Supplemental Operating & Financial Data An S&P 500 Dividend Aristocrats® index member Q1 2025 Exhibit 99.2

Q1 2025 Supplemental Operating & Financial Data 2 Forward-Looking Statements March 31, 2025 FORWARD-LOOKING STATEMENTS This Supplemental Operating & Financial Data contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended. When used in this presentation, the words “estimated,” “anticipated,” “expect,” “believe,” “intend,” “continue,” “should,” “may,” “likely,” “plans,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements include discussions of our business and portfolio; growth strategies and intentions to acquire or dispose of properties (including geographies, timing, partners, clients and terms); re-leases, re-development and speculative development of properties and expenditures related thereto; future operations and results; the announcement of operating results, strategy, plans, and the intentions of management; guidance; statements made regarding our share repurchase program; settlement of shares of common stock sold pursuant to forward sale confirmations under our ATM program; dividends, including the amount, timing and payments of dividends; and trends in our business, including trends in the market for long-term leases of freestanding, single-client properties. Forward-looking statements are subject to risks, uncertainties, and assumptions about us, which may cause our actual future results to differ materially from expected results. Some of the factors that could cause actual results to differ materially are, among others, our continued qualification as a real estate investment trust; general domestic and foreign business, economic, or financial conditions; competition; fluctuating interest and currency rates; inflation and its impact on our clients and us; access to debt and equity capital markets and other sources of funding (including the terms and partners of such funding); continued volatility and uncertainty in the credit markets and broader financial markets; other risks inherent in the real estate business including our clients' solvency, client defaults under leases, increased client bankruptcies, potential liability relating to environmental matters, illiquidity of real estate investments, and potential damages from natural disasters; impairments in the value of our real estate assets; volatility and changes in domestic and foreign laws and the application, enforcement or interpretation thereof (including with respect to income tax laws and rates); property ownership through co-investment ventures, funds, joint ventures, partnerships and other arrangements which may transfer or limit our control of the underlying investments; epidemics or pandemics including measures taken to limit their spread, the impacts on us, our business, our clients, and the economy generally; the loss of key personnel; the outcome of any legal proceedings to which we are a party or which may occur in the future; acts of terrorism and war; the anticipated benefits from mergers and acquisitions; and those additional risks and factors discussed in our reports filed with the U.S. Securities and Exchange Commission. Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements are not guarantees of future plans and performance and speak only as of the date of this presentation. Actual plans and operating results may differ materially from what is expressed or forecasted in this presentation and forecasts made in the forward-looking statements discussed in this presentation might not materialize. We do not undertake any obligation to update forward-looking statements or publicly release the results of any forward-looking statements that may be made to reflect events or circumstances after the date these statements were made. Additional Information This Supplemental Operating & Financial Data should be read in connection with the company's earnings press release for the three months ended March 31, 2025 (included as Exhibit 99.1 of the company's Current Report on Form 8-K, filed on May 5, 2025) as certain disclosures, definitions, and reconciliations in such announcement have not been included in this Supplemental Operating & Financial Data presentation. Realty Income is not affiliated or associated with, is not endorsed by, does not endorse, and is not sponsored by or a sponsor of the clients or of their products or services pictured or mentioned. The names, logos, and all related product and service names, design marks, and slogans are the trademarks or service marks of their respective companies. Table of Contents ↪

5 Table of Contents Highlights 4 Corporate Overview 6 Highlights 12 Summary Financial Information Financial Summary 14 Consolidated Statements of Income 15 Funds From Operations (FFO) and Normalized Funds From Operations (Normalized FFO) 16 Adjusted Funds From Operations (AFFO) 18 Consolidated Balance Sheets 19 Capitalization & Financial Ratios 20 Debt Summary 21 Debt by Currency 22 Debt Maturities 23 Adjusted EBITDAre & Coverage Ratios 24 Debt Covenants Transaction Summary 25 Investment Summary 26 Disposition Summary 27 Development Activity Real Estate Portfolio Summary 28 Client Diversification 29 Investment Grade Clients 30 Top 20 Industries 31 Geographic Diversification 32 Property Type Composition Operations 33 Same Store Rental Revenue 35 Leasing Activity 36 Lease Expirations Earnings Guidance 37 Earnings Guidance Analyst Coverage 38 Analyst Coverage Glossary 39 Glossary Appendix 42 Appendix Q1 2025 Supplemental Operating & Financial Data 3

Q1 2025 Supplemental Operating & Financial Data 4 Corporate Overview CORPORATE PROFILE Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies®. Founded in 1969, we invest in diversified commercial real estate and, as of March 31, 2025, have a portfolio of over 15,600 properties in all 50 U.S. states, the U.K., and six other countries in Europe. We are known as “The Monthly Dividend Company®” and have a mission to invest in people and places to deliver dependable monthly dividends that increase over time. Since our founding, we have declared 658 consecutive monthly dividends and are a member of the S&P 500 Dividend Aristocrats® index for having increased our dividend for over 30 consecutive years. Additional information about the company can be found at www.realtyincome.com. Corporate Headquarters 11995 El Camino Real San Diego, CA 92130 Phone: +1 (858) 284-5000 Website: www.realtyincome.com London Office 19 Wells Street London, United Kingdom W1T 3PQ Phone: +44 (20) 3931 6858 Amsterdam Office Eduard van Beinumstraat 8 Amsterdam, Netherlands 1077 CZ ONE TEAM SENIOR MANAGEMENT Neil M. Abraham EVP, Chief Strategy Officer and President, Realty Income International Michelle Bushore EVP, Chief Legal Officer, General Counsel and Secretary Mark E. Hagan EVP, Chief Investment Officer Shannon Kehle EVP, Chief People Officer Jonathan Pong EVP, Chief Financial Officer and Treasurer Sumit Roy President, Chief Executive Officer Gregory J. Whyte EVP, Chief Operating Officer CREDIT RATINGS Senior Unsecured Outlook Commercial Paper Moody’s A3 Stable P-2 Standard & Poor’s A- Stable A-2 DIVIDEND INFORMATION AS OF APRIL 2025 $3.222 current annualized dividend per share 658 consecutive monthly dividends declared 110 consecutive quarterly dividend increases 4.3% compound annual growth rate of dividend since NYSE listing Table of Contents ↪

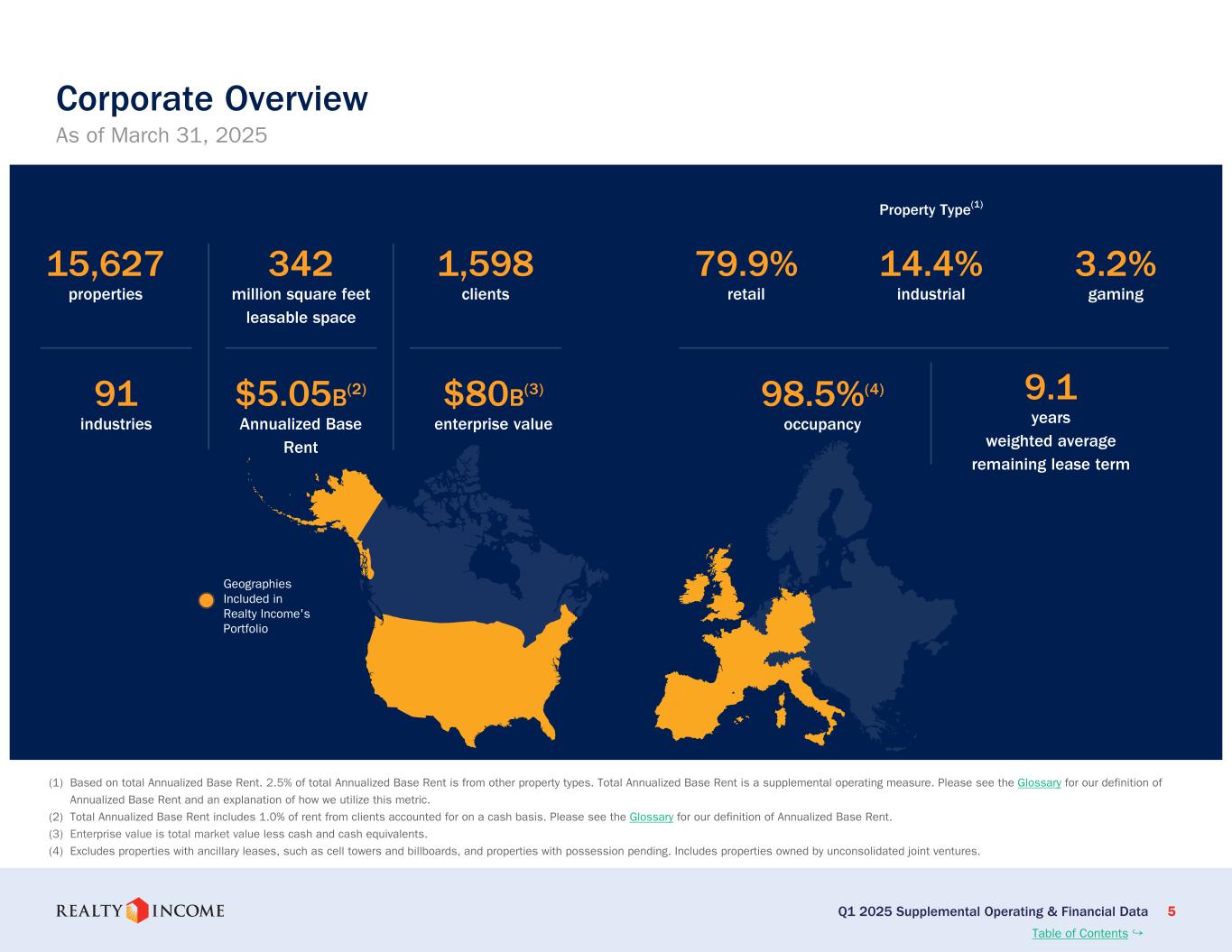

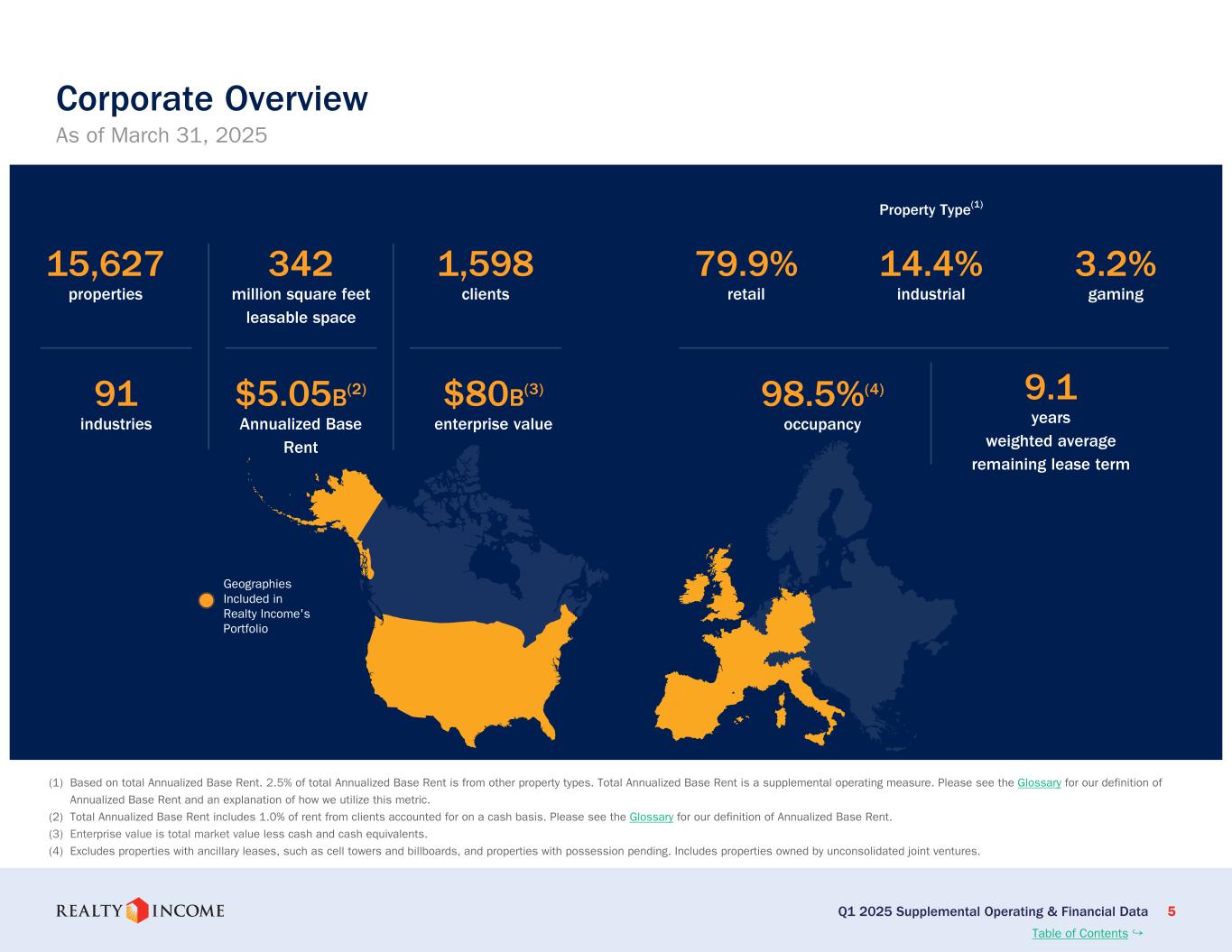

Q1 2025 Supplemental Operating & Financial Data 5 98.5%(4) occupancy Corporate Overview As of March 31, 2025 (1) Based on total Annualized Base Rent. 2.5% of total Annualized Base Rent is from other property types. Total Annualized Base Rent is a supplemental operating measure. Please see the Glossary for our definition of Annualized Base Rent and an explanation of how we utilize this metric. (2) Total Annualized Base Rent includes 1.0% of rent from clients accounted for on a cash basis. Please see the Glossary for our definition of Annualized Base Rent. (3) Enterprise value is total market value less cash and cash equivalents. (4) Excludes properties with ancillary leases, such as cell towers and billboards, and properties with possession pending. Includes properties owned by unconsolidated joint ventures. 15,627 properties 342 million square feet leasable space 1,598 clients 91 industries $5.05B(2) Annualized Base Rent $80B(3) enterprise value 9.1 years weighted average remaining lease term 79.9% retail 14.4% industrial 3.2% gaming Geographies Included in Realty Income's Portfolio Property Type(1) Table of Contents ↪

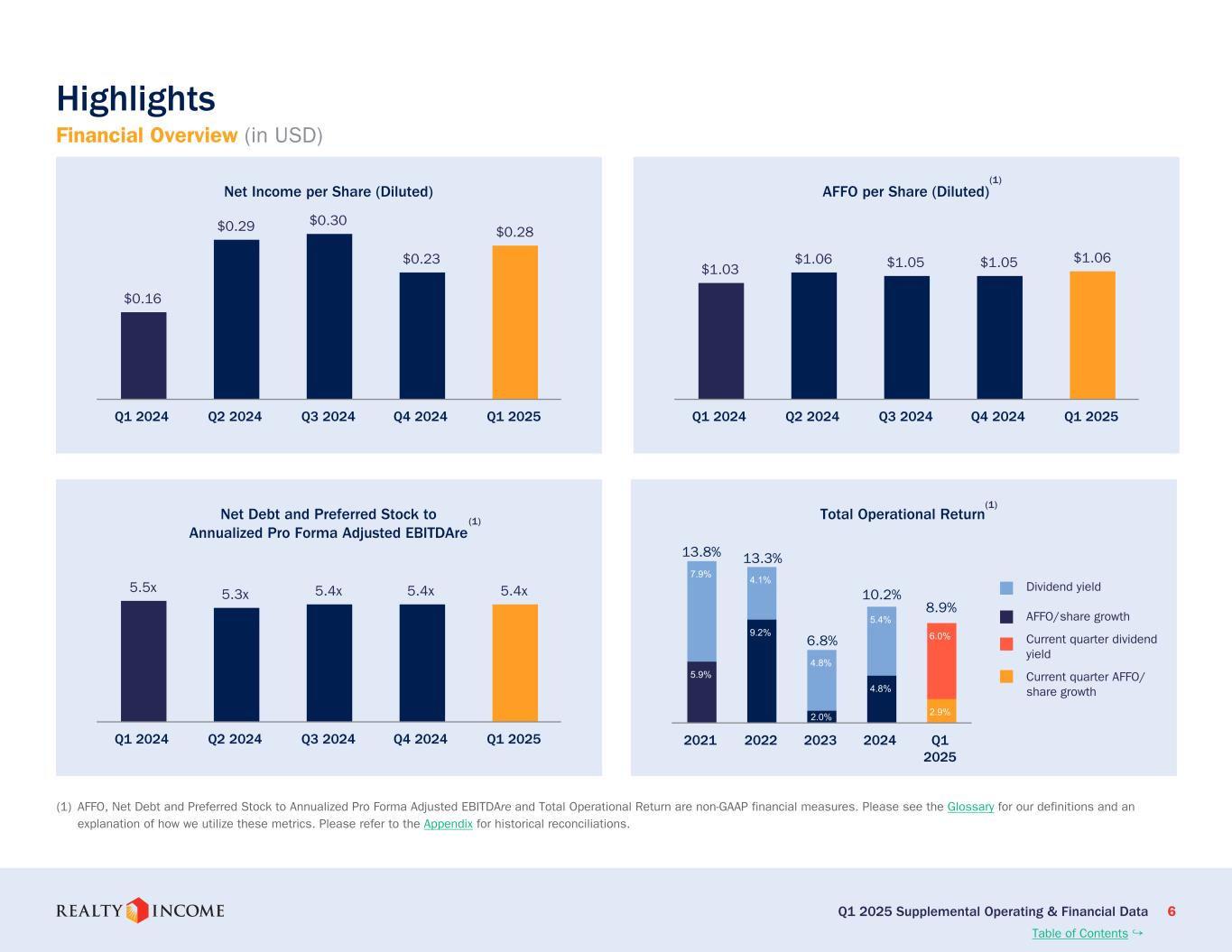

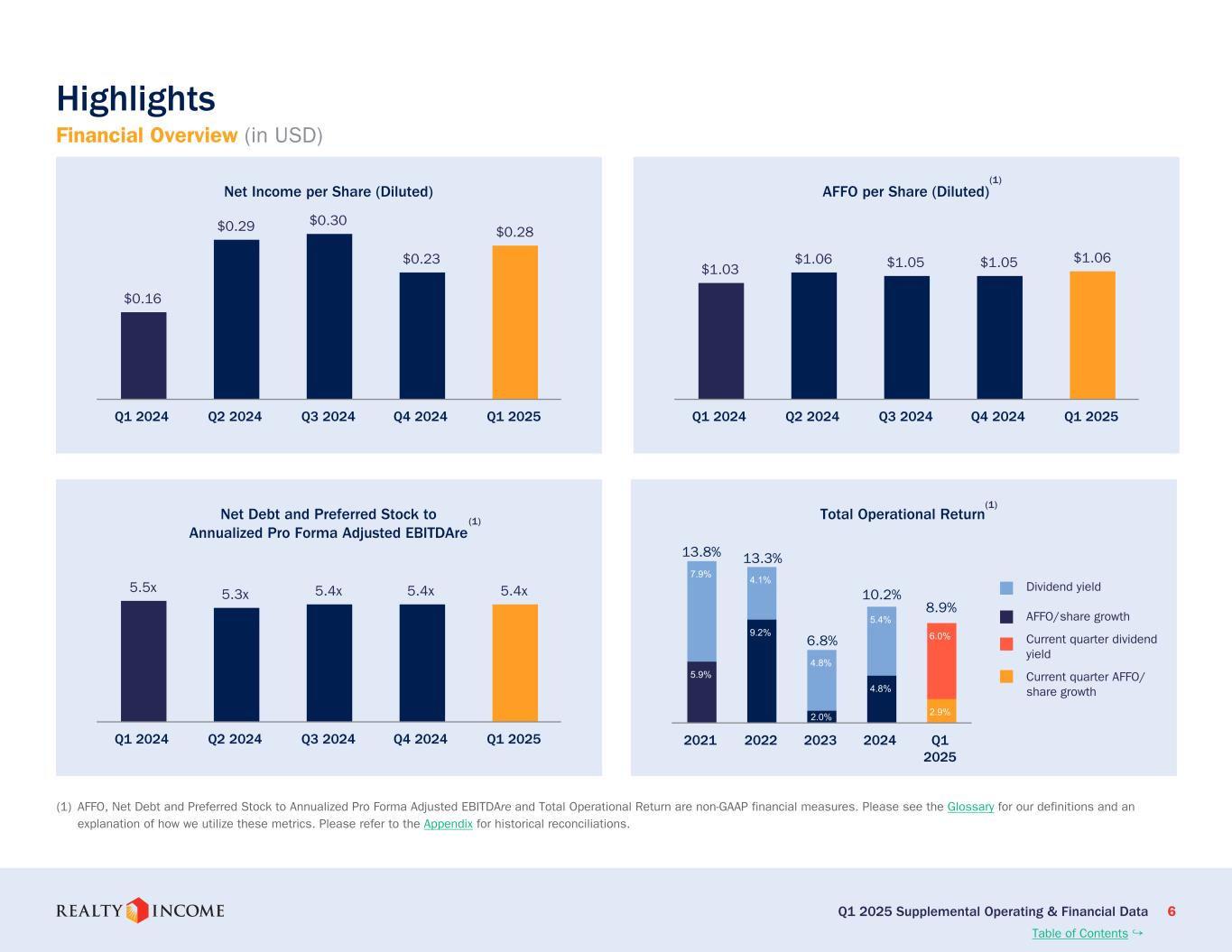

Q1 2025 Supplemental Operating & Financial Data 6 Highlights Financial Overview (in USD) Net Income per Share (Diluted) $0.16 $0.29 $0.30 $0.23 $0.28 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Net Debt and Preferred Stock to Annualized Pro Forma Adjusted EBITDAre 5.5x 5.3x 5.4x 5.4x 5.4x Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 AFFO per Share (Diluted) $1.03 $1.06 $1.05 $1.05 $1.06 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 (1) AFFO, Net Debt and Preferred Stock to Annualized Pro Forma Adjusted EBITDAre and Total Operational Return are non-GAAP financial measures. Please see the Glossary for our definitions and an explanation of how we utilize these metrics. Please refer to the Appendix for historical reconciliations. (1) Table of Contents ↪ (1) Total Operational Return 5.9% 9.2% 4.8% 2.9% 7.9% 4.1% 4.8% 5.4% 6.0% AFFO/share growth Dividend returns 2021 2022 2023 2024 Q1 2025 10.2% 6.8% 13.3%13.8% 8.9% Dividend yield AFFO/share growth Current quarter dividend yield Current quarter AFFO/ share growth (1) 2.0%

Q1 2025 Supplemental Operating & Financial Data 7 Highlights (Continued) Portfolio Overview (USD in thousands) Number of Properties Domestic International Q4 2021 Q4 2022 Q4 2023 Q4 2024 Q1 2025 15,621 13,458 12,237 Occupancy (by number of properties) 98.5% 99.0% 98.6% 98.7% 98.5% Q4 2021 Q4 2022 Q4 2023 Q4 2024 Q1 2025 Number of Clients 1,040 1,240 1,326 1,565 1,598 Q4 2021 Q4 2022 Q4 2023 Q4 2024 Q1 2025 (1) Please see the Glossary for our definition of Gross Asset Value. (2) Excludes properties with ancillary leases, such as cell towers and billboards, and properties with possession pending. Includes properties owned by unconsolidated joint ventures. (2) 11,136 Table of Contents ↪ 15,627 International Domestic Current quarter International Current quarter Domestic Gross Asset Value Domestic U.K. Europe Q4 2021 Q4 2022 Q4 2023 Q4 2024 Q1 2025 (1) $77,516$76,216 $63,851 $54,577 $47,087 Europe U.K. Domestic Current quarter Europe Current quarter U.K. Current quarter Domestic

