false2024FYIDEXX LABORATORIES INC /DE0000874716P1YP5Y1111111111111111P2YP2Yhttp://fasb.org/us-gaap/2024#AccountsPayableCurrenthttp://fasb.org/us-gaap/2024#AccountsPayableCurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrentiso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pureidxx:arrangementidxx:stageiso4217:EURidxx:amendementidxx:segment00008747162024-01-012024-12-3100008747162024-06-3000008747162025-02-120000874716idxx:JonathanW.AyersMember2024-10-012024-12-310000874716idxx:JonathanW.AyersMember2024-01-012024-12-3100008747162024-10-012024-12-3100008747162024-12-3100008747162023-12-310000874716us-gaap:ProductMember2024-01-012024-12-310000874716us-gaap:ProductMember2023-01-012023-12-310000874716us-gaap:ProductMember2022-01-012022-12-310000874716us-gaap:ServiceMember2024-01-012024-12-310000874716us-gaap:ServiceMember2023-01-012023-12-310000874716us-gaap:ServiceMember2022-01-012022-12-3100008747162023-01-012023-12-3100008747162022-01-012022-12-3100008747162021-12-3100008747162022-12-310000874716us-gaap:CommonStockMember2021-12-310000874716us-gaap:AdditionalPaidInCapitalMember2021-12-310000874716idxx:DeferredStockUnitsMember2021-12-310000874716us-gaap:RetainedEarningsMember2021-12-310000874716us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000874716us-gaap:TreasuryStockCommonMember2021-12-310000874716us-gaap:RetainedEarningsMember2022-01-012022-12-310000874716us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310000874716us-gaap:TreasuryStockCommonMember2022-01-012022-12-310000874716us-gaap:CommonStockMember2022-01-012022-12-310000874716us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000874716idxx:DeferredStockUnitsMember2022-01-012022-12-310000874716us-gaap:CommonStockMember2022-12-310000874716us-gaap:AdditionalPaidInCapitalMember2022-12-310000874716idxx:DeferredStockUnitsMember2022-12-310000874716us-gaap:RetainedEarningsMember2022-12-310000874716us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000874716us-gaap:TreasuryStockCommonMember2022-12-310000874716us-gaap:RetainedEarningsMember2023-01-012023-12-310000874716us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000874716us-gaap:TreasuryStockCommonMember2023-01-012023-12-310000874716us-gaap:CommonStockMember2023-01-012023-12-310000874716us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000874716idxx:DeferredStockUnitsMember2023-01-012023-12-310000874716us-gaap:CommonStockMember2023-12-310000874716us-gaap:AdditionalPaidInCapitalMember2023-12-310000874716idxx:DeferredStockUnitsMember2023-12-310000874716us-gaap:RetainedEarningsMember2023-12-310000874716us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000874716us-gaap:TreasuryStockCommonMember2023-12-310000874716us-gaap:RetainedEarningsMember2024-01-012024-12-310000874716us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310000874716us-gaap:TreasuryStockCommonMember2024-01-012024-12-310000874716us-gaap:CommonStockMember2024-01-012024-12-310000874716us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310000874716idxx:DeferredStockUnitsMember2024-01-012024-12-310000874716us-gaap:CommonStockMember2024-12-310000874716us-gaap:AdditionalPaidInCapitalMember2024-12-310000874716idxx:DeferredStockUnitsMember2024-12-310000874716us-gaap:RetainedEarningsMember2024-12-310000874716us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310000874716us-gaap:TreasuryStockCommonMember2024-12-310000874716srt:MinimumMember2024-01-012024-12-310000874716srt:MaximumMember2024-01-012024-12-310000874716us-gaap:OperatingSegmentsMemberidxx:CAGDiagnosticsRecurringRevenueMemberidxx:CompanionAnimalGroupSegmentMember2024-01-012024-12-310000874716us-gaap:OperatingSegmentsMemberidxx:CAGDiagnosticsRecurringRevenueMemberidxx:CompanionAnimalGroupSegmentMember2023-01-012023-12-310000874716us-gaap:OperatingSegmentsMemberidxx:CAGDiagnosticsRecurringRevenueMemberidxx:CompanionAnimalGroupSegmentMember2022-01-012022-12-310000874716us-gaap:OperatingSegmentsMemberidxx:VetLabConsumablesMemberidxx:CompanionAnimalGroupSegmentMember2024-01-012024-12-310000874716us-gaap:OperatingSegmentsMemberidxx:VetLabConsumablesMemberidxx:CompanionAnimalGroupSegmentMember2023-01-012023-12-310000874716us-gaap:OperatingSegmentsMemberidxx:VetLabConsumablesMemberidxx:CompanionAnimalGroupSegmentMember2022-01-012022-12-310000874716us-gaap:OperatingSegmentsMemberidxx:RapidAssayProductsMemberidxx:CompanionAnimalGroupSegmentMember2024-01-012024-12-310000874716us-gaap:OperatingSegmentsMemberidxx:RapidAssayProductsMemberidxx:CompanionAnimalGroupSegmentMember2023-01-012023-12-310000874716us-gaap:OperatingSegmentsMemberidxx:RapidAssayProductsMemberidxx:CompanionAnimalGroupSegmentMember2022-01-012022-12-310000874716us-gaap:OperatingSegmentsMemberidxx:ReferenceLaboratoryDiagnosticAndConsultingServicesMemberidxx:CompanionAnimalGroupSegmentMember2024-01-012024-12-310000874716us-gaap:OperatingSegmentsMemberidxx:ReferenceLaboratoryDiagnosticAndConsultingServicesMemberidxx:CompanionAnimalGroupSegmentMember2023-01-012023-12-310000874716us-gaap:OperatingSegmentsMemberidxx:ReferenceLaboratoryDiagnosticAndConsultingServicesMemberidxx:CompanionAnimalGroupSegmentMember2022-01-012022-12-310000874716us-gaap:OperatingSegmentsMemberidxx:CAGDiagnosticsServiceAndAccessoriesMemberidxx:CompanionAnimalGroupSegmentMember2024-01-012024-12-310000874716us-gaap:OperatingSegmentsMemberidxx:CAGDiagnosticsServiceAndAccessoriesMemberidxx:CompanionAnimalGroupSegmentMember2023-01-012023-12-310000874716us-gaap:OperatingSegmentsMemberidxx:CAGDiagnosticsServiceAndAccessoriesMemberidxx:CompanionAnimalGroupSegmentMember2022-01-012022-12-310000874716us-gaap:OperatingSegmentsMemberidxx:CAGDiagnosticCapitalInstrumentsMemberidxx:CompanionAnimalGroupSegmentMember2024-01-012024-12-310000874716us-gaap:OperatingSegmentsMemberidxx:CAGDiagnosticCapitalInstrumentsMemberidxx:CompanionAnimalGroupSegmentMember2023-01-012023-12-310000874716us-gaap:OperatingSegmentsMemberidxx:CAGDiagnosticCapitalInstrumentsMemberidxx:CompanionAnimalGroupSegmentMember2022-01-012022-12-310000874716us-gaap:OperatingSegmentsMemberidxx:VeterinarySoftwareServicesAndDiagnosticImagingSystemsMemberidxx:CompanionAnimalGroupSegmentMember2024-01-012024-12-310000874716us-gaap:OperatingSegmentsMemberidxx:VeterinarySoftwareServicesAndDiagnosticImagingSystemsMemberidxx:CompanionAnimalGroupSegmentMember2023-01-012023-12-310000874716us-gaap:OperatingSegmentsMemberidxx:VeterinarySoftwareServicesAndDiagnosticImagingSystemsMemberidxx:CompanionAnimalGroupSegmentMember2022-01-012022-12-310000874716us-gaap:OperatingSegmentsMemberidxx:RecurringRevenueMemberidxx:CompanionAnimalGroupSegmentMember2024-01-012024-12-310000874716us-gaap:OperatingSegmentsMemberidxx:RecurringRevenueMemberidxx:CompanionAnimalGroupSegmentMember2023-01-012023-12-310000874716us-gaap:OperatingSegmentsMemberidxx:RecurringRevenueMemberidxx:CompanionAnimalGroupSegmentMember2022-01-012022-12-310000874716us-gaap:OperatingSegmentsMemberidxx:SystemsAndHardwareMemberidxx:CompanionAnimalGroupSegmentMember2024-01-012024-12-310000874716us-gaap:OperatingSegmentsMemberidxx:SystemsAndHardwareMemberidxx:CompanionAnimalGroupSegmentMember2023-01-012023-12-310000874716us-gaap:OperatingSegmentsMemberidxx:SystemsAndHardwareMemberidxx:CompanionAnimalGroupSegmentMember2022-01-012022-12-310000874716us-gaap:OperatingSegmentsMemberidxx:CompanionAnimalGroupSegmentMember2024-01-012024-12-310000874716us-gaap:OperatingSegmentsMemberidxx:CompanionAnimalGroupSegmentMember2023-01-012023-12-310000874716us-gaap:OperatingSegmentsMemberidxx:CompanionAnimalGroupSegmentMember2022-01-012022-12-310000874716us-gaap:OperatingSegmentsMemberidxx:WaterSegmentMember2024-01-012024-12-310000874716us-gaap:OperatingSegmentsMemberidxx:WaterSegmentMember2023-01-012023-12-310000874716us-gaap:OperatingSegmentsMemberidxx:WaterSegmentMember2022-01-012022-12-310000874716us-gaap:OperatingSegmentsMemberidxx:LivestockAndPoultryDiagnosticsSegmentMember2024-01-012024-12-310000874716us-gaap:OperatingSegmentsMemberidxx:LivestockAndPoultryDiagnosticsSegmentMember2023-01-012023-12-310000874716us-gaap:OperatingSegmentsMemberidxx:LivestockAndPoultryDiagnosticsSegmentMember2022-01-012022-12-310000874716us-gaap:CorporateNonSegmentMember2024-01-012024-12-310000874716us-gaap:CorporateNonSegmentMember2023-01-012023-12-310000874716us-gaap:CorporateNonSegmentMember2022-01-012022-12-310000874716country:US2024-01-012024-12-310000874716country:US2023-01-012023-12-310000874716country:US2022-01-012022-12-310000874716country:CA2024-01-012024-12-310000874716country:CA2023-01-012023-12-310000874716country:CA2022-01-012022-12-310000874716idxx:LatinAmericaAndCaribbeanMember2024-01-012024-12-310000874716idxx:LatinAmericaAndCaribbeanMember2023-01-012023-12-310000874716idxx:LatinAmericaAndCaribbeanMember2022-01-012022-12-310000874716srt:AmericasMember2024-01-012024-12-310000874716srt:AmericasMember2023-01-012023-12-310000874716srt:AmericasMember2022-01-012022-12-310000874716country:DE2024-01-012024-12-310000874716country:DE2023-01-012023-12-310000874716country:DE2022-01-012022-12-310000874716country:GB2024-01-012024-12-310000874716country:GB2023-01-012023-12-310000874716country:GB2022-01-012022-12-310000874716country:FR2024-01-012024-12-310000874716country:FR2023-01-012023-12-310000874716country:FR2022-01-012022-12-310000874716country:ES2024-01-012024-12-310000874716country:ES2023-01-012023-12-310000874716country:ES2022-01-012022-12-310000874716country:IT2024-01-012024-12-310000874716country:IT2023-01-012023-12-310000874716country:IT2022-01-012022-12-310000874716country:CH2024-01-012024-12-310000874716country:CH2023-01-012023-12-310000874716country:CH2022-01-012022-12-310000874716country:NL2024-01-012024-12-310000874716country:NL2023-01-012023-12-310000874716country:NL2022-01-012022-12-310000874716idxx:EuropetheMiddleEastandAfricaOtherMember2024-01-012024-12-310000874716idxx:EuropetheMiddleEastandAfricaOtherMember2023-01-012023-12-310000874716idxx:EuropetheMiddleEastandAfricaOtherMember2022-01-012022-12-310000874716us-gaap:EMEAMember2024-01-012024-12-310000874716us-gaap:EMEAMember2023-01-012023-12-310000874716us-gaap:EMEAMember2022-01-012022-12-310000874716country:AU2024-01-012024-12-310000874716country:AU2023-01-012023-12-310000874716country:AU2022-01-012022-12-310000874716country:JP2024-01-012024-12-310000874716country:JP2023-01-012023-12-310000874716country:JP2022-01-012022-12-310000874716country:CN2024-01-012024-12-310000874716country:CN2023-01-012023-12-310000874716country:CN2022-01-012022-12-310000874716idxx:AsiaPacificOtherMember2024-01-012024-12-310000874716idxx:AsiaPacificOtherMember2023-01-012023-12-310000874716idxx:AsiaPacificOtherMember2022-01-012022-12-310000874716srt:AsiaPacificMember2024-01-012024-12-310000874716srt:AsiaPacificMember2023-01-012023-12-310000874716srt:AsiaPacificMember2022-01-012022-12-310000874716idxx:ExtendedWarrantiesAndPostContractSupportRevenueMembersrt:MinimumMember2024-01-012024-12-310000874716idxx:ExtendedWarrantiesAndPostContractSupportRevenueMembersrt:MaximumMember2024-01-012024-12-310000874716idxx:ExtendedWarrantiesAndPostContractSupportRevenueMember2024-01-012024-12-310000874716idxx:FreeOrDiscountedInstrumentsAndSystemsMember2023-12-310000874716idxx:FreeOrDiscountedInstrumentsAndSystemsMember2024-01-012024-12-310000874716idxx:FreeOrDiscountedInstrumentsAndSystemsMember2024-12-310000874716idxx:CustomerCommitmentArrangementsMultiYearArrangementsMember2023-12-310000874716idxx:CustomerCommitmentArrangementsMultiYearArrangementsMember2024-01-012024-12-310000874716idxx:CustomerCommitmentArrangementsMultiYearArrangementsMember2024-12-310000874716idxx:RebateAndUpFrontConsiderationsArrangementsMember2023-12-310000874716idxx:RebateAndUpFrontConsiderationsArrangementsMember2024-01-012024-12-310000874716idxx:RebateAndUpFrontConsiderationsArrangementsMember2024-12-3100008747162025-01-01idxx:RebateAndUpFrontConsiderationsArrangementsMember2024-12-3100008747162026-01-01idxx:RebateAndUpFrontConsiderationsArrangementsMember2024-12-3100008747162027-01-01idxx:RebateAndUpFrontConsiderationsArrangementsMember2024-12-3100008747162028-01-01idxx:RebateAndUpFrontConsiderationsArrangementsMember2024-12-3100008747162029-01-01idxx:RebateAndUpFrontConsiderationsArrangementsMember2024-12-3100008747162025-01-01idxx:CustomerCommitmentArrangementsMultiYearArrangementsMember2024-12-3100008747162026-01-01idxx:CustomerCommitmentArrangementsMultiYearArrangementsMember2024-12-3100008747162027-01-01idxx:CustomerCommitmentArrangementsMultiYearArrangementsMember2024-12-3100008747162028-01-01idxx:CustomerCommitmentArrangementsMultiYearArrangementsMember2024-12-3100008747162029-01-01idxx:CustomerCommitmentArrangementsMultiYearArrangementsMember2024-12-310000874716idxx:SalesTypeReagentRentalArrangementsMember2023-12-310000874716idxx:SalesTypeReagentRentalArrangementsMember2024-01-012024-12-310000874716idxx:SalesTypeReagentRentalArrangementsMember2024-12-310000874716idxx:OperatingTypeReagentRentalArrangementsMember2024-01-012024-12-310000874716idxx:OperatingTypeReagentRentalArrangementsMember2023-01-012023-12-310000874716idxx:ReagentRentalArrangementsMember2024-12-3100008747162025-01-01idxx:ReagentRentalArrangementsMember2024-12-3100008747162026-01-01idxx:ReagentRentalArrangementsMember2024-12-3100008747162027-01-01idxx:ReagentRentalArrangementsMember2024-12-3100008747162028-01-01idxx:ReagentRentalArrangementsMember2024-12-3100008747162029-01-01idxx:ReagentRentalArrangementsMember2024-12-310000874716idxx:ExtendedWarrantiesAndPostContractSupportRevenueMember2023-12-310000874716idxx:ExtendedWarrantiesAndPostContractSupportRevenueMember2024-12-3100008747162025-01-01idxx:ExtendedWarrantiesAndPostContractSupportRevenueMember2024-12-3100008747162026-01-01idxx:ExtendedWarrantiesAndPostContractSupportRevenueMember2024-12-3100008747162027-01-01idxx:ExtendedWarrantiesAndPostContractSupportRevenueMember2024-12-3100008747162028-01-01idxx:ExtendedWarrantiesAndPostContractSupportRevenueMember2024-12-3100008747162029-01-01idxx:ExtendedWarrantiesAndPostContractSupportRevenueMember2024-12-310000874716srt:MinimumMember2024-12-310000874716srt:MaximumMember2024-12-310000874716idxx:PerpetualIntellectualPropertyLicenseMember2024-01-012024-12-310000874716idxx:PerpetualIntellectualPropertyLicenseMember2024-12-310000874716idxx:LicenseIntellectualPropertyRightsMember2022-01-012022-12-310000874716idxx:LicenseIntellectualPropertyRightsMember2022-12-310000874716idxx:LicenseIntellectualPropertyRightsMember2023-01-012023-03-310000874716idxx:PerpetualIntellectualPropertyLicenseMember2022-01-012022-12-310000874716idxx:PerpetualIntellectualPropertyLicenseMember2022-12-310000874716country:USidxx:PrivatelyOwnedSoftwareAndDataPlatformBusinessMember2024-01-012024-03-310000874716country:USidxx:PrivatelyOwnedSoftwareAndDataPlatformBusinessMember2024-03-310000874716country:USidxx:PrivatelyOwnedSoftwareAndDataPlatformBusinessMemberus-gaap:TechnologyBasedIntangibleAssetsMember2024-03-310000874716country:USidxx:PrivatelyOwnedSoftwareAndDataPlatformBusinessMemberus-gaap:CustomerRelationshipsMember2024-03-310000874716country:USidxx:PrivatelyOwnedSoftwareAndDataPlatformBusinessMemberus-gaap:NoncompeteAgreementsMember2024-03-310000874716country:USidxx:PrivatelyOwnedSoftwareAndDataPlatformBusinessMemberus-gaap:TrademarksMember2024-03-310000874716country:USidxx:PrivatelyOwnedSoftwareAndDataPlatformBusinessMemberus-gaap:OtherIntangibleAssetsMember2024-03-310000874716country:CAidxx:InternationalWaterTestingCompanyMember2022-07-012022-09-300000874716country:CAidxx:InternationalWaterTestingCompanyMember2022-09-300000874716country:CAidxx:InternationalWaterTestingCompanyMemberus-gaap:TechnologyBasedIntangibleAssetsMember2022-09-300000874716country:CAidxx:InternationalWaterTestingCompanyMemberus-gaap:CustomerRelationshipsMember2022-09-300000874716country:CAidxx:InternationalWaterTestingCompanyMemberus-gaap:OtherIntangibleAssetsMember2022-09-300000874716us-gaap:PerformanceSharesMember2024-01-012024-12-310000874716idxx:TwoThousandEighteenStockIncentivePlanMember2018-12-310000874716idxx:StockOptionsAndStockAppreciationRightsMember2018-01-012018-12-310000874716idxx:AwardsOtherThanStockOptionsAndStockAppreciationRightsMember2018-01-012018-12-310000874716idxx:TwoThousandEighteenStockIncentivePlanMember2024-12-310000874716us-gaap:CostOfSalesMember2024-01-012024-12-310000874716us-gaap:CostOfSalesMember2023-01-012023-12-310000874716us-gaap:CostOfSalesMember2022-01-012022-12-310000874716idxx:OperatingExpensesMember2024-01-012024-12-310000874716idxx:OperatingExpensesMember2023-01-012023-12-310000874716idxx:OperatingExpensesMember2022-01-012022-12-310000874716idxx:StockOptionsGrantedToEmployeesWithRatableVestingMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2019-01-012019-12-310000874716idxx:StockOptionsGrantedToEmployeesWithRatableVestingMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2019-01-012019-12-310000874716us-gaap:EmployeeStockOptionMember2019-01-012019-12-310000874716us-gaap:EmployeeStockOptionMember2024-01-012024-12-310000874716us-gaap:EmployeeStockOptionMember2023-01-012023-12-310000874716us-gaap:EmployeeStockOptionMember2022-01-012022-12-310000874716idxx:RestrictedStockUnitsGrantedToEmployeesWithRatableVestingMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2019-01-012019-12-310000874716idxx:RestrictedStockUnitsGrantedToEmployeesWithRatableVestingMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2019-01-012019-12-310000874716idxx:RestrictedStockUnitsGrantedToEmployeesWithRatableVestingMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2019-01-012019-12-310000874716us-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310000874716us-gaap:RestrictedStockUnitsRSUMember2023-12-310000874716us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-12-310000874716us-gaap:RestrictedStockUnitsRSUMember2024-12-310000874716us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310000874716us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310000874716us-gaap:PerformanceSharesMember2024-02-142024-02-140000874716us-gaap:PerformanceSharesMember2023-12-310000874716us-gaap:PerformanceSharesMember2024-12-310000874716us-gaap:PerformanceSharesMember2023-01-012023-12-310000874716us-gaap:PerformanceSharesMember2022-01-012022-12-3100008747162014-01-012014-12-310000874716idxx:DeferredStockUnitsMember2024-12-310000874716idxx:DeferredStockUnitsMember2023-12-310000874716idxx:DeferredStockUnitsMember2024-01-012024-12-310000874716idxx:NineteenNinetySevenEmployeeStockPurchasePlanMember2024-12-310000874716idxx:NineteenNinetySevenEmployeeStockPurchasePlanMember2024-01-012024-12-310000874716idxx:NineteenNinetySevenEmployeeStockPurchasePlanMember2023-01-012023-12-310000874716idxx:NineteenNinetySevenEmployeeStockPurchasePlanMember2022-01-012022-12-310000874716idxx:ReagentRentalArrangementsMember2024-01-012024-12-310000874716idxx:ReagentRentalArrangementsMember2023-01-012023-12-310000874716idxx:ReagentRentalArrangementsMember2022-01-012022-12-310000874716srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2024-12-310000874716srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2024-12-310000874716srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2024-12-310000874716srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2024-12-310000874716srt:MinimumMemberus-gaap:OfficeEquipmentMember2024-12-310000874716srt:MaximumMemberus-gaap:OfficeEquipmentMember2024-12-310000874716srt:MinimumMemberidxx:ComputerHardwareAndSoftwareMember2024-12-310000874716srt:MaximumMemberidxx:ComputerHardwareAndSoftwareMember2024-12-310000874716us-gaap:LandAndLandImprovementsMember2024-12-310000874716us-gaap:LandAndLandImprovementsMember2023-12-310000874716us-gaap:BuildingAndBuildingImprovementsMember2024-12-310000874716us-gaap:BuildingAndBuildingImprovementsMember2023-12-310000874716us-gaap:LeaseholdImprovementsMember2024-12-310000874716us-gaap:LeaseholdImprovementsMember2023-12-310000874716us-gaap:MachineryAndEquipmentMember2024-12-310000874716us-gaap:MachineryAndEquipmentMember2023-12-310000874716us-gaap:OfficeEquipmentMember2024-12-310000874716us-gaap:OfficeEquipmentMember2023-12-310000874716idxx:ComputerHardwareAndSoftwareMember2024-12-310000874716idxx:ComputerHardwareAndSoftwareMember2023-12-310000874716us-gaap:ConstructionInProgressMember2024-12-310000874716us-gaap:ConstructionInProgressMember2023-12-310000874716idxx:SoftwareDevelopedForInternalUseMember2024-01-012024-12-310000874716idxx:SoftwareDevelopedForInternalUseMember2023-01-012023-12-310000874716idxx:SoftwareDevelopedForInternalUseMember2022-01-012022-12-310000874716us-gaap:IntellectualPropertyMember2024-12-310000874716us-gaap:OperatingSegmentsMemberidxx:CompanionAnimalGroupSegmentMember2021-12-310000874716us-gaap:OperatingSegmentsMemberidxx:WaterSegmentMember2021-12-310000874716us-gaap:OperatingSegmentsMemberidxx:LivestockAndPoultryDiagnosticsSegmentMember2021-12-310000874716us-gaap:CorporateNonSegmentMember2021-12-310000874716us-gaap:OperatingSegmentsMemberidxx:CompanionAnimalGroupSegmentMember2022-12-310000874716us-gaap:OperatingSegmentsMemberidxx:WaterSegmentMember2022-12-310000874716us-gaap:OperatingSegmentsMemberidxx:LivestockAndPoultryDiagnosticsSegmentMember2022-12-310000874716us-gaap:CorporateNonSegmentMember2022-12-310000874716us-gaap:OperatingSegmentsMemberidxx:CompanionAnimalGroupSegmentMember2023-12-310000874716us-gaap:OperatingSegmentsMemberidxx:WaterSegmentMember2023-12-310000874716us-gaap:OperatingSegmentsMemberidxx:LivestockAndPoultryDiagnosticsSegmentMember2023-12-310000874716us-gaap:CorporateNonSegmentMember2023-12-310000874716us-gaap:OperatingSegmentsMemberidxx:CompanionAnimalGroupSegmentMember2024-12-310000874716us-gaap:OperatingSegmentsMemberidxx:WaterSegmentMember2024-12-310000874716us-gaap:OperatingSegmentsMemberidxx:LivestockAndPoultryDiagnosticsSegmentMember2024-12-310000874716us-gaap:CorporateNonSegmentMember2024-12-310000874716us-gaap:CustomerRelatedIntangibleAssetsMembersrt:MinimumMember2024-12-310000874716us-gaap:CustomerRelatedIntangibleAssetsMembersrt:MaximumMember2024-12-310000874716idxx:ProductRightsMembersrt:MinimumMember2024-12-310000874716idxx:ProductRightsMembersrt:MaximumMember2024-12-310000874716us-gaap:NoncompeteAgreementsMembersrt:MinimumMember2024-12-310000874716us-gaap:NoncompeteAgreementsMembersrt:MaximumMember2024-12-310000874716us-gaap:CustomerRelatedIntangibleAssetsMember2024-12-310000874716us-gaap:CustomerRelatedIntangibleAssetsMember2023-12-310000874716idxx:ProductRightsMember2024-12-310000874716idxx:ProductRightsMember2023-12-310000874716us-gaap:NoncompeteAgreementsMember2024-12-310000874716us-gaap:NoncompeteAgreementsMember2023-12-310000874716us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-10-202022-10-200000874716us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-10-200000874716us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2022-10-200000874716us-gaap:LineOfCreditMember2022-10-200000874716us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMemberus-gaap:PrimeRateMembersrt:MinimumMember2022-10-202022-10-200000874716us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMemberus-gaap:PrimeRateMembersrt:MaximumMember2022-10-202022-10-200000874716us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrMember2022-10-202022-10-200000874716us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrMembersrt:MinimumMember2022-10-202022-10-200000874716us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrMembersrt:MaximumMember2022-10-202022-10-200000874716us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMemberidxx:DailySecuredOvernightFinancingRateSOFRMember2022-10-202022-10-200000874716us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMemberidxx:DailySecuredOvernightFinancingRateSOFRMembersrt:MinimumMember2022-10-202022-10-200000874716us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMemberidxx:DailySecuredOvernightFinancingRateSOFRMembersrt:MaximumMember2022-10-202022-10-200000874716us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2023-03-310000874716srt:MinimumMemberidxx:RevolvingCreditFacilityIndividualBorrowingsMember2022-10-202022-10-200000874716srt:MaximumMemberidxx:RevolvingCreditFacilityIndividualBorrowingsMember2022-10-202022-10-200000874716us-gaap:RevolvingCreditFacilityMember2024-12-310000874716us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2024-12-310000874716us-gaap:RevolvingCreditFacilityMember2023-12-310000874716us-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2023-12-310000874716us-gaap:RevolvingCreditFacilityMember2024-01-012024-12-310000874716idxx:A2025SeriesBNotesMemberus-gaap:SeniorNotesMember2024-12-310000874716idxx:A2026SeniorNotesMemberus-gaap:SeniorNotesMember2024-12-310000874716idxx:A2025SeriesCNotesMemberus-gaap:SeniorNotesMember2024-12-310000874716idxx:Prudential2030SeriesDNotesMemberus-gaap:SeniorNotesMember2024-12-310000874716idxx:A2027SeriesBNotesMemberus-gaap:SeniorNotesMember2024-12-310000874716idxx:A2029SeriesCNotesMemberus-gaap:SeniorNotesMember2024-12-310000874716idxx:MetLife2030SeriesDNotesMemberus-gaap:SeniorNotesMember2024-12-310000874716idxx:A2023SeriesANotesAnd2025SeriesBNotesMemberus-gaap:SeniorNotesMember2013-12-310000874716idxx:A2023SeriesANotesMemberus-gaap:SeniorNotesMember2013-12-310000874716idxx:A2025SeriesBNotesMemberus-gaap:SeniorNotesMember2013-12-310000874716idxx:A2023SeriesANotesMemberus-gaap:SeniorNotesMember2023-12-012023-12-310000874716idxx:A2026SeniorNotesMemberus-gaap:SeniorNotesMember2014-09-300000874716idxx:NYLife2013NoteAgreementAndTheNYLife2014NoteAgreementMemberus-gaap:SeniorNotesMember2020-04-100000874716idxx:A2021SeriesANotesAnd2024SeriesBNotesMemberus-gaap:SeniorNotesMember2014-07-310000874716idxx:A2021SeriesANotesMemberus-gaap:SeniorNotesMember2014-07-310000874716idxx:A2024SeriesBNotesMemberus-gaap:SeniorNotesMember2014-07-310000874716idxx:A2021SeriesANotesMemberus-gaap:SeniorNotesMember2021-07-012021-07-310000874716idxx:A2024SeriesBNotesMemberus-gaap:SeniorNotesMember2024-07-012024-07-310000874716idxx:A2025SeriesCNotesMemberus-gaap:SeniorNotesMember2015-06-300000874716idxx:Prudential2030SeriesDNotesMemberus-gaap:SeniorNotesMember2020-04-100000874716idxx:Prudential2030SeriesDNotesMemberus-gaap:SeniorNotesMember2020-04-140000874716idxx:A2022SeriesANotesand2027SeriesBNotesMemberus-gaap:SeniorNotesMember2014-12-190000874716idxx:A2022SeriesANotesMemberus-gaap:SeniorNotesMember2014-12-190000874716idxx:A2022SeriesANotesMemberus-gaap:SeniorNotesMember2014-12-192014-12-190000874716idxx:A2027SeriesBNotesMemberus-gaap:SeniorNotesMember2014-12-190000874716idxx:A2027SeriesBNotesMemberus-gaap:SeniorNotesMember2014-12-192014-12-190000874716idxx:A2022SeriesANotesMemberus-gaap:SeniorNotesMember2022-02-012022-02-280000874716idxx:A2029SeriesCNotesMemberus-gaap:SeniorNotesMember2019-03-140000874716idxx:MetLife2030SeriesDNotesMemberus-gaap:SeniorNotesMember2020-03-220000874716idxx:MetLife2030SeriesDNotesMemberus-gaap:SeniorNotesMember2020-03-230000874716idxx:MetLife2030SeriesDNotesMemberus-gaap:SeniorNotesMember2020-04-020000874716us-gaap:SeniorNotesMember2024-01-012024-12-310000874716us-gaap:StateAndLocalJurisdictionMember2024-12-310000874716us-gaap:EmployeeStockOptionMember2024-01-012024-12-310000874716us-gaap:EmployeeStockOptionMember2023-01-012023-12-310000874716us-gaap:EmployeeStockOptionMember2022-01-012022-12-310000874716us-gaap:StockCompensationPlanMember2024-01-012024-12-310000874716us-gaap:StockCompensationPlanMember2023-01-012023-12-310000874716us-gaap:StockCompensationPlanMember2022-01-012022-12-3100008747162004-01-012020-06-3000008747162024-04-012024-06-300000874716us-gaap:OperatingSegmentsMember2024-01-012024-12-310000874716us-gaap:MaterialReconcilingItemsMember2024-01-012024-12-310000874716us-gaap:OperatingSegmentsMember2023-01-012023-12-310000874716us-gaap:MaterialReconcilingItemsMember2023-01-012023-12-310000874716us-gaap:OperatingSegmentsMember2022-01-012022-12-310000874716us-gaap:MaterialReconcilingItemsMember2022-01-012022-12-310000874716country:US2024-12-310000874716country:US2023-12-310000874716country:BR2024-12-310000874716country:BR2023-12-310000874716country:CA2024-12-310000874716country:CA2023-12-310000874716srt:AmericasMember2024-12-310000874716srt:AmericasMember2023-12-310000874716country:DE2024-12-310000874716country:DE2023-12-310000874716country:CH2024-12-310000874716country:CH2023-12-310000874716country:GB2024-12-310000874716country:GB2023-12-310000874716country:NL2024-12-310000874716country:NL2023-12-310000874716country:FR2024-12-310000874716country:FR2023-12-310000874716idxx:EuropetheMiddleEastandAfricaOtherMember2024-12-310000874716idxx:EuropetheMiddleEastandAfricaOtherMember2023-12-310000874716us-gaap:EMEAMember2024-12-310000874716us-gaap:EMEAMember2023-12-310000874716country:AU2024-12-310000874716country:AU2023-12-310000874716country:JP2024-12-310000874716country:JP2023-12-310000874716idxx:OtherAsiaPacificMember2024-12-310000874716idxx:OtherAsiaPacificMember2023-12-310000874716srt:AsiaPacificMember2024-12-310000874716srt:AsiaPacificMember2023-12-310000874716us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310000874716us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310000874716us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000874716us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000874716us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2024-12-310000874716us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2024-12-310000874716us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2024-12-310000874716us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2024-12-310000874716us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CrossCurrencyInterestRateContractMember2024-12-310000874716us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CrossCurrencyInterestRateContractMember2024-12-310000874716us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CrossCurrencyInterestRateContractMember2024-12-310000874716us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CrossCurrencyInterestRateContractMember2024-12-310000874716us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeContractMember2024-12-310000874716us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeContractMember2024-12-310000874716us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeContractMember2024-12-310000874716us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeContractMember2024-12-310000874716us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2024-12-310000874716us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2024-12-310000874716us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2024-12-310000874716us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2024-12-310000874716us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310000874716us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310000874716us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310000874716us-gaap:FairValueMeasurementsRecurringMember2024-12-310000874716us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310000874716us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310000874716us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310000874716us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310000874716us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberidxx:EquityMutualFundsMember2023-12-310000874716us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberidxx:EquityMutualFundsMember2023-12-310000874716us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberidxx:EquityMutualFundsMember2023-12-310000874716us-gaap:FairValueMeasurementsRecurringMemberidxx:EquityMutualFundsMember2023-12-310000874716us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CrossCurrencyInterestRateContractMember2023-12-310000874716us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CrossCurrencyInterestRateContractMember2023-12-310000874716us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CrossCurrencyInterestRateContractMember2023-12-310000874716us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CrossCurrencyInterestRateContractMember2023-12-310000874716us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeContractMember2023-12-310000874716us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeContractMember2023-12-310000874716us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeContractMember2023-12-310000874716us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeContractMember2023-12-310000874716us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2023-12-310000874716us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2023-12-310000874716us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2023-12-310000874716us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2023-12-310000874716us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberidxx:DeferredCompensationMember2023-12-310000874716us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberidxx:DeferredCompensationMember2023-12-310000874716us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberidxx:DeferredCompensationMember2023-12-310000874716us-gaap:FairValueMeasurementsRecurringMemberidxx:DeferredCompensationMember2023-12-310000874716srt:MaximumMemberus-gaap:MoneyMarketFundsMember2024-01-012024-12-310000874716us-gaap:InterestRateSwapMemberus-gaap:SecuredDebtMember2023-03-310000874716us-gaap:ForeignExchangeContractMember2024-01-012024-12-310000874716us-gaap:InterestRateSwapMember2024-01-012024-12-310000874716us-gaap:InterestRateSwapMember2023-03-310000874716us-gaap:ForeignExchangeContractMembersrt:MinimumMember2024-01-012024-12-310000874716us-gaap:ForeignExchangeContractMembersrt:MaximumMember2024-01-012024-12-310000874716us-gaap:ForeignExchangeContractMember2024-12-310000874716us-gaap:ForeignExchangeContractMember2023-12-310000874716us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-01-012024-12-310000874716us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-12-310000874716us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-12-310000874716us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-01-012024-12-310000874716us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-12-310000874716us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-12-310000874716idxx:SeriesCSeniorNoteMember2015-06-300000874716idxx:CrossCurrencyInterestRateContract1Memberus-gaap:DesignatedAsHedgingInstrumentMember2024-12-310000874716idxx:CrossCurrencyInterestRateContract1Memberus-gaap:DesignatedAsHedgingInstrumentMembersrt:ScenarioForecastMember2025-06-182025-06-180000874716idxx:CrossCurrencyInterestRateContract2Memberus-gaap:DesignatedAsHedgingInstrumentMember2024-12-310000874716idxx:CrossCurrencyInterestRateContract2Memberus-gaap:DesignatedAsHedgingInstrumentMembersrt:ScenarioForecastMember2028-03-312028-03-310000874716idxx:CrossCurrencyInterestRateContract3Memberus-gaap:DesignatedAsHedgingInstrumentMember2024-12-310000874716idxx:CrossCurrencyInterestRateContract3Memberus-gaap:DesignatedAsHedgingInstrumentMembersrt:ScenarioForecastMember2028-06-302028-06-300000874716idxx:CrossCurrencyInterestRateContract4Memberus-gaap:DesignatedAsHedgingInstrumentMember2024-12-310000874716idxx:CrossCurrencyInterestRateContract4Memberus-gaap:DesignatedAsHedgingInstrumentMembersrt:ScenarioForecastMember2029-06-292029-06-290000874716us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-06-300000874716us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-04-012023-06-300000874716us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentAssetsMember2024-12-310000874716us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentAssetsMember2023-12-310000874716us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentAssetsMember2024-12-310000874716us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentAssetsMember2023-12-310000874716us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentAssetsMember2024-12-310000874716us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentAssetsMember2023-12-310000874716us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentAssetsMember2024-12-310000874716us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentAssetsMember2023-12-310000874716us-gaap:DesignatedAsHedgingInstrumentMember2024-12-310000874716us-gaap:DesignatedAsHedgingInstrumentMember2023-12-310000874716us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMember2024-12-310000874716us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMember2023-12-310000874716us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentLiabilitiesMember2024-12-310000874716us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherNoncurrentLiabilitiesMember2023-12-310000874716us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-12-310000874716us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310000874716idxx:ForeignCurrencyBorrowingsDesignatedAsNetInvestmentHedgeOnBalanceSheetMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:LongTermDebtMember2024-12-310000874716idxx:ForeignCurrencyBorrowingsDesignatedAsNetInvestmentHedgeOnBalanceSheetMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:LongTermDebtMember2023-12-3100008747162024-12-030000874716us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-12-310000874716us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeContractMember2022-12-310000874716us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:InterestRateSwapMember2022-12-310000874716us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMemberidxx:SeriesCSeniorNoteMember2022-12-310000874716us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMemberus-gaap:CrossCurrencyInterestRateContractMember2022-12-310000874716us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310000874716idxx:AccumulatedCumulativeTranslationAdjustmentAttributableToParentMember2022-12-310000874716us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-01-012023-12-310000874716us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeContractMember2023-01-012023-12-310000874716us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:InterestRateSwapMember2023-01-012023-12-310000874716us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMemberidxx:SeriesCSeniorNoteMember2023-01-012023-12-310000874716us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMemberus-gaap:CrossCurrencyInterestRateContractMember2023-01-012023-12-310000874716us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310000874716idxx:AccumulatedCumulativeTranslationAdjustmentAttributableToParentMember2023-01-012023-12-310000874716us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-12-310000874716us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeContractMember2023-12-310000874716us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:InterestRateSwapMember2023-12-310000874716us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMemberidxx:SeriesCSeniorNoteMember2023-12-310000874716us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMemberus-gaap:CrossCurrencyInterestRateContractMember2023-12-310000874716us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310000874716idxx:AccumulatedCumulativeTranslationAdjustmentAttributableToParentMember2023-12-310000874716us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-01-012024-12-310000874716us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeContractMember2024-01-012024-12-310000874716us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:InterestRateSwapMember2024-01-012024-12-310000874716us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMemberidxx:SeriesCSeniorNoteMember2024-01-012024-12-310000874716us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMemberus-gaap:CrossCurrencyInterestRateContractMember2024-01-012024-12-310000874716us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-01-012024-12-310000874716idxx:AccumulatedCumulativeTranslationAdjustmentAttributableToParentMember2024-01-012024-12-310000874716us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-12-310000874716us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeContractMember2024-12-310000874716us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:InterestRateSwapMember2024-12-310000874716us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMemberidxx:SeriesCSeniorNoteMember2024-12-310000874716us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMemberus-gaap:CrossCurrencyInterestRateContractMember2024-12-310000874716us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-12-310000874716idxx:AccumulatedCumulativeTranslationAdjustmentAttributableToParentMember2024-12-310000874716us-gaap:ForeignExchangeContractMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310000874716us-gaap:ForeignExchangeContractMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000874716us-gaap:ForeignExchangeContractMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310000874716us-gaap:InterestRateSwapMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310000874716us-gaap:InterestRateSwapMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000874716us-gaap:InterestRateSwapMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310000874716us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310000874716us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000874716us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310000874716us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310000874716us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000874716us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Mark One) |

|

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________

COMMISSION FILE NUMBER: 0-19271

IDEXX LABORATORIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

| Delaware |

|

|

01-0393723 |

(State or other jurisdiction of incorporation

or organization) |

|

|

(IRS Employer Identification No.) |

|

|

|

|

| One IDEXX Drive |

Westbrook, |

Maine |

04092 |

| (Address of principal executive offices) |

|

|

(ZIP Code) |

207-556-0300

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.10 par value per share |

IDXX |

NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☒ |

Accelerated filer |

☐ |

Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

Based on the closing sale price on June 30, 2024, of the registrant’s Common Stock, the last business day of the registrant’s most recently completed second fiscal quarter, as reported by the NASDAQ Global Select Market, the aggregate market value of the voting stock held by non-affiliates of the registrant was $40,083,530,200. For these purposes, the registrant considers its directors and executive officers to be its only affiliates.

The number of shares outstanding of the registrant’s Common Stock was 81,328,233 on February 12, 2025.

DOCUMENTS INCORPORATED BY REFERENCE

Part III—Specifically identified portions of the Company’s definitive Proxy Statement to be filed in connection with the Company’s 2025 annual meeting of stockholders (the “2025 Annual Meeting”), to be held on May 7, 2025, are incorporated herein by reference.

GLOSSARY OF TERMS AND SELECTED ABBREVIATIONS

|

|

|

|

|

|

|

|

|

| Term/Abbreviation |

|

Definition |

|

|

|

AI |

|

Artificial intelligence |

| AOCI |

|

Accumulated other comprehensive income or loss |

| ASC |

|

Accounting Standards Codification |

| ASU |

|

Accounting Standards Update |

| CAG |

|

Companion Animal Group, a reporting segment that provides veterinarians diagnostic products and services and information management solutions that enhance the health and well-being of pets. |

| cGMP |

|

The FDA’s current Good Manufacturing Practice regulations. |

| Clinical visits |

|

The reason for the visit involves an interaction between a clinician and a pet. |

| Credit Facility |

|

Our $1.25 billion five-year unsecured credit facility under an amended and restated credit agreement; consisting of i) $1 billion revolving credit facility, also referred to as line of credit, and ii) $250 million three-year term loan. |

Customer commitment arrangements |

|

Customer contractual arrangements that provide customers incentives in exchange for multi-year commitments to purchase annual minimum amounts of products and services. |

| EPA |

|

U.S. Environmental Protection Agency |

| EPS |

|

Earnings per share, if not specifically stated, EPS refers to earnings per share on a diluted basis. |

| EU |

|

European Union |

| FASB |

|

U.S. Financial Accounting Standards Board |

| FDA |

|

U.S. Food and Drug Administration |

| IVLS |

|

IDEXX VetLab Station, connects and integrates the diagnostic information from all the IDEXX VetLab analyzers and thus provides reference laboratory information management system capability. |

| Kits and consumables |

|

Rapid assay kits and IDEXX VetLab consumables |

| LPD |

|

Livestock, Poultry and Dairy, a reporting segment that provides diagnostic products and services for livestock and poultry health and ensures the quality and safety of milk and improves producer efficiency. |

| OPTI Medical |

|

OPTI Medical Systems, Inc., a wholly-owned subsidiary of IDEXX Laboratories Inc., located in Roswell, Georgia. This business provides point-of-care and laboratory diagnostics (including electrolyte and blood gas analyzers and related consumable products) for the human medical diagnostics sector. The Roswell facility also manufactures electrolytes slides (instrument consumables) to run Catalyst One®, Catalyst Dx®, and blood gas analyzers and consumables for the veterinary market; also referred to as OPTI. |

| Organic revenue growth |

|

A non-GAAP financial measure that represents the percentage change in revenue, compared to the same period for the prior year, net of the effect of changes in foreign currency exchange rates, certain business acquisitions and divestitures. Organic revenue growth should be considered in addition to, and not as a replacement for or as a superior measure to, revenues reported in accordance with U.S. GAAP, and may not be comparable to similarly titled measures reported by other companies. |

| Ortho |

|

Ortho-Clinical Diagnostics, Inc., a subsidiary of QuidelOrtho Corporation, a supplier of dry slide consumables used in our Catalyst One and Catalyst Dx Chemistry Analyzers and VetTest Chemistry Analyzer. |

| Prime rate |

|

The prime rate is an interest rate determined by individual banks. It is often used as a reference rate for many types of loans. |

| PACS |

|

Picture archiving and communication software, our software solution for accessing, storing, and sharing diagnostic images. |

| PCR |

|

Polymerase chain reaction, a technique used to amplify small segments of DNA. |

| R&D |

|

Research and Development |

| Reagent rentals |

|

Instruments being placed at customer sites at little or no cost in exchange for a long-term customer commitment to purchase instrument consumables. |

| Reported revenue growth |

|

The percentage change in revenue reported in accordance with U.S. GAAP, compared to the same period in the prior year. |

| S&P |

|

Standard & Poor’s |

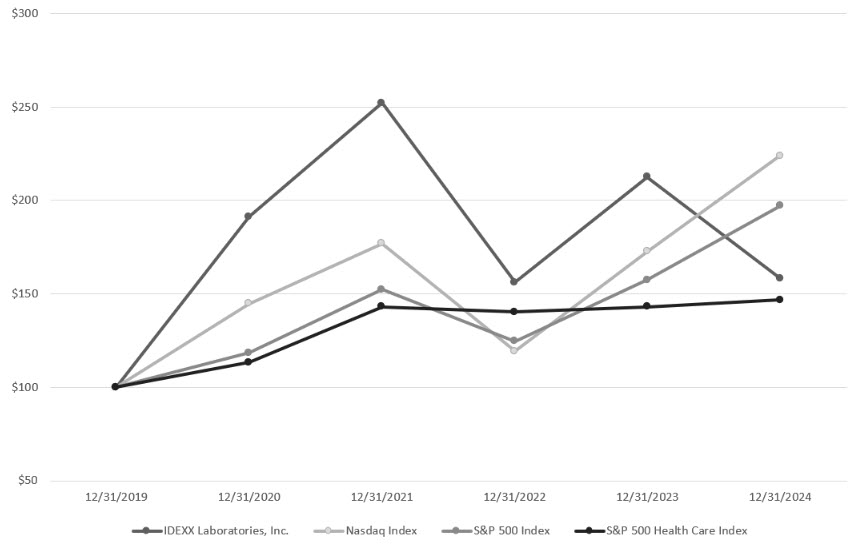

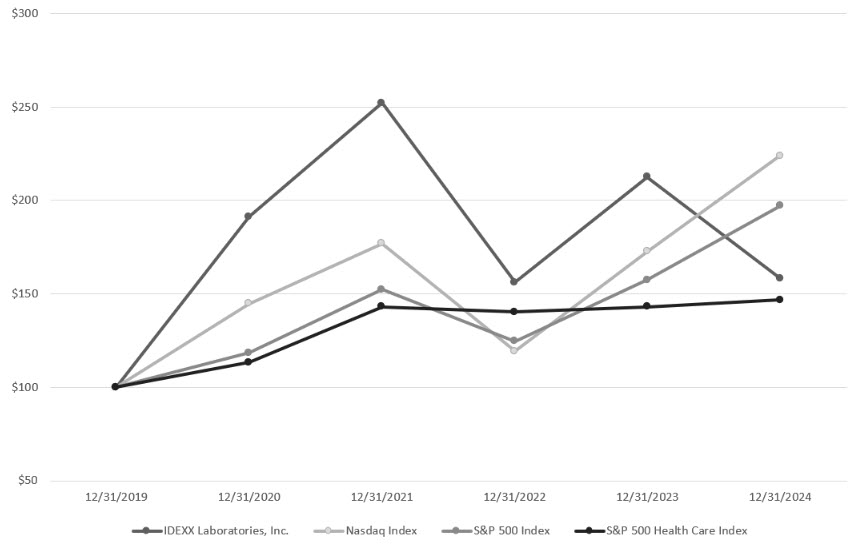

| S&P 500 Health Care Index |

|

The index for the S&P 500 Health Care (U.S. companies) measures the performance of companies that are classified as members in the Global Industry Classification Standard of health care services sub-industry. |

| S&P 500 Index |

|

The S&P 500 Index is a U.S. stock market index based on the market capitalization of 500 large companies having common stock listed on the New York Stock Exchange or NASDAQ, including IDEXX. |

|

|

|

|

|

|

|

|

|

| SaaS |

|

Software-as-a-service |

| SDMA |

|

Symmetrical dimethyl arginine, a biomarker that detects kidney disease. |

| SEC |

|

U.S. Securities and Exchange Commission |

| Senior Note Agreements |

|

Note purchase agreements for the private placement of senior notes, referred to as senior notes or long-term debt. |

| SOFR |

|

The secured overnight financing rate as administered by the Federal Reserve Board of New York (or a successor administrator of the secured overnight financing rate) |

| U.S. GAAP |

|

Accounting principles generally accepted in the United States of America |

| USDA |

|

U.S. Department of Agriculture |

| Water |

|

Water, a reporting segment that provides water microbiology testing products. |

IDEXX LABORATORIES, INC.

Annual Report on Form 10-K

Table of Contents

|

|

|

|

|

|

|

|

|

| Item No. |

|

Page No. |

|

|

|

|

PART I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART II |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART III |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART IV |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The terms “IDEXX,” “Company,” “registrant,” “we,” “us,” and “our” included in this Annual Report on Form 10-K mean IDEXX Laboratories, Inc. and all subsidiaries that are consolidated under U.S. GAAP.

We have included certain terms and abbreviations used throughout this Annual Report on Form 10-K in the "Glossary of Terms and Selected Abbreviations.”

Our name, logo and the following terms used in this Annual Report on Form 10-K are either registered trademarks or trademarks of IDEXX Laboratories, Inc. in the United States and/or other countries: 4Dx®, Alertys®, Animana®, Catalyst Dx®, Catalyst One®, Coag Dx™, Colilert®, Colisure®, Cornerstone®, Enterolert®, ezyVet®, Feline Triple®, Filta-Max®, Filta-Max xpress®, IDEXX DecisionIQ™, IDEXX inVue Dx™, IDEXX I-Vision CR®, IDEXX I-Vision DR®, IDEXX I-Vision Mobile™, IDEXX Neo®, IDEXX-PACS™, IDEXX SDMA®, IDEXX VetAutoread™, IDEXX VetLab®, IDEXX VetLab® UA™, IDEXX VetMedStat®, LaserCyte®, LaserCyte® Dx, OPTI®, Pet Health Network®, Petly® Plans, ProCyte Dx®, Pseudalert®, Quanti-Tray®, rVetLink®, SediVue Dx®, SNAP®, SNAPduo®, SNAP Pro®, SNAPshot Dx®, TECTA®, VetConnect®, VetLINK®, VetLyte®, Vet Radar®, VetStat®, and VetTest®. VetAutoread is a trademark of QBC Diagnostics.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K for the year ended December 31, 2024, contains statements which, to the extent they are not statements of historical fact, constitute “forward-looking statements.” Such forward-looking statements about our business and expectations within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), include statements relating to, among other things, global trends in companion animal healthcare and demand for our products and services; our expectations regarding supply chain and logistics challenges; our expectations regarding the labor supply; future revenue growth rates; future tax benefits; the impact of tax legislation and regulatory action; revenue recognition timing and amounts; business trends, earnings and other measures of financial performance; the effect of economic downturns and inflation on our business performance; tariffs; the projected effect of patent and license expirations; the projected impact of foreign currency exchange rates and hedging activities; realizability of assets; future cash flow and uses of cash; future repurchases of common stock; future levels of indebtedness and capital spending; the working capital and liquidity outlook; interest expense; warranty expense; share-based compensation expense; the adoption and projected impact of new accounting standards; critical accounting estimates; deductibility of goodwill; future commercial and operational efforts; future incorporation of artificial intelligence into our products, services and business processes; future product launches; projected cost and completion of capital investments; and competition. Forward-looking statements can be identified by the use of words such as “expects,” “may,” “anticipates,” “intends,” “would,” “will,” “plans,” “believes,” “estimates,” “should,” “project,” and similar words and expressions. These forward-looking statements are intended to provide our current expectations or forecasts of future events, are based on current estimates, projections, beliefs, and assumptions, and are not guarantees of future performance. Actual events or results may differ materially from those described in the forward-looking statements. These forward-looking statements involve a number of risks and uncertainties, including, among other things, the matters described under the headings “Business,” “Risk Factors,” “Legal Proceedings,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Quantitative and Qualitative Disclosures About Market Risk” in this Annual Report on Form 10-K. Any forward-looking statements represent our estimates only as of the day this Annual Report on Form 10-K was first filed with the Securities and Exchange Commission (“SEC”) and should not be relied upon as representing our estimates as of any subsequent date. From time to time, oral or written forward-looking statements may also be included in other materials released to the public and they are subject to the risks and uncertainties described or cross-referenced in this section. While we may elect to update forward-looking statements at some point in the future, we specifically disclaim any obligation to do so, even if our estimates or expectations change.

PART I

ITEM 1. BUSINESS

COMPANY OVERVIEW

IDEXX was incorporated in Delaware in 1983. We develop, manufacture, and distribute products and provide services primarily for the companion animal veterinary, livestock and poultry, dairy and water testing industries. We also provide human medical point-of-care and laboratory diagnostics. Our primary products and services are:

•Point-of-care veterinary diagnostic products, comprised of instruments, consumables, and rapid assay test kits;

•Veterinary reference laboratory diagnostic and consulting services;

•Practice management and diagnostic imaging systems and services used by veterinarians;

•Health monitoring, biological materials testing, laboratory diagnostic instruments, and services used by the biomedical research community;

•Diagnostic and health-monitoring products for livestock, poultry, and dairy;

•Products that test water for certain microbiological contaminants; and

•Point-of-care electrolytes and blood gas analyzers.

Our Purpose is to be a great company that creates exceptional long-term value for our customers, employees, and stockholders by enhancing the health and well-being of pets, people, and livestock.

DESCRIPTION OF BUSINESS BY SEGMENT

We operate primarily through three business segments: Companion Animal Group, Water quality products, and Livestock, Poultry and Dairy. Our Other operating segment combines and presents our human medical diagnostic products business with our out-licensing arrangements because they do not meet the quantitative or qualitative thresholds for reportable segments.

Companion Animal Group (“CAG”) - Diagnostic and information management-based products and services for the companion animal veterinary industry, including in-clinic diagnostic solutions, outside reference laboratory services, and veterinary software and services.

CAG Diagnostics

We provide diagnostic capabilities that meet veterinarians’ diverse needs through a variety of modalities, including in-clinic diagnostic solutions and outside reference laboratory services. Regardless of modality utilized, veterinarians are provided with clinically relevant data which is integrated within our information management technologies. The result is a comprehensive view of patient diagnostic information that is easily accessible by both the veterinarian and pet owner.

In-Clinic Diagnostic Solutions. Our in-clinic diagnostic solutions are comprised of our IDEXX VetLab suite of in-clinic chemistry, hematology, immunoassay, electrolyte, urinalysis, cytology, blood gas, and coagulation analyzers, as well as associated consumable products that provide real-time reference lab quality diagnostic results. Several of these in-clinic analyzers, including the Catalyst One Chemistry analyzer, ProCyte One hematology analyzer, SediVue Dx Analyzer, and IDEXX inVue Dx Cellular Analyzer, utilize proprietary artificial intelligence (“AI”) capabilities in their image capture systems to analyze samples. IDEXX in-clinic analyzers feature load-and-go sample handling and integration with a cloud-enabled software ecosystem, including the IDEXX VetLab Station and VetConnect PLUS. Our in-clinic diagnostic solutions also include a broad range of single-use, IDEXX SNAP rapid assay test kits that provide quick, accurate, and convenient point-of-care diagnostic test results for a variety of companion animal disease-causing pathogens and health conditions. Additionally, we offer extended maintenance agreements in connection with the sale of our instruments.

Blood and Urine Chemistry. Our blood and urine chemistry analyzers are used by veterinarians to measure levels of certain enzymes and other substances in blood or urine for monitoring health status and assisting in diagnosing physiologic conditions. We actively sell the Catalyst One Chemistry Analyzer and continue to support the Catalyst Dx Analyzer, both of which perform chemistry, immunoassay, and electrolyte tests. We also support the VetStat Electrolyte and Blood Gas analyzer.

Sales of consumables to customers who use our chemistry analyzers provide the majority of our instrument consumables revenues from our installed base of IDEXX VetLab instruments.

Hematology. Our hematology analyzers assess the cellular components of blood, including red blood cells, white blood cells, and platelets (also called a complete blood count). These analyzers include the ProCyte One and ProCyte Dx hematology analyzers. We also sell the Coag Dx Analyzer, which permits the detection and diagnosis of blood clotting disorders. We continue to offer consumables to support analyzers that are not actively marketed including the LaserCyte Dx Hematology Analyzer.

Urinalysis. The SediVue Dx Analyzer provides a complete urine sediment analysis. This platform features proprietary AI capabilities. The IDEXX VetLab UA Analyzer provides rapid, automated capture of semi-quantitative chemical urinalysis from IDEXX UA strips and is validated specifically for veterinary use.

Cytology. During the fourth quarter of 2024, we launched in North America our new cellular analyzer, IDEXX inVue Dx, which detects the most common cytologic changes found in blood. The IDEXX inVue Dx Cellular Analyzer uses advanced optics and AI technology in a slide-free, load-and-go platform.

Rapid Assay. The SNAP rapid assays are single-use, handheld test kits that can work without the use of instrumentation, although many kits may also be activated with results automatically captured and interpreted by the SNAP Pro Analyzer. This device improves medical care by allowing veterinarians to share the test results with the pet owner on the SNAP Pro Analyzer screen, or via VetConnect PLUS. The principal canine SNAP rapid assay tests include SNAP 4Dx Plus, which tests for the seven vector-borne diseases causing pathogens, including Lyme disease as well as canine heartworm, and SNAP Heartworm RT, which tests for heartworm. Sales of our canine vector-borne disease tests are typically greater in the first half of our fiscal year due to seasonality of disease testing in the veterinary practices in the Northern Hemisphere. The principal feline SNAP rapid assay tests include SNAP Feline Triple, which tests for feline immunodeficiency virus (“FIV”) (which is similar to the virus that leads to AIDS in humans), feline leukemia virus (“FeLV”) and heartworm, and SNAP FIV/FeLV Combo Test, which tests for FIV and FeLV.

IDEXX VetLab Station. The IDEXX VetLab Station (“IVLS”) connects and integrates the diagnostic information from all the IDEXX VetLab analyzers, and thus provides reference laboratory information management system capability. IVLS also sends all results created on connected instruments instantly to VetConnect PLUS. We sell IVLS as an integral component for our in-clinic analyzer suite. In 2024, we upgraded our IVLS to work easier and faster than our previous version, providing two times faster performance on common workflows and access to historical results five times faster.

Integrated Diagnostic Information Management. VetConnect PLUS is a cloud-based technology that enables veterinarians to access and analyze patients’ data from all of IDEXX’s diagnostic modalities. These integrated diagnostic results provide the veterinarian with a visualization of patient-specific information, allowing the veterinarian to easily see and trend diagnostic results, enabling greater medical insight and enhanced decision-making through IDEXX DecisionIQ, an analytical tool incorporated in VetConnect PLUS that utilizes proprietary technology, including AI, to aid practitioners in making medical diagnoses. In addition, VetConnect PLUS provides instant mobile or browser-based access to results, which can be printed or emailed to pet owners and other veterinarians.

Reference Laboratory Diagnostic and Consulting Services. We offer commercial reference laboratory diagnostic and consulting services to veterinarians in many developed geographies worldwide, including customers in the U.S., Europe, Canada, Australia, Japan, New Zealand, South Africa, and South Korea, through a network of approximately 80 laboratories. Customers use our services by submitting samples by courier or overnight delivery to one of our facilities. Most test results have same-day or next-day turnaround times. Our diagnostic laboratory business also provides health monitoring and diagnostic testing services to biomedical research customers in North America, Europe, and Asia.

Our reference laboratories offer a large selection of tests and diagnostic panels to detect a number of disease states and other conditions in animals, including all tests that can be run in-clinic at the veterinary practice with our instruments or rapid assays. This menu of tests also includes a number of specialized tests that we have developed that allow practitioners to diagnose increasingly relevant diseases and conditions in dogs and cats, including parasites, heart disease, allergies, pancreatitis, diabetes, renal disease, and infectious diseases. We also offer cancer screening to aid in diagnosis, assist in therapy selection, and support therapy management and monitoring.

IDEXX Telemedicine. Additionally, we provide specialized veterinary consultation, telemedicine, and advisory services, including radiology, dental radiography, cardiology, internal medicine, and ultrasound consulting. These services enable veterinarians to obtain diagnostic interpretations, and radiology and cardiology assessments. IDEXX Telemedicine services are accessed through IDEXX VetMedStat, a cloud-based software platform for case submission and interpretation that embeds proprietary AI capabilities aiding analysis of images and electrocardiogram results.

Veterinary Software and Services & Diagnostic Imaging Systems

Veterinary Software and Services. We develop, market, and sell a portfolio of software and services for independent veterinary clinics and corporate groups. This portfolio includes:

Practice management systems. We provide software, hardware, and integrated services that run key functions of veterinary clinics, including managing patient electronic health records, scheduling, client communication, billing, and inventory management. Our practice management systems offerings include cloud-based ezyVet, Animana, and IDEXX Neo, and on-premises Cornerstone. To support the software system needs of practices, IDEXX provides integrated services including Payment Solutions, Data Backup & Recovery, and Practice Supplies.

Third-party integrations strengthen our practice management systems value proposition by improving user workflows and can quickly add new functionality to the practice management systems. Our commercial application programming interfaces and partner management processes allow controlled access to the practice management systems platform while providing an enhanced user experience. Our large practice management systems installed base provides access to veterinary channel transaction activity, enabling a syndicated data offering. Industry pharmaceutical and nutrition partners leverage our data to understand channel market performance and to provide behavioral insights.

Software applications that extend workflow capabilities for practices and groups. We are able to improve overall patient management and workflow optimization through coordination and tracking of every step of a patient during a hospital stay. Our SmartFlow cloud offering works in conjunction with major veterinary practice management systems, including ezyVet, Cornerstone, Animana, IDEXX Neo, and certain third-party practice management systems, and VetRadar provides workflow capability for ezyVet.

Client marketing and wellness plan management. In addition, we offer cloud-based client communication (Pet Health Network Pro, Pet Health Network 3D, and Vello) and preventive care plan management software (Petly Plans) designed to strengthen the relationship between the veterinarian and the pet owner. To support the communication needs between general practices and specialty referral practices, IDEXX offers rVetLink software. Lastly, IDEXX Enterprise provides centralized management and reporting capabilities for groups of veterinary practices.

Diagnostic Imaging Systems. Our diagnostic imaging systems capture radiographic images in digital form, replacing traditional x-ray film and the film development process, which generally requires the use of hazardous chemicals and darkrooms. We market and sell two diagnostic imaging systems primarily used in small animal veterinary applications: IDEXX ImageVue DR50 and IDEXX ImageVue DR30.

Our diagnostic imaging systems employ picture archiving and communication system (“PACS”) software called IDEXX-PACS, which facilitates radiographic image capture and review. IDEXX Web PACS is our cloud-based software-as-a-service (“SaaS”) offering for viewing, accessing, storing, and sharing multi-modality diagnostic images. IDEXX Web PACS is integrated with Cornerstone, ezyVet, IDEXX Neo, and IDEXX VetConnect PLUS to provide centralized access to diagnostic imaging results alongside patient diagnostic results from any internet-connected device. IDEXX Web PACS uses proprietary AI capabilities to enable optimal sharing, analysis, and storage of diagnostic images.

We believe that the breadth of our full diagnostic solution, including novel products and services developed and made available only by IDEXX, as well as the seamless software integration of our offering, provide a differentiated competitive advantage by giving veterinarians the tools and services to offer advanced veterinary medical care. We believe that with the use of our products and services, veterinary practices significantly improve the quality of veterinary care provided to their patients, increase staff efficiencies, and better communicate the value of this medical care to the pet owner. We believe that these capabilities, enabled by the use of IDEXX products and services, improve the effectiveness and financial health of the veterinary practice.

Water quality products (“Water”) - Water provides innovative testing solutions for easy, rapid, and accurate detection and quantification of various microbiological parameters in water.

Water testing. Our principal products are the Colilert, Colilert-18, and Colisure tests, which detect the presence of total coliforms and E. coli in water. These organisms are broadly used as microbial indicators for potential fecal contamination in water. Our products utilize nutrient-indicators that produce a change in color or fluorescence when metabolized by target microbes in the sample. Our water tests are used by government laboratories, water utilities, and private certified laboratories to test drinking water in compliance with regulatory standards, including U.S. Environmental Protection Agency (“EPA”) standards. The tests also are used in evaluating water used in production processes (for example, in beverage and pharmaceutical applications) and in evaluating bottled water, recreational water, wastewater, and water from private wells. We also sell consumables, parts, and accessories to be used with many of our water testing products. IDEXX also offers the following products:

Enterolert. Our Enterolert products detect the presence of enterococci in drinking, waste, and recreational waters. Enterococci, bacteria normally found in human and animal waste, are organisms broadly used as microbial indicators for potential fecal contamination in water.

Pseudalert. Our Pseudalert products detect the presence of Pseudomonas aeruginosa in pool, spa, and bottled water. Pseudomonas aeruginosa is a pathogen that can cause “hot-tub rash,” “swimmer’s ear,” and potentially fatal infections in individuals with weakened immune systems.

Filta-Max and Filta-Max xpress. Our Filta-Max and Filta-Max xpress products are used in the detection of Cryptosporidium and Giardia in water. Cryptosporidium and Giardia are parasites that can cause potentially fatal gastrointestinal illness if ingested. We also distribute certain water testing kits manufactured by Thermo Fisher Scientific, Inc. that complement our Cryptosporidium and Giardia testing products.

Legiolert. Our Legiolert product is a simple culture method test for the detection of Legionella pneumophila, the most common Legionella species in water and the primary cause of Legionnaires’ disease. The Legiolert test is designed to be used on potable or non-potable water sources with results in seven days.