Document

DTE Energy reports first quarter accomplishments, investments and earnings

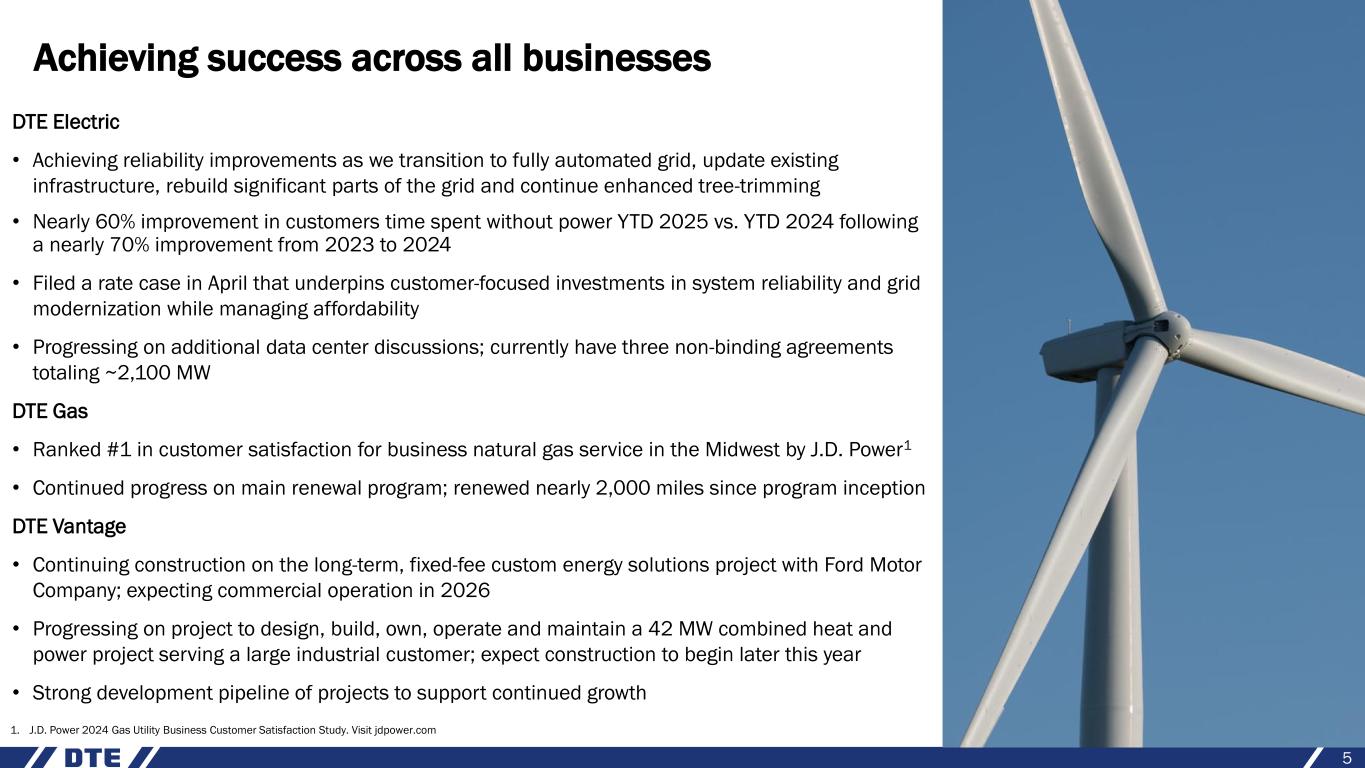

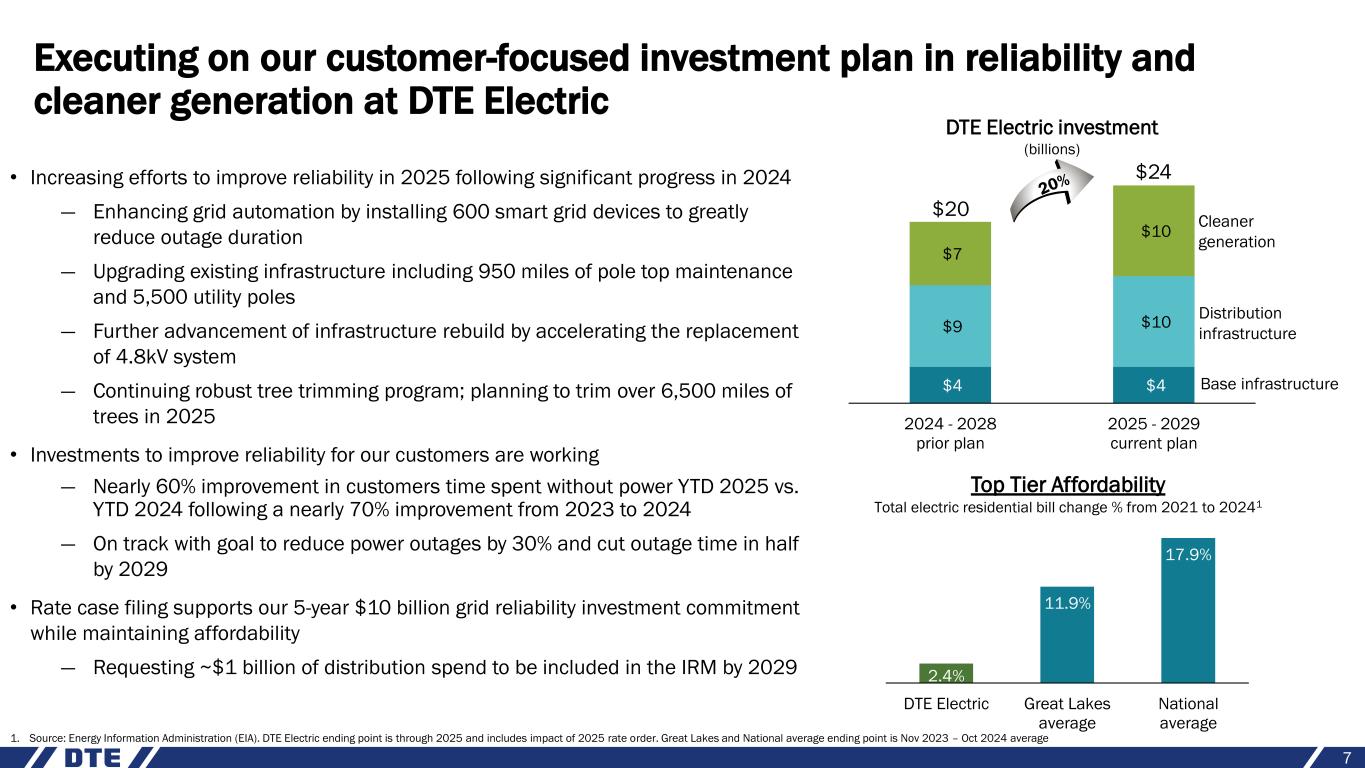

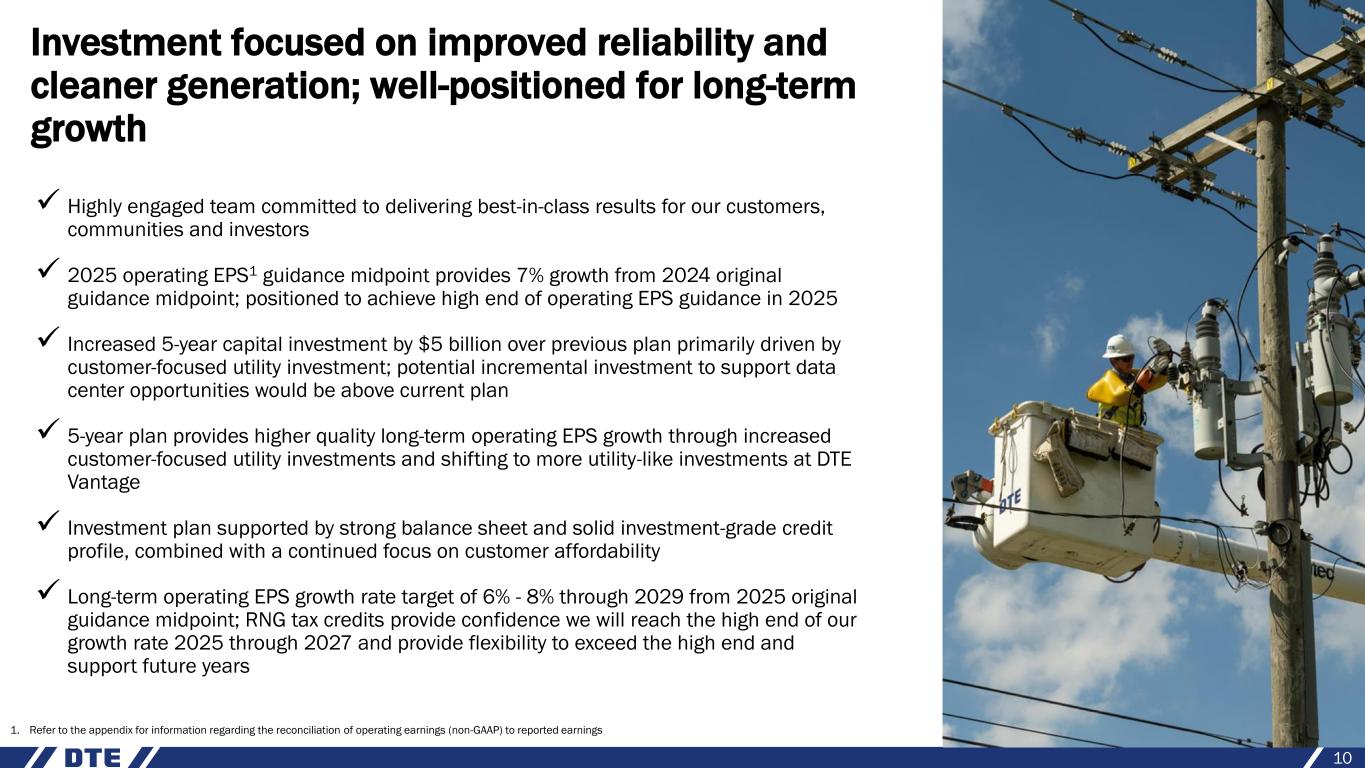

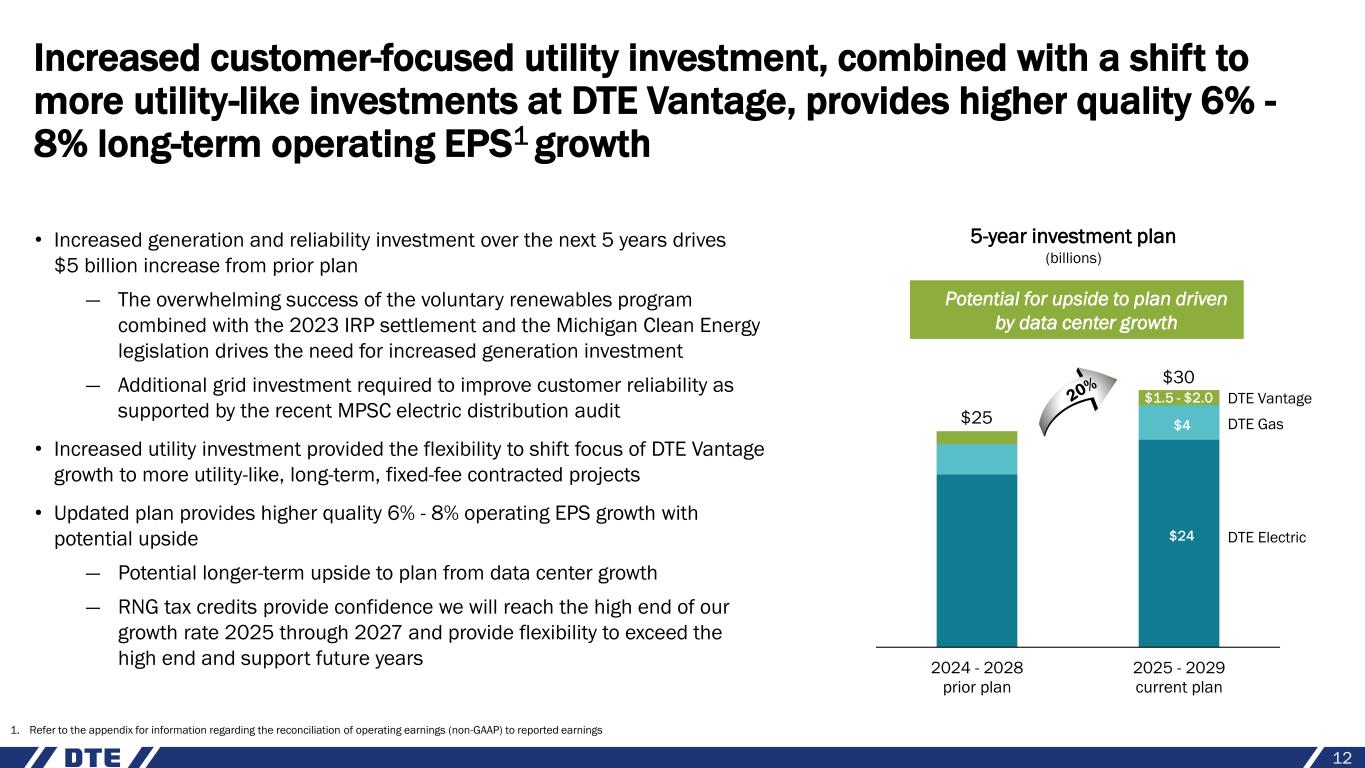

