C O N F I D E N T I A L September 23, 2025 Discussion Materials Exhibit 99.2

C O N F I D E N T I A L This presentation contains confidential information pertaining to Urban One, Inc. (“we” or the “Company”). This presentation is being provided on a confidential basis to the recipient solely to assist the recipient in evaluating a potential transaction (the “Transaction”) with the Company. The Company does not intend for this presentation to form the entire basis of any transaction or investment decision by the recipient. ANY TRANSACTION WITH THE COMPANY INVOLVES A HIGH DEGREE OF RISK. Any party to a transaction should inquire into, independently investigate and consider such risks before entering into any transaction with the Company. This presentation contains forward-looking statements within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended, about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this presentation, including but not limited to statements regarding guidance, our future results of operations or financial condition, future securities repurchase programs, business strategy and plans, cost saving initiatives, user growth and engagement and objectives of management for future operations are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “going to,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” or the negative of these words or other similar terms or expressions. We caution you that the foregoing may not include all of the forward-looking statements made in this presentation. You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this presentation primarily on our current expectations, assumptions, projections and other information available at the time the statements are being made. These forward-looking statements are subject to risks and uncertainties related to: the proposed terms of the Transaction and the use of any proceeds therefrom; macroeconomic uncertainty and geopolitical events; our leverage and market conditions; fluctuations in the local economies and business sectors in which we operate; increased costs; the implementation and execution of our business diversification strategy; our investments; regulation by the Federal Communications Commission; changes in our key personnel and on-air talent; increases in competition for and in the costs of our programming and content; financial losses; increased competition for advertising revenues; the impact of our acquisitions, dispositions and similar transactions; consolidation in industries in which we and our advertisers operate; disruptions to our technology network; material weaknesses identified in our internal control over financial reporting; failure to meet the continued listing standards of NASDAQ Stock Market; and other factors described in “Risk Factors” and elsewhere in our Annual Report on Form 10-K for the year ended December 31, 2024, as well as the other documents we file from time to time with the Securities and Exchange Commission (the “SEC”), available on the SEC’s website at www.sec.gov. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this presentation. The results, events, and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events, or circumstances could differ materially from those described in the forward-looking statements. These statements are inherently uncertain, and you are cautioned not to unduly rely on these statements. The forward-looking statements made in this presentation relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this presentation to reflect events or circumstances after the date of this presentation or to reflect new information or the occurrence of unanticipated events, except as required by law. This presentation may also contain estimates and other statistical data made by independent parties and by the Company relating to market size and growth and other industry data. Such data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. The Company has not independently verified the statistical and other industry data generated by independent parties and contained in this presentation and, accordingly, it cannot guarantee their accuracy or completeness. The information in this presentation was provided by the Company or is from public or other sources. The Company does not make any representation or warranty, express or implied, or accept any responsibility or liability for the accuracy or completeness of this presentation or any other written or oral information that the Company or any other person makes available to any recipient. The Company does not make any representation or warranty as to the achievement or reasonableness of any projections, management estimates, prospects or returns. This presentation speaks only as of the date of the information herein and the Company does not have any obligation to update or correct any information herein. This presentation is intended only for recipients who have agreed to keep this presentation and the Transaction confidential. If you have not agreed to keep this presentation and the Transaction confidential, you must return this presentation immediately. This presentation is confidential and by accepting this presentation, you agree not to disclose, copy or distribute this presentation or the information herein without the Company’s prior written consent. This presentation contains references to trademarks, service marks and trade names owned by the Company or belonging to other entities. Solely for convenience, trademarks, service marks and trade names referred to in this presentation may appear without the © or symbols, but such references are not intended to indicate, in any way, that the Company or the applicable licensor will not assert, to the fullest extent under applicable law, the Company’s or its rights to these trademarks, service marks and trade names. The Company does not intend its use or display of other companies’ trademarks, service marks or trade names to imply a relationship with, or endorsement or sponsorship of it by, any other companies. All trademarks, service marks and trade names included in this presentation are the property of their respective owners. The securities to which this presentation relates have not been registered under the Securities Act, or the securities laws of any other jurisdiction. The Company is offering securities to which this presentation relates in reliance on exemptions from the registration requirements of the Securities Act and other applicable laws. These exemptions apply to offers and sales of securities that do not involve a public offering. The securities have not been approved or recommended by any federal, state or foreign securities authorities, nor have any of these authorities passed upon the merits of this offering or determined that this presentation is accurate or complete. Any representation to the contrary is a criminal offense. This presentation is not, and should not be construed as, an offer to sell or a solicitation of an offer to buy any securities of, or to make any investments in, the Company in any jurisdiction. Any transaction will not be registered under the Securities Act or any state securities laws. Applicable law may restrict the delivery of this presentation to persons in certain jurisdictions. You should inform yourself about, and observe, any such restrictions. By accepting this presentation, you represent that you are a person to whom the Company may deliver this presentation without a violation of the laws of any relevant jurisdiction. This presentation includes certain financial measures that have not been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). The presentation of non-GAAP financial measures is not intended to be considered in isolation from, as a substitute for, or superior to the financial information prepared and presented in accordance with GAAP. We use non-GAAP financial measures as additional means to evaluate our business and operating results through period-to-period comparisons. Reconciliations of our non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the appendix of this presentation. Reliance should not be placed on any single financial measure to evaluate our business. Disclaimers 2

C O N F I D E N T I A L 3 36Appendix3. 25Business Plan Overview2. 4Financial Performance1. TABLE OF CONTENTS

C O N F I D E N T I A L FINANCIAL PERFORMANCE 4

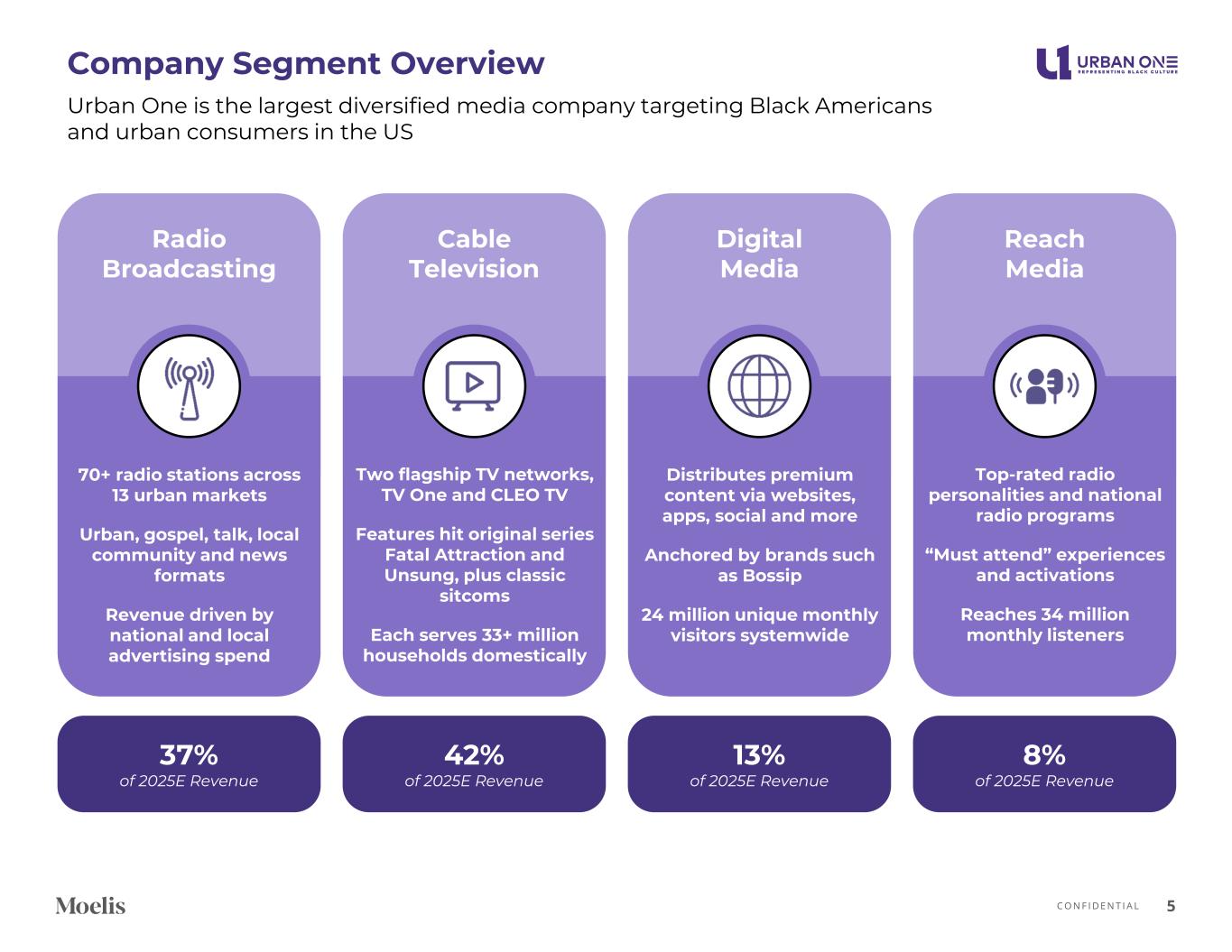

C O N F I D E N T I A L Company Segment Overview 5 Urban One is the largest diversified media company targeting Black Americans and urban consumers in the US Radio Broadcasting 70+ radio stations across 13 urban markets Urban, gospel, talk, local community and news formats Revenue driven by national and local advertising spend 37% of 2025E Revenue Cable Television Two flagship TV networks, TV One and CLEO TV Features hit original series Fatal Attraction and Unsung, plus classic sitcoms Each serves 33+ million households domestically Digital Media Distributes premium content via websites, apps, social and more Anchored by brands such as Bossip 24 million unique monthly visitors systemwide Reach Media Top-rated radio personalities and national radio programs “Must attend” experiences and activations Reaches 34 million monthly listeners 42% of 2025E Revenue 13% of 2025E Revenue 8% of 2025E Revenue

C O N F I D E N T I A L $131 $103 $60 $70 2023A 2024A 2025E 2026E $478 $450 $384 $392 2023A 2024A 2025E 2026E Adj. EBITDA ($ in millions)Consolidated Net Revenue ($ in millions) Financial Overview 6 Commentary • Urban One is facing headwinds recently due the reversal of ad spend momentum as corporates revise DEI policies • Cable TV segment is also dealing with subscriber churn, while national and network radio demand continues to shrink • Mid-term political ad revenue will help drive a modest rebound in 2026 in the Radio and Digital segments alongside growth related to Urban One’s efforts in Connected Television Advertising (“CTV”) o Local digital revenues have opportunities for upside by gaining significant market share in local digital audio markets through the audience extension business which has been a focus area for growth • Historically, Urban One has had higher Radio and Cable TV margins relative to market peers, and the company continues to actively look for opportunities to optimize cost structure across the organization in the hopes of returning margins closer to historical norms Note: 2023A figures include partial year contribution only from net acquisition of two Houston radio stations; four stations acquired and two divested % Growth–% % Margin–% (6%) (15%) 2% 23% 16% 18%27%

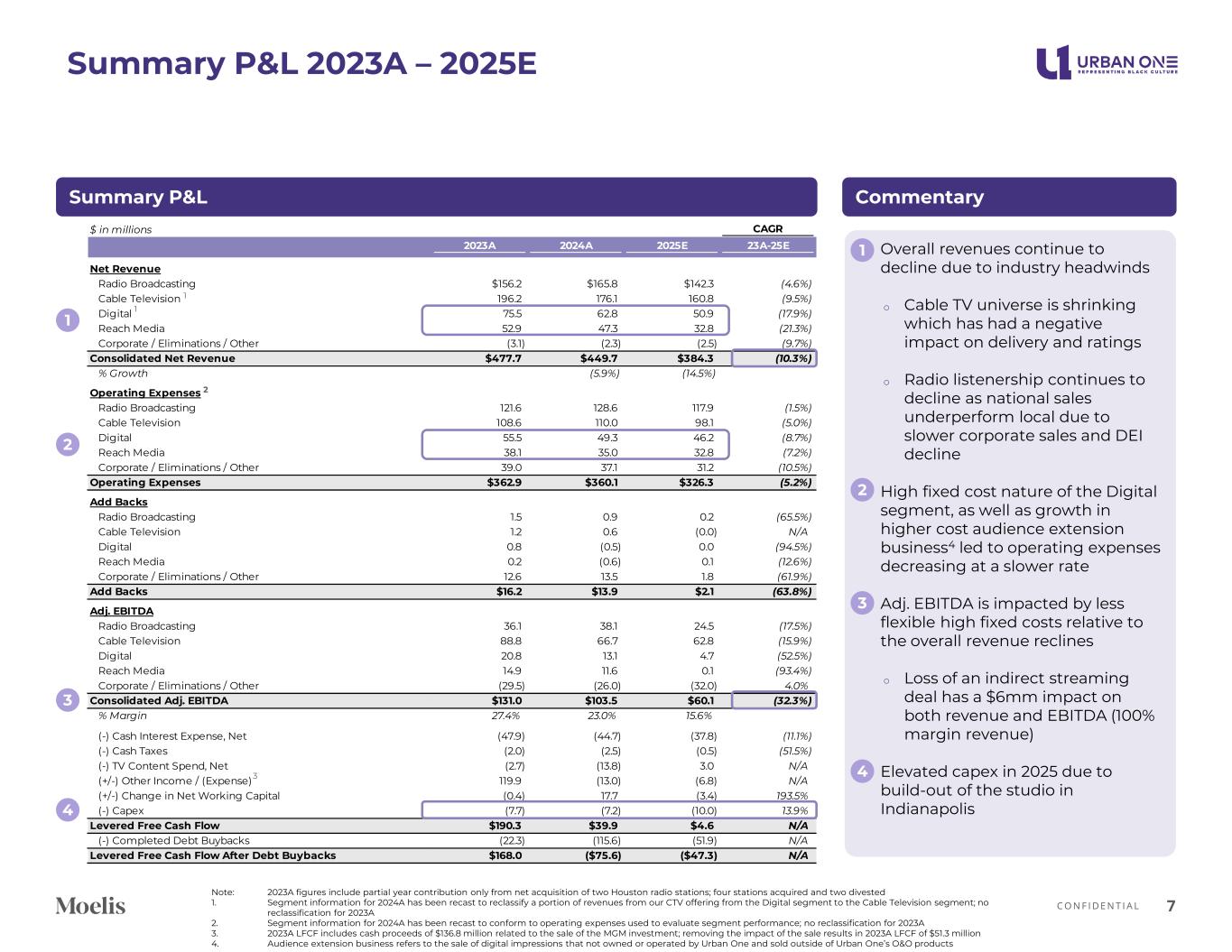

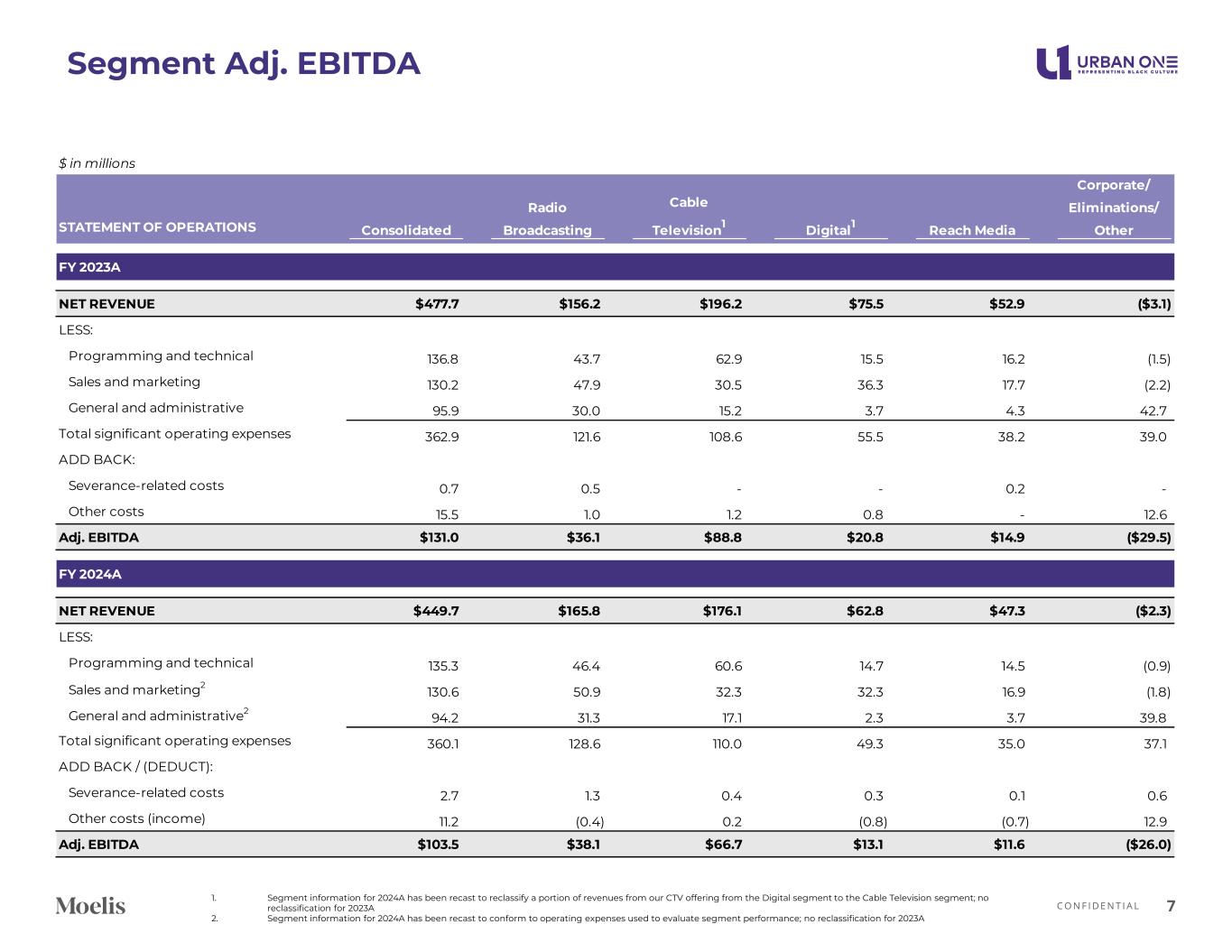

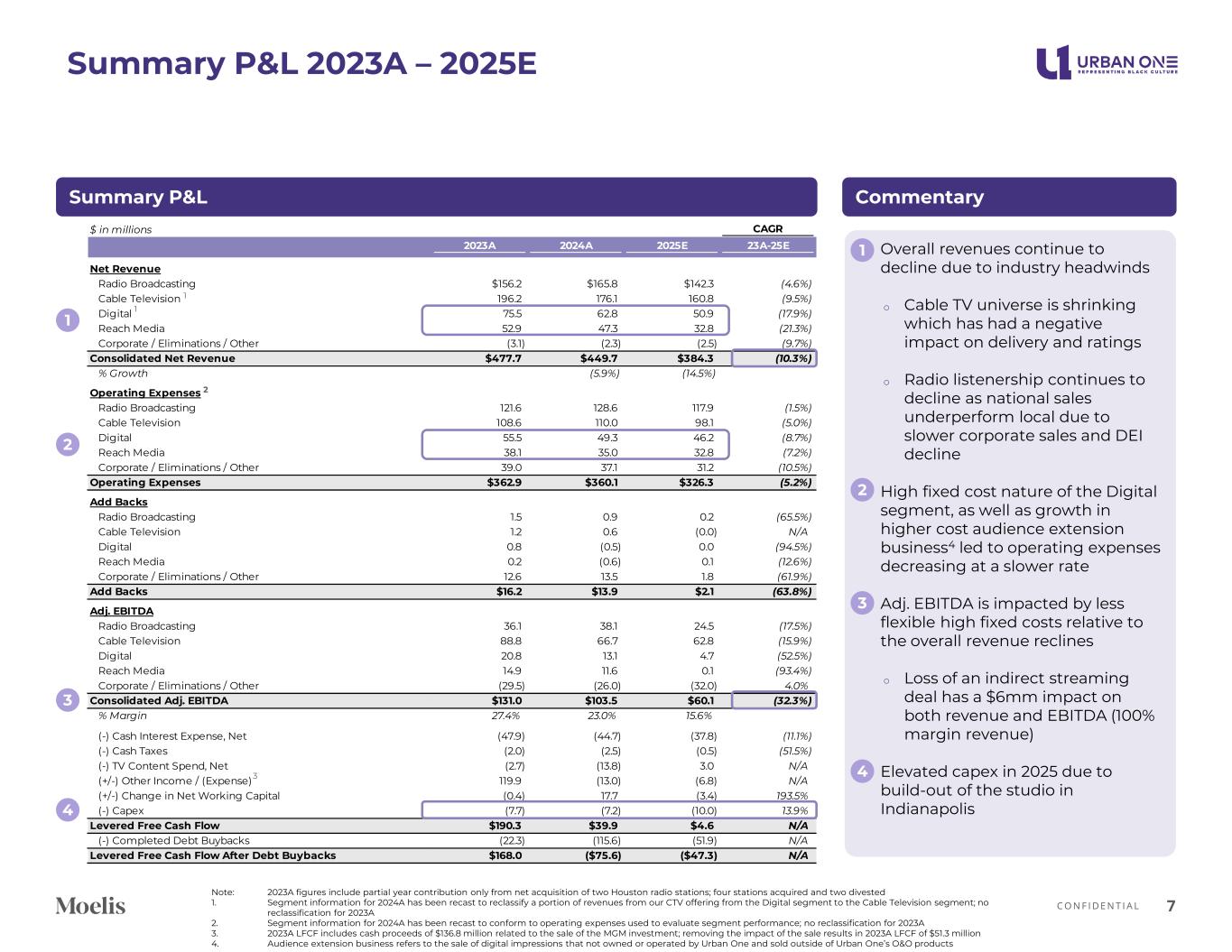

C O N F I D E N T I A L • Overall revenues continue to decline due to industry headwinds o Cable TV universe is shrinking which has had a negative impact on delivery and ratings o Radio listenership continues to decline as national sales underperform local due to slower corporate sales and DEI decline • High fixed cost nature of the Digital segment, as well as growth in higher cost audience extension business4 led to operating expenses decreasing at a slower rate • Adj. EBITDA is impacted by less flexible high fixed costs relative to the overall revenue reclines o Loss of an indirect streaming deal has a $6mm impact on both revenue and EBITDA (100% margin revenue) • Elevated capex in 2025 due to build-out of the studio in Indianapolis CommentarySummary P&L Summary P&L 2023A – 2025E 7 1 2 3 4 1 2 3 4 Note: 2023A figures include partial year contribution only from net acquisition of two Houston radio stations; four stations acquired and two divested 1. Segment information for 2024A has been recast to reclassify a portion of revenues from our CTV offering from the Digital segment to the Cable Television segment; no reclassification for 2023A 2. Segment information for 2024A has been recast to conform to operating expenses used to evaluate segment performance; no reclassification for 2023A 3. 2023A LFCF includes cash proceeds of $136.8 million related to the sale of the MGM investment; removing the impact of the sale results in 2023A LFCF of $51.3 million 4. Audience extension business refers to the sale of digital impressions that not owned or operated by Urban One and sold outside of Urban One’s O&O products $ in millions CAGR 2023A 2024A 2025E 23A-25E Net Revenue Radio Broadcasting $156.2 $165.8 $142.3 (4.6%) Cable Television 196.2 176.1 160.8 (9.5%) Digital 75.5 62.8 50.9 (17.9%) Reach Media 52.9 47.3 32.8 (21.3%) Corporate / Eliminations / Other (3.1) (2.3) (2.5) (9.7%) Consolidated Net Revenue $477.7 $449.7 $384.3 (10.3%) % Growth (5.9%) (14.5%) Operating Expenses Radio Broadcasting 121.6 128.6 117.9 (1.5%) Cable Television 108.6 110.0 98.1 (5.0%) Digital 55.5 49.3 46.2 (8.7%) Reach Media 38.1 35.0 32.8 (7.2%) Corporate / Eliminations / Other 39.0 37.1 31.2 (10.5%) Operating Expenses $362.9 $360.1 $326.3 (5.2%) Add Backs Radio Broadcasting 1.5 0.9 0.2 (65.5%) Cable Television 1.2 0.6 (0.0) N/A Digital 0.8 (0.5) 0.0 (94.5%) Reach Media 0.2 (0.6) 0.1 (12.6%) Corporate / Eliminations / Other 12.6 13.5 1.8 (61.9%) Add Backs $16.2 $13.9 $2.1 (63.8%) Adj. EBITDA Radio Broadcasting 36.1 38.1 24.5 (17.5%) Cable Television 88.8 66.7 62.8 (15.9%) Digital 20.8 13.1 4.7 (52.5%) Reach Media 14.9 11.6 0.1 (93.4%) Corporate / Eliminations / Other (29.5) (26.0) (32.0) 4.0% Consolidated Adj. EBITDA $131.0 $103.5 $60.1 (32.3%) % Margin 27.4% 23.0% 15.6% (-) Cash Interest Expense, Net (47.9) (44.7) (37.8) (11.1%) (-) Cash Taxes (2.0) (2.5) (0.5) (51.5%) (-) TV Content Spend, Net (2.7) (13.8) 3.0 N/A (+/-) Other Income / (Expense) 119.9 (13.0) (6.8) N/A (+/-) Change in Net Working Capital (0.4) 17.7 (3.4) 193.5% (-) Capex (7.7) (7.2) (10.0) 13.9% Levered Free Cash Flow $190.3 $39.9 $4.6 N/A (-) Completed Debt Buybacks (22.3) (115.6) (51.9) N/A Levered Free Cash Flow After Debt Buybacks $168.0 ($75.6) ($47.3) N/A 3 1 1 2

C O N F I D E N T I A L Key Radio Industry Trends 8 Declining Local / Network Ad Revenue Increased competition from digital platforms is reducing traditional radio’s share of advertising dollars, making it harder to sustain revenue growth 1 Streaming services and podcasts are pulling audiences away from terrestrial radio reducing listener engagement and altering consumption patterns Shifting Listener Habits 2 High Leverage Levels and Financial Strain Many radio broadcasters' high debt limits flexibility, restricting digital investment and increasing economic vulnerability 3 Rising music licensing fees and talent contract demands add financial pressure, increasing operational costs Increased Licensing Costs 4 Fragmentation of Audience Younger demographics are consuming audio content across multiple platforms (e.g., Spotify, YouTube, podcasts), making it increasingly difficult to maintain audience loyalty and engagement 5 Advertisers are pursuing programmatic audio investments industry-wide, creating the need to identify supporting technology solutions Technology Solutions 6

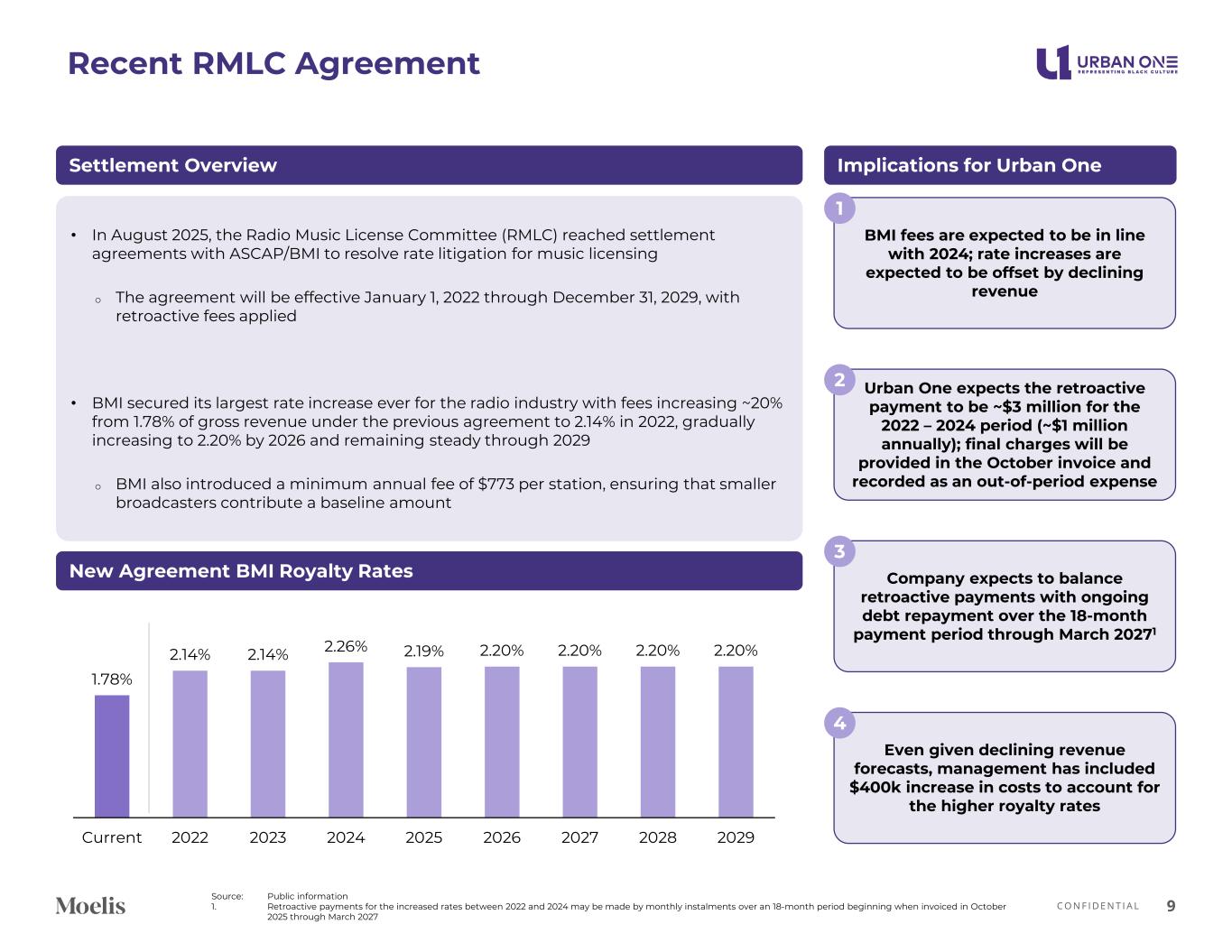

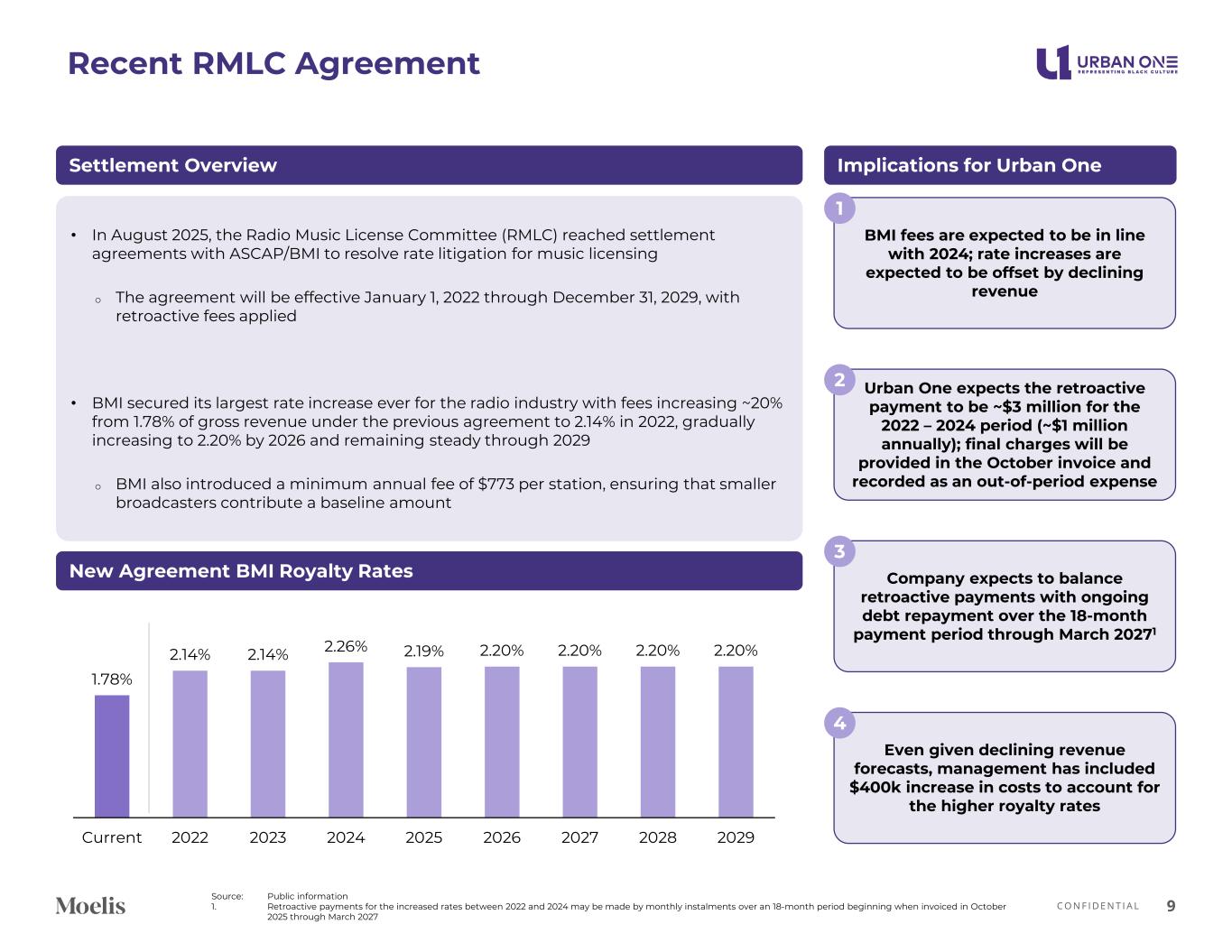

C O N F I D E N T I A L Recent RMLC Agreement 9 Settlement Overview • In August 2025, the Radio Music License Committee (RMLC) reached settlement agreements with ASCAP/BMI to resolve rate litigation for music licensing o The agreement will be effective January 1, 2022 through December 31, 2029, with retroactive fees applied • BMI secured its largest rate increase ever for the radio industry with fees increasing ~20% from 1.78% of gross revenue under the previous agreement to 2.14% in 2022, gradually increasing to 2.20% by 2026 and remaining steady through 2029 o BMI also introduced a minimum annual fee of $773 per station, ensuring that smaller broadcasters contribute a baseline amount New Agreement BMI Royalty Rates Implications for Urban One BMI fees are expected to be in line with 2024; rate increases are expected to be offset by declining revenue 1 Urban One expects the retroactive payment to be ~$3 million for the 2022 – 2024 period (~$1 million annually); final charges will be provided in the October invoice and recorded as an out-of-period expense 2 Company expects to balance retroactive payments with ongoing debt repayment over the 18-month payment period through March 20271 3 Even given declining revenue forecasts, management has included $400k increase in costs to account for the higher royalty rates 4 1.78% 2.14% 2.14% 2.26% 2.19% 2.20% 2.20% 2.20% 2.20% Current 2022 2023 2024 2025 2026 2027 2028 2029 Source: Public information 1. Retroactive payments for the increased rates between 2022 and 2024 may be made by monthly instalments over an 18-month period beginning when invoiced in October 2025 through March 2027

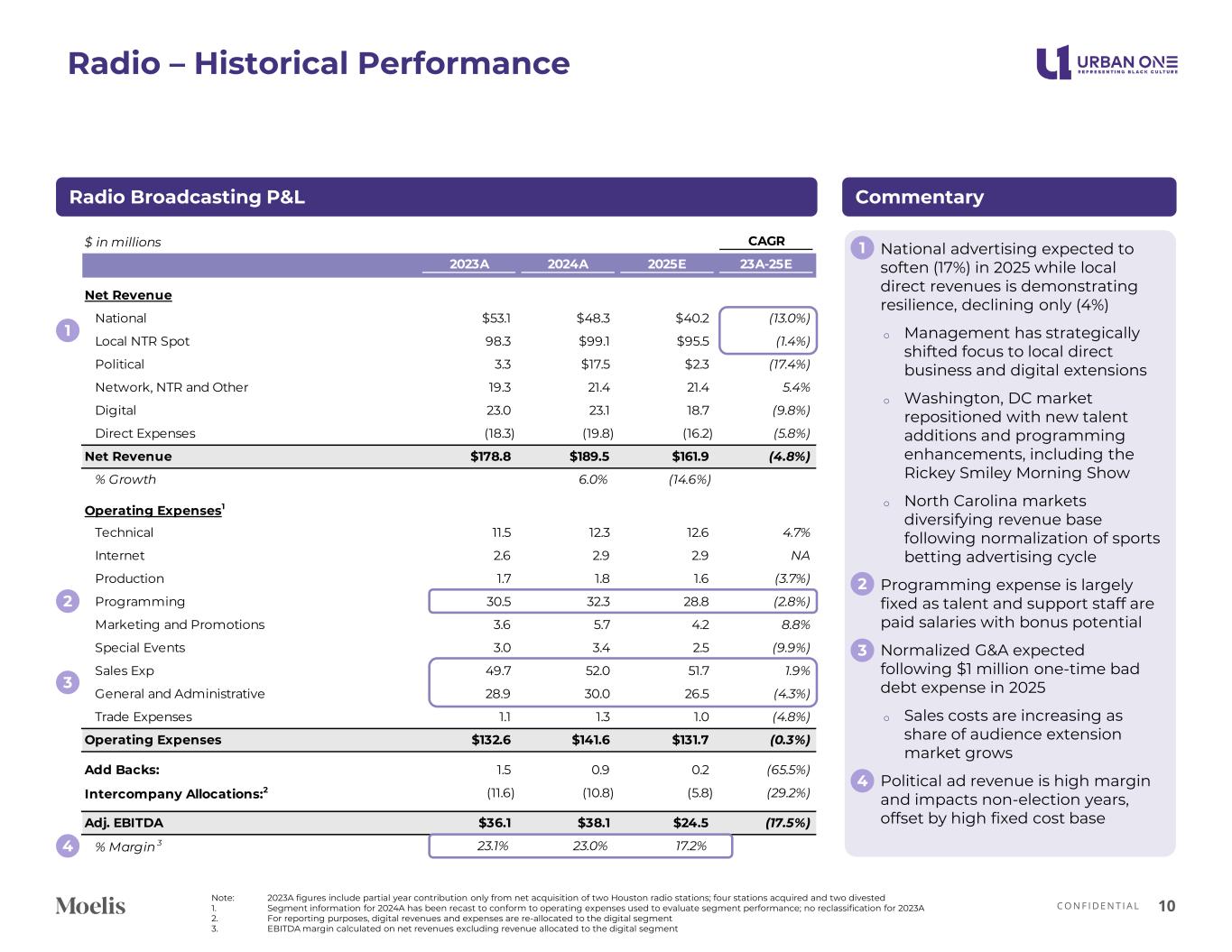

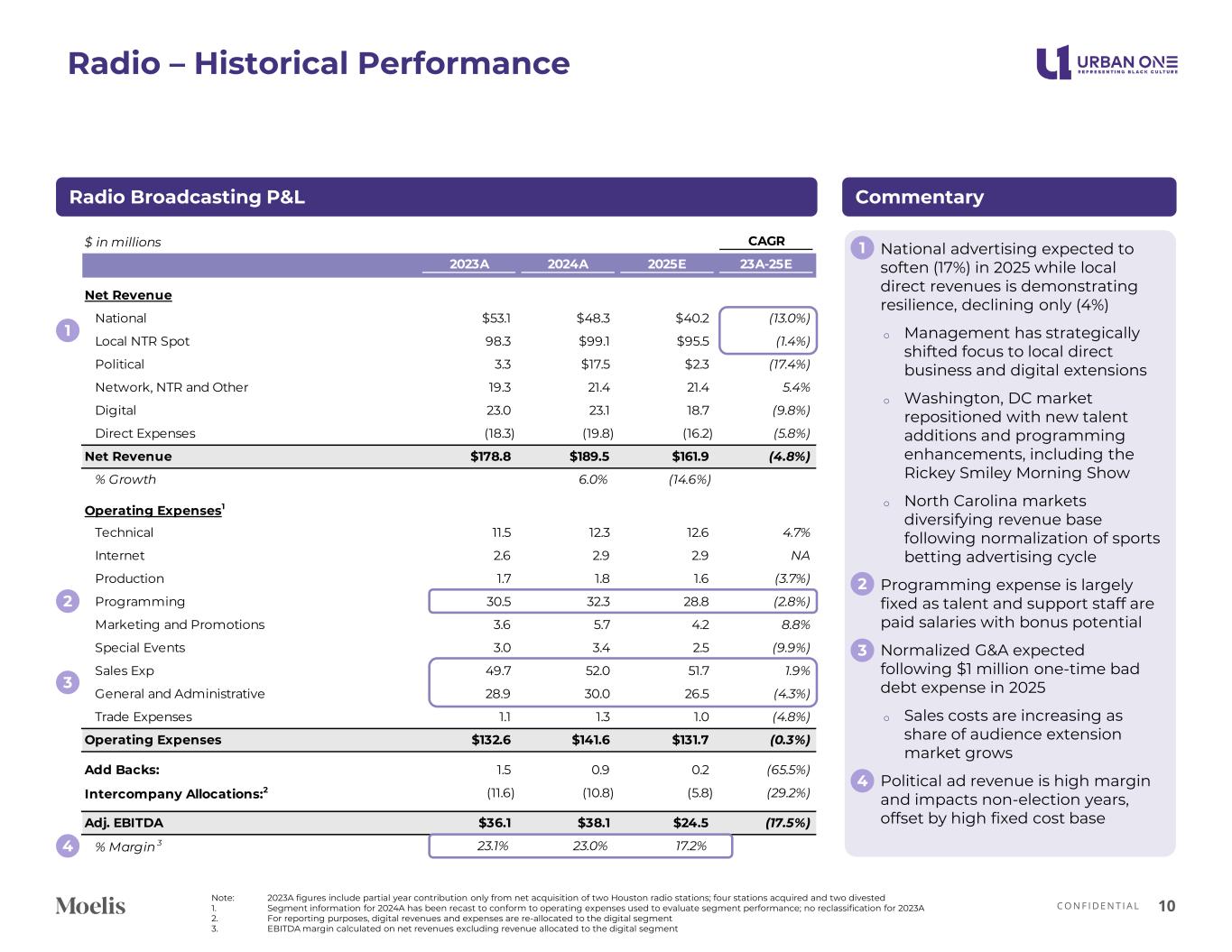

C O N F I D E N T I A L Radio – Historical Performance 10 1 2 • National advertising expected to soften (17%) in 2025 while local direct revenues is demonstrating resilience, declining only (4%) o Management has strategically shifted focus to local direct business and digital extensions o Washington, DC market repositioned with new talent additions and programming enhancements, including the Rickey Smiley Morning Show o North Carolina markets diversifying revenue base following normalization of sports betting advertising cycle • Programming expense is largely fixed as talent and support staff are paid salaries with bonus potential • Normalized G&A expected following $1 million one-time bad debt expense in 2025 o Sales costs are increasing as share of audience extension market grows • Political ad revenue is high margin and impacts non-election years, offset by high fixed cost base CommentaryRadio Broadcasting P&L 1 2 3 3 4 Note: 2023A figures include partial year contribution only from net acquisition of two Houston radio stations; four stations acquired and two divested 1. Segment information for 2024A has been recast to conform to operating expenses used to evaluate segment performance; no reclassification for 2023A 2. For reporting purposes, digital revenues and expenses are re-allocated to the digital segment 3. EBITDA margin calculated on net revenues excluding revenue allocated to the digital segment $ in millions CAGR 2023A 2024A 2025E 23A-25E Net Revenue National $53.1 $48.3 $40.2 (13.0%) Local NTR Spot 98.3 $99.1 $95.5 (1.4%) Political 3.3 $17.5 $2.3 (17.4%) Network, NTR and Other 19.3 21.4 21.4 5.4% Digital 23.0 23.1 18.7 (9.8%) Direct Expenses (18.3) (19.8) (16.2) (5.8%) Net Revenue $178.8 $189.5 $161.9 (4.8%) % Growth 6.0% (14.6%) Operating Expenses1 Technical 11.5 12.3 12.6 4.7% Internet 2.6 2.9 2.9 NA Production 1.7 1.8 1.6 (3.7%) Programming 30.5 32.3 28.8 (2.8%) Marketing and Promotions 3.6 5.7 4.2 8.8% Special Events 3.0 3.4 2.5 (9.9%) Sales Exp 49.7 52.0 51.7 1.9% General and Administrative 28.9 30.0 26.5 (4.3%) Trade Expenses 1.1 1.3 1.0 (4.8%) Operating Expenses $132.6 $141.6 $131.7 (0.3%) Add Backs: 1.5 0.9 0.2 (65.5%) Intercompany Allocations:2 (11.6) (10.8) (5.8) (29.2%) Adj. EBITDA $36.1 $38.1 $24.5 (17.5%) % Margin 3 23.1% 23.0% 17.2%4

