Second Quarter 2025Corporate Update August 7, 2025

Forward-Looking Statements This presentation contains forward-looking statements, including statements about the continued execution of PureCycle’s business plan, the expected results of tests and trials, the expected timing of commercial sales, and planned future updates. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements generally relate to future events or PureCycle’s future financial or operating performance and may refer to projections and forecasts. Forward-looking statements are often identified by future or conditional words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such words or expressions), but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements are based on the current expectations of PureCycle’s management and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of this presentation. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section entitled “Risk Factors” in each of PureCycle’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and PureCycle’s Quarterly Reports on Form 10-Q for various quarterly periods, those discussed and identified in other public filings made with the Securities and Exchange Commission by PureCycle and the following: PCT's ability to obtain funding for its operations and future growth and to continue as a going concern; PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT’s PureFive™ resin in food grade applications (including in the United States, Europe, Asia and other future international locations); PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the PureFive™ resin and PCT’s facilities (including in the United States, Europe, Asia and other future international locations); expectations and changes regarding PCT’s strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT’s ability to invest in growth initiatives, which could be impacted by significant changes to tariffs on foreign imports; the ability of PCT’s first commercial-scale recycling facility in Lawrence County, Ohio, the Ironton Facility, to be appropriately certified by Leidos, following certain performance and other tests, and commence full-scale commercial operations in a timely and cost-effective manner, or at all; PCT’s ability to meet, and to continue to meet, the requirements imposed upon it and its subsidiaries by the funding for its operations, including the funding for the Ironton Facility; PCT’s ability to minimize or eliminate the many hazards and operational risks at its manufacturing facilities that can result in potential injury to individuals, disrupt its business (including interruptions or disruptions in operations at its facilities), and subject PCT to liability and increased costs; PCT’s ability to complete the necessary funding with respect to, and complete the construction of its new polypropylene recycling facility in Thailand, its first commercial-scale European plant located in Antwerp, Belgium, and the multi-line purification facility to be built in Augusta, Georgia in a timely and cost-effective manner; PCT's ability to execute its growth plan to bring an additional one billion pounds of installed polypropylene recycling capability online before 2030, including its ability to meet related construction, regulatory, and financing requirements; PCT’s ability to procure, sort and process polypropylene plastic waste at its planned plastic waste prep facilities; PCT’s ability to maintain exclusivity under The Procter & Gamble Company license; the implementation, market acceptance and success of PCT’s business model and growth strategy; the success or profitability of PCT’s offtake arrangements; the potential impact of economic, business, and/or competitive factors, including interest rates, availability of capital, economic cycles, and other macro-economic impacts (such as tariffs); changes in the prices and availability of materials (such as steel and other materials needed for the construction of future PreP and purification facilities), including those changes caused by inflation, tariffs and supply chain conditions, such as increased transportation costs, and our ability to obtain such materials in a timely and cost-effective manner; the ability to source feedstock with a high polypropylene content at a reasonable cost; PCT’s future capital requirements and sources and uses of cash; developments and projections relating to PCT’s competitors and industry; the outcome of any legal or regulatory proceedings to which PCT is, or may become, a party including the securities class action and putative class action cases; geopolitical risk and changes in applicable laws or regulations; the possibility that PCT may be adversely affected by other economic, business, and/or competitive factors, including interest rates, availability of capital, economic cycles, and other macro-economic impacts; turnover in employees and increases in employee-related costs; changes in the prices and availability of labor (including labor shortages); any business disruptions due to political or economic instability, pandemics, armed hostilities (including the ongoing conflict between Russia and Ukraine and the conflict in the Middle East); the potential impact of climate change on PCT, including physical and transition risks, higher regulatory and compliance costs, reputational risks, and availability of capital on attractive terms; and operational risk. PCT undertakes no obligation to update any forward-looking statements made in this presentation to reflect events or circumstances after the date of this presentation or to reflect new information or the occurrence of unanticipated events, except as required by law. Should one or more of these risks or uncertainties materialize or should any of the assumptions made prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events

