1 AMENDED AND RESTATED ARTICLES OF ASSOCIATION OF FLAGSTAR BANK, NATIONAL ASSOCIATION FIRST. The title of this association shall be Flagstar Bank, National Association.. SECOND. The main office of the association shall be located in Hicksville in the County of Nassau and State of New York. The general business of the association shall be conducted at its main office and its branches. THIRD. The board of directors of this association shall consist of not less than five nor more than twenty-five persons, unless the OCC has exempted the bank from the 25-member limit. The exact number is to be fixed and determined from time to time by resolution of a majority of the full board of directors or by resolution of a majority of the shareholders at any annual or special meeting thereof. Each director shall own common or preferred stock of the association or of a holding company owning the association, with either an aggregate par, fair market, or equity value of $1,000. Determination of these values may be based as of either (i) the date of purchase, or (ii) the date the person became a director, whichever value is greater. Any combination of common or preferred stock of the association or holding company may be used. Any vacancy in the board of directors may be filled by the shareholders or by action of a majority of the remaining directors between meetings of shareholders. The directors, other than those who may be elected by the holders of any class or series of preferred stock, shall be elected annually for terms of one year and will hold office until the next succeeding annual meeting of shareholders. Despite the expiration of a director’s term, the director shall continue to serve until his or her successor is elected and qualifies or until there is a decrease in the number of directors and his or her position is eliminated. FOURTH. There shall be an annual meeting of the shareholders to elect directors and transact whatever other business may be brought before the meeting. It shall be held at the main office or any other convenient place the board of directors may designate, on the day of each year specified therefore in the bylaws or by the board. In the absence of such designation, the annual meeting of shareholders shall be held on the last Tuesday during the month of May of each year or, if that day falls on a legal holiday in the state in which the association is located, on the next following banking day. If no election is held on the day fixed or in the event of a legal holiday on the following banking day, an election may be held on any subsequent day within 60 days of the day fixed, to be designated by the board of directors, or, if the directors fail to fix the day, by shareholders representing two-thirds of the shares issued and outstanding. A national bank must mail shareholders notice of the time, place, and purpose of all shareholders’ meetings at least 10 days prior to the meeting by first class mail, unless the OCC determines that an emergency circumstance exists. No action required to be taken or which may be taken at any annual or special meeting of shareholders may be taken without a meeting, and the power of shareholders to consent, without a meeting, to the taking of any action is specifically denied.

2 In all elections of directors, each holder of common stock shall have the right to vote, in person or by proxy, each share of common stock owned by the holder for as many persons as there are directorships to be voted. There will be no right of cumulative voting for the election of directors. On all other questions, each holder of common stock shall be entitled to one vote for each share of common stock owned. A director may resign at any time by delivering written notice to the board of directors, its chairperson, or to the association, which resignation shall be effective when the notice is delivered unless the notice specifies a later effective date. Subject to the rights of the holders of any series of preferred stock then outstanding, any director, or the entire board of directors, may be removed from office at any time, with or without cause, by the affirmative vote of the holders of a majority of shares then entitled to vote at an election of directors FIFTH. The authorized amount of capital stock of this association shall be 916,666,666 shares of common stock of the par value of one cent ($0.01) each (the “Common Stock”); and 5,000,000 shares of preferred stock of the par value of one cent ($0.01) each (the “Preferred Stock”); but said capital stock may be increased or decreased from time to time, according to the provisions of the laws of the United States. The board of directors is expressly vested with the authority to (i) approve the issuance of shares of Common Stock and determine the timing, manner or terms of such issuance, (ii) approve the repurchase of any shares of Common Stock, determine the timing, manner or terms of any such repurchase or establish the methodology for determining any such timing, manner or terms, including by means of one or more share repurchase programs or plans, and determine whether any such repurchased shares shall be held by the association as treasury shares or shall be retired and the consequences thereof, and (iii) declare and pay dividends upon shares of Common Stock out of its undivided profits or, subject to the National Bank Act and the approval of the Office of the Comptroller of Currency, out of its permanent capital accounts. The board of directors is authorized, subject to any limitations prescribed by law, to provide for the issuance of the shares of Preferred Stock in series. As to any series of Preferred Stock, the board of directors is authorized to determine the number of shares constituting such series, and to increase or decrease (but not below the number of shares of such series then outstanding) the number of shares of that series. The board of directors is expressly vested with the authority to determine, with respect to any class of Preferred Stock, the dividend rights (including rights as to cumulative, noncumulative or partially cumulative dividends) and preferences, dividend rate, conversion rights, voting rights, rights and terms of redemption (including sinking fund provisions), redemption price or prices, and the liquidation preferences. The board of directors is expressly vested with the authority to approve the repurchase or redemptions of shares of any class or series of Preferred Stock, and determine the timing, manner or terms of any such repurchase or redemption or establish the methodology for determining any such timing, manner or terms, including by means of one or more share repurchase programs or

3 plans, and determine whether any such shares shall be held by the Association as treasury shares or shall be retired and the consequences thereof. The board of directors is expressly vested with the authority, subject to Article FIFTH in these Articles of Association, to declare and pay dividends upon shares of Preferred Stock out of its undivided profits or, subject to the National Bank Act and the approval of the Office of the Comptroller of the Currency, out of its permanent capital accounts. No holder of shares of the capital stock of any class of the association shall have any preemptive or preferential right of subscription to any shares of any class of stock of the association, whether now or hereafter authorized, or to any obligations convertible into stock of the association, issued, or sold, nor any right of subscription to any thereof other than such, if any, as the board of directors, in its discretion may from time to time determine and at such price as the board of directors may from time to time fix. Preemptive rights also must be approved by a vote of holders of two-thirds of the bank’s outstanding voting shares. A. Series A Preferred Stock 1. Designation and Number, Issue Date. The series will be designated the “Fixed-to- Floating Rate Series A Noncumulative Perpetual Preferred Stock” (hereinafter called the “Series A Preferred Stock”) and will initially consist of 575,000 shares. The number of shares constituting the Series A Preferred Stock may be increased from time to time by resolution of the board of directors (or a duly authorized committee of the board of directors), without the vote or consent of the holders of the Series A Preferred Stock in accordance with law up to the maximum number of shares of Preferred Stock authorized to be issued under the Articles of Association of the association, as amended, less all shares at the time authorized of any other series of Preferred Stock. Shares of the Series A Preferred Stock will be dated the date of issue. If the number of shares constituting the Series A Preferred Stock is increased, such additional shares will be issued only if they are fungible with the initial 575,000 shares for tax purposes. Shares of the Series A Preferred Stock outstanding that are redeemed, purchased or otherwise acquired by the association shall, after such redemption, purchase or acquisition, be cancelled and shall revert to authorized but unissued shares of preferred stock undesignated as to series until such shares are once more designated as part of a particular series by the board of directors. 2. Definitions. As used in this Article Fifth, Section A with respect to the Series A Preferred Stock: “Appropriate Federal Banking Agency” means the “appropriate federal banking agency” with respect to the association as defined in Section 3(q) of the Federal Deposit Insurance Act (12 U.S.C. § 1813(q)), or any successor provision. “Articles of Association” means these Amended and Restated Articles of Association, as may be further amended from time to time. “Board of Directors” means the board of directors of the association.

4 “Business Day” means each weekday on which banking institutions in New York, New York are not authorized or obligated by law, regulation or executive order to close. “Bylaws” means the Amended and Restated Bylaws of the association, as may be amended from time to time. “Calculation Agent” means, at any time, the person or entity appointed by the association and serving as such agent at such time. “Common Stock” means the common stock, par value $0.01 per share, of the association. “Dividend Parity Stock” has the meaning specified in Article Fifth, Section A.3(b). “Dividend Payment Date” means (i) each March 17, June 17, September 17 and December 17, commencing June 17, 2017, to and including March 17, 2027 and (ii) each March 17, June 17, September 17 and December 17, commencing June 17, 2027; provided, however, that (x) if any such date on or before March 17, 2027 is not a Business Day, then such date shall nevertheless be a Dividend Payment Date but dividends on the Series A Preferred Stock, when, as and if declared, shall be paid on the next succeeding Business Day (without adjustment in the amount of the dividend per share of the Series A Preferred Stock), and (y) if any such date after March 17, 2027 is not a Business Day, then the next succeeding Business Day shall be the applicable Dividend Payment Date and dividends, when, as and if declared, shall be paid on such next succeeding Business Day. However, if the postponement would cause the day to fall in the next calendar month during a floating rate period, the dividend payment date will instead be brought forward to the immediately preceding business day. Each Dividend Payment Date “relates” to the Dividend Period most recently ending before such Dividend Payment Date, and vice versa (with the words “related” and “relating” of having correlative meanings). “Dividend Period” means each period from and including a Dividend Payment Date (except that the initial Dividend Period shall commence on and include the Original Issue Date) and continuing to but not including the next succeeding Dividend Payment Date. “Dividend Record Date” has the meaning specified in Article Fifth, Section A.3(a). “Fixed Rate Period” means each Dividend Period relating to a Dividend Payment Date on or before March 17, 2027. “Floating Rate Period” means each Dividend Period relating to a Dividend Payment Date after March 17, 2027. “Junior Stock” means the Common Stock and any other class or series of stock of the association (other than the Series A Preferred Stock) that ranks junior to the Series A Preferred Stock either or both as to the payment of dividends and/or as to the distribution of assets on any liquidation, dissolution or winding up of the association. “Liquidation Preference” has the meaning specified in Article Fifth, Section A.4(b).

