Document

EXHIBIT 99.1

News Release

13320 Ballantyne Corporate Place, Suite D

Immediate Release Charlotte, NC 28277

Columbus McKinnon Reports Record Orders in Fiscal 2025

CHARLOTTE, NC, May 28, 2025 - Columbus McKinnon Corporation (Nasdaq: CMCO) ("Columbus McKinnon" or the "Company"), a leading designer, manufacturer and marketer of intelligent motion solutions for material handling, today announced financial results for its full year and fourth quarter fiscal 2025, which ended March 31, 2025.

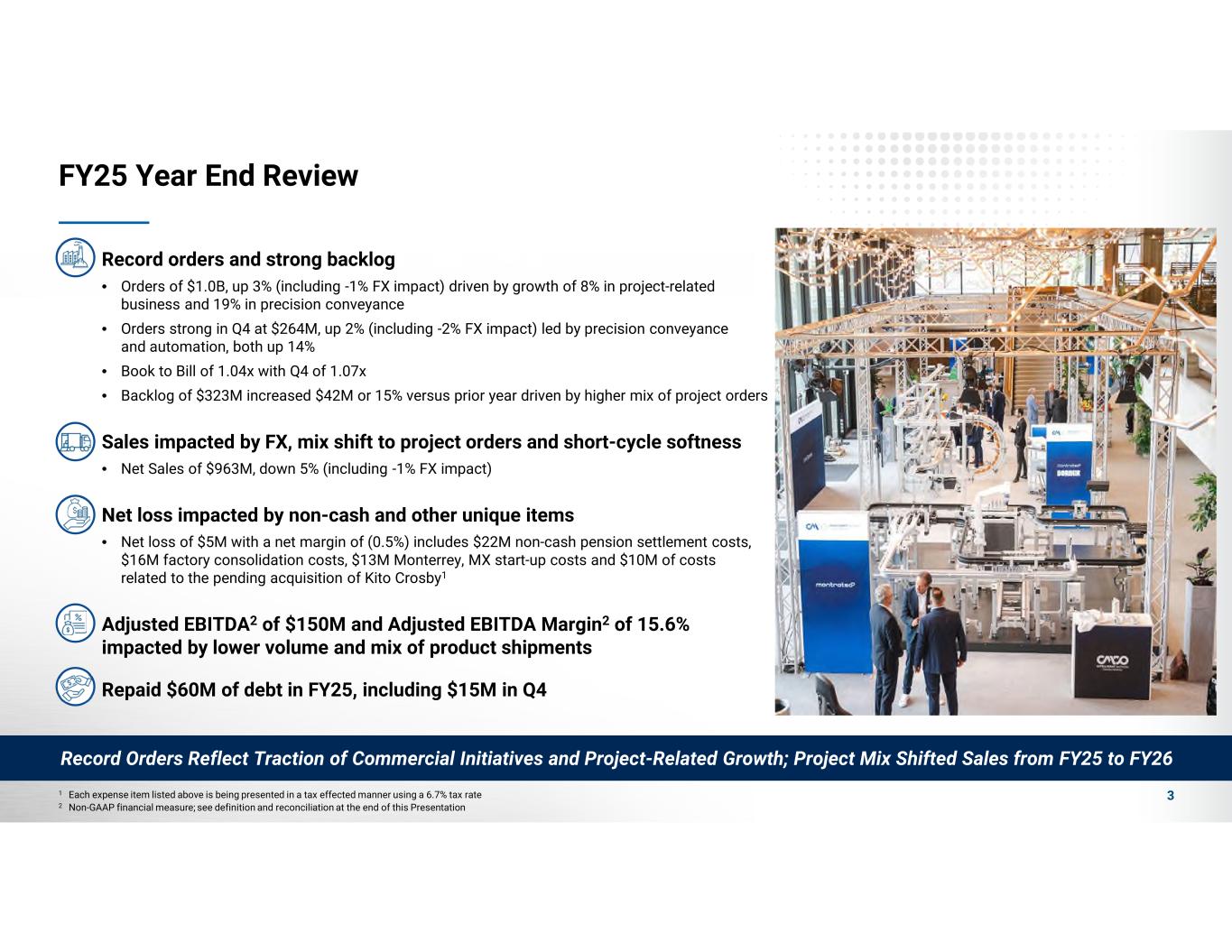

Fiscal Year 2025 Highlights (compared with prior year period)

•Record orders of $1.0 billion, up 3%, inclusive of a negative 1% foreign exchange impact, driven by 8% growth in project-related business and 19% in precision conveyance

•Backlog of $322.5 million increased $41.7 million, or 15%

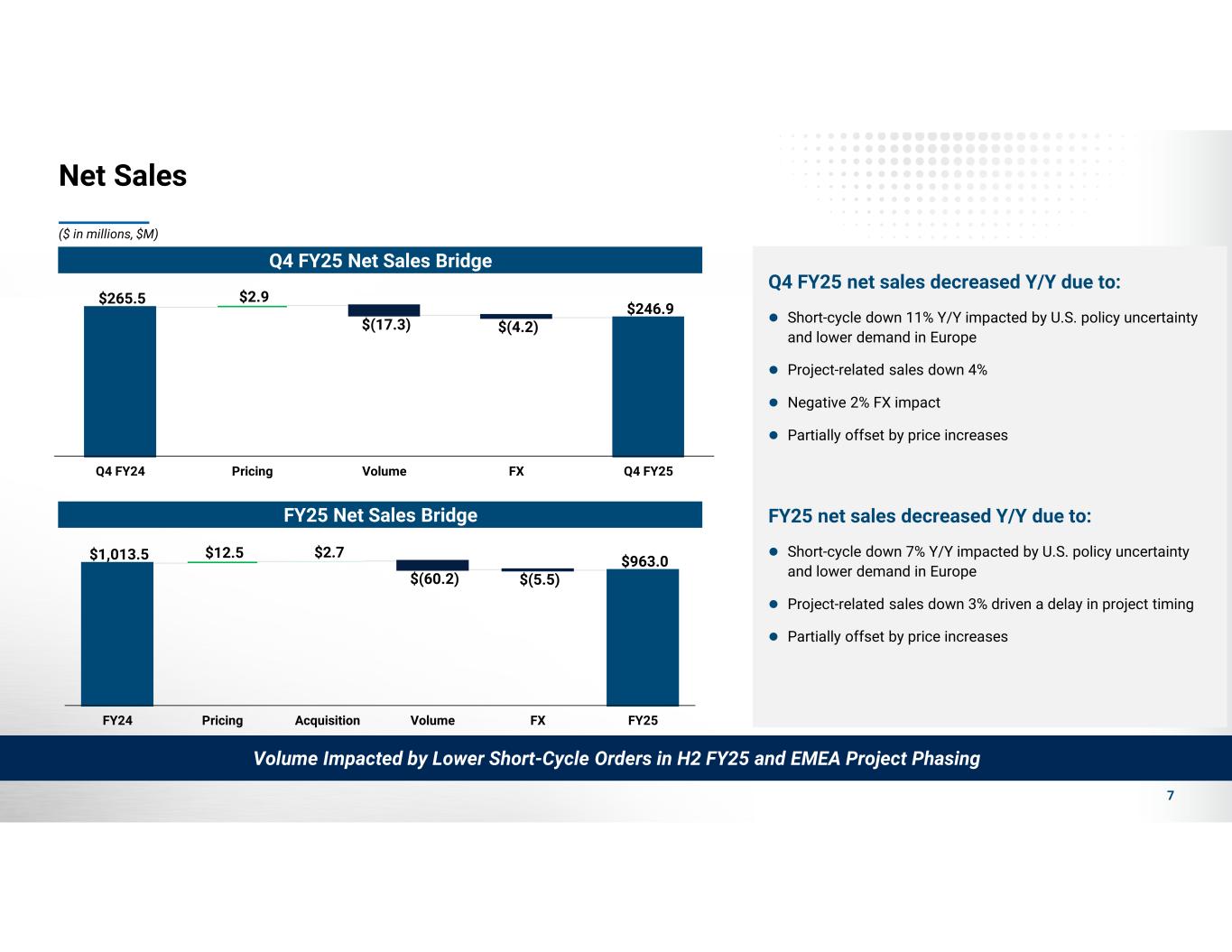

•Net sales of $963.0 million, down 5%, inclusive of a negative 1% foreign exchange impact, driven by short cycle order softness and higher project-related orders with a longer delivery timeframe

•Net loss of $5.1 million with a net margin of (0.5%) includes $22.1 million non-cash pension settlement costs, $16.4 million factory consolidation costs, $12.8 million Monterrey, MX start-up costs and $10.3 million of costs related to the pending acquisition of Kito Crosby2

