | Broker Non-Votes |

| 44,256,523 | 968,162 | 467,117 | 5,418,447 |

Proposal 4: Ratification of Independent Registered Public Accounting Firm

The ratification of the selection of Crowe LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025. The results are set forth below:

| For | Against | Abstentions | Broker Non-Votes |

| 50,484,642 | 586,318 | 39,289 | 0 |

| ITEM 7.01 | Regulation FD Disclosure |

Robertson Clay Jones, President and Chief Executive Officer of the Company, made a presentation to shareholders at the Shareholders Meeting. A copy of the information in the shareholder presentation is furnished herewith as Exhibit 99.1.

Also on May 22, 2025, the Company issued a press release announcing the succession of Julianne Biagini-Komas to the role of Chair of the Board of Directors. This announcement also reflected the appointment of Director Jack Conner to the role of Chair Emeritus and the retirement of Director Laura Roden effective as of the Shareholders Meeting, as well as the anticipated retirement of Mr. Conner in October 2025. Each of these events was effective as of the conclusion of the Shareholders Meeting. A copy of this press release is furnished herewith as Exhibit 99.2.

The information in Exhibits 99.1 and 99.2 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing. The information in the materials is presented as of March 31, 2025, and the Company does not assume any obligations to update such information in the future.

| ITEM 9.01 | Financial Statements and Exhibits |

(D) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: May 23, 2025

| Heritage Commerce Corp | ||

| By: | /s/ Thomas A. Sa | |

| Name: Thomas A. Sa | ||

| Executive Vice President and Chief Operating Officer and Interim Chief Financial Officer | ||

Exhibit 99.1

Welcome to the Virtual Annual Meeting of Shareholders Thursday, May 22, 2025 at 1:00 p.m. Pacific Daylight Time (PDT)

Virtual Annual Meeting of Shareholders Today’s Agenda 1. Call to Order and Opening Remarks 2. New Business / Proposals a. To elect 8 members of the Board of Directors, each for a term of one year; b. To approve an amendment to the Company’s Bylaws to increase the range of the permitted number of Directors; c. To approve an advisory proposal on the Company’s 2024 executive compensation; and d. To ratify the selection of Crowe LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2025. 3. Voting on Proposals 4. Closing of the Formal Meeting / Begin Presentation Virtual Annual Meeting of Shareholders Presentation May 22, 2025

