Blackstone Mortgage Trust, Inc. Blackstone Mortgage Trust, Inc. Blackstone Mortgage Trust, Inc. Second Quarter 2025 Results JULY 30, 2025

Blackstone |Blackstone Mortgage Trust, Inc. BXMT HIGHLIGHTS Note: The information in this presentation is as of June 30, 2025, and all averages are weighted averages, unless otherwise stated. Opinions expressed reflect the current opinions of BXMT as of the date indicated only and are based on BXMT’s opinions of the current market environment, which is subject to change. Estimates, targets, forecasts, or similar predictions or returns are necessarily speculative, hypothetical, and inherently uncertain in nature, and it can be expected that some or all of the assumptions underlying such estimates, targets, forecasts, or similar predictions or returns contained herein will not materialize and/or that actual events and consequences thereof will vary materially from the assumptions upon which such estimates, targets, forecasts, or similar predictions or returns have been based. BXMT’s manager is a subsidiary of Blackstone. (1) See Appendix for definition and reconciliation to GAAP net income (loss). 1 ▪ Q2 GAAP EPS of $0.04 and Distributable EPS(1) of $0.19; Distributable EPS prior to charge-offs(1) of $0.45 excludes realized loss from loan resolution ▪ Robust capital deployment, loan resolution momentum, and balance sheet management demonstrating strong execution on key priorities and driving earnings power Investment Activity Actively deploying capital into compelling opportunities Credit Performance Continued momentum in loan repayments and resolutions $0.2B resolutions of impaired loans(d) Balance Sheet Strength Robust liquidity and proactive liability management $1.1B quarter-end liquidity 65bps spread reduction on $1.0B Term Loan B $2.6B loan originations and acquisitions(a) $1.6B loan repayments >9% avg. levered spread over base rates(b)(c)

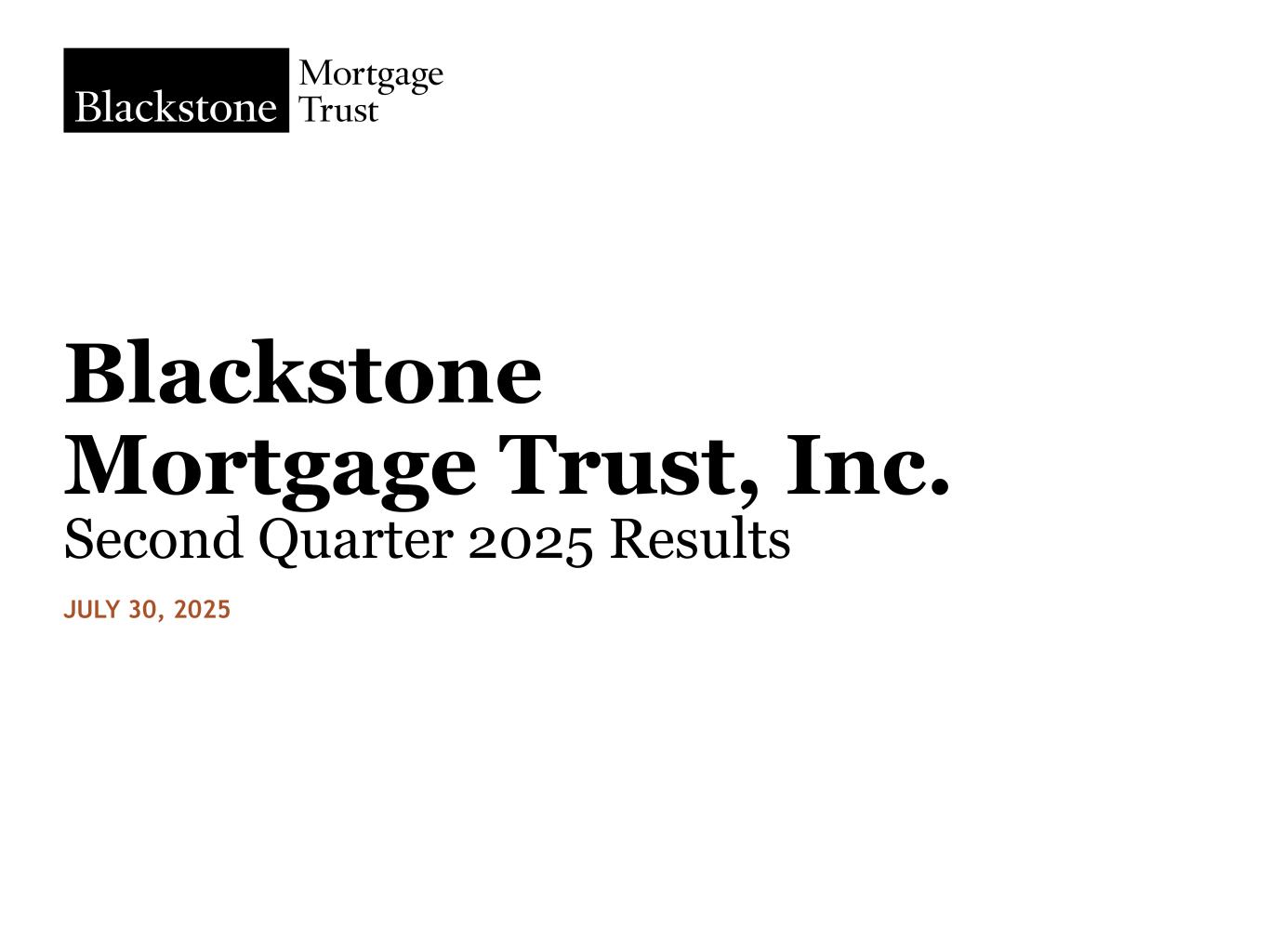

Blackstone |Blackstone Mortgage Trust, Inc. SECOND QUARTER RESULTS (1) See Appendix for definition and reconciliation to GAAP net income (loss). 2 ▪ Q2 GAAP basic income per share of $0.04, Distributable Earnings(1) per share of $0.19, and Distributable EPS prior to charge-offs(1) of $0.45 ▪ Book value per share of $21.04, incorporates $4.39 per share of CECL reserves ▪ Paid Q2 dividend of $0.47 per share, equating to a 9.7% annualized dividend yield(e) Earnings ▪ Originated $2.2B and collected $1.6B of repayments in Q2; quarter-end portfolio of $18.4B(f) across 144 loans – 82% of originations secured by multifamily or diversified industrial portfolios with attractive credit and return characteristics; 68% sourced internationally ▪ Acquired $0.4B share of a performing senior loan portfolio from a US regional bank at a discount to par; largely concentrated in neighborhood retail, multifamily, and industrial sectors with a w.a. LTV of 59%(g) Portfolio ▪ Portfolio performance and w.a. risk rating steady at 94%(f) and 3.1, respectively ▪ Resolved $0.2B of impaired assets(d) in Q2 above aggregate carrying value; total resolutions of $1.7B ($69M above aggregate carrying value) since Q3 2024, reducing impaired loan balance by 55% from peak ▪ CECL reserves stable QoQ at $755M, representing 3.8% of principal balance ▪ Collected $0.3B of office repayments in Q2; total office down $2.1B from 36% to 28% of loan portfolio over the last twelve months Credit ▪ Repriced $1.0B of Term Loan B, reduced spread by 65bps and extended maturity to 2030 ▪ Strong liquidity of $1.1B continuing to support portfolio turnover into new investments in attractive environment ▪ Total credit facility capacity of $19.1B across 14 bank counterparties, including over $7.0B undrawn Capitalization and Liquidity

