| Maryland | 001-13779 | 45-4549771 | |||||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | |||||||||

| One Manhattan West, 395 9th Avenue, 58th Floor | |||||||||||

| New York, | New York | 10001 | |||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Stock, $0.001 Par Value | WPC | New York Stock Exchange | ||||||||||||

| Exhibit No. | Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 99.3 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |||||||

| W. P. Carey Inc. | |||||||||||

| Date: | July 29, 2025 | By: | /s/ ToniAnn Sanzone | ||||||||

| ToniAnn Sanzone | |||||||||||

| Chief Financial Officer | |||||||||||

2025 Second Quarter |

|||||

| Net income attributable to W. P. Carey (millions) | $51.2 | ||||

| Diluted earnings per share | $0.23 | ||||

| AFFO (millions) | $282.7 | ||||

| AFFO per diluted share | $1.28 | ||||

| June 30, 2025 | December 31, 2024 | ||||||||||

| Assets | |||||||||||

| Investments in real estate: | |||||||||||

| Land, buildings and improvements — net lease and other | $ | 13,627,841 | $ | 12,842,869 | |||||||

| Land, buildings and improvements — operating properties | 1,005,605 | 1,198,676 | |||||||||

| Net investments in finance leases and loans receivable | 1,063,719 | 798,259 | |||||||||

In-place lease intangible assets and other |

2,407,752 | 2,297,572 | |||||||||

Above-market rent intangible assets |

679,068 | 665,495 | |||||||||

| Investments in real estate | 18,783,985 | 17,802,871 | |||||||||

Accumulated depreciation and amortization (a) |

(3,503,850) | (3,222,396) | |||||||||

| Assets held for sale, net | 60,011 | — | |||||||||

| Net investments in real estate | 15,340,146 | 14,580,475 | |||||||||

| Equity method investments | 311,411 | 301,115 | |||||||||

| Cash and cash equivalents | 244,831 | 640,373 | |||||||||

| Other assets, net | 1,115,337 | 1,045,218 | |||||||||

| Goodwill | 986,472 | 967,843 | |||||||||

| Total assets | $ | 17,998,197 | $ | 17,535,024 | |||||||

| Liabilities and Equity | |||||||||||

| Debt: | |||||||||||

| Senior unsecured notes, net | $ | 6,540,432 | $ | 6,505,907 | |||||||

| Unsecured term loans, net | 1,199,256 | 1,075,826 | |||||||||

| Unsecured revolving credit facility | 660,872 | 55,448 | |||||||||

| Non-recourse mortgages, net | 235,425 | 401,821 | |||||||||

| Debt, net | 8,635,985 | 8,039,002 | |||||||||

| Accounts payable, accrued expenses and other liabilities | 654,958 | 596,994 | |||||||||

Below-market rent and other intangible liabilities, net |

111,829 | 119,831 | |||||||||

| Deferred income taxes | 168,184 | 147,461 | |||||||||

| Dividends payable | 201,909 | 197,612 | |||||||||

| Total liabilities | 9,772,865 | 9,100,900 | |||||||||

Preferred stock, $0.001 par value, 50,000,000 shares authorized; none issued |

— | — | |||||||||

Common stock, $0.001 par value, 450,000,000 shares authorized; 218,978,908 and 218,848,844 shares, respectively, issued and outstanding |

219 | 219 | |||||||||

| Additional paid-in capital | 11,803,487 | 11,805,179 | |||||||||

| Distributions in excess of accumulated earnings | (3,424,094) | (3,203,974) | |||||||||

| Deferred compensation obligation | 97,002 | 78,503 | |||||||||

| Accumulated other comprehensive loss | (264,750) | (250,232) | |||||||||

| Total stockholders’ equity | 8,211,864 | 8,429,695 | |||||||||

| Noncontrolling interests | 13,468 | 4,429 | |||||||||

| Total equity | 8,225,332 | 8,434,124 | |||||||||

| Total liabilities and equity | $ | 17,998,197 | $ | 17,535,024 | |||||||

| Three Months Ended | |||||||||||||||||

| June 30, 2025 | March 31, 2025 | June 30, 2024 | |||||||||||||||

| Revenues | |||||||||||||||||

| Real Estate: | |||||||||||||||||

| Lease revenues | $ | 364,195 | $ | 353,768 | $ | 324,104 | |||||||||||

| Income from finance leases and loans receivable | 20,276 | 17,458 | 14,961 | ||||||||||||||

| Operating property revenues | 34,287 | 33,094 | 38,715 | ||||||||||||||

| Other lease-related income | 9,643 | 3,121 | 9,149 | ||||||||||||||

| 428,401 | 407,441 | 386,929 | |||||||||||||||

| Investment Management: | |||||||||||||||||

| Asset management revenue | 1,304 | 1,350 | 1,686 | ||||||||||||||

| Other advisory income and reimbursements | 1,072 | 1,067 | 1,057 | ||||||||||||||

| 2,376 | 2,417 | 2,743 | |||||||||||||||

| 430,777 | 409,858 | 389,672 | |||||||||||||||

| Operating Expenses | |||||||||||||||||

| Depreciation and amortization | 120,595 | 129,607 | 137,481 | ||||||||||||||

| General and administrative | 24,150 | 26,967 | 24,168 | ||||||||||||||

| Reimbursable tenant costs | 17,718 | 17,092 | 14,004 | ||||||||||||||

| Operating property expenses | 16,721 | 16,544 | 18,565 | ||||||||||||||

| Property expenses, excluding reimbursable tenant costs | 13,623 | 11,706 | 13,931 | ||||||||||||||

| Stock-based compensation expense | 10,943 | 9,148 | 8,903 | ||||||||||||||

| Impairment charges — real estate | 4,349 | 6,854 | 15,752 | ||||||||||||||

| Merger and other expenses | 192 | 556 | 206 | ||||||||||||||

| 208,291 | 218,474 | 233,010 | |||||||||||||||

| Other Income and Expenses | |||||||||||||||||

Other gains and (losses) (a) |

(148,768) | (42,197) | 2,504 | ||||||||||||||

| Interest expense | (71,795) | (68,804) | (65,307) | ||||||||||||||

| Gain on sale of real estate, net | 52,824 | 43,777 | 39,363 | ||||||||||||||

| Earnings from equity method investments | 6,161 | 5,378 | 6,636 | ||||||||||||||

Non-operating income (b) |

3,495 | 7,910 | 9,215 | ||||||||||||||

| (158,083) | (53,936) | (7,589) | |||||||||||||||

| Income before income taxes | 64,403 | 137,448 | 149,073 | ||||||||||||||

| Provision for income taxes | (13,091) | (11,632) | (6,219) | ||||||||||||||

| Net Income | 51,312 | 125,816 | 142,854 | ||||||||||||||

| Net (income) loss attributable to noncontrolling interests | (92) | 8 | 41 | ||||||||||||||

| Net Income Attributable to W. P. Carey | $ | 51,220 | $ | 125,824 | $ | 142,895 | |||||||||||

| Basic Earnings Per Share | $ | 0.23 | $ | 0.57 | $ | 0.65 | |||||||||||

| Diluted Earnings Per Share | $ | 0.23 | $ | 0.57 | $ | 0.65 | |||||||||||

| Weighted-Average Shares Outstanding | |||||||||||||||||

| Basic | 220,569,259 | 220,401,156 | 220,195,910 | ||||||||||||||

| Diluted | 220,874,935 | 220,720,310 | 220,214,118 | ||||||||||||||

| Dividends Declared Per Share | $ | 0.900 | $ | 0.890 | $ | 0.870 | |||||||||||

| Six Months Ended June 30, | |||||||||||

| 2025 | 2024 | ||||||||||

| Revenues | |||||||||||

| Real Estate: | |||||||||||

| Lease revenues | $ | 717,963 | $ | 646,355 | |||||||

| Income from finance leases and loans receivable | 37,734 | 40,754 | |||||||||

| Operating property revenues | 67,381 | 75,358 | |||||||||

| Other lease-related income | 12,764 | 11,304 | |||||||||

| 835,842 | 773,771 | ||||||||||

| Investment Management: | |||||||||||

| Asset management and other revenue | 2,654 | 3,579 | |||||||||

| Other advisory income and reimbursements | 2,139 | 2,120 | |||||||||

| 4,793 | 5,699 | ||||||||||

| 840,635 | 779,470 | ||||||||||

| Operating Expenses | |||||||||||

| Depreciation and amortization | 250,202 | 256,249 | |||||||||

| General and administrative | 51,117 | 52,036 | |||||||||

| Reimbursable tenant costs | 34,810 | 26,977 | |||||||||

| Operating property expenses | 33,265 | 36,515 | |||||||||

| Property expenses, excluding reimbursable tenant costs | 25,329 | 26,104 | |||||||||

| Stock-based compensation expense | 20,091 | 17,759 | |||||||||

| Impairment charges — real estate | 11,203 | 15,752 | |||||||||

| Merger and other expenses | 748 | 4,658 | |||||||||

| 426,765 | 436,050 | ||||||||||

| Other Income and Expenses | |||||||||||

| Other gains and (losses) | (190,965) | 16,343 | |||||||||

| Interest expense | (140,599) | (133,958) | |||||||||

| Gain on sale of real estate, net | 96,601 | 54,808 | |||||||||

| Earnings from equity method investments | 11,539 | 11,500 | |||||||||

| Non-operating income | 11,405 | 24,720 | |||||||||

| (212,019) | (26,587) | ||||||||||

| Income before income taxes | 201,851 | 316,833 | |||||||||

| Provision for income taxes | (24,723) | (14,893) | |||||||||

| Net Income | 177,128 | 301,940 | |||||||||

| Net (income) loss attributable to noncontrolling interests | (84) | 178 | |||||||||

| Net Income Attributable to W. P. Carey | $ | 177,044 | $ | 302,118 | |||||||

| Basic Earnings Per Share | $ | 0.80 | $ | 1.37 | |||||||

| Diluted Earnings Per Share | $ | 0.80 | $ | 1.37 | |||||||

| Weighted-Average Shares Outstanding | |||||||||||

| Basic | 220,485,859 | 220,113,753 | |||||||||

| Diluted | 220,913,225 | 220,261,525 | |||||||||

| Dividends Declared Per Share | $ | 1.790 | $ | 1.735 | |||||||

| Three Months Ended | |||||||||||||||||

| June 30, 2025 | March 31, 2025 | June 30, 2024 | |||||||||||||||

| Net income attributable to W. P. Carey | $ | 51,220 | $ | 125,824 | $ | 142,895 | |||||||||||

| Adjustments: | |||||||||||||||||

| Depreciation and amortization of real property | 119,930 | 128,937 | 136,840 | ||||||||||||||

| Gain on sale of real estate, net | (52,824) | (43,777) | (39,363) | ||||||||||||||

| Impairment charges — real estate | 4,349 | 6,854 | 15,752 | ||||||||||||||

Proportionate share of adjustments to earnings from equity method investments (a) |

2,231 | 1,643 | 3,015 | ||||||||||||||

Proportionate share of adjustments for noncontrolling interests (b) |

(82) | (78) | (101) | ||||||||||||||

| Total adjustments | 73,604 | 93,579 | 116,143 | ||||||||||||||

FFO (as defined by NAREIT) Attributable to W. P. Carey (c) |

124,824 | 219,403 | 259,038 | ||||||||||||||

| Adjustments: | |||||||||||||||||

Other (gains) and losses (d) |

148,768 | 42,197 | (2,504) | ||||||||||||||

| Straight-line and other leasing and financing adjustments | (15,374) | (19,033) | (15,310) | ||||||||||||||

| Stock-based compensation | 10,943 | 9,148 | 8,903 | ||||||||||||||

| Above- and below-market rent intangible lease amortization, net | 5,061 | 1,123 | 5,766 | ||||||||||||||

| Amortization of deferred financing costs | 4,628 | 4,782 | 4,555 | ||||||||||||||

| Tax expense (benefit) – deferred and other | 2,820 | (782) | (1,392) | ||||||||||||||

| Other amortization and non-cash items | 579 | 560 | 580 | ||||||||||||||

| Merger and other expenses | 192 | 556 | 206 | ||||||||||||||

Proportionate share of adjustments to earnings from equity method investments (a) |

309 | (86) | (2,646) | ||||||||||||||

Proportionate share of adjustments for noncontrolling interests (b) |

(80) | (48) | (97) | ||||||||||||||

| Total adjustments | 157,846 | 38,417 | (1,939) | ||||||||||||||

AFFO Attributable to W. P. Carey (c) |

$ | 282,670 | $ | 257,820 | $ | 257,099 | |||||||||||

| Summary | |||||||||||||||||

FFO (as defined by NAREIT) attributable to W. P. Carey (c) |

$ | 124,824 | $ | 219,403 | $ | 259,038 | |||||||||||

FFO (as defined by NAREIT) attributable to W. P. Carey per diluted share (c) |

$ | 0.57 | $ | 0.99 | $ | 1.18 | |||||||||||

AFFO attributable to W. P. Carey (c) |

$ | 282,670 | $ | 257,820 | $ | 257,099 | |||||||||||

AFFO attributable to W. P. Carey per diluted share (c) |

$ | 1.28 | $ | 1.17 | $ | 1.17 | |||||||||||

| Diluted weighted-average shares outstanding | 220,874,935 | 220,720,310 | 220,214,118 | ||||||||||||||

| Six Months Ended June 30, | |||||||||||

| 2025 | 2024 | ||||||||||

| Net income attributable to W. P. Carey | $ | 177,044 | $ | 302,118 | |||||||

| Adjustments: | |||||||||||

| Depreciation and amortization of real property | 248,867 | 254,953 | |||||||||

| Gain on sale of real estate, net | (96,601) | (54,808) | |||||||||

| Impairment charges — real estate | 11,203 | 15,752 | |||||||||

Proportionate share of adjustments to earnings from equity method investments (a) |

3,874 | 5,964 | |||||||||

Proportionate share of adjustments for noncontrolling interests (b) |

(160) | (204) | |||||||||

| Total adjustments | 167,183 | 221,657 | |||||||||

FFO (as defined by NAREIT) Attributable to W. P. Carey (c) |

344,227 | 523,775 | |||||||||

| Adjustments: | |||||||||||

| Other (gains) and losses | 190,965 | (16,343) | |||||||||

| Straight-line and other leasing and financing adjustments | (34,407) | (34,863) | |||||||||

| Stock-based compensation | 20,091 | 17,759 | |||||||||

| Amortization of deferred financing costs | 9,410 | 9,143 | |||||||||

| Above- and below-market rent intangible lease amortization, net | 6,184 | 9,834 | |||||||||

| Tax expense (benefit) – deferred and other | 2,038 | (2,765) | |||||||||

| Other amortization and non-cash items | 1,139 | 1,159 | |||||||||

| Merger and other expenses | 748 | 4,658 | |||||||||

Proportionate share of adjustments to earnings from equity method investments (a) |

