| Maryland | No. | 001-11954 | No. | 22-1657560 | ||||||||||||||||

| (State or Other | (Commission | (IRS Employer | ||||||||||||||||||

| Jurisdiction of Incorporation) | File Number) | Identification No.) | ||||||||||||||||||

| Delaware | No. | 001-34482 | No. | 13-3925979 | ||||||||||||||||

| (State or Other | (Commission | (IRS Employer | ||||||||||||||||||

| Jurisdiction of Incorporation) | File Number) | Identification No.) | ||||||||||||||||||

| 888 Seventh Avenue | |||||||||||

| New York, | New York | 10019 | |||||||||

| (Address of Principal Executive offices) | (Zip Code) | ||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

Registrant |

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|||||||||||||||||

Vornado Realty Trust |

Common Shares of beneficial interest, $.04 par value per share |

VNO |

New York Stock Exchange |

|||||||||||||||||

Cumulative Redeemable Preferred Shares of beneficial interest, liquidation preference $25.00 per share: |

||||||||||||||||||||

Vornado Realty Trust |

5.40% Series L |

VNO/PL |

New York Stock Exchange |

|||||||||||||||||

Vornado Realty Trust |

5.25% Series M |

VNO/PM |

New York Stock Exchange |

|||||||||||||||||

Vornado Realty Trust |

5.25% Series N |

VNO/PN |

New York Stock Exchange |

|||||||||||||||||

Vornado Realty Trust |

4.45% Series O | VNO/PO | New York Stock Exchange |

|||||||||||||||||

| (d) | Exhibits. | ||||||||||

| The following exhibits are being furnished as part of this Current Report on Form 8-K: | |||||||||||

| Vornado Realty Trust press release dated May 5, 2025 | |||||||||||

| Vornado Realty Trust supplemental operating and financial data for the quarter ended March 31, 2025 | |||||||||||

| Vornado Realty Trust supplemental fixed income data for the quarter ended March 31, 2025 | |||||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | ||||||||||

| VORNADO REALTY TRUST | ||||||||

| (Registrant) | ||||||||

| By: | /s/ Deirdre Maddock | |||||||

| Name: | Deirdre Maddock | |||||||

| Title: | Chief Accounting Officer (duly authorized officer and principal accounting officer) | |||||||

| VORNADO REALTY L.P. | ||||||||

| (Registrant) | ||||||||

| By: | VORNADO REALTY TRUST, | |||||||

| Sole General Partner | ||||||||

| By: | /s/ Deirdre Maddock | |||||||

| Name: | Deirdre Maddock | |||||||

| Title: | Chief Accounting Officer of Vornado Realty Trust, sole General Partner of Vornado Realty L.P. (duly authorized officer and principal accounting officer) |

|||||||

| (Amounts in thousands, except per share amounts) | For the Three Months Ended March 31, |

||||||||||

| 2025 | 2024 | ||||||||||

FFO attributable to common shareholders plus assumed conversions (non-GAAP)(1) |

$ | 135,039 | $ | 104,129 | |||||||

| Per diluted share (non-GAAP) | $ | 0.67 | $ | 0.53 | |||||||

| Certain (income) expense items that impact FFO attributable to common shareholders plus assumed conversions: | |||||||||||

| After-tax net gain on sale of 220 Central Park South ("220 CPS") condominium units and ancillary amenities | $ | (11,028) | $ | — | |||||||

| Deferred tax liability on our investment in the Farley Building (held through a taxable REIT subsidiary) | 3,205 | 4,134 | |||||||||

| Other | (1,735) | 1,009 | |||||||||

| (9,558) | 5,143 | ||||||||||

| Noncontrolling interests' share of above adjustments on a dilutive basis | 764 | (425) | |||||||||

| Total of certain (income) expense items that impact FFO attributable to common shareholders plus assumed conversions, net | $ | (8,794) | $ | 4,718 | |||||||

| Per diluted share (non-GAAP) | $ | (0.04) | $ | 0.02 | |||||||

| FFO attributable to common shareholders plus assumed conversions, as adjusted (non-GAAP) | $ | 126,245 | $ | 108,847 | |||||||

| Per diluted share (non-GAAP) | $ | 0.63 | $ | 0.55 | |||||||

| NYSE: VNO | WWW.VNO.COM | PAGE 1 OF 14

|

|||||||

| (Amounts in millions, except per share amounts) | FFO, as Adjusted | ||||||||||

| Amount | Per Share | ||||||||||

| FFO attributable to common shareholders plus assumed conversions, as adjusted (non-GAAP) for the three months ended March 31, 2024 | $ | 108.8 | $ | 0.55 | |||||||

| Increase / (decrease) in FFO, as adjusted due to: | |||||||||||

| Impact of PENN 1 ground rent reset determination (including a $17.2 reversal of rent expense that was accrued in prior periods) | 20.0 | ||||||||||

| Lower interest income | (5.6) | ||||||||||

| Variable businesses (primarily signage) | 2.4 | ||||||||||

| Rent commencements, net of lease expirations and other tenant related items | 2.1 | ||||||||||

| Other, net | (0.5) | ||||||||||

| 18.4 | |||||||||||

| Noncontrolling interests' share of above items and impact of assumed conversions of convertible securities | (1.0) | ||||||||||

| Net increase | 17.4 | 0.08 | |||||||||

| FFO attributable to common shareholders plus assumed conversions, as adjusted (non-GAAP) for the three months ended March 31, 2025 | $ | 126.2 | $ | 0.63 | |||||||

| NYSE: VNO | WWW.VNO.COM | PAGE 2 OF 14

|

|||||||

| NYSE: VNO | WWW.VNO.COM | PAGE 3 OF 14

|

|||||||

| (Square feet in thousands) | New York | 555 California Street |

||||||||||||||||||||||||

| Office | Retail | THE MART | ||||||||||||||||||||||||

| Three Months Ended March 31, 2025 | ||||||||||||||||||||||||||

| Total square feet leased | 709 | 25 | 83 | 222 | ||||||||||||||||||||||

| Our share of square feet leased: | 685 | 18 | 83 | 155 | ||||||||||||||||||||||

Initial rent(1) |

$ | 95.53 | $ | 222.20 | $ | 51.33 | $ | 120.65 | ||||||||||||||||||

| Weighted average lease term (years) | 14.7 | 14.3 | 8.0 | 13.1 | ||||||||||||||||||||||

| Second generation relet space: | ||||||||||||||||||||||||||

| Square feet | 254 | 10 | 42 | 155 | ||||||||||||||||||||||

| GAAP basis: | ||||||||||||||||||||||||||

Straight-line rent(2) |

$ | 80.23 | $ | 139.99 | $ | 51.80 | $ | 132.08 | ||||||||||||||||||

| Prior straight-line rent | $ | 73.25 | $ | 108.59 | $ | 54.68 | $ | 110.28 | ||||||||||||||||||

| Percentage increase (decrease) | 9.5 | % | 28.9 | % | (5.3) | % | 19.8 | % | ||||||||||||||||||

| Cash basis (non-GAAP): | ||||||||||||||||||||||||||

Initial rent(1) |

$ | 84.72 | $ | 139.40 | $ | 51.67 | $ | 121.04 | ||||||||||||||||||

| Prior escalated rent | $ | 79.56 | $ | 112.57 | $ | 60.43 | $ | 117.37 | ||||||||||||||||||

| Percentage increase (decrease) | 6.5 | % | 23.8 | % | (14.5) | % | 3.1 | % | ||||||||||||||||||

| Tenant improvements and leasing commissions: | ||||||||||||||||||||||||||

| Per square foot | $ | 168.88 | $ | 377.61 | $ | 90.82 | $ | 229.71 | ||||||||||||||||||

| Per square foot per annum | $ | 11.49 | $ | 26.41 | $ | 11.35 | $ | 17.54 | ||||||||||||||||||

| Percentage of initial rent | 12.0 | % | 11.9 | % | 22.1 | % | 14.5 | % | ||||||||||||||||||

| (At Vornado's share) | New York | THE MART | 555 California Street | ||||||||||||||||||||||||||

| Total | Office(1) |

Retail | |||||||||||||||||||||||||||

| Occupancy as of March 31, 2025 | 83.5 | % | 84.4 | % | 72.2 | % | 78.2 | % | 92.3 | % | |||||||||||||||||||

| NYSE: VNO | WWW.VNO.COM | PAGE 4 OF 14

|

|||||||

Same Store Net Operating Income ("NOI") (non-GAAP) At Share: |

Total | New York | THE MART(3) |

555 California Street | |||||||||||||||||||

Same store NOI at share % increase (decrease)(1): |

|||||||||||||||||||||||

| Three months ended March 31, 2025 compared to March 31, 2024 | 3.5 | % | 3.0 | % | (2) | 9.7 | % | 5.2 | % | ||||||||||||||

| Three months ended March 31, 2025 compared to December 31, 2024 | (1.5) | % | (6.3) | % | (2) | 160.8 | % | 10.5 | % | ||||||||||||||

Same store NOI at share - cash basis % increase (decrease)(1): |

|||||||||||||||||||||||

| Three months ended March 31, 2025 compared to March 31, 2024 | 0.9 | % | (0.7) | % | 16.7 | % | 7.1 | % | |||||||||||||||

| Three months ended March 31, 2025 compared to December 31, 2024 | (1.5) | % | (4.8) | % | 66.9 | % | 0.8 | % | |||||||||||||||

| (Amounts in thousands) | For the Three Months Ended | ||||||||||||||||

| March 31, | December 31, 2024 | ||||||||||||||||

| 2025 | 2024 | ||||||||||||||||

| NOI at share: | |||||||||||||||||

| New York: | |||||||||||||||||

Office(1) |

$ | 191,501 | $ | 167,988 | $ | 193,215 | |||||||||||

| Retail | 46,115 | 47,466 | 48,238 | ||||||||||||||

| Residential | 6,192 | 5,968 | 6,072 | ||||||||||||||

| Alexander's | 9,509 | 11,707 | 9,515 | ||||||||||||||

| Total New York | 253,317 | 233,129 | 257,040 | ||||||||||||||

| Other: | |||||||||||||||||

THE MART(2) |

15,916 | 14,486 | 6,168 | ||||||||||||||

| 555 California Street | 17,843 | 16,529 | 15,854 | ||||||||||||||

| Other investments | 6,214 | 4,980 | 5,904 | ||||||||||||||

| Total Other | 39,973 | 35,995 | 27,926 | ||||||||||||||

| NOI at share | $ | 293,290 | $ | 269,124 | $ | 284,966 | |||||||||||

| NOI at share - cash basis: | |||||||||||||||||

| New York: | |||||||||||||||||

Office(1) |

$ | 167,457 | $ | 166,370 | $ | 181,438 | |||||||||||

| Retail | 43,727 | 43,873 | 44,130 | ||||||||||||||

| Residential | 5,848 | 5,690 | 5,750 | ||||||||||||||

| Alexander's | 10,538 | 14,861 | 10,615 | ||||||||||||||

| Total New York | 227,570 | 230,794 | 241,933 | ||||||||||||||

| Other: | |||||||||||||||||

| THE MART | 17,517 | 14,949 | 10,550 | ||||||||||||||

| 555 California Street | 18,137 | 16,938 | 18,138 | ||||||||||||||

| Other investments | 6,147 | 4,932 | 5,967 | ||||||||||||||

| Total Other | 41,801 | 36,819 | 34,655 | ||||||||||||||

| NOI at share - cash basis | $ | 269,371 | $ | 267,613 | $ | 276,588 | |||||||||||

| NYSE: VNO | WWW.VNO.COM | PAGE 5 OF 14

|

|||||||

| (Amounts in thousands, except square feet) | ||||||||||||||||||||||||||||||||||||||||||||

| (at Vornado’s share) | Projected Incremental Cash Yield |

|||||||||||||||||||||||||||||||||||||||||||

|

New York segment:

|

Property Rentable Sq. Ft. |

Budget | Cash Amount Expended |

Remaining Expenditures | Stabilization Year |

|||||||||||||||||||||||||||||||||||||||

| PENN District: | ||||||||||||||||||||||||||||||||||||||||||||

| PENN 2 | 1,815,000 | $ | 750,000 | $ | 708,267 | $ | 41,733 | 2026 | 10.2% | |||||||||||||||||||||||||||||||||||

| Districtwide Improvements | N/A | 100,000 | 75,189 | 24,811 | N/A | N/A | ||||||||||||||||||||||||||||||||||||||

