|

Nevada

|

81-0422894

|

|

|

(State or other jurisdiction of incorporation)

|

(IRS Employer

Identification No.)

|

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $.001 par value

|

LNW

|

The NASDAQ Stock Market

|

|

Preferred Stock Purchase Rights

|

The NASDAQ Stock Market

|

|

Exhibit No.

|

Description

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

|

Date: May 17, 2022

|

LIGHT & WONDER, INC.

|

||

|

|

By:

|

/s/ Constance P. James

|

|

|

|

|

Name:

|

Constance P. James

|

|

|

|

Title:

|

Executive Vice President, Chief Financial

Officer, Treasurer and Corporate Secretary |

| LNW Investor Day Highlights Press Release |

|

|

● |

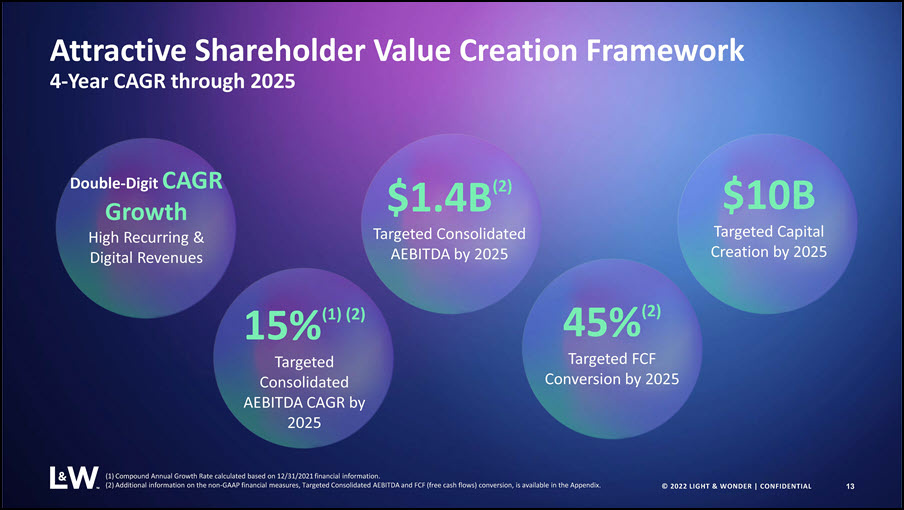

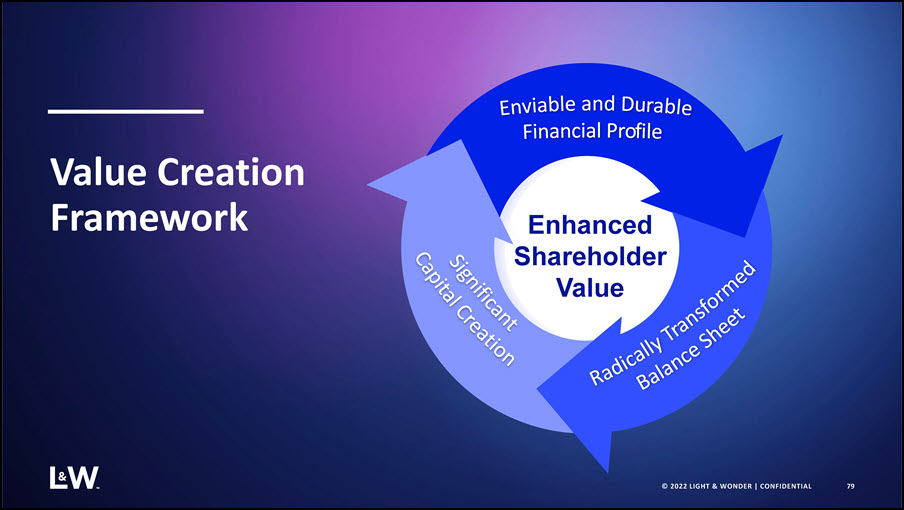

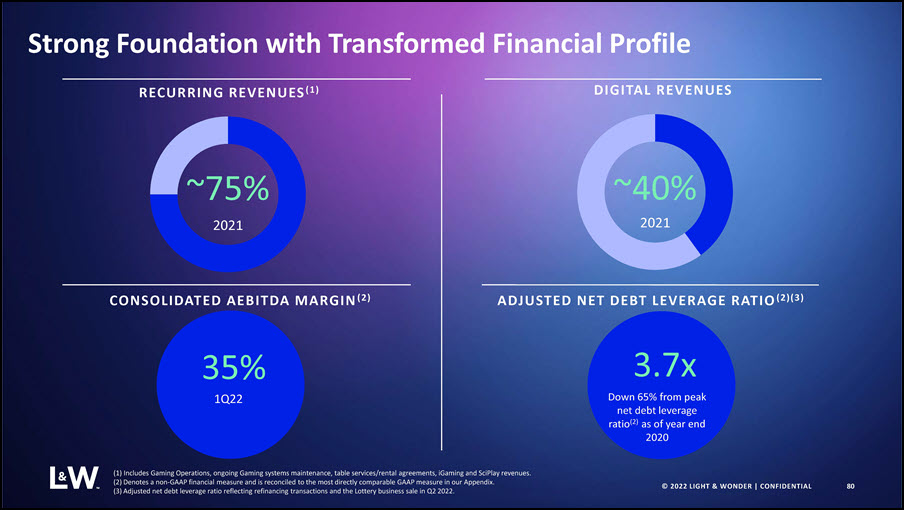

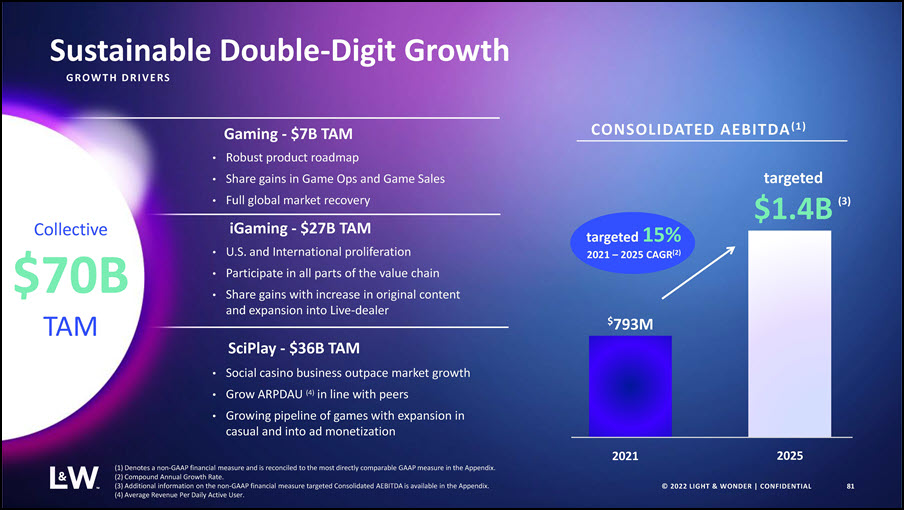

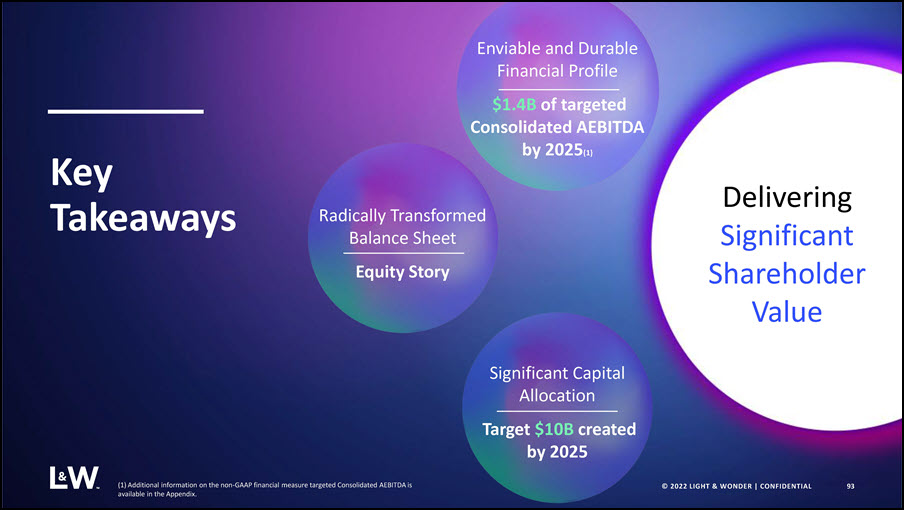

Double-digit growth with targeted 2025 Consolidated AEBITDA(1) of $1.4 billion or a CAGR(3) of 15%.

|

|

|

● |

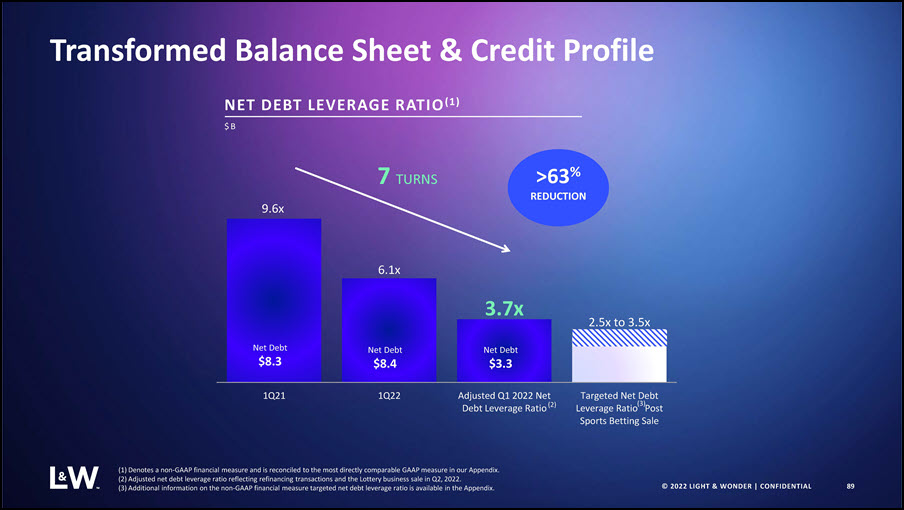

Reaffirmed its targeted net debt leverage ratio range(1) of 2.5x to 3.5x, further strengthening the Company’s balance sheet and credit profile.