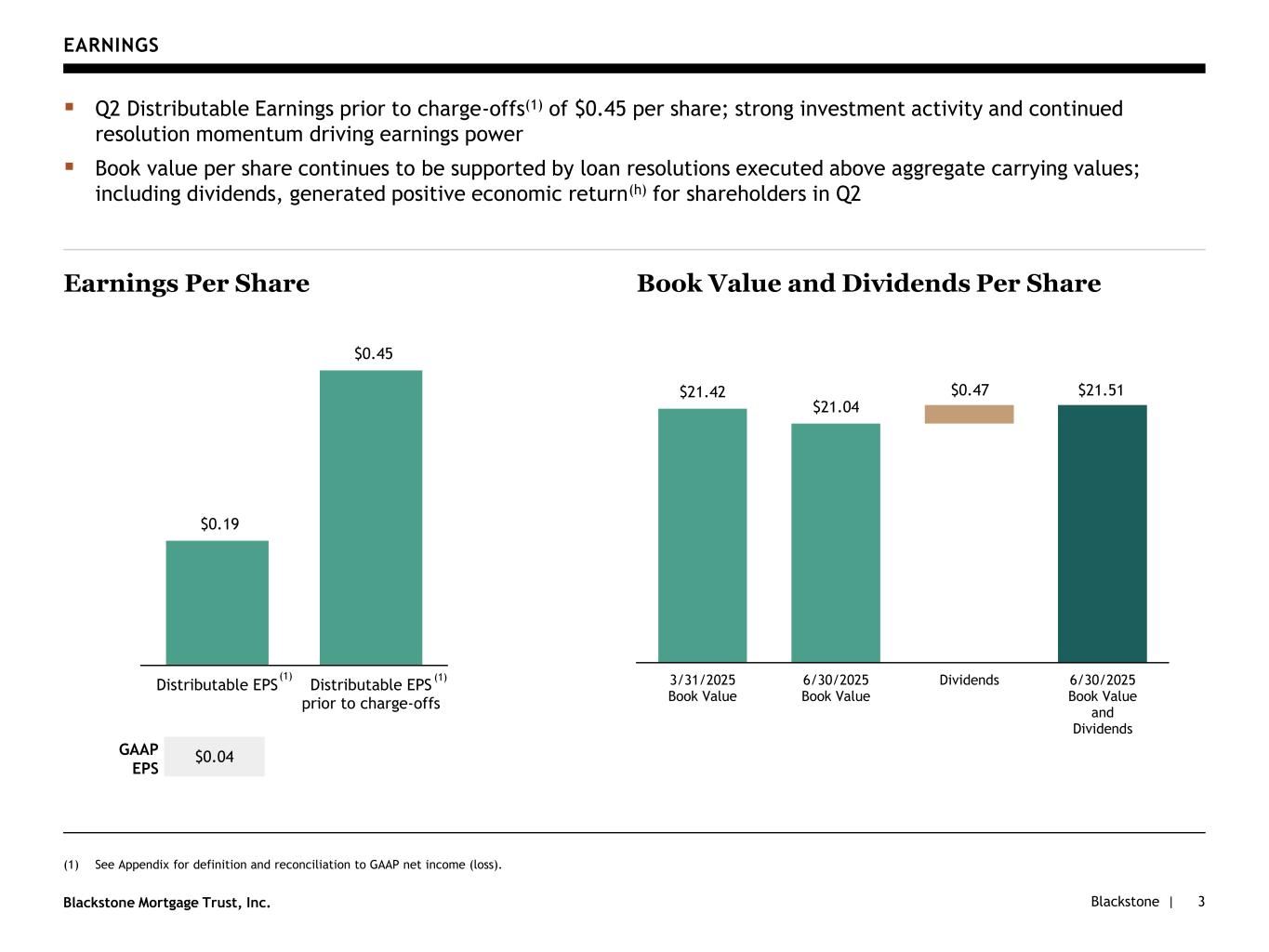

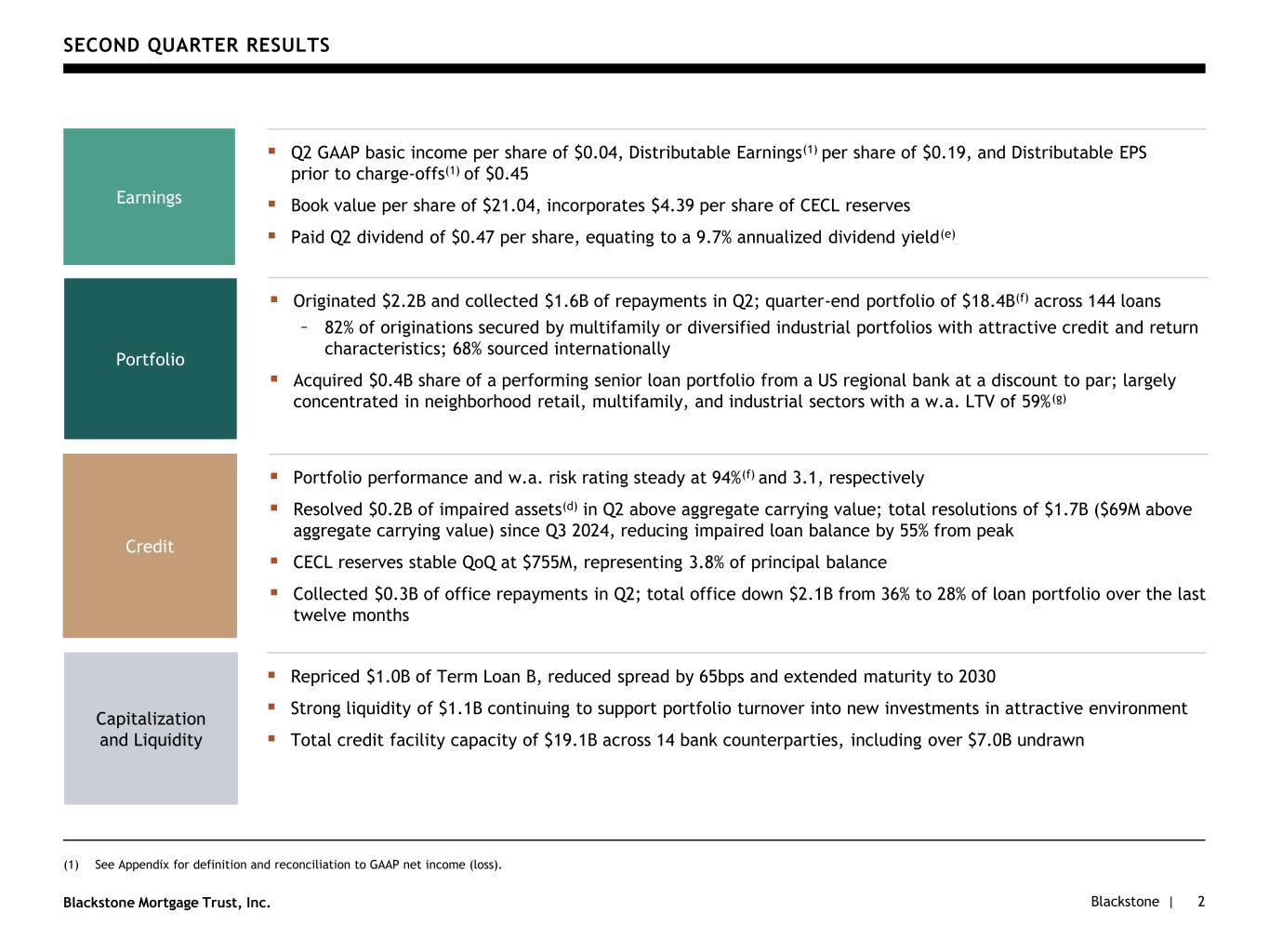

Blackstone |Blackstone Mortgage Trust, Inc. EARNINGS ▪ Q2 Distributable Earnings prior to charge-offs(1) of $0.45 per share; strong investment activity and continued resolution momentum driving earnings power ▪ Book value per share continues to be supported by loan resolutions executed above aggregate carrying values; including dividends, generated positive economic return(h) for shareholders in Q2 Earnings Per Share (1) See Appendix for definition and reconciliation to GAAP net income (loss). Book Value and Dividends Per Share GAAP EPS $0.04 $21.42 $21.04 $21.51$0.47 3/31/2025 Book Value 6/30/2025 Book Value Dividends 6/30/2025 Book Value and Dividends $0.19 $0.45 Distributable EPS Distributable EPS prior to charge-offs (1)(1) 3

Blackstone |Blackstone Mortgage Trust, Inc. LOAN PORTFOLIO OVERVIEW(f) 4 AU, 6% ES, 4% IE, 7% UK, 20% SE, 3% DEU, 1% TX, 6% NY, 11% NV, 2% MA, 1% IL, 3% GA, 2% FL, 8% CA, 9% VA, 2% AZ, 2% CO, 2% WA, 2% Sunbelt 24% Northeast 14% West 10%Midwest 4% Northwest 3% UK 20% Other Europe 17% Australia 6% Canada 2% Multifamily 27% US Office 20% Industrial 18% Hospitality 15% Retail 4% Self-Storage 3% Other Property 4% Life Sciences / Studio 1% HI, 1% 45% International ▪ Well-diversified portfolio of 144 loans, secured by institutional-quality assets across sectors and markets ▪ Office exposure has declined by 29% over the past year; now comprising only 28% of the portfolio Geographic Footprint(f)(i) CAN, 2% Collateral Diversification(f)(j)(k) NL, 1% Non-US Office 8%