223 | (3,165) | |||||||||

Proportionate share of adjustments for noncontrolling interests (b) |

(128) | (201) | |||||||||

| Total adjustments | 196,263 | (14,784) | |||||||||

AFFO Attributable to W. P. Carey (c) |

$ | 540,490 | $ | 508,991 | |||||||

| Summary | |||||||||||

FFO (as defined by NAREIT) attributable to W. P. Carey (c) |

$ | 344,227 | $ | 523,775 | |||||||

FFO (as defined by NAREIT) attributable to W. P. Carey per diluted share (c) |

$ | 1.56 | $ | 2.38 | |||||||

AFFO attributable to W. P. Carey (c) |

$ | 540,490 | $ | 508,991 | |||||||

AFFO attributable to W. P. Carey per diluted share (c) |

$ | 2.45 | $ | 2.31 | |||||||

| Diluted weighted-average shares outstanding | 220,913,225 | 220,261,525 | |||||||||

| REIT | Real estate investment trust | ||||

| U.S. | United States | ||||

| ABR | Contractual minimum annualized base rent | ||||

| ASC | Accounting Standards Codification | ||||

| NAREIT | National Association of Real Estate Investment Trusts (an industry trade group) | ||||

| CPI | Consumer price index | ||||

| EUR | Euro | ||||

| EURIBOR | Euro Interbank Offered Rate | ||||

| SOFR | Secured Overnight Financing Rate | ||||

| NIBOR | Norwegian Interbank Offered Rate | ||||

| TIBOR | Tokyo Interbank Offered Rate | ||||

| Table of Contents | |||||

| Overview | |||||

| Financial Results | |||||

| Balance Sheets and Capitalization | |||||

| Real Estate | |||||

| Investment Activity | |||||

| Appendix | |||||

| Summary Metrics | |||||

| Financial Results | |||||||||||||||||||||||

| Revenues, including reimbursable costs – consolidated ($000s) | $ | 430,777 | |||||||||||||||||||||

| Net income attributable to W. P. Carey ($000s) | 51,220 | ||||||||||||||||||||||

| Net income attributable to W. P. Carey per diluted share | 0.23 | ||||||||||||||||||||||

Normalized pro rata cash NOI ($000s) (a) (b) |

369,178 | ||||||||||||||||||||||

Adjusted EBITDA ($000s) (a) (b) |

361,370 | ||||||||||||||||||||||

AFFO attributable to W. P. Carey ($000s) (a) (b) |

282,670 | ||||||||||||||||||||||

AFFO attributable to W. P. Carey per diluted share (a) (b) |

1.28 | ||||||||||||||||||||||

| Dividends declared per share – current quarter | 0.900 | ||||||||||||||||||||||

| Dividends declared per share – current quarter annualized | 3.600 | ||||||||||||||||||||||

| Dividend yield – annualized, based on quarter end share price of $62.38 | 5.8 | % | |||||||||||||||||||||

Dividend payout ratio – for the six months ended June 30, 2025 (c) |

73.1 | % | |||||||||||||||||||||

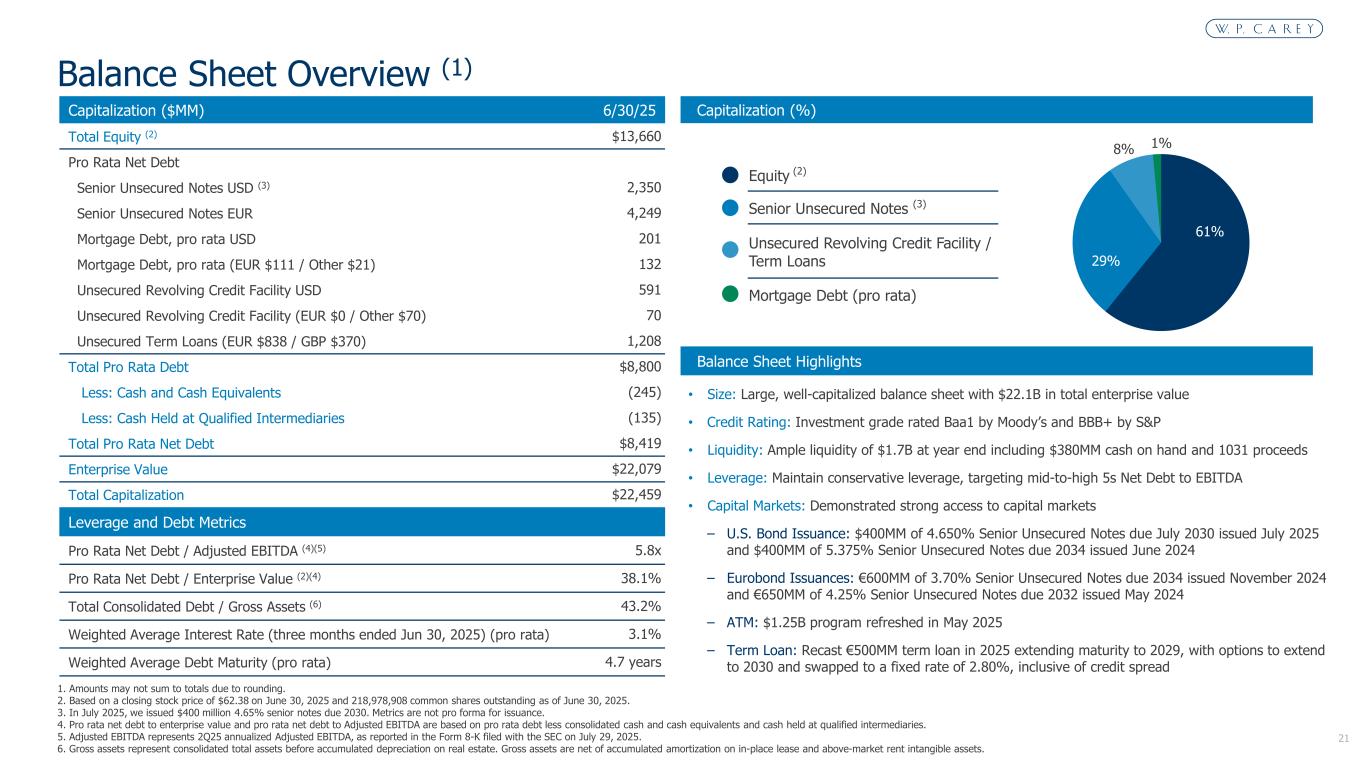

| Balance Sheet and Capitalization | |||||||||||||||||||||||

| Equity market capitalization – based on quarter end share price of $62.38 ($000s) | $ | 13,659,904 | |||||||||||||||||||||

Pro rata net debt ($000s) (d) |

8,419,490 | ||||||||||||||||||||||

| Enterprise value ($000s) | 22,079,394 | ||||||||||||||||||||||

| Total consolidated debt ($000s) | 8,635,985 | ||||||||||||||||||||||

Gross assets ($000s) (e) |

19,980,920 | ||||||||||||||||||||||

Liquidity ($000s) (f) |

1,718,601 | ||||||||||||||||||||||

Pro rata net debt to enterprise value (b) |

38.1 | % | |||||||||||||||||||||

Pro rata net debt to adjusted EBITDA (annualized) (a) (b) |

5.8x | ||||||||||||||||||||||

| Total consolidated debt to gross assets | 43.2 | % | |||||||||||||||||||||

| Total consolidated secured debt to gross assets | 1.2 | % | |||||||||||||||||||||

Cash interest expense coverage ratio (a) (b) |

5.1x | ||||||||||||||||||||||

Weighted-average interest rate – for the three months ended June 30, 2025 (b) |

3.1 | % | |||||||||||||||||||||

Weighted-average interest rate – as of June 30, 2025 (b) |

3.2 | % | |||||||||||||||||||||

Weighted-average debt maturity (years) (b) |

4.7 | ||||||||||||||||||||||

| Moody's Investors Service – issuer rating | Baa1 (stable) | ||||||||||||||||||||||

| Standard & Poor's Ratings Services – issuer rating | BBB+ (stable) | ||||||||||||||||||||||

| Real Estate Portfolio (Pro Rata) | |||||||||||||||||||||||

ABR – total portfolio ($000s) (g) |

$ | 1,469,552 | |||||||||||||||||||||

ABR – unencumbered portfolio (% / $000s) (g) (h) |

96.5% / |

$ | 1,418,585 | ||||||||||||||||||||

| Number of net-leased properties | 1,600 | ||||||||||||||||||||||

Number of operating properties (i) |

72 | ||||||||||||||||||||||

Number of tenants – net-leased properties |

370 | ||||||||||||||||||||||

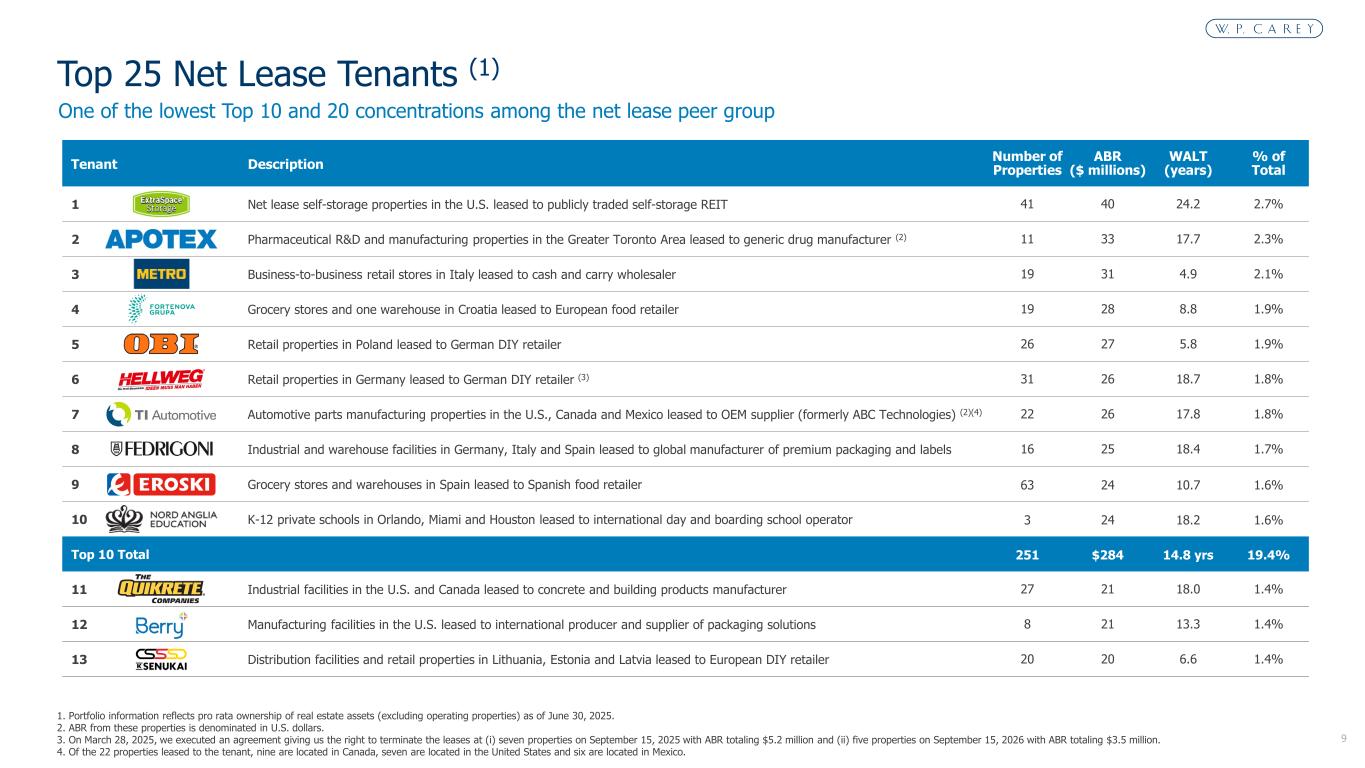

| ABR from top ten tenants as a % of total ABR – net-leased properties | 19.4 | % | |||||||||||||||||||||

ABR from investment grade tenants as a % of total ABR – net-leased properties (j) |

21.8 | % | |||||||||||||||||||||

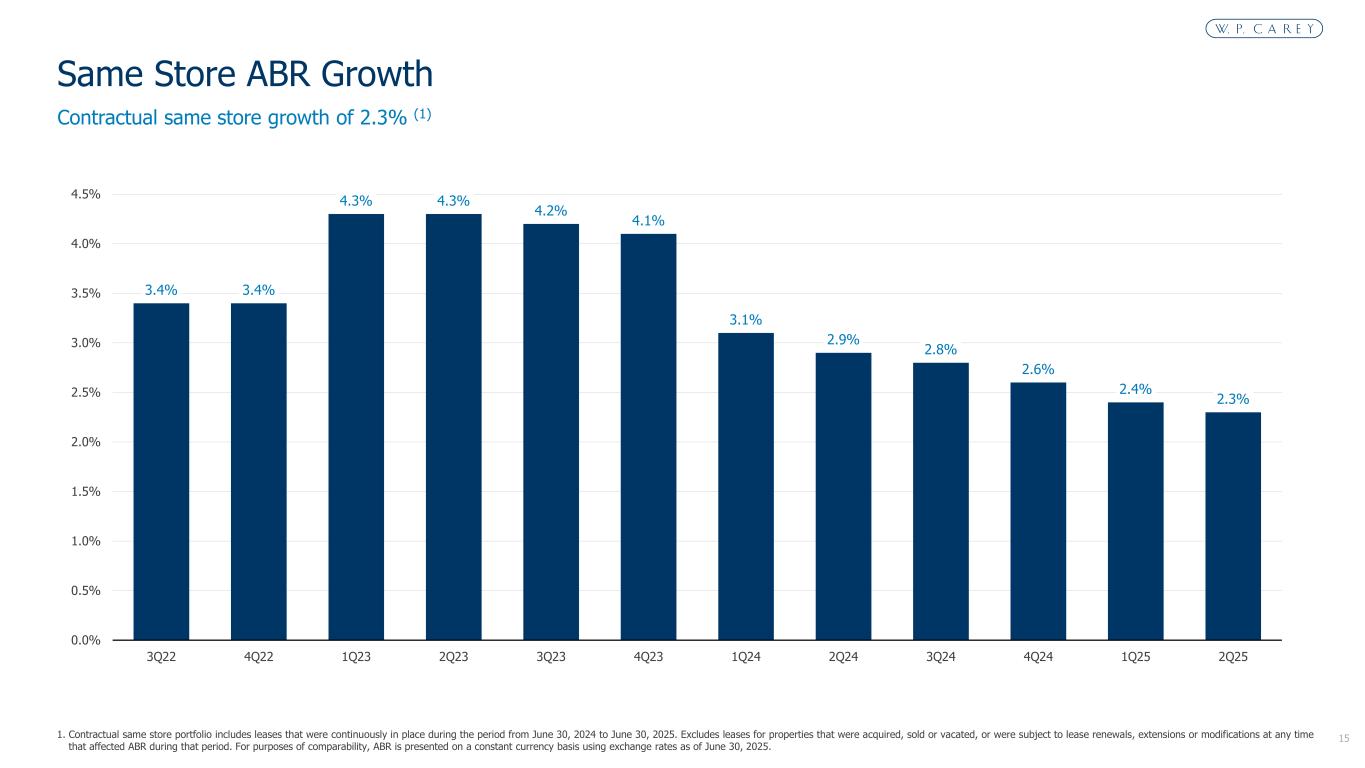

Contractual same-store growth (k) |

2.3 | % | |||||||||||||||||||||

| Net-leased properties – square footage (millions) | 178.0 | ||||||||||||||||||||||

