Document

Creative Media & Community Trust Corporation Reports 2025 First Quarter Results

Dallas—(May 9, 2025) Creative Media & Community Trust Corporation (NASDAQ and TASE: CMCT) (“we”, “our”, “CMCT”, or the “Company”), today reported operating results for the three months ended March 31, 2025.

On April 15, 2025, the previously announced 1-for-25 reverse stock split of our Common Stock became effective. All of the

share and per share amounts in this release have been adjusted to give retroactive effect to the reverse stock split.

First Quarter 2025 Highlights

Real Estate Portfolio

•Same-store office portfolio(2) was 71.4% leased.

•Executed 30,333 square feet of leases with terms longer than 12 months.

•During the three months ended March 31, 2025, closed a $5.0 million mortgage loan on an office property in Los Angeles, California.

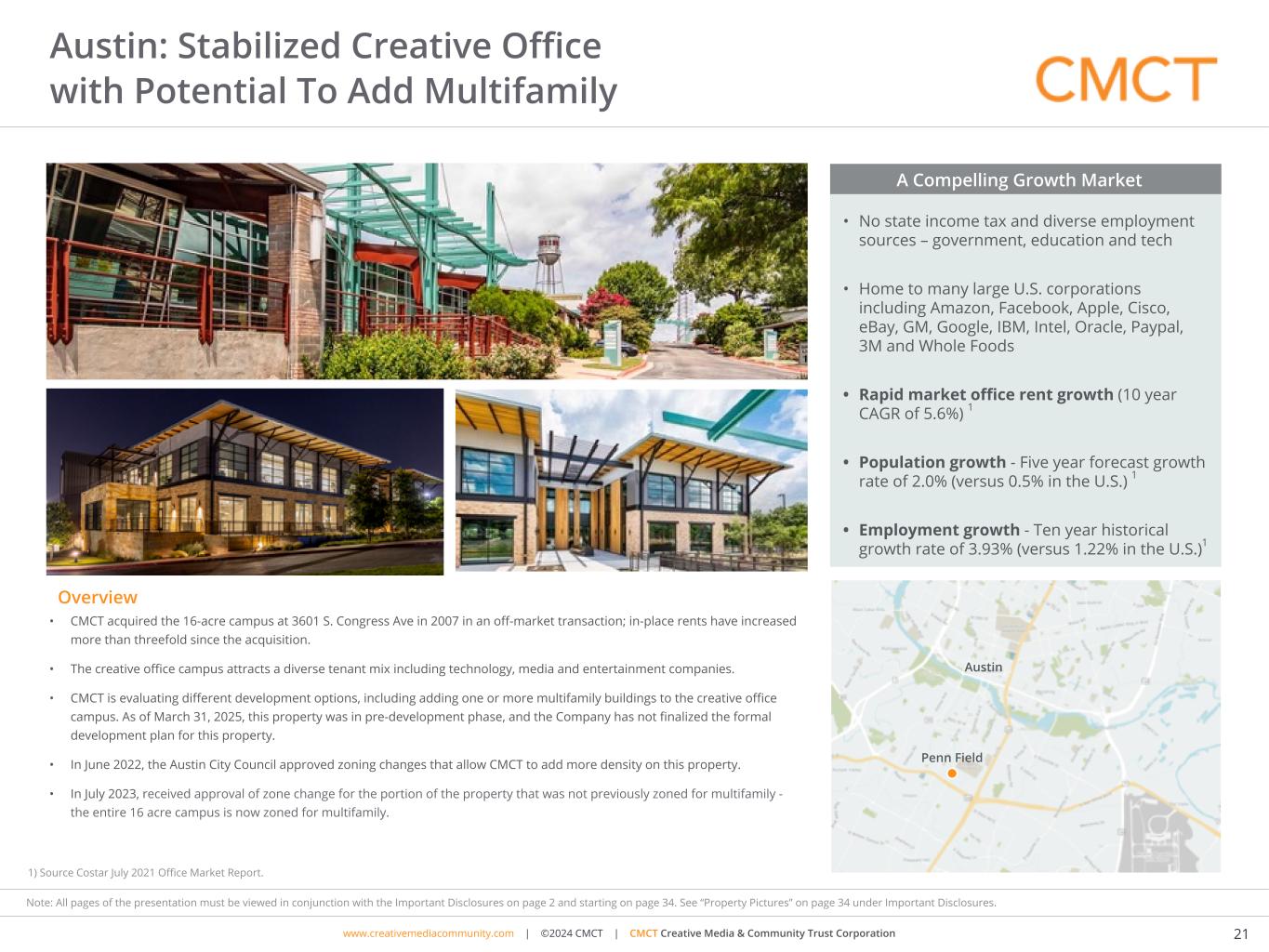

•On April 3, 2025, closed a $35.5 million variable-rate mortgage on an office property in Austin, Texas, using a portion of the proceeds to repay all outstanding obligations under the 2022 Credit Facility.

Financial Results

•Net loss attributable to common stockholders of $(11.9) million, or $(20.73) per diluted share.

•Funds from operations attributable to common stockholders (“FFO”)(3)1 was $(5.4) million, or $(9.42) per diluted share.

•Core FFO attributable to common stockholders(4)1 was $(5.1) million, or $(8.85) per diluted share.

Management Commentary

“We continue to make progress on our previously announced plan to accelerate our focus towards premier multifamily assets, strengthen our balance sheet and improve our liquidity,” said David Thompson, Chief Executive Officer of Creative Media & Community Trust Corporation.

“In September 2024, we announced plans to place property-level financing on several assets and to use part of the proceeds to fully repay the $169 million balance on our recourse corporate-level credit facility. In early April 2025, we completed our fourth property level financing and fully repaid and retired this recourse credit facility.”

“In our office segment, we executed over 30,000 square feet of leases in the first quarter. We are seeing an increase in activity in the Los Angeles and Austin markets, and we have a solid pipeline of leasing activity. In our hotel segment, net operating income increased approximately 15% from the prior year period after we completed the renovation of all 505 rooms at our one hotel asset. We anticipate commencing upgrades to the public spaces later this year. In our multifamily segment, we believe there is an opportunity to significantly improve our net operating income as our occupancy improves, newly developed assets lease-up, we mark rents to market and benefit from cost savings initiatives.”

