A

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 14, 2022

GENERATION INCOME PROPERTIES, INC.

(Exact Name of Registrant as Specified in its Charter)

Maryland |

|

001-40771 |

|

47-4427295 |

|

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|||

|

|

401 East Jackson Street, Suite 3300 Tampa, Florida |

|

33602 |

|

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (813)-448-1234

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

Common Stock, par value $0.01 per share

|

|

GIPR |

|

The Nasdaq Stock Market LLC |

Warrants to purchase Common Stock |

|

GIPRW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 14, 2022, Generation Income Properties, Inc. (the “Company”) issued a press release reporting its financial results for its third quarter ended September 30, 2022. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated by reference herein.

Item 7.01. Regulation FD Disclosure.

The Company is also furnishing in this Current Report on Form 8-K a presentation (the “Investor Presentation”) to be used by the Company at various meetings with investors, analysts, or others from time to time. The Investor Presentation may be amended or updated at any time and from time to time through another Current Report on Form 8-K, a later company filing or other means. A copy of the Investor Presentation is furnished herewith as Exhibit 99.2 and is incorporated into this Item 7.01 by reference.

The information furnished in these Items 2.02 and 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filings.

Item 9.01. |

Financial Statements and Exhibits.

|

|

(d) |

Exhibits.

|

|

Exhibit No. |

|

Description |

|

|

|

|

|

|

|

||

|

||

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

|

|

|

Forward-Looking Statements

This Current Report on Form 8-K may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainty. Words such as “anticipate,” “estimate,” “expect,” “intend,” “plan,” and “project” and other similar words and expressions are intended to signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various risks and uncertainties. Such statements are based on management’s current expectations and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Investors are cautioned that there can be no assurance actual results or business conditions will not differ materially from those projected or suggested in such forward-looking statements as a result of various factors. Please refer to the risks detailed from time to time in the reports we file with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2021 filed with the SEC, as well as other filings on Form 10-Q and periodic filings on Form 8-K, for additional factors that could cause actual results to differ materially from those stated or implied by such forward-looking statements. We disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

GENERATION INCOME PROPERTIES, INC. |

|||

|

|

|

|||

Date: November 14, 2022 |

|

By: |

|

/s/ Allison Davies |

|

|

|

|

|

Allison Davies |

|

|

|

|

|

Chief Financial Officer |

|

Exhibit 99.1

FOR IMMEDIATE RELEASE

November 14, 2022

Generation Income Properties Announces Third Quarter 2022 Financial and Operating Results

TAMPA, FLORIDA – Generation Income Properties, Inc. (NASDAQ:GIPR) ("GIPR" or the "Company") today announced its financial and operating results for the period ended September 30, 2022.

Highlights

(For the 3 months ended September 30, 2022)

Commenting on the quarter, CEO David Sobelman stated, “During the third quarter we focused on maximizing internal growth and growing our pipeline in order to better navigate the uncertainty that is prevalent throughout today’s markets. By positioning ourselves to take advantage of the imbalances within the market, we’ll look to opportunistically acquire assets when the time is right. We’re glad to be able to say that we’re in a stable position as it relates to our 100% rent collection, fixed debt rates that are well below today’s market interest rates, and the high credit worthiness of our tenants.”

FFO and related measures are supplemental non-GAAP financial measures used in the real estate industry to measure and compare the operating performance of real estate companies. A complete reconciliation containing adjustments from GAAP net income to Core FFO and Core AFFO is included at the end of this release.

Portfolio (as of September 30, 2022, unless otherwise stated)

Liquidity and Capital Resources

Financial Results

1

2022 Guidance

The Company is not providing guidance on future financial results or acquisitions and dispositions at this time. However, the Company will provide timely updates on material events, which will be broadly disseminated in due course. The Company’s executives, along with its Board of Directors, continue to assess the advisability and timing of providing such guidance to better align GIPR with its industry peers.

Conference Call and Webcast

The Company will host its third quarter earnings conference call and audio webcast on Tuesday, November 15, 2022, at 9:00 a.m. Eastern Time. To access the live webcast, which will be available in listen-only mode, please follow this link. If you prefer to listen via phone, U.S. participants may dial: 877-407-3141 (toll free) or 201-689-7803 (local).

About Generation Income Properties

Generation Income Properties, Inc., located in Tampa, Florida, is an internally managed real estate investment trust formed to acquire and own, directly and jointly, real estate investments focused on retail, office, and industrial net lease properties in densely populated submarkets. Additional information about Generation Income Properties, Inc. can be found at the Company's corporate website: www.gipreit.com.

Forward-Looking Statements

This press release, whether or not expressly stated, may contain "forward-looking" statements as defined in the Private Securities Litigation Reform Act of 1995. The words "believe," "intend," "expect," "plan," "should," "will," "would," and similar expressions and all statements, which are not historical facts, are intended to identify forward-looking statements. These statements reflect the Company's expectations regarding future events and economic performance and are forward-looking in nature and, accordingly, are subject to risks and uncertainties. Such forward-looking statements include risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such forward-looking statements which are, in some cases, beyond the Company’s control which could have a material adverse effect on the Company's business, financial condition, and results of operations. These risks and uncertainties include the risk that we may not be able to timely identify and close on acquisition opportunities, our limited operating history, potential changes in the economy in general and the real estate market in particular, the COVID-19 pandemic, and other risks and uncertainties that are identified from time to in our SEC filings, including those identified in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 filed on March 18, 2022, which are available at www.sec.gov. The occurrence of any of these risks and uncertainties could have a material adverse effect on the Company's business, financial condition, and results of operations. For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release. Any forward-looking statement made by us herein speaks only as of the date on which it is made. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof, except as may be required by law.

