Powering Arizona’s Future November Investor Meetings

2 This presentation contains forward-looking statements based on current expectations, including statements regarding our earnings guidance and financial outlook and goals. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume,” “project,” "anticipate," "goal," "seek," "strategy," "likely," "should," "will," "could," and similar words. Because actual results may differ materially from expectations, we caution you not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factors include, but are not limited to: uncertainties associated with the current and future economic environment, including economic growth rates, labor market conditions, tariffs, inflation, supply chain delays, increased expenses, volatile capital markets, or other unpredictable effects; current and future economic conditions in Arizona, such as the housing market and overall business and regulatory environment; our ability to manage capital expenditures and operations and maintenance costs while maintaining reliability and customer service levels; our ability to meet current and anticipated future needs for generation and associated transmission facilities in our region; including due to unprecedented demand from high load factor customers; the direct or indirect effect on our facilities or business from cybersecurity threats or occurrences; variations in demand for electricity, including those due to weather, seasonality (including large increases in ambient temperatures), the general economy or social conditions, customer, and sales growth (or decline), the effects of energy conservation measures and distributed generation, and technological advancements; the potential effects of climate change on our electric system, including as a result of weather extremes such as prolonged drought and high temperature variations in the area where APS conducts its business; power plant and transmission system performance and outages; competition in retail and wholesale power markets; regulatory and judicial decisions, developments, and proceedings; new legislation, ballot initiatives and regulation or interpretations of existing legislation or regulations, including those relating to tax, environmental requirements, regulatory and energy policy, nuclear plant operations and potential deregulation of retail electric markets; fuel and water supply availability; our ability to achieve timely and adequate rate recovery of our costs through our rates and adjustor recovery mechanisms, including returns on and of debt and equity capital investment; the ability of APS to meet renewable energy and energy efficiency mandates and recover related costs; the ability of APS to achieve its clean energy goal to be carbon-neutral by 2050 and, if this goal is achieved, the impact of such achievement on APS, its customers, and its business, financial condition, and results of operations; risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty; data security breaches, terrorist attack, physical attack, severe storms, or other catastrophic events, such as fires, explosions, pandemic health events or similar occurrences; the development of new technologies which may affect electric sales or delivery, including as a result of delays in the development and application of new technologies; the cost of debt, including increased cost as a result of rising interest rates, and equity capital and our ability to access capital markets when required; environmental, economic, and other concerns surrounding coal-fired generation, including regulation of greenhouse gas emissions; volatile fuel and purchased power costs; the investment performance of the assets of our nuclear decommissioning trust, captive insurance cell, coal mine reclamation escrow, pension, and other postretirement benefit plans and the resulting impact on future funding requirements; the liquidity of wholesale power markets and the use of derivative contracts in our business; potential shortfalls in insurance coverage; new accounting requirements or new interpretations of existing requirements; generation, transmission and distribution facilities and system conditions and operating costs; the willingness or ability of counterparties, power plant participants and power plant landowners to meet contractual or other obligations or extend the rights for continued power plant operations; and restrictions on dividends or other provisions in our credit agreements and ACC orders. These and other factors are discussed in the most recent Pinnacle West/APS Form 10-K along with other public filings with the Securities and Exchange Commission, which you should review carefully before placing any reliance on our financial statements, disclosures or earnings outlook. Neither Pinnacle West nor APS assumes any obligation to update these statements, even if our internal estimates change, except as required by law. In this presentation, references to net income and earnings per share (EPS) refer to amounts attributable to common shareholders. Forward Looking Statements

1. Company Profile 2. Growth Outlook & Energy Future 3. Financial Outlook 4. 2025 Rate Case Table of Contents

Company Profile

Key facts as of Dec. 31, 2024 Consolidated assets $26B Market cap $9.64B Generating capacity owned or leased (year end) 6.5GW Customers 1.4M Current % from clean energy 54% Retail sales mix (Residential/Non-Residential) 52%/48% Service Territory 5 Arizona’s largest electric company As of December 31, 2024.

Growth Outlook & Energy Future

2.4% 2.2% 2.1% 2.3% 2.0%-2.5% 1.5%-2.5% 0% 1% 2% 3% 2021 2022 2023 2024 2025E 2026E Residential Customer Growth1 APS Residential Growth Natn'l Avg.-Residential 7 • Phoenix housing is affordable compared to major cities in the region • Maricopa County ranked top county for economic development in 2025 by Site Selection Magazine • U.S. Census ranked Maricopa County third among U.S. counties for growth • Phoenix is ranked #1 out of 15 top growth markets for manufacturing by Newmark Group, a global real estate firm • Arizona State University ranked #1 in Innovation for 11th straight year by U.S. News and World Report • Phoenix remains #1 as best positioned industrial real estate market by Commercial Café Report Arizona economy continues to be robust and attractive 1 National average from 2025 Itron Annual Energy Survey Report. Arizona continues to be an attractive service territory with strong customer growth - 10,000 20,000 30,000 40,000 2012 2016 2020 2024 New APS Customer Meter Sets

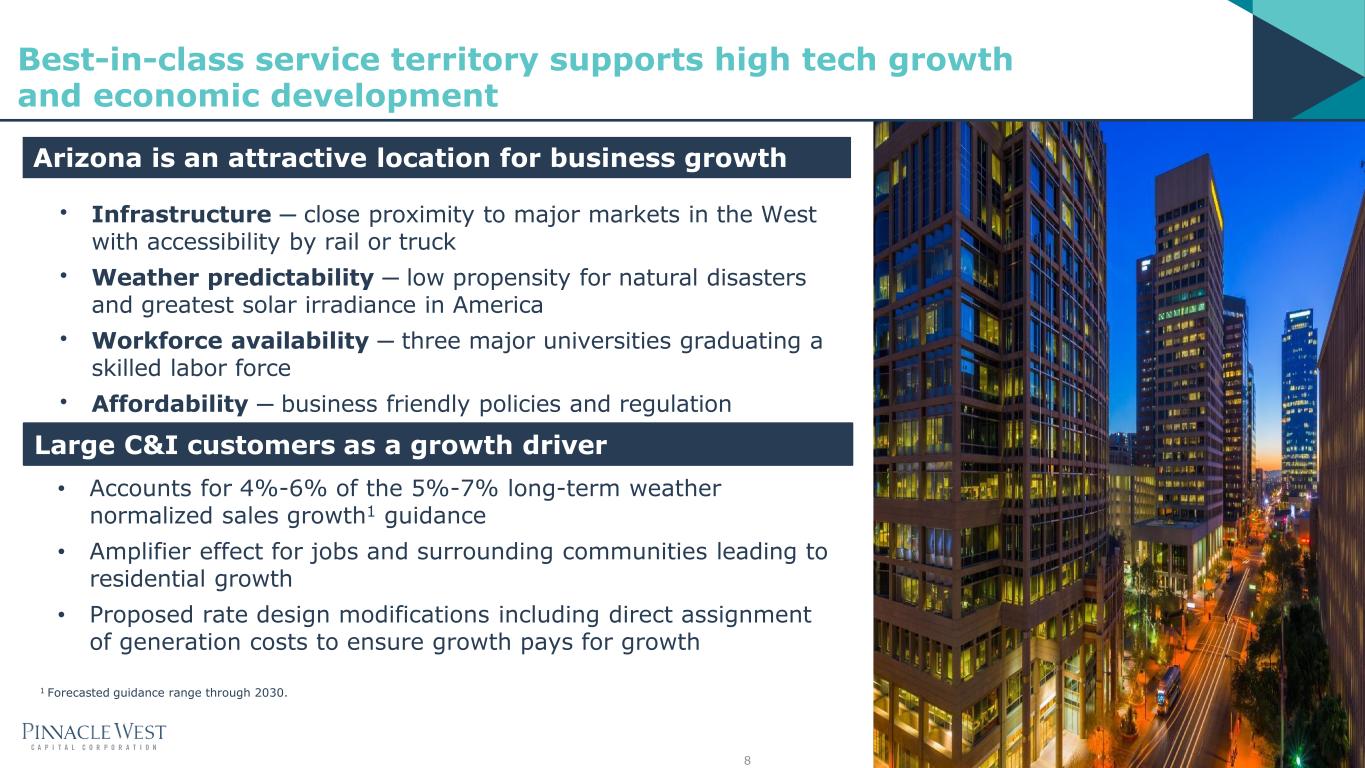

• Infrastructure ─ close proximity to major markets in the West with accessibility by rail or truck • Weather predictability ─ low propensity for natural disasters and greatest solar irradiance in America • Workforce availability ─ three major universities graduating a skilled labor force • Affordability ─ business friendly policies and regulation • Accounts for 4%-6% of the 5%-7% long-term weather normalized sales growth1 guidance • Amplifier effect for jobs and surrounding communities leading to residential growth • Proposed rate design modifications including direct assignment of generation costs to ensure growth pays for growth Large C&I customers as a growth driver Arizona is an attractive location for business growth Best-in-class service territory supports high tech growth and economic development 8 1 Forecasted guidance range through 2030.

