© 2025 ANI Pharmaceuticals, Inc. 1 Corporate Presentation November 2025

© 2025 ANI Pharmaceuticals, Inc. 2 Disclaimers Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Act, and Section 21E of the Securities Exchange Act of 1934, as amended. The guidance included herein is from or supplemental to the Company’s press release and related earnings call on November 7, 2025. The Company is neither reconfirming this guidance as of the date of this investor presentation nor assuming any obligation to update or revise such guidance. Any statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but are not always, made through the use of words or phrases such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or the negative of these words or other comparable terminology. Accordingly, these statements involve estimates, assumptions and uncertainties which could cause actual results to differ materially from those expressed in them. These statements may include, but are not limited to, statements concerning the following: the ability of our approved products, including Cortrophin Gel and ILUVIEN, to achieve commercialization at levels of market acceptance that will continue to allow us to achieve continued profitability; our ability to complete or achieve any, or all of the intended benefits of acquisitions and investments, including the acquisition of Alimera, in a timely manner or at all; the limitation of our cash flow as a result of the indebtedness and liabilities incurred from the acquisition of Alimera; the risks that our acquisitions and investments, including the acquisition of Alimera, could disrupt our business and harm our financial position and operating results; delays and disruptions in production of our approved products, increased costs and potential loss of revenues if we need to change suppliers due to the limited number of suppliers for our raw materials, active pharmaceutical ingredients, expedients, and other materials; delays and disruptions in production of our approved products as a result of our reliance on single source third party contract manufacturing supply for certain of our key products, including Cortrophin Gel and ILUVIEN; delays or failure in obtaining and maintaining approvals by the FDA of the products we sell; changes in policy or actions that may be taken by the FDA, United States Drug Enforcement Administration and other regulatory agencies, and the focus of the current U.S. presidential administration, including among other things, drug recalls, regulatory approvals, facility inspections and potential enforcement actions; risks that we may face with respect to importing raw materials and delays in delivery of raw materials and other ingredients and supplies necessary for the manufacture of our products from both domestic and overseas sources due to supply chain disruptions or for any other reason, including increased costs due to tariffs; the ability of our manufacturing partners to meet our product demands and timelines; the impact of changes or fluctuations in exchange rates; our ability to develop, license or acquire, and commercialize new products; our obligations in agreements under which we license, develop or commercialize rights to products or technology from third parties and our ability to maintain such licenses; the level of competition we face and the legal, regulatory and/or legislative strategies employed by our competitors to prevent or delay competition from generic alternatives to branded products; our ability to protect our intellectual property rights; the impact of legislative or regulatory reform on the pricing for pharmaceutical products; the impact of any litigation to which we are, or may become, a party; our ability, and that of our suppliers, development partners, and manufacturing partners, to comply with laws, regulations and standards that govern or affect the pharmaceutical and biotechnology industries; our ability to maintain the services of our key executives and other personnel; the potential impact of new U.S. tax legislation on our business, including the One Big Beautiful Bill Act; and general business and economic conditions, such as inflationary pressures, geopolitical conflicts and conditions including conflicts related to the attacks on cargo ships in the Red Sea, and other risks and uncertainties that are described in the Company’s most recent Annual Report on Form 10-K, any subsequent quarterly reports filed by the Company on Form 10-Q, and other periodic reports filed with the Securities and Exchange Commission. You should not rely upon forward-looking statements as predictions of future events. Such statements are based on management’s expectations as of the date of this presentation and involve many risks and uncertainties that could cause our actual results, events or circumstances to differ materially from those expressed or implied in our forward-looking statements. We undertake no obligation to update any forward-looking statements made in this presentation to reflect events or circumstances after the date of this presentation or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make. More detailed information on these and additional factors that could affect the Company’s actual results are described in the Company’s filings with the Securities and Exchange Commission (SEC), including its most recent annual report on Form 10-K and quarterly reports on Form 10-Q, as well as other filings with the SEC. All forward-looking statements in this presentation speak only as of the date of this presentation and are based on the Company’s current beliefs, assumptions, and expectations. The Company undertakes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

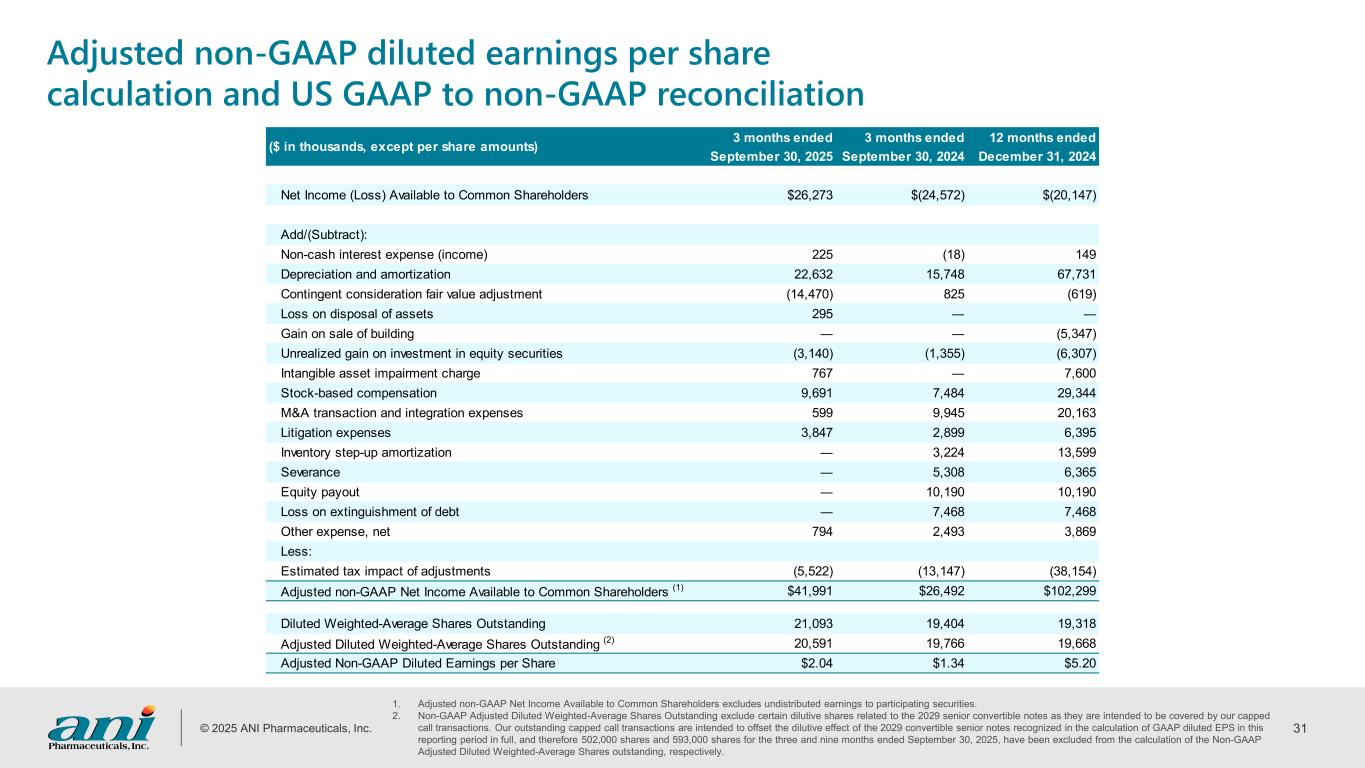

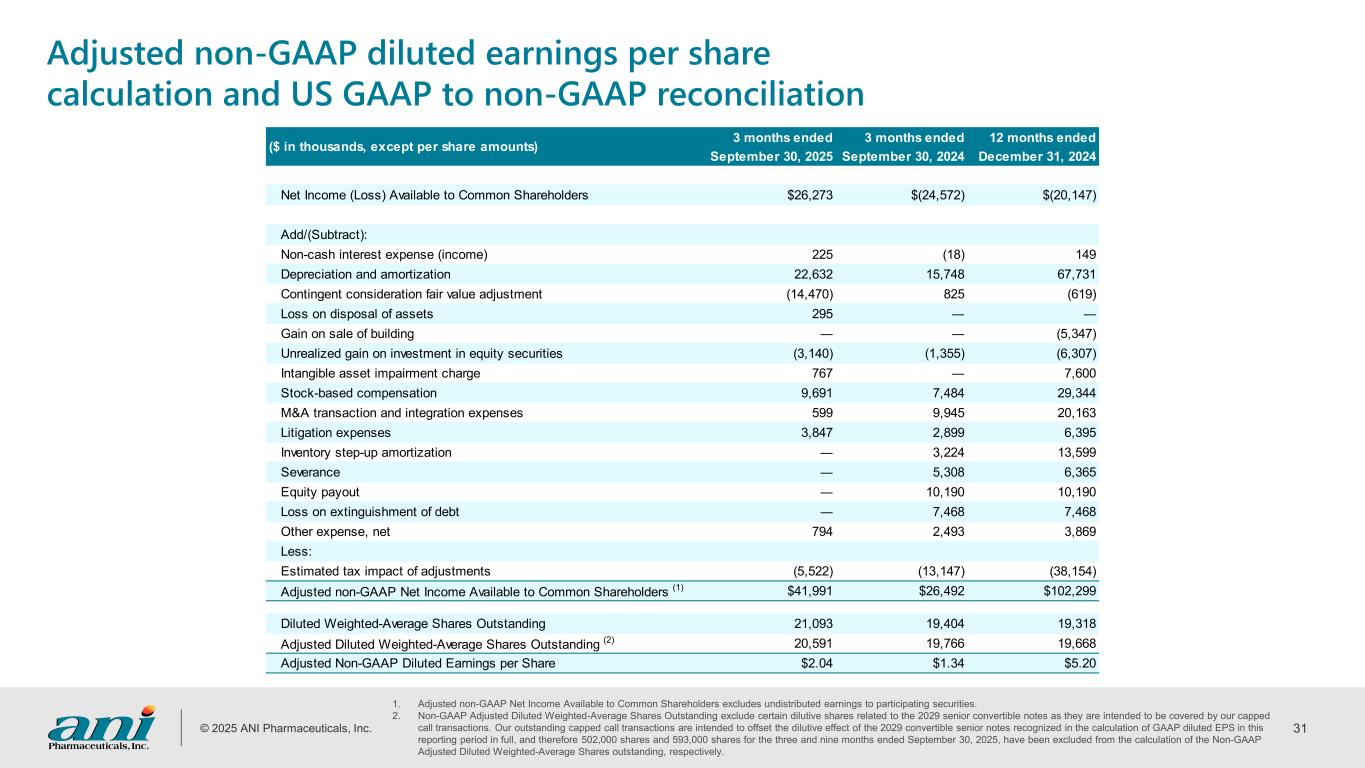

© 2025 ANI Pharmaceuticals, Inc. 3 Presentation of financial information Non-GAAP Financial Measures Adjusted non-GAAP EBITDA ANI’s management considers adjusted non-GAAP EBITDA to be an important financial indicator of ANI’s operating performance, providing investors and analysts with a useful measure of operating results unaffected by non- cash stock-based compensation and differences in capital structures, tax structures, capital investment cycles, ages of related assets, and compensation structures among otherwise comparable companies. Management uses adjusted non-GAAP EBITDA when analyzing Company performance. Adjusted non-GAAP EBITDA is defined as net income (loss), excluding tax expense (benefit), interest expense, net, other (income) expense, net, depreciation and amortization expense, non-cash stock-based compensation expense, M&A transaction and integration expenses, contingent consideration fair value adjustments, unrealized (gain) loss on our investment in equity securities, loss (gain) on disposal of assets, intangible asset impairment charges, litigation expenses related to certain matters, severance expense, and certain other items that vary in frequency and impact on ANI’s results of operations. Adjusted non-GAAP EBITDA should be considered in addition to, but not in lieu of, net income or loss reported under GAAP. A reconciliation of adjusted non-GAAP EBITDA to the most directly comparable GAAP financial measure is provided below. ANI is not providing a reconciliation for the forward-looking full year 2025 adjusted EBITDA guidance because it does not currently have sufficient information to accurately estimate all of the variables and individual adjustments for such reconciliation, including “with” and “without” tax provision information. As such, ANI’s management cannot estimate on a forward-looking basis without unreasonable effort the impact these variables and individual adjustments will have on its reported results. Adjusted non-GAAP Diluted Earnings per Share ANI’s management considers adjusted non-GAAP diluted earnings per share to be an important financial indicator of ANI’s operating performance, providing investors and analysts with a useful measure of operating results unaffected by the non-cash stock-based compensation, non-cash interest expense, depreciation and amortization, M&A transaction and integration expenses, contingent consideration fair value adjustment, unrealized (gain) loss on our investment in equity securities, loss (gain) on disposal of assets, intangible asset impairment charges, litigation expenses related to certain matters, severance expense, and certain other items that vary in frequency and impact on ANI’s results of operations. Management uses adjusted non-GAAP diluted earnings per share when analyzing Company performance. Non-GAAP Adjusted Diluted Weighted-Average Shares Outstanding exclude certain dilutive shares related to the 2029 senior convertible notes as they are intended to be covered by our capped call transactions. Our outstanding capped call transactions are intended to offset the dilutive effect of the 2029 convertible senior notes recognized in the calculation of GAAP diluted EPS in this reporting period in full, and therefore 502,000 shares and 593,000 shares for the three and nine months ended September 30, 2025, have been excluded from the calculation of the Non-GAAP Adjusted Diluted Weighted-Average Shares outstanding, respectively. Adjusted non-GAAP diluted earnings per share is defined as adjusted non-GAAP net income, as defined above, divided by the diluted weighted average shares outstanding during the period. Management will continually analyze this metric and may include additional adjustments in the calculation in order to provide further understanding of ANI’s results. Adjusted non-GAAP diluted earnings per share should be considered in addition to, but not in lieu of, diluted earnings (loss) per share reported under GAAP. A reconciliation of adjusted non-GAAP diluted earnings per share to the most directly comparable GAAP financial measure is provided below. ANI is not providing a reconciliation for the forward-looking full year 2025 adjusted diluted earnings per share guidance because it does not currently have sufficient information to accurately estimate all of the variables and individual adjustments for such reconciliation, including “with” and “without” tax provision information. As such, ANI’s management cannot estimate on a forward-looking basis without unreasonable effort the impact these variables and individual adjustments will have on its reported results.

© 2025 ANI Pharmaceuticals, Inc. 4 Rare Disease and Generics businesses drive robust, profitable growth as we fulfill our purpose of Serving Patients, Improving Lives 1. ANI received FDA approval to add the NIU-PS indication to ILUVIEN in the U.S. and transitioned commercialization efforts for ILUVIEN and YUTIQ to one brand, ILUVIEN, in the U.S. in June 2025. 2. Based on 2025 financial guidance issued by the Company on November 7, 2025. 3. Adjusted Non-GAAP EBITDA is a Non-GAAP financial measure. 4. As of September 30, 2025. 5. Based upon trailing twelve-month non-GAAP EBITDA as of November 7, 2025. Rare Disease business underpinned by lead product, Purified Cortrophin Gel, a key driver of growth; Rare Disease portfolio also includes unique product, ILUVIEN(1). Portfolio expansion through M&A and in-licensing. Key Growth Drivers Financial Strength Generics with superior R&D capabilities driving new product launches; operational excellence Brands with unique commercial capability, high margins and strong cash flow generation $614 $854-$873 2025 E2024 +39-42% Total Company Net Revenues ($ millions)(2) $156 $221-$228 2025 E2024 +42-46% Adjusted Non-GAAP EBITDA ($ millions)(2)(3) $263M Cash(4) 1.7x Net Leverage(5)

© 2025 ANI Pharmaceuticals, Inc. 5 Multi-year growth trajectory driven by: • Lead Rare Disease asset Cortrophin Gel expected to reach ~$350M(1) of sales in the fourth year of launch • Expanded Rare Disease franchise with the acquisition of Alimera in Q3 2024 • Organic generic revenue growth on strength of R&D productivity; retained #2 in Competitive Generic Therapy (CGT) approvals $316 $487 2022 2023 2025 E $854-$873 ~40% CAGR(2) $56 $134 $156 2022 2023 2024 2025 E $221-$228 ~59% CAGR(2) 2024 $614 Well-positioned to continue driving strong growth in 2025 and beyond Adjusted Non-GAAP EBITDA ($ millions)(1),(3)Total Company Net Revenues ($ millions)(1) 1. Based on 2025 financial guidance issued by the Company on November 7, 2025. 2. CAGR calculated using 2022-2025E utilizing mid-point of full year 2025 guidance. 3. Adjusted Non-GAAP EBITDA is a Non-GAAP financial measure.

© 2025 ANI Pharmaceuticals, Inc. 6 Delivered record results in Q3 2025 1. Adjusted non-GAAP EBITDA and Adjusted Diluted non-GAAP EPS are non-GAAP financial measures. 2. Non-GAAP Adjusted Diluted Weighted-Average Shares Outstanding exclude certain dilutive shares related to the 2029 senior convertible notes as they are intended to be covered by our capped call transactions. Highlights • Lead Rare Disease asset Cortrophin Gel delivered exceptional sequential and year-over-year growth • Record new patient starts and new cases initiated • Growth across therapeutic areas, and across new and existing prescribers • Continued strong demand for pre-filled syringe launch • Acute gouty arthritis, an indication unique to Cortrophin Gel, is a significant growth driver representing over 15% of Cortrophin Gel use • Revenue synergies in Ophthalmology with ~42% sequential quarterly volume growth • ILUVIEN net revenues pressured due to further impact from continued reduced access for Medicare patients and utilization of the remaining YUTIQ units at physician offices. Adoption of ILUVIEN for NIU-PS began in Q3; ANI continues to make tangible progress toward full adoption of the label transition • Generic net revenues reached new record on opportunistic partnered launch, operational excellence, and U.S. based manufacturing Q3 Total Revenues $228M 54% YoY Q3 Rare Disease & Brand Revenues $129M 97% YoY Q3 Cortrophin Gel Revenues $102M 94% YoY Q3 Adj. Non- GAAP EBITDA(1) $60M 70% YoY Q3 ILUVIEN Revenues $17M Q3 Adj. Diluted Non-GAAP EPS(1)(2) $2.04 52% YoY

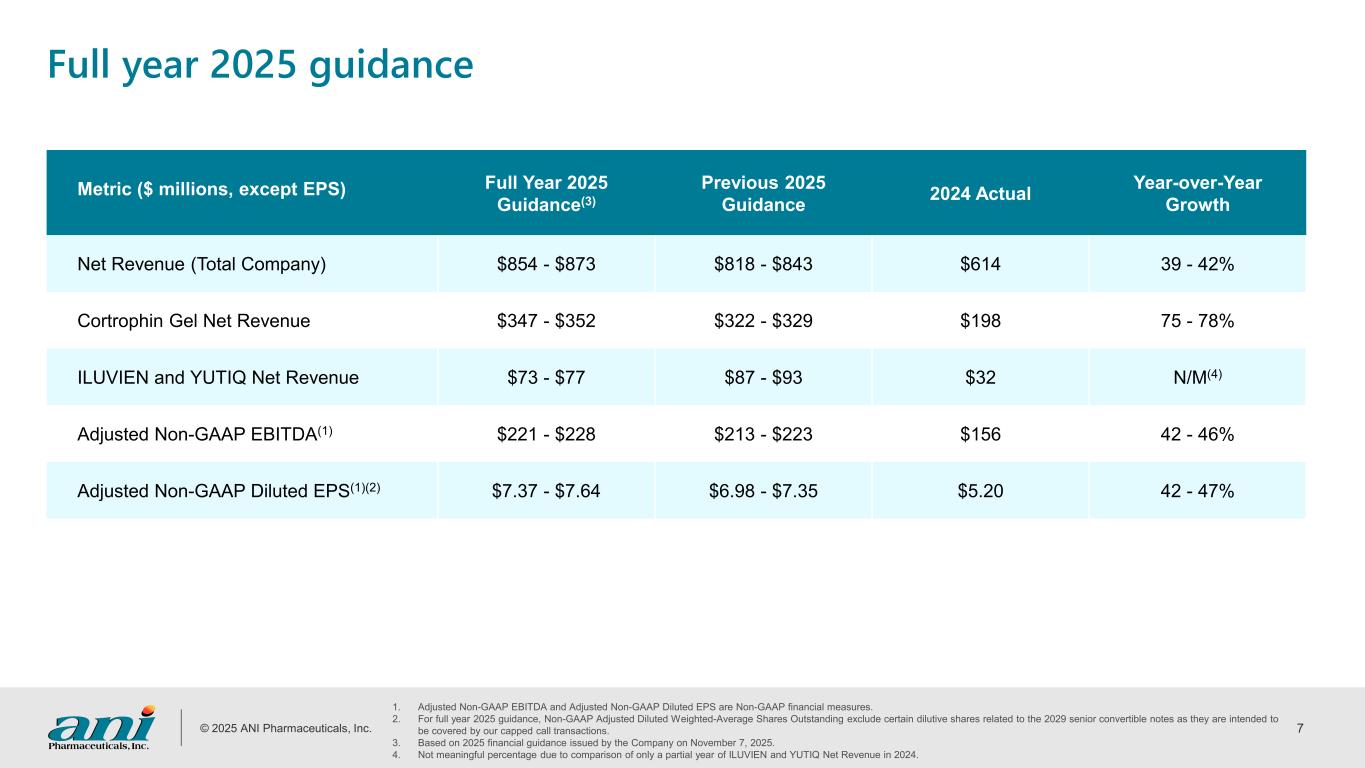

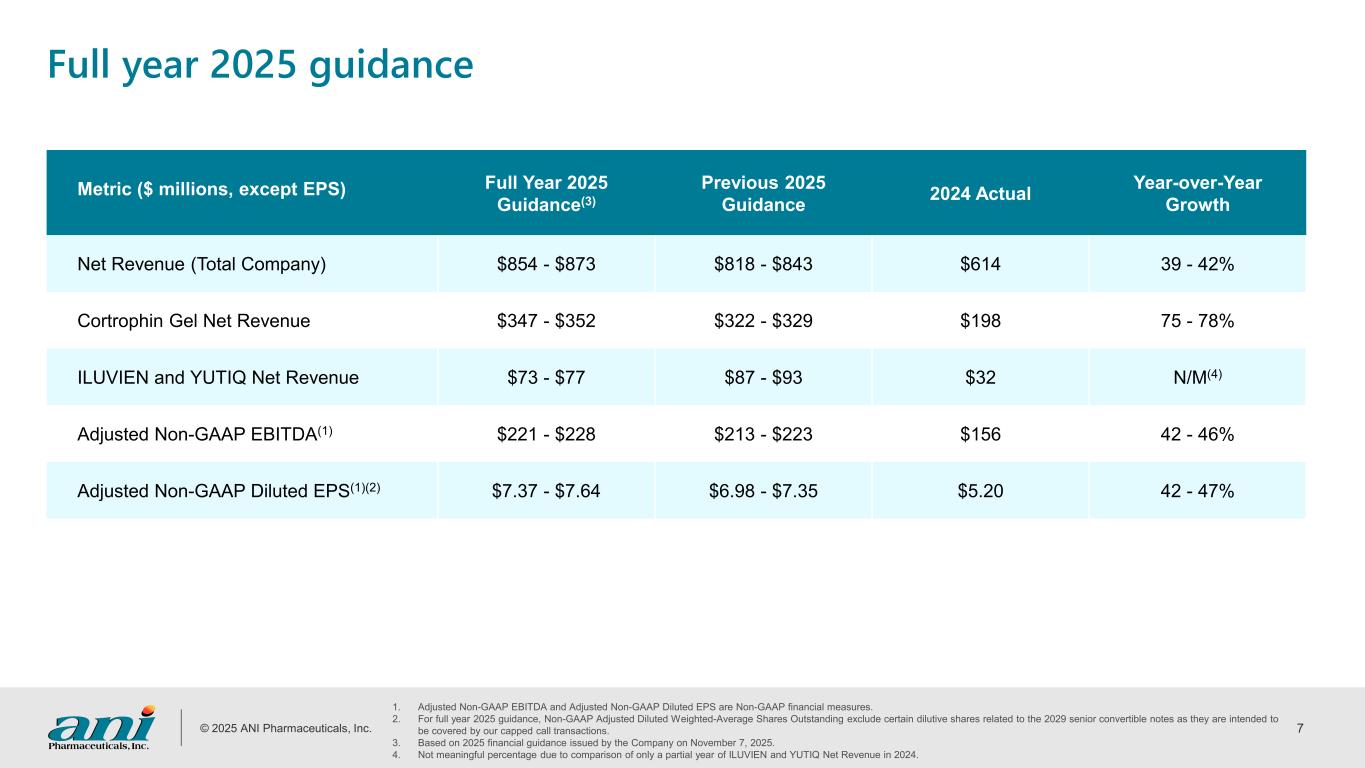

© 2025 ANI Pharmaceuticals, Inc. 7 Full year 2025 guidance Metric ($ millions, except EPS) Full Year 2025 Guidance(3) Previous 2025 Guidance 2024 Actual Year-over-Year Growth Net Revenue (Total Company) $854 - $873 $818 - $843 $614 39 - 42% Cortrophin Gel Net Revenue $347 - $352 $322 - $329 $198 75 - 78% ILUVIEN and YUTIQ Net Revenue $73 - $77 $87 - $93 $32 N/M(4) Adjusted Non-GAAP EBITDA(1) $221 - $228 $213 - $223 $156 42 - 46% Adjusted Non-GAAP Diluted EPS(1)(2) $7.37 - $7.64 $6.98 - $7.35 $5.20 42 - 47% 1. Adjusted Non-GAAP EBITDA and Adjusted Non-GAAP Diluted EPS are Non-GAAP financial measures. 2. For full year 2025 guidance, Non-GAAP Adjusted Diluted Weighted-Average Shares Outstanding exclude certain dilutive shares related to the 2029 senior convertible notes as they are intended to be covered by our capped call transactions. 3. Based on 2025 financial guidance issued by the Company on November 7, 2025. 4. Not meaningful percentage due to comparison of only a partial year of ILUVIEN and YUTIQ Net Revenue in 2024.

