UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 21, 2025

WINTRUST FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

| Illinois | 001-35077 | 36-3873352 | ||||||||||||||||||

| (State or other jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

||||||||||||||||||

9700 W. Higgins Road, Suite 800 |

Rosemont | Illinois | 60018 | |||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||

Registrant’s telephone number, including area code (847) 939-9000

Not Applicable

(Former name or former address, if changed since last year)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of Each Class | Ticker Symbol | Name of Each Exchange on Which Registered | ||||||

| Common Stock, no par value | WTFC | The Nasdaq Global Select Market | ||||||

| Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series D, no par value | WTFCM | The Nasdaq Global Select Market | ||||||

Depositary Shares, Each Representing a 1/1,000th Interest in a Share of |

WTFCP | The Nasdaq Global Select Market | ||||||

| 6.875% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock, Series E, no par value | ||||||||

Depositary Shares, Each Representing a 1/1,000th Interest in a Share of |

WTFCN | The Nasdaq Global Select Market | ||||||

| 7.875% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock, Series F, no par value | ||||||||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

The information in this Current Report is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

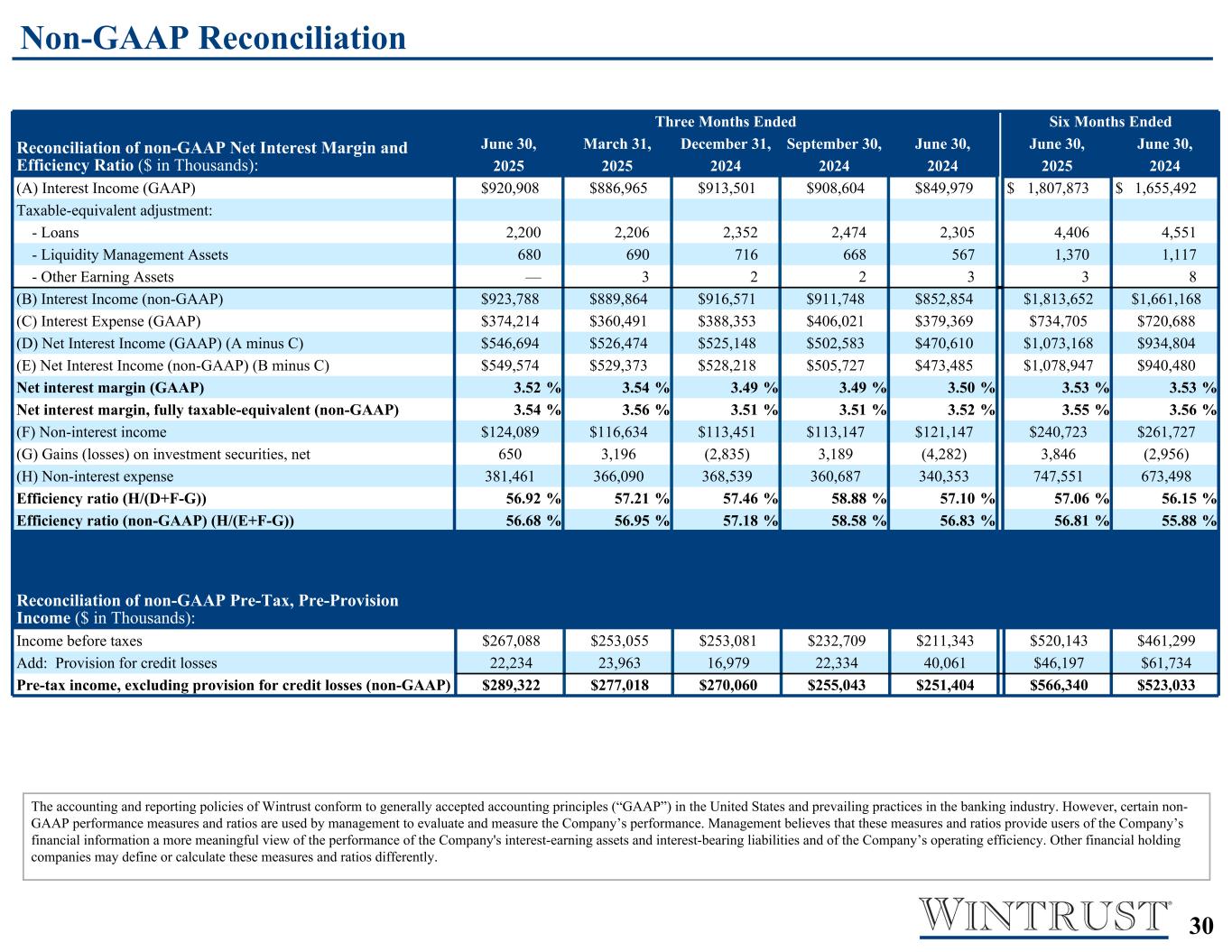

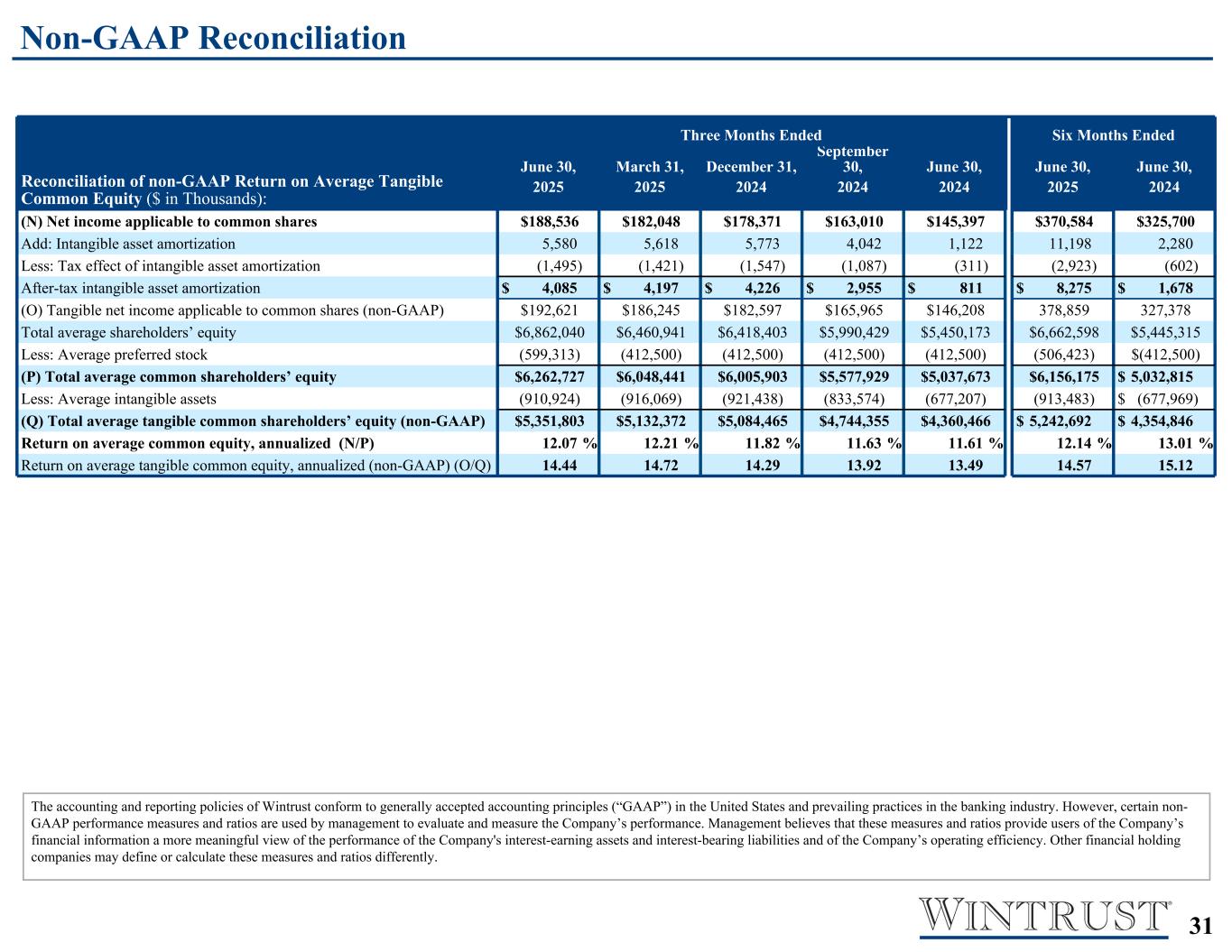

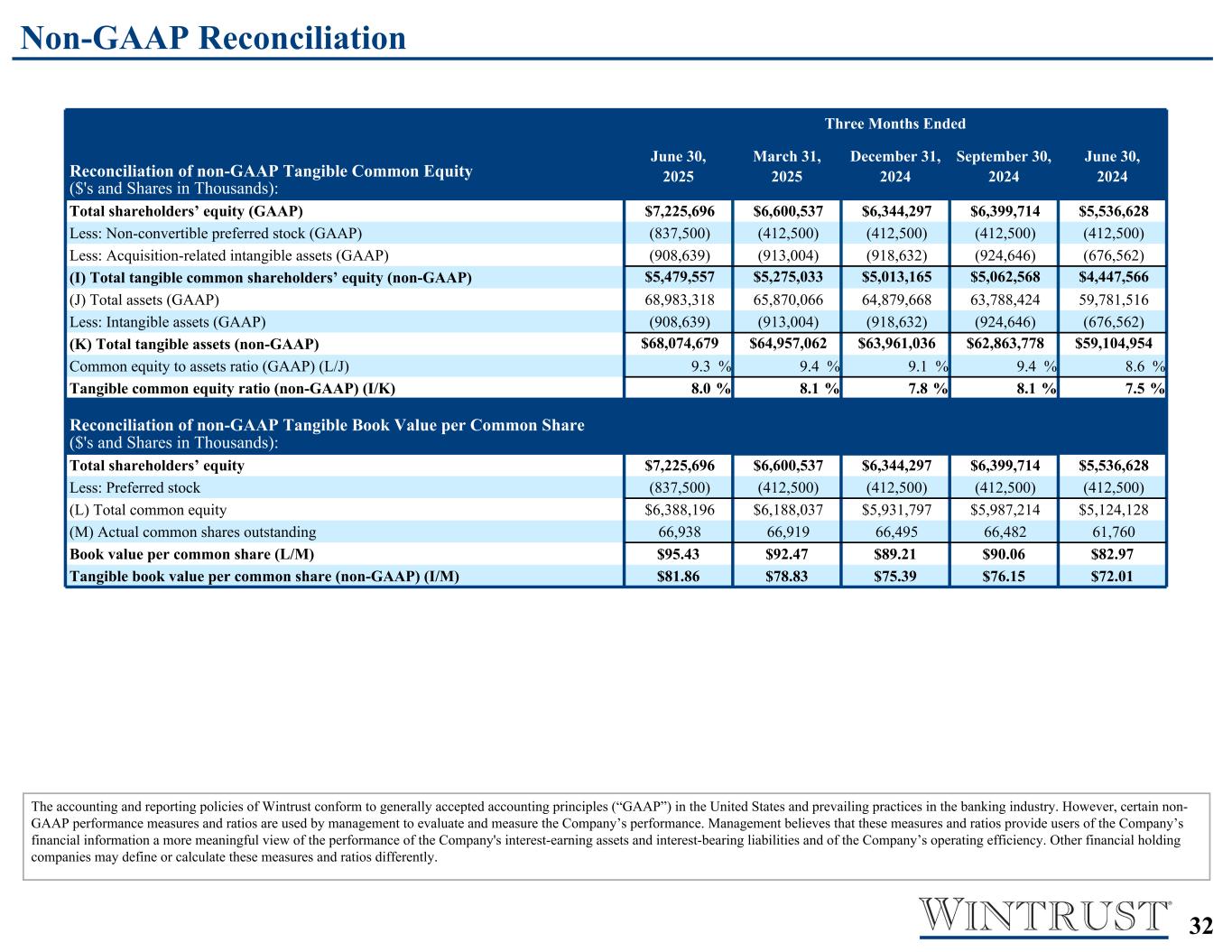

On July 21, 2025, Wintrust Financial Corporation (the “Company”) announced earnings for the second quarter of 2025 and posted on its website the Second Quarter 2025 Earnings Release Presentation. Copies of the press release relating to the Company’s earnings results and the related presentation are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively. Certain supplemental information relating to non-GAAP financial measures reported in the attached press release and presentation is included on pages 33 through 34 of Exhibit 99.1 and pages 30 through 32 of Exhibit 99.2.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| Exhibit | |||||

2

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| WINTRUST FINANCIAL CORPORATION (Registrant) |

||||||||

| By: | /s/ David L. Stoehr | |||||||

| David L. Stoehr Executive Vice President and Chief Financial Officer |

||||||||

Date: July 21, 2025

3

INDEX TO EXHIBITS

| Exhibit | |||||

4

Exhibit 99.1

Wintrust Financial Corporation

9700 W. Higgins Road, Suite 800, Rosemont, Illinois 60018

News Release

| FOR IMMEDIATE RELEASE | July 21, 2025 | |||||||

FOR MORE INFORMATION CONTACT:

David A. Dykstra, Vice Chairman & Chief Operating Officer

(847) 939-9000

Amy Yuhn, Executive Vice President, Communications

(847) 939-9591

Web site address: www.wintrust.com

Wintrust Financial Corporation Reports Record Net Income

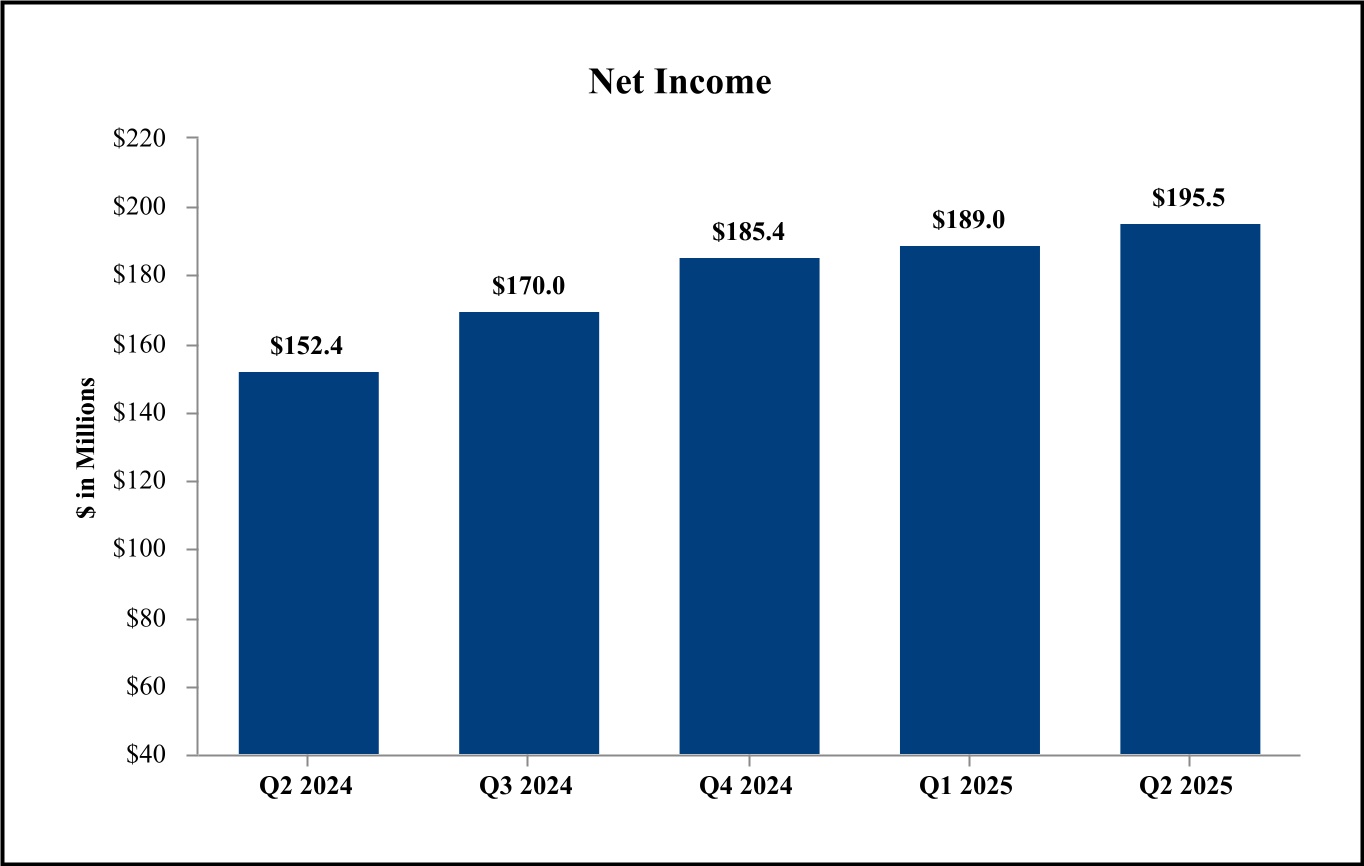

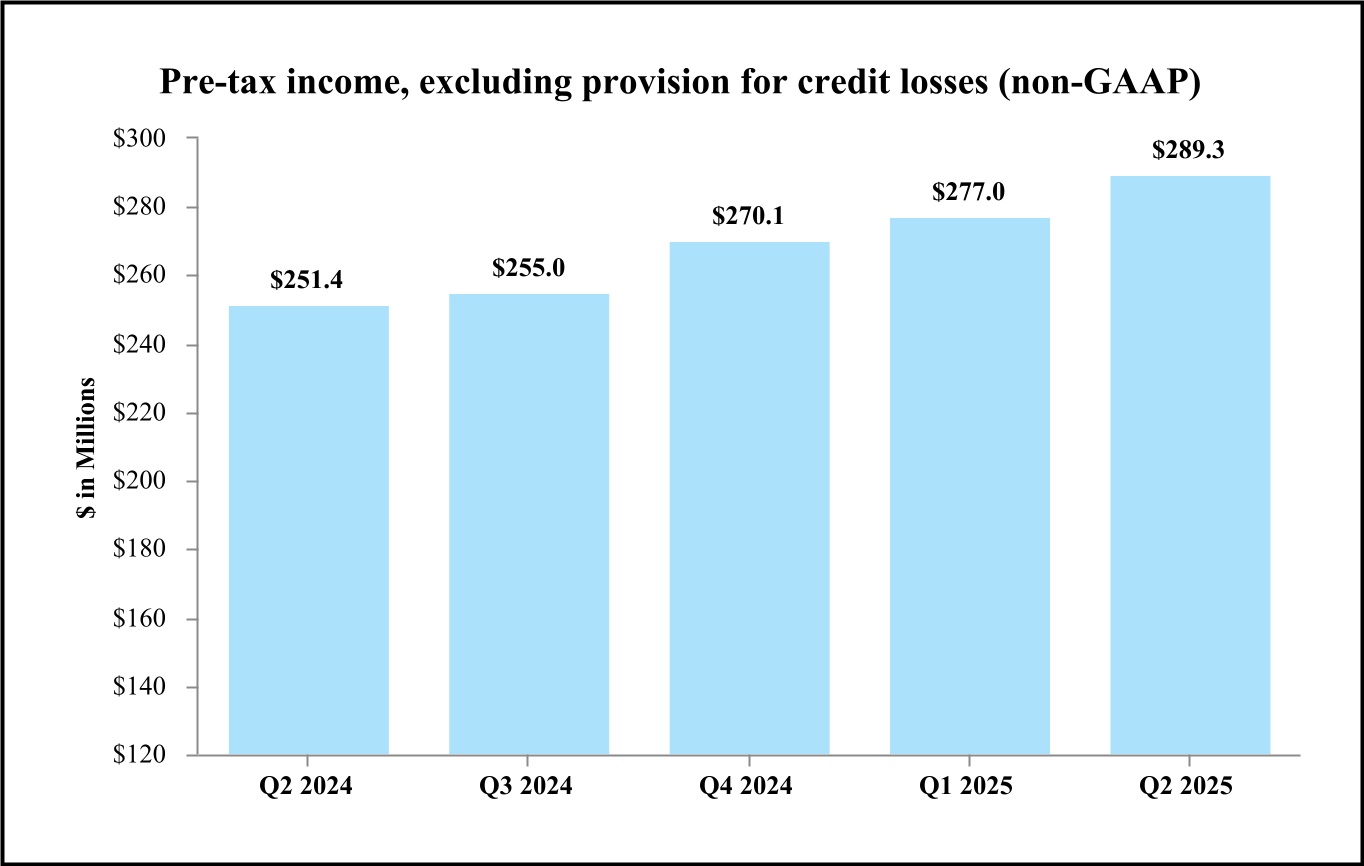

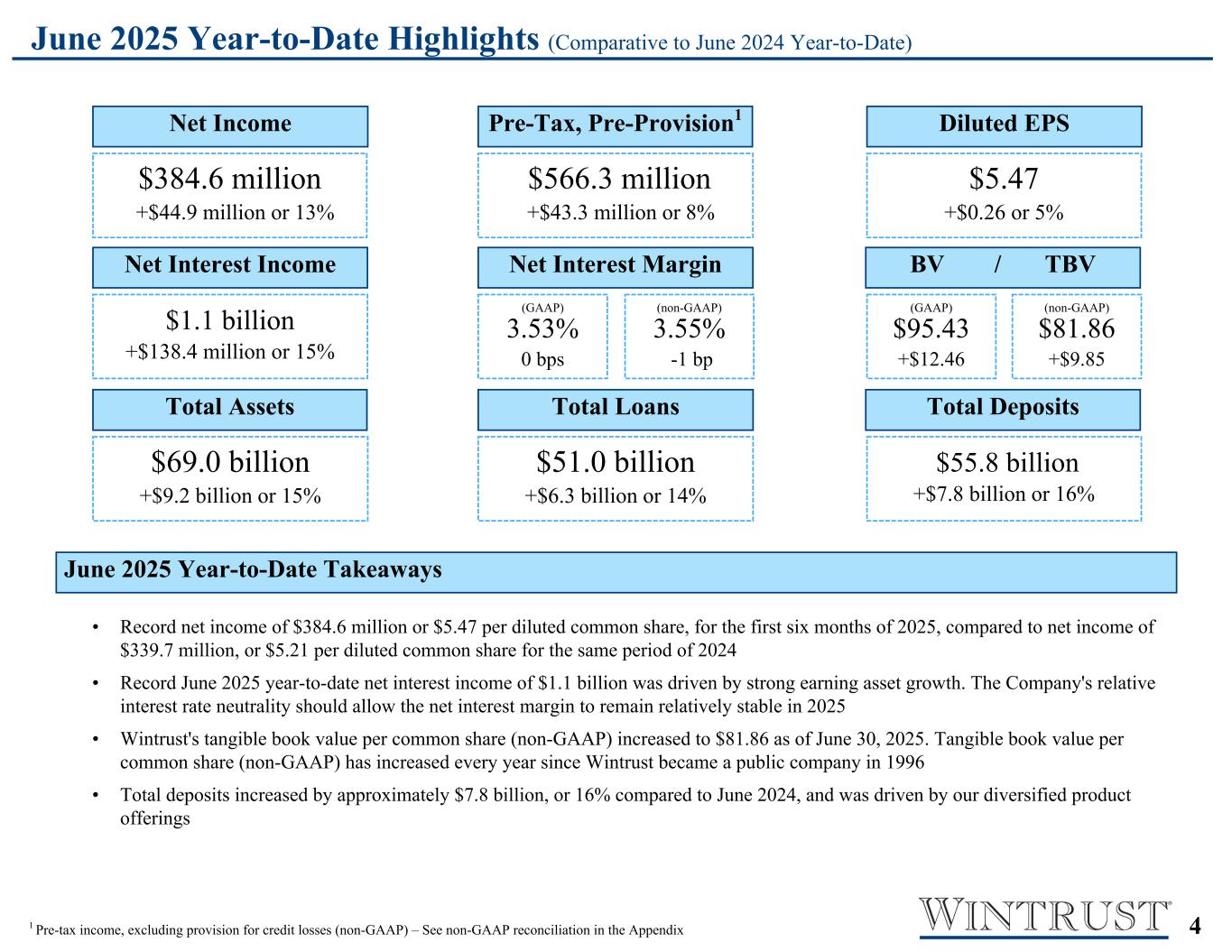

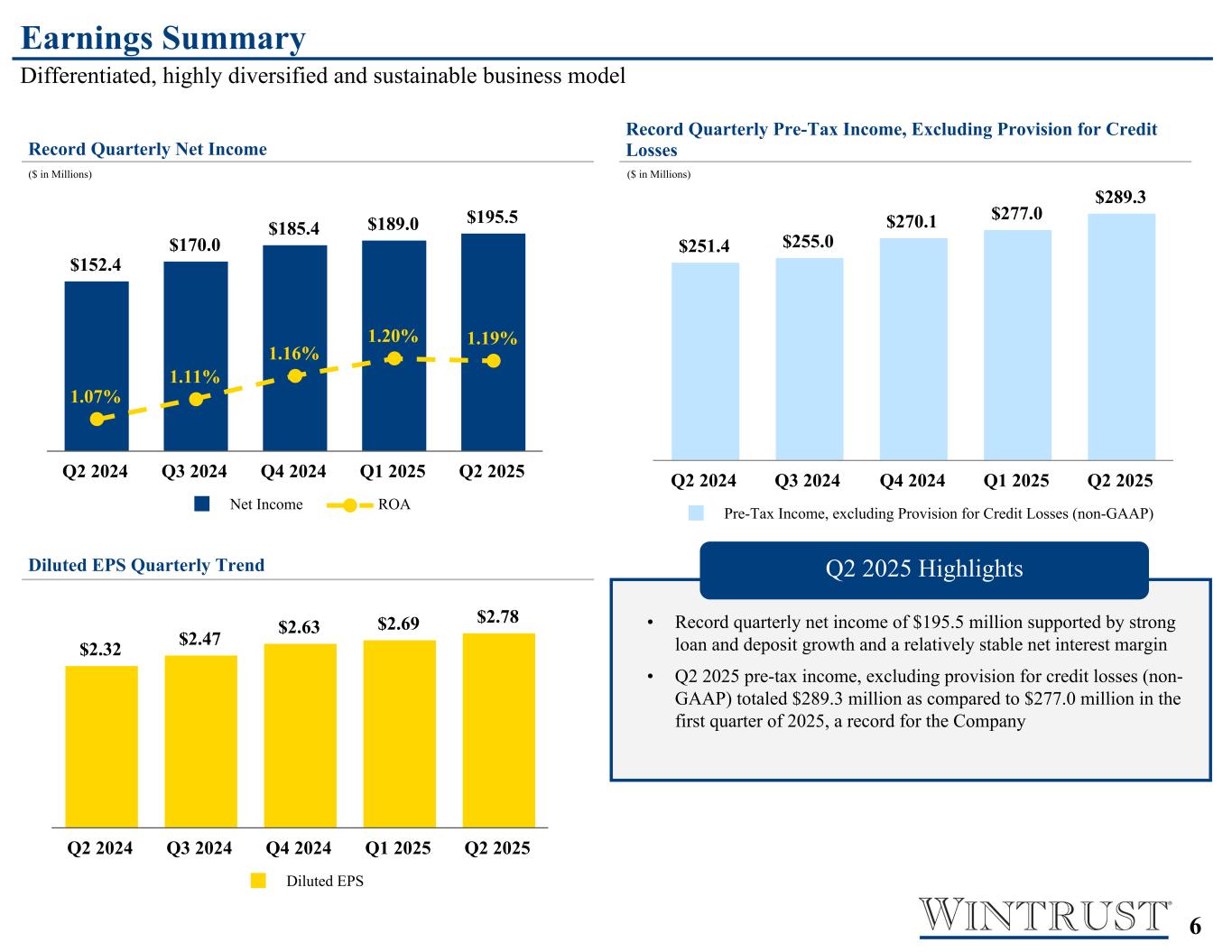

ROSEMONT, ILLINOIS – Wintrust Financial Corporation (“Wintrust”, “the Company”, “we” or “our”) (Nasdaq: WTFC) announced record net income of $384.6 million, or $5.47 per diluted common share, for the first six months of 2025, compared to net income of $339.7 million, or $5.21 per diluted common share for the same period of 2024. Pre-tax, pre-provision income (non-GAAP) for the first six months of the year totaled a record $566.3 million, compared to $523.0 million for the first six months of 2024.

