UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 12, 2025

ADC Therapeutics SA

(Exact Name of Registrant as Specified in Its Charter)

|

Switzerland (State or Other Jurisdiction of Incorporation) |

001-39071 (Commission File Number) |

N/A (IRS Employer Identification Number) |

|

Biopôle Route de la Corniche 3B 1066 Epalinges Switzerland (Address of Principal Executive Offices) (Zip Code) |

+41 21 653 02 00 (Registrant’s Telephone Number) |

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common Shares, par value CHF 0.08 per share | ADCT | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 C.F.R. § 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 C.F.R. § 240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On October 12, 2025, ADC Therapeutics SA (the “Company”) entered into securities purchase agreements for the sale of its equity securities to certain institutional investors in a $60.0 million private placement. In the private placement, the Company will sell 11,250,000 common shares at $4.00 per share and pre-funded warrants to purchase 3,846,153 common shares at $3.90 per pre-funded warrant, which is the price per common share in the private placement minus the exercise price per pre-funded warrant. The private placement is expected to close on October 27, 2025, subject to customary closing conditions.

The purchase agreements provide certain registration rights, pursuant to which the Company has agreed to file a registration statement within 30 business days to register the resale of the common shares sold in the private placement and the common shares issuable upon exercise of the pre-funded warrants sold in the private placement.

The private placement is exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”) under Section 4(a)(2) of the Securities Act in that the private placement is between an issuer and sophisticated investors not involving any public offering. The Company is relying on this exemption from registration based in part on representations made in the purchase agreements for the private placement, a form of which is attached to this Current Report on Form 8-K as Exhibit 10.1.

The pre-funded warrants are exercisable at any time after their original issuance until the tenth anniversary of their original issuance. At any time during the last 90 days of the term, the holder may exchange the pre-funded warrant for, and the Company will issue, a new pre-funded warrant for the number of common shares then remaining under the pre-funded warrant. The pre-funded warrants will be exercisable, at the option of each holder, in whole or in part (but not for less than a common share) by delivering to the Company a duly executed exercise notice and by payment of the aggregate exercise price; provided that any exercise of the pre-funded warrants must be for at least 50,000 common shares (or, if less, the remaining common shares available for purchase under the pre-funded warrants). A holder will not be entitled to exercise any portion of any pre-funded warrants that, upon giving effect to such exercise, would cause the aggregate number of the Company’s common shares beneficially owned by the holder (together with its affiliates and certain attribution parties) to exceed 9.99% (or, 61 days after a written notice from such holder, any other percentage not in excess of 19.99%) of the number of the Company’s common shares outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the pre-funded warrants. The exercise price per common share purchasable upon the exercise of the pre-funded warrants is CHF 0.08 per share, subject to customary adjustments. In lieu of making cash payment of the aggregate exercise price, a holder may elect to exercise the pre-funded warrants on a cashless basis. However, if the Company, at the time of receipt of an exercise notice electing cashless exercise, (i) does not, or has reason to believe that the Company does not, have a sufficient amount of freely distributable equity to fund the nominal value of the number of common shares the Company would be required to deliver upon such cashless exercise, and (ii) (x) holds common shares representing more than 2% of its share capital registered in the commercial register at that time (the “Minimum Stock”) in treasury, then the Company will not be obligated to (but may) deliver more than such number of common shares to the holder as exceeds the Minimum Stock or (y) holds up to the Minimum Stock in treasury, then the Company will not be obligated to deliver any common shares to the holder. The exercise notice will be deemed to be null and void to the extent the holder receives fewer common shares than to which such exercise notice relates. In the event of (i) a sale, lease or other transfer of all or substantially all of the Company’s assets, (ii) a merger or consolidation involving the Company in which the Company is not the surviving entity or in which the Company’s outstanding share capital is converted into or exchanged for shares of capital stock or other securities or property of another entity, or (iii) any sale by holders of the Company’s outstanding voting equity securities in a single transaction or series of related transactions of shares constituting a majority of the Company’s outstanding combined voting power, and (x) if the consideration received by the Company’s shareholders consists solely of cash and/or marketable securities, then holders of the pre-funded warrants will be deemed to have exercised their pre-funded warrants (without regard to the exercise limitations described above) immediately prior to the closing date of such transaction or (y) if the consideration received by the Company’s shareholders does not consist solely of cash and/or marketable securities, then the Company will cause the successor or surviving entity to assume the pre-funded warrants. Subject to applicable laws, the pre-funded warrants may be offered for sale, sold, transferred or assigned without the Company’s consent. The pre-funded warrants are governed by the laws of Switzerland. The foregoing description of the pre-funded warrants does not purport to be complete and is qualified in its entirety by reference to the form of pre-funded warrant, which is attached to this Current Report on Form 8-K as Exhibit 10.2.

Item 2.02. Results of Operations and Financial Condition.

