Investor Presentation August 2025

Forward Looking Statement This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” and similar expressions are intended to identify forward-looking statements. All statements contained in this presentation that do not relate to matters of historical fact should be considered forward-looking statements, including statements regarding the significant market opportunity in both polyp and non-polyp CRS populations, whether the majority of patients with CRS are not served by current treatments, our evaluation and investigation of the ENLIGHTEN 2 results and how they inform our path forward, our planned regulatory interaction and path for LYR-210, our expectations on the need, size and timing for any pivotal trial for LYR-210, our ability to raise money to fund a pivotal trial for LYR-210, our ability to design, implement and complete a new Phase 3 trial, if necessary, our ability to be targeted in our go to market strategy, the expected label for LYR-210, our ability to correctly interpret FDA guidance received in December 2024 including on endpoints, inclusion criteria, patient population, background therapy, and assessments, whether LYR-210, if advanced, would be positioned to align with current ENT practices, and statements regarding the potential market opportunity for LYR-210. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause the Company's actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: the fact that the Company has incurred significant losses since inception and expects to incur additional losses for the foreseeable future; the Company's need for substantial additional funding, which may not be available, including funding to initiate and complete another Phase 3 trial for LYR-210 in CRSsNP, if necessary; the Company’s ability to continue as a going concern; the failure of our ENLIGHTEN 1 Phase 3 trial to meet its primary endpoint has made it more difficult for the Company to raise capital; our loss of personnel from a reduction in force in May 2024 following the failure of our ENLIGHTEN 1 Phase 3 trial to meet its primary endpoint significantly and adversely affects our operations; the Company’s limited operating history; the fact that the Company has no approved products; the fact that the Company’s product candidates are in various stages of development; the fact that clinical trial data is subject to change until the completion of the applicable clinical study report; the fact that the Company may not be successful in its efforts to identify and successfully commercialize its product candidates; the fact that clinical trials required for the Company’s product candidates are expensive and time-consuming, and their outcome is uncertain; the Company’s potential inability to obtain required regulatory approvals; effects of recently enacted and future legislation; the possibility of system failures or security breaches; effects of significant competition; the fact that the successful commercialization of the Company’s product candidates will depend in part on the extent to which governmental authorities and health insurers establish coverage, adequate reimbursement levels and pricing policies; failure to achieve market acceptance; product liability lawsuits; while we restarted the manufacturing of our product candidates internally, we may face delays and challenges in achieving our desired production level, especially with our limited staff; the fact that the Company must scale our in-house manufacturing capabilities for the manufacture of materials for its clinical trials and commercial supply; the Company's reliance on third parties to conduct its clinical trials; the Company's inability to succeed in establishing and maintaining collaborative relationships; the Company's reliance on certain suppliers critical to its production; failure to obtain and maintain or adequately protect the Company's intellectual property rights; failure to retain key personnel or to recruit qualified personnel; difficulties in managing the Company's growth; effects of natural disasters, terrorism, wars and global pandemics; the fact that the price of the Company's common stock may be volatile and fluctuate substantially; significant costs and required management time as a result of operating as a public company and any securities class action litigation. These and other important factors discussed under the caption "Risk Factors" in the Company's Quarterly Report on Form 10-Q filed with the SEC on August 12, 2025 and its other filings with the SEC could cause actual results to differ materially from those indicated by the forward-looking statements made in this presentation. Any such forward-looking statements represent management's estimates as of the date of this presentation. While the Company may elect to update such forward-looking statements at some point in the future, it disclaims any obligation to do so, even if subsequent events cause its views to change. This presentation also includes statistical and market data that we obtained from industry, publications and research, surveys and studies conducted by third parties or us. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. All of the market data used in this presentation involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. While we believe these industry publications and third-party research, surveys and studies are reliable, we have not independently verified such data. The industry in which we operate is subject to a high degree of uncertainty, change and risk due to a variety of factors, which could cause results to differ materially from those expressed in the estimates made by the independent partners and by us. Neither Lyra’s most advanced product candidate, LYR-210, nor its pipeline product candidate, LYR-220, have been approved by FDA. This presentation does not constitute an offer to sell or a solicitation of an offer to buy securities, nor shall there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