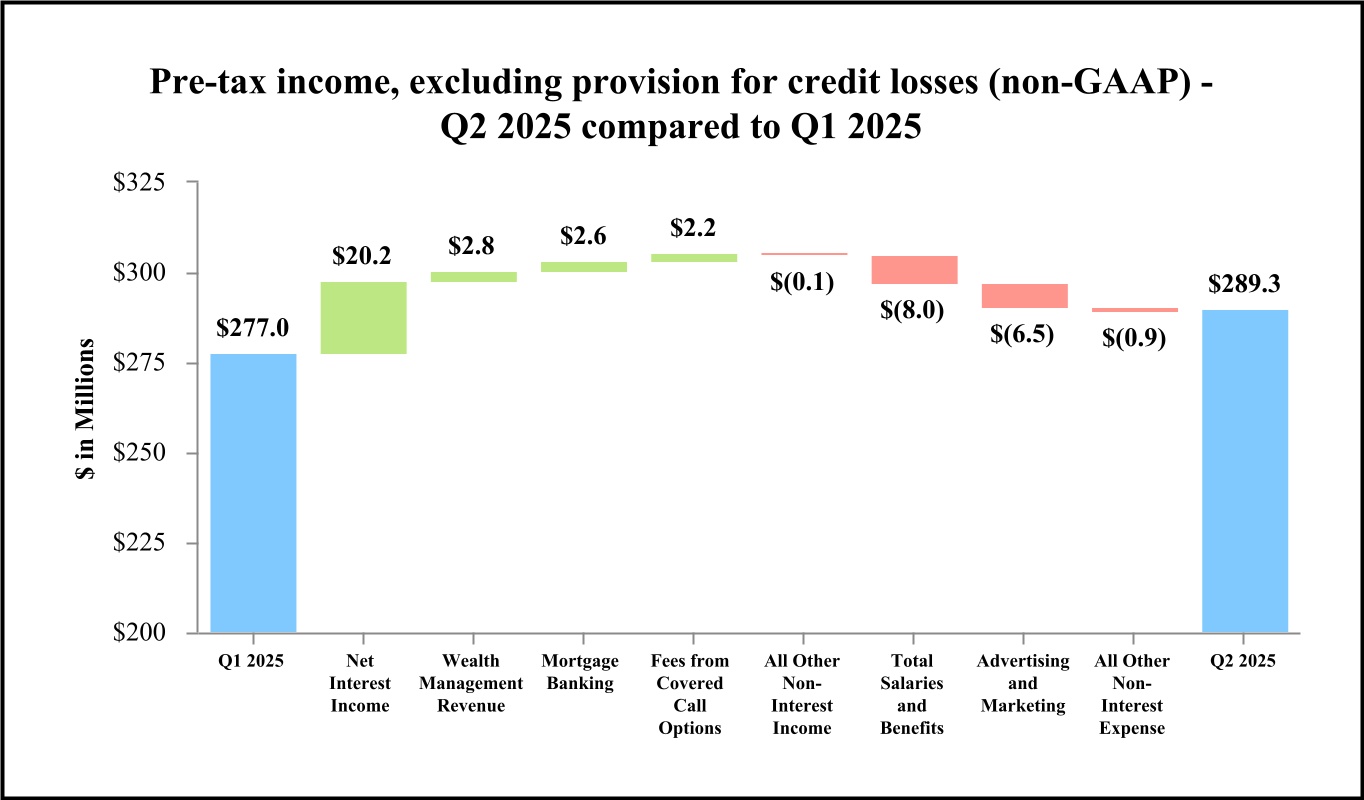

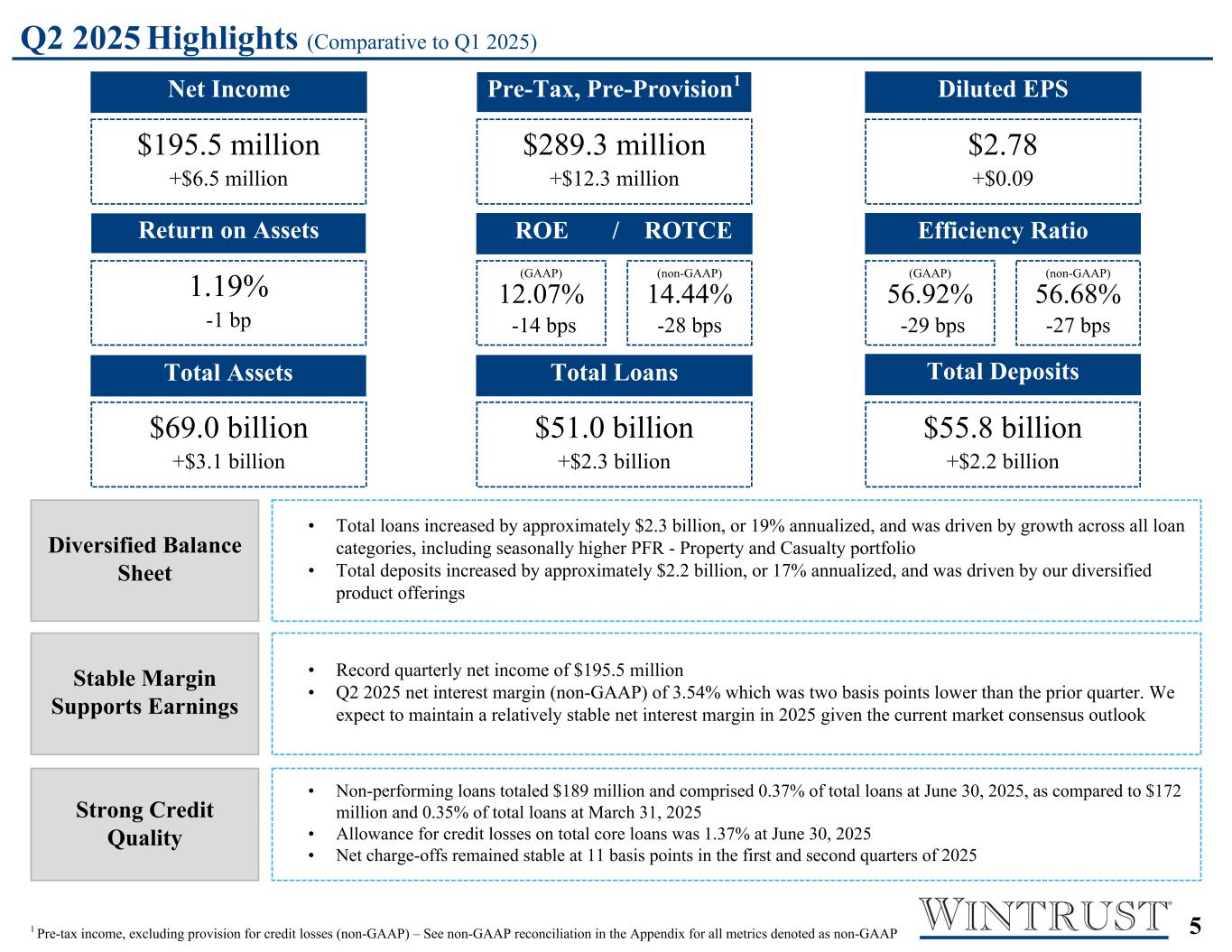

The Company recorded record quarterly net income of $195.5 million, or $2.78 per diluted common share, for the second quarter of 2025, compared to net income of $189.0 million, or $2.69 per diluted common share for the first quarter of 2025. Pre-tax, pre-provision income (non-GAAP) for the second quarter of 2025 totaled a record $289.3 million, as compared to $277.0 million for the first quarter of 2025.

Timothy S. Crane, President and Chief Executive Officer, commented, “Building on the momentum of a strong first quarter, we are pleased to deliver record results again this quarter, reflecting the underlying strength and momentum of our business. A combination of balance sheet growth and a stable net interest margin drove our record results in the second quarter of 2025.”

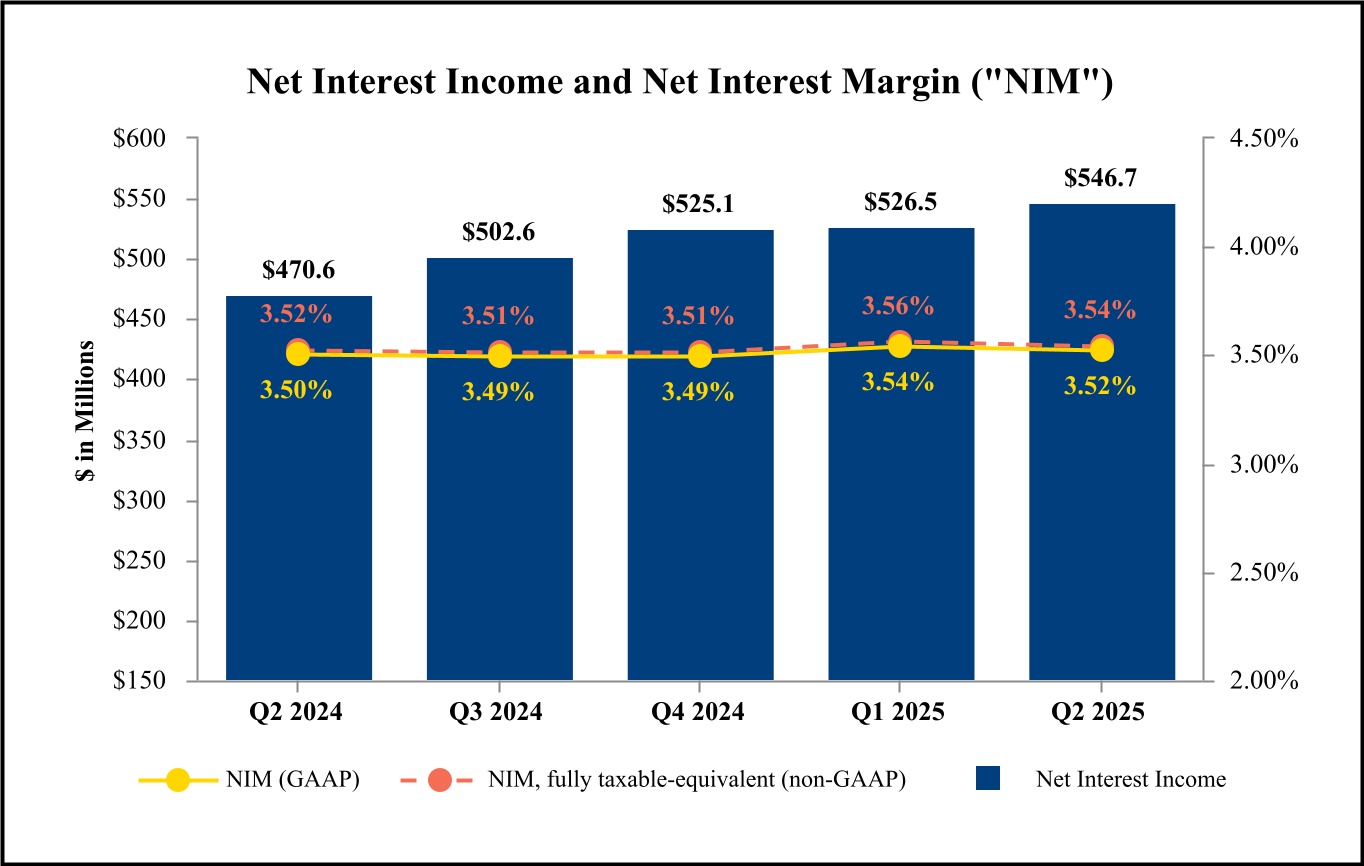

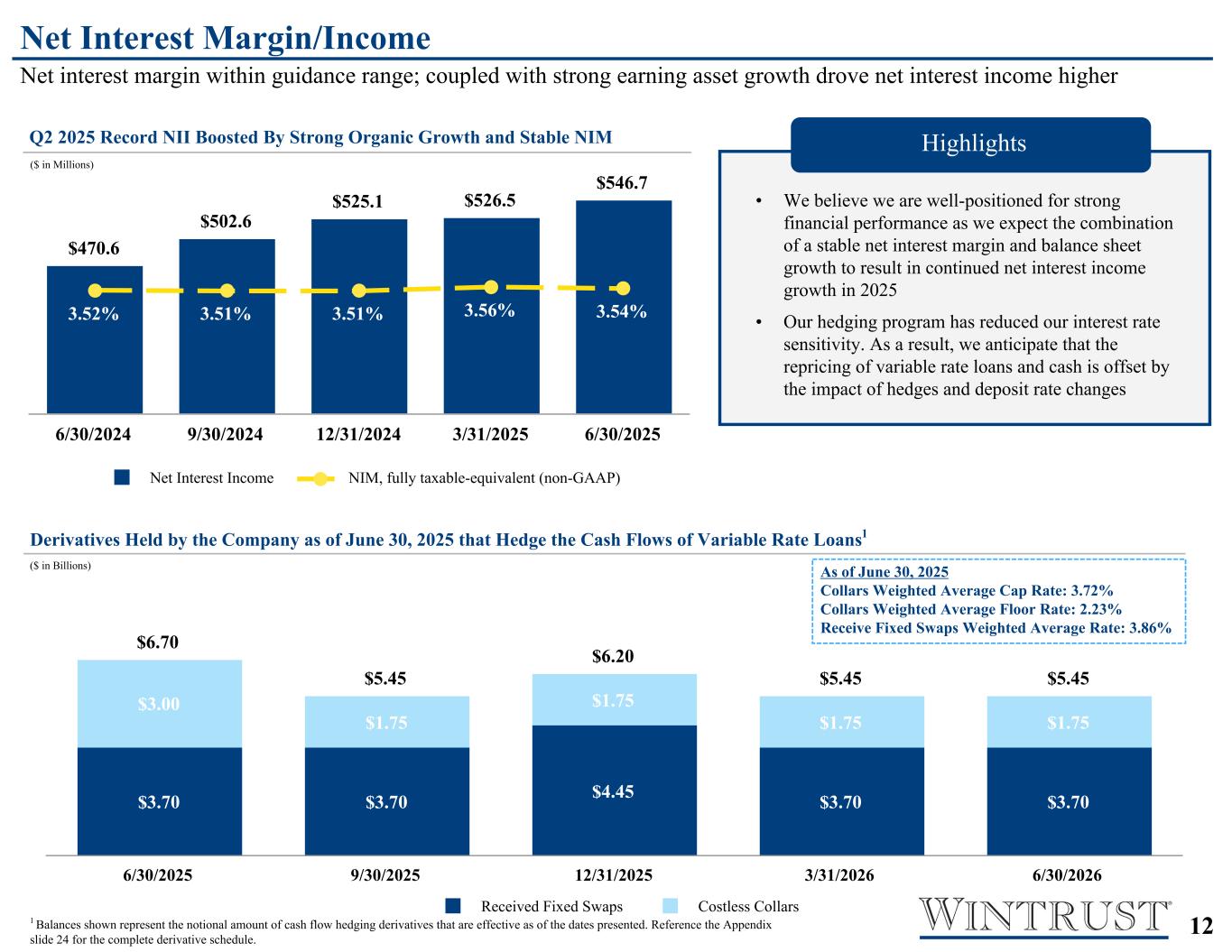

Additionally, Mr. Crane noted, “Net interest margin in the second quarter remained within our expected range at 3.54% and we generated record net interest income driven by average earning asset growth. We expect a relatively stable net interest margin coupled with continued balance sheet growth to drive net interest income higher in the third quarter.”

Highlights of the second quarter of 2025:

Comparative information to the first quarter of 2025, unless otherwise noted

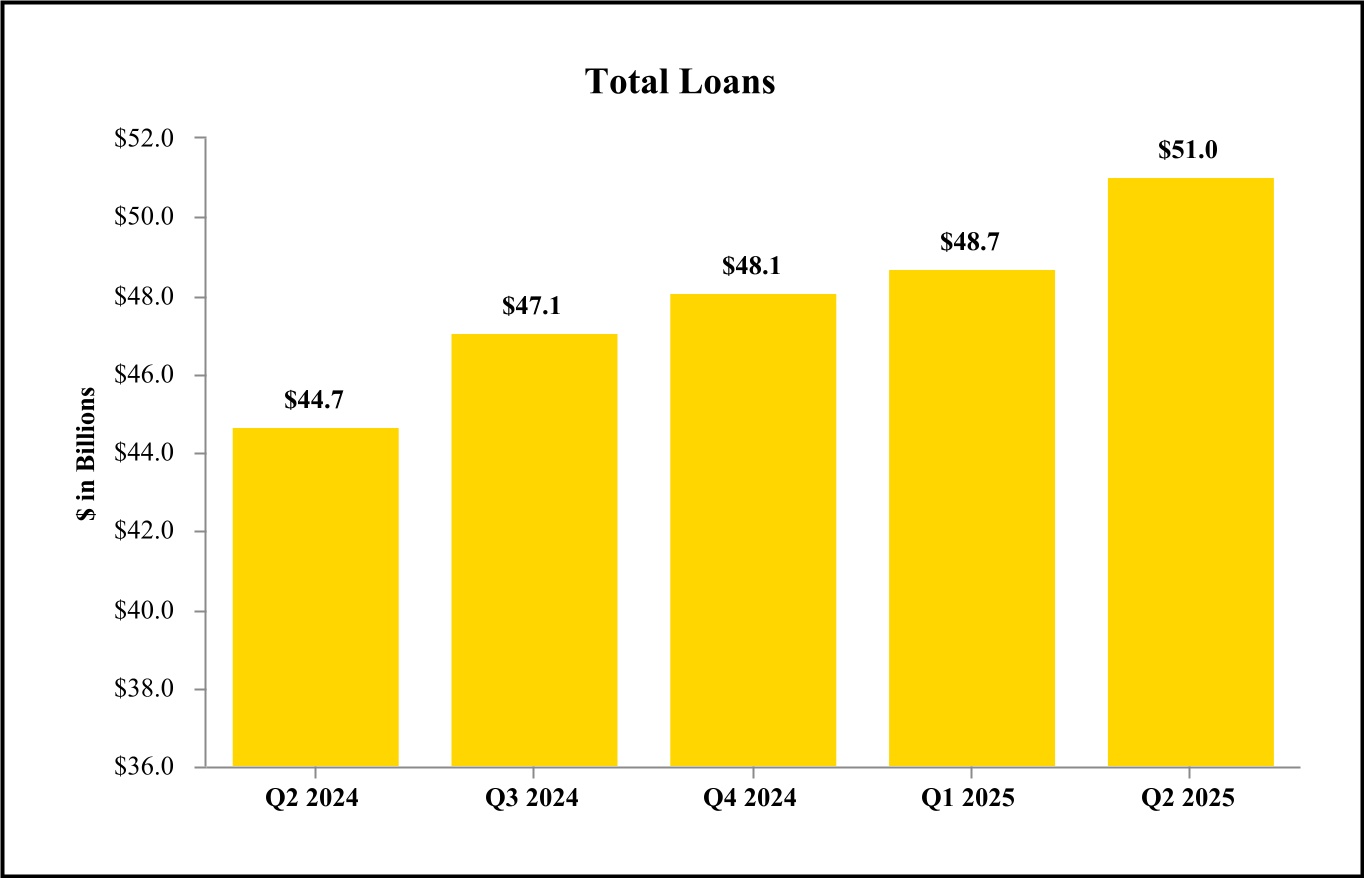

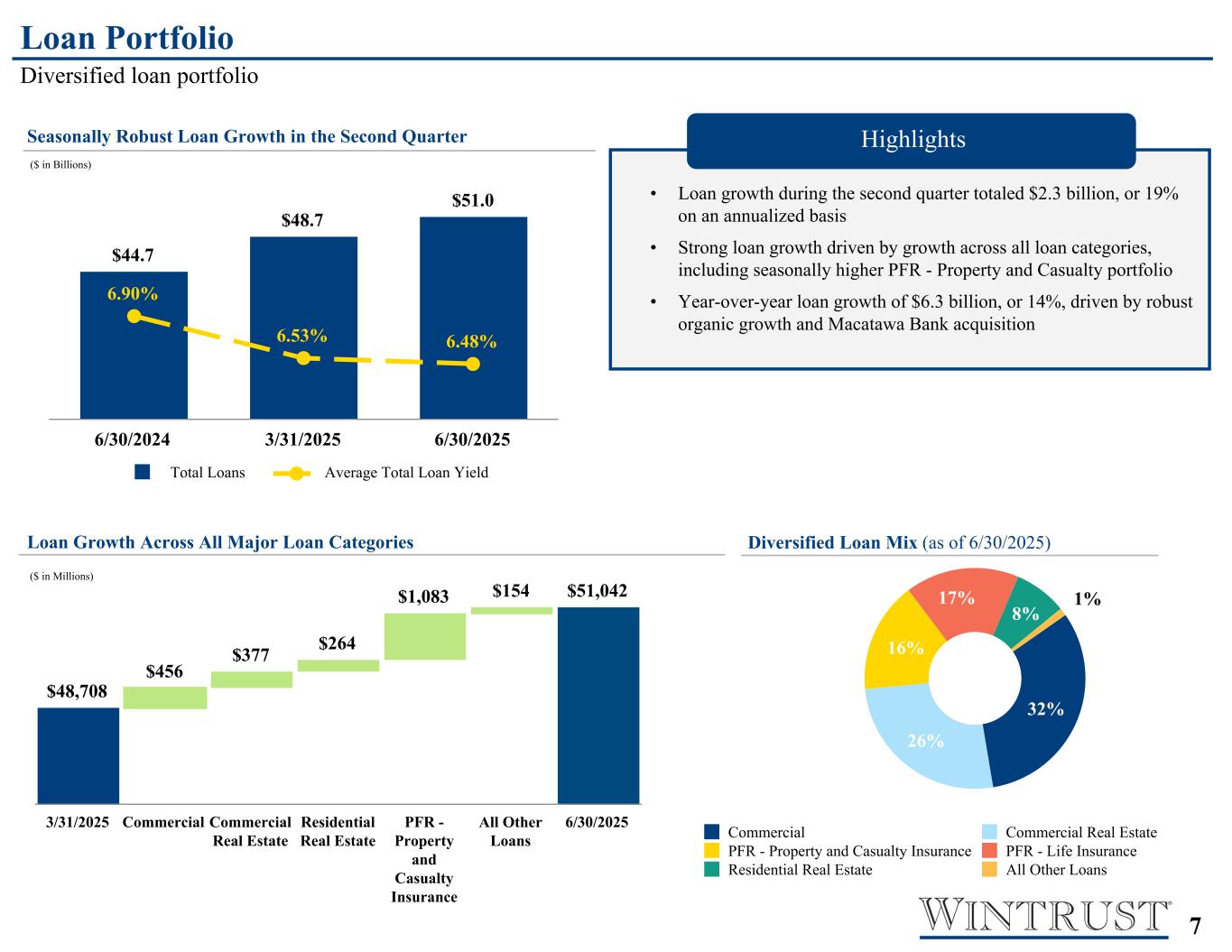

•Total loans increased by $2.3 billion, or 19% annualized.