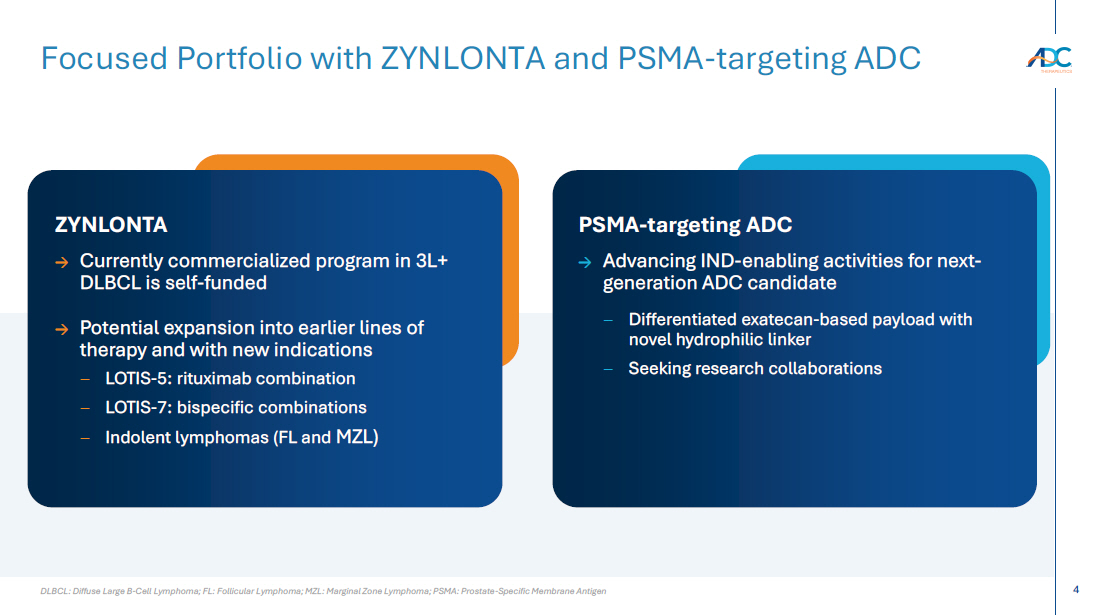

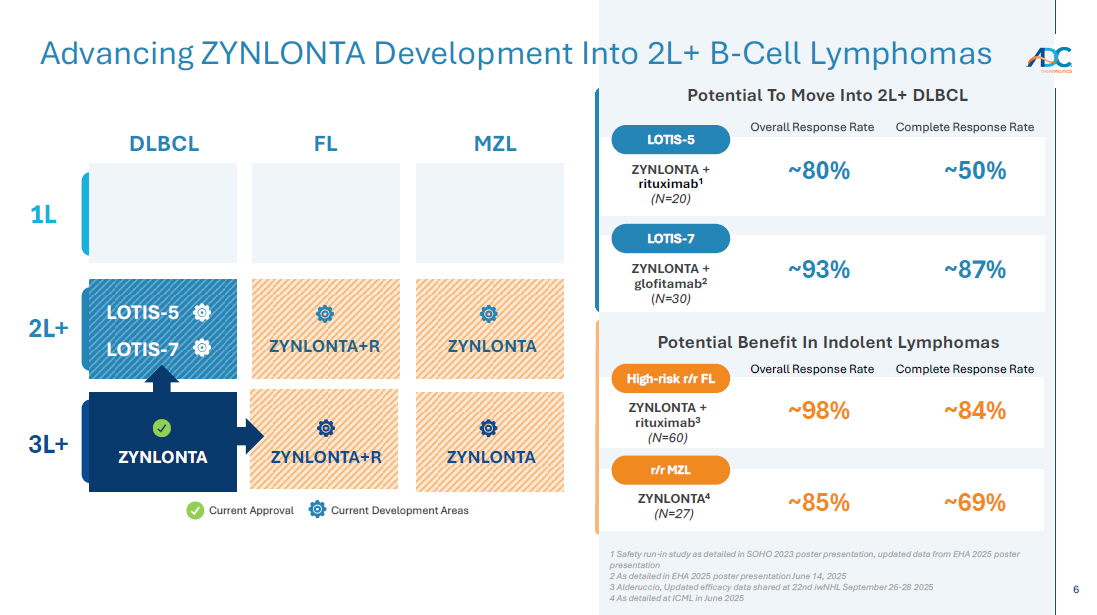

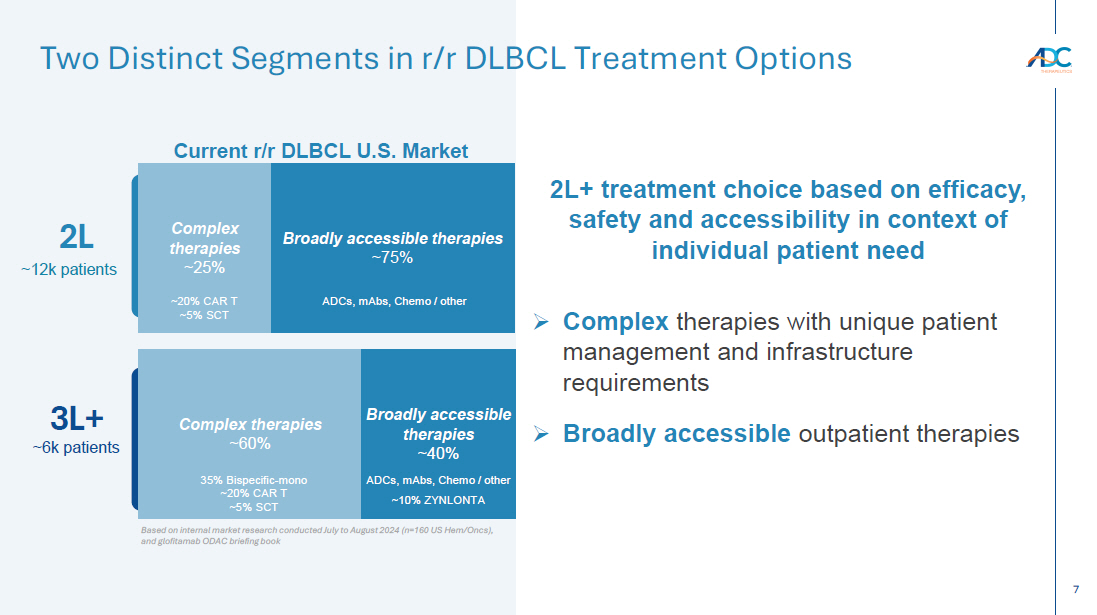

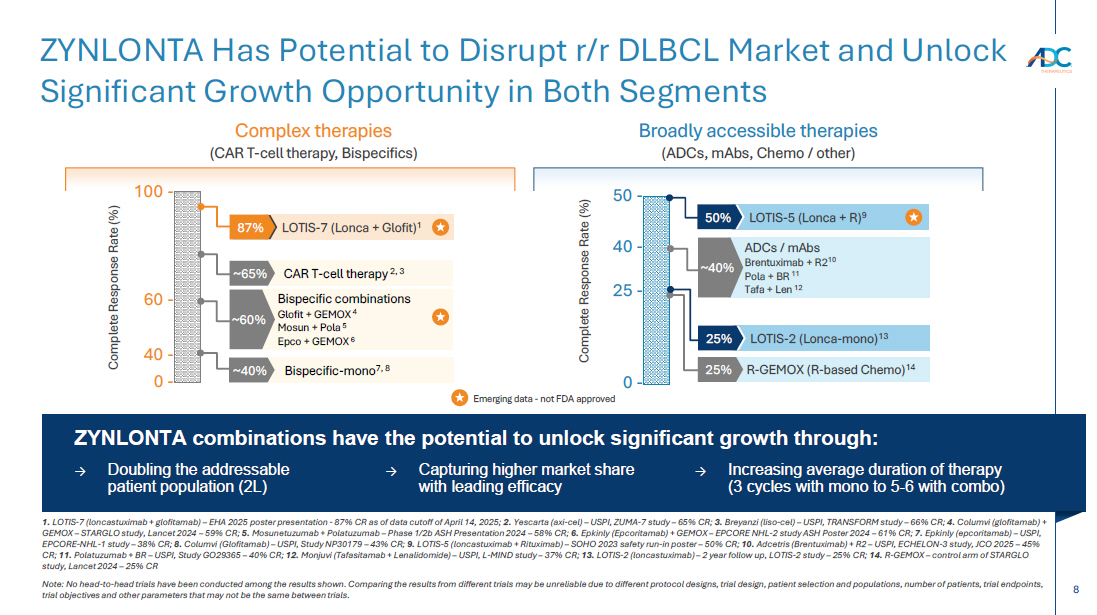

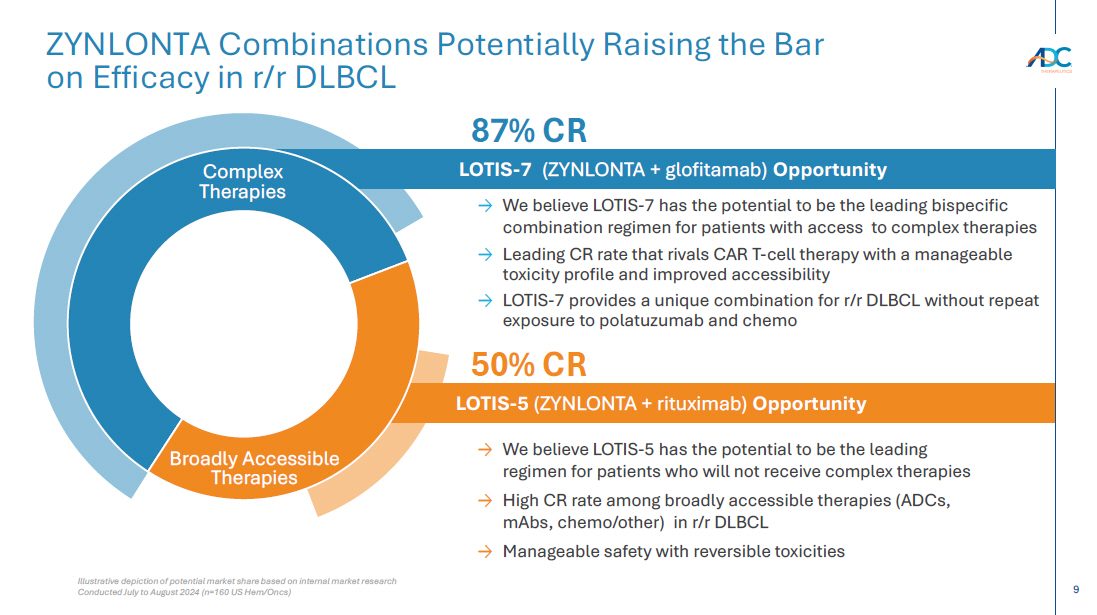

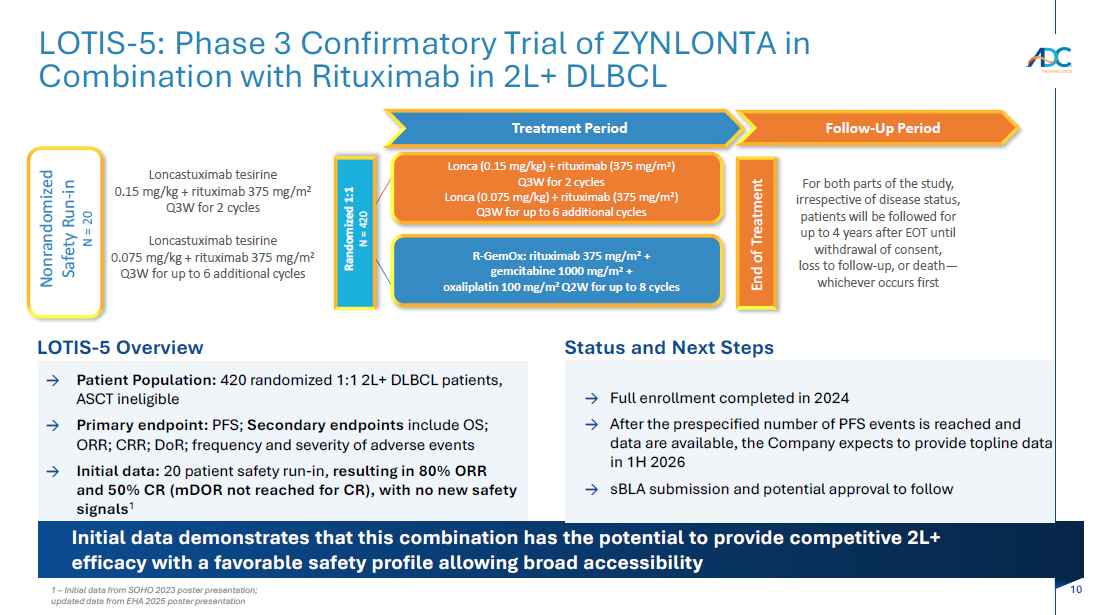

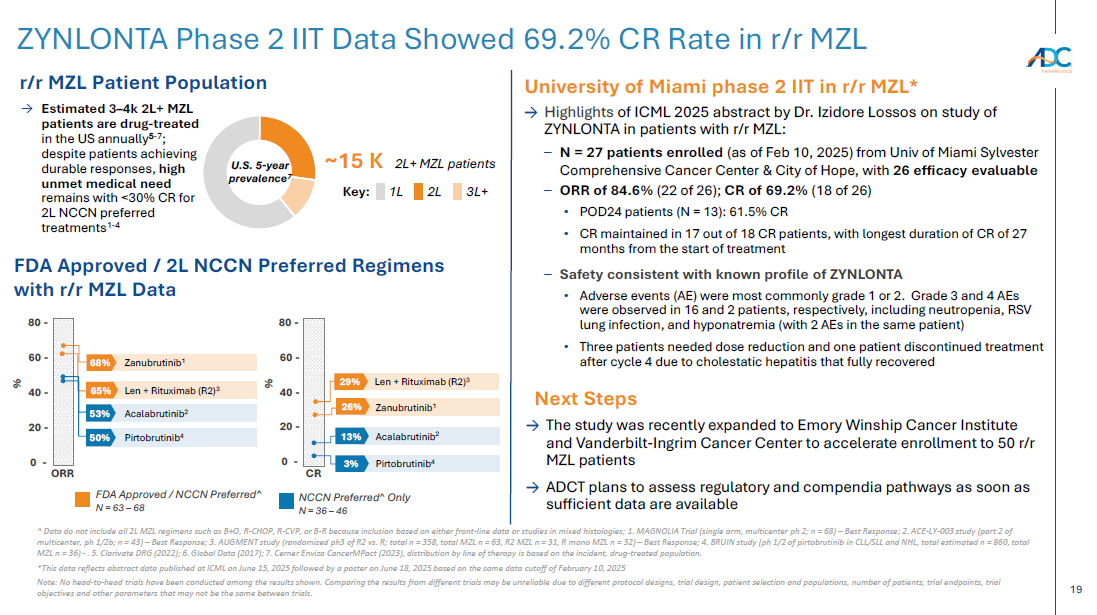

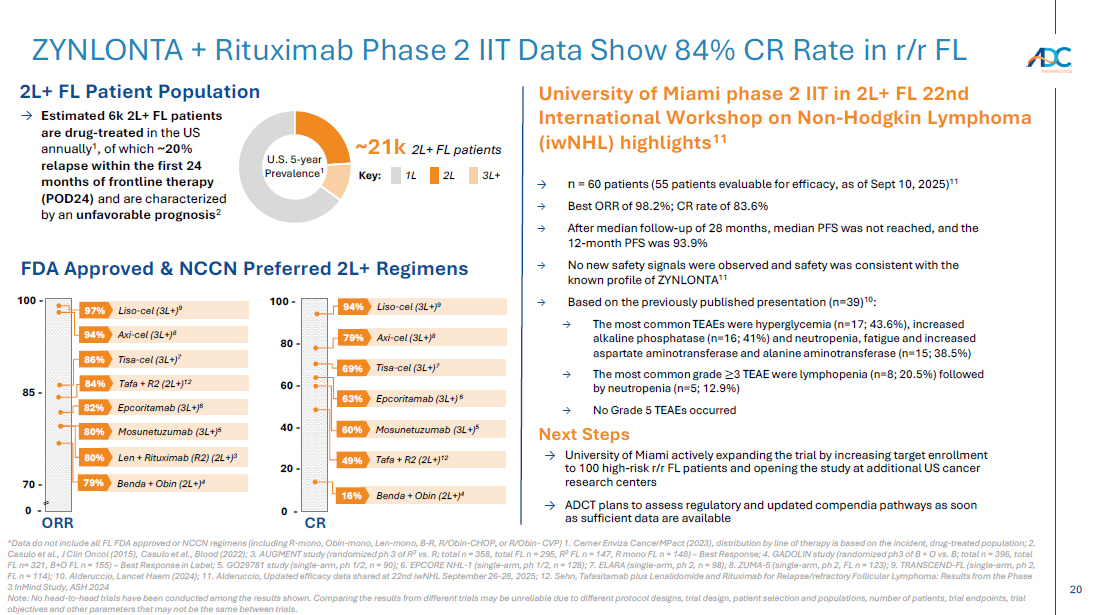

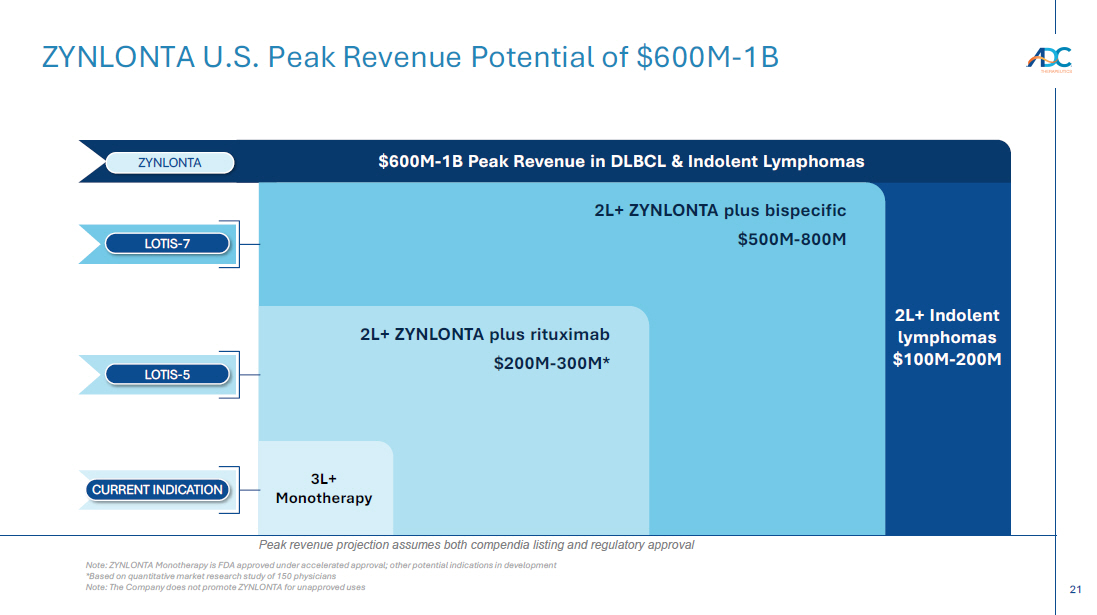

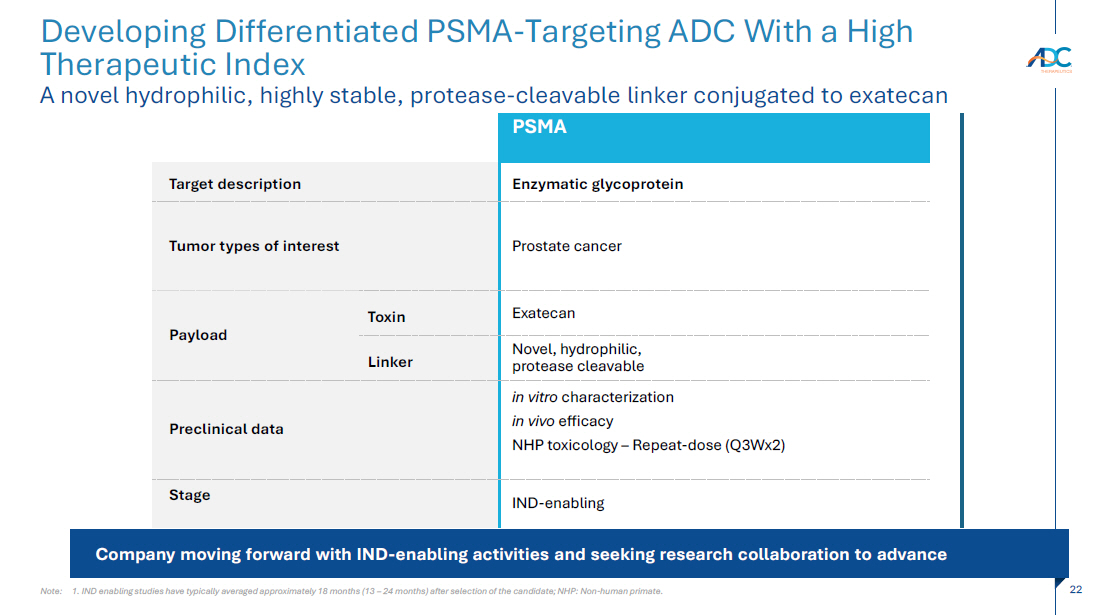

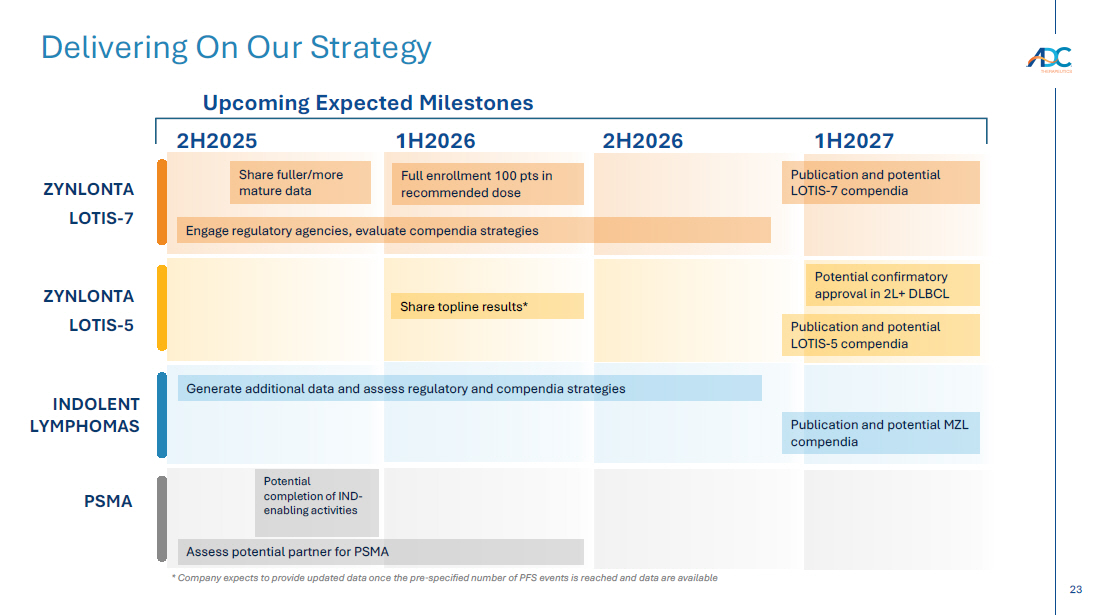

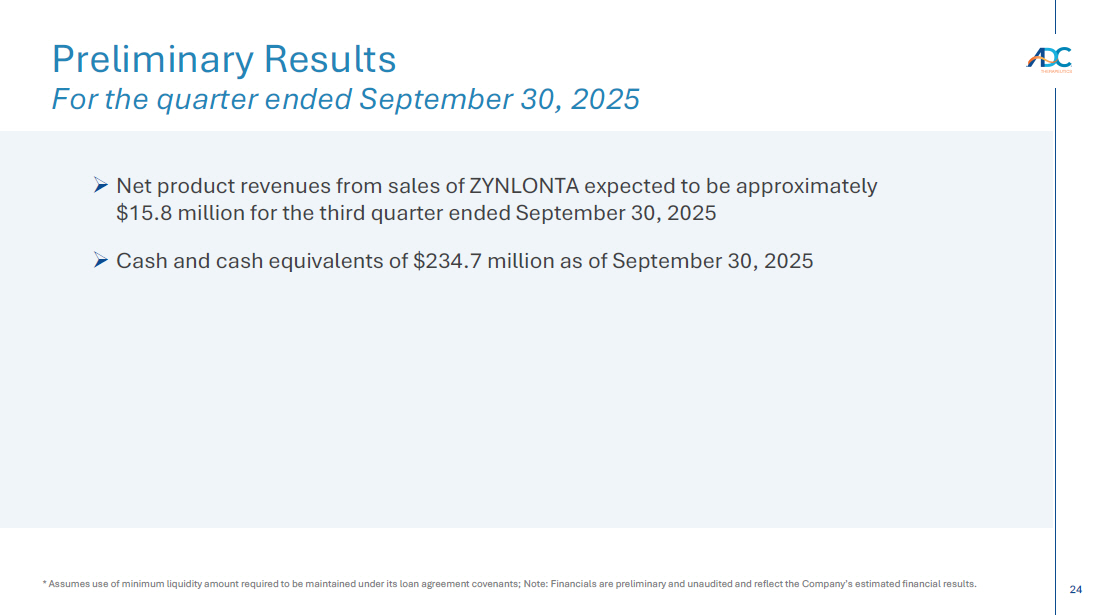

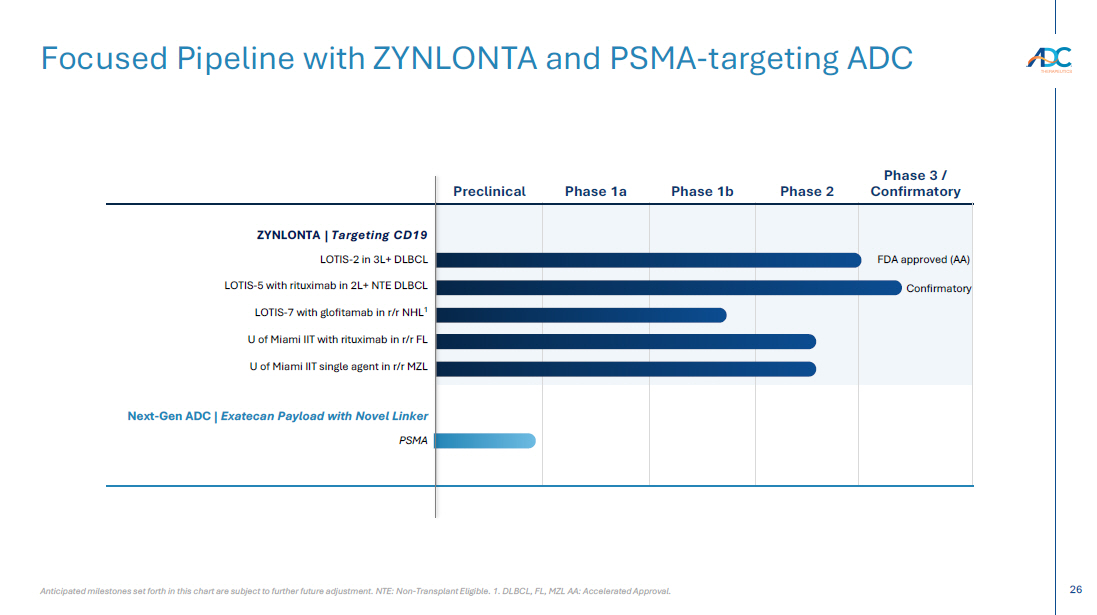

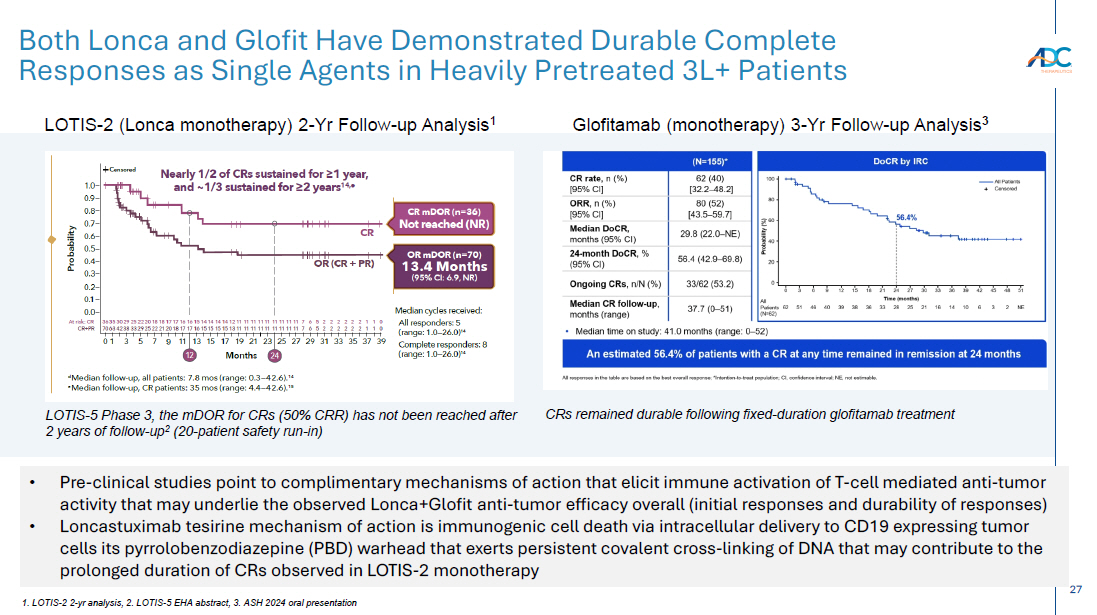

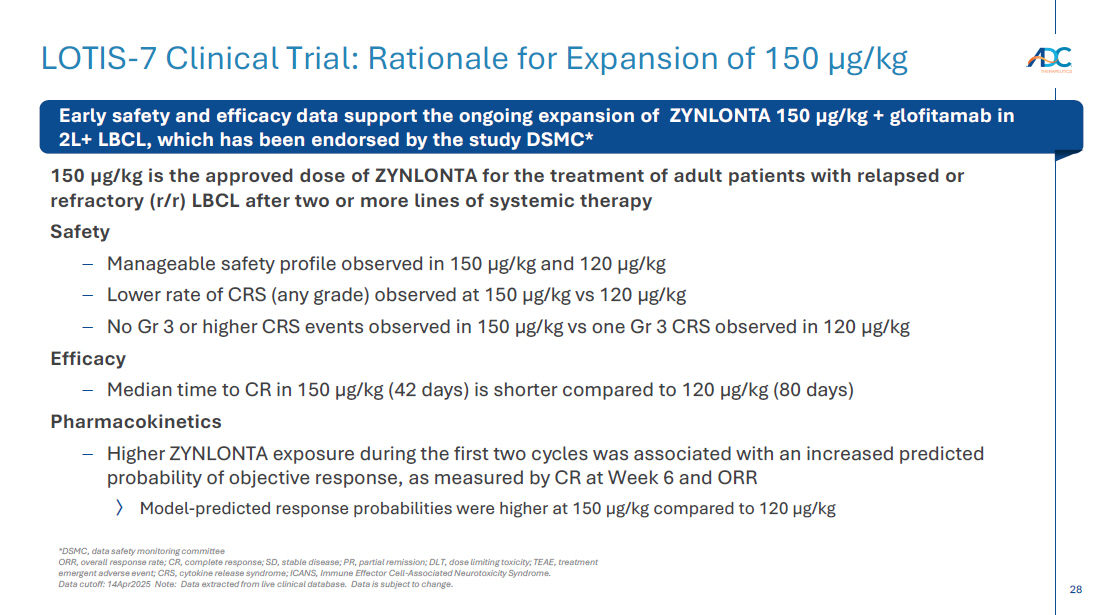

On October 13, 2025, the Company issued a press release and made available a corporate presentation that include the preliminary net product revenues from sales of ZYNLONTA for the quarter ended September 30, 2025 and the preliminary cash and cash equivalents as of September 30, 2025. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein. A copy of the corporate presentation is attached as Exhibit 99.2 to this Current Report on Form 8-K and incorporated by reference herein.

The ZYNLONTA net product revenues and cash and cash equivalents figures are preliminary and unaudited and reflect the Company’s estimated financial results. In preparing this information, management made a number of complex and subjective judgments and estimates about the appropriateness of certain reported amounts and disclosures. The Company’s actual financial results for the quarter ended September 30, 2025 have not yet been finalized by management or audited or reviewed by the Company’s independent auditors. The preliminary financial information is not a comprehensive statement of all financial results for the quarter ended September 30, 2025. Subsequent information or events may lead to material differences between the foregoing preliminary financial results and those reported in the Company’s subsequent SEC filings. Accordingly, investors should not place undue reliance on these preliminary financial results.

The information contained in this Item 2.02, Exhibit 99.1 and Exhibit 99.2 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 3.02. Unregistered Sales of Equity Securities.

The information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated by reference in this Item 3.02.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit Number |

Description |

| 10.1 | Form of securities purchase agreement |

| 10.2 | Form of pre-funded warrant |

| 99.1 | Press release dated October 13, 2025 |

| 99.2 | Corporate presentation dated October 13, 2025 |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ADC Therapeutics SA | ||

| Date: October 14, 2025 | ||

| By: | /s/ Peter J. Graham | |

| Name: | Peter J. Graham | |

| Title: | Chief Legal Officer | |

Exhibit 10.1

SECURITIES PURCHASE AGREEMENT

This SECURITIES PURCHASE AGREEMENT (this “Agreement”) is dated as of October 12, 2025, by and between ADC Therapeutics SA, a société anonyme domiciled in Epalinges, Canton of Vaud, Switzerland, and organized under the laws of Switzerland (the “Company”), and the undersigned investor (the “Investor”). Substantially concurrently with the execution of this Agreement, the Company is entering into separate purchase agreements (collectively, the “Additional Purchase Agreements”) with certain investors (the “Additional Investors”), severally and not jointly, to purchase securities from the Company in one or more transactions exempt from the registration requirements of the Securities Act (as defined below) pursuant to Section 4(a)(2) thereof (the transactions contemplated by this Agreement and the Additional Purchase Agreements, collectively, the “PIPE Transaction”).