1 Non-GAAP financial measure. Refer to the explanations and reconciliations elsewhere in this release.

First Quarter 2025 Results

Real Estate Portfolio

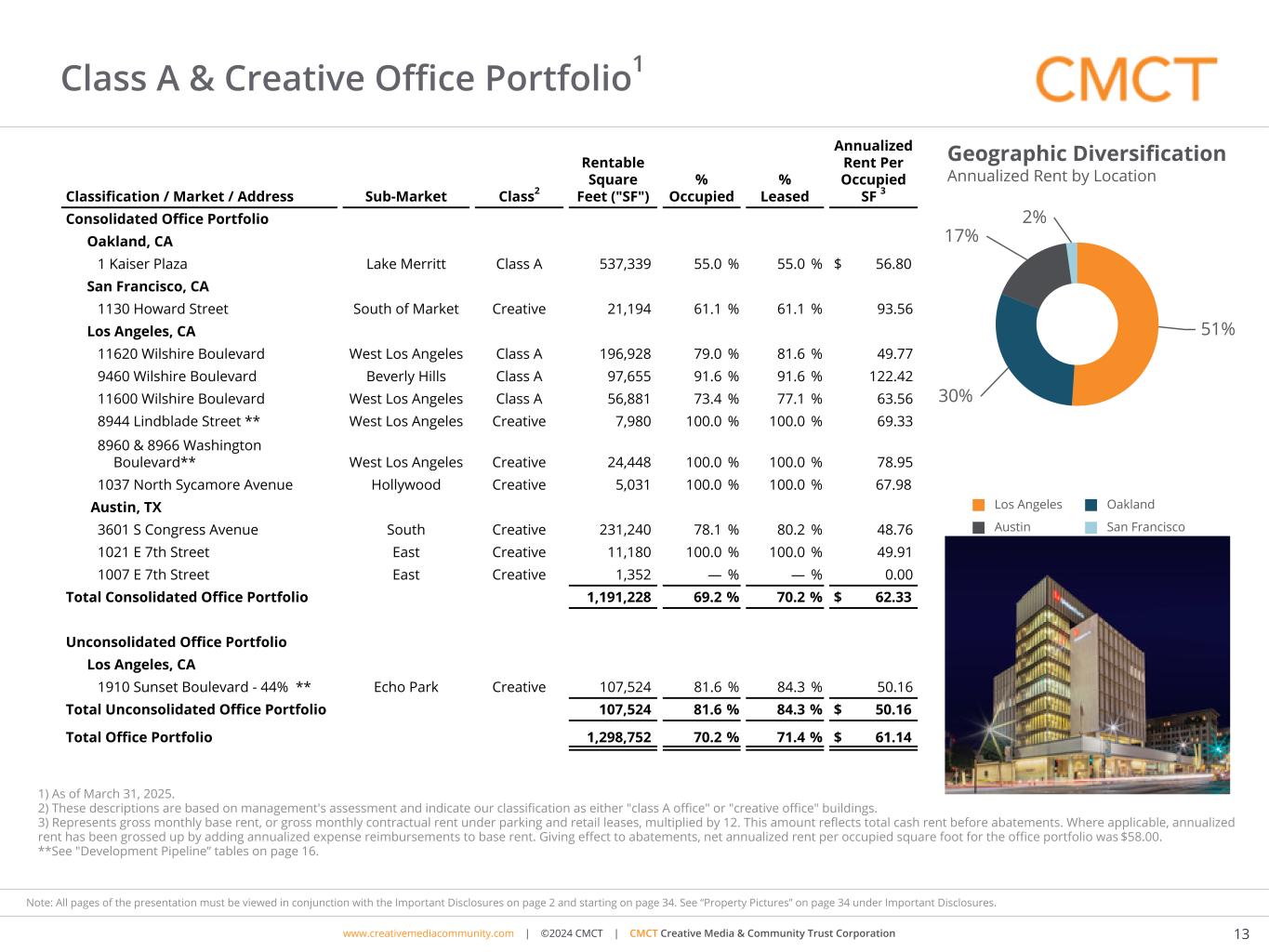

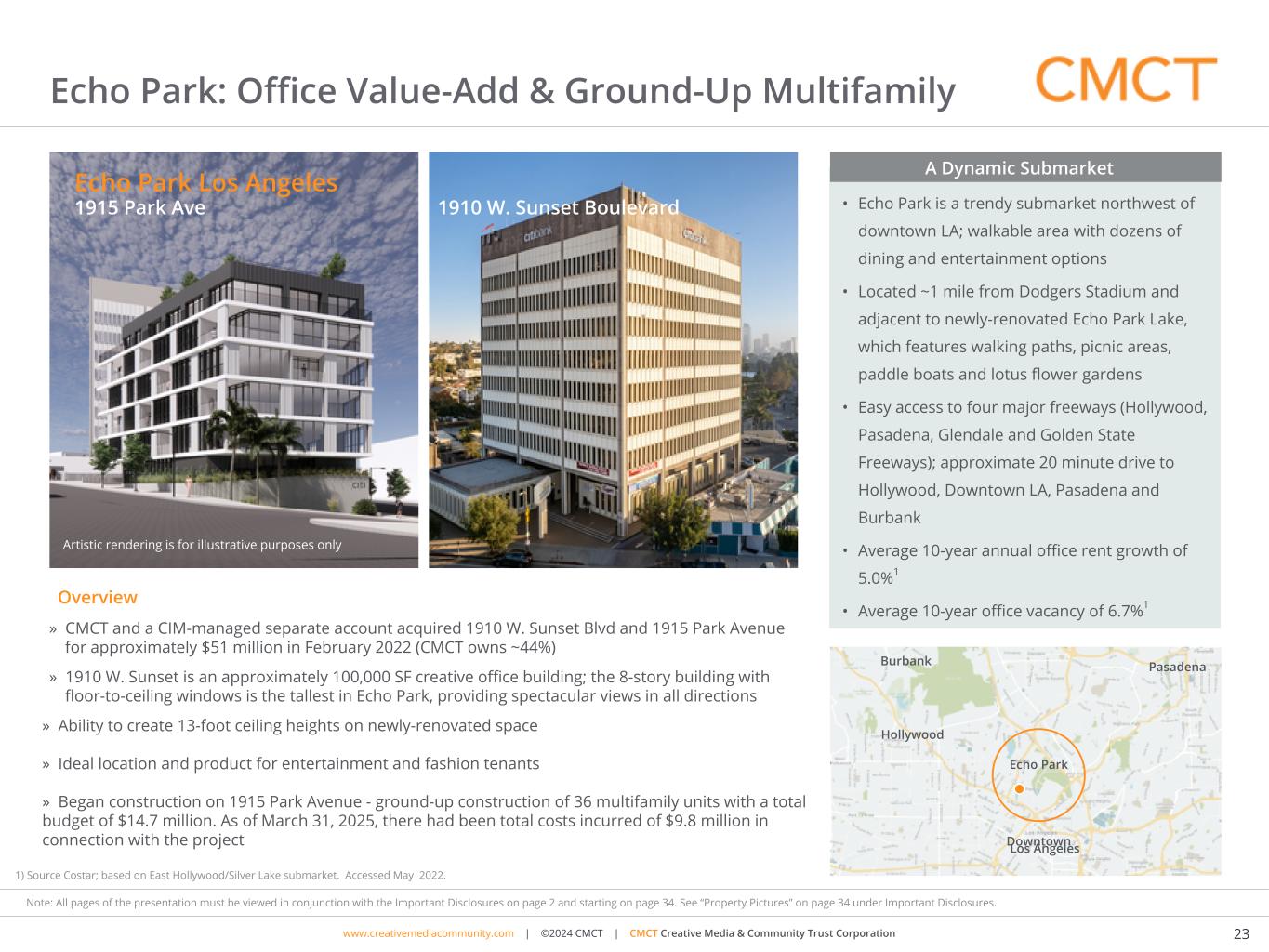

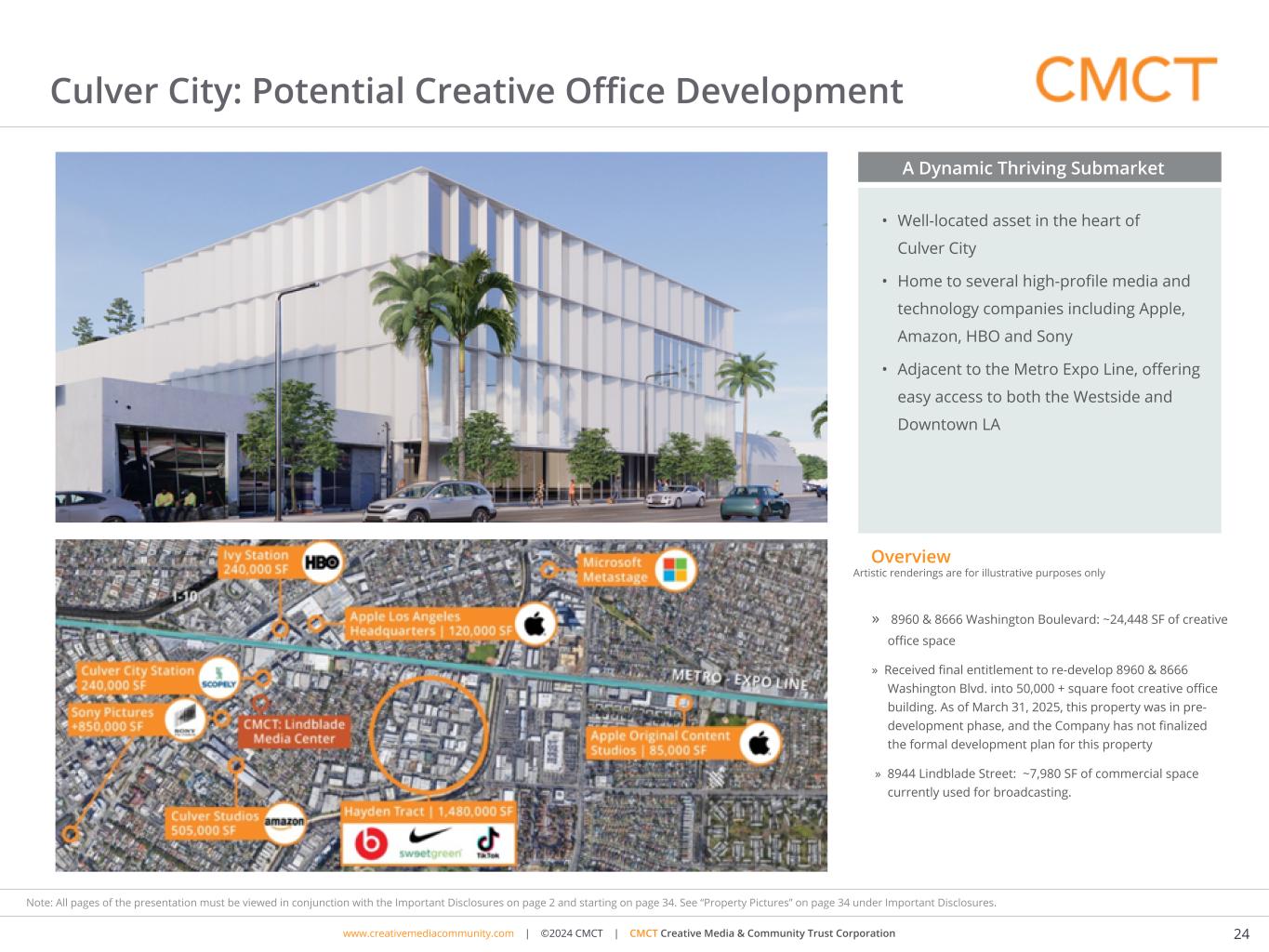

As of March 31, 2025, our real estate portfolio consisted of 27 assets, all of which were fee-simple properties and five of which we own through investments in unconsolidated joint ventures (the “Unconsolidated Joint Ventures”). Our Unconsolidated Joint Ventures contain one office property, one multifamily site currently under development, two multifamily properties (one of which has been partially converted from office into multifamily units and is now being classified as a multifamily property) and one commercial development site. The portfolio includes 12 office properties, totaling approximately 1.3 million rentable square feet, four multifamily properties totaling 696 units, nine development sites (three of which are being used as parking lots) and one 505-room hotel with an ancillary parking garage.

Financial Results

Net loss attributable to common stockholders was $(11.9) million, or $(20.73) per diluted share of Common Stock, for the three months ended March 31, 2025, compared to a net loss attributable to common stockholders of $(12.3) million, or $(125.46) per diluted share of Common Stock, for the same period in 2024. The decrease in net loss attributable to common stockholders was primarily driven by a decrease in redeemable preferred stock dividends of $2.3 million, a decrease in transaction-related costs of $664,000, and a decrease in redeemable preferred stock redemptions of $506,000. These were partially offset by a decrease of $1.9 million in segment net operating income and an increase in interest expense of $1.1 million.

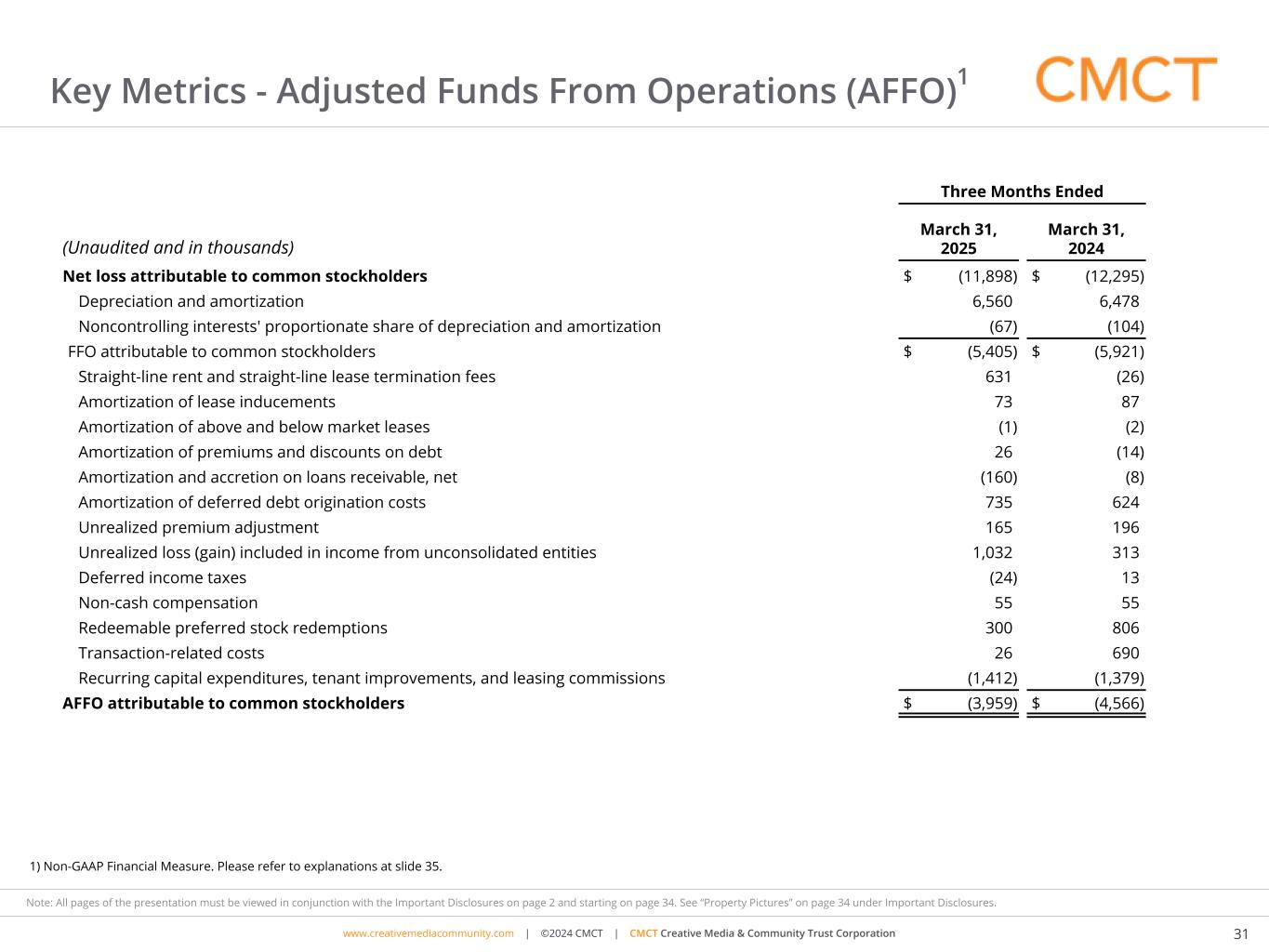

