Document

Creative Media & Community Trust Corporation Reports 2025 Third Quarter Results

Dallas—(November 14, 2025) Creative Media & Community Trust Corporation (NASDAQ and TASE: CMCT) (“we”, “our”, “CMCT”, or the “Company”) today reported operating results for the three months ended September 30, 2025.

Third Quarter 2025 Highlights

Real Estate Portfolio

•Office portfolio was 73.6% leased. Excluding our one Oakland office asset, the office leased percentage is 86.6%, compared to 81.7% at the end of 2024.

•Executed 80,962 square feet of leases with terms longer than 12 months.

•Refinanced an $81.0 million mortgage loan at a multifamily property in Oakland, CA, extending the maturity date to January 2027.

Financial Results

•Net loss attributable to common stockholders of $(17.7) million, or $(23.52) per diluted share.

•Funds from operations attributable to common stockholders (“FFO”)(3)1 was $(11.1) million, or $(14.75) per diluted share.

•Core FFO attributable to common stockholders(4)1 was $(10.5) million, or $(13.96) per diluted share.

Asset Sales

•On November 6, 2025, we entered into an agreement with a third-party buyer to sell our lending business for a price of approximately $44 million2.

Management Commentary

“We continue to make significant progress on our previously announced plan to accelerate our focus towards premier multifamily assets, strengthen our balance sheet and improve our liquidity,” said David Thompson, Chief Executive Officer of Creative Media & Community Trust Corporation.

“Earlier this week, we announced that we entered into a definitive agreement to sell our lending business for approximately $44 million2. The Company continues to evaluate additional asset sales. In addition, the company has now completed four refinancings across seven assets, has extended the debt maturities on two multifamily assets, and is in the process of extending another mortgage for a creative office joint venture and upsizing a recently closed mortgage at Penn Field after signing an eleven year lease with an investment grade tenant.

“We continue to see an increase in office leasing activity. We executed approximately 159,000 square feet of leases through the first 9 months of 2025, representing a 69% increase from the prior year period. In our hotel segment, we are nearing completion of our renovation of the public space after previously renovating all 505 rooms, setting the property up well for 2026 and beyond. In our multifamily segment, we continue to believe there is an opportunity to significantly improve our net operating income as our occupancy improves, newly developed assets lease-up, we mark rents to market and benefit from cost savings initiatives.”

1 Non-GAAP financial measure. Refer to the explanations and reconciliations elsewhere in this release.

2 The sales price of approximately $44 million is net of the outstanding balance of SBA 7(a) loan-backed notes and subject to adjustment and updated information through the closing of the sale. We estimate net proceeds from the sale, after payment of other debt, transaction expenses and other matters, will be approximately $31 million.

Third Quarter 2025 Results

Real Estate Portfolio

As of September 30, 2025, our real estate portfolio consisted of 27 assets, all of which were fee-simple properties and five of which we own through investments in unconsolidated joint ventures (the “Unconsolidated Joint Ventures”). Our Unconsolidated Joint Ventures contain one office property, one multifamily site currently under development, two multifamily properties (one of which has been partially converted from office into multifamily units and is now being classified as a multifamily property) and one commercial development site. The portfolio includes 12 office properties, totaling approximately 1.3 million rentable square feet, four multifamily properties totaling 696 units, nine development sites (three of which are being used as parking lots) and one 505-room hotel with an ancillary parking garage.

Financial Results

Net loss attributable to common stockholders was $(17.7) million, or $(23.52) per diluted share of Common Stock, for the three months ended September 30, 2025, compared to a net loss attributable to common stockholders of $(34.8) million, or $(305.04) per diluted share of Common Stock, for the same period in 2024. The decrease in net loss attributable to common stockholders was primarily driven by a decrease in redeemable preferred stock redemptions of $16.1 million in redeemable preferred stock dividends of $2.7 million, partially offset by a decrease of $617,000 in segment net operating income, an increase in interest expense of $782,000 and an increase in depreciation and amortization expense of $922,000.

