| Delaware | 001-34657 | 75-2679109 | ||||||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Stock, par value $0.01 per share | TCBI | The Nasdaq Stock Market | ||||||||||||

| 5.75% Non-Cumulative Perpetual Preferred Stock Series B, par value $0.01 per share | TCBIO | The Nasdaq Stock Market | ||||||||||||

| Date: | July 17, 2025 | TEXAS CAPITAL BANCSHARES, INC. | |||||||||||||||

| By: | /s/ J. Matthew Scurlock | ||||||||||||||||

| J. Matthew Scurlock Chief Financial Officer |

|||||||||||||||||

| INVESTOR CONTACT | ||||||||

| Jocelyn Kukulka, 469.399.8544 | ||||||||

| jocelyn.kukulka@texascapitalbank.com | ||||||||

| MEDIA CONTACT | ||||||||

| Julia Monter, 469.399.8425 | ||||||||

| julia.monter@texascapitalbank.com | ||||||||

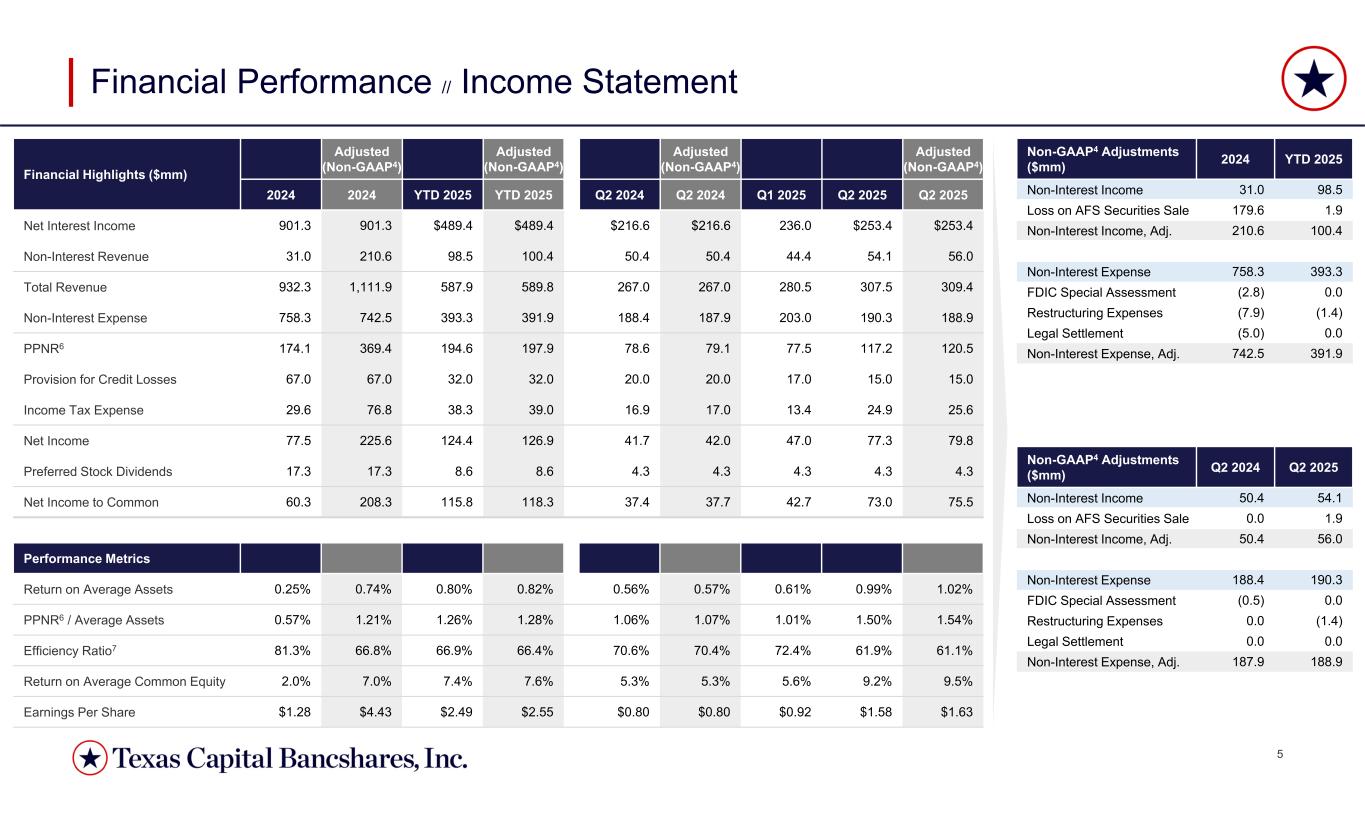

| 2nd Quarter | 1st Quarter | 2nd Quarter | |||||||||||||||

| (dollars in thousands except per share data) | 2025 | 2025 | 2024 | ||||||||||||||

| OPERATING RESULTS | |||||||||||||||||

| Net income | $ | 77,328 | $ | 47,047 | $ | 41,662 | |||||||||||

| Net income available to common stockholders | $ | 73,016 | $ | 42,734 | $ | 37,350 | |||||||||||

Pre-provision net revenue(3) |

$ | 117,188 | $ | 77,458 | $ | 78,597 | |||||||||||

| Diluted earnings per common share | $ | 1.58 | $ | 0.92 | $ | 0.80 | |||||||||||

| Diluted common shares | 46,215,394 | 46,616,704 | 46,872,498 | ||||||||||||||

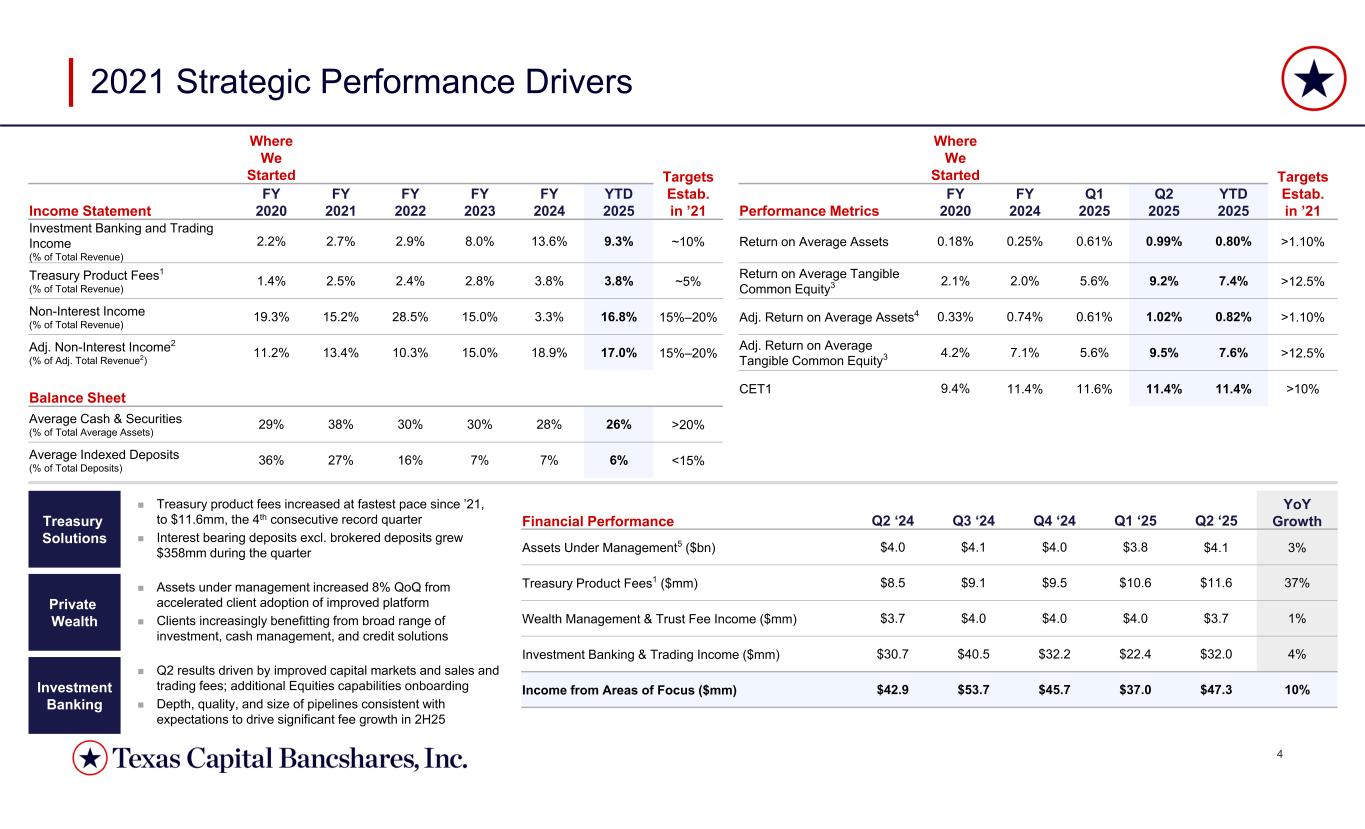

| Return on average assets | 0.99 | % | 0.61 | % | 0.56 | % | |||||||||||

| Return on average common equity | 9.17 | % | 5.56 | % | 5.26 | % | |||||||||||

OPERATING RESULTS, ADJUSTED(1) |

|||||||||||||||||

| Net income | $ | 79,841 | $ | 47,047 | $ | 42,020 | |||||||||||

| Net income available to common stockholders | $ | 75,529 | $ | 42,734 | $ | 37,708 | |||||||||||