Source: Arizona Commerce Authority 9 Arizona’s commercial and industrial growth is diverse

4.0% 5.9% 5.5% 5.9% 5.5% 4.0%* 5.2% 5.4% 0% 1% 2% 3% 4% 5% 6% Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Weather-Normalized Retail Sales Growth 10 Strong track record of consistently robust sales growth * Excludes $11M reduction to unbilled revenues in January 2025 • 8 consecutive quarters of growth within the original long-term guidance range of 4%-6% • Strong C&I sales growth as extra high load factor customers continue to ramp • Residential sales showing strength in 2025 • 4.3% Residential Sales Growth in Q3 • 2.0% Residential Sales Growth YTD • 2026 sales growth guidance of 4%-6% • Long term sales growth increased to 5%-7% and extended through 2030 Continued trend of robust sales growth

• Balanced, constructive and more consistent outcomes, including improved ROE to APS • Approval of Formula Rate Policy Statement • Reaffirmation of Rate Case Settlement Policy • Continued support of adjustor mechanisms to improve cost recovery, including SRB 11 Commitments by the Company • Sustain investment in customer experience improvements • Continue to find alignment with regulators and work with stakeholders on common issues • Advocate for reduced regulatory lag • Focus on customer affordability Improvements at the Arizona Corporation Commission We have an improved regulatory environment

12 Significant investment opportunity to serve increased demand Which is requiring us to invest There is significant additional load we need to be ready to serve New gas generation: • Procured site with ability to build up to 2 GWs of new gas generation • Anchor shipper on new gas pipeline, expected to be in service by late 2029 Palo Verde generating station: • Approximately $200 million incremental investment made during Q3 2025 on buyout option for nearly 100 MW of nuclear capacity previously under sale-leaseback • Increased investment in Palo Verde capital program of approximately $500M over the next 10 years Strategic transmission: • Several major transmission investments to support new resources and the overall system buildout • Additional investment in large transmission projects to enable access to out of state generation and additional markets 8.6GW 2025 System Peak 4.5GW Committed Load ~20GW Uncommitted Load Opportunity

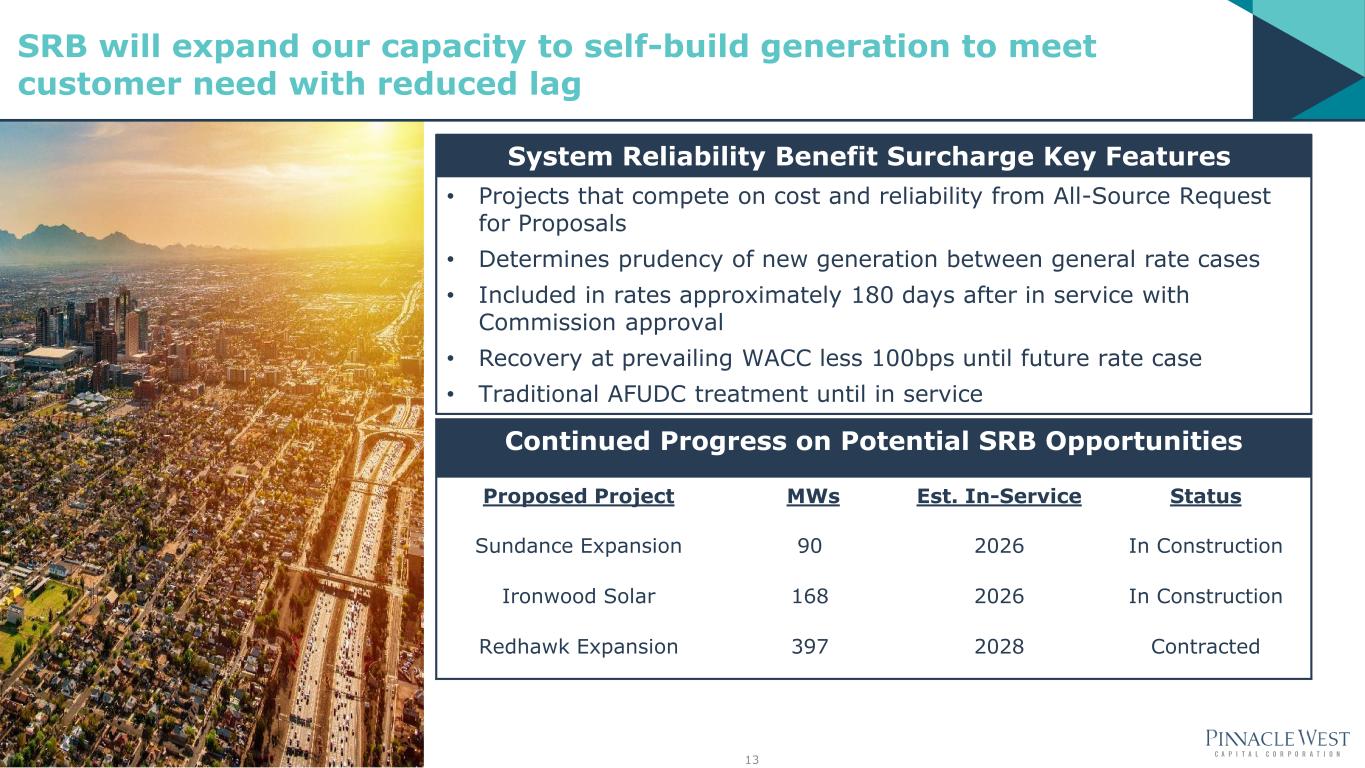

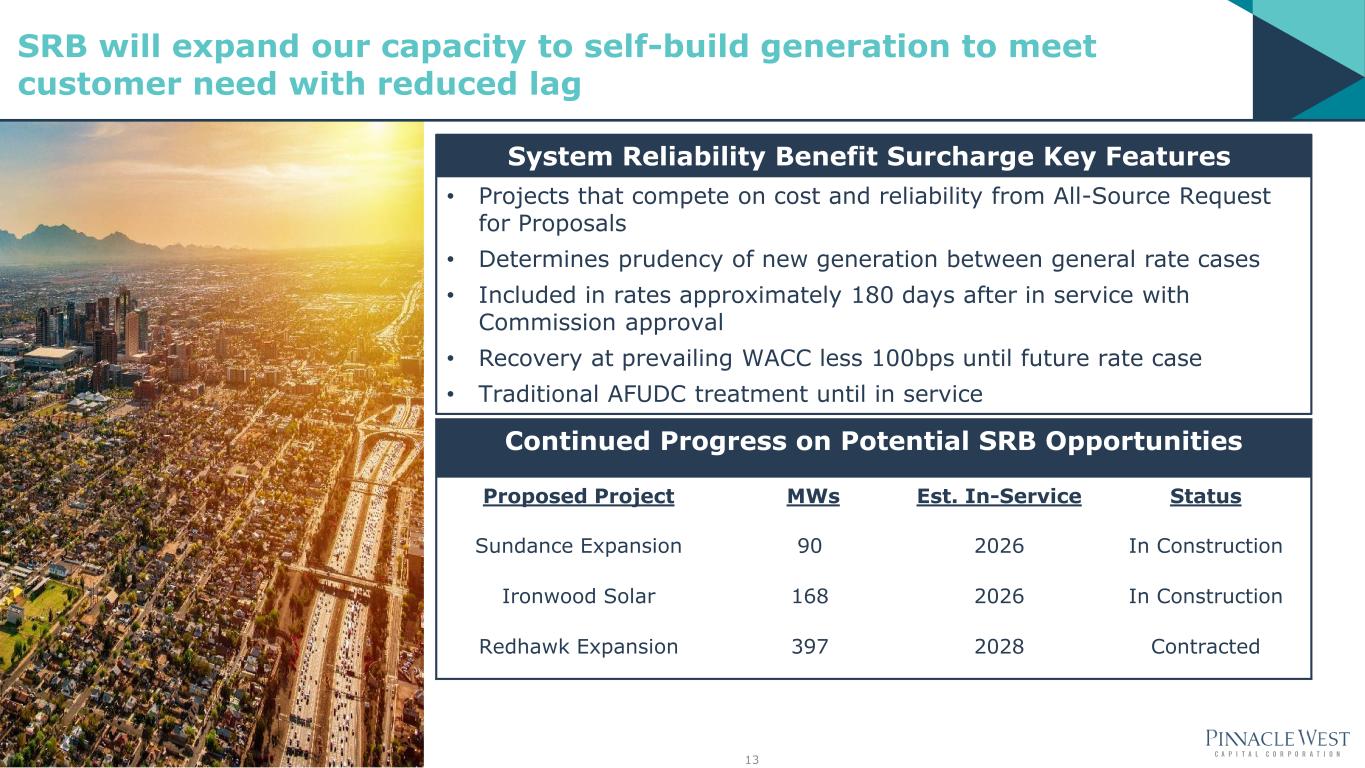

13 • Projects that compete on cost and reliability from All-Source Request for Proposals • Determines prudency of new generation between general rate cases • Included in rates approximately 180 days after in service with Commission approval • Recovery at prevailing WACC less 100bps until future rate case • Traditional AFUDC treatment until in service System Reliability Benefit Surcharge Key Features Continued Progress on Potential SRB Opportunities Proposed Project MWs Est. In-Service Status Sundance Expansion 90 2026 In Construction Ironwood Solar 168 2026 In Construction Redhawk Expansion 397 2028 Contracted SRB will expand our capacity to self-build generation to meet customer need with reduced lag

14 Transmission expansion will drive significant capital investment $6 billion + of investmentCumulative Transmission CapEx 2025 2028 2034 Source: APS 2025-2034 Ten Year Transmission System Plan • Investments in Extra High Voltage (EHV) transmission to support reliability, resiliency, and integration of new resources – Over 600 miles of 345kV and above in planning period • Investments in large transmission projects to enable access to out of state generation and additional markets • Constructive and timely recovery through annual FERC Formula rate with wheeling revenue benefiting retail customers $0.5B $2.6B Major Transmission Projects in Development Project Miles/kV Est. in-service Sundance to Milligan ~23 mi/230kV 2027 Pinnacle Peak to Ocotillo ~100 mi/230kV 2029 Cotton Transmission Corridor: Panda to Freedom Jojoba to Rudd ~40 mi/230kV ~28 mi/500kV 2030 2032 Proposed Transmission for New Gas TBD 2030 Transmission Investment Strategy