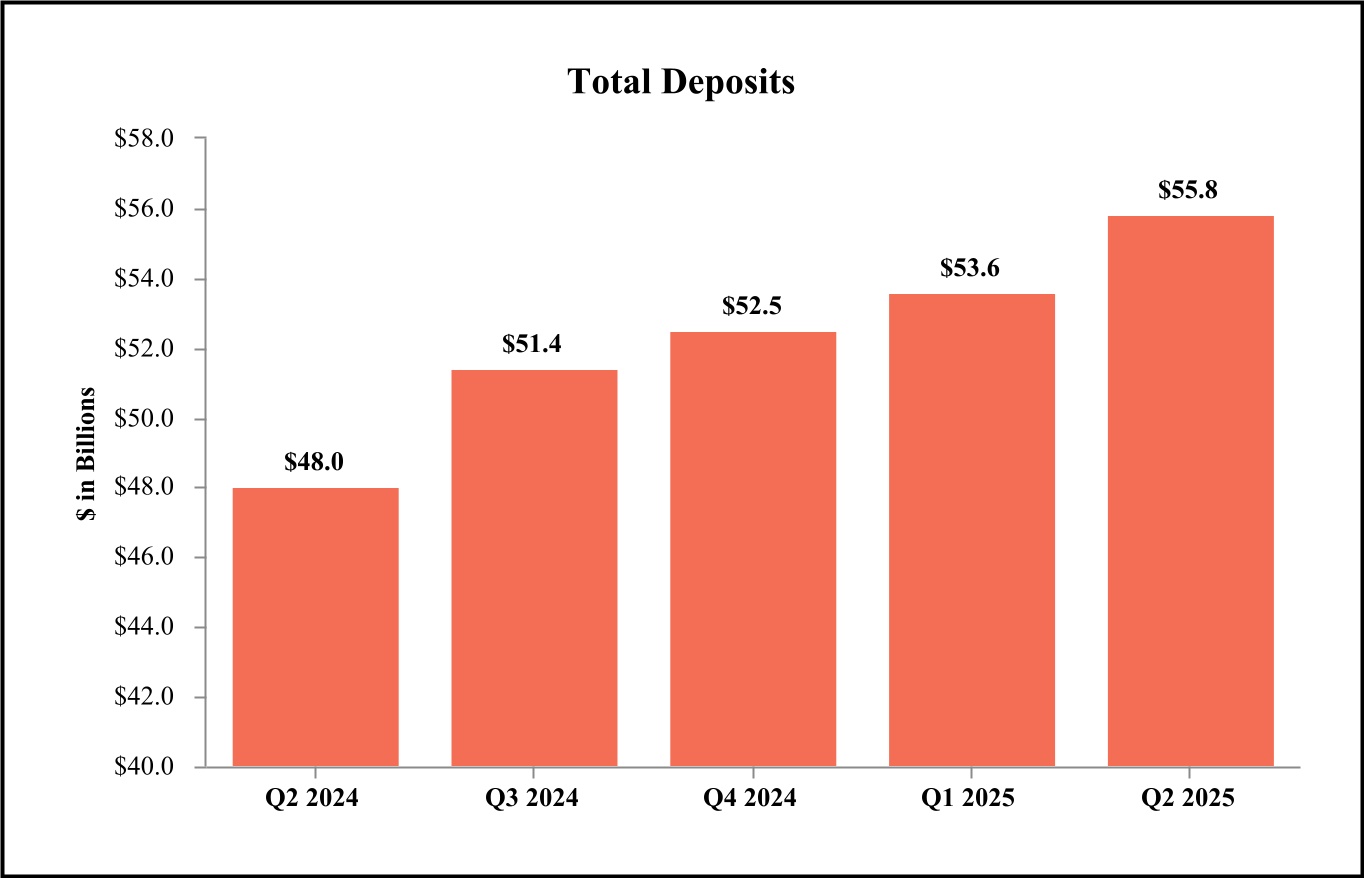

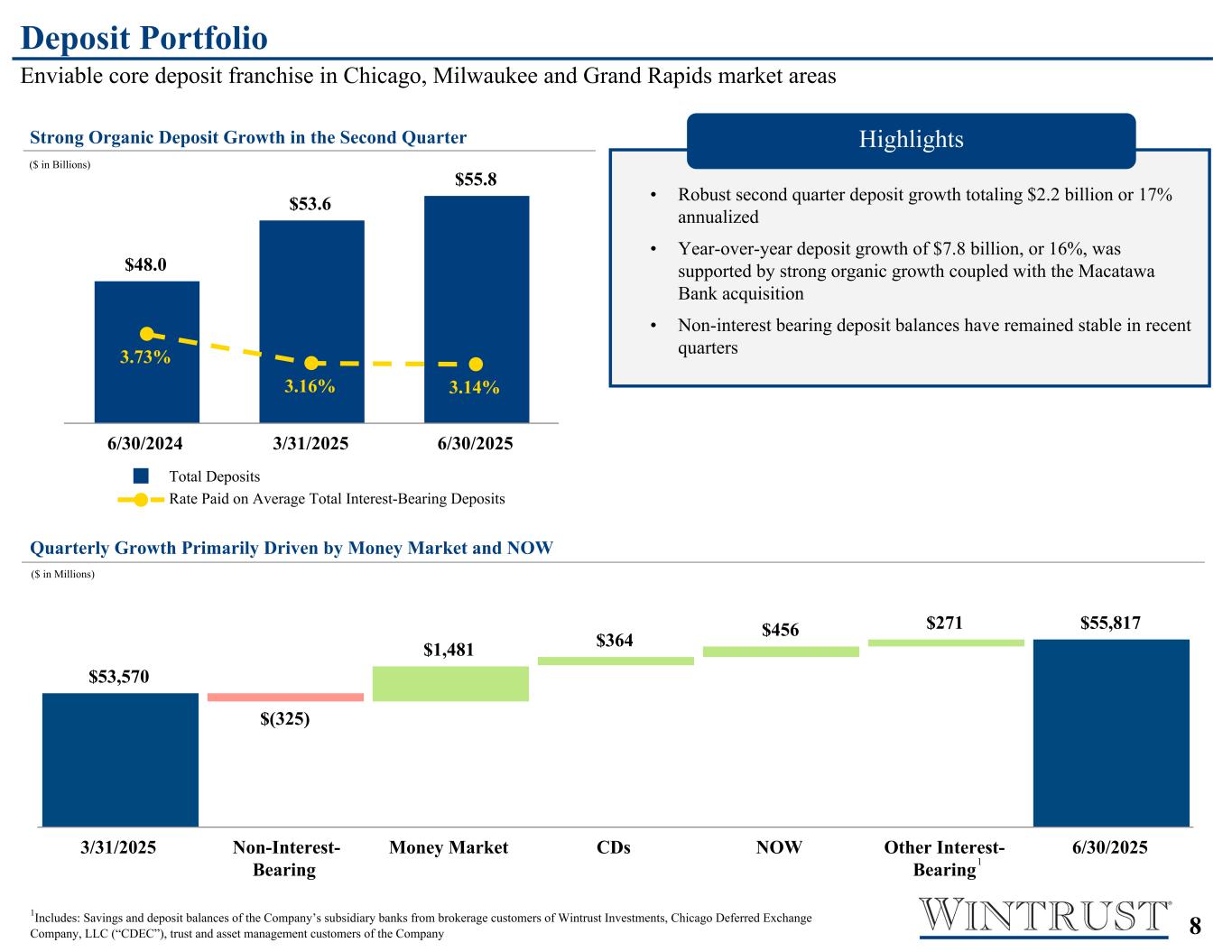

•Total deposits increased by approximately $2.2 billion, or 17% annualized.

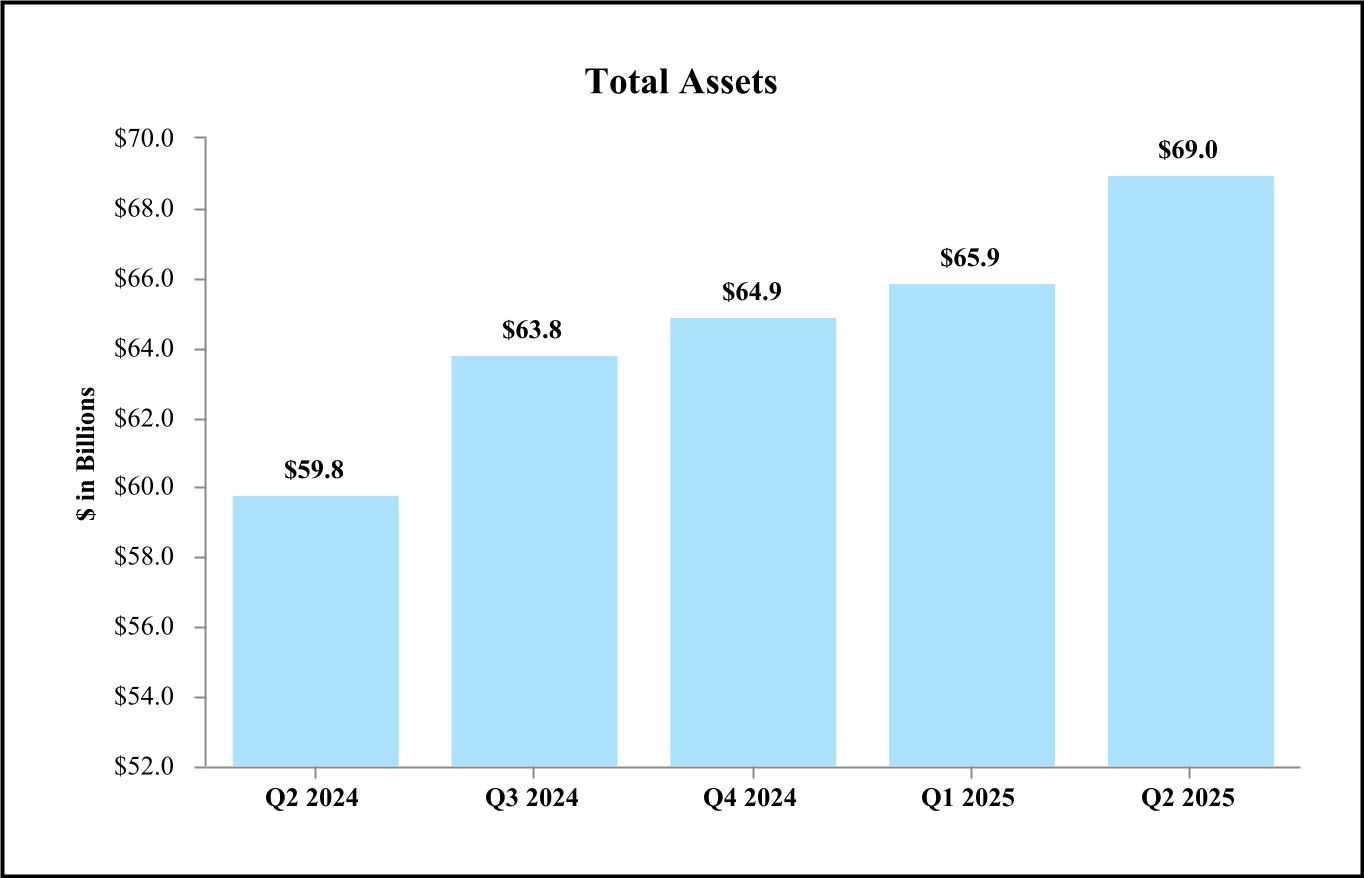

•Total assets increased by $3.1 billion, or 19% annualized.

•Net interest income increased to $546.7 million in the second quarter of 2025, compared to $526.5 million in the first quarter of 2025, driven by strong average earning asset growth.

◦Net interest margin was 3.52% (3.54% on a fully taxable-equivalent basis, non-GAAP) during the second quarter of 2025.

•Non-interest income was impacted by the following:

◦Wealth management revenue totaled $36.8 million in the second quarter of 2025, compared to $34.0 million in the first quarter of 2025.

◦Mortgage banking revenue totaled $23.2 million in the second quarter of 2025, compared to $20.5 million in the first quarter of 2025. An unfavorable fair value mark of $1.4 million was offset by an increase in operational revenue of $4.1 million driven by higher origination volumes and improved production margin. For more information regarding mortgage banking revenue, see Table 16 in this report.

◦Net gains on investment securities totaled approximately $650,000 in the second quarter of 2025, compared to net gains of $3.2 million in the first quarter of 2025.

•Non-interest expense was impacted by the following:

◦Advertising and Marketing increased by $6.5 million and totaled $18.8 million in the second quarter of 2025. The increase in the quarter was related to planned and primarily seasonal expenses in various sports sponsorships and other summer community sponsorship events.

◦Macatawa Bank acquisition-related costs were $2.9 million in the second quarter of 2025, compared to $2.7 million in the first quarter of 2025.

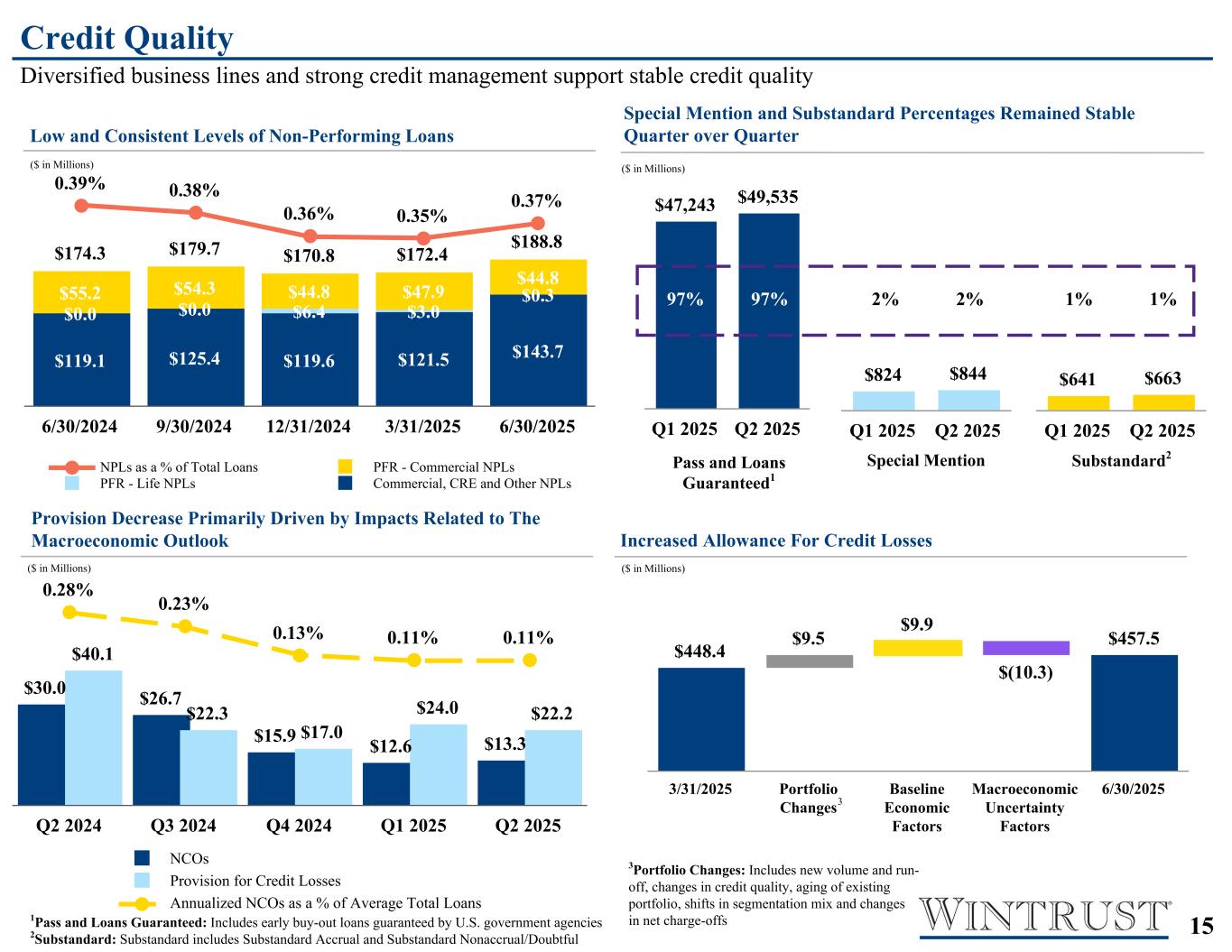

•Provision for credit losses totaled $22.2 million in the second quarter of 2025, compared to a provision for credit losses of $24.0 million in the first quarter of 2025.

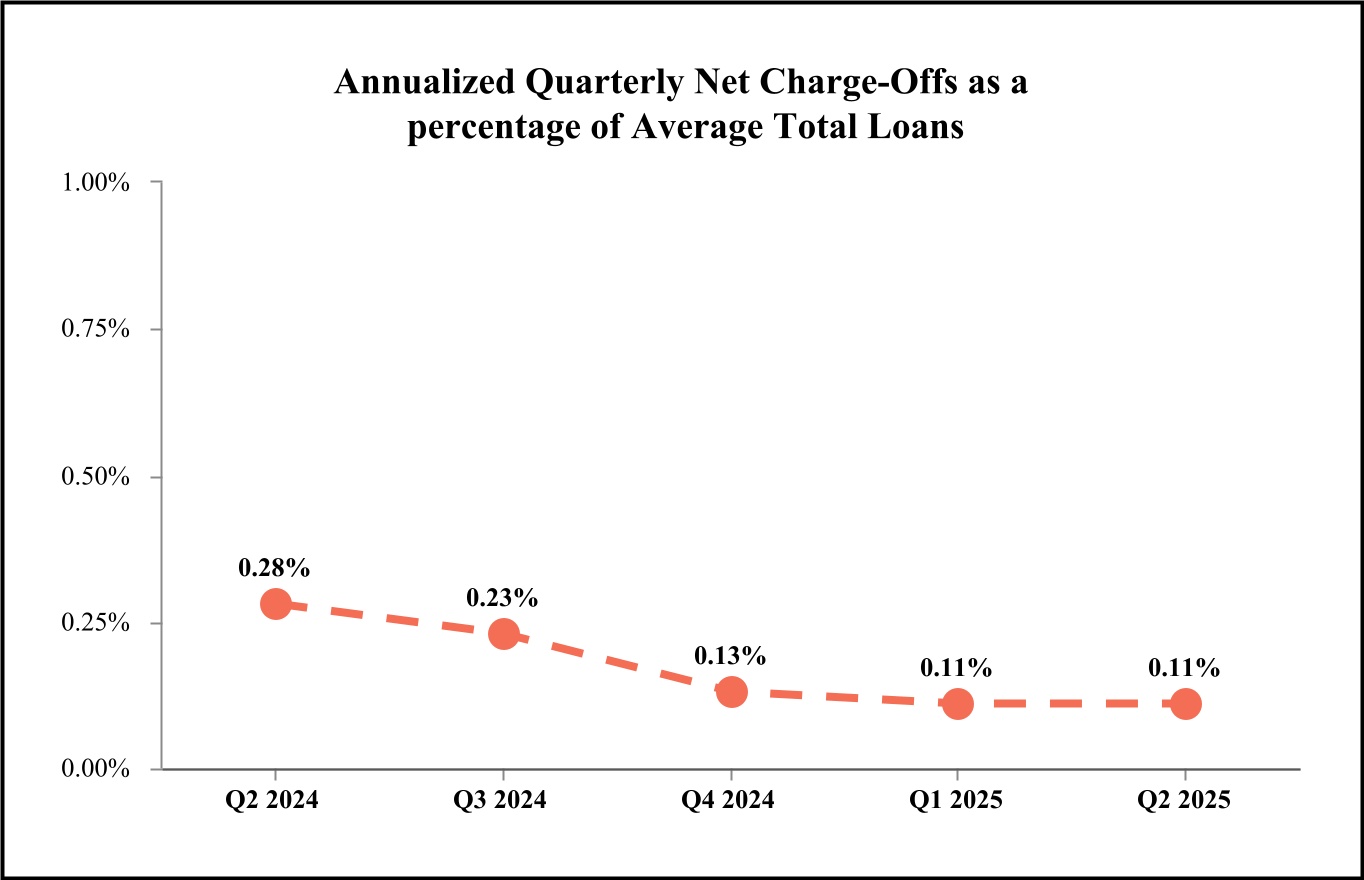

•Net charge-offs totaled $13.3 million, or 11 basis points of average total loans on an annualized basis, in the second quarter of 2025 compared to $12.6 million, or 11 basis points of average total loans on an annualized basis, in the first quarter of 2025.

Mr. Crane noted, “Solid loan growth in the second quarter totaled $2.3 billion, or 19% on an annualized basis. We are pleased with our diversified loan growth across all major loan portfolios and strong seasonal growth in our property & casualty insurance premium finance business. Loan pipelines remain strong and we expect loan growth in the mid-to-high single digits in the second half of the year. We continue to be prudent in our review of credit opportunities, ensuring our loan growth adheres to our conservative credit standards. Strong deposit growth totaled $2.2 billion, or 17% on an annualized basis, in the second quarter of 2025. Our loan growth was funded by our deposit growth in the second quarter of 2025 resulting in our loans-to-deposits ratio ending the quarter at 91.4%. We continue to benefit from our customer relationships and unique market positioning to generate deposits, grow loans and enhance our long-term franchise value.”

