Welcoming Remarks Chris R. Burritt Chairman of the Board

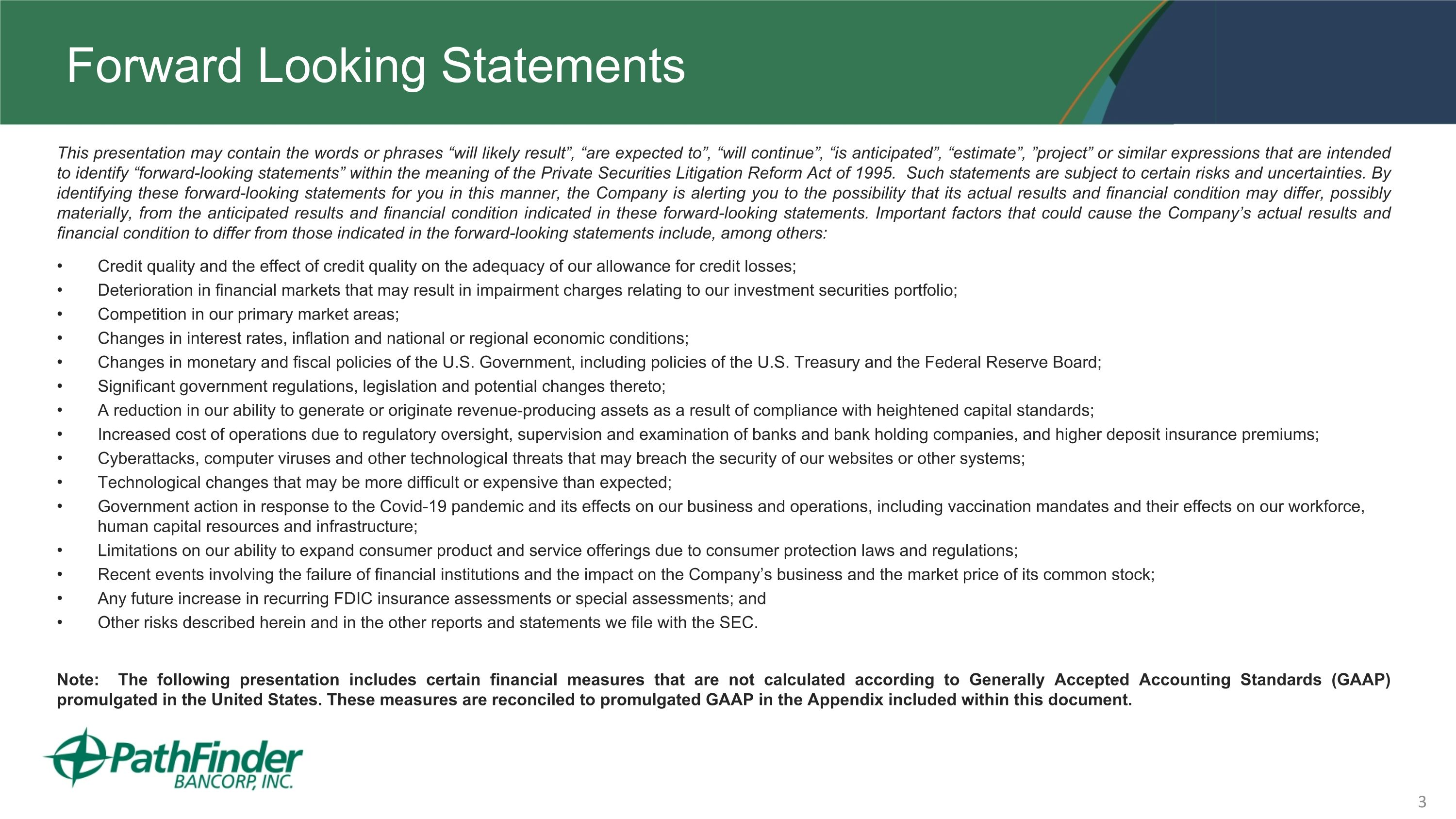

Forward Looking Statements This presentation may contain the words or phrases “will likely result”, “are expected to”, “will continue”, “is anticipated”, “estimate”, ”project” or similar expressions that are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are subject to certain risks and uncertainties. By identifying these forward-looking statements for you in this manner, the Company is alerting you to the possibility that its actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Important factors that could cause the Company’s actual results and financial condition to differ from those indicated in the forward-looking statements include, among others: Credit quality and the effect of credit quality on the adequacy of our allowance for credit losses; Deterioration in financial markets that may result in impairment charges relating to our investment securities portfolio; Competition in our primary market areas; Changes in interest rates, inflation and national or regional economic conditions; Changes in monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury and the Federal Reserve Board; Significant government regulations, legislation and potential changes thereto; A reduction in our ability to generate or originate revenue-producing assets as a result of compliance with heightened capital standards; Increased cost of operations due to regulatory oversight, supervision and examination of banks and bank holding companies, and higher deposit insurance premiums; Cyberattacks, computer viruses and other technological threats that may breach the security of our websites or other systems; Technological changes that may be more difficult or expensive than expected; Government action in response to the Covid-19 pandemic and its effects on our business and operations, including vaccination mandates and their effects on our workforce, human capital resources and infrastructure; Limitations on our ability to expand consumer product and service offerings due to consumer protection laws and regulations; Recent events involving the failure of financial institutions and the impact on the Company’s business and the market price of its common stock; Any future increase in recurring FDIC insurance assessments or special assessments; and Other risks described herein and in the other reports and statements we file with the SEC. Note: The following presentation includes certain financial measures that are not calculated according to Generally Accepted Accounting Standards (GAAP) promulgated in the United States. These measures are reconciled to promulgated GAAP in the Appendix included within this document.

Agenda – 2023 Annual Meeting of Shareholders Introduction of Directors, Management and Guests Conduct of the Meeting Notice and proxy Report of Inspector of Elections Meeting proposals Call for vote Management Presentation, Questions & Answers to Follow Results of Shareholder Vote Meeting Adjournment

Board of Directors Pathfinder Bancorp, Inc. Director Since Eric Allyn 2022 David A. Ayoub 2012 William A. Barclay 2011 Chris R. Burritt 1986 Meghan Crawford-Hamlin 2022 John P. Funiciello 2011 Adam C. Gagas 2014 Melanie Littlejohn 2016 John F. Sharkey, III 2014 Lloyd “Buddy” Stemple 2005 James A. Dowd, New Director Nominee N/A Pathfinder Bank Director Since George P. Joyce 2000

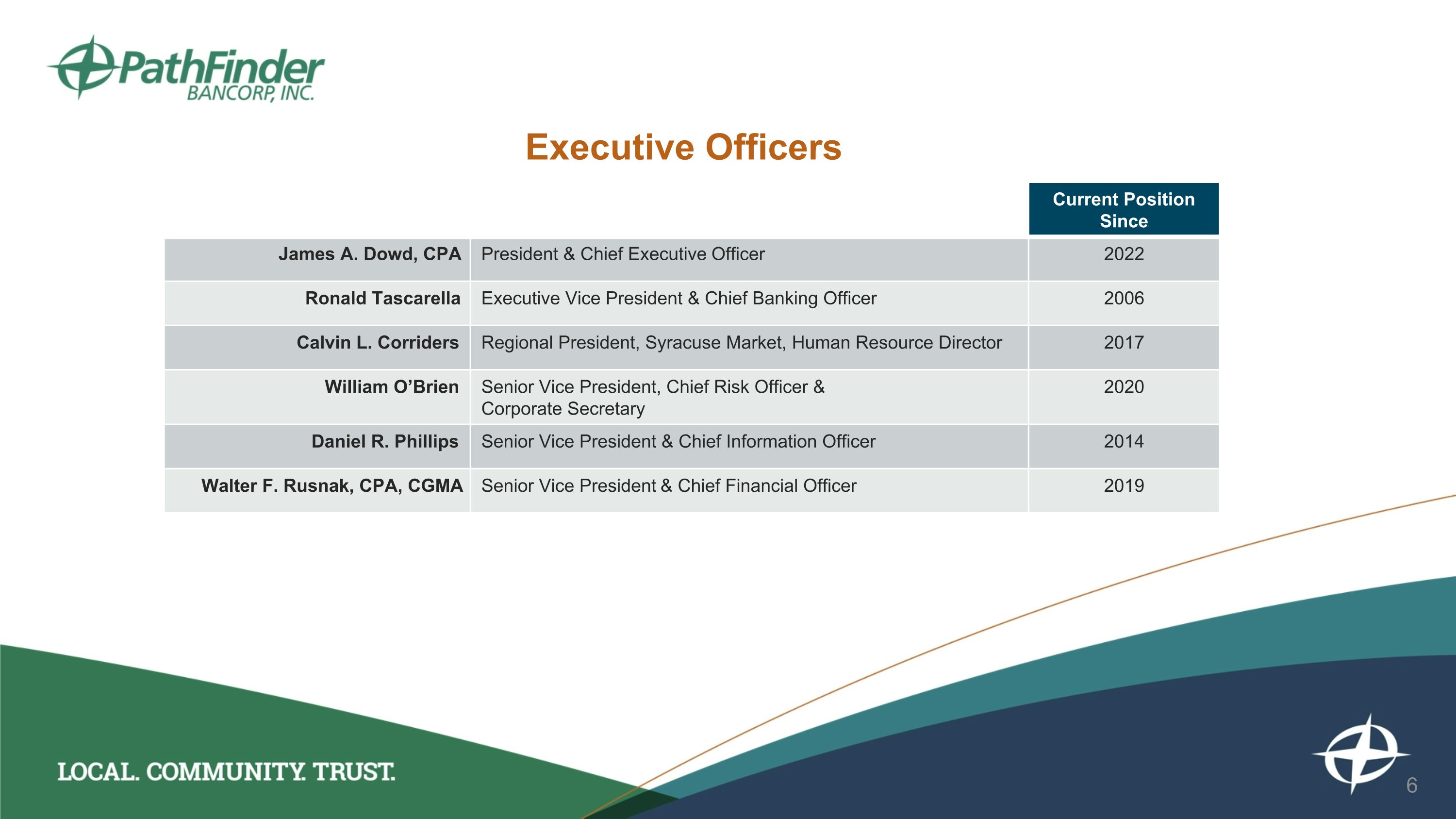

Executive Officers Name Title Current Position Since James A. Dowd, CPA President & Chief Executive Officer 2022 Ronald Tascarella Executive Vice President & Chief Banking Officer 2006 Calvin L. Corriders Regional President, Syracuse Market, Human Resource Director 2017 William O’Brien Senior Vice President, Chief Risk Officer & Corporate Secretary 2020 Daniel R. Phillips Senior Vice President & Chief Information Officer 2014 Walter F. Rusnak, CPA, CGMA Senior Vice President & Chief Financial Officer 2019

Independent Registered Public Accounting Firm Jamie L. Card, CPA Tamara L. Gamble, CPA Partners, Bonadio & Company, LLP

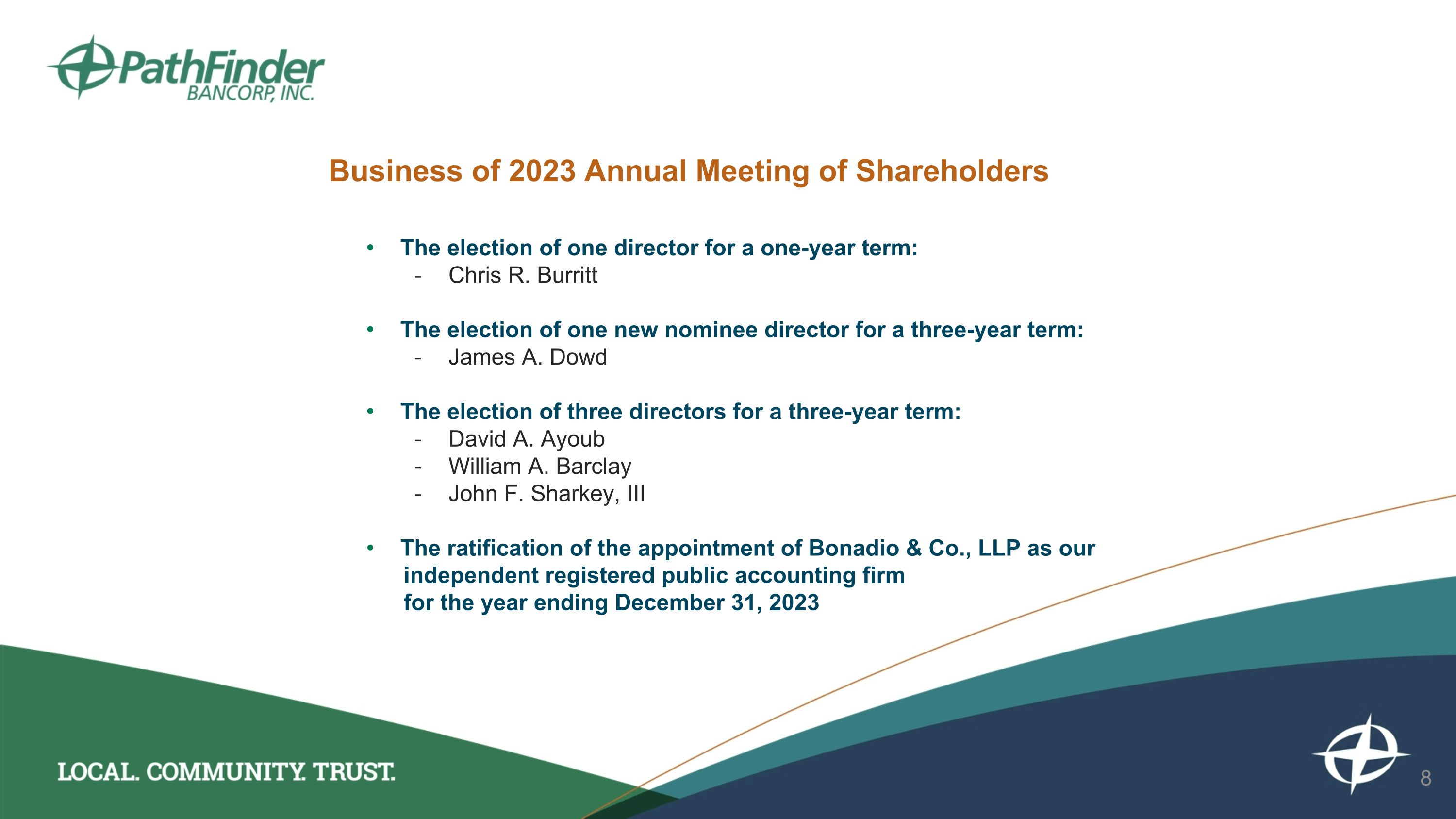

Business of 2023 Annual Meeting of Shareholders The election of one director for a one-year term: Chris R. Burritt The election of one new nominee director for a three-year term: James A. Dowd The election of three directors for a three-year term: David A. Ayoub William A. Barclay John F. Sharkey, III The ratification of the appointment of Bonadio & Co., LLP as our independent registered public accounting firm for the year ending December 31, 2023

Executive Management Presentation James A. Dowd President and Chief Executive Officer Walter F. Rusnak Senior Vice President and Chief Financial Officer

Introduction to Pathfinder Bancorp, Inc. Corporate Financial Highlights Market Performance Strategy and Conclusions Table of Contents

Company Overview Key Milestones Corporate Highlights Introduction to Pathfinder Bancorp, Inc.