FFO2 attributable to common stockholders(3) was $(5.4) million, or $(9.42) per diluted share of Common Stock for the three months ended March 31, 2025, compared to $(5.9) million, or $(60.42) per diluted share of Common Stock, for the same period in 2024. The increase in FFO2 attributable to common stockholders was driven by the previously discussed decrease in net loss attributable to common stockholders.

Core FFO2 attributable to common stockholders(4) was $(5.1) million, or $(8.85) per diluted share of Common Stock for the three months ended March 31, 2025 compared to $(4.4) million, or $(45.15) per diluted share of Common Stock, for the same period in 2024. Unlike FFO2, Core FFO2 was not impacted by the decrease in transaction-related costs and redeemable preferred stock redemptions, as these are excluded from our Core FFO2 calculation.

Segment Information

Our reportable segments during the three months ended March 31, 2025 and 2024 consisted of three types of commercial real estate properties, namely, office, hotel and multifamily, as well as a segment for our lending business. Total segment net operating income (“NOI”)(5) was $11.8 million for the three months ended March 31, 2025, compared to$13.6 million for the same period in 2024.

Office

Same-Store

Same-store(2) office segment NOI(5) was $7.1 million for the three months ended March 31, 2025, a decrease from $7.9 million in the same period in 2024, while same-store(1) office Cash NOI(6)2 was $7.8 million for the three months ended March 31, 2025, a decrease from $8.8 million in the same period in 2024. The decreases in same-store(2) office Segment NOI(5) and same-store(1) office Cash NOI(6)2 were primarily due to a decrease in rental revenue at our office property in Oakland, California attributable to a decrease in occupancy resulting from a large tenant exercising a partial lease termination option.