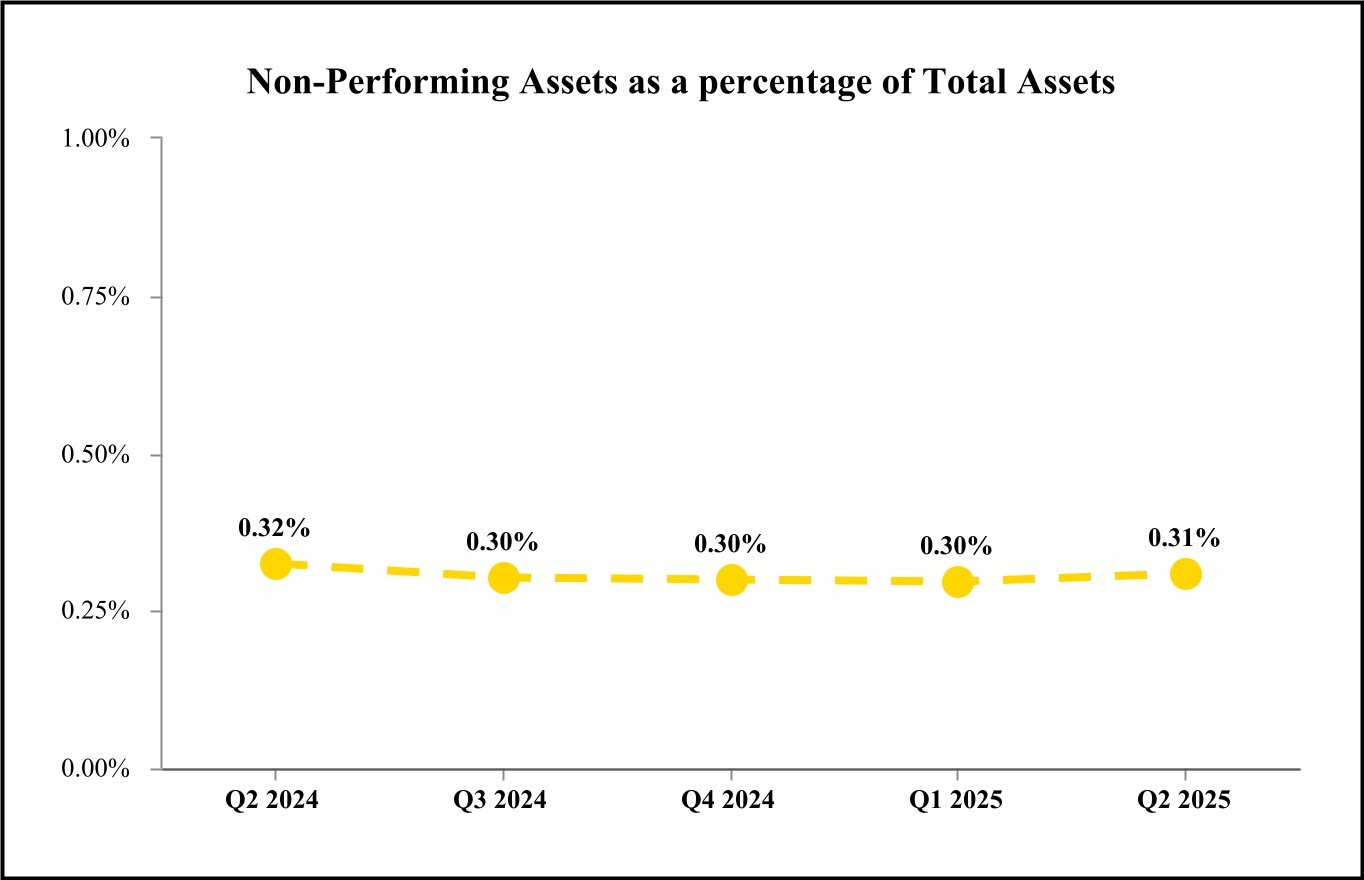

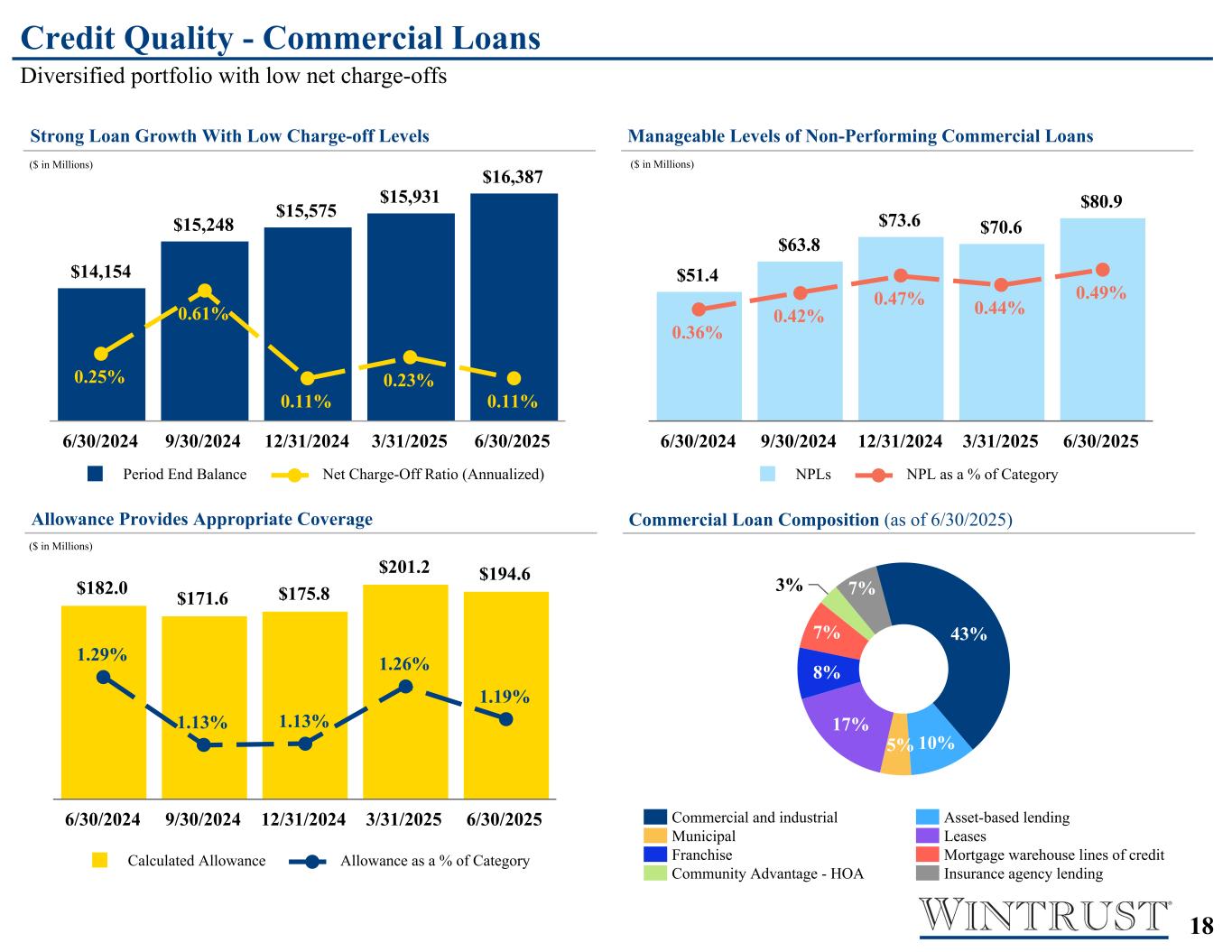

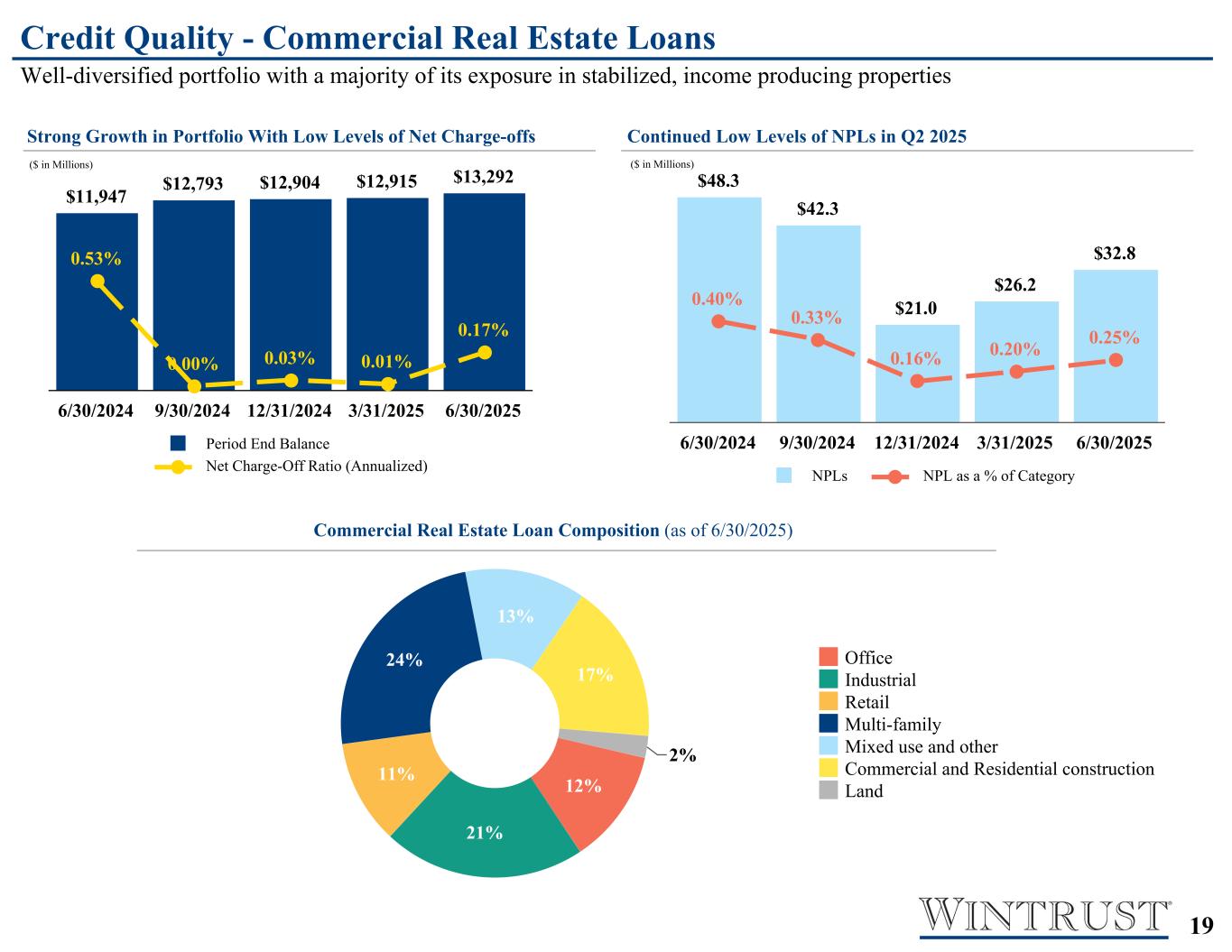

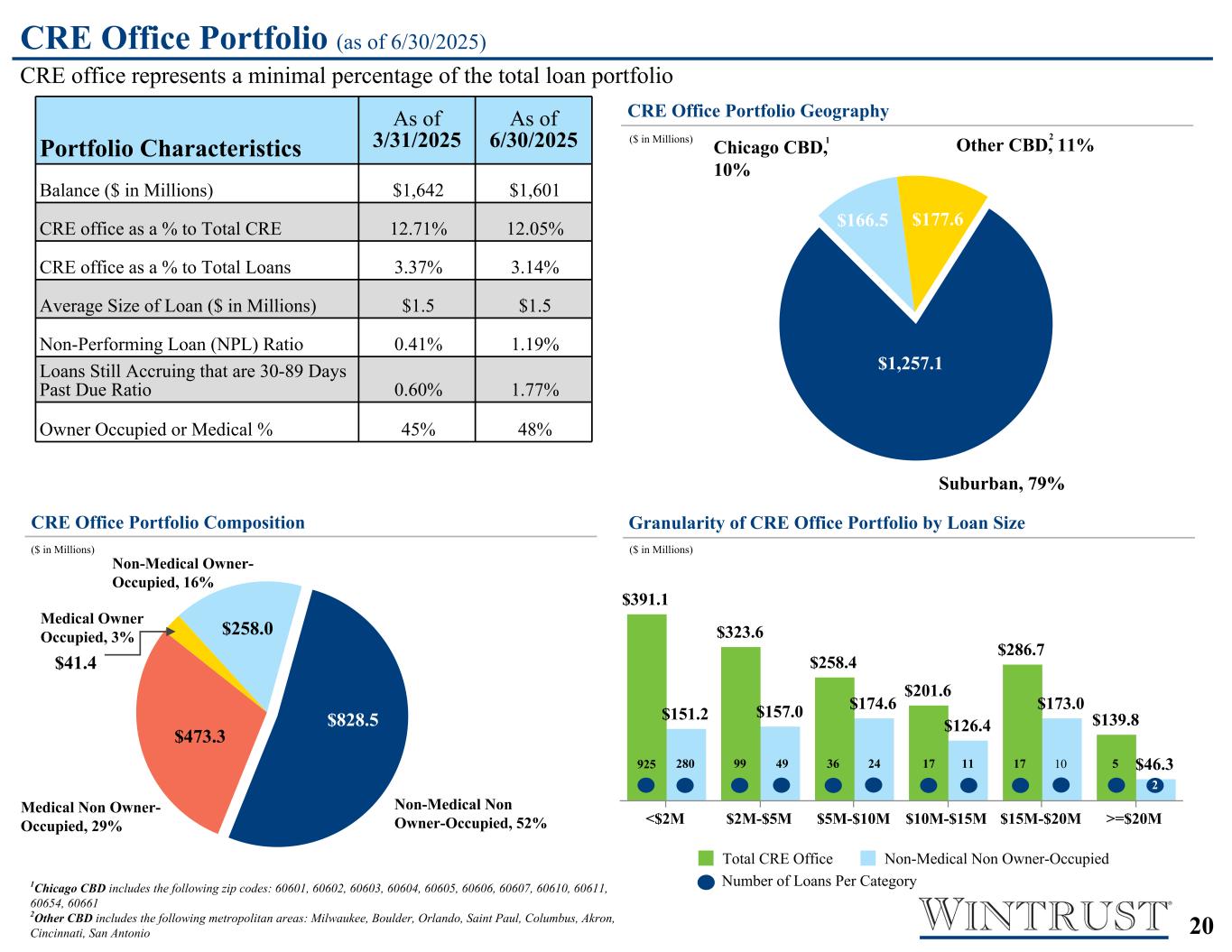

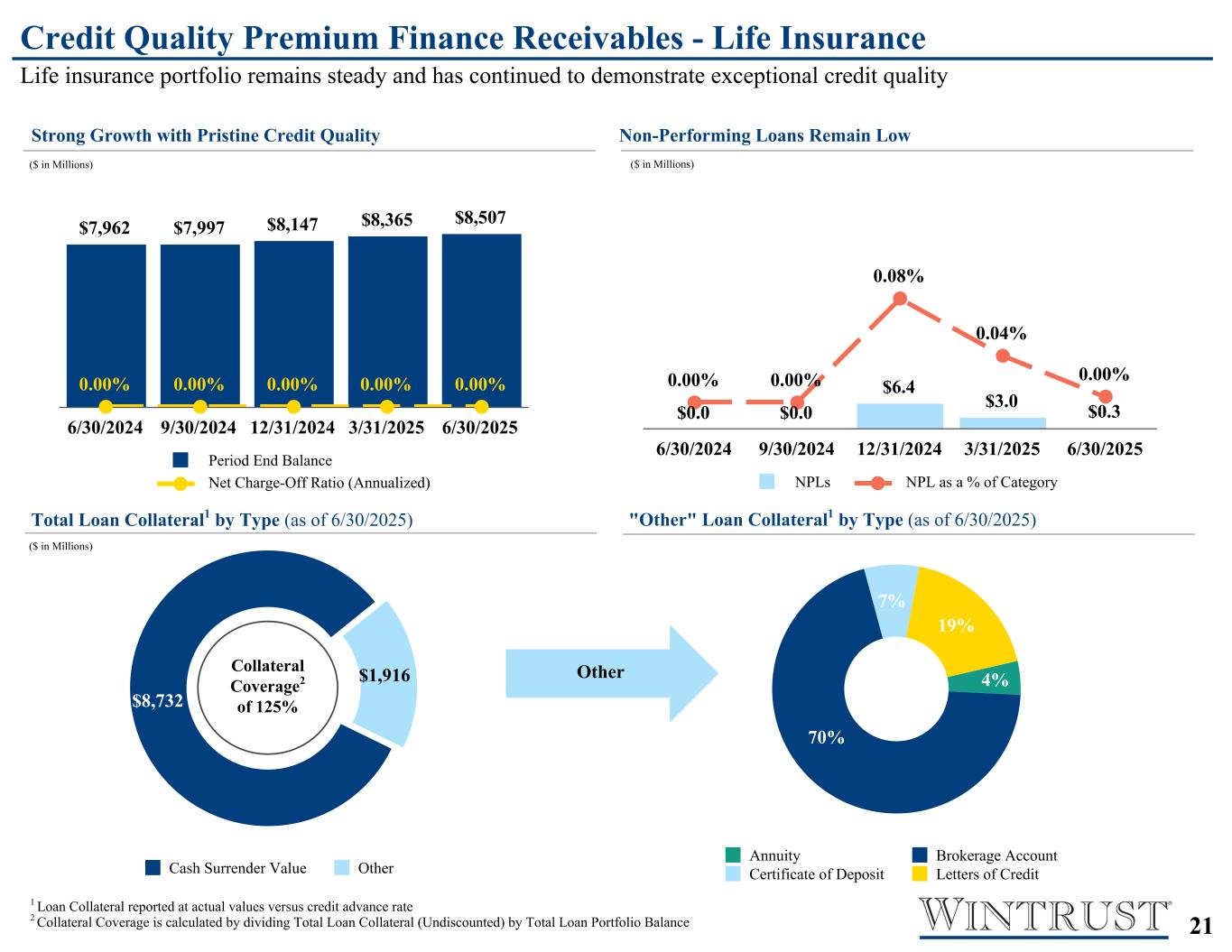

Commenting on credit quality, Mr. Crane stated, “Disciplined credit management, supported by thorough portfolio reviews, has driven consistent positive outcomes by enabling early identification and resolution of problem credits. We continue to be conservative and diversified in regard to maintaining our strong credit standards. We believe the Company’s reserves are appropriate and we remain committed to sustaining high credit quality as evidenced by our low levels of net charge-offs and non-performing loans as well as our core loan allowance for credit losses of 1.37%.”

In summary, Mr. Crane concluded, “We are proud of our second quarter performance and record results year to date. We expect our strong momentum to continue into the third quarter as our loan growth in the second quarter provides positive revenue momentum. The balance sheet growth in the second quarter highlights our enviable core deposit franchise and multifaceted business model. Our commitment to growing net interest income, disciplined expense control and conservative credit standards should lead to increasing our franchise value.”

* * *

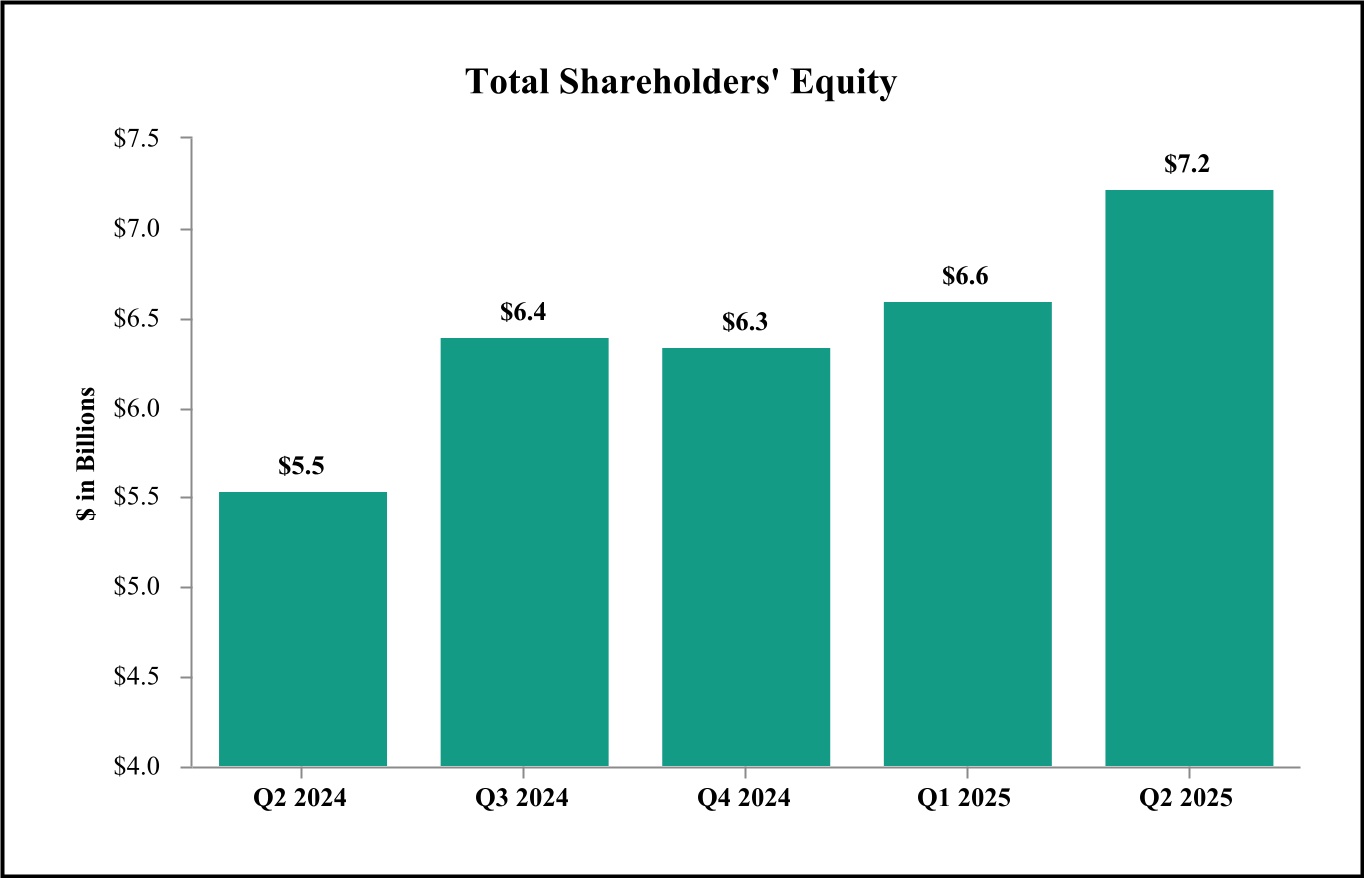

The graphs shown on pages 3-7 illustrate certain financial highlights of the second quarter of 2025 as well as historical financial performance. See “Supplemental Non-GAAP Financial Measures/Ratios” at Table 18 for additional information with respect to non-GAAP financial measures/ratios, including the reconciliations to the corresponding GAAP financial measures/ratios.

2

3

4

5

6

7

SUMMARY OF RESULTS:

BALANCE SHEET

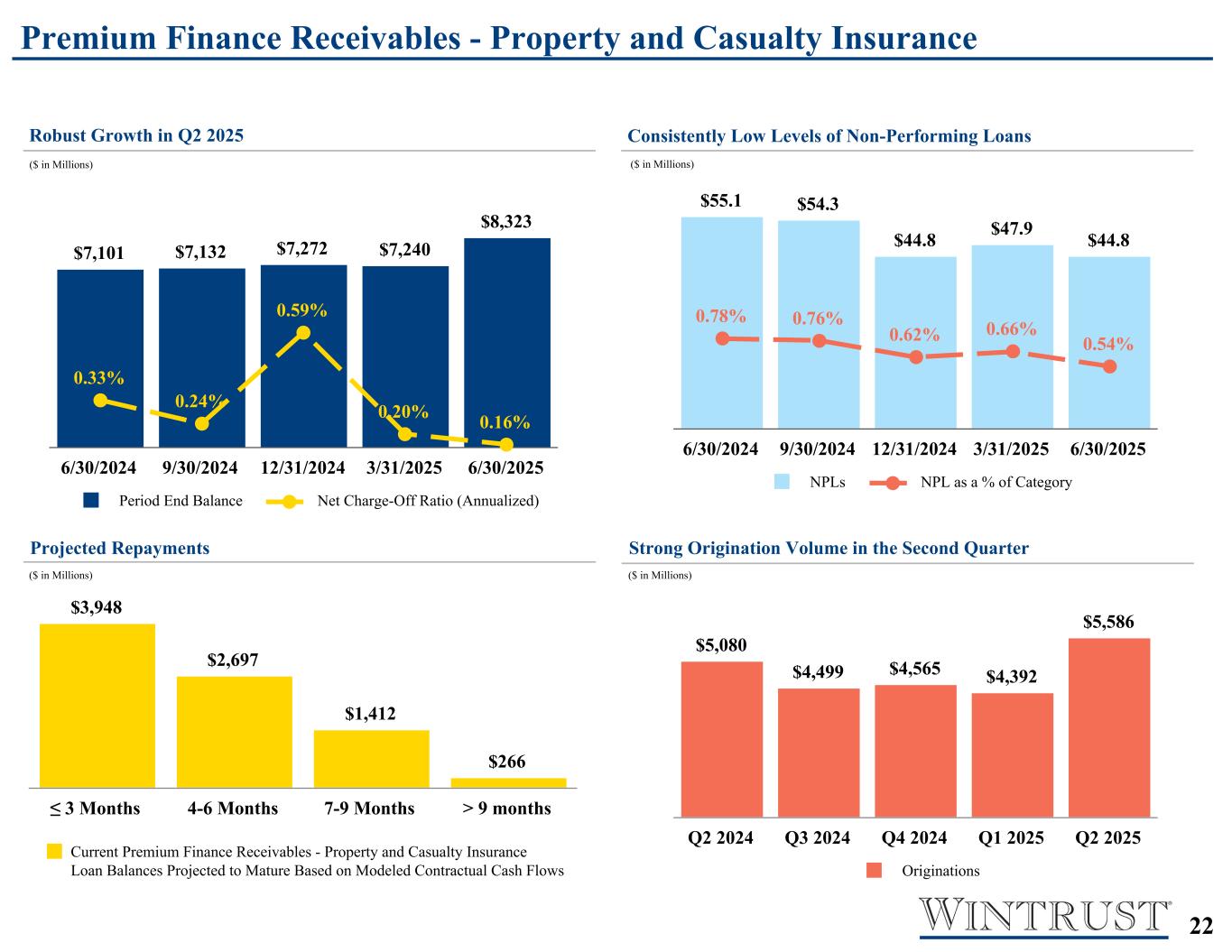

Total assets increased $3.1 billion in the second quarter of 2025 compared to the first quarter of 2025. Total loans increased by $2.3 billion compared to the first quarter of 2025. The increase in loans was driven by growth across all major loan portfolios, including seasonally higher Premium Finance Receivables - Property and Casualty portfolio.

Total liabilities increased by $2.5 billion in the second quarter of 2025 compared to the first quarter of 2025, driven by a $2.2 billion increase in total deposits. Robust organic deposit growth in the second quarter of 2025 was driven by our diverse deposit product offerings. Non-interest bearing deposit balances have remained stable in recent quarters. The Company's loans-to-deposits ratio ended the quarter at 91.4%.

