false2024FY0000915913P2YP5Yhttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#LiabilitiesCurrenthttp://fasb.org/us-gaap/2024#LiabilitiesCurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrent http://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrent0.05http://www.albemarle.com/20241231#RestructuringChargesAndAssetWriteOffshttp://www.albemarle.com/20241231#RestructuringChargesAndAssetWriteOffshttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2024#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrent http://fasb.org/us-gaap/2024#LongTermDebtCurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrent http://fasb.org/us-gaap/2024#LongTermDebtCurrenthttp://fasb.org/us-gaap/2024#LongTermDebtNoncurrenthttp://fasb.org/us-gaap/2024#LongTermDebtNoncurrentP1YP1Yiso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:purealb:metricTonalb:paymentalb:installmentutr:Dalb:segment00009159132024-01-012024-12-310000915913us-gaap:CommonStockMember2024-01-012024-12-310000915913alb:DepositarySharesMember2024-01-012024-12-3100009159132024-06-2800009159132025-02-0500009159132023-01-012023-12-3100009159132022-01-012022-12-310000915913us-gaap:RelatedPartyMember2024-01-012024-12-310000915913us-gaap:RelatedPartyMember2023-01-012023-12-310000915913us-gaap:RelatedPartyMember2022-01-012022-12-3100009159132024-12-3100009159132023-12-310000915913us-gaap:NonrelatedPartyMember2024-12-310000915913us-gaap:NonrelatedPartyMember2023-12-310000915913us-gaap:RelatedPartyMember2024-12-310000915913us-gaap:RelatedPartyMember2023-12-310000915913us-gaap:CommonStockMember2021-12-310000915913us-gaap:PreferredStockMember2021-12-310000915913us-gaap:AdditionalPaidInCapitalMember2021-12-310000915913us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000915913us-gaap:RetainedEarningsMember2021-12-310000915913us-gaap:ParentMember2021-12-310000915913us-gaap:NoncontrollingInterestMember2021-12-3100009159132021-12-310000915913us-gaap:RetainedEarningsMember2022-01-012022-12-310000915913us-gaap:ParentMember2022-01-012022-12-310000915913us-gaap:NoncontrollingInterestMember2022-01-012022-12-310000915913us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310000915913us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000915913us-gaap:CommonStockMember2022-01-012022-12-310000915913us-gaap:CommonStockMember2022-12-310000915913us-gaap:PreferredStockMember2022-12-310000915913us-gaap:AdditionalPaidInCapitalMember2022-12-310000915913us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000915913us-gaap:RetainedEarningsMember2022-12-310000915913us-gaap:ParentMember2022-12-310000915913us-gaap:NoncontrollingInterestMember2022-12-3100009159132022-12-310000915913us-gaap:RetainedEarningsMember2023-01-012023-12-310000915913us-gaap:ParentMember2023-01-012023-12-310000915913us-gaap:NoncontrollingInterestMember2023-01-012023-12-310000915913us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000915913us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000915913us-gaap:CommonStockMember2023-01-012023-12-310000915913us-gaap:CommonStockMember2023-12-310000915913us-gaap:PreferredStockMember2023-12-310000915913us-gaap:AdditionalPaidInCapitalMember2023-12-310000915913us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000915913us-gaap:RetainedEarningsMember2023-12-310000915913us-gaap:ParentMember2023-12-310000915913us-gaap:NoncontrollingInterestMember2023-12-310000915913us-gaap:RetainedEarningsMember2024-01-012024-12-310000915913us-gaap:ParentMember2024-01-012024-12-310000915913us-gaap:NoncontrollingInterestMember2024-01-012024-12-310000915913us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310000915913us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310000915913us-gaap:CommonStockMember2024-01-012024-12-310000915913us-gaap:PreferredStockMember2024-01-012024-12-310000915913us-gaap:CommonStockMember2024-12-310000915913us-gaap:PreferredStockMember2024-12-310000915913us-gaap:AdditionalPaidInCapitalMember2024-12-310000915913us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310000915913us-gaap:RetainedEarningsMember2024-12-310000915913us-gaap:ParentMember2024-12-310000915913us-gaap:NoncontrollingInterestMember2024-12-310000915913us-gaap:NonrelatedPartyMember2024-01-012024-12-310000915913us-gaap:NonrelatedPartyMember2023-01-012023-12-310000915913us-gaap:NonrelatedPartyMember2022-01-012022-12-310000915913alb:MineralResourcesLimitedWodginaProjectMemberalb:MineralResourcesLimitedWodginaProjectMember2023-10-180000915913alb:MineralResourcesLimitedWodginaProjectMemberalb:MineralResourcesLimitedWodginaProjectMember2019-10-310000915913srt:RestatementAdjustmentMember2024-01-012024-12-310000915913srt:RestatementAdjustmentMember2023-01-012023-12-310000915913srt:MinimumMember2024-01-012024-12-310000915913srt:MaximumMember2024-01-012024-12-310000915913alb:PlannedMajorMaintenanceActivitiesMember2024-12-310000915913srt:MinimumMember2024-12-310000915913srt:MaximumMember2024-12-310000915913us-gaap:OtherNonoperatingIncomeExpenseMember2024-01-012024-12-310000915913alb:GuangxiTianyuanNewEnergyMaterialsCoLtdMember2022-10-252022-10-250000915913alb:GuangxiTianyuanNewEnergyMaterialsCoLtdMember2022-10-2500009159132022-01-012022-03-3100009159132024-01-012024-03-310000915913alb:MineralResourcesLimitedWodginaProjectMemberalb:LithiumHydroxideConversionAssetsMember2023-01-012023-12-310000915913alb:MineralResourcesLimitedWodginaProjectMemberalb:LithiumHydroxideConversionAssetsMember2022-01-012022-12-310000915913alb:LithiumHydroxideConversionAssetsMember2019-10-312019-10-310000915913alb:MineralResourcesLimitedWodginaProjectMemberalb:LithiumHydroxideConversionAssetsMember2019-01-012019-12-310000915913alb:LithiumMember2024-12-310000915913alb:LithiumMember2023-12-310000915913alb:OtherVariableInterestEntitiesExcludingWindfieldHoldingsMember2024-01-012024-12-310000915913alb:OtherVariableInterestEntitiesExcludingWindfieldHoldingsMember2023-01-012023-12-310000915913srt:MinimumMemberus-gaap:LandImprovementsMember2024-12-310000915913srt:MaximumMemberus-gaap:LandImprovementsMember2024-12-310000915913srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2024-12-310000915913srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2024-12-310000915913srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2024-12-310000915913srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2024-12-310000915913srt:MinimumMemberalb:MineralRightsAndReservesMember2024-12-310000915913srt:MaximumMemberalb:MineralRightsAndReservesMember2024-12-310000915913srt:MinimumMemberalb:ShortLivedEquipmentMember2024-12-310000915913srt:MaximumMemberalb:ShortLivedEquipmentMember2024-12-310000915913srt:MinimumMemberus-gaap:EquipmentMember2024-12-310000915913srt:MaximumMemberus-gaap:EquipmentMember2024-12-310000915913srt:MinimumMemberalb:ProductionProcessEquipmentMajorUnitComponentsMember2024-12-310000915913srt:MaximumMemberalb:ProductionProcessEquipmentMajorUnitComponentsMember2024-12-310000915913srt:MinimumMemberalb:ProductionProcessEquipmentInfrastructureAndOtherMember2024-12-310000915913srt:MaximumMemberalb:ProductionProcessEquipmentInfrastructureAndOtherMember2024-12-3100009159132022-10-3100009159132023-08-310000915913us-gaap:PropertyPlantAndEquipmentMember2024-12-310000915913alb:JointVentureWindfieldHoldingsMember2024-12-310000915913alb:JointVentureWindfieldHoldingsMember2023-12-310000915913alb:JointVentureWindfieldHoldingsMember2022-12-310000915913alb:JointVentureNipponAluminumAlkylsMember2024-12-310000915913alb:JointVentureNipponAluminumAlkylsMember2023-12-310000915913alb:JointVentureNipponAluminumAlkylsMember2022-12-310000915913alb:JointVentureNipponKetjenCompanyLimitedMember2024-12-310000915913alb:JointVentureNipponKetjenCompanyLimitedMember2023-12-310000915913alb:JointVentureNipponKetjenCompanyLimitedMember2022-12-310000915913alb:JointVentureEurecatSAMember2024-12-310000915913alb:JointVentureEurecatSAMember2023-12-310000915913alb:JointVentureEurecatSAMember2022-12-310000915913alb:JointVentureFabricaCariocaDeCatalisadoresMember2024-12-310000915913alb:JointVentureFabricaCariocaDeCatalisadoresMember2023-12-310000915913alb:JointVentureFabricaCariocaDeCatalisadoresMember2022-12-310000915913alb:JointVentureWindfieldHoldingsMember2024-01-012024-12-310000915913alb:JointVentureWindfieldHoldingsMember2023-01-012023-12-310000915913alb:JointVentureWindfieldHoldingsMember2022-01-012022-12-310000915913alb:OtherJointVenturesMember2024-01-012024-12-310000915913alb:OtherJointVenturesMember2023-01-012023-12-310000915913alb:OtherJointVenturesMember2022-01-012022-12-310000915913alb:SignificantUnconsolidatedJointVenturesMember2024-12-310000915913alb:SignificantUnconsolidatedJointVenturesMember2023-12-310000915913alb:SignificantUnconsolidatedJointVenturesMember2024-01-012024-12-310000915913alb:SignificantUnconsolidatedJointVenturesMember2023-01-012023-12-310000915913alb:SignificantUnconsolidatedJointVenturesMember2022-01-012022-12-310000915913alb:SignificantUnconsolidatedJointVenturesMember2024-01-012024-12-310000915913alb:SignificantUnconsolidatedJointVenturesMember2023-01-012023-12-310000915913alb:SignificantUnconsolidatedJointVenturesMember2022-01-012022-12-310000915913alb:JointVentureWindfieldHoldingsMember2024-12-310000915913alb:JointVentureWindfieldHoldingsMember2023-12-310000915913alb:KemertonPlantMember2023-10-182023-10-180000915913alb:KemertonPlantMember2023-10-180000915913alb:MineralResourcesLimitedWodginaProjectMember2023-10-182023-10-180000915913alb:MineralResourcesLimitedMember2023-10-012023-12-3100009159132023-10-012023-12-3100009159132024-01-012024-01-310000915913us-gaap:OtherNonoperatingIncomeExpenseMember2024-01-012024-03-310000915913alb:JordanBromineCompanyLimitedMemberalb:JointVentureJordanBromineCompanyLimitedMember2024-12-310000915913alb:FineChemistryServicesMember2021-06-010000915913alb:FineChemistryServicesMember2023-06-012023-06-010000915913alb:FineChemistryServicesMember2024-12-310000915913alb:FineChemistryServicesMember2023-12-310000915913us-gaap:TrustForBenefitOfEmployeesMember2024-12-310000915913us-gaap:TrustForBenefitOfEmployeesMember2023-12-310000915913us-gaap:OperatingSegmentsMemberalb:EnergyStorageMember2022-12-310000915913us-gaap:OperatingSegmentsMemberalb:SpecialtiesMember2022-12-310000915913us-gaap:OperatingSegmentsMemberalb:KetjenMember2022-12-310000915913us-gaap:OperatingSegmentsMemberalb:EnergyStorageMember2023-01-012023-12-310000915913us-gaap:OperatingSegmentsMemberalb:SpecialtiesMember2023-01-012023-12-310000915913us-gaap:OperatingSegmentsMemberalb:KetjenMember2023-01-012023-12-310000915913us-gaap:OperatingSegmentsMemberalb:EnergyStorageMember2023-12-310000915913us-gaap:OperatingSegmentsMemberalb:SpecialtiesMember2023-12-310000915913us-gaap:OperatingSegmentsMemberalb:KetjenMember2023-12-310000915913us-gaap:OperatingSegmentsMemberalb:EnergyStorageMember2024-01-012024-12-310000915913us-gaap:OperatingSegmentsMemberalb:SpecialtiesMember2024-01-012024-12-310000915913us-gaap:OperatingSegmentsMemberalb:KetjenMember2024-01-012024-12-310000915913us-gaap:OperatingSegmentsMemberalb:EnergyStorageMember2024-12-310000915913us-gaap:OperatingSegmentsMemberalb:SpecialtiesMember2024-12-310000915913us-gaap:OperatingSegmentsMemberalb:KetjenMember2024-12-310000915913alb:MineralResourcesLimitedWodginaProjectMember2023-10-172023-10-170000915913alb:KetjenMember2024-12-310000915913alb:KetjenMember2023-12-310000915913alb:CustomerListsAndRelationshipsMember2022-12-310000915913us-gaap:TrademarksAndTradeNamesMember2022-12-310000915913alb:PatentsAndTechnologyMember2022-12-310000915913us-gaap:OtherIntangibleAssetsMember2022-12-310000915913alb:CustomerListsAndRelationshipsMember2023-01-012023-12-310000915913us-gaap:TrademarksAndTradeNamesMember2023-01-012023-12-310000915913alb:PatentsAndTechnologyMember2023-01-012023-12-310000915913us-gaap:OtherIntangibleAssetsMember2023-01-012023-12-310000915913alb:CustomerListsAndRelationshipsMember2023-12-310000915913us-gaap:TrademarksAndTradeNamesMember2023-12-310000915913alb:PatentsAndTechnologyMember2023-12-310000915913us-gaap:OtherIntangibleAssetsMember2023-12-310000915913alb:CustomerListsAndRelationshipsMember2024-01-012024-12-310000915913us-gaap:TrademarksAndTradeNamesMember2024-01-012024-12-310000915913alb:PatentsAndTechnologyMember2024-01-012024-12-310000915913us-gaap:OtherIntangibleAssetsMember2024-01-012024-12-310000915913alb:CustomerListsAndRelationshipsMember2024-12-310000915913us-gaap:TrademarksAndTradeNamesMember2024-12-310000915913alb:PatentsAndTechnologyMember2024-12-310000915913us-gaap:OtherIntangibleAssetsMember2024-12-310000915913alb:CustomerListsAndRelationshipsMembersrt:MinimumMember2024-12-310000915913alb:CustomerListsAndRelationshipsMembersrt:MaximumMember2024-12-310000915913alb:PatentsAndTechnologyMembersrt:MinimumMember2024-12-310000915913alb:PatentsAndTechnologyMembersrt:MaximumMember2024-12-310000915913us-gaap:OtherIntangibleAssetsMembersrt:MinimumMember2024-12-310000915913us-gaap:OtherIntangibleAssetsMembersrt:MaximumMember2024-12-310000915913alb:AmortizedusingthepatternofeconomicbenefitmethodMember2024-01-012024-12-310000915913alb:AmortizedusingthepatternofeconomicbenefitmethodMember2023-01-012023-12-310000915913alb:AmortizedusingthepatternofeconomicbenefitmethodMember2022-01-012022-12-310000915913alb:ConcentrationRiskThresholdPercentageMemberus-gaap:ProductConcentrationRiskMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2024-01-012024-12-310000915913alb:OnePointOneTwoFivePercentNoteMember2023-12-310000915913alb:OnePointOneTwoFivePercentNoteMember2024-12-310000915913alb:OnePointOneTwoFivePercentNoteMemberus-gaap:UnsecuredDebtMember2024-12-310000915913alb:OnePointOneTwoFivePercentNoteMemberus-gaap:UnsecuredDebtMember2023-12-310000915913alb:OnePointSixTwoFivePercentNotesMember2023-12-310000915913alb:OnePointSixTwoFivePercentNotesMember2024-12-310000915913alb:OnePointSixTwoFivePercentNotesMemberus-gaap:UnsecuredDebtMember2024-12-310000915913alb:OnePointSixTwoFivePercentNotesMemberus-gaap:UnsecuredDebtMember2023-12-310000915913alb:ThreePointFourFivePercentSeniorNotesMember2023-12-310000915913alb:ThreePointFourFivePercentSeniorNotesMember2024-12-310000915913alb:ThreePointFourFivePercentSeniorNotesMemberus-gaap:SeniorNotesMember2024-12-310000915913alb:ThreePointFourFivePercentSeniorNotesMemberus-gaap:SeniorNotesMember2023-12-310000915913alb:FourPointSixFivePercentSeniorNotesMember2023-12-310000915913alb:FourPointSixFivePercentSeniorNotesMemberus-gaap:SeniorNotesMember2024-12-310000915913alb:FourPointSixFivePercentSeniorNotesMemberus-gaap:SeniorNotesMember2023-12-310000915913alb:FivePointZeroFivePercentSeniorNotesMember2023-12-310000915913alb:FivePointZeroFivePercentSeniorNotesMemberus-gaap:SeniorNotesMember2024-12-310000915913alb:FivePointZeroFivePercentSeniorNotesMemberus-gaap:SeniorNotesMember2023-12-310000915913alb:FivePointFourFivePercentSeniorNotesMember2023-12-310000915913alb:FivePointFourFivePercentSeniorNotesMember2024-12-310000915913alb:FivePointFourFivePercentSeniorNotesMemberus-gaap:SeniorNotesMember2024-12-310000915913alb:FivePointFourFivePercentSeniorNotesMemberus-gaap:SeniorNotesMember2023-12-310000915913alb:FivePointSixFivePercentSeniorNotesMember2023-12-310000915913alb:FivePointSixFivePercentSeniorNotesMemberus-gaap:SeniorNotesMember2024-12-310000915913alb:FivePointSixFivePercentSeniorNotesMemberus-gaap:SeniorNotesMember2023-12-310000915913us-gaap:CommercialPaperMember2024-12-310000915913us-gaap:CommercialPaperMember2023-12-310000915913alb:InterestFreeLoanMember2024-12-310000915913alb:InterestFreeLoanMember2023-12-310000915913alb:VariablerateforeignbankloansMember2024-12-310000915913alb:VariablerateforeignbankloansMember2023-12-310000915913us-gaap:CapitalLeaseObligationsMember2024-12-310000915913us-gaap:CapitalLeaseObligationsMember2023-12-310000915913us-gaap:OtherDebtSecuritiesMember2024-12-310000915913us-gaap:OtherDebtSecuritiesMember2023-12-310000915913alb:FourPointSixFivePercentSeniorNotesMember2022-05-130000915913alb:FivePointZeroFivePercentSeniorNotesMember2022-05-130000915913alb:FivePointSixFivePercentSeniorNotesMember2022-05-130000915913alb:FourPointOneFivePercentSeniorNotesMember2014-11-240000915913us-gaap:InterestExpenseMember2022-01-012022-12-310000915913alb:OnePointOneTwoFivePercentNoteMember2019-11-250000915913alb:OnePointSixTwoFivePercentNotesMember2019-11-250000915913alb:ThreePointFourFivePercentSeniorNotesMember2019-11-250000915913alb:FivePointFourFivePercentSeniorNotesMember2014-11-240000915913us-gaap:InterestRateSwapMemberalb:JPMorganMember2014-01-220000915913alb:FourPointOneFivePercentSeniorNotesMember2014-01-220000915913us-gaap:InterestRateSwapMemberalb:JPMorganMember2014-10-152014-10-150000915913alb:A2022CreditAgreementMember2022-10-280000915913srt:MinimumMemberalb:A2022CreditAgreementMember2022-10-282022-10-280000915913srt:MaximumMemberalb:A2022CreditAgreementMember2022-10-282022-10-280000915913alb:A2022CreditAgreementMember2022-10-282022-10-280000915913alb:A2022CreditAgreementMember2024-01-012024-12-310000915913alb:A2022CreditAgreementMember2024-12-310000915913alb:CreditFacilitiesMember2024-10-012024-12-310000915913srt:ScenarioForecastMemberalb:CreditFacilitiesMember2025-01-012025-03-310000915913srt:ScenarioForecastMemberalb:CreditFacilitiesMember2025-04-012025-06-300000915913srt:ScenarioForecastMemberalb:CreditFacilitiesMember2025-07-012025-09-300000915913srt:ScenarioForecastMemberalb:CreditFacilitiesMember2025-10-012025-12-310000915913srt:ScenarioForecastMemberalb:CreditFacilitiesMember2026-01-012026-06-300000915913srt:ScenarioForecastMemberalb:CreditFacilitiesMember2026-07-012026-09-300000915913us-gaap:RevolvingCreditFacilityMember2024-12-310000915913srt:ScenarioForecastMemberalb:CreditFacilitiesMember2025-01-012025-06-300000915913srt:ScenarioForecastMemberalb:CreditFacilitiesMember2026-01-012026-03-310000915913us-gaap:CommercialPaperMembersrt:MaximumMember2023-05-170000915913us-gaap:CommercialPaperMembersrt:MaximumMember2024-01-012024-12-310000915913alb:ZeroPercentRateLoanMemberus-gaap:OtherDebtSecuritiesMember2023-06-300000915913us-gaap:LineOfCreditMember2024-12-310000915913us-gaap:LineOfCreditMember2023-12-310000915913country:USus-gaap:PensionPlansDefinedBenefitMember2023-12-310000915913us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000915913country:USus-gaap:PensionPlansDefinedBenefitMember2022-12-310000915913us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000915913country:USus-gaap:PensionPlansDefinedBenefitMember2024-01-012024-12-310000915913us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2024-01-012024-12-310000915913country:USus-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310000915913us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310000915913country:USus-gaap:PensionPlansDefinedBenefitMember2024-12-310000915913us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000915913us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000915913us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000915913us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-01-012024-12-310000915913us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-12-310000915913us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-12-310000915913country:USus-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310000915913us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310000915913country:USus-gaap:PensionPlansDefinedBenefitMember2021-01-012021-12-310000915913us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-01-012021-12-310000915913country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:SubsequentEventMember2025-01-012025-01-010000915913us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:SubsequentEventMember2025-01-012025-01-010000915913us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-01-012022-12-310000915913us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2024-12-310000915913us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2024-12-310000915913us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2024-12-310000915913us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2024-12-310000915913us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2024-12-310000915913us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2024-12-310000915913us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2024-12-310000915913us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2024-12-310000915913us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMember2024-12-310000915913us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMember2024-12-310000915913us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMember2024-12-310000915913us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMember2024-12-310000915913us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000915913us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashMember2024-12-310000915913us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashMember2024-12-310000915913us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashMember2024-12-310000915913us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashMember2024-12-310000915913us-gaap:PensionPlansDefinedBenefitMember2024-12-310000915913us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000915913us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000915913us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000915913us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2023-12-310000915913us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2023-12-310000915913us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2023-12-310000915913us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2023-12-310000915913us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2023-12-310000915913us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2023-12-310000915913us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2023-12-310000915913us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2023-12-310000915913us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMember2023-12-310000915913us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMember2023-12-310000915913us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMember2023-12-310000915913us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMember2023-12-310000915913us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000915913us-gaap:FairValueInputsLevel12And3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashMember2023-12-310000915913us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashMember2023-12-310000915913us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashMember2023-12-310000915913us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashMember2023-12-310000915913us-gaap:PensionPlansDefinedBenefitMember2023-12-310000915913us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000915913us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000915913us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000915913us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2024-12-310000915913us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMember2024-12-310000915913us-gaap:PensionPlansDefinedBenefitMemberalb:AbsoluteReturnMember2024-12-310000915913us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2024-01-012024-12-310000915913us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2023-01-012023-12-310000915913us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2022-01-012022-12-310000915913us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2024-12-310000915913us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2023-12-310000915913alb:A2004DefinedContributionPlanMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2024-01-012024-12-310000915913alb:A2004DefinedContributionPlanMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310000915913alb:A2004DefinedContributionPlanMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310000915913alb:EmployeeSavingsPlanMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2024-01-012024-12-310000915913alb:EmployeeSavingsPlanMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310000915913alb:EmployeeSavingsPlanMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310000915913alb:ConcentrationRiskThresholdPercentageMemberus-gaap:ProductConcentrationRiskMemberus-gaap:OtherNoncurrentLiabilitiesMember2024-01-012024-12-310000915913us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-12-3100009159132024-05-0900009159132024-05-100000915913alb:DepositarySharesMember2024-03-080000915913us-gaap:SeriesAPreferredStockMember2024-03-080000915913us-gaap:SeriesAPreferredStockMember2024-03-082024-03-080000915913us-gaap:SeriesAPreferredStockMember2024-06-012024-06-010000915913us-gaap:SeriesAPreferredStockMember2024-09-012024-09-010000915913us-gaap:SeriesAPreferredStockMember2024-12-012024-12-010000915913us-gaap:SeriesAPreferredStockMemberus-gaap:SubsequentEventMember2025-02-142025-02-140000915913us-gaap:SeriesAPreferredStockMembersrt:MinimumMember2024-03-080000915913us-gaap:SeriesAPreferredStockMembersrt:MaximumMember2024-03-080000915913us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2021-12-310000915913us-gaap:AccumulatedOtherComprehensiveIncomeLossDerivativeQualifyingAsHedgeExcludedComponentIncludingPortionAttributableToNoncontrollingInterestMember2021-12-310000915913us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2021-12-310000915913us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2022-01-012022-12-310000915913us-gaap:AccumulatedOtherComprehensiveIncomeLossDerivativeQualifyingAsHedgeExcludedComponentIncludingPortionAttributableToNoncontrollingInterestMember2022-01-012022-12-310000915913us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2022-01-012022-12-310000915913us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2022-12-310000915913us-gaap:AccumulatedOtherComprehensiveIncomeLossDerivativeQualifyingAsHedgeExcludedComponentIncludingPortionAttributableToNoncontrollingInterestMember2022-12-310000915913us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2022-12-310000915913us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-01-012023-12-310000915913us-gaap:AccumulatedOtherComprehensiveIncomeLossDerivativeQualifyingAsHedgeExcludedComponentIncludingPortionAttributableToNoncontrollingInterestMember2023-01-012023-12-310000915913us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2023-01-012023-12-310000915913us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-12-310000915913us-gaap:AccumulatedOtherComprehensiveIncomeLossDerivativeQualifyingAsHedgeExcludedComponentIncludingPortionAttributableToNoncontrollingInterestMember2023-12-310000915913us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2023-12-310000915913us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-01-012024-12-310000915913us-gaap:AccumulatedOtherComprehensiveIncomeLossDerivativeQualifyingAsHedgeExcludedComponentIncludingPortionAttributableToNoncontrollingInterestMember2024-01-012024-12-310000915913us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2024-01-012024-12-310000915913us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-12-310000915913us-gaap:AccumulatedOtherComprehensiveIncomeLossDerivativeQualifyingAsHedgeExcludedComponentIncludingPortionAttributableToNoncontrollingInterestMember2024-12-310000915913us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2024-12-310000915913alb:FourPointOneFivePercentSeniorNotesMemberus-gaap:SeniorNotesMember2022-12-310000915913alb:SecondHalf2024RestructuringMembersrt:MinimumMember2024-12-310000915913alb:SecondHalf2024RestructuringMembersrt:MaximumMember2024-12-310000915913us-gaap:CostOfSalesMemberalb:SecondHalf2024RestructuringMember2024-01-012024-12-310000915913alb:RestructuringChargesAndAssetWriteOffsMemberalb:SecondHalf2024RestructuringMember2024-01-012024-12-310000915913us-gaap:OtherNonoperatingIncomeExpenseMemberalb:SecondHalf2024RestructuringMember2024-01-012024-12-310000915913alb:SecondHalf2024RestructuringMembersrt:MinimumMembersrt:ScenarioForecastMember2025-01-012025-12-310000915913alb:SecondHalf2024RestructuringMembersrt:MaximumMembersrt:ScenarioForecastMember2025-01-012025-12-310000915913alb:RestructuringChargesAndAssetWriteOffsMemberalb:FirstHalf2024RestructuringMember2024-01-012024-12-310000915913us-gaap:OtherNonoperatingIncomeExpenseMemberalb:FirstHalf2024RestructuringMember2024-01-012024-12-310000915913alb:RestructuringChargesAndAssetWriteOffsMemberalb:A2023RestructuringMember2023-01-012023-12-310000915913alb:AssetWriteOffsMemberalb:FirstHalf2024RestructuringMember2024-01-012024-12-310000915913alb:SeveranceAndEmployeeBenefitsMemberalb:FirstHalf2024RestructuringMember2024-01-012024-12-310000915913us-gaap:ContractTerminationMemberalb:FirstHalf2024RestructuringMember2024-01-012024-12-310000915913us-gaap:OtherRestructuringMemberalb:FirstHalf2024RestructuringMember2024-01-012024-12-310000915913alb:FirstHalf2024RestructuringMember2024-01-012024-12-310000915913alb:AssetWriteOffsMemberalb:SecondHalf2024RestructuringMember2024-01-012024-12-310000915913alb:SeveranceAndEmployeeBenefitsMemberalb:SecondHalf2024RestructuringMember2024-01-012024-12-310000915913us-gaap:ContractTerminationMemberalb:SecondHalf2024RestructuringMember2024-01-012024-12-310000915913us-gaap:OtherRestructuringMemberalb:SecondHalf2024RestructuringMember2024-01-012024-12-310000915913alb:SecondHalf2024RestructuringMember2024-01-012024-12-310000915913alb:AssetWriteOffsMember2024-01-012024-12-310000915913alb:SeveranceAndEmployeeBenefitsMember2024-01-012024-12-310000915913us-gaap:ContractTerminationMember2024-01-012024-12-310000915913us-gaap:OtherRestructuringMember2024-01-012024-12-310000915913alb:SeveranceAndEmployeeBenefitsMemberalb:A2023RestructuringMember2023-12-310000915913alb:AssetWriteOffsMemberalb:FirstHalf2024RestructuringMember2023-12-310000915913alb:SeveranceAndEmployeeBenefitsMemberalb:FirstHalf2024RestructuringMember2023-12-310000915913us-gaap:ContractTerminationMemberalb:FirstHalf2024RestructuringMember2023-12-310000915913us-gaap:OtherRestructuringMemberalb:FirstHalf2024RestructuringMember2023-12-310000915913alb:FirstHalf2024RestructuringMember2023-12-310000915913alb:AssetWriteOffsMemberalb:FirstHalf2024RestructuringMember2024-12-310000915913alb:SeveranceAndEmployeeBenefitsMemberalb:FirstHalf2024RestructuringMember2024-12-310000915913us-gaap:ContractTerminationMemberalb:FirstHalf2024RestructuringMember2024-12-310000915913us-gaap:OtherRestructuringMemberalb:FirstHalf2024RestructuringMember2024-12-310000915913alb:FirstHalf2024RestructuringMember2024-12-310000915913alb:AssetWriteOffsMemberalb:SecondHalf2024RestructuringMember2023-12-310000915913alb:SeveranceAndEmployeeBenefitsMemberalb:SecondHalf2024RestructuringMember2023-12-310000915913us-gaap:ContractTerminationMemberalb:SecondHalf2024RestructuringMember2023-12-310000915913us-gaap:OtherRestructuringMemberalb:SecondHalf2024RestructuringMember2023-12-310000915913alb:SecondHalf2024RestructuringMember2023-12-310000915913alb:AssetWriteOffsMemberalb:SecondHalf2024RestructuringMember2024-12-310000915913alb:SeveranceAndEmployeeBenefitsMemberalb:SecondHalf2024RestructuringMember2024-12-310000915913us-gaap:ContractTerminationMemberalb:SecondHalf2024RestructuringMember2024-12-310000915913us-gaap:OtherRestructuringMemberalb:SecondHalf2024RestructuringMember2024-12-310000915913alb:SecondHalf2024RestructuringMember2024-12-310000915913us-gaap:AccruedLiabilitiesMember2024-12-310000915913us-gaap:OtherNoncurrentLiabilitiesMember2024-12-310000915913srt:MinimumMemberus-gaap:BuildingMember2024-12-310000915913srt:MaximumMemberus-gaap:BuildingMember2024-12-310000915913srt:MinimumMemberalb:NonrealestateMember2024-12-310000915913srt:MaximumMemberalb:NonrealestateMember2024-12-310000915913us-gaap:EmployeeStockOptionMember2024-01-012024-12-310000915913alb:RestrictedStockAndRestrictedStockUnitsMembersrt:MinimumMember2024-01-012024-12-310000915913alb:RestrictedStockAndRestrictedStockUnitsMembersrt:MaximumMember2024-01-012024-12-310000915913alb:PerformanceUnitAwardsMembersrt:MinimumMember2024-01-012024-12-310000915913alb:PerformanceUnitAwardsMembersrt:MaximumMember2024-01-012024-12-310000915913alb:FirstDistributionAfterAwardMeasurementPeriodMember2024-01-012024-12-310000915913alb:SecondDistributionAfterAwardMeasurementPeriodMember2024-01-012024-12-310000915913alb:StockIncentivePlanTwentySeventeenMembersrt:MaximumMember2024-12-310000915913alb:NonEmployeeDirectorsPlanMember2024-12-310000915913alb:NonEmployeeDirectorsPlanMembersrt:MaximumMember2024-01-012024-12-310000915913alb:StockIncentivePlanTwentySeventeenMember2024-12-310000915913us-gaap:EmployeeStockOptionMember2023-01-012023-12-310000915913us-gaap:EmployeeStockOptionMember2022-01-012022-12-310000915913us-gaap:EmployeeStockOptionMember2024-12-310000915913alb:PerformanceUnitAwardsMember2023-12-310000915913alb:PerformanceUnitAwardsMember2024-01-012024-12-310000915913alb:PerformanceUnitAwardsMember2024-12-310000915913alb:PerformanceUnitAwardsMember2023-01-012023-12-310000915913alb:PerformanceUnitAwardsMember2022-01-012022-12-310000915913alb:RestrictedStockAndRestrictedStockUnitsMember2023-12-310000915913alb:RestrictedStockAndRestrictedStockUnitsMember2024-01-012024-12-310000915913alb:RestrictedStockAndRestrictedStockUnitsMember2024-12-310000915913alb:RestrictedStockAndRestrictedStockUnitsMember2023-01-012023-12-310000915913alb:RestrictedStockAndRestrictedStockUnitsMember2022-01-012022-12-310000915913alb:ChineseEntityCurrentYearLossesMember2024-01-012024-12-310000915913alb:AustralianEntityCurrentYearLossesMember2024-01-012024-12-310000915913alb:ForeignChangesInExpectedProfitabilityMember2024-01-012024-12-310000915913alb:JordanBromineCompanyLimitedMember2024-01-012024-12-310000915913alb:JordanBromineCompanyLimitedMember2023-01-012023-12-310000915913alb:JordanBromineCompanyLimitedMember2022-01-012022-12-310000915913us-gaap:DomesticCountryMember2024-12-310000915913alb:TaxYears20252041Memberus-gaap:DomesticCountryMember2024-12-310000915913alb:IndefiniteLifeMemberus-gaap:DomesticCountryMember2024-12-310000915913us-gaap:ForeignCountryMember2024-12-310000915913alb:TaxYear2028Memberus-gaap:ForeignCountryMember2024-12-310000915913alb:TaxYear2029Memberus-gaap:ForeignCountryMember2024-12-310000915913alb:TaxYear2035Memberus-gaap:ForeignCountryMember2024-12-310000915913alb:TaxYear2036Memberus-gaap:ForeignCountryMember2024-12-310000915913alb:TaxYear2037Memberus-gaap:ForeignCountryMember2024-12-310000915913alb:IndefiniteLifeMemberus-gaap:ForeignCountryMember2024-12-310000915913us-gaap:StateAndLocalJurisdictionMember2024-12-310000915913us-gaap:RedeemablePreferredStockMember2024-01-012024-12-310000915913us-gaap:StockCompensationPlanMember2024-01-012024-12-310000915913us-gaap:StockCompensationPlanMember2023-01-012023-12-310000915913us-gaap:StockCompensationPlanMember2022-01-012022-12-310000915913us-gaap:RestrictedStockMember2024-12-310000915913srt:MaximumMember2016-11-300000915913us-gaap:ForwardContractsMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310000915913us-gaap:ForwardContractsMemberus-gaap:NondesignatedMember2024-12-310000915913us-gaap:ForwardContractsMemberus-gaap:NondesignatedMember2023-12-310000915913us-gaap:ForwardContractsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentAssetsMember2024-12-310000915913us-gaap:ForwardContractsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentAssetsMember2023-12-310000915913us-gaap:ForwardContractsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherAssetsMember2024-12-310000915913us-gaap:ForwardContractsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherAssetsMember2023-12-310000915913us-gaap:ForwardContractsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMember2024-12-310000915913us-gaap:ForwardContractsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMember2023-12-310000915913us-gaap:ForwardContractsMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-12-310000915913us-gaap:ForwardContractsMemberus-gaap:NondesignatedMemberus-gaap:OtherCurrentAssetsMember2024-12-310000915913us-gaap:ForwardContractsMemberus-gaap:NondesignatedMemberus-gaap:OtherCurrentAssetsMember2023-12-310000915913us-gaap:ForwardContractsMemberus-gaap:NondesignatedMemberus-gaap:AccruedLiabilitiesMember2024-12-310000915913us-gaap:ForwardContractsMemberus-gaap:NondesignatedMemberus-gaap:AccruedLiabilitiesMember2023-12-310000915913us-gaap:ForwardContractsMemberus-gaap:NondesignatedMemberus-gaap:OtherNoncurrentLiabilitiesMember2024-12-310000915913us-gaap:ForwardContractsMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-01-012024-12-310000915913us-gaap:ForwardContractsMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-12-310000915913us-gaap:ForwardContractsMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-12-310000915913us-gaap:ForwardContractsMemberus-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMember2024-01-012024-12-310000915913us-gaap:ForwardContractsMemberus-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMember2023-01-012023-12-310000915913us-gaap:ForwardContractsMemberus-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMember2022-01-012022-12-310000915913us-gaap:ForwardContractsMemberalb:OtherNetMember2024-01-012024-12-310000915913us-gaap:ForwardContractsMemberalb:OtherNetMember2023-01-012023-12-310000915913us-gaap:ForwardContractsMemberalb:OtherNetMember2022-01-012022-12-310000915913us-gaap:FairValueInputsLevel1Member2024-12-310000915913us-gaap:FairValueInputsLevel2Member2024-12-310000915913us-gaap:FairValueInputsLevel3Member2024-12-310000915913us-gaap:FairValueInputsLevel1Member2023-12-310000915913us-gaap:FairValueInputsLevel2Member2023-12-310000915913us-gaap:FairValueInputsLevel3Member2023-12-310000915913us-gaap:EquityMethodInvesteeMember2024-01-012024-12-310000915913us-gaap:EquityMethodInvesteeMember2023-01-012023-12-310000915913us-gaap:EquityMethodInvesteeMember2022-01-012022-12-310000915913us-gaap:EquityMethodInvesteeMember2024-12-310000915913us-gaap:EquityMethodInvesteeMember2023-12-310000915913us-gaap:OperatingSegmentsMember2024-01-012024-12-310000915913us-gaap:OperatingSegmentsMember2023-01-012023-12-310000915913us-gaap:OperatingSegmentsMemberalb:EnergyStorageMember2022-01-012022-12-310000915913us-gaap:OperatingSegmentsMemberalb:SpecialtiesMember2022-01-012022-12-310000915913us-gaap:OperatingSegmentsMemberalb:KetjenMember2022-01-012022-12-310000915913us-gaap:OperatingSegmentsMember2022-01-012022-12-310000915913us-gaap:CorporateNonSegmentMember2024-01-012024-12-310000915913us-gaap:CorporateNonSegmentMember2023-01-012023-12-310000915913us-gaap:CorporateNonSegmentMember2022-01-012022-12-310000915913srt:RevisionOfPriorPeriodErrorCorrectionAdjustmentMember2022-01-012022-12-310000915913us-gaap:OtherNonoperatingIncomeExpenseMember2023-01-012023-12-310000915913us-gaap:OtherNonoperatingIncomeExpenseMember2022-01-012022-12-310000915913us-gaap:CostOfSalesMember2024-01-012024-12-310000915913us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-01-012024-12-310000915913us-gaap:CostOfSalesMember2023-01-012023-12-310000915913us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-12-310000915913us-gaap:CostOfSalesMember2022-01-012022-12-310000915913us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310000915913us-gaap:SellingGeneralAndAdministrativeExpensesMemberalb:FinancialImprovementPlanMember2022-01-012022-12-310000915913us-gaap:OperatingSegmentsMember2024-12-310000915913us-gaap:OperatingSegmentsMember2023-12-310000915913us-gaap:OperatingSegmentsMember2022-12-310000915913us-gaap:CorporateNonSegmentMember2024-12-310000915913us-gaap:CorporateNonSegmentMember2023-12-310000915913us-gaap:CorporateNonSegmentMember2022-12-310000915913country:US2024-01-012024-12-310000915913country:US2023-01-012023-12-310000915913country:US2022-01-012022-12-310000915913country:KR2024-01-012024-12-310000915913country:KR2023-01-012023-12-310000915913country:KR2022-01-012022-12-310000915913country:CN2024-01-012024-12-310000915913country:CN2023-01-012023-12-310000915913country:CN2022-01-012022-12-310000915913country:JP2024-01-012024-12-310000915913country:JP2023-01-012023-12-310000915913country:JP2022-01-012022-12-310000915913alb:OtherForeignCountriesMember2024-01-012024-12-310000915913alb:OtherForeignCountriesMember2023-01-012023-12-310000915913alb:OtherForeignCountriesMember2022-01-012022-12-310000915913alb:EnergyStorageCustomerMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueSegmentMember2023-01-012023-12-310000915913alb:EnergyStorageCustomerMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueSegmentMember2022-01-012022-12-310000915913country:US2024-12-310000915913country:US2023-12-310000915913country:US2022-12-310000915913country:AU2024-12-310000915913country:AU2023-12-310000915913country:AU2022-12-310000915913country:CL2024-12-310000915913country:CL2023-12-310000915913country:CL2022-12-310000915913country:CN2024-12-310000915913country:CN2023-12-310000915913country:CN2022-12-310000915913country:JO2024-12-310000915913country:JO2023-12-310000915913country:JO2022-12-310000915913country:NL2024-12-310000915913country:NL2023-12-310000915913country:NL2022-12-310000915913country:DE2024-12-310000915913country:DE2023-12-310000915913country:DE2022-12-310000915913country:FR2024-12-310000915913country:FR2023-12-310000915913country:FR2022-12-310000915913country:BR2024-12-310000915913country:BR2023-12-310000915913country:BR2022-12-310000915913alb:OtherForeignCountriesMember2024-12-310000915913alb:OtherForeignCountriesMember2023-12-310000915913alb:OtherForeignCountriesMember2022-12-3100009159132024-10-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________