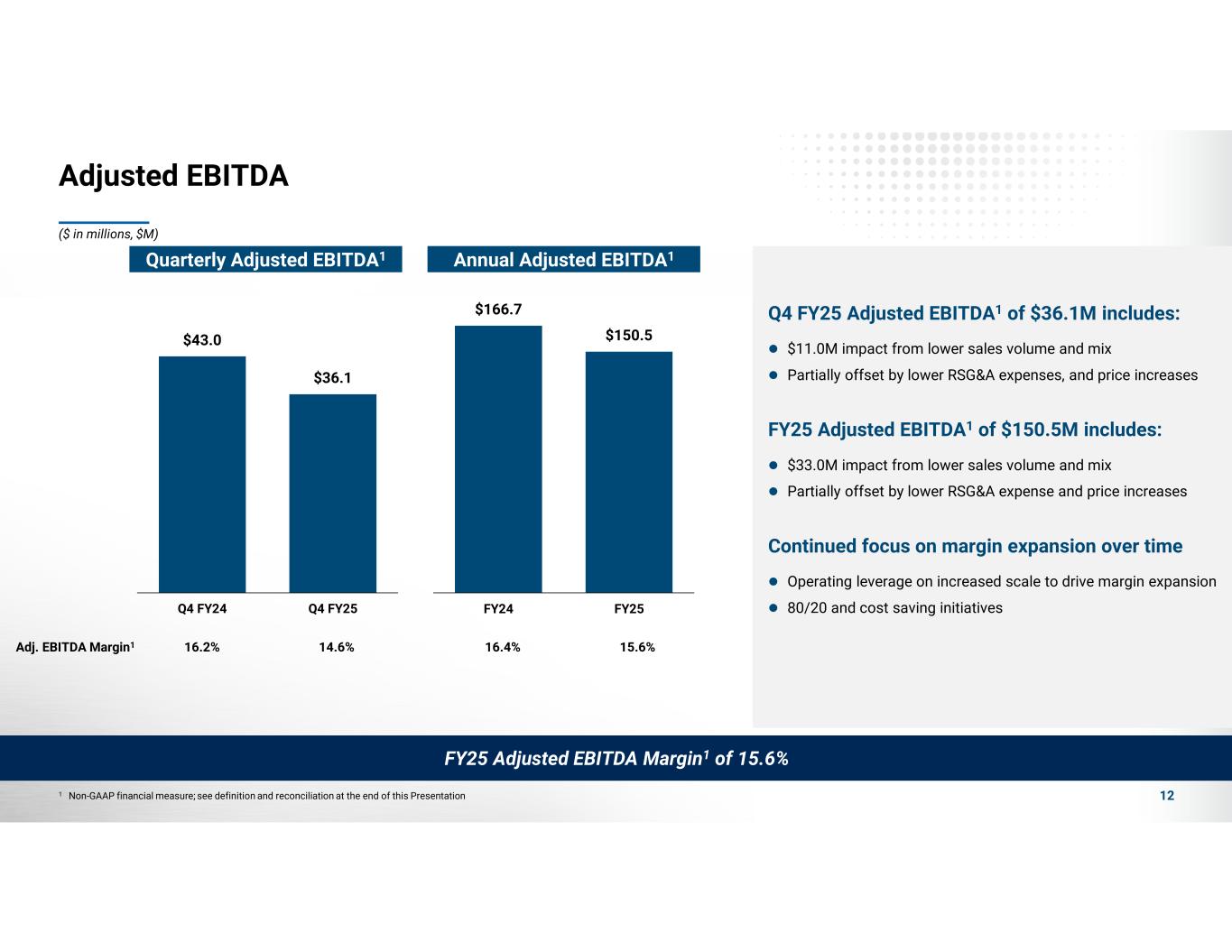

•Adjusted EBITDA1 of $150.5 million with Adjusted EBITDA Margin1 of 15.6%

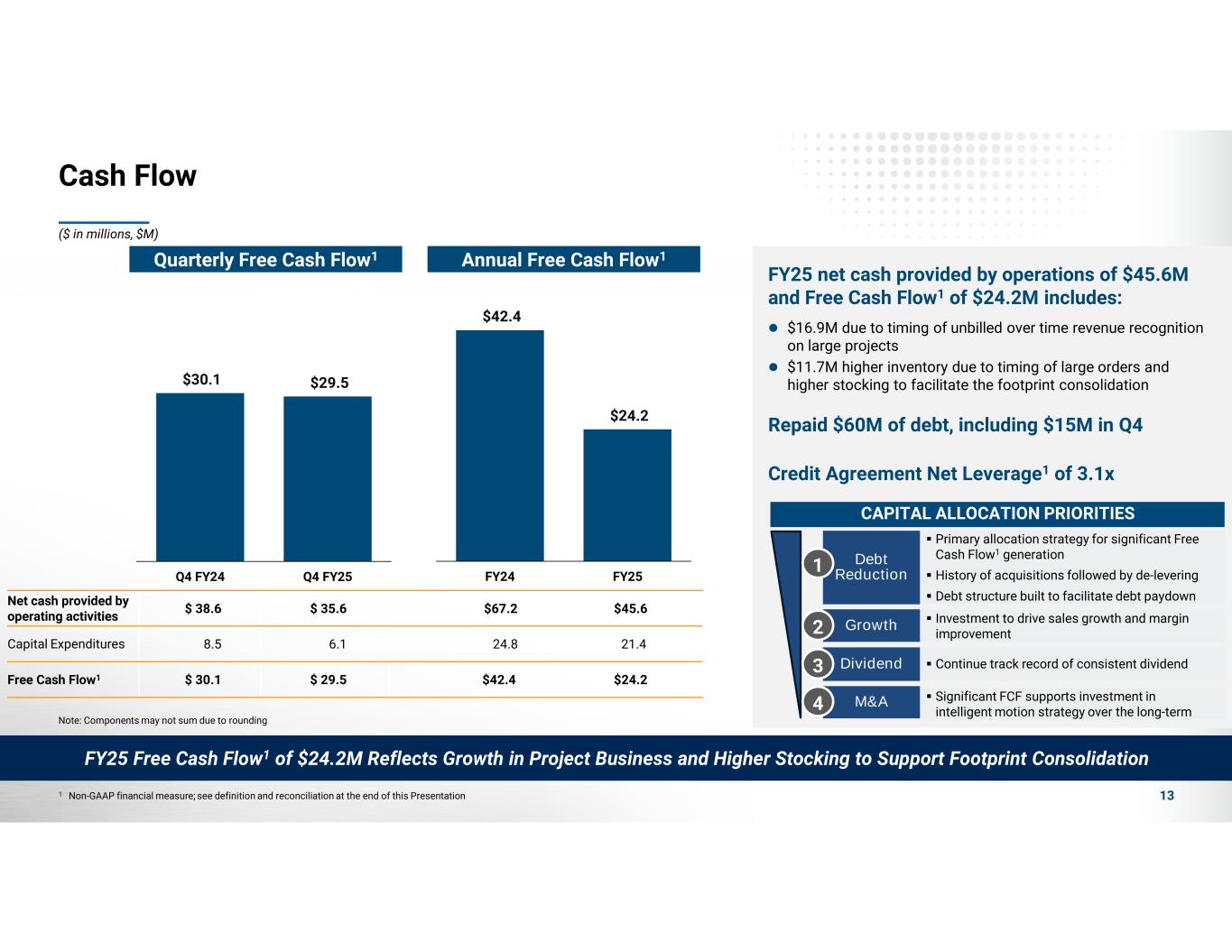

•Repaid $60.7 million of debt in FY25

Fourth Quarter 2025 Highlights (compared with prior year period)

•Orders increased 2%, inclusive of a negative 2% foreign exchange impact, led by precision conveyance and automation, both up 14%

•Delivered $246.9 million of net sales, down 7%, inclusive of a negative 2% foreign exchange impact, driven by short cycle demand softness

•Net loss of $2.7 million with a net margin of (1.1%) includes $8.5 million costs related to the pending acquisition of Kito Crosby, $3.8 million factory consolidation costs and $2.4 million Monterrey, MX start-up costs2

•Adjusted EBITDA1 of $36.1 million with Adjusted EBITDA Margin1 of 14.6%

“We enter fiscal 2026 with a strong backlog and continued order growth as our commercial initiatives gain traction. Our conviction in Columbus McKinnon's strategy and business model remains strong as we continue to anticipate tailwinds from industry megatrends like on-shoring, scarcity of labor and global infrastructure investments over time,” said David Wilson, President and Chief Executive Officer. "We have a strong track record of navigating through uncertain environments and managing performance through volatility. Accordingly, we are actively working to mitigate the impact of tariff policies with supply chain adjustments, surcharges and price. I want to thank our Columbus McKinnon team for their relentless efforts to continuously improve customer service and advance our strategic initiatives as we execute on fiscal 2026 and work toward the closing of the Kito Crosby acquisition." For the quarter, net sales decreased $18.6 million, or 7.0%.

Columbus McKinnon Reports Record Orders in Fiscal 2025

May 28, 2025

Fourth Quarter Fiscal 2025 Sales

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in millions) |

Q4 FY 25 |

|

Q4 FY 24 |

|

Change |

|

% Change |

| Net sales |

$ |

246.9 |

|

|

$ |

265.5 |

|

|

$ |

(18.6) |

|

|

(7.0) |

% |

| U.S. sales |

$ |

139.4 |

|

|

$ |

155.0 |

|

|

$ |

(15.6) |

|

|

(10.1) |

% |

| % of total |

56 |

% |

|

58 |

% |

|

|

|

|

| Non-U.S. sales |

$ |

107.5 |

|

|

$ |

110.5 |

|

|

$ |

(3.0) |

|

|

(2.7) |

% |

| % of total |

44 |

% |

|

42 |

% |

|

|

|

|

In the U.S., sales were down $15.6 million, or 10.1%, driven by unfavorable sales volume of $16.2 million slightly offset by price improvement of $0.6 million. Sales outside the U.S. decreased $3.0 million, or 2.7%, driven by $1.1 million of lower sales volume offset by $2.3 million of price improvement. Unfavorable foreign currency translation was $4.2 million.

Fourth Quarter Fiscal 2025 Operating Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in millions) |

Q4 FY 25 |

|

Q4 FY 24 |

|

Change |

|

% Change |

| Gross profit |

$ |

79.8 |

|

|

$ |

94.3 |

|

|

$ |

(14.5) |

|

|

(15.4) |

% |

| Gross margin |

32.3 |

% |

|

35.5 |

% |

|

(320) bps |

|

|

Adjusted Gross Profit1 |

$ |

87.0 |

|

|

$ |

97.1 |

|

|

$ |

(10.1) |

|

|

(10.4) |

% |

Adjusted Gross Margin1 |

35.2 |

% |

|

36.6 |

% |

|

(140) bps |

|

|

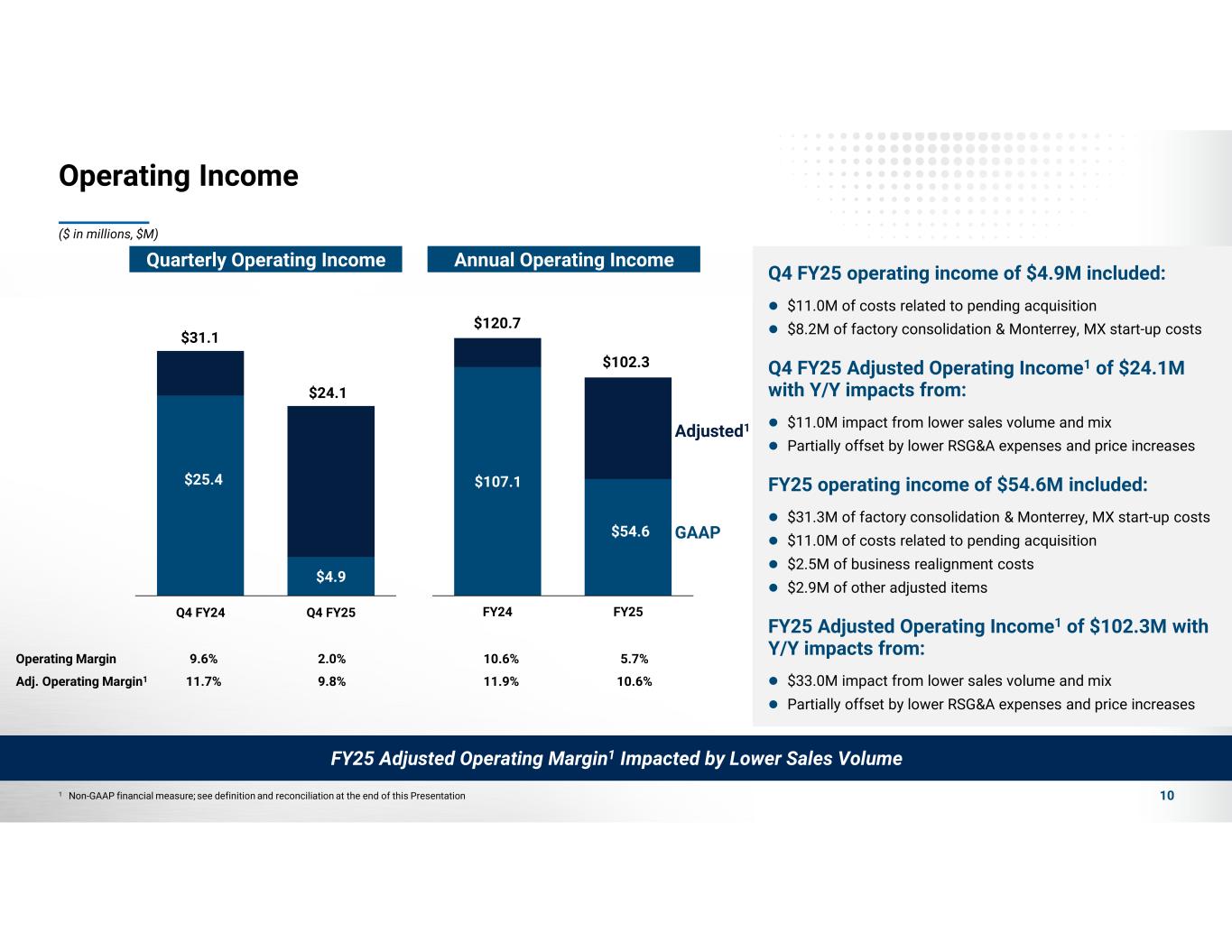

| Income from operations |

$ |

4.9 |

|

|

$ |

25.4 |

|

|

$ |

(20.5) |

|

|

(80.6) |

% |

| Operating margin |

2.0 |

% |

|

9.6 |

% |

|

(760) bps |

|

|

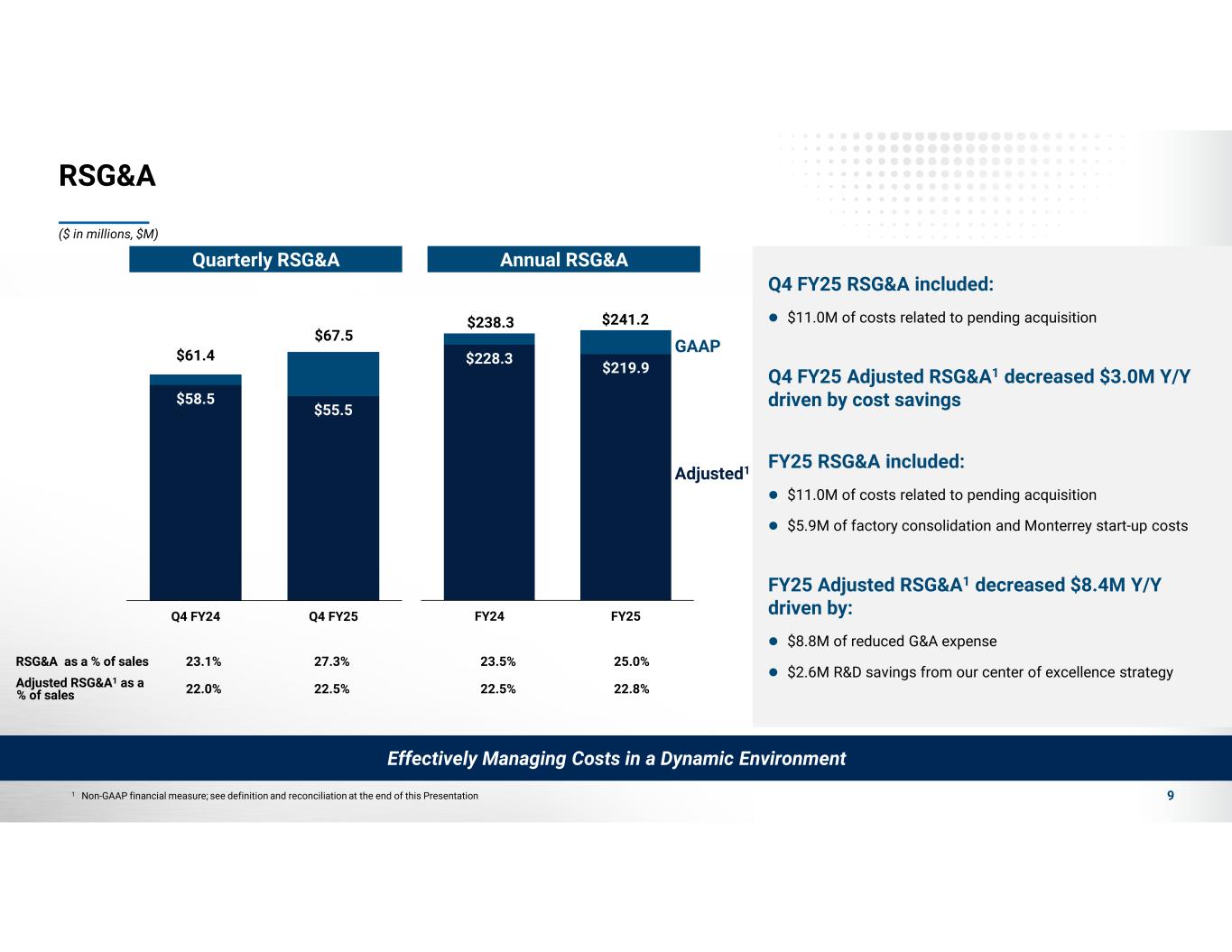

Adjusted Operating Income1 |

$ |

24.1 |

|

|

$ |

31.1 |

|

|

$ |

(7.0) |

|

|

(22.4) |

% |

Adjusted Operating Margin1 |

9.8 |

% |

|

11.7 |

% |

|

(190) bps |

|

|

| Net income (loss) |

$ |

(2.7) |

|

|

$ |

11.8 |

|

|

$ |

(14.5) |

|

|

NM |

| Net income (loss) margin |

(1.1) |

% |

|

4.4 |

% |

|

(550) bps |

|

|

| GAAP EPS |

$ |

(0.09) |

|

|

$ |

0.41 |

|

|

$ |

(0.50) |

|

|

NM |

Adjusted EPS1 |

$ |

0.60 |

|

|

$ |

0.75 |

|

|

$ |

(0.15) |

|

|

(20.0) |

% |

Adjusted EBITDA1 |

$ |

36.1 |

|

|

$ |

43.0 |

|

|

$ |

(6.9) |

|

|

(16.1) |

% |

Adjusted EBITDA margin1 |

14.6 |

% |

|

16.2 |

% |

|

(160) bps |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EPS1 excludes, among other adjustments, amortization of intangible assets. The Company believes this better represents its inherent earnings power and cash generation capability.

