Quarter to Date Financial Results

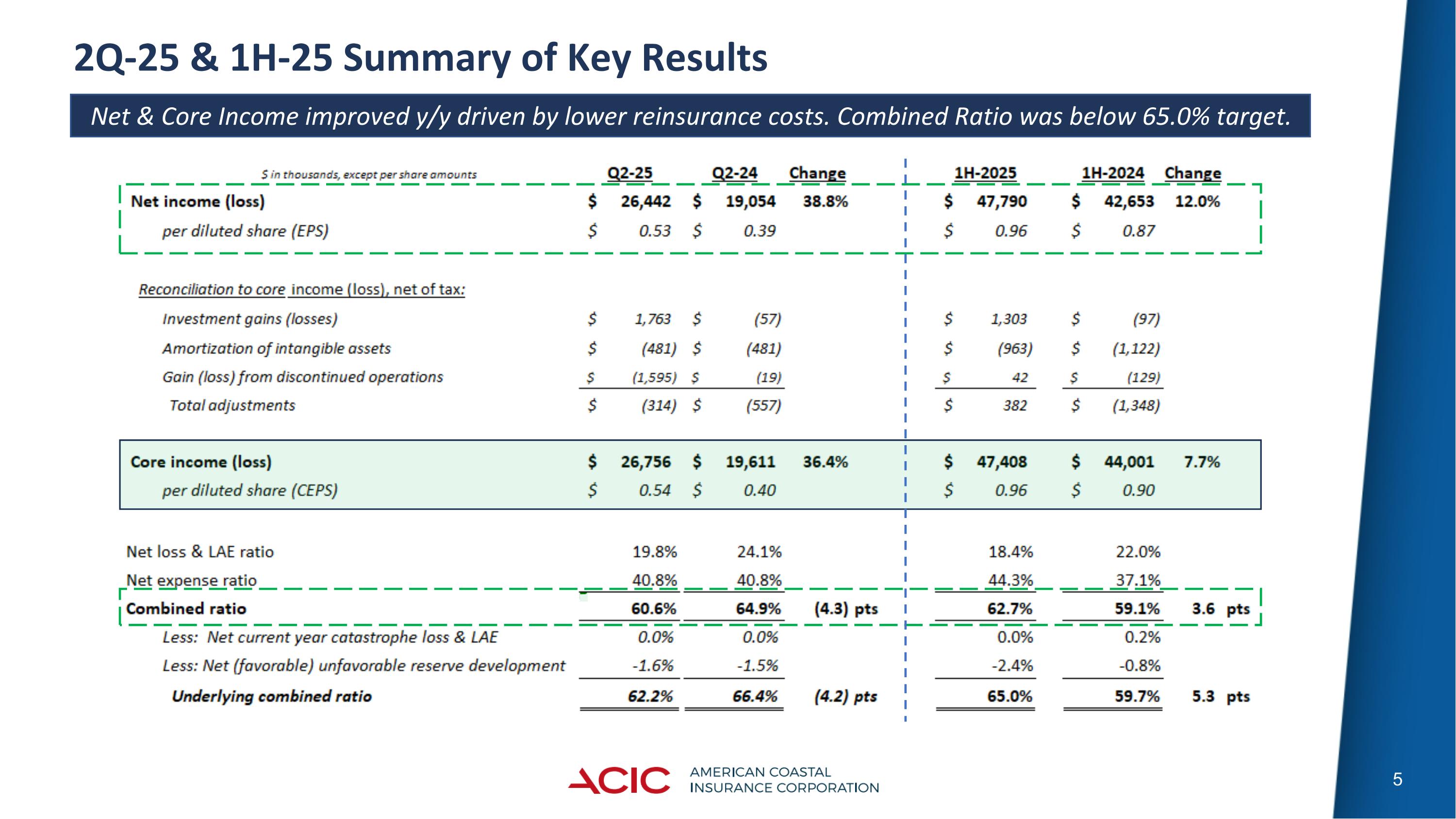

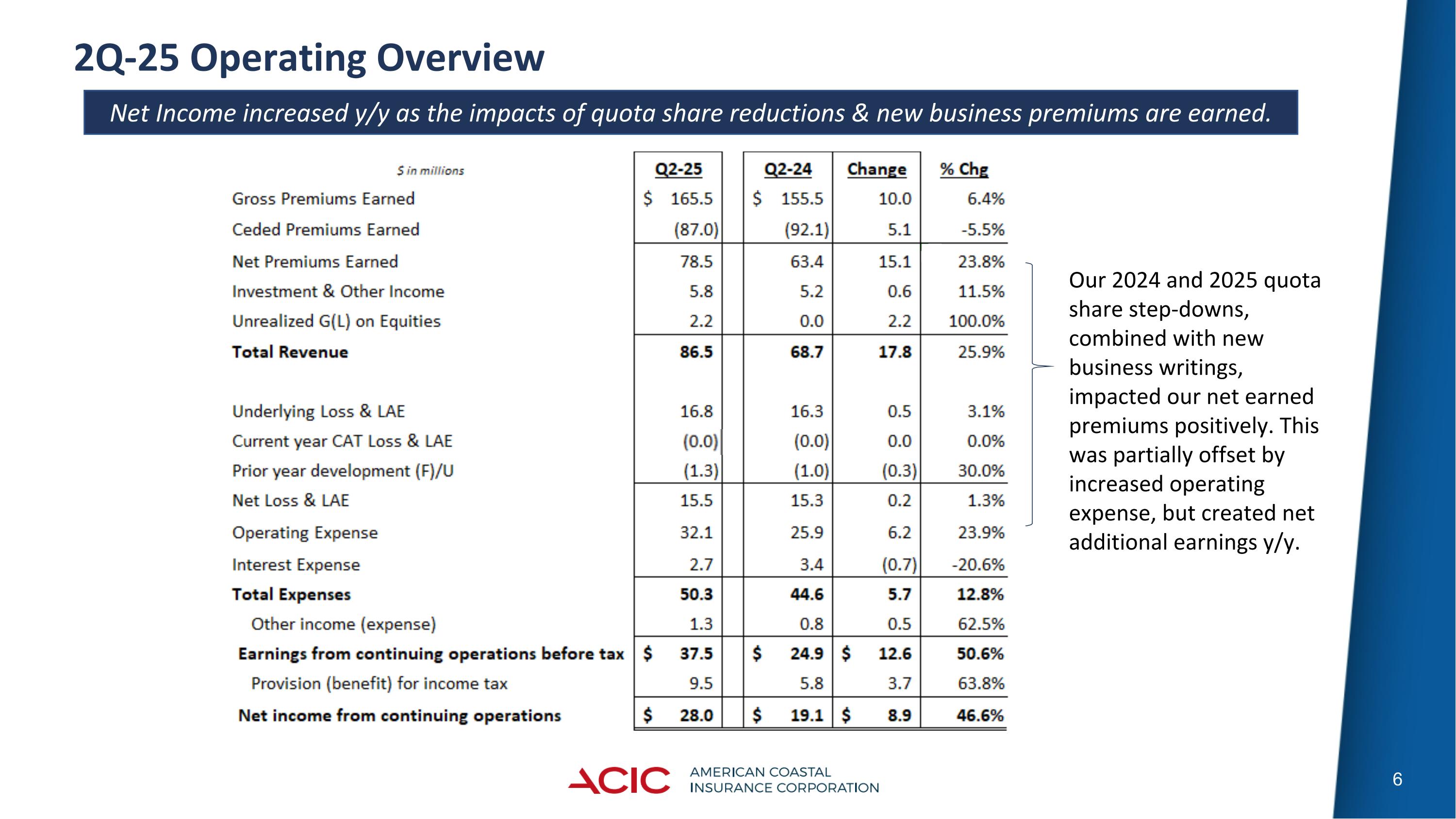

Net income for the second quarter ended June 30, 2025 was $26.4 million, or $0.53 per diluted share, compared to net income of $19.1 million, or $0.39 per diluted share, for the second quarter ended June 30, 2024. Drivers of net income during the second quarter of 2025 included increased gross premiums earned and decreased ceded premiums earned, driving an overall increase in revenues. This increase in revenue was offset by increased policy acquisition costs quarter-over-quarter, partially offset by decreased general and administrative expenses. During the second quarter of 2025, the Company's net loss attributable to discontinued operations was $1.6 million, compared to a net loss of $19 thousand attributable to discontinued operations during the second quarter of 2024.

The Company's total gross written premium decreased by $1.1 million, or 0.5%, to $228.3 million for the second quarter ended June 30, 2025, from $229.4 million for the second quarter ended June 30, 2024. The breakdown of the quarter-over-quarter changes in both direct written and assumed premiums are shown in the table below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in thousands) |

Three Months Ended June 30, |

|

|

|

|

|

|

|

|

2025 |

|

|

2024 |

|

|

Change $ |

|

|

Change % |

|

Direct Written and Assumed Premium |

|

|

|

|

|

|

|

|

|

|

|

Direct premium |

$ |

228,373 |

|

|

$ |

229,449 |

|

|

$ |

(1,076 |

) |

|

|

(0.5 |

)% |

Assumed premium (1) |

|

(27 |

) |

|

|

— |

|

|

|

(27 |

) |

|

|

(100.0 |

)% |

Total commercial property gross written premium |

$ |

228,346 |

|

|

$ |

229,449 |

|

|

$ |

(1,103 |

) |

|

|

(0.5 |

)% |

(1) Assumed premium written for 2025 primarily included commercial property business assumed from unaffiliated insurers that was subsequently cancelled.

