0000750686false

00007506862022-06-232022-06-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (date of earliest event reported): June 23, 2022

Camden National Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

Maine |

01-28190 |

01-0413282 |

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

Two Elm Street |

Camden |

Maine |

04843 |

(Address of principal executive offices) |

(Zip Code) |

Registrant's telephone number, including area code: (207) 236-8821

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, without par value |

CAC |

The NASDAQ Stock Market LLC |

|

|

|

|

|

|

| Item 7.01 |

Regulation FD Disclosure. |

Camden National Corporation (the "Company") prepared an investor presentation with information about the Company for an investor meeting to be held on June 23, 2022. The investor presentation is attached as Exhibit 99.1. The investor presentation is being furnished pursuant to Item 7.01, and the information contained therein shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities under that Section. Furthermore, the information contained in Exhibit 99.1 shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933.

|

|

|

|

|

|

| Item 9.01 |

Financial Statements and Exhibits. |

(d) The following exhibits are filed with this Report:

|

|

|

|

|

|

| Exhibit No. |

Description |

|

|

| 101 |

Cover Page Interactive Data - the cover page XBRL tags are embedded within the Inline XBRL document. |

| 104 |

Cover Page Interactive Data File - Included in Exhibit 101. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: June 23, 2022

|

|

|

|

|

|

|

|

|

| |

CAMDEN NATIONAL CORPORATION

(Registrant) |

| |

|

| |

|

|

By: |

/s/ MICHAEL R. ARCHER |

| |

|

Michael R. Archer

Chief Financial Officer and Principal Financial & Accounting Officer |

EX-99.1

2

ex99.htm

EX-99.1

ex99

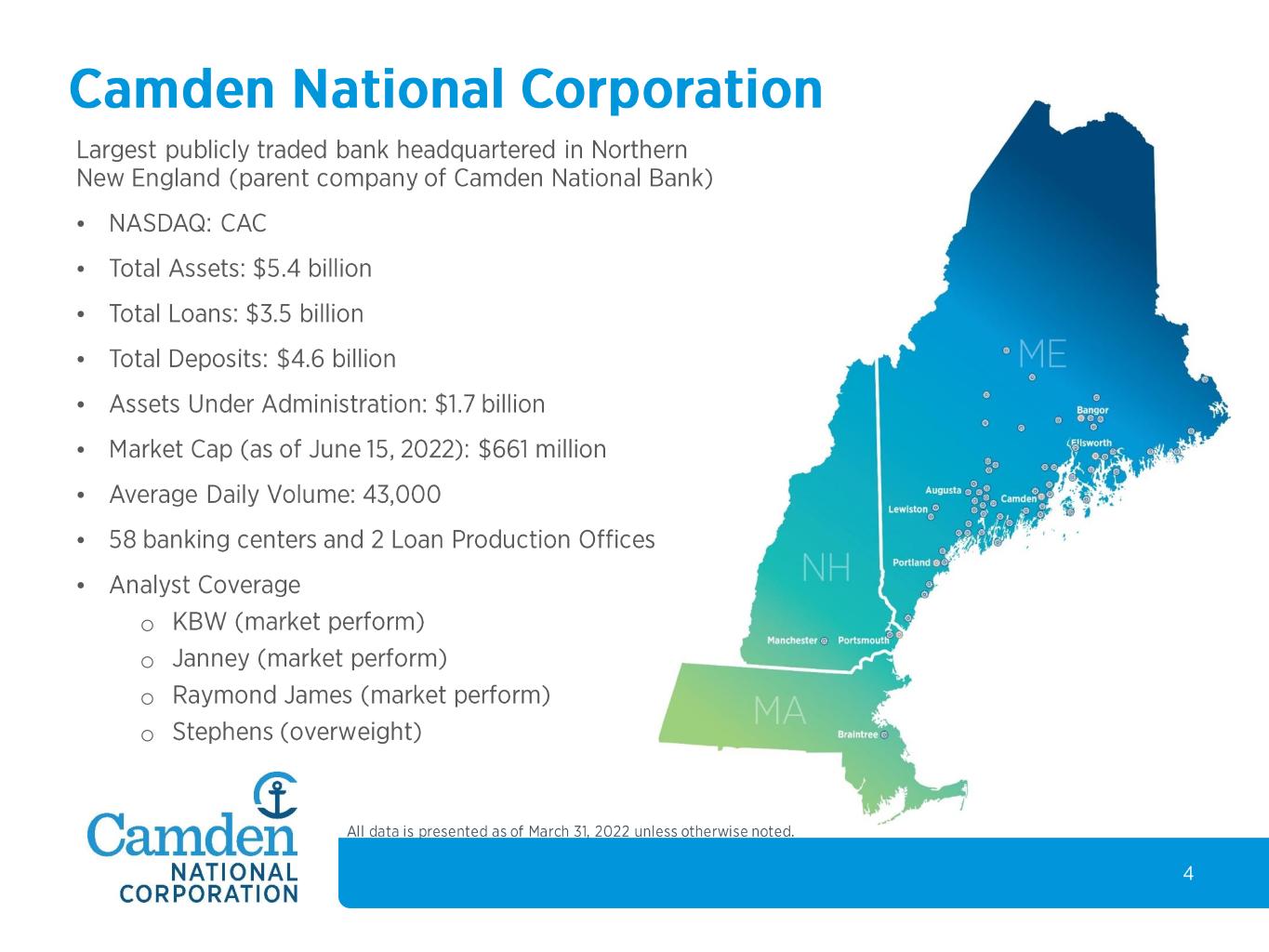

• • • • • • • • • o o o o

• • • • • • • • • • • • •

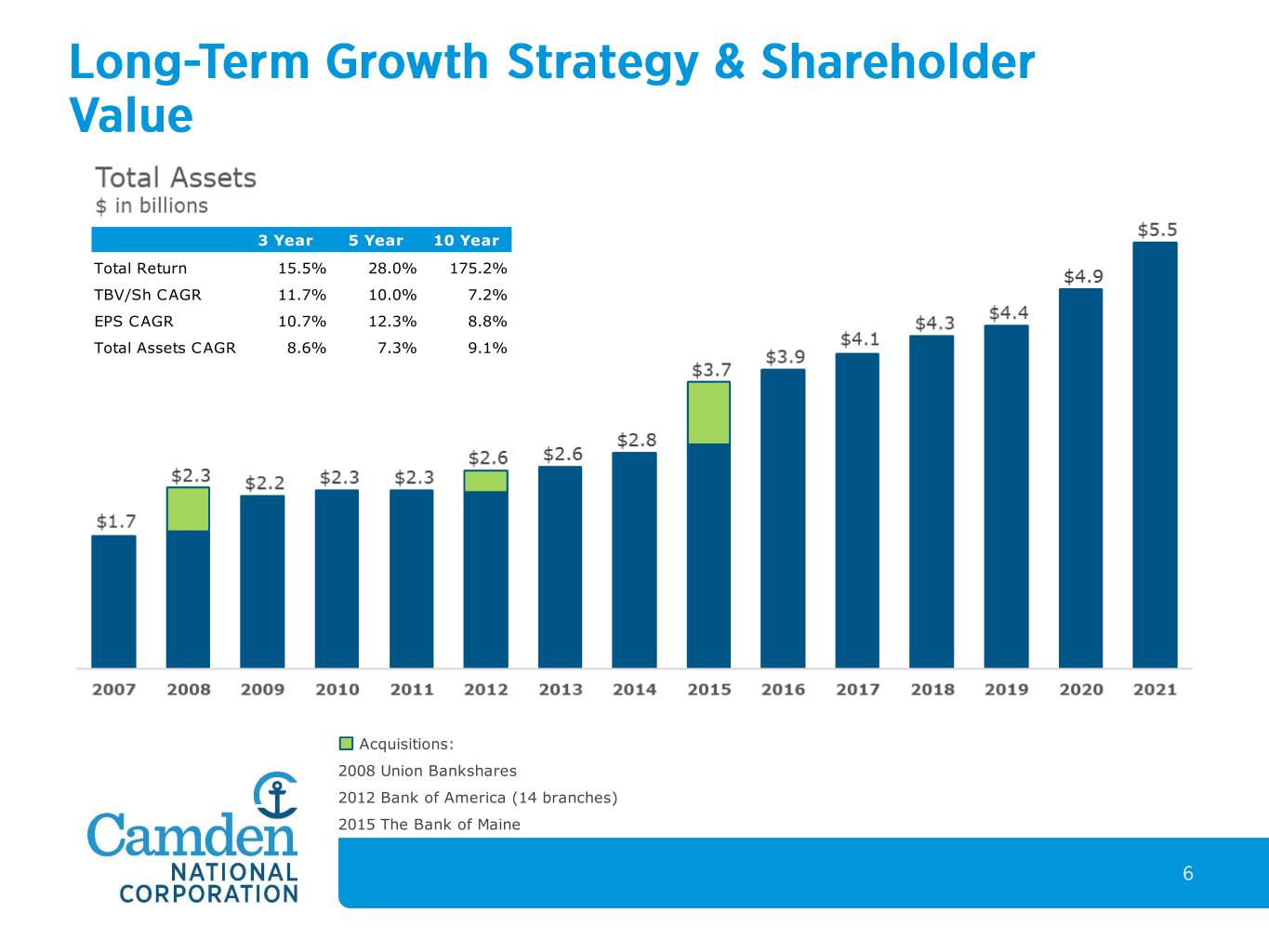

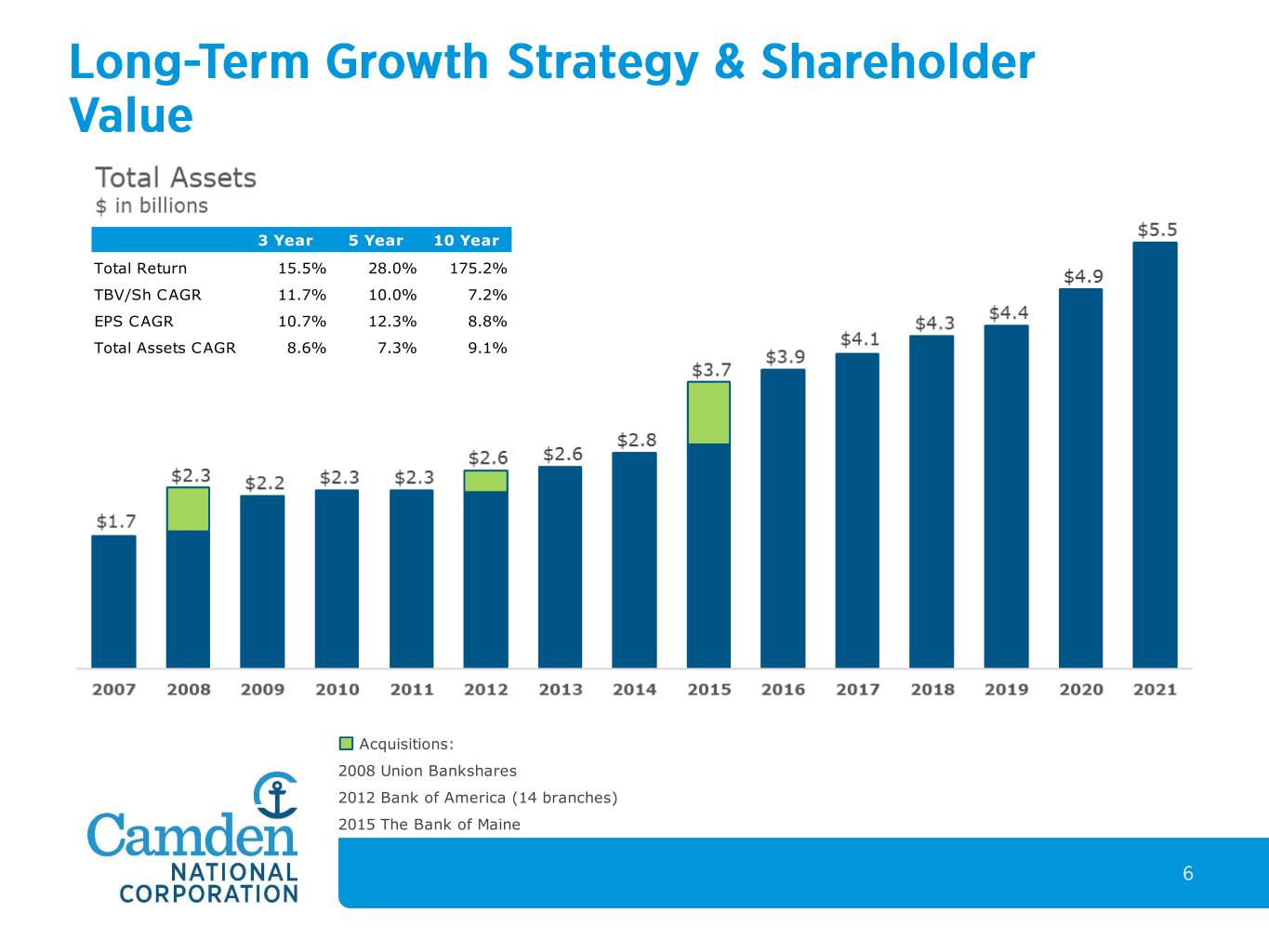

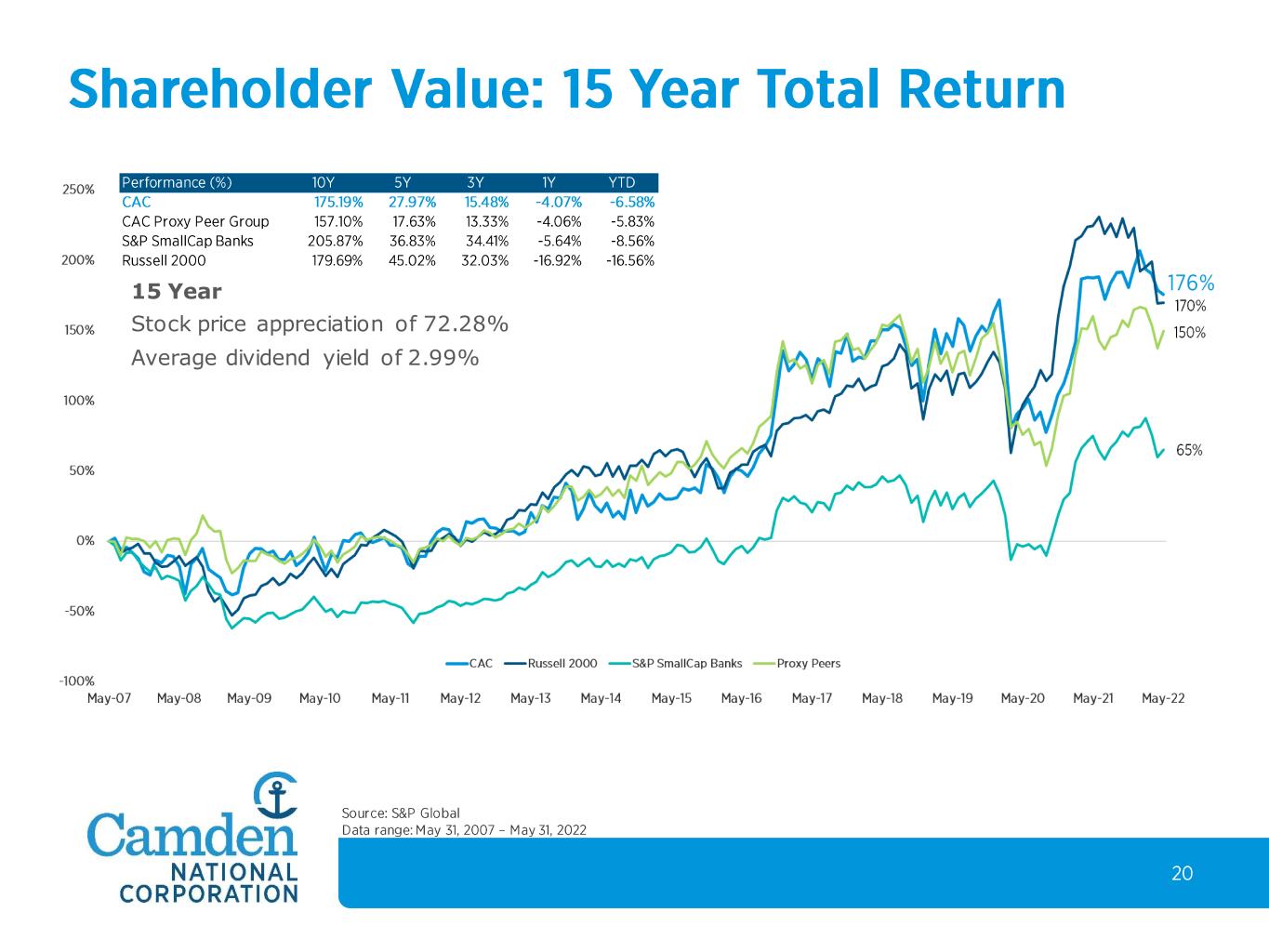

Acquisitions: 2008 Union Bankshares 2012 Bank of America (14 branches) 2015 The Bank of Maine 3 Year 5 Year 10 Year Total Return 15.5% 28.0% 175.2% TBV/Sh CAGR 11.7% 10.0% 7.2% EPS CAGR 10.7% 12.3% 8.8% Total Assets CAGR 8.6% 7.3% 9.1%