Columbus McKinnon Reports Record Orders in Fiscal 2025

May 28, 2025

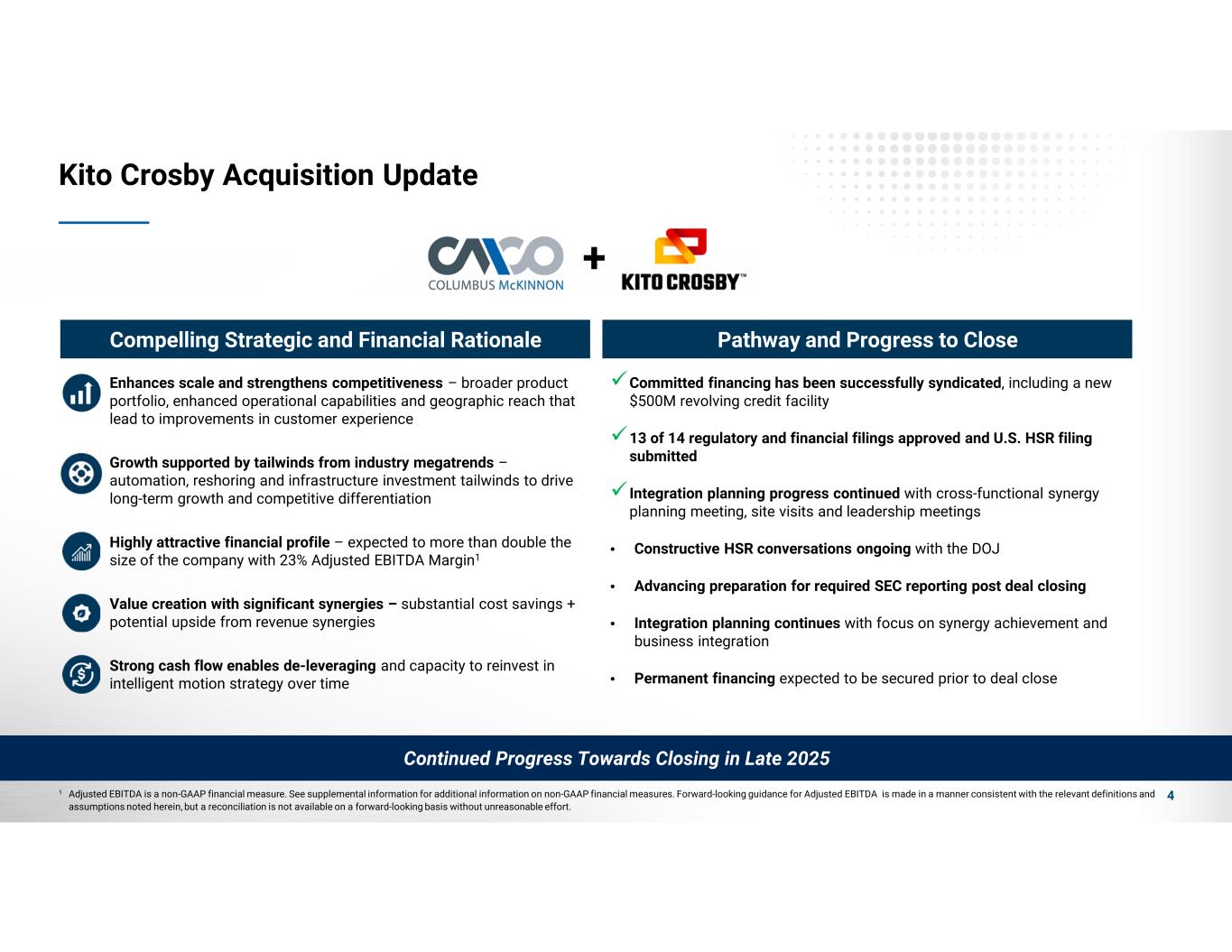

Kito Crosby Transaction

As it announced on February 10, 2025, Columbus McKinnon believes that the acquisition of Kito Crosby Limited ("Kito Crosby") will scale its business and accelerate the realization of the Company’s Intelligent Motion strategy. Through this complementary combination, Columbus McKinnon believes it will be better positioned to deliver a superior customer value proposition through an expanded product offering across a broader set of geographies, generating enhanced financial results and long-term value for shareholders.

The acquisition is conditioned on the receipt of regulatory clearance and satisfactory completion of customary closing conditions. The Company continues to make progress towards completing the proposed acquisition and work collaboratively with the Department of Justice on regulatory clearance matters with regards to the transaction through the date of this release. The Company continues to anticipate the closing of the transaction later this calendar year.

Capital Allocation Priorities

The Company plans to continue to allocate capital to pay down debt to deleverage its balance sheet in the near term while continuing its track record of consistent dividend payment. Over time, the Company believes it will be positioned to utilize its expected significant free cash flow generation to advance its Intelligent Motion strategy across the fragmented marketplace.

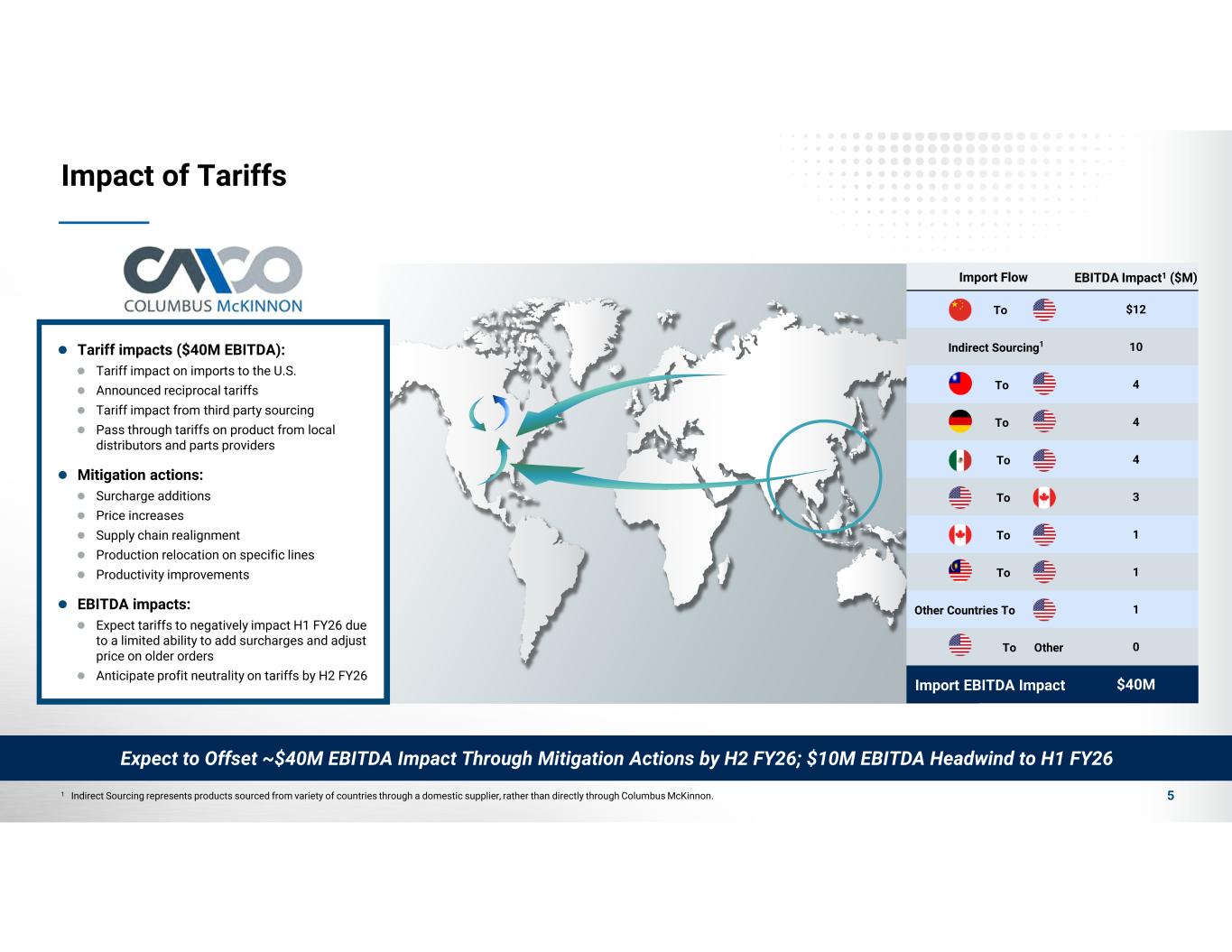

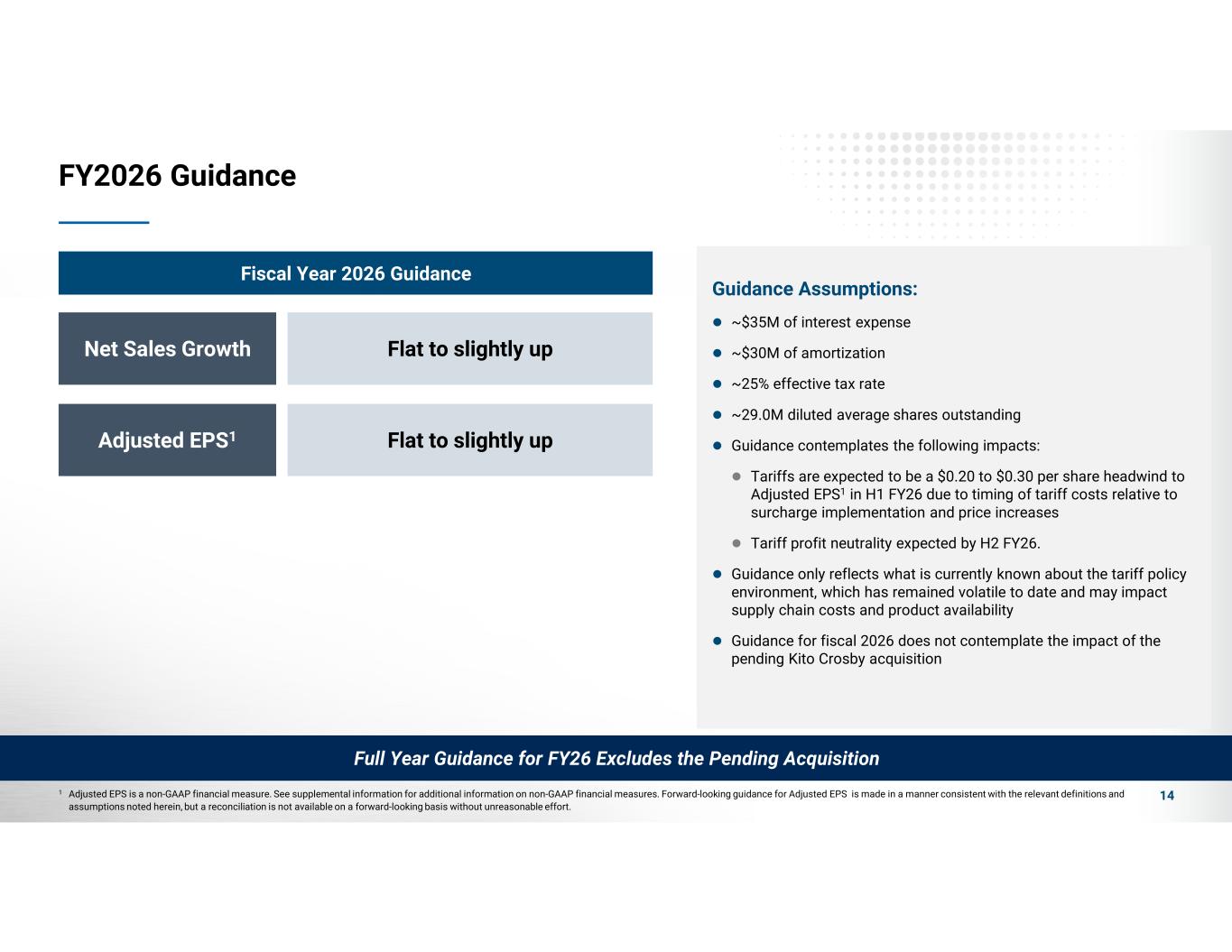

Fiscal Year 2026 Guidance

The Company’s outlook for fiscal 2026 does not contemplate the impact of the pending Kito Crosby acquisition. Additionally, the guidance only reflects what is known as of the date of this release about the tariff policy environment, which has remained volatile to date and may impact supply chain costs and product availability. This forecast assumes tariffs will be a headwind to Adjusted EPS in the first half of fiscal 2026 due to the timing of supply chain adjustments, pricing increases and surcharge implementation lagging tariff costs and tariff cost neutrality expected by the second half of fiscal 2026.

The Company is issuing the following guidance for fiscal 2026, ending March 31, 2026:

|

|

|

|

|

|

|

|

|

| Metric |

FY26 |

|

| Net sales |

Flat to slightly up |

|

Adjusted EPS3 |

Flat to slightly up |

|

Fiscal 2026 guidance assumes approximately $35 million of interest expense, $30 million of amortization, an effective tax rate of 25% and 29.0 million diluted average shares outstanding.

Teleconference and Webcast

Columbus McKinnon will host a conference call today at 10:00 AM Eastern Time to discuss the Company’s financial results and strategy. The conference call, earnings release and earnings presentation will be accessible through live webcast on the Company's investor relations website at investors.cmco.com. A replay of the webcast will also be archived on the Company's investor relations website through June 4, 2025.