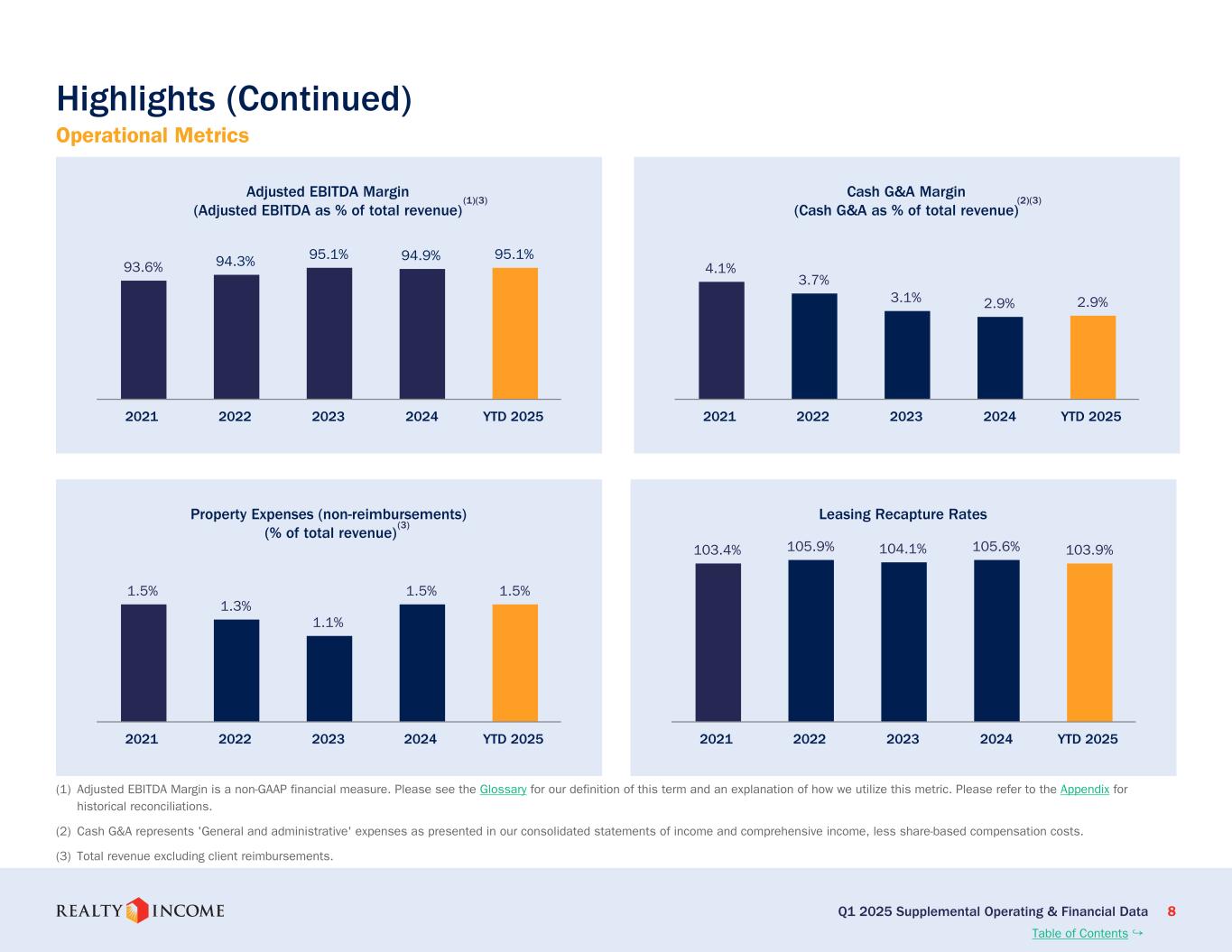

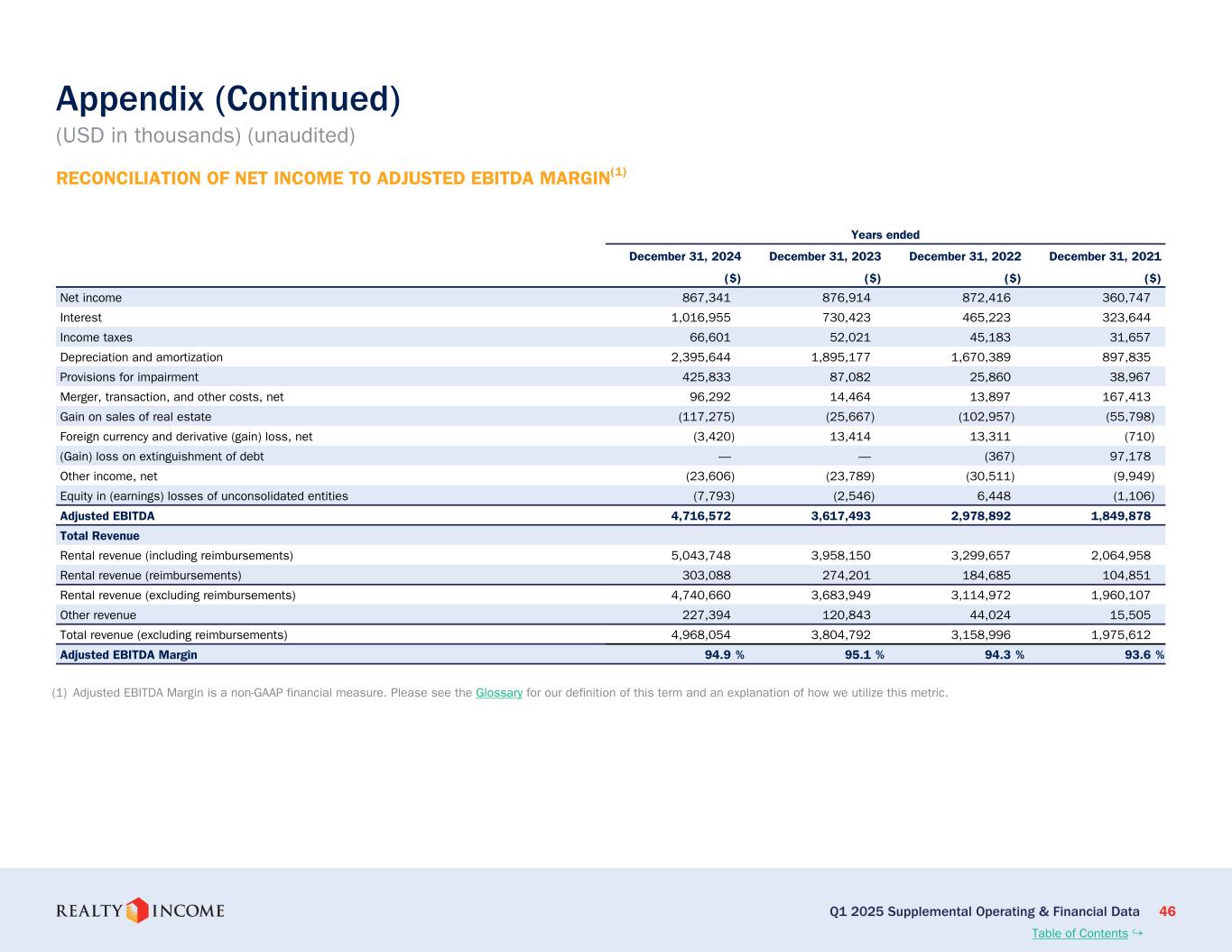

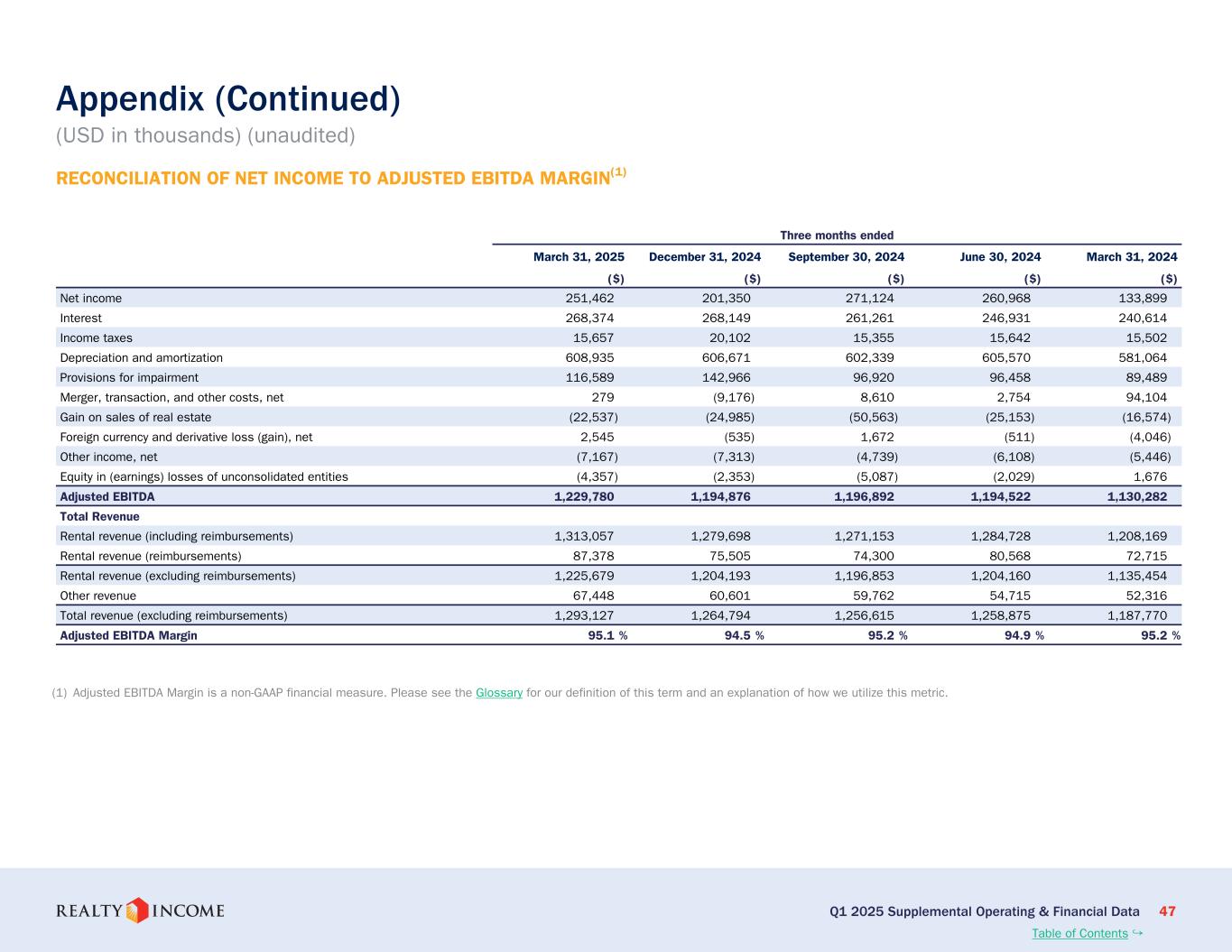

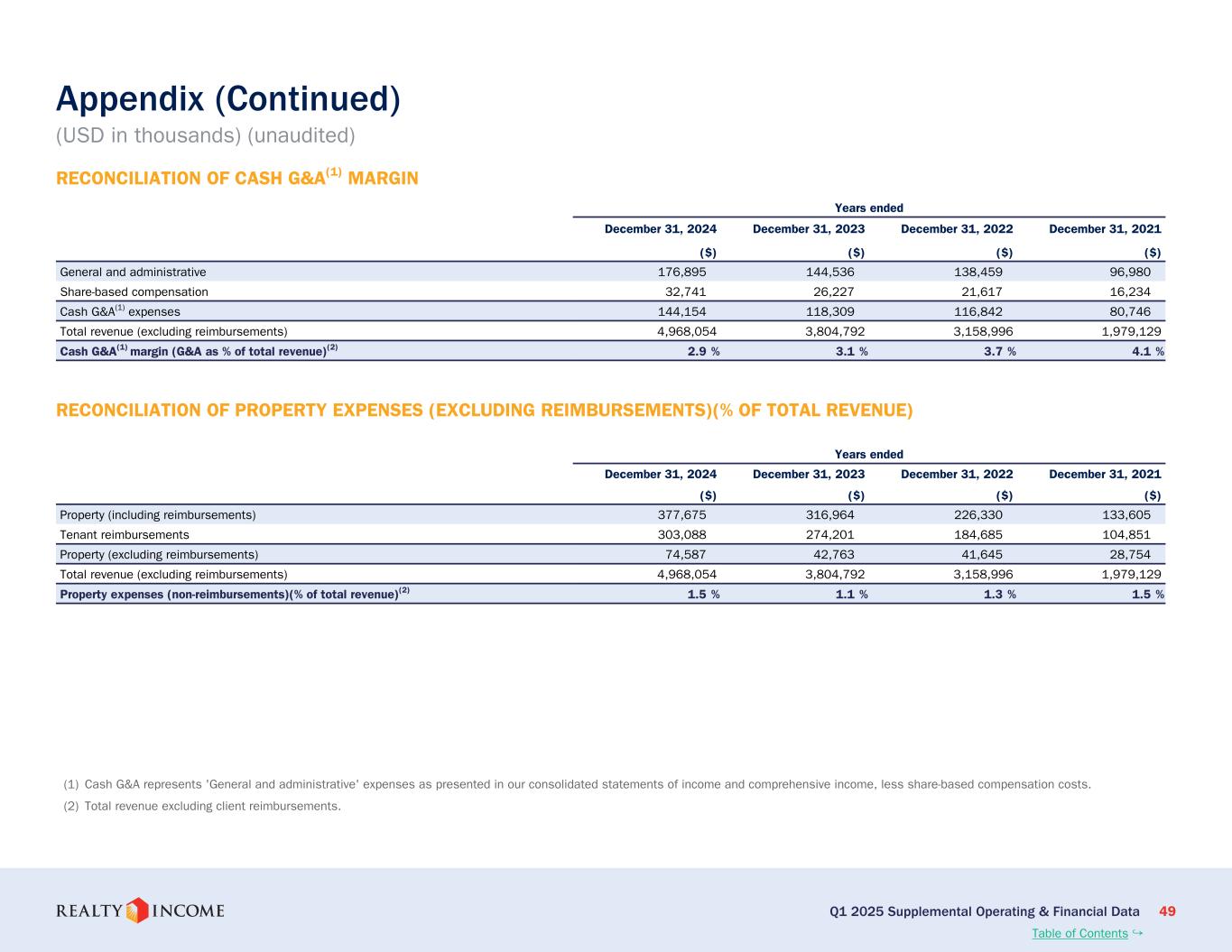

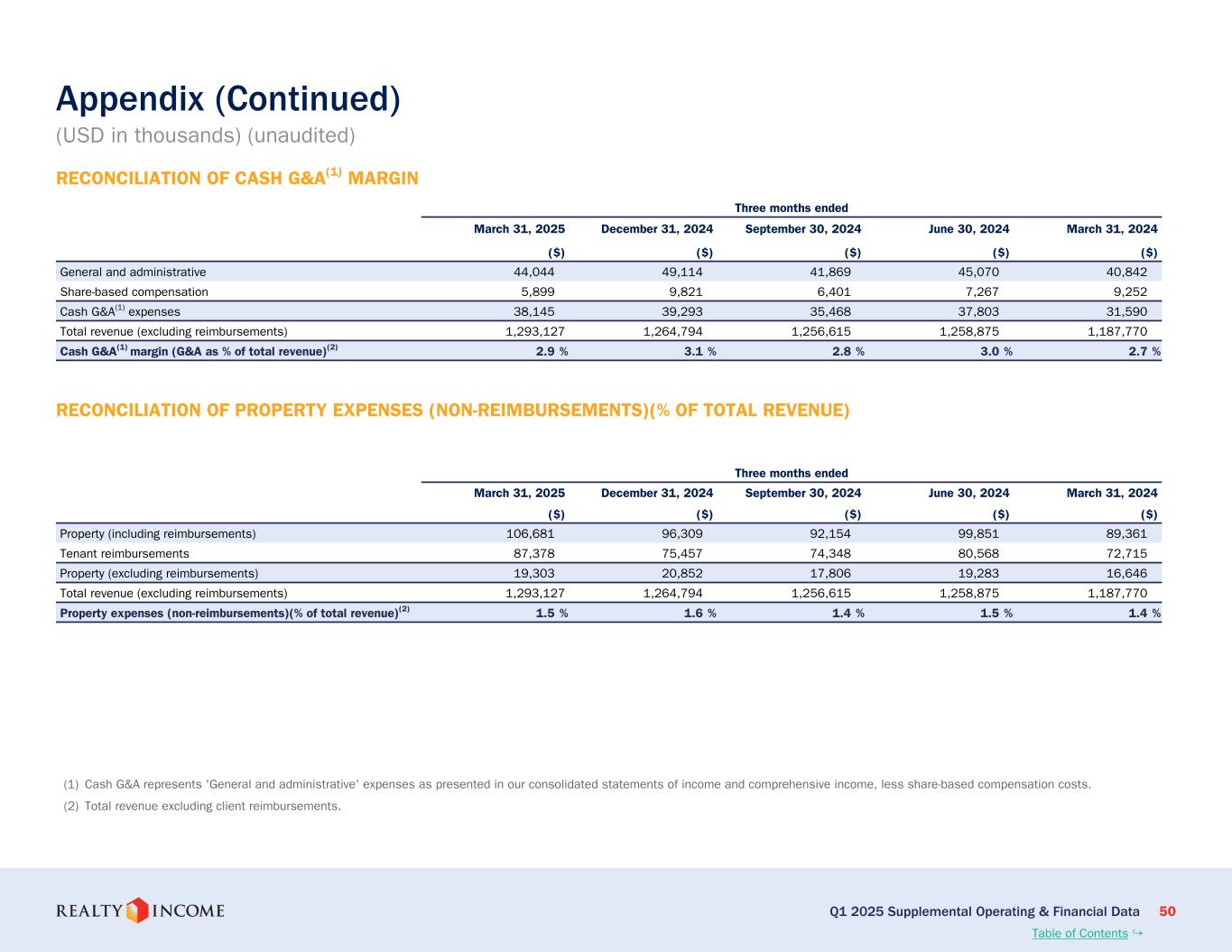

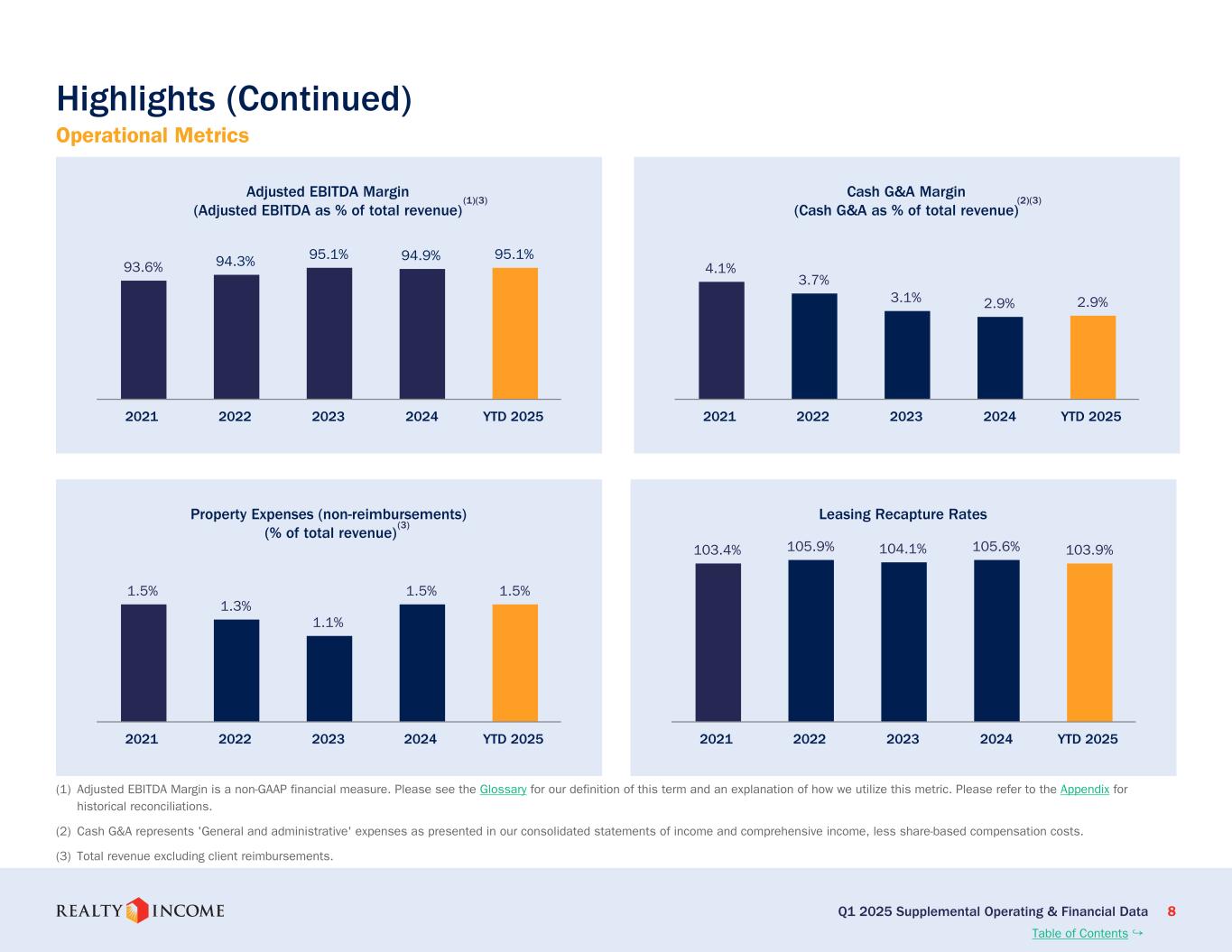

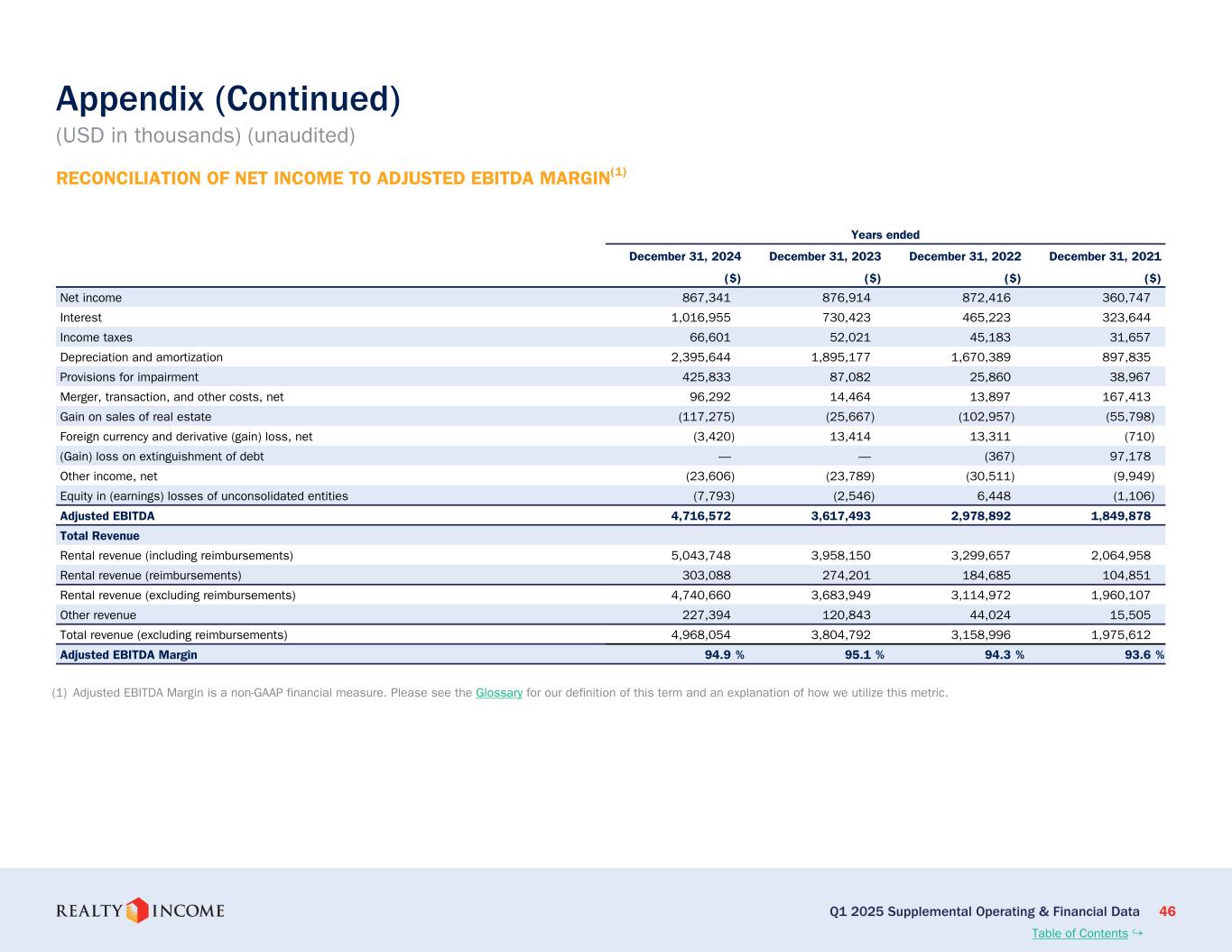

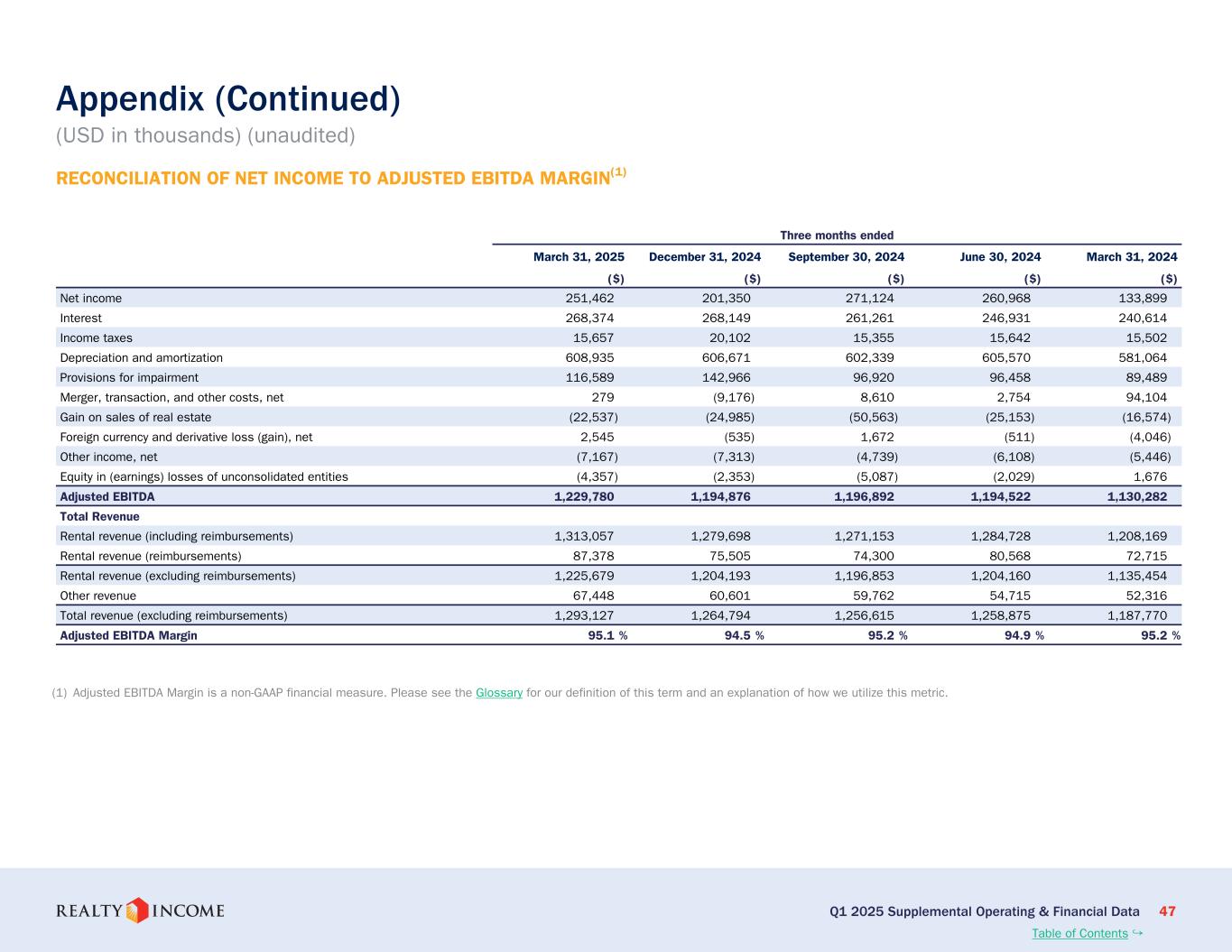

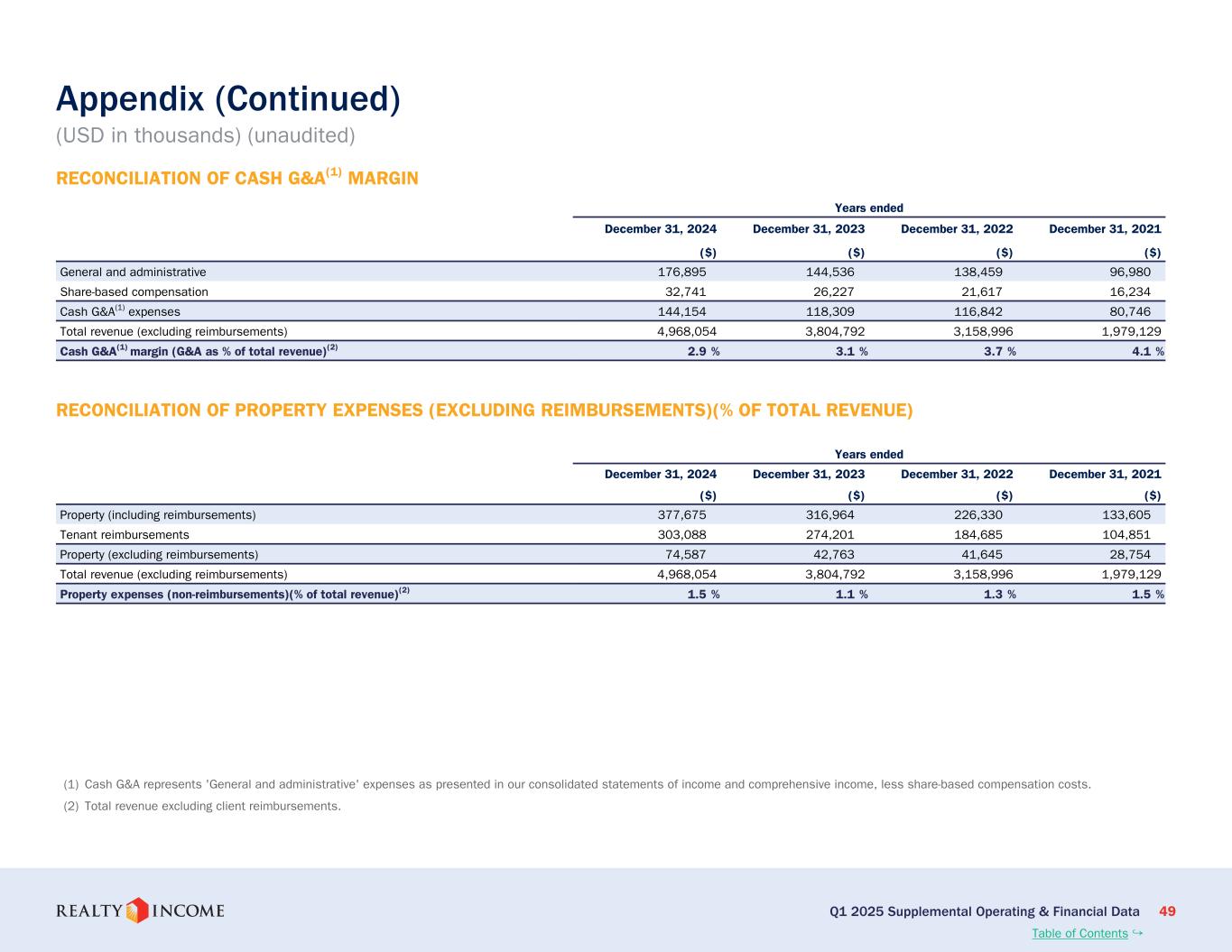

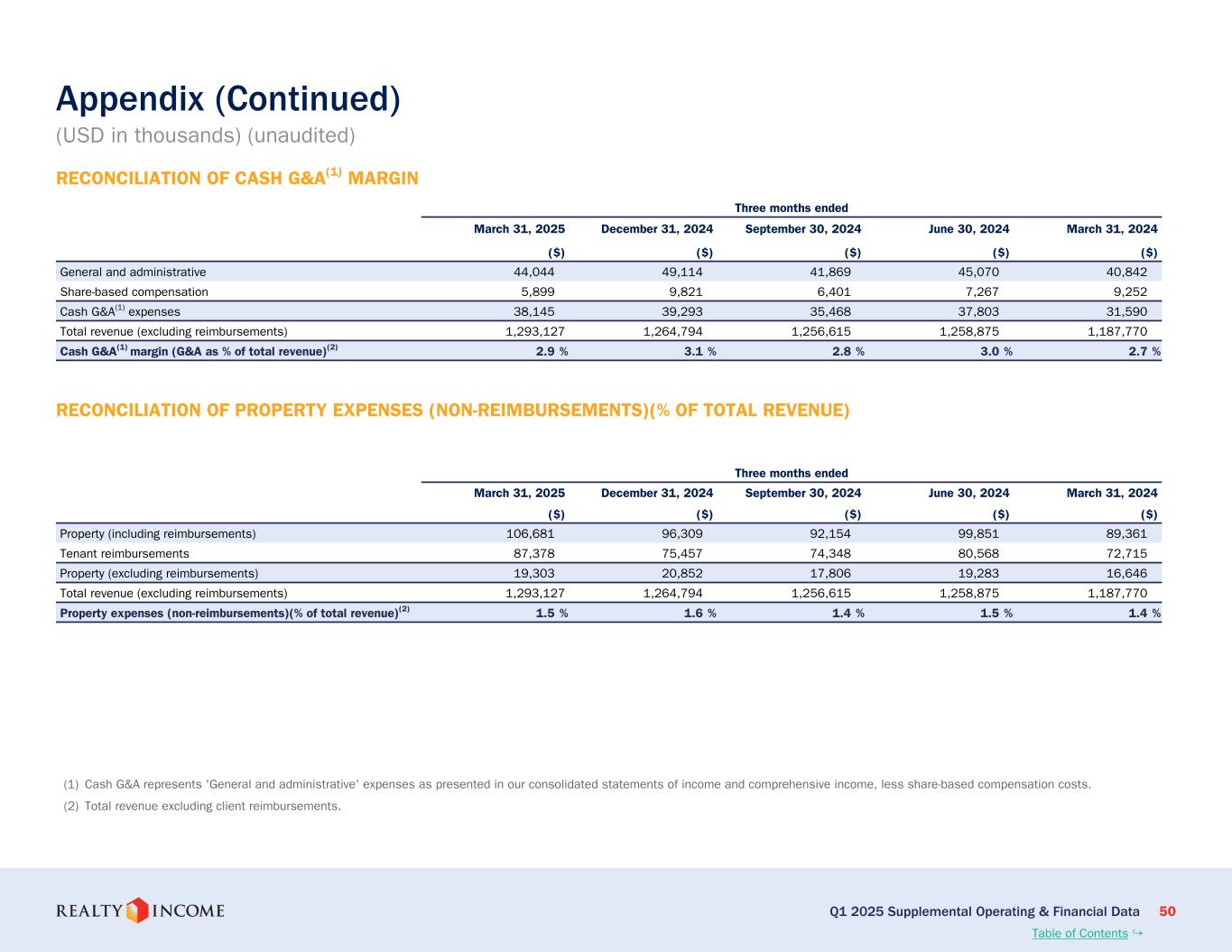

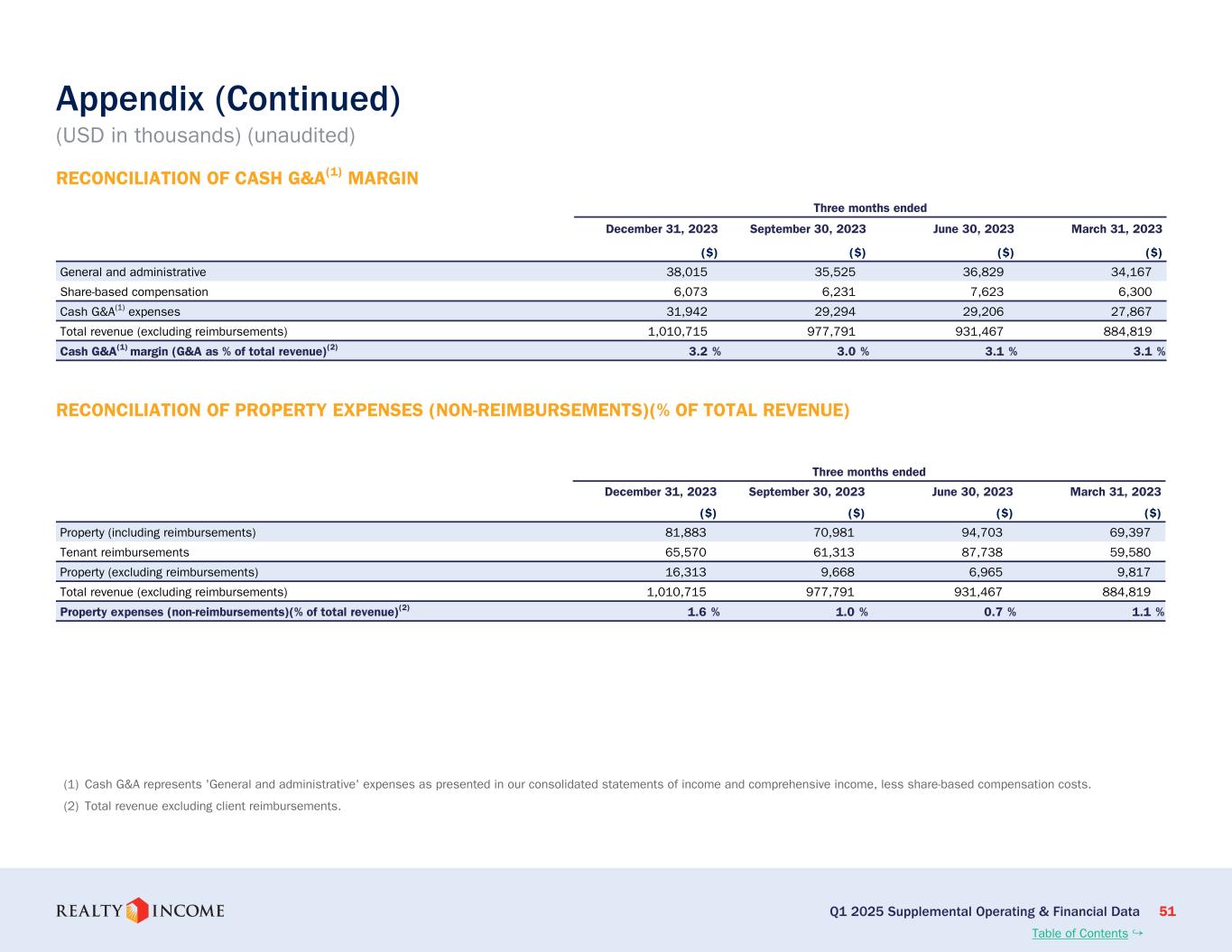

Q1 2025 Supplemental Operating & Financial Data 8 Highlights (Continued) Operational Metrics Adjusted EBITDA Margin (Adjusted EBITDA as % of total revenue) 93.6% 94.3% 95.1% 94.9% 95.1% 2021 2022 2023 2024 YTD 2025 Cash G&A Margin (Cash G&A as % of total revenue) 4.1% 3.7% 3.1% 2.9% 2.9% 2021 2022 2023 2024 YTD 2025 Property Expenses (non-reimbursements) (% of total revenue) 1.5% 1.3% 1.1% 1.5% 1.5% 2021 2022 2023 2024 YTD 2025 (1) Adjusted EBITDA Margin is a non-GAAP financial measure. Please see the Glossary for our definition of this term and an explanation of how we utilize this metric. Please refer to the Appendix for historical reconciliations. (2) Cash G&A represents 'General and administrative' expenses as presented in our consolidated statements of income and comprehensive income, less share-based compensation costs. (3) Total revenue excluding client reimbursements. (2)(3) (3) Table of Contents ↪ (1)(3) Leasing Recapture Rates 103.4% 105.9% 104.1% 105.6% 103.9% 2021 2022 2023 2024 YTD 2025

Q1 2025 Supplemental Operating & Financial Data 9 Highlights (Continued) Company Metrics (in USD) Annualized Dividends Declared Per Share $2.958 $2.982 $3.078 $3.168 $3.222 Q4 2021 Q4 2022 Q4 2023 Q4 2024 Q1 2025 Annualized Dividend Yield 4.1% 4.7% 5.4% 5.9% 5.6% Q4 2021 Q4 2022 Q4 2023 Q4 2024 Q1 2025 Table of Contents ↪ Same Store Rental Revenue Growth 2.8% 1.8% 1.9% 0.5% 1.3% 2021 2022 2023 2024 YTD 2025 Net Debt to Total Enterprise Value 26.1% 29.7% 33.6% 35.9% 34.5% Q4 2021 Q4 2022 Q4 2023 Q4 2024 Q1 2025 (1) Please see the Glossary for our definitions of Same Store Pool and Same Store Rental Revenue. (1)

Q1 2025 Supplemental Operating & Financial Data 10 Highlights (Continued) Capital Deployment – Investment Activity (USD in millions) Real Estate Acquisitions Domestic International 2021 2022 2023 2024 YTD 2025 $7,184 $8,187 $6,168 Development Investments Domestic International 2021 2022 2023 2024 YTD 2025 $757 $1,497 $808 Other Investments $— $— $858 $632 $201 Domestic International 2021 2022 2023 2024 YTD 2025 (1) Other investments consist primarily of credit investments which commenced in 2023. (1) $2,475 Table of Contents ↪ $1,026 $146 International Domestic Current quarter International Current quarter Domestic $243 International Domestic Current quarter International Current quarter Domestic International Domestic Current quarter International Current quarter Domestic Total Investments $6,411 $8,995 $9,539 $3,864 $1,373 Domestic International 2021 2022 2023 2024 YTD 2025 International Domestic Current quarter International Current quarter Domestic

Q1 2025 Supplemental Operating & Financial Data 11 Highlights (Continued) Capital Deployment – Initial Weighted Average Cash Yields(1) Other Investments —% —% 8.7% 8.9% 10.2% 2021 2022 2023 2024 YTD 2025 Real Estate Acquisitions 5.5% 6.0% 7.0% 7.0% 7.0% 2021 2022 2023 2024 YTD 2025 Development Investments 6.0% 5.3% 6.8% 7.4% 7.3% 2021 2022 2023 2024 YTD 2025 Total Investments 5.5% 5.9% 7.1% 7.4% 7.5% 2021 2022 2023 2024 YTD 2025 (1) Initial Weighted Average Cash Yield is a supplemental operating measure. Please see the Glossary for our definition of Initial Weighted Average Cash Yield. (2) Other investments consist primarily of credit investments, which commenced in 2023. (2) Table of Contents ↪

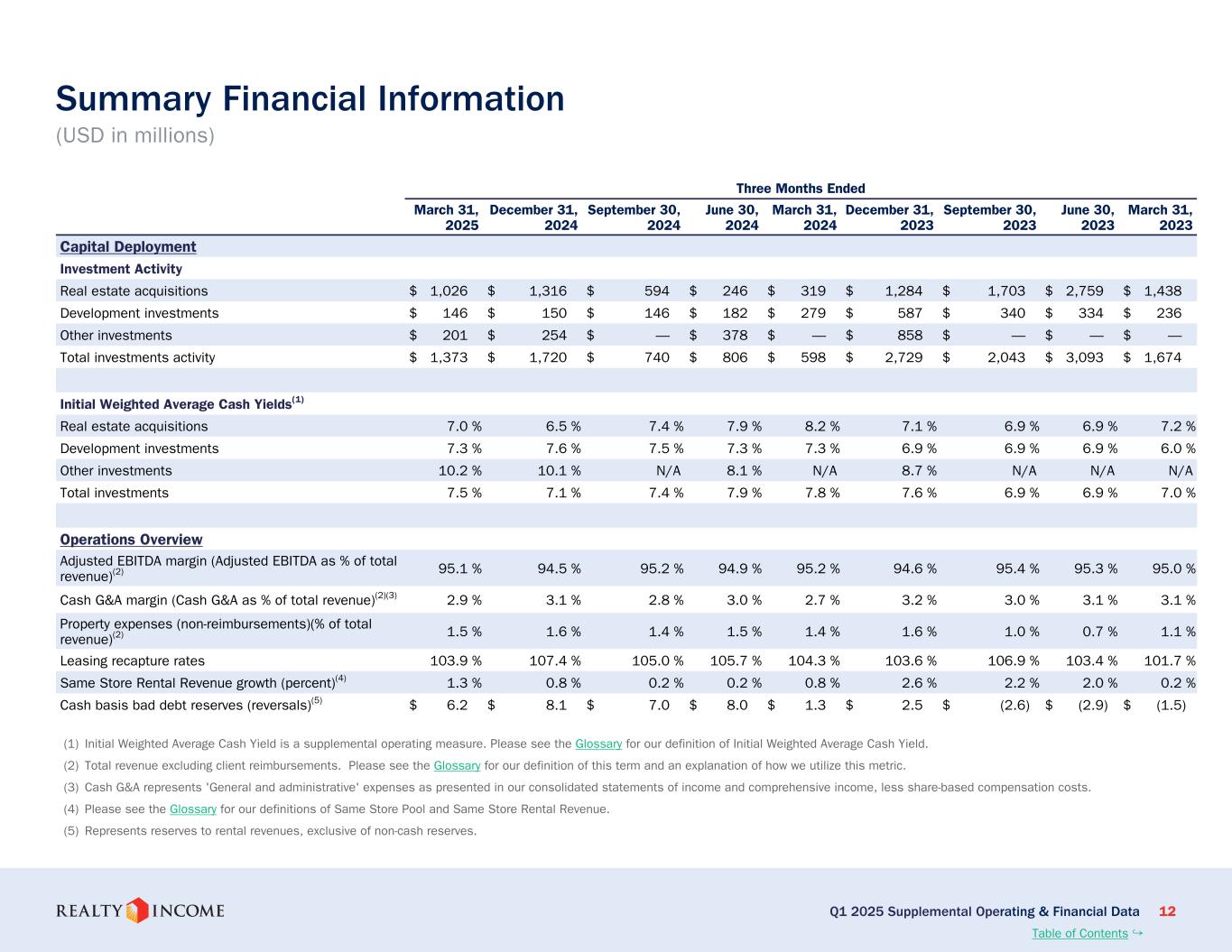

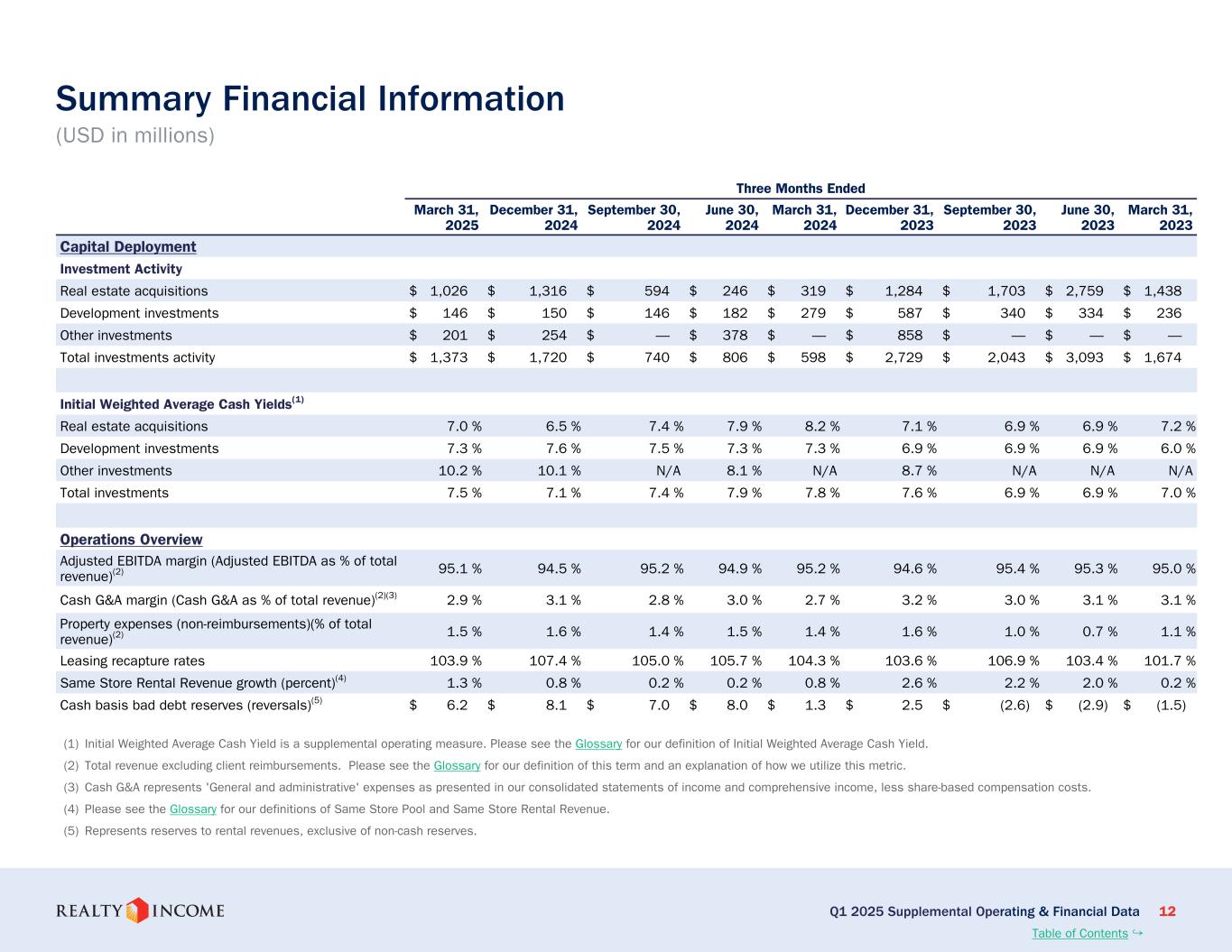

Q1 2025 Supplemental Operating & Financial Data 12 Summary Financial Information (USD in millions) Three Months Ended March 31, 2025 December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 September 30, 2023 June 30, 2023 March 31, 2023 Capital Deployment Investment Activity Real estate acquisitions $ 1,026 $ 1,316 $ 594 $ 246 $ 319 $ 1,284 $ 1,703 $ 2,759 $ 1,438 Development investments $ 146 $ 150 $ 146 $ 182 $ 279 $ 587 $ 340 $ 334 $ 236 Other investments $ 201 $ 254 $ — $ 378 $ — $ 858 $ — $ — $ — Total investments activity $ 1,373 $ 1,720 $ 740 $ 806 $ 598 $ 2,729 $ 2,043 $ 3,093 $ 1,674 Initial Weighted Average Cash Yields(1) Real estate acquisitions 7.0 % 6.5 % 7.4 % 7.9 % 8.2 % 7.1 % 6.9 % 6.9 % 7.2 % Development investments 7.3 % 7.6 % 7.5 % 7.3 % 7.3 % 6.9 % 6.9 % 6.9 % 6.0 % Other investments 10.2 % 10.1 % N/A 8.1 % N/A 8.7 % N/A N/A N/A Total investments 7.5 % 7.1 % 7.4 % 7.9 % 7.8 % 7.6 % 6.9 % 6.9 % 7.0 % Operations Overview Adjusted EBITDA margin (Adjusted EBITDA as % of total revenue)(2) 95.1 % 94.5 % 95.2 % 94.9 % 95.2 % 94.6 % 95.4 % 95.3 % 95.0 % Cash G&A margin (Cash G&A as % of total revenue)(2)(3) 2.9 % 3.1 % 2.8 % 3.0 % 2.7 % 3.2 % 3.0 % 3.1 % 3.1 % Property expenses (non-reimbursements)(% of total revenue)(2) 1.5 % 1.6 % 1.4 % 1.5 % 1.4 % 1.6 % 1.0 % 0.7 % 1.1 % Leasing recapture rates 103.9 % 107.4 % 105.0 % 105.7 % 104.3 % 103.6 % 106.9 % 103.4 % 101.7 % Same Store Rental Revenue growth (percent)(4) 1.3 % 0.8 % 0.2 % 0.2 % 0.8 % 2.6 % 2.2 % 2.0 % 0.2 % Cash basis bad debt reserves (reversals)(5) $ 6.2 $ 8.1 $ 7.0 $ 8.0 $ 1.3 $ 2.5 $ (2.6) $ (2.9) $ (1.5) Table of Contents ↪ (1) Initial Weighted Average Cash Yield is a supplemental operating measure. Please see the Glossary for our definition of Initial Weighted Average Cash Yield. (2) Total revenue excluding client reimbursements. Please see the Glossary for our definition of this term and an explanation of how we utilize this metric. (3) Cash G&A represents 'General and administrative' expenses as presented in our consolidated statements of income and comprehensive income, less share-based compensation costs. (4) Please see the Glossary for our definitions of Same Store Pool and Same Store Rental Revenue. (5) Represents reserves to rental revenues, exclusive of non-cash reserves.