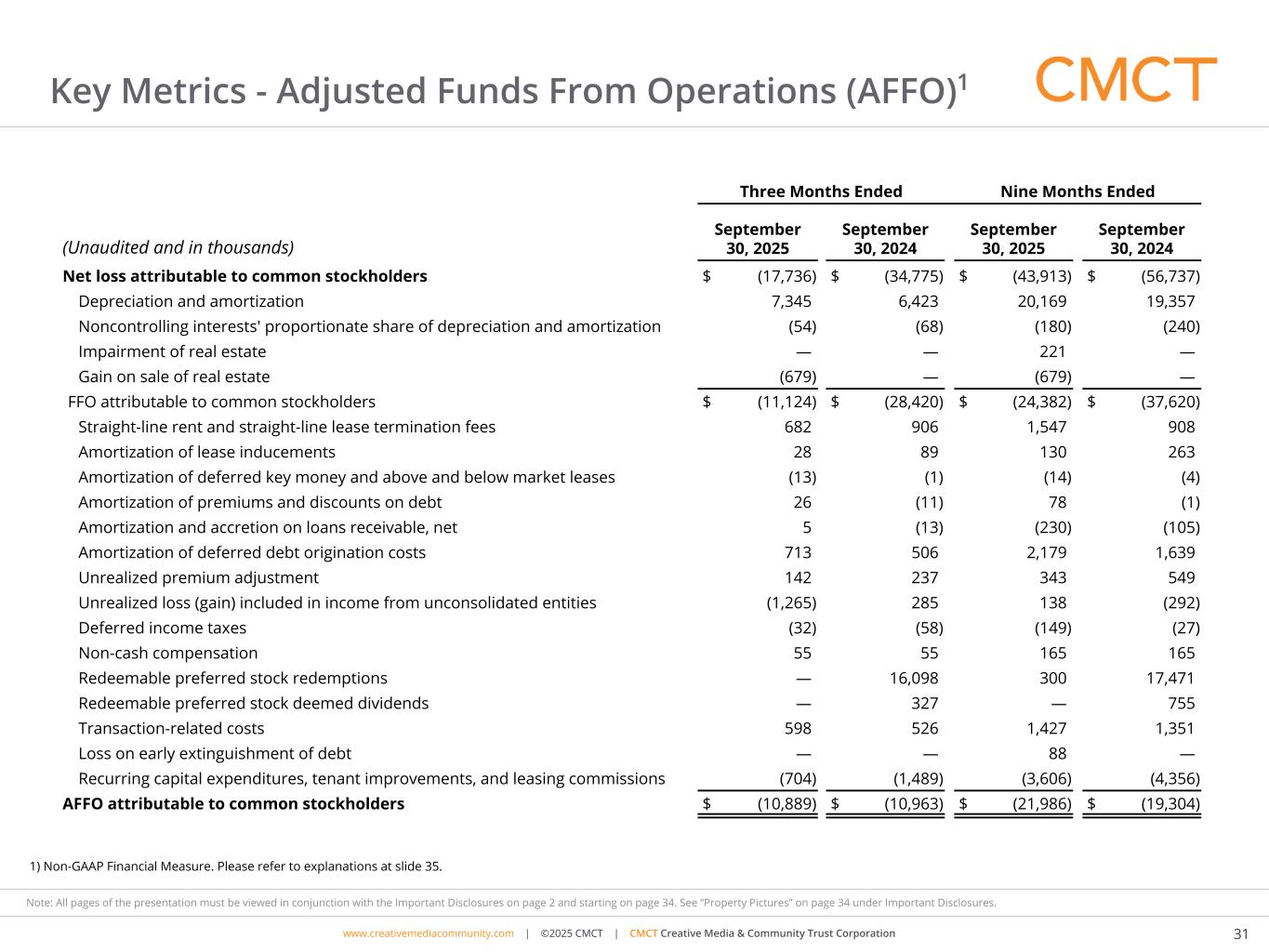

FFO3 attributable to common stockholders(3) was $(11.1) million, or $(14.75) per diluted share of Common Stock for the three months ended September 30, 2025, compared to $(28.4) million, or $(249.30) per diluted share of Common Stock, for the same period in 2024. The decrease in FFO3 attributable to common stockholders was driven by the previously discussed decrease in net loss attributable to common stockholders, while not impacted by depreciation and amortization expense.

Core FFO3 attributable to common stockholders(4) was $(10.5) million, or $(13.96) per diluted share of Common Stock for the three months ended September 30, 2025 compared to $(11.5) million, or $(100.61) per diluted share of Common Stock, for the same period in 2024. Unlike FFO3, Core FFO3 was not impacted by the decrease redeemable preferred stock redemptions, as this is excluded from our Core FFO3 calculation.

Segment Information

Our reportable segments during the three months ended September 30, 2025 and 2024 consisted of three types of commercial real estate properties, namely, office, hotel and multifamily, as well as a segment for our lending business. Total segment net operating income (“NOI”)(5) was $7.0 million for the three months ended September 30, 2025, compared to $7.6 million for the same period in 2024.

Office

Same-Store

Same-store(2) office Segment NOI(5) was $5.0 million for the three months ended September 30, 2025, a decrease from $5.4 million in the same period in 2024, while same-store(1) office Cash NOI(6)3 was $5.7 million for the three months ended September 30, 2025, a decrease from $6.4 million in the same period in 2024. The decreases in same-store(2) office Segment NOI(5) and same-store(1) office Cash NOI(6)2 were primarily driven by a decrease in rental revenues at an office property in Los Angeles, California and an office property in San Francisco, California, as a result of a decline occupancy, as well as an increase in operating expenses at an office property in Austin, Texas, driven by an increase in real estate taxes during the current period.

At September 30, 2025, the Company’s office portfolio was 69.8% occupied, a decrease of (240) basis points year-over-year, and 73.6% leased, an increase of 70 basis points year-over-year. The annualized rent per occupied square foot(7) was $60.22 at September 30, 2025, compared to $60.31 at September 30, 2024. During the three months ended September 30, 2025, the Company executed 80,962 square feet of leases with terms longer than 12 months.

Total

Results for office Segment NOI(5) decreased to $5.0 million for the three months ended September 30, 2025, as compared to $5.4 million for the same period in 2024, driven by the aforementioned decrease in same-store(2) office Segment NOI(5) as there was no non-same-store office activity during either period.

3 Non-GAAP financial measure. Refer to the explanations and reconciliations elsewhere in this release.

Hotel

Hotel Segment NOI(5) was $850,000 for the three months ended September 30, 2025, a decrease from $1.0 million for the same period in 2024, primarily due to a decrease in food and beverage sale revenues, partially offset by an increase in room revenue. Operations at our hotel property were negatively impacted by our room renovation project and lobby renovation project during the three months ended September 30, 2025 and 2024, respectively:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

| |

|

2025 |

|

2024 |

| Occupancy |

|

68.9 |

% |

|

55.5 |

% |

Average daily rate(a) |

|

$ |

194.47 |

|

|

$ |

184.69 |

|

Revenue per available room(b) |

|

$ |

133.92 |

|

|

$ |

102.55 |

|

______________________

(a)Calculated as trailing 3-month room revenue divided by the number of rooms occupied.

(b)Calculated as trailing 3-month room revenue divided by the number of available rooms.