Pre-provision net revenue(3) |

$ | 120,475 | $ | 77,458 | $ | 79,059 | |||||||||||

| Diluted earnings per common share | $ | 1.63 | $ | 0.92 | $ | 0.80 | |||||||||||

| Diluted common shares | 46,215,394 | 46,616,704 | 46,872,498 | ||||||||||||||

| Return on average assets | 1.02 | % | 0.61 | % | 0.57 | % | |||||||||||

| Return on average common equity | 9.48 | % | 5.56 | % | 5.31 | % | |||||||||||

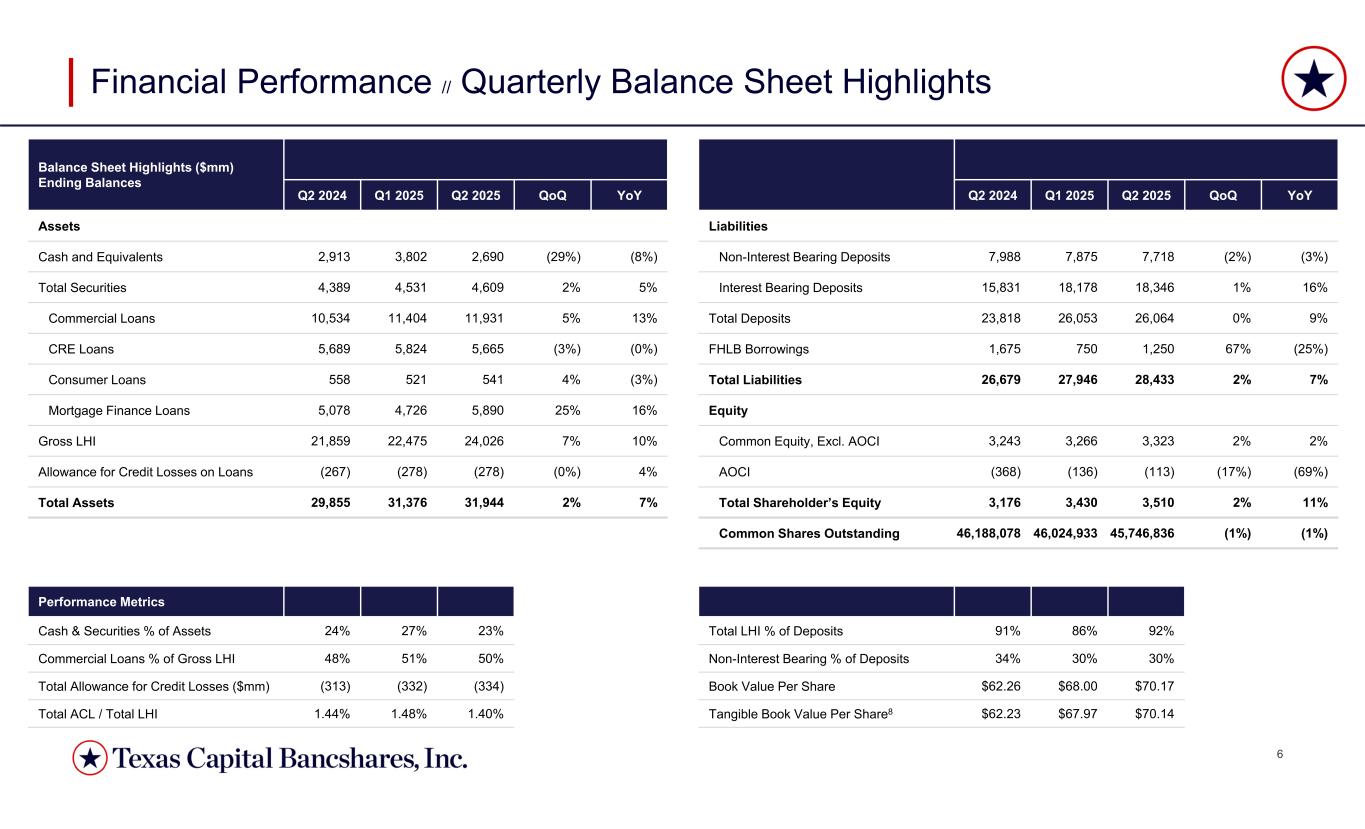

| BALANCE SHEET | |||||||||||||||||

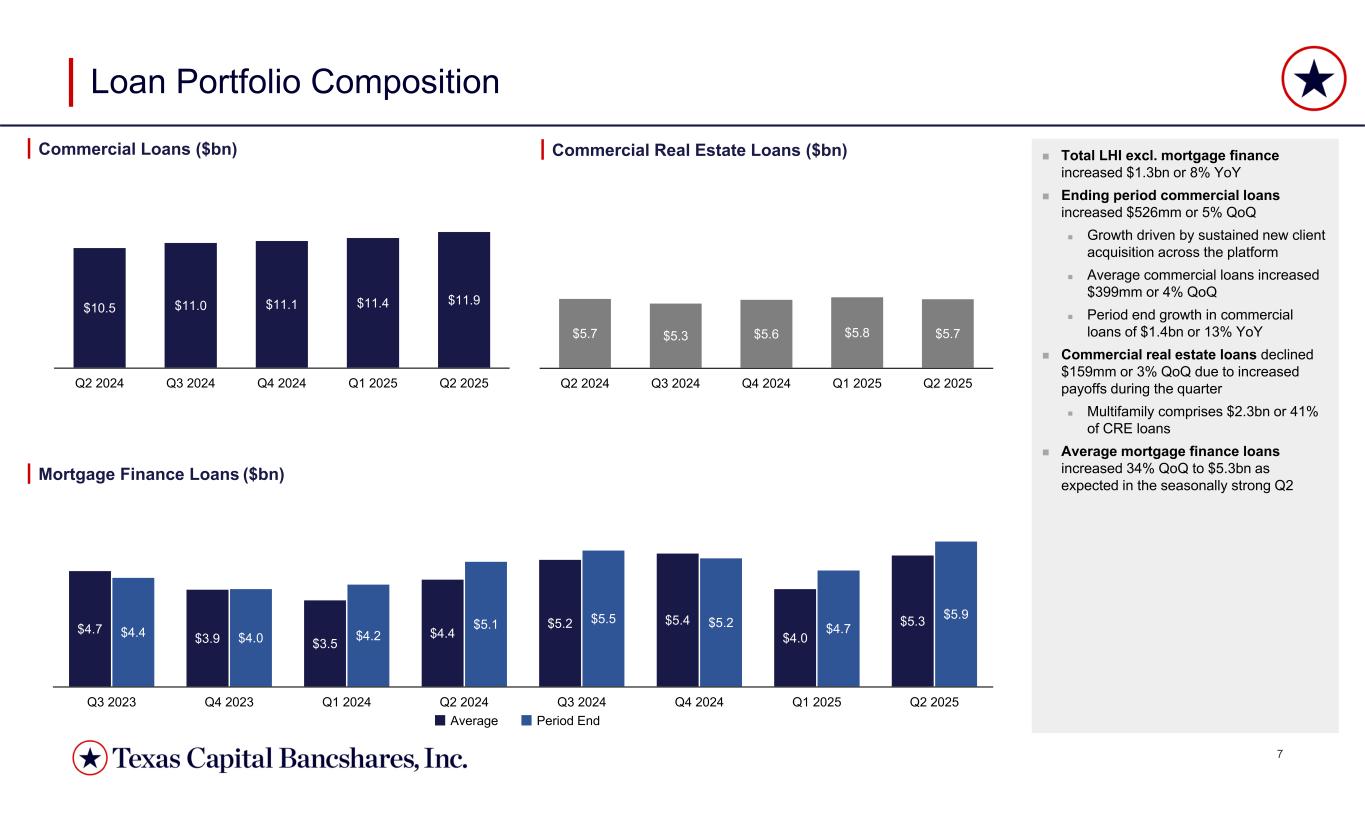

| Loans held for investment | $ | 18,035,945 | $ | 17,654,243 | $ | 16,700,569 | |||||||||||

| Loans held for investment, mortgage finance | 5,889,589 | 4,725,541 | 5,078,161 | ||||||||||||||

| Total loans held for investment | 23,925,534 | 22,379,784 | 21,778,730 | ||||||||||||||