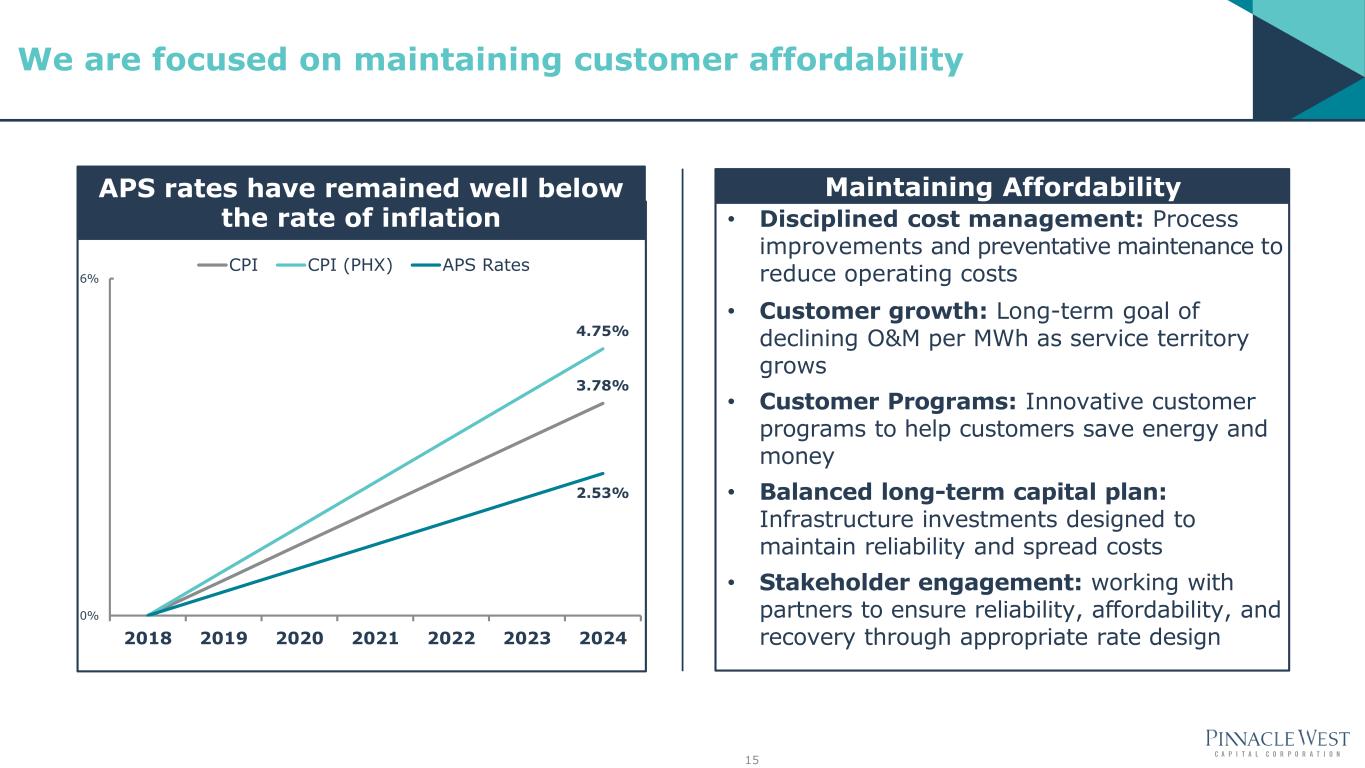

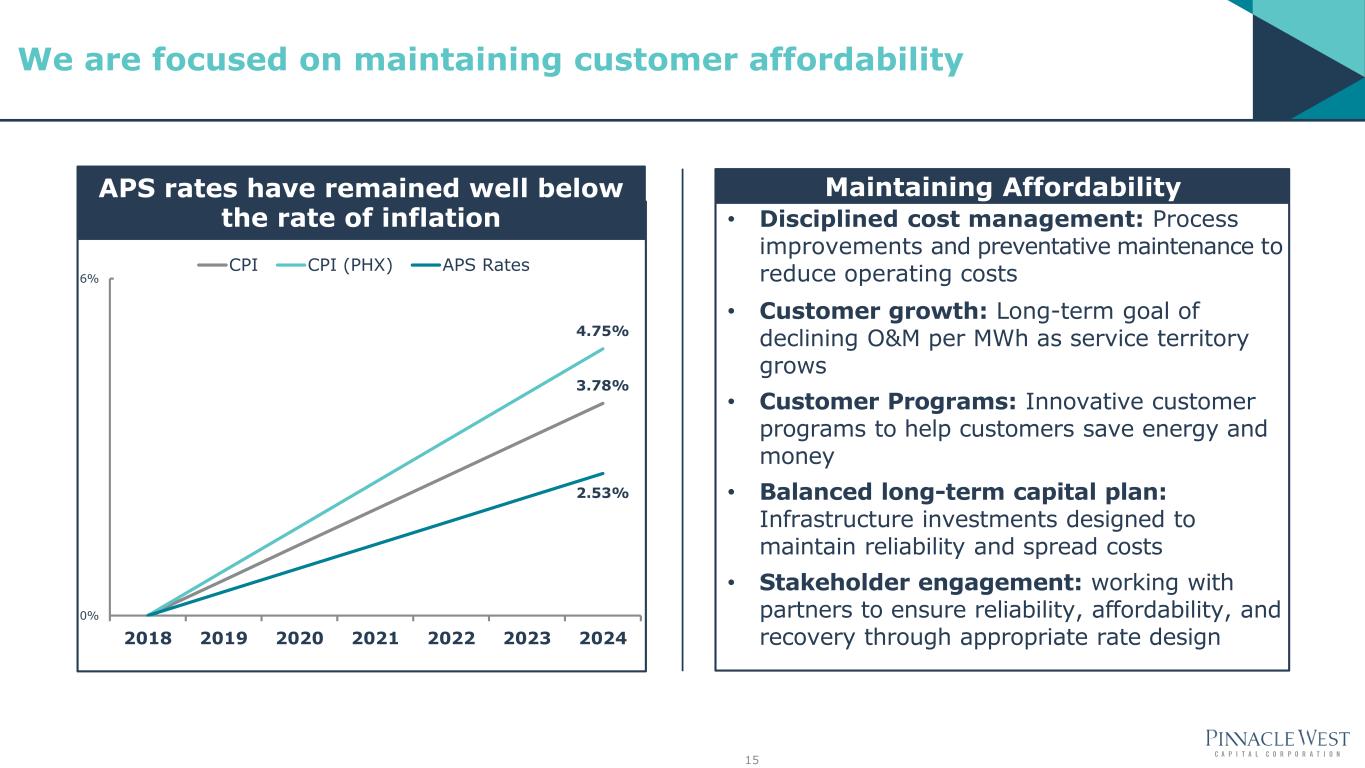

Maintaining Affordability • Disciplined cost management: Process improvements and preventative maintenance to reduce operating costs • Customer growth: Long-term goal of declining O&M per MWh as service territory grows • Customer Programs: Innovative customer programs to help customers save energy and money • Balanced long-term capital plan: Infrastructure investments designed to maintain reliability and spread costs • Stakeholder engagement: working with partners to ensure reliability, affordability, and recovery through appropriate rate design 15 3.78% 4.75% 2.53% 0% 6% 2018 2019 2020 2021 2022 2023 2024 Average annual % change 2018-2024 CPI CPI (PHX) APS Rates APS rates have remained well below the rate of inflation We are focused on maintaining customer affordability

Future Financial Outlook

1. Long-term EPS growth of 5%-7% off original 2024 midpoint, supporting competitive total shareholder return 2. Optimized capital plan to reliably serve growing service territory, driving strong rate base growth and supported by SRB 3. Managing a healthy capital structure with accretive equity to support investment 4. Declining O&M per MWh with focus on customer affordability 5. Competitive shareholder dividend 6. Solid balance sheet and credit ratings 17 Our investor goals going forward

Potential drivers for more consistent and timely cost recovery EPS Growth off original 2024 midpoint1 5%-7% CAGR • Reduction of regulatory lag including formula rates • Rate case cadence and potential settlement of future rate cases • Continued support of adjustor mechanisms • Continued economic development driving sales and customer growth • Continued cost management 18 Long-term outlook potential remains solid 1 Long-term EPS growth target based on the Company’s current weather normalized compound annual growth rate projections from 2024-2028.

$380 $460 $420 $380 $665 $765 $795 $750 $450 $550 $695 $860 $905 $825 $740 $710 2025E 2026E 2027E 2028E APS Total 2025-2028 $10.35B1 Generation Transmission Distribution Other $2.40B $2.60B $2.65B $2.70B Source: 2025-2028 as disclosed in the Third Quarter 2025 Form 10-Q 1 Excludes $199M investment to buy out two of the three Palo Verde VIE lease agreements in September 2025. 19 Capital plan to support reliability and continued growth within our service territory

Current Approved Rate Base and Test Year Detail End-of-Year Rate Base and Growth Guidance1 ACC FERC Rate Effective Date 03/08/2024 06/01/2025 Test Year Ended 6/30/20221 12/31/2024 Equity Layer 51.93% 52.28% Allowed ROE 9.55% 10.75% Rate Base $10.36B2 $2.47B $12.23 $15.7 $2.52 $4.0 2024 2025 2026 2027 2028 ACC FERC 20 Rate base $ in billions, rounded Projected 1 Guidance excludes CWIP amounts of $1.6B in 2024 and $2.7B-$3.2B in 2028. 2 Derived from APS annual update of formula transmission service rates. 3 Represents unadjusted ACC jurisdictional rate base consistent with regulatory filings. 1 Adjusted to include post-test year plant in service through 06/30/2023. 2 Rate Base excludes $215M approved through Joint Resolution in Case No. E-01345A-19-0236. Increased rate base growth within our service territory