In consideration of the mutual promises made herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

Section 1. Definitions. For the purposes of this Agreement, capitalized terms not otherwise defined shall have the meanings set forth below:

“Affiliate” means, with respect to any Person, any other Person which directly or indirectly through one or more intermediaries Controls, is controlled by, or is under common Control with, such Person.

“Business Day” means a day, other than a Saturday or Sunday, on which banks in New York City are open for the general transaction of business.

“Common Shares” means the common shares, par value CHF 0.08 per share, of the Company.

“Control” (including the terms “controlling,” “controlled by” or “under common control with”) means the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, or any successor statute, and the rules and regulations promulgated thereunder.

“Health Care Laws” means (i) the Federal Food, Drug, and Cosmetic Act (21 U.S.C. §§ 301 et seq.), the Public Health Service Act (42 U.S.C. §§ 201 et seq.); (ii) all applicable federal, state, local and all applicable foreign health care related fraud and abuse laws, including, without limitation, the U.S. Anti-Kickback Statute (42 U.S.C. § 1320a-7b(b)), the U.S. False Statements Law (42 U.S.C. § 1320a-7b(a)), the Civil Monetary Penalties Law (42 U.S.C. §1320a-7a), the U.S. Civil False Claims Act (31 U.S.C. § 3729 et seq.), all criminal laws relating to health care fraud and abuse, including but not limited to 18 U.S.C. §§ 286 and 287, and the health care fraud criminal provisions under the U.S. Health Insurance Portability and Accountability Act of 1996 (“HIPAA”) (42 U.S.C. §§ 1320d et seq.), the Physician Payments Sunshine Act (42 U.S.C. § 1320a-7h), the exclusion law (42 U.S.C. §1320a-7); (iii) HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act (42 U.S.C. §§ 17921 et seq.); (iv) regulations promulgated pursuant to such statutes; and (v) any and all other applicable federal, state, or foreign health care laws and regulation applicable to the ownership, testing, development, manufacture, packaging, processing, use, distribution, marketing, advertising, labeling, promotion, sale, offer for sale, storage, import, export or disposal of any product manufactured or distributed by the Company.

“NYSE” means the New York Stock Exchange.

“Person” means an individual, corporation, partnership, limited liability company, trust, business trust, association, joint stock company, joint venture, sole proprietorship, unincorporated organization, governmental authority or any other form of entity not specifically listed herein.

“Placement Agent” means Jefferies LLC.

“Pre-Funded Warrants” means the pre-funded warrants of the Company, in the form attached as Exhibit A hereto.