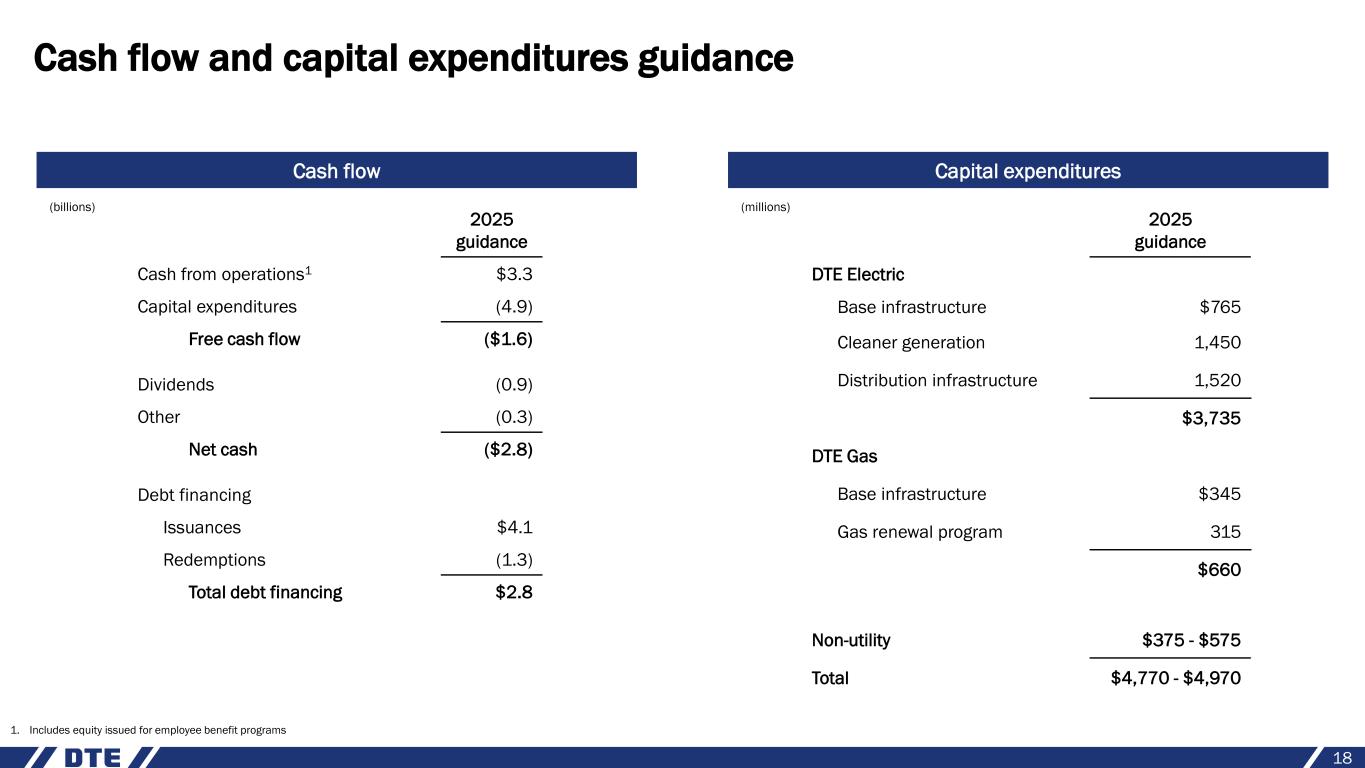

•Continued significant investment to improve reliability and transition to cleaner generation; on track to invest $4.4 billion into our utilities in 2025

•Began operations of Michigan’s largest battery energy storage system

•Boosted small businesses with energy efficiency upgrade grants

•Recognized as a Gallup Exceptional Workplace for 13th consecutive year

DETROIT, May 1, 2025 — DTE Energy (NYSE: DTE) today reported that it invested over $850 million into its utilities in the first quarter of 2025 and is on track to invest $4.4 billion this year to improve electric reliability, generate more renewable energy and ensure continued safe and reliable natural gas service for its customers.