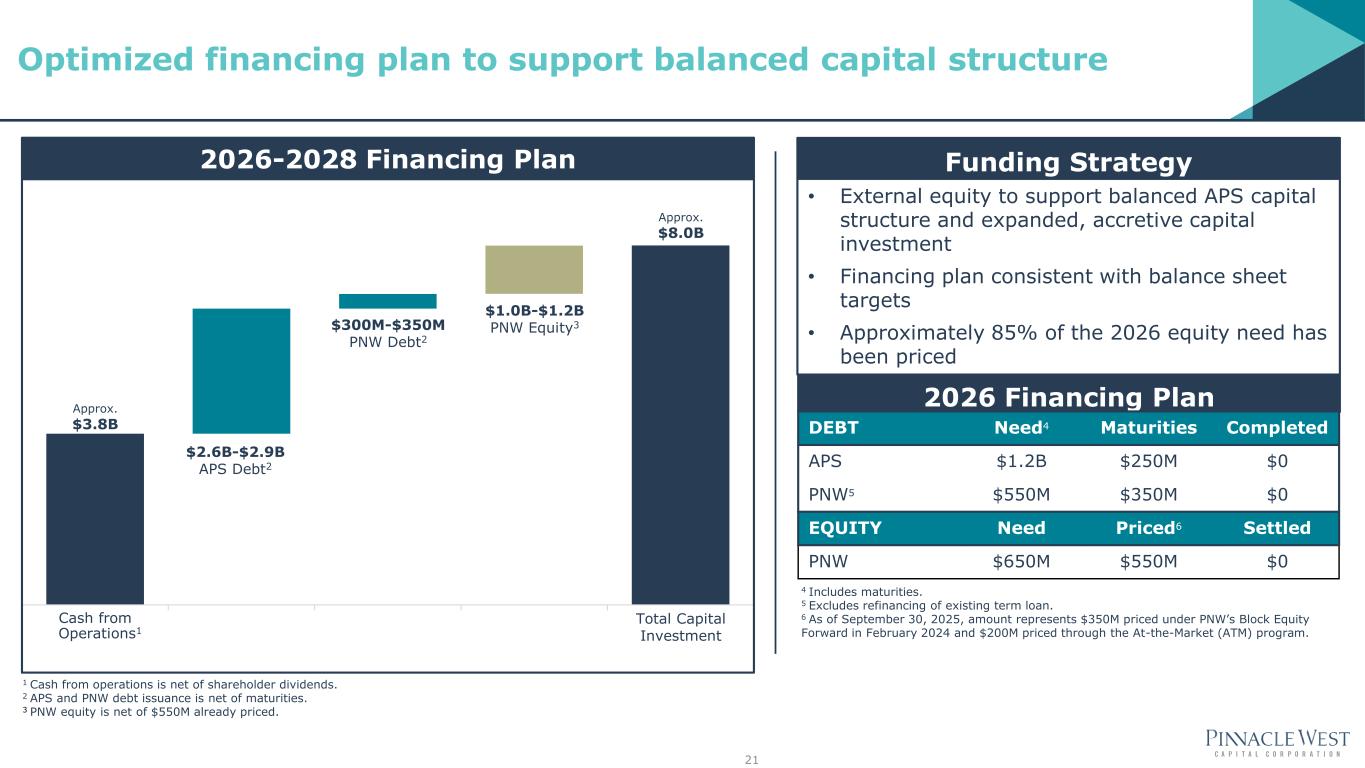

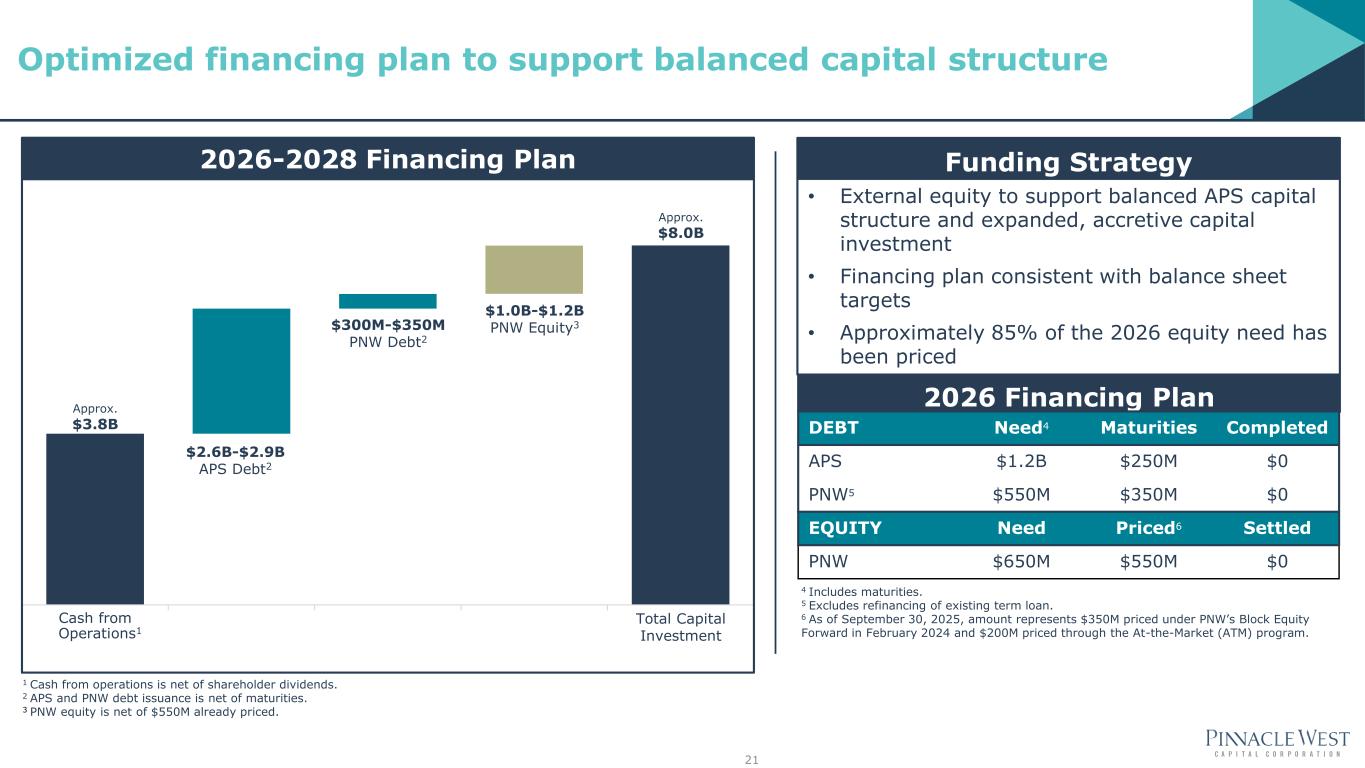

Approx. $3.8B Cash from Operations1 Total Capital Investment $2.6B-$2.9B APS Debt2 $300M-$350M PNW Debt2 1 Cash from operations is net of shareholder dividends. 2 APS and PNW debt issuance is net of maturities. 3 PNW equity is net of $550M already priced. 2026 Financing Plan 2026-2028 Financing Plan Approx. $8.0B $1.0B-$1.2B PNW Equity3 21 Optimized financing plan to support balanced capital structure 4 Includes maturities. 5 Excludes refinancing of existing term loan. 6 As of September 30, 2025, amount represents $350M priced under PNW’s Block Equity Forward in February 2024 and $200M priced through the At-the-Market (ATM) program. DEBT Need4 Maturities Completed APS $1.2B $250M $0 PNW5 $550M $350M $0 EQUITY Need Priced6 Settled PNW $650M $550M $0 Funding Strategy • External equity to support balanced APS capital structure and expanded, accretive capital investment • Financing plan consistent with balance sheet targets • Approximately 85% of the 2026 equity need has been priced

22 Operations & Maintenance Guidance • Core O&M remains flat with rapidly growing customer base • Lean culture and declining O&M per MWh goal • Slight reduction of year-over-year O&M including planned outages We are focused on cost control and customer affordability $955 $965 - $975 $970-$980 $141 $145 - $155 $130-$140 $70 $60 - $70 $45-$55 2024A 2025E 2026E O&M Guidance (millions) Planned Outages RES/DSM Core O&M Numbers may not foot due to rounding.

$2.62 $3.64 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Annualized Dividends per Share ~3.7% DPS CAGR Dividend Targets • Long-term dividend growth • Attractive dividend yield • Managing long-term dividend payout ratio into sustained 65-75% 23 1 Future dividends are subject to declaration at Board of Directors’ discretion. We have a proven dividend growth track record 1

Balance Sheet Targets • Solid investment-grade credit ratings • APS equity layer >50% • PNW FFO/Debt range of 14%-16% Corporate Ratings Senior Unsecured Ratings Short-Term Ratings Outlook APS Moody’s Baa1 Baa1 P-2 Stable S&P BBB+ BBB+ A-2 Stable Fitch BBB+ A- F2 Stable Pinnacle West Moody’s Baa2 Baa2 P-2 Stable S&P BBB+ BBB A-2 Stable Fitch BBB BBB F3 Stable 24 1 We are disclosing credit ratings to enhance understanding of our sources of liquidity and the effects of our ratings on our costs of funds. Ratings are as of October 30, 2025. We are focused on maintaining healthy credit ratings to support affordable growth1

$0 $200 $400 $600 $800 $1,000 $1,200 2026 2028 2030 2032 2034 2036 2038 2040 2042 2044 2046 2048 2050 2052 2054 APS Fixed APS Floating PNW Fixed PNW Floating($millions) As of September 30, 2025 25 Debt maturity profile shows well managed and stable financing plan

26 • Service territory is one of the fastest growing in the nation with a diverse customer base • Improved regulatory environment with focus on reducing regulatory lag • Strong customer centric strategy focused on reliability and customer experience • Proven track record of efficient O&M practices and focus on customer affordability • Solid balance sheet and well managed financing plan • Attractive financial growth profile building off original 2024 midpoint We have a stable foundation with solid execution going forward

2025 Rate Case

28 2025 APS rate case application Overview of rate request ($ in millions) key components Rate Base Growth $208 12 months Post-test Year Plant $82 Fair Value Increment $101 WACC (7.63%) $129 Other (Base fuel, depreciation study, etc.) $143 Total Revenue Requirement $662 Adjustor Transfers $(82) Net Revenue Increase $580 Customer Net Revenue Impact on Day 1 13.99% Additional details • APS has requested rates become effective in the second half of 2026 • Docket number: E-01345A-25-0105 • Additional details, including filing, can be found at http://www.pinnaclewest.com/investors Numbers may not foot due to rounding.