“Registrable Securities” means (i) the Shares and the Warrant Shares and (ii) any other Common Shares issued as a dividend or other distribution with respect to, in exchange for or in replacement of the Shares or the Warrant Shares; provided, however, that any such Registrable Securities shall cease to be Registrable Securities (and the Company shall not be required to maintain the effectiveness of any, or file another, registration statement hereunder with respect thereto) upon the first to occur of (A) a registration statement with respect to the sale of such Registrable Securities being declared effective by the SEC under the Securities Act and such Registrable Securities having been disposed of or transferred by the holder thereof in accordance with such effective registration statement, (B) such Registrable Securities having been previously sold or transferred in accordance with Rule 144 (or another exemption from the registration requirements of the Securities Act), (C) such securities becoming eligible for resale without volume or manner-of-sale restrictions and without current public information requirements pursuant to Rule 144, (D) such securities are no longer outstanding or (E) the third anniversary of the Closing Date.

“Regulation D” means Regulation D as promulgated by the SEC under the Securities Act.

“Rule 144” means Rule 144 promulgated under the Securities Act.

“SEC” means the U.S. Securities and Exchange Commission.

“SEC Documents” means the documents filed by the Company with the SEC pursuant to the Exchange Act on or after January 1, 2025.

“Securities Act” means the Securities Act of 1933, as amended, or any successor statute, and the rules and regulations promulgated thereunder.

“Short Sales” means all “short sales” as defined in Rule 200 of Regulation SHO under the Exchange Act (but shall not be deemed to include the location and/or reservation of borrowable shares of Common Shares).

“Trading Day” means a day on which the NYSE is open for trading.

“Transaction Documents” means this Agreement and the Warrants (as defined below).

“Warrant Shares” means the Common Shares issuable upon exercise of the Warrants in full without regard to any exercise limitations therein.

Section 2. Purchase and Sale of the Securities. At the Closing (as defined below), upon the terms of and subject to the conditions set forth in this Agreement, the Company will issue and sell to the Investor, and the Investor will purchase from the Company, (i) the number of Common Shares set forth under the heading “Number of Shares” on the Investor’s signature page to this Agreement (such Common Shares, collectively, the “Shares”), at a price per Share equal to $4.00 and (ii) the number of Pre-Funded Warrants set forth under the heading “Number of Pre-Funded Warrants” on the Investor’s signature page to this Agreement (such Pre-Funded Warrants, collectively, the “Warrants” and, together with the Shares, the “Securities”), at a price per Warrant equal to $3.90, which is the price per Share under this Agreement minus the U.S. dollar equivalent of the exercise price of such Warrant.

Section 3. Closing.

Section 3.1. The closing of the purchase and sale of the Securities pursuant to this Agreement (the “Closing”) shall be held remotely no later than 9:30 a.m. (New York City time) on October 27, 2025 (the “Closing Date”).