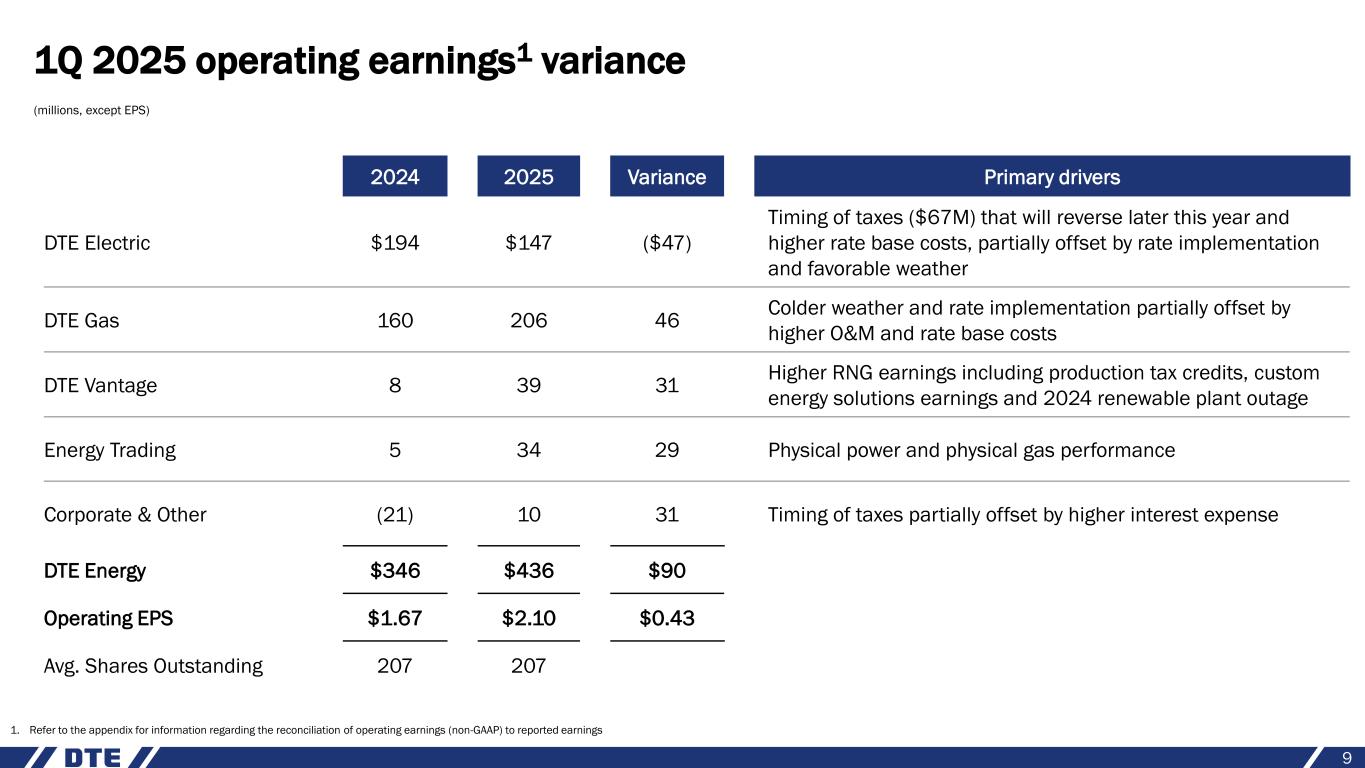

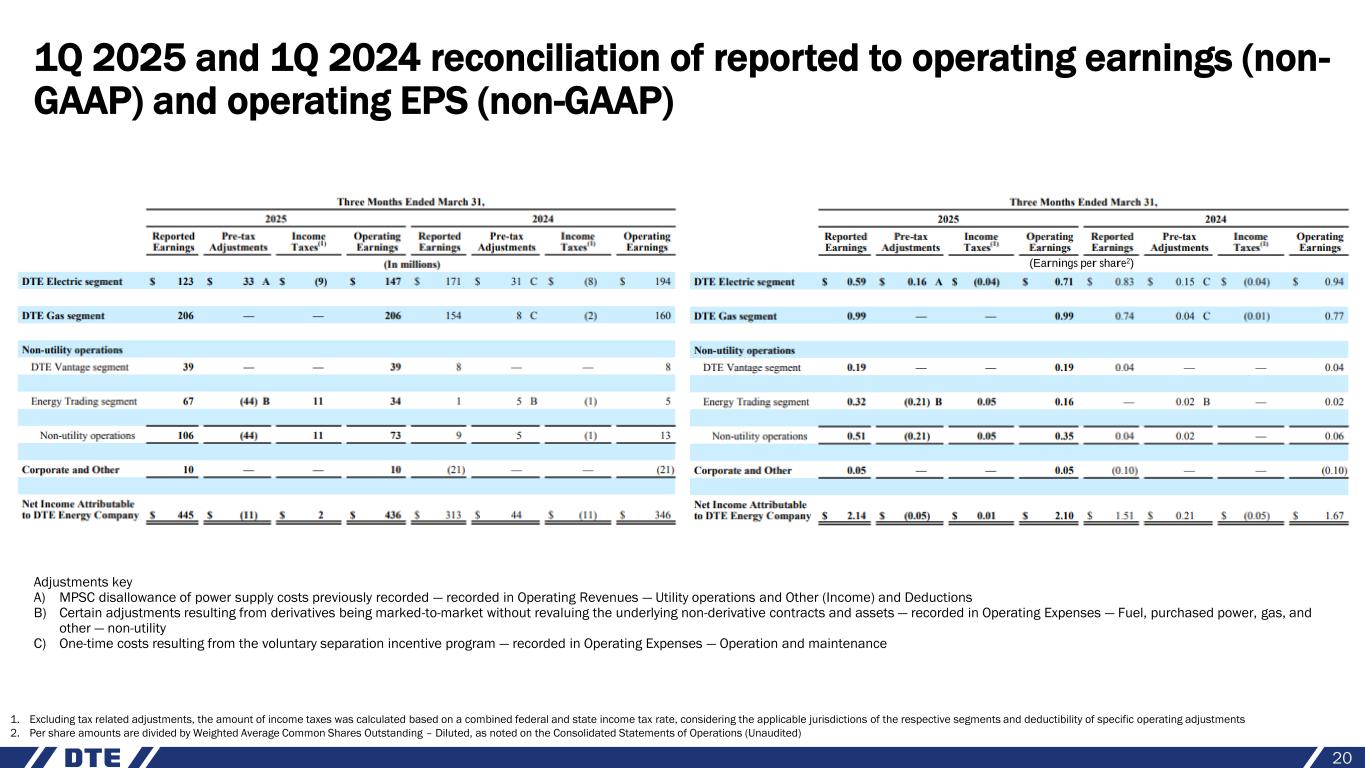

The company also reported first quarter earnings of $445 million or $2.14 per diluted share, compared with $313 million, or $1.51 per diluted share in 2024. Operating earnings for the first quarter 2025 were $436 million, or $2.10 per diluted share, compared with 2024 operating earnings of $346 million, or $1.67 per diluted share. Operating earnings exclude non-recurring items, certain mark-to-market adjustments and discontinued operations. Reconciliations of reported earnings to operating earnings are included at the end of this news release.

“We know that when we invest, it works, which is why we are making significant investments to build the electric grid of the future, making it more resilient to extreme weather and more reliable for our customers,” said Jerry Norcia, DTE Energy chairman and CEO. “At the same time, our innovative and highly engaged workforce is rebuilding our generation fleet to create a more balanced and diversified mix of energy.”

Norcia noted the following accomplishments:

•Invested nearly $370 million to improve electric infrastructure for customers: So far this year, DTE Electric has invested nearly $370 million to continue to build the electric grid of the future and build on the improved electric reliability that customers experienced in 2024. Last year, DTE’s investments into transitioning to a smarter grid, aggressively updating existing infrastructure, rebuilding significant portions of the electric grid and trimming trees, coupled with less extreme weather impacting the service territory, led to a nearly 70% decrease in time spent without power for customers in 2024, compared to 2023. Year-to-date, DTE customers have experienced a nearly 60% reduction in time spent without power, compared to the first quarter of 2024.

•Began operations of Michigan’s largest battery energy storage system: DTE began operations of its first utility-scale battery energy storage facility, Slocum Energy Center, in Trenton in February. At 14 megawatts, Slocum is the largest facility of its kind operating in Michigan and is comprised of 95 state-of-the-art lithium-ion battery segments capable of storing and releasing enough energy to power 2,500 homes. Slocum was designed as a pilot project and will provide valuable