29 2025 APS rate case application Overview of rate request ($ in millions) key components Test Year Ended December 31, 2024 Total Rate Base - Adjusted $15.3B ACC Rate Base - Adjusted $12.5B Embedded Long-Term Cost of Debt 4.26% Allowed Return on Equity 10.70% ROE Band for Formula Rate +/- 20bps Capital Structure Long-Term Debt 47.65% Common Equity 52.35% Base Fuel Rate (¢/kWh) 4.3881¢/kWh Post-Test Year Plant period 12 months Proposed rate design modifications • Direct assignment of generation costs to ensure extra high load factor customers pay for the resources they require • Align rates with costs to move classes closer to their cost of service which supports small and medium sized businesses • Ensure growth pays for growth and offers significant customer protections

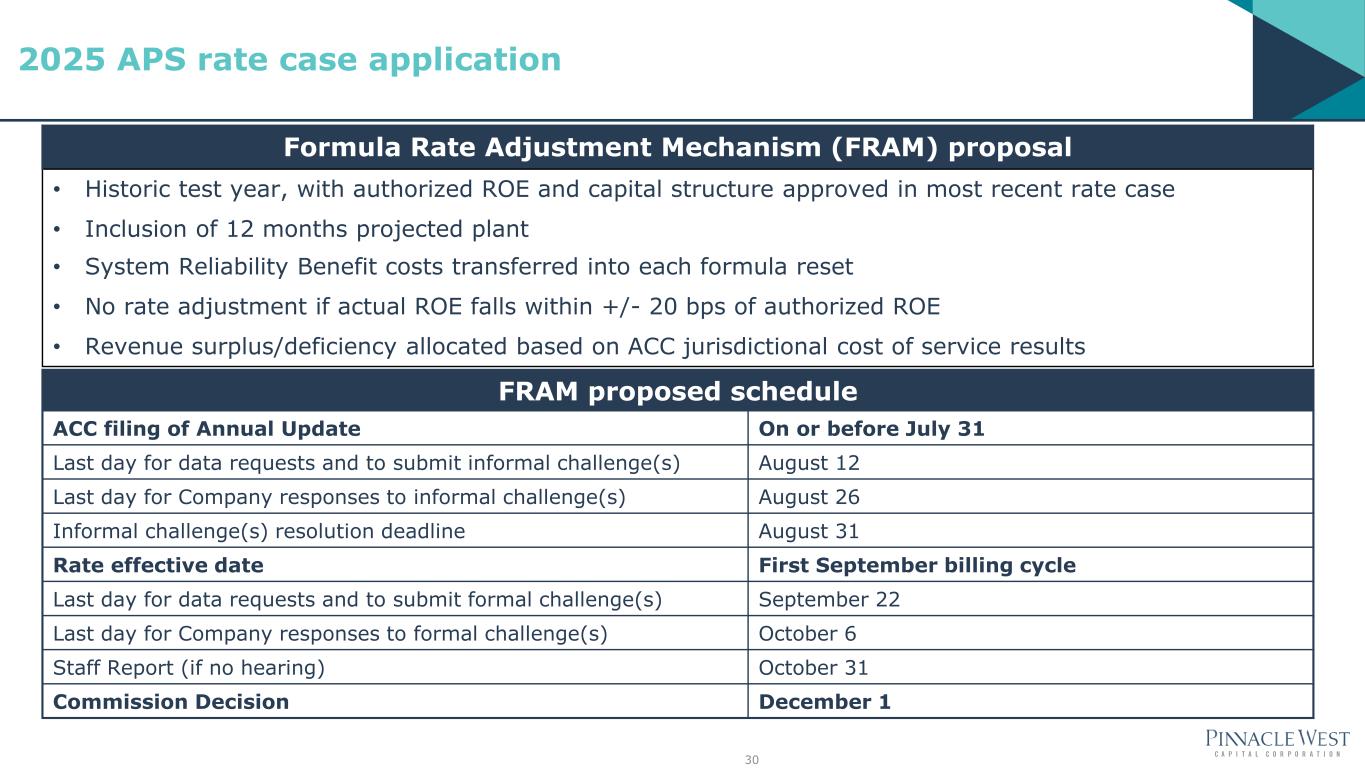

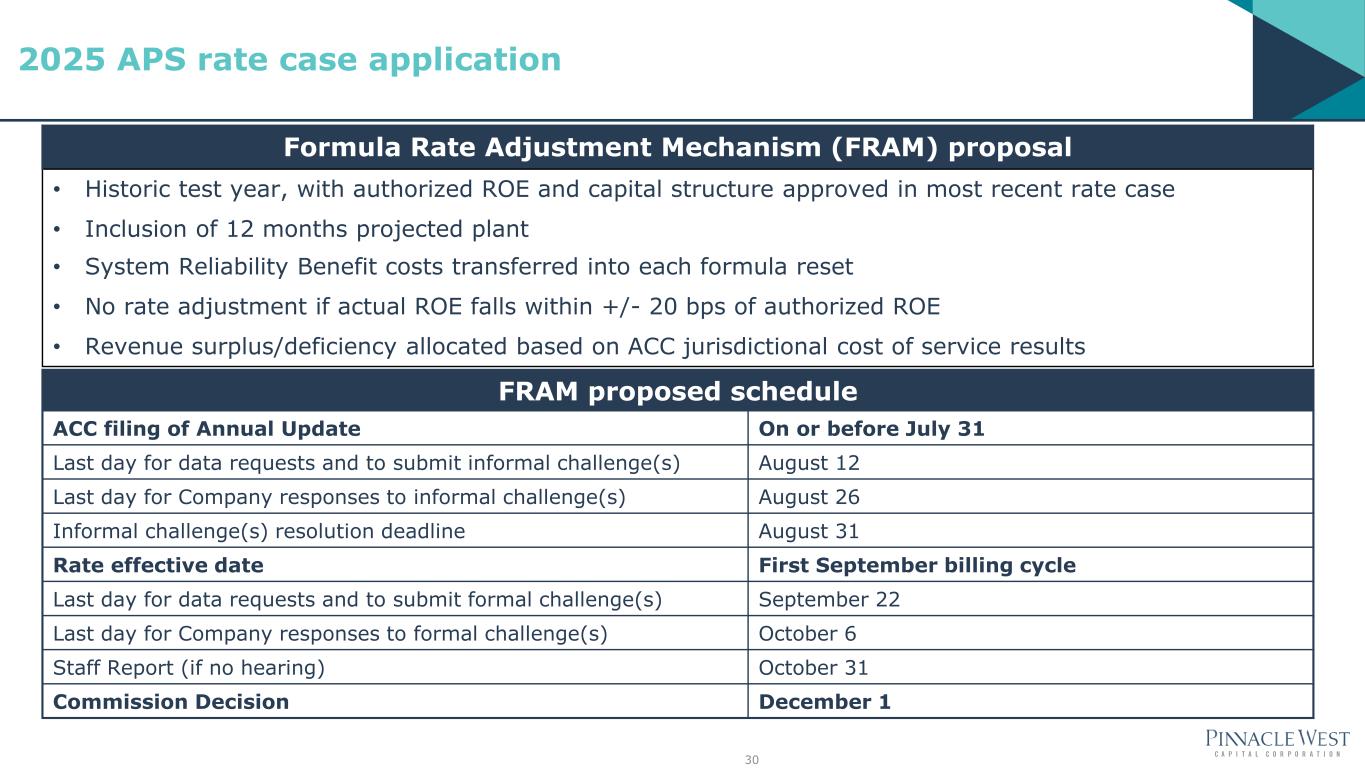

30 2025 APS rate case application Formula Rate Adjustment Mechanism (FRAM) proposal • Historic test year, with authorized ROE and capital structure approved in most recent rate case • Inclusion of 12 months projected plant • System Reliability Benefit costs transferred into each formula reset • No rate adjustment if actual ROE falls within +/- 20 bps of authorized ROE • Revenue surplus/deficiency allocated based on ACC jurisdictional cost of service results FRAM proposed schedule ACC filing of Annual Update On or before July 31 Last day for data requests and to submit informal challenge(s) August 12 Last day for Company responses to informal challenge(s) August 26 Informal challenge(s) resolution deadline August 31 Rate effective date First September billing cycle Last day for data requests and to submit formal challenge(s) September 22 Last day for Company responses to formal challenge(s) October 6 Staff Report (if no hearing) October 31 Commission Decision December 1

Appendix

Case/Docket # Q1 Q2 Q3 Q4 2025 Rate Case E-01345A-25-0105: Notice of Intent filed May 15 Application filed June 13 ACC Letter of Sufficiency filed July 14 Power Supply Adjustor (PSA) E-01345A-22-0144: 2025 PSA rate reset effective March 1 PSA reset to be filed Nov. 26 Transmission Cost Adjustor E-01345A-22-0144: Filed May 15; effective June 1 Lost Fixed Cost Recovery E-01345A-25-0155: 2025 LFCR filed July 31 2025 LFCR effective Dec. 2025/Jan. 2026 (if approved) ACC Inquiry Into Nuclear Issues E-00000A-25-0026: ACC Nuclear Issues Workshop held May 21 Resource Comparison Proxy E-01345A-25-0093: Updated RCP calculation filed May 1 RCP Update effective Sep. 1 Test Year Rules (Regulatory Lag) AU-00000A-23-0012: ACC adopted Formula Rates Policy Statement Dec. 13, 2024 2026 RES Implementation Plan E-01345A-25-0140: 2026 RES plan filed July 1 2026 DSM Implementation Plan E-01345A-25-0106: 2026 DSM Plan 120-day extension request granted 2026 DSM Implementation Plan to be filed (TBD) ACC Inquiry Into Natural Gas Infrastructure G-00000A-25-0029: ACC Natural Gas Workshop held August 26 32 2025 Key Regulatory Dates