Multifamily

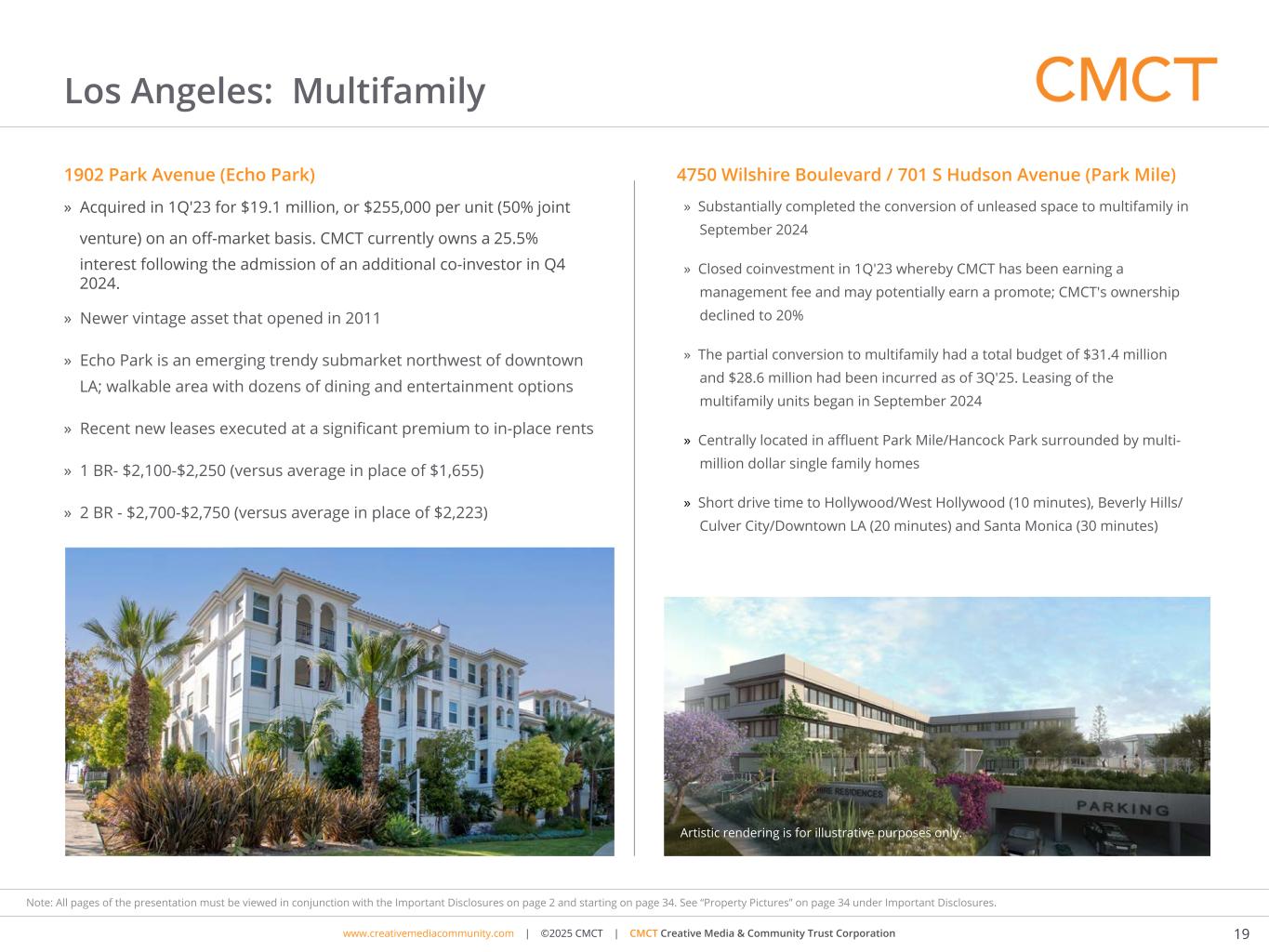

Our Multifamily Segment consists of two multifamily buildings located in Oakland, California as well as two investments in multifamily buildings in Los Angeles, California, each owned through unconsolidated joint ventures (one of which, 701 S Hudson / 4750 Wilshire Boulevard, was reclassified from an office segment property to a multifamily segment property as of October 1, 2024, following the substantial completion of the conversion of two of the building’s three floors from office-use into 68 for-lease multifamily units). Our multifamily segment NOI(5) was $792,000 for the three months ended September 30, 2025, compared to $508,000 for the same period in 2024. The increase our multifamily segment NOI(5) was primarily driven by a decrease in real estate taxes at our multifamily properties in Oakland, California during the three months ended September 30, 2025, partially offset by a decrease in revenues at our multifamily properties in Oakland, California as a result of decreases in occupancy and monthly rent per occupied unit, net of rent concessions, for the three months ended September 30, 2025 compared to the prior year period. As of September 30, 2025, our Multifamily Segment was 85.3% occupied, monthly rent per occupied unit(8) was $2,508 and net monthly rent per occupied unit(9) was $2,215, compared to 92.0%, $2,555, and $2,444, respectively, as of September 30, 2024.

Lending

Our lending segment primarily consists of our SBA 7(a) lending platform, which is a national lender that primarily originates loans to small businesses in the hospitality industry. Lending segment NOI(5) was $314,000 for the three months ended September 30, 2025, compared to income of $688,000 for the same period in 2024. The decrease was primarily due to a decrease in interest income as a result of loan payoffs and lower interest rates, partially offset by a decrease in expenses due to a decrease in interest expense, resulting from net loan paydowns, and decrease in additions to current expected credit losses.

Debt and Equity

On August 4, 2025 the Company reached an agreement with the lender to extend the maturity date of our $81.0 million mortgage at a multifamily property in Oakland, California through January 31, 2027 (the “Channel House Mortgage Extension”). In connection with the Channel House Mortgage Extension, the Company made a repayment of $6.0 million under such mortgage, reducing it from its previous balance of $87.0 million.

Dividends

We declared preferred stock dividends on our Series A, Series A1 and Series D Preferred Stock for the third quarter of 2025. The dividends were payable on October 15, 2025 to holders of record at the close of business on October 5, 2025.

The dividend amounts are as follows:

|

|

|

|

|

|

|

Quarterly Dividend Amount |

Series A Preferred Stock |

$0.34375 per share |

| Series A1 Preferred Stock |

$0.426875 per share* |

| Series D Preferred Stock |

$0.353125 per share |

*The quarterly cash dividend of $0.426875 per share represents an annualized dividend rate of 6.83% (2.5% plus the federal funds rate of 4.33% on the applicable determination date). The terms of the Series A1 Preferred Stock provide for cumulative cash dividends (if, as and when authorized by the Board of Directors) on each share of Series A1 Preferred Stock at a quarterly rate of the greater of (i) 6.00% of the Series A1 Stated Value, divided by four (4) and (ii) the Federal Funds (Effective) Rate on the applicable determination date, plus 2.50%, of the Series A1 Stated Value, divided by four (4), up to a maximum of 2.50% of the Series A1 Stated Value per quarter.

About the Data

Descriptions of certain performance measures, including Segment NOI, Cash NOI, FFO attributable to common stockholders, and Core FFO attributable to common stockholders are provided below. Certain of these performance measures—Cash NOI, FFO attributable to common stockholders and Core FFO attributable to common stockholders —are non-GAAP financial measures. Refer to the subsequent tables for reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measure.

(1)Stabilized office portfolio: represents office properties where occupancy was not impacted by a redevelopment or repositioning during the period.

(2)Same-store properties: are properties that we have owned and operated in a consistent manner and reported in our consolidated results during the entire span of the periods being reported. We excluded from our same-store property set this quarter any properties (i) acquired on or after July 1, 2024; (ii) sold or otherwise removed from our consolidated financial statements on or before September 30, 2025; or (iii) that underwent a major repositioning project we believed significantly affected its results at any point during the period commencing on July 1, 2024 and ending on September 30, 2025. When determining our same-store office properties as of September 30, 2025, one office property was excluded pursuant to (i) and (iii) above and one office property was excluded pursuant to (ii) above.

(3)FFO attributable to common stockholders (“FFO”): represents net income (loss) attributable to common stockholders, computed in accordance with GAAP, which reflects the deduction of redeemable preferred stock dividends accumulated, excluding gain (or loss) from sales of real estate, impairment of real estate, and real estate depreciation and amortization. We calculate FFO in accordance with the standards established by the National Association of Real Estate Investment Trusts (the “NAREIT”). See ‘Core FFO’ definition below for discussion of the benefits and limitations of FFO as a supplemental measure of operating performance.

(4)Core FFO attributable to common stockholders (“Core FFO”): represents FFO attributable to common stockholders (computed as described above), excluding gain (loss) on early extinguishment of debt, redeemable preferred stock deemed dividends, redeemable preferred stock redemptions, gain (loss) on termination of interest rate swaps, and transaction costs.

We believe that FFO is a widely recognized and appropriate measure of the performance of a REIT and that it is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs, many of which present FFO when reporting their results. In addition, we believe that Core FFO is a useful metric for securities analysts, investors and other interested parties in the evaluation of our Company as it excludes from FFO the effect of certain amounts that we believe are non-recurring, are non-operating in nature as they relate to the manner in which we finance our operations, or transactions outside of the ordinary course of business.

Like any metric, FFO and Core FFO should not be used as the only measure of our performance because it excludes depreciation and amortization and captures neither the changes in the value of our real estate properties that result from use or market conditions nor the level of capital expenditures and leasing commissions necessary to maintain the operating performance of our properties, and Core FFO excludes amounts incurred in connection with non-recurring special projects, prepaying or defeasing our debt, repurchasing our preferred stock, and adjusting the carrying value of our preferred stock classified in temporary equity to its redemption value, all of which have real economic effect and could materially impact our operating results. Other REITs may not calculate FFO and Core FFO in the same manner as we do, or at all; accordingly, our FFO and Core FFO may not be comparable to the FFOs and Core FFOs of other REITs.

Therefore, FFO and Core FFO should be considered only as a supplement to net income (loss) as a measure of our performance and should not be used as a supplement to or substitute measure for cash flows from operating activities computed in accordance with GAAP. FFO and Core FFO should not be used as a measure of our liquidity, nor is it indicative of funds available to fund our cash needs, including our ability to pay dividends. FFO and Core FFO per share for the year-to-date period may differ from the sum of quarterly FFO and Core FFO per share amounts due to the required method for computing per share amounts for the respective periods. In addition, FFO and Core FFO per share is calculated independently for each component and may not be additive due to rounding.

(5)Segment NOI: for our real estate segments represents rental and other property income and expense reimbursements less property related expenses and excludes non-property income and expenses, interest expense, depreciation and amortization, corporate related general and administrative expenses, gain (loss) on sale of real estate, gain (loss) on early extinguishment of debt, impairment of real estate, transaction costs, and benefit (provision) for income taxes. For our lending segment, Segment NOI represents interest income net of interest expense and general overhead expenses. See ‘Cash NOI’ definition below for discussion of the benefits and limitations of Segment NOI as a supplemental measure of operating performance.

(6)Cash NOI: for our real estate segments, represents Segment NOI adjusted to exclude the effect of the straight lining of rents, acquired above/below market lease amortization and other adjustments required by generally accepted accounting principles (“GAAP”). For our lending segment, there is no distinction between Cash NOI and Segment NOI. We also evaluate the operating performance and financial results of our operating segments using cash basis NOI excluding lease termination income, or “Cash NOI excluding lease termination income”.

Segment NOI and Cash NOI are not measures of operating results or cash flows from operating activities as measured by GAAP and should not be considered alternatives to income from continuing operations, or to cash flows as a measure of liquidity, or as an indication of our performance or of our ability to pay dividends. Companies may not calculate Segment NOI or Cash NOI in the same manner. We consider Segment NOI and Cash NOI to be useful performance measures to investors and management because, when compared across periods, they reflect the revenues and expenses directly associated with owning and operating our properties and the impact to operations from trends in occupancy rates, rental rates and operating costs, providing a perspective not immediately apparent from income from continuing operations. Additionally, we believe that Cash NOI is helpful to investors because it eliminates straight line rent and other non-cash adjustments to revenue and expenses.

(7)Annualized rent per occupied square foot: represents gross monthly base rent under leases commenced as of the specified periods, multiplied by twelve. This amount reflects total cash rent before abatements. Where applicable, annualized rent has been grossed up by adding annualized expense reimbursements to base rent. Annualized rent for certain office properties includes rent attributable to retail.

(8)Monthly rent per occupied unit: Represents gross monthly base rent under leases commenced as of the specified period, divided by occupied units. This amount reflects total cash rent before concessions.

(9)Net monthly rent per occupied unit: Represents gross monthly base rent under leases commenced as of the specified period less rent concessions granted during the specified period, divided by occupied units.