Blackstone |Blackstone Mortgage Trust, Inc. PORTFOLIO ACTIVITY 5 ▪ Strong new origination activity exceeding repayments and driving earnings inflection in portfolio, which has grown by $1.4B over the last two quarters to $18.4B(f) ▪ New investments largely concentrated in multifamily, well-leased industrial portfolios, and a $0.4B share of a diversified, performing senior loan portfolio acquired from a US regional bank at a discount to par Q2 2025 Originations Highlights(c)(l) ✓ 64% avg. origination LTV(m) ✓ +3.5% avg. loan yield ✓ 82% multifamily or industrial portfolios ✓ 68% international $20.8B $19.3B $17.0B $17.8B $18.4B 6/30/2024 9/30/2024 12/31/2024 3/31/2025 6/30/2025 ✓ >9% avg. levered spread over base rates(b) Portfolio Size(f) ($ in billions)

Blackstone |Blackstone Mortgage Trust, Inc. CREDIT 6 ▪ Resolved $0.2B of impaired loans(d) in Q2, bringing total resolutions since Q3 2024 to $1.7B across 15 transactions; Q2 resolutions executed above aggregate carrying value, supporting book value ▪ Loan portfolio performance steady at 94%,(f) benefiting from loan resolutions, new vintage investments, and limited credit migration Impaired Loans(f) ($ in billions) Performing Portfolio(f) $2.3 $1.0 9/30/2024 6/30/2025 94% performing 55% decrease

Blackstone |Blackstone Mortgage Trust, Inc. CAPITALIZATION 7 ▪ Well-structured balance sheet with ample liquidity of $1.1B and debt-to-equity(n) ratio of 3.8x; marginal cost of financing on new investments continues to decline as capital markets improve ▪ Enhanced capital structure in Q2 with accretive $1.0B Term Loan B repricing and maturity extension to 2030, reducing borrowing spread by 65bps; no significant corporate debt maturing until 2027 Corporate Debt Maturities(p) ($ in billions) Secured Debt(o) Costs on New Originations $0.3 $0.4 $1.0 $0.3 $0.3 $0.5 2025 2026 2027 2028 2029 2030 Term Loan B Convertible Notes Senior Secured Notes +1.80% +1.72% +1.59% FY 2024 Q1 2025 Q2 2025