(1) Summary Health Statistics Tables for U.S. Adults: National Health Interview Survey, 2018, Tables A-2b, A-2c; (2) Baguley et al. Int Forum Allergy Rhinol, 2014;4(7):525-3 Company Overview Innovative, proprietary sinonasal drug implant Designed to deliver 6 months of continuous anti-inflammatory therapy (mometasone furoate) with a single administration Robust clinical data and safety package in over 500 CRS patients with and without nasal polyps treated across six clinical trials Multi-billion dollar market opportunity in both non-polyp and polyp patients with high unmet need CRS affects ~12% of the US population(1) with ~50% of patients failing medical therapy(2) CRS without Nasal Polyps (CRSsNP) – complex inflammatory condition that affects ~70% of CRS patients CRS with Nasal Polyps (CRSwNP) – characterized by presence of nasal polyps that affects ~30% of CRS patients Advancing lead program, LYR-210 to approval in both non-polyp and polyp patients ENLIGHTEN 2 Phase 3 trial met primary and key secondary endpoints Align with FDA on approval strategy for CRS without polyps Pooled nasal polyp data in the ENLIGHTEN program showed consistent improvement over sham control in multiple subjective and objective endpoints Broad pipeline expansion opportunities in CRS Robust patent portfolio with multiple lineages including one potentially extending coverage to 2042 Late-stage biotechnology company developing long-acting, bioabsorbable, anti-inflammatory sinonasal drug implants for the treatment of chronic rhinosinusitis (CRS)

Chronic Rhinosinusitis (CRS): An “Unrecognized Epidemic”(1) CRS Cardinal Symptoms(1) Nasal obstruction and congestion Facial pain and pressure Nasal discharge Reduced sense of smell (1) Tan BK et al. Am J Respir Crit Care Med, 2013;188(11):1275–7; (2) Jang et al. Otolaryngol Head Neck Surg, 2018; (3) Baguley et al. Int Forum Allergy Rhinol, 2014;4(7):525-32; (4) Caulley et al. J Allergy Clin Immunol. 2015;136(6):1517-1522; (5) Biomedical Insights Market Sizing Assessment 2020 CRS in the United States Annually ~8M ~4M ~$60B ~30% ~70% With Nasal Polyps(5) Without Nasal Polyps(5) CRS patients treated(2) CRS patients failing medical management(3) Annual healthcare expenditure(4) Significant market opportunity in both polyp and non-polyp CRS populations

Note: Clinical development for LYR-220 is currently paused. (1) Biomedical Insights Market Sizing Assessment 2020; (2) Jang et al. Otolaryngol Head Neck Surg, 2018; (3) Baguley et al. Int Forum Allergy Rhinol, 2014;4(7):525-32; (4) OM1 Real World Data Cloud (OM1, Inc, Boston, MA, US), 2015 – 4/2019. Analysis 9/2019 Annual Incidence of CRS in the U.S. Both polyp and non-polyp CRS includes ~4M eligible patients for Lyra products CRS patients treated(2) CRS patients failing medical management(3) ~2.4M ~420K ~1.2M (Eligible Population) CRS patients currently presenting to an ENT(4) CRS with Polyps (~30%)(1) ~5.6M ~2.8M (Eligible Population) ~980K CRS without Polyps (~70%)(1)

Despite the introduction of biologics for severe polyp patients, the CRS market remains highly underpenetrated with the vast majority of patients not served by current treatments CRS is a Large, Underserved Market (1) Sinuva approved 12/2017. Estimated patients based on Intersect 2022 guidance of <$10M in annual sales, assumes annual price of $2,500/patient; (2) Dupixent, market leader of antibody class, approved 6/2019. Assumes annual net price of $30,000 and 80% of antibody market share; (3) Xhance approved 9/2017. Lyra analysis based on Xhance CRSsNP revenue. Assumes net price per patient of $220/mo x 4 rx/patient/year; (4) 1/3 of 400K annual sinus surgeries are done on patients with polyps (Denneny et al. A Pathway to Value-Based Care of Chronic Rhinosinusitis Using a Claims Database, 2018); (5) Breakdown of Xhance between polyp and non-polyp patients is not available; (6) N. Campion et al. Prevalence and Symptom Burden of Nasal Polyps in a Large Austrian Population, July 12, 2021, Journal of Allergy and Clinical Immunology (AAAAI). ~2.8 Million Failed Non-Polyp Patients Market Size Medical Management ` Surgery ` Biologics for Polyps Only ` ~50% of patients fail topical medical management as a first-line therapy, due to sub-optimal delivery and poor compliance Xhance, a nasal spray, is not shown to have better clinical performance relative to inexpensive, over-the-counter steroid sprays Non-responders referred to sinus surgery, which does not treat the underlying cause and requires ongoing medical management 65% of surgical patients have recurring CRS, with 20% requiring revision surgery Given systemic exposure and high cost, reserved for the most severe cases (Grade 3-4 nasal polyps, which represent only 27.5% of patients(6)) and effective only in patients with Type 2 inflammation Despite this, Dupixent did >$1 billion in sales in CRSwNP in 2024 ~1.2 Million Failed Polyp Patients Non-Polyp Market Size Polyp Market Size 2.5M Other Non-Polyp Patients 270K FESS ?(5) Xhance Current Standard of Care & Key Limitations