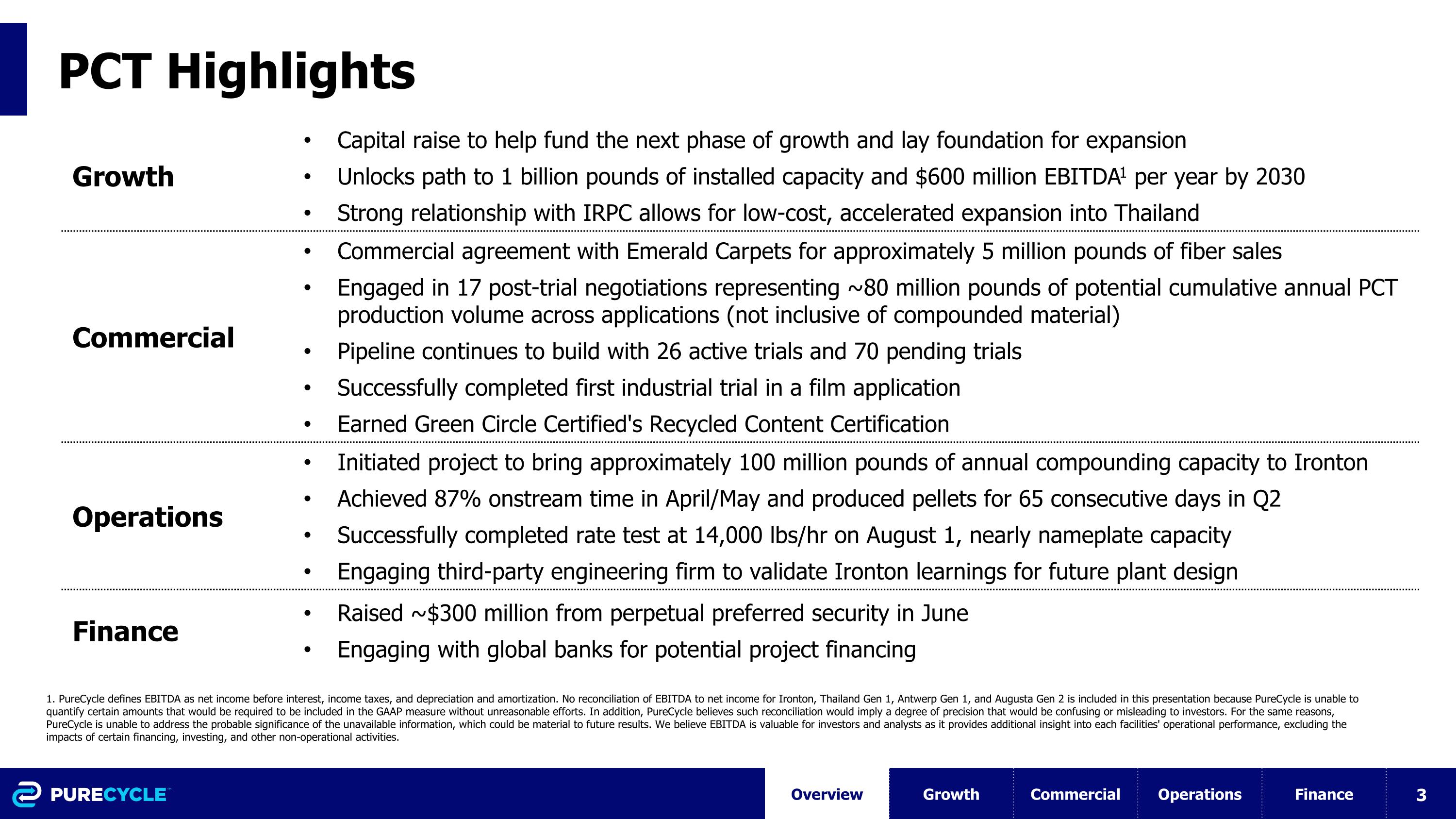

PCT Highlights Growth Capital raise to help fund the next phase of growth and lay foundation for expansion Unlocks path to 1 billion pounds of installed capacity and $600 million EBITDA1 per year by 2030 Strong relationship with IRPC allows for low-cost, accelerated expansion into Thailand Commercial Commercial agreement with Emerald Carpets for approximately 5 million pounds of fiber sales Engaged in 17 post-trial negotiations representing ~80 million pounds of potential cumulative annual PCT production volume across applications (not inclusive of compounded material) Pipeline continues to build with 26 active trials and 70 pending trials Successfully completed first industrial trial in a film application Earned Green Circle Certified's Recycled Content Certification Operations Initiated project to bring approximately 100 million pounds of annual compounding capacity to Ironton Achieved 87% onstream time in April/May and produced pellets for 65 consecutive days in Q2 Successfully completed rate test at 14,000 lbs/hr on August 1, nearly nameplate capacity Engaging third-party engineering firm to validate Ironton learnings for future plant design Finance Raised ~$300 million from perpetual preferred security in June Engaging with global banks for potential project financing Overview Growth Commercial Operations Finance 1. PureCycle defines EBITDA as net income before interest, income taxes, and depreciation and amortization. No reconciliation of EBITDA to net income for Ironton, Thailand Gen 1, Antwerp Gen 1, and Augusta Gen 2 is included in this presentation because PureCycle is unable to quantify certain amounts that would be required to be included in the GAAP measure without unreasonable efforts. In addition, PureCycle believes such reconciliation would imply a degree of precision that would be confusing or misleading to investors. For the same reasons, PureCycle is unable to address the probable significance of the unavailable information, which could be material to future results. We believe EBITDA is valuable for investors and analysts as it provides additional insight into each facilities' operational performance, excluding the impacts of certain financing, investing, and other non-operational activities.

