EX-99.1

CULP ANNOUNCES FOURTH QUARTER AND FULL YEAR FISCAL 2025 RESULTS

Completed Restructuring Provides Foundation for Improved Operating Performance

in Fiscal 2026

HIGH POINT, N.C. (June 25, 2025) – Culp, Inc. (NYSE: CULP), a leading provider of fabrics for bedding and upholstery fabrics for residential and commercial furniture, today reported financial and operating results for the fourth quarter and fiscal year ended April 27, 2025.

Iv Culp, President and Chief Executive Officer, commented, “Fiscal 2025 was a year of heavy lifting across CULP, and we are encouraged by the results of our work to transform our cost structure and better position the company for growth. Given the challenging revenue environment and tariff-related uncertainty that is evident and continues across the industry, we concentrated on what we can control and successfully executed on a variety of aggressive initiatives that should drive better operating leverage, particularly as market conditions improve. We also continued to play to our strength in providing the highest levels of service, product offerings and supply chain optionality to our customers, and we believe that our market share remains strong and continues to expand within certain targeted segments.

“The recent sale of our manufacturing facility in Canada capped the completion of the restructuring plan we announced last year including facility closures and consolidations in our mattress fabrics division, as well as a transition to an asset-light, strategic sourcing model for certain major product lines. We are pleased to see the benefits of that plan reflected in our financial results, with a lower fixed cost base and increased efficiencies in our mattress fabrics division helping to drive improvement during the year and significantly better overall operating results for the quarter despite the pressured macro conditions.

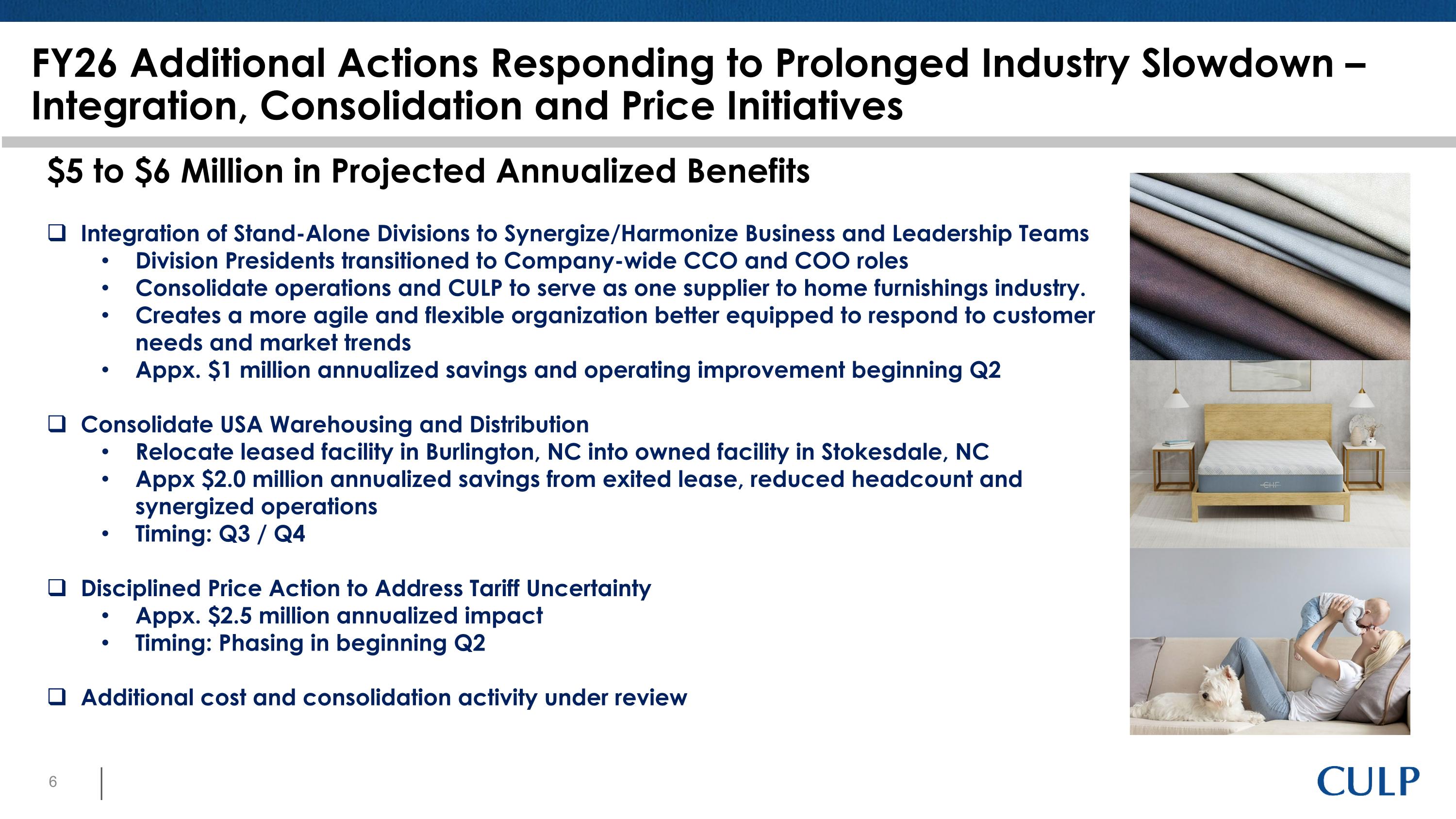

“In light of the continuing market softness, along with heightened tariff uncertainty, we are taking additional action including the integration of our two operating divisions, Culp Upholstery Fabrics and Culp Home Fashions, into a unified CULP-branded business that enhances our ability to anticipate and react to market trends as well as optimize resources across our organization. We expect this more centralized approach to improve scale efficiencies throughout CULP and to generate additional savings as we progress through fiscal 2026. In addition, the related facility consolidation activity should elevate the operating profile of our upholstery fabrics business, which continues to achieve profitability in the face of historically low demand for home furnishings and challenges from high tariff rates on China-produced goods. We also recently extended our credit facility with Wells Fargo for an additional three years, which we believe will provide us with additional flexibility and liquidity as needed to fund and grow our business going forward.

Mr. Culp concluded, “I remain incredibly proud of our team’s ability to respond to the changing needs of our business. Thanks to their hard work and dedication, we move into our new fiscal year with a leaner, more flexible global platform enabling us to quickly respond to market and tariff fluidity, as well as a highly resilient business model well-positioned to seize opportunities and meet the challenges ahead."

CULP Announces Results for Fourth Quarter and Full Year Fiscal 2025

Page 2

June 25, 2025

Fiscal 2025 Fourth Quarter Financial Highlights

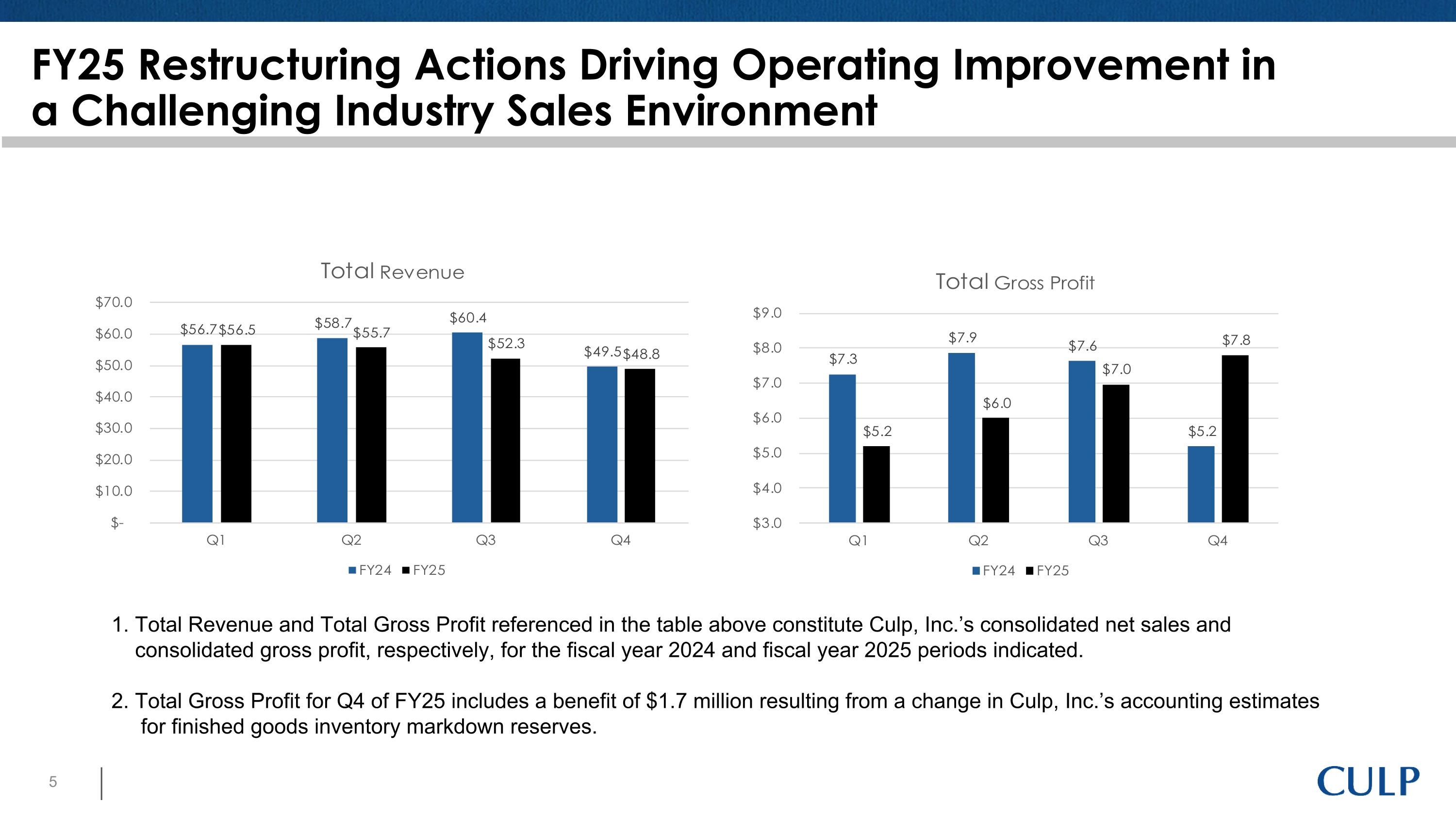

▪ Consolidated net sales of $48.8 million, generally flat to prior-year period net sales of $49.5 million, with mattress fabric sales up 5.3 percent and upholstery fabric sales down 8.9 percent year-over-year.

