| 1-13199 | 13-3956775 | ||||

| (Commission File Number) | (I.R.S. Employer Identification No.) | ||||

| One Vanderbilt Avenue | 10017 | |||||||

| New York, | New York | (Zip Code) | ||||||

(Address of principal executive offices) |

||||||||

| Registrant | Trading Symbol | Title of Each Class | Name of Each Exchange on Which Registered | |||||||||||||||||

| SL Green Realty Corp. | SLG | Common Stock, $0.01 par value | New York Stock Exchange | |||||||||||||||||

| SL Green Realty Corp. | SLG.PRI | 6.500% Series I Cumulative Redeemable Preferred Stock, $0.01 par value | New York Stock Exchange | |||||||||||||||||

| SL GREEN REALTY CORP. | |||||

| /s/ Matthew J. DiLiberto | |||||

| Matthew J. DiLiberto | |||||

| Chief Financial Officer | |||||

Date: April 17, 2025 |

|||||

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| Revenues: | 2025 | 2024 | |||||||||

| Rental revenue, net | $ | 144,518 | $ | 128,203 | |||||||

| Escalation and reimbursement revenues | 18,501 | 13,301 | |||||||||

| SUMMIT Operator revenue | 22,534 | 25,604 | |||||||||

| Investment income | 16,114 | 7,403 | |||||||||

| Interest income from real estate loans held by consolidated securitization vehicles | 15,981 | — | |||||||||

| Other income | 22,198 | 13,371 | |||||||||

| Total revenues | 239,846 | 187,882 | |||||||||

| Expenses: | |||||||||||

Operating expenses, including related party expenses of $3 in 2025 and $0 in 2024 |

56,062 | 43,608 | |||||||||

| Real estate taxes | 37,217 | 31,606 | |||||||||

| Operating lease rent | 6,106 | 6,405 | |||||||||

| SUMMIT Operator expenses | 21,764 | 21,858 | |||||||||

| Interest expense, net of interest income | 45,681 | 31,173 | |||||||||

| Amortization of deferred financing costs | 1,687 | 1,539 | |||||||||

| SUMMIT Operator tax expense | (45) | (1,295) | |||||||||

| Interest expense on senior obligations of consolidated securitization vehicles | 13,972 | — | |||||||||

| Depreciation and amortization | 64,498 | 48,584 | |||||||||

| Loan loss and other investment reserves, net of recoveries | (25,039) | — | |||||||||

| Transaction related costs | 295 | 16 | |||||||||

| Marketing, general and administrative | 21,724 | 21,313 | |||||||||

| Total expenses | 243,922 | 204,807 | |||||||||

| Equity in net income from unconsolidated joint ventures | 1,170 | 111,160 | |||||||||

| Equity in net gain on sale of interest in unconsolidated joint venture/real estate | — | 26,764 | |||||||||

| Purchase price and other fair value adjustments | (9,611) | (50,492) | |||||||||

| Loss on sale of real estate, net | (482) | — | |||||||||

| Depreciable real estate reserves | (8,546) | (52,118) | |||||||||

| Net (loss) income | (21,545) | 18,389 | |||||||||

| Net loss attributable to noncontrolling interests: | |||||||||||

| Noncontrolling interests in the Operating Partnership | 1,465 | (901) | |||||||||

| Noncontrolling interests in other partnerships | 4,897 | 1,294 | |||||||||

| Preferred units distributions | (2,154) | (1,903) | |||||||||

| Net (loss) income attributable to SL Green | (17,337) | 16,879 | |||||||||

| Perpetual preferred stock dividends | (3,738) | (3,738) | |||||||||

| Net (loss) income attributable to SL Green common stockholders | $ | (21,075) | $ | 13,141 | |||||||

| Earnings Per Share (EPS) | |||||||||||

| Basic (loss) earnings per share | $ | (0.30) | $ | 0.20 | |||||||

| Diluted (loss) earnings per share | $ | (0.30) | $ | 0.20 | |||||||

| Funds From Operations (FFO) | |||||||||||

| Basic FFO per share | $ | 1.43 | $ | 3.11 | |||||||

| Diluted FFO per share | $ | 1.40 | $ | 3.07 | |||||||

| Basic ownership interest | |||||||||||

| Weighted average REIT common shares for net income per share | 70,424 | 64,328 | |||||||||

| Weighted average partnership units held by noncontrolling interests | 4,103 | 4,439 | |||||||||

| Basic weighted average shares and units outstanding | 74,527 | 68,767 | |||||||||

| Diluted ownership interest | |||||||||||

| Weighted average REIT common share and common share equivalents | 72,230 | 65,656 | |||||||||

| Weighted average partnership units held by noncontrolling interests | 4,103 | 4,439 | |||||||||

| Diluted weighted average shares and units outstanding | 76,333 | 70,095 | |||||||||

| March 31, | December 31, | ||||||||||

| 2025 | 2024 | ||||||||||

| Assets | |||||||||||

| Commercial real estate properties, at cost: | |||||||||||

| Land and land interests | $ | 1,450,892 | $ | 1,357,041 | |||||||

| Building and improvements | 3,828,638 | 3,862,224 | |||||||||

| Building leasehold and improvements | 1,399,376 | 1,388,476 | |||||||||

| 6,678,906 | 6,607,741 | ||||||||||

| Less: accumulated depreciation | (2,174,667) | (2,126,081) | |||||||||

| 4,504,239 | 4,481,660 | ||||||||||

| Cash and cash equivalents | 180,133 | 184,294 | |||||||||

| Restricted cash | 156,895 | 147,344 | |||||||||

| Investment in marketable securities | 12,295 | 22,812 | |||||||||

| Tenant and other receivables | 48,074 | 44,055 | |||||||||

| Related party receivables | 18,630 | 26,865 | |||||||||

| Deferred rents receivable | 264,982 | 266,428 | |||||||||

Debt and preferred equity investments, net of discounts and deferred origination fees of $2,231 and $1,618 in 2025 and 2024, respectively, and allowances of $13,520 and $13,520 in 2025 and 2024, respectively |

318,189 | 303,726 | |||||||||

| Investments in unconsolidated joint ventures | 2,712,582 | 2,690,138 | |||||||||

| Deferred costs, net | 114,317 | 117,132 | |||||||||

| Right-of-use assets - operating leases | 860,449 | 865,639 | |||||||||

Real estate loans held by consolidated securitization vehicles (includes $1,449,291 and $584,134 at fair value as of March 31, 2025 and December 31, 2024, respectively) |

1,599,291 | 709,095 | |||||||||

| Other assets | 620,547 | 610,911 | |||||||||

| Total assets | $ | 11,410,623 | $ | 10,470,099 | |||||||

| Liabilities | |||||||||||

| Mortgages and other loans payable | $ | 2,036,727 | $ | 1,951,024 | |||||||

| Revolving credit facility | 490,000 | 320,000 | |||||||||

| Unsecured term loan | 1,150,000 | 1,150,000 | |||||||||

| Unsecured notes | 100,000 | 100,000 | |||||||||

| Deferred financing costs, net | (15,275) | (14,242) | |||||||||

| Total debt, net of deferred financing costs | 3,761,452 | 3,506,782 | |||||||||

| Accrued interest payable | 18,473 | 16,527 | |||||||||

| Accounts payable and accrued expenses | 123,256 | 122,674 | |||||||||

| Deferred revenue | 166,240 | 164,887 | |||||||||

| Lease liability - financing leases | 107,183 | 106,853 | |||||||||

| Lease liability - operating leases | 806,669 | 810,989 | |||||||||

| Dividend and distributions payable | 21,978 | 21,816 | |||||||||

| Security deposits | 62,210 | 60,331 | |||||||||

| Junior subordinate deferrable interest debentures held by trusts that issued trust preferred securities | 100,000 | 100,000 | |||||||||

Senior obligations of consolidated securitization vehicles (includes $1,409,185 and $567,487 at fair value as of March 31, 2025 and December 31, 2024, respectively) |

1,409,185 | 590,131 | |||||||||

Other liabilities (includes $254,447 and $251,096 at fair value as of March 31, 2025 and December 31, 2024, respectively) |

395,832 | 414,153 | |||||||||

| Total liabilities | 6,972,478 | 5,915,143 | |||||||||

| Commitments and contingencies | |||||||||||

| Noncontrolling interests in Operating Partnership | 288,702 | 288,941 | |||||||||

| Preferred units and redeemable equity | 196,016 | 196,064 | |||||||||

| Equity | |||||||||||

| SL Green stockholders' equity: | |||||||||||

Series I Preferred Stock, $0.01 par value, $25.00 liquidation preference, 9,200 issued and outstanding at both March 31, 2025 and December 31, 2024 |

221,932 | 221,932 | |||||||||

Common stock, $0.01 par value 160,000 shares authorized, 71,016 and 71,097 issued and outstanding at March 31, 2025 and December 31, 2024, respectively |

710 | 711 | |||||||||

| Additional paid-in capital | 4,156,242 | 4,159,562 | |||||||||

| Accumulated other comprehensive (loss) income | (4,842) | 18,196 | |||||||||

| Retained deficit | (537,585) | (449,101) | |||||||||

| Total SL Green Realty Corp. stockholders’ equity | 3,836,457 | 3,951,300 | |||||||||

| Noncontrolling interests in other partnerships | 116,970 | 118,651 | |||||||||

| Total equity | 3,953,427 | 4,069,951 | |||||||||

| Total liabilities and equity | $ | 11,410,623 | $ | 10,470,099 | |||||||

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| Funds From Operations (FFO) Reconciliation: | 2025 | 2024 | |||||||||

| Net (loss) income attributable to SL Green common stockholders | $ | (21,075) | $ | 13,141 | |||||||

| Add: | |||||||||||

| Depreciation and amortization | 64,498 | 48,584 | |||||||||

| Joint venture depreciation and noncontrolling interest adjustments | 53,361 | 74,258 | |||||||||

| Net loss attributable to noncontrolling interests | (6,362) | (393) | |||||||||

| Less: | |||||||||||

| Equity in net gain on sale of interest in unconsolidated joint venture/real estate | — | 26,764 | |||||||||

| Purchase price and other fair value adjustments | (6,544) | (55,652) | |||||||||

| Loss on sale of real estate, net | (482) | — | |||||||||

| Depreciable real estate reserves | (8,546) | (52,118) | |||||||||

| Depreciable real estate reserves in unconsolidated joint venture | (1,780) | — | |||||||||

| Depreciation on non-rental real estate assets | 1,263 | 1,153 | |||||||||

| FFO attributable to SL Green common stockholders and unit holders | $ | 106,511 | $ | 215,443 | |||||||