© 2025 ANI Pharmaceuticals, Inc. 8 Rare Disease Business

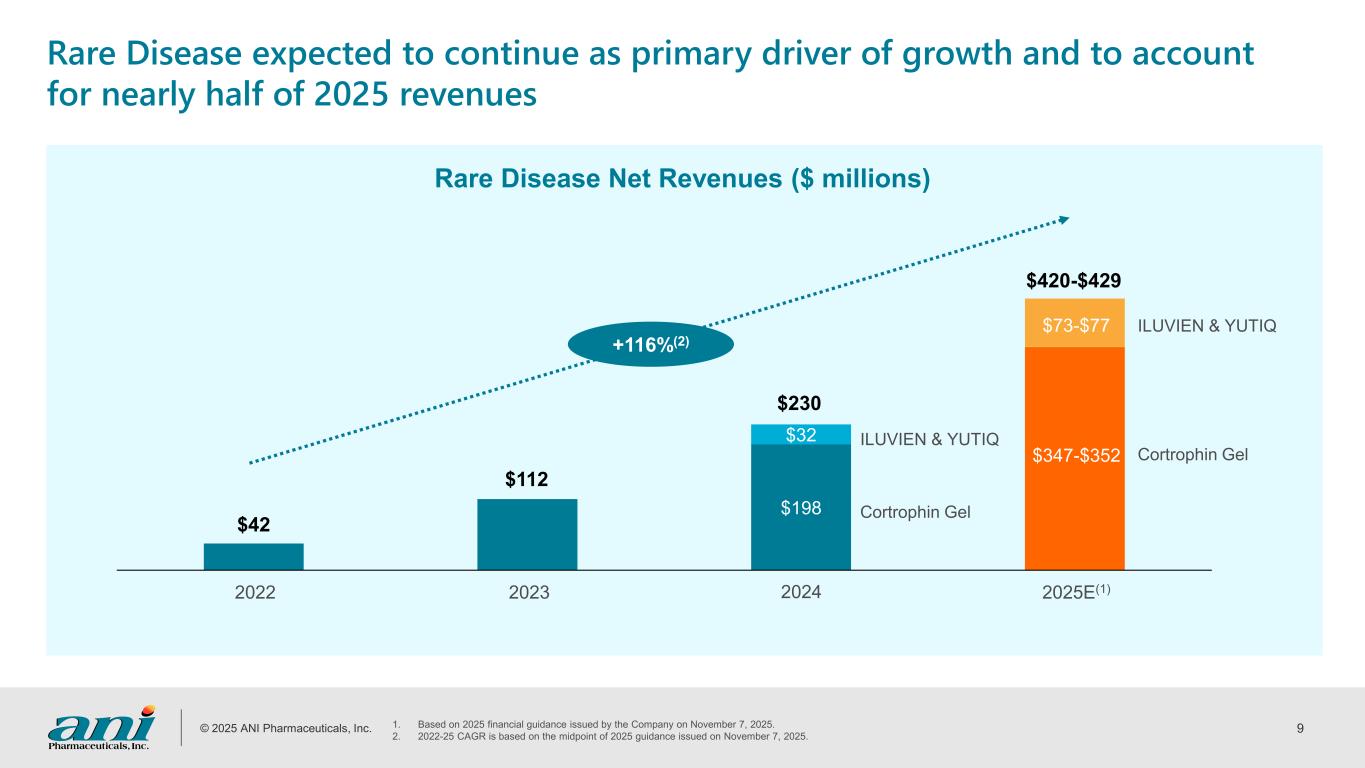

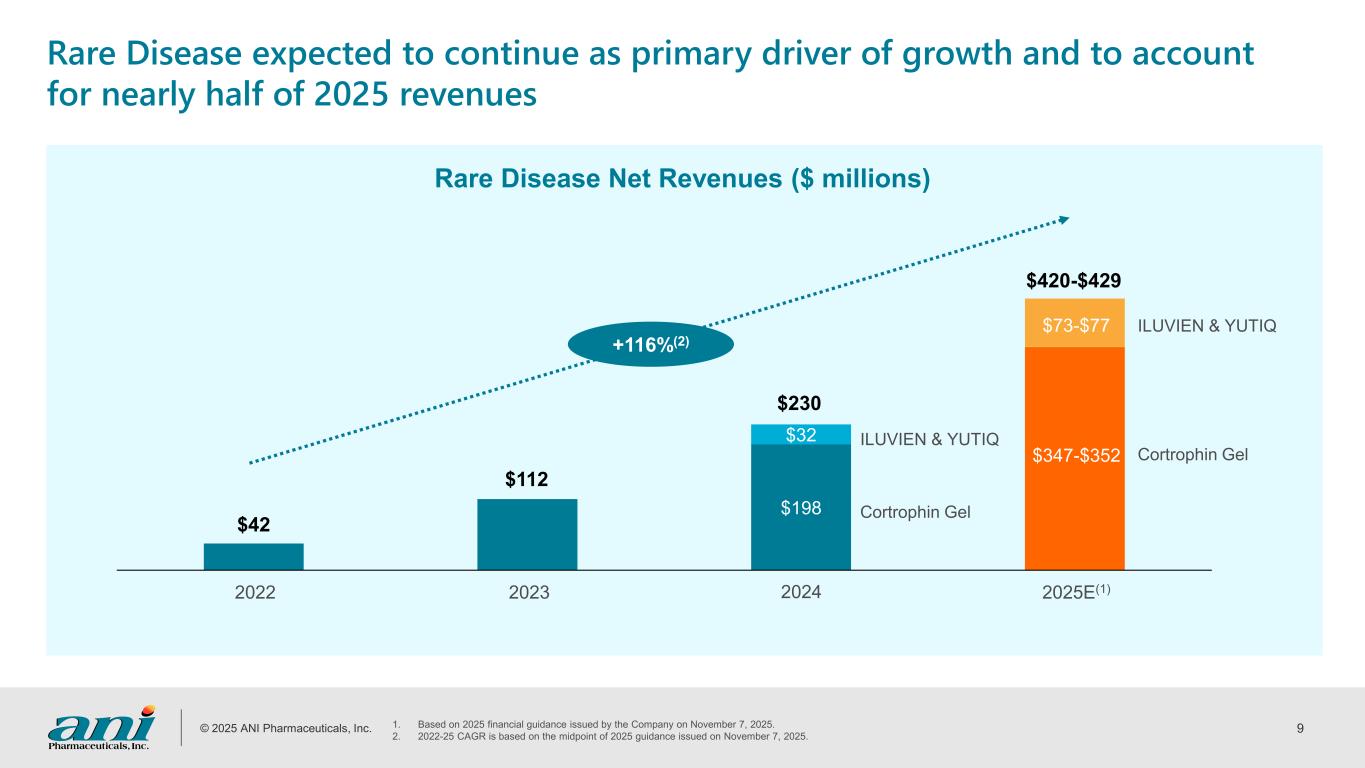

© 2025 ANI Pharmaceuticals, Inc. 9 Rare Disease expected to continue as primary driver of growth and to account for nearly half of 2025 revenues 1. Based on 2025 financial guidance issued by the Company on November 7, 2025. 2. 2022-25 CAGR is based on the midpoint of 2025 guidance issued on November 7, 2025. Rare Disease Net Revenues ($ millions) $198 $32 $347-$352 +116%(2) ILUVIEN & YUTIQ Cortrophin Gel 2022 2023 2024 2025E(1) ILUVIEN & YUTIQ Cortrophin Gel $230 $420-$429 $42 $112 $73-$77

© 2025 ANI Pharmaceuticals, Inc. 10 Rare Disease portfolio focuses on patients underserved by other therapies 1. Based on the US FDA considered definition of rare disease – disorders affecting <200,000 persons, translating to a prevalence of 58.5 per 100,000 at current time. 2. ANI continues to keep the NDA for YUTIQ active and support use of inventory in the channel for NIU-PS. Rare Disease(1) • Idiopathic Nephrotic Syndrome • Sarcoidosis • Systemic Dermatomyositis (Polymyositis) Underserved patients: High prevalence disease • Chronic Non-Infectious Uveitis Affecting Posterior Segment(2) • Rheumatoid Arthritis • Multiple Sclerosis • Acute Gouty Arthritis • Systemic Lupus Erythematosus • Psoriatic Arthritis • Keratitis and other inflammatory eye conditions • Diffuse posterior uveitis • Diabetic Macular Edema

© 2025 ANI Pharmaceuticals, Inc. 11 U.S. Indications FDA-approved ACTH treatment option with 22 indications for patients suffering from specific chronic autoimmune and inflammatory conditions, including multiple sclerosis, rheumatoid arthritis, excess urinary protein due to nephrotic syndrome, acute gouty arthritis flares, and acute and chronic allergic and inflammatory processes involving the eye and its adnexa. Indicated for the treatment of: • diabetic macular edema (DME) in patients who have been previously treated with a course of corticosteroids and did not have a clinically significant rise in intraocular pressure and • chronic non-infectious uveitis affecting the posterior segment of the eye (NIU-PS).(1) U.S. Approval Date November 2021 sNDA September 2014 (DME) March 2025 (NIU-PS) Ex-U.S. Indications N/A For DME and NIU-PS in select countries in Europe and the Middle East 1. ANI received FDA approval to add the NIU-PS indication to ILUVIEN in the U.S. and transitioned commercialization efforts for ILUVIEN and YUTIQ to one brand, ILUVIEN, in the U.S. in June 2025. Rare Disease business markets two high-growth, durable therapeutics with multiple indications