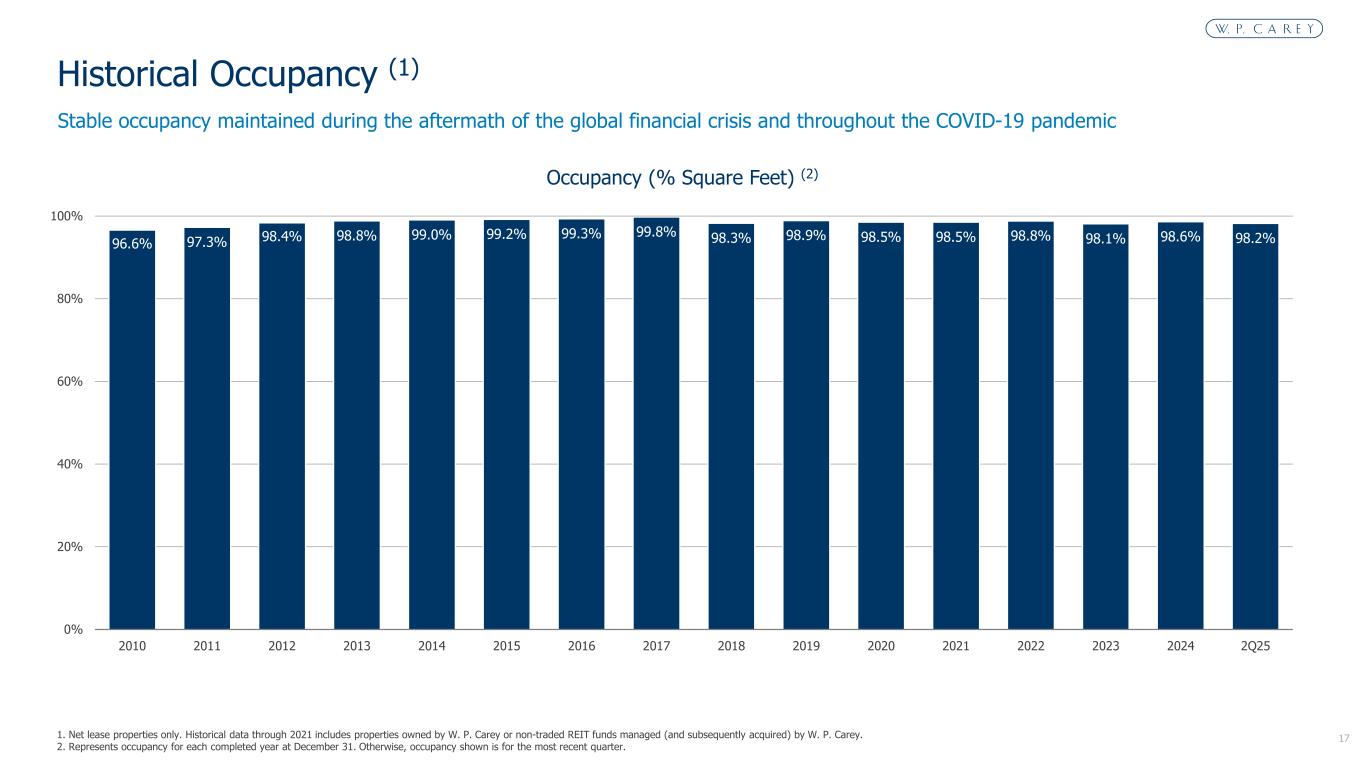

| Occupancy – net-leased properties | 98.2 | % | |||||||||||||||||||||

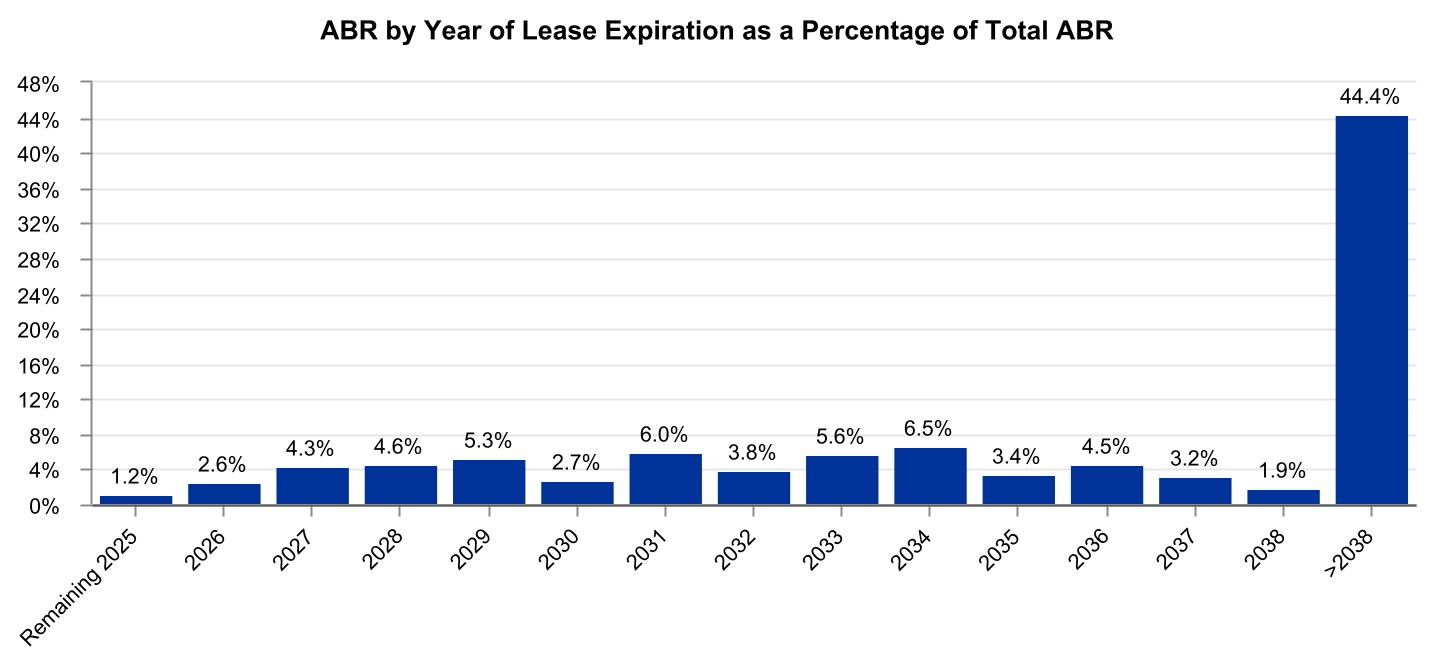

| Weighted-average lease term (years) | 12.1 | ||||||||||||||||||||||

| Investment volume – current quarter ($000s) | $ | 548,638 | |||||||||||||||||||||

| Dispositions – current quarter ($000s) | 364,203 | ||||||||||||||||||||||

| Maximum commitment for capital investments and commitments expected to be completed during 2025 ($000s) | 109,525 | ||||||||||||||||||||||

|

Investing for the Long Run® | 1 |

|||||||

|

Investing for the Long Run® | 2 |

|||||||

| Components of Net Asset Value | |||||

Normalized Pro Rata Cash NOI (a) (b) |

Three Months Ended Jun. 30, 2025 | ||||||||||||||||

| Net lease properties | $ | 353,095 | |||||||||||||||

Self-storage and other operating properties (c) |

16,083 | ||||||||||||||||

Total normalized pro rata cash NOI (a) (b) |

$ | 369,178 | |||||||||||||||

| Balance Sheet – Selected Information (Consolidated Unless Otherwise Stated) | As of Jun. 30, 2025 | ||||||||||||||||

| Assets | |||||||||||||||||

Book value of real estate excluded from normalized pro rata cash NOI (d) |

$ | 255,786 | |||||||||||||||

| Cash and cash equivalents | 244,831 | ||||||||||||||||

Las Vegas retail complex construction loan (e) |

245,884 | ||||||||||||||||

| Other secured loans receivable, net | 33,841 | ||||||||||||||||

| Other assets, net: | |||||||||||||||||

| Straight-line rent adjustments | $ | 424,839 | |||||||||||||||

Investment in shares of Lineage (a cold storage REIT) (f) |

201,827 | ||||||||||||||||

Cash held at qualified intermediaries (g) |

135,181 | ||||||||||||||||

| Deferred charges | 76,595 | ||||||||||||||||

| Office lease right-of-use assets, net | 49,544 | ||||||||||||||||

| Non-rent tenant and other receivables | 48,027 | ||||||||||||||||

| Taxes receivable | 47,160 | ||||||||||||||||

| Restricted cash, including escrow (excludes cash held at qualified intermediaries) | 46,137 | ||||||||||||||||

| Prepaid expenses | 24,136 | ||||||||||||||||

| Deferred income taxes | 22,682 | ||||||||||||||||

| Leasehold improvements, furniture and fixtures | 11,595 | ||||||||||||||||

Rent receivables (h) |

2,907 | ||||||||||||||||

| Securities and derivatives | 1,772 | ||||||||||||||||

| Due from affiliates | 1,066 | ||||||||||||||||

| Other | 21,869 | ||||||||||||||||

| Total other assets, net | $ | 1,115,337 | |||||||||||||||

| Liabilities | |||||||||||||||||

Total pro rata debt outstanding (b) (i) |

$ | 8,799,502 | |||||||||||||||

| Dividends payable | 201,909 | ||||||||||||||||

| Deferred income taxes | 168,184 | ||||||||||||||||

| Accounts payable, accrued expenses and other liabilities: | |||||||||||||||||

| Accounts payable and accrued expenses | $ | 173,858 | |||||||||||||||

| Prepaid and deferred rents | 153,382 | ||||||||||||||||

| Operating lease liabilities | 147,216 | ||||||||||||||||

| Tenant security deposits | 57,231 | ||||||||||||||||

| Accrued taxes payable | 45,861 | ||||||||||||||||

| Securities and derivatives | 29,044 | ||||||||||||||||

| Other | 48,366 | ||||||||||||||||

| Total accounts payable, accrued expenses and other liabilities | $ | 654,958 | |||||||||||||||

|

Investing for the Long Run® | 3 |

|||||||

|

Investing for the Long Run® | 4 |

|||||||

|

Investing for the Long Run® | 5 |

|||||||

| Consolidated Statements of Income – Last Five Quarters | |||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Jun. 30, 2025 | Mar. 31, 2025 | Dec. 31, 2024 | Sep. 30, 2024 | Jun. 30, 2024 | |||||||||||||||||||||||||

| Revenues | |||||||||||||||||||||||||||||

| Real Estate: | |||||||||||||||||||||||||||||

| Lease revenues | $ | 364,195 | $ | 353,768 | $ | 351,394 | $ | 334,039 | $ | 324,104 | |||||||||||||||||||

| Income from finance leases and loans receivable | 20,276 | 17,458 | 16,796 | 15,712 | 14,961 | ||||||||||||||||||||||||

| Operating property revenues | 34,287 | 33,094 | 34,132 | 37,323 | 38,715 | ||||||||||||||||||||||||

| Other lease-related income | 9,643 | 3,121 | 1,329 | 7,701 | 9,149 | ||||||||||||||||||||||||

| 428,401 | 407,441 | 403,651 | 394,775 | 386,929 | |||||||||||||||||||||||||

| Investment Management: | |||||||||||||||||||||||||||||

| Asset management revenue | 1,304 | 1,350 | 1,461 | 1,557 | 1,686 | ||||||||||||||||||||||||

| Other advisory income and reimbursements | 1,072 | 1,067 | 1,053 | 1,051 | 1,057 | ||||||||||||||||||||||||

| 2,376 | 2,417 | 2,514 | 2,608 | 2,743 | |||||||||||||||||||||||||

| 430,777 | 409,858 | 406,165 | 397,383 | 389,672 | |||||||||||||||||||||||||

| Operating Expenses | |||||||||||||||||||||||||||||

| Depreciation and amortization | 120,595 | 129,607 | 115,770 | 115,705 | 137,481 | ||||||||||||||||||||||||

| General and administrative | 24,150 | 26,967 | 24,254 | 22,679 | 24,168 | ||||||||||||||||||||||||

| Reimbursable tenant costs | 17,718 | 17,092 | 15,661 | 13,337 | 14,004 | ||||||||||||||||||||||||

| Operating property expenses | 16,721 | 16,544 | 16,586 | 17,765 | 18,565 | ||||||||||||||||||||||||

| Property expenses, excluding reimbursable tenant costs | 13,623 | 11,706 | 12,580 | 10,993 | 13,931 | ||||||||||||||||||||||||

| Stock-based compensation expense | 10,943 | 9,148 | 9,667 | 13,468 | 8,903 | ||||||||||||||||||||||||

| Impairment charges — real estate | 4,349 | 6,854 | 27,843 | — | 15,752 | ||||||||||||||||||||||||

| Merger and other expenses | 192 | 556 | (484) | 283 | 206 | ||||||||||||||||||||||||

| 208,291 | 218,474 | 221,877 | 194,230 | 233,010 | |||||||||||||||||||||||||

| Other Income and Expenses | |||||||||||||||||||||||||||||

Other gains and (losses) (a) |

(148,768) | (42,197) | (77,224) | (77,107) | 2,504 | ||||||||||||||||||||||||

| Interest expense | (71,795) | (68,804) | (70,883) | (72,526) | (65,307) | ||||||||||||||||||||||||

| Gain on sale of real estate, net | 52,824 | 43,777 | 4,480 | 15,534 | 39,363 | ||||||||||||||||||||||||

| Earnings from equity method investments | 6,161 | 5,378 | 302 | 6,124 | 6,636 | ||||||||||||||||||||||||