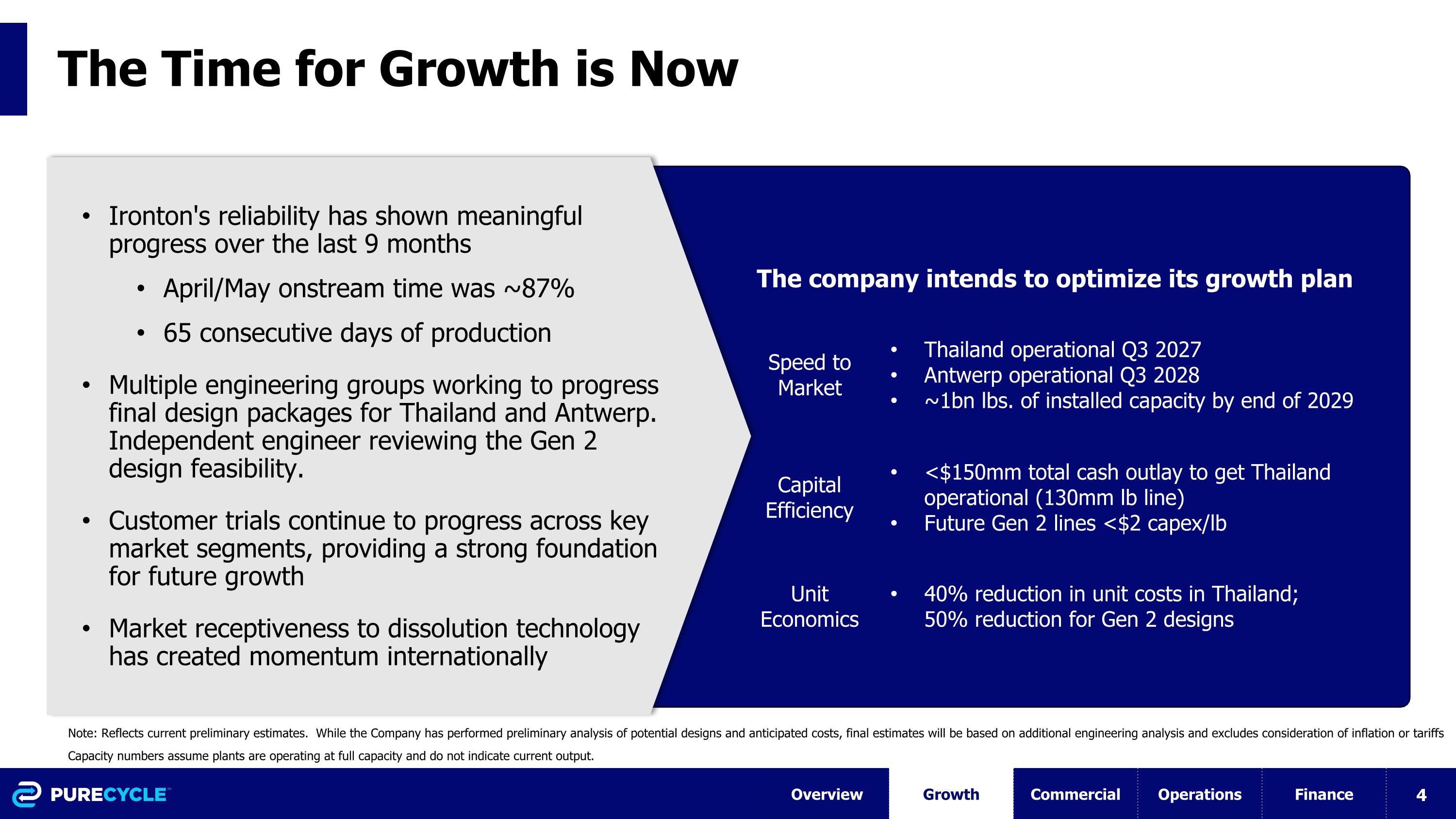

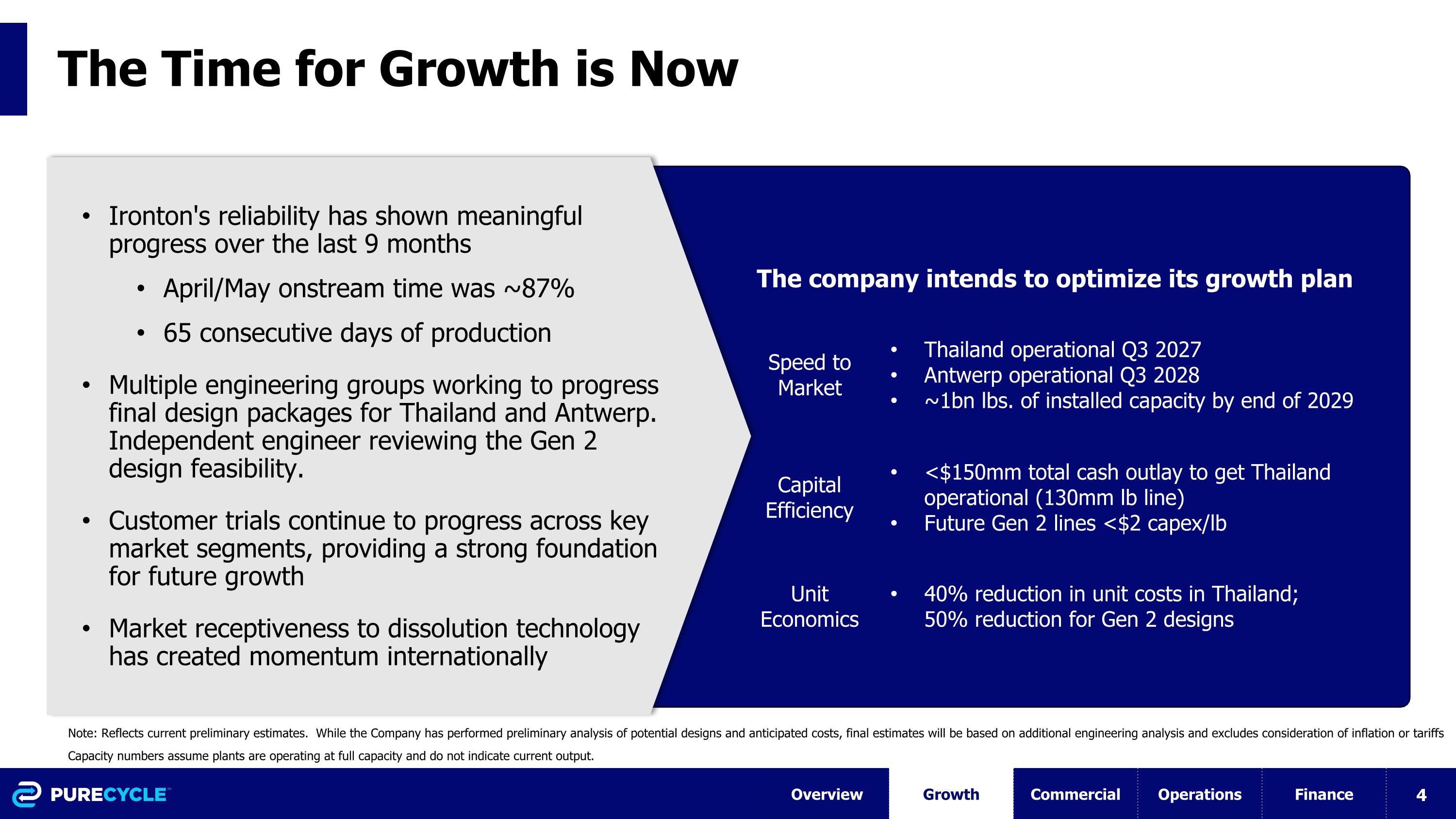

The Time for Growth is Now Ironton's reliability has shown meaningful progress over the last 9 months April/May onstream time was ~87% 65 consecutive days of production Multiple engineering groups working to progress final design packages for Thailand and Antwerp. Independent engineer reviewing the Gen 2 design feasibility. Customer trials continue to progress across key market segments, providing a strong foundation for future growth Market receptiveness to dissolution technology has created momentum internationally The company intends to optimize its growth plan Speed to Market Thailand operational Q3 2027 Antwerp operational Q3 2028 ~1bn lbs. of installed capacity by end of 2029 Capital Efficiency <$150mm total cash outlay to get Thailand operational (130mm lb line) Future Gen 2 lines <$2 capex/lb Unit Economics 40% reduction in unit costs in Thailand; 50% reduction for Gen 2 designs Capacity numbers assume plants are operating at full capacity and do not indicate current output. Note: Reflects current preliminary estimates. While the Company has performed preliminary analysis of potential designs and anticipated costs, final estimates will be based on additional engineering analysis and excludes consideration of inflation or tariffs Overview Growth Commercial Operations Finance