FORWARD-LOOKING STATEMENTS

This press release contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are intended to be covered by the safe harbors created thereby. These statements include the plans and objectives of management for future operations, including plans and objectives relating to future growth of CMCT’s business and availability of funds. Such forward-looking statements can be identified by the use of forward-looking terminology such as “may,” “will,” “project,” “target,” “expect,” “intend,” “might,” “believe,” “anticipate,” “estimate,” “could,” “would,” “continue,” “pursue,” “potential,” “forecast,” “seek,” “plan,” or “should,” or “goal” or the negative thereof or other variations or similar words or phrases. Such forward-looking statements also include, among others, statements about CMCT’s plans and objectives relating to future growth and outlook. Such forward-looking statements are based on particular assumptions that management of CMCT has made in light of its experience, as well as its perception of expected future developments and other factors that it believes are appropriate under the circumstances. Forward-looking statements are necessarily estimates reflecting the judgment of CMCT’s management and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. These risks and uncertainties include those associated with (i) the timing, form, and operational effects of CMCT’s development activities, (ii) the ability of CMCT to raise in place rents to existing market rents and to maintain or increase occupancy levels, (iii) fluctuations in market rents, (iv) the effects of inflation and continuing higher interest rates on the operations and profitability of CMCT and (v) general economic, market and other conditions, including the effects of high unemployment rates, continued or renewed inflation and any recession or slowdown in economic growth. Additional important factors that could cause CMCT’s actual results to differ materially from CMCT’s expectations are discussed in “Item 1A—Risk Factors” in CMCT’s Annual Report on Form 10-K for the year ended December 31, 2024 and in Part II, Item 1A of CMCT’s Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission from time to time. The forward-looking statements included herein are based on current expectations and there can be no assurance that these expectations will be attained. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond CMCT’s control. Although we believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurance that the forward-looking statements expressed or implied will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements expressed or implied herein, the inclusion of such information should not be regarded as a representation by CMCT or any other person that CMCT’s objectives and plans will be achieved. Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date they are made. CMCT does not undertake to update them to reflect changes that occur after the date they are made, except as may be required by applicable laws.

For Creative Media & Community Trust Corporation

Media Relations:

Bill Mendel, 212-397-1030

bill@mendelcommunications.com

or

Shareholder Relations:

Steve Altebrando, 646-652-8473

shareholders@creativemediacommunity.com

CREATIVE MEDIA & COMMUNITY TRUST CORPORATION AND SUBSIDIARIES

Consolidated Balance Sheets

(Unaudited and in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 |

|

December 31, 2024 |

| ASSETS |

|

|

|

|

| Investments in real estate, net |

|

$ |

702,671 |

|

|

$ |

709,194 |

|

| Investments in unconsolidated entities |

|

32,601 |

|

|

33,677 |

|

| Cash and cash equivalents |

|

17,320 |

|

|

20,262 |

|

| Restricted cash |

|

30,907 |

|

|

32,606 |

|

| Loans receivable, net |

|

51,517 |

|

|

56,210 |

|

| Accounts receivable, net |

|

3,379 |

|

|

4,345 |

|

| Deferred rent receivable and charges, net |

|

19,687 |

|

|

19,896 |

|

| Other intangible assets, net |

|

3,427 |

|

|

3,568 |

|

| Other assets |

|

10,317 |

|

|

9,797 |

|

|

|

|

|

|

| TOTAL ASSETS |

|

$ |

871,826 |

|

|

$ |

889,555 |

|

| LIABILITIES, REDEEMABLE PREFERRED STOCK, AND EQUITY |

|

|

|

|

| LIABILITIES: |

|

|

|

|

| Debt, net |

|

$ |

527,767 |

|

|

$ |

505,732 |

|

| Accounts payable and accrued expenses |

|

31,757 |

|

|

32,204 |

|

|

|

|

|

|

| Due to related parties |

|

18,611 |

|

|

14,068 |

|

| Other liabilities |

|

10,740 |

|

|

10,488 |

|

|

|

|

|

|

| Total liabilities |

|

588,875 |

|

|

562,492 |

|

| COMMITMENTS AND CONTINGENCIES |

|

|

|

|

REDEEMABLE PREFERRED STOCK: Series A1 cumulative redeemable preferred stock, $0.001 par value; 0 and 25,045,401 shares authorized as of September 30, 2025 and December 31, 2024, respectively; no shares issued or outstanding as of September 30, 2025 and 913,630 and 913,590 shares issued and outstanding, respectively, as of December 31, 2024; liquidation preference of $25.00 per share, subject to adjustment |

|

— |

|

|

20,799 |

|

| EQUITY: |

|

|

|

|

Series A cumulative redeemable preferred stock, $0.001 par value; 31,200,554 and 31,305,025 shares authorized as of September 30, 2025 and December 31, 2024, respectively; 8,820,338 and 4,020,892 shares issued and outstanding, respectively, as of September 30, 2025 and 8,820,338 and 4,125,363 shares issued and outstanding, respectively, as of December 31, 2024; liquidation preference of $25.00 per share, subject to adjustment |

|

100,720 |

|

|

103,326 |

|

Series A1 cumulative redeemable preferred stock, $0.001 par value; 24,851,185 and 25,045,401 shares authorized as of September 30, 2025 and December 31, 2024, respectively; 12,240,878 and 9,092,063 shares issued and outstanding, respectively, as of September 30, 2025 and 11,327,248 and 8,372,689 shares issued and outstanding, respectively, as of December 31, 2024; liquidation preference of $25.00 per share, subject to adjustment |

|

225,959 |

|

|

207,387 |

|

Series D cumulative redeemable preferred stock, $0.001 par value; 26,991,590 shares authorized as of September 30, 2025 and December 31, 2024; 56,857 and 48,447 shares issued and outstanding, respectively, as of both September 30, 2025 and December 31, 2024; liquidation preference of $25.00 per share, subject to adjustment |

|

1,190 |

|

|

1,190 |

|

|

|

|

|

|

Common stock, $0.001 par value; 900,000,000 shares authorized; 789,251 shares issued and outstanding as of September 30, 2025 and 466,176 shares issued and outstanding as of December 31, 2024 |

|

3 |

|

|

119 |

|

| Additional paid-in capital |

|

1,000,454 |

|

|

994,973 |

|

| Distributions in excess of earnings |

|

(1,046,395) |

|

|

(1,002,479) |

|

| Total stockholders’ equity |

|

281,931 |

|

|

304,516 |

|

| Non-controlling interests |

|

1,020 |

|

|

1,748 |

|

| Total equity |

|

282,951 |

|

|

306,264 |

|

| TOTAL LIABILITIES, REDEEMABLE PREFERRED STOCK, AND EQUITY |

|

$ |

871,826 |

|

|

$ |

889,555 |

|

CREATIVE MEDIA & COMMUNITY TRUST CORPORATION AND SUBSIDIARIES

Consolidated Statements of Operations

(Unaudited and in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| REVENUES: |

