| Delaware | 001-16441 | 76-0470458 | |||||||||||||||||||||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) | |||||||||||||||||||||

| (Former name or former address, if changed since last report.) | ||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |||||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |||||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |||||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock, $0.01 par value | CCI | New York Stock Exchange | ||||||

| Exhibit No. | Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document | |||||||

| CROWN CASTLE INC. | ||||||||||||||

| By: | /s/ Sunit S. Patel | |||||||||||||

| Name: | Sunit S. Patel | |||||||||||||

| Title: | Executive Vice President and Chief Financial Officer |

|||||||||||||

|

NEWS RELEASE

July 23, 2025

|

|||||||

Contacts: Sunit Patel, CFO |

|||||

| Kris Hinson, VP Corp Finance & Treasurer | |||||

FOR IMMEDIATE RELEASE |

Crown Castle Inc. | ||||

713-570-3050 |

|||||

| (dollars in millions, except per share amounts) | Current Full Year 2025 Outlook Midpoint(a) |

Full Year 2024 Actual | % Change |

Previous Full Year 2025 Outlook(b) |

Current Compared to Previous Outlook | ||||||||||||

Site rental revenues(c) |

$4,020 | $4,268 | (6)% | $4,010 | $10 | ||||||||||||

| Net income (loss) | $240 | $(3,903) | N/A | $205 | $35 | ||||||||||||

| Net income (loss) per share—diluted | $0.55 | $(8.98) | N/A | $0.47 | $0.08 | ||||||||||||

Adjusted EBITDA(c)(d) |

$2,805 | $3,035 | (8)% | $2,780 | $25 | ||||||||||||

AFFO(c)(d) |

$1,830 | $1,980 | (8)% | $1,795 | $35 | ||||||||||||

AFFO per share(c)(d) |

$4.20 | $4.55 | (8)% | $4.12 | $0.08 | ||||||||||||

| News Release continued: | Page 2 |

|||||||

| (dollars in millions, except per share amounts) | Q2 2025 | Q2 2024 | Change | % Change | |||||||||||||

Site rental revenues(a) |

$1,008 | $1,064 | $(56) | (5)% | |||||||||||||

| Net income (loss) | $291 | $251 | $40 | 16% | |||||||||||||

| Net income (loss) per share—diluted | $0.67 | $0.58 | $0.09 | 16% | |||||||||||||

Adjusted EBITDA(a)(b) |

$705 | $727 | $(22) | (3)% | |||||||||||||

AFFO(a)(b) |

$444 | $449 | $(5) | (1)% | |||||||||||||

AFFO per share(a)(b) |

$1.02 | $1.03 | $(0.01) | (1)% | |||||||||||||

($ in millions) |

Current Full Year 2025 Outlook Midpoint(a) |

Q2 2025 |

Q2 2024 |

||||||||||||||||||||||||||

Core leasing activity(b) |

$115 | 2.9% | $28 |

2.9% |

$28 |

3.0% |

|||||||||||||||||||||||

Escalator |

$95 |

2.4% |

$24 |

2.5% |

$23 |

2.4% | |||||||||||||||||||||||

Non-renewals(b) |

($30) |

(0.8%) |

($7) |

(0.7%) |

($7) |

(0.8%) |

|||||||||||||||||||||||

Change in other billings(b) |

$5 | 0.1% | $0 | 0.0% | $2 | 0.2% | |||||||||||||||||||||||

Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations(b) |

$185 | 4.7% | $45 | 4.7% | $45 | 4.8% | |||||||||||||||||||||||

| News Release continued: | Page 3 |

|||||||

| News Release continued: | Page 4 |

|||||||

| (in millions, except per share amounts) | Full Year 2025(a) |

Changes to Midpoint from Previous Outlook(b) |

|||||||||||||||

Site rental billings(c) |

$3,895 | to | $3,925 | $10 | |||||||||||||

| Amortization of prepaid rent | $80 | to | $110 | $0 | |||||||||||||

| Straight-lined revenues | ($15) | to | $15 | $0 | |||||||||||||

Other revenues |

$15 | to | $15 | $0 | |||||||||||||

| Site rental revenues | $3,997 | to | $4,042 | $10 | |||||||||||||

Site rental costs of operations(d) |

$972 | to | $1,017 | ($15) | |||||||||||||

| Services and other gross margin | $75 | to | $105 | $5 | |||||||||||||

Net income (loss)(e) |

$100 | to | $380 | $35 | |||||||||||||

Net income (loss) per share—diluted(e) |

$0.23 | to | $0.87 | $0.08 | |||||||||||||

Adjusted EBITDA(c) |

$2,780 | to | $2,830 | $25 | |||||||||||||

| Depreciation, amortization and accretion | $678 | to | $773 | $0 | |||||||||||||

Interest expense and amortization of deferred financing costs, net(f) |

$972 | to | $1,017 | ($10) | |||||||||||||

Income (loss) from discontinued operations, net of tax(g) |

($830) | to | ($590) | $0 | |||||||||||||

FFO(c) |

$1,645 | to | $1,675 | $35 | |||||||||||||

AFFO(c) |

$1,805 | to | $1,855 | $35 | |||||||||||||

AFFO per share(c) |

$4.14 | to | $4.25 | $0.08 | |||||||||||||

Discretionary capital expenditures(c) |

$185 | to | $185 | $0 | |||||||||||||

Discretionary capital expenditures from discontinued operations(c)(h) |

$920 | to | $1,020 | $0 | |||||||||||||

| News Release continued: | Page 5 |

|||||||

| News Release continued: | Page 6 |

|||||||

| News Release continued: | Page 7 |

|||||||

| News Release continued: | Page 8 |

|||||||

| News Release continued: | Page 9 |

|||||||

For the Three Months Ended |

For the Six Months Ended |

For the Twelve Months Ended |

|||||||||||||||||||||||||||

(in millions; totals may not sum due to rounding) |

June 30, 2025 | June 30, 2024 | June 30, 2025 | June 30, 2024 | December 31, 2024 | ||||||||||||||||||||||||

Net income (loss)(a) |

$ | 291 | $ | 251 | $ | (173) | $ | 562 | $ | (3,903) | |||||||||||||||||||

| Adjustments to increase (decrease) net income (loss): | |||||||||||||||||||||||||||||

| Asset write-down charges | 2 | 3 | 4 | 8 | 11 | ||||||||||||||||||||||||

| Depreciation, amortization and accretion | 175 | 180 | 352 | 371 | 736 | ||||||||||||||||||||||||

Restructuring charges(b) |

— | 19 | — | 30 | 70 | ||||||||||||||||||||||||

| Amortization of prepaid lease purchase price adjustments | 4 | 4 | 8 | 8 | 16 | ||||||||||||||||||||||||

Interest expense and amortization of deferred financing costs, net(c) |

243 | 230 | 479 | 455 | 932 | ||||||||||||||||||||||||

| Interest income | (4) | (4) | (7) | (8) | (20) | ||||||||||||||||||||||||

| Other (income) expense | (2) | (1) | (3) | (3) | 26 | ||||||||||||||||||||||||

| (Benefit) provision for income taxes | 4 | 5 | 9 | 11 | 18 | ||||||||||||||||||||||||

| Stock-based compensation expense, net | 18 | 26 | 36 | 50 | 84 | ||||||||||||||||||||||||

(Income) loss from discontinued operations, net of tax(d) |

(26) | 14 | 722 | (3) | 5,065 | ||||||||||||||||||||||||

Adjusted EBITDA(e)(f) |

$ | 705 | $ | 727 | $ | 1,428 | $ | 1,481 | $ | 3,035 | |||||||||||||||||||

| Full Year 2025 | |||||||||||

(in millions; totals may not sum due to rounding) |

Outlook(h) |

||||||||||

Net income (loss)(a) |

$100 | to | $380 | ||||||||

| Adjustments to increase (decrease) net income (loss): | |||||||||||

Asset write-down charges |

$5 | to | $15 | ||||||||

| Acquisition and integration costs | $0 | to | $6 | ||||||||

| Depreciation, amortization and accretion | $678 | to | $773 | ||||||||

| Amortization of prepaid lease purchase price adjustments | $14 | to | $16 | ||||||||

Interest expense and amortization of deferred financing costs, net(g) |

$972 | to | $1,017 | ||||||||

| (Gains) losses on retirement of long-term obligations | — | to | — | ||||||||

| Interest income | $(15) | to | $(15) | ||||||||

| Other (income) expense | $6 | to | $15 | ||||||||

| (Benefit) provision for income taxes | $11 | to | $19 | ||||||||

| Stock-based compensation expense, net | $78 | to | $82 | ||||||||

(Income) loss from discontinued operations, net of tax(i) |

$590 | to |

$830 | ||||||||

Adjusted EBITDA(e)(f) |

$2,780 | to | $2,830 | ||||||||

| News Release continued: | Page 10 |

|||||||

For the Three Months Ended |

For the Six Months Ended |

For the Twelve Months Ended | |||||||||||||||||||||||||||

(in millions; totals may not sum due to rounding) |

June 30, 2025 | June 30, 2024 | June 30, 2025 | June 30, 2024 | December 31, 2024 | ||||||||||||||||||||||||

Net income (loss)(a) |

$ | 291 | $ | 251 | $ | (173) | $ | 562 | $ | (3,903) | |||||||||||||||||||

| Real estate related depreciation, amortization and accretion | 162 | 168 | 326 | 347 | 690 | ||||||||||||||||||||||||

| Asset write-down charges | 2 | 3 | 4 | 8 | 11 | ||||||||||||||||||||||||

(Income) loss from discontinued operations, net of tax(b) |

(26) | 14 | 722 | (3) | 5,065 | ||||||||||||||||||||||||

FFO(c)(d) |

$ | 429 | $ | 436 | $ | 879 | $ | 914 | $ | 1,863 | |||||||||||||||||||

| Weighted-average common shares outstanding—diluted | 437 | 435 | 436 | 435 | 434 | ||||||||||||||||||||||||

| FFO (from above) | $ | 429 | $ | 436 | $ | 879 | $ | 914 | $ | 1,863 | |||||||||||||||||||

| Adjustments to increase (decrease) FFO: | |||||||||||||||||||||||||||||

| Straight-lined revenues | (20) | (54) | (39) | (112) | (160) | ||||||||||||||||||||||||

| Straight-lined expenses | 14 | 17 | 29 | 33 | 65 | ||||||||||||||||||||||||

| Stock-based compensation expense, net | 18 | 26 | 36 | 50 | 84 | ||||||||||||||||||||||||

| Non-cash portion of tax provision | (5) | — | — | 5 | 8 | ||||||||||||||||||||||||

| Non-real estate related depreciation, amortization and accretion | 13 | 12 | 26 | 24 | 46 | ||||||||||||||||||||||||

| Amortization of non-cash interest expense | 4 | 3 | 8 | 6 | 12 | ||||||||||||||||||||||||

| Other (income) expense | (2) | (1) | (3) | (3) | 26 | ||||||||||||||||||||||||

Restructuring charges(e) |

— | 19 | — | 30 | 70 | ||||||||||||||||||||||||

| Sustaining capital expenditures | (7) | (9) | (13) | (16) | (34) | ||||||||||||||||||||||||