Non-operating income (b) |

3,495 | 7,910 | 13,847 | 13,669 | 9,215 | ||||||||||||||||||||||||

Gain on change in control of interests (c) |

— | — | — | 31,849 | — | ||||||||||||||||||||||||

| (158,083) | (53,936) | (129,478) | (82,457) | (7,589) | |||||||||||||||||||||||||

| Income before income taxes | 64,403 | 137,448 | 54,810 | 120,696 | 149,073 | ||||||||||||||||||||||||

| Provision for income taxes | (13,091) | (11,632) | (7,772) | (9,044) | (6,219) | ||||||||||||||||||||||||

| Net Income | 51,312 | 125,816 | 47,038 | 111,652 | 142,854 | ||||||||||||||||||||||||

| Net (income) loss attributable to noncontrolling interests | (92) | 8 | (15) | 46 | 41 | ||||||||||||||||||||||||

| Net Income Attributable to W. P. Carey | $ | 51,220 | $ | 125,824 | $ | 47,023 | $ | 111,698 | $ | 142,895 | |||||||||||||||||||

| Basic Earnings Per Share | $ | 0.23 | $ | 0.57 | $ | 0.21 | $ | 0.51 | $ | 0.65 | |||||||||||||||||||

| Diluted Earnings Per Share | $ | 0.23 | $ | 0.57 | $ | 0.21 | $ | 0.51 | $ | 0.65 | |||||||||||||||||||

| Weighted-Average Shares Outstanding | |||||||||||||||||||||||||||||

| Basic | 220,569,259 | 220,401,156 | 220,223,239 | 220,221,366 | 220,195,910 | ||||||||||||||||||||||||

| Diluted | 220,874,935 | 220,720,310 | 220,577,900 | 220,404,149 | 220,214,118 | ||||||||||||||||||||||||

| Dividends Declared Per Share | $ | 0.900 | $ | 0.890 | $ | 0.880 | $ | 0.875 | $ | 0.870 | |||||||||||||||||||

|

Investing for the Long Run® | 6 |

|||||||

| FFO and AFFO, Consolidated – Last Five Quarters | |||||

| Three Months Ended | |||||||||||||||||||||||||||||

| Jun. 30, 2025 | Mar. 31, 2025 | Dec. 31, 2024 | Sep. 30, 2024 | Jun. 30, 2024 | |||||||||||||||||||||||||

| Net income attributable to W. P. Carey | $ | 51,220 | $ | 125,824 | $ | 47,023 | $ | 111,698 | $ | 142,895 | |||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

| Depreciation and amortization of real property | 119,930 | 128,937 | 115,107 | 115,028 | 136,840 | ||||||||||||||||||||||||

| Gain on sale of real estate, net | (52,824) | (43,777) | (4,480) | (15,534) | (39,363) | ||||||||||||||||||||||||

| Impairment charges — real estate | 4,349 | 6,854 | 27,843 | — | 15,752 | ||||||||||||||||||||||||

Gain on change in control of interests (a) |

— | — | — | (31,849) | — | ||||||||||||||||||||||||

Proportionate share of adjustments to earnings from equity method investments (b) |

2,231 | 1,643 | 2,879 | 3,028 | 3,015 | ||||||||||||||||||||||||

Proportionate share of adjustments for noncontrolling interests (c) |

(82) | (78) | (79) | (96) | (101) | ||||||||||||||||||||||||

| Total adjustments | 73,604 | 93,579 | 141,270 | 70,577 | 116,143 | ||||||||||||||||||||||||

FFO (as defined by NAREIT) Attributable to W. P. Carey (d) |

124,824 | 219,403 | 188,293 | 182,275 | 259,038 | ||||||||||||||||||||||||

| Adjustments: | |||||||||||||||||||||||||||||

Other (gains) and losses (e) |

148,768 | 42,197 | 77,224 | 77,107 | (2,504) | ||||||||||||||||||||||||

| Straight-line and other leasing and financing adjustments | (15,374) | (19,033) | (24,849) | (21,187) | (15,310) | ||||||||||||||||||||||||

| Stock-based compensation | 10,943 | 9,148 | 9,667 | 13,468 | 8,903 | ||||||||||||||||||||||||

Above- and below-market rent intangible lease amortization, net |

5,061 | 1,123 | 10,047 | 6,263 | 5,766 | ||||||||||||||||||||||||

| Amortization of deferred financing costs | 4,628 | 4,782 | 4,851 | 4,851 | 4,555 | ||||||||||||||||||||||||

| Tax expense (benefit) – deferred and other | 2,820 | (782) | 96 | (1,576) | (1,392) | ||||||||||||||||||||||||

| Other amortization and non-cash items | 579 | 560 | 557 | 587 | 580 | ||||||||||||||||||||||||

| Merger and other expenses | 192 | 556 | (484) | 283 | 206 | ||||||||||||||||||||||||

Proportionate share of adjustments to earnings from equity method investments (b) |

309 | (86) | 2,266 | (2,632) | (2,646) | ||||||||||||||||||||||||

Proportionate share of adjustments for noncontrolling interests (c) |

(80) | (48) | (62) | (91) | (97) | ||||||||||||||||||||||||

| Total adjustments | 157,846 | 38,417 | 79,313 | 77,073 | (1,939) | ||||||||||||||||||||||||

AFFO Attributable to W. P. Carey (d) |

$ | 282,670 | $ | 257,820 | $ | 267,606 | $ | 259,348 | $ | 257,099 | |||||||||||||||||||

| Summary | |||||||||||||||||||||||||||||

FFO (as defined by NAREIT) attributable to W. P. Carey (d) |

$ | 124,824 | $ | 219,403 | $ | 188,293 | $ | 182,275 | $ | 259,038 | |||||||||||||||||||

FFO (as defined by NAREIT) attributable to W. P. Carey per diluted share (d) |

$ | 0.57 | $ | 0.99 | $ | 0.85 | $ | 0.83 | $ | 1.18 | |||||||||||||||||||

AFFO attributable to W. P. Carey (d) |

$ | 282,670 | $ | 257,820 | $ | 267,606 | $ | 259,348 | $ | 257,099 | |||||||||||||||||||

AFFO attributable to W. P. Carey per diluted share (d) |

$ | 1.28 | $ | 1.17 | $ | 1.21 | $ | 1.18 | $ | 1.17 | |||||||||||||||||||

| Diluted weighted-average shares outstanding | 220,874,935 | 220,720,310 | 220,577,900 | 220,404,149 | 220,214,118 | ||||||||||||||||||||||||

|

Investing for the Long Run® | 7 |

|||||||

| Elements of Pro Rata Statement of Income and AFFO Adjustments | |||||

Equity Method Investments (a) |

Noncontrolling Interests (b) |

AFFO Adjustments | ||||||||||||||||||

| Revenues | ||||||||||||||||||||

| Real Estate: | ||||||||||||||||||||

Lease revenues |

$ | 7,798 | $ | (269) | $ | (10,699) | (c) |

|||||||||||||

| Income from finance leases and loans receivable | 53 | (13) | 310 | |||||||||||||||||

| Operating property revenues | — | — | ||||||||||||||||||

| Other lease-related income | 294 | — | — | |||||||||||||||||

Investment Management: |

||||||||||||||||||||

| Asset management revenue | — | — | — | |||||||||||||||||

| Other advisory income and reimbursements | — | — | — | |||||||||||||||||

| Operating Expenses | ||||||||||||||||||||

| Depreciation and amortization | 1,994 | (82) | (121,943) | (d) |

||||||||||||||||

| General and administrative | — | — | — | |||||||||||||||||

Reimbursable tenant costs |

740 | (46) | — | |||||||||||||||||

| Operating property expenses | — | — | (30) | (e) |

||||||||||||||||

Property expenses, excluding reimbursable tenant costs |

368 | (21) | (454) | (e) |

||||||||||||||||

Stock-based compensation expense |

— | — | (10,943) | (e) |

||||||||||||||||

| Impairment charges — real estate | — | — | (4,349) | (e) |

||||||||||||||||

| Merger and other expenses | — | — | (192) | |||||||||||||||||

| Other Income and Expenses | ||||||||||||||||||||

| Other gains and (losses) | — | 80 | 148,688 | (f) |

||||||||||||||||

| Interest expense | (824) | 39 | 4,669 | (g) |

||||||||||||||||

| Gain on sale of real estate, net | — | — | (52,824) | |||||||||||||||||

| Earnings from equity method investments | (4,226) | — | 376 | (h) |

||||||||||||||||

| Non-operating income | 190 | (1) | — | |||||||||||||||||

| Provision for income taxes | (183) | 3 | 3,019 | (i) |

||||||||||||||||

| Net income attributable to noncontrolling interests | — | 12 | — | |||||||||||||||||

|

Investing for the Long Run® | 8 |

|||||||

| Capital Expenditures | |||||

Turnover Costs (a) |

|||||

| Tenant improvements | $ | 1,345 | |||

| Leasing costs | 369 | ||||

| Total Tenant Improvements and Leasing Costs | 1,714 | ||||

| Property improvements — net-lease properties | 306 | ||||

| Property improvements — operating properties | 60 | ||||

| Total Turnover Costs | $ | 2,080 | |||

| Maintenance Capital Expenditures | |||||

| Net-lease properties | $ | 389 | |||

| Operating properties | 716 | ||||

| Total Maintenance Capital Expenditures | $ | 1,105 | |||

|

Investing for the Long Run® | 9 |

|||||||

|

Investing for the Long Run® | 10 |

|||||||

| Consolidated Balance Sheets | |||||

| June 30, 2025 | December 31, 2024 | ||||||||||

| Assets | |||||||||||

| Investments in real estate: | |||||||||||

| Land, buildings and improvements — net lease and other | $ | 13,627,841 | $ | 12,842,869 | |||||||

| Land, buildings and improvements — operating properties | 1,005,605 | 1,198,676 | |||||||||

| Net investments in finance leases and loans receivable | 1,063,719 | 798,259 | |||||||||

In-place lease intangible assets and other |

2,407,752 | 2,297,572 | |||||||||

Above-market rent intangible assets |

679,068 | 665,495 | |||||||||

| Investments in real estate | 18,783,985 | 17,802,871 | |||||||||

Accumulated depreciation and amortization (a) |

(3,503,850) | (3,222,396) | |||||||||

| Assets held for sale, net | 60,011 | — | |||||||||

| Net investments in real estate | 15,340,146 | 14,580,475 | |||||||||

| Equity method investments | 311,411 | 301,115 | |||||||||

| Cash and cash equivalents | 244,831 | 640,373 | |||||||||

| Other assets, net | 1,115,337 | 1,045,218 | |||||||||

| Goodwill | 986,472 | 967,843 | |||||||||

| Total assets | $ | 17,998,197 | $ | 17,535,024 | |||||||

| Liabilities and Equity | |||||||||||

| Debt: | |||||||||||

| Senior unsecured notes, net | $ | 6,540,432 | $ | 6,505,907 | |||||||

| Unsecured term loans, net | 1,199,256 | 1,075,826 | |||||||||

| Unsecured revolving credit facility | 660,872 | 55,448 | |||||||||

| Non-recourse mortgages, net | 235,425 | 401,821 | |||||||||

| Debt, net | 8,635,985 | 8,039,002 | |||||||||

| Accounts payable, accrued expenses and other liabilities | 654,958 | 596,994 | |||||||||

Below-market rent and other intangible liabilities, net |

111,829 | 119,831 | |||||||||

| Deferred income taxes | 168,184 | 147,461 | |||||||||

| Dividends payable | 201,909 | 197,612 | |||||||||

| Total liabilities | 9,772,865 | 9,100,900 | |||||||||

Preferred stock, $0.001 par value, 50,000,000 shares authorized; none issued |

— | — | |||||||||

Common stock, $0.001 par value, 450,000,000 shares authorized; 218,978,908 and 218,848,844 shares, respectively, issued and outstanding |

219 | 219 | |||||||||

| Additional paid-in capital | 11,803,487 | 11,805,179 | |||||||||

| Distributions in excess of accumulated earnings | (3,424,094) | (3,203,974) | |||||||||

| Deferred compensation obligation | 97,002 | 78,503 | |||||||||

| Accumulated other comprehensive loss | (264,750) | (250,232) | |||||||||

| Total stockholders' equity | 8,211,864 | 8,429,695 | |||||||||

| Noncontrolling interests | 13,468 | 4,429 | |||||||||

| Total equity | 8,225,332 | 8,434,124 | |||||||||

| Total liabilities and equity | $ | 17,998,197 | $ | 17,535,024 | |||||||

|

Investing for the Long Run® | 11 |

|||||||

| Capitalization | |||||

| Description | Shares | Share Price | Market Value | |||||||||||||||||||||||

| Equity | ||||||||||||||||||||||||||

| Common equity | 218,978,908 | $ | 62.38 | $ | 13,659,904 | |||||||||||||||||||||

| Preferred equity | — | |||||||||||||||||||||||||

| Total Equity Market Capitalization | 13,659,904 | |||||||||||||||||||||||||

Outstanding Balance (a) |

||||||||||||||||||||||||||

| Pro Rata Debt | ||||||||||||||||||||||||||

| Non-recourse mortgages | 332,261 | |||||||||||||||||||||||||

| Unsecured term loans (due February 14, 2028) | 621,869 | |||||||||||||||||||||||||

| Unsecured term loan (due April 24, 2029) | 586,000 | |||||||||||||||||||||||||

| Unsecured revolving credit facility (due February 14, 2029) | 660,872 | |||||||||||||||||||||||||

Senior unsecured notes (b): |

||||||||||||||||||||||||||

| Due April 9, 2026 (EUR) | 586,000 | |||||||||||||||||||||||||

| Due October 1, 2026 (USD) | 350,000 | |||||||||||||||||||||||||

| Due April 15, 2027 (EUR) | 586,000 | |||||||||||||||||||||||||

| Due April 15, 2028 (EUR) | 586,000 | |||||||||||||||||||||||||

| Due July 15, 2029 (USD) | 325,000 | |||||||||||||||||||||||||

| Due September 28, 2029 (EUR) | 175,800 | |||||||||||||||||||||||||

| Due June 1, 2030 (EUR) | 615,300 | |||||||||||||||||||||||||

| Due February 1, 2031 (USD) | 500,000 | |||||||||||||||||||||||||

| Due February 1, 2032 (USD) | 350,000 | |||||||||||||||||||||||||

| Due July 23, 2032 (EUR) | 761,800 | |||||||||||||||||||||||||

| Due September 28, 2032 (EUR) | 234,400 | |||||||||||||||||||||||||

| Due April 1, 2033 (USD) | 425,000 | |||||||||||||||||||||||||

| Due June 30, 2034 (USD) | 400,000 | |||||||||||||||||||||||||

| Due November 19, 2034 (EUR) | 703,200 | |||||||||||||||||||||||||

| Total Pro Rata Debt | 8,799,502 | |||||||||||||||||||||||||

| Total Capitalization | $ | 22,459,406 | ||||||||||||||||||||||||

|

Investing for the Long Run® | 12 |

|||||||

| Debt Overview | |||||

| USD-Denominated | EUR-Denominated | Other Currencies (a) |

Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Outstanding Balance | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Out-standing Balance (in USD) |

Weigh-ted Avg. Interest Rate |

Out-standing Balance (in USD) |

Weigh-ted Avg. Interest Rate |

Out-standing Balance (in USD) |

Weigh-ted Avg. Interest Rate |

Amount (in USD) |

% of Total | Weigh-ted Avg. Interest Rate |

Weigh-ted Avg. Maturity (Years) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Non-Recourse Debt (b) (c) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fixed (d) |

$ | 200,604 | 4.8 | % | $ | 74,740 | 5.0 | % | $ | 21,066 | 4.6 | % | $ | 296,410 | 3.4 | % | 4.8 | % | 1.7 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Floating | — | — | % | 35,851 | 4.1 | % | — | — | % | 35,851 | 0.4 | % | 4.1 | % | 0.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Total Pro Rata Non-Recourse Debt |