| Total PENN District | 850,000 | (1) |

783,456 | 66,544 | ||||||||||||||||||||||||||||||||||||||||

| Sunset Pier 94 Studios (49.9% interest) | 266,000 | 125,000 | (2) |

66,551 | 58,449 | 2026 | 10.3% | |||||||||||||||||||||||||||||||||||||

| Total Active Development Projects | $ | 975,000 | $ | 850,007 | $ | 124,993 | ||||||||||||||||||||||||||||||||||||||

| NYSE: VNO | WWW.VNO.COM | PAGE 6 OF 14

|

|||||||

| (Amounts in thousands) | As of | Increase (Decrease) |

|||||||||||||||

| March 31, 2025 | December 31, 2024 | ||||||||||||||||

| ASSETS | |||||||||||||||||

| Real estate, at cost: | |||||||||||||||||

| Land | $ | 2,434,209 | $ | 2,434,209 | $ | — | |||||||||||

| Buildings and improvements | 10,719,995 | 10,439,113 | 280,882 | ||||||||||||||

| Development costs and construction in progress | 879,601 | 1,097,395 | (217,794) | ||||||||||||||

| Leasehold improvements and equipment | 111,983 | 120,915 | (8,932) | ||||||||||||||

| Total | 14,145,788 | 14,091,632 | 54,156 | ||||||||||||||

| Less accumulated depreciation and amortization | (4,105,413) | (4,025,349) | (80,064) | ||||||||||||||

| Real estate, net | 10,040,375 | 10,066,283 | (25,908) | ||||||||||||||

| Right-of-use assets | 677,312 | 678,804 | (1,492) | ||||||||||||||

| Cash, cash equivalents, and restricted cash | |||||||||||||||||

| Cash and cash equivalents | 568,861 | 733,947 | (165,086) | ||||||||||||||

| Restricted cash | 238,027 | 215,672 | 22,355 | ||||||||||||||

| Total | 806,888 | 949,619 | (142,731) | ||||||||||||||

| Tenant and other receivables | 70,920 | 58,853 | 12,067 | ||||||||||||||

| Investments in partially owned entities | 2,421,283 | 2,691,478 | (270,195) | ||||||||||||||

| Receivable arising from the straight-lining of rents | 711,334 | 707,020 | 4,314 | ||||||||||||||

| Deferred leasing costs, net | 385,658 | 354,882 | 30,776 | ||||||||||||||

| Identified intangible assets, net | 116,280 | 118,215 | (1,935) | ||||||||||||||

| Other assets | 369,182 | 373,454 | (4,272) | ||||||||||||||

| Total assets | $ | 15,599,232 | $ | 15,998,608 | $ | (399,376) | |||||||||||

| LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS AND EQUITY | |||||||||||||||||

| Liabilities: | |||||||||||||||||

| Mortgages payable, net | $ | 5,674,519 | $ | 5,676,014 | $ | (1,495) | |||||||||||

| Senior unsecured notes, net | 746,282 | 1,195,914 | (449,632) | ||||||||||||||

| Unsecured term loan, net | 796,295 | 795,948 | 347 | ||||||||||||||

| Unsecured revolving credit facilities | 575,000 | 575,000 | — | ||||||||||||||

| Lease liabilities | 734,123 | 749,759 | (15,636) | ||||||||||||||

| Accounts payable and accrued expenses | 387,898 | 374,013 | 13,885 | ||||||||||||||

| Deferred compensation plan | 111,144 | 114,580 | (3,436) | ||||||||||||||

| Other liabilities | 345,778 | 345,511 | 267 | ||||||||||||||

| Total liabilities | 9,371,039 | 9,826,739 | (455,700) | ||||||||||||||

| Redeemable noncontrolling interests | 738,224 | 834,658 | (96,434) | ||||||||||||||

| Shareholders' equity | 5,314,118 | 5,158,242 | 155,876 | ||||||||||||||

| Noncontrolling interests in consolidated subsidiaries | 175,851 | 178,969 | (3,118) | ||||||||||||||

| Total liabilities, redeemable noncontrolling interests and equity | $ | 15,599,232 | $ | 15,998,608 | $ | (399,376) | |||||||||||

| NYSE: VNO | WWW.VNO.COM | PAGE 7 OF 14

|

|||||||

| (Amounts in thousands, except per share amounts) | For the Three Months Ended March 31, |

||||||||||

| 2025 | 2024 | ||||||||||

| Revenues | $ | 461,579 | $ | 436,375 | |||||||

| Net income (loss) | $ | 99,824 | $ | (6,273) | |||||||

| Less net loss (income) attributable to noncontrolling interests in: | |||||||||||

| Consolidated subsidiaries | 10,433 | 11,982 | |||||||||

| Operating Partnership | (7,889) | 786 | |||||||||

| Net income attributable to Vornado | 102,368 | 6,495 | |||||||||

| Preferred share dividends | (15,526) | (15,529) | |||||||||

| Net income (loss) attributable to common shareholders | $ | 86,842 | $ | (9,034) | |||||||

| Income (loss) per common share - basic: | |||||||||||

| Net income (loss) per common share | $ | 0.45 | $ | (0.05) | |||||||

| Weighted average shares outstanding | 191,371 | 190,429 | |||||||||

| Income (loss) per common share - diluted: | |||||||||||

| Net income (loss) per common share | $ | 0.43 | $ | (0.05) | |||||||

| Weighted average shares outstanding | 200,735 | 190,429 | |||||||||

| FFO attributable to common shareholders plus assumed conversions (non-GAAP) | $ | 135,039 | $ | 104,129 | |||||||

| Per diluted share (non-GAAP) | $ | 0.67 | $ | 0.53 | |||||||

| FFO attributable to common shareholders plus assumed conversions, as adjusted (non-GAAP) | $ | 126,245 | $ | 108,847 | |||||||

| Per diluted share (non-GAAP) | $ | 0.63 | $ | 0.55 | |||||||

| Weighted average shares used in determining FFO attributable to common shareholders plus assumed conversions per diluted share | 200,784 | 196,481 | |||||||||

| NYSE: VNO | WWW.VNO.COM | PAGE 8 OF 14

|

|||||||

| (Amounts in thousands, except per share amounts) | For the Three Months Ended March 31, |

||||||||||

| 2025 | 2024 | ||||||||||

| Net income (loss) attributable to common shareholders | $ | 86,842 | $ | (9,034) | |||||||

| Per diluted share | $ | 0.43 | $ | (0.05) | |||||||

| FFO adjustments: | |||||||||||

| Depreciation and amortization of real property | $ | 104,257 | $ | 96,783 | |||||||

| Our share of partially owned entities: | |||||||||||

| Net gain on sale of real estate | (77,008) | — | |||||||||

| Depreciation and amortization of real property | 24,525 | 26,163 | |||||||||

| FFO adjustments, net | 51,774 | 122,946 | |||||||||

| Impact of assumed conversion of dilutive convertible securities | 310 | 388 | |||||||||

| Noncontrolling interests' share of above adjustments on a dilutive basis | (3,887) | (10,171) | |||||||||

| FFO attributable to common shareholders plus assumed conversions (non-GAAP) | $ | 135,039 | $ | 104,129 | |||||||

| Per diluted share | $ | 0.67 | $ | 0.53 | |||||||

| Reconciliation of weighted average shares outstanding: | |||||||||||

| Weighted average common shares outstanding | 191,371 | 190,429 | |||||||||

| Effect of dilutive securities: | |||||||||||

| Share-based payment awards | 8,161 | 4,204 | |||||||||

| Convertible securities | 1,252 | 1,848 | |||||||||

| Denominator for FFO per diluted share | 200,784 | 196,481 | |||||||||

| NYSE: VNO | WWW.VNO.COM | PAGE 9 OF 14

|

|||||||

| (Amounts in thousands) | For the Three Months Ended | ||||||||||||||||

| March 31, | December 31, 2024 | ||||||||||||||||

| 2025 | 2024 | ||||||||||||||||

| Net income (loss) | $ | 99,824 | $ | (6,273) | $ | 5,758 | |||||||||||

| Depreciation and amortization expense | 116,155 | 108,659 | 113,061 | ||||||||||||||

| General and administrative expense | 38,597 | 37,897 | 36,637 | ||||||||||||||

| Transaction related costs and other | 43 | 653 | 1,341 | ||||||||||||||

| Income from partially owned entities | (96,977) | (16,279) | (30,007) | ||||||||||||||

| Interest and other investment income, net | (8,261) | (11,724) | (11,348) | ||||||||||||||

| Interest and debt expense | 95,816 | 90,478 | 100,483 | ||||||||||||||

| Net gains on disposition of wholly owned and partially owned assets | (15,551) | — | — | ||||||||||||||

| Income tax expense | 7,193 | 6,740 | 5,822 | ||||||||||||||

| NOI from partially owned entities | 67,111 | 70,369 | 73,270 | ||||||||||||||

| NOI attributable to noncontrolling interests in consolidated subsidiaries | (10,660) | (11,396) | (10,051) | ||||||||||||||

| NOI at share | 293,290 | 269,124 | 284,966 | ||||||||||||||

| Non-cash adjustments for straight-line rents, amortization of acquired below-market leases, net, and other | (23,919) | (1,511) | (8,378) | ||||||||||||||

| NOI at share - cash basis | $ | 269,371 | $ | 267,613 | $ | 276,588 | |||||||||||

| NYSE: VNO | WWW.VNO.COM | PAGE 10 OF 14

|

|||||||

| (Amounts in thousands) | Total | New York | THE MART | 555 California Street | Other | ||||||||||||||||||||||||

| NOI at share for the three months ended March 31, 2025 | $ | 293,290 | $ | 253,317 | $ | 15,916 | $ | 17,843 | $ | 6,214 | |||||||||||||||||||

| Less NOI at share from: | |||||||||||||||||||||||||||||

| Dispositions | (221) | (153) | (68) | — | — | ||||||||||||||||||||||||

| Development properties | (6,730) | (6,730) | — | — | — | ||||||||||||||||||||||||

| Other non-same store income, net | (27,536) | (20,866) | — | (456) | (6,214) | ||||||||||||||||||||||||

| Same store NOI at share for the three months ended March 31, 2025 | $ | 258,803 | $ | 225,568 | $ | 15,848 | $ | 17,387 | $ | — | |||||||||||||||||||

| NOI at share for the three months ended March 31, 2024 | $ | 269,124 | $ | 233,129 | $ | 14,486 | $ | 16,529 | $ | 4,980 | |||||||||||||||||||

| Less NOI at share from: | |||||||||||||||||||||||||||||

| Dispositions | (3,408) | (3,374) | (34) | — | — | ||||||||||||||||||||||||

| Development properties | (9,727) | (9,727) | — | — | — | ||||||||||||||||||||||||

| Other non-same store income, net | (6,029) | (1,049) | — | — | (4,980) | ||||||||||||||||||||||||

| Same store NOI at share for the three months ended March 31, 2024 | $ | 249,960 | $ | 218,979 | $ | 14,452 | $ | 16,529 | $ | — | |||||||||||||||||||

| Increase in same store NOI at share | $ | 8,843 | $ | 6,589 | $ | 1,396 | $ | 858 | $ | — | |||||||||||||||||||

| % increase in same store NOI at share | 3.5 | % | 3.0 | % | 9.7 | % | 5.2 | % | 0.0 | % | |||||||||||||||||||

| NYSE: VNO | WWW.VNO.COM | PAGE 11 OF 14

|

|||||||

| (Amounts in thousands) | Total | New York | THE MART | 555 California Street | Other | ||||||||||||||||||||||||

| NOI at share - cash basis for the three months ended March 31, 2025 | $ | 269,371 | $ | 227,570 | $ | 17,517 | $ | 18,137 | $ | 6,147 | |||||||||||||||||||

| Less NOI at share - cash basis from: | |||||||||||||||||||||||||||||

| Dispositions | (223) | (153) | (70) | — | — | ||||||||||||||||||||||||

| Development properties | (6,489) | (6,489) | — | — | — | ||||||||||||||||||||||||