|

|

|

|

|

|

|

|

| Rental and other property income |

|

$ |

16,162 |

|

|

$ |

18,150 |

|

|

$ |

49,161 |

|

|

$ |

56,172 |

|

| Hotel income |

|

7,243 |

|

|

6,808 |

|

|

30,550 |

|

|

29,768 |

|

| Interest and other income |

|

2,829 |

|

|

3,658 |

|

|

8,507 |

|

|

11,113 |

|

| Total Revenues |

|

26,234 |

|

|

28,616 |

|

|

88,218 |

|

|

97,053 |

|

| EXPENSES: |

|

|

|

|

|

|

|

|

| Rental and other property operating |

|

16,141 |

|

|

17,373 |

|

|

50,240 |

|

|

52,550 |

|

| Asset management and other fees to related parties |

|

331 |

|

|

515 |

|

|

1,040 |

|

|

1,334 |

|

| Expense reimbursements to related parties—corporate |

|

1,174 |

|

|

592 |

|

|

2,691 |

|

|

1,809 |

|

| Expense reimbursements to related parties—lending segment |

|

679 |

|

|

672 |

|

|

2,016 |

|

|

1,908 |

|

| Interest |

|

10,312 |

|

|

9,616 |

|

|

30,246 |

|

|

27,819 |

|

| General and administrative |

|

2,148 |

|

|

2,221 |

|

|

6,130 |

|

|

5,243 |

|

| Transaction-related costs |

|

598 |

|

|

526 |

|

|

1,427 |

|

|

1,351 |

|

| Depreciation and amortization |

|

7,345 |

|

|

6,423 |

|

|

20,169 |

|

|

19,357 |

|

|

|

|

|

|

|

|

|

|

| Loss on early extinguishment of debt (Note 7) |

|

— |

|

|

— |

|

|

88 |

|

|

— |

|

| Impairment of real estate (Note 3) |

|

— |

|

|

— |

|

|

221 |

|

|

111,371 |

|

| Total Expenses |

|

38,728 |

|

|

37,938 |

|

|

114,268 |

|

|

111,371 |

|

| Loss from unconsolidated entities |

|

(697) |

|

|

(1,239) |

|

|

(2,285) |

|

|

(442) |

|

| Gain on sale of real estate (Note 3) |

|

679 |

|

|

— |

|

|

679 |

|

|

— |

|

| LOSS BEFORE (BENEFIT) PROVISION FOR INCOME TAXES |

|

(12,512) |

|

|

(10,561) |

|

|

(27,656) |

|

|

(14,760) |

|

| Provision for income taxes |

|

74 |

|

|

15 |

|

|

353 |

|

|

573 |

|

| NET LOSS |

|

(12,586) |

|

|

(10,576) |

|

|

(28,009) |

|

|

(15,333) |

|

| Net loss attributable to non-controlling interests |

|

131 |

|

|

192 |

|

|

441 |

|

|

423 |

|

| NET LOSS ATTRIBUTABLE TO THE COMPANY |

|

(12,455) |

|

|

(10,384) |

|

|

(27,568) |

|

|

(14,910) |

|

Redeemable preferred stock dividends declared or accumulated |

|

(5,281) |

|

|

(7,966) |

|

|

(16,045) |

|

|

(23,601) |

|

| Redeemable preferred stock deemed dividends (Note 11) |

|

— |

|

|

(327) |

|

|

— |

|

|

(755) |

|

Redeemable preferred stock redemptions |

|

— |

|

|

(16,098) |

|

|

(300) |

|

|

(17,471) |

|

| NET LOSS ATTRIBUTABLE TO COMMON STOCKHOLDERS |

|

$ |

(17,736) |

|

|

$ |

(34,775) |

|

|

$ |

(43,913) |

|

|

$ |

(56,737) |

|

| NET LOSS ATTRIBUTABLE TO COMMON STOCKHOLDERS PER SHARE: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(23.52) |

|

|

$ |

(305.04) |

|

|

$ |

(63.18) |

|

|

$ |

(550.84) |

|

| Diluted |

|

$ |

(23.52) |

|

|

$ |

(305.04) |

|

|

$ |

(63.18) |

|

|

$ |

(550.84) |

|

| WEIGHTED AVERAGE SHARES OF COMMON STOCK OUTSTANDING: |

|

|

|

|

|

|

|

|

| Basic |

|

754 |

|

|

114 |

|

|

695 |

|

|

103 |

|

| Diluted |

|

754 |

|

|

114 |

|

|

695 |

|

|

103 |

|

CREATIVE MEDIA & COMMUNITY TRUST CORPORATION AND SUBSIDIARIES

Funds from Operations Attributable to Common Stockholders

(Unaudited and in thousands, except per share amounts)

We believe that FFO is a widely recognized and appropriate measure of the performance of a REIT and that it is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs, many of which present FFO when reporting their results. FFO represents net income (loss) attributable to common stockholders, computed in accordance with generally accepted accounting principles ("GAAP"), which reflects the deduction of redeemable preferred stock dividends accumulated, excluding gains (or losses) from sales of real estate, impairment of real estate, and real estate depreciation and amortization. We calculate FFO in accordance with the standards established by the National Association of Real Estate Investment Trusts (the "NAREIT").