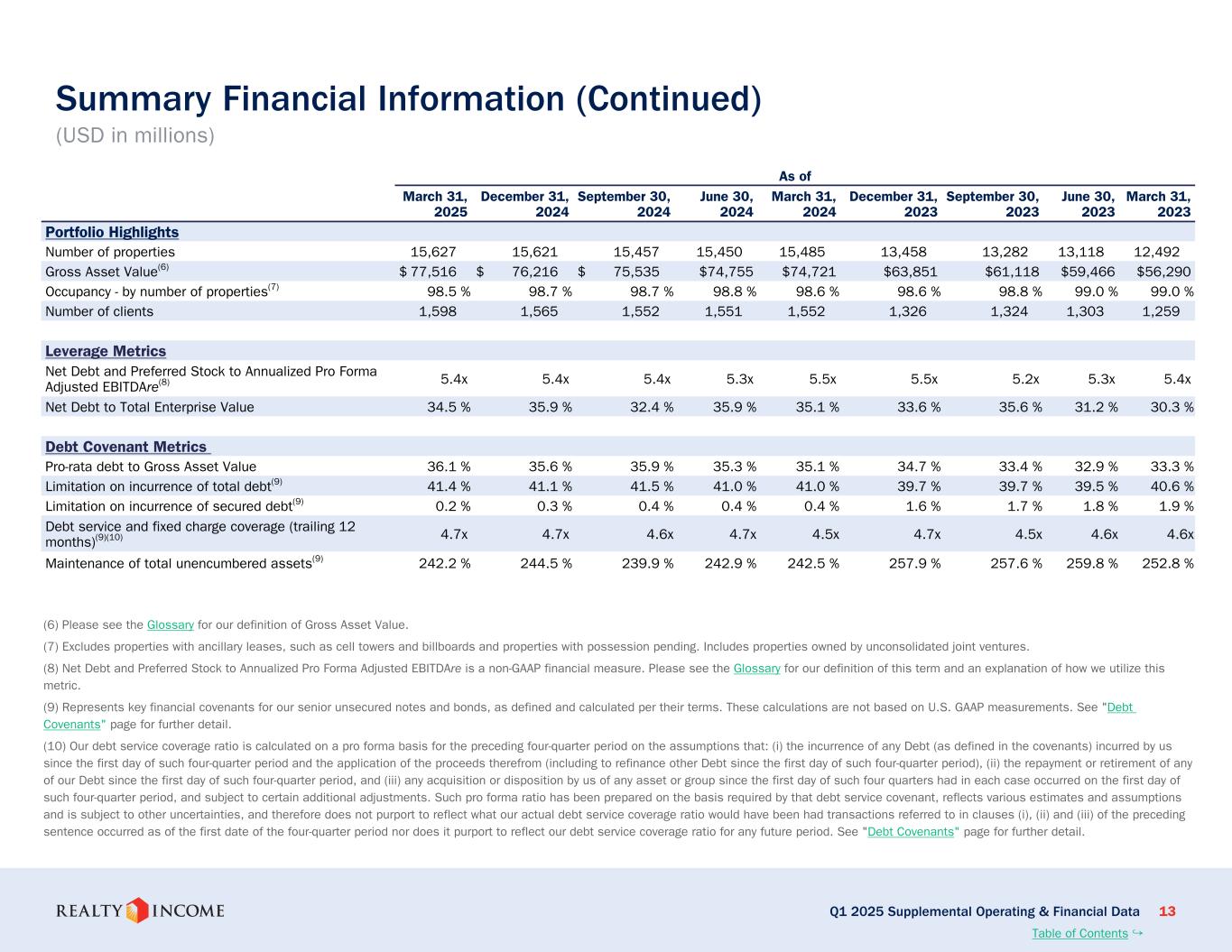

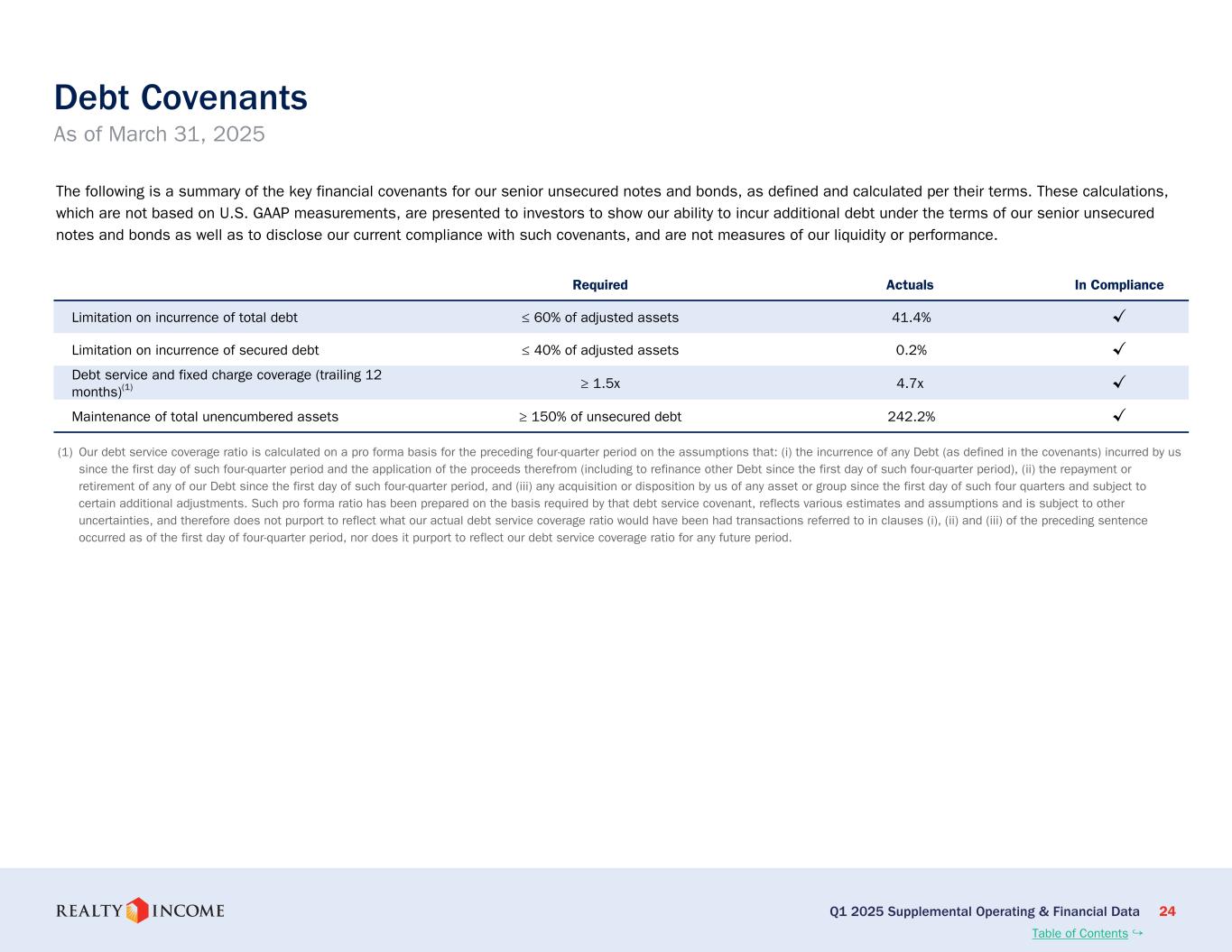

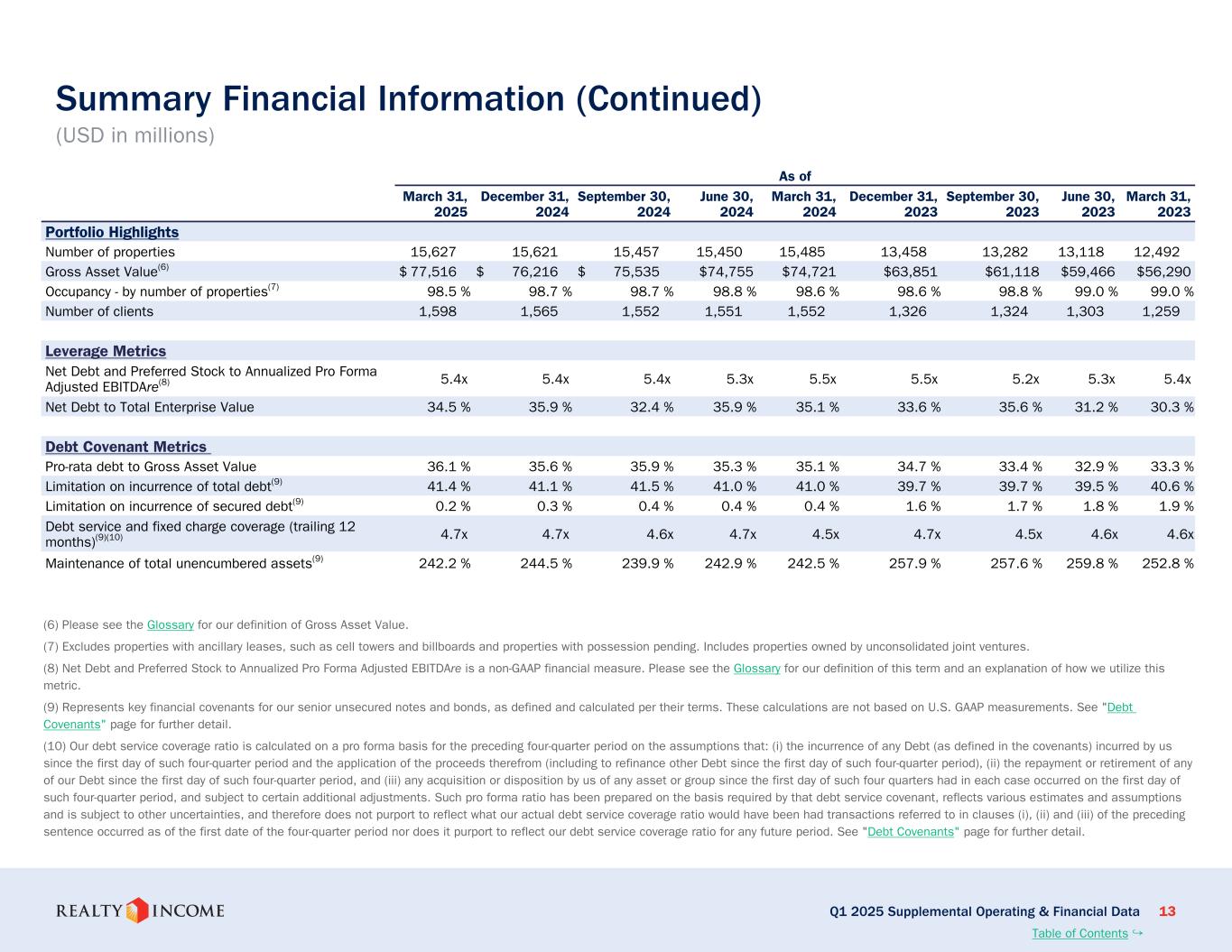

Q1 2025 Supplemental Operating & Financial Data 13 Summary Financial Information (Continued) (USD in millions) As of March 31, 2025 December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 December 31, 2023 September 30, 2023 June 30, 2023 March 31, 2023 Portfolio Highlights Number of properties 15,627 15,621 15,457 15,450 15,485 13,458 13,282 13,118 12,492 Gross Asset Value(6) $ 77,516 $ 76,216 $ 75,535 $74,755 $74,721 $63,851 $61,118 $59,466 $56,290 Occupancy - by number of properties(7) 98.5 % 98.7 % 98.7 % 98.8 % 98.6 % 98.6 % 98.8 % 99.0 % 99.0 % Number of clients 1,598 1,565 1,552 1,551 1,552 1,326 1,324 1,303 1,259 Leverage Metrics Net Debt and Preferred Stock to Annualized Pro Forma Adjusted EBITDAre(8) 5.4x 5.4x 5.4x 5.3x 5.5x 5.5x 5.2x 5.3x 5.4x Net Debt to Total Enterprise Value 34.5 % 35.9 % 32.4 % 35.9 % 35.1 % 33.6 % 35.6 % 31.2 % 30.3 % Debt Covenant Metrics Pro-rata debt to Gross Asset Value 36.1 % 35.6 % 35.9 % 35.3 % 35.1 % 34.7 % 33.4 % 32.9 % 33.3 % Limitation on incurrence of total debt(9) 41.4 % 41.1 % 41.5 % 41.0 % 41.0 % 39.7 % 39.7 % 39.5 % 40.6 % Limitation on incurrence of secured debt(9) 0.2 % 0.3 % 0.4 % 0.4 % 0.4 % 1.6 % 1.7 % 1.8 % 1.9 % Debt service and fixed charge coverage (trailing 12 months)(9)(10) 4.7x 4.7x 4.6x 4.7x 4.5x 4.7x 4.5x 4.6x 4.6x Maintenance of total unencumbered assets(9) 242.2 % 244.5 % 239.9 % 242.9 % 242.5 % 257.9 % 257.6 % 259.8 % 252.8 % (6) Please see the Glossary for our definition of Gross Asset Value. (7) Excludes properties with ancillary leases, such as cell towers and billboards and properties with possession pending. Includes properties owned by unconsolidated joint ventures. (8) Net Debt and Preferred Stock to Annualized Pro Forma Adjusted EBITDAre is a non-GAAP financial measure. Please see the Glossary for our definition of this term and an explanation of how we utilize this metric. (9) Represents key financial covenants for our senior unsecured notes and bonds, as defined and calculated per their terms. These calculations are not based on U.S. GAAP measurements. See "Debt Covenants" page for further detail. (10) Our debt service coverage ratio is calculated on a pro forma basis for the preceding four-quarter period on the assumptions that: (i) the incurrence of any Debt (as defined in the covenants) incurred by us since the first day of such four-quarter period and the application of the proceeds therefrom (including to refinance other Debt since the first day of such four-quarter period), (ii) the repayment or retirement of any of our Debt since the first day of such four-quarter period, and (iii) any acquisition or disposition by us of any asset or group since the first day of such four quarters had in each case occurred on the first day of such four-quarter period, and subject to certain additional adjustments. Such pro forma ratio has been prepared on the basis required by that debt service covenant, reflects various estimates and assumptions and is subject to other uncertainties, and therefore does not purport to reflect what our actual debt service coverage ratio would have been had transactions referred to in clauses (i), (ii) and (iii) of the preceding sentence occurred as of the first date of the four-quarter period nor does it purport to reflect our debt service coverage ratio for any future period. See "Debt Covenants" page for further detail. Table of Contents ↪

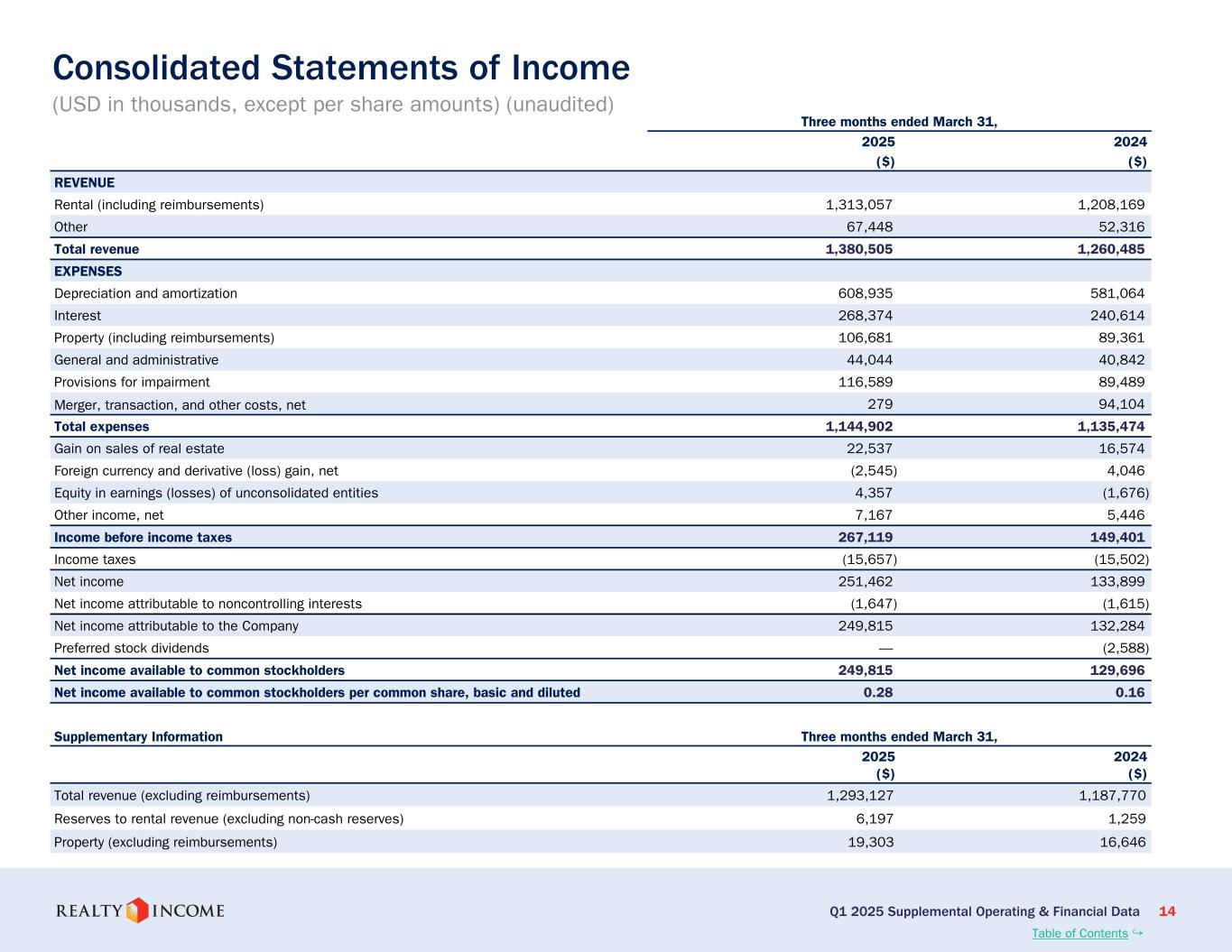

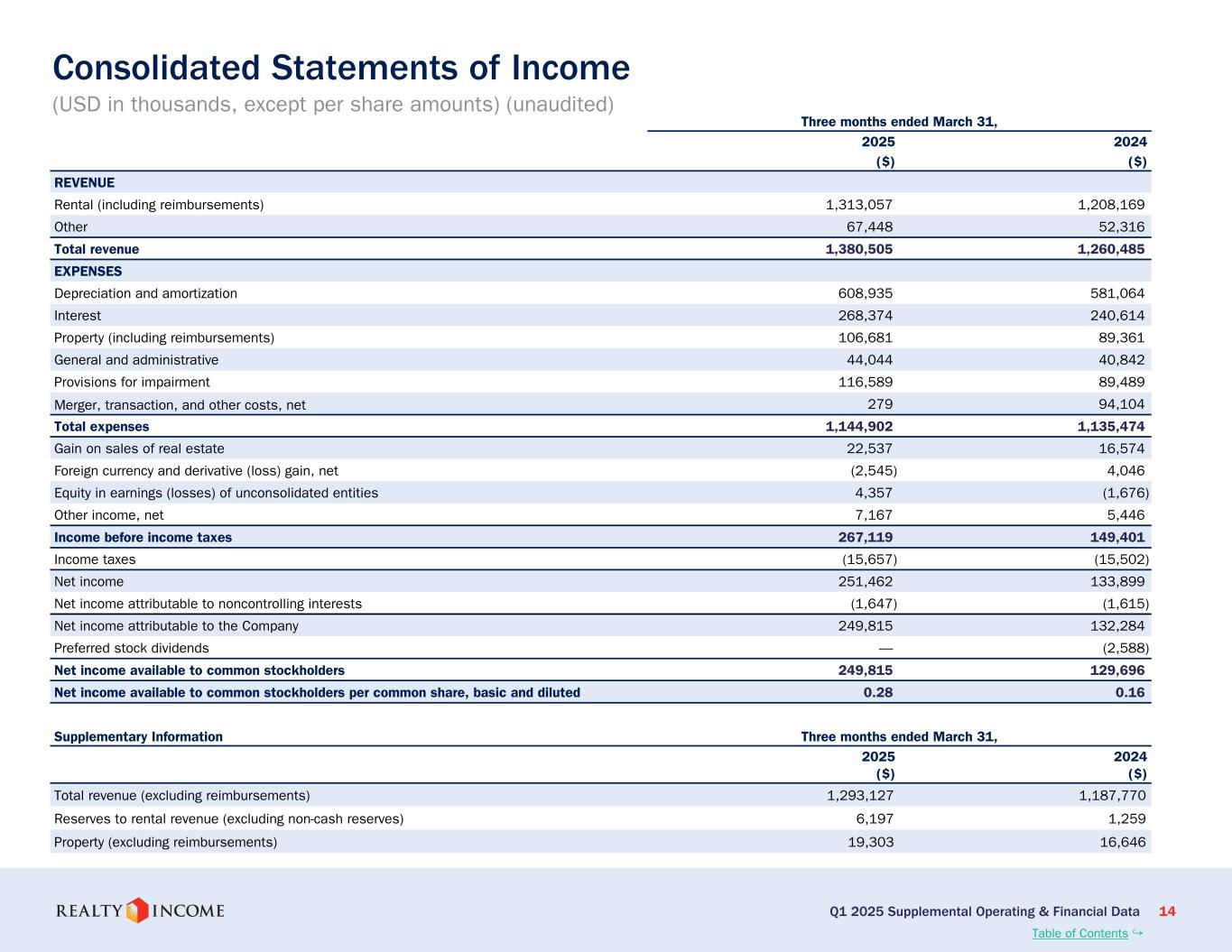

Q1 2025 Supplemental Operating & Financial Data 14 Three months ended March 31, 2025 2024 ($) ($) REVENUE Rental (including reimbursements) 1,313,057 1,208,169 Other 67,448 52,316 Total revenue 1,380,505 1,260,485 EXPENSES Depreciation and amortization 608,935 581,064 Interest 268,374 240,614 Property (including reimbursements) 106,681 89,361 General and administrative 44,044 40,842 Provisions for impairment 116,589 89,489 Merger, transaction, and other costs, net 279 94,104 Total expenses 1,144,902 1,135,474 Gain on sales of real estate 22,537 16,574 Foreign currency and derivative (loss) gain, net (2,545) 4,046 Equity in earnings (losses) of unconsolidated entities 4,357 (1,676) Other income, net 7,167 5,446 Income before income taxes 267,119 149,401 Income taxes (15,657) (15,502) Net income 251,462 133,899 Net income attributable to noncontrolling interests (1,647) (1,615) Net income attributable to the Company 249,815 132,284 Preferred stock dividends — (2,588) Net income available to common stockholders 249,815 129,696 Net income available to common stockholders per common share, basic and diluted 0.28 0.16 Consolidated Statements of Income (USD in thousands, except per share amounts) (unaudited) Supplementary Information Three months ended March 31, 2025 ($) 2024 ($) Total revenue (excluding reimbursements) 1,293,127 1,187,770 Reserves to rental revenue (excluding non-cash reserves) 6,197 1,259 Property (excluding reimbursements) 19,303 16,646 Table of Contents ↪

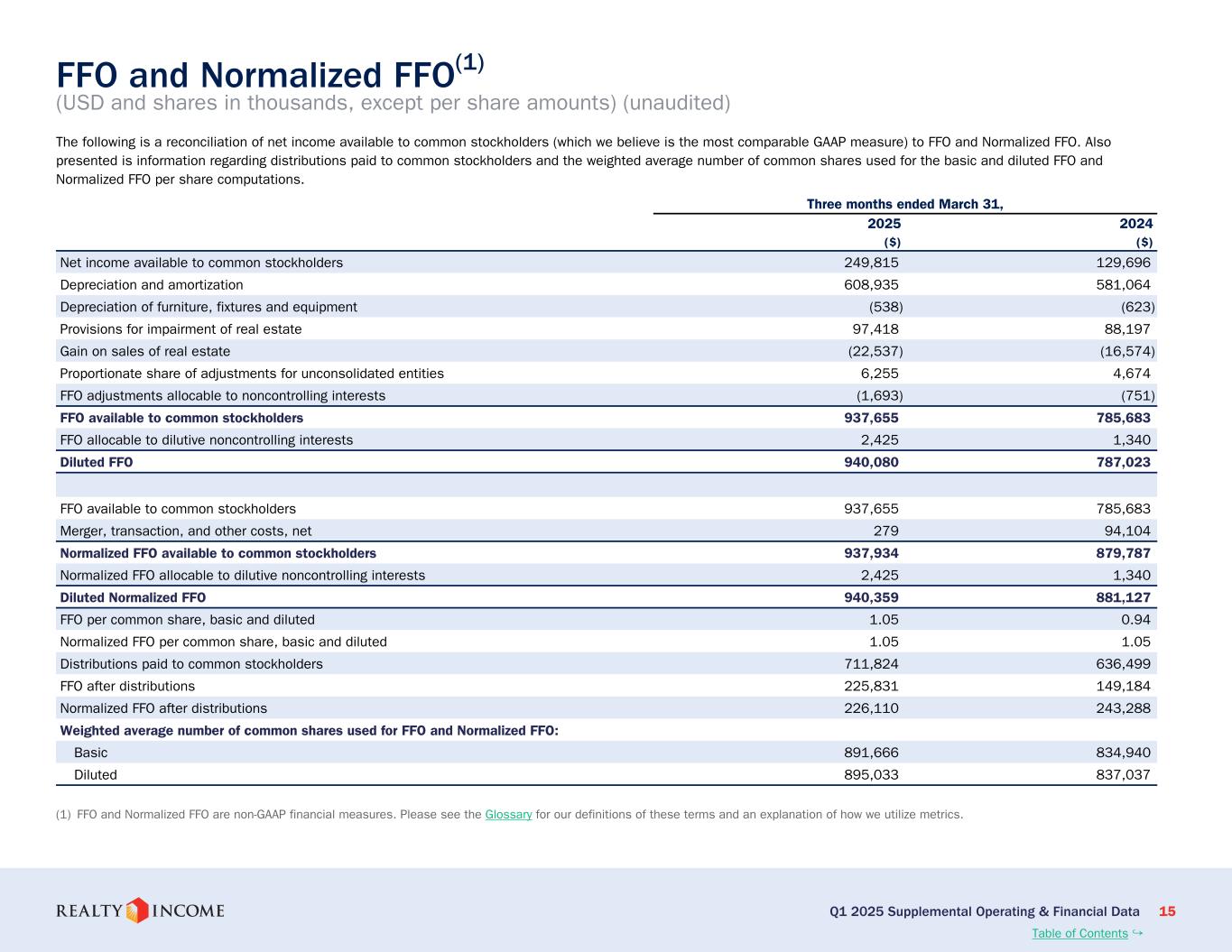

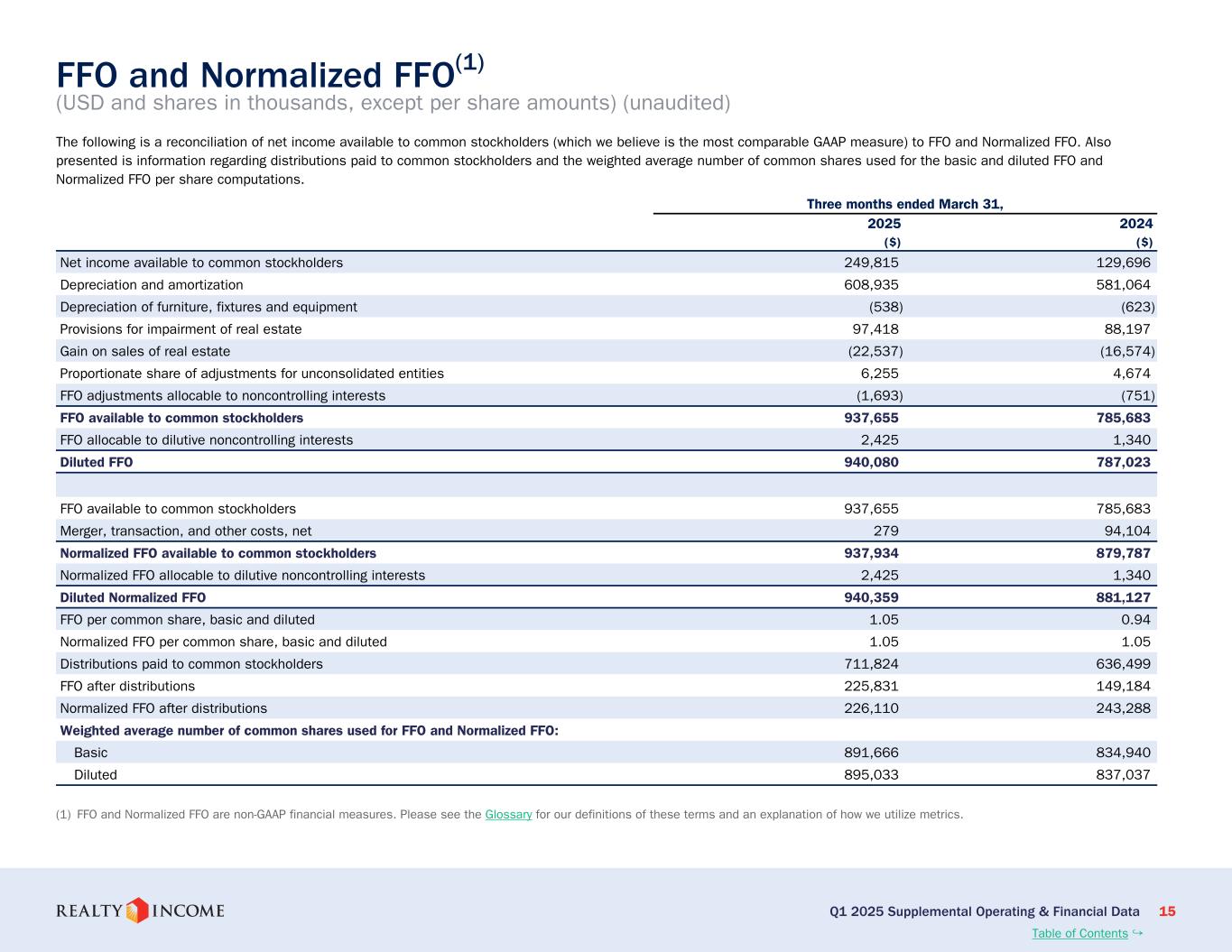

Q1 2025 Supplemental Operating & Financial Data 15 The following is a reconciliation of net income available to common stockholders (which we believe is the most comparable GAAP measure) to FFO and Normalized FFO. Also presented is information regarding distributions paid to common stockholders and the weighted average number of common shares used for the basic and diluted FFO and Normalized FFO per share computations. Three months ended March 31, 2025 2024 ($) ($) Net income available to common stockholders 249,815 129,696 Depreciation and amortization 608,935 581,064 Depreciation of furniture, fixtures and equipment (538) (623) Provisions for impairment of real estate 97,418 88,197 Gain on sales of real estate (22,537) (16,574) Proportionate share of adjustments for unconsolidated entities 6,255 4,674 FFO adjustments allocable to noncontrolling interests (1,693) (751) FFO available to common stockholders 937,655 785,683 FFO allocable to dilutive noncontrolling interests 2,425 1,340 Diluted FFO 940,080 787,023 FFO available to common stockholders 937,655 785,683 Merger, transaction, and other costs, net 279 94,104 Normalized FFO available to common stockholders 937,934 879,787 Normalized FFO allocable to dilutive noncontrolling interests 2,425 1,340 Diluted Normalized FFO 940,359 881,127 FFO per common share, basic and diluted 1.05 0.94 Normalized FFO per common share, basic and diluted 1.05 1.05 Distributions paid to common stockholders 711,824 636,499 FFO after distributions 225,831 149,184 Normalized FFO after distributions 226,110 243,288 Weighted average number of common shares used for FFO and Normalized FFO: Basic 891,666 834,940 Diluted 895,033 837,037 FFO and Normalized FFO(1) (USD and shares in thousands, except per share amounts) (unaudited) (1) FFO and Normalized FFO are non-GAAP financial measures. Please see the Glossary for our definitions of these terms and an explanation of how we utilize metrics. Table of Contents ↪