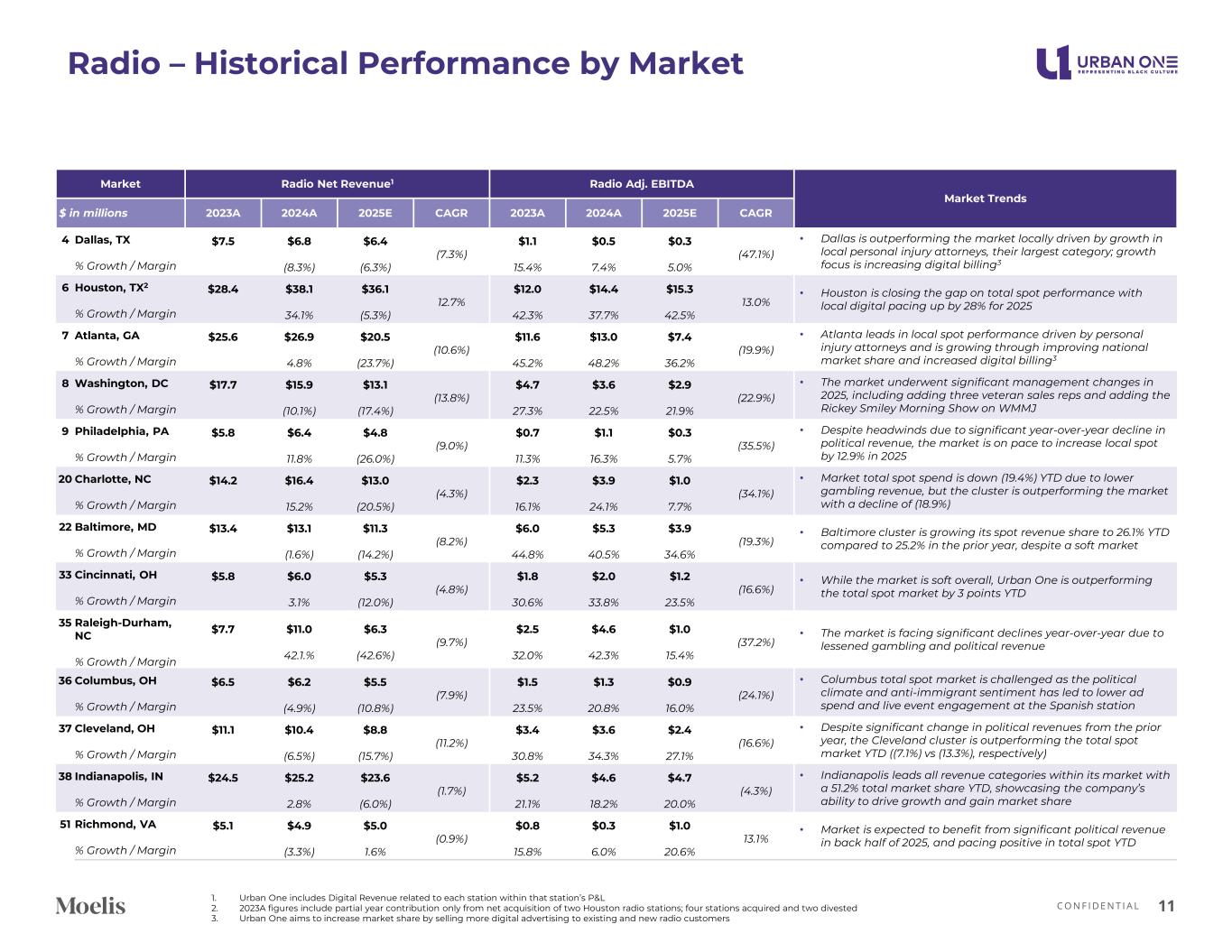

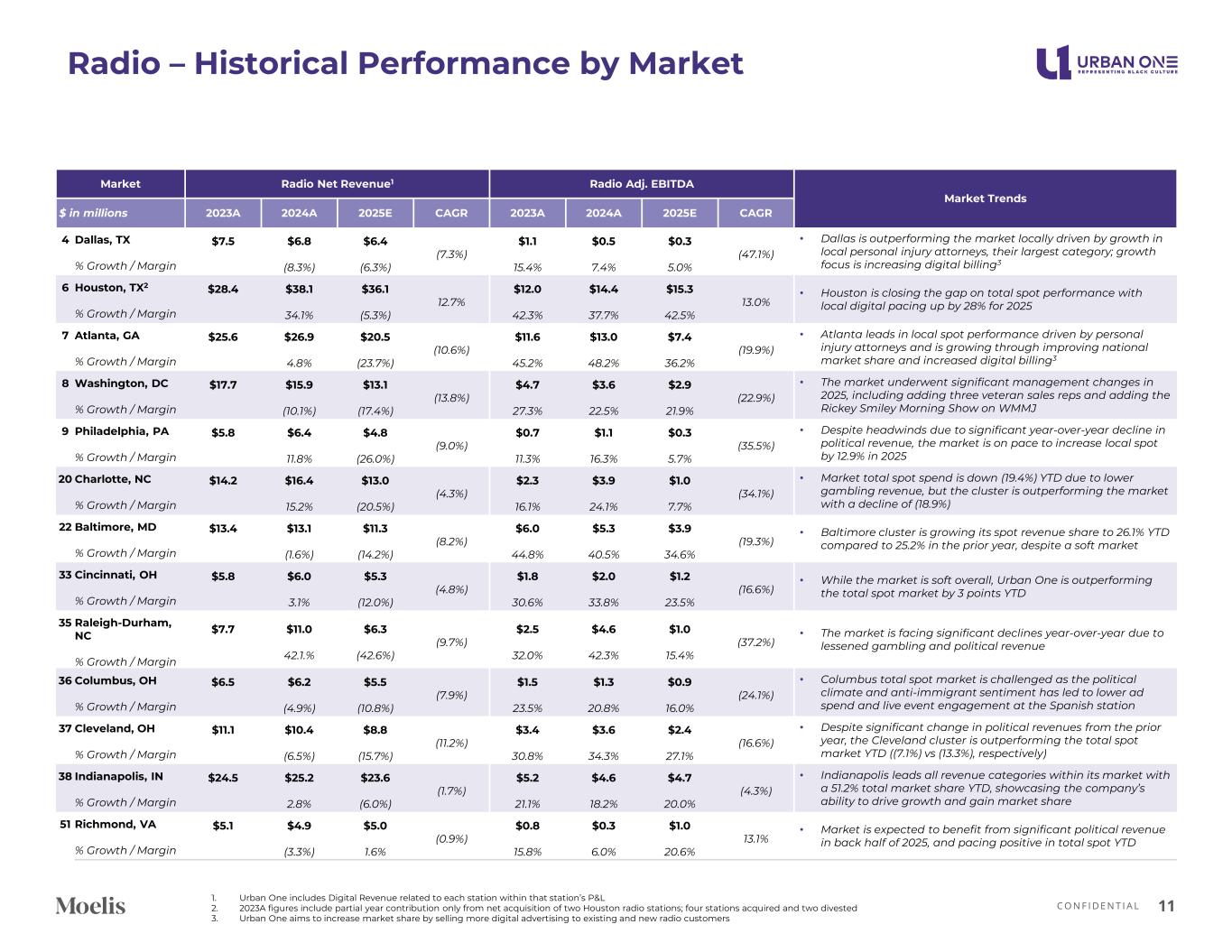

C O N F I D E N T I A L Radio – Historical Performance by Market 11 Market Radio Net Revenue1 Radio Adj. EBITDA Market Trends $ in millions 2023A 2024A 2025E CAGR 2023A 2024A 2025E CAGR 4 Dallas, TX % Growth / Margin $7.5 $6.8 (8.3%) $6.4 (6.3%) (7.3%) $1.1 15.4% $0.5 7.4% $0.3 5.0% (47.1%) • Dallas is outperforming the market locally driven by growth in local personal injury attorneys, their largest category; growth focus is increasing digital billing3 6 Houston, TX2 % Growth / Margin $28.4 $38.1 34.1% $36.1 (5.3%) 12.7% $12.0 42.3% $14.4 37.7% $15.3 42.5% 13.0% • Houston is closing the gap on total spot performance with local digital pacing up by 28% for 2025 7 Atlanta, GA % Growth / Margin $25.6 $26.9 4.8% $20.5 (23.7%) (10.6%) $11.6 45.2% $13.0 48.2% $7.4 36.2% (19.9%) • Atlanta leads in local spot performance driven by personal injury attorneys and is growing through improving national market share and increased digital billing3 8 Washington, DC % Growth / Margin $17.7 $15.9 (10.1%) $13.1 (17.4%) (13.8%) $4.7 27.3% $3.6 22.5% $2.9 21.9% (22.9%) • The market underwent significant management changes in 2025, including adding three veteran sales reps and adding the Rickey Smiley Morning Show on WMMJ 9 Philadelphia, PA % Growth / Margin $5.8 $6.4 11.8% $4.8 (26.0%) (9.0%) $0.7 11.3% $1.1 16.3% $0.3 5.7% (35.5%) • Despite headwinds due to significant year-over-year decline in political revenue, the market is on pace to increase local spot by 12.9% in 2025 20 Charlotte, NC % Growth / Margin $14.2 $16.4 15.2% $13.0 (20.5%) (4.3%) $2.3 16.1% $3.9 24.1% $1.0 7.7% (34.1%) • Market total spot spend is down (19.4%) YTD due to lower gambling revenue, but the cluster is outperforming the market with a decline of (18.9%) 22 Baltimore, MD % Growth / Margin $13.4 $13.1 (1.6%) $11.3 (14.2%) (8.2%) $6.0 44.8% $5.3 40.5% $3.9 34.6% (19.3%) • Baltimore cluster is growing its spot revenue share to 26.1% YTD compared to 25.2% in the prior year, despite a soft market 33 Cincinnati, OH % Growth / Margin $5.8 $6.0 3.1% $5.3 (12.0%) (4.8%) $1.8 30.6% $2.0 33.8% $1.2 23.5% (16.6%) • While the market is soft overall, Urban One is outperforming the total spot market by 3 points YTD 35 Raleigh-Durham, NC % Growth / Margin $7.7 $11.0 42.1.% $6.3 (42.6%) (9.7%) $2.5 32.0% $4.6 42.3% $1.0 15.4% (37.2%) • The market is facing significant declines year-over-year due to lessened gambling and political revenue 36 Columbus, OH % Growth / Margin $6.5 $6.2 (4.9%) $5.5 (10.8%) (7.9%) $1.5 23.5% $1.3 20.8% $0.9 16.0% (24.1%) • Columbus total spot market is challenged as the political climate and anti-immigrant sentiment has led to lower ad spend and live event engagement at the Spanish station 37 Cleveland, OH % Growth / Margin $11.1 $10.4 (6.5%) $8.8 (15.7%) (11.2%) $3.4 30.8% $3.6 34.3% $2.4 27.1% (16.6%) • Despite significant change in political revenues from the prior year, the Cleveland cluster is outperforming the total spot market YTD ((7.1%) vs (13.3%), respectively) 38 Indianapolis, IN % Growth / Margin $24.5 $25.2 2.8% $23.6 (6.0%) (1.7%) $5.2 21.1% $4.6 18.2% $4.7 20.0% (4.3%) • Indianapolis leads all revenue categories within its market with a 51.2% total market share YTD, showcasing the company’s ability to drive growth and gain market share 51 Richmond, VA % Growth / Margin $5.1 $4.9 (3.3%) $5.0 1.6% (0.9%) $0.8 15.8% $0.3 6.0% $1.0 20.6% 13.1% • Market is expected to benefit from significant political revenue in back half of 2025, and pacing positive in total spot YTD 1. Urban One includes Digital Revenue related to each station within that station’s P&L 2. 2023A figures include partial year contribution only from net acquisition of two Houston radio stations; four stations acquired and two divested 3. Urban One aims to increase market share by selling more digital advertising to existing and new radio customers

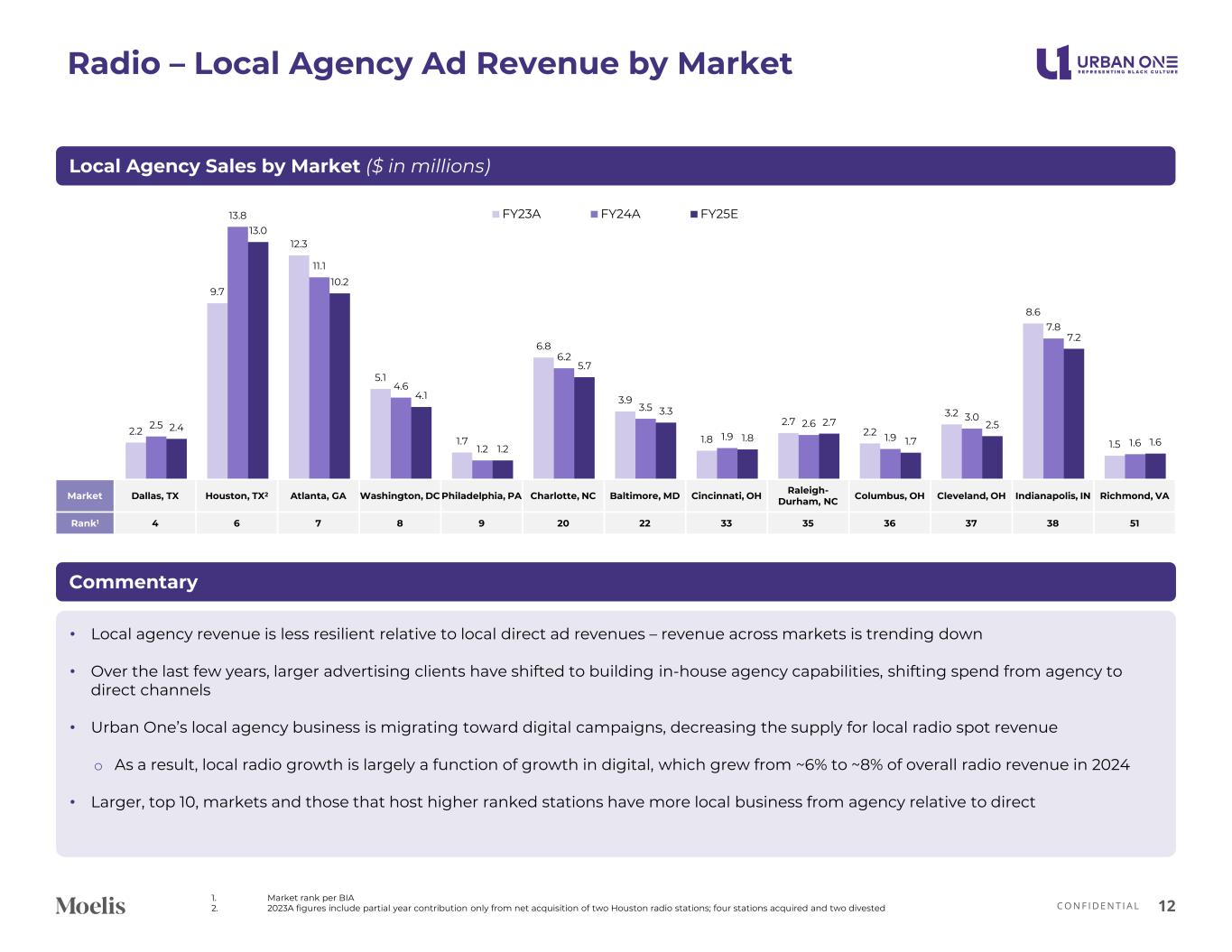

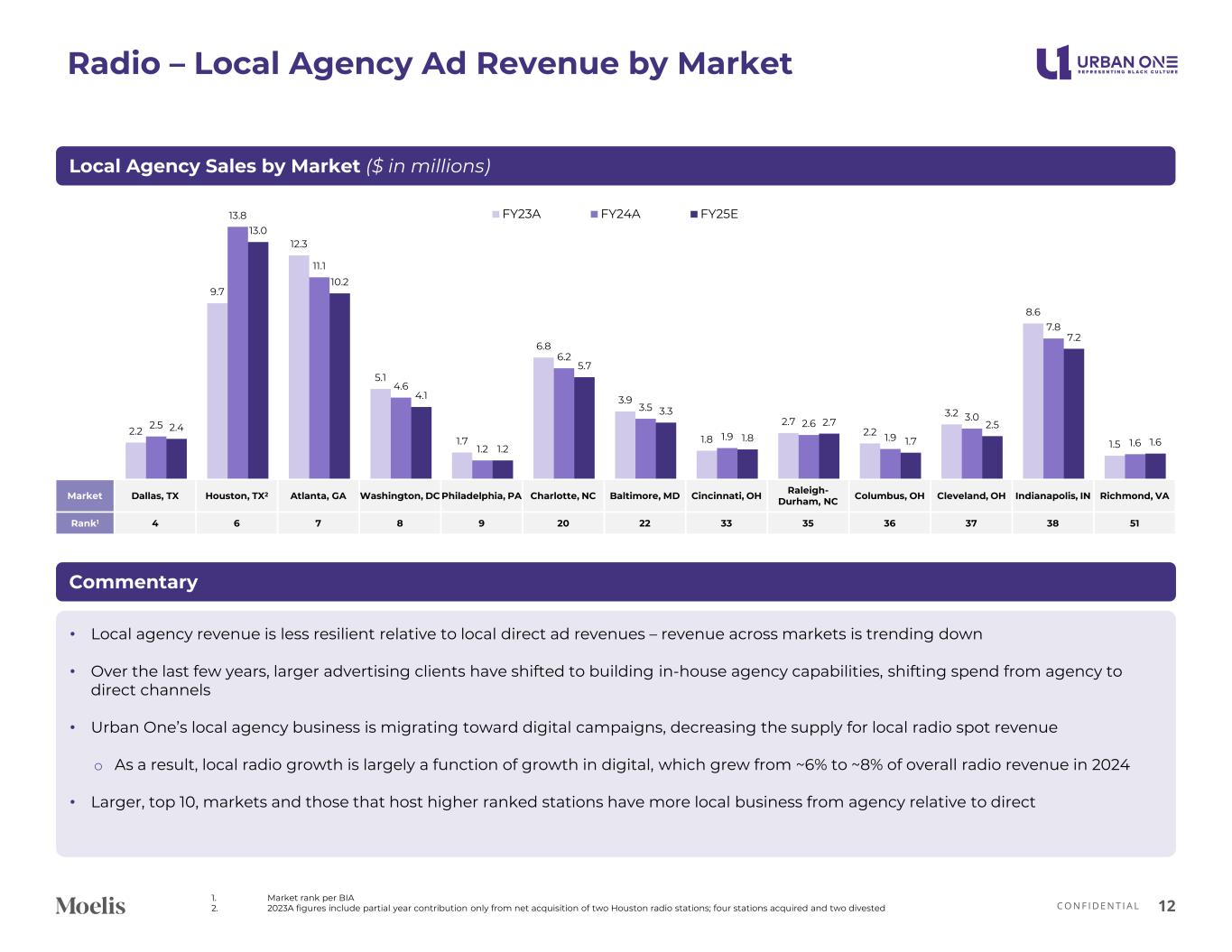

C O N F I D E N T I A L Radio – Local Agency Ad Revenue by Market 12 1. Market rank per BIA 2. 2023A figures include partial year contribution only from net acquisition of two Houston radio stations; four stations acquired and two divested Commentary Local Agency Sales by Market ($ in millions) • Local agency revenue is less resilient relative to local direct ad revenues – revenue across markets is trending down • Over the last few years, larger advertising clients have shifted to building in-house agency capabilities, shifting spend from agency to direct channels • Urban One’s local agency business is migrating toward digital campaigns, decreasing the supply for local radio spot revenue o As a result, local radio growth is largely a function of growth in digital, which grew from ~6% to ~8% of overall radio revenue in 2024 • Larger, top 10, markets and those that host higher ranked stations have more local business from agency relative to direct 2.2 9.7 12.3 5.1 1.7 6.8 3.9 1.8 2.7 2.2 3.2 8.6 1.5 2.5 13.8 11.1 4.6 1.2 6.2 3.5 1.9 2.6 1.9 3.0 7.8 1.6 2.4 13.0 10.2 4.1 1.2 5.7 3.3 1.8 2.7 1.7 2.5 7.2 1.6 FY23A FY24A FY25E Market Dallas, TX Houston, TX2 Atlanta, GA Washington, DC Philadelphia, PA Charlotte, NC Baltimore, MD Cincinnati, OH Raleigh- Durham, NC Columbus, OH Cleveland, OH Indianapolis, IN Richmond, VA Rank1 4 6 7 8 9 20 22 33 35 36 37 38 51

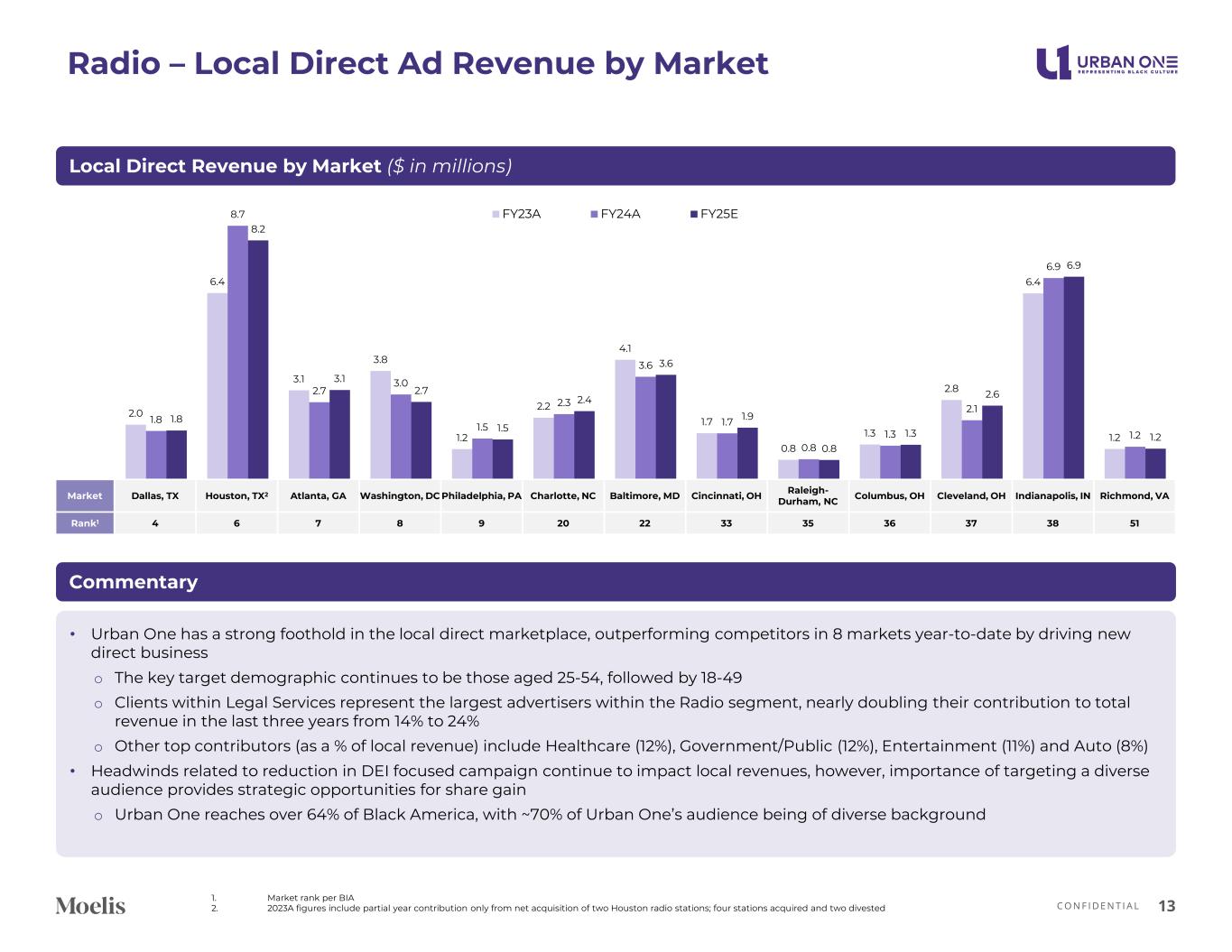

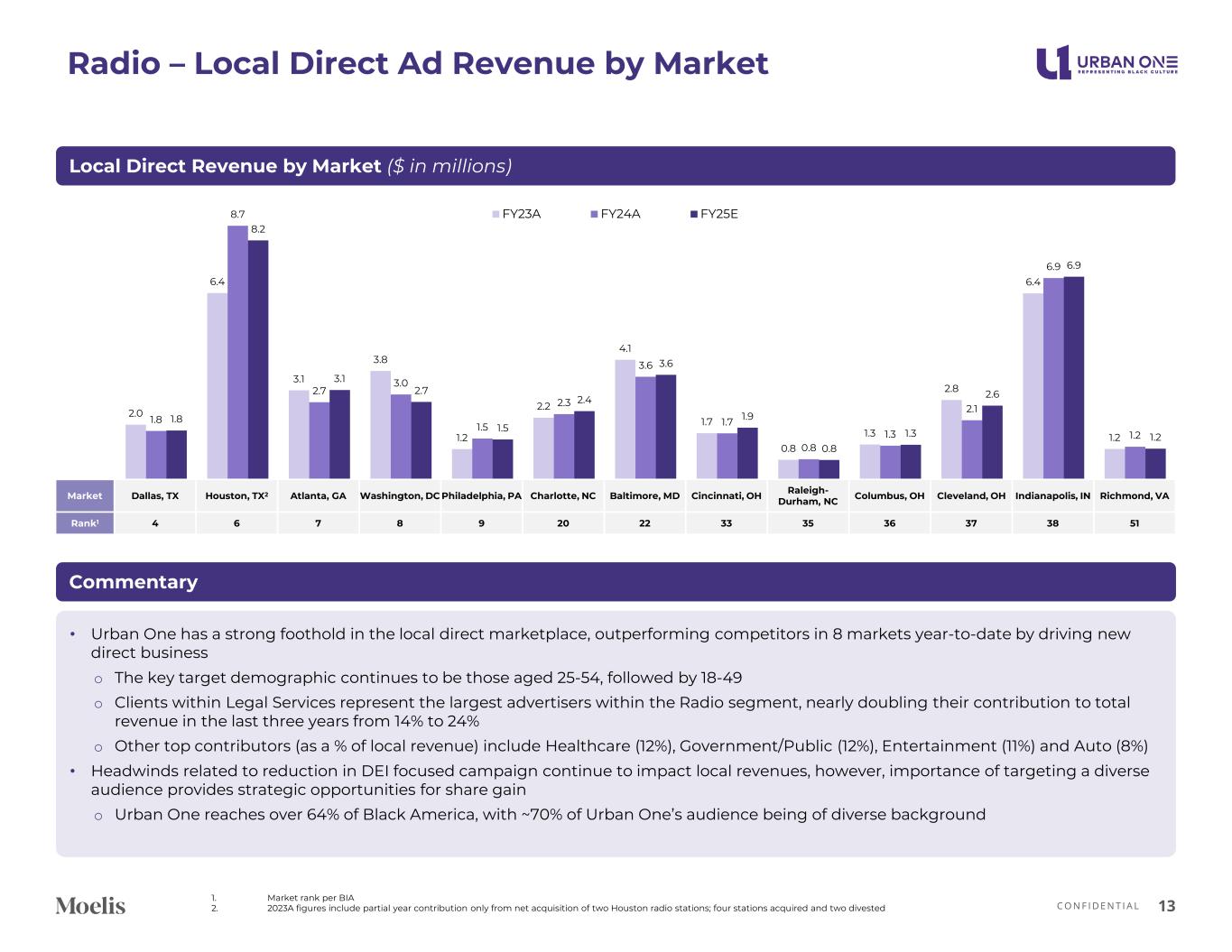

C O N F I D E N T I A L Radio – Local Direct Ad Revenue by Market 13 Commentary Local Direct Revenue by Market ($ in millions) • Urban One has a strong foothold in the local direct marketplace, outperforming competitors in 8 markets year-to-date by driving new direct business o The key target demographic continues to be those aged 25-54, followed by 18-49 o Clients within Legal Services represent the largest advertisers within the Radio segment, nearly doubling their contribution to total revenue in the last three years from 14% to 24% o Other top contributors (as a % of local revenue) include Healthcare (12%), Government/Public (12%), Entertainment (11%) and Auto (8%) • Headwinds related to reduction in DEI focused campaign continue to impact local revenues, however, importance of targeting a diverse audience provides strategic opportunities for share gain o Urban One reaches over 64% of Black America, with ~70% of Urban One’s audience being of diverse background 2.0 6.4 3.1 3.8 1.2 2.2 4.1 1.7 0.8 1.3 2.8 6.4 1.2 1.8 8.7 2.7 3.0 1.5 2.3 3.6 1.7 0.8 1.3 2.1 6.9 1.2 1.8 8.2 3.1 2.7 1.5 2.4 3.6 1.9 0.8 1.3 2.6 6.9 1.2 FY23A FY24A FY25E Market Dallas, TX Houston, TX2 Atlanta, GA Washington, DC Philadelphia, PA Charlotte, NC Baltimore, MD Cincinnati, OH Raleigh- Durham, NC Columbus, OH Cleveland, OH Indianapolis, IN Richmond, VA Rank1 4 6 7 8 9 20 22 33 35 36 37 38 51 1. Market rank per BIA 2. 2023A figures include partial year contribution only from net acquisition of two Houston radio stations; four stations acquired and two divested

C O N F I D E N T I A L Radio – National Ad Revenue by Market 14 Commentary 2.5 10.8 8.2 6.6 1.9 2.9 4.1 1.6 3.2 1.8 3.2 4.6 1.2 1.9 13.1 6.4 5.1 1.6 4.0 3.9 1.2 2.6 1.1 2.6 3.8 1.0 1.7 12.8 5.0 3.3 1.3 2.3 3.2 0.9 1.7 0.9 1.9 4.0 1.1 FY23A FY24A FY25E National Ad Revenue by Market ($ in millions) • National advertising trends reflect industry-wide challenges, with Miller Kaplan estimating a (12.4%) market decline through June relative to an Urban One decline of (19.5%) o Ex-political performance in line with, or exceeding market benchmarks o The Telecom category represents the largest portion of national revenue at 20%, along with Retail (17%), Financial (11%), Government/Public (11%) Services (11%), Healthcare (7%) and Auto (5%) o Actively reducing concentration risk and impact of attrition in corporate sales revenue from select consumer goods and auto accounts • Washington, DC market implementing strategic repositioning with programming enhancements and rate optimization to drive recovery in market share and ratings • Raleigh-Durham and Charlotte, NC are impacted by natural maturation of the sports betting advertising cycle post legalization in 2024 • Ohio markets showing mixed performance with share gains in Cleveland and Columbus offsetting softness in Cincinnati; management focusing resources on highest-opportunity markets Market Dallas, TX Houston, TX2 Atlanta, GA Washington, DC Philadelphia, PA Charlotte, NC Baltimore, MD Cincinnati, OH Raleigh- Durham, NC Columbus, OH Cleveland, OH Indianapolis, IN Richmond, VA Rank1 4 6 7 8 9 20 22 33 35 36 37 38 51 1. Market rank per BIA 2. 2023A figures include partial year contribution only from net acquisition of two Houston radio stations; four stations acquired and two divested

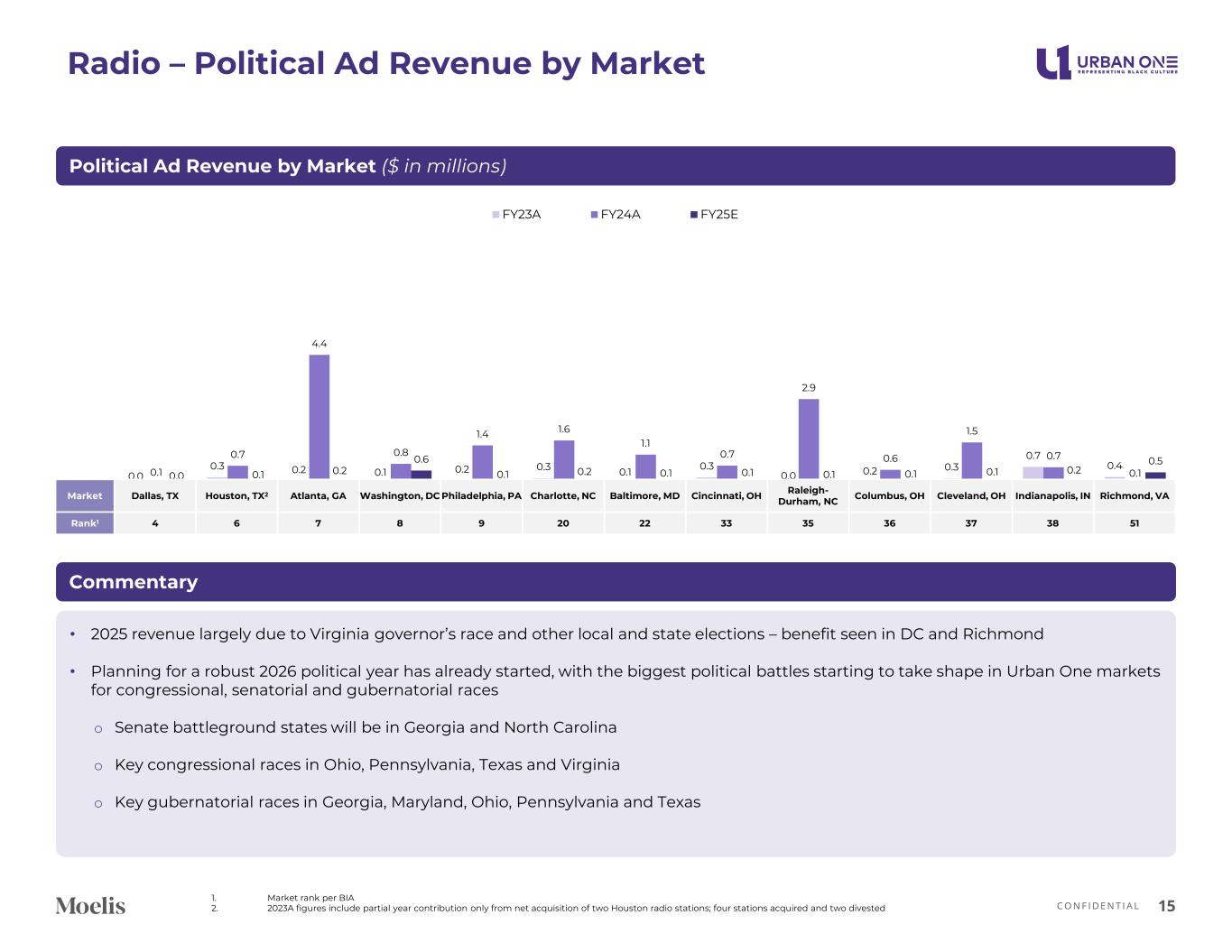

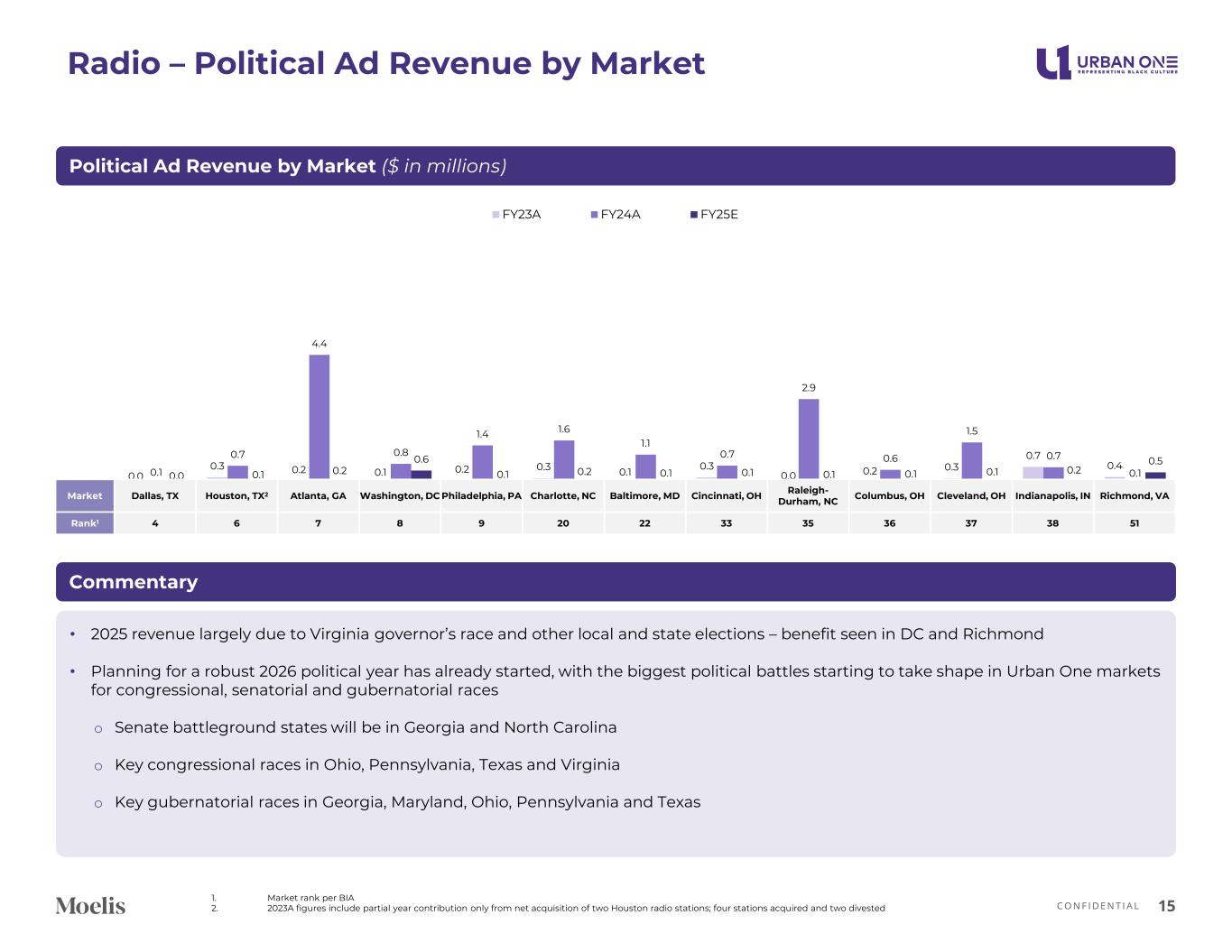

C O N F I D E N T I A L Radio – Political Ad Revenue by Market 15 Commentary 0.0 0.3 0.2 0.1 0.2 0.3 0.1 0.3 0.0 0.2 0.3 0.7 0.4 0.1 0.7 4.4 0.8 1.4 1.6 1.1 0.7 2.9 0.6 1.5 0.7 0.10.0 0.1 0.2 0.6 0.1 0.2 0.1 0.1 0.1 0.1 0.1 0.2 0.5 FY23A FY24A FY25E Political Ad Revenue by Market ($ in millions) • 2025 revenue largely due to Virginia governor’s race and other local and state elections – benefit seen in DC and Richmond • Planning for a robust 2026 political year has already started, with the biggest political battles starting to take shape in Urban One markets for congressional, senatorial and gubernatorial races o Senate battleground states will be in Georgia and North Carolina o Key congressional races in Ohio, Pennsylvania, Texas and Virginia o Key gubernatorial races in Georgia, Maryland, Ohio, Pennsylvania and Texas Market Dallas, TX Houston, TX2 Atlanta, GA Washington, DC Philadelphia, PA Charlotte, NC Baltimore, MD Cincinnati, OH Raleigh- Durham, NC Columbus, OH Cleveland, OH Indianapolis, IN Richmond, VA Rank1 4 6 7 8 9 20 22 33 35 36 37 38 51 1. Market rank per BIA 2. 2023A figures include partial year contribution only from net acquisition of two Houston radio stations; four stations acquired and two divested