At March 31, 2025, the Company’s same-store(2) office portfolio was 70.2% occupied, a decrease of (1,280) basis points year-over-year on a same-store(2) basis, and 71.4% leased, a decrease of (1,230) basis points year-over-year on a same-store(2) basis. The annualized rent per occupied square foot(7) on a same-store(2) basis was $61.23 at March 31, 2025, compared to $58.30 at March 31, 2024. During the three months ended March 31, 2025, the Company executed 30,333 square feet of leases with terms longer than 12 months at our same-store(2) office portfolio.

Total

Office Segment NOI(5) decreased to $7.1 million for the three months ended March 31, 2025, as compared to $7.9 million for the same period in 2024. The decrease was driven by the aforementioned decrease in same-store(2) office Segment NOI(5).

2 Non-GAAP financial measure. Refer to the explanations and reconciliations elsewhere in this release.

Hotel

Hotel Segment NOI(5) was $4.7 million for the three months ended March 31, 2025, an increase from $4.1 million for the same period in 2024, primarily due to an increase in occupancy and average daily rate. The following table sets forth the occupancy, average daily rate and revenue per available room for our hotel in Sacramento, California for the specified periods:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended March 31, |

| |

|

2025 |

|

2024 |

| Occupancy |

|

80.0 |

% |

|

79.0 |

% |

Average daily rate(a) |

|

$ |

220.57 |

|

|

$ |

211.06 |

|

Revenue per available room(b) |

|

$ |

176.47 |

|

|

$ |

166.84 |

|

______________________

(a)Calculated as trailing 3-month room revenue divided by the number of rooms occupied.

(b)Calculated as trailing 3-month room revenue divided by the number of available rooms.

Multifamily

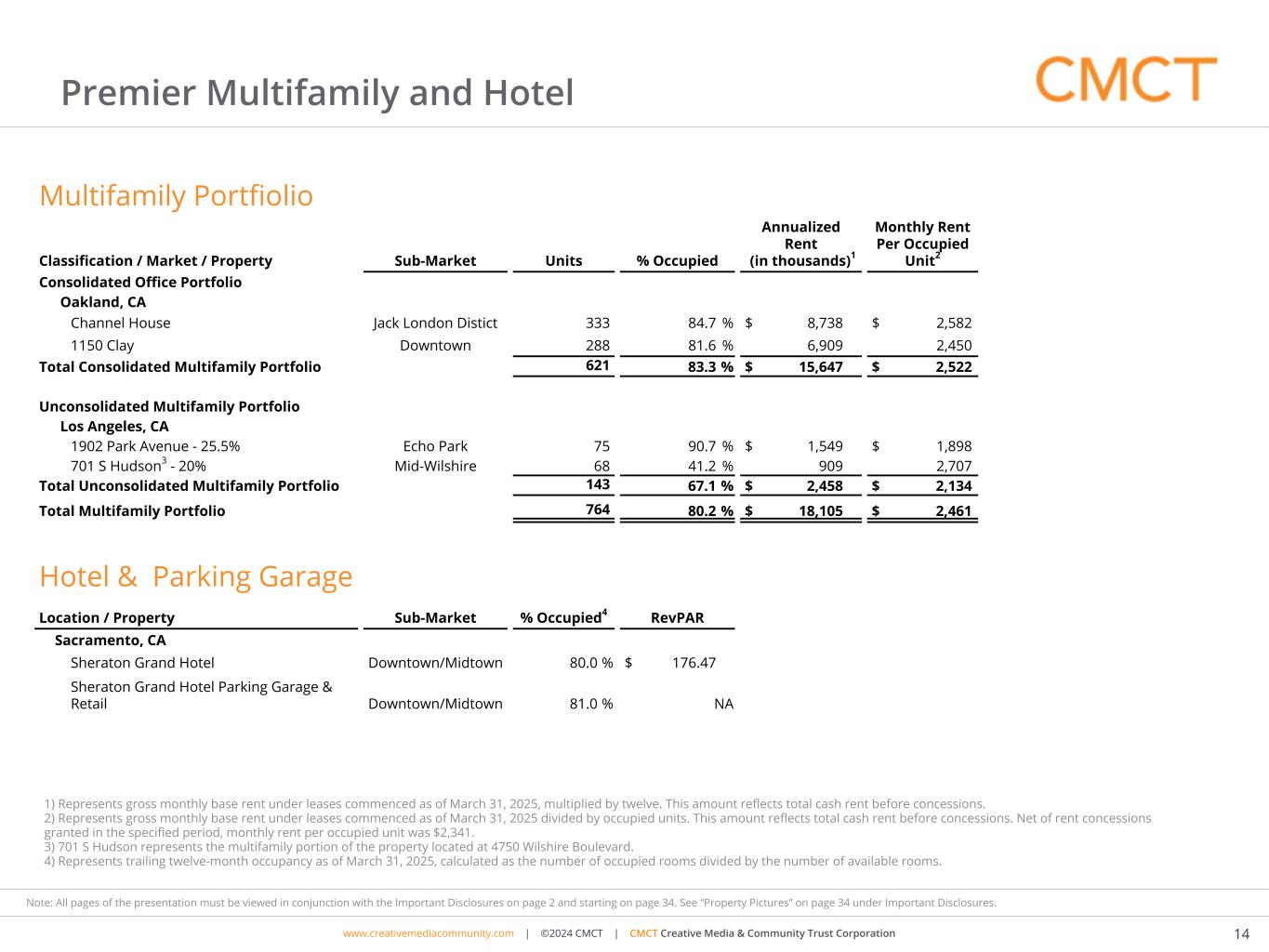

Our Multifamily Segment consists of two multifamily buildings located in Oakland, California as well as two investments in multifamily buildings in Los Angeles, California, each owned through unconsolidated joint ventures (one of which, 701 S Hudson / 4750 Wilshire Boulevard, was reclassified from an office segment property to a multifamily segment property as of October 1, 2024, following the substantial completion of the conversion of two of the building’s three floors from office-use into 68 for-lease multifamily units). Our multifamily segment NOI(5) totaled a loss of $620,000 for the three months ended March 31, 2025, compared to income of $917,000 for the same period in 2024. The decrease in our multifamily segment NOI(5) was primarily due to an unrealized loss on investment in real estate at one of our unconsolidated joint ventures during the three months ended March 31, 2025. As of March 31, 2025, our Multifamily Segment was 80.2% occupied, monthly rent per occupied unit(8) was $2,461 and net monthly rent per occupied unit(9) was $2,341, compared to 86.2%, $2,737, and $2,429, respectively, as of March 31, 2024.

Lending

Our lending segment primarily consists of our SBA 7(a) lending platform, which is a national lender that primarily originates loans to small businesses in the hospitality industry. Lending segment NOI(5) was $590,000 for the three months ended March 31, 2025, compared to $789,000 for the same period in 2024, primarily due to a decrease in interest income as a result of loan payoffs and lower interest rates.