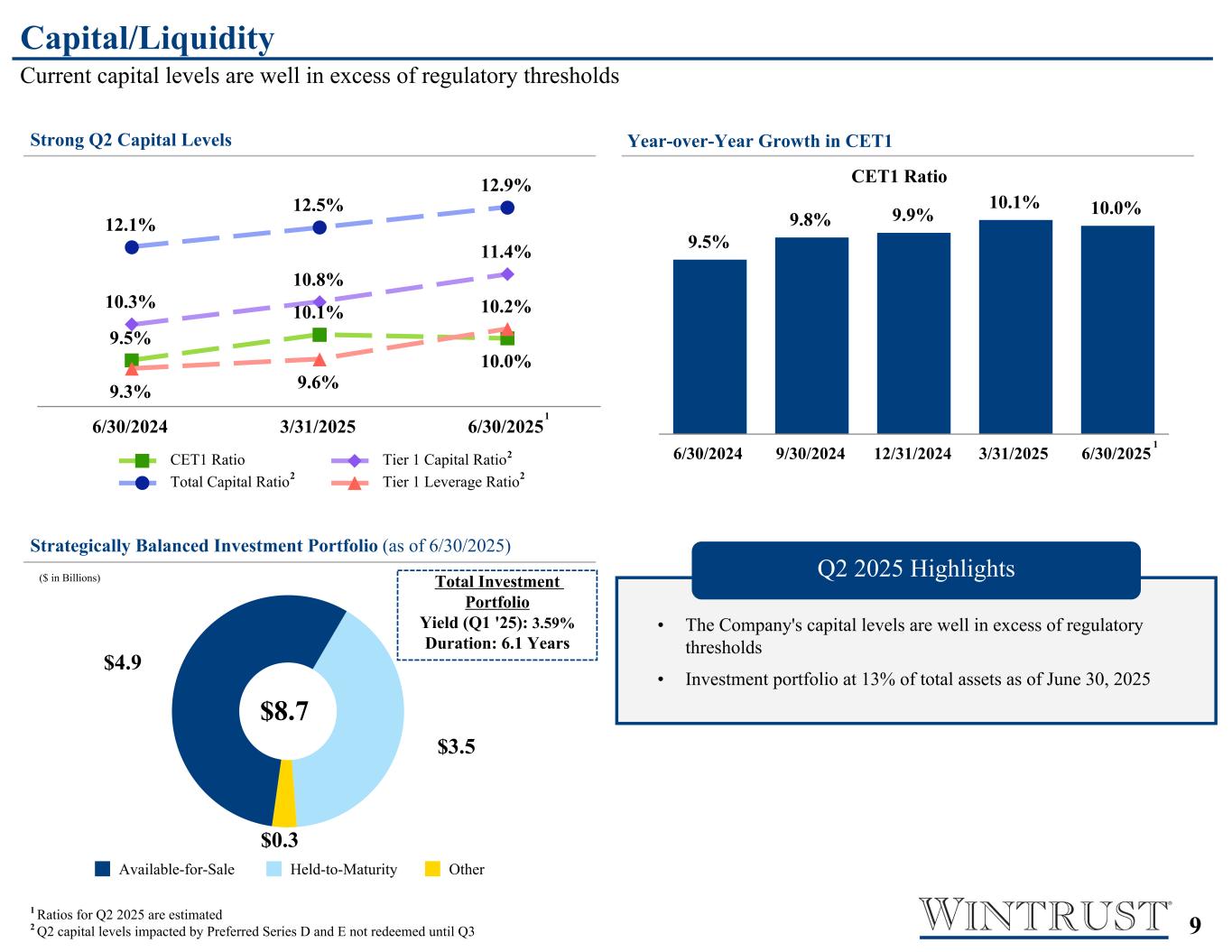

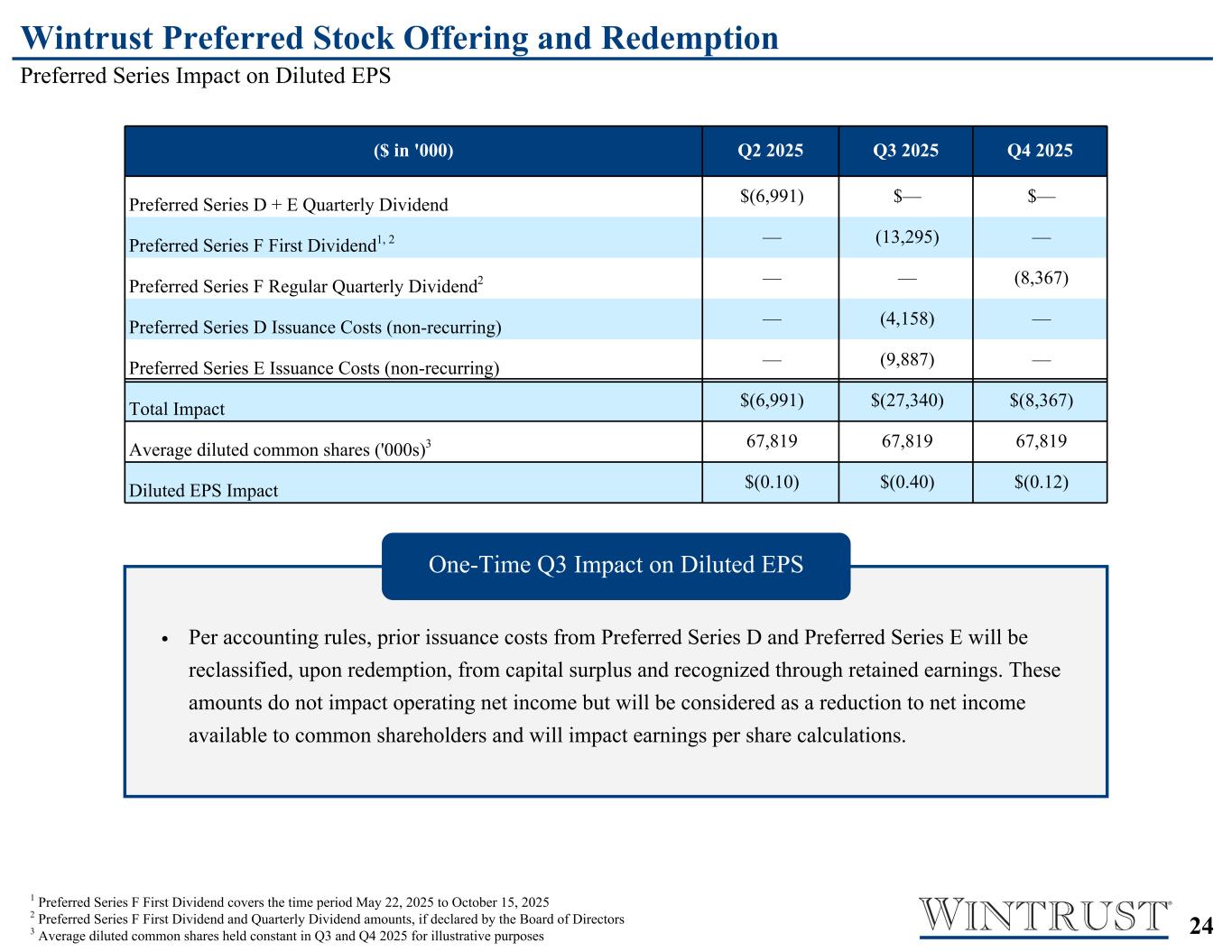

On May 22, 2025, the Company completed the issuance of $425 million of Series F Preferred Stock. The issuance was in contemplation of redeeming $412.5 million of Series D and Series E preferred stock that was expected to reprice at rates higher than existing market rates. The Series D and Series E Preferred Stock were redeemed on July 15, 2025. The Tier 1 capital ratio, Total capital ratio, and Tier 1 leverage ratio noted in the “Selected Financial Highlights” would have been 10.8%, 12.3%, and 9.6%, respectively, if the Series D and Series E Preferred Stock had been redeemed as of June 30, 2025.

For more information regarding changes in the Company’s balance sheet, see Consolidated Statements of Condition and Table 1 through Table 3 in this report.

NET INTEREST INCOME

For the second quarter of 2025, net interest income totaled $546.7 million, an increase of $20.2 million compared to the first quarter of 2025. The $20.2 million increase in net interest income in the second quarter of 2025 was primarily due to average earning asset growth of $1.9 billion, or 12% annualized.

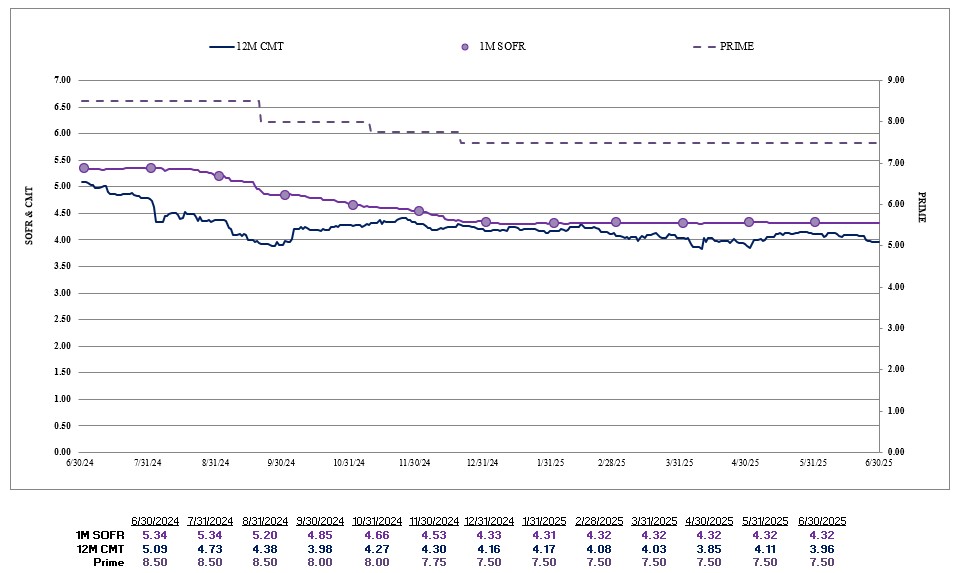

Net interest margin was largely stable at 3.52% (3.54% on a fully taxable-equivalent basis, non-GAAP) during the second quarter of 2025, down two basis points compared to the first quarter of 2025. The yield on earning assets declined two basis points during the second quarter of 2025 primarily due to a five basis point decrease in loan yields. The net free funds contribution declined two basis points compared to the first quarter of 2025. These declines were partially offset by a two basis point reduction in funding cost on interest-bearing deposits, compared to the first quarter of 2025.

For more information regarding net interest income, see Table 4 through Table 8 in this report.

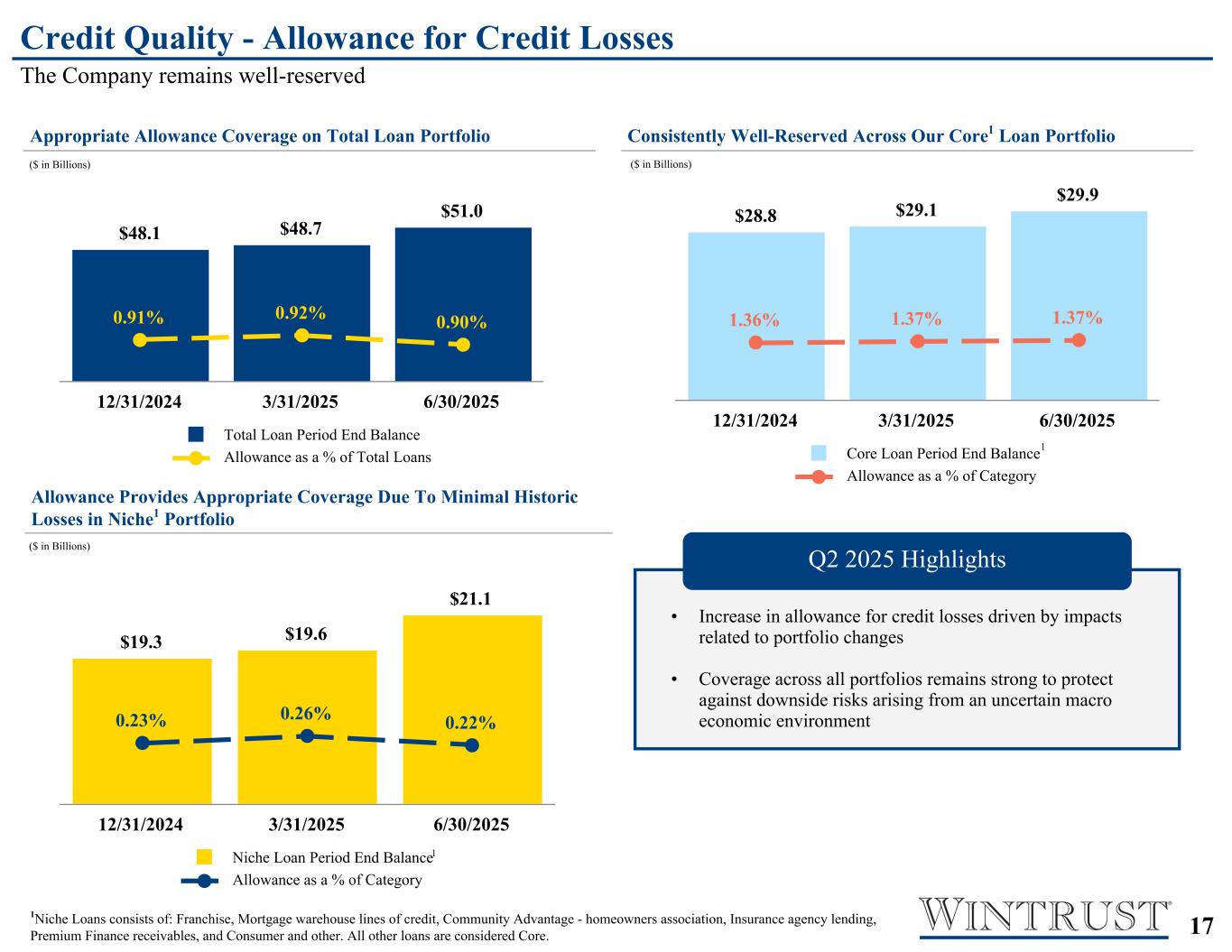

ASSET QUALITY

The allowance for credit losses totaled $457.5 million as of June 30, 2025, an increase from $448.4 million as of March 31, 2025. A provision for credit losses totaling $22.2 million was recorded for the second quarter of 2025 compared to $24.0 million recorded in the first quarter of 2025. The lower provision for credit losses recognized in the second quarter of 2025 is primarily attributable to the macroeconomic outlook, partially offset by portfolio growth. While future economic performance remains uncertain, lower volatility in equity markets at the end of the second quarter reduced the provision related to macroeconomic uncertainty. This reduction was partially offset by qualitative additions to the provision that reflect widening credit spreads. For more information regarding the allowance for credit losses and provision for credit losses, see Table 11 in this report.

Management believes the allowance for credit losses is appropriate to account for expected credit losses. The Company is required to estimate expected credit losses over the life of the Company’s financial assets as of the reporting date. There can be no assurances, however, that future losses will not significantly exceed the amounts provided for, thereby affecting future results of operations. A summary of the allowance for credit losses calculated for the loan components in each portfolio as of June 30, 2025, March 31, 2025, and December 31, 2024 is shown on Table 12 of this report.

Net charge-offs totaled $13.3 million in the second quarter of 2025, an increase of $0.7 million compared to $12.6 million of net charge-offs in the first quarter of 2025. Net charge-offs as a percentage of average total loans were 11 basis points in both the first and second quarter of 2025 on an annualized basis. For more information regarding net charge-offs, see Table 10 in this report.

8

The Company’s loan portfolio delinquency rates remain low and manageable. For more information regarding past due loans, see Table 13 in this report.

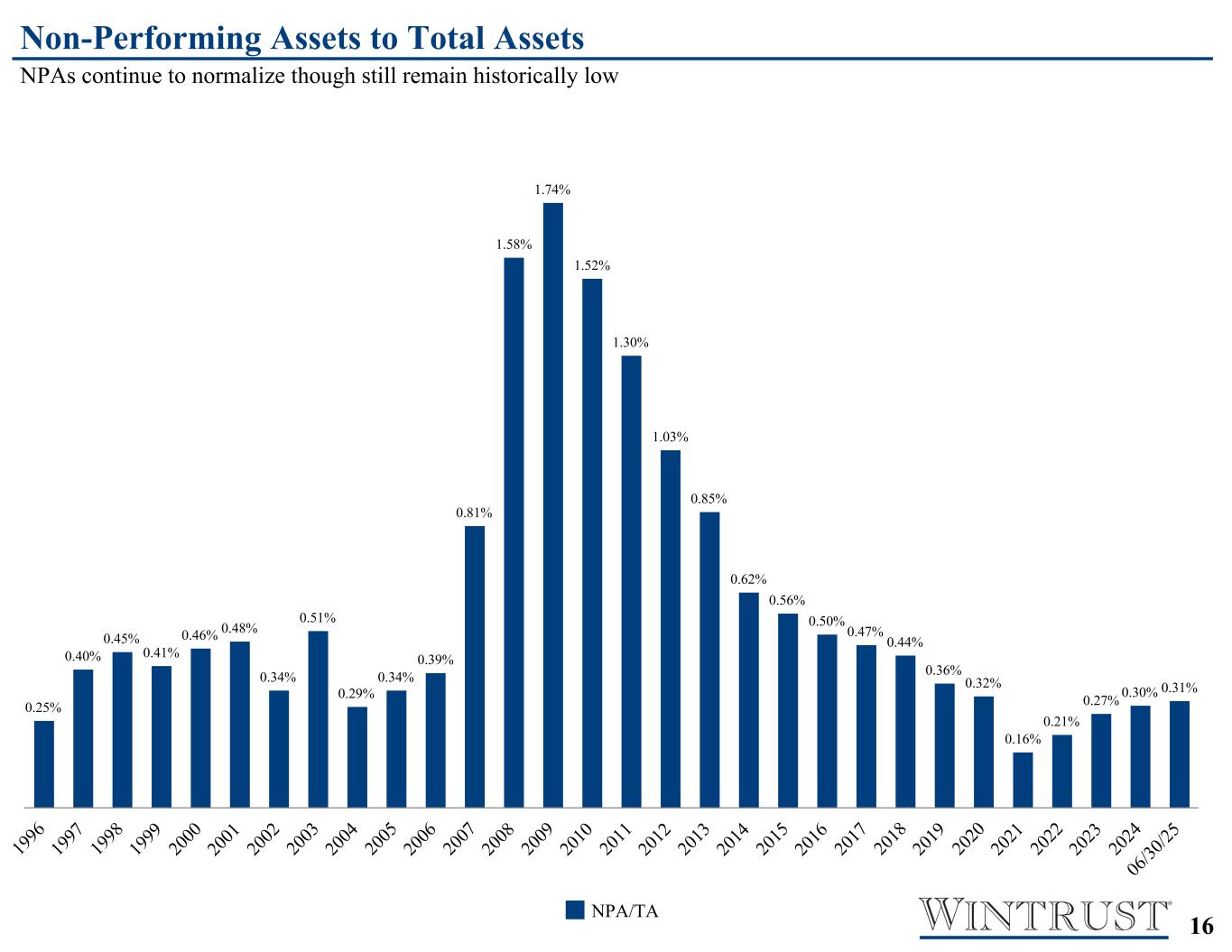

Non-performing assets and non-performing loans have remained relatively stable compared to prior quarters. Non-performing assets totaled $212.5 million and comprised 0.31% of total assets as of June 30, 2025, as compared to $195.0 million, or 0.30% of total assets, as of March 31, 2025. Non-performing loans totaled $188.8 million and comprised 0.37% of total loans at June 30, 2025, as compared to $172.4 million and 0.35% of total loans at March 31, 2025. For more information regarding non-performing assets, see Table 14 in this report.

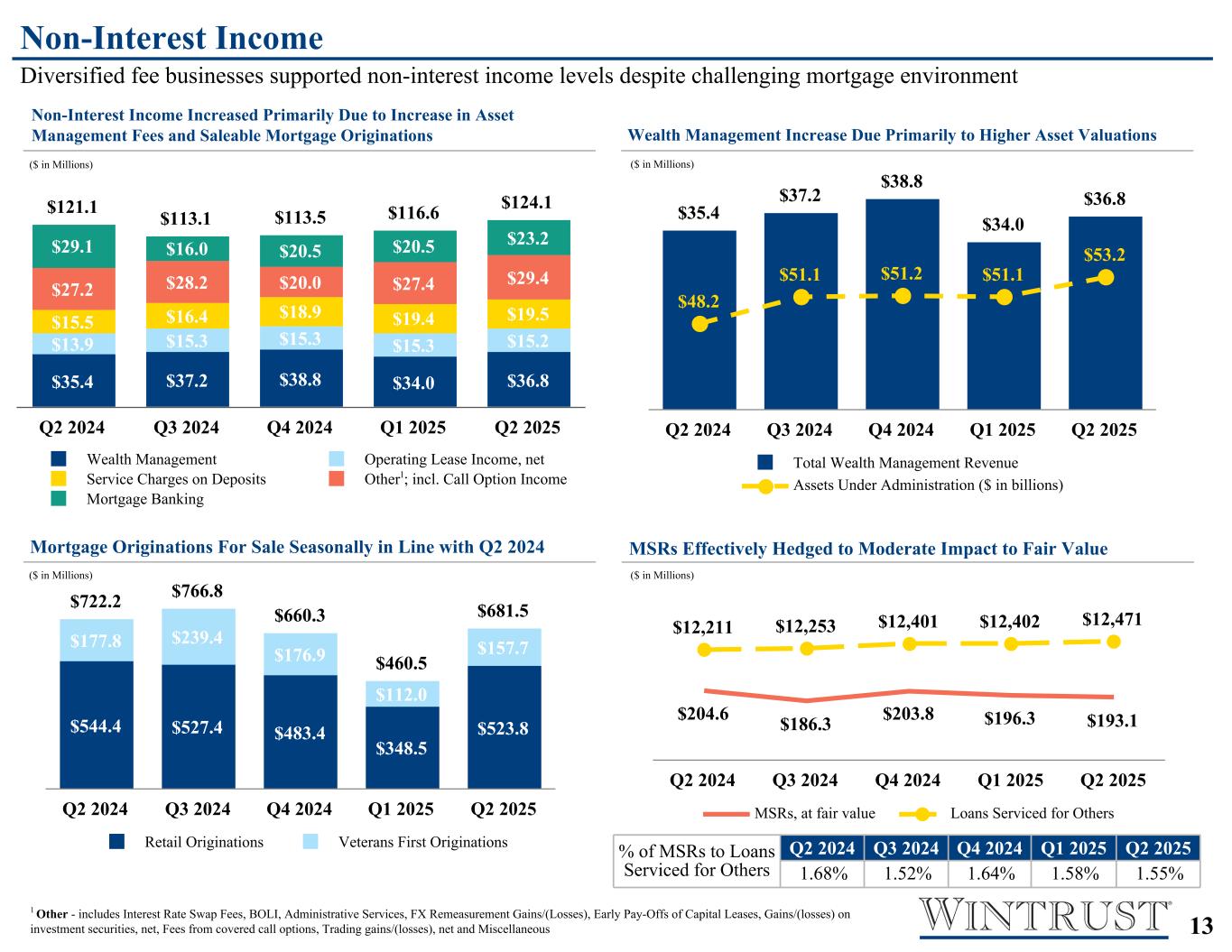

NON-INTEREST INCOME

Non-interest income totaled $124.1 million in the second quarter of 2025, increasing $7.5 million, compared to $116.6 million in the first quarter of 2025.

Wealth management revenue increased by $2.8 million in the second quarter of 2025, compared to the first quarter of 2025. The increase in the second quarter of 2025 was primarily driven by an increase in asset valuations within the quarter, coupled with an increase in activity following the transition of systems and support for brokerage and certain private client business to a new third party that occurred in the first quarter of 2025. Wealth management revenue is comprised of the trust and asset management revenue of Wintrust Private Trust Company and Great Lakes Advisors, the brokerage commissions, managed money fees and insurance product commissions at Wintrust Investments and fees from tax-deferred like-kind exchange services provided by the Chicago Deferred Exchange Company.

Mortgage banking revenue totaled $23.2 million in the second quarter of 2025, compared to $20.5 million in the first quarter of 2025. The increase in the second quarter of 2025 was primarily attributed to higher production revenue due to higher origination volumes and improved production margin. For more information regarding mortgage banking revenue, see Table 16 in this report.

Fees from covered call options increased by $2.2 million in the second quarter of 2025 compared to the first quarter of 2025. The Company has typically written call options with terms of less than three months against certain U.S. Treasury and agency securities held in its portfolio for liquidity and other purposes. Management has entered into these transactions with the goal of economically hedging security positions and enhancing its overall return on its investment portfolio. These option transactions are designed to mitigate overall interest rate risk and do not qualify as hedges pursuant to accounting guidance.

The Company recognized approximately $650,000 in net gains on investment securities in the second quarter of 2025 compared to $3.2 million in net gains in the first quarter of 2025. The net gains in the second quarter of 2025 were primarily the result of unrealized gains on the Company’s equity investment securities with a readily determinable fair value.

For more information regarding non-interest income, see Table 15 in this report.

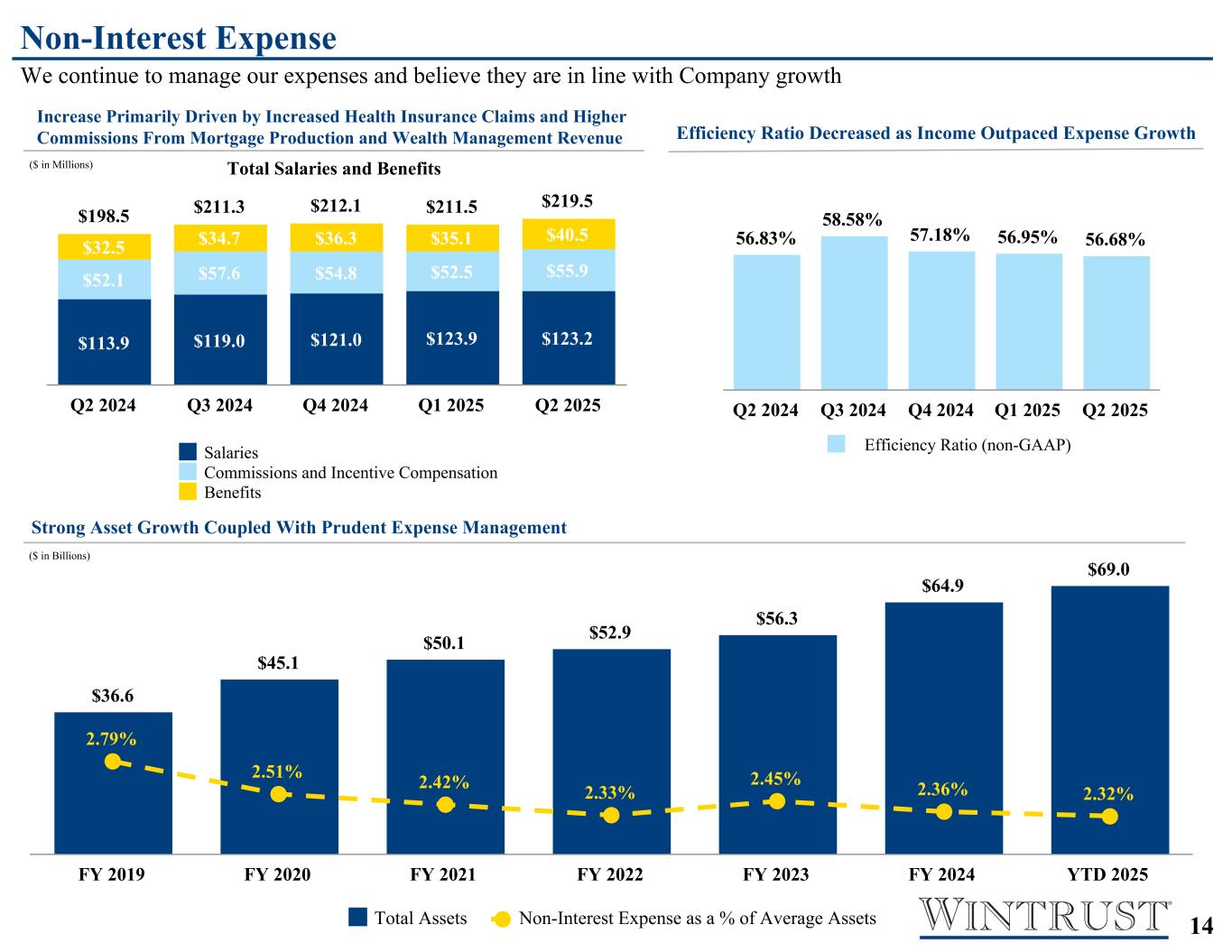

NON-INTEREST EXPENSE

Non-interest expense totaled $381.5 million in the second quarter of 2025, increasing $15.4 million, compared to $366.1 million in the first quarter of 2025. Non-interest expense, as a percent of average assets, remained stable in the second quarter of 2025 at 2.32%.