AFFO(c)(d) |

$ | 444 | $ | 449 | $ | 923 | $ | 932 | $ | 1,980 | |||||||||||||||||||

| Weighted-average common shares outstanding—diluted | 437 | 435 | 436 | 435 | 434 | ||||||||||||||||||||||||

| News Release continued: | Page 11 |

|||||||

For the Three Months Ended |

For the Six Months Ended |

For the Twelve Months Ended | ||||||||||||||||||||||||

(in millions, except per share amounts; totals may not sum due to rounding) |

June 30, 2025 | June 30, 2024 | June 30, 2025 | June 30, 2024 | December 31, 2024 | |||||||||||||||||||||

Net income (loss)(a) |

$ | 0.67 | $ | 0.58 | $ | (0.40) | $ | 1.29 | $ | (8.98) | ||||||||||||||||

| Real estate related depreciation, amortization and accretion | 0.37 | 0.39 | 0.75 | 0.80 | 1.59 | |||||||||||||||||||||

| Asset write-down charges | — | 0.01 | 0.01 | 0.02 | 0.03 | |||||||||||||||||||||

(Income) loss from discontinued operations, net of tax(b) |

(0.06) | 0.04 | 1.65 | (0.01) | 11.64 | |||||||||||||||||||||

FFO(c)(d) |

$ | 0.98 | $ | 1.00 | $ | 2.01 | $ | 2.10 | $ | 4.28 | ||||||||||||||||

| Weighted-average common shares outstanding—diluted | 437 | 435 | 436 | 435 | 434 | |||||||||||||||||||||

| FFO (from above) | $ | 0.98 | $ | 1.00 | $ | 2.01 | $ | 2.10 | $ | 4.28 | ||||||||||||||||

| Adjustments to increase (decrease) FFO: | ||||||||||||||||||||||||||

| Straight-lined revenues | (0.05) | (0.12) | (0.09) | (0.26) | (0.37) | |||||||||||||||||||||

| Straight-lined expenses | 0.03 | 0.04 | 0.07 | 0.08 | 0.15 | |||||||||||||||||||||

| Stock-based compensation expense, net | 0.04 | 0.06 | 0.08 | 0.11 | 0.20 | |||||||||||||||||||||

| Non-cash portion of tax provision | (0.01) | — | — | 0.01 | 0.02 | |||||||||||||||||||||

| Non-real estate related depreciation, amortization and accretion | 0.03 | 0.03 | 0.06 | 0.06 | 0.11 | |||||||||||||||||||||

| Amortization of non-cash interest expense | 0.01 | 0.01 | 0.02 | 0.01 | 0.03 | |||||||||||||||||||||

| Other (income) expense | — | — | (0.01) | (0.01) | 0.06 | |||||||||||||||||||||

Restructuring charges(e) |

— | 0.04 | — | 0.07 | 0.16 | |||||||||||||||||||||

| Sustaining capital expenditures | (0.02) | (0.02) | (0.03) | (0.04) | (0.08) | |||||||||||||||||||||

AFFO(c)(d) |

$ | 1.02 | $ | 1.03 | $ | 2.11 | $ | 2.14 | $ | 4.55 | ||||||||||||||||

| Weighted-average common shares outstanding—diluted | 437 | 435 | 436 | 435 | 434 | |||||||||||||||||||||

| News Release continued: | Page 12 |

|||||||

| Full Year 2025 | Full Year 2025 | ||||||||||||||||||||||

(in millions, except per share amounts; totals may not sum due to rounding) |

Outlook(a) |

Outlook per Share(a) |

|||||||||||||||||||||

Net income (loss)(b) |

$100 | to | $380 | $0.23 | to | $0.87 | |||||||||||||||||

| Real estate related depreciation, amortization and accretion | $660 | to | $740 | $1.51 | to | $1.70 | |||||||||||||||||

Asset write-down charges |

$5 | to | $15 | $0.01 | to | $0.03 | |||||||||||||||||

(Income) loss from discontinued operations, net of tax(c) |

$590 | to |

$830 | $1.35 | to |

$1.90 | |||||||||||||||||

FFO(d)(e) |

$1,645 | to | $1,675 | $3.77 | to | $3.84 | |||||||||||||||||

| Weighted-average common shares outstanding—diluted | 436 | 436 | |||||||||||||||||||||

| FFO (from above) | $1,645 | to | $1,675 | $3.77 | to | $3.84 | |||||||||||||||||

| Adjustments to increase (decrease) FFO: | |||||||||||||||||||||||

| Straight-lined revenues | $(15) | to | $15 | $(0.03) | to | $0.03 | |||||||||||||||||

| Straight-lined expenses | $55 | to | $75 | $0.13 | to | $0.17 | |||||||||||||||||

| Stock-based compensation expense, net | $78 | to | $82 | $0.18 | to | $0.19 | |||||||||||||||||

| Non-cash portion of tax provision | $(8) | to | $8 | $(0.02) | to | $0.02 | |||||||||||||||||

| Non-real estate related depreciation, amortization and accretion | $20 | to | $35 | $0.04 | to | $0.08 | |||||||||||||||||

| Amortization of non-cash interest expense | $7 | to | $17 | $0.02 | to | $0.04 | |||||||||||||||||

| Other (income) expense | $6 | to | $15 | $0.01 | to | $0.03 | |||||||||||||||||

| (Gains) losses on retirement of long-term obligations | — | to | — | — | to | — | |||||||||||||||||

| Acquisition and integration costs | $0 | to | $6 | $0.00 | to | $0.01 | |||||||||||||||||

| Sustaining capital expenditures | $(55) | to | $(35) | $(0.13) | to | $(0.08) | |||||||||||||||||

AFFO(d)(e) |

$1,805 | to | $1,855 | $4.14 | to | $4.25 | |||||||||||||||||

| Weighted-average common shares outstanding—diluted | 436 | 436 | |||||||||||||||||||||

| News Release continued: | Page 13 |

|||||||

| Previously Issued | |||||||||||

(in millions; totals may not sum due to rounding) |

Full Year 2025 Outlook(a) |

||||||||||

Net income (loss)(b) |

$65 | to | $345 | ||||||||

Adjustments to increase (decrease) net income (loss): |

|||||||||||

| Asset write-down charges | $5 | to | $15 | ||||||||

| Acquisition and integration costs | $0 | to | $6 | ||||||||

| Depreciation, amortization and accretion | $678 | to | $773 | ||||||||

| Amortization of prepaid lease purchase price adjustments | $14 | to | $16 | ||||||||

Interest expense and amortization of deferred financing costs, net(c) |

$982 | to | $1,027 | ||||||||

| (Gains) losses on retirement of long-term obligations | — | to | — | ||||||||

| Interest income | $(15) | to | $(15) | ||||||||

| Other (income) expense | $6 | to | $15 | ||||||||

| (Benefit) provision for income taxes | $11 | to | $19 | ||||||||

| Stock-based compensation expense, net | $93 | to | $97 | ||||||||

(Income) loss from discontinued operations, net of tax(d) |

$590 | to | $830 | ||||||||

Adjusted EBITDA(e)(f) |

$2,755 | to | $2,805 | ||||||||

| Previously Issued | Previously Issued | ||||||||||||||||||||||

(in millions, except per share amounts; totals may not sum due to rounding) |

Full Year 2025

Outlook(a)

|

Full Year 2025 Outlook

per share(a)

|

|||||||||||||||||||||

Net income (loss)(b) |

$65 | to | $345 | $0.15 | to | $0.79 | |||||||||||||||||

| Real estate related depreciation, amortization and accretion | $660 | to | $740 | $1.51 | to | $1.70 | |||||||||||||||||

| Asset write-down charges | $5 | to | $15 | $0.01 | to | $0.03 | |||||||||||||||||

(Income) loss from discontinued operations, net of tax(d) |

$590 | to | $830 | $1.35 | to | $1.90 | |||||||||||||||||

FFO(e)(f) |

$1,610 | to | $1,640 | $3.69 | to | $3.76 | |||||||||||||||||

| Weighted-average common shares outstanding—diluted | 436 | 436 | |||||||||||||||||||||

| FFO (from above) | $1,610 | to | $1,640 | $3.69 | to | $3.76 | |||||||||||||||||

| Adjustments to increase (decrease) FFO: | |||||||||||||||||||||||

| Straight-lined revenues | $(15) | to | $15 | $(0.03) | to | $0.03 | |||||||||||||||||

| Straight-lined expenses | $55 | to | $75 | $0.13 | to | $0.17 | |||||||||||||||||

| Stock-based compensation expense, net | $93 | to | $97 | $0.21 | to | $0.22 | |||||||||||||||||

| Non-cash portion of tax provision | $(8) | to | $8 | $(0.02) | to | $0.02 | |||||||||||||||||

| Non-real estate related depreciation, amortization and accretion | $20 | to | $35 | $0.05 | to | $0.08 | |||||||||||||||||

| Amortization of non-cash interest expense | $7 | to | $17 | $0.02 | to | $0.04 | |||||||||||||||||

| Other (income) expense | $6 | to | $15 | $0.01 | to | $0.03 | |||||||||||||||||

| (Gains) losses on retirement of long-term obligations | — | to | — | — | to | — | |||||||||||||||||

| Acquisition and integration costs | $0 | to | $6 | $0.00 | to | $0.01 | |||||||||||||||||

| Sustaining capital expenditures | $(55) | to | $(35) | $(0.13) | to | $(0.08) | |||||||||||||||||

AFFO(e)(f) |

$1,770 | to | $1,820 | $4.06 | to | $4.17 | |||||||||||||||||

| Weighted-average common shares outstanding—diluted | 436 | 436 | |||||||||||||||||||||

| News Release continued: | Page 14 |

|||||||

| Three Months Ended June 30, | |||||||||||

(dollars in millions; totals may not sum due to rounding) |

2025 | 2024 | |||||||||

| Components of changes in site rental revenues: | |||||||||||

Prior year site rental billings(b) |

$ | 966 | $ | 922 | |||||||

Core leasing activity(b) |

28 | 28 | |||||||||

| Escalators | 24 | 23 | |||||||||

Non-renewals(b) |

(7) | (7) | |||||||||

Other billings(b) |

— | 2 | |||||||||

Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations(b) |

45 | 45 | |||||||||

Non-renewals associated with Sprint Cancellations(b) |

(51) | — | |||||||||

Organic Contribution to Site Rental Billings(b) |

(6) | 45 | |||||||||

| Straight-lined revenues | 20 | 54 | |||||||||

| Amortization of prepaid rent | 23 | 39 | |||||||||

Other revenues |

4 | 4 | |||||||||

| Total site rental revenues | $ | 1,008 | $ | 1,064 | |||||||

| Year-over-year changes in revenues: | |||||||||||

| Site rental revenues as a percentage of prior year site rental revenues | (5.3) | % | (1.5) | % | |||||||

Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations as a percentage of prior year site rental billings(b) |

4.7 | % | 4.8 | % | |||||||

Organic Contribution to Site Rental Billings as a percentage of prior year site rental billings(b) |