Section 3.2. At or prior to the Closing, the Investor shall execute any related agreements or other documents required to be executed under this Agreement, dated on or before the Closing Date, including but not limited to the Investor Questionnaire in the form attached as Annex A hereto (the “Investor Questionnaire”).

Section 3.3. At the Closing, (i) the Investor shall pay the purchase price of the Securities to the Company by wire transfer in immediately available U.S. federal funds to an account designated by the Company in writing not later than two Business Days prior to the Closing Date and (ii) the Company shall issue and deliver to the Investor the Shares in book-entry form and registered in the name of the Investor (or its nominee if specified in writing not later than two Business Days prior to the Closing Date) and the Warrants in electronic form and registered in the name of the Investor (or its nominee if specified in writing not later than two Business Days prior to the Closing Date).

Section 3.4. The book-entry positions evidencing the Shares and the Warrants, in each case, delivered on the Closing Date, shall bear the following legend: “THE SECURITIES REPRESENTED HEREBY (AND ANY SECURITIES ISSUED UPON THE EXERCISE OF THE SECURITIES REPRESENTED HEREBY) HAVE NOT BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED, AND, ACCORDINGLY, MAY NOT BE TRANSFERRED UNLESS (I) SUCH SECURITIES HAVE BEEN REGISTERED FOR SALE PURSUANT TO THE SECURITIES ACT OF 1933, AS AMENDED, (II) SUCH SECURITIES MAY BE SOLD PURSUANT TO RULE 144, OR (III) THE COMPANY HAS RECEIVED AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO IT THAT SUCH TRANSFER MAY LAWFULLY BE MADE WITHOUT REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED.”

Section 4. Representations and Warranties of the Company. The Company represents and warrants to the Investor, as of the date hereof and as of the Closing Date (except to the extent made only as of a specified date, in which case such representation and warranty is made as of such date):

Section 4.1. The Company has filed all reports, schedules, forms, statements and other documents required to be filed by the Company under the Exchange Act. At the time of filing thereof, each SEC Document complied in all material respects with the Exchange Act. At the time of filing thereof, each SEC Document did not contain any untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statements therein, in light of the circumstances under which they were made, not misleading.

Section 4.2. The Common Shares are registered pursuant to Section 12(b) of the Exchange Act and listed for trading on NYSE. There is no suit, action, proceeding or investigation pending or, to the knowledge of the Company, threatened against the Company by NYSE or the SEC, respectively, to prohibit or terminate the listing of the Common Shares on NYSE or to deregister the Common Shares under the Exchange Act.

Section 4.3. The Company has been duly incorporated and is validly existing as a Swiss stock corporation (société anonyme) in good standing (to the extent this concept applies) under the laws of Switzerland, has the corporate power and authority to own its property and to conduct its business, is not in liquidation or receivership or the subject of any insolvency or bankruptcy proceedings and is duly qualified to transact business (and, if applicable, is in good standing) in each jurisdiction in which the conduct of its business or its ownership or leasing of property requires such qualification, except to the extent that the failure to be so qualified or be in good standing (to the extent this concept applies) would not, individually or in the aggregate, be reasonably expected to have a material adverse effect on the Company and its subsidiaries, taken as a whole.

Section 4.4. Each subsidiary of the Company has been duly incorporated, is validly existing as a corporation (and, if applicable, in good standing) under the laws of the jurisdiction of its incorporation, has the corporate power and authority to own its property and to conduct its business, is not in liquidation or receivership or the subject of any insolvency or bankruptcy proceedings and is duly qualified to transact business (and, if applicable, is in good standing) in each jurisdiction in which the conduct of its business or its ownership or leasing of property requires such qualification, except to the extent that the failure to be so qualified or be in good standing (to the extent this concept applies) would not, individually or in the aggregate, be reasonably expected to have a material adverse effect on the Company and its subsidiaries, taken as a whole. Except as otherwise described in the SEC Documents, all of the issued shares of capital stock of each subsidiary of the Company have been duly and validly authorized and issued, are fully paid and non-assessable and such shares are owned directly by the Company, free and clear of all liens, encumbrances, equities or claims.

Section 4.5. This Agreement has been duly authorized, executed and delivered by the Company. Assuming due authorization, execution and delivery of this Agreement by the Investor, this Agreement constitutes a legal, valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, except as the enforcement thereof may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws relating to or affecting the rights and remedies of creditors or by general equitable principles.

Section 4.6. The Common Shares issued and outstanding prior to the issuance of the Securities have been duly authorized and are validly issued, fully paid and non-assessable.

Section 4.7. The Common Shares conform as to legal matters to the description thereof contained in the SEC Documents. Except as otherwise described in the SEC Documents or in connection with the PIPE Transaction, there are no outstanding rights (including, without limitation, subscription rights), warrants or options to acquire, or instruments, securities or rights convertible into or exchangeable for, any Common Shares or other equity interest in the Company to which the Company or any of its subsidiaries is a party, or any contract, commitment, or arrangement of any kind to which the Company or any of its subsidiaries is a party under which the Company or any of its subsidiaries have committed to issue any Common Shares or grant any such convertible or exchangeable securities or any such rights, warrants or options. Except as otherwise described in the SEC Documents, there are no outstanding rights (including, without limitation, subscription rights), warrants or options to acquire, or instruments, securities or rights convertible into or exchangeable for, any shares of any of the Company’s subsidiaries to which the Company or any of its subsidiaries is a party, or any contract, commitment, or arrangement of any kind to which the Company or any of its subsidiaries is a party under which the Company or any of its subsidiaries have committed to issue any shares, rights, warrants or options or instruments convertible into or exchangeable for, any shares of any subsidiary of the Company.

Section 4.8. The issuance and sale of the Securities will have been duly authorized on the Closing Date. The Shares, when delivered and paid for in the manner contemplated by this Agreement, will, at all times, be validly issued, fully paid and non-assessable. The Shares, when delivered and paid for in the manner contemplated by this Agreement, will be, subject only to any restrictions applicable under the Company’s articles of association or applicable laws, freely transferable except as described in the SEC Documents, and will not be subject to any pre-emptive right, third-party rights or similar rights (including, without limitation, any security interest under articles 24 and 25 of the Swiss Federal Act on Intermediated Securities) granted by the Company or any of its subsidiaries other than as contemplated by this Agreement. The Warrants, when executed and delivered by the Company, will be valid and binding agreements of the Company, enforceable against the Company in accordance with their terms, except as the enforcement thereof may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws relating to or affecting the rights and remedies of creditors or by general equitable principles. The Warrant Shares, when issued and delivered upon exercise of the Warrants in accordance therewith, will, at all times, be validly issued, fully paid and non-assessable, and when delivered and paid for in the manner contemplated by the Warrants, will be, subject only to any restrictions applicable under the Company’s articles of association or applicable laws, freely transferable except as otherwise described in the SEC Documents, and will not be subject to any pre-emptive right, third-party rights or similar rights (including, without limitation, any security interest under articles 24 and 25 of the Swiss Federal Act on Intermediated Securities) granted by the Company or any of its subsidiaries other than as contemplated by the Warrants. The Company has a valid conditional share capital for financing purposes, out of which the Warrant Shares may be issued in compliance with the Company's articles of association (Statuts) and then delivered. On the Closing Date, the Company will have duly reserved in its conditional share capital for financing purposes the number of Warrant Shares that are issuable and deliverable upon the exercise of the Warrants.

Section 4.9. The execution and delivery by the Company of, and the performance by the Company of its obligations under, the Transaction Documents do not contravene any provision of (i) applicable law, (ii) the articles of association (Statuts) or the organizational regulations (Règlement d’organisation) of the Company or (iii) any agreement or other instrument binding upon the Company or any of its subsidiaries that is material to the Company and its subsidiaries, taken as a whole, or any judgment, order or decree of any governmental body, agency, or court having jurisdiction over the Company or any subsidiary, except that in the case of clauses (i) and (iii) as would not, individually or in the aggregate, be reasonably expected to have a material adverse effect on the Company or on the power and ability of the Company to perform its obligations under the Transaction Documents. No consent, approval, authorization or order of, or qualification with, any governmental body or agency is required for the performance by the Company of its obligations under this Agreement, except (A) such as have been obtained or waived or as may be required by the securities or blue sky laws of the various states in connection with the offer and sale of the Securities and the Warrant Shares, (B) the registration of the share capital increase for the Transaction with the Commercial Register of the Canton of Vaud, (C) the listing of the Shares and the Warrant Shares on the NYSE and (D) the registration of the Registrable Securities as contemplated by Section 7.9, subject to (A) to (B) being obtained or done on or prior to the Closing Date.

Section 4.10. There has not occurred any material adverse effect on the Company and its subsidiaries, taken as a whole, or any development involving a prospective material adverse effect on the Company and its subsidiaries, taken as a whole, in the condition, financial or otherwise, or in the earnings, business or operations of the Company and its subsidiaries, taken as a whole, from that set forth in the SEC Documents or otherwise disclosed to the Investor.

Section 4.11. There are no legal or governmental proceedings pending or, to the knowledge of the Company, threatened to which the Company or any of its subsidiaries is a party or to which any of the properties of the Company or any of its subsidiaries is subject, other than proceedings accurately described in all material respects in the SEC Documents and proceedings that would not, individually or in the aggregate, be reasonably expected to have a material adverse effect on the Company and its subsidiaries, taken as a whole, or a material adverse effect on the power or ability of the Company to perform its obligations under this Agreement or to consummate the transactions contemplated by the Transaction Documents. There are no orders, writs, injunctions, judgments or decrees outstanding of any court or government agency or instrumentality and binding upon the Company or any of its subsidiaries, other than proceedings accurately described in all material respects in the SEC Documents and orders, writs, injunctions, judgments or decrees that would not, individually or in the aggregate, be reasonably expected to have a material adverse effect on the Company and its subsidiaries, taken as a whole, or a material adverse effect on the power or ability of the Company to perform its obligations under this Agreement or to consummate the transactions contemplated by the Transaction Documents. Neither the Company nor any subsidiary, nor to the knowledge of the Company, any director or officer of the Company or any subsidiary, is, or within the last ten years has been, the subject of any action involving a claim of violation of or liability under federal or state securities laws relating to the Company or such subsidiary or a claim of breach of fiduciary duty relating to the Company or such subsidiary.

Section 4.12. The Company is not, and after giving effect to the offering and sale of the Securities contemplated hereby and the application of the proceeds thereof will not be, required to register as an “investment company” as such term is defined in the Investment Company Act of 1940, as amended.

Section 4.13. The Company and its subsidiaries (i) are in compliance with any and all applicable foreign, federal, state, cantonal and local laws and regulations relating to the protection of human health and safety, the environment or hazardous or toxic substances or wastes, pollutants or contaminants (“Environmental Laws”), (ii) have received all permits, licenses or other approvals required of them under applicable Environmental Laws to conduct their respective businesses and (iii) are in compliance with all terms and conditions of any such permit, license or approval, except where such noncompliance with Environmental Laws, failure to receive required permits, licenses or other approvals or failure to comply with the terms and conditions of such permits, licenses or approvals would not, individually or in the aggregate, be reasonably expected to have a material adverse effect on the Company and its subsidiaries, taken as a whole.