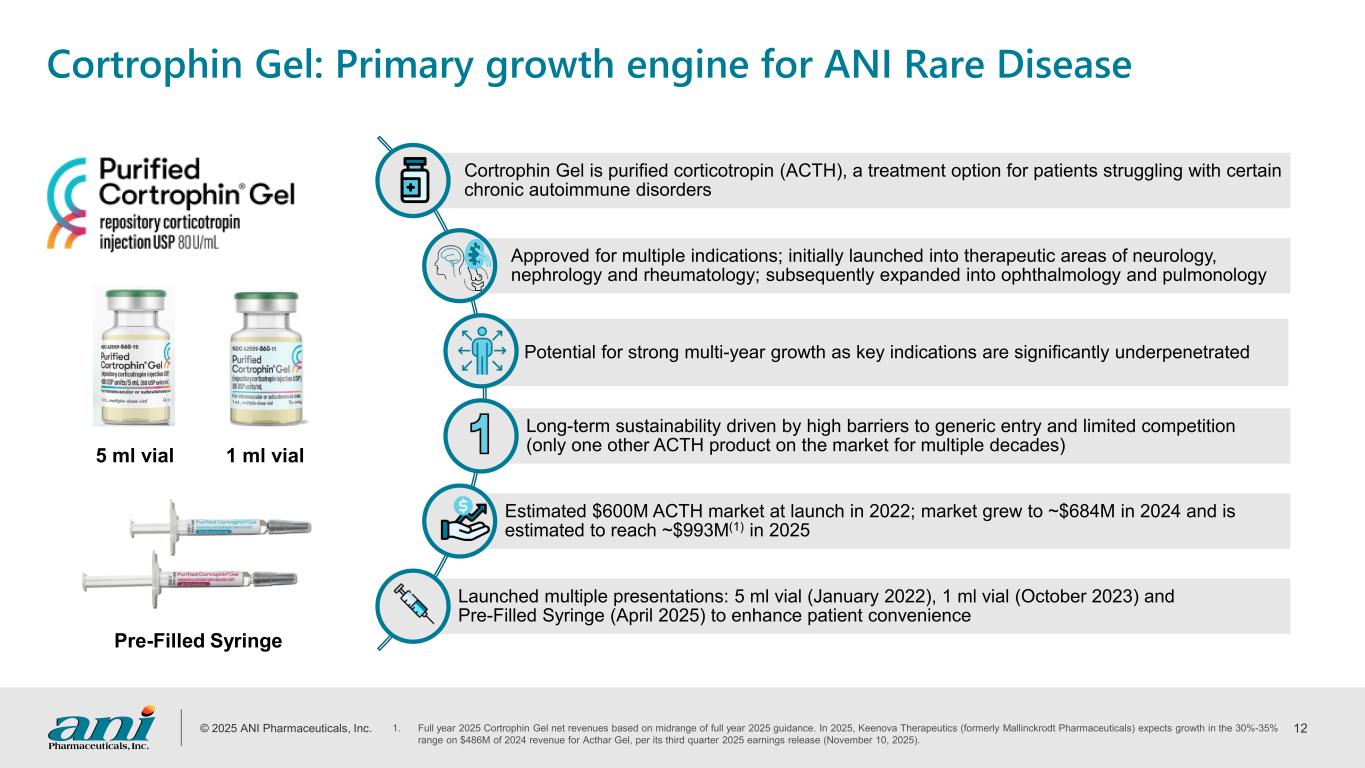

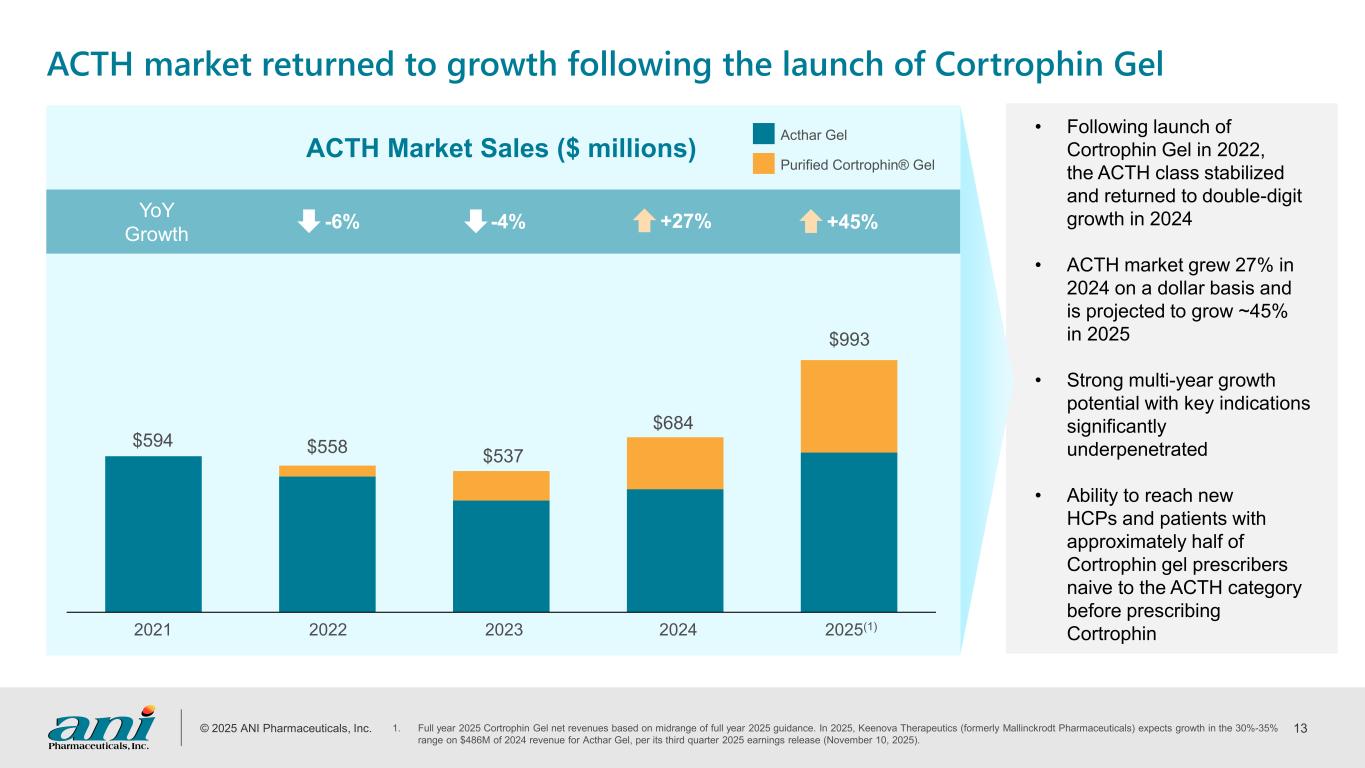

© 2025 ANI Pharmaceuticals, Inc. 12 Cortrophin Gel: Primary growth engine for ANI Rare Disease 5 ml vial 1 ml vial Pre-Filled Syringe Cortrophin Gel is purified corticotropin (ACTH), a treatment option for patients struggling with certain chronic autoimmune disorders Approved for multiple indications; initially launched into therapeutic areas of neurology, nephrology and rheumatology; subsequently expanded into ophthalmology and pulmonology Potential for strong multi-year growth as key indications are significantly underpenetrated Long-term sustainability driven by high barriers to generic entry and limited competition (only one other ACTH product on the market for multiple decades) Estimated $600M ACTH market at launch in 2022; market grew to ~$684M in 2024 and is estimated to reach ~$993M(1) in 2025 Launched multiple presentations: 5 ml vial (January 2022), 1 ml vial (October 2023) and Pre-Filled Syringe (April 2025) to enhance patient convenience 1. Full year 2025 Cortrophin Gel net revenues based on midrange of full year 2025 guidance. In 2025, Keenova Therapeutics (formerly Mallinckrodt Pharmaceuticals) expects growth in the 30%-35% range on $486M of 2024 revenue for Acthar Gel, per its third quarter 2025 earnings release (November 10, 2025).

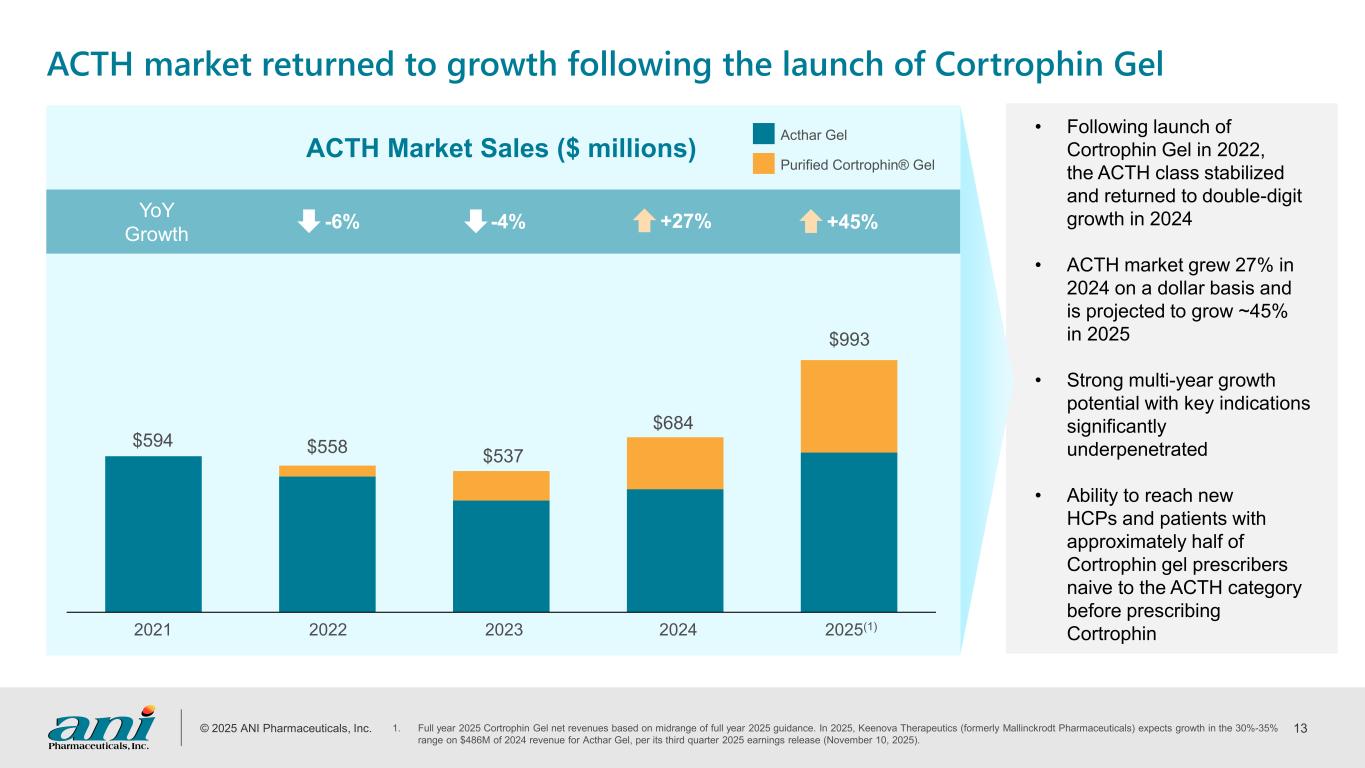

© 2025 ANI Pharmaceuticals, Inc. 13 • Following launch of Cortrophin Gel in 2022, the ACTH class stabilized and returned to double-digit growth in 2024 • ACTH market grew 27% in 2024 on a dollar basis and is projected to grow ~45% in 2025 • Strong multi-year growth potential with key indications significantly underpenetrated • Ability to reach new HCPs and patients with approximately half of Cortrophin gel prescribers naive to the ACTH category before prescribing Cortrophin ACTH market returned to growth following the launch of Cortrophin Gel 1. Full year 2025 Cortrophin Gel net revenues based on midrange of full year 2025 guidance. In 2025, Keenova Therapeutics (formerly Mallinckrodt Pharmaceuticals) expects growth in the 30%-35% range on $486M of 2024 revenue for Acthar Gel, per its third quarter 2025 earnings release (November 10, 2025). 2021 2022 2023 2024 2025(1) $594 $558 $537 $684 $993 ACTH Market Sales ($ millions) -6% -4% +27% YoY Growth +45% Acthar Gel Purified Cortrophin® Gel

© 2025 ANI Pharmaceuticals, Inc. 14 Cortrophin Gel Net Revenues ($ millions)(1) Cortrophin Gel: Robust underlying demand; further strengthening the franchise to support strong multi-year growth $42 $112 $198 2022 2023 2025E +103% CAGR $347-$352 2024 1. Based on 2025 financial guidance issued by the Company on November 7, 2025. • Continued strong growth across initially targeted specialties; neurology, rheumatology, and nephrology • Prescribing momentum across existing and new prescribers • Increasing momentum in Q3 2025 driven by expanded sales team Growth in specialties targeted at launch • Ophthalmology sales team capturing revenue synergies as Cortrophin ophthalmology volume grew ~42% Q/Q in Q3 2025 • Acute gouty arthritis flares indication has grown to over 15% of Cortrophin Gel use; only approved ACTH therapy for this indication • Focused pulmonology sales team yielding positive results Gaining traction in newer therapeutic areas • Investing in research to provide additional support for the use of Cortrophin Gel • Phase 4 clinical trial for acute gouty arthritis flares ongoing • Launched Pre-Filled Syringe in April 2025 and have seen very strong demand • Continuing to enhance convenience for patients • Investing in high ROI commercial efforts to drive growth across all specialties Continuing to strengthen the franchise