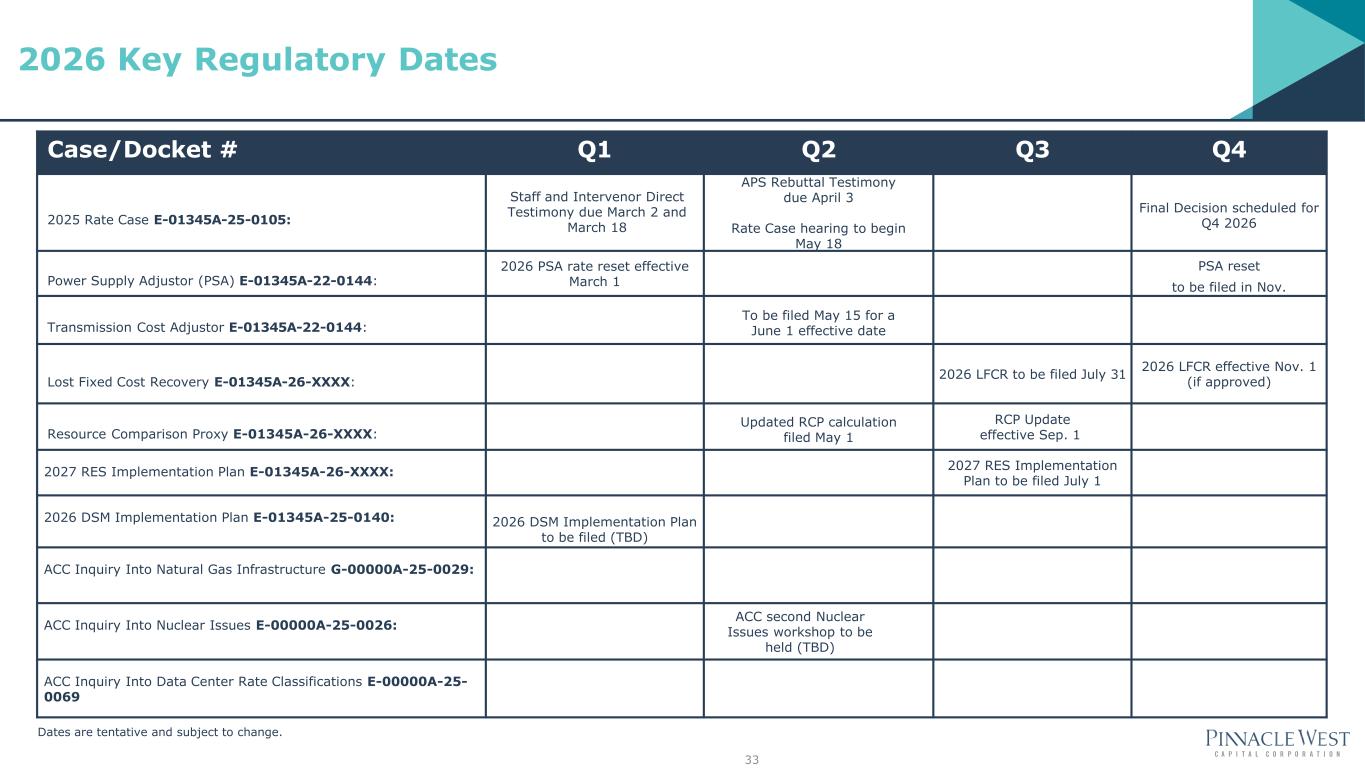

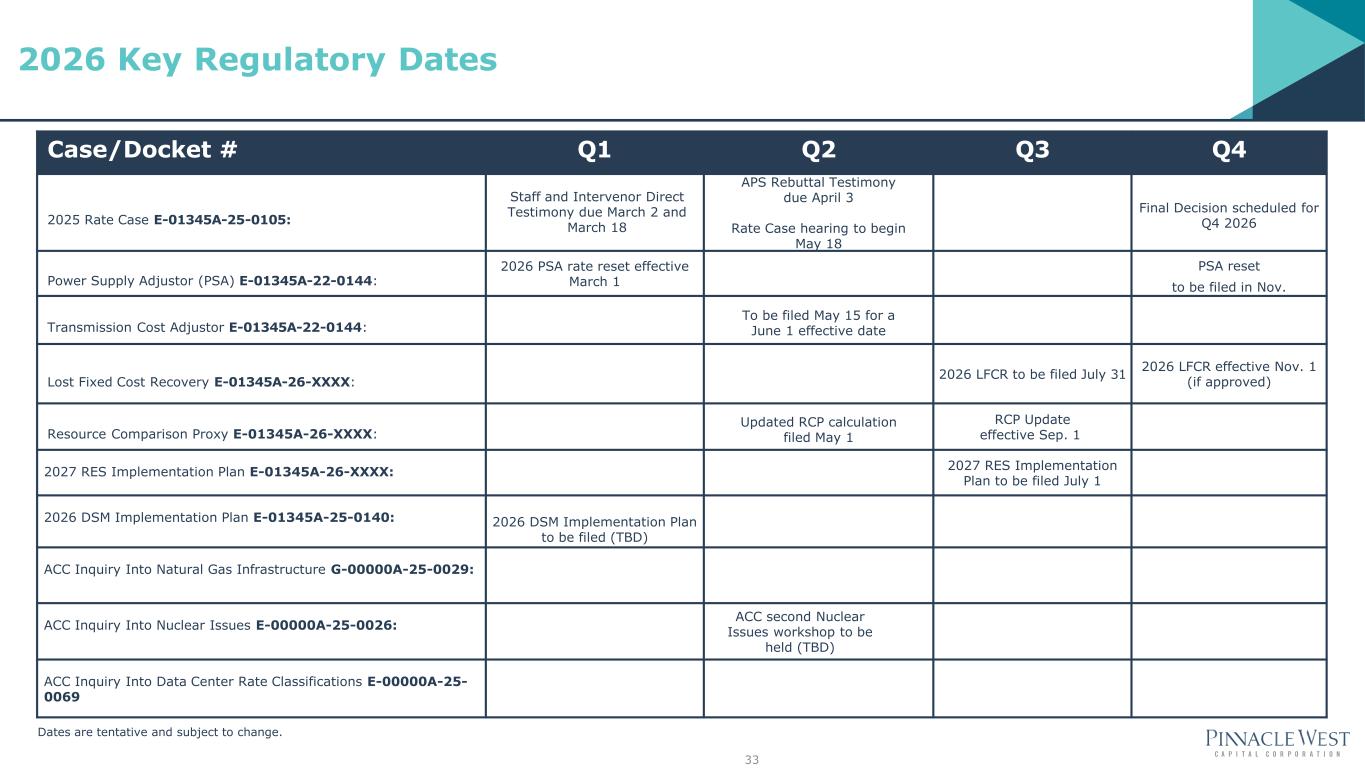

Case/Docket # Q1 Q2 Q3 Q4 2025 Rate Case E-01345A-25-0105: Staff and Intervenor Direct Testimony due March 2 and March 18 APS Rebuttal Testimony due April 3 Rate Case hearing to begin May 18 Final Decision scheduled for Q4 2026 Power Supply Adjustor (PSA) E-01345A-22-0144: 2026 PSA rate reset effective March 1 PSA reset to be filed in Nov. Transmission Cost Adjustor E-01345A-22-0144: To be filed May 15 for a June 1 effective date Lost Fixed Cost Recovery E-01345A-26-XXXX: 2026 LFCR to be filed July 31 2026 LFCR effective Nov. 1 (if approved) Resource Comparison Proxy E-01345A-26-XXXX: Updated RCP calculation filed May 1 RCP Update effective Sep. 1 2027 RES Implementation Plan E-01345A-26-XXXX: 2027 RES Implementation Plan to be filed July 1 2026 DSM Implementation Plan E-01345A-25-0140: 2026 DSM Implementation Plan to be filed (TBD) ACC Inquiry Into Natural Gas Infrastructure G-00000A-25-0029: ACC Inquiry Into Nuclear Issues E-00000A-25-0026: ACC second Nuclear Issues workshop to be held (TBD) ACC Inquiry Into Data Center Rate Classifications E-00000A-25- 0069 33 2026 Key Regulatory Dates Dates are tentative and subject to change.