| Loans held for sale | — | — | 36,785 | ||||||||||||||

| Total assets | 31,943,535 | 31,375,749 | 29,854,994 | ||||||||||||||

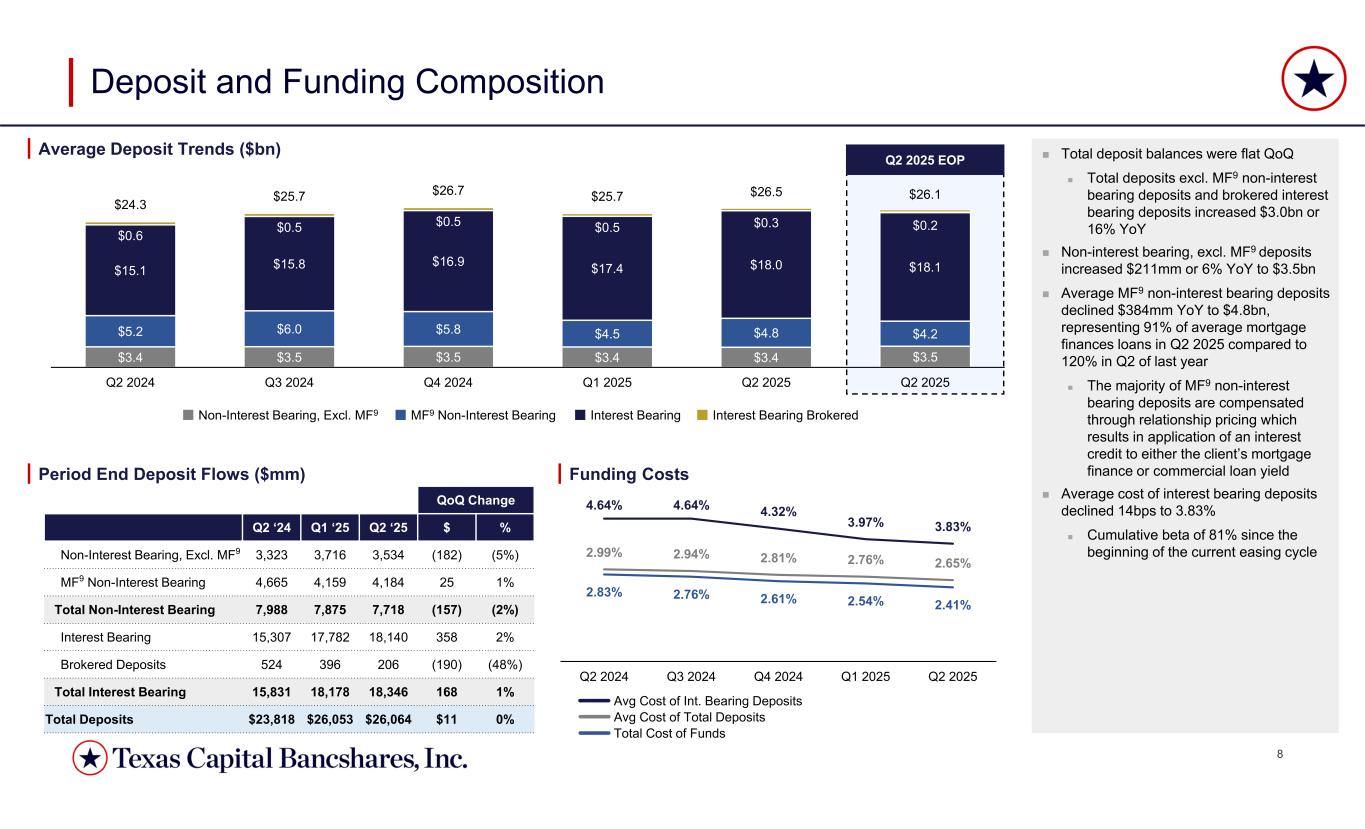

| Non-interest bearing deposits | 7,718,006 | 7,874,780 | 7,987,715 | ||||||||||||||

| Total deposits | 26,064,309 | 26,053,034 | 23,818,327 | ||||||||||||||

| Stockholders’ equity | 3,510,070 | 3,429,774 | 3,175,601 | ||||||||||||||

| TEXAS CAPITAL BANCSHARES, INC. | |||||||||||||||||

| SELECTED FINANCIAL HIGHLIGHTS (UNAUDITED) | |||||||||||||||||

| (dollars in thousands except per share data) | |||||||||||||||||

| 2nd Quarter | 1st Quarter | 4th Quarter | 3rd Quarter | 2nd Quarter | |||||||||||||

| 2025 | 2025 | 2024 | 2024 | 2024 | |||||||||||||

| CONSOLIDATED STATEMENTS OF INCOME | |||||||||||||||||

| Interest income | $ | 439,567 | $ | 427,289 | $ | 437,571 | $ | 452,533 | $ | 422,068 | |||||||

| Interest expense | 186,172 | 191,255 | 207,964 | 212,431 | 205,486 | ||||||||||||

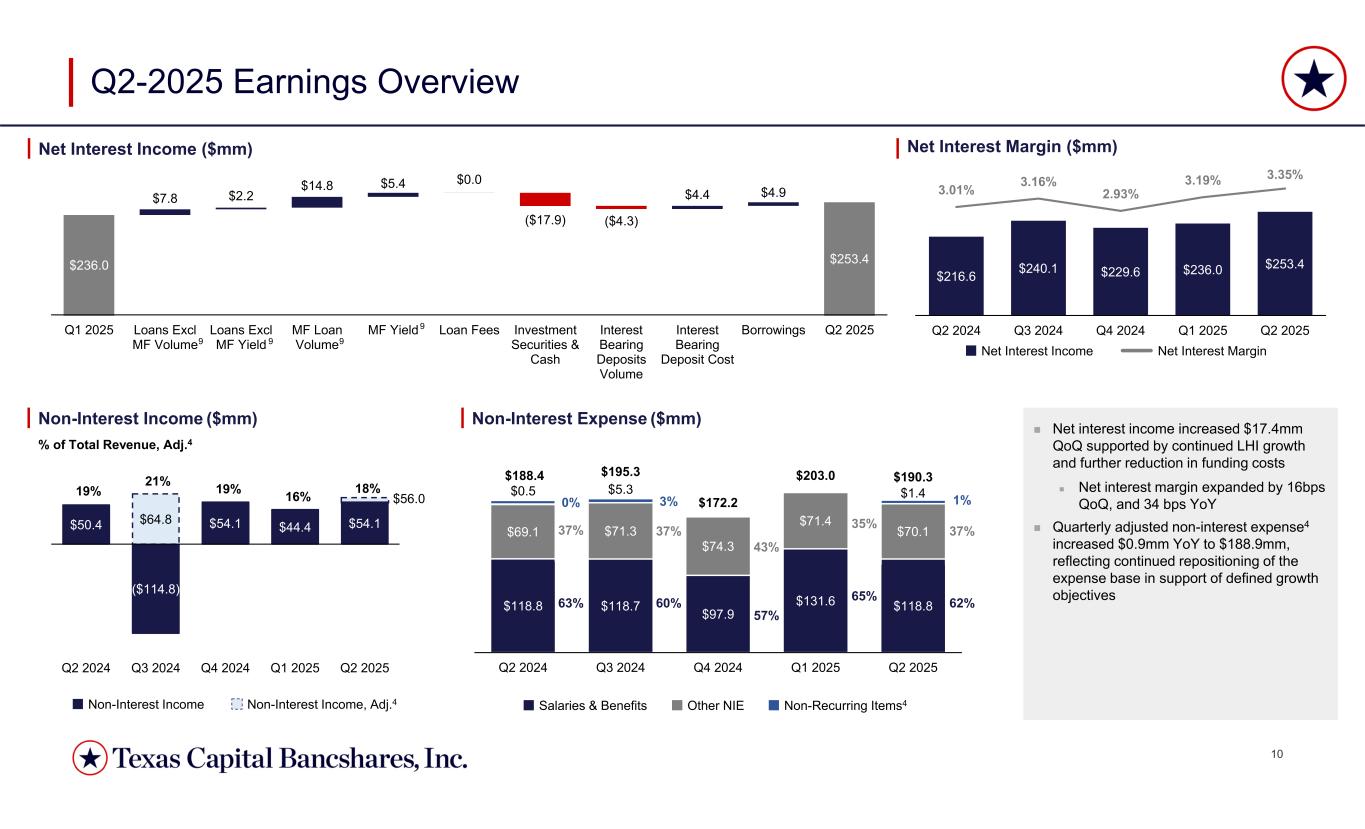

| Net interest income | 253,395 | 236,034 | 229,607 | 240,102 | 216,582 | ||||||||||||

| Provision for credit losses | 15,000 | 17,000 | 18,000 | 10,000 | 20,000 | ||||||||||||

| Net interest income after provision for credit losses | 238,395 | 219,034 | 211,607 | 230,102 | 196,582 | ||||||||||||

| Non-interest income | 54,069 | 44,444 | 54,074 | (114,771) | 50,424 | ||||||||||||

| Non-interest expense | 190,276 | 203,020 | 172,159 | 195,324 | 188,409 | ||||||||||||

| Income/(loss) before income taxes | 102,188 | 60,458 | 93,522 | (79,993) | 58,597 | ||||||||||||