Blackstone |Blackstone Mortgage Trust, Inc. II. Appendix 8

Blackstone |Blackstone Mortgage Trust, Inc. APPENDIX 9 Portfolio Details ($ in millions) Property Type Location Origination Date (q) Total Commitment (r) Principal Balance Net Book Value (s) Cash Coupon (t) All-in Yield (t) Maximum Maturity (u) Loan per SF/Unit/Key Origination LTV (m) 1 Mixed-Use Dublin, IE 8/14/2019 $1,059 $1,007 $1,005 +3.20% +3.95% 1/29/2027 $281 / sqft 74% 2 Hospitality Diversified, AU 6/24/2022 871 871 865 +4.75% +4.93% 6/21/2030 $396 / sqft 59% 3 Mixed-Use Diversified, Spain 3/22/2018 563 563 563 +3.25% +3.31% 3/15/2026 n / a 71% 4 Industrial Diversified, SE 3/30/2021 504 504 503 +3.20% +3.41% 5/15/2026 $95 / sqft 76% 5 Self-Storage Diversified, CAN 2/20/2025 459 459 459 +3.50% +3.50% 2/9/2030 $160 / sqft 58% 6 Mixed-Use Austin 6/28/2022 675 454 449 +4.60% +5.07% 7/9/2029 $377 / sqft 53% 7 Mixed-Use New York 12/9/2021 385 381 381 +2.76% +3.00% 12/9/2026 $131 / sqft 50% 8 Industrial Diversified, UK 4/7/2025 357 357 356 +2.55% +2.88% 4/7/2030 $369 / sqft 67% 9 Multifamily London, UK 12/23/2021 354 354 350 +4.25% +4.95% 6/24/2028 $391,231 / unit 59% 10 Hospitality Diversified, EUR 7/15/2021 339 339 339 +4.25% +4.76% 7/16/2026 $259,296 / key 53% 11 Office Chicago 12/11/2018 356 324 326 +1.75% +1.75% 12/9/2026 $272 / sqft 78% 12 Industrial Diversified, UK 5/6/2022 310 310 310 +3.50% +3.79% 5/6/2027 $98 / sqft 53% 13 Industrial Diversified, UK 5/15/2025 310 310 310 +2.70% +2.89% 5/15/2028 $149 / sqft 69% 14 Other Diversified, UK 1/11/2019 296 296 295 +5.15% +5.06% 6/14/2028 $292 / sqft 74% 15 Hospitality New York 11/30/2018 291 291 247 +2.54% +2.54% 8/9/2025 $311,724 / key n/m Loans 16–144 14,157 13,054 12,948 CECL Reserve (741) $21,286 $19,875 $18,965 +3.30% +3.57% 2.3 yrs 64%Total / Wtd. Avg.

