0000896878falseP3Y0M0DP3Y0M0DP2YP3Yhttp://fasb.org/us-gaap/2025#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2025#OtherLiabilitiesCurrentP3YP3YadoptedadoptedterminatedterminatedInsider Trading Policyiso4217:USDiso4217:USDxbrli:sharesxbrli:sharesintu:hostingintu:vendorxbrli:pureintu:option_to_extendintu:periodintu:segment00008968782025-11-202025-11-200000896878us-gaap:ProductMember2024-08-012025-07-310000896878us-gaap:ProductMember2023-08-012024-07-310000896878us-gaap:ProductMember2022-08-012023-07-310000896878us-gaap:ServiceMember2024-08-012025-07-310000896878us-gaap:ServiceMember2023-08-012024-07-310000896878us-gaap:ServiceMember2022-08-012023-07-3100008968782024-08-012025-07-3100008968782023-08-012024-07-3100008968782022-08-012023-07-3100008968782025-07-3100008968782024-07-310000896878us-gaap:SeriesAPreferredStockMember2025-07-310000896878us-gaap:SeriesAPreferredStockMember2024-07-310000896878us-gaap:SeriesBPreferredStockMember2025-07-310000896878us-gaap:SeriesBPreferredStockMember2024-07-310000896878us-gaap:CommonStockMember2022-07-310000896878us-gaap:AdditionalPaidInCapitalMember2022-07-310000896878us-gaap:TreasuryStockCommonMember2022-07-310000896878us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-310000896878us-gaap:RetainedEarningsMember2022-07-3100008968782022-07-310000896878us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-08-012023-07-310000896878us-gaap:RetainedEarningsMember2022-08-012023-07-310000896878us-gaap:CommonStockMember2022-08-012023-07-310000896878us-gaap:AdditionalPaidInCapitalMember2022-08-012023-07-310000896878us-gaap:TreasuryStockCommonMember2022-08-012023-07-310000896878us-gaap:CommonStockMember2023-07-310000896878us-gaap:AdditionalPaidInCapitalMember2023-07-310000896878us-gaap:TreasuryStockCommonMember2023-07-310000896878us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-310000896878us-gaap:RetainedEarningsMember2023-07-3100008968782023-07-310000896878us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-08-012024-07-310000896878us-gaap:RetainedEarningsMember2023-08-012024-07-310000896878us-gaap:CommonStockMember2023-08-012024-07-310000896878us-gaap:AdditionalPaidInCapitalMember2023-08-012024-07-310000896878us-gaap:TreasuryStockCommonMember2023-08-012024-07-310000896878us-gaap:CommonStockMember2024-07-310000896878us-gaap:AdditionalPaidInCapitalMember2024-07-310000896878us-gaap:TreasuryStockCommonMember2024-07-310000896878us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-310000896878us-gaap:RetainedEarningsMember2024-07-310000896878us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-08-012025-07-310000896878us-gaap:RetainedEarningsMember2024-08-012025-07-310000896878us-gaap:CommonStockMember2024-08-012025-07-310000896878us-gaap:AdditionalPaidInCapitalMember2024-08-012025-07-310000896878us-gaap:TreasuryStockCommonMember2024-08-012025-07-310000896878us-gaap:CommonStockMember2025-07-310000896878us-gaap:AdditionalPaidInCapitalMember2025-07-310000896878us-gaap:TreasuryStockCommonMember2025-07-310000896878us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-07-310000896878us-gaap:RetainedEarningsMember2025-07-310000896878us-gaap:OperatingSegmentsMemberintu:ReorganizationOfCertainWorkplaceAndRealEstateFunctionsMemberintu:GlobalBusinessSolutionsSegmentMember2023-08-012024-07-310000896878us-gaap:OperatingSegmentsMemberintu:ReorganizationOfCertainWorkplaceAndRealEstateFunctionsMemberintu:GlobalBusinessSolutionsSegmentMember2022-08-012023-07-310000896878us-gaap:OperatingSegmentsMemberintu:ReorganizationOneOfCertainTechnologyFunctionsMemberintu:ConsumerSegmentMember2023-08-012024-07-310000896878us-gaap:MaterialReconcilingItemsMemberintu:ReorganizationOneOfCertainTechnologyFunctionsMember2023-08-012024-07-310000896878us-gaap:MaterialReconcilingItemsMemberintu:ReorganizationOneOfCertainTechnologyFunctionsMember2022-08-012023-07-310000896878us-gaap:OperatingSegmentsMemberintu:ReorganizationOneOfCertainTechnologyFunctionsMemberintu:ConsumerSegmentMember2022-08-012023-07-310000896878us-gaap:OperatingSegmentsMemberus-gaap:ReclassificationSegmentationBasisChangeMemberintu:GlobalBusinessSolutionsSegmentMember2024-08-012025-07-310000896878us-gaap:OperatingSegmentsMemberus-gaap:ReclassificationSegmentationBasisChangeMemberintu:GlobalBusinessSolutionsSegmentMember2023-08-012024-07-310000896878us-gaap:OperatingSegmentsMemberus-gaap:ReclassificationSegmentationBasisChangeMemberintu:GlobalBusinessSolutionsSegmentMember2022-08-012023-07-310000896878us-gaap:OperatingSegmentsMemberus-gaap:ReclassificationSegmentationBasisChangeMemberintu:ConsumerSegmentMember2024-08-012025-07-310000896878us-gaap:OperatingSegmentsMemberus-gaap:ReclassificationSegmentationBasisChangeMemberintu:ConsumerSegmentMember2023-08-012024-07-310000896878us-gaap:OperatingSegmentsMemberus-gaap:ReclassificationSegmentationBasisChangeMemberintu:ConsumerSegmentMember2022-08-012023-07-310000896878srt:MinimumMember2025-07-310000896878srt:MaximumMember2025-07-310000896878srt:MinimumMemberus-gaap:SoftwareDevelopmentMember2025-07-310000896878srt:MaximumMemberus-gaap:SoftwareDevelopmentMember2025-07-310000896878us-gaap:SupplierConcentrationRiskMemberus-gaap:CostOfGoodsTotalMember2024-08-012025-07-310000896878us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2025-07-310000896878us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2025-07-310000896878us-gaap:FairValueMeasurementsRecurringMember2025-07-310000896878us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2024-07-310000896878us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-07-310000896878us-gaap:FairValueMeasurementsRecurringMember2024-07-310000896878us-gaap:CorporateNoteSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2025-07-310000896878us-gaap:CorporateNoteSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2025-07-310000896878us-gaap:CorporateNoteSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2025-07-310000896878us-gaap:CorporateNoteSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2024-07-310000896878us-gaap:CorporateNoteSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-07-310000896878us-gaap:CorporateNoteSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2024-07-310000896878us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2025-07-310000896878us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2025-07-310000896878us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2025-07-310000896878us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2024-07-310000896878us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-07-310000896878us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2024-07-310000896878us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2025-07-310000896878us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2025-07-310000896878us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMember2025-07-310000896878us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2024-07-310000896878us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-07-310000896878us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMember2024-07-310000896878intu:AvailableForSaleDebtSecuritiesInInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2025-07-310000896878intu:AvailableForSaleDebtSecuritiesInInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2025-07-310000896878intu:AvailableForSaleDebtSecuritiesInInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2025-07-310000896878intu:AvailableForSaleDebtSecuritiesInInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2024-07-310000896878intu:AvailableForSaleDebtSecuritiesInInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-07-310000896878intu:AvailableForSaleDebtSecuritiesInInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2024-07-310000896878intu:FundsReceivableAndAmountsHeldForCustomersMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2025-07-310000896878intu:FundsReceivableAndAmountsHeldForCustomersMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2025-07-310000896878intu:FundsReceivableAndAmountsHeldForCustomersMemberus-gaap:FairValueMeasurementsRecurringMember2025-07-310000896878intu:FundsReceivableAndAmountsHeldForCustomersMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2024-07-310000896878intu:FundsReceivableAndAmountsHeldForCustomersMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-07-310000896878intu:FundsReceivableAndAmountsHeldForCustomersMemberus-gaap:FairValueMeasurementsRecurringMember2024-07-310000896878us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberintu:SeniorUnsecuredNotesMemberus-gaap:UnsecuredDebtMember2025-07-310000896878us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberintu:SeniorUnsecuredNotesMemberus-gaap:UnsecuredDebtMember2024-07-310000896878intu:SeniorUnsecuredNotesMemberus-gaap:UnsecuredDebtMember2025-07-310000896878intu:SeniorUnsecuredNotesMemberus-gaap:UnsecuredDebtMember2024-07-310000896878us-gaap:FairValueInputsLevel3Member2024-08-012025-07-310000896878us-gaap:FairValueInputsLevel3Member2023-08-012024-07-310000896878us-gaap:FairValueInputsLevel3Member2022-08-012023-07-310000896878us-gaap:FairValueInputsLevel3Member2025-07-310000896878intu:CashAndCashEquivalentsIncludingFundsHeldForCustomersMember2025-07-310000896878intu:CashAndCashEquivalentsIncludingFundsHeldForCustomersMember2024-07-310000896878us-gaap:CorporateNoteSecuritiesMember2025-07-310000896878us-gaap:CorporateNoteSecuritiesMember2024-07-310000896878us-gaap:USGovernmentAgenciesDebtSecuritiesMember2025-07-310000896878us-gaap:USGovernmentAgenciesDebtSecuritiesMember2024-07-310000896878intu:SmallBusinessLoanMember2025-07-310000896878srt:MinimumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2025-07-310000896878srt:MaximumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2025-07-310000896878srt:MinimumMemberus-gaap:BuildingMember2025-07-310000896878srt:MaximumMemberus-gaap:BuildingMember2025-07-310000896878srt:MinimumMemberus-gaap:LeaseholdImprovementsMember2025-07-310000896878srt:MaximumMemberus-gaap:LeaseholdImprovementsMember2025-07-310000896878srt:MinimumMemberus-gaap:EquipmentMember2025-07-310000896878srt:MaximumMemberus-gaap:EquipmentMember2025-07-310000896878us-gaap:FurnitureAndFixturesMember2025-07-310000896878intu:GlobalBusinessSolutionsSegmentMember2023-07-310000896878intu:GlobalBusinessSolutionsSegmentMember2023-08-012024-07-310000896878intu:GlobalBusinessSolutionsSegmentMember2024-07-310000896878intu:GlobalBusinessSolutionsSegmentMember2024-08-012025-07-310000896878intu:GlobalBusinessSolutionsSegmentMember2025-07-310000896878intu:ConsumerSegmentMember2023-07-310000896878intu:ConsumerSegmentMember2023-08-012024-07-310000896878intu:ConsumerSegmentMember2024-07-310000896878intu:ConsumerSegmentMember2024-08-012025-07-310000896878intu:ConsumerSegmentMember2025-07-310000896878us-gaap:CustomerListsMember2025-07-310000896878intu:PurchasedTechnologyMember2025-07-310000896878us-gaap:TradeNamesMember2025-07-310000896878us-gaap:CustomerListsMember2024-07-310000896878intu:PurchasedTechnologyMember2024-07-310000896878us-gaap:TradeNamesMember2024-07-310000896878intu:A0.950NotesDueJuly2025Memberintu:SeniorUnsecuredNotesMember2025-07-310000896878intu:A0.950NotesDueJuly2025Memberintu:SeniorUnsecuredNotesMember2024-07-310000896878intu:A1.350notesdueJuly2027Memberintu:SeniorUnsecuredNotesMember2025-07-310000896878intu:A1.350notesdueJuly2027Memberintu:SeniorUnsecuredNotesMember2024-07-310000896878intu:A1.650notesdueJuly2030Memberintu:SeniorUnsecuredNotesMember2025-07-310000896878intu:A1.650notesdueJuly2030Memberintu:SeniorUnsecuredNotesMember2024-07-310000896878intu:FivePointTwoFiveZeroPercentNotesDueSeptember2026Memberintu:SeniorUnsecuredNotesMember2025-07-310000896878intu:FivePointTwoFiveZeroPercentNotesDueSeptember2026Memberintu:SeniorUnsecuredNotesMember2024-07-310000896878intu:FivePointOneTwoFivePercentNotesDueSeptember2028Memberintu:SeniorUnsecuredNotesMember2025-07-310000896878intu:FivePointOneTwoFivePercentNotesDueSeptember2028Memberintu:SeniorUnsecuredNotesMember2024-07-310000896878intu:FivePointTwoZeroZeroPercentNotesDueSeptember2033Memberintu:SeniorUnsecuredNotesMember2025-07-310000896878intu:FivePointTwoZeroZeroPercentNotesDueSeptember2033Memberintu:SeniorUnsecuredNotesMember2024-07-310000896878intu:FivePointFiveZeroZeroPercentNotesDueSeptember2053Memberintu:SeniorUnsecuredNotesMember2025-07-310000896878intu:FivePointFiveZeroZeroPercentNotesDueSeptember2053Memberintu:SeniorUnsecuredNotesMember2024-07-310000896878us-gaap:RevolvingCreditFacilityMemberintu:SubsidiaryMemberus-gaap:LineOfCreditMember2025-07-310000896878us-gaap:RevolvingCreditFacilityMemberintu:SubsidiaryMemberus-gaap:LineOfCreditMember2024-07-310000896878intu:TheSeniorUnsecuredNotesMemberintu:SeniorUnsecuredNotesMember2020-06-012020-06-300000896878intu:TheSeniorUnsecuredNotesMemberintu:SeniorUnsecuredNotesMember2020-06-300000896878intu:TheSeniorUnsecuredNotesMemberintu:SeniorUnsecuredNotesMember2025-05-012025-07-310000896878intu:TheSeniorUnsecuredNotesMemberintu:SeniorUnsecuredNotesMember2025-07-310000896878intu:The2023SeniorUnsecuredNotesMember2023-09-012023-09-300000896878intu:The2023SeniorUnsecuredNotesMember2023-09-300000896878us-gaap:RevolvingCreditFacilityMemberintu:A2024CreditFacilityMemberus-gaap:LineOfCreditMember2024-02-050000896878us-gaap:RevolvingCreditFacilityMemberintu:A2024CreditFacilityMemberus-gaap:LineOfCreditMember2024-02-052024-02-050000896878intu:SwinglineLoansMemberintu:A2024CreditFacilityMemberus-gaap:LineOfCreditMember2024-02-050000896878us-gaap:LetterOfCreditMemberintu:A2024CreditFacilityMemberus-gaap:LineOfCreditMember2024-02-050000896878us-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMemberintu:A2024CreditFacilityMembersrt:MinimumMemberus-gaap:LineOfCreditMember2024-02-052024-02-050000896878us-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMemberintu:A2024CreditFacilityMembersrt:MaximumMemberus-gaap:LineOfCreditMember2024-02-052024-02-050000896878us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrMemberintu:A2024CreditFacilityMembersrt:MinimumMemberus-gaap:LineOfCreditMember2024-02-052024-02-050000896878us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrMemberintu:A2024CreditFacilityMembersrt:MaximumMemberus-gaap:LineOfCreditMember2024-02-052024-02-050000896878us-gaap:RevolvingCreditFacilityMemberintu:InterestBenchmarkForRelevantCurrencyMemberintu:A2024CreditFacilityMembersrt:MinimumMemberus-gaap:LineOfCreditMember2024-02-052024-02-050000896878us-gaap:RevolvingCreditFacilityMemberintu:InterestBenchmarkForRelevantCurrencyMemberintu:A2024CreditFacilityMembersrt:MaximumMemberus-gaap:LineOfCreditMember2024-02-052024-02-050000896878us-gaap:RevolvingCreditFacilityMemberintu:A2024CreditFacilityMembersrt:MinimumMemberus-gaap:LineOfCreditMember2024-02-052024-02-050000896878us-gaap:RevolvingCreditFacilityMemberintu:A2024CreditFacilityMembersrt:MaximumMemberus-gaap:LineOfCreditMember2024-02-052024-02-050000896878us-gaap:RevolvingCreditFacilityMemberintu:A2024CreditFacilityMemberus-gaap:LineOfCreditMember2025-07-310000896878us-gaap:RevolvingCreditFacilityMemberintu:ShortTermRevolvingCreditFacilityMember2025-01-300000896878us-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMemberintu:TheUnsecured2025CreditFacilityMemberus-gaap:LineOfCreditMember2025-01-302025-01-300000896878us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrMemberintu:TheUnsecured2025CreditFacilityMemberus-gaap:LineOfCreditMember2025-01-302025-01-300000896878us-gaap:RevolvingCreditFacilityMemberintu:TheUnsecured2025CreditFacilityMember2025-01-302025-01-300000896878us-gaap:RevolvingCreditFacilityMemberintu:SecuredRevolvingCreditFacility2019Memberintu:SubsidiaryMemberus-gaap:LineOfCreditMember2022-07-180000896878us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrMemberintu:SecuredRevolvingCreditFacility2019Memberintu:SubsidiaryMemberus-gaap:LineOfCreditMember2022-07-182022-07-180000896878us-gaap:RevolvingCreditFacilityMemberintu:SecuredRevolvingCreditFacility2019Membersrt:MinimumMemberintu:SubsidiaryMemberus-gaap:LineOfCreditMember2022-07-182022-07-180000896878us-gaap:RevolvingCreditFacilityMemberintu:SecuredRevolvingCreditFacility2019Membersrt:MaximumMemberintu:SubsidiaryMemberus-gaap:LineOfCreditMember2022-07-182022-07-180000896878us-gaap:RevolvingCreditFacilityMemberintu:SecuredRevolvingCreditFacility2019Memberintu:SubsidiaryMemberus-gaap:LineOfCreditMember2025-07-310000896878us-gaap:RevolvingCreditFacilityMemberintu:SecuredRevolvingCreditFacility2022Memberintu:SubsidiaryMemberus-gaap:LineOfCreditMember2024-04-300000896878us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrMemberintu:SecuredRevolvingCreditFacility2022Memberintu:SubsidiaryMemberus-gaap:LineOfCreditMember2024-04-302024-04-300000896878us-gaap:RevolvingCreditFacilityMemberintu:SecuredRevolvingCreditFacility2022Membersrt:MinimumMemberintu:SubsidiaryMemberus-gaap:LineOfCreditMember2024-04-302024-04-300000896878us-gaap:RevolvingCreditFacilityMemberintu:SecuredRevolvingCreditFacility2022Membersrt:MaximumMemberintu:SubsidiaryMemberus-gaap:LineOfCreditMember2024-04-302024-04-300000896878us-gaap:RevolvingCreditFacilityMemberintu:SecuredRevolvingCreditFacility2022Memberintu:SubsidiaryMemberus-gaap:LineOfCreditMember2025-07-310000896878us-gaap:RevolvingCreditFacilityMemberintu:SecuredRevolvingCreditFacility2024Memberintu:SubsidiaryMemberus-gaap:LineOfCreditMember2024-04-300000896878us-gaap:RevolvingCreditFacilityMemberintu:SecuredRevolvingCreditFacility2024Memberintu:SubsidiaryMemberus-gaap:LineOfCreditMember2025-07-310000896878us-gaap:CommercialPaperMemberintu:CommercialPaperProgramMemberus-gaap:LineOfCreditMember2025-07-310000896878us-gaap:StateAndLocalJurisdictionMember2024-08-012025-07-310000896878us-gaap:StateAndLocalJurisdictionMember2023-08-012024-07-310000896878us-gaap:StateAndLocalJurisdictionMember2022-08-012023-07-310000896878us-gaap:DomesticCountryMember2025-07-310000896878us-gaap:StateAndLocalJurisdictionMember2025-07-310000896878us-gaap:ForeignCountryMember2025-07-310000896878us-gaap:StateAndLocalJurisdictionMemberus-gaap:ResearchMember2025-07-310000896878intu:CurrentProgramMember2025-07-310000896878us-gaap:SubsequentEventMember2025-08-190000896878us-gaap:SubsequentEventMember2025-08-312025-08-310000896878intu:Restated2005PlanMember2025-07-310000896878intu:Restated2005PlanMemberus-gaap:EmployeeStockOptionMember2024-08-012025-07-310000896878srt:MinimumMemberus-gaap:EmployeeStockOptionMember2024-08-012025-07-310000896878srt:MaximumMemberus-gaap:EmployeeStockOptionMember2024-08-012025-07-310000896878us-gaap:EmployeeStockOptionMember2024-08-012025-07-310000896878srt:MinimumMemberus-gaap:RestrictedStockUnitsRSUMember2024-08-012025-07-310000896878srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMember2024-08-012025-07-3100008968782022-01-212022-07-310000896878us-gaap:EmployeeStockOptionMember2025-07-310000896878us-gaap:EmployeeStockMember2025-07-310000896878us-gaap:SalesRevenueProductLineMember2024-08-012025-07-310000896878us-gaap:SalesRevenueProductLineMember2023-08-012024-07-310000896878us-gaap:SalesRevenueProductLineMember2022-08-012023-07-310000896878us-gaap:CostOfSalesMember2024-08-012025-07-310000896878us-gaap:CostOfSalesMember2023-08-012024-07-310000896878us-gaap:CostOfSalesMember2022-08-012023-07-310000896878us-gaap:SellingAndMarketingExpenseMember2024-08-012025-07-310000896878us-gaap:SellingAndMarketingExpenseMember2023-08-012024-07-310000896878us-gaap:SellingAndMarketingExpenseMember2022-08-012023-07-310000896878us-gaap:ResearchAndDevelopmentExpenseMember2024-08-012025-07-310000896878us-gaap:ResearchAndDevelopmentExpenseMember2023-08-012024-07-310000896878us-gaap:ResearchAndDevelopmentExpenseMember2022-08-012023-07-310000896878us-gaap:GeneralAndAdministrativeExpenseMember2024-08-012025-07-310000896878us-gaap:GeneralAndAdministrativeExpenseMember2023-08-012024-07-310000896878us-gaap:GeneralAndAdministrativeExpenseMember2022-08-012023-07-310000896878us-gaap:RestructuringChargesMember2024-08-012025-07-310000896878us-gaap:RestructuringChargesMember2023-08-012024-07-310000896878us-gaap:RestructuringChargesMember2022-08-012023-07-310000896878us-gaap:SegmentContinuingOperationsMember2024-08-012025-07-310000896878us-gaap:SegmentContinuingOperationsMember2023-08-012024-07-310000896878us-gaap:SegmentContinuingOperationsMember2022-08-012023-07-310000896878us-gaap:RestrictedStockUnitsRSUMember2024-08-012025-07-310000896878srt:MaximumMemberus-gaap:EmployeeStockOptionMember2023-08-012024-07-310000896878srt:MinimumMemberus-gaap:EmployeeStockOptionMember2022-08-012023-07-310000896878srt:MaximumMemberus-gaap:EmployeeStockOptionMember2022-08-012023-07-310000896878us-gaap:EmployeeStockOptionMember2023-08-012024-07-310000896878us-gaap:EmployeeStockOptionMember2022-08-012023-07-310000896878srt:MinimumMemberus-gaap:EmployeeStockMember2024-08-012025-07-310000896878srt:MaximumMemberus-gaap:EmployeeStockMember2024-08-012025-07-310000896878srt:MinimumMemberus-gaap:EmployeeStockMember2023-08-012024-07-310000896878srt:MaximumMemberus-gaap:EmployeeStockMember2023-08-012024-07-310000896878srt:MinimumMemberus-gaap:EmployeeStockMember2022-08-012023-07-310000896878srt:MaximumMemberus-gaap:EmployeeStockMember2022-08-012023-07-310000896878us-gaap:EmployeeStockMember2024-08-012025-07-310000896878us-gaap:EmployeeStockMember2023-08-012024-07-310000896878us-gaap:EmployeeStockMember2022-08-012023-07-310000896878us-gaap:RestrictedStockUnitsRSUMember2023-08-012024-07-310000896878us-gaap:RestrictedStockUnitsRSUMember2022-08-012023-07-310000896878us-gaap:RestrictedStockUnitsRSUMember2025-07-310000896878intu:StockOptionsAndEsppMember2024-08-012025-07-310000896878intu:StockOptionsAndEsppMember2023-08-012024-07-310000896878intu:StockOptionsAndEsppMember2022-08-012023-07-310000896878us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2025-07-310000896878us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-07-310000896878us-gaap:AccumulatedTranslationAdjustmentMember2025-07-310000896878us-gaap:AccumulatedTranslationAdjustmentMember2024-07-310000896878intu:IntuitInc401kPlanMember2024-08-012025-07-310000896878intu:CreditKarma401KPlanMember2024-08-012025-07-3100008968782022-05-042022-05-040000896878us-gaap:NonUsMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-08-012025-07-310000896878us-gaap:NonUsMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-08-012023-07-310000896878us-gaap:NonUsMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-08-012024-07-310000896878us-gaap:OperatingSegmentsMemberintu:GlobalBusinessSolutionsSegmentMember2024-08-012025-07-310000896878us-gaap:OperatingSegmentsMemberintu:GlobalBusinessSolutionsSegmentMember2023-08-012024-07-310000896878us-gaap:OperatingSegmentsMemberintu:GlobalBusinessSolutionsSegmentMember2022-08-012023-07-310000896878us-gaap:OperatingSegmentsMemberintu:ConsumerSegmentMember2024-08-012025-07-310000896878us-gaap:OperatingSegmentsMemberintu:ConsumerSegmentMember2023-08-012024-07-310000896878us-gaap:OperatingSegmentsMemberintu:ConsumerSegmentMember2022-08-012023-07-310000896878us-gaap:OperatingSegmentsMember2024-08-012025-07-310000896878us-gaap:OperatingSegmentsMember2023-08-012024-07-310000896878us-gaap:OperatingSegmentsMember2022-08-012023-07-310000896878us-gaap:MaterialReconcilingItemsMember2024-08-012025-07-310000896878us-gaap:MaterialReconcilingItemsMember2023-08-012024-07-310000896878us-gaap:MaterialReconcilingItemsMember2022-08-012023-07-310000896878us-gaap:MaterialReconcilingItemsMemberintu:July2024RestructuringPlanMember2023-08-012024-07-310000896878intu:QuickBooksOnlineAccountingMemberintu:GlobalBusinessSolutionsSegmentMember2024-08-012025-07-310000896878intu:QuickBooksOnlineAccountingMemberintu:GlobalBusinessSolutionsSegmentMember2023-08-012024-07-310000896878intu:QuickBooksOnlineAccountingMemberintu:GlobalBusinessSolutionsSegmentMember2022-08-012023-07-310000896878intu:OnlineServicesMemberintu:GlobalBusinessSolutionsSegmentMember2024-08-012025-07-310000896878intu:OnlineServicesMemberintu:GlobalBusinessSolutionsSegmentMember2023-08-012024-07-310000896878intu:OnlineServicesMemberintu:GlobalBusinessSolutionsSegmentMember2022-08-012023-07-310000896878intu:OnlineEcosystemMemberintu:GlobalBusinessSolutionsSegmentMember2024-08-012025-07-310000896878intu:OnlineEcosystemMemberintu:GlobalBusinessSolutionsSegmentMember2023-08-012024-07-310000896878intu:OnlineEcosystemMemberintu:GlobalBusinessSolutionsSegmentMember2022-08-012023-07-310000896878intu:QuickBooksDesktopAccountingMemberintu:GlobalBusinessSolutionsSegmentMember2024-08-012025-07-310000896878intu:QuickBooksDesktopAccountingMemberintu:GlobalBusinessSolutionsSegmentMember2023-08-012024-07-310000896878intu:QuickBooksDesktopAccountingMemberintu:GlobalBusinessSolutionsSegmentMember2022-08-012023-07-310000896878intu:DesktopServicesandSuppliesMemberintu:GlobalBusinessSolutionsSegmentMember2024-08-012025-07-310000896878intu:DesktopServicesandSuppliesMemberintu:GlobalBusinessSolutionsSegmentMember2023-08-012024-07-310000896878intu:DesktopServicesandSuppliesMemberintu:GlobalBusinessSolutionsSegmentMember2022-08-012023-07-310000896878intu:DesktopEcosystemMemberintu:GlobalBusinessSolutionsSegmentMember2024-08-012025-07-310000896878intu:DesktopEcosystemMemberintu:GlobalBusinessSolutionsSegmentMember2023-08-012024-07-310000896878intu:DesktopEcosystemMemberintu:GlobalBusinessSolutionsSegmentMember2022-08-012023-07-310000896878intu:GlobalBusinessSolutionsSegmentMember2022-08-012023-07-310000896878intu:TurboTaxMemberintu:ConsumerSegmentMember2024-08-012025-07-310000896878intu:TurboTaxMemberintu:ConsumerSegmentMember2023-08-012024-07-310000896878intu:TurboTaxMemberintu:ConsumerSegmentMember2022-08-012023-07-310000896878intu:CreditKarmaMemberintu:ConsumerSegmentMember2024-08-012025-07-310000896878intu:CreditKarmaMemberintu:ConsumerSegmentMember2023-08-012024-07-310000896878intu:CreditKarmaMemberintu:ConsumerSegmentMember2022-08-012023-07-310000896878intu:ProTaxMemberintu:ConsumerSegmentMember2024-08-012025-07-310000896878intu:ProTaxMemberintu:ConsumerSegmentMember2023-08-012024-07-310000896878intu:ProTaxMemberintu:ConsumerSegmentMember2022-08-012023-07-310000896878intu:ConsumerSegmentMember2022-08-012023-07-310000896878us-gaap:OperatingSegmentsMemberintu:GlobalBusinessSolutionsSegmentMember2024-07-310000896878us-gaap:OperatingSegmentsMemberintu:GlobalBusinessSolutionsSegmentMember2025-07-310000896878us-gaap:OperatingSegmentsMemberintu:ConsumerSegmentMember2024-07-310000896878us-gaap:OperatingSegmentsMemberintu:ConsumerSegmentMember2025-07-310000896878us-gaap:CorporateNonSegmentMember2024-07-310000896878us-gaap:CorporateNonSegmentMember2024-08-012025-07-310000896878us-gaap:CorporateNonSegmentMember2025-07-310000896878us-gaap:OperatingSegmentsMemberintu:GlobalBusinessSolutionsSegmentMember2023-07-310000896878us-gaap:OperatingSegmentsMemberintu:ConsumerSegmentMember2023-07-310000896878us-gaap:CorporateNonSegmentMember2023-07-310000896878us-gaap:CorporateNonSegmentMember2023-08-012024-07-310000896878intu:SECSchedule1209AllowanceDoubtfulAccountsMember2024-07-310000896878intu:SECSchedule1209AllowanceDoubtfulAccountsMember2024-08-012025-07-310000896878intu:SECSchedule1209AllowanceDoubtfulAccountsMember2025-07-310000896878intu:SECSchedule1209ReserveForReturnsCreditsAndPromotionalDiscountsMember2024-07-310000896878intu:SECSchedule1209ReserveForReturnsCreditsAndPromotionalDiscountsMember2024-08-012025-07-310000896878intu:SECSchedule1209ReserveForReturnsCreditsAndPromotionalDiscountsMember2025-07-310000896878intu:SECSchedule1209AllowanceDoubtfulAccountsMember2023-07-310000896878intu:SECSchedule1209AllowanceDoubtfulAccountsMember2023-08-012024-07-310000896878intu:SECSchedule1209ReserveForReturnsCreditsAndPromotionalDiscountsMember2023-07-310000896878intu:SECSchedule1209ReserveForReturnsCreditsAndPromotionalDiscountsMember2023-08-012024-07-310000896878intu:SECSchedule1209AllowanceDoubtfulAccountsMember2022-07-310000896878intu:SECSchedule1209AllowanceDoubtfulAccountsMember2022-08-012023-07-310000896878intu:SECSchedule1209ReserveForReturnsCreditsAndPromotionalDiscountsMember2022-07-310000896878intu:SECSchedule1209ReserveForReturnsCreditsAndPromotionalDiscountsMember2022-08-012023-07-3100008968782025-05-012025-07-31

Washington, D.C. 20549

INTUIT INC.

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 8.01 OTHER EVENTS.

As previously announced, effective August 1, 2025, Intuit Inc. (the Company) combined its Consumer, Credit Karma, and ProTax businesses into a single Consumer business in order to better serve the diverse financial needs of its customers as one consumer platform. Since August 1, 2025, the Company has operated as two reporting segments: Consumer and Global Business Solutions. Since that date, the information that the Company's chief operating decision maker is regularly provided and reviews for purposes of allocating resources and assessing performance reflects this change.

To conform with these segment reporting changes, the Company has recast certain previously reported amounts and updated related disclosures contained in its Annual Report on Form 10-K for the fiscal year ended July 31, 2025 (2025 Form 10-K).

The Company is filing this Current Report on Form 8-K to provide the recast consolidated financial information for each of the three years covered in the 2025 Form 10-K. The updates do not represent a restatement of previously issued financial statements. The recast information of Items contained in the 2025 Form 10-K is presented in Exhibit 99.01 and incorporated herein by reference.

The information included in this Form 8-K is presented for informational purposes only in connection with the segment reporting changes described above and does not amend or restate our audited consolidated financial statements, which were included in our 2025 Form 10-K. This Form 8-K does not reflect events occurring after we filed our 2025 Form 10-K and does not modify or update the disclosures therein in any way, other than to illustrate the impact of the segment changes described above. For developments subsequent to the filing of the 2025 Form 10-K, refer to our Quarterly Report on Form 10-Q for the quarter ended October 31, 2025. This Form 8-K should be read in conjunction with the 2025 Form 10-K and our Quarterly Report on Form 10-Q for the quarter ended October 31, 2025.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Explanatory Note:

Intuit Inc. (Intuit) is filing this exhibit to update certain information set forth in its Annual Report on Form 10-K for the year ended July 31, 2025 (the 2025 Form 10-K), as filed with the Securities and Exchange Commission on September 3, 2025, to reflect changes in its reportable segments that became effective on August 1, 2025. This exhibit has not been updated for any other changes since the filing of the 2025 Form 10-K. For developments subsequent to the filing of the 2025 Form 10-K, refer to our Quarterly Report on Form 10-Q for the quarter ended October 31, 2025.

Intuit, TurboTax, Credit Karma, QuickBooks, and Mailchimp, among others, are registered trademarks and/or registered service marks of Intuit Inc., or one of its subsidiaries, in the United States and other countries. Other parties’ marks are the property of their respective owners.

Intuit is a global financial technology platform with a mission to power prosperity around the world. Serving approximately 100 million consumers, small and mid-market businesses, and accountants worldwide, Intuit’s platform brings the power of artificial intelligence (AI) and human intelligence together to fuel customers’ success. With TurboTax, Credit Karma, QuickBooks, Mailchimp, and Intuit Enterprise Suite, we help put more money in customers’ pockets, save them time by eliminating work, and help ensure that they have complete confidence in every financial decision they make.

Our strategy is to be an AI-driven expert platform by connecting customers to a virtual team of AI agents and AI-enabled human tax and financial experts. We're creating done-for-you experiences by automating everyday tasks, managing complex workflows and processes, and solving challenges before they arise with predictive insights. We connect customers to AI-enabled human experts for that last mile of decisions or to complete the work for them.

We harness the power of data, data services, AI, and human intelligence that help customers reach their financial goals. Intuit's all-in-one business platform helps customers run and grow their businesses end-to-end, from lead to cash. This includes financial management - including payments and capital - compliance, human capital management, and marketing products and services. Intuit's consumer platform helps customers do their taxes with ease and confidence and improve their financial success, from credit building to wealth building, with tax and personal financial management products and services. For accounting professionals, we provide professional tax and financial management products and services.

Intuit Inc. was incorporated in California in March 1984. We reincorporated in Delaware and completed our initial public offering in March 1993. Our principal executive offices are located at 2700 Coast Avenue, Mountain View, California, 94043, and our main telephone number is 650-944-6000. When we refer to “we,” “our,” or “Intuit” in this Annual Report on Form 10-K, we mean the current Delaware corporation (Intuit Inc.) and its California predecessor, as well as all of our consolidated subsidiaries.

Our Business Portfolio

Effective August 1, 2025, we combined our Consumer, Credit Karma, and ProTax businesses into a single Consumer segment in order to better serve the diverse financial needs of our customers as one consumer platform. Our chief operating decision maker allocates resources and assesses segment performance using regularly provided segment revenue and segment operating income information under this updated segment structure. The segment information in this Form 8-K has been recast to reflect these changes.

We organize our businesses into two reportable segments:

|

|

|

|

Global Business Solutions(1): This segment serves small and mid-market businesses around the world, and the accounting professionals who assist and advise them. QuickBooks and Intuit Enterprise Suite are offerings powered by our all-in-one business platform which includes financial management services, human capital management solutions such as payroll and time tracking, money solutions, such as merchant payment processing, bill pay, checking accounts through an FDIC-member bank partner, and financing for small and mid-market businesses. Intuit Enterprise Suite provides mid-market businesses with a configurable, AI-powered solution that includes multi-entity and multi-dimensional financial management capabilities designed to seamlessly scale and enhance productivity and profitability for more complex businesses to streamline operations. Mailchimp offerings include marketing automation and customer relationship tools.

Consumer: This segment primarily serves consumers and professional accountants.

Our TurboTax offerings primarily help consumers complete their taxes with confidence and maximize their financial outcomes—whether they do it themselves or with the help of an AI-enabled human expert. TurboTax delivers do-it-yourself and assisted income tax preparation products and services sold in the United States (U.S.) and Canada. We offer a variety of money products directly to consumers, including early refund access to any bank, as well as Credit Karma Money branded savings and checking accounts through an FDIC-member bank partner.

Credit Karma is a personal finance solution that helps members find the right financial products and make smarter money decisions throughout the year to reach their financial goals. This includes personalized recommendations for credit card, home, auto, and personal loan, and insurance products; and access to their credit scores and reports, credit and identity monitoring, credit report dispute, credit building tools, credit card rewards optimization, and connected account capabilities to help members understand net worth and make financial progress.

Finally, our ProTax offerings help professional accountants in the U.S. and Canada, who are essential to both business success and tax preparation and filing. Our professional tax offerings include Lacerte, ProSeries, and ProConnect Tax Online in the U.S., and ProFile and ProTax Online in Canada.

|

(1) On August 1, 2024, we renamed our Small Business & Self-Employed segment as the Global Business Solutions segment.

Our Business and Growth Strategy

The era of AI is igniting global innovations at an incredible pace and will fundamentally transform every part of our work and personal lives. We made an early bet on AI, declaring our AI-driven expert platform strategy in 2019. We have transformed the company from a tax and accounting platform to an AI-driven expert platform. We have a significant competitive advantage with our scale of data, data services, AI capabilities, ecosystem of applications, and our large network of AI-enabled human experts to become the all-in-one platform for consumers, businesses, and accountants. We're disrupting the categories we operate in to drive better money outcomes for our customers.

We leverage AI and human intelligence to provide our customers with done-for-you experiences that automate tasks, identify actionable insights to drive important decisions, and manage end-to-end workflows or entire processes to eliminate work, while ensuring the customer remains in control. When customers need additional help or want help to complete the work on their behalf, we connect them with the best human expert from our network of thousands of AI-enabled financial, tax, and bookkeeping experts who can complete a specific task, address specialized questions, or manage the entire workload. Our strategy, combined with our Big Bets that focus on the largest customer problems and growth opportunities, positions us for durable growth.

In fiscal 2025, we launched a transformative set of AI agents that provide customers with a virtual team to complete jobs on their behalf, dramatically improving how businesses run and grow. Combined with our AI-enabled human experts, these agents are automating workflows and delivering real-time insights to drive growth and improve cash flow. Our redesigned user interface and new business feed highlights these real-time insights and recommendations and the tasks completed by agents on behalf of the customer. We also launched AI agents in Intuit Enterprise Suite, including accounting, payments, finance, and project management agents, transforming how our small and mid-market business customers manage their finances by automating a variety of day-to-day tasks, and increasing productivity.

Our innovation has been possible with the investments in our proprietary Generative AI Operating System (GenOS), which have enabled us to fuel innovation with unparalleled speed for our customers. Built for our internal developers, GenOS not only keeps pace with rapid technological industry advances but is setting the pace—by melding the best of artificial intelligence and human intelligence on our platform. This enables us to rapidly deliver a new class of intelligent, autonomous financial solutions that will define the next decade of growth for our customers and for Intuit. Our AI-driven expert platform and products are built in keeping with the company’s commitment to data privacy, security, and responsible AI governance. We safeguard customer data and protect privacy using industry-leading technology and practices, and adhere to responsible AI principles that guide how we operate and scale our platform with our customers’ best interests in mind.

As we execute our global AI-driven expert platform strategy, we prioritize resources on our Big Bets across the company. We have driven significant momentum across the company over the past year. Looking ahead, we are doubling down on the areas that drove strong results this year where the combination of AI and human intelligence delivers done-for-you experiences, helps customers put more money in their pockets, and builds our mid-market business.

As the external environment evolves, we continue to innovate and adapt our strategy and anticipate our customers’ needs. For more than 40 years, we have been dedicated to developing innovative solutions that are designed to solve our customers' most important financial problems. At Intuit, we believe that everyone should have the opportunity to prosper, and we never stop working to find new, innovative ways to make that possible.

During fiscal 2025, we offered our products and services in the two segments described in “Our Business Portfolio” above. The following table shows the percentage of total revenue contributed by each of these segments over the last three fiscal years.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal 2025 |

|

Fiscal 2024 |

|

Fiscal 2023 |

|

|

|

|

|

|

| Global Business Solutions |

59 |

% |

|

59 |

% |

|

56 |

% |

| Consumer |

41 |

% |

|

41 |

% |

|

44 |

% |

Total international net revenue was approximately 8% of consolidated total net revenue in each of the twelve months ended July 31, 2025, 2024, and 2023.

For financial information about our reportable segments, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 and Note 14 to the consolidated financial statements in Item 8.

Global Business Solutions

Our Global Business Solutions segment serves small and mid-market businesses around the world, and the accounting professionals who assist and advise them. Our vision is to be the connected all-in-one platform with a virtual team of AI agents and AI-enabled human experts that small and mid-market businesses rely on every day to run and grow their businesses.

Small and mid-market business owners are constantly faced with challenges and barriers in their journey to success. Universally, businesses at every stage of growth struggle to get customers, pay and get paid, get capital, manage their workforce, get access to advice, and stay compliant. Our all-in-one platform features AI agents, providing actionable, AI-driven insights and automation to help our customers grow and run their businesses with confidence. These AI agents are also able to work alongside our large network of AI-enabled human experts to provide businesses with additional expertise and support.

Get Customers

Mailchimp. Mailchimp offers email and other marketing solutions that enable small and mid-market businesses to digitally promote themselves across email, social media, short message service (SMS), landing pages, ads, websites, and more, all from one place.

Pay and Get Paid

Payment Processing Solutions. Our full range of merchant services for small and mid-market businesses includes credit card, debit card, Apple Pay, and ACH payment services for in-person and card-not-present payments. We offer instant deposit and payment dispute protection options for eligible customers. Through seamless onboarding and automated transaction reconciliation, our payment processing solutions are deeply integrated into our QuickBooks Online, Desktop, and Intuit Enterprise Suite offerings.

QuickBooks Checking. The QuickBooks Checking business bank account comes with a physical and virtual debit card for more spending power, fast payments with no-fee Instant Deposit, and powerful cash flow management with envelopes for partitioning funds for future expenses, all with no fees.

Bill Pay. Our QuickBooks Online offerings and Intuit Enterprise Suite allow small and mid-market businesses to organize bills and make payments online. Small and mid-market businesses can connect with vendors and automatically import bills through our network, resulting in easier and faster payments.

Get Capital

Capital. We offer financing options for small and mid-market businesses to help them get the capital they need to succeed. The financing process provides customers with the ability to use their QuickBooks data to qualify to borrow capital, whether from Intuit via our originating bank partner or from partners on our QuickBooks Capital Marketplace. Additionally, QuickBooks Line of Credit provides flexible access to capital through pre-approved credit limits. Qualified small and mid-market businesses can choose to borrow funds through a series of term loans within a maximum approved credit limit.

Manage Their Workforce

Workforce Solutions. Our payroll solutions, available as online or desktop solutions, are sold on a subscription basis and integrate with our QuickBooks Online and Desktop offerings and Intuit Enterprise Suite, or may be purchased standalone. Our online payroll offerings include automated tax payments and filings, as well as access to human resources solutions and employee benefits offerings such as health insurance and 401(k) plans. We also offer time tracking solutions, which seamlessly integrate with our online payroll offerings to help businesses easily and accurately track time for their mobile workforce, including tools for project planning, job costing, and tracking billable hours per client.

Access Advice

QuickBooks Live. Businesses can get support through Expert Assisted and Full-Service Bookkeeping. With QuickBooks Live Expert Assisted, businesses have on-demand access to expert bookkeepers who can provide guidance and support on managing their books and making smart business decisions. With QuickBooks Live Full-Service Bookkeeping, businesses get one-on-one support from our team of expert bookkeepers to manage and maintain books with guaranteed accuracy. Our experienced bookkeepers are certified QuickBooks ProAdvisors, and many are Certified Public Accountants.

QuickBooks ProAdvisor. Accounting professionals can assist with bookkeeping, taxes, payroll, and more. Our free Find a ProAdvisor service helps customers find a QuickBooks Certified accountant or bookkeeper who knows their niche, speaks their language, or is nearby. To enable our network of hundreds of thousands of accountants, we offer memberships to the QuickBooks ProAdvisor program, which provides accountants access to QuickBooks Online Accountant, technical support, training, product certification, marketing tools, and discounts on Intuit products and services purchased on behalf of clients.

Be Compliant

QuickBooks Online. Designed for all kinds of businesses, QuickBooks Online helps simplify accounting and tax compliance. Users can track income and expenses, create and send invoices and estimates, manage and pay bills, and review a variety of financial reports. QuickBooks Online also has powerful industry-specific capabilities such as features for product-based businesses. QuickBooks Online is an open platform, enabling third-party developers to create online and mobile applications that integrate with our offering.

We offer different QuickBooks Online solutions depending on the size and complexity of the business, including Simple Start, Essentials, and Plus. QuickBooks Online Advanced is designed for mid-market businesses with more complex needs. QuickBooks Solopreneur and QuickBooks Self-Employed are designed for independent contractors and solo entrepreneurs.

Intuit Enterprise Suite. Designed for complex mid-market companies seeking to streamline operations, enhance productivity, and support growth, this solution builds upon the familiar QuickBooks Online interface. It integrates advanced financial management solutions, such as multi-entity accounting and multi-dimensional reporting, along with human resource and marketing tools in a unified solution.

QuickBooks Desktop Software. Our QuickBooks financial management solutions are also available as desktop versions for businesses on a subscription basis. QuickBooks Desktop Plus is designed for small businesses. QuickBooks Enterprise is designed for mid-market businesses with more complex needs and is available for download or as a hosted solution. This offering provides industry-specific reports and features for a range of industries, including Contractor, Manufacturing, Wholesale and Distribution, Retail, Nonprofit, Professional Services, and Accountants.

Financial Supplies. We offer a range of financial supplies designed for individuals and businesses that use our QuickBooks offerings. These include standard paper checks, Secure Plus checks with CheckLock fraud protection features, a variety of stationery, tax forms, and related supplies.

Consumer

Our Consumer segment primarily serves consumers and professional accountants and is comprised of our TurboTax, Credit Karma, and ProTax offerings. Our vision is to be a platform that engages consumers year-round to solve their most critical financial problems that include making ends meet, maximizing tax refunds, saving more, paying off debt, knowing where they stand, and reducing payments. We believe the combined strengths and reach of our brands will enable us to provide differentiated and durable personal finance benefits to consumers throughout the year.

TurboTax. Our TurboTax products and services are designed to enable consumers and businesses to prepare and file their federal and state income tax returns quickly and accurately. These offerings are available either online or as desktop versions in the U.S. and Canada. They are designed to be easy to use yet sophisticated enough for complex tax returns, serving the varied needs of our customers, from those who file simple returns to those who itemize deductions, own investments or rental property, and manage small and mid-market businesses.

Our do-it-yourself tax products and services are designed for customers who choose to independently prepare and file their tax returns. Our assisted tax products and services, such as TurboTax Live and TurboTax Live Full Service, are designed for customers who seek professional tax advice or who want their returns prepared by an expert. We also offer complementary

services, including electronic filing of federal and state income tax returns, audit defense, audit support, as well as a variety of financial offerings including early access to tax refunds and Credit Karma Money branded online savings and checking accounts through FDIC-member partner banks.

Our online tax preparation, filing, and other services are offered through the websites and mobile apps of thousands of financial institutions, electronic retailers, and other online merchants.

Credit Karma. Credit Karma provides consumers with a financial solution that propels them forward wherever they are on their financial journey, enabling them to understand their financial picture, make smart financial decisions, and stick to their financial plan. The platform offers a number of services to our members: access to their credit scores and reports, credit and identity monitoring, credit building, credit report dispute, tools to help understand net worth and make financial progress, personalized recommendations of credit card, loan, and insurance products, and access to our TurboTax offerings. To provide services to our members, Credit Karma works with a variety of partners, including credit bureaus, banks, credit card issuers, insurance carriers, and other financial institutions and lending partners. Additionally, Credit Karma leverages Lightbox, a first-of-its-kind enterprise platform which allows lenders to leverage thousands of de-identified data points from Credit Karma members to help provide our members with greater certainty that they will be approved if they apply for a financial product.

ProTax. Our ProTax professional tax offerings serve professional accountants in the U.S. and Canada, who are essential to both small business success and tax preparation and filing. Our professional tax offerings consist of Lacerte, ProSeries, and ProConnect Tax Online in the U.S., and ProFile and ProTax Online in Canada. These offerings enable accountants to accurately and efficiently complete and electronically file a full range of federal and state tax returns for individuals and businesses. Lacerte is designed for full-service, year-round accounting firms who handle more complex returns. ProSeries is designed for year-round tax practices handling moderately complex tax returns. ProConnect Tax Online is our cloud-based solution, designed for full-service, year-round practices that prepare all types of individual and business returns and integrates with our QuickBooks Online offerings. ProFile is our Canadian desktop tax offering, which serves year-round, full-service accounting firms for both individual and business tax returns. ProTax Online is our Canadian cloud-based tax solution, designed for full-service, year-round practices who prepare all forms of individual and business tax returns. It is integrated into QuickBooks Online Accountant to provide seamless integration of data across books and tax through our Workpapers solution. We also offer a variety of tax-related services that complement the tax return preparation process, including advisory services, year-round document storage, bank products, e-signature, and collaboration services, as well as additional capabilities such as desktop hosting, fixed asset management, and third-party solutions for practice management for some of our U.S. tax offerings.

Within our Consumer segment, our TurboTax and ProTax offerings have a significant and distinct seasonal pattern as sales and revenue from our income tax preparation products and services are typically heavily concentrated in the period from November through April. This seasonal pattern typically results in higher net revenues during our second and third quarters ending January 31 and April 30, respectively.

We expect the seasonality of these offerings to continue to have a material impact on our quarterly financial results in the future.

We are subject to federal, state, local, and international laws and regulations that add compliance costs, affect how we operate, and may impact our ability to compete. For example, the tax offerings in our Consumer segment are subject to federal, state, and international government requirements, including regulations related to the electronic filing of tax returns, the provision of tax preparer assistance, and the use and disclosure of customer information. The personal finance offerings in our Consumer segment, such as recommendations of credit card, loan, and insurance products and access to credit scores and reports, are also subject to certain regulatory requirements. Our Global Business Solutions segment offers products and services to small and mid-market businesses and consumers, such as payroll, payments, financing for small and mid-market businesses, and other financial service offerings, which are also subject to certain regulatory requirements. For additional information regarding the government regulations to which we are subject, see “Risk Factors” in Item 1A of Part I of our Annual Report on Form 10-K for the fiscal year ended July 31, 2025 (2025 Form 10-K), including without limitation the risks under “Legal and Compliance Risks.”

Our principal locations, their purposes, and the expiration dates for the leases on facilities at those locations as of July 31, 2025, are shown in the table below. We have renewal options on many of our leases.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Location |

|

Purpose |

|

Approximate

Square

Feet |

|

Principal

Lease

Expiration

Dates |

|

|

|

|

|

|

|

| Mountain View, California |

|

Corporate headquarters and principal offices for Global Business Solutions segment |

|

364,000 |

|

Owned |

| Mountain View, California |

|

Corporate headquarters and principal offices for Global Business Solutions segment |

|

359,000 |

|

2026 - 2034 |

| Bangalore, India |

|

Principal offices for Intuit India |

|

478,000 |

|

2026 - 2029 |

| San Diego, California |

|

Principal offices for Consumer segment’s TurboTax business |

|

466,000 |

|

Owned |

| Oakland, California |

|

Principal offices for Consumer segment’s Credit Karma business |

|

167,000 |

|

2031 |

| Plano, Texas |

|

Principal offices for Consumer segment’s ProTax business |

|

166,000 |

|

2026 |

We also lease or own facilities in a number of domestic locations and lease facilities internationally in Canada, Israel, the United Kingdom, Australia, and other locations. We believe our facilities are suitable and adequate for our current and near-term needs, and that we will be able to locate additional facilities as needed. See Note 9 to the consolidated financial statements in Item 8 for more information about our lease commitments.

|

|

|

ITEM 7 - MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS |

Note: Intuit Inc. (Intuit) is filing this exhibit to update certain information set forth in its Annual Report on Form 10-K for the year ended July 31, 2025 (the 2025 Form 10-K), as filed with the Securities and Exchange Commission on September 3, 2025, to reflect changes in its reportable segments that became effective on August 1, 2025. This exhibit has not been updated for any other changes since the filing of the 2025 Form 10-K. For developments subsequent to the filing of the 2025 Form 10-K, refer to our Quarterly Report on Form 10-Q for the quarter ended October 31, 2025.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) is intended to provide readers of our consolidated financial statements with the perspectives of management. This should allow the readers of this report to obtain a comprehensive understanding of our businesses, strategies, current trends, and future prospects. Our MD&A includes the following sections:

|

|

|

|

• Executive Overview: High-level discussion of our operating results and some of the trends that affect our business.

• Critical Accounting Estimates: Policies and estimates that we believe are important to understanding the assumptions and judgments underlying our financial statements.

• Results of Operations: A more detailed discussion of our revenue and expenses.

• Liquidity and Capital Resources: Discussion of key aspects of our consolidated statements of cash flows, changes in our consolidated balance sheets, and our financial commitments.

|

You should note that this MD&A contains forward-looking statements that involve risks and uncertainties. Please see the section entitled “Forward-Looking Statements” immediately preceding Part I of our 2025 Form 10-K for important information to consider when evaluating such statements.

You should read this MD&A in conjunction with the consolidated financial statements and related notes in Item 8.

In the Results of Operations sections of this MD&A, where we describe two or more factors that contributed to changes in revenue and operating income, we have, where possible, quantified the impact of those factors. Where a change is the result of multiple factors that are interrelated and cannot be separately quantified, we have identified the interrelated factors without quantifying them.

In July 2024, our management approved, committed to, and initiated a plan of reorganization (the Plan) focused on reallocating resources to our key growth areas. The Plan included the exit of employees and the closing of real estate sites in certain markets to support growing technology teams and capabilities in strategic locations. The actions associated with the Plan were substantially complete in the first quarter of fiscal 2025. Total restructuring costs associated with the Plan were $238 million. During the twelve months ended July 31, 2025 and 2024, we recorded charges in connection with the Plan of $15 million and $223 million, respectively. These charges are primarily related to severance and employee benefits and are recorded to restructuring in our consolidated statements of operations. See Note 15 to the consolidated financial statements in Item 8 for more information.

On August 1, 2024, we renamed our Small Business & Self-Employed segment as the Global Business Solutions segment. This new name better aligns with the global reach of the Mailchimp and QuickBooks platform, our focus on serving both small and mid-market businesses, and our vision to become the all-in-one platform that customers use to grow and run their business.

On August 1, 2024, we reorganized certain technology and customer success functions in our Global Business Solutions and Consumer segments that support and benefit our overall platform and are managed at the corporate level rather than at the segment level. As a result of these reorganizations, costs associated with these functions are no longer included in segment operating income and are now included in other corporate expenses. For the twelve months ended July 31, 2024 and 2023, we reclassified $1.4 billion and $1.3 billion from Global Business Solutions and $606 million and $509 million from Consumer, to other corporate expenses, respectively, to conform to the current presentation. See Note 14 to the consolidated financial statements in Item 8 for more information.

Effective August 1, 2025, we combined our Consumer, Credit Karma, and ProTax businesses into a single Consumer segment in order to better serve the diverse financial needs of our customers as one consumer platform. Our chief operating decision maker allocates resources and assesses segment performance using regularly provided segment revenue and segment operating income information under this updated segment structure. To align results under this segment change, certain selling and marketing, product development, and general and administrative expenses for Credit Karma that were managed at the segment level are now managed at the platform level and are included in other corporate expenses rather than in segment expenses. Also on August 1, 2025, we reorganized certain marketing, communications, and customer success functions in our Global Business Solutions segment that support and benefit our overall platform and are managed at that level rather than at

the segment level. Additionally, certain data science and analytics teams that were managed at the platform level are now managed at the segment level. We have recast certain previously reported amounts to conform to these segment changes. For the twelve months ended July 31, 2025, 2024, and 2023, we reclassified expenses totaling $9 million, $16 million, and $4 million from Global Business Solutions and $606 million, $585 million, and $581 million from Consumer to other corporate expenses, respectively, to conform to the current presentation. See Note 14 to the consolidated financial statements in Item 8 for more information.

This overview provides a high-level discussion of our operating results and some of the trends that affect our business. We believe that an understanding of these trends is important in order to understand our financial results for fiscal 2025, as well as our future prospects. This summary is not intended to be exhaustive, nor is it a substitute for the detailed discussion and analysis provided elsewhere in this Annual Report on Form 10-K.

|

|

|

Industry Trends and Seasonality |

Industry Trends

AI, including GenAI, predictive AI, and agentic AI, is transforming multiple industries, in particular financial technology. Disruptive start-ups, emerging ecosystems, and mega-platforms are harnessing new technology to create personalized experiences, deliver data-driven insights, and increase speed of service. These shifts are creating a more dynamic and highly competitive environment where customer expectations are shifting around the world as more services become digitized and the array of choices continues to increase.

Seasonality

Within our Consumer segment, our TurboTax and ProTax offerings have a significant and distinct seasonal pattern as sales and revenue from our income tax preparation products and services are typically heavily concentrated in the period from November through April. This seasonal pattern typically results in higher net revenues during our second and third quarters ending January 31 and April 30, respectively.

We expect the seasonality of these offerings to continue to have a material impact on our quarterly financial results in the future.

Our growth strategy depends upon our ability to innovate, develop, and introduce emerging technologies, including AI and GenAI, to drive broad adoption of our products and services and enter new markets. Our future growth also increasingly depends on the strength of our third-party business relationships and our ability to continue to develop, maintain, and strengthen new and existing relationships. To remain competitive and continue to grow, we are investing significant resources in our product development, marketing, and sales capabilities, and we expect to continue to do so in the future. Much of our future success also depends on our ability to continue to attract, retain, and develop highly skilled employees, including those in technical and leadership roles who are critical to our strategic growth, in a highly competitive talent environment.

As we offer more online services, the ongoing operation and availability of our platforms and systems and those of our external service providers is becoming increasingly important. Because we help customers manage their financial lives, we face risks associated with the hosting, collection, use, and retention of personal customer information and data. We are investing significant management attention and resources in our information technology infrastructure and in our privacy and security capabilities, and we expect to continue to do so in the future.

We operate in industries that are experiencing an increasing amount of fraudulent activities by malicious third parties, and those fraudulent activities are becoming increasingly sophisticated, including through the use of AI. We implement additional security measures, and we continue to work with state and federal governments to implement industry-wide security and anti-fraud measures, including sharing information regarding suspicious activity. We continue to invest in security measures and to work with the broader industry and government to protect our customers against this type of fraud.

Our operations are impacted by a rapidly-evolving regulatory environment and face increasingly heightened scrutiny. We are subject to numerous federal, state, and local, as well as foreign laws and regulations covering a broad and increasing range of subjects, both in the United States (U.S.) and internationally.

For a complete discussion of the most significant risks and uncertainties affecting our business, please see “Forward-Looking Statements” immediately preceding Part I and “Risk Factors” in Item 1A of Part I of our 2025 Form 10-K.

|

|

|

Overview of Financial Results |

The most important financial indicators that we use to assess our business are revenue growth for the company as a whole and for each reportable segment; operating income growth for the company as a whole; earnings per share; and cash flow from operations. We also track certain non-financial drivers of revenue growth and, when material, identify them in the applicable discussions of segment results below. Service offerings are a significant part of our business. Our total service revenue was $16.4 billion, or 87% of our total revenue in fiscal 2025, and we expect our total service revenue as a percentage of our total revenue to grow over the long term.

Key highlights for fiscal 2025 include the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue of |

|

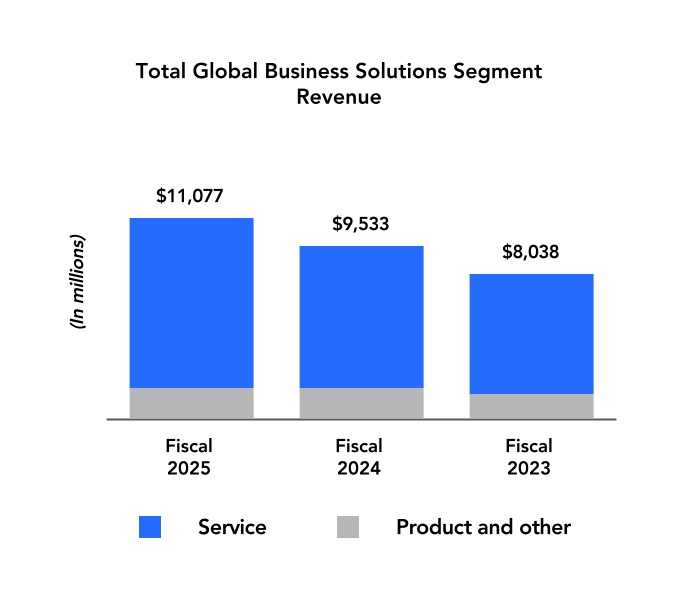

Global Business Solutions revenue of |

|

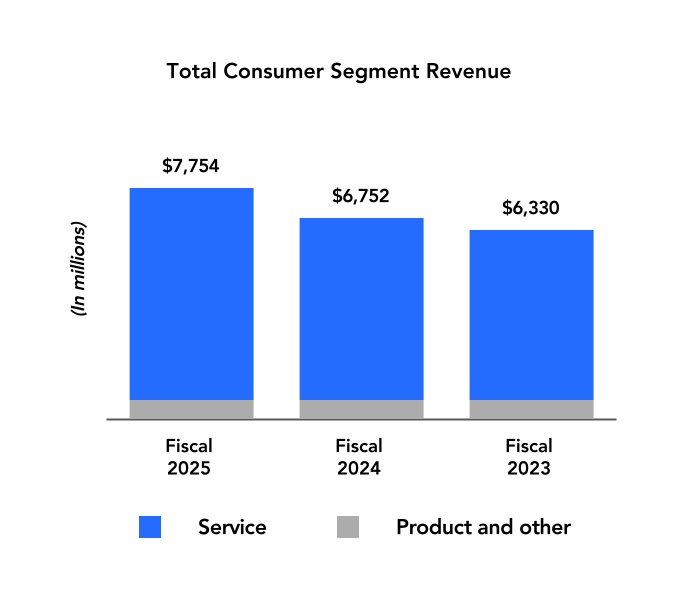

Consumer revenue of |

| $18.8 B |

|

$11.1 B |

|

$7.8 B |

| up 16% from fiscal 2024 |

|

up 16% from fiscal 2024 |

|

up 15% from fiscal 2024 |

|

|

|

|

|

|

|

|

|

|

| Operating income of |

|

Net income of |

|

Diluted net income per share of |

| $4.9 B |

|

$3.9 B |

|

$13.67 |

| up 36% from fiscal 2024 |

|

up 31% from fiscal 2024 |

|

up 31% from fiscal 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash flow from operations of |

|

|

|

|

$6.2 B |

|

|

|

|

up 27% from fiscal 2024 |

|

|

A discussion regarding our financial condition and results of operations for fiscal 2025 compared to fiscal 2024 is presented below. Also included below is a discussion regarding our segment results for fiscal 2024 compared to fiscal 2023. For a discussion regarding our consolidated financial condition and results of operations for fiscal 2024 compared to fiscal 2023, refer to Item 7 of Part II in our Annual Report on Form 10-K for the fiscal year ended July 31, 2024, filed with the SEC on September 4, 2024, which is available free of charge on the SEC’s website at www.sec.gov and on the Investor Relations section of our corporate website at investors.intuit.com.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial Overview |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollars in millions, except per share amounts) |

Fiscal

2025 |

|

Fiscal

2024 |

|

Fiscal

2023 |

|

2025-2024

% Change |

|

2024-2023

% Change |

| Total net revenue |

$18,831 |

|

|

$16,285 |

|

|

$14,368 |

|

|

16 |

% |

|

13 |

% |

| Operating income |

4,923 |

|

|

3,630 |

|

|

3,141 |

|

|

36 |

% |

|

16 |

% |

| Net income |

3,869 |

|

|

2,963 |

|

|

2,384 |

|

|

31 |

% |

|

24 |

% |

| Diluted net income per share |

$13.67 |

|

|

$10.43 |

|

|

$8.42 |

|

|

31 |

% |

|

24 |

% |

Fiscal 2025 Compared with Fiscal 2024

Total net revenue increased $2.5 billion, or 16%, in fiscal 2025 compared with fiscal 2024. Global Business Solutions segment revenue increased 16% due to growth in our Online Ecosystem revenue. Consumer segment revenue increased 15% due to strength in our Credit Karma personal loan, credit card, and auto insurance verticals, and growth in TurboTax from higher-priced and additional service offerings, such as TurboTax Live and our early tax refund offerings. See “Segment Results” later in this Item 7 for more information.

Operating income increased $1.3 billion, or 36%, in fiscal 2025 compared with fiscal 2024. The increase in operating income was due to the increase in revenue described above partially offset by an increase in expenses. Expenses increased due to increases in marketing, staffing, outside services, and sales-related expenses partially offset by a decrease in restructuring expenses. See “Operating Expenses” later in this Item 7 for more information. See Note 15 to the consolidated financial statements in Item 8 for more information on our restructuring charges.

Net income increased $906 million, or 31%, in fiscal 2025 compared with fiscal 2024. The increase in net income was due to the increase in operating income described above, partially offset by an increase in income tax expense. The increase in income tax expense is due to the increase in operating income described above and a decrease in excess tax benefits related to share-based compensation. Diluted net income per share increased 31% to $13.67 for fiscal 2025, in line with the increase in net income.

Fiscal 2024 Compared with Fiscal 2023

Total net revenue increased $1.9 billion, or 13%, in fiscal 2024 compared with fiscal 2023. Global Business Solutions segment revenue increased 19% due to growth in our Online Ecosystem revenue. Consumer segment revenue increased 7% due to growth in TurboTax from the interrelated factors of a shift in mix to our higher-priced TurboTax services offerings, such as TurboTax Live, and higher effective prices. See “Segment Results” later in this Item 7 for more information.

Operating income increased $489 million, or 16%, in fiscal 2024 compared with fiscal 2023. The increase in operating income was due to the increase in revenue described above and an increase in expenses. Expenses increased due to staffing, marketing, restructuring, share-based compensation, and outside services. See “Operating Expenses” later in this Item 7 for more information. See Note 15 to the consolidated financial statements in Item 8 for more information on our restructuring charges.

Net income increased $579 million, or 24%, in fiscal 2024 compared with fiscal 2023. The increase in net income was due to the increase in operating income described above, an increase in interest income due to higher average interest rates, and a decrease in income tax expense related to higher excess tax benefits on share-based compensation. Diluted net income per share increased 24% to $10.43 for fiscal 2024, in line with the increase in net income.

The information below is organized in accordance with our two reportable segments. All of our segments operate and sell to customers primarily in the U.S. Total international net revenue was approximately 8% of consolidated total net revenue in each of the twelve months ended July 31, 2025, 2024, and 2023.

On August 1, 2024, we renamed our Small Business & Self-Employed segment as the Global Business Solutions segment. This new name better aligns with the global reach of the Mailchimp and QuickBooks platform, our focus on serving both small and mid-market businesses, and our vision to become the all-in-one platform that customers use to grow and run their business.

On August 1, 2024, we reorganized certain technology and customer success functions in our Global Business Solutions and Consumer segments that support and benefit our overall platform and are managed at the corporate level rather than at the segment level. As a result of these reorganizations, costs associated with these functions are no longer included in segment operating income and are now included in other corporate expenses. For the twelve months ended July 31, 2024 and 2023, we reclassified $1.4 billion and $1.3 billion from Global Business Solutions and $606 million and $509 million from Consumer to other corporate expenses, respectively, to conform to the current presentation.