_____________________

1 Adjusted Gross Profit, Adjusted Gross Margin, Adjusted Operating Income, Adjusted Operating Margin, Adjusted EPS, Adjusted EBITDA, and Adjusted EBITDA Margin are non-GAAP financial measures. See accompanying discussion and reconciliation tables provided in this release for reconciliations of these non-GAAP financial measures to the closest corresponding GAAP financial measures.

2 Each expense listed is being presented in a tax effected manner using a 6.7% tax rate for fiscal 2025 and 23.2% tax rate for Q4 fiscal 2025

3 The Company has not reconciled the Adjusted EPS guidance for fiscal 2026 to the most comparable GAAP outlook because it is not possible to do so without unreasonable efforts due to the uncertainty and potential variability of reconciling items, which are dependent on future events and often outside of management’s control and which could be significant. Because such items cannot be reasonably predicted with the level of precision required, we are unable to provide guidance for the comparable GAAP financial measure. Forward-looking guidance regarding Adjusted EPS is made in a manner consistent with the relevant definitions and assumptions noted herein.

Columbus McKinnon Reports Record Orders in Fiscal 2025

May 28, 2025

About Columbus McKinnon

Columbus McKinnon is a leading worldwide designer, manufacturer and marketer of intelligent motion solutions that move the world forward and improve lives by efficiently and ergonomically moving, lifting, positioning, and securing materials. Key products include hoists, crane components, precision conveyor systems, rigging tools, light rail workstations and digital power and motion control systems. The Company is focused on commercial and industrial applications that require the safety and quality provided by its superior design and engineering know-how. Comprehensive information on Columbus McKinnon is available at www.cmco.com.

Safe Harbor Statement

This news release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are generally identified by the use of forward-looking terminology, including the terms “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “illustrative,” “intend,” “likely,” “may,” “opportunity,” “plan,” “possible,” “potential,” “predict,” “project,” “shall,” “should,” “target,” “will,” “would” and, in each case, their negative or other various or comparable terminology. All statements other than statements of historical facts contained in this release, including, but are not limited to, statements relating to: (i) our strategy, outlook and growth prospects, including the Company's full year fiscal 2026 guidance as the associated assumed inputs for fiscal 2026 regarding interest expense, amortization, effective tax rate and diluted shares outstanding; (ii) our operational and financial targets and capital distribution policy; (iii) general economic trend and trends in the industry and markets; (iv) the the timing for the closing of the Kito Crosby acquisition and expected benefits of the Kito Crosby acquisition; (v) the repayment of indebtedness; and (vi) the competitive environment in which we operate are forward looking statements. Forward-looking statements are not based on historical facts but instead represent our current expectations and assumptions regarding our business, the economy and other future conditions, and involve known and unknown risks, uncertainties and other factors that could cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. It is not possible to predict or identify all such risks. These risks include, but are not limited to, the risk factors that are described under the section titled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended March 31, 2024 as well as in our other filings with the Securities and Exchange Commission, which are available on its website at www.sec.gov. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements speak only as of the date they are made. Columbus McKinnon undertakes no duty to update publicly any such forward-looking statement, whether as a result of new information, future events or otherwise, except as may be required by applicable law, regulation or other competent legal authority.

Contacts:

|

|

|

|

|

|

|

|

|

| Gregory P. Rustowicz |

|

Kristine Moser |

| EVP Finance and CFO |

|

VP IR and Treasurer |

Columbus McKinnon Corporation |

|

Columbus McKinnon Corporation |

| 716-689-5442 |

|

704-322-2488 |

| greg.rustowicz@cmco.com |

|

kristy.moser@cmco.com |

Financial tables follow.

Columbus McKinnon Reports Record Orders in Fiscal 2025

May 28, 2025

COLUMBUS McKINNON CORPORATION

Condensed Consolidated Income Statements - Unaudited

(In thousands, except per share and percentage data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended |

|

|

| |

|

March 31, 2025 |

|

March 31, 2024 |

|

Change |

| Net sales |

|

$ |

963,027 |

|

|

$ |

1,013,540 |

|

|

(5.0) |

% |

| Cost of products sold |

|

637,347 |

|

|

638,702 |

|

|

(0.2) |

% |

| Gross profit |

|

325,680 |

|

|

374,838 |

|

|

(13.1) |

% |

| Gross profit margin |

|

33.8 |

% |

|

37.0 |

% |

|

|

| Selling expenses |

|

110,043 |

|

|

105,341 |

|

|

4.5 |

% |

| % of net sales |

|

11.4 |

% |

|

10.4 |

% |

|

|

| General and administrative expenses |

|

107,249 |

|

|

106,760 |

|

|

0.5 |

% |

| % of net sales |

|

11.1 |

% |

|

10.5 |

% |

|

|

| Research and development expenses |

|

23,869 |

|

|

26,193 |

|

|

(8.9) |

% |

| % of net sales |

|

2.5 |

% |

|

2.6 |

% |

|

|

| Amortization of intangibles |

|

29,946 |

|

|

29,396 |

|

|

1.9 |

% |

| Income from operations |

|

54,573 |

|

|

107,148 |

|

|

(49.1) |

% |

| Operating margin |

|

5.7 |

% |

|

10.6 |

% |

|

|

| Interest and debt expense |

|

32,426 |

|

|

37,957 |

|

|

(14.6) |

% |

|

|

|

|

|

|

|

| Investment (income) loss, net |

|

(1,302) |

|

|

(1,759) |

|

|

(26.0) |

% |

| Foreign currency exchange loss (gain), net |

|

3,179 |

|

|

1,826 |

|

|

74.1 |

% |

| Other (income) expense, net |

|

25,775 |

|

|

7,597 |

|

|

239.3 |

% |

| Income before income tax expense |

|

(5,505) |

|

|

61,527 |

|

|

NM |

| Income tax (benefit) expense |

|

(367) |

|

|

14,902 |

|

|

NM |

| Net income (loss) |

|

$ |

(5,138) |

|

|

$ |

46,625 |

|

|

NM |

|

|

|

|

|

|

|

| Average basic shares outstanding |

|

28,738 |

|

|

28,728 |

|

|

— |

% |

| Basic income (loss) per share |

|

$ |

(0.18) |

|

|

$ |

1.62 |

|

|

NM |

|

|

|

|

|

|

|

| Average diluted shares outstanding |

|

28,738 |

|

|

29,026 |

|

|

(1.0) |

% |

| Diluted income (loss) per share |

|

$ |

(0.18) |

|

|

$ |

1.61 |

|

|

NM |

|

|

|

|

|

|

|

| Dividends declared per common share |

|

$ |

0.28 |

|

|

$ |

0.28 |

|

|

|

Columbus McKinnon Reports Record Orders in Fiscal 2025

May 28, 2025

COLUMBUS McKINNON CORPORATION

Condensed Consolidated Income Statements - Unaudited

(In thousands, except per share and percentage data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

| |

|

March 31, 2025 |

|

March 31, 2024 |

|

Change |

| Net sales |

|

$ |

246,889 |

|

|

$ |

265,504 |

|

|

(7.0) |

% |

| Cost of products sold |

|

167,079 |

|

|

171,189 |

|

|

(2.4) |

% |

| Gross profit |

|

79,810 |

|

|

94,315 |

|

|

(15.4) |

% |

| Gross profit margin |

|

32.3 |

% |

|

35.5 |

% |

|

|

| Selling expenses |

|

27,999 |

|

|

26,941 |

|

|

3.9 |

% |

| % of net sales |

|

11.3 |

% |

|

10.1 |

% |

|

|

| General and administrative expenses |

|

33,206 |

|

|

27,353 |

|

|

21.4 |

% |

| % of net sales |

|

13.4 |

% |

|

10.3 |

% |

|

|

| Research and development expenses |

|

6,276 |

|

|

7,059 |

|

|

(11.1) |

% |

| % of net sales |

|

2.5 |

% |

|

2.7 |

% |

|

|

| Amortization of intangibles |

|

7,398 |

|

|

7,525 |

|

|

(1.7) |

% |

| Income from operations |

|

4,931 |

|

|

25,437 |

|

|

(80.6) |

% |

| Operating margin |

|

2.0 |

% |

|

9.6 |

% |

|

|

| Interest and debt expense |

|

8,141 |

|

|

9,169 |

|

|

(11.2) |

% |

|

|

|

|

|

|

|

| Investment (income) loss, net |

|

(429) |

|

|

(547) |

|

|

(21.6) |

% |

| Foreign currency exchange loss (gain), net |

|

449 |

|

|

752 |

|

|

(40.3) |

% |

| Other (income) expense, net |

|

263 |

|

|

1,757 |

|

|

(85.0) |

% |

| Income before income tax expense |

|

(3,493) |

|

|

14,306 |

|

|

NM |

| Income tax (benefit) expense |

|

(809) |

|

|

2,497 |

|

|

NM |

| Net income (loss) |

|

$ |

(2,684) |

|

|

$ |

11,809 |

|

|

NM |

|

|

|

|

|

|

|

| Average basic shares outstanding |

|

28,615 |

|

|

28,780 |

|

|

(0.6) |

% |

| Basic income (loss) per share |

|

$ |

(0.09) |

|

|

$ |

0.41 |

|

|

NM |

|

|

|

|

|

|

|

| Average diluted shares outstanding |

|

28,615 |

|

|

29,129 |

|

|

(1.8) |

% |

| Diluted income (loss) per share |

|

$ |

(0.09) |

|

|

$ |

0.41 |

|

|

NM |

|

|

|

|

|

|

|

| Dividends declared per common share |

|

$ |

0.14 |

|

|

$ |

0.14 |

|

|

|

Columbus McKinnon Reports Record Orders in Fiscal 2025

May 28, 2025

COLUMBUS McKINNON CORPORATION

Condensed Consolidated Balance Sheets - Unaudited

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

March 31, 2025 |

|

March 31, 2024 |

| ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and cash equivalents |

|

$ |

53,683 |

|

|

$ |

114,126 |

|

| Trade accounts receivable |

|

165,481 |

|

|

171,186 |

|

| Inventories |

|

198,598 |

|

|

186,091 |

|

| Prepaid expenses and other |

|

48,007 |

|

|

42,752 |

|

| Total current assets |

|

465,769 |

|

|

514,155 |

|

|

|

|

|

|

| Net property, plant, and equipment |

|

106,164 |

|

|

106,395 |

|

| Goodwill |

|

710,807 |

|

|

710,334 |

|

| Other intangibles, net |

|

356,562 |

|

|

385,634 |

|

| Marketable securities |

|

10,112 |

|

|

11,447 |

|

| Deferred taxes on income |

|

2,904 |

|

|

1,797 |

|

| Other assets |

|

86,470 |

|

|

96,183 |

|

| Total assets |

|

$ |

1,738,788 |

|

|

$ |

1,825,945 |

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

| Current liabilities: |

|

|

|

|

| Trade accounts payable |

|

$ |

93,273 |

|

|

$ |

83,118 |

|

| Accrued liabilities |

|

113,907 |

|

|

127,973 |

|

| Current portion of long-term debt and finance lease obligations |

|

50,739 |

|

|

50,670 |

|

| Total current liabilities |

|

257,919 |

|

|

261,761 |

|

|

|

|

|

|

| Term loan, AR securitization facility and finance lease obligations |

|

420,236 |

|

|

479,566 |

|

| Other non-current liabilities |

|

178,538 |

|

|

202,555 |

|

| Total liabilities |

|

856,693 |

|

|

943,882 |

|

|

|

|

|

|

| Shareholders’ equity: |

|

|

|

|

| Common stock |

|

286 |

|

|

288 |

|

| Treasury stock |

|

(11,000) |

|

|

(1,001) |

|

| Additional paid-in capital |

|

531,750 |

|

|

527,125 |

|

| Retained earnings |

|

382,160 |

|

|

395,328 |

|

| Accumulated other comprehensive loss |

|

(21,101) |

|

|

(39,677) |

|

| Total shareholders’ equity |

|

882,095 |

|

|

882,063 |

|

| Total liabilities and shareholders’ equity |

|

$ |

1,738,788 |

|

|

$ |

1,825,945 |

|

Columbus McKinnon Reports Record Orders in Fiscal 2025

May 28, 2025

COLUMBUS McKINNON CORPORATION

Condensed Consolidated Statements of Cash Flows - Unaudited

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year Ended |

| |

|

March 31, 2025 |

|

March 31, 2024 |

| Operating activities: |

|

|

|

|

| Net income (loss) |

|

$ |

(5,138) |

|

|

$ |

46,625 |

|

| Adjustments to reconcile net income to net cash provided by (used for) operating activities: |

|

|

|

|

| Depreciation and amortization |

|

48,187 |

|

|

45,945 |

|

| Deferred income taxes and related valuation allowance |

|

(20,256) |

|

|

(15,285) |

|

| Net loss (gain) on sale of real estate, investments and other |

|

(972) |

|

|

(1,431) |

|

| Stock-based compensation |

|

6,256 |

|

|

12,039 |

|

| Amortization of deferred financing costs |

|

2,487 |

|

|

2,349 |

|

| Loss (gain) on hedging instruments |

|

(382) |

|

|

(1,366) |

|

|

|

|

|

|

| Cost of debt repricing |

|

— |

|

|

958 |

|

| Impairment of operating lease |

|

3,911 |

|

|

— |

|

| Loss on disposals and impairments of fixed assets |

|

2,533 |

|

|

— |

|

| Non-cash pension settlement expense |

|

23,634 |

|

|

4,984 |

|

|

|

|

|

|

| Non-cash lease expense |

|

10,105 |

|

|

9,735 |

|

| Changes in operating assets and liabilities, net of effects of business acquisitions: |