| Income tax expense/(benefit) | 24,860 | 13,411 | 22,499 | (18,674) | 16,935 | ||||||||||||

| Net income/(loss) | 77,328 | 47,047 | 71,023 | (61,319) | 41,662 | ||||||||||||

| Preferred stock dividends | 4,312 | 4,313 | 4,312 | 4,313 | 4,312 | ||||||||||||

| Net income/(loss) available to common stockholders | $ | 73,016 | $ | 42,734 | $ | 66,711 | $ | (65,632) | $ | 37,350 | |||||||

| Diluted earnings/(loss) per common share | $ | 1.58 | $ | 0.92 | $ | 1.43 | $ | (1.41) | $ | 0.80 | |||||||

| Diluted common shares | 46,215,394 | 46,616,704 | 46,770,961 | 46,608,742 | 46,872,498 | ||||||||||||

| CONSOLIDATED BALANCE SHEET DATA | |||||||||||||||||

| Total assets | $ | 31,943,535 | $ | 31,375,749 | $ | 30,731,883 | $ | 31,629,299 | $ | 29,854,994 | |||||||

| Loans held for investment | 18,035,945 | 17,654,243 | 17,234,492 | 16,764,512 | 16,700,569 | ||||||||||||

| Loans held for investment, mortgage finance | 5,889,589 | 4,725,541 | 5,215,574 | 5,529,659 | 5,078,161 | ||||||||||||

| Loans held for sale | — | — | — | 9,022 | 36,785 | ||||||||||||

| Interest bearing cash and cash equivalents | 2,507,691 | 3,600,969 | 3,012,307 | 3,894,537 | 2,691,352 | ||||||||||||

| Investment securities | 4,608,628 | 4,531,219 | 4,396,115 | 4,405,520 | 4,388,976 | ||||||||||||

| Non-interest bearing deposits | 7,718,006 | 7,874,780 | 7,485,428 | 9,070,804 | 7,987,715 | ||||||||||||

| Total deposits | 26,064,309 | 26,053,034 | 25,238,599 | 25,865,255 | 23,818,327 | ||||||||||||

| Short-term borrowings | 1,250,000 | 750,000 | 885,000 | 1,035,000 | 1,675,000 | ||||||||||||

| Long-term debt | 620,256 | 660,521 | 660,346 | 660,172 | 659,997 | ||||||||||||

| Stockholders’ equity | 3,510,070 | 3,429,774 | 3,367,936 | 3,354,044 | 3,175,601 | ||||||||||||

| End of period shares outstanding | 45,746,836 | 46,024,933 | 46,233,812 | 46,207,757 | 46,188,078 | ||||||||||||

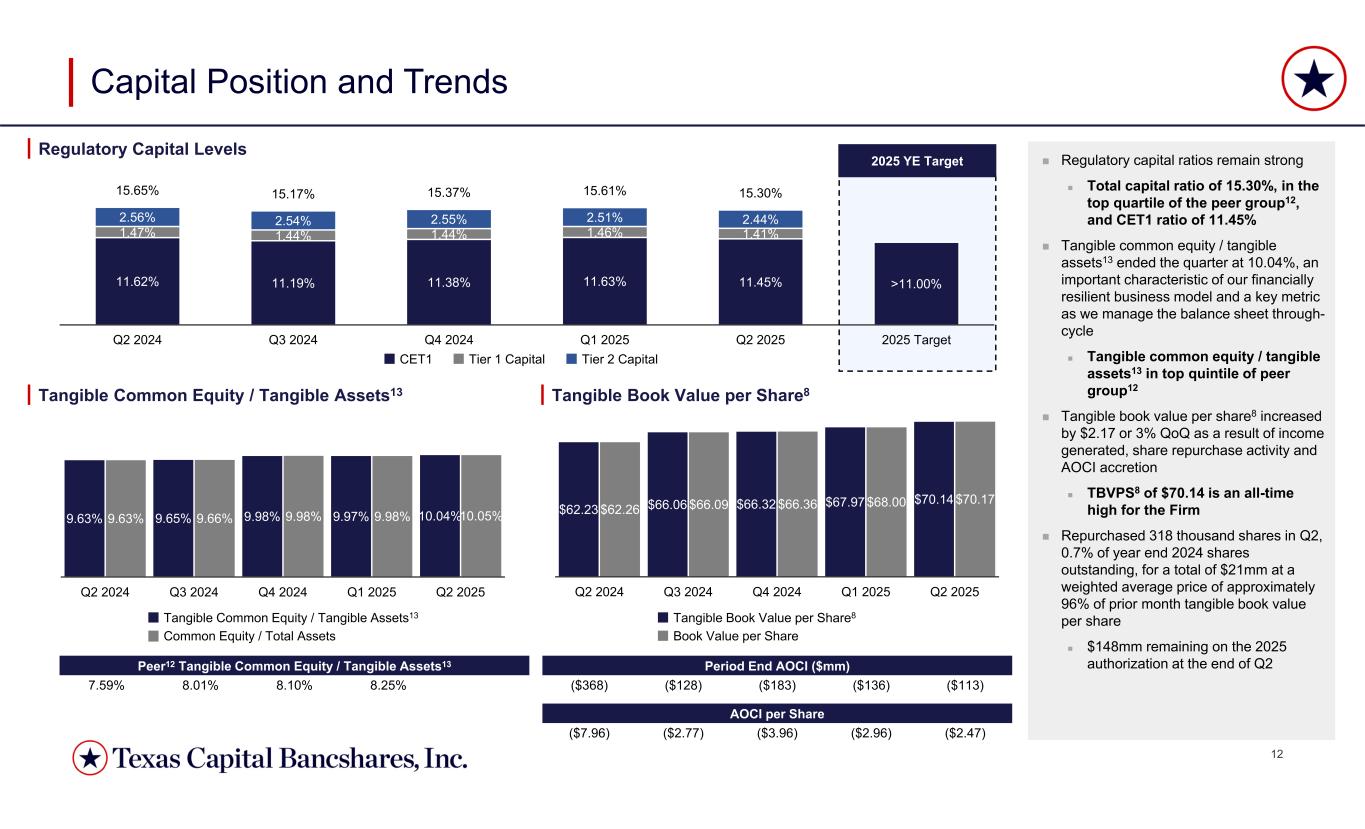

| Book value per share | $ | 70.17 | $ | 68.00 | $ | 66.36 | $ | 66.09 | $ | 62.26 | |||||||

Tangible book value per share(1) |

$ | 70.14 | $ | 67.97 | $ | 66.32 | $ | 66.06 | $ | 62.23 | |||||||

| SELECTED FINANCIAL RATIOS | |||||||||||||||||

| Net interest margin | 3.35 | % | 3.19 | % | 2.93 | % | 3.16 | % | 3.01 | % | |||||||

| Return on average assets | 0.99 | % | 0.61 | % | 0.88 | % | (0.78) | % | 0.56 | % | |||||||

Return on average assets, adjusted(4) |

1.02 | % | 0.61 | % | 0.88 | % | 1.00 | % | 0.57 | % | |||||||

| Return on average common equity | 9.17 | % | 5.56 | % | 8.50 | % | (8.87) | % | 5.26 | % | |||||||

Return on average common equity, adjusted(4) |

9.48 | % | 5.56 | % | 8.50 | % | 10.04 | % | 5.31 | % | |||||||

Efficiency ratio(2) |

61.9 | % | 72.4 | % | 60.7 | % | 155.8 | % | 70.6 | % | |||||||

Efficiency ratio, adjusted(2)(4) |

61.1 | % | 72.4 | % | 60.7 | % | 62.3 | % | 70.4 | % | |||||||

| Non-interest income to average earning assets | 0.72 | % | 0.60 | % | 0.69 | % | (1.52) | % | 0.71 | % | |||||||

Non-interest income to average earning assets, adjusted(4) |

0.74 | % | 0.60 | % | 0.69 | % | 0.86 | % | 0.71 | % | |||||||

| Non-interest expense to average earning assets | 2.52 | % | 2.75 | % | 2.21 | % | 2.59 | % | 2.65 | % | |||||||

Non-interest expense to average earning assets, adjusted(4) |

2.50 | % | 2.75 | % | 2.21 | % | 2.52 | % | 2.65 | % | |||||||

| Common equity to total assets | 10.1 | % | 10.0 | % | 10.0 | % | 9.7 | % | 9.6 | % | |||||||