▪ GAAP consolidated loss from operations of $(2.2) million (including $1.5 million in restructuring and related expenses), compared with GAAP consolidated loss from operations of $(4.2) million (including $204,000 in restructuring expense during the period).

•

Non-GAAP operating loss of $(704) thousand, a marked improvement over the prior-year period’s non-GAAP operating loss of $(4.0) million (see reconciliation table on page 16) driven primarily by cost and efficiency benefits from the restructuring plan and also favorably impacted by lower inventory markdowns.

•

Continued momentum in mattress fabrics operating performance, including significant improvement in operating loss from the prior-year period and consistent improvement throughout the year.

•

Continued profitability in the upholstery fabrics segment despite a low-revenue industry environment and tariff-related challenges.

▪ Net loss of $(2.1) million (including $1.5 million in restructuring and related expenses), or $(.17) per diluted share, compared to a net loss of $(4.9) million, or $(.39) per diluted share, in the prior-year period.

•

Adjusted EBITDA for the period was $559 thousand, compared to negative $(2.2) million in the prior-year period (see reconciliation table on page 20), with the improvement driven primarily by restructuring activities and also favorably impacted by lower inventory markdowns.

Fiscal 2025 Full Year Financial Highlights

▪ Consolidated net sales of $213.2 million, down 5.4 percent from the prior year, with mattress fabric sales down 2.1 percent and upholstery fabric sales down 8.8 percent.

▪ GAAP consolidated loss from operations of $(18.4) million (including $9.4 million in restructuring and related expenses), compared with GAAP consolidated loss from operations of $(11.3) million (including $676,000 in restructuring and related expenses during the period).

•

Non-GAAP operating loss of $(9.0) million, an improvement over the prior-year period’s non-GAAP operating loss of $(10.6) million (see reconciliation table on page 17) driven primarily by the same dynamics driving the improvement in non-GAAP operating loss during the fourth quarter.

▪ Net loss of $(19.1) million (including $9.4 million in restructuring and related expenses), or $(1.53) per diluted share, compared with a net loss of $(13.8) million, or $(1.11) per diluted share, for the prior year.

CULP Announces Results for Fourth Quarter and Full Year Fiscal 2025

Page 3

June 25, 2025

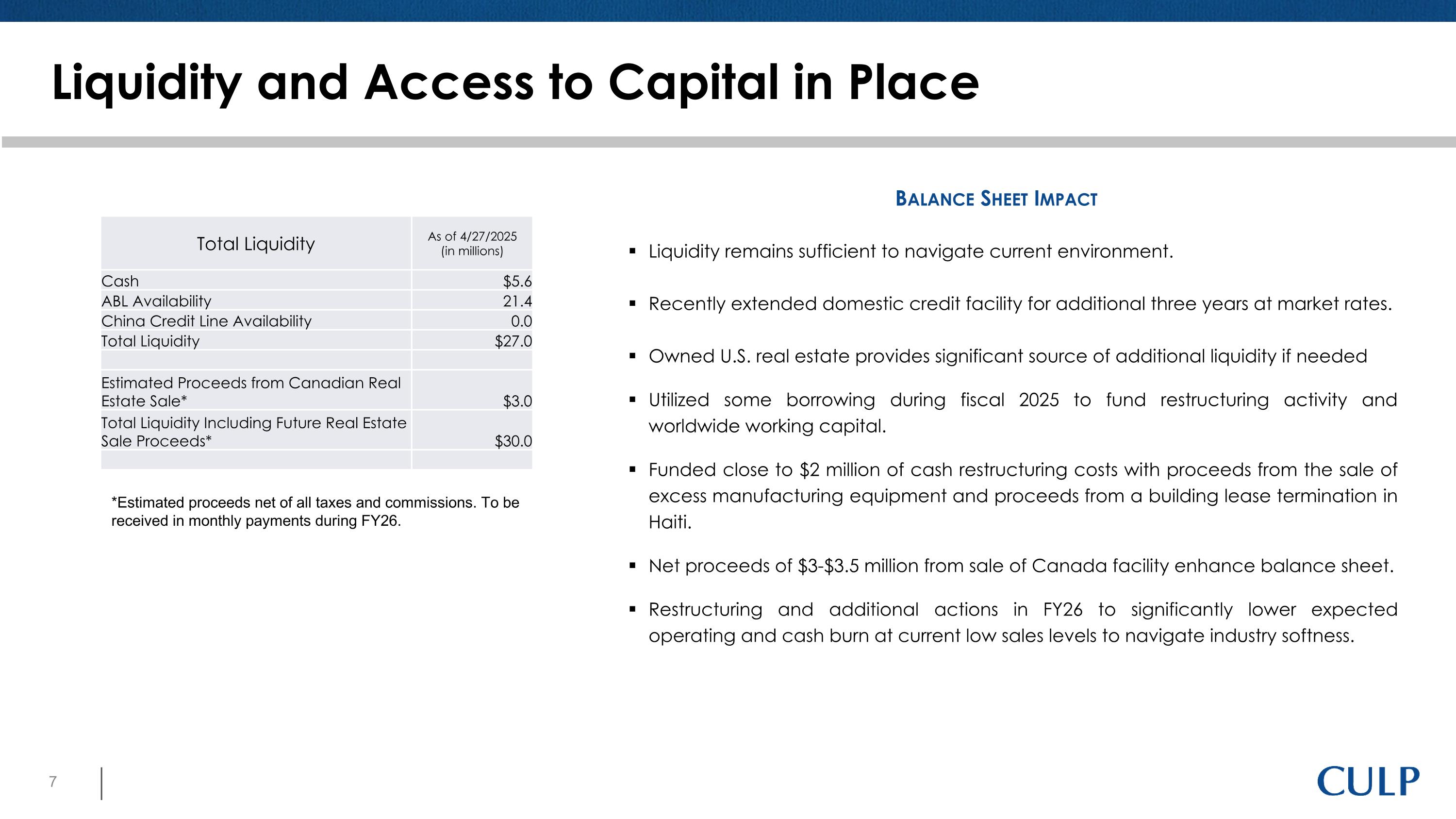

▪ As of April 27, 2025, the Company maintained $5.6 million in total cash and $12.7 million in outstanding debt under its credit facilities.