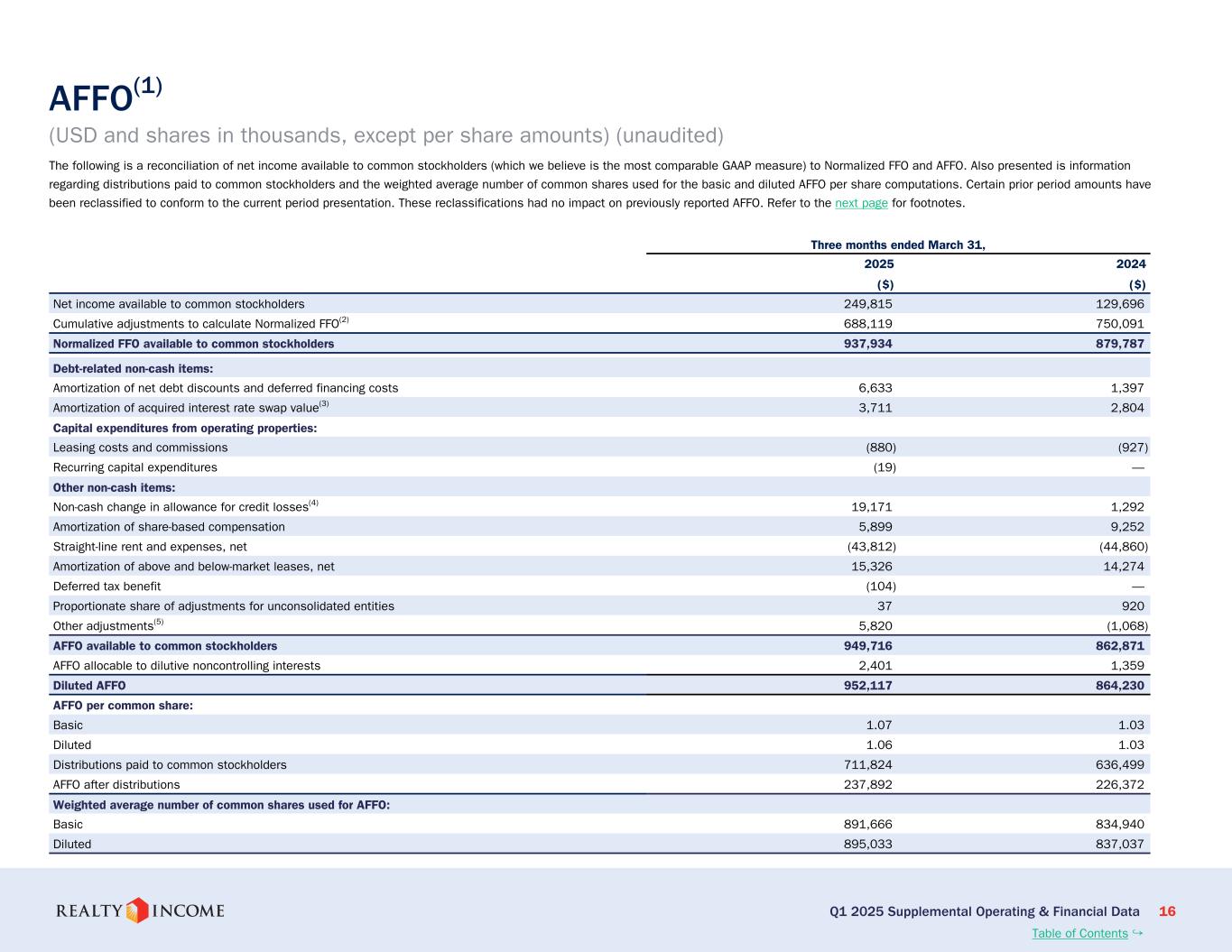

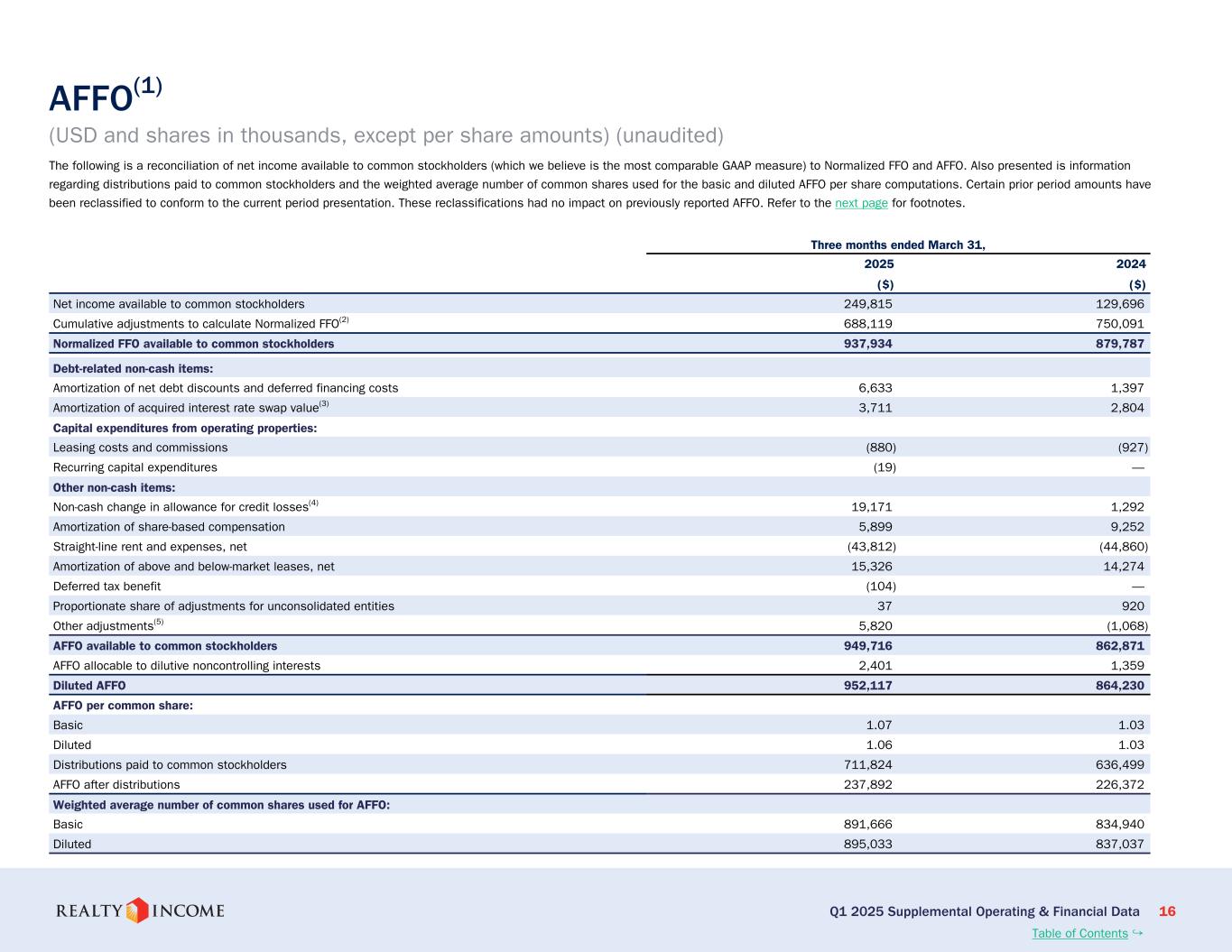

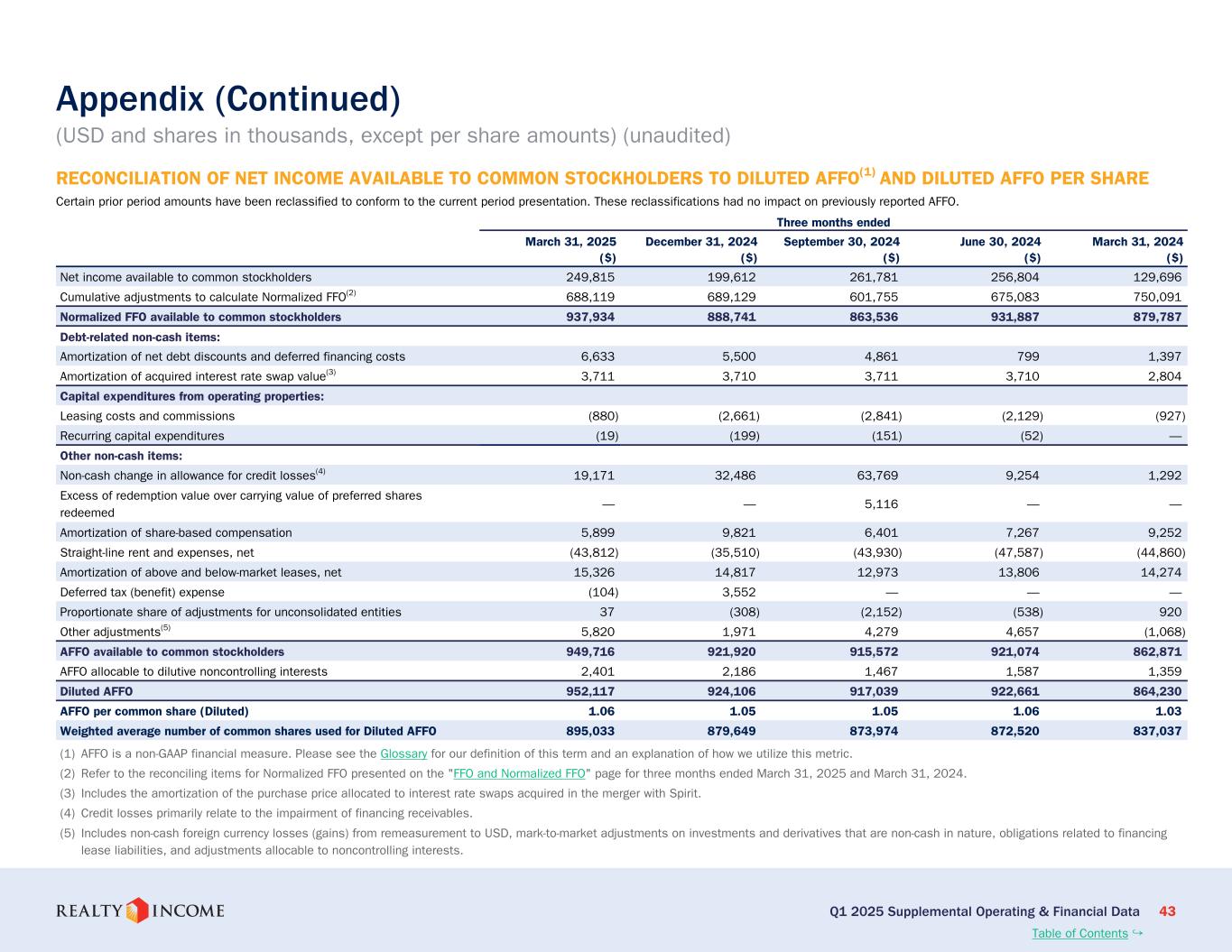

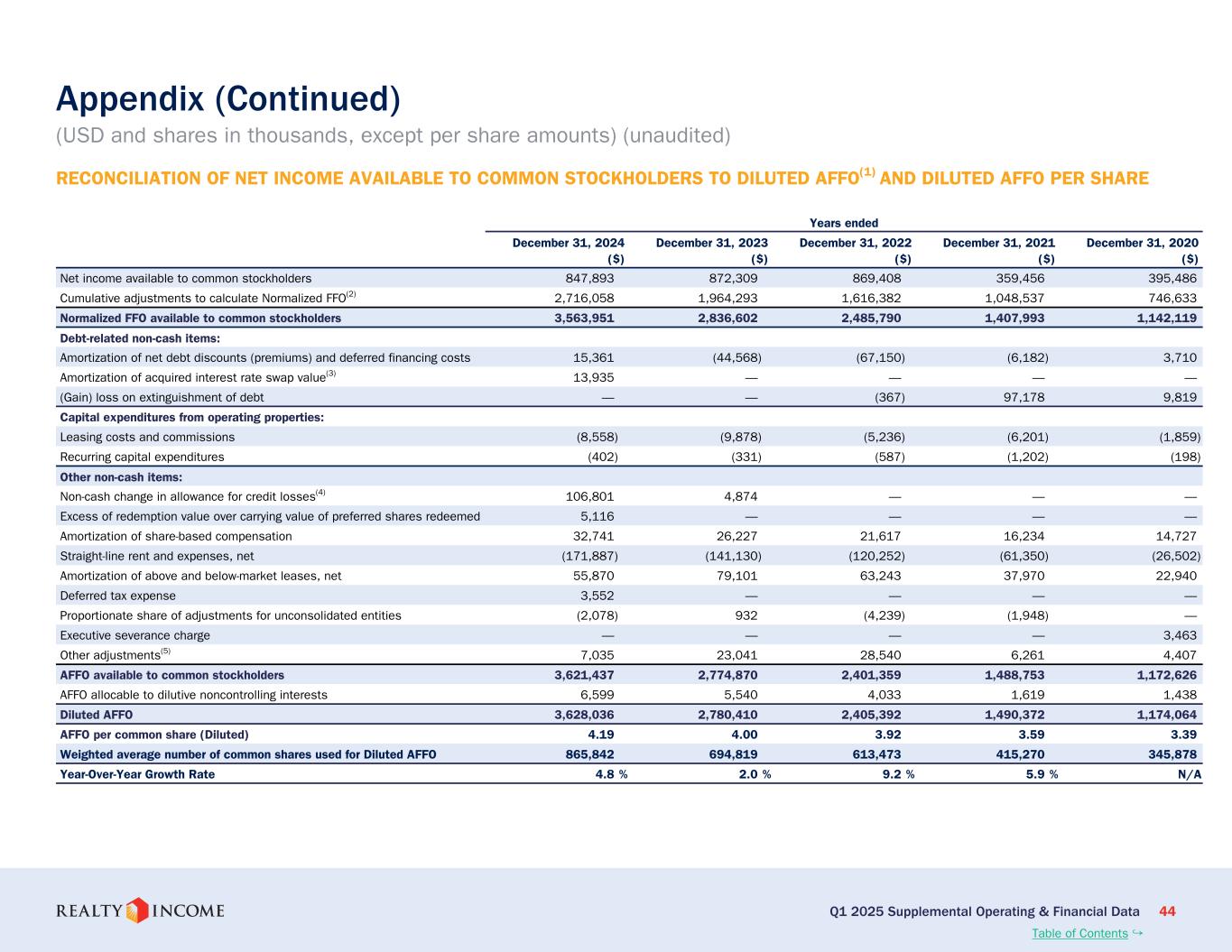

Q1 2025 Supplemental Operating & Financial Data 16 The following is a reconciliation of net income available to common stockholders (which we believe is the most comparable GAAP measure) to Normalized FFO and AFFO. Also presented is information regarding distributions paid to common stockholders and the weighted average number of common shares used for the basic and diluted AFFO per share computations. Certain prior period amounts have been reclassified to conform to the current period presentation. These reclassifications had no impact on previously reported AFFO. Refer to the next page for footnotes. Three months ended March 31, 2025 2024 ($) ($) Net income available to common stockholders 249,815 129,696 Cumulative adjustments to calculate Normalized FFO(2) 688,119 750,091 Normalized FFO available to common stockholders 937,934 879,787 Debt-related non-cash items: Amortization of net debt discounts and deferred financing costs 6,633 1,397 Amortization of acquired interest rate swap value(3) 3,711 2,804 Capital expenditures from operating properties: Leasing costs and commissions (880) (927) Recurring capital expenditures (19) — Other non-cash items: Non-cash change in allowance for credit losses(4) 19,171 1,292 Amortization of share-based compensation 5,899 9,252 Straight-line rent and expenses, net (43,812) (44,860) Amortization of above and below-market leases, net 15,326 14,274 Deferred tax benefit (104) — Proportionate share of adjustments for unconsolidated entities 37 920 Other adjustments(5) 5,820 (1,068) AFFO available to common stockholders 949,716 862,871 AFFO allocable to dilutive noncontrolling interests 2,401 1,359 Diluted AFFO 952,117 864,230 AFFO per common share: Basic 1.07 1.03 Diluted 1.06 1.03 Distributions paid to common stockholders 711,824 636,499 AFFO after distributions 237,892 226,372 Weighted average number of common shares used for AFFO: Basic 891,666 834,940 Diluted 895,033 837,037 AFFO(1) (USD and shares in thousands, except per share amounts) (unaudited) Table of Contents ↪

Q1 2025 Supplemental Operating & Financial Data 17 (1) AFFO is a non-GAAP financial measure. Please see the Glossary for our definition of this term and an explanation of how we utilize this metric. (2) Refer to the reconciling items for Normalized FFO presented on the "FFO and Normalized FFO" page. (3) Includes the amortization of the purchase price allocated to interest rate swaps acquired in the merger with Spirit Realty Capital, Inc. ("Spirit"). (4) Credit losses primarily relate to the impairment of financing receivables. (5) Includes non-cash foreign currency losses (gains) from remeasurement to USD, mark-to-market adjustments on investments and derivatives that are non-cash in nature, obligations related to financing lease liabilities, and adjustments allocable to noncontrolling interests. AFFO(1) (Continued) (USD and shares in thousands, except per share amounts) (unaudited) Table of Contents ↪

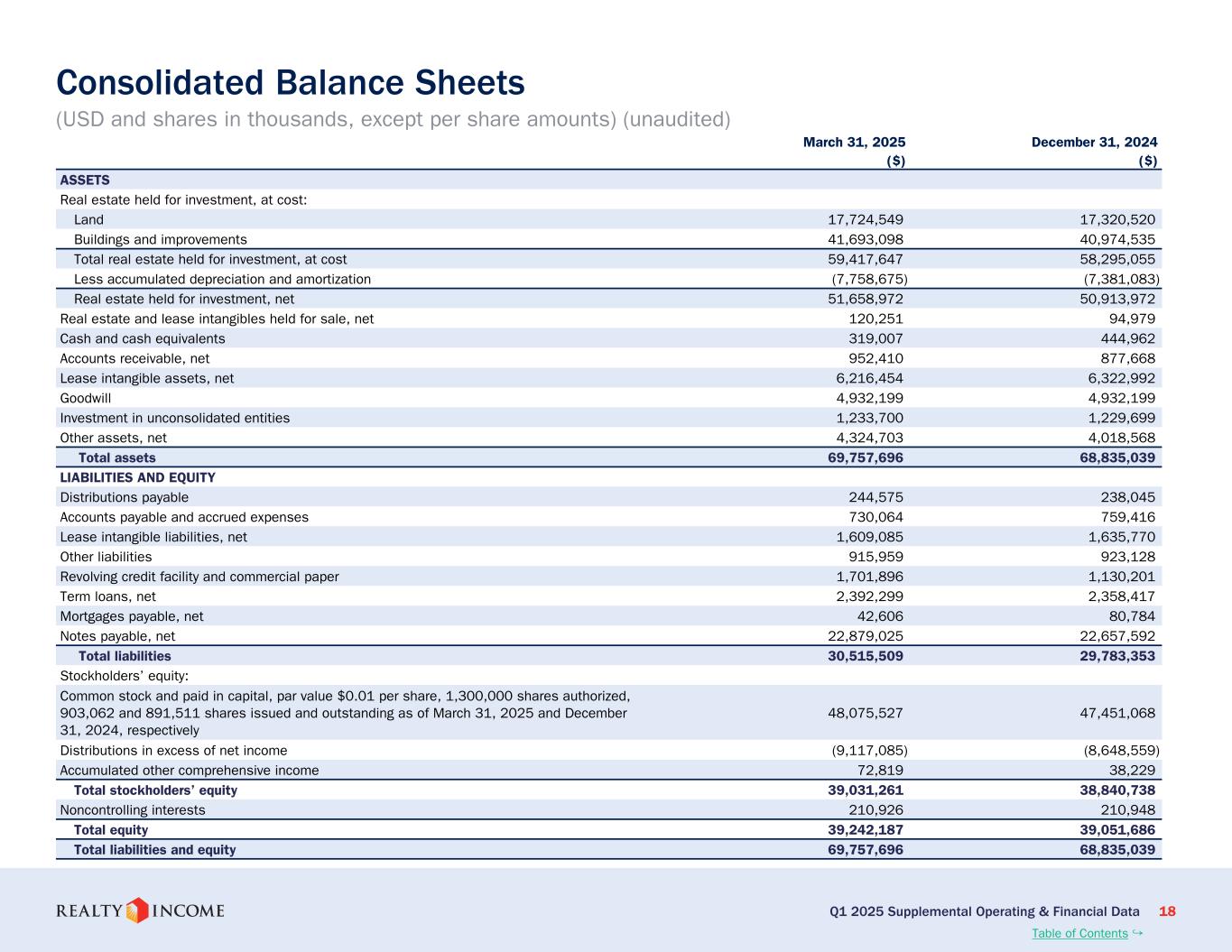

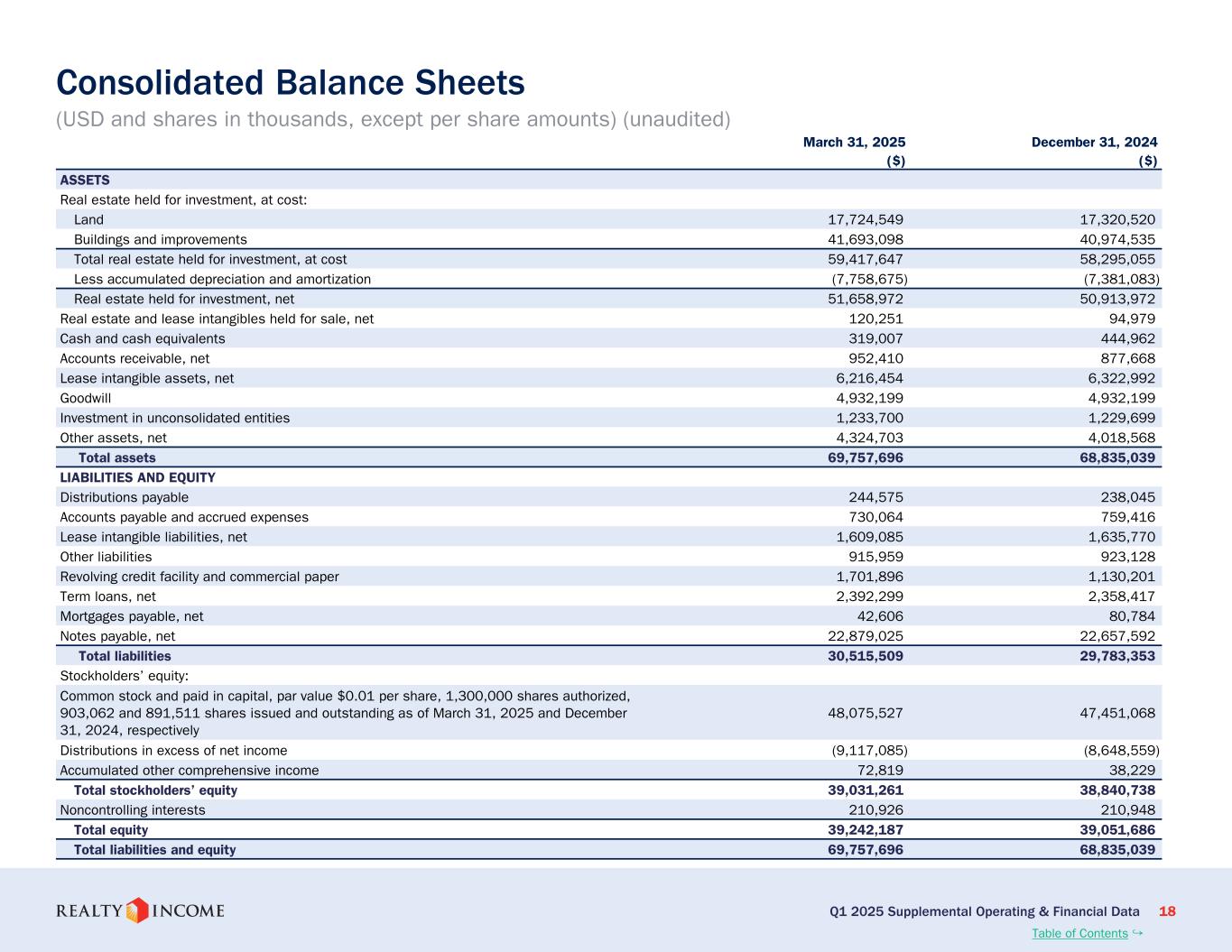

Q1 2025 Supplemental Operating & Financial Data 18 March 31, 2025 December 31, 2024 ($) ($) ASSETS Real estate held for investment, at cost: Land 17,724,549 17,320,520 Buildings and improvements 41,693,098 40,974,535 Total real estate held for investment, at cost 59,417,647 58,295,055 Less accumulated depreciation and amortization (7,758,675) (7,381,083) Real estate held for investment, net 51,658,972 50,913,972 Real estate and lease intangibles held for sale, net 120,251 94,979 Cash and cash equivalents 319,007 444,962 Accounts receivable, net 952,410 877,668 Lease intangible assets, net 6,216,454 6,322,992 Goodwill 4,932,199 4,932,199 Investment in unconsolidated entities 1,233,700 1,229,699 Other assets, net 4,324,703 4,018,568 Total assets 69,757,696 68,835,039 LIABILITIES AND EQUITY Distributions payable 244,575 238,045 Accounts payable and accrued expenses 730,064 759,416 Lease intangible liabilities, net 1,609,085 1,635,770 Other liabilities 915,959 923,128 Revolving credit facility and commercial paper 1,701,896 1,130,201 Term loans, net 2,392,299 2,358,417 Mortgages payable, net 42,606 80,784 Notes payable, net 22,879,025 22,657,592 Total liabilities 30,515,509 29,783,353 Stockholders’ equity: Common stock and paid in capital, par value $0.01 per share, 1,300,000 shares authorized, 903,062 and 891,511 shares issued and outstanding as of March 31, 2025 and December 31, 2024, respectively 48,075,527 47,451,068 Distributions in excess of net income (9,117,085) (8,648,559) Accumulated other comprehensive income 72,819 38,229 Total stockholders’ equity 39,031,261 38,840,738 Noncontrolling interests 210,926 210,948 Total equity 39,242,187 39,051,686 Total liabilities and equity 69,757,696 68,835,039 Consolidated Balance Sheets (USD and shares in thousands, except per share amounts) (unaudited) Table of Contents ↪

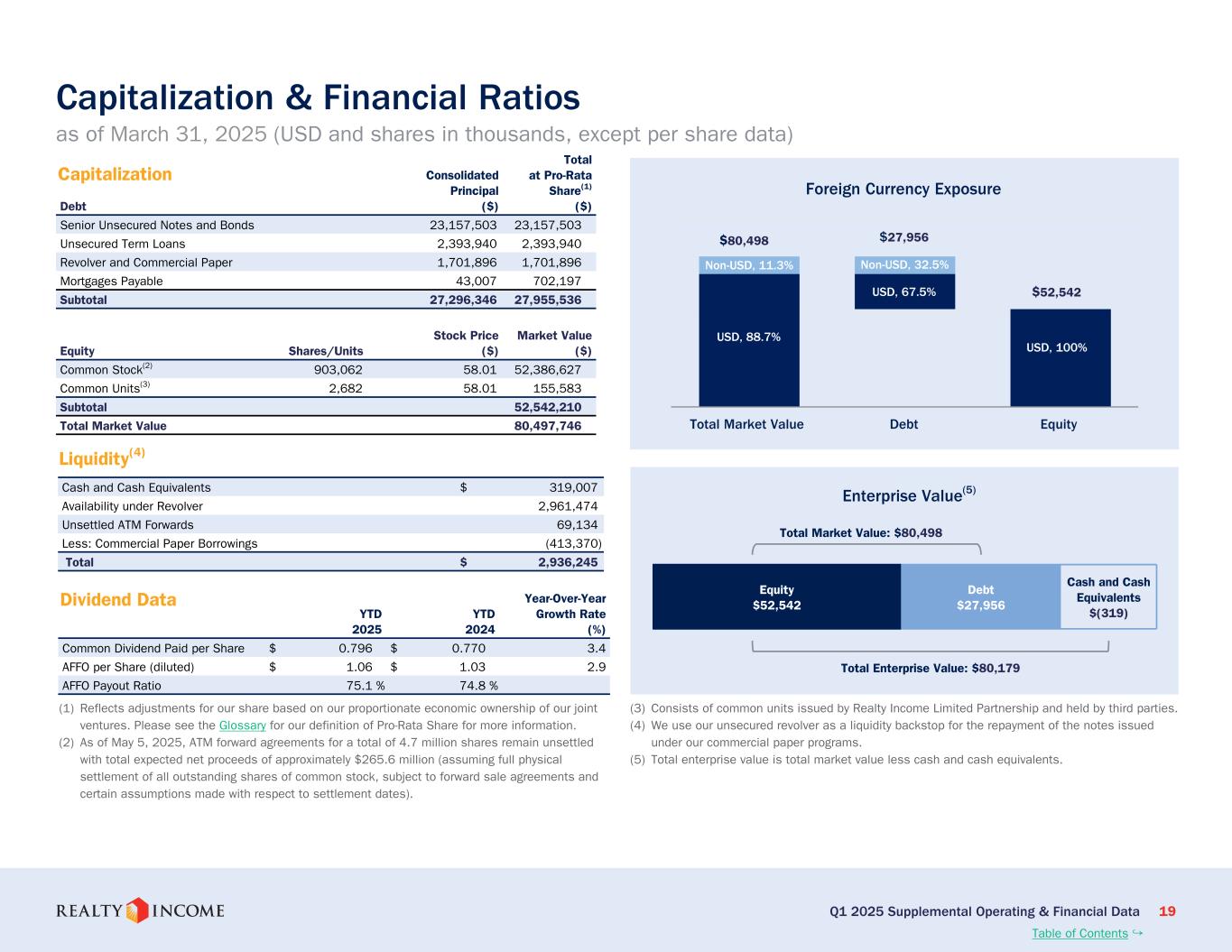

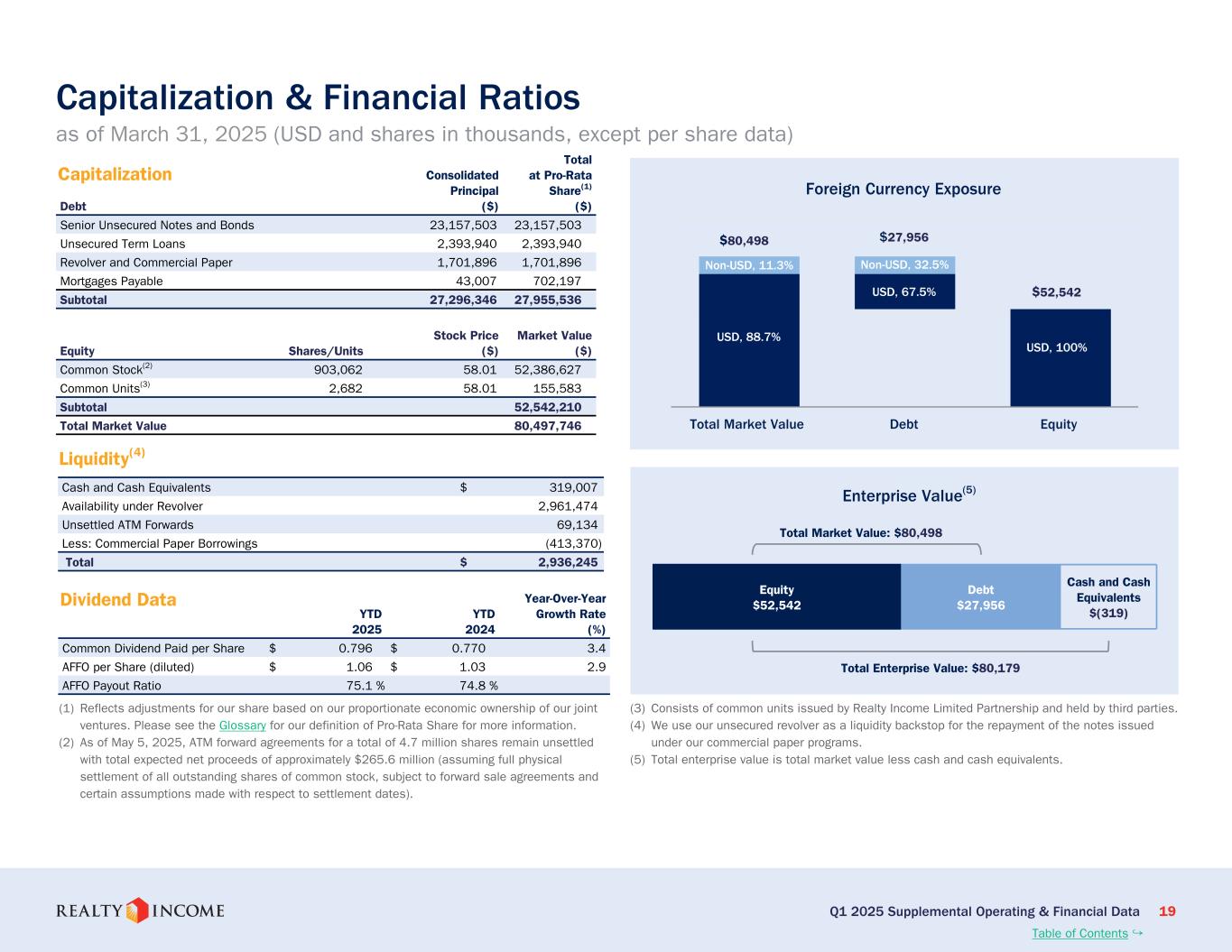

Q1 2025 Supplemental Operating & Financial Data 19 Capitalization & Financial Ratios as of March 31, 2025 (USD and shares in thousands, except per share data) Debt Consolidated Principal ($) Total at Pro-Rata Share(1) ($) Senior Unsecured Notes and Bonds 23,157,503 23,157,503 Unsecured Term Loans 2,393,940 2,393,940 Revolver and Commercial Paper 1,701,896 1,701,896 Mortgages Payable 43,007 702,197 Subtotal 27,296,346 27,955,536 Equity Shares/Units Stock Price ($) Market Value ($) Common Stock(2) 903,062 58.01 52,386,627 Common Units(3) 2,682 58.01 155,583 Subtotal 52,542,210 Total Market Value 80,497,746 Capitalization Dividend Data YTD 2025 YTD 2024 Year-Over-Year Growth Rate (%) Common Dividend Paid per Share $ 0.796 $ 0.770 3.4 AFFO per Share (diluted) $ 1.06 $ 1.03 2.9 AFFO Payout Ratio 75.1 % 74.8 % Cash and Cash Equivalents $ 319,007 Availability under Revolver 2,961,474 Unsettled ATM Forwards 69,134 Less: Commercial Paper Borrowings (413,370) Total $ 2,936,245 Liquidity(4) Foreign Currency Exposure Total Market Value Debt Equity $80,498 $27,956 $52,542 Non-USD, 32.5%Non-USD, 11.3% USD, 67.5% USD, 88.7% USD, 100% Equity $52,542 Debt $27,956 Cash and Cash Equivalents $(319) Enterprise Value(5) Total Market Value: $80,498 Total Enterprise Value: $80,179 (1) Reflects adjustments for our share based on our proportionate economic ownership of our joint ventures. Please see the Glossary for our definition of Pro-Rata Share for more information. (2) As of May 5, 2025, ATM forward agreements for a total of 4.7 million shares remain unsettled with total expected net proceeds of approximately $265.6 million (assuming full physical settlement of all outstanding shares of common stock, subject to forward sale agreements and certain assumptions made with respect to settlement dates). (3) Consists of common units issued by Realty Income Limited Partnership and held by third parties. (4) We use our unsecured revolver as a liquidity backstop for the repayment of the notes issued under our commercial paper programs. (5) Total enterprise value is total market value less cash and cash equivalents. Table of Contents ↪

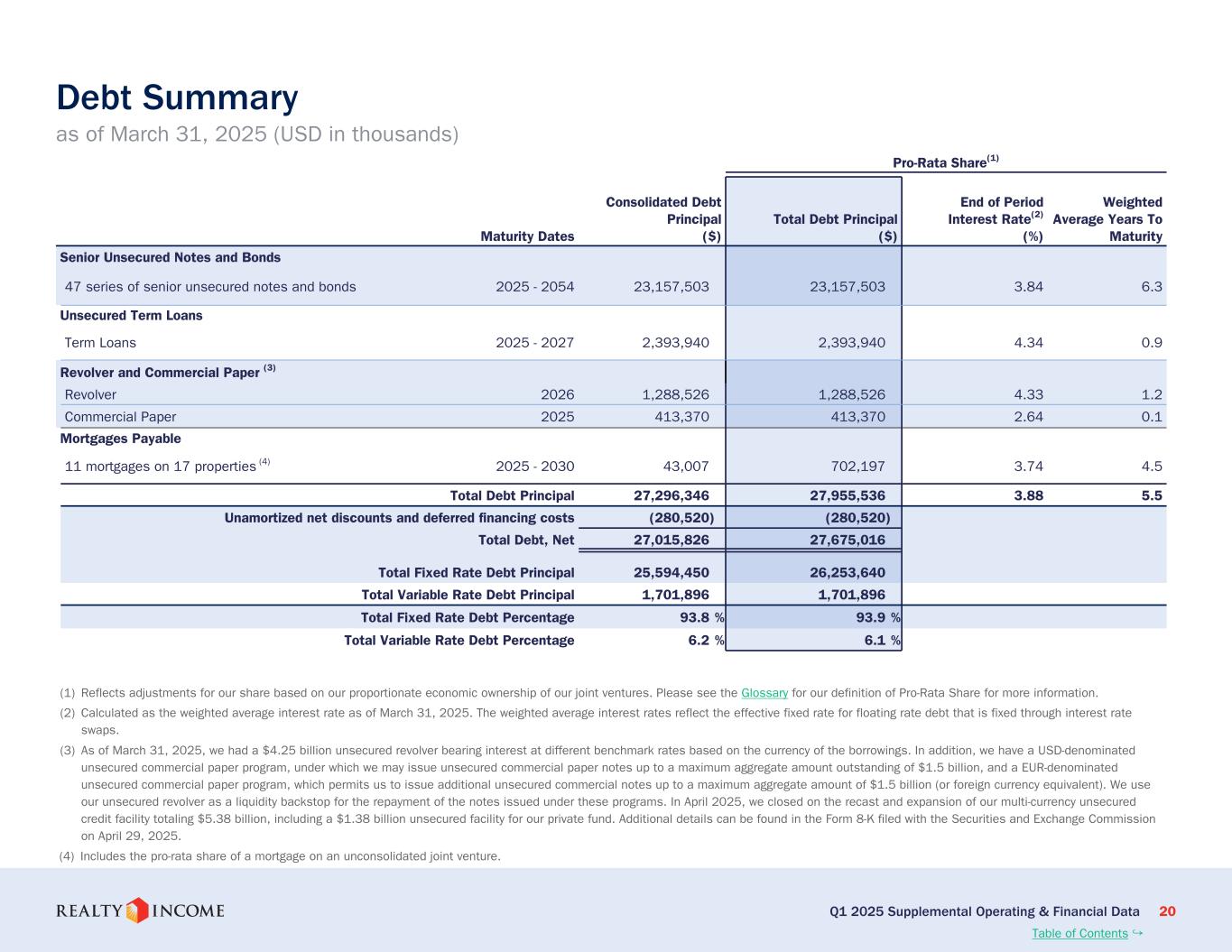

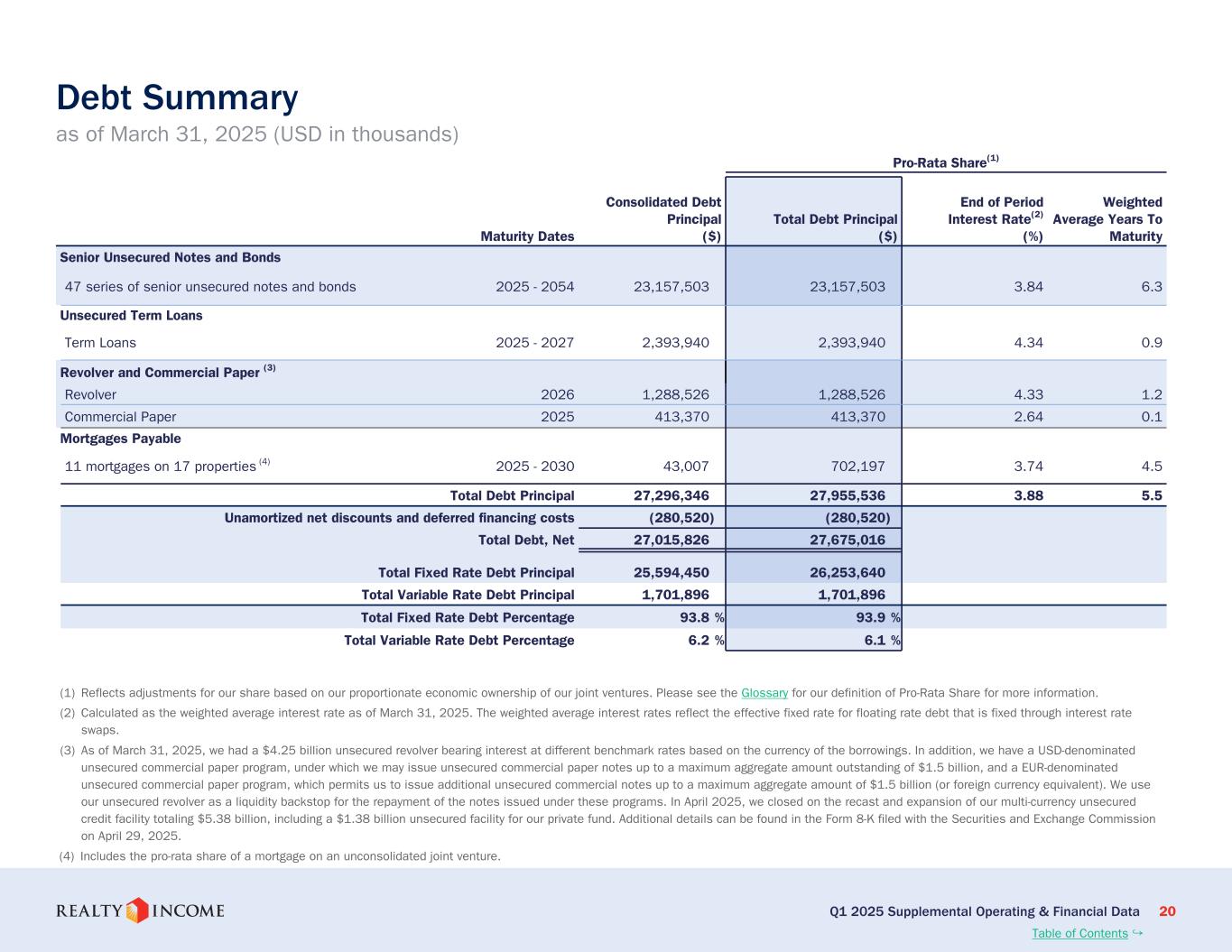

Q1 2025 Supplemental Operating & Financial Data 20 Debt Summary as of March 31, 2025 (USD in thousands) Pro-Rata Share(1) Maturity Dates Consolidated Debt Principal ($) Total Debt Principal ($) End of Period Interest Rate(2) (%) Weighted Average Years To Maturity Senior Unsecured Notes and Bonds 47 series of senior unsecured notes and bonds 2025 - 2054 23,157,503 23,157,503 3.84 6.3 Unsecured Term Loans Term Loans 2025 - 2027 2,393,940 2,393,940 4.34 0.9 Revolver and Commercial Paper (3) Revolver 2026 1,288,526 1,288,526 4.33 1.2 Commercial Paper 2025 413,370 413,370 2.64 0.1 Mortgages Payable 11 mortgages on 17 properties (4) 2025 - 2030 43,007 702,197 3.74 4.5 Total Debt Principal 27,296,346 27,955,536 3.88 5.5 Unamortized net discounts and deferred financing costs (280,520) (280,520) Total Debt, Net 27,015,826 27,675,016 Total Fixed Rate Debt Principal 25,594,450 26,253,640 Total Variable Rate Debt Principal 1,701,896 1,701,896 Total Fixed Rate Debt Percentage 93.8 % 93.9 % Total Variable Rate Debt Percentage 6.2 % 6.1 % (1) Reflects adjustments for our share based on our proportionate economic ownership of our joint ventures. Please see the Glossary for our definition of Pro-Rata Share for more information. (2) Calculated as the weighted average interest rate as of March 31, 2025. The weighted average interest rates reflect the effective fixed rate for floating rate debt that is fixed through interest rate swaps. (3) As of March 31, 2025, we had a $4.25 billion unsecured revolver bearing interest at different benchmark rates based on the currency of the borrowings. In addition, we have a USD-denominated unsecured commercial paper program, under which we may issue unsecured commercial paper notes up to a maximum aggregate amount outstanding of $1.5 billion, and a EUR-denominated unsecured commercial paper program, which permits us to issue additional unsecured commercial notes up to a maximum aggregate amount of $1.5 billion (or foreign currency equivalent). We use our unsecured revolver as a liquidity backstop for the repayment of the notes issued under these programs. In April 2025, we closed on the recast and expansion of our multi-currency unsecured credit facility totaling $5.38 billion, including a $1.38 billion unsecured facility for our private fund. Additional details can be found in the Form 8-K filed with the Securities and Exchange Commission on April 29, 2025. (4) Includes the pro-rata share of a mortgage on an unconsolidated joint venture. Table of Contents ↪