Tangible common equity to total tangible assets(3) |

10.1 | % | 10.0 | % | 10.0 | % | 9.7 | % | 9.6 | % | |||||||

| Common Equity Tier 1 | 11.4 | % | 11.6 | % | 11.4 | % | 11.2 | % | 11.6 | % | |||||||

| Tier 1 capital | 12.9 | % | 13.1 | % | 12.8 | % | 12.6 | % | 13.1 | % | |||||||

| Total capital | 15.3 | % | 15.6 | % | 15.4 | % | 15.2 | % | 15.7 | % | |||||||

| Leverage | 11.8 | % | 11.8 | % | 11.3 | % | 11.4 | % | 12.2 | % | |||||||

| TEXAS CAPITAL BANCSHARES, INC. | |||||||||||||||||

| CONSOLIDATED BALANCE SHEETS (UNAUDITED) | |||||||||||||||||

| (dollars in thousands) | |||||||||||||||||

|

June 30,

2025

|

March 31,

2025

|

December 31, 2024 |

September 30, 2024 |

June 30, 2024 |

|||||||||||||

| Assets | |||||||||||||||||

| Cash and due from banks | $ | 182,451 | $ | 201,504 | $ | 176,501 | $ | 297,048 | $ | 221,727 | |||||||

| Interest bearing cash and cash equivalents | 2,507,691 | 3,600,969 | 3,012,307 | 3,894,537 | 2,691,352 | ||||||||||||

| Available-for-sale debt securities | 3,774,141 | 3,678,378 | 3,524,686 | 3,518,662 | 3,483,231 | ||||||||||||

| Held-to-maturity debt securities | 761,907 | 779,354 | 796,168 | 812,432 | 831,513 | ||||||||||||

| Equity securities | 68,692 | 71,679 | 75,261 | 74,426 | 74,232 | ||||||||||||

| Trading securities | 3,888 | 1,808 | — | — | — | ||||||||||||

| Investment securities | 4,608,628 | 4,531,219 | 4,396,115 | 4,405,520 | 4,388,976 | ||||||||||||

| Loans held for sale | — | — | — | 9,022 | 36,785 | ||||||||||||

| Loans held for investment, mortgage finance | 5,889,589 | 4,725,541 | 5,215,574 | 5,529,659 | 5,078,161 | ||||||||||||

| Loans held for investment | 18,035,945 | 17,654,243 | 17,234,492 | 16,764,512 | 16,700,569 | ||||||||||||

| Less: Allowance for credit losses on loans | 277,648 | 278,379 | 271,709 | 273,143 | 267,297 | ||||||||||||

| Loans held for investment, net | 23,647,886 | 22,101,405 | 22,178,357 | 22,021,028 | 21,511,433 | ||||||||||||

| Premises and equipment, net | 86,831 | 84,575 | 85,443 | 81,577 | 69,464 | ||||||||||||

| Accrued interest receivable and other assets | 908,552 | 854,581 | 881,664 | 919,071 | 933,761 | ||||||||||||

| Goodwill and intangibles, net | 1,496 | 1,496 | 1,496 | 1,496 | 1,496 | ||||||||||||

| Total assets | $ | 31,943,535 | $ | 31,375,749 | $ | 30,731,883 | $ | 31,629,299 | $ | 29,854,994 | |||||||

| Liabilities and Stockholders’ Equity | |||||||||||||||||

| Liabilities: | |||||||||||||||||

| Non-interest bearing deposits | $ | 7,718,006 | $ | 7,874,780 | $ | 7,485,428 | $ | 9,070,804 | $ | 7,987,715 | |||||||

| Interest bearing deposits | 18,346,303 | 18,178,254 | 17,753,171 | 16,794,451 | 15,830,612 | ||||||||||||

| Total deposits | 26,064,309 | 26,053,034 | 25,238,599 | 25,865,255 | 23,818,327 | ||||||||||||

| Accrued interest payable | 14,120 | 25,270 | 23,680 | 18,679 | 23,841 | ||||||||||||

| Other liabilities | 484,780 | 457,150 | 556,322 | 696,149 | 502,228 | ||||||||||||

| Short-term borrowings | 1,250,000 | 750,000 | 885,000 | 1,035,000 | 1,675,000 | ||||||||||||

| Long-term debt | 620,256 | 660,521 | 660,346 | 660,172 | 659,997 | ||||||||||||

| Total liabilities | 28,433,465 | 27,945,975 | 27,363,947 | 28,275,255 | 26,679,393 | ||||||||||||

| Stockholders’ equity: | |||||||||||||||||

| Preferred stock, $.01 par value, $1,000 liquidation value: | |||||||||||||||||

| Authorized shares - 10,000,000 | |||||||||||||||||

Issued shares(1) |

300,000 | 300,000 | 300,000 | 300,000 | 300,000 | ||||||||||||

| Common stock, $.01 par value: | |||||||||||||||||

| Authorized shares - 100,000,000 | |||||||||||||||||

Issued shares(2) |

517 | 517 | 515 | 515 | 515 | ||||||||||||

| Additional paid-in capital | 1,065,083 | 1,060,028 | 1,056,719 | 1,054,614 | 1,050,114 | ||||||||||||

| Retained earnings | 2,611,401 | 2,538,385 | 2,495,651 | 2,428,940 | 2,494,572 | ||||||||||||

Treasury stock(3) |

(354,000) | (332,994) | (301,842) | (301,868) | (301,868) | ||||||||||||

| Accumulated other comprehensive loss, net of taxes | (112,931) | (136,162) | (183,107) | (128,157) | (367,732) | ||||||||||||

| Total stockholders’ equity | 3,510,070 | 3,429,774 | 3,367,936 | 3,354,044 | 3,175,601 | ||||||||||||

| Total liabilities and stockholders’ equity | $ | 31,943,535 | $ | 31,375,749 | $ | 30,731,883 | $ | 31,629,299 | $ | 29,854,994 | |||||||

(1) Preferred stock - issued shares |

300,000 | 300,000 | 300,000 | 300,000 | 300,000 | ||||||||||||

(2) Common stock - issued shares |

51,747,305 | 51,707,542 | 51,520,315 | 51,494,260 | 51,474,581 | ||||||||||||

(3) Treasury stock - shares at cost |

6,000,469 | 5,682,609 | 5,286,503 | 5,286,503 | 5,286,503 | ||||||||||||

| TEXAS CAPITAL BANCSHARES, INC. | ||||||||||||||

| CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) | ||||||||||||||

| (dollars in thousands except per share data) | ||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||

| Interest income | ||||||||||||||

| Interest and fees on loans | $ | 364,358 | $ | 345,251 | $ | 698,508 | $ | 676,130 | ||||||

| Investment securities | 45,991 | 33,584 | 92,556 | 65,728 | ||||||||||

| Interest bearing cash and cash equivalents | 29,218 | 43,233 | 75,792 | 97,588 | ||||||||||

| Total interest income | 439,567 | 422,068 | 866,856 | 839,446 | ||||||||||

| Interest expense | ||||||||||||||

| Deposits | 174,798 | 181,280 | 349,734 | 356,880 | ||||||||||

| Short-term borrowings | 3,444 | 12,749 | 11,690 | 25,532 | ||||||||||

| Long-term debt | 7,930 | 11,457 | 16,003 | 25,443 | ||||||||||

| Total interest expense | 186,172 | 205,486 | 377,427 | 407,855 | ||||||||||

| Net interest income | 253,395 | 216,582 | 489,429 | 431,591 | ||||||||||

| Provision for credit losses | 15,000 | 20,000 | 32,000 | 39,000 | ||||||||||

| Net interest income after provision for credit losses | 238,395 | 196,582 | 457,429 | 392,591 | ||||||||||

| Non-interest income | ||||||||||||||

| Service charges on deposit accounts | 8,182 | 5,911 | 16,022 | 12,250 | ||||||||||

| Wealth management and trust fee income | 3,730 | 3,699 | 7,694 | 7,266 | ||||||||||

| Brokered loan fees | 2,398 | 2,131 | 4,347 | 4,042 | ||||||||||

| Investment banking and advisory fees | 24,109 | 25,048 | 40,587 | 43,472 | ||||||||||

| Trading income | 7,896 | 5,650 | 13,835 | 10,362 | ||||||||||

| Available-for-sale debt securities losses | (1,886) | — | (1,886) | — | ||||||||||

| Other | 9,640 | 7,985 | 17,914 | 14,351 | ||||||||||

| Total non-interest income | 54,069 | 50,424 | 98,513 | 91,743 | ||||||||||

| Non-interest expense | ||||||||||||||

| Salaries and benefits | 120,154 | 118,840 | 251,795 | 247,567 | ||||||||||

| Occupancy expense | 12,144 | 10,666 | 22,988 | 20,403 | ||||||||||

| Marketing | 3,624 | 5,996 | 8,633 | 12,032 | ||||||||||

| Legal and professional | 11,069 | 11,273 | 26,058 | 27,468 | ||||||||||

| Communications and technology | 24,314 | 22,013 | 47,956 | 43,127 | ||||||||||

| Federal Deposit Insurance Corporation insurance assessment | 5,096 | 5,570 | 10,437 | 13,991 | ||||||||||

| Other | 13,875 | 14,051 | 25,429 | 26,214 | ||||||||||

| Total non-interest expense | 190,276 | 188,409 | 393,296 | 390,802 | ||||||||||

| Income before income taxes | 102,188 | 58,597 | 162,646 | 93,532 | ||||||||||

| Income tax expense | 24,860 | 16,935 | 38,271 | 25,728 | ||||||||||

| Net income | 77,328 | 41,662 | 124,375 | 67,804 | ||||||||||

| Preferred stock dividends | 4,312 | 4,312 | 8,625 | 8,625 | ||||||||||

| Net income available to common stockholders | $ | 73,016 | $ | 37,350 | $ | 115,750 | $ | 59,179 | ||||||