Lyra’s Proprietary Drug-Eluting Implant Engineered Elastomeric Matrix Shape memory intended to keep implant in place Polymer-Drug Complex Designed to deliver 6 months of continuous, local drug therapy with a single placement Bioabsorbable Mesh Scaffold Designed to maximize surface area for drug release while maintaining underlying tissue function Larger dimension for patients with enlarged anatomy including those with previous full ethmoid sinus surgery ` ` Designed to be the New Standard of Care for CRS Product Family to Address Full Spectrum of CRS Patients Only product candidate designed to provide 6 months of CRS therapy with a single treatment FDA-approved steroid: Mometasone furoate Designed to provide continuous anti-inflammatory therapy Straightforward, office-based procedure with topical anesthesia Administered nasally via a single-use applicator Potential additional indication as a surgical adjunct to improve outcomes Smaller dimension for surgery naïve patients or those with previous surgery and narrow ethmoid cavity

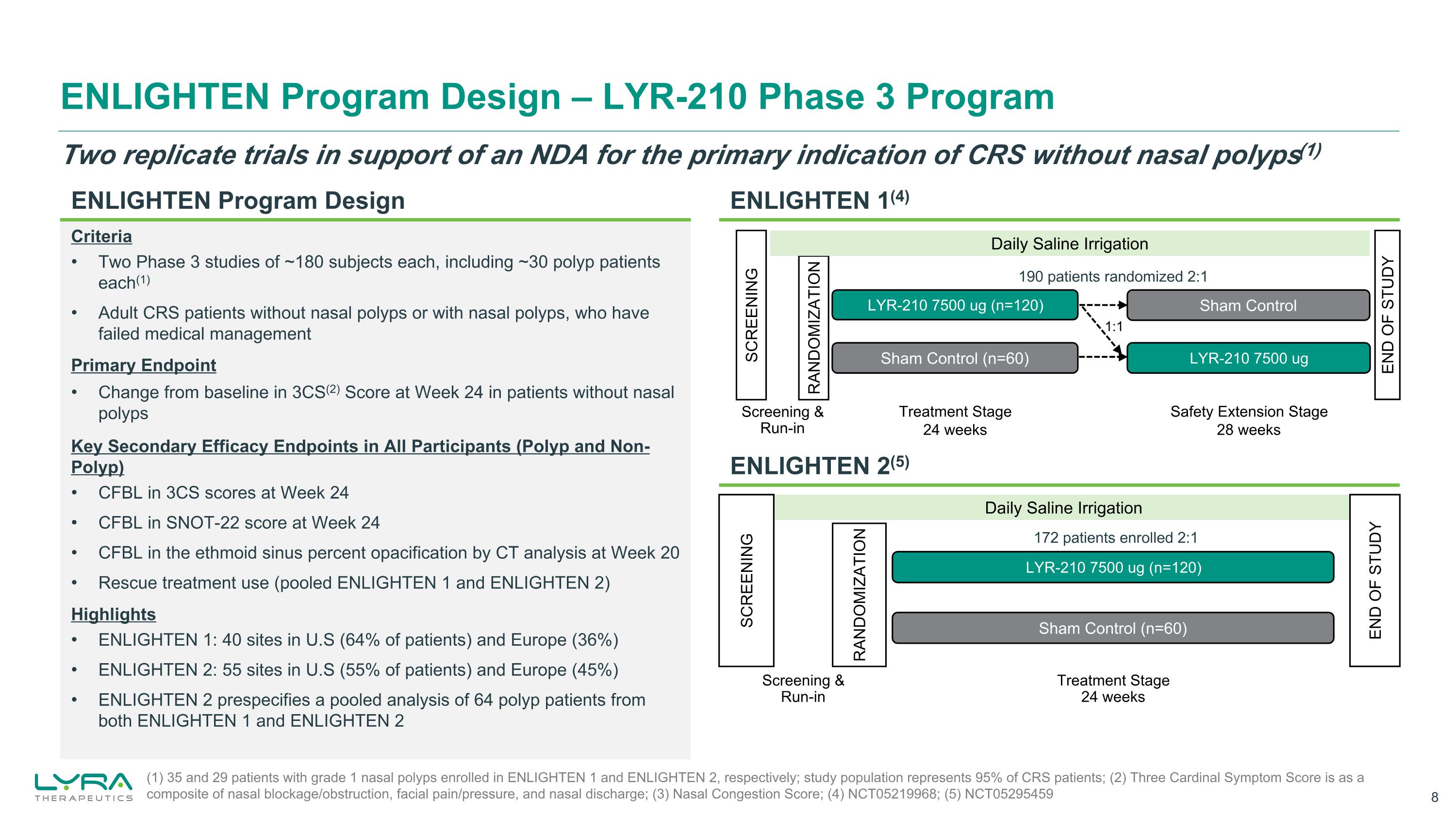

ENLIGHTEN Program Design – LYR-210 Phase 3 Program (1) 35 and 29 patients with grade 1 nasal polyps enrolled in ENLIGHTEN 1 and ENLIGHTEN 2, respectively; study population represents 95% of CRS patients; (2) Three Cardinal Symptom Score is as a composite of nasal blockage/obstruction, facial pain/pressure, and nasal discharge; (3) Nasal