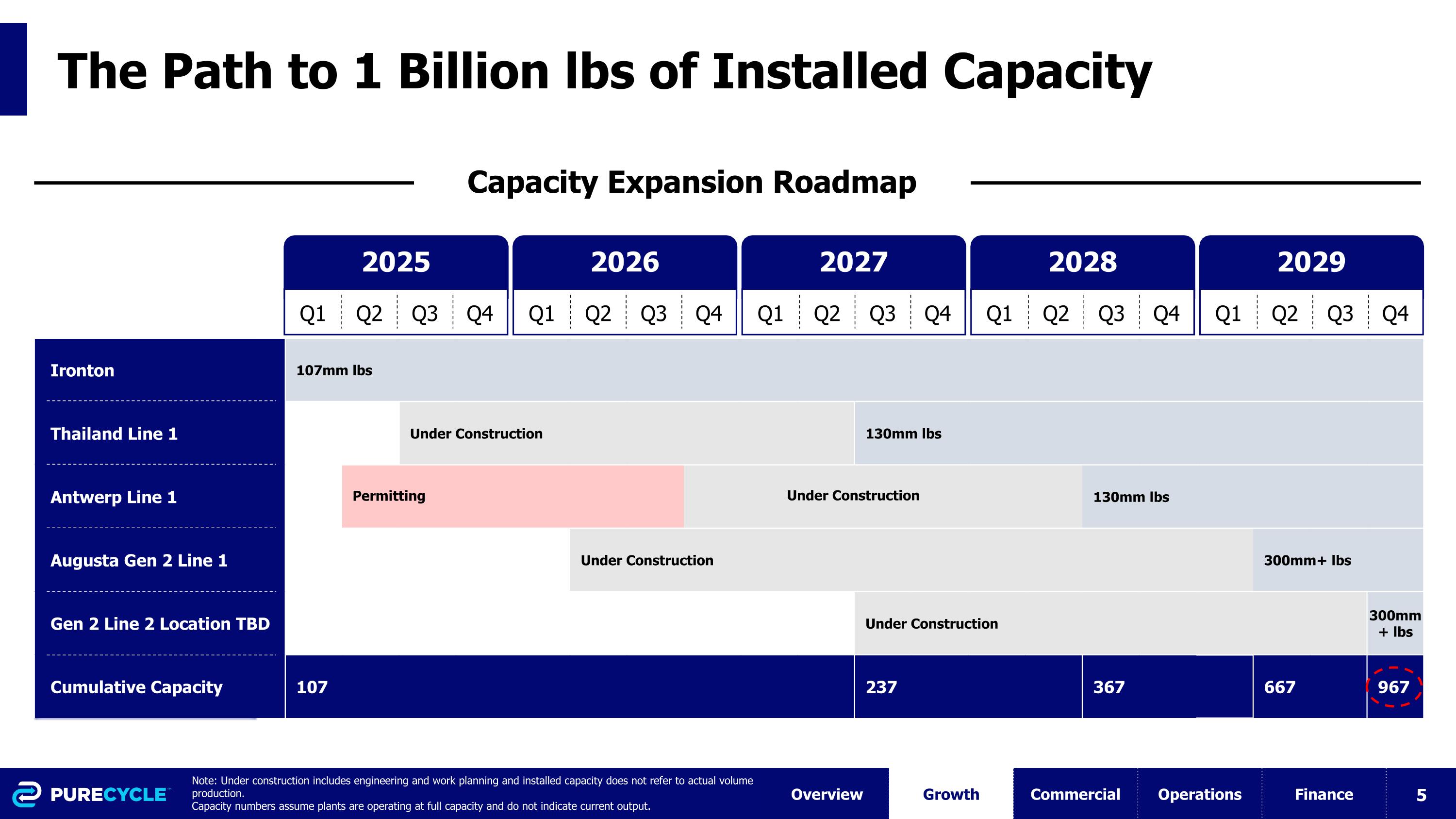

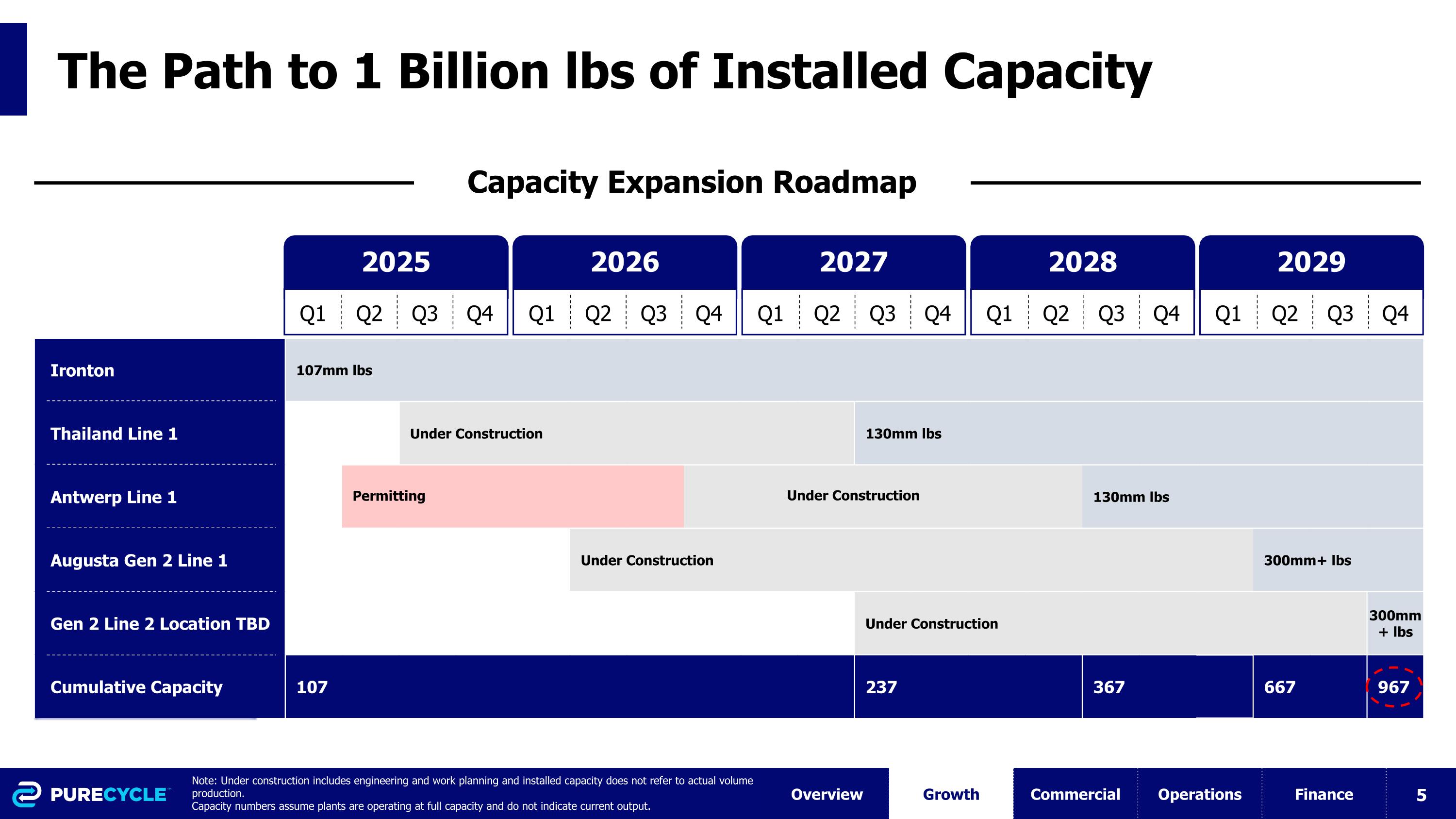

The Path to 1 Billion lbs of Installed Capacity Capacity Expansion Roadmap 2025 Q1 Q2 Q3 Q4 Ironton 107mm lbs Thailand Line 1 Under Construction 130mm lbs Antwerp Line 1 130mm lbs Augusta Gen 2 Line 1 Under Construction 300mm+ lbs Gen 2 Line 2 Location TBD Under Construction 300mm+ lbs Cumulative Capacity 107 237 367 667 967 2026 Q1 Q2 Q3 Q4 2027 Q1 Q2 Q3 Q4 2028 Q1 Q2 Q3 Q4 2029 Q1 Q2 Q3 Q4 Note: Under construction includes engineering and work planning and installed capacity does not refer to actual volume production. Capacity numbers assume plants are operating at full capacity and do not indicate current output. Permitting Under Construction Overview Growth Commercial Operations Finance

Rayong and Antwerp Projects are Ramping Land Lease Being finalized Permitting In process Engineering Wood Group (EPCm) Capex/Lb. $1.50-1.75 Opex/Lb. ~$0.25 EBITDA/Lb. $0.65-0.75 Current Staffing ~12 Rayong, Thailand Antwerp, Belgium Land Lease Secured Permitting Application in preparation, support: Arcadis Engineering Worley Belgium (permit package support) Capex/Lb. $2.75-3.00 Opex/Lb. ~$0.30 EBITDA/Lb. $0.50-0.60 Current Staffing ~5 Overview Growth Commercial Operations Finance Note: Reflects current preliminary estimates. While the Company has performed preliminary analysis of potential designs and anticipated costs, final estimates will be based on additional engineering analysis and excludes consideration of inflation or tariffs