| Basic earnings per common share | $ | 1.59 | $ | 0.80 | $ | 2.52 | $ | 1.26 | ||||||

| Diluted earnings per common share | $ | 1.58 | $ | 0.80 | $ | 2.49 | $ | 1.25 | ||||||

| TEXAS CAPITAL BANCSHARES, INC. | |||||||||||||||||

| SUMMARY OF CREDIT LOSS EXPERIENCE | |||||||||||||||||

| (dollars in thousands) | |||||||||||||||||

| 2nd Quarter | 1st Quarter | 4th Quarter | 3rd Quarter | 2nd Quarter | |||||||||||||

| 2025 | 2025 | 2024 | 2024 | 2024 | |||||||||||||

| Allowance for credit losses on loans: | |||||||||||||||||

| Beginning balance | $ | 278,379 | $ | 271,709 | $ | 273,143 | $ | 267,297 | $ | 263,962 | |||||||

| Allowance established for acquired purchase credit deterioration loans | — | — | — | 2,579 | — | ||||||||||||

| Loans charged-off: | |||||||||||||||||

| Commercial | 13,020 | 10,197 | 14,100 | 6,120 | 9,997 | ||||||||||||

| Commercial real estate | 431 | 500 | 2,566 | 262 | 2,111 | ||||||||||||

| Consumer | — | — | — | 30 | — | ||||||||||||

| Total charge-offs | 13,451 | 10,697 | 16,666 | 6,412 | 12,108 | ||||||||||||

| Recoveries: | |||||||||||||||||

| Commercial | 486 | 483 | 4,562 | 329 | 153 | ||||||||||||

| Commercial real estate | — | 413 | 18 | — | — | ||||||||||||

| Consumer | — | 4 | 15 | — | — | ||||||||||||

| Total recoveries | 486 | 900 | 4,595 | 329 | 153 | ||||||||||||

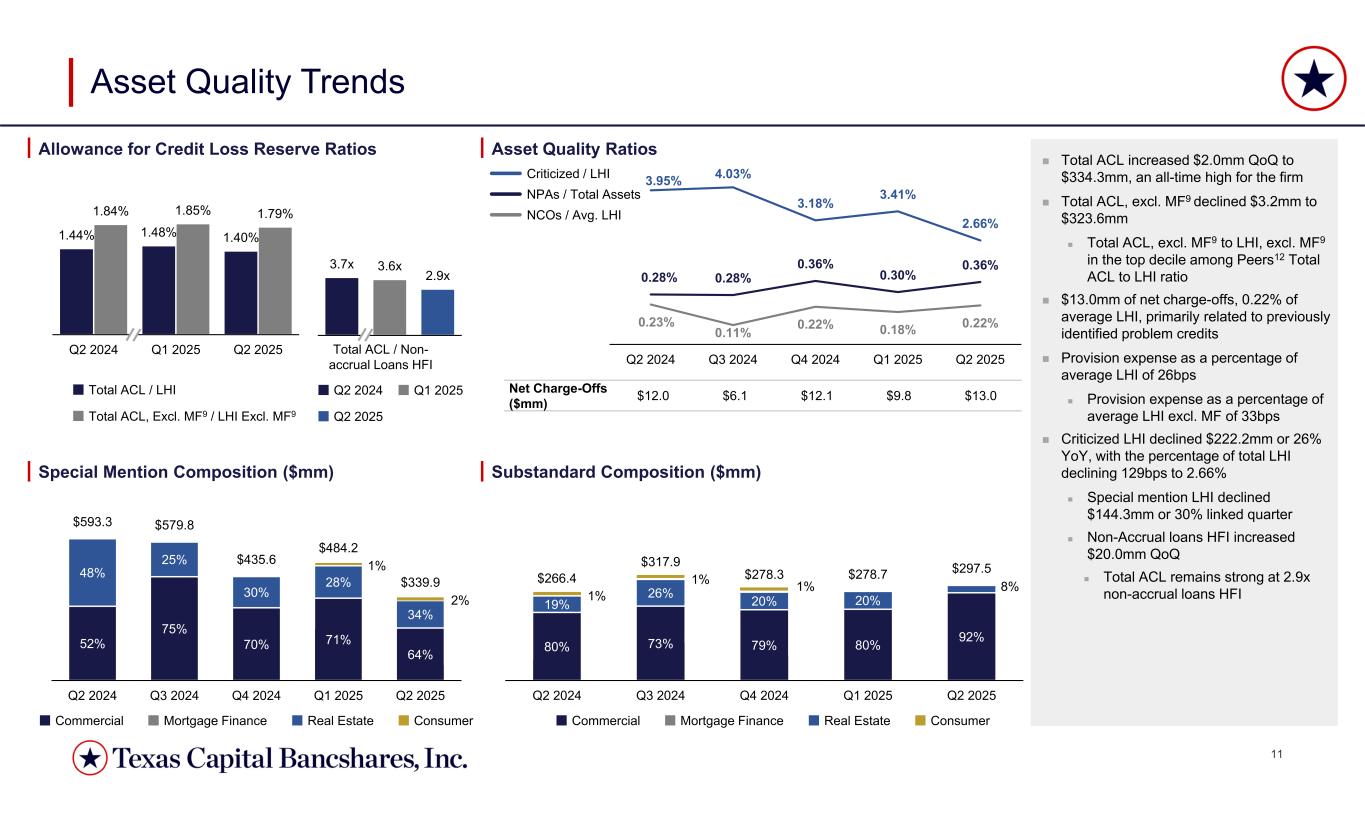

| Net charge-offs | 12,965 | 9,797 | 12,071 | 6,083 | 11,955 | ||||||||||||

| Provision for credit losses on loans | 12,234 | 16,467 | 10,637 | 9,350 | 15,290 | ||||||||||||

| Ending balance | $ | 277,648 | $ | 278,379 | $ | 271,709 | $ | 273,143 | $ | 267,297 | |||||||

| Allowance for off-balance sheet credit losses: | |||||||||||||||||

| Beginning balance | $ | 53,865 | $ | 53,332 | $ | 45,969 | $ | 45,319 | $ | 40,609 | |||||||

| Provision for off-balance sheet credit losses | 2,766 | 533 | 7,363 | 650 | 4,710 | ||||||||||||

| Ending balance | $ | 56,631 | $ | 53,865 | $ | 53,332 | $ | 45,969 | $ | 45,319 | |||||||

| Total allowance for credit losses | $ | 334,279 | $ | 332,244 | $ | 325,041 | $ | 319,112 | $ | 312,616 | |||||||

| Total provision for credit losses | $ | 15,000 | $ | 17,000 | $ | 18,000 | $ | 10,000 | $ | 20,000 | |||||||

| Allowance for credit losses on loans to total loans held for investment | 1.16 | % | 1.24 | % | 1.21 | % | 1.23 | % | 1.23 | % | |||||||

| Allowance for credit losses on loans to average total loans held for investment | 1.19 | % | 1.29 | % | 1.22 | % | 1.24 | % | 1.27 | % | |||||||

Net charge-offs to average total loans held for investment(1) |

0.22 | % | 0.18 | % | 0.22 | % | 0.11 | % | 0.23 | % | |||||||

Net charge-offs to average total loans held for investment for last 12 months(1) |

0.18 | % | 0.18 | % | 0.19 | % | 0.20 | % | 0.22 | % | |||||||

Total provision for credit losses to average total loans held for investment(1) |

0.26 | % | 0.32 | % | 0.32 | % | 0.18 | % | 0.38 | % | |||||||

Total allowance for credit losses to total loans held for investment |

1.40 | % | 1.48 | % | 1.45 | % | 1.43 | % | 1.44 | % | |||||||

| TEXAS CAPITAL BANCSHARES, INC. | |||||||||||||||||

| NON-PERFORMING ASSETS, PAST DUE LOANS AND CRITICIZED LOANS | |||||||||||||||||

| (dollars in thousands) | |||||||||||||||||

| 2nd Quarter | 1st Quarter | 4th Quarter | 3rd Quarter | 2nd Quarter | |||||||||||||

| 2025 | 2025 | 2024 | 2024 | 2024 | |||||||||||||

| NON-PERFORMING ASSETS | |||||||||||||||||

| Non-accrual loans held for investment | $ | 113,609 | $ | 93,565 | $ | 111,165 | $ | 88,960 | $ | 85,021 | |||||||

| Non-accrual loans held for sale | — | — | — | — | — | ||||||||||||

| Other real estate owned | — | — | — | — | — | ||||||||||||

| Total non-performing assets | $ | 113,609 | $ | 93,565 | $ | 111,165 | $ | 88,960 | $ | 85,021 | |||||||

| Non-accrual loans held for investment to total loans held for investment | 0.47 | % | 0.42 | % | 0.50 | % | 0.40 | % | 0.39 | % | |||||||

| Total non-performing assets to total assets | 0.36 | % | 0.30 | % | 0.36 | % | 0.28 | % | 0.28 | % | |||||||

| Allowance for credit losses on loans to non-accrual loans held for investment | 2.4x | 3.0x | 2.4x | 3.1x | 3.1x | ||||||||||||

| Total allowance for credit losses to non-accrual loans held for investment | 2.9x | 3.6x | 2.9x | 3.6x | 3.7x | ||||||||||||

| LOANS PAST DUE | |||||||||||||||||

Loans held for investment past due 90 days and still accruing |

$ | 2,068 | $ | 791 | $ | 4,265 | $ | 5,281 | $ | 286 | |||||||

| Loans held for investment past due 90 days to total loans held for investment | 0.01 | % | — | % | 0.02 | % | 0.02 | % | — | % | |||||||