5 “London Banking Day” means any day on which commercial banks are open for general business (including dealings in deposits in U.S. dollars) in London, England. “Nonpayment Event” has the meaning specified in Article Fifth, Section A.6(b). “Original Issue Date” means the first date on which any share of the Series A Preferred Stock is issued and outstanding. “Preferred Stock” means any and all series of Preferred Stock, having a par value of $0.01 per share, of the association, including the Series A Preferred Stock. “Preferred Stock Director” has the meaning specified in Article Fifth, Section A.6(b). “Regulatory Capital Treatment Event” means the good faith determination by the association that, as a result of (i) any amendment to, or change in, the laws, rules or regulations of the United States (including, for the avoidance of doubt, any agency or instrumentality of the United States, including the Office of the Comptroller of the Currency and other federal bank regulatory agencies) or any political subdivision of or in the United States that is enacted or becomes effective after the initial issuance of any share of the Series A Preferred Stock, (ii) any proposed change in those laws, rules or regulations that is announced or becomes effective after the initial issuance of any share of the Series A Preferred Stock, or (iii) any official administrative decision or judicial decision or administrative action or other official pronouncement interpreting or applying those laws, rules or regulations or policies with respect thereto that is announced after the initial issuance of any share of the Series A Preferred Stock, there is more than an insubstantial risk that the association will not be entitled to treat the full liquidation preference amount of $1,000 per share of the Series A Preferred Stock then outstanding as “tier 1 capital” (or its equivalent) for purposes of the capital adequacy rules of the Office of the comptroller of the Currency (or, as and if applicable, the capital adequacy rules or regulations of any successor Appropriate Federal Banking Agency) as then in effect and applicable, for so long as any share of the Series A Preferred Stock is outstanding. “Series A Liquidation Amount” has the meaning specified in Article Fifth, Section A.4(a). “Three-month Term SOFR” means, with respect to any Floating Rate Period, the CME Term SOFR Reference Rate published for the three-month tenor as administered by CME Group Benchmark Administration, Ltd. (or any successor administrator thereof), as that rate is published as of 11:00 A.M., London time, on the second London Banking Day immediately preceding the first day of such Floating Rate Period, plus a tenor spread adjustment of 0.26161 percent. “Voting Preferred Stock” means, with regard to any election or removal of a Preferred Stock Director or any other matter as to which the holders of the Series A Preferred Stock are entitled to vote as specified in Article Fifth, Section A.6, any and all series of Preferred Stock (other than the Series A Preferred Stock) that rank equally with the Series A Preferred Stock as to the payment of dividends, whether bearing dividends on a non-cumulative or cumulative basis, and having voting rights equivalent to those described in Article Fifth, Section A.6(b).

6 3. Dividends. (a) Rate. Holders of the Series A Preferred Stock shall be entitled to receive, when, as and if declared by the Board of Directors (or a duly authorized committee of the Board of Directors), on each Dividend Payment Date, out of funds legally available therefor, non-cumulative cash dividends on the Series A Liquidation Amount of $1,000 per share of the Series A Preferred Stock at a rate per annum equal to (i) 6.375% on each Dividend Payment Date relating to a Fixed Rate Period (and for such Fixed Rate Period) and (ii) Three-month Term SOFR plus 408.26 basis points on each Dividend Payment Date relating to a Floating Rate Period (and for such Floating Rate Period). Such dividends shall be payable in arrear (as provided below in this Article Fifth, Section A.3(a)), but only when, as and if declared by the Board of Directors (or a duly authorized committee of the Board of Directors). Dividends on the Series A Preferred Stock shall not be cumulative; holders of the Series A Preferred Stock shall not be entitled to receive any dividends not declared by the Board of Directors (or a duly authorized committee of the Board of Directors) and no interest, or sum of money in lieu of interest, shall be payable in respect of any dividend not so declared. Dividends on the Series A Preferred Stock shall not be declared or set aside for payment if and to the extent such dividends would cause the association to fail to comply with the capital adequacy rules of the Office of the Comptroller of the Currency (or, as and if applicable, the capital adequacy rules or regulations of any successor Appropriate Federal Banking Agency) applicable to the association. Dividends that are payable on the Series A Preferred Stock on any Dividend Payment Date will be payable to holders of record of the Series A Preferred Stock as they appear on the stock register of the association on the applicable record date, which shall be the 15th calendar day before such Dividend Payment Date or such other record date fixed by the Board of Directors (or a duly authorized committee of the Board of Directors) that is not more than 60 nor less than 10 days prior to such Dividend Payment Date (each, a “Dividend Record Date”). Any such day that is a Dividend Record Date shall be a Dividend Record Date whether or not such day is a Business Day. Dividends payable on the Series A Preferred Stock in respect of each Fixed Rate Period shall be computed by the Calculation Agent on the basis of a 360-day year consisting of twelve 30-day months, and dividends payable on the Series A Preferred Stock in respect of each Floating Rate Period shall be computed by the Calculation Agent by multiplying the per annum dividend rate in effect for that Floating Rate Period by a fraction, the numerator of which will be the actual number of days in that Floating Rate Period and the denominator of which will be 360, and multiplying the rate obtained by $1,000 to determine the dividend per share of the Series A Preferred Stock. The Calculation Agent’s determination of any dividend rate, and its calculation of the amount of dividends for any Dividend Period, will be maintained on file at the

7 association’s principal offices and will be available to any stockholder upon request and will be final and binding in the absence of manifest error. The association may terminate the appointment of the Calculation Agent and may appoint a successor agent at any time and from time to time, provided that the association shall use its best efforts to ensure that there is, at all times during the Floating Rate Period, a person or entity appointed and serving as such agent. The Calculation Agent may be a person or entity affiliated with the association. Holders of the Series A Preferred Stock shall not be entitled to any dividends, whether payable in cash, securities or other property, other than dividends (if any) declared and payable on the Series A Preferred Stock as specified in this Article Fifth, Section A.3 (subject to the other provisions of this Articles of Association). (b) Priority of Dividends. So long as any share of the Series A Preferred Stock remains outstanding, no dividend shall be declared or paid on the Common Stock or any other shares of Junior Stock (other than (1) a dividend payable solely in Junior Stock or (2) any dividend in connection with the implementation of a shareholders’ rights plan or the redemption or repurchase of any rights under any such plan), unless (i) full dividends for the last preceding Dividend Period on all outstanding shares of the Series A Preferred Stock have been declared and paid (or declared and a sum sufficient for the payment thereof has been set aside) and (ii) the association is not in default on its obligation to redeem any shares of the Series A Preferred Stock that have been called for redemption. The association and its subsidiaries shall not purchase, redeem or otherwise acquire, directly or indirectly, for consideration any shares of Common Stock or other Junior Stock (other than (1) as a result of a reclassification of such Junior Stock for or into other Junior Stock, (2) the exchange or conversion of one share of such Junior Stock for or into another share of such Junior Stock, (3) through the use of the proceeds of a substantially contemporaneous sale of other shares of Junior Stock, (4) purchases, redemptions or other acquisitions of shares of Junior Stock in connection with any employment contract, benefit plan or other similar arrangement with or for the benefit of employees, officers, directors or consultants, (5) purchases of shares of Junior Stock pursuant to a contractually binding requirement to buy Junior Stock existing prior to the preceding Dividend Period, including under a contractually binding stock repurchase plan, or (6) the purchase of fractional interests in shares of Junior Stock pursuant to the conversion or exchange provisions of such securities or the security being converted or exchanged) nor shall the association pay or make available any monies for a sinking fund for the redemption of any shares of Common Stock or any other shares of Junior Stock during a Dividend Period, unless the full dividends for the most recently completed Dividend Period on all outstanding shares of the Series A Preferred Stock have been declared and paid (or declared and a sum sufficient for the payment thereof has been set aside). The foregoing provision shall not restrict the ability of the association or any other affiliate of the

8 association to engage in any market-making transactions in Junior Stock in the ordinary course of business. When dividends are not paid in full upon the shares of the Series A Preferred Stock and any other equity securities ranking on a parity with the Series A Preferred Stock as to payment of dividends (“Dividend Parity Stock”), all dividends paid or declared for payment on a dividend payment date with respect to the Series A Preferred Stock and the Dividend Parity Stock shall be shared based on the ratio between the then-current dividends due on shares of the Series A Preferred Stock and (i) in the case of any series of non-cumulative Dividend Parity Stock, the aggregate of the current and unpaid dividends due on such series of preferred stock and (ii) in the case of any series of cumulative Dividend Parity Stock, the aggregate of the current and accumulated and unpaid dividends due on such series of preferred stock. Subject to the foregoing, such dividends (payable in cash, securities or other property) as may be determined by the Board of Directors (or a duly authorized committee of the Board of Directors) may be declared and paid on any securities, including Common Stock, any other Junior Stock and any Dividend Parity Stock, from time to time out of any funds legally available for such payment, and the Series A Preferred Stock shall not be entitled to participate in any such dividends. 4. Liquidation Rights (a) Voluntary or Involuntary Liquidation. In the event of any liquidation, dissolution or winding up of the affairs of the association, whether voluntary or involuntary, holders of the Series A Preferred Stock shall be entitled to receive, out of the assets of the association or proceeds thereof (whether capital or surplus) available for distribution to stockholders of the association, and after satisfaction of all liabilities and obligations to creditors of the association and subject to the rights of any securities ranking senior to the Series A Preferred Stock, before any distribution of such assets or proceeds is made to or set aside for the holders of Common Stock and any other stock of the association ranking junior to the Series A Preferred Stock as to such distribution, in full an amount equal to $1,000 per share (the “Series A Liquidation Amount”), together with an amount equal to all dividends (if any) that have been declared but not paid prior to the date of payment of such distribution (but without any amount in respect of dividends that have not been declared prior to such payment date). After payment of the full amount of such liquidation distribution, the holders of the Series A Preferred Stock shall not be entitled to any further participation in any distribution of assets of the association. (b) Partial Payment. If in any distribution described in Article Fifth, Section A.4(a) above the assets of the association or proceeds thereof are not sufficient to pay the Liquidation Preferences (as defined below) in full to all holders of the Series A Preferred Stock and all holders of any stock of the association ranking equally with the Series A Preferred Stock as to such