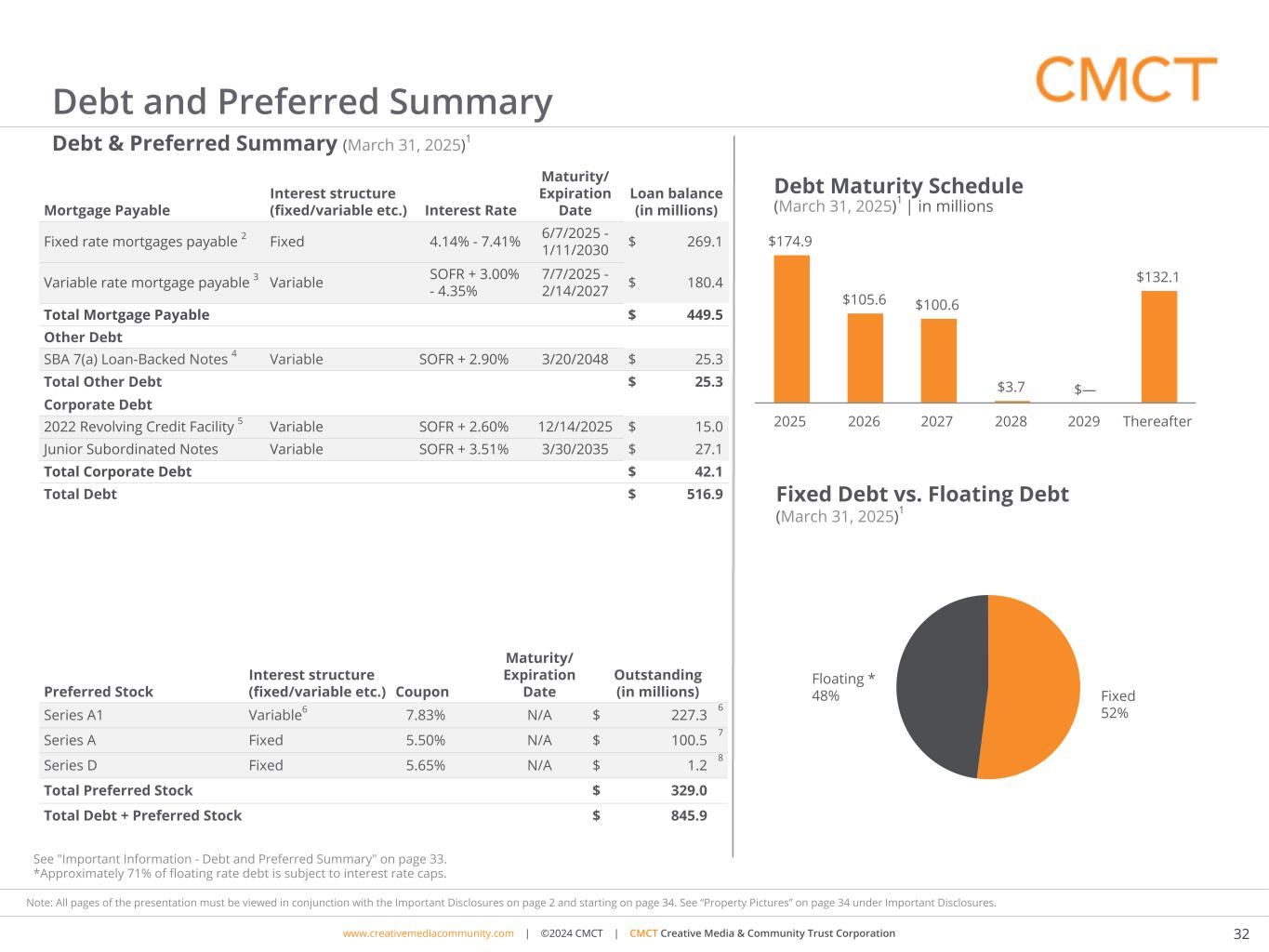

Debt and Equity

During the three months ended March 31, 2025, the Company had redemptions of 194,216 shares of Series A1 Preferred Stock (all of which were redeemed in shares of Common Stock) and had redemptions of 104,471 shares of Series A Preferred Stock (all of which were redeemed in shares of Common Stock). These redemptions resulted in the collective issuance of 288,427 shares of Common Stock during the three months ended March 31, 2025.

During the three months ended March 31, 2025, we closed a $5.0 million variable-rate mortgage loan on an office property in Los Angeles, California.

In addition, on April 3, 2025, we closed a $35.5 million variable-rate mortgage on an office property in Austin, Texas. In connection with entry into such mortgage loan, we repaid all of the outstanding obligations under the 2022 Credit Facility and terminated the 2022 Credit Facility.

Dividends

We declared preferred stock dividends on our Series A, Series A1 and Series D Preferred Stock for the fourth quarter of 2024. The dividends were payable on April 15, 2025 to holders of record at the close of business on April 5, 2025.

The dividend amounts are as follows:

|

|

|

|

|

|

|

Quarterly Dividend Amount |

Series A Preferred Stock |

$0.34375 per share |

| Series A1 Preferred Stock |

$0.44250 per share* |

| Series D Preferred Stock |

$0.353125 per share |

*The quarterly cash dividend of $0.44250 per share represents an annualized dividend rate of 7.08% (2.5% plus the federal funds rate of 4.58% on the applicable determination date). The terms of the Series A1 Preferred Stock provide for cumulative cash dividends (if, as and when authorized by the Board of Directors) on each share of Series A1 Preferred Stock at a quarterly rate of the greater of (i) 6.00% of the Series A1 Stated Value, divided by four (4) and (ii) the Federal Funds (Effective) Rate on the applicable determination date, plus 2.50%, of the Series A1 Stated Value, divided by four (4), up to a maximum of 2.50% of the Series A1 Stated Value per quarter.

About the Data

Descriptions of certain performance measures, including Segment NOI, Cash NOI, FFO attributable to common stockholders, and Core FFO attributable to common stockholders are provided below. Certain of these performance measures—Cash NOI, FFO attributable to common stockholders and Core FFO attributable to common stockholders —are non-GAAP financial measures. Refer to the subsequent tables for reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measure.

(1)Stabilized office portfolio: represents office properties where occupancy was not impacted by a redevelopment or repositioning during the period.

(2)Same-store properties: are properties that we have owned and operated in a consistent manner and reported in our consolidated results during the entire span of the periods being reported. We excluded from our same-store property set this quarter any properties (i) acquired on or after January 1, 2024; (ii) sold or otherwise removed from our consolidated financial statements on or before March 31, 2025; or (iii) that underwent a major repositioning project we believed significantly affected its results at any point during the period commencing on January 1, 2024 and ending on March 31, 2025. When determining our same-store office properties as of March 31, 2025, one office property was excluded pursuant to (i) and (iii) above and one office property was excluded pursuant to (ii) above.

(3)FFO attributable to common stockholders (“FFO”): represents net income (loss) attributable to common stockholders, computed in accordance with GAAP, which reflects the deduction of redeemable preferred stock dividends accumulated, excluding gain (or loss) from sales of real estate, impairment of real estate, and real estate depreciation and amortization. We calculate FFO in accordance with the standards established by the National Association of Real Estate Investment Trusts (the “NAREIT”). See ‘Core FFO’ definition below for discussion of the benefits and limitations of FFO as a supplemental measure of operating performance.

(4)Core FFO attributable to common stockholders (“Core FFO”): represents FFO attributable to common stockholders (computed as described above), excluding gain (loss) on early extinguishment of debt, redeemable preferred stock deemed dividends, redeemable preferred stock redemptions, gain (loss) on termination of interest rate swaps, and transaction costs.

We believe that FFO is a widely recognized and appropriate measure of the performance of a REIT and that it is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs, many of which present FFO when reporting their results. In addition, we believe that Core FFO is a useful metric for securities analysts, investors and other interested parties in the evaluation of our Company as it excludes from FFO the effect of certain amounts that we believe are non-recurring, are non-operating in nature as they relate to the manner in which we finance our operations, or transactions outside of the ordinary course of business.

Like any metric, FFO and Core FFO should not be used as the only measure of our performance because it excludes depreciation and amortization and captures neither the changes in the value of our real estate properties that result from use or market conditions nor the level of capital expenditures and leasing commissions necessary to maintain the operating performance of our properties, and Core FFO excludes amounts incurred in connection with non-recurring special projects, prepaying or defeasing our debt, repurchasing our preferred stock, and adjusting the carrying value of our preferred stock classified in temporary equity to its redemption value, all of which have real economic effect and could materially impact our operating results. Other REITs may not calculate FFO and Core FFO in the same manner as we do, or at all; accordingly, our FFO and Core FFO may not be comparable to the FFOs and Core FFOs of other REITs.

Therefore, FFO and Core FFO should be considered only as a supplement to net income (loss) as a measure of our performance and should not be used as a supplement to or substitute measure for cash flows from operating activities computed in accordance with GAAP. FFO and Core FFO should not be used as a measure of our liquidity, nor is it indicative of funds available to fund our cash needs, including our ability to pay dividends. FFO and Core FFO per share for the year-to-date period may differ from the sum of quarterly FFO and Core FFO per share amounts due to the required method for computing per share amounts for the respective periods. In addition, FFO and Core FFO per share is calculated independently for each component and may not be additive due to rounding.