Restructuring Plan Update

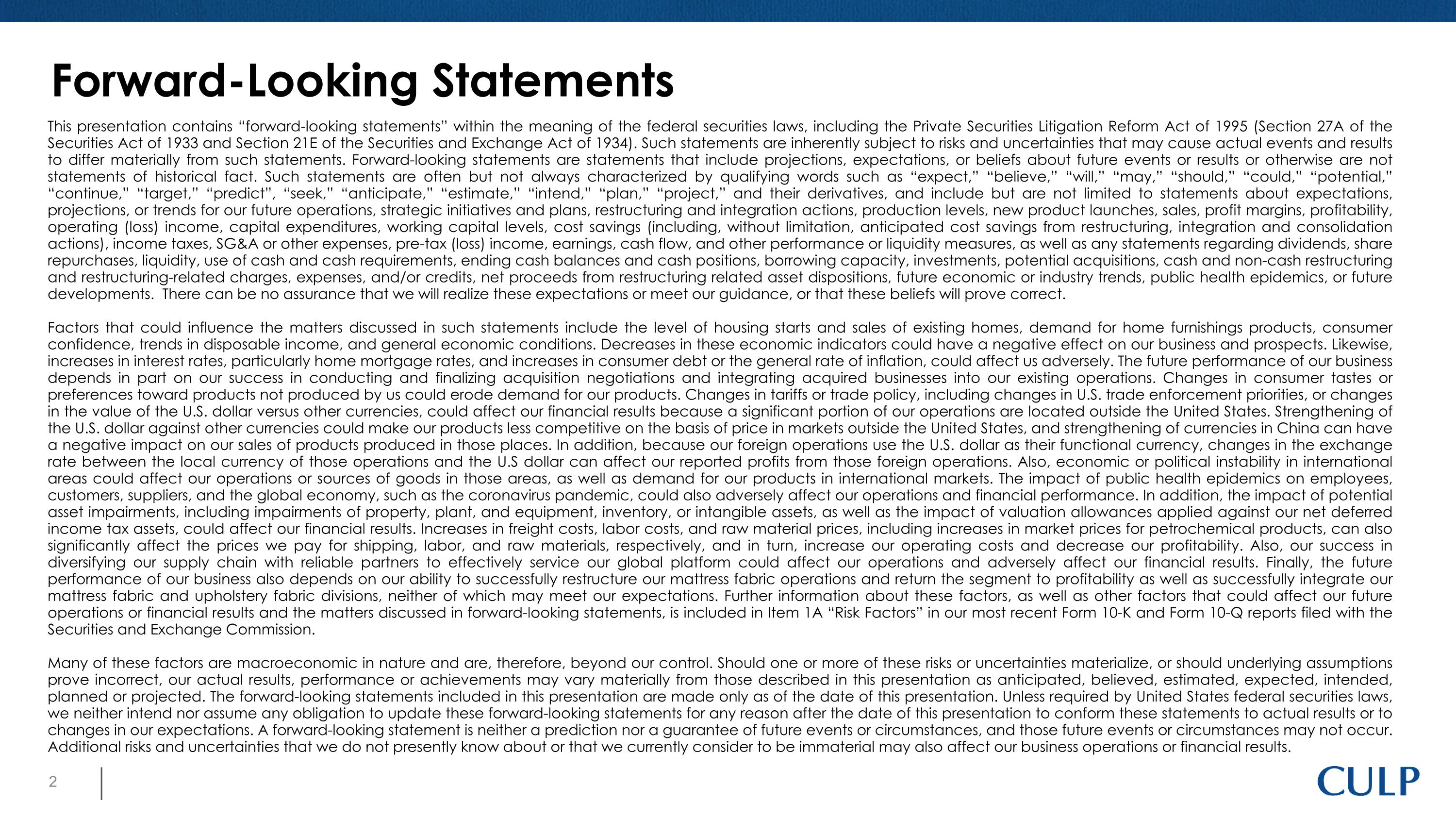

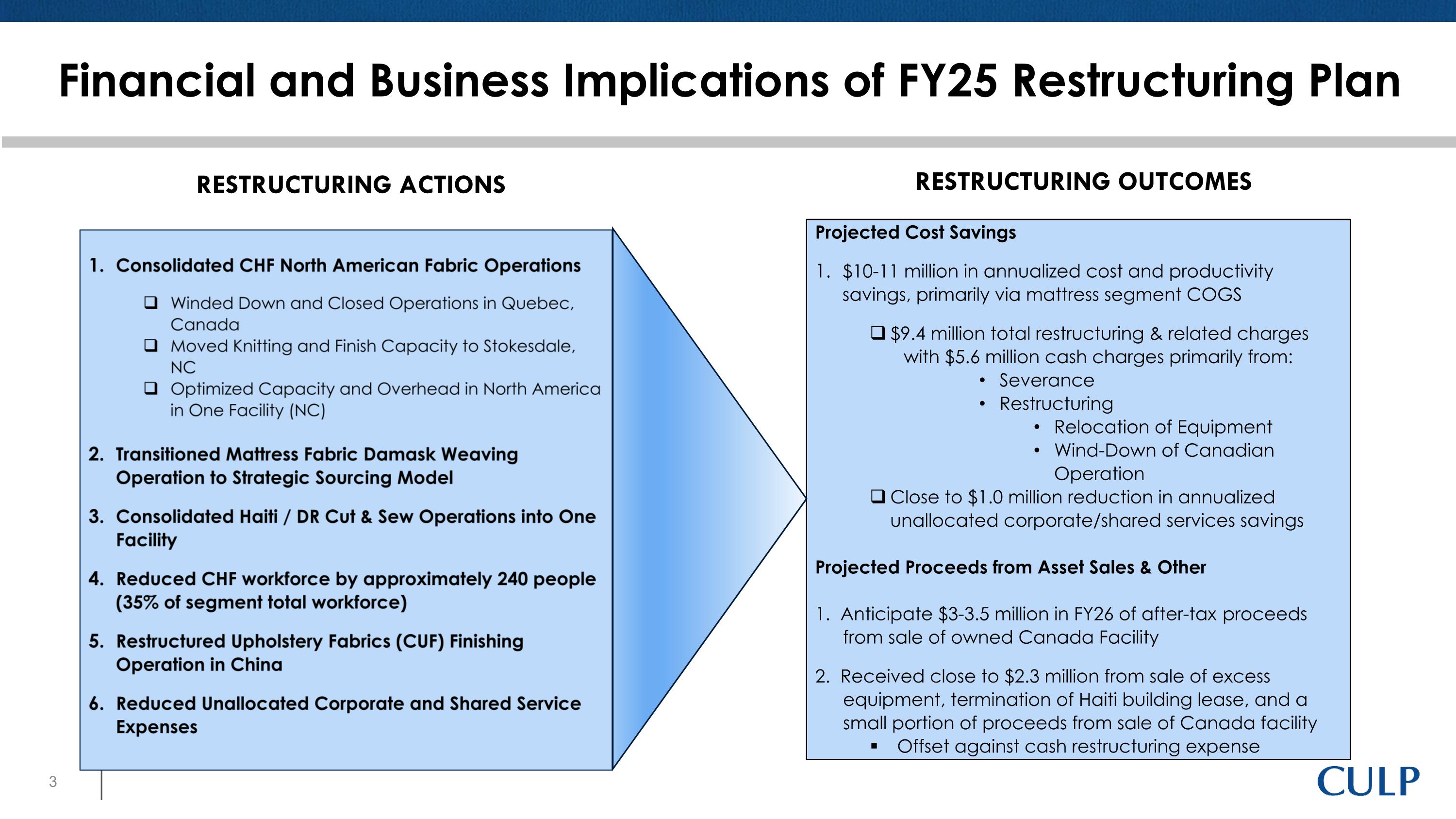

The restructuring plan announced in May of 2024, which was primarily focused within the Company's mattress fabrics business, was completed as planned, with the sale of the Company's manufacturing facility in Quebec, Canada, consummated on April 30, 2025. The Company continues to expect the restructuring plan to generate $10.0-$11.0 million in annualized savings and operating improvements, with many of these benefits already beginning to manifest in the Company’s fourth quarter fiscal 2025 results.

The Company incurred total restructuring and restructuring-related expenses of $9.4 million in fiscal 2025, of which $5.6 million consisted of cash expenditures. The Company funded close to $2.3 million of these cash expenditures with proceeds from the sale of excess manufacturing equipment, proceeds from a building lease termination in Haiti, and a small portion of the proceeds from the sale of its Canada facility. In fiscal 2026, the Company expects to realize a total of approximately $3.0 to $3.5 million in cash proceeds, net of all taxes and commissions, on the sale of its Canada facility.

Business Segment Highlights

Mattress Fabrics Segment

▪ Sales for this segment were $27.1 million for the fourth quarter, up 5.3 percent compared with sales of $25.8 million in the prior-year period. Sales continued to be pressured by industry-wide low demand and related challenges from weaker consumer spending and housing market trends, but the Company continues to win new business with larger customers.

▪ Operating loss was $(217) thousand for the fourth quarter, compared to an operating loss of $(2.9) million in the prior-year period, with the improvement driven primarily by higher gross margins attributable to lower fixed costs and operating efficiency improvements derived from the restructuring plan and lower inventory markdowns.

▪ For the full year, sales were $113.9 million, down 2.1 percent compared with sales of $116.4 million for fiscal 2024, with the decrease driven by the above-referenced weak industry conditions and related macro-economic challenges.

▪ For the full year, operating loss was $(5.2) million, compared with an operating loss of ($6.8) million for fiscal 2024. Operating performance continued to be pressured by lower sales, but improved consistently during the year, with the improvement driven primarily by the same dynamics impacting the segment’s operating performance for the fourth quarter.

Upholstery Fabrics Segment

▪ Sales for this segment were $21.7 million for the fourth quarter, down 8.9 percent compared with sales of $23.8 million in the prior-year period.

CULP Announces Results for Fourth Quarter and Full Year Fiscal 2025

Page 4

June 25, 2025

The year-over-year decline was driven primarily by continued softness in the home furnishings market and lower comparable sales to a large residential fabric customer that uniquely concentrated more of its annual purchasing in the first half of fiscal 2025 and strategically managed inventory levels in the back half of the year. The market uncertainty from the recent tariff-related actions and the timing of the Chinese New Year holiday (which predominantly affected only the fourth quarter rather than multiple periods) also contributed to lower sales. However, demand with hospitality/contract customers remained relatively solid during the quarter, with sales in that market accounting for approximately 42.0 percent of the segment's total sales.

▪ Operating income was $1.1 million for the fourth quarter, compared with operating income of $975 thousand in the prior-year period. Operating performance continued to be pressured by lower sales, but that pressure was partially offset by lower inventory markdowns, a more favorable mix of higher-margin hospitality/contract sales, and lower SG&A expenses.

▪ For the full year, sales were $99.3 million, down 8.8 percent compared with sales of $109.0 million for fiscal 2024, with the decrease primarily reflecting the ongoing demand deterioration in the home furnishings industry due to what remains a challenging macro-economic environment.

▪ For the full year, operating income was $4.1 million, compared to operating income of $5.8 million for fiscal 2024, with the decline driven primarily by lower sales partially offset by lower inventory markdowns and lower SG&A expenses.

Balance Sheet, Cash Flow, and Liquidity

▪ As of April 27, 2025, the Company maintained $5.6 million in total cash and $12.7 million in outstanding debt under its credit facilities, of which $2.8 million constituted supplier financing. The outstanding debt was primarily incurred for restructuring activities and to fund worldwide working capital.