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| Operating income and Same-store NOI Reconciliation: | 2025 | 2024 | |||||||||

| Net (loss) income | $ | (21,545) | $ | 18,389 | |||||||

| Depreciable real estate reserves | 8,546 | 52,118 | |||||||||

| Loss on sale of real estate, net | 482 | — | |||||||||

| Purchase price and other fair value adjustments | 9,611 | 50,492 | |||||||||

| Equity in net gain on sale of interest in unconsolidated joint venture/real estate | — | (26,764) | |||||||||

| Depreciation and amortization | 64,498 | 48,584 | |||||||||

| SUMMIT Operator tax expense | (45) | (1,295) | |||||||||

| Amortization of deferred financing costs | 1,687 | 1,539 | |||||||||

| Interest expense, net of interest income | 45,681 | 31,173 | |||||||||

| Interest expense on senior obligations of consolidated securitization vehicles | 13,972 | — | |||||||||

| Operating income | 122,887 | 174,236 | |||||||||

| Equity in net income from unconsolidated joint ventures | (1,170) | (111,160) | |||||||||

| Marketing, general and administrative expense | 21,724 | 21,313 | |||||||||

| Transaction related costs | 295 | 16 | |||||||||

| Loan loss and other investment reserves, net of recoveries | (25,039) | — | |||||||||

| SUMMIT Operator expenses | 21,764 | 21,858 | |||||||||

| Investment income | (16,114) | (7,403) | |||||||||

| Interest income from real estate loans held by consolidated securitization vehicles | (15,981) | — | |||||||||

| SUMMIT Operator revenue | (22,534) | (25,604) | |||||||||

| Non-building revenue | (10,486) | (5,049) | |||||||||

| Net operating income (NOI) | 75,346 | 68,207 | |||||||||

| Equity in net income from unconsolidated joint ventures | 1,170 | 111,160 | |||||||||

| SLG share of unconsolidated JV depreciable real estate reserves | 1,780 | — | |||||||||

| SLG share of unconsolidated JV depreciation and amortization | 63,075 | 69,446 | |||||||||

| SLG share of unconsolidated JV amortization of deferred financing costs | 3,191 | 3,095 | |||||||||

| SLG share of unconsolidated JV interest expense, net of interest income | 62,965 | 72,803 | |||||||||

| SLG share of unconsolidated JV gain on early extinguishment of debt | — | (141,664) | |||||||||

| SLG share of unconsolidated JV investment income | (4,918) | — | |||||||||

| SLG share of unconsolidated JV non-building revenue | (1,291) | (501) | |||||||||

| NOI including SLG share of unconsolidated JVs | 201,318 | 182,546 | |||||||||

| NOI from other properties/affiliates | (37,817) | (20,845) | |||||||||

| Same-Store NOI | 163,501 | 161,701 | |||||||||

| Straight-line and free rent | 641 | (3,181) | |||||||||

| Amortization of acquired above and below-market leases, net | 728 | 49 | |||||||||

| Operating lease straight-line adjustment | 204 | 204 | |||||||||

| SLG share of unconsolidated JV straight-line and free rent | (5,131) | (2,832) | |||||||||

| SLG share of unconsolidated JV amortization of acquired above and below-market leases, net | (6,394) | (6,285) | |||||||||

| Same-store cash NOI | $ | 153,549 | $ | 149,656 | |||||||

| Lease termination income | (4,355) | (1,278) | |||||||||

| SLG share of unconsolidated JV lease termination income | (23) | (2,717) | |||||||||

| Same-store cash NOI excluding lease termination income | $ | 149,171 | $ | 145,661 | |||||||

|

||||||||

| Supplemental Information | 2 |

First Quarter 2025 |

||||||

| TABLE OF CONTENTS |  |

|||||||

| Definitions | |||||||||||

| Highlights | - | ||||||||||

| Comparative Balance Sheets | |||||||||||

| Comparative Statements of Operations | |||||||||||

| Comparative Computation of FFO and FAD | |||||||||||

| Consolidated Statement of Equity | |||||||||||

| Joint Venture Statements | - | ||||||||||

| Selected Financial Data | - | ||||||||||

| Debt Summary Schedule | - | ||||||||||

| Derivative Summary Schedule | |||||||||||

| Lease Liability Schedule | |||||||||||

| Debt and Preferred Equity Investments | - | ||||||||||

| Selected Property Data | |||||||||||

| Property Portfolio | - | ||||||||||

| Largest Tenants | |||||||||||

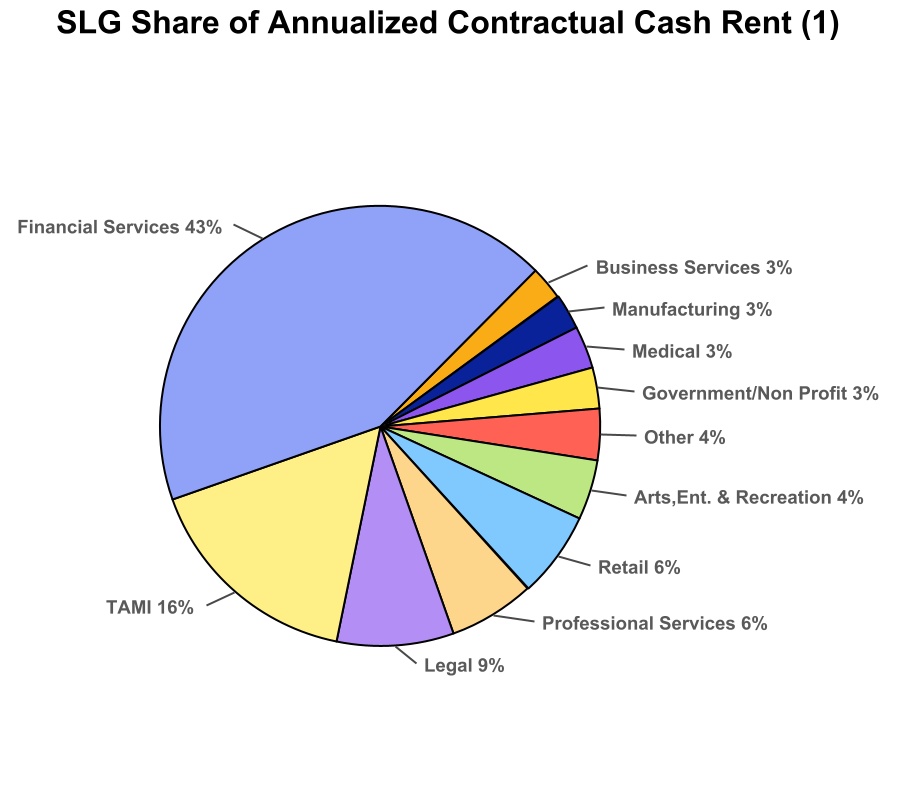

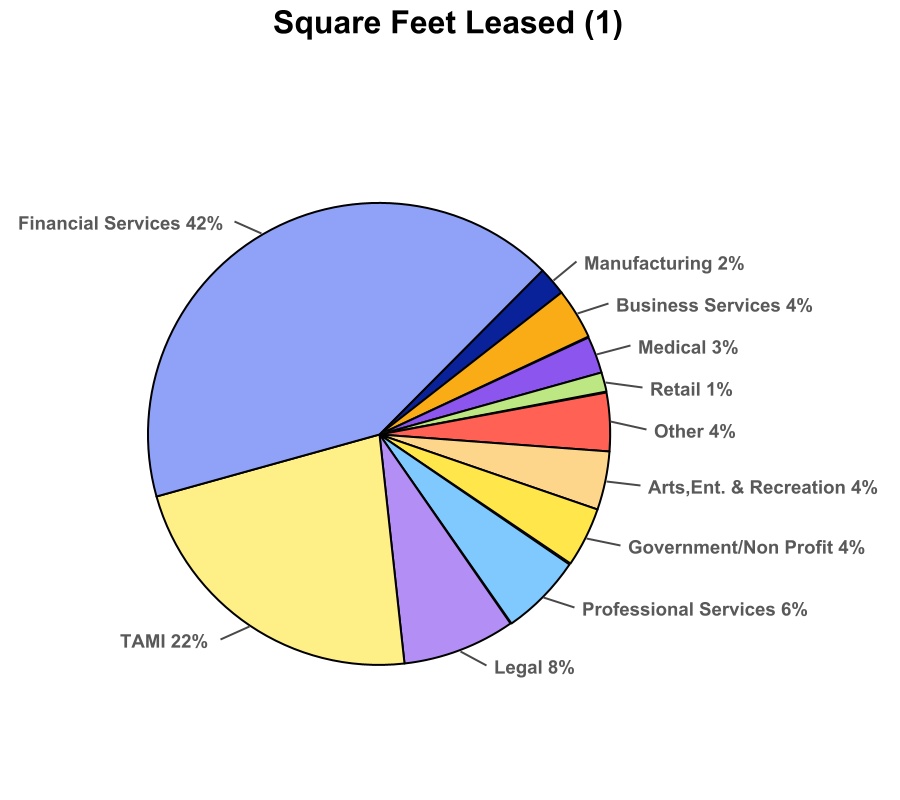

| Tenant Diversification | |||||||||||

| Leasing Activity | - | ||||||||||

| Lease Expirations | - | ||||||||||

| Summary of Real Estate Acquisition/Disposition Activity | - | ||||||||||

| Non-GAAP Disclosures and Reconciliations | |||||||||||

| Analyst Coverage | |||||||||||

| Executive Management | |||||||||||

| Supplemental Information | 3 |

First Quarter 2025 |

||||||

|

DEFINITIONS

|

|

|||||||

| Supplemental Information | 4 |

First Quarter 2025 |

||||||

|

DEFINITIONS

|

|

|||||||

| Added to Same-Store in 2025: | Removed from Same-Store in 2025: | ||||

| 7 Dey Street | 10 East 53rd Street (interest acquired) | ||||

| 760 Madison Avenue - Retail | |||||

| 15 Beekman Street | |||||

| 245 Park Avenue | |||||

| Supplemental Information | 5 |

First Quarter 2025 |

||||||

|

FIRST QUARTER 2025 HIGHLIGHTS

Unaudited

|

|

|||||||

| Supplemental Information | 6 |

First Quarter 2025 |

||||||

|

FIRST QUARTER 2025 HIGHLIGHTS

Unaudited

|

|

|||||||

| Supplemental Information | 7 |

First Quarter 2025 |

||||||

|

FIRST QUARTER 2025 HIGHLIGHTS

Unaudited

|

|

|||||||

| Supplemental Information | 8 |

First Quarter 2025 |

||||||

|

KEY FINANCIAL DATA

Unaudited

(Dollars in Thousands Except Per Share)

|

|

|||||||

| As of or for the three months ended | |||||||||||||||||||||||||||||

| 3/31/2025 | 12/31/2024 | 9/30/2024 | 6/30/2024 | 3/31/2024 | |||||||||||||||||||||||||

| Earnings Per Share | |||||||||||||||||||||||||||||

| Net (loss) income available to common stockholders (EPS) - diluted | $ | (0.30) | $ | 0.13 | $ | (0.21) | $ | (0.04) | $ | 0.20 | |||||||||||||||||||

| Funds from operations (FFO) available to common stockholders - diluted | $ | 1.40 | $ | 1.81 | $ | 1.13 | $ | 2.05 | $ | 3.07 | |||||||||||||||||||

| Common Share Price & Dividends | |||||||||||||||||||||||||||||

| Closing price at the end of the period | $ | 57.70 | $ | 67.92 | $ | 69.61 | $ | 56.64 | $ | 55.13 | |||||||||||||||||||

| Closing high price during period | $ | 68.38 | $ | 81.13 | $ | 72.21 | $ | 57.38 | $ | 55.13 | |||||||||||||||||||

| Closing low price during period | $ | 55.58 | $ | 66.24 | $ | 54.99 | $ | 48.32 | $ | 42.45 | |||||||||||||||||||

| Annual dividend per common share | $ | 3.09 | $ | 3.09 | $ | 3.00 | $ | 3.00 | $ | 3.00 | |||||||||||||||||||

| FFO dividend payout ratio (trailing 12 months) | 47.4% | 37.3% | 43.6% | 43.7% | 48.8% | ||||||||||||||||||||||||

| Funds available for distribution (FAD) dividend payout ratio (trailing 12 months) | 75.6% | 52.3% | 53.1% | 54.2% | 63.8% | ||||||||||||||||||||||||