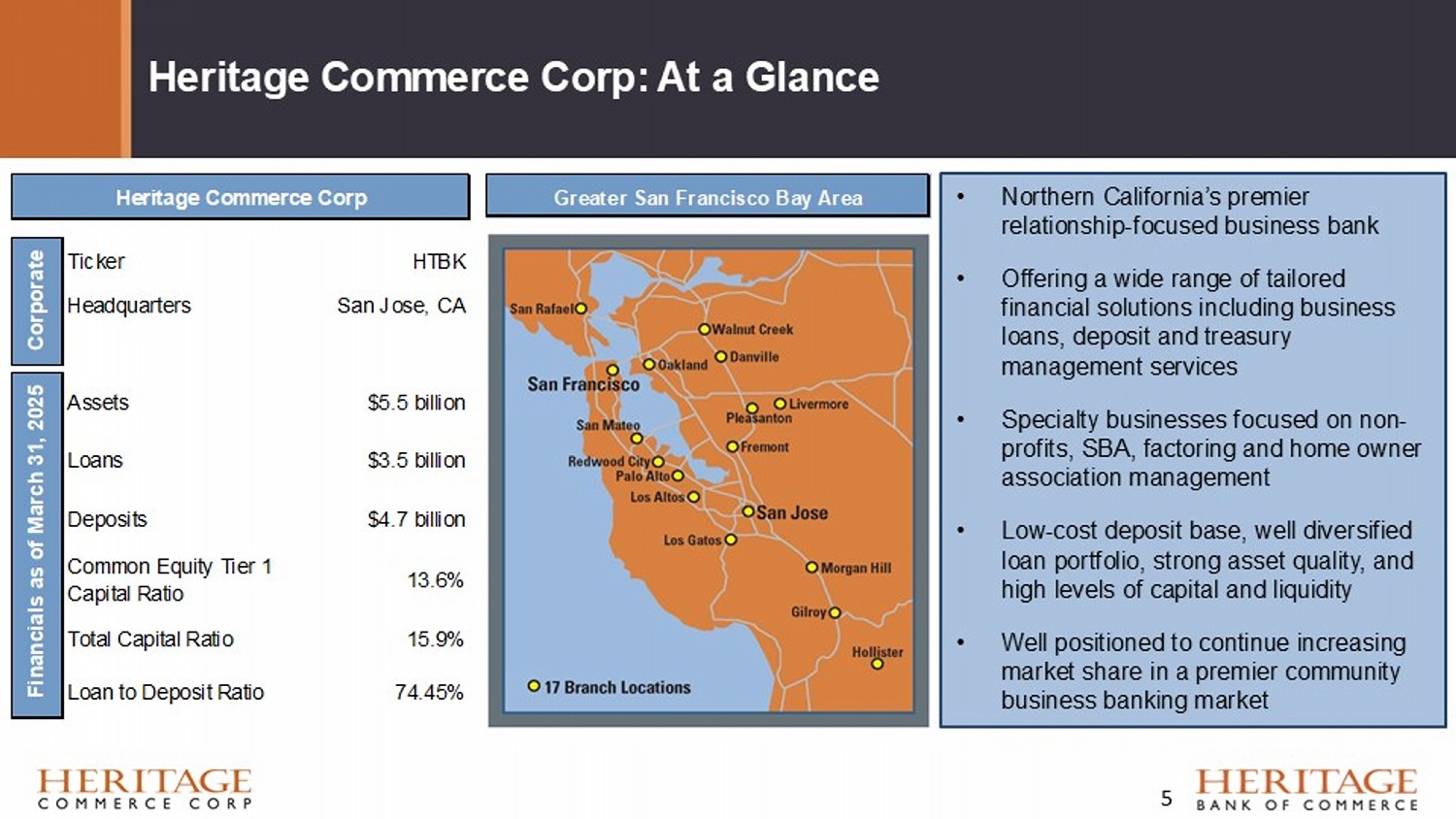

Forward Looking Statement Disclaimer and Basis of Presentation • Forward - looking statements are based on management’s knowledge and belief as of today and include information concerning Heritage Commerce Corp, the holding company (the “Company”) for Heritage Bank of Commerce (the “Bank”), possible or assumed future financial condition, and its results of operations, business and earnings outlook. These forward - looking statements are subject to risks and uncertainties. For a discussion of risk factors which could cause results to differ, please see the Company’s reports on Forms 10 - K and 10 - Q as filed with the Securities and Exchange Commission and the Company’s press releases. Readers should not place undue reliance on the forward - looking statements, which reflect management's view only as of the date hereof. The Company undertakes no obligation to publicly revise these forward - looking statements to reflect subsequent events or circumstances. • Financial results are presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and with reference to certain non - GAAP financial measures. However, certain non - GAAP performance measures and ratios are used by management to evaluate and measure the Company’s performance. The Company believes these non - GAAP financial measures are common in the banking industry, and may enhance comparability for peer comparison purposes. These non - GAAP financial measures should be supplemental to primary GAAP financial measures and should not be read in isolation or relied upon as a substitute for primary GAAP financial measures. A reconciliation of GAAP to non - GAAP financial measures are presented in the Company’s reports on Forms 10 - K and 10 - Q as filed with the Securities and Exchange Commission and the Company’s press releases. 4 Heritage Commerce Corp: At a Glance Greater San Francisco Bay Area Strategy Heritage Commerce Corp Greater San Francisco Bay Area Ticker HTBK Headquarters San Jose, CA Assets $5.5 billion Loans $3.5 billion Deposits $4.7 billion 13.6% Total Capital Ratio 15.9% Loan to Deposit Ratio 74.45% Corporate Financials as of March 31, 2025 Common Equity Tier 1 Capital Ratio • Northern California’s premier relationship - focused business bank • Offering a wide range of tailored financial solutions including business loans, deposit and treasury management services • Specialty businesses focused on non - profits, SBA, factoring and home owner association management • Low - cost deposit base, well diversified loan portfolio, strong asset quality, and high levels of capital and liquidity • Well positioned to continue increasing market share, adding clients, and generating profitable growth 5