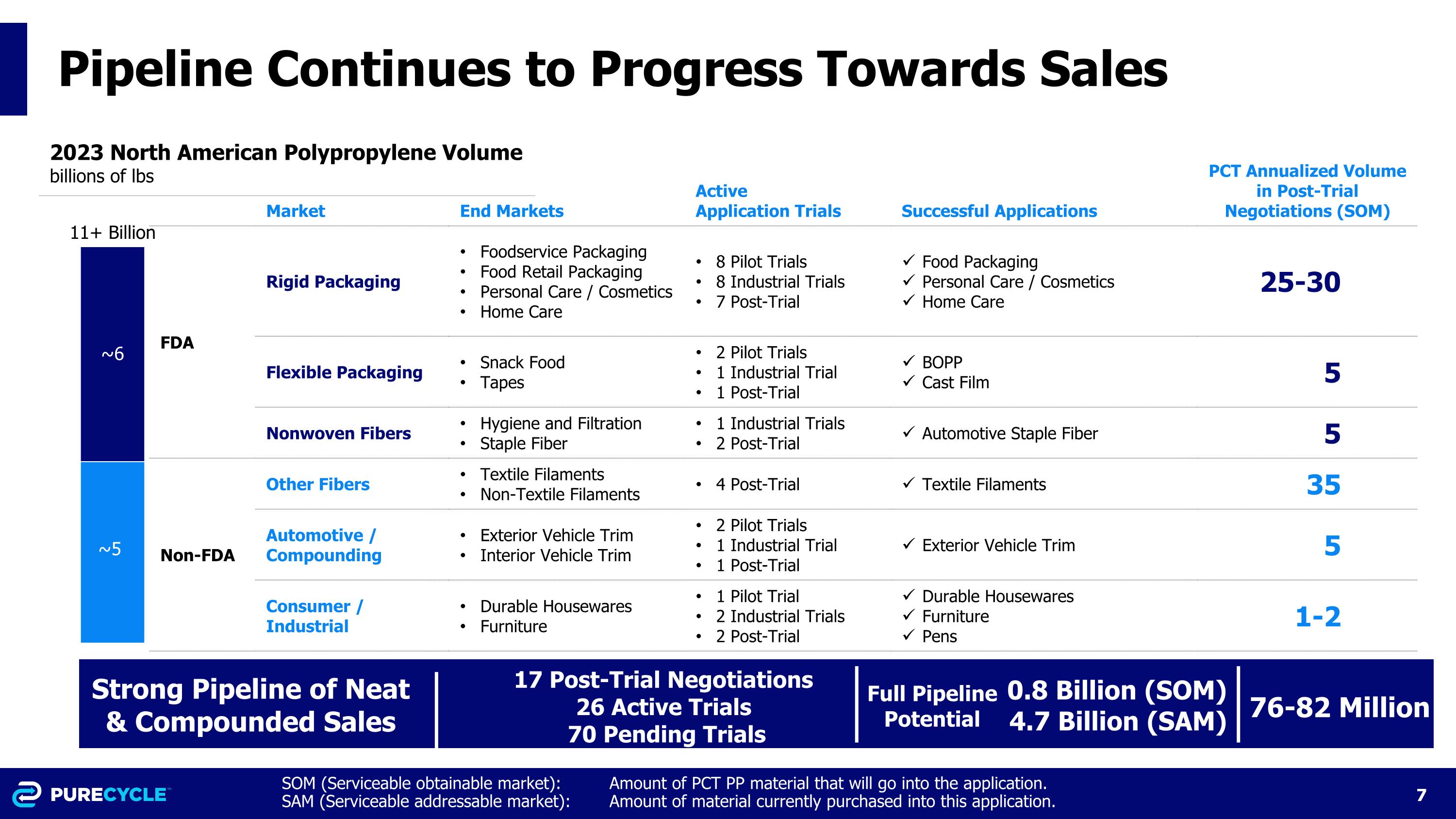

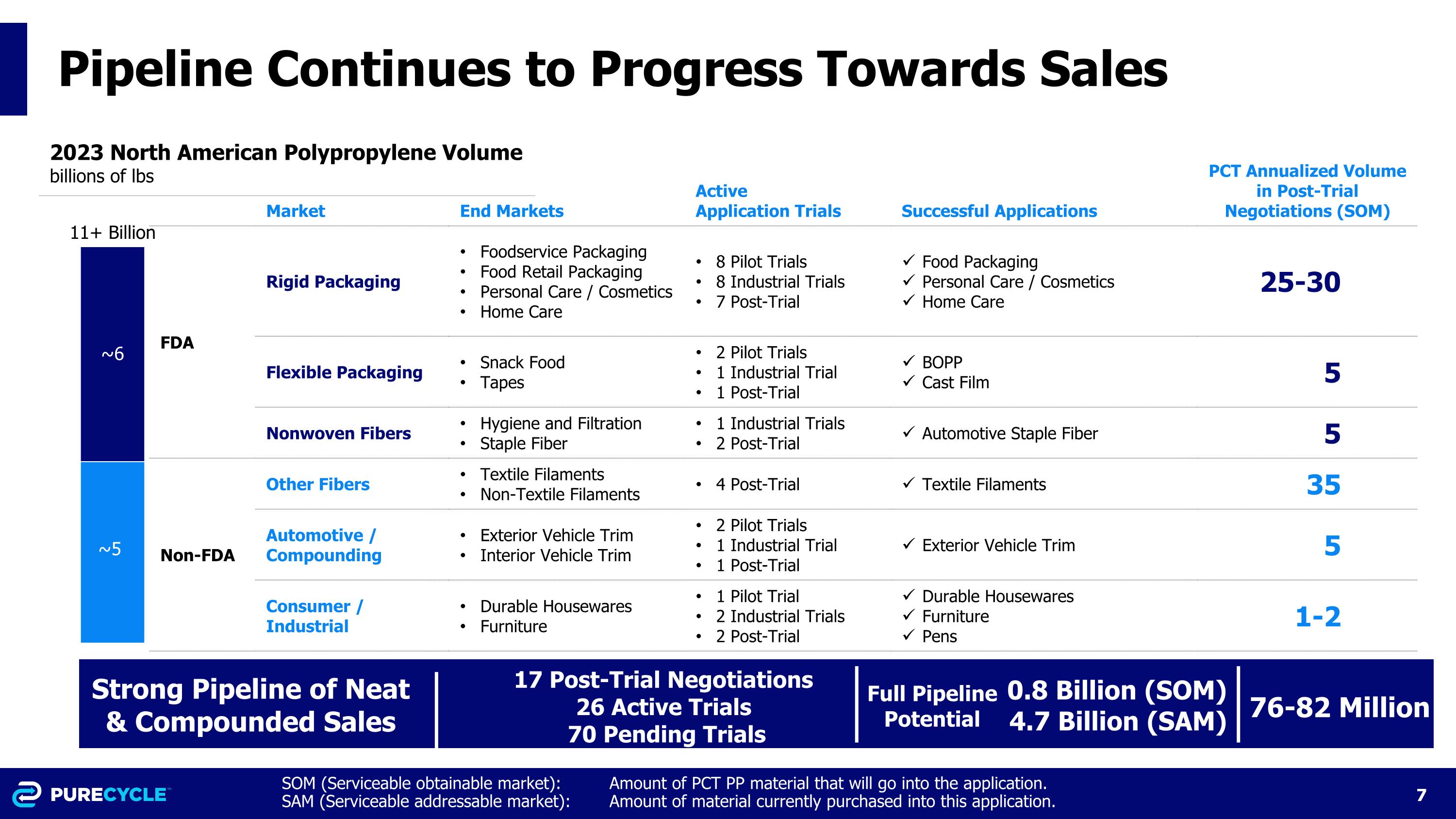

Pipeline Continues to Progress Towards Sales 11+ Billion Market End Markets Active Application Trials Successful Applications PCT Annualized Volume in Post-Trial Negotiations (SOM) FDA Rigid Packaging Foodservice Packaging Food Retail Packaging Personal Care / Cosmetics Home Care 8 Pilot Trials 8 Industrial Trials 7 Post-Trial Food Packaging Personal Care / Cosmetics Home Care 25-30 Flexible Packaging Snack Food Tapes 2 Pilot Trials 1 Industrial Trial 1 Post-Trial BOPP Cast Film 5 Nonwoven Fibers Hygiene and Filtration Staple Fiber 1 Industrial Trials 2 Post-Trial Automotive Staple Fiber 5 Non-FDA Other Fibers Textile Filaments Non-Textile Filaments 4 Post-Trial Textile Filaments 35 Automotive / Compounding Exterior Vehicle Trim Interior Vehicle Trim 2 Pilot Trials 1 Industrial Trial 1 Post-Trial Exterior Vehicle Trim 5 Consumer / Industrial Durable Housewares Furniture 1 Pilot Trial 2 Industrial Trials 2 Post-Trial Durable Housewares Furniture Pens 1-2 17 Post-Trial Negotiations 26 Active Trials 70 Pending Trials 2023 North American Polypropylene Volume billions of lbs Strong Pipeline of Neat & Compounded Sales ~6 ~5 0.8 Billion (SOM) 4.7 Billion (SAM) 76-82 Million Full Pipeline Potential SOM (Serviceable obtainable market): Amount of PCT PP material that will go into the application. SAM (Serviceable addressable market): Amount of material currently purchased into this application.