(5)Segment NOI: for our real estate segments represents rental and other property income and expense reimbursements less property related expenses and excludes non-property income and expenses, interest expense, depreciation and amortization, corporate related general and administrative expenses, gain (loss) on sale of real estate, gain (loss) on early extinguishment of debt, impairment of real estate, transaction costs, and benefit (provision) for income taxes. For our lending segment, Segment NOI represents interest income net of interest expense and general overhead expenses. See ‘Cash NOI’ definition below for discussion of the benefits and limitations of Segment NOI as a supplemental measure of operating performance.

(6)Cash NOI: for our real estate segments, represents Segment NOI adjusted to exclude the effect of the straight lining of rents, acquired above/below market lease amortization and other adjustments required by generally accepted accounting principles (“GAAP”). For our lending segment, there is no distinction between Cash NOI and Segment NOI. We also evaluate the operating performance and financial results of our operating segments using cash basis NOI excluding lease termination income, or “Cash NOI excluding lease termination income”.

Segment NOI and Cash NOI are not measures of operating results or cash flows from operating activities as measured by GAAP and should not be considered alternatives to income from continuing operations, or to cash flows as a measure of liquidity, or as an indication of our performance or of our ability to pay dividends. Companies may not calculate Segment NOI or Cash NOI in the same manner. We consider Segment NOI and Cash NOI to be useful performance measures to investors and management because, when compared across periods, they reflect the revenues and expenses directly associated with owning and operating our properties and the impact to operations from trends in occupancy rates, rental rates and operating costs, providing a perspective not immediately apparent from income from continuing operations. Additionally, we believe that Cash NOI is helpful to investors because it eliminates straight line rent and other non-cash adjustments to revenue and expenses.

(7)Annualized rent per occupied square foot: represents gross monthly base rent under leases commenced as of the specified periods, multiplied by twelve. This amount reflects total cash rent before abatements. Where applicable, annualized rent has been grossed up by adding annualized expense reimbursements to base rent. Annualized rent for certain office properties includes rent attributable to retail.

(8)Monthly rent per occupied unit: Represents gross monthly base rent under leases commenced as of the specified period, divided by occupied units. This amount reflects total cash rent before concessions.

(9)Net monthly rent per occupied unit: Represents gross monthly base rent under leases commenced as of the specified period less rent concessions granted during the specified period, divided by occupied units.

FORWARD-LOOKING STATEMENTS

This press release contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are intended to be covered by the safe harbors created thereby. These statements include the plans and objectives of management for future operations, including plans and objectives relating to future growth of CMCT’s business and availability of funds. Such forward-looking statements can be identified by the use of forward-looking terminology such as “may,” “will,” “project,” “target,” “expect,” “intend,” “might,” “believe,” “anticipate,” “estimate,” “could,” “would,” “continue,” “pursue,” “potential,” “forecast,” “seek,” “plan,” or “should,” or “goal” or the negative thereof or other variations or similar words or phrases. Such forward-looking statements also include, among others, statements about CMCT’s plans and objectives relating to future growth and outlook. Such forward-looking statements are based on particular assumptions that management of CMCT has made in light of its experience, as well as its perception of expected future developments and other factors that it believes are appropriate under the circumstances. Forward-looking statements are necessarily estimates reflecting the judgment of CMCT’s management and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. These risks and uncertainties include those associated with (i) the timing, form, and operational effects of CMCT’s development activities, (ii) the ability of CMCT to raise in place rents to existing market rents and to maintain or increase occupancy levels, (iii) fluctuations in market rents, (iv) the effects of inflation and continuing higher interest rates on the operations and profitability of CMCT and (v) general economic, market and other conditions, including the effects of high unemployment rates, continued or renewed inflation and any recession or slowdown in economic growth. Additional important factors that could cause CMCT’s actual results to differ materially from CMCT’s expectations are discussed in “Item 1A—Risk Factors” in CMCT’s Annual Report on Form 10-K for the year ended December 31, 2024 and in Part II, Item 1A of CMCT’s Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission from time to time. The forward-looking statements included herein are based on current expectations and there can be no assurance that these expectations will be attained. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond CMCT’s control. Although we believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurance that the forward-looking statements expressed or implied will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements expressed or implied herein, the inclusion of such information should not be regarded as a representation by CMCT or any other person that CMCT’s objectives and plans will be achieved. Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date they are made. CMCT does not undertake to update them to reflect changes that occur after the date they are made, except as may be required by applicable laws.

For Creative Media & Community Trust Corporation

Media Relations:

Bill Mendel, 212-397-1030

bill@mendelcommunications.com

or

Shareholder Relations:

Steve Altebrando, 646-652-8473

shareholders@creativemediacommunity.com

CREATIVE MEDIA & COMMUNITY TRUST CORPORATION AND SUBSIDIARIES

Consolidated Balance Sheets

(Unaudited and in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2025 |

|

December 31, 2024 |

| ASSETS |

|

|

|

|

| Investments in real estate, net |

|

$ |

706,537 |

|

|

$ |

709,194 |

|

| Investments in unconsolidated entities |

|

33,341 |

|

|

33,677 |

|

| Cash and cash equivalents |

|

19,772 |

|

|

20,262 |

|

| Restricted cash |

|

29,353 |

|

|

32,606 |

|

Loans receivable, net |

|

53,039 |

|

|

56,210 |

|

| Accounts receivable, net |

|

3,844 |

|

|

4,345 |

|

| Deferred rent receivable and charges, net |

|

19,341 |

|

|

19,896 |

|

| Other intangible assets, net |

|

3,488 |

|

|

3,568 |

|

| Other assets |

|

13,628 |

|

|

9,797 |

|

|

|

|

|

|

| TOTAL ASSETS |

|

$ |

882,343 |

|

|

$ |

889,555 |

|

| LIABILITIES, REDEEMABLE PREFERRED STOCK, AND EQUITY |

|

|

|

|

| LIABILITIES: |

|

|

|

|

| Debt, net |

|

$ |

512,658 |

|

|

$ |

505,732 |

|

| Accounts payable and accrued expenses |

|

26,656 |

|

|

32,204 |

|

|

|

|

|

|

| Due to related parties |

|

18,198 |

|

|

14,068 |

|

| Other liabilities |

|

9,397 |

|

|

10,488 |

|

|

|

|

|

|

| Total liabilities |

|

566,909 |

|

|

562,492 |

|

| COMMITMENTS AND CONTINGENCIES |

|

|

|

|

REDEEMABLE PREFERRED STOCK: Series A1 cumulative redeemable preferred stock, $0.001 par value; 24,851,185 and 25,045,401 shares authorized as of March 31, 2025 and December 31, 2024, respectively; 913,630 and 913,590 shares issued and outstanding as of both March 31, 2025 and December 31, 2024; liquidation preference of $25.00 per share, subject to adjustment |

|

20,799 |

|

|

20,799 |

|

| EQUITY: |

|

|

|

|

Series A cumulative redeemable preferred stock, $0.001 par value; 31,200,554 and 31,305,025 shares authorized as of March 31, 2025 and December 31, 2024, respectively; 8,820,338 and 4,020,892 shares issued and outstanding, respectively, as of March 31, 2025 and 8,820,338 and 4,125,363 shares issued and outstanding, respectively, as of December 31, 2024; liquidation preference of $25.00 per share, subject to adjustment |

|

100,720 |

|

|

103,326 |

|

Series A1 cumulative redeemable preferred stock, $0.001 par value; 24,851,185 and 25,045,401 shares authorized as of March 31, 2025 and December 31, 2024, respectively; 11,327,248 and 8,178,473 shares issued and outstanding, respectively, as of March 31, 2025 and 11,327,248 and 8,372,689 shares issued and outstanding, respectively, as of December 31, 2024; liquidation preference of $25.00 per share, subject to adjustment |

|

202,574 |

|

|

207,387 |

|

Series D cumulative redeemable preferred stock, $0.001 par value; 26,991,590 shares authorized as of March 31, 2025 and December 31, 2024; 56,857 and 48,447 shares issued and outstanding, respectively, as of March 31, 2025 and 56,857 and 48,447 shares issued and outstanding, respectively, as of December 31, 2024; liquidation preference of $25.00 per share, subject to adjustment |