2

Notice Regarding Non-GAAP Financial Measures

In addition to our reported results and net earnings per diluted share, which are financial measures presented in accordance with GAAP, this press release contains and may refer to certain non-GAAP financial measures, including Funds from Operations ("FFO"), Core Funds From Operations ("Core FFO"), Adjusted Funds from Operations (“AFFO”), Core Adjusted Funds from Operations ("Core AFFO"), and Net Operating Income (“NOI”). We believe the use of Core FFO, Core AFFO and NOI are useful to investors because they are widely accepted industry measures used by analysts and investors to compare the operating performance of REITs. FFO and related measures, including NOI, should not be considered alternatives to net income as a performance measure or to cash flows from operations, as reported on our statement of cash flows, or as a liquidity measure, and should be considered in addition to, and not in lieu of, GAAP financial measures. You should not consider our Core FFO, Core AFFO, or NOI as an alternative to net income or cash flows from operating activities determined in accordance with GAAP. Our reconciliation of non-GAAP measures to the most directly comparable GAAP financial measure and statements of why management believes these measures are useful to investors are included below.

3

Generation Income Properties, Inc.

Consolidated Balance Sheets

|

As of September 30, |

|

|

As of December 31, |

|

||

|

2022 |

|

|

2021 |

|

||

|

(unaudited) |

|

|

(audited) |

|

||

Assets |

|

|

|

|

|

||

|

|

|

|

|

|

||

Investment in real estate |

|

|

|

|

|

||

Land |

$ |

12,577,544 |

|

|

$ |

9,443,445 |

|

Building and site improvements |

|

39,762,696 |

|

|

|

31,581,864 |

|

Tenant improvements |

|

907,382 |

|

|

|

482,701 |

|

Acquired lease intangible assets |

|

4,677,928 |

|

|

|

3,304,014 |

|

Less: accumulated depreciation and amortization |

|

(5,063,422 |

) |

|

|

(3,512,343 |

) |

Net real estate investments |

|

52,862,128 |

|

|

|

41,299,681 |

|

Investment in tenancy-in-common |

|

1,204,811 |

|

|

|

725,082 |

|

Cash and cash equivalents |

|

2,587,669 |

|

|

|

10,589,576 |

|

Restricted cash |

|

34,500 |

|

|

|

34,500 |

|

Deferred rent asset |

|

272,183 |

|

|

|

156,842 |

|

Deferred financing costs |

|

66,767 |

|

|

|

- |

|

Prepaid expenses |

|

226,537 |

|

|

|

237,592 |

|

Accounts receivable |

|

61,950 |

|

|

|

88,661 |

|

Escrow deposit and other assets |

|

238,389 |

|

|

|

288,782 |

|

Right of use asset, net |

|

6,253,975 |

|

|

|

- |

|

Total Assets |

$ |

63,808,909 |

|

|

$ |

53,420,716 |

|

|

|

|

|

|

|

||

Liabilities and Equity |

|

|

|

|

|

||

|

|

|

|

|

|

||

Liabilities |

|

|

|

|

|

||

Accounts payable |

$ |

104,772 |

|

|

$ |

201,727 |

|

Accrued expenses |

|

386,079 |

|

|

|

134,816 |

|

Acquired lease intangible liabilities, net |

|

666,270 |

|

|

|

577,388 |

|

Insurance payable |

|

127,103 |

|

|

|

33,359 |

|

Deferred rent liability |

|

177,011 |

|

|

|

228,938 |

|

Lease liability, net |

|

6,303,232 |

|

|

|

- |

|

Other payable - related party |

|

2,587,300 |

|

|

|

- |

|

Mortgage loans, net of unamortized discount |

|

35,364,605 |

|

|

|

28,969,295 |

|

Total liabilities |

|

45,716,372 |

|

|

|

30,145,523 |

|

|

|

|

|

|

|

||

Redeemable Non-Controlling Interests |

|

5,773,636 |

|

|

|

9,134,979 |

|

|

|

|

|

|

|

||

Stockholders' Equity |

|

|

|

|

|

||

Common stock, $0.01 par value |

|

24,892 |

|

|

|

21,729 |

|

Additional paid-in capital |

|

19,506,770 |

|

|

|

19,051,929 |

|

Accumulated deficit |

|

(7,664,430 |

) |

|

|

(5,403,156 |

) |

Total stockholders' equity |

|

11,867,232 |

|

|

|

13,670,502 |

|

|

|

|

|

|

|

||

Non-Controlling Interests |

|

451,669 |

|

|

|

469,712 |

|

Total equity |

|

12,318,901 |

|

|

|

14,140,214 |

|

|

|

|

|

|

|

||

Total Liabilities and Equity |

$ |

63,808,909 |

|

|

$ |

53,420,716 |

|

4

Generation Income Properties, Inc.

Consolidated Statements of Operations

(unaudited)