(0.6) | % | 4.8 | % | |||||||

| News Release continued: | Page 15 |

|||||||

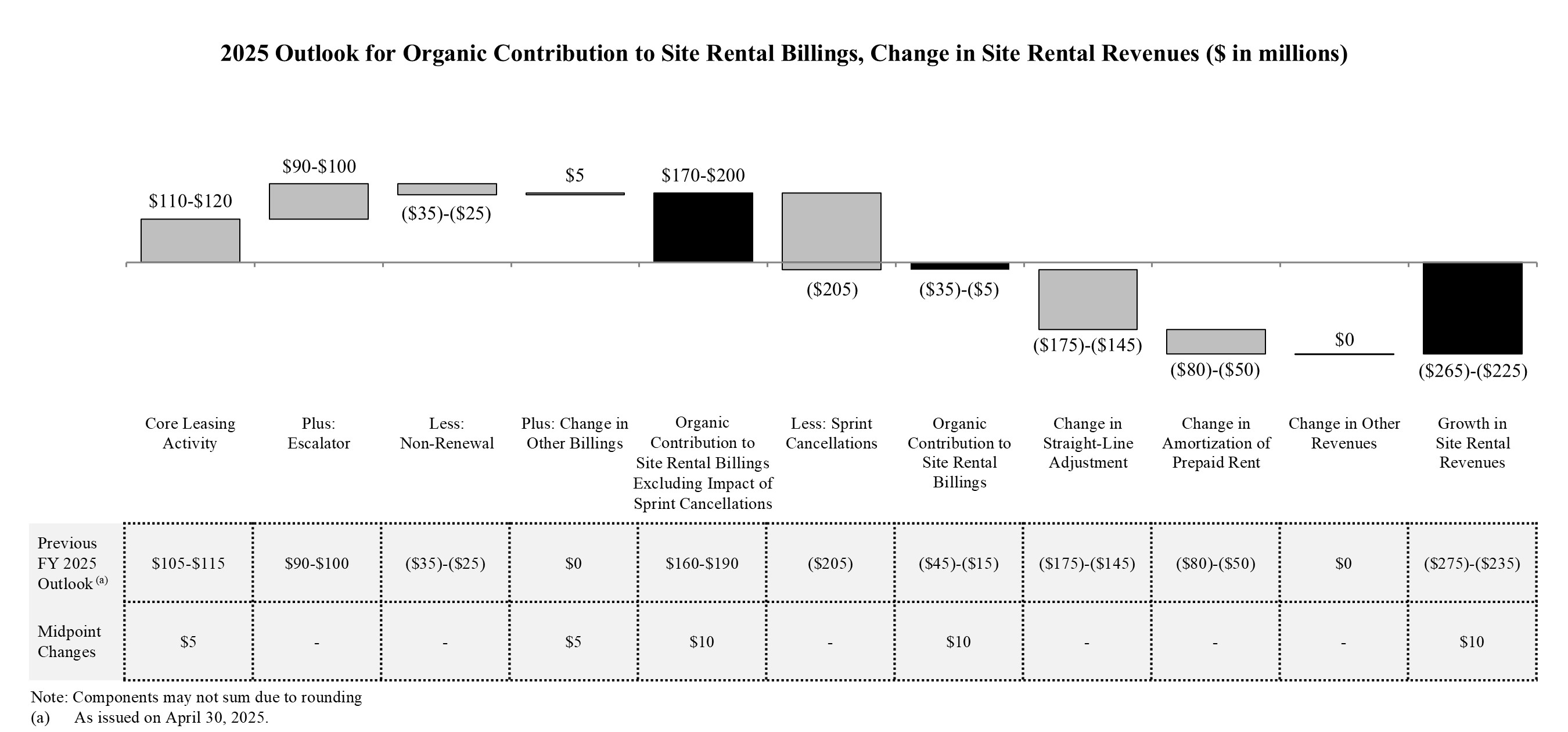

(dollars in millions; totals may not sum due to rounding) |

Full Year 2025 Outlook(a) |

Previously Issued Full Year 2025 Outlook(b) |

|||||||||||||||||||||

| Components of changes in site rental revenues: | |||||||||||||||||||||||

Prior year site rental billings(c)(d) |

$3,931 | $3,931 | |||||||||||||||||||||

Core leasing activity(d) |

$110 | to | $120 | $105 | to | $115 | |||||||||||||||||

| Escalators | $90 | to | $100 | $90 | to | $100 | |||||||||||||||||

Non-renewals(d) |

$(35) | to | $(25) | $(35) | to | $(25) | |||||||||||||||||

Other billings(d) |

$5 | to | $5 | $0 | to | $0 | |||||||||||||||||

Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations(d) |

$170 | to | $200 | $160 | to | $190 | |||||||||||||||||

Non-renewals associated with Sprint Cancellations(d) |

$(205) | to | $(205) | $(205) | to | $(205) | |||||||||||||||||

Organic Contribution to Site Rental Billings(d) |

$(35) | to | $(5) | $(45) | to | $(15) | |||||||||||||||||

| Straight-lined revenues | $(15) | to | $15 | $(15) | to | $15 | |||||||||||||||||

| Amortization of prepaid rent | $80 | to | $110 | $80 | to | $110 | |||||||||||||||||

Other revenues |

$15 | to | $15 | $15 | to | $15 | |||||||||||||||||

Acquisitions(e) |

— | — | |||||||||||||||||||||

| Total site rental revenues | $3,997 | to | $4,042 | $3,987 | to | $4,032 | |||||||||||||||||

Year-over-year changes in revenues:(f) |

|||||||||||||||||||||||

Site rental revenues as a percentage of prior year site rental revenues |

(5.8)% | (6.0)% | |||||||||||||||||||||

Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations as a percentage of prior year site rental billings(d) |

4.7% | 4.5% | |||||||||||||||||||||

Organic Contribution to Site Rental Billings as a percentage of prior year site rental billings(d) |

(0.5)% | (0.8)% | |||||||||||||||||||||

| News Release continued: | Page 16 |

|||||||

For the Three Months Ended |

For the Six Months Ended |

||||||||||||||||||||||

| (in millions) | June 30, 2025 | June 30, 2024 | June 30, 2025 | June 30, 2024 | |||||||||||||||||||

| Discretionary capital expenditures: | |||||||||||||||||||||||

Towers improvements and other capital projects |

$ | 17 | $ | 21 | $ | 33 | $ | 46 | |||||||||||||||

| Purchases of land interests | 16 | 10 | 34 | 24 | |||||||||||||||||||

| Sustaining capital expenditures | 7 | 9 | 13 | 16 | |||||||||||||||||||

| Total capital expenditures | $ | 40 | $ | 40 | $ | 80 | $ | 86 | |||||||||||||||

| (in millions) | Full Year 2025 Outlook(d) |

||||||||||

Discretionary capital expenditures |

$185 | to | $185 | ||||||||

Less: Prepaid rent additions(e) |

~$40 | ||||||||||

Discretionary capital expenditures less prepaid rent additions |

$145 | to | $145 | ||||||||

For the Three Months Ended |

|||||||||||

| (in millions) | June 30, 2025 | June 30, 2024 | |||||||||

| Interest expense on debt obligations | $ | 239 | $ | 227 | |||||||

| Amortization of deferred financing costs and adjustments on long-term debt | 8 | 8 | |||||||||

| Capitalized interest | (4) | (5) | |||||||||

| Interest expense and amortization of deferred financing costs, net | $ | 243 | $ | 230 | |||||||

| (in millions) | Full Year 2025 Outlook(d) |

Previous Full Year 2025 Outlook(f) |

|||||||||||||||||||||

| Interest expense on debt obligations | $960 | to | $1,000 | $970 | to | $1,010 | |||||||||||||||||

| Amortization of deferred financing costs and adjustments on long-term debt | $20 | to | $30 | $20 | to | $30 | |||||||||||||||||

| Capitalized interest | $(15) | to | $(5) | $(15) | to | $(5) | |||||||||||||||||

| Interest expense and amortization of deferred financing costs, net | $972 | to | $1,017 | $982 | to | $1,027 | |||||||||||||||||

| News Release continued: | Page 17 |

|||||||

| (in millions) | Face Value(a) |

Final Maturity | |||||||||

Cash and cash equivalents and restricted cash and cash equivalents(b) |

$ | 260 | |||||||||

Senior Secured Notes, Series 2009-1, Class A-2(c) |

29 | Aug. 2029 | |||||||||

Senior Secured Tower Revenue Notes, Series 2018-2(d) |

750 | July 2048 | |||||||||

Installment purchase liabilities and finance leases(e) |

263 | Various | |||||||||

| Total secured debt | $ | 1,042 | |||||||||

2016 Revolver(f) |

400 | July 2027 | |||||||||

2016 Term Loan A(g) |

1,087 | July 2027 | |||||||||

Commercial Paper Notes(h) |

1,905 | Various |

|||||||||

1.350% Senior Notes(i) |

500 | July 2025 | |||||||||

4.450% Senior Notes |

900 | Feb. 2026 | |||||||||

3.700% Senior Notes |

750 | June 2026 | |||||||||

| 1.050% Senior Notes | 1,000 | July 2026 | |||||||||

| 2.900% Senior Notes | 750 | Mar. 2027 | |||||||||

4.000% Senior Notes |

500 | Mar. 2027 | |||||||||

3.650% Senior Notes |

1,000 | Sept. 2027 | |||||||||

| 5.000% Senior Notes | 1,000 | Jan. 2028 | |||||||||

3.800% Senior Notes |

1,000 | Feb. 2028 | |||||||||

| 4.800% Senior Notes | 600 | Sept. 2028 | |||||||||

4.300% Senior Notes |

600 | Feb. 2029 | |||||||||

5.600% Senior Notes |

750 | June 2029 | |||||||||

4.900% Senior Notes |

550 | Sept. 2029 | |||||||||

| 3.100% Senior Notes | 550 | Nov. 2029 | |||||||||

3.300% Senior Notes |

750 | July 2030 | |||||||||

2.250% Senior Notes |

1,100 | Jan. 2031 | |||||||||

| 2.100% Senior Notes | 1,000 | Apr. 2031 | |||||||||

| 2.500% Senior Notes | 750 | July 2031 | |||||||||

| 5.100% Senior Notes | 750 | May 2033 | |||||||||

5.800% Senior Notes |

750 | Mar. 2034 | |||||||||

5.200% Senior Notes |

700 | Sept. 2034 | |||||||||

| 2.900% Senior Notes | 1,250 | Apr. 2041 | |||||||||

4.750% Senior Notes |

350 | May 2047 | |||||||||

5.200% Senior Notes |

400 | Feb. 2049 | |||||||||

| 4.000% Senior Notes | 350 | Nov. 2049 | |||||||||

| 4.150% Senior Notes | 500 | July 2050 | |||||||||

| 3.250% Senior Notes | 900 | Jan. 2051 | |||||||||

| Total unsecured debt | $ | 23,392 | |||||||||

Net Debt(j) |

$ | 24,174 | |||||||||

| News Release continued: | Page 18 |

|||||||

| News Release continued: | Page 19 |

|||||||

| News Release continued: | Page 20 |

|||||||

|

CROWN CASTLE INC.