| Common Shares & Units | |||||||||||||||||||||||||||||

| Common shares outstanding | 71,016 | 71,097 | 65,235 | 64,814 | 64,806 | ||||||||||||||||||||||||

| Units outstanding | 5,010 | 4,510 | 4,474 | 4,299 | 4,417 | ||||||||||||||||||||||||

| Total common shares and units outstanding | 76,026 | 75,607 | 69,709 | 69,113 | 69,223 | ||||||||||||||||||||||||

| Weighted average common shares and units outstanding - basic | 74,527 | 70,654 | 67,999 | 68,740 | 68,767 | ||||||||||||||||||||||||

| Weighted average common shares and units outstanding - diluted | 76,333 | 72,915 | 69,733 | 70,180 | 70,095 | ||||||||||||||||||||||||

| Market Capitalization | |||||||||||||||||||||||||||||

| Market value of common equity | $ | 4,386,700 | $ | 5,135,227 | $ | 4,852,443 | $ | 3,914,560 | $ | 3,816,264 | |||||||||||||||||||

| Liquidation value of preferred equity/units and redeemable equity | 426,016 | 426,064 | 396,730 | 396,730 | 396,500 | ||||||||||||||||||||||||

| Consolidated debt | 3,876,727 | 3,621,024 | 3,833,798 | 3,639,892 | 3,801,378 | ||||||||||||||||||||||||

| Consolidated market capitalization | $ | 8,689,443 | $ | 9,182,315 | $ | 9,082,971 | $ | 7,951,182 | $ | 8,014,142 | |||||||||||||||||||

| SLG share of unconsolidated JV debt | 6,033,918 | 6,027,862 | 6,876,416 | 6,866,190 | 7,087,348 | ||||||||||||||||||||||||

| Market capitalization including SLG share of unconsolidated JVs | $ | 14,723,361 | $ | 15,210,177 | $ | 15,959,387 | $ | 14,817,372 | $ | 15,101,490 | |||||||||||||||||||

| Consolidated debt service coverage (trailing 12 months) | 3.49x | 3.80x | 3.36x | 3.26x | 2.82x | ||||||||||||||||||||||||

| Consolidated fixed charge coverage (trailing 12 months) | 2.83x | 3.08x | 2.72x | 2.63x | 2.32x | ||||||||||||||||||||||||

| Debt service coverage, including SLG share of unconsolidated JVs (trailing 12 months) | 1.83x | 1.91x | 1.73x | 1.69x | 1.59x | ||||||||||||||||||||||||

| Fixed charge coverage, including SLG share of unconsolidated JVs (trailing 12 months) | 1.66x | 1.74x | 1.58x | 1.54x | 1.44x | ||||||||||||||||||||||||

| Supplemental Information | 9 |

First Quarter 2025 |

||||||

|

KEY FINANCIAL DATA

Unaudited

(Dollars in Thousands Except Per Share)

|

|

|||||||

| As of or for the three months ended | |||||||||||||||||||||||||||||

| 3/31/2025 | 12/31/2024 | 9/30/2024 | 6/30/2024 | 3/31/2024 | |||||||||||||||||||||||||

| Selected Balance Sheet Data | |||||||||||||||||||||||||||||

| Real estate assets before depreciation | $ | 6,678,906 | $ | 6,607,741 | $ | 6,289,894 | $ | 6,264,757 | $ | 6,260,955 | |||||||||||||||||||

| Investments in unconsolidated joint ventures | $ | 2,712,582 | $ | 2,690,138 | $ | 2,871,683 | $ | 2,895,399 | $ | 2,984,786 | |||||||||||||||||||

| Debt and preferred equity investments | $ | 318,189 | $ | 303,726 | $ | 293,924 | $ | 290,487 | $ | 352,347 | |||||||||||||||||||

| Cash and cash equivalents | $ | 180,133 | $ | 184,294 | $ | 188,216 | $ | 199,501 | $ | 196,035 | |||||||||||||||||||

| Investment in marketable securities | $ | 12,295 | $ | 22,812 | $ | 16,522 | $ | 16,593 | $ | 10,673 | |||||||||||||||||||

| Total assets | $ | 11,410,623 | $ | 10,470,099 | $ | 10,216,072 | $ | 9,548,652 | $ | 9,764,292 | |||||||||||||||||||

| Consolidated fixed rate & hedged debt | $ | 3,367,361 | $ | 3,257,474 | $ | 3,287,898 | $ | 3,039,399 | $ | 3,040,885 | |||||||||||||||||||

| Consolidated variable rate debt | 509,366 | 363,550 | 485,000 | 540,000 | 650,000 | ||||||||||||||||||||||||

| Consolidated ASP debt | — | — | 60,900 | 60,493 | 110,493 | ||||||||||||||||||||||||

| Total consolidated debt | $ | 3,876,727 | $ | 3,621,024 | $ | 3,833,798 | $ | 3,639,892 | $ | 3,801,378 | |||||||||||||||||||

| Deferred financing costs, net of amortization | (15,275) | (14,242) | (12,903) | (14,304) | (15,875) | ||||||||||||||||||||||||

| Total consolidated debt, net | $ | 3,861,452 | $ | 3,606,782 | $ | 3,820,895 | $ | 3,625,588 | $ | 3,785,503 | |||||||||||||||||||

| Total liabilities | $ | 6,972,478 | $ | 5,915,143 | $ | 6,135,743 | $ | 5,358,337 | $ | 5,521,908 | |||||||||||||||||||

| Fixed rate & hedged debt, including SLG share of unconsolidated JV debt | $ | 8,827,482 | $ | 8,711,539 | $ | 8,975,687 | $ | 8,720,916 | $ | 8,418,284 | |||||||||||||||||||

Variable rate debt, including SLG share of unconsolidated JV debt (1) |

509,366 | 363,550 | 732,761 | 785,013 | 1,429,640 | ||||||||||||||||||||||||

| ASP debt, including SLG share of unconsolidated ASP JV debt | 573,797 | 573,797 | 1,001,766 | 1,000,153 | 1,040,802 | ||||||||||||||||||||||||

| Total debt, including SLG share of unconsolidated JV debt | $ | 9,910,645 | $ | 9,648,886 | $ | 10,710,214 | $ | 10,506,082 | $ | 10,888,726 | |||||||||||||||||||

| Selected Operating Data | |||||||||||||||||||||||||||||

| Property operating revenues | $ | 163,019 | $ | 156,930 | $ | 156,933 | $ | 150,632 | $ | 141,504 | |||||||||||||||||||

| Property operating expenses | (99,385) | (89,129) | (86,701) | (84,759) | (81,619) | ||||||||||||||||||||||||

| Property NOI | $ | 63,634 | $ | 67,801 | $ | 70,232 | $ | 65,873 | $ | 59,885 | |||||||||||||||||||

| SLG share of unconsolidated JV Property NOI | 113,876 | 118,072 | 122,936 | 117,506 | 116,741 | ||||||||||||||||||||||||

| Property NOI, including SLG share of unconsolidated JV Property NOI | $ | 177,510 | $ | 185,873 | $ | 193,168 | $ | 183,379 | $ | 176,626 | |||||||||||||||||||

| SUMMIT Operator revenue | 22,534 | 38,571 | 36,437 | 32,602 | 25,604 | ||||||||||||||||||||||||

| Investment income, including SLG share of unconsolidated JV | 21,032 | 10,463 | 10,089 | 7,911 | 7,403 | ||||||||||||||||||||||||

| Interest income from real estate loans held by consolidated securitization vehicles, net | 2,009 | 2,905 | 1,441 | — | — | ||||||||||||||||||||||||

| Other income, including SLG share of unconsolidated JV | 23,518 | 31,805 | 26,894 | 35,077 | 17,162 | ||||||||||||||||||||||||

| Gain on early extinguishment of debt, including SLG share of unconsolidated JV | — | 25,985 | — | 48,482 | 141,664 | ||||||||||||||||||||||||

| SUMMIT Operator expenses | (21,764) | (28,792) | (37,901) | (23,188) | (21,858) | ||||||||||||||||||||||||

| Transaction costs, including SLG share of unconsolidated JVs | (295) | (138) | (171) | (76) | (16) | ||||||||||||||||||||||||

| Marketing general & administrative expenses | (21,724) | (22,827) | (21,015) | (20,032) | (21,313) | ||||||||||||||||||||||||

| Income taxes | 653 | 2,324 | 1,406 | 1,230 | 606 | ||||||||||||||||||||||||

| EBITDAre | $ | 228,512 | $ | 246,169 | $ | 210,348 | $ | 265,385 | $ | 325,878 | |||||||||||||||||||

| (1) Does not reflect floating rate debt and preferred equity investments that provide a hedge against floating rate debt. | |||||||||||||||||||||||||||||

| Supplemental Information | 10 |

First Quarter 2025 |

||||||

|

KEY FINANCIAL DATA

Manhattan Properties (1)

Unaudited

(Dollars in Thousands Except Per Share)

|

|

|||||||

| As of or for the three months ended | |||||||||||||||||||||||||||||

| 3/31/2025 | 12/31/2024 | 9/30/2024 | 6/30/2024 | 3/31/2024 | |||||||||||||||||||||||||

| Selected Operating Data | |||||||||||||||||||||||||||||

| Property operating revenues | $ | 158,037 | $ | 151,614 | $ | 151,886 | $ | 145,369 | $ | 136,869 | |||||||||||||||||||

| Property operating expenses | 87,410 | 77,371 | 73,841 | 73,436 | 70,223 | ||||||||||||||||||||||||

| Property NOI | $ | 70,627 | $ | 74,243 | $ | 78,045 | $ | 71,933 | $ | 66,646 | |||||||||||||||||||

| Other income - consolidated | $ | 5,551 | $ | 4,157 | $ | 2,967 | $ | 2,270 | $ | 2,136 | |||||||||||||||||||

| SLG share of property NOI from unconsolidated JVs | $ | 113,627 | $ | 117,958 | $ | 123,401 | $ | 117,384 | $ | 116,617 | |||||||||||||||||||

| Office Portfolio Statistics (Manhattan Operating Properties) | |||||||||||||||||||||||||||||

| Consolidated office buildings in service | 16 | 15 | 14 | 14 | 14 | ||||||||||||||||||||||||

| Unconsolidated office buildings in service | 9 | 9 | 10 | 10 | 10 | ||||||||||||||||||||||||

| 25 | 24 | 24 | 24 | 24 | |||||||||||||||||||||||||

| Consolidated office buildings in service - square footage | 9,788,852 | 9,587,441 | 8,753,441 | 8,753,441 | 8,753,441 | ||||||||||||||||||||||||

| Unconsolidated office buildings in service - square footage | 12,175,149 | 12,175,149 | 13,009,149 | 13,009,149 | 13,009,149 | ||||||||||||||||||||||||

| 21,964,001 | 21,762,590 | 21,762,590 | 21,762,590 | 21,762,590 | |||||||||||||||||||||||||

| Same-Store office occupancy inclusive of leases signed not yet commenced | 91.8% | 92.4% | 89.7% | 89.2% | 88.4% | ||||||||||||||||||||||||

| Office Leasing Statistics (Manhattan Operating Properties) | |||||||||||||||||||||||||||||

| New leases commenced | 27 | 24 | 29 | 30 | 31 | ||||||||||||||||||||||||

| Renewal leases commenced | 9 | 10 | 17 | 12 | 19 | ||||||||||||||||||||||||

| Total office leases commenced | 36 | 34 | 46 | 42 | 50 | ||||||||||||||||||||||||

| Commenced office square footage filling vacancy | 388,305 | 133,978 | 179,200 | 195,953 | 109,576 | ||||||||||||||||||||||||