• • • • •

• • • • • •

• • • • •

• • • • •

• • • • • • • • •

• • • •

• • • • • • • •

• • • • •

• • • • • • • • •

• • • • • • • • • • • • •

• •

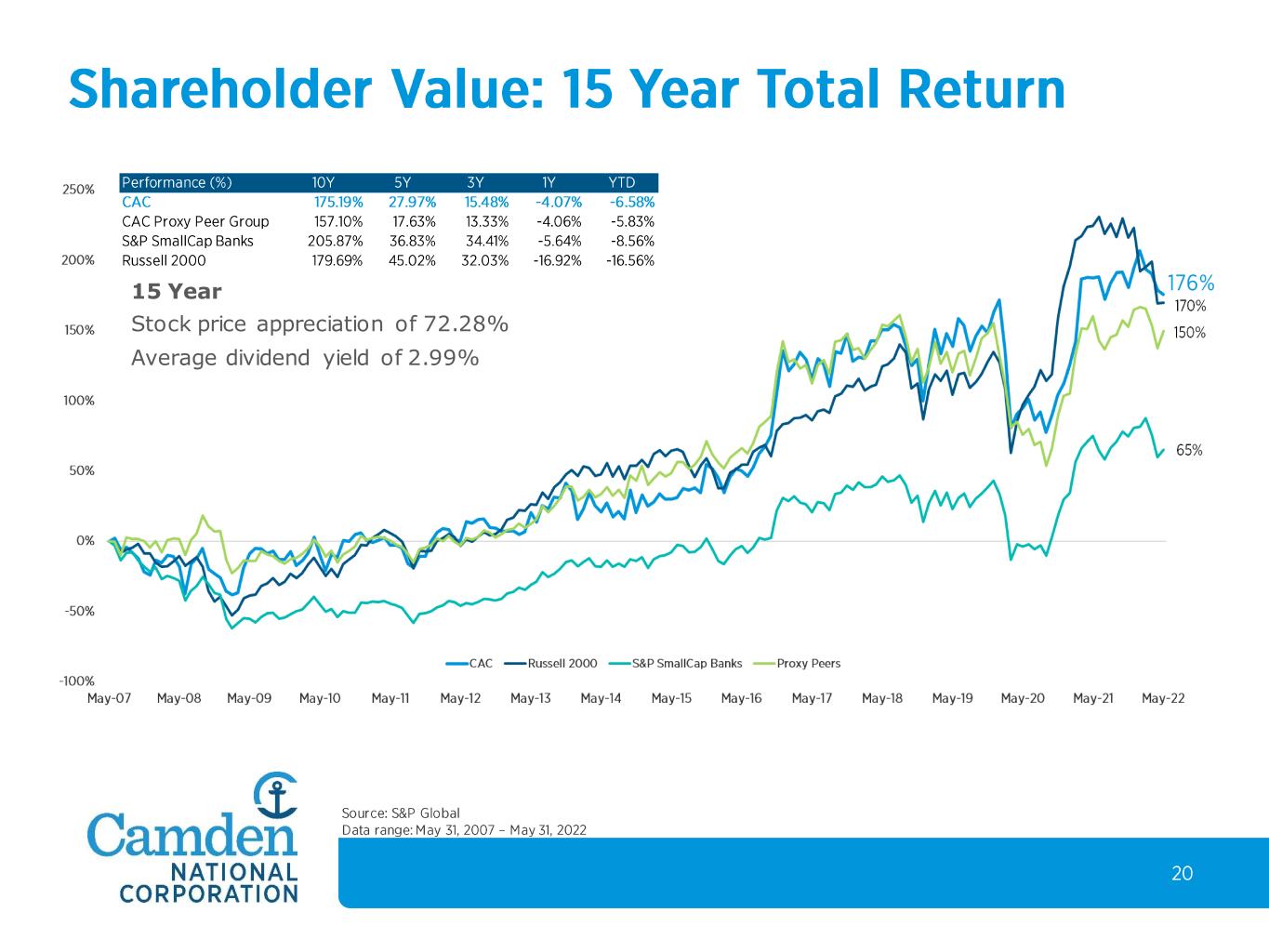

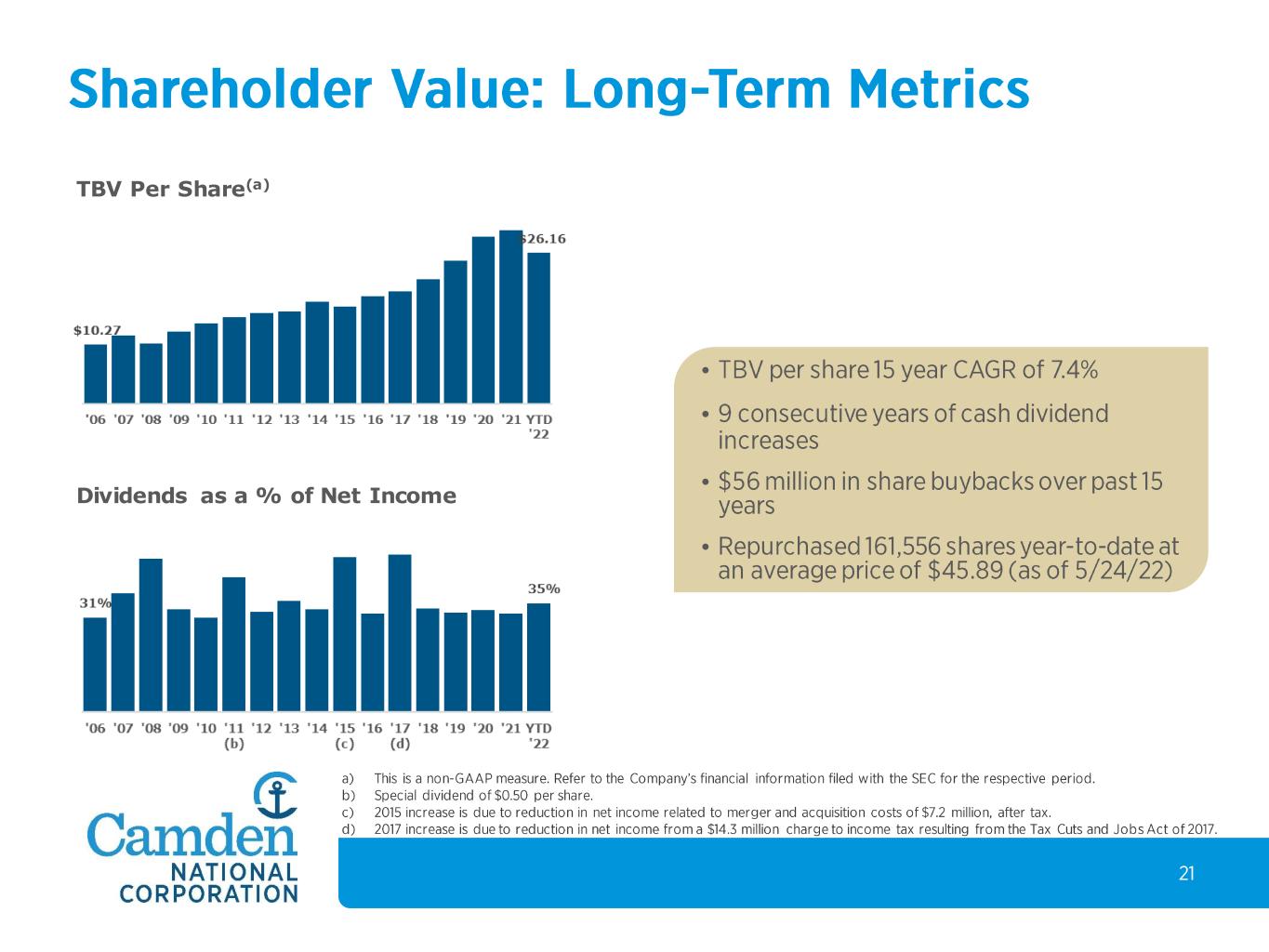

15 Year Stock price appreciation of 72.28% Average dividend yield of 2.99%

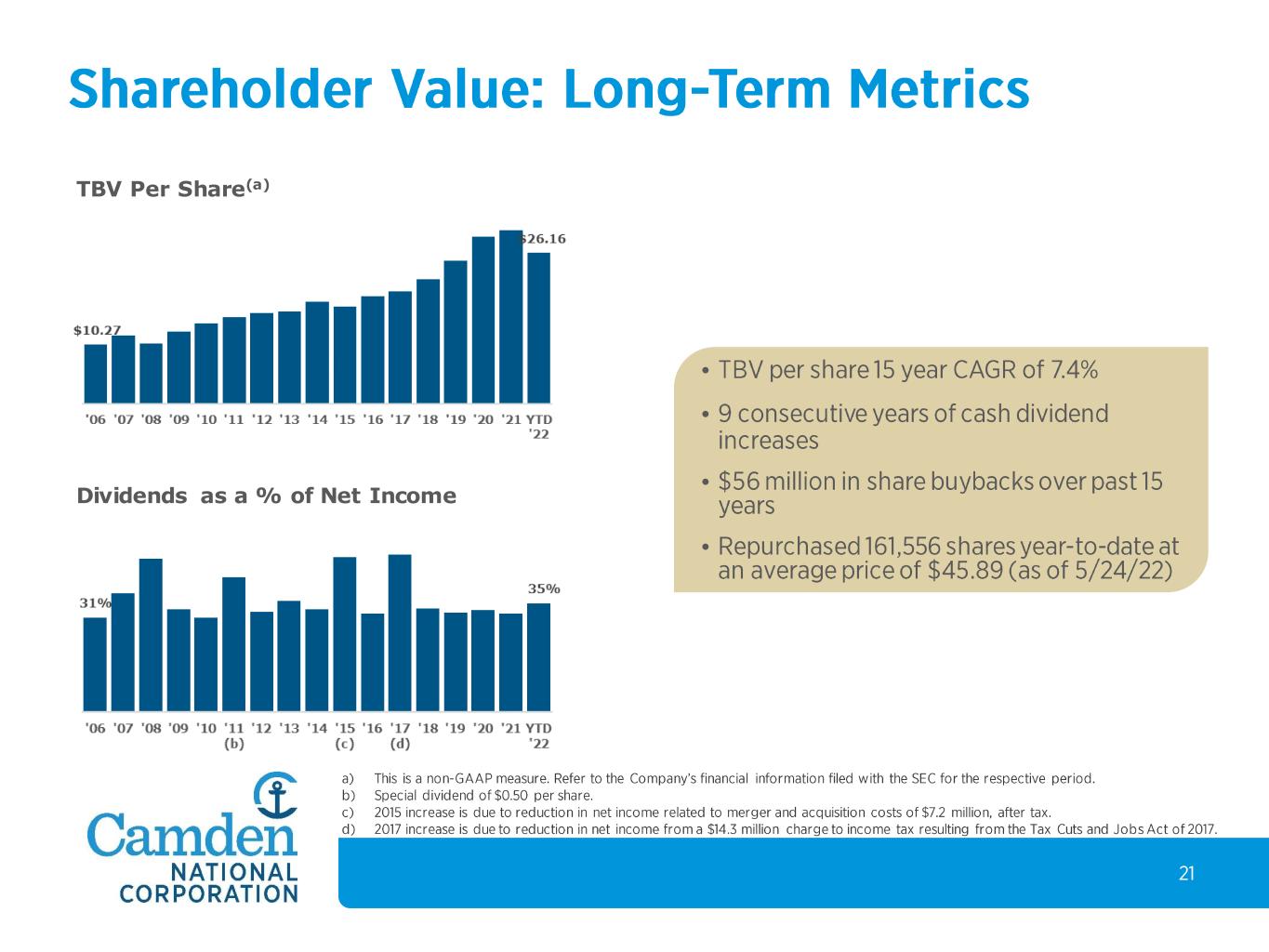