CONDENSED CONSOLIDATED BALANCE SHEET (UNAUDITED)

(Amounts in millions, except par values)

|

||||

| June 30, 2025 | December 31, 2024 | ||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 94 | $ | 100 | |||||||

Restricted cash and cash equivalents |

161 | 170 | |||||||||

| Receivables, net | 100 | 129 | |||||||||

| Prepaid expenses | 70 | 74 | |||||||||

| Deferred site rental receivables | 205 | 164 | |||||||||

| Other current assets | 24 | 24 | |||||||||

Current assets of discontinued operations |

420 | 429 | |||||||||

| Total current assets | 1,074 | 1,090 | |||||||||

| Deferred site rental receivables | 2,277 | 2,279 | |||||||||

| Property and equipment, net | 6,402 | 6,577 | |||||||||

| Operating lease right-of-use assets | 5,562 | 5,600 | |||||||||

| Goodwill | 5,127 | 5,127 | |||||||||

| Other intangible assets, net | 949 | 1,037 | |||||||||

| Other assets, net | 63 | 58 | |||||||||

Non-current assets of discontinued operations |

10,182 | 10,968 | |||||||||

| Total assets | $ | 31,636 | $ | 32,736 | |||||||

LIABILITIES AND EQUITY (DEFICIT) |

|||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 48 | $ | 48 | |||||||

| Accrued interest | 238 | 244 | |||||||||

| Deferred revenues | 139 | 141 | |||||||||

| Other accrued liabilities | 154 | 167 | |||||||||

| Current maturities of debt and other obligations | 2,251 | 603 | |||||||||

| Current portion of operating lease liabilities | 267 | 264 | |||||||||

| Current liabilities of discontinued operations | 706 | 710 | |||||||||

| Total current liabilities | 3,803 | 2,177 | |||||||||

| Debt and other long-term obligations | 22,039 | 23,451 | |||||||||

| Operating lease liabilities | 5,009 | 5,062 | |||||||||

| Other long-term liabilities | 628 | 645 | |||||||||

Non-current liabilities of discontinued operations |

1,539 | 1,534 | |||||||||

| Total liabilities | 33,018 | 32,869 | |||||||||

| Commitments and contingencies | |||||||||||

Stockholders' equity (deficit): |

|||||||||||

Common stock, 0.01 par value; 1,200 shares authorized; shares issued and outstanding: June 30, 2025—435 and December 31, 2024—435 |

4 | 4 | |||||||||

| Additional paid-in capital | 18,463 | 18,393 | |||||||||

| Accumulated other comprehensive income (loss) | (5) | (5) | |||||||||

| Dividends/distributions in excess of earnings | (19,844) | (18,525) | |||||||||

Total equity (deficit) |

(1,382) | (133) | |||||||||

Total liabilities and equity (deficit) |

$ | 31,636 | $ | 32,736 | |||||||

| News Release continued: | Page 21 |

|||||||

|

CROWN CASTLE INC.

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS (UNAUDITED)

(Amounts in millions, except per share amounts)

|

||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| Net revenues: | |||||||||||||||||||||||

| Site rental | $ | 1,008 | $ | 1,064 | $ | 2,019 | $ | 2,132 | |||||||||||||||

| Services and other | 52 | 43 | 102 | 89 | |||||||||||||||||||

| Net revenues | 1,060 | 1,107 | 2,121 | 2,221 | |||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

Costs of operations:(a) |

|||||||||||||||||||||||

| Site rental | 251 | 249 | 491 | 494 | |||||||||||||||||||

| Services and other | 27 | 25 | 55 | 54 | |||||||||||||||||||

| Selling, general and administrative | 99 | 136 | 192 | 250 | |||||||||||||||||||

| Asset write-down charges | 2 | 3 | 4 | 8 | |||||||||||||||||||

| Depreciation, amortization and accretion | 175 | 180 | 352 | 371 | |||||||||||||||||||

Restructuring charges |

— | 19 | — | 30 | |||||||||||||||||||

| Total operating expenses | 554 | 612 | 1,094 | 1,207 | |||||||||||||||||||

| Operating income (loss) | 506 | 495 | 1,027 | 1,014 | |||||||||||||||||||

| Interest expense and amortization of deferred financing costs, net | (243) | (230) | (479) | (455) | |||||||||||||||||||

| Interest income | 4 | 4 | 7 | 8 | |||||||||||||||||||

| Other income (expense) | 2 | 1 | 3 | 3 | |||||||||||||||||||

Income (loss) from continuing operations before income taxes |

269 | 270 | 558 | 570 | |||||||||||||||||||

| Benefit (provision) for income taxes | (4) | (5) | (9) | (11) | |||||||||||||||||||

Income (loss) from continuing operations |

$ | 265 | $ | 265 | $ | 549 | $ | 559 | |||||||||||||||

Discontinued Operations |

|||||||||||||||||||||||

| Income (loss) from discontinued operations before gain (loss) from disposal, net of tax | 278 | (14) | 360 | 3 | |||||||||||||||||||

Gain (loss) from disposal of discontinued operations |

(252) | — | (1,082) | — | |||||||||||||||||||

Income (loss) from discontinued operations, net of tax |

26 | (14) | (722) | 3 | |||||||||||||||||||

Net income (loss) |

$ | 291 | $ | 251 | $ | (173) | $ | 562 | |||||||||||||||

| Net income (loss), per common share: | |||||||||||||||||||||||

Income (loss) from continuing operations, basic |

$ | 0.61 | $ | 0.61 | $ | 1.26 | $ | 1.28 | |||||||||||||||

Income (loss) from discontinued operations, basic |

$ | 0.06 | $ | (0.03) | $ | (1.66) | $ | 0.01 | |||||||||||||||

| Net income (loss)—basic | $ | 0.67 | $ | 0.58 | $ | (0.40) | $ | 1.29 | |||||||||||||||

Income (loss) from continuing operations, diluted |

$ | 0.61 | $ | 0.61 | $ | 1.26 | $ | 1.28 | |||||||||||||||

Income (loss) from discontinued operations, diluted |

$ | 0.06 | $ | (0.03) | $ | (1.66) | $ | 0.01 | |||||||||||||||

| Net income (loss)—diluted | $ | 0.67 | $ | 0.58 | $ | (0.40) | $ | 1.29 | |||||||||||||||

| Weighted-average common shares outstanding: | |||||||||||||||||||||||

| Basic | 435 | 435 | 435 | 434 | |||||||||||||||||||

| Diluted | 437 | 435 | 436 | 435 | |||||||||||||||||||

| News Release continued: | Page 22 |

|||||||

|

CROWN CASTLE INC.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED)

(In millions of dollars)

|

||||

| Six Months Ended June 30, | |||||||||||

| 2025 | 2024 | ||||||||||

| Cash flows from operating activities: | |||||||||||

| Net income (loss) | $ | (173) | $ | 562 | |||||||

(Income) loss from discontinued operations before (gain) loss from disposal, net of tax |

(360) | (3) | |||||||||

(Gain) loss from disposal of discontinued operations |

1,082 | — | |||||||||

Income (loss) from continuing operations |

549 | 559 | |||||||||

Adjustments to reconcile income (loss) from continuing operations to net cash provided by (used for) operating activities: |

|||||||||||

| Depreciation, amortization and accretion | 352 | 371 | |||||||||

| Amortization of deferred financing costs and other non-cash interest | 16 | 18 | |||||||||

| Stock-based compensation expense, net | 36 | 50 | |||||||||

| Asset write-down charges | 4 | 8 | |||||||||

| Deferred income tax (benefit) provision | 1 | 5 | |||||||||

| Other non-cash adjustments, net | (4) | 8 | |||||||||

Net cash provided by (used for) operating activities from discontinued operations |

581 | 556 | |||||||||

| Changes in assets and liabilities, excluding the effects of acquisitions: | |||||||||||

| Increase (decrease) in liabilities | (38) | (118) | |||||||||

| Decrease (increase) in assets | (24) | (90) | |||||||||

| Net cash provided by (used for) operating activities | 1,473 | 1,367 | |||||||||

| Cash flows from investing activities: | |||||||||||

| Capital expenditures | (80) | (86) | |||||||||

| Payments for acquisitions, net of cash acquired | — | (7) | |||||||||

| Other investing activities, net | 3 | 6 | |||||||||

| Net cash provided by (used for) investing activities from discontinued operations | (446) | (563) | |||||||||

| Net cash provided by (used for) investing activities | (523) | (650) | |||||||||

| Cash flows from financing activities: | |||||||||||

| Principal payments on debt and other long-term obligations | (59) | (36) | |||||||||

| Purchases and redemptions of long-term debt | (700) | — | |||||||||

| Borrowings under revolving credit facility | 400 | — | |||||||||

| Payments under revolving credit facility | — | (670) | |||||||||

Net issuances (repayments) under commercial paper program |

564 | 1,438 | |||||||||

| Purchases of common stock | (23) | (30) | |||||||||

| Dividends/distributions paid on common stock | (1,153) | (1,368) | |||||||||

| Net cash provided by (used for) financing activities | (971) | (666) | |||||||||

Net increase (decrease) in cash and cash equivalents and restricted cash and cash equivalents |

(21) | 51 | |||||||||

| Effect of exchange rate changes on cash | — | (1) | |||||||||

Cash and cash equivalents and restricted cash and cash equivalents at beginning of period(a) |

295 | 281 | |||||||||

Cash and cash equivalents and restricted cash and cash equivalents at end of period(a) |

$ | 274 | $ | 331 | |||||||

| Supplemental disclosure of cash flow information: | |||||||||||

| Interest paid | $ | 478 | $ | 441 | |||||||

| Income taxes paid (refunded) | $ | 9 | $ | 6 | |||||||

| TABLE OF CONTENTS | |||||

| Page | |||||

| Company Overview | |||||

| Company Profile | |||||

| Strategy | |||||

| General Company Information | |||||

Tower Asset Portfolio Footprint |

|||||

| Historical Common Stock Data | |||||

| Executive Management Team | |||||

| Board of Directors | |||||

| Research Coverage | |||||

| Outlook | |||||

| Outlook | |||||

| Outlook for Components of Changes in Site Rental Revenues | |||||

| Outlook for Components of Interest Expense | |||||

Financial Highlights |

|||||

Summary Financial Highlights |

|||||

Components of Changes in Site Rental Revenues |

|||||

Summary of Capital Expenditures |

|||||

Portfolio Highlights |

|||||

Consolidated Return on Invested Capital |

|||||

Cash Yield on Invested Capital |

11 |

||||

Tenant Overview |

|||||

Annualized Rental Cash Payments at Time of Renewal |

|||||

Projected Revenues from Tenant Contracts Associated with Active Licenses |

|||||

Projected Expenses from Existing Ground Leases |

|||||

| Summary of Tower Portfolio by Vintage | |||||

| Ground Interest Overview | |||||

| Capitalization Overview | |||||

| Capitalization Overview | |||||

| Debt Maturity Overview | |||||

| Liquidity Overview | |||||

| Summary of Maintenance and Financial Covenants | |||||

| Interest Rate Exposure | |||||

| Components of Interest Expense | |||||

| Appendix of Condensed Consolidated Financial Statements and Non-GAAP Reconciliations | |||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