▪ As of April 27, 2025, the Company maintained approximately $27.0 million in liquidity consisting of $5.6 million in cash and $21.4 million in borrowing availability under its domestic credit facility. On June 12, 2025, the Company extended the term of its domestic credit facility with Wells Fargo Bank for an additional three years and amended it in certain other respects. Subject to borrowing base limitations, this credit facility allows the Company to borrow up to $30 million and contains an accordion feature that could increase that amount by an additional $10 million based on mutual agreement.

▪ Cash flow from operations and free cash flow were negative $(17.7) million and negative $(17.1) million, respectively, for fiscal 2025 (see reconciliation table on page 13), with both primarily affected by operating losses, including $5.6 million in non-recurring cash restructuring charges, and, with respect to free cash flow, planned strategic investments in capital expenditures mostly related to the mattress fabrics segment as we focused on restructuring that business.

▪ Capital expenditures for fiscal 2025 were $2.9 million, down from $3.7 million for fiscal 2024 due to an effort to strategically manage capital and focus on projects targeting operating efficiency and future growth.

CULP Announces Results for Fourth Quarter and Full Year Fiscal 2025

Page 5

June 25, 2025

Financial Outlook

▪ Due to macro-economic uncertainty and the fluid tariff environment, the Company is not providing specific financial guidance, but only limited annual guidance at this time.

▪ The Company anticipates year-over-year sales growth in its mattress fabrics business and for the sales pressure on the residential side of its upholstery business to continue.

▪ The cost and efficiency benefits of the recently completed restructuring plan are expected to continue to drive meaningful operating improvement as the year progresses, particularly as the Company moves beyond the tariff-related sales and margin pressure impacting the first quarter. In addition, the fiscal 2026 division integration initiative and related facility consolidation activity, along with tariff-related price increases, should further bolster operating performance, particularly as the Company progresses beyond the first quarter.

▪ While the Company intends to continue utilizing borrowings as necessary under its domestic and foreign credit facilities during fiscal 2026 in connection with funding working capital needs and growth, integration and efficiency initiatives, it will continue to aggressively manage liquidity and capital expenditures and prioritize free cash flow.

▪ The Company’s expectations are based on information available at the time of this press release and reflect certain assumptions by management regarding the Company’s business and industry trends, the projected impact of restructuring and integration initiatives, and ongoing tariff and market headwinds. The Company's expectations also assume no further meaningful impacts from tariffs and trade negotiations.

Conference Call

Culp, Inc. will hold a conference call to discuss financial results for the fourth quarter and full fiscal year 2025 on Thursday, June 26, 2025, at 9:00 a.m. Eastern Time. A live webcast of this call can be accessed on the “Upcoming Events” section on the “Investor Relations” page of the Company’s website, www.culp.com. A replay of the webcast will be available for 30 days under the “Past Events” section on the “Investor Relations” page of the Company’s website.

About the Company

Culp, Inc. is one of the largest marketers of mattress fabrics for bedding and upholstery fabrics for residential and commercial furniture in North America. The Company markets a variety of fabrics to its global customer base of leading bedding and furniture companies, including fabrics produced at Culp’s manufacturing facilities and fabrics sourced through other suppliers. Culp has manufacturing and sourcing capabilities located in the United States, China, Haiti, Turkey, and Vietnam.

Investor Relations Contact

Ken Bowling, Executive Vice President, Chief Financial Officer, and Treasurer:

(336) 881-5630

krbowling@culp.com

CULP Announces Results for Fourth Quarter and Full Year Fiscal 2025

Page 6

June 25, 2025

Forward Looking Statements

This release contains “forward-looking statements” within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995 (Section 27A of the Securities Act of 1933 and Section 21E of the Securities and Exchange Act of 1934). Such statements are inherently subject to risks and uncertainties that may cause actual events and results to differ materially from such statements. Forward-looking statements are statements that include projections, expectations, or beliefs about future events or results or otherwise are not statements of historical fact. Such statements are often but not always characterized by qualifying words such as “expect,” “believe,” “will,” “may,” “should,” “could,” “potential,” “continue,” “target,” “predict”, “seek,” “anticipate,” “estimate,” “intend,” “plan,” “project,” and their derivatives, and include but are not limited to statements about expectations, projections, or trends for our future operations, strategic initiatives and plans, restructuring and integration actions, production levels, new product launches, sales, profit margins, profitability, operating (loss) income, capital expenditures, working capital levels, cost savings (including, without limitation, anticipated cost savings from restructuring and integration actions), income taxes, SG&A or other expenses, pre-tax (loss) income, earnings, cash flow, and other performance or liquidity measures, as well as any statements regarding dividends, share repurchases, liquidity, use of cash and cash requirements, ending cash balances and cash positions, borrowing capacity, investments, potential acquisitions, cash and non-cash restructuring and restructuring-related charges, expenses, and/or credits, net proceeds from restructuring related asset dispositions, future economic or industry trends, public health epidemics, or future developments. There can be no assurance that we will realize these expectations or meet our guidance, or that these beliefs will prove correct.

Factors that could influence the matters discussed in such statements include the level of housing starts and sales of existing homes, demand for home furnishings products, consumer confidence, trends in disposable income, and general economic conditions. Decreases in these economic indicators could have a negative effect on our business and prospects. Likewise, increases in interest rates, particularly home mortgage rates, and increases in consumer debt or the general rate of inflation, could affect us adversely. The future performance of our business depends in part on our success in conducting and finalizing acquisition negotiations and integrating acquired businesses into our existing operations. Changes in consumer tastes or preferences toward products not produced by us could erode demand for our products. Changes in tariffs or trade policy, including changes in U.S. trade enforcement priorities, or changes in the value of the U.S. dollar versus other currencies, could affect our financial results because a significant portion of our operations are located outside the United States. Strengthening of the U.S. dollar against other currencies could make our products less competitive on the basis of price in markets outside the United States, and strengthening of currency in China can have a negative impact on our sales of products produced there. In addition, because our foreign operations use the U.S. dollar as their functional currency, changes in the exchange rate between the local currency of those operations and the U.S dollar can affect our reported profits from those foreign operations. Also, economic or political instability in international areas could affect our operations or sources of goods in those areas, as well as demand for our products in international markets. The impact of public health epidemics on employees, customers, suppliers, and the global economy, such as the coronavirus pandemic, could also adversely affect our operations and financial performance. In addition, the impact of potential asset impairments, including impairments of property, plant, and equipment, inventory, or intangible assets, as well as the impact of

CULP Announces Results for Fourth Quarter and Full Year Fiscal 2025

Page 7

June 25, 2025

valuation allowances applied against our net deferred income tax assets, could affect our financial results. Increases in freight costs, labor costs, and raw material prices, including increases in market prices for petrochemical products, can also significantly affect the prices we pay for shipping, labor, and raw materials, respectively, and in turn, increase our operating costs and decrease our profitability. Also, our success in diversifying our supply chain with reliable partners to effectively service our global platform could affect our operations and adversely affect our financial results. Finally, the future performance of our business also depends on our ability to successfully restructure our mattress fabric operations and return the segment to profitability as well as successfully integrate our mattress fabrics and upholstery fabrics segments and realize the expected benefits of that integration effort, which may not meet our expectations. Further information about these factors, as well as other factors that could affect our future operations or financial results and the matters discussed in forward-looking statements, is included in Item 1A “Risk Factors” in our most recent Form 10-K and Form 10-Q reports filed with the Securities and Exchange Commission.

Many of these factors are macroeconomic in nature and are, therefore, beyond our control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, our actual results, performance or achievements may vary materially from those described in this release as anticipated, believed, estimated, expected, intended, planned or projected. The forward-looking statements included in this release are made only as of the date of this report. Unless required by United States federal securities laws, we neither intend nor assume any obligation to update these forward-looking statements for any reason after the date of this release to conform these statements to actual results or to changes in our expectations. A forward-looking statement is neither a prediction nor a guarantee of future events or circumstances, and those future events or circumstances may not occur. Additional risks and uncertainties that we do not presently know about or that we currently consider to be immaterial may also affect our business operations or financial results.

CULP Announces Results for Fourth Quarter and Full Year Fiscal 2025

Page 8

June 25, 2025

CULP, INC.

CONSOLIDATED STATEMENTS OF NET LOSS

FOR THE THREE MONTHS ENDED APRIL 27, 2025, AND APRIL 28, 2024

Unaudited

(Amounts in Thousands, Except for Per Share Data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THREE MONTHS ENDED |