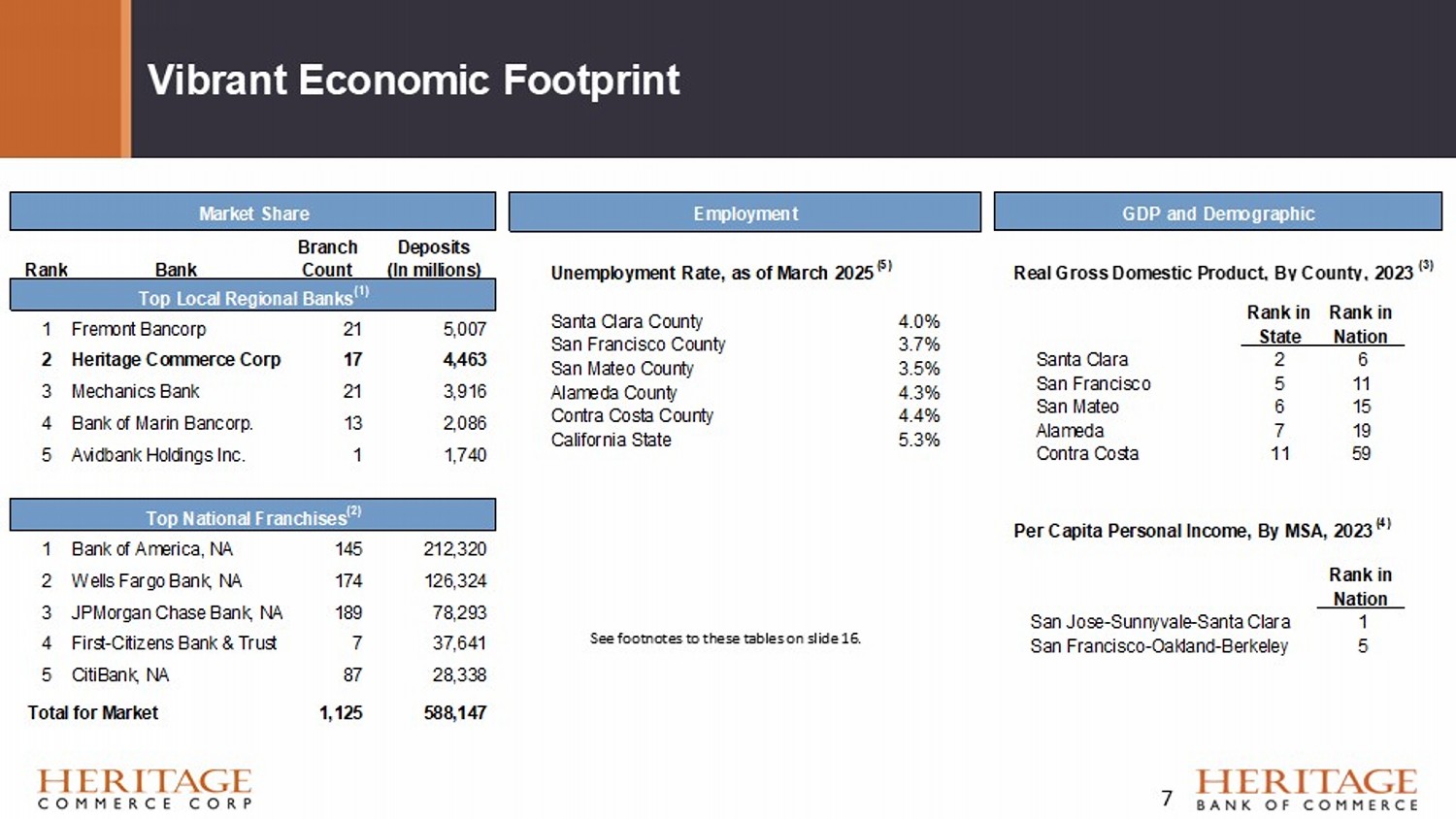

Management Team Robertson Clay Jones President and Chief Executive Officer Chris Edmonds - Waters Executive Vice President Chief People & Culture Susan Just Executive Vice President Chief Credit Officer Deborah K. Reuter Executive Vice President Chief Risk Officer & Corporate Secretary Janisha Sabnani Executive Vice President General Counsel Sachin Vaidya Executive Vice President Chief Information Officer Karol Watson Executive Vice President Branch Operations Tom Sa Executive Vice President Chief Operating Officer and Interim Chief Financial Officer Glen E. Shu Executive Vice President President, Specialty Finance Group Dustin Warford Executive Vice President Chief Banking Officer Mr . Jones, Mr . Sa, Ms . Reuter and Ms . Sabnani are officers of the Company and the Bank 6 Vibrant Economic Footprint Market Share Branch Deposits Rank Bank Count (In millions) 1 Fremont Bancorp 21 5,007 2 Heritage Commerce Corp 17 4,463 3 Mechanics Bank 21 3,916 4 Bank of Marin Bancorp.