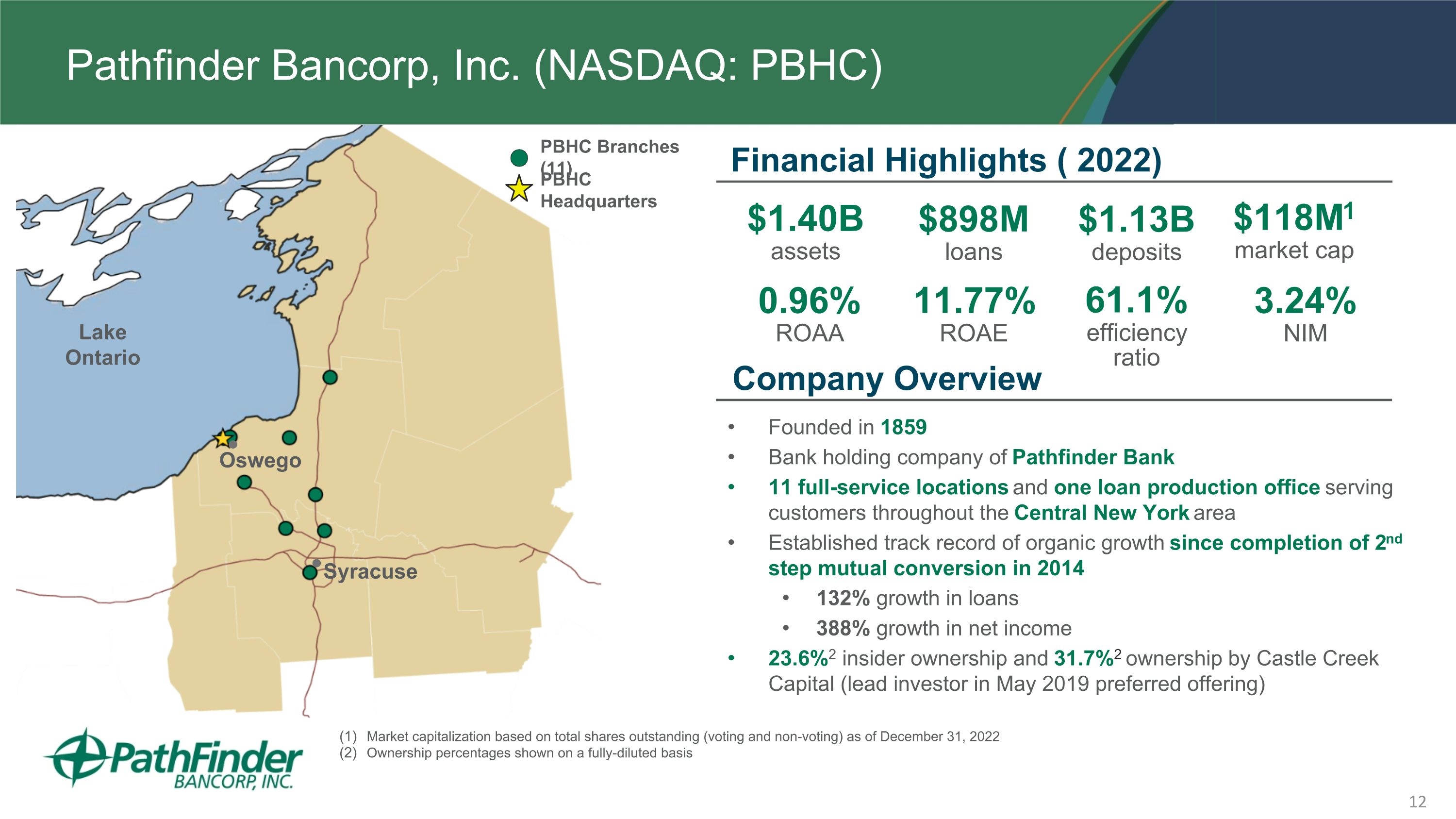

Lake Ontario Oswego Syracuse Founded in 1859 Bank holding company of Pathfinder Bank 11 full-service locations and one loan production office serving customers throughout the Central New York area Established track record of organic growth since completion of 2nd step mutual conversion in 2014 132% growth in loans 388% growth in net income 23.6%2 insider ownership and 31.7%2 ownership by Castle Creek Capital (lead investor in May 2019 preferred offering) Pathfinder Bancorp, Inc. (NASDAQ: PBHC) PBHC Branches (11) PBHC Headquarters $1.40B assets $118M1 market cap $898M loans $1.13B deposits Financial Highlights ( 2022) 3.24% NIM 0.96% ROAA 11.77% ROAE Company Overview 61.1% efficiency ratio Market capitalization based on total shares outstanding (voting and non-voting) as of December 31, 2022 Ownership percentages shown on a fully-diluted basis

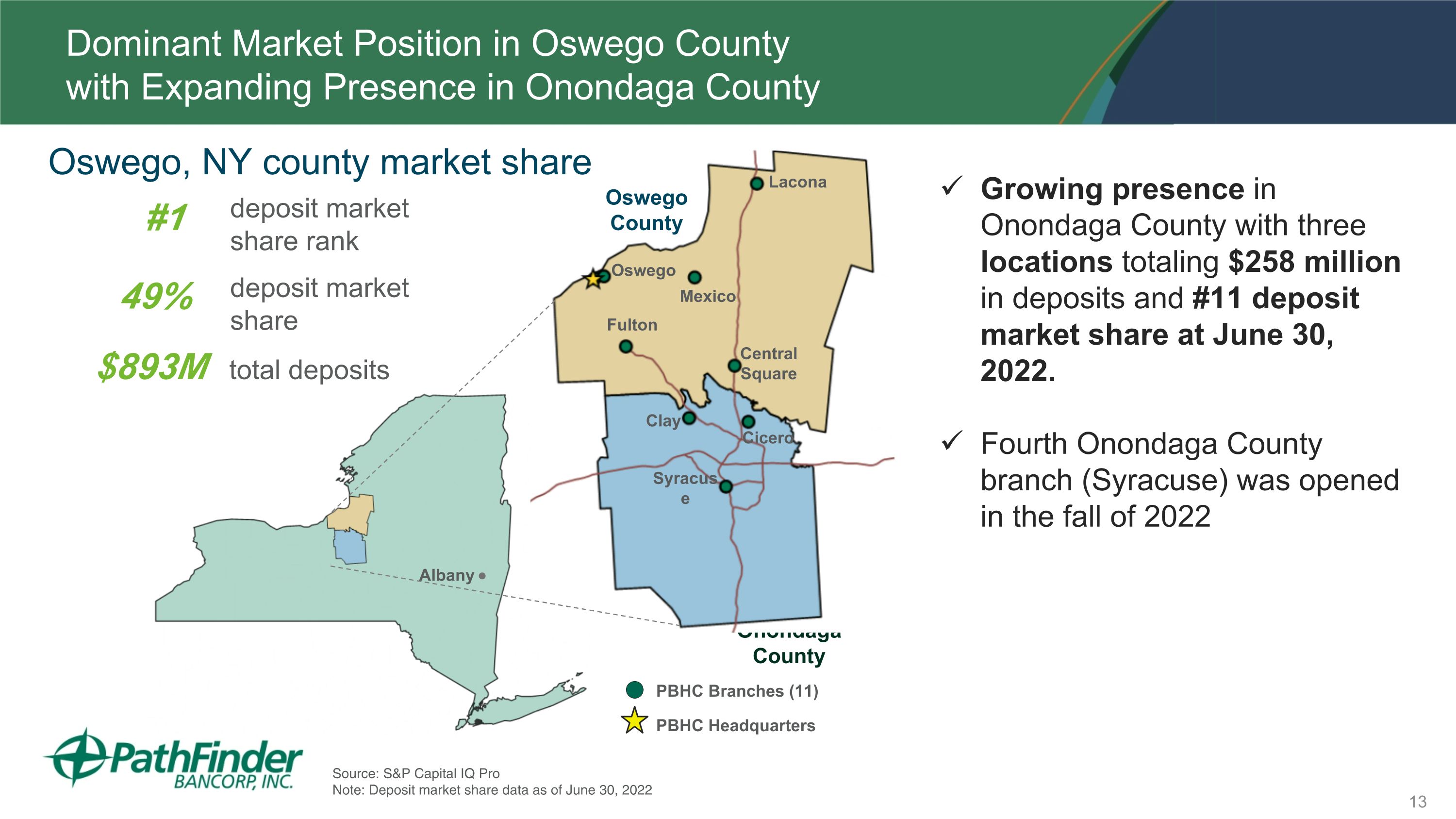

Dominant Market Position in Oswego County with Expanding Presence in Onondaga County PBHC Branches (11) PBHC Headquarters Onondaga County Albany deposit market share rank #1 49% deposit market share $893M total deposits Growing presence in Onondaga County with three locations totaling $258 million in deposits and #11 deposit market share at June 30, 2022. Fourth Onondaga County branch (Syracuse) was opened in the fall of 2022 Source: S&P Capital IQ Pro Note: Deposit market share data as of June 30, 2022 Syracuse Oswego Lacona Mexico Fulton Central Square Clay Cicero Oswego, NY county market share Oswego County

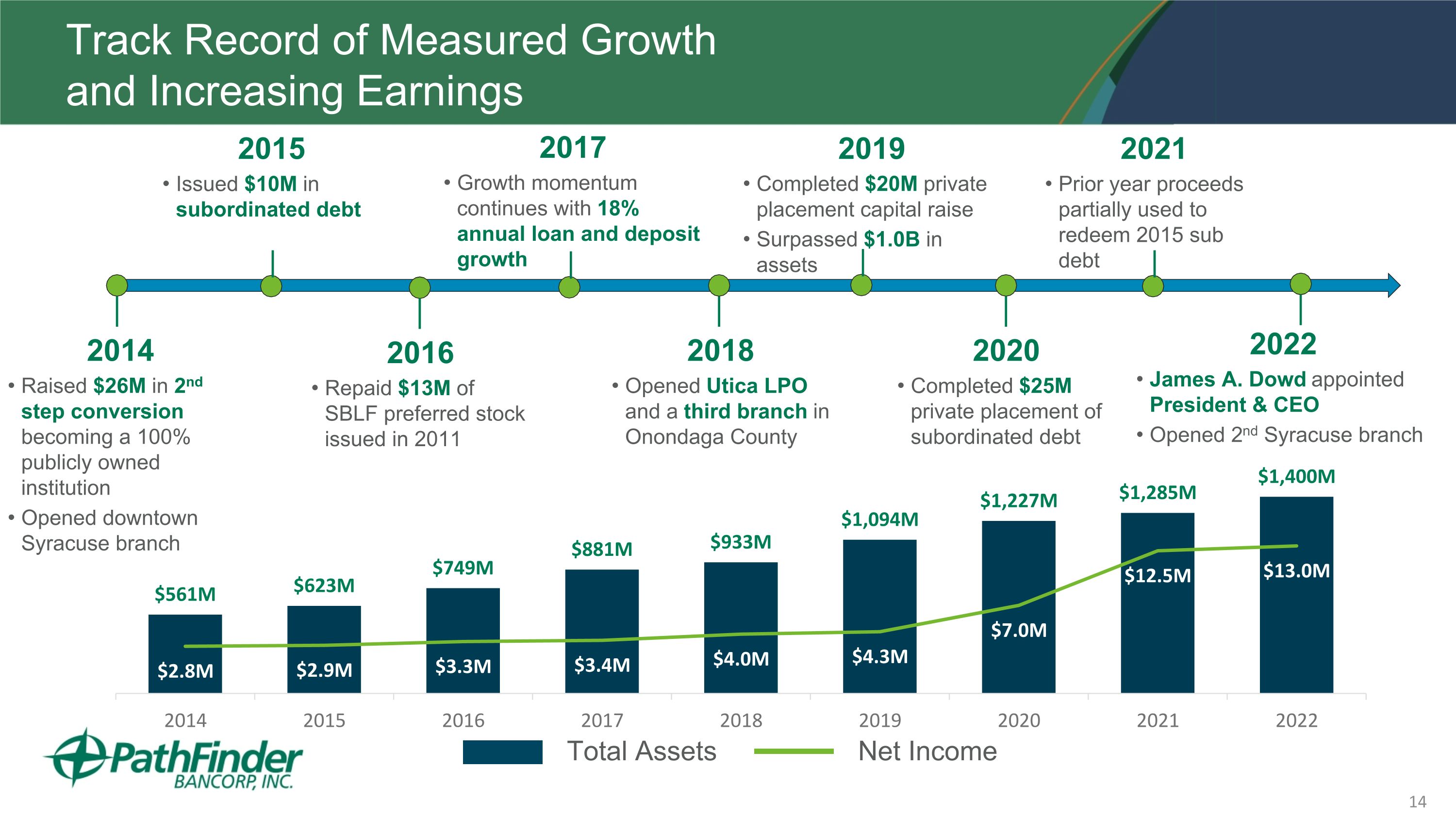

Track Record of Measured Growth and Increasing Earnings 2014 Raised $26M in 2nd step conversion becoming a 100% publicly owned institution Opened downtown Syracuse branch 2015 Issued $10M in subordinated debt 2017 Growth momentum continues with 18% annual loan and deposit growth 2019 Completed $20M private placement capital raise Surpassed $1.0B in assets 2021 Prior year proceeds partially used to redeem 2015 sub debt 2016 Repaid $13M of SBLF preferred stock issued in 2011 2018 Opened Utica LPO and a third branch in Onondaga County 2020 Completed $25M private placement of subordinated debt 2022 James A. Dowd appointed President & CEO Opened 2nd Syracuse branch Total Assets Net Income