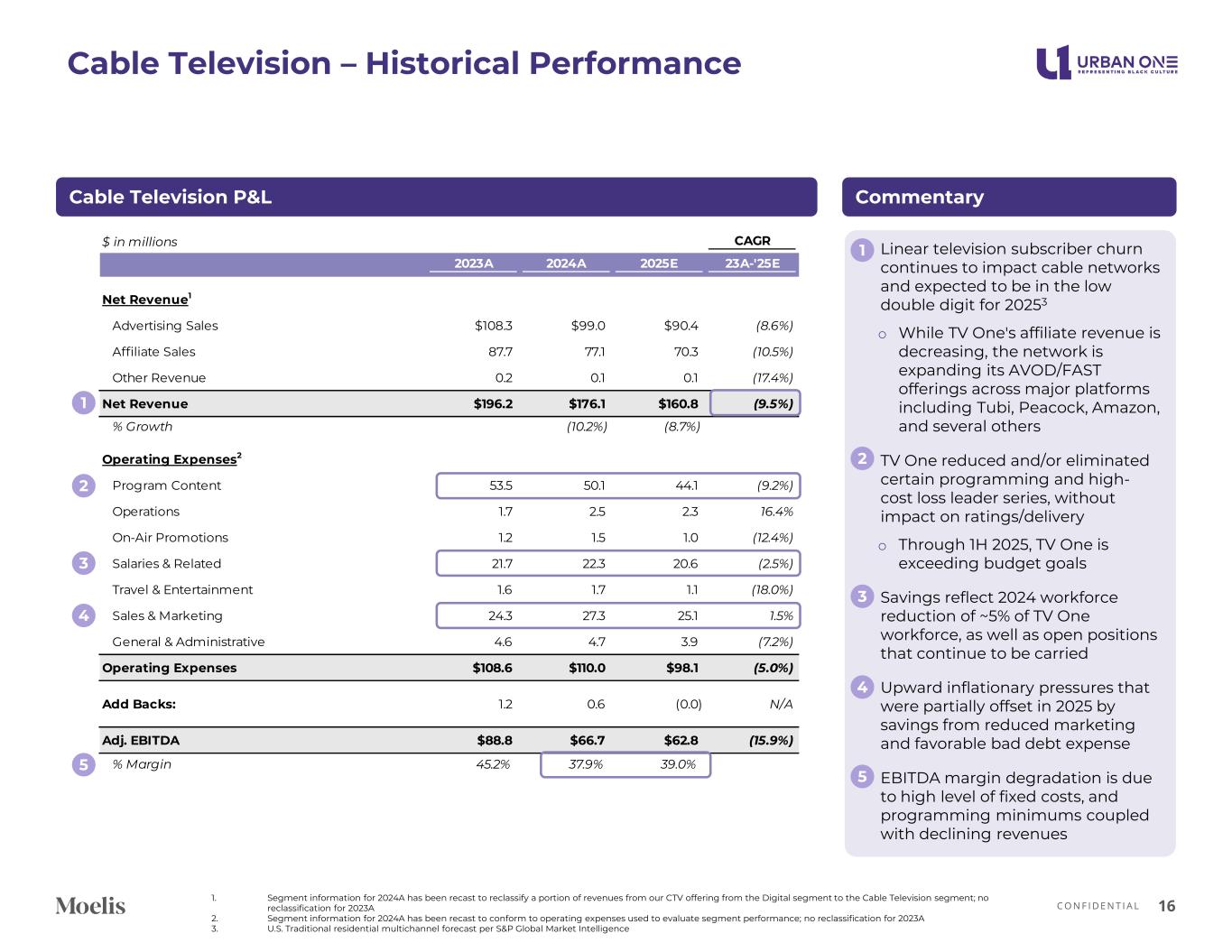

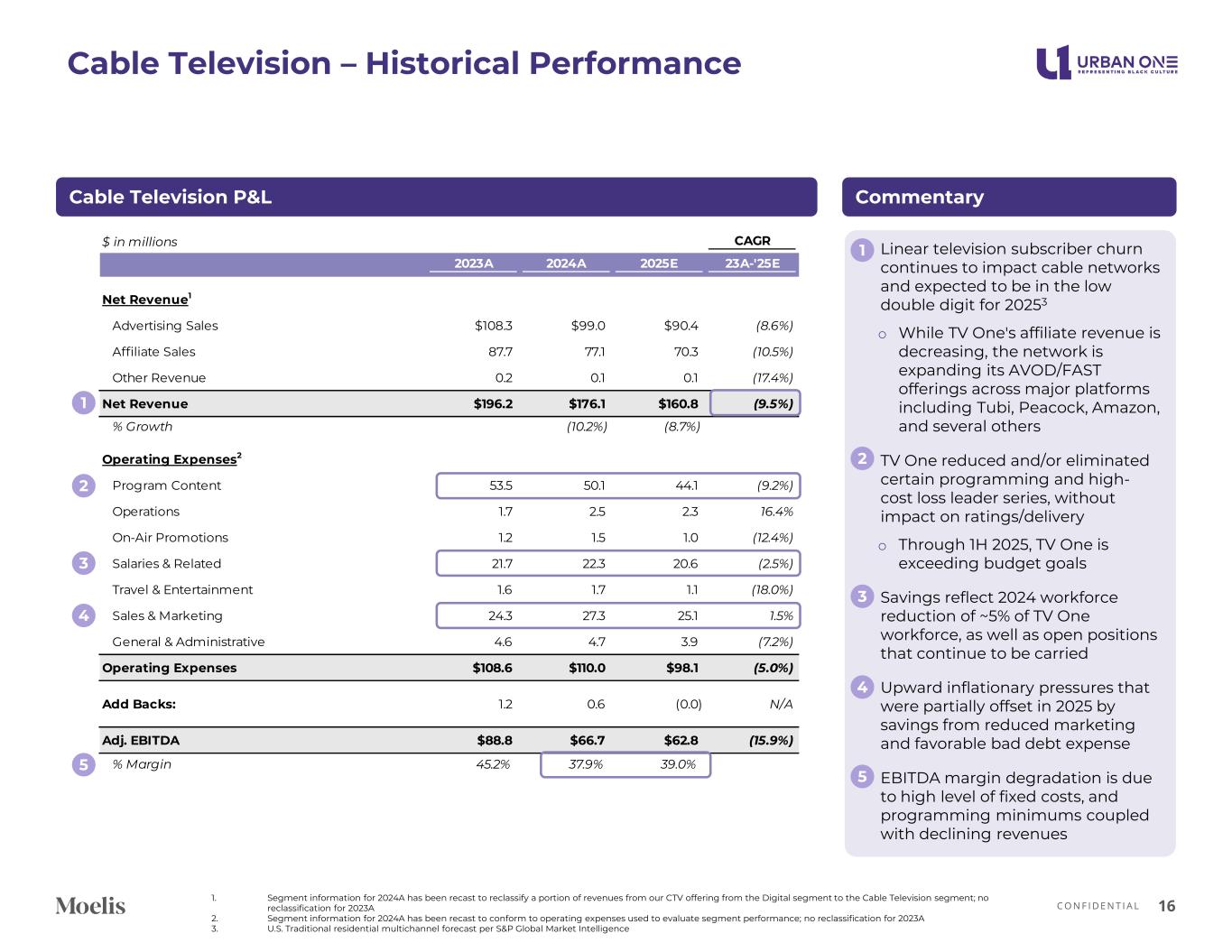

C O N F I D E N T I A L Cable Television – Historical Performance 16 1 2 5 • Linear television subscriber churn continues to impact cable networks and expected to be in the low double digit for 20253 o While TV One's affiliate revenue is decreasing, the network is expanding its AVOD/FAST offerings across major platforms including Tubi, Peacock, Amazon, and several others • TV One reduced and/or eliminated certain programming and high- cost loss leader series, without impact on ratings/delivery o Through 1H 2025, TV One is exceeding budget goals • Savings reflect 2024 workforce reduction of ~5% of TV One workforce, as well as open positions that continue to be carried • Upward inflationary pressures that were partially offset in 2025 by savings from reduced marketing and favorable bad debt expense • EBITDA margin degradation is due to high level of fixed costs, and programming minimums coupled with declining revenues CommentaryCable Television P&L 1 2 3 5 $ in millions CAGR 2023A 2024A 2025E 23A-'25E Net Revenue1 Advertising Sales $108.3 $99.0 $90.4 (8.6%) Affiliate Sales 87.7 77.1 70.3 (10.5%) Other Revenue 0.2 0.1 0.1 (17.4%) Net Revenue $196.2 $176.1 $160.8 (9.5%) % Growth (10.2%) (8.7%) Operating Expenses2 Program Content 53.5 50.1 44.1 (9.2%) Operations 1.7 2.5 2.3 16.4% On-Air Promotions 1.2 1.5 1.0 (12.4%) Salaries & Related 21.7 22.3 20.6 (2.5%) Travel & Entertainment 1.6 1.7 1.1 (18.0%) Sales & Marketing 24.3 27.3 25.1 1.5% General & Administrative 4.6 4.7 3.9 (7.2%) Operating Expenses $108.6 $110.0 $98.1 (5.0%) Add Backs: 1.2 0.6 (0.0) N/A Adj. EBITDA $88.8 $66.7 $62.8 (15.9%) % Margin 45.2% 37.9% 39.0% 4 3 4 1. Segment information for 2024A has been recast to reclassify a portion of revenues from our CTV offering from the Digital segment to the Cable Television segment; no reclassification for 2023A 2. Segment information for 2024A has been recast to conform to operating expenses used to evaluate segment performance; no reclassification for 2023A 3. U.S. Traditional residential multichannel forecast per S&P Global Market Intelligence

C O N F I D E N T I A L Cable Television – Advertising Sales Commentary 17 Advertising Sales Detail $ in millions CAGR 2023A 2024A 2025E 23A-25E Advertising Sales National Sales $80.2 $66.3 $51.3 (20.0%) Ad Revenue - CTV 0.0 9.6 14.1 N/A Direct Response Sale 13.6 9.1 8.7 (20.2%) Paid Programming 0.7 0.5 0.4 (24.8%) AVOD/FAST 1.5 3.3 4.8 81.8% Barter 0.3 - - (100.0%) Advertising Sales - CLEO TV 12.0 10.1 11.1 (3.7%) Advertising Sales $108.3 $99.0 $90.4 (8.6%) 1 4 2 3 • Overall TV One advertising revenue is tracking with the increase in industry subscriber churn of 11% over Q4’ 2024 and Q1’ 20252 o Audience as a percentage of Nielsen’s Universe has been relatively flat over the last 3 years3 • To balance the loss of linear revenues, Urban One has expanded Connected Television Advertising (CTV) efforts o CTV allows advertisers to target audiences with more precision with dynamic ad insertion o Expansion in CTV will continue into late 2025 with additional vMPVD’s • AVOD/FAST is an area of significant growth, and includes ads on 3rd party platforms like Amazon and Peacock o Expected to add Roku and Vizio to the portfolio in the near term • CLEO TV viewership benefited from Nielsen panel changes in Q1 2025 o Q4 2025 Nielsen methodology transition (45M households) expected to improve measurement stability for niche networks 1. Segment information for 2024A has been recast to reclassify a portion of revenues from our CTV offering from the Digital segment to the Cable Television segment; no reclassification for 2023A 2. Estimate per N Screen Media 3. Nielsen Npower; based on prime and total day ratings P25-54 from 2023 to Q2 2025 2 3 4 1 1

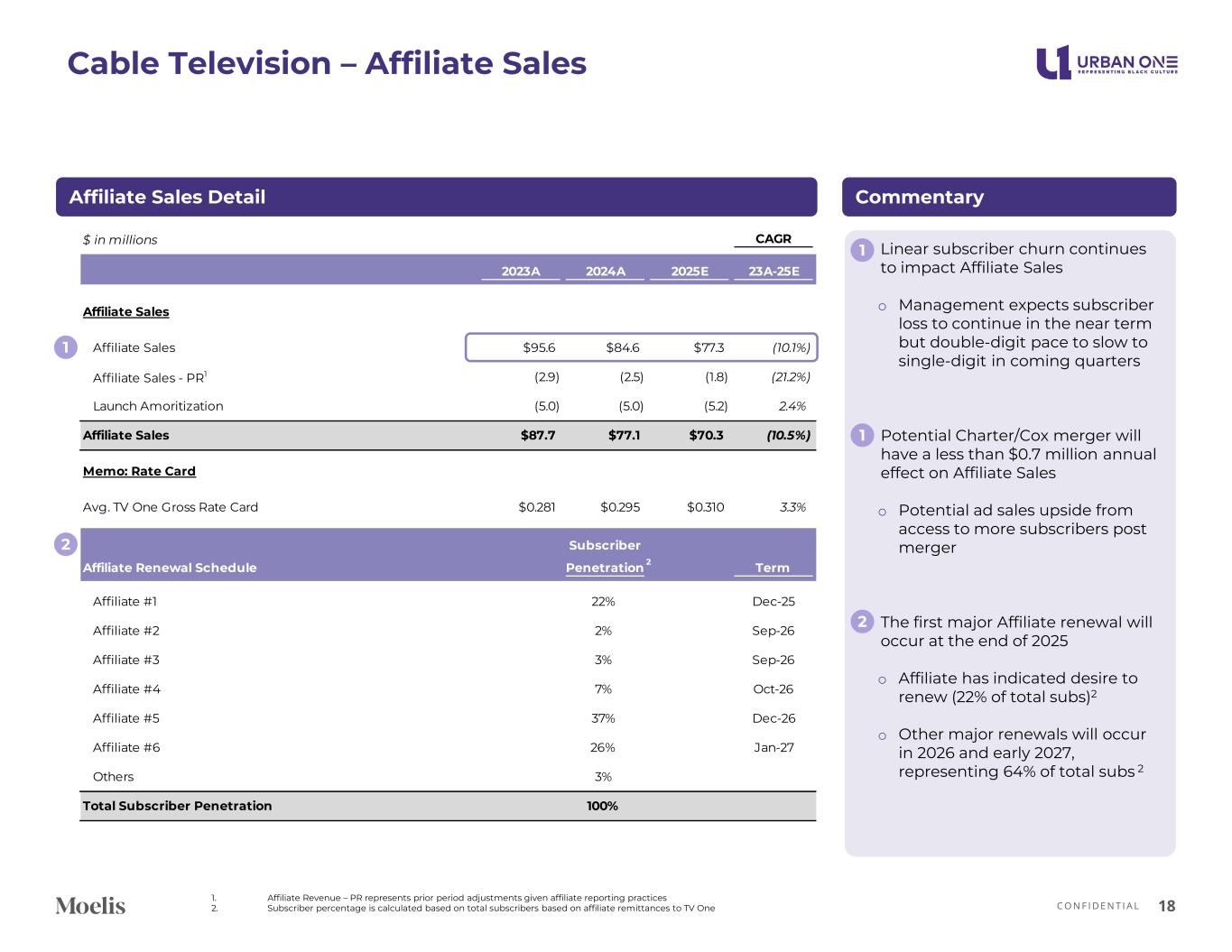

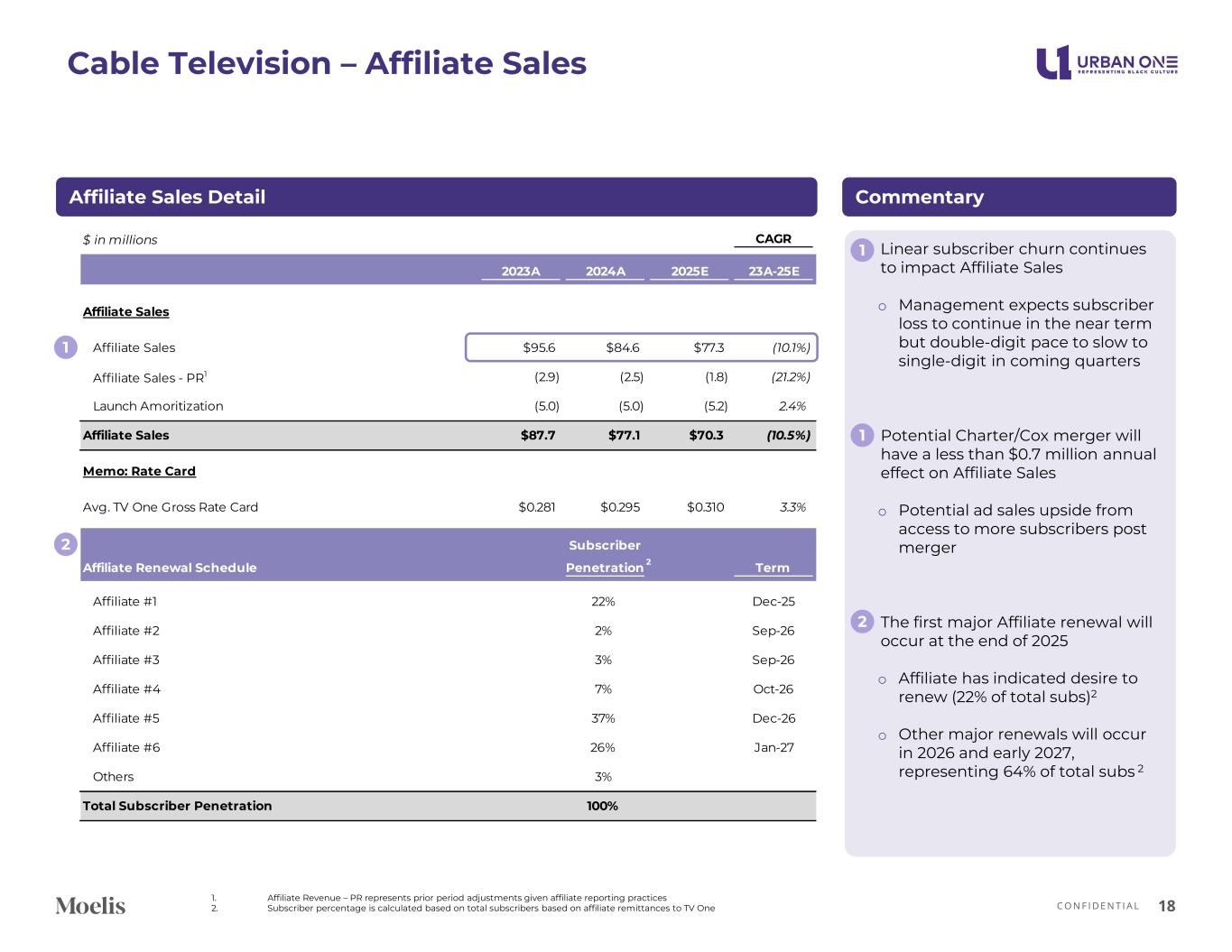

C O N F I D E N T I A L Cable Television – Affiliate Sales 18 1. Affiliate Revenue – PR represents prior period adjustments given affiliate reporting practices 2. Subscriber percentage is calculated based on total subscribers based on affiliate remittances to TV One Affiliate Sales Detail 1 $ in millions CAGR 2023A 2024A 2025E 23A-25E Affiliate Sales Affiliate Sales $95.6 $84.6 $77.3 (10.1%) Affiliate Sales - PR1 (2.9) (2.5) (1.8) (21.2%) Launch Amoritization (5.0) (5.0) (5.2) 2.4% Affiliate Sales $87.7 $77.1 $70.3 (10.5%) Memo: Rate Card Avg. TV One Gross Rate Card $0.281 $0.295 $0.310 3.3% Affiliate Renewal Schedule Subscriber Penetration Term Affiliate #1 22% Dec-25 Affiliate #2 2% Sep-26 Affiliate #3 3% Sep-26 Affiliate #4 7% Oct-26 Affiliate #5 37% Dec-26 Affiliate #6 26% Jan-27 Others 3% Total Subscriber Penetration 100% 2 • Linear subscriber churn continues to impact Affiliate Sales o Management expects subscriber loss to continue in the near term but double-digit pace to slow to single-digit in coming quarters • Potential Charter/Cox merger will have a less than $0.7 million annual effect on Affiliate Sales o Potential ad sales upside from access to more subscribers post merger • The first major Affiliate renewal will occur at the end of 2025 o Affiliate has indicated desire to renew (22% of total subs)2 o Other major renewals will occur in 2026 and early 2027, representing 64% of total subs 2 Commentary 2 1 1 2

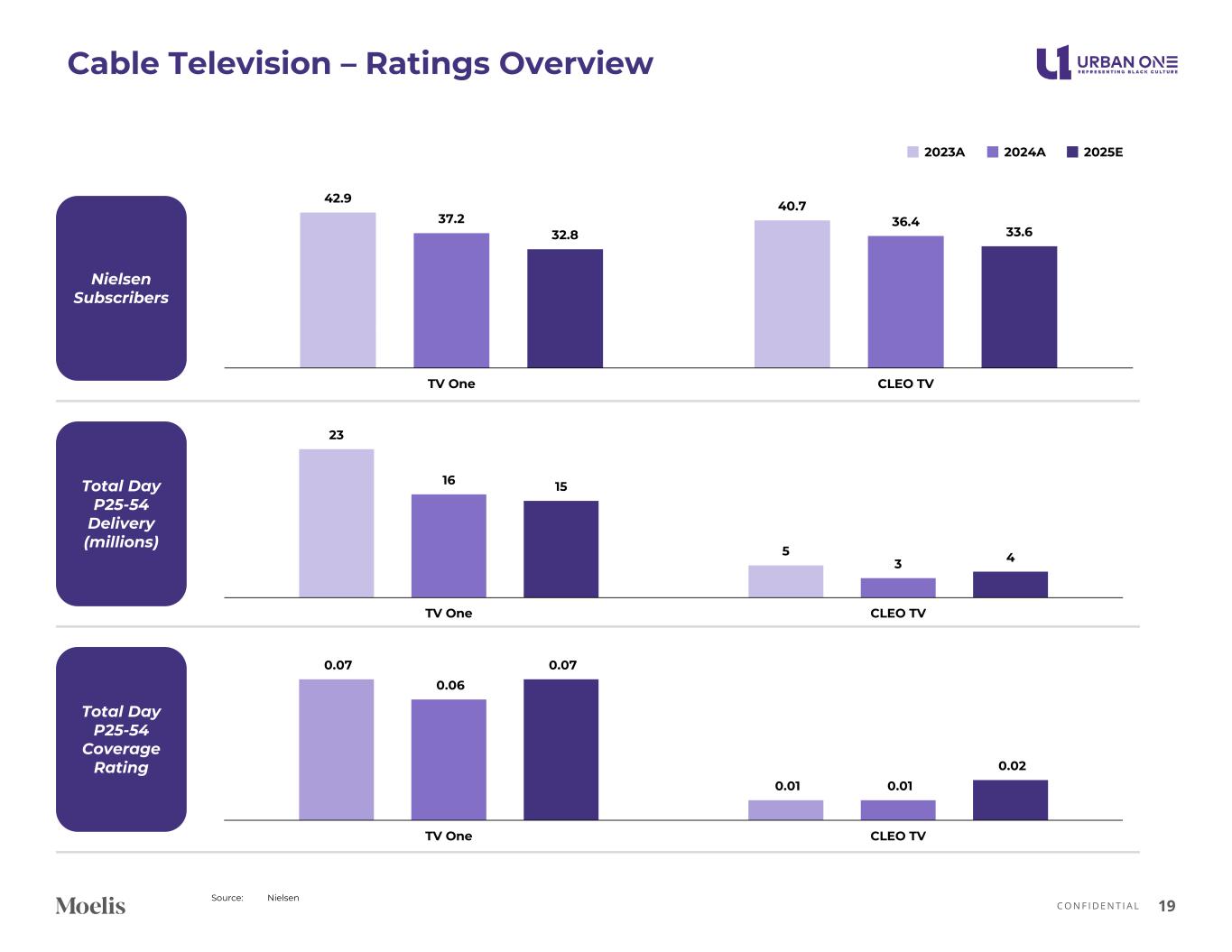

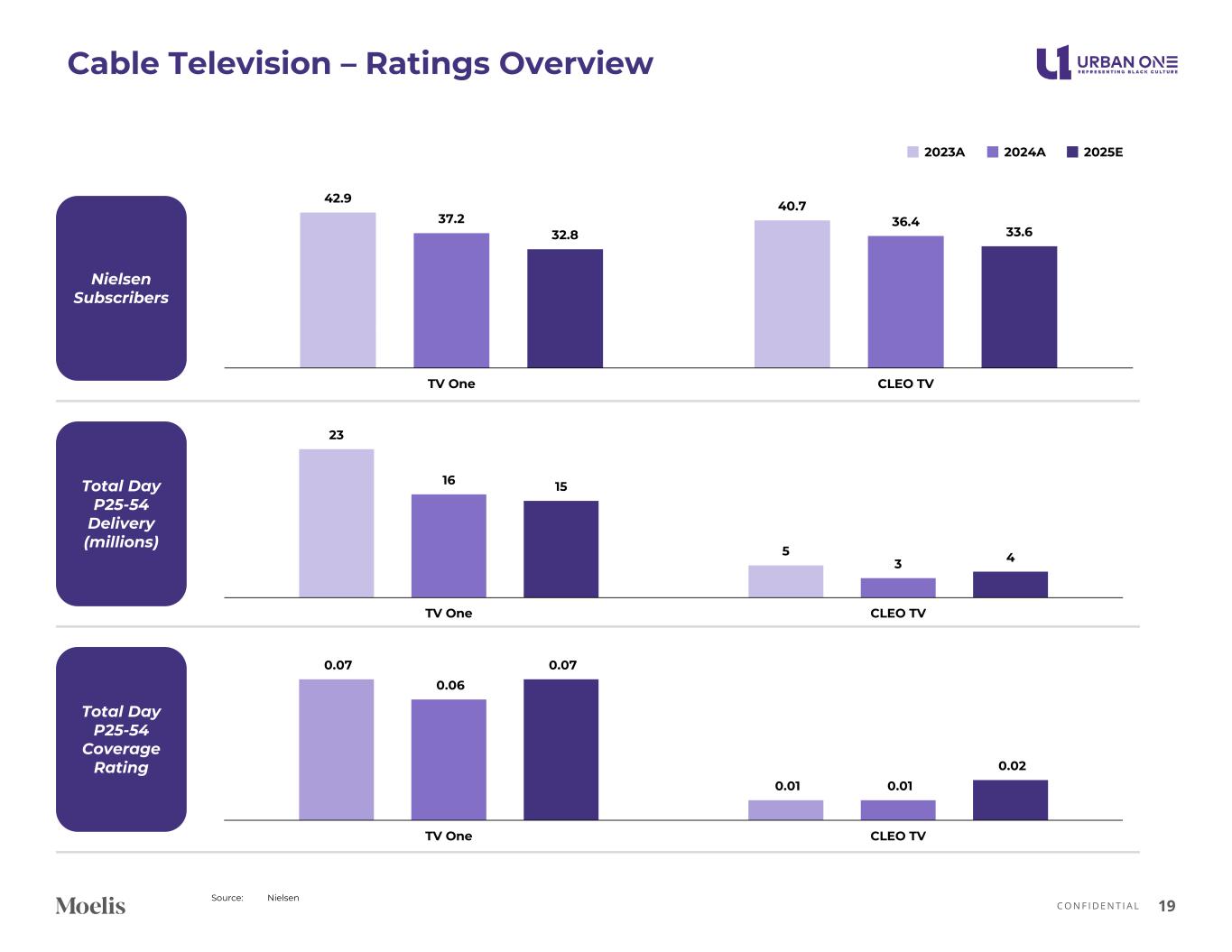

C O N F I D E N T I A L Cable Television – Ratings Overview 19 Source: Nielsen Nielsen Subscribers Total Day P25-54 Coverage Rating 42.9 40.7 37.2 36.4 32.8 33.6 TV One CLEO TV 0.07 0.01 0.06 0.01 0.07 0.02 TV One CLEO TV 2025E2023A 2024A Total Day P25-54 Delivery (millions) 23 5 16 3 15 4 TV One CLEO TV

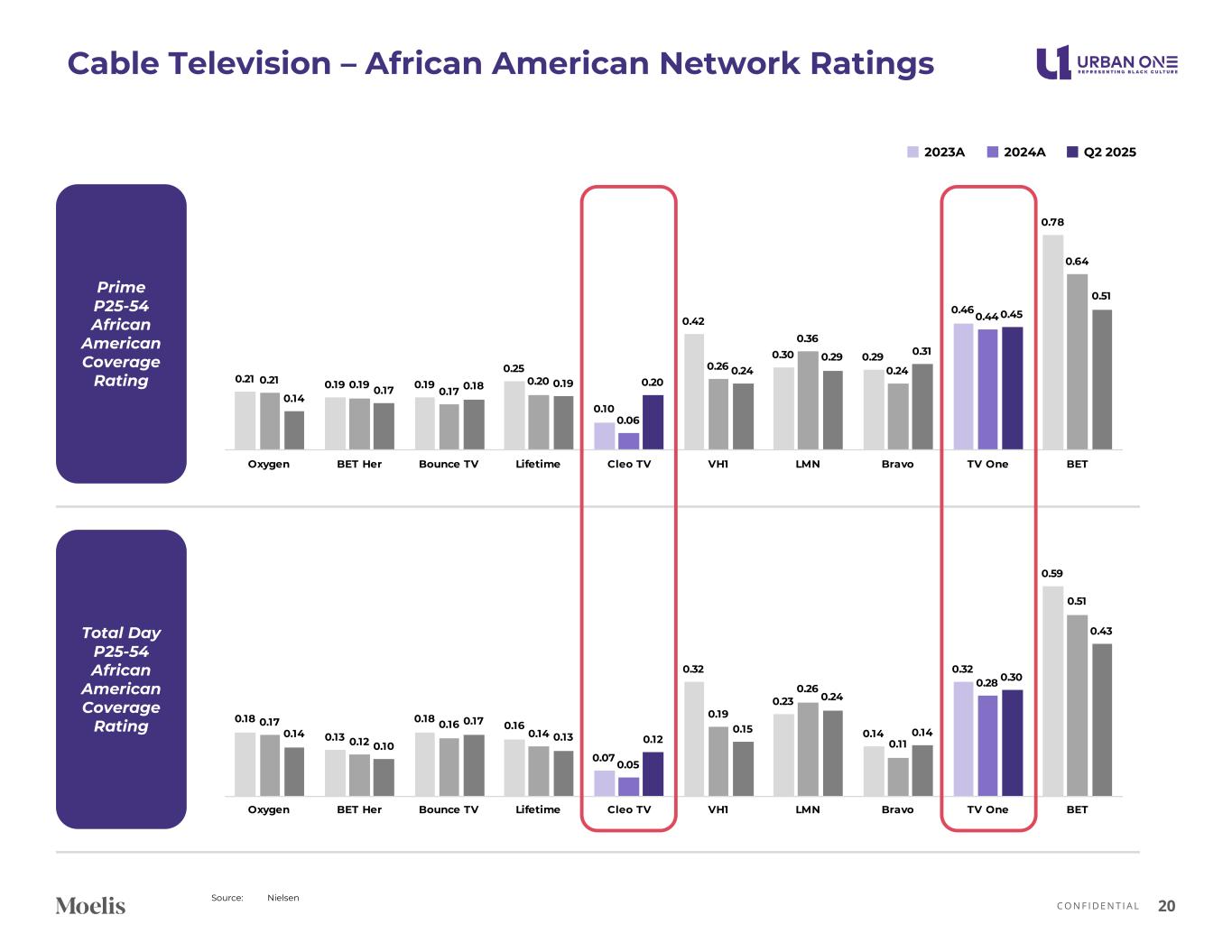

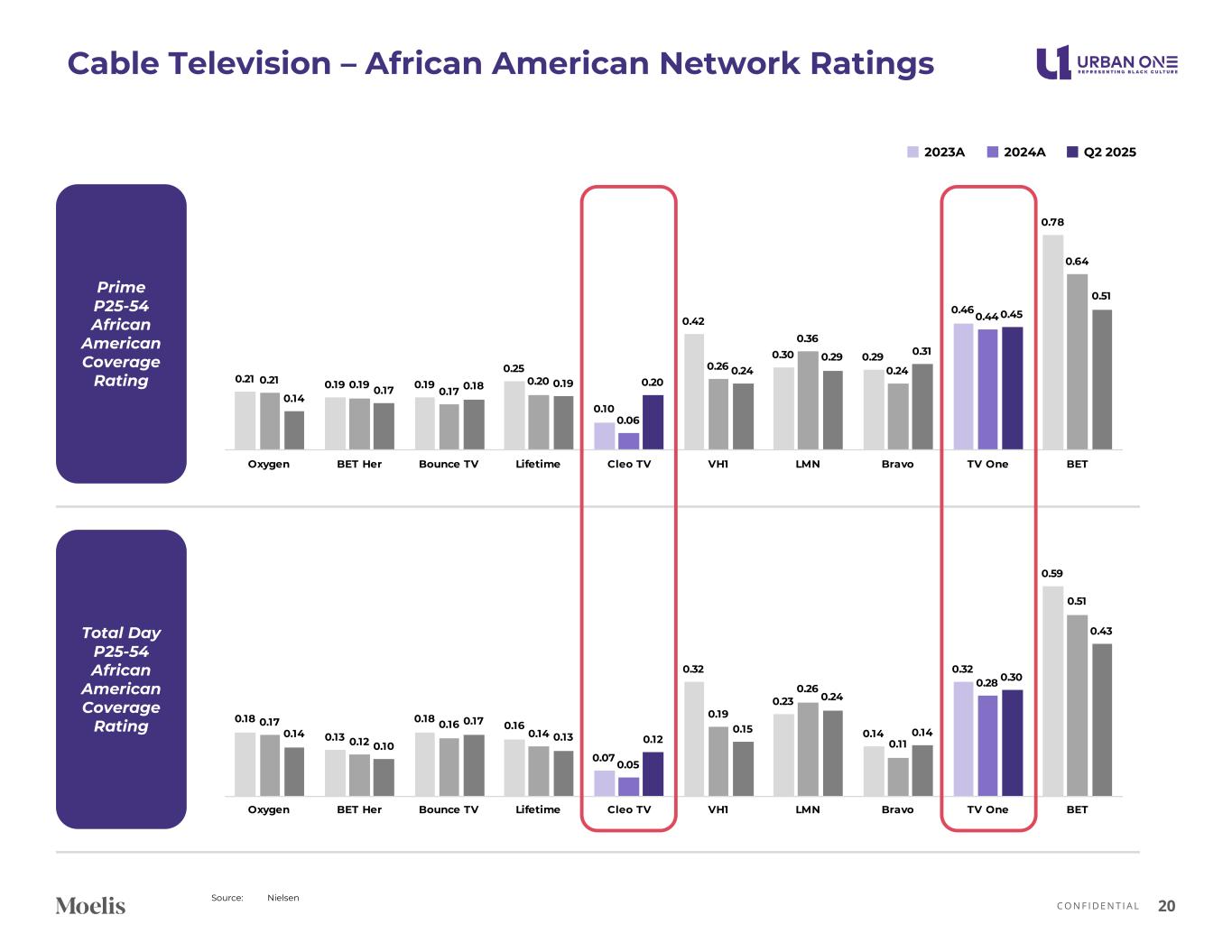

C O N F I D E N T I A L Cable Television – African American Network Ratings 20 Source: Nielsen Total Day P25-54 African American Coverage Rating 0.18 0.13 0.18 0.16 0.07 0.32 0.23 0.14 0.32 0.59 0.17 0.12 0.16 0.14 0.05 0.19 0.26 0.11 0.28 0.51 0.14 0.10 0.17 0.13 0.12 0.15 0.24 0.14 0.30 0.43 Oxygen BET Her Bounce TV Lifetime Cleo TV VH1 LMN Bravo TV One BET Q2 20252023A 2024A Prime P25-54 African American Coverage Rating 0.21 0.19 0.19 0.25 0.10 0.42 0.30 0.29 0.46 0.78 0.21 0.19 0.17 0.20 0.06 0.26 0.36 0.24 0.44 0.64 0.14 0.17 0.18 0.19 0.20 0.24 0.29 0.31 0.45 0.51 Oxygen BET Her Bounce TV Lifetime Cleo TV VH1 LMN Bravo TV One BET

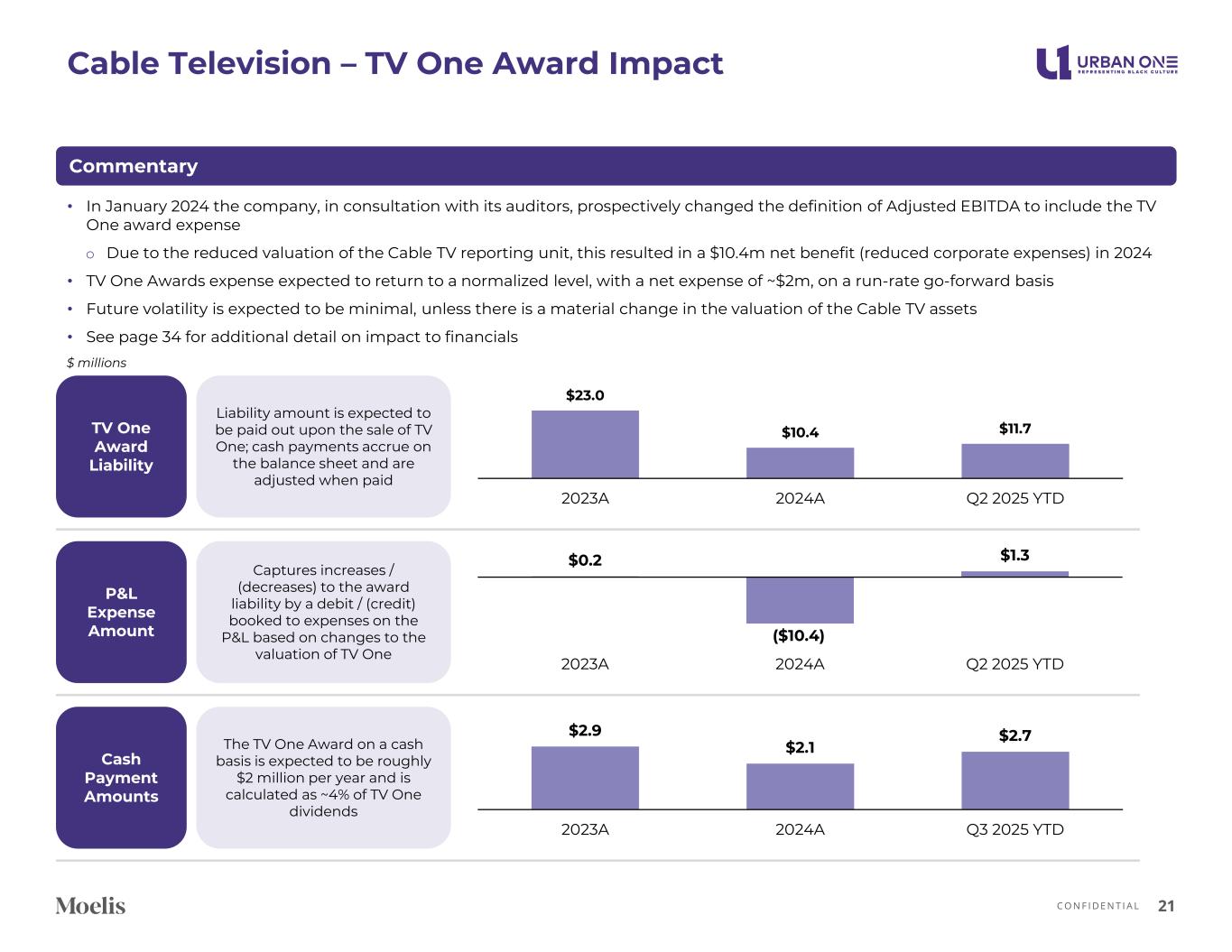

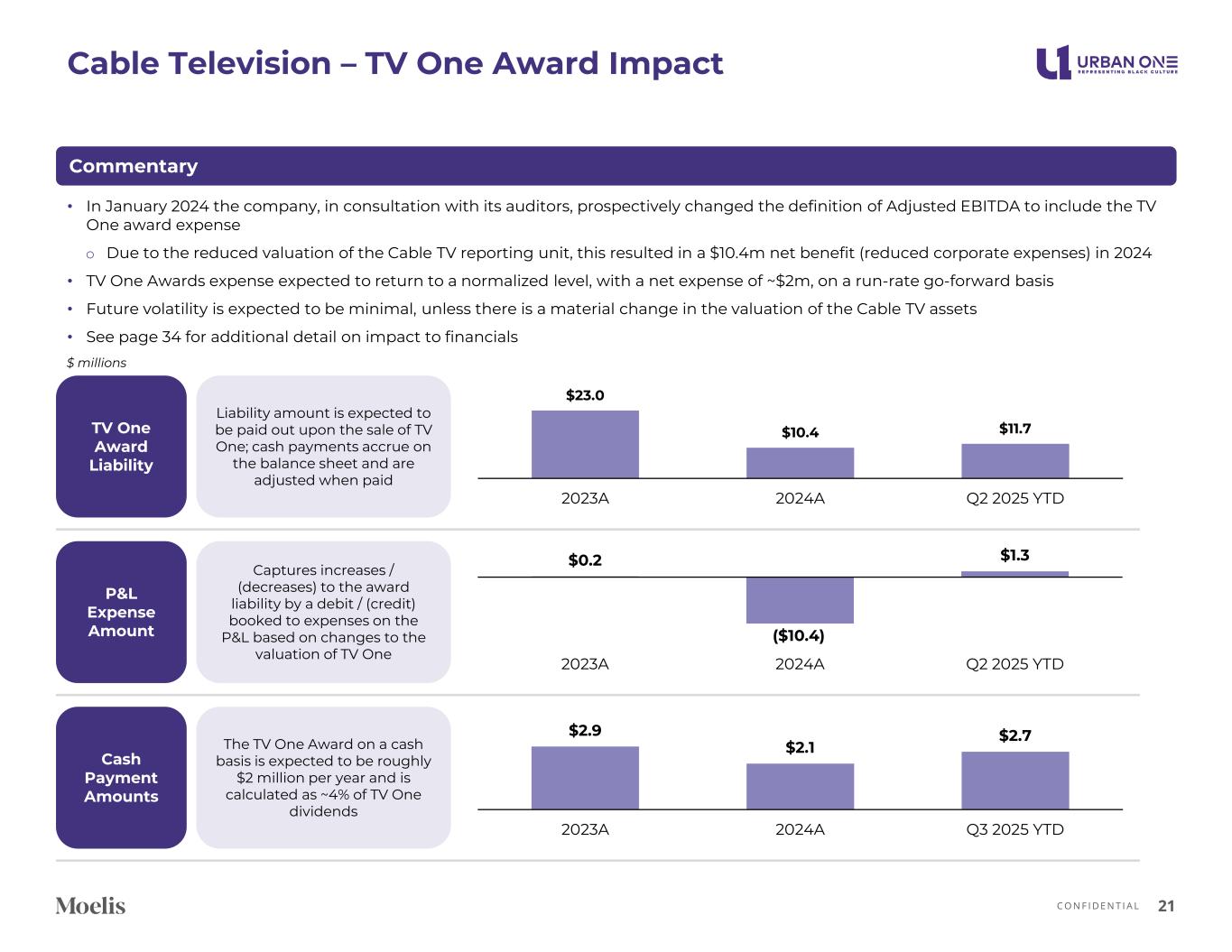

C O N F I D E N T I A L Cable Television – TV One Award Impact 21 TV One Award Liability Cash Payment Amounts P&L Expense Amount $23.0 $10.4 $11.7 2023A 2024A Q2 2025 YTD $2.9 $2.1 $2.7 2023A 2024A Q3 2025 YTD $ millions $0.2 ($10.4) $1.3 2023A 2024A Q2 2025 YTD Commentary • In January 2024 the company, in consultation with its auditors, prospectively changed the definition of Adjusted EBITDA to include the TV One award expense o Due to the reduced valuation of the Cable TV reporting unit, this resulted in a $10.4m net benefit (reduced corporate expenses) in 2024 • TV One Awards expense expected to return to a normalized level, with a net expense of ~$2m, on a run-rate go-forward basis • Future volatility is expected to be minimal, unless there is a material change in the valuation of the Cable TV assets • See page 34 for additional detail on impact to financials Liability amount is expected to be paid out upon the sale of TV One; cash payments accrue on the balance sheet and are adjusted when paid The TV One Award on a cash basis is expected to be roughly $2 million per year and is calculated as ~4% of TV One dividends Captures increases / (decreases) to the award liability by a debit / (credit) booked to expenses on the P&L based on changes to the valuation of TV One