|

|

|

● |

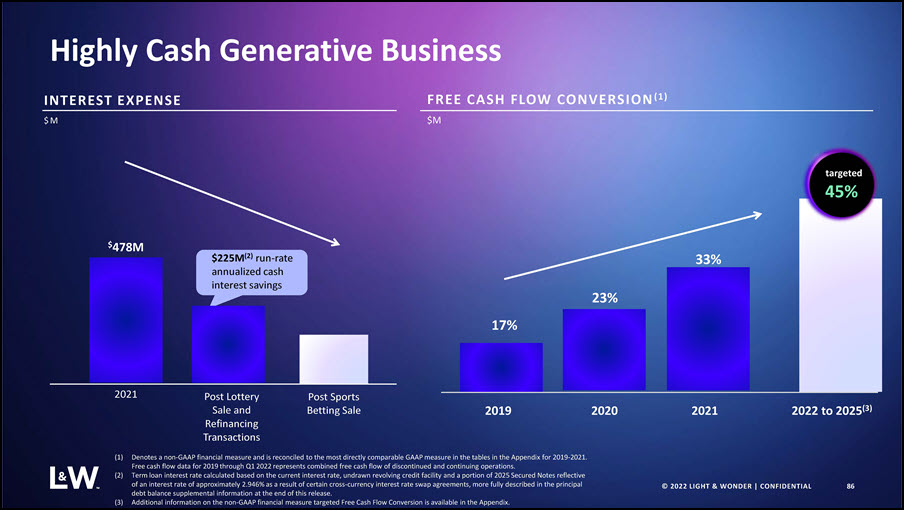

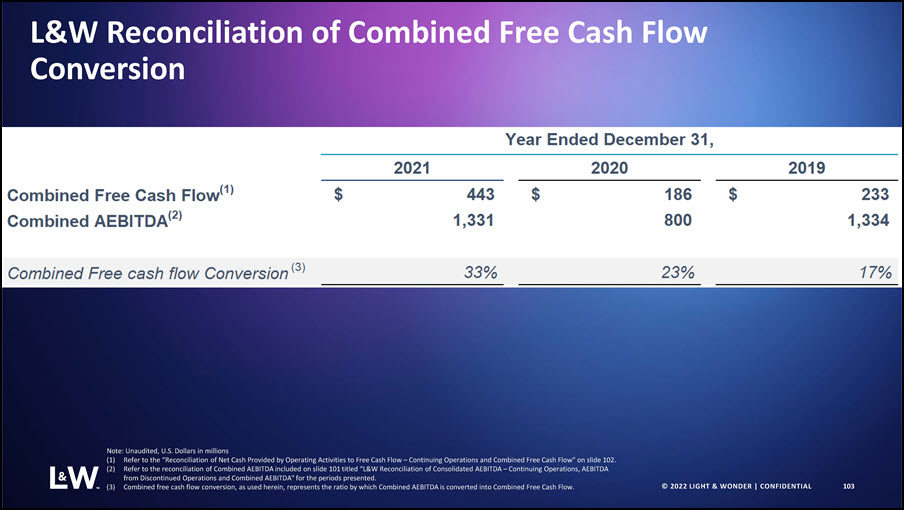

Significant cash flow generation, reflecting a targeted free cash flow conversion rate(1) of 45% by 2025.

|

|

|

● |

Targeting a total of $10 billion of available capital to deploy through the Company’s balanced and opportunistic capital allocation priorities.