Congestion Score; (4) NCT05219968; (5) NCT05295459 ENLIGHTEN 2(5) ENLIGHTEN 1(4) Two replicate trials in support of an NDA for the primary indication of CRS without nasal polyps(1) Criteria Two Phase 3 studies of ~180 subjects each, including ~30 polyp patients each(1) Adult CRS patients without nasal polyps or with nasal polyps, who have failed medical management Primary Endpoint Change from baseline in 3CS(2) Score at Week 24 in patients without nasal polyps Key Secondary Efficacy Endpoints in All Participants (Polyp and Non-Polyp) CFBL in 3CS scores at Week 24 CFBL in SNOT-22 score at Week 24 CFBL in the ethmoid sinus percent opacification by CT analysis at Week 20 Rescue treatment use (pooled ENLIGHTEN 1 and ENLIGHTEN 2) Highlights ENLIGHTEN 1: 40 sites in U.S (64% of patients) and Europe (36%) ENLIGHTEN 2: 55 sites in U.S (55% of patients) and Europe (45%) ENLIGHTEN 2 prespecifies a pooled analysis of 64 polyp patients from both ENLIGHTEN 1 and ENLIGHTEN 2 Daily Saline Irrigation Sham Control (n=60) LYR-210 7500 ug (n=120) SCREENING RANDOMIZATION END OF STUDY Screening &Run-in 172 patients enrolled 2:1 Treatment Stage 24 weeks Sham Control Sham Control (n=60) LYR-210 7500 ug (n=120) LYR-210 7500 ug SCREENING RANDOMIZATION Treatment Stage 24 weeks Safety Extension Stage 28 weeks Screening &Run-in 1:1 190 patients randomized 2:1 Daily Saline Irrigation END OF STUDY ENLIGHTEN Program Design