9 distribution, the amounts paid to the holders of the Series A Preferred Stock and to the holders of all such other stock shall be paid pro rata in accordance with the respective aggregate Liquidation Preferences of the holders of the Series A Preferred Stock and the holders of all such other stock. In any such distribution, the “Liquidation Preference” of any holder of stock of the association shall mean the amount otherwise payable to such holder in such distribution (assuming no limitation on the assets of the association available for such distribution), including an amount equal to any declared but unpaid dividends (and, in the case of any holder of stock other than the Series A Preferred Stock and on which dividends accrue on a cumulative basis, an amount equal to any unpaid, accrued, cumulative dividends, whether or not declared, as applicable). (c) Residual Distributions. If the Liquidation Preference has been paid in full to all holders of the Series A Preferred Stock and any other stock of the association ranking equally with the Series A Preferred Stock as to distribution described in Article Fifth, Section A.4(a) above, the holders of other stock of the association shall be entitled to receive all remaining assets of the association (or proceeds thereof) according to their respective rights and preferences. (d) Merger, Consolidation and Sale of Assets Not Liquidation. For purposes of this Article Fifth, Section A.4, the merger or consolidation of the association with any other association or other entity, including a merger or consolidation in which the holders of the Series A Preferred Stock receive cash, securities or other property for their shares, or the sale, lease or exchange (for cash, securities or other property) of all or substantially all of the assets of the association, shall not constitute a liquidation, dissolution or winding up of the association. 5. Redemption. (a) Optional Redemption. The Series A Preferred Stock is perpetual and has no maturity date. The association may, at its option, redeem the shares of the Series A Preferred Stock (i) in whole or in part, from time to time, on any Dividend Payment Date on or after the Dividend Payment Date in March 2027, or (ii) in whole but not in part at any time within 90 days following a Regulatory Capital Treatment Event, in each case, at a cash redemption price equal to $1,000 per share, together (except as otherwise provided herein) with an amount equal to any dividends that have been declared but not paid prior to the redemption date (but with no amount in respect of any dividends that have not been declared prior to such date). The redemption price for any shares of the Series A Preferred Stock shall be payable on the redemption date to the holder of such shares against surrender of the certificate(s) evidencing such shares to the association or its agent, if the shares of the Series A Preferred Stock are issued in certificated form. Any declared but unpaid dividends payable on a redemption date that occurs subsequent to the Dividend Record Date for a Dividend Period shall not be paid to the holder entitled to receive the redemption price on the redemption date, but rather shall be paid to the holder of record of the redeemed shares on such Dividend Record Date relating to the Dividend Payment Date as provided in

10 Article Fifth, Section A.3 above. Notwithstanding the foregoing, the association may not redeem shares of the Series A Preferred Stock without having received the prior approval of the Appropriate Federal Banking Agency if then required under capital rules applicable to the association. (b) No Sinking Fund. The Series A Preferred Stock will not be subject to any mandatory redemption, sinking fund or other similar provisions. Holders of the Series A Preferred Stock will have no right to require redemption of any shares of the Series A Preferred Stock. (c) Notice of Redemption. Notice of every redemption of shares of the Series A Preferred Stock shall be given by first class mail, postage prepaid, addressed to the holders of record of the shares to be redeemed at their respective last addresses appearing on the books of the association. Such mailing shall be at least 30 days and not more than 60 days before the date fixed for redemption. Any notice mailed as provided in this Subsection shall be conclusively presumed to have been duly given, whether or not the holder receives such notice, but failure duly to give such notice by mail, or any defect in such notice or in the mailing thereof, to any holder of shares of the Series A Preferred Stock designated for redemption shall not affect the validity of the proceedings for the redemption of any other shares of the Series A Preferred Stock. Notwithstanding the foregoing, if the Series A Preferred Stock or any depositary shares representing interests in the Series A Preferred Stock are issued in book-entry form through The Depository Trust Company or any other similar facility, notice of redemption may be given to the holders of the Series A Preferred Stock at such time and in any manner permitted by such facility. Each such notice given to a holder shall state: (1) the redemption date; (2) the number of shares of the Series A Preferred Stock to be redeemed and, if less than all the shares held by such holder are to be redeemed, the number of such shares to be redeemed from such holder; (3) the redemption price or the manner of its calculation; and (4) if the shares of the Series A Preferred Stock are issued in certificated form, the place or places where certificates for such shares are to be surrendered for payment of the redemption price. (d) Partial Redemption. In case of any redemption of only part of the shares of the Series A Preferred Stock at the time outstanding, the shares to be redeemed shall be selected by the association either pro rata or by lot or in such other manner as the association may determine to be fair and equitable. Subject to the provisions hereof, the association shall have full power and authority to prescribe the terms and conditions upon which shares of the Series A Preferred Stock shall be redeemed from time to time. If fewer than all the shares represented by any certificate (if the shares of the Series A Preferred Stock are issued in certificated form) are redeemed, a new certificate shall be issued representing the unredeemed shares without charge to the holder thereof. (e) Effectiveness of Redemption. If notice of redemption has been duly given and if, on or before the redemption date specified in the notice, all funds

11 necessary for the redemption have been set aside by the association, separate and apart from its other funds, in trust for the pro rata benefit of the holders of the shares called for redemption, so as to be and continue to be available therefor, then, notwithstanding that any certificate for any share so called for redemption has not been surrendered for cancellation in the case that the shares of the Series A Preferred Stock are issued in certificated form, on and after the redemption date dividends shall cease to accrue on all shares so called for redemption, all shares so called for redemption shall no longer be deemed outstanding and all rights with respect to such shares shall forthwith on such redemption date cease and terminate, except only the right of the holders thereof to receive the amount payable on such redemption, without interest. Any funds unclaimed at the end of two years from the redemption date, to the extent permitted by law, shall be released to the association, after which time the holders of the shares so called for redemption shall look only to the association for payment of the redemption price of such shares. 6. Voting Rights. (a) General. The holders of the Series A Preferred Stock shall not have any voting rights except as set forth below or as otherwise from time to time required by applicable law. (b) Right To Elect Two Directors Upon Nonpayment Events. If and whenever the dividends on the Series A Preferred Stock and any other class or series of Voting Preferred Stock have not been declared and paid in an aggregate amount (i) in the case of the Series A Preferred Stock and any other class or series of Voting Preferred Stock bearing non-cumulative dividends, in full for at least three semi-annual or six quarterly dividend periods or their equivalent (whether or not consecutive) or (ii) in the case of any class or series of Voting Preferred Stock bearing cumulative dividends, in an aggregate amount equal to full dividends for at least three semi-annual or six quarterly dividend periods or their equivalent (whether or not consecutive) (a “Nonpayment Event”), the number of directors then constituting the Board of Directors shall automatically be increased by two and the holders of the Series A Preferred Stock, together with the holders of any outstanding shares of Voting Preferred Stock, voting together as a single class, shall be entitled to elect the two additional directors (the “Preferred Stock Directors”), provided that it shall be a qualification for election for any such Preferred Stock Director that the election of such director shall not cause the association to violate the corporate governance requirement of the New York Stock Exchange (or any other securities exchange or other trading facility on which securities of the association may then be listed or traded) that listed or traded companies must have a majority of independent directors and provided further that the Board of Directors shall at no time include more than two Preferred Stock Directors (including, for purposes of this limitation, all directors that the holders of any series of Voting Preferred Stock are entitled to elect pursuant to like voting rights).