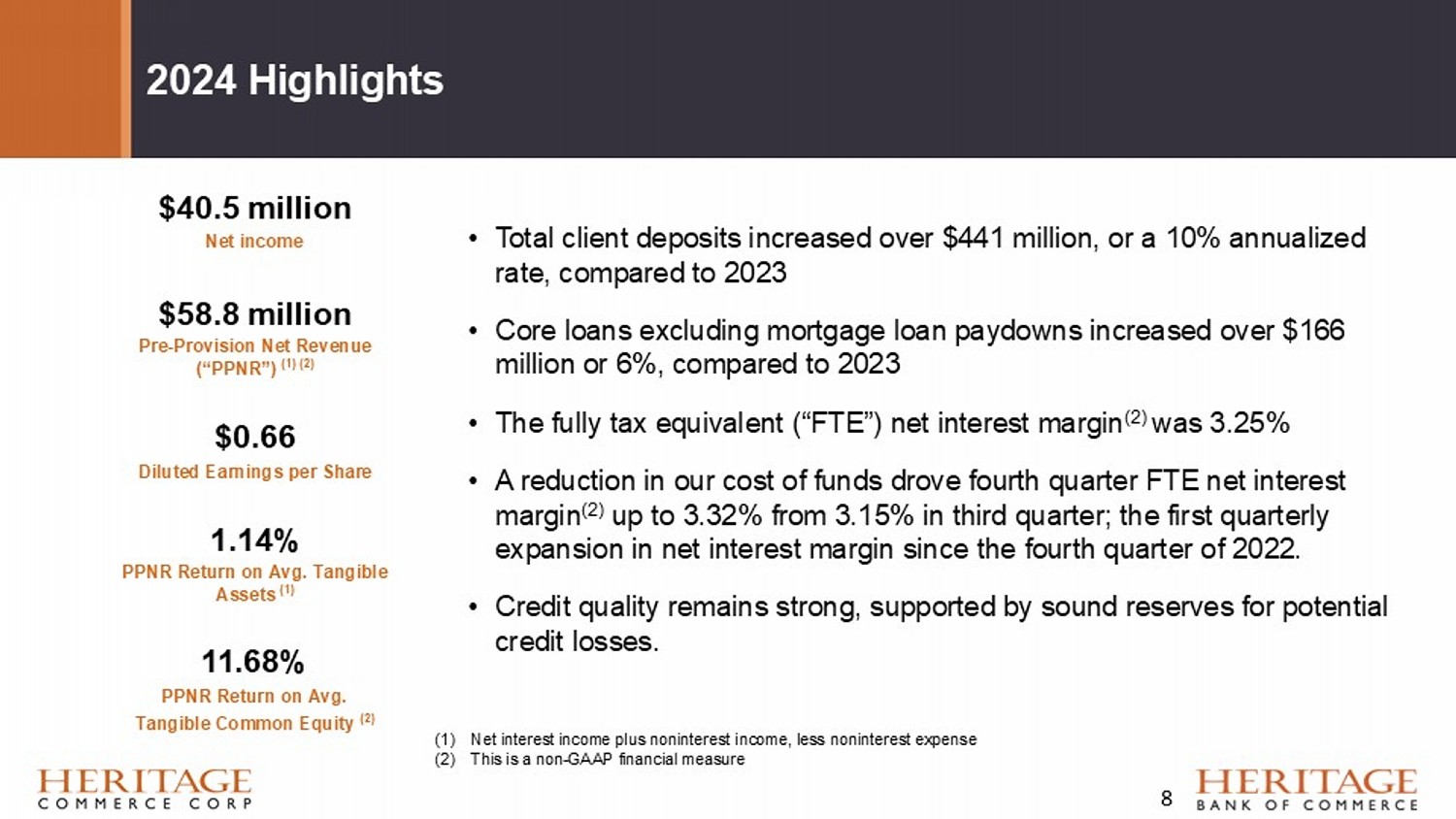

13 2,086 5 Avidbank Holdings Inc. 1 1,740 1 Bank of America, NA 145 212,320 2 Wells Fargo Bank, NA 174 126,324 3 JPMorgan Chase Bank, NA 189 78,293 4 First-Citizens Bank & Trust 7 37,641 5 CitiBank, NA 87 28,338 Total for Market 1,125 588,147 Top Local Regional Banks (1) Top National Franchises (2) See footnotes to these tables on slide 16. 7 GDP and Demographic Real Gross Domestic Product, By County, 2023 (3) Rank in State Rank in Nation Santa Clara 2 6 San Francisco 5 11 San Mateo 6 15 Alameda 7 19 Contra Costa 11 59 Per Capita Personal Income, By MSA, 2023 (4) Rank in Nation San Jose-Sunnyvale-Santa Clara 1 San Francisco-Oakland-Berkeley 5 Employment Unemployment Rate, as of March 2025 (5) Santa Clara County 4.0% San Francisco County 3.7% San Mateo County 3.5% Alameda County 4.3% Contra Costa County 4.4% California State 5.3% • T otal client deposits increased over $441 million, or a 10 % annualized rate , compared to 2023 • Core loans excluding mortgage loan paydowns increased over $166 million or 6%, compared to 2023 • The fully tax equivalent (“FTE”) net interest margin (2) was 3.25% • A reduction in our cost of funds drove fourth quarter FTE net interest margin (2) up to 3.32% from 3.15% in third quarter; the first quarterly expansion in net interest margin since the fourth quarter of 2022.

• Credit quality remains strong, supported by sound reserves for potential credit losses. 2024 Highlights $40.5 million Net income $58.8 million Pre - Provision Net Revenue (“PPNR”) (1) (2) $0.66 Diluted Earnings per Share 1.14% PPNR Return on Avg. Tangible Assets (1) 11.68% PPNR Return on Avg.