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

||||||||

|

2022 |

|

2021 |

|

|

2022 |

|

2021 |

|

||||

Revenue |

|

|

|

|

|

|

|

|

|

||||

Rental income |

$ |

1,473,789 |

|

$ |

988,244 |

|

|

$ |

4,034,286 |

|

$ |

2,913,322 |

|

Other income |

|

296 |

|

|

45,250 |

|

|

|

837 |

|

|

45,250 |

|

Total revenue |

$ |

1,474,085 |

|

$ |

1,033,494 |

|

|

$ |

4,035,123 |

|

$ |

2,958,572 |

|

|

|

|

|

|

|

|

|

|

|

||||

Expenses |

|

|

|

|

|

|

|

|

|

||||

General, administrative and organizational costs |

|

408,570 |

|

|

181,746 |

|

|

|

1,222,986 |

|

|

621,987 |

|

Building expenses |

|

269,781 |

|

|

195,464 |

|

|

|

848,373 |

|

|

539,739 |

|

Depreciation and amortization |

|

561,510 |

|

|

388,141 |

|

|

|

1,551,079 |

|

|

1,164,838 |

|

Interest expense, net |

|

382,440 |

|

|

336,025 |

|

|

|

1,088,361 |

|

|

1,028,446 |

|

Compensation costs |

|

334,992 |

|

|

204,218 |

|

|

|

925,432 |

|

|

515,030 |

|

Total expenses |

|

1,957,293 |

|

|

1,305,594 |

|

|

|

5,636,231 |

|

|

3,870,040 |

|

Operating loss |

|

(483,208 |

) |

|

(272,100 |

) |

|

|

(1,601,108 |

) |

|

(911,468 |

) |

Income on investment in tenancy-in-common |

|

16,751 |

|

|

4,750 |

|

|

|

23,841 |

|

|

4,750 |

|

Gain on sale of property |

|

- |

|

|

923,178 |

|

|

|

- |

|

|

923,178 |

|

Dead deal expense |

|

(45,660 |

) |

|

- |

|

|

|

(153,031 |

) |

|

- |

|

Loss on debt extinguishment |

|

- |

|

|

- |

|

|

|

(144,029 |

) |

|

- |

|

Net income (loss) |

$ |

(512,117 |

) |

$ |

655,828 |

|

|

$ |

(1,874,327 |

) |

$ |

16,460 |

|

Less: Net income attributable to non-controlling interest |

|

126,803 |

|

|

200,277 |

|

|

|

386,947 |

|

|

398,781 |

|

Net income (loss) attributable to Generation Income Properties, Inc. |

$ |

(638,920 |

) |

$ |

455,551 |

|

|

$ |

(2,261,274 |

) |

$ |

(382,321 |

) |

|

|

|

|

|

|

|

|

|

|

||||

Total Weighted Average Shares of Common Stock Outstanding – Basic & Diluted |

|

2,304,841 |

|

|

939,559 |

|

|

|

2,251,522 |

|

|

699,395 |

|

|

|

|

|

|

|

|

|

|

|

||||

Basic & Diluted Income (Loss) Per Share Attributable to Common Stockholders |

$ |

(0.28 |

) |

$ |

0.48 |

|

|

$ |

(1.00 |

) |

$ |

(0.55 |

) |

Reconciliation of Non-GAAP Measures

The following tables reconcile net income (loss), which we believe is the most comparable GAAP measure, to Net Operating Income (“NOI”):

5

|

|

Three Months Ended September 30, |

|

|

|

Nine Months Ended September 30, |

|

|||||||||

|

|

2022 |

|

2021 |

|

|

|

2022 |

|

2021 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net income (loss) attributable to Generation Income Properties, Inc. |

|

|

(638,920 |

) |

|

455,551 |

|

|

|

|

(2,261,274 |

) |

|

(382,321 |

) |

|

Plus: Net income attributable to non-controlling interest |

|

|

126,803 |

|

|

200,277 |

|

|

|

|

386,947 |

|

|

398,781 |

|

|

Net income (loss) |

|

|

(512,117 |

) |

|

655,828 |

|

|

- |

|

|

(1,874,327 |

) |

|

16,460 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Plus: |

|

|

|

|

|

|

|

|

|

|

|

|||||

General, administrative and organizational costs |

|

|

408,570 |

|

|

181,746 |

|

|

|

|

1,222,986 |

|

|

621,987 |

|

|

Depreciation and amortization |

|

|

561,510 |

|

|

388,141 |

|

|

|

|

1,551,079 |

|

|

1,164,838 |

|

|

Interest expense, net |

|

|

382,440 |

|

|

336,025 |

|

|

|

|

1,088,361 |

|

|

1,028,446 |

|

|

Compensation costs |

|

|

334,992 |

|

|

204,218 |

|

|

|

|

925,432 |

|

|

515,030 |

|

|

Income on investment in tenancy-in-common |

|

|

(16,751 |

) |

|

(4,750 |

) |

|

|

|

(23,841 |

) |

|

(4,750 |

) |

|

Gain on sale of property |

|

|

- |

|

|

(923,178 |

) |

|

|

|

- |

|

|

(923,178 |

) |

|

Dead deal expense |

|

|

45,660 |

|

|

- |

|

|

|

|

153,031 |

|

|

- |

|

|

Loss on debt extinguishment |

|

|

- |

|

|

- |

|

|

|

|

144,029 |

|

|

- |

|

|

Net Operating Income |

|

$ |

1,204,304 |

|

$ |

838,030 |

|

|

|

$ |

3,186,750 |

|

$ |

2,418,833 |

|

|

6

The following tables reconcile net income (loss), which we believe is the most comparable GAAP measure, to FFO, Core FFO, AFFO, and Core AFFO:

|

Three Months Ended September 30, |

|

|

|

Nine Months Ended September 30, |

|

|||||||||

|

2022 |

|

2021 |

|

|

|

2022 |

|

2021 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||

Net income (loss) |

$ |

(512,117 |

) |

$ |

655,828 |

|

|

|

$ |

(1,874,327 |

) |

$ |

16,460 |

|

|

Gain on disposal of property |

|

- |

|

|

(923,178 |

) |

|

|

|

- |

|

|

(923,178 |

) |

|

Depreciation and amortization |

|

561,510 |

|

|

388,141 |

|

|

|

|

1,551,079 |

|

|

1,164,838 |

|

|

Funds From Operations |

$ |

49,393 |

|

$ |

120,791 |

|

|

|

$ |

(323,248 |

) |

$ |

258,120 |

|

|

Amortization of debt issuance costs |

|

27,758 |

|

|

30,678 |

|

|

|

|

89,364 |

|

|

94,600 |

|

|

Non-cash stock compensation |

|

110,869 |

|

|

53,887 |

|

|

|

|

328,913 |

|

|

186,636 |

|

|

Write off of deferred financing cost |

|

137,522 |

|

|

- |

|

|

|

|

137,522 |

|

|

- |

|

|

Adjustments to Funds From Operations |

$ |

276,149 |

|

$ |

84,565 |

|

|

|

$ |

555,799 |

|

$ |

281,236 |

|

|

Core Funds From Operations |

$ |

325,542 |

|

$ |

205,356 |

|

|

|

$ |

232,551 |

|

$ |

539,356 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net income (loss) |

$ |

(512,117 |

) |

$ |

655,828 |

|

|

|

$ |

(1,874,327 |

) |

$ |

16,460 |

|

|

Gain on disposal of property |

|

- |

|

|

(923,178 |

) |

|

- |

|

|

- |

|

|

(923,178 |

) |

Depreciation and amortization |

|

561,510 |

|

|

388,141 |

|

|

- |

|

|

1,551,079 |

|

|

1,164,838 |

|

Amortization of debt issuance costs |

|

27,758 |

|

|

30,678 |

|

|

- |

|

|

89,364 |

|

|

94,600 |

|

Above and below-market lease amortization, net |

|

(26,297 |

) |

|

(40,329 |

) |

|

- |

|

|

(76,478 |

) |

|

(115,921 |

) |

Straight line rent, net |

|

13,203 |

|

|

(14,796 |

) |

|

|

|

29,263 |

|

|

(42,785 |

) |

|

Adjustments to net income (loss) |

$ |

576,174 |

|

$ |

(559,484 |

) |

|

|

$ |

1,593,228 |

|

$ |

177,554 |

|

|

Adjusted Funds From Operations |

$ |

64,057 |

|

$ |

96,344 |

|

|

|

$ |

(281,099 |

) |

$ |

194,014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Dead deal expense |

|

45,660 |

|

|

- |

|

|

|

|

153,031 |

|

|

- |

|

|

Loss on debt extinguishment |

|

- |

|

|

- |

|

|

|

|

144,029 |

|

|

- |

|

|

Non-cash stock compensation |

|

110,869 |

|

|

53,887 |

|

|

|

|

328,913 |

|

|

186,636 |

|

|

Write off of deferred financing cost |

|

137,522 |

|

|

- |

|

|

|

|

137,522 |

|

|

- |

|

|

Adjustments to Adjusted Funds From Operations |

$ |

294,051 |

|

$ |

53,887 |

|

|

|

$ |

763,495 |

|

$ |

186,636 |

|

|

Core Adjusted Funds From Operations |

$ |

358,108 |

|

$ |

150,231 |

|

|

|

$ |

482,396 |

|

$ |

380,650 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net income (loss) |

$ |

(512,117 |

) |

$ |

655,828 |

|

|

|

$ |

(1,874,327 |

) |

$ |

16,460 |

|

|

Net income attributable to non-controlling interests |

|

(126,803 |

) |

|

(200,277 |

) |

|

|

|

(386,947 |

) |

|

(398,781 |

) |

|

Net income (loss) attributable to Generation Income Properties, Inc. |

$ |

(638,920 |

) |

$ |

455,551 |

|

|

|

$ |

(2,261,274 |

) |

$ |

(382,321 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Note 1: Subsequent to the issuance of the Company’s 2021 Form 10-K and Q1 2022 Form 10-Q, management of the Company identified an immaterial error in application of Accounting Standards Codification (ASC) 480-10, Distinguishing Liabilities from Equity. Specifically, the Company incorrectly classified the partnership interest of GIP Fund 1, LLC as Redeemable non-controlling interest rather than Non-controlling interest within Equity. The Company has accordingly corrected certain numbers in the prior year presentation above.

Our reported results are presented in accordance with GAAP. We also disclose funds from operations ("FFO"), adjusted funds from operations ("AFFO"), core funds from operations ("Core FFO") and core adjusted funds of operations ("Core AFFO") all of which are non-GAAP financial measures. We believe these non-GAAP financial measures are useful to investors because they are widely accepted industry measures used by analysts and investors to compare the operating performance of REITs.

7

FFO and related measures do not represent cash generated from operating activities and are not necessarily indicative of cash available to fund cash requirements; accordingly, they should not be considered alternatives to net income or loss as a performance measure or cash flows from operations as reported on our statement of cash flows as a liquidity measure and should be considered in addition to, and not in lieu of, GAAP financial measures.

We compute FFO in accordance with the definition adopted by the Board of Governors of the National Association of Real Estate Investment Trusts ("NAREIT"). NAREIT defines FFO as GAAP net income or loss adjusted to exclude extraordinary items (as defined by GAAP), net gains from sales of depreciable real estate assets, impairment write-downs associated with depreciable real estate assets, and real estate related depreciation and amortization, including the pro rata share of such adjustments of unconsolidated subsidiaries. We then adjust FFO for non-cash revenues and expenses such as amortization of deferred financing costs, above and below market lease intangible amortization, straight line rent adjustment where the Company is both the lessor and lessee, and non-cash stock compensation to calculate Core AFFO.

FFO is used by management, investors, and analysts to facilitate meaningful comparisons of operating performance between periods and among our peers primarily because it excludes the effect of real estate depreciation and amortization and net gains on sales, which are based on historical costs and implicitly assume that the value of real estate diminishes predictably over time, rather than fluctuating based on existing market conditions. We believe that AFFO is an additional useful supplemental measure for investors to consider because it will help them to better assess our operating performance without the distortions created by other non-cash revenues or expenses. FFO and AFFO may not be comparable to similarly titled measures employed by other companies. We believe that Core FFO and Core AFFO are useful measures for management and investors because they further remove the effect of non-cash expenses and certain other expenses that are not directly related to real estate operations. We use each as measures of our performance when we formulate corporate goals.

As FFO excludes depreciation and amortization, gains and losses from property dispositions that are available for distribution to stockholders and extraordinary items, it provides a performance measure that, when compared year over year, reflects the impact to operations from trends in occupancy rates, rental rates, operating costs, general and administrative expenses and interest costs, providing a perspective not immediately apparent from net income or loss. However, FFO should not be viewed as an alternative measure of our operating performance since it does not reflect either depreciation and amortization costs or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties which could be significant economic costs and could materially impact our results from operations. Additionally, FFO does not reflect distributions paid to redeemable non-controlling interests.

