UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 3, 2024

UNITED COMMUNITY BANKS, INC.

(Exact name of registrant as specified in its charter)

| Georgia | 001-35095 | 58-1807304 |

| (State or other jurisdiction of incorporation) | (Commission file number) | (IRS Employer Identification No.) |

200 East Camperdown Way

Greenville, South Carolina 29601

(Address of principal executive offices)

Registrant's telephone number,

including area code:

(800) 822-2651

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

| Common stock, par value $1 per share | UCB | New York Stock Exchange | ||

| Depositary shares, each representing 1/1000th interest in a share of Series I Non-Cumulative Preferred Stock | UCB PRI | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 8.01 | Other Events. |

On September 3, 2024, United Community Banks, Inc. (the “Company”) issued a press release announcing that it entered into a definitive agreement to sell is manufactured housing loan portfolio. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

In addition, the Company provided supplemental information regarding the transaction in connection with a presentation to analysts and investors. A copy of the investor presentation is attached as Exhibit 99.2 to this Current Report on Form 8-K.

| Item 9.01 | Financial Statements and Exhibits. |

| (d) Exhibits | The following exhibit index lists the exhibits that are either filed or furnished with the Current Report on Form 8-K. |

EXHIBIT INDEX

| Exhibit No. | Description |

| 99.1 | United Community Banks, Inc. Press Release, dated September 3, 2024. |

| 99.2 | United Community Banks, Inc. Investor Presentation, dated September 3, 2024 |

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| UNITED COMMUNITY BANKS, INC. | ||

| By: | /s/ Jefferson L. Harralson | |

| Jefferson L. Harralson | ||

| Executive Vice President and | ||

| Chief Financial Officer | ||

| Date: September 3, 2024 | ||

Exhibit 99.1

For Immediate Release

For more information:

Jefferson Harralson

Chief Financial Officer

(864) 240-6208

Jefferson_Harralson@ucbi.com

UNITED COMMUNITY BANKS, INC. AND 21ST MORTGAGE CORPORATION CLOSE SALE OF MANUFACTURED HOUSING LOAN PORTFOLIO

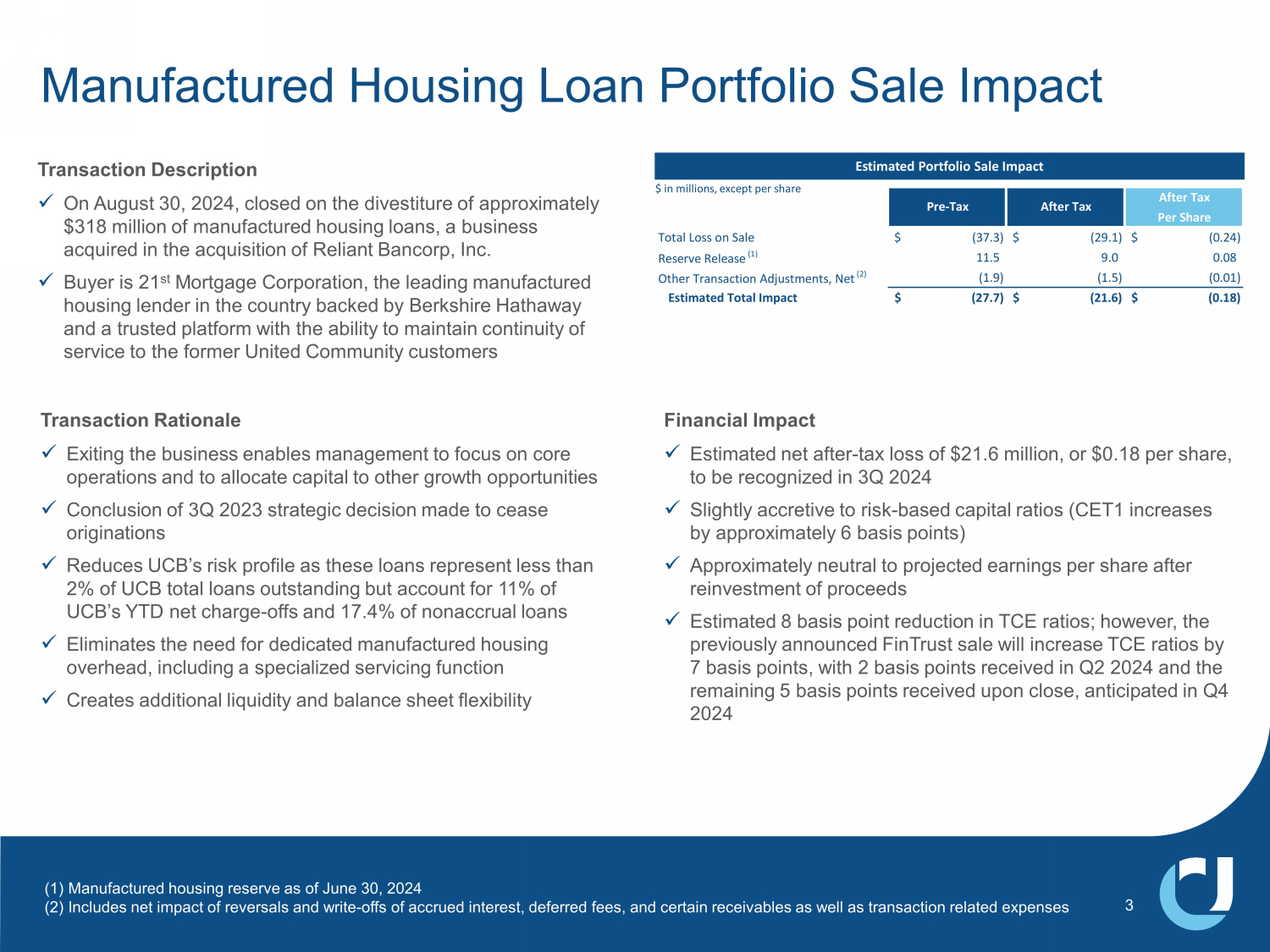

GREENVILLE, SC, September 3, 2024 – United Community Banks, Inc. (NYSE: UCB) (“United”) announced today the August 30th closing of the sale of substantially all of its manufactured housing loan portfolio, totaling $318.2 million, to 21st Mortgage Corporation, a division of Clayton Homes. The business was part of the Reliant Bancorp, Inc. acquisition in January of 2022. The portfolio had been in runoff following United’s decision to cease originations in the third quarter of 2023.

“Rather than continue to slowly liquidate the portfolio through normal collections, we took this opportunity to accelerate our exit from this business,” said Lynn Harton, Chairman and CEO. “21st Mortgage Corporation is the premier lender in this area with great capability to service the customers. In addition to removing a management distraction, the sale also reduces our risk profile slightly. While only 2% of loans, the portfolio represented 11% of our YTD net charge offs and 18% of our non-performing assets.” Harton continued, “After the one-time loss on the sale of the portfolio, we do not expect any ongoing effect on earnings.”

Including the approximately $11.5 million release of its associated reserve, transaction costs, and other accounting influences, United estimates an $0.18 per share impact to third quarter results. The transaction is slightly accretive to regulatory capital ratios.

Stephens Inc. served as United’s exclusive financial advisor for the transaction.

About United Community Banks, Inc.

United Community Banks, Inc. (NYSE: UCB) is the financial holding company for United Community, a top 100 U.S. financial institution that is committed to improving the financial health and well-being of its customers and the communities it serves. United Community provides a full range of banking, wealth management and mortgage services. As of June 30, 2024, United Community Banks, Inc. had $27.1 billion in assets, 203 offices across Alabama, Florida, Georgia, North Carolina, South Carolina, and Tennessee, as well as a national SBA lending franchise and a national equipment lending subsidiary. In 2024, United Community became a 10-time winner of J.D. Power’s award for the best customer satisfaction among consumer banks in the Southeast region and was recognized as the most trusted bank in the Southeast. In 2023, United was named by American Banker as one of the “Best Banks to Work For” for the seventh consecutive year and was recognized in the Greenwich Excellence and Best Brands Awards, receiving 15 awards that included national honors for overall satisfaction in small business banking and middle market banking. Forbes has also consistently listed United Community as one of the World’s Best Banks and one of America’s Best Banks. Additional information about United can be found at ucbi.com.