Corporate Highlights Experienced Management Team Backed by a Leading Institutional Investor Senior management has decades of experience in the community banking industry The Board and management own 23.6%(1) of the voting shares. An affiliate of Castle Creek Capital LLC owns 31.7% of the Company on a fully diluted basis including non-voting shares and warrants(2) Improving Profitability Metrics Improving profitability with a 36 bps increase in ROAA and 434 bps increase in ROAE from 2020 to 2022 Improving expense control with a 7.60% decrease in efficiency ratio since 2020. Noninterest expense / average assets ranging from 2.15% to 2.18% in 2021 and 2022; low net non-interest expense to average assets of 1.75% in 2022 provides cushion against possible future net interest margin compression Well-Diversified Portfolio with Good Credit Quality PBHC’s loan portfolio is well diversified, primarily consisting of commercial and residential mortgage loans (32% and 32%, respectively) and commercial loans (26%) Net charge-offs / average loans of 0.04% in 2022 and 0.07% on average for the last 3 years Well-Capitalized The Bank has a Tier 1 leverage ratio of 9.67% and total RBC ratio of 15.14% as of December 31, 2022 The Company has been proactive in supplementing capital ratios for future growth as exhibited by our subordinated debt issuances in 2015 and 2020, and an equity capital raise in 2019; additionally, the Company had $9.6 million in holding company cash as of December 31, 2022 Focus on Measured Growth & Risk Mitigation Bank positioned as the market share leader in Oswego County, NY by deposit market share (48.7% deposit market share(3)) with a growing presence in the attractive Onondaga County market Consistent balance sheet growth over the past 5 years; total loan compounded annual growth rate (CAGR) of 9.1% and total deposit CAGR of 9.2% since 2017 As of the record date of April 12, 2023 and includes all options that vest within 60 days of the record date (2) Includes 125,000 of in the money warrants

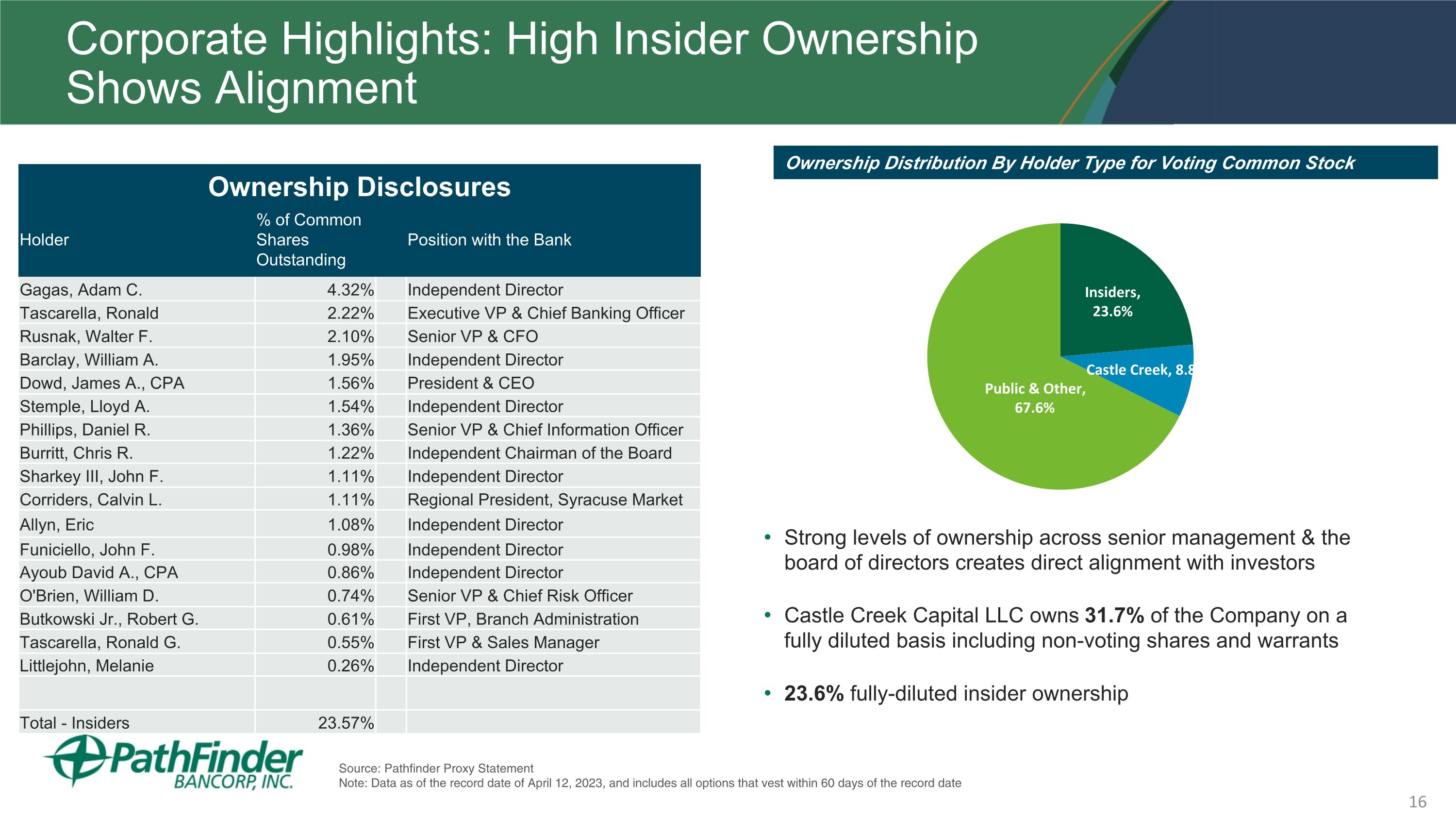

Corporate Highlights: High Insider Ownership Shows Alignment Source: Pathfinder Proxy Statement Note: Data as of the record date of April 12, 2023, and includes all options that vest within 60 days of the record date Strong levels of ownership across senior management & the board of directors creates direct alignment with investors Castle Creek Capital LLC owns 31.7% of the Company on a fully diluted basis including non-voting shares and warrants 23.6% fully-diluted insider ownership Ownership Distribution By Holder Type for Voting Common Stock Ownership Disclosures Holder % of Common Shares Outstanding Position with the Bank Gagas, Adam C. 4.32% Independent Director Tascarella, Ronald 2.22% Executive VP & Chief Banking Officer Rusnak, Walter F. 2.10% Senior VP & CFO Barclay, William A. 1.95% Independent Director Dowd, James A., CPA 1.56% President & CEO Stemple, Lloyd A. 1.54% Independent Director Phillips, Daniel R. 1.36% Senior VP & Chief Information Officer Burritt, Chris R. 1.22% Independent Chairman of the Board Sharkey III, John F. 1.11% Independent Director Corriders, Calvin L. 1.11% Regional President, Syracuse Market Allyn, Eric 1.08% Independent Director Funiciello, John F. 0.98% Independent Director Ayoub David A., CPA 0.86% Independent Director O'Brien, William D. 0.74% Senior VP & Chief Risk Officer Butkowski Jr., Robert G. 0.61% First VP, Branch Administration Tascarella, Ronald G. 0.55% First VP & Sales Manager Littlejohn, Melanie 0.26% Independent Director Total - Insiders 23.57%

Pathfinder Investment Thesis Management believes that the current industry-wide headwinds are transitory Personally invested and experienced management team and board of directors Significant progress in sustainable profitability since achieving $1 billion in total assets in 2019 Strong balance sheet with high levels of capital Durable core deposit base built from our decades-long presence in the communities that we serve Unique positioning as a provider of solutions to our customers, most especially small- and medium-sized businesses Conservative approach to lending decisions and cost management (two key drivers of long-term success) Well-positioned to take advantage of the potentially large opportunities in our local marketplace

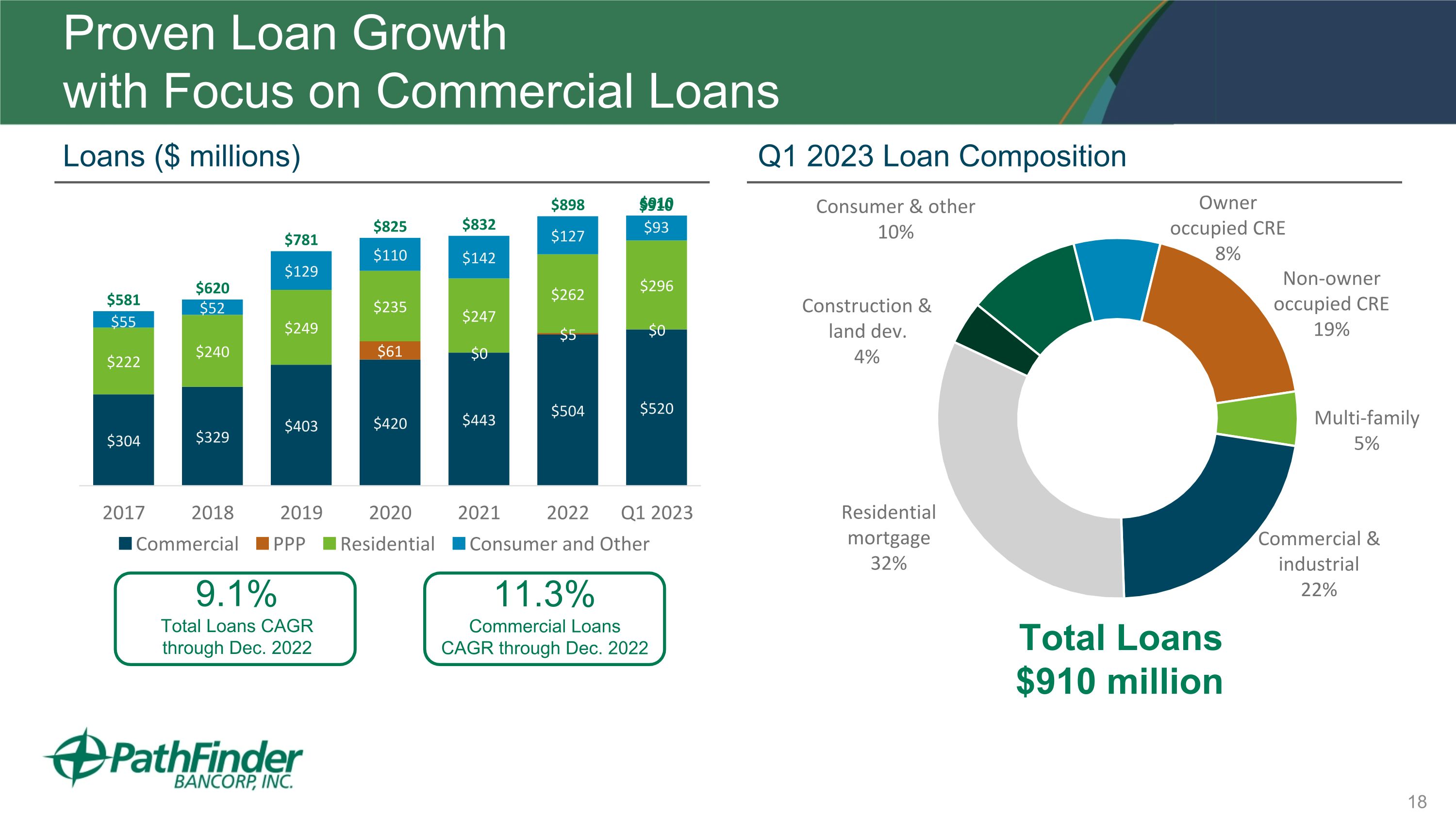

Proven Loan Growth with Focus on Commercial Loans 9.1% Total Loans CAGR through Dec. 2022 Q1 2023 Loan Composition Loans ($ millions) Total Loans $910 million $910 11.3% Commercial Loans CAGR through Dec. 2022