Investor Contacts

Investor Relations

ir@gipreit.com

8

GENERATION INCOME PROPERTIES NASDAQ: GIPR INVESTOR PRESENTATION November 2022 *All information as of 09/30/2022 unless stated otherwise Real Estate Investments for Generations

FORWARD-LOOKING STATEMENTS This presentation may contain forward-looking statements and information relating to, among other things, Generation Income Properties, Inc. (“the company”), its business plan and strategy, its properties and assets, and its industry. These forward-looking statements are based on the beliefs of, assumptions made by, and information currently available to the company’s management. When used in the offering materials, the words “estimate,” “project,” “believe,” “anticipate,” “intend,” “expect” and similar expressions are intended to identify forward-looking statements. These statements reflect management’s current views with respect to future events and are subject to risks and uncertainties that could cause the company’s actual results to differ materially from those contained in the forward- looking statements. Investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. The company does not undertake any obligation to revise or update these forward-looking statements to reflect events or circumstances after such date or to reflect the occurrence of unanticipated events. Use of Non-GAAP Financial Measures. This presentation contains certain financial measures that are not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). Such measures include funds from operations ("FFO"), Adjusted FFO (”AFFO”), Core FFO and Core AFFO. These non-GAAP financial measures are presented because the company's management believes these measures help investors understand its business, performance and ability to earn and distribute cash to its shareholders by providing perspectives not immediately apparent from net income or loss. These measures are also frequently used by securities analysts, investors and other interested parties in evaluating real estate companies. The presentation of FFO, Adjusted FFO, Core FFO and Core AFFO herein are not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP and should not be considered as alternative measures of liquidity. In addition, readers are advised that the company’s definitions and method of calculating these measures may be different from those used by other companies, and, accordingly, may not be comparable to similar measures as defined and calculated by other companies that do not use the same methodology as the company. DISCLAIMER | 2

100% Occupied 92% Assets w/ Contractual Bumps 92% Investment Grade Tenants* GIPR Nasdaq 5.6 years Weighted Average Remaining Lease Term $61M Gross Asset Value eneration ncome roperties EIT G I P R 13 Properties 338K Square Feet 5.8X Rent Coverage | 3 100% Rent Collections *Tenant or parent company is investment grade credit or equivalent As of 9/30/2022

INVESTMENT THESIS DISCIPLINED UNDERWRITING Focused on high quality real estate, tenant credit, site-specific performance and geographic attributes. 3 OPPORTUNISTIC LEASE TERMS & CONSISTENT OCCUPANCY Acquiring assets with less than 10 years remaining on lease term in higher density markets with a high likelihood of renewing leases or re-tenanting in a short period following a potential vacancy. 2 STRONG TENANT CREDIT Academic research-based focus on investment grade credit tenants with strong corporate financial metrics. 1 ACTIVE MANAGEMENT Creating strong relationships with each tenant at the corporate and property level, to glean site specific performance and improve the profitability of long-term, consistent occupancy. 4 INTERNAL GROWTH 5 Platform poised for advantageous internal growth through lease renewals, rental increases, re-tenancy and/or asset appreciation. | 4 shorter lease terms high credit quality tenants dense submarkets

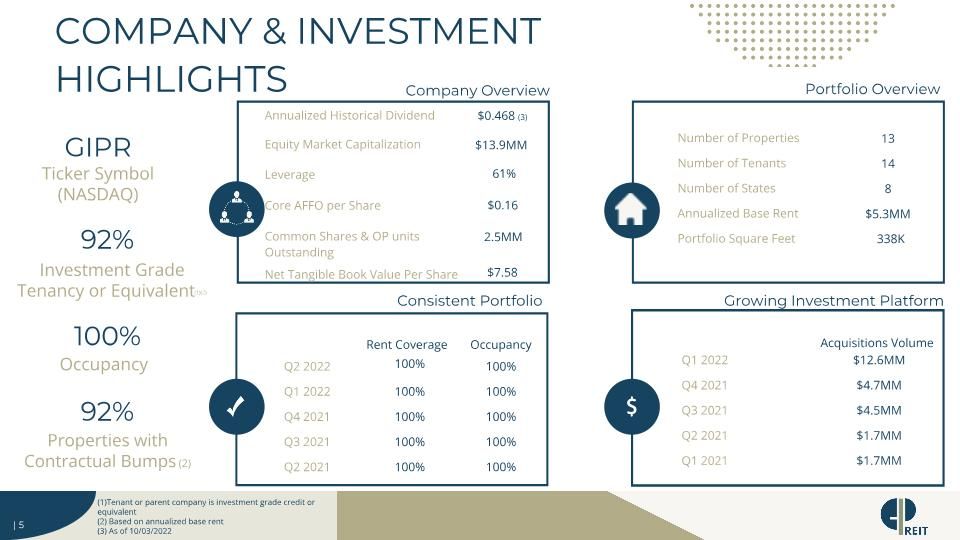

Consistent Portfolio COMPANY & INVESTMENT HIGHLIGHTS Investment Grade Tenancy or Equivalent(1)(2) 92% 100% Occupancy 92% GIPR Ticker Symbol (NASDAQ) Properties with Contractual Bumps (2) $1.7MM Q1 2022 Q4 2021 Q3 2021 Q2 2021 Growing Investment Platform Q1 2021 $1.7MM $4.5MM $4.7MM $12.6MM Acquisitions Volume 100% Q2 2022 Q1 2022 Q4 2021 Q3 2021 Q2 2021 100% 100% 100% 100% 100% 100% 100% 100% Rent Coverage Occupancy Portfolio Overview Company Overview Number of Properties Portfolio Square Feet Number of States Annualized Base Rent Number of Tenants 8 14 13 $5.3MM 338K Annualized Historical Dividend Core AFFO per Share Leverage Equity Market Capitalization 61% $13.9MM $0.468 (3) Common Shares & OP units Outstanding 2.5MM $0.16 100% | 5 Net Tangible Book Value Per Share $7.58 (1)Tenant or parent company is investment grade credit or equivalent (2) Based on annualized base rent(3) As of 10/03/2022