FORM 10-K

________________________________________

|

|

|

|

|

|

| ☒ |

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2024

or

|

|

|

|

|

|

☐ |

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission file number 001-12658

ALBEMARLE CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| Virginia |

|

54-1692118 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

4250 Congress Street, Suite 900

Charlotte, North Carolina 28209

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (980) - 299-5700

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| COMMON STOCK, $.01 Par Value |

|

ALB |

|

New York Stock Exchange |

| DEPOSITARY SHARES, each representing a 1/20th interest in a share of 7.25% Series A Mandatory Convertible Preferred Stock |

|

ALB PR A |

|

New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for at least the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

| Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☐ |

|

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity stock held by non-affiliates of the registrant was approximately $11.2 billion based on the last reported sale price of common stock on June 28, 2024, the last business day of the registrant’s most recently completed second quarter.

Number of shares of common stock outstanding as of February 5, 2025: 117,573,461

Documents Incorporated by Reference

Portions of Albemarle Corporation’s definitive Proxy Statement for its 2025 Annual Meeting of Shareholders to be filed with the U.S. Securities and Exchange Commission pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended, are incorporated by reference into Part III of this Annual Report on Form 10-K.

|

|

|

|

|

|

|

|

|

| Albemarle Corporation and Subsidiaries |

|

Index to Form 10-K

Year Ended December 31, 2024

|

|

|

|

|

|

|

|

|

| Albemarle Corporation and Subsidiaries |

|

PART I

Albemarle Corporation was incorporated in Virginia in 1993. Our principal executive offices are located at 4250 Congress Street, Suite 900, Charlotte, North Carolina 28209. Unless the context otherwise indicates, the terms “Albemarle,” “we,” “us,” “our” or “the Company” mean Albemarle Corporation and its consolidated subsidiaries.

Albemarle is a world leader in transforming essential resources into critical ingredients for mobility, energy, connectivity, and health. Our purpose is to enable a more resilient world. We partner to pioneer new ways to move, power, connect, and protect. The end markets we serve include grid storage, automotive, aerospace, conventional energy, electronics, construction, agriculture and food, pharmaceuticals and medical devices. We believe that our world-class resources with reliable and consistent supply, our leading process chemistry, high-impact innovation, customer centricity and focus on people and planet will enable us to maintain a leading position in the industries in which we operate.

We and our joint ventures currently operate more than 25 production and research and development (“R&D”) facilities, as well as a number of administrative and sales offices, around the world. As of December 31, 2024, we served approximately 1,900 customers in approximately 70 countries. For information regarding our unconsolidated joint ventures, see Note 8, “Investments,” to our consolidated financial statements included in Part II, Item 8 of this report.

Effective November 1, 2024, we transitioned our operating structure from two core global business units - Energy Storage and Specialties - to a fully integrated functional model designed to increase agility, deliver significant cost savings and maintain long-term competitiveness. In addition, our Ketjen business continues to be operated under a separate, wholly-owned subsidiary. We will continue to report results across three existing operating segments: Energy Storage, Specialties and Ketjen.

Business Segments

During 2024, we managed and reported our operations under three reportable segments: Energy Storage, Specialties and Ketjen. The segments are organized based on their similar markets, customers, economic characteristics and production processes. Financial results and discussion about our segments included in this report are organized according to these categories except where noted.

For financial information regarding our reportable segments and geographic area information, see Note 25, “Segment and Geographic Area Information,” to our consolidated financial statements included in Part II, Item 8 of this report.

Energy Storage Segment

Our Energy Storage business enables better lithium use through reliable supply and consistent quality. We develop and manufacture a broad range of basic lithium compounds, including lithium carbonate, lithium hydroxide, and lithium chloride. Lithium is a key component in products and processes used in a variety of applications and industries, which include lithium batteries used in consumer electronics and electric vehicles, power grids and solar panels, high performance greases, specialty glass used in consumer appliances and electronics, organic synthesis processes in the areas of steroid chemistry and vitamins, various life science applications, as well as intermediates in the pharmaceutical industry, among other applications.

In addition to developing and supplying lithium compounds, we provide technical services, including the handling and use of reactive lithium products. We also offer our customers recycling services for lithium-containing by-products resulting from synthesis with organolithium products, lithium metal and other reagents. We plan to continue to focus on the development of new products and applications.

Competition

The global lithium market is highly competitive and growing very rapidly. It is characterized by aggressive expansion and entry from existing and new players, including automotive OEMs, commodity traders, junior miners, and large, well-capitalized diversified miners. Producers are primarily located in the Americas, Africa, Asia and Australia. Major competitors in lithium compounds include Sociedad Quimica y Minera de Chile S.A., Sichuan Tianqi Lithium, Jiangxi Ganfeng Lithium, Rio Tinto plc, Pilbara Minerals, Arcadium Lithium, Tesla and a large number of additional Chinese companies. Competition in the global lithium market is increasingly based on index-based market pricing and differentiated via product quality, product diversity, reliability of supply and customer service.