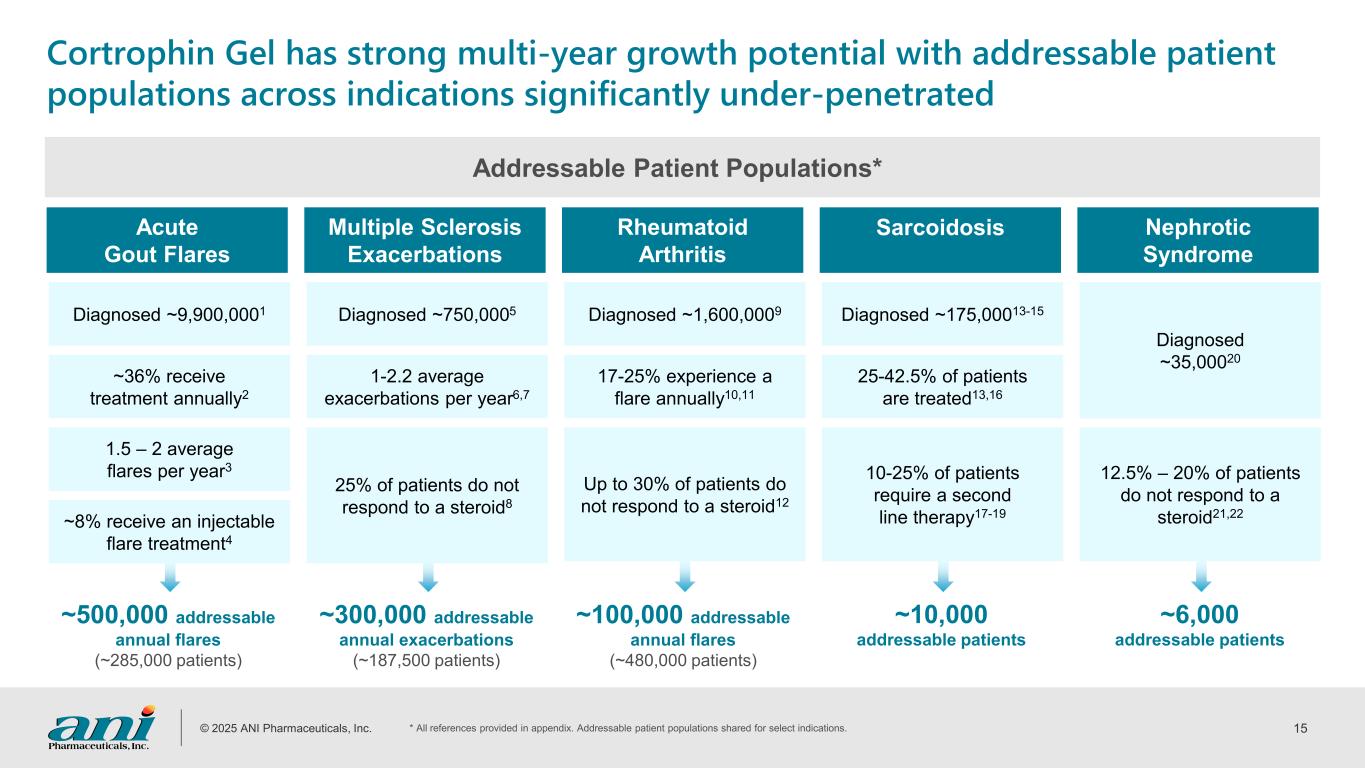

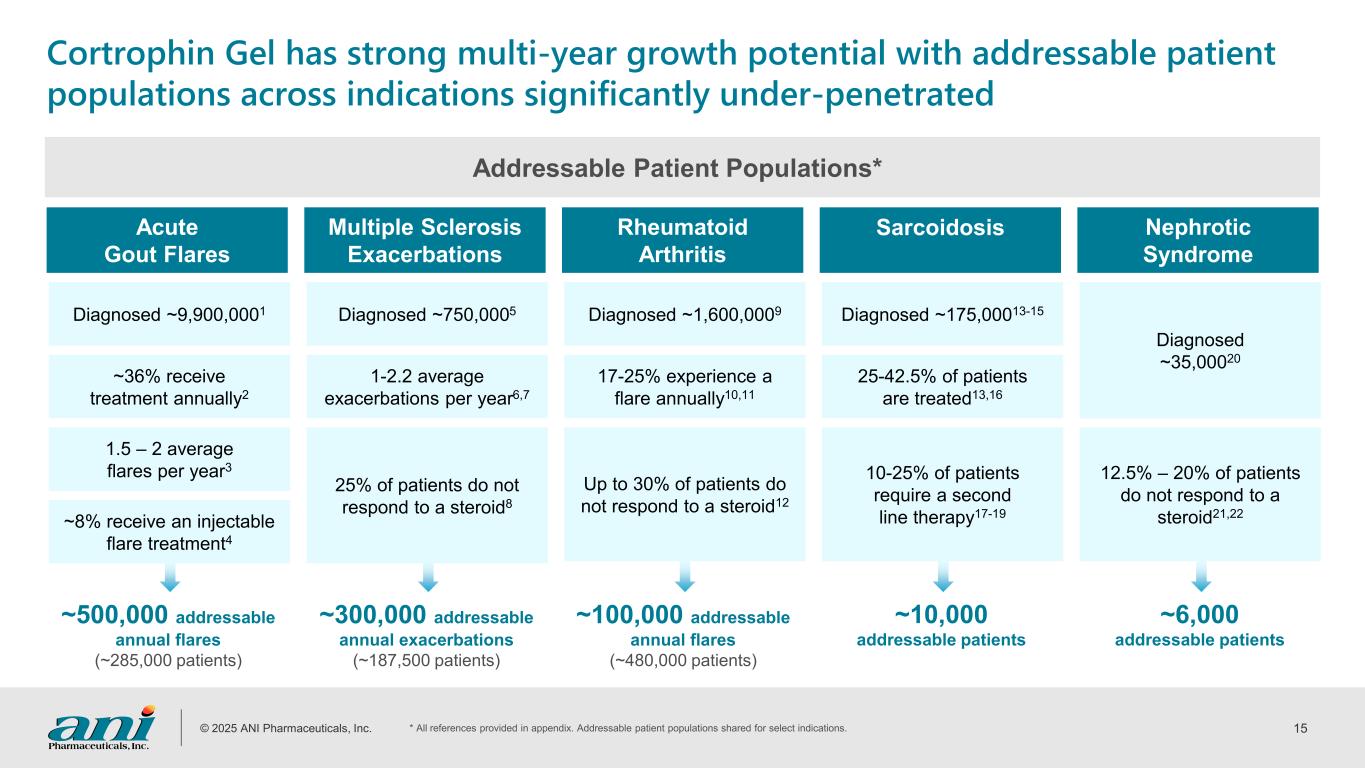

© 2025 ANI Pharmaceuticals, Inc. 15 Addressable Patient Populations* Diagnosed ~9,900,0001 ~500,000 addressable annual flares (~285,000 patients) Acute Gout Flares Cortrophin Gel has strong multi-year growth potential with addressable patient populations across indications significantly under-penetrated ~36% receive treatment annually2 1.5 – 2 average flares per year3 ~8% receive an injectable flare treatment4 Diagnosed ~750,0005 Multiple Sclerosis Exacerbations 1-2.2 average exacerbations per year6,7 25% of patients do not respond to a steroid8 Diagnosed ~1,600,0009 Rheumatoid Arthritis 17-25% experience a flare annually10,11 Up to 30% of patients do not respond to a steroid12 Diagnosed ~35,00020 Nephrotic Syndrome 12.5% – 20% of patients do not respond to a steroid21,22 Diagnosed ~175,00013-15 Sarcoidosis 25-42.5% of patients are treated13,16 10-25% of patients require a second line therapy17-19 ~300,000 addressable annual exacerbations (~187,500 patients) ~100,000 addressable annual flares (~480,000 patients) ~10,000 addressable patients ~6,000 addressable patients * All references provided in appendix. Addressable patient populations shared for select indications.

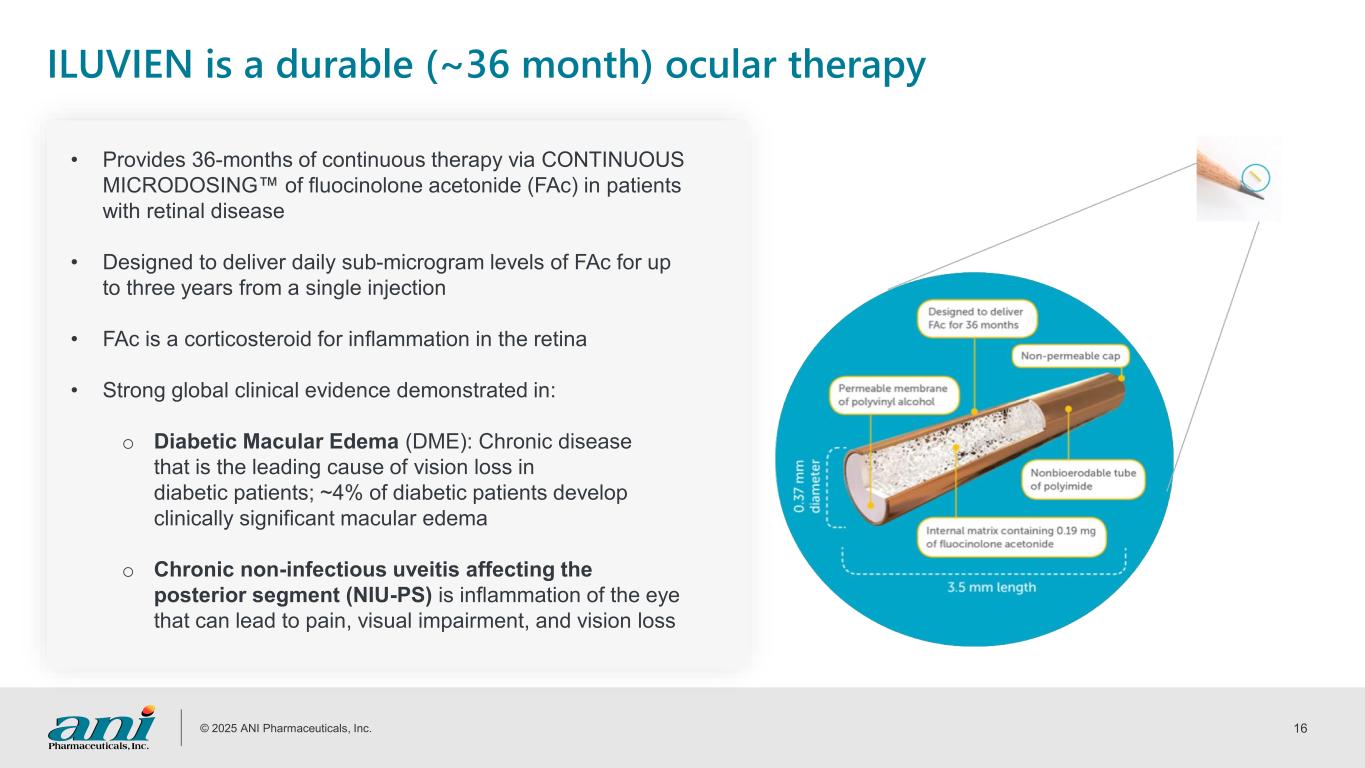

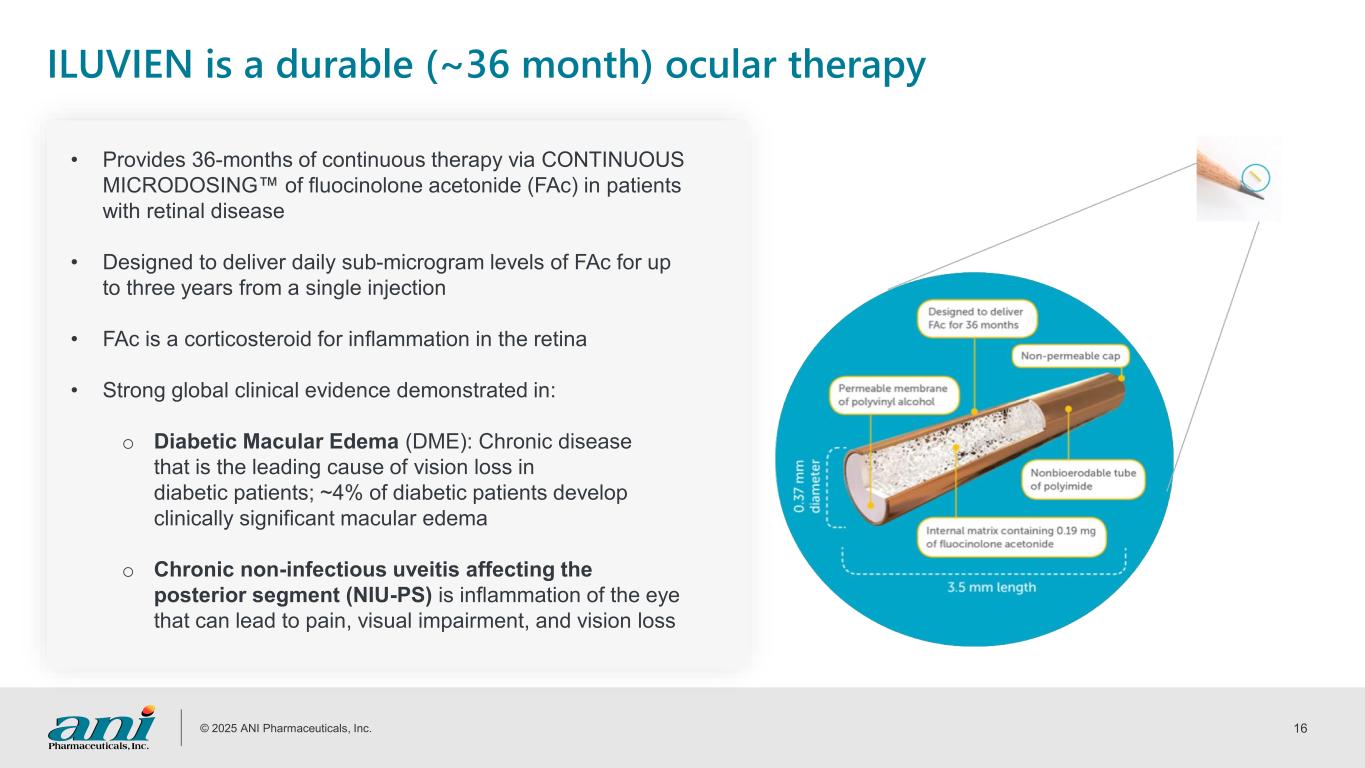

© 2025 ANI Pharmaceuticals, Inc. 16 ILUVIEN is a durable (~36 month) ocular therapy • Provides 36-months of continuous therapy via CONTINUOUS MICRODOSING of fluocinolone acetonide (FAc) in patients with retinal disease • Designed to deliver daily sub-microgram levels of FAc for up to three years from a single injection • FAc is a corticosteroid for inflammation in the retina • Strong global clinical evidence demonstrated in: o Diabetic Macular Edema (DME): Chronic disease that is the leading cause of vision loss in diabetic patients; ~4% of diabetic patients develop clinically significant macular edema o Chronic non-infectious uveitis affecting the posterior segment (NIU-PS) is inflammation of the eye that can lead to pain, visual impairment, and vision loss