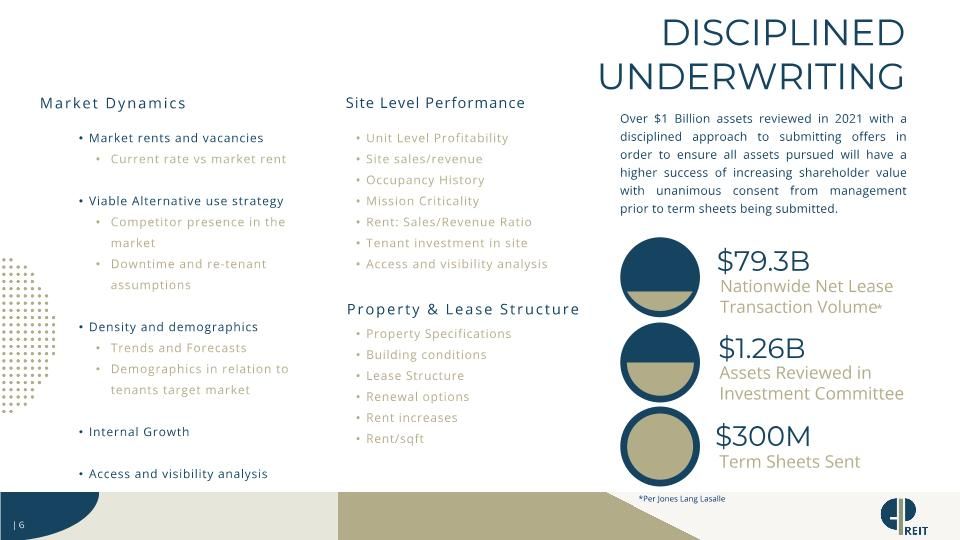

DISCIPLINED UNDERWRITING | 6 Over $1 Billion assets reviewed in 2021 with a disciplined approach to submitting offers in order to ensure all assets pursued will have a higher success of increasing shareholder value with unanimous consent from management prior to term sheets being submitted. Market Dynamics Market rents and vacancies Current rate vs market rent Viable Alternative use strategy Competitor presence in the market Downtime and re-tenant assumptions Density and demographics Trends and Forecasts Demographics in relation to tenants target market Internal Growth Access and visibility analysis Site Level Performance Unit Level Profitability Site sales/revenue Occupancy History Mission Criticality Rent: Sales/Revenue Ratio Tenant investment in site Access and visibility analysis Property & Lease Structure Property Specifications Building conditions Lease Structure Renewal options Rent increases Rent/sqft $79.3B $1.26B $300M Nationwide Net Lease Transaction Volume* Assets Reviewed in Investment Committee Term Sheets Sent *Per Jones Lang Lasalle

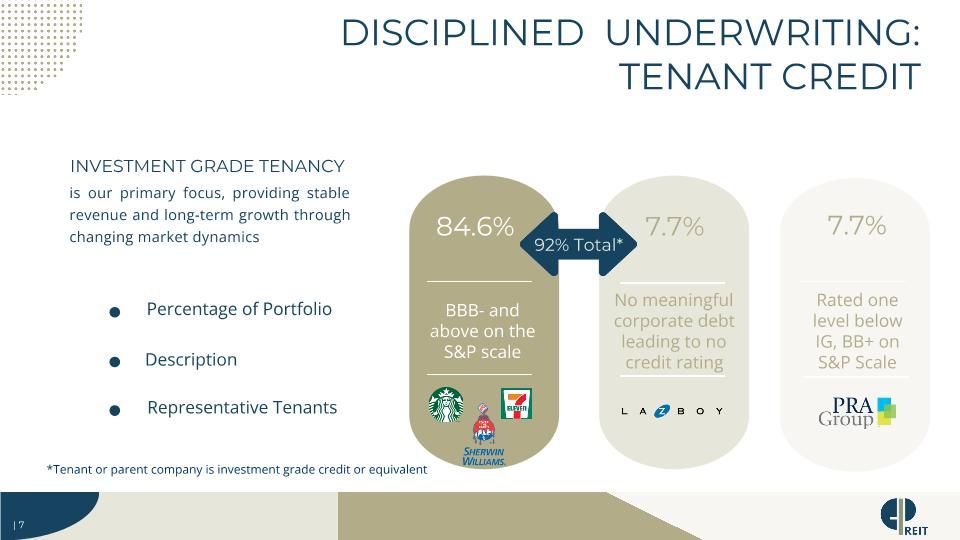

84.6% is our primary focus, providing stable revenue and long-term growth through changing market dynamics | 7 DISCIPLINED UNDERWRITING: TENANT CREDIT No meaningful corporate debt leading to no credit rating 84.6% BBB- and above on the S&P scale 7.7% 7.7% Rated one level below IG, BB+ on S&P Scale 92% Total* Percentage of Portfolio Description Representative Tenants INVESTMENT GRADE TENANCY *Tenant or parent company is investment grade credit or equivalent

OPPORTUNISTIC LEASE TERMS & CONSISTENT OCCUPANCY 11.4 9.6 7.7 7.1 5.6 ADC NTST PINE GOOD GIPR GIPR’s Shorter Lease Terms Create Greater Flexibility & Potential Higher Rental Rate Increases (in years) Low weighted average remaining lease term allows for asset appreciation and internal growth through rent escalations and lease renewals, and allows GIPR to purchase assets at ~100-200bps higher than assets with 10+ years remaining High credit quality tenants with essential businesses 100% occupied stabilized net lease portfolio Annualized ABR of $5.3MM | 8 LEASE MATURITIES

ACTIVE MANAGEMENT | 9 DISCIPLINED ACQUISITIONS RELATIONSHIP FOCUSED Asset Management assists in underwriting of assets to enhance property knowledge from the outset. Strong relationships formed with each tenant at the property level to better understand site specific performance creating partnership like communications. INTERNAL GROWTH ACTIVE MONITORING PROACTIVE REVIEW Semi-annual site visits to continuously build strong relationships with tenants, actively monitor building conditions and site performance, and hold tenants accountable to lease responsibilities. Consistently review portfolio for changes in property and tenant performance inclusive of micro and macro-economic shifts. Through actively managing assets, GIPR can realize strong internal growth through potential asset appreciation, rent escalation, and lease renewals.