|

|

|

|

| Trade accounts receivable |

|

4,482 |

|

|

(14,428) |

|

| Inventories |

|

(13,042) |

|

|

(1,314) |

|

| Prepaid expenses and other |

|

(20,998) |

|

|

(8,555) |

|

| Other assets |

|

3,498 |

|

|

537 |

|

| Trade accounts payable |

|

11,144 |

|

|

4,748 |

|

| Accrued liabilities |

|

(250) |

|

|

(9,583) |

|

| Non-current liabilities |

|

(9,587) |

|

|

(8,760) |

|

| Net cash provided by (used for) operating activities |

|

45,612 |

|

|

67,198 |

|

|

|

|

|

|

| Investing activities: |

|

|

|

|

| Proceeds from sales of marketable securities |

|

5,057 |

|

|

3,526 |

|

| Purchases of marketable securities |

|

(3,676) |

|

|

(4,076) |

|

| Capital expenditures |

|

(21,411) |

|

|

(24,813) |

|

|

|

|

|

|

|

|

|

|

|

| Purchases of businesses, net of cash acquired |

|

— |

|

|

(108,145) |

|

| Dividend received from equity method investment |

|

— |

|

|

144 |

|

| Proceeds from sale of fixed assets |

|

139 |

|

|

— |

|

| Net cash provided by (used for) investing activities |

|

(19,891) |

|

|

(133,364) |

|

|

|

|

|

|

| Financing activities: |

|

|

|

|

| Proceeds from issuance of common stock |

|

371 |

|

|

1,600 |

|

| Purchases of treasury stock |

|

(10,000) |

|

|

— |

|

|

|

|

|

|

| Fees paid for debt repricing |

|

(169) |

|

|

(958) |

|

| Repayment of debt |

|

(60,670) |

|

|

(60,604) |

|

| Payment to former owners of montratec |

|

(6,711) |

|

|

— |

|

| Proceeds from issuance of long-term debt |

|

— |

|

|

120,000 |

|

|

|

|

|

|

|

|

|

|

|

| Cash inflows from hedging activities |

|

23,608 |

|

|

24,057 |

|

| Cash outflows from hedging activities |

|

(23,134) |

|

|

(22,687) |

|

| Fees paid for borrowing on long-term debt |

|

— |

|

|

(2,859) |

|

| Payment of dividends |

|

(8,042) |

|

|

(8,044) |

|

| Other |

|

(2,000) |

|

|

(2,304) |

|

| Net cash provided by (used for) financing activities |

|

(86,747) |

|

|

48,201 |

|

|

|

|

|

|

| Effect of exchange rate changes on cash |

|

583 |

|

|

(1,085) |

|

|

|

|

|

|

| Net change in cash and cash equivalents |

|

(60,443) |

|

|

(19,050) |

|

| Cash, cash equivalents, and restricted cash at beginning of year |

|

114,376 |

|

|

133,426 |

|

| Cash, cash equivalents, and restricted cash at end of year |

|

$ |

53,933 |

|

|

$ |

114,376 |

|

Columbus McKinnon Reports Record Orders in Fiscal 2025

May 28, 2025

COLUMBUS McKINNON CORPORATION

Q4 FY 2025 Sales Bridge

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter |

|

Year |

| ($ in millions) |

|

$ Change |

|

% Change |

|

$ Change |

|

% Change |

Fiscal 2024 Net Sales |

|

$ |

265.5 |

|

|

|

|

$ |

1,013.5 |

|

|

|

| Acquisition |

|

— |

|

|

— |

% |

|

2.7 |

|

|

0.3 |

% |

| Volume |

|

(17.3) |

|

|

(6.5) |

% |

|

(60.2) |

|

|

(5.9) |

% |

| Pricing |

|

2.9 |

|

|

1.1 |

% |

|

12.5 |

|

|

1.2 |

% |

| Foreign currency translation |

|

(4.2) |

|

|

(1.6) |

% |

|

(5.5) |

|

|

(0.5) |

% |

Total change2 |

|

$ |

(18.6) |

|

|

(7.0) |

% |

|

$ |

(50.5) |

|

|

(5.0) |

% |

Fiscal 2025 Net Sales |

|

$ |

246.9 |

|

|

|

|

$ |

963.0 |

|

|

|

COLUMBUS McKINNON CORPORATION

Q4 FY 2025 Gross Profit Bridge

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in millions) |

Quarter |

|

Year |

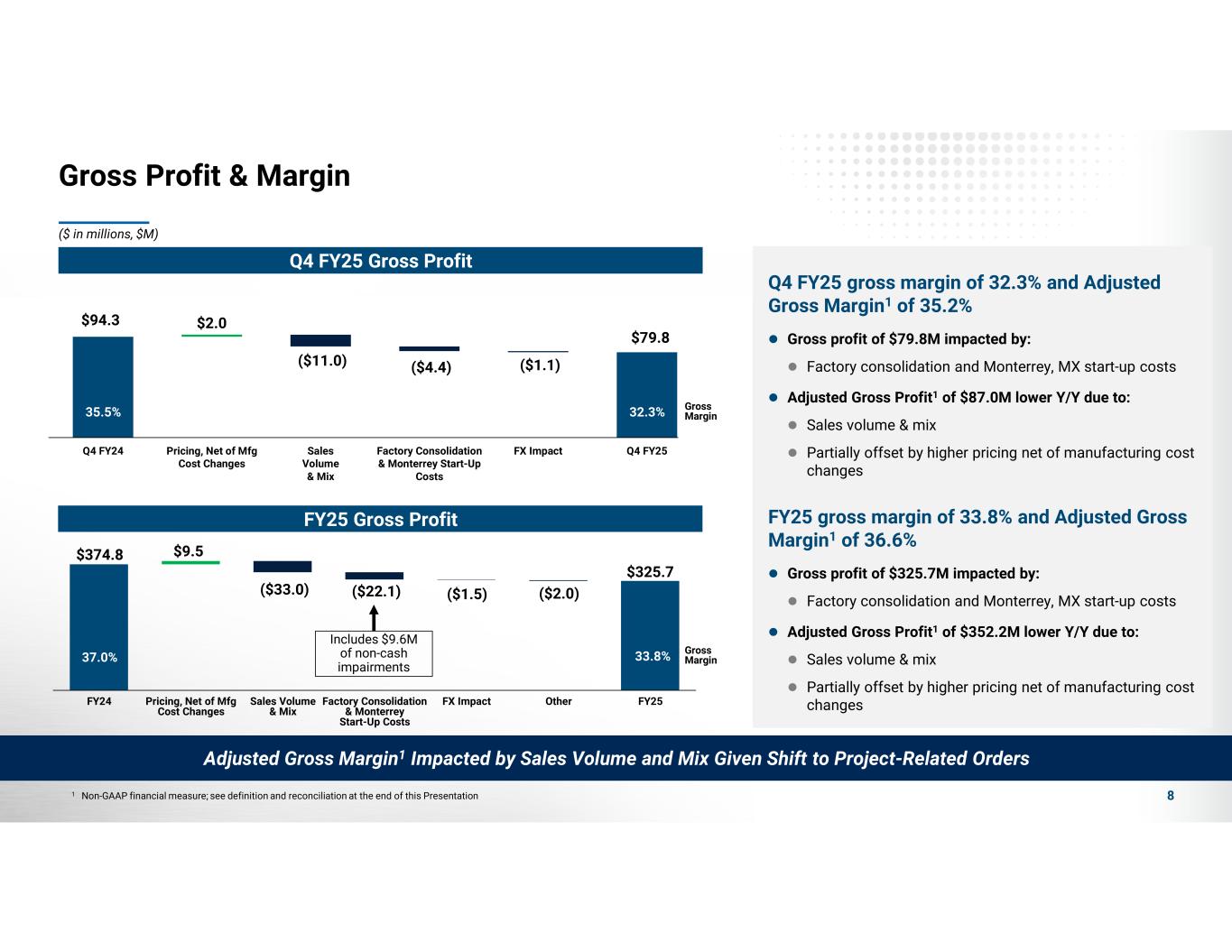

Fiscal 2024 Gross Profit |

$ |

94.3 |

|

|

$ |

374.8 |

|

| Acquisition |

— |

|

|

0.8 |

|

| Price, net of manufacturing cost changes (incl. inflation) |

2.0 |

|

|

9.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation |

(1.1) |

|

|

(1.5) |

|

|

|

|

|

| Monterrey, MX new factory start-up costs |

(0.5) |

|

|

(6.9) |

|

| Factory and warehouse consolidation costs |

(3.9) |

|

|

(15.2) |

|

| Sales volume & mix |

(11.0) |

|

|

(33.0) |

|

| Other |

— |

|

|

(0.8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Product liability1 |

— |

|

|

(2.0) |

|

|

|

|

|

Total change2 |

(14.5) |

|

|

(49.1) |

|

Fiscal 2025 Gross Profit |

$ |

79.8 |

|

|

$ |

325.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. Shipping Days by Quarter |

| |

|

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

Total |

| FY 26 |

|

63 |

|

63 |

|

62 |

|

61 |

|

249 |

|

|

|

|

|

|

|

|

|

|

|

| FY 25 |

|

64 |

|

63 |

|

62 |

|

62 |

|

251 |

|

|

|

|

|

|

|

|

|

|

|

| FY 24 |

|

63 |

|

62 |

|

61 |

|

62 |

|

248 |

______________________

1 Product liability represents a year-over-year difference between the current year adjustment increasing the Company's product liability reserve and the prior year's adjustment decreasing the Company's product liability reserve. For more details please see the Company's Annual Report on Form 10-K filed with the Securities and Exchange Commission.

2 Components may not add due to rounding.

Columbus McKinnon Reports Record Orders in Fiscal 2025

May 28, 2025

COLUMBUS McKINNON CORPORATION

Additional Data1

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period Ended |

| |

|

March 31, 2025 |

|

December 31, 2024 |

|

March 31, 2024 |

| ($ in millions) |

|

|

|

|

|

|

|

|

|

| Backlog |

|

$ |

322.5 |

|

|

|

$ |

296.5 |

|

|

|

$ |

280.8 |

|

|

| Long-term backlog |

|

|

|

|

|

|

|

|

|

| Expected to ship beyond 3 months |

|

$ |

190.3 |

|

|

|

$ |

166.1 |

|

|

|

$ |

144.6 |

|

|

| Long-term backlog as % of total backlog |

|

59.0 |

|

% |

|

56.0 |

|

% |

|

51.5 |

|

% |

|

|

|

|

|

|

|

|

|

|

| Debt to total capitalization percentage |

|

34.8 |

|

% |

|

35.8 |

|

% |

|

37.5 |

|

% |

|

|

|

|

|

|

|

|

|

|

| Debt, net of cash, to net total capitalization |

|

32.1 |

|

% |

|

33.8 |

|

% |

|

32.0 |

|

% |

|

|

|

|

|

|

|

|

|

|

Working capital as a % of sales 2 |

|

21.3 |

|

% |

|

23.7 |

|

% |

|

19.1 |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

| |

|

March 31, 2025 |

|

December 31, 2024 |

|

March 31, 2024 |

| ($ in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Trade accounts receivable |

|

|

|

|

|

|

|

|

|

| Days sales outstanding |

|

61.0 |

|

days |

|

61.0 |

|

days |

|

58.7 |

|

days |

|

|

|

|

|

|

|

|

|

|

| Inventory turns per year |

|

|

|

|

|

|

|

|

|

| (based on cost of products sold) |

|

3.4 |

|

turns |

|

3.0 |

|

turns |

|

3.7 |

|

turns |

| Days' inventory |

|

107.4 |

|

days |

|

121.7 |

|

days |

|

98.6 |

|

days |

|

|

|

|

|

|

|

|

|

|

| Trade accounts payable |

|

|

|

|

|

|

|

|

|

| Days payables outstanding |

|

54.9 |

|

days |

|

50.5 |

|

days |

|

50.9 |

|

days |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by (used for) operating activities |

|

$ |

35.6 |

|

|

|

$ |

11.4 |

|

|

|

$ |

38.6 |

|

|

| Capital expenditures |

|

$ |

6.1 |

|

|

|

$ |

5.2 |

|

|

|

$ |

8.5 |

|

|

Free Cash Flow 3 |

|

$ |

29.5 |

|

|

|

$ |

6.2 |

|

|

|

$ |

30.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

______________________

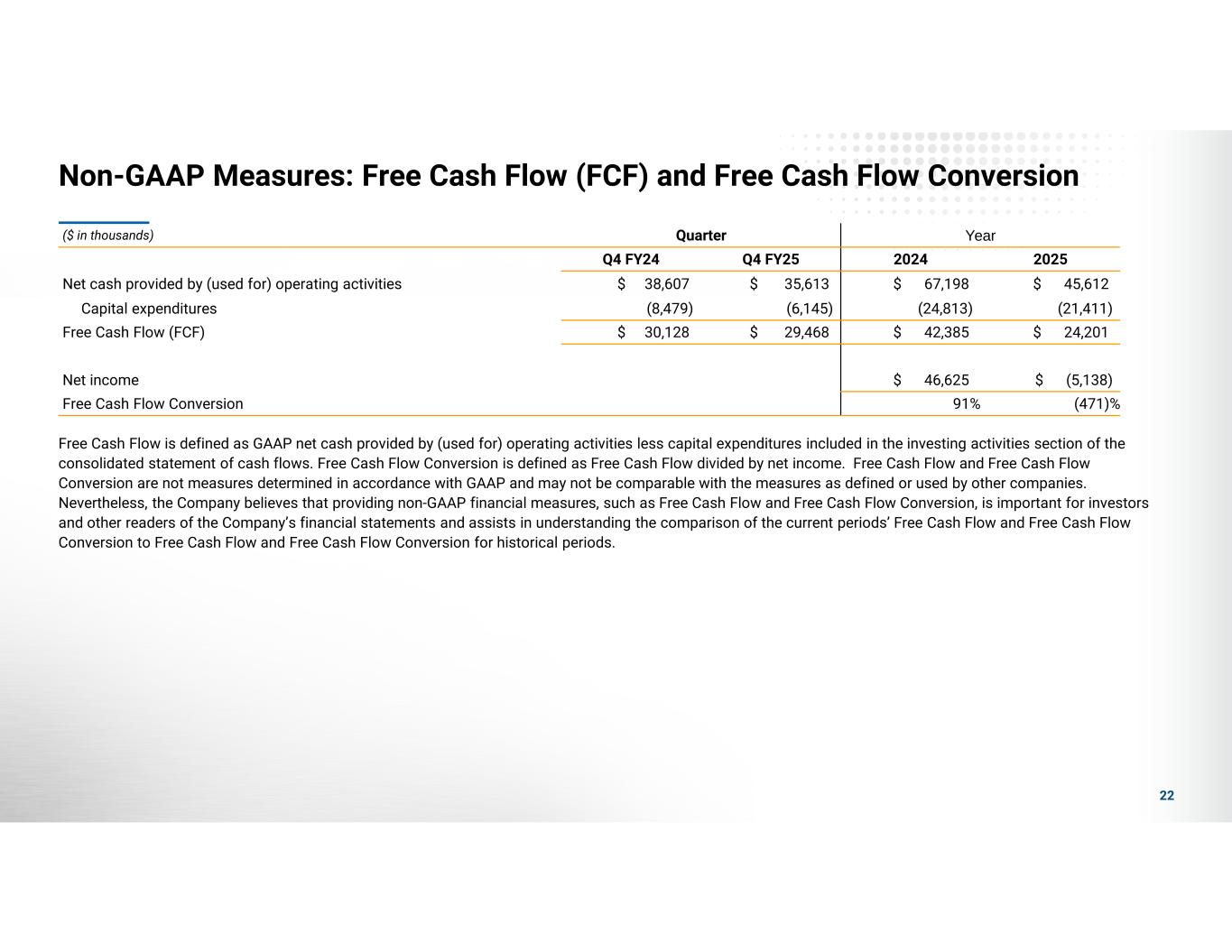

1 Additional Data: This data is provided to help investors understand financial and operational metrics that management uses to measure the Company’s financial performance and identify trends affecting the business. These measures may not be comparable with or defined in the same manner as other companies. Components may not add due to rounding.