TBV Per Share(a) Dividends as a % of Net Income • • • •

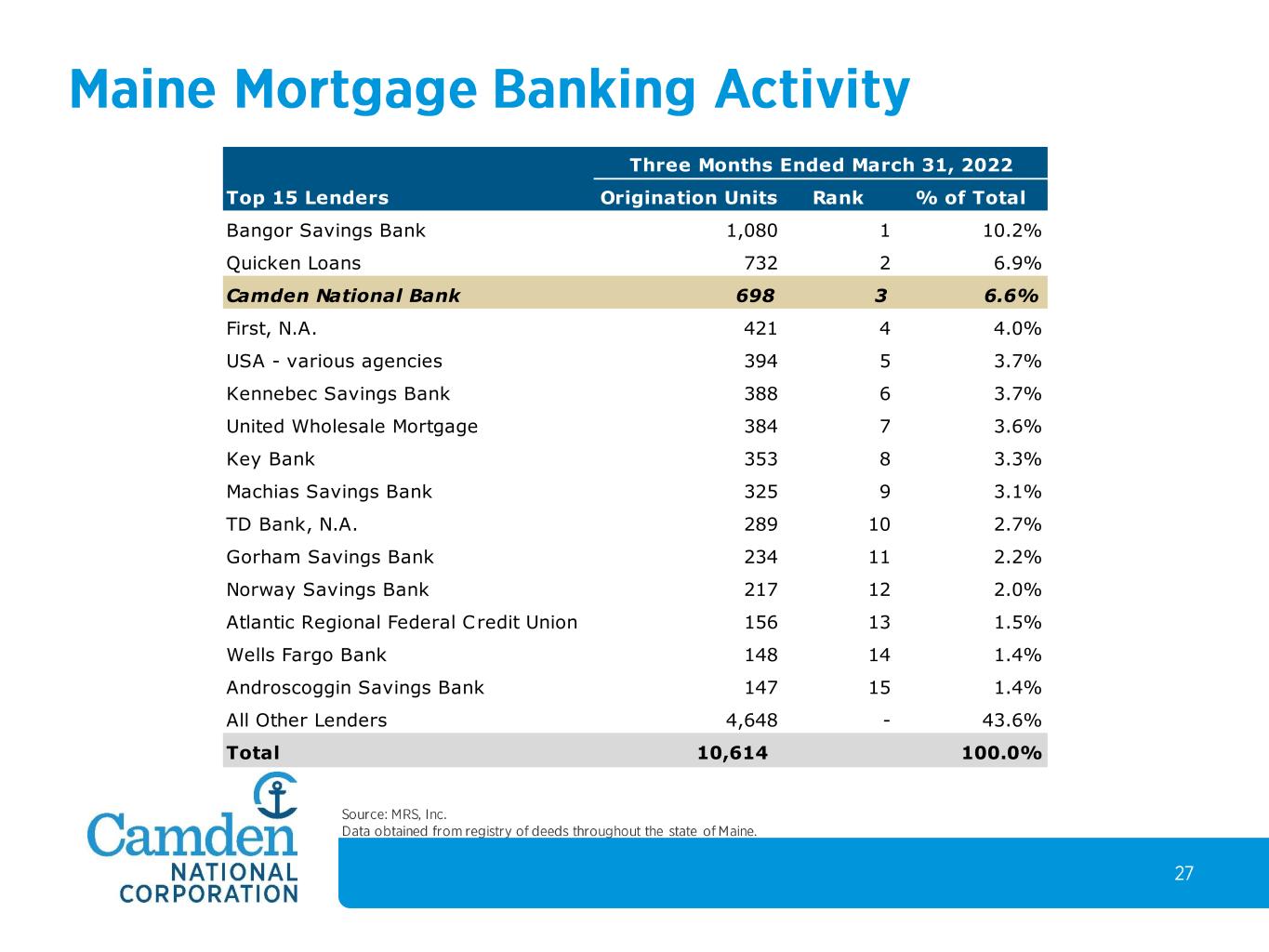

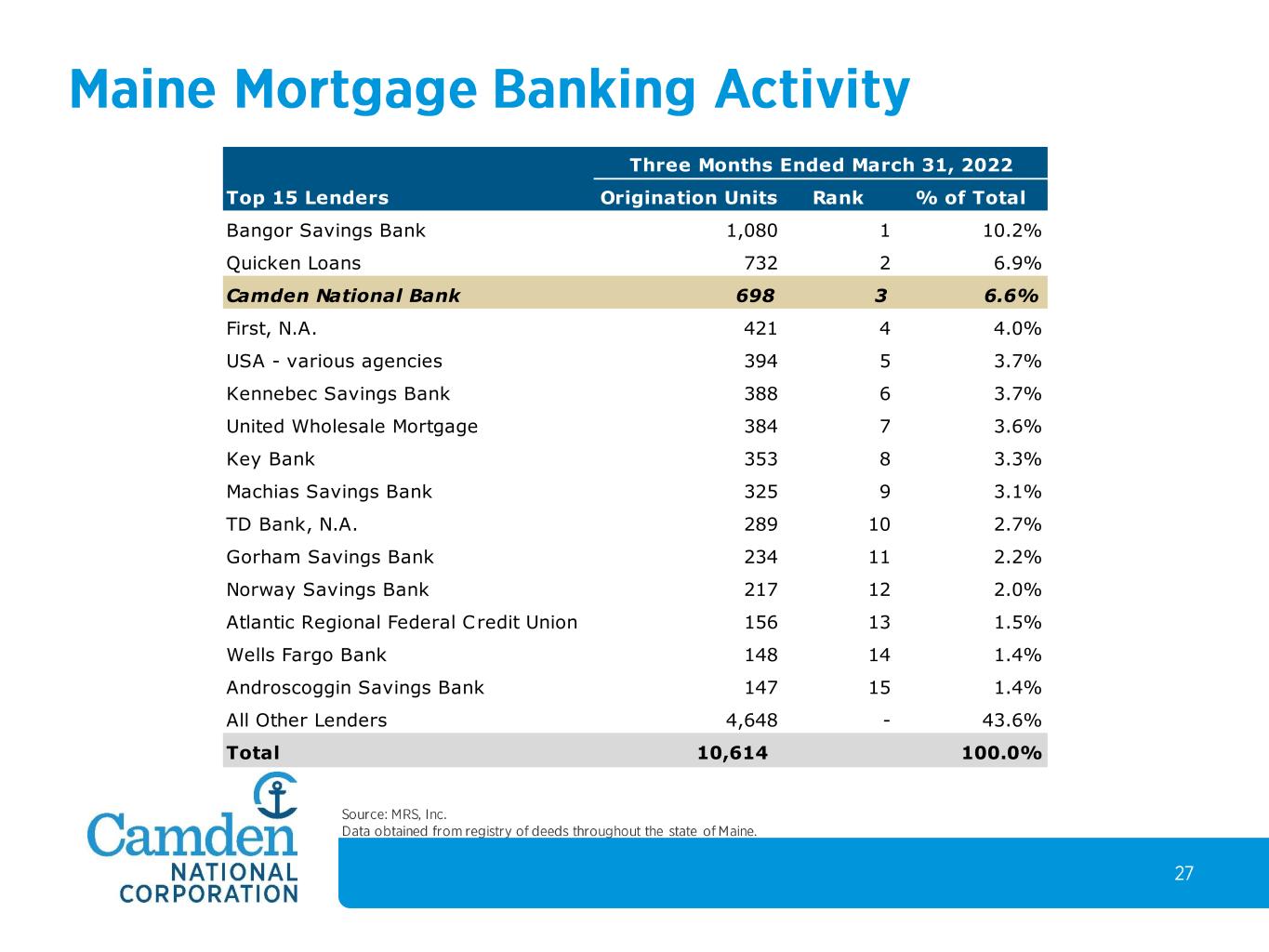

Top 15 Lenders Origination Units Rank % of Total Bangor Savings Bank 1,080 1 10.2% Quicken Loans 732 2 6.9% Camden National Bank 698 3 6.6% First, N.A. 421 4 4.0% USA - various agencies 394 5 3.7% Kennebec Savings Bank 388 6 3.7% United Wholesale Mortgage 384 7 3.6% Key Bank 353 8 3.3% Machias Savings Bank 325 9 3.1% TD Bank, N.A. 289 10 2.7% Gorham Savings Bank 234 11 2.2% Norway Savings Bank 217 12 2.0% Atlantic Regional Federal Credit Union 156 13 1.5% Wells Fargo Bank 148 14 1.4% Androscoggin Savings Bank 147 15 1.4% All Other Lenders 4,648 - 43.6% Total 10,614 100.0% Three Months Ended March 31, 2022