Section 4.14. There are no costs or liabilities associated with Environmental Laws (including, without limitation, any capital or operating expenditures required for clean up, closure of properties or compliance with Environmental Laws or any permit, license or approval, any related constraints on operating activities and any potential liabilities to third parties) which would, individually or in the aggregate, be reasonably expected to have a material adverse effect on the Company and its subsidiaries, taken as a whole.

Section 4.15. None of the Company or its subsidiaries or controlled Affiliates, or any director or officer, or, to the Company’s knowledge, any employee, agent or representative of the Company or of any of its subsidiaries or controlled Affiliates, has taken or will take any action in furtherance of an offer, payment, promise to pay, or authorization or approval of the payment, giving or receipt of money, property, gifts or anything else of value, directly or indirectly, to any government official (including any officer or employee of a government or government-owned or controlled entity or of a public international organization, or any person acting in an official capacity for or on behalf of any of the foregoing, or any political party or party official or candidate for political office) (“Government Official”) in order to influence official action, or to any person in violation of any applicable anti-corruption laws.

The Company and its subsidiaries and controlled Affiliates have conducted their businesses in compliance with applicable anti-corruption laws and have instituted and maintained and will continue to maintain policies and procedures reasonably designed to promote and achieve compliance with such laws and with the representations and warranties contained herein. Neither the Company nor its subsidiaries will use, directly or indirectly, the proceeds of the offering in furtherance of an offer, payment, promise to pay, or authorization of the payment or giving of money, or anything else of value, to any person in violation of any applicable anti-corruption laws.

Section 4.16. The operations of the Company and its subsidiaries are and have been conducted at all times in material compliance with all applicable financial recordkeeping and reporting requirements, including, to the extent applicable, those of the Bank Secrecy Act, as amended by Title III of the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (USA PATRIOT Act), and the applicable anti-money laundering statutes of jurisdictions where the Company and its subsidiaries conduct business, the rules and regulations thereunder and any related or similar rules, regulations or guidelines issued, administered or enforced by any governmental agency (collectively, the “Anti-Money Laundering Laws”), and no action, suit or proceeding by or before any court or governmental agency, authority or body or any arbitrator involving the Company or any of its subsidiaries with respect to the Anti-Money Laundering Laws is pending or, to the knowledge of the Company, threatened.

Section 4.17. Neither the Company nor any of its subsidiaries, nor any director or officer thereof, nor, to the Company’s knowledge, any employee, agent, controlled Affiliate or representative of the Company or any of its subsidiaries, is a Person that is, or is owned or controlled by a Person that is (i) the subject of any sanctions administered or enforced by the U.S. Department of Treasury’s Office of Foreign Assets Control, the United Nations Security Council, the European Union, His Majesty’s Treasury, the Swiss State Secretariat of Economic Affairs, the Swiss Directorate of International Law or other relevant sanctions authority (collectively, “Sanctions”), or (ii) located, organized or resident in a country or territory that is the subject of Sanctions (including, without limitation, Cuba, Iran, North Korea, Syria, the Crimea Region located in Ukraine, and the so-called Donetsk People’s Republic, the so-called Luhansk People’s Republic and any other Covered Region of Ukraine as may be determined by the U.S. Secretary of the Treasury pursuant to Executive Order 14065). The Company will not, directly or indirectly, use the proceeds of the sale of the Securities, or lend, contribute or otherwise make available such proceeds to any subsidiary, joint venture partner or other Person (i) to fund or facilitate any activities or business of or with any Person or in any country or territory that, at the time of such funding or facilitation, is the subject of Sanctions or (ii) in any other manner that will result in a violation of Sanctions by any Person (including any Person participating in the offering, whether as underwriter, advisor, investor or otherwise). Since April 24, 2019, the Company and its subsidiaries have not engaged in, are not now engaged in, and will not engage in, any dealings or transactions with any Person, or in any country or territory, that at the time of the dealing or transaction is or was the subject of Sanctions.

Section 4.18. Subsequent to December 31, 2024, except as described in the SEC Documents, in connection with the PIPE Transaction or otherwise disclosed to the Investor, (i) the Company and its subsidiaries have not incurred any material liability or obligation, direct or contingent, nor entered into any material transaction, (ii) the Company has not purchased any of its outstanding share capital other than from its employees or other service providers in connection with the termination of their service pursuant to the terms of the equity compensation plans, nor declared, paid or otherwise made any dividend or distribution of any kind on its share capital and (iii) except for the issuance of Common Shares into treasury, there has not been any material change in the share capital (other than the exercise or settlement of equity awards or grants or forfeiture of equity awards granted pursuant to the equity compensation plans), short-term debt or long-term debt of the Company and its subsidiaries.

Section 4.19. The Company and its subsidiaries have good and marketable title to all real property and good and marketable title to all personal property (other than intellectual property, which is addressed exclusively in Section 4.20) owned by them which is material to the business of the Company and its subsidiaries, in each case free and clear of all liens, encumbrances and defects except such as are described in the SEC Documents or such as do not materially affect the value of such property and do not materially interfere with the use made and proposed to be made of such property by the Company and its subsidiaries. Any real property and buildings held under lease by the Company and its subsidiaries are held by them under valid, subsisting and enforceable leases with such exceptions as are not material and do not materially interfere with the use made and proposed to be made of such property and buildings by the Company and its subsidiaries, in each case except as described in the SEC Documents.

Section 4.20. Except as described in the SEC Documents and except as would not, individually or in the aggregate, be reasonably expected to have a material adverse effect on the Company and its subsidiaries, taken as a whole, (i) the Company and its subsidiaries own or have a valid license to all patents, inventions, copyrights, know how (including trade secrets and other unpatented and/or unpatentable proprietary or confidential information, systems or procedures), trademarks, service marks and trade names (collectively, “Intellectual Property Rights”) used in or reasonably necessary to the conduct of their businesses as now operated by them, and as proposed to be operated in the future (including upon the commercialization of the Company’s and its subsidiaries’ products or services), in each case as described in the SEC Documents (the “Company Intellectual Property”), (ii) to the Company’s knowledge, there are no third parties who have rights to any Company Intellectual Property, except for customary reversionary rights of third-party licensors, (iii) the Company Intellectual Property owned by the Company and its subsidiaries and, to the Company’s knowledge, the Company Intellectual Property licensed to the Company and its subsidiaries, are subsisting and, to the Company’s knowledge, valid and enforceable, (iv) there is no pending or, to the Company’s knowledge, threatened action, suit, proceeding or claim by others challenging the validity, scope or enforceability of any Company Intellectual Property, and, to the Company’s knowledge, the Company is unaware of any facts which would form a reasonable basis for any such action, suit, proceeding or claim, (v) there is no pending or, to the Company’s knowledge, threatened in writing action, suit, proceeding or claim by others challenging the Company’s rights in or to any Company Intellectual Property, and the Company is unaware of any facts which would form a reasonable basis for any such action, suit, proceeding or claim, (vi) neither the Company nor any of its subsidiaries has received any written notice alleging any infringement, misappropriation or other violation of Intellectual Property Rights, (vii) to the Company’s knowledge, no third party is infringing, misappropriating or otherwise violating, or has infringed, misappropriated or otherwise violated, any Company Intellectual Property owned by the Company, (viii) to the Company’s knowledge, (A) neither the Company nor any of its subsidiaries infringes, misappropriates or otherwise violates, or has infringed, misappropriated or otherwise violated, any third-party Intellectual Property Rights, and (B) the commercialization of the products or services described in the SEC Documents as under development by the Company will not infringe, misappropriate, or otherwise violate any third-party Intellectual Property Rights, (ix) to the Company’s knowledge, the Company and its subsidiaries have complied with the terms of each agreement to which they are a party and pursuant to which Intellectual Property Rights have been licensed to the Company or its subsidiaries, and all such agreements are in full force and effect, (x) to the Company’s knowledge, during the prosecution of the patents and patent applications included in the Company Intellectual Property, the Company and its subsidiaries have complied with the duty of candor and good faith with respect to such patents and patent applications as required by the United States Patent and Trademark Office and all foreign offices having similar requirements, (xi) all employees or contractors engaged in the development of Company Intellectual Property on behalf of the Company or any subsidiary of the Company have executed an invention assignment agreement whereby such employees or contractors presently assign all of their right, title and interest in and to such Company Intellectual Property to the Company or the applicable subsidiary, and no such agreement has been breached or violated, (xii) to the Company’s knowledge, none of the Company Intellectual Property has been obtained, or is being used, by the Company or its subsidiary in violation of any contractual obligation binding on the Company or its subsidiaries or any of their respective officers, directors or employees or otherwise in violation of the rights of any persons and (xiii) the Company and its subsidiaries use, and have used, commercially reasonable efforts to appropriately maintain all information intended to be maintained as a trade secret.

Section 4.21. No labor dispute with the employees of the Company or any of its subsidiaries exists, except as described in the SEC Documents, or, to the knowledge of the Company, is imminent, in either case, that could have a material adverse effect on the Company and its subsidiaries, taken as a whole; and the Company is not aware of any existing, threatened or imminent labor disturbance by the employees of any of its principal suppliers, manufacturers or contractors that could have a material adverse effect on the Company and its subsidiaries, taken as a whole.

Section 4.22. The Company and each of its subsidiaries are insured by insurers of recognized financial responsibility against such losses and risks and in such amounts as the Company reasonably believes are prudent and customary in the businesses in which they are engaged, except where the failure to be so insured would not, individually or in the aggregate, be reasonably expected to have a material adverse effect on the Company and its subsidiaries, taken as a whole.

Neither the Company nor any of its subsidiaries has been refused any insurance coverage sought or applied for three years preceding the date of this Agreement. Neither the Company nor any of its subsidiaries has any reason to believe that it will not be able to renew its existing insurance coverage as and when such coverage expires or to obtain similar coverage from similar insurers as may be necessary to continue its business at a cost that would not, individually or in the aggregate, be reasonably expected to have a material adverse effect on the Company and its subsidiaries, taken as a whole, except as described in the SEC Documents.

Section 4.23. The Company and its subsidiaries, taken as a whole, possess all certificates, authorizations and permits issued by the appropriate federal, state or foreign regulatory authorities necessary to conduct their respective businesses, except where the failure to obtain such certificates, authorization and permits would not, individually or in the aggregate, be reasonably expected to have a material adverse effect on the Company and its subsidiaries, taken as a whole, and neither the Company nor any of its subsidiaries has received any notice of proceedings relating to the revocation or modification of any such certificate, authorization or permit which, singly or in the aggregate, if the subject of an unfavorable decision, ruling or finding, would have a material adverse effect on the Company and its subsidiaries, taken as a whole, except as described in the SEC Documents.

Section 4.24. The Company and its subsidiaries on a consolidated basis maintain a system of internal accounting controls sufficient to provide reasonable assurance that (i) transactions are executed in accordance with management’s general or specific authorizations, (ii) transactions are recorded as necessary to permit preparation of financial statements in conformity with generally accepted accounting principles as applied in the United States (“GAAP”) and to maintain asset accountability, (iii) access to assets is permitted only in accordance with management’s general or specific authorization, (iv) the recorded accountability for assets is compared with the existing assets at reasonable intervals and appropriate action is taken with respect to any differences and (v) the interactive data in eXtensible Business Reporting Language included in the SEC Documents fairly presents the information called for in all material respects and is prepared in accordance with the SEC’s rules and guidelines applicable thereto.