2 March 31, 2024 figure excludes the impact of the acquisition of montratec.

3 Free Cash Flow is a non-GAAP financial measure. Free Cash Flow is defined as GAAP net cash provided by (used for) operating activities less capital expenditures included in the investing activities section of the consolidated statement of cash flows. See the table above for the calculation of Free Cash Flow.

Columbus McKinnon Reports Record Orders in Fiscal 2025

May 28, 2025

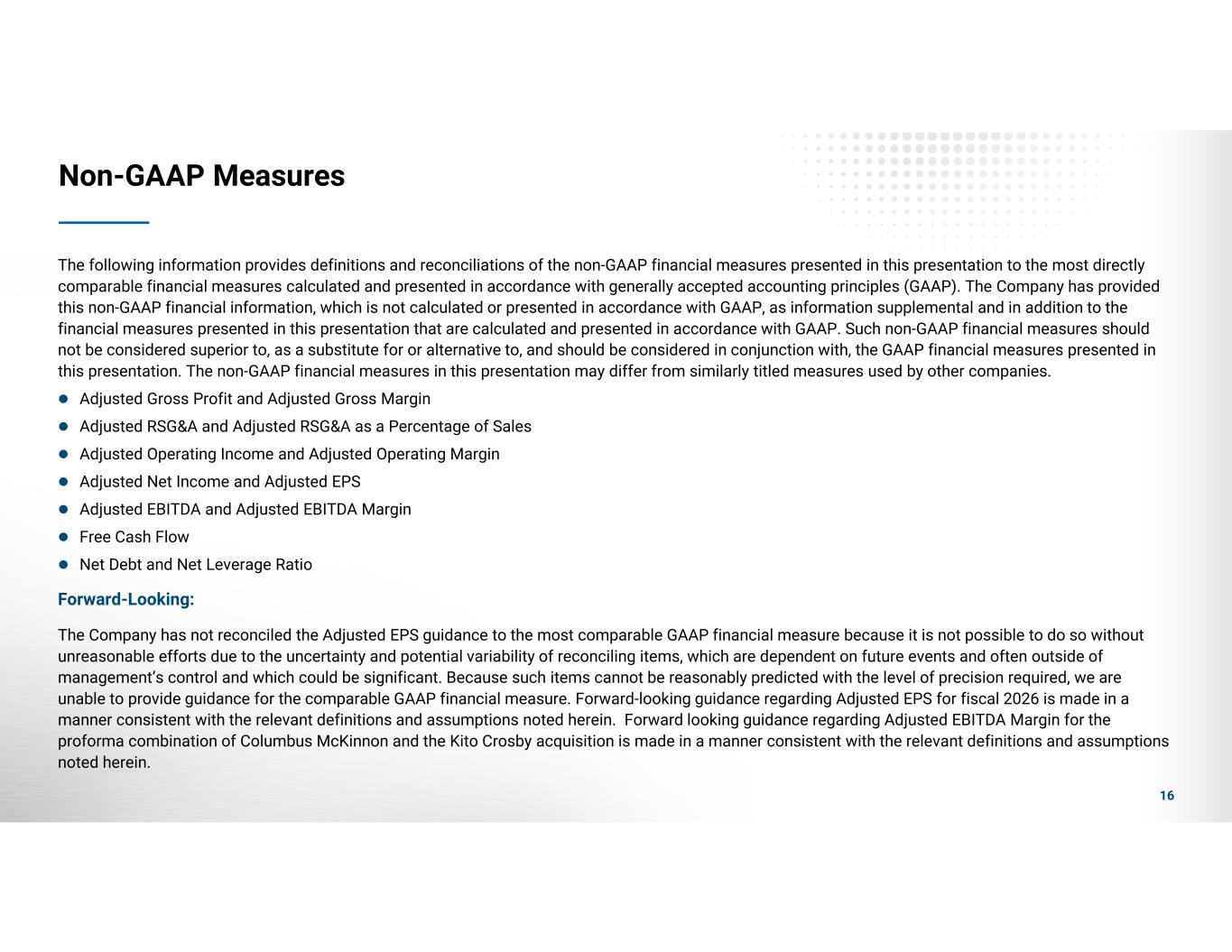

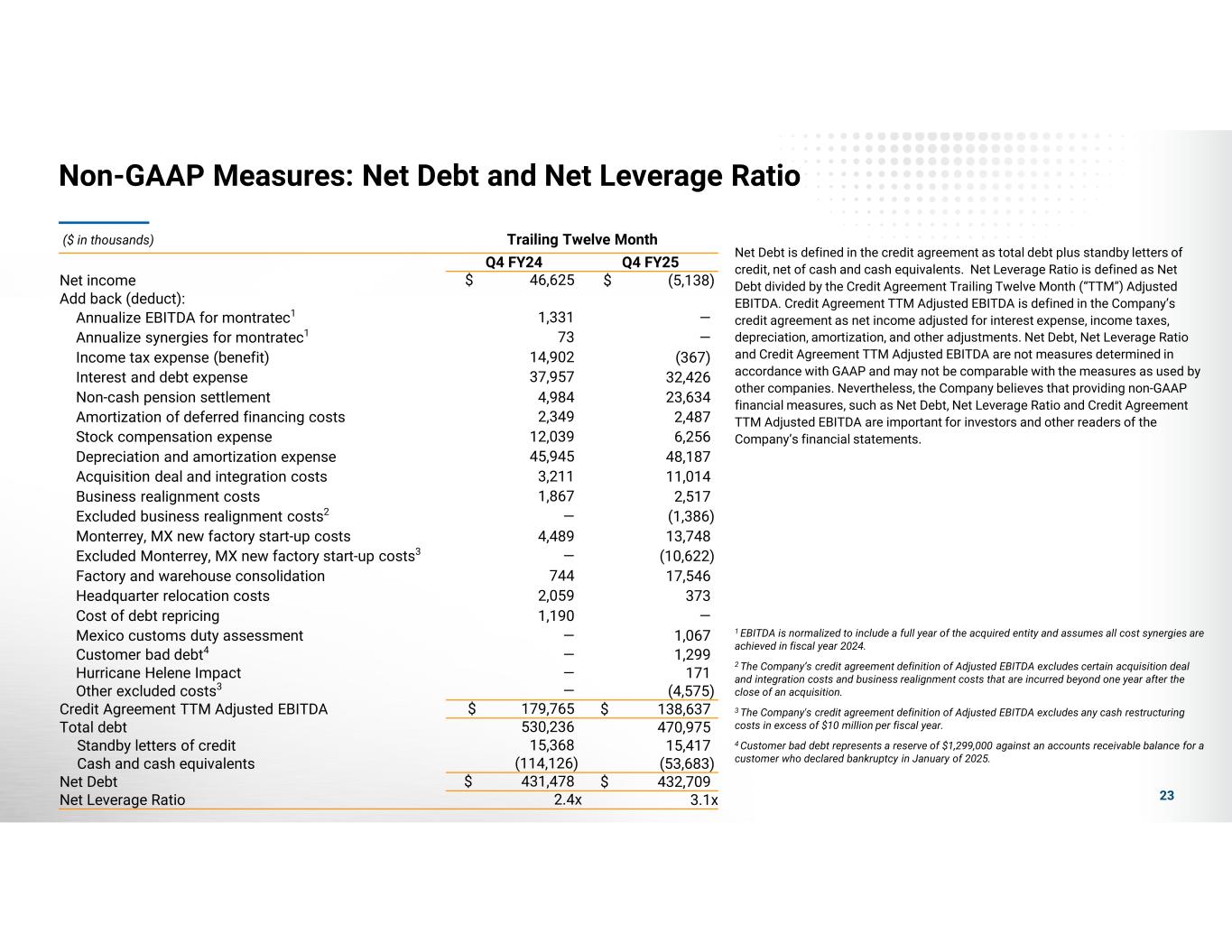

NON-GAAP FINANCIAL MEASURES

The following information provides definitions and reconciliations of the non-GAAP financial measures presented in this earnings release to the most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles (GAAP). The Company has provided this non-GAAP financial information, which is not calculated or presented in accordance with GAAP, as information supplemental and in addition to the financial measures presented in this earnings release that are calculated and presented in accordance with GAAP. Such non-GAAP financial measures should not be considered superior to, as a substitute for or alternative to, and should be considered in conjunction with, the GAAP financial measures presented in this earnings release. The non-GAAP financial measures in this earnings release may differ from similarly titled measures used by other companies.

COLUMBUS McKINNON CORPORATION

Reconciliation of Gross Profit to Adjusted Gross Profit

($ in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

Year Ended

March 31, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Gross profit |

$ |

79,810 |

|

|

$ |

94,315 |

|

|

$ |

325,680 |

|

|

$ |

374,838 |

|

| Add back (deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Business realignment costs |

— |

|

|

— |

|

|

994 |

|

|

346 |

|

| Hurricane Helene cost impact |

— |

|

|

— |

|

|

171 |

|

|

— |

|

| Factory and warehouse consolidation costs |

4,120 |

|

|

262 |

|

|

15,439 |

|

|

262 |

|

| Monterrey, MX new factory start-up costs |

3,058 |

|

|

2,552 |

|

|

9,906 |

|

|

2,987 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Gross Profit |

$ |

86,988 |

|

|

$ |

97,129 |

|

|

$ |

352,190 |

|

|

$ |

378,433 |

|

|

|

|

|

|

|

|

|

| Net sales |

$ |

246,889 |

|

|

$ |

265,504 |

|

|

$ |

963,027 |

|

|

$ |

1,013,540 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross margin |

32.3 |

% |

|

35.5 |

% |

|

33.8 |

% |

|

37.0 |

% |

| Adjusted Gross Margin |

35.2 |

% |

|

36.6 |

% |

|

36.6 |

% |

|

37.3 |

% |

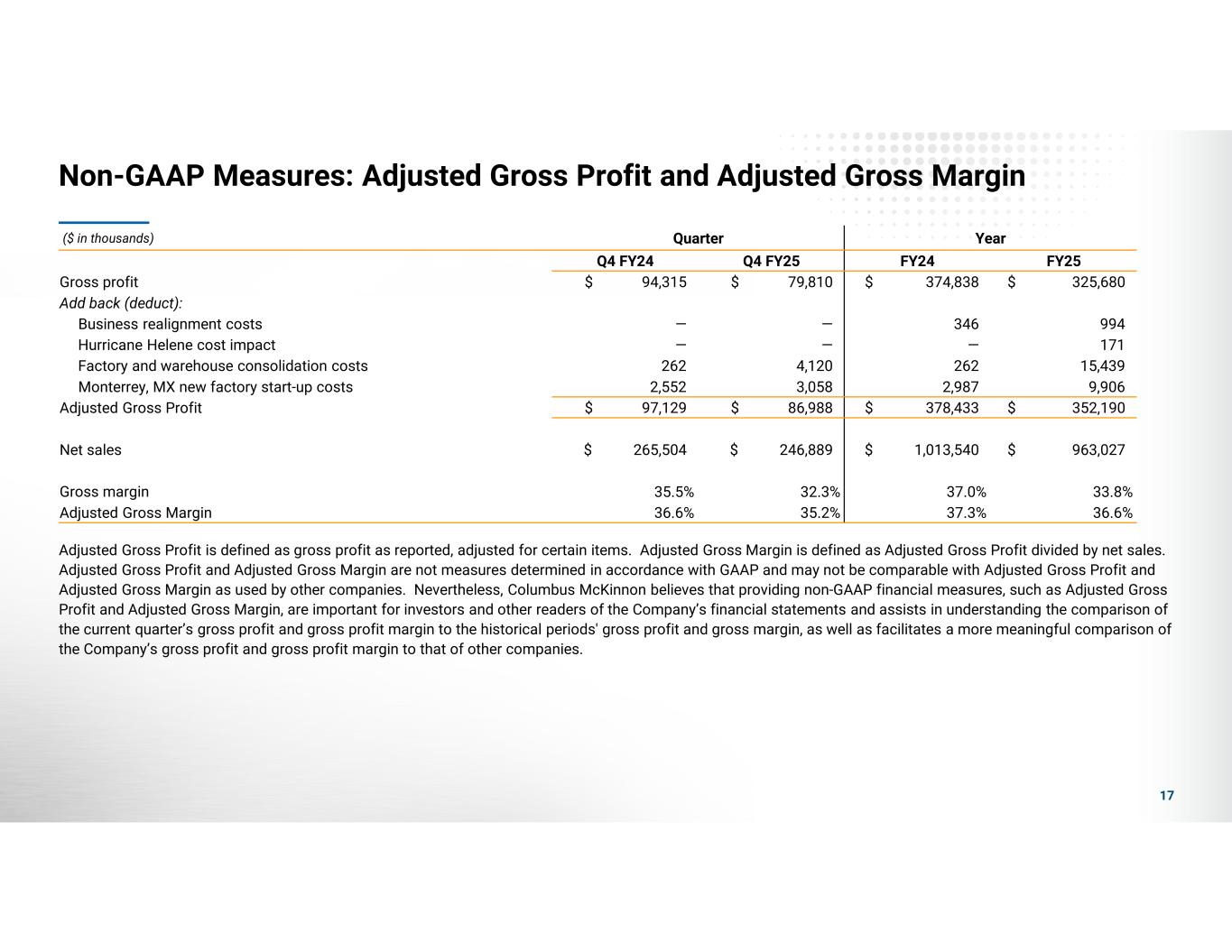

Adjusted Gross Profit is defined as gross profit as reported, adjusted for certain items. Adjusted Gross Margin is defined as Adjusted Gross Profit divided by net sales. Adjusted Gross Profit and Adjusted Gross Margin are not measures determined in accordance with GAAP and may not be comparable with Adjusted Gross Profit and Adjusted Gross Margin as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP financial measures, such as Adjusted Gross Profit and Adjusted Gross Margin, are important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year's gross profit and gross margin to the historical periods' gross profit, as well as facilitates a more meaningful comparison of the Company’s gross profit and gross margin to that of other companies.