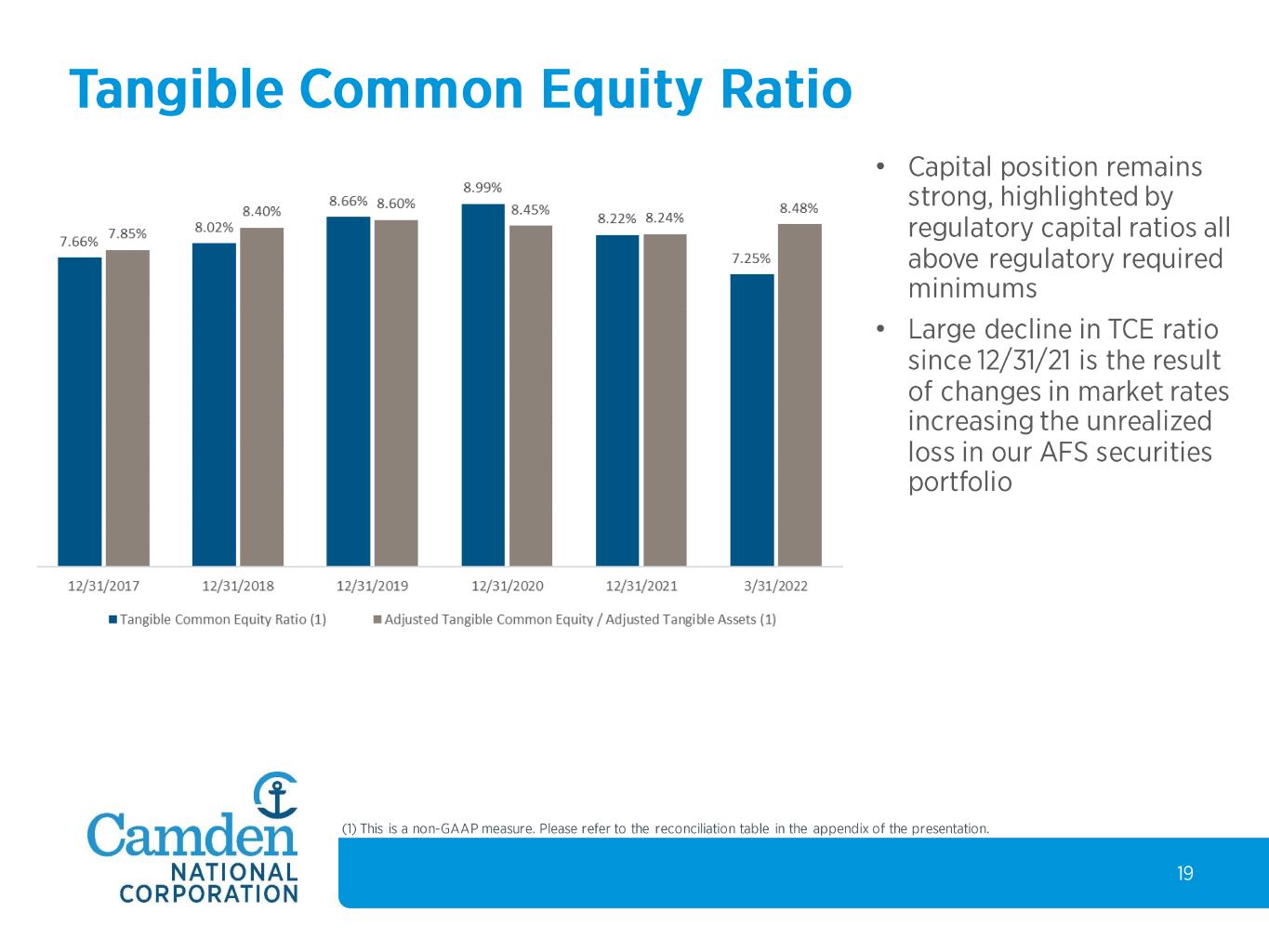

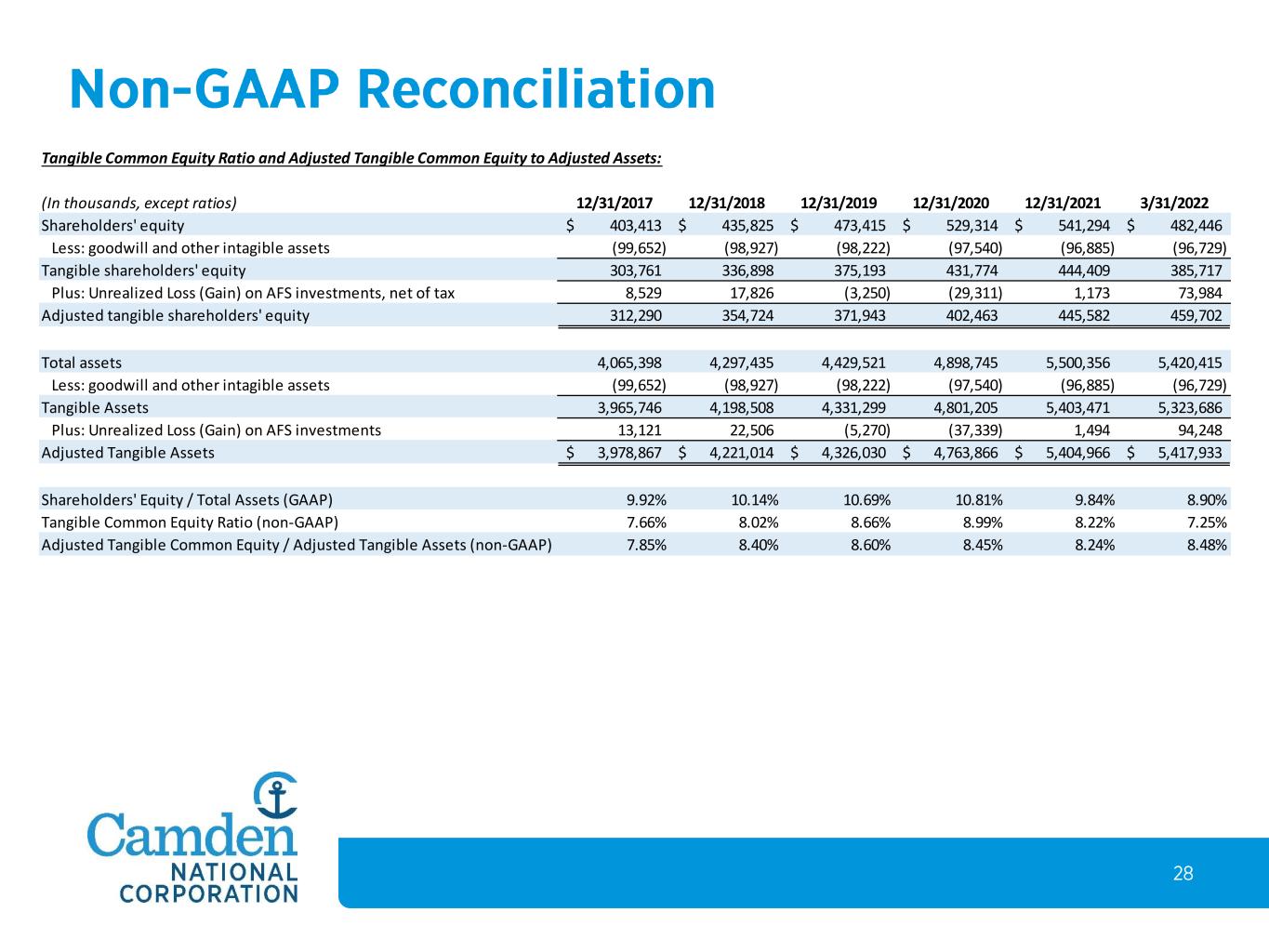

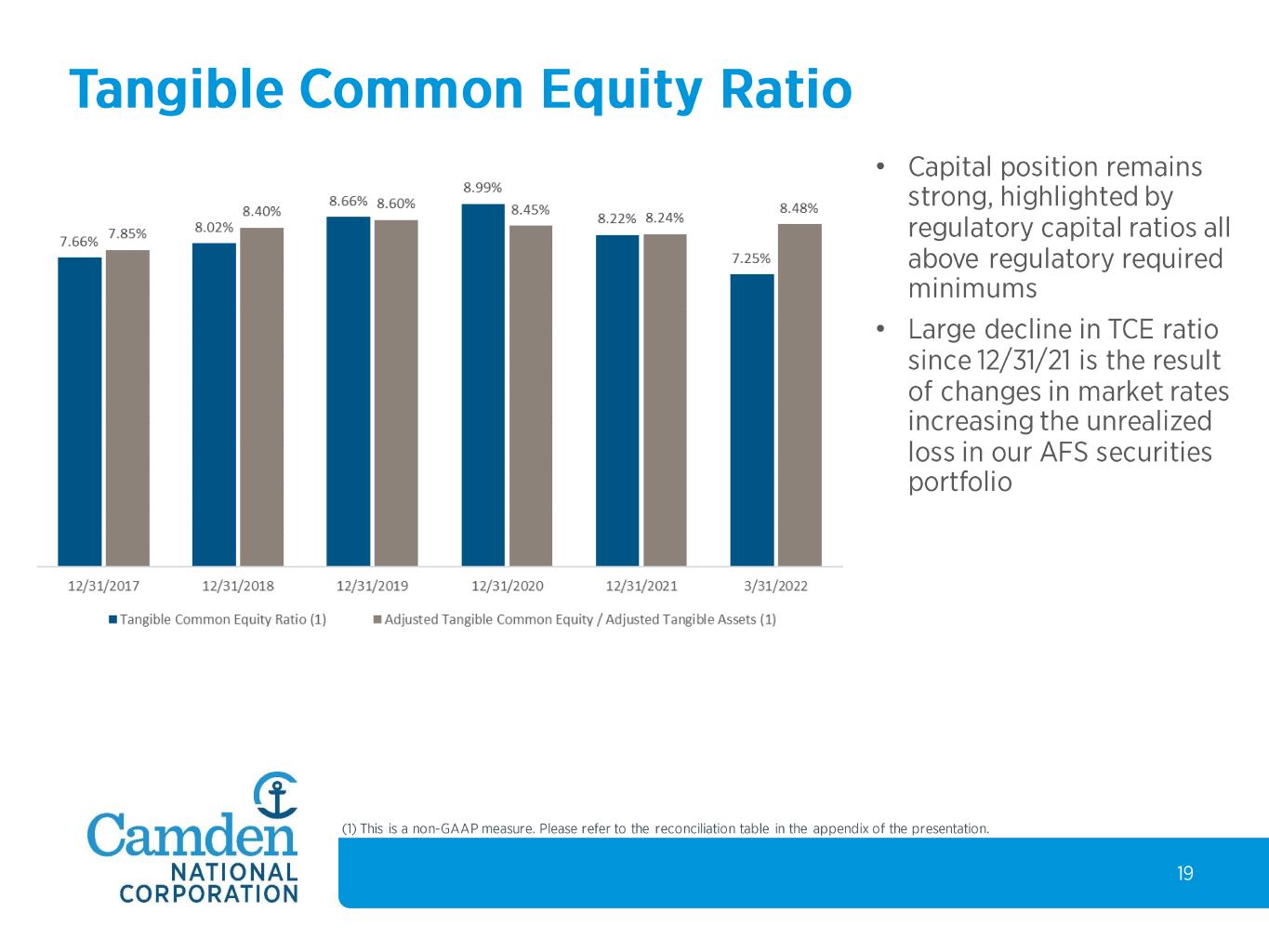

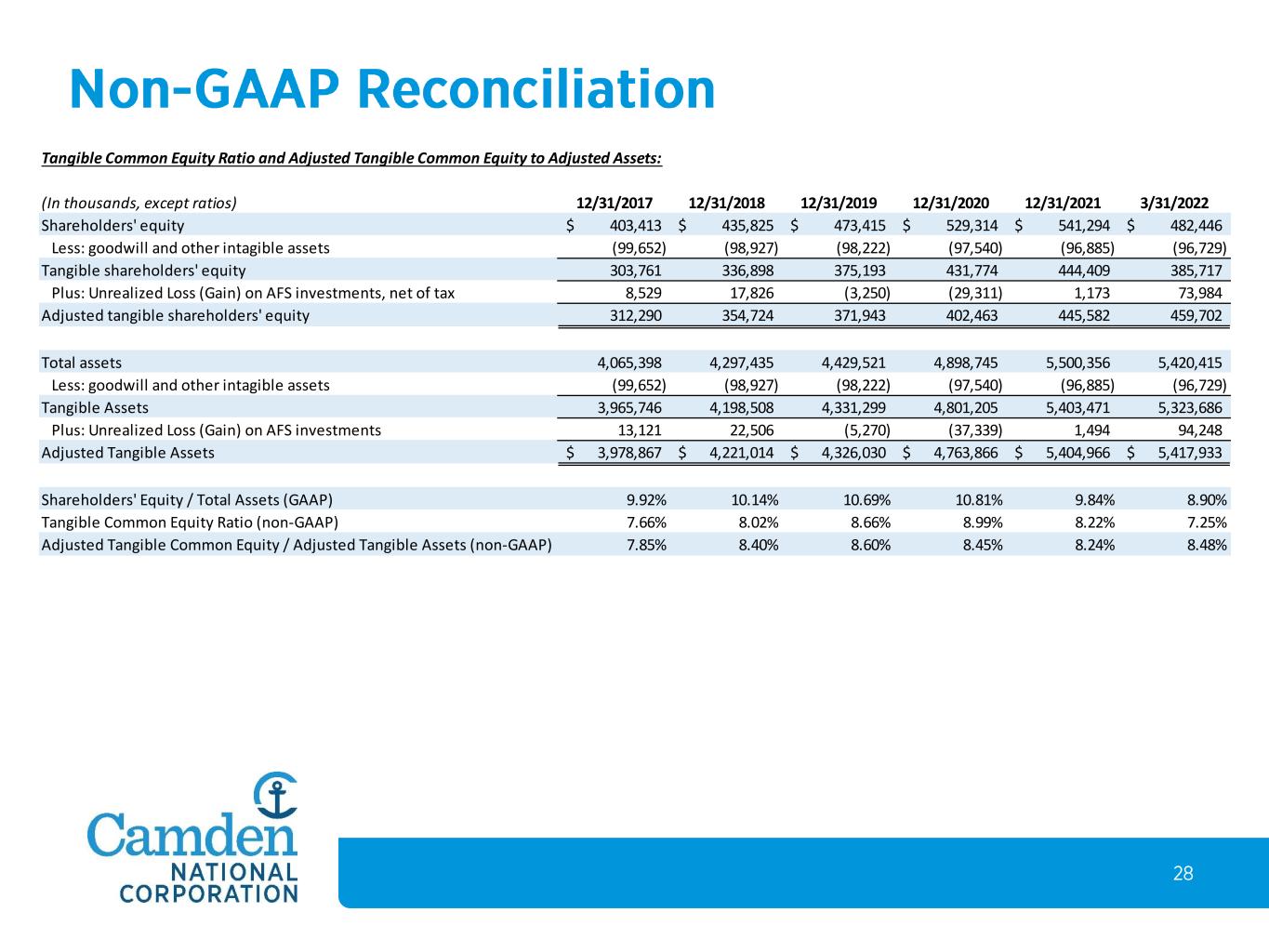

Tangible Common Equity Ratio and Adjusted Tangible Common Equity to Adjusted Assets: (In thousands, except ratios) 12/31/2017 12/31/2018 12/31/2019 12/31/2020 12/31/2021 3/31/2022 Shareholders' equity 403,413$ 435,825$ 473,415$ 529,314$ 541,294$ 482,446$ Less: goodwill and other intagible assets (99,652) (98,927) (98,222) (97,540) (96,885) (96,729) Tangible shareholders' equity 303,761 336,898 375,193 431,774 444,409 385,717 Plus: Unrealized Loss (Gain) on AFS investments, net of tax 8,529 17,826 (3,250) (29,311) 1,173 73,984 Adjusted tangible shareholders' equity 312,290 354,724 371,943 402,463 445,582 459,702 Total assets 4,065,398 4,297,435 4,429,521 4,898,745 5,500,356 5,420,415 Less: goodwill and other intagible assets (99,652) (98,927) (98,222) (97,540) (96,885) (96,729) Tangible Assets 3,965,746 4,198,508 4,331,299 4,801,205 5,403,471 5,323,686 Plus: Unrealized Loss (Gain) on AFS investments 13,121 22,506 (5,270) (37,339) 1,494 94,248 Adjusted Tangible Assets 3,978,867$ 4,221,014$ 4,326,030$ 4,763,866$ 5,404,966$ 5,417,933$ Shareholders' Equity / Total Assets (GAAP) 9.92% 10.14% 10.69% 10.81% 9.84% 8.90% Tangible Common Equity Ratio (non-GAAP) 7.66% 8.02% 8.66% 8.99% 8.22% 7.25% Adjusted Tangible Common Equity / Adjusted Tangible Assets (non-GAAP) 7.85% 8.40% 8.60% 8.45% 8.24% 8.48%