200,604 | 4.8 | % | 110,591 | 4.7 | % | 21,066 | 4.6 | % | 332,261 | 3.8 | % | 4.8 | % | 1.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Recourse Debt (b) (c) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fixed – Senior unsecured notes (e): |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due April 9, 2026 | — | — | % | 586,000 | 2.3 | % | — | — | % | 586,000 | 6.7 | % | 2.3 | % | 0.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due October 1, 2026 | 350,000 | 4.3 | % | — | — | % | — | — | % | 350,000 | 4.0 | % | 4.3 | % | 1.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due April 15, 2027 | — | — | % | 586,000 | 2.1 | % | — | — | % | 586,000 | 6.7 | % | 2.1 | % | 1.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due April 15, 2028 | — | — | % | 586,000 | 1.4 | % | — | — | % | 586,000 | 6.7 | % | 1.4 | % | 2.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due July 15, 2029 | 325,000 | 3.9 | % | — | — | % | — | — | % | 325,000 | 3.7 | % | 3.9 | % | 4.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due September 28, 2029 | — | — | % | 175,800 | 3.4 | % | — | — | % | 175,800 | 2.0 | % | 3.4 | % | 4.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due June 1, 2030 | — | — | % | 615,300 | 1.0 | % | — | — | % | 615,300 | 7.0 | % | 1.0 | % | 4.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due February 1, 2031 | 500,000 | 2.4 | % | — | — | % | — | — | % | 500,000 | 5.7 | % | 2.4 | % | 5.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due February 1, 2032 | 350,000 | 2.5 | % | — | — | % | — | — | % | 350,000 | 4.0 | % | 2.5 | % | 6.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due July 23, 2032 | — | — | % | 761,800 | 4.3 | % | — | — | % | 761,800 | 8.6 | % | 4.3 | % | 7.1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due September 28, 2032 | — | — | % | 234,400 | 3.7 | % | — | — | % | 234,400 | 2.7 | % | 3.7 | % | 7.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due April 1, 2033 | 425,000 | 2.3 | % | — | — | % | — | — | % | 425,000 | 4.8 | % | 2.3 | % | 7.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due June 30, 2034 | 400,000 | 5.4 | % | — | — | % | — | — | % | 400,000 | 4.4 | % | 5.4 | % | 9.0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due November 19, 2034 | — | — | % | 703,200 | 3.7 | % | — | — | % | 703,200 | 8.0 | % | 3.7 | % | 9.4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Total Senior Unsecured Notes |

2,350,000 | 3.4 | % | 4,248,500 | 2.6 | % | — | — | % | 6,598,500 | 75.0 | % | 2.9 | % | 5.2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Swapped to Fixed: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Unsecured term loan (due April 24, 2029) (f) |

— | — | % | 586,000 | 2.8 | % | — | — | % | 586,000 | 6.7 | % | 2.8 | % | 3.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Unsecured term loan (due February 14, 2028) (f) |

— | — | % | — | — | % | 369,889 | 4.7 | % | 369,889 | 4.2 | % | 4.7 | % | 2.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Floating: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Unsecured revolving credit facility (due February 14, 2029) (g) |

590,500 | 5.0 | % | — | — | % | 70,372 | 4.2 | % | 660,872 | 7.4 | % | 4.9 | % | 3.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Unsecured term loan (due February 14, 2028) (h) |

— | — | % | 251,980 | 2.8 | % | — | — | % | 251,980 | 2.9 | % | 2.8 | % | 2.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Recourse Debt | 2,940,500 | 3.7 | % | 5,086,480 | 2.7 | % | 440,261 | 4.6 | % | 8,467,241 | 96.2 | % | 3.1 | % | 4.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Total Pro Rata Debt Outstanding |

$ | 3,141,104 | 3.8 | % | $ | 5,197,071 | 2.7 | % | $ | 461,327 | 4.6 | % | $ | 8,799,502 | 100.0 | % | 3.2 | % | 4.7 | |||||||||||||||||||||||||||||||||||||||||||||||||

|

Investing for the Long Run® | 13 |

|||||||

| Debt Maturity | |||||

| Real Estate | Debt | |||||||||||||||||||||||||||||||||||||

Number of Properties (a) |

Weighted-Average Interest Rate | Total Outstanding Balance (b) (c) |

% of Total Outstanding Balance | |||||||||||||||||||||||||||||||||||

| Year of Maturity | ABR (a) |

Balloon | ||||||||||||||||||||||||||||||||||||

| Non-Recourse Debt | ||||||||||||||||||||||||||||||||||||||

| Remaining 2025 | 12 | $ | 2,397 | 4.6 | % | $ | 42,152 | $ | 42,537 | 0.5 | % | |||||||||||||||||||||||||||

| 2026 | 36 | 28,356 | 4.8 | % | 154,899 | 162,111 | 1.9 | % | ||||||||||||||||||||||||||||||

| 2027 | 3 | 1,272 | 4.2 | % | 28,561 | 28,946 | 0.4 | % | ||||||||||||||||||||||||||||||

| 2028 | 5 | 13,983 | 5.0 | % | 73,869 | 81,134 | 0.9 | % | ||||||||||||||||||||||||||||||

| 2029 | 3 | 1,435 | 4.0 | % | 10,931 | 11,871 | 0.1 | % | ||||||||||||||||||||||||||||||

| 2031 | 1 | 1,131 | 6.0 | % | — | 2,236 | — | % | ||||||||||||||||||||||||||||||

| 2033 | 1 | 2,393 | 5.6 | % | 1,671 | 3,426 | — | % | ||||||||||||||||||||||||||||||

Total Pro Rata Non-Recourse Debt |

61 | $ | 50,967 | 4.8 | % | $ | 312,083 | 332,261 | 3.8 | % | ||||||||||||||||||||||||||||

| Recourse Debt | ||||||||||||||||||||||||||||||||||||||

Fixed – Senior unsecured notes (d): |

||||||||||||||||||||||||||||||||||||||

| Due April 9, 2026 (EUR) | 2.3 | % | 586,000 | 6.7 | % | |||||||||||||||||||||||||||||||||

| Due October 1, 2026 (USD) | 4.3 | % | 350,000 | 4.0 | % | |||||||||||||||||||||||||||||||||

| Due April 15, 2027 (EUR) | 2.1 | % | 586,000 | 6.7 | % | |||||||||||||||||||||||||||||||||

| Due April 15, 2028 (EUR) | 1.4 | % | 586,000 | 6.7 | % | |||||||||||||||||||||||||||||||||

| Due July 15, 2029 (USD) | 3.9 | % | 325,000 | 3.7 | % | |||||||||||||||||||||||||||||||||

| Due September 28, 2029 (EUR) | 3.4 | % | 175,800 | 2.0 | % | |||||||||||||||||||||||||||||||||

| Due June 1, 2030 (EUR) | 1.0 | % | 615,300 | 7.0 | % | |||||||||||||||||||||||||||||||||

| Due February 1, 2031 (USD) | 2.4 | % | 500,000 | 5.7 | % | |||||||||||||||||||||||||||||||||

| Due February 1, 2032 (USD) | 2.5 | % | 350,000 | 4.0 | % | |||||||||||||||||||||||||||||||||

| Due July 23, 2032 (EUR) | 4.3 | % | 761,800 | 8.6 | % | |||||||||||||||||||||||||||||||||

| Due September 28, 2032 (EUR) | 3.7 | % | 234,400 | 2.7 | % | |||||||||||||||||||||||||||||||||

| Due April 1, 2033 (USD) | 2.3 | % | 425,000 | 4.8 | % | |||||||||||||||||||||||||||||||||

| Due June 30, 2034 (USD) | 5.4 | % | 400,000 | 4.4 | % | |||||||||||||||||||||||||||||||||

| Due November 19, 2034 (EUR) | 3.7 | % | 703,200 | 8.0 | % | |||||||||||||||||||||||||||||||||

| Total Senior Unsecured Notes | 2.9 | % | 6,598,500 | 75.0 | % | |||||||||||||||||||||||||||||||||

| Swapped to Fixed: | ||||||||||||||||||||||||||||||||||||||

Unsecured term loan (due April 24, 2029) (e) |

2.8 | % | 586,000 | 6.7 | % | |||||||||||||||||||||||||||||||||

Unsecured term loan (due Feb 14, 2028) (e) |

4.7 | % | 369,889 | 4.2 | % | |||||||||||||||||||||||||||||||||

| Floating: | ||||||||||||||||||||||||||||||||||||||

Unsecured revolving credit facility (due February 14, 2029) (f) |

4.9 | % | 660,872 | 7.4 | % | |||||||||||||||||||||||||||||||||

Unsecured term loan (due February 14, 2028) (g) |

2.8 | % | 251,980 | 2.9 | % | |||||||||||||||||||||||||||||||||

| Total Recourse Debt | 3.1 | % | 8,467,241 | 96.2 | % | |||||||||||||||||||||||||||||||||

| Total Pro Rata Debt Outstanding | 3.2 | % | $ | 8,799,502 | 100.0 | % | ||||||||||||||||||||||||||||||||

|

Investing for the Long Run® | 14 |

|||||||

| Senior Unsecured Notes | |||||

| Issuer | Senior Unsecured Notes | |||||||||||||||||||

| Ratings Agency | Rating | Outlook | Rating | |||||||||||||||||

| Moody's | Baa1 | Stable | Baa1 | |||||||||||||||||

| Standard & Poor’s | BBB+ | Stable | BBB+ | |||||||||||||||||

| Covenant | Metric | Required | As of Jun. 30, 2025 |

|||||||||||||||||

| Limitation on the incurrence of debt | "Total Debt" / "Total Assets" |

≤ 60% | 42.1% | |||||||||||||||||

| Limitation on the incurrence of secured debt | "Secured Debt" / "Total Assets" |

≤ 40% | 1.2% | |||||||||||||||||

Limitation on the incurrence of debt based on consolidated EBITDA to annual debt service charge |

"Consolidated EBITDA" / "Annual Debt Service Charge" |

≥ 1.5x | 4.9x | |||||||||||||||||

| Maintenance of unencumbered asset value | "Unencumbered Assets" / "Total Unsecured Debt" | ≥ 150% | 230.4% | |||||||||||||||||

|

Investing for the Long Run® | 15 |

|||||||

|

Investing for the Long Run® | 16 |

|||||||

| Investment Activity – Investment Volume | |||||

| Property Type(s) | Closing Date / Asset Completion Date | Gross Investment Amount | Investment Type | Lease Term (Years) (a) |

Gross Square Footage | |||||||||||||||||||||||||||||||||||||||

| Tenant / Lease Guarantor | Property Location(s) | |||||||||||||||||||||||||||||||||||||||||||

| 1Q25 | ||||||||||||||||||||||||||||||||||||||||||||

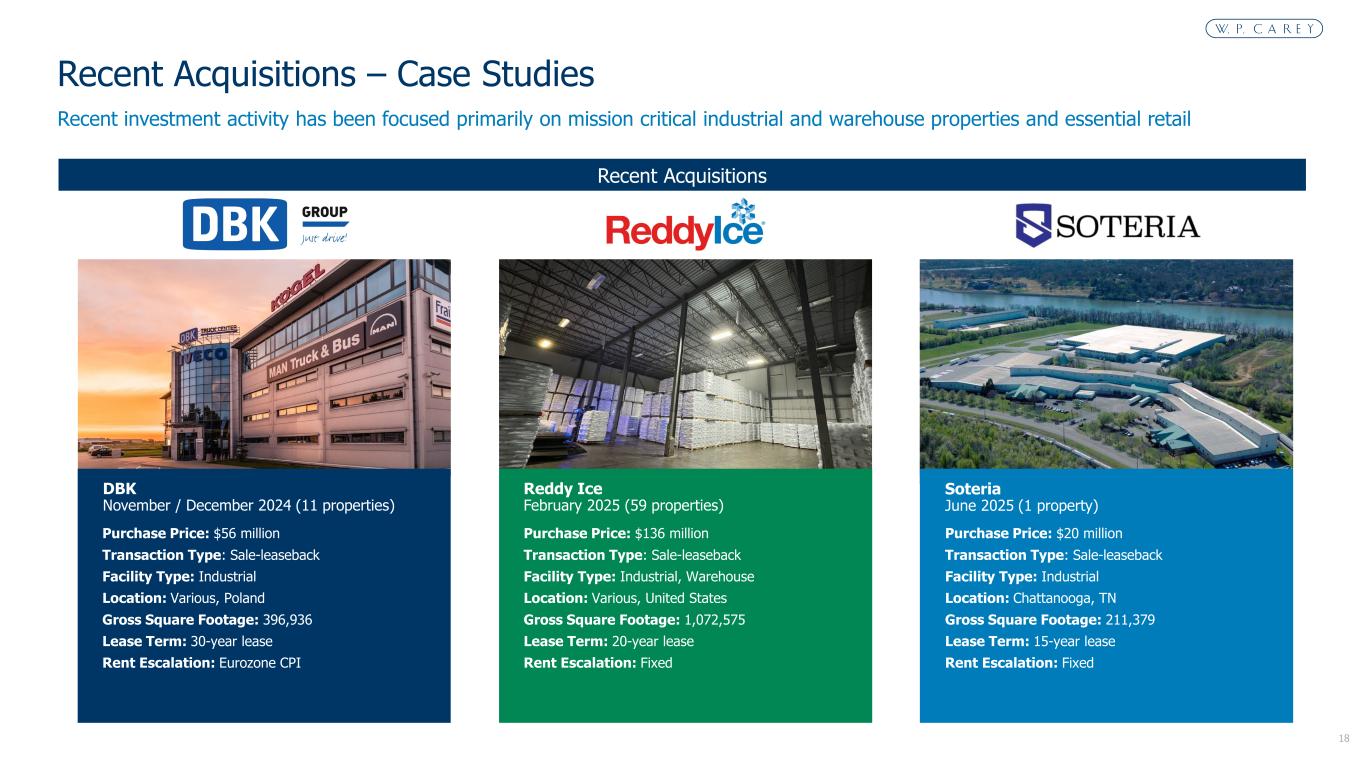

| Reddy Ice LLC (59 properties) | Various, United States | Industrial, Warehouse | Feb-25 | $ | 136,022 | Sale-leaseback | 20 | 1,072,575 | ||||||||||||||||||||||||||||||||||||

| Las Vegas Retail Complex | Las Vegas, NV | Retail | Feb-25 | 5,000 | 47.5% Joint Venture Acquisition | 8 | 75,255 | |||||||||||||||||||||||||||||||||||||

Dollar General Corporation (4 properties) |

Various, United States | Retail | Mar-25 | 8,474 | Acquisition | 15 | 42,388 | |||||||||||||||||||||||||||||||||||||

| Ernest Health Holdings, LLC | Mishawaka, IN | Specialty (Healthcare) | Mar-25 | 31,762 | Acquisition | 15 | 55,210 | |||||||||||||||||||||||||||||||||||||