Loans held for sale past due 90 days and still accruing |

$ | — | $ | — | $ | — | $ | — | $ | 64 | |||||||

| CRITICIZED LOANS | |||||||||||||||||

| Criticized loans | $ | 637,462 | $ | 762,887 | $ | 713,951 | $ | 897,727 | $ | 859,671 | |||||||

| Criticized loans to total loans held for investment | 2.66 | % | 3.41 | % | 3.18 | % | 4.03 | % | 3.95 | % | |||||||

| Special mention loans | $ | 339,923 | $ | 484,165 | $ | 435,626 | $ | 579,802 | $ | 593,305 | |||||||

| Special mention loans to total loans held for investment | 1.42 | % | 2.16 | % | 1.94 | % | 2.60 | % | 2.72 | % | |||||||

| TEXAS CAPITAL BANCSHARES, INC. | |||||||||||||||||

| CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) | |||||||||||||||||

| (dollars in thousands) | |||||||||||||||||

| 2nd Quarter | 1st Quarter | 4th Quarter | 3rd Quarter | 2nd Quarter | |||||||||||||

| 2025 | 2025 | 2024 | 2024 | 2024 | |||||||||||||

| Interest income | |||||||||||||||||

| Interest and fees on loans | $ | 364,358 | $ | 334,150 | $ | 340,388 | $ | 361,407 | $ | 345,251 | |||||||

| Investment securities | 45,991 | 46,565 | 44,102 | 38,389 | 33,584 | ||||||||||||

| Interest bearing deposits in other banks | 29,218 | 46,574 | 53,081 | 52,737 | 43,233 | ||||||||||||

| Total interest income | 439,567 | 427,289 | 437,571 | 452,533 | 422,068 | ||||||||||||

| Interest expense | |||||||||||||||||

| Deposits | 174,798 | 174,936 | 189,061 | 190,255 | 181,280 | ||||||||||||

| Short-term borrowings | 3,444 | 8,246 | 10,678 | 13,784 | 12,749 | ||||||||||||

| Long-term debt | 7,930 | 8,073 | 8,225 | 8,392 | 11,457 | ||||||||||||

| Total interest expense | 186,172 | 191,255 | 207,964 | 212,431 | 205,486 | ||||||||||||

| Net interest income | 253,395 | 236,034 | 229,607 | 240,102 | 216,582 | ||||||||||||

| Provision for credit losses | 15,000 | 17,000 | 18,000 | 10,000 | 20,000 | ||||||||||||

| Net interest income after provision for credit losses | 238,395 | 219,034 | 211,607 | 230,102 | 196,582 | ||||||||||||

| Non-interest income | |||||||||||||||||

| Service charges on deposit accounts | 8,182 | 7,840 | 6,989 | 6,307 | 5,911 | ||||||||||||

| Wealth management and trust fee income | 3,730 | 3,964 | 4,009 | 4,040 | 3,699 | ||||||||||||

| Brokered loan fees | 2,398 | 1,949 | 2,519 | 2,400 | 2,131 | ||||||||||||

| Investment banking and advisory fees | 24,109 | 16,478 | 26,740 | 34,753 | 25,048 | ||||||||||||

| Trading income | 7,896 | 5,939 | 5,487 | 5,786 | 5,650 | ||||||||||||

| Available-for-sale debt securities losses | (1,886) | — | — | (179,581) | — | ||||||||||||

| Other | 9,640 | 8,274 | 8,330 | 11,524 | 7,985 | ||||||||||||

| Total non-interest income | 54,069 | 44,444 | 54,074 | (114,771) | 50,424 | ||||||||||||

| Non-interest expense | |||||||||||||||||

| Salaries and benefits | 120,154 | 131,641 | 97,873 | 121,138 | 118,840 | ||||||||||||

| Occupancy expense | 12,144 | 10,844 | 11,926 | 12,937 | 10,666 | ||||||||||||

| Marketing | 3,624 | 5,009 | 4,454 | 5,863 | 5,996 | ||||||||||||

| Legal and professional | 11,069 | 14,989 | 15,180 | 11,135 | 11,273 | ||||||||||||

| Communications and technology | 24,314 | 23,642 | 24,007 | 25,951 | 22,013 | ||||||||||||

| Federal Deposit Insurance Corporation insurance assessment | 5,096 | 5,341 | 4,454 | 4,906 | 5,570 | ||||||||||||

| Other | 13,875 | 11,554 | 14,265 | 13,394 | 14,051 | ||||||||||||

| Total non-interest expense | 190,276 | 203,020 | 172,159 | 195,324 | 188,409 | ||||||||||||

| Income/(loss) before income taxes | 102,188 | 60,458 | 93,522 | (79,993) | 58,597 | ||||||||||||

| Income tax expense/(benefit) | 24,860 | 13,411 | 22,499 | (18,674) | 16,935 | ||||||||||||

| Net income/(loss) | 77,328 | 47,047 | 71,023 | (61,319) | 41,662 | ||||||||||||

| Preferred stock dividends | 4,312 | 4,313 | 4,312 | 4,313 | 4,312 | ||||||||||||

| Net income/(loss) available to common shareholders | $ | 73,016 | $ | 42,734 | $ | 66,711 | $ | (65,632) | $ | 37,350 | |||||||

| TEXAS CAPITAL BANCSHARES, INC. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

TAXABLE EQUIVALENT NET INTEREST INCOME ANALYSIS (UNAUDITED)(1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2nd Quarter 2025 | 1st Quarter 2025 | 2nd Quarter 2024 | YTD June 30, 2025 | YTD June 30, 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Balance |

Income/ Expense |

Yield/ Rate |

Average Balance |

Income/ Expense |

Yield/ Rate |

Average Balance |

Income/ Expense |

Yield/ Rate |

Average Balance |

Income/ Expense |

Yield/ Rate |

Average Balance |

Income/ Expense |

Yield/ Rate |

|||||||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Investment securities(2) |

$ | 4,573,164 | $ | 45,999 | 3.93 | % | $ | 4,463,876 | $ | 46,565 | 4.10 | % | $ | 4,427,023 | $ | 33,584 | 2.80 | % | $ | 4,518,822 | $ | 92,564 | 4.01 | % | $ | 4,363,195 | $ | 65,728 | 2.79 | % | |||||||||||||||||||||||||||||

| Interest bearing cash and cash equivalents | 2,661,037 | 29,218 | 4.40 | % | 4,255,796 | 46,574 | 4.44 | % | 3,273,069 | 43,233 | 5.31 | % | 3,454,011 | 75,792 | 4.43 | % | 3,662,348 | 97,588 | 5.36 | % | |||||||||||||||||||||||||||||||||||||||

| Loans held for sale | — | — | — | % | 335 | 2 | 2.97 | % | 28,768 | 683 | 9.55 | % | 167 | 2 | 2.97 | % | 39,966 | 1,867 | 9.40 | % | |||||||||||||||||||||||||||||||||||||||

| Loans held for investment, mortgage finance | 5,327,559 | 58,707 | 4.42 | % | 3,972,106 | 38,527 | 3.93 | % | 4,357,288 | 42,722 | 3.94 | % | 4,653,577 | 97,234 | 4.21 | % | 3,937,498 | 74,177 | 3.79 | % | |||||||||||||||||||||||||||||||||||||||

Loans held for investment(3) |

18,018,626 | 306,142 | 6.81 | % | 17,527,070 | 296,091 | 6.85 | % | 16,750,788 | 301,910 | 7.25 | % | 17,774,206 | 602,233 | 6.83 | % | 16,636,438 | 600,216 | 7.26 | % | |||||||||||||||||||||||||||||||||||||||