|

|

|

|

|

|

|

|

|

| Albemarle Corporation and Subsidiaries |

|

Raw Materials and Significant Supply Sources

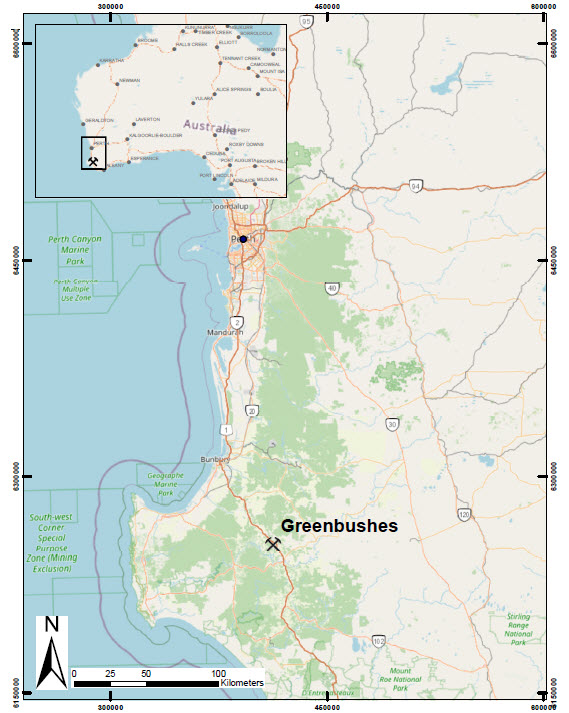

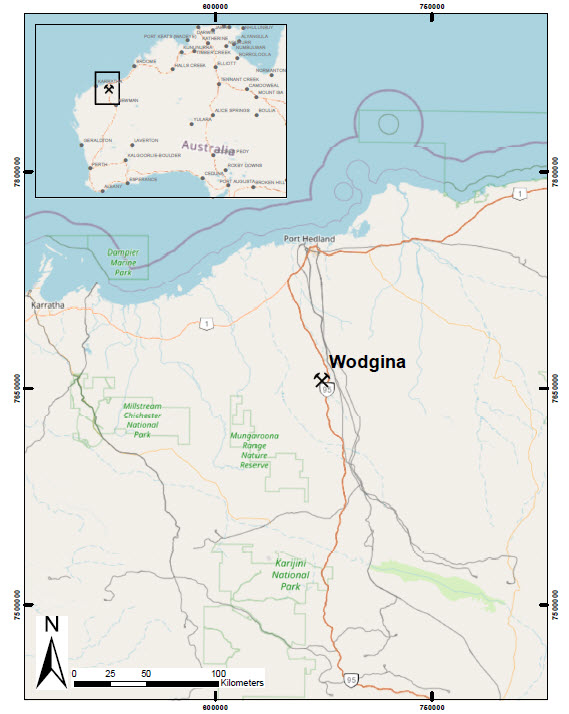

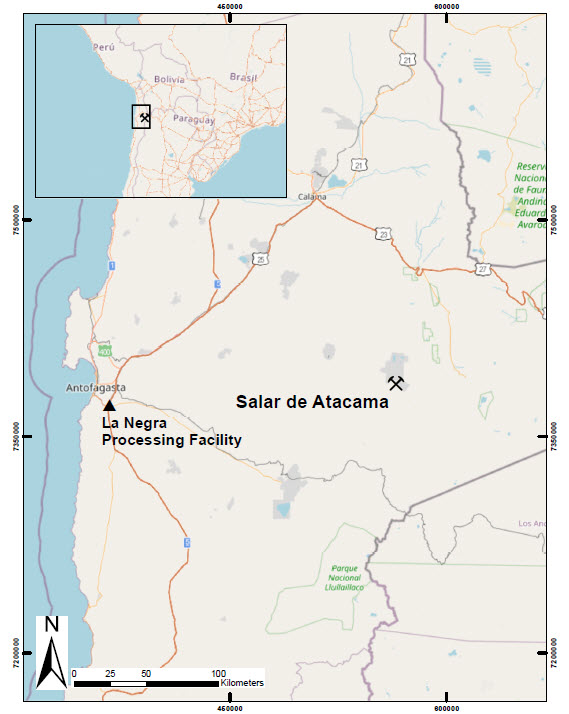

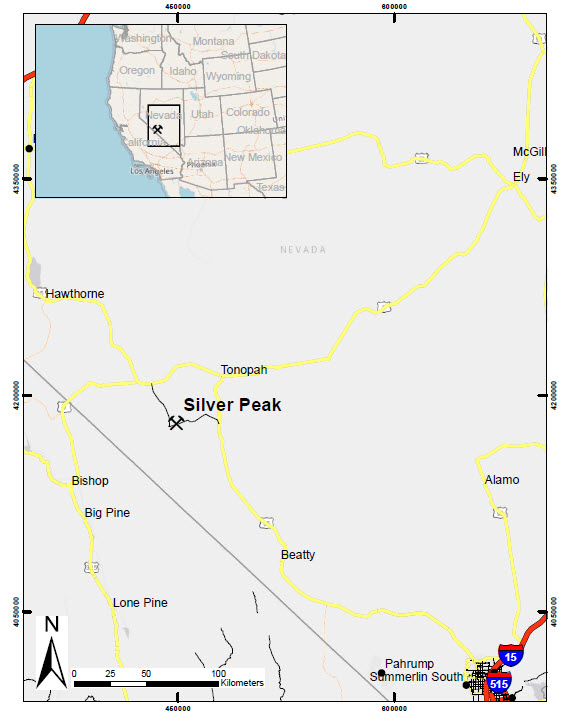

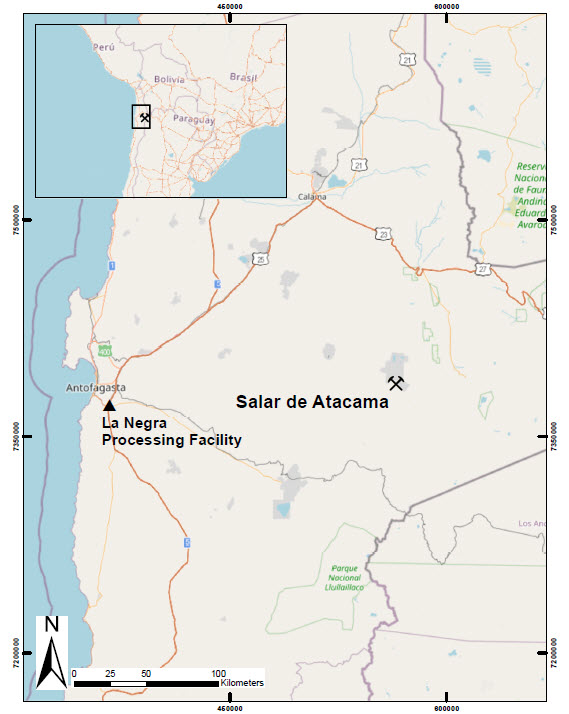

We obtain lithium: (a) by purchasing lithium concentrate from our 49%-owned joint venture, Windfield Holdings Pty. Ltd. (“Windfield”), which directly owns 100% of the equity of Talison Lithium Pty. Ltd., a company incorporated in Australia (“Talison”) that owns the Greenbushes mine, and from our 50%-owned unincorporated joint venture, MARBL Lithium Joint Venture (“MARBL”) in Western Australia, which owns the Wodgina hard rock lithium mine project (“Wodgina”); and (b) through solar evaporation of our ponds at the Salar de Atacama, in Chile, and in Silver Peak, Nevada. In addition, we hold mineral rights in defined areas of Kings Mountain, North Carolina with available lithium resources and we own undeveloped land with access to a lithium resource in Antofalla, within the Catamarca Province of Argentina. See Item 2. Properties, for additional disclosures of our lithium mineral properties.

Specialties Segment

Our Specialties business optimizes our portfolio of bromine and highly specialized lithium solutions. Our Specialties business serves a variety of industries, including energy, mobility, connectivity, and health. Specialty products are essential in both internal combustion and electric vehicles, from high-voltage cables and powertrains to airbags and tires. We enable digital innovation focused on safety and reliability, including fire safety compounds. Our fire safety technology enables the use of plastics in high performance, high heat applications by enhancing the flame resistant properties of these materials. End market products that benefit from our fire safety technology include plastic enclosures for consumer electronics, printed circuit boards, wire and cable products, electrical connectors, textiles and foam insulation. In energy, infrastructure for renewable grid and electrified transport is enabled by our fire safety solutions. In health, our lithium specialties products are precursors for many pharmaceuticals, while bromine specialties are used to help ensure safer food and water supplies. Other bromine-based specialty chemicals products include elemental bromine, alkyl bromides, inorganic bromides, brominated powdered activated carbon and a number of bromine fine chemicals. Our value-added lithium specialties products include butyllithium and lithium aluminum hydride. We also develop and manufacture cesium products for the chemical and pharmaceutical industries, and zirconium, barium and titanium products for various pyrotechnical applications, including airbag initiators. A number of customers of our Specialties business operate in cyclical industries, including the consumer electronics and oil field industries. As a result, demand from our customers in such industries is also cyclical.

Competition

Our Specialties business serves markets in the Americas, Asia, Europe and the Middle East, each of which is highly competitive. Product performance and quality, price and contract terms are the primary factors in determining which qualified supplier is awarded a contract. R&D, product and process improvements, specialized customer services, the ability to attract and retain skilled personnel and maintenance of a good safety record have also been important factors to compete effectively in the marketplace. Our most significant competitors are Lanxess AG, Israel Chemicals Ltd and Arcadium Lithium, as well as producers in India and China.