12 In the event that the holders of the Series A Preferred Stock and such other holders of Voting Preferred Stock shall be entitled to vote for the election of the Preferred Stock Directors following a Nonpayment Event, such directors shall be initially elected following such Nonpayment Event only at a special meeting called at the request of the holders of record of at least 20% of the Series A Preferred Stock and each other series of Voting Preferred Stock then outstanding (unless such request for a special meeting is received less than 90 days before the date fixed for the next annual or special meeting of the stockholders of the association, in which event such election shall be held only at such next annual or special meeting of stockholders), and at each subsequent annual meeting of stockholders of the association. Such request to call a special meeting for the initial election of the Preferred Stock Directors after a Nonpayment Event shall be made by written notice, signed by the requisite holders of the Series A Preferred Stock or Voting Preferred Stock, and delivered to the Secretary of the association in such manner as provided for in Article Fifth, Section A.8 below, or as may otherwise be required by applicable law. If the Secretary of the association fails to call a special meeting for the election of the Preferred Stock Directors within 20 days of receiving proper notice, any holder of the Series A Preferred Stock may call such a meeting at the association’s expense solely for the election of the Preferred Stock Directors, and for this purpose only such Series A Preferred Stock holder shall have access to the association’s stock ledger. When dividends have been paid in full on the Series A Preferred Stock and any and all series of non-cumulative Voting Preferred Stock (other than the Series A Preferred Stock) for Dividend Periods, whether or not consecutive, equivalent to at least one year after a Nonpayment Event and all dividends on any cumulative Voting Preferred Stock have been paid in full, then the right of the holders of the Series A Preferred Stock to elect the Preferred Stock Directors shall cease (but subject always to revesting of such voting rights in the case of any future Nonpayment Event), and, if and when any rights of holders of the Series A Preferred Stock and Voting Preferred Stock to elect the Preferred Stock Directors shall have ceased, the terms of office of all the Preferred Stock Directors shall forthwith terminate and the number of directors constituting the Board of Directors shall automatically be reduced accordingly. Any Preferred Stock Director may be removed at any time without cause by the holders of record of a majority of the outstanding shares of the Series A Preferred Stock and Voting Preferred Stock, when they have the voting rights described above (voting together as a single class). The Preferred Stock Directors elected at any such special meeting shall hold office until the next annual meeting of the stockholders if such office shall not have previously terminated as set forth in the preceding paragraph. In case any vacancy shall occur among the Preferred Stock Directors, a successor shall be elected by the Board of Directors to serve until the next annual meeting of the stockholders upon the nomination of the then remaining Preferred Stock Director or, if no Preferred Stock Director remains in office, by the vote of the holders of record of a majority of the outstanding shares of the Series A Preferred Stock and such Voting Preferred Stock for which

13 dividends have not been paid, voting as a single class. The Preferred Stock Directors shall each be entitled to one vote per director on any matter that shall come before the Board of Directors for a vote. (c) Other Voting Rights. So long as any shares of the Series A Preferred Stock are outstanding, in addition to any other vote or consent of stockholders required by law or by the Articles of Association, the vote or consent of the holders of at least two-thirds of the shares of the Series A Preferred Stock at the time outstanding and entitled to vote thereon, voting separately as a single class, given in person or by proxy, either in writing without a meeting or by vote at any meeting called for the purpose, shall be necessary for effecting or validating: (1) Authorization of Senior Stock. Any amendment, alteration or repeal of any provision of the Articles of Association or Bylaws to authorize or create, or increase the authorized amount of, any shares of any class or series of capital stock of the association ranking senior to the Series A Preferred Stock with respect to either the payment of dividends or the distribution of assets on any liquidation, dissolution or winding up of the association; (2) Amendment of the Series A Preferred Stock. Any amendment, alteration or repeal of any provision of the Articles of Association or Bylaws so as to materially and adversely affect the special rights, preferences, privileges or voting powers of the Series A Preferred Stock (taken as a whole); provided, however, that any amendment of the Articles of Association to authorize or create or to increase the authorized amount of any Junior Stock or any class or series or any securities convertible into shares of any class or series of Dividend Parity Stock or other series of Preferred Stock ranking equally with the Series A Preferred Stock with respect to the distribution of assets upon liquidation, dissolution or winding up of the association will not be deemed to materially and adversely affect the rights, preferences, privileges or voting powers of the Series A Preferred Stock; or (3) Share Exchanges, Reclassifications, Mergers and Consolidations. Any consummation of a binding share exchange or reclassification involving the Series A Preferred Stock, or of a merger or consolidation of the association with another corporation, or any merger or consolidation of the association with or into any entity other than a corporation unless in each case (x) the shares of the Series A Preferred Stock remain outstanding or, in the case of any such merger or consolidation with respect to which the association is not the surviving or resulting corporation, are converted into or exchanged for preference securities of the surviving or resulting corporation or a corporation controlling such corporation, and (y) such shares remaining outstanding or such preference securities, as the case may be, have such rights, preferences, privileges and voting powers, and limitations and restrictions thereof, as would not

14 require a vote of the holders of the Preferred Stock pursuant to clauses (i) or (ii) above if such change were effected by an amendment of the Articles of Association. If any amendment, alteration, repeal, share exchange, reclassification, merger or consolidation specified in this Article Fifth, Section A.6(c) would adversely affect the Series A Preferred Stock and one or more but not all other series of Preferred Stock, then only the Series A Preferred Stock and such series of Preferred Stock as are adversely affected by and entitled to vote on the matter shall vote on the matter together as a single class in proportion to their respective stated liquidation amounts (in lieu of all other series of Preferred Stock). (d) Changes for Clarification. Without the consent of the holders of the Series A Preferred Stock, so long as such action does not adversely affect the rights, preferences, privileges and voting powers, and limitations and restrictions thereof, of the Series A Preferred Stock, the association may amend, alter, supplement or repeal any terms of the Series A Preferred Stock: (1) to cure any ambiguity, or to cure, correct or supplement any provision contained in this Article Fifth, Section A that may be defective or inconsistent; or (2) to make any provision with respect to matters or questions arising with respect to the Series A Preferred Stock that is not inconsistent with the provisions of this Article Fifth, Section A. (e) Changes after Provision for Redemption. No vote or consent of the holders of the Series A Preferred Stock shall be required pursuant to Article Fifth, Section A.6(b) or (c) above if, at or prior to the time when any such vote or consent would otherwise be required pursuant to such Section, all outstanding shares of the Series A Preferred Stock shall have been redeemed, or shall have been called for redemption upon proper notice and sufficient funds shall have been set aside for such redemption, in each case pursuant to Article Fifth, Section A.5 above. (f) Procedures for Voting and Consents. The rules and procedures for calling and conducting any meeting of the holders of the Series A Preferred Stock (including, without limitation, the fixing of a record date in connection therewith), the solicitation and use of proxies at such a meeting, the obtaining of written consents and any other aspect or matter with regard to such a meeting or such consents shall be governed by any rules the Board of Directors, in its discretion, may adopt from time to time, which rules and procedures shall conform to the requirements of the Articles of Association, the Bylaws, applicable law and any national securities exchange or other trading facility on which the Series A Preferred Stock is listed or traded at the time. Whether the vote or consent of the holders of a plurality, majority or other portion of the shares of the Series A

15 Preferred Stock and any Voting Preferred Stock has been cast or given on any matter on which the holders of shares of the Series A Preferred Stock are entitled to vote shall be determined by the association by reference to the specified liquidation amounts of the shares voted or covered by the consent. For purposes of determining the voting rights of the holders of shares of the Series A Preferred Stock under this Article Fifth, Section A.6, each holder will be entitled to one vote for each $1,000 of the Series A Liquidation Amount to which his or her shares are entitled. Holders of shares of the Series A Preferred Stock will be entitled to one vote for each such share of the Series A Preferred Stock held by them. 7. Record Holders. To the fullest extent permitted by applicable law, the association and the transfer agent for the Series A Preferred Stock may deem and treat the record holder of any share of the Series A Preferred Stock as the true and lawful owner thereof for all purposes, and neither the association nor such transfer agent shall be affected by any notice to the contrary. 8. Notices. All notices or communications in respect of the Series A Preferred Stock shall be sufficiently given if given in writing and delivered in person or by first class mail, postage prepaid, or if given in such other manner as may be permitted in this Article Fifth, Section A, otherwise in the Articles of Association or Bylaws or by applicable law. Notwithstanding the foregoing, if the shares of Series A Preferred Stock are issued in book entry form through The Depository Trust Company (“DTC”), such notices may be given to the holders of the Series A Preferred Stock in any matter permissible by the DTC. 9. No Preemptive Rights. No share of the Series A Preferred Stock shall have any rights of preemption whatsoever as to any securities of the association, or any warrants, rights or options issued or granted with respect thereto, regardless of how such securities, or such warrants, rights or options, may be designated, issued or granted. 10. Other Rights. The shares of the Series A Preferred Stock shall not have any voting powers, preferences or relative, participating, optional or other special rights, or qualifications, limitations or restrictions thereof, other than as set forth herein or as provided by applicable law. 11. Certificates. The association may at its option issue shares of the Series A Preferred Stock without certificates. B. Series B Preferred Stock 1. Designation and Amount. A series of Preferred Stock designated as the “Series B Noncumulative Convertible Preferred Stock” (“Series B Preferred Stock”) is hereby established. The total number of authorized shares of Series B Preferred Stock shall be 267,062.