|

|

|

● |

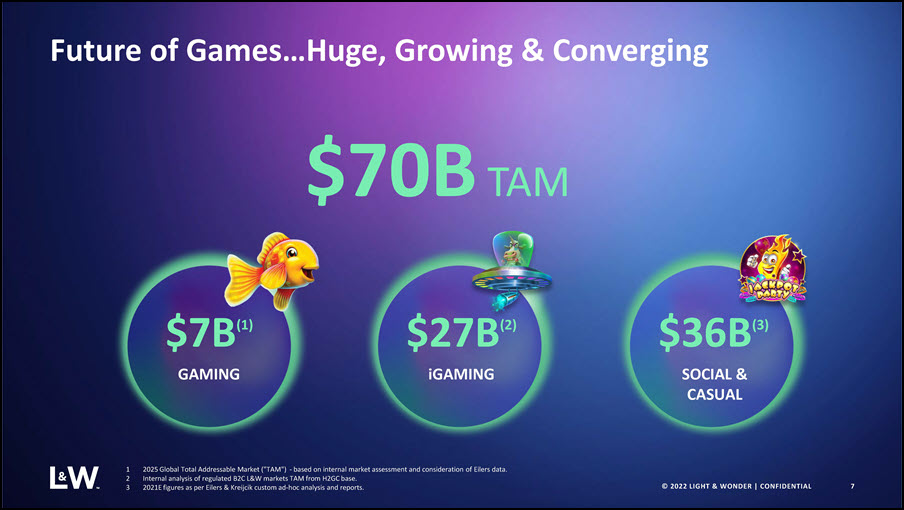

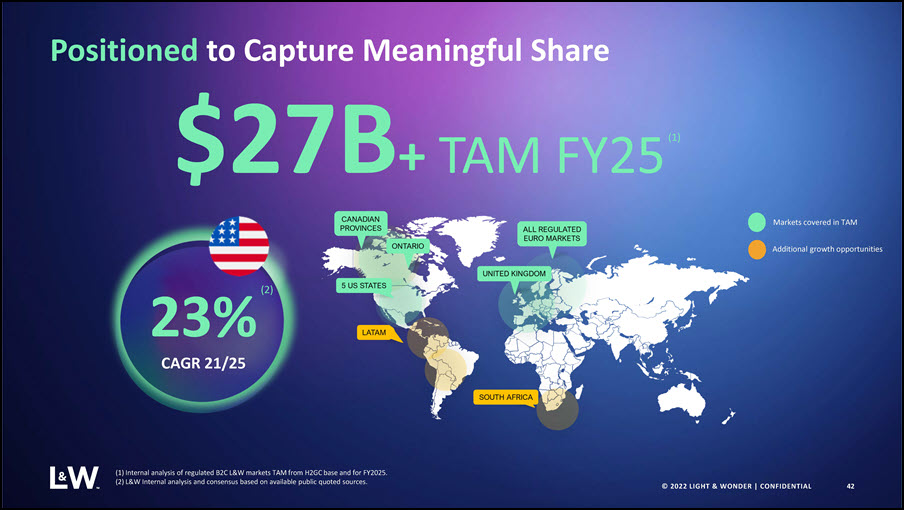

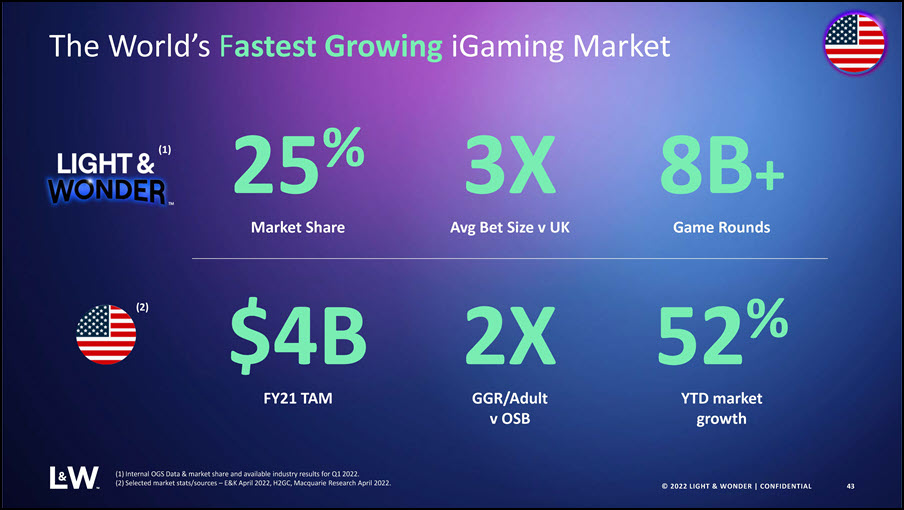

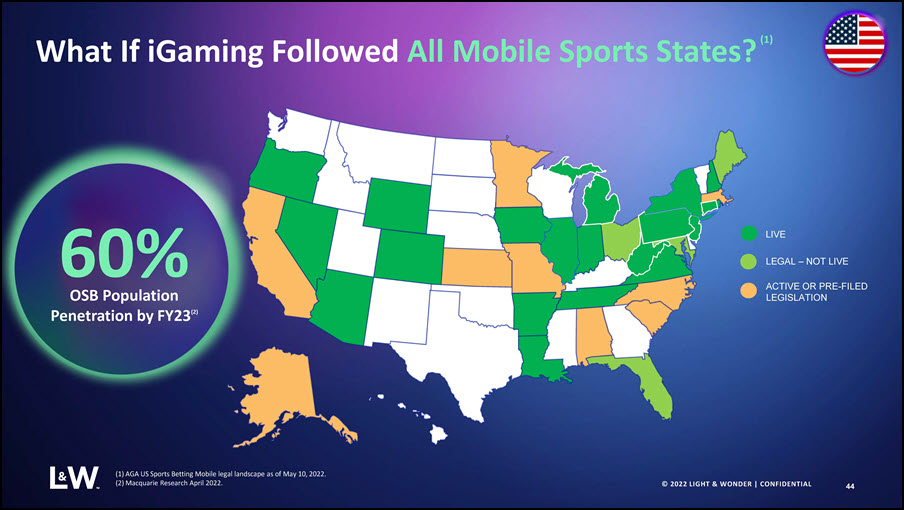

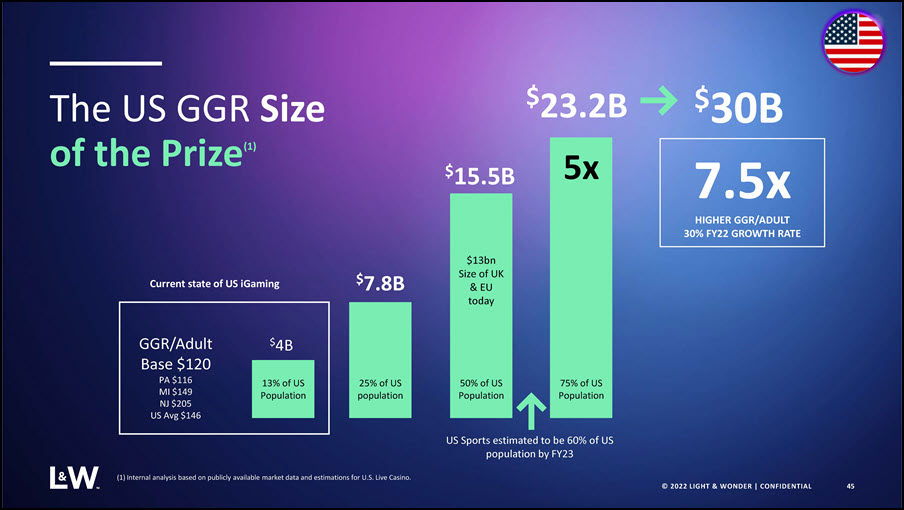

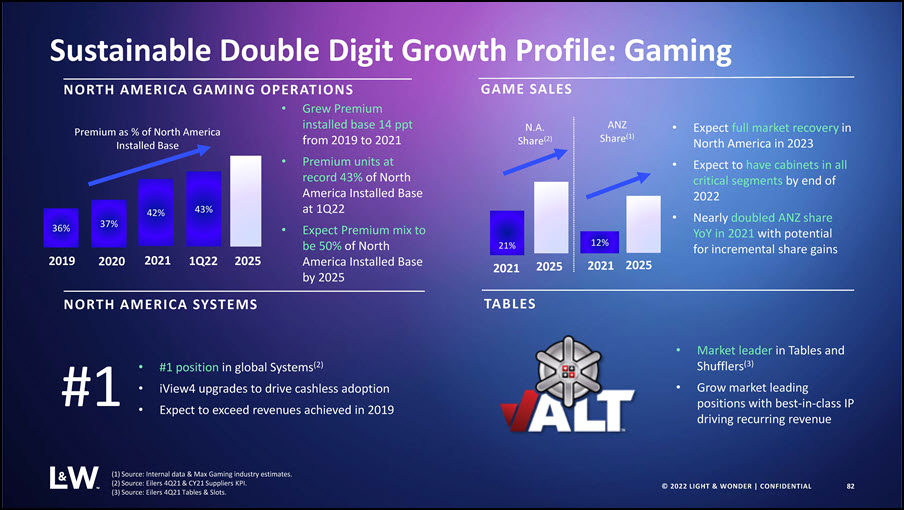

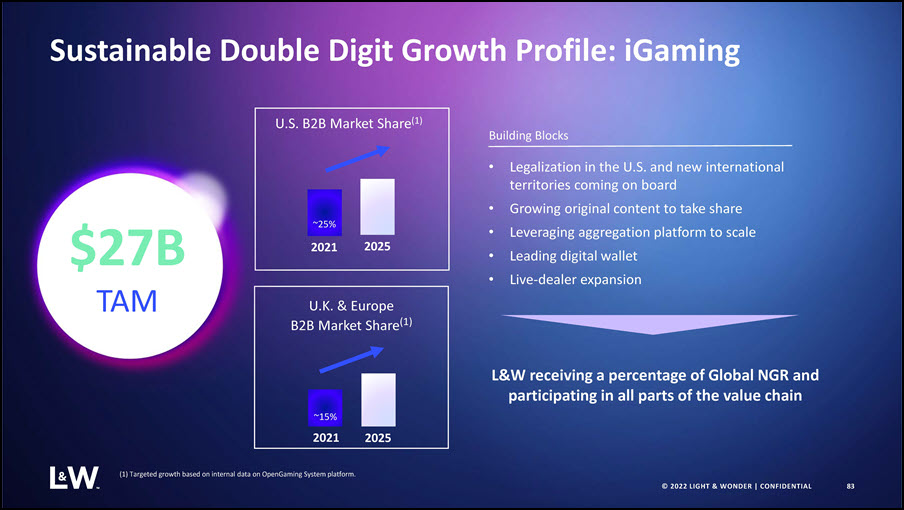

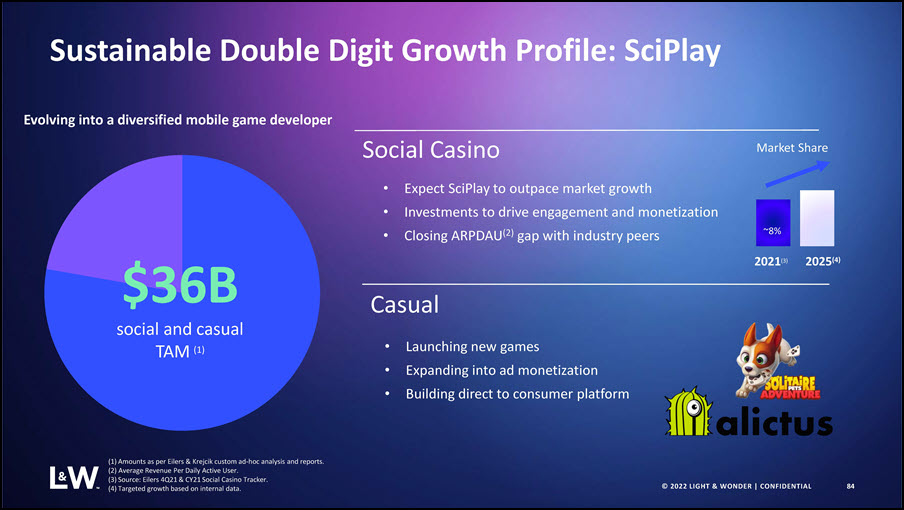

Uniquely positioned to take advantage of estimated $70 billion game market TAM opportunity with a clear roadmap and strategy to win in a converging gaming world

|