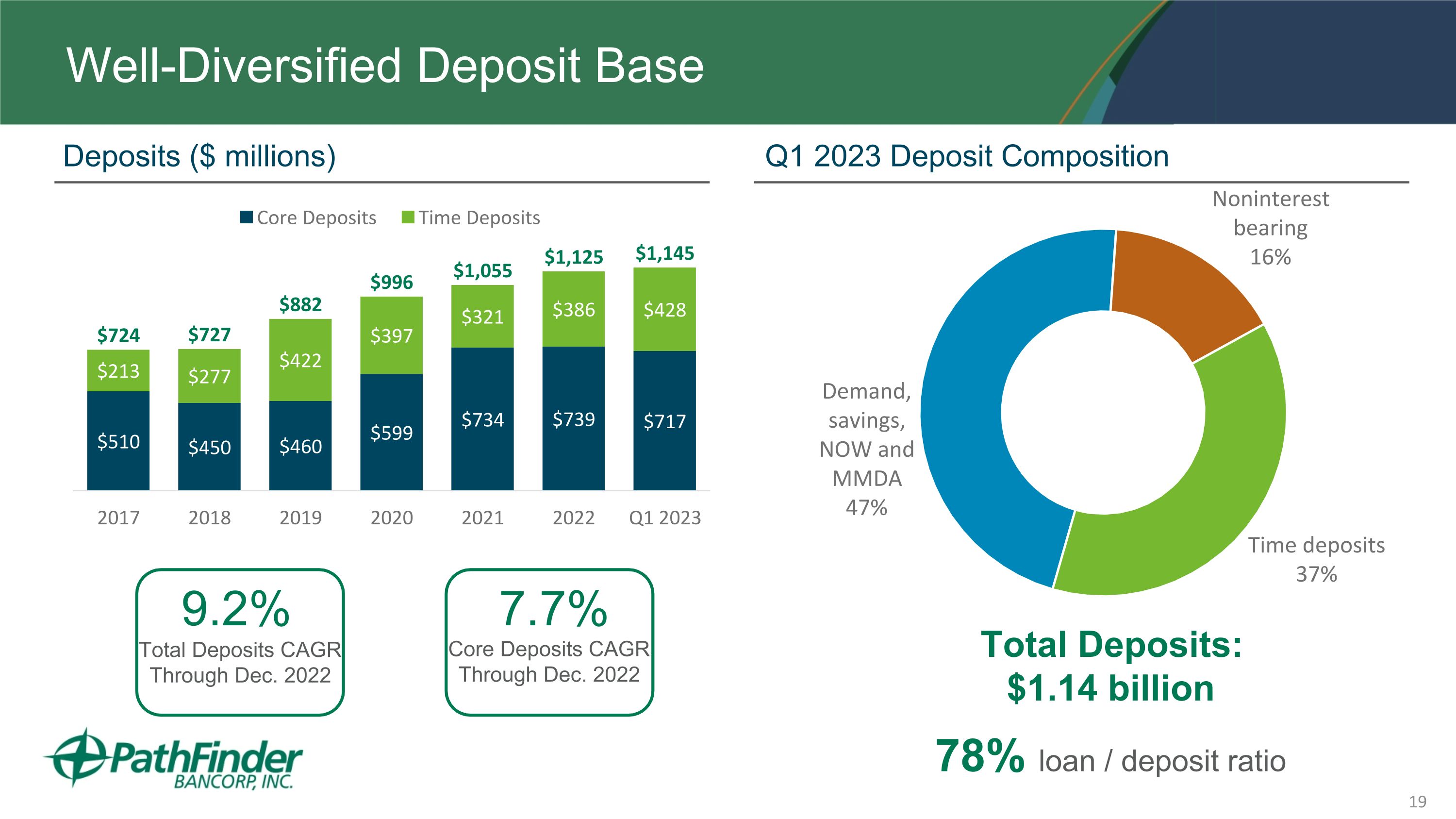

Well-Diversified Deposit Base Deposits ($ millions) Q1 2023 Deposit Composition 78% loan / deposit ratio Total Deposits: $1.14 billion 9.2% Total Deposits CAGR Through Dec. 2022 7.7% Core Deposits CAGR Through Dec. 2022

Technology Pathfinder has an active Technology Steering function with strong engagement from external advisors, our board of directors and all levels of management We have also established a project-oriented Digitization Committee to facilitate prioritization and implementation efforts within our technological evolution We maintain that existing and potential customers will select the delivery channel that is most efficient for them and that the ways in which they interface with the Bank can change quickly We are investing in customer-facing technologies at a measured pace and have recently introduced enhanced; Treasury management and merchant services for small businesses Updated internet and mobile platforms Online mortgage application facilities

Technology Pathfinder will benefit from its interactions within the Castle Creek Capital’s ‘ecosystem’ of financial institutions and emerging financial technology (fintech) companies Technological progress and the emergence of financial technology companies that will partner with community banks continues to: Help smaller banks to control noninterest expenses Serve their customers in a variety of new ways Extend the relevance of community banks to younger demographics Help to tailor product offerings to individual customers We remain committed to significantly increasing our digitization capabilities to generate both “back office’ cost savings and improved customer service levels.

Experienced and Seasoned Management Team Significant Experience & Insider Ownership Senior management has decades of experience in the community banking industry President & CEO James Dowd has over 28 years of banking experience and previously served as COO CFO Walter Rusnak has over 30 years of banking experience Significant levels of ownership across senior management and Board of Directors creates direct alignment with investors 23.6% fully-diluted insider ownership, excluding Castle Creek Capital James A. Dowd, CPA President & Chief Executive Officer Role since: 2022 William O’Brien SVP, Chief Risk Officer & Corporate Secretary Role since: 2020 Ronald Tascarella EVP & Chief Banking Officer Role since: 2006 Daniel R. Phillips SVP & Chief Information Officer Role since: 2014 Calvin L. Corriders Regional President, Syracuse Market, Human Resources Director Role since: 2017 Walter F. Rusnak, CPA, CGMA Senior Vice President & Chief Financial Officer Role since: 2019

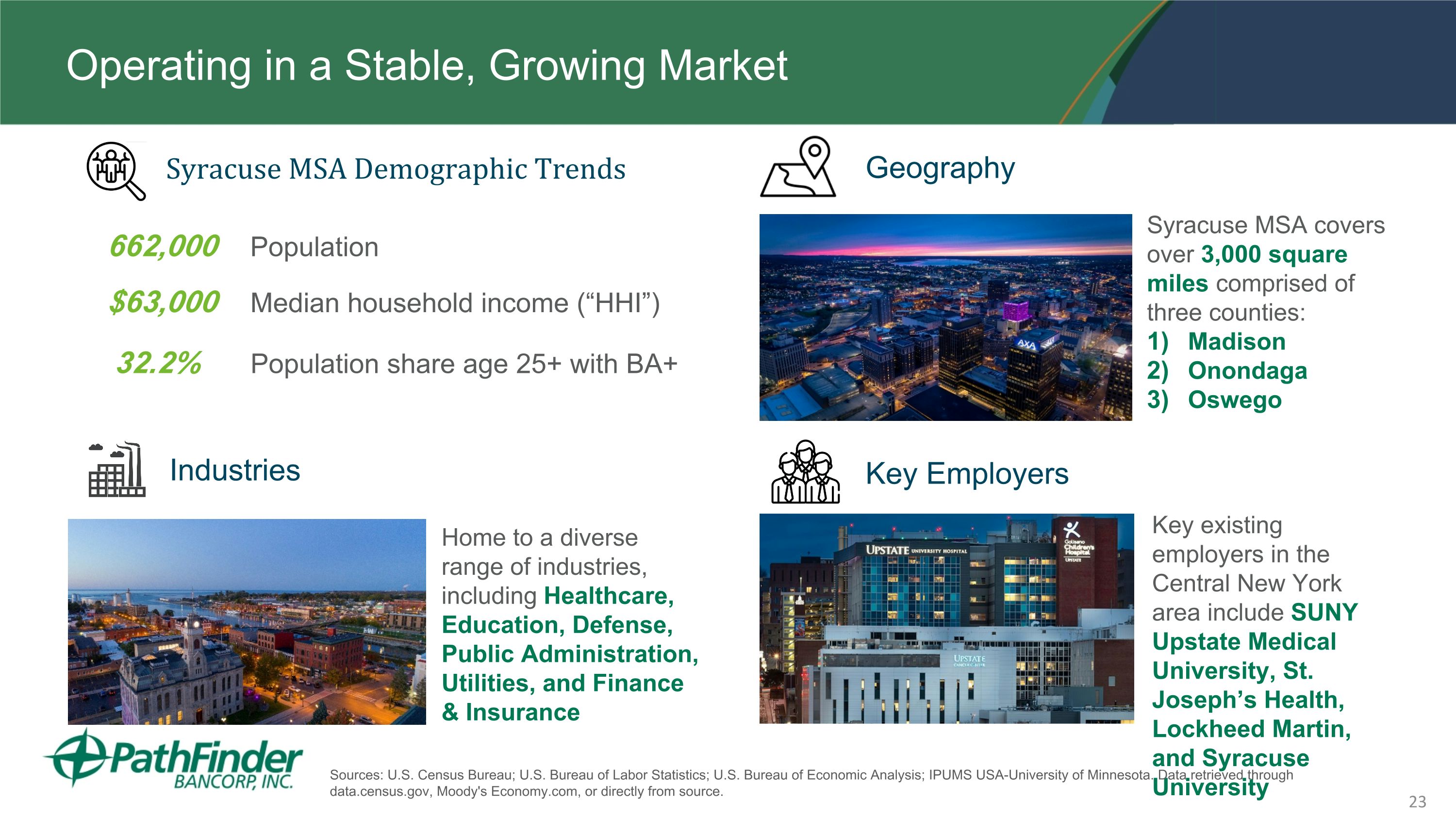

Operating in a Stable, Growing Market Syracuse MSA Demographic Trends Geography Key Employers Industries Syracuse MSA covers over 3,000 square miles comprised of three counties: Madison Onondaga Oswego Key existing employers in the Central New York area include SUNY Upstate Medical University, St. Joseph’s Health, Lockheed Martin, and Syracuse University Home to a diverse range of industries, including Healthcare, Education, Defense, Public Administration, Utilities, and Finance & Insurance 662,000 Population $63,000 Median household income (“HHI”) 32.2% Population share age 25+ with BA+ Sources: U.S. Census Bureau; U.S. Bureau of Labor Statistics; U.S. Bureau of Economic Analysis; IPUMS USA-University of Minnesota. Data retrieved through data.census.gov, Moody's Economy.com, or directly from source.

Economic Trends in Our Market

Economic Trends in Our Market

Economic Trends in Our Market Micron Technology Announcement $27.7B FY2020 annual revenue 13 manufacturing sites and 14 customer labs Founded more than 40 years ago on October 5, 1978 Headquartered in Boise, Idaho, USA Company Overview 135 on the 2020 Fortune 500 4th largest semiconductor company in the world 17 countries Economic Impact 48,000 team members An independent economic impact study projects that Micron will generate significant economic growth for New York State in the following ways: 50,000 plus new permanent jobs in New York State by 2055 Approximately 12,000 annual temporary jobs from capital expenditures from 2025–2044 $9.6 billion annually in real Gross Domestic Product (GDP) impact from 2025-2055 $16.7 billion annually in real output impact from 2025-2055. $17.2 billion in total New York State government revenues spanning 2025-2055 $31 billion in Micron construction spending, with 5,600 related jobs on average at the prevailing federal wage for the initial 20 years, 2025-2044 Micron will invest $250 million over the duration of the project, targeting investments in workforce development, education, community assets and organizations, and affordable housing In October of 2022, Micron Technology, Inc. announced its plans to spend up to $100 billion building a mega-complex of computer chip plants in Clay, New York representing the largest private investment in New York history.

Corporate Financial Highlights Walter F. Rusnak, SVP, Chief Financial Officer

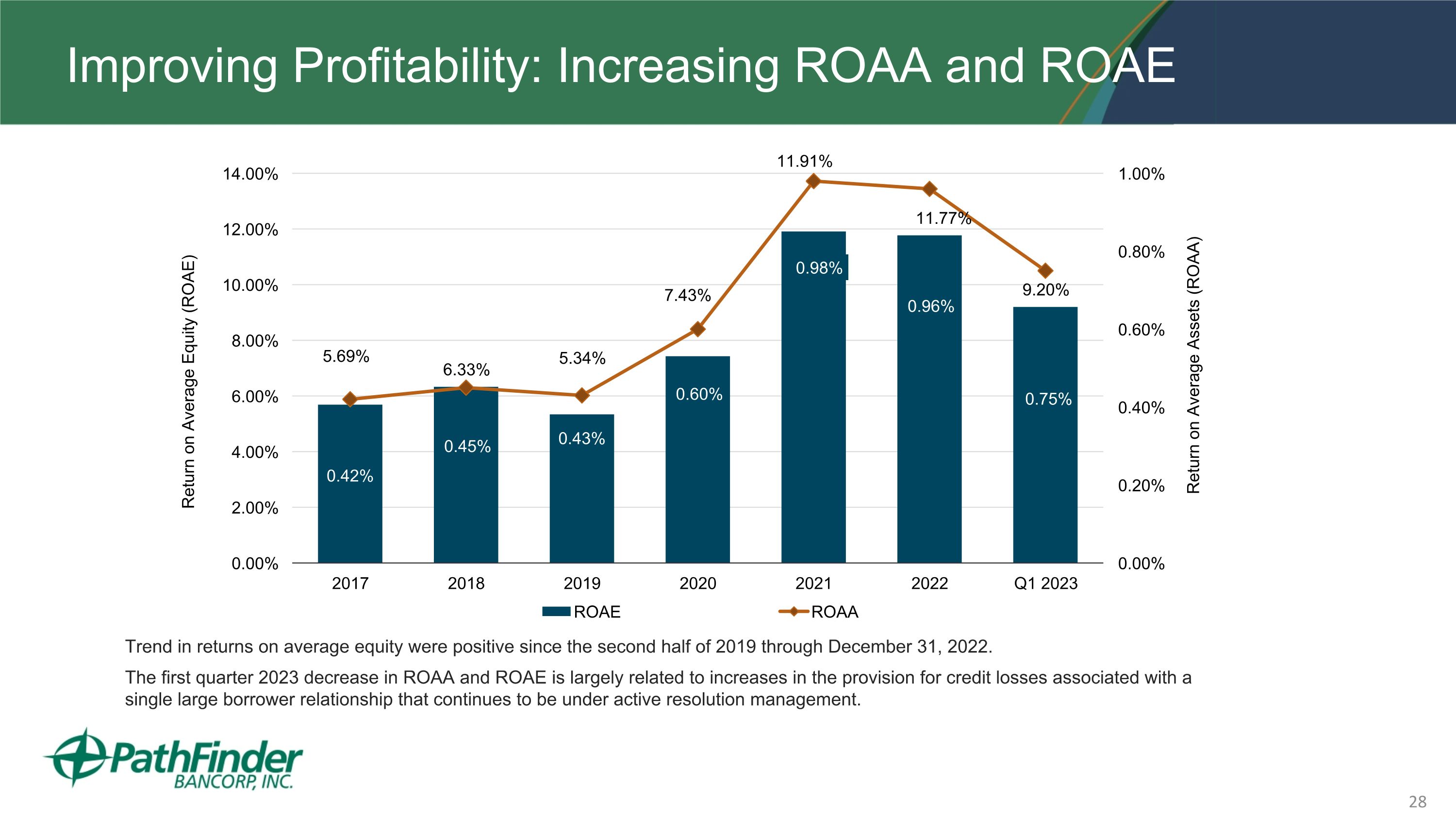

Improving Profitability: Increasing ROAA and ROAE Trend in returns on average equity were positive since the second half of 2019 through December 31, 2022. The first quarter 2023 decrease in ROAA and ROAE is largely related to increases in the provision for credit losses associated with a single large borrower relationship that continues to be under active resolution management.