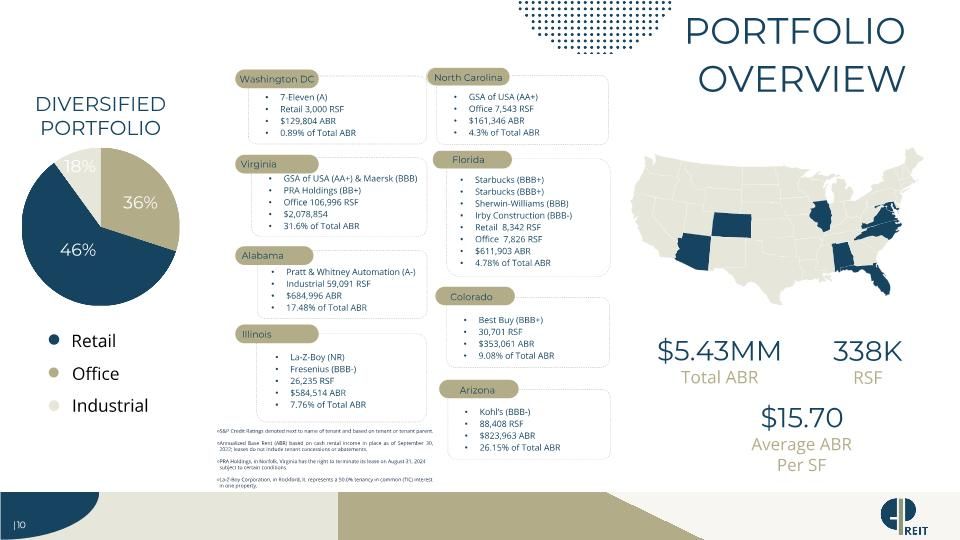

Virginia GSA of USA (AA+) & Maersk (BBB) PRA Holdings (BB+) Office 106,996 RSF $2,078,854 31.6% of Total ABR Washington DC 7-Eleven (A) Retail 3,000 RSF $129,804 ABR 0.89% of Total ABR Florida Starbucks (BBB+) Starbucks (BBB+) Sherwin-Williams (BBB) Irby Construction (BBB-) Retail 8,342 RSF Office 7,826 RSF $611,903 ABR 4.78% of Total ABR Alabama Pratt & Whitney Automation (A-) Industrial 59,091 RSF $684,996 ABR 17.48% of Total ABR North Carolina GSA of USA (AA+) Office 7,543 RSF $161,346 ABR 4.3% of Total ABR Colorado Best Buy (BBB+) 30,701 RSF $353,061 ABR 9.08% of Total ABR Illinois La-Z-Boy (NR) Fresenius (BBB-) 26,235 RSF $584,514 ABR 7.76% of Total ABR S&P Credit Ratings denoted next to name of tenant and based on tenant or tenant parent. Annualized Base Rent (ABR) based on cash rental income in place as of September 30, 2022; leases do not include tenant concessions or abatements. PRA Holdings, in Norfolk, Virginia has the right to terminate its lease on August 31, 2024 subject to certain conditions. La-Z-Boy Corporation, in Rockford, IL represents a 50.0% tenancy in common (TIC) interest in one property. Arizona Kohl’s (BBB-) 88,408 RSF $823,963 ABR 26.15% of Total ABR | 10 $5.43MM Total ABR 338K RSF $15.70 Average ABR Per SF PORTFOLIO OVERVIEW DIVERSIFIED PORTFOLIO 46% 36% 18% Retail Office Industrial

FINANCIAL OVERVIEW | 11 LEASE TERM VS DEBT MATURITY Lease Date Debt Maturity Date 7- Eleven Starbucks Pratt & Whitney GSA Navy Maersk PRA Holdings, Inc. Sherwin Williams GSA - FBI Irby / Quanta Services Best Buy Fresenius Starbucks Kohl’s La-Z-Boy

04 02 MANAGEMENT TEAM DAVID SOBELMAN Chief Executive Officer & Chairman of the Board 18+ years of experience in net lease real estate Oversees strategy and long-term vision for GIPR EMILY CUSMANO Chief of Staff 12+ years of experience in net lease real estate Oversees organizational strategies and administrative functions EMILY HEWLAND Director of Capital Markets 5+ years of experience in net lease real estate Oversees acquisitions, capital markets and investment strategy | 12 ALLISON DAVIES Chief Financial Officer 17+ years of experience in real estate and accounting Leads the accounting, corporate finance and capital markets functions NOAH SHAFFER Director of Asset Management 6+ years of experience in net lease real estate Oversees property maintenance, data analytics and tenant relations

STUART EISENBERG Audit Committee Chair 04 02 BENJAMIN ADAMS Compensation Committee Chair Founder and CEO of Ten Capital Management ($616 million GAV) 20+ years in business, government, and law EUGENIA CHENG Independent Director Managing Director of Prospect Avenue Partners 20+ years in the real estate industry Retired from BDO USA LLP where he was partner in the RE service group 30+ years in real estate and construction accounting industry | 13 BETSY PECK Governance Committee Chair Retired Chief Operating Officer, Markets of Jones Lang Lasalle (NYSE: JLL) 30+ years in leasing, property management, and capital markets PATRICK QUILTY Independent Director Chief Credit Officer for a multinational & alternative risk group 20+ years in real estate BOARD OF DIRECTORS