Salaries and employee benefits expense increased by $8.0 million in the second quarter of 2025 as compared to the first quarter of 2025. This was primarily driven by an increased level of health insurance claims as well as higher mortgage and wealth management commissions expense attributable to an increase in mortgage originations and wealth management revenue in the quarter.

Advertising and marketing expenses in the second quarter of 2025 totaled $18.8 million, which was a $6.5 million increase compared to the first quarter of 2025. The increase in the second quarter was primarily driven by summer sports sponsorships and other summer community sponsorship events. Advertising and marketing expense are typically higher in the second and third quarters of the year.

The Macatawa Bank acquisition-related costs were $2.9 million in the second quarter of 2025, compared to $2.7 million in the first quarter of 2025.

For more information regarding non-interest expense, see Table 17 in this report.

9

INCOME TAXES

The Company recorded income tax expense of $71.6 million in the second quarter of 2025 compared to $64.0 million in the first quarter of 2025. The effective tax rates were 26.79% in the second quarter of 2025 compared to 25.30% in the first quarter of 2025. The effective tax rates were partially impacted by the tax effects related to share-based compensation, which fluctuate based on the Company’s stock price and timing of employee stock option exercises and vesting of other share-based awards. The Company recorded net excess tax benefits of $80,000 in the second quarter of 2025, compared to net excess tax benefits of $3.7 million in the first quarter of 2025 related to share-based compensation.

BUSINESS SUMMARY

Community Banking

Through community banking, the Company provides banking and financial services primarily to individuals, small to mid-sized businesses, local governmental units and institutional clients residing primarily in the local areas the Company services. In the second quarter of 2025, community banking increased its commercial, commercial real estate and residential real estate loan portfolios.

Mortgage banking revenue was $23.2 million for the second quarter of 2025, an increase of $2.6 million compared to the first quarter of 2025. See Table 16 for more detail. Service charges on deposit accounts totaled $19.5 million in the second quarter of 2025 as compared to $19.4 million in the first quarter of 2025. The Company’s gross commercial and commercial real estate loan pipelines remained solid as of June 30, 2025 indicating momentum for expected continued loan growth in the third quarter of 2025.

Specialty Finance

Through specialty finance, the Company offers financing of insurance premiums for businesses and individuals, equipment financing through structured loans and lease products to customers in a variety of industries, accounts receivable financing and value-added, out-sourced administrative services and other services. Originations within the insurance premium financing receivables portfolios were $6.1 billion during the second quarter of 2025. Average balances increased by $776.6 million, as compared to the first quarter of 2025. The Company’s leasing divisions’ portfolio balances increased in the second quarter of 2025, with capital leases, loans, and equipment on operating leases of $2.8 billion, $1.2 billion, and $289.8 million as of June 30, 2025, respectively, compared to $2.7 billion, $1.1 billion, and $280.5 million as of March 31, 2025, respectively. Revenues from the Company’s out-sourced administrative services business were $1.3 million in the second quarter of 2025, which was relatively stable compared to the first quarter of 2025.

Wealth Management

Through wealth management, the Company offers a full range of wealth management services, including trust and investment services, tax-deferred like-kind exchange services, asset management, and securities brokerage services. Wealth management revenue totaled $36.8 million in the second quarter of 2025, an increase as compared to the first quarter of 2025. At June 30, 2025, the Company’s wealth management subsidiaries had approximately $53.2 billion of assets under administration, which included $8.9 billion of assets owned by the Company and its subsidiary banks.

ITEMS IMPACTING COMPARATIVE FINANCIAL RESULTS

Business Combination

On August 1, 2024, the Company completed its previously announced acquisition of Macatawa, the parent company of Macatawa Bank. In conjunction with the completed acquisition, the Company issued approximately 4.7 million shares of common stock. Macatawa operates 26 full-service branches located throughout communities in Kent, Ottawa and northern Allegan counties in the state of Michigan. Macatawa offers a full range of banking, retail and commercial lending, wealth management and ecommerce services to individuals, businesses and governmental entities. As of August 1, 2024, Macatawa had fair values of approximately $2.9 billion in assets, $2.3 billion in deposits and $1.3 billion in loans. As of June 30, 2025, the Company recorded goodwill of approximately $142.1 million on the purchase.

10

WINTRUST FINANCIAL CORPORATION

Key Operating Measures

Wintrust’s key operating measures and growth rates for the second quarter of 2025, as compared to the first quarter of 2025 (sequential quarter) and second quarter of 2024 (linked quarter), are shown in the table below:

|

% or (1)

basis point (bp) change from

1st Quarter

2025

|

% or basis point (bp) change from 2nd Quarter 2024 |

||||||||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | Jun 30, 2025 | Mar 31, 2025 | Jun 30, 2024 | ||||||||||||||||||||||||||||||||

| Net income | $ | 195,527 | $ | 189,039 | $ | 152,388 | 3 | % | 28 | % | |||||||||||||||||||||||||

Pre-tax income, excluding provision for credit losses (non-GAAP) (2) |

289,322 | 277,018 | 251,404 | 4 | 15 | ||||||||||||||||||||||||||||||

| Net income per common share – Diluted | 2.78 | 2.69 | 2.32 | 3 | 20 | ||||||||||||||||||||||||||||||

| Cash dividends declared per common share | 0.50 | 0.50 | 0.45 | — | 11 | ||||||||||||||||||||||||||||||

Net revenue (3) |

670,783 | 643,108 | 591,757 | 4 | 13 | ||||||||||||||||||||||||||||||

| Net interest income | 546,694 | 526,474 | 470,610 | 4 | 16 | ||||||||||||||||||||||||||||||

| Net interest margin | 3.52 | % | 3.54 | % | 3.50 | % | (2) | bps | 2 | bps | |||||||||||||||||||||||||

Net interest margin – fully taxable-equivalent (non-GAAP) (2) |

3.54 | 3.56 | 3.52 | (2) | 2 | ||||||||||||||||||||||||||||||

Net overhead ratio (4) |

1.57 | 1.58 | 1.53 | (1) | 4 | ||||||||||||||||||||||||||||||

| Return on average assets | 1.19 | 1.20 | 1.07 | (1) | 12 | ||||||||||||||||||||||||||||||

| Return on average common equity | 12.07 | 12.21 | 11.61 | (14) | 46 | ||||||||||||||||||||||||||||||

Return on average tangible common equity (non-GAAP) (2) |

14.44 | 14.72 | 13.49 | (28) | 95 | ||||||||||||||||||||||||||||||

| At end of period | |||||||||||||||||||||||||||||||||||

| Total assets | $ | 68,983,318 | $ | 65,870,066 | $ | 59,781,516 | 19 | % | 15 | % | |||||||||||||||||||||||||

Total loans (5) |

51,041,679 | 48,708,390 | 44,675,531 | 19 | 14 | ||||||||||||||||||||||||||||||

| Total deposits | 55,816,811 | 53,570,038 | 48,049,026 | 17 | 16 | ||||||||||||||||||||||||||||||

| Total shareholders’ equity | 7,225,696 | 6,600,537 | 5,536,628 | 38 | 31 | ||||||||||||||||||||||||||||||

(1)Period-end balance sheet percentage changes are annualized.

(2)See Table 18: Supplemental Non-GAAP Financial Measures/Ratios for additional information on this performance measure/ratio.

(3)Net revenue is net interest income plus non-interest income.

(4)The net overhead ratio is calculated by netting total non-interest expense and total non-interest income, annualizing this amount, and dividing by that period’s average total assets. A lower ratio indicates a higher degree of efficiency.

(5)Excludes mortgage loans held-for-sale.

Certain returns, yields, performance ratios, or quarterly growth rates are “annualized” in this presentation to represent an annual time period. This is done for analytical purposes to better discern, for decision-making purposes, underlying performance trends when compared to full-year or year-over-year amounts. For example, a 5% growth rate for a quarter would represent an annualized 20% growth rate. Additional supplemental financial information showing quarterly trends can be found on the Company’s website at www.wintrust.com by choosing “Financial Reports” under the “Investor Relations” heading, and then choosing “Financial Highlights.”

11

WINTRUST FINANCIAL CORPORATION

Selected Financial Highlights

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | Jun 30, 2025 | Mar 31, 2025 | Dec 31, 2024 | Sep 30, 2024 | Jun 30, 2024 | Jun 30, 2025 | Jun 30, 2024 | ||||||||||||||||||||||||||||||||||

| Selected Financial Condition Data (at end of period): | |||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 68,983,318 | $ | 65,870,066 | $ | 64,879,668 | $ | 63,788,424 | $ | 59,781,516 | |||||||||||||||||||||||||||||||

Total loans (1) |

51,041,679 | 48,708,390 | 48,055,037 | 47,067,447 | 44,675,531 | ||||||||||||||||||||||||||||||||||||

| Total deposits | 55,816,811 | 53,570,038 | 52,512,349 | 51,404,966 | 48,049,026 | ||||||||||||||||||||||||||||||||||||

| Total shareholders’ equity | 7,225,696 | 6,600,537 | 6,344,297 | 6,399,714 | 5,536,628 | ||||||||||||||||||||||||||||||||||||

| Selected Statements of Income Data: | |||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 546,694 | $ | 526,474 | $ | 525,148 | $ | 502,583 | $ | 470,610 | $ | 1,073,168 | $ | 934,804 | |||||||||||||||||||||||||||

Net revenue (2) |

670,783 | 643,108 | 638,599 | 615,730 | 591,757 | 1,313,891 | 1,196,531 | ||||||||||||||||||||||||||||||||||

| Net income | 195,527 | 189,039 | 185,362 | 170,001 | 152,388 | 384,566 | 339,682 | ||||||||||||||||||||||||||||||||||

Pre-tax income, excluding provision for credit losses (non-GAAP) (3) |

289,322 | 277,018 | 270,060 | 255,043 | 251,404 | 566,340 | 523,033 | ||||||||||||||||||||||||||||||||||

| Net income per common share – Basic | 2.82 | 2.73 | 2.68 | 2.51 | 2.35 | 5.55 | 5.28 | ||||||||||||||||||||||||||||||||||

| Net income per common share – Diluted | 2.78 | 2.69 | 2.63 | 2.47 | 2.32 | 5.47 | 5.21 | ||||||||||||||||||||||||||||||||||

| Cash dividends declared per common share | 0.50 | 0.50 | 0.45 | 0.45 | 0.45 | 1.00 | 0.90 | ||||||||||||||||||||||||||||||||||

| Selected Financial Ratios and Other Data: | |||||||||||||||||||||||||||||||||||||||||

| Performance Ratios: | |||||||||||||||||||||||||||||||||||||||||

| Net interest margin | 3.52 | % | 3.54 | % | 3.49 | % | 3.49 | % | 3.50 | % | 3.53 | % | 3.53 | % | |||||||||||||||||||||||||||

Net interest margin – fully taxable-equivalent (non-GAAP) (3) |

3.54 | 3.56 | 3.51 | 3.51 | 3.52 | 3.55 | 3.56 | ||||||||||||||||||||||||||||||||||

| Non-interest income to average assets | 0.76 | 0.74 | 0.71 | 0.74 | 0.85 | 0.75 | 0.93 | ||||||||||||||||||||||||||||||||||

| Non-interest expense to average assets | 2.32 | 2.32 | 2.31 | 2.36 | 2.38 | 2.32 | 2.40 | ||||||||||||||||||||||||||||||||||

Net overhead ratio (4) |

1.57 | 1.58 | 1.60 | 1.62 | 1.53 | 1.57 | 1.46 | ||||||||||||||||||||||||||||||||||

| Return on average assets | 1.19 | 1.20 | 1.16 | 1.11 | 1.07 | 1.19 | 1.21 | ||||||||||||||||||||||||||||||||||

| Return on average common equity | 12.07 | 12.21 | 11.82 | 11.63 | 11.61 | 12.14 | 13.01 | ||||||||||||||||||||||||||||||||||

Return on average tangible common equity (non-GAAP) (3) |

14.44 | 14.72 | 14.29 | 13.92 | 13.49 | 14.57 | 15.12 | ||||||||||||||||||||||||||||||||||

| Average total assets | $ | 65,840,345 | $ | 64,107,042 | $ | 63,594,105 | $ | 60,915,283 | $ | 57,493,184 | $ | 64,978,481 | $ | 56,547,939 | |||||||||||||||||||||||||||

| Average total shareholders’ equity | 6,862,040 | 6,460,941 | 6,418,403 | 5,990,429 | 5,450,173 | 6,662,598 | 5,445,315 | ||||||||||||||||||||||||||||||||||

| Average loans to average deposits ratio | 93.0 | % | 92.3 | % | 91.9 | % | 93.8 | % | 95.1 | % | 92.7 | % | 94.8 | % | |||||||||||||||||||||||||||

| Period-end loans to deposits ratio | 91.4 | 90.9 | 91.5 | 91.6 | 93.0 | ||||||||||||||||||||||||||||||||||||

| Common Share Data at end of period: | |||||||||||||||||||||||||||||||||||||||||

| Market price per common share | $ | 123.98 | $ | 112.46 | $ | 124.71 | $ | 108.53 | $ | 98.56 | |||||||||||||||||||||||||||||||

| Book value per common share | 95.43 | 92.47 | 89.21 | 90.06 | 82.97 | ||||||||||||||||||||||||||||||||||||

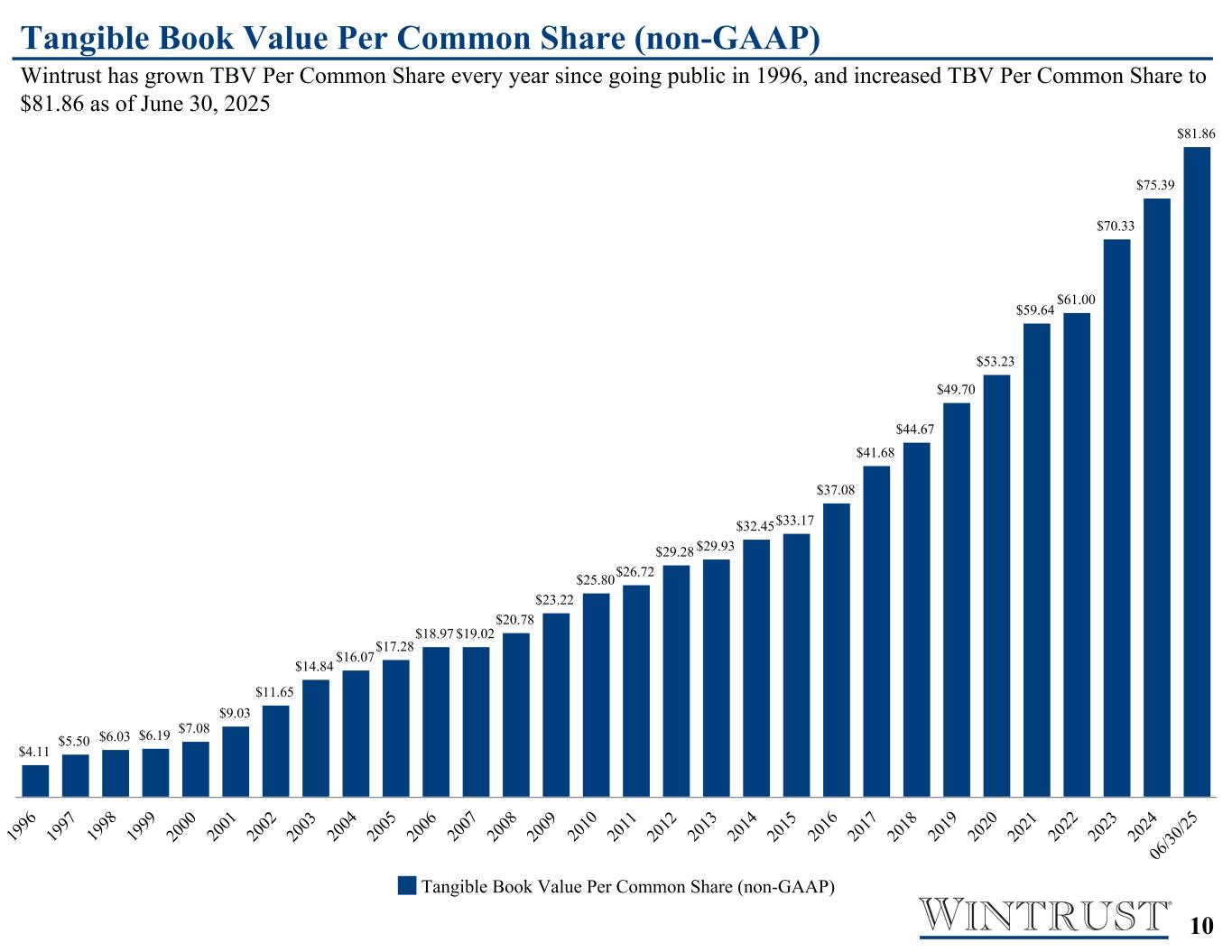

Tangible book value per common share (non-GAAP) (3) |

81.86 | 78.83 | 75.39 | 76.15 | 72.01 | ||||||||||||||||||||||||||||||||||||

| Common shares outstanding | 66,937,732 | 66,919,325 | 66,495,227 | 66,481,543 | 61,760,139 | ||||||||||||||||||||||||||||||||||||

| Other Data at end of period: | |||||||||||||||||||||||||||||||||||||||||

| Common equity to assets ratio | 9.3 | % | 9.4 | % | 9.1 | % | 9.4 | % | 8.6 | % | |||||||||||||||||||||||||||||||

Tangible common equity ratio (non-GAAP) (3) |

8.0 | 8.1 | 7.8 | 8.1 | 7.5 | ||||||||||||||||||||||||||||||||||||

Tier 1 leverage ratio (5) |

10.2 | 9.6 | 9.4 | 9.6 | 9.3 | ||||||||||||||||||||||||||||||||||||

| Risk-based capital ratios: | |||||||||||||||||||||||||||||||||||||||||

Tier 1 capital ratio (5) |

11.4 | 10.8 | 10.7 | 10.6 | 10.3 | ||||||||||||||||||||||||||||||||||||

Common equity tier 1 capital ratio (5) |

10.0 | 10.1 | 9.9 | 9.8 | 9.5 | ||||||||||||||||||||||||||||||||||||

Total capital ratio (5) |

12.9 | 12.5 | 12.3 | 12.2 | 12.1 | ||||||||||||||||||||||||||||||||||||

Allowance for credit losses (6) |

$ | 457,461 | $ | 448,387 | $ | 437,060 | $ | 436,193 | $ | 437,560 | |||||||||||||||||||||||||||||||

| Allowance for loan and unfunded lending-related commitment losses to total loans | 0.90 | % | 0.92 | % | 0.91 | % | 0.93 | % | 0.98 | % | |||||||||||||||||||||||||||||||

| Number of: | |||||||||||||||||||||||||||||||||||||||||

| Bank subsidiaries | 16 | 16 | 16 | 16 | 15 | ||||||||||||||||||||||||||||||||||||

| Banking offices | 208 | 208 | 205 | 203 | 177 | ||||||||||||||||||||||||||||||||||||

(1)Excludes mortgage loans held-for-sale.

(2)Net revenue is net interest income plus non-interest income.

(3)See Table 18: Supplemental Non-GAAP Financial Measures/Ratios for additional information on this performance measure/ratio.

(4)The net overhead ratio is calculated by netting total non-interest expense and total non-interest income, annualizing this amount, and dividing by that period’s average total assets. A lower ratio indicates a higher degree of efficiency.

(5)Capital ratios for current quarter-end are estimated.

(6)The allowance for credit losses includes the allowance for loan losses, the allowance for unfunded lending-related commitments and the allowance for held-to-maturity securities losses.

12

WINTRUST FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CONDITION

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||||||||||||||||||

| Jun 30, | Mar 31, | Dec 31, | Sep 30, | Jun 30, | ||||||||||||||||||||||||||||

| (In thousands) | 2025 | 2025 | 2024 | 2024 | 2024 | |||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||

| Cash and due from banks | $ | 695,501 | $ | 616,216 | $ | 452,017 | $ | 725,465 | $ | 415,462 | ||||||||||||||||||||||

| Federal funds sold and securities purchased under resale agreements | 63 | 63 | 6,519 | 5,663 | 62 | |||||||||||||||||||||||||||

| Interest-bearing deposits with banks | 4,569,618 | 4,238,237 | 4,409,753 | 3,648,117 | 2,824,314 | |||||||||||||||||||||||||||

| Available-for-sale securities, at fair value | 4,885,715 | 4,220,305 | 4,141,482 | 3,912,232 | 4,329,957 | |||||||||||||||||||||||||||

| Held-to-maturity securities, at amortized cost | 3,502,186 | 3,564,490 | 3,613,263 | 3,677,420 | 3,755,924 | |||||||||||||||||||||||||||

| Trading account securities | — | — | 4,072 | 3,472 | 4,134 | |||||||||||||||||||||||||||

| Equity securities with readily determinable fair value | 273,722 | 270,442 | 215,412 | 125,310 | 112,173 | |||||||||||||||||||||||||||

| Federal Home Loan Bank and Federal Reserve Bank stock | 282,087 | 281,893 | 281,407 | 266,908 | 256,495 | |||||||||||||||||||||||||||

| Brokerage customer receivables | — | — | 18,102 | 16,662 | 13,682 | |||||||||||||||||||||||||||

| Mortgage loans held-for-sale, at fair value | 299,606 | 316,804 | 331,261 | 461,067 | 411,851 | |||||||||||||||||||||||||||

| Loans, net of unearned income | 51,041,679 | 48,708,390 | 48,055,037 | 47,067,447 | 44,675,531 | |||||||||||||||||||||||||||

| Allowance for loan losses | (391,654) | (378,207) | (364,017) | (360,279) | (363,719) | |||||||||||||||||||||||||||

| Net loans | 50,650,025 | 48,330,183 | 47,691,020 | 46,707,168 | 44,311,812 | |||||||||||||||||||||||||||

| Premises, software and equipment, net | 776,324 | 776,679 | 779,130 | 772,002 | 722,295 | |||||||||||||||||||||||||||

| Lease investments, net | 289,768 | 280,472 | 278,264 | 270,171 | 275,459 | |||||||||||||||||||||||||||

| Accrued interest receivable and other assets | 1,610,025 | 1,598,255 | 1,739,334 | 1,721,090 | 1,671,334 | |||||||||||||||||||||||||||

| Receivable on unsettled securities sales | 240,039 | 463,023 | — | 551,031 | — | |||||||||||||||||||||||||||

| Goodwill | 798,144 | 796,932 | 796,942 | 800,780 | 655,955 | |||||||||||||||||||||||||||

| Other acquisition-related intangible assets | 110,495 | 116,072 | 121,690 | 123,866 | 20,607 | |||||||||||||||||||||||||||

| Total assets | $ | 68,983,318 | $ | 65,870,066 | $ | 64,879,668 | $ | 63,788,424 | $ | 59,781,516 | ||||||||||||||||||||||

| Liabilities and Shareholders’ Equity | ||||||||||||||||||||||||||||||||

| Deposits: | ||||||||||||||||||||||||||||||||

| Non-interest-bearing | $ | 10,877,166 | $ | 11,201,859 | $ | 11,410,018 | $ | 10,739,132 | $ | 10,031,440 | ||||||||||||||||||||||

| Interest-bearing | 44,939,645 | 42,368,179 | 41,102,331 | 40,665,834 | 38,017,586 | |||||||||||||||||||||||||||

| Total deposits | 55,816,811 | 53,570,038 | 52,512,349 | 51,404,966 | 48,049,026 | |||||||||||||||||||||||||||

| Federal Home Loan Bank advances | 3,151,309 | 3,151,309 | 3,151,309 | 3,171,309 | 3,176,309 | |||||||||||||||||||||||||||

| Other borrowings | 625,392 | 529,269 | 534,803 | 647,043 | 606,579 | |||||||||||||||||||||||||||

| Subordinated notes | 298,458 | 298,360 | 298,283 | 298,188 | 298,113 | |||||||||||||||||||||||||||

| Junior subordinated debentures | 253,566 | 253,566 | 253,566 | 253,566 | 253,566 | |||||||||||||||||||||||||||

| Payable on unsettled securities sales | 39,105 | — | — | — | — | |||||||||||||||||||||||||||

| Accrued interest payable and other liabilities | 1,572,981 | 1,466,987 | 1,785,061 | 1,613,638 | 1,861,295 | |||||||||||||||||||||||||||

| Total liabilities | 61,757,622 | 59,269,529 | 58,535,371 | 57,388,710 | 54,244,888 | |||||||||||||||||||||||||||

| Shareholders’ Equity: | ||||||||||||||||||||||||||||||||

| Preferred stock | 837,500 | 412,500 | 412,500 | 412,500 | 412,500 | |||||||||||||||||||||||||||

| Common stock | 67,025 | 67,007 | 66,560 | 66,546 | 61,825 | |||||||||||||||||||||||||||

| Surplus | 2,495,637 | 2,494,347 | 2,482,561 | 2,470,228 | 1,964,645 | |||||||||||||||||||||||||||

| Treasury stock | (9,156) | (9,156) | (6,153) | (6,098) | (5,760) | |||||||||||||||||||||||||||

| Retained earnings | 4,200,923 | 4,045,854 | 3,897,164 | 3,748,715 | 3,615,616 | |||||||||||||||||||||||||||

| Accumulated other comprehensive loss | (366,233) | (410,015) | (508,335) | (292,177) | (512,198) | |||||||||||||||||||||||||||

| Total shareholders’ equity | 7,225,696 | 6,600,537 | 6,344,297 | 6,399,714 | 5,536,628 | |||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 68,983,318 | $ | 65,870,066 | $ | 64,879,668 | $ | 63,788,424 | $ | 59,781,516 | ||||||||||||||||||||||