insights for DTE’s future energy storage initiatives, including the company’s 220-megawatt Trenton Channel Energy Center, which is slated for operations in 2026 and will be 15 times the size of Slocum. As part of its transformational CleanVision Integrated Resource Plan, DTE will have more than 2,900 megawatts of energy storage by 2042, doubling its total energy storage capacity. This plan aligns with Michigan’s statewide energy storage target and its carbon neutrality goal.

•Boosted small businesses with energy efficiency upgrade grants: As part of its Energy Efficiency Makeover contest, DTE awarded three small businesses in Michigan with $5,000 for energy efficiency improvements. The winning Michigan small businesses were chosen for demonstrating knowledge, commitment and a need for energy efficiency improvements. In addition to the prize money, winners will receive a walk-through energy assessment with a DTE energy advisor, including business-specific energy efficiency recommendations and help in coordinating the installation of upgrades.

•Recognized as a Gallup Exceptional Workplace for 13th consecutive year: DTE was recognized by Gallup as a workplace with exceptionally high employee engagement – in the top six percent of Gallup’s worldwide database of companies.

Outlook for 2025

DTE Energy confirms 2025 operating EPS guidance of $7.09 - $7.23.

“We remain focused on achieving strong financial results and a constructive relationship with our regulators to continue investing above our generated cash flows,” said David Ruud, DTE executive vice president and CFO. “At the same time our DTE team members are making exceptional progress improving our systems and generating efficiencies to keep bills as low as possible for our customers.”

This earnings announcement and presentation slides are available at dteenergy.com/investors.

The company will conduct a conference call to discuss earnings results at 9:00 a.m. ET. Investors, the news media and the public may listen to a live internet broadcast of the call at dteenergy.com/investors. The telephone dial-in number in the U.S. and Canada toll free is: (888) 510-2008. The telephone dial-in USA toll is: (646) 960-0306 and the Canada dial-in toll is: (289) 514-5035. The passcode is 4987588. The webcast will be archived on the DTE website at dteenergy.com/investors.