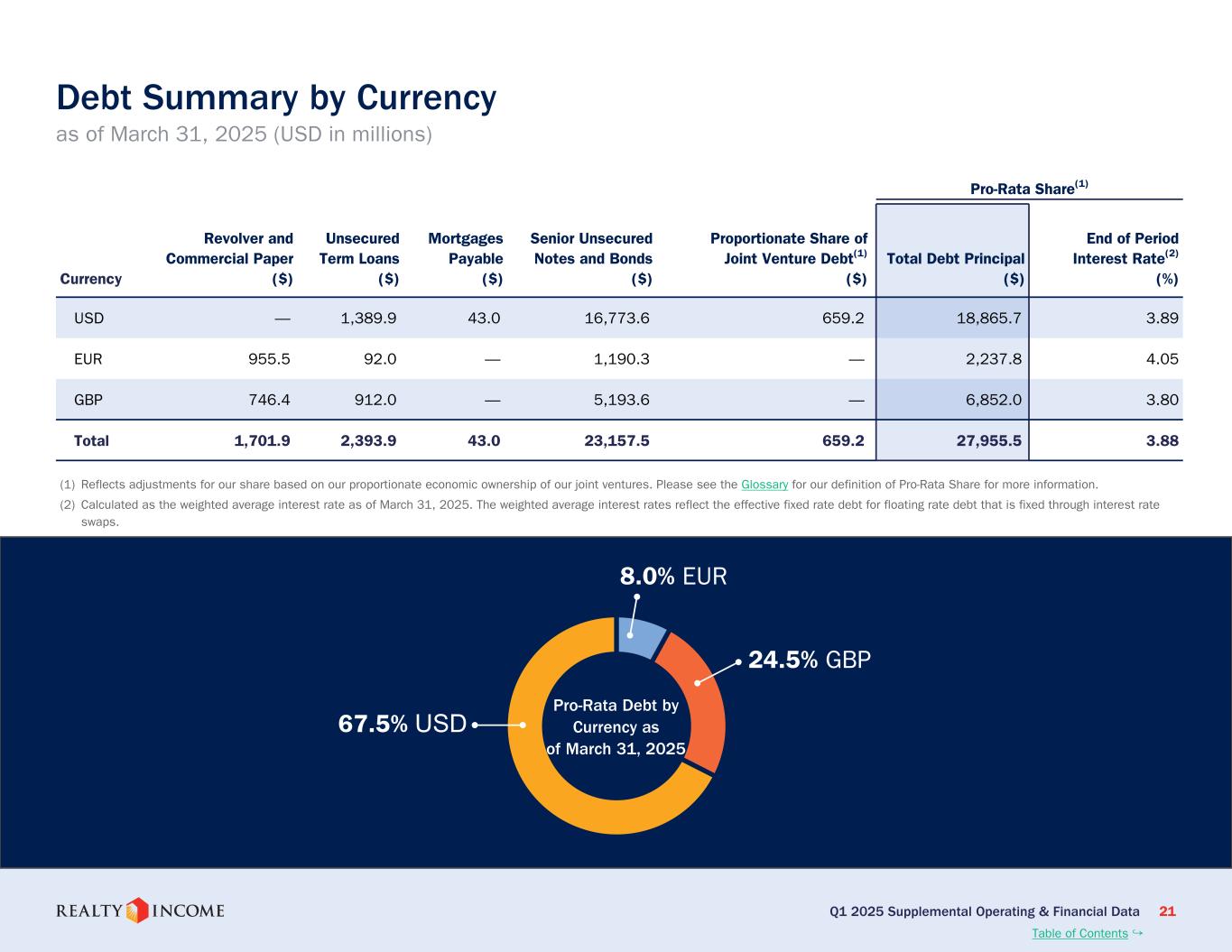

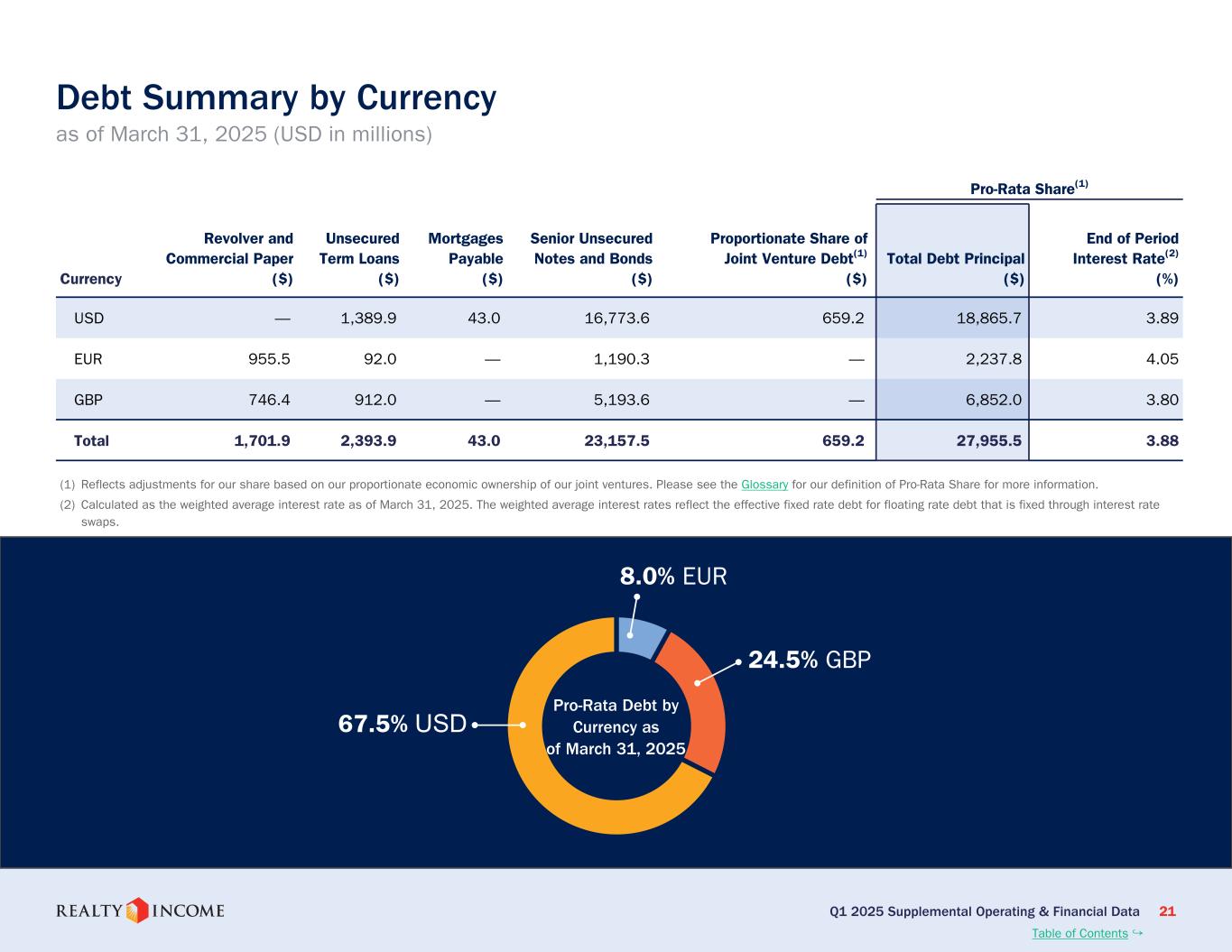

Q1 2025 Supplemental Operating & Financial Data 21 Debt Summary by Currency as of March 31, 2025 (USD in millions) Pro-Rata Share(1) Currency Revolver and Commercial Paper ($) Unsecured Term Loans ($) Mortgages Payable ($) Senior Unsecured Notes and Bonds ($) Proportionate Share of Joint Venture Debt(1) ($) Total Debt Principal ($) End of Period Interest Rate(2) (%) USD — 1,389.9 43.0 16,773.6 659.2 18,865.7 3.89 EUR 955.5 92.0 — 1,190.3 — 2,237.8 4.05 GBP 746.4 912.0 — 5,193.6 — 6,852.0 3.80 Total 1,701.9 2,393.9 43.0 23,157.5 659.2 27,955.5 3.88 (1) Reflects adjustments for our share based on our proportionate economic ownership of our joint ventures. Please see the Glossary for our definition of Pro-Rata Share for more information. (2) Calculated as the weighted average interest rate as of March 31, 2025. The weighted average interest rates reflect the effective fixed rate debt for floating rate debt that is fixed through interest rate swaps. 8.0% EUR 24.5% GBP 67.5% USD Pro-Rata Debt by Currency as of March 31, 2025 Table of Contents ↪

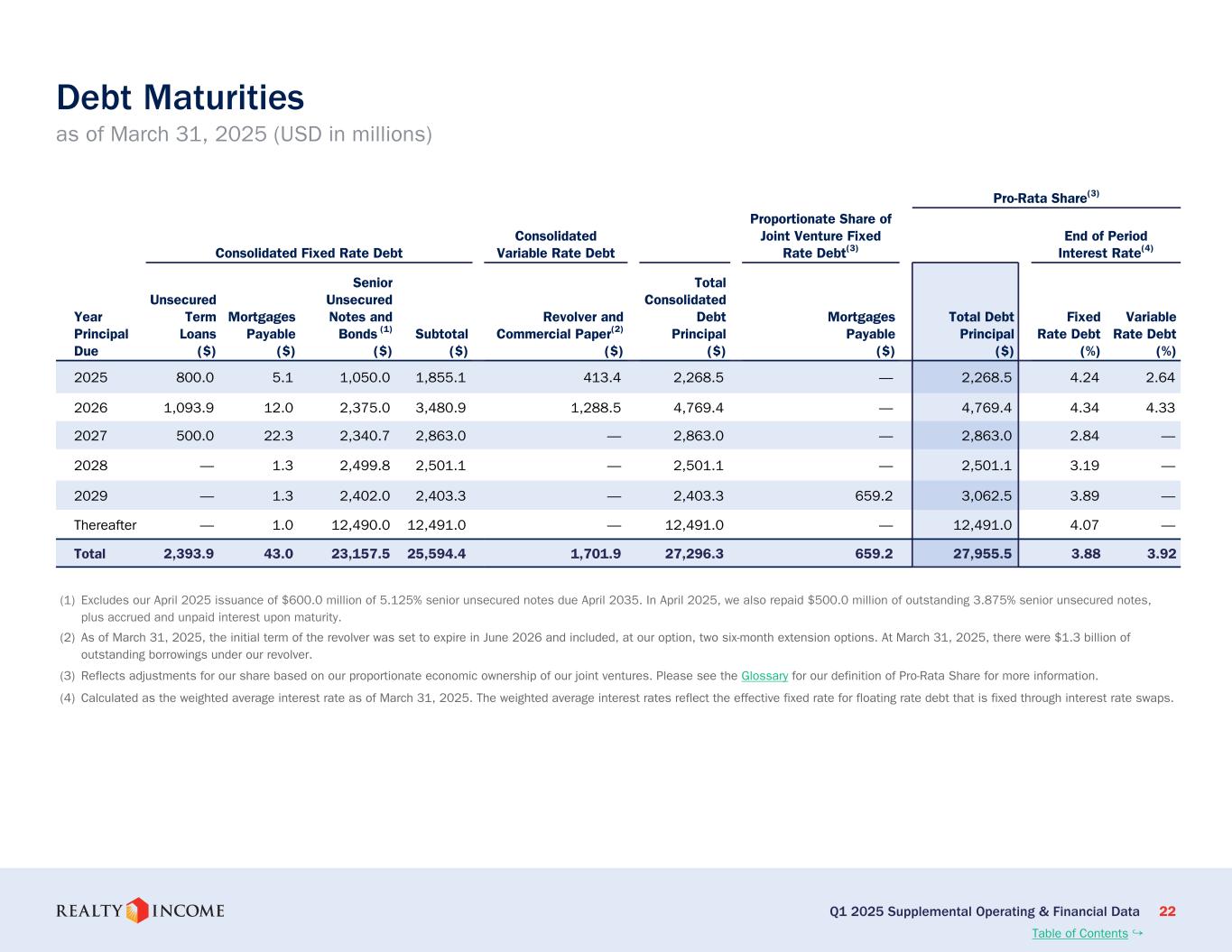

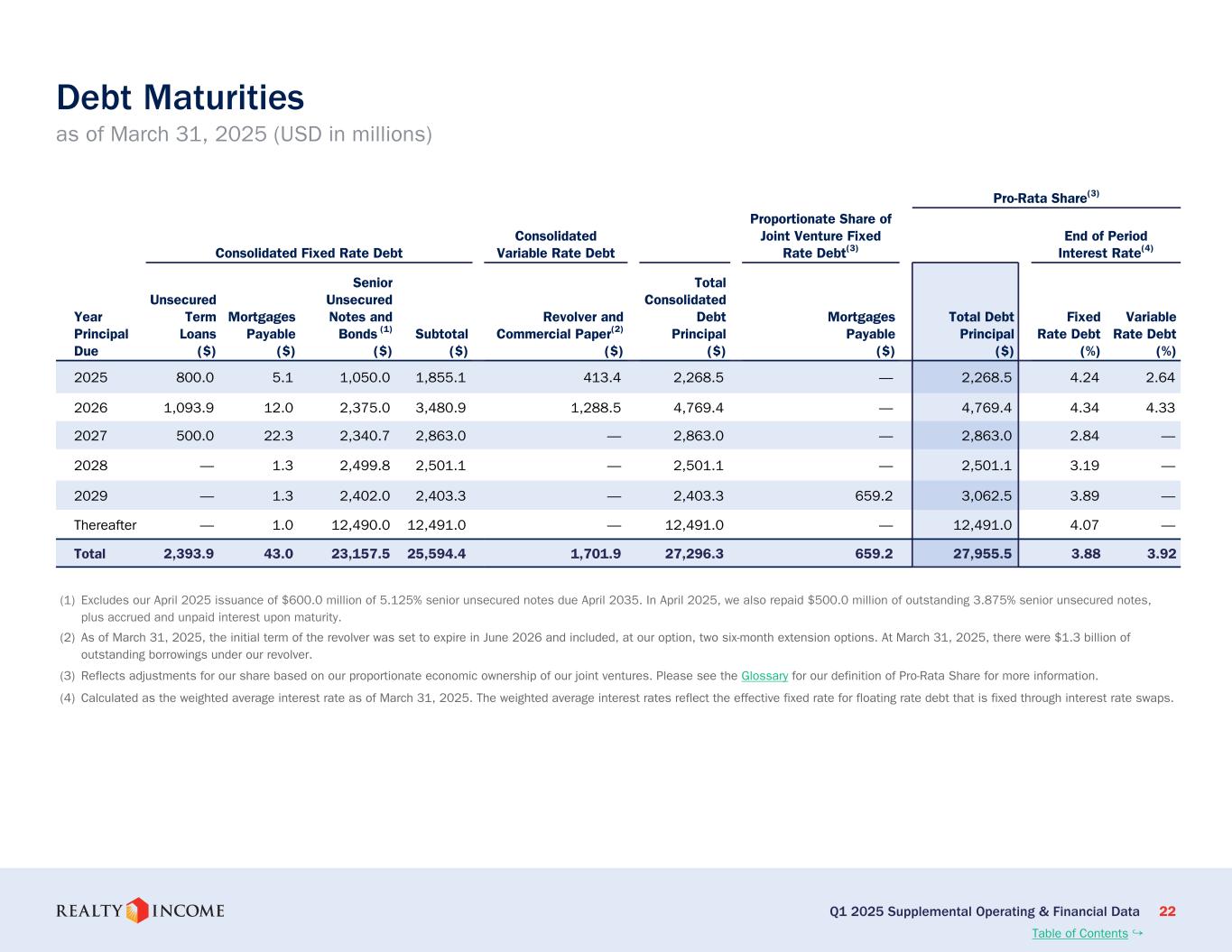

Q1 2025 Supplemental Operating & Financial Data 22 Debt Maturities as of March 31, 2025 (USD in millions) Pro-Rata Share(3) Consolidated Fixed Rate Debt Consolidated Variable Rate Debt Proportionate Share of Joint Venture Fixed Rate Debt(3) End of Period Interest Rate(4) Year Principal Due Unsecured Term Loans ($) Mortgages Payable ($) Senior Unsecured Notes and Bonds (1) ($) Subtotal ($) Revolver and Commercial Paper(2) ($) Total Consolidated Debt Principal ($) Mortgages Payable ($) Total Debt Principal ($) Fixed Rate Debt (%) Variable Rate Debt (%) 2025 800.0 5.1 1,050.0 1,855.1 413.4 2,268.5 — 2,268.5 4.24 2.64 2026 1,093.9 12.0 2,375.0 3,480.9 1,288.5 4,769.4 — 4,769.4 4.34 4.33 2027 500.0 22.3 2,340.7 2,863.0 — 2,863.0 — 2,863.0 2.84 — 2028 — 1.3 2,499.8 2,501.1 — 2,501.1 — 2,501.1 3.19 — 2029 — 1.3 2,402.0 2,403.3 — 2,403.3 659.2 3,062.5 3.89 — Thereafter — 1.0 12,490.0 12,491.0 — 12,491.0 — 12,491.0 4.07 — Total 2,393.9 43.0 23,157.5 25,594.4 1,701.9 27,296.3 659.2 27,955.5 3.88 3.92 (1) Excludes our April 2025 issuance of $600.0 million of 5.125% senior unsecured notes due April 2035. In April 2025, we also repaid $500.0 million of outstanding 3.875% senior unsecured notes, plus accrued and unpaid interest upon maturity. (2) As of March 31, 2025, the initial term of the revolver was set to expire in June 2026 and included, at our option, two six-month extension options. At March 31, 2025, there were $1.3 billion of outstanding borrowings under our revolver. (3) Reflects adjustments for our share based on our proportionate economic ownership of our joint ventures. Please see the Glossary for our definition of Pro-Rata Share for more information. (4) Calculated as the weighted average interest rate as of March 31, 2025. The weighted average interest rates reflect the effective fixed rate for floating rate debt that is fixed through interest rate swaps. Table of Contents ↪

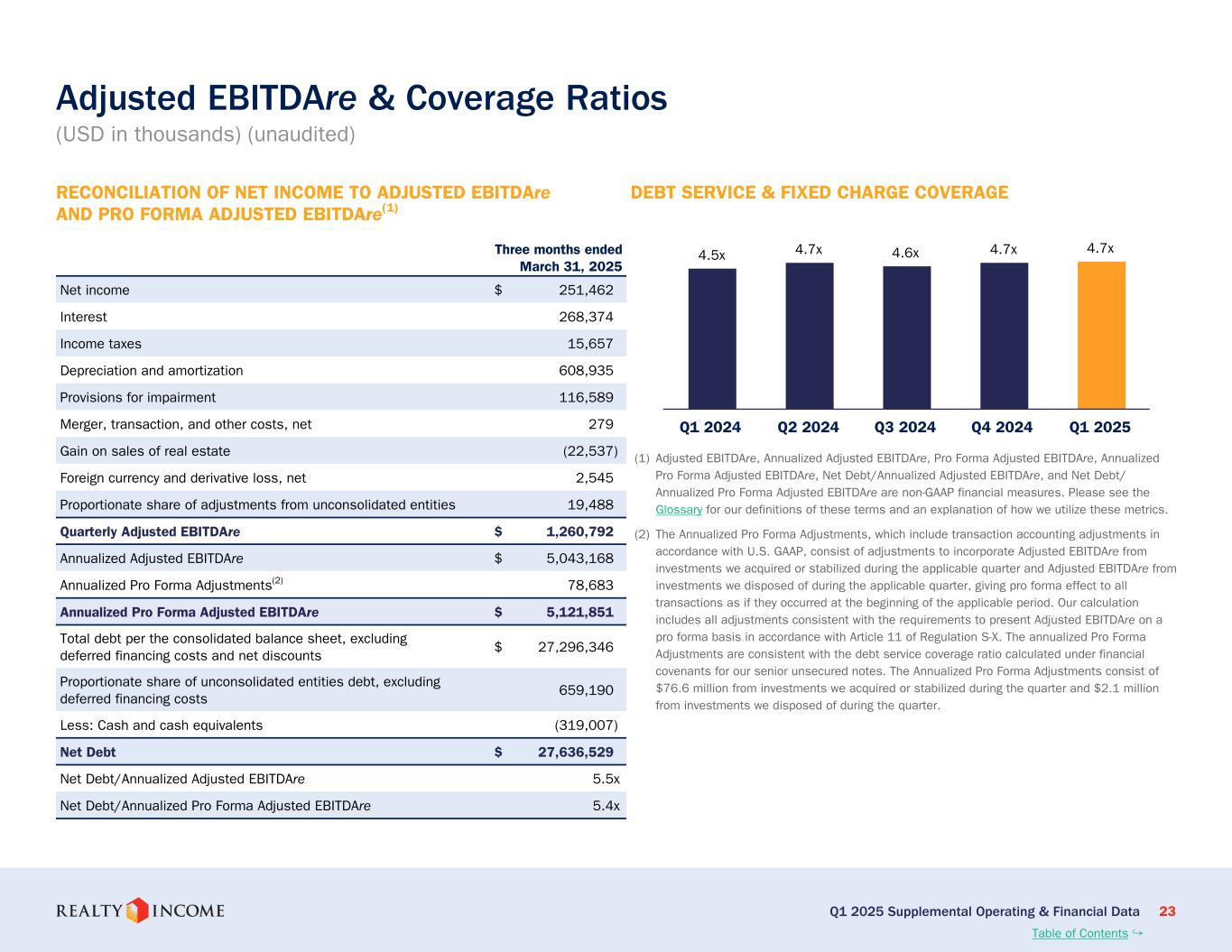

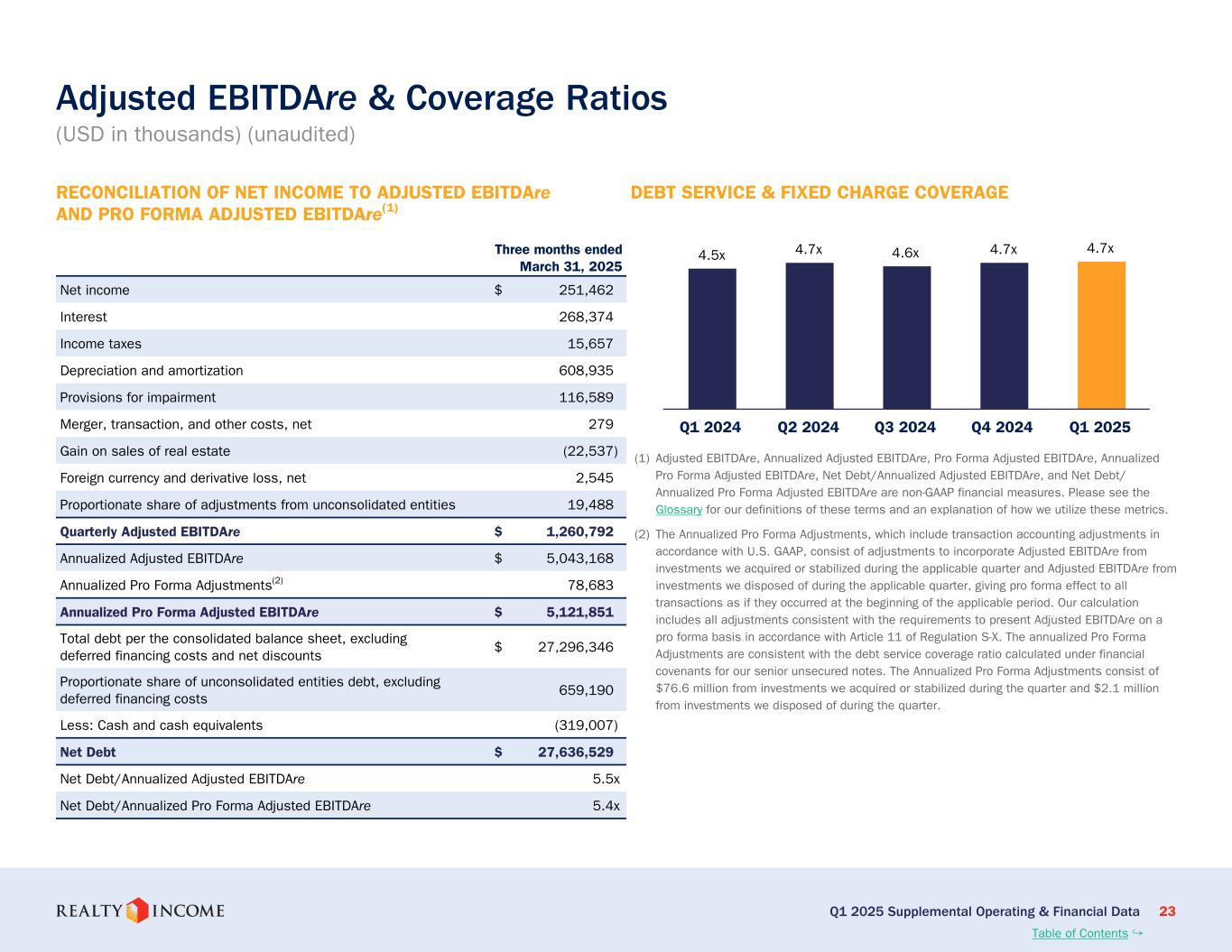

Q1 2025 Supplemental Operating & Financial Data 23 Adjusted EBITDAre & Coverage Ratios (USD in thousands) (unaudited) Three months ended March 31, 2025 Net income $ 251,462 Interest 268,374 Income taxes 15,657 Depreciation and amortization 608,935 Provisions for impairment 116,589 Merger, transaction, and other costs, net 279 Gain on sales of real estate (22,537) Foreign currency and derivative loss, net 2,545 Proportionate share of adjustments from unconsolidated entities 19,488 Quarterly Adjusted EBITDAre $ 1,260,792 Annualized Adjusted EBITDAre $ 5,043,168 Annualized Pro Forma Adjustments(2) 78,683 Annualized Pro Forma Adjusted EBITDAre $ 5,121,851 Total debt per the consolidated balance sheet, excluding deferred financing costs and net discounts $ 27,296,346 Proportionate share of unconsolidated entities debt, excluding deferred financing costs 659,190 Less: Cash and cash equivalents (319,007) Net Debt $ 27,636,529 Net Debt/Annualized Adjusted EBITDAre 5.5x Net Debt/Annualized Pro Forma Adjusted EBITDAre 5.4x (1) Adjusted EBITDAre, Annualized Adjusted EBITDAre, Pro Forma Adjusted EBITDAre, Annualized Pro Forma Adjusted EBITDAre, Net Debt/Annualized Adjusted EBITDAre, and Net Debt/ Annualized Pro Forma Adjusted EBITDAre are non-GAAP financial measures. Please see the Glossary for our definitions of these terms and an explanation of how we utilize these metrics. (2) The Annualized Pro Forma Adjustments, which include transaction accounting adjustments in accordance with U.S. GAAP, consist of adjustments to incorporate Adjusted EBITDAre from investments we acquired or stabilized during the applicable quarter and Adjusted EBITDAre from investments we disposed of during the applicable quarter, giving pro forma effect to all transactions as if they occurred at the beginning of the applicable period. Our calculation includes all adjustments consistent with the requirements to present Adjusted EBITDAre on a pro forma basis in accordance with Article 11 of Regulation S-X. The annualized Pro Forma Adjustments are consistent with the debt service coverage ratio calculated under financial covenants for our senior unsecured notes. The Annualized Pro Forma Adjustments consist of $76.6 million from investments we acquired or stabilized during the quarter and $2.1 million from investments we disposed of during the quarter. 4.5x 4.7x 4.6x 4.7x 4.7x Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 DEBT SERVICE & FIXED CHARGE COVERAGERECONCILIATION OF NET INCOME TO ADJUSTED EBITDAre AND PRO FORMA ADJUSTED EBITDAre(1) Table of Contents ↪

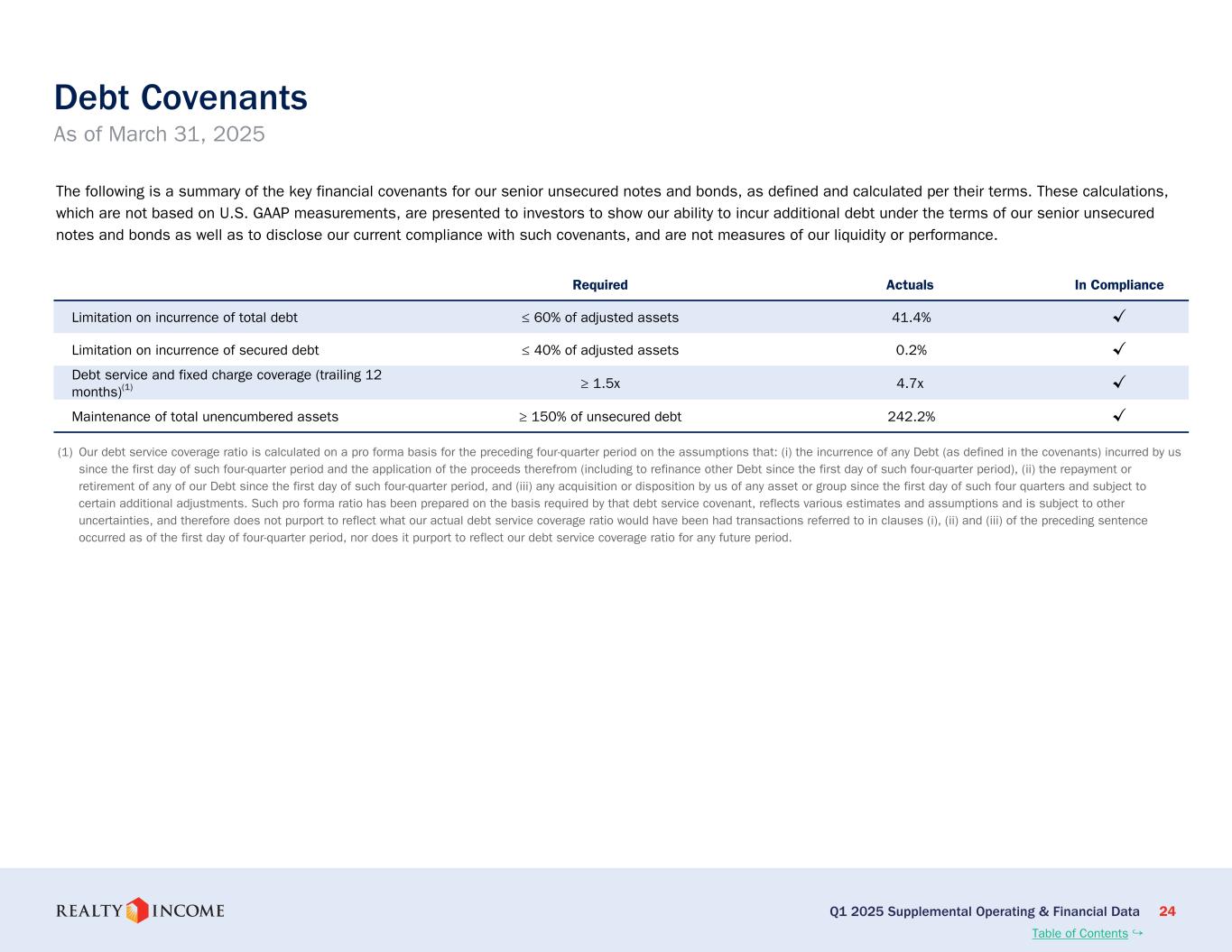

Q1 2025 Supplemental Operating & Financial Data 24 Required Actuals In Compliance Limitation on incurrence of total debt ≤ 60% of adjusted assets 41.4% ✓ Limitation on incurrence of secured debt ≤ 40% of adjusted assets 0.2% ✓ Debt service and fixed charge coverage (trailing 12 months)(1) ≥ 1.5x 4.7x ✓ Maintenance of total unencumbered assets ≥ 150% of unsecured debt 242.2% ✓ (1) Our debt service coverage ratio is calculated on a pro forma basis for the preceding four-quarter period on the assumptions that: (i) the incurrence of any Debt (as defined in the covenants) incurred by us since the first day of such four-quarter period and the application of the proceeds therefrom (including to refinance other Debt since the first day of such four-quarter period), (ii) the repayment or retirement of any of our Debt since the first day of such four-quarter period, and (iii) any acquisition or disposition by us of any asset or group since the first day of such four quarters and subject to certain additional adjustments. Such pro forma ratio has been prepared on the basis required by that debt service covenant, reflects various estimates and assumptions and is subject to other uncertainties, and therefore does not purport to reflect what our actual debt service coverage ratio would have been had transactions referred to in clauses (i), (ii) and (iii) of the preceding sentence occurred as of the first day of four-quarter period, nor does it purport to reflect our debt service coverage ratio for any future period. Debt Covenants As of March 31, 2025 The following is a summary of the key financial covenants for our senior unsecured notes and bonds, as defined and calculated per their terms. These calculations, which are not based on U.S. GAAP measurements, are presented to investors to show our ability to incur additional debt under the terms of our senior unsecured notes and bonds as well as to disclose our current compliance with such covenants, and are not measures of our liquidity or performance. Table of Contents ↪