Commenced office square footage on previously occupied space (M-T-M leasing) (2) |

283,236 | 1,015,833 | 540,288 | 211,251 | 280,879 | ||||||||||||||||||||||||

| Total office square footage commenced | 671,541 | 1,149,811 | 719,488 | 407,204 | 390,455 | ||||||||||||||||||||||||

| Average starting cash rent psf - office leases commenced | $ | 84.80 | $ | 80.72 | $ | 106.76 | $ | 96.79 | $ | 75.11 | |||||||||||||||||||

Previous escalated cash rent psf - office leases commenced (3) |

$ | 88.34 | $ | 71.18 | $ | 95.44 | $ | 100.86 | $ | 76.02 | |||||||||||||||||||

Increase (decrease) in new cash rent over previously escalated cash rent (2) (3) |

(4.0)% | 13.4% | 11.9% | (4.0)% | (1.2)% | ||||||||||||||||||||||||

| Average lease term | 9.1 | 10.5 | 10.5 | 11.9 | 7.0 | ||||||||||||||||||||||||

| Tenant concession packages psf | $ | 109.37 | $ | 102.30 | $ | 103.37 | $ | 105.17 | $ | 52.48 | |||||||||||||||||||

| Free rent months | 9.5 | 11.8 | 11.5 | 10.0 | 7.3 | ||||||||||||||||||||||||

| (1) Property data for operating buildings only. | |||||||||||||||||||||||||||||

| (2) Calculated on space that was occupied within the previous 12 months. | |||||||||||||||||||||||||||||

| (3) Previously escalated cash rent includes base rent plus all additional amounts paid by the previous tenant in the form of real estate taxes, operating expenses, porters wage or a consumer price index (CPI) adjustment. | |||||||||||||||||||||||||||||

| Supplemental Information | 11 |

First Quarter 2025 |

||||||

|

COMPARATIVE BALANCE SHEETS

Unaudited

(Dollars in Thousands)

|

|

|||||||

| As of | |||||||||||||||||||||||||||||

| 3/31/2025 | 12/31/2024 | 9/30/2024 | 6/30/2024 | 3/31/2024 | |||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||

| Commercial real estate properties, at cost: | |||||||||||||||||||||||||||||

| Land and land interests | $ | 1,450,892 | $ | 1,357,041 | $ | 1,134,432 | $ | 1,134,432 | $ | 1,150,681 | |||||||||||||||||||

| Building and improvements | 3,828,638 | 3,862,224 | 3,781,403 | 3,743,316 | 3,729,884 | ||||||||||||||||||||||||

| Building leasehold and improvements | 1,399,376 | 1,388,476 | 1,374,059 | 1,365,423 | 1,358,851 | ||||||||||||||||||||||||

| 6,678,906 | 6,607,741 | 6,289,894 | 6,243,171 | 6,239,416 | |||||||||||||||||||||||||

| Less: accumulated depreciation | (2,174,667) | (2,126,081) | (2,084,755) | (2,041,102) | (2,005,893) | ||||||||||||||||||||||||

| Net real estate | 4,504,239 | 4,481,660 | 4,205,139 | 4,202,069 | 4,233,523 | ||||||||||||||||||||||||

| Other real estate investments: | |||||||||||||||||||||||||||||

Debt and preferred equity investments, net (1) |

318,189 | 303,726 | 293,924 | 290,487 | 352,347 | ||||||||||||||||||||||||

| Investment in unconsolidated joint ventures | 2,712,582 | 2,690,138 | 2,871,683 | 2,895,399 | 2,984,786 | ||||||||||||||||||||||||

| Assets held for sale, net | — | — | — | 21,615 | 21,586 | ||||||||||||||||||||||||

| Cash and cash equivalents | 180,133 | 184,294 | 188,216 | 199,501 | 196,035 | ||||||||||||||||||||||||

| Restricted cash | 156,895 | 147,344 | 126,909 | 116,310 | 122,461 | ||||||||||||||||||||||||

| Investment in marketable securities | 12,295 | 22,812 | 16,522 | 16,593 | 10,673 | ||||||||||||||||||||||||

| Tenant and other receivables | 48,074 | 44,055 | 53,628 | 41,202 | 38,659 | ||||||||||||||||||||||||

| Related party receivables | 18,630 | 26,865 | 13,077 | 8,127 | 12,229 | ||||||||||||||||||||||||

| Deferred rents receivable | 264,982 | 266,428 | 266,606 | 266,596 | 267,969 | ||||||||||||||||||||||||

| Deferred costs, net | 114,317 | 117,132 | 105,646 | 107,163 | 109,296 | ||||||||||||||||||||||||

| Right-of-use assets - operating leases | 860,449 | 865,639 | 870,782 | 875,878 | 880,926 | ||||||||||||||||||||||||

| Real estate loans held by consolidated securitization vehicles | 1,599,291 | 709,095 | 713,218 | — | — | ||||||||||||||||||||||||

| Other assets | 620,547 | 610,911 | 490,722 | 507,712 | 533,802 | ||||||||||||||||||||||||

| Total Assets | $ | 11,410,623 | $ | 10,470,099 | $ | 10,216,072 | $ | 9,548,652 | $ | 9,764,292 | |||||||||||||||||||

| (1) This balance excludes a $219.4 million preferred equity investment included in the Investment in unconsolidated joint ventures line item. | |||||||||||||||||||||||||||||

| Supplemental Information | 12 |

First Quarter 2025 |

||||||

|

COMPARATIVE BALANCE SHEETS

Unaudited

(Dollars in Thousands)

|

|

|||||||

| As of | |||||||||||||||||||||||||||||

| 3/31/2025 | 12/31/2024 | 9/30/2024 | 6/30/2024 | 3/31/2024 | |||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||

| Mortgages and other loans payable | $ | 2,036,727 | $ | 1,951,024 | $ | 1,648,798 | $ | 1,649,892 | $ | 1,701,378 | |||||||||||||||||||

| Unsecured term loans | 1,150,000 | 1,150,000 | 1,250,000 | 1,250,000 | 1,250,000 | ||||||||||||||||||||||||

| Unsecured notes | 100,000 | 100,000 | 100,000 | 100,000 | 100,000 | ||||||||||||||||||||||||

| Revolving credit facility | 490,000 | 320,000 | 735,000 | 540,000 | 650,000 | ||||||||||||||||||||||||

| Deferred financing costs | (15,275) | (14,242) | (12,903) | (14,304) | (15,875) | ||||||||||||||||||||||||

| Total debt, net of deferred financing costs | 3,761,452 | 3,506,782 | 3,720,895 | 3,525,588 | 3,685,503 | ||||||||||||||||||||||||

| Accrued interest payable | 18,473 | 16,527 | 22,825 | 20,083 | 23,217 | ||||||||||||||||||||||||

| Accounts payable and accrued expenses | 123,256 | 122,674 | 125,377 | 121,050 | 101,495 | ||||||||||||||||||||||||

| Deferred revenue | 166,240 | 164,887 | 154,700 | 153,660 | 157,756 | ||||||||||||||||||||||||

| Lease liability - financing leases | 107,183 | 106,853 | 106,518 | 106,187 | 105,859 | ||||||||||||||||||||||||

| Lease liability - operating leases | 806,669 | 810,989 | 815,238 | 819,439 | 823,594 | ||||||||||||||||||||||||

| Dividends and distributions payable | 21,978 | 21,816 | 20,147 | 20,088 | 20,135 | ||||||||||||||||||||||||

| Security deposits | 62,210 | 60,331 | 56,297 | 58,002 | 56,398 | ||||||||||||||||||||||||

| Liabilities related to assets held for sale | — | — | — | 10,424 | 10,649 | ||||||||||||||||||||||||

| Junior subordinated deferrable interest debentures | 100,000 | 100,000 | 100,000 | 100,000 | 100,000 | ||||||||||||||||||||||||

| Senior obligations of consolidated securitization vehicles | 1,409,185 | 590,131 | 603,902 | — | — | ||||||||||||||||||||||||

| Other liabilities | 395,832 | 414,153 | 409,844 | 423,816 | 437,302 | ||||||||||||||||||||||||

| Total Liabilities | 6,972,478 | 5,915,143 | 6,135,743 | 5,358,337 | 5,521,908 | ||||||||||||||||||||||||

| Noncontrolling interests in Operating Partnership | |||||||||||||||||||||||||||||

(5,010 units outstanding at 3/31/2025) |

288,702 | 288,941 | 293,593 | 265,823 | 272,235 | ||||||||||||||||||||||||

| Preferred units and redeemable equity | 196,016 | 196,064 | 166,731 | 166,731 | 166,501 | ||||||||||||||||||||||||

| Equity | |||||||||||||||||||||||||||||

| SL Green stockholders' equity: | |||||||||||||||||||||||||||||

| Series I Preferred Stock | 221,932 | 221,932 | 221,932 | 221,932 | 221,932 | ||||||||||||||||||||||||

Common stock, $0.01 par value, 160,000 shares authorized, 71,016 |

|||||||||||||||||||||||||||||

issued and outstanding at 3/31/2025 |

710 | 711 | 663 | 660 | 660 | ||||||||||||||||||||||||

| Additional paid–in capital | 4,156,242 | 4,159,562 | 3,866,088 | 3,836,751 | 3,831,130 | ||||||||||||||||||||||||

| Treasury stock at cost | — | — | (128,655) | (128,655) | (128,655) | ||||||||||||||||||||||||

| Accumulated other comprehensive earnings (loss) | (4,842) | 18,196 | (27,308) | 40,371 | 40,151 | ||||||||||||||||||||||||

| Retained deficit | (537,585) | (449,101) | (376,435) | (279,763) | (229,607) | ||||||||||||||||||||||||

| Total SL Green Realty Corp. stockholders' equity | 3,836,457 | 3,951,300 | 3,556,285 | 3,691,296 | 3,735,611 | ||||||||||||||||||||||||

| Noncontrolling interests in other partnerships | 116,970 | 118,651 | 63,720 | 66,465 | 68,037 | ||||||||||||||||||||||||

| Total Equity | 3,953,427 | 4,069,951 | 3,620,005 | 3,757,761 | 3,803,648 | ||||||||||||||||||||||||

| Total Liabilities and Equity | $ | 11,410,623 | $ | 10,470,099 | $ | 10,216,072 | $ | 9,548,652 | $ | 9,764,292 | |||||||||||||||||||

| Supplemental Information | 13 |

First Quarter 2025 |

||||||

|

COMPARATIVE STATEMENT OF OPERATIONS

Unaudited

(Dollars in Thousands Except Per Share)

|

|

|||||||

| Three Months Ended | |||||||||||||||||||||||

| March 31, | March 31, | December 31, | September 30, | ||||||||||||||||||||

| 2025 | 2024 | 2024 | 2024 | ||||||||||||||||||||

| Revenues | |||||||||||||||||||||||

| Rental revenue, net | $ | 144,518 | $ | 128,203 | $ | 139,613 | $ | 139,616 | |||||||||||||||

| Escalation and reimbursement revenues | 18,501 | 13,301 | 17,317 | 17,317 | |||||||||||||||||||

| SUMMIT Operator revenue | 22,534 | 25,604 | 38,571 | 36,437 | |||||||||||||||||||

| Investment income | 16,114 | 7,403 | 5,415 | 5,344 | |||||||||||||||||||

| Interest income from real estate loans held by consolidated securitization vehicles | 15,981 | — | 14,209 | 4,771 | |||||||||||||||||||