Majestic Steel USA, Inc. (b) |

Blytheville, AR | Industrial | Mar-25 | 91,910 | Sale-leaseback | 24 | 513,633 | |||||||||||||||||||||||||||||||||||||

| 1Q25 Total | 273,168 | 16 | 1,759,061 | |||||||||||||||||||||||||||||||||||||||||

| 2Q25 | ||||||||||||||||||||||||||||||||||||||||||||

Linde + Wiemann SE & Co. KG (4 properties) (c) |

Various, Germany (3 properties) and La Garriga, Spain |

Industrial | Apr-25 | 42,981 | Sale-leaseback | 25 | 640,732 | |||||||||||||||||||||||||||||||||||||

| United Natural Foods, Inc. | Santa Fe Springs, CA | Warehouse | Apr-25 | 128,043 | Acquisition | 10 | 302,850 | |||||||||||||||||||||||||||||||||||||

| Berry Global Group, Inc. | Evansville, IN | Industrial | Apr-25 | 8,150 | Renovation | 15 | N/A | |||||||||||||||||||||||||||||||||||||

Morato Pane S.p.A. (9 properties) (c) |

Various, Italy (7 properties) and Málaga and Burgos, Spain | Industrial | May-25 | 73,280 | Sale-leaseback | 20 | 1,159,154 | |||||||||||||||||||||||||||||||||||||

| Soteria Intermediate Inc. | Chattanooga, TN | Industrial | Jun-25 | 20,247 | Sale-leaseback | 15 | 211,379 | |||||||||||||||||||||||||||||||||||||

Hertz Global Holdings, Inc (2 properties) |

Newark, NJ and Boston, MA | Industrial | Jun-25 | 101,856 | Sale-leaseback | 20 | 81,664 | |||||||||||||||||||||||||||||||||||||

| TI Automotive (formerly ABC Technologies Holdings Inc.) | Galeras, Mexico | Industrial | Jun-25 | 4,843 | Expansion | 18 | 60,181 | |||||||||||||||||||||||||||||||||||||

Premium Brands Holdings Corporation (b) |

McDonald, TN | Industrial | Jun-25 | 166,060 | Sale-leaseback | 25 | 356,960 | |||||||||||||||||||||||||||||||||||||

| 2Q25 Total | 545,460 | 19 | 2,812,920 | |||||||||||||||||||||||||||||||||||||||||

| Year-to-Date Total | 818,628 | 18 | 4,571,981 | |||||||||||||||||||||||||||||||||||||||||

| Property Type | Loan Origination | Loan Maturity Date | Funding | Outstanding | Maximum Commitment | |||||||||||||||||||||||||||||||||||||||||||||

| Description | Property Location | Current Quarter | Year to Date | |||||||||||||||||||||||||||||||||||||||||||||||

Construction Loan (d) | ||||||||||||||||||||||||||||||||||||||||||||||||||

SW Corner of Las Vegas & Harmon (e) (f) |

Las Vegas, NV | Retail | Jun-21 | 2026 | $ | 2,000 | $ | 3,170 | $ | 245,884 | $ | 256,887 | ||||||||||||||||||||||||||||||||||||||

SE Corner of Las Vegas & Harmon (g) |

Las Vegas, NV | Retail | Nov-24 | 2025 | 579 | 624 | 17,435 | 23,449 | ||||||||||||||||||||||||||||||||||||||||||

SE Corner of Las Vegas & Elvis Presley (g) |

Las Vegas, NV | Retail | Nov-24 | 2025 | 599 | 1,360 | 16,406 | 25,000 | ||||||||||||||||||||||||||||||||||||||||||

| Total | 3,178 | 5,154 | 279,725 | 305,336 | ||||||||||||||||||||||||||||||||||||||||||||||

| Year-to-Date Total Investment Volume | $ | 823,782 | ||||||||||||||||||||||||||||||||||||||||||||||||

|

Investing for the Long Run® | 17 |

|||||||

Investment Activity – Capital Investments and Commitments (a) | |||||

| Primary Transaction Type | Property Type | Expected Completion / Closing Date | Additional Gross Square Footage | Lease Term (Years) (b) |

Funded During Three Months Ended Jun. 30, 2025 (c) |

Total Funded Through Jun. 30, 2025 | Maximum Commitment / Gross Investment Amount | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tenant | Location | Remaining | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sumitomo Heavy Industries, LTD. | Bedford, MA | Redevelopment | Research and Development | Q3 2025 | N/A | 15 | $ | 8,134 | $ | 25,069 | $ | 19,071 | $ | 44,140 | ||||||||||||||||||||||||||||||||||||||||||||||||

Janus International Group, Inc. (d) |

Surprise, AZ | Build-to-Suit | Industrial | Q3 2025 | 131,753 | 20 | 13 | 9,937 | 11,475 | 21,713 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Hedin Mobility Group AB (e) (f) |

Amsterdam, The Netherlands | Renovation | Retail | Q3 2025 | 39,826 | 22 | — | — | 17,580 | 17,580 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Tidal Wave Auto Spa (f) |

New Hartford, NY | Purchase Commitment | Retail (Car Wash) | Q3 2025 | 3,600 | 18 | — | — | 5,077 | 5,077 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Fraikin SAS (e) |

Various, France | Renovation | Industrial | Q4 2025 | N/A | 17 | 1,254 | 4,508 | 3,579 | 8,087 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Various | Various, United States | Solar Projects | Various | Various | N/A | N/A | 298 | 4,298 | 8,630 | 12,928 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expected Completion Date 2025 Total | 175,179 | 17 | 9,699 | 43,812 | 65,412 | 109,525 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Scania CV AB (e) |

Oskarshamn, Sweden | Build-to-Suit | Warehouse | Q1 2026 | 204,645 | 15 | 1,735 | 1,748 | 15,245 | 16,993 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

EOS Fitness OPCO Holdings, LLC (d) |

Surprise, AZ | Build-to-Suit | Retail | Q1 2026 | 40,000 | 20 | 2,128 | 4,721 | 7,195 | 12,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rocky Vista University LLC | Billings, MT | Build-to-Suit | Education (Medical School) | Q2 2026 | 57,000 | 25 | — | 2,508 | 22,492 | 25,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

TI Automotive (formerly ABC Technologies Holdings Inc.) (d) (e) (g) |

Brampton, Canada | Build-to-Suit | Industrial | Q4 2026 | 110,456 | 20 | 247 | 247 | 17,695 | 17,950 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expected Completion Date 2026 Total | 412,101 | 21 | 4,110 | 9,224 | 62,627 | 71,943 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

AEG Presents LLC (h) |

Austin, TX | Build-to-Suit | Specialty | Q2 2027 | 56,403 | 30 | 3,873 | 3,873 | 43,683 | 47,556 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

AEG Presents LLC (h) |

Portland, OR | Build-to-Suit | Specialty | Q2 2027 | 57,825 | 30 | 4,801 | 4,801 | 55,912 | 60,713 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expected Completion Date 2027 Total | 114,228 | 30 | 8,674 | 8,674 | 99,595 | 108,269 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Capital Investments and Commitments Total | 701,508 | 23 | $ | 22,483 | $ | 61,710 | $ | 227,634 | $ | 289,737 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Investing for the Long Run® | 18 |

|||||||

| Investment Activity – Dispositions | |||||

| Tenant / Lease Guarantor | Property Location(s) | Gross Sale Price | Closing Date | Property Type(s) | Gross Square Footage | |||||||||||||||||||||||||||

| 1Q25 | ||||||||||||||||||||||||||||||||

Hedin Mobility Group AB (2 properties) (a) |

Eindhoven and Amsterdam, The Netherlands | $ | 16,593 | Jan-25 | Retail | 136,465 | ||||||||||||||||||||||||||

Pendragon PLC (a) |

Derby, United Kingdom | 2,158 | Jan-25 | Retail | 34,764 | |||||||||||||||||||||||||||

Pendragon PLC (a) |

Newport, United Kingdom | 752 | Jan-25 | Retail | 3,868 | |||||||||||||||||||||||||||

Vacant (formerly Pendragon PLC) (a) |

Milton Keynes, United Kingdom | 6,560 | Feb-25 | Retail | 25,942 | |||||||||||||||||||||||||||

Pendragon PLC (a) |

Portsmouth, United Kingdom | 1,506 | Feb-25 | Retail | 28,638 | |||||||||||||||||||||||||||

| Vacant (former Prima Wawona Packing Co., LLC) | Reedley, CA | 21,500 | Mar-25 | Warehouse | 325,981 | |||||||||||||||||||||||||||

Hellweg Die Profi-Baumärkte GmbH & Co. KG (a) |

Gronau, Germany | 3,569 | Mar-25 | Retail | 45,876 | |||||||||||||||||||||||||||

| Belk, Inc. | Jonesville, SC | 77,194 | Mar-25 | Warehouse | 861,141 | |||||||||||||||||||||||||||

| 1Q25 Total | 129,832 | 1,462,675 | ||||||||||||||||||||||||||||||

| 2Q25 | ||||||||||||||||||||||||||||||||

Vita Euroland Agriculture B.V (a) |

Gorinchem, The Netherlands | 8,488 | Apr-25 | Warehouse | 133,500 | |||||||||||||||||||||||||||

Accord Carton LLC (2 properties) (b) |

Alsip, IL | 20,757 | Apr-25 | Industrial | 471,890 | |||||||||||||||||||||||||||

Hellweg Die Profi-Baumärkte GmbH & Co. KG (3 properties) (a) |

Ennepetal, Nordhausen, and Paderborn, Germany | 14,501 | May-25 | Retail | 198,002 | |||||||||||||||||||||||||||

| Vacant | Middleburg Heights, OH | 2,225 | May-25 | Industrial | 28,185 | |||||||||||||||||||||||||||

| TI Automotive (formerly ABC Technologies Holdings Inc.) | Saline, MI | 7,900 | May-25 | Industrial | 111,072 | |||||||||||||||||||||||||||

Memora Servicios Funerarios S.L (26 properties) (a) |

Various, Spain | 161,952 | Jun-25 | Specialty (Funeral Home) | 370,204 | |||||||||||||||||||||||||||

| Self-Storage Operating Properties (10 properties) | Various, United States | 111,525 | Jun-25 | Self-Storage (Operating) | 678,767 | |||||||||||||||||||||||||||

| Serco Inc. | San Diego, CA | 26,250 | Jun-25 | Research & Development | 157,721 | |||||||||||||||||||||||||||

Do It Best Corp. (formerly True Value Company, LLC) (c) |

Mankato, MN | 10,605 | Jun-25 | Warehouse | 309,507 | |||||||||||||||||||||||||||

| 2Q25 Total | 364,203 | 2,458,848 | ||||||||||||||||||||||||||||||

| Year-to-Date Total Dispositions | $ | 494,035 | 3,921,523 | |||||||||||||||||||||||||||||

|

Investing for the Long Run® | 19 |

|||||||

| Joint Ventures | |||||

| Joint Venture or JV (Principal Tenant) | JV Partnership | Consolidated | Pro Rata (a) |

|||||||||||||||||||||||||||||||||||

| Asset Type | WPC % | Debt Outstanding (b) |

ABR | Debt Outstanding (c) |

ABR | |||||||||||||||||||||||||||||||||

Unconsolidated Joint Venture (Equity Method Investment) (d) |

||||||||||||||||||||||||||||||||||||||

Las Vegas Retail Complex (e) |

Net lease | 47.50% | $ | 245,884 | $ | 22,430 | $ | 116,795 | $ | 10,654 | ||||||||||||||||||||||||||||

| Harmon Retail Corner | Common equity interest | 15.00% | 143,000 | — | 21,450 | — | ||||||||||||||||||||||||||||||||

Kesko Senukai (f) |

Net lease | 70.00% | 102,433 | 18,059 | 71,703 | 12,641 | ||||||||||||||||||||||||||||||||

| Total Unconsolidated Joint Ventures | 491,317 | 40,489 | 209,948 | 23,295 | ||||||||||||||||||||||||||||||||||

Consolidated Joint Ventures (g) |

||||||||||||||||||||||||||||||||||||||

COOP Ost SA (f) |

Net lease | 90.10% | — | 6,984 | — | 6,293 | ||||||||||||||||||||||||||||||||

Fentonir Trading & Investments Limited (f) |

Net lease | 94.90% | — | 2,862 | — | 2,716 | ||||||||||||||||||||||||||||||||

| McCoy-Rockford, Inc. | Net lease | 90.00% | — | 972 | — | 875 | ||||||||||||||||||||||||||||||||

| State of Iowa Board of Regents | Net lease | 90.00% | — | 643 | — | 579 | ||||||||||||||||||||||||||||||||

| Total Consolidated Joint Ventures | — | 11,461 | — | 10,463 | ||||||||||||||||||||||||||||||||||

Total Unconsolidated and Consolidated Joint Ventures |

$ | 491,317 | $ | 51,950 | $ | 209,948 | $ | 33,758 | ||||||||||||||||||||||||||||||

|

Investing for the Long Run® | 20 |

|||||||

| Top 25 Tenants | |||||

| Tenant / Lease Guarantor | Description | Number of Properties | ABR | ABR % | Weighted-Average Lease Term (Years) | |||||||||||||||||||||||||||

| Extra Space Storage, Inc. | Net lease self-storage properties in the U.S. leased to publicly traded self-storage REIT | 41 | $ | 40,139 | 2.7 | % | 24.2 | |||||||||||||||||||||||||

Apotex Pharmaceutical Holdings Inc. (a) |

Pharmaceutical R&D and manufacturing properties in the Greater Toronto Area leased to generic drug manufacturer | 11 | 33,448 | 2.3 | % | 17.7 | ||||||||||||||||||||||||||

Metro Cash & Carry Italia S.p.A. (b) |

Business-to-business retail stores in Italy leased to cash and carry wholesaler | 19 | 30,767 | 2.1 | % | 4.9 | ||||||||||||||||||||||||||

Fortenova Grupa d.d. (b) |

Grocery stores and one warehouse in Croatia leased to European food retailer | 19 | 28,332 | 1.9 | % | 8.8 | ||||||||||||||||||||||||||

OBI Group (b) |

Retail properties in Poland leased to German DIY retailer | 26 | 27,395 | 1.9 | % | 5.8 | ||||||||||||||||||||||||||

Hellweg Die Profi-Baumärkte GmbH & Co. KG (b) (c) |

Retail properties in Germany leased to German DIY retailer | 31 | 26,451 | 1.8 | % | 18.7 | ||||||||||||||||||||||||||

TI Automotive (formerly ABC Technologies Holdings Inc.) (a) (d) |

Automotive parts manufacturing properties in the U.S., Canada and Mexico leased to OEM supplier | 22 | 25,510 | 1.8 | % | 17.8 | ||||||||||||||||||||||||||

Fedrigoni S.p.A (b) |

Industrial and warehouse facilities in Germany, Italy and Spain leased to global manufacturer of premium packaging and labels | 16 | 25,033 | 1.7 | % | 18.4 | ||||||||||||||||||||||||||