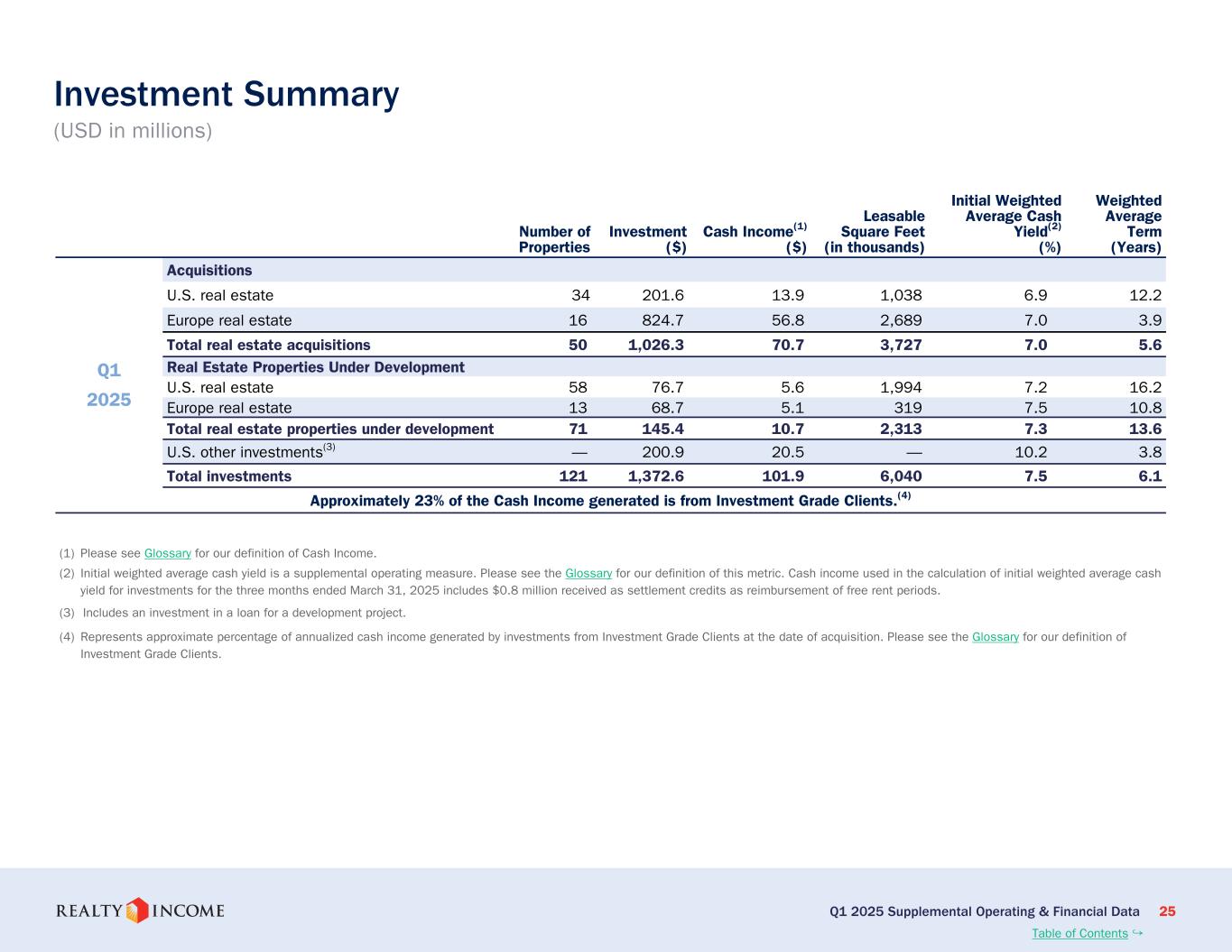

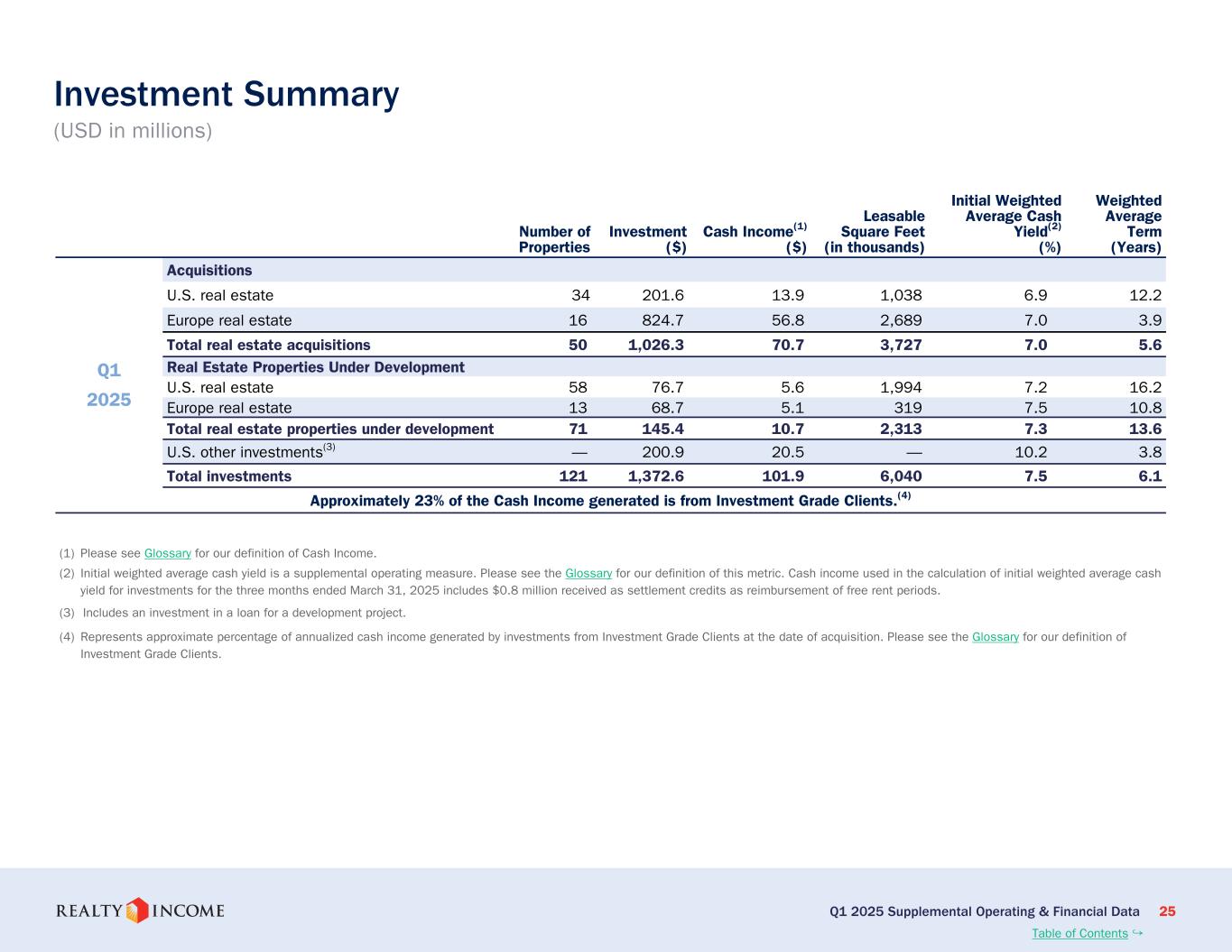

Q1 2025 Supplemental Operating & Financial Data 25 Number of Properties Investment ($) Cash Income(1) ($) Leasable Square Feet (in thousands) Initial Weighted Average Cash Yield(2) (%) Weighted Average Term (Years) Acquisitions Q1 2025 U.S. real estate 34 201.6 13.9 1,038 6.9 12.2 Europe real estate 16 824.7 56.8 2,689 7.0 3.9 Total real estate acquisitions 50 1,026.3 70.7 3,727 7.0 5.6 Real Estate Properties Under Development U.S. real estate 58 76.7 5.6 1,994 7.2 16.2 Europe real estate 13 68.7 5.1 319 7.5 10.8 Total real estate properties under development 71 145.4 10.7 2,313 7.3 13.6 U.S. other investments(3) — 200.9 20.5 — 10.2 3.8 Total investments 121 1,372.6 101.9 6,040 7.5 6.1 Approximately 23% of the Cash Income generated is from Investment Grade Clients.(4) Investment Summary (USD in millions) (1) Please see Glossary for our definition of Cash Income. (2) Initial weighted average cash yield is a supplemental operating measure. Please see the Glossary for our definition of this metric. Cash income used in the calculation of initial weighted average cash yield for investments for the three months ended March 31, 2025 includes $0.8 million received as settlement credits as reimbursement of free rent periods. (3) Includes an investment in a loan for a development project. (4) Represents approximate percentage of annualized cash income generated by investments from Investment Grade Clients at the date of acquisition. Please see the Glossary for our definition of Investment Grade Clients. Table of Contents ↪

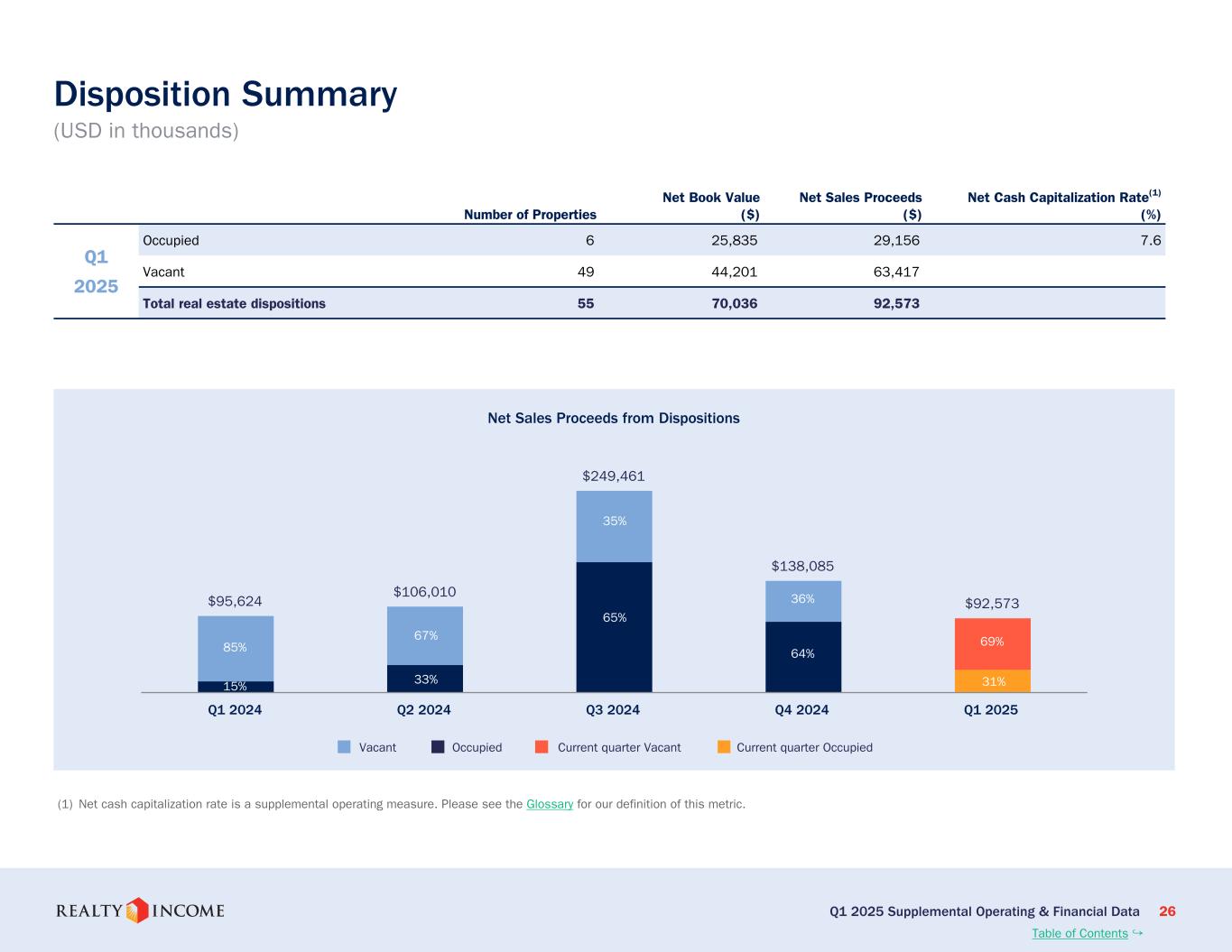

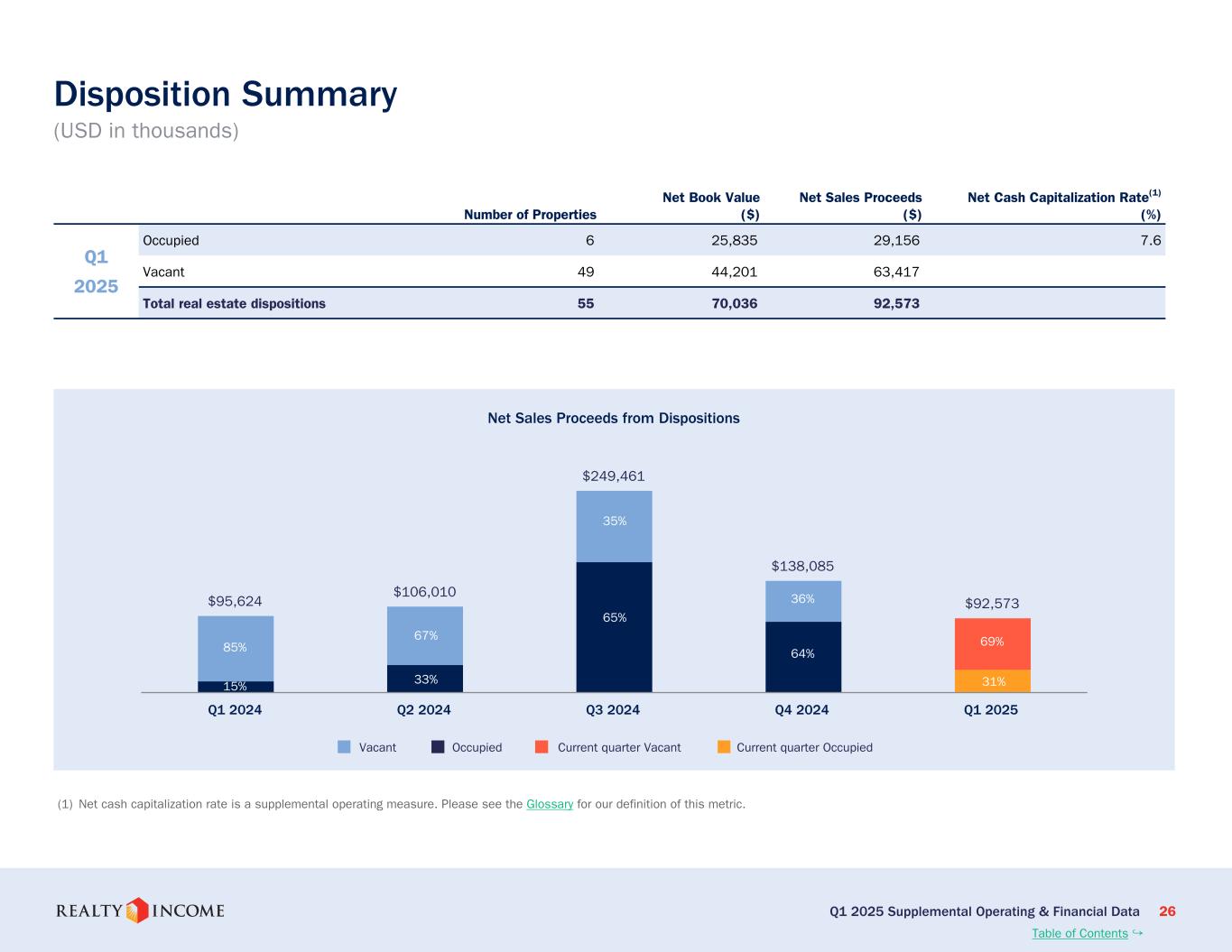

Q1 2025 Supplemental Operating & Financial Data 26 Number of Properties Net Book Value ($) Net Sales Proceeds ($) Net Cash Capitalization Rate(1) (%) Q1 2025 Occupied 6 25,835 29,156 7.6 Vacant 49 44,201 63,417 Total real estate dispositions 55 70,036 92,573 Disposition Summary (USD in thousands) Net Sales Proceeds from Dispositions $95,624 $106,010 $249,461 $138,085 $92,573 Occupied Vacant Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 (1) Net cash capitalization rate is a supplemental operating measure. Please see the Glossary for our definition of this metric. Table of Contents ↪ 69% 31% 36% 64% 35% 65% 67% 33% 85% 15% Vacant Occupied Current quarter Vacant Current quarter Occupied

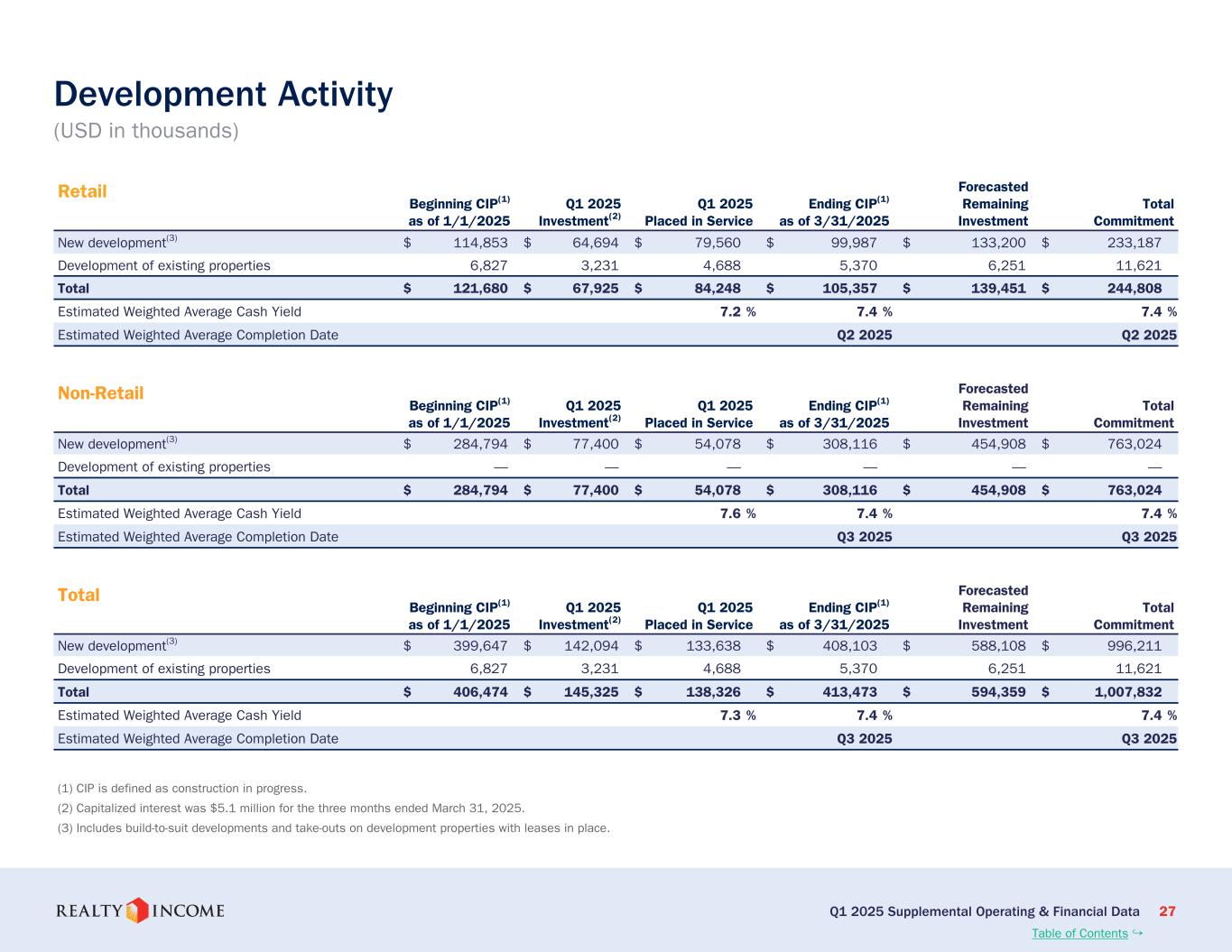

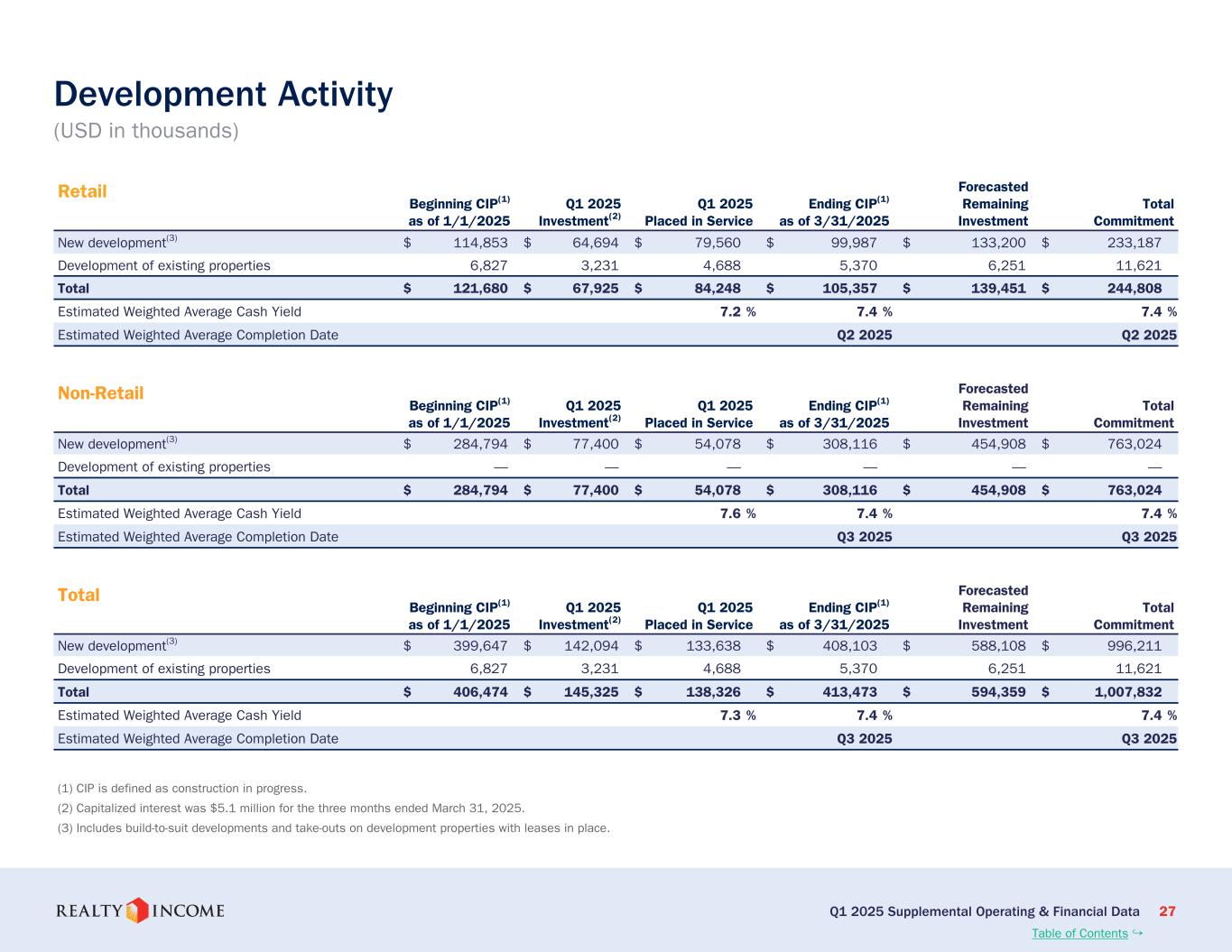

Q1 2025 Supplemental Operating & Financial Data 27 Development Activity (USD in thousands) Retail Beginning CIP(1) as of 1/1/2025 Q1 2025 Investment(2) Q1 2025 Placed in Service Ending CIP(1) as of 3/31/2025 Forecasted Remaining Investment Total Commitment New development(3) $ 114,853 $ 64,694 $ 79,560 $ 99,987 $ 133,200 $ 233,187 Development of existing properties 6,827 3,231 4,688 5,370 6,251 11,621 Total $ 121,680 $ 67,925 $ 84,248 $ 105,357 $ 139,451 $ 244,808 Estimated Weighted Average Cash Yield 7.2 % 7.4 % 7.4 % Estimated Weighted Average Completion Date Q2 2025 Q2 2025 Non-Retail Beginning CIP(1) as of 1/1/2025 Q1 2025 Investment(2) Q1 2025 Placed in Service Ending CIP(1) as of 3/31/2025 Forecasted Remaining Investment Total Commitment New development(3) $ 284,794 $ 77,400 $ 54,078 $ 308,116 $ 454,908 $ 763,024 Development of existing properties — — — — — — Total $ 284,794 $ 77,400 $ 54,078 $ 308,116 $ 454,908 $ 763,024 Estimated Weighted Average Cash Yield 7.6 % 7.4 % 7.4 % Estimated Weighted Average Completion Date Q3 2025 Q3 2025 Total Beginning CIP(1) as of 1/1/2025 Q1 2025 Investment(2) Q1 2025 Placed in Service Ending CIP(1) as of 3/31/2025 Forecasted Remaining Investment Total Commitment New development(3) $ 399,647 $ 142,094 $ 133,638 $ 408,103 $ 588,108 $ 996,211 Development of existing properties 6,827 3,231 4,688 5,370 6,251 11,621 Total $ 406,474 $ 145,325 $ 138,326 $ 413,473 $ 594,359 $ 1,007,832 Estimated Weighted Average Cash Yield 7.3 % 7.4 % 7.4 % Estimated Weighted Average Completion Date Q3 2025 Q3 2025 (1) CIP is defined as construction in progress. (2) Capitalized interest was $5.1 million for the three months ended March 31, 2025. (3) Includes build-to-suit developments and take-outs on development properties with leases in place. Table of Contents ↪

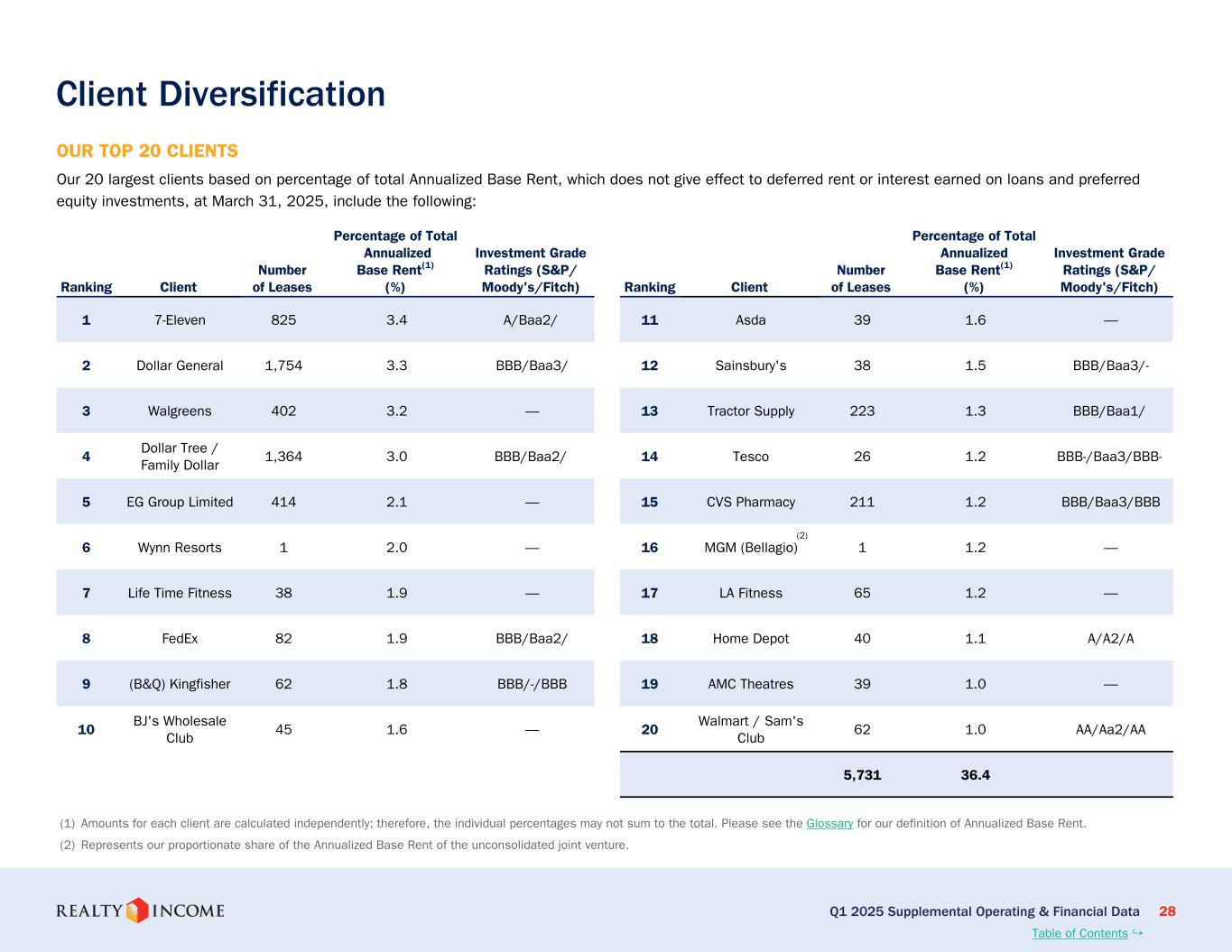

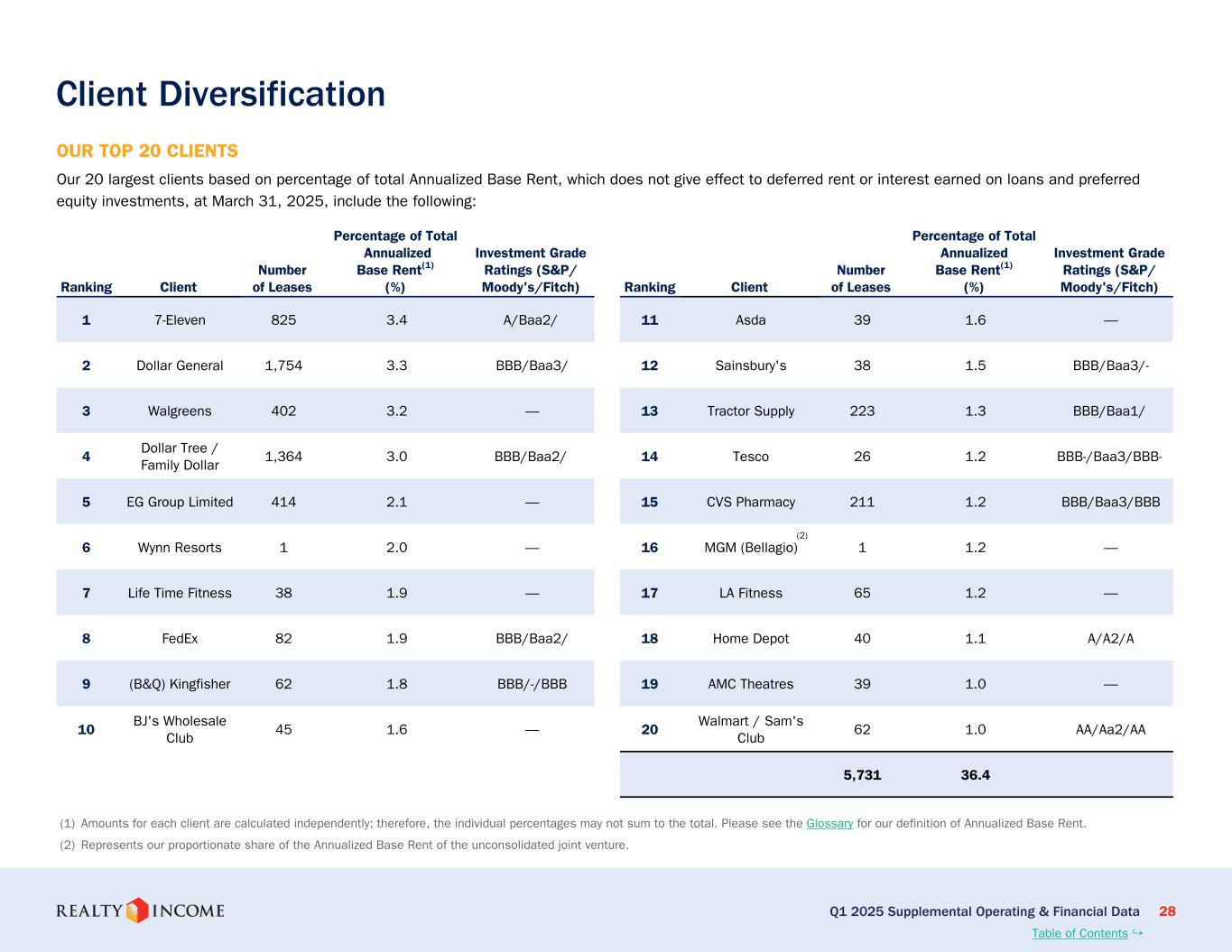

Q1 2025 Supplemental Operating & Financial Data 28 Ranking Client Number of Leases Percentage of Total Annualized Base Rent(1) (%) Investment Grade Ratings (S&P/ Moody's/Fitch) 1 7-Eleven 825 3.4 A/Baa2/ 2 Dollar General 1,754 3.3 BBB/Baa3/ 3 Walgreens 402 3.2 — 4 Dollar Tree / Family Dollar 1,364 3.0 BBB/Baa2/ 5 EG Group Limited 414 2.1 — 6 Wynn Resorts 1 2.0 — 7 Life Time Fitness 38 1.9 — 8 FedEx 82 1.9 BBB/Baa2/ 9 (B&Q) Kingfisher 62 1.8 BBB/-/BBB 10 BJ's Wholesale Club 45 1.6 — Client Diversification OUR TOP 20 CLIENTS Our 20 largest clients based on percentage of total Annualized Base Rent, which does not give effect to deferred rent or interest earned on loans and preferred equity investments, at March 31, 2025, include the following: (1) Amounts for each client are calculated independently; therefore, the individual percentages may not sum to the total. Please see the Glossary for our definition of Annualized Base Rent. (2) Represents our proportionate share of the Annualized Base Rent of the unconsolidated joint venture. Table of Contents ↪ Ranking Client Number of Leases Percentage of Total Annualized Base Rent(1) (%) Investment Grade Ratings (S&P/ Moody's/Fitch) 11 Asda 39 1.6 — 12 Sainsbury's 38 1.5 BBB/Baa3/- 13 Tractor Supply 223 1.3 BBB/Baa1/ 14 Tesco 26 1.2 BBB-/Baa3/BBB- 15 CVS Pharmacy 211 1.2 BBB/Baa3/BBB 16 MGM (Bellagio) 1 1.2 — 17 LA Fitness 65 1.2 — 18 Home Depot 40 1.1 A/A2/A 19 AMC Theatres 39 1.0 — 20 Walmart / Sam's Club 62 1.0 AA/Aa2/AA 5,731 36.4 (2)

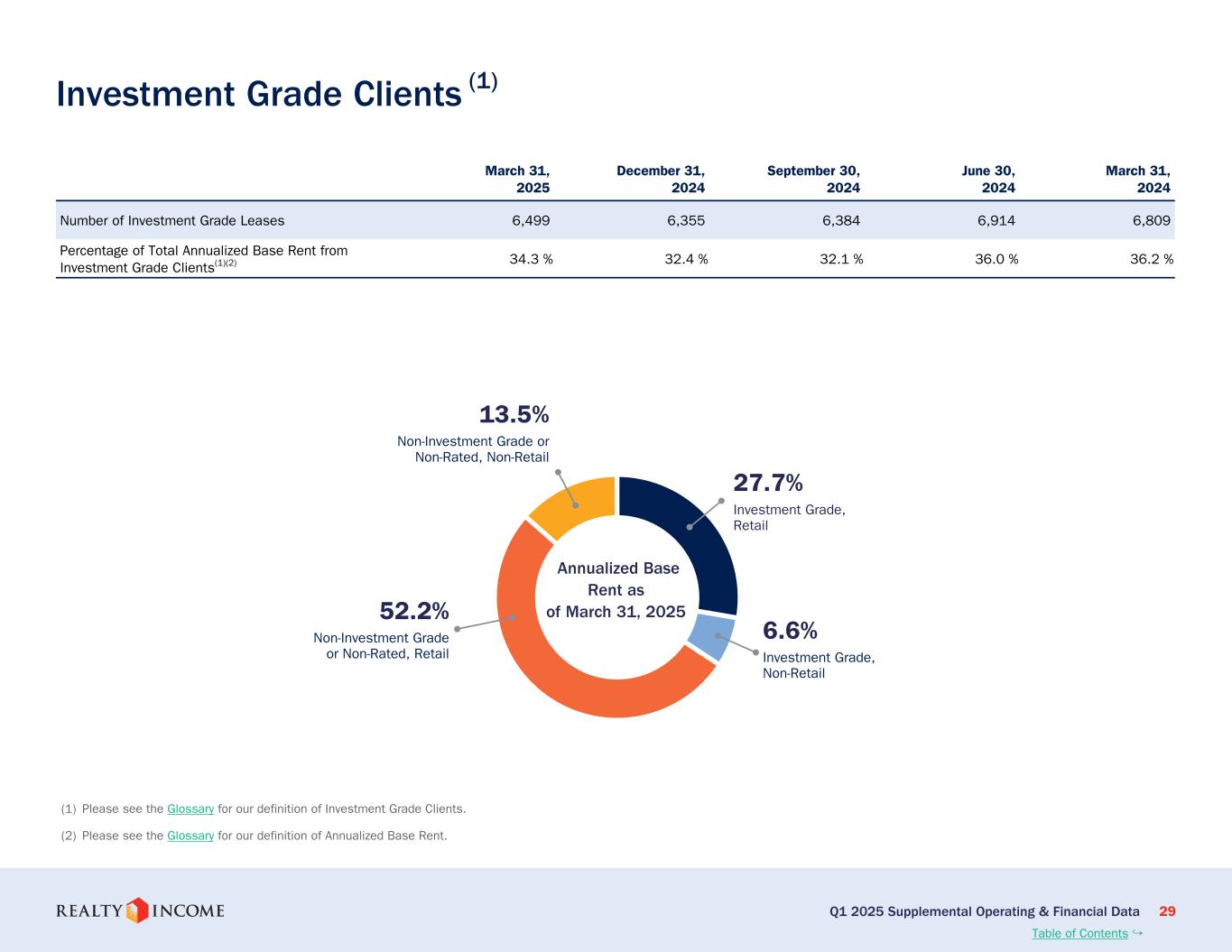

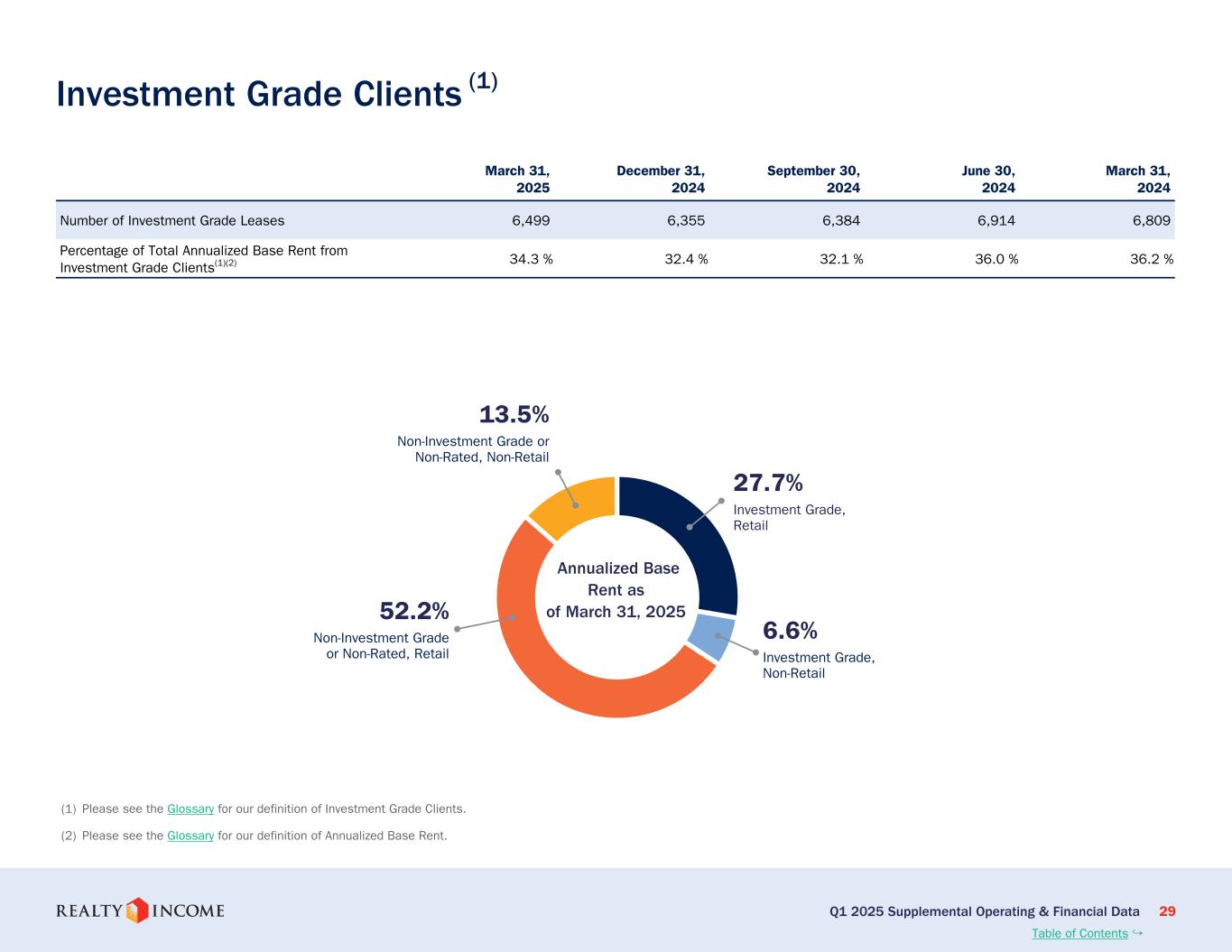

Q1 2025 Supplemental Operating & Financial Data 29 March 31, 2025 December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 Number of Investment Grade Leases 6,499 6,355 6,384 6,914 6,809 Percentage of Total Annualized Base Rent from Investment Grade Clients(1)(2) 34.3 % 32.4 % 32.1 % 36.0 % 36.2 % Investment Grade Clients (1) 27.7% Investment Grade, Retail 52.2% Non-Investment Grade or Non-Rated, Retail 13.5% Non-Investment Grade or Non-Rated, Non-Retail 6.6% Investment Grade, Non-Retail (1) Please see the Glossary for our definition of Investment Grade Clients. (2) Please see the Glossary for our definition of Annualized Base Rent. Table of Contents ↪ Annualized Base Rent as of March 31, 2025