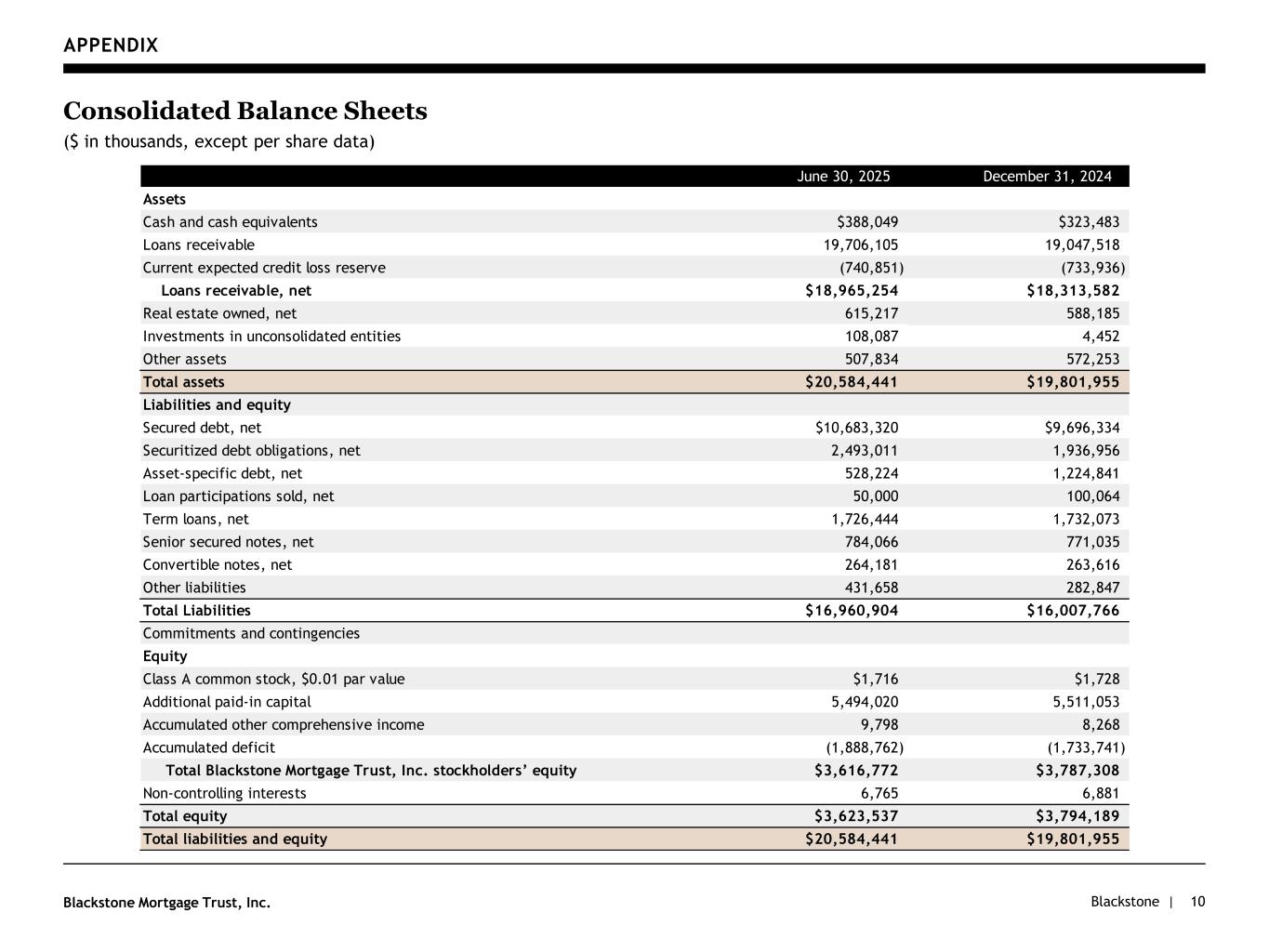

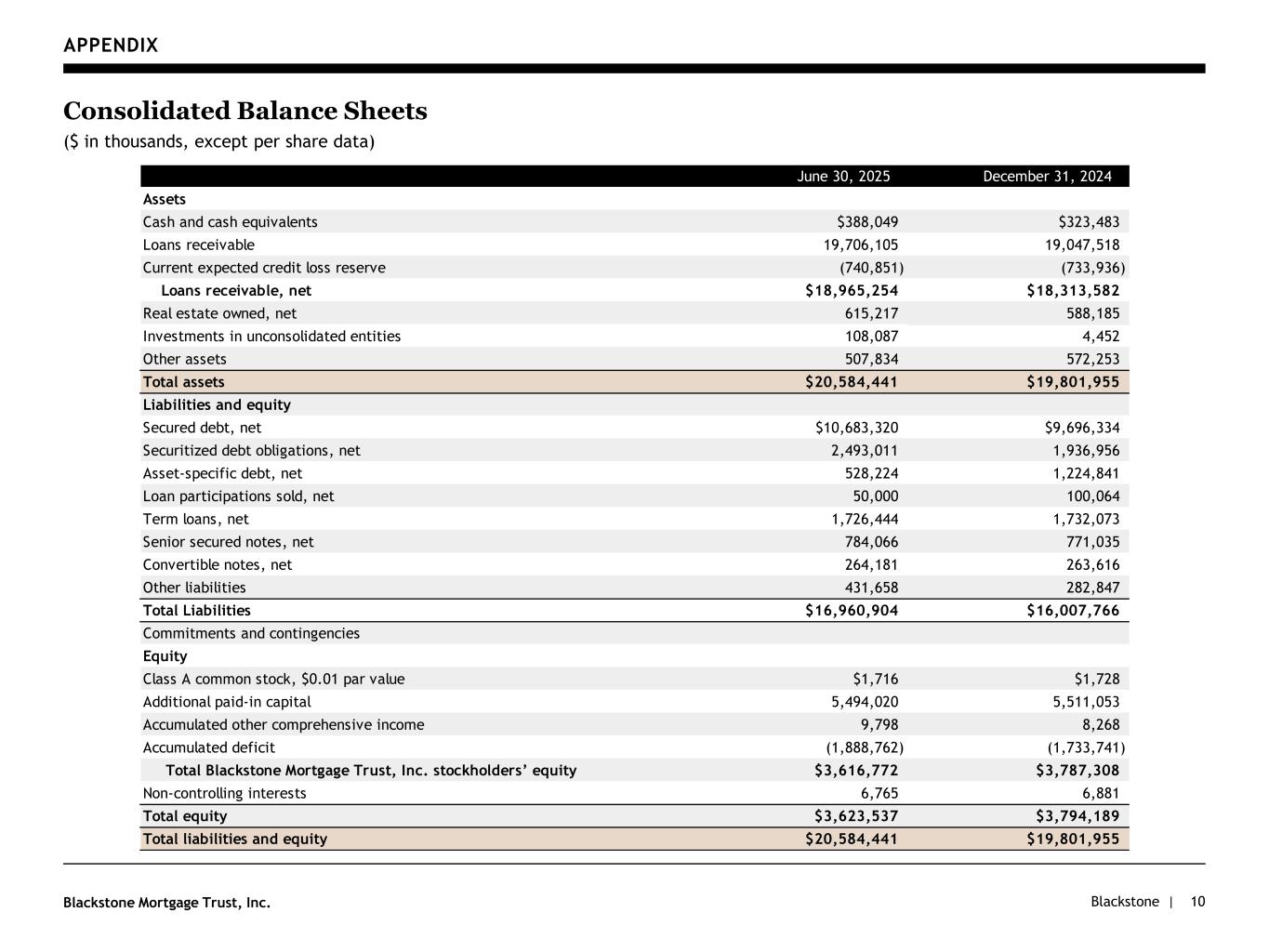

Blackstone |Blackstone Mortgage Trust, Inc. APPENDIX 10 Consolidated Balance Sheets ($ in thousands, except per share data) June 30, 2025 December 31, 2024 Assets Cash and cash equivalents $388,049 $323,483 Loans receivable 19,706,105 19,047,518 Current expected credit loss reserve (740,851) (733,936) Loans receivable, net $18,965,254 $18,313,582 Real estate owned, net 615,217 588,185 Investments in unconsolidated entities 108,087 4,452 Other assets 507,834 572,253 Total assets $20,584,441 $19,801,955 Liabilities and equity Secured debt, net $10,683,320 $9,696,334 Securitized debt obligations, net 2,493,011 1,936,956 Asset-specific debt, net 528,224 1,224,841 Loan participations sold, net 50,000 100,064 Term loans, net 1,726,444 1,732,073 Senior secured notes, net 784,066 771,035 Convertible notes, net 264,181 263,616 Other liabilities 431,658 282,847 Total Liabilities $16,960,904 $16,007,766 Commitments and contingencies Equity Class A common stock, $0.01 par value $1,716 $1,728 Additional paid-in capital 5,494,020 5,511,053 Accumulated other comprehensive income 9,798 8,268 Accumulated deficit (1,888,762) (1,733,741) Total Blackstone Mortgage Trust, Inc. stockholders’ equity $3,616,772 $3,787,308 Non-controlling interests 6,765 6,881 Total equity $3,623,537 $3,794,189 Total liabilities and equity $20,584,441 $19,801,955

Blackstone |Blackstone Mortgage Trust, Inc. APPENDIX 11 Consolidated Statements of Operations ($ in thousands, except per share data) nice 2025 2024 2025 2024 Income from loans and other investments Interest and related income $359,537 $466,152 $691,594 $952,275 Less: Interest and related expenses 264,727 339,380 506,960 683,110 Income from loans and other investments, net $94,810 $126,772 $184,634 $269,165 Revenue from real estate owned 38,812 — 75,845 — Gain on extinguishment of debt — — — 2,963 Other income 231 — 321 — Total net revenues $133,853 $126,772 $260,800 $272,128 Expenses Management and incentive fees $17,036 $18,726 $34,271 $37,653 General and administrative expenses 13,526 13,660 26,190 27,388 Expenses from real estate owned 47,796 963 94,098 963 Total expenses $78,358 $33,349 $154,559 $66,004 Increase in current expected credit loss reserve (45,593) (152,408) (95,098) (387,277) Loss from unconsolidated entities (2,015) — (2,889) — Income (loss) before income taxes $7,887 ($58,985) $8,254 ($181,153) Income tax provision 903 1,217 1,621 2,219 Net income (loss) $6,984 ($60,202) $6,633 ($183,372) Net income attributable to non-controlling interests (15) (855) (21) (1,523) Net income (loss) attributable to Blackstone Mortgage Trust, Inc. $6,969 ($61,057) $6,612 ($184,895) Per share information (basic and diluted) Net income (loss) per share of common stock, basic and diluted $0.04 ($0.35) $0.04 ($1.06) Weighted-average shares of common stock outstanding, basic and diluted 171,893,905 173,967,340 171,949,090 174,004,464 Three Months Ended June 30, Six Months Ended June 30,