COMPANY PROFILE | ||||||||||||||

STRATEGY | ||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

| GENERAL COMPANY INFORMATION | |||||

| Principal executive offices | 8020 Katy Freeway, Houston, TX 77024 | ||||

| Common shares trading symbol | CCI | ||||

| Stock exchange listing | New York Stock Exchange | ||||

| Fiscal year ending date | December 31 | ||||

| Fitch - Long-term Issuer Default Rating | BBB+ | ||||

| Moody’s - Long-term Corporate Family Rating | Baa3 | ||||

| Standard & Poor’s - Long-term Local Issuer Credit Rating | BBB | ||||

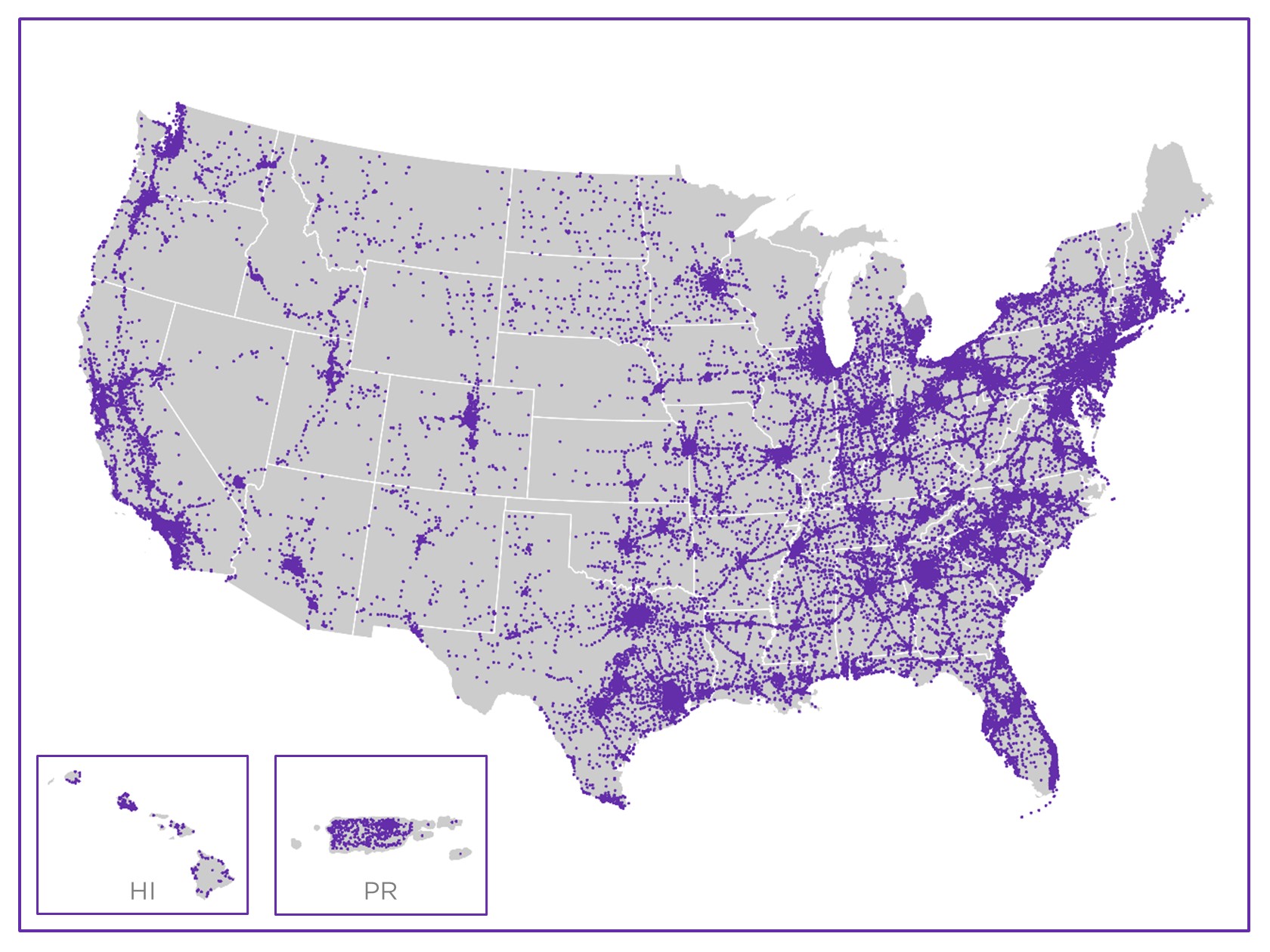

TOWER ASSET PORTFOLIO FOOTPRINT | ||

| ||

| HISTORICAL COMMON STOCK DATA | |||||||||||||||||

| Three Months Ended | |||||||||||||||||

| (in millions, except per share amounts) | 6/30/24 | 9/30/24 | 12/31/24 | 3/31/25 | 6/30/25 | ||||||||||||

High price(a) |

$ | 98.42 | $ | 115.83 | $ | 114.66 | $ | 106.24 | $ | 107.94 | |||||||

Low price(a) |

$ | 85.90 | $ | 89.79 | $ | 86.50 | $ | 81.93 | $ | 90.17 | |||||||

Period end closing price(b) |

$ | 92.34 | $ | 113.61 | $ | 88.32 | $ | 103.12 | $ | 102.73 | |||||||

| Dividends paid per common share | $ | 1.57 | $ | 1.57 | $ | 1.57 | $ | 1.57 | $ | 1.06 | |||||||

Volume weighted average price for the period(a) |

$ | 91.48 | $ | 104.65 | $ | 98.93 | $ | 92.69 | $ | 100.18 | |||||||

| Common shares outstanding, at period end | 435 | 435 | 435 | 435 | 435 | ||||||||||||

Market value of outstanding common shares, at period end(c) |

$ | 40,126 | $ | 49,374 | $ | 38,385 | $ | 44,903 | $ | 44,736 | |||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

| EXECUTIVE MANAGEMENT TEAM | |||||||||||

| Age | Years with Company | Position | |||||||||

| Daniel K. Schlanger | 51 | 9 | Interim President and Chief Executive Officer |

||||||||

Sunit Patel |

63 | <1 |

Executive Vice President and Chief Financial Officer |

||||||||

Catherine Piche |

54 | 13(a) |

Executive Vice President and Chief Operating Officer - Towers |

||||||||

| Christopher D. Levendos | 57 | 7 | Executive Vice President and Chief Operating Officer - Fiber |

||||||||

| Edward B. Adams, Jr. | 56 | 8 | Executive Vice President and General Counsel | ||||||||

| BOARD OF DIRECTORS | ||||||||||||||

| Name | Position | Committees | Age | Years as Director | ||||||||||

| P. Robert Bartolo | Chair | Nominating and Governance, Finance, Fiber Review, CEO Search |

53 | 11 | ||||||||||

| Jason Genrich | Director | Finance, Fiber Review, CEO Search |

38 | 1 | ||||||||||

| Andrea J. Goldsmith | Director | Compensation and Human Capital |

61 | 7 | ||||||||||

| Tammy K. Jones | Director | Audit, Nominating and Governance, Finance, CEO Search |

59 | 4 | ||||||||||

| Kevin T. Kabat | Director | Compensation and Human Capital, Nominating and Governance, CEO Search |

68 | 1 | ||||||||||

| Anthony J. Melone | Director | Audit, Nominating and Governance, Fiber Review |

65 | 10 | ||||||||||

Katherine Motlagh |

Director |

Audit, Compensation and Human Capital, Finance |

51 | <1 |

||||||||||

| Kevin A. Stephens | Director |

Audit, Compensation and Human Capital, Fiber Review |

63 | 4 | ||||||||||

| Matthew Thornton III | Director |

Audit, Compensation and Human Capital, Nominating and Governance |

66 | 4 | ||||||||||

| RESEARCH COVERAGE | ||||||||

| Equity Research | ||||||||

|

Bank of America

Michael Funk

(646) 855-5664

|

Barclays Brendan Lynch (212) 526-9428 |

BMO Capital Markets Ari Klein (212) 885-4103 |

||||||

| Citigroup Michael Rollins (212) 816-1116 |

Deutsche Bank Matthew Niknam (212) 250-4711 |

Goldman Sachs

Jim Schneider

(212) 357-2929

|

||||||

| Green Street David Guarino (949) 640-8780 |

HSBC

Luigi Minerva

(207) 991-6928

|

Jefferies Jonathan Petersen (212) 284-1705 |

||||||

|

JMP Securities

Greg Miller

(212) 699-2917

|

JPMorgan

Richard Choe

(212) 622-6708

|

KeyBanc Brandon Nispel (503) 821-3871 |

||||||

| MoffettNathanson Nick Del Deo (212) 519-0025 |

Morgan Stanley

Benjamin Swinburne

(212) 761-7527

|

New Street Research Jonathan Chaplin (212) 921-9876 |

||||||

| Raymond James Ric Prentiss (727) 567-2567 |

RBC Capital Markets Jonathan Atkin (415) 633-8589 |

Scotiabank

Maher Yaghi

(437) 995-5548

|

||||||

|

TD Cowen

Michael Elias

(646) 562-1358

|

UBS Batya Levi (212) 713-8824 |

Wells Fargo

Eric Luebchow

(312) 630-2386

|

||||||

| Wolfe Research Andrew Rosivach (646) 582-9350 |

||||||||

| Rating Agencies | ||||||||

|

Fitch

Jeff Danforth

(312) 368-5447

|

Moody’s

Ranjini Venkatesan

(212) 553-3828

|

Standard & Poor’s

Allyn Arden

(212) 438-7832

|

||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

| OUTLOOK | |||||||||||

| (in millions, except per share amounts) | Full Year 2025 Outlook(a) |

||||||||||

Site rental billings(b) |

$3,895 | to | $3,925 | ||||||||

| Amortization of prepaid rent | $80 | to | $110 | ||||||||

| Straight-lined revenues | ($15) | to | $15 | ||||||||

Other revenues |

$15 | to | $15 | ||||||||

| Site rental revenues | $3,997 | to | $4,042 | ||||||||

Site rental costs of operations(c) |

$972 | to | $1,017 | ||||||||

| Services and other gross margin | $75 | to | $105 | ||||||||

Net income (loss) |

$100 | to | $380 | ||||||||

Net income (loss) per share—diluted |

$0.23 | to | $0.87 | ||||||||

Adjusted EBITDA(b) |

$2,780 | to | $2,830 | ||||||||

| Depreciation, amortization and accretion | $678 | to | $773 | ||||||||

Interest expense and amortization of deferred financing costs, net(d) |

$972 | to | $1,017 | ||||||||

Income (loss) from discontinued operations, net of tax(e) |

($830) | to | ($590) | ||||||||

FFO(b) |

$1,645 | to | $1,675 | ||||||||

AFFO(b) |

$1,805 | to | $1,855 | ||||||||

AFFO per share(b) |

$4.14 | to | $4.25 | ||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

| OUTLOOK FOR COMPONENTS OF CHANGES IN SITE RENTAL REVENUES | |||||||||||

(dollars in millions; totals may not sum due to rounding) |

Full Year 2025 Outlook(a) |

||||||||||

| Components of changes in site rental revenues: | |||||||||||

Prior year site rental billings(b)(c) |

$3,931 | ||||||||||

Core leasing activity(b) |

$110 | to | $120 | ||||||||

| Escalators | $90 | to | $100 | ||||||||

Non-renewals(b) |

$(35) | to | $(25) | ||||||||

Other billings(b) |

$5 | to | $5 | ||||||||

Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations(b) |

$170 | to | $200 | ||||||||

Non-renewals associated with Sprint Cancellations(b) |

$(205) | to | $(205) | ||||||||

Organic Contribution to Site Rental Billings(b) |

$(35) | to | $(5) | ||||||||

| Straight-lined revenues | $(15) | to | $15 | ||||||||

| Amortization of prepaid rent | $80 | to | $110 | ||||||||

Other revenues |

$15 | to | $15 | ||||||||

Acquisitions(d) |

— | to | — | ||||||||

| Total site rental revenues | $3,997 | to | $4,042 | ||||||||

Year-over-year changes in revenues:(e) |

|||||||||||

Site rental revenues as a percentage of prior year site rental revenues |

(5.8)% | ||||||||||

Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations as a percentage of prior year site rental billings(b) |