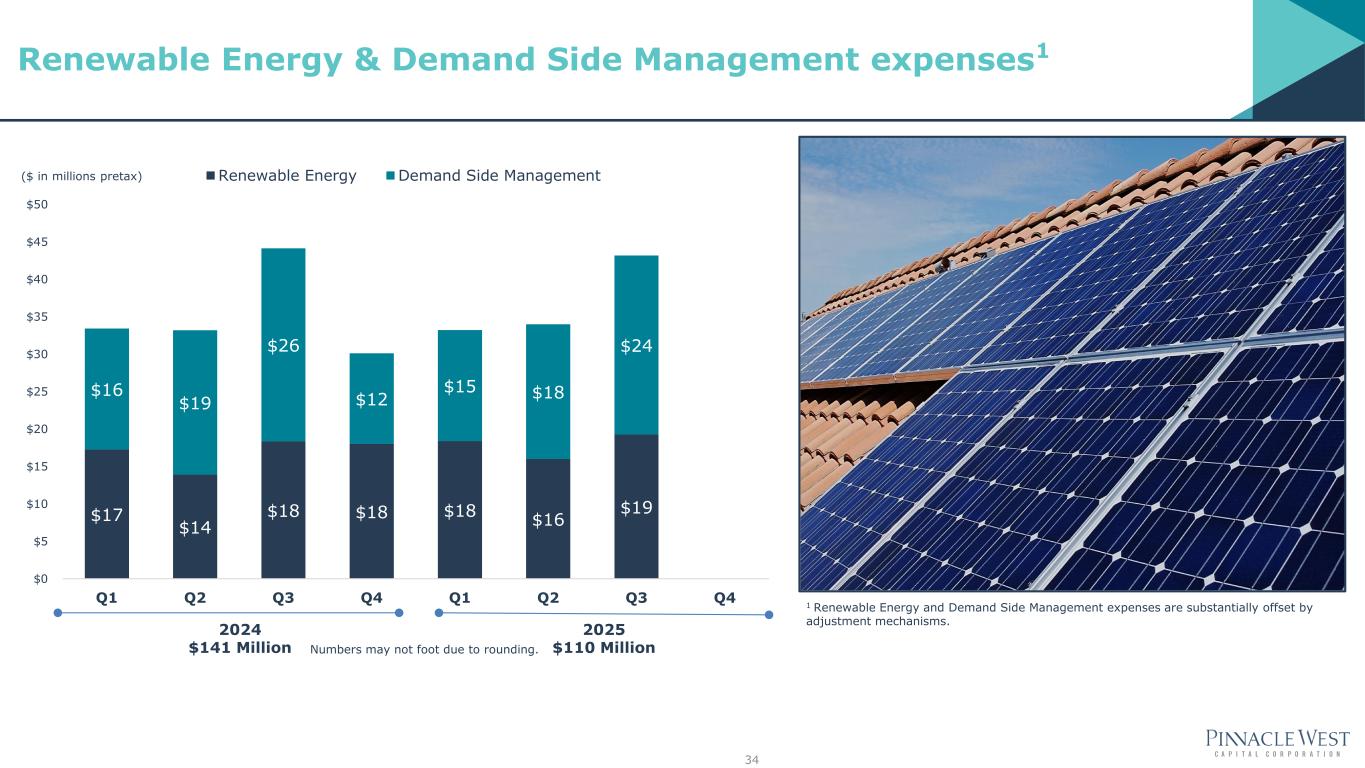

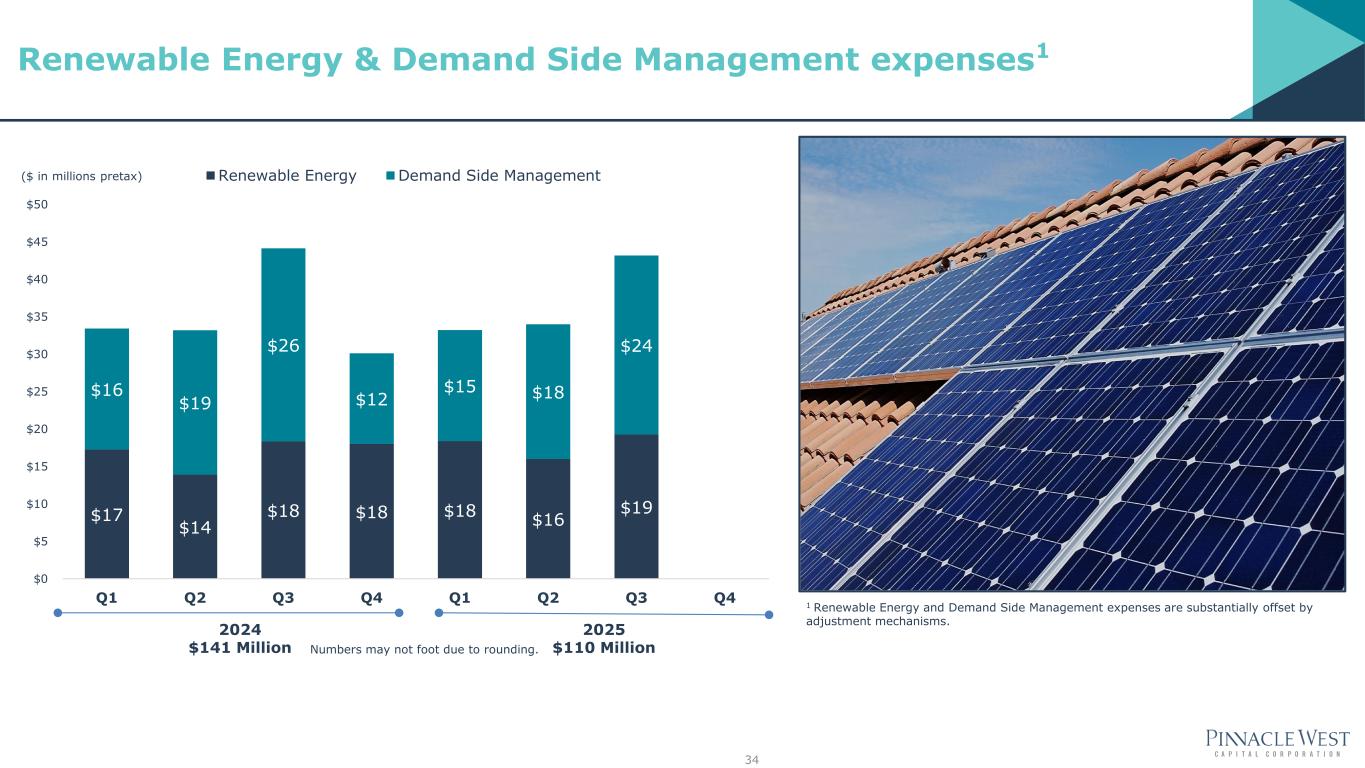

$17 $14 $18 $18 $18 $16 $19 $16 $19 $26 $12 $15 $18 $24 $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 $50 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Renewable Energy Demand Side Management 2024 $141 Million 2025 $110 Million 1 Renewable Energy and Demand Side Management expenses are substantially offset by adjustment mechanisms. Numbers may not foot due to rounding. ($ in millions pretax) 34 Renewable Energy & Demand Side Management expenses1

($3) $14 $26 Q1 Q2 Q3 Q4 Variances vs. Normal All periods recalculated to current 10-year rolling average (2014 – 2023). Numbers may not foot due to rounding. ($ in millions pretax) 2025 Total Weather Impact: $37 Million 35 2025 gross margin effects of weather