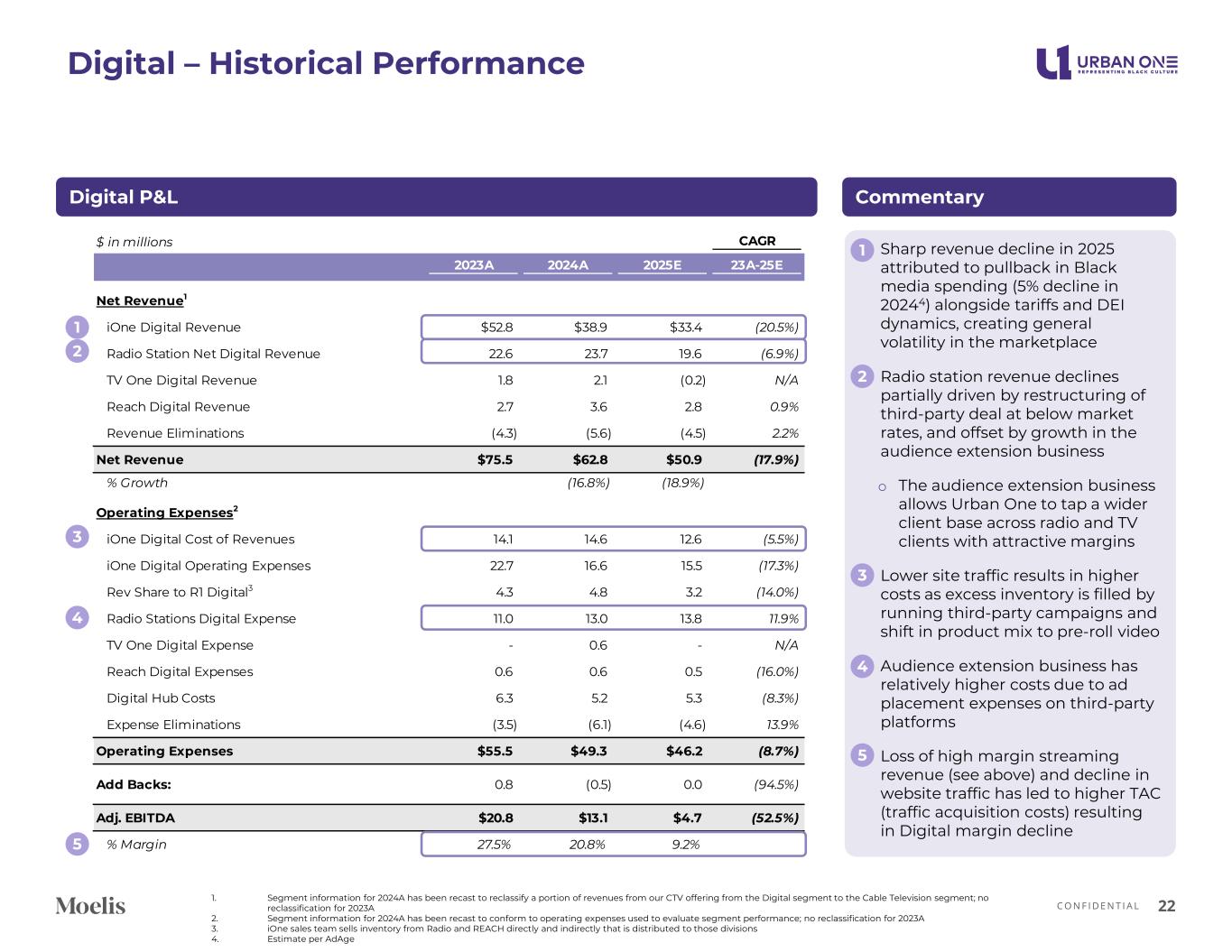

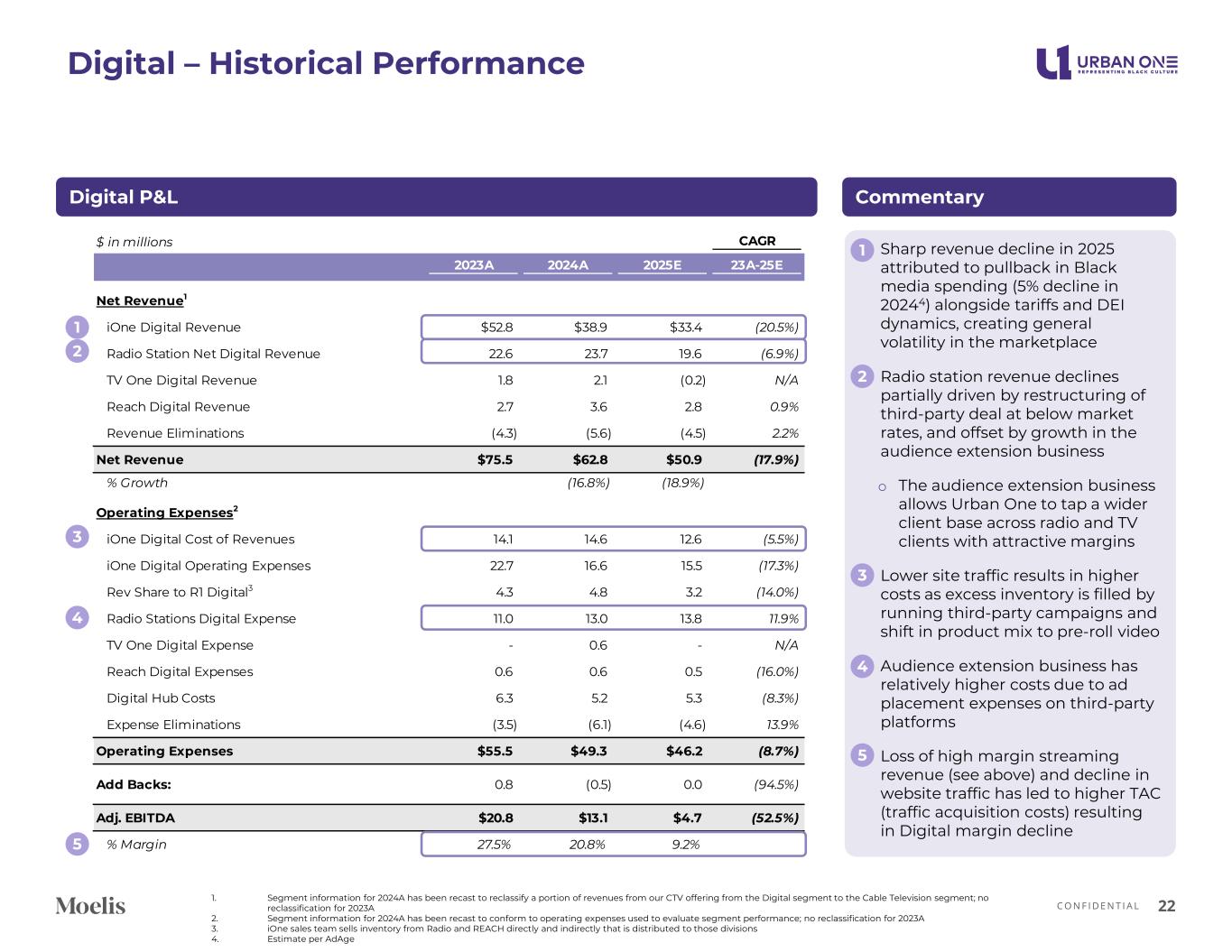

C O N F I D E N T I A L • Sharp revenue decline in 2025 attributed to pullback in Black media spending (5% decline in 20244) alongside tariffs and DEI dynamics, creating general volatility in the marketplace • Radio station revenue declines partially driven by restructuring of third-party deal at below market rates, and offset by growth in the audience extension business o The audience extension business allows Urban One to tap a wider client base across radio and TV clients with attractive margins • Lower site traffic results in higher costs as excess inventory is filled by running third-party campaigns and shift in product mix to pre-roll video • Audience extension business has relatively higher costs due to ad placement expenses on third-party platforms • Loss of high margin streaming revenue (see above) and decline in website traffic has led to higher TAC (traffic acquisition costs) resulting in Digital margin decline Digital – Historical Performance 22 1. Segment information for 2024A has been recast to reclassify a portion of revenues from our CTV offering from the Digital segment to the Cable Television segment; no reclassification for 2023A 2. Segment information for 2024A has been recast to conform to operating expenses used to evaluate segment performance; no reclassification for 2023A 3. iOne sales team sells inventory from Radio and REACH directly and indirectly that is distributed to those divisions 4. Estimate per AdAge 1 3 4 5 CommentaryDigital P&L 1 2 3 4 $ in millions CAGR 2023A 2024A 2025E 23A-25E Net Revenue1 iOne Digital Revenue $52.8 $38.9 $33.4 (20.5%) Radio Station Net Digital Revenue 22.6 23.7 19.6 (6.9%) TV One Digital Revenue 1.8 2.1 (0.2) N/A Reach Digital Revenue 2.7 3.6 2.8 0.9% Revenue Eliminations (4.3) (5.6) (4.5) 2.2% Net Revenue $75.5 $62.8 $50.9 (17.9%) % Growth (16.8%) (18.9%) Operating Expenses2 iOne Digital Cost of Revenues 14.1 14.6 12.6 (5.5%) iOne Digital Operating Expenses 22.7 16.6 15.5 (17.3%) Rev Share to R1 Digital3 4.3 4.8 3.2 (14.0%) Radio Stations Digital Expense 11.0 13.0 13.8 11.9% TV One Digital Expense - 0.6 - N/A Reach Digital Expenses 0.6 0.6 0.5 (16.0%) Digital Hub Costs 6.3 5.2 5.3 (8.3%) Expense Eliminations (3.5) (6.1) (4.6) 13.9% Operating Expenses $55.5 $49.3 $46.2 (8.7%) Add Backs: 0.8 (0.5) 0.0 (94.5%) Adj. EBITDA $20.8 $13.1 $4.7 (52.5%) % Margin 27.5% 20.8% 9.2% 2 5

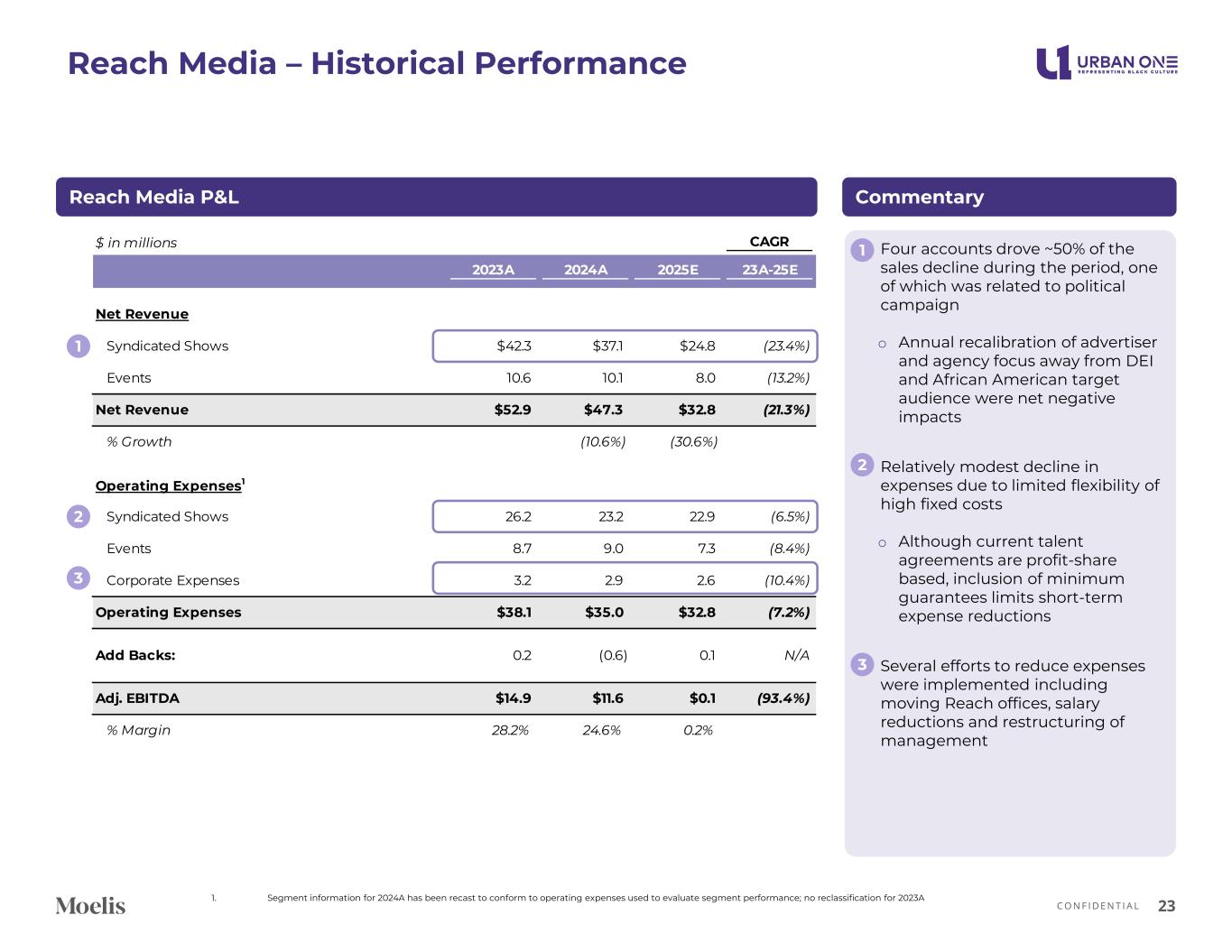

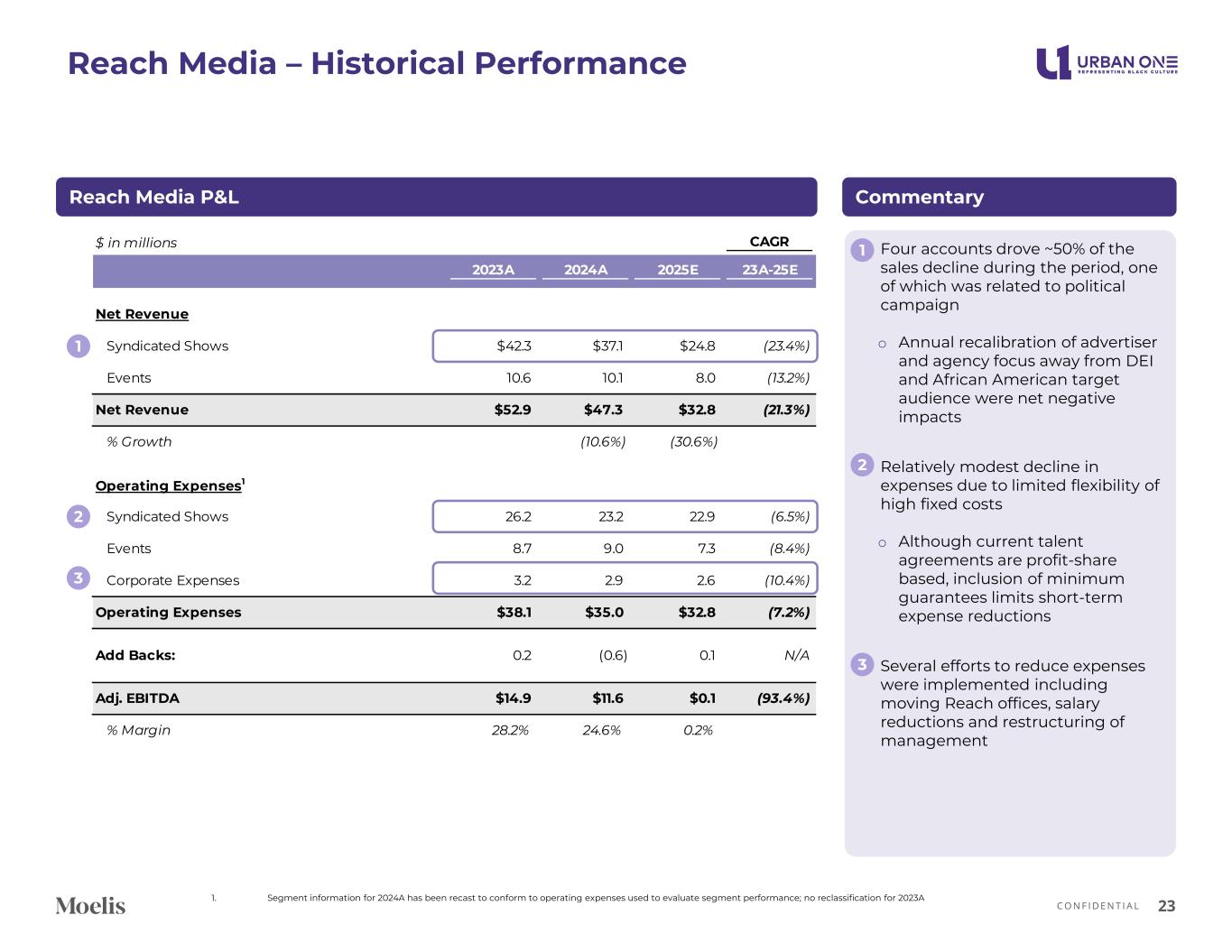

C O N F I D E N T I A L Reach Media – Historical Performance 23 1. Segment information for 2024A has been recast to conform to operating expenses used to evaluate segment performance; no reclassification for 2023A CommentaryReach Media P&L $ in millions CAGR 2023A 2024A 2025E 23A-25E Net Revenue Syndicated Shows $42.3 $37.1 $24.8 (23.4%) Events 10.6 10.1 8.0 (13.2%) Net Revenue $52.9 $47.3 $32.8 (21.3%) % Growth (10.6%) (30.6%) Operating Expenses1 Syndicated Shows 26.2 23.2 22.9 (6.5%) Events 8.7 9.0 7.3 (8.4%) Corporate Expenses 3.2 2.9 2.6 (10.4%) Operating Expenses $38.1 $35.0 $32.8 (7.2%) Add Backs: 0.2 (0.6) 0.1 N/A Adj. EBITDA $14.9 $11.6 $0.1 (93.4%) % Margin 28.2% 24.6% 0.2% 1 2 • Four accounts drove ~50% of the sales decline during the period, one of which was related to political campaign o Annual recalibration of advertiser and agency focus away from DEI and African American target audience were net negative impacts • Relatively modest decline in expenses due to limited flexibility of high fixed costs o Although current talent agreements are profit-share based, inclusion of minimum guarantees limits short-term expense reductions • Several efforts to reduce expenses were implemented including moving Reach offices, salary reductions and restructuring of management 1 2 3 3

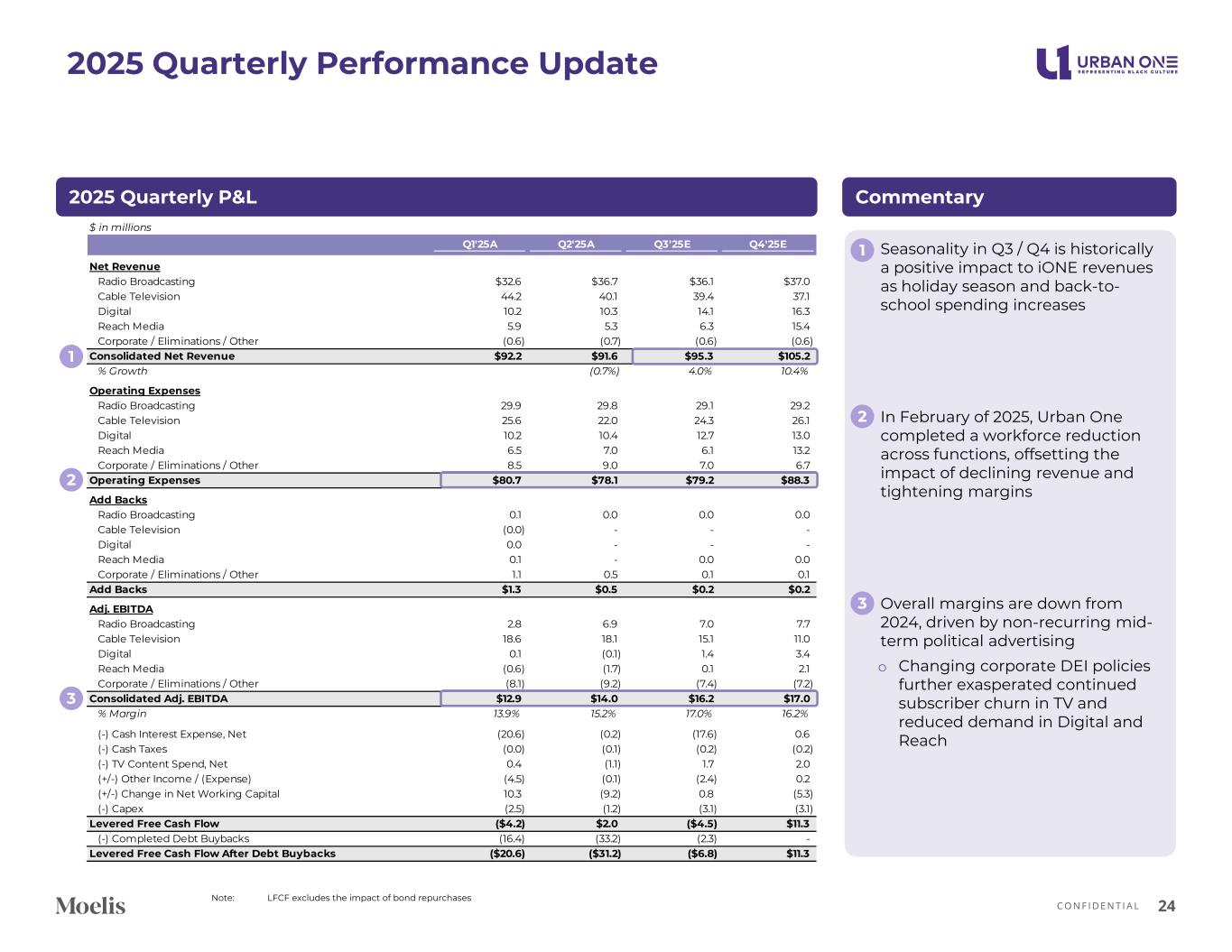

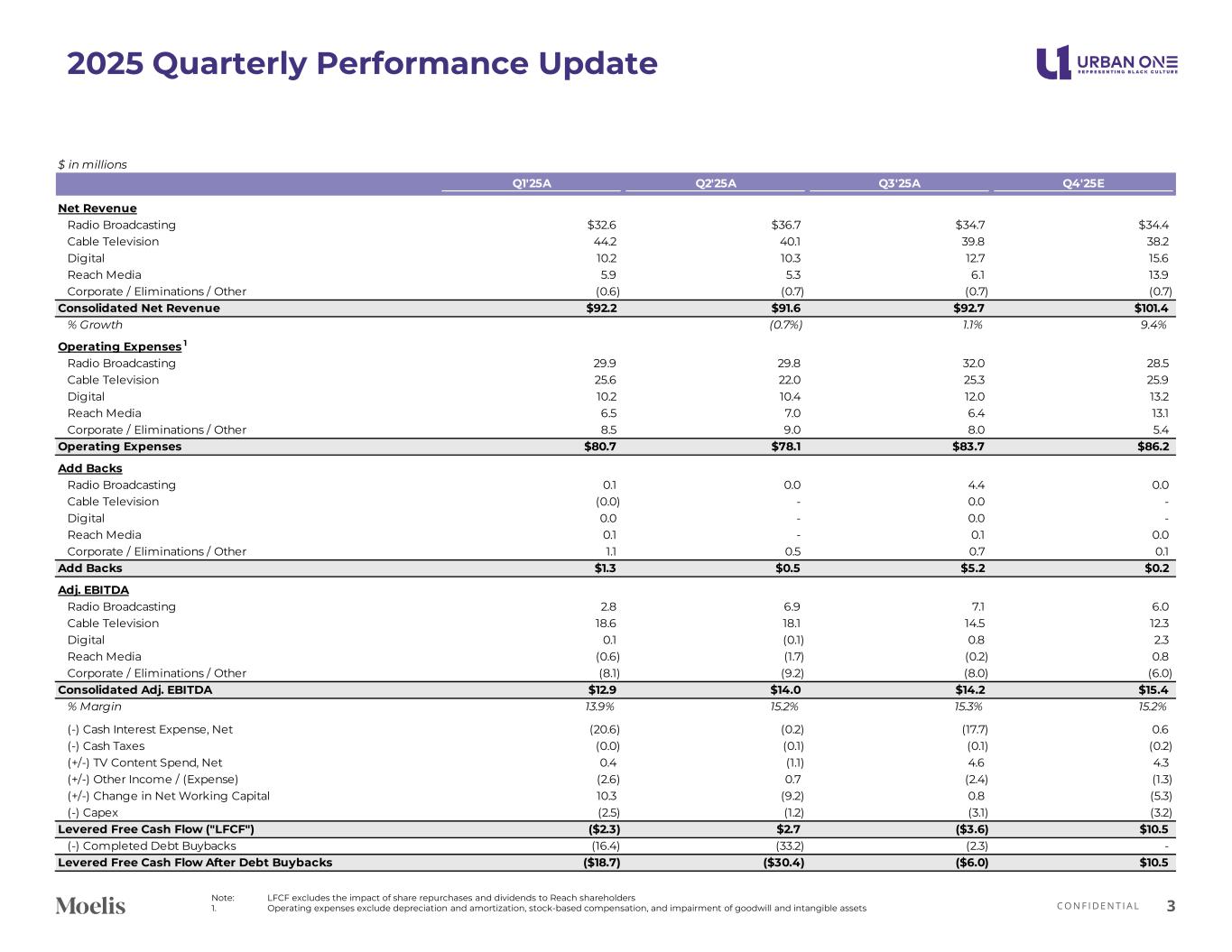

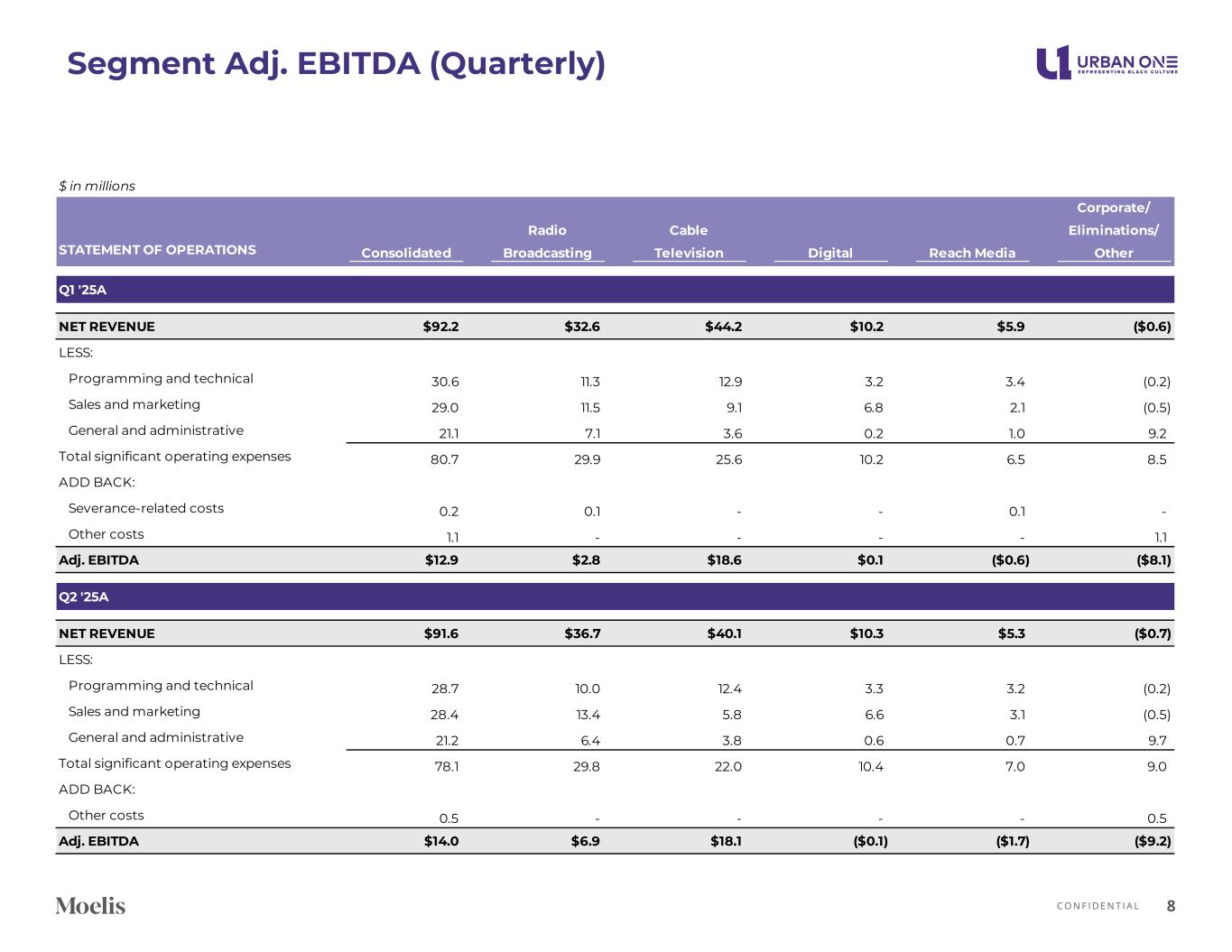

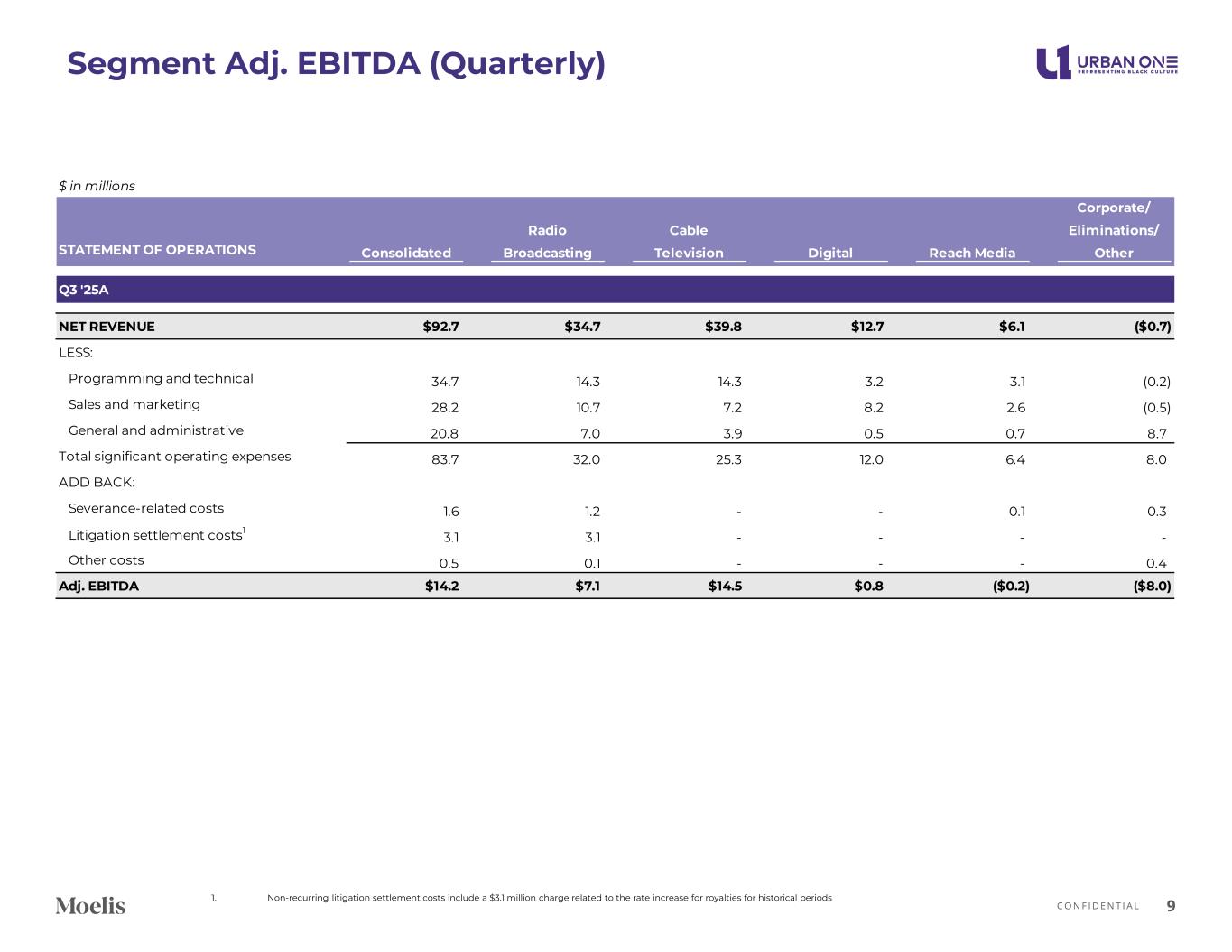

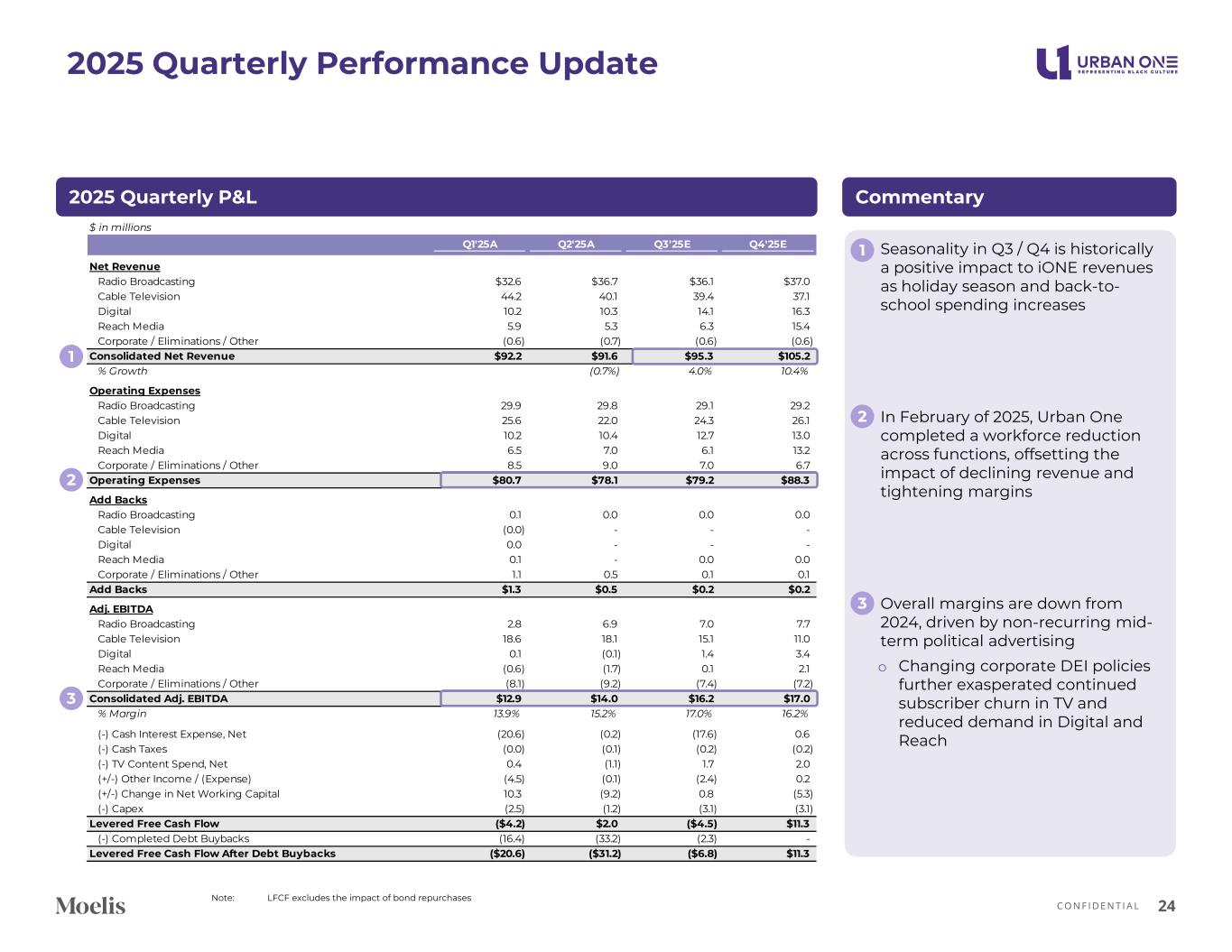

C O N F I D E N T I A L 2025 Quarterly Performance Update 24 Note: LFCF excludes the impact of bond repurchases • Seasonality in Q3 / Q4 is historically a positive impact to iONE revenues as holiday season and back-to- school spending increases • In February of 2025, Urban One completed a workforce reduction across functions, offsetting the impact of declining revenue and tightening margins • Overall margins are down from 2024, driven by non-recurring mid- term political advertising o Changing corporate DEI policies further exasperated continued subscriber churn in TV and reduced demand in Digital and Reach Commentary2025 Quarterly P&L 1 2 3 $ in millions Q1'25A Q2'25A Q3'25E Q4'25E Net Revenue Radio Broadcasting $32.6 $36.7 $36.1 $37.0 Cable Television 44.2 40.1 39.4 37.1 Digital 10.2 10.3 14.1 16.3 Reach Media 5.9 5.3 6.3 15.4 Corporate / Eliminations / Other (0.6) (0.7) (0.6) (0.6) Consolidated Net Revenue $92.2 $91.6 $95.3 $105.2 % Growth (0.7%) 4.0% 10.4% Operating Expenses Radio Broadcasting 29.9 29.8 29.1 29.2 Cable Television 25.6 22.0 24.3 26.1 Digital 10.2 10.4 12.7 13.0 Reach Media 6.5 7.0 6.1 13.2 Corporate / Eliminations / Other 8.5 9.0 7.0 6.7 Operating Expenses $80.7 $78.1 $79.2 $88.3 Add Backs Radio Broadcasting 0.1 0.0 0.0 0.0 Cable Television (0.0) - - - Digital 0.0 - - - Reach Media 0.1 - 0.0 0.0 Corporate / Eliminations / Other 1.1 0.5 0.1 0.1 Add Backs $1.3 $0.5 $0.2 $0.2 Adj. EBITDA Radio Broadcasting 2.8 6.9 7.0 7.7 Cable Television 18.6 18.1 15.1 11.0 Digital 0.1 (0.1) 1.4 3.4 Reach Media (0.6) (1.7) 0.1 2.1 Corporate / Eliminations / Other (8.1) (9.2) (7.4) (7.2) Consolidated Adj. EBITDA $12.9 $14.0 $16.2 $17.0 % Margin 13.9% 15.2% 17.0% 16.2% (-) Cash Interest Expense, Net (20.6) (0.2) (17.6) 0.6 (-) Cash Taxes (0.0) (0.1) (0.2) (0.2) (-) TV Content Spend, Net 0.4 (1.1) 1.7 2.0 (+/-) Other Income / (Expense) (4.5) (0.1) (2.4) 0.2 (+/-) Change in Net Working Capital 10.3 (9.2) 0.8 (5.3) (-) Capex (2.5) (1.2) (3.1) (3.1) Levered Free Cash Flow ($4.2) $2.0 ($4.5) $11.3 (-) Completed Debt Buybacks (16.4) (33.2) (2.3) - Levered Free Cash Flow After Debt Buybacks ($20.6) ($31.2) ($6.8) $11.3 1 2 3

C O N F I D E N T I A L BUSINESS PLAN OVERVIEW 25

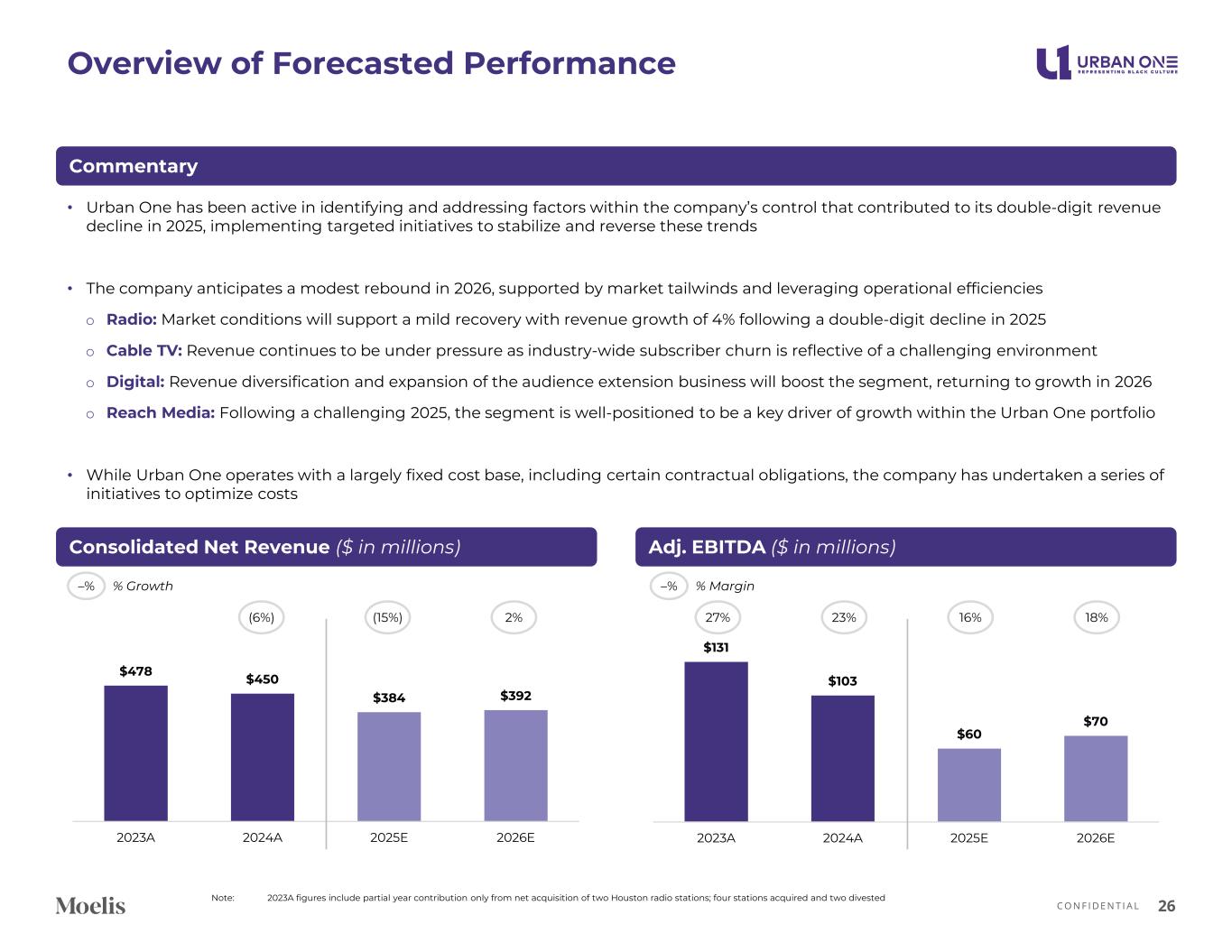

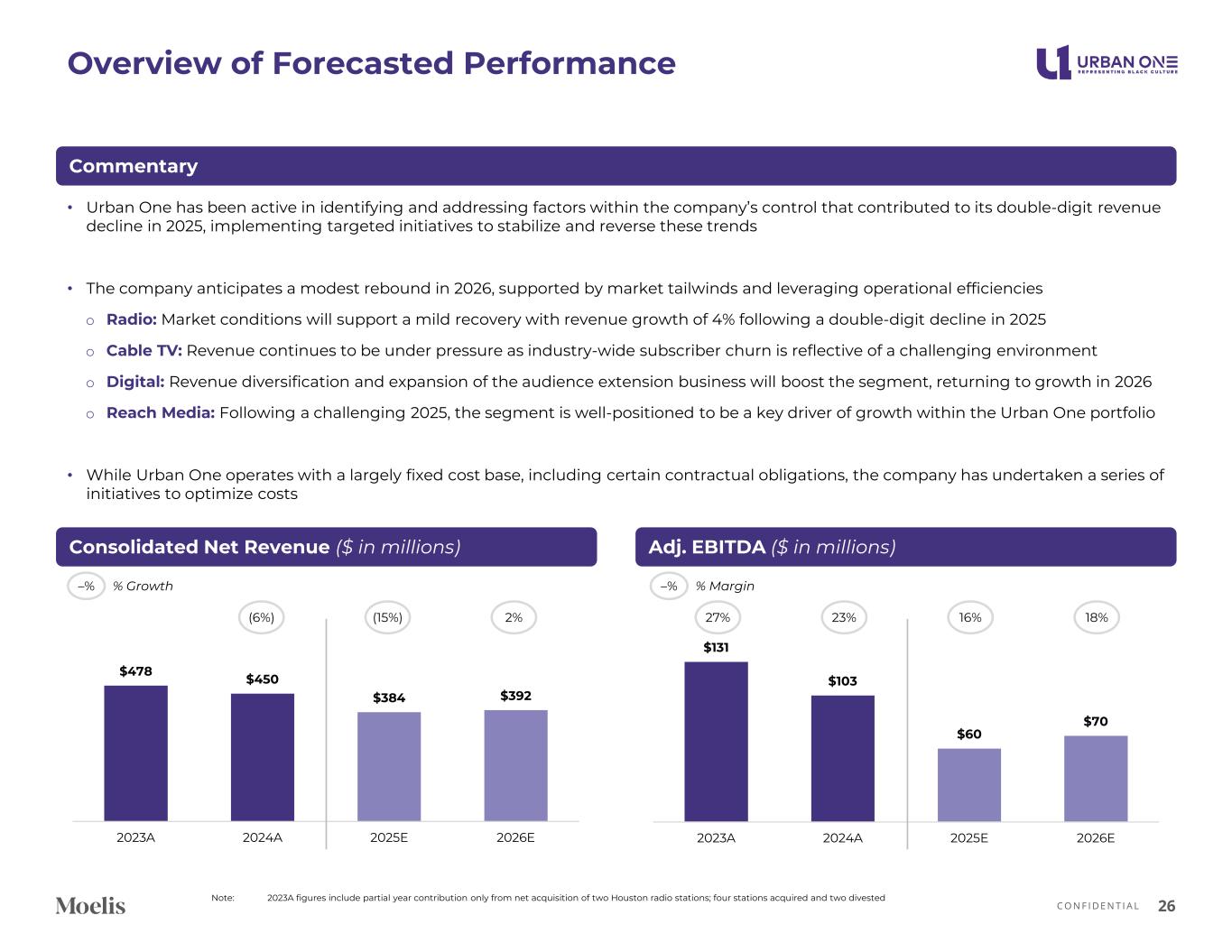

C O N F I D E N T I A L $131 $103 $60 $70 2023A 2024A 2025E 2026E $478 $450 $384 $392 2023A 2024A 2025E 2026E Adj. EBITDA ($ in millions)Consolidated Net Revenue ($ in millions) Overview of Forecasted Performance 26 Commentary • Urban One has been active in identifying and addressing factors within the company’s control that contributed to its double-digit revenue decline in 2025, implementing targeted initiatives to stabilize and reverse these trends • The company anticipates a modest rebound in 2026, supported by market tailwinds and leveraging operational efficiencies o Radio: Market conditions will support a mild recovery with revenue growth of 4% following a double-digit decline in 2025 o Cable TV: Revenue continues to be under pressure as industry-wide subscriber churn is reflective of a challenging environment o Digital: Revenue diversification and expansion of the audience extension business will boost the segment, returning to growth in 2026 o Reach Media: Following a challenging 2025, the segment is well-positioned to be a key driver of growth within the Urban One portfolio • While Urban One operates with a largely fixed cost base, including certain contractual obligations, the company has undertaken a series of initiatives to optimize costs Note: 2023A figures include partial year contribution only from net acquisition of two Houston radio stations; four stations acquired and two divested % Growth–% % Margin–% (6%) (15%) 2% 23% 16% 18%27%