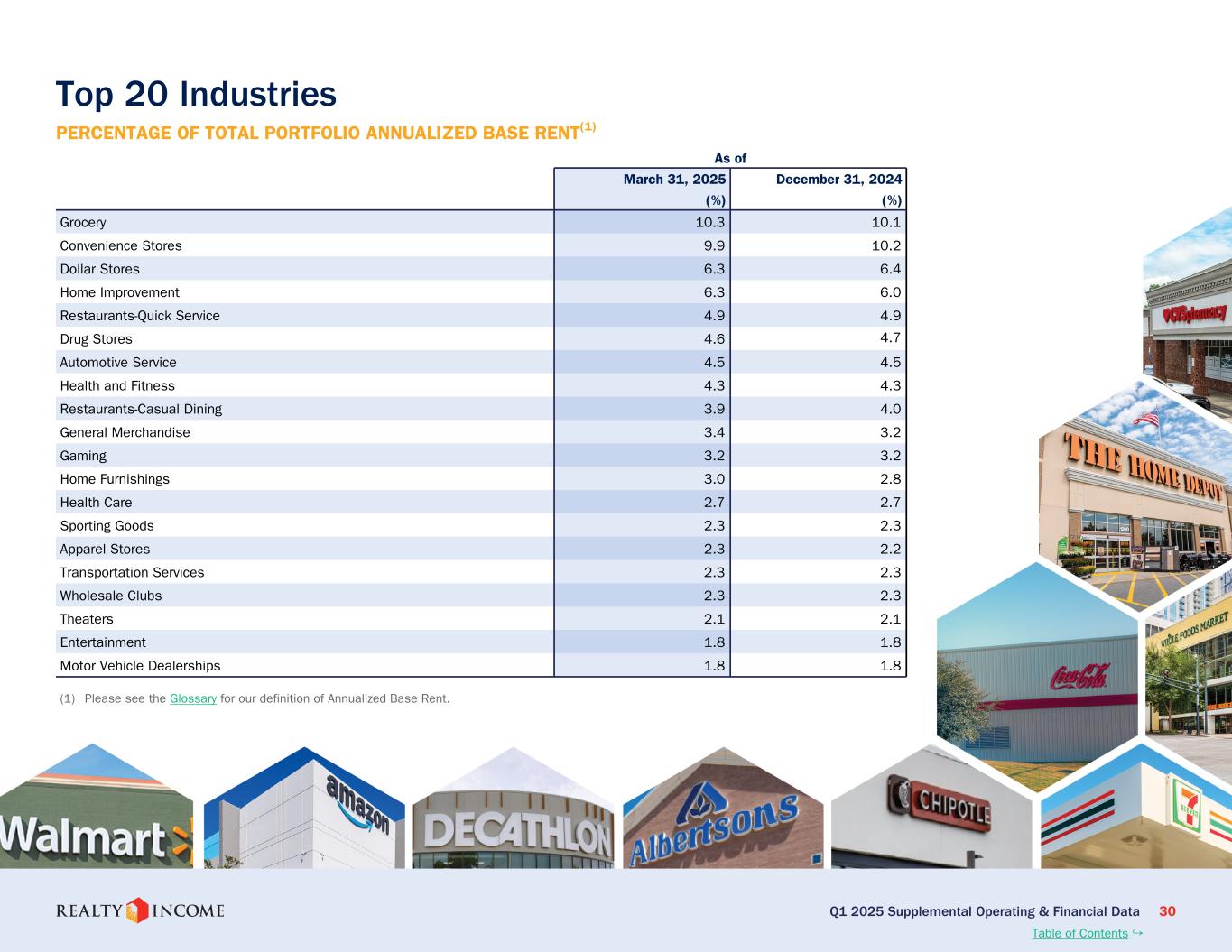

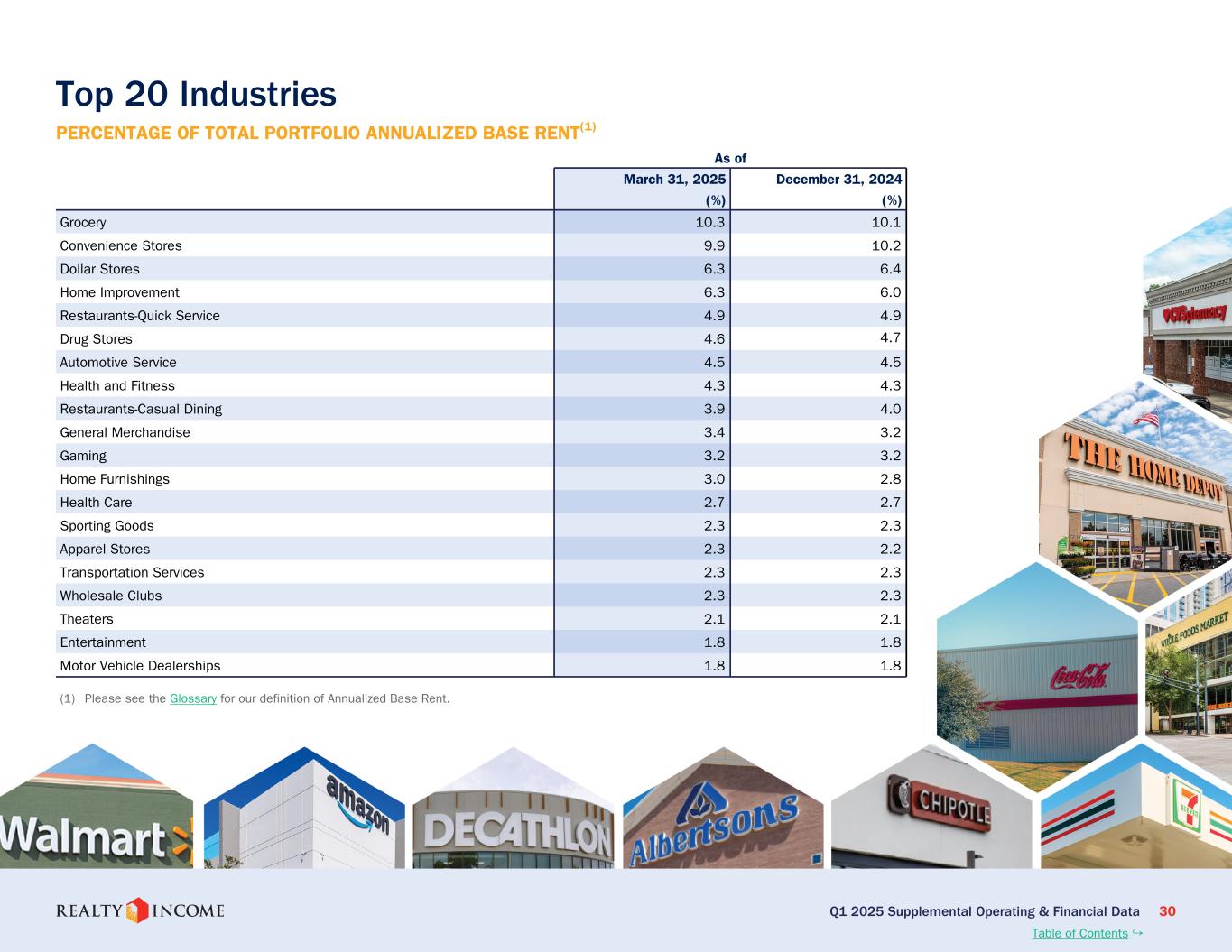

Q1 2025 Supplemental Operating & Financial Data 30 As of March 31, 2025 December 31, 2024 (%) (%) Grocery 10.3 10.1 Convenience Stores 9.9 10.2 Dollar Stores 6.3 6.4 Home Improvement 6.3 6.0 Restaurants-Quick Service 4.9 4.9 Drug Stores 4.6 4.7 Automotive Service 4.5 4.5 Health and Fitness 4.3 4.3 Restaurants-Casual Dining 3.9 4.0 General Merchandise 3.4 3.2 Gaming 3.2 3.2 Home Furnishings 3.0 2.8 Health Care 2.7 2.7 Sporting Goods 2.3 2.3 Apparel Stores 2.3 2.2 Transportation Services 2.3 2.3 Wholesale Clubs 2.3 2.3 Theaters 2.1 2.1 Entertainment 1.8 1.8 Motor Vehicle Dealerships 1.8 1.8 (1) Please see the Glossary for our definition of Annualized Base Rent. Top 20 Industries PERCENTAGE OF TOTAL PORTFOLIO ANNUALIZED BASE RENT(1) Table of Contents ↪

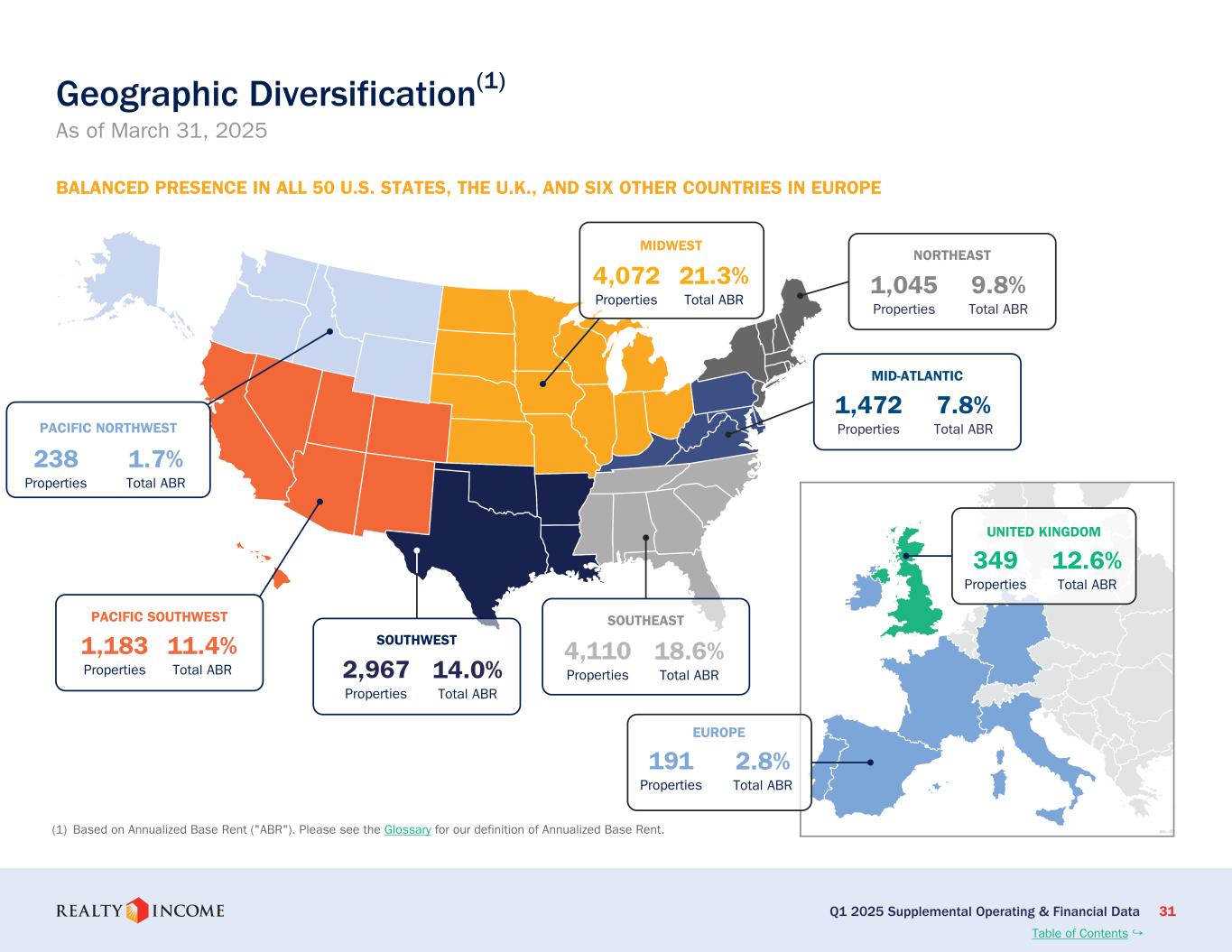

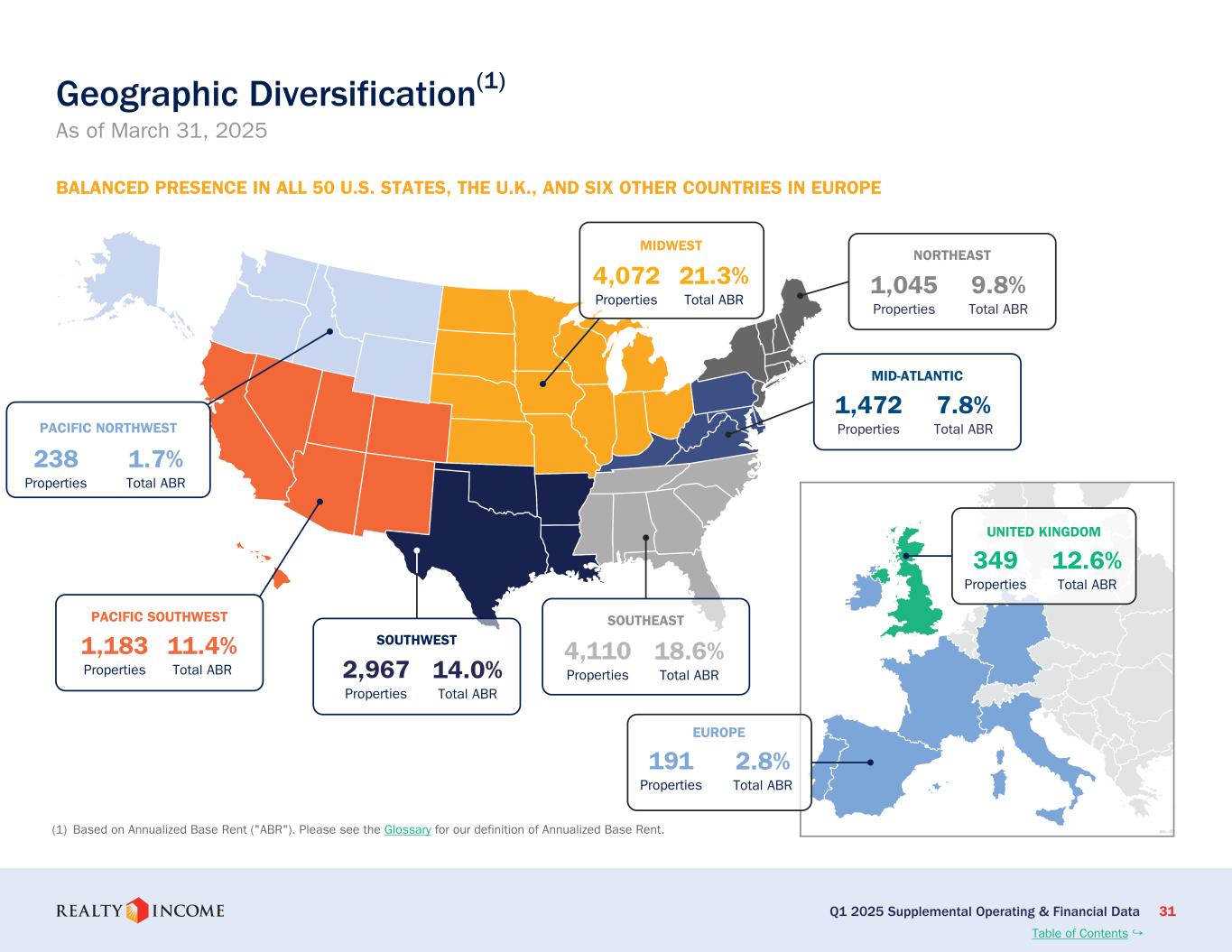

Q1 2025 Supplemental Operating & Financial Data 31 Geographic Diversification(1) As of March 31, 2025 (1) Based on Annualized Base Rent ("ABR"). Please see the Glossary for our definition of Annualized Base Rent. BALANCED PRESENCE IN ALL 50 U.S. STATES, THE U.K., AND SIX OTHER COUNTRIES IN EUROPE MIDWEST 4,072 Properties 21.3% Total ABR MID-ATLANTIC SOUTHWEST 2,967 Properties 14.0% Total ABR 1,472 Properties SOUTHEAST 4,110 Properties 18.6% Total ABR EUROPE 191 Properties 2.8% Total ABR NORTHEAST 1,045 Properties 9.8% Total ABR 7.8% Total ABR PACIFIC SOUTHWEST 1,183 Properties 11.4% Total ABR PACIFIC NORTHWEST 238 Properties 1.7% Total ABR UNITED KINGDOM 349 Properties 12.6% Total ABR Table of Contents ↪

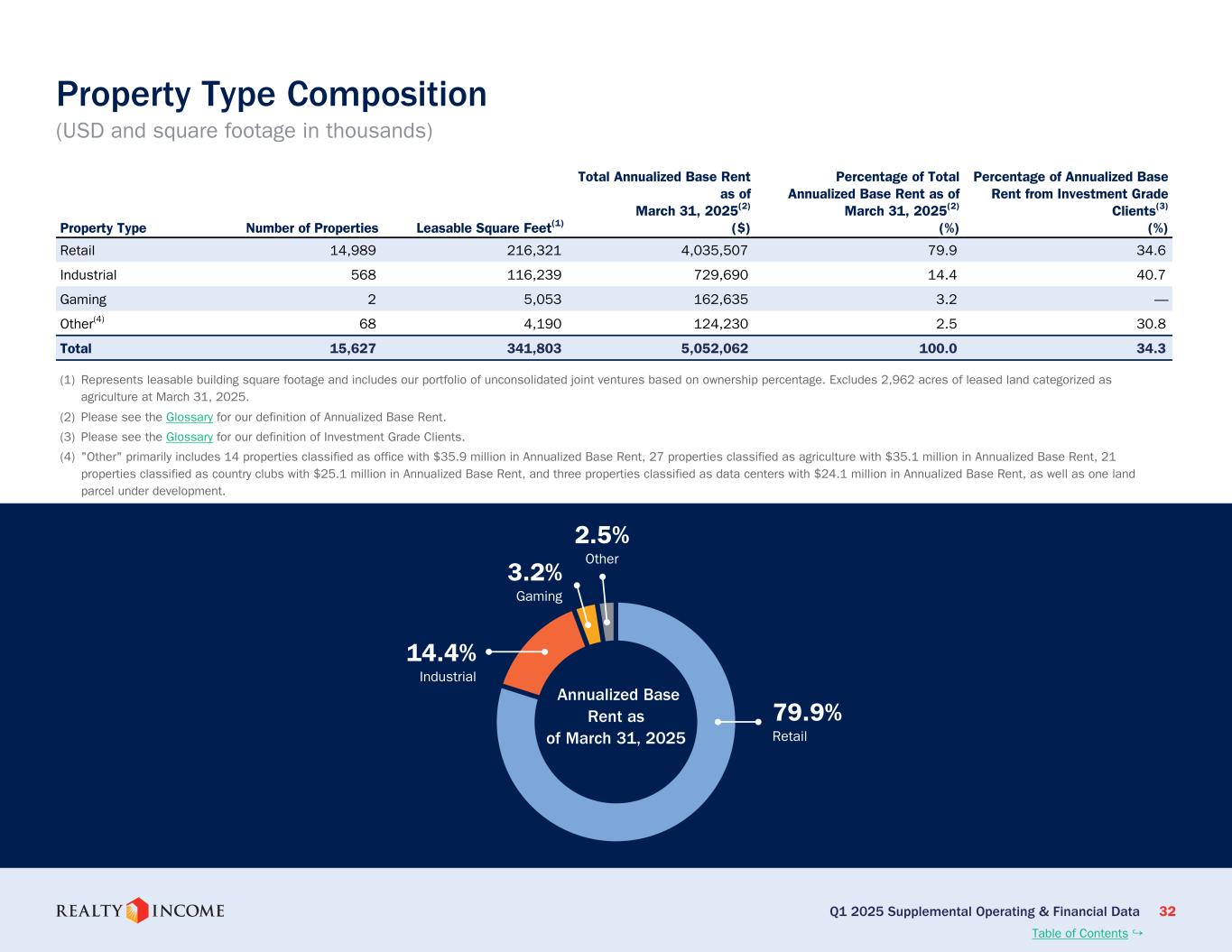

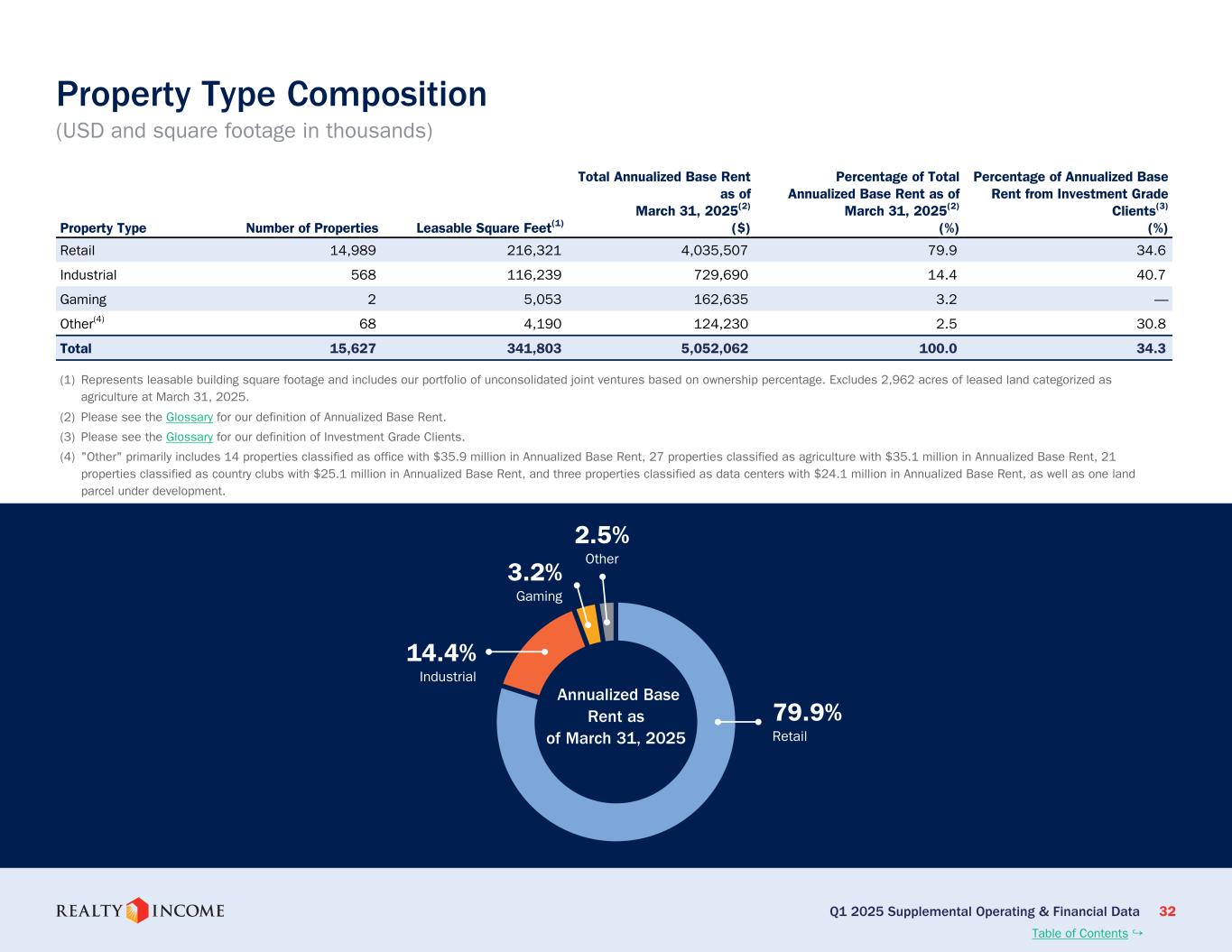

Q1 2025 Supplemental Operating & Financial Data 32 Property Type Number of Properties Leasable Square Feet(1) Total Annualized Base Rent as of March 31, 2025(2) ($) Percentage of Total Annualized Base Rent as of March 31, 2025(2) (%) Percentage of Annualized Base Rent from Investment Grade Clients(3) (%) Retail 14,989 216,321 4,035,507 79.9 34.6 Industrial 568 116,239 729,690 14.4 40.7 Gaming 2 5,053 162,635 3.2 — Other(4) 68 4,190 124,230 2.5 30.8 Total 15,627 341,803 5,052,062 100.0 34.3 (1) Represents leasable building square footage and includes our portfolio of unconsolidated joint ventures based on ownership percentage. Excludes 2,962 acres of leased land categorized as agriculture at March 31, 2025. (2) Please see the Glossary for our definition of Annualized Base Rent. (3) Please see the Glossary for our definition of Investment Grade Clients. (4) "Other" primarily includes 14 properties classified as office with $35.9 million in Annualized Base Rent, 27 properties classified as agriculture with $35.1 million in Annualized Base Rent, 21 properties classified as country clubs with $25.1 million in Annualized Base Rent, and three properties classified as data centers with $24.1 million in Annualized Base Rent, as well as one land parcel under development. Property Type Composition (USD and square footage in thousands) 14.4% Industrial 79.9% Retail 3.2% Gaming 2.5% Other Table of Contents ↪ Annualized Base Rent as of March 31, 2025

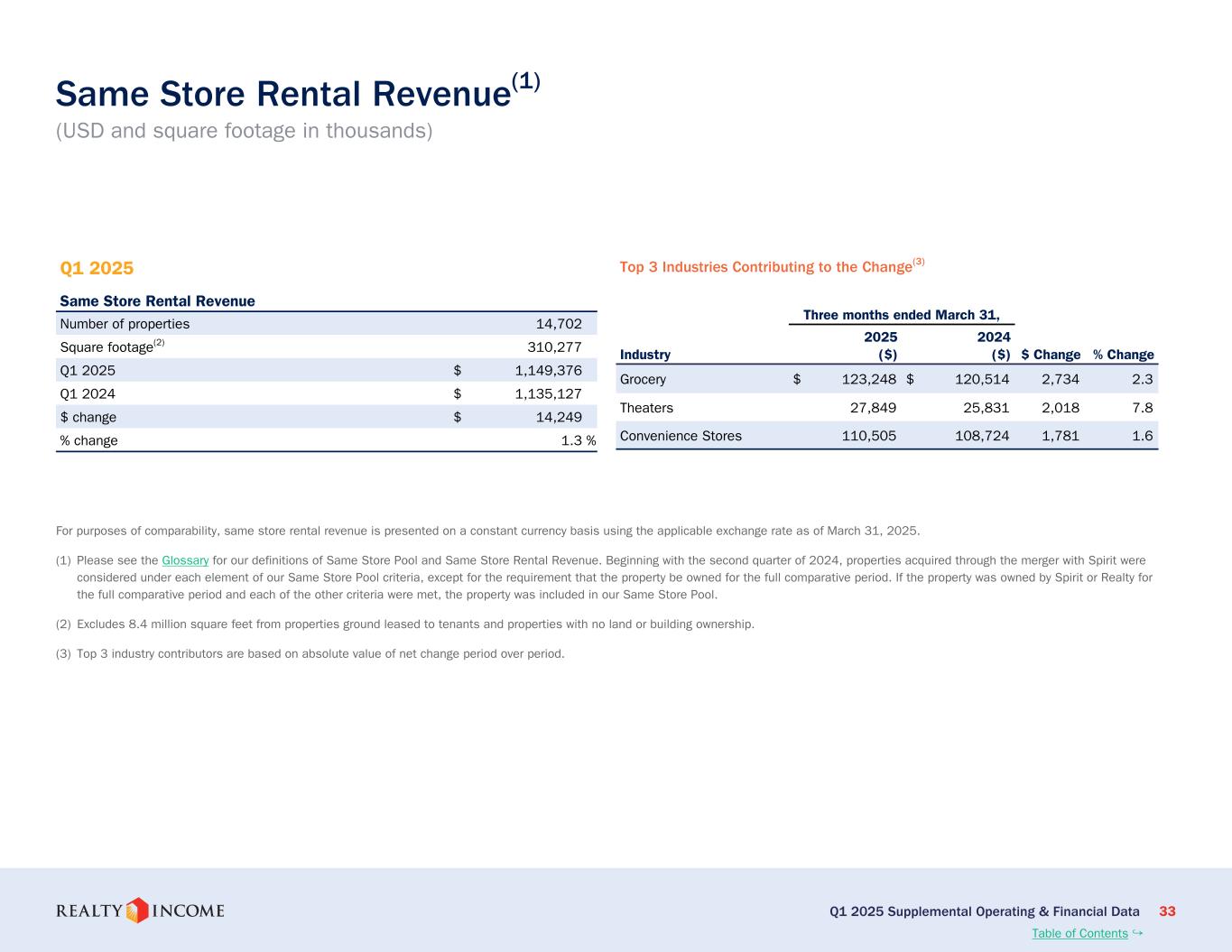

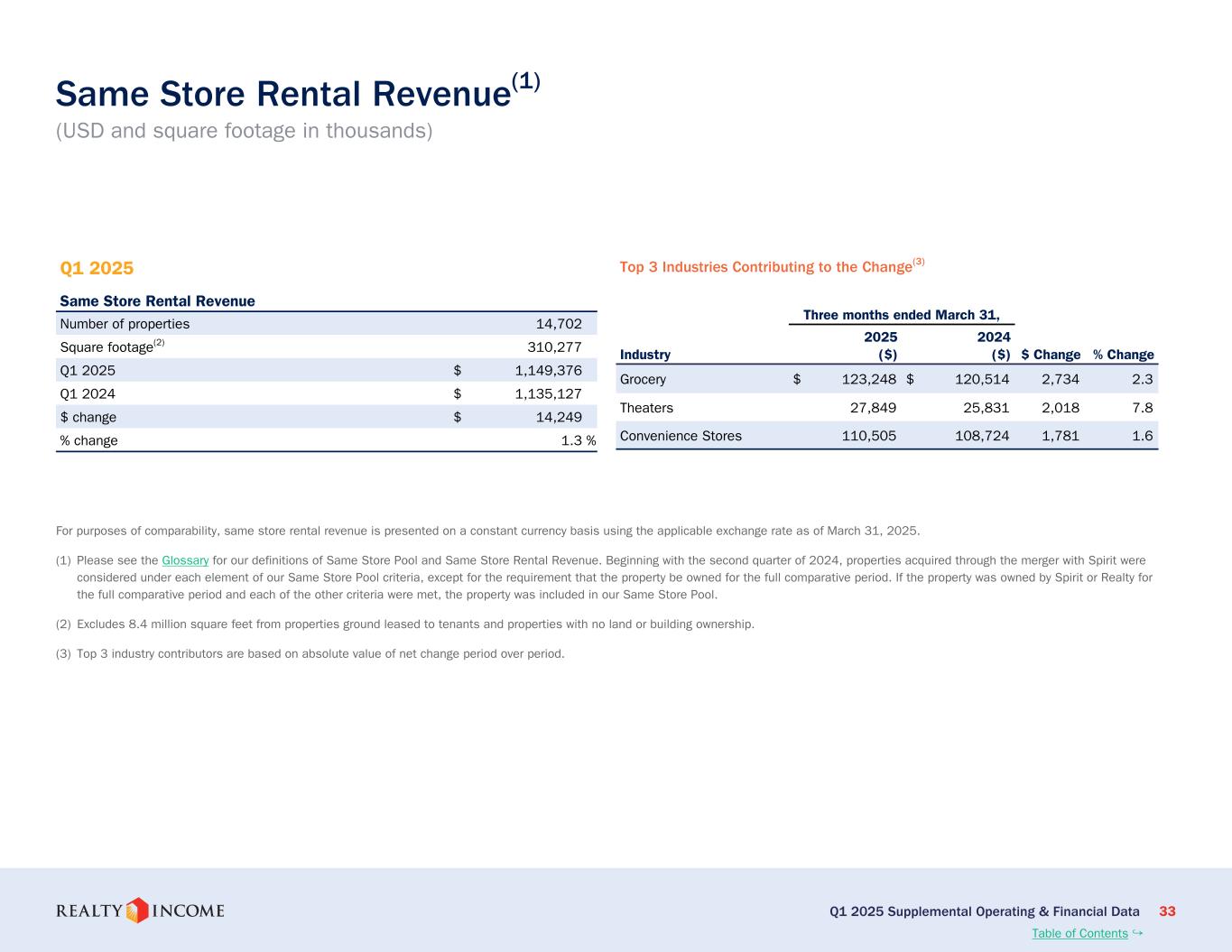

Q1 2025 Supplemental Operating & Financial Data 33 Q1 2025 Same Store Rental Revenue Number of properties 14,702 Square footage(2) 310,277 Q1 2025 $ 1,149,376 Q1 2024 $ 1,135,127 $ change $ 14,249 % change 1.3 % Top 3 Industries Contributing to the Change(3) Three months ended March 31, Industry 2025 2024 $ Change % Change($) ($) Grocery $ 123,248 $ 120,514 2,734 2.3 Theaters 27,849 25,831 2,018 7.8 Convenience Stores 110,505 108,724 1,781 1.6 For purposes of comparability, same store rental revenue is presented on a constant currency basis using the applicable exchange rate as of March 31, 2025. (1) Please see the Glossary for our definitions of Same Store Pool and Same Store Rental Revenue. Beginning with the second quarter of 2024, properties acquired through the merger with Spirit were considered under each element of our Same Store Pool criteria, except for the requirement that the property be owned for the full comparative period. If the property was owned by Spirit or Realty for the full comparative period and each of the other criteria were met, the property was included in our Same Store Pool. (2) Excludes 8.4 million square feet from properties ground leased to tenants and properties with no land or building ownership. (3) Top 3 industry contributors are based on absolute value of net change period over period. Same Store Rental Revenue(1) (USD and square footage in thousands) Table of Contents ↪

Q1 2025 Supplemental Operating & Financial Data 34 Three months ended March 31, 2025 2024 ($) ($) Rental revenue (including reimbursements) 1,313,057 1,208,169 Constant currency adjustment(3) 5,394 2,493 Straight-line rent and other non-cash adjustments 3,148 (6,155) Contractually obligated reimbursements by our clients (87,800) (74,308) Revenue from excluded properties(1) (83,393) (43,442) Other excluded revenue(4) (1,030) (190) Add: Spirit rental revenue(5) — 48,560 Same Store Rental Revenue 1,149,376 1,135,127 (1) Please see the Glossary for our definitions of Same Store Pool and Same Store Rental Revenue. Beginning with the second quarter of 2024, properties acquired through the merger with Spirit were considered under each element of our Same Store Pool criteria, except for the requirement that the property be owned for the full comparative period. If the property was owned by Spirit or Realty for the full comparative period and each of the other criteria were met, the property was included in our Same Store Pool. (2) "Other" includes properties classified as agriculture, office, and data center. (3) For purposes of comparability, Same Store Rental Revenue is presented on a constant currency basis using the applicable exchange rate as of March 31, 2025. (4) "Other excluded revenue" primarily consists of reimbursements for tenant improvements and rental revenue that is not contractual base rent such as lease termination settlements. (5) Amounts for the three months ended March 31, 2024 represent rental revenue from Spirit properties, which were not included in our financial statements prior to the close of the merger with Spirit on January 23, 2024. Three months ended March 31, 2025 2024 Property Type ($) ($) $ Change % Change Retail 928,499 917,331 11,168 1.2 Industrial 176,467 174,202 2,265 1.3 Gaming 25,883 25,438 445 1.7 Other (2) 18,527 18,156 371 2.0 Total 1,149,376 1,135,127 14,249 1.3 Same Store Rental Revenue(1) (Continued) (USD in thousands) SAME STORE RENTAL REVENUE BY PROPERTY TYPE RECONCILIATION OF SAME STORE RENTAL REVENUE TO RENTAL REVENUE (INCLUDING REIMBURSEMENTS) Table of Contents ↪