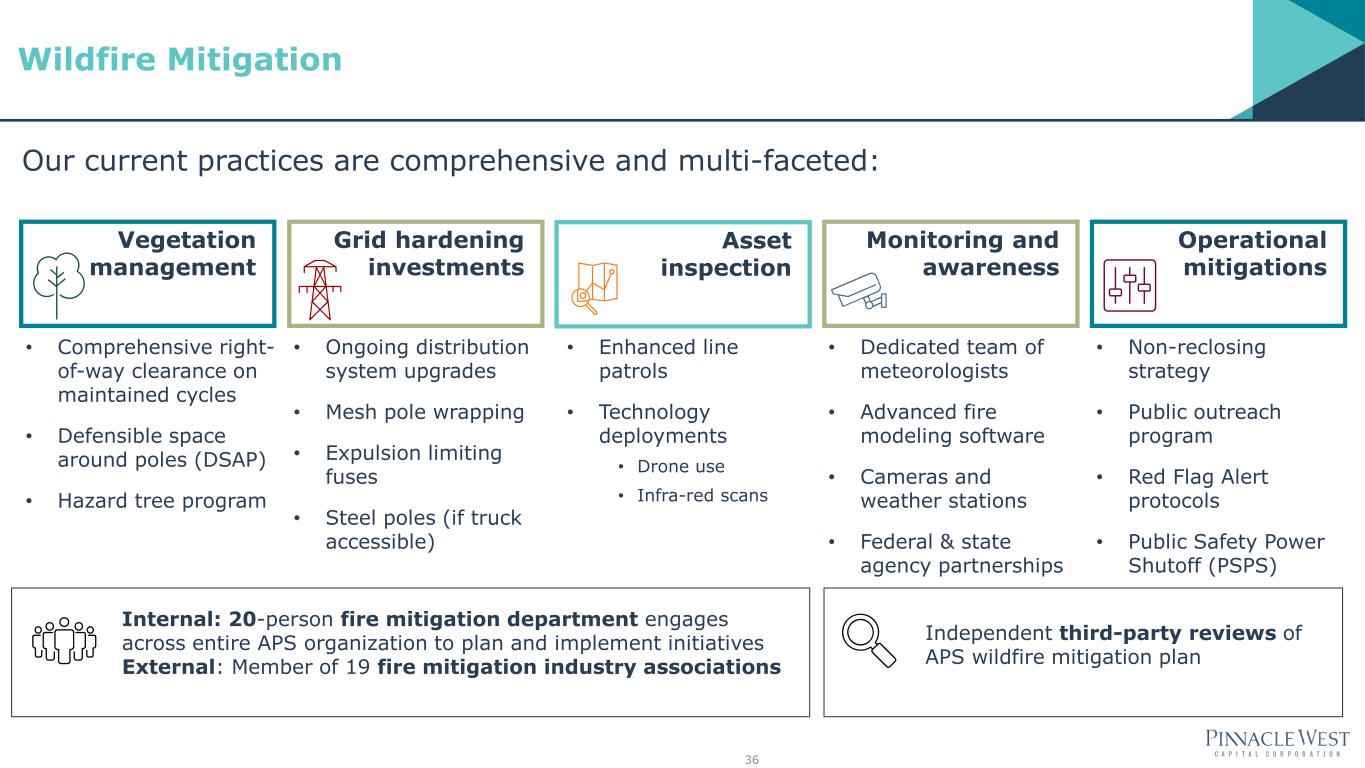

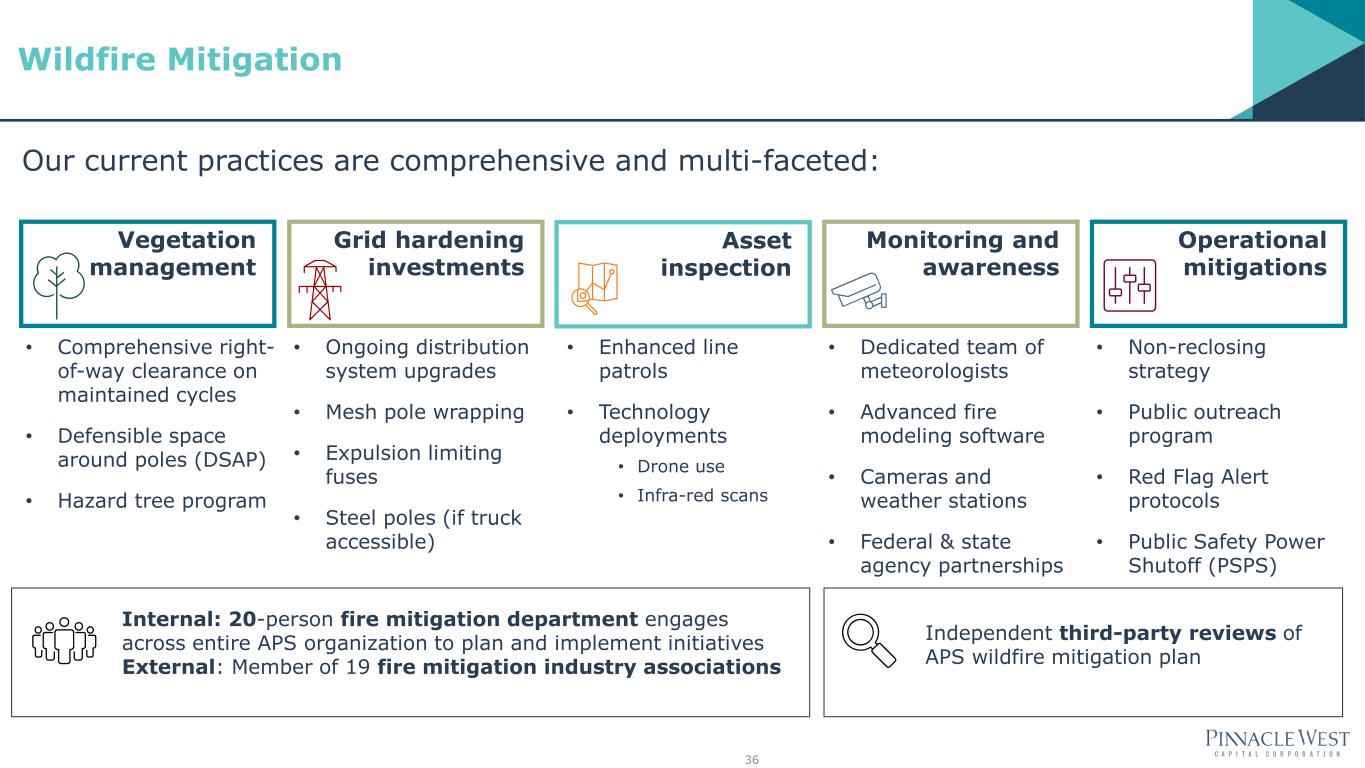

36 Wildfire Mitigation Vegetation management Asset inspection Monitoring and awareness Operational mitigations • Comprehensive right- of-way clearance on maintained cycles • Defensible space around poles (DSAP) • Hazard tree program • Enhanced line patrols • Technology deployments • Drone use • Infra-red scans • Non-reclosing strategy • Public outreach program • Red Flag Alert protocols • Public Safety Power Shutoff (PSPS) • Dedicated team of meteorologists • Advanced fire modeling software • Cameras and weather stations • Federal & state agency partnerships Grid hardening investments • Ongoing distribution system upgrades • Mesh pole wrapping • Expulsion limiting fuses • Steel poles (if truck accessible) Internal: 20-person fire mitigation department engages across entire APS organization to plan and implement initiatives External: Member of 19 fire mitigation industry associations Independent third-party reviews of APS wildfire mitigation plan Our current practices are comprehensive and multi-faceted:

Q1 Plant Unit Actual Duration in Days Redhawk CC2 60 Four Corners 4 72 Coal, Nuclear and Large Gas Planned Outages 37 2025 Planned Outage Schedule Q2 Plant Unit Actual Duration in Days Palo Verde1 1 42 Four Corners 4 12 Q4 Plant Unit Estimated Duration in Days Palo Verde 3 36 1 Outage began at end of Q1

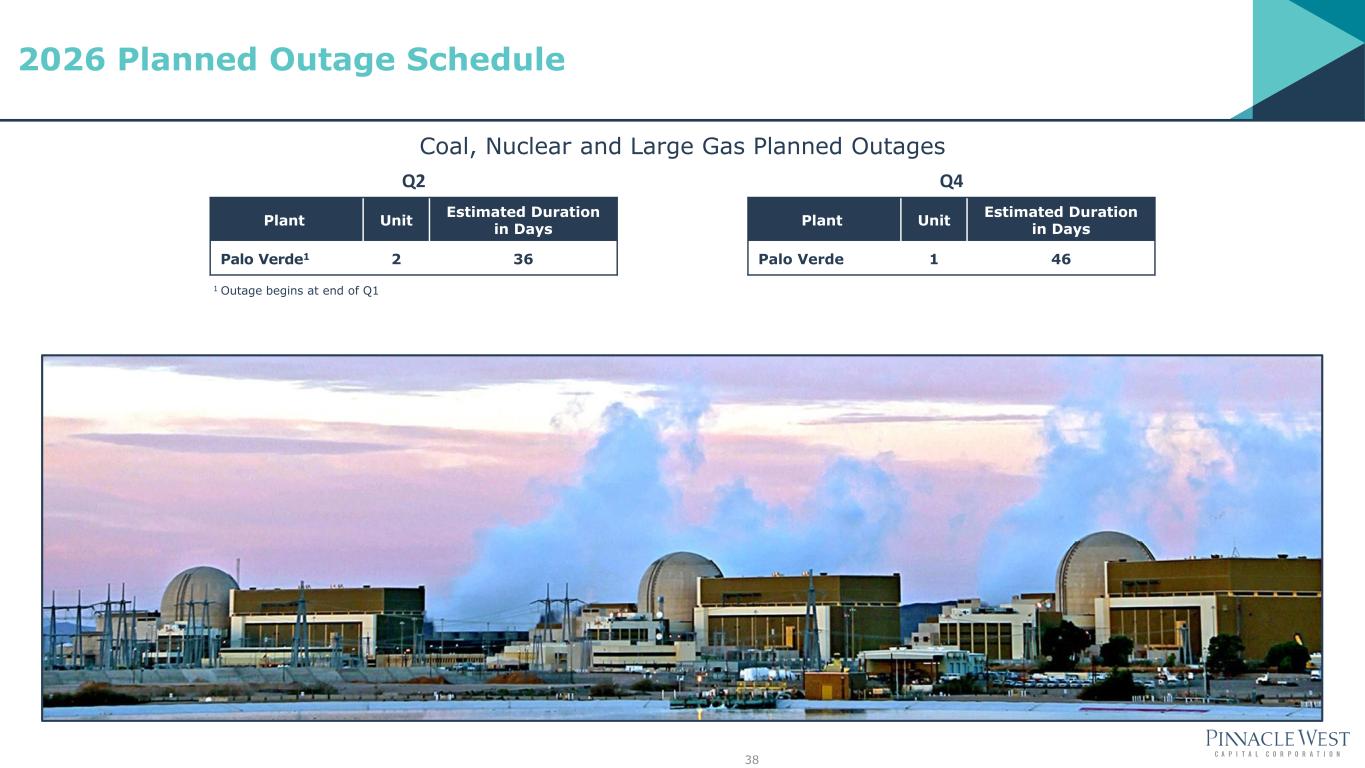

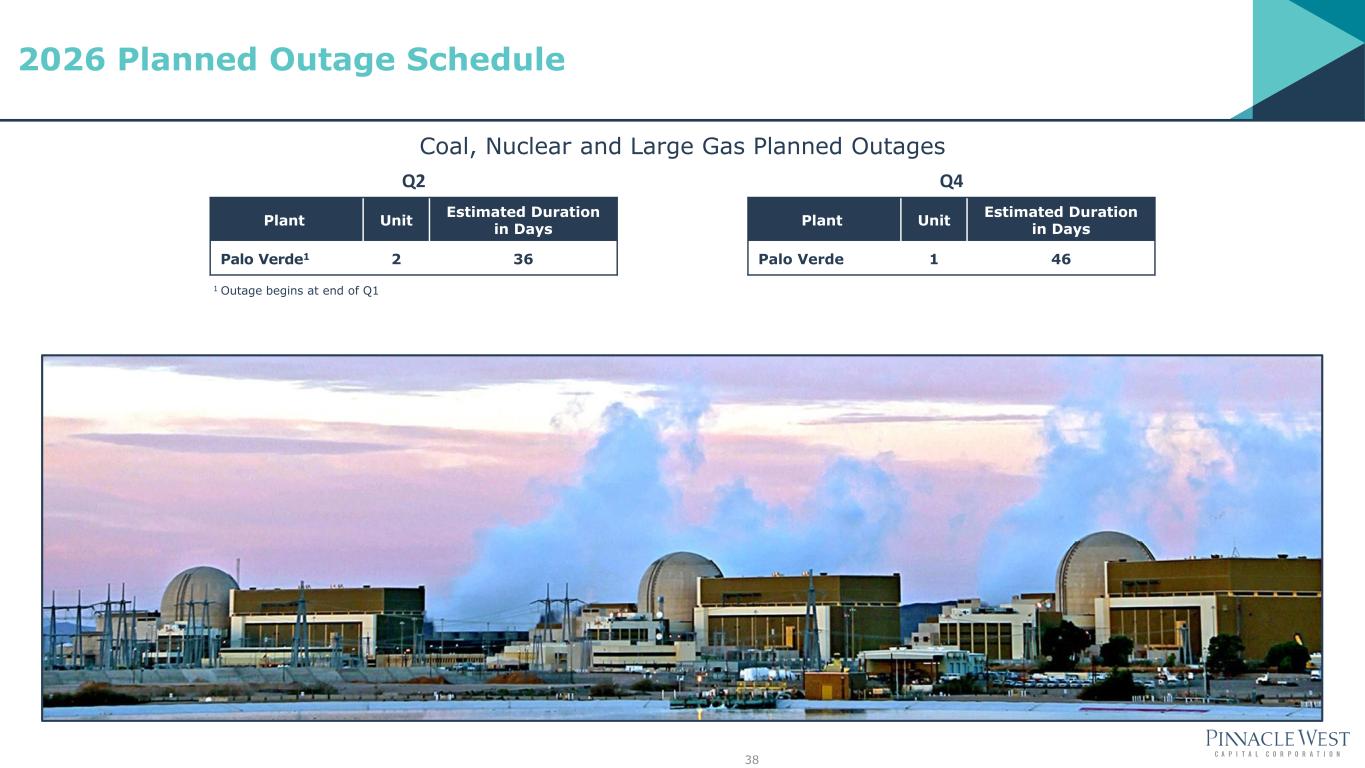

Coal, Nuclear and Large Gas Planned Outages 38 2026 Planned Outage Schedule Q2 Plant Unit Estimated Duration in Days Palo Verde1 2 36 Q4 Plant Unit Estimated Duration in Days Palo Verde 1 46 1 Outage begins at end of Q1