13

WINTRUST FINANCIAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

| Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | Jun 30, 2025 |

Mar 31, 2025 |

Dec 31, 2024 |

Sep 30, 2024 |

Jun 30, 2024 |

Jun 30, 2025 | Jun 30, 2024 | |||||||||||||||||||||||||||||||

| Interest income | ||||||||||||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 797,997 | $ | 768,362 | $ | 789,038 | $ | 794,163 | $ | 749,812 | $ | 1,566,359 | $ | 1,460,153 | ||||||||||||||||||||||||

| Mortgage loans held-for-sale | 4,872 | 4,246 | 5,623 | 6,233 | 5,434 | 9,118 | 9,580 | |||||||||||||||||||||||||||||||

| Interest-bearing deposits with banks | 34,317 | 36,766 | 46,256 | 32,608 | 19,731 | 71,083 | 36,389 | |||||||||||||||||||||||||||||||

| Federal funds sold and securities purchased under resale agreements | 276 | 179 | 53 | 277 | 17 | 455 | 36 | |||||||||||||||||||||||||||||||

| Investment securities | 78,053 | 72,016 | 67,066 | 69,592 | 69,779 | 150,069 | 139,457 | |||||||||||||||||||||||||||||||

| Trading account securities | — | 11 | 6 | 11 | 13 | 11 | 31 | |||||||||||||||||||||||||||||||

| Federal Home Loan Bank and Federal Reserve Bank stock | 5,393 | 5,307 | 5,157 | 5,451 | 4,974 | 10,700 | 9,452 | |||||||||||||||||||||||||||||||

| Brokerage customer receivables | — | 78 | 302 | 269 | 219 | 78 | 394 | |||||||||||||||||||||||||||||||

| Total interest income | 920,908 | 886,965 | 913,501 | 908,604 | 849,979 | 1,807,873 | 1,655,492 | |||||||||||||||||||||||||||||||

| Interest expense | ||||||||||||||||||||||||||||||||||||||

| Interest on deposits | 333,470 | 320,233 | 346,388 | 362,019 | 335,703 | 653,703 | 635,235 | |||||||||||||||||||||||||||||||

| Interest on Federal Home Loan Bank advances | 25,724 | 25,441 | 26,050 | 26,254 | 24,797 | 51,165 | 46,845 | |||||||||||||||||||||||||||||||

| Interest on other borrowings | 6,957 | 6,792 | 7,519 | 9,013 | 8,700 | 13,749 | 17,948 | |||||||||||||||||||||||||||||||

| Interest on subordinated notes | 3,735 | 3,714 | 3,733 | 3,712 | 5,185 | 7,449 | 10,672 | |||||||||||||||||||||||||||||||

| Interest on junior subordinated debentures | 4,328 | 4,311 | 4,663 | 5,023 | 4,984 | 8,639 | 9,988 | |||||||||||||||||||||||||||||||

| Total interest expense | 374,214 | 360,491 | 388,353 | 406,021 | 379,369 | 734,705 | 720,688 | |||||||||||||||||||||||||||||||

| Net interest income | 546,694 | 526,474 | 525,148 | 502,583 | 470,610 | 1,073,168 | 934,804 | |||||||||||||||||||||||||||||||

| Provision for credit losses | 22,234 | 23,963 | 16,979 | 22,334 | 40,061 | 46,197 | 61,734 | |||||||||||||||||||||||||||||||

| Net interest income after provision for credit losses | 524,460 | 502,511 | 508,169 | 480,249 | 430,549 | 1,026,971 | 873,070 | |||||||||||||||||||||||||||||||

| Non-interest income | ||||||||||||||||||||||||||||||||||||||

| Wealth management | 36,821 | 34,042 | 38,775 | 37,224 | 35,413 | 70,863 | 70,228 | |||||||||||||||||||||||||||||||

| Mortgage banking | 23,170 | 20,529 | 20,452 | 15,974 | 29,124 | 43,699 | 56,787 | |||||||||||||||||||||||||||||||

| Service charges on deposit accounts | 19,502 | 19,362 | 18,864 | 16,430 | 15,546 | 38,864 | 30,357 | |||||||||||||||||||||||||||||||

| Gains (losses) on investment securities, net | 650 | 3,196 | (2,835) | 3,189 | (4,282) | 3,846 | (2,956) | |||||||||||||||||||||||||||||||

| Fees from covered call options | 5,624 | 3,446 | 2,305 | 988 | 2,056 | 9,070 | 6,903 | |||||||||||||||||||||||||||||||

| Trading gains (losses), net | 151 | (64) | (113) | (130) | 70 | 87 | 747 | |||||||||||||||||||||||||||||||

| Operating lease income, net | 15,166 | 15,287 | 15,327 | 15,335 | 13,938 | 30,453 | 28,048 | |||||||||||||||||||||||||||||||

| Other | 23,005 | 20,836 | 20,676 | 24,137 | 29,282 | 43,841 | 71,613 | |||||||||||||||||||||||||||||||

| Total non-interest income | 124,089 | 116,634 | 113,451 | 113,147 | 121,147 | 240,723 | 261,727 | |||||||||||||||||||||||||||||||

| Non-interest expense | ||||||||||||||||||||||||||||||||||||||

| Salaries and employee benefits | 219,541 | 211,526 | 212,133 | 211,261 | 198,541 | 431,067 | 393,714 | |||||||||||||||||||||||||||||||

| Software and equipment | 36,522 | 34,717 | 34,258 | 31,574 | 29,231 | 71,239 | 56,962 | |||||||||||||||||||||||||||||||

| Operating lease equipment | 10,757 | 10,471 | 10,263 | 10,518 | 10,834 | 21,228 | 21,517 | |||||||||||||||||||||||||||||||

| Occupancy, net | 20,228 | 20,778 | 20,597 | 19,945 | 19,585 | 41,006 | 38,671 | |||||||||||||||||||||||||||||||

| Data processing | 12,110 | 11,274 | 10,957 | 9,984 | 9,503 | 23,384 | 18,795 | |||||||||||||||||||||||||||||||

| Advertising and marketing | 18,761 | 12,272 | 13,097 | 18,239 | 17,436 | 31,033 | 30,476 | |||||||||||||||||||||||||||||||

| Professional fees | 9,243 | 9,044 | 11,334 | 9,783 | 9,967 | 18,287 | 19,520 | |||||||||||||||||||||||||||||||

| Amortization of other acquisition-related intangible assets | 5,580 | 5,618 | 5,773 | 4,042 | 1,122 | 11,198 | 2,280 | |||||||||||||||||||||||||||||||

| FDIC insurance | 10,971 | 10,926 | 10,640 | 10,512 | 10,429 | 21,897 | 24,966 | |||||||||||||||||||||||||||||||

| Other real estate owned (“OREO”) expenses, net | 505 | 643 | 397 | (938) | (259) | 1,148 | 133 | |||||||||||||||||||||||||||||||

| Other | 37,243 | 38,821 | 39,090 | 35,767 | 33,964 | 76,064 | 66,464 | |||||||||||||||||||||||||||||||

| Total non-interest expense | 381,461 | 366,090 | 368,539 | 360,687 | 340,353 | 747,551 | 673,498 | |||||||||||||||||||||||||||||||

| Income before taxes | 267,088 | 253,055 | 253,081 | 232,709 | 211,343 | 520,143 | 461,299 | |||||||||||||||||||||||||||||||

| Income tax expense | 71,561 | 64,016 | 67,719 | 62,708 | 58,955 | 135,577 | 121,617 | |||||||||||||||||||||||||||||||

| Net income | $ | 195,527 | $ | 189,039 | $ | 185,362 | $ | 170,001 | $ | 152,388 | $ | 384,566 | $ | 339,682 | ||||||||||||||||||||||||

| Preferred stock dividends | 6,991 | 6,991 | 6,991 | 6,991 | 6,991 | 13,982 | 13,982 | |||||||||||||||||||||||||||||||

| Net income applicable to common shares | $ | 188,536 | $ | 182,048 | $ | 178,371 | $ | 163,010 | $ | 145,397 | $ | 370,584 | $ | 325,700 | ||||||||||||||||||||||||

| Net income per common share - Basic | $ | 2.82 | $ | 2.73 | $ | 2.68 | $ | 2.51 | $ | 2.35 | $ | 5.55 | $ | 5.28 | ||||||||||||||||||||||||

| Net income per common share - Diluted | $ | 2.78 | $ | 2.69 | $ | 2.63 | $ | 2.47 | $ | 2.32 | $ | 5.47 | $ | 5.21 | ||||||||||||||||||||||||

| Cash dividends declared per common share | $ | 0.50 | $ | 0.50 | $ | 0.45 | $ | 0.45 | $ | 0.45 | $ | 1.00 | $ | 0.90 | ||||||||||||||||||||||||

| Weighted average common shares outstanding | 66,931 | 66,726 | 66,491 | 64,888 | 61,839 | 66,829 | 61,660 | |||||||||||||||||||||||||||||||

| Dilutive potential common shares | 888 | 923 | 1,233 | 1,053 | 926 | 903 | 901 | |||||||||||||||||||||||||||||||

| Average common shares and dilutive common shares | 67,819 | 67,649 | 67,724 | 65,941 | 62,765 | 67,732 | 62,561 | |||||||||||||||||||||||||||||||

14

TABLE 1: LOAN PORTFOLIO MIX AND GROWTH RATES

% Growth From (1) |

|||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | Jun 30, 2025 | Mar 31, 2025 | Dec 31, 2024 | Sep 30, 2024 |

Jun 30, 2024 | Mar 31, 2025 (2) |

Jun 30, 2024 | ||||||||||||||||||||||||||||

| Balance: | |||||||||||||||||||||||||||||||||||

| Mortgage loans held-for-sale, excluding early buy-out exercised loans guaranteed by U.S. government agencies | $ | 192,633 | $ | 181,580 | $ | 189,774 | $ | 314,693 | $ | 281,103 | 24 | % | (31) | % | |||||||||||||||||||||

| Mortgage loans held-for-sale, early buy-out exercised loans guaranteed by U.S. government agencies | 106,973 | 135,224 | 141,487 | 146,374 | 130,748 | (84) | (18) | ||||||||||||||||||||||||||||

| Total mortgage loans held-for-sale | $ | 299,606 | $ | 316,804 | $ | 331,261 | $ | 461,067 | $ | 411,851 | (22) | % | (27) | % | |||||||||||||||||||||

| Core loans: | |||||||||||||||||||||||||||||||||||

| Commercial | |||||||||||||||||||||||||||||||||||

| Commercial and industrial | $ | 7,028,247 | $ | 6,871,206 | $ | 6,867,422 | $ | 6,774,683 | $ | 6,236,290 | 9 | % | 13 | % | |||||||||||||||||||||

| Asset-based lending | 1,663,693 | 1,701,962 | 1,611,001 | 1,709,685 | 1,465,867 | (9) | 13 | ||||||||||||||||||||||||||||

| Municipal | 771,785 | 798,646 | 826,653 | 827,125 | 747,357 | (13) | 3 | ||||||||||||||||||||||||||||

| Leases | 2,757,331 | 2,680,943 | 2,537,325 | 2,443,721 | 2,439,128 | 11 | 13 | ||||||||||||||||||||||||||||

| Commercial real estate | |||||||||||||||||||||||||||||||||||

| Residential construction | 59,027 | 55,849 | 48,617 | 73,088 | 55,019 | 23 | 7 | ||||||||||||||||||||||||||||

| Commercial construction | 2,165,263 | 2,086,797 | 2,065,775 | 1,984,240 | 1,866,701 | 15 | 16 | ||||||||||||||||||||||||||||

| Land | 304,827 | 306,235 | 319,689 | 346,362 | 338,831 | (2) | (10) | ||||||||||||||||||||||||||||

| Office | 1,601,208 | 1,641,555 | 1,656,109 | 1,675,286 | 1,585,312 | (10) | 1 | ||||||||||||||||||||||||||||

| Industrial | 2,824,889 | 2,677,555 | 2,628,576 | 2,527,932 | 2,307,455 | 22 | 22 | ||||||||||||||||||||||||||||

| Retail | 1,452,351 | 1,402,837 | 1,374,655 | 1,404,586 | 1,365,753 | 14 | 6 | ||||||||||||||||||||||||||||

| Multi-family | 3,200,578 | 3,091,314 | 3,125,505 | 3,193,339 | 2,988,940 | 14 | 7 | ||||||||||||||||||||||||||||

| Mixed use and other | 1,683,867 | 1,652,759 | 1,685,018 | 1,588,584 | 1,439,186 | 8 | 17 | ||||||||||||||||||||||||||||

| Home equity | 466,815 | 455,683 | 445,028 | 427,043 | 356,313 | 10 | 31 | ||||||||||||||||||||||||||||

| Residential real estate | |||||||||||||||||||||||||||||||||||

| Residential real estate loans for investment | 3,814,715 | 3,561,417 | 3,456,009 | 3,252,649 | 2,933,157 | 29 | 30 | ||||||||||||||||||||||||||||

| Residential mortgage loans, early buy-out eligible loans guaranteed by U.S. government agencies | 80,800 | 86,952 | 114,985 | 92,355 | 88,503 | (28) | (9) | ||||||||||||||||||||||||||||

| Residential mortgage loans, early buy-out exercised loans guaranteed by U.S. government agencies | 53,267 | 36,790 | 41,771 | 43,034 | 45,675 | NM | 17 | ||||||||||||||||||||||||||||

| Total core loans | $ | 29,928,663 | $ | 29,108,500 | $ | 28,804,138 | $ | 28,363,712 | $ | 26,259,487 | 11 | % | 14 | % | |||||||||||||||||||||

| Niche loans: | |||||||||||||||||||||||||||||||||||

| Commercial | |||||||||||||||||||||||||||||||||||

| Franchise | $ | 1,286,265 | $ | 1,262,555 | $ | 1,268,521 | $ | 1,191,686 | $ | 1,150,460 | 8 | % | 12 | % | |||||||||||||||||||||

| Mortgage warehouse lines of credit | 1,232,530 | 1,019,543 | 893,854 | 750,462 | 593,519 | 84 | NM | ||||||||||||||||||||||||||||

| Community Advantage - homeowners association | 526,595 | 525,492 | 525,446 | 501,645 | 491,722 | 1 | 7 | ||||||||||||||||||||||||||||

| Insurance agency lending | 1,120,985 | 1,070,979 | 1,044,329 | 1,048,686 | 1,030,119 | 19 | 9 | ||||||||||||||||||||||||||||

| Premium Finance receivables | |||||||||||||||||||||||||||||||||||

| U.S. property & casualty insurance | 7,378,340 | 6,486,663 | 6,447,625 | 6,253,271 | 6,142,654 | 55 | 20 | ||||||||||||||||||||||||||||

| Canada property & casualty insurance | 944,836 | 753,199 | 824,417 | 878,410 | 958,099 | NM | (1) | ||||||||||||||||||||||||||||

| Life insurance | 8,506,960 | 8,365,140 | 8,147,145 | 7,996,899 | 7,962,115 | 7 | 7 | ||||||||||||||||||||||||||||

| Consumer and other | 116,505 | 116,319 | 99,562 | 82,676 | 87,356 | 1 | 33 | ||||||||||||||||||||||||||||

| Total niche loans | $ | 21,113,016 | $ | 19,599,890 | $ | 19,250,899 | $ | 18,703,735 | $ | 18,416,044 | 31 | % | 15 | % | |||||||||||||||||||||

| Total loans, net of unearned income | $ | 51,041,679 | $ | 48,708,390 | $ | 48,055,037 | $ | 47,067,447 | $ | 44,675,531 | 19 | % | 14 | % | |||||||||||||||||||||

(1)NM - Not Meaningful.

(2)Annualized.

15

TABLE 2: DEPOSIT PORTFOLIO MIX AND GROWTH RATES

| % Growth From | ||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | Jun 30, 2025 |

Mar 31, 2025 |

Dec 31, 2024 |

Sep 30, 2024 |

Jun 30, 2024 |

Mar 31, 2025 (1) |

Jun 30, 2024 | |||||||||||||||||||||||||||||||

| Balance: | ||||||||||||||||||||||||||||||||||||||

| Non-interest-bearing | $ | 10,877,166 | $ | 11,201,859 | $ | 11,410,018 | $ | 10,739,132 | $ | 10,031,440 | (12) | % | 8 | % | ||||||||||||||||||||||||

| NOW and interest-bearing demand deposits | 6,795,725 | 6,340,168 | 5,865,546 | 5,466,932 | 5,053,909 | 29 | 34 | |||||||||||||||||||||||||||||||

Wealth management deposits (2) |

1,595,764 | 1,408,790 | 1,469,064 | 1,303,354 | 1,490,711 | 53 | 7 | |||||||||||||||||||||||||||||||

| Money market | 19,556,041 | 18,074,733 | 17,975,191 | 17,713,726 | 16,320,017 | 33 | 20 | |||||||||||||||||||||||||||||||

| Savings | 6,659,419 | 6,576,251 | 6,372,499 | 6,183,249 | 5,882,179 | 5 | 13 | |||||||||||||||||||||||||||||||

| Time certificates of deposit | 10,332,696 | 9,968,237 | 9,420,031 | 9,998,573 | 9,270,770 | 15 | 11 | |||||||||||||||||||||||||||||||

| Total deposits | $ | 55,816,811 | $ | 53,570,038 | $ | 52,512,349 | $ | 51,404,966 | $ | 48,049,026 | 17 | % | 16 | % | ||||||||||||||||||||||||

| Mix: | ||||||||||||||||||||||||||||||||||||||

| Non-interest-bearing | 19 | % | 21 | % | 22 | % | 21 | % | 21 | % | ||||||||||||||||||||||||||||

| NOW and interest-bearing demand deposits | 12 | 12 | 11 | 11 | 11 | |||||||||||||||||||||||||||||||||

Wealth management deposits (2) |

3 | 3 | 3 | 3 | 3 | |||||||||||||||||||||||||||||||||

| Money market | 35 | 34 | 34 | 34 | 34 | |||||||||||||||||||||||||||||||||

| Savings | 12 | 12 | 12 | 12 | 12 | |||||||||||||||||||||||||||||||||

| Time certificates of deposit | 19 | 18 | 18 | 19 | 19 | |||||||||||||||||||||||||||||||||

| Total deposits | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | ||||||||||||||||||||||||||||

(1)Annualized.

(2)Represents deposit balances of the Company’s subsidiary banks from brokerage customers of Wintrust Investments, Chicago Deferred Exchange Company, LLC (“CDEC”), and trust and asset management customers of the Company.

TABLE 3: TIME CERTIFICATES OF DEPOSIT MATURITY/RE-PRICING ANALYSIS

As of June 30, 2025

| (Dollars in thousands) | Total Time Certificates of Deposit |

Weighted-Average Rate of Maturing Time Certificates of Deposit |

||||||||||||

| 1-3 months | $ | 2,486,694 | 3.92 | % | ||||||||||

| 4-6 months | 4,464,126 | 3.80 | ||||||||||||

| 7-9 months | 2,187,365 | 3.74 | ||||||||||||

| 10-12 months | 771,114 | 3.64 | ||||||||||||

| 13-18 months | 262,094 | 3.41 | ||||||||||||

| 19-24 months | 99,689 | 2.92 | ||||||||||||

| 24+ months | 61,614 | 2.36 | ||||||||||||

| Total | $ | 10,332,696 | 3.78 | % | ||||||||||

16

TABLE 4: QUARTERLY AVERAGE BALANCES

| Average Balance for three months ended, | ||||||||||||||||||||||||||||||||

| Jun 30, | Mar 31, | Dec 31, | Sep 30, | Jun 30, | ||||||||||||||||||||||||||||

| (In thousands) | 2025 | 2025 | 2024 | 2024 | 2024 | |||||||||||||||||||||||||||

Interest-bearing deposits with banks, securities purchased under resale agreements and cash equivalents (1) |

$ | 3,308,199 | $ | 3,520,048 | $ | 3,934,016 | $ | 2,413,728 | $ | 1,485,481 | ||||||||||||||||||||||

Investment securities (2) |

8,801,560 | 8,409,735 | 8,090,271 | 8,276,576 | 8,203,764 | |||||||||||||||||||||||||||

FHLB and FRB stock (3) |

282,001 | 281,702 | 271,825 | 263,707 | 253,614 | |||||||||||||||||||||||||||

Liquidity management assets (4) |

$ | 12,391,760 | $ | 12,211,485 | $ | 12,296,112 | $ | 10,954,011 | $ | 9,942,859 | ||||||||||||||||||||||

Other earning assets (4) (5) |

— | 13,140 | 20,528 | 17,542 | 15,257 | |||||||||||||||||||||||||||

| Mortgage loans held-for-sale | 310,534 | 286,710 | 378,707 | 376,251 | 347,236 | |||||||||||||||||||||||||||

Loans, net of unearned income (4) (6) |

49,517,635 | 47,833,380 | 47,153,014 | 45,920,586 | 43,819,354 | |||||||||||||||||||||||||||

Total earning assets (4) |

$ | 62,219,929 | $ | 60,344,715 | $ | 59,848,361 | $ | 57,268,390 | $ | 54,124,706 | ||||||||||||||||||||||

| Allowance for loan and investment security losses | (398,685) | (375,371) | (367,238) | (383,736) | (360,504) | |||||||||||||||||||||||||||

| Cash and due from banks | 478,707 | 476,423 | 470,033 | 467,333 | 434,916 | |||||||||||||||||||||||||||

| Other assets | 3,540,394 | 3,661,275 | 3,642,949 | 3,563,296 | 3,294,066 | |||||||||||||||||||||||||||

Total assets |

$ | 65,840,345 | $ | 64,107,042 | $ | 63,594,105 | $ | 60,915,283 | $ | 57,493,184 | ||||||||||||||||||||||

| NOW and interest-bearing demand deposits | $ | 6,423,050 | $ | 6,046,189 | $ | 5,601,672 | $ | 5,174,673 | $ | 4,985,306 | ||||||||||||||||||||||

| Wealth management deposits | 1,552,989 | 1,574,480 | 1,430,163 | 1,362,747 | 1,531,865 | |||||||||||||||||||||||||||

| Money market accounts | 18,184,754 | 17,581,141 | 17,579,395 | 16,436,111 | 15,272,126 | |||||||||||||||||||||||||||

| Savings accounts | 6,578,698 | 6,479,444 | 6,288,727 | 6,096,746 | 5,878,844 | |||||||||||||||||||||||||||

| Time deposits | 9,841,702 | 9,406,126 | 9,702,948 | 9,598,109 | 8,546,172 | |||||||||||||||||||||||||||

| Interest-bearing deposits | $ | 42,581,193 | $ | 41,087,380 | $ | 40,602,905 | $ | 38,668,386 | $ | 36,214,313 | ||||||||||||||||||||||

FHLB advances (3) |

3,151,310 | 3,151,309 | 3,160,658 | 3,178,973 | 3,096,920 | |||||||||||||||||||||||||||

| Other borrowings | 593,657 | 582,139 | 577,786 | 622,792 | 587,262 | |||||||||||||||||||||||||||

| Subordinated notes | 298,398 | 298,306 | 298,225 | 298,135 | 410,331 | |||||||||||||||||||||||||||

| Junior subordinated debentures | 253,566 | 253,566 | 253,566 | 253,566 | 253,566 | |||||||||||||||||||||||||||

Total interest-bearing liabilities |

$ | 46,878,124 | $ | 45,372,700 | $ | 44,893,140 | $ | 43,021,852 | $ | 40,562,392 | ||||||||||||||||||||||

| Non-interest-bearing deposits | 10,643,798 | 10,732,156 | 10,718,738 | 10,271,613 | 9,879,134 | |||||||||||||||||||||||||||

| Other liabilities | 1,456,383 | 1,541,245 | 1,563,824 | 1,631,389 | 1,601,485 | |||||||||||||||||||||||||||

| Equity | 6,862,040 | 6,460,941 | 6,418,403 | 5,990,429 | 5,450,173 | |||||||||||||||||||||||||||

Total liabilities and shareholders’ equity |

$ | 65,840,345 | $ | 64,107,042 | $ | 63,594,105 | $ | 60,915,283 | $ | 57,493,184 | ||||||||||||||||||||||

Net free funds/contribution (6) |

$ | 15,341,805 | $ | 14,972,015 | $ | 14,955,221 | $ | 14,246,538 | $ | 13,562,314 | ||||||||||||||||||||||

(1)Includes interest-bearing deposits from banks and securities purchased under resale agreements with original maturities of greater than three months. Cash equivalents include federal funds sold and securities purchased under resale agreements with original maturities of three months or less.