| Other income | 22,198 | 13,371 | 30,754 | 26,206 | |||||||||||||||||||

| Total Revenues | 239,846 | 187,882 | 245,879 | 229,691 | |||||||||||||||||||

| Gain on early extinguishment of debt | — | — | 25,985 | — | |||||||||||||||||||

| Expenses | |||||||||||||||||||||||

| Operating expenses ⁽¹⁾ | 56,062 | 43,608 | 50,150 | 49,507 | |||||||||||||||||||

| Real estate taxes | 37,217 | 31,606 | 33,692 | 30,831 | |||||||||||||||||||

| Operating lease rent | 6,106 | 6,405 | 5,287 | 6,363 | |||||||||||||||||||

| SUMMIT Operator expenses | 21,764 | 21,858 | 28,792 | 37,901 | |||||||||||||||||||

| Loan loss and other investment reserves, net of recoveries | (25,039) | — | — | — | |||||||||||||||||||

| Transaction related costs | 295 | 16 | 138 | 171 | |||||||||||||||||||

| Marketing, general and administrative | 21,724 | 21,313 | 22,827 | 21,015 | |||||||||||||||||||

| Total Operating Expenses | 118,129 | 124,806 | 140,886 | 145,788 | |||||||||||||||||||

| Equity in net income (loss) from unconsolidated joint ventures ⁽²⁾ | 2,950 | 111,160 | (16,562) | (15,428) | |||||||||||||||||||

| Operating Income | 124,667 | 174,236 | 114,416 | 68,475 | |||||||||||||||||||

| Interest expense, net of interest income | 45,681 | 31,173 | 38,153 | 42,091 | |||||||||||||||||||

| Amortization of deferred financing costs | 1,687 | 1,539 | 1,734 | 1,669 | |||||||||||||||||||

| SUMMIT Operator tax expense | (45) | (1,295) | 1,949 | (1,779) | |||||||||||||||||||

| Interest expense on senior obligations of consolidated securitization vehicles | 13,972 | — | 11,304 | 3,330 | |||||||||||||||||||

| Depreciation and amortization | 64,498 | 48,584 | 53,436 | 53,176 | |||||||||||||||||||

| (Loss) Income from Continuing Operations ⁽³⁾ | (1,126) | 94,235 | 7,840 | (30,012) | |||||||||||||||||||

| Equity in net gain on sale of interest in unconsolidated joint venture/real estate | — | 26,764 | 189,138 | 371 | |||||||||||||||||||

| Purchase price and other fair value adjustments | (9,611) | (50,492) | 125,287 | 12,906 | |||||||||||||||||||

| (Loss) gain on sale of real estate, net | (482) | — | (1,705) | 7,471 | |||||||||||||||||||

| Depreciable real estate reserves | (8,546) | (52,118) | (38,232) | — | |||||||||||||||||||

| Depreciable real estate reserves in unconsolidated joint venture | (1,780) | — | (263,190) | — | |||||||||||||||||||

| Net (Loss) Income | (21,545) | 18,389 | 19,138 | (9,264) | |||||||||||||||||||

| Net loss (income) attributable to noncontrolling interests | 6,362 | 393 | (3,885) | 1,899 | |||||||||||||||||||

| Preferred units distributions | (2,154) | (1,903) | (2,158) | (2,176) | |||||||||||||||||||

| Net (Loss) Income attributable to SL Green | (17,337) | 16,879 | 13,095 | (9,541) | |||||||||||||||||||

| Perpetual preferred stock dividends | (3,738) | (3,738) | (3,737) | (3,738) | |||||||||||||||||||

| Net (Loss) Income attributable to SL Green common stockholders | $ | (21,075) | $ | 13,141 | $ | 9,358 | $ | (13,279) | |||||||||||||||

| Basic (loss) earnings per share | $ | (0.30) | $ | 0.20 | $ | 0.13 | $ | (0.21) | |||||||||||||||

| Diluted (loss) earnings per share | $ | (0.30) | $ | 0.20 | $ | 0.13 | $ | (0.21) | |||||||||||||||

(1) Includes property operating expenses and expenses of SL Green Management Corp., Emerge 212, Belmont Insurance Company and Ticonderoga Insurance Company. |

|||||||||||||||||||||||

| (2) Excludes Depreciable real estate reserves in unconsolidated joint venture. | |||||||||||||||||||||||

| (3) Before equity in net gain, purchase price and other fair value adjustments, (loss) gain on sale and depreciable real estate reserves shown below. | |||||||||||||||||||||||

| Supplemental Information | 14 |

First Quarter 2025 |

||||||

|

COMPARATIVE COMPUTATION OF FFO AND FAD

Unaudited

(Dollars in Thousands Except Per Share)

|

|

|||||||

| Three Months Ended | ||||||||||||||||||||||||||

| March 31, | March 31, | December 31, | September 30, | |||||||||||||||||||||||

| 2025 | 2024 | 2024 | 2024 | |||||||||||||||||||||||

| Funds from Operations | ||||||||||||||||||||||||||

| Net (Loss) Income attributable to SL Green common stockholders | $ | (21,075) | $ | 13,141 | $ | 9,358 | $ | (13,279) | ||||||||||||||||||

| Depreciation and amortization | 64,498 | 48,584 | 53,436 | 53,176 | ||||||||||||||||||||||

| Joint ventures depreciation and noncontrolling interests adjustments | 53,361 | 74,258 | 69,636 | 71,539 | ||||||||||||||||||||||

| Net (loss) income attributable to noncontrolling interests | (6,362) | (393) | 3,885 | (1,899) | ||||||||||||||||||||||

| Equity in net (gain) loss on sale of interest in unconsolidated joint venture/real estate | — | (26,764) | (189,138) | (371) | ||||||||||||||||||||||

| Purchase price and other fair value adjustments | 6,544 | 55,652 | (117,195) | (21,937) | ||||||||||||||||||||||

| Loss (gain) on sale of real estate, net | 482 | — | 1,705 | (7,471) | ||||||||||||||||||||||

| Depreciable real estate reserves | 8,546 | 52,118 | 38,232 | — | ||||||||||||||||||||||

| Depreciable real estate reserves in unconsolidated joint venture | 1,780 | — | 263,190 | |||||||||||||||||||||||

| Depreciation on non-rental real estate assets | (1,263) | (1,153) | (1,226) | (1,204) | ||||||||||||||||||||||

| Funds From Operations | $ | 106,511 | $ | 215,443 | $ | 131,883 | $ | 78,554 | ||||||||||||||||||

| Funds From Operations - Basic per Share | $ | 1.43 | $ | 3.11 | $ | 1.87 | $ | 1.16 | ||||||||||||||||||

| Funds From Operations - Diluted per Share | $ | 1.40 | $ | 3.07 | $ | 1.81 | $ | 1.13 | ||||||||||||||||||

| Funds Available for Distribution | ||||||||||||||||||||||||||

| FFO | $ | 106,511 | $ | 215,443 | $ | 131,883 | $ | 78,554 | ||||||||||||||||||

| Non real estate depreciation and amortization | 1,263 | 1,153 | 1,226 | 1,204 | ||||||||||||||||||||||

| Amortization of deferred financing costs | 1,687 | 1,539 | 1,734 | 1,669 | ||||||||||||||||||||||

| Non-cash deferred compensation | 10,537 | 10,780 | 15,936 | 9,392 | ||||||||||||||||||||||

| FAD adjustment for joint ventures | (25,873) | (11,381) | (60,733) | (13,960) | ||||||||||||||||||||||

| Straight-line rental income and other non-cash adjustments | 3,207 | (3,067) | 129 | 1,094 | ||||||||||||||||||||||

| Non-cash fair value adjustments on mark-to-market derivatives | 3,068 | (5,160) | (8,092) | 9,030 | ||||||||||||||||||||||

| Second cycle tenant improvements | (17,858) | (13,479) | (21,826) | (17,401) | ||||||||||||||||||||||

| Second cycle leasing commissions | (4,246) | (3,487) | (8,545) | (4,292) | ||||||||||||||||||||||

| Revenue enhancing recurring CAPEX | (309) | (19) | (204) | (19) | ||||||||||||||||||||||

| Non-revenue enhancing recurring CAPEX | (4,458) | (2,375) | (10,984) | (5,138) | ||||||||||||||||||||||

| Reported Funds Available for Distribution | $ | 73,529 | $ | 189,947 | $ | 40,524 | $ | 60,133 | ||||||||||||||||||

| First cycle tenant improvements | $ | 64 | $ | 461 | $ | 285 | $ | 439 | ||||||||||||||||||

| First cycle leasing commissions | $ | 128 | $ | — | $ | 2,686 | $ | 11 | ||||||||||||||||||

| Development costs | $ | 10,638 | $ | 15,697 | $ | 9,904 | $ | 10,742 | ||||||||||||||||||

| Redevelopment costs | $ | 2,710 | $ | 1,654 | $ | 2,800 | $ | 1,165 | ||||||||||||||||||

| Capitalized interest | $ | 6,470 | $ | 17,949 | $ | 8,922 | $ | 9,493 | ||||||||||||||||||

| Supplemental Information | 15 |

First Quarter 2025 |

||||||

|

CONSOLIDATED STATEMENT OF EQUITY

Unaudited

(Dollars in Thousands)

|

|

|||||||

| Accumulated | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Series I | Other | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred | Common | Additional | Treasury | Retained | Noncontrolling | Comprehensive | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock | Stock | Paid-In Capital | Stock | Deficit | Interests | Loss | Total | |||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2024 | $ | 221,932 | $ | 711 | $ | 4,159,562 | $ | — | $ | (449,101) | $ | 118,651 | $ | 18,196 | $ | 4,069,951 | ||||||||||||||||||||||||||||||||||||||||

| Net loss | (17,337) | (4,897) | (22,234) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss - net unrealized loss on derivative instruments | (16,835) | (16,835) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss - SLG share of unconsolidated joint venture net unrealized loss on derivative instruments | (6,852) | (6,852) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income - net unrealized gain on marketable securities | 649 | 649 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Perpetual preferred stock dividends | (3,738) | (3,738) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DRSPP proceeds | — | 75 | 75 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Measurement adjustment for redeemable noncontrolling interest | (12,940) | (12,940) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deferred compensation plan and stock awards, net of forfeitures and tax withholdings | (1) | (2,524) | (2,525) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Proceeds from issuance of common stock | — | (871) | (871) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Contributions to consolidated joint venture interests | 3,437 | 3,437 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash distributions to noncontrolling interests | (221) | (221) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Cash distributions declared ($0.77 per common share, none of which represented a return of capital for federal income tax purposes) |

(54,469) | (54,469) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at March 31, 2025 | $ | 221,932 | $ | 710 | $ | 4,156,242 | $ | — | $ | (537,585) | $ | 116,970 | $ | (4,842) | $ | 3,953,427 | ||||||||||||||||||||||||||||||||||||||||

| RECONCILIATION OF SHARES AND UNITS OUTSTANDING, AND DILUTION COMPUTATION | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Stock | OP Units | Stock-Based Compensation | Contingently Issuable Shares | Diluted Shares | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share Count at December 31, 2024 | 71,096,743 | 4,509,953 | — | — | 75,606,696 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| YTD share activity | (80,295) | 500,038 | — | — | 419,743 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Share Count at March 31, 2025 | 71,016,448 | 5,009,991 | — | — | 76,026,439 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Weighted Average Share Count at March 31, 2025 - Basic | 70,423,772 | 4,102,732 | — | — | 74,526,504 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Dilution | — | — | 1,263,563 | 543,215 | 1,806,778 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Weighted Average Share Count at March 31, 2025 - Diluted | 70,423,772 | 4,102,732 | 1,263,563 | 543,215 | 76,333,282 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Supplemental Information | 16 |