| Other non-same store income, net | (11,631) | (5,484) | — | — | (6,147) | ||||||||||||||||||||||||

| Same store NOI at share - cash basis for the three months ended March 31, 2025 | $ | 251,028 | $ | 215,444 | $ | 17,447 | $ | 18,137 | $ | — | |||||||||||||||||||

| NOI at share - cash basis for the three months ended March 31, 2024 | $ | 267,613 | $ | 230,794 | $ | 14,949 | $ | 16,938 | $ | 4,932 | |||||||||||||||||||

| Less NOI at share - cash basis from: | |||||||||||||||||||||||||||||

| Dispositions | (2,894) | (2,895) | 1 | — | — | ||||||||||||||||||||||||

| Development properties | (9,244) | (9,244) | — | — | — | ||||||||||||||||||||||||

| Other non-same store income, net | (6,598) | (1,666) | — | — | (4,932) | ||||||||||||||||||||||||

| Same store NOI at share - cash basis for the three months ended March 31, 2024 | $ | 248,877 | $ | 216,989 | $ | 14,950 | $ | 16,938 | $ | — | |||||||||||||||||||

| Increase (decrease) in same store NOI at share - cash basis | $ | 2,151 | $ | (1,545) | $ | 2,497 | $ | 1,199 | $ | — | |||||||||||||||||||

| % increase (decrease) in same store NOI at share - cash basis | 0.9 | % | (0.7) | % | 16.7 | % | 7.1 | % | 0.0 | % | |||||||||||||||||||

| NYSE: VNO | WWW.VNO.COM | PAGE 12 OF 14

|

|||||||

| (Amounts in thousands) | Total | New York | THE MART | 555 California Street | Other | ||||||||||||||||||||||||

| NOI at share for the three months ended March 31, 2025 | $ | 293,290 | $ | 253,317 | $ | 15,916 | $ | 17,843 | $ | 6,214 | |||||||||||||||||||

| Less NOI at share from: | |||||||||||||||||||||||||||||

| Dispositions | (221) | (153) | (68) | — | — | ||||||||||||||||||||||||

| Development properties | (6,196) | (6,196) | — | — | — | ||||||||||||||||||||||||

| Other non-same store income, net | (26,946) | (20,276) | — | (456) | (6,214) | ||||||||||||||||||||||||

| Same store NOI at share for the three months ended March 31, 2025 | $ | 259,927 | $ | 226,692 | $ | 15,848 | $ | 17,387 | $ | — | |||||||||||||||||||

| NOI at share for the three months ended December 31, 2024 | $ | 284,966 | $ | 257,040 | $ | 6,168 | $ | 15,854 | $ | 5,904 | |||||||||||||||||||

| Less NOI at share from: | |||||||||||||||||||||||||||||

| Dispositions | (3,610) | (3,518) | (92) | — | — | ||||||||||||||||||||||||

| Development properties | (5,627) | (5,627) | — | — | — | ||||||||||||||||||||||||

| Other non-same store income, net | (11,880) | (5,850) | — | (126) | (5,904) | ||||||||||||||||||||||||

| Same store NOI at share for the three months ended December 31, 2024 | $ | 263,849 | $ | 242,045 | $ | 6,076 | $ | 15,728 | $ | — | |||||||||||||||||||

| (Decrease) increase in same store NOI at share | $ | (3,922) | $ | (15,353) | $ | 9,772 | $ | 1,659 | $ | — | |||||||||||||||||||

| % (decrease) increase in same store NOI at share | (1.5) | % | (6.3) | % | 160.8 | % | 10.5 | % | 0.0 | % | |||||||||||||||||||

| NYSE: VNO | WWW.VNO.COM | PAGE 13 OF 14

|

|||||||

| (Amounts in thousands) | Total | New York | THE MART | 555 California Street | Other | ||||||||||||||||||||||||

| NOI at share - cash basis for the three months ended March 31, 2025 | $ | 269,371 | $ | 227,570 | $ | 17,517 | $ | 18,137 | $ | 6,147 | |||||||||||||||||||

| Less NOI at share - cash basis from: | |||||||||||||||||||||||||||||

| Dispositions | (223) | (153) | (70) | — | — | ||||||||||||||||||||||||

| Development properties | 137 | 137 | — | — | — | ||||||||||||||||||||||||

| Other non-same store income, net | (10,995) | (4,848) | — | — | (6,147) | ||||||||||||||||||||||||

| Same store NOI at share - cash basis for the three months ended March 31, 2025 | $ | 258,290 | $ | 222,706 | $ | 17,447 | $ | 18,137 | $ | — | |||||||||||||||||||

| NOI at share - cash basis for the three months ended December 31, 2024 | $ | 276,588 | $ | 241,933 | $ | 10,550 | $ | 18,138 | $ | 5,967 | |||||||||||||||||||

| Less NOI at share - cash basis from: | |||||||||||||||||||||||||||||

| Dispositions | (2,312) | (2,218) | (94) | — | — | ||||||||||||||||||||||||

| Development properties | (1,664) | (1,664) | — | — | — | ||||||||||||||||||||||||

| Other non-same store income, net | (10,263) | (4,153) | — | (143) | (5,967) | ||||||||||||||||||||||||

| Same store NOI at share - cash basis for the three months ended December 31, 2024 | $ | 262,349 | $ | 233,898 | $ | 10,456 | $ | 17,995 | $ | — | |||||||||||||||||||

| (Decrease) increase in same store NOI at share - cash basis | $ | (4,059) | $ | (11,192) | $ | 6,991 | $ | 142 | $ | — | |||||||||||||||||||

| % (decrease) increase in same store NOI at share - cash basis | (1.5) | % | (4.8) | % | 66.9 | % | 0.8 | % | 0.0 | % | |||||||||||||||||||

| NYSE: VNO | WWW.VNO.COM | PAGE 14 OF 14

|

|||||||

| INDEX | |||||||||||||||||

| Page | |||||||||||||||||

| BUSINESS DEVELOPMENTS | |||||||||||||||||

| FINANCIAL INFORMATION | |||||||||||||||||

| Financial Highlights | |||||||||||||||||

| FFO, As Adjusted Bridge | |||||||||||||||||

| Consolidated Balance Sheets | |||||||||||||||||

| Net Income (Loss) Attributable to Common Shareholders (Consolidated and by Segment) | - | ||||||||||||||||

| Net Operating Income at Share and Net Operating Income at Share - Cash Basis (by Segment and by Subsegment) | - | ||||||||||||||||

| Same Store NOI at Share and Same Store NOI at Share - Cash Basis | |||||||||||||||||

| DEVELOPMENT/REDEVELOPMENT - ACTIVE PROJECTS AND FUTURE OPPORTUNITIES | |||||||||||||||||

| LEASING ACTIVITY AND LEASE EXPIRATIONS | |||||||||||||||||

| Leasing Activity | |||||||||||||||||

| Lease Expirations | - | ||||||||||||||||

| CAPITAL EXPENDITURES, TENANT IMPROVEMENTS AND LEASING COMMISSIONS | |||||||||||||||||

| UNCONSOLIDATED JOINT VENTURES | - | ||||||||||||||||

| DEBT AND CAPITALIZATION | |||||||||||||||||

| Capital Structure | |||||||||||||||||

| Common Shares Data | |||||||||||||||||

| Debt Analysis | |||||||||||||||||

| Hedging Instruments | |||||||||||||||||

| Consolidated Debt Maturities | |||||||||||||||||

| PROPERTY STATISTICS | |||||||||||||||||

| Top 30 Tenants | |||||||||||||||||

| Square Footage | |||||||||||||||||

| Occupancy and Residential Statistics | |||||||||||||||||

| Ground Leases | |||||||||||||||||

| Property Table | - | ||||||||||||||||

| EXECUTIVE OFFICERS AND RESEARCH COVERAGE | |||||||||||||||||

| APPENDIX: DEFINITIONS AND NON-GAAP RECONCILIATIONS | |||||||||||||||||

| Definitions | |||||||||||||||||

| Reconciliations | - | ||||||||||||||||

| BUSINESS DEVELOPMENTS | ||||||||||||||

| FINANCIAL HIGHLIGHTS (unaudited) | |||||||||||||||||

| (Amounts in thousands, except per share amounts) | |||||||||||||||||

| For the Three Months Ended | |||||||||||||||||

| March 31, | December 31, 2024 | ||||||||||||||||

| 2025 | 2024 | ||||||||||||||||

| Total revenues | $ | 461,579 | $ | 436,375 | $ | 457,790 | |||||||||||

| Net income (loss) attributable to common shareholders | $ | 86,842 | $ | (9,034) | $ | 1,203 | |||||||||||

| Per common share: | |||||||||||||||||

| Basic | $ | 0.45 | $ | (0.05) | $ | 0.01 | |||||||||||

| Diluted | $ | 0.43 | $ | (0.05) | $ | 0.01 | |||||||||||

| FFO attributable to common shareholders plus assumed conversions, as adjusted (non-GAAP) | $ | 126,245 | $ | 108,847 | $ | 122,212 | |||||||||||

| Per diluted share (non-GAAP) | $ | 0.63 | $ | 0.55 | $ | 0.61 | |||||||||||

| FFO attributable to common shareholders plus assumed conversions (non-GAAP) | $ | 135,039 | $ | 104,129 | $ | 117,085 | |||||||||||

| FFO - Operating Partnership ("OP") basis (non-GAAP) | $ | 146,786 | $ | 113,485 | $ | 126,975 | |||||||||||

| Per diluted share (non-GAAP) | $ | 0.67 | $ | 0.53 | $ | 0.58 | |||||||||||

| Dividends per common share | N/A | N/A | $ | 0.74 | |||||||||||||

FFO payout ratio (based on FFO attributable to common shareholders plus assumed conversions, as adjusted)(1) |

N/A | N/A | N/A | ||||||||||||||

FAD payout ratio(1) |

N/A | N/A | N/A | ||||||||||||||

| Weighted average VNO common shares outstanding | 191,371 | 190,429 | 190,679 | ||||||||||||||

| Redeemable Class A units and LTIP Unit awards | 17,323 | 17,174 | 16,996 | ||||||||||||||

| Weighted average VRLP Class A units outstanding | 208,694 | 207,603 | 207,675 | ||||||||||||||

| Dilutive share-based equity awards | 8,161 | 4,204 | 9,405 | ||||||||||||||

| Redeemable preferred units - common share equivalents | 1,252 | 1,875 | 1,197 | ||||||||||||||

| Weighted average VRLP Class A units outstanding - diluted | 218,107 | 213,682 | 218,277 | ||||||||||||||

| FFO, AS ADJUSTED BRIDGE - Q1 2025 VS. Q1 2024 (unaudited) | ||

| (Amounts in millions, except per share amounts) | FFO, as Adjusted | ||||||||||

| Amount | Per Share | ||||||||||

| FFO attributable to common shareholders plus assumed conversions, as adjusted (non-GAAP) for the three months ended March 31, 2024 | $ | 108.8 | $ | 0.55 | |||||||

| Increase / (decrease) in FFO, as adjusted due to: | |||||||||||

| Impact of PENN 1 ground rent reset determination (including a $17.2 reversal of rent expense that was accrued in prior periods) | 20.0 | ||||||||||

| Lower interest income | (5.6) | ||||||||||

| Variable businesses (primarily signage) | 2.4 | ||||||||||

| Rent commencements, net of lease expirations and other tenant related items | 2.1 | ||||||||||

| Other, net | (0.5) | ||||||||||

| 18.4 | |||||||||||

| Noncontrolling interests' share of above items and impact of assumed conversions of convertible securities | (1.0) | ||||||||||

| Net increase | 17.4 | 0.08 | |||||||||

| FFO attributable to common shareholders plus assumed conversions, as adjusted (non-GAAP) for the three months ended March 31, 2025 | $ | 126.2 | $ | 0.63 | |||||||