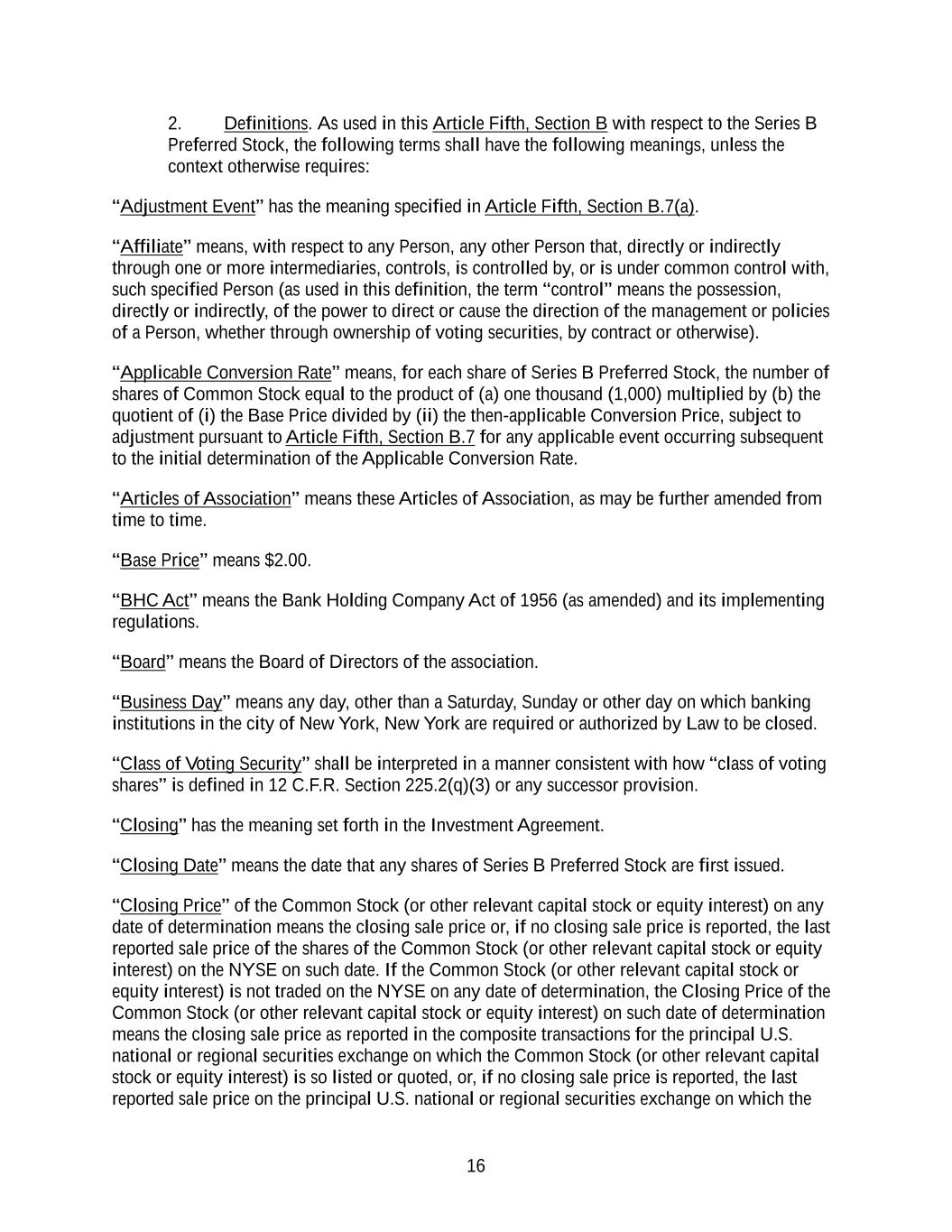

16 2. Definitions. As used in this Article Fifth, Section B with respect to the Series B Preferred Stock, the following terms shall have the following meanings, unless the context otherwise requires: “Adjustment Event” has the meaning specified in Article Fifth, Section B.7(a). “Affiliate” means, with respect to any Person, any other Person that, directly or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, such specified Person (as used in this definition, the term “control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of a Person, whether through ownership of voting securities, by contract or otherwise). “Applicable Conversion Rate” means, for each share of Series B Preferred Stock, the number of shares of Common Stock equal to the product of (a) one thousand (1,000) multiplied by (b) the quotient of (i) the Base Price divided by (ii) the then-applicable Conversion Price, subject to adjustment pursuant to Article Fifth, Section B.7 for any applicable event occurring subsequent to the initial determination of the Applicable Conversion Rate. “Articles of Association” means these Articles of Association, as may be further amended from time to time. “Base Price” means $2.00. “BHC Act” means the Bank Holding Company Act of 1956 (as amended) and its implementing regulations. “Board” means the Board of Directors of the association. “Business Day” means any day, other than a Saturday, Sunday or other day on which banking institutions in the city of New York, New York are required or authorized by Law to be closed. “Class of Voting Security” shall be interpreted in a manner consistent with how “class of voting shares” is defined in 12 C.F.R. Section 225.2(q)(3) or any successor provision. “Closing” has the meaning set forth in the Investment Agreement. “Closing Date” means the date that any shares of Series B Preferred Stock are first issued. “Closing Price” of the Common Stock (or other relevant capital stock or equity interest) on any date of determination means the closing sale price or, if no closing sale price is reported, the last reported sale price of the shares of the Common Stock (or other relevant capital stock or equity interest) on the NYSE on such date. If the Common Stock (or other relevant capital stock or equity interest) is not traded on the NYSE on any date of determination, the Closing Price of the Common Stock (or other relevant capital stock or equity interest) on such date of determination means the closing sale price as reported in the composite transactions for the principal U.S. national or regional securities exchange on which the Common Stock (or other relevant capital stock or equity interest) is so listed or quoted, or, if no closing sale price is reported, the last reported sale price on the principal U.S. national or regional securities exchange on which the