|

|

o |

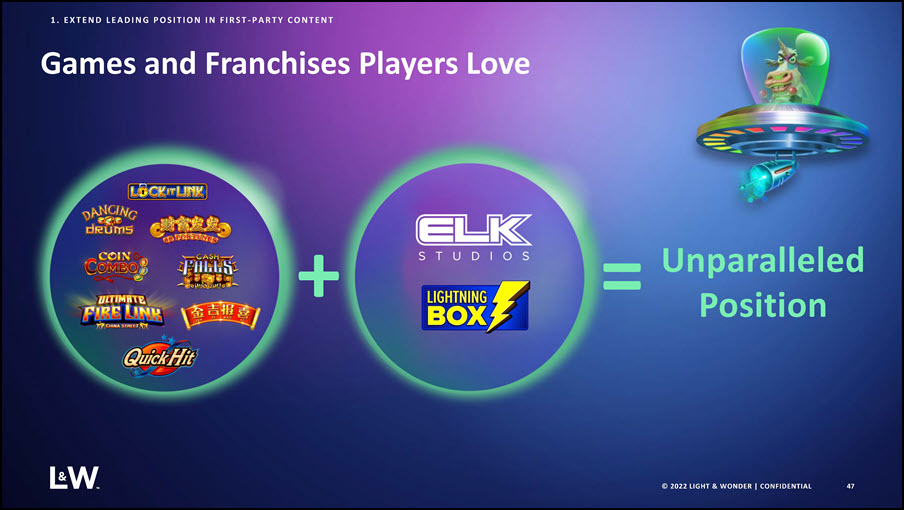

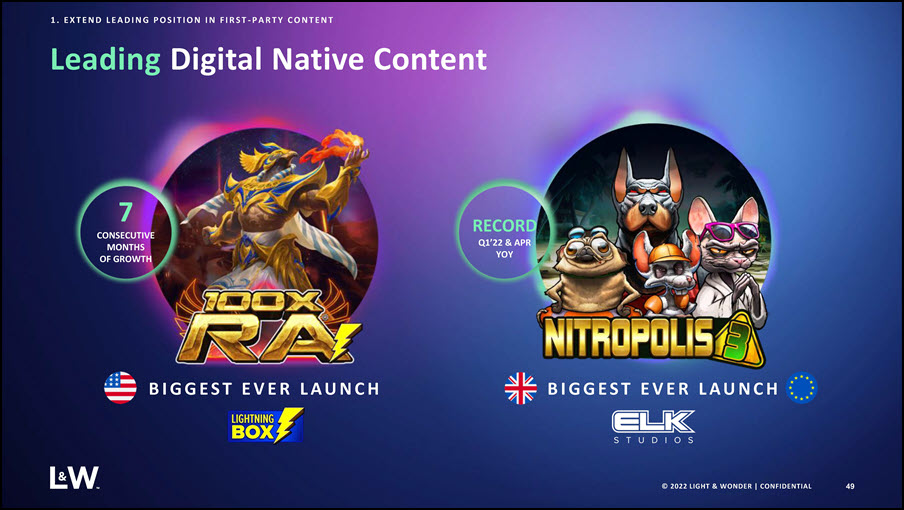

Best talent in the industry creating hit games and franchises that players can enjoy anywhere provides a sustainable differentiation and a competitive advantage.

|

|

|

o |

Only company with leadership positions across land-based, iGaming and social, with content that can be delivered anywhere.

|

|

|

o |

Greatest collection of IP and content, highlighting the breadth of Light & Wonder’s evergreen franchises.