© 2025 ANI Pharmaceuticals, Inc. 17 Operational Efficiency Simplifies the manufacturing process and reduces complexity by focusing on a single product, ILUVIEN, which already has a broader approval outside the U.S. Supply Chain Security Extended partnership with Siegfried and capacity expansion ensures a stable and secure supply chain for both products. Siegfried has been CDMO for over 10 years Market Strategy Transition to a single product allows for streamlined marketing and sales efforts, enhancing brand recognition and simplifying communication with healthcare providers Customer Value Simplifies ordering and processes for healthcare providers, offering a single injector for both indications, adding value to customers and the retina community Growth trajectory Positions the franchise for strong multiyear growth by enhancing supply security and operational efficiency ILUVIEN label expansion enhances supply security and operational efficiency ANI began marketing ILUVIEN in the U.S. under the combined label in June 2025 ILUVIEN is now approved for the treatment of chronic NIU-PS in addition to diabetic macular edema (DME)

© 2025 ANI Pharmaceuticals, Inc. 18 The most underserved patient group within DME represents more than 50,000 patients in the U.S. alone DME epidemiology model flow – inputs informed by ANI’s market research Diagnosed DME population (~3%): ~900,000 patients Treated DME population (~50%): ~450,000 patients Patients receiving 2+ anti-VEGFs (57%): ~260,000 patients Suboptimal response to anti-VEGFs (29%): ~75,000 patients Positive steroid trial, i.e., low IOP risk (~70%): ~53,000 patients Significant room for ILUVIEN growth – <5,000 patient starts annually for DME in the U.S. >50,000 patients in the U.S. are not well served by anti-VEGF therapy 1. Source: Ophthalmologists survey, n = 64

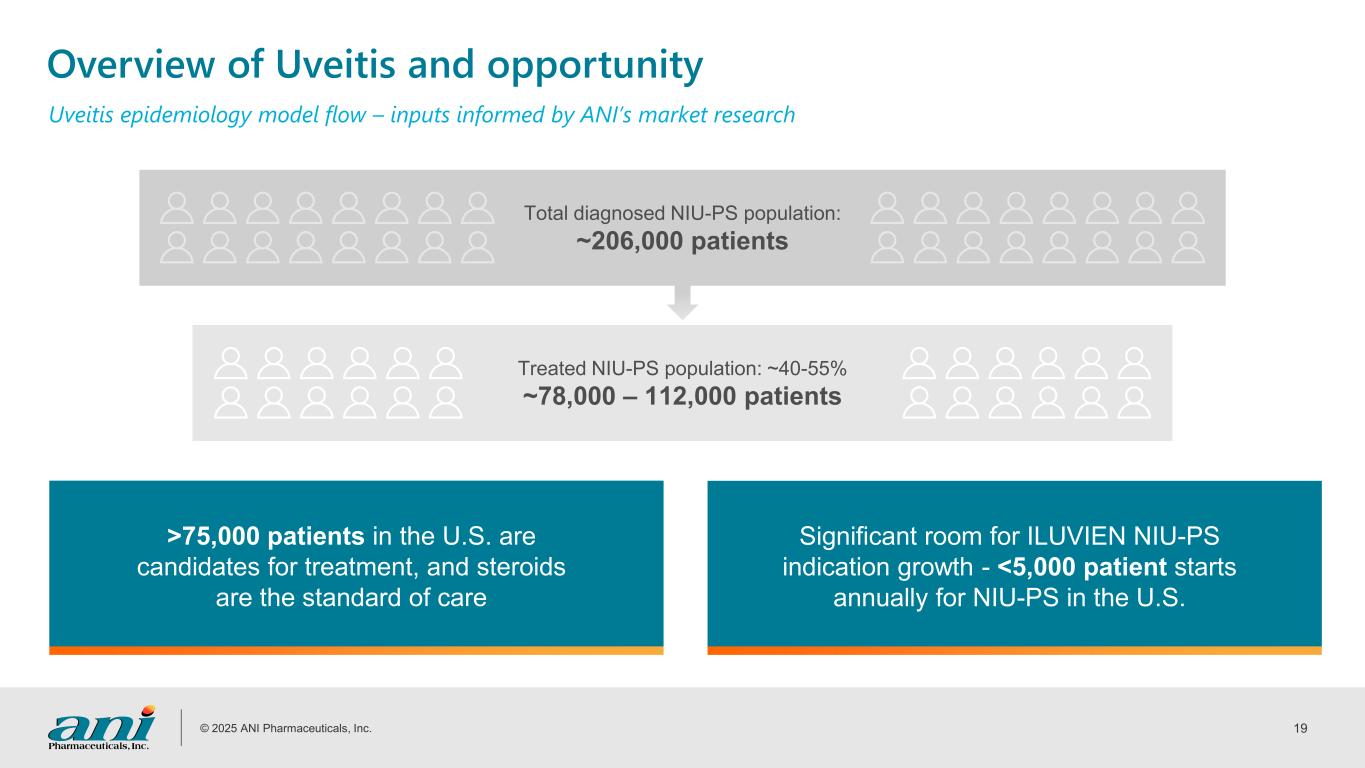

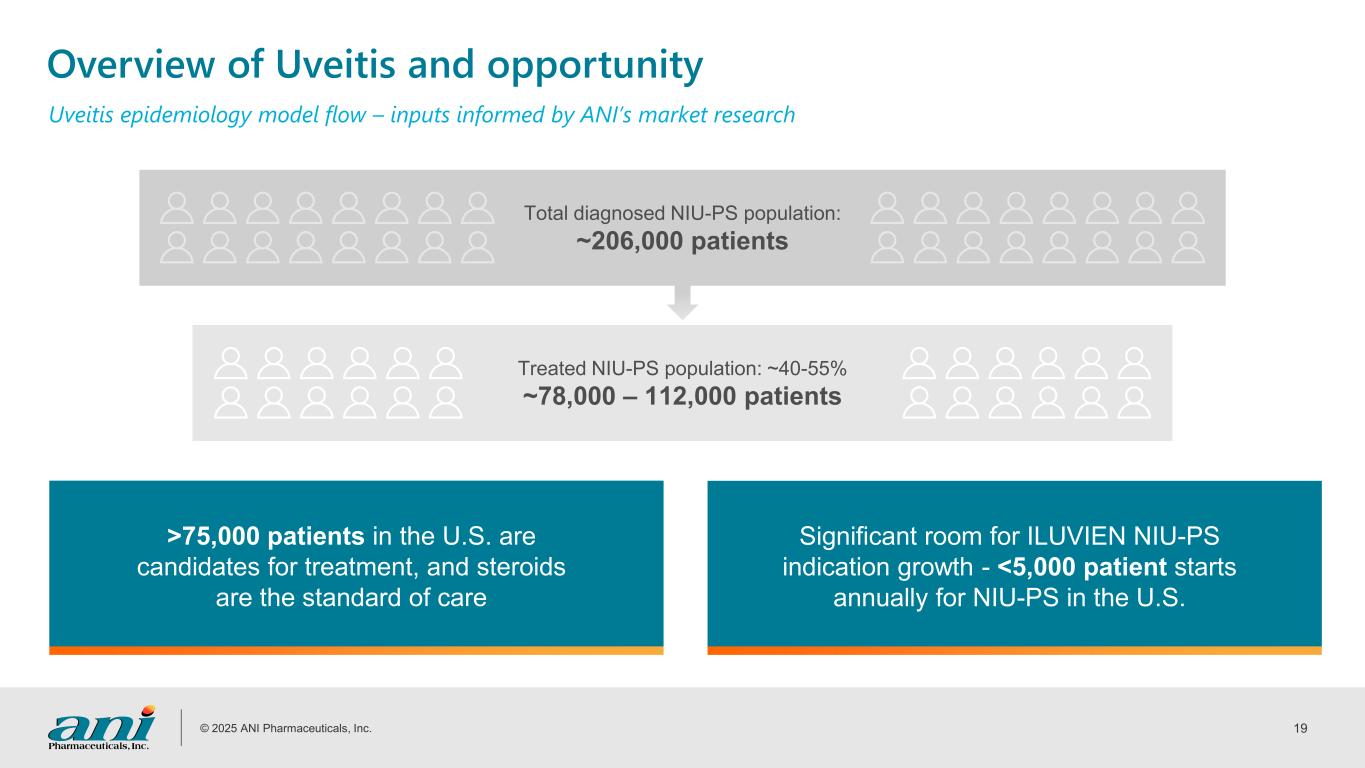

© 2025 ANI Pharmaceuticals, Inc. 19 Uveitis epidemiology model flow – inputs informed by ANI’s market research Total diagnosed NIU-PS population: ~206,000 patients Treated NIU-PS population: ~40-55% ~78,000 – 112,000 patients Significant room for ILUVIEN NIU-PS indication growth - <5,000 patient starts annually for NIU-PS in the U.S. >75,000 patients in the U.S. are candidates for treatment, and steroids are the standard of care Overview of Uveitis and opportunity