(2)Investment securities includes investment securities classified as available-for-sale and held-to-maturity, and equity securities with readily determinable fair values. Equity securities without readily determinable fair values are included within other assets.

(3)Federal Home Loan Bank (“FHLB”) and Federal Reserve Bank (“FRB”)

(4)See Table 18: Supplemental Non-GAAP Financial Measures/Ratios for additional information on this performance measure/ratio.

(5)Other earning assets include brokerage customer receivables and trading account securities.

(6)Loans, net of unearned income, include non-accrual loans.

(7)Net free funds are the difference between total average earning assets and total average interest-bearing liabilities. The estimated contribution to net interest margin from net free funds is calculated using the rate paid for total interest-bearing liabilities.

17

TABLE 5: QUARTERLY NET INTEREST INCOME

| Net Interest Income for three months ended, | ||||||||||||||||||||||||||||||||

| Jun 30, | Mar 31, | Dec 31, | Sep 30, | Jun 30, | ||||||||||||||||||||||||||||

| (In thousands) | 2025 | 2025 | 2024 | 2024 | 2024 | |||||||||||||||||||||||||||

| Interest income: | ||||||||||||||||||||||||||||||||

| Interest-bearing deposits with banks, securities purchased under resale agreements and cash equivalents | $ | 34,593 | $ | 36,945 | $ | 46,308 | $ | 32,885 | $ | 19,748 | ||||||||||||||||||||||

| Investment securities | 78,733 | 72,706 | 67,783 | 70,260 | 70,346 | |||||||||||||||||||||||||||

FHLB and FRB stock (1) |

5,393 | 5,307 | 5,157 | 5,451 | 4,974 | |||||||||||||||||||||||||||

Liquidity management assets (2) |

$ | 118,719 | $ | 114,958 | $ | 119,248 | $ | 108,596 | $ | 95,068 | ||||||||||||||||||||||

Other earning assets (2) |

— | 92 | 310 | 282 | 235 | |||||||||||||||||||||||||||

| Mortgage loans held-for-sale | 4,872 | 4,246 | 5,623 | 6,233 | 5,434 | |||||||||||||||||||||||||||

Loans, net of unearned income (2) |

800,197 | 770,568 | 791,390 | 796,637 | 752,117 | |||||||||||||||||||||||||||

| Total interest income | $ | 923,788 | $ | 889,864 | $ | 916,571 | $ | 911,748 | $ | 852,854 | ||||||||||||||||||||||

| Interest expense: | ||||||||||||||||||||||||||||||||

| NOW and interest-bearing demand deposits | $ | 37,517 | $ | 33,600 | $ | 31,695 | $ | 30,971 | $ | 32,719 | ||||||||||||||||||||||

| Wealth management deposits | 8,182 | 8,606 | 9,412 | 10,158 | 10,294 | |||||||||||||||||||||||||||

| Money market accounts | 155,890 | 146,374 | 159,945 | 167,382 | 155,100 | |||||||||||||||||||||||||||

| Savings accounts | 37,637 | 35,923 | 38,402 | 42,892 | 41,063 | |||||||||||||||||||||||||||

| Time deposits | 94,244 | 95,730 | 106,934 | 110,616 | 96,527 | |||||||||||||||||||||||||||

| Interest-bearing deposits | $ | 333,470 | $ | 320,233 | $ | 346,388 | $ | 362,019 | $ | 335,703 | ||||||||||||||||||||||

FHLB advances (1) |

25,724 | 25,441 | 26,050 | 26,254 | 24,797 | |||||||||||||||||||||||||||

| Other borrowings | 6,957 | 6,792 | 7,519 | 9,013 | 8,700 | |||||||||||||||||||||||||||

| Subordinated notes | 3,735 | 3,714 | 3,733 | 3,712 | 5,185 | |||||||||||||||||||||||||||

| Junior subordinated debentures | 4,328 | 4,311 | 4,663 | 5,023 | 4,984 | |||||||||||||||||||||||||||

| Total interest expense | $ | 374,214 | $ | 360,491 | $ | 388,353 | $ | 406,021 | $ | 379,369 | ||||||||||||||||||||||

| Less: Fully taxable-equivalent adjustment | (2,880) | (2,899) | (3,070) | (3,144) | (2,875) | |||||||||||||||||||||||||||

Net interest income (GAAP) (3) |

546,694 | 526,474 | 525,148 | 502,583 | 470,610 | |||||||||||||||||||||||||||

| Fully taxable-equivalent adjustment | 2,880 | 2,899 | 3,070 | 3,144 | 2,875 | |||||||||||||||||||||||||||

Net interest income, fully taxable-equivalent (non-GAAP) (3) |

$ | 549,574 | $ | 529,373 | $ | 528,218 | $ | 505,727 | $ | 473,485 | ||||||||||||||||||||||

(1)Federal Home Loan Bank (“FHLB”) and Federal Reserve Bank (“FRB”)

(2)Interest income on tax-advantaged loans, trading securities and investment securities reflects a taxable-equivalent adjustment based on the marginal federal corporate tax rate in effect as of the applicable period.

(3)See Table 18: Supplemental Non-GAAP Financial Measures/Ratios for additional information on this performance measure/ratio.

18

TABLE 6: QUARTERLY NET INTEREST MARGIN

| Net Interest Margin for three months ended, | ||||||||||||||||||||||||||||||||

| Jun 30, 2025 | Mar 31, 2025 | Dec 31, 2024 |

Sep 30, 2024 | Jun 30, 2024 |

||||||||||||||||||||||||||||

| Yield earned on: | ||||||||||||||||||||||||||||||||

| Interest-bearing deposits with banks, securities purchased under resale agreements and cash equivalents | 4.19 | % | 4.26 | % | 4.68 | % | 5.42 | % | 5.35 | % | ||||||||||||||||||||||

| Investment securities | 3.59 | 3.51 | 3.33 | 3.38 | 3.45 | |||||||||||||||||||||||||||

FHLB and FRB stock (1) |

7.67 | 7.64 | 7.55 | 8.22 | 7.89 | |||||||||||||||||||||||||||

| Liquidity management assets | 3.84 | % | 3.82 | % | 3.86 | % | 3.94 | % | 3.85 | % | ||||||||||||||||||||||

| Other earning assets | — | 2.84 | 6.01 | 6.38 | 6.23 | |||||||||||||||||||||||||||

| Mortgage loans held-for-sale | 6.29 | 6.01 | 5.91 | 6.59 | 6.29 | |||||||||||||||||||||||||||

| Loans, net of unearned income | 6.48 | 6.53 | 6.68 | 6.90 | 6.90 | |||||||||||||||||||||||||||

| Total earning assets | 5.96 | % | 5.98 | % | 6.09 | % | 6.33 | % | 6.34 | % | ||||||||||||||||||||||

| Rate paid on: | ||||||||||||||||||||||||||||||||

| NOW and interest-bearing demand deposits | 2.34 | % | 2.25 | % | 2.25 | % | 2.38 | % | 2.64 | % | ||||||||||||||||||||||

| Wealth management deposits | 2.11 | 2.22 | 2.62 | 2.97 | 2.70 | |||||||||||||||||||||||||||

| Money market accounts | 3.44 | 3.38 | 3.62 | 4.05 | 4.08 | |||||||||||||||||||||||||||

| Savings accounts | 2.29 | 2.25 | 2.43 | 2.80 | 2.81 | |||||||||||||||||||||||||||

| Time deposits | 3.84 | 4.13 | 4.38 | 4.58 | 4.54 | |||||||||||||||||||||||||||

| Interest-bearing deposits | 3.14 | % | 3.16 | % | 3.39 | % | 3.72 | % | 3.73 | % | ||||||||||||||||||||||

| FHLB advances | 3.27 | 3.27 | 3.28 | 3.29 | 3.22 | |||||||||||||||||||||||||||

| Other borrowings | 4.70 | 4.73 | 5.18 | 5.76 | 5.96 | |||||||||||||||||||||||||||

| Subordinated notes | 5.02 | 5.05 | 4.98 | 4.95 | 5.08 | |||||||||||||||||||||||||||

| Junior subordinated debentures | 6.85 | 6.90 | 7.32 | 7.88 | 7.91 | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | 3.20 | % | 3.22 | % | 3.44 | % | 3.75 | % | 3.76 | % | ||||||||||||||||||||||

Interest rate spread (2) (3) |

2.76 | % | 2.76 | % | 2.65 | % | 2.58 | % | 2.58 | % | ||||||||||||||||||||||

| Less: Fully taxable-equivalent adjustment | (0.02) | (0.02) | (0.02) | (0.02) | (0.02) | |||||||||||||||||||||||||||

Net free funds/contribution (4) |

0.78 | 0.80 | 0.86 | 0.93 | 0.94 | |||||||||||||||||||||||||||

Net interest margin (GAAP) (3) |

3.52 | % | 3.54 | % | 3.49 | % | 3.49 | % | 3.50 | % | ||||||||||||||||||||||

| Fully taxable-equivalent adjustment | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | |||||||||||||||||||||||||||

Net interest margin, fully taxable-equivalent (non-GAAP) (3) |

3.54 | % | 3.56 | % | 3.51 | % | 3.51 | % | 3.52 | % | ||||||||||||||||||||||

(1)Federal Home Loan Bank (“FHLB”) and Federal Reserve Bank (“FRB”)

(2)Interest rate spread is the difference between the yield earned on earning assets and the rate paid on interest-bearing liabilities.

(3)See Table 18: Supplemental Non-GAAP Financial Measures/Ratios for additional information on this performance measure/ratio.

(4)Net free funds are the difference between total average earning assets and total average interest-bearing liabilities. The estimated contribution to net interest margin from net free funds is calculated using the rate paid for total interest-bearing liabilities.

19

TABLE 7: YEAR-TO-DATE AVERAGE BALANCES, AND NET INTEREST INCOME AND MARGIN

|

Average Balance

for six months ended,

|

Interest

for six months ended,

|

Yield/Rate

for six months ended,

|

|||||||||||||||||||||||||||

| (Dollars in thousands) | Jun 30, 2025 | Jun 30, 2024 |

Jun 30, 2025 | Jun 30, 2024 | Jun 30, 2025 | Jun 30, 2024 | |||||||||||||||||||||||

Interest-bearing deposits with banks, securities purchased under resale agreements and cash equivalents (1) |

$ | 3,413,538 | $ | 1,369,906 | $ | 71,538 | $ | 36,425 | 4.23 | % | 5.35 | % | |||||||||||||||||

Investment securities (2) |

8,606,730 | 8,276,780 | 151,439 | 140,574 | 3.55 | 3.42 | |||||||||||||||||||||||

FHLB and FRB stock (3) |

281,853 | 242,131 | 10,700 | 9,452 | 7.66 | 7.85 | |||||||||||||||||||||||

Liquidity management assets (4) (5) |

$ | 12,302,121 | $ | 9,888,817 | $ | 233,677 | $ | 186,451 | 3.83 | % | 3.79 | % | |||||||||||||||||

Other earning assets (4) (5) (6) |

6,533 | 15,169 | 92 | 433 | 2.84 | 5.74 | |||||||||||||||||||||||

| Mortgage loans held-for-sale | 298,688 | 318,756 | 9,118 | 9,580 | 6.16 | 6.04 | |||||||||||||||||||||||

Loans, net of unearned income (4) (5) (7) |

48,680,160 | 42,974,623 | 1,570,765 | 1,464,704 | 6.51 | 6.85 | |||||||||||||||||||||||

Total earning assets (5) |

$ | 61,287,502 | $ | 53,197,365 | $ | 1,813,652 | $ | 1,661,168 | 5.97 | % | 6.28 | % | |||||||||||||||||

| Allowance for loan and investment security losses | (387,092) | (361,119) | |||||||||||||||||||||||||||

| Cash and due from banks | 477,571 | 442,591 | |||||||||||||||||||||||||||

| Other assets | 3,600,500 | 3,269,102 | |||||||||||||||||||||||||||

Total assets |

$ | 64,978,481 | $ | 56,547,939 | |||||||||||||||||||||||||

| NOW and interest-bearing demand deposits | $ | 6,235,661 | $ | 5,332,786 | $ | 71,117 | $ | 67,615 | 2.30 | % | 2.55 | % | |||||||||||||||||

| Wealth management deposits | 1,563,675 | 1,521,034 | 16,788 | 20,755 | 2.17 | 2.74 | |||||||||||||||||||||||

| Money market accounts | 17,884,615 | 14,873,309 | 302,264 | 293,084 | 3.41 | 3.96 | |||||||||||||||||||||||

| Savings accounts | 6,529,345 | 5,835,481 | 73,560 | 80,134 | 2.27 | 2.76 | |||||||||||||||||||||||

| Time deposits | 9,625,117 | 7,847,314 | 189,974 | 173,647 | 3.98 | 4.45 | |||||||||||||||||||||||

| Interest-bearing deposits | $ | 41,838,413 | $ | 35,409,924 | $ | 653,703 | $ | 635,235 | 3.15 | % | 3.61 | % | |||||||||||||||||

| Federal Home Loan Bank advances | 3,151,310 | 2,912,884 | 51,165 | 46,845 | 3.27 | 3.23 | |||||||||||||||||||||||

| Other borrowings | 587,930 | 607,487 | 13,749 | 17,948 | 4.72 | 5.94 | |||||||||||||||||||||||

| Subordinated notes | 298,353 | 424,112 | 7,449 | 10,672 | 5.04 | 5.06 | |||||||||||||||||||||||

| Junior subordinated debentures | 253,566 | 253,566 | 8,639 | 9,988 | 6.87 | 7.92 | |||||||||||||||||||||||

Total interest-bearing liabilities |

$ | 46,129,572 | $ | 39,607,973 | $ | 734,705 | $ | 720,688 | 3.21 | % | 3.66 | % | |||||||||||||||||

| Non-interest-bearing deposits | 10,687,733 | 9,925,890 | |||||||||||||||||||||||||||

| Other liabilities | 1,498,578 | 1,568,761 | |||||||||||||||||||||||||||

| Equity | 6,662,598 | 5,445,315 | |||||||||||||||||||||||||||

Total liabilities and shareholders’ equity |

$ | 64,978,481 | $ | 56,547,939 | |||||||||||||||||||||||||

Interest rate spread (5) (8) |

2.76 | % | 2.62 | % | |||||||||||||||||||||||||

| Less: Fully taxable-equivalent adjustment | (5,779) | (5,676) | (0.02) | (0.03) | |||||||||||||||||||||||||

Net free funds/contribution (9) |

$ | 15,157,930 | $ | 13,589,392 | 0.79 | 0.94 | |||||||||||||||||||||||

Net interest income/margin (GAAP) (5) |

$ | 1,073,168 | $ | 934,804 | 3.53 | % | 3.53 | % | |||||||||||||||||||||

| Fully taxable-equivalent adjustment | 5,779 | 5,676 | 0.02 | 0.03 | |||||||||||||||||||||||||

Net interest income/margin, fully taxable-equivalent (non-GAAP) (4) |

$ | 1,078,947 | $ | 940,480 | 3.55 | % | 3.56 | % | |||||||||||||||||||||

(1)Includes interest-bearing deposits from banks and securities purchased under resale agreements with original maturities of greater than three months. Cash equivalents include federal funds sold and securities purchased under resale agreements with original maturities of three months or less.

(2)Investment securities includes investment securities classified as available-for-sale and held-to-maturity, and equity securities with readily determinable fair values. Equity securities without readily determinable fair values are included within other assets.

(3)Federal Home Loan Bank (“FHLB”) and Federal Reserve Bank (“FRB”)

(4)Interest income on tax-advantaged loans, trading securities and investment securities reflects a taxable-equivalent adjustment based on the marginal federal corporate tax rate in effect as of the applicable period.

(5)See Table 18: Supplemental Non-GAAP Financial Measures/Ratios for additional information on this performance measure/ratio.

(6)Other earning assets include brokerage customer receivables and trading account securities.

(7)Loans, net of unearned income, include non-accrual loans.

(8)Interest rate spread is the difference between the yield earned on earning assets and the rate paid on interest-bearing liabilities.

(9)Net free funds are the difference between total average earning assets and total average interest-bearing liabilities. The estimated contribution to net interest margin from net free funds is calculated using the rate paid for total interest-bearing liabilities.

20

TABLE 8: INTEREST RATE SENSITIVITY

As an ongoing part of its financial strategy, the Company attempts to manage the impact of fluctuations in market interest rates on net interest income. Management measures its exposure to changes in interest rates by modeling many different interest rate scenarios.

The following interest rate scenarios display the percentage change in net interest income over a one-year time horizon assuming increases and decreases of 100 and 200 basis points as compared to projected net interest income in a scenario with no assumed rate changes. The Static Shock Scenario results incorporate actual cash flows and repricing characteristics for balance sheet instruments following an instantaneous, parallel change in market rates based upon a static (i.e. no growth or constant) balance sheet. Conversely, the Ramp Scenario results incorporate management’s projections of future volume and pricing of each of the product lines following a gradual, parallel change in market rates over twelve months. Actual results may differ from these simulated results due to timing, magnitude, and frequency of interest rate changes as well as changes in market conditions and management strategies. The interest rate sensitivity for both the Static Shock and Ramp Scenario is as follows:

| Static Shock Scenario | +200 Basis Points | +100 Basis Points | -100 Basis Points | -200 Basis Points | ||||||||||||||||||||||

| Jun 30, 2025 | (1.5) | % | (0.4) | % | (0.2) | % | (1.2) | % | ||||||||||||||||||

| Mar 31, 2025 | (1.8) | (0.6) | (0.2) | (1.2) | ||||||||||||||||||||||

| Dec 31, 2024 | (1.6) | (0.6) | (0.3) | (1.5) | ||||||||||||||||||||||

| Sep 30, 2024 | 1.2 | 1.1 | 0.4 | (0.9) | ||||||||||||||||||||||

| Jun 30, 2024 | 1.5 | 1.0 | 0.6 | (0.0) | ||||||||||||||||||||||

| Ramp Scenario | +200 Basis Points | +100 Basis Points | -100 Basis Points | -200 Basis Points | |||||||||||||||||||

| Jun 30, 2025 | 0.0 | % | 0.0 | % | (0.1) | % | (0.4) | % | |||||||||||||||

| Mar 31, 2025 | 0.2 | 0.2 | (0.1) | (0.5) | |||||||||||||||||||

| Dec 31, 2024 | (0.2) | (0.0) | 0.0 | (0.3) | |||||||||||||||||||

| Sep 30, 2024 | 1.6 | 1.2 | 0.7 | 0.5 | |||||||||||||||||||

| Jun 30, 2024 | 1.2 | 1.0 | 0.9 | 1.0 | |||||||||||||||||||

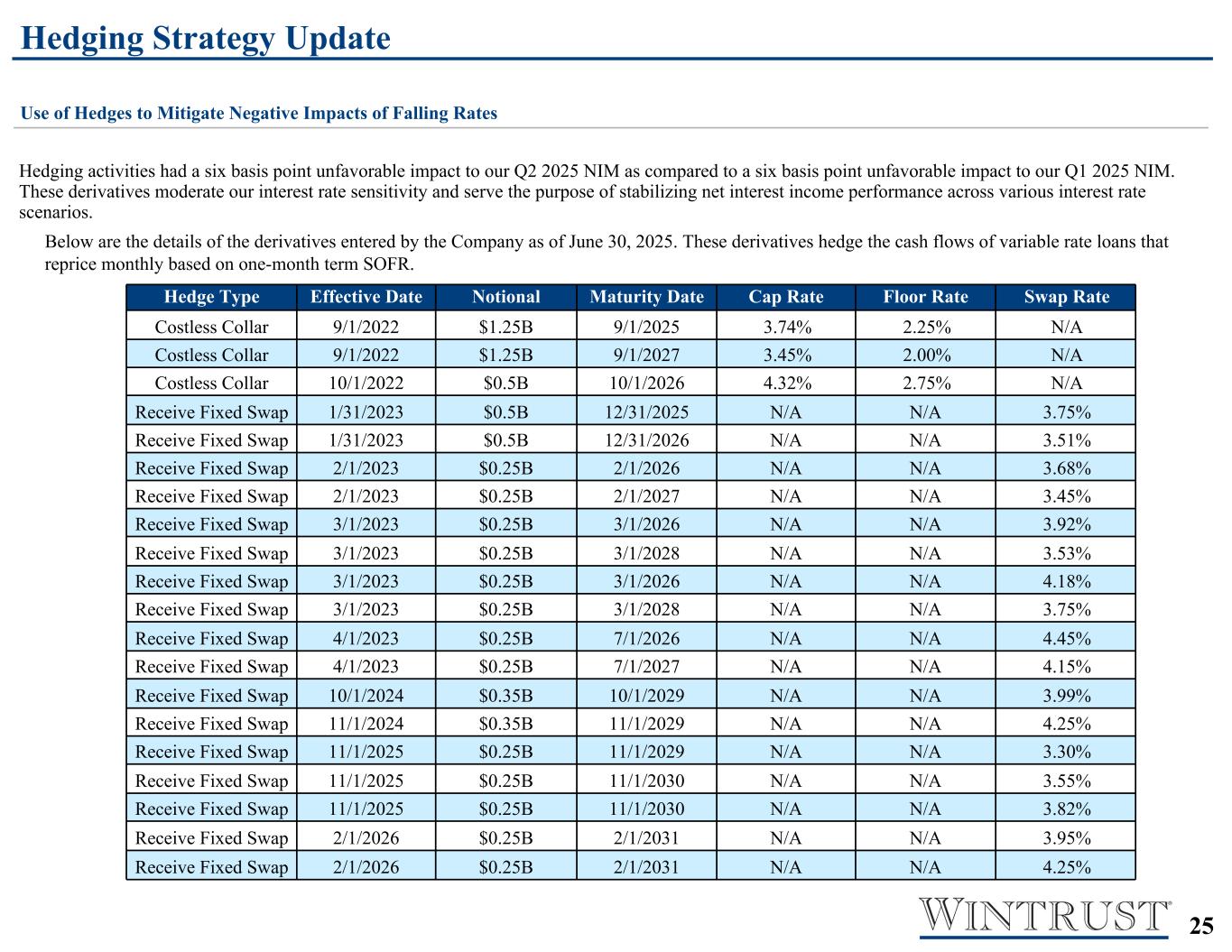

As shown above, the magnitude of potential changes in net interest income in various interest rate scenarios has continued to remain relatively neutral. As the current interest rate cycle progressed, management took action to reposition its sensitivity to interest rates. To this end, management has executed various derivative instruments including collars and receive fixed swaps to hedge variable rate loan exposures and originated a higher percentage of its loan originations in longer-term fixed-rate loans. The Company will continue to monitor current and projected interest rates and may execute additional derivatives to mitigate potential fluctuations in the net interest margin in future periods.

21

TABLE 9: MATURITIES AND SENSITIVITIES TO CHANGES IN INTEREST RATES

| Loans repricing or contractual maturity period | |||||||||||||||||||||||||||||

| As of June 30, 2025 | One year or less |

From one to five years |

From five to fifteen years | After fifteen years | Total | ||||||||||||||||||||||||

| (In thousands) | |||||||||||||||||||||||||||||

| Commercial | |||||||||||||||||||||||||||||

| Fixed rate | $ | 429,173 | $ | 3,756,650 | $ | 2,117,493 | $ | 14,925 | $ | 6,318,241 | |||||||||||||||||||

| Variable rate | 10,068,079 | 1,111 | — | — | 10,069,190 | ||||||||||||||||||||||||

| Total commercial | $ | 10,497,252 | $ | 3,757,761 | $ | 2,117,493 | $ | 14,925 | $ | 16,387,431 | |||||||||||||||||||

| Commercial real estate | |||||||||||||||||||||||||||||

| Fixed rate | $ | 712,348 | $ | 2,732,428 | $ | 369,615 | $ | 70,471 | $ | 3,884,862 | |||||||||||||||||||

| Variable rate | 9,396,306 | 10,775 | 67 | — | 9,407,148 | ||||||||||||||||||||||||

| Total commercial real estate | $ | 10,108,654 | $ | 2,743,203 | $ | 369,682 | $ | 70,471 | $ | 13,292,010 | |||||||||||||||||||

| Home equity | |||||||||||||||||||||||||||||

| Fixed rate | $ | 9,626 | $ | 773 | $ | — | $ | 15 | $ | 10,414 | |||||||||||||||||||

| Variable rate | 456,401 | — | — | — | 456,401 | ||||||||||||||||||||||||

| Total home equity | $ | 466,027 | $ | 773 | $ | — | $ | 15 | $ | 466,815 | |||||||||||||||||||

| Residential real estate | |||||||||||||||||||||||||||||

| Fixed rate | $ | 15,271 | $ | 4,318 | $ | 72,630 | $ | 1,056,508 | $ | 1,148,727 | |||||||||||||||||||

| Variable rate | 108,431 | 699,875 | 1,991,749 | — | 2,800,055 | ||||||||||||||||||||||||

| Total residential real estate | $ | 123,702 | $ | 704,193 | $ | 2,064,379 | $ | 1,056,508 | $ | 3,948,782 | |||||||||||||||||||

| Premium finance receivables - property & casualty | |||||||||||||||||||||||||||||