4.7% | ||||||||||

Organic Contribution to Site Rental Billings as a percentage of prior year site rental billings(b) |

(0.5)% | ||||||||||

| OUTLOOK FOR COMPONENTS OF INTEREST EXPENSE | |||||||||||

| (in millions) | Full Year 2025 Outlook(a) |

||||||||||

| Interest expense on debt obligations | $960 | to | $1,000 | ||||||||

| Amortization of deferred financing costs and adjustments on long-term debt | $20 | to | $30 | ||||||||

| Capitalized interest | $(15) | to | $(5) | ||||||||

| Interest expense and amortization of deferred financing costs, net | $972 | to | $1,017 | ||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

SUMMARY FINANCIAL HIGHLIGHTS(a) | |||||||||||||||||||||||||||||||||||

| 2024 | 2025 | ||||||||||||||||||||||||||||||||||

(in millions, except per share amounts; totals may not sum due to rounding) |

Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | |||||||||||||||||||||||||||||

| Net revenues: | |||||||||||||||||||||||||||||||||||

| Site rental | |||||||||||||||||||||||||||||||||||

Site rental billings(b) |

$ | 966 | $ | 967 | $ | 995 | $ | 1,006 | $ | 964 | $ | 961 | |||||||||||||||||||||||

| Amortization of prepaid rent | 41 | 39 | 39 | 40 | 25 | 23 | |||||||||||||||||||||||||||||

| Straight-lined revenues | 57 | 54 | 28 | 20 | 19 | 20 | |||||||||||||||||||||||||||||

Other revenues |

4 | 4 | 4 | 4 | 4 | 4 | |||||||||||||||||||||||||||||

| Total site rental | 1,068 | 1,064 | 1,066 | 1,070 | 1,011 | 1,008 | |||||||||||||||||||||||||||||

| Services and other | 46 | 43 | 54 | 49 | 50 | 52 | |||||||||||||||||||||||||||||

| Net revenues | $ | 1,114 | $ | 1,107 | $ | 1,117 | $ | 1,119 | $ | 1,061 | $ | 1,060 | |||||||||||||||||||||||

| Select operating expenses: | |||||||||||||||||||||||||||||||||||

Costs of operations(c) |

|||||||||||||||||||||||||||||||||||

| Site rental exclusive of straight-lined expenses | $ | 227 | $ | 233 | $ | 229 | $ | 227 | $ | 225 | $ | 236 | |||||||||||||||||||||||

| Straight-lined expenses | 16 | 16 | 15 | 15 | 15 | 15 | |||||||||||||||||||||||||||||

| Total site rental | 243 | 249 | 244 | 242 | 240 | 251 | |||||||||||||||||||||||||||||

| Services and other | 29 | 25 | 27 | 26 | 28 | 27 | |||||||||||||||||||||||||||||

| Total costs of operations | 272 | 274 | 271 | 268 | 268 | 278 | |||||||||||||||||||||||||||||

| Selling, general and administrative | $ | 114 | $ | 136 | $ | 93 | $ | 92 | $ | 93 | $ | 99 | |||||||||||||||||||||||

Net income (loss) |

$ | 311 | $ | 251 | $ | 303 | $ | (4,768) | $ | (464) | $ | 291 | |||||||||||||||||||||||

Adjusted EBITDA(d) |

754 | 727 | 777 | 777 | 722 | 705 | |||||||||||||||||||||||||||||

| Depreciation, amortization and accretion | 191 | 180 | 181 | 183 | 177 | 175 | |||||||||||||||||||||||||||||

| Interest expense and amortization of deferred financing costs, net | 226 | 230 | 236 | 240 | 236 | 243 | |||||||||||||||||||||||||||||

FFO(d) |

478 | 436 | 466 | 483 | 451 | 429 | |||||||||||||||||||||||||||||

AFFO(d) |

$ | 484 | $ | 449 | $ | 525 | $ | 523 | $ | 479 | $ | 444 | |||||||||||||||||||||||

Weighted-average common shares outstanding— diluted |

435 | 435 | 436 | 435 | 436 | 437 | |||||||||||||||||||||||||||||

Net income (loss) per share—diluted |

$ | 0.71 | $ | 0.58 | $ | 0.70 | $ | (10.97) | $ | (1.07) | $ | 0.67 | |||||||||||||||||||||||

AFFO per share(d) |

$ | 1.11 | $ | 1.03 | $ | 1.20 | $ | 1.20 | $ | 1.10 | $ | 1.02 | |||||||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

COMPONENTS OF CHANGES IN SITE RENTAL REVENUES(a) | |||||||||||||||||||||||||||||||||||

| 2024 | 2025 | ||||||||||||||||||||||||||||||||||

(dollars in millions; totals may not sum due to rounding) |

Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | |||||||||||||||||||||||||||||

| Components of changes in site rental revenues: | |||||||||||||||||||||||||||||||||||

Prior year site rental billings(b) |

$ | 923 | $ | 922 | $ | 952 | $ | 966 | $ | 966 | $ | 966 | |||||||||||||||||||||||

Core leasing activity(b) |

28 | 28 | 27 | 28 | 28 | 28 | |||||||||||||||||||||||||||||

| Escalators | 23 | 23 | 23 | 24 | 24 | 24 | |||||||||||||||||||||||||||||

Non-renewals(b) |

(8) | (7) | (8) | (8) | (7) | (7) | |||||||||||||||||||||||||||||

Other billings(b) |

— | 2 | — | (4) | 3 | — | |||||||||||||||||||||||||||||

Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations(b) |

43 | 45 | 43 | 40 | 49 | 45 | |||||||||||||||||||||||||||||

Non-renewals associated with Sprint Cancellations(b) |

— | — | — | — | (51) | (51) | |||||||||||||||||||||||||||||

Organic Contribution to Site Rental Billings(b) |

43 | 45 | 43 | 40 | (2) | (6) | |||||||||||||||||||||||||||||

| Straight-lined revenues | 57 | 54 | 28 | 20 | 19 | 20 | |||||||||||||||||||||||||||||

| Amortization of prepaid rent | 41 | 39 | 39 | 40 | 25 | 23 | |||||||||||||||||||||||||||||

Other revenues |

4 | 4 | 4 | 4 | 4 | 4 | |||||||||||||||||||||||||||||

| Total site rental revenues | $ | 1,068 | $ | 1,064 | $ | 1,066 | $ | 1,070 | $ | 1,011 | $ | 1,008 | |||||||||||||||||||||||

| Year-over-year changes in revenues: | |||||||||||||||||||||||||||||||||||

Site rental revenues as a percentage of prior year site rental revenues |

(1.2) | % | (1.5) | % | (0.8) | % | (0.8) | % | (5.3) | % | (5.3) | % | |||||||||||||||||||||||

Organic Contribution to Site Rental Billings as Adjusted for Impact of Sprint Cancellations as a percentage of prior year site rental billings(b) |

4.6 | % | 4.8 | % | 4.5 | % | 4.1 | % | 5.1 | % | 4.7 | % | |||||||||||||||||||||||

Organic Contribution to Site Rental Billings as a percentage of prior year site rental billings(b) |

4.6 | % | 4.8 | % | 4.5 | % | 4.1 | % | (0.2) | % | (0.6) | % | |||||||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

SUMMARY OF CAPITAL EXPENDITURES(a) | |||||||||||||||||||||||||||||||||||

| 2024 | 2025 | ||||||||||||||||||||||||||||||||||

(dollars in millions; totals may not sum due to rounding) |

Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | |||||||||||||||||||||||||||||

| Discretionary capital expenditures: | |||||||||||||||||||||||||||||||||||

Towers improvements and other capital projects |

$ | 26 | $ | 20 | $ | 21 | $ | 18 | $ | 15 | $ | 17 | |||||||||||||||||||||||

| Purchases of land interests | 13 | 11 | 14 | 20 | 18 | 16 | |||||||||||||||||||||||||||||

| Total discretionary capital expenditures | 39 | 31 | 35 | 38 | 33 | 33 | |||||||||||||||||||||||||||||

| Sustaining capital expenditures | 8 | 9 | 6 | 12 | 7 | 7 | |||||||||||||||||||||||||||||

| Total capital expenditures | 47 | 40 | 41 | 50 | 40 | 40 | |||||||||||||||||||||||||||||

Less: Prepaid rent additions(b) |

12 | 8 | 13 | 12 | 10 | 11 | |||||||||||||||||||||||||||||

| Capital expenditures less prepaid rent additions | $ | 35 | $ | 32 | $ | 28 | $ | 38 | $ | 30 | $ | 29 | |||||||||||||||||||||||

PORTFOLIO HIGHLIGHTS | |||||

(as of June 30, 2025) |

|||||

Number of towers (in thousands)(c) |

40 | ||||

| Average number of tenants per tower | 2.4 | ||||

Remaining contracted tenant receivables (in billions)(d) |

$ | 29 | |||

Weighted average remaining tenant contract term (years)(d)(e) |

6 | ||||

| Percent of towers in the Top 50 / 100 Basic Trading Areas | 56% / 71% | ||||

Percent of ground leased / owned(f) |

57% / 43% |

||||

Weighted average maturity of ground leases (years)(f)(g) |

36 | ||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

CONSOLIDATED RETURN ON INVESTED CAPITAL(a)(b) | ||||||||

(as of June 30, 2025; dollars in millions) |

Q2 2025 LQA |

Q2 2024 LQA | ||||||

Adjusted EBITDA(c) |

$ | 2,820 | $ | 2,908 | ||||

| Cash taxes (paid) refunded | (38) | (23) | ||||||

Adjusted EBITDA less cash taxes paid |

$ | 2,782 | $ | 2,885 | ||||

Historical gross investment in property and equipment(d) |

$ | 16,907 | $ | 16,854 | ||||

| Historical gross investment in site rental contracts and tenant relationships | 4,590 | 4,589 | ||||||