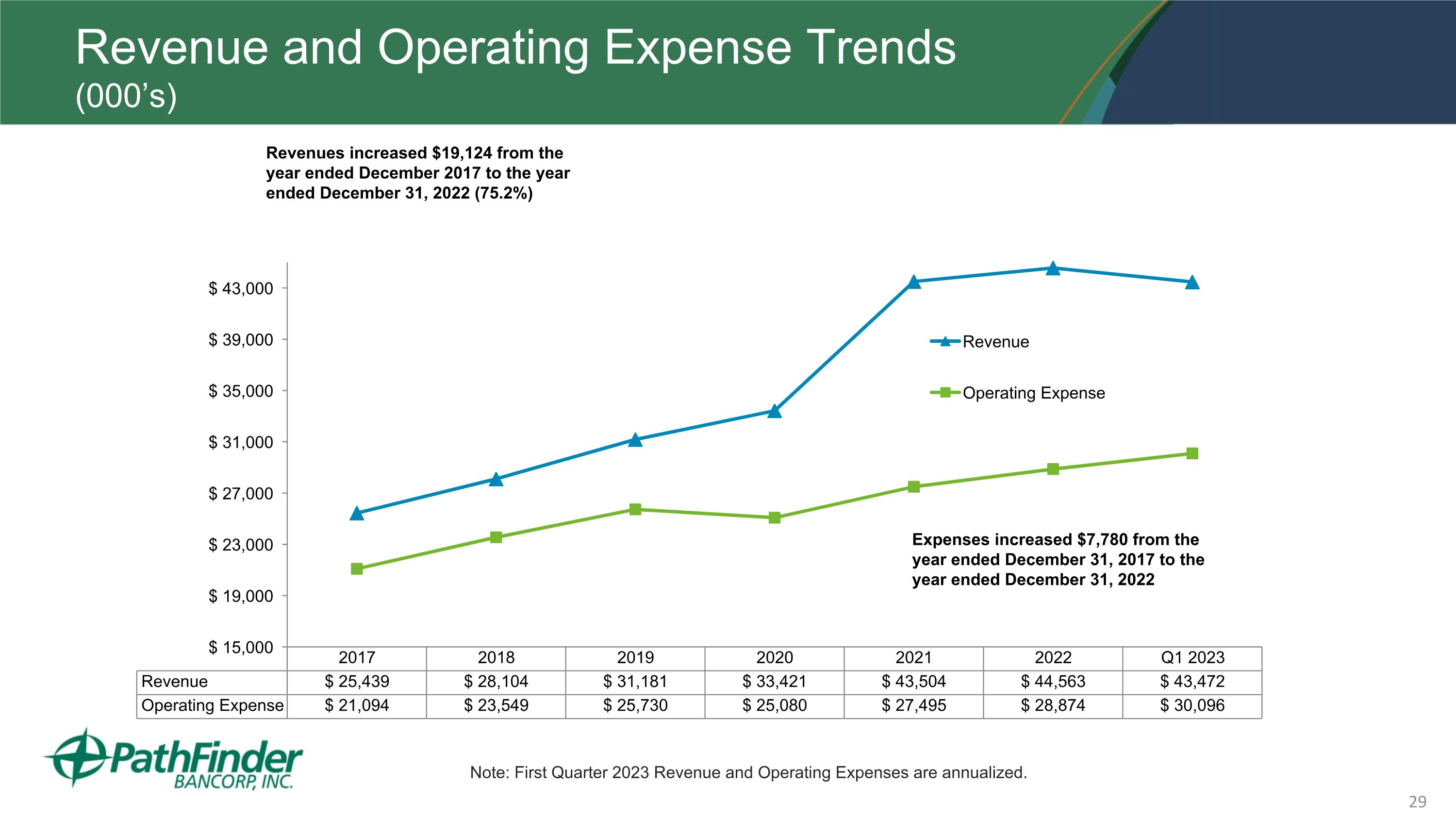

Revenue and Operating Expense Trends (000’s) Expenses increased $7,780 from the year ended December 31, 2017 to the year ended December 31, 2022 (36.9%) Revenues increased $19,124 from the year ended December 2017 to the year ended December 31, 2022 (75.2%) Note: First Quarter 2023 Revenue and Operating Expenses are annualized.

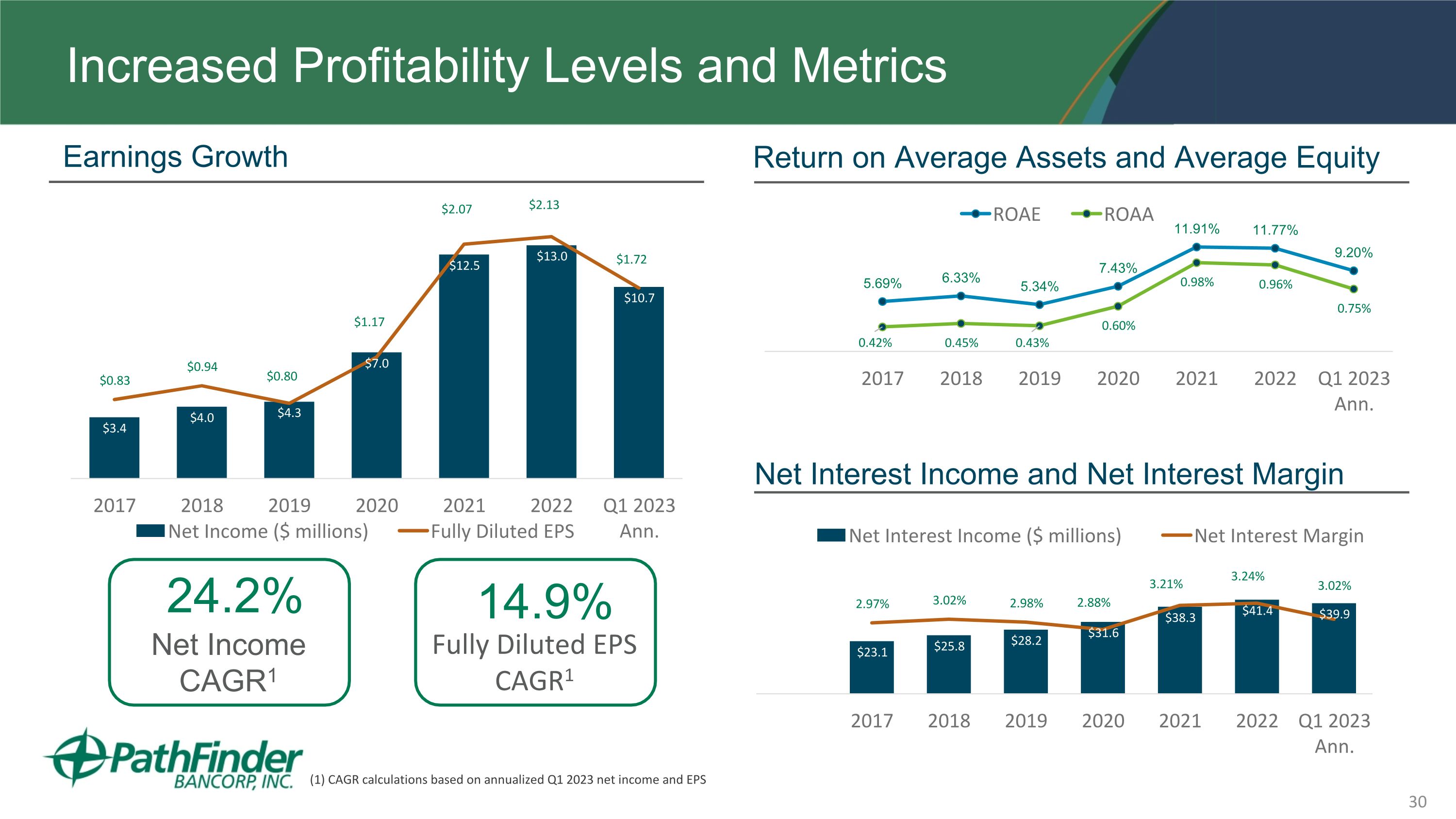

Increased Profitability Levels and Metrics Earnings Growth Return on Average Assets and Average Equity Net Interest Income and Net Interest Margin (1) CAGR calculations based on annualized Q1 2023 net income and EPS 24.2% Net Income CAGR1 14.9% Fully Diluted EPS CAGR1

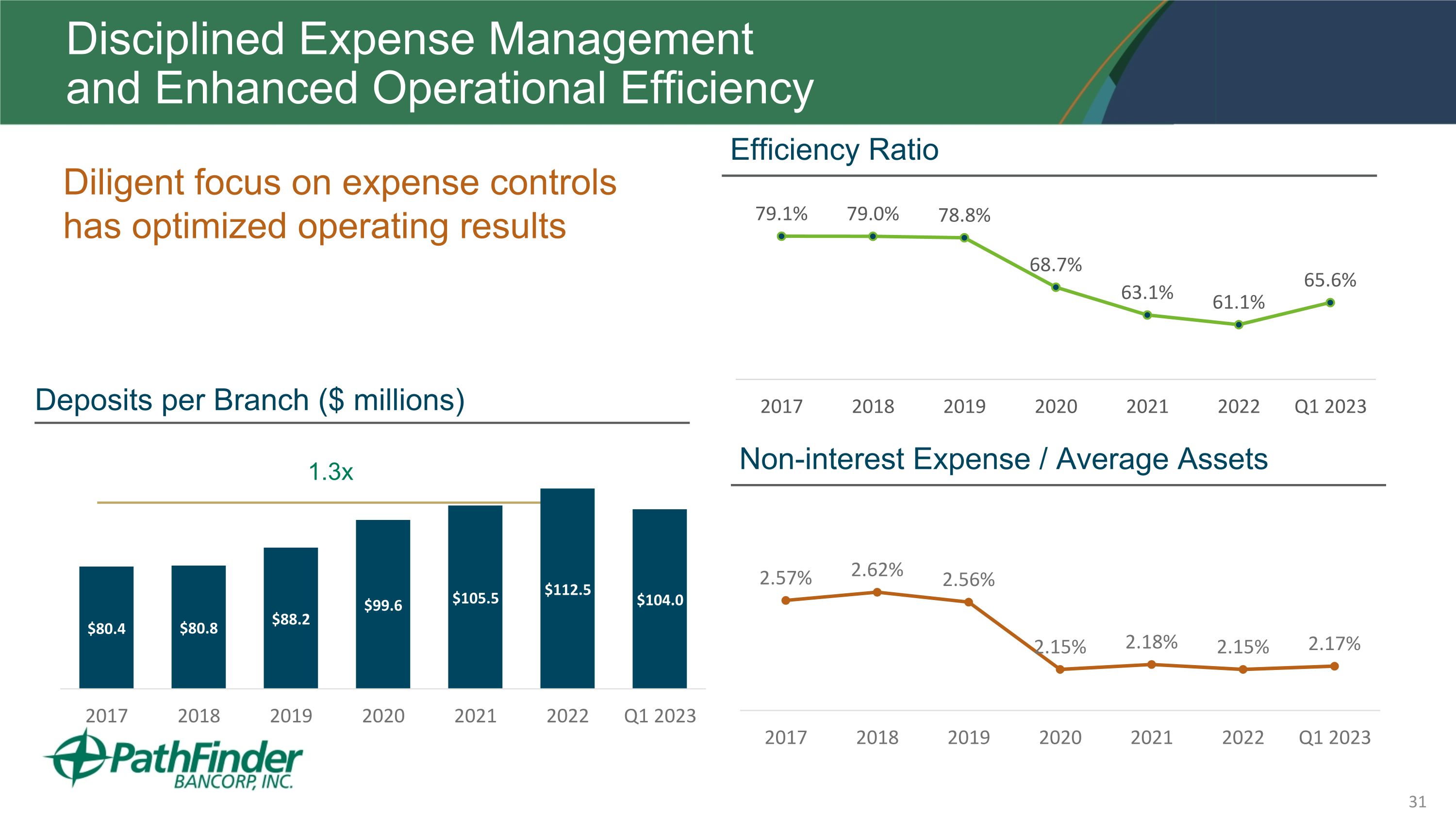

1.3x Disciplined Expense Management and Enhanced Operational Efficiency Diligent focus on expense controls has optimized operating results Efficiency Ratio Deposits per Branch ($ millions) Non-interest Expense / Average Assets