|

|

|

o |

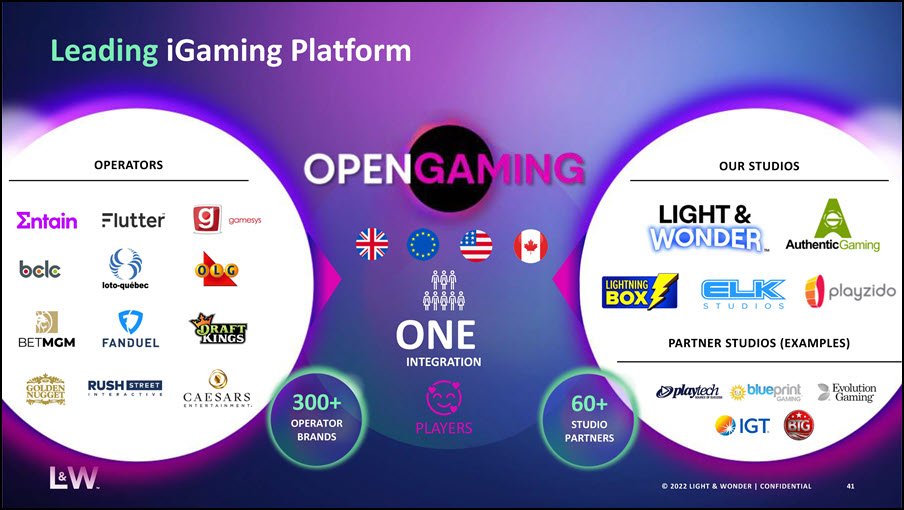

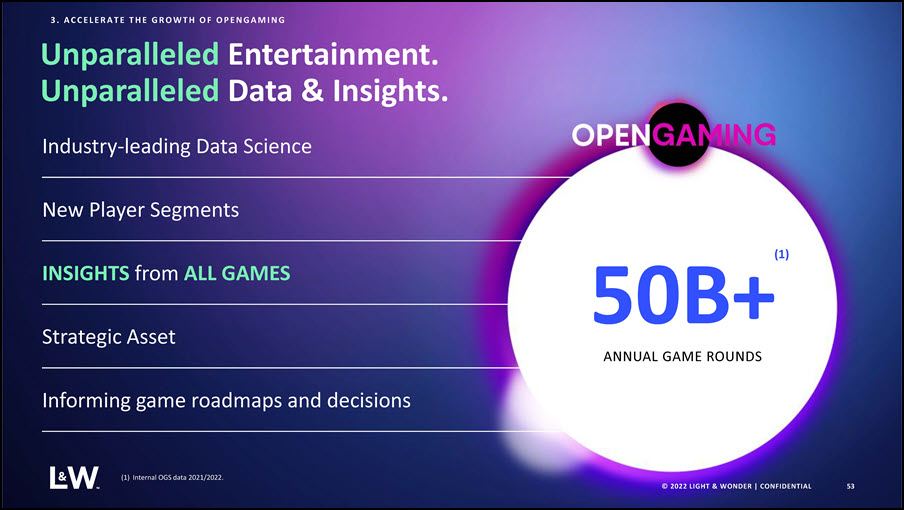

Unrivaled aggregation platform and industry leading insights on players.

|

|

|

o |

Deep relationship with operators, players and studios positions the Company to disproportionately benefit by connecting players across land-based and digital to create a seamless player

experience.

|

|

|

o |

Expanding into high-growth digital markets investing organically and inorganically.

|

|

|

● |

Executing a balanced and opportunistic capital allocation strategy to unlock value

|

|

|

o |

Paying down debt with the proceeds of the Lottery business sale and pending Sports Betting business divestiture to further strengthen Light & Wonder’s financial profile and transform Light

& Wonder into an equity story.

|

|

|

o |

Returning substantial capital to shareholders by actively repurchasing shares under the Company’s $750 million share repurchase authorization.

|

|

|

o |

Investing in key growth opportunities, prioritizing organic investments and taking a disciplined approach to M&A that delivers significant long-term value.

|

|

Twelve Months Ended

|

||||

|

March 31, 2022

|

||||

|

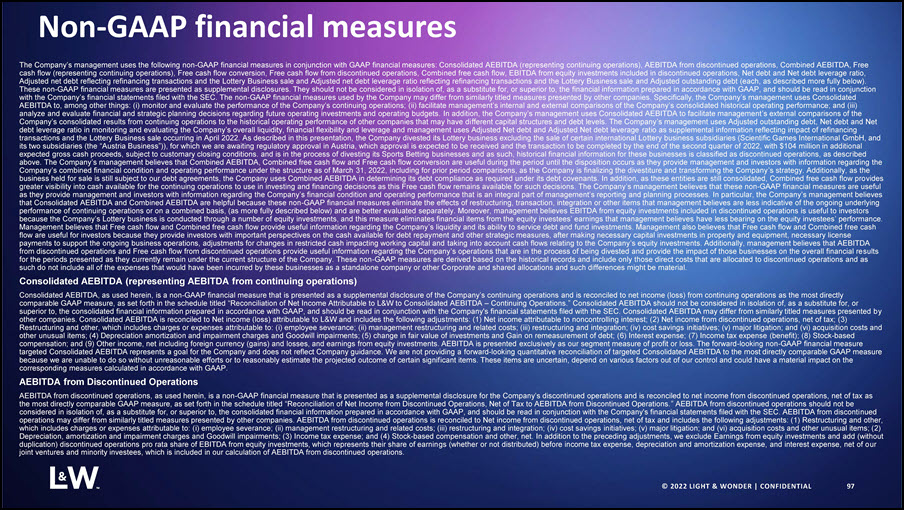

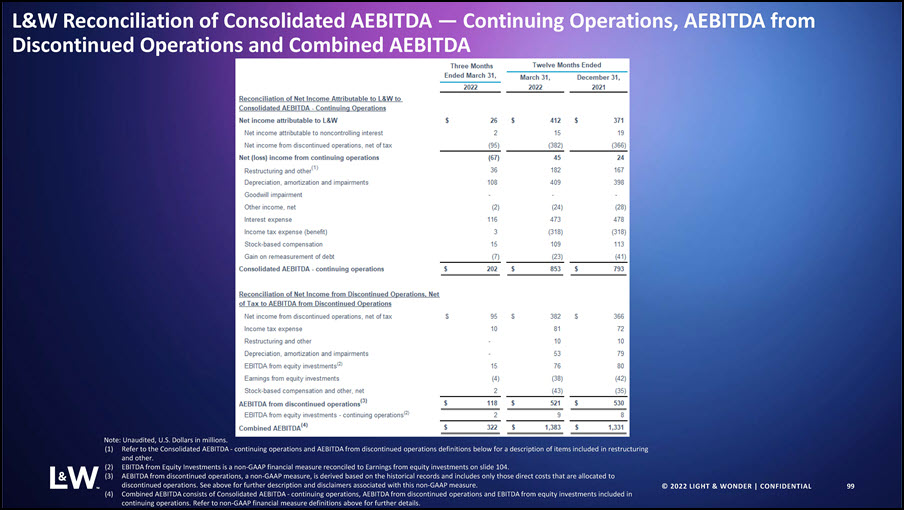

Net income attributable to L&W

|

$

|

412

|

||

|

Net income attributable to noncontrolling interest

|

15

|

|||

|

Net income from discontinued operations, net of tax

|

(382

|

)