Loss and LAE increased by $263,000, or 1.7%, to $15.5 million for the second quarter ended June 30, 2025, from $15.3 million for the second quarter ended June 30, 2024. Loss and LAE expense as a percentage of net earned premiums decreased 4.3 points to 19.8% for the second quarter ended June 30, 2025, compared to 24.1% for the second quarter ended June 30, 2024. Excluding catastrophe losses and reserve development, the Company's gross underlying loss and LAE ratio for the second quarter ended June 30, 2025, would have been 10.2%, a decrease of 0.3 points from 10.5% for the second quarter ended June 30, 2024.

Policy acquisition costs increased by $10.4 million, or 74.8%, to $24.3 million for the second quarter ended June 30, 2025, from $13.9 million for the second quarter ended June 30, 2024, primarily due to a decrease in ceding commission income as the result of the Company's decrease in quota share reinsurance coverage from 40% to 20%, effective June 1, 2024 and from 20% to 15%, effective June 1, 2025. External management fees also increased as a result of a one percent increase in the management fee and profit share accrual agreed to in our contract renewal with AmRisc, LLC.

General and administrative expenses decreased by $4.1 million, or 34.5%, to $7.8 million for the second quarter ended June 30, 2025, from $11.9 million for the second quarter ended June 30, 2024, driven by a non-recurring employee retention tax credit refund submitted to the Internal Revenue Service in 2022 and received during the second quarter of 2025. This non-recurring refund was previously disclosed in our Quarterly Report on Form 10-Q, filed on May 8, 2025, as a gain contingency. In addition, external spending for professional and consulting services decreased quarter-over-quarter.

Reinsurance Costs as a Percentage of Gross Earned Premium