About DTE Energy

DTE Energy (NYSE:DTE) is a Detroit-based diversified energy company involved in the development and management of energy-related businesses and services nationwide. Its operating units include an electric company serving 2.3 million customers in Southeast Michigan and a natural gas company serving 1.3 million customers across Michigan. The DTE portfolio also includes energy businesses focused on custom energy solutions, renewable energy generation, and energy marketing and trading. DTE has continued to accelerate its carbon reduction goals to meet aggressive targets and is committed to serving with its energy through volunteerism, education and employment initiatives, philanthropy, emission reductions and economic progress. Information about DTE is available at dteenergy.com, empoweringmichigan.com, x.com/DTE_Energy and facebook.com/dteenergy.

Use of Operating Earnings Information - DTE Energy management believes that operating earnings provide a meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors.

Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Operating earnings is a non-GAAP measure and should be viewed as a supplement and not a substitute for reported earnings, which represents the company’s net income and the most comparable GAAP measure. In this release, DTE Energy discusses 2025 operating earnings guidance. It is likely that certain items that impact the company's 2025 reported results will be excluded from operating results. Reconciliations to the comparable 2025 reported earnings guidance are not provided because it is not possible to provide a reliable forecast of specific line items (i.e. future non-recurring items, certain mark-to-market adjustments and discontinued operations). These items may fluctuate significantly from period to period and may have a significant impact on reported earnings. The information contained herein is as of the date of this document. DTE Energy expressly disclaims any current intention to update any information contained in this document as a result of new information or future events or developments. Certain information presented herein includes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, and businesses of DTE Energy. Words such as “anticipate,” “believe,” “expect,” “may,” “could,” “projected,” “aspiration,” “plans” and “goals” signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to numerous assumptions, risks and uncertainties that may cause actual future results to be materially different from those contemplated, projected, estimated or budgeted. Many factors may impact forward-looking statements including, but not limited to, the following: the impact of regulation by the EPA, EGLE, the FERC, the MPSC, the NRC, and for DTE Energy, the CFTC and CARB, as well as other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals, or new legislation, including legislative amendments and retail access programs; economic conditions and population changes in DTE Energy’s geographic area resulting in changes in demand, customer conservation, and thefts of electricity and, for DTE Energy, natural gas; the operational failure of electric or gas distribution systems or infrastructure; impact of volatility in prices in international steel markets and in prices of environmental attributes generated from renewable natural gas investments on the operations of DTE Vantage; the risk of a major safety incident; environmental issues, laws, regulations, and the increasing costs of remediation and compliance, including actual and potential new federal and state requirements; the cost of protecting assets and customer data against, or damage due to, cyber incidents and terrorism; health, safety, financial, environmental, and regulatory risks associated with ownership and operation of nuclear facilities; volatility in commodity markets, deviations in weather and related risks impacting the results of DTE Energy’s energy trading operations; changes in the cost and availability of coal and other raw materials, purchased power, and natural gas; advances in technology that produce power, store power or reduce or increase power consumption; changes in the financial condition of significant customers and strategic partners; the potential for losses on investments, including nuclear decommissioning trust and benefit plan assets and the related increases in future expense and contributions; access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; instability in capital markets which could impact availability of short and long-term financing; impacts of inflation, tariffs, and the timing and extent of changes in interest rates; the level of borrowings; the potential for increased costs or delays in completion of significant capital projects; changes in, and application of, federal, state, and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings, and audits; the effects of weather and other natural phenomena, including climate change, on operations and sales to customers, and purchases from suppliers; unplanned outages at our generation plants; employee relations and the impact of collective bargaining agreements; the availability, cost, coverage, and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of generation and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy, and other business issues; successful execution of new business development and future growth plans; contract disputes, binding arbitration, litigation, and related appeals; the ability of the electric and gas utilities to achieve goals for carbon emission reductions; and the risks discussed in DTE Energy’s public filings with the Securities and Exchange Commission. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events.