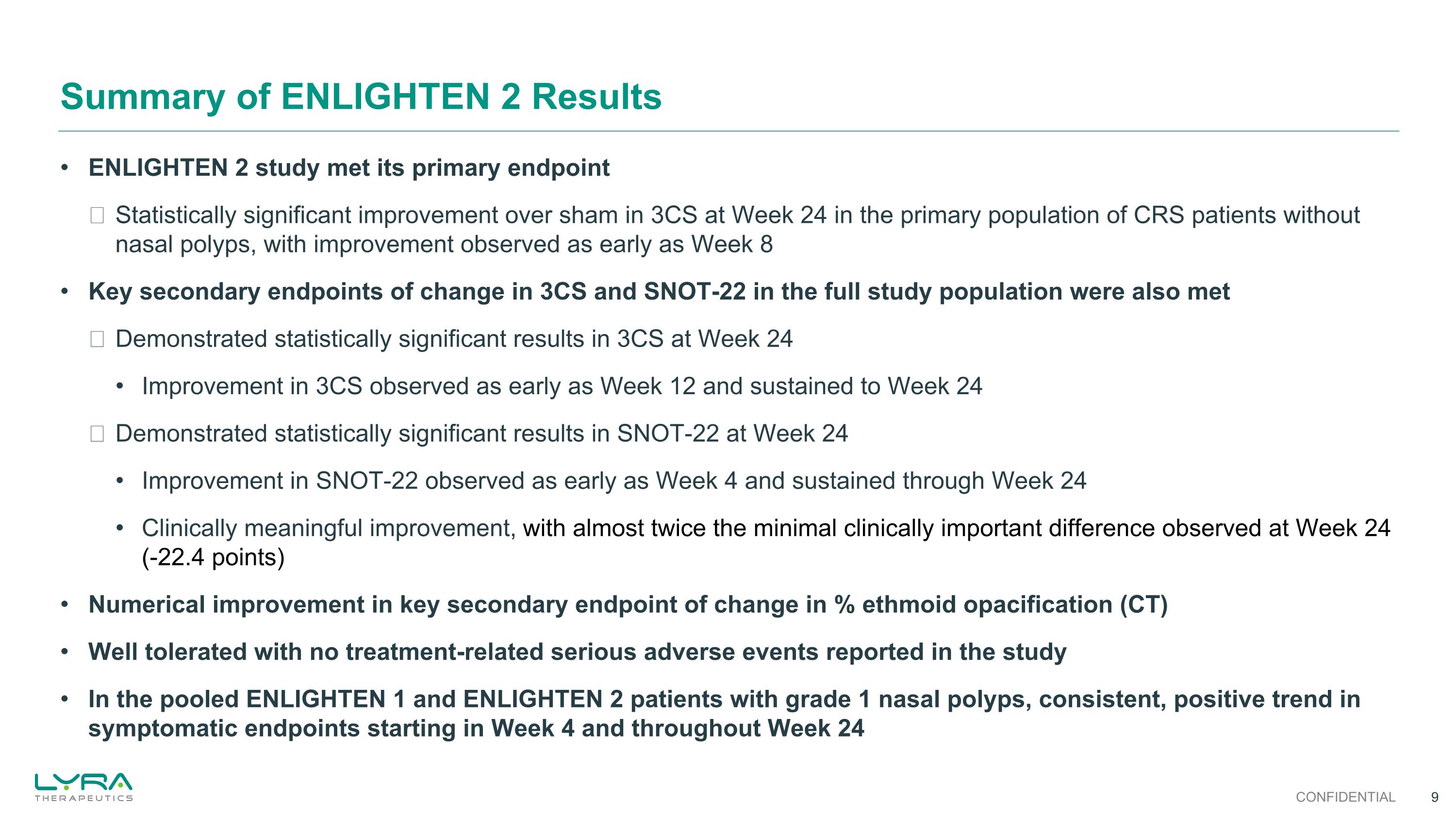

ENLIGHTEN 2 study met its primary endpoint Statistically significant improvement over sham in 3CS at Week 24 in the primary population of CRS patients without nasal polyps, with improvement observed as early as Week 8 Key secondary endpoints of change in 3CS and SNOT-22 in the full study population were also met Demonstrated statistically significant results in 3CS at Week 24 Improvement in 3CS observed as early as Week 12 and sustained to Week 24 Demonstrated statistically significant results in SNOT-22 at Week 24 Improvement in SNOT-22 observed as early as Week 4 and sustained through Week 24 Clinically meaningful improvement, with almost twice the minimal clinically important difference observed at Week 24 (-22.4 points) Numerical improvement in key secondary endpoint of change in % ethmoid opacification (CT) Well tolerated with no treatment-related serious adverse events reported in the study In the pooled ENLIGHTEN 1 and ENLIGHTEN 2 patients with grade 1 nasal polyps, consistent, positive trend in symptomatic endpoints starting in Week 4 and throughout Week 24 Summary of ENLIGHTEN 2 Results CONFIDENTIAL

ENLIGHTEN 2: Patient Demographics & Baseline Characteristics CONFIDENTIAL ITT Analysis Set LYR-210 (n=111) Sham (n=61) Age in years (mean, SD) 50 (15.5) 49 (12.99) Sex (n, %) Male Female 65 ( 58.6) 46 ( 41.4) 31 ( 50.8) 30 ( 49.2) Race (n, %) White Black or African American 94 ( 84.7) 9 ( 8.1) 51 ( 83.6) 5 ( 8.2) Region (n, %) North America European Union 63 ( 56.8) 48 ( 43.2) 31 ( 50.8) 30 ( 49.2) Baseline 3CS Score (mean, SD) 6.5 (1.29) 7.2 (1.37) Baseline SNOT-22 Score (mean, SD) 56.2 (17.38) 58.8 (22.21) Baseline % Ethmoid Opacification Volume (CT) (mean, SD) 45.3 (19.28) 45.7 (18.04)