First Quarter 2025 |

||||||

|

JOINT VENTURE STATEMENTS

Balance Sheet for Unconsolidated Joint Ventures

Unaudited

(Dollars in Thousands)

|

|

|||||||

| As of | |||||||||||||||||||||||||||||||||||

| March 31, 2025 | December 31, 2024 | September 30, 2024 | |||||||||||||||||||||||||||||||||

| Total | SLG Share | Total | SLG Share | Total | SLG Share | ||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||

| Commercial real estate properties, at cost: | |||||||||||||||||||||||||||||||||||

| Land and land interests | $ | 4,146,384 | $ | 2,009,704 | $ | 4,146,384 | $ | 2,009,704 | $ | 4,222,970 | $ | 2,110,135 | |||||||||||||||||||||||

| Building and improvements | 13,399,570 | 6,495,268 | 13,341,755 | 6,474,343 | 14,209,648 | 7,119,004 | |||||||||||||||||||||||||||||

| Building leasehold and improvements | 276,725 | 183,339 | 274,456 | 181,184 | 1,023,401 | 415,555 | |||||||||||||||||||||||||||||

| 17,822,679 | 8,688,311 | 17,762,595 | 8,665,231 | 19,456,019 | 9,644,694 | ||||||||||||||||||||||||||||||

| Less: accumulated depreciation | (2,517,805) | (1,316,797) | (2,435,053) | (1,274,525) | (2,921,620) | (1,483,770) | |||||||||||||||||||||||||||||

| Net real estate | 15,304,874 | 7,371,514 | 15,327,542 | 7,390,706 | 16,534,399 | 8,160,924 | |||||||||||||||||||||||||||||

| Other real estate investments: | |||||||||||||||||||||||||||||||||||

| Debt and preferred equity investments, net | 241,921 | 219,979 | 236,512 | 215,061 | 231,080 | 210,121 | |||||||||||||||||||||||||||||

| Cash and cash equivalents | 290,158 | 129,516 | 330,348 | 131,568 | 312,785 | 156,150 | |||||||||||||||||||||||||||||

| Restricted cash | 343,567 | 180,467 | 319,078 | 164,682 | 383,225 | 208,895 | |||||||||||||||||||||||||||||

| Tenant and other receivables | 16,238 | 9,186 | 17,509 | 9,620 | 36,225 | 22,928 | |||||||||||||||||||||||||||||

| Deferred rents receivable | 636,171 | 338,392 | 604,239 | 325,897 | 607,085 | 349,136 | |||||||||||||||||||||||||||||

| Deferred costs, net | 390,069 | 196,208 | 390,646 | 196,818 | 367,001 | 196,994 | |||||||||||||||||||||||||||||

| Right-of-use assets - financing leases | 725,760 | 511,774 | 728,149 | 513,345 | 730,386 | 515,245 | |||||||||||||||||||||||||||||

| Right-of-use assets - operating leases | 187,879 | 96,626 | 191,509 | 92,920 | 195,075 | 94,555 | |||||||||||||||||||||||||||||

| Other assets | 1,293,982 | 601,318 | 1,348,903 | 625,717 | 2,085,063 | 875,529 | |||||||||||||||||||||||||||||

| Total Assets | $ | 19,430,619 | $ | 9,654,980 | $ | 19,494,435 | $ | 9,666,334 | $ | 21,482,324 | $ | 10,790,477 | |||||||||||||||||||||||

| Liabilities and Equity | |||||||||||||||||||||||||||||||||||

|

Mortgage and other loans payable, net of deferred financing costs of

$91,632 at 3/31/2025, of which $46,097 is SLG share

|

$ | 12,270,945 | $ | 5,987,821 | $ | 12,234,261 | $ | 5,978,804 | $ | 13,653,311 | $ | 6,829,019 | |||||||||||||||||||||||

| Accrued interest payable | 71,044 | 31,899 | 56,299 | 25,445 | 99,785 | 40,179 | |||||||||||||||||||||||||||||

| Accounts payable and accrued expenses | 238,923 | 127,943 | 346,726 | 162,633 | 223,087 | 114,935 | |||||||||||||||||||||||||||||

| Deferred revenue | 945,454 | 428,079 | 956,217 | 431,127 | 1,011,333 | 459,505 | |||||||||||||||||||||||||||||

| Lease liability - financing leases | 790,165 | 546,404 | 790,252 | 547,115 | 790,341 | 548,358 | |||||||||||||||||||||||||||||

| Lease liability - operating leases | 214,681 | 108,729 | 217,833 | 107,460 | 220,920 | 108,935 | |||||||||||||||||||||||||||||

| Security deposits | 43,134 | 19,681 | 43,544 | 19,690 | 46,854 | 21,672 | |||||||||||||||||||||||||||||

| Other liabilities | 80,937 | 43,762 | 73,013 | 40,197 | 129,683 | 76,074 | |||||||||||||||||||||||||||||

| Equity | 4,775,336 | 2,360,662 | 4,776,290 | 2,353,863 | 5,307,010 | 2,591,800 | |||||||||||||||||||||||||||||

| Total Liabilities and Equity | $ | 19,430,619 | $ | 9,654,980 | $ | 19,494,435 | $ | 9,666,334 | $ | 21,482,324 | $ | 10,790,477 | |||||||||||||||||||||||

| Supplemental Information | 17 |

First Quarter 2025 |

||||||

|

JOINT VENTURE STATEMENTS

Statement of Operations for Unconsolidated Joint Ventures

Unaudited

(Dollars in Thousands)

|

|

|||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||

| March 31, 2025 | March 31, 2024 | December 31, 2024 | |||||||||||||||||||||||||||||||||

| Total | SLG Share | Total | SLG Share | Total | SLG Share | ||||||||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||||||||

| Rental revenue, net | $ | 301,123 | $ | 153,205 | $ | 300,675 | $ | 159,279 | $ | 304,267 | $ | 157,190 | |||||||||||||||||||||||

| Escalation and reimbursement revenues | 62,938 | 33,859 | 58,872 | 33,076 | 64,234 | 35,069 | |||||||||||||||||||||||||||||

| Investment income | 5,409 | 4,918 | 20 | — | 5,865 | 5,048 | |||||||||||||||||||||||||||||

| Other income | 2,456 | 1,320 | 5,772 | 3,791 | 2,798 | 1,051 | |||||||||||||||||||||||||||||

| Total Revenues | 371,926 | 193,302 | 365,339 | 196,146 | 377,164 | 198,358 | |||||||||||||||||||||||||||||

| Gain on early extinguishment of debt | — | — | 172,519 | 141,664 | — | — | |||||||||||||||||||||||||||||

| Expenses | |||||||||||||||||||||||||||||||||||

| Operating expenses | 68,015 | 34,814 | 65,750 | 34,701 | 66,971 | 34,568 | |||||||||||||||||||||||||||||

| Real estate taxes | 71,504 | 36,718 | 75,632 | 38,785 | 74,723 | 37,826 | |||||||||||||||||||||||||||||

| Operating lease rent | 6,581 | 1,656 | 9,025 | 2,128 | 7,217 | 1,793 | |||||||||||||||||||||||||||||

| Total Operating Expenses | 146,100 | 73,188 | 150,407 | 75,614 | 148,911 | 74,187 | |||||||||||||||||||||||||||||

| Operating Income | 225,826 | 120,114 | 387,451 | 262,196 | 228,253 | 124,171 | |||||||||||||||||||||||||||||

| Interest expense, net of interest income | 128,896 | 62,965 | 149,854 | 72,803 | 140,031 | 67,099 | |||||||||||||||||||||||||||||

| Amortization of deferred financing costs | 6,019 | 3,191 | 6,072 | 3,095 | 6,571 | 3,459 | |||||||||||||||||||||||||||||

| Depreciation and amortization | 121,305 | 63,075 | 134,178 | 69,446 | 130,961 | 67,046 | |||||||||||||||||||||||||||||

| Net (Loss) Income | (30,394) | (9,117) | 97,347 | 116,852 | (49,310) | (13,433) | |||||||||||||||||||||||||||||

| Real estate depreciation | 121,304 | 63,074 | 134,172 | 69,442 | 130,959 | 67,046 | |||||||||||||||||||||||||||||

| FFO Contribution | $ | 90,910 | $ | 53,957 | $ | 231,519 | $ | 186,294 | $ | 81,649 | $ | 53,613 | |||||||||||||||||||||||

| FAD Adjustments: | |||||||||||||||||||||||||||||||||||

| Non real estate depreciation and amortization | $ | 1 | $ | 1 | $ | 6 | $ | 4 | $ | 2 | $ | — | |||||||||||||||||||||||

| Amortization of deferred financing costs | 6,019 | 3,191 | 6,072 | 3,095 | 6,571 | 3,459 | |||||||||||||||||||||||||||||

| Straight-line rental income and other non-cash adjustments | (45,752) | (22,926) | (9,519) | (10,841) | (41,700) | (21,369) | |||||||||||||||||||||||||||||

| Second cycle tenant improvements | (6,348) | (3,226) | (4,909) | (2,640) | (27,204) | (13,939) | |||||||||||||||||||||||||||||

| Second cycle leasing commissions | (5,066) | (2,606) | (1,411) | (830) | (46,837) | (23,832) | |||||||||||||||||||||||||||||

| Revenue enhancing recurring CAPEX | — | — | (41) | (22) | (72) | (36) | |||||||||||||||||||||||||||||

| Non-revenue enhancing recurring CAPEX | (409) | (307) | (357) | (147) | (10,087) | (5,016) | |||||||||||||||||||||||||||||

| Total FAD Adjustments | $ | (51,555) | $ | (25,873) | $ | (10,159) | $ | (11,381) | $ | (119,327) | $ | (60,733) | |||||||||||||||||||||||

| First cycle tenant improvements | $ | 3,698 | $ | 1,782 | $ | 3,081 | $ | 1,027 | $ | 2,215 | $ | 911 | |||||||||||||||||||||||

| First cycle leasing commissions | $ | 811 | $ | 219 | $ | 1,735 | $ | 489 | $ | 6,881 | $ | 3,446 | |||||||||||||||||||||||

| Development costs | $ | 11,005 | $ | 3,258 | $ | 51,737 | $ | 14,174 | $ | 112,422 | $ | 30,121 | |||||||||||||||||||||||

| Redevelopment costs | $ | 14,619 | $ | 7,102 | $ | 11,489 | $ | 3,848 | $ | 29,541 | $ | 14,151 | |||||||||||||||||||||||

| Capitalized interest | $ | 19,564 | $ | 9,430 | $ | 34,889 | $ | 13,256 | $ | 36,726 | $ | 15,407 | |||||||||||||||||||||||

| Supplemental Information | 18 |

First Quarter 2025 |

||||||

|

SELECTED FINANCIAL DATA

Net Operating Income(1)