ENVIRONMENTAL SOCIAL CORPORATE GOVERNANCE Committed Approach From working in a co-working space to using reusable and environmentally friendly products, GIPR is committed to reducing its environmental footprint. Tenant Alignment Focus on tenants who have strong corporate practices in place to recognize and act upon their environmental responsibility. Relational Culture Strong company culture underpinned by company values; relational, generational and ethical. GIPR believes that smart, empowered, and diverse teams build great companies. Out approach sets us apart, and we continually strive to put others and the relationships we build first. It’s imperative to GIP, and our roles in the organization, that we create a diversified team and provide women and other minorities the platform to be heard. | 14 CORPORATE RESPONSIBILITY GIPR has a strong handle on corporate governance with 5 out of 6 Board members being independent, coupled with a focus on strong internal controls. All team members adhere to our Code of Ethics and Company Handbook which include robust policies and procedures. Additionally, unanimous consent from all Investment Committee members for property acquisitions. Focus on Internal Controls

INVESTOR RELATIONS ir@gipreit.com (813) 448-1234

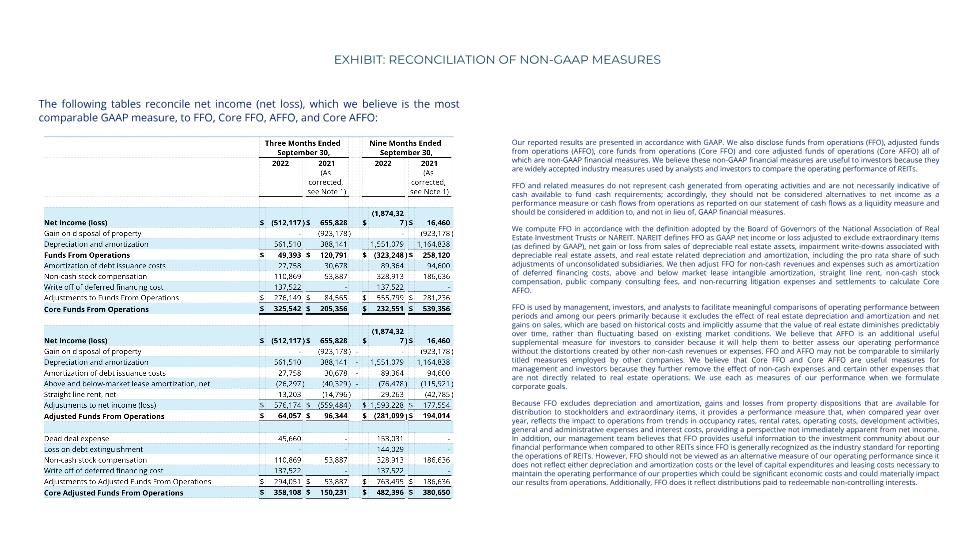

EXHIBIT: RECONCILIATION OF NON-GAAP MEASURES The following tables reconcile net income (net loss), which we believe is the most comparable GAAP measure, to FFO, Core FFO, AFFO, and Core AFFO: Our reported results are presented in accordance with GAAP. We also disclose funds from operations (FFO), adjusted funds from operations (AFFO), core funds from operations (Core FFO) and core adjusted funds of operations (Core AFFO) all of which are non-GAAP financial measures. We believe these non-GAAP financial measures are useful to investors because they are widely accepted industry measures used by analysts and investors to compare the operating performance of REITs. FFO and related measures do not represent cash generated from operating activities and are not necessarily indicative of cash available to fund cash requirements; accordingly, they should not be considered alternatives to net income as a performance measure or cash flows from operations as reported on our statement of cash flows as a liquidity measure and should be considered in addition to, and not in lieu of, GAAP financial measures. We compute FFO in accordance with the definition adopted by the Board of Governors of the National Association of Real Estate Investment Trusts or NAREIT. NAREIT defines FFO as GAAP net income or loss adjusted to exclude extraordinary items (as defined by GAAP), net gain or loss from sales of depreciable real estate assets, impairment write-downs associated with depreciable real estate assets, and real estate related depreciation and amortization, including the pro rata share of such adjustments of unconsolidated subsidiaries. We then adjust FFO for non-cash revenues and expenses such as amortization of deferred financing costs, above and below market lease intangible amortization, straight line rent, non-cash stock compensation, public company consulting fees, and non-recurring litigation expenses and settlements to calculate Core AFFO. FFO is used by management, investors, and analysts to facilitate meaningful comparisons of operating performance between periods and among our peers primarily because it excludes the effect of real estate depreciation and amortization and net gains on sales, which are based on historical costs and implicitly assume that the value of real estate diminishes predictably over time, rather than fluctuating based on existing market conditions. We believe that AFFO is an additional useful supplemental measure for investors to consider because it will help them to better assess our operating performance without the distortions created by other non-cash revenues or expenses. FFO and AFFO may not be comparable to similarly titled measures employed by other companies. We believe that Core FFO and Core AFFO are useful measures for management and investors because they further remove the effect of non-cash expenses and certain other expenses that are not directly related to real estate operations. We use each as measures of our performance when we formulate corporate goals. Because FFO excludes depreciation and amortization, gains and losses from property dispositions that are available for distribution to stockholders and extraordinary items, it provides a performance measure that, when compared year over year, reflects the impact to operations from trends in occupancy rates, rental rates, operating costs, development activities, general and administrative expenses and interest costs, providing a perspective not immediately apparent from net income. In addition, our management team believes that FFO provides useful information to the investment community about our financial performance when compared to other REITs since FFO is generally recognized as the industry standard for reporting the operations of REITs. However, FFO should not be viewed as an alternative measure of our operating performance since it does not reflect either depreciation and amortization costs or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties which could be significant economic costs and could materially impact our results from operations. Additionally, FFO does it reflect distributions paid to redeemable non-controlling interests.