|

1,190 |

|

|

1,190 |

|

|

|

|

|

|

Common stock, $0.001 par value; 900,000,000 shares authorized; 754,607 shares issued and outstanding as of March 31, 2025 and 466,176 shares issued and outstanding as of December 31, 2024 |

|

20 |

|

|

119 |

|

| Additional paid-in capital |

|

1,002,913 |

|

|

994,973 |

|

| Distributions in excess of earnings |

|

(1,014,372) |

|

|

(1,002,479) |

|

| Total stockholders’ equity |

|

293,045 |

|

|

304,516 |

|

| Non-controlling interests |

|

1,590 |

|

|

1,748 |

|

| Total equity |

|

294,635 |

|

|

306,264 |

|

| TOTAL LIABILITIES, REDEEMABLE PREFERRED STOCK, AND EQUITY |

|

$ |

882,343 |

|

|

$ |

889,555 |

|

CREATIVE MEDIA & COMMUNITY TRUST CORPORATION AND SUBSIDIARIES

Consolidated Statements of Operations

(Unaudited and in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

2025 |

|

2024 |

|

|

|

|

| REVENUES: |

|

|

|

|

|

|

|

|

| Rental and other property income |

|

$ |

17,220 |

|

|

$ |

18,773 |

|

|

|

|

|

| Hotel income |

|

12,134 |

|

|

11,264 |

|

|

|

|

|

| Interest and other income |

|

2,941 |

|

|

3,961 |

|

|

|

|

|

| Total Revenues |

|

32,295 |

|

|

33,998 |

|

|

|

|

|

| EXPENSES: |

|

|

|

|

|

|

|

|

| Rental and other property operating |

|

17,125 |

|

|

17,981 |

|

|

|

|

|

| Asset management and other fees to related parties |

|

360 |

|

|

394 |

|

|

|

|

|

| Expense reimbursements to related parties—corporate |

|

626 |

|

|

605 |

|

|

|

|

|

| Expense reimbursements to related parties—lending segment |

|

659 |

|

|

563 |

|

|

|

|

|

| Interest |

|

9,758 |

|

|

8,977 |

|

|

|

|

|

| General and administrative |

|

2,181 |

|

|

1,619 |

|

|

|

|

|

| Transaction-related costs |

|

26 |

|

|

690 |

|

|

|

|

|

| Depreciation and amortization |

|

6,560 |

|

|

6,478 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Expenses |

|

37,295 |

|

|

37,307 |

|

|

|

|

|

| Loss from unconsolidated entities |

|

(1,151) |

|

|

(326) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOSS BEFORE PROVISION FOR INCOME TAXES |

|

(6,151) |

|

|

(3,635) |

|

|

|

|

|

| Provision for income taxes |

|

121 |

|

|

270 |

|

|

|

|

|

| NET LOSS |

|

(6,272) |

|

|

(3,905) |

|

|

|

|

|

| Net loss attributable to non-controlling interests |

|

158 |

|

|

175 |

|

|

|

|

|

| NET LOSS ATTRIBUTABLE TO THE COMPANY |

|

(6,114) |

|

|

(3,730) |

|

|

|

|

|

Redeemable preferred stock dividends declared or accumulated |

|

(5,484) |

|

|

(7,759) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redeemable preferred stock redemptions |

|

(300) |

|

|

(806) |

|

|

|

|

|

| NET LOSS ATTRIBUTABLE TO COMMON STOCKHOLDERS |

|

$ |

(11,898) |

|

|

$ |

(12,295) |

|

|

|

|

|

| NET LOSS ATTRIBUTABLE TO COMMON STOCKHOLDERS PER SHARE: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(20.73) |

|

|

$ |

(125.46) |

|

|

|

|

|

| Diluted |

|

$ |

(20.73) |

|

|

$ |

(125.46) |

|

|

|

|

|

| WEIGHTED AVERAGE SHARES OF COMMON STOCK OUTSTANDING: |

|

|

|

|

|

|

|

|

| Basic |

|

574 |

|

|

98 |

|

|

|

|

|

| Diluted |

|

574 |

|

|

98 |

|

|

|

|

|

CREATIVE MEDIA & COMMUNITY TRUST CORPORATION AND SUBSIDIARIES

Funds from Operations Attributable to Common Stockholders

(Unaudited and in thousands, except per share amounts)

We believe that FFO is a widely recognized and appropriate measure of the performance of a REIT and that it is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs, many of which present FFO when reporting their results. FFO represents net income (loss) attributable to common stockholders, computed in accordance with generally accepted accounting principles ("GAAP"), which reflects the deduction of redeemable preferred stock dividends accumulated, excluding gains (or losses) from sales of real estate, impairment of real estate, and real estate depreciation and amortization. We calculate FFO in accordance with the standards established by the National Association of Real Estate Investment Trusts (the "NAREIT").

Like any metric, FFO should not be used as the only measure of our performance because it excludes depreciation and amortization and captures neither the changes in the value of our real estate properties that result from use or market conditions nor the level of capital expenditures and leasing commissions necessary to maintain the operating performance of our properties, all of which have real economic effect and could materially impact our operating results. Other REITs may not calculate FFO in accordance with the standards established by the NAREIT; accordingly, our FFO may not be comparable to the FFO of other REITs. Therefore, FFO should be considered only as a supplement to net income (loss) as a measure of our performance and should not be used as a supplement to or substitute measure for cash flows from operating activities computed in accordance with GAAP. FFO should not be used as a measure of our liquidity, nor is it indicative of funds available to fund our cash needs, including our ability to pay dividends. The following table sets forth a reconciliation of net income (loss) attributable to common stockholders to FFO attributable to common stockholders for the three months ended March 31, 2025 and 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended March 31, |

|

|

| |

|

2025 |

|

2024 |

|

|

|

|

| Numerator: |

|

|

|

|

|

|

|

|

| Net loss attributable to common stockholders |

|

$ |

(11,898) |

|

|

$ |

(12,295) |

|

|

|

|

|

| Depreciation and amortization |

|

6,560 |

|

|

6,478 |

|

|

|

|

|

| Noncontrolling interests’ proportionate share of depreciation and amortization |

|

(67) |

|

|

(104) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FFO attributable to common stockholders |

|

(5,405) |

|

|

(5,921) |

|

|

|

|

|

| Redeemable preferred stock dividends declared on dilutive shares (a) |

|

— |

|

|

— |

|

|

|

|

|

| Diluted FFO attributable to common stockholders |

|

$ |

(5,405) |

|

|

$ |

(5,921) |

|

|

|

|

|

| Denominator: |

|

|

|

|

|

|

|

|

| Basic weighted average shares of common stock outstanding |

|

574 |

|

|

98 |

|

|

|

|

|

| Effect of dilutive securities—contingently issuable shares (a) |

|

— |

|

|

— |

|

|

|

|

|

| Diluted weighted average shares and common stock equivalents outstanding |

|

574 |

|

|

98 |

|

|

|

|

|

| FFO attributable to common stockholders per share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(9.42) |

|

|

$ |

(60.42) |

|

|

|

|

|

| Diluted |

|

$ |

(9.42) |

|

|

$ |

(60.42) |

|

|

|

|

|

______________________

(a)For the three months ended March 31, 2025 and 2024, the effect of certain shares of redeemable preferred stock were excluded from the computation of diluted FFO attributable to common stockholders and the diluted weighted average shares and common stock equivalents outstanding as such inclusion would be anti-dilutive.

CREATIVE MEDIA & COMMUNITY TRUST CORPORATION AND SUBSIDIARIES

Core Funds from Operations Attributable to Common Stockholders

(Unaudited and in thousands, except per share amounts)

In addition to calculating FFO in accordance with the standards established by NAREIT, we also calculate a supplemental FFO metric we call Core FFO attributable to common stockholders. Core FFO attributable to common stockholders represents FFO attributable to common stockholders, computed in accordance with NAREIT's standards, excluding losses (or gains) on early extinguishment of debt, redeemable preferred stock redemptions, gains (or losses) on termination of interest rate swaps, and transaction costs. We believe that Core FFO is a useful metric for securities analysts, investors and other interested parties in the evaluation of our Company as it excludes from FFO the effect of certain amounts that we believe are non-recurring, are non-operating in nature as they relate to the manner in which we finance our operations, or transactions outside of the ordinary course of business.

Like any metric, Core FFO should not be used as the only measure of our performance because, in addition to excluding those items prescribed by NAREIT when calculating FFO, it excludes amounts incurred in connection with non-recurring special projects, prepaying or defeasing our debt and repurchasing our preferred stock, all of which have real economic effect and could materially impact our operating results. Other REITs may not calculate Core FFO in the same manner as we do, or at all; accordingly, our Core FFO may not be comparable to the Core FFO of other REITs who calculate such a metric. Therefore, Core FFO should be considered only as a supplement to net income (loss) as a measure of our performance and should not be used as a supplement to or substitute measure for cash flows from operating activities computed in accordance with GAAP. Core FFO should not be used as a measure of our liquidity, nor is it indicative of funds available to fund our cash needs, including our ability to pay dividends. The following table sets forth a reconciliation of net income (loss) attributable to common stockholders to Core FFO attributable to common stockholders for the three months ended March 31, 2025 and 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

2025 |

|

2024 |

|

|

|

|

| Numerator: |

|

|

|

|

|

|

|

|

| Net loss attributable to common stockholders |

|

$ |

(11,898) |

|

|

$ |

(12,295) |

|

|

|

|

|

| Depreciation and amortization |

|

6,560 |

|

|

6,478 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noncontrolling interests’ proportionate share of depreciation and amortization |

|

(67) |

|

|

(104) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FFO attributable to common stockholders |

|

$ |

(5,405) |

|

|

$ |

(5,921) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Redeemable preferred stock redemptions |

|

300 |

|

|

806 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Transaction-related costs |

|

26 |

|

|

690 |

|

|

|

|

|

| Core FFO attributable to common stockholders |

|

$ |

(5,079) |

|

|

$ |

(4,425) |

|

|

|

|

|

| Redeemable preferred stock dividends declared on dilutive shares (a) |

|

— |

|

|

— |

|

|

|

|

|

| Diluted Core FFO attributable to common stockholders |

|

$ |

(5,079) |

|

|

$ |

(4,425) |

|

|

|

|

|

| Denominator: |

|

|

|

|

|

|

|

|

| Basic weighted average shares of common stock outstanding |

|

574 |

|

|

98 |

|

|

|

|

|

| Effect of dilutive securities-contingently issuable shares (a) |

|

— |

|

|

— |

|

|

|

|

|

| Diluted weighted average shares and common stock equivalents outstanding |

|

574 |

|

|

98 |

|

|

|

|

|

| Core FFO attributable to common stockholders per share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(8.85) |

|

|

$ |

(45.15) |

|

|

|

|

|

| Diluted |

|

$ |

(8.85) |

|

|

$ |

(45.15) |

|

|

|

|

|

______________________

(a)For the three months ended March 31, 2025 and 2024, the effect of certain shares of redeemable preferred stock were excluded from the computation of diluted Core FFO attributable to common stockholders and the diluted weighted average shares and common stock equivalents outstanding as such inclusion would be anti-dilutive.

CREATIVE MEDIA & COMMUNITY TRUST CORPORATION AND SUBSIDIARIES

Reconciliation of Net Operating Income

(Unaudited and in thousands)

We internally evaluate the operating performance and financial results of our real estate segments based on segment NOI, which is defined as rental and other property income and expense reimbursements less property related expenses and excludes non-property income and expenses, interest expense, depreciation and amortization, corporate related general and administrative expenses, gain (loss) on sale of real estate, gain (loss) on early extinguishment of debt, impairment of real estate, transaction costs, and provision for income taxes. For our lending segment, we define segment NOI as interest income net of interest expense and general overhead expenses. We also evaluate the operating performance and financial results of our operating segments using cash basis NOI, or "cash NOI". For our real estate segments, we define cash NOI as segment NOI adjusted to exclude the effect of the straight lining of rents, acquired above/below market lease amortization and other adjustments required by GAAP.

Cash NOI is not a measure of operating results or cash flows from operating activities as measured by GAAP and should not be considered an alternative to income from continuing operations, or to cash flows as a measure of liquidity, or as an indication of our performance or of our ability to pay dividends. Companies may not calculate cash NOI in the same manner. We consider cash NOI to be a useful performance measure to investors and management because, when compared across periods, it reflects the revenues and expenses directly associated with owning and operating our properties and the impact to operations from trends in occupancy rates, rental rates and operating costs, providing a perspective not immediately apparent from income from continuing operations. Additionally, we believe that cash NOI is helpful to investors because it eliminates straight line rent and other non-cash adjustments to revenue and expenses.

Below is a reconciliation of cash NOI to segment NOI and net loss attributable to the Company for the three months ended March 31, 2025 and 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2025 |

|

|

Same-Store

Office |

|

Non-Same-Store Office |

|

Total Office |

|

Hotel |

|

Multi-family |

|

Lending |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash net operating income |

|

$ |

7,806 |

|

|

$ |

— |

|

|

$ |

7,806 |

|

|

$ |

4,682 |

|

|

$ |

(620) |

|

|

$ |

590 |

|

|

$ |

12,458 |

|

| Deferred rent and amortization of intangible assets, liabilities, and lease inducements |

|

(705) |

|

|

— |

|

|

(705) |

|

|

2 |

|

|

— |

|

|

— |

|

|

(703) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment net operating income |

|

$ |

7,101 |

|

|

$ |

— |

|

|

$ |

7,101 |

|

|

$ |

4,684 |

|

|

$ |

(620) |

|

|

$ |

590 |

|

|

$ |

11,755 |

|

| Interest and other income |

|

|

|

|

|

|

|

|

|

|

|

|

|

91 |

|

| Asset management and other fees to related parties |

|

|

|

|

|

|

|

|

|

|

|

|

|

(360) |

|

| Expense reimbursements to related parties — corporate |

|

|

|

|

|

|

|

|

|

|

|

|

|

(626) |

|

| Interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

(9,184) |

|

| General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,241) |

|

| Transaction-related costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

(26) |

|

| Depreciation and amortization |

|

|

|

|

|

|

|

|

|

|

|

|

|

(6,560) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before provision for income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

(6,151) |

|

| Provision for income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

(121) |

|

| Net loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

(6,272) |

|

| Net loss attributable to noncontrolling interests |

|

|

|

|

|

|

|

|

|

|

|

|

|

158 |

|

| Net loss attributable to the Company |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

(6,114) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2024 |

|

|

Same-Store

Office |

|

Non-Same-Store Office |

|

Total Office |

|

Hotel |

|

Multi-family |

|

Lending |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash net operating income |

|

$ |

8,765 |

|

|

$ |

17 |

|

|

$ |

8,782 |

|

$ |

— |

|

$ |

4,061 |

|

|

$ |

917 |

|

|

$ |

789 |

|

|

$ |

14,549 |

|

| Deferred rent and amortization of intangible assets, liabilities, and lease inducements |

|

(917) |

|

|

— |

|

|

(917) |

|

— |

|

1 |

|

|

— |

|

|

— |

|

|

(916) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment net operating income |

|

$ |

7,848 |

|

|

$ |

17 |

|

|

$ |

7,865 |

|

$ |

— |

|

$ |

4,062 |

|

|

$ |

917 |

|

|

$ |

789 |

|

|

$ |

13,633 |

|

| Interest and other income |

|

|

|

|

|

|

|

|

|

|

|

|

|

144 |

|

| Asset management and other fees to related parties |

|

|

|

|

|

|

|

|

|

|

|

|

|

(394) |

|

| Expense reimbursements to related parties — corporate |

|

|

|

|

|

|

|

|

|

|

|

|

|

(605) |

|

| Interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

(8,057) |

|

| General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,188) |

|

| Transaction costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

(690) |

|

| Depreciation and amortization |

|

|

|

|

|

|

|

|

|

|

|

|

|

(6,478) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before provision for income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

(3,635) |

|

| Provision for income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

(270) |

|

Net Loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

(3,905) |

|

Net loss attributable to noncontrolling interests |

|

|

|

|

|

|

|

|

|

|

|

|

|

175 |

|

Net loss attributable to the Company |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

(3,730) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|