Unaudited

(Dollars in Thousands)

|

|

|||||||

| Three Months Ended | |||||||||||||||||||||||

| March 31, | March 31, | December 31, | September 30, | ||||||||||||||||||||

| 2025 | 2024 | 2024 | 2024 | ||||||||||||||||||||

Net Operating Income (1) |

$ | 72,013 | $ | 68,338 | $ | 91,459 | $ | 88,718 | |||||||||||||||

| SLG share of NOI from unconsolidated JVs | 114,596 | 112,990 | 117,761 | 122,317 | |||||||||||||||||||

| NOI, including SLG share of unconsolidated JVs | 186,609 | 181,328 | 209,220 | 211,035 | |||||||||||||||||||

| Partners' share of NOI - consolidated JVs | (1,563) | 88 | (2,112) | (1,970) | |||||||||||||||||||

| NOI - SLG share | $ | 185,046 | $ | 181,416 | $ | 207,108 | $ | 209,065 | |||||||||||||||

| NOI, including SLG share of unconsolidated JVs | $ | 186,609 | $ | 181,328 | $ | 209,220 | $ | 211,035 | |||||||||||||||

| Free rent (net of amortization) | (5,629) | (4,554) | (4,687) | 932 | |||||||||||||||||||

| Straight-line revenue adjustment | (8,312) | (5,198) | (8,677) | (7,008) | |||||||||||||||||||

| Amortization of acquired above and below-market leases, net | (5,435) | (6,311) | (6,220) | (4,680) | |||||||||||||||||||

| Operating lease straight-line adjustment | 528 | 985 | (374) | 823 | |||||||||||||||||||

| Straight-line tenant credit loss | (437) | 5,841 | (1,004) | 157 | |||||||||||||||||||

| Cash NOI, including SLG share of unconsolidated JVs | 167,324 | 172,091 | 188,258 | 201,259 | |||||||||||||||||||

| Partners' share of cash NOI - consolidated JVs | (1,219) | 25 | (2,120) | (2,190) | |||||||||||||||||||

| Cash NOI - SLG share | $ | 166,105 | $ | 172,116 | $ | 186,138 | $ | 199,069 | |||||||||||||||

| (1) Includes SL Green Management Corp. and Emerge 212. Excludes lease termination income. | |||||||||||||||||||||||

NOI Summary by Portfolio (1) - SLG Share |

|||||||||||||||||

| Three Months Ended | |||||||||||||||||

| March 31, 2025 | |||||||||||||||||

| NOI | Cash NOI | ||||||||||||||||

| Manhattan Office | $ | 156,479 | $ | 147,976 | |||||||||||||

| Development / Redevelopment | 7,032 | (504) | |||||||||||||||

| High Street Retail | 5,697 | 4,634 | |||||||||||||||

| Suburban & Residential | 4,514 | 4,389 | |||||||||||||||

| Total Operating and Development | 173,722 | 156,495 | |||||||||||||||

| Alternative Strategy Portfolio | 11,615 | 9,674 | |||||||||||||||

Property Dispositions (2) |

(17) | (17) | |||||||||||||||

Other (3) |

(274) | (47) | |||||||||||||||

| Total | $ | 185,046 | $ | 166,105 | |||||||||||||

(1) Portfolio composition consistent with the Selected Property Data tables. |

|||||||||||||||||

(2) Includes properties sold or otherwise disposed of during the respective period. |

|||||||||||||||||

(3) Includes SL Green Management Corp., Emerge 212, Belmont Insurance Company and Ticonderoga Insurance Company. |

|||||||||||||||||

| Supplemental Information | 19 |

First Quarter 2025 |

||||||

|

SELECTED FINANCIAL DATA

Same Store Net Operating Income - Wholly Owned and Consolidated JVs

Unaudited

(Dollars in Thousands)

|

|

|||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||||||||

| March 31, | March 31, | December 31, | September 30, | ||||||||||||||||||||||||||||||||||||||

| 2025 | 2024 | % | 2024 | 2024 | % | ||||||||||||||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||||||||||||||

| Rental revenue, net | $ | 132,251 | $ | 131,075 | $ | 135,432 | $ | 135,075 | |||||||||||||||||||||||||||||||||

| Escalation & reimbursement revenues | 16,918 | 14,016 | 16,839 | 17,642 | |||||||||||||||||||||||||||||||||||||

| Other income | 4,482 | 1,362 | 3,126 | 1,940 | |||||||||||||||||||||||||||||||||||||

| Total Revenues | $ | 153,651 | $ | 146,453 | $ | 155,397 | $ | 154,657 | |||||||||||||||||||||||||||||||||

| Expenses | |||||||||||||||||||||||||||||||||||||||||

| Operating expenses | $ | 43,150 | $ | 38,356 | $ | 41,461 | $ | 41,244 | |||||||||||||||||||||||||||||||||

| Real estate taxes | 34,437 | 33,787 | 34,882 | 32,184 | |||||||||||||||||||||||||||||||||||||

| Operating lease rent | 6,106 | 6,106 | 6,106 | 6,106 | |||||||||||||||||||||||||||||||||||||

| Total Operating Expenses | $ | 83,693 | $ | 78,249 | $ | 82,449 | $ | 79,534 | |||||||||||||||||||||||||||||||||

| Operating Income | $ | 69,958 | $ | 68,204 | $ | 72,948 | $ | 75,123 | |||||||||||||||||||||||||||||||||

| Interest expense & amortization of financing costs | $ | 25,667 | $ | 24,615 | $ | 28,234 | $ | 24,986 | |||||||||||||||||||||||||||||||||

| Depreciation & amortization | 52,191 | 47,048 | 48,506 | 48,197 | |||||||||||||||||||||||||||||||||||||

| (Loss) income before noncontrolling interest | $ | (7,900) | $ | (3,459) | $ | (3,792) | $ | 1,940 | |||||||||||||||||||||||||||||||||

| Real estate depreciation & amortization | 52,191 | 47,048 | 48,506 | 48,197 | |||||||||||||||||||||||||||||||||||||

| FFO Contribution | $ | 44,291 | $ | 43,589 | $ | 44,714 | $ | 50,137 | |||||||||||||||||||||||||||||||||

| Non–building revenue | (99) | (66) | (345) | (525) | |||||||||||||||||||||||||||||||||||||

| Interest expense & amortization of financing costs | 25,667 | 24,615 | 28,234 | 24,986 | |||||||||||||||||||||||||||||||||||||

| Non-real estate depreciation | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| NOI | $ | 69,859 | $ | 68,138 | 2.5 | % | $ | 72,603 | $ | 74,598 | (8.2) | % | |||||||||||||||||||||||||||||

| Cash Adjustments | |||||||||||||||||||||||||||||||||||||||||

| Free rent (net of amortization) | $ | (1,602) | $ | (5,079) | $ | (1,503) | $ | (1,090) | |||||||||||||||||||||||||||||||||

| Straight-line revenue adjustment | 4,193 | 1,228 | 1,981 | 1,554 | |||||||||||||||||||||||||||||||||||||

| Amortization of acquired above and below-market leases, net | 728 | 49 | 25 | 31 | |||||||||||||||||||||||||||||||||||||

| Operating lease straight-line adjustment | 204 | 204 | 204 | 204 | |||||||||||||||||||||||||||||||||||||

| Straight-line tenant credit loss | (1,950) | 670 | (428) | 122 | |||||||||||||||||||||||||||||||||||||

| Cash NOI | $ | 71,432 | $ | 65,210 | 9.5 | % | $ | 72,882 | $ | 75,419 | (3.5) | % | |||||||||||||||||||||||||||||

| Lease termination income | (4,355) | (1,278) | (2,743) | (1,369) | |||||||||||||||||||||||||||||||||||||

| Cash NOI excluding lease termination income | $ | 67,077 | $ | 63,932 | 4.9 | % | $ | 70,139 | $ | 74,050 | (4.3) | % | |||||||||||||||||||||||||||||

| Operating Margins | |||||||||||||||||||||||||||||||||||||||||

| NOI to real estate revenue, net | 45.5 | % | 46.5 | % | 46.8 | % | 48.4 | % | |||||||||||||||||||||||||||||||||

| Cash NOI to real estate revenue, net | 46.5 | % | 44.5 | % | 47.0 | % | 48.9 | % | |||||||||||||||||||||||||||||||||

| NOI before operating lease rent/real estate revenue, net | 49.5 | % | 50.7 | % | 50.8 | % | 52.4 | % | |||||||||||||||||||||||||||||||||

| Cash NOI before operating lease rent/real estate revenue, net | 50.4 | % | 48.6 | % | 50.8 | % | 52.8 | % | |||||||||||||||||||||||||||||||||

| Supplemental Information | 20 |

First Quarter 2025 |

||||||

|

SELECTED FINANCIAL DATA

Same Store Net Operating Income - Unconsolidated JVs

Unaudited

(Dollars in Thousands, SLG Share)

|

|

|||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||||||||

| March 31, | March 31, | December 31, | September 30, | |||||||||||||||||||||||||||||||||||

| 2025 | 2024 | % | 2024 | 2024 | % | |||||||||||||||||||||||||||||||||

| Revenues | ||||||||||||||||||||||||||||||||||||||

| Rental revenue, net | $ | 127,455 | $ | 123,663 | $ | 129,969 | $ | 132,834 | ||||||||||||||||||||||||||||||

| Escalation & reimbursement revenues | 31,333 | 28,213 | 32,695 | 31,486 | ||||||||||||||||||||||||||||||||||

| Other income | 263 | 2,928 | 290 | 455 | ||||||||||||||||||||||||||||||||||

| Total Revenues | $ | 159,051 | $ | 154,804 | $ | 162,954 | $ | 164,775 | ||||||||||||||||||||||||||||||

| Expenses | ||||||||||||||||||||||||||||||||||||||

| Operating expenses | $ | 31,503 | $ | 28,170 | $ | 30,585 | $ | 30,590 | ||||||||||||||||||||||||||||||

| Real estate taxes | 33,561 | 32,757 | 33,924 | 33,024 | ||||||||||||||||||||||||||||||||||

| Operating lease rent | 108 | 108 | 108 | 108 | ||||||||||||||||||||||||||||||||||

| Total Operating Expenses | $ | 65,172 | $ | 61,035 | $ | 64,617 | $ | 63,722 | ||||||||||||||||||||||||||||||

| Operating Income | $ | 93,879 | $ | 93,769 | $ | 98,337 | $ | 101,053 | ||||||||||||||||||||||||||||||

| Interest expense & amortization of financing costs | $ | 55,846 | $ | 59,510 | $ | 56,293 | $ | 56,121 | ||||||||||||||||||||||||||||||

| Depreciation & amortization | 54,717 | 55,160 | 55,980 | 56,192 | ||||||||||||||||||||||||||||||||||

| Loss before noncontrolling interest | $ | (16,684) | $ | (20,901) | $ | (13,936) | $ | (11,260) | ||||||||||||||||||||||||||||||

| Real estate depreciation & amortization | 54,717 | 55,160 | 55,980 | 56,192 | ||||||||||||||||||||||||||||||||||

| FFO Contribution | $ | 38,033 | $ | 34,259 | $ | 42,044 | $ | 44,932 | ||||||||||||||||||||||||||||||

| Non–building revenue | (237) | (206) | (287) | (231) | ||||||||||||||||||||||||||||||||||

| Interest expense & amortization of financing costs | 55,846 | 59,510 | 56,293 | 56,121 | ||||||||||||||||||||||||||||||||||

| Non-real estate depreciation | ||||||||||||||||||||||||||||||||||||||

| NOI | $ | 93,642 | $ | 93,563 | 0.1 | % | $ | 98,050 | $ | 100,822 | (0.5) | % | ||||||||||||||||||||||||||

| Cash Adjustments | ||||||||||||||||||||||||||||||||||||||

| Free rent (net of amortization) | $ | 4,296 | $ | (94) | $ | 1,517 | $ | 1,946 | ||||||||||||||||||||||||||||||

| Straight-line revenue adjustment | (9,032) | (2,993) | (7,003) | (5,075) | ||||||||||||||||||||||||||||||||||