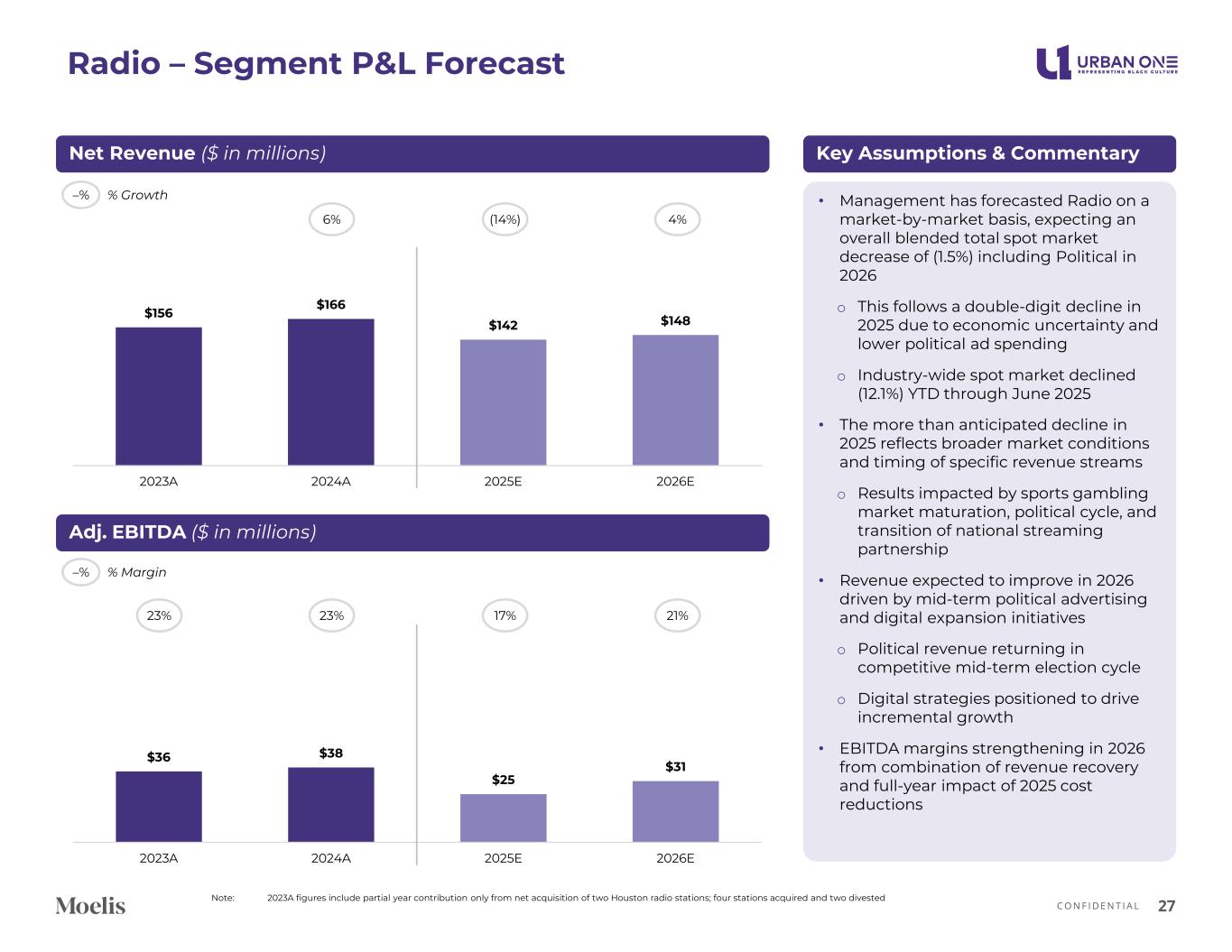

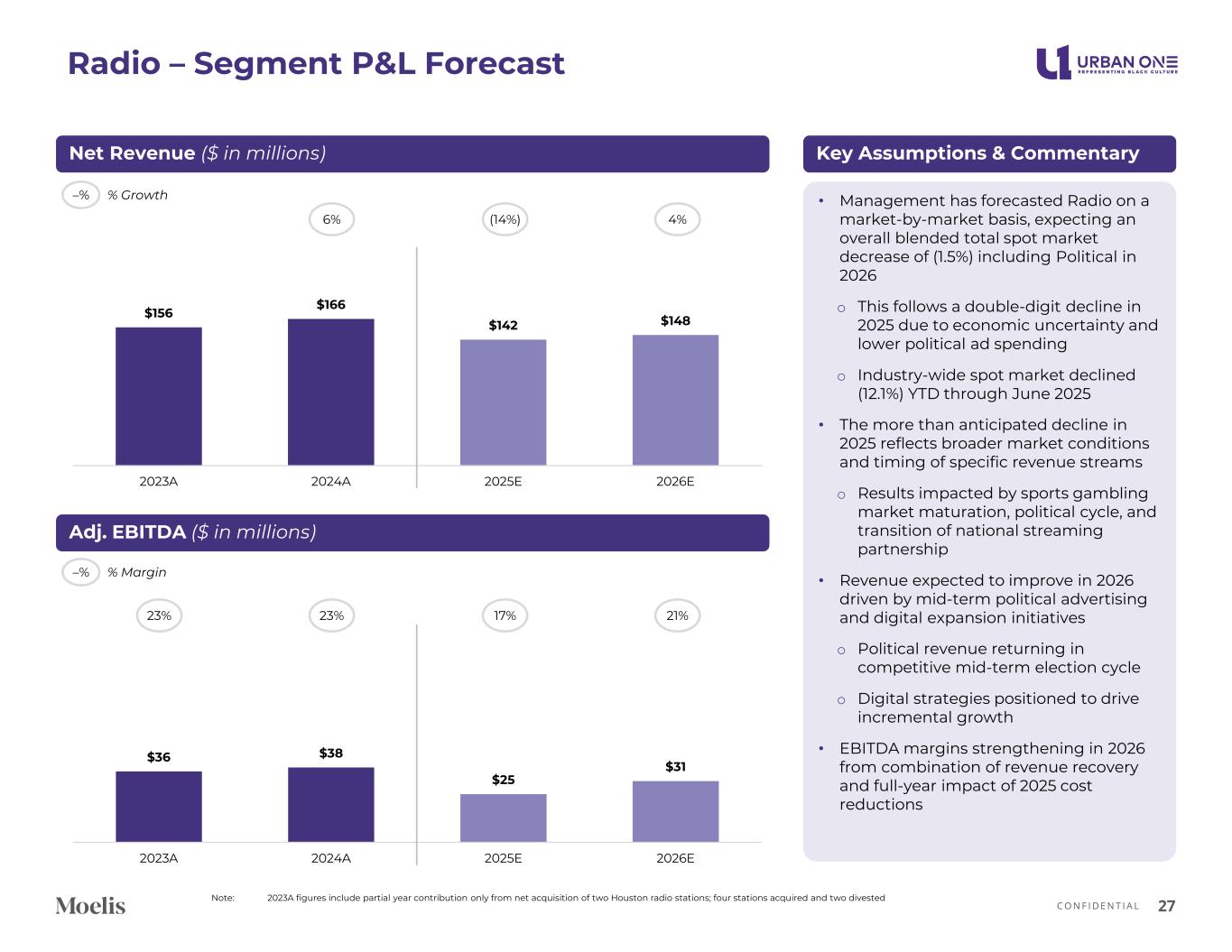

C O N F I D E N T I A L • Management has forecasted Radio on a market-by-market basis, expecting an overall blended total spot market decrease of (1.5%) including Political in 2026 o This follows a double-digit decline in 2025 due to economic uncertainty and lower political ad spending o Industry-wide spot market declined (12.1%) YTD through June 2025 • The more than anticipated decline in 2025 reflects broader market conditions and timing of specific revenue streams o Results impacted by sports gambling market maturation, political cycle, and transition of national streaming partnership • Revenue expected to improve in 2026 driven by mid-term political advertising and digital expansion initiatives o Political revenue returning in competitive mid-term election cycle o Digital strategies positioned to drive incremental growth • EBITDA margins strengthening in 2026 from combination of revenue recovery and full-year impact of 2025 cost reductions $36 $38 $25 $31 2023A 2024A 2025E 2026E Net Revenue ($ in millions) Key Assumptions & Commentary Radio – Segment P&L Forecast 27 Adj. EBITDA ($ in millions) $156 $166 $142 $148 2023A 2024A 2025E 2026E Note: 2023A figures include partial year contribution only from net acquisition of two Houston radio stations; four stations acquired and two divested 6% (14%) 4% % Growth–% % Margin–% 23% 17% 21%23%

C O N F I D E N T I A L • Management has forecasted single-digit declines driven by ongoing shift of advertising spend away from TV and lower Affiliate Sales, but offset by growth in CTV and AVOD/FAST o Industry-wide linear subscriber churn of (10%) annually impacting Affiliate and Advertising revenue o TV One's ability to maintain stable ratings demonstrates strong content quality and viewer loyalty despite subscriber base changes • Material cost saving initiatives are driving margin protection o Newly negotiated ratings service contracts provide immediate cost benefits o Additional optimization opportunities identified but not yet reflected in forecast • EBITDA impact mitigated through combination of cost management and launch asset amortization • Multiple growth initiatives positioned to diversify revenue beyond traditional linear model o AVOD/FAST platform expansion accelerating o CTV opportunities and content partnerships in development o Direct-to-consumer options under evaluation Cable Television – Segment P&L Forecast 28 $196 $176 $161 $154 2023A 2024A 2025E 2026E (10%) (9%) (5%) % Growth–% % Margin–% 38% 39% 37%45% Net Revenue ($ in millions)1 Key Assumptions & Commentary Adj. EBITDA ($ in millions) $89 $67 $63 $56 2023A 2024A 2025E 2026E 1. Segment information for 2024A has been recast to reclassify a portion of revenues from our CTV offering from the Digital segment to the Cable Television segment; no reclassification for 2023A

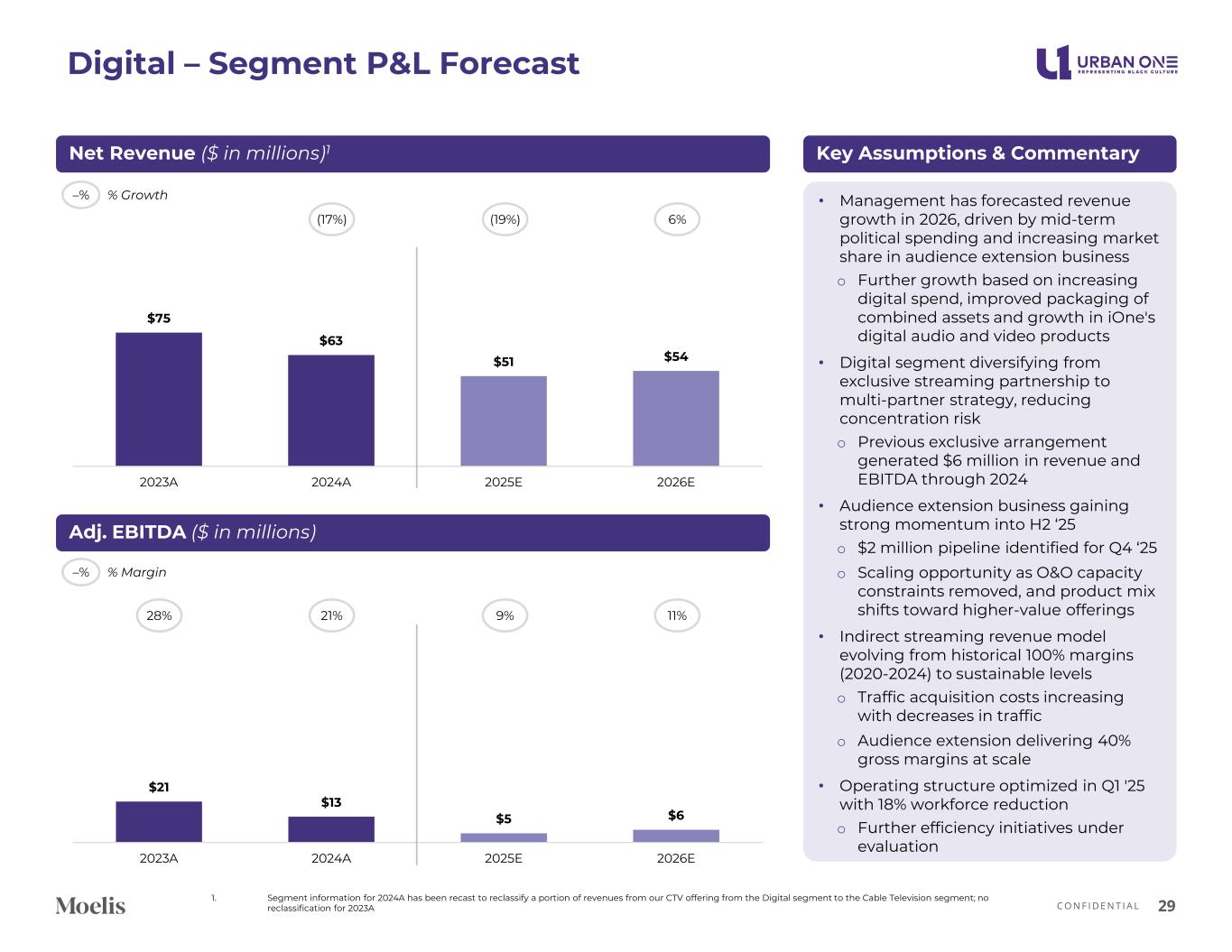

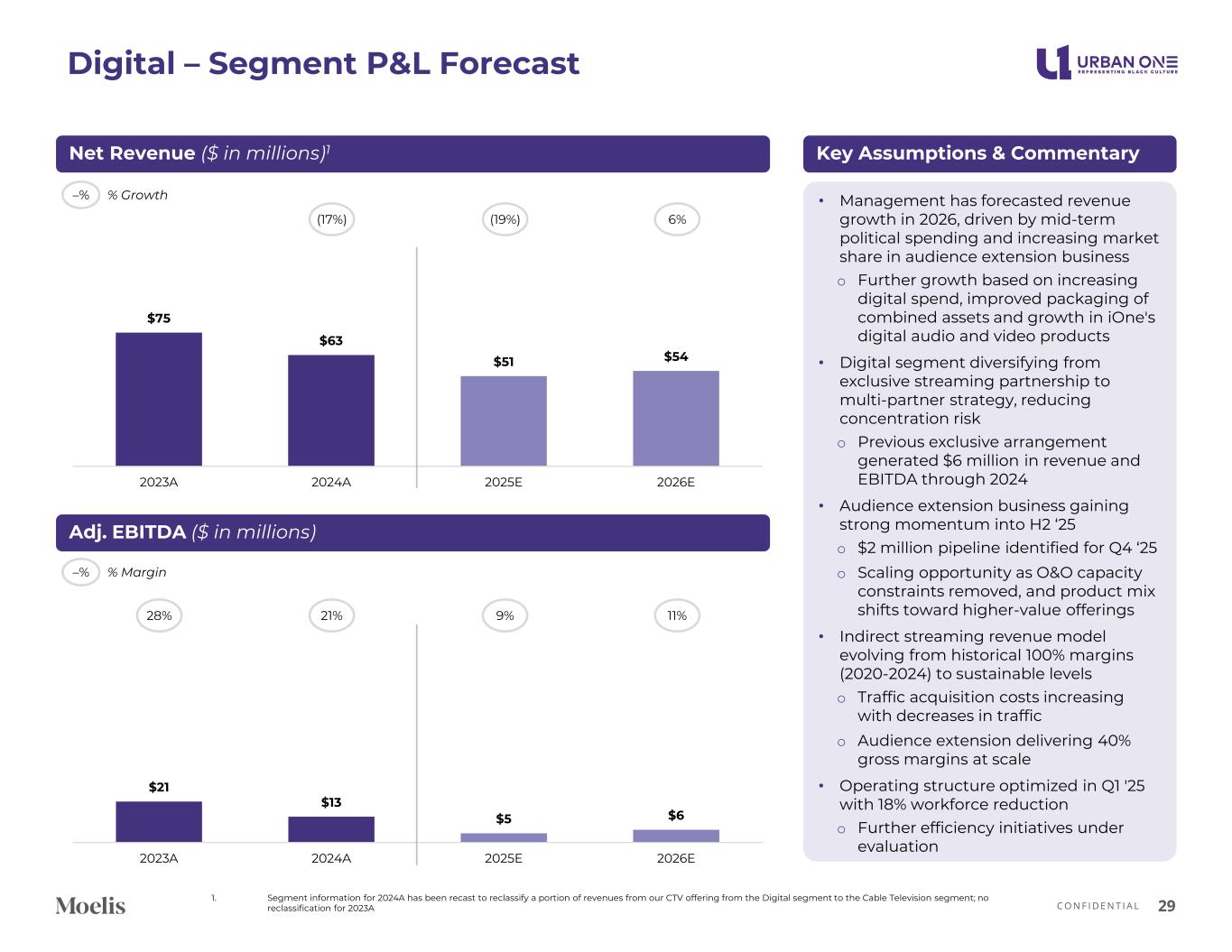

C O N F I D E N T I A L • Management has forecasted revenue growth in 2026, driven by mid-term political spending and increasing market share in audience extension business o Further growth based on increasing digital spend, improved packaging of combined assets and growth in iOne's digital audio and video products • Digital segment diversifying from exclusive streaming partnership to multi-partner strategy, reducing concentration risk o Previous exclusive arrangement generated $6 million in revenue and EBITDA through 2024 • Audience extension business gaining strong momentum into H2 ‘25 o $2 million pipeline identified for Q4 ‘25 o Scaling opportunity as O&O capacity constraints removed, and product mix shifts toward higher-value offerings • Indirect streaming revenue model evolving from historical 100% margins (2020-2024) to sustainable levels o Traffic acquisition costs increasing with decreases in traffic o Audience extension delivering 40% gross margins at scale • Operating structure optimized in Q1 '25 with 18% workforce reduction o Further efficiency initiatives under evaluation Digital – Segment P&L Forecast 29 $75 $63 $51 $54 2023A 2024A 2025E 2026E (17%) (19%) 6% % Growth–% % Margin–% Net Revenue ($ in millions)1 Key Assumptions & Commentary 21% 9% 11%28% Adj. EBITDA ($ in millions) $21 $13 $5 $6 2023A 2024A 2025E 2026E 1. Segment information for 2024A has been recast to reclassify a portion of revenues from our CTV offering from the Digital segment to the Cable Television segment; no reclassification for 2023A

C O N F I D E N T I A L Reach Media – Segment P&L Forecast 30 $15 $12 $0 $7 2023A 2024A 2025E 2026E $53 $47 $33 $39 2023A 2024A 2025E 2026E (11%) (31%) 20% % Growth–% % Margin–% Key Assumptions & CommentaryNet Revenue ($ in millions) Adj. EBITDA ($ in millions) 25% 0% 17%28% • Management has forecasted Reach Media to be the fastest growing segment of the portfolio in 2026 due to expectation of recapturing market share lost in 2025 • Revenue declined in 2025 due to loss of key brands and network market softness, with recovery targeted for 2026 o Despite challenges, management is targeting 3% network radio market share in 2026, resulting in 20% revenue growth o Sales reorganization underway with three new sellers already onboarded • Integrated sales strategy leveraging Urban One's broader platform capabilities o Cross-selling opportunities across 100+ seller network and all Reach assets o Enhanced efficiency through consolidated sales efforts across markets • EBITDA margins expected to recover to 17% in 2026 from near break-even in 2025 o Mid-term political advertising providing high-margin revenue boost o Market share gains expected to establish sustainable baseline beyond political cycles

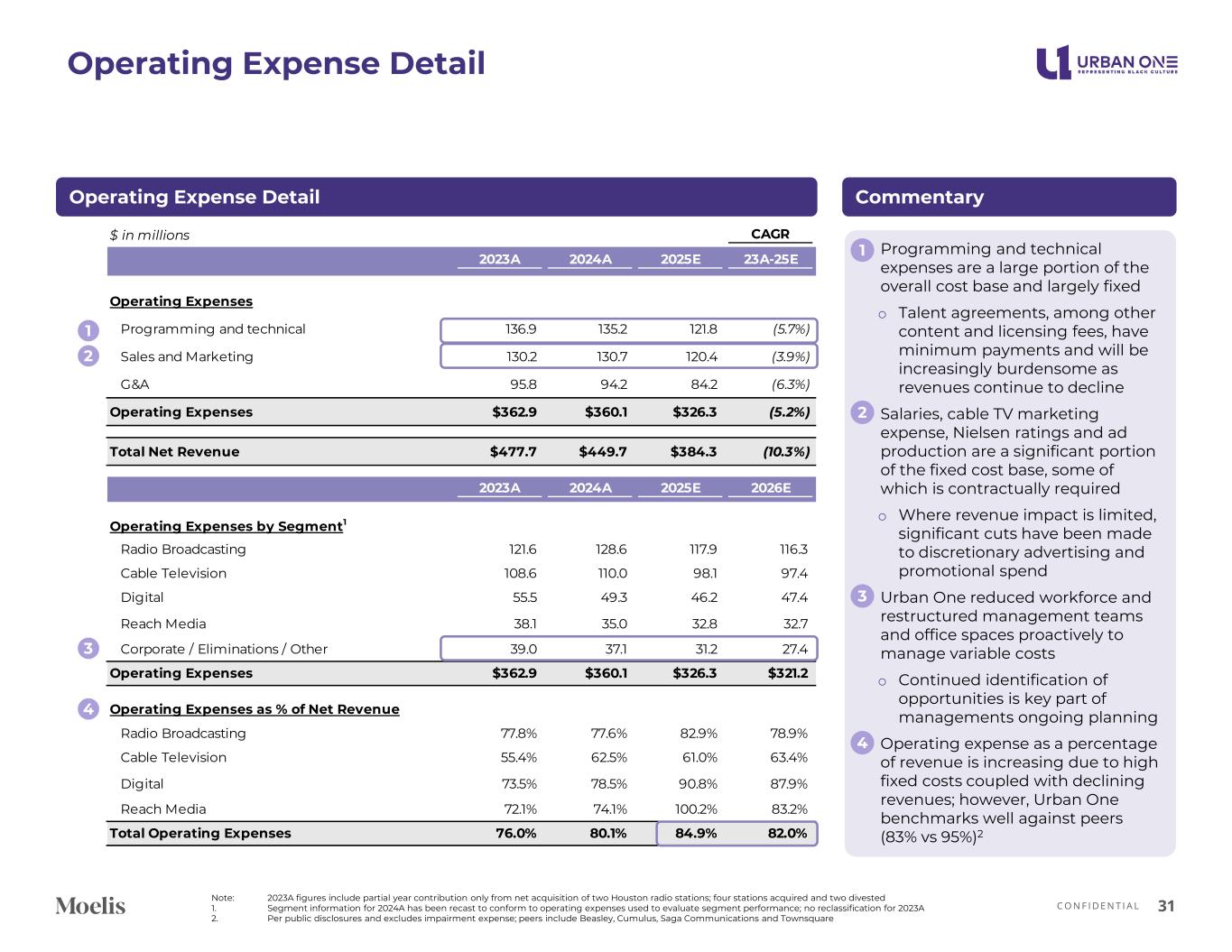

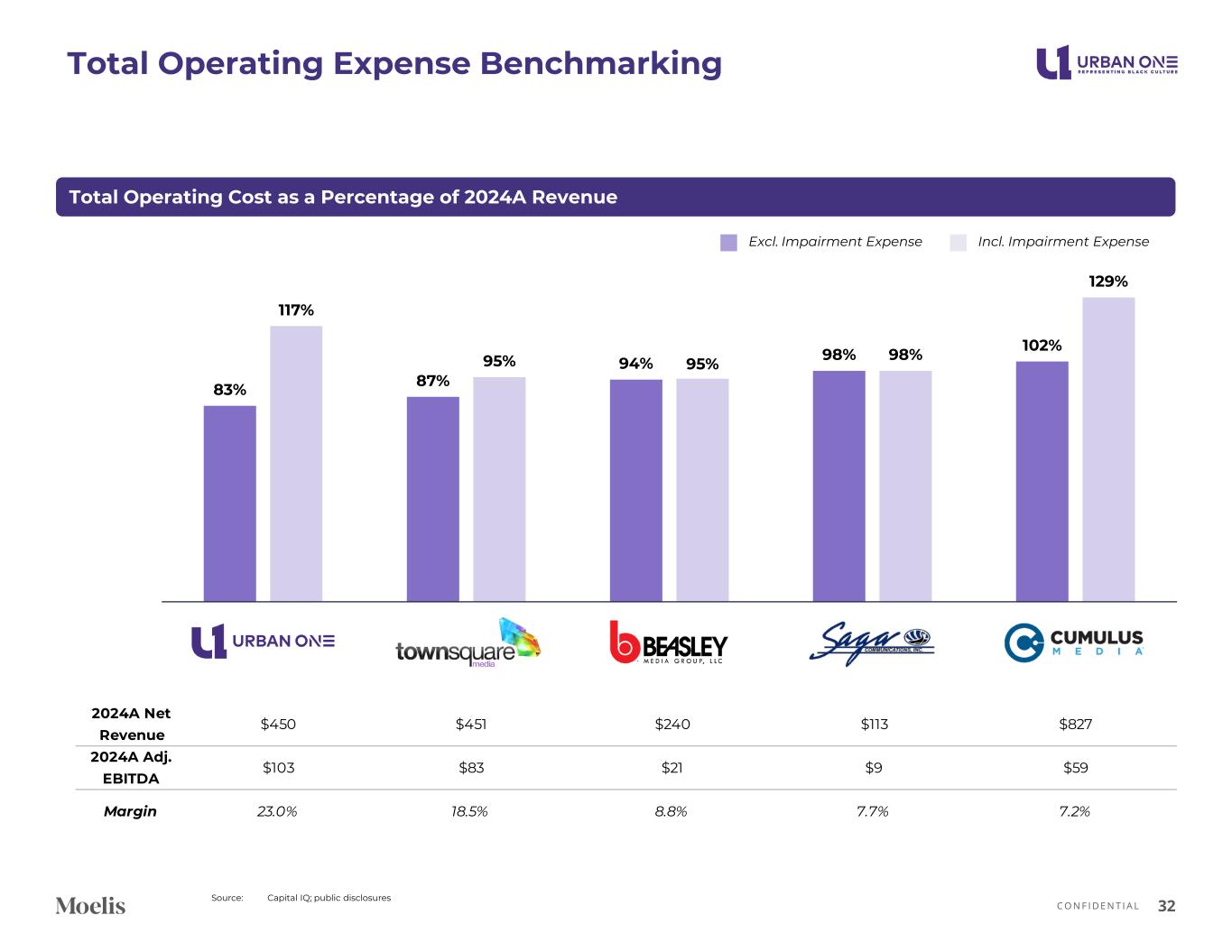

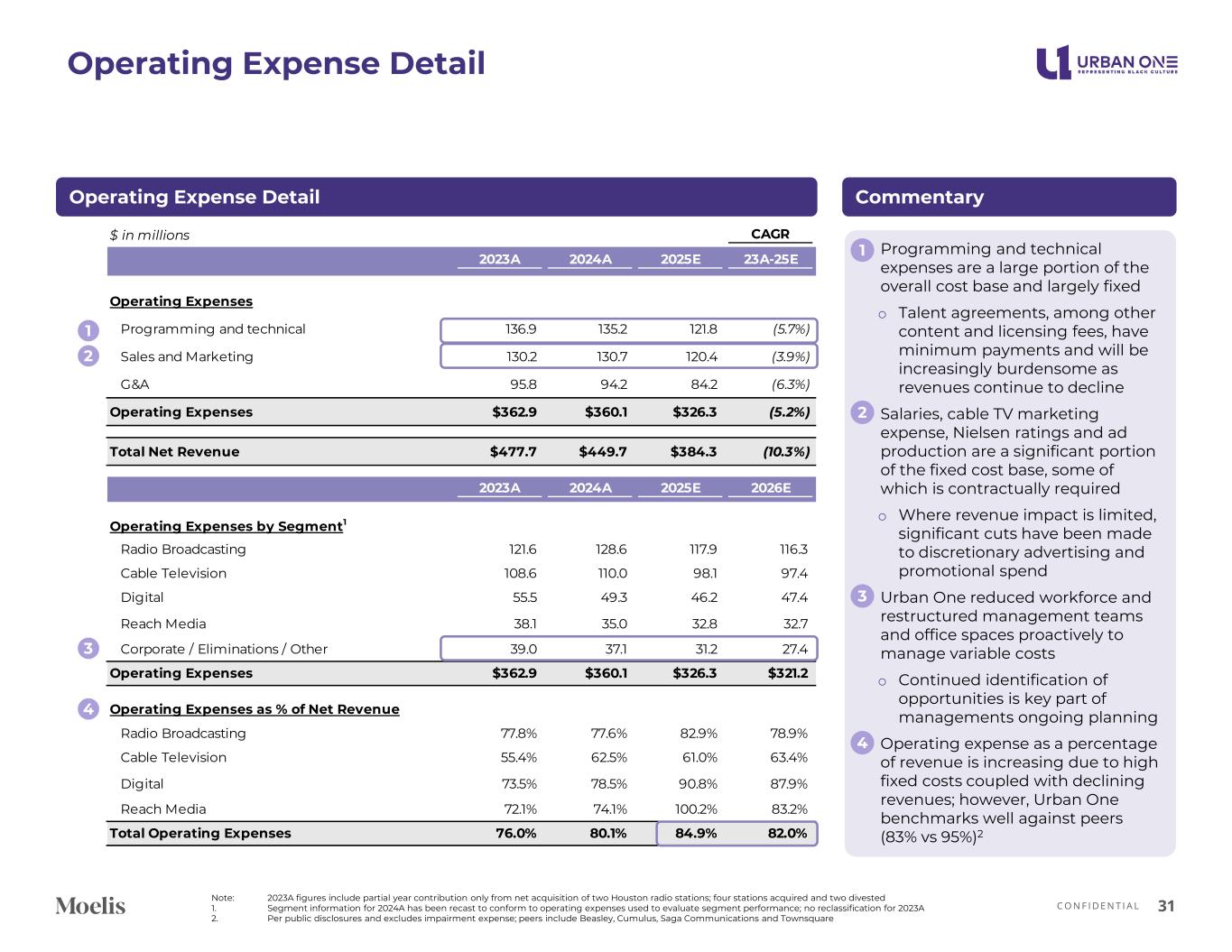

C O N F I D E N T I A L Operating Expense Detail 31 Note: 2023A figures include partial year contribution only from net acquisition of two Houston radio stations; four stations acquired and two divested 1. Segment information for 2024A has been recast to conform to operating expenses used to evaluate segment performance; no reclassification for 2023A 2. Per public disclosures and excludes impairment expense; peers include Beasley, Cumulus, Saga Communications and Townsquare CommentaryOperating Expense Detail • Programming and technical expenses are a large portion of the overall cost base and largely fixed o Talent agreements, among other content and licensing fees, have minimum payments and will be increasingly burdensome as revenues continue to decline • Salaries, cable TV marketing expense, Nielsen ratings and ad production are a significant portion of the fixed cost base, some of which is contractually required o Where revenue impact is limited, significant cuts have been made to discretionary advertising and promotional spend • Urban One reduced workforce and restructured management teams and office spaces proactively to manage variable costs o Continued identification of opportunities is key part of managements ongoing planning • Operating expense as a percentage of revenue is increasing due to high fixed costs coupled with declining revenues; however, Urban One benchmarks well against peers (83% vs 95%)2 1 2 $ in millions CAGR 2023A 2024A 2025E 23A-25E Operating Expenses Programming and technical 136.9 135.2 121.8 (5.7%) Sales and Marketing 130.2 130.7 120.4 (3.9%) G&A 95.8 94.2 84.2 (6.3%) Operating Expenses $362.9 $360.1 $326.3 (5.2%) Total Net Revenue $477.7 $449.7 $384.3 (10.3%) 2023A 2024A 2025E 2026E Operating Expenses by Segment1 Radio Broadcasting 121.6 128.6 117.9 116.3 Cable Television 108.6 110.0 98.1 97.4 Digital 55.5 49.3 46.2 47.4 Reach Media 38.1 35.0 32.8 32.7 Corporate / Eliminations / Other 39.0 37.1 31.2 27.4 Operating Expenses $362.9 $360.1 $326.3 $321.2 Operating Expenses as % of Net Revenue Radio Broadcasting 77.8% 77.6% 82.9% 78.9% Cable Television 55.4% 62.5% 61.0% 63.4% Digital 73.5% 78.5% 90.8% 87.9% Reach Media 72.1% 74.1% 100.2% 83.2% Total Operating Expenses 76.0% 80.1% 84.9% 82.0% 1 3 2 3 4 4

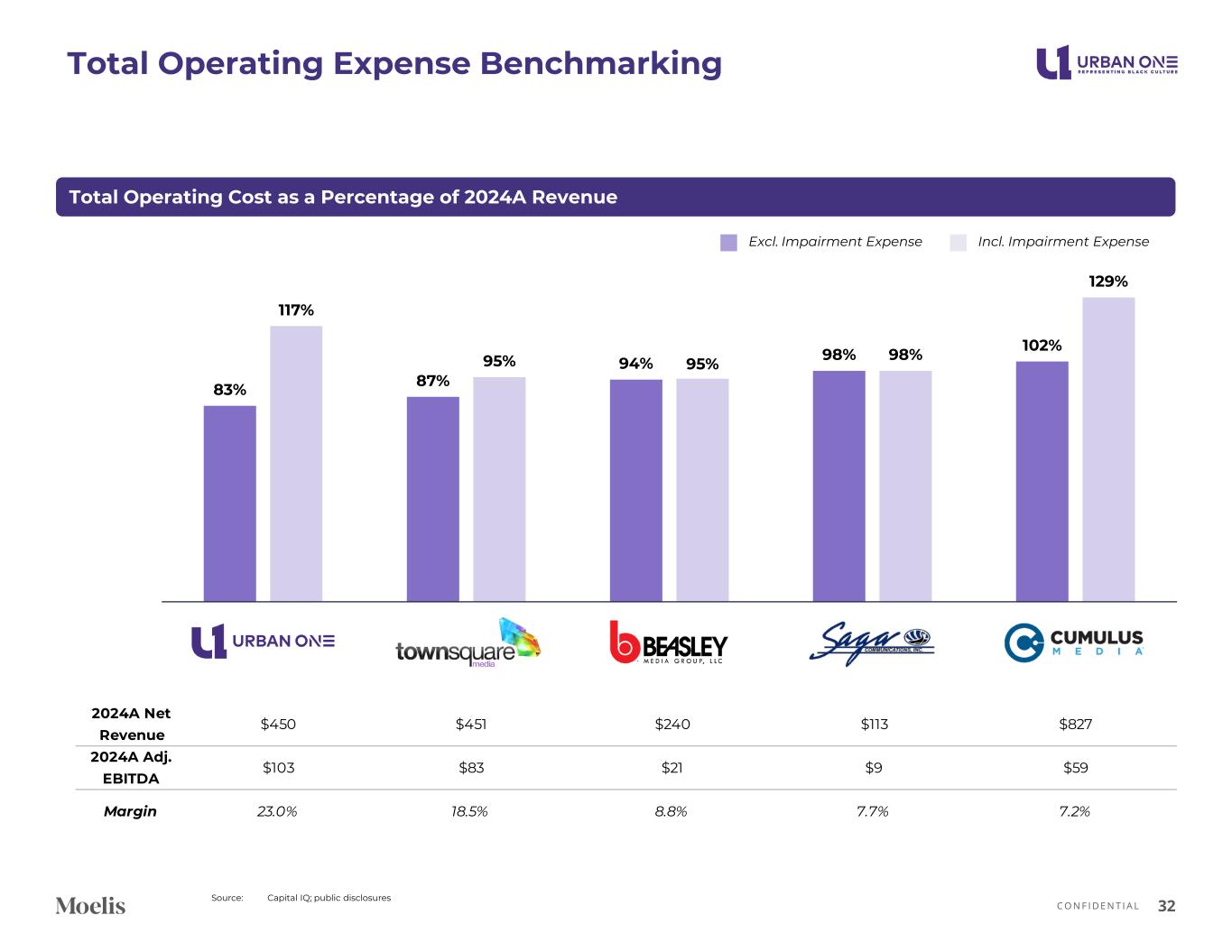

C O N F I D E N T I A L 83% 87% 94% 98% 102% 117% 95% 95% 98% 129% Urban One Townsquare Beasley Saga Cumulus Total Operating Expense Benchmarking 32 Source: Capital IQ; public disclosures Total Operating Cost as a Percentage of 2024A Revenue 2024A Net Revenue $450 $451 $240 $113 $827 2024A Adj. EBITDA $103 $83 $21 $9 $59 Margin 23.0% 18.5% 8.8% 7.7% 7.2% Excl. Impairment Expense Incl. Impairment Expense

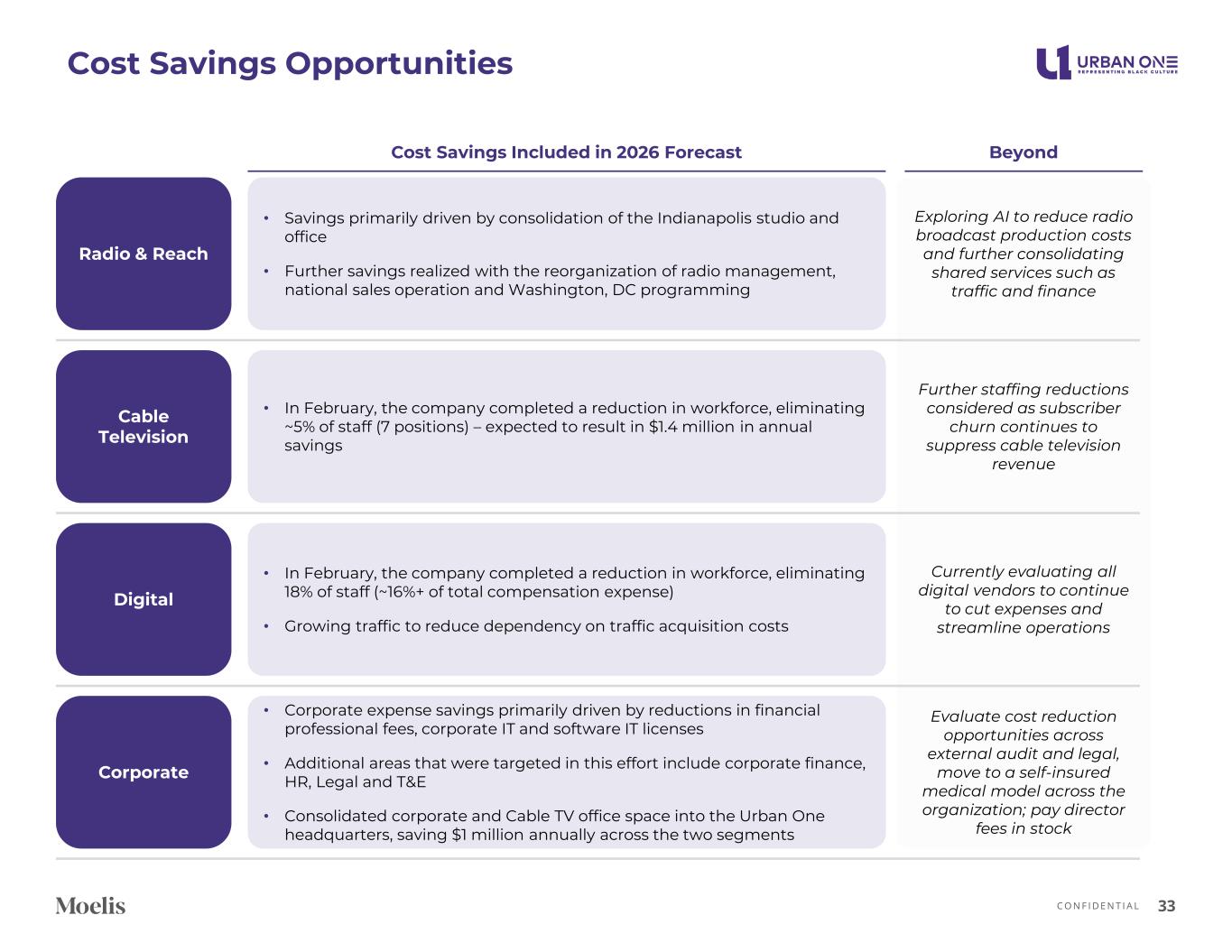

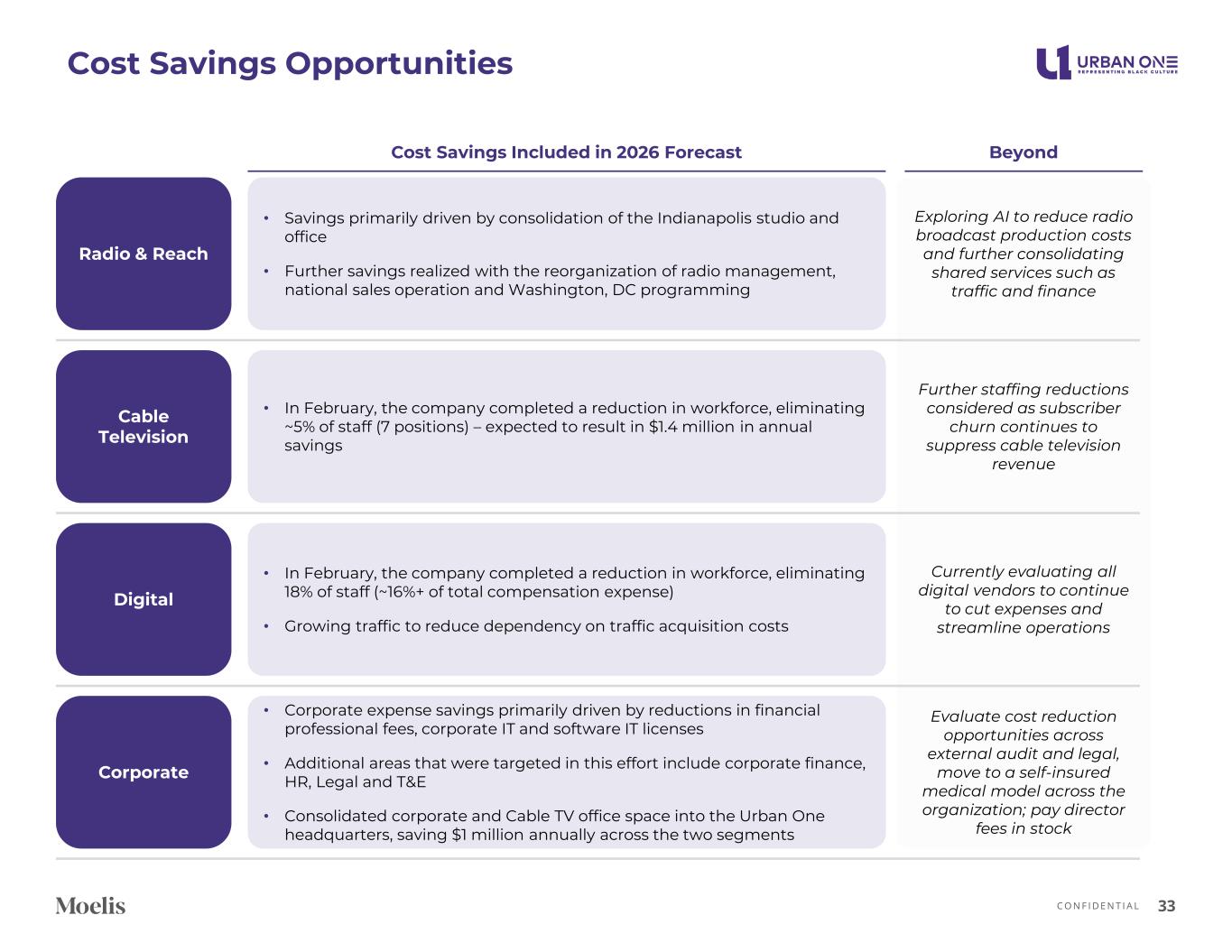

C O N F I D E N T I A L Cost Savings Opportunities 33 Radio & Reach Digital Cable Television Corporate • Savings primarily driven by consolidation of the Indianapolis studio and office • Further savings realized with the reorganization of radio management, national sales operation and Washington, DC programming • In February, the company completed a reduction in workforce, eliminating ~5% of staff (7 positions) – expected to result in $1.4 million in annual savings • In February, the company completed a reduction in workforce, eliminating 18% of staff (~16%+ of total compensation expense) • Growing traffic to reduce dependency on traffic acquisition costs • Corporate expense savings primarily driven by reductions in financial professional fees, corporate IT and software IT licenses • Additional areas that were targeted in this effort include corporate finance, HR, Legal and T&E • Consolidated corporate and Cable TV office space into the Urban One headquarters, saving $1 million annually across the two segments Beyond Exploring AI to reduce radio broadcast production costs and further consolidating shared services such as traffic and finance Further staffing reductions considered as subscriber churn continues to suppress cable television revenue Currently evaluating all digital vendors to continue to cut expenses and streamline operations Evaluate cost reduction opportunities across external audit and legal, move to a self-insured medical model across the organization; pay director fees in stock Cost Savings Included in 2026 Forecast