|

|

|

Amount |

|

|

|

|

|

Percent of Sales |

|

|

|

(1) |

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

April 27, |

|

|

April 28, |

|

|

% Over |

|

|

April 27, |

|

|

April 28, |

|

|

|

2025 |

|

|

2024 |

|

|

(Under) |

|

|

2025 |

|

|

2024 |

|

Net sales |

|

$ |

48,773 |

|

|

$ |

49,528 |

|

|

|

(1.5 |

)% |

|

|

100.0 |

% |

|

|

100.0 |

% |

Cost of sales (1) |

|

|

(41,120 |

) |

|

|

(44,327 |

) |

|

|

(7.2 |

)% |

|

|

84.3 |

% |

|

|

89.5 |

% |

Gross profit |

|

|

7,653 |

|

|

|

5,201 |

|

|

|

47.1 |

% |

|

|

15.7 |

% |

|

|

10.5 |

% |

Selling, general and administrative

expenses |

|

|

(8,470 |

) |

|

|

(9,245 |

) |

|

|

(8.4 |

)% |

|

|

17.4 |

% |

|

|

18.7 |

% |

Restructuring expense (2) |

|

|

(1,422 |

) |

|

|

(204 |

) |

|

N.M |

|

|

|

2.9 |

% |

|

|

0.4 |

% |

Loss from operations |

|

|

(2,239 |

) |

|

|

(4,248 |

) |

|

|

(47.3 |

)% |

|

|

(4.6 |

)% |

|

|

(8.6 |

)% |

Interest expense |

|

|

(110 |

) |

|

|

(11 |

) |

|

N.M. |

|

|

|

0.2 |

% |

|

|

0.0 |

% |

Interest income |

|

|

154 |

|

|

|

263 |

|

|

|

(41.4 |

)% |

|

|

0.3 |

% |

|

|

0.5 |

% |

Other expense |

|

|

(121 |

) |

|

|

(64 |

) |

|

|

89.1 |

% |

|

|

(0.2 |

)% |

|

|

(0.1 |

)% |

Loss before income taxes |

|

|

(2,316 |

) |

|

|

(4,060 |

) |

|

|

(43.0 |

)% |

|

|

(4.7 |

)% |

|

|

(8.2 |

)% |

Income tax benefit (expense) (3) |

|

|

243 |

|

|

|

(805 |

) |

|

|

(130.2 |

)% |

|

|

10.5 |

% |

|

|

(19.8 |

)% |

Net loss |

|

$ |

(2,073 |

) |

|

$ |

(4,865 |

) |

|

|

(57.4 |

)% |

|

|

(4.3 |

)% |

|

|

(9.8 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share - basic |

|

$ |

(0.17 |

) |

|

$ |

(0.39 |

) |

|

|

(56.4 |

)% |

|

|

|

|

|

|

Net loss per share - diluted |

|

$ |

(0.17 |

) |

|

$ |

(0.39 |

) |

|

|

(56.4 |

)% |

|

|

|

|

|

|

Average shares outstanding-basic |

|

|

12,559 |

|

|

|

12,470 |

|

|

|

0.7 |

% |

|

|

|

|

|

|

Average shares outstanding-diluted |

|

|

12,559 |

|

|

|

12,470 |

|

|

|

0.7 |

% |

|

|

|

|

|

|

Notes

(1) See page 16 for a Reconciliation of Selected Income Statement Information to Adjusted Results for the three months ending April 27, 2025, and April 28, 2024.

(2) See page 18 for a Summary of Restructuring Expense for the three months ending April 27, 2025, and April 28, 2024.

(3) Percent of sales column for income tax benefit (expense) is calculated as a percent of loss before income taxes.

CULP Announces Results for Fourth Quarter and Full Year Fiscal 2025

Page 9

June 25, 2025

CULP, INC.

CONSOLIDATED STATEMENTS OF NET LOSS

FOR THE TWELVE MONTHS ENDED APRIL 27, 2025, AND APRIL 28, 2024

Unaudited

(Amounts in Thousands, Except for Per Share Data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TWELVE MONTHS ENDED |

|

|

|

Amount |

|

|

|

|

|

Percent of Sales |

|

|

|

(1) |

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

April 27, |

|

|

April 28, |

|

|

% Over |

|

|

April 27, |

|

|

April 28, |

|

|

|

2025 |

|

|

2024 |

|

|

(Under) |

|

|

2025 |

|

|

2024 |

|

Net sales |

|

$ |

213,237 |

|

|

$ |

225,333 |

|

|

|

(5.4 |

)% |

|

|

100.0 |

% |

|

|

100.0 |

% |

Cost of sales (1) |

|

|

(188,170 |

) |

|

|

(197,394 |

) |

|

|

(4.7 |

)% |

|

|

88.2 |

% |

|

|

87.6 |

% |

Gross profit |

|

|

25,067 |

|

|

|

27,939 |

|

|

|

(10.3 |

)% |

|

|

11.8 |

% |

|

|

12.4 |

% |

Selling, general and administrative

expenses |

|

|

(35,705 |

) |

|

|

(38,611 |

) |

|

|

(7.5 |

)% |

|

|

16.7 |

% |

|

|

17.1 |

% |

Restructuring expense (2) |

|

|

(7,739 |

) |

|

|

(636 |

) |

|

N.M. |

|

|

|

3.6 |

% |

|

|

0.3 |

% |

Loss from operations |

|

|

(18,377 |

) |

|

|

(11,308 |

) |

|

|

62.5 |

% |

|

|

(8.6 |

)% |

|

|

(5.0 |

)% |

Interest expense |

|

|

(231 |

) |

|

|

(11 |

) |

|

N.M. |

|

|

|

0.1 |

% |

|

|

0.0 |

% |

Interest income |

|

|

915 |

|

|

|

1,174 |

|

|

|

(22.1 |

)% |

|

|

0.4 |

% |

|

|

0.5 |

% |

Other expense |

|

|

(1,018 |

) |

|

|

(625 |

) |

|

|

62.9 |

% |

|

|

0.5 |

% |

|

|

0.3 |

% |

Loss before income taxes |

|

|

(18,711 |

) |

|

|

(10,770 |

) |

|

|

73.7 |

% |

|

|

(8.8 |

)% |

|

|

(4.8 |

)% |

Income tax expense (3) |

|

|

(392 |

) |

|

|

(3,049 |

) |

|

|

(87.1 |

)% |

|

|

(2.1 |

)% |

|

|

(28.3 |

)% |

Net loss |

|

$ |

(19,103 |

) |

|

$ |

(13,819 |

) |

|

|

38.2 |

% |

|

|

(9.0 |

)% |

|

|

(6.1 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share - basic |

|

$ |

(1.53 |

) |

|

$ |

(1.11 |

) |

|

|

37.8 |

% |

|

|

|

|

|

|

Net loss per share - diluted |

|

$ |

(1.53 |

) |

|

$ |

(1.11 |

) |

|

|

37.8 |

% |

|

|

|

|

|

|

Average shares outstanding-basic |

|

|

12,525 |

|

|

|

12,432 |

|

|

|

0.7 |

% |

|

|

|

|

|

|

Average shares outstanding-diluted |

|

|

12,525 |

|

|

|

12,432 |

|

|

|

0.7 |

% |

|

|

|

|

|

|

Notes

(1) See page 17 for a Reconciliation of Selected Income Statement Information to Adjusted Results for the twelve months ending April 27, 2025, and April 28, 2024.

(2) See page 19 for a Summary of Restructuring Expense for the twelve months ending April 27, 2025, and April 28, 2024.

(3) Percent of sales column for income tax expense is calculated as a percent of loss before income taxes.

CULP Announces Results for Fourth Quarter and Full Year Fiscal 2025

Page 10

June 25, 2025

CONSOLIDATED BALANCE SHEETS

APRIL 27, 2025, AND APRIL 28, 2024

Unaudited

(Amounts in Thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amounts |

|

|

|

|

|

|

|

|

|

(Condensed) |

|

|

(Condensed) |

|

|

|

|

|

|

|

|

|

April 27, |

|

|

April 28, |

|

|

Increase (Decrease) |

|

|

|

2025 |

|

|

2024* |

|

|

Dollars |

|

|

Percent |

|

Current assets |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

5,629 |

|

|

$ |

10,012 |

|

|

|

(4,383 |

) |

|

|

(43.8 |

)% |

Short-term investments - rabbi trust |

|

|

1,325 |

|

|

|

903 |

|

|

|

422 |

|

|

|

46.7 |

% |

Accounts receivable, net |

|

|

21,844 |

|

|

|

21,138 |

|

|

|

706 |

|

|

|

3.3 |

% |

Inventories |

|

|

49,309 |

|

|

|

44,843 |

|

|

|

4,466 |

|

|

|

10.0 |

% |

Short-term notes receivable |

|

|

280 |

|

|

|

264 |

|

|

|

16 |

|

|

|

6.1 |

% |

Current income taxes receivable |

|

|

— |

|

|

|

350 |

|

|

|

(350 |

) |

|

|

(100.0 |

)% |

Assets held for sale |

|

|

2,177 |

|

|

|

— |

|

|

|

2,177 |

|

|

|

100.0 |

% |

Other current assets |

|

|

2,970 |

|

|

|

3,371 |

|

|

|

(401 |

) |

|

|

(11.9 |

)% |

Total current assets |

|

|

83,534 |

|

|

|

80,881 |

|

|

|

2,653 |

|

|

|

3.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant & equipment, net |

|

|

24,836 |

|

|

|

33,182 |

|

|

|

(8,346 |

) |

|

|

(25.2 |

)% |

Right of use assets |

|

|

5,908 |

|

|

|

6,203 |

|

|

|

(295 |

) |

|

|

(4.8 |

)% |

Intangible assets |

|

|

960 |

|

|

|

1,876 |

|

|

|

(916 |

) |

|

|

(48.8 |

)% |

Long-term investments - rabbi trust |

|

|

5,722 |

|

|

|

7,102 |

|

|

|

(1,380 |

) |

|

|

(19.4 |

)% |

Long-term notes receivable |

|

|

1,182 |

|

|

|

1,462 |

|

|

|

(280 |

) |

|

|

(19.2 |

)% |

Deferred income taxes |

|

|

637 |

|

|

|

518 |

|

|

|

119 |

|

|

|

23.0 |

% |

Other assets |

|

|

591 |

|

|

|

830 |

|

|

|

(239 |

) |

|

|

(28.8 |

)% |

Total assets |

|

$ |

123,370 |

|

|

$ |

132,054 |

|

|

|

(8,684 |

) |

|

|

(6.6 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

Lines of credit - current |

|

|

8,114 |

|

|

|

— |

|

|

|

8,114 |

|

|

|

100.0 |

% |

Accounts payable - trade |

|

|

27,323 |

|

|

|

25,607 |

|

|

|

1,716 |

|

|

|

6.7 |

% |

Accounts payable - capital expenditures |

|

|

23 |

|

|

|

343 |

|

|

|

(320 |

) |

|

|

(93.3 |

)% |

Operating lease liability - current |

|

|

2,394 |

|

|

|

2,061 |

|

|

|

333 |

|

|

|

16.2 |

% |

Deferred compensation - current |

|

|

1,325 |

|

|

|

903 |

|

|

|

422 |

|

|

|

46.7 |

% |

Deferred revenue |

|

|

422 |

|

|

|

1,495 |

|

|

|

(1,073 |

) |

|

|

(71.8 |

)% |

Accrued expenses |

|

|

5,333 |

|

|

|

6,726 |

|

|

|

(1,393 |

) |

|

|

(20.7 |

)% |

Accrued restructuring |

|

|

610 |

|

|

|

— |

|

|

|

610 |

|

|

|

100.0 |

% |

Income taxes payable - current |

|

|

1,420 |

|

|

|

972 |

|

|

|

448 |

|

|

|

46.1 |

% |

Total current liabilities |

|

|

46,964 |

|

|

|

38,107 |

|

|

|

8,857 |

|

|

|

23.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Lines of credit - long-term |