ENLIGHTEN 2: Most Frequent Adverse Events (≥5% of patients) Safety Analysis Set (Preferred Term) LYR-210 (n=111) n (%) Sham (n=61) n (%) Any treatment-emergent adverse events (TEAEs) 67 (60.4%) 27 (44.3%) Epistaxis 18 (16.2%) 1 (1.6%) Upper respiratory tract infection 10 (9.0%) 5 (8.2%) Chronic sinusitis 8 (7.2%) 6 (9.8%) Acute sinusitis 9 (8.1%) 3 (4.9%) Nasopharyngitis 7 (6.3%) 4 (6.6%) COVID-19 5 (4.5%) 4 (6.6%) Headache 6 (5.4%) 3 (4.9%) Favorable safety profile with no product-related serious adverse events CONFIDENTIAL

ENLIGHTEN 2: Change from Baseline in 3CS at Week 24 (Primary Endpoint in Patients Without Nasal Polyps) Statistically significant improvement in 3CS at 24 weeks, with consistent improvement over sham control starting as early as Week 8 * Statistically significant 3CS – Non-Polyp Patients CONFIDENTIAL * Represents p-value < 0.05.

ENLIGHTEN 2: Change from Baseline in 3CS at Week 24 for Full Population (1st Key Secondary Endpoint)(1) Statistically significant improvement in 3CS at 24 weeks, with robust improvement over sham control starting at Week 12 (1) Key secondary endpoint population is the intent-to-treat (ITT) analysis set (patients with or without Nasal Polyps). 3CS – All Patients CONFIDENTIAL * Statistically significant * Represents p-value < 0.05.

ENLIGHTEN 2: Change from Baseline in SNOT-22 at Week 24(2nd Key Secondary Endpoint)(1) Statistically significant improvement in clinically-validated SNOT-22 score at 24 weeks, with robust improvement over sham control starting at Week 4 (1) Key secondary endpoint population is the intent-to-treat (ITT) analysis set (patients with or without Nasal Polyps). SNOT-22 – All Patients CONFIDENTIAL * Statistically significant * Represents p-value < 0.05.

-2.15 p=0.1809 ENLIGHTEN 2: Change in % Ethmoid Opacification at Week 20(3rd Key Secondary Endpoint)(1) N=172 Numerical improvement in % ethmoid opacification by CT (1) Key secondary endpoint population is the intent-to-treat (ITT) analysis set (patients with or without Nasal Polyps). % Ethmoid Opacification – All Patients CONFIDENTIAL