Like any metric, FFO should not be used as the only measure of our performance because it excludes depreciation and amortization and captures neither the changes in the value of our real estate properties that result from use or market conditions nor the level of capital expenditures and leasing commissions necessary to maintain the operating performance of our properties, all of which have real economic effect and could materially impact our operating results. Other REITs may not calculate FFO in accordance with the standards established by the NAREIT; accordingly, our FFO may not be comparable to the FFO of other REITs. Therefore, FFO should be considered only as a supplement to net income (loss) as a measure of our performance and should not be used as a supplement to or substitute measure for cash flows from operating activities computed in accordance with GAAP. FFO should not be used as a measure of our liquidity, nor is it indicative of funds available to fund our cash needs, including our ability to pay dividends. The following table sets forth a reconciliation of net income (loss) attributable to common stockholders to FFO attributable to common stockholders for the three months ended September 30, 2025 and 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Numerator: |

|

|

|

|

|

|

|

|

| Net loss attributable to common stockholders |

|

$ |

(17,736) |

|

|

$ |

(34,775) |

|

|

$ |

(43,913) |

|

|

$ |

(56,737) |

|

| Depreciation and amortization |

|

7,345 |

|

|

6,423 |

|

|

20,169 |

|

|

19,357 |

|

| Noncontrolling interests’ proportionate share of depreciation and amortization |

|

(54) |

|

|

(68) |

|

|

(180) |

|

|

(240) |

|

| Impairment of real estate |

|

— |

|

|

— |

|

|

221 |

|

|

— |

|

| Gain on sale of real estate |

|

(679) |

|

|

— |

|

|

— |

|

|

— |

|

| FFO attributable to common stockholders |

|

(11,124) |

|

|

(28,420) |

|

|

$ |

(24,382) |

|

|

$ |

(37,620) |

|

| Redeemable preferred stock dividends declared on dilutive shares (a) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Diluted FFO attributable to common stockholders |

|

$ |

(11,124) |

|

|

$ |

(28,420) |

|

|

$ |

(24,382) |

|

|

$ |

(37,620) |

|

| Denominator: |

|

|

|

|

|

|

|

|

| Basic weighted average shares of common stock outstanding |

|

754 |

|

|

114 |

|

|

695 |

|

|

103 |

|

| Effect of dilutive securities—contingently issuable shares (a) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Diluted weighted average shares and common stock equivalents outstanding |

|

754 |

|

|

114 |

|

|

695 |

|

|

103 |

|

| FFO attributable to common stockholders per share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(14.75) |

|

|

$ |

(249.30) |

|

|

$ |

(35.08) |

|

|

$ |

(365.24) |

|

| Diluted |

|

$ |

(14.75) |

|

|

$ |

(249.30) |

|

|

$ |

(35.08) |

|

|

$ |

(365.24) |

|

______________________

(a)For the three months ended September 30, 2025 and 2024, the effect of certain shares of redeemable preferred stock were excluded from the computation of diluted FFO attributable to common stockholders and the diluted weighted average shares and common stock equivalents outstanding as such inclusion would be anti-dilutive.

CREATIVE MEDIA & COMMUNITY TRUST CORPORATION AND SUBSIDIARIES

Core Funds from Operations Attributable to Common Stockholders

(Unaudited and in thousands, except per share amounts)

In addition to calculating FFO in accordance with the standards established by NAREIT, we also calculate a supplemental FFO metric we call Core FFO attributable to common stockholders. Core FFO attributable to common stockholders represents FFO attributable to common stockholders, computed in accordance with NAREIT's standards, excluding losses (or gains) on early extinguishment of debt, redeemable preferred stock redemptions, gains (or losses) on termination of interest rate swaps, and transaction costs. We believe that Core FFO is a useful metric for securities analysts, investors and other interested parties in the evaluation of our Company as it excludes from FFO the effect of certain amounts that we believe are non-recurring, are non-operating in nature as they relate to the manner in which we finance our operations, or transactions outside of the ordinary course of business.

Like any metric, Core FFO should not be used as the only measure of our performance because, in addition to excluding those items prescribed by NAREIT when calculating FFO, it excludes amounts incurred in connection with non-recurring special projects, prepaying or defeasing our debt and repurchasing our preferred stock, all of which have real economic effect and could materially impact our operating results. Other REITs may not calculate Core FFO in the same manner as we do, or at all; accordingly, our Core FFO may not be comparable to the Core FFO of other REITs who calculate such a metric. Therefore, Core FFO should be considered only as a supplement to net income (loss) as a measure of our performance and should not be used as a supplement to or substitute measure for cash flows from operating activities computed in accordance with GAAP. Core FFO should not be used as a measure of our liquidity, nor is it indicative of funds available to fund our cash needs, including our ability to pay dividends. The following table sets forth a reconciliation of net income (loss) attributable to common stockholders to Core FFO attributable to common stockholders for the three months ended September 30, 2025 and 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Numerator: |

|

|

|

|

|

|

|

|

| Net loss attributable to common stockholders |

|

$ |

(17,736) |

|

|

$ |

(34,775) |

|

|

$ |

(43,913) |

|

|

$ |

(56,737) |

|

| Depreciation and amortization |

|

7,345 |

|

|

6,423 |

|

|

20,169 |

|

|

19,357 |

|

| Noncontrolling interests’ proportionate share of depreciation and amortization |

|

(54) |

|

|

(68) |

|

|

(180) |

|

|

(240) |

|

| Impairment of real estate |

|

— |

|

|

— |

|

|

221 |

|

|

— |

|

| Gain on sale of real estate |

|

(679) |

|

|

— |

|

|

(679) |

|

|

— |

|

| FFO attributable to common stockholders |

|

$ |

(11,124) |

|

|

$ |

(28,420) |

|

|

$ |

(24,382) |

|

|

$ |

(37,620) |

|

| Loss on early extinguishment of debt |

|

— |

|

|

— |

|

|

88 |

|

|

— |

|

| Redeemable preferred stock redemptions |

|

— |

|

|

16,098 |

|

|

300 |

|

|

17,471 |

|

Redeemable preferred stock deemed dividends |

|

— |

|

|

327 |

|

|

— |

|

|

755 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Transaction-related costs |

|

598 |

|

|

526 |

|

|

1,427 |

|

|

1,351 |

|

| Core FFO attributable to common stockholders |

|

$ |

(10,526) |

|

|

$ |

(11,469) |

|

|

$ |

(22,567) |

|

|

$ |

(18,043) |

|

| Redeemable preferred stock dividends declared on dilutive shares (a) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Diluted Core FFO attributable to common stockholders |