CAUTIONARY STATEMENT

This Press Release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In general, forward-looking statements usually may be identified through use of words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential,” or the negative of these terms or other comparable terminology. Forward-looking statements are not historical facts and represent management’s beliefs, based upon information available at the time the statements are made, with regard to the matters addressed; they are not guarantees of future performance. Actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial conditions to differ materially from those expressed in or implied by such statements. Factors that could cause or contribute to such differences include, but are not limited to general competitive, economic, political, regulatory and market conditions. Further information regarding additional factors which could affect the forward-looking statements contained in this Press Release can be found in the cautionary language included under the headings “Cautionary Note Regarding Forward[1]Looking Statements” and “Risk Factors” in United’s Annual Report on Form 10-K for the year ended December 31, 2023 and other documents subsequently filed by United with the United States Securities and Exchange Commission (“SEC”). Many of these factors are beyond United’s ability to control or predict. If one or more events related to these or other risks or uncertainties materialize, or if the underlying assumptions prove to be incorrect, actual results may differ materially from the forward-looking statements. Accordingly, shareholders and investors should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date of this communication, and United undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. New risks and uncertainties may emerge from time to time, and it is not possible for United to predict their occurrence or how they will affect United. United qualifies all forward-looking statements by these cautionary statements.

Exhibit 99.2

Member FDIC.

© 2024 United Community Bank | ucbi.com 3Q24 Financial Update – Manufactured Housing Loan Portfolio Sale September 3, 2024 Disclosures 2 CAUTIONARY STATEMENT This Investor Presentation contains “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . In general, forward - looking statements usually may be identified through use of words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential,” or the negative of these terms or other comparable terminology . Forward - looking statements are not historical facts and represent management’s beliefs, based upon information available at the time the statements are made, with regard to the matters addressed ; they are not guarantees of future performance . Actual results may prove to be materially different from the results expressed or implied by the forward - looking statements . Forward - looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial conditions to differ materially from those expressed in or implied by such statements . Factors that could cause or contribute to such differences include, but are not limited to general competitive, economic, political, regulatory and market conditions . Further information regarding additional factors which could affect the forward - looking statements contained in this presentation can be found in the cautionary language included under the headings “Cautionary Note Regarding Forward - Looking Statements” and “Risk Factors” in United Community Banks, Inc . ’s (“United’s”) Annual Report on Form 10 - K for the year ended December 31 , 2023 and other documents subsequently filed by United with the United States Securities and Exchange Commission (“SEC”) . Many of these factors are beyond United’s ability to control or predict . If one or more events related to these or other risks or uncertainties materialize, or if the underlying assumptions prove to be incorrect, actual results may differ materially from the forward - looking statements . Accordingly, shareholders and investors should not place undue reliance on any such forward - looking statements . Any forward - looking statement speaks only as of the date of this communication, and United undertakes no obligation to update or revise any forward - looking statements, whether as a result of new information, future events or otherwise, except as required by law . New risks and uncertainties may emerge from time to time, and it is not possible for United to predict their occurrence or how they will affect United . United qualifies all forward - looking statements by these cautionary statements .

Manufactured Housing Loan Portfolio Sale Impact 3 Financial Impact x Estimated net after - tax loss of $21.6 million, or $0.18 per share, to be recognized in 3Q 2024 x Slightly accretive to risk - based capital ratios (CET1 increases by approximately 6 basis points) x Approximately neutral to projected earnings per share after reinvestment of proceeds x Estimated 8 basis point reduction in TCE ratios; however, the previously announced FinTrust sale will increase TCE ratios by 7 basis points, with 2 basis points received in Q2 2024 and the remaining 5 basis points received upon close, anticipated in Q4 2024 Transaction Rationale x Exiting the business enables management to focus on core operations and to allocate capital to other growth opportunities x Conclusion of 3Q 2023 strategic decision made to cease originations x Reduces UCB’s risk profile as these loans represent less than 2% of UCB total loans outstanding but account for 11% of UCB’s YTD net charge - offs and 17.4% of nonaccrual loans x Eliminates the need for dedicated manufactured housing overhead, including a specialized servicing function x Creates additional liquidity and balance sheet flexibility Estimated Portfolio Sale Impact $ in millions, except per share After Tax Per Share Total Loss on Sale (37.3)$ (29.1)$ (0.24)$ Reserve Release (1) 11.5 9.0 0.08 Other Transaction Adjustments, Net (2) (1.9) (1.5) (0.01) Estimated Total Impact (27.7)$ (21.6)$ (0.18)$ After TaxPre-Tax Transaction Description x On August 30, 2024, closed on the divestiture of approximately $318 million of manufactured housing loans, a business acquired in the acquisition of Reliant Bancorp, Inc. x Buyer is 21 st Mortgage Corporation, the leading manufactured housing lender in the country backed by Berkshire Hathaway and a trusted platform with the ability to maintain continuity of service to the former United Community customers (1) Manufactured housing reserve as of June 30, 2024 (2) Includes net impact of reversals and write - offs of accrued interest, deferred fees, and certain receivables as well as trans action related expenses