|

||

|

Net income from continuing operations

|

45

|

|||

|

Restructuring and other

|

182

|

|||

|

Depreciation, amortization and impairments

|

409

|

|||

|

Other income, net

|

(24

|

)

|

||

|

Interest expense

|

473

|

|||

|

Income tax benefit

|

(318

|

)

|

||

|

Stock-based compensation

|

109

|

|||

|

Gain on remeasurement of debt and other

|

(23

|

)

|

||

|

Consolidated AEBITDA - continuing operations

|

$

|

853

|

||

|

Twelve Months Ended

|

||||

|

March 31, 2022

|

||||

|

Net income from discontinued operations, net of tax

|

$

|

382

|

||

|

Income tax expense

|

81

|

|||

|

Restructuring and other

|

10

|

|||

|

Depreciation, amortization and impairments

|

53

|

|||

|

EBITDA from equity investments

|

76

|

|||

|

Earnings from equity investments

|

(38

|

)

|

||

|

Stock-based compensation and other, net

|

(43

|

)

|

||

|

AEBITDA from discontinued operations(1)

|

$

|

521

|

||

|

EBITDA from equity investments - continuing operations(2)

|

9

|

|||

|

Combined AEBITDA(2)

|

$

|

1,383

|

||

|

As of

|

||||

|

March 31, 2022

|

||||

|

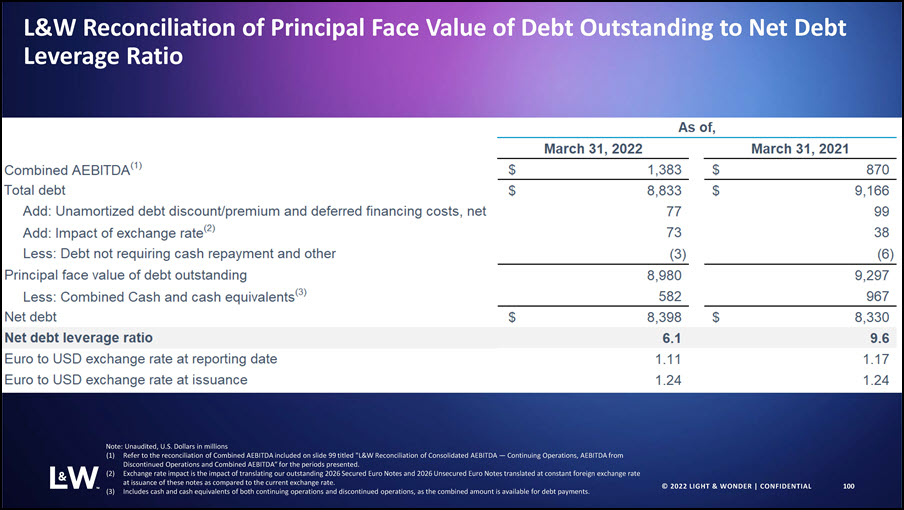

Combined AEBITDA(2)

|

$

|

1,383

|

||

|

Total debt

|

$

|

8,833

|

||

|

Add: Unamortized debt discount/premium and deferred financing costs, net

|

77

|

|||

|

Add: Impact of exchange rate(3)

|

73

|

|||

|

Less: Debt not requiring cash repayment and other

|

(3

|

)

|

||

|

Principal face value of debt outstanding

|

8,980

|

|||

|

Less: Combined Cash and cash equivalents(4)

|

582

|

|||

|

Net debt

|

$

|

8,398

|

||

|

Net debt leverage ratio

|

6.1

|

|||

|

Twelve Months Ended

|

||||||||

|

March 31, 2022

|

||||||||

|

Continuing Operations

|

Discontinued Operations

|

|||||||

|

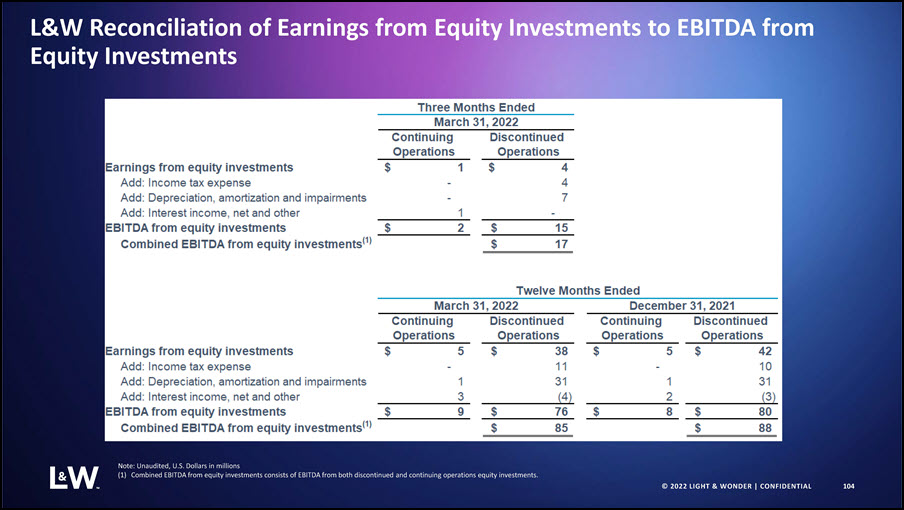

Earnings from equity investments

|

$

|

5

|

$

|

38

|

||||

|

Add: Income tax expense

|

–

|

11

|

||||||

|

Add: Depreciation, amortization and impairments

|

1

|

31

|

||||||

|

Add: Interest income, net and other

|

3

|

(4

|

)

|

|||||

|

EBITDA from equity investments

|

$

|

9

|

$

|

76

|

||||

|

Combined EBITDA from equity investments(1)