Raw Materials and Significant Supply Sources

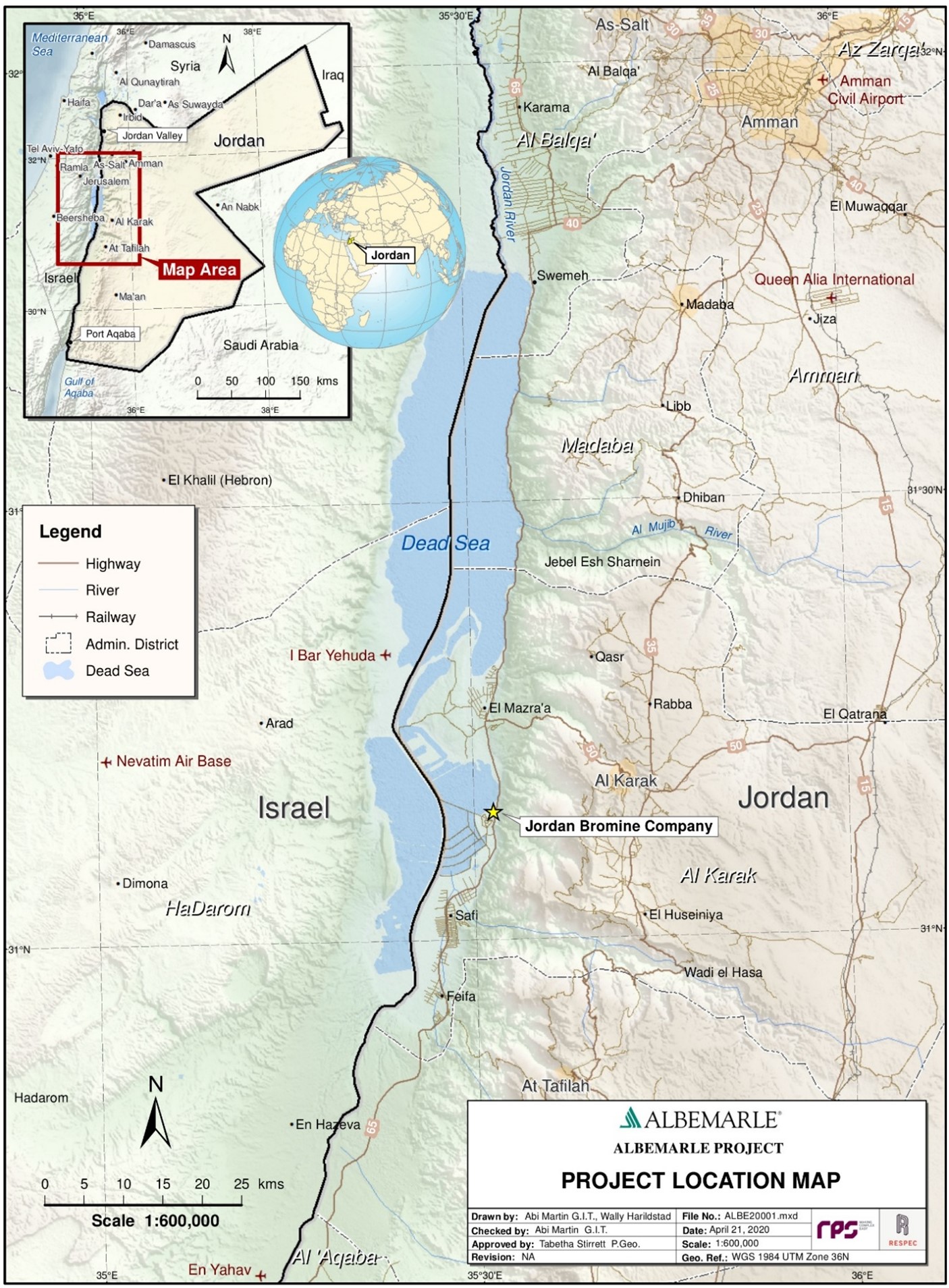

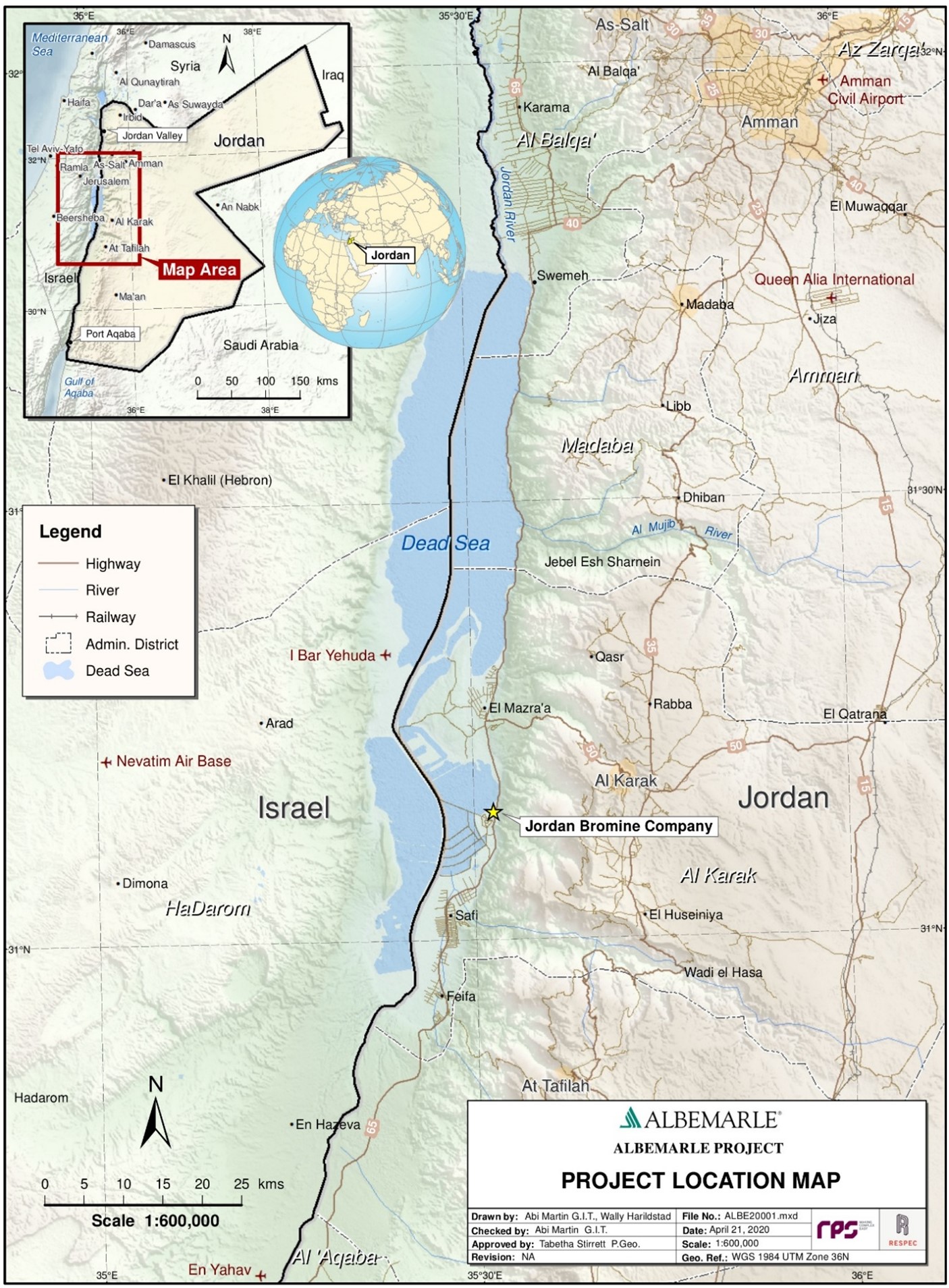

The bromine we use is originally sourced from two locations: Arkansas and the Dead Sea. Our bromine production operations in Arkansas are supported by an active brine rights leasing program. In addition, through our 50% interest in Jordan Bromine Company Limited (“JBC”), a consolidated joint venture established in 1999 with operations in Safi, Jordan, we acquire bromine that is originally sourced from the Dead Sea. JBC processes the bromine at its facilities into a variety of end products. See Item 2. Properties, for additional disclosures for our mineral properties. The lithium concentrate used in our lithium specialties products are originally sourced from the same sources as the Energy Storage lithium concentrate noted above.

Ketjen Segment

Our three main product lines in this segment are (i) Clean Fuels Technologies (“CFT”), which is primarily composed of hydroprocessing catalysts (“HPC”) together with isomerization and alkylation catalysts; (ii) fluidized catalytic cracking (“FCC”) catalysts and additives; and (iii) performance catalyst solutions (“PCS”), which is primarily composed of organometallics and curatives.

We offer a wide range of HPC products, which are applied throughout the oil refining industry. Their application enables the upgrading of oil fractions to clean fuels and other usable oil feedstocks and products by removing sulfur, nitrogen and other impurities from the feedstock. In addition, they improve product properties by adding hydrogen and in some cases improve the performance of downstream catalysts and processes. We continuously seek to add more value to refinery operations by offering HPC products that meet our customers’ requirements for profitability and performance in the very demanding refining market.

|

|

|

|

|

|

|

|

|

| Albemarle Corporation and Subsidiaries |

|

We provide our customers with customized FCC catalyst systems, which assist in the high yield cracking of refinery petroleum streams into derivative, higher-value products such as transportation fuels and petrochemical feedstocks like propylene. Our FCC additives are used to reduce emissions of sulfur dioxide and nitrogen oxide in FCC units and to increase liquefied petroleum gas olefins yield, such as propylene, and to boost octane in gasoline. Ketjen offers unique refinery catalysts to crack and treat the lightest to the heaviest feedstocks while meeting refinery yield and product needs.

Within our PCS product line, we manufacture organometallic co-catalysts (e.g., aluminum, magnesium, and zinc alkyls) used in the manufacture of alpha-olefins (e.g., hexene, octene, decene), polyolefins (e.g., polyethylene and polypropylene), and electronics. Our curatives include a range of curing agents used in polyurethanes, epoxies and other engineered resins.

There were more than 700 refineries world-wide as of December 31, 2024. We expect to continue to see some less profitable, typically smaller, refineries shutting down and, over the long-term, being replaced by larger scale and more complex refineries, with growth concentrated in the Middle East, India and South-East Asia. Advances in sustainable aviation fuels, petroleum products and renewable diesel are expected to continue. We estimate that there are currently approximately 600 FCC units being operated globally, each of which requires a constant supply of FCC catalysts. In addition, we estimate that there are approximately 4,000 HPC units being operated globally, each of which typically requires replacement HPC catalysts once every one to four years.

Competition

Our Ketjen segment serves the global market including the Americas, Asia, Europe and the Middle East, each of which is highly competitive. Competition in these markets is driven by a variety of factors. Product performance, quality, price, contract terms, product and process improvements, specialized customer services, the ability to attract and retain skilled technical support, and the maintenance of a good safety record are the primary factors to compete effectively in the catalysts marketplace. In addition, through our research and development programs, we strive to differentiate our business by developing value-added products based on proprietary technologies.

Our major competitors in the CFT catalysts market include Shell Catalysts & Technologies, Advanced Refining Technologies and Haldor Topsoe. Our major competitors in the FCC catalysts market include W.R. Grace & Co. and BASF Corporation. In the PCS market, our major competitors include Nouryon, Lanxess AG and Arxada.