Columbus McKinnon Reports Record Orders in Fiscal 2025

May 28, 2025

COLUMBUS McKINNON CORPORATION

Reconciliation of Income from Operations to Adjusted Operating Income

($ in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

Year Ended

March 31, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Income from operations |

$ |

4,931 |

|

|

$ |

25,437 |

|

|

$ |

54,573 |

|

|

$ |

107,148 |

|

| Add back (deduct): |

|

|

|

|

|

|

|

| Acquisition deal and integration costs |

11,014 |

|

|

3 |

|

|

11,014 |

|

|

3,211 |

|

|

|

|

|

|

|

|

|

| Business realignment costs |

399 |

|

|

— |

|

|

2,517 |

|

|

1,867 |

|

| Factory and warehouse consolidation costs |

4,989 |

|

|

545 |

|

|

17,546 |

|

|

744 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Headquarter relocation costs |

51 |

|

|

175 |

|

|

373 |

|

|

2,059 |

|

| Hurricane Helene cost impact |

— |

|

|

— |

|

|

171 |

|

|

— |

|

| Mexico customs duty assessment |

(433) |

|

|

— |

|

|

1,067 |

|

|

— |

|

Customer bad debt1 |

— |

|

|

— |

|

|

1,299 |

|

|

— |

|

| Monterrey, MX new factory start-up costs |

3,161 |

|

|

3,734 |

|

|

13,748 |

|

|

4,489 |

|

| Cost of debt repricing |

— |

|

|

1,190 |

|

|

— |

|

|

1,190 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Operating Income |

$ |

24,112 |

|

|

$ |

31,084 |

|

|

$ |

102,308 |

|

|

$ |

120,708 |

|

|

|

|

|

|

|

|

|

| Net sales |

$ |

246,889 |

|

|

$ |

265,504 |

|

|

$ |

963,027 |

|

|

$ |

1,013,540 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating margin |

2.0 |

% |

|

9.6 |

% |

|

5.7 |

% |

|

10.6 |

% |

| Adjusted Operating Margin |

9.8 |

% |

|

11.7 |

% |

|

10.6 |

% |

|

11.9 |

% |

1 Customer bad debt represents a reserve of $1,299,000 against an accounts receivable balance for a customer who declared bankruptcy in January of 2025.

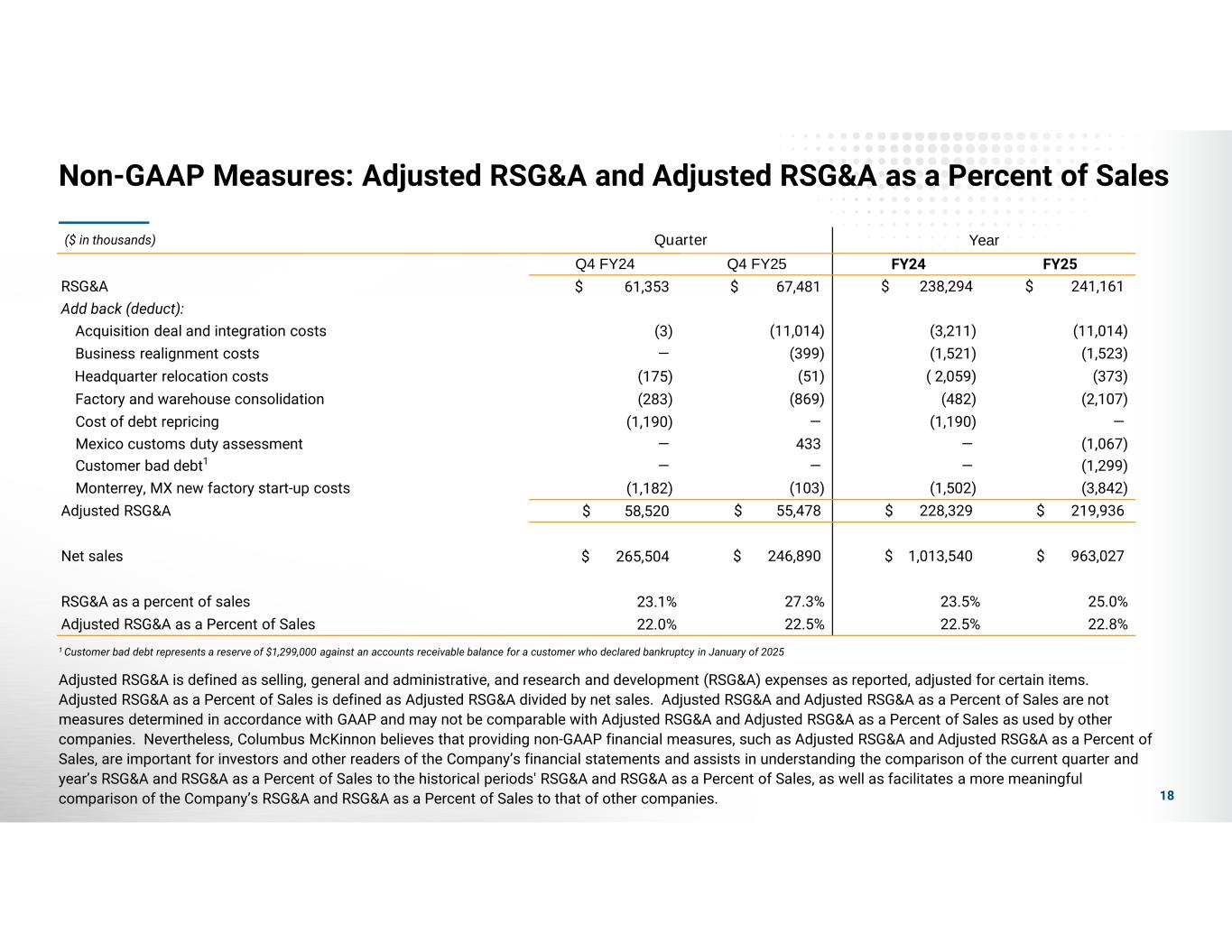

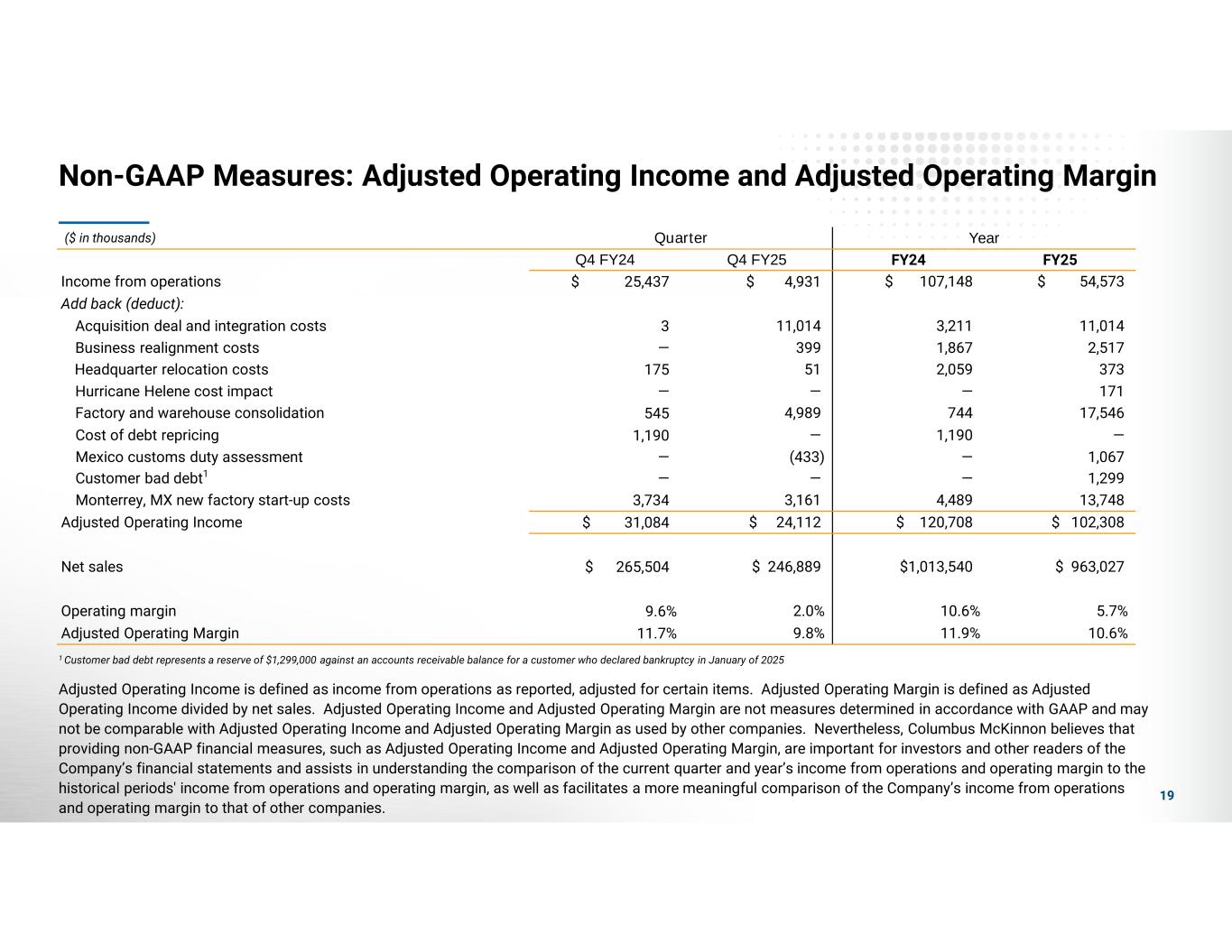

Adjusted Operating Income is defined as income from operations as reported, adjusted for certain items. Adjusted Operating Margin is defined as Adjusted Operating Income divided by net sales. Adjusted Operating Income and Adjusted Operating Margin are not measures determined in accordance with GAAP and may not be comparable with Adjusted Operating Income and Adjusted Operating Margin as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP financial measures, such as Adjusted Operating Income and Adjusted Operating Margin, are important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current quarter’s and current year's income from operations to the historical periods' income from operations and operating margin, as well as facilitates a more meaningful comparison of the Company’s income from operations and operating margin to that of other companies.