Driving Circularity with Emerald Carpets Multi-faceted partnership established following the successful introduction of fiber-grade PureFive Choice™ resin PureCycle R&D team developed HPP18-50 grade to match Emerald incumbent material Commercial supply agreement of ~5 million lbs. of PureFive Choice™ resin, with goal to increase over time PureCycle plans to recycle used trade show carpets into purified fiber-grade PureFive Choice™ resin Regulatory pressures are driving the need for carpet-to-carpet recycled content “Conference organizers we work with are looking for sustainable solutions and this partnership with PureCycle will allow us to offer them a carpet that includes post-consumer recycled content." - Emerald Carpets President, Tom Boykin Overview Growth Commercial Operations Finance

PureCycle offers GreenCircle Certified Recycled Content Earned GreenCircle Certified's Recycled Content Certification for nearly 30 grades of PureFive™ resin and both co-products GreenCircle Certified is a third-party certification company that conducts audits of organizations to verify sustainability claims The certification process is ISO 17065 compliant and confirms PureCycle’s sustainability claims about the percentage of PCR content Overview Growth Commercial Operations Finance

Integrating Compounding into Ironton PureCycle initiated a project expected to add compounding operations to the Ironton, Ohio purification facility by the end of the year This will bring approximately 100 million pounds of annual compounding capacity onsite and enable the blending of specific resins for key customer applications FDA and non-FDA PureFive Choice™ resin for film, thermoforming and thin-wall injection molding Key customers demand rail car deliveries due to high volume requirements Expected to eliminate approximately $4 million of annualized third-party costs currently associated with compounding the Company’s PureFive Choice™ resin Overview Growth Commercial Operations Finance