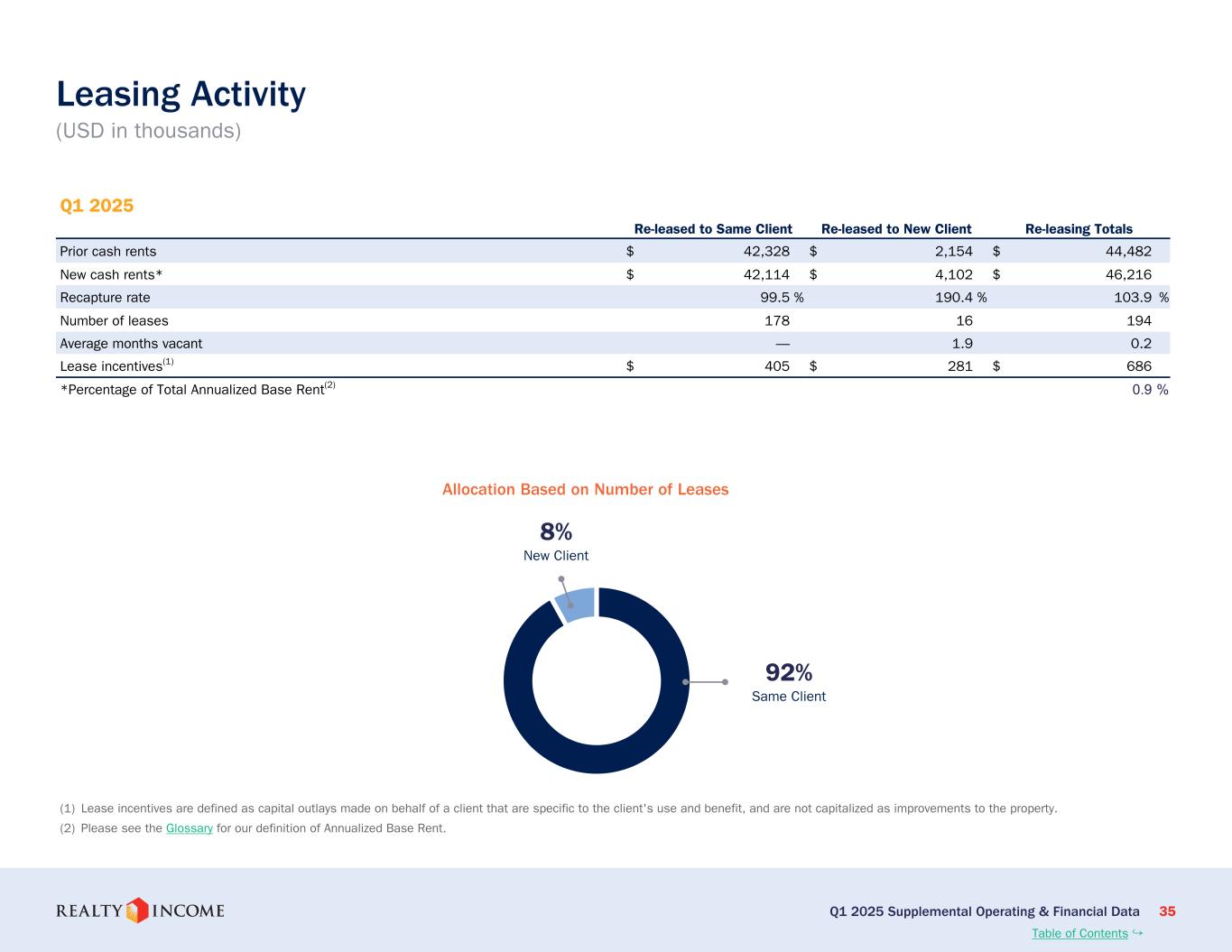

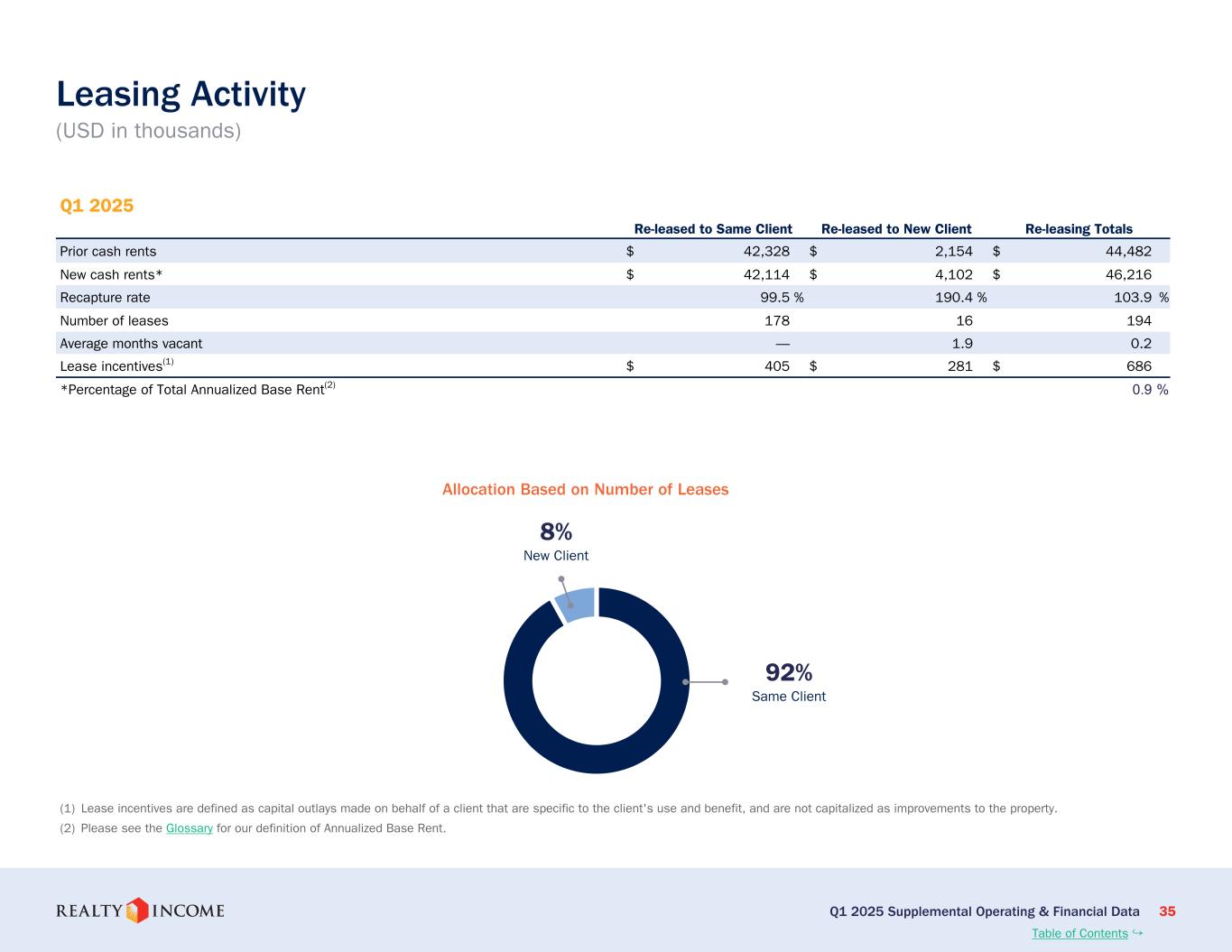

Q1 2025 Supplemental Operating & Financial Data 35 Q1 2025 Re-leased to Same Client Re-leased to New Client Re-leasing Totals Prior cash rents $ 42,328 $ 2,154 $ 44,482 New cash rents* $ 42,114 $ 4,102 $ 46,216 Recapture rate 99.5 % 190.4 % 103.9 % Number of leases 178 16 194 Average months vacant — 1.9 0.2 Lease incentives(1) $ 405 $ 281 $ 686 *Percentage of Total Annualized Base Rent(2) 0.9 % (1) Lease incentives are defined as capital outlays made on behalf of a client that are specific to the client's use and benefit, and are not capitalized as improvements to the property. (2) Please see the Glossary for our definition of Annualized Base Rent. Leasing Activity (USD in thousands) Allocation Based on Number of Leases 92% Same Client 8% New Client Table of Contents ↪

Q1 2025 Supplemental Operating & Financial Data 36 (1) This table sets forth the timing of remaining lease term expirations in our portfolio (excluding rights to extend a lease at the option of the client) and their contributions to Annualized Base Rent as of March 31, 2025. Leases on our multi-client properties are counted separately in the table above. (2) Of the 16,856 in-place leases in the portfolio, 13,825, or 82.0% were under leases that provide for increases in rents through: base rent increases tied to inflation (typically subject to ceilings), percentage rent based on a percentage of the clients’ gross sales, fixed increases, or a combination of two or more of the aforementioned rent provisions. (3) Please see the Glossary for our definition of Annualized Base Rent. OUR LEASES HAVE A WEIGHTED AVERAGE REMAINING LEASE TERM OF APPROXIMATELY 9.1 YEARS (ASSUMING NO EXERCISE OF LEASE OPTIONS). Lease Expirations (USD in thousands) Total Portfolio(1)(2) Total Annualized Base Rent as of March 31, 2025(3) ($) Percentage of Total Annualized Base Rent(3) (%) Expiring Leases Year Retail Non-Retail 2025 568 17 124,524 2.5 2026 931 53 232,852 4.6 2027 1,621 50 364,541 7.2 2028 1,862 72 458,009 9.1 2029 1,855 49 445,231 8.8 2030 1,094 44 325,587 6.4 2031 697 54 327,021 6.5 2032 1,132 47 313,629 6.2 2033 956 27 279,233 5.5 2034 803 30 337,656 6.7 2035 607 23 187,671 3.7 2036 604 23 195,123 3.9 2037 553 23 159,990 3.2 2038 377 24 147,797 2.9 2039 545 7 156,415 3.1 2040-2143 1,983 125 996,783 19.7 Total 16,188 668 5,052,062 100.0 Table of Contents ↪

Q1 2025 Supplemental Operating & Financial Data 37 Earnings Guidance Revised 2025 Guidance Prior 2025 Guidance(1) YTD Actuals at March 31, 2025 Net income per share(2) $1.40 - $1.46 $1.52 - $1.58 $0.28 Real estate depreciation per share $2.70 $2.68 $0.68 Other adjustments per share(3) $0.12 $0.02 $0.10 AFFO per share(4) $4.22 - $4.28 $4.22 - $4.28 $1.06 Same store rent growth Approx 1.0% Approx 1.0% 1.3% Occupancy Over 98% Over 98% 98.5% Cash G&A expenses (% of total revenue)(5)(6) Approx 3.0% Approx 3.0% 2.9% Property expenses (non-reimburseable) (% of total revenue)(5) 1.4% - 1.7% 1.4% - 1.7% 1.5% Income tax expenses $80 - $90 million $80 - $90 million $15.7 million Investment volume Approx $4.0 billion Approx $4.0 billion $1.4 billion (1) As issued on February 24, 2025. (2) Net income per share excludes future impairment and foreign currency or derivative gains or losses due to the inherent unpredictability of forecasting these items. (3) Includes net adjustments for gains or losses on sales of properties, impairments, and merger, transaction, and other non-recurring costs. (4) AFFO per share excludes merger, transaction, and other costs, net. (5) Cash G&A represents 'General and administrative' expenses as presented in our consolidated statements of income and comprehensive income, less share-based compensation costs. Total revenue excludes client reimbursements. (6) G&A expenses inclusive of stock-based compensation expense as a percentage of rental revenue, excluding reimbursements, is expected to be approximately 3.4% - 3.7% in 2025. Summarized below are approximate estimates of the key components of our 2025 earnings guidance: Table of Contents ↪

Q1 2025 Supplemental Operating & Financial Data 38 Baird Wes Golladay wgolladay@rwbaird.com (216) 737-7510 Bank of America Securities Jana Galan jana.galan@bofa.com (646) 855-5042 BMO Capital Markets Eric Borden eric.borden@bmo.com (347) 213-9706 BNP Paribas Exane Nate Crossett nate.crossett@exanebnpparibas.com (646) 725-3716 BTIG Michael Gorman mgorman@btig.com (212) 738-6138 Citigroup Smedes Rose smedes.rose@citi.com (212) 816-6243 Edward Jones James Shanahan jim.shanahan@edwardjones.com (314) 515-5292 Goldman Sachs Caitlin Burrows caitlin.burrows@gs.com (212) 902-4736 Green Street Spenser Allaway sallaway@greenstreetadvisors.com (949) 640-8780 Janney Montgomery Scott Robert Stevenson robstevenson@janney.com (646) 840-3217 Jefferies Linda Tsai ltsai@jefferies.com (212) 778-8011 J.P. Morgan Anthony Paolone anthony.paolone@jpmorgan.com (212) 622-6682 KeyBanc Upal Rana upal.rana@key.com (917) 368-2316 Mizuho Haendel St. Juste haendel.st.juste@us.mizuho-sc.com (212) 205-7860 Morgan Stanley Ronald Kamdem ronald.kamdem@morganstanley.com (212) 296-8319 Raymond James RJ Milligan rjmilligan@raymondjames.com (727) 567-2585 RBC Capital Markets Brad Heffern brad.heffern@rbccm.com (512) 708-6311 Scotiabank Greg McGinniss greg.mcginniss@scotiabank.com (212) 225-6906 Stifel Simon Yarmak yarmaks@stifel.com (443) 224-1345 UBS Michael Goldsmith michael.goldsmith@ubs.com (212) 713-2951 Wedbush Jay Kornreich jay.kornreich@wedbush.com (212) 938-9942 Wells Fargo John Kilichowski john.kilichowski@wellsfargo.com (212) 214-5311 Wolfe Research Andrew Rosivach arosivach@wolferesearch.com (646) 582-9250 Realty Income is covered by the analysts at the firms listed above. This list may not be complete and is subject to change. Please note that any opinions, estimates or forecasts regarding Realty Income's performance made by these analysts are theirs alone and do not represent opinions, estimates or forecasts of Realty Income or its management. Realty Income does not by its reference above or distribution imply, and expressly disclaims, any endorsement of or concurrence with any information, estimates, forecasts, opinions, conclusions or recommendations provided by analysts. Analyst Coverage EQUITY RESEARCH Table of Contents ↪

Q1 2025 Supplemental Operating & Financial Data 39 Adjusted EBITDAre. The National Association of Real Estate Investment Trusts (Nareit) established an EBITDA metric for real estate companies (i.e., EBITDA for real estate, or EBITDAre) it believed would provide investors with a consistent measure to help make investment decisions among certain REITs. Our definition of “Adjusted EBITDAre” is generally consistent with the Nareit definition, other than our adjustment to remove foreign currency and derivative gain and loss and merger, transaction, and other costs, net. We define Adjusted EBITDAre, a non-GAAP financial measure, for the most recent quarter as earnings (net income) before (i) interest expense, (ii) income taxes, (iii) depreciation and amortization, (iv) provisions for impairment, (v) merger, transaction, and other costs, net, (vi) gain on sales of real estate, (vii) foreign currency and derivative gain and loss, net, and (viii) our proportionate share of adjustments from unconsolidated entities. Our Adjusted EBITDAre may not be comparable to Adjusted EBITDAre reported by other companies or as defined by Nareit, and other companies may interpret or define Adjusted EBITDAre differently than we do. Management believes Adjusted EBITDAre to be a meaningful measure of a REIT’s performance because it provides a view of our operating performance, analyzes our ability to meet interest payment obligations before the effects of income tax, depreciation and amortization expense, provisions for impairment, gain on sales of real estate and other items, as defined above, that affect comparability, including the removal of non-recurring and non-cash items that industry observers believe are less relevant to evaluating the operating performance of a company. In addition, EBITDAre is widely followed by industry analysts, lenders, investors, rating agencies, and others as a means of evaluating the operational cash generating capacity of a company prior to servicing debt obligations. Management also believes the use of an annualized quarterly Adjusted EBITDAre metric is meaningful because it represents our current earnings run rate for the period presented. The ratio of our total debt to our annualized quarterly Adjusted EBITDAre is also used to determine vesting of performance share awards granted to our executive officers. Adjusted EBITDAre should be considered along with, but not as an alternative to, net income as a measure of our operating performance. Adjusted EBITDA Margin, a non-GAAP financial measure, is defined as Adjusted EBITDAre before (i) our proportionate share of adjustments and equity in earnings from unconsolidated entities, (ii) gains and losses on extinguishment of debt, and (iii) other income, net, expressed as a percentage of total revenue (excluding reimbursements). We believe Adjusted EBITDA Margin provides useful information to investors on the effectiveness of our operations and underlying business trends. Adjusted Funds From Operations (AFFO), a non-GAAP financial measure, is defined as FFO adjusted for unique revenue and expense items, which we believe are not as pertinent to the measurement of our ongoing operating performance. Most companies in our industry use a similar measurement to AFFO, but they may use the term "CAD" (for Cash Available for Distribution) or "FAD" (for Funds Available for Distribution). We believe AFFO provides useful information to investors because it is a widely accepted industry measure of the operating performance of real estate companies used by the investment community. In particular, AFFO provides an additional measure to compare the operating performance of different REITs without having to account for differing depreciation assumptions and other unique revenue and expense items which are not pertinent to measuring a particular company’s ongoing operating performance. Therefore, we believe that AFFO is an appropriate supplemental performance metric, and that the most appropriate GAAP performance metric to which AFFO should be reconciled is net income available to common stockholders. Annualized Adjusted EBITDAre, a non-GAAP financial measure, is calculated by annualizing Adjusted EBITDAre. Annualized Base Rent of our acquisitions and properties under development is the monthly aggregate cash amount charged to clients, inclusive of monthly base rent receivables, as of the balance sheet date, multiplied by 12, excluding percentage rent, interest income on loans and preferred equity investments, and including our pro rata share of such revenues from properties owned by unconsolidated joint ventures. We believe total annualized base rent is a useful supplemental operating measure, as it excludes entities that were no longer owned at the balance sheet date and includes the annualized rent from properties acquired during the quarter. Total annualized base rent has not been reduced to reflect reserves recorded as reductions to GAAP rental revenue in the periods presented. Annualized Pro Forma Adjusted EBITDAre, a non-GAAP financial measure, is defined as Adjusted EBITDAre, which includes transaction accounting adjustments in accordance with U.S. GAAP, consists of adjustments to incorporate Adjusted EBITDAre from investments we acquired or stabilized during the applicable quarter and Adjusted EBITDAre from investments we disposed of during the applicable quarter, giving pro forma effect to all transactions as if they occurred at the beginning of the applicable quarter. Our calculation includes all adjustments consistent with the requirements to present Adjusted EBITDAre on a pro forma basis in accordance with Article 11 of Regulation S-X. The annualized pro forma adjustments are consistent with the debt service coverage ratio calculated under financial covenants for our senior unsecured notes and bonds. See "Adjusted EBITDAre & Coverage Ratios" page for further information regarding our debt covenants. Glossary Table of Contents ↪

Q1 2025 Supplemental Operating & Financial Data 40 Cash Income represents expected rent for real estate acquisitions as well as rent to be received upon completion of the properties under development. For unconsolidated entities, this represents our pro rata share of the cash income. For loans receivable and preferred equity investments, this represents earned interest income and preferred dividend income, respectively. Funds From Operations (FFO), a non-GAAP financial measure, consistent with the Nareit definition, is net income available to common stockholders, plus depreciation and amortization of real estate assets, plus provisions for impairments of depreciable real estate assets, and reduced by gain on property sales. Presentation of the information regarding FFO and AFFO (described on the "FFO and Normalized FFO" and "AFFO" pages) is intended to assist the reader in comparing the operating performance of different REITs, although it should be noted that not all REITs calculate FFO and AFFO in the same way, so comparisons with other REITs may not be meaningful. FFO and AFFO should not be considered alternatives to reviewing our cash flows from operating, investing, and financing activities. In addition, FFO and AFFO should not be considered measures of liquidity, of our ability to make cash distributions, or of our ability to pay interest payments. We consider FFO to be an appropriate supplemental measure of a REIT’s operating performance as it is based on a net income analysis of property portfolio performance that adds back items such as depreciation and impairments for FFO. The historical accounting convention used for real estate assets requires straight-line depreciation of buildings and improvements, which implies that the value of real estate assets diminishes predictably over time. Since real estate values historically rise and fall with market conditions, presentations of operating results for a REIT using historical accounting for depreciation could be less informative. The use of FFO is recommended by the REIT industry as a supplemental performance measure. In addition, FFO is used as a measure of our compliance with the financial covenants of our credit facility. Gross Asset Value is total assets before accumulated depreciation and amortization. Initial Weighted Average Cash Yield for acquisitions and properties under development is computed as cash income for the first twelve months following the acquisition date, divided by the total cost of the property (including all expenses borne by us), and includes our pro-rata share of cash income from unconsolidated joint ventures. Initial weighted average cash yield for loans receivable is computed using the cash income for the first twelve months following the acquisition date, divided by the total cost of the investment. Investment Grade Clients are our clients with a credit rating, and our clients that are subsidiaries or affiliates of companies with a credit rating, as of the balance sheet date, of Baa3/BBB- or higher from one of the three major rating agencies (Moody’s/S&P/Fitch). Net Cash Capitalization Rates (dispositions) are computed as annualized current month contractual cash net operating income, divided by the net proceeds received upon sale of the property (including all expenses borne by us). Net Debt/Annualized Adjusted EBITDAre, a ratio used by management as a measure of leverage, is calculated as net debt (which we define as total debt per our consolidated balance sheet, excluding deferred financing costs and net premiums and discounts, but including our proportionate share of debt from unconsolidated entities, less cash and cash equivalents), divided by Annualized Adjusted EBITDAre. Net Debt/Annualized Pro Forma Adjusted EBITDAre, a ratio used by management as a measure of leverage, is calculated as net debt (which we define as total debt per our consolidated balance sheet, excluding deferred financing costs and net premiums and discounts, but including our proportionate share of debt from unconsolidated entities, less cash and cash equivalents), divided by Annualized Pro Forma Adjusted EBITDAre. Net Debt and Preferred Stock/Annualized Pro Forma Adjusted EBITDAre, a ratio used by management as a measure of leverage, is calculated as net debt (which we define as total debt per our consolidated balance sheet, excluding deferred financing costs and net premiums and discounts, but including our proportionate share of debt from unconsolidated entities, plus preferred stock, less cash and cash equivalents), divided by Annualized Pro Forma Adjusted EBITDAre. We utilize net debt plus preferred stock in certain periods, as applicable. In September 2024, we redeemed all 6.9 million shares of Realty Income Series A Preferred Stock outstanding. Glossary (Continued) Table of Contents ↪

Q1 2025 Supplemental Operating & Financial Data 41 Normalized Funds from Operations Available to Common Stockholders (Normalized FFO), a non-GAAP financial measure, is FFO excluding merger, transaction, and other costs, net. Pro-Rata Share represents our proportionate economic ownership of our joint ventures, which is derived by applying our economic ownership percentage of each such joint venture to calculate our proportionate share of the relevant line item information being presented as of the end of the applicable period being presented, and aggregating that information for all such joint ventures. We believe this form of presentation offers insights into the financial performance and condition of our company as a whole, given the significance of our joint ventures that are accounted for either under the equity method or consolidated with the third parties' share included in noncontrolling interest, although the presentation of such information may not accurately depict the legal and economic implications of holding a noncontrolling interest in the joint venture. We do not control the unconsolidated joint ventures in which we are invested for purposes of GAAP and do not represent legal claim to such items. The operating agreements of the joint ventures may contain provisions that would cause us to receive a different economic percentage of distributions from the joint venture under certain circumstances, such as the amount of capital contributed by each investor and whether any contributions are entitled to priority distributions. Similarly, upon a liquidation of any such joint venture, subject to the applicable terms of the operating agreement of such joint venture, we generally would be entitled to the applicable percentage of residual cash or other assets that remain only after repayment of all liabilities, priority distributions, and initial equity contributions. In addition, the economic interests in any joint venture may be different than our other legal interests or rights in such joint venture. We provide pro-rata financial information because we believe it assists investors and analysts in estimating our economic interest in our joint ventures when read in conjunction with our reported results under GAAP. Other companies may calculate their proportionate interest differently than we do, limiting the usefulness as a comparative measure. Due to these limitations, the non-GAAP pro-rata financial information should not be considered in isolation or as a substitute for our consolidated financial statements as reported under GAAP. Same Store Pool, for purposes of determining the properties used to calculate our same store rental revenue, includes all properties that we owned for the entire year-to-date period, for both the current and prior year except for properties during the current or prior year that were: (i) vacant at any time, (ii) under development or redevelopment, or (iii) involved in eminent domain and rent was reduced. Same Store Rental Revenue excludes straight-line rent, the amortization of above and below-market leases, and reimbursements from clients for recoverable real estate taxes and operating expenses. For purposes of comparability, same store rental revenue is presented on a constant currency basis by applying the exchange rate as of the balance sheet date to base currency rental revenue. Total Operational Return is defined as the sum of AFFO per share growth and dividend yield for the period (using the prior year ending stock price). Glossary (Continued) Table of Contents ↪

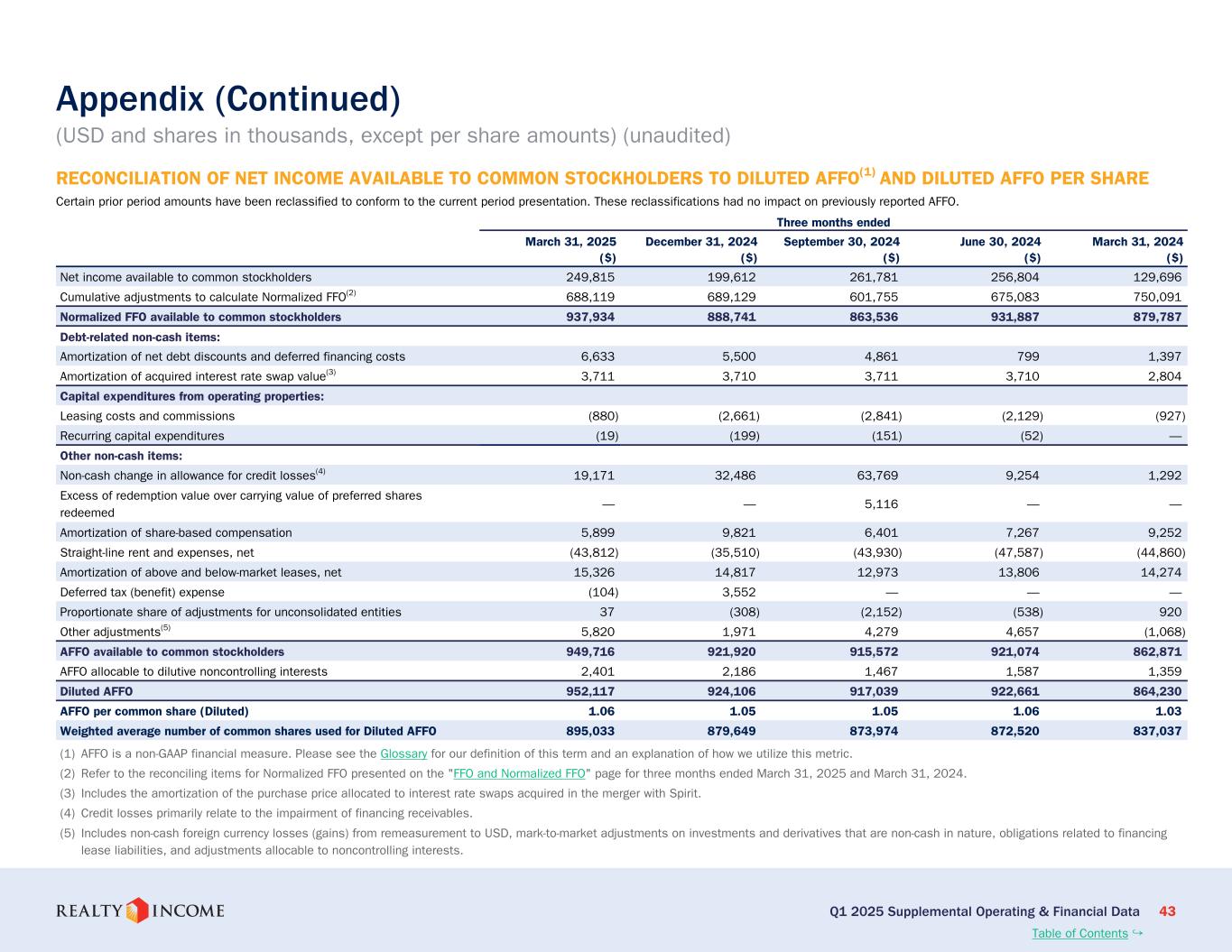

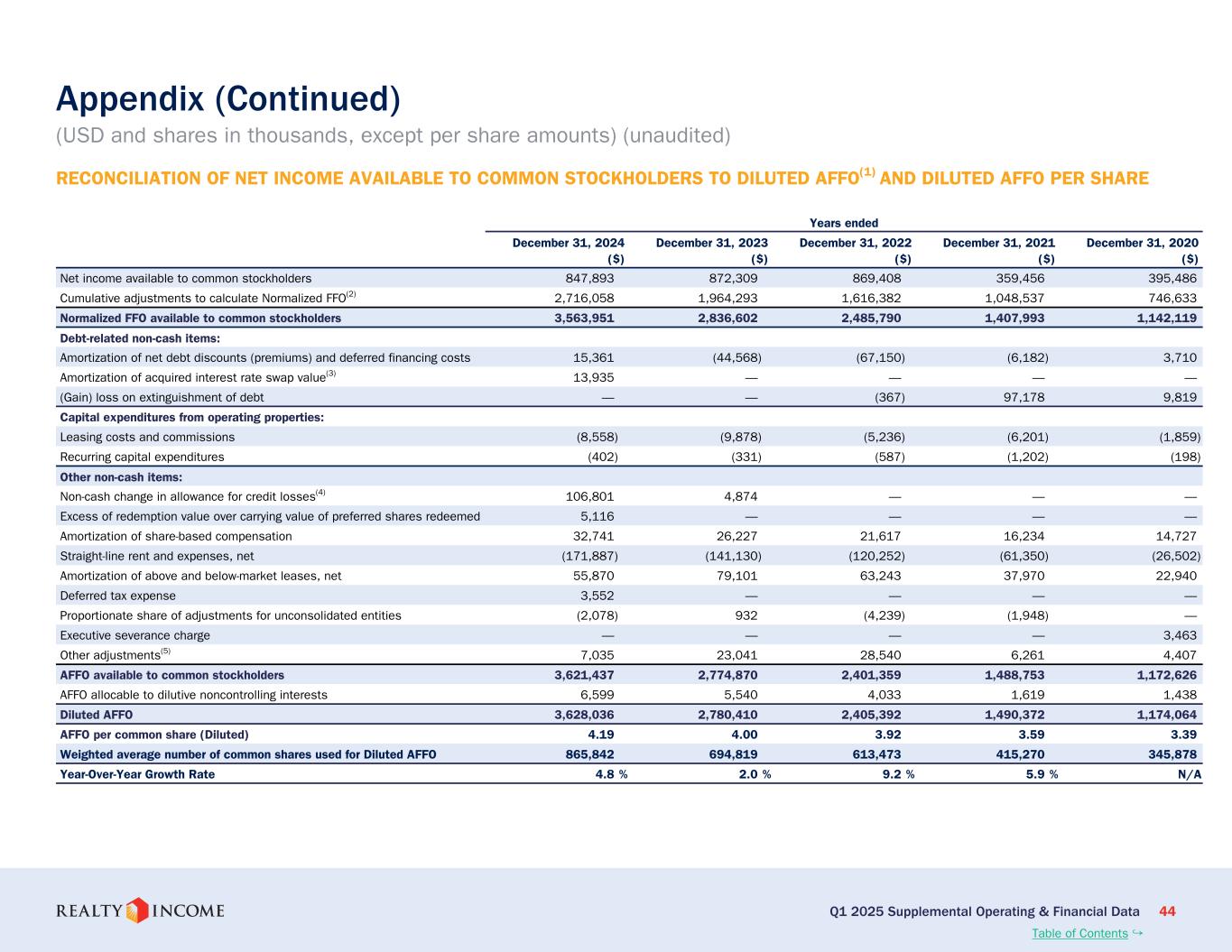

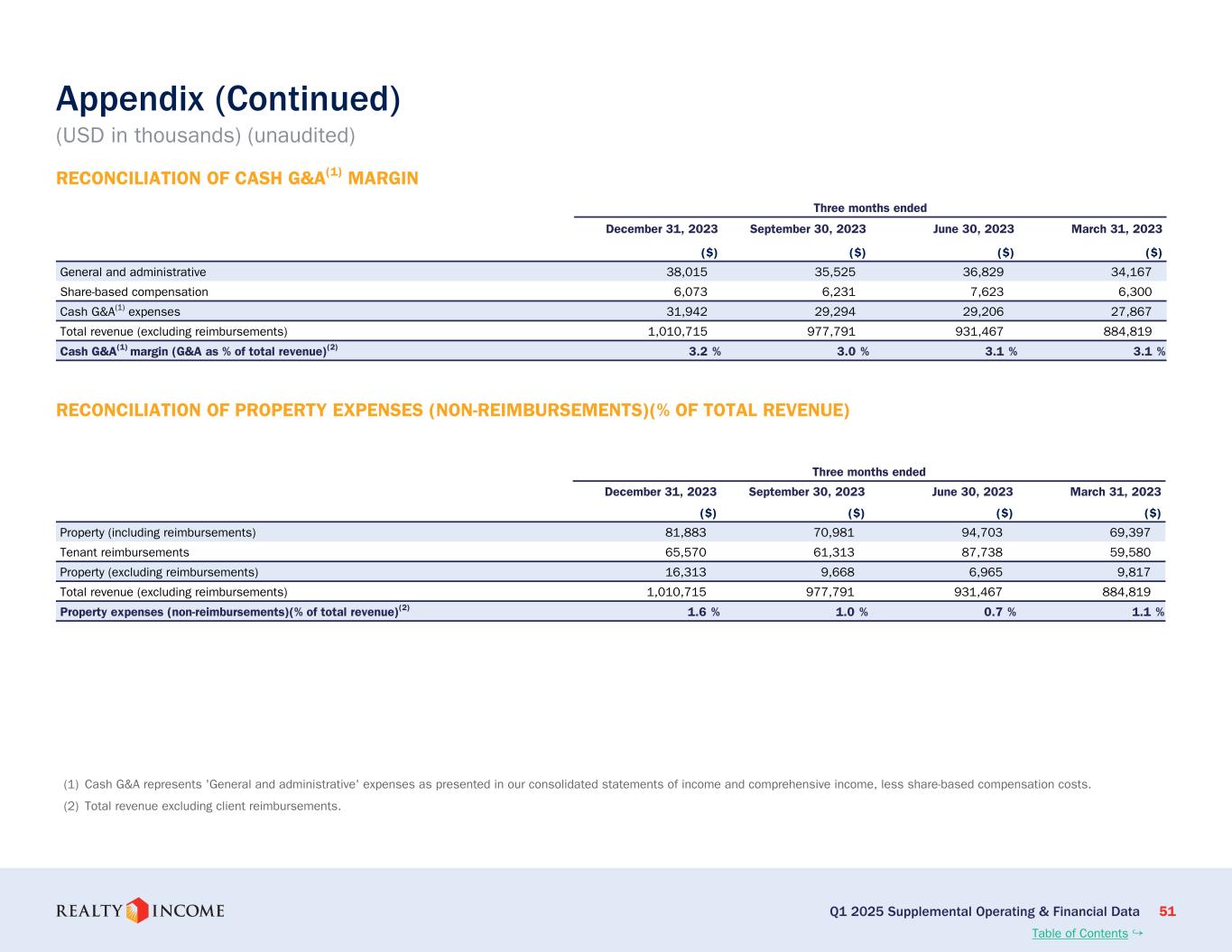

Q1 2025 Supplemental Operating & Financial Data 42 Appendix (USD in thousands) (unaudited) Table of Contents ↪ Three months ended March 31, 2025 December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 ($) ($) ($) ($) ($) Net income 251,462 201,350 271,124 260,968 133,899 Interest 268,374 268,149 261,261 246,931 240,614 Income taxes 15,657 20,102 15,355 15,642 15,502 Depreciation and amortization 608,935 606,671 602,339 605,570 581,064 Provisions for impairment 116,589 142,966 96,920 96,458 89,489 Merger, transaction, and other costs, net 279 (9,176) 8,610 2,754 94,104 Gain on sales of real estate (22,537) (24,985) (50,563) (25,153) (16,574) Foreign currency and derivative loss (gain), net 2,545 (535) 1,672 (511) (4,046) Proportionate share of adjustments from unconsolidated entities 19,488 18,991 20,340 16,911 15,236 Quarterly Adjusted EBITDAre 1,260,792 1,223,533 1,227,058 1,219,570 1,149,288 Annualized Adjusted EBITDAre 5,043,168 4,894,132 4,908,232 4,878,280 4,597,152 Annualized Pro Forma Adjustments(2) 78,683 79,143 29,347 33,813 82,199 Annualized Pro Forma Adjusted EBITDAre 5,121,851 4,973,275 4,937,579 4,912,093 4,679,351 Total debt per the consolidated balance sheet, excluding deferred financing costs and net premiums and discounts 27,296,346 26,510,798 26,437,045 25,712,293 25,598,604 Proportionate share of unconsolidated entities debt, excluding deferred financing costs 659,190 659,190 659,190 659,190 659,190 Less: Cash and cash equivalents (319,007) (444,962) (396,956) (442,820) (680,159) Net Debt 27,636,529 26,725,026 26,699,279 25,928,663 25,577,635 Preferred Stock — — — 167,934 167,394 Net Debt and Preferred Stock 27,636,529 26,725,026 26,699,279 26,096,597 25,745,029 Net Debt and Preferred Stock to Annualized Pro Forma Adjusted EBITDAre 5.4 x 5.4 x 5.4 x 5.3 x 5.5 x RECONCILIATION OF NET DEBT AND PREFERRED STOCK TO ANNUALIZED PRO FORMA ADJUSTED EBITDAre(1) (1) Adjusted EBITDAre, Annualized Adjusted EBITDAre, Pro Forma Adjusted EBITDAre, Annualized Pro Forma Adjusted EBITDAre, and Net Debt and Preferred Stock/Annualized Pro Forma Adjusted EBITDAre are non-GAAP financial measures. Please see the Glossary for our definitions of these terms and an explanation of how we utilize these metrics. (2) The Annualized Pro Forma Adjustments, which include transaction accounting adjustments in accordance with U.S. GAAP, consist of adjustments to incorporate Adjusted EBITDAre from investments we acquired or stabilized during the applicable quarter and Adjusted EBITDAre from investments we disposed of during the applicable quarter, giving pro forma effect to all transactions as if they occurred at the beginning of the applicable period. Our calculation includes all adjustments consistent with the requirements to present Adjusted EBITDAre on a pro forma basis in accordance with Article 11 of Regulation S-X. The annualized Pro Forma Adjustments are consistent with the debt service coverage ratio calculated under financial covenants for our senior unsecured notes.