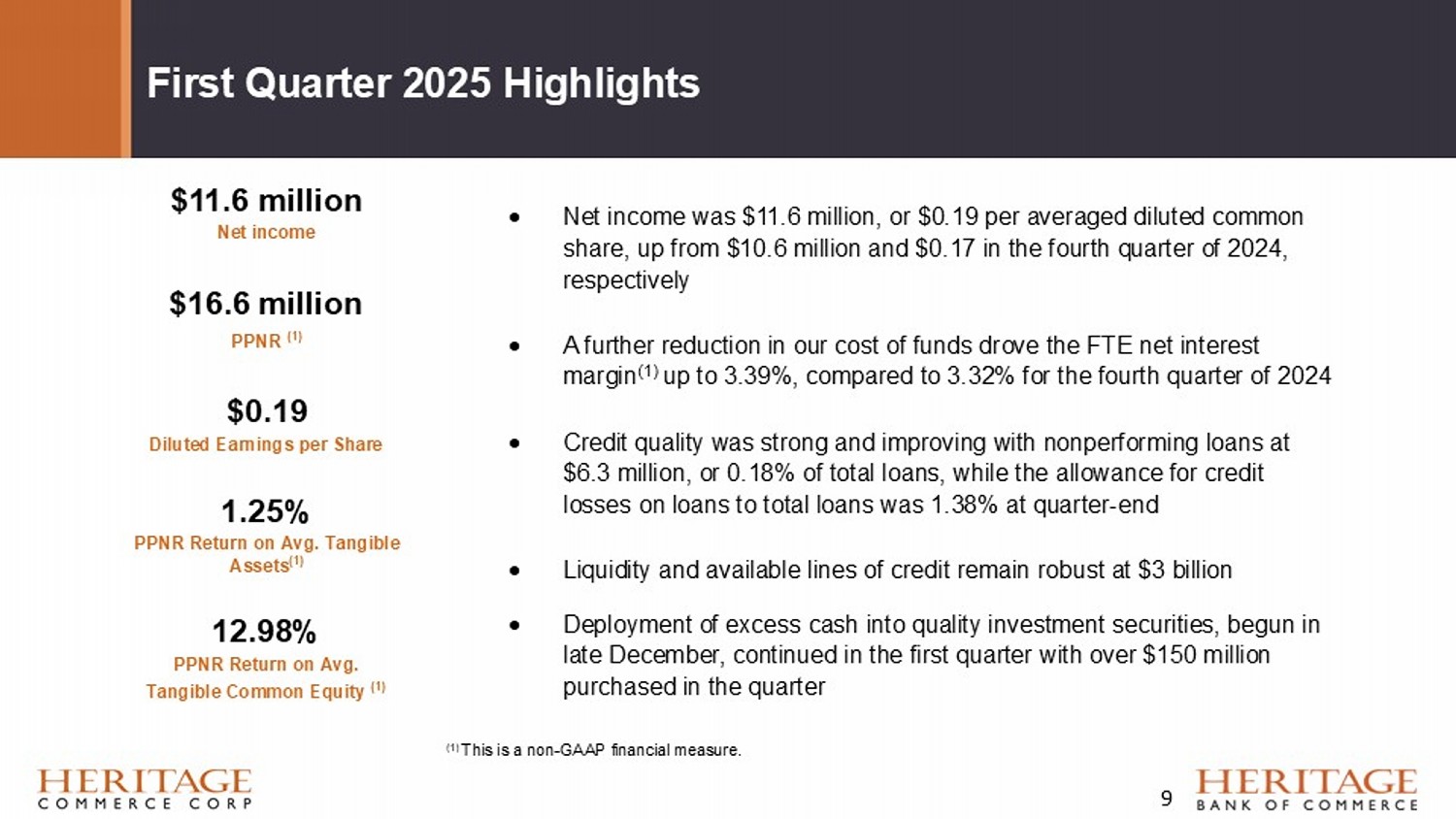

Tangible Common Equity (2) (1) Net interest income plus noninterest income, less noninterest expense (2) This is a non - GAAP financial measure 8 First Quarter 2025 Highlights Net income was $11.6 million, or $0.19 per averaged diluted common share, up from $10.6 million and $0.17 in the fourth quarter of 2024, respectively A further reduction in our cost of funds drove the FTE net interest margin (1) up to 3.39%, compared to 3.32% for the fourth quarter of 2024 Credit quality was strong and improving with nonperforming loans at $6.3 million, or 0.18% of total loans, while the allowance for credit losses on loans to total loans was 1.38% at quarter - end Liquidity and available lines of credit remain robust at $3 billion Deployment of excess cash into quality investment securities, begun in late December, continued in the first quarter with over $150 million purchased in the quarter (1) This is a non - GAAP financial measure. $11.6 million Net income $16.6 million PPNR (1) $0.19 Diluted Earnings per Share 1.25% PPNR Return on Avg. Tangible Assets (1) 12.98% PPNR Return on Avg.