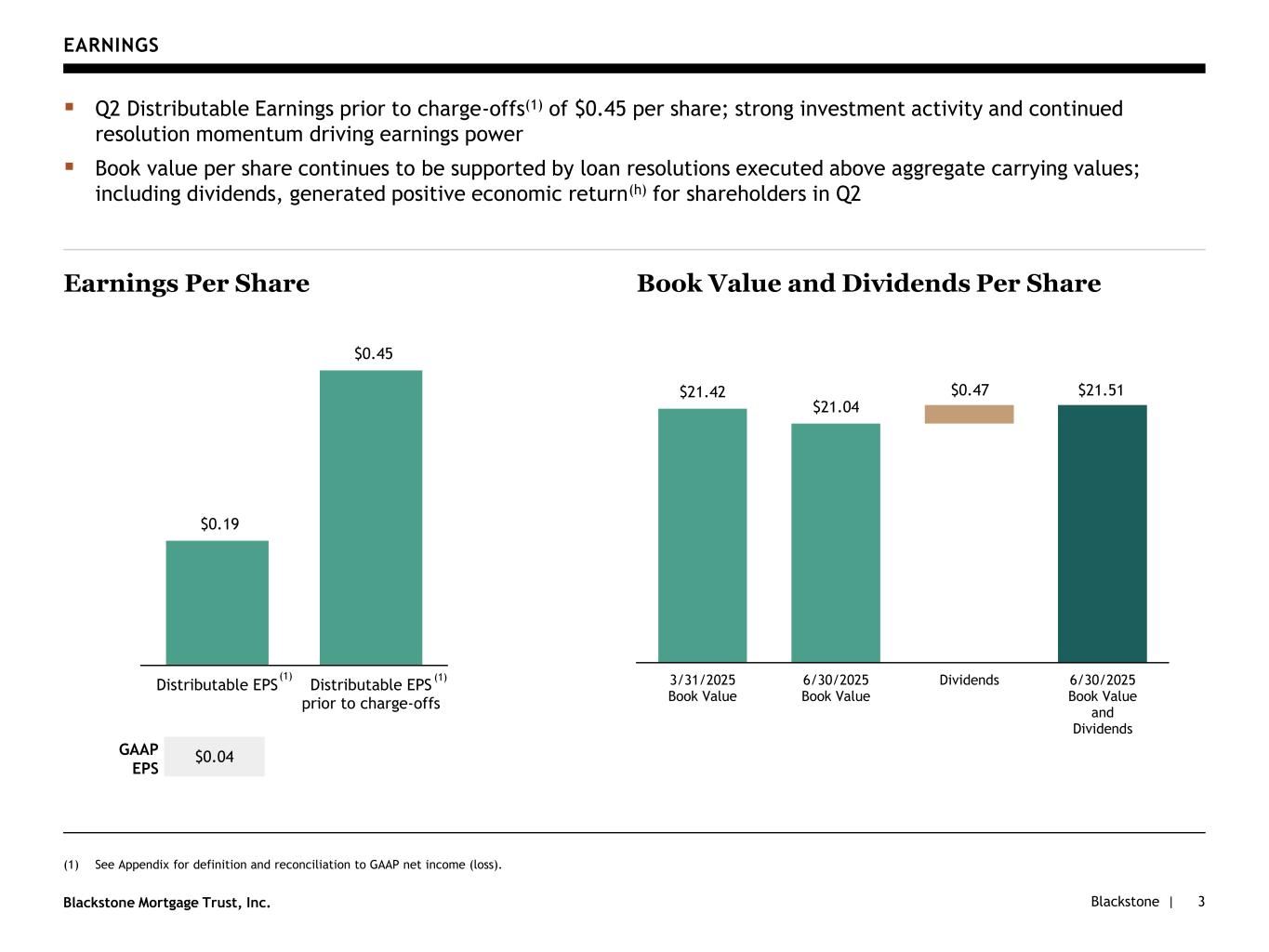

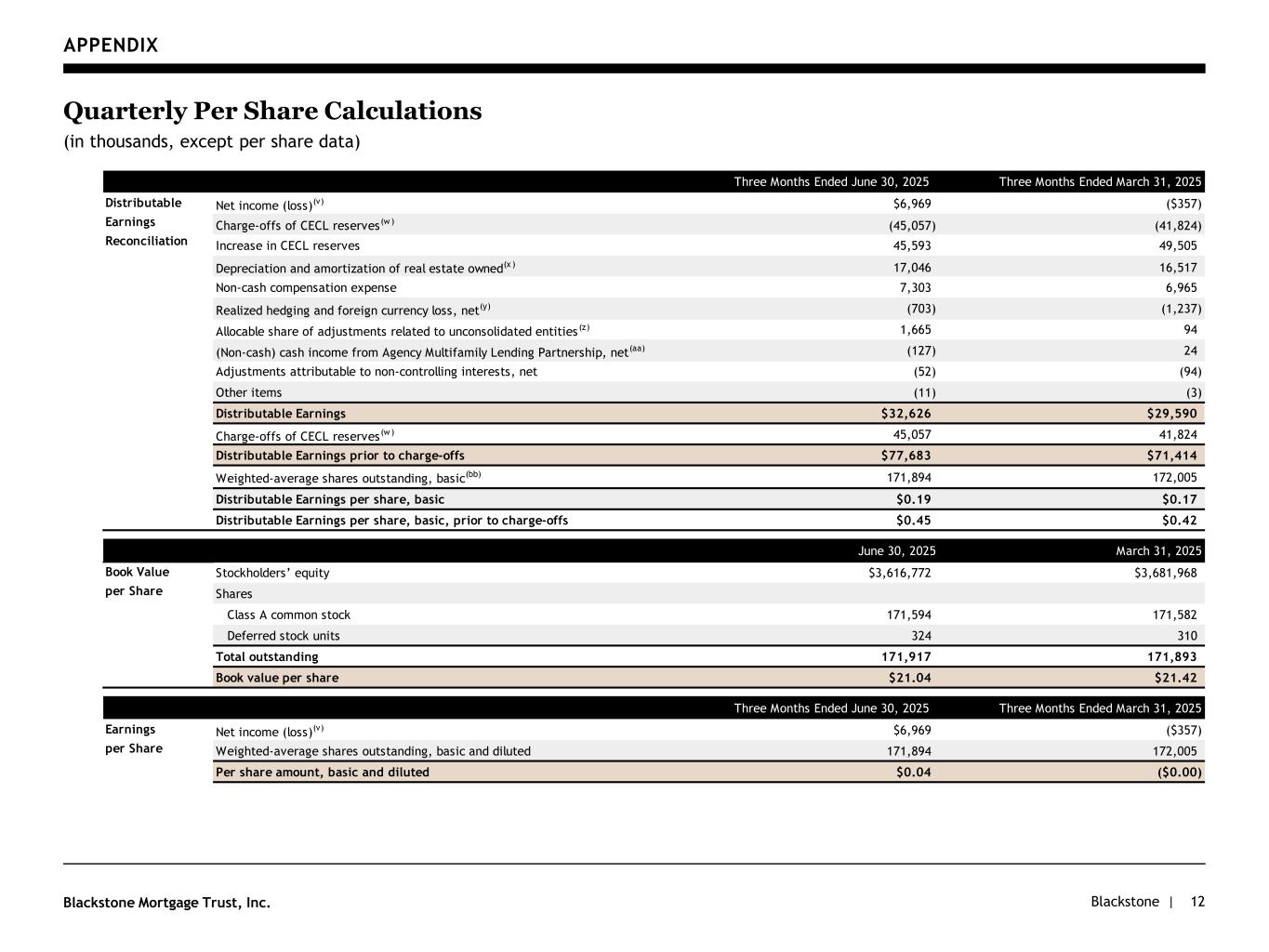

Blackstone |Blackstone Mortgage Trust, Inc. APPENDIX 12 Quarterly Per Share Calculations (in thousands, except per share data) Three Months Ended June 30, 2025 Three Months Ended March 31, 2025 Net income (loss)(v) $6,969 ($357) Charge-offs of CECL reserves (w ) (45,057) (41,824) Increase in CECL reserves 45,593 49,505 Depreciation and amortization of real estate owned(x ) 17,046 16,517 Non-cash compensation expense 7,303 6,965 Realized hedging and foreign currency loss, net(y) (703) (1,237) Allocable share of adjustments related to unconsolidated entities (z) 1,665 94 (Non-cash) cash income from Agency Multifamily Lending Partnership, net(aa) (127) 24 Adjustments attributable to non-controlling interests, net (52) (94) Other items (11) (3) Distributable Earnings $32,626 $29,590 Charge-offs of CECL reserves (w ) 45,057 41,824 Distributable Earnings prior to charge-offs $77,683 $71,414 Weighted-average shares outstanding, basic(bb) 171,894 172,005 Distributable Earnings per share, basic $0.19 $0.17 Distributable Earnings per share, basic, prior to charge-offs $0.45 $0.42 June 30, 2025 March 31, 2025 Stockholders’ equity $3,616,772 $3,681,968 Shares Class A common stock 171,594 171,582 Deferred stock units 324 310 Total outstanding 171,917 171,893 Book value per share $21.04 $21.42 Three Months Ended June 30, 2025 Three Months Ended March 31, 2025 Net income (loss)(v) $6,969 ($357) Weighted-average shares outstanding, basic and diluted 171,894 172,005 Per share amount, basic and diluted $0.04 ($0.00) Distributable Earnings Reconciliation Book Value per Share Earnings per Share

Blackstone |Blackstone Mortgage Trust, Inc. DEFINITIONS 13 Bank Loan Portfolio JV: A joint venture BXMT entered into with a Blackstone-advised investment vehicle in June 2025 to acquire a portfolio of performing commercial mortgage loans. BXMT’s equity interest in the joint venture is accounted for as an investment in an unconsolidated entity and is included in investments in unconsolidated entities on BXMT’s balance sheet. Distributable Earnings: Blackstone Mortgage Trust, Inc. (“BXMT”) discloses Distributable Earnings in this presentation. Distributable Earnings is a financial measure that is calculated and presented on the basis of methodologies other than in accordance with generally accepted accounting principles in the United States of America (“GAAP”). Distributable Earnings is a non-GAAP measure, which is defined as GAAP net income (loss), including realized gains and losses not otherwise recognized in current period GAAP net income (loss), and excluding (i) non-cash equity compensation expense, (ii) depreciation and amortization, (iii) unrealized gains (losses), and (iv) certain non-cash items. Distributable Earnings may also be adjusted from time to time to exclude one-time events pursuant to changes in GAAP and certain other non-cash charges as determined by BXMT’s manager, subject to approval by a majority of its independent directors. Distributable Earnings mirrors the terms of BXMT’s management agreement between BXMT’s Manager and BXMT, for purposes of calculating its incentive fee expense. BXMT’s CECL reserves have been excluded from Distributable Earnings consistent with other unrealized gains (losses) pursuant to its existing policy for reporting Distributable Earnings. BXMT expects to only recognize such potential credit losses in Distributable Earnings if and when such amounts are realized and deemed non-recoverable upon a realization event. This is generally at the time a loan is repaid, or in the case of foreclosure, when the underlying asset is sold, but realization and non-recoverability may also be concluded if, in