For more information, members of the media may contact:

Dan Miner, DTE Energy: 313.235.5555

For further information, analysts may call:

Matt Krupinski, DTE Energy: 313.235.6649

John Dermody, DTE Energy: 313.235.8750

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DTE Energy Company |

| Segment Net Income (Unaudited) |

|

|

|

Three Months Ended March 31, |

|

2025 |

|

2024 |

|

Reported

Earnings |

|

Pre-tax Adjustments |

|

Income

Taxes(1) |

|

Operating

Earnings |

|

Reported

Earnings |

|

Pre-tax Adjustments |

|

Income

Taxes(1) |

|

Operating

Earnings |

|

(In millions) |

| DTE Electric segment |

$ |

123 |

|

|

$ |

33 |

|

A |

|

$ |

(9) |

|

|

|

$ |

147 |

|

|

$ |

171 |

|

|

$ |

31 |

|

C |

|

$ |

(8) |

|

|

|

$ |

194 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DTE Gas segment |

206 |

|

|

— |

|

|

|

— |

|

|

|

206 |

|

|

154 |

|

|

8 |

|

C |

|

(2) |

|

|

|

160 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-utility operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DTE Vantage segment |

39 |

|

|

— |

|

|

|

— |

|

|

|

39 |

|

|

8 |

|

|

— |

|

|

|

— |

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Energy Trading segment |

67 |

|

|

(44) |

|

B |

|

11 |

|

|

|

34 |

|

|

1 |

|

|

5 |

|

B |

|

(1) |

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-utility operations |

106 |

|

|

(44) |

|

|

|

11 |

|

|

|

73 |

|

|

9 |

|

|

5 |

|

|

|

(1) |

|

|

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Corporate and Other |

10 |

|

|

— |

|

|

|

— |

|

|

|

10 |

|

|

(21) |

|

|

— |

|

|

|

— |

|

|

|

(21) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income Attributable to DTE Energy Company |

$ |

445 |

|

|

$ |

(11) |

|

|

|

$ |

2 |

|

|

|

$ |

436 |

|

|

$ |

313 |

|

|

$ |

44 |

|

|

|

$ |

(11) |

|

|

|

$ |

346 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Excluding tax related adjustments, the amount of income taxes was calculated based on a combined federal and state income tax rate, considering the applicable jurisdictions of the respective segments and deductibility of specific operating adjustments. |

|

| Adjustments key |

| A) MPSC disallowance of power supply costs previously recorded — recorded in Operating Revenues — Utility operations and Other (Income) and Deductions |

| B) Certain adjustments resulting from derivatives being marked-to-market without revaluing the underlying non-derivative contracts and assets — recorded in Operating Expenses — Fuel, purchased power, gas, and other — non-utility |

| C) One-time costs resulting from the voluntary separation incentive program — recorded in Operating Expenses — Operation and maintenance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DTE Energy Company |

Segment Diluted Earnings Per Share (Unaudited)(2) |

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

2025 |

|

2024 |

|

Reported

Earnings |

|

Pre-tax Adjustments |

|

Income

Taxes(1) |

|

Operating

Earnings |

|

Reported

Earnings |

|

Pre-tax Adjustments |

|

Income

Taxes(1) |

|

Operating

Earnings |

|

|

| DTE Electric segment |

$ |

0.59 |

|

|

$ |

0.16 |

|

A |

|

$ |

(0.04) |

|

|

|

$ |

0.71 |

|

|

$ |

0.83 |

|

|

$ |

0.15 |

|

C |

|

$ |

(0.04) |

|

|

|

$ |

0.94 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DTE Gas segment |

0.99 |

|

|

— |

|

|

|

— |

|

|

|

0.99 |

|

|

0.74 |

|

|

0.04 |

|

C |

|

(0.01) |

|

|

|

0.77 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-utility operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DTE Vantage segment |

0.19 |

|

|

— |

|

|

|

— |

|

|

|

0.19 |

|

|

0.04 |

|

|

— |

|

|

|

— |

|

|

|

0.04 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Energy Trading segment |

0.32 |

|

|

(0.21) |

|

B |

|

0.05 |

|

|

|

0.16 |

|

|

— |

|

|

0.02 |

|

B |

|

— |

|

|

|

0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-utility operations |

0.51 |

|

|

(0.21) |

|

|

|

0.05 |

|

|

|

0.35 |

|

|

0.04 |

|

|

0.02 |

|

|

|

— |

|

|

|

0.06 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Corporate and Other |

0.05 |

|

|

— |

|

|

|

— |

|

|

|

0.05 |

|

|

(0.10) |

|

|

— |

|

|

|

— |

|

|

|

(0.10) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income Attributable to DTE Energy Company |

$ |

2.14 |

|

|

$ |

(0.05) |

|

|

|

$ |

0.01 |

|

|

|

$ |

2.10 |

|

|

$ |

1.51 |

|

|

$ |

0.21 |

|

|

|

$ |

(0.05) |

|

|

|

$ |

1.67 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Excluding tax related adjustments, the amount of income taxes was calculated based on a combined federal and state income tax rate, considering the applicable jurisdictions of the respective segments and deductibility of specific operating adjustments. |

|

| (2) Per share amounts are divided by Weighted Average Common Shares Outstanding — Diluted, as noted on the Consolidated Statements of Operations (Unaudited). |

|

|

|

|

|

|

|

Adjustments key — see previous page |

|

|

|

|

|

|