|

$

|

85

|

||||||

|

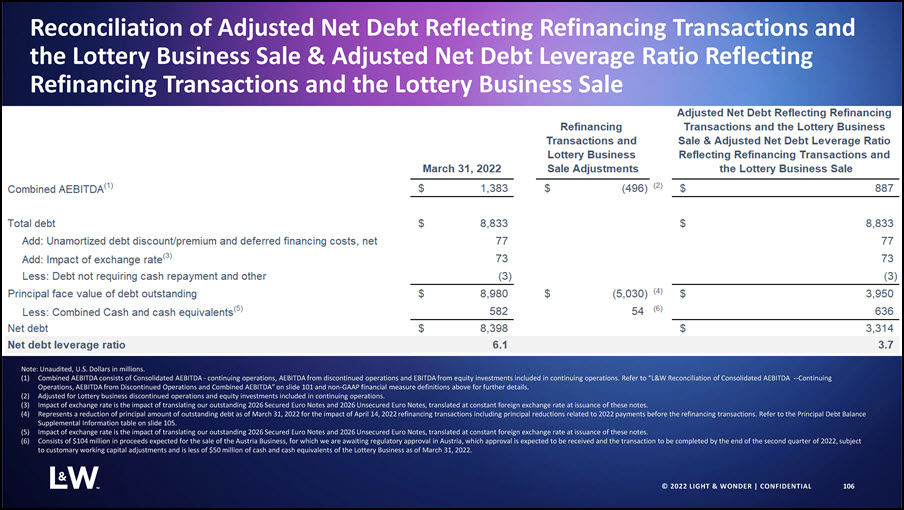

March 31, 2022

|

Refinancing Transactions and Lottery Business Sale Adjustments

|

Adjusted Net Debt Reflecting Refinancing Transactions and the Lottery Business Sale & Adjusted Net Debt Leverage Ratio

Reflecting Refinancing Transactions and the Lottery Business Sale

|

|||||||||||

|

Combined AEBITDA(1)

|

$

|

1,383

|

$

|

(496

|

)

|

(2) |

|

$

|

887

|

||||

|

Total debt

|

$

|

8,833

|

$

|

8,833

|

|||||||||

|

Add: Unamortized debt discount/premium and deferred financing costs, net

|

77

|

77

|

|||||||||||

|

Add: Impact of exchange rate(3)

|

73

|

73

|

|||||||||||

|

Less: Debt not requiring cash repayment and other

|

(3

|

)

|

(3

|

)

|

|||||||||

|

Principal face value of debt outstanding

|

$

|

8,980

|

$

|

(5,030

|

)

|

(4) |

|

$

|

3,950

|

||||

|

Less: Combined Cash and cash equivalents(5)

|

582

|

54

|

(6) |

|

636

|

||||||||

|

Net debt

|

$

|

8,398

|

$

|

3,314

|

|||||||||

|

Net debt leverage ratio

|

6.1

|

3.7

|

|||||||||||

|

|

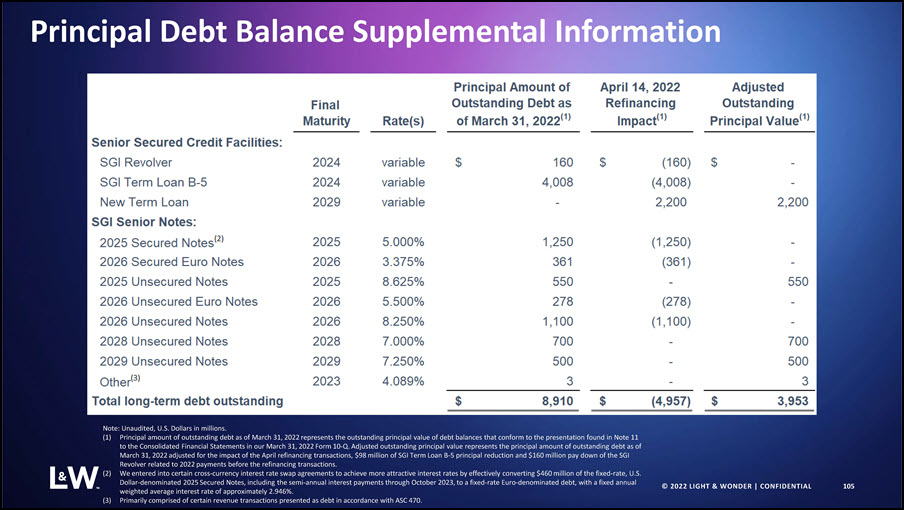

Final

Maturity

|

Rate(s)

|

Principal Amount of Outstanding Debt as of March 31, 2022(1)

|

April 14, 2022 Refinancing Impact(1)

|

Adjusted Outstanding Principal Value(1)

|

||||||||||||

|

Senior Secured Credit Facilities:

|

|||||||||||||||||

|

SGI Revolver

|

2024

|

variable

|

$

|

160

|

$

|

(160

|

)

|

$

|

–

|

||||||||

|

SGI Term Loan B-5

|

2024

|

variable

|

4,008

|

(4,008

|

)

|

–

|

|||||||||||

|

New Term Loan

|

2029

|

variable

|

–

|

2,200

|

2,200

|

||||||||||||

|

SGI Senior Notes:

|

|||||||||||||||||

|

2025 Secured Notes(2)

|

2025

|

5.000%

|

|

1,250

|

(1,250

|

)

|

–

|

||||||||||

|

2026 Secured Euro Notes

|

2026

|

3.375%

|

|

361

|

(361

|

)

|

–

|

||||||||||

|

2025 Unsecured Notes

|

2025

|

8.625%

|

|

550

|

–

|

550

|

|||||||||||

|

2026 Unsecured Euro Notes

|

2026

|

5.500%

|

|

278

|

(278

|

)

|

–

|

||||||||||

|

2026 Unsecured Notes

|

2026

|

8.250%

|

|

1,100

|

(1,100

|

)

|

–

|

||||||||||

|

2028 Unsecured Notes

|

2028

|

7.000%

|

|

700

|

–

|

700

|

|||||||||||

|

2029 Unsecured Notes

|

2029

|

7.250%

|

|

500

|

–

|

500

|

|||||||||||

|

Other(3)

|

2023

|

4.089%

|

|

3

|

–

|

3

|

|||||||||||

|

Total long-term debt outstanding

|

|

$

|

8,910

|

$

|

(4,957

|

)

|

$

|

3,953

|

|||||||||