|

|

4,600 |

|

|

|

— |

|

|

|

4,600 |

|

|

|

100.0 |

% |

Operating lease liability - long-term |

|

|

2,535 |

|

|

|

2,422 |

|

|

|

113 |

|

|

|

4.7 |

% |

Income taxes payable - long-term |

|

|

790 |

|

|

|

2,088 |

|

|

|

(1,298 |

) |

|

|

(62.2 |

)% |

Deferred income taxes |

|

|

5,155 |

|

|

|

6,379 |

|

|

|

(1,224 |

) |

|

|

(19.2 |

)% |

Deferred compensation - long-term |

|

|

5,686 |

|

|

|

6,929 |

|

|

|

(1,243 |

) |

|

|

(17.9 |

)% |

Total liabilities |

|

|

65,730 |

|

|

|

55,925 |

|

|

|

9,805 |

|

|

|

17.5 |

% |

Shareholders' equity |

|

|

57,640 |

|

|

|

76,129 |

|

|

|

(18,489 |

) |

|

|

(24.3 |

)% |

Total liabilities and shareholders'

equity |

|

$ |

123,370 |

|

|

$ |

132,054 |

|

|

|

(8,684 |

) |

|

|

(6.6 |

)% |

Shares outstanding |

|

|

12,559 |

|

|

|

12,470 |

|

|

|

89 |

|

|

|

0.7 |

% |

* Derived from audited financial statements.

CULP Announces Results for Fourth Quarter and Full Year Fiscal 2025

Page 11

June 25, 2025

CULP, INC.

SUMMARY OF CASH AND DEBT

APRIL 27, 2025, AND APRIL 28, 2024

Unaudited

(Amounts in Thousands)

|

|

|

|

|

|

|

|

|

|

|

Amounts |

|

|

|

April 27, |

|

|

April 28, |

|

|

|

2025 |

|

|

2024* |

|

Cash: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

5,629 |

|

|

$ |

10,012 |

|

Less Debt: |

|

|

|

|

|

|

Lines of credit - current |

|

|

8,114 |

|

|

|

— |

|

Lines of credit - long-term |

|

|

4,600 |

|

|

|

— |

|

Net (debt) cash position |

|

$ |

(7,085 |

) |

|

$ |

10,012 |

|

|

|

|

|

|

|

|

* Derived from audited financial statements.

CULP Announces Results for Fourth Quarter and Full Year Fiscal 2025

Page 12

June 25, 2025

CULP, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE TWELVE MONTHS ENDED APRIL 27, 2025, AND APRIL 28, 2024

Unaudited

(Amounts in Thousands)

|

|

|

|

|

|

|

|

|

|

|

TWELVE MONTHS ENDED |

|

|

|

Amounts |

|

|

|

April 27, |

|

|

April 28, |

|

|

|

2025 |

|

|

2024* |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(19,103 |

) |

|

$ |

(13,819 |

) |

Adjustments to reconcile net loss to net cash used in

operating activities: |

|

|

|

|

|

|

Depreciation |

|

|

5,440 |

|

|

|

6,521 |

|

Non-cash inventory credit |

|

|

(2,423 |

) |

|

|

(1,628 |

) |

Amortization |

|

|

405 |

|

|

|

390 |

|

Stock-based compensation |

|

|

650 |

|

|

|

915 |

|

Deferred income taxes |

|

|

(1,343 |

) |

|

|

387 |

|

Gain on sale of equipment |

|

|

(27 |

) |

|

|

(299 |

) |

Non-cash restructuring expense |

|

|

2,708 |

|

|

|

330 |

|

Foreign currency exchange gain |

|

|

(145 |

) |

|

|

(593 |

) |

Changes in assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

(722 |

) |

|

|

3,559 |

|

Inventories |

|

|

(2,059 |

) |

|

|

1,593 |

|

Other current assets |

|

|

384 |

|

|

|

(329 |

) |

Other assets |

|

|

114 |

|

|

|

(115 |

) |

Accounts payable - trade |

|

|

1,852 |

|

|

|

(2,926 |

) |

Deferred revenue |

|

|

(1,073 |

) |

|

|

303 |

|

Accrued restructuring |

|

|

633 |

|

|

|

— |

|

Accrued expenses and deferred compensation |

|

|

(2,456 |

) |

|

|

(1,870 |

) |

Income taxes |

|

|

(485 |

) |

|

|

(643 |

) |

Net cash used in operating activities |

|

|

(17,650 |

) |

|

|

(8,224 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

Capital expenditures |

|

|

(2,947 |

) |

|

|

(3,711 |

) |

Proceeds from the sale of property, plant and equipment |

|

|

1,945 |

|

|

|

385 |

|

Proceeds from note receivable |

|

|

610 |

|

|

|

330 |

|

Proceeds from the sale of investments (rabbi trust) |

|

|

1,725 |

|

|

|

1,449 |

|

Purchase of investments (rabbi trust) |

|

|

(735 |

) |

|

|

(884 |

) |

Net cash provided by (used in) investing activities |

|

|

598 |

|

|

|

(2,431 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from lines of credit |

|

|

21,648 |

|

|

|

4,166 |

|

Payments on lines of credit |

|

|

(8,907 |

) |

|

|

(4,146 |

) |

Common stock surrendered for withholding taxes payable |

|

|

(68 |

) |

|

|

(146 |

) |

Net cash provided by (used in) financing activities |

|

|

12,673 |

|

|

|

(126 |

) |

Effect of foreign currency exchange rate changes on cash and cash equivalents |

|

|

(4 |

) |

|

|

(171 |

) |

Decrease in cash and cash equivalents |

|

|

(4,383 |

) |

|

|

(10,952 |

) |

Cash and cash equivalents at beginning of year |

|

|

10,012 |

|

|

|

20,964 |

|

Cash and cash equivalents at end of year |

|

$ |

5,629 |

|

|

$ |

10,012 |

|

Free Cash Flow (1) |

|

$ |

(17,056 |

) |

|

$ |

(10,826 |

) |

(1) See next page for Reconciliation of Free Cash Flow for the twelve months ending April 27, 2025, and April 28, 2024.

CULP Announces Results for Fourth Quarter and Full Year Fiscal 2025

Page 13

June 25, 2025

CULP, INC.

RECONCILIATION OF FREE CASH FLOW

FOR THE TWELVE MONTHS ENDED APRIL 27, 2025, AND APRIL 28, 2024

Unaudited

(Amounts in Thousands)

|

|

|

|

|

|

|

|

|

|

|

TWELVE MONTHS ENDED |

|

|

|

Amounts |

|

|

|

April 27, |

|

|

April 28, |

|

|

|

2025 |

|

|

2024 |

|

A) Net cash used in operating activities |

|

$ |

(17,650 |

) |

|

$ |

(8,224 |

) |

B) Minus: Capital expenditures |

|

|

(2,947 |

) |

|

|

(3,711 |

) |

C) Plus: Proceeds from the sale of buildings and equipment |

|

|

1,945 |

|

|

|

385 |

|

D) Plus: Proceeds from note receivable |

|

|

610 |

|

|

|

330 |

|

E) Plus: Proceeds from the sale of investments (rabbi trust) |

|

|

1,725 |

|

|

|

1,449 |

|

F) Minus: Purchase of investments (rabbi trust) |

|

|

(735 |

) |

|

|

(884 |

) |

G) Effects of foreign currency exchange rate changes on cash and cash equivalents |

|

|

(4 |

) |

|

|

(171 |

) |

Free Cash Flow |

|

$ |

(17,056 |

) |

|

$ |

(10,826 |

) |

CULP Announces Results for Fourth Quarter and Full Year Fiscal 2025

Page 14

June 25, 2025

CULP, INC.