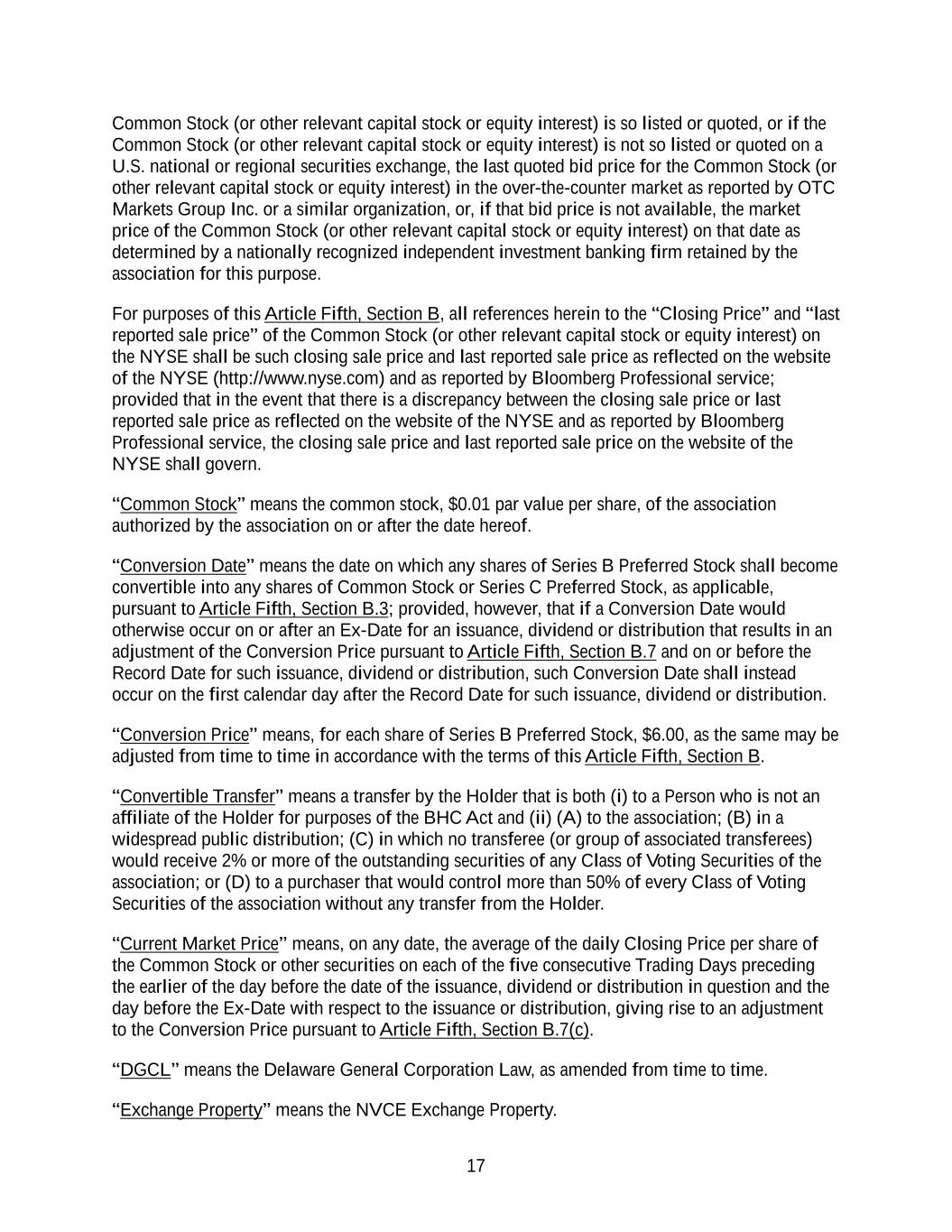

17 Common Stock (or other relevant capital stock or equity interest) is so listed or quoted, or if the Common Stock (or other relevant capital stock or equity interest) is not so listed or quoted on a U.S. national or regional securities exchange, the last quoted bid price for the Common Stock (or other relevant capital stock or equity interest) in the over-the-counter market as reported by OTC Markets Group Inc. or a similar organization, or, if that bid price is not available, the market price of the Common Stock (or other relevant capital stock or equity interest) on that date as determined by a nationally recognized independent investment banking firm retained by the association for this purpose. For purposes of this Article Fifth, Section B, all references herein to the “Closing Price” and “last reported sale price” of the Common Stock (or other relevant capital stock or equity interest) on the NYSE shall be such closing sale price and last reported sale price as reflected on the website of the NYSE (http://www.nyse.com) and as reported by Bloomberg Professional service; provided that in the event that there is a discrepancy between the closing sale price or last reported sale price as reflected on the website of the NYSE and as reported by Bloomberg Professional service, the closing sale price and last reported sale price on the website of the NYSE shall govern. “Common Stock” means the common stock, $0.01 par value per share, of the association authorized by the association on or after the date hereof. “Conversion Date” means the date on which any shares of Series B Preferred Stock shall become convertible into any shares of Common Stock or Series C Preferred Stock, as applicable, pursuant to Article Fifth, Section B.3; provided, however, that if a Conversion Date would otherwise occur on or after an Ex-Date for an issuance, dividend or distribution that results in an adjustment of the Conversion Price pursuant to Article Fifth, Section B.7 and on or before the Record Date for such issuance, dividend or distribution, such Conversion Date shall instead occur on the first calendar day after the Record Date for such issuance, dividend or distribution. “Conversion Price” means, for each share of Series B Preferred Stock, $6.00, as the same may be adjusted from time to time in accordance with the terms of this Article Fifth, Section B. “Convertible Transfer” means a transfer by the Holder that is both (i) to a Person who is not an affiliate of the Holder for purposes of the BHC Act and (ii) (A) to the association; (B) in a widespread public distribution; (C) in which no transferee (or group of associated transferees) would receive 2% or more of the outstanding securities of any Class of Voting Securities of the association; or (D) to a purchaser that would control more than 50% of every Class of Voting Securities of the association without any transfer from the Holder. “Current Market Price” means, on any date, the average of the daily Closing Price per share of the Common Stock or other securities on each of the five consecutive Trading Days preceding the earlier of the day before the date of the issuance, dividend or distribution in question and the day before the Ex-Date with respect to the issuance or distribution, giving rise to an adjustment to the Conversion Price pursuant to Article Fifth, Section B.7(c). “DGCL” means the Delaware General Corporation Law, as amended from time to time. “Exchange Property” means the NVCE Exchange Property.

18 “Ex-Date” means, when used with respect to any issuance, dividend or distribution giving rise to an adjustment to the Conversion Price pursuant to Article Fifth, Section B.7, the first date on which the applicable Common Stock or other securities trade without the right to receive the issuance, dividend or distribution. “Government Entity” means any (a) federal, state, local, municipal, foreign or other government; (b) governmental entity of any nature (including any governmental agency, branch, department, official, committee or entity and any court or other tribunal), whether foreign or domestic; or (c) body exercising or entitled to exercise any administrative, executive, judicial, legislative, police, regulatory, or taxing authority or power of any nature, whether foreign or domestic, including any arbitral tribunal and self-regulatory organizations. “Holder” means the Person in whose name any shares of Series B Preferred Stock are registered, which may be treated by the association as the absolute owner of such shares of Series B Preferred Stock for the purpose of making payment and settling conversion and for all other purposes. “HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended from time to time. “HSR Approvals” means, with respect to the shares of Series B Preferred Stock of any Holder, the expiration or termination of any applicable waiting period (or extension thereof) under the HSR Act with respect to such Holder’s acquisition or ownership of Common Stock upon conversion or exchange of such shares of Series B Preferred Stock. “Investment Agreement(s)” means the investment agreement(s), by and between Flagstar Financial, Inc., predecessor of the association, and the investor parties thereto, dated as of March 7, 2024 (as amended, supplemented or restated from time to time). “Law” means, with respect to any Person, any legal, regulatory and administrative laws, statutes, rules, Orders and regulations applicable to such Person. “Liens” means any and all liens, charges, security interests, options, claims, mortgages, pledges, proxies, voting trusts or agreements, obligations, understandings or arrangements, or other restrictions on title or transfer of any nature whatsoever. “NVCE Exchange Property” has the meaning specified in Article Fifth, Section B.7(i)(2)(i). “NYSE” means the New York Stock Exchange. “Order” means any applicable order, injunction, judgment, decree, ruling, or writ of any Government Entity. “Person” means an individual, corporation, partnership, limited partnership, limited liability company, syndicate, person (including a “person” as defined in Sections 13(d)(3) and 14(d) of the Exchange Act), trust, association or entity or government, political subdivision, agency or instrumentality of a government.

19 “Permanent Warrant” has the meaning set forth in the Investment Agreements. “Preferred Stock” has the meaning set forth in the Articles of Association. “Record Date” means, with respect to any dividend, distribution or other transaction or event in which the holders of the Common Stock have the right to receive any cash, securities or other property or in which the Common Stock is exchanged for or converted into any combination of cash, securities or other property, the date fixed for determination of holders of the Common Stock entitled to receive such cash, securities or other property (whether such date is fixed by the Board or a duly authorized committee of the Board or by Law, contract or otherwise). “Reorganization Event” has the meaning specified in Article Fifth, Section B.7(i)(3). “Series A Preferred Stock” means the association’s Fixed-to-Floating Rate Series A Noncumulative Perpetual Preferred Stock, par value $0.01 per share. “Series B NVCE Dividend Amount” has the meaning specified in Article Fifth, Section B.4(a). “Series B Preferred Stock” has the meaning specified in Article Fifth, Section B.1. “Series C Preferred Stock” means the Series C Noncumulative Convertible Preferred Stock, par value $0.01 per share, of the association, issued pursuant to the Investment Agreement(s). “Series D NVCE Stock” means the Series D Non-Voting Common Equivalent Stock, par value $0.01 per share, of the association, issuable upon conversion of a Permanent Warrant. “Subject Series B Share” means a share of Series B Preferred Stock that is automatically converted pursuant to Article Fifth, Section B.3(a). “Trading Day” means a day on which the shares of Common Stock (i) are not suspended from trading on any national or regional securities exchange or association or over-the-counter market at the close of business; and (ii) have traded at least once on the national or regional securities exchange or association or over-the-counter market that is the primary market for the trading of the Common Stock. 3. Conversion. (a) Conversion upon Convertible Transfer (1) The shares of Series B Preferred Stock shall not be convertible into any other class of capital stock of the association, except in accordance with this Article Fifth, Section B.3. On the terms and in the manner set forth in this Article Fifth, Section B.3, upon the consummation of any Convertible Transfer of shares of Series B Preferred Stock, each outstanding share of Series B Preferred Stock subject to such Convertible Transfer (each, a “Subject Series B Share”) shall automatically convert into a number of shares of Common Stock equal to the Applicable Conversion Rate; provided that, if at that time of the Convertible Transfer,