Raw Materials and Significant Supply Sources

The major raw materials we use in our Ketjen operations include sodium silicate, sodium aluminate, kaolin, aluminum, ethylene, alpha-olefins, isobutylene, toluene and metals, such as lanthanum, molybdenum, nickel and cobalt, most of which are readily available from numerous independent suppliers and are purchased or provided under contracts at prices we believe are competitive. The cost of raw materials is generally based on market prices, although we may use contracts with price caps or other tools, as appropriate, to mitigate price volatility.

Human Capital

Our main human capital management objectives are to attract, retain and develop the highest quality talent and ensure they feel safe, supported and empowered to do the best work they can do. We believe providing an inclusive workplace facilitates opportunities for innovation, fosters good decision-making practices, and promotes employee engagement and high productivity across our organization.

As of December 31, 2024, we had approximately 8,300 employees, including employees of our consolidated joint ventures, of whom 3,300, or 39%, are employed in the U.S. and the Americas; 2,900, or 35%, are employed in Asia Pacific; 1,500, or 19%, are employed in Europe; and 600, or 7%, are employed in the Middle East or other areas. Approximately 28% of these employees are represented by unions or works councils. We strive to foster positive relationships with our employees and their representatives.

Health and Safety

The health and safety of our employees is a part of our core values at Albemarle and is integral to how we conduct business. Our employees, contractors, and visitors are instructed to follow a comprehensive set of written health and safety policies and procedures at both corporate and local sites. Our internal incident and issues management system gives all employees the ability to report incidents anonymously without fear of retaliation, and allow us to be more proactive in developing safety programs that address at-risk conditions or behaviors, which could lead to an incident. We routinely audit ourselves against our policies, procedures and standards, using internal and third-party resources. We also include health and safety metrics in our annual incentive plan to further incentivize our employees’ commitment to safety. In 2024, we maintained our Occupational Safety and Health Act (“OSHA”) occupational injury and illness incident rate of 0.13 for our employees and nested contractors, compared to 0.14 in 2023.

|

|

|

|

|

|

|

|

|

| Albemarle Corporation and Subsidiaries |

|

In addition, we provide all employees and their dependents with access to our Employee Assistance Program, which provides free mental and behavioral health resources.

Talent and Culture

Investing in talent is a critical process for Albemarle because it allows us to be proactive and anticipate key organizational needs for talent and capabilities. This enables us to efficiently and effectively ensure that we have the right talent pipeline to drive Albemarle’s success into the future. We also provide leadership development through performance coaching, comprehensive feedback, plant training including health, safety and environmental topics, and experiential development and mentoring. Our leadership development is a cornerstone to our talent management strategy. We also invest in our people through enhanced training and development opportunities and by seeking to foster an equitable workplace and an inclusive culture that enables employees to feel a sense of belonging and reach their full potential.

It is important for us to have a workforce of highly engaged employees who understand how their work connects to Albemarle’s purpose and values. We have measured employee engagement through an empowerment survey, which tracks job satisfaction and how likely an employee is to recommend Albemarle to people they know. In addition, we are committed to empowering and supporting the next generation of talent in their career development by engaging in various initiatives to attract people from all backgrounds to our internship, co-op and rotational development programs.

Our incentive program is designed to provide incentives and rewards for achieving Albemarle’s annual goals and objectives. The Executive Compensation and Talent Development Committee of the Board has the overall responsibility of evaluating the performance of the CEO and approving the compensation structure for senior management and other key employees. The Executive Compensation and Talent Development Committee determines performance goals under our incentive program annually to ensure our executive officers execute on short-term financial and strategic initiatives that drive our business strategy and long-term shareholder value.

We develop holistic inclusion and belonging initiatives to foster a values-driven workplace where all individuals feel a sense of belonging as they grow in their professions. We continue to pursue strategies and partnerships to attract highly qualified applicants from all backgrounds, offer cross-cultural learning sessions for our employees, and assess promotion, retention, and turnover data to identify potential opportunities for greater inclusion efforts.

We seek to provide employees with a desirable workplace that will enable us to attract and retain top talent. We believe employees should be fairly compensated through wages and benefits, based on experience, expertise, performance, and the criticality of their roles in the Company. We also perform an annual review of our pay practices to ensure that they are fair and equitable. In addition, we have established employee resource groups, known as Connect groups, to promote an atmosphere of inclusion and encouragement in which every employee’s voice can be heard. These Connect groups provide opportunities for employees to share their backgrounds and experiences, and to use them to benefit others through mentoring and volunteering in the local community, among other activities.

Human Rights

Albemarle is guided by its Code of Conduct, which sets forth the high ethical standards we have for all employees and encourages a ‘Speak Up’ culture. We understand our responsibility to uphold the human rights of our employees, workers in our supply chain, members of our communities and other stakeholders. We recognize the human rights of our stakeholders as expressed in the International Bill of Human Rights and the International Labor Organization’s (ILO) Declaration on Fundamental Principles and Rights at Work. We acknowledge the human rights of Indigenous Peoples in culturally sensitive locations, such as Chile and Western Australia, where our sites are located on Indigenous Peoples’ lands through clear policy commitments, due diligence initiatives, formal community agreements and accessible grievance mechanisms for reporting concerns.

Albemarle offers multiple avenues for employees and stakeholders to raise concerns. We maintain internal investigation standards to thoroughly review and address concerns that may arise. We take measures to maintain confidentiality, protect the integrity of all investigations, and prevent retaliation against those who speak up in good faith. In conducting investigations, we are committed to the U.N. Guiding Principles on Business and Human Rights.

Sales, Marketing and Distribution

We have an international strategic account program that uses cross-functional teams to serve large global customers. This program emphasizes creative strategies to improve and strengthen strategic customer relationships with emphasis on creating value for customers and promoting post-sale service.

|

|

|

|

|

|

|

|

|

| Albemarle Corporation and Subsidiaries |

|

Complementing this program are regional Albemarle sales and technical personnel who serve our global customer base. We also utilize sales representatives and specialists in specific market areas when necessary or required by law.

Research and Development

We believe that in order to generate revenue growth, maintain our margins and remain competitive, we must continually invest in research and development, product and process improvements and specialized customer services. Our research and development efforts support each of our business segments. The objective of our research and development efforts is to develop innovative chemistries and technologies with applications relevant within targeted key markets through both process and new product development. Through research and development, we continue to seek increased margins by introducing value-added products and proprietary processes and innovative green chemistry technologies. Our green chemistry efforts focus on the development of products in a manner that minimizes waste and the use of raw materials and energy, avoids the use of toxic reagents and solvents and utilizes safe, environmentally friendly manufacturing processes. Green chemistry is encouraged with our researchers through periodic focus group discussions and special rewards and recognition for outstanding new green developments.

Intellectual Property

Our intellectual property, including our patents, licenses and trade names, is an important component of our business. As of December 31, 2024, we owned more than 1,650 active patents and more than 400 pending patent applications in key strategic markets worldwide. We also have acquired rights under patents and inventions of others through licenses, and we license certain patents and inventions to third parties. The Company believes the duration of its intellectual property rights is adequate relative to the expected lives of its products and services.

Regulation

Our business is subject to a broad array of employee health and safety laws and regulations, including those under the OSHA. We also are subject to similar state laws and regulations as well as local laws and regulations for our non-U.S. operations. We devote significant resources and have developed and implemented comprehensive programs to promote the health and safety of our employees, and we maintain an active health, safety and environmental program. We finished 2024 with an OSHA occupational injury and illness incident rate of 0.13 for Albemarle employees and nested contractors, compared to 0.14 in 2023.

Our business and our customers are subject to significant requirements under the European Community Regulation for the Registration, Evaluation, Authorization and Restriction of Chemicals (“REACH”). REACH imposes obligations on European Union manufacturers and importers of chemicals and other products into the European Union to compile and file comprehensive reports, including testing data, on each chemical substance, and perform chemical safety assessments. Additionally, substances of high concern, as defined under REACH, are subject to an authorization process. Authorization may result in restrictions in the use of products by application or even banning the product. REACH regulations impose significant additional responsibilities on chemical producers, importers, downstream users of chemical substances and preparations, and the entire supply chain. Our significant manufacturing presence and sales activities in the European Union require significant compliance costs and may result in increases in the costs of raw materials we purchase and the products we sell. Increases in the costs of our products could result in a decrease in their overall demand; additionally, customers may seek products with lower regulatory compliance requirements, which could also result in a decrease in the demand of certain products subject to the REACH regulations.

The Toxic Substances Control Act (“TSCA”), as amended in June 2016, requires chemicals to be assessed against a risk-based safety standard and calls for the elimination of unreasonable risks identified during risk evaluation. This regulation and other pending initiatives at the U.S. state level, as well as initiatives in Canada, Asia and other regions, will potentially require toxicological testing and risk assessments of a wide variety of chemicals, including chemicals used or produced by us. These assessments may result in heightened concerns about the chemicals involved and additional requirements being placed on the production, handling, labeling or use of the subject chemicals. Such concerns and additional requirements could also increase the cost incurred by our customers to use our chemical products and otherwise limit the use of these products, which could lead to a decrease in demand for these products.

Historically, there has been scrutiny of certain brominated fire safety solutions by regulatory authorities, legislative bodies and environmental interest groups in various countries. We manufacture a broad range of brominated fire safety solution products, which are used in a variety of applications. Concern about the impact of some of our products on human health or the environment may lead to regulation or reaction in our markets independent of regulation.

|

|

|

|

|

|

|

|

|

| Albemarle Corporation and Subsidiaries |

|

Environmental Regulation

We are subject to numerous foreign, federal, state and local environmental laws and regulations, including those governing the discharge of pollutants into the air and water, the management and disposal of hazardous substances and wastes and the cleanup of contaminated properties. Ongoing compliance with such laws and regulations is an important consideration for us. Key aspects of our operations are subject to these laws and regulations. In addition, we incur substantial capital and operating costs in our efforts to comply with them.