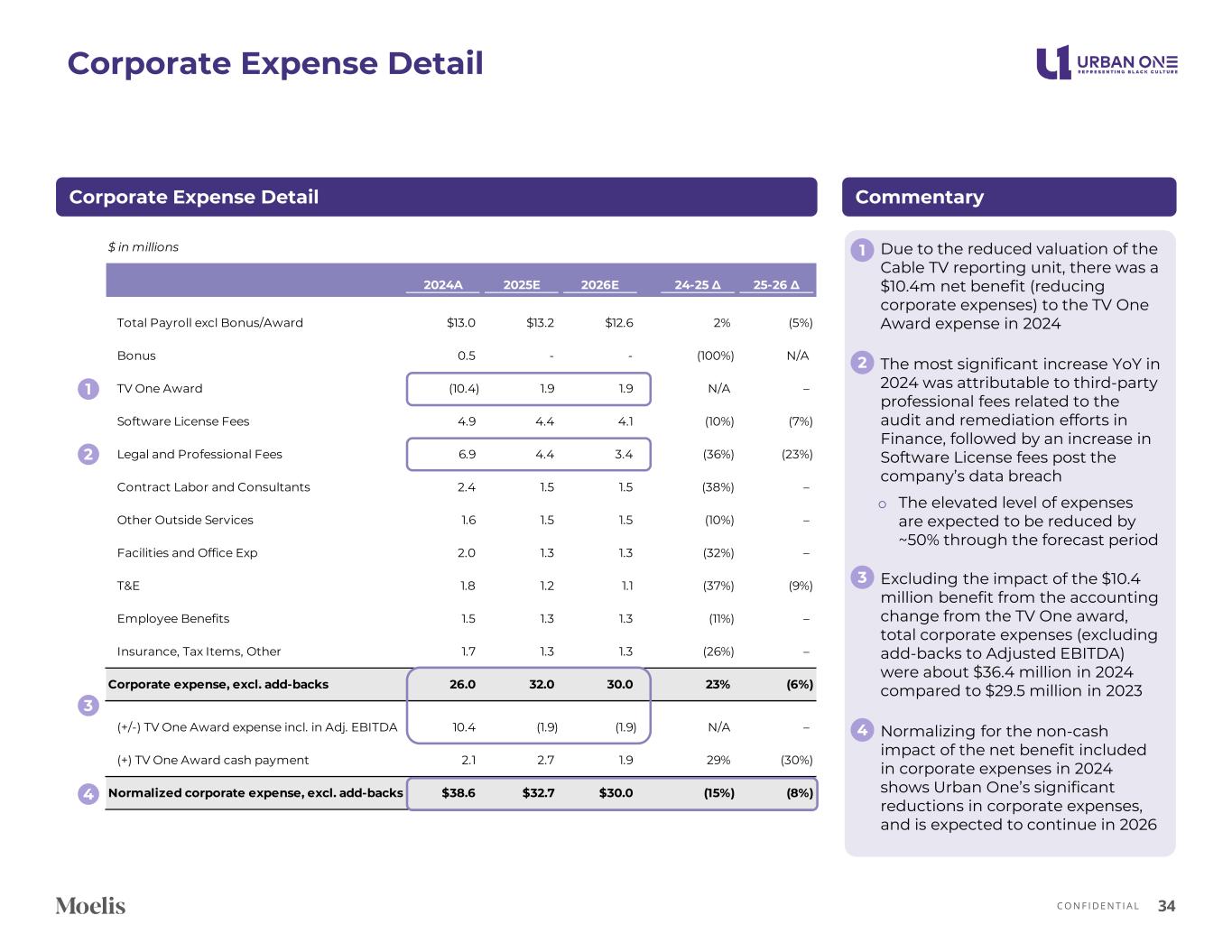

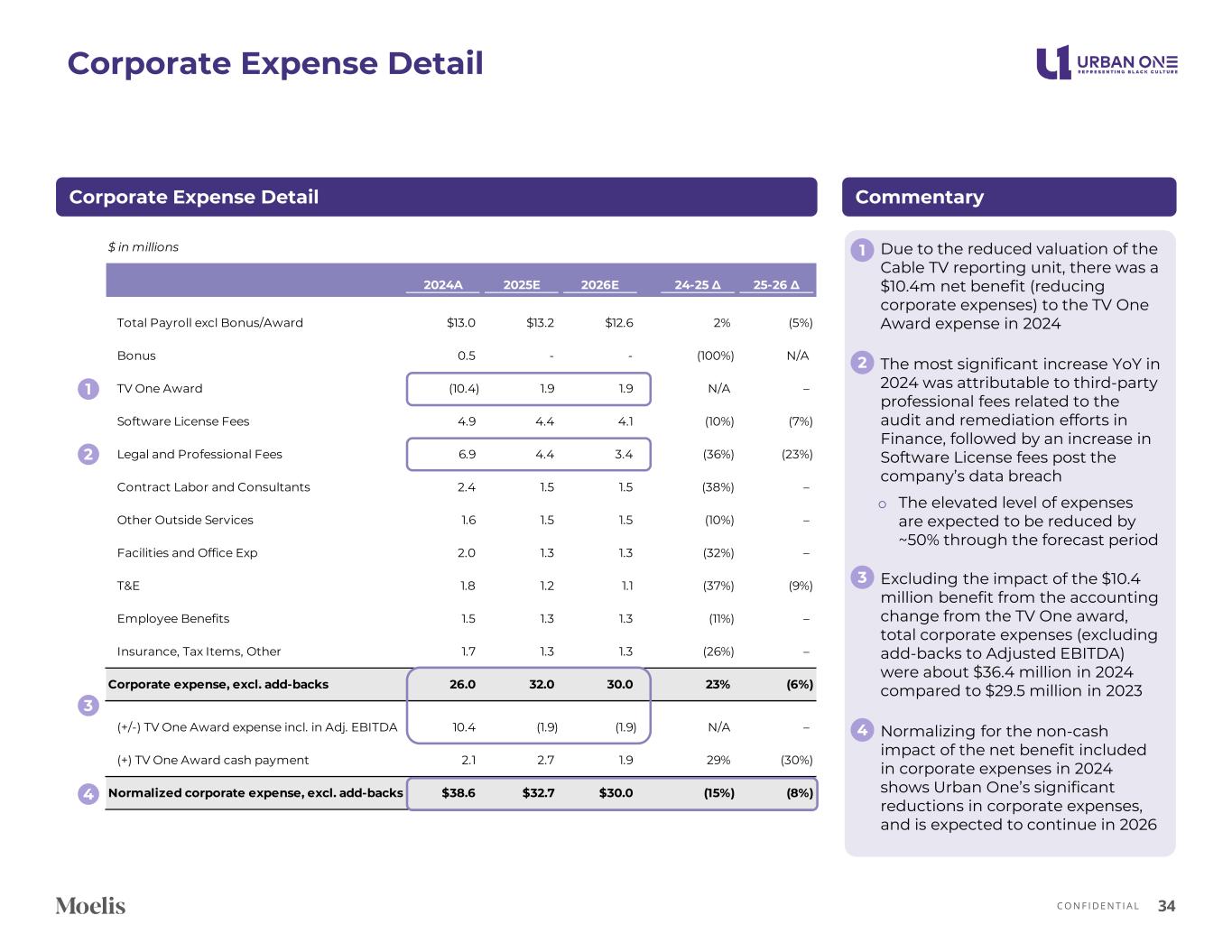

C O N F I D E N T I A L Corporate Expense Detail 34 CommentaryCorporate Expense Detail • Due to the reduced valuation of the Cable TV reporting unit, there was a $10.4m net benefit (reducing corporate expenses) to the TV One Award expense in 2024 • The most significant increase YoY in 2024 was attributable to third-party professional fees related to the audit and remediation efforts in Finance, followed by an increase in Software License fees post the company’s data breach o The elevated level of expenses are expected to be reduced by ~50% through the forecast period • Excluding the impact of the $10.4 million benefit from the accounting change from the TV One award, total corporate expenses (excluding add-backs to Adjusted EBITDA) were about $36.4 million in 2024 compared to $29.5 million in 2023 • Normalizing for the non-cash impact of the net benefit included in corporate expenses in 2024 shows Urban One’s significant reductions in corporate expenses, and is expected to continue in 2026 1 2 1 3 2 3 4 4 $ in millions 2024A 2025E 2026E 24-25 Δ 25-26 Δ Total Payroll excl Bonus/Award $13.0 $13.2 $12.6 2% (5%) Bonus 0.5 - - (100%) N/A TV One Award (10.4) 1.9 1.9 N/A – Software License Fees 4.9 4.4 4.1 (10%) (7%) Legal and Professional Fees 6.9 4.4 3.4 (36%) (23%) Contract Labor and Consultants 2.4 1.5 1.5 (38%) – Other Outside Services 1.6 1.5 1.5 (10%) – Facilities and Office Exp 2.0 1.3 1.3 (32%) – T&E 1.8 1.2 1.1 (37%) (9%) Employee Benefits 1.5 1.3 1.3 (11%) – Insurance, Tax Items, Other 1.7 1.3 1.3 (26%) – Corporate expense, excl. add-backs 26.0 32.0 30.0 23% (6%) (+/-) TV One Award expense incl. in Adj. EBITDA 10.4 (1.9) (1.9) N/A – (+) TV One Award cash payment 2.1 2.7 1.9 29% (30%) Normalized corporate expense, excl. add-backs $38.6 $32.7 $30.0 (15%) (8%)

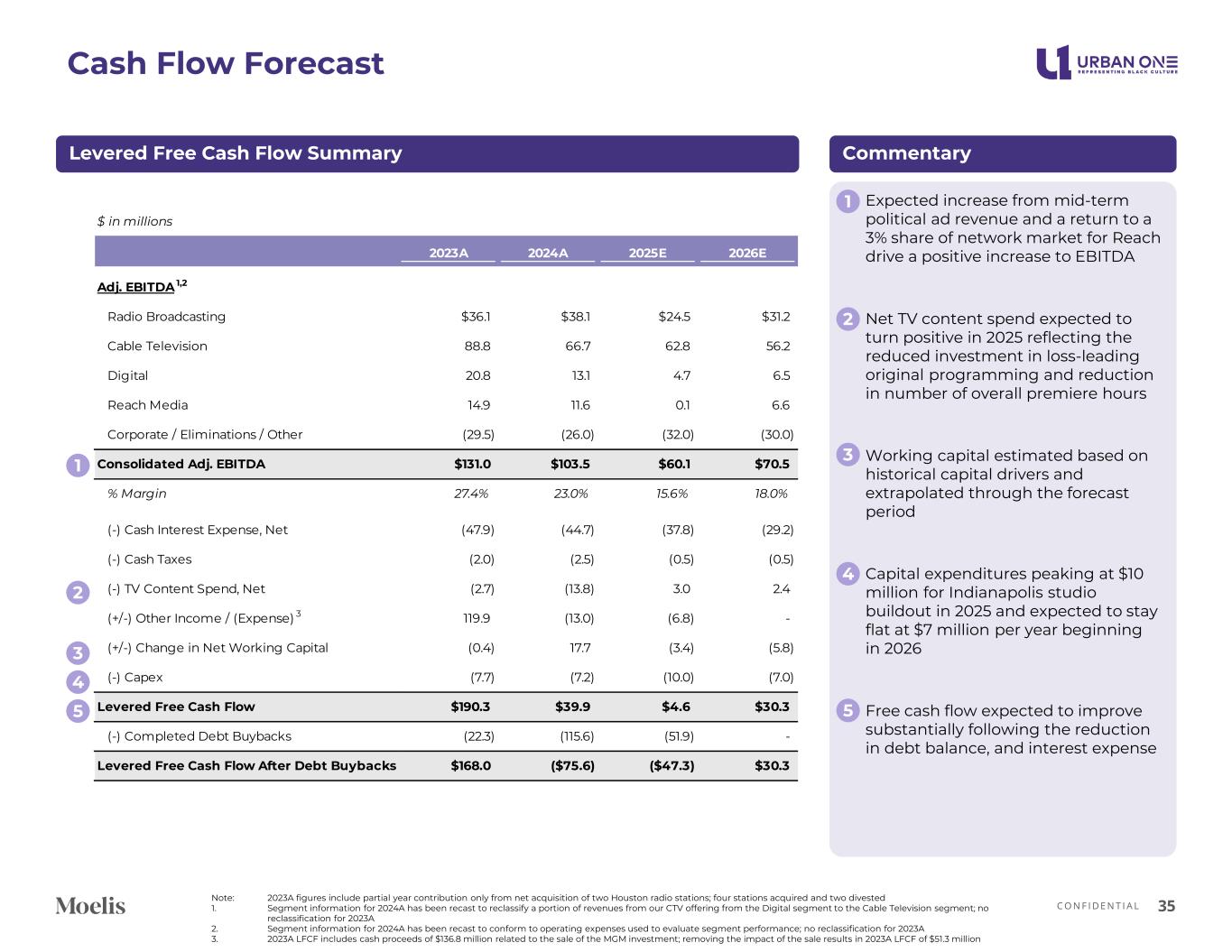

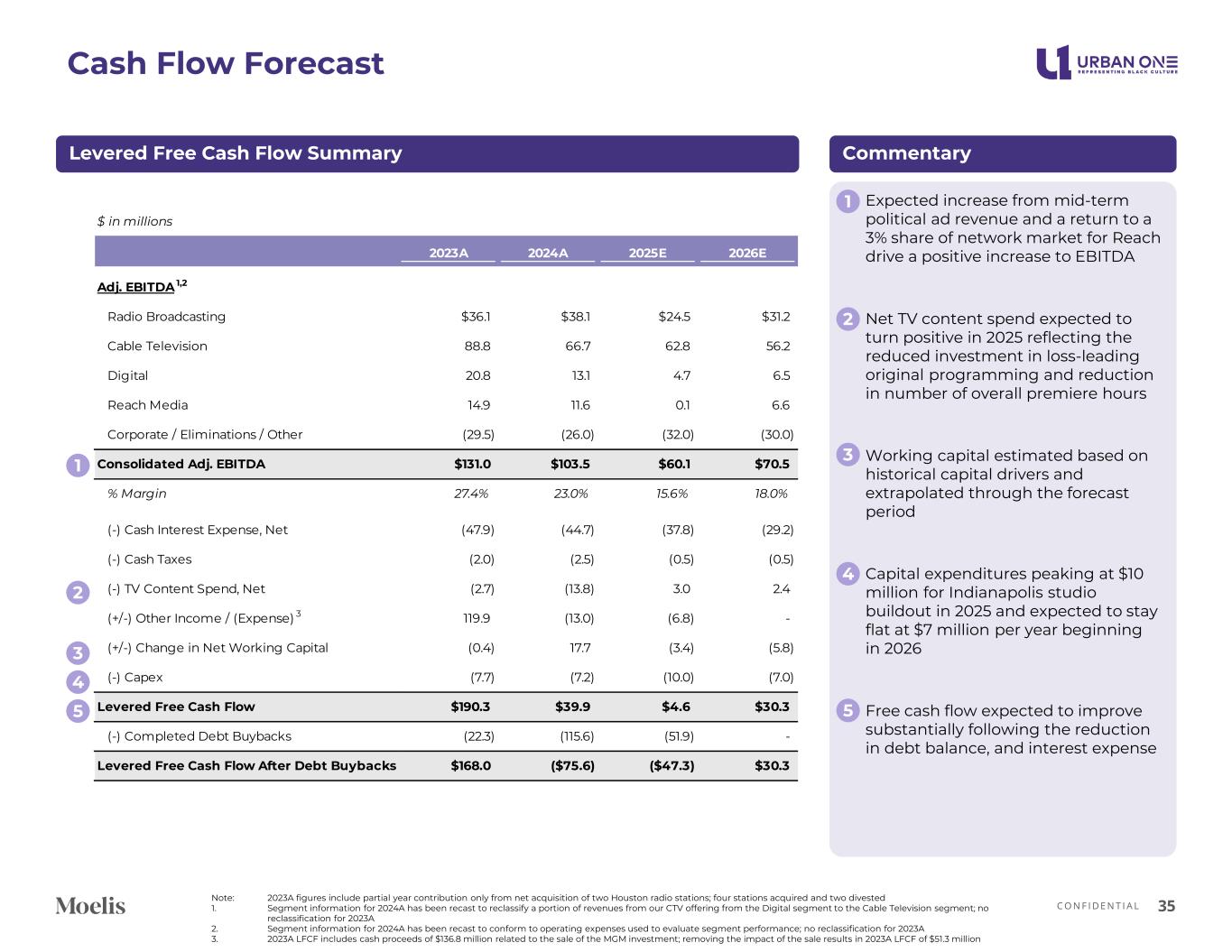

C O N F I D E N T I A L Cash Flow Forecast 35 Note: 2023A figures include partial year contribution only from net acquisition of two Houston radio stations; four stations acquired and two divested 1. Segment information for 2024A has been recast to reclassify a portion of revenues from our CTV offering from the Digital segment to the Cable Television segment; no reclassification for 2023A 2. Segment information for 2024A has been recast to conform to operating expenses used to evaluate segment performance; no reclassification for 2023A 3. 2023A LFCF includes cash proceeds of $136.8 million related to the sale of the MGM investment; removing the impact of the sale results in 2023A LFCF of $51.3 million Levered Free Cash Flow Summary • Expected increase from mid-term political ad revenue and a return to a 3% share of network market for Reach drive a positive increase to EBITDA • Net TV content spend expected to turn positive in 2025 reflecting the reduced investment in loss-leading original programming and reduction in number of overall premiere hours • Working capital estimated based on historical capital drivers and extrapolated through the forecast period • Capital expenditures peaking at $10 million for Indianapolis studio buildout in 2025 and expected to stay flat at $7 million per year beginning in 2026 • Free cash flow expected to improve substantially following the reduction in debt balance, and interest expense Commentary $ in millions 2023A 2024A 2025E 2026E Adj. EBITDA Radio Broadcasting $36.1 $38.1 $24.5 $31.2 Cable Television 88.8 66.7 62.8 56.2 Digital 20.8 13.1 4.7 6.5 Reach Media 14.9 11.6 0.1 6.6 Corporate / Eliminations / Other (29.5) (26.0) (32.0) (30.0) Consolidated Adj. EBITDA $131.0 $103.5 $60.1 $70.5 % Margin 27.4% 23.0% 15.6% 18.0% (-) Cash Interest Expense, Net (47.9) (44.7) (37.8) (29.2) (-) Cash Taxes (2.0) (2.5) (0.5) (0.5) (-) TV Content Spend, Net (2.7) (13.8) 3.0 2.4 (+/-) Other Income / (Expense) 119.9 (13.0) (6.8) - (+/-) Change in Net Working Capital (0.4) 17.7 (3.4) (5.8) (-) Capex (7.7) (7.2) (10.0) (7.0) Levered Free Cash Flow $190.3 $39.9 $4.6 $30.3 (-) Completed Debt Buybacks (22.3) (115.6) (51.9) - Levered Free Cash Flow After Debt Buybacks $168.0 ($75.6) ($47.3) $30.3 1 2 3 4 5 1 2 3 4 5 3 1,2

C O N F I D E N T I A L APPENDIX 36

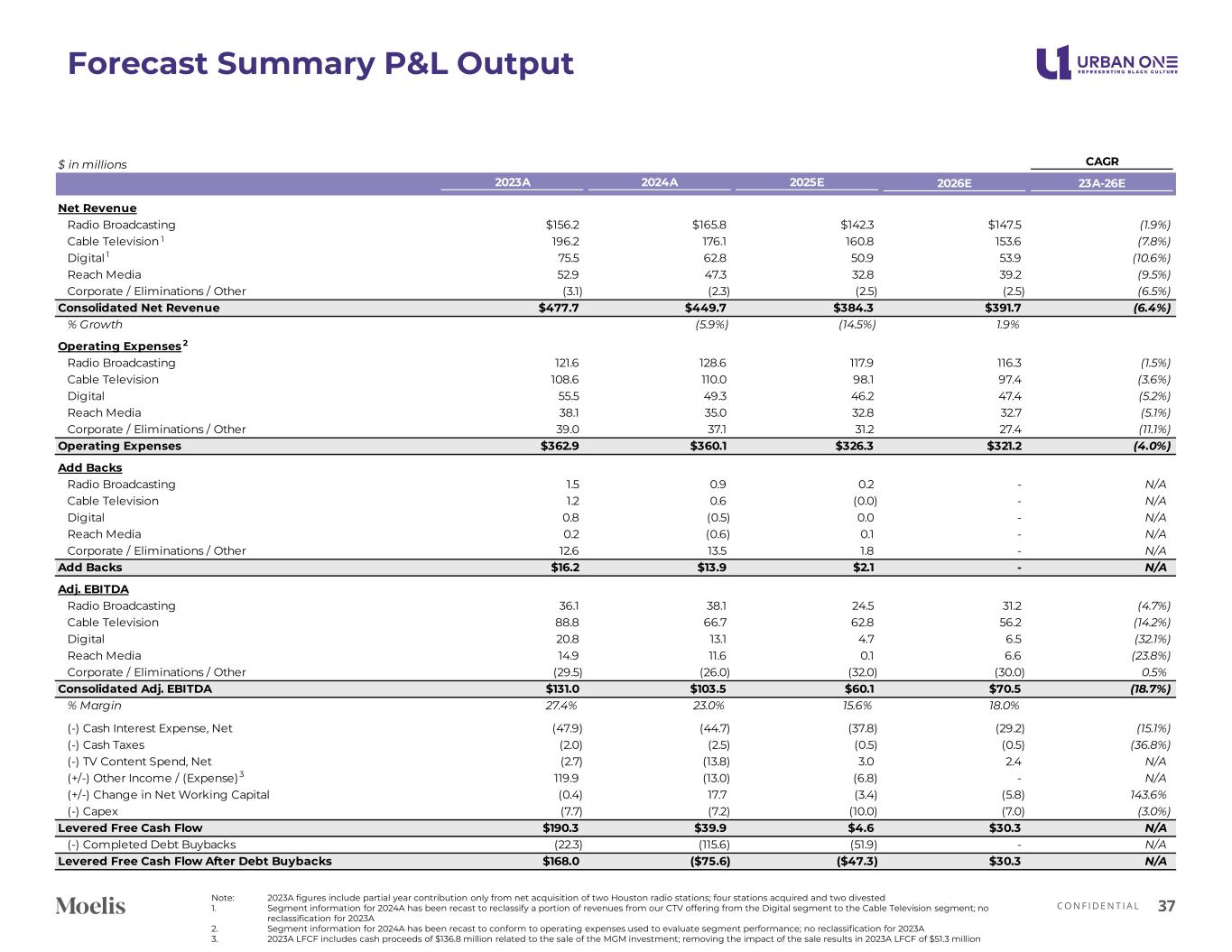

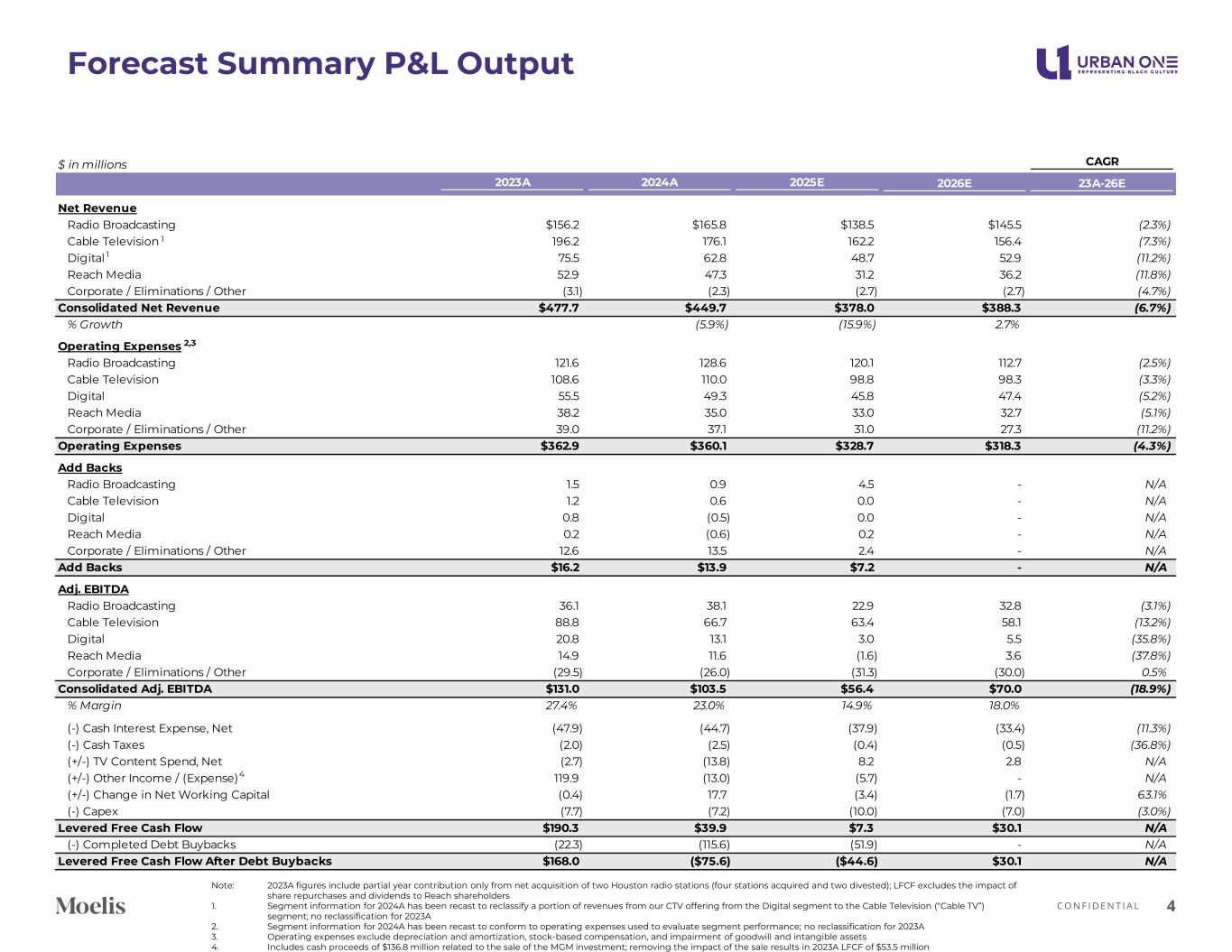

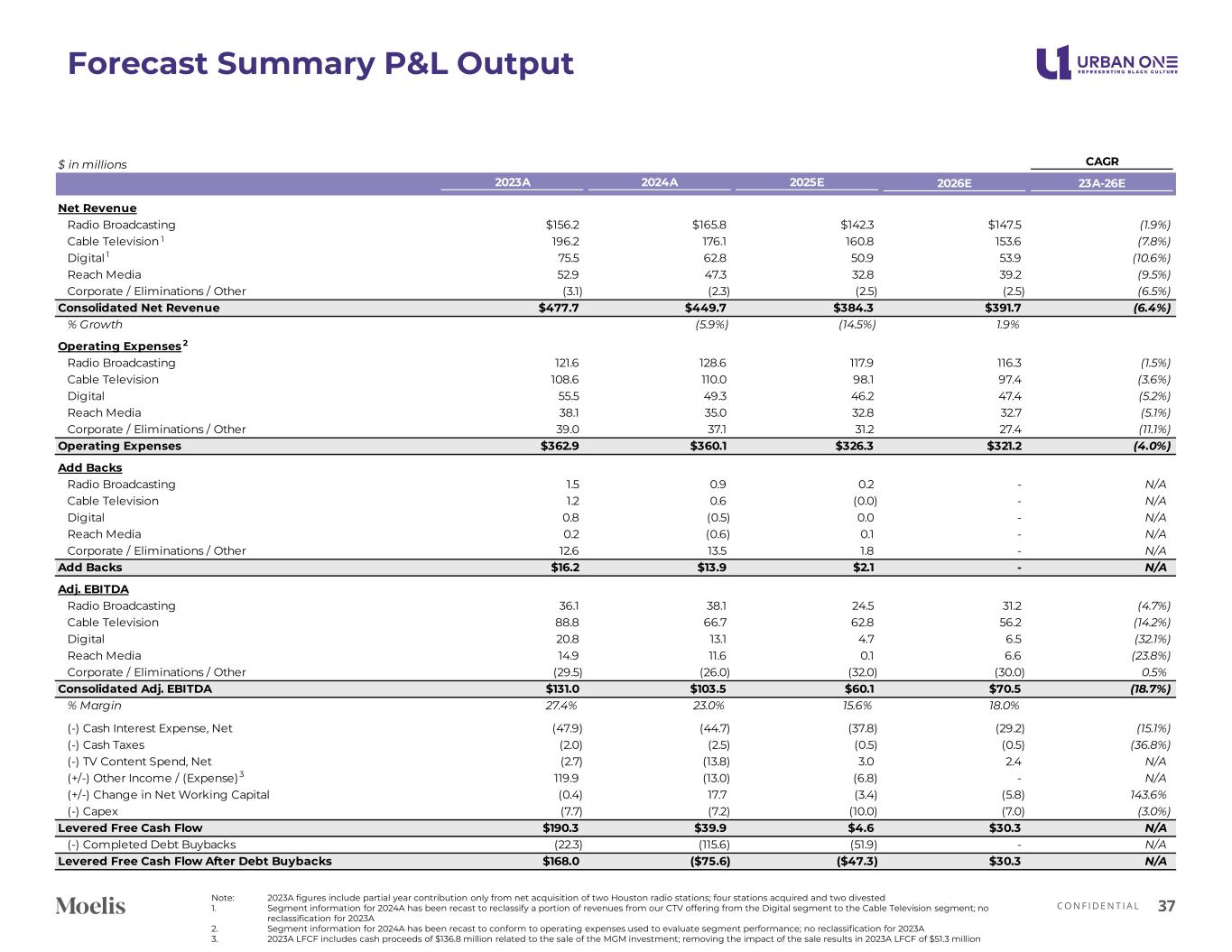

C O N F I D E N T I A L Forecast Summary P&L Output 37 Note: 2023A figures include partial year contribution only from net acquisition of two Houston radio stations; four stations acquired and two divested 1. Segment information for 2024A has been recast to reclassify a portion of revenues from our CTV offering from the Digital segment to the Cable Television segment; no reclassification for 2023A 2. Segment information for 2024A has been recast to conform to operating expenses used to evaluate segment performance; no reclassification for 2023A 3. 2023A LFCF includes cash proceeds of $136.8 million related to the sale of the MGM investment; removing the impact of the sale results in 2023A LFCF of $51.3 million $ in millions CAGR 2023A 2024A 2025E 2026E 23A-26E Net Revenue Radio Broadcasting $156.2 $165.8 $142.3 $147.5 (1.9%) Cable Television 196.2 176.1 160.8 153.6 (7.8%) Digital 75.5 62.8 50.9 53.9 (10.6%) Reach Media 52.9 47.3 32.8 39.2 (9.5%) Corporate / Eliminations / Other (3.1) (2.3) (2.5) (2.5) (6.5%) Consolidated Net Revenue $477.7 $449.7 $384.3 $391.7 (6.4%) % Growth (5.9%) (14.5%) 1.9% Operating Expenses Radio Broadcasting 121.6 128.6 117.9 116.3 (1.5%) Cable Television 108.6 110.0 98.1 97.4 (3.6%) Digital 55.5 49.3 46.2 47.4 (5.2%) Reach Media 38.1 35.0 32.8 32.7 (5.1%) Corporate / Eliminations / Other 39.0 37.1 31.2 27.4 (11.1%) Operating Expenses $362.9 $360.1 $326.3 $321.2 (4.0%) Add Backs Radio Broadcasting 1.5 0.9 0.2 - N/A Cable Television 1.2 0.6 (0.0) - N/A Digital 0.8 (0.5) 0.0 - N/A Reach Media 0.2 (0.6) 0.1 - N/A Corporate / Eliminations / Other 12.6 13.5 1.8 - N/A Add Backs $16.2 $13.9 $2.1 - N/A Adj. EBITDA Radio Broadcasting 36.1 38.1 24.5 31.2 (4.7%) Cable Television 88.8 66.7 62.8 56.2 (14.2%) Digital 20.8 13.1 4.7 6.5 (32.1%) Reach Media 14.9 11.6 0.1 6.6 (23.8%) Corporate / Eliminations / Other (29.5) (26.0) (32.0) (30.0) 0.5% Consolidated Adj. EBITDA $131.0 $103.5 $60.1 $70.5 (18.7%) % Margin 27.4% 23.0% 15.6% 18.0% (-) Cash Interest Expense, Net (47.9) (44.7) (37.8) (29.2) (15.1%) (-) Cash Taxes (2.0) (2.5) (0.5) (0.5) (36.8%) (-) TV Content Spend, Net (2.7) (13.8) 3.0 2.4 N/A (+/-) Other Income / (Expense) 119.9 (13.0) (6.8) - N/A (+/-) Change in Net Working Capital (0.4) 17.7 (3.4) (5.8) 143.6% (-) Capex (7.7) (7.2) (10.0) (7.0) (3.0%) Levered Free Cash Flow $190.3 $39.9 $4.6 $30.3 N/A (-) Completed Debt Buybacks (22.3) (115.6) (51.9) - N/A Levered Free Cash Flow After Debt Buybacks $168.0 ($75.6) ($47.3) $30.3 N/A 3 1 1 2

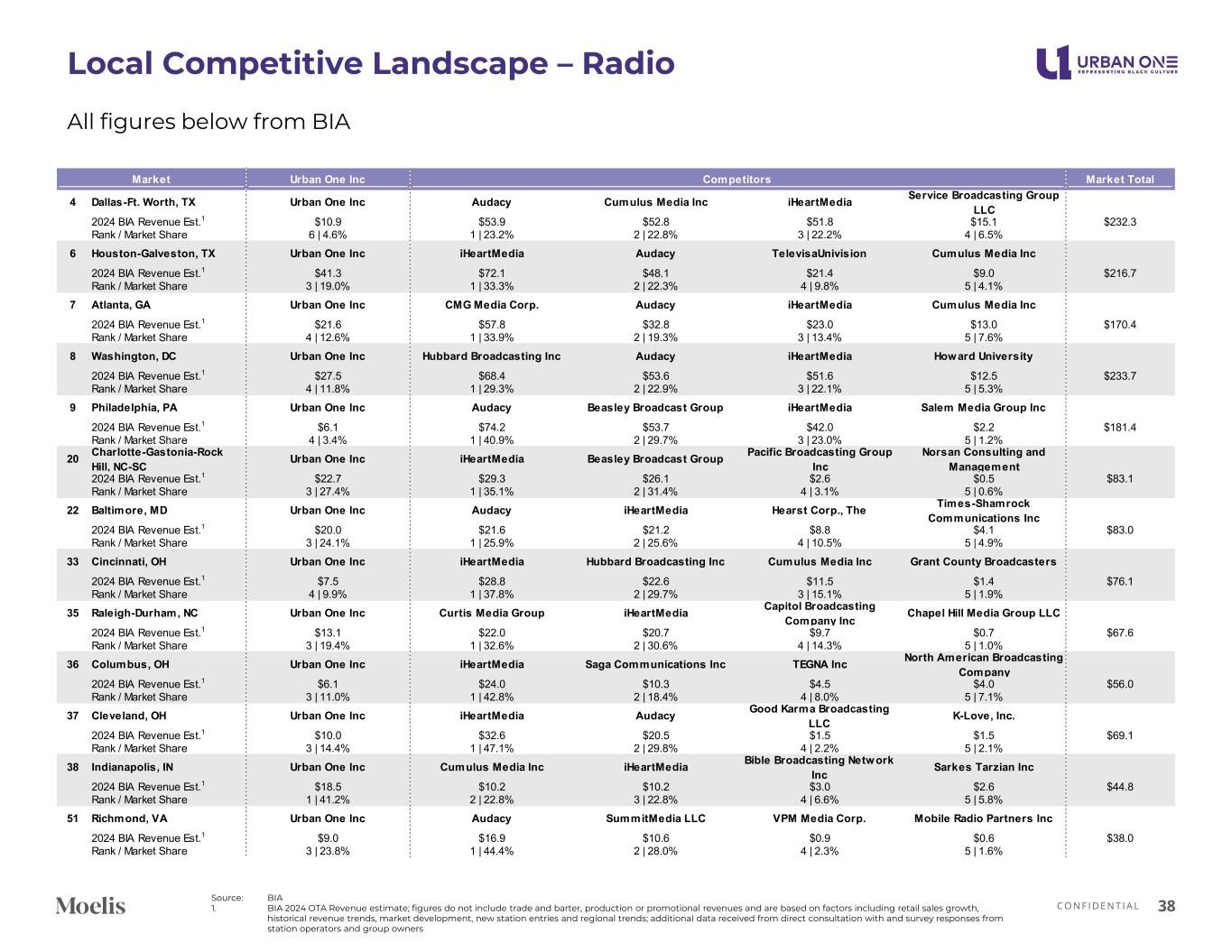

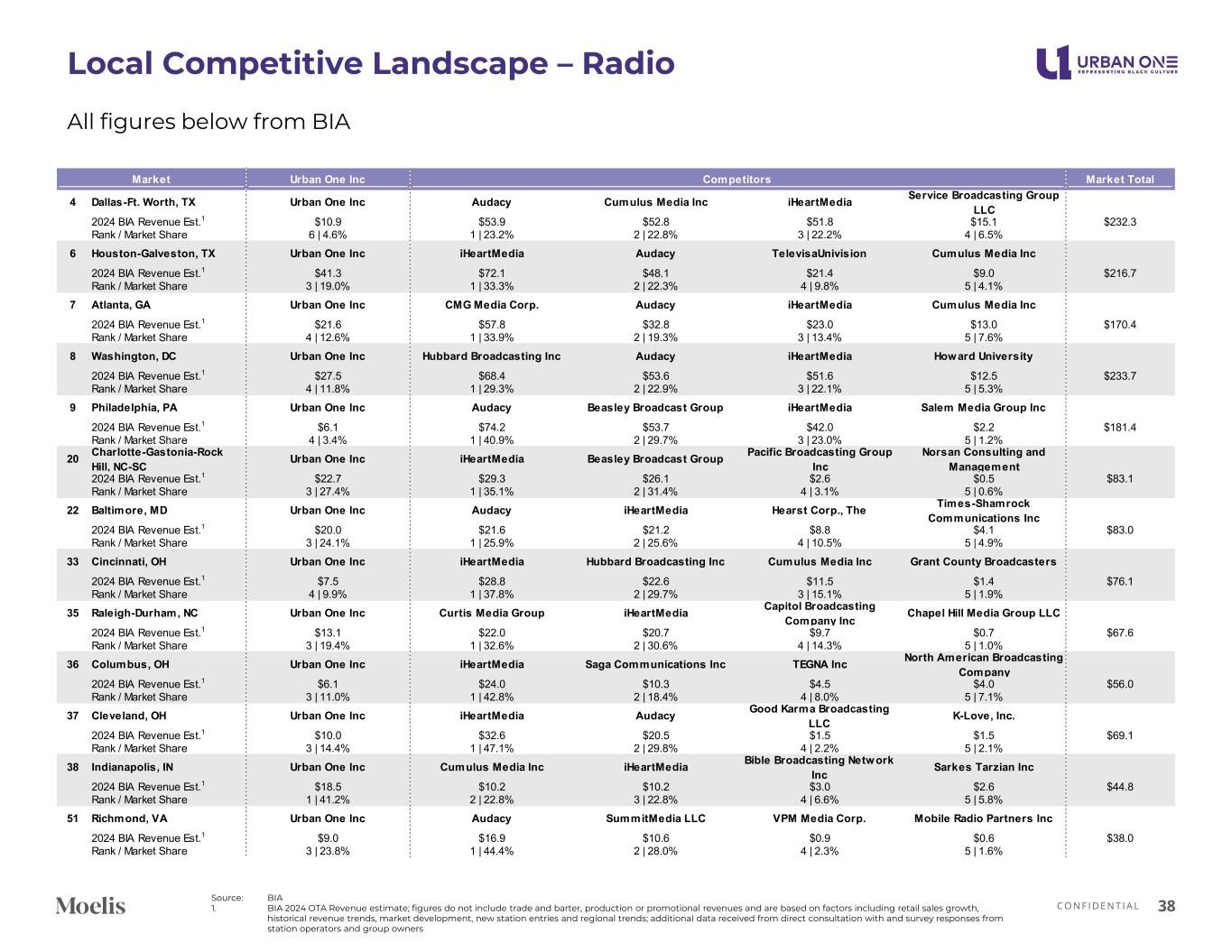

C O N F I D E N T I A L Local Competitive Landscape – Radio 38 All figures below from BIA Source: BIA 1. BIA 2024 OTA Revenue estimate; figures do not include trade and barter, production or promotional revenues and are based on factors including retail sales growth, historical revenue trends, market development, new station entries and regional trends; additional data received from direct consultation with and survey responses from station operators and group owners Urban One Inc Market Total 4 Dallas-Ft. Worth, TX Urban One Inc Audacy Cumulus Media Inc iHeartMedia Service Broadcasting Group LLC 2024 BIA Revenue Est.1 $10.9 $53.9 $52.8 $51.8 $15.1 $232.3 Rank / Market Share 6 | 4.6% 1 | 23.2% 2 | 22.8% 3 | 22.2% 4 | 6.5% 6 Houston-Galveston, TX Urban One Inc iHeartMedia Audacy TelevisaUnivision Cumulus Media Inc 2024 BIA Revenue Est.1 $41.3 $72.1 $48.1 $21.4 $9.0 $216.7 Rank / Market Share 3 | 19.0% 1 | 33.3% 2 | 22.3% 4 | 9.8% 5 | 4.1% 7 Atlanta, GA Urban One Inc CMG Media Corp. Audacy iHeartMedia Cumulus Media Inc 2024 BIA Revenue Est.1 $21.6 $57.8 $32.8 $23.0 $13.0 $170.4 Rank / Market Share 4 | 12.6% 1 | 33.9% 2 | 19.3% 3 | 13.4% 5 | 7.6% 8 Washington, DC Urban One Inc Hubbard Broadcasting Inc Audacy iHeartMedia Howard University 2024 BIA Revenue Est.1 $27.5 $68.4 $53.6 $51.6 $12.5 $233.7 Rank / Market Share 4 | 11.8% 1 | 29.3% 2 | 22.9% 3 | 22.1% 5 | 5.3% 9 Philadelphia, PA Urban One Inc Audacy Beasley Broadcast Group iHeartMedia Salem Media Group Inc 2024 BIA Revenue Est.1 $6.1 $74.2 $53.7 $42.0 $2.2 $181.4 Rank / Market Share 4 | 3.4% 1 | 40.9% 2 | 29.7% 3 | 23.0% 5 | 1.2% 20 Charlotte-Gastonia-Rock Hill, NC-SC Urban One Inc iHeartMedia Beasley Broadcast Group Pacific Broadcasting Group Inc Norsan Consulting and Management 2024 BIA Revenue Est.1 $22.7 $29.3 $26.1 $2.6 $0.5 $83.1 Rank / Market Share 3 | 27.4% 1 | 35.1% 2 | 31.4% 4 | 3.1% 5 | 0.6% 22 Baltimore, MD Urban One Inc Audacy iHeartMedia Hearst Corp., The Times-Shamrock Communications Inc 2024 BIA Revenue Est.1 $20.0 $21.6 $21.2 $8.8 $4.1 $83.0 Rank / Market Share 3 | 24.1% 1 | 25.9% 2 | 25.6% 4 | 10.5% 5 | 4.9% 33 Cincinnati, OH Urban One Inc iHeartMedia Hubbard Broadcasting Inc Cumulus Media Inc Grant County Broadcasters 2024 BIA Revenue Est.1 $7.5 $28.8 $22.6 $11.5 $1.4 $76.1 Rank / Market Share 4 | 9.9% 1 | 37.8% 2 | 29.7% 3 | 15.1% 5 | 1.9% 35 Raleigh-Durham, NC Urban One Inc Curtis Media Group iHeartMedia Capitol Broadcasting Company Inc Chapel Hill Media Group LLC 2024 BIA Revenue Est.1 $13.1 $22.0 $20.7 $9.7 $0.7 $67.6 Rank / Market Share 3 | 19.4% 1 | 32.6% 2 | 30.6% 4 | 14.3% 5 | 1.0% 36 Columbus, OH Urban One Inc iHeartMedia Saga Communications Inc TEGNA Inc North American Broadcasting Company 2024 BIA Revenue Est.1 $6.1 $24.0 $10.3 $4.5 $4.0 $56.0 Rank / Market Share 3 | 11.0% 1 | 42.8% 2 | 18.4% 4 | 8.0% 5 | 7.1% 37 Cleveland, OH Urban One Inc iHeartMedia Audacy Good Karma Broadcasting LLC K-Love, Inc. 2024 BIA Revenue Est.1 $10.0 $32.6 $20.5 $1.5 $1.5 $69.1 Rank / Market Share 3 | 14.4% 1 | 47.1% 2 | 29.8% 4 | 2.2% 5 | 2.1% 38 Indianapolis, IN Urban One Inc Cumulus Media Inc iHeartMedia Bible Broadcasting Network Inc Sarkes Tarzian Inc 2024 BIA Revenue Est.1 $18.5 $10.2 $10.2 $3.0 $2.6 $44.8 Rank / Market Share 1 | 41.2% 2 | 22.8% 3 | 22.8% 4 | 6.6% 5 | 5.8% 51 Richmond, VA Urban One Inc Audacy SummitMedia LLC VPM Media Corp. Mobile Radio Partners Inc 2024 BIA Revenue Est.1 $9.0 $16.9 $10.6 $0.9 $0.6 $38.0 Rank / Market Share 3 | 23.8% 1 | 44.4% 2 | 28.0% 4 | 2.3% 5 | 1.6% Market Competitors