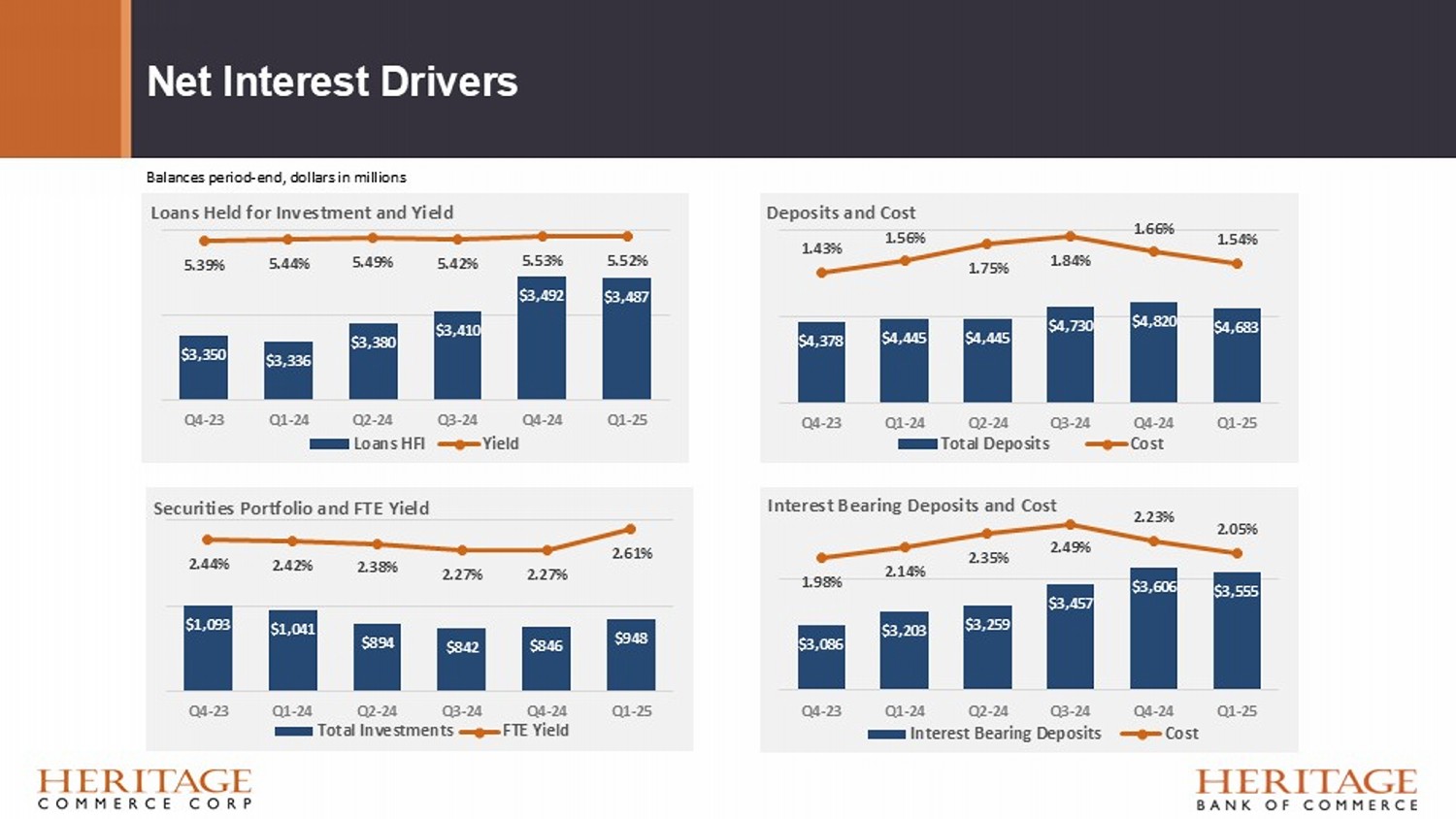

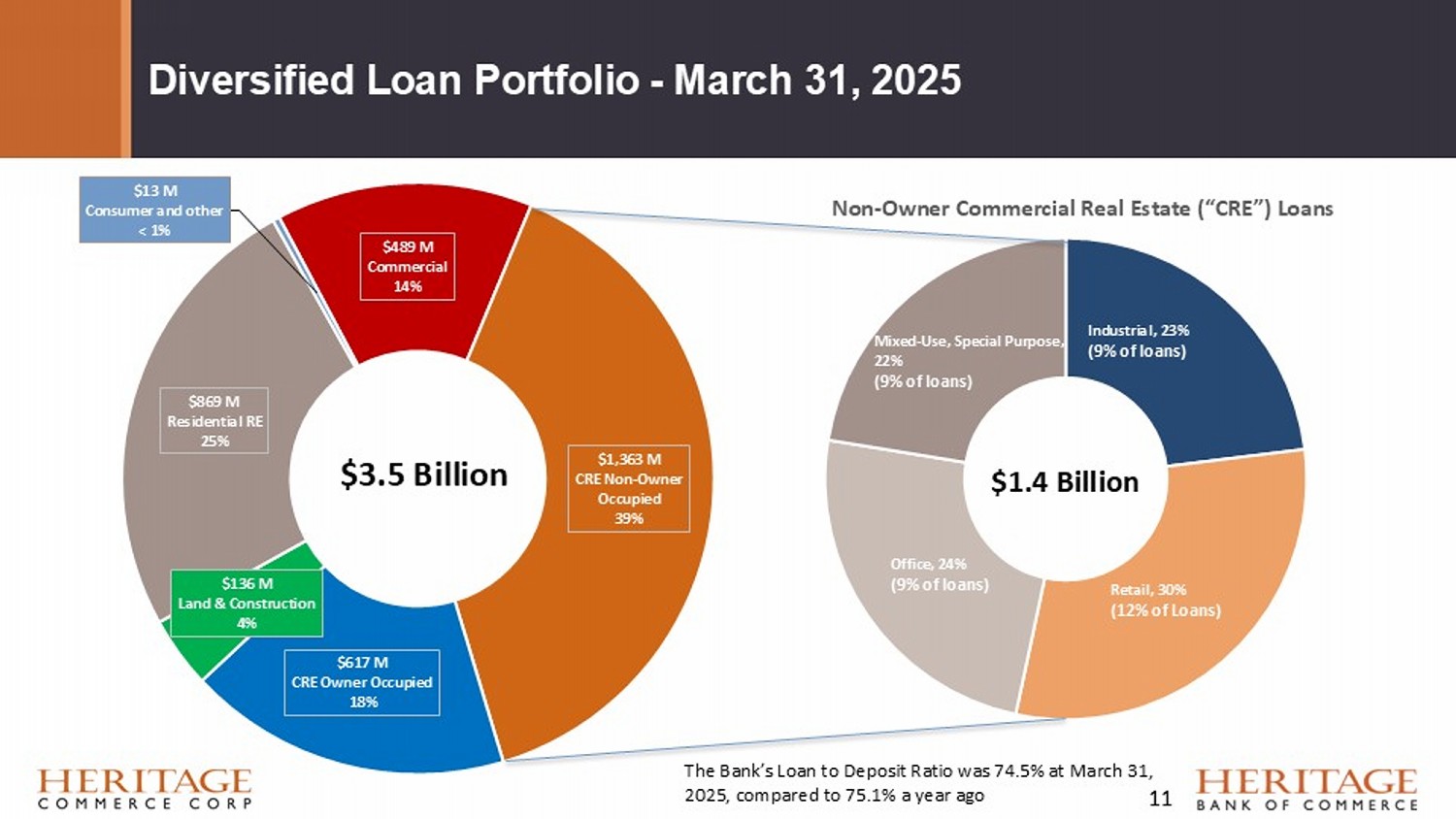

Tangible Common Equity (1) 9 Net Interest Drivers $3,350 $3,336 $3,380 $3,410 $3,492 $3,487 5.39% 5.44% 5.49% 5.42% 5.53% 5.52% Q4-23 Q1-24 Q2-24 Q3-24 Q4-24 Q1-25 Loans Held for Investment and Yield Loans HFI Yield $1,093 $1,041 $894 $842 $846 $948 2.44% 2.42% 2.38% 2.27% 2.27% 2.61% Q4-23 Q1-24 Q2-24 Q3-24 Q4-24 Q1-25 Securities Portfolio and FTE Yield Total Investments FTE Yield $4,378 $4,445 $4,445 $4,730 $4,820 $4,683 1.43% 1.56% 1.75% 1.84% 1.66% 1.54% Q4-23 Q1-24 Q2-24 Q3-24 Q4-24 Q1-25 Deposits and Cost Total Deposits Cost $3,086 $3,203 $3,259 $3,457 $3,606 $3,555 1.98% 2.14% 2.35% 2.49% 2.23% 2.05% Q4-23 Q1-24 Q2-24 Q3-24 Q4-24 Q1-25 Interest Bearing Deposits and Cost Interest Bearing Deposits Cost Balances period - end, dollars in millions Diversified Loan Portfolio - March 31, 2025 Industrial , 23% (9% of loans) Retail , 30% (12% of Loans) Office , 24% (9% of loans) Mixed - Use, Special Purpose , 22% (9% of loans) Non - Owner Commercial Real Estate (“CRE”) Loans $1.4 Billion $489 M Commercial 14% $1,363 M CRE Non - Owner Occupied 39% $617 M CRE Owner Occupied 18% $136 M Land & Construction 4% $869 M Residential RE 25% $13 M Consumer and other < 1% $3.5 Billion The Bank’s Loan to Deposit Ratio was 74.5% at March 31, 2025, compared to 75.1% a year ago 11