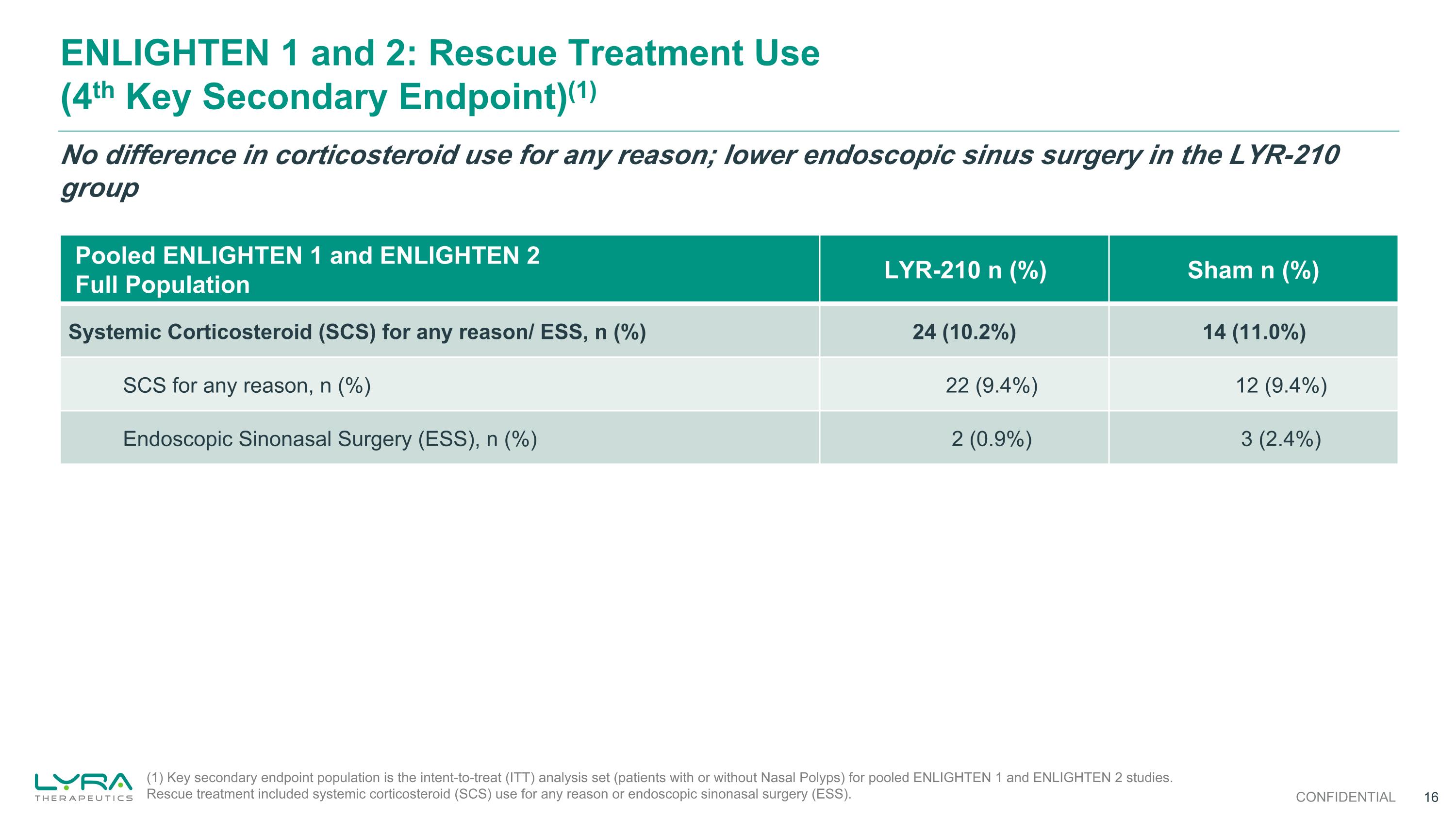

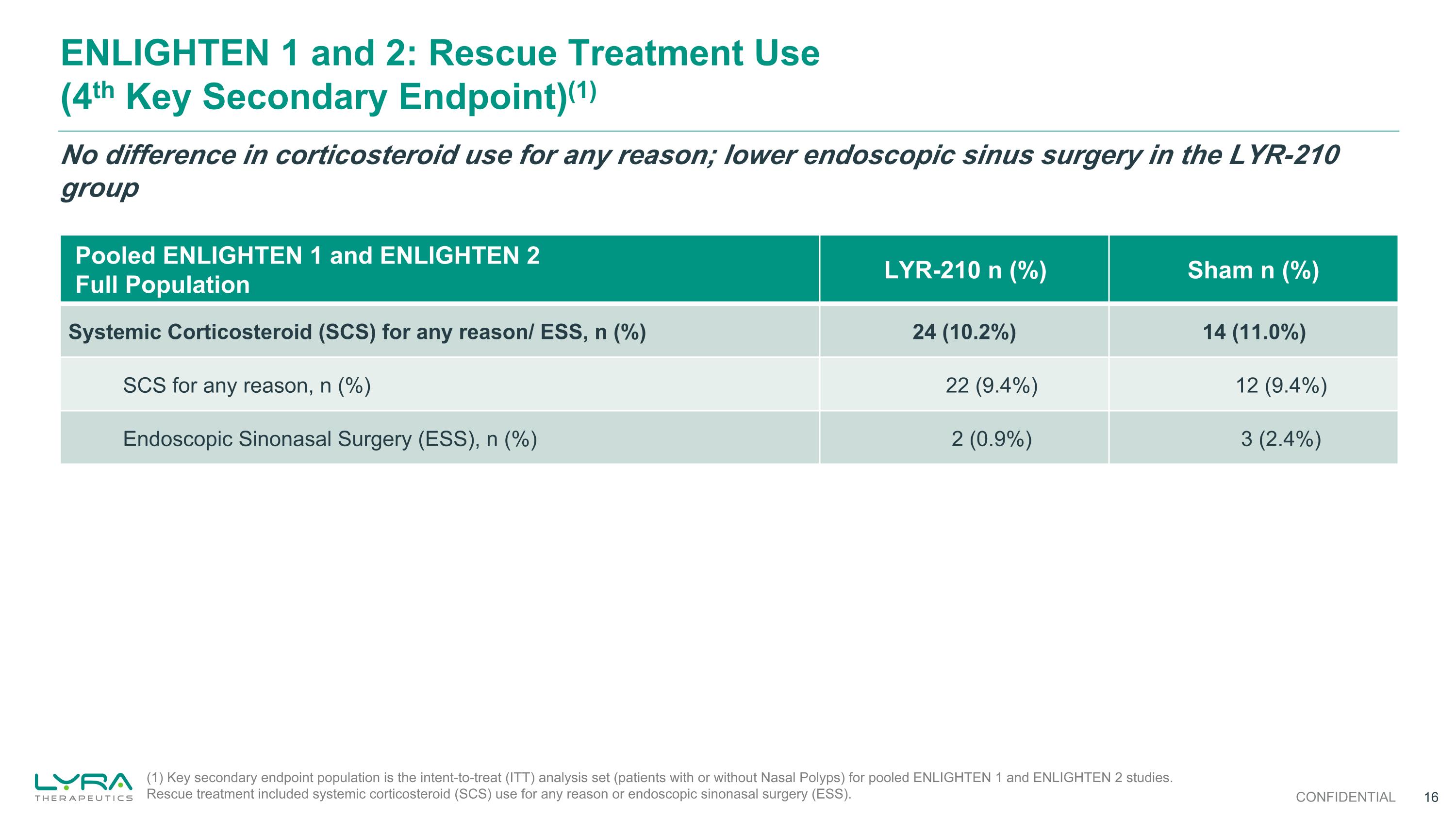

ENLIGHTEN 1 and 2: Rescue Treatment Use (4th Key Secondary Endpoint)(1) Pooled ENLIGHTEN 1 and ENLIGHTEN 2 Full Population LYR-210 n (%) Sham n (%) Systemic Corticosteroid (SCS) for any reason/ ESS, n (%) 24 (10.2%) 14 (11.0%) SCS for any reason, n (%) 22 (9.4%) 12 (9.4%) Endoscopic Sinonasal Surgery (ESS), n (%) 2 (0.9%) 3 (2.4%) No difference in corticosteroid use for any reason; lower endoscopic sinus surgery in the LYR-210 group (1) Key secondary endpoint population is the intent-to-treat (ITT) analysis set (patients with or without Nasal Polyps) for pooled ENLIGHTEN 1 and ENLIGHTEN 2 studies. Rescue treatment included systemic corticosteroid (SCS) use for any reason or endoscopic sinonasal surgery (ESS). CONFIDENTIAL

We intend to advocate for NDA submission based on totality of ENLIGHTEN data Next Steps Towards NDA Approval in CRS without Nasal Polyps If required, design additional Phase 3 trial Hold FDA meeting to align on strategy Complete CMC package at Waltham manufacturing facility

Pooled ENLIGHTEN 1 & 2 Data: CFBL in 3CS in European, Non-Polyp Patients with Ethmoid Opacification by CT >25% Demonstrates Robust Improvement (p = 0.0017) -2.48 p=0.0017* N=38 CONFIDENTIAL Potential “ENLIGHTEN 3” study, if required by FDA, would intend to target similar patient population with 1) >25% opacification by CT and 2) primarily European patients