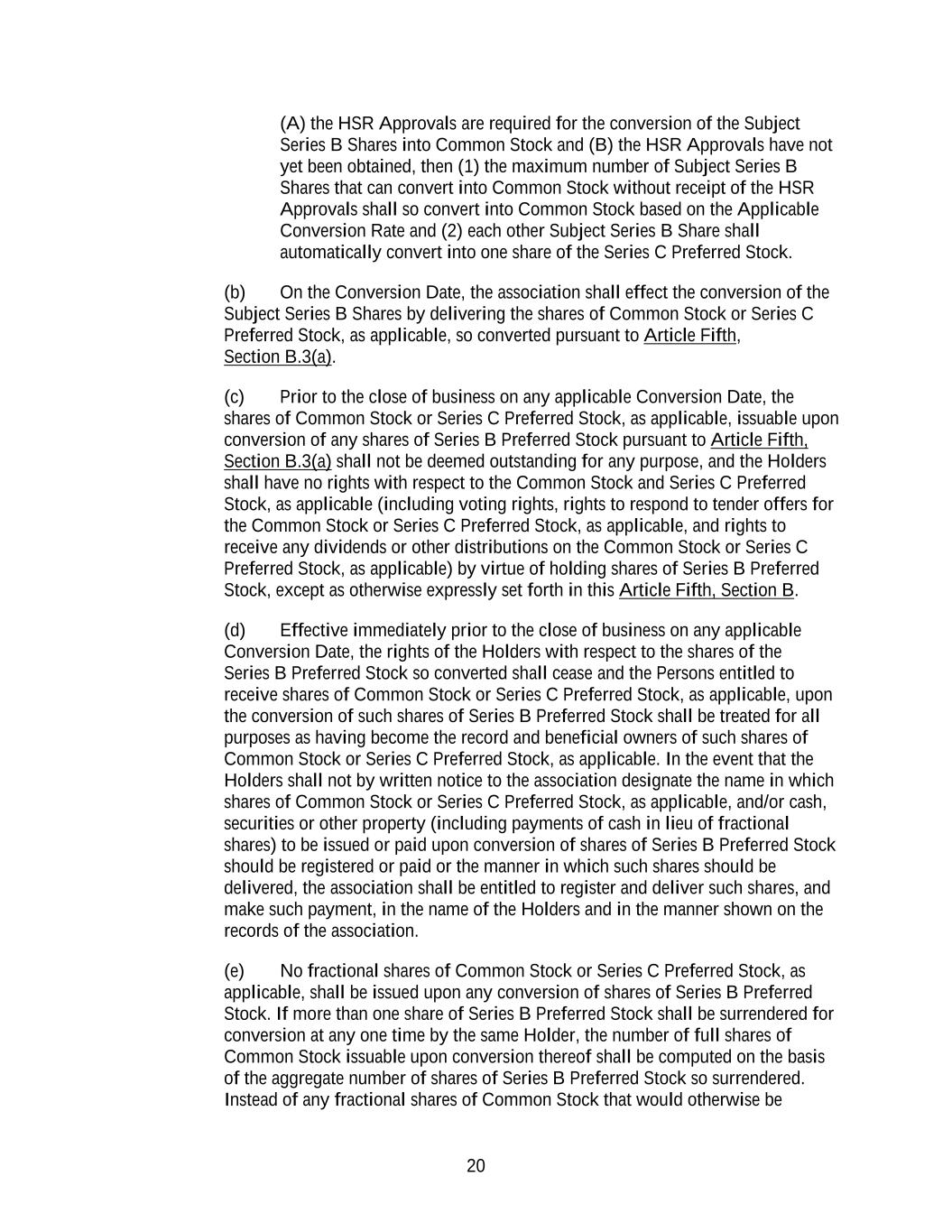

20 (A) the HSR Approvals are required for the conversion of the Subject Series B Shares into Common Stock and (B) the HSR Approvals have not yet been obtained, then (1) the maximum number of Subject Series B Shares that can convert into Common Stock without receipt of the HSR Approvals shall so convert into Common Stock based on the Applicable Conversion Rate and (2) each other Subject Series B Share shall automatically convert into one share of the Series C Preferred Stock. (b) On the Conversion Date, the association shall effect the conversion of the Subject Series B Shares by delivering the shares of Common Stock or Series C Preferred Stock, as applicable, so converted pursuant to Article Fifth, Section B.3(a). (c) Prior to the close of business on any applicable Conversion Date, the shares of Common Stock or Series C Preferred Stock, as applicable, issuable upon conversion of any shares of Series B Preferred Stock pursuant to Article Fifth, Section B.3(a) shall not be deemed outstanding for any purpose, and the Holders shall have no rights with respect to the Common Stock and Series C Preferred Stock, as applicable (including voting rights, rights to respond to tender offers for the Common Stock or Series C Preferred Stock, as applicable, and rights to receive any dividends or other distributions on the Common Stock or Series C Preferred Stock, as applicable) by virtue of holding shares of Series B Preferred Stock, except as otherwise expressly set forth in this Article Fifth, Section B. (d) Effective immediately prior to the close of business on any applicable Conversion Date, the rights of the Holders with respect to the shares of the Series B Preferred Stock so converted shall cease and the Persons entitled to receive shares of Common Stock or Series C Preferred Stock, as applicable, upon the conversion of such shares of Series B Preferred Stock shall be treated for all purposes as having become the record and beneficial owners of such shares of Common Stock or Series C Preferred Stock, as applicable. In the event that the Holders shall not by written notice to the association designate the name in which shares of Common Stock or Series C Preferred Stock, as applicable, and/or cash, securities or other property (including payments of cash in lieu of fractional shares) to be issued or paid upon conversion of shares of Series B Preferred Stock should be registered or paid or the manner in which such shares should be delivered, the association shall be entitled to register and deliver such shares, and make such payment, in the name of the Holders and in the manner shown on the records of the association. (e) No fractional shares of Common Stock or Series C Preferred Stock, as applicable, shall be issued upon any conversion of shares of Series B Preferred Stock. If more than one share of Series B Preferred Stock shall be surrendered for conversion at any one time by the same Holder, the number of full shares of Common Stock issuable upon conversion thereof shall be computed on the basis of the aggregate number of shares of Series B Preferred Stock so surrendered. Instead of any fractional shares of Common Stock that would otherwise be

21 issuable upon conversion of any Subject Series B Share, the association shall pay an amount in cash (rounded to the nearest cent) equal to the fractional share of Common Stock, that otherwise would be issuable hereunder, multiplied by the Closing Price of the Common Stock determined as of the second Trading Day immediately preceding the applicable Conversion Date, in the case of Common Stock. (f) All shares of Common Stock or Series C Preferred Stock, as applicable, which may be issued upon conversion of the shares of Series B Preferred Stock will, upon issuance by the association, be duly authorized, validly issued, fully paid and non-assessable, free and clear of all Liens (other than transfer restrictions imposed under applicable securities Laws) and not issued in violation of any preemptive right or Law. (g) Effective immediately prior to the Conversion Date, dividends or distributions shall no longer be declared on any Subject Series B Shares and such shares shall cease to be outstanding, in each case, subject to the rights of a Holder to receive any declared and unpaid dividends or distributions on such shares and any other payments to which they are otherwise entitled pursuant to Article Fifth, Section B.4 or Section B.7. 4. Dividend Rights. (a) To (but excluding) the applicable Conversion Date, (i) the Holders shall be entitled to receive, when, as and if declared by the Board or any duly authorized committee of the Board (but only out of assets legally available therefor under the DGCL) all cash dividends or distributions (including regular quarterly dividends or distributions) declared and paid or made in respect of the shares of Common Stock, at the same time and on the same terms as holders of Common Stock, in an amount per share of Series B Preferred Stock equal to the product of (x) the Applicable Conversion Rate then in effect and (y) any per share dividend or distribution, as applicable, declared and paid or made in respect of each share of Common Stock (the “Series B NVCE Dividend Amount”), and (ii) the Board or any duly authorized committee thereof may not declare and pay any cash dividend or make any cash distribution in respect of Common Stock unless the Board or any duly authorized committee of the Board declares and pays to the Holders, at the same time and on the same terms as holders of Common Stock, the Series B NVCE Dividend Amount per share of Series B Preferred Stock. Notwithstanding any provision in this Article Fifth, Section B.5(a) to the contrary, no Holder of a share of Series B Preferred Stock shall be entitled to receive any dividend or distribution made with respect to the Common Stock where the Record Date for determination of holders of Common Stock entitled to receive such dividend or distribution occurs prior to the date of issuance of such share of Series B Preferred Stock. The foregoing shall not limit or modify the rights of any Holder to receive any dividend or other distribution pursuant to Article Fifth, Section B.7.

22 (b) Each dividend or distribution declared and paid pursuant to Article Fifth, Section B.5(a) will be payable to Holders of record of shares of Series B Preferred Stock as they appear in the records of the association at the close of business on the same day as the Record Date for the corresponding dividend or distribution to the holders of shares of Common Stock. (c) Except as set forth in this Article Fifth, Section B, the association shall have no obligation to pay, and the holders of shares of Series B Preferred Stock shall have no right to receive, dividends or distributions at any time, including with respect to dividends or distributions with respect to Common Stock or any other class or series of authorized Preferred Stock. To the extent the association declares dividends or distributions on the Series B Preferred Stock and on any Common Stock and the Series D NVCE Stock, but does not make full payment of such declared dividends or distributions, the association will allocate the dividend payments on a pro rata basis among the holders of the shares of Series B Preferred Stock and the holders of any Common Stock and Series D NVCE Stock then outstanding. For purposes of calculating the allocation of partial dividend payments, the association will allocate dividend payments on a pro rata basis among the Holders and the holders of any Common Stock and Series D NVCE Stock so that the amount of dividends or distributions paid per share on the shares of Series B Preferred Stock and such Common Stock and Series D NVCE Stock shall in all cases bear to each other the same ratio that payable dividends or distributions per share on the shares of the Series B Preferred Stock and such Common Stock and Series D NVCE Stock (but without, in the case of any noncumulative Preferred Stock, accumulation of dividends or distributions for prior dividend periods) bear to each other. The foregoing right shall not be cumulative and shall not in any way create any claim or right in favor of Holders in the event that dividends or distributions have not been declared or paid in respect of any prior calendar quarter. (d) No interest or sum of money in lieu of interest will be payable in respect of any dividend payment or payments on shares of Series B Preferred Stock that may be in arrears. (e) Holders shall not be entitled to any dividends or distributions, whether payable in cash, securities or other property, other than dividends or distributions (if any) declared and payable on shares of Series B Preferred Stock as specified in this Article Fifth, Section B. (f) Notwithstanding any provision in this Article Fifth, Section B to the contrary, Holders shall not be entitled to receive any dividends or distributions on any shares of Series B Preferred Stock on or after the applicable Conversion Date in respect of such shares of Series B Preferred Stock that have been converted as provided herein, except to the extent that any such dividends or distributions have been declared by the Board or any duly authorized committee of the Board and the Record Date for such dividend occurs prior to such applicable Conversion Date.