BXMT’s determination, it is nearly certain that all amounts due will not be collected. The timing of any such credit loss realization in BXMT’s Distributable Earnings may differ materially from the timing of CECL reserves or charge-offs in BXMT’s consolidated financial statements prepared in accordance with GAAP. The realized loss amount reflected in Distributable Earnings will equal the difference between the cash received, or expected to be received, and the book value of the asset, and is reflective of its economic experience as it relates to the ultimate realization of the loan. BXMT believes that Distributable Earnings provides meaningful information to consider in addition to net income (loss) and cash flow from operating activities determined in accordance with GAAP. BXMT believes Distributable Earnings is a useful financial metric for existing and potential future holders of its class A common stock as historically, over time, Distributable Earnings has been a strong indicator of its dividends per share. As a REIT, BXMT generally must distribute annually at least 90% of its net taxable income, subject to certain adjustments, and therefore BXMT believes its dividends are one of the principal reasons stockholders may invest in BXMT’s class A common stock. Distributable Earnings helps BXMT to evaluate its performance excluding the effects of certain transactions and GAAP adjustments that BXMT believes are not necessarily indicative of BXMT’s current loan portfolio and operations and is a performance metric BXMT considers when declaring its dividends. Furthermore, BXMT believes it is useful to present Distributable Earnings prior to charge-offs of CECL reserves to reflect BXMT’s direct operating results and help existing and potential future holders of BXMT’s class A common stock assess the performance of BXMT’s business excluding such charge-offs. BXMT utilizes Distributable Earnings prior to charge-offs of CECL reserves as an additional performance metric to consider when declaring BXMT’s dividends. Distributable Earnings mirrors the terms of BXMT’s Management Agreement for purposes of calculating BXMT’s incentive fee expense. Therefore, Distributable Earnings prior to charge-offs of CECL reserves is calculated net of the incentive fee expense that would have been recognized if such charge-offs had not occurred. Distributable Earnings and Distributable Earnings prior to charge-offs of CECL reserves are non-GAAP measures. BXMT defines Distributable Earnings as GAAP net income (loss), including realized gains and losses not otherwise recognized in current period GAAP net income (loss), and excluding (i) non-cash equity compensation expense, (ii) depreciation and amortization, (iii) unrealized gains (losses), and (iv) certain non-cash items. Distributable Earnings may also be adjusted from time to time to exclude one-time events pursuant to changes in GAAP and certain other non-cash charges as determined by BXMT’s Manager, subject to approval by a majority of BXMT’s independent directors. Distributable Earnings mirrors the terms of BXMT’s management agreement between its Manager and BXMT, or BXMT’s Management Agreement, for purposes of calculating BXMT’s incentive fee expense. Therefore, Distributable Earnings prior to charge-offs of CECL reserves is calculated net of the incentive fee expense that would have been recognized if such charge-offs had not occurred. Net Loan Exposure: Represents the principal balance of loans that are included in BXMT’s consolidated financial statements, net of (i) asset-specific debt, (ii) participations sold, (iii) cost-recovery proceeds, and (iv) CECL reserves on its loans receivable. Does not include REO assets or investments in unconsolidated entities.