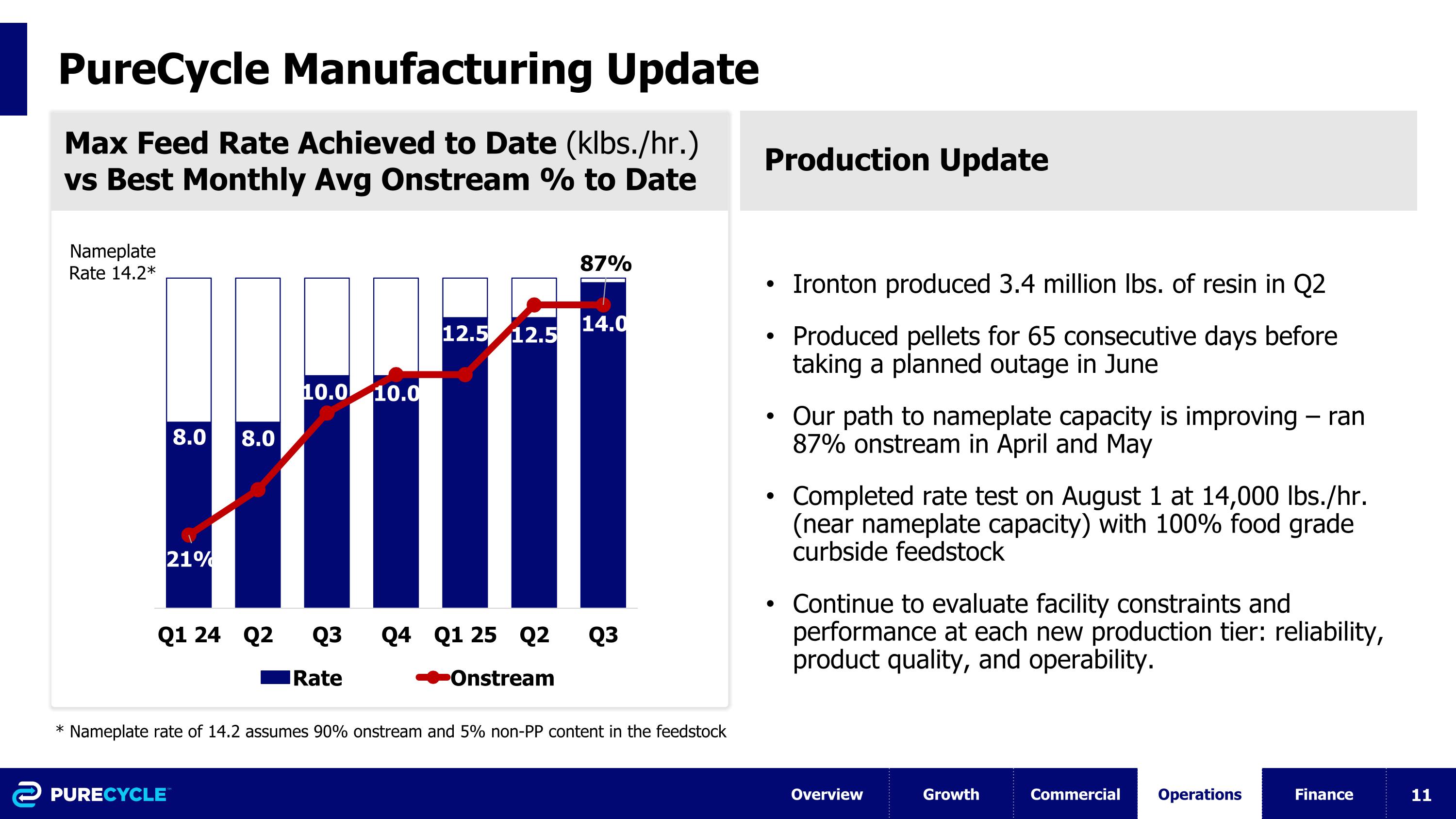

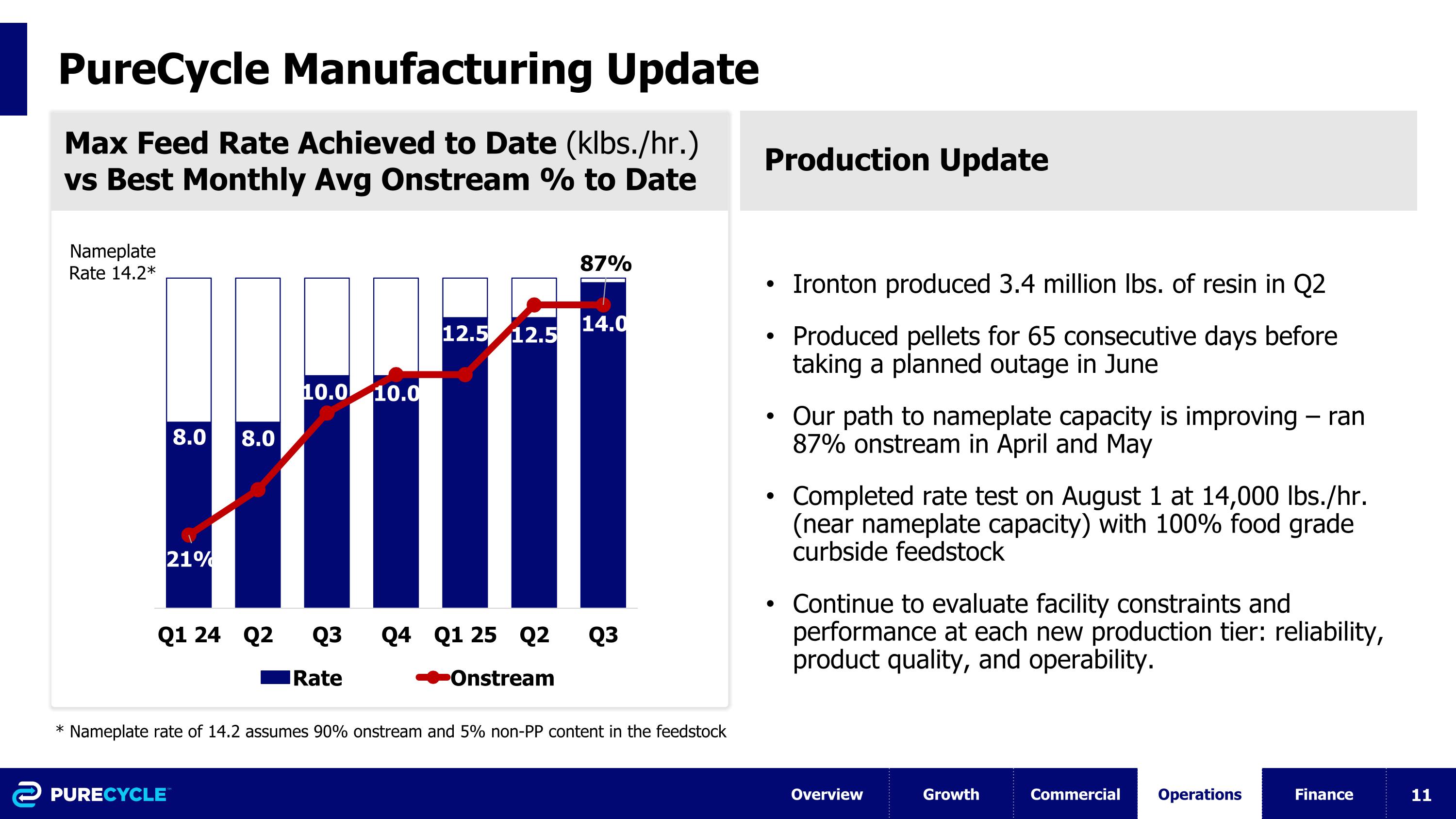

PureCycle Manufacturing Update Ironton produced 3.4 million lbs. of resin in Q2 Produced pellets for 65 consecutive days before taking a planned outage in June Our path to nameplate capacity is improving – ran 87% onstream in April and May Completed rate test on August 1 at 14,000 lbs./hr. (near nameplate capacity) with 100% food grade curbside feedstock Continue to evaluate facility constraints and performance at each new production tier: reliability, product quality, and operability. Max Feed Rate Achieved to Date (klbs./hr.) vs Best Monthly Avg Onstream % to Date Nameplate Rate 14.2* Production Update * Nameplate rate of 14.2 assumes 90% onstream and 5% non-PP content in the feedstock Overview Growth Commercial Operations Finance