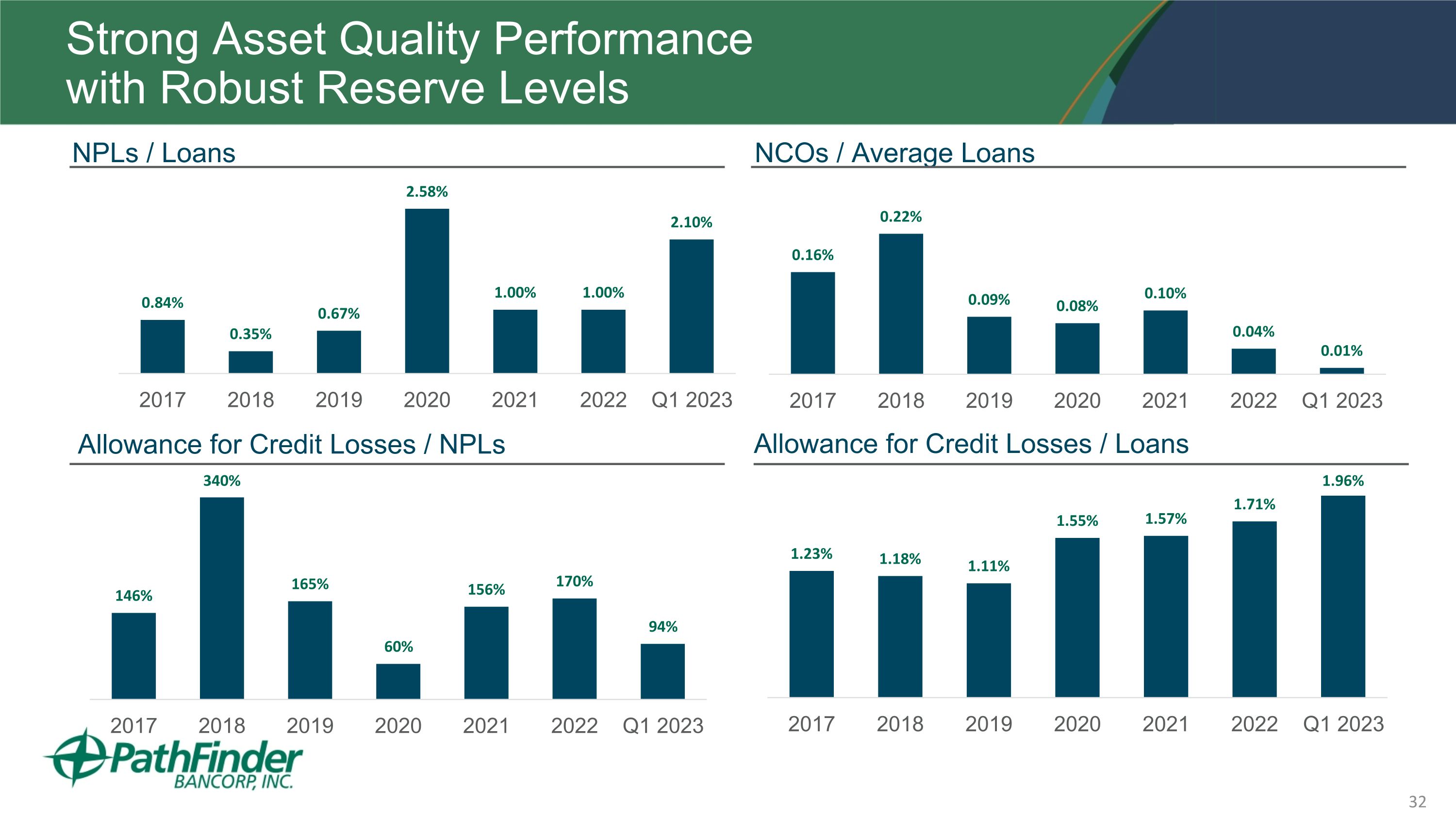

Strong Asset Quality Performance with Robust Reserve Levels NCOs / Average Loans Allowance for Credit Losses / Loans Allowance for Credit Losses / NPLs NPLs / Loans

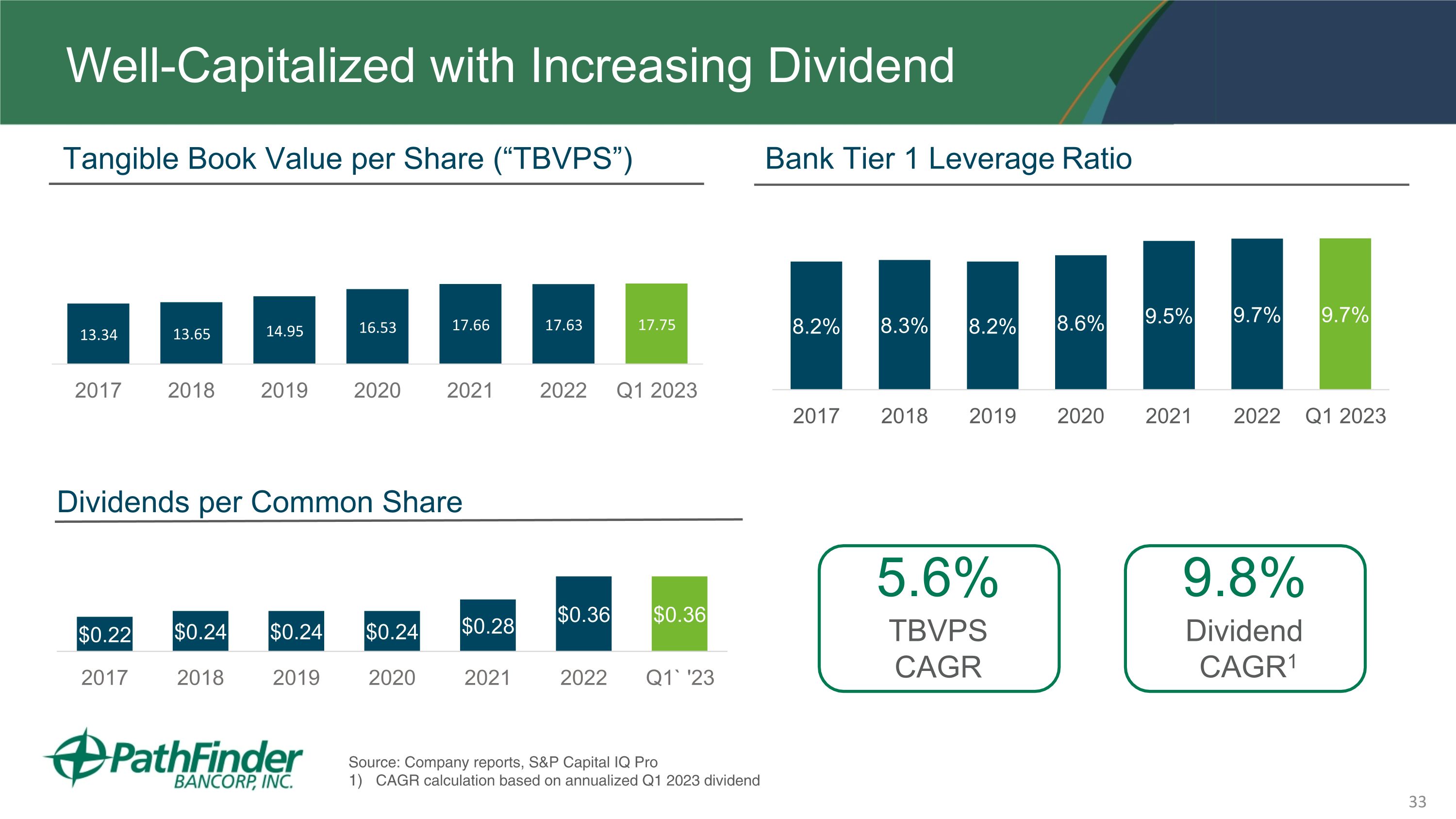

Well-Capitalized with Increasing Dividend Tangible Book Value per Share (“TBVPS”) Dividends per Common Share Bank Tier 1 Leverage Ratio Source: Company reports, S&P Capital IQ Pro CAGR calculation based on annualized Q1 2023 dividend 5.6% TBVPS CAGR 9.8% Dividend CAGR1

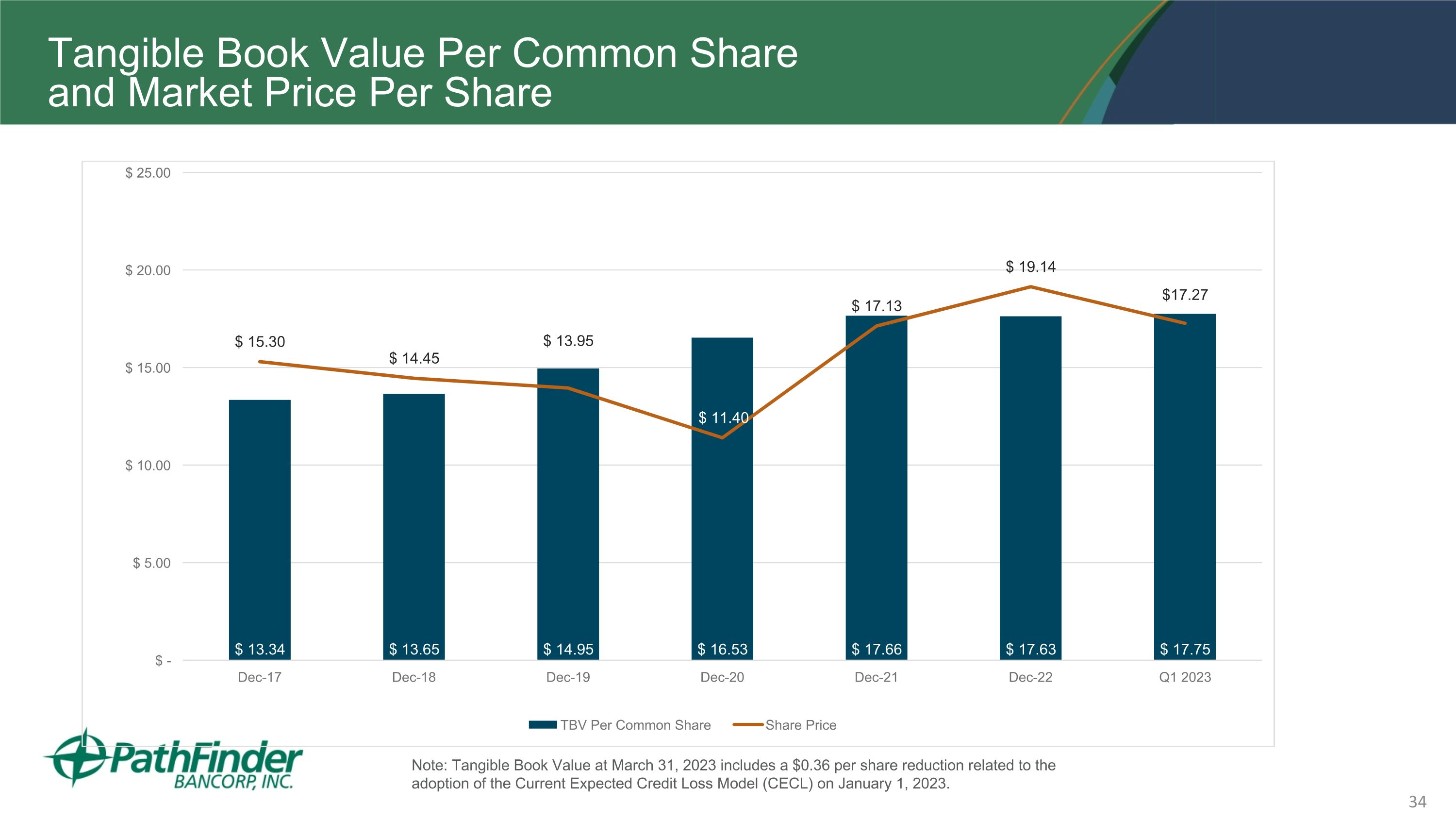

Tangible Book Value Per Common Share and Market Price Per Share Note: Tangible Book Value at March 31, 2023 includes a $0.36 per share reduction related to the adoption of the Current Expected Credit Loss Model (CECL) on January 1, 2023.