| CONSOLIDATED BALANCE SHEETS (unaudited) | |||||||||||||||||

| (Amounts in thousands) | |||||||||||||||||

| As of | Increase (Decrease) |

||||||||||||||||

| March 31, 2025 | December 31, 2024 | ||||||||||||||||

| ASSETS | |||||||||||||||||

| Real estate, at cost: | |||||||||||||||||

| Land | $ | 2,434,209 | $ | 2,434,209 | $ | — | |||||||||||

| Buildings and improvements | 10,719,995 | 10,439,113 | 280,882 | ||||||||||||||

| Development costs and construction in progress | 879,601 | 1,097,395 | (217,794) | ||||||||||||||

| Leasehold improvements and equipment | 111,983 | 120,915 | (8,932) | ||||||||||||||

| Total | 14,145,788 | 14,091,632 | 54,156 | ||||||||||||||

| Less accumulated depreciation and amortization | (4,105,413) | (4,025,349) | (80,064) | ||||||||||||||

| Real estate, net | 10,040,375 | 10,066,283 | (25,908) | ||||||||||||||

| Right-of-use assets | 677,312 | 678,804 | (1,492) | ||||||||||||||

| Cash, cash equivalents, and restricted cash | |||||||||||||||||

| Cash and cash equivalents | 568,861 | 733,947 | (165,086) | ||||||||||||||

| Restricted cash | 238,027 | 215,672 | 22,355 | ||||||||||||||

| Total | 806,888 | 949,619 | (142,731) | ||||||||||||||

| Tenant and other receivables | 70,920 | 58,853 | 12,067 | ||||||||||||||

| Investments in partially owned entities | 2,421,283 | 2,691,478 | (270,195) | ||||||||||||||

| Receivable arising from the straight-lining of rents | 711,334 | 707,020 | 4,314 | ||||||||||||||

| Deferred leasing costs, net | 385,658 | 354,882 | 30,776 | ||||||||||||||

| Identified intangible assets, net | 116,280 | 118,215 | (1,935) | ||||||||||||||

| Other assets | 369,182 | 373,454 | (4,272) | ||||||||||||||

| Total assets | $ | 15,599,232 | $ | 15,998,608 | $ | (399,376) | |||||||||||

| LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS AND EQUITY | |||||||||||||||||

| Liabilities: | |||||||||||||||||

| Mortgages payable, net | $ | 5,674,519 | $ | 5,676,014 | $ | (1,495) | |||||||||||

| Senior unsecured notes, net | 746,282 | 1,195,914 | (449,632) | ||||||||||||||

| Unsecured term loan, net | 796,295 | 795,948 | 347 | ||||||||||||||

| Unsecured revolving credit facilities | 575,000 | 575,000 | — | ||||||||||||||

| Lease liabilities | 734,123 | 749,759 | (15,636) | ||||||||||||||

| Accounts payable and accrued expenses | 387,898 | 374,013 | 13,885 | ||||||||||||||

| Deferred compensation plan | 111,144 | 114,580 | (3,436) | ||||||||||||||

| Other liabilities | 345,778 | 345,511 | 267 | ||||||||||||||

| Total liabilities | 9,371,039 | 9,826,739 | (455,700) | ||||||||||||||

| Redeemable noncontrolling interests | 738,224 | 834,658 | (96,434) | ||||||||||||||

| Shareholders' equity | 5,314,118 | 5,158,242 | 155,876 | ||||||||||||||

| Noncontrolling interests in consolidated subsidiaries | 175,851 | 178,969 | (3,118) | ||||||||||||||

| Total liabilities, redeemable noncontrolling interests and equity | $ | 15,599,232 | $ | 15,998,608 | $ | (399,376) | |||||||||||

| CONSOLIDATED NET INCOME (LOSS) ATTRIBUTABLE TO COMMON SHAREHOLDERS (unaudited) | |||||||||||||||||||||||

| (Amounts in thousands) | |||||||||||||||||||||||

| For the Three Months Ended | |||||||||||||||||||||||

| March 31, | December 31, 2024 | ||||||||||||||||||||||

| 2025 | 2024 | Variance | |||||||||||||||||||||

Property rentals(1) |

$ | 348,385 | $ | 337,376 | $ | 11,009 | $ | 345,005 | |||||||||||||||

Tenant expense reimbursements(1) |

51,983 | 46,638 | 5,345 | 45,229 | |||||||||||||||||||

| Amortization of acquired below-market leases, net | 88 | 693 | (605) | 193 | |||||||||||||||||||

| Straight-lining of rents | 4,299 | 4,571 | (272) | 8,036 | |||||||||||||||||||

| Total rental revenues | 404,755 | 389,278 | 15,477 | 398,463 | |||||||||||||||||||

| Fee and other income: | |||||||||||||||||||||||

| Building Maintenance Services ("BMS") cleaning fees | 36,476 | 35,780 | 696 | 37,208 | |||||||||||||||||||

| Management and leasing fees | 3,030 | 2,611 | 419 | 2,519 | |||||||||||||||||||

| Other income | 17,318 | 8,706 | 8,612 | 19,600 | |||||||||||||||||||

| Total revenues | 461,579 | 436,375 | 25,204 | 457,790 | |||||||||||||||||||

| Operating expenses | (224,740) | (226,224) | 1,484 | (236,043) | |||||||||||||||||||

| Depreciation and amortization | (116,155) | (108,659) | (7,496) | (113,061) | |||||||||||||||||||

| General and administrative | (38,597) | (37,897) | (700) | (36,637) | |||||||||||||||||||

| Income (expense) from deferred compensation plan liability | 1,089 | (4,520) | 5,609 | (1,549) | |||||||||||||||||||

| Transaction related costs and other | (43) | (653) | 610 | (1,341) | |||||||||||||||||||

| Total expenses | (378,446) | (377,953) | (493) | (388,631) | |||||||||||||||||||

| Income from partially owned entities | 96,977 | 16,279 | 80,698 | 30,007 | |||||||||||||||||||

| Interest and other investment income, net | 8,261 | 11,724 | (3,463) | 11,348 | |||||||||||||||||||

| (Expense) income from deferred compensation plan assets | (1,089) | 4,520 | (5,609) | 1,549 | |||||||||||||||||||

| Interest and debt expense | (95,816) | (90,478) | (5,338) | (100,483) | |||||||||||||||||||

| Net gains on disposition of wholly owned and partially owned assets | 15,551 | — | 15,551 | — | |||||||||||||||||||

| Income before income taxes | 107,017 | 467 | 106,550 | 11,580 | |||||||||||||||||||

| Income tax expense | (7,193) | (6,740) | (453) | (5,822) | |||||||||||||||||||

| Net income (loss) | 99,824 | (6,273) | 106,097 | 5,758 | |||||||||||||||||||

| Less net loss (income) attributable to noncontrolling interests in: | |||||||||||||||||||||||

| Consolidated subsidiaries | 10,433 | 11,982 | (1,549) | 11,107 | |||||||||||||||||||

| Operating Partnership | (7,889) | 786 | (8,675) | (136) | |||||||||||||||||||

| Net income attributable to Vornado | 102,368 | 6,495 | 95,873 | 16,729 | |||||||||||||||||||

| Preferred share dividends | (15,526) | (15,529) | 3 | (15,526) | |||||||||||||||||||

| Net income (loss) attributable to common shareholders | $ | 86,842 | $ | (9,034) | $ | 95,876 | $ | 1,203 | |||||||||||||||

| Capitalized expenditures: | |||||||||||||||||||||||

| Interest and debt expense | $ | 10,868 | $ | 12,564 | $ | (1,696) | $ | 12,417 | |||||||||||||||

| Development payroll | 1,101 | 2,499 | (1,398) | 990 | |||||||||||||||||||

| NET INCOME (LOSS) ATTRIBUTABLE TO COMMON SHAREHOLDERS BY SEGMENT (unaudited) | ||

| (Amounts in thousands) | ||

| For the Three Months Ended March 31, 2025 | |||||||||||||||||

| Total | New York | Other | |||||||||||||||

Property rentals(1) |

$ | 348,385 | $ | 279,691 | $ | 68,694 | |||||||||||

Tenant expense reimbursements(1) |

51,983 | 38,992 | 12,991 | ||||||||||||||

| Amortization of acquired below-market leases, net | 88 | 31 | 57 | ||||||||||||||

| Straight-lining of rents | 4,299 | 5,585 | (1,286) | ||||||||||||||

| Total rental revenues | 404,755 | 324,299 | 80,456 | ||||||||||||||

| Fee and other income: | |||||||||||||||||

| BMS cleaning fees | 36,476 | 38,497 | (2,021) | ||||||||||||||

| Management and leasing fees | 3,030 | 3,205 | (175) | ||||||||||||||

| Other income | 17,318 | 10,205 | 7,113 | ||||||||||||||

| Total revenues | 461,579 | 376,206 | 85,373 | ||||||||||||||

| Operating expenses | (224,740) | (183,640) | (41,100) | ||||||||||||||

| Depreciation and amortization | (116,155) | (92,365) | (23,790) | ||||||||||||||

| General and administrative | (38,597) | (13,415) | (25,182) | ||||||||||||||

| Income from deferred compensation plan liability | 1,089 | — | 1,089 | ||||||||||||||

| Transaction related costs and other | (43) | — | (43) | ||||||||||||||

| Total expenses | (378,446) | (289,420) | (89,026) | ||||||||||||||

| Income from partially owned entities | 96,977 | 94,276 | 2,701 | ||||||||||||||

| Interest and other investment income, net | 8,261 | 3,474 | 4,787 | ||||||||||||||

| Expense from deferred compensation plan assets | (1,089) | — | (1,089) | ||||||||||||||

| Interest and debt expense | (95,816) | (50,394) | (45,422) | ||||||||||||||

| Net gains on disposition of wholly owned and partially owned assets | 15,551 | 1,975 | 13,576 | ||||||||||||||

| Income (loss) before income taxes | 107,017 | 136,117 | (29,100) | ||||||||||||||

| Income tax expense | (7,193) | (1,302) | (5,891) | ||||||||||||||

| Net income (loss) | 99,824 | 134,815 | (34,991) | ||||||||||||||

| Less net loss attributable to noncontrolling interests in consolidated subsidiaries | 10,433 | 9,160 | 1,273 | ||||||||||||||

| Net income (loss) attributable to Vornado Realty L.P. | 110,257 | $ | 143,975 | $ | (33,718) | ||||||||||||

| Less net income attributable to noncontrolling interests in the Operating Partnership | (7,860) | ||||||||||||||||

| Preferred unit distributions | (15,555) | ||||||||||||||||

| Net income attributable to common shareholders | $ | 86,842 | |||||||||||||||

| For the three months ended March 31, 2024 | |||||||||||||||||

| Net income (loss) attributable to Vornado Realty L.P. | $ | 5,709 | $ | 59,917 | $ | (54,208) | |||||||||||

| Net loss attributable to common shareholders | $ | (9,034) | |||||||||||||||

| NET OPERATING INCOME AT SHARE AND NET OPERATING INCOME AT SHARE - CASH BASIS BY SEGMENT (NON-GAAP) (unaudited) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Amounts in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| For the Three Months Ended March 31, 2025 | |||||||||||||||||

| Total | New York | Other | |||||||||||||||

| Total revenues | $ | 461,579 | $ | 376,206 | $ | 85,373 | |||||||||||

| Operating expenses | (224,740) | (183,640) | (41,100) | ||||||||||||||

| NOI - consolidated | 236,839 | 192,566 | 44,273 | ||||||||||||||

| Deduct: NOI attributable to noncontrolling interests in consolidated subsidiaries | (10,660) | (3,347) | (7,313) | ||||||||||||||

| Add: Our share of NOI from partially owned entities | 67,111 | 64,098 | 3,013 | ||||||||||||||

| NOI at share | 293,290 | 253,317 | 39,973 | ||||||||||||||

| Non-cash adjustments for straight-line rents, amortization of acquired below-market leases, net, and other | (23,919) | (25,747) | 1,828 | ||||||||||||||

| NOI at share - cash basis | $ | 269,371 | $ | 227,570 | $ | 41,801 | |||||||||||