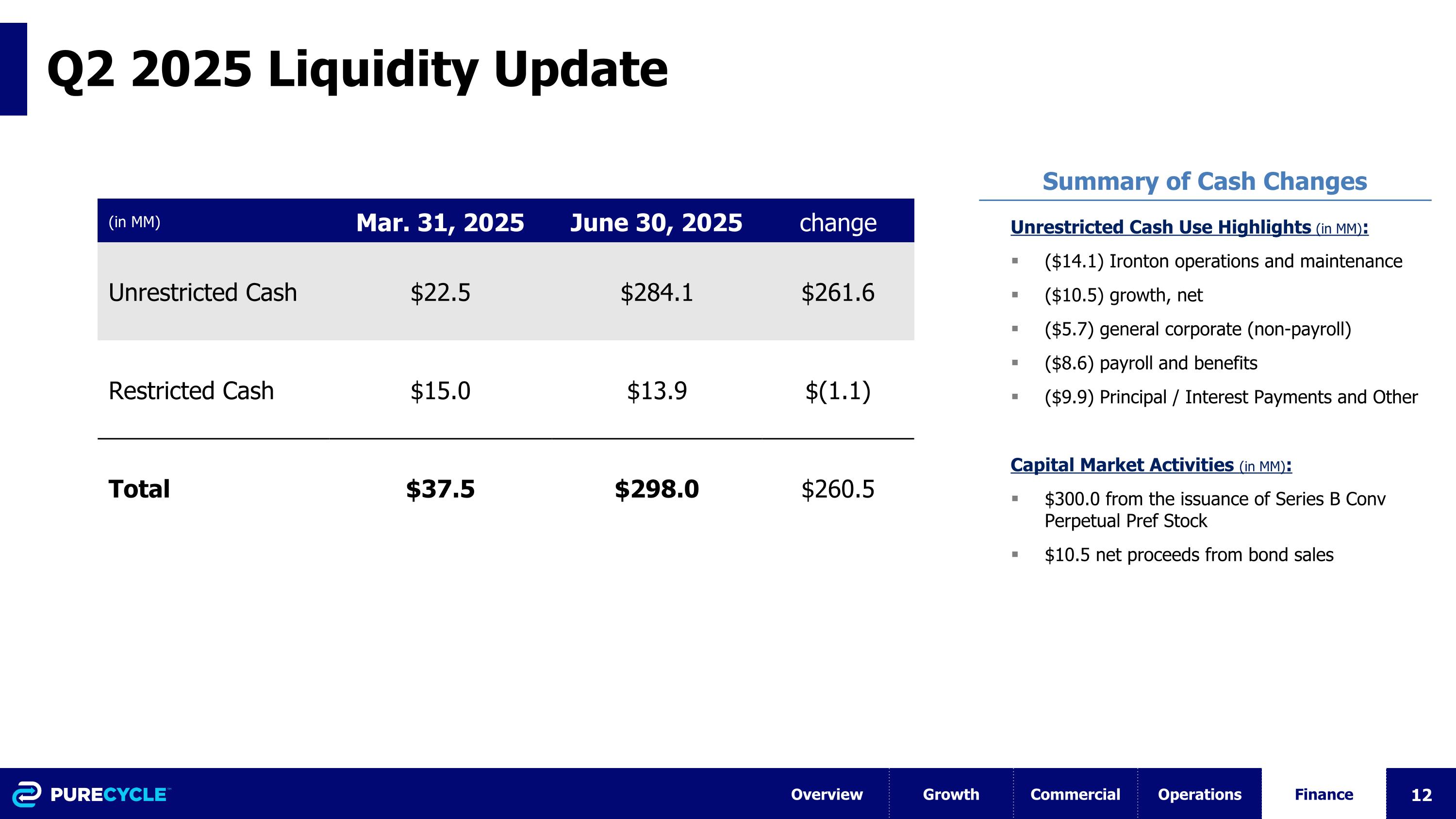

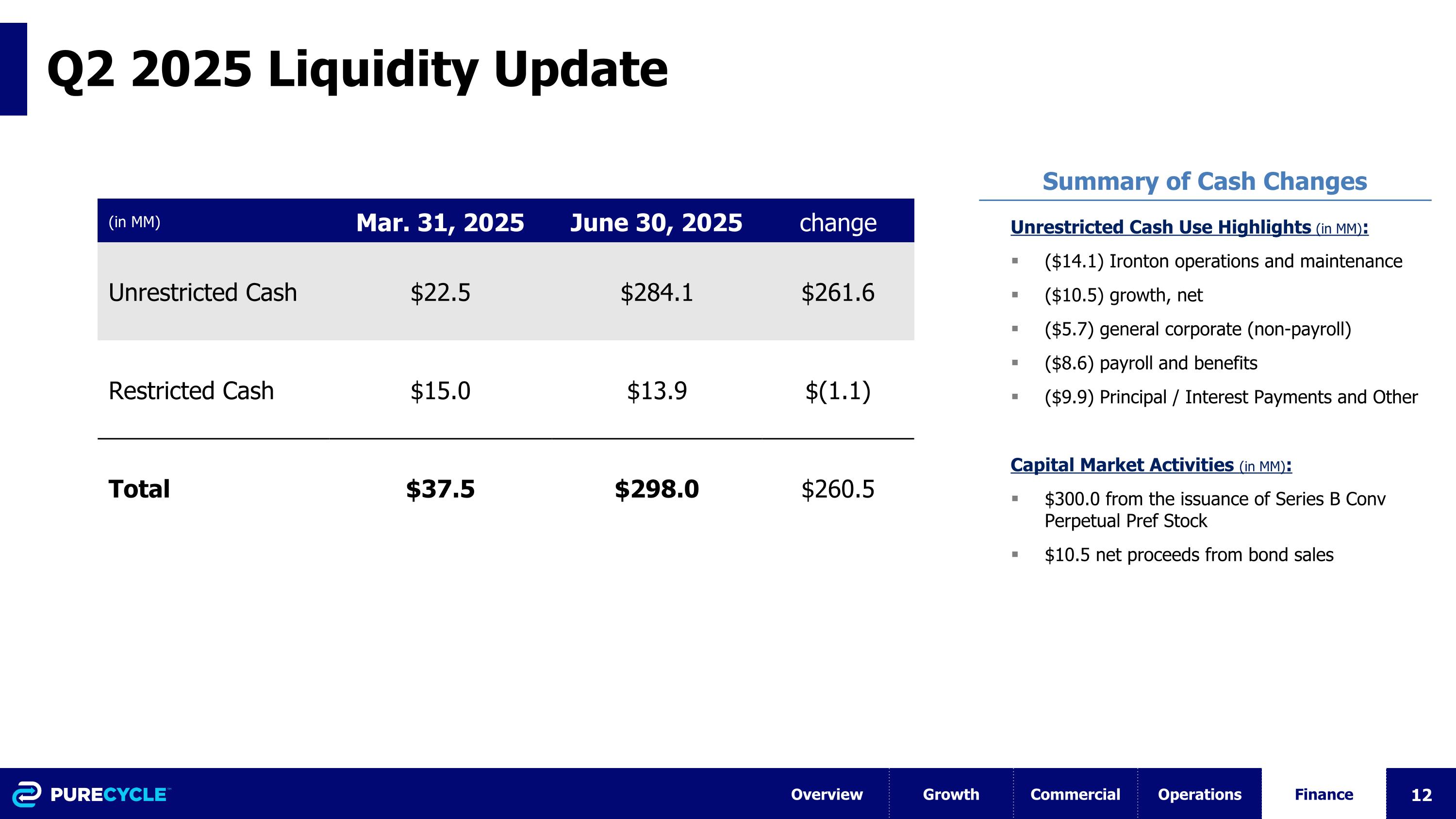

Q2 2025 Liquidity Update Overview Growth Commercial Operations Finance Unrestricted Cash Use Highlights (in MM): ($14.1) Ironton operations and maintenance ($10.5) growth, net ($5.7) general corporate (non-payroll) ($8.6) payroll and benefits ($9.9) Principal / Interest Payments and Other Capital Market Activities (in MM): $300.0 from the issuance of Series B Conv Perpetual Pref Stock $10.5 net proceeds from bond sales Summary of Cash Changes (in MM) Mar. 31, 2025 June 30, 2025 change Unrestricted Cash $22.5 $284.1 $261.6 Restricted Cash $15.0 $13.9 $(1.1) Total $37.5 $298.0 $260.5

Second Quarter 2025Corporate Update August 7, 2025