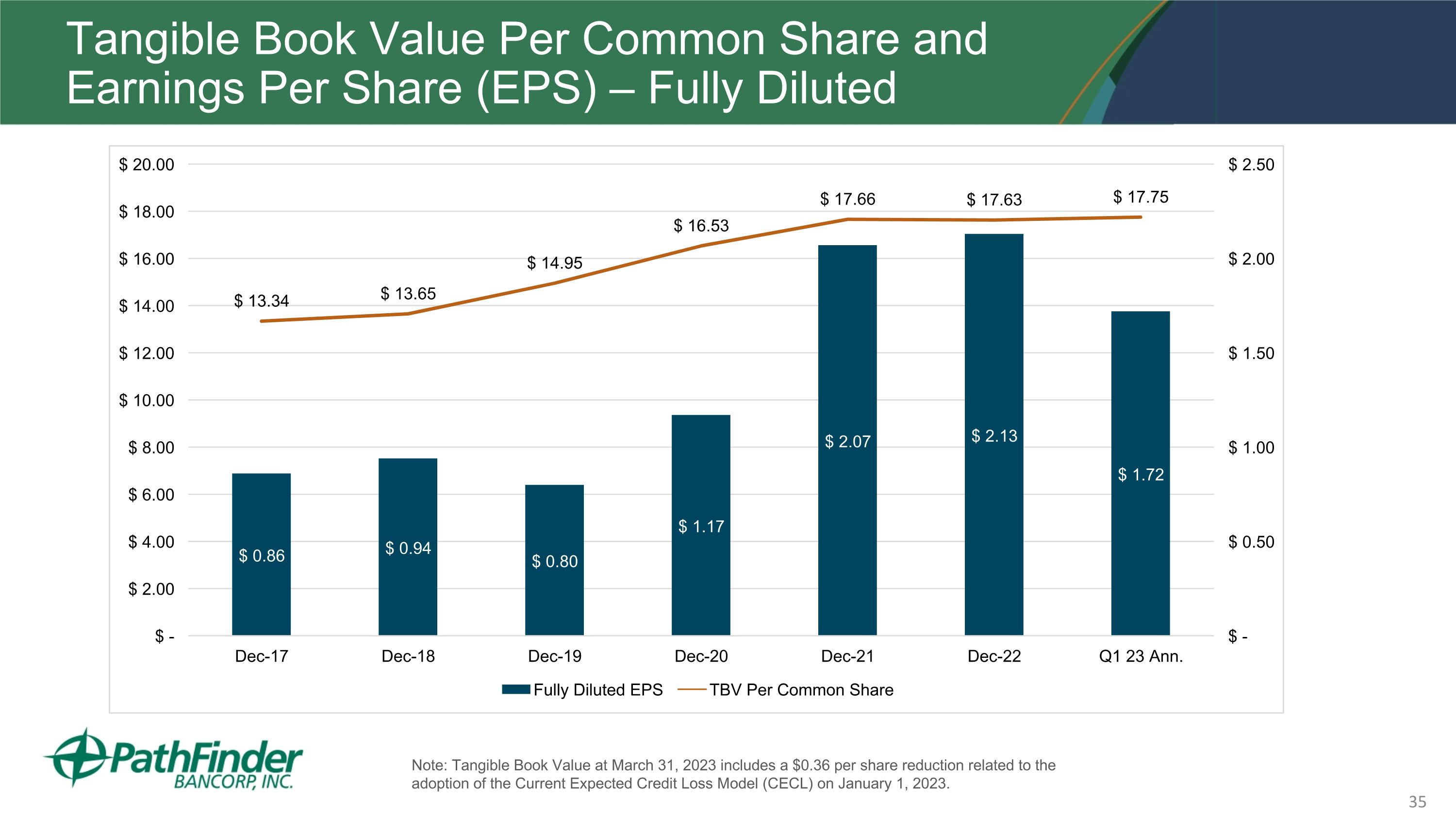

Tangible Book Value Per Common Share and Earnings Per Share (EPS) – Fully Diluted Note: Tangible Book Value at March 31, 2023 includes a $0.36 per share reduction related to the adoption of the Current Expected Credit Loss Model (CECL) on January 1, 2023.

Industry Challenges Pressure on All Bank Stocks With Increased Uncertainty

Investor ChallengesPressure on All Bank Stocks with Increased Uncertainty Mark-to-Market Adjusted Capital Balance Sheet Liquidity Core Deposit Franchise Quality Net Interest Margin (NIM) Credit Quality Commercial Real Estate Concentrations Long Term Earning Power

Industry ChallengesPressure on All Bank Stocks with Increased Uncertainty Mark-to-Market Adjusted Capital The Bank’s regulatory capital is $134.7 million, or 9.7% of Bank assets; Even if 100% of the current mark-to-market regulatory adjustment for available-for-sale securities was disallowed, the Bank’s regulatory capital would still be $125.6 million, or 9.0% of Bank assets This level remains above the well-capitalized level of 5.0%, including all capital preservation buffers Balance Sheet Liquidity Deposits increased in the first quarter of 2023 by $18.8 million, or 1.7% All data as of March 31, 2023

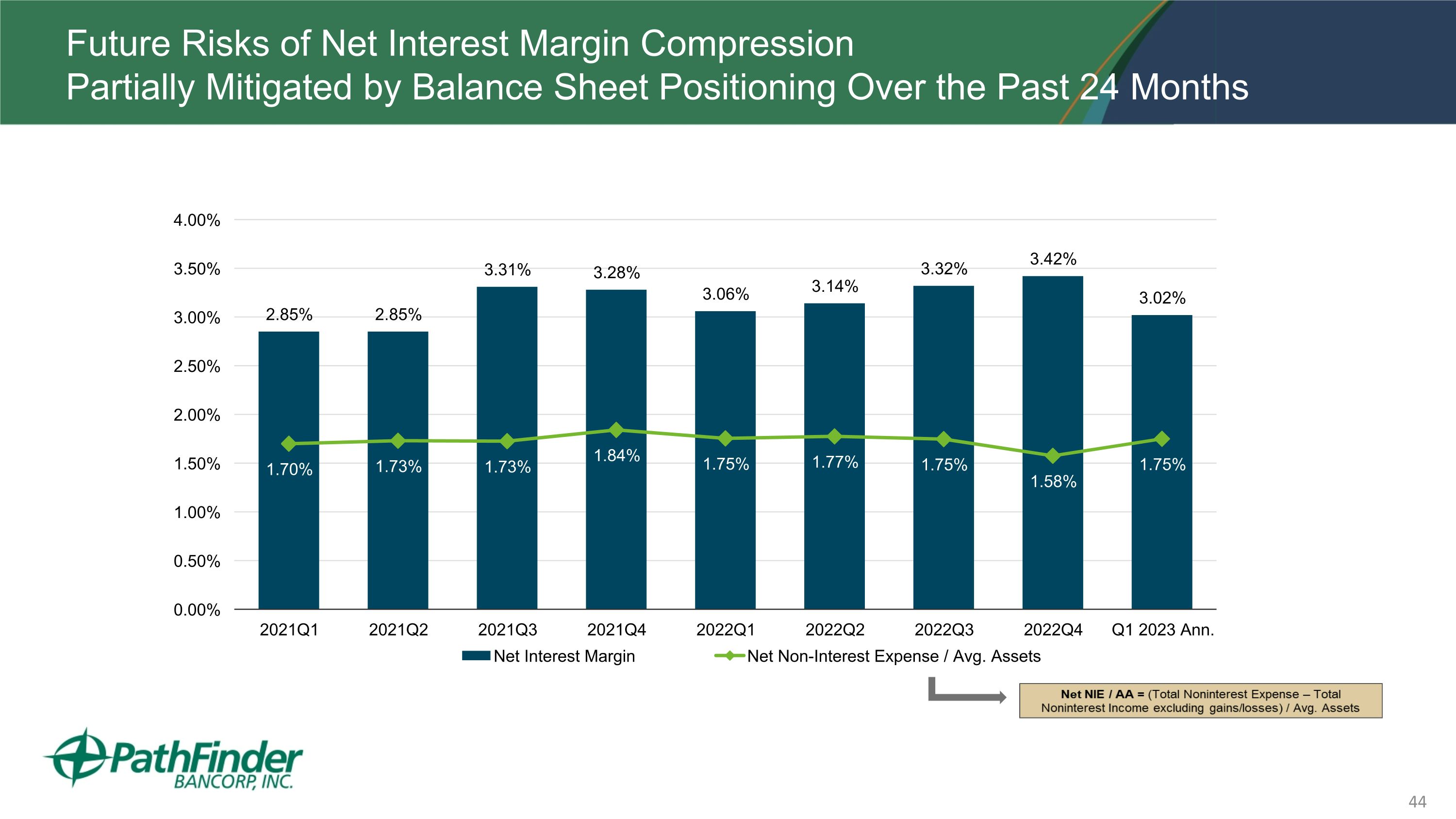

Industry ChallengesPressure on All Bank Stocks with Increased Uncertainty Core Deposit Franchise Quality Pathfinder enjoys a dominating deposit market share in Oswego County and continues to attract new deposit customers in Onondaga County Two new and well-positioned branches now open in Onondaga County, adding to the two well-established branches already operating in that growing region Net Interest Margin (NIM) Some NIM compression will be an issue for most banks in the near-term Management believes that our balance sheet assets and liabilities are well-matched in terms of duration and repricing characteristics In the next 12-18 months, NIM will depend greatly on the actions of the Federal Reserve as well as depositor behaviors in this unprecedented environment NIM cannot be predicted with certainty at this time

Industry ChallengesPressure on All Bank Stocks with Increased Uncertainty Credit Quality Pathfinder has a high level of reserves in place in its Allowance for Credit Losses and a very conservative approach to managing both credit decisioning and borrower relationships Commercial Real Estate Concentrations Pathfinder has an extremely well-diversified commercial real estate portfolio with no significant property-type concentrations Our local real estate market is likely to be strong Long Term Earning Power Multiple initiatives are in place to manage net interest margin, noninterest income and noninterest expense in the current environment While short-term earnings will be under pressure for almost all banks, we believe that these trends are transitory

Liquidity Recent large regional bank failures (primarily, on the West Coast) have garnered substantial press coverage and intensive regulatory scrutiny The Bank’s management monitors liquidity on a continuous basis through a broad range of internal and externally-sourced programs and considers effective liquidity management to be one of its primary objectives Pathfinder has never experienced a significant liquidity event We do, however, expect increasing liquidity requirements from a regulatory perspective in the future The impact of those potential changes to the Company’s liquidity management programs can not be predicted at this time

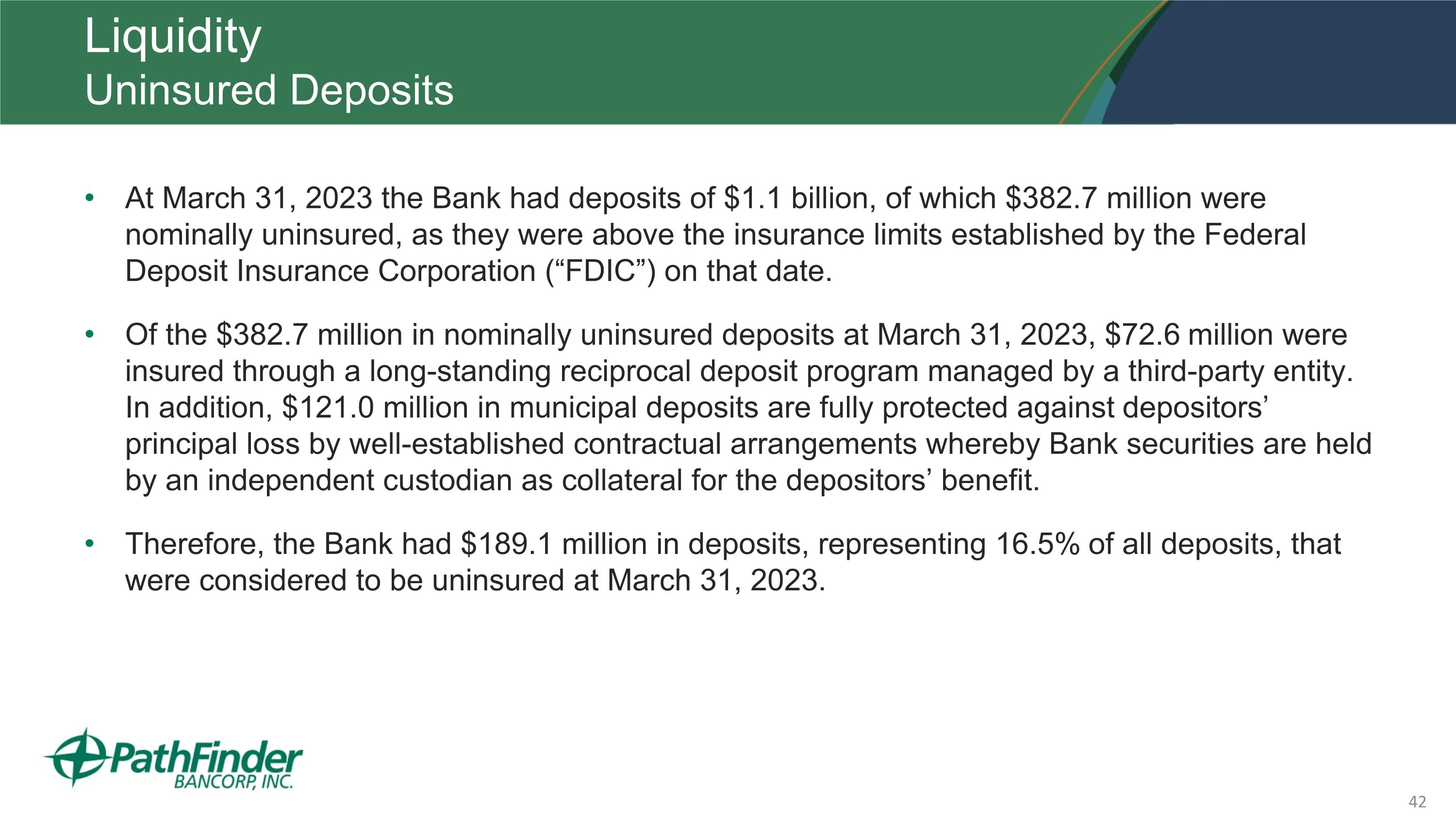

LiquidityUninsured Deposits At March 31, 2023 the Bank had deposits of $1.1 billion, of which $382.7 million were nominally uninsured, as they were above the insurance limits established by the Federal Deposit Insurance Corporation (“FDIC”) on that date. Of the $382.7 million in nominally uninsured deposits at March 31, 2023, $72.6 million were insured through a long-standing reciprocal deposit program managed by a third-party entity. In addition, $121.0 million in municipal deposits are fully protected against depositors’ principal loss by well-established contractual arrangements whereby Bank securities are held by an independent custodian as collateral for the depositors’ benefit. Therefore, the Bank had $189.1 million in deposits, representing 16.5% of all deposits, that were considered to be uninsured at March 31, 2023.