| For the Three Months Ended March 31, 2024 | |||||||||||||||||

| Total | New York | Other | |||||||||||||||

| Total revenues | $ | 436,375 | $ | 358,234 | $ | 78,141 | |||||||||||

| Operating expenses | (226,224) | (188,278) | (37,946) | ||||||||||||||

| NOI - consolidated | 210,151 | 169,956 | 40,195 | ||||||||||||||

| Deduct: NOI attributable to noncontrolling interests in consolidated subsidiaries | (11,396) | (4,536) | (6,860) | ||||||||||||||

| Add: Our share of NOI from partially owned entities | 70,369 | 67,709 | 2,660 | ||||||||||||||

| NOI at share | 269,124 | 233,129 | 35,995 | ||||||||||||||

| Non-cash adjustments for straight-line rents, amortization of acquired below-market leases, net, and other | (1,511) | (2,335) | 824 | ||||||||||||||

| NOI at share - cash basis | $ | 267,613 | $ | 230,794 | $ | 36,819 | |||||||||||

| For the Three Months Ended December 31, 2024 | |||||||||||||||||

| Total | New York | Other | |||||||||||||||

| Total revenues | $ | 457,790 | $ | 383,702 | $ | 74,088 | |||||||||||

| Operating expenses | (236,043) | (194,195) | (41,848) | ||||||||||||||

| NOI - consolidated | 221,747 | 189,507 | 32,240 | ||||||||||||||

| Deduct: NOI attributable to noncontrolling interests in consolidated subsidiaries | (10,051) | (3,644) | (6,407) | ||||||||||||||

| Add: Our share of NOI from partially owned entities | 73,270 | 71,177 | 2,093 | ||||||||||||||

| NOI at share | 284,966 | 257,040 | 27,926 | ||||||||||||||

| Non-cash adjustments for straight-line rents, amortization of acquired below-market leases, net, and other | (8,378) | (15,107) | 6,729 | ||||||||||||||

| NOI at share - cash basis | $ | 276,588 | $ | 241,933 | $ | 34,655 | |||||||||||

| NET OPERATING INCOME AT SHARE AND NET OPERATING INCOME AT SHARE - CASH BASIS BY SEGMENT AND SUBSEGMENT (NON-GAAP) (unaudited) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Amounts in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| For the Three Months Ended | |||||||||||||||||

| March 31, | December 31, 2024 | ||||||||||||||||

| 2025 | 2024 | ||||||||||||||||

| NOI at share: | |||||||||||||||||

| New York: | |||||||||||||||||

Office(1) |

$ | 191,501 | $ | 167,988 | $ | 193,215 | |||||||||||

| Retail | 46,115 | 47,466 | 48,238 | ||||||||||||||

| Residential | 6,192 | 5,968 | 6,072 | ||||||||||||||

| Alexander’s | 9,509 | 11,707 | 9,515 | ||||||||||||||

| Total New York | 253,317 | 233,129 | 257,040 | ||||||||||||||

| Other: | |||||||||||||||||

THE MART(2) |

15,916 | 14,486 | 6,168 | ||||||||||||||

| 555 California Street | 17,843 | 16,529 | 15,854 | ||||||||||||||

| Other investments | 6,214 | 4,980 | 5,904 | ||||||||||||||

| Total Other | 39,973 | 35,995 | 27,926 | ||||||||||||||

| NOI at share | $ | 293,290 | $ | 269,124 | $ | 284,966 | |||||||||||

| NOI at share - cash basis: | |||||||||||||||||

| New York: | |||||||||||||||||

Office(1) |

$ | 167,457 | $ | 166,370 | $ | 181,438 | |||||||||||

| Retail | 43,727 | 43,873 | 44,130 | ||||||||||||||

| Residential | 5,848 | 5,690 | 5,750 | ||||||||||||||

| Alexander's | 10,538 | 14,861 | 10,615 | ||||||||||||||

| Total New York | 227,570 | 230,794 | 241,933 | ||||||||||||||

| Other: | |||||||||||||||||

| THE MART | 17,517 | 14,949 | 10,550 | ||||||||||||||

| 555 California Street | 18,137 | 16,938 | 18,138 | ||||||||||||||

| Other investments | 6,147 | 4,932 | 5,967 | ||||||||||||||

| Total Other | 41,801 | 36,819 | 34,655 | ||||||||||||||

| NOI at share - cash basis | $ | 269,371 | $ | 267,613 | $ | 276,588 | |||||||||||

| SAME STORE NOI AT SHARE AND SAME STORE NOI AT SHARE - CASH BASIS (NON-GAAP) (unaudited) | ||||||||||||||||||||

| Total | New York | THE MART(3) |

555 California Street | |||||||||||||||||||||||

Same store NOI at share % increase (decrease)(1): |

||||||||||||||||||||||||||

| Three months ended March 31, 2025 compared to March 31, 2024 | 3.5 | % | 3.0 | % | (2) | 9.7 | % | 5.2 | % | |||||||||||||||||

| Three months ended March 31, 2025 compared to December 31, 2024 | (1.5) | % | (6.3) | % | (2) | 160.8 | % | 10.5 | % | |||||||||||||||||

Same store NOI at share - cash basis % increase (decrease)(1): |

||||||||||||||||||||||||||

| Three months ended March 31, 2025 compared to March 31, 2024 | 0.9 | % | (0.7) | % | 16.7 | % | 7.1 | % | ||||||||||||||||||

| Three months ended March 31, 2025 compared to December 31, 2024 | (1.5) | % | (4.8) | % | 66.9 | % | 0.8 | % | ||||||||||||||||||

| DEVELOPMENT/REDEVELOPMENT - ACTIVE PROJECTS AND FUTURE OPPORTUNITIES | ||||||||||||||||||||||||||||||||||||||||||||

| (Amounts in thousands, except square feet) | ||||||||||||||||||||||||||||||||||||||||||||

| (at Vornado’s share) | Projected Incremental Cash Yield |

|||||||||||||||||||||||||||||||||||||||||||

|

Active Development Projects:

New York segment:

|

Property Rentable Sq. Ft. |

Budget | Cash Amount Expended |

Remaining Expenditures | Stabilization Year |

|||||||||||||||||||||||||||||||||||||||

| PENN District: | ||||||||||||||||||||||||||||||||||||||||||||

| PENN 2 | 1,815,000 | $ | 750,000 | $ | 708,267 | $ | 41,733 | 2026 | 10.2% | |||||||||||||||||||||||||||||||||||

| Districtwide Improvements | N/A | 100,000 | 75,189 | 24,811 | N/A | N/A | ||||||||||||||||||||||||||||||||||||||

| Total PENN District | 850,000 | (1) |

783,456 | 66,544 | ||||||||||||||||||||||||||||||||||||||||

Sunset Pier 94 Studios (49.9% interest)(2) |

266,000 | 125,000 | (3) |

66,551 | 58,449 | 2026 | 10.3% | |||||||||||||||||||||||||||||||||||||

| Total Active Development Projects | $ | 975,000 | $ | 850,007 | $ | 124,993 | ||||||||||||||||||||||||||||||||||||||

|

Future Opportunities:

New York segment:

|

Zoning Sq. Ft. | |||||||||||||||||||||||||||||||||||||||||||

| PENN District: | ||||||||||||||||||||||||||||||||||||||||||||

| Hotel Pennsylvania site (PENN 15) | 2,052,000 | |||||||||||||||||||||||||||||||||||||||||||

| Eighth Avenue and 34th Street land | 105,000 | |||||||||||||||||||||||||||||||||||||||||||

| Multiple other opportunities - office/residential/retail | ||||||||||||||||||||||||||||||||||||||||||||

| Total PENN District | 2,157,000 | |||||||||||||||||||||||||||||||||||||||||||

350 Park Avenue assemblage (the “350 Park Site”)(4) |

1,389,000 | |||||||||||||||||||||||||||||||||||||||||||

260 Eleventh Avenue - office(2) |

280,000 | |||||||||||||||||||||||||||||||||||||||||||

| 57th Street land (50% interest) | 150,000 | |||||||||||||||||||||||||||||||||||||||||||

| Other segment: | ||||||||||||||||||||||||||||||||||||||||||||

| 527 West Kinzie land, Chicago | 330,000 | |||||||||||||||||||||||||||||||||||||||||||

| Total Future Opportunities | 4,306,000 | |||||||||||||||||||||||||||||||||||||||||||

| LEASING ACTIVITY (unaudited) | ||

| (Square feet in thousands) | ||

| New York | 555 California Street |

|||||||||||||||||||||||||

| Office | Retail | THE MART | ||||||||||||||||||||||||

| Three Months Ended March 31, 2025 | ||||||||||||||||||||||||||

| Total square feet leased | 709 | 25 | 83 | 222 | ||||||||||||||||||||||

| Our share of square feet leased: | 685 | 18 | 83 | 155 | ||||||||||||||||||||||

Initial rent(1) |

$ | 95.53 | $ | 222.20 | $ | 51.33 | $ | 120.65 | ||||||||||||||||||

| Weighted average lease term (years) | 14.7 | 14.3 | 8.0 | 13.1 | ||||||||||||||||||||||

| Second generation relet space: | ||||||||||||||||||||||||||

| Square feet | 254 | 10 | 42 | 155 | ||||||||||||||||||||||

| GAAP basis: | ||||||||||||||||||||||||||

Straight-line rent(2) |

$ | 80.23 | $ | 139.99 | $ | 51.80 | $ | 132.08 | ||||||||||||||||||

| Prior straight-line rent | $ | 73.25 | $ | 108.59 | $ | 54.68 | $ | 110.28 | ||||||||||||||||||

| Percentage increase (decrease) | 9.5 | % | 28.9 | % | (5.3) | % | 19.8 | % | ||||||||||||||||||

| Cash basis (non-GAAP): | ||||||||||||||||||||||||||

Initial rent(1) |

$ | 84.72 | $ | 139.40 | $ | 51.67 | $ | 121.04 | ||||||||||||||||||

| Prior escalated rent | $ | 79.56 | $ | 112.57 | $ | 60.43 | $ | 117.37 | ||||||||||||||||||

| Percentage increase (decrease) | 6.5 | % | 23.8 | % | (14.5) | % | 3.1 | % | ||||||||||||||||||

| Tenant improvements and leasing commissions: | ||||||||||||||||||||||||||

| Per square foot | $ | 168.88 | $ | 377.61 | $ | 90.82 | $ | 229.71 | ||||||||||||||||||

| Per square foot per annum | $ | 11.49 | $ | 26.41 | $ | 11.35 | $ | 17.54 | ||||||||||||||||||

| Percentage of initial rent | 12.0 | % | 11.9 | % | 22.1 | % | 14.5 | % | ||||||||||||||||||

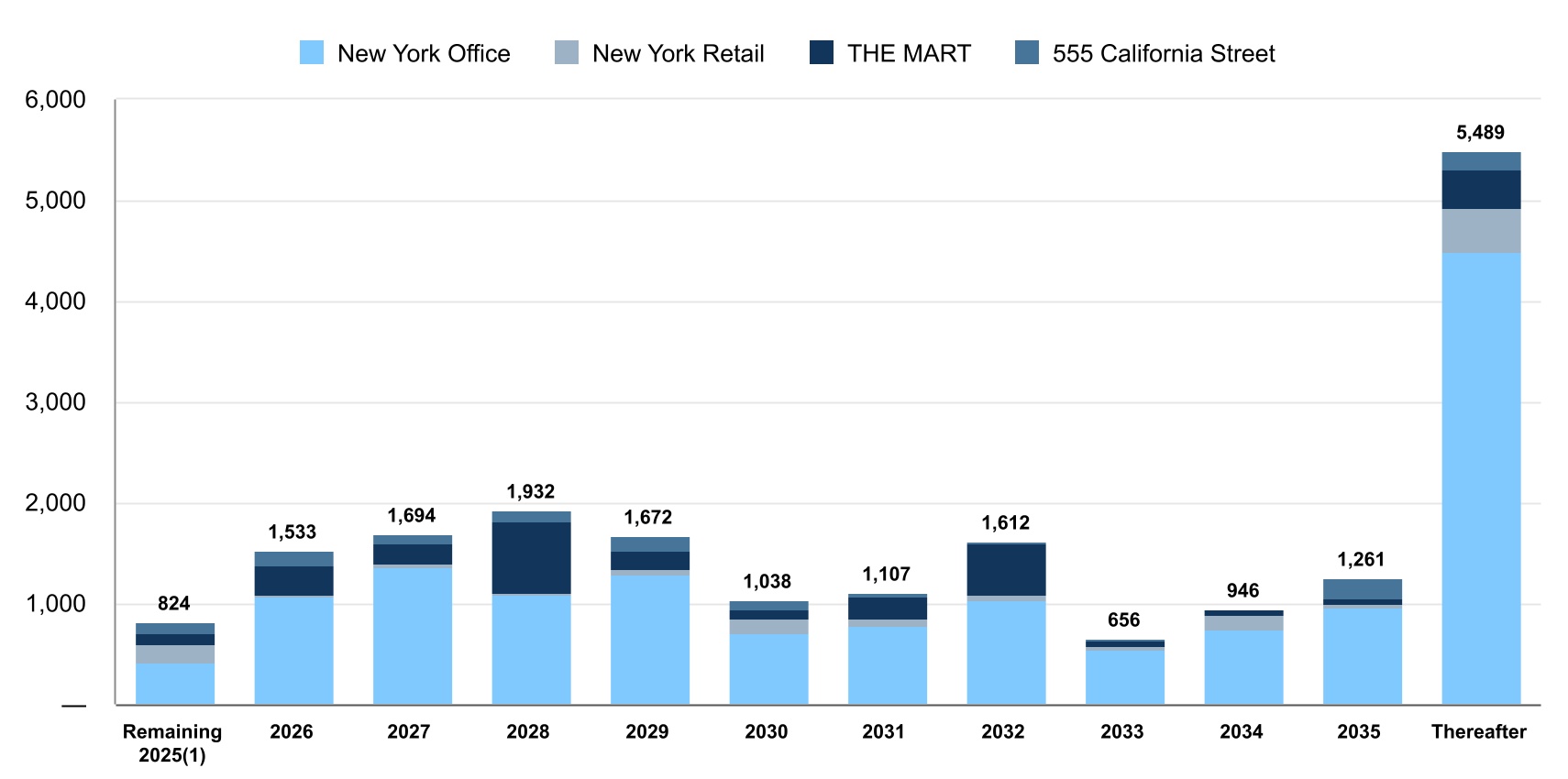

| LEASE EXPIRATIONS (unaudited) NEW YORK SEGMENT | |||||||||||||||||||||||||||||

| Period of Lease Expiration |

Our Share of

Square Feet

of Expiring

Leases(1)

|

Annualized Escalated Rents of Expiring Leases |

Percentage of Annualized Escalated Rent |

||||||||||||||||||||||||||

| Total | Per Sq. Ft. | ||||||||||||||||||||||||||||

| Office: | First Quarter 2025(2) |

26,000 | $ | 1,883,000 | $ | 72.42 | 0.1 | % | |||||||||||||||||||||

| Second Quarter 2025 | 282,000 | 21,362,000 | 75.75 | 1.7 | % | ||||||||||||||||||||||||

| Third Quarter 2025 | 64,000 | 3,618,000 | 56.53 | 0.3 | % | ||||||||||||||||||||||||

| Fourth Quarter 2025 | 49,000 | 4,123,000 | 84.14 | 0.3 | % | ||||||||||||||||||||||||

| Remaining 2025 | 395,000 | 29,103,000 | 73.68 | 2.3 | % | ||||||||||||||||||||||||

| First Quarter 2026 | 118,000 | 11,276,000 | 95.56 | 0.9 | % | ||||||||||||||||||||||||

| Remaining 2026 | 950,000 | 78,729,000 | 82.87 | 6.3 | % | ||||||||||||||||||||||||

| 2027 | 1,357,000 | 108,759,000 | 80.15 | 8.7 | % | ||||||||||||||||||||||||

| 2028 | 1,082,000 | 88,213,000 | 81.53 | 7.0 | % | ||||||||||||||||||||||||

| 2029 | 1,289,000 | 106,397,000 | 82.54 | 8.5 | % | ||||||||||||||||||||||||

| 2030 | 713,000 | 60,526,000 | 84.89 | 4.8 | % | ||||||||||||||||||||||||

| 2031 | 783,000 | 71,186,000 | 90.91 | 5.7 | % | ||||||||||||||||||||||||

| 2032 | 1,039,000 | 101,715,000 | 97.90 | 8.1 | % | ||||||||||||||||||||||||

| 2033 | 548,000 | 47,660,000 | 86.97 | 3.8 | % | ||||||||||||||||||||||||

| 2034 | 748,000 | 78,753,000 | 105.28 | 6.3 | % | ||||||||||||||||||||||||

| 2035 | 970,000 | 76,821,000 | 79.20 | 6.1 | % | ||||||||||||||||||||||||

| Thereafter | 4,500,000 | (3) |

395,657,000 | 87.92 | 31.4 | % | |||||||||||||||||||||||

| Retail: | First Quarter 2025(2) |

— | $ | — | $ | — | 0.0 | % | |||||||||||||||||||||

| Second Quarter 2025 | 120,000 | 7,533,000 | 62.78 | 2.8 | % | ||||||||||||||||||||||||

| Third Quarter 2025 | 11,000 | 2,137,000 | 194.27 | 0.8 | % | ||||||||||||||||||||||||

| Fourth Quarter 2025 | 52,000 | 3,568,000 | 68.62 | 1.3 | % | ||||||||||||||||||||||||

| Remaining 2025 | 183,000 | 13,238,000 | 72.34 | 4.9 | % | ||||||||||||||||||||||||

| First Quarter 2026 | 17,000 | 6,756,000 | 397.41 | 2.6 | % | ||||||||||||||||||||||||

| Remaining 2026 | 4,000 | 3,794,000 | 948.50 | 1.4 | % | ||||||||||||||||||||||||

| 2027 | 52,000 | 22,313,000 | 429.10 | 8.4 | % | ||||||||||||||||||||||||

| 2028 | 26,000 | 10,359,000 | 398.42 | 3.9 | % | ||||||||||||||||||||||||

| 2029 | 53,000 | 23,578,000 | 444.87 | 8.9 | % | ||||||||||||||||||||||||

| 2030 | 146,000 | 24,540,000 | 168.08 | 9.3 | % | ||||||||||||||||||||||||

| 2031 | 68,000 | 30,987,000 | 455.69 | 11.7 | % | ||||||||||||||||||||||||

| 2032 | 52,000 | 29,710,000 | 571.35 | 11.2 | % | ||||||||||||||||||||||||

| 2033 | 39,000 | 12,718,000 | 326.10 | 4.8 | % | ||||||||||||||||||||||||

| 2034 | 147,000 | 20,598,000 | 140.12 | 7.8 | % | ||||||||||||||||||||||||

| 2035 | 33,000 | 11,693,000 | 354.33 | 4.4 | % | ||||||||||||||||||||||||

| Thereafter | 436,000 | 54,550,000 | 125.11 | 20.7 | % | ||||||||||||||||||||||||

| LEASE EXPIRATIONS (unaudited) THE MART | |||||||||||||||||||||||||||||

| Period of Lease Expiration |

Our Share of

Square Feet

of Expiring

Leases(1)

|

Annualized Escalated Rents of Expiring Leases |

Percentage of Annualized Escalated Rent |

||||||||||||||||||||||||||

| Total | Per Sq. Ft. | ||||||||||||||||||||||||||||

| Office / Showroom / Retail: | First Quarter 2025(2) |

6,000 | $ | 487,000 | $ | 81.17 | 0.3 | % | |||||||||||||||||||||

| Second Quarter 2025 | 22,000 | 1,562,000 | 71.00 | 1.0 | % | ||||||||||||||||||||||||

| Third Quarter 2025 | 31,000 | 1,771,000 | 57.13 | 1.2 | % | ||||||||||||||||||||||||

| Fourth Quarter 2025 | 38,000 | 2,428,000 | 63.89 | 1.6 | % | ||||||||||||||||||||||||

| Remaining 2025 | 91,000 | 5,761,000 | 63.31 | 3.8 | % | ||||||||||||||||||||||||

| First Quarter 2026 | 32,000 | 2,261,000 | 70.66 | 1.5 | % | ||||||||||||||||||||||||

| Remaining 2026 | 252,000 | 15,016,000 | 59.59 | 9.9 | % | ||||||||||||||||||||||||

| 2027 | 199,000 | 11,593,000 | 58.26 | 7.6 | % | ||||||||||||||||||||||||

| 2028 | 712,000 | 37,725,000 | 52.98 | 24.8 | % | ||||||||||||||||||||||||

| 2029 | 187,000 | 10,595,000 | 56.66 | 7.0 | % | ||||||||||||||||||||||||

| 2030 | 94,000 | 5,575,000 | 59.31 | 3.7 | % | ||||||||||||||||||||||||

| 2031 | 227,000 | 11,904,000 | 52.44 | 7.8 | % | ||||||||||||||||||||||||

| 2032 | 508,000 | 25,426,000 | 50.05 | 16.7 | % | ||||||||||||||||||||||||

| 2033 | 54,000 | 2,807,000 | 51.98 | 1.8 | % | ||||||||||||||||||||||||

| 2034 | 51,000 | 2,652,000 | 52.00 | 1.7 | % | ||||||||||||||||||||||||

| 2035 | 48,000 | 2,555,000 | 53.23 | 1.7 | % | ||||||||||||||||||||||||

| Thereafter | 376,000 | 17,762,000 | 47.24 | 11.7 | % | ||||||||||||||||||||||||

| LEASE EXPIRATIONS (unaudited) 555 California Street | |||||||||||||||||||||||||||||

| Period of Lease Expiration |

Our Share of

Square Feet

of Expiring

Leases(1)

|

Annualized Escalated Rents of Expiring Leases |

Percentage of Annualized Escalated Rent |

||||||||||||||||||||||||||

| Total | Per Sq. Ft. | ||||||||||||||||||||||||||||

| Office / Retail: | First Quarter 2025(2) |

— | $ | — | $ | — | 0.0 | % | |||||||||||||||||||||

| Second Quarter 2025 | 10,000 | 1,141,000 | 114.10 | 1.0 | % | ||||||||||||||||||||||||

| Third Quarter 2025 | 81,000 | 7,364,000 | 90.91 | 6.5 | % | ||||||||||||||||||||||||

| Fourth Quarter 2025 | 32,000 | 3,274,000 | 102.31 | 2.9 | % | ||||||||||||||||||||||||

| Remaining 2025 | 123,000 | 11,779,000 | 95.76 | 10.4 | % | ||||||||||||||||||||||||

| First Quarter 2026 | 100,000 | 8,976,000 | 89.76 | 7.9 | % | ||||||||||||||||||||||||

| Remaining 2026 | 60,000 | 6,847,000 | 114.12 | 6.1 | % | ||||||||||||||||||||||||

| 2027 | 86,000 | 8,241,000 | 95.83 | 7.3 | % | ||||||||||||||||||||||||

| 2028 | 112,000 | 10,940,000 | 97.68 | 9.7 | % | ||||||||||||||||||||||||

| 2029 | 143,000 | 15,458,000 | 108.10 | 13.7 | % | ||||||||||||||||||||||||

| 2030 | 85,000 | 8,079,000 | 95.05 | 7.1 | % | ||||||||||||||||||||||||

| 2031 | 29,000 | 2,210,000 | 76.21 | 2.0 | % | ||||||||||||||||||||||||

| 2032 | 13,000 | 1,423,000 | 109.46 | 1.3 | % | ||||||||||||||||||||||||

| 2033 | 15,000 | 1,815,000 | 121.00 | 1.6 | % | ||||||||||||||||||||||||

| 2034 | — | — | — | 0.0 | % | ||||||||||||||||||||||||

| 2035 | 210,000 | 18,530,000 | 88.24 | 16.4 | % | ||||||||||||||||||||||||

| Thereafter | 177,000 | 18,813,000 | 106.29 | 16.5 | % | ||||||||||||||||||||||||

| CAPITAL EXPENDITURES, TENANT IMPROVEMENTS AND LEASING COMMISSIONS (unaudited) | ||||||||||||||||||||||||||||||||

| CONSOLIDATED | ||||||||||||||||||||||||||||||||

| (Amounts in thousands) | ||||||||||||||||||||||||||||||||

| For the Three Months Ended March 31, 2025 | ||||||||||||||||||||||||||||||||

| Total Company | New York | THE MART | 555 California Street | Other | ||||||||||||||||||||||||||||

| Capital expenditures: | ||||||||||||||||||||||||||||||||

| Expenditures to maintain assets | $ | 12,114 | $ | 9,203 | $ | 2,278 | $ | 616 | $ | 17 | ||||||||||||||||||||||

| Tenant improvements | 15,933 | 11,889 | 4,044 | — | — | |||||||||||||||||||||||||||

| Leasing commissions | 13,132 | 7,222 | 296 | 5,614 | — | |||||||||||||||||||||||||||

| Recurring tenant improvements, leasing commissions and other capital expenditures | 41,179 | 28,314 | 6,618 | 6,230 | 17 | |||||||||||||||||||||||||||

Non-recurring capital expenditures(1) |

14,168 | 6,544 | 7,565 | — | 59 | |||||||||||||||||||||||||||

| Total capital expenditures and leasing commissions | $ | 55,347 | $ | 34,858 | $ | 14,183 | $ | 6,230 | $ | 76 | ||||||||||||||||||||||

Development and redevelopment expenditures(2): |

||||||||||||||||||||||||||||||||

| PENN 2 | $ | 23,575 | $ | 23,575 | $ | — | $ | — | $ | — | ||||||||||||||||||||||

| Hotel Pennsylvania site (PENN 15) | 4,830 | 4,830 | — | — | — | |||||||||||||||||||||||||||

| PENN Districtwide improvements | 4,375 | 4,375 | — | — | — | |||||||||||||||||||||||||||

| Other | 8,154 | 7,895 | — | — | 259 | |||||||||||||||||||||||||||

| $ | 40,934 | $ | 40,675 | $ | — | $ | — | $ | 259 | |||||||||||||||||||||||

| UNCONSOLIDATED JOINT VENTURES (unaudited) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (Amounts in thousands) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| As of March 31, 2025 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Joint Venture Name | Asset Category |

Percentage Ownership | Company's Carrying Amount |

Company's

Pro rata

Share of Debt(1)

|

100% of

Joint Venture Debt(1)

|

Maturity Date(2) |

Spread over SOFR | Interest Rate(3) |

||||||||||||||||||||||||||||||||||||||||||

| Fifth Avenue and Times Square JV | Retail/Office | 51.5% | $ | 1,965,973 | $ | 364,863 | $ | 751,136 | Various | Various | Various | |||||||||||||||||||||||||||||||||||||||

| Alexander's | Office/Retail | 32.4% | 64,677 | 322,624 | 995,754 | Various | Various | Various | ||||||||||||||||||||||||||||||||||||||||||

| Partially owned office buildings/land: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 280 Park Avenue | Office/Retail | 50.0% | 107,049 | 537,500 | 1,075,000 | 09/27 | N/A | 5.84% | ||||||||||||||||||||||||||||||||||||||||||

| West 57th Street properties | Office/Retail/Land | 50.0% | 42,371 | — | — | N/A | N/A | N/A | ||||||||||||||||||||||||||||||||||||||||||

| 512 West 22nd Street | Office/Retail | 55.0% | 29,571 | 68,581 | 124,693 | 06/25 | S+235 | 6.67% | ||||||||||||||||||||||||||||||||||||||||||

| 825 Seventh Avenue | Office | 50.0% | 6,318 | 27,000 | 54,000 | 01/26 | S+275 | 7.07% | ||||||||||||||||||||||||||||||||||||||||||

| 61 Ninth Avenue | Office/Retail | 45.1% | 649 | 75,543 | 167,500 | 01/26 | S+146 | 5.79% | ||||||||||||||||||||||||||||||||||||||||||

| 650 Madison Avenue | Office/Retail | 20.1% | — | 161,024 | 800,000 | 12/29 | N/A | 3.49% | ||||||||||||||||||||||||||||||||||||||||||

| Other investments: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Sunset Pier 94 Studios | Studio Campus | 49.9% | 86,914 | 30,164 | 60,449 | 09/26 | S+476 | 9.08% | ||||||||||||||||||||||||||||||||||||||||||

| Independence Plaza | Residential/Retail | 50.1% | 62,628 | 338,175 | 675,000 | 07/25 | N/A | 4.25% | ||||||||||||||||||||||||||||||||||||||||||

| Rosslyn Plaza | Office/Residential | 43.7% to 50.4% | 35,230 | 12,603 | 25,000 | 04/26 | S+200 | 6.32% | ||||||||||||||||||||||||||||||||||||||||||

| Other | Various | Various | 19,903 | 78,152 | 573,404 | Various | Various | Various | ||||||||||||||||||||||||||||||||||||||||||

| $ | 2,421,283 | $ | 2,016,229 | $ | 5,301,936 | |||||||||||||||||||||||||||||||||||||||||||||

Investments in partially owned entities included in other liabilities(4): |

||||||||||||||||||||||||||||||||||||||||||||||||||

| 7 West 34th Street | Office/Retail | 53.0% | $ | (67,656) | $ | 159,000 | $ | 300,000 | 06/26 | N/A | 3.65% | |||||||||||||||||||||||||||||||||||||||

| 85 Tenth Avenue | Office/Retail | 49.9% | (20,939) | 311,875 | 625,000 | 12/26 | N/A | 4.55% | ||||||||||||||||||||||||||||||||||||||||||

| $ | (88,595) | $ | 470,875 | $ | 925,000 | |||||||||||||||||||||||||||||||||||||||||||||

| UNCONSOLIDATED JOINT VENTURES (unaudited) | |||||||||||||||||||||||||||||

| (Amounts in thousands) | |||||||||||||||||||||||||||||

| Percentage Ownership at March 31, 2025 |

Our Share of Net Income (Loss) for the

Three Months Ended March 31,

|

Our Share of NOI (non-GAAP) for the Three Months Ended March 31, | |||||||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||||||||

| Joint Venture Name | |||||||||||||||||||||||||||||

| New York: | |||||||||||||||||||||||||||||

| Fifth Avenue and Times Square JV: | |||||||||||||||||||||||||||||

| Equity in net income | 51.5% | $ | 5,837 | $ | 9,291 | $ | 23,577 | $ | 28,102 | ||||||||||||||||||||

| Return on preferred equity, net of our share of the expense | 8,543 | 9,328 | — | — | |||||||||||||||||||||||||

| Net gain on sale | 76,162 | (1) |

— | — | — | ||||||||||||||||||||||||

| 90,542 | 18,619 | 23,577 | 28,102 | ||||||||||||||||||||||||||

| 280 Park Avenue | 50.0% | (4,469) | (8,042) | 8,294 | 8,340 | ||||||||||||||||||||||||

| Alexander's | 32.4% | 3,923 | 5,154 | 9,509 | 11,707 | ||||||||||||||||||||||||

| 7 West 34th Street | 53.0% | 2,979 | 1,139 | 5,852 | 3,623 | ||||||||||||||||||||||||

| 85 Tenth Avenue | 49.9% | (1,962) | (2,522) | 3,493 | 3,075 | ||||||||||||||||||||||||

| Independence Plaza | 50.1% | 1,011 | (427) | 6,192 | 5,169 | ||||||||||||||||||||||||

| West 57th Street properties | 50.0% | (183) | (200) | 18 | (7) | ||||||||||||||||||||||||

| 512 West 22nd Street | 55.0% | (124) | (529) | 1,871 | 1,664 | ||||||||||||||||||||||||

| 61 Ninth Avenue | 45.1% | 59 | (80) | 1,944 | 1,908 | ||||||||||||||||||||||||

| Other, net | Various | 2,500 | 2,119 | 3,348 | 4,128 | ||||||||||||||||||||||||

| 94,276 | 15,231 | 64,098 | 67,709 | ||||||||||||||||||||||||||

| Other: | |||||||||||||||||||||||||||||

| Alexander's corporate fee income | 32.4% | 1,633 | 1,180 | 1,010 | 658 | ||||||||||||||||||||||||

| Rosslyn Plaza | 43.7% to 50.4% | (44) | (105) | 439 | 523 | ||||||||||||||||||||||||

| Other, net | Various | 1,112 | (27) | 1,564 | 1,479 | ||||||||||||||||||||||||

| 2,701 | 1,048 | 3,013 | 2,660 | ||||||||||||||||||||||||||

| Total | $ | 96,977 | $ | 16,279 | $ | 67,111 | $ | 70,369 | |||||||||||||||||||||

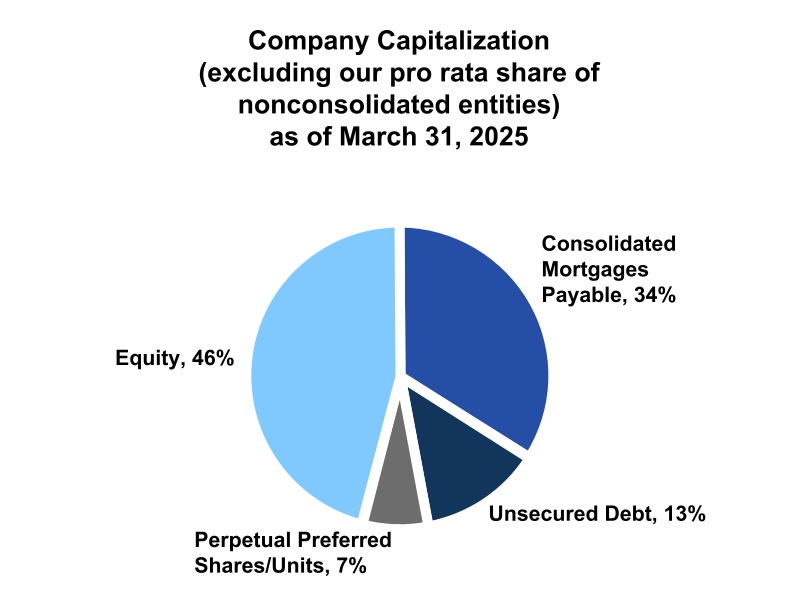

| CAPITAL STRUCTURE (unaudited) | ||||||||||||||||||||

| (Amounts in thousands, except per share and per unit amounts) | ||||||||||||||||||||

| As of March 31, 2025 | ||||||||||||||||||||

| Debt (contractual balances): | ||||||||||||||||||||

Consolidated debt(1): |

||||||||||||||||||||

| Mortgages payable | $ | 5,702,807 | ||||||||||||||||||

| Senior unsecured notes | 750,000 | |||||||||||||||||||

| $800 Million unsecured term loan | 800,000 | |||||||||||||||||||

| $2.2 Billion unsecured revolving credit facilities | 575,000 | |||||||||||||||||||

| 7,827,807 | ||||||||||||||||||||

| Pro rata share of debt of non-consolidated entities | 2,487,104 | |||||||||||||||||||

| Less: Noncontrolling interests' share of consolidated debt (primarily 1290 Avenue of the Americas and 555 California Street) | (682,059) | |||||||||||||||||||

| 9,632,852 | (A) | |||||||||||||||||||

| Shares/Units | Liquidation Preference | |||||||||||||||||||

| Perpetual Preferred: | ||||||||||||||||||||

| 3.25% preferred units (D-17) (141,400 units @ $25.00 per unit) | 3,535 | |||||||||||||||||||

| 5.40% Series L preferred shares | 12,000 | $ | 25.00 | 300,000 | ||||||||||||||||

| 5.25% Series M preferred shares | 12,780 | 25.00 | 319,500 | |||||||||||||||||

| 5.25% Series N preferred shares | 12,000 | 25.00 | 300,000 | |||||||||||||||||

| 4.45% Series O preferred shares | 12,000 | 25.00 | 300,000 | |||||||||||||||||

| 1,223,035 | (B) | |||||||||||||||||||

|

Converted

Shares(2)

|

March 31, 2025 Common Share Price | |||||||||||||||||||

| Equity: | ||||||||||||||||||||

| Common shares | 191,949 | $ | 36.99 | 7,100,194 | ||||||||||||||||

| Redeemable Class A units and LTIP Unit awards | 16,745 | 36.99 | 619,398 | |||||||||||||||||

| Convertible share equivalents: | ||||||||||||||||||||

| Series D-13 preferred units | 1,262 | 36.99 | 46,681 | |||||||||||||||||

| Series G-1 through G-4 preferred units | 76 | 36.99 | 2,811 | |||||||||||||||||

Series A preferred shares |

18 | 36.99 | 666 | |||||||||||||||||

| 210,050 | 7,769,750 | (C) | ||||||||||||||||||

| Total Market Capitalization (A+B+C) | $ | 18,625,637 | ||||||||||||||||||

| COMMON SHARES DATA (NYSE: VNO) (unaudited) | ||

| First Quarter | Fourth Quarter | Third Quarter | Second Quarter | ||||||||||||||||||||

| 2025 | 2024 | 2024 | 2024 | ||||||||||||||||||||

| High price | $ | 45.37 | $ | 46.63 | $ | 39.91 | $ | 30.02 | |||||||||||||||

| Low price | $ | 34.91 | $ | 37.88 | $ | 25.36 | $ | 22.42 | |||||||||||||||

| Closing price - end of quarter | $ | 36.99 | $ | 42.04 | $ | 39.40 | $ | 26.29 | |||||||||||||||

| Outstanding shares, Class A units and convertible preferred units as converted (in thousands) | 210,050 | 208,897 | 208,949 | 209,573 | |||||||||||||||||||

| Closing market value of outstanding shares, Class A units and convertible preferred units as converted | $ | 7.8 | Billion | $ | 8.8 | Billion | $ | 8.2 | Billion | $ | 5.5 | Billion | |||||||||||

| DEBT ANALYSIS (unaudited) | |||||||||||||||||||||||||||||||||||

| (Amounts in thousands) | |||||||||||||||||||||||||||||||||||

| As of March 31, 2025 | |||||||||||||||||||||||||||||||||||

| Total | Variable | Fixed(1) |

|||||||||||||||||||||||||||||||||

| (Contractual debt balances) | Amount | Weighted Average Interest Rate | Amount | Weighted Average Interest Rate | Amount | Weighted Average Interest Rate | |||||||||||||||||||||||||||||

Consolidated debt(2) |

$ | 7,827,807 | 4.61% | $ | 1,307,807 | 5.92%(3) |

$ | 6,520,000 | 4.34% | ||||||||||||||||||||||||||

| Pro rata share of debt of non-consolidated entities | 2,487,104 | 5.13% | 458,282 | 6.39% | 2,028,822 | 4.85% | |||||||||||||||||||||||||||||

| Total | 10,314,911 | 4.73% | 1,766,089 | 6.04% | 8,548,822 | 4.46% | |||||||||||||||||||||||||||||

| Less: Noncontrolling interests' share of consolidated debt (primarily 1290 Avenue of the Americas and 555 California Street) | (682,059) | (397,059) | (285,000) | ||||||||||||||||||||||||||||||||

| Company's pro rata share of total debt | $ | 9,632,852 | 4.73% | $ | 1,369,030 | 5.95% | $ | 8,263,822 | 4.53% | ||||||||||||||||||||||||||

| Senior Unsecured Notes Due 2026 and 2031 |

Unsecured Revolving Credit Facilities and Unsecured Term Loan | ||||||||||||||||||||||||||||||||||

Debt Covenant Ratios(4): |

Required | Actual | Required | Actual | |||||||||||||||||||||||||||||||

| Total outstanding debt/total assets | Less than 65% | 48% | (5) |

Less than 60% | 39% | (6) |

|||||||||||||||||||||||||||||

| Secured debt/total assets | Less than 50% | 35% | (5) |

Less than 50% | 30% | (6) |

|||||||||||||||||||||||||||||

| Interest coverage ratio (annualized combined EBITDA to annualized interest expense) | Greater than 1.50 | 1.87 | N/A | ||||||||||||||||||||||||||||||||

| Fixed charge coverage | N/A | Greater than 1.40 | 1.96 | ||||||||||||||||||||||||||||||||

| Unencumbered assets/unsecured debt | Greater than 150% | 470% | N/A | ||||||||||||||||||||||||||||||||

| Unsecured debt/cap value of unencumbered assets | N/A | Less than 60% | 17% | ||||||||||||||||||||||||||||||||

| Unencumbered coverage ratio | N/A | Greater than 1.75 | 8.01 | ||||||||||||||||||||||||||||||||

Consolidated Unencumbered EBITDA (non-GAAP): |

Q1 2025 Annualized |

||||

| New York | $ | 313,860 | |||

| Other | 84,440 | ||||

| Total | $ | 398,300 | |||

| HEDGING INSTRUMENTS AS OF MARCH 31, 2025 (unaudited) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Amounts in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Debt Information | Swap / Cap Information | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at Share | Maturity Date(1) |

Variable Rate Spread | Notional Amount at Share | Expiration Date | All-In Swapped Rate | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Rate Swaps: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 555 California Street mortgage loan | $ | 840,000 | 05/28 | S+205 | $ | 840,000 | 05/26 | 6.03% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 770 Broadway mortgage loan | 700,000 | 07/27 | S+225 | 700,000 | 07/27 | 4.98% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PENN 11 mortgage loan | 500,000 | 10/25 | S+206 | 500,000 | 10/25 | 6.28% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unsecured revolving credit facility | 575,000 | 12/27 | S+115 | 575,000 | 08/27 | 3.88% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unsecured term loan | 800,000 | 12/27 | S+130 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Through 07/25 | 700,000 | 07/25 | 4.53% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 07/25 through 10/26 | 550,000 | 10/26 | 4.36% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10/26 through 8/27 | 50,000 | 08/27 | 4.04% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 100 West 33rd Street mortgage loan | 480,000 | 06/27 | S+185 | 480,000 | 06/27 | 5.26% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 888 Seventh Avenue mortgage loan | 253,688 | 12/25 | S+180 | 200,000 | 09/27 | 4.76% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 435 Seventh Avenue mortgage loan | 75,000 | 04/28 | S+210 | 75,000 | 04/26 | 6.96% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unconsolidated: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 280 Park Avenue mortgage loan | 537,500 | 09/27 | S+178 | 537,500 | 09/28 | 5.84% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 731 Lexington Avenue - retail condominium mortgage loan | 97,200 | 08/25 | S+151 | 97,200 | 05/25 | 1.76% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest Rate Caps: | Index Strike Rate | Cash Interest Rate(2) |

Effective Interest Rate(3) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidated: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1290 Avenue of the Americas mortgage loan | $ | 665,000 | 11/28 | S+162 | $ | 665,000 | 11/25 | 1.00% | 2.62% | 5.94% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| One Park Avenue mortgage loan | 525,000 | 03/26 | S+122 | 525,000 | 03/26 | 4.39% | 5.54% | 5.60% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 150 West 34th Street mortgage loan | 75,000 | 02/28 | S+215 | 75,000 | 02/26 | 5.00% | 6.46% | 7.06% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unconsolidated: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 61 Ninth Avenue mortgage loan | 75,543 | 01/26 | S+146 | 75,543 | 01/26 | 4.39% | 5.79% | 6.24% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 512 West 22nd Street mortgage loan | 68,581 | 06/25 | S+235 | 68,581 | 06/25 | 4.50% | 6.67% | 6.98% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rego Park II mortgage loan | 65,368 | 12/25 | S+145 | 65,368 | 12/25 | 4.15% | 5.60% | 5.93% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fashion Centre Mall/Washington Tower mortgage loan | 34,125 | 05/26 | S+305 | 34,125 | 05/25 | 3.00% | 6.05% | 7.61% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Debt subject to interest rate swaps and subject to a 1.00% SOFR interest rate cap | $ | 5,369,700 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Variable rate debt subject to interest rate caps | 843,617 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fixed rate debt per loan agreements | 2,894,122 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Variable rate debt not subject to interest rate swaps or caps | 525,413 | (4) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total debt at share | $ | 9,632,852 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

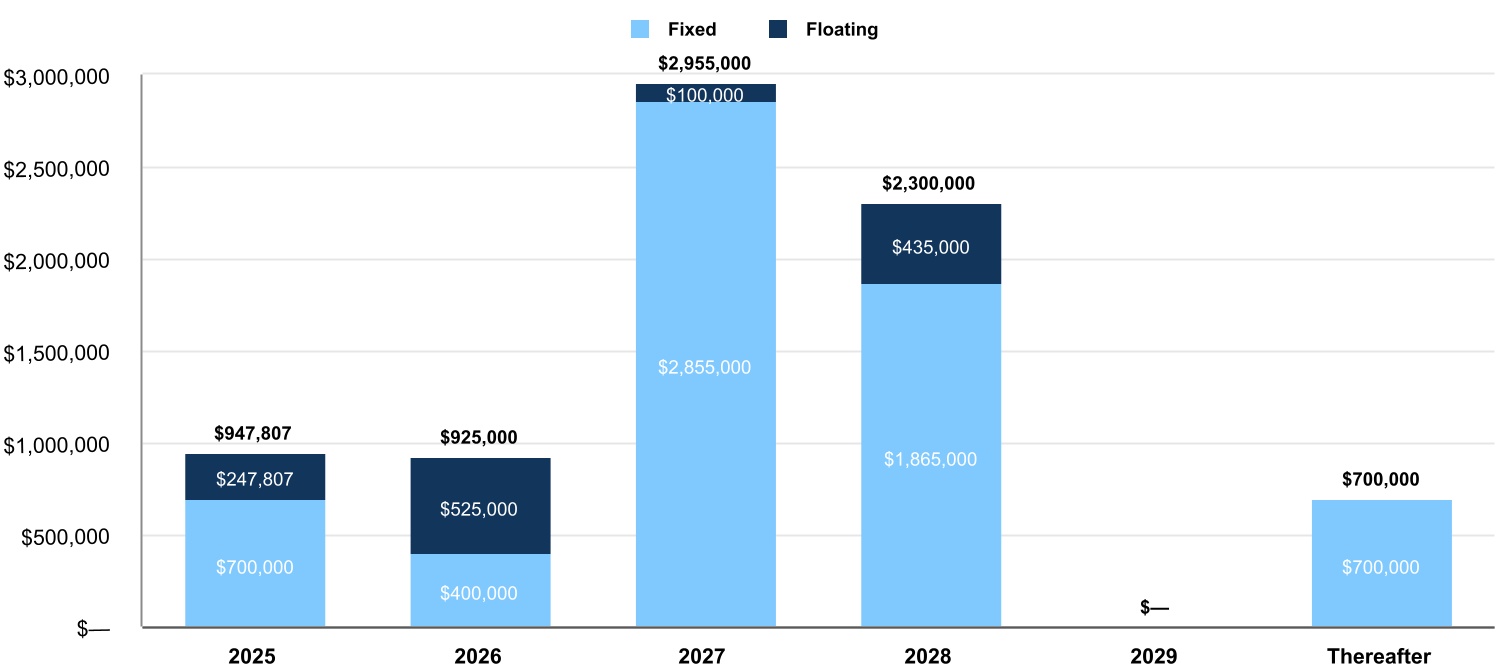

| CONSOLIDATED DEBT MATURITIES AT 100% (CONTRACTUAL BALANCES) (unaudited) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Amounts in thousands) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Property | Maturity Date(1) |

Spread over SOFR | Interest Rate(2) |

2025 | 2026 | 2027 | 2028 | 2029 | Thereafter | Total | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Secured Debt: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 606 Broadway (50.0% interest) | (3) | S+191 | 6.24% | (4) |

$ | 74,119 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 74,119 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 4 Union Square South | 08/25 | S+150 | 5.82% | 120,000 | — | — | — | — | — | 120,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PENN 11 | 10/25 | 6.28% | 500,000 | — | — | — | — | — | 500,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 888 Seventh Avenue | 12/25 | S+180 | (5) |

5.05% | 253,688 | — | — | — | — | — | 253,688 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| One Park Avenue | 03/26 | S+122 | 5.54% | — | 525,000 | — | — | — | — | 525,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 350 Park Avenue | 01/27 | 3.92% | — | — | 400,000 | — | — | — | 400,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 100 West 33rd Street | 06/27 | 5.26% | — | — | 480,000 | — | — | — | 480,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 770 Broadway | 07/27 | 4.98% | — | — | 700,000 | — | — | — | 700,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||