STATEMENTS OF OPERATIONS BY SEGMENT

FOR THE THREE MONTHS ENDED APRIL 27, 2025, AND APRIL 28, 2024

Unaudited

(Amounts in Thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THREE MONTHS ENDED |

|

|

|

Amounts |

|

|

|

|

|

Percent of Total Sales |

|

|

|

April 27, |

|

|

April 28, |

|

|

% Over |

|

|

April 27, |

|

|

April 28, |

|

Net Sales by Segment |

|

2025 |

|

|

2024 |

|

|

(Under) |

|

|

2025 |

|

|

2024 |

|

Mattress Fabrics |

|

$ |

27,114 |

|

|

$ |

25,750 |

|

|

|

5.3 |

% |

|

|

55.6 |

% |

|

|

52.0 |

% |

Upholstery Fabrics |

|

|

21,659 |

|

|

|

23,778 |

|

|

|

(8.9 |

)% |

|

|

44.4 |

% |

|

|

48.0 |

% |

Net Sales |

|

$ |

48,773 |

|

|

$ |

49,528 |

|

|

|

(1.5 |

)% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit by Segment |

|

|

|

|

|

|

|

|

|

|

Gross Margin |

|

Mattress Fabrics |

|

$ |

3,075 |

|

|

$ |

292 |

|

|

N.M. |

|

|

|

11.3 |

% |

|

|

1.1 |

% |

Upholstery Fabrics |

|

|

4,691 |

|

|

|

4,909 |

|

|

|

(4.4 |

)% |

|

|

21.7 |

% |

|

|

20.6 |

% |

Total Segment Gross Profit |

|

|

7,766 |

|

|

|

5,201 |

|

|

|

49.3 |

% |

|

|

15.9 |

% |

|

|

10.5 |

% |

Restructuring Related Charge (1) |

|

|

(113 |

) |

|

|

— |

|

|

|

100.0 |

% |

|

|

(0.2 |

)% |

|

|

— |

|

Gross Profit |

|

$ |

7,653 |

|

|

$ |

5,201 |

|

|

|

47.1 |

% |

|

|

15.7 |

% |

|

|

10.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, General and Administrative

Expenses by Segment |

|

|

|

|

|

|

|

|

|

|

Percent of Sales |

|

Mattress Fabrics |

|

$ |

3,292 |

|

|

$ |

3,221 |

|

|

|

2.2 |

% |

|

|

12.1 |

% |

|

|

12.5 |

% |

Upholstery Fabrics |

|

|

3,638 |

|

|

|

3,934 |

|

|

|

(7.5 |

)% |

|

|

16.8 |

% |

|

|

16.5 |

% |

Unallocated Corporate Expenses |

|

|

1,540 |

|

|

|

2,090 |

|

|

|

(26.3 |

)% |

|

|

3.2 |

% |

|

|

4.2 |

% |

Selling, General and Administrative

Expenses |

|

$ |

8,470 |

|

|

$ |

9,245 |

|

|

|

(8.4 |

)% |

|

|

17.4 |

% |

|

|

18.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) Income from Operations

by Segment |

|

|

|

|

|

|

|

|

|

|

Operating Margin |

|

Mattress Fabrics |

|

$ |

(217 |

) |

|

$ |

(2,929 |

) |

|

|

(92.6 |

)% |

|

|

(0.8 |

)% |

|

|

(11.4 |

)% |

Upholstery Fabrics |

|

$ |

1,053 |

|

|

$ |

975 |

|

|

|

8.0 |

% |

|

|

4.9 |

% |

|

|

4.1 |

% |

Unallocated Corporate Expenses |

|

$ |

(1,540 |

) |

|

$ |

(2,090 |

) |

|

|

(26.3 |

)% |

|

|

(3.2 |

)% |

|

|

(4.2 |

)% |

Total Segment Loss from

Operations |

|

|

(704 |

) |

|

|

(4,044 |

) |

|

|

(82.6 |

)% |

|

|

(1.4 |

)% |

|

|

(8.2 |

)% |

Restructuring Related Charge (1) |

|

|

(113 |

) |

|

|

— |

|

|

|

100.0 |

% |

|

|

(0.2 |

)% |

|

|

— |

|

Restructuring Expense (2) |

|

|

(1,422 |

) |

|

|

(204 |

) |

|

N.M. |

|

|

|

(2.9 |

)% |

|

|

(0.4 |

)% |

Loss from Operations |

|

$ |

(2,239 |

) |

|

$ |

(4,248 |

) |

|

|

(47.3 |

)% |

|

|

(4.6 |

)% |

|

|

(8.6 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation Expense by Segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mattress Fabrics |

|

$ |

1,015 |

|

|

$ |

1,461 |

|

|

|

(30.5 |

)% |

|

|

|

|

|

|

Upholstery Fabrics |

|

|

137 |

|

|

|

162 |

|

|

|

(15.4 |

)% |

|

|

|

|

|

|

Depreciation Expense |

|

$ |

1,152 |

|

|

$ |

1,623 |

|

|

|

(29.0 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes

(1) See page 16 for a Reconciliation of Selected Income Statement Information to Adjusted Results for the three months ending April 27, 2025, and April 28, 2024.

(2) See page 18 for a Summary of Restructuring Expense for the three months ending April 27, 2025, and April 28, 2024.

CULP Announces Results for Fourth Quarter and Full Year Fiscal 2025

Page 15

June 25, 2025

CULP, INC.

STATEMENTS OF OPERATIONS BY SEGMENT

FOR THE TWELVE MONTHS ENDED APRIL 27, 2025, AND APRIL 28, 2024

Unaudited

(Amounts in Thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TWELVE MONTHS ENDED |

|

|

|

Amounts |

|

|

|

|

|

Percent of Total Sales |

|

|

|

April 27, |

|

|

April 28, |

|

|

% Over |

|

|

April 27, |

|

|

April 28, |

|

Net Sales by Segment |

|

2025 |

|

|

2024 |

|

|

(Under) |

|

|

2025 |

|

|

2024 |

|

Mattress Fabrics |

|

$ |

113,906 |

|

|

$ |

116,370 |

|

|

|

(2.1 |

)% |

|

|

53.4 |

% |

|

|

51.6 |

% |

Upholstery Fabrics |

|

|

99,331 |

|

|

|

108,963 |

|

|

|

(8.8 |

)% |

|

|

46.6 |

% |

|

|

48.4 |

% |

Net Sales |

|

$ |

213,237 |

|

|

$ |

225,333 |

|

|

|

(5.4 |

)% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit by Segment |

|

|

|

|

|

|

|

|

|

|

Gross Margin |

|

Mattress Fabrics |

|

$ |

7,936 |

|

|

$ |

6,289 |

|

|

|

26.2 |

% |

|

|

7.0 |

% |

|

|

5.4 |

% |

Upholstery Fabrics |

|

|

18,752 |

|

|

|

21,690 |

|

|

|

(13.5 |

)% |

|

|

18.9 |

% |

|

|

19.9 |

% |

Total Segment Gross Profit |

|

|

26,688 |

|

|

|

27,979 |

|

|

|

(4.6 |

)% |

|

|

12.5 |

% |

|

|

12.4 |

% |

Restructuring Related Charge (1) |

|

|

(1,621 |

) |

|

|

(40 |

) |

|

N.M. |

|

|

|

(0.8 |

)% |

|

|

(0.0 |

)% |

Gross Profit |

|

$ |

25,067 |

|

|

$ |

27,939 |

|

|

|

(10.3 |

)% |

|

|

11.8 |

% |

|

|

12.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, General and Administrative

Expenses by Segment |

|

|

|

|

|

|

|

|

|

|

Percent of Sales |

|

Mattress Fabrics |

|

$ |

13,171 |

|

|

$ |

13,134 |

|

|

|

0.3 |

% |

|

|

11.6 |

% |

|

|

11.3 |

% |

Upholstery Fabrics |

|

|

14,695 |

|

|

|

15,903 |

|

|

|

(7.6 |

)% |

|

|

14.8 |

% |

|

|

14.6 |

% |

Unallocated Corporate Expenses |

|

|

7,839 |

|

|

|

9,574 |

|

|

|

(18.1 |

)% |

|

|

3.7 |

% |

|

|

4.2 |

% |

Selling, General and Administrative

Expenses |

|

$ |

35,705 |

|

|

$ |

38,611 |

|

|

|

(7.5 |

)% |

|

|

16.7 |

% |

|

|

17.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) Income from Operations

by Segment |

|

|

|

|

|

|

|

|

|

|

Operating Margin |

|

Mattress Fabrics |

|

$ |

(5,235 |

) |

|

$ |

(6,845 |

) |

|

|

(23.5 |

)% |

|

|

(4.6 |

)% |

|

|

(5.9 |

)% |

Upholstery Fabrics |

|

$ |

4,057 |

|

|

|

5,787 |

|

|

|

(29.9 |

)% |

|

|

4.1 |

% |

|

|

5.3 |

% |

Unallocated Corporate Expenses |

|

$ |

(7,839 |

) |

|

|

(9,574 |

) |

|

|

(18.1 |

)% |

|

|

(3.7 |

)% |

|

|

(4.2 |

)% |

Total Segment Loss from

Operations |

|

|

(9,017 |

) |

|

|

(10,632 |

) |

|

|

(15.2 |

)% |

|

|

(4.2 |

)% |

|

|

(4.7 |

)% |

Restructuring Related Charge (1) |

|

|

(1,621 |

) |

|

|

(40 |

) |

|

N.M. |

|

|

|

(0.8 |

)% |

|

|

(0.0 |

)% |

Restructuring Expense (2) |

|

|

(7,739 |

) |

|

|

(636 |

) |

|

N.M. |

|

|

|

(3.6 |

)% |

|

|

(0.3 |

)% |

Loss from Operations |

|

$ |

(18,377 |

) |

|

$ |

(11,308 |

) |

|

|

62.5 |

% |

|

|

(8.6 |

)% |

|

|

(5.0 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on Capital Employed (ttm) (3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mattress Fabrics |