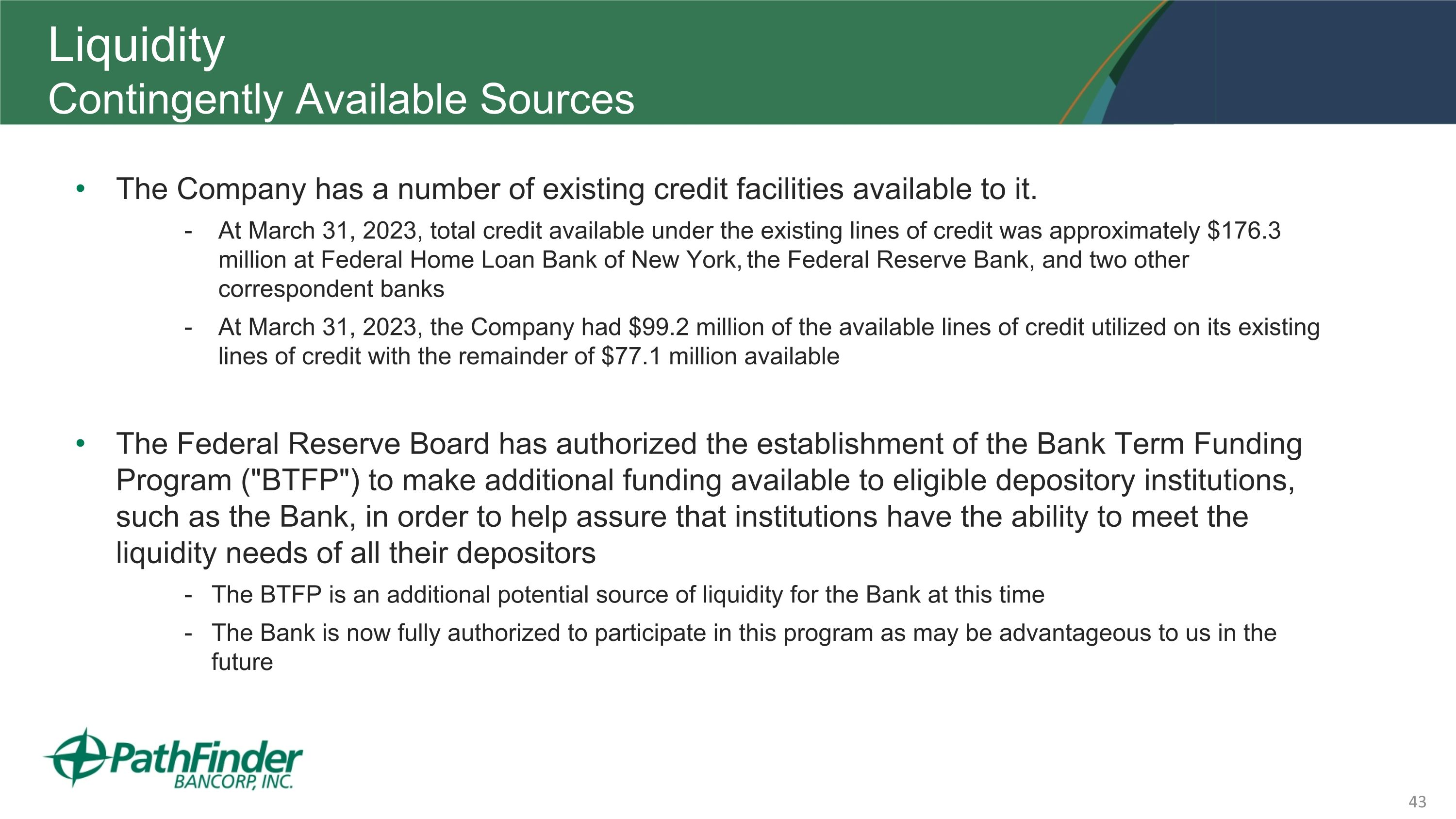

LiquidityContingently Available Sources The Company has a number of existing credit facilities available to it. At March 31, 2023, total credit available under the existing lines of credit was approximately $176.3 million at Federal Home Loan Bank of New York, the Federal Reserve Bank, and two other correspondent banks At March 31, 2023, the Company had $99.2 million of the available lines of credit utilized on its existing lines of credit with the remainder of $77.1 million available The Federal Reserve Board has authorized the establishment of the Bank Term Funding Program ("BTFP") to make additional funding available to eligible depository institutions, such as the Bank, in order to help assure that institutions have the ability to meet the liquidity needs of all their depositors The BTFP is an additional potential source of liquidity for the Bank at this time The Bank is now fully authorized to participate in this program as may be advantageous to us in the future

Future Risks of Net Interest Margin Compression Partially Mitigated by Balance Sheet Positioning Over the Past 24 Months

Market Performance Share Price Performance vs. Peers Market-Based Expectations

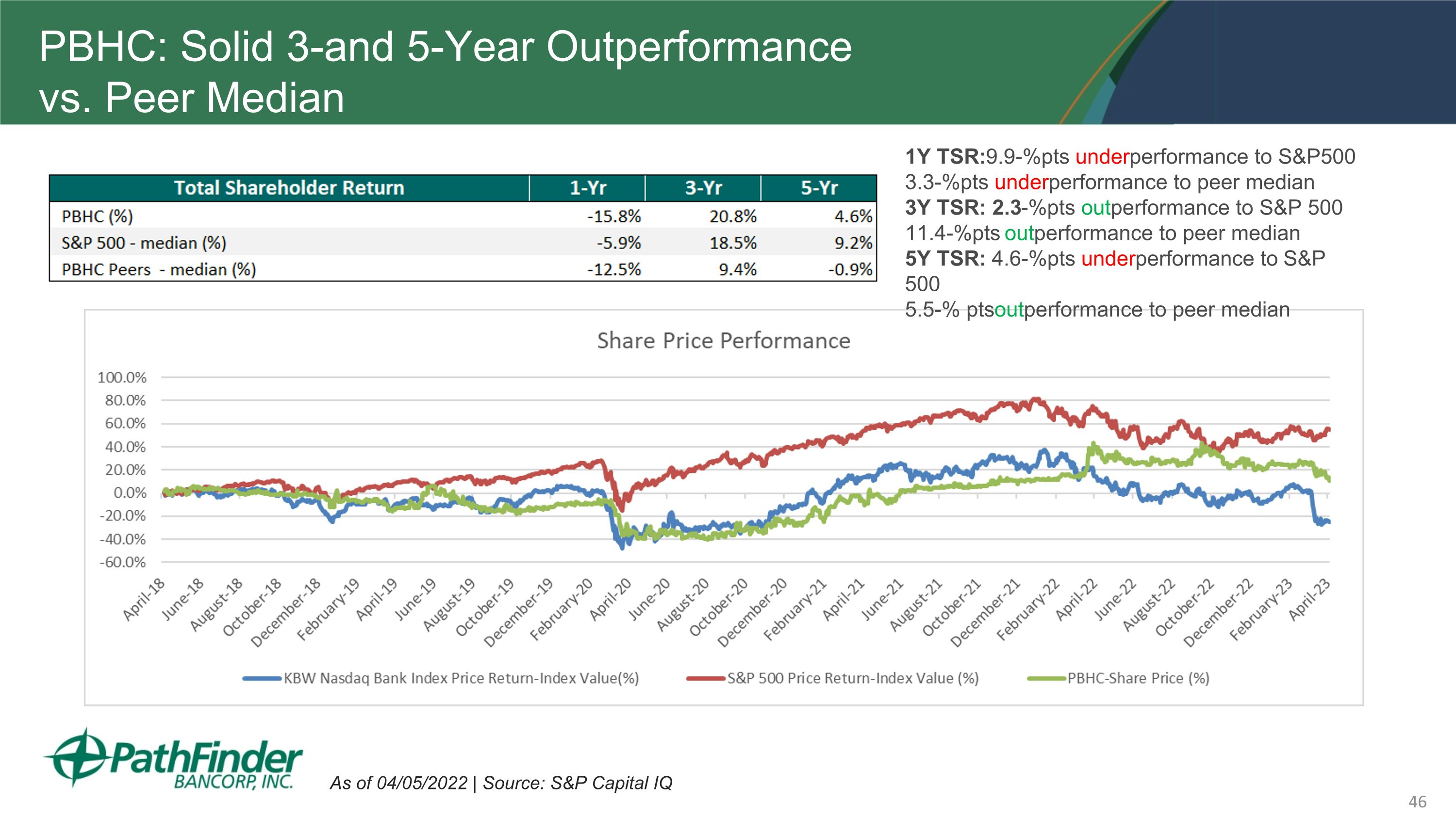

PBHC: Solid 3-and 5-Year Outperformance vs. Peer Median 1Y TSR:9.9-%pts underperformance to S&P500 3.3-%pts underperformance to peer median 3Y TSR: 2.3-%pts outperformance to S&P 500 11.4-%pts outperformance to peer median 5Y TSR: 4.6-%pts underperformance to S&P 500 5.5-% ptsoutperformance to peer median As of 04/05/2022 | Source: S&P Capital IQ

PBHC: Year-To-Date (YTD) Stock Price Performance Pathfinder stock has experienced a significant share price decline, along with the rest of the industry since March of this year The SPDR S&P Regional Banking Exchange Traded Fund (ETF) has the following YTD share price change and total returns through May 31, 2023: Price Change > -34.18% With Dividends Reinvested > -33.63% During the same five month period, PBHC has had the following YTD share price change and total returns: Price Change > -29.61% With Dividends Reinvested > -28.88% Data provided by Bloomberg, LP as of May 31, 2023

Strategy UpdateRefined Focus on Profitability Drivers We have identified our six most impactful opportunities for the next three to five years: Expense allocation and control; Accelerate digitization; Generate additional fee income consistent with our customer service orientation; Increase non-maturity deposits; Expand small business offerings; Explore expanded Wealth Management/Insurance/Mortgage Banking opportunities These opportunities will be realized through increased internal focus and execution as well as through partnerships and alliances with carefully-selected external partners.

Conclusion Pathfinder can grow significantly in the rapidly-emerging local economic environment The current uncertainties notwithstanding, there remains a place for community focused banks Well run community banks can profitably serve their customers in many ways and will continue to be sound investments for their shareholders Emerging technologies bring more “big bank” services to the customers of smaller institutions every day. Customers of approachable community banks will have an increasing number of ways to access banking services in the future

Conclusion Pathfinder’s focus on small business customers, along with an increasing ability to meet the needs of consumers, will facilitate our growth in the next three to five years The value of our franchise is likely to increase, perhaps substantially, as we leverage our current position and benefit from the area’s demonstrable growth While no assurances relative to our future stock performance can be given, we believe that in the long run that our stock price will likely follow this growth path

Questions and Discussion

Voting Results Chris R. Burritt, Chairman Inspector of Elections Report William O’Brien, Corporate Secretary

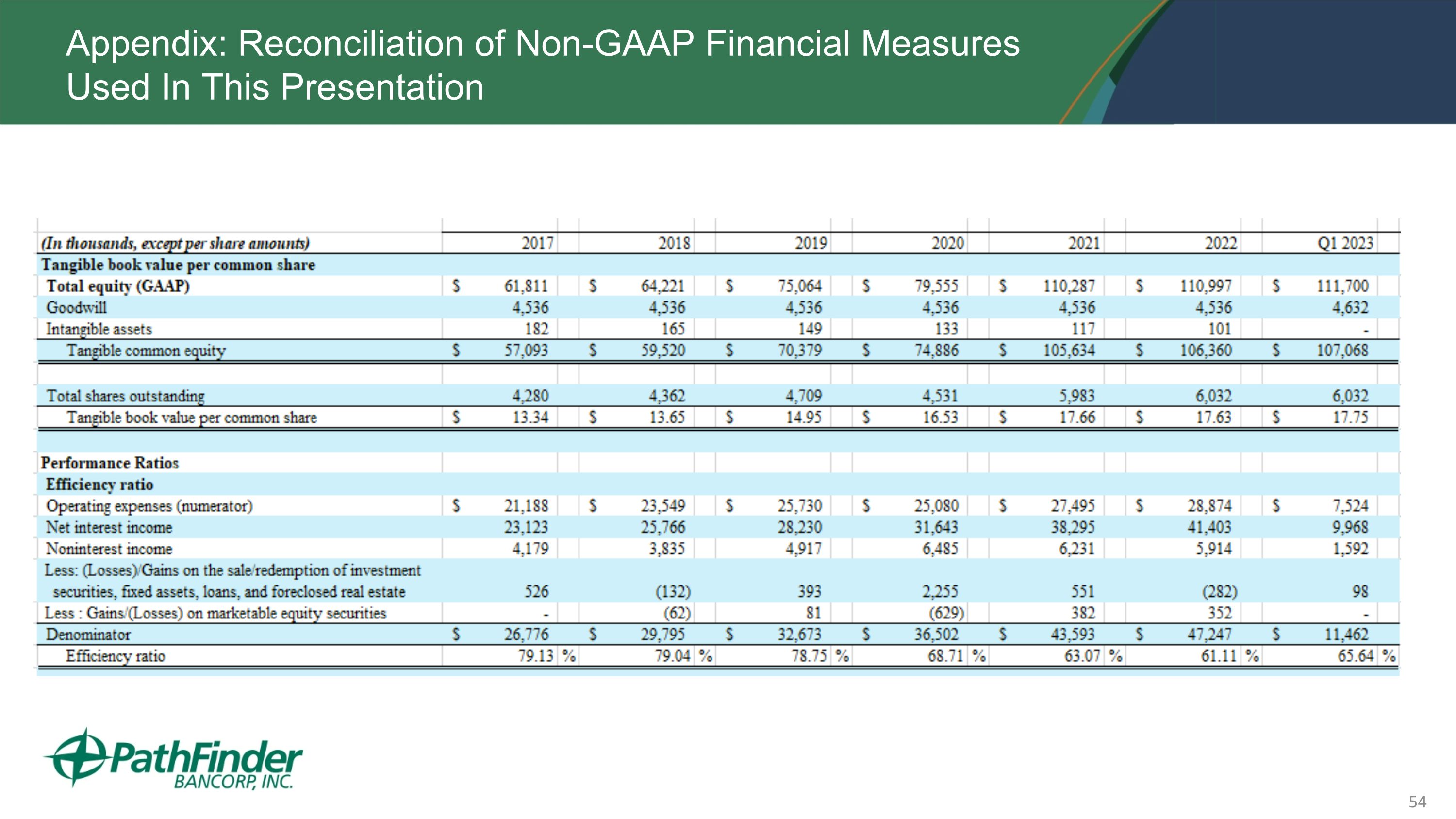

Appendix: Reconciliation of Non-GAAP Financial Measures Used In This Presentation