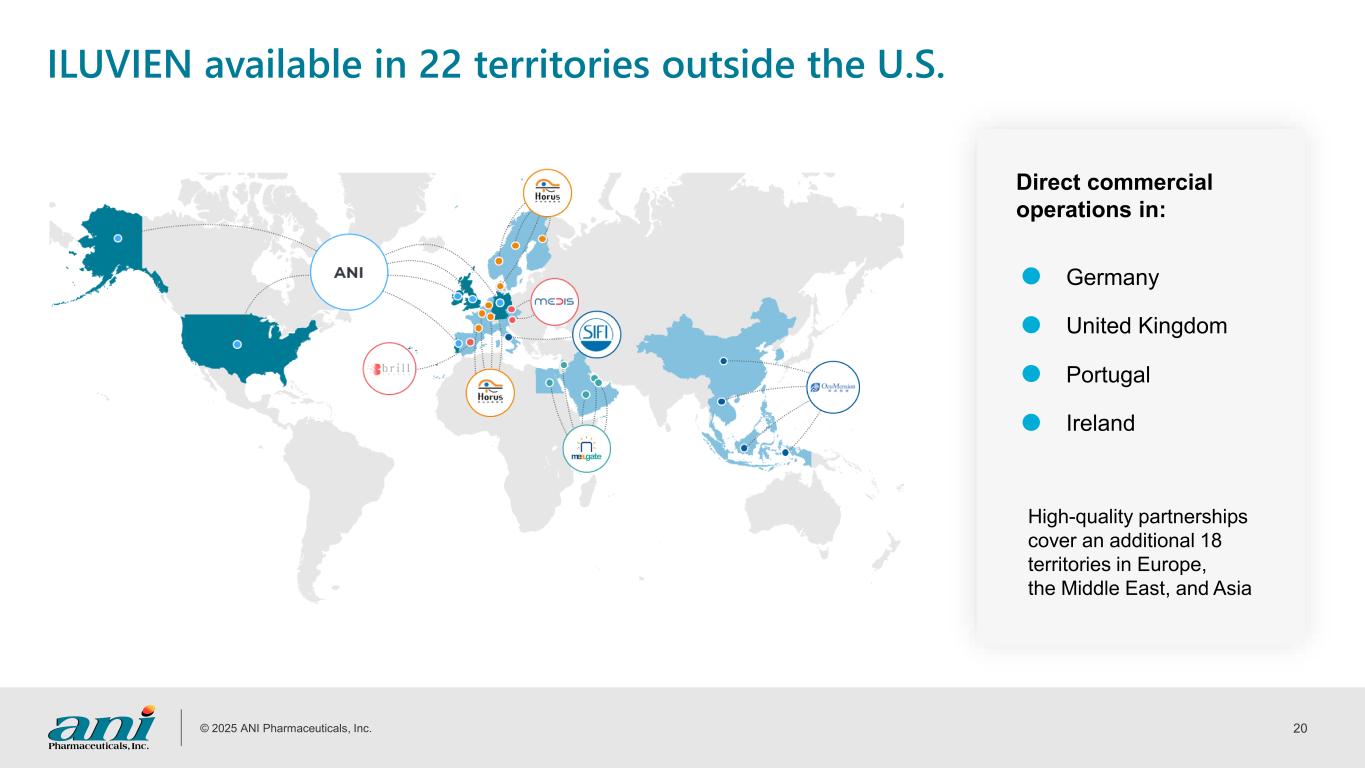

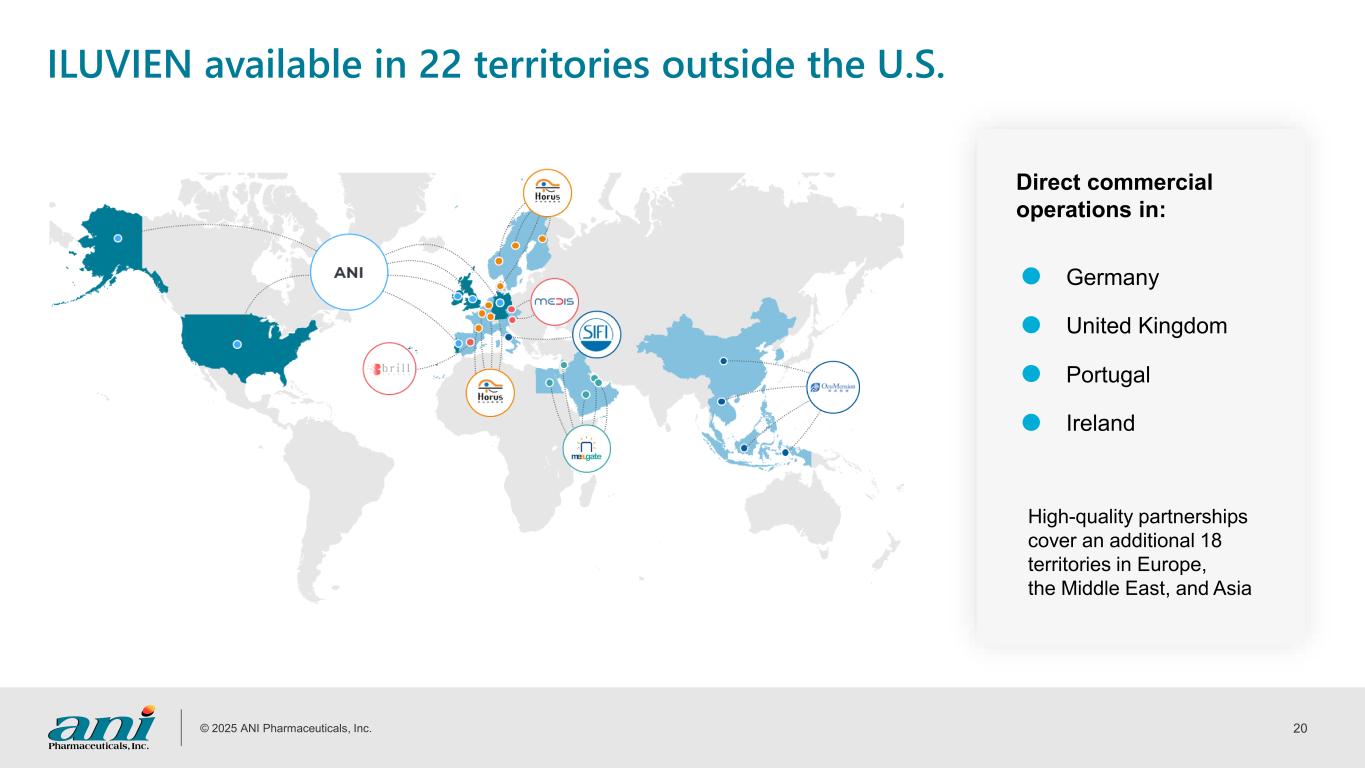

© 2025 ANI Pharmaceuticals, Inc. 20 Direct commercial operations in: High-quality partnerships cover an additional 18 territories in Europe, the Middle East, and Asia Germany United Kingdom Portugal Ireland ILUVIEN available in 22 territories outside the U.S.

© 2025 ANI Pharmaceuticals, Inc. 21 NEW DAY study results shared across national and international conferences Jan 2026Oct 2025Sep 2025Jul 2025 American Society of Retina Specialists (ASRS) Dr. Michael Singer, Presentation on Demand EURETINA Dr. Wykoff, Spotlight Oral Presentation American Academy of Ophthalmology (AAO) Dr. Gonzalez, Podium Presentation Hawaiian Eye Dr. Gonzalez, Podium Presentation SYNCHRONICITY Multicenter, open label study investigates YUTIQ across 110 patients with chronic NIU-PS Topline data readout expected in Q1 20261 1. Results of Synchronicity clinical trial will be applicable to ILUVIEN. Announced New Day Study Results Jul 2025

© 2025 ANI Pharmaceuticals, Inc. 22 Generics Business

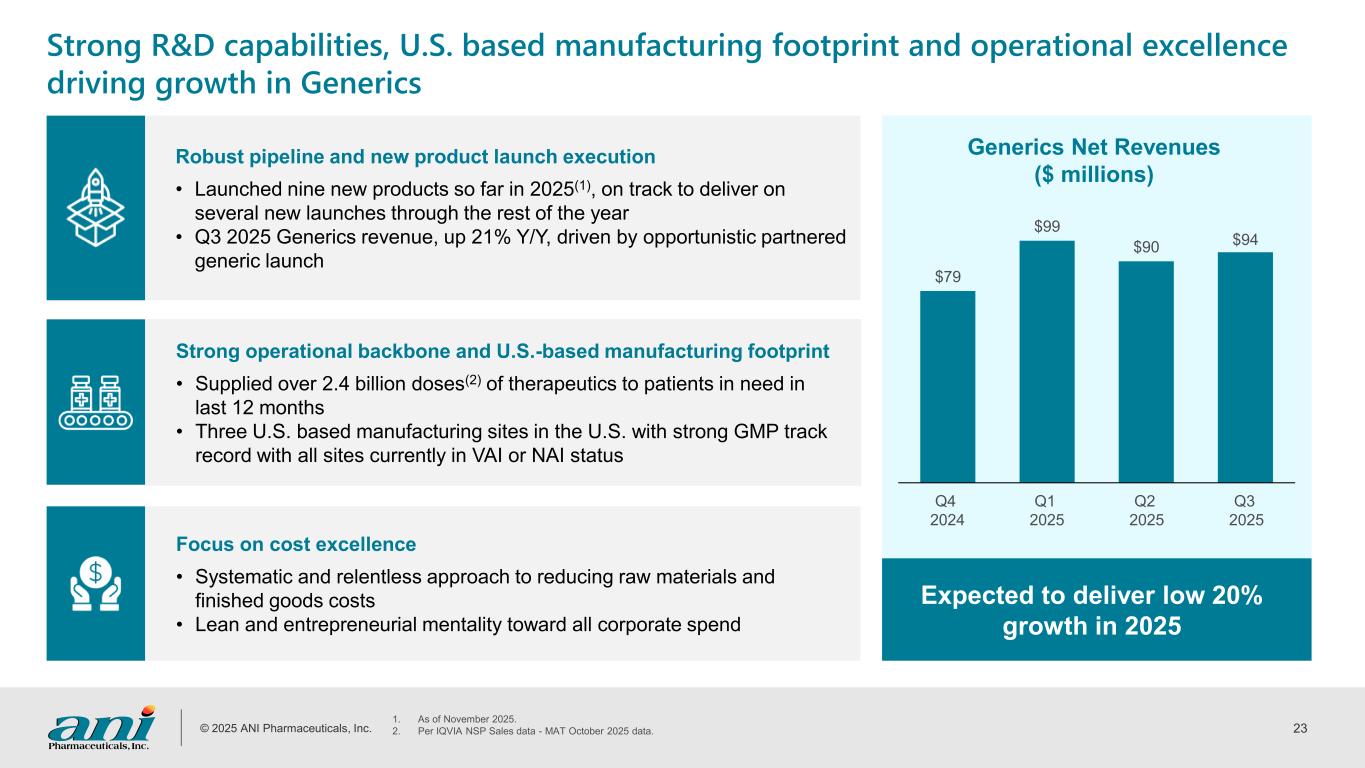

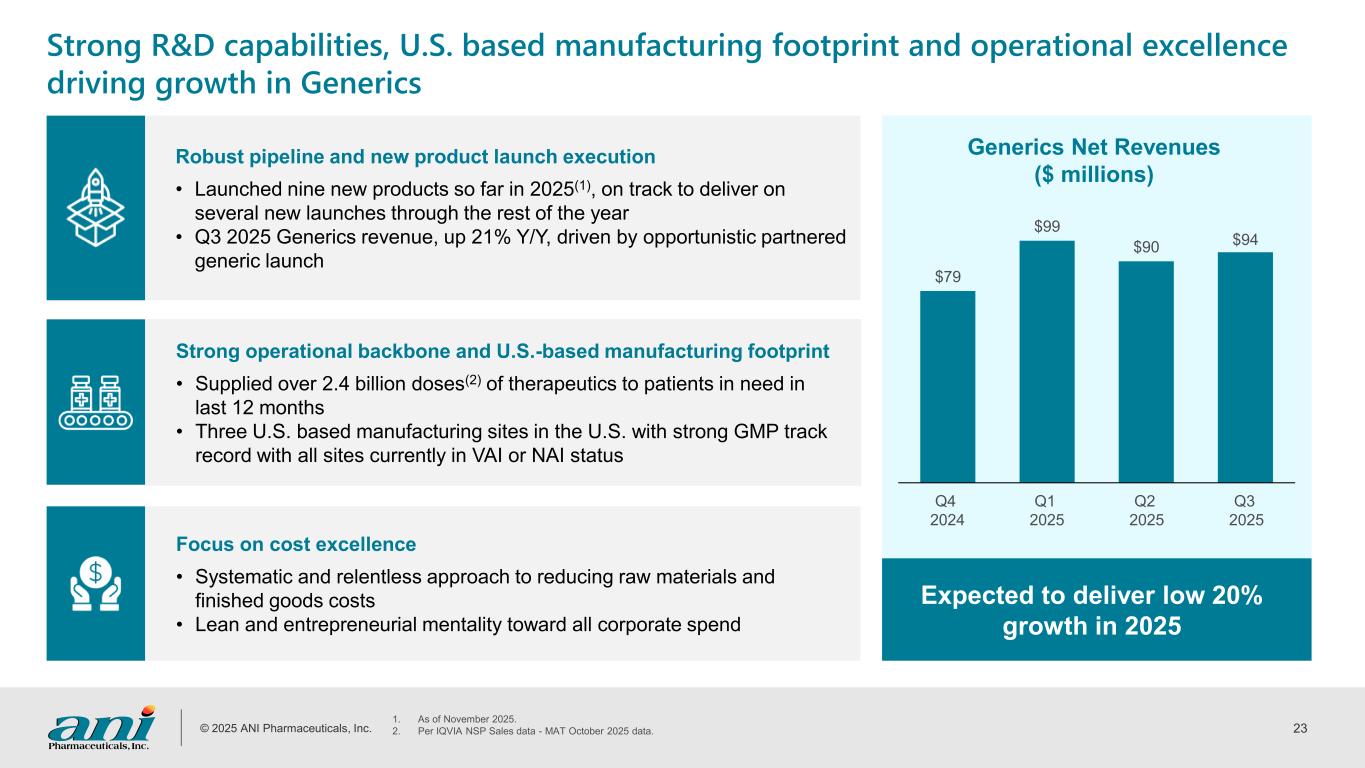

© 2025 ANI Pharmaceuticals, Inc. 23 Robust pipeline and new product launch execution • Launched nine new products so far in 2025(1), on track to deliver on several new launches through the rest of the year • Q3 2025 Generics revenue, up 21% Y/Y, driven by opportunistic partnered generic launch Focus on cost excellence • Systematic and relentless approach to reducing raw materials and finished goods costs • Lean and entrepreneurial mentality toward all corporate spend Strong operational backbone and U.S.-based manufacturing footprint • Supplied over 2.4 billion doses(2) of therapeutics to patients in need in last 12 months • Three U.S. based manufacturing sites in the U.S. with strong GMP track record with all sites currently in VAI or NAI status Strong R&D capabilities, U.S. based manufacturing footprint and operational excellence driving growth in Generics 1. As of November 2025. 2. Per IQVIA NSP Sales data - MAT October 2025 data. $79 $99 $90 $94 Generics Net Revenues ($ millions) Q4 2024 Q1 2025 Q2 2025 Expected to deliver low 20% growth in 2025 Q3 2025