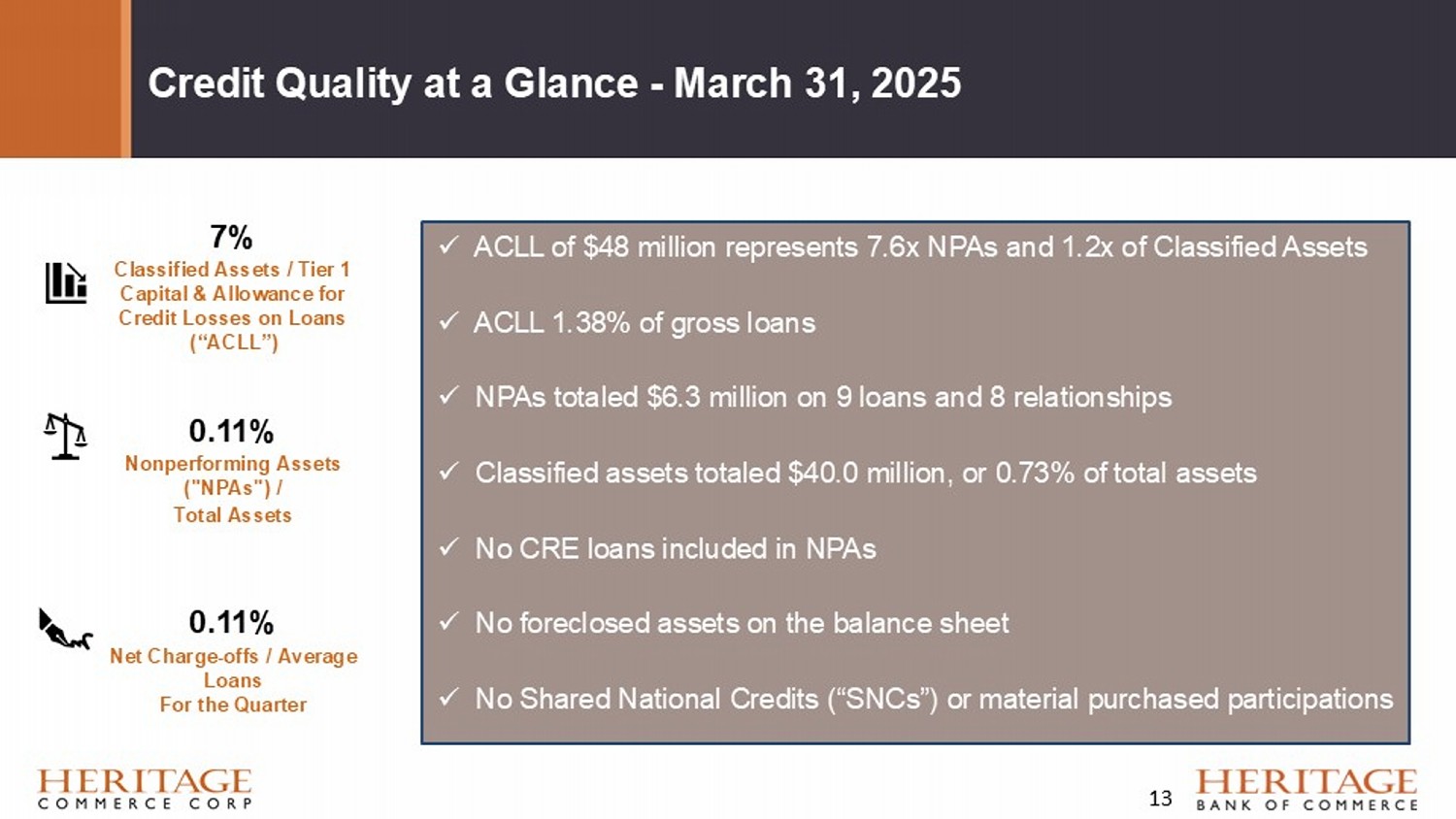

Total Deposits - March 31, 2025 • Total deposits were $4.7 billion, compared to $4.4 billion at March 31, 2024, an increase of 5% • Noninterest bearing deposits represent 24% of total deposits, compared to 28% prior year • Deposit accounts numbered 25,471, with an average balance of $184,000, compared to 24,730 accounts at March 31, 2024, averaging $180,000 • Uninsured deposits were $2.1 billion, or 45% of total deposits, 2025, compared to $2.0 billion, or 45% of total deposits, at March 31, 2024 • The Company’s total available liquidity and borrowing capacity was $3.2 billion, up from $3.0 billion at March 31, 2024 Demand, noninterest - bearing 24% Demand, interest - bearing 20% Savings and money market 29% Time deposits - under $250,000 1% Time deposits - $250,000 and over 5% ICS and CDARS * 21% Total Cost of Deposits of 1.54% Total Deposits: $4,683,268,000 12 * ICS is Client Reciprocal Insured Cash Sweep; CDARS = Client Reciprocal Certificate of Deposit Account Registry Service Credit Quality at a Glance - March 31, 2025 x ACLL of $48 million represents 7.6x NPAs and 1.2x of Classified Assets x ACLL 1.38% of gross loans x NPAs totaled $6.3 million on 9 loans and 8 relationships x Classified assets totaled $40.0 million, or 0.73% of total assets x No CRE loans included in NPAs x No foreclosed assets on the balance sheet x No Shared National Credits (“SNCs”) or material purchased participations 7% Classified Assets / Tier 1 Capital & Allowance for Credit Losses on Loans (“ACLL”) 0.11% Nonperforming Assets ("NPAs") / Total Assets 0.11% Net Charge - offs / Average Loans For the Quarter 13