Less: Allowance for credit losses on loans |

278,035 | — | — | % | 272,758 | — | — | 263,145 | — | — | % | 275,411 | — | — | 256,541 | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Loans held for investment, net | 23,068,150 | 364,849 | 6.34 | % | 21,226,418 | 334,618 | 6.39 | % | 20,844,931 | 344,632 | 6.65 | % | 22,152,372 | 699,467 | 6.37 | % | 20,317,395 | 674,393 | 6.68 | % | |||||||||||||||||||||||||||||||||||||||

| Total earning assets | 30,302,351 | 440,066 | 5.80 | % | 29,946,425 | 427,759 | 5.76 | % | 28,573,791 | 422,132 | 5.86 | % | 30,125,372 | 867,825 | 5.78 | % | 28,382,904 | 839,576 | 5.87 | % | |||||||||||||||||||||||||||||||||||||||

| Cash and other assets | 1,117,118 | 1,157,184 | 1,177,061 | 1,137,040 | 1,117,763 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 31,419,469 | $ | 31,103,609 | $ | 29,750,852 | $ | 31,262,412 | $ | 29,500,667 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities and Stockholders’ Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Transaction deposits | $ | 2,213,037 | $ | 13,731 | 2.49 | % | $ | 2,163,250 | $ | 13,908 | 2.61 | % | $ | 2,061,622 | $ | 16,982 | 3.31 | % | $ | 2,188,282 | $ | 27,639 | 2.55 | % | $ | 2,034,057 | $ | 33,840 | 3.35 | % | |||||||||||||||||||||||||||||

| Savings deposits | 13,727,095 | 134,272 | 3.92 | % | 13,357,243 | 133,577 | 4.06 | % | 11,981,668 | 143,173 | 4.81 | % | 13,543,190 | 267,849 | 3.99 | % | 11,695,673 | 279,963 | 4.81 | % | |||||||||||||||||||||||||||||||||||||||

| Time deposits | 2,361,525 | 26,795 | 4.55 | % | 2,329,384 | 27,451 | 4.78 | % | 1,658,899 | 21,125 | 5.12 | % | 2,345,543 | 54,246 | 4.66 | % | 1,689,112 | 43,077 | 5.13 | % | |||||||||||||||||||||||||||||||||||||||

| Total interest bearing deposits | 18,301,657 | 174,798 | 3.83 | % | 17,849,877 | 174,936 | 3.97 | % | 15,702,189 | 181,280 | 4.64 | % | 18,077,015 | 349,734 | 3.90 | % | 15,418,842 | 356,880 | 4.65 | % | |||||||||||||||||||||||||||||||||||||||

| Short-term borrowings | 306,176 | 3,444 | 4.51 | % | 751,500 | 8,246 | 4.45 | % | 927,253 | 12,749 | 5.53 | % | 527,608 | 11,690 | 4.47 | % | 919,670 | 25,532 | 5.58 | % | |||||||||||||||||||||||||||||||||||||||

| Long-term debt | 649,469 | 7,930 | 4.90 | % | 660,445 | 8,073 | 4.96 | % | 778,401 | 11,457 | 5.92 | % | 654,927 | 16,003 | 4.93 | % | 818,955 | 25,443 | 6.25 | % | |||||||||||||||||||||||||||||||||||||||

| Total interest bearing liabilities | 19,257,302 | 186,172 | 3.88 | % | 19,261,822 | 191,255 | 4.03 | % | 17,407,843 | 205,486 | 4.75 | % | 19,259,550 | 377,427 | 3.95 | % | 17,157,467 | 407,855 | 4.78 | % | |||||||||||||||||||||||||||||||||||||||

| Non-interest bearing deposits | 8,191,402 | 7,875,244 | 8,647,594 | 8,034,196 | 8,642,685 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 475,724 | 552,154 | 537,754 | 513,728 | 523,520 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stockholders’ equity | 3,495,041 | 3,414,389 | 3,157,661 | 3,454,938 | 3,176,995 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 31,419,469 | $ | 31,103,609 | $ | 29,750,852 | $ | 31,262,412 | $ | 29,500,667 | |||||||||||||||||||||||||||||||||||||||||||||||||

Net interest income |

$ | 253,894 | $ | 236,504 | $ | 216,646 | $ | 490,398 | $ | 431,721 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest margin | 3.35 | % | 3.19 | % | 3.01 | % | 3.27 | % | 3.02 | % | |||||||||||||||||||||||||||||||||||||||||||||||||

| Reconciliation of Non-GAAP Financial Measures | |||||||||||||||||

| (dollars in thousands except per share data) | 2nd Quarter 2025 |

1st Quarter 2025 |

4th Quarter 2024 |

3rd Quarter 2024 |

2nd Quarter 2024 |

||||||||||||

| Net interest income | $ | 253,395 | $ | 236,034 | $ | 229,607 | $ | 240,102 | $ | 216,582 | |||||||

| Non-interest income | 54,069 | 44,444 | 54,074 | (114,771) | 50,424 | ||||||||||||

| Available-for-sale debt securities losses, net | 1,886 | — | — | 179,581 | — | ||||||||||||

| Non-interest income, adjusted | 55,955 | 44,444 | 54,074 | 64,810 | 50,424 | ||||||||||||

| Non-interest expense | 190,276 | 203,020 | 172,159 | 195,324 | 188,409 | ||||||||||||

| FDIC special assessment | — | — | — | 651 | (462) | ||||||||||||

| Restructuring expenses | (1,401) | — | — | (5,923) | — | ||||||||||||

| Non-interest expense, adjusted | 188,875 | 203,020 | 172,159 | 190,052 | 187,947 | ||||||||||||

| Provision for credit losses | 15,000 | 17,000 | 18,000 | 10,000 | 20,000 | ||||||||||||

| Income tax expense/(benefit) | 24,860 | 13,411 | 22,499 | (18,674) | 16,935 | ||||||||||||

| Tax effect of adjustments | 774 | — | — | 44,880 | 104 | ||||||||||||

| Income tax expense/(benefit), adjusted | 25,634 | 13,411 | 22,499 | 26,206 | 17,039 | ||||||||||||

Net income/(loss)(1) |

$ | 77,328 | $ | 47,047 | $ | 71,023 | $ | (61,319) | $ | 41,662 | |||||||

Net income/(loss), adjusted(1) |

$ | 79,841 | $ | 47,047 | $ | 71,023 | $ | 78,654 | $ | 42,020 | |||||||

| Preferred stock dividends | 4,312 | 4,313 | 4,312 | 4,313 | 4,312 | ||||||||||||

Net income/(loss) to common stockholders(2) |

$ | 73,016 | $ | 42,734 | $ | 66,711 | $ | (65,632) | $ | 37,350 | |||||||

Net income/(loss) to common stockholders, adjusted(2) |

$ | 75,529 | $ | 42,734 | $ | 66,711 | $ | 74,341 | $ | 37,708 | |||||||

PPNR(3) |

$ | 117,188 | $ | 77,458 | $ | 111,522 | $ | (69,993) | $ | 78,597 | |||||||

PPNR(3), adjusted |

$ | 120,475 | $ | 77,458 | $ | 111,522 | $ | 114,860 | $ | 79,059 | |||||||

| Weighted average common shares outstanding, diluted | 46,215,394 | 46,616,704 | 46,770,961 | 46,608,742 | 46,872,498 | ||||||||||||

| Diluted earnings/(loss) per common share | $ | 1.58 | $ | 0.92 | $ | 1.43 | $ | (1.41) | $ | 0.80 | |||||||

| Diluted earnings/(loss) per common share, adjusted | $ | 1.63 | $ | 0.92 | $ | 1.43 | $ | 1.59 | $ | 0.80 | |||||||

| Average total assets | $ | 31,419,469 | $ | 31,103,609 | $ | 32,212,087 | $ | 31,215,173 | $ | 29,750,852 | |||||||

| Return on average assets | 0.99 | % | 0.61 | % | 0.88 | % | (0.78) | % | 0.56 | % | |||||||

| Return on average assets, adjusted | 1.02 | % | 0.61 | % | 0.88 | % | 1.00 | % | 0.57 | % | |||||||

Average common equity |

$ | 3,195,041 | $ | 3,114,389 | $ | 3,120,933 | $ | 2,945,238 | $ | 2,857,661 | |||||||

| Return on average common equity | 9.17 | % | 5.56 | % | 8.50 | % | (8.87) | % | 5.26 | % | |||||||

| Return on average common equity, adjusted | 9.48 | % | 5.56 | % | 8.50 | % | 10.04 | % | 5.31 | % | |||||||

Efficiency ratio(4) |

61.9 | % | 72.4 | % | 60.7 | % | 155.8 | % | 70.6 | % | |||||||

Efficiency ratio, adjusted(4) |

61.1 | % | 72.4 | % | 60.7 | % | 62.3 | % | 70.4 | % | |||||||

| Average earning assets | $ | 30,302,351 | $ | 29,946,425 | $ | 31,033,803 | $ | 29,975,318 | $ | 28,573,791 | |||||||

| Non-interest income to average earning assets | 0.72 | % | 0.60 | % | 0.69 | % | (1.52) | % | 0.71 | % | |||||||

| Non-interest income to average earning assets, adjusted | 0.74 | % | 0.60 | % | 0.69 | % | 0.86 | % | 0.71 | % | |||||||

| Non-interest expense to average earning assets | 2.52 | % | 2.75 | % | 2.21 | % | 2.59 | % | 2.65 | % | |||||||

| Non-interest expense to average earning assets, adjusted | 2.50 | % | 2.75 | % | 2.21 | % | 2.52 | % | 2.65 | % | |||||||