Eroski Sociedad Cooperative (b) |

Grocery stores and warehouses in Spain leased to Spanish food retailer | 63 | 23,811 | 1.6 | % | 10.7 | ||||||||||||||||||||||||||

| Nord Anglia Education, Inc. | K-12 private schools in Orlando, Miami and Houston leased to international day and boarding school operator | 3 | 23,599 | 1.6 | % | 18.2 | ||||||||||||||||||||||||||

| Top 10 Total | 251 | 284,485 | 19.4 | % | 14.8 | |||||||||||||||||||||||||||

Quikrete Holdings, Inc. (b) |

Industrial facilities in the U.S. and Canada leased to concrete and building products manufacturer | 27 | 20,662 | 1.4 | % | 18.0 | ||||||||||||||||||||||||||

| Berry Global Inc. | Manufacturing facilities in the U.S. leased to international producer and supplier of packaging solutions | 8 | 20,616 | 1.4 | % | 13.3 | ||||||||||||||||||||||||||

Kesko Senukai (b) |

Distribution facilities and retail properties in Lithuania, Estonia and Latvia leased to European DIY retailer | 20 | 20,077 | 1.4 | % | 6.6 | ||||||||||||||||||||||||||

Pendragon PLC (b) |

Dealerships in the United Kingdom leased to automotive retailer | 47 | 19,096 | 1.3 | % | 13.1 | ||||||||||||||||||||||||||

| Advance Auto Parts, Inc. | Distribution facilities in the U.S. leased to automotive aftermarket parts provider | 28 | 18,980 | 1.3 | % | 7.6 | ||||||||||||||||||||||||||

Do It Best Corp. (formerly True Value Company, LLC) (e) |

Distribution facilities and manufacturing facility in the U.S. leased to global hardware wholesaler | 8 | 17,889 | 1.2 | % | 5.2 | ||||||||||||||||||||||||||

| Maker’s Pride (formerly Hearthside Food Solutions LLC) | Production, packaging and distribution facilities in the U.S. leased to North American contract food manufacturer | 18 | 17,206 | 1.2 | % | 17.1 | ||||||||||||||||||||||||||

Koninklijke Jumbo Food Groep B.V (b) |

Logistics and cold storage warehouse facilities in the Netherlands leased to European supermarket chain | 5 | 16,849 | 1.1 | % | 6.5 | ||||||||||||||||||||||||||

Danske Fragtmaend Ejendomme A/S (b) |

Distribution facilities in Denmark leased to Danish freight company | 15 | 15,074 | 1.0 | % | 11.6 | ||||||||||||||||||||||||||

| Dollar General Corporation | Retail properties in the U.S. leased to discount retailer | 110 | 14,836 | 1.0 | % | 13.8 | ||||||||||||||||||||||||||

| Top 20 Total | 537 | 465,770 | 31.7 | % | 13.5 | |||||||||||||||||||||||||||

Intergamma Bouwmarkten B.V. (b) |

Retail properties in the Netherlands leased to European DIY retailer | 36 | 14,410 | 1.0 | % | 8.1 | ||||||||||||||||||||||||||

| Dick’s Sporting Goods, Inc. | Retail properties and single distribution facility in the U.S. leased to sporting goods retailer | 9 | 13,616 | 0.9 | % | 6.1 | ||||||||||||||||||||||||||

| Premium Brands Holdings Corporation | Food processing facility in Tennessee leased to global specialty food manufacturer | 1 | 12,616 | 0.9 | % | 25.1 | ||||||||||||||||||||||||||

| Lineage | Cold storage warehouse facilities in the Los Angeles and San Francisco areas leased to publicly traded cold storage REIT | 4 | 11,862 | 0.8 | % | 5.4 | ||||||||||||||||||||||||||

| Henkel AG & Co. KGaA | Distribution facility in Kentucky leased to global provider of consumer products and adhesives | 1 | 11,624 | 0.8 | % | 16.8 | ||||||||||||||||||||||||||

Top 25 Total (f) |

588 | $ | 529,898 | 36.1 | % | 13.3 | ||||||||||||||||||||||||||

|

Investing for the Long Run® | 21 |

|||||||

| Diversification by Property Type | |||||

| Total Net-Lease Portfolio | ||||||||||||||||||||||||||

| Property Type | ABR | ABR % | Square Footage (a) |

Square Footage % | ||||||||||||||||||||||

| U.S. | ||||||||||||||||||||||||||

| Industrial | $ | 381,081 | 25.9 | % | 56,865 | 31.9 | % | |||||||||||||||||||

| Warehouse | 228,174 | 15.5 | % | 43,384 | 24.4 | % | ||||||||||||||||||||

Retail (b) |

108,048 | 7.4 | % | 4,994 | 2.8 | % | ||||||||||||||||||||

Other (c) |

167,212 | 11.4 | % | 9,385 | 5.3 | % | ||||||||||||||||||||

| U.S. Total | 884,515 | 60.2 | % | 114,628 | 64.4 | % | ||||||||||||||||||||

| International | ||||||||||||||||||||||||||

| Industrial | 173,356 | 11.8 | % | 22,387 | 12.6 | % | ||||||||||||||||||||

| Warehouse | 156,839 | 10.7 | % | 22,077 | 12.4 | % | ||||||||||||||||||||

Retail (b) |

220,134 | 14.9 | % | 17,133 | 9.6 | % | ||||||||||||||||||||

Other (c) |

34,708 | 2.4 | % | 1,760 | 1.0 | % | ||||||||||||||||||||

| International Total | 585,037 | 39.8 | % | 63,357 | 35.6 | % | ||||||||||||||||||||

| Total | ||||||||||||||||||||||||||

| Industrial | 554,437 | 37.7 | % | 79,252 | 44.5 | % | ||||||||||||||||||||

| Warehouse | 385,013 | 26.2 | % | 65,461 | 36.8 | % | ||||||||||||||||||||

Retail (b) |

328,182 | 22.3 | % | 22,127 | 12.4 | % | ||||||||||||||||||||

Other (c) |

201,920 | 13.8 | % | 11,145 | 6.3 | % | ||||||||||||||||||||

Total (d) |

$ | 1,469,552 | 100.0 | % | 177,985 | 100.0 | % | |||||||||||||||||||

|

Investing for the Long Run® | 22 |

|||||||

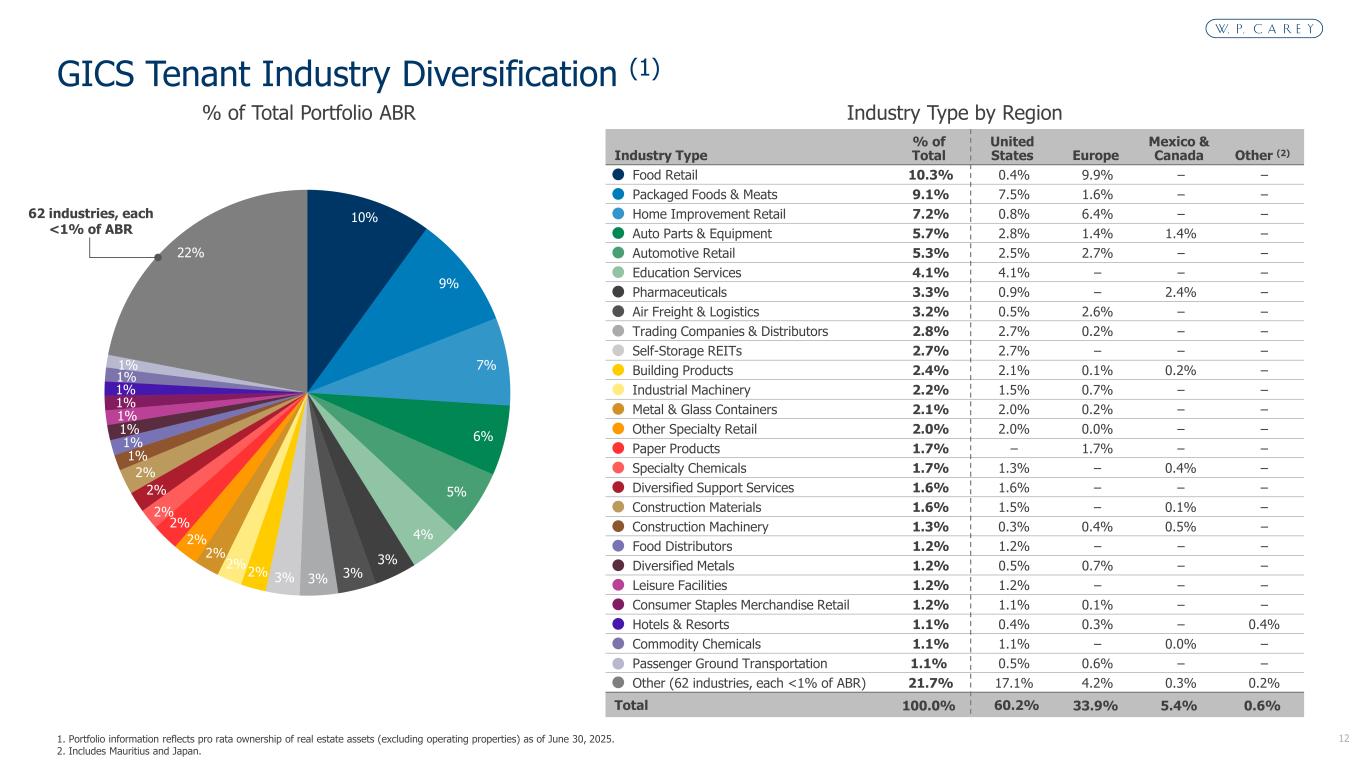

| Diversification by Tenant Industry | |||||

| Total Net-Lease Portfolio | ||||||||||||||||||||||||||

Industry Type (a) |

ABR | ABR % | Square Footage | Square Footage % | ||||||||||||||||||||||

| Food Retail | $ | 151,160 | 10.3 | % | 11,744 | 6.6 | % | |||||||||||||||||||

| Packaged Foods & Meats | 134,038 | 9.1 | % | 16,478 | 9.3 | % | ||||||||||||||||||||

| Home Improvement Retail | 105,607 | 7.2 | % | 12,823 | 7.2 | % | ||||||||||||||||||||

| Auto Parts & Equipment | 83,231 | 5.7 | % | 12,471 | 7.0 | % | ||||||||||||||||||||

| Automotive Retail | 77,345 | 5.3 | % | 7,038 | 4.0 | % | ||||||||||||||||||||

| Education Services | 59,787 | 4.1 | % | 2,778 | 1.6 | % | ||||||||||||||||||||

| Pharmaceuticals | 47,850 | 3.3 | % | 3,076 | 1.7 | % | ||||||||||||||||||||

| Air Freight & Logistics | 46,366 | 3.1 | % | 7,075 | 4.0 | % | ||||||||||||||||||||

| Trading Companies & Distributors | 41,782 | 2.8 | % | 9,486 | 5.3 | % | ||||||||||||||||||||

| Self-Storage REITs | 40,139 | 2.7 | % | 3,082 | 1.7 | % | ||||||||||||||||||||

| Building Products | 35,315 | 2.4 | % | 7,643 | 4.3 | % | ||||||||||||||||||||

| Industrial Machinery | 32,347 | 2.2 | % | 5,045 | 2.8 | % | ||||||||||||||||||||

| Metal & Glass Containers | 31,465 | 2.1 | % | 4,301 | 2.4 | % | ||||||||||||||||||||

| Other Specialty Retail | 28,845 | 2.0 | % | 3,233 | 1.8 | % | ||||||||||||||||||||

| Paper Products | 25,033 | 1.7 | % | 4,458 | 2.5 | % | ||||||||||||||||||||

| Specialty Chemicals | 24,393 | 1.7 | % | 4,303 | 2.4 | % | ||||||||||||||||||||

| Diversified Support Services | 23,909 | 1.6 | % | 2,372 | 1.3 | % | ||||||||||||||||||||

| Construction Materials | 23,575 | 1.6 | % | 3,781 | 2.1 | % | ||||||||||||||||||||

| Construction Machinery | 18,832 | 1.3 | % | 2,528 | 1.4 | % | ||||||||||||||||||||

| Food Distributors | 18,339 | 1.2 | % | 1,552 | 0.9 | % | ||||||||||||||||||||

| Diversified Metals | 17,979 | 1.2 | % | 3,622 | 2.0 | % | ||||||||||||||||||||

| Leisure Facilities | 17,593 | 1.2 | % | 645 | 0.4 | % | ||||||||||||||||||||

| Consumer Staples Merchandise Retail | 17,036 | 1.2 | % | 1,456 | 0.8 | % | ||||||||||||||||||||

| Hotels & Resorts | 16,329 | 1.1 | % | 1,073 | 0.6 | % | ||||||||||||||||||||

| Commodity Chemicals | 16,192 | 1.1 | % | 2,493 | 1.4 | % | ||||||||||||||||||||

| Passenger Ground Transportation | 15,517 | 1.1 | % | 780 | 0.5 | % | ||||||||||||||||||||