Targeted Go-to-Market Strategy Specialist Physicians 1,800 ENTs manage ~80% of CRS volume(6) 1,800 10,000 ENTs Significant market opportunity with targeted focus on ENTs specializing in sinus procedures Highly Accessible Patients 1.4M failed CRS patients actively seek care from ENT annually(5) 4MFailed Patients 1.4M CRS patients treated(2) CRS patients failing medical management(3) CRS patients currently presenting to an ENT(4) ~5.6M ~2.8M (Eligible Population) ~980K CRS without Polyps (~70%)(1) ~2.4M ~420K ~1.2M (Eligible Population) CRS with Polyps (~30%)(1) Targeted Patient and Physician Base ~4M of Eligible Polyp and Non-Polyp Patients Annual Incidence of CRS in the U.S. Note: Clinical development for LYR-220 is currently paused. (1) Biomedical Insights Market Sizing Assessment 2020; (2) Jang et al. Otolaryngol Head Neck Surg, 2018; (3) Baguley et al. Int Forum Allergy Rhinol, 2014;4(7):525-32; (4) OM1 Real World Data Cloud (OM1, Inc, Boston, MA, US), 2015 – 4/2019. Analysis 9/2019; (5) OM1 Real World Data Cloud (OM1, Inc, Boston, MA, US), 2015 – 4/2019. Analysis 9/2019; (6) IQVIA In-Office Medical Claims Data, June 2021.

Key Milestones May 2024: Data readout from ENLIGHTEN 1 Q4 2024: Extension study data from ENLIGHTEN 1 2H 2024: Complete enrollment in ENLIGHTEN 2 2Q 2025: Data readout from ENLIGHTEN 2 Est. 2H 2025: FDA meeting to align on strategy for CRS without Nasal Polyps