|

|

(9.5 |

)% |

|

|

(10.8 |

)% |

|

|

(12.0 |

)% |

|

|

|

|

|

|

Upholstery Fabrics |

|

|

40.5 |

% |

|

|

62.5 |

% |

|

|

(35.2 |

)% |

|

|

|

|

|

|

Unallocated Corporate |

|

N.M. |

|

|

N.M. |

|

|

N.M. |

|

|

|

|

|

|

|

Consolidated |

|

|

(13.0 |

)% |

|

|

(13.9 |

)% |

|

|

(6.5 |

)% |

|

|

|

|

|

|

Capital Employed (3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mattress Fabrics |

|

$ |

52,331 |

|

|

$ |

62,257 |

|

|

|

(15.9 |

)% |

|

|

|

|

|

|

Upholstery Fabrics |

|

|

16,751 |

|

|

|

7,259 |

|

|

|

130.8 |

% |

|

|

|

|

|

|

Unallocated Corporate |

|

|

2,945 |

|

|

|

4,999 |

|

|

|

(41.1 |

)% |

|

|

|

|

|

|

Consolidated |

|

$ |

72,027 |

|

|

$ |

74,515 |

|

|

|

(3.3 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation Expense by Segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mattress Fabrics (4) |

|

$ |

6,178 |

|

|

$ |

5,883 |

|

|

|

5.0 |

% |

|

|

|

|

|

|

Upholstery Fabrics |

|

|

601 |

|

|

|

638 |

|

|

|

(5.8 |

)% |

|

|

|

|

|

|

Depreciation Expense |

|

$ |

6,779 |

|

|

$ |

6,521 |

|

|

|

4.0 |

% |

|

|

|

|

|

|

Notes

(1) See page 17 for a Reconciliation of Selected Income Statement Information to Adjusted Results for the twelve months ending April 27, 2025, and April 28, 2024.

(2) See page 19 for a Summary of Restructuring Expense for the twelve months ending April 27, 2025, and April 28, 2024.

(3) See pages 21 through 24 for calculation of Return on Capital Employed by Segment for the trailing twelve months ending April 27, 2025, and April 28, 2024, and a reconciliation to information from our U.S. GAAP financial statements. The capital employed balances are as of April 27, 2025, and April 28, 2024.

(4) During the twelve-month period ending April 27, 2025, depreciation expense for the mattress fabrics segment included additional depreciation expense related to the shortening of useful lives of equipment associated with the closure of operations at our manufacturing facility located in Quebec, Canada. The amount of additional depreciation expense totaling $1.3 million was classified as restructuring expense in our fiscal 2025 Consolidated Statements of Net Loss.

CULP Announces Results for Fourth Quarter and Full Year Fiscal 2025

Page 16

June 25, 2025

CULP, INC.

RECONCILIATION OF SELECTED INCOME STATEMENT INFORMATION TO ADJUSTED RESULTS

FOR THE THREE MONTHS ENDED APRIL 27, 2025, AND APRIL 28, 2024

Unaudited

(Amounts in Thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As Reported |

|

|

|

|

|

Adjusted Results |

|

|

|

April 27, |

|

|

|

|

|

April 27, |

|

|

|

2025 |

|

|

Adjustments |

|

|

2025 |

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

48,773 |

|

|

|

— |

|

|

$ |

48,773 |

|

Cost of sales (1) |

|

|

(41,120 |

) |

|

|

113 |

|

|

|

(41,007 |

) |

Gross profit |

|

|

7,653 |

|

|

|

113 |

|

|

|

7,766 |

|

Selling, general and administrative

expenses |

|

|

(8,470 |

) |

|

|

— |

|

|

|

(8,470 |

) |

Restructuring expense (2) |

|

|

(1,422 |

) |

|

|

1,422 |

|

|

|

— |

|

Loss from operations |

|

$ |

(2,239 |

) |

|

|

1,535 |

|

|

$ |

(704 |

) |

Notes

(1) During the three months ending April 27, 2025, cost of sales included a restructuring related charge of $113,000 for losses on the disposal of inventory related to the closure of operations at the company's manufacturing facility located in Quebec, Canada.

(2) See page 18 for a Summary of Restructuring Expense for the three months ending April 27, 2025.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As Reported |

|

|

|

|

|

Adjusted Results |

|

|

|

April 28, |

|

|

|

|

|

April 28, |

|

|

|

2024 |

|

|

Adjustments |

|

|

2024 |

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

49,528 |

|

|

|

— |

|

|

$ |

49,528 |

|

Cost of sales |

|

|

(44,327 |

) |

|

|

— |

|

|

|

(44,327 |

) |

Gross profit |

|

|

5,201 |

|

|

|

— |

|

|

|

5,201 |

|

Selling, general and administrative

expenses |

|

|

(9,245 |

) |

|

|

— |

|

|

|

(9,245 |

) |

Restructuring expense (1) |

|

|

(204 |

) |

|

|

204 |

|

|

|

— |

|

Loss from operations |

|

$ |

(4,248 |

) |

|

|

204 |

|

|

$ |

(4,044 |

) |

Notes

(1) See page 18 for a Summary of Restructuring Expense for the three months ending April 28, 2024.

CULP Announces Results for Fourth Quarter and Full Year Fiscal 2025

Page 17

June 25, 2025

CULP, INC.

RECONCILIATION OF SELECTED INCOME STATEMENT INFORMATION TO ADJUSTED RESULTS

FOR THE TWELVE MONTHS ENDED APRIL 27, 2025, AND APRIL 28, 2024

Unaudited

(Amounts in Thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As Reported |

|

|

|

|

|

Adjusted Results |

|

|

|

April 27, |

|

|

|

|

|

April 27, |

|

|

|

2025 |

|

|

Adjustments |

|

|

2025 |

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

213,237 |

|

|

|

— |

|

|

$ |

213,237 |

|

Cost of sales (1) |

|

|

(188,170 |

) |

|

|

1,621 |

|

|

|

(186,549 |

) |

Gross profit |

|

|

25,067 |

|

|

|

1,621 |

|

|

|

26,688 |

|

Selling, general and administrative

expenses |

|

|

(35,705 |

) |

|

|

— |

|

|

|

(35,705 |

) |

Restructuring expense (2) |

|

|

(7,739 |

) |

|

|

7,739 |

|

|

|

— |

|

Loss from operations |

|

$ |

(18,377 |

) |

|

|

9,360 |

|

|

$ |

(9,017 |

) |

Notes

(1) During the twelve months ending April 27, 2025, cost of sales included a restructuring related charge of $1.6 million for losses on the disposal, valuation, and markdowns of inventory related to the closure of the company's manufacturing facility located in Quebec, Canada.

(2) See page 19 for a Summary of Restructuring Expense for the twelve months ending April 27, 2025.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As Reported |

|

|

|

|

|

Adjusted Results |

|

|

|

April 28, |

|

|

|

|

|

April 28, |

|

|

|

2024 |

|

|

Adjustments |

|

|

2024 |

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

225,333 |

|

|

|

— |

|

|

$ |

225,333 |

|

Cost of sales (1) |

|

|

(197,394 |

) |

|

|

40 |

|

|

|

(197,354 |

) |

Gross profit |

|

|

27,939 |

|

|

|

40 |

|

|

|

27,979 |

|

Selling, general and administrative

expenses |

|

|

(38,611 |

) |

|

|

— |

|

|

|

(38,611 |

) |

Restructuring expense (2) |

|

|

(636 |

) |

|

|

636 |

|

|

|

— |

|

Loss from operations |

|

$ |

(11,308 |

) |

|

|

676 |

|

|

$ |

(10,632 |

) |

Notes

(1) During the twelve months ending April 27, 2024, cost of sales included a restructuring related charge of $40,000 for markdowns of inventory related to the discontinuance of production of cut and sewn upholstery kits at the company's facility in Ouanaminthe, Haiti.

(2) See page 19 for a Summary of Restructuring Expense for the twelve months ending April 28, 2024.

CULP Announces Results for Fourth Quarter and Full Year Fiscal 2025

Page 18

June 25, 2025

CULP, INC.

SUMMARY OF RESTRUCTURING EXPENSE

FOR THE THREE MONTHS ENDED APRIL 27, 2025, AND APRIL 28, 2024

Unaudited

(Amounts in Thousands)

The following summarizes restructuring expense for three-month period ending April 27, 2025:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Upholstery |

|

|

Mattress |

|

|

Unallocated |

|

|

|

|

Description |

|

Fabrics |

|

|

Fabrics |

|

|

Corporate |

|

|

Total |

|

Employee termination benefits |

|

$ |

112 |

|

|

$ |

12 |

|

|

$ |

— |

|

|

$ |

124 |

|

Impairment charge related to intangible asset |

|

|

— |

|

|

|

— |

|

|

|

540 |

|

|

|

540 |

|

Loss on the sale and disposal of equipment |

|

|

24 |

|

|

|

2 |

|

|

|

— |

|

|

|

26 |

|

Facility consolidation and relocation expenses |

|

|

— |

|

|

|

322 |

|

|

|

— |

|

|

|

322 |

|

Cost incurred to ready a closed facility for sale |

|

|

— |

|

|

|

360 |

|

|

|

— |

|

|

|

360 |

|

Other associated costs |

|

|

— |

|

|

|

50 |

|

|

|

— |

|

|

|

50 |

|

Total restructuring expense (1) |

|

$ |

136 |

|

|

$ |

746 |

|

|

$ |

540 |

|

|

$ |

1,422 |

|