Other (62 industries, each <1% ABR) (b) |

319,548 | 21.7 | % | 42,649 | 24.0 | % | ||||||||||||||||||||

Total (c) |

$ | 1,469,552 | 100.0 | % | 177,985 | 100.0 | % | |||||||||||||||||||

|

Investing for the Long Run® | 23 |

|||||||

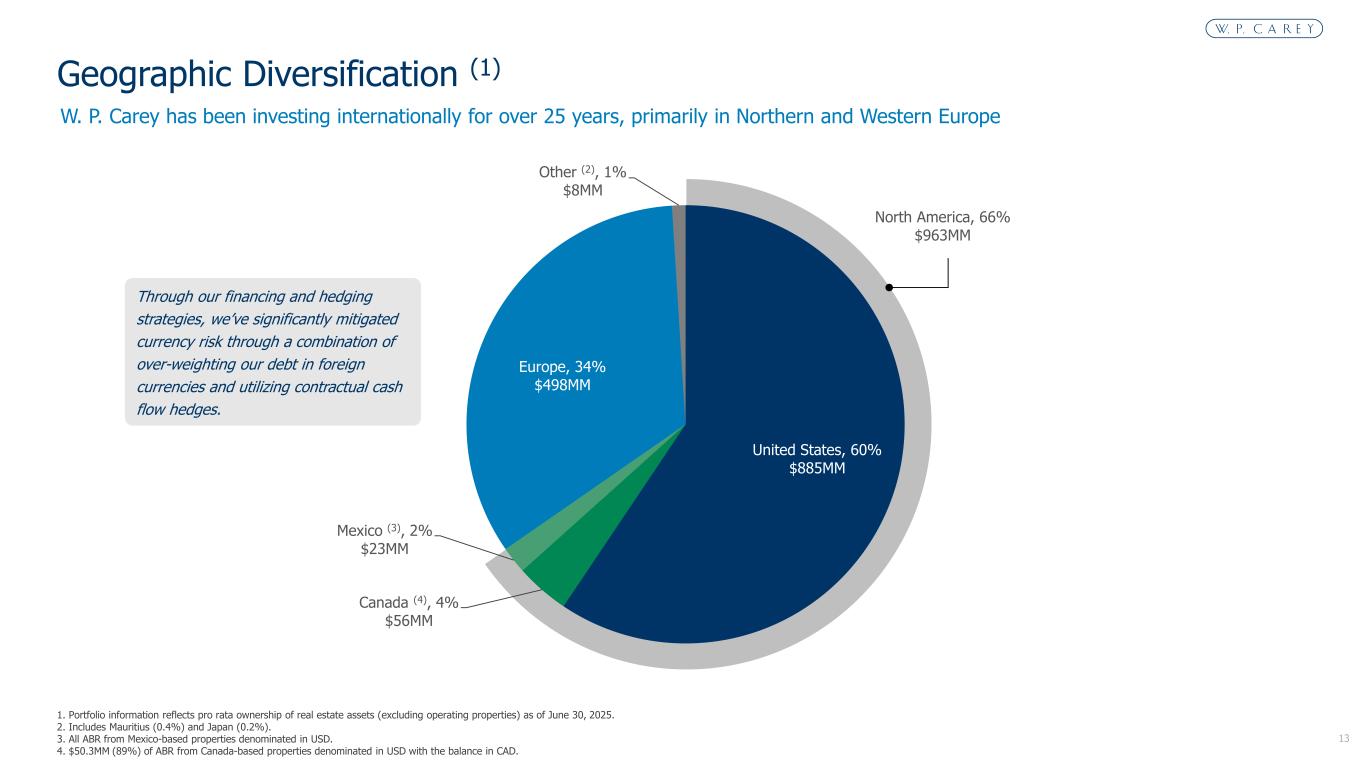

| Diversification by Geography | |||||

| Total Net-Lease Portfolio | ||||||||||||||||||||||||||

| Region | ABR | ABR % | Square Footage (a) |

Square Footage % | ||||||||||||||||||||||

| U.S. | ||||||||||||||||||||||||||

| Midwest | ||||||||||||||||||||||||||

| Illinois | $ | 63,025 | 4.3 | % | 9,474 | 5.3 | % | |||||||||||||||||||

| Ohio | 42,946 | 2.9 | % | 8,384 | 4.7 | % | ||||||||||||||||||||

| Indiana | 39,978 | 2.7 | % | 6,162 | 3.5 | % | ||||||||||||||||||||

| Michigan | 26,827 | 1.8 | % | 4,488 | 2.5 | % | ||||||||||||||||||||

| Wisconsin | 19,609 | 1.4 | % | 3,340 | 1.9 | % | ||||||||||||||||||||

Other (b) |

50,803 | 3.5 | % | 6,918 | 3.9 | % | ||||||||||||||||||||

| Total Midwest | 243,188 | 16.6 | % | 38,766 | 21.8 | % | ||||||||||||||||||||

| South | ||||||||||||||||||||||||||

| Texas | 86,041 | 5.9 | % | 10,780 | 6.0 | % | ||||||||||||||||||||

| Florida | 42,845 | 2.9 | % | 3,684 | 2.1 | % | ||||||||||||||||||||

| Tennessee | 39,007 | 2.7 | % | 4,572 | 2.6 | % | ||||||||||||||||||||

| Georgia | 25,300 | 1.7 | % | 4,378 | 2.4 | % | ||||||||||||||||||||

| Alabama | 21,171 | 1.4 | % | 3,504 | 2.0 | % | ||||||||||||||||||||

Other (b) |

26,469 | 1.8 | % | 3,024 | 1.7 | % | ||||||||||||||||||||

| Total South | 240,833 | 16.4 | % | 29,942 | 16.8 | % | ||||||||||||||||||||

| East | ||||||||||||||||||||||||||

| North Carolina | 40,969 | 2.8 | % | 8,858 | 5.0 | % | ||||||||||||||||||||

| Pennsylvania | 32,542 | 2.2 | % | 3,416 | 1.9 | % | ||||||||||||||||||||

| Kentucky | 29,249 | 2.0 | % | 4,485 | 2.5 | % | ||||||||||||||||||||

| New York | 22,561 | 1.5 | % | 2,284 | 1.3 | % | ||||||||||||||||||||

| New Jersey | 22,330 | 1.5 | % | 1,008 | 0.5 | % | ||||||||||||||||||||

| Massachusetts | 20,310 | 1.4 | % | 1,216 | 0.7 | % | ||||||||||||||||||||

| South Carolina | 19,428 | 1.3 | % | 4,485 | 2.5 | % | ||||||||||||||||||||

Other (b) |

34,978 | 2.4 | % | 5,287 | 3.0 | % | ||||||||||||||||||||

| Total East | 222,367 | 15.1 | % | 31,039 | 17.4 | % | ||||||||||||||||||||

| West | ||||||||||||||||||||||||||

| California | 71,578 | 4.9 | % | 5,282 | 3.0 | % | ||||||||||||||||||||

| Arizona | 22,299 | 1.5 | % | 2,372 | 1.3 | % | ||||||||||||||||||||

| Nevada | 17,714 | 1.2 | % | 485 | 0.3 | % | ||||||||||||||||||||

| Utah | 14,860 | 1.0 | % | 2,021 | 1.1 | % | ||||||||||||||||||||

Other (b) |

51,676 | 3.5 | % | 4,721 | 2.7 | % | ||||||||||||||||||||

| Total West | 178,127 | 12.1 | % | 14,881 | 8.4 | % | ||||||||||||||||||||

| U.S. Total | 884,515 | 60.2 | % | 114,628 | 64.4 | % | ||||||||||||||||||||

| International | ||||||||||||||||||||||||||

| Italy | 69,128 | 4.7 | % | 8,902 | 5.0 | % | ||||||||||||||||||||

| The Netherlands | 66,864 | 4.6 | % | 6,784 | 3.8 | % | ||||||||||||||||||||

| Poland | 65,929 | 4.5 | % | 8,460 | 4.8 | % | ||||||||||||||||||||

| Germany | 56,422 | 3.8 | % | 6,114 | 3.4 | % | ||||||||||||||||||||

Canada (c) |

56,261 | 3.8 | % | 5,450 | 3.1 | % | ||||||||||||||||||||

| United Kingdom | 54,369 | 3.7 | % | 4,412 | 2.5 | % | ||||||||||||||||||||

| Spain | 34,042 | 2.3 | % | 3,266 | 1.8 | % | ||||||||||||||||||||

| Croatia | 29,254 | 2.0 | % | 2,063 | 1.2 | % | ||||||||||||||||||||

| Denmark | 27,571 | 1.9 | % | 3,002 | 1.7 | % | ||||||||||||||||||||

| France | 25,243 | 1.7 | % | 1,679 | 0.9 | % | ||||||||||||||||||||

Mexico (d) |

22,541 | 1.5 | % | 3,604 | 2.0 | % | ||||||||||||||||||||

| Lithuania | 15,117 | 1.0 | % | 1,640 | 0.9 | % | ||||||||||||||||||||

Other (e) |

62,296 | 4.3 | % | 7,981 | 4.5 | % | ||||||||||||||||||||

| International Total | 585,037 | 39.8 | % | 63,357 | 35.6 | % | ||||||||||||||||||||

Total (f) |

$ | 1,469,552 | 100.0 | % | 177,985 | 100.0 | % | |||||||||||||||||||

|

Investing for the Long Run® | 24 |

|||||||

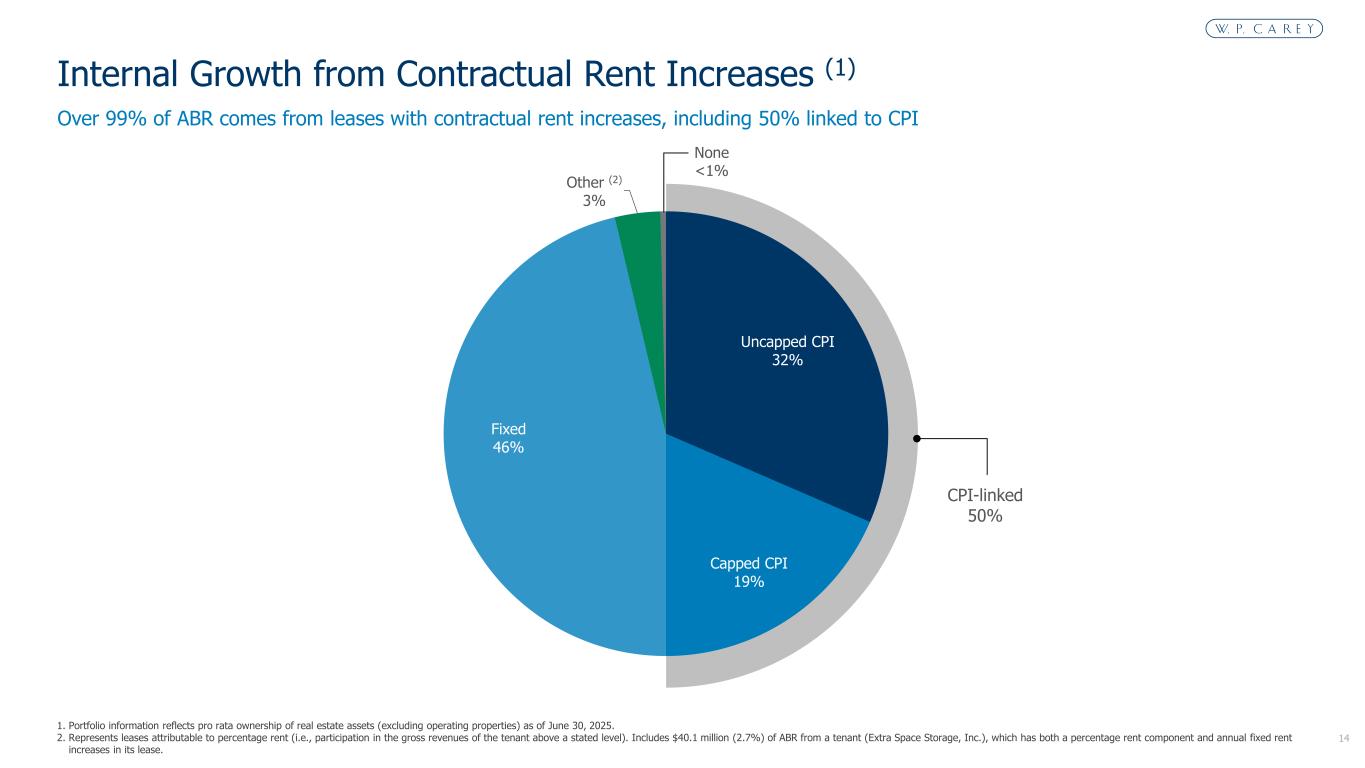

| Contractual Rent Increases | |||||

| Total Net-Lease Portfolio | ||||||||||||||||||||||||||

| Rent Adjustment Measure | ABR | ABR % | Square Footage | Square Footage % | ||||||||||||||||||||||

| Uncapped CPI | $ | 463,035 | 31.5 | % | 44,566 | 25.0 | % | |||||||||||||||||||

| Capped CPI | 272,027 | 18.5 | % | 37,943 | 21.3 | % | ||||||||||||||||||||

| CPI-linked | 735,062 | 50.0 | % | 82,509 | 46.3 | % | ||||||||||||||||||||

| Fixed | 680,581 | 46.3 | % | 88,388 | 49.7 | % | ||||||||||||||||||||

Other (a) |

47,859 | 3.3 | % | 3,509 | 2.0 | % | ||||||||||||||||||||

| None | 6,050 | 0.4 | % | 298 | 0.2 | % | ||||||||||||||||||||

| Vacant | — | — | % | 3,281 | 1.8 | % | ||||||||||||||||||||

Total (b) |

$ | 1,469,552 | 100.0 | % | 177,985 | 100.0 | % | |||||||||||||||||||

|

Investing for the Long Run® | 25 |

|||||||

| Same-Store Analysis | |||||

| ABR | |||||||||||||||||||||||

| As of | |||||||||||||||||||||||

| Jun. 30, 2025 | Jun. 30, 2024 | Increase | % Increase | ||||||||||||||||||||

| Property Type | |||||||||||||||||||||||

| Industrial | $ | 424,319 | $ | 414,199 | $ | 10,120 | 2.4 | % | |||||||||||||||

| Warehouse | 359,819 | 352,339 | 7,480 | 2.1 | % | ||||||||||||||||||

Retail (a) |

287,058 | 280,586 | 6,472 | 2.3 | % | ||||||||||||||||||

Other (b) |

142,647 | 138,954 | 3,693 | 2.7 | % | ||||||||||||||||||

| Total | $ | 1,213,843 | $ | 1,186,078 | $ | 27,765 | 2.3 | % | |||||||||||||||

| Rent Adjustment Measure | |||||||||||||||||||||||

| Uncapped CPI | $ | 411,012 | $ | 399,848 | $ | 11,164 | 2.8 | % | |||||||||||||||

| Capped CPI | 258,380 | 252,627 | 5,753 | 2.3 | % | ||||||||||||||||||

| CPI-linked | 669,392 | 652,475 | 16,917 | 2.6 | % | ||||||||||||||||||

| Fixed | 532,473 | 521,625 | 10,848 | 2.1 | % | ||||||||||||||||||

Other (c) |

7,545 | 7,545 | — | — | % | ||||||||||||||||||

| None | 4,433 | 4,433 | — | — | % | ||||||||||||||||||

| Total | $ | 1,213,843 | $ | 1,186,078 | $ | 27,765 | 2.3 | % | |||||||||||||||

| Geography | |||||||||||||||||||||||

| U.S. | $ | 676,762 | $ | 662,692 | $ | 14,070 | 2.1 | % | |||||||||||||||

| Europe | 464,105 | 452,422 | 11,683 | 2.6 | % | ||||||||||||||||||

Other International (d) |

72,976 | 70,964 | 2,012 | 2.8 | % | ||||||||||||||||||

| Total | $ | 1,213,843 | $ | 1,186,078 | $ | 27,765 | 2.3 | % | |||||||||||||||

| Same-Store Portfolio Summary | |||||||||||||||||||||||

| Number of properties | 1,113 | ||||||||||||||||||||||

| Square footage (in thousands) | 149,776 | ||||||||||||||||||||||

|

Investing for the Long Run® | 26 |

|||||||

| Same-Store Pro Rata Rental Income | |||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||

| Jun. 30, 2025 | Jun. 30, 2024 | Increase | % Increase | ||||||||||||||||||||

| Property Type | |||||||||||||||||||||||

| Industrial | $ | 112,904 | $ | 109,034 | $ | 3,870 | 3.5 | % | |||||||||||||||

| Warehouse | 90,578 | 88,249 | 2,329 | 2.6 | % | ||||||||||||||||||

Retail (a) |

72,811 | 69,088 | 3,723 | 5.4 | % | ||||||||||||||||||

Other (b) |

41,374 | 39,196 | 2,178 | 5.6 | % | ||||||||||||||||||

| Total | $ | 317,667 | $ | 305,567 | $ | 12,100 | 4.0 | % | |||||||||||||||