Section 4.25. Except as described in each of the SEC Documents, since the end of the Company’s most recent audited fiscal year, there has been (i) no material weakness in the Company’s internal control over financial reporting (whether or not remediated) and (ii) no change in the Company’s internal control over financial reporting that has materially and adversely affected, or is reasonably likely to materially and adversely affect, the Company’s internal control over financial reporting.

Section 4.26. The Company and each of its subsidiaries have filed all federal, state, local and foreign tax returns required to be filed through the date of this Agreement or have requested extensions thereof (except where the failure to file would not, individually or in the aggregate, be reasonably expected to have a material adverse effect on the Company and its subsidiaries, taken as a whole) and have paid all taxes required to be paid thereon (except for cases in which the failure to file or pay would not have a material adverse effect on the Company and its subsidiaries, taken as a whole, or, except as currently being contested in good faith and for which reserves required by GAAP have been created in the financial statements of the Company), and no tax deficiency has been determined adversely to the Company or any of its subsidiaries which has had (nor does the Company nor any of its subsidiaries have any notice or knowledge of any tax deficiency which could reasonably be expected to be determined adversely to the Company or its subsidiaries and which could reasonably be expected to have) a material adverse effect on the Company and its subsidiaries, taken as a whole.

Section 4.27. The consolidated financial statements included in the SEC Documents, together with the related schedules and notes thereto, present fairly in all material respects the consolidated financial position of the Company as of the dates shown and its results of operations and cash flows for the periods shown, and, except as otherwise disclosed in the SEC Documents, such financial statements have been prepared in conformity with GAAP applied on a consistent basis throughout the periods covered thereby except for any normal year-end adjustments in the Company’s quarterly financial statements and except as otherwise noted therein.

Section 4.28. PricewaterhouseCoopers SA, who has audited certain financial statements of the Company, is (i) an independent registered public accounting firm with respect to the Company within the meaning of the Securities Act and the applicable rules and regulations thereunder adopted by the SEC and the Public Company Accounting Oversight Board (United States) and (ii) an independent statutory auditor with respect to the Company and a state regulated audit firm (société d’audit réglementée par l’État) under the applicable provisions of the Swiss Code of Obligations, and the Swiss Audit Oversight Act (Loi fédérale sur l’agrément et la surveillance des réviseurs) and any ordinances promulgated thereunder, respectively.

Section 4.29. Except as described in the SEC Documents and except as would not, individually or in the aggregate, be reasonably expected to have a material adverse effect on the Company and its subsidiaries, taken as a whole, (i) the pre-clinical studies and clinical trials conducted by or, to the knowledge of the Company, on behalf of or sponsored by the Company or its subsidiaries or in which the Company or its subsidiaries have participated, that are described in the SEC Documents or the results of which are referred to in the SEC Documents, as applicable, were, and if still pending are, being conducted in accordance with the protocols submitted to the U.S. Food and Drug Administration (the “FDA”), the Swiss Agency for Therapeutic Products (“swissmedic”), and other applicable regulatory authorities (including, without limitation, any foreign, federal, state or local governmental or regulatory authority performing functions similar to those performed by the FDA, FOPH, swissethics and swissmedic) (collectively, the “Regulatory Authorities”), the applicable rules and regulations of the Regulatory Authorities, and current Good Clinical Practices and Good Laboratory Practices, (ii) the descriptions in the SEC Documents of the results of such studies and trials are accurate and fairly present the data derived therefrom, (iii) the Company has no knowledge of any other studies or trials not described in the SEC Documents, the results of which call into question the results described or referred to in the SEC Documents, (iv) the Company and its subsidiaries have operated at all times and are currently in material compliance with all applicable statutes, rules and regulations of the Regulatory Authorities and (v) neither the Company nor any of its subsidiaries have received any written notices, correspondence or other communications from the Regulatory Authorities or any other governmental agency requiring or threatening the termination, modification or suspension of any pre-clinical studies or clinical trials that are described in the SEC Documents or the results of which are referred to in the SEC Documents, other than ordinary course communications with respect to modifications in connection with the design and implementation of such studies or trials, and, to the Company’s best knowledge, there are no reasonable grounds for the same.

Section 4.30. Except as described in the SEC Documents and except as would not, individually or in the aggregate, be reasonably expected to have a material adverse effect on the Company and its subsidiaries, taken as a whole, the Company has not failed to file with the Regulatory Authorities any required filing, declaration, listing, registration, report or submission that is a responsibility with the Company with respect to the Company’s product candidates that are described or referred to in the SEC Documents. All such filings, declarations, listings, registrations, reports or submissions were to the Company’s knowledge in compliance with applicable laws when filed. To the Company’s knowledge no deficiencies regarding compliance with applicable law have been asserted by any applicable Regulatory Authority with respect to any such filings, declarations, listings, registrations, reports or submissions.

Section 4.31. Except as described in the SEC Documents and except as would not, individually or in the aggregate, be reasonably expected to have a material adverse effect on the Company and its subsidiaries, taken as a whole, the Company and its subsidiaries are, and at all times have been, in compliance with all applicable Health Care Laws. Neither the Company nor its subsidiaries has received written notice of any claim, action, suit, proceeding, hearing, enforcement, investigation, arbitration or other action from any court or arbitrator or governmental or regulatory authority or third party alleging that it is in violation of any Health Care Laws and, to the Company’s knowledge, no such claim, action, suit, proceeding, hearing, enforcement, investigation, arbitration or other action is threatened. Neither the Company nor its subsidiaries, nor their respective officers, directors, employees, contractors or agents, is a party to any corporate integrity agreements, monitoring agreements, consent decrees, settlement orders, or similar agreements with or imposed by any governmental or regulatory authority. Additionally, neither the Company nor any of its employees, officers, directors, contractors or agents, nor its subsidiaries or any of the subsidiary’s employees, officers, directors, contractors or agents, has been excluded, suspended or debarred from participation in any U.S. federal health care program (as defined in 42 U.S.C. § 1320a-7b(f)) or human clinical research or, to the knowledge of the Company, is subject to a governmental inquiry, investigation, proceeding, or other similar action that could reasonably be expected to result in such debarment, suspension, or exclusion. The Company and its subsidiaries have filed, obtained, maintained or submitted all material reports, documents, forms, notices, applications, records, claims, submissions and supplements or amendments as required by the Health Care Laws, and all such reports, documents, forms, notices, applications, records, claims, submissions and supplements or amendments were timely, complete, accurate and not misleading on the date filed in all material respects (or were corrected or supplemented by a subsequent submission).

Section 4.32. Except as described in the SEC Documents and except as would not, individually or in the aggregate, be reasonably expected to have a material adverse effect on the Company and its subsidiaries, taken as a whole, (i) there has been no security breach or incident, unauthorized access or disclosure, or other compromise of the Company and its subsidiaries’ information technology assets and equipment, computers, systems, networks, hardware, software, websites, applications, technology, data and databases, including Personal Data (defined below), the data and information of their respective customers and employees, and any sensitive, confidential or regulated data maintained, processed or stored by the Company and its subsidiaries (collectively, “IT Systems and Data”); (ii) the IT Systems and Data are adequate for, and operate and perform as required in connection with the operation of the business of the Company and its subsidiaries as currently conducted; (iii) the Company and its subsidiaries have used commercially reasonable efforts to implement and maintain, and have implemented and maintained, commercially reasonable information technology, information security, cyber security and data protection controls, policies and procedures, including oversight, access controls, encryption, physical, technological and administrative safeguards and controls, and business continuity/disaster recovery and security plans that are designed to protect against and prevent security breaches, unauthorized use or access, disablement, misappropriation, modification, or other compromise or misuse of the IT Systems and Data, and maintain and protect their material confidential information and the integrity, continuous operation, redundancy and security of all IT Systems and Data used in connection with the operation of the Company’s and its subsidiaries’ businesses, which are reasonably consistent with industry standards. “Personal Data” means (i) a natural person’s name, street address, telephone number, e-mail address, photograph, social security number or tax identification number, driver’s license number, passport number, credit card number, bank information, or customer or account number; (ii) “personal data” as defined by GDPR (defined below); (iii) any information which would qualify as “protected health information” under HIPAA; and (iv) any other piece of information that (A) is regulated by an applicable privacy law, regulation or contract and (B) allows the identification of such natural person, or his or her family, or permits the collection or analysis of any data related to an identified person’s health or sexual orientation.

Section 4.33. Except as described in the SEC Documents and except as would not, individually or in the aggregate, be reasonably expected to have a material adverse effect on the Company and its subsidiaries, taken as a whole, (i) the Company and each of its subsidiaries have complied, and are presently in compliance, with all applicable internal and external privacy policies, contractual obligations, applicable state, federal and international data privacy and security laws and regulations, including, without limitation, HIPAA, the European Union General Data Protection Regulation (“GDPR”) (EU 2016/679), and other statutes, judgments, orders, rules and regulations of any applicable court or arbitrator or other governmental or regulatory authority (collectively, the “Data Security Obligations”), (ii) the Company has not received from any applicable governmental authority any written notification of or written complaint alleging non-compliance by the Company or its subsidiaries with any Data Security Obligation, (iii) there is no action, suit or proceeding by or before any applicable court or governmental agency, authority or body pending or threatened in writing alleging non-compliance by the Company or its subsidiaries, (iv) to ensure compliance with the Data Security Obligations, the Company and its subsidiaries have at all times had in place, comply with, and take appropriate steps reasonably designed to ensure compliance in all material respects with their policies and procedures relating to data privacy and security and the collection, storage, use, disclosure, handling and analysis of Personal Data that is subject to the Data Security Obligations (the “Policies”) and (v) the Company and its subsidiaries have made all disclosures of its then-current Policies to users or customers required by applicable laws and regulatory rules or requirements, and none of such disclosures made or contained in any Policy have, to the knowledge of the Company, been inaccurate or in violation of any applicable laws and regulatory rules or requirements.

Section 4.34. The Company maintains disclosure controls and procedures that comply with the requirements of the Exchange Act. Such disclosure controls and procedures have been designed to ensure that material information relating to the Company is made known to the Company’s principal executive officer and principal financial officer by others within the Company and such disclosure controls and procedures are effective at the reasonable assurance level.

Section 4.35. Other than the Placement Agent, no Person will have, as a result of the transactions contemplated by this Agreement, any valid right, interest or claim against or upon the Company or, to the Company’s knowledge, the Investor for any commission, fee or other compensation pursuant to any agreement, arrangement or understanding entered into by or on behalf of the Company.

Section 4.36. Neither the Company nor any of its subsidiaries nor any Person acting on their behalf has conducted any general solicitation or general advertising (as those terms are used in Regulation D) in connection with the offer or sale of the Securities.

Section 4.37. Neither the Company nor any of its subsidiaries nor any Person acting on their behalf has, directly or indirectly, made any offers or sales of any Company security or solicited any offers to buy any Company security, under circumstances that would adversely affect reliance by the Company on Section 4(a)(2) for the exemption from the registration requirements of the Securities Act for the transactions contemplated hereby or would require registration of the Securities under the Securities Act or cause this offering of the Securities to require approval of stockholders of the Company for purposes of the Securities Act or any applicable stockholder approval provisions, including, without limitation, under the rules and regulations of the NYSE.