| Amortization of acquired above and below-market leases, net | (6,394) | (6,285) | (6,393) | (5,440) | ||||||||||||||||||||||||||||||||||

| Operating lease straight-line adjustment | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Straight-line tenant credit loss | (395) | 255 | (591) | 10 | ||||||||||||||||||||||||||||||||||

| Cash NOI | $ | 82,117 | $ | 84,446 | (2.8) | % | $ | 85,580 | $ | 92,263 | 1.8 | % | ||||||||||||||||||||||||||

| Lease termination income | (23) | (2,717) | — | (223) | ||||||||||||||||||||||||||||||||||

| Cash NOI excluding lease termination income | $ | 82,094 | $ | 81,729 | 0.4 | % | $ | 85,580 | $ | 92,040 | 1.5 | % | ||||||||||||||||||||||||||

| Operating Margins | ||||||||||||||||||||||||||||||||||||||

| NOI to real estate revenue, net | 59.0 | % | 60.5 | % | 60.3 | % | 61.3 | % | ||||||||||||||||||||||||||||||

| Cash NOI to real estate revenue, net | 51.7 | % | 54.6 | % | 52.6 | % | 56.1 | % | ||||||||||||||||||||||||||||||

| NOI before operating lease rent/real estate revenue, net | 59.0 | % | 60.6 | % | 60.3 | % | 61.3 | % | ||||||||||||||||||||||||||||||

| Cash NOI before operating lease rent/real estate revenue, net | 51.8 | % | 54.7 | % | 52.7 | % | 56.1 | % | ||||||||||||||||||||||||||||||

| Supplemental Information | 21 |

First Quarter 2025 |

||||||

|

SELECTED FINANCIAL DATA

Same Store Net Operating Income

Unaudited

(Dollars in Thousands)

|

|

|||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||||||||

| March 31, | March 31, | December 31, | September 30, | |||||||||||||||||||||||||||||||||||

| 2025 | 2024 | % | 2024 | 2024 | % | |||||||||||||||||||||||||||||||||

| Revenues | ||||||||||||||||||||||||||||||||||||||

| Rental revenue, net | $ | 132,251 | $ | 131,075 | $ | 135,432 | $ | 135,075 | ||||||||||||||||||||||||||||||

| Escalation & reimbursement revenues | 16,918 | 14,016 | 16,839 | 17,642 | ||||||||||||||||||||||||||||||||||

| Other income | 4,482 | 1,362 | 3,126 | 1,940 | ||||||||||||||||||||||||||||||||||

| Total Revenues | $ | 153,651 | $ | 146,453 | $ | 155,397 | $ | 154,657 | ||||||||||||||||||||||||||||||

Equity in net income (loss) from unconsolidated joint ventures (1) |

$ | (16,684) | $ | (20,901) | $ | (13,936) | $ | (11,260) | ||||||||||||||||||||||||||||||

| Expenses | ||||||||||||||||||||||||||||||||||||||

| Operating expenses | $ | 43,150 | $ | 38,356 | $ | 41,461 | $ | 41,244 | ||||||||||||||||||||||||||||||

| Real estate taxes | 34,437 | 33,787 | 34,882 | 32,184 | ||||||||||||||||||||||||||||||||||

| Operating lease rent | 6,106 | 6,106 | 6,106 | 6,106 | ||||||||||||||||||||||||||||||||||

| Total Operating Expenses | $ | 83,693 | $ | 78,249 | $ | 82,449 | $ | 79,534 | ||||||||||||||||||||||||||||||

| Operating Income | $ | 53,274 | $ | 47,303 | $ | 59,012 | $ | 63,863 | ||||||||||||||||||||||||||||||

| Interest expense & amortization of financing costs | $ | 25,667 | $ | 24,615 | $ | 28,234 | $ | 24,986 | ||||||||||||||||||||||||||||||

| Depreciation & amortization | 52,191 | 47,048 | 48,506 | 48,197 | ||||||||||||||||||||||||||||||||||

| Loss before noncontrolling interest | $ | (24,584) | $ | (24,360) | $ | (17,728) | $ | (9,320) | ||||||||||||||||||||||||||||||

| Real estate depreciation & amortization | 52,191 | 47,048 | 48,506 | 48,197 | ||||||||||||||||||||||||||||||||||

Joint Ventures Real estate depreciation & amortization (1) |

54,717 | 55,160 | 55,980 | 56,192 | ||||||||||||||||||||||||||||||||||

| FFO Contribution | $ | 82,324 | $ | 77,848 | $ | 86,758 | $ | 95,069 | ||||||||||||||||||||||||||||||

| Non–building revenue | (99) | (66) | (345) | (525) | ||||||||||||||||||||||||||||||||||

Joint Ventures Non–building revenue (1) |

(237) | (206) | (287) | (231) | ||||||||||||||||||||||||||||||||||

| Interest expense & amortization of financing costs | 25,667 | 24,615 | 28,234 | 24,986 | ||||||||||||||||||||||||||||||||||

Joint Ventures Interest expense & amortization of financing costs (1) |

55,846 | 59,510 | 56,293 | 56,121 | ||||||||||||||||||||||||||||||||||

| Non-real estate depreciation | — | — | — | — | ||||||||||||||||||||||||||||||||||

Joint Ventures Non-real estate depreciation (1) |

||||||||||||||||||||||||||||||||||||||

| NOI | $ | 163,501 | $ | 161,701 | 1.1 | % | $ | 170,653 | $ | 175,420 | (4.0) | % | ||||||||||||||||||||||||||

| Cash Adjustments | ||||||||||||||||||||||||||||||||||||||

| Non-cash adjustments | $ | 1,573 | $ | (2,928) | $ | 279 | $ | 821 | ||||||||||||||||||||||||||||||

Joint Ventures non-cash adjustments (1) |

(11,525) | (9,117) | (12,470) | (8,559) | ||||||||||||||||||||||||||||||||||

| Cash NOI | $ | 153,549 | $ | 149,656 | 2.6 | % | $ | 158,462 | $ | 167,682 | (0.7) | % | ||||||||||||||||||||||||||

| Lease termination income | $ | (4,355) | $ | (1,278) | $ | (2,743) | $ | (1,369) | ||||||||||||||||||||||||||||||

Joint Ventures lease termination income (1) |

(23) | (2,717) | — | (223) | ||||||||||||||||||||||||||||||||||

| Cash NOI excluding lease termination income | $ | 149,171 | $ | 145,661 | 2.4 | % | $ | 155,719 | $ | 166,090 | (1.2) | % | ||||||||||||||||||||||||||

| Operating Margins | ||||||||||||||||||||||||||||||||||||||

| NOI to real estate revenue, net | 52.3 | % | 53.7 | % | 53.7 | % | 55.0 | % | ||||||||||||||||||||||||||||||

| Cash NOI to real estate revenue, net | 49.2 | % | 49.7 | % | 49.9 | % | 52.6 | % | ||||||||||||||||||||||||||||||

| NOI before operating lease rent/real estate revenue, net | 54.3 | % | 55.8 | % | 55.7 | % | 57.0 | % | ||||||||||||||||||||||||||||||

| Cash NOI before operating lease rent/real estate revenue, net | 51.1 | % | 51.7 | % | 51.8 | % | 54.5 | % | ||||||||||||||||||||||||||||||

(1) The amount represents the Company's share of same-store unconsolidated joint venture activity. The Company does not control investments in unconsolidated joint ventures. |

||||||||||||||||||||||||||||||||||||||

| Supplemental Information | 22 |

First Quarter 2025 |

||||||

|

DEBT SUMMARY SCHEDULE

Consolidated

Unaudited

(Dollars in Thousands)

|

|

|||||||

| Principal | 2025 | Current | Final | Principal | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ownership | Outstanding | Principal | Maturity | Maturity | Due at | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Fixed rate debt | Interest (%) | 3/31/2025 | Coupon (1) | Amortization | Date | Date (2) | Final Maturity | |||||||||||||||||||||||||||||||||||||||||||||||||

| Secured fixed rate debt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10 East 53rd Street (swapped) | 100.0 | $ | 204,888 | 5.37% | $ | — | May-25 | May-28 | (3) | $ | 204,888 | |||||||||||||||||||||||||||||||||||||||||||||

| 100 Church Street (swapped) | 100.0 | 370,000 | 5.89% | — | Jun-25 | Jun-27 | 370,000 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 185 Broadway / 7 Dey Street | 100.0 | 190,148 | 6.65% | — | Nov-25 | Nov-26 | (3) | 190,148 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Landmark Square | 100.0 | 100,000 | 4.90% | — | Jan-27 | Jan-27 | 100,000 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 485 Lexington Avenue | 100.0 | 450,000 | 4.25% | — | Feb-27 | Feb-27 | 450,000 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 500 Park Avenue (swapped) | 100.0 | 80,000 | 6.57% | — | Jan-28 | Jan-30 | 80,000 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 420 Lexington Avenue | 100.0 | 272,325 | 8.24% | — | Oct-40 | Oct-40 | 272,325 | |||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 1,667,361 | 5.83% | $ | — | $ | 1,667,361 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Unsecured fixed rate debt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Term Loan B (swapped) | $ | 100,000 | 4.56% | $ | — | Nov-25 | Nov-26 | (3) | $ | 100,000 | ||||||||||||||||||||||||||||||||||||||||||||||

| Unsecured notes | 100,000 | 4.27% | — | Dec-25 | Dec-25 | 100,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Revolving credit facility (swapped) | 350,000 | 4.86% | (4) | — | May-26 | May-27 | (3) | 350,000 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Term Loan A (swapped) | 1,050,000 | 4.54% | — | May-27 | May-27 | 1,050,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Junior subordinated deferrable interest debentures (swapped) | 100,000 | 5.27% | — | Jul-35 | Jul-35 | 100,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 1,700,000 | 4.64% | $ | — | $ | 1,700,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Fixed Rate Debt | $ | 3,367,361 | 5.23% | $ | — | $ | 3,367,361 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Floating rate debt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Secured floating rate debt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 100 Park Avenue (SOFR + 232 bps) | 49.9 | $ | 369,366 | 6.64% | $ | — | Jun-25 | Dec-27 | (3) | $ | 369,366 | |||||||||||||||||||||||||||||||||||||||||||||

| $ | 369,366 | 6.64% | $ | — | $ | 369,366 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Unsecured floating rate debt | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revolving credit facility (SOFR + 148 bps) | 100.0 | $ | 140,000 | 5.80% | May-26 | May-27 | (3) | $ | 140,000 | |||||||||||||||||||||||||||||||||||||||||||||||

| $ | 140,000 | 5.80% | $ | — | $ | 140,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Floating Rate Debt | $ | 509,366 | 6.41% | $ | — | $ | 509,366 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated Debt | $ | 3,876,727 | 5.38% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alternative Strategy Portfolio Debt | $ | — | —% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Debt - Consolidated | $ | 3,876,727 | 5.38% | $ | — | $ | 3,876,727 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Deferred financing costs | (15,275) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Debt - Consolidated, net | $ | 3,861,452 | 5.38% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Debt - Unconsolidated JV, net | $ | 5,987,821 | 4.36% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Debt including SLG share of JV Debt | $ | 9,336,848 | 4.73% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alternative Strategy Portfolio Debt including SLG share of JV Debt | $ | 573,797 | 5.18% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Debt including SLG share of JV Debt | $ | 9,910,645 | 4.76% | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Weighted Average Balance & Interest Rate for the quarter, including SLG share of JV Debt | $ | 9,863,250 | 4.73% | |||||||||||||||||||||||||||||||||||||||||||||||||||||