23 5. Voting. (a) Notwithstanding any stated or statutory voting rights, except as set forth in Article Fifth, Section B.5(b), the Holders shall not be entitled to vote (in their capacity as Holders) on any matter submitted to a vote of the stockholders of the association. (b) So long as any shares of Series B Preferred Stock are outstanding, the association shall not, without the written consent or affirmative vote, given in person or by proxy, at a meeting called for that purpose by holders of at least a majority of the outstanding shares of Series B Preferred Stock, voting as a single and separate class, amend, alter or repeal (including by merger, consolidation or otherwise, and whether in a single transaction or a series of related transactions, other than a Reorganization Event pursuant to which the Series B Preferred Stock is treated in accordance with Article Fifth, Section B.7(i)) any provision of the Articles of Association that would alter, modify or change the preferences, rights, privileges or powers of the Series B Preferred Stock so as to, or in a manner that would, significantly and adversely affect the preferences, rights, privileges or powers of the Series B Preferred Stock; provided, that any such amendment or alteration to any provision of the Articles of Association that alters, modifies or changes the preferences, rights, privileges or powers of a particular Holder so as to, or in a manner that would, significantly and adversely affect the preferences, rights, privileges or powers of such Holder in a manner disproportionate from any other Holder shall require the prior written consent of such significantly and adversely affected Holder; provided, further, that neither (x) any increase in the amount of the authorized or issued Series B Preferred Stock or any securities convertible into Series B Preferred Stock nor (y) the creation and issuance, or an increase in the authorized or issued amount, of any series of Preferred Stock, or any securities convertible into Preferred Stock, ranking equal with and/or junior to the Series B Preferred Stock with respect to the payment of dividends (whether such dividends are cumulative or non-cumulative) and/or the distribution of assets upon the association’s liquidation, dissolution or winding up, in either case, will, in and of itself, be deemed to significantly and adversely affect the preferences, rights, privileges or powers of the Series B Preferred Stock or any Holder and the Holders will have no right to vote their shares of Series B Preferred Stock or consent to such action solely by reason of such an increase, creation or issuance. (c) Notwithstanding the foregoing, the association shall not, without the written consent or affirmative vote, given in person or by proxy, at a meeting called for that purpose by the unanimous consent of the holders of the outstanding shares of Series B Preferred Stock, amend, alter or repeal (including by merger, consolidation or otherwise, and whether in a single transaction or a series of related transactions, other than a Reorganization Event pursuant to which the Series B Preferred Stock is treated in accordance with Article Fifth, Section B.7(i)) the definitions of Applicable Conversion Rate, Base Price, Conversion Price, or Dividend Rate under this Article Fifth, Section B.

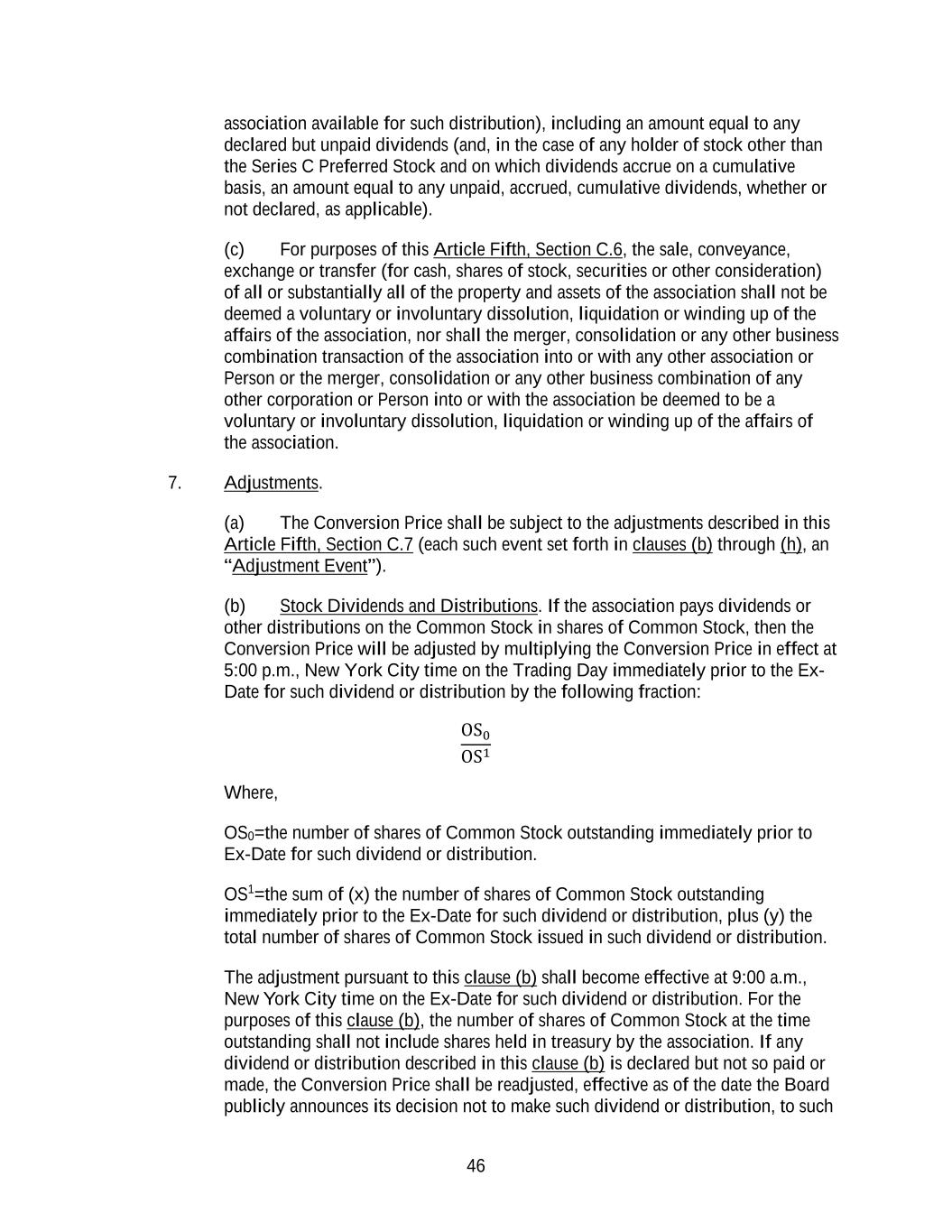

24 (d) Notwithstanding the foregoing, the Holders shall not have any voting rights set out in Article Fifth, Section B.6(b) if, at or prior to the effective time of the act with respect to which such vote would otherwise be required, all outstanding shares of Series B Preferred Stock shall have been converted into shares of Common Stock. 6. Rank; Liquidation. (a) The Series B Preferred Stock shall, consistent with the requirements of 12 C.F.R. Section 3.20(b)(1) (or any successor regulation) with respect to common equity tier 1 capital, rank equally with, and have identical rights, preferences and privileges as, the Common Stock with respect to dividends or distributions (including regular quarterly dividends) declared by the Board and rights upon any liquidation, dissolution, winding up or similar proceeding of the association, as provided in the Articles of Association. (b) For purposes of this Article Fifth, Section B.6, the sale, conveyance, exchange or transfer (for cash, shares of stock, securities or other consideration) of all or substantially all of the property and assets of the association shall not be deemed a voluntary or involuntary dissolution, liquidation or winding up of the affairs of the association, nor shall the merger, consolidation or any other business combination transaction of the association into or with any other corporation or Person or the merger, consolidation or any other business combination of any other corporation or Person into or with the association be deemed to be a voluntary or involuntary dissolution, liquidation or winding up of the affairs of the association. 7. Adjustments. (a) The Conversion Price shall be subject to the adjustments described in this Article Fifth, Section B.7 (each such event set forth in clauses (b) through (j), an “Adjustment Event”). (b) Stock Dividends and Distributions. If the association pays dividends or other distributions on the Common Stock in shares of Common Stock, then the Conversion Price will be adjusted by multiplying the Conversion Price in effect at 5:00 p.m., New York City time on the Trading Day immediately prior to the Ex- Date for such dividend or distribution by the following fraction: OS0 OS1 Where, OS0 = the number of shares of Common Stock outstanding immediately prior to Ex-Date for such dividend or distribution.

25 OS1= the sum of (x) the number of shares of Common Stock outstanding immediately prior to the Ex-Date for such dividend or distribution, plus (y) the total number of shares of Common Stock issued in such dividend or distribution. The adjustment pursuant to this clause (b) shall become effective at 9:00 a.m., New York City time on the Ex-Date for such dividend or distribution. For the purposes of this clause (b), the number of shares of Common Stock at the time outstanding shall not include shares held in treasury by the association. If any dividend or distribution described in this clause (b) is declared but not so paid or made, the Conversion Price shall be readjusted, effective as of the date the Board publicly announces its decision not to make such dividend or distribution, to such Conversion Price that would be in effect if such dividend or distribution had not been declared. (c) Subdivisions, Splits and Combinations of Common Stock. If the association subdivides, splits or combines the shares of Common Stock, then the Conversion Price will be adjusted by multiplying the Conversion Price in effect at 5:00 p.m., New York City time on the Trading Day immediately prior to the effective date of such share subdivision, split or combination by the following fraction: OS0 OS1 Where, OS0 = the number of shares of Common Stock outstanding immediately prior to the effective date of such share subdivision, split or combination. OS1 = the number of shares of Common Stock outstanding immediately after the opening of business on the effective date of such share subdivision, split or combination. The adjustment pursuant to this clause (c) shall become effective at 9:00 a.m., New York City time on the effective date of such subdivision, split or combination. For the purposes of this clause (c), the number of shares of Common Stock at the time outstanding shall not include shares held in treasury by the association. If any subdivision, split or combination described in this clause (c) is announced but the outstanding shares of Common Stock are not subdivided, split or combined, the Conversion Price shall be readjusted, effective as of the date the Board publicly announces its decision not to subdivide, split or combine the outstanding shares of Common Stock, to such Conversion Price that would be in effect if such subdivision, split or combination had not been announced. (d) Issuance of Stock Purchase Rights. If the association issues to all or substantially all holders of the shares of Common Stock rights or warrants (other than rights or warrants issued pursuant to a dividend reinvestment plan or share purchase plan or other similar plans) entitling them, for a period of up to 45 days