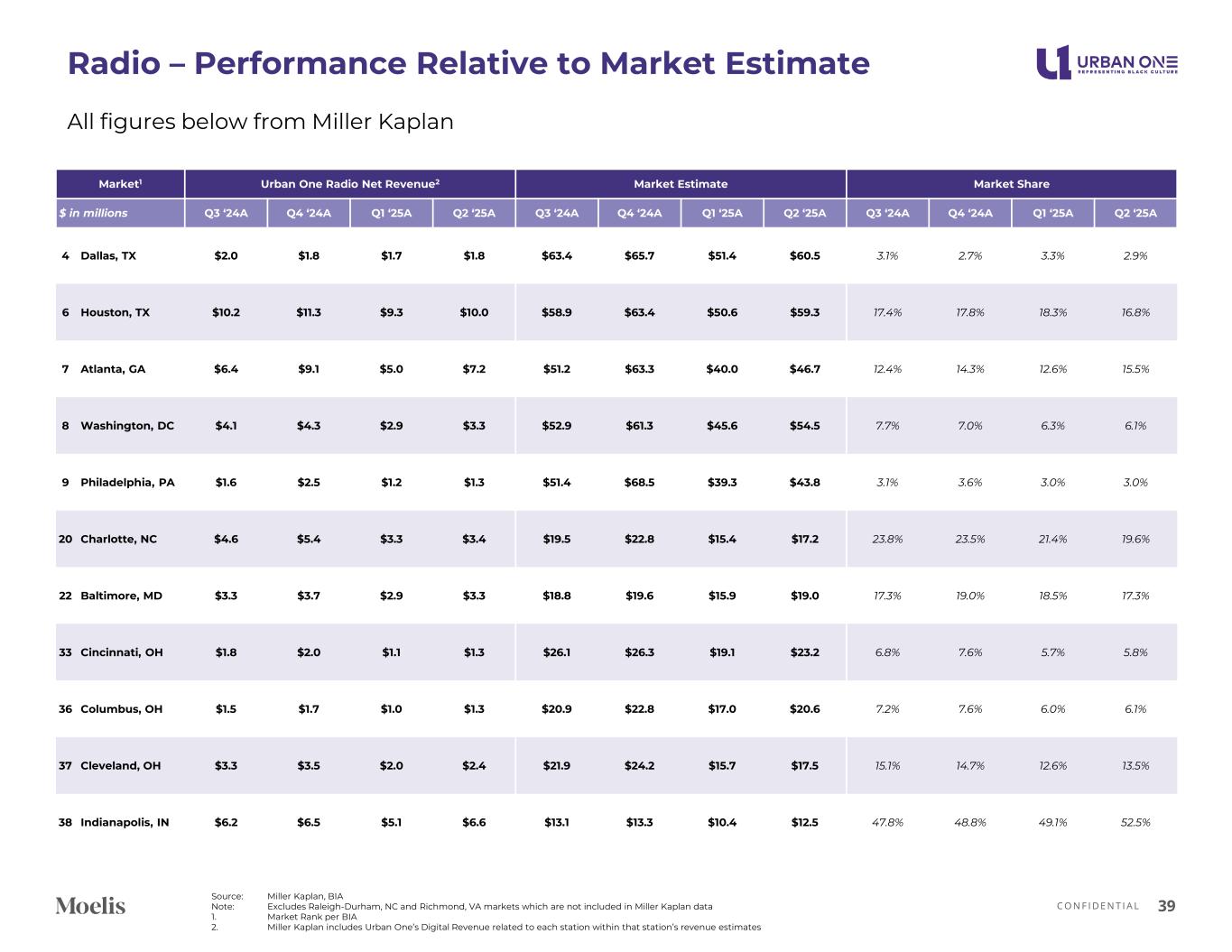

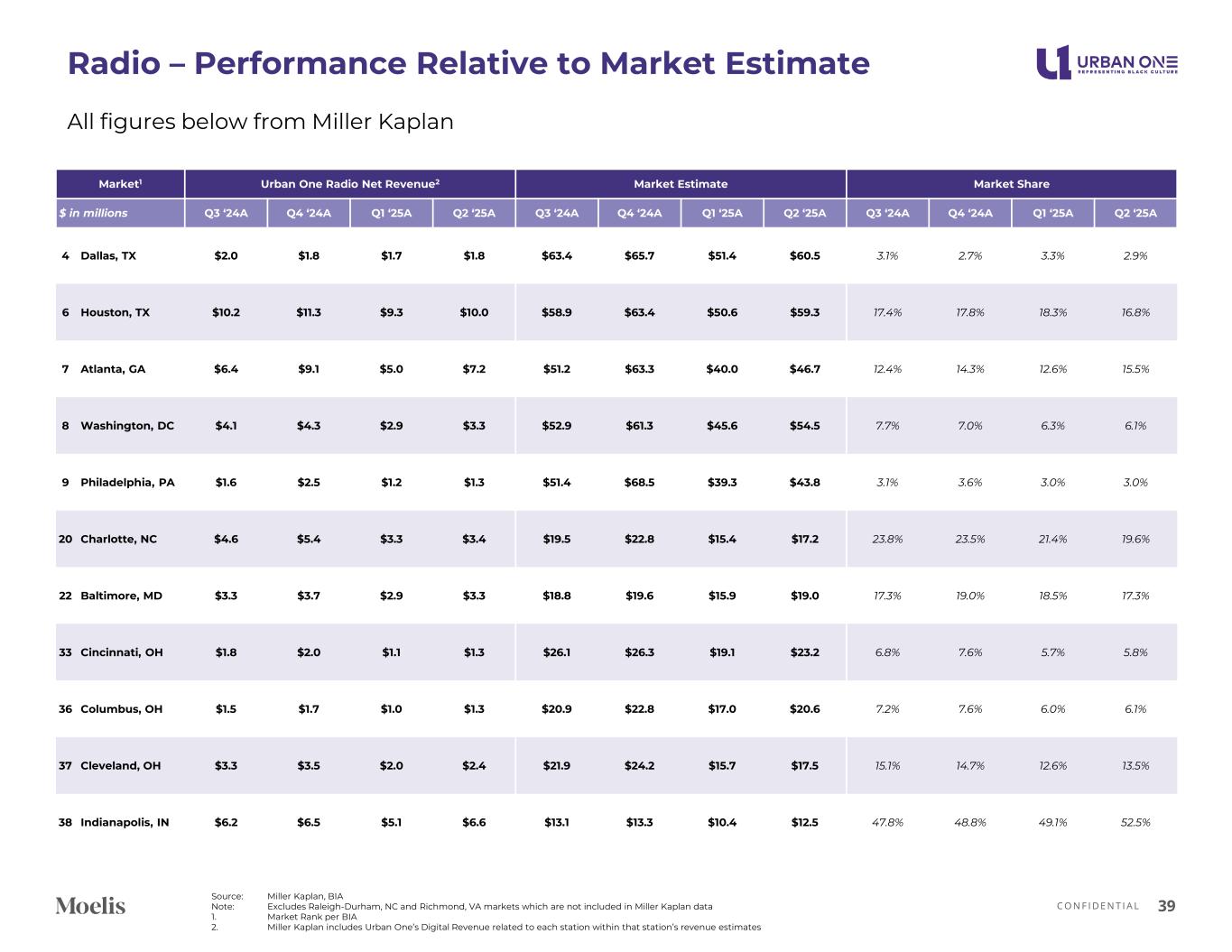

C O N F I D E N T I A L Radio – Performance Relative to Market Estimate 39 Market1 Urban One Radio Net Revenue2 Market Estimate Market Share $ in millions Q3 ‘24A Q4 ‘24A Q1 ‘25A Q2 ‘25A Q3 ‘24A Q4 ‘24A Q1 ‘25A Q2 ‘25A Q3 ‘24A Q4 ‘24A Q1 ‘25A Q2 ‘25A 4 Dallas, TX $2.0 $1.8 $1.7 $1.8 $63.4 $65.7 $51.4 $60.5 3.1% 2.7% 3.3% 2.9% 6 Houston, TX $10.2 $11.3 $9.3 $10.0 $58.9 $63.4 $50.6 $59.3 17.4% 17.8% 18.3% 16.8% 7 Atlanta, GA $6.4 $9.1 $5.0 $7.2 $51.2 $63.3 $40.0 $46.7 12.4% 14.3% 12.6% 15.5% 8 Washington, DC $4.1 $4.3 $2.9 $3.3 $52.9 $61.3 $45.6 $54.5 7.7% 7.0% 6.3% 6.1% 9 Philadelphia, PA $1.6 $2.5 $1.2 $1.3 $51.4 $68.5 $39.3 $43.8 3.1% 3.6% 3.0% 3.0% 20 Charlotte, NC $4.6 $5.4 $3.3 $3.4 $19.5 $22.8 $15.4 $17.2 23.8% 23.5% 21.4% 19.6% 22 Baltimore, MD $3.3 $3.7 $2.9 $3.3 $18.8 $19.6 $15.9 $19.0 17.3% 19.0% 18.5% 17.3% 33 Cincinnati, OH $1.8 $2.0 $1.1 $1.3 $26.1 $26.3 $19.1 $23.2 6.8% 7.6% 5.7% 5.8% 36 Columbus, OH $1.5 $1.7 $1.0 $1.3 $20.9 $22.8 $17.0 $20.6 7.2% 7.6% 6.0% 6.1% 37 Cleveland, OH $3.3 $3.5 $2.0 $2.4 $21.9 $24.2 $15.7 $17.5 15.1% 14.7% 12.6% 13.5% 38 Indianapolis, IN $6.2 $6.5 $5.1 $6.6 $13.1 $13.3 $10.4 $12.5 47.8% 48.8% 49.1% 52.5% Source: Miller Kaplan, BIA Note: Excludes Raleigh-Durham, NC and Richmond, VA markets which are not included in Miller Kaplan data 1. Market Rank per BIA 2. Miller Kaplan includes Urban One’s Digital Revenue related to each station within that station’s revenue estimates All figures below from Miller Kaplan

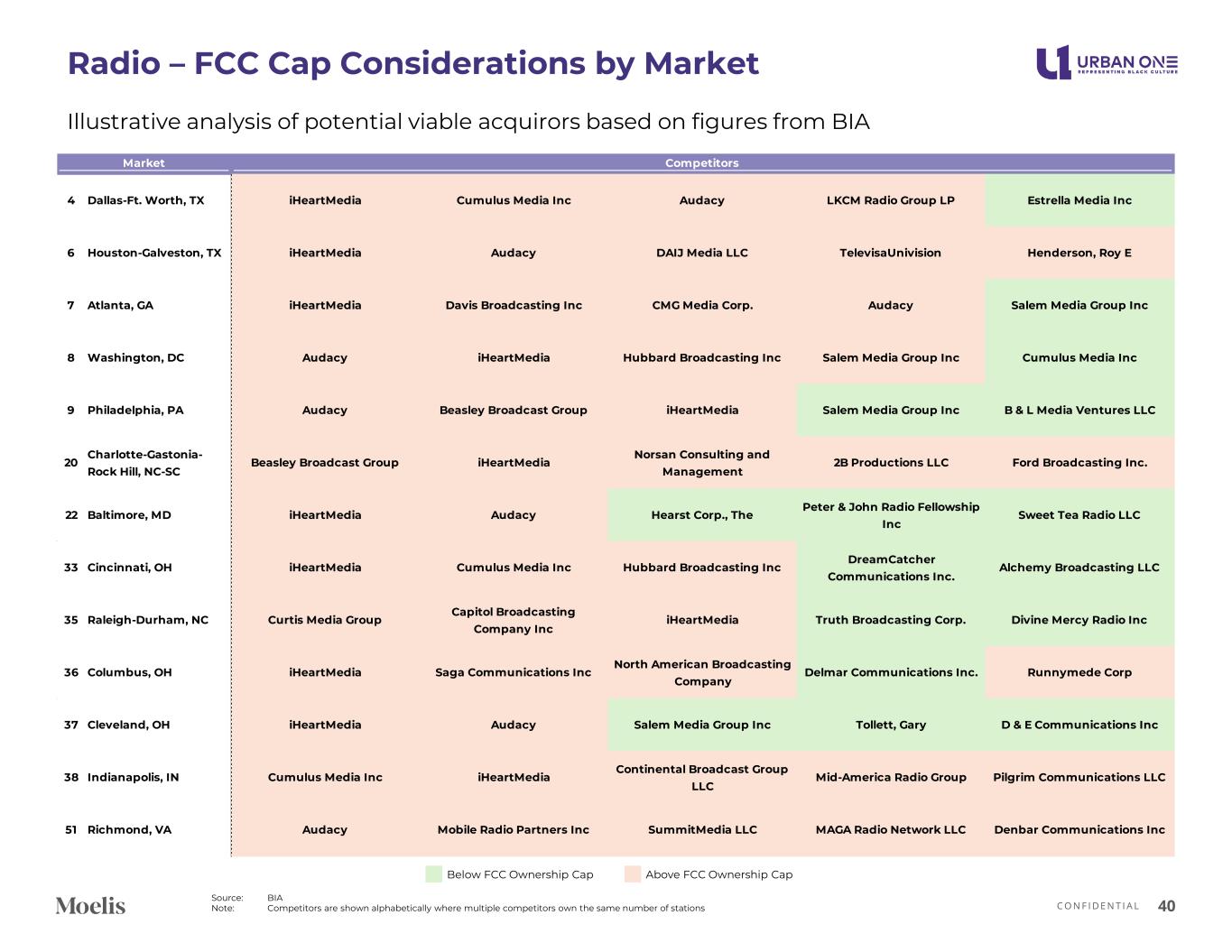

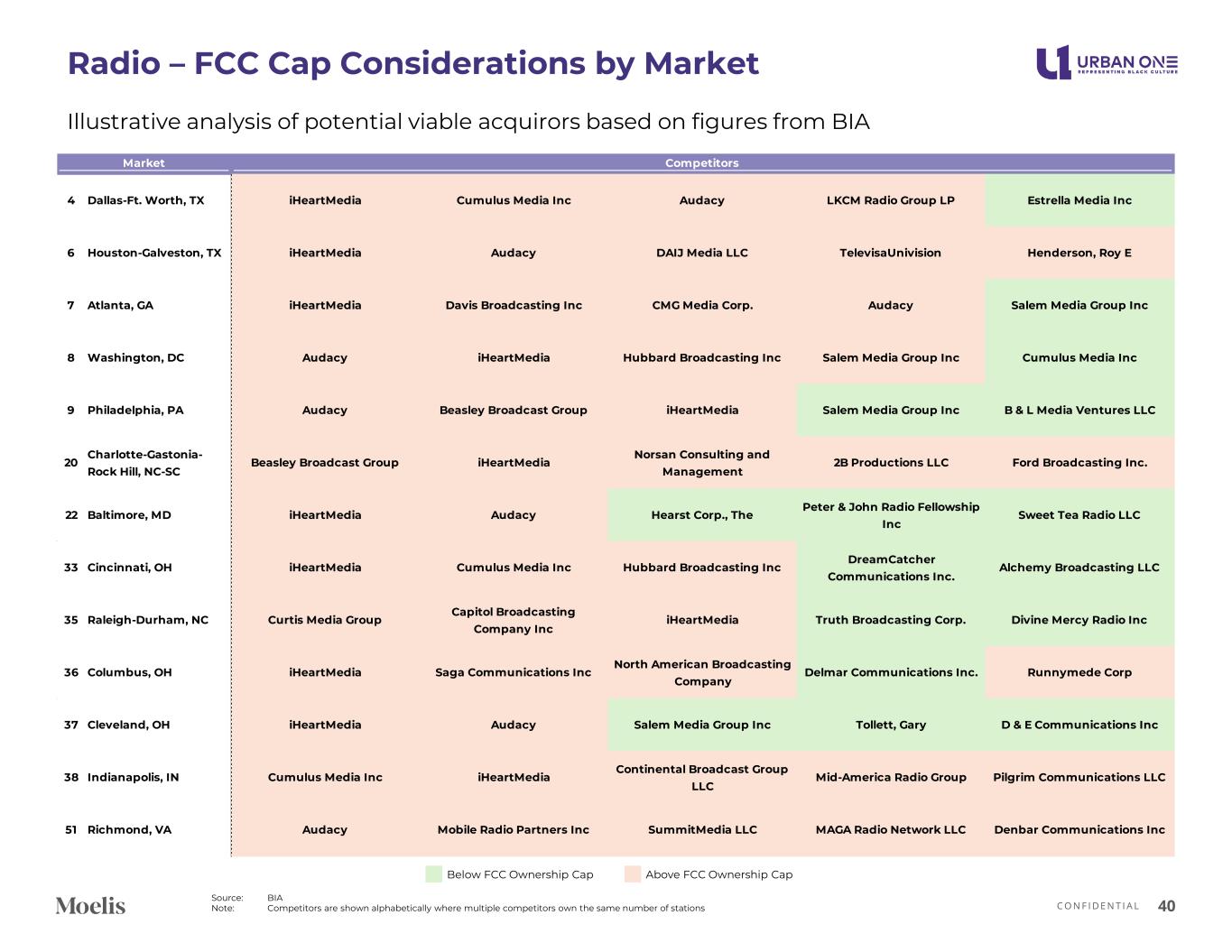

C O N F I D E N T I A L Radio – FCC Cap Considerations by Market 40 Source: BIA Note: Competitors are shown alphabetically where multiple competitors own the same number of stations Below FCC Ownership Cap Above FCC Ownership Cap Market Competitors 4 Dallas-Ft. Worth, TX iHeartMedia Cumulus Media Inc Audacy LKCM Radio Group LP Estrella Media Inc 6 Houston-Galveston, TX iHeartMedia Audacy DAIJ Media LLC TelevisaUnivision Henderson, Roy E 7 Atlanta, GA iHeartMedia Davis Broadcasting Inc CMG Media Corp. Audacy Salem Media Group Inc 8 Washington, DC Audacy iHeartMedia Hubbard Broadcasting Inc Salem Media Group Inc Cumulus Media Inc 9 Philadelphia, PA Audacy Beasley Broadcast Group iHeartMedia Salem Media Group Inc B & L Media Ventures LLC 20 Charlotte-Gastonia- Rock Hill, NC-SC Beasley Broadcast Group iHeartMedia Norsan Consulting and Management 2B Productions LLC Ford Broadcasting Inc. 22 Baltimore, MD iHeartMedia Audacy Hearst Corp., The Peter & John Radio Fellowship Inc Sweet Tea Radio LLC 33 Cincinnati, OH iHeartMedia Cumulus Media Inc Hubbard Broadcasting Inc DreamCatcher Communications Inc. Alchemy Broadcasting LLC 35 Raleigh-Durham, NC Curtis Media Group Capitol Broadcasting Company Inc iHeartMedia Truth Broadcasting Corp. Divine Mercy Radio Inc 36 Columbus, OH iHeartMedia Saga Communications Inc North American Broadcasting Company Delmar Communications Inc. Runnymede Corp 37 Cleveland, OH iHeartMedia Audacy Salem Media Group Inc Tollett, Gary D & E Communications Inc 38 Indianapolis, IN Cumulus Media Inc iHeartMedia Continental Broadcast Group LLC Mid-America Radio Group Pilgrim Communications LLC 51 Richmond, VA Audacy Mobile Radio Partners Inc SummitMedia LLC MAGA Radio Network LLC Denbar Communications Inc Illustrative analysis of potential viable acquirors based on figures from BIA

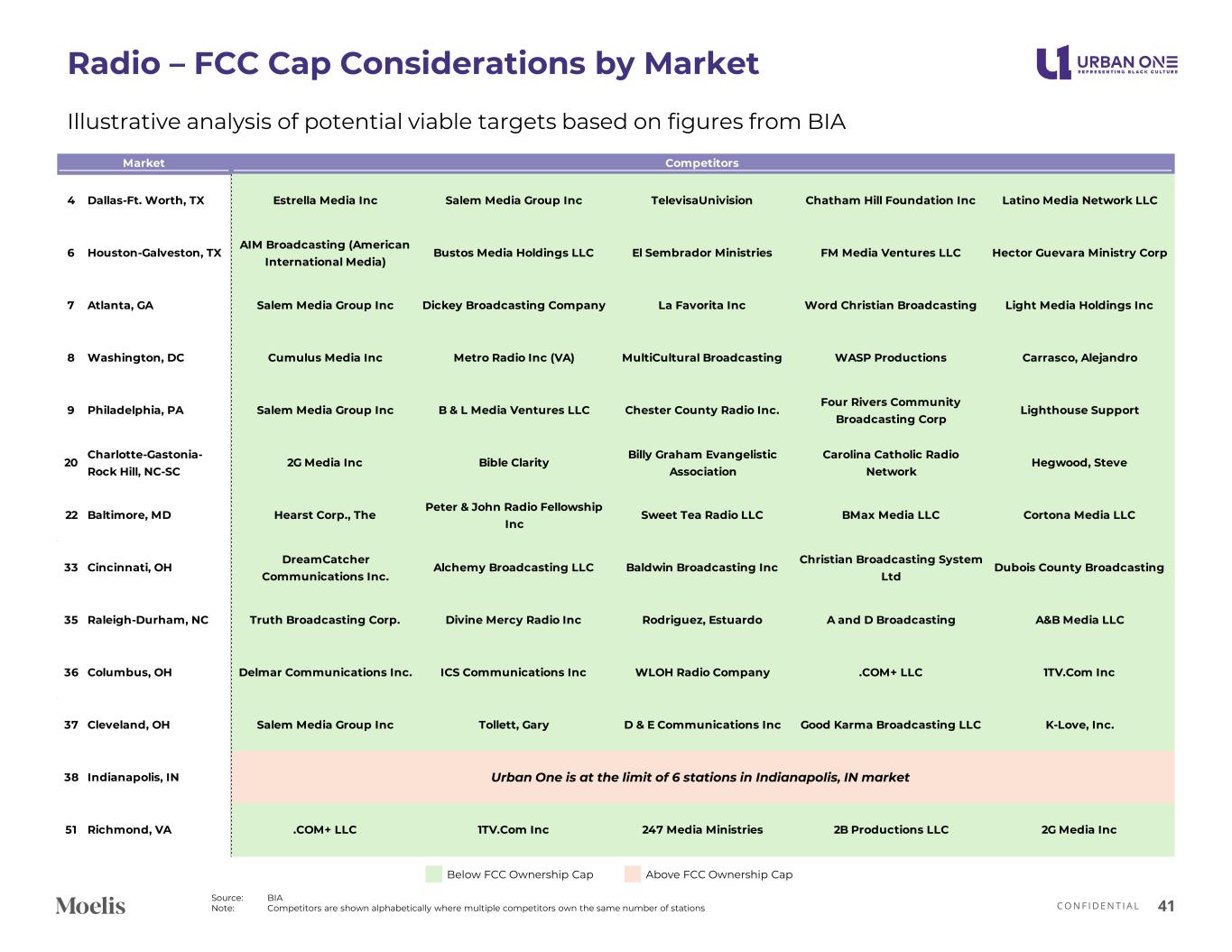

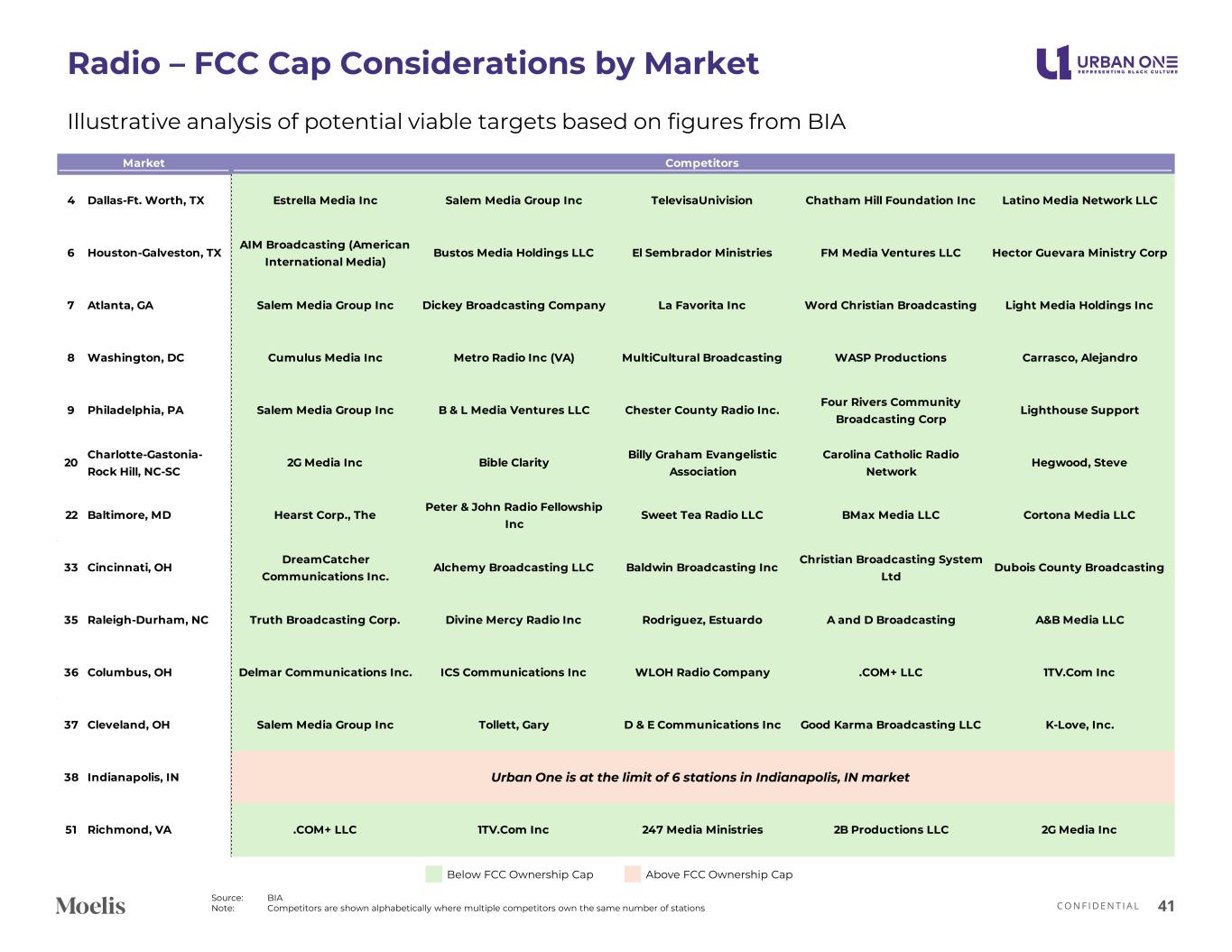

C O N F I D E N T I A L Radio – FCC Cap Considerations by Market 41 Source: BIA Note: Competitors are shown alphabetically where multiple competitors own the same number of stations Below FCC Ownership Cap Above FCC Ownership Cap Market Competitors 4 Dallas-Ft. Worth, TX Estrella Media Inc Salem Media Group Inc TelevisaUnivision Chatham Hill Foundation Inc Latino Media Network LLC 6 Houston-Galveston, TX AIM Broadcasting (American International Media) Bustos Media Holdings LLC El Sembrador Ministries FM Media Ventures LLC Hector Guevara Ministry Corp 7 Atlanta, GA Salem Media Group Inc Dickey Broadcasting Company La Favorita Inc Word Christian Broadcasting Light Media Holdings Inc 8 Washington, DC Cumulus Media Inc Metro Radio Inc (VA) MultiCultural Broadcasting WASP Productions Carrasco, Alejandro 9 Philadelphia, PA Salem Media Group Inc B & L Media Ventures LLC Chester County Radio Inc. Four Rivers Community Broadcasting Corp Lighthouse Support 20 Charlotte-Gastonia- Rock Hill, NC-SC 2G Media Inc Bible Clarity Billy Graham Evangelistic Association Carolina Catholic Radio Network Hegwood, Steve 22 Baltimore, MD Hearst Corp., The Peter & John Radio Fellowship Inc Sweet Tea Radio LLC BMax Media LLC Cortona Media LLC 33 Cincinnati, OH DreamCatcher Communications Inc. Alchemy Broadcasting LLC Baldwin Broadcasting Inc Christian Broadcasting System Ltd Dubois County Broadcasting 35 Raleigh-Durham, NC Truth Broadcasting Corp. Divine Mercy Radio Inc Rodriguez, Estuardo A and D Broadcasting A&B Media LLC 36 Columbus, OH Delmar Communications Inc. ICS Communications Inc WLOH Radio Company .COM+ LLC 1TV.Com Inc 37 Cleveland, OH Salem Media Group Inc Tollett, Gary D & E Communications Inc Good Karma Broadcasting LLC K-Love, Inc. 38 Indianapolis, IN 51 Richmond, VA .COM+ LLC 1TV.Com Inc 247 Media Ministries 2B Productions LLC 2G Media Inc Illustrative analysis of potential viable targets based on figures from BIA Urban One is at the limit of 6 stations in Indianapolis, IN market

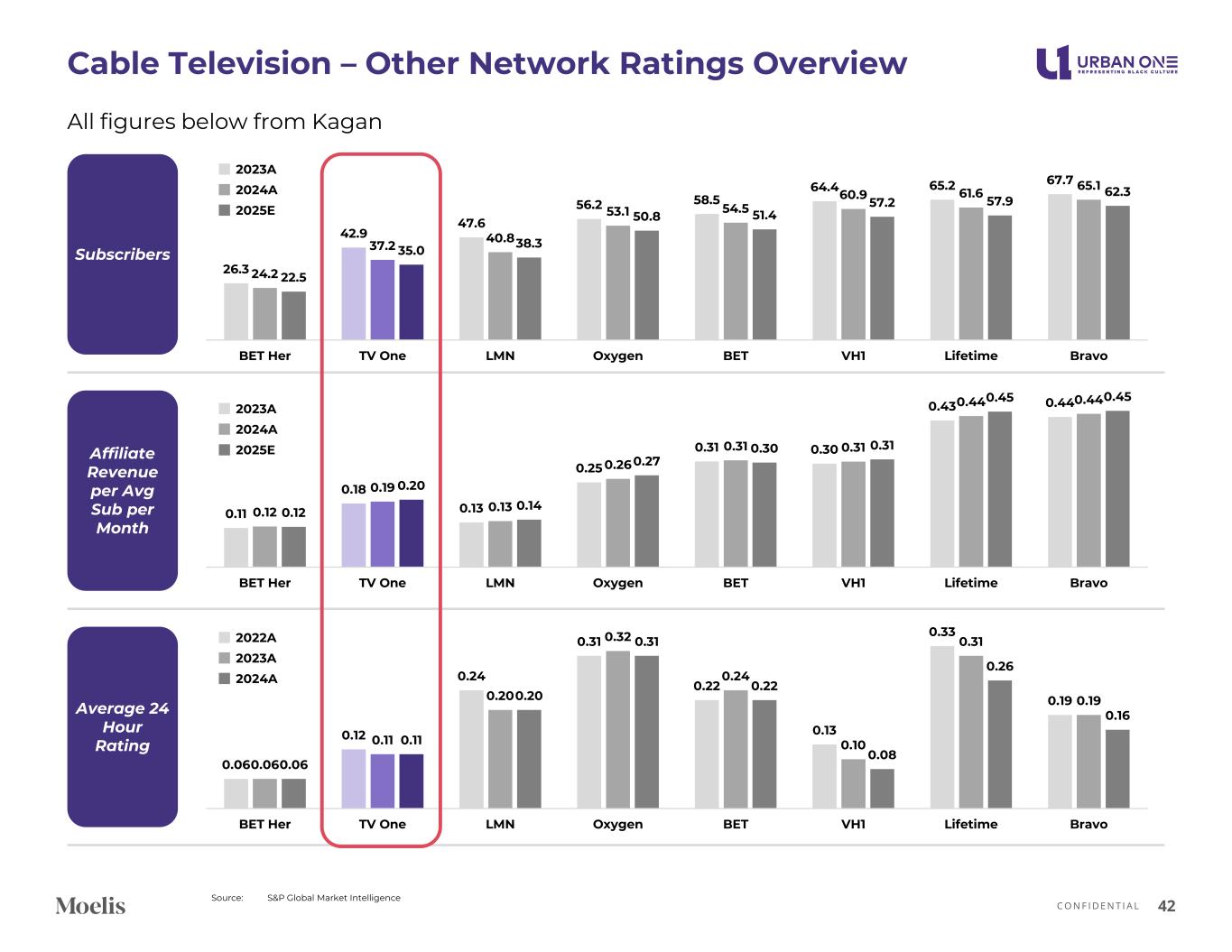

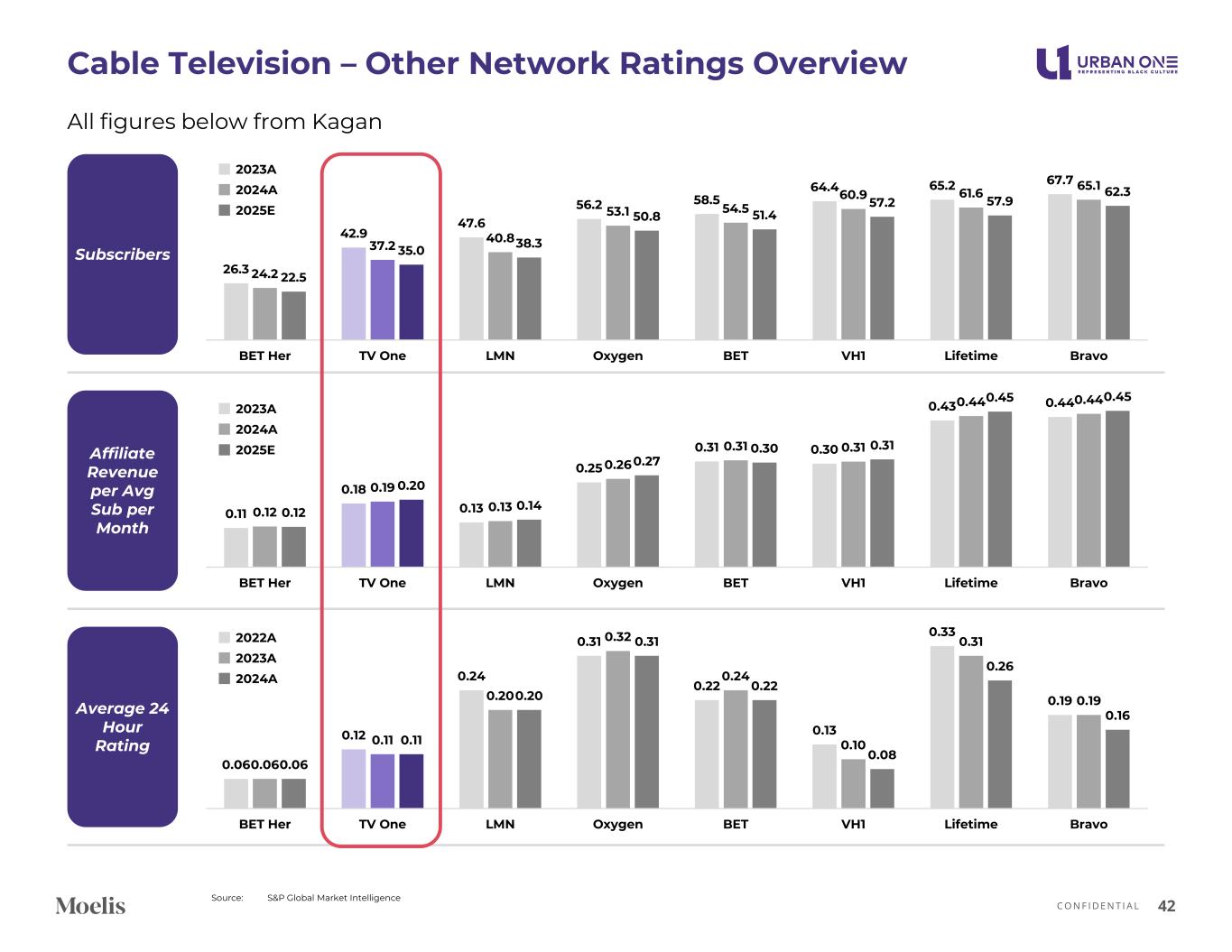

C O N F I D E N T I A L Cable Television – Other Network Ratings Overview 42 Source: S&P Global Market Intelligence Subscribers Average 24 Hour Rating 26.3 42.9 47.6 56.2 58.5 64.4 65.2 67.7 24.2 37.2 40.8 53.1 54.5 60.9 61.6 65.1 22.5 35.0 38.3 50.8 51.4 57.2 57.9 62.3 BET Her TV One LMN Oxygen BET VH1 Lifetime Bravo Affiliate Revenue per Avg Sub per Month 0.11 0.18 0.13 0.25 0.31 0.30 0.43 0.44 0.12 0.19 0.13 0.26 0.31 0.31 0.44 0.44 0.12 0.20 0.14 0.27 0.30 0.31 0.45 0.45 BET Her TV One LMN Oxygen BET VH1 Lifetime Bravo 0.06 0.12 0.24 0.31 0.22 0.13 0.33 0.19 0.06 0.11 0.20 0.32 0.24 0.10 0.31 0.19 0.06 0.11 0.20 0.31 0.22 0.08 0.26 0.16 BET Her TV One LMN Oxygen BET VH1 Lifetime Bravo 2025E 2023A 2024A 2025E 2023A 2024A 2024A 2022A 2023A All figures below from Kagan