Historical gross investment in goodwill |

5,127 | 5,127 | ||||||

Consolidated Invested Capital(a) |

$ | 26,624 | $ | 26,570 | ||||

Consolidated Return on Invested Capital(a) |

10.4 | % | 10.9 | % | ||||

CASH YIELD ON INVESTED CAPITAL(a)(b)(e) | |||||||||||

(as of June 30, 2025; dollars in millions) |

Q2 2025 LQA |

Q2 2024 LQA | |||||||||

Adjusted Site Rental Gross Margin(c) |

$ | 3,048 | $ | 3,276 | |||||||

| Less: Amortization of prepaid rent | (92) | (156) | |||||||||

| Less: Straight-lined revenues | (80) | (216) | |||||||||

Add: Straight-lined expenses(f) |

44 | 48 | |||||||||

Numerator |

$ | 2,920 | $ | 2,952 | |||||||

Net investment in property and equipment(g) |

$ | 13,590 | $ | 13,501 | |||||||

Investment in site rental contracts and tenant relationships |

4,590 | 4,589 | |||||||||

Investment in goodwill(h) |

5,351 | 5,351 | |||||||||

Net Invested Capital(a) |

$ | 23,531 | $ | 23,441 | |||||||

Cash Yield on Invested Capital(a)(f) |

12.4 | % | 12.6 | % | |||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

TENANT OVERVIEW(a) | |||||||||||

(as of June 30, 2025) |

Percentage of Q2 2025 LQA Site Rental Revenues |

Weighted Average Current Term Remaining(b) |

Long-Term Credit Rating (S&P / Moody’s) |

||||||||

| T-Mobile | 40% | 7 | BBB / Baa2 |

||||||||

| AT&T | 27% | 4 | BBB / Baa2 | ||||||||

| Verizon | 21% | 6 | BBB+ / Baa1 | ||||||||

| All Others Combined | 12% | 7 | N/A | ||||||||

| Total / Weighted Average | 100% | 6 | |||||||||

ANNUALIZED RENTAL CASH PAYMENTS AT TIME OF RENEWAL(a)(c) | ||||||||||||||||||||

Remaining Six Months |

Years Ending December 31, | |||||||||||||||||||

(as of June 30, 2025; in millions) |

2025 |

2026 |

2027 |

2028 |

2029 |

|||||||||||||||

| T-Mobile | $ | 3 | $ | 27 | $ | 32 | $ | 26 | $ | 24 | ||||||||||

| AT&T | 6 | 23 | 13 | 774 | 240 | |||||||||||||||

| Verizon | 3 | 6 | 7 | 31 | 48 | |||||||||||||||

| All Others Combined | 28 | 42 | 37 | 28 | 45 | |||||||||||||||

| Total | $ | 40 | $ | 98 | $ | 89 | $ | 859 | $ | 357 | ||||||||||

PROJECTED REVENUES FROM TENANT CONTRACTS ASSOCIATED WITH ACTIVE LICENSES(a)(d) | ||||||||||||||||||||

Remaining Six Months |

Years Ending December 31, | |||||||||||||||||||

(as of June 30, 2025; in millions) |

2025 |

2026 |

2027 |

2028 |

2029 |

|||||||||||||||

| Components of site rental revenues: | ||||||||||||||||||||

Site rental billings(e) |

$ | 1,970 | $ | 3,995 | $ | 4,104 | $ | 4,223 | $ | 4,348 | ||||||||||

| Amortization of prepaid rent | 44 | 77 | 65 | 43 | 28 | |||||||||||||||

| Straight-lined revenues | 1 | (59) | (172) | (235) | (206) | |||||||||||||||

| Site rental revenues | $ | 2,015 | $ | 4,013 | $ | 3,997 | $ | 4,031 | $ | 4,170 | ||||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

PROJECTED EXPENSES FROM EXISTING GROUND LEASES(a)(b) | ||||||||||||||||||||

Remaining Six Months |

Years Ending December 31, | |||||||||||||||||||

(as of June 30, 2025; in millions) |

2025 |

2026 |

2027 |

2028 |

2029 |

|||||||||||||||

Components of ground lease expenses: |

||||||||||||||||||||

Ground lease expenses exclusive of straight-lined expenses |

$ | 343 | $ | 701 | $ | 721 | $ | 741 | $ | 761 | ||||||||||

| Straight-lined expenses | 26 | 43 | 31 | 20 | 10 | |||||||||||||||

Ground lease expenses |

$ | 369 | $ | 744 | $ | 752 | $ | 761 | $ | 771 | ||||||||||

SUMMARY OF TOWER PORTFOLIO BY VINTAGE(c) | ||||||||||||||

(as of June 30, 2025; dollars in thousands) |

Acquired and Built 2006 and Prior | Acquired and Built 2007 to Present | ||||||||||||

Cash yield(d) |

20 | % | 10 | % | ||||||||||

| Number of tenants per tower | 2.8 | 2.2 | ||||||||||||

Last quarter annualized average cash site rental revenue per tower(e) |

$ | 135 | $ | 81 | ||||||||||

Last quarter annualized average site rental gross cash margin per tower(f) |

$ | 116 | $ | 57 | ||||||||||

Net invested capital per tower(g) |

$ | 566 | $ | 592 | ||||||||||

| Number of towers | 11,172 | 28,725 | ||||||||||||

| GROUND INTEREST OVERVIEW | |||||||||||||||||||||||

(as of June 30, 2025; dollars in millions) |

LQA Cash Site Rental Revenues(e) |

Percentage of LQA Cash Site Rental Revenues(e) |

LQA Site Rental Gross Cash Margin(f) |

Percentage of LQA Site Rental Gross Cash Margin(f) |

Number of Towers(h) |

Percentage of Towers | Weighted Average Term Remaining (by years)(i) |

||||||||||||||||

| Less than 10 years | $ | 417 | 11 | % | $ | 225 | 7 | % | 5,333 | 14 | % | ||||||||||||

| 10 to 20 years | 559 | 14 | % | 349 | 12 | % | 6,067 | 15 | % | ||||||||||||||

| Greater than 20 years | 1,529 | 40 | % | 1,099 | 38 | % | 16,486 | 41 | % | ||||||||||||||

| Total leased | 2,505 | 65 | % | 1,673 | 57 | % | 27,886 | 70 | % | 36 | |||||||||||||

| Owned | $ | 1,334 | 35 | % | $ | 1,256 | 43 | % | 12,011 | 30 | % | ||||||||||||

| Total / Average | $ | 3,839 | 100 | % | $ | 2,929 | 100 | % | 39,897 | 100 | % | ||||||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

CAPITALIZATION OVERVIEW | ||||||||||||||

(as of June 30, 2025; dollars in millions) |

Face Value(a) |

Fixed vs. Variable | Interest Rate(b) |

Maturity | ||||||||||

Cash and cash equivalents and restricted cash and cash equivalents(c) |

$ | 260 | ||||||||||||

Senior Secured Notes, Series 2009-1, Class A-2(d) |

29 | Fixed | 9.0% | 2029 | ||||||||||

Senior Secured Tower Revenue Notes, Series 2018-2(e) |

750 | Fixed | 4.2% | 2048 |

||||||||||

Installment purchase liabilities and finance leases(f) |

263 | Fixed | Various | Various |

||||||||||

| Total secured debt | $ | 1,042 | 4.4% | |||||||||||

2016 Revolver(g) |

400 | Variable | 5.5% | 2027 | ||||||||||

2016 Term Loan A(h) |

1,087 | Variable | 5.5% | 2027 | ||||||||||

Commercial Paper Notes(i) |

1,905 | Variable | 5.1% | Various | ||||||||||

1.350% Senior Notes(j) |

500 | Fixed | 1.4% | 2025 | ||||||||||

| 4.450% Senior Notes | 900 | Fixed | 4.5% | 2026 | ||||||||||

| 3.700% Senior Notes | 750 | Fixed | 3.7% | 2026 | ||||||||||

| 1.050% Senior Notes | 1,000 | Fixed | 1.1% | 2026 | ||||||||||

| 2.900% Senior Notes | 750 | Fixed | 2.9% | 2027 | ||||||||||

| 4.000% Senior Notes | 500 | Fixed | 4.0% | 2027 | ||||||||||

| 3.650% Senior Notes | 1,000 | Fixed | 3.7% | 2027 | ||||||||||

| 5.000% Senior Notes | 1,000 | Fixed | 5.0% | 2028 | ||||||||||

| 3.800% Senior Notes | 1,000 | Fixed | 3.8% | 2028 | ||||||||||

| 4.800% Senior Notes | 600 | Fixed | 4.8% | 2028 | ||||||||||

| 4.300% Senior Notes | 600 | Fixed | 4.3% | 2029 | ||||||||||

| 5.600% Senior Notes | 750 | Fixed | 5.6% | 2029 | ||||||||||

| 4.900% Senior Notes | 550 | Fixed | 4.9% | 2029 | ||||||||||

| 3.100% Senior Notes | 550 | Fixed | 3.1% | 2029 | ||||||||||

| 3.300% Senior Notes | 750 | Fixed | 3.3% | 2030 | ||||||||||

| 2.250% Senior Notes | 1,100 | Fixed | 2.3% | 2031 | ||||||||||

| 2.100% Senior Notes | 1,000 | Fixed | 2.1% | 2031 | ||||||||||

| 2.500% Senior Notes | 750 | Fixed | 2.5% | 2031 | ||||||||||

| 5.100% Senior Notes | 750 | Fixed | 5.1% | 2033 | ||||||||||

| 5.800% Senior Notes | 750 | Fixed | 5.8% | 2034 | ||||||||||

| 5.200% Senior Notes | 700 | Fixed | 5.2% | 2034 | ||||||||||

| 2.900% Senior Notes | 1,250 | Fixed | 2.9% | 2041 | ||||||||||

| 4.750% Senior Notes | 350 | Fixed | 4.8% | 2047 | ||||||||||

| 5.200% Senior Notes | 400 | Fixed | 5.2% | 2049 | ||||||||||

| 4.000% Senior Notes | 350 | Fixed | 4.0% | 2049 | ||||||||||

| 4.150% Senior Notes | 500 | Fixed | 4.2% | 2050 | ||||||||||

| 3.250% Senior Notes | 900 | Fixed | 3.3% | 2051 | ||||||||||

| Total unsecured debt | $ | 23,392 | 3.9% | |||||||||||

Net Debt(k) |

$ | 24,174 | 3.9% | |||||||||||

Market Capitalization(l) |

44,736 | |||||||||||||

Firm Value(m) |

$ | 68,910 | ||||||||||||

| COMPANY OVERVIEW |

OUTLOOK | FINANCIAL HIGHLIGHTS |

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

DEBT MATURITY OVERVIEW(a)(b) | ||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

LIQUIDITY OVERVIEW(a) | |||||

| (in millions) | June 30, 2025 |

||||

Cash and cash equivalents, and restricted cash and cash equivalents(b)(c) |

$ | 260 | |||

Undrawn 2016 Revolver availability(d) |

6,560 | ||||

Total debt and other obligations (current and non-current)(c)(e) |

24,290 | ||||

Total equity (deficit) |

(1,382) | ||||

| SUMMARY OF MAINTENANCE AND FINANCIAL COVENANTS | |||||||||||||||||

| Debt | Borrower / Issuer | Covenant(f) |

Covenant Level Requirement | As of June 30, 2025 |

|||||||||||||

Maintenance Financial Covenants(g) | |||||||||||||||||

| 2016 Credit Facility | CCI | Total Net Leverage Ratio | ≤ 6.50x | 5.8x | |||||||||||||

| 2016 Credit Facility | CCI | Total Senior Secured Leverage Ratio | ≤ 3.50x | 0.2x | |||||||||||||

| 2016 Credit Facility | CCI | Consolidated Interest Coverage Ratio(h) |

N/A | N/A | |||||||||||||

| Financial covenants requiring excess cash flows to be deposited in a cash trap reserve account and not released | |||||||||||||||||

Tower Revenue Notes, Series 2018-2 |

Crown Castle Towers LLC and its Subsidiaries | Debt Service Coverage Ratio | > 1.75x | (i) |

30.6x | ||||||||||||

| 2009 Securitized Notes | Pinnacle Towers Acquisition Holdings LLC and its Subsidiaries | Debt Service Coverage Ratio | > 1.30x | (i) |

37.1x | ||||||||||||

| Financial covenants restricting ability of relevant issuer to issue additional notes under the applicable indenture | |||||||||||||||||

Tower Revenue Notes, Series 2018-2 |

Crown Castle Towers LLC and its Subsidiaries | Debt Service Coverage Ratio | ≥ 2.00x | (j) |