© 2025 ANI Pharmaceuticals, Inc. 24 U.S. Manufacturing Footprint

© 2025 ANI Pharmaceuticals, Inc. 25 United States 93% Europe 2% India 2% Others 3% United States 48% Europe 26% India 18% China 5% Others 3% Over 90% of ANI’s revenues come from finished goods manufactured in the U.S.; only ~5% revenues have a direct reliance on China API by Country of Origin Finished Goods (FG) by Country of Origin % of Revenues % of Revenues ~95% of revenues from products sold in the U.S. NOTE: Statistics on this slide based upon internal analysis utilizing estimated / projected full year 2025 Revenue, procurement, manufacturing and other data as prepared June 2025

© 2025 ANI Pharmaceuticals, Inc. 26 U.S.-based manufacturing footprint with strong GMP track record Baudette, MN 130k sf Baudette, MN Containment Facility - 47k sf East Windsor, NJ 120k sf Facility Overview and Capabilities • Manufacturing, packaging, warehouse • Schedule CII vault & CIII cage space • Lab space - R&D/analytical testing • Solutions, suspensions, topicals, tablets, capsules, and powder for suspension • DEA-licensed for Schedule II controlled substances • Manufacturing, packaging, warehouse • Low-humidity suite for moisture-sensitive compounds • Fully-contained high potency facility for hormone, steroid, and oncolytic products • DEA Schedule III capability • 100K ft2 of manufacturing, packaging, lab, warehouse, and administrative space • 20K ft2 expansion added 15 new manufacturing suites and new QC lab • Solid oral tablets and capsules, liquid suspensions and solutions, powder for oral suspension, controlled substances as well as containment & nano-milling • API development & low volume production Annual Capacity • Solid Dose ~2.5BN doses • Liquid Unit ~23MM doses • Liquids ~20MM bottles • Powder ~4MM bottles • Tablets ~2.5BN doses • Capsules ~150MM doses • Blisters ~ 45MM doses • Tablets & Capsules ~3.0BN doses • Packaged Units ~20MM units • Liquids ~10MM bottles • Powder ~ 2MM bottles ; Semi Solids GMP Five FDA inspections since 2013 Latest FDA inspection – December 2024 Current site status: VAI Seven DEA inspections since 2013 Latest DEA inspection – August 2023 Current site status: VAI Seven FDA inspections since 2017, Four DEA inspections since 2016 Latest FDA inspection – January 2024 Current site status: NAI status (zero 483s)

© 2025 ANI Pharmaceuticals, Inc. 27 Summary

© 2025 ANI Pharmaceuticals, Inc. 28 Investment summary Strategic focus on strong and growing Rare Disease business • Expected to represent nearly 50% of 2025 revenues and be largest driver of future growth • Cortrophin Gel 2025 revenue forecast at ~$350M(1) and is on a strong multi-year growth trajectory • ILUVIEN added second durable franchise(2) to platform and Cortrophin Gel revenue synergies Robust foundational Generics business delivering low 20% year-over-year growth in 2025 • Highly-seasoned R&D, manufacturing and commercial infrastructure delivering value to customers • Well-diversified portfolio with ~125 product families • Reliable US-based manufacturing with strong GMP track record; over 2.4(3) billion doses filled annually 2025 Priorities • Expand adoption of Cortrophin Gel in targeted specialties and grow the ACTH category • Address factors impacting ILUVIEN U.S. sales and capture opportunities in DME and NIU-PS • Sustain momentum in Generics to deliver low 20% growth • Explore further expansion in Rare Disease through M&A Financial Strength • $263M(4) cash and cash equivalents; forward looking net leverage of 1.7x(4) • Projected 2025 (5) : o Revenues of $854-873M, up 39-42% year-over-year o Adjusted non-GAAP EBITDA of $221-228M, up 42-46% year-over-year o Adjusted non-GAAP diluted EPS of $7.37-$7.64 (6) 1. Mid-point of 2025 financial guidance. issued by the Company on November 7, 2025. 2. ANI received FDA approval to add the NIU-PS indication to ILUVIEN in the U.S. and transitioned commercialization efforts for ILUVIEN and YUTIQ to one brand, ILUVIEN, in the U.S. in June 2025. 3. Per IQVIA NSP Sales data - MAT October 2025 data. 4. Cash and Net leverage as of September 30, 2025, utilizing mid-point of forward Adjusted Non-GAAP EBITDA guidance of $225 million as issued on November 7, 2025. 5. Based on 2025 financial guidance issued by the Company on November 7, 2025. 6. Non-GAAP Adjusted Diluted Weighted-Average Shares Outstanding exclude certain dilutive shares related to the 2029 senior convertible notes as they are intended to be covered by our capped call transactions.

© 2025 ANI Pharmaceuticals, Inc. 29 Appendix

© 2025 ANI Pharmaceuticals, Inc. 30 Adjusted non-GAAP EBITDA calculation and US GAAP to non-GAAP reconciliation 3 months ended 3 months ended 12 months ended September 30, 2025 September 30, 2024 December 31, 2024 Net Income (Loss) $26,617 $(24,166) $(18,522) Add/(Subtract): Interest expense, net 4,727 2,331 17,602 Other expense, net 853 2,535 4,033 Loss on extinguishment of debt ― 7,468 7,468 Income tax expense (benefit) 7,183 (7,332) (3,690) Depreciation and amortization 22,632 15,748 67,731 Contingent consideration fair value adjustment (14,470) 825 (619) Unrealized gain on investment in equity securities (3,140) (1,355) (6,307) Intangible asset impairment charge 767 ― 7,600 Loss on disposal of assets 295 ― ― Gain on sale of building ― ― (5,347) Stock-based compensation 9,691 7,484 29,344 M&A transaction and integration expenses 599 9,945 20,163 Litigation expenses 3,847 2,899 6,395 Inventory step-up amortization ― 3,224 13,599 Severance ― 5,308 6,365 Equity payout ― 10,190 10,190 Adjusted non-GAAP EBITDA $59,601 $35,104 $156,005 ($ in thousands, except per share amounts)

© 2025 ANI Pharmaceuticals, Inc. 31 Adjusted non-GAAP diluted earnings per share calculation and US GAAP to non-GAAP reconciliation 1. Adjusted non-GAAP Net Income Available to Common Shareholders excludes undistributed earnings to participating securities. 2. Non-GAAP Adjusted Diluted Weighted-Average Shares Outstanding exclude certain dilutive shares related to the 2029 senior convertible notes as they are intended to be covered by our capped call transactions. Our outstanding capped call transactions are intended to offset the dilutive effect of the 2029 convertible senior notes recognized in the calculation of GAAP diluted EPS in this reporting period in full, and therefore 502,000 shares and 593,000 shares for the three and nine months ended September 30, 2025, have been excluded from the calculation of the Non-GAAP Adjusted Diluted Weighted-Average Shares outstanding, respectively. 3 months ended 3 months ended 12 months ended September 30, 2025 September 30, 2024 December 31, 2024 Net Income (Loss) Available to Common Shareholders $26,273 $(24,572) $(20,147) Add/(Subtract): Non-cash interest expense (income) 225 (18) 149 Depreciation and amortization 22,632 15,748 67,731 Contingent consideration fair value adjustment (14,470) 825 (619) Loss on disposal of assets 295 ― ― Gain on sale of building ― ― (5,347) Unrealized gain on investment in equity securities (3,140) (1,355) (6,307) Intangible asset impairment charge 767 ― 7,600 Stock-based compensation 9,691 7,484 29,344 M&A transaction and integration expenses 599 9,945 20,163 Litigation expenses 3,847 2,899 6,395 Inventory step-up amortization ― 3,224 13,599 Severance ― 5,308 6,365 Equity payout ― 10,190 10,190 Loss on extinguishment of debt ― 7,468 7,468 Other expense, net 794 2,493 3,869 Less: Estimated tax impact of adjustments (5,522) (13,147) (38,154) Adjusted non-GAAP Net Income Available to Common Shareholders (1) $41,991 $26,492 $102,299 Diluted Weighted-Average Shares Outstanding 21,093 19,404 19,318 Adjusted Diluted Weighted-Average Shares Outstanding (2) 20,591 19,766 19,668 Adjusted Non-GAAP Diluted Earnings per Share $2.04 $1.34 $5.20 ($ in thousands, except per share amounts)

© 2025 ANI Pharmaceuticals, Inc. 32 References for Cortrophin Gel Addressable Patient Population Gout 1. Singh G, Lingala B, Mithal A. Gout and hyperuricaemia in the USA: prevalence and trends. Rheumatology (Oxford). 2019 Dec 1;58(12):2177-2180. doi: 10.1093/rheumatology/kez196. PMID: 31168609 2. Thorpe K. Partnership to fight chronic disease. May 21, 2018 3. Singh JA, Morlock A, Morlock R. Gout Flare Burden in the United States: A Multiyear Cross‐Sectional Survey Study. ACR Open Rheumatology. 2025 Jan;7(1):e11759, ANI claims data analysis (data on file), Proudman C, et al. Arthritis Res Ther. 2019;21:132. 4. Based on ANI claims analysis Multiple Sclerosis 5. Hittle M, Culpepper WJ, Langer-Gould A, Marrie RA, Cutter GR, Kaye WE, Wagner L, Topol B, LaRocca NG, Nelson LM, Wallin MT. Population-based estimates for the prevalence of multiple sclerosis in the United States by race, ethnicity, age, sex, and geographic region. JAMA neurology. 2023 Jul 1;80(7):693-701. 6. Nazareth TA, Rava AR, Polyakov JL, Banfe EN, Waltrip II RW, Zerkowski KB, Herbert LB. Relapse prevalence, symptoms, and health care engagement: patient insights from the Multiple Sclerosis in America 2017 survey. Multiple sclerosis and related disorders. 2018 Nov 1;26:219-34. 7. Oleen-Burkey M, Castelli-Haley J, Lage MJ, Johnson KP. Burden of a multiple sclerosis relapse: the patient’s perspective. The Patient-Patient-Centered Outcomes Research. 2012 Mar;5(1):57-69. 8. Wynn D, Goldstick L, Bauer W, Zhao E, Tarau E, Cohen JA, Robertson D, Miller A. Results from a multicenter, randomized, double‐blind, placebo‐controlled study of repository corticotropin injection for multiple sclerosis relapse that did not adequately respond to corticosteroids. CNS Neuroscience & Therapeutics. 2022 Mar;28(3):364-71. Rheumatoid Arthritis 9. Evaluate Pharma, Evaluate Epi USA Population Insight 10. Bachman K. et al. J Rheumatol. 2018;45(11):1515-1521 11. Oh YJ, Moon KW. Predictors of flares in patients with rheumatoid arthritis who exhibit low disease activity: A nationwide cohort study. Journal of Clinical Medicine. 2020 Oct 7;9(10):3219. 12. Chikanza IC, Kozaci DL. Corticosteroid resistance in rheumatoid arthritis: molecular and cellular perspectives. Rheumatology. 2004 Nov 1;43(11):1337-45. Sarcoidosis 13. Baughman RP, et al. Ann Am Thorac Soc. 2016;13(8):1244-1252 14. Gerke AK, Judson MA, Cozier YC, Culver DA, Koth LL. Disease burden and variability in sarcoidosis. Annals of the American Thoracic Society. 2017 Dec;14(Supplement 6):S421-8. 15. Nam HH, Washington A, Butt M, Maczuga S, Guck D, Yanosky JD, Helm MF. The prevalence and geographic distribution of sarcoidosis in the United States. JAAD international. 2022 Dec 1;9:30-2. 16. Sangani R, Bosch NA, Govender P, Scarpato B, Walkey AJ, Newman J, Law AC, Gillmeyer KR, Shankar DA. Sarcoidosis treatment patterns in the United States: 2016-2022. Chest. 2025 Apr 1;167(4):1099-106. 17. ANI primary market research 2023 18. El Jammal T, Jamilloux Y, Gerfaud-Valentin M, Valeyre D, Sève P. Refractory sarcoidosis: a review. Therapeutics and clinical risk management. 2020 Apr 17:323-45. 19. Mahmood K, Butt NI, Ashfaq F, Younus R. Refractory Sarcoidosis. Journal of Ayub Medical College Abbottabad. 2023 Jul 9;35(3):479-81. Nephrotic Syndrome 20. Evaluate Pharma, Evaluate Epi USA Population Insight 21. Bensimhon AR, Williams AE, Gbadegesin RA. Treatment of steroid-resistant nephrotic syndrome in the genomic era. Pediatric nephrology. 2019 Nov;34(11):2279-93. / 22. Ghedira-Besbes L, Mallek A, Guediche MN. Idiopathic nephrotic syndrome in children: report of 57 cases. La Tunisie Medicale. 2003 Sep 1;81(9):702-8.

© 2025 ANI Pharmaceuticals, Inc. 33 November 2025