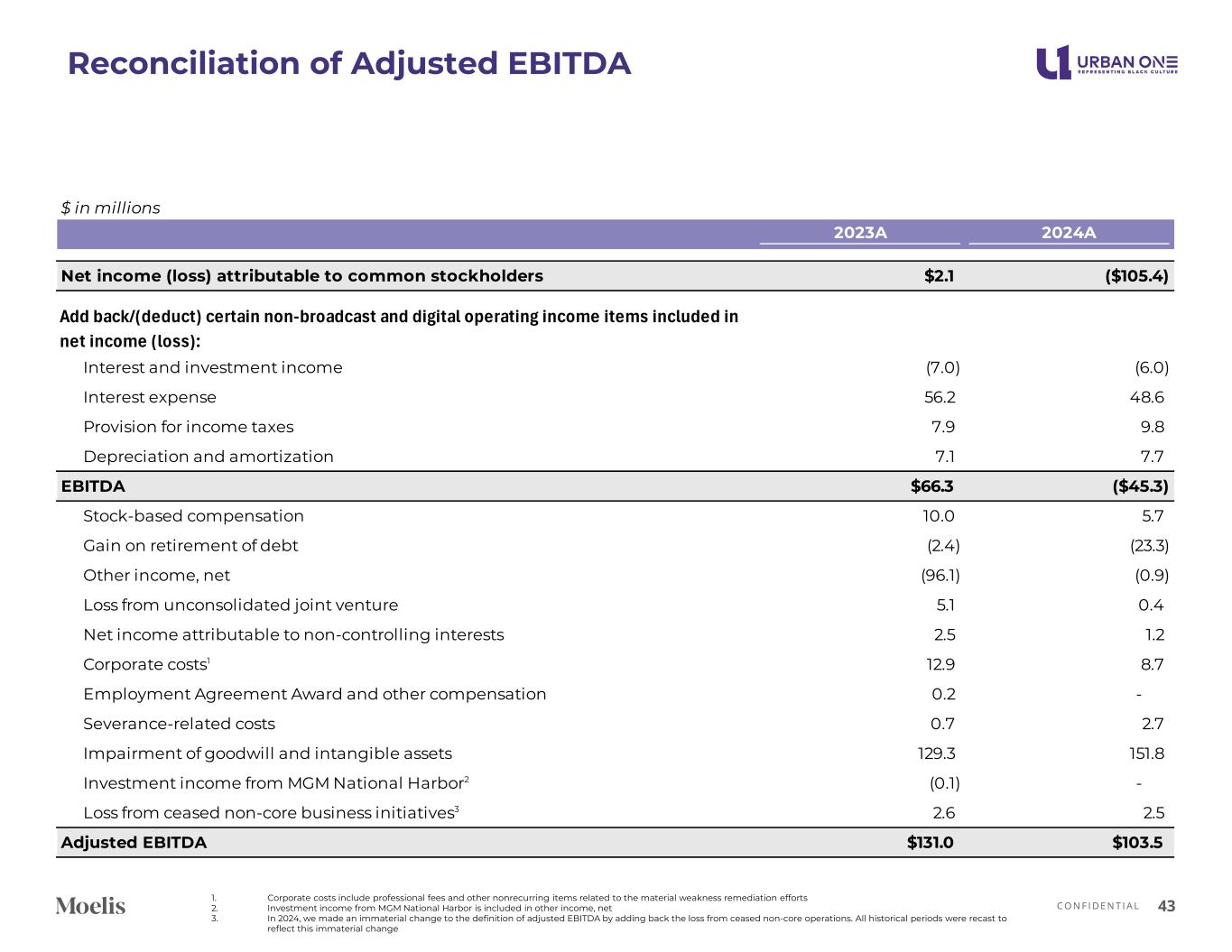

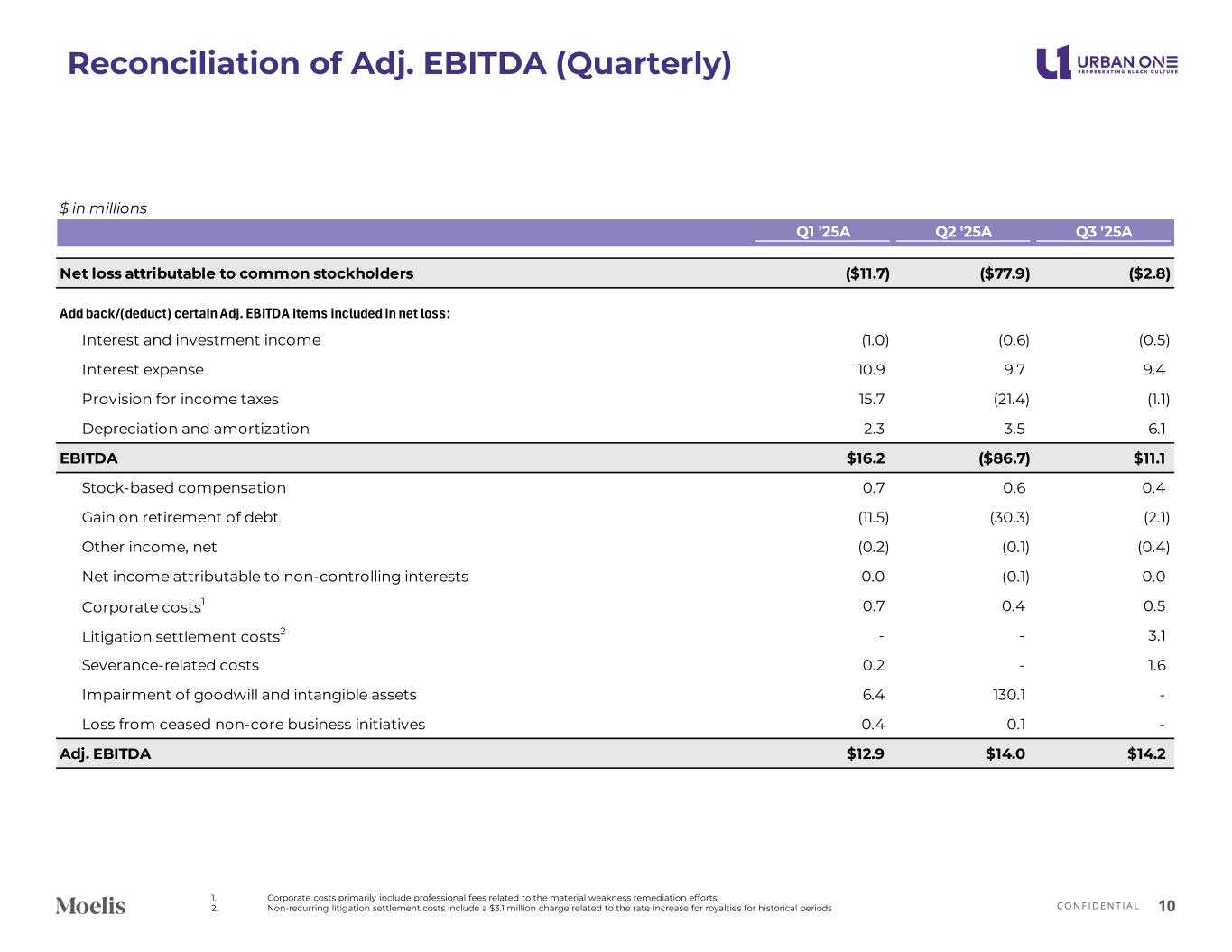

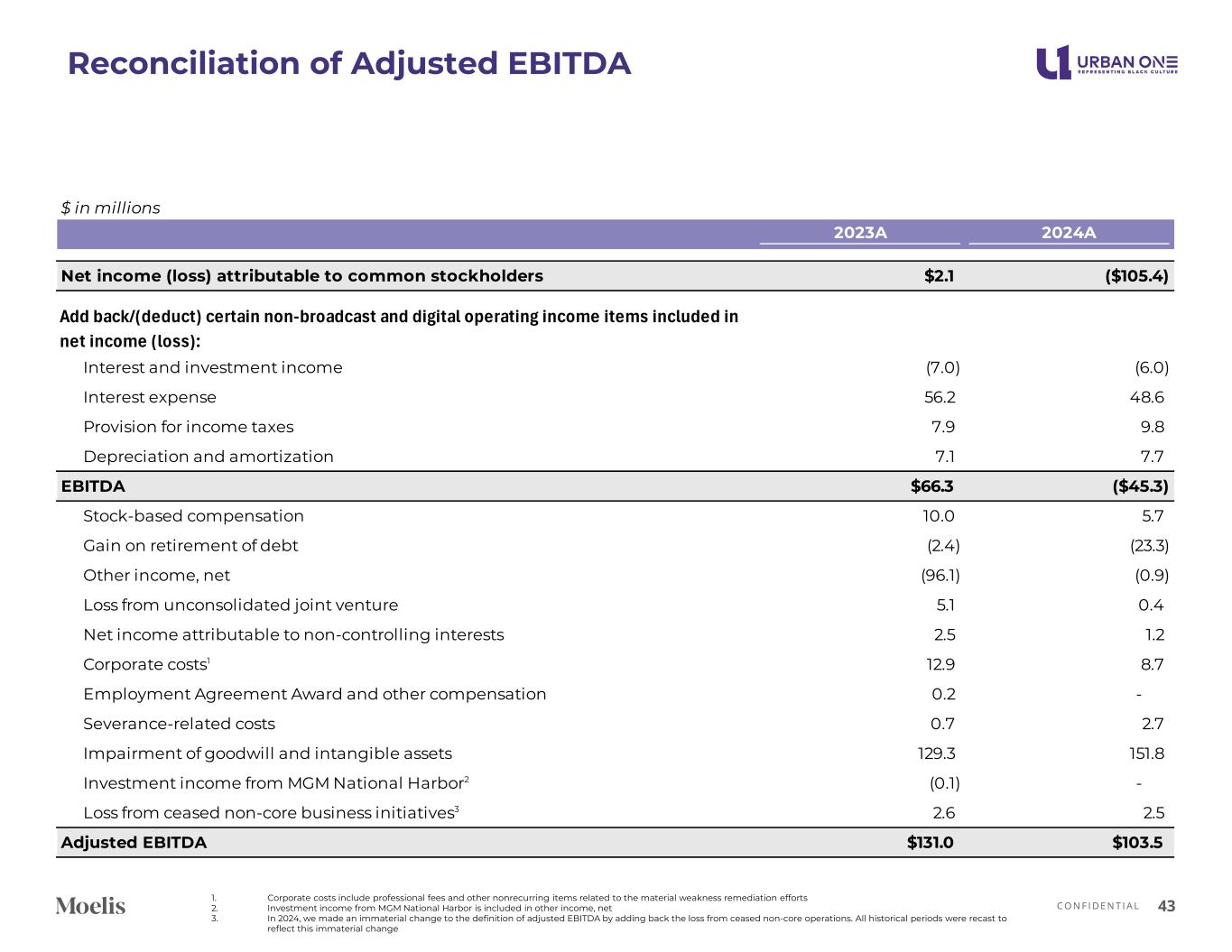

C O N F I D E N T I A L Reconciliation of Adjusted EBITDA 43 1. Corporate costs include professional fees and other nonrecurring items related to the material weakness remediation efforts 2. Investment income from MGM National Harbor is included in other income, net 3. In 2024, we made an immaterial change to the definition of adjusted EBITDA by adding back the loss from ceased non-core operations. All historical periods were recast to reflect this immaterial change $ in millions 2023A 2024A Net income (loss) attributable to common stockholders $2.1 ($105.4) Add back/(deduct) certain non-broadcast and digital operating income items included in net income (loss): Interest and investment income (7.0) (6.0) Interest expense 56.2 48.6 Provision for income taxes 7.9 9.8 Depreciation and amortization 7.1 7.7 EBITDA $66.3 ($45.3) Stock-based compensation 10.0 5.7 Gain on retirement of debt (2.4) (23.3) Other income, net (96.1) (0.9) Loss from unconsolidated joint venture 5.1 0.4 Net income attributable to non-controlling interests 2.5 1.2 Corporate costs1 12.9 8.7 Employment Agreement Award and other compensation 0.2 - Severance-related costs 0.7 2.7 Impairment of goodwill and intangible assets 129.3 151.8 Investment income from MGM National Harbor2 (0.1) - Loss from ceased non-core business initiatives3 2.6 2.5 Adjusted EBITDA $131.0 $103.5

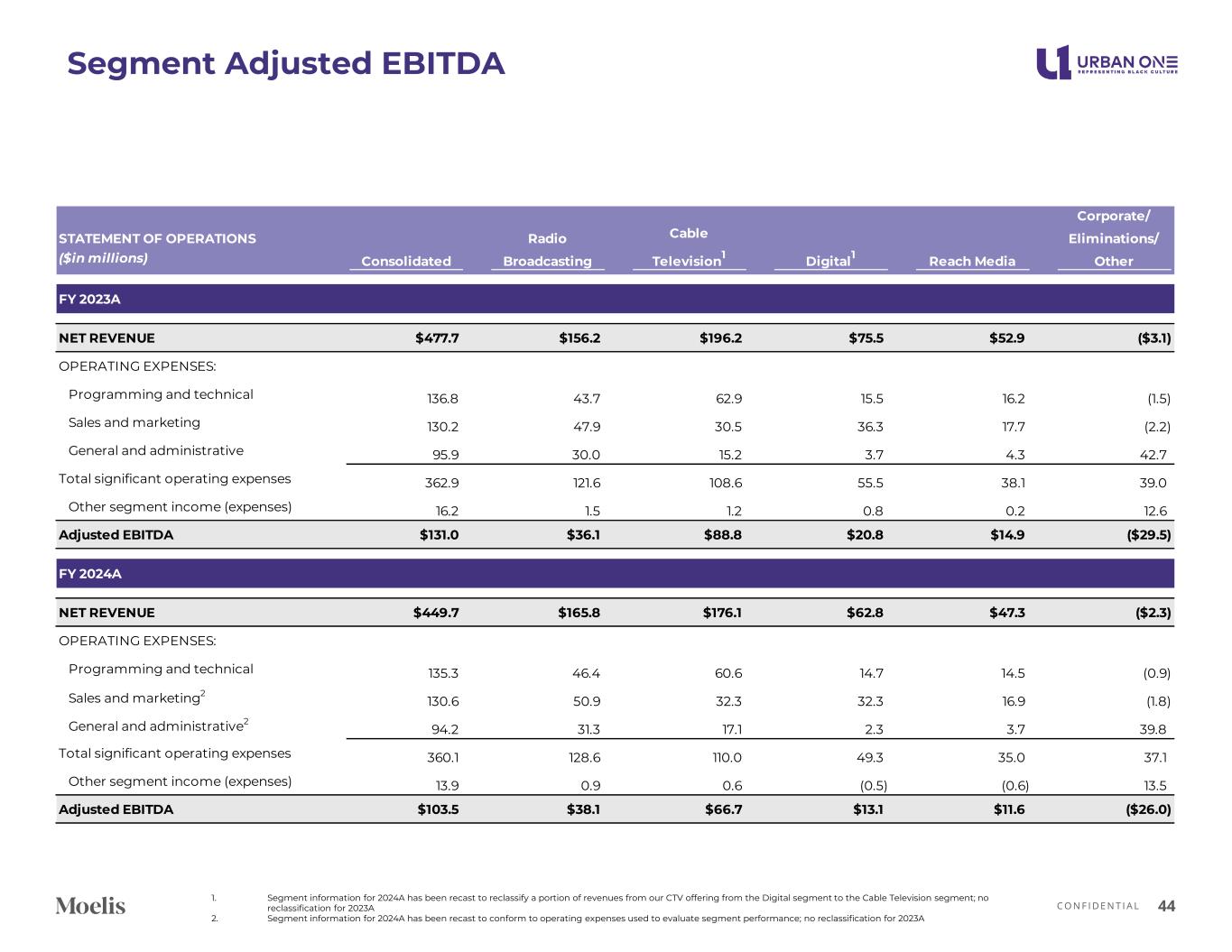

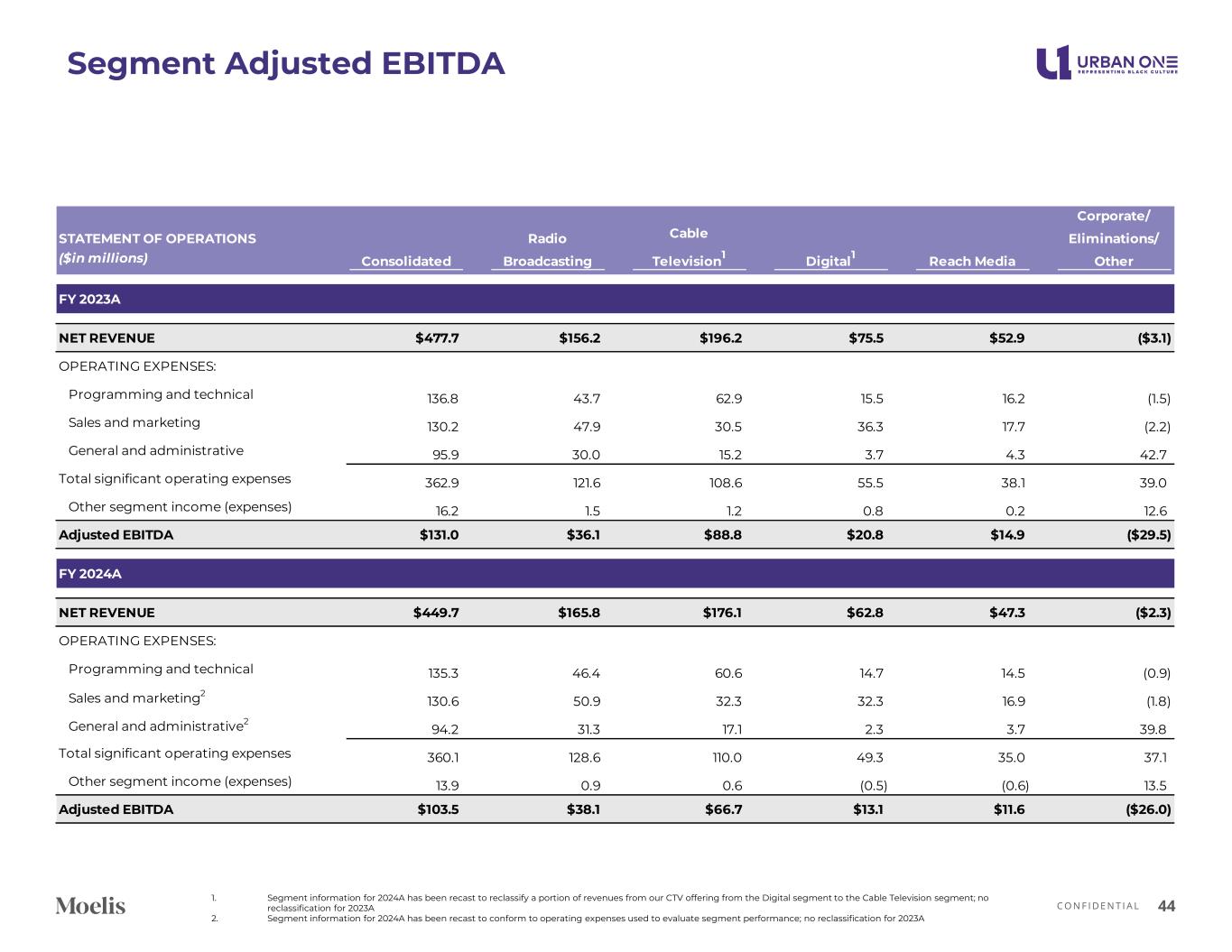

C O N F I D E N T I A L Segment Adjusted EBITDA 44 1. Segment information for 2024A has been recast to reclassify a portion of revenues from our CTV offering from the Digital segment to the Cable Television segment; no reclassification for 2023A 2. Segment information for 2024A has been recast to conform to operating expenses used to evaluate segment performance; no reclassification for 2023A STATEMENT OF OPERATIONS ($in millions) Consolidated Radio Broadcasting Cable Television1 Digital1 Reach Media Corporate/ Eliminations/ Other FY 2023A NET REVENUE $477.7 $156.2 $196.2 $75.5 $52.9 ($3.1) OPERATING EXPENSES: Programming and technical 136.8 43.7 62.9 15.5 16.2 (1.5) Sales and marketing 130.2 47.9 30.5 36.3 17.7 (2.2) General and administrative 95.9 30.0 15.2 3.7 4.3 42.7 Total significant operating expenses 362.9 121.6 108.6 55.5 38.1 39.0 Other segment income (expenses) 16.2 1.5 1.2 0.8 0.2 12.6 Adjusted EBITDA $131.0 $36.1 $88.8 $20.8 $14.9 ($29.5) FY 2024A NET REVENUE $449.7 $165.8 $176.1 $62.8 $47.3 ($2.3) OPERATING EXPENSES: Programming and technical 135.3 46.4 60.6 14.7 14.5 (0.9) Sales and marketing2 130.6 50.9 32.3 32.3 16.9 (1.8) General and administrative2 94.2 31.3 17.1 2.3 3.7 39.8 Total significant operating expenses 360.1 128.6 110.0 49.3 35.0 37.1 Other segment income (expenses) 13.9 0.9 0.6 (0.5) (0.6) 13.5 Adjusted EBITDA $103.5 $38.1 $66.7 $13.1 $11.6 ($26.0)

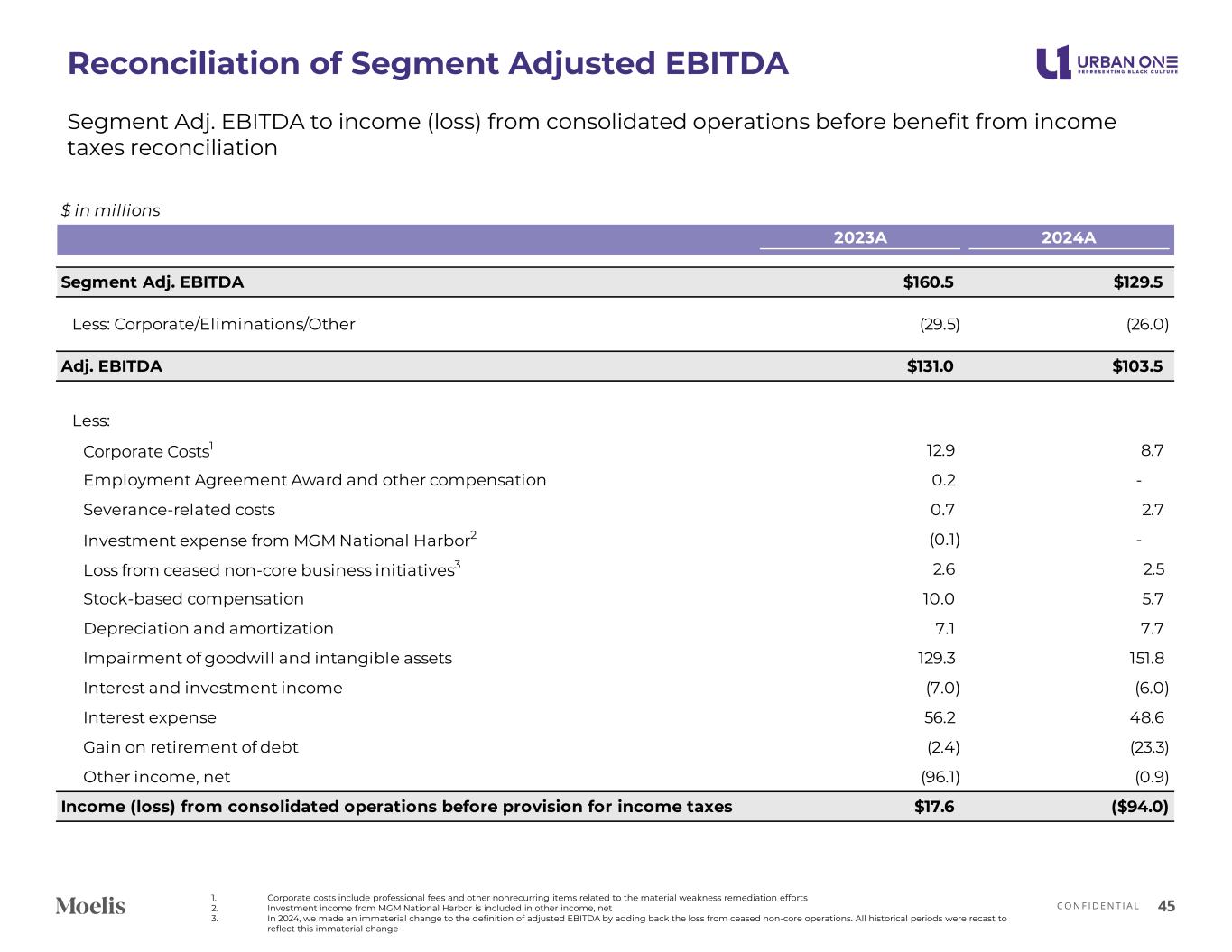

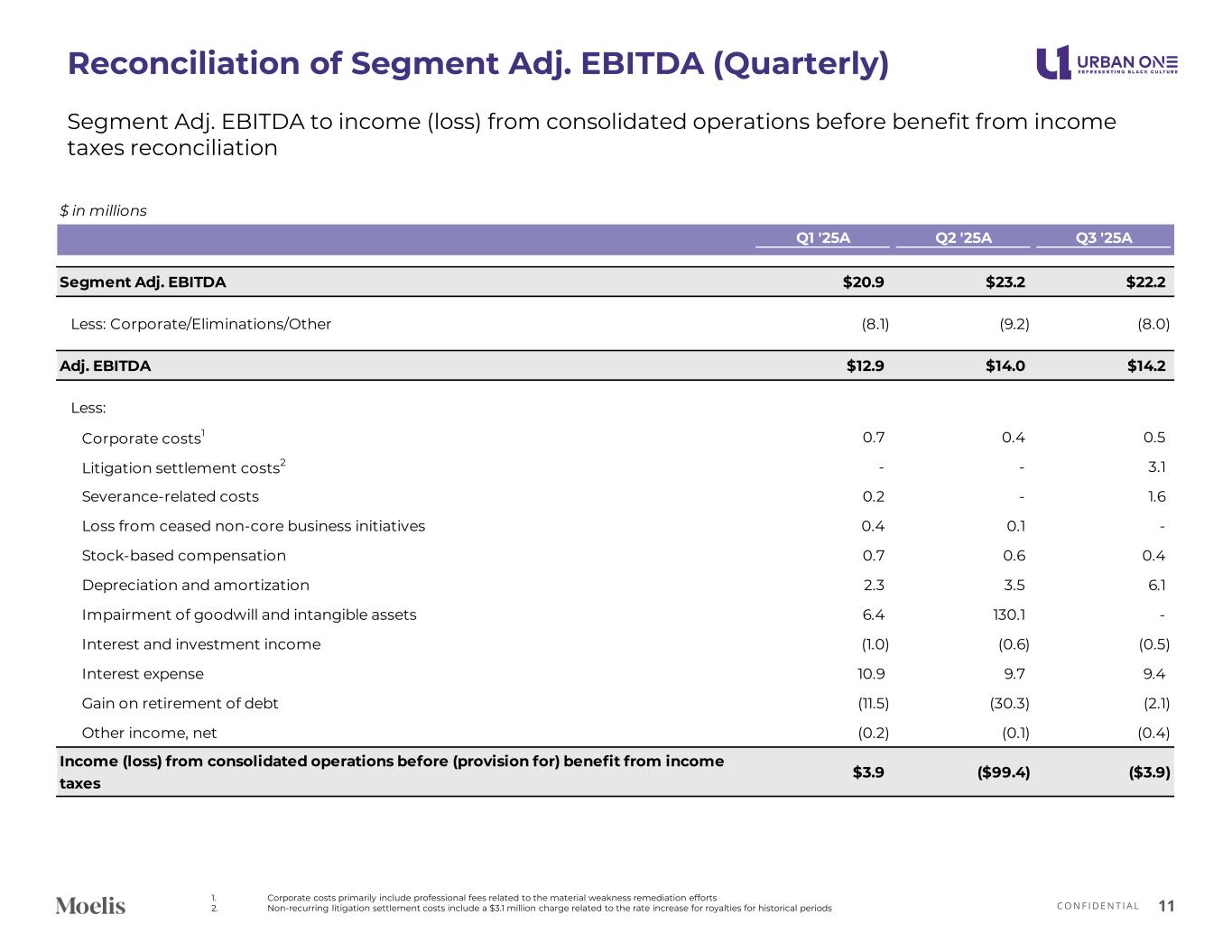

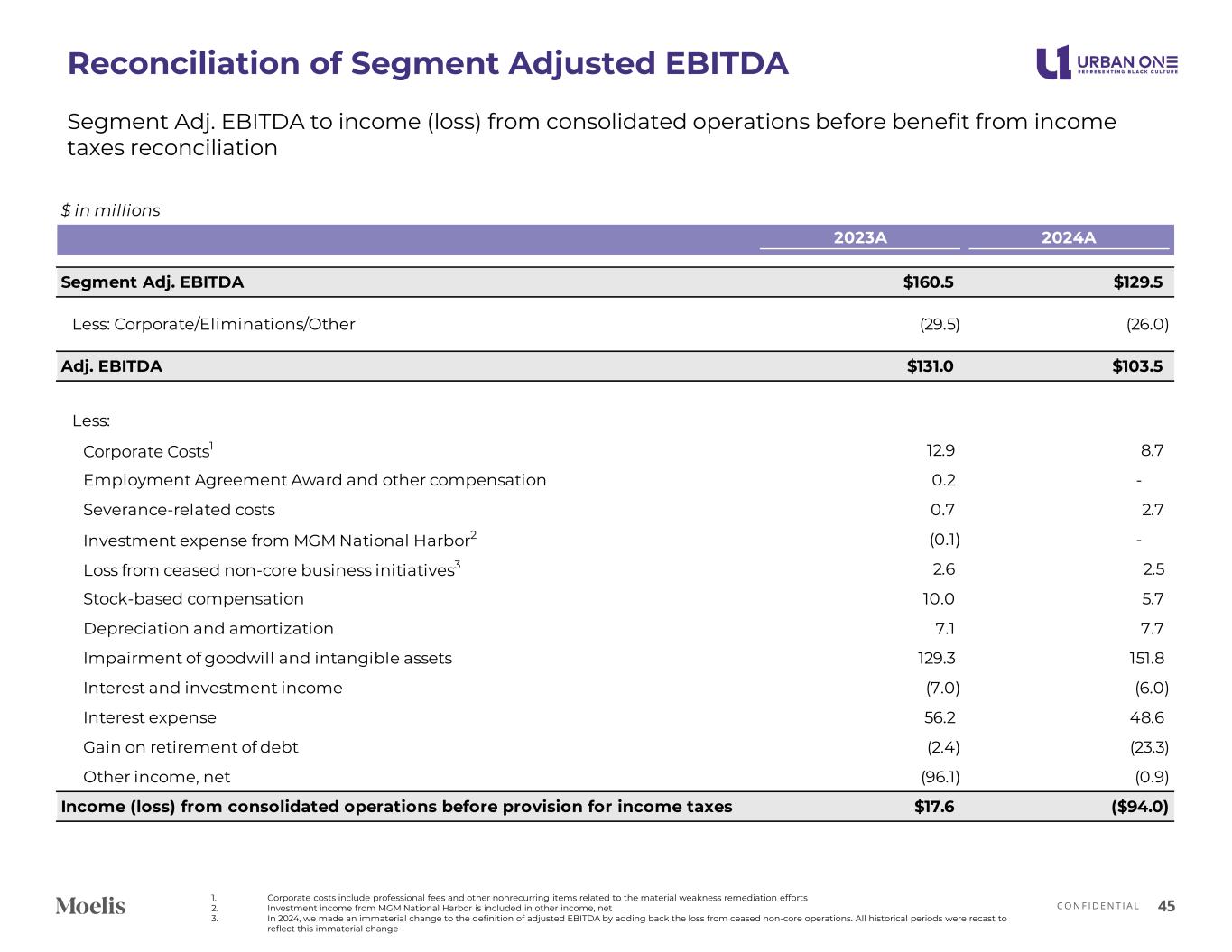

C O N F I D E N T I A L Reconciliation of Segment Adjusted EBITDA 45 1. Corporate costs include professional fees and other nonrecurring items related to the material weakness remediation efforts 2. Investment income from MGM National Harbor is included in other income, net 3. In 2024, we made an immaterial change to the definition of adjusted EBITDA by adding back the loss from ceased non-core operations. All historical periods were recast to reflect this immaterial change Segment Adj. EBITDA to income (loss) from consolidated operations before benefit from income taxes reconciliation $ in millions 2023A 2024A Segment Adj. EBITDA $160.5 $129.5 Less: Corporate/Eliminations/Other (29.5) (26.0) Adj. EBITDA $131.0 $103.5 Less: Corporate Costs1 12.9 8.7 Employment Agreement Award and other compensation 0.2 - Severance-related costs 0.7 2.7 Investment expense from MGM National Harbor2 (0.1) - Loss from ceased non-core business initiatives3 2.6 2.5 Stock-based compensation 10.0 5.7 Depreciation and amortization 7.1 7.7 Impairment of goodwill and intangible assets 129.3 151.8 Interest and investment income (7.0) (6.0) Interest expense 56.2 48.6 Gain on retirement of debt (2.4) (23.3) Other income, net (96.1) (0.9) Income (loss) from consolidated operations before provision for income taxes $17.6 ($94.0)

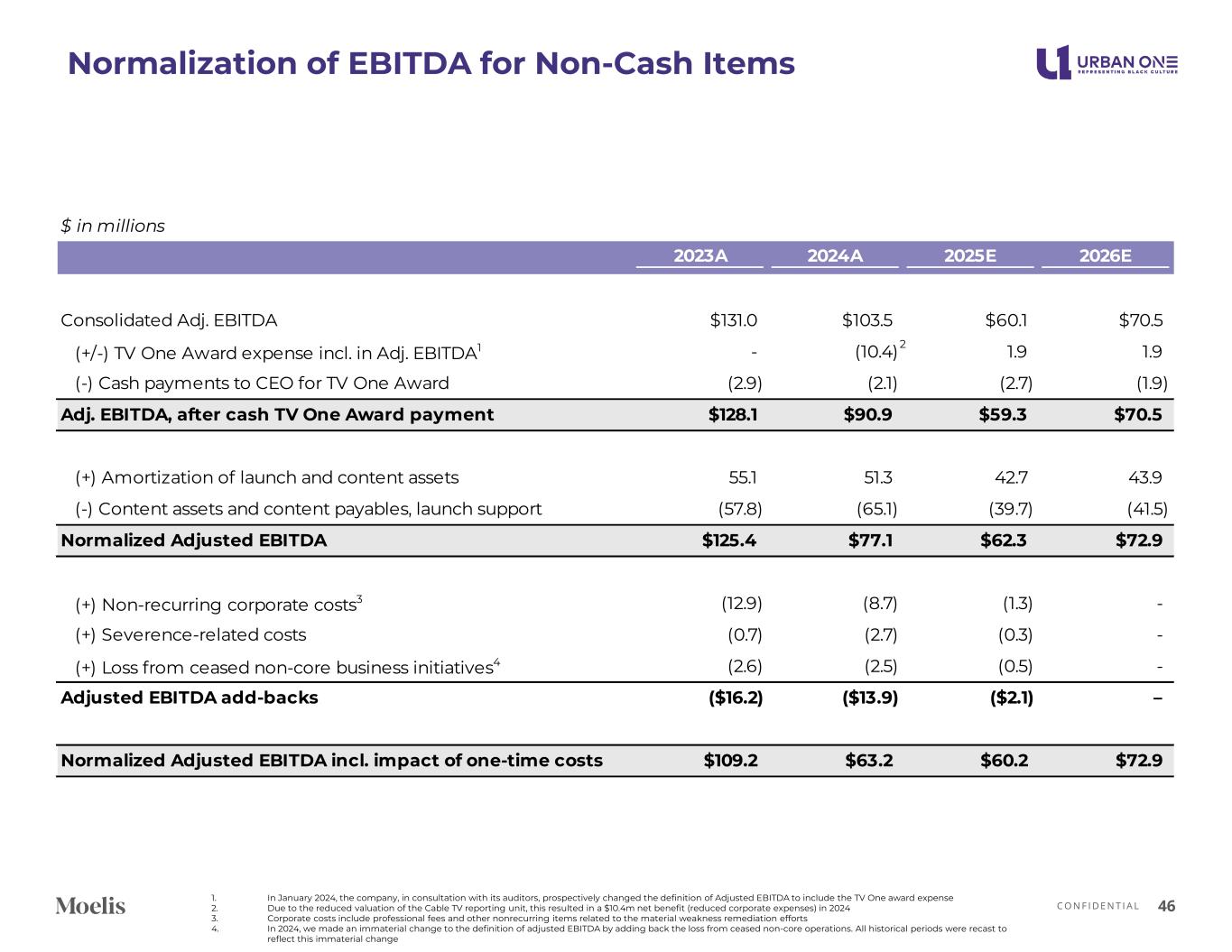

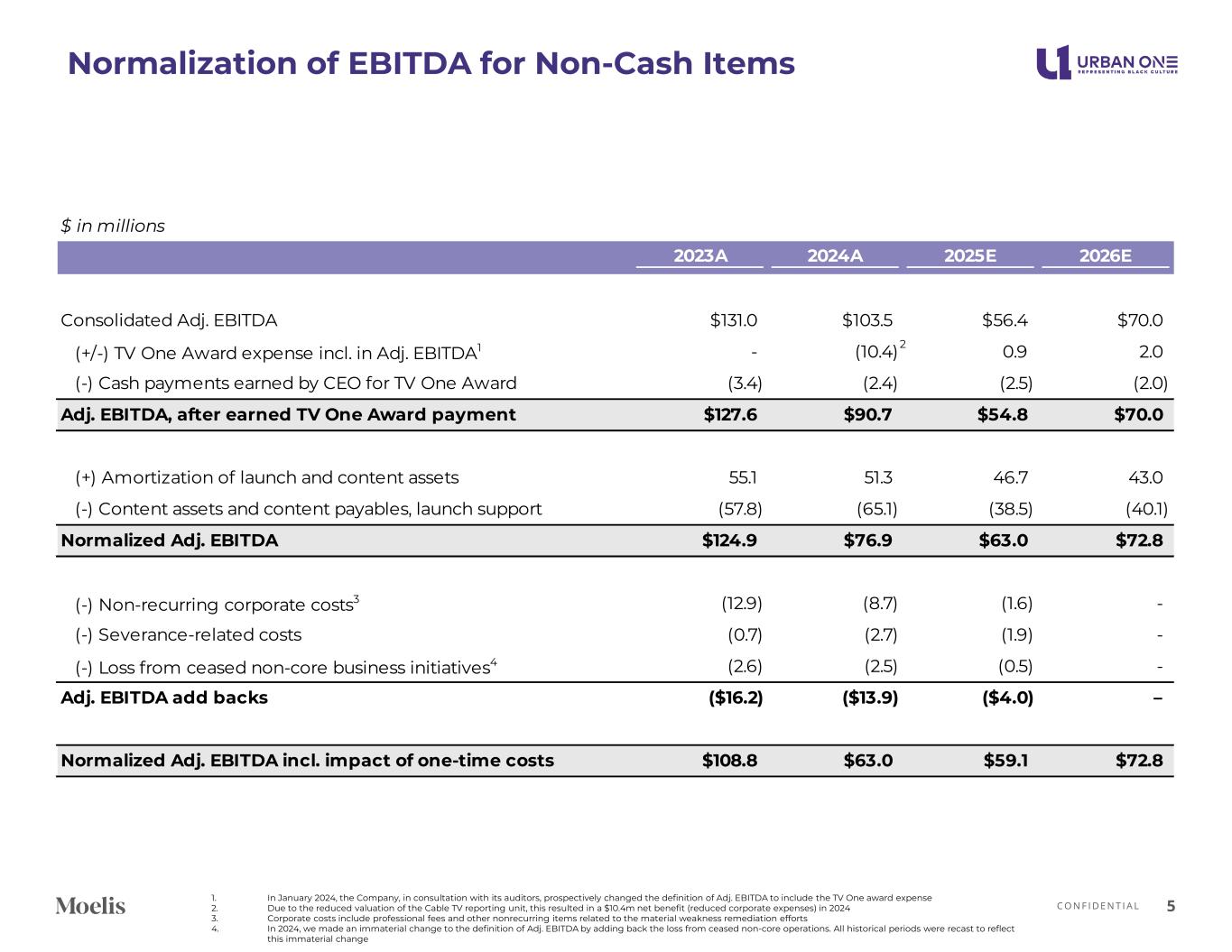

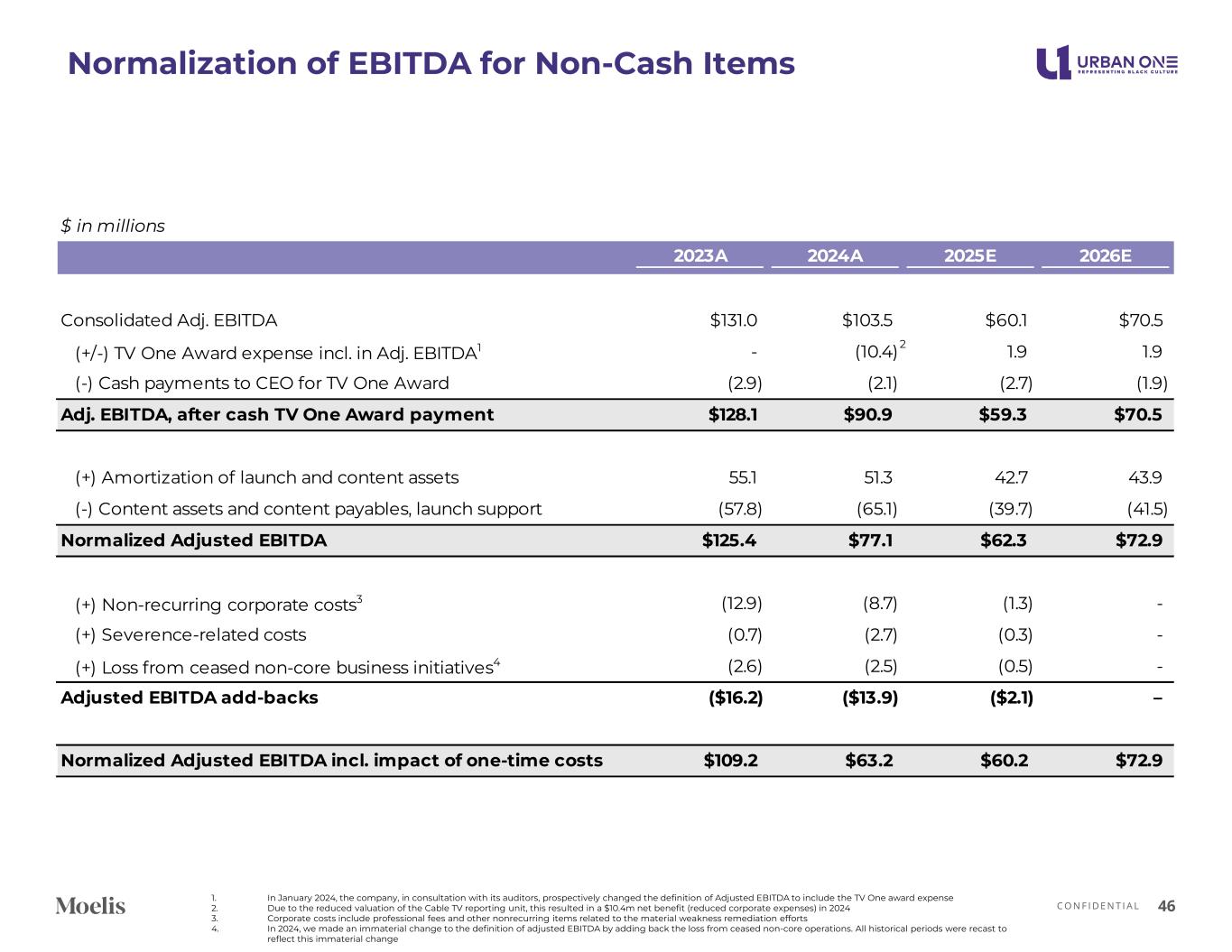

C O N F I D E N T I A L Normalization of EBITDA for Non-Cash Items 46 1. In January 2024, the company, in consultation with its auditors, prospectively changed the definition of Adjusted EBITDA to include the TV One award expense 2. Due to the reduced valuation of the Cable TV reporting unit, this resulted in a $10.4m net benefit (reduced corporate expenses) in 2024 3. Corporate costs include professional fees and other nonrecurring items related to the material weakness remediation efforts 4. In 2024, we made an immaterial change to the definition of adjusted EBITDA by adding back the loss from ceased non-core operations. All historical periods were recast to reflect this immaterial change $ in millions 2023A 2024A 2025E 2026E Consolidated Adj. EBITDA $131.0 $103.5 $60.1 $70.5 (+/-) TV One Award expense incl. in Adj. EBITDA1 - (10.4) 1.9 1.9 (-) Cash payments to CEO for TV One Award (2.9) (2.1) (2.7) (1.9) Adj. EBITDA, after cash TV One Award payment $128.1 $90.9 $59.3 $70.5 (+) Amortization of launch and content assets 55.1 51.3 42.7 43.9 (-) Content assets and content payables, launch support (57.8) (65.1) (39.7) (41.5) Normalized Adjusted EBITDA $125.4 $77.1 $62.3 $72.9 (+) Non-recurring corporate costs3 (12.9) (8.7) (1.3) - (+) Severence-related costs (0.7) (2.7) (0.3) - (+) Loss from ceased non-core business initiatives4 (2.6) (2.5) (0.5) - Adjusted EBITDA add-backs ($16.2) ($13.9) ($2.1) – Normalized Adjusted EBITDA incl. impact of one-time costs $109.2 $63.2 $60.2 $72.9 2