30.6x | ||||||||||||

| 2009 Securitized Notes | Pinnacle Towers Acquisition Holdings LLC and its Subsidiaries | Debt Service Coverage Ratio | ≥ 2.34x | (j) |

37.1x | ||||||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

INTEREST RATE EXPOSURE(a) | |||||||||||||||||

(as of June 30, 2025; dollars in millions) | |||||||||||||||||

| Fixed Rate Debt | Floating Rate Debt | ||||||||||||||||

Face value of principal outstanding(b) |

$20,779 | Face value of principal outstanding(b) |

$3,392 | ||||||||||||||

| % of total debt | 86% | % of total debt | 14% | ||||||||||||||

| Weighted average interest rate | 3.7% | Weighted average interest rate(c) |

5.3% | ||||||||||||||

| Upcoming maturities: | 2025 | 2026 | Interest rate sensitivity of 25 bps increase in interest rates: | ||||||||||||||

Face value of principal outstanding(b) |

$500 | $2,650 | Full year effect(d) |

$8.5 | |||||||||||||

| Weighted average interest rate | 1.4% | 3.0% | |||||||||||||||

| COMPONENTS OF INTEREST EXPENSE | |||||||||||||||||||||||||||||||||||

| 2024 | 2025 | ||||||||||||||||||||||||||||||||||

| (in millions) | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | |||||||||||||||||||||||||||||

| Interest expense on debt obligations | $ | 223 | $ | 227 | $ | 234 | $ | 236 | $ | 233 | $ | 239 | |||||||||||||||||||||||

| Amortization of deferred financing costs and adjustments on long-term debt | 8 | 8 | 8 | 8 | 8 | 8 | |||||||||||||||||||||||||||||

| Capitalized interest | (5) | (5) | (6) | (4) | (5) | (4) | |||||||||||||||||||||||||||||

| Interest expense and amortization of deferred financing costs, net | $ | 226 | $ | 230 | $ | 236 | $ | 240 | $ | 236 | $ | 243 | |||||||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

| CONDENSED CONSOLIDATED BALANCE SHEET (Unaudited) | |||||||||||

| (in millions, except par values) | June 30, 2025 | December 31, 2024 | |||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 94 | $ | 100 | |||||||

Restricted cash and cash equivalents |

161 | 170 | |||||||||

| Receivables, net | 100 | 129 | |||||||||

| Prepaid expenses | 70 | 74 | |||||||||

Current portion of deferred site rental receivables |

205 | 164 | |||||||||

| Other current assets | 24 | 24 | |||||||||

Current assets of discontinued operations |

420 | 429 | |||||||||

| Total current assets | 1,074 | 1,090 | |||||||||

| Deferred site rental receivables | 2,277 | 2,279 | |||||||||

| Property and equipment, net | 6,402 | 6,577 | |||||||||

| Operating lease right-of-use assets | 5,562 | 5,600 | |||||||||

| Goodwill | 5,127 | 5,127 | |||||||||

| Other intangible assets, net | 949 | 1,037 | |||||||||

| Other assets, net | 63 | 58 | |||||||||

Non-current assets of discontinued operations |

10,182 | 10,968 | |||||||||

| Total assets | $ | 31,636 | $ | 32,736 | |||||||

LIABILITIES AND EQUITY (DEFICIT) | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 48 | $ | 48 | |||||||

| Accrued interest | 238 | 244 | |||||||||

| Deferred revenues | 139 | 141 | |||||||||

| Other accrued liabilities | 154 | 167 | |||||||||

| Current maturities of debt and other obligations | 2,251 | 603 | |||||||||

| Current portion of operating lease liabilities | 267 | 264 | |||||||||

Current liabilities of discontinued operations |

706 | 710 | |||||||||

| Total current liabilities | 3,803 | 2,177 | |||||||||

| Debt and other long-term obligations | 22,039 | 23,451 | |||||||||

| Operating lease liabilities | 5,009 | 5,062 | |||||||||

| Other long-term liabilities | 628 | 645 | |||||||||

Non-current liabilities of discontinued operations |

1,539 | 1,534 | |||||||||

| Total liabilities | 33,018 | 32,869 | |||||||||

| Commitments and contingencies | |||||||||||

Stockholders' equity (deficit): |

|||||||||||

Common stock, 0.01 par value; 1,200 shares authorized; shares issued and outstanding: June 30, 2025—435 and December 31, 2024—435 |

4 | 4 | |||||||||

| Additional paid-in capital | 18,463 | 18,393 | |||||||||

| Accumulated other comprehensive income (loss) | (5) | (5) | |||||||||

| Dividends/distributions in excess of earnings | (19,844) | (18,525) | |||||||||

Total equity (deficit) |

(1,382) | (133) | |||||||||

Total liabilities and equity (deficit) |

$ | 31,636 | $ | 32,736 | |||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

| CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS (Unaudited) | |||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| (in millions, except per share amounts) | 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||

| Net revenues: | |||||||||||||||||||||||

| Site rental | $ | 1,008 | $ | 1,064 | $ | 2,019 | $ | 2,132 | |||||||||||||||

| Services and other | 52 | 43 | 102 | 89 | |||||||||||||||||||

| Net revenues | 1,060 | 1,107 | 2,121 | 2,221 | |||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

Costs of operations:(a) |

|||||||||||||||||||||||

| Site rental | 251 | 249 | 491 | 494 | |||||||||||||||||||

| Services and other | 27 | 25 | 55 | 54 | |||||||||||||||||||

| Selling, general and administrative | 99 | 136 | 192 | 250 | |||||||||||||||||||

| Asset write-down charges | 2 | 3 | 4 | 8 | |||||||||||||||||||

| Depreciation, amortization and accretion | 175 | 180 | 352 | 371 | |||||||||||||||||||

| Restructuring charges | — | 19 | — | 30 | |||||||||||||||||||

| Total operating expenses | 554 | 612 | 1,094 | 1,207 | |||||||||||||||||||

| Operating income (loss) | 506 | 495 | 1,027 | 1,014 | |||||||||||||||||||

| Interest expense and amortization of deferred financing costs, net | (243) | (230) | (479) | (455) | |||||||||||||||||||

| Interest income | 4 | 4 | 7 | 8 | |||||||||||||||||||

| Other income (expense) | 2 | 1 | 3 | 3 | |||||||||||||||||||

Income (loss) from continuing operations before income taxes |

269 | 270 | 558 | 570 | |||||||||||||||||||

| Benefit (provision) for income taxes | (4) | (5) | (9) | (11) | |||||||||||||||||||

Income (loss) from continuing operations |

$ | 265 | $ | 265 | $ | 549 | $ | 559 | |||||||||||||||

| Discontinued operations: | |||||||||||||||||||||||

Income (loss) from discontinued operations before gain (loss) from disposal, net of tax |

278 | (14) | 360 | 3 | |||||||||||||||||||

Gain (loss) from disposal of discontinued operations |

(252) | — | (1,082) | — | |||||||||||||||||||

Income (loss) from discontinued operations, net of tax |

26 | (14) | (722) | 3 | |||||||||||||||||||

| Net income (loss) | $ | 291 | $ | 251 | $ | (173) | $ | 562 | |||||||||||||||

| Net income (loss), per common share: | |||||||||||||||||||||||

| Income (loss) from continuing operations, basic | $ | 0.61 | $ | 0.61 | $ | 1.26 | $ | 1.28 | |||||||||||||||

| Income (loss) from discontinued operations, basic | $ | 0.06 | $ | (0.03) | $ | (1.66) | $ | 0.01 | |||||||||||||||

| Net income (loss)—basic | $ | 0.67 | $ | 0.58 | $ | (0.40) | $ | 1.29 | |||||||||||||||

Income (loss) from continuing operations, diluted |

$ | 0.61 | $ | 0.61 | $ | 1.26 | $ | 1.28 | |||||||||||||||

Income (loss) from discontinued operations, diluted |

$ | 0.06 | $ | (0.03) | $ | (1.66) | $ | 0.01 | |||||||||||||||

Net income (loss)—diluted |

$ | 0.67 | $ | 0.58 | $ | (0.40) | $ | 1.29 | |||||||||||||||

| Weighted-average common shares outstanding: | |||||||||||||||||||||||

| Basic | 435 | 435 | 435 | 434 | |||||||||||||||||||

| Diluted | 437 | 435 | 436 | 435 | |||||||||||||||||||

| COMPANY OVERVIEW |

OUTLOOK |

FINANCIAL

HIGHLIGHTS

|

CAPITALIZATION OVERVIEW | APPENDIX | ||||||||||

| CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (Unaudited) | |||||||||||

| Six Months Ended June 30, | |||||||||||

| (in millions) | 2025 | 2024 | |||||||||

| Cash flows from operating activities: | |||||||||||

| Net income (loss) | $ | (173) | $ | 562 | |||||||

(Income) loss from discontinued operations before (gain) loss from disposal, net of tax |

(360) | (3) | |||||||||

(Gain) loss from disposal of discontinued operations |

1,082 | — | |||||||||

Income (loss) from continuing operations |

549 | 559 | |||||||||

Adjustments to reconcile income (loss) from continuing operations to net cash provided by (used for) operating activities: |

|||||||||||

| Depreciation, amortization and accretion | 352 | 371 | |||||||||

| Amortization of deferred financing costs and other non-cash interest | 16 | 18 | |||||||||

| Stock-based compensation expense, net | 36 | 50 | |||||||||

| Asset write-down charges | 4 | 8 | |||||||||

| Deferred income tax (benefit) provision | 1 | 5 | |||||||||

| Other non-cash adjustments, net | (4) | 8 | |||||||||

| Net cash provided by (used for) operating activities from discontinued operations | 581 | 556 | |||||||||

| Changes in assets and liabilities, excluding the effects of acquisitions: | |||||||||||

| Increase (decrease) in liabilities | (38) | (118) | |||||||||

| Decrease (increase) in assets | (24) | (90) | |||||||||

| Net cash provided by (used for) operating activities | 1,473 | 1,367 | |||||||||

| Cash flows from investing activities: | |||||||||||

| Capital expenditures | (80) | (86) | |||||||||

| Payments for acquisitions, net of cash acquired | — | (7) | |||||||||

| Other investing activities, net | 3 | 6 | |||||||||

| Net cash provided by (used for) investing activities from discontinued operations | (446) | (563) | |||||||||

| Net cash provided by (used for) investing activities | (523) | (650) | |||||||||

| Cash flows from financing activities: | |||||||||||

| Principal payments on debt and other long-term obligations | (59) | (36) | |||||||||

| Purchases and redemptions of long-term debt | (700) | — | |||||||||

| Borrowings under revolving credit facility | 400 | — | |||||||||

| Payments under revolving credit facility | — | (670) | |||||||||

Net issuances (repayments) under commercial paper program |

564 | 1,438 | |||||||||

| Purchases of common stock | (23) | (30) | |||||||||

| Dividends/distributions paid on common stock | (1,153) | (1,368) | |||||||||

| Net cash provided by (used for) financing activities | (971) | (666) | |||||||||

| Net increase (decrease) in cash and cash equivalents and restricted cash and cash equivalents | (21) | 51 | |||||||||

| Effect of exchange rate changes on cash | — | (1) | |||||||||

Cash and cash equivalents and restricted cash and cash equivalents at beginning of period(a) |

295 | 281 | |||||||||

Cash and cash equivalents and restricted cash and cash equivalents at end of period(a) |