Blackstone |Blackstone Mortgage Trust, Inc. ENDNOTES 14 a. Includes $0.4B in Outstanding Principal Balance reflecting BXMT’s 29% share in the Bank Loan Portfolio JV. Refer to Definitions. b. For illustrative purposes only. Actual results for each investment could differ materially from the results presented. Based on completed or expected asset-level financing, as applicable. Represents BXMT’s expectations of implied levered spreads over applicable base rate, based on all-in loan yield and all-in cost of maximum asset-level borrowings; excludes corporate-level debt as well as management fees and expenses. c. Does not include $0.4B in Outstanding Principal Balance reflecting BXMT’s 29% share in the Bank Loan Portfolio JV. Refer to Definitions. d. Based on Net Loan Exposure as of March 31, 2025. e. Dividend yield based on share price of $19.36 as of July 29, 2025. f. Based on Net Loan Exposure. Refer to Definitions. g. Reflects weighted average loan-to-value (“LTV”) as of the date investments were originated prior to acquisition by BXMT. h. Reflects the change in book value per share plus the aggregate dividends declared per share over the relevant period. i. States and countries comprising less than 1% of total loan portfolio are excluded. j. Assets with multiple components are proportioned into the relevant collateral types and geographies based on their relative value. k. Excludes one U.S. dollar-denominated loan (0.3% of portfolio) that is located in Bermuda and allocated to “Other International”. l. Excludes a $34M upsize on an existing loan. m. Reflects weighted average loan-to-value (“LTV”) as of the date investments were originated or acquired by BXMT, excluding any loans that are impaired and any junior participations sold. n. Represents debt-to-equity ratio, which is the ratio of (i) total outstanding secured debt, asset-specific debt, term loans, senior secured notes, and convertible notes, in each case excluding unamortized deferred financing costs and discounts, less cash, to (ii) total equity. o. Represents borrowings under BXMT’s secured credit facilities for all new originations during the applicable period. p. Excludes 1.0% per annum of scheduled amortization payments under the Term Loan B. q. Date loan was originated or acquired by BXMT. Origination dates are subsequently updated to reflect material loan modifications. r. Total commitment reflects outstanding principal balance as well as any related unfunded loan commitment. s. Net book value represents outstanding principal balance, net of purchase and sale discounts or premiums, exit fees, deferred origination expenses, and cost-recovery proceeds. t. The weighted-average cash coupon and all-in yield are expressed as a spread over the relevant floating benchmark rates. Excludes loans accounted for under the cost-recovery and nonaccrual methods, if any. u. Maximum maturity assumes all extension options are exercised; however, BXMT’s loans may be repaid prior to such date. Excludes loans accounted for under the cost-recovery and nonaccrual methods, if any. v. Represents net income (loss) attributable to Blackstone Mortgage Trust, Inc. w. Represents realized losses related to loan principal amounts deemed non-recoverable during the applicable period. x. Represents depreciation of REO assets and amortization of intangible real estate assets and liabilities. y. Represents realized loss on the repatriation of unhedged foreign currency. These amounts were not included in GAAP net income (loss), but rather as a component of other comprehensive income in BXMT’s consolidated financial statements. z. Allocable share of adjustments related to unconsolidated entities reflects BXMT’s share of (i) non-cash items such as depreciation and amortization, (ii) unrealized gains and losses recorded by such unconsolidated entities, if any, and (iii) related adjustments for realized gains, if any. aa. Represents (i) the non-cash income recognized under GAAP related to BXMT’s Agency Multifamily Lending Partnership, in which BXMT receives a portion of origination, servicing, and other fees for loans BXMT refers to M&T Realty Capital Corporation for origination, offset by the related loss-sharing obligation accruals and (ii) the cash received related to such income previously recognized under GAAP. bb. The weighted-average shares outstanding, basic, exclude shares issuable from a potential conversion of BXMT’s convertible notes. Consistent with the treatment of other unrealized adjustments to Distributable Earnings, these potentially issuable shares are excluded until a conversion occurs.

Blackstone |Blackstone Mortgage Trust, Inc. FORWARD-LOOKING STATEMENTS & IMPORTANT DISCLOSURE INFORMATION 15 References herein to “Blackstone Mortgage Trust,” “Company,” “we,” “us,” or “our” refer to Blackstone Mortgage Trust, Inc. and its subsidiaries unless the context specifically requires otherwise. Opinions expressed reflect the current opinions of BXMT as of the date appearing in this document only and are based on the BXMT's opinions of the current market environment, which is subject to change. There can be no assurances that any of the trends described herein will continue or will not reverse. Past events and trends do not imply, predict or guarantee, and are not necessarily indicative of, future events or results. This presentation may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect BXMT’s current views with respect to, among other things, its operations and financial performance, its business plans and the impact of the current macroeconomic environment, including interest rate changes. You can identify these forward-looking statements by the use of words such as “outlook,” “objective,” “indicator,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. BXMT believes these factors include but are not limited to those described under the section entitled “Risk Factors” in its Annual Report on Form 10-K for the fiscal year ended December 31, 2024, as such factors may be updated from time to time in its periodic filings with the Securities and Exchange Commission (“SEC”) which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation and in the filings. BXMT assumes no obligation to update or supplement forward‐looking statements that become untrue because of subsequent events or circumstances.