|

$ |

(10,526) |

|

|

$ |

(11,469) |

|

|

$ |

(22,567) |

|

|

$ |

(18,043) |

|

| Denominator: |

|

|

|

|

|

|

|

|

| Basic weighted average shares of common stock outstanding |

|

754 |

|

|

114 |

|

|

695 |

|

|

103 |

|

| Effect of dilutive securities-contingently issuable shares (a) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Diluted weighted average shares and common stock equivalents outstanding |

|

754 |

|

|

114 |

|

|

695 |

|

|

103 |

|

| Core FFO attributable to common stockholders per share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(13.96) |

|

|

$ |

(100.61) |

|

|

$ |

(32.47) |

|

|

$ |

(175.17) |

|

| Diluted |

|

$ |

(13.96) |

|

|

$ |

(100.61) |

|

|

$ |

(32.47) |

|

|

$ |

(175.17) |

|

______________________

(a)For the three months ended September 30, 2025 and 2024, the effect of certain shares of redeemable preferred stock were excluded from the computation of diluted Core FFO attributable to common stockholders and the diluted weighted average shares and common stock equivalents outstanding as such inclusion would be anti-dilutive.

CREATIVE MEDIA & COMMUNITY TRUST CORPORATION AND SUBSIDIARIES

Reconciliation of Net Operating Income

(Unaudited and in thousands)

We internally evaluate the operating performance and financial results of our real estate segments based on segment NOI, which is defined as rental and other property income and expense reimbursements less property related expenses and excludes non-property income and expenses, interest expense, depreciation and amortization, corporate related general and administrative expenses, gain (loss) on sale of real estate, gain (loss) on early extinguishment of debt, impairment of real estate, transaction costs, and provision for income taxes. For our lending segment, we define segment NOI as interest income net of interest expense and general overhead expenses. We also evaluate the operating performance and financial results of our operating segments using cash basis NOI, or "cash NOI". For our real estate segments, we define cash NOI as segment NOI adjusted to exclude the effect of the straight lining of rents, acquired above/below market lease amortization and other adjustments required by GAAP.

Cash NOI is not a measure of operating results or cash flows from operating activities as measured by GAAP and should not be considered an alternative to income from continuing operations, or to cash flows as a measure of liquidity, or as an indication of our performance or of our ability to pay dividends. Companies may not calculate cash NOI in the same manner. We consider cash NOI to be a useful performance measure to investors and management because, when compared across periods, it reflects the revenues and expenses directly associated with owning and operating our properties and the impact to operations from trends in occupancy rates, rental rates and operating costs, providing a perspective not immediately apparent from income from continuing operations. Additionally, we believe that cash NOI is helpful to investors because it eliminates straight line rent and other non-cash adjustments to revenue and expenses.

Below is a reconciliation of cash NOI to segment NOI and net loss attributable to the Company for the three months ended September 30, 2025 and 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2025 |

|

|

Same-Store

Office |

|

Non-Same-Store Office |

|

Total Office |

|

Hotel |

|

Multi-family |

|

Lending |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash net operating income |

|

$ |

5,726 |

|

|

$ |

— |

|

|

$ |

5,726 |

|

|

$ |

851 |

|

|

$ |

792 |

|

|

$ |

314 |

|

|

$ |

7,683 |

|

| Deferred rent and amortization of intangible assets, liabilities, and lease inducements |

|

(711) |

|

|

— |

|

|

(711) |

|

|

(1) |

|

|

— |

|

|

|

|

(712) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment net operating income |

|

$ |

5,015 |

|

|

$ |

— |

|

|

$ |

5,015 |

|

|

$ |

850 |

|

|

$ |

792 |

|

|

$ |

314 |

|

|

$ |

6,971 |

|

| Interest and other income |

|

|

|

|

|

|

|

|

|

|

|

|

|

87 |

|

| Asset management and other fees to related parties |

|

|

|

|

|

|

|

|

|

|

|

|

|

(331) |

|

| Expense reimbursements to related parties — corporate |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,174) |

|

| Interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

(9,612) |

|

| General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,189) |

|

| Transaction-related costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

(598) |

|

| Depreciation and amortization |

|

|

|

|

|

|

|

|

|

|

|

|

|

(7,345) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gain on sale of real estate |

|

|

|

|

|

|

|

|

|

|

|

|

|

679 |

|

| Loss before provision for income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

(12,512) |

|

| Provision for income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

(74) |

|

| Net loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

(12,586) |

|

| Net loss attributable to noncontrolling interests |

|

|

|

|

|

|

|

|

|

|

|

|

|

131 |

|

| Net loss attributable to the Company |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

(12,455) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2024 |

|

|

Same-Store

Office |

|

Non-Same-Store Office |

|

Total Office |

|

Hotel |

|

Multi-family |

|

Lending |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash net operating income |

|

$ |

6,415 |

|

|

$ |

— |

|

|

$ |

6,415 |

|

|

$ |

973 |

|

|

$ |

508 |

|

|

$ |

688 |

|

|

$ |

8,584 |

|

| Deferred rent and amortization of intangible assets, liabilities, and lease inducements |

|

(996) |

|

|

— |

|

|

(996) |

|

|

— |

|

|

— |

|

|

|

|

(996) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment net operating income |

|

$ |

5,419 |

|

|

$ |

— |

|

|

$ |

5,419 |

|

|

$ |

973 |

|

|

$ |

508 |

|

|

$ |

688 |

|

|

$ |

7,588 |

|

| Interest and other income |

|

|

|

|

|

|

|

|

|

|

|

|

|

158 |

|

| Asset management and other fees to related parties |

|

|

|

|

|

|

|

|

|

|

|

|

|

(515) |

|

| Expense reimbursements to related parties — corporate |

|

|

|

|

|

|

|

|

|

|

|

|

|

(592) |

|

| Interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

(8,830) |

|

| General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,421) |

|

| Transaction costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

(526) |

|

| Depreciation and amortization |

|

|

|

|

|

|

|

|

|

|

|

|

|

(6,423) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before provision for income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

(10,561) |

|

| Provision for income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

(15) |

|

| Net Loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

(10,576) |

|

| Net loss attributable to noncontrolling interests |

|

|

|

|

|

|

|

|

|

|

|

|

|

192 |

|

| Net loss attributable to the Company |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

(10,384) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|