Section 4.38. Assuming the accuracy of the Investor’s representations and warranties set forth in Section 5, the offer and sale of the Securities by the Company to the Investor, and the issuance of the Warrant Shares upon exercise of the Warrants, is exempt from the registration requirements of the Securities Act. The issuance and sale of the Securities by the Company to the Investor, and the issuance of the Warrant Shares upon exercise of the Warrants, do not contravene the rules and regulations of the NYSE applicable to the Company. The Company is in compliance with applicable NYSE continued listing requirements.

Section 4.39. The Company is not, and has never been, an issuer identified in, or subject to, Rule 144(i)(1) of the Securities Act.

Section 4.40. The Company acknowledges and agrees that, during the period beginning on the date of this Agreement and ending on the Closing Date, the Company will not enter into any Additional Purchase Agreements (or any side letter) with terms and conditions that are more advantageous to the investors thereunder than the terms and conditions set forth in this Agreement, unless such terms and conditions are also offered to the Investor. The Additional Purchase Agreements have not been amended or modified following the date of this Agreement. In addition, no amendment shall be made to an Additional Purchase Agreement, and no consideration shall be offered or paid to any Additional Investor to amend or consent to a waiver or modification of any provision of any of such Additional Investor’s Additional Purchase Agreement, unless the same amendment or consideration (other than the reimbursement of legal fees), as the case may be, also is offered to the Investor.

Section 5. Representations and Warranties of the Investors. The Investor represents and warrants to the Company, as of the date hereof and as of the Closing Date (except to the extent made only as of a specified date, in which case such representation and warranty is made as of such date):

Section 5.1. The Investor has been duly incorporated or formed, as applicable, and is validly existing and in good standing (to the extent this concept applies) under the laws of its jurisdiction of incorporation and is not in liquidation or receivership or the subject of any insolvency or bankruptcy proceedings, except to the extent that the failure to be so qualified or be in good standing (to the extent this concept applies) would not have a material adverse effect on the power and ability of the Investor to perform its obligations under this Agreement.

Section 5.2. This Agreement has been duly authorized, executed and delivered by the Investor. Assuming due authorization, execution and delivery of this Agreement by the Company, this Agreement constitutes a legal, valid and binding obligation of the Investor, enforceable against the Investor in accordance with its terms, except as the enforcement thereof may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws relating to or affecting the rights and remedies of creditors or by general equitable principles.

Section 5.3. The execution and delivery by the Investor of, and the performance by the Investor of its obligations under, this Agreement do not contravene any provision of (i) applicable law, (ii) certificate of incorporation, bylaws or other constitutive document of the Investor, or (iii) any agreement, or other instrument binding upon the Investor or any of its subsidiaries that is material to the Investor, or any judgment, order or decree of any governmental body, agency, or court having jurisdiction over the Investor or any subsidiary, except that in the case of clauses (i) and (iii) as would not, individually, or in the aggregate, reasonably be expected to have a material adverse effect on the power and ability of the Investor to perform its obligations under this Agreement.

No consent, approval, authorization or order of, or qualification with, any governmental body or agency is required on behalf of the Investor for the performance by the Investor of its obligations under this Agreement, except such as have been obtained or waived.

Section 5.4. The Securities will be acquired for the Investor’s own account, not as nominee or agent, and not with a view to the resale or distribution of any part thereof in violation of the Securities Act, and the Investor has no present intention of selling, granting any participation in, or otherwise distributing the same in violation of the Securities Act without prejudice, however, to the Investor’s right at all times to sell or otherwise dispose of all or any part of such Securities in compliance with applicable federal and state securities laws. Nothing contained herein shall be deemed a representation or warranty by the Investor to hold the Securities for any period of time. The Investor is not a broker-dealer registered with the SEC under the Exchange Act or an entity engaged in a business that would require it to be so registered.

Section 5.5. The Investor acknowledges that it can bear the economic risk and complete loss of its investment in the Securities and has such knowledge and experience in financial or business matters that it is capable of evaluating the merits and risks of the investment contemplated hereby.

Section 5.6. The Investor has had an opportunity to receive, review and understand all information related to the Company requested by it and to ask questions of and receive answers from the Company regarding the Company, its business and the terms and conditions of the offering of the Securities, and has had the opportunity to conduct and complete its own independent due diligence. The Investor has received copies of the SEC Documents, which were made available to the Investor through the SEC’s EDGAR system. Based on the information the Investor has deemed appropriate, and without reliance upon the Placement Agent, it has independently made its own analysis and decision to enter into the Transaction Documents. The Investor is relying exclusively on its own sources of information, investment analysis and due diligence (including professional advice it deems appropriate) with respect to the execution, delivery and performance of the Transaction Documents, the Securities and the business, condition (financial and otherwise), management, operations, properties and prospects of the Company, including, but not limited to, all business, legal, regulatory, accounting, credit and tax matters. The Investor has not relied on any advice furnished by or on behalf of the Placement Agent in connection with the transactions contemplated hereby. Neither such inquiries nor any other due diligence investigation conducted by the Investor shall modify, limit or otherwise affect the Investor’s right to rely on the Company’s representations and warranties contained in this Agreement or on the truth, accuracy and completeness of the SEC Documents.

Section 5.7. The Investor understands that the Securities are “restricted securities” under the U.S. federal securities laws inasmuch as they are being acquired from the Company in a transaction not involving a public offering and that under such laws and applicable regulations such securities may be resold without registration under the Securities Act only in certain limited circumstances.

Section 5.8. The Investor is either an institution that is an “accredited investor” within the meaning of Rule 501(a)(1), (a)(2), (a)(3), (a)(7), (a)(8), (a)(9), (a)(12) or (a)(13) under the Securities Act or a “qualified institutional buyer” within the meaning of Rule 144A under the Securities Act, and the Investor is an “institutional account” within the meaning of FINRA Rule 4512(c) and has executed and delivered to the Company its Investor Questionnaire, which the Investor represents and warrants is true, correct and complete. The Investor is a sophisticated institutional investor with sufficient knowledge, sophistication and experience in business, including transactions involving private investments in public equity, to properly evaluate the risks and merits of its purchase of the Securities. The Investor has determined based on its own independent review and such professional advice as it deems appropriate that its purchase of the Securities and participation in the transactions contemplated by this Agreement (a) are fully consistent with its financial needs, objectives and condition, (b) comply and are fully consistent with all investment policies, guidelines and other restrictions applicable to the Investor and (c) are a fit, proper and suitable investment for the Investor, notwithstanding the substantial risks inherent in investing in or holding the Securities.

Section 5.9.

The Investor hereby acknowledges and agrees that it has independently evaluated the merits of its decision to purchase the Securities, and that (i) the Placement Agent is acting solely as placement agent in connection with the execution, delivery and performance of this Agreement and is not acting as an underwriter or in any other capacity and is not and shall not be construed as a fiduciary for the Investor, the Company or any other person or entity in connection with the execution, delivery and performance of the Transaction Documents, (b) the Placement Agent has not made and will not make any representation or warranty, whether express or implied, of any kind or character and have not provided any advice or recommendation in connection with the execution, delivery and performance of the Transaction Documents, (c) the Placement Agent will not have any responsibility with respect to (i) any representations, warranties or agreements made by any person or entity under or in connection with the execution, delivery and performance of the Transaction Documents, or the execution, legality, validity or enforceability (with respect to any person) thereof, or (ii) the business, affairs, financial condition, operations, properties or prospects of, or any other matter concerning the Company and (d) the Placement Agent will not have any liability or obligation (including without limitation, for or with respect to any losses, claims, damages, obligations, penalties, judgments, awards, liabilities, costs, expenses or disbursements incurred by the Investor, the Company or any other person or entity), whether in contract, tort or otherwise, to the Investor, or to any person claiming through it, in respect of the execution, delivery and performance of the Transaction Documents.

Section 5.10. The Investor did not learn of the investment in the Securities as a result of any general solicitation or general advertising (as those terms are used in Regulation D).

Section 5.11. Other than the Placement Agent, no Person will have, as a result of the transactions contemplated by this Agreement, any valid right, interest or claim against or upon the Company for any commission, fee or other compensation pursuant to any agreement, arrangement or understanding entered into by or on behalf of such Investor.

Section 5.12. Other than consummating the transactions contemplated hereunder, the Investor has not, nor has any Person acting on behalf of or pursuant to any understanding with the Investor, directly or indirectly, executed any purchases or sales, including Short Sales, of the securities of the Company during the period commencing as of the time that the Investor was first contacted by the Company, the Placement Agent or any other Person regarding the transactions contemplated hereby and ending on the date hereof. Notwithstanding the foregoing, in the case of the Investor that is a multi-managed investment vehicle whereby separate portfolio managers manage separate portions of the Investor’s assets and the portfolio managers have no direct knowledge of the investment decision made by the portfolio managers managing other portions of the Investor’s assets, the representation set forth above shall only apply with respect to the portion of assets managed by the portfolio manager that made the investment decision to purchase the Securities. The Investor, its Affiliates and, to the knowledge of such Investor, authorized representatives and advisors of the Investor who are aware of the transactions contemplated hereby, maintained the confidentiality of all disclosures made to it in connection with this transaction (including the existence and terms of this transaction). Notwithstanding the foregoing, for avoidance of doubt, nothing contained herein shall constitute a representation or warranty, or preclude any actions, with respect to the identification of the availability of, or securing of, available shares to borrow in order to effect Short Sales or similar transactions in the future.

Section 6. Conditions to Closing.

Section 6.1. Conditions to the Investors’ Obligations. The obligation of the Investor to purchase Securities at the Closing is subject to the fulfillment to the Investor’s satisfaction, on or prior to the Closing Date, of the following conditions, any of which may be waived by the Investor:

(a) The representations and warranties made by the Company in Section 4 hereof shall be true and correct in all material respects (except for those representations and warranties which are qualified as to materiality or by material adverse effect, in which case such representations and warranties shall be true and correct in all respects) as of the date hereof and on the Closing Date, except to the extent any such representation or warranty expressly speaks as of an earlier date, in which case such representation or warranty shall be true and correct as of such earlier date. The Company shall have performed in all material respects all obligations and covenants herein required to be performed by it on or prior to the Closing Date.

(b) The Company shall have obtained any and all consents, permits, approvals, registrations and waivers necessary for consummation of the purchase and sale of the Securities and the consummation of the other transactions contemplated by the Transaction Documents, all of which shall be in full force and effect.

(c) The Company shall have submitted with the NYSE a Supplemental Listing Application with respect to the Shares and the Warrant Shares.

(d) No judgment, writ, order, injunction, award or decree of or by any court, or judge, justice or magistrate, including any bankruptcy court or judge, or any order of or by any governmental authority, shall have been issued, and no action or proceeding shall have been instituted by any governmental authority, enjoining or preventing the consummation of the transactions contemplated by the Transaction Documents.

(e) No stop order or suspension of trading shall have been imposed by the NYSE, the SEC or any other governmental or regulatory body with respect to public trading in the Common Shares.

Section 6.2. Conditions to Obligations of the Company. The obligation of the Company to issue and sell the Securities at the Closing is subject to the fulfillment to the Company’s satisfaction, on or prior to the Closing Date, of the following conditions, any of which may be waived by the Company: