|

Federally chartered instrumentality

of the United States

|

001-14951 | 52-1578738 | ||||||||||||

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer Identification No.) | ||||||||||||

| 2100 Pennsylvania Avenue, N.W., Suite 450N, | 20037 | |||||||||||||

| Washington, | DC | |||||||||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||||||||

| Title of each class | Trading symbol | Exchange on which registered | ||||||||||||

| Class A voting common stock | AGM.A | New York Stock Exchange | ||||||||||||

| Class C non-voting common stock | AGM | New York Stock Exchange | ||||||||||||

| 5.700% Non-Cumulative Preferred Stock, Series D | AGM.PRD | New York Stock Exchange | ||||||||||||

| 5.750% Non-Cumulative Preferred Stock, Series E | AGM.PRE | New York Stock Exchange | ||||||||||||

| 5.250% Non-Cumulative Preferred Stock, Series F | AGM.PRF | New York Stock Exchange | ||||||||||||

| 4.875% Non-Cumulative Preferred Stock, Series G | AGM.PRG | New York Stock Exchange | ||||||||||||

| 6.500% Non-Cumulative Preferred Stock, Series H | AGM.PRH | New York Stock Exchange | ||||||||||||

| $ in thousands, except per share amounts | Quarter Ended | ||||||||||||||||

| September 30, 2025 | June 30, 2025 |

September 30, 2024 | Sequential % Change |

YoY % Change |

|||||||||||||

| Net Change in Business Volume |

$531,903 | $831,916 | $(290,036) | N/A | N/A | ||||||||||||

| Net Interest Income (GAAP) | $98,477 | $96,797 | $86,791 | 2% | 13% | ||||||||||||

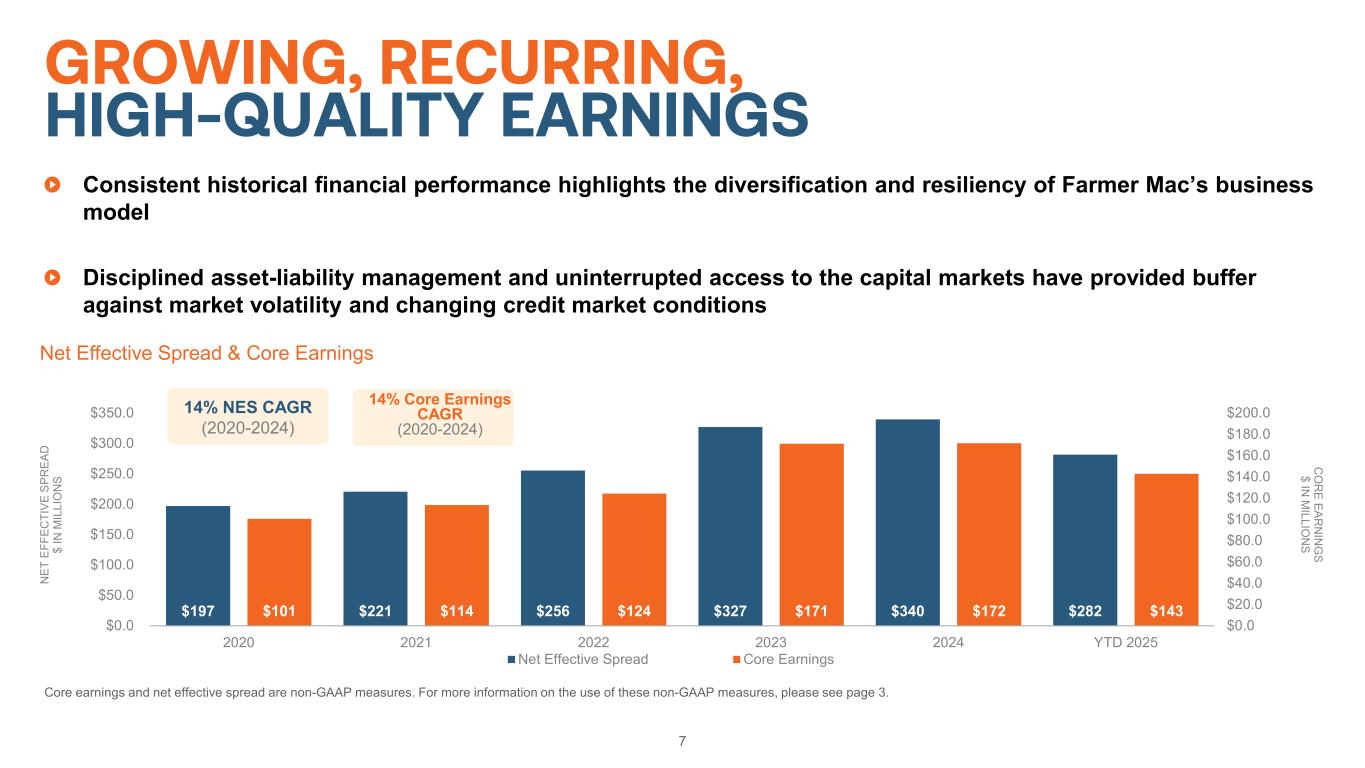

| Net Effective Spread (Non-GAAP) |

$97,769 | $93,893 | $85,396 | 4% | 14% | ||||||||||||

| Diluted EPS (GAAP) | $4.44 | $4.48 | $3.86 | (1)% | 15% | ||||||||||||

| Diluted Core EPS (Non-GAAP) | $4.52 | $4.32 | $4.10 | 5% | 10% | ||||||||||||

| As of | |||||||||||

| September 30, 2025 | December 31, 2024 | ||||||||||

| (in thousands) | |||||||||||

| Assets: | |||||||||||

| Cash and cash equivalents (includes restricted cash of $16,579 and $16,190, respectively) | $ | 901,023 | $ | 1,024,007 | |||||||

| Investment securities: | |||||||||||

| Available-for-sale, at fair value (amortized cost of $6,714,777 and $6,105,116, respectively) | 6,655,946 | 5,953,014 | |||||||||

| Held-to-maturity, at amortized cost | 8,815 | 9,270 | |||||||||

| Other investments | 14,343 | 11,017 | |||||||||

| Total Investment Securities | 6,679,104 | 5,973,301 | |||||||||

| Farmer Mac Guaranteed Securities: | |||||||||||

| Available-for-sale, at fair value (amortized cost of $6,042,789 and $5,835,658, respectively) | 5,854,098 | 5,514,546 | |||||||||

| Held-to-maturity, at amortized cost | 1,692,601 | 2,717,688 | |||||||||

| Total Farmer Mac Guaranteed Securities | 7,546,699 | 8,232,234 | |||||||||

| USDA Securities: | |||||||||||

| Trading, at fair value | 456 | 818 | |||||||||

| Held-to-maturity, at amortized cost | 2,389,180 | 2,370,534 | |||||||||

| Total USDA Securities | 2,389,636 | 2,371,352 | |||||||||

| Loans: | |||||||||||

| Loans held for sale, at lower of cost or fair value | — | 6,170 | |||||||||

| Loans held for investment, at amortized cost | 13,192,117 | 11,183,408 | |||||||||

| Loans held for investment in consolidated trusts, at amortized cost | 2,205,213 | 2,038,283 | |||||||||

| Allowance for losses | (35,340) | (23,223) | |||||||||

| Total loans, net of allowance | 15,361,990 | 13,204,638 | |||||||||

| Financial derivatives, at fair value | 32,667 | 27,789 | |||||||||

| Accrued interest receivable (includes $22,373 and $28,563, respectively, related to consolidated trusts) | 284,786 | 310,592 | |||||||||

| Guarantee and commitment fees receivable | 50,775 | 50,499 | |||||||||

| Deferred tax asset, net | 3,225 | 1,544 | |||||||||

| Prepaid expenses and other assets | 129,655 | 128,786 | |||||||||

| Total Assets | $ | 33,379,560 | $ | 31,324,742 | |||||||

| Liabilities and Equity: | |||||||||||

| Liabilities: | |||||||||||

| Notes payable | $ | 29,196,780 | $ | 27,371,174 | |||||||

| Debt securities of consolidated trusts held by third parties | 2,089,042 | 1,929,628 | |||||||||

| Financial derivatives, at fair value | 29,161 | 77,326 | |||||||||

| Accrued interest payable (includes $11,945 and $12,387, respectively, related to consolidated trusts) | 238,582 | 195,113 | |||||||||

| Guarantee and commitment obligation | 48,426 | 48,326 | |||||||||

| Accounts payable and accrued expenses | 88,910 | 212,527 | |||||||||

| Reserve for losses | 1,576 | 1,622 | |||||||||

| Total Liabilities | 31,692,477 | 29,835,716 | |||||||||

| Commitments and Contingencies | |||||||||||

| Equity: | |||||||||||

| Preferred stock: | |||||||||||

| Series D, par value $25 per share, 4,000,000 shares authorized, issued and outstanding | 96,659 | 96,659 | |||||||||

Series E, par value $25 per share, 3,180,000 shares authorized, issued and outstanding |

77,003 | 77,003 | |||||||||

| Series F, par value $25 per share, 4,800,000 shares authorized, issued and outstanding | 116,160 | 116,160 | |||||||||

| Series G, par value $25 per share, 5,000,000 shares authorized, issued and outstanding | 121,327 | 121,327 | |||||||||

Series H, par value $25 per share, 4,000,000 shares authorized, issued and outstanding |

96,889 | — | |||||||||

| Common stock: | |||||||||||

| Class A Voting, $1 par value, no maximum authorization, 1,030,780 shares outstanding | 1,031 | 1,031 | |||||||||

| Class B Voting, $1 par value, no maximum authorization, 500,301 shares outstanding | 500 | 500 | |||||||||

Class C Non-Voting, $1 par value, no maximum authorization, 9,403,453 shares and 9,360,083 shares outstanding, respectively |

9,403 | 9,360 | |||||||||

| Additional paid-in capital | 137,602 | 135,894 | |||||||||

| Accumulated other comprehensive loss, net of tax | (5,431) | (12,147) | |||||||||

| Retained earnings | 1,035,940 | 943,239 | |||||||||

| Total Equity | 1,687,083 | 1,489,026 | |||||||||

| Total Liabilities and Equity | $ | 33,379,560 | $ | 31,324,742 | |||||||

| For the Three Months Ended | For the Nine Months Ended | ||||||||||||||||||||||

| September 30, 2025 | September 30, 2024 | September 30, 2025 | September 30, 2024 | ||||||||||||||||||||

| (in thousands, except per share amounts) | |||||||||||||||||||||||

| Interest income: | |||||||||||||||||||||||

| Investments and cash equivalents | $ | 93,398 | $ | 88,879 | $ | 265,691 | $ | 258,341 | |||||||||||||||

| Farmer Mac Guaranteed Securities and USDA Securities | 123,484 | 156,602 | 374,824 | 489,478 | |||||||||||||||||||

| Loans | 198,459 | 162,247 | 555,262 | 459,932 | |||||||||||||||||||

| Total interest income | 415,341 | 407,728 | 1,195,777 | 1,207,751 | |||||||||||||||||||

| Total interest expense | 316,864 | 320,937 | 909,564 | 947,252 | |||||||||||||||||||

| Net interest income | 98,477 | 86,791 | 286,213 | 260,499 | |||||||||||||||||||

| Provision for losses | (7,477) | (3,428) | (16,874) | (7,806) | |||||||||||||||||||

| Net interest income after provision for losses | 91,000 | 83,363 | 269,339 | 252,693 | |||||||||||||||||||

| Non-interest income/(expense): | |||||||||||||||||||||||

| Guarantee and commitment fees | 5,021 | 4,015 | 14,316 | 11,729 | |||||||||||||||||||

| Losses on financial derivatives | (1,062) | (1,934) | (3,618) | (1,654) | |||||||||||||||||||

| Losses on sale of mortgage loans | — | — | — | (1,147) | |||||||||||||||||||

| Gains on sale of available-for-sale investment securities | — | — | — | 1,052 | |||||||||||||||||||

| Release of reserve for losses | 44 | 170 | 46 | 188 | |||||||||||||||||||

| Other income | 1,482 | 1,222 | 3,958 | 3,145 | |||||||||||||||||||

| Non-interest income | 5,485 | 3,473 | 14,702 | 13,313 | |||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

| Compensation and employee benefits | 17,743 | 15,237 | 53,126 | 48,334 | |||||||||||||||||||

| General and administrative | 11,052 | 8,625 | 32,669 | 25,784 | |||||||||||||||||||

| Regulatory fees | 1,000 | 725 | 3,000 | 2,175 | |||||||||||||||||||

| Operating expenses | 29,795 | 24,587 | 88,795 | 76,293 | |||||||||||||||||||

| Income before income taxes | 66,690 | 62,249 | 195,246 | 189,713 | |||||||||||||||||||

| Income tax expense | 11,687 | 12,421 | 35,755 | 39,034 | |||||||||||||||||||

| Net income | 55,003 | 49,828 | 159,491 | 150,679 | |||||||||||||||||||

| Preferred stock dividends | (6,303) | (5,897) | (17,636) | (19,480) | |||||||||||||||||||

| Loss on retirement of preferred stock | — | (1,619) | — | (1,619) | |||||||||||||||||||

| Net income attributable to common stockholders | $ | 48,700 | $ | 42,312 | $ | 141,855 | $ | 129,580 | |||||||||||||||

| Earnings per common share: | |||||||||||||||||||||||

| Basic earnings per common share | $ | 4.45 | $ | 3.89 | $ | 12.99 | $ | 11.93 | |||||||||||||||

| Diluted earnings per common share | $ | 4.44 | $ | 3.86 | $ | 12.93 | $ | 11.82 | |||||||||||||||

| Reconciliation of Net Income Attributable to Common Stockholders to Core Earnings | |||||||||||||||||

| For the Three Months Ended | |||||||||||||||||

| September 30, 2025 | June 30, 2025 | September 30, 2024 | |||||||||||||||

| (in thousands, except per share amounts) | |||||||||||||||||

| Net income attributable to common stockholders | $ | 48,700 | $ | 49,170 | $ | 42,312 | |||||||||||

| Less reconciling items: | |||||||||||||||||

| Gains/(losses) on undesignated financial derivatives due to fair value changes | 882 | (639) | (1,064) | ||||||||||||||

| (Losses)/gains on hedging activities due to fair value changes | (137) | 2,709 | 205 | ||||||||||||||

| Unrealized (losses)/gains on trading assets | (4) | (65) | 99 | ||||||||||||||

| Net effects of amortization of premiums/discounts and deferred gains on assets consolidated at fair value | 26 | 25 | 27 | ||||||||||||||

| Net effects of terminations or net settlements on financial derivatives | (1,934) | 255 | (503) | ||||||||||||||

| Issuance costs on the retirement of preferred stock | — | — | (1,619) | ||||||||||||||

| Income tax effect related to reconciling items | 245 | (480) | 260 | ||||||||||||||

| Sub-total | (922) | 1,805 | (2,595) | ||||||||||||||

| Core earnings | $ | 49,622 | $ | 47,365 | $ | 44,907 | |||||||||||

| Composition of Core Earnings: | |||||||||||||||||

| Revenues: | |||||||||||||||||

Net effective spread(1) |

$ | 97,769 | $ | 93,893 | $ | 85,396 | |||||||||||

Guarantee and commitment fees(2) |

6,132 | 5,874 | 4,997 | ||||||||||||||

Other(3) |

1,185 | 742 | 1,133 | ||||||||||||||

| Total revenues | 105,086 | 100,509 | 91,526 | ||||||||||||||

| Credit related expense/(income) (GAAP): | |||||||||||||||||

| Provision for losses | 7,433 | 7,812 | 3,258 | ||||||||||||||

| REO operating expenses | — | 148 | 196 | ||||||||||||||

| Gain on sale of REO | — | (87) | — | ||||||||||||||

| Total credit related expense/(income) | 7,433 | 7,873 | 3,454 | ||||||||||||||

| Operating expenses (GAAP): | |||||||||||||||||

| Compensation and employee benefits | 17,743 | 17,631 | 15,237 | ||||||||||||||

| General and administrative | 11,052 | 10,859 | 8,625 | ||||||||||||||

| Regulatory fees | 1,000 | 1,000 | 725 | ||||||||||||||

| Total operating expenses | 29,795 | 29,490 | 24,587 | ||||||||||||||

| Net earnings | 67,858 | 63,146 | 63,485 | ||||||||||||||

Income tax expense(4) |

11,933 | 10,114 | 12,681 | ||||||||||||||

| Preferred stock dividends (GAAP) | 6,303 | 5,667 | 5,897 | ||||||||||||||

| Core earnings | $ | 49,622 | $ | 47,365 | $ | 44,907 | |||||||||||

| Core earnings per share: | |||||||||||||||||

| Basic | $ | 4.54 | $ | 4.33 | $ | 4.13 | |||||||||||

| Diluted | $ | 4.52 | $ | 4.32 | $ | 4.10 | |||||||||||

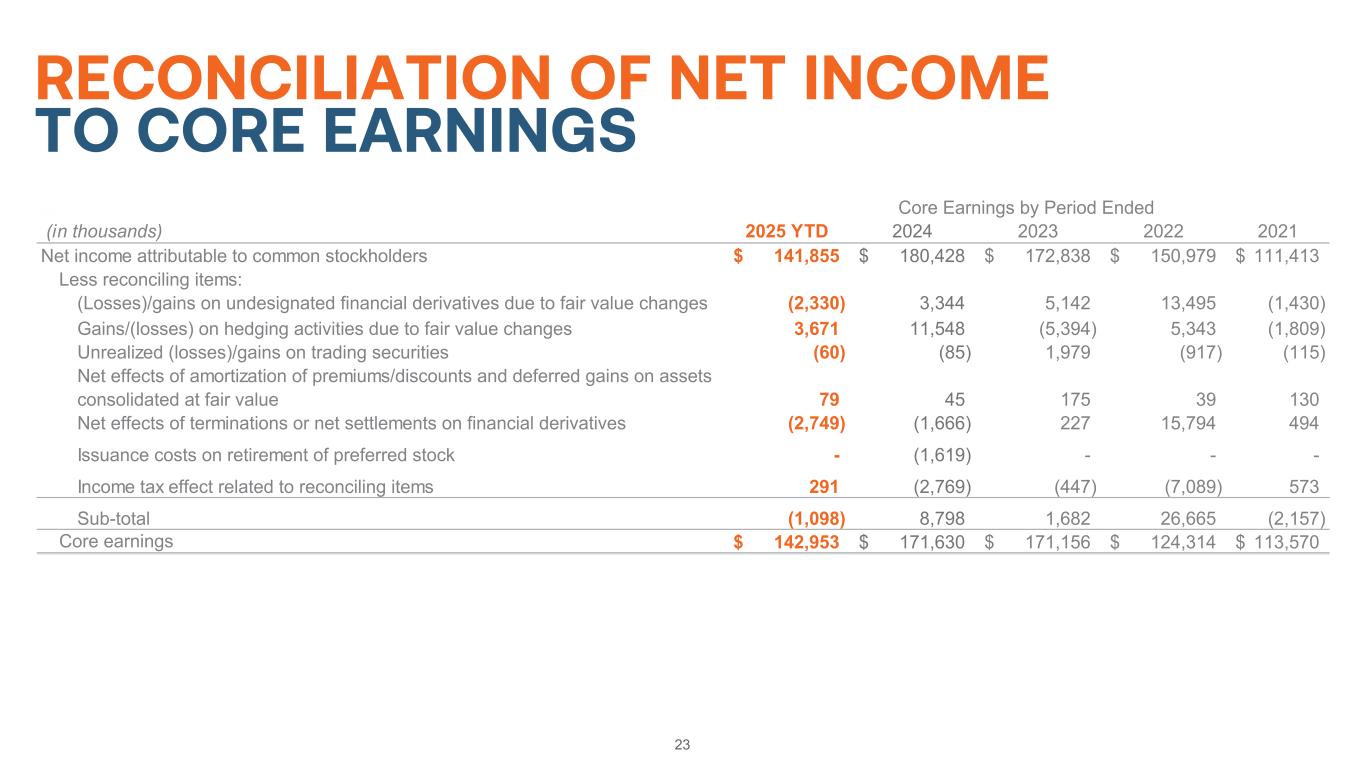

| Reconciliation of Net Income Attributable to Common Stockholders to Core Earnings | |||||||||||

| For the Nine Months Ended | |||||||||||

| September 30, 2025 | September 30, 2024 | ||||||||||

| (in thousands, except per share amounts) | |||||||||||

| Net income attributable to common stockholders | $ | 141,855 | $ | 129,580 | |||||||

| Less reconciling items: | |||||||||||

| (Losses)/gains on undesignated financial derivatives due to fair value changes | (2,330) | 260 | |||||||||

| Gains on hedging activities due to fair value changes | 3,671 | 5,811 | |||||||||

| Unrealized losses on trading assets | (60) | (2) | |||||||||

| Net effects of amortization of premiums/discounts and deferred gains on assets consolidated at fair value | 79 | 84 | |||||||||

| Net effects of terminations or net settlements on financial derivatives | (2,749) | (2,200) | |||||||||

| Issuance costs on the retirement of preferred stock | — | (1,619) | |||||||||

| Income tax effect related to reconciling items | 291 | (830) | |||||||||

| Sub-total | (1,098) | 1,504 | |||||||||

| Core earnings | $ | 142,953 | $ | 128,076 | |||||||

| Composition of Core Earnings: | |||||||||||

| Revenues: | |||||||||||

Net effective spread(1) |

$ | 281,652 | $ | 252,036 | |||||||

Guarantee and commitment fees(2) |

17,494 | 15,235 | |||||||||

| Gain on sale of investment securities (GAAP) | — | 1,052 | |||||||||

| Loss on sale of mortgage loan (GAAP) | — | (1,147) | |||||||||

Other(3) |

3,242 | 2,691 | |||||||||

| Total revenues | 302,388 | 269,867 | |||||||||

| Credit related expense/(income) (GAAP): | |||||||||||

| Provision for losses | 16,828 | 7,618 | |||||||||

| REO operating expenses | 148 | 196 | |||||||||

| Gain on sale of REO | (19) | — | |||||||||

| Total credit related expense/(income) | 16,957 | 7,814 | |||||||||

| Operating expenses (GAAP): | |||||||||||

| Compensation and employee benefits | 53,126 | 48,334 | |||||||||

| General and administrative | 32,669 | 25,784 | |||||||||

| Regulatory fees | 3,000 | 2,175 | |||||||||

| Total operating expenses | 88,795 | 76,293 | |||||||||

| Net earnings | 196,636 | 185,760 | |||||||||

Income tax expense(4) |

36,047 | 38,204 | |||||||||

| Preferred stock dividends (GAAP) | 17,636 | 19,480 | |||||||||

| Core earnings | $ | 142,953 | $ | 128,076 | |||||||

| Core earnings per share: | |||||||||||

| Basic | $ | 13.09 | $ | 11.79 | |||||||

| Diluted | $ | 13.03 | $ | 11.69 | |||||||

| Reconciliation of GAAP Basic Earnings Per Share to Core Earnings Basic Earnings Per Share | |||||||||||||||||||||||||||||

| For the Three Months Ended | For the Nine Months Ended | ||||||||||||||||||||||||||||

| September 30, 2025 | June 30, 2025 |

September 30, 2024 | September 30, 2025 | September 30, 2024 | |||||||||||||||||||||||||

| (in thousands, except per share amounts) | |||||||||||||||||||||||||||||

| GAAP - Basic EPS | $ | 4.45 | $ | 4.50 | $ | 3.89 | $ | 12.99 | $ | 11.93 | |||||||||||||||||||

| Less reconciling items: | |||||||||||||||||||||||||||||

| Gains/(losses) on undesignated financial derivatives due to fair value changes | 0.08 | (0.06) | (0.09) | (0.21) | 0.02 | ||||||||||||||||||||||||

| (Losses)/gains on hedging activities due to fair value changes | (0.01) | 0.25 | 0.02 | 0.33 | 0.54 | ||||||||||||||||||||||||

| Unrealized (losses)/gains on trading securities | — | (0.01) | 0.01 | (0.01) | — | ||||||||||||||||||||||||

| Net effects of amortization of premiums/discounts and deferred gains on assets consolidated at fair value | — | — | — | 0.01 | 0.01 | ||||||||||||||||||||||||

| Net effects of terminations or net settlements on financial derivatives | (0.18) | 0.03 | (0.05) | (0.25) | (0.20) | ||||||||||||||||||||||||

| Issuance costs on the retirement of preferred stock | — | — | (0.15) | — | (0.15) | ||||||||||||||||||||||||

| Income tax effect related to reconciling items | 0.02 | (0.04) | 0.02 | 0.03 | (0.08) | ||||||||||||||||||||||||

| Sub-total | (0.09) | 0.17 | (0.24) | (0.10) | 0.14 | ||||||||||||||||||||||||

| Core Earnings - Basic EPS | $ | 4.54 | $ | 4.33 | $ | 4.13 | $ | 13.09 | $ | 11.79 | |||||||||||||||||||

| Shares used in per share calculation (GAAP and Core Earnings) | 10,934 | 10,933 | 10,883 | 10,921 | 10,869 | ||||||||||||||||||||||||

| Reconciliation of GAAP Diluted Earnings Per Share to Core Earnings Diluted Earnings Per Share | |||||||||||||||||||||||||||||

| For the Three Months Ended | For the Nine Months Ended | ||||||||||||||||||||||||||||

| September 30, 2025 | June 30, 2025 |

September 30, 2024 | September 30, 2025 | September 30, 2024 | |||||||||||||||||||||||||

| (in thousands, except per share amounts) | |||||||||||||||||||||||||||||

| GAAP - Diluted EPS | $ | 4.44 | $ | 4.48 | $ | 3.86 | $ | 12.93 | $ | 11.82 | |||||||||||||||||||

| Less reconciling items: | |||||||||||||||||||||||||||||

| Gains/(losses) on undesignated financial derivatives due to fair value changes | 0.08 | (0.06) | (0.09) | (0.21) | 0.02 | ||||||||||||||||||||||||

| (Losses)/gains on hedging activities due to fair value changes | (0.01) | 0.25 | 0.02 | 0.33 | 0.53 | ||||||||||||||||||||||||

| Unrealized (losses)/gains on trading securities | — | (0.01) | 0.01 | (0.01) | — | ||||||||||||||||||||||||

| Net effects of amortization of premiums/discounts and deferred gains on assets consolidated at fair value | — | — | — | 0.01 | 0.01 | ||||||||||||||||||||||||

| Net effects of terminations or net settlements on financial derivatives | (0.17) | 0.02 | (0.05) | (0.25) | (0.20) | ||||||||||||||||||||||||

| Issuance costs on the retirement of preferred stock | — | — | (0.15) | — | (0.15) | ||||||||||||||||||||||||

| Income tax effect related to reconciling items | 0.02 | (0.04) | 0.02 | 0.03 | (0.08) | ||||||||||||||||||||||||

| Sub-total | (0.08) | 0.16 | (0.24) | (0.10) | 0.13 | ||||||||||||||||||||||||

| Core Earnings - Diluted EPS | $ | 4.52 | $ | 4.32 | $ | 4.10 | $ | 13.03 | $ | 11.69 | |||||||||||||||||||

| Shares used in per share calculation (GAAP and Core Earnings) | 10,972 | 10,963 | 10,966 | 10,973 | 10,968 | ||||||||||||||||||||||||

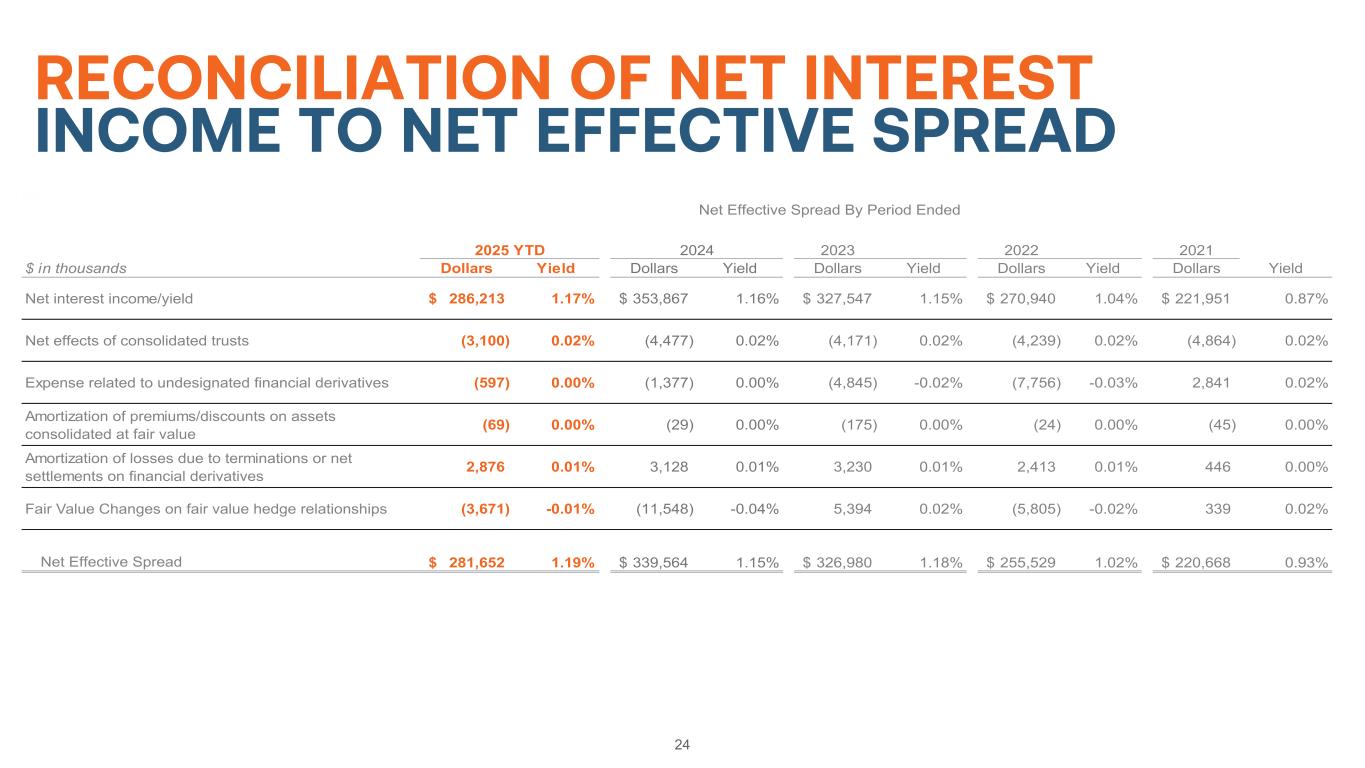

| Reconciliation of GAAP Net Interest Income/Yield to Net Effective Spread | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| For the Three Months Ended | For the Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| September 30, 2025 | June 30, 2025 |

September 30, 2024 | September 30, 2025 | September 30, 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dollars | Yield | Dollars | Yield | Dollars | Yield | Dollars | Yield | Dollars | Yield | ||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 98,477 | 1.18 | % | $ | 96,797 | 1.20 | % | $ | 86,791 | 1.15 | % | $ | 286,213 | 1.17 | % | $ | 260,499 | 1.15 | % | |||||||||||||||||||||||||||||||||||||||

| Net effects of consolidated trusts | (1,102) | 0.02 | % | (987) | 0.02 | % | (1,065) | 0.02 | % | (3,100) | 0.02 | % | (3,488) | 0.02 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Expense related to undesignated financial derivatives | (707) | (0.01) | % | (208) | — | % | (858) | (0.01) | % | (597) | — | % | (1,379) | (0.01) | % | ||||||||||||||||||||||||||||||||||||||||||||

| Amortization of premiums/discounts on assets consolidated at fair value | (23) | — | % | (22) | — | % | (24) | — | % | (69) | — | % | (72) | — | % | ||||||||||||||||||||||||||||||||||||||||||||

| Amortization of losses due to terminations or net settlements on financial derivatives | 987 | 0.01 | % | 1,022 | 0.01 | % | 757 | 0.01 | % | 2,876 | 0.01 | % | 2,287 | 0.01 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Fair value changes on fair value hedge relationships | 137 | — | % | (2,709) | (0.04) | % | (205) | (0.01) | % | (3,671) | (0.01) | % | (5,811) | (0.02) | % | ||||||||||||||||||||||||||||||||||||||||||||

| Net effective spread | $ | 97,769 | 1.20 | % | $ | 93,893 | 1.19 | % | $ | 85,396 | 1.16 | % | $ | 281,652 | 1.19 | % | $ | 252,036 | 1.15 | % | |||||||||||||||||||||||||||||||||||||||

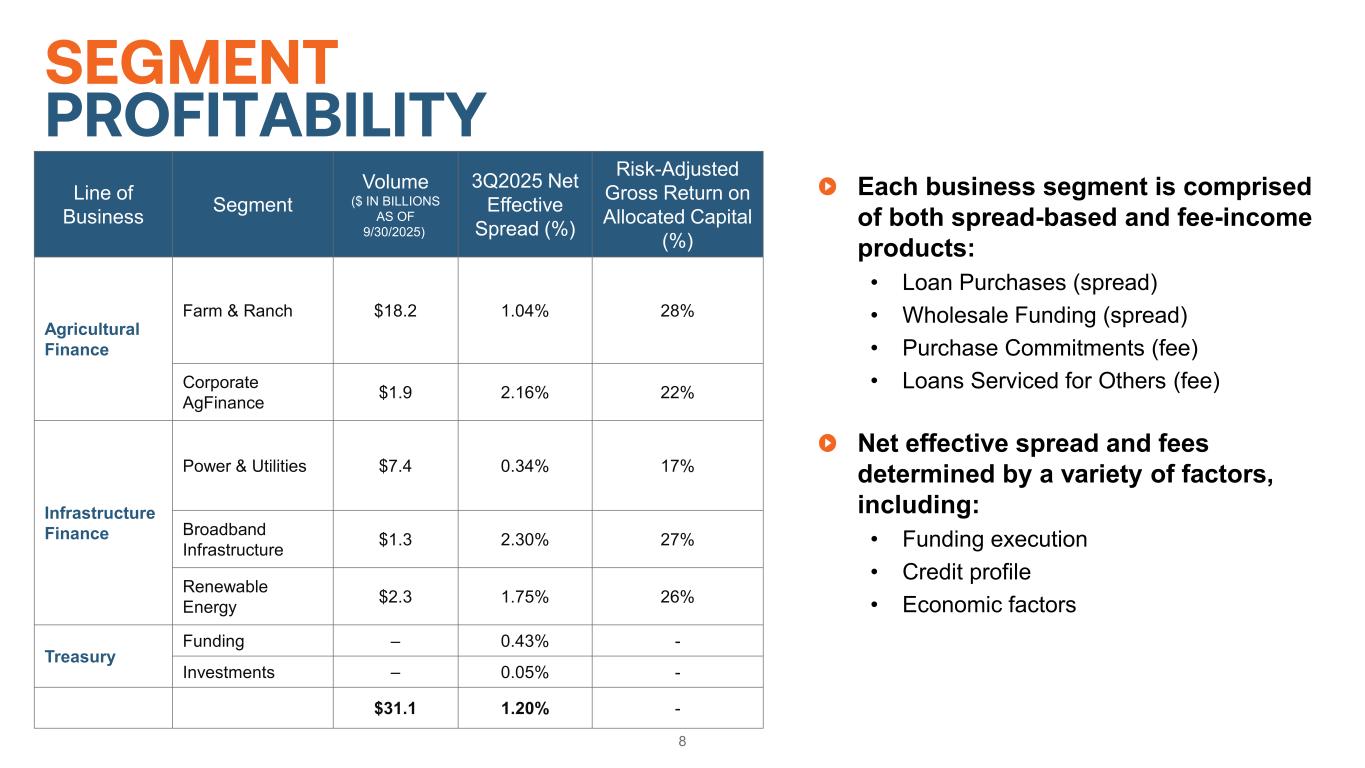

| Core Earnings by Business Segment | |||||||||||||||||||||||||||||||||||||||||||||||

For the Three Months Ended September 30, 2025 | |||||||||||||||||||||||||||||||||||||||||||||||

| Agricultural Finance | Infrastructure Finance | Treasury | |||||||||||||||||||||||||||||||||||||||||||||

| Farm & Ranch | Corporate AgFinance |

Power &

Utilities

|

Broadband Infrastructure |

Renewable Energy | Funding | Investments | Total |

||||||||||||||||||||||||||||||||||||||||

| (in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||

Interest income |

$ | 154,020 | $ | 26,662 | $ | 69,746 | $ | 13,375 | $ | 28,616 | $ | 36,139 | $ | 86,783 | $ | 415,341 | |||||||||||||||||||||||||||||||

Interest expense(1) |

(118,081) | (17,615) | (63,810) | (8,996) | (20,886) | (1,686) | (85,790) | (316,864) | |||||||||||||||||||||||||||||||||||||||

Less: reconciling adjustments(2)(3) |

(1,099) | — | (26) | — | — | 324 | 93 | (708) | |||||||||||||||||||||||||||||||||||||||

| Net effective spread | 34,840 | 9,047 | 5,910 | 4,379 | 7,730 | 34,777 | 1,086 | 97,769 | |||||||||||||||||||||||||||||||||||||||

Guarantee and commitment fees(3) |

4,572 | 218 | 212 | 701 | 429 | — | — | 6,132 | |||||||||||||||||||||||||||||||||||||||

Other income/(expense) |

1,080 | 111 | (7) | — | — | — | (1) | 1,183 | |||||||||||||||||||||||||||||||||||||||

| (Provision for)/release of losses | (4,050) | (2,787) | 424 | (410) | (616) | — | 6 | (7,433) | |||||||||||||||||||||||||||||||||||||||

Operating expenses(1) |

(6,721) | (3,131) | (1,122) | (1,362) | (1,649) | (2,712) | (760) | (17,457) | |||||||||||||||||||||||||||||||||||||||

| Income tax (expense)/benefit | (6,240) | (727) | (1,137) | (695) | (1,238) | (6,734) | (70) | (16,841) | |||||||||||||||||||||||||||||||||||||||

Segment core earnings |

$ | 23,481 | $ | 2,731 | $ | 4,280 | $ | 2,613 | $ | 4,656 | $ | 25,331 | $ | 261 | $ | 63,353 | |||||||||||||||||||||||||||||||

Reconciliation to net income: |

|||||||||||||||||||||||||||||||||||||||||||||||

Net effects of derivatives and trading securities |

$ | (1,193) | |||||||||||||||||||||||||||||||||||||||||||||

Unallocated (expenses)/income |

(12,311) | ||||||||||||||||||||||||||||||||||||||||||||||

| Income tax effect related to reconciling items | 5,154 | ||||||||||||||||||||||||||||||||||||||||||||||

Net income |

$ | 55,003 | |||||||||||||||||||||||||||||||||||||||||||||

Total Assets: |

|||||||||||||||||||||||||||||||||||||||||||||||

Total on- and off-balance sheet segment assets at principal balance |

$ | 18,218,755 | $ | 1,891,228 | $ | 7,426,517 | $ | 1,299,097 | $ | 2,283,565 | $ | — | $ | — | $ | 31,119,162 | |||||||||||||||||||||||||||||||

Off-balance sheet assets under management |

(5,264,616) | ||||||||||||||||||||||||||||||||||||||||||||||

Unallocated assets |

7,525,014 | ||||||||||||||||||||||||||||||||||||||||||||||

Total assets on the consolidated balance sheets |

$ | 33,379,560 | |||||||||||||||||||||||||||||||||||||||||||||

| Outstanding Business Volume | ||||||||||||||||||||

| On or Off Balance Sheet |

As of September 30, 2025 | As of December 31, 2024 | ||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Agricultural Finance: | ||||||||||||||||||||

| Farm & Ranch: | ||||||||||||||||||||

| Loans | On-balance sheet | $ | 5,915,220 | $ | 5,414,732 | |||||||||||||||

| Loans held in consolidated trusts: | ||||||||||||||||||||

Beneficial interests owned by third-party investors (single-class)(1) |

On-balance sheet | 840,636 | 885,295 | |||||||||||||||||

Beneficial interests owned by third-party investors (structured)(1) |

On-balance sheet | 1,364,577 | 1,152,988 | |||||||||||||||||

IO-FMGS(2) |

On-balance sheet | 8,206 | 8,710 | |||||||||||||||||

| USDA Securities | On-balance sheet | 2,443,583 | 2,402,423 | |||||||||||||||||

AgVantage Securities(1) |

On-balance sheet | 3,745,000 | 4,720,000 | |||||||||||||||||

| LTSPCs and unfunded loan commitments | Off-balance sheet | 3,100,205 | 3,070,554 | |||||||||||||||||

Other Farmer Mac Guaranteed Securities(3) |

Off-balance sheet | 392,358 | 426,310 | |||||||||||||||||

| Loans serviced for others | Off-balance sheet | 408,970 | 525,956 | |||||||||||||||||

| Total Farm & Ranch | $ | 18,218,755 | $ | 18,606,968 | ||||||||||||||||

| Corporate AgFinance: | ||||||||||||||||||||

| Loans | On-balance sheet | $ | 1,452,398 | $ | 1,381,674 | |||||||||||||||

AgVantage Securities(1) |

On-balance sheet | 202,561 | 280,297 | |||||||||||||||||

| Unfunded loan commitments | Off-balance sheet | 236,269 | 225,734 | |||||||||||||||||

| Total Corporate AgFinance | $ | 1,891,228 | $ | 1,887,705 | ||||||||||||||||

| Total Agricultural Finance | $ | 20,109,983 | $ | 20,494,673 | ||||||||||||||||

| Infrastructure Finance: | ||||||||||||||||||||

| Power & Utilities: | ||||||||||||||||||||

| Loans | On-balance sheet | $ | 3,337,176 | $ | 2,886,576 | |||||||||||||||

AgVantage Securities(1) |

On-balance sheet | 3,734,085 | 3,521,143 | |||||||||||||||||

| LTSPCs and unfunded loan commitments | Off-balance sheet | 355,256 | 401,647 | |||||||||||||||||

Total Power & Utilities |

$ | 7,426,517 | $ | 6,809,366 | ||||||||||||||||

| Broadband Infrastructure: | ||||||||||||||||||||

| Loans | On-balance sheet | $ | 817,587 | $ | 622,207 | |||||||||||||||

Unfunded loan commitments |

Off-balance sheet | 481,510 | 180,259 | |||||||||||||||||

| Total Broadband Infrastructure | $ | 1,299,097 | $ | 802,466 | ||||||||||||||||

| Renewable Energy: | ||||||||||||||||||||

| Loans | On-balance sheet | $ | 1,993,517 | $ | 1,265,700 | |||||||||||||||

| Unfunded loan commitments | Off-balance sheet | 290,048 | 150,825 | |||||||||||||||||

| Total Renewable Energy | $ | 2,283,565 | $ | 1,416,525 | ||||||||||||||||

| Total Infrastructure Finance | $ | 11,009,179 | $ | 9,028,357 | ||||||||||||||||

| Total | $ | 31,119,162 | $ | 29,523,030 | ||||||||||||||||

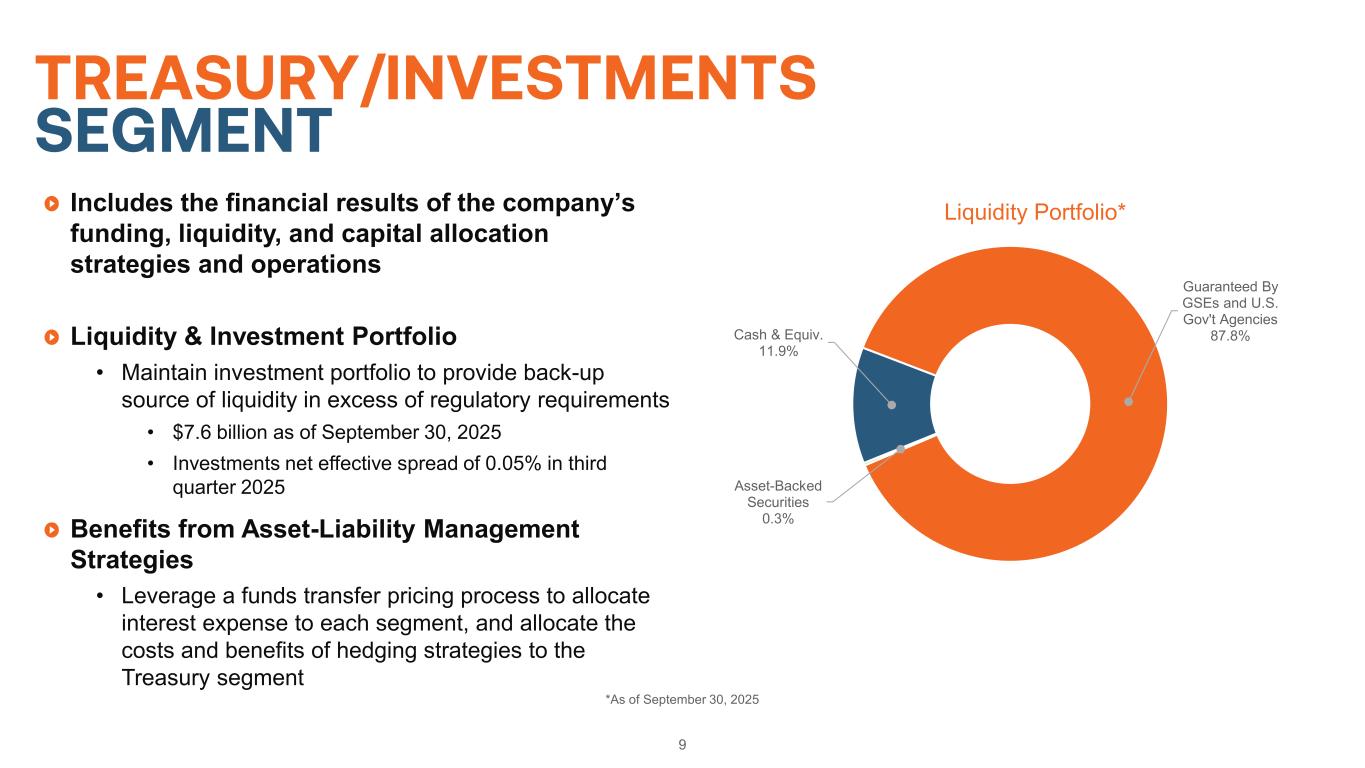

Net Effective Spread |

|||||||||||||||||||||||||||||||||||||||||||||||

| Agricultural Finance | Infrastructure Finance | Treasury | |||||||||||||||||||||||||||||||||||||||||||||

| Farm & Ranch |

Corporate AgFinance | Power & Utilities | Broadband Infrastructure | Renewable Energy | Funding | Investments | Net Effective Spread | ||||||||||||||||||||||||||||||||||||||||

|

Dollars

Yield

|

Dollars Yield |

Dollars Yield |

Dollars Yield |

Dollars Yield |

Dollars Yield |

Dollars Yield |

Dollars Yield |

||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||

| For the quarter ended: | |||||||||||||||||||||||||||||||||||||||||||||||

| September 30, 2025 | $ | 34,840 | $ | 9,047 | $ | 5,910 | $ | 4,379 | $ | 7,730 | $ | 34,777 | $ | 1,086 | $ | 97,769 | |||||||||||||||||||||||||||||||

| 1.04 | % | 2.16 | % | 0.34 | % | 2.30 | % | 1.75 | % | 0.43 | % | 0.05 | % | 1.20 | % | ||||||||||||||||||||||||||||||||

| June 30, 2025 | 35,710 | 8,609 | 5,636 | 3,932 | 6,227 | 31,668 | 2,111 | 93,893 | |||||||||||||||||||||||||||||||||||||||

| 1.07 | % | 2.07 | % | 0.33 | % | 2.24 | % | 1.68 | % | 0.40 | % | 0.11 | % | 1.19 | % | ||||||||||||||||||||||||||||||||

| March 31, 2025 | 33,885 | 8,640 | 5,329 | 3,566 | 5,112 | 31,604 | 1,854 | 89,990 | |||||||||||||||||||||||||||||||||||||||

| 1.01 | % | 2.09 | % | 0.32 | % | 2.27 | % | 1.55 | % | 0.41 | % | 0.10 | % | 1.17 | % | ||||||||||||||||||||||||||||||||

| December 31, 2024 | 32,556 | 7,891 | 5,059 | 3,414 | 4,859 | 31,242 | 2,507 | 87,528 | |||||||||||||||||||||||||||||||||||||||

| 0.96 | % | 1.95 | % | 0.32 | % | 2.34 | % | 1.76 | % | 0.42 | % | 0.15 | % | 1.16 | % | ||||||||||||||||||||||||||||||||

| September 30, 2024 | 35,755 | 6,397 | 4,785 | 2,794 | 3,810 | 30,912 | 943 | 85,396 | |||||||||||||||||||||||||||||||||||||||

| 1.05 | % | 1.56 | % | 0.30 | % | 2.21 | % | 1.78 | % | 0.42 | % | 0.05 | % | 1.16 | % | ||||||||||||||||||||||||||||||||

| June 30, 2024 | 34,156 | 7,866 | 5,253 | 2,393 | 2,999 | 30,268 | 661 | 83,596 | |||||||||||||||||||||||||||||||||||||||

| 0.98 | % | 1.91 | % | 0.32 | % | 2.16 | % | 1.86 | % | 0.41 | % | 0.04 | % | 1.14 | % | ||||||||||||||||||||||||||||||||

| March 31, 2024 | 32,843 | 7,971 | 4,890 | 2,342 | 2,049 | 32,474 | 475 | 83,044 | |||||||||||||||||||||||||||||||||||||||

| 0.95 | % | 2.05 | % | 0.30 | % | 2.08 | % | 1.75 | % | 0.45 | % | 0.03 | % | 1.14 | % | ||||||||||||||||||||||||||||||||

December 31, 2023 |

33,329 | 8,382 | 4,916 | 2,426 | 1,540 | 33,361 | 597 | 84,551 | |||||||||||||||||||||||||||||||||||||||

| 0.98 | % | 2.06 | % | 0.31 | % | 2.06 | % | 1.69 | % | 0.47 | % | 0.04 | % | 1.19 | % | ||||||||||||||||||||||||||||||||

| September 30, 2023 | 32,718 | 8,250 | 3,979 | 2,383 | 1,150 | 34,412 | 532 | 83,424 | |||||||||||||||||||||||||||||||||||||||

| 0.97 | % | 2.05 | % | 0.26 | % | 2.15 | % | 1.46 | % | 0.49 | % | 0.04 | % | 1.20 | % | ||||||||||||||||||||||||||||||||

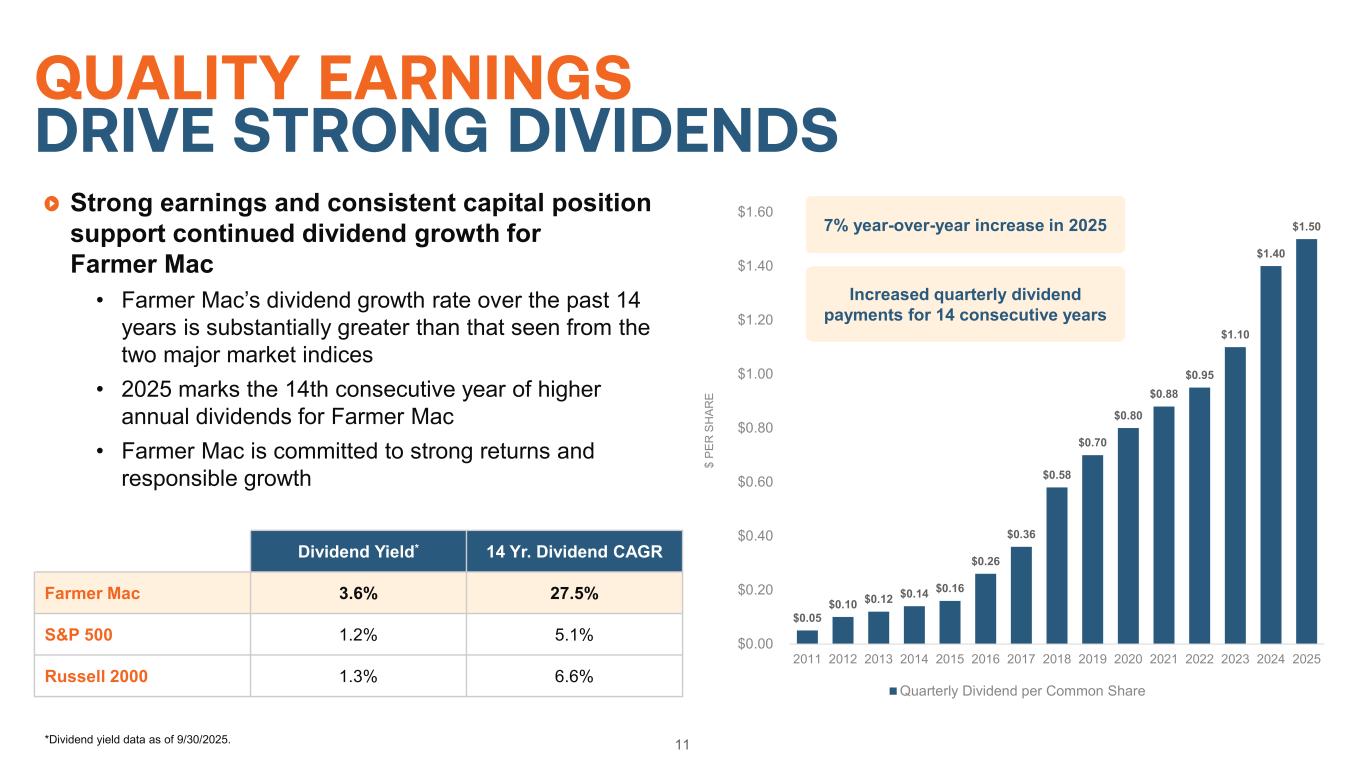

| Core Earnings by Quarter Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| September 2025 | June 2025 | March 2025 | December 2024 | September 2024 | June 2024 | March 2024 | December 2023 | September 2023 | |||||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net effective spread | $ | 97,769 | $ | 93,893 | $ | 89,990 | $ | 87,528 | $ | 85,396 | $ | 83,596 | $ | 83,044 | $ | 84,551 | $ | 83,424 | |||||||||||||||||||||||||||||||||||

| Guarantee and commitment fees | 6,132 | 5,874 | 5,488 | 5,086 | 4,997 | 5,256 | 4,982 | 4,865 | 4,828 | ||||||||||||||||||||||||||||||||||||||||||||

| Gain on sale of investment securities | — | — | — | — | — | 1,052 | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Loss on sale of mortgage loan | — | — | — | — | — | (1,147) | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Other | 1,185 | 742 | 1,315 | (491) | 1,133 | 481 | 1,077 | 767 | 1,056 | ||||||||||||||||||||||||||||||||||||||||||||

| Total revenues | 105,086 | 100,509 | 96,793 | 92,123 | 91,526 | 89,238 | 89,103 | 90,183 | 89,308 | ||||||||||||||||||||||||||||||||||||||||||||

| Credit related expense/(income): | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Provision for/(release of) losses | 7,433 | 7,812 | 1,583 | 3,872 | 3,258 | 6,230 | (1,870) | (575) | (181) | ||||||||||||||||||||||||||||||||||||||||||||

| REO operating expenses | — | 148 | — | — | 196 | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| (Gain)/loss on REO | — | (87) | 68 | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Total credit related expense/(income) | 7,433 | 7,873 | 1,651 | 3,872 | 3,454 | 6,230 | (1,870) | (575) | (181) | ||||||||||||||||||||||||||||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Compensation and employee benefits | 17,743 | 17,631 | 17,752 | 15,641 | 15,237 | 14,840 | 18,257 | 15,523 | 14,103 | ||||||||||||||||||||||||||||||||||||||||||||

| General and administrative | 11,052 | 10,859 | 10,758 | 12,452 | 8,625 | 8,904 | 8,255 | 8,916 | 9,100 | ||||||||||||||||||||||||||||||||||||||||||||

| Regulatory fees | 1,000 | 1,000 | 1,000 | 1,000 | 725 | 725 | 725 | 725 | 831 | ||||||||||||||||||||||||||||||||||||||||||||

| Total operating expenses | 29,795 | 29,490 | 29,510 | 29,093 | 24,587 | 24,469 | 27,237 | 25,164 | 24,034 | ||||||||||||||||||||||||||||||||||||||||||||

| Net earnings | 67,858 | 63,146 | 65,632 | 59,158 | 63,485 | 58,539 | 63,736 | 65,594 | 65,455 | ||||||||||||||||||||||||||||||||||||||||||||

| Income tax expense | 11,933 | 10,114 | 14,000 | 9,938 | 12,681 | 11,970 | 13,553 | 13,881 | 13,475 | ||||||||||||||||||||||||||||||||||||||||||||

| Preferred stock dividends | 6,303 | 5,667 | 5,666 | 5,666 | 5,897 | 6,792 | 6,791 | 6,791 | 6,792 | ||||||||||||||||||||||||||||||||||||||||||||

| Core earnings | $ | 49,622 | $ | 47,365 | $ | 45,966 | $ | 43,554 | $ | 44,907 | $ | 39,777 | $ | 43,392 | $ | 44,922 | $ | 45,188 | |||||||||||||||||||||||||||||||||||

| Reconciling items: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gains/(losses) on undesignated financial derivatives due to fair value changes | $ | 882 | $ | (639) | $ | (2,573) | $ | 3,084 | $ | (1,064) | $ | (359) | $ | 1,683 | $ | (836) | $ | 2,921 | |||||||||||||||||||||||||||||||||||

| (Losses)/gains on hedging activities due to fair value changes | (137) | 2,709 | 1,099 | 5,737 | 205 | 2,604 | 3,002 | (3,598) | 3,210 | ||||||||||||||||||||||||||||||||||||||||||||

| Unrealized (losses)/gains on trading assets | (4) | (65) | 9 | (83) | 99 | (87) | (14) | (37) | 1,714 | ||||||||||||||||||||||||||||||||||||||||||||

| Net effects of amortization of premiums/discounts and deferred gains on assets consolidated at fair value | 26 | 25 | 28 | (39) | 27 | 26 | 31 | 88 | 29 | ||||||||||||||||||||||||||||||||||||||||||||

| Net effects of terminations or net settlements on financial derivatives | (1,934) | 255 | (1,070) | 534 | (503) | (1,505) | (192) | (800) | (79) | ||||||||||||||||||||||||||||||||||||||||||||

| Issuance costs on the retirement of preferred stock | — | — | — | — | (1,619) | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Income tax effect related to reconciling items | 245 | (480) | 526 | (1,939) | 260 | (143) | (947) | 1,089 | (1,638) | ||||||||||||||||||||||||||||||||||||||||||||

| Net income attributable to common stockholders | $ | 48,700 | $ | 49,170 | $ | 43,985 | $ | 50,848 | $ | 42,312 | $ | 40,313 | $ | 46,955 | $ | 40,828 | $ | 51,345 | |||||||||||||||||||||||||||||||||||