Consistent Returns to Shareholders Strong Dividends Stabilize Returns for Equity Holders Dividend Yield as of May 19, 2025: 5.54% $6.55 $6.57 $6.91 $7.46 $8.12 $8.41 $0.48 $0.52 $0.52 $0.52 $0.52 $0.52 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024 FY Tangible Book Value Per Share (1) and Dividends Tangible Book Value Per Share (1) Dividends 14 (1) This is a non - GAAP financial measure Long - Term Strategic Goals Enhance profitability via operating leverage Drive high - quality loan and deposit growth Scale via organic growth and acquisitions to gain efficiency Grow non - interest income through best - in - class service levels Invest in talent and emerging technology A disciplined and strategic approach to delivering value long - term 15

For more information email: InvestorRelations@herbank.com Economic and Demographic data footnotes: (1) HBC ranks second amongst inde pendent community banks headquartered in t he Metropolitan Statistical Area (“MSA”) of San Francisco - Oakland - Fremont, CA and San J ose - Sunnyvale - Santa Clara, CA. Source: S&P Global Market Intelligence as of June 30, 2024. (2) San Francisco Bay Area refers to Alameda, Contra Costa, Marin, San Benito, San Francisco, San Mateo, and Santa Clara counties . S ource: FDIC, Summary of Deposits as of June 30, 20 24 (3) Source: U.S. Bureau of Economic Analysis. Data for the year ended December 31, 2023 (4) Source: U.S. Bureau of Economic Analysis. Data for the year ended December 31, 2023 (5) Source: California Employment Development Department 16

Exhibit 99.2

Heritage Commerce Corp and Heritage Bank of Commerce

Continue Board Leadership Succession

San Jose, California – May 22, 2025 -- Heritage Commerce Corp (NASDAQ: HTBK) (“Heritage” or “Company”), parent company of Heritage Bank of Commerce (the “Bank”), a premier community business bank, today announces the appointment of Julianne Biagini-Komas as Chair of the Board of Directors (the “Board”), replacing Chairman Jack W. Conner who has assumed the role of Chair Emeritus and has indicated he intends to remain on the Board to provide a smooth and orderly transition through October 2025. Ms. Biagini-Komas, a Certified Public Accountant, has served as Vice Chair of the Board since October 2024, as a director since 2014 and as the Chair of the Audit Committee since 2020.

“The Board and I are delighted to announce Julie’s key role in the Company’s leadership succession plans,” stated Mr. Conner, “Having worked with Julie for many years, I can think of no one better suited to guide the Board and our management team into the future. I am proud of what we have accomplished together, and I look forward to watching Heritage continue to thrive in the years ahead.”

Ms. Biagini-Komas said, “The entire Board and executive team are immensely grateful for Jack’s experience and leadership for over 20 years. He has led us through tremendous growth, both organically and by acquisition, and through many business cycles. We are confident that he has positioned us well to take advantage of the broad skills and talents of our executives and directors, and I am personally thankful for his willingness to continue in a transitional role.”

The Company also announced the retirement of Laura Roden from the Board at the conclusion of the Company’s Annual Meeting of the Shareholders this year.

Of Ms. Roden, Robertson “Clay” Jones, President & CEO stated, “We are grateful for Laura’s 13 years of service as a director, and we congratulate her on a well-deserved retirement.” Ms. Roden expressed her continuing support and appreciation for the Board and the management team, stating, “It has been a privilege to serve with the outstanding team of astute and dedicated individuals on the Heritage Board. As a shareholder I look forward to applauding the Bank's future successes.”

Heritage Commerce Corp, a bank holding company established in October 1997, is the parent company of Heritage Bank of Commerce, established in 1994 and headquartered in San Jose, CA with full-service branches in Danville, Fremont, Gilroy, Hollister, Livermore, Los Altos, Los Gatos, Morgan Hill, Oakland, Palo Alto, Pleasanton, Redwood City, San Francisco, San Jose, San Mateo, San Rafael, and Walnut Creek. Heritage Bank of Commerce is an SBA Preferred Lender. Bay View Funding, a subsidiary of Heritage Bank of Commerce, is based in San Jose, CA and provides business-essential working capital factoring financing to various industries throughout the United States. For more information, please visit www.heritagecommercecorp.com. Statements and information presented on our website are not incorporated into and do not form a part of this press release or of any of our filings with the Securities and Exchange Commission.

Member FDIC

Cautionary Note Regarding Forward-Looking Statements

Certain matters set forth herein constitute “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Among these are statements about the Company’s current intentions and expectations relating to our succession plans for the Board of Directors. These statements reflect the Board’s current intentions and expectations based on currently available information and, as such, are subject to risks and uncertainties that could cause actual results, performance or achievements to differ materially from those expressed in this release. These risks and uncertainties, some of which are beyond our control, include, but are not limited to, factors that affect the timing and effectiveness of the changes in leadership positions described in this release, such as our ability to attract, appropriately evaluate and retain directors having the desired qualifications and experience; our ability to manage the integration of new directors; our ability to address adequately the loss of the talents and experience of the retiring directors; the plans, intentions and decisions of our individual directors with respect to their continuing willingness and availability to serve; and our ability accurately to assess the financial impacts of the recruitment and retention process. Our forward-looking statements are not assurances that we will not deviate from the stated plans and expectations, particularly if changes occur in the economy or the banking environment in general, or in factors that are specific to one or more of our markets. A more comprehensive list of the factors that affect our business can be under Item 1A. “Risk Factors,” of our latest Annual Report on Form 10-K for the year ended December 31, 2024, and in our other subsequent filings with the Securities and Exchange Commission. Readers should consider those factors carefully in making investment decisions about our common stock.

For additional information, email:

InvestorRelations@herbank.com