Columbus McKinnon Reports Record Orders in Fiscal 2025

May 28, 2025

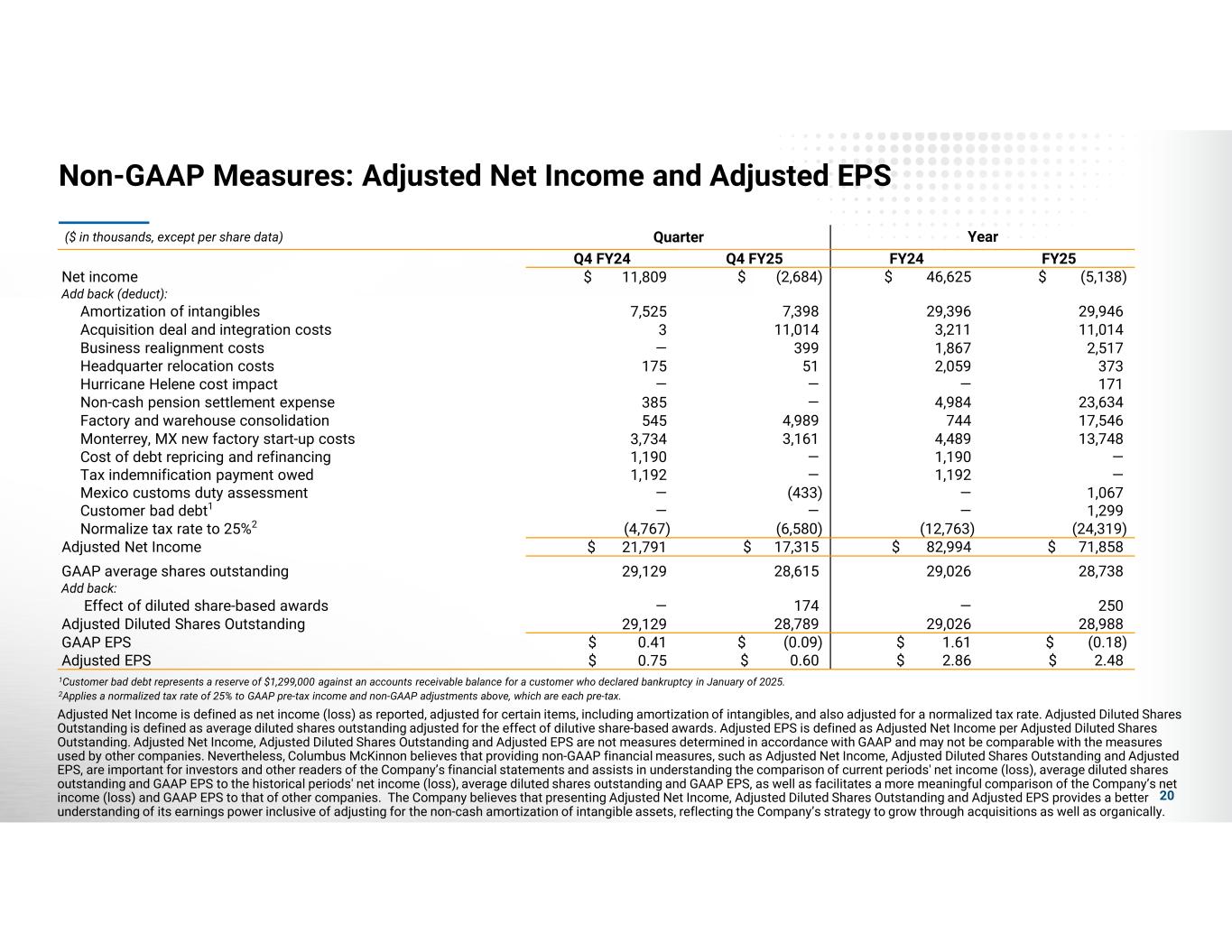

COLUMBUS McKINNON CORPORATION

Reconciliation of Net Income and Diluted Earnings per Share to

Adjusted Net Income and Adjusted Earnings per Diluted Share

($ in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

Year Ended

March 31, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net income (loss) |

$ |

(2,684) |

|

|

$ |

11,809 |

|

|

$ |

(5,138) |

|

|

$ |

46,625 |

|

| Add back (deduct): |

|

|

|

|

|

|

|

| Amortization of intangibles |

7,398 |

|

|

7,525 |

|

|

29,946 |

|

|

29,396 |

|

|

|

|

|

|

|

|

|

| Acquisition deal and integration costs |

11,014 |

|

|

3 |

|

|

11,014 |

|

|

3,211 |

|

|

|

|

|

|

|

|

|

| Business realignment costs |

399 |

|

|

— |

|

|

2,517 |

|

|

1,867 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Factory and warehouse consolidation costs |

4,989 |

|

|

545 |

|

|

17,546 |

|

|

744 |

|

|

|

|

|

|

|

|

|

| Headquarter relocation costs |

51 |

|

|

175 |

|

|

373 |

|

|

2,059 |

|

| Hurricane Helene cost impact |

— |

|

|

— |

|

|

171 |

|

|

— |

|

| Mexico customs duty assessment |

(433) |

|

|

— |

|

|

1,067 |

|

|

— |

|

Customer bad debt1 |

— |

|

|

— |

|

|

1,299 |

|

|

— |

|

| Monterrey, MX new factory start-up costs |

3,161 |

|

|

3,734 |

|

|

13,748 |

|

|

4,489 |

|

| Cost of debt repricing |

— |

|

|

1,190 |

|

|

— |

|

|

1,190 |

|

| Non-cash pension settlement expense |

— |

|

|

385 |

|

|

23,634 |

|

|

4,984 |

|

Tax indemnification payment owed2 |

— |

|

|

1,192 |

|

|

— |

|

|

1,192 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Normalize tax rate3 |

(6,580) |

|

|

(4,767) |

|

|

(24,319) |

|

|

(12,763) |

|

| Adjusted Net Income |

$ |

17,315 |

|

|

$ |

21,791 |

|

|

$ |

71,858 |

|

|

$ |

82,994 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP average diluted shares outstanding |

28,615 |

|

|

29,129 |

|

|

28,738 |

|

|

29,026 |

|

| Add back: |

|

|

|

|

|

|

|

| Effect of dilutive share-based awards |

174 |

|

|

— |

|

|

250 |

|

|

— |

|

| Adjusted Diluted Shares Outstanding |

28,789 |

|

|

29,129 |

|

|

28,988 |

|

|

29,026 |

|

|

|

|

|

|

|

|

|

| GAAP EPS |

$ |

(0.09) |

|

|

$ |

0.41 |

|

|

$ |

(0.18) |

|

|

$ |

1.61 |

|

|

|

|

|

|

|

|

|

| Adjusted EPS |

$ |

0.60 |

|

|

$ |

0.75 |

|

|

$ |

2.48 |

|

|

$ |

2.86 |

|

1 Customer bad debt represents a reserve of $1,299,000 against an accounts receivable balance for a customer who declared bankruptcy in January of 2025.

2 Represents tax indemnification payment owed to the former owner of STAHL for a tax refund received by the Company in the quarter ended March 31, 2024 for periods prior to the acquisition of STAHL by the Company.

3 Applies a normalized tax rate of 25% to GAAP pre-tax income and non-GAAP adjustments above, which are each pre-tax.

Adjusted Net Income and Adjusted EPS are defined as net income (loss) and GAAP EPS as reported, adjusted for certain items, including amortization of intangibles, and also adjusted for a normalized tax rate. Adjusted Diluted Shares Outstanding is defined as GAAP average diluted shares outstanding adjusted for the effect of dilutive share-based awards. Adjusted Net Income, Adjusted Diluted Shares Outstanding and Adjusted EPS are not measures determined in accordance with GAAP and may not be comparable with the measures used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP financial measures, such as Adjusted Net Income, Adjusted Diluted Shares Outstanding and Adjusted EPS, are important for investors and other readers of the Company’s financial statements and assists in understanding the comparison of the current periods’ net income (loss), average diluted shares outstanding and GAAP EPS to the historical periods' net income (loss), average diluted shares outstanding and GAAP EPS, as well as facilitates a more meaningful comparison of the Company’s net income (loss) and GAAP EPS to that of other companies. The Company believes that presenting Adjusted Net Income, Adjusted Diluted Shares Outstanding and Adjusted EPS provides a better understanding of its earnings power inclusive of adjusting for the non-cash amortization of intangible assets, reflecting the Company’s strategy to grow through acquisitions as well as organically.

Columbus McKinnon Reports Record Orders in Fiscal 2025

May 28, 2025

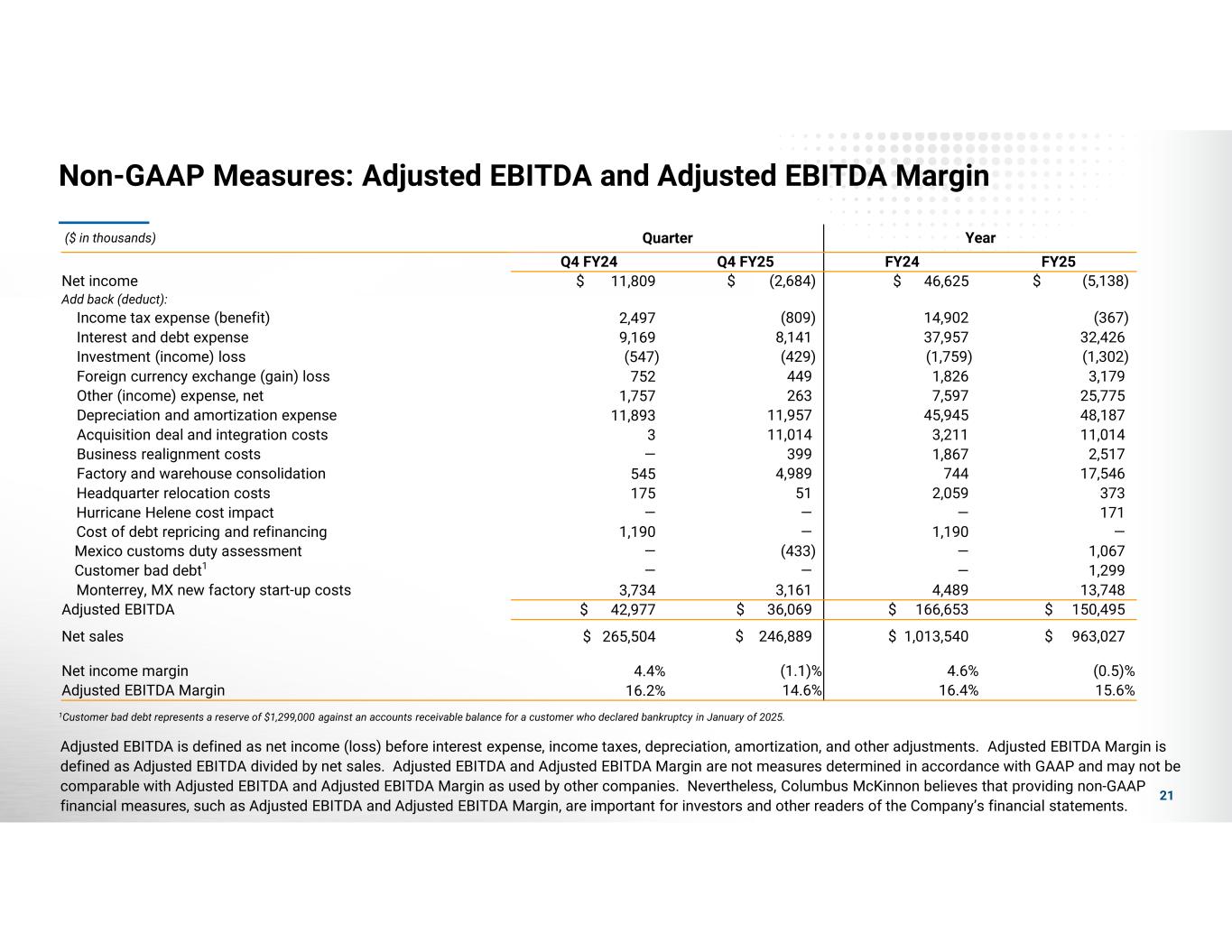

COLUMBUS McKINNON CORPORATION

Reconciliation of Net Income to Adjusted EBITDA

($ in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

Year Ended

March 31, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net income (loss) |

$ |

(2,684) |

|

|

$ |

11,809 |

|

|

$ |

(5,138) |

|

|

$ |

46,625 |

|

| Add back (deduct): |

|

|

|

|

|

|

|

| Income tax (benefit) expense |

(809) |

|

|

2,497 |

|

|

(367) |

|

|

14,902 |

|

| Interest and debt expense |

8,141 |

|

|

9,169 |

|

|

32,426 |

|

|

37,957 |

|

| Investment (income) loss, net |

(429) |

|

|

(547) |

|

|

(1,302) |

|

|

(1,759) |

|

| Foreign currency exchange loss (gain), net |

449 |

|

|

752 |

|

|

3,179 |

|

|

1,826 |

|

| Other (income) expense, net |

263 |

|

|

1,757 |

|

|

25,775 |

|

|

7,597 |

|

Depreciation and amortization expense |

11,957 |

|

|

11,893 |

|

|

48,187 |

|

|

45,945 |

|

|

|

|

|

|

|

|

|

| Acquisition deal and integration costs |

11,014 |

|

|

3 |

|

|

11,014 |

|

|

3,211 |

|

|

|

|

|

|

|

|

|

| Business realignment costs |

399 |

|

|

— |

|

|

2,517 |

|

|

1,867 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Factory and warehouse consolidation costs |

4,989 |

|

|

545 |

|

|

17,546 |

|

|

744 |

|

|

|

|

|

|

|

|

|

| Headquarter relocation costs |

51 |

|

|

175 |

|

|

373 |

|

|

2,059 |

|

| Hurricane Helene cost impact |

— |

|

|

— |

|

|

171 |

|

|

— |

|

| Mexico customs duty assessment |

(433) |

|

|

— |

|

|

1,067 |

|

|

— |

|

Customer bad debt1 |

— |

|

|

— |

|

|

1,299 |

|

|

— |

|

| Monterrey, MX new factory start-up costs |

3,161 |

|

|

3,734 |

|

|

13,748 |

|

|

4,489 |

|

| Cost of debt repricing |

— |

|

|

1,190 |

|

|

— |

|

|

1,190 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

$ |

36,069 |

|

|

$ |

42,977 |

|

|

$ |

150,495 |

|

|

$ |

166,653 |

|

|

|

|

|

|

|

|

|

| Net sales |

$ |

246,889 |

|

|

$ |

265,504 |

|

|

$ |

963,027 |

|

|

$ |

1,013,540 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income margin |

(1.1) |

% |

|

4.4 |

% |

|

(0.5) |

% |

|

4.6 |

% |

| Adjusted EBITDA Margin |

14.6 |

% |

|

16.2 |

% |

|

15.6 |

% |

|

16.4 |

% |

1 Customer bad debt represents a reserve of $1,299,000 against an accounts receivable balance for a customer who declared bankruptcy in January of 2025.

Adjusted EBITDA is defined as net income (loss) before interest expense, income taxes, depreciation, amortization, and other adjustments. Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by net sales. Adjusted EBITDA and Adjusted EBITDA Margin are not measures determined in accordance with GAAP and may not be comparable with Adjusted EBITDA and Adjusted EBITDA Margin as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP financial measures, such as Adjusted EBITDA and Adjusted EBITDA Margin, are important for investors and other readers of the Company